STOCKS

WITH A LASTING STOCKS WITH A LASTING

How companies can sustain a competitive advantage

How companies can sustain a competitive advantage

The Scottish Mortgage Investment Trust seeks out the world’s most exciting growth companies and invests in them for the long term. We believe this is the best way for you to enjoy strong returns for decades to come.

We explore a number of exciting themes on our mission to find these world-changing businesses. Transport is just one of them. Why not discover them all? Capital is at risk. A Key Information Document is available. Explore the future at

How do companies maintain a sustainable advantage?

One of the most important criteria when choosing stocks to invest in is whether or not a company has a durable competitive edge over its rivals. We explain what this means in simple terms and provide some useful examples.

If you thought financial stocks were boring, think again

The UK financial services sector may seem dull on the surface, but it is full of dynamic businesses and has been one of the best-performing areas of the market this year.

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

Which stocks have hedge funds been buying this year?

Hedge funds tend to make the news for their short selling, but few people look at which stocks they have been buying. Thanks to volatile markets since Liberation Day, the ‘smart money’ has been more active than normal.

I’ve written before in these pages – particularly in the 2010s – about how financial markets seemed to exist in a looking glass world. Bad news gets taken as good news because it raises the prospect of an intervention by central banks or governments on rates or stimulus which might, in turn, act as a catalyst for equities.

There have been elements of that at play in more recent times as investors look for reasons why the Federal Reserve and its counterparts in London and Brussels might seek to lower rates from the levels they reached as the battle against post-pandemic inflation reached its peak.

In China, the sluggish performance of the economy post-Covid has also sometimes had the inverse reaction to what you would expect, something which can be measured in the showing of London’s mining contingent, as investors hope this will push Beijing into adopting measures to boost growth.

However, sometimes bad news is just bad news, and that seems to have been the case with the latest US jobs numbers on 5 September, which Sabuhi Gard analyses in more detail in this week’s News section.

Giving his own take on the data, Berenberg’s chief economist Holger Schmieding says: ‘Judging by the second weakish labour market report in a row, the US economy seems to be losing momentum. Employment increased by just 22,000 in August (far below the Bloomberg consensus estimate of 75,000), following an upwardly revised rise of 79,000 in July. The three-month average of job gains

reached 29,000 in August – almost unchanged from 28,000 in July.

‘Accounting for future benchmark revisions, these numbers suggest that the US is now losing jobs. All in all, this was a weak jobs report from every angle.’

Schmeiding suggests that, as a consequence, a 25 basis point cut at the 17 September meeting now appears almost certain.

He observes that while Fed officials such as Christoper Waller and Michelle Bowman might be inclined to vote for a 50 basis point cut, the possibility of such a large move is low. Backing this up with the observation that the unemployment rate, considered the key metric, had only risen slightly to 4.3% in August from 4.2% in July.

Regarding payrolls, he argues headline figures of 50,000 to 60,000 would not necessarily indicate a weak labour market, particularly given reduced immigration was limiting the pool of available workers.

However, he adds that a three-month average below 30,000 for two consecutive months, combined with a rising unemployment rate, could suggest that labour demand was cooling more quickly than labour supply.

Also in this week’s magazine, we examine how companies can achieve a durable competitive advantage and look at some real-world examples. Plus, we look at why the financial sector is not as dull as it sounds and flag the stocks which hedge funds are buying and selling right now.

At Aberdeen Equity Income Trust we see the combination of still-cheap valuations for UK stocks and any signs of a pick-up in economic activity as a powerful opportunity.

We scour the market for UK companies of all sizes with both low valuations and positive earnings momentum as we go about identifying our best ideas.

So, if you’re looking for a diversified UK portfolio with potential to deliver above-average income as well as real growth in both capital and income, Aberdeen Equity Income Trust may be a good choice for you.

Please remember, the value of shares and the income from them can go down as well as up and you may get back less than the amount invested.

Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Eligible for Individual Savings Accounts (ISAs) and Self-Invested Personal Pensions (SIPPs). Invest via leading platforms.

US added only 22,000 jobs in August, paving the way for a September rate cut

Investors were hoping for more of a ‘Goldilocks’ US non-farm payrolls report last week – neither too hot nor too cold, showing moderate growth in hiring – but what they got on 5 September was worse than expected.

The US job market slowed over the summer, adding just 22,000 jobs in August – a significant decrease from July’s 79,000 - as employers digested the fallout from Trump’s tariffs.

The report showed the unemployment rate at 4.3% and the number of unemployed people at 7.4 million - the highest figure since October 2021, although only a slight increase from the previous month, and more than the total number of jobs advertised according to the August JOLTS data.

The goods-producing sector performed poorly, shedding 25,000 jobs, and hiring in the services sector slowed from 85,000 to 63,000, but there was a glimmer of hope from the healthcare sector, which added 31,000 jobs last month.

Christian Scherrmann, chief US economist at German asset management firm DWS, said: ‘Overall, the report supports the idea labour markets may be moving away from full employment equilibrium, implying a risk of accelerating unemployment rates in the future.

‘While the recent figures will likely secure a 25-bps (basis-point) rate cut at the upcoming September FOMC (Federal Open Market

Committee) meeting, the discrepancy between hiring and employment data, as well as upside risks to inflation, suggests that a balanced, datadependent approach is more likely than any pre-commitment to setting monetary policy on autopilot.’

Markets are pricing in a 90% chance of a 25-bp (basis-point) rate cut on 16-17 September and a 10% probability of a larger 50-bp reduction, according to the CME’s Fedwatch tool.

Global markets didn’t react kindly to the latest US jobs data sparking recessionary fears for the world’s largest economy.

The gold price hit yet another record high on 8 September at $3,600 per ounce, with the dollar remaining under pressure, although on the plus side 30-year yields were lower after hitting record highs of late.

All eyes will be on the US economy once again with the release of the US August CPI (consumer price index) data on 11 September.

Investors will focus on signals from the inflation data about the prospects of interest rate cuts and fallout from tariffs on prices which could spell more ‘doom and gloom’ for the US economy.

Only a CPI number that comes in ‘egregiously higher’ than estimates could dent assumptions of imminent monetary policy easing, said Art Hogan, chief market strategist at B Riley Wealth. [SG]

Will outlandish targets re-energise CEO and Tesla growth after political distractions?

The board of Tesla (TSLA:NASDAQ) is asking investors to approve a record pay package which could deliver Elon Musk as much as $1 trillion in stock over the next decade.

