THE WEIGHT LOSS WAR

WHO IS WINNING OUT BETWEEN NOVO-NORDISK AND ELI LILLY?

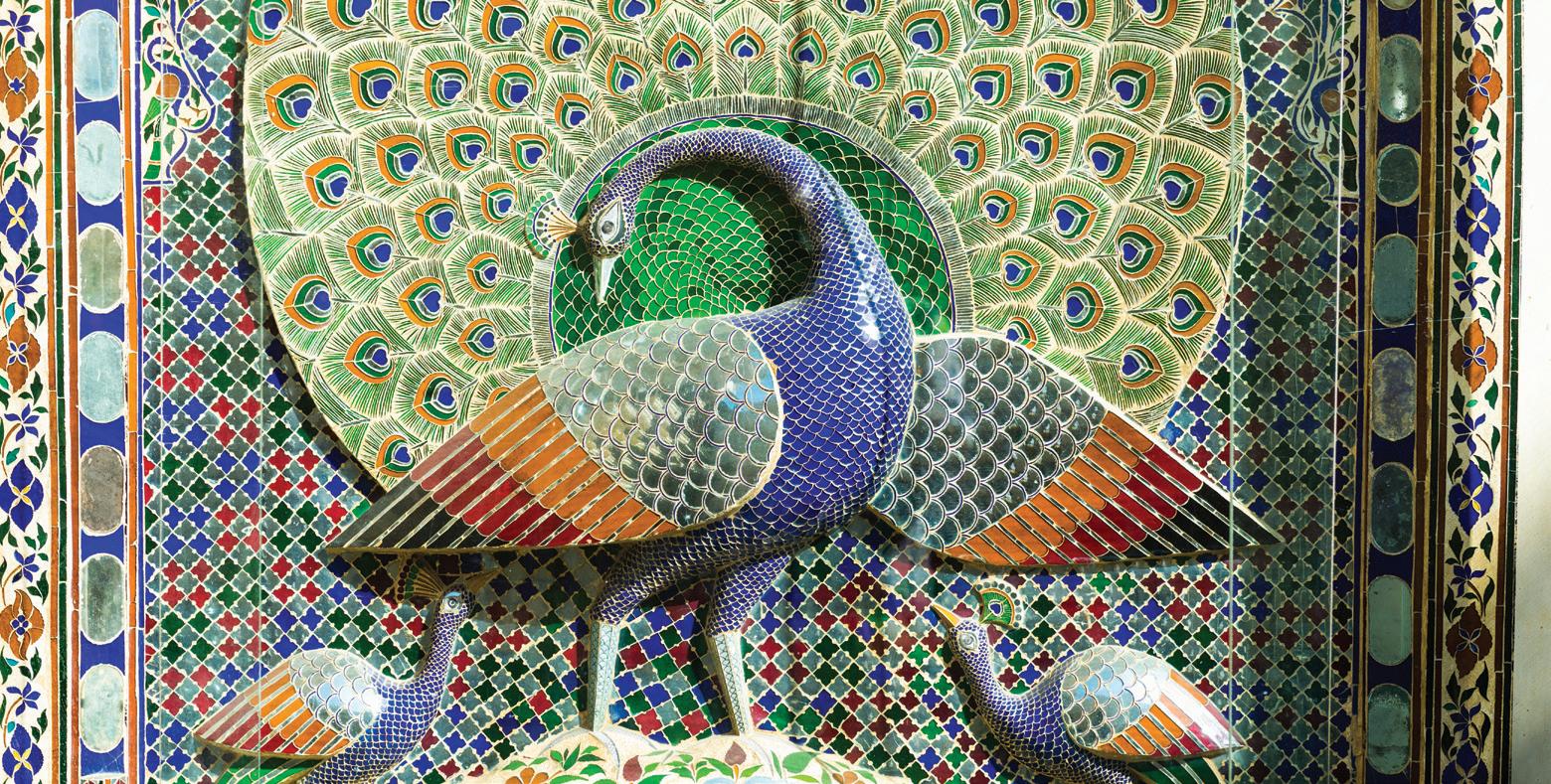

abrdn New India Investment Trust

managed by Aberdeen

India: a vibrant investment opportunity

India’s vibrant economy is fast evolving, with remarkable demographics: the largest population in the world, a growing and aspirational middle class and increasing integration into the global economy.

The Indian growth story is an exciting one, with a wealth of opportunities, but not without risk. So, if you’re keen to explore this market’s promise, quality matters. That’s why at abrdn New India Investment Trust we’re always on the lookout for world class, well governed companies that operate in attractive industries and sectors.

For a portfolio that’s at the heart of India’s growth and potential, take a look at abrdn New India Investment Trust

Tax efficient investing

Please remember, the value of shares and the income from them can go down as well as up and you may get back less than the amount invested.

Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future.

Eligible for Individual Savings Accounts (ISAs) and Self-Invested Personal Pensions (SIPPs).

Invest via leading platforms.

05 EDITOR’S VIEW

Could European outperformance hit a roadblock and what about the long-term?

07 Another Trump tariff U-turn sends stocks higher

08 Games Workshop disappoints the market with guidance on licensing revenue

09 Johnson Matthey shares soar to a new yearhigh on £1.4 billion cash return

09 Digital commerce outfit Pebble Group’s shares hit a new 52-week low

10 British American Tobacco has been a stalwart for investors so far this year

11 Trillion-dollar Broadcom is a good bet for a forecast beat

12 High-quality, market-leading threads company Coats just looks much too cheap

14 Capture the long-term outperformance of small caps through Artemis UK Future Leaders

16 Take profits on MercadoLibre after 64% gain

17 Why we would sit tight in Renold despite a 50% takeover premium 18 COVER STORY THE WEIGHT LOSS WAR

Who is winning between Novo-Nordisk and Eli Lilly?

27 Small World: cobalt, beauty products and seaweed feature in our latest round-up of smaller companies

Three important things in this week’s magazine

Analysing investment trust discounts

What

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

Could European outperformance hit a roadblock

US since the early 2000s.

And yet as it says: ‘A number of policy shifts over recent months have improved Europe’s structural outlook: (a) more supportive German fiscal policy, which should start to boost German and, hence, Euro area, GDP growth from next year onwards; (b) the push towards joint European defence spending; (c)renewed momentum towards European integration, which could help to unlock productivity gains; and (d) an increasingly stretched fiscal balance in the US, which, our economists highlight, could put pressure on policymakers to engage in renewed fiscal consolidation.’

‘A good-case scenario could see German fiscal and broader European defence spending, the implementation of an ambitious European reform agenda and some fiscal consolidation in the US over the coming years, which could help to break the spell of Europe’s two-decade-long underperformance.’

However, BofA remains sceptical about the continent’s near-term growth and the immediate outlook for European shares – particularly after their relatively strong start to the year.

The debate about whether a period of US exceptionalism is coming to an end and whether European stocks can close the gap on Wall Street continues. We have seen some evidence of such a shift so far in 2025 but, given the scale and protracted nature of European stocks’ underperformance, there could be a long way to go. A potential trade war between the EU and US, the chances of which – as we discuss in this News section – have eased slightly, adds a wildcard element.

Bank of America (BofA) notes European equities’ price relative to US equities has declined by more than 60% since the mid-noughties. The investment bank acknowledging this is thanks to weaker earnings growth, resulting from weaker economic performance. It flags that Europe’s nominal GDP has fallen by more than 20% relative to that in the

This is a view shared by Berenberg, analyst Jonathan Stubbs arguing: ‘The “easy money” has been made in the near term. Despite soft growth and net earnings downgrades, European equities have performed well year-to-date with returns of around 10%. European shares have re-rated back above the long-term average 12-month forward PE (price to earnings ratio) of 14 times and are no longer cheap here.’

BofA concludes: ‘The catalysts for a potential end of European equities’ structural underperformance are coming into view, but it might take time and some luck for them to start showing up in the data.’

This trend of US leaving Europe in the shade has been reflected at a micro level in the recent fortunes of US obesity drug maker Eli Lilly (LLY:NYSE) versus its Danish counterpart Novo-Nordisk (NOVO-B:CPH). This week Martin Gamble compares the two and how they are placed as competition ramps up and the race to deliver a weight loss treatment in pill form accelerates.

Another Trump tariff U-turn sends stocks higher

Long-term bond yields have risen despite weakening economic data

President Trump’s has performed his latest U-turn on trade tariffs providing some respite to nervy financial markets.

European markets fell sharply on 23 May after Trump threatened to slap 50% tariffs on the EU from 1 June before pulling back after a conversation with European Commission president Ursula von der Leyen on 25 May, after which he agreed to moving back the start date to 9 July.

European stock markets duly rallied on 26 May, regaining the losses, while both the UK and US were closed for a bank holiday and Memorial Day, respectively.

While the immediate relief is understandable, it does not capture the full picture. Even after backing down on initial threats, net tariff increases across the board are higher than before, implying the US will be less open to international trade when the dust finally settles.

It is also worth highlighting that existing tariffs are already having a positive impact on US finances. US customs duties and excise taxes hit a record high in May, bringing in at least $22.3 billion according to the Department of Treasury data.

