3 minute read

Research: Shopping for resilience in retail property

The recent CBRE research report interrogates the resilience of retail assets, assesses growth areas and advises how landlords can future-proof their assets to ensure they remain resilient, despite changing consumer demands and broader economic challenges.

Advertisement

Last mile retailing, showroom style shopping, Click & Collect, customer analytics technology, food delivery offerings and flexible leases are set to become the hallmarks of resilient retail assets.

This is a key takeaway of CBRE Research’s new report: Retail Therapy – Shopping for Resilience in Retail Property, which looks at how landlords can future-proof their assets to ensure they remain resilient despite changing consumer demands and broader economic challenges.

The report provides an overview of retailers that are expected to experience growth in floorspace requirements, the potential uplift to MAT (Moving Annual Total) by incorporating mixed-use development in traditional retail assets and what practical measures landlords can implement to ensure they remain relevant to changing consumer needs.

As retailers in larger centres reduced department store and large-specialty store floor space – conserving costs and catering for increasing ecommerce demand – the opportunity existed for centre owners to reinforce the original retail recipe with the introduction of mixed-use offerings.

Incorporating mixed-use into a precinct can help drive spending with office and education offerings providing the greatest increase in centre MAT growth. MEAGAN WAKEFIELD Regional Director of Retail Services, CBRE KATE BAILEY Head of Retail Research, CBRE

Figure 1: Selected A-REIT cap rate compression and cumulative impact on value since June 2015 Source: CBRE Research

According to the report, a 10,000m2 office space could provide an additional $3 million per annum in centre MAT, while a 10,000m2 education facility could see an additional $2.2 million per annum in MAT.

A strategic floorplate reconfiguration, converting underutilised retail space into an attached ecommerce-driven distribution centre could benefit not just the store in reducing its footprint, but also other stores in the centre.

Online retailing and the growth of ecommerce is fuelling an overall net increase in commercial property space. Landlords can capitalise on this demand

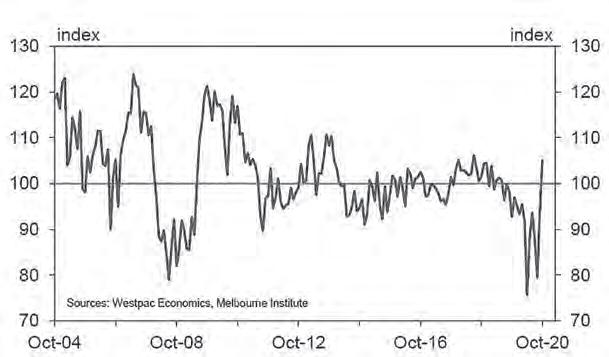

for industrial space by repurposing shopping centres had proved more redundant loading bays or back of house resilient in terms of capital value space into last mile warehouse space. preservation than their regional The analysis shows that discount and sub-regional counterparts. department stores in centres that had Since 2015, neighbourhood a catchment with a higher population shopping centres have experienced density, younger population and higher the highest cap rate compression average household income were more at 96bps, generating 13% capital resilient and less likely to close as value growth (see figure 1), and part of network optimisation projects. outperforming sub-regional (45bps Looking at how the retail sector has compression and 6.3% growth) and performed in recent years, the report regional shopping centres (43bps highlighted that smaller neighbourhood and 7.2% growth). The report also reveals that the re-pricing of retail assets, relative to other sectors, means that future total returns for the retail sector should be higher than for other lower yielding property sectors, such as office and industrial. Our view is that the widening retail yield spread, relative to office and industrial, will be exacerbated by the COVID19 pandemic’s impact on retail trade. COVID-19 has also driven the increase in online retail penetration sharply to an estimated 13.3%, a number originally not expected to be reached until 2024, and we’re now expecting to see department store selling space decrease to 2.6% annually by the end of the same year – the largest forecast decline of all retail categories. Conversely, grocery stores are slated to see the What retail sectors will see growth going forward? strongest growth, followed by health and beauty, while home furnishing stores are forecast to record the strongest growth in floorspace. CBD and regional shopping centre assets have the greatest amount of apparel selling space and will be most impacted by shrinking demand. SCN

Next issue: BIG GUNS