The deal will allow Musk to receive instalments of shares if Tesla hits a series of market capitalisation and business operational milestones. The board is proposing to offer Musk up to an additional 12% stake in the electric vehicle maker if all milestones are met, or up to

423.7 million additional shares over the next decade. To get the full stock package, Tesla will have to hit a series of seemingly outlandish targets, including a market value of nearly eight times its current capitalisation and twice as much as any company on the planet has ever been worth, together with enormous profit goals.

Tesla will also have to massively expand its full-self driving subscriptions, scale its robotaxi fleet and demonstrate a substantial market for its Optimus humanoid robots.

Musk's pathway to massive $1 trillion pay-out

The pay package will also have to overcome likely legal challenges. The world’s richest person has consistently asked for a bigger stake in the company to gain more control, even as a legal battle over his 2018 pay package, then valued at a mere $56 billion, continues.

The newly proposed award is roughly 18 times the size of the contested plan and is close to the company’s current market valuation of $1.09 trillion.

$2.0 trillion 20m vehicle deliveries

$2.5 trillion 10m active full-self-driving subscriptions

$3.0 trillion 1m robots delivered

$3.5 trillion 1m robotaxis in operation

$4.0 trillion $50bn adjusted EBITDA

$4.5 trillion $80bn adjusted EBITDA

$5.0 trillion $130bn adjusted EBITDA

$5.5 trillion $210bn adjusted EBITDA

$6.0 trillion $300bn adjusted EBITDA

$6.5 trillion $400bn adjusted EBITDA

$7.5 trillion None

$8.5 trillion None Market value milestones Operational

Source: Tesla, Reuters

The proposal highlights the board’s confidence in Musk’s ability to steer the company in a new direction while reigniting growth, even as it loses ground to Chinese rivals in key markets amid softening EV demand.

‘While bold compensation tied to performance is nothing new, the sheer scale here sets a new bar for CEO incentives and will dominate boardroom debates everywhere’, said Adam Sarhan, chief executive of 50 Park Investments in New York, as reported by Reuters.

Tesla’s board will also hope such a massive financial commitment to Musk will refocus the chief executive back on the company and its growth strategy after a series of political distractions.

Musk has transformed Tesla from a niche EV start-up into the world’s most valuable automaker, scaling production, expanding globally and pushing the industry toward electric mobility, while running several other companies including SpaceX, xAI and Neuralink. [SF]

been ahead of expectations meaning profit for the year to June would be at the top end of forecasts, sending its shares up 20% on the day.

Shares in animal genetics company Genus (GNS) have risen 75% this year after a succession of positive trading updates.

In January, the firm said first-half trading to the end of December had

It followed this up in April with news the US FDA (Food & Drug Administration) had approved its anti-PRRS pig vaccine sooner than expected, leading analysts to pencil in a substantial increase in operating profits and their fair value estimates for the shares.

On 4 September, Genus reported forecast-busting full-year earnings thanks to continued strong trading in the second half, along with record free cash flow, sending its shares up 12% on the day.

Source: LSEG

The firm also revealed it had formalised a deal with its strategic partner in China, one of its biggest markets, to accelerate the roll-out of its anti-PRRS pig vaccine.

It has been a tumultuous 2025 for posh timepiece seller Watches of Switzerland Group (WOSG), with the shares having lost 40% of their value as of the end of last week.

Fears over the impact of hefty (39%)

US tariffs on Swiss exports, including high-end watches, have seen the stock price hit its lowest level since late 2020.

The group’s latest trading update salved some of those concerns, with chief executive Brian Duffy noting

strong trading in both the UK and US markets since the start of the new financial year in May and a positive performance from recent acquisition Roberto Coin.

Duffy also assured investors the firm would avoid any ‘material’ impact from US tariffs in the first half of the financial year after its brand partners front-loaded shipments.

However, that leaves the question of what happens when the firm works through that inventory with analysts

As part of the agreement, Genus will receive a gross cash payment of $160 million next year which could be used to reduce its net debt or potentially to increase shareholder returns. [IC]

at Shore Capital describing it as ‘a delay rather than a mitigation’.

The big unknowns for investors are what the impact on demand will be if and when higher prices do come into effect, and whether the firm will have to absorb some of the tariff impact in its own margins in order to support sales. [IC]

FULL-YEAR RESULTS

15 Sep: Craneware

16 Sep: Eagle Eye Solutions, Kier Group, MJ Gleeson

17 Sep: Barratt Redrow, Galliford Try, Mcbride

FIRST-HALF RESULTS

15 Sep: Bango, HGCapital Trust, S4 Capital

16 Sep: Fintel, Mitie, Pennant International, Personal Group Holdings, Trustpilot

17 Sep: Advanced Medical Solutions, Centaur Media

18 Sep: Capricorn Energy, Foresight Solar Fund, Judges Scientific, Next

TRADING

ANNOUNCEMENTS

17 Sep: Moonpig

The retailer has a cautious outlook but has proven its ability to eke out market share gains

CEO Simon Wolfson’s ‘Big Picture’ thoughts on the business and the growth avenues ahead, as well as his read on the UK consumer, will be in focus when Next (NXT) delivers firsthalf results on 18 September.

Shareholders will be hoping the fashion-to-homewares seller has maintained its positive trading momentum with the all-important golden quarter in sight. Only the bravest souls would be against another full-year 2026 profit upgrade from the high street bellwether, although Next faces trickier times ahead if Deutsche Bank’s prediction of an incoming consumer spending slowdown stoked by unemployment fears proves correct.

On 31 July, the best-in-class retailer delivered its third upgrade to full-year 2026 profit guidance in 2025-to-date after warm weather boosted seasonal ranges in the second quarter and the Next benefited from cyber-attackdriven disruption at competitor Marks & Spencer (MKS).

Next generated a 10.5% rise in fullprice sales in the 13 weeks to 26 July, £49 million ahead of the previously-

Source: LSEG

guided 6.5%, and bumped up its yearto-January 2026 pre-tax profit outlook by £25 million to a tad above £1.1 billion. However, the Leicester-based company, which recently snapped up the Seraphine maternity brand out of administration, remained cautious for the second half due to tough comparatives and with the effects of April’s national insurance changes likely to dampen consumer spending. UK sales could come under pressure as consumer confidence weakens and arch-rival Marks & Spencer gets back on the front foot, having taken almost five months to recover from the hackattack, although analysts expect Next’s excellent international performance to persist into the second half and beyond. [JC]

Source: Stockopedia, January year-end

Logistics and delivery firm may offer update on planned spin-off of freight business

Given it operates in a fast-changing industry like global logistics and delivery, whose fortunes are so closely tied to the wider economy, earnings from FedEx (FDX:NYSE) are likely to attract broad interest when they are reported on 17 September.

