4 minute read

Special Feature: Little Guns 2020

2020

MAT Moving Annual Turnover Total retail sales (August 1, 2019 to July 31, 2020) including GST. Excludes sales from casual tenants, ATMs, financial institutions, gaming venues, TAB and soft gambling.

Advertisement

MAT/m2 Total retail sales (August 1, 2019 to July 31, 2020) of the centre including GST divided by the retail area from which the retail sales were derived. Sales from casual tenants, financial institutions, soft gambling and cinemas excluded.

Specialty MAT/m2 Total retail sales (August 1, 2019 to July 31, 2020) including GST, for all trade-reporting tenants with a GLA below 400m2, divided by the retail area from which the retail sales were derived. Excludes sales from cinemas, entertainment venues, ATMs, financial institutions, health insurance, TAB/soft gambling, gaming venues, travel agencies, amusements (rides), professional services and suites, offices, casual mall tenants and storage tenants. (In accordance with SCCA definitions).

LITTLE GUNS

annual feature

Belmont Forum retains its Number 1 place on the MAT (Moving Annual Turnover) ladder with a creditable $386 million, a small improvement on last year which, in these times, shows the strength of the centre. These are turbulent times and of course, the COVID factor has hit some centres, while others have shown gains.

The figures this year are reporting from August 1, 2019 to July 31, 2020 so they take in some five months of COVID affected period. Park Beach Plaza had a significant improvement – up some 8% on last year – to take second place with $316 million.

There were three new entries into the MAT Top 10 table this year: Perron Group’s JLL managed, The Square Mirrabooka in Perth, came in at Number 8 with a 5.7% rise, reflecting WA’s resistance to the COVID factor; Charter Hall’s Bateau Bay Square took 9th spot and Vicinity’s Eastlands came in at Number 10. There are 84 Little Gun centres ranked this year. If we treat MAT rises and falls of less than 1% as ‘static’, we see 34 centres showed a drop in MAT, 23 were up and 27 remained the same. In a pandemic year, a very creditable result showing the resilience of these centres.

On the MAT/m2 table, Mirvac’s East Village retained its Number 1 ranking even after dropping by 4.6% on last year, with $14,748 – still well ahead of second placegetter Marrickville Metro (UniSuper and AMP Capital) at $12,538. The turbulent year saw four new entries into the Top 10: Vicinity’s Karratha City; AMP’s Casula Mall; SPH REIT’s Figtree Grove and Charter Hall’s Rockdale Plaza.

In terms of Specialty MAT/m2, last year’s Number 1 and 2 switched places with Vicinity’s Mount Pleasant Centre (QLD) taking the honours with $14,262, just pipping Winston Hills Mall's $14,188. Stockland Bundaberg entered the Top 10 in 9th spot and Q Super Centre (also in QLD) was a new entry taking out the 10th spot in the table.

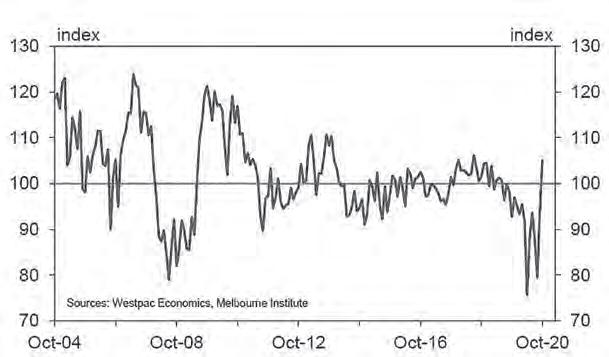

Analysis of figures this year has no validity. Early in the year, COVID struck and we were altogether in an unknown place. Some Little Gun centres suffered, while others did well out of the ‘convenience’ and ‘local’ factors. The real performance tests are yet to come and will do so when some sort of normalcy, even if it emerges as a ‘new normal’, emerges. SCN

TOP 10 MAT (million)

Rank Centre name, State, Owner/Management 1 2 3 4 5 6 7 8 9 10 Belmont Forum, WA, Perron Group/JLL Park Beach Plaza, NSW, H A Bachrach/BNG Kawana Shoppingworld, QLD, Mirvac & ISPT/Mirvac Lake Haven Centre, NSW, Vicinity/Vicinity Centres Chirnside Park S/C, VIC, GWSCF/GPT Ocean Keys S/C, WA, AMP Capital S/C Fund, AMPCSC Willows S/C, QLD, DWPF/Dexus The Square Mirrabooka, WA, Perron Group/JLL Bateau Bay, NSW, CH Retail P.No.2/Charter Hall Eastlands, TAS, Vicinity/ Vicinity Centres

TOP 10 MAT/m2

MAT (million) Change % $386.14 $315.86 $313.34 $296.79 $290.67 $290.14 $279.95 $271.30 $268.95 $268.01 0.4% 7.9% -5.0% -0.6% -4.6% 1.2% -2.1% 5.7% 0.2% 0.3%

Rank

1 2 3 4 5 6 7 8 9 10

East Village, NSW, Mirvac/Mirvac Marrickville Metro, NSW, Unisuper/AMPCSC Nepean Village, NSW, Vicinity/Vicinity Centres Winston Hills Mall, NSW, Private/TGC Bateau Bay, NSW, CH Retail P.No.2/Charter Hall Mount Pleasant Centre, QLD, CBGS/Vicinity Centres Karratha City, WA, Vicinity & Challenger/Vicinity Centres Casula Mall, NSW, Wholesale Australian PF/AMPCSC Figtree Grove, NSW, SPH REIT & Moelis/RetPro Group Rockdale, NSW, CH Retail REIT/Charter Hall $14,748 $12,538 $11,639 $11,524 $10,872 $10,637 $10,394 $10,106 $9,904 $9,723 -4.5% 0.7% 2.2% 3.3% 1.6% -1.9% 4.4% -1.8% -3.6% 3.9%

TOP 10 Specialty MAT/m2

1 2 3 4 5 6 7 8 9 10 Mount Pleasant Centre, QLD, CBGS/Vicinity Centres Winston Hills Mall, NSW, Private/TGC Whitsunday Plaza, QLD, Vicinity/Vicinity Centres Nepean Village, NSW, Vicinity/Vicinity Centres Rockdale, NSW, CH Retail REIT/Charter Hall Victoria Gardens, VIC, Vicinity & Salta/Vicinity Centres Chirnside Park S/C, VIC, GWSCF/GPT Marrickville Metro, NSW, UniSuper/AMPCSC Stockland Bundaberg, QLD, Stockland/Stockland Q Super Centre, QLD, Jen/Jen Mgt QLD $14,262 $14,188 $12,733 $12,272 $12,128 $11,616 $11,243 $11,127 $10,695 $10,596 -0.4% -4.3% -3.1% -2.7% -4.9% -0.8% -8.8% -7.4% -7.6% -3.5%