As the US and other nations reconsider trade relationships and political alliances, governments around the world are taking steps to prioritise security.

There has been a recognition among US allies that they must become more self-sufficient in terms of their own defence. In the first quarter of 2025, Germany disclosed plans for aggressive fiscal stimulus focused primarily on defence and infrastructure spending. In December 2024, Japan’s cabinet approved a 9.4% increase in its defence budget.1

This trend towards autonomy is likely to remain beyond the current US administration, bringing potential tailwinds for companies along the defence supply chain for the next five to 10-years.

However, the push for security extends beyond military defence to reliable energy sources, stable infrastructure and secure supply chains.

The US and Europe are both seeking to expand sources of traditional energy, as well as pursuing development of nuclear power and other alternatives.

The energy transition away from hydrocarbons is progressing slowly but remains a critical component of long-term energy security. Investments in renewables, energy storage, and infrastructure are key to reducing dependence on traditional energy sources. In Europe, energy independence effectively means more renewables and less imported hydrocarbons. The main

bottlenecks are the transmission and distribution grids. In 2024, 46% of EU electricity generation was from renewables.2 The existing infrastructure has not kept up with this level of growth, creating a favourable political and regulatory backdrop for networks.

Artificial intelligence (AI) has enabled more efficient and effective cyber-attacks. The frequency of global cyberattacks increased 23% per annum over the past five years, compared with 10% p.a. in the five years previous.3

However, growth in cyber security spend is forecast to be just half of that necessary. This dislocation may represent a continued runway for growth and profitability for cyber security-focused companies.

Of course, higher government investment over the long term will not benefit all industrial companies equally. Going forward, deep research will be crucial to find opportunities. Capital Group UK – New Perspective Fund is a diversified global equity portfolio that invests broadly across a range of industries and sectors. Each investment in is grounded in fundamental research, where the focus is on identifying individual companies that we believe are best-placed to thrive in a fast-evolving world.

It’s goodbye for now in our final

07 Shipping shares under pressure as global container rates tumble

08 Microlise has built some strong market positions and is targeting continued growth 09 Apple shares gain following iPhone 17 launch 09 Pets at Home shares pounded after profit warning and CEO departure

10 Tesco could deliver positive first-half results given spending trends 11 Is it still uphill running for Nike?

Our top share picks Great ideas for the long term 22 Three investment lessons from observing Warren Buffett over four decades

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

Paying tribute to more than 26 years of insights, ideas and analysis

After well over 1,000 issues Shares time as a weekly publication is coming to an end. A new monthly version is in the works for customers of AJ Bell and, if that applies to you, remember to look out for that later this year.

However, it is clearly a good time to take stock. Having worked for Shares for 18 of its 26 years it’s been my privilege and pleasure to edit the magazine for the last 18 months or so. Throughout my time in charge and under my predecessors we have tried to remain true to our mission of making investing easier by offering education, insight and analysis and investment ideas on a regular basis.

I’ve asked two key questions of anything we produce, both in my role as an editor and a writer for Shares. First, have we explained what can be quite complex concepts in a way which can be easily understood? Second, have we added any value beyond just reporting what has happened?

We won’t always have got it right – after all if we had that ability we would be sitting on a desert island right now supping cocktails – but a huge amount of hard work has gone in from countless individuals over the years to making Shares what it is and has been.

I’d like to pay tribute to the current editorial team – Ian Conway, James Crux, Martin Gamble, Sabuhi Gard and Steven Frazer – for all of their efforts, to our team of talented designers, those working on the commercial side too and those who filled those roles in the past. I’d also like to thank the many companies and funds we have interviewed, PR professionals and wider industry for their support over the years too.

Nothing of what we have achieved the last quarter of a century or so could have happened without them.

From flagging oil at $100 per barrel months before it reached that milestone in 2008 to our much more recent prediction for gold to hit $4,000 (a mark it

is fast approaching) we have certainly made some bold calls which have been proven correct.

Less positively, and just to bring us back down to earth, among our key ideas for 2025 was Diageo (DGE), one of the very worst FTSE 100 performers so far this year. This illustrates just how tricky it can be to call the markets. That’s why the best parting advice I can offer is to maintain diversified exposure to the financial markets for the long term. Finally, a big thanks to all of you for reading without which none of this would have been possible.

In this final weekly edition the team has come up with a list of their favourite stocks, we interview popular investment trust RIT Capital (RCP) and Martin Gamble looks at three key bits of wisdom from Warren Buffett which can be applied to your own investing.

One last administrative point, the Shares website should continue operating until the end of the year but without new content being uploaded after the end of this week.

Aberdeen Asian Income Fund (AAIF)

Isaac Thong, Portfolio Manager

Aberdeen Asian Income Fund (AAIF) Limited targets the income and growth potential of Asias most compelling and sustainable companies. It does this by using a bottom-up, unconstrained strategy focused on delivering rising income and capital growth by investing in quality Asia-Pacific companies at sensible valuations.

JPMorgan Claverhouse Investment Trust (JCH)

Anthony Lynch, Portfolio Manager

JPMorgan Claverhouse Investment Trust (JCH) has been helping investors tap directly into the long-term growth potential of UK large cap stocks since 1963. The trust focuses on attractively valued, high quality stocks with the ability to generate consistent and growing dividends.

Strategic Equity Capital (SEC)

Ken Wotton, Fund Manager

Strategic Equity Capital (SEC) is a specialist alternative equity trust. Actively managed by Ken Wotton and the Gresham House UK equity team, it maintains a highly concentrated portfolio of 15-25 high-quality, dynamic, UK smaller companies, each operating in a niche market offering structural growth opportunities.

Afall in global shipping rates led to a sharp sell-off in the shares of A.P Moeller-Maersk (MAERSK-B:CPH), Hapag-Lloyd (HLAG:ETR), DSV (DSV:CPH) and Kuehne + Nagel International (KNIA:ETR) on 18 September, with broad share price falls of between 5% and 9%.

The sell-off was sparked by news that the Drewry World Container index fell a further 6% to $1,913 per 40-foot container in the week to 18 September, marking the fourteenth consecutive week of decline. A weakening of demand for US-bound cargo after an initial spike in May resulting from a temporary tariff reprieve, has driven shipping rates lower.

Analyst Kristoffer Barth Skeie at Arctic Securities said: ‘US port volumes are set to ease after a summer spike from front-loading ahead of tariffs and holiday demand.’

Spot rates for the Shanghai to Los Angeles route fell by 4% to $2,561 while those from Shanghai to New York dropped by 5% to $3,571, per forty-foot container, according to Drewry data.

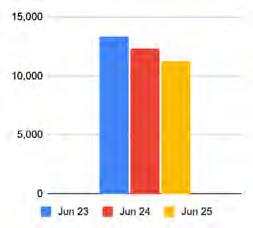

Container rates to the US west coast now sit 56% below their June peak and are 61% below where they started the year.

Analysis by maritime research firm Drewry suggests the supply-demand situation is expected to decline further in the second half of 2025, putting pressure on spot rates and therefore, threatening profitability for the major shipping and logistics companies.

Part of the price decline is related to increased shipping capacity with new vessels entering the market.

‘The volatility and timing of any rate changes will depend on Trump’s future tariffs and on capacity changes related to the introduction of US penalties on Chinese ships,’ which are uncertain, wrote Drewry.

The US announced plans to introduce port fees for Chinese ships in April aimed at countering China’s shipbuilding dominance. The fees, which are due to begin in mid-October will start at $50 per tonne of cargo with fees increasing every year over the next three years.

Source: LSEG

Vessels moving goods between US ports are exempt as are those shipping goods to the Caribbean and US territories. Meanwhile trade negotiations between the US and China continue with the current truce expected to end on 10 November. [MG]

The company’s software is deployed across nearly 200 countries

The CEO of small cap technology company

Microlise (SAAS:AIM) has big ambitions. With this in mind Shares recently took the opportunity to sit down with the man in question Nadeem Raza.