Whether tariff levies will be sufficient to offset the impact from Trump’s ‘big, beautiful tax bill’ remains an open question.

US 30-year treasury yields recently breached the psychological 5% barrier, the highest level since 2007, before slipping back below on 27 May. This may reflect investor concerns over high and rising US debts.

A higher cost of financing matters when the

interest payments on existing debt topped £880 billion in 2024, eclipsing the amount the US spends on healthcare and the military. Most of the current debt was financed when interest rates were lower than they are today.

Credit rating agency Moody’s (MCO:NYSE) removed its triple A rating on the US (16 May) due to concerns on rising and persistent budget deficits which it predicts will increase from 6.4% to just under 9% by 2035.

Treasury secretary Scott Bessent insists the economy can grow out of its debts. He believes the US can grow ‘way north’ of 3% a year, driven by reregulation and tax cuts.

The administration also believes debt will fall due to spending cuts plus revenue from those pesky trade tariffs.

Bessent pushes back on the idea that rising bond yields reflect debt concerns, and instead sees them as confirmation that the administration’s growth agenda is working. [MG]

Games Workshop disappoints the market with guidance on licensing revenue

Company doesn’t see record levels from this area being repeated in the current financial year

It’s been a fabulous year for Games Workshop (GAW), the fantasy games and miniatures maker that has delivered a string of good news around earnings and enjoyed promotion to the ranks of the FTSE 100.

But the shares slipped on 23 May after the Nottinghambased company warned it doesn’t see the record levels of licensing revenue generated in the current financial year repeating in the new one.

This guidance disappointed investors and took the shine off yet another earnings upgrade from a business bulls believe has only just scratched the surface of its global expansion opportunity.

For the uninitiated, Games Workshop’s rocksolid core business is underpinned by an army of fans obsessed by its fantasy worlds who collect miniature figures and play its board games.

This success has enabled the company to build a rich library of intellectual property (IP) that provides the platform for additional revenue generation.

Much of the excitement surrounding Games Workshop centres on a deal struck with (AMZN:NASDAQ) to create a Warhammer 40,000 film and TV series, for which creative guidelines have been agreed. This agreement gives Amazon exclusive rights with an option to license equivalent rights in the broader Warhammer universe after any initial productions have been released.

For the year ending 1 June 2025, Games Workshop guided for core revenue to be ‘not less than £560 million’, implying at least 13% year-onyear growth, with licensing revenue forecast at around £50 million, a healthy uptick from £31 million a year ago.

Licensing revenue in the period is at a record level and we are not expecting this to be repeated in 2025/26”

However, Games Workshop cautioned: ‘Licensing revenue in the period is at a record level and we are not expecting this to be repeated in 2025/26’, though the company stressed that ‘licensing remains a significant area of focus’.

While the licensing guidance fell flat, Games Workshop said profit before tax for the year about to end is estimated to be ‘not less than’ £255 million, comfortably ahead of market expectations for £240 million and implying a year-on-year rise of at least 26%.

Russ Mould, investment director at AJ Bell, explained that licencing the rights to certain brands and characters is ‘easy money’, but Games Workshop is ‘fiercely protective of its assets and won’t let anyone come along and milk them. It wants to be sure that any custodians of its IP are using it wisely and do not tarnish its reputation.’

Mould continued: ‘Games Workshop has enjoyed terrific success with licencing assets for the Warhammer 40,000: Space Marine 2 video game. There’s a warning that licencing gains seen over the past 12 months won’t be matched in the new financial year, which explains why the shares have pulled back on the trading update.’ [JC]

DISCLAIMER: Financial services company AJ Bell referenced in this article owns Shares magazine. The author of this article (James Crux) and the editor (Tom Sieber) own shares in AJ Bell

Johnson Matthey shares soar to a new year-high on £1.4 billion cash return

Specialty chemicals group has been under pressure from its biggest shareholder to unlock value

Shares in Johnson Matthey (JMAT) soared more than 30% this week after the specialty chemicals group agreed to sell its Catalyst Technologies division to US industrial giant Honeywell (HON:NASDAQ) for an enterprise value of £1.8 billion.

The specialty chemicals group has come under increasing pressure from its largest shareholder Standard Investments to take ‘decisive action’ to unlock ‘unrealised promise,’ and this is a decisive move in that direction.

a transformation programme under chief executive Liam Condon to increase cash generation and create value for shareholders.

The sale of its catalyst unit follows the divestment of the battery materials business in 2022 and the sale of its medical device components unit last year.

Over the past three years, Johnson Matthey has embarked on

Digital

The company has promised to return £1.4 billion of the sale proceeds to shareholders as well as committing itself to ‘enhanced returns’ to investors as part of its restructuring.

The latest set of results for the year

commerce outfit

Pebble Group’s shares hit a new 52-week low

Tariff uncertainty and US exposure knocks company’s confidence

Shares in Pebble Group (PEBB:AIM) hit a new 52-week low on Thursday (22 May) as the digital commerce company continued to weigh up the impact of Trump’s trade tariffs on its business.

The company, which operates through two divisions, Brand Addition and Facilisgroup, has exposure to

various international markets which will be affected by Trump’s new trade tariff policy.

Pebble’s Facilisgroup North American SaaS (software as a service) business generates 45% of adjusted EBITDA (earnings before interest, tax, depreciation and amortisation), while Brand Addition works with global brands and clients in China, Europe and North America.

Analysts at Edison research said: ‘The only impact to date may be in the level of Facilisgroup business being transacted through the preferred supplier base, which has dipped in the first weeks of full year 2025 and may be attributable to distributors stepping up their direct purchases to build a buffer of nontariff affected stock.’

In March, the company reported a

Source: LSEG

to 31 March 2025 showed revenue down 2% excluding divestments and currency moves, and a 5% increase in operating profit on the same basis.

For the year to March 2026, which will include a contribution from the catalyst business, the firm expects operating profit to grow by midsingle-digits again. [SG]

Source: LSEG

9.5% rise in pre-tax profit to £8.1 million for the year ending 31 December.

The company said it was confident of delivering ‘long-term sustainable earnings growth’ and ‘creating shareholder value.’

Pebble has also recently appointed a CRO (chief revenue officer) to focus on rejuvenating organic growth. [SG]

British American Tobacco has been a stalwart for investors so far this year

Shareholders will hope it’s ‘steady as she goes’ in terms of the full-year outlook

It has been a good 2025 so far for shareholders in dull defensive stocks like British American Tobacco (BATS), as markets get whipsawed one way and another by on-off tariff announcements and trade deals.

At the time of writing, BAT shares are up 430p or 15% year-to-date, on top of which the firm has paid out two dividends totalling roughly 119p, so the total return has been more like 19%, while the FTSE 100 has eked out a 5% gain.

Therefore, investors will be looking for a reassuring pre-close first-half trading update on 3 June and possibly a small increase in full-year guidance.

At the AGM in April, chairman Luc Jobin described 2025 as ‘a deployment year’ where the company builds on its investments, returning to profit growth in the U.S and gradually deploying its New Category product innovations as the year unfolds.

The key things to look for will be the outlook for total revenue, which the consensus forecasting around £26.2 billion this year, allowing for currency headwinds, and new category product revenue, which is seen around £3.9 billion against £3.4 billion last year.

Analysts and investors will also be eyeing the adjusted operating margin,

is seen flat at around 44% excluding the Canadian business and the impact of a £6.2 billion provision to settle litigation in the country after six years of legal proceedings. [IC] DISCLAIMER: The author (Ian Conway) owns shares in British American Tobacco.

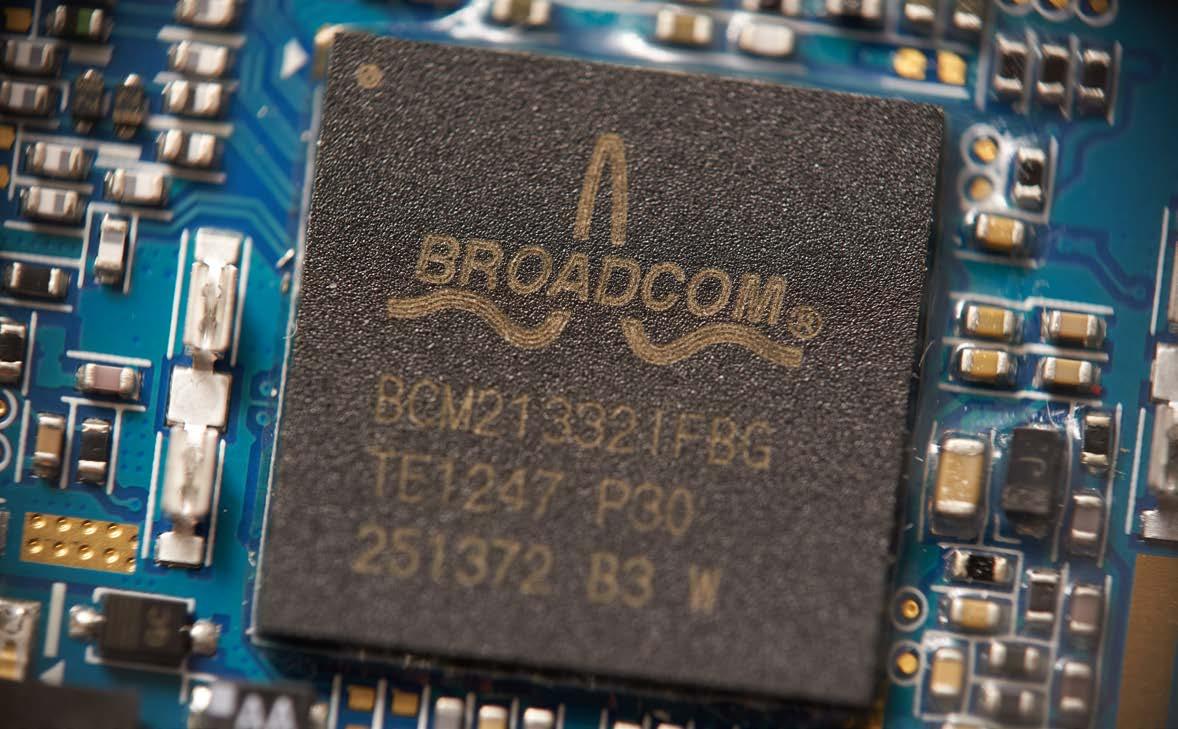

Trillion-dollar Broadcom is a good bet for a forecast beat

A little healthy investment speculation can be useful and fun. In August 2024, we wondered if Broadcom (AVGO:NASDAQ) might become the next trillion-dollar company, joining the likes of Microsoft (MSFT:NASDAQ), Nvidia (NVDA:NASDAQ) and Apple (AAPL:NASDAQ). At the time, the company had a market cap of $732 billion.

The answer, it transpired, was yes, with the company's valuation leaping that hurdle in December 2024 and staying above that mark for much of this year.

At the time of writing, Broadcom’s market cap is $1.08 trillion, based on its $230.53 share price (at close 22 May), so it is still part of an exclusive club.

Whether it can remain there in the short term depends on incoming second-quarter earnings, due after the market close on 5 June.

The Palo Alto-based company operates across the semiconductor and infrastructure software spaces, but investors typically see it as an AI

Source: LSEG

(artificial intelligence) play, and rightly so, while its sheer scale means most investors will have some sort of exposure, either directly or through various funds and ETFs.

Analysts expect Broadcom to report EPS (earnings per share) of $1.57 on $14.98 billion revenue, implying annual growth of around 45% and 20% respectively after accounting for the 10-for1 stock split in July 2024.

Betting on a forecast beat would tally with its fine track record of doing just that in an almost unbroken run stretching back 10 quarters, and analysts remain largely optimistic over both its short-term and longerterm future. [SF]

QUARTERLY RESULTS

30 May: Costco

3 June: Dollar General, Hewlett Packard

4 June: Brown Forman, Campbell Soup, MongoDB

5 June: Broadcom, JM Smucker

Source: Koyfin

Source: Koyfin

High-quality, market-leading threads company Coats just looks much too cheap

The business has consistently outperformed its markets over the long term

Coats

(COA) 76.2p

Market cap: £1.2 billion

World-leading thread and structural components maker Coats (COA) has set its sights on delivering accelerated cash flow and shareholder returns after de-risking its pension liabilities and divesting non-core assets.

We believe this high-quality business can deliver mid-teens percentage total shareholder returns, which looks very attractive against a PE (price to earnings) ratio of only 10 times and a free cash flow yield of 9%.

Our expectation is based on EPS (earnings per share) growth of 10% a year over the next five years (see more below) and a starting dividend yield of 4%. There is added appeal should investors recognise the company’s attractions and re-rate the shares.

For example, the cyclically adjusted PE is currently depressed and trading close to 10-year

Coats (p)

Source: LSEG

Coats revenue by production

lows. Should the rating ‘mean revert’ over the next 12-months, the shares offer 53% upside.

In short, we believe there is tremendous value on offer at Coats which is not being recognised.

NEW MID-TERM TARGETS

David Paja was appointed chief executive in October 2024 and was previously head of GKN Aerospace (part of Melrose Industries), where he played a key role in the successful turnaround of the business and the delivery of profitable growth.

At Coats’ full year results (6 March), Paja laid out new medium-term financial targets for the group following a review of its operations including delivering high-single-digit organic EPS growth and expanding EBIT (earnings before interest) margins to between 19% and 21% from 18% in 2024.

Including acquisitions and share repurchases, the company expects to deliver a CAGR (compound annual growth rate) in earnings of more than 10% per year while maintaining a progressive dividend policy.

The company is targeting $750 million in cumulative free cash flow over the next five

years, and intends to make additional returns to shareholders should net debt fall below one times EBITDA (earnings before interest, tax, depreciation, and amortisation).

PENSION HAS BEEN DE-RISKED

One of the drivers of higher free cash flow is the removal of the group’s pension liabilities under its defined benefit scheme. These schemes, also known as final salary schemes, guarantee a fixed income for life based on salary and number of years’ service.

In 2022, the company purchased a bulk annuity policy covering 20% of its liabilities and in 2024 it purchased a £1.3 billion bulk policy from PIC (Pension Insurance Corporation) for the remaining 80%.

The agreement with PIC is anticipated to require £100 million of additional funding by Coats, involving a £70 million upfront payment.

Chief financial officer Jackie Callaway said: ‘From having $3 billion of liabilities across three schemes in 2016, with a Technical Provisions deficit of circa $750 million, we are now securing fully-insured benefits for our pensioners and removing volatility and uncertainty for our investors.’

‘Now the scheme is fully funded and cash

Coats revenue by division

Year End: 31 December

Source: Stockopedia, Refinitiv

contributions have ceased, this will lock in a significant improvement in the group’s free cash generation.’

On 3 April, Coats announced its intention to exit the Performance Materials division’s US business in North Carolina following a strategic review which had already resulted in the closure of the firm’s Mexican facility in December 2024.

The US exit is expected to have a positive annualised impact on EBIT margins not just at the Performance Materials division but across the group.

A RESILIENT, QUALITY BUSINESS

Coats has a strong heritage and has been in business for more than 250 years. The company is the market leader in more than 85% of its product portfolio, and in apparel it is substantially larger than all its competitors combined with an estimated market share of 26%.

The sheer scale of the business, operating in over 50 countries with more than 100 manufacturing sites, gives it a major advantage over its competitors.

The company can provide unrivaled customer service and timely product delivery from its robust supply chain, allowing it to earn superior margins and returns on capital.

In 2024, Coats reported an 18% operating margin and a 38% return on capital employed which, meaning returns have averaged 33% over the last three years.

Meanwhile, healthy cash generation allows the company to invest in research and development which has led to many innovations such as its EcoVerde recycled thread.

In summary, we believe the market is not giving Coats enough credit either for the quality of the existing business or the new CEO’s growth ambitions. [MG]

Capture the long-term outperformance of small caps through Artemis UK Future Leaders

Renamed and under new management, this trust offers exposure to attractivelyvalued market leaders with pricing power

Artemis UK Future Leaders (AFL) 368p

Market cap: £112 million

Awide 15% discount to net asset value (NAV) at the recently-renamed Artemis UK Future Leaders (AFL) presents a compelling entry point for investors keen to capture the long-term outperformance of small caps and back the top-quality investment team at Artemis who took over the portfolio on 10 March 2025.

New managers Mark Niznik and William

Artemis UK Future Leaders

PE = price to earnings ratio. EV/EBIT = enterprise value to earnings before interest and tax. EBITDA = earnings before interest, tax, depreciation and amortisation

Source: Artemis, Bloomberg, as at 23 April 2025

Tamworth have a proven track record of investing in UK smaller companies and, importantly, both have backed the trust with their own money.

They are excited by the opportunities they are seeing in the undervalued UK stock market, especially at the inefficient micro-cap end of the spectrum, and have the ability to use the trust’s gearing to turbo-charge returns.

Shares believes when confidence in UK companies begins to recover, this should drive a strong re-rating of small cap share prices and narrow the NAV discount delivering a powerful performance double-whammy.

PROVEN PROCESS

Niznik and Tamworth have taken over the running of the previously poorly-performing Invesco Perpetual UK Smaller Companies trust, whose returns had fallen behind the benchmark.

The pair currently manage the Artemis UK Smaller Companies Fund (B2PLJL5), ranked top-quartile in the IA UK Smaller Companies sector over one, three and five years.

Both are passionate believers in the ‘small-cap premium’, the historic long-term outperformance of small caps over large caps of between 3% and 4%

per year, and believe the closed-ended structure is the ideal way to access companies further down the cap spectrum.

NICHE LEADERS

Artemis UK Future Leaders seeks to invest in UK smaller companies which occupy market-leading positions or which the managers believe can establish leading positions in the future.

As Niznik explains, ‘Market leaders in their little niches tend to have better pricing power than the number two, three and four, which gives them the ability to cover off any cost of goods inflation they face, which is really important to protect the underlying profit of the business. Niche market leaders in our experience tend to have better pricing power than most.’

The word ‘future’ in the new name is a reminder market positions are not static, and the managers like to invest in companies which can strengthen existing leadership positions or establish new ones.

In terms of their stockpicking process, Niznik and Tamworth use a disciplined approach to analysing the value of companies and the strength of their cash flows and profitability.

A key tenet of their approach is a strong valuation discipline, which helps them avoid over-hyped

Top 10 holdings

Serco

Mears

Alpha Group

MONY

Moonpig

Hilton Food

Chemring

Hollywood Bowl

Gamma Communications

GB Group

Source: Artemis, Bloomberg, as at 23 April 2025

companies and deliver better long-term returns.

‘Our portfolio is on about an 11 times price-toearnings ratio (PE) for double-digit earnings growth and is on an 8% free cash flow yield,and the average company has no debt at all, so we are quite debtaverse,’ says Niznik.

FOLLOW THE LEADERS

Shares believes Artemis UK Future Leaders would suit investors with a long-term horizon, since the smaller companies sector can remain out of favour for prolonged periods.

However, when it comes, performance can be ‘substantial and rapid’, so this requires investor patience to maximise the full value of the small-cap premium.

The heavy lifting in terms of repositioning the portfolio is largely done now, with top 10 positions as at 23 April 2025 including government outsourcing leader Serco (SRP), social housing maintenance leader Mears (MER) and the price comparison market leader MONY Group (MONY), not to mention niche market leaders ranging from Moonpig (MOON) and Hollywood Bowl (BOWL) to Gamma Communications (GAMA) and Hilton Food (HFG)

Corporate buyers and companies themselves are seeing 50% undervaluation in many of the holdings across the two Artemis small cap portfolios.

‘We are seeing lots of takeovers at the moment, but lots of opportunities to reinvest in similarly attractive undervalued companies which have the traits we are looking for,’ insists Tamworth, while Niznik observes an ‘unprecedented’ level of smallcap share buybacks underway, which is a result of attractive valuations, strong balance sheets and management teams’ confident outlooks. [JC]

Take profits on MercadoLibre after 64% gain

Shares in Latin American ecommerce and digital finance firm have soared although long-term investors may want to stick rather than twist

Gain to date: 64%

Shares in Wall Street-listed MercadoLibre (MELI:NASDAQ) have been riding high on its dominant presence in Latin America and a diversified business model across ecommerce and fintech.

Year-to-date, the stock is up 42%, insulated largely from US tariffs chaos, and aided by robust earnings over the past couple of quarters, far outstripping the Nasdaq Composite’s negative return in 2025.

Since our original Great Idea pitch in early April 2024, the stock has rallied 64%, again beating the Nasdaq’s rough 15% gain.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

Uruguay-based MercadoLibre has most recently been expanding its advertising reach with the launch of the Mercado Play app on smart TVs across Latin America. The app, now available for download on over 70 million smart TVs, offers users access to more than 15,000 hours of free content.

With fewer than half of the region’s population subscribed to paid streaming services, MercadoLibre sees this as a significant opportunity to engage new audiences. The initiative is positioned as a triple-win, benefiting consumers through free content, content studios through broader distribution, and Mercado Ads through enhanced ad inventory and reach.

Source: LSEG

Total revenue in the first quarter of 2025 (reported in early May) were driven by accelerating

commerce and fintech revenues, which grew 32.3% and 43.3% year-on-year, respectively. The marketplace’s Unique Active Buyers grew 25% and fintech’s Monthly Active Users rose 31%.

Yet challenges remain: credit risk, where margins declined in Q1, and competition the most obvious elephants in the room, with Amazon (AMZN:NASDAQ) apparently scaling up and Walmart (WMT:NYSE) already Latin America’s biggest bricks and mortar retailer.

WHAT SHOULD INVESTORS DO NOW?

In short, we see nothing wrong with sticking with your investment if it suits your goals and timeframe. On the other hand, 60%-plus gains are not to be sniffed at, and more cautious investors may want to lock-in these excellent returns and redeploy funds elsewhere. Take profits. [SF] MercadoLibre

This is a tough call and will largely depend on your own investment horizon and appetite for risk. Over the longer term, this still looks like an attractive growth investment, a company well positioned to capitalise on a sizeable ecommerce and digital finance opportunity across the region.

Analysts still estimate earnings and revenue growth of 30%-odd over the next couple of years, while margins could also see improvement.

That may justify a 12-month rolling PE (price to earnings) multiple of 44 in the eyes of some investors, but to others that valuation may look stretched, especially given average price target consensus sees less than 10% further upside.

Why we would sit tight in Renold despite a 50% takeover premium

The potential for double-digit profit growth and increasing cash generation is not reflected in a lowly eight times forward PE

Renold

(RNO:AIM) 73.9p

Gain to date: 35.2%

We highlighted industrial chains and specialist torque transmission maker Renold (RNO:AIM) as a great investment opportunity in August 2024.

The company has a clear strategy to deliver shareholder value by consolidating a fragmented global market and driving margin expansion via scale benefits and efficiencies.

We argued growth, quality and value is a rare combination not to be missed.

WHAT HAS HAPPENED SINCE WE SAID BUY?

After noting press speculation, Renold confirmed on 20 May it had received two separate, unsolicited and non-binding all-cash proposals, one at 81p per share from a consortium comprising Buckthorn Partners and One Equity Partners, and one at 77p per share from Webster Industries, which is majority-owned by a fund managed and controlled

by Morgenthaler Private Equity.

The shares rallied 37% on the day of the announcement to 73.4p, some way shy of the highest offer, and the board said it would provide both parties with access to management and due diligence information.

In accordance with London Stock Exchange rules, the two bidders must announce their intention to make a firm offer or walk away by the close of play on 17 June, and as usual there is no certainty a formal offer will be made or accepted.

WHAT SHOULD INVESTORS DO NOW?

Even after the big jump in the share price, Renold shares still trade on a miserly single-digit PE (price earnings) ratio of eight times.

The business makes a healthy return on capital of 22.5% and has potential to grow to two to three times its current size while increasing operating margins.

Looked at another way, today the business makes four times the annual profit it made a decade ago when the share price was last trading close to 81p.

We would sit tight, let the situation play out and hope a bidding war ensues. [MG]

THE WEIGHT LOSS WAR

WHO IS WINNING BETWEEN NOVO-NORDISK AND ELI LILLY?

If a picture can tell a thousand words, a share price chart of Novo Nordisk (NOVOB-B:CPH) versus Eli Lilly (LLY:NYSE) strongly suggests the US firm is well ahead in the race to dominate the market for weight loss drugs, which analysts predict could be worth $150 billion per year by 2030.

Over the last five years an investor in Lilly would have made 360% excluding dividends, while an investor in Novo would be sitting on a gain of ‘only’ around 93%.

It is notable that the share prices of both companies are way below their peaks of roughly a year ago, with Novo suffering a circa 60% drop while Lilly is down by around a fifth, reflecting the emergence of

greater competition and supply bottlenecks for both companies.

The sharp underperformance of Novo’s shares led to the surprise exit of its chief executive Lars Fruergaard Jorgensen on 16 May. While a chief executive falling on their sword is a common occurrence in the UK and the US, in Scandinavia it is relatively rare.

As Barclays analyst Emily Field commented: ‘It is really not the way the company’s ever done things, so that would be a huge departure from what they’ve done, that would be a big surprise to people.

‘They need someone who understands the US system better because they have not competed to the same degree that (Eli) Lilly has.’

Martin Gamble Education Editor

Rebased to 100

Source: LSEG

Guggenheim analyst Seamus Fernandez commented: ‘This announcement, following in the wake of recent senior departures, retirement of those responsible for US senior commercial leadership, and the reshuffling of reporting structure will only intensify questions around Novo’s strategic market position vs. Lilly and may even escalate concerns over new competitors poised to emerge in 2028-2030.’

Despite Novo’s nearly two-year head start, Lilly’s weight loss drug Zepbound garnered $4.9 billion in sales in its first full year of 2024, more than half of the $8.2 billion reported by Novo’s Wegovy.

Analysts predict sales of Lilly’s anti-obesity drug will overtake Novo’s by 2027, as its superior effectiveness drives higher sales penetration. Clinical trial results and, increasingly, real-world evidence suggests Zepbound induces greater weight loss.

For example, a recent (11 May) Lilly sponsored

head-to-head study showed participants lost an average of 22.8 kilogrames over 72 weeks on Zepbound while those on Novo’s Wegovy lost 15 kilograms.

The Lilly group trimmed around 18 centimetres from waist circumference compared with 13 centimetres for Novo. Nearly a third of participants taking Zepbound lost at least a quarter of their bodyweight compared with around 16% for Wegovy.

Some scientists believe the reason Lilly’s drug may be more effective is because it targets two hormones while Novo’s Wegovy just targets just one.

In the first quarter of 2025 Zepbound accounted for 53.3% of all prescriptions in the US, up five percentage points on the prior year, according to Lilly, while Novo prescriptions had a 46.1% share, based on rolling four-week data.

A contributing factor has been Novo’s struggle to keep up with demand, leading to

FIXING THE GLOBAL OBESITY CRISIS

Obesity is a major global health crisis with the World Obesity Atlas 2025 projecting the number of adults living with the disease expected to double between 2010 and 2030 to over a billion people.

Obesity is associated with a host of chronic conditions such as type 2 diabetes, heart failure, kidney disease and cancers. The breakthrough in the development of obesity drugs came out of a niche class of

drugs developed to treat diabetes, called GLP -1 (glucagon-like peptide -1) agonists. These drugs mimic naturally-occurring hormones which regulate appetite and blood sugars.

Medically, obese describes people with a BMI (Body Mass Index) of more than 30. According to the WHO (World Health Organisation), in 2019 an estimated 15 million noncommunicable disease deaths were caused by higher-than-optimal BMI.

Top five GLP-1 drugs on the market are dominated

by Novo Nordisk and Eli Lilly

$35,000

$30,000

$25,000

$20,000

$20,000

$15,000

$10,000

$5,000

shortages which lasted until February 2025 while Lilly fixed its own supply issues much earlier in October 2024.

This left Novo vulnerable to competition from ‘copycat’ pharmacies which, under FDA rules, are allowed to fill the supply gap while the drug remains in shortage. These so-called compounders are sold at a big discount to the branded product.

These headwinds led Novo to downgrade full year sales and earnings growth on 5 February. Sales growth expectations for 2025 have dropped by three percentage points to a range of 16% to 24% and operating profit growth is now expected to be in a range of 16% to 24%, down from 19% to 27% previously.

Lars Fruergaard Jørgensen explained: ‘We have reduced our full-year outlook

due to lower-than-planned branded GLP-1 penetration, which is impacted by the rapid expansion of compounding in the US.

‘We are actively focused on preventing unlawful and unsafe compounding and on efforts to expand patient access to our GLP-1 treatments.’

Pharmacies making compounders have until the end of May 2025 to stop manufacturing copycat versions of Wegovy.

DRAWBACKS MAY LEVEL THE PLAYING FIELD

While Lilly and Novo have stolen a march on competitors, existing treatments have several drawbacks including nasty side effects which cause some patients to stop taking them after a few weeks.

The treatments are currently administered by weekly injections, making them costly to deliver to patients and consumer-unfriendly. There are also longer-term health issues including the loss of muscle tissue and brittle bones. Patients who stop taking the medicines tend to put the lost weight back on.

What all this means is companies focused on making treatments more tolerable or less damaging to muscle and bone health have a shot at getting in on the action and taking market share.

Scientists have known for some time

Diabetes Drug Revenue Projections ($M) - Novo Nordisk vs. Eli Lilly

Drug Revenue Projections ($M) - Novo Nordisk vs. Eli Lilly

(LLY)

(NVO)

(NVO)

(LLY)

Source: Visible Alpha consensus (March 25, 2025)

that reducing weight can have other knockon health benefits and reduce risk of cardiovascular and other diseases.

However, making that claim requires further trials to show a drug’s true effectiveness and safety.

Novo has been successful at extending the use of its diabetes and weight loss drugs to treat other diseases. For example, in January the FDA approved Novo’s diabetes treatment Ozempic to reduce the risk of kidney disease worsening, as well as kidney failure and death due to cardiovascular disease.

Therefore, Ozempic has the potential to offer significant relief across a host of obesity-related diseases and cut healthcare costs, reducing the need for multiple drugs.

These are important considerations for healthcare professionals and the insurance companies paying for obesity treatments.

Novo received a boost on 7 May after US retail pharmacy chain CVS Health (CVS:NYSE) removed Lilly’s Zepbound from the list of medicines it covers for reimbursement from July 1 in favour of Wegovy after negotiating a better price.

Furthermore, Novo has struck a longterm collaboration with telehealth platform Hims & Hers (HIMS:NASDDAQ) which gives Americans access to Wegovy via a bundled care subscription starting at $599 per month. Beyond the initial deal the two companies

are developing a roadmap which combines Novo’s innovative medications with Hims & Hers ability to deliver quality care at scale. Meanwhile, Lilly also sells its obesity treatment through the same platform directly to consumers. It is worth noting Hims & Hers has been a big beneficiary of the rise of compounders.

Currently around a tenth of obesity drugs are sold directly to consumers and both Lilly and Novo are keen to grow this channel, as president Donald Trump doubles down on reducing the cost of US medicines.

It is important to point out that although Lilly appears to be nudging ahead of Novo in its home market, Novo claims to be the clear market leader globally with a 54% market share of prescriptions.

THE BATTLEGROUND MOVES TO ORAL TREATMENTS

The battleground for weight loss is shifting to oral pills. Lilly’s oral GLP-1b Orforglipron demonstrated statistically significant efficacy in late-stage trial results on 17 April.

The once-daily oral pill reduced weight by an average 7.9% of bodyweight and had a safety profile consistent with injectable GLP-1 medicines.

Lilly’s CEO David Ricks commented: ‘As a convenient once-daily pill, Orforglipron may provide a new option and, if approved, could be readily manufactured and launched at scale for use by people around the world.’

If approved, Lilly plans to launch its oral obesity pill in early 2026. Novo already has an oral diabetes drug on the market called Rybelsus which generated sales of $3.4 billion in 2024.

A late-stage trial of an oral version of Wegovy showed positive results almost two years ago, but the company has only recently made a regulatory submission.

The trial showed patients on the higher dose lost 15% of their bodyweight after 64 weeks. The relatively late filing in relation to the positive clinical results reflects Novo’s manufacturing issues in supplying enough Wegovy to meet demand (both drugs use the same active ingredient) and a focus on developing its next generation dual-hormone treatment CagriSema.

Novo had hoped the injectable drug could induce a 25% weight loss, pushing it ahead of Zepbound in terms of effectiveness. Disappointingly, late-stage clinical trial results in April showed an average 15.6% weight loss in patients after 68 weeks.

That said, 40% of participants did manage to lose 25% of their bodyweight after 68 weeks and the drug is more effective than Novo’s existing products. The company expects approval of CagriSema in early 2026.

Novo has also submitted a regulatory application for an oral version of Wegovy with a decision expected in late 2025.

To hedge its bets, Novo recently agreed (14 May) an exclusive $2.2 billion collaboration with San Francisco-based biotech firm Septerna (SEPN:NSDAQ) to develop oral obesity drugs, sending Septurna shares up 64%.

This follows a $1.75 billion deal (28 March) with Lexicon (LXRX:NASDAQ) to jointly develop an oral obesity pill. Novo Nordisk will hold an exclusive, worldwide license to develop, manufacture and commercialize the drug candidate, while Lexicon is eligible to receive $1 billion upfront in potential milestone payments.

THE NEXT GENERATION

There are an estimated 157 clinical assets being investigated to combat obesity, 43% of which are aimed at the oral pill market with seven in late-stage clinical trials, according to data from

IQVIA

Private healthcare company Boehringer Ingelheim’s Survodutide is the first new competitor to enter market outside the two leaders, Novo and Lilly. The glucagon/GLP-1 receptor dual agonist is a potential treatment for obesity and metabolic dysfunction-associated steatohepatitis (MASH), currently in late-stage trials.

Elcella has the potential to disrupt the GLP1 market due to its unique all-natural weight loss pill, made from specific nutrients found in food that supresses appetite using your natural hormones.

Spun out of Queen Mary University of LondonElcella was founded by Dr Madusha Peiris and Dr Rubina Akjtar who have spent a decade researching gut health.

‘We differ from other weight-loss drugs in that Elcella releases your own naturally occurring appetite-reducing hormones rather than replacing them with synthetic hormones,’ explains Peiris.

The drug has been available in the UK since February and will be rolling out worldwide by August 2025. It costs £595 for three-months supply. Other companies are working on some of the long-term health issues and side effects of current injectable treatments. What follows are the views of Marek Poszepczynscki , co-manager of International Biotechnology Trust (IBT)

‘There is ongoing research into preserving muscle mass during weight loss, with several companies focusing on the ratio of fat loss to muscle retention.

‘Innovations in administration methods, such as Amgen’s (AMGN:NASDAQ) monthly injection versus weekly dosages, and the oral alternatives that several smaller biotech companies are developing, such as Structure Therapeutics (GPCR:NASDASQ), continue to progress through the clinical trial process.

‘The bar for new entrants is set high; to succeed, drugs must be well-tolerated, efficacious and convenient.

‘As with other chronic diseases such as cholesterol and diabetes, one could foresee a product fragmentation of the market where premium brands are prescribed to those with the highest need or willingness to pay out of pocket and more basic products are offered at a highly discounted and/or generic price to a wider patient population,’ added Poszepczynscki.

Consensus forecasts for Eli Lilly and Novo Nordisk

DKK= Danish

DKK= Danish Krona. PE= Price earnings . Source: Stockopedia, Refinitv

NOVO OR LILLY?

It is the stock market’s job to discount or ‘handicap’ the future and from today’s starting point we would observe that the valuations of both companies are less stretched than they were a year ago.

This makes intuitive sense as both companies have struggled to keep pace with demand, leaving the door open to cheaper copycat compounders to take a share of the pie.

In addition, more companies have entered the space as competition heats up. But which company do we think offers the better investment opportunity? As ever in investing, the answer depends on what you could get in future earnings compared with what price you pay today. Let’s have a look.

