3 minute read

Research: Retail trends from 2020

This year has seen many economic records broken, with retail being one of the hardest hit sectors during the pandemic. With the focus now centred on recovery as Australian life begins to return to life pre-COVID, Colliers International looks at what trends have emerged from the retail sector as a result of the events of 2020.

Retail trends from 2020

Advertisement

Fashion retailers have fared well

Colliers International’s most recent Retail Research and Forecast Report has found that, despite the initial disruptions to 2020, some retail categories have been profitable during the pandemic.

The report found that even in challenging categories, such as fashion, retail was able to reach record profits as a result of the government assistance measures put in place. Online retailers such as Kogan saw sales up 110% on the prior year, and profits up 56%. Temple and Webster has seen sales up 74% and EBITA up 500%.

Premier Investments, owner of Peter Alexander, Smiggle, Just Group, Dotti, Jay Jays, Just Jeans and Portmans, reported an increase in online sales (up to 18% of total sales) with a 29% increase in net profit, despite sales being down 4.3% for the financial year.

Although many fashion retailers have seen significant falls in sales during the second quarter, many have pivoted to online retailing and have seen online penetration jump dramatically.

Total online market penetration has surged in the non-food categories, reaching more than 20% at the peak of the pandemic and 17.6% in

August, according to the ABS online index recording.

The COVID-19 crisis has required retailers to adapt rapidly to changing MICHAEL BATE KATE GRAY consumer demands, with some having Head of Retail Director, Research to change business models overnight; Colliers International Colliers International those retailers that are able to maintain a connection to their consumers and domestic travel and is therefore likely create further loyalty through an engaged to be spent in other retail categories. and value-added experience, have Categories such as cars, home continued to thrive. renovations and large ticket purchases Shopper spending patterns are all expected to be beneficiaries of this spend. As time goes on – and have changed restrictions ease further – increased

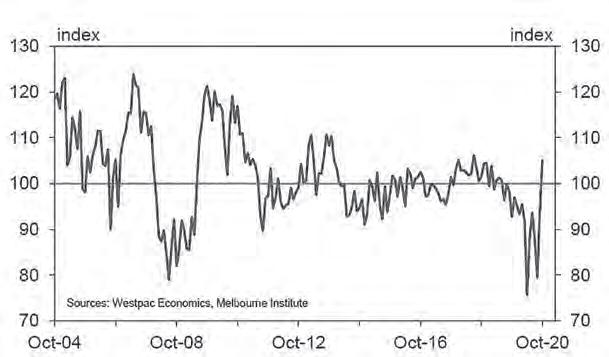

The spending patterns of Australian spend on cafés, restaurants and shoppers have been highly disrupted entertainment is likely. throughout 2020, although some normality is starting to return. Essential Consumer confidence returns spending spiked at the beginning of the to pre-pandemic levels pandemic in March, as many stocked Australian consumer confidence took up on toilet paper, cleaning products a nosedive in April as the pandemic hit and pantry staples. Australian shores with the lowest level When JobKeeper and early superannuation withdrawals commenced, discretionary spending took off. Throughout August and September, spending started to show more normal patterns and spending is now slightly below normal levels. There have been interesting dynamics of consumer confidence ever recorded since the survey commenced in the 1970s, according to Colliers’ Retail Research and Forecast report. Since then, consumer confidence has recovered to sit above pre-pandemic levels. It is now in positive territory at at play with consumers unable to spend 105.0 and there is much more positivity in certain categories; the most obvious surrounding consumers’ financial is overseas travel, which is off the cards positions in the coming 12 months, this year and most likely will continue to which is 6.2% above levels as at be for until at least mid-2021. October 2019.

Overseas travel accounted for Supporting consumers to feel $61 billion during 2019, which is almost confident and wanting to spend again double the superannuation withdrawals is key to the economic recovery, with to date. Not all of the overseas travel about 60% of GDP derived from spend is expected to be spent on household consumption. SCN