Raza has been with the company since 1987 and became chief executive after he led a management buyout in 2008. The company floated on AIM in July 2021 and Raza owns half of the company.

For the uninitiated, Microlise provides a suite of fleet management software to large UK HGV (heavy goods vehicles) fleets, where it has built a market leading 58% share of fleets with more than 500 vehicles.

Clients include the top 15 food retailers, third party logistics providers like DHL as well as leading original manufacturing equipment makers like JCB.

Microlise typically sells five-year contracts which provide long term revenue visibility while the churn rate among customers is under 1% a year. Selling multiple products into clients makes the company’s products sticker and difficult to substitute.

The company has a track record of growing recurring revenue which, today makes up around two-thirds of total revenue.

The organic growth opportunity is significant given the potential to upsell more of the firm’s product suite. Raza told Shares that if all customers signed up for all the company’s software modules, ARR (annual recurring revenues) could reach £250 million.

In addition, there is an opportunity for Microlise to increase its share of wallet among fleets with less than 500 vehicles, where its market share is around 26%.

and New Zealand and has an active acquisition strategy to augment organic growth. It has made 11 acquisitions over the last five years.

The business achieves high gross margins in the mid-60s in percentage terms and EBITDA (earnings before interest, tax, depreciation, and amortisation) margins on sales of around 14%.

In the medium term the company believes it can achieve EBITDA margins of between 15% and 20%, with a stretch target of 25%.

Stripping out intangibles and goodwill the business makes an operating profit return on tangible capital of 54%.

The company has no debts and has around £11 million of cash on the balance sheet. It pays a dividend of 1.8p per share, covered two times by diluted earnings per share.

The company also operates in France, Australia

Based on Canaccord Genuity estimates the shares trade on a forward 2025 PE (price to earnings) ratio of 27 times, falling to 22 times in 2026. [MG]

Shares in Apple (AAPL:NASDAQ) shares rose more than 3% to $245.50 on 19 September after the Californiabased colossus unveiled its new iPhone 17.

Early sales across the US, Europe and Asia saw strong demand – especially for the Pro and Pro Max models.

Analysts’ reaction to the new iPhones have been mixed with some saying further AI upgrades are needed for the devices.

A wider criticism of the US tech giant is that is has been bit slow out of the gate in the AI race which has allowed rivals in China to gain market share.

Yet US bank Morgan Stanley is fairly upbeat about the latest product developments calling the iPhone Air ‘a small positive surprise’.

Over the past six months, Apple shares are up 11%.

The spectre of Trump’s trade tariffs always looms large, but Apple says it is mitigating this thorny

Shares in Pets at Home (PETS) are firmly in the doghouse with investors, down 35% over one year with the latest sharp plunge triggered by a nasty profit warning (18 September) from the UK pet care leader which led to the immediate departure of CEO Lyssa McGowan. Non-executive chair, Ian Burke will assume the role of executive chair until a permanent CEO has been recruited. McGowan was given quite a bit of time to turn round Pets at Home, but her strategic decisions haven’t yielded the necessary success. In an unscheduled trading update,

the pet food-to-veterinary services group downgraded its full-year 2026 underlying pre-tax profit guidance to between £90 and £100 million from the previous £110 million to £120 million range. As one of the UK’s biggest pet retailers, a nation of pet lovers should be keeping the tills ringing all day long at Pets at Home, but business hasn’t been as good since the pandemic boom faded.

While Pets at Home’s Vet Group continues to deliver high-single digit sales growth, the pet retail market has remained subdued, impacting sales in Pets at Home’s operationally

Source: LSEG

issue by pivoting its supply chain to India and Vietnam from its principle manufacturing base in China.

Apple CEO Tim Cook told CNBC that the company remains committed to domestic manufacturing and plans to invest $600 billion to boosting its US footprint over the next four years. [SG]

geared retail business, while stiff competition from smaller rivals Jollyes and Pets Corner will hardly have helped. Jefferies believes the debate around Pets at Home ‘will now focus on what measures (price, product, range) can be implemented to alleviate market share losses and/or recover the substantial profit declines’. [JC]

FULL YEAR RESULTS

30 Sep: AG Barr, Big Technologies, Card Factory, Genicode, Jadestone Energy, Malvern International, Northcoders

2 Oct: Tesco

Latest market share data puts the firm even further ahead of its rivals

If the monthly Worldpanel grocery figures are anything to go by, the UK’s biggest supermarket chain Tesco (TESCO) has had a good 2025, so investors will be keen to hear from chief executive Ken Murphy just how good the year has been when the group unveils its half-year results on 2 October.

As of the start of September, Tesco’s share of UK grocery spending stood at 28.4%, up 0.8% on the same time last year, while customer spending rose 7.7% in the latest 12-week period, the highest rate since December 2023.

The group has successfully defended itself against the discounters Aldi and Lidl through its Price Match and Clubcard offerings, so although the duo now account for 18.9% of the market against just 17.3% at the end of 2024, the big casualties are elsewhere in the sector. They include Asda and

Oct 2024 Jan 2025 AprJul

Source: LSEG

Sainsbury’s (SBRY) which between them have lost 1.8% of market share since the turn of the year.

Inflation is still the main driver of grocery sales, with volumes hovering around flat over the last few months and shoppers making more visits to stores but baskets getting progressively smaller over time.

It's worth noting supermarkets’ own lines now account for just over 51% of all sales, with premium products the real standout posting six consecutive months of doubledigit growth.

That should bode well for Tesco’s Finest* range, which enjoyed 18% growth in the first three months of the current financial year helped by the introduction of new products.

The group has also pushed ahead with its online offering, where UK sales were up over 11% in the first three months and market share increased.

Plus, the firm’s popular F+F clothing range went online in May, so that should bring a boost to sales for the first half. [IC] Tesco (p)

Investors will be hoping for evidence that new-ish Nike (NKE:NYSE) CEO Elliott Hill’s turnaround strategy is gaining traction when the world’s biggest sportswear firm posts firstquarter results (30 September). Bulls believe the Oregon-based running shoes-to-soccer balls brand is now at an inflection point, with sales and profit declines set to moderate as stale inventory is cleared out and new and innovative running products fly off the shelves.

Under Hill, Nike is sorting out its digital business and rebuilding relationships with wholesale partners after a previous strategy of focusing heavily on direct-to-consumer sales failed to pay off. Another challenge is competition from arch-rival Adidas (ADS:ETR) as well as new brands in running where Hoka and On have emerged triumphant, but athleisure big beast Nike is refocusing its attention on sport and innovation to fight off this threat.

Shares in Nike rallied following the delivery of better-than-feared fourthquarter sales and earnings (26 June), with revenue of $11.1 billion for the quarter ended 31 May 2025 down 12% year-on-year but ahead of the

$10.7 billion consensus estimate, while earnings of 14 cents per share topped the 13 cents analysts were looking for. That said, the magnitude of the turnaround task facing Nike was demonstrated by the fact its operating margin was a razor-thin 2.9% and sales declined in all regions during the quarter, with China revenues of $1.48 billion coming in shy of the $1.50 billion analysts expected. Nevertheless, revenues of $4.7 billion from North America, Nike’s biggest market, were better-than-feared and the sportswear giant highlighted better momentum in Europe and the US. [JC]

UPDATES OVER THE NEXT 7 DAYS

QUARTERLY RESULTS

26 Sep: Carnival

30 Sep: Lamb Weston Holdings, Nike

1 Oct: Acuity Brands, Conagra Brands, Constellation Brands, Levi Strauss, Novagold 2 Oct: Penguin Solutions, Tilray

n this our final big feature as a weekly publication, the Shares team has gone to the ideas well one last time to identify five stocks that individual members of our team really like.

There is a pretty broad spread of ideas both by market value and by sector, read on to discover more about these conviction plays and why the authors are such big fans.