Back in June FedEx reported revenue for the fourth quarter of $22.2 billion, which represented a modest year-over-year decline attributed in part to muted demand in certain shipping segments and ongoing economic uncertainty.

Earnings per share (EPS) stood at $3.86, ahead of consensus estimates but still trailing the same quarter from the previous year.

Operating income was affected by several factors, including increased costs across the supply chain, wage inflation, and fuel price fluctuations. Despite these headwinds, FedEx demonstrated resilience by improving its operating margins to 6.8%, up from 6.1% in the prior quarter, largely due to aggressive cost-cutting measures.

The company’s ‘Deliver Today, Innovate for Tomorrow’ initiative, which aims to streamline operations and invest in digital transformation,

Source: LSEG

does appear to be yielding some tangible benefits.

Cash flow from operations was relatively robust, enabling FedEx to continue its shareholder return program through dividends and share buybacks. The company also reaffirmed its guidance for the current financial year, albeit with a cautious tone, emphasising the need for ongoing vigilance amid macroeconomic volatility.

QUARTERLY

15

16

17

18

Source: Zacks

Source: Zacks

Investors will be watching the upcoming earnings report closely to see if FedEx is sticking with its guidance and whether it has been able to sustain strong cash generation. There may also be an update on plans to spin off the freight trucking business – which is expected to go through by June 2026. [TS]

Foresight is ideally positioned to capture long-term structural growth

Founded in 1984, Foresight Group (FSG) is a leading investment manager in real assets and growth capital for small- and mid-sized private companies.

Foresight seeks to provide attractive returns to its diverse institutional and retail client base across a broad range of fund strategies and investment vehicles.

Since floating on the London Stock Exchange in 2021, the group has almost doubled AUM (assets under management) to £13.2 billion while tripling core adjusted operating profit to £47 million.

At the 2025 full year results (26 June), the company announced new guidance to organically double core EBITDA (earnings before interest, tax, depreciation, and amortisation) over the five years to 2029. In addition, the group is actively pursuing

earnings-accretive acquisitions to enhance growth and has committed to a share buyback programme of up to £50 million over the next three years.

Despite demonstrating consistently profitable growth and shareholder-friendly actions, the shares trade on a miserly 10.5 times consensus 2026 EPS (earnings per share), falling to 8.6 times in 2027, equating to 48% growth.

The 1.6 times-covered forecast 2026 dividend of 27.2p per share equates to a 6% yield. This represents a 12.4% increase on the 2025 dividend and takes dividend growth since flotation to 20% a year, underscoring the strong cash generation characteristics of the business.

Foresight’s largest division, with £10.2 billion of AUM, is private infrastructure investing comprised of 430 assets within 12 distinct asset classes across the UK, Europe and Australia.

The strategy seeks to capitalise on the long-term structural and regulatory tailwinds arising from decarbonisation, concerns around energy security and increasing demand for electricity for AI and data centres.

Foresight Energy Infrastructure Partners II SCSp is the group’s flagship energy transition strategy vehicle, building on its first fund which closed with AUM of £854 million in 2021. The second fund is

Source: Foresight annual report 2025

aiming to raise £1.25 billion, of which £485 million has already been committed.

Foresight estimates investment in infrastructure to grow at a compound annual growth rate of between 8% and 9% across the UK, Europe and Australia between 2024 and 2030.

Leveraging the company’s experience of managing roughly £250 million of natural capital assets (forests, water, land, clean air), Foresight Natural Capital II is due to begin marketing in the current financial year with a target fund size of £500 million.

In a recent update the company highlighted new institutional inflows of between £20 million and £30 million.

Foresight Capital Management is the group’s public markets division looking after £1.2 billion of

Year End: March

Source: Stockopedia, Refinitiv

assets, enabling institutional and retail investors access to infrastructure, renewables and real estate investments through actively managed funds.

After a challenging period for publicly traded infrastructure funds, the division is targeting a return to growth.

Foresight announced the acquisition of impact fund investment manager WHEB in January for an undisclosed amount. Analysts at Deutsche Bank estimate WHEB has AUM of £700 million and could contribute annual revenues of £3.9 million.

As a result of strong performance and multi-year market tailwinds, fundraising for Foresight’s retail UK tax efficient products business is expected to eclipse the record £587 million achieved in 2025, itself up 35% from 2024.

Lastly, the group’s institutional private equity business is expected to provide further growth opportunities as the company looks to launch further vintages to consolidate coverage of the UK and Ireland, where 15 funds are currently active.

Tailwinds from government support for regional investments and increased pension fund allocations are expected to see the historical growth rates of 5% to 6% maintained.

In summary, we believe Foresight is a high-quality company offering the potential for double-digit profit growth and increasing shareholder returns, trading at a knock-down price, while a growing dividend and attractive yield provide downside protection. [MG]

specialist supplier is focusing on growth

Headquartered in Windsor, Morgan Advanced Materials (MGAM) supplies a range of high-performance products to industries as diverse as metal processing, cement making, glass and ceramics, power generation, health care, the aerospace sector and even semiconductors.

Generally, we tend to prefer higher-margin ‘assetlight’ businesses to those in manufacturing, and admittedly MGAM’s earnings have been ‘lumpy’ in the past, in line with the business cycle, which makes this a slightly contrarian call.

Indeed, the firm’s first-half results published last month contained several references to ongoing weakness in its end-markets due to ‘global uncertainty’.

However, we were encouraged by new chief executive Damien Caby’s decision to clear the air and reset earnings expectations for the year at the low end of market forecasts.

Caby, who joined MGAM from German chemical

forecasts

Source: Stockopedia, Forecasts correct as of 8 September 2025

Source: Stockopedia, Forecasts correct as of 8 September 2025

giant BASF in 2022 as president of the Thermal Products division, and took over the top job at the start of July, has been part of the drive to simplify the company and optimise its operating processes.

Therefore, it was little surprise when after less than two months in the hot seat he announced the sale of the Molten Metal Systems unit, part of the Thermal Products division he used to head.