Lilly trades on 25 times consensus 2026 EPS compared with 40 times a year ago. For that,

consensus growth is pegged at 34% in 2025 and 37% in 2026 or an average of 35.5%.

Novo trades on just 14.4 times 2026 EPS compared with 31.5 times a year ago. For that, growth is expected to be 8% in 2025 and 19.4% in 2026 or an average of 13.7%.

Another factor to consider is that consensus growth expectations for Lilly are above company guidance while for Novo, consensus is below guidance. In other words, Novo could see upward revisions if the company can deliver on its guidance while Lilly needs to ‘over deliver’ to merely maintain consensus expectations.

It is also worth noting both companies have seen consensus expectations drift lower over the last nine months. We believe both companies trade on reasonable valuations today relative to 12 months ago and compared to their current growth outlooks, although Novo just edges it because of the recovery potential.

Should the company hire a strong CEO to reinvigorate its US strategy, we think it would be well received by the market. [MG]

Mini-Berkshire Hathaway Markel has a strong track record

‘We believe having uniquely aligned and stable capital partners is a competitive advantage’ Markel CEO Thomas Gaynor

Markel Group (MKL:NYSE) Price: $1,867

Cap: £17.8 billion

With Warren Buffett recently (3 May) announcing his retirement from Berkshire Hathaway (BRK-B:NYSE), which he steered into one of the most successful firms in the US, it is surprising the Berkshire model has not been copied by more companies.

One contender for a ‘mini-Berkshire’ is Markel Group (MKL:NYSE) which runs a diverse family of companies encompassing everything from insurance to bakery equipment and building supplies.

Specialty insurance sits at the heart of the company and provides the capital to invest into wholly-owned market leading private businesses, and partial ownership positions in publicly traded companies. The company claims it is ‘a home for

Source: LSEG

businesses designed to relentlessly compound capital over decades.’

How has it done relative to that lofty goal? In the words of chief executive Thomas Gaynor: ‘Our stock price has compounded at approximately 15% a year since 1986. A recent share price of $2,000 marked our eighth doubling of your money. That’s a 250-bagger, if you like to count it that way.’

Over the last five years, Markel’s intrinsic value per share has grown at a CAGR (compound annual growth rate) of 18% compared with a 9% CAGR in the share price. Markel is unusual in the corporate world in that it reveals to investors its workings to arrive at intrinsic value.

Markel’s estimate of intrinsic value is calculated by applying a 12-times multiple to the firm’s threeyear average adjusted operating income, then adding the value of its equities and cash, minus debts and non-controlling interests, then dividing that sum by shares outstanding.

At the end of 2024, intrinsic value per share as calculated by Markel was $2,610, up 131% from the $1,125 value calculated in 2019. Gaynor adds some caveats: ‘Given its simplified nature, this calculation should be viewed as a directional indicator rather than a precise valuation.

Warren Buffet popularised the idea of ‘float’ in the insurance business, and it has been a core part of Berkshire’s success, giving it access to cheap funding for several decades.

Float is the money received from selling insurance premiums which a company gets to keep until claims are paid. As Buffett explained in a shareholder letter: ‘Insurers receive premiums upfront and pay claims later. This collect-now, pay-later model leaves us

WHAT IS FLOAT?

‘While the five-year CAGR of intrinsic value provides an initial view of value creation, we consider additional factors in evaluating shareholder returns and in making capital allocation decisions,’ adds Gaynor.

TAKEOVER TARGET

In recent years Markel’s core insurance operations have lagged the performance of other leading

* Except intrinsic value per share in $

Source: Markel Group

holding large sums – money we call “float” – that will eventually go to others. Meanwhile, we get to invest this float for Berkshire’s benefit.

‘If premiums exceed the total of expenses and eventual losses, we register an underwriting profit that adds to the investment income produced from the float. This combination allows us to enjoy the use of free money – and, better yet, get paid for holding it.’

insurers. For example, its reported combined ratio over the last five years has averaged 94.7%, underperforming the likes of Chubb (CB:NYSE) at 89.2% and Kinsale Capital Group (LNSL:NYSE) at 78.7%.

The combined ratio measures total claims and administration costs as a proportion of underwriting income. A ratio below 100 indicates a company makes an underwriting profit.

For context, Markel has made an underwriting profit nearly every year over the last two decades. This is an important factor because it can provide cheap funding to make investments outside of its insurance operations.

Activist investor Jana Partners has built a stake in Markel to push the company to explore a separation or sale of its private businesses, believing the entire company is an ‘attractive’ takeover target for larger insurance groups.

In response, Virginia-based Markel is reviewing ways to simplify its business structure. Markel commented: ‘Insurance is at the heart of what we do, and we’re fully committed to supporting areas within insurance that are excelling while also addressing underperformance.’

internationally over the ensuing decades before listing on Nasdaq in 1986 at $8.33 per share, giving Markel a market capitalisation of around $30 million.

In 2005, Markel Ventures was established to deploy permanent capital into private businesses which had opportunities for sustainable growth. Today the portfolio comprises 21 companies.

The public and private equities portfolios are managed on four investment principles. Companies must demonstrate a good return on capital and low debt, be managed by teams with equal parts of talent and integrity, possess reinvestment opportunities to grow, and/or capital discipline. Finally, the company must be available to buy at a reasonable price.

These principles have been espoused at various times by Buffett in his annual shareholder letters. Not surprisingly, chief executive Gaynor is an admirer of Buffett. Gaynor assumed leadership over the wider group in 2023, having previously been its chief investment officer.

One important distinguishing feature of Markel’s investing philosophy which mirrors Berkshire’s approach is the benefit its sees in running unrealised investment gains, which reached $7.9 billion in 2024.

The company has asked shareholders, including Jana, for feedback on where it could improve. As part of the review, the company will also consider ways to improve capital allocation.

THREE ENGINES OF GROWTH

The specialty insurance division originated in 1930 when Sam Markel started an insurance business, coincidentally the same year as the birth of Warren Buffett.

The business grew domestically and

Assuming a tax rate of 25%, the gain represents a deferred tax liability of approximately $2 billion. As Gaynor explains in his shareholder letter: ‘This low-cost source of funds is a significant tailwind to our financial performance and our reward for being patient, long-term owners of businesses.

‘It sounds so simple. Why don’t more companies pursue this strategy? ’We compounded this interest-free loan steadily and unrelentingly, year by year and decade by decade,’ adds Gaynor.

Top equity holdings across the $11.7 billion public equities portfolio include Alphabet (GOOG:NASDAQ), Amazon (AMZN:NASDAQ), Berkshire Hathaway (BRK.B:NYSE), and Visa (V:NYSE).

Martin Gamble Education Editor

Small World: cobalt, beauty products and seaweed feature in our latest round-up of smaller companies

A whistle-stop tour of new faces, farewells, winners and losers

In what could be one of the biggest listings of the year, Cobalt Holdings – a company set up to buy and hold cobalt, as its name suggests –said it intended to float in London next month through a $230 million issue of new equity partly underwritten by mining giant Glencore (GLEN).

The company, which will seek admission to the commercial companies segment of the official list, claims it will be the only publicly-quoted pure-play cobalt stock on the market at a time when annual demand is expected to grow by 50% between 2024 and 2031 due to the ‘energy transition’.

Also confirming its intention to float is multi-asset CFD (contracts-for-difference) platform iFOREX, which also expects to join the market next month.

At the time of writing there are no details of the size of the placing, which will be made up of new shares and managed by Shore Capital, but management has confirmed there will be a 12-month lock-up period with regard to employee share holdings followed by a 12-month period where shares can be sold via an ‘orderly market’.

THE EXODUS CONTINUES

At the same time, there have been several takeover bids this month spanning the pawn shop industry, the power transmission market and the property service sector.

First, pawnbroker to jewellery retailer H&T (HAT:AIM) agreed an all-cash offer from US operator FirstCash (FCFS:NASDAQ).

Source: LSEG

The deal, pitched at 661p or a 44% premium to the undisturbed share price, values H&T at £297

million and, as the company’s board put it, ‘gives shareholders the opportunity to realise the value of their holdings’ at a higher level than the shares have ever traded on AIM.

Just over a year ago, Shares ran the rule over H&T and concluded the shares looked attractive on a valuation and dividend yield basis:

Also saying farewell to the market is specialist provider of safety, compliance and sustainability solutions to housing associations and local authorities Kinovo (KINO:AIM), which agreed to be acquired by deal-hungry Sureserve, once a listed company itself but now owned by private equity.

The deal, which was pitched at 87.5p per share or a 41% premium to the undisturbed price, valued the business at roughly £56 million and was recommended by the directors as a means of accelerating the firm’s growth.

Most recently, industrial chain, gear and couplingmaker Renold (RNO:AIM) revealed it had received two competing all-cash bids, one at 77p and one at 81p, the latter – pitched at a 48% premium to the undisturbed price – from a consortium of private equity firms.

Manchester-based Renold is a running Shares Great Idea based on its ability to grow faster than its markets and continually increase margins thanks to operational leverage.

Mention must also go to financial solutions firm Alpha Group (ALPH), which rebuffed an allcash approach from US payments firm Corpay (CPAY:NYSE) sending its shares to an all-time high of £31.40 in the process.

DASH FOR CASH

It also looks as if it may be the end of the road as a public company for seaweed-based animal feed producer Ocean Harvest Technology (OHT:AIM), which revealed earlier this month that despite growing its sales by 65% in the first quarter was still making losses and rapidly running out of money.

As of the end of April the firm held stock of £1.2 million and had a cash balance of £0.4 million, enough to fund it till mid-June, but it warned its lack of capital could constitute a default event under the terms of the recently-issued loan notes which have kept it afloat this far.

Source: LSEG

Alpha Group

Another firm which has been struggling with its funding situation is former market darling Revolution Beauty (REVB:AIM), which saw its market value tumble earlier this month to under £20 million from close to £500 million at its peak.

Shares in the cosmetics firm, which is 27% owned by online fashion retailer Boohoo (BOO:AIM), tumbled almost 40% in a single day after it warned 2025 results would miss estimates after revenue fell 26% in the year to the end of February due to softer US and digital demand.

The board had been considering tapping shareholders for cash, but revealed last week it had received an approach and has therefore begun the Formal Sales Process, which means interested parties don’t have to be disclosed to the market, unlike in a normal bid situation.

The news sparked a jump of almost 50% in the share price, bringing some relief to beleaguered shareholders.

NEW ORDERS

In contrast, there was good news for several smaller firms in the shape of growing order books including green energy company ITM Power (ITM:AIM) which celebrated the award of a new large-scale mandate in the Asia-Pacific region.

The firm announced this month it had signed an agreement to supply over 300MW of electrolysers to produce ‘green hydrogen’, for use in a power plant.

The news sent the shares sharply higher, arresting a four-year slide which has seen the stock price drop from almost 800p to just over 25p.

Antenna designer and manufacturer MTI Wireless Edge (MWE:AIM) received two large orders in the last month, both from existing customers.

The first, worth $0.8 million, is for a defence application, while the second, worth $1 million, is part of the renewal and expansion of a water irrigation system installed over decade ago, and the firm expects the contract to be extended as the upgrade enters the next phase.

Sheffield-based security and surveillance systems provider Synectics (SNX:AIM) picked up a new £1.1 million contract with bus operator Stagecoach, the UK transport business now owned by German investment fund DWS Infrastructure.

Synectics said the pilot scheme, which uses an on-board hub to improve efficiency and which is expected to be completed in a year, should lead to its

technology being deployed more widely across the Stagecoach fleet.

Last, but by no means least, advanced materialsmaker Velocity Composites (VEL:AIM) announced it extended its relationship with BAE Systems (BA.), the UK’s largest defence contractor, for another three years.

Velocity has been supplying BAE with process material kits for the F35 and Typhoon fighter programmes since 2010, and as with other recentlyrenewed contracts, the agreement allows for price increases due to increased labour, energy and finance costs, which will help support 2025 revenue expectations.

By Ian Conway Deputy Editor

Emerging markets outlook

Sponsored by Templeton

Exploring the relationship between emerging markets and the dollar

US currency weakness has been a supportive factor for developing world stocks in the first part of 2025

Astrong dollar is typically a problem for emerging markets and, conversely, when the US currency is relatively weak it is a positive.

As the chart shows the inverse correlation (one goes up when the other falls and vice versa) between the Dixie – the US dollar index which measures its value relative to a basket of other currencies – and the MSCI Emerging Markets index

is pretty clear.

Why is this the case though? First, when the dollar is strong, developing economies feel under pressure to hike interest rates to defend the value of their own currencies and higher rates are usually bad news for equity performance.

A lot of emerging market debt is denominated in dollars too, and that means when the dollar strengthens is becomes more expensive for countries to service these debts. When the reverse happens, these costs come down.

Flows of foreign capital into emerging markets may also wax and wane with a rising dollar – as this would usually be accompanied by higher US rates which, in turn, will draw capital which might have been invested elsewhere, including in the developing world.

Finally, for those emerging markets which are reliant on commodity exports, most of these commodities are priced in dollars which affects demand as it makes them more expensive to buy but also sees exporters lose out if their domestic currency depreciates against the dollar.

Sponsored by Templeton

Emerging markets: outperforming developed world shares, Mexico and Korea

Three things the Templeton Emerging Markets Investment Trust team are thinking about right now

1. Emerging markets (EMs) outperformance: EMs have outperformed global equities year-to-date, with a number of factors driving gains, including US dollar weakness, domestic demand opportunities and policy flexibility. EM equities have historically outperformed global equities during periods of US dollar weakness, and this cycle appears to be similar. The potential for growth in domestic demand to offset Trump tariffs also spurred interest in EM equities. In addition, the policy flexibility that EM governments have, in contrast to limited flexibility in developed markets, has also supported EM equities. Taken together, these factors support our view that EMs are underowned, undervalued and underappreciated.

2.

Mexico moves closer to a deal: US President Trump has made it clear that he wants to renegotiate the United States-Mexico-Canada Agreement (USMCA), which he agreed to in his first term. Mexico’s president, Claudia Sheinbaum, has been quick to address US concerns, delivering a dramatic reduction in immigration and making progress on the flow of Fentanyl into the United States. The market seems to expect that the two countries and Canada will successfully renegotiate the USMCA and prevent a surge in tariffs, as reflected in the 20% gain in the MSCI Mexico Index yearto-date.

3.

South Korean equities manage to advance: The country announced an increase in its support package for the semiconductor industry to cope with heavier costs and launched a supplementary budget to support key industries. The country’s central bank also paused its easing cycle and kept its policy rate steady to stabilize the Korean won.

Portfolio Managers

TEMIT is the UK’s largest and oldest emerging markets investment trust seeking long-term capital appreciation.

Chetan Sehgal Singapore

TEMPLETON EMERGING MARKETS INVESTMENT TRUST (TEMIT)

Andrew Ness Edinburgh

How to analyse investment trust discounts

Understanding the reasons behind NAV discounts and why you need to put them in context before making an investment decision

Discounts to the value of assets held, and more rarely premiums, are par for the course when it comes to investment trusts. These are best understood as the gap between the share price and the net asset value (NAV). For example, a trust with 100p of assets per share and a 95p share price trades at a 5% discount to NAV. Discounts can give savvy investors the chance to buy assets for less than they are worth, at least in theory, but in practice it is important to do some digging and understand why a discount exists.

Most trusts trade at a discount most of the time, which should pique the interest of bargain-hunters since discounts can be a ‘buy’ signal. However, buying at a discount isn’t automatically a good thing, because the price of investment trust shares depends on a raft of factors ranging from market sentiment towards the strategy, to the manager’s track record, so there may be a good reason that explains a persistent discount to NAV.

In recent years, a number of headwinds have pushed average investment trust discounts to record levels, creating opportunities for investors. 2022’s sharp rise in interest rates drove investors away from high-yielding trusts in favour of more traditional sources of income and many renewable energy infrastructure trusts, for example, swung from large premiums to cavernous discounts.

At the time of writing, the Association of Investment Companies’ (AIC) website shows the

average discount of all trusts save for private equity outlier 3i (III) is 14.5%. By historical standards that is very wide, and yet some trusts trade at discounts of 50% or more.

James Carthew, head of investment companies at QuotedData, observes that at the end of April 2025, just 20 of the 284 investment companies his firm follows were trading at a premium to NAV, while the median discount was 12%.

WHAT IS THE DISCOUNT TELLING YOU?

The level of discount at which you buy can affect the return you get as a shareholder; how much discounts matter really depends on your time horizon; short-term traders may invest at deep discounts in the hope they narrow quickly, whereas long-term investors tend to be less fixated on the gap between share price and NAV.

Discounts are usually down to a mixture of factors and there may be no simple fix or catalyst to bring the discount in. Subdued demand for a trust’s shares could be attributable to poor performance or an investment style which is firmly out of favour. Trusts with a low profile can also trade at sizeable discounts, as those managed by boutique fund management firms can fly under the radar of many investors.

Another factor is changes in supply of a trust’s shares, which can happen through share buybacks or issuing new shares. Buybacks reduce supply,

UNDERSTANDING THE MECHANICS

If you buy at a discount and the share price rises more than the NAV, narrowing the discount, you’ll get a better return than the NAV. If the discount widens, for example by the NAV rising faster than the share price, you won’t get as big a return as the NAV but you won’t necessarily make a loss. If the discount widens because the share price and the NAV are both falling, but the share price is falling faster, you will lose more than the fall in the NAV.

Say you invest in a trust where the investments it holds rise in value by 10%, which is called the NAV return. You invest on a 10% discount, and sell it when the discount has narrowed to 5%. The effect of this can be seen in the table provided. You invested at a share price of 90p, but sold at 104.5p, and the narrowing of the discount has transformed a 10% NAV return into a 16.1% share price return. Of course, this can work the other way round should the discount widen.

Narrowing discounts can deliver strong returns

Narrowing discounts can deliver strong returns

can deliver strong returns

Source: The AIC/Shares

which can reduce a discount or stop it widening further. Issuance has the opposite effect and is normally done when trusts trade at a premium, stopping that premium getting too wide and putting off new investors. Boards use buybacks and issuance to reduce the volatility of discounts.

Nick Britton, research director at the AIC, tells Shares: ‘Discounts have been described as a kind of opinion poll on an investment trust – an index of its popularity or otherwise. However, there is a bit more to it than that.’

He points out discounts can also be moved by changes in a trust’s shareholder base. ‘Say there’s an institutional investor who holds a big stake in a trust, and wants to sell it over time. Unless others are equally keen to buy, heavy selling by the institution can keep the trust’s discount wide until it has offloaded its whole stake. Recently, we have also seen the opposite happen – activist investors gradually building up large stakes in trusts in order

to acquire voting rights, in the process helping to narrow their discounts.’

Also lending his view is Alan Ray, investment trust research analyst at Kepler Partners. ‘Market sentiment, positive or negative, is the simplest explanation for a discount, and investors can take a view whether they believe that sentiment is too pessimistic, or optimistic,’ says the Kepler numbercruncher. ‘Investment trusts can often be “oversold” because they may have a limited range of investors willing to buy when everyone else is selling. So negative markets can result in an even more pessimistic discount.’

In other instances, there could be a technical reason for the discount, such as the ongoing cost disclosures issue which provides investors with a misleading impression on charges and led to large wealth managers selling investment trusts.

‘One of the reasons activists like Saba have been able to capitalise on discounts is they are able to buy

THE MIGO VIEW

Charlotte Cuthbertson, co-manager of specialist closed-end fund investor MIGO Opportunities

Trust (MIGO), tells Shares: ‘Not all discounts represent an opportunity, and therefore our key focus is to find the discounted investment trusts where we can identify a concrete catalyst which will allow the discount to narrow. That catalyst can be organic; for example, last year The Schiehallion Fund (MNTN) saw its discount narrow as sentiment towards growth strategies improved, and investors gained greater confidence in Baillie Gifford’s valuation process for private companies.’

However, more often the catalyst must be created, argues Cuthbertson. ‘Professional investors can play an active role in unlocking value, such as engaging with boards to initiate discount-reducing measures like tender offers, portfolio sales, or wind-downs. In today’s market, activist pressure has become a key driver of returns and has the potential to be very profitable for catalyst-driven investors like MIGO.’

large amounts of shares in conventional investment trusts when few others are willing or able to do so,’ says Ray.

Of course, a discount may be an indication that something is wrong. ‘This is where doing some homework can pay off,’ adds Ray. ‘Reading annual reports and looking into things such as gearing, dividend cover, the valuations of the assets, especially if they are unlisted assets. And it might simply be that on further reading, one doesn’t really understand the investment. That’s a very good reason not to invest in something. The biggest discount may not be the biggest opportunity.’

Trusts investing in unlisted assets often trade at discounts to reflect the greater uncertainty involved in valuing these assets, and the fact they are less liquid or, in other words, more difficult for managers to sell should they want to.

The AIC’s Britton says an upcoming continuation vote often has the effect of narrowing a discount. ‘Investors assume if the discount is too wide then shareholders will opt to wind up the trust and get their money out close to NAV. That creates demand

as investors look to take advantage of the short-term opportunity, which then closes the discount. You get a similar effect if investors believe an activist shareholder will put pressure on a trust’s board to wind it up, or return capital to investors through a tender offer.’

Popular trusts whose discounts have come in this year include Murray International (MYI), whose strategy of avoiding highly-rated growth stocks has paid off year-to-date and helped to narrow the discount from 9% at the start of the year to 4.6%. The popular Fidelity Special Values (FSV) has enjoyed a strong re-rating from the tariff-tantrum lows reached in April, bringing its discount in from 8% at the start of the year to 4.2%. Elsewhere, a more recent rally at Octopus Renewables Infrastructure (ORIT), which has tended to trade at a slightly wider discount to its rivals, possibly due to a shorter track record and previously high level of commitments, has brought its discount in to 28.1%, slightly narrower than the renewables peer group average.

DO YOUR RESEARCH

The first port of call for discount analysis is the AIC website. By clicking on a sector, take Global, for example, you can see whether the discount on the trust you are researching is wide or narrow versus its peers. To view a particular trust’s discount history, click on the company page – global growth fund Scottish Mortgage (SMT) is a good example - then click the ‘performance’ tab at the top left of the page and scroll down to the interactive graph, which you can customise to show the discount history over various time periods.

BARGAINS GALORE OR CAVEAT EMPTOR?

QuotedData’s Carthew says trusts with liquid portfolios can be more aggressive about controlling

Selected trusts trading on wide discounts

Source: The AIC, Morningstar, as of 21 May 2025

their discounts and cites Bellevue Healthcare (BBH) as a recent example of a trust which has adopted an aggressive discount control mechanism. European Opportunities (EOT) is going down a different route,’ says Carthew, ‘implementing another 25% tender offer, but this has helped bring its discount down recently.’

Carthew says there is no right discount number for illiquid assets, but 20–25% ‘looks a bit high and it is worth remembering often these portfolios can be realised at asset value or higher, if you are prepared to be patient.’ Great recent examples of this have been the bids for Harmony Energy Income (HEIT), which ended being struck at asset value, and BBGI Global Infrastructure (BBGI), one of the most reliable infrastructure trusts, which is being taken

private at a small premium.

The QuotedData analyst sees some bargains on offer, but warns some of these are riskier than others. HydrogenOne’s (HGEN) 75% discount seems ‘excessive, but it is investing in businesses that are still at an early stage’, says Carthew. Another exceptionally cheap Renewable Energy Infrastructure sector constituent is SDCL Energy Efficiency Income (SEIT), whose 51% discount likely reflects its US exposure and the antipathy of the Trump regime to the sector. Yet Carthew reckons the misery is ‘probably overdone. The company is exploring ways of narrowing the discount and it seems inevitable more of these trusts will disappear. Bids like the one for Harmony Energy Income are rare and harder to achieve for trusts with diversified portfolios such as SDCL’s, but more trusts may join the ranks of those selling off their portfolios to fund returns of capital to investors.’

DISCLAIMER: James Crux has a personal investment in Fidelity Special Values.

By James Crux

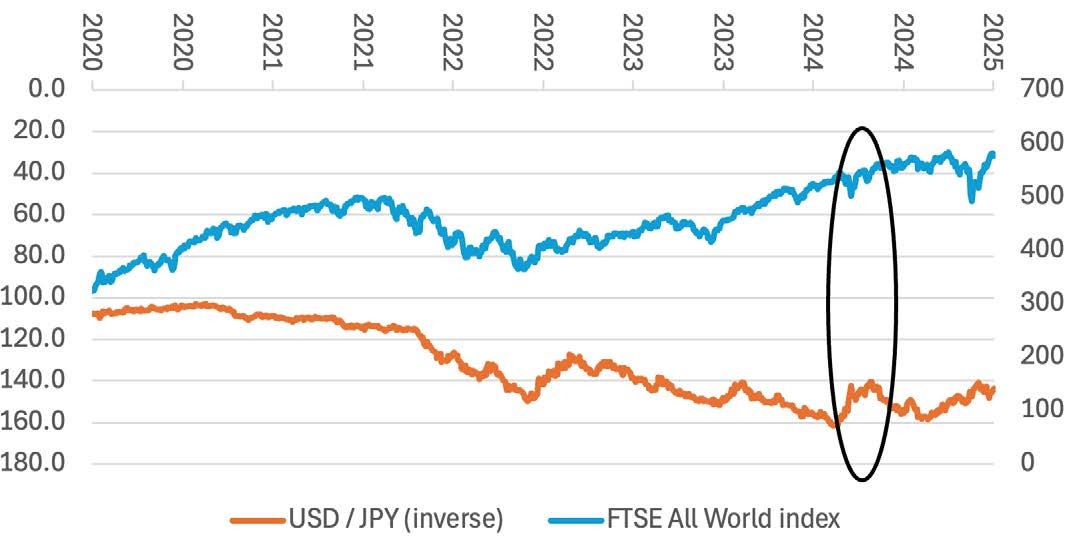

Why Japan could yet affect wider markets’ mood

Watching events in Tokyo closely is likely to be a smart move

Moody’s downgrade of its rating of American government debt by one notch, to the second-highest mark of Aa1 from the highest of all, AAA, is not causing too many market ripples, and nor should it.

Fellow ratings agency Standard & Poor’s made this move back in 2011, after all, and Moody’s action reflects the issues which are obvious to even the more casual observer: America’s federal debt is $36 trillion and going higher, especially if president Donald Trump’s ‘One Big Beautiful Bill’ extended tax breaks and introduces new ones. The annual interest bill is $1.1 trillion, or a painful one fifth of the tax take; and half of the debt has to be refinanced within three years, almost certainly at higher rates of interest, to make the first two sets of figures even worse.

In this respect, Moody’s actions are simply an example of a well-known phrase that involves words like horse, door, stable and bolt. As such, investors may be better off watching events in the Japanese government debt markets, rather than the American ones, at least for now, because what is happening in Tokyo could prove to the template for Washington in the fullness of time.

HIGHER YIELDS