In my years covering the beverages sector, one high-quality business whose results have rarely left a sour taste in the mouths of investors is AG Barr (BAG), the drinks group whose strong brands include iconic Scottish fizzy drink IRN-BRU as well as Rubicon, Boost and FUNKIN.

Under long-serving CEO Roger White, AG Barr was transformed from a regional soft drinks maker into a branded ‘multi-beverage business’, an evolution that has left the company strategically well-placed for growth under the stewardship of White’s successor, Euan Sutherland.

AG Barr’s beloved tipples, allied to world-class manufacturing sites at Cumbernauld and Milton Keynes, no little marketing clout, high returns on capital and a fortress balance sheet represent a cocktail of enduring competitive strengths. Continuing to take share in the UK soft drinks market, AG Barr is expanding operating margins through ongoing efficiency and in-sourcing initiatives, and has the pricing power to mitigate inflationary pressures.

The £763 million cap is growing sales at acquired branded porridge-to-plant-based milk business MOMA and more recently snapped up a 50.1% stake in Innate-Essence, for an initial consideration of £15 million. For the uninitiated, Innate-Essence owns The Turmeric Co., a leading brand in the functional shots market, as well as a number of other speciality health drinks with growth potential.

On 29 July, the FTSE 250 company served up a robust update for the first half ended 26 July 2025, with trading momentum picking up as the half progressed and AG Barr highlighting ‘several record volume weeks’ in the second quarter.

For the year to January 2026, Shore Capital sees adjusted pre-tax profits bubbling up from £58.5 million to £65 million ahead of £70 million in 2027, and forecasts year-end net cash north of £50 million on the balance sheet. I believe the strong momentum behind the business means earnings upgrades should be on the way, potentially as soon as the half-year results on 30 September.

Irn-Bru maker AG Barr offers plenty of earnings fizz

to January

Source: AG Barr, Shore Capital Markets

Based on forecast earnings of 43.6p, AG Barr trades on a forward price to earnings ratio of 15.7 falling to rather palatable 14.6 on the broker’s 2027 estimate of 46.9p, while copious cash generation and a robust balance sheet provide the company with the firepower for further accretive acquisitions in high-growth drinks categories and the capacity to keep paying out progressive

dividends into the future.

I share the view of Panmure Liberum, which believes that AG Barr has ‘significant opportunities for value creation through distribution gains, product innovation, and portfolio extension in the UK.’ [JC]

Source:

PRICE : 483P MARKET CAP : £387 MILLION

In my view there is very little not to like about Bloomsbury Publishing (BMY). The publishing house, founded by current CEO Nigel Newton in 1986, achieved astonishing success with JK Rowling’s Harry Potter series. For which the upcoming HBO series could help boost backlist sales.

After a difficult period in the wake of the initial

Pottermania craze waned, the publisher has pursued a more diversified strategy while still benefiting from having some blockbuster authors on its books such as ‘romantasy’ writer Sarah J. Maas.

Maas topped bestseller lists in the UK and US this year with the paperback launch of House of Flame and Shadow of June

The publisher is award winning and won many accolades this year including Publisher of the Year at the British Book Awards and Publicity Campaign of the Year for Gillian Anderson’s Want.

The stock is widely held by several funds and features in the top 10 holdings of the Free Spirit Fund (BYYQC495) and Montanaro UK Income (BYSRYZ31)

The shares have stalled a little of late, after a great run coming out of the pandemic as people rediscovered a love of reading. A July trading update forecast full-year revenue to be £335.9 million and to deliver adjusted pre-tax profit of £41.6 million in line with consensus expectations which didn’t exactly get the pulses running.

But I always like to these a company CEO (and in Bloomsbury’s case the founder) snapping up shares, Newton recently bought £100,000 shares on 29 August, if he has faith so should investors, particularly with the shares trading on an attractive price to earnings ratio of 12.6 times and a FCF (free cash flow) yield of 7.6%

Bloomsbury has plenty of new titles in the pipeline, Sarah J. Maas’s next title A Court of

Thorns and Roses Book 6 is slated for release late in 2025 or early 2026.

The appointment of a new CFO and COO Keith Underwood (18 September) could bring uplift to the share price, as Underwood brings 20 years of media experience and expertise to the company after Penny Scott-Bayfield’s retirement.

In addition, the company now boasts a highly diverse portfolio by division, genre, format, and geography.

It has notably branched out into academic publishing, a move accelerated by the acquisition of US academic publisher Rowman & Littlefield for £65 million in 2024. This newly-acquired business contributed £19.8 million in revenue within nine months of the deal and boosted the academic and professional division’s profit by 34%. [SG]

Simply put, ratings platform Trustpilot (TRST) looks a winning proposition to this author.

In a world where purchases of goods and services are increasingly taking place online Trustpilot provides a really important function for consumers and businesses alike. From a personal perspective if you’re buying from someone you cannot see then knowing other people have had a positive experience offers much needed reassurance.

During the pandemic, like many of its peers, Trustpilot’s business enjoyed a surge as more people turned to ecommerce. Currently, the platform hosts 330 million active reviews, with annual recurring revenues reaching $230 million by the end of 2024.

Thousands of companies now rely on Trustpilot for both customer transparency and essential analytics derived from its rich database. This fuels a classic network effect: as more consumers contribute reviews, Trustpilot’s insights grow in value for businesses.

This virtuous cycle means consumers are drawn to Trustpilot because it features the most relevant services and reviews, while more businesses feel compelled to join the platform in order to reach these engaged buyers.

Research shows that 87% of consumers in the UK and US find ads more trustworthy when they include the Trustpilot logo and star ratings, with 63% of EU consumers saying a strong Trustpilot score increases their likelihood to purchase.

While facing strong competition from firms

SHIFTING BUSINESS MIX TO LARGER CUSTOMERS

Source: Trustpilot

such as Yelp (YELP:NYSE), Trustpilot’s brand has already become a familiar choice for millions of buyers worldwide and it is the market leader by number of reviews and levels of engagement.

One area which has sparked concern among investors is rising investment costs not being reflected in the P&L. While the merits of this from an accounting point of view can be debated the decision to invest for future growth is a sound one from our perspective.

Recent first-half results (16 September) were encouraging with cash flow and earnings coming in materially ahead of expectations . Average annual contract value was up 17% year-on-year to $9,781 with the company snaring some bigger name clients like Barclays, Boots, Lindt, ING and Experian.

Optically the shares do not look particularly

cheap, trading on 55 times 2026 earnings but for us this is a long-term story and investors should not get too hung up on short-term earnings multiples.

Notably the strong cash generation supported the unveiling of a fresh £30 million share buyback programme alongside the recent first-half results and further returns of capital to shareholders look likely. The scheduled departure of chief financial officer Hanno Damm in 2026 does not give us any great cause for concern. [TS]

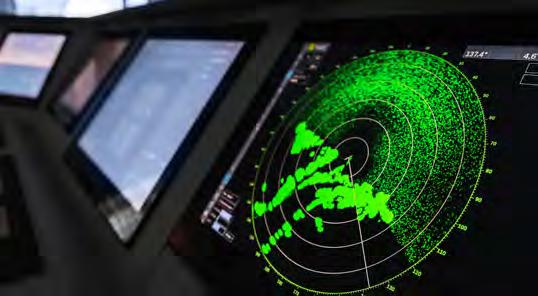

I doubt anyone, least of all my colleagues, will be surprised at my choice of stock to hold ‘forever’, as I have championed SRT Marine Systems (SRT:AIM) almost since I arrived at Shares.

During that time, the Radstock-based company has grown into the global leader in AIS/VHF navigation and communication transceivers for boats as well as a leading supplier of advanced turn-key marine domain awareness and management systems to coast guard and fisheries agencies around the world.

Chief executive Simon Tucker compares the evolution of marine domain management with

the dawn of air traffic control, which started a century ago at London’s Croydon airport and is still developing today.

Just as there was a need to monitor which planes were in the sky, not just to reduce the risk of accidents but to know who was doing what and where, so government agencies today need to know which boats are where in order to solve issues such as border sovereignty, smuggling, illegal fishing, pollution and navigational safety.

Each system is tailored specifically to a customer’s needs, with a range of unique functions including airborne, surface and subsea monitoring, and is installed and connected by SRT.

Sites are scalable into a fully integrated surveillance system if needed, giving governments and national agencies complete control over their fisheries and sea lanes.

The firm’s customers include several Asian and Middle Eastern nations, and the more countries buy into the need for marine domain management the more SRT’s systems are becoming the de facto standard, creating strong barriers to entry.

While each site is manned and operated by local agents, staff are trained by SRT and the firm has in-country managers to provide ongoing support and build capacity if needed.

As its systems orders, which can run into the hundreds of millions of pounds in value, translate into sales, so the firm’s top and bottom line are set to grow rapidly over the rest of this decade.

For the year to June 2025, revenue rose 423% from under £15 million to over £77 million and the firm swung from a loss of £14.4 million to a profit of £4.4 million.

At the last count, SRT had a validated pipeline of new system contracts worth roughly £1.4 billion, in addition to which the latest generation of transceivers is set to begin shipping before the end of this year, so I am expecting more positive news flow ahead of the AGM in December.

Disclaimer: Ian Conway owns shares in SRT Marine Systems

The most successful companies tend to be the ones which solve real-world problems. For decades moving money across borders was slow, cumbersome and expensive as big banks marked up exchange rates and applied hidden charges.

In 2011 Kristos Kaarmann, co-founder and chief executive of money transfer company Wise (WISE) set out to make cross border money transfers more transparent, faster, cheaper and more reliable than correspondent networks. The business was floated in 2021 in the biggest direct listing on the London Stock Exchange, valuing the company at £8 billion. This means no money was raised and no existing shareholders

sold any shares.

It is also worth noting the dual class structure which gives the founders enhanced voting rights.

In the year to 31 March 2025 Wise moved £145 billion across borders for 15.6 million people and businesses. That represents less than 5% and 1% market share respectively of the approximately £32 trillion market opportunity, providing a long runway of growth.

Management believes the business can sustainably grow revenues by between 15% and 20% a year and achieve operating margins of between 13% to 15%.

If the company can deliver on those goals, it implies profits will grow five-fold over the next decade. That does not look a stretch given operating profits have increased at a compound annual growth rate of 89% since 2020, or 24.5 times.

Wise is laser focused on delivering value and transparency to its customers and, importantly, it shares operational efficiencies and scale benefits with its customers through lower fees. The company estimates its customers save between £1.6 billion and £2 billion annually.

The firm’s average fee across all routes was reduced again in 2025 by 14 basis points to 0.53%.

Wise has a huge advantage over incumbent banks who often see international transfers as an add-on service rather than a core competency.

Big banks typically charge 2.7% for major currency transfers and nearly 10% for less mainstream currencies. A further cost advantage of Wise’s model is that two thirds of new customer growth is through word of mouth.

Perhaps surprisingly, many banks have been encouraging their customers to use Wise which has led the company to develop the ‘Wise platform’ offering banks and institutions the same experience as retail customers.

It is a win-win for customers, banks, and Wise, claims Kaarmann.

Partners include Standard Chartered (STAN), Morgan Stanley (MS:NYSE), Monzo, Raiffeisen Bank International and Itau.

Wise has built infrastructure to connect to local payment systems with more than 90 integrations via domestic banks and eight direct connections, in its push to create ‘the’ network for the world’s money.

I believe the company has many decades of growth ahead and will continue to create shareholder value. [MG]

Today’s later life savings need to work harder. Retirement is longer and more ambitious, and there may be more commitments, such as supporting education and housing costs for children or paying for longterm care. Today’s retirees need to harness all the tools available to them to ensure retirement is a time of real fulfilment, rather than worry. Investment trusts have a role to play. Later life savings need to go further today than they have ever done before. It is no secret that retirements are getting longer. A man aged 50 today can expect to live until 84 and has a 1 in 10 chance of making it to 97. A 50-year-old woman can expect to live to 87 and has a 1 in 10 chance of making it to 99. While the retirement age has edged higher, for many people retirement may last 2025 years.

With the right financial resources, these long retirements can be a peaceful and relaxing end to a life well-lived, a chance to pursue all the interests that the demands of working life have prevented. Many retirees have expansive plans for travel, entrepreneurship, or to spend unhurried time with the family. The ‘golden gap year’ is now a phenomenon, with a quarter of retirees hoping to head off round the world. ONS figures show a 37% rise in spending by over 65s on trips abroad in the last four years alone.

But there are other pressures on later life funds – care costs, for example. NHS data suggests that

around a quarter of adults (24% of men and 28% of women) aged 65 and over needed help with at least one daily activity. The need increases significantly with age, with over half (52%) of adults aged 80 and over needing help with day to day living.

Then there’s the problem of the next generation. Many older people recognise that younger generations are struggling with higher housing and education costs. They want to help. Many need to balance their own income needs in retirement with a desire to ensure that their children and grandchildren are not left struggling with debt.

This changes the dynamic for a retirement portfolio. It may not be enough to simply put retirement savings in low-risk assets and hope for the best. Retirees have to

harness investment growth and compounding as effectively as possible. This has implications for their investment approach, and this is where investment trusts can help.

Any retirement portfolio needs a strong focus on assets that protect against inflation. The past few years have shown why: a basket of goods that cost £100 in 2020 now costs £128. That means investors have needed a 28% return just to maintain their purchasing power.

In practice, this calls for prioritising stock market investments – which have historically offered better inflation protection – over bonds, which generally haven’t. However, while stock markets have delivered handsomely on growth, it has come

with a level of volatility that may be uncomfortable for many retirees. They cannot re-earn their wealth and watching the capital value of their savings bounce around can be unsettling. Across the Aberdeen range of investment trusts, we see three main ways that may help to solve this conundrum.

The first is to target companies that can grow their payouts to investors over time. This gives investors the best possible chance of outpacing inflation, providing greater protection of the purchasing power of retirement savings over time.

Dunedin Income Growth Investment Trust and Murray International Trust prioritise companies that grow their dividends and, as a result, have reliably grown their payouts to investors to date. Murray International Trust is an AIC “Dividend hero”, meaning the trust has delivered year on year income growth for more than 20 years.

Prioritising dividend growth has the secondary effect of investing in companies that tend to show

Risk factors you should consider prior to investing:

• The value of investments and the income from them can fall and investors may get back less than the amount invested.

• Past performance is not a guide to future results.

• Tax treatment depends on the individual circumstances of each investor and be subject to change in the future.

• If you require advice please speak to a qualified financial adviser.

less volatility than the market. For a company to grow its dividends, it needs to grow its earnings. To do this, it should have a sustainable competitive advantage, such as intellectual property, brands, scale, or a powerful network effect, be led by an experienced management team, have sound financial characteristics and robust growth opportunities. This helps ensure greater stability of capital returns as well.

The global economy is moving fast. Technology is disrupting more parts of the global economy, geopolitical tension is rife and the norms that have governed international trading relationships are being turned upside down. Investors looking to grow their capital and income over time will need to make sure they are on the right side of these major global shifts. Outside the UK, investors could look to the opportunities in Asia. Asia remains the fastest growing region in the world, with the International Monetary Fund (IMF) forecasting growth of 5.1% for emerging and

Other important information:

The abrdn Asia Focus plc Key Information Document can be obtained here.

The abrdn New India Investment Trust plc Key Information Document can be obtained here.

Dunedin Income Growth Investment Trust PLC Key Information Document can be obtained here.

Murray International Trust PLC Key Information Document can be obtained here.

developing Asia this year, outpacing developed markets by around 3x. abrdn Asia Focus targets smaller, fast-growing companies across the region, while abrdn New India Investment Trust specifically focuses on opportunities in India, currently the world’s fastest growing major economy. Looking to these markets has the added bonus of diversifying a retirement portfolio, which should help smooth investment performance over time.

The investment trust structure is a natural home for these investments. The closed-ended structure allows fund managers the broadest possible investment choice, unconstrained by the need to manage inflows and outflows. This also allows exploration of markets across the world, including less liquid markets.

Investment trusts can be a vital tool in supporting a long and ambitious retirement. They may help deliver reliable growth in income, while managing the inevitable fluctuations associated with stock market investment. They can be a part of delivering the financial freedom for a fulfilling later life.

Issued by abrdn Fund Managers Limited, registered in England and Wales (740118) at 280 Bishopsgate, London EC2M 4AG

Authorised and regulated by the Financial Conduct Authority in the UK.

Find out more at aberdeeninvestments.com/ trusts or by registering for updates

You can also follow us on social media: Facebook, X and LinkedIn

‘Investing is simple, but not easy’Charlie Munger

The Sage of Omaha, Warren Buffett, is arguably the best investor who ever lived which explains why 70,000 fans flock to Nebraska every year in the hope of discovering his investment secrets and insights.

I have been following Buffett since the early 1990s when a colleague gave me a copy of the Outstanding Investor Digest.

A large chunk of the publication was devoted to the questions and answers session from Berkshire Hathaway’s (BRK-B:NYSE) annual shareholder meeting.

I have since consumed many books about Buffett and two written by his business partner Charlie Munger, including his magnum opus Poor Charlie’s Almanack (see books section later in the article).

What follows are three investment principles which best define Buffett’s investment approach and underpin his track record.

NO 1: THE STOCK MARKET IS THERE TO SERVE YOU

At a presentation to students at Columbia Business School in the 1960s, Buffett unveiled a simple, but remarkably insightful observation.

Citing data from research and publishing firm Value Line which tracks around 1,700 publicly traded stocks, Buffett noted the average difference between a stock’s 52-week high and low was nearly 80%.

Buffett told the audience that business value does not change by 80% in a single year, implying stock prices can swing wildly away from fundamental values at times. Rational investors should embrace this feature of stock markets, not fear it, said Buffett.

The observation supports Benjamin Graham’s idea that the stock market is there to serve investors, not guide them.

Fear and greed drive stock prices away from fair value over the short term, but over longer periods, stock prices are driven by cash flow and profits.

This idea was encapsulated in Graham’s quote that the stock market is a voting machine in the short term and a weighing machine over the long term.

KEY TAKEAWAY: Price turbulence is your friend in investing as long as you have a sound understanding of a company’s economic strengths and the courage to act on your convictions.

NO 2: INVEST IN BUSINESSES YOU UNDERSTAND Buffett will only contemplate buying a business if he fully understands its economic strengths and weaknesses and the competitive landscape in which it operates. Buffett refers to this as his ‘circle

of competence’.

Defining an accurate perimeter comes down to having a realistic understanding of one’s own capabilities. Some people instinctively know when they are straying away from what they know, but it is not easy, and for many investors the lines are blurry.

Even Buffett has strayed from this principle from time to time, usually resulting in a poor decision, as he has freely admitted.

Being humble is an asset in the investment business because the future is unknowable, and mistakes are commonplace. At the other end of the spectrum, overconfidence can be very dangerous.

Buffett and Munger have learned how to think in terms of probabilities rather than absolute certainties. This helps to develop a flexible mindset which embraces uncertainty rather than ignoring it.

In their excellent book Super-Forecasting: The Art and Science of Prediction, Philip Tetlock and Dan Gardner describe how the best forecasters constantly make small iterative changes to reflect new information.

It may sound counter-intuitive, but having access to more information is not necessarily helpful in investing. Knowing the few things which are important is far more valuable than knowing a lot of irrelevant things.

This is where Buffett and Munger have excelled, and it all comes back to having a good grasp of your own circle of competence.

In this context it is worth being aware of a cognitive bias called the Dunning-Kruger effect which is where individuals with low competence overestimate their skills, and highly competent individuals often underestimate their abilities.

KEY TAKEAWAY: Having a realistic understanding of what you know and how much you know relative to other investors is important in developing insights and an investment edge.

Many people might think the key to investment success has something to do with finding high growth companies, but growth by itself cannot protect a business from competitive forces.

High growth businesses tend to attract competition, which puts more of a premium on building protection strategies.

The best investments tend to possess economic moats which protect returns on capital and allow a

business to compound earnings over many years.

The longer a business can continue to earn superior returns, the greater its value to an owner who is willing to hold on to the shares for the long term. To illustrate we introduce a current Berkshire holding.

Berkshire Hathaway received a stake in bond rating agency Moody’s (MCO:NYSE) when it was spun-off from Dun & Bradstreet in September 2000. Buffett revealed a stake of 24 million shares in his 2001 annual shareholder letter for a cost of $499 million.

Moody’s has been around for more than a century and Buffett liked the firm’s capital-light business model, the fact it operated with few competitors, (Moody’s, Standard & Poors and Fitch control 95% of the global credit rating market) and strong pricing power.

Had Buffett decided to take a profit when the stock doubled within two years, he would have made a big mistake.

The stock price recently surpassing $500, equating to a 50-fold return, while dividends have increased 13-fold. Berkshire Hathaway has purchased and sold shares in Moody’s over the last quarter of a century and at the time of writing held a 13.75% stake, with a value of $12.5 billion.

The investment in Moody’s demonstrates Buffett’s approach of waiting for a ‘fat-pitch’ and betting heavily when the odds seem to be in his favour.

While Buffett and Munger have probably made

thousands of investment decisions over the last half century they freely admit that most of the wealth they have created is due to the outsized returns in just a handful of investments.

In this context, it is worth noting that the asymmetry experienced by Berkshire has been corroborated by academic researcher Hendrik Bessembinder, who conducted a study of global stock market returns between 1900 and 2018.

Bessembinder found that just 1.3% of stocks contributed all of the net gain relative to the performance of US treasury bills, implying that most companies do not add value.

Calculating the intrinsic value of a business should never be a precise calculation, but rather a ballpark estimate of earnings power, based on conservative assumptions.

‘It is better to be roughly right than precisely wrong,’ insists Buffett.

Buffett has often articulated his framework for thinking about intrinsic value in terms of a discounted cash flow calculation. Famously Buffett only uses a computer to play Bridge, therefore all the relevant calculations are made in his head, not in a spreadsheet.

If it isn’t clearly obvious to Buffett and Munger after looking at the relevant variables they ‘pass’ and move on to the next investment.

Later we illustrate how to calculate a discounted cash flow using Moody’s as an example.

Before that, it is necessary to introduce the idea of ‘margin of safety’ which Buffett has said are the three most important words in investing.

The idea was introduced by Ben Graham in his seminal 1934 book Security Analysis and makes an appearance again in the more digestible 1949 book The Intelligent Investor, which remains one of Buffett’s favourite books.

Graham’s view is that investors should look at the downside risks before considering the returns. Applying a discount to intrinsic value can protect an investor from uncertainties and errors of judgement.

So, what is intrinsic value?

Buffett believes the intrinsic value of any business is the equivalent of adding up all the free cash flows it could produce over its life, discounted at an appropriate discount rate.

The discount rate is comprised of the risk-free rate plus a premium to account for uncertainties. Long-term government bond yields are a good proxy for the risk-free rate.

For businesses with reasonably stable cash flows, Buffett might typically apply a 10% discount rate but his does depend on the prevailing level of government bond yields.

Make a forecast for free cash flow growth.

Moody’s has historically grown free cash at 11% a year, and we have assumed a lower 9% rate for the next 15 years. In 2024 the company generated $2.52 billion of free cash.

We have a applied a 10% discount rate. Why apply a discount rate?

The idea behind discounting is related to the value of cash today versus cash in the future and opportunity cost.

Cash today can be invested, either in risk free government bonds or in riskier assets. This means it has greater value than the same cash flow received in a year’s time.

Free cash flow is divided by the discount rate. In our example, year one cash flow of $2.75 billion is divided by 10%. (2.75 / 1.1) = $2.5 billion.

Year two cash flow is discounted by 10% x 10% or 1.1 x 1.1 = 1.21. Note this is higher than 10%+10% (20%) because we have multiplied the rates, not added them.

We continue to do this for all 15 years of cash flow. Year 15 cash flow of $9.19 billion is discounted by 4.17 (1.1^15) = $2.2 billion.

The discounted cash flows are added together ($35.2 billion).

In theory companies can generate cash flows forever. To calculate what cash flows beyond 15 years are worth we need to estimate a terminal or perpetuity growth rate. It should be a conservative, sustainable growth rate.

For Moody’s we have assumed the business can sustainably grow at 6% which, is faster than the economy (3% to 4%) due to Moody’s strong competitive position and sticky demand for debt rating services.

We subtract our assumed 6% long-term growth rate from the discount rate to arrive at a capitalisation rate. (10%-6% = 4%)

Year 16 cash flow is $9.19 billion x 1.04 =$9.56

before calculating intrinsic value, so it is interesting that we ended up roughly at the current market value. This means there is no margin of safety based on the growth assumptions we have applied to Moody’s.

Buffett typically demands a margin of safety to justify an attractive entry point.

KEY TAKEAWAY: Focus on companies which possess durable economic moats and try to buy with a margin of safety and hold on for the long term to benefit from the compounding of profits.

billion.

Year 16 cash flow is divided by the capitalisation rate (9.56/0.04) which equals $239 billion. The terminal value is discounted by the year 16 discount rate of 4.59 which, equals $52.1 billion.

We now add the two discounted values (35.2 + 52.1) to arrive at intrinsic value ($87.3 billion). We compare this value to the company’s current market capitalisation of $90 billion.

We had no idea what the result would reveal

• The Intelligent Investor - Benjamin Graham

• The Superinvestors of Graham and Doddsville – Warren Buffett *(article)

• The Warren Buffett Way - Robert G. Hagstrom

• The Midas Touch – John Train

• The Essays of Warren Buffett – Lawrence A. Cunningham

• Common Stocks and Uncommon Profits –Philip A. Fisher

• The Making of an American Capitalist –Roger Lowenstein

• The Snowball – Warren Buffett and the Business of Life – Alice Schroeder

• Buffettology – David Clark and Mary Buffett

• Poor Charlie’s Almanack – Charlie Munger

• Damn Right! – Charlie Munger

Martin Gamble Education Editor

SREI’s brown-to-green strategy is taking shape – with clear financial rewards now emerging

With real estate responsible for nearly 40% of global CO₂ emissions1, environmental performance has become a core consideration for the industry. For Schroder Real Estate Investment Trust (SREI), it’s also increasingly proving to be a source of measurable financial gain.

Following the strategic realignment which was strongly supported by shareholders in 2023, SREI has placed sustainability at the core of its investment proposition. The trust is now executing on that clearly defined plan – and the early results offer clear proof that improved sustainability can drive better returns. Across a growing number of assets, targeted environmental upgrades are delivering meaningful uplifts in rental income. The so-called “green premium” is no longer theoretical – it’s being realised through lettings, valuations and total returns.

In this article, we explore three assets within the SREI portfolio that are at various stages of their brownto-green transition. By examining these case studies, we aim to demonstrate the effectiveness of the trust’s sustainability strategy and draw broader conclusions about its impact on the overall portfolio.

The portfolio outperformed the MSCI Benchmark2 by 4.3% per annum over the three years ended 30 June 2025, and the quarterly dividend paid by the fund has increased by 13% over the same period to 0.897 pence per share. Based on the share price of 48.9 pence as at close 22 September 2025 this reflects an annualised dividend yield of 7.3%, which is fully covered by earnings3

As the first asset to embark on its sustainability transition, Stanley Green Trading Estate in Cheadle, Manchester, provides the clearest evidence of how the strategy delivers tangible returns. Acquired in December 2020 for £17.3 million, the estate has since undergone a comprehensive redevelopment and

expansion programme, and now comprises around 230,000 sq ft of modern industrial space. As at 30 June 2025, it was valued at £43.9 million and has delivered an annualised total return of 15.9% since acquisition – well ahead of the 8.2% achieved by the MSCI All Industrial benchmark.

The new-build phase at Stanley Green completed in May 2023, achieving BREEAM New Construction ‘Excellent’ accreditation, including a rooftop photovoltaic system that can generate over 250 MWh of energy per annum, 24 electric vehicle charging points and an 800kVA substation.

Recent leasing activity underscores the value of these sustainability improvements. A 4,000 sq ft unit on the existing estate with an Energy Performance Certificate (EPC) rating of ‘C’, was let at £14.00 per sq ft. By contrast, the comparable units developed to operationally Net Zero Carbon standards with an ‘A+’ EPC – the highest rating available – have achieved rents of around £19.50 per sq ft. This is a near 40% premium that highlights the rental uplift associated with enhanced environmental performance. Indeed, a recently refurbished unit was renewed with Screwfix at a 54% premium to the previous rent, benefitting

1 Source: United Nations Environment Programme Finance Initiative (UNEP FI), 2023.

from enhanced sustainability specification and the higher rental tone set by the new-build units.

The outcomes at Stanley Green – and the clear rental delta between legacy and refurbished units –has helped to strengthen SREI’s blueprint for future investment in other portfolio assets: selective, insightled and underpinned by clear environmental and financial rewards.

Stacey Bushes Industrial Estate in Milton Keynes is another strong example of how SREI’s sustainability strategy enhances financial returns. Acquired in 2014 for £14.3 million, the estate has since been expanded and repositioned. Today, it comprises 67 units totalling nearly 348,000 sq ft.

As at 30 June 2025, it was valued at £53.0 million, with a net initial yield of 4.5% and a reversionary yield of 7.0%4. Since acquisition, it has delivered a total return of 16.0% per annum – ahead of the MSCI All Industrial benchmark at 10.7%.

This is further clear evidence of the green premium in action. A recently completed warehouse at Stacey Bushes was delivered to BREEAM New Construction ‘Excellent’ and EPC ‘A+’ standards, reflecting the Trust’s commitment to embedding sustainability in every development phase. This has been let to BYD at £14.79 per sq ft – 40% above the estate’s average estimated rental value (ERV). Additional lettings to Europcar and My Warehouse have helped reinforce this higher rental level, validating the investment in targeted environmental upgrades.

Looking ahead, five vacant units are currently being refurbished to capture further uplift. The team is also seeking to acquire adjoining ownerships to expand the estate and further enhance its long-term value.

Millshaw Park Industrial Estate in Leeds illustrates how SREI’s strategy can unlock further value as sustainability improvements are scaled across the portfolio. Acquired in 2015 for £22.7 million, the 460,000 sq ft multi-let estate spans 27 units across 28 acres – making it one of the largest single-ownership industrial estates in Leeds.

As at 30 June 2025, the asset was valued at £49.3 million, reflecting a net initial yield of 4.8% and a reversionary yield of 7.5%. It has delivered an annualised total return of 12.3% since acquisition –ahead of the MSCI All Industrial benchmark return of 9.7%.

Active asset management is increasingly driving better performance. Recent rent reviews covering

182,000 sq ft have increased income by 32% on the relevant units. A new lease effective October with existing tenant Alliance Healthcare on the largest unit secured a 42% uplift. Together with other lettings, these transactions contributed to ERV growth of 13.2% year-on-year – well ahead of the MSCI Benchmark industrial average of 5.5%.

As an asset poised to commence its brown-togreen journey, Millshaw represents an opportunity for further performance improvements through targeted sustainability upgrades. With low local vacancy and proven rental reversion already in play, the next phase of asset repositioning should support meaningfully enhanced rents and capital values, as seen elsewhere in the portfolio.

The trust is now actively applying the same valuefocused approach to other assets across the portfolio. As well as Millshaw Park, several other retail and mixed-use assets are earmarked for strategic upgrades, aligned with the lessons learned from Stanley Green and Stacey Bushes.

At the University of Law site in Bloomsbury, the team is engaging with planning authorities regarding a major asset repositioning promoting sustainable characteristics. St John’s Retail Park in Bedford and Headingley Central in Leeds are both benefiting from targeted sustainability improvements to drive income and relevance. Meanwhile, at Stanley Green, works continue across selected legacy units and discussions are progressing with key tenants to support further

upgrades.

On the wider programme, 15 assets have now been externally assessed using Schroders’ proprietary ESG Scorecard – three of which have already improved their score since April 2024 – providing a clear framework for targeting further sustainability upgrades.

This broader programme is already contributing to income growth and strengthening the longterm rental potential of the portfolio as a whole. In the most recently announced full year financial results, rental income, including from joint ventures, grew by 7% year-on-year, while EPRA earnings rose 4%5, supporting both an increased and fully covered dividend. The portfolio reversionary yield currently stands at 8.3%, significantly above the MSCI UK Balanced Portfolios Quarterly Property Index level of 6.2% – highlighting the embedded rental growth potential from asset management initiatives already underway.

Importantly, SREI is not pursuing sustainability for its own sake. It is investing where the financial case is strongest – where targeted environmental improvements can drive higher rents, enhance valuations and support long-term income growth. The results at Stanley Green, Stacey Bushes and beyond clearly demonstrate the tangible value created for shareholders through this approach.

The green premium is no longer just a theory. It is being captured – and reinvested –across the portfolio through a pragmatic, evidence-led strategy. With a growing pipeline of opportunities and a clear blueprint for action, the trust is well positioned to continue converting environmental improvement into shareholder value.

5 EPRA earnings is a measure of underlying operating profit, defined by the European Public Real Estate Association. It excludes revaluation gains, disposals and other non-recurring items to reflect a property company’s recurring rental income.

We recommend you seek financial advice from an Independent Adviser before making an investment decision. If you don’t already have an Adviser, you can find one at www.unbiased.co.uk or www.vouchedfor.co.uk. Before investing in an Investment Trust, the latest Key Information Document (KID) at www.schroders.co.uk/ investor or on request.

For help in understanding any terms used, please visit www.schroders.com/en-gb/uk/individual/glossary/.

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as

amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

This trust offers exposure to uncorrelated strategies and some of the world’s most exciting private companies

Among the investment trust sector’s most storied trusts is RIT Capital Partners (RCP), the big beast of the Association of Investment Companies’ (AIC) Flexible Investment sector in which the Rothschild family remains the largest shareholder.

Boasting total assets north of £4.2 billion, the trust sits in the bottom half of the sector’s five-year share price total return rankings, but RIT Capital Partners resides towards the top end of the oneyear performance table.

NAV (net asset value) returns disappointed in 2022 and 2023, largely due to a weak showing from the trust’s private investments that is still reflected in the three-year performance numbers. In addition, a cavernous 28.5% discount to NAV partially reflects lingering concerns over the ‘marks’ of the private investments, but there is scope for this to narrow so long as recent solid investment performance persists.

As such, Shares believes this well-regarded family office with low ongoing charges of 0.76% merits another look from investors seeking growth and a degree of capital preservation. RIT Capital’s NAV performance is picking up under the stewardship of manager Maggie Fanari and there is a sunnier outlook for the fund given an increase in M&A (mergers and acquisitions) and a reopening of the IPO (initial public offering) window.

The portfolio performed well during August, benefitting from the ongoing focus on its highest-conviction themes including AI (artificial intelligence), fintech and enterprise software. Encouragingly, all three of RIT Capital Partners’ investment pillars - Quoted Equities, Private Investments and Uncorrelated Strategies - delivered positive returns in the month, with Quoted Equities leading the charge.

RIT Capital Partner’s stated purpose is to ‘grow

your wealth meaningfully over time, through a diversified and resilient global portfolio’. As such, this fund has a role to play as a core diversifier and part of a portfolio’s global equity exposure. Its assets are categorised under Quoted Equities, where RIT invests in stocks and funds, as well as Private Investments, held through direct investments and specialist managers, and finally Uncorrelated Strategies. The latter category consists of a mix of different alternative strategies that have a low correlation with equities. These include absolute return and hedge fund strategies, credit investments, real assets, and government bonds, which RIT Capital Partners primarily accesses through specialist external managers and co-investments.

Source: Morningstar/The AIC

Speaking to Shares, Fanari explains RIT Capital Partners offers investors a combination of growth and capital preservation, but the fund is really ‘oriented towards growth and you can see that over time. We’ve compounded at 10.5% from an NAV and share price perspective and that’s really oriented towards capturing global growth but

RIT Capital Partners aims to deliver longterm capital growth, while preserving shareholders’ capital, investing on an unconstrained basis to deliver returns in excess of the relevant benchmark indices over time.

The investment policy is to invest in a widely diversified, international portfolio across a range of asset classes, both quoted and unquoted, and in doing so allocating part of the portfolio to exceptional third-party managers to ensure access to the best talent available. This fund offers investors exposure to exciting themes including AI and advanced technology, as well as fintech, enterprise software and healthcare and consumer.

doing that with lower risk than equity markets, and that’s where that capital preservation element comes in.’

Fanari explains the FTSE 250 fund is diversified across three strategies with privates geared towards global growth and the quoted equities pillar bringing diversification globally. ‘You’ve seen that in some of the managers we’ve been invested in places like Japan and China’, she explains.

As for RIT’s uncorrelated strategies pillar, this ‘really gives us the resilience in the portfolio with credit and absolute returning managers that are uncorrelated to markets, and you will have seen that in our Q1 results where we were ahead of our equity benchmark’.

Realisations from the private book drove performance in the half to June 2025, including the successful IPO of trading platform Webull (BULL:NASDAQ) and Meta’s (META:NASDAQ) acquisition of a 49% stake in data labelling pioneer Scale AI for $14.3 billion with the aim of boosting its AI capabilities.

RIT Capital Partners also exited an investment in cryptocurrency bank Xapo, while Israeli cloud security firm Wiz was snapped up by Googleparent Alphabet (GOOG:NASDAQ).

‘Most people would say this has been another difficult year for realisations, but in the last 18 months we’ve realised 9% of our balance sheet of privates and we’ve generated positive returns,’ enthuses Fanari. ‘The realisations we’ve had this year have come through because we were in the right themes, which were AI and fintech infrastructure. That’s where Scale AI, WeBull and Xapo came into play.’

Two of RIT Capital Partner’s largest direct investments, namely Motiv and Kraken, are said to be mulling IPOs in the coming months. ‘Motiv is in that enterprise software space and Kraken is the second largest crypotocurrency exchange in the US, so you can imagine there’s a good window for those sorts of investments today’, says Fanari, who is palpably excited about the potential of other private investments in the portfolio.

‘We have some parts of our portfolio that will be acquired like a Wiz or a Scale AI, and then we have some really strong compounders in our portfolio like SpaceX, Stripe, and Epic Systems in the healthcare space. These are great companies, market leaders, great cash flows and margins, where it feels like they are ahead of everybody else for the next decade.’

RIT Capital’s quoted investments include the likes of Microsoft (MSFT:NASDAQ), National Grid (NG.), Amazon (AMZN:NASDAQ) and also Coupang (CPNG:NYSE), commonly referred to as the ‘Amazon of South Korea’. Fanari recounts that

An early form of the company was founded in 1959 to hold some of the investments of the British branch of the Rothschild family, but it was not until 1971 that the company was formally founded by the late Lord Jacob Rothschild.

He served as chairman until 2019, overseeing the trust’s restructuring and public listing, as well as other milestones, such as FTSE 250 inclusion in 2002. Incomeseekers should note the trust is also an AIC ‘Next Generation’ Dividend Hero, having racked up 12 consecutive years of dividend growth.

AIC Sector Flexible Investment

Source: The AIC, as at 15 September 2025

RIT Capital Partners ‘made seven times our money on the private side when we did that investment and we continue to own Coupang, which is like the Amazon of the early 2000s. Coupang just continues to grow.’

Albeit unsurprisingly, Fanari believes this is ‘exactly the right moment in time to be shareholders in RIT because we give you the diversification outside the US, we’re giving you more than “Mag 7”, we’re giving you a lot of access to great companies in the private space, but also some really interesting hedge fund managers as well.’

Over the past three years the most material shift has been the gradual decline in the proportion of NAV allocated to Private Investments to 32% of NAV as of 31 August 2025, down from 41% as at 31 December 2022. Of the remainder, Quoted Equities represented 41% of NAV as at 31 August 2025, while uncorrelated strategies spoke for 20% of NAV.

Allied to improved performance, this shift should help bring in the discount over time. ‘If you are a trust that has private assets, there’s been question marks around what are the marks on the assets, and over the last 18 months we’ve been able to realise assets at or above carrying value. My hope is that continues’, says Fanari.

‘And we’ve got lots of room to continue to buy back our shares, but we’ve seen buybacks across the sector increase and that really hasn’t helped discounts in the sector, but buybacks are definitely accretive to NAV.’ [JC]

By James Crux Funds and Investment Trusts Editor

Sponsored by Templeton

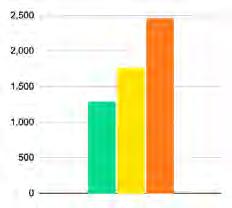

Stocks in the developing world have outperformed their developed world counterparts in 2025 MSCI Emerging Markets index versus MSCI World index

Another very strong performer is the Brazilian market – helped by limited exposure to US tariffs and resilient domestic economic growth. In contrast it has been a much quieter year for Indian stocks after an impressive run over a number of years which has driven valuations to new highs.

After a long period of doing worse than stocks in the developed world, emerging markets have outperformed handsomely in 2025.

Up to the end of August the MSCI Emerging Markets index was up 19% versus 13.8% for the broader MSCI World index.

A weaker dollar has been a big factor but which markets have contributed the most to this strong showing? The table shows how some of the most prominent emerging markets have done so far this year. The heavy weighting of Chinese shares in the broader MSCI Emerging Markets index (more than 30%) means their robust advance has undoubtedly been helpful.

Source: LSEG, data to 17 September 2025

Both domestic-facing and multinational Chinese names have performed well – with both the Hang Seng and SSE Composite indices achieving doubledigit gains. This outlook is part of a series being sponsored by Templeton Emerging Markets Investment Trust. For more information on the trust, visit www.temit.co.uk

Three things the Templeton Emerging Markets Investment Trust team are thinking about today

1.

India – weathering higher tariffs: The United States increased tariffs on imports from India to 50% on August 27, 2025. The MSCI India Index has declined a modest 5% from its second quarter peak, weathering the initial tariff storm. These tariffs will likely impact an estimated 55%–65% of India’s exports to the United States, mostly in the apparel, auto parts and chemical sectors. High-value exports, including electronics and pharmaceuticals, are currently exempt. Our base case remains that these tariffs could eventually be lowered. While negotiations have been delayed, many countries have been able to lower tariffs through negotiation with the United States.

2.

China equities at a four-year high:

The MSCI China Index has risen to a four-year high on optimism that US President Trump will likely agree to a USChina trade deal. Resilient corporate earnings among Chinese companies with a domestic focus has also buoyed sentiment. There is also recognition that while challenges remain, the lows the market reached in 2024 discounted an overly pessimistic outlook given the fiscal and monetary resources available to Chinese policymakers.

3.

Mixed markets in the Middle East: Strong investor confidence, economic reforms and robust corporate earnings lifted stocks in Egypt. However, oil price volatility weighed on Kuwait and Saudi Arabia’s energy-heavy equity markets, dampening investor sentiment in those countries. Mixed corporate earnings results across sectors also led to mixed results in the region.

Despite legitimate concerns this does not look like a repeat of the mini-Budget crisis three years ago

On 23 September 2025 we marked the third anniversary of the Truss/Kwarteng mini-Budget, an extraordinary and calamitous episode which ultimately claimed the jobs of both the chancellor and the prime minister, and set the scene for a Labour victory in the 2024 general election. The minibudget sparked a sharp sell-off in the UK gilt market, which led to a Bank of England bail out and a wholesale government policy U-turn.

The gilt market is important because it sets the rate for government borrowing, which affects the taxes we pay. It also determines what rate UK companies can borrow at, and how mortgages are priced. Lots of people will also have exposure to the gilt market through their pensions. So, it’s highly influential. And now, three years on from the mini-budget, long-dated UK gilt yields are now actually higher than in September 2022. So should we be worried?

There’s never room for complacency, but there are a number of reasons why the level of concern about UK gilt yields isn’t the same as in the wake of the mini-Budget. Probably the biggest component in the gilt crisis of September 2022 compared to the situation today is the speed with which yields rose. Between 22 and 27 September 2022, the 30year gilt yield rose by 1.2% in three trading days. By comparison the 30-year gilt yield has risen by 1.2% over the course of a year to reach its recent high of 5.7% (as at 2 September 2025). This has allowed investors to absorb and adjust to the rise in yields, which are also offset by income payments from the bonds.

The global picture is also different. Long-term bond yields are today higher not just in the UK, but in the US and Europe too. At the height of the UK gilt crisis in the wake of the mini-Budget, the 30-year UK gilt was trading at 1.2% above the 30-year US bond and 2.9% against the 30-year German bond.

Long-term gilts are still trading at a premium to those international comparators, but a significantly lower one, to the tune of 0.8% higher than the US and 2.2% higher than German government bonds.

Mortgages aren’t so badly affected by the current fluctuations in the gilt market either, because the recent sell-off looks to be centred around the long end of the market, while in 2022 it was all across the curve. This is significant particularly in the two-year and five-year gilt market, which reflect short term interest rate expectations that feed through into mortgage pricing. These are currently lower than during the mini-budget crisis and more stable.

The two-year gilt yield currently stands at 4%, down from 4.4% at the beginning of this year. This compares to the two-year gilt yield rising from 3.5% on 22 September 2022 to 4.7% on 27 September 2022. We all know what then happened to mortgages.

Source: LSEG

Inflation expectations also play their part. While inflation is now above target and uncomfortably high, it’s nowhere near the levels it was in 2022. At the time of the mini-Budget, the latest published inflation data for August 2022 showed CPI at 9.9%. Inflationary fears were high. A survey of market participants conducted by the Bank of England in early September 2022 shows than on average they expected inflation to hit 13.3% in 2023.

Inflation is the nemesis of conventional bonds because it erodes the real value of their fixed income streams and the final capital repayment. It also spells interest rate rises from the central bank, which make bonds less attractive, forcing yields upwards. In such an environment, the fiscal stimulus injected by the mini-Budget pushed hard against the Bank of England’s attempts to curb inflation and led to the market fearing even higher interest rates would be needed, with knock on consequences for bond prices. The current inflationary outlook, and the approach of the chancellor, are less of a threat to the gilt market.

Lastly, some conventional process has returned to fiscal policy. Orthodoxy might be a dirty word for Truss and her supporters when it comes

to economics, but if you’re asking to borrow bucketloads or money, it turns out potential lenders like to stick to some established rules. Truss and Kwarteng announced £45 billion of unfunded tax cuts in the mini-Budget without any scrutiny or projections from the OBR, on top of an uncosted energy package which, at the time, the IFS reckoned could have cost £100 billion in its first year.