The deal will see MGAM receive £75.8 million, or 14.6 times 2024’s operating profit, in a mix of cash and shares, and frees the company up to invest in higher-return businesses in faster-growing markets, like its semiconductor division, while reducing the total amount of capital spending needed to keep the group’s operations ticking over.

As well as self-help measures, we see positive tailwinds for the company over the next few years in the form of falling input prices, in particular energy, and falling interest rates, which will help reduce the cost of the firm’s net debt.

Assuming Stockopedia’s revised earnings forecasts are roughly in the right ballpark, the shares are currently trading on a multiple of just under 10 times this year’s profit, falling to just over nine times next year’s profit.

Although growth will take a while to come through, we think the valuation is attractive given the strength of the group’s underlying businesses, its trusted relationships and its diverse global markets. [IC]

The guitars, drums and keyboards seller has more than doubled since our ‘buy’ call in May

Shares urged investors to tune into the exciting recovery story at Gear4music (G4M:AIM) on 15 May, with the shares swapping hands at 140p-a-pop. We highlighted that the online musical instrument and equipment retailer was trading at a discount to its recent history and had returned to growth, while financial risk was also reducing with net bank debt coming down.

Our buy thesis was also based on the fact the e-commerce play was poised to profit from the insolvency of two price discounters in the UK and wider European markets, which would lessen competitive pressures on the business.

We also observed that the guitar, keyboard and drum seller had extended its addressable market through acquisitions in the AV market and made a foray into trading second-hand products.

With positive trading momentum at its heels, Gear4music has delivered two upgrades to forecasts for the year ending 31 March 2026 in just three months, the latest upwards earnings revision announced on 5 September. Gear4music now expects to beat consensus estimates for sales of £155.8 million, EBITDA (earnings before interest, tax, depreciation and amortisation) of £11.3 million and taxable profits of £3 million.

Revenues were up 27% year-on-year in the first quarter, marking Gear4music’s best growth rate since Covid lockdowns triggered a boom in spending on hobbies including music, with management’s refreshed growth strategy delivering ‘tangible results’.

As we predicted, following the demise of several weak competitors, Gear4music is profiting from ‘a more favourable competitive landscape across both our UK and European markets’ which is allowing the group to ‘successfully capture additional market share’.

While the shares have more than doubled since our ‘buy’ call, they remain well below peaks scaled during the pandemic and with ‘traction’ under a refreshed growth strategy driving earnings higher, we’d be minded to let this winner run.

Following the latest update, Singer Capital Markets analyst Matthew McEachran noted the ‘the elevated competitive standing of this sector “winner”, higher growth rate and profitability, and visible path to net cash next year’. [JC]

Identifying companies which have an edge over their competitors which they are able to maintain is an important component of investing.

After all, it is the companies which possess these qualities which can deliver above average returns for longer than might otherwise be expected.

In this context, legendary investor Warren Buffett popularised the idea of an ‘economic moat’ which is the modern-day equivalent of a medieval moat around a castle. The term moat is interchangeable with competitive advantage.

His UK counterpart Terry Smith puts it this way: ‘If you seek to invest in companies which have above average profit margins, cash generation and growth and produce higher than average returns on capital they naturally face competitive threats.

‘How do they defend those returns from competition? What Warren Buffett calls the “moat”.’

Before discussing the various types of economic moat, we want to introduce a Buffett principle which remains central to his

investment approach.

Buffett only contemplates buying a business if it is within his ‘circle of competence’. This means he understands a company’s economic characteristics and the competitive landscape.

Every investor will have their own areas of expertise, but what matters most is knowing where the boundary of that knowledge ends.

‘Know your circle of competence, and stick within it,’ insists Buffett.

Having a good understanding of the economic characteristics of a business is crucial for working out what it might be worth. This, in turn, gives investors their own edge.

A business which possesses strong economic characteristics, such as healthy operating margins and high returns on capital is worth a lot more if these characteristics are long lasting and durable.

This is the key to creating profitable growth and value for shareholders.

The durability principle also explains why Buffett prefers to own relatively stable businesses where he is more certain of their future, and steers away from industries like technology where the future is more uncertain.

When searching out competitive advantages, it is useful to bear in mind that companies can possess more than one moat, giving them multiple defences against the competition.

Most competitive advantages are intangible in nature, because something which is intangible like a brand or patent is harder to replicate than something physical like a factory.

While there are clear advantages to owning intangible assets, that does not necessarily mean that all physical assets can be replicated.

British hedge fund manager Christopher Hohn who founded The Children’s Investment Fund, was a cornerstone investor in Spain’s Aena (AENA:BME) airport group when the government sold a stake in the airport operator.

Hohn believes the investment is a good

Brands: strong brands attract consumers and can achieve superior pricing and returns.

Distribution: It is not enough to have strong brands. You also need to get the products to the customer through supply chain logistics and relationships with retailers and ecommerce platforms.

Installed bases of equipment and/or software: if you install elevators or testing equipment, software or processing systems then you often develop a relatively tame client base which is locked into using your equipment and systems to whom you can supply upgrades, service and spares, at a charge of course.

Network effects: some products produce powerful network effects and once a leader is established there is little incentive for consumers to shop around or use competitors. Social media is an

example of a high-quality infrastructure asset possessing a strong economic moat. Major cities like Madrid are unlikely to add a second airport given its size and importance, according to Hohn. Infrastructure assets like toll roads, bridges and communication networks are essential for the smooth running of local communities, tend to have high barriers to entry and offer predictable, long-term cash flows.

Scale by itself is a powerful economic moat because it provides a cost advantage through economies of scale and increased efficiencies. This enables a firm to lower prices and take market share.

Alternatively large firms can use their cost advantage to fund innovation and expansion, further strengthening their market position.

obvious example.

Patents: a patent is legal protection against competition granted to inventors in order to encourage investment in innovation. A typical example is drugs. The problem with patents is that they expire and the patent holder then faces generic competition.

But the best companies parlay patent protection into a defensible market position. Mr Otis patented the safety elevator before the American Civil War so the patent has long expired, but Otis has the largest installed base of elevators and escalators of any company in the world to which it sells servicing, spares and modernisation.

An example of a British company with a competitive advantage in my view is Unilever (ULVR), the consumer goods business. Unilever’s brands which have over €1 billion in sales include:

• Dove – personal care

• Knorr – food

• Hellmann’s – food

• Magnum – ice cream

• Rexona (also known as Sure) – deodorant

• Lux and Lifebuoy – soap

It is not enough just to own brands with large sales revenues. The brands have to maintain relevance for consumers through innovation and be supported by advertising and promotion, increasingly through digital channels.

There is another type of scale advantage which was first identified by fund managers Nick Sleep and Qais Zacharia who ran the Nomad Partnership and fund between 2001 and 2014.

The Nomad Partnership delivered an exceptional track record achieving a 921% total return compared to the MSCI World index’s 117% return over the same period.

Sleep and Zacharia focussed exclusively on identifying companies with durable economic advantages that leverage the idea of ‘scale economies shared’. This means passing on scale advantages to customers in lower prices.

Their analysis showed that companies which embed this model into their core operations become stronger over time because the value proposition improves for everyone in the ecosystem, not just shareholders.

The insight is counterintuitive because it is commonplace for businesses to want to maximise a cost advantage by keeping all the gains for themselves. By passing on the savings, customers reciprocate by patronising the business more frequently.

US retailer Costco Wholesale (COST:NYSE) guarantees its customers cannot buy their goods any cheaper by passing on its bulk buying advantages. This builds customer loyalty which extends their lifetime value.

Sleep and Zacharia believe online market place Amazon (AMZN:NASDAQ) is one of the best companies operating the scale benefits shared model.

Source:

A UK example is grocer Tesco (TSCO) which takes advantage of its leading market position

Not all fund managers see the benefits of applying Buffett’s idea of competitive moats. Portfolio manager of the JO Hambro UK Dynamic Fund, (BDZRJ10) Tom Matthews believes the idea of economic moats is potentially dangerous.

‘We don’t really like to talk about durable advantage as it can lull investors into a false sense of security and, in doing so, suggest there is no need for an observable margin of safety with the future cashflows,’ explains Mattews.

‘Increasingly, nothing lasts for ever. The lifecycle of businesses have shortened dramatically. In 1990 the average tenure of a company in the S&P 500 was 20 years and by 2021 this had fallen to just 14 years. AI will accelerate this trend further.’

Matthews and the team prefer to focus on ‘strategic transformation where management actions are unlocking capital and re-allocating to where the company can increasingly build a sustainable competitive advantage’.

What Matthews is looking for are situations where the market underestimates the sustainable trajectory of new revenue streams and cash flow.

‘A classic example of this would be Rolls Royce (RR.). Does Rolls Royce have a durable competitive advantage in Small Modular Reactors (SMRs) and data centre power?

‘Possibly. But of more interest to us as investors is that the current share price still does not reflect Rolls Royce’s growth as being sustainable.’

and bulk buying by sharing the savings with customers, in the form of lower prices. This drives customer footfall, creating a powerful flywheel effect.

Pricing power is a powerful economic moat because it implies a company can raise its prices without meaningfully impacting the volume of product sold.

Often this come down to the strength of a brand, but there is another aspect of price which is just as important. Companies which grow revenue by producing more stuff have an associated cost attached.

On the other hand, companies which can increase price see 100% of that benefit drop though to profits, which makes it more powerful.

So far, we have discussed the importance of moats and how to identify different types of competitive advantage. How do investors decide how durable that advantage might be?

Eric Burns, Fund Manager at Sanford DeLand says: ‘A great test of the durability of a competitive advantage of a business is how it performs during an economic downturn. Is its product or service so special that customers still need to buy it, even when times are tough?

‘Businesses such as Unilever that own strong consumer brands tend to be resilient across the cycle, but they are not bomb-proof. One business that is, in our view, is Rightmove (RMV).

‘There is a textbook network effect at play whereby the more homes it lists on the site, the more house hunters use it to search for properties, which in turn leads to more listings.

‘It has become so ubiquitous in the property market that estate agents cannot afford to withdraw from it – even in a tough market. As a result, with the exception of the Covid period, it has grown earnings per share every year since its IPO in 2006,’ explains Burns.

Porter’s Five Forces analytical framework was developed by Michael Porter in 1979 and it has become a widely accepted way to analyse a company’s place in its competitive landscape.

The model consists of five basic forces, as shown in the graphic.

Bargaining powers of suppliers Rivalry among existing competitors

Bargaining powers of buyers

Microsoft (MSFT:NASDAQ) needs no introduction. There are few other companies whose products are so embedded in clients’ everyday processes, whether it is Word, Excel, Outlook, Teams, or more advanced tools within its cloud computing platform Azure, which offers powerful analytics, secure data storage, global networking and much more.

Years of robust financial growth and huge cash flows allow Microsoft to compete with anyone in bleeding edge technology development and its large-scale investments in AI and innovation are paid for by years of robust financial performance and huge cash flows, allowing Microsoft to extend its global reach, make strategic acquisitions and continually expand its market influence and diversification.

With the help of research by industry analysts and academic studies, Shares’ Five Forces analysis of Microsoft shows that competition is likely the company’s biggest threat, while the likelihood of rival products being developed that can compete head-on with Microsoft and the bargaining power of customers, its lowest risks.

The intensities of the Five Forces in Microsoft’s industry environment are assessed, while the box which follows shows the sub-factors that play the biggest role.

COMPETITIVE RIVALRY OR COMPETITION

• Customers’ incentives to switch: WEAK

• Aggressiveness of consumer electronics and IT firms: STRONG

• Diversity of firms: STRONG

BARGAINING POWER OF BUYERS OR CUSTOMERS

• Low substitute availability: WEAK

• Customers’ incentives to switch: WEAK

• High quality information on IT firms and products: STRONG

BARGAINING POWER OF SUPPLIERS

• Size of suppliers: MODERATE

• Population of suppliers: MODERATE

• Overall supply: MODERATE

THREAT OF SUBSTITUTES OR SUBSTITUTION

• Performance of substitutes: WEAK

• Availability of substitutes: WEAK

• Customers’ incentives to switch: WEAK

THREAT OF NEW ENTRANTS OR NEW ENTRY

• Cost of IT and technology: WEAK

• Cost of doing business: MODERATE

• Customers’ incentives to switch: WEAK

• Competitive rivalry or competition: STRONG

• Bargaining power of buyers or customers: MODERATE

• Bargaining power of suppliers: MODERATE

• Threat of substitutes or substitution: WEAK

• Threat of new entrants or new entry: MODERATE

Japan’s AI role is growing – and Schroder Japan Trust is well-placed to benefit

The rise of artificial intelligence (AI) has become one of the most powerful themes in global equity markets in recent years. Since the launch of ChatGPT in late 2022, we’ve seen a rapid acceleration in the development of large-scale AI platforms, which have in turn, enabled a growing ecosystem of tools and applications across all industries. Supporting this surge in capability is an expanding value chain of specialist hardware and infrastructure – high-performance semiconductors, advanced packaging technologies and the data centres and interconnects needed to power them.

US stocks have led the enthusiasm…

For most investors, the definitive poster child of the AI era has been Nvidia. Once a niche graphics chip maker, it has become synonymous with the infrastructure powering modern AI. The company’s share price has soared as demand for its graphics processing units (GPUs), which power the vast majority of AI data centres, has translated into exceptional earnings growth. While its valuation has at times looked stretched, the scale and speed of its ascent have rapidly made it one of the most widely owned stocks in global equity markets.

It’s a remarkable story, but also a familiar one. When investor enthusiasm for a theme reaches fever pitch, it’s common for valuations to rise rapidly in anticipation of future growth. Indeed, often the exuberance will take share prices further than fundamentals can ultimately justify. From Japan’s own asset bubble in the 1980s to the dotcom boom at the turn of the millennium, markets have repeatedly shown that such extreme popularity can be a doubleedged sword. As Ben Graham, one of the greatest investors of the 20th century, once said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” Popularity can lead to stellar performance while the enthusiasm builds, but in the long run, history demonstrates how it can become a liability when a bubble bursts.

…but Japan also has its beneficiaries

That’s why it’s important to stay focused on fundamentals – and one reason Japan stands out. While US stocks have dominated the AI narrative so far, Japan is home to several businesses with meaningful exposure to the AI value chain, but without the elevated valuations that can accompany the spotlight.

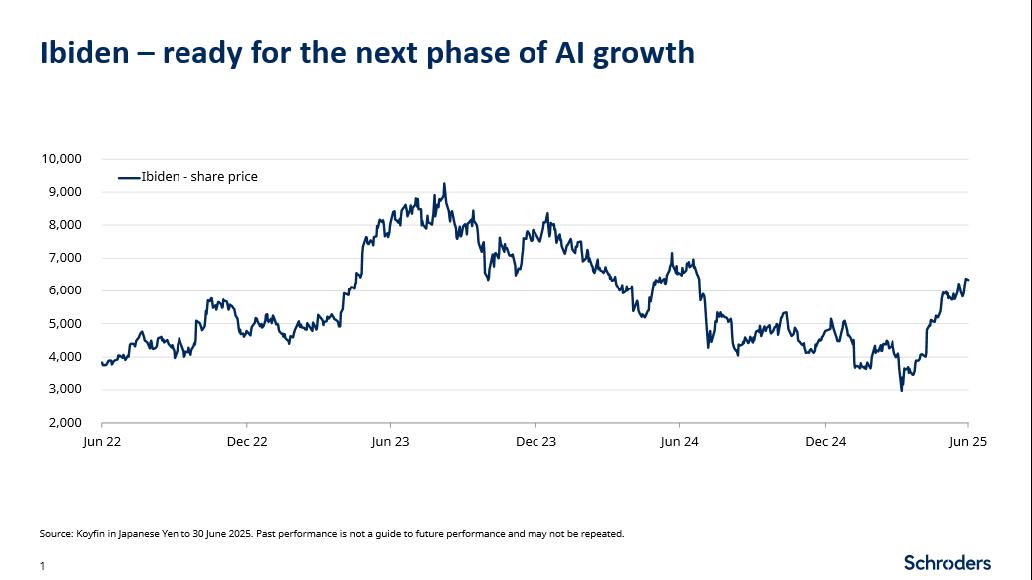

One such business held in the Schroder Japan Trust portfolio is Ibiden, a mid-cap manufacturer of high-end integrated circuit (IC) packaging substrates. These components form the critical base layer that connects a semiconductor chip to the rest of the system – managing the flow of power, data and heat to enable faster processing, energy efficiency and thermal stability in the advanced processors that AI servers and data centres rely upon. Ibiden isn’t designing the chips themselves, but it is helping to make the architecture possible – a behind-the-scenes role that is increasingly vital as the demands on computing power grow.

While Ibiden may not have been among the early beneficiaries of the AI boom, that’s largely because it was preparing for it. Over the past two years, the company has invested heavily in new production capacity, expanding facilities in Japan and the Philippines to meet future demand for advanced

substrates. That investment initially weighed on earnings – with rising costs and depreciation arriving well before the revenue uplift.

But with that capacity now becoming operational, and broader AI infrastructure demand moving into its next phase of growth, Ibiden is now much better positioned to capture the opportunity. Recent margin improvement and stronger earnings guidance suggest the groundwork is beginning to pay off – and investor recognition is starting to follow.

Ibiden’s appeal goes beyond its improving market position, however. The company is also an example of the corporate governance reforms that are driving better performance from Japanese businesses more broadly. A leadership transition last year was handled smoothly, with a long-serving internal executive appointed CEO to steer the business through its next phase of growth. Ibiden is also actively selling down its legacy cross-shareholdings – improving capital efficiency and aligning with investor interests – in line with the broader corporate governance improvements reshaping the market.

These developments reflect wider shifts taking place in Japan. Structural reform continues to progress, shareholder returns are improving, and corporate fundamentals are benefiting from a more favourable macroeconomic backdrop. Inflation – long absent from Japan’s economy – has returned, helping to support pricing power and break the grip of

Concentration risk: The fund may be concentrated in a limited number of geographical regions, industry sectors, markets and/or individual positions. This may result in large changes in the value of the fund, both up or down.

deflationary expectations. For investors, that’s a significant positive development. But for households, the effects are more nuanced. Rising food prices, in particular, have become politically sensitive –contributing to a decline in public support for the ruling Liberal Democratic Party (LDP).

That discontent was brought into sharp focus in Japan’s Upper House elections earlier this month. For the first time since 1955, the LDP no longer holds a majority in either chamber of Japan’s parliament. This marks a significant moment in Japanese politics and introduces a degree of policy uncertainty.

Nevertheless, it does not undermine the underlying investment case for Japan. As well as the governance reforms and improving macro fundamentals, Japan remains a large, liquid, but relatively inefficient equity market – particularly in the small and mid-cap space –where active management can add real value.

With selective exposure to exciting stocks such as Ibiden – and a disciplined focus on valuation and long-term fundamentals across the portfolio – we are confident that Schroder Japan is well positioned to capture the opportunity that lies ahead.

Counterparty risk: The fund may have contractual agreements with counterparties. If a counterparty is unable to fulfil their obligations, the sum that they owe to the fund may be lost in part or in whole.

Currency risk: If the fund’s investments are denominated in currencies different to the fund’s base currency, the fund may lose value as a result of movements in foreign exchange rates, otherwise known as currency rates. If the investor holds a share class in a different currency to the base currency of the fund, investors may be exposed to losses as a result of movements in currency rates.

Derivatives risk: Derivatives, which are financial instruments deriving their value from an underlying asset, may be used for investment purposes and/ or to manage the portfolio efficiently. A derivative may not perform as expected, may create losses greater than the cost of the derivative and may result in losses to the fund.

Liquidity risk: The fund invests in illiquid instruments, which are harder to sell. Illiquidity increases the risks that the fund will be unable to sell its holdings in a timely manner in order to meet its financial obligations at a given point in time. It may also mean that there could be delays in investing committed capital into the asset class.

Market risk: The value of investments can go up and down and an investor may not get back the amount initially invested.

Operational risk: Operational processes, including those related to the safekeeping of assets, may fail. This may result in losses to the fund.

Performance risk: Investment objectives express an intended result but there is no guarantee that such a result will be achieved. Depending on market conditions and the macro economic environment, investment objectives may become more difficult to achieve.

Smaller companies risk: Smaller companies generally carry greater liquidity risk than larger companies, meaning they are harder to buy and sell, and they may also fluctuate in value to a greater extent.

Gearing risk:The fund may borrow money to make further investments, this is known as gearing. Gearing will increase returns if the value of the investments purchased increase by more than the cost of borrowing, or reduce returns if they fail to do so. In falling markets, the whole of the value in that investment could be lost, which would result in losses to the fund.

Capital Erosion: As a result of fees being charged to capital, the distributable income of the fund may be higher, but there is the potential that performance or capital value may be eroded.

We recommend you seek financial advice from an Independent Adviser before making an investment decision. If you don’t already have an Adviser, you can find one at www.unbiased.co.uk or www.vouchedfor.co.uk.

Before investing in an Investment Trust, the latest Key Information Document (KID) at www.schroders.co.uk/ investor or on request.

For help in understanding any terms used, please visit www.schroders.com/en-gb/uk/individual/glossary/.

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as

amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Why investors shouldn’t ignore this space in their search for dividends, diversification and growth

Since they facilitate the flow of capital and debt, financial companies play a crucial role in oiling the wheels of the global economy and due to the fact it permeates almost every aspect of corporate and personal life, the vast financial services sector has been dubbed the ‘nervous system of capitalism’.

Candidly, this sector has a reputation for being, well, a bit dull, yet financials have a role to play in investors’ portfolios as they tend to generate stable cash flows and dish out dependable dividends.

Given the sheer breadth of the space, the sector’s constituents offer portfolio builders diversification, although its stocks are typically sensitive to economic downturns and volatile markets and the sector is not immune to ‘Black Swan’ events, as demonstrated by the GFC (global financial crisis) of 2008, which marked a turning point for financials.

Since the crash, financial stocks have gradually recovered. Banks have strengthened their balance sheets, reduced risk and improved operational efficiency, while disruptive fintech companies offering innovative financial products and services have also emerged.

Banks form the backbone of the diverse financials sector, providing essential services such as deposit taking, lending and payment processing, but insurers, asset managers, investment platforms and exchange operators also make the cut alongside an

array of exciting fintechs.

There are two key earnings drivers in the financials sector, namely interest rates and the velocity of financial transactions which is fuelled by consumer confidence and the health of the underlying economy. Financial stocks tend

Source: GICS, McGraw Hill Financial, MSCI

to perform well when yield curves are steep, regulatory environments favour banks, and credit markets aren’t under strain.

As the chart shows, the MSCI All Country World Index Financials sector has outperformed the wider All Country World Index this year, so while there is a lot to like about the sector, investors should be mindful of the price they pay for stocks which have rallied hard year-to-date.

Martin Connaghan, co-manager of Murray International (MYI), informs Shares: ‘Interestingly, the financial sector has been one of the bestperforming areas of the markets year to date, particularly since it has been banks that have been leading the charge, with this subsector outperforming the areas of insurance and diversified financials. It’s interesting because we’ve already seen considerable rate cuts in Europe with the expectation that, except for Japan, interest rates are to fall globally towards the end of this year and into next.’

‘As long as a recession is avoided, funds specialising in this space can continue to perform well,’ argues McDermott, ‘as a stable or growing economy lifts investor confidence and drives demand for banking, insurance and broader financial services.’

David Eiwert, manager of the T. Rowe Price Global Focused Growth Equity Strategy, says the financials sector, and US large cap banks in particular, is ‘what we term a “good Trump pond”. This means that the Trump administration is likely supportive of these institutions, possibly leading to regulatory changes that could benefit them. There’s the possibility of relaxing some of the constraints around capital and other regulatory adjustments. We have optimism about regulatory changes in the financials sector, particularly in the US, that could boost banksthe lack of a traditional credit cycle, along with other factors like government spending and low energy prices, creates a positive environment for financials stocks.’

A global equity income trust with a value bias, Connaghan says Murray International’s financial exposure is well spread across three sub-sectors with banking stocks in Singapore, Thailand and Italy. Insurance holdings in Ping An Insurance (Hong Kong), Tryg (Denmark) and Zurich Insurance (Switzerland). Exchange businesses Hong Kong Exchanges & Clearing (0388:HKG) and CME (CME:NASDAQ) finish off the trust’s exposure to financials.

As such, Connaghan warns investors to be ‘mindful of the direction of interest rates moving forward and the impact this could have on net interest income for the banks.’

FundCalibre’s Darius McDermott says financials have enjoyed a strong run recently thanks to rising interest rates, which have boosted bank profit margins, and resilient economies that have kept loan demand steady.

‘It would probably be these two businesses that fall into the “exciting us” camp,’ says Connaghan. ‘There is a lot to like about exchange businesses. They have considerable barriers to entry, high margins, strong cash flows, and generate excellent returns.’ CME, the world’s largest derivatives exchange operator and the leader in futures trading in the US, is the most prominent financials position in the portfolio as of 31 July 2025.

‘CME’s products include futures and options on futures on interest rates, equities, energy, FX, metals, and other commodities,’ enthuses Connaghan. ‘The macroeconomic uncertainty that market participants have been trying to negotiate has been very supportive of the average daily volumes that exchange companies like CME have been seeing. CME also usually pays out a special

dividend at the end of the year, which puts it on a reasonable yield for an exchange company, something that is very important for Murray International given the investment objective.’

Nigel Hikmet, co-portfolio manager of the Developed Markets UCITS Strategy at Lansdowne Partners, adds: ‘One of our highest-conviction ideas at the moment is UK and Irish banks. We believe there are two basic truths of banking that are often forgotten. First, it is an industry that tends to grow at least in line with nominal GDP over time. Secondly, economies of scale are incredibly powerful, both from cost efficiencies - only increasing with artificial intelligence - and because new business flows tend to be less profitable than the sticky stock of customers, rendering new entrant economics poor. As a result, incumbents earn higher returns and gain market share over time, organically or via consolidation.’

Hikmet believes that after 15 years of extreme stress for the industry, ‘this norm is reasserting itself – as businesses have simplified, consolidated and interest-rate extremes corrected. While many banks posted strong returns in recent quarters, those returns remain understated due to interest rate hedges. As these hedges unwind in the coming years, and banks are exposed to higher rates, we expect continued positive momentum. In combination with balance-sheet growth outpacing cost inflation and share buybacks at low valuations, the growth of earnings possible for the sector is compelling.’

Insurance is another area where Hikmet sees potential for a ‘profound structural opportunity. Relative to other financial services, personal (car/ homes) insurance is unusual - large corporate clients offer higher returns than retail customers. Following recent consolidation and regulatory changes, this could reverse, especially if the value of data in risk analysis develops as we would

A dissenting voice is Paul Middleton, global equity portfolio manager at Mirabaud Asset Management, who warns that financials have ‘begun to flag to us as being expensive, with price earnings ratios for the sector at 10-year highs of 13 times. Fundamentals are also not as good as they have been in some areas, with a hard pricing market in US Insurance beginning to roll over. We therefore think it pays to be more selective, and some of the slightly more defensive names stand out to us as looking attractive here.’ One example is Murray International favourite CME, which Middleton says should continue to do well if market volatility remains elevated and pays an attractive 3.8% yield.

anticipate. We also think that changes in interestrates and the maturing DC pension market could allow ROE (return on equity) for the savings business to rise appreciably.’

Eiwert sees potential opportunities in European banks due to the steepening of the yield curve, changes in regulation and low valuations. ‘Some European bank stocks are really cheap and unowned, and even though some have already

Redwheel, which manages Temple Bar (TMPL), believes Korean banks currently offer some of the most attractive value opportunities globally, while the dividend outlook for the sector remains ‘exceptional’. Among the trust’s new positions are several Korean lenders which enjoy ‘steady loan growth in a growing economy, are efficiently run and have strong capital ratios’ according to Redwheel’s Ian Lance and Nick Purves. ‘Both undertake prudent lending policies and offer attractive shareholder returns and yet they also are valued at historical price earnings ratios of around seven times and large discounts to net asset value.’

performed well, they may still have upside potential if their thesis proves correct,’ says Eiwert. ‘During the period of market volatility in April, we added to US and European financial sector exposure, as we see financials as a promising area for potential growth.’

Also weighing in is Brendan Gulston, co-manager of the WS Gresham House UK Multi Cap Income Fund (BYXVGS7), who steers clear of banks due to their inherent cyclicality and sensitivity to interest rates, which he says places too much of the value creation outside management’s control. ‘Instead, we prefer capital light financial services businesses where long-term structural trends are driving opportunity. The UK wealth management sector is a growing market underpinned by structural drivers such as rising household wealth, an advice gap, and government policy, making it a longterm attractive thematic opportunity to deploy capital.’

Gulston also sees upside in Sabre Insurance (SBRE), which has a 20-year-plus track record in specialist motor underwriting leveraging its proprietary datasets. ‘Due to its sustainable competitive advantage, Sabre has consistently generated attractive margins relative to the insurance industry and pays a substantial dividend,’ observes Gulston.

FundCalibre’s McDermott is a fan of the Polar Capital Global Insurance (B5339C5) fund, which gives investors ‘targeted access’ to the non-life insurance sector, a specialist, often overlooked part of the market. ‘Insurance is embedded in our daily lives, regardless of the economic cycle, giving this fund strong defensive characteristics,’ stresses McDermott. ‘Its long-term track record and focus on quality make it a great diversifier for income and total return investors alike. The sector’s dominance within the FTSE 100 has also helped drive the UK market higher this year. Investment trusts City of London (CTY) and Schroder Income Growth Fund (SCF) both maintain a significant overweight to financials, with holdings such as HSBC (HSBA) and Lloyds (LLOY) among the top positions across both funds.’

By James Crux Funds and Investment Trusts Editor

Last month we revealed which stocks hedge funds had been shorting in the second quarter after the remarkable postLiberation Day rally which has seen UK and The ‘smart money’ has been busy thanks to the rise in stock market volatility

UK markets hit record highs. This month, with the help of Joachim Klement and Susana Cruz of Panmure Liberum’s strategy, economics and ESG team, we take a look at which

Prices correct as of 3 September 2025 Table: Panmure Liberum, Bloomberg, Whalewatcher.com

UK and European stocks are most popular with hedge funds and which stocks they have been buying and selling.

Hedge funds get a bad rap from some companies and investors for selling stocks in order to profit from a fall in the share price, but in most cases they will have done a great deal of research on the stocks in question and concluded they are either bad businesses, badly-run businesses or they are overvalued and will therefore underperform.

By the same token, they only buy shares in companies they believe will outperform, on the basis they are better-than-average or undervalued, which means they often take quite contrarian bets and their ‘active share’ – that is the proportion of the portfolio which is different to the benchmark –tends to be quite high.

The second quarter of this year saw a spike in stock market volatility and political uncertainty due to the fallout from the Liberation Day tariff announcement, which presented investors – hedge funds included – with a huge opportunity set.

According to the 10-Q filings of around 2,000 hedge funds, the most popular – as in widely-

owned – European stock is Dutch semiconductor equipment maker ASML (ASML:AMS) with some 309 funds owning the shares or 15.1% of the total, and 23 funds holding the stock among their top 10 positions.

Considering tariffs weren’t introduced on semiconductors, and the fact there is a shortage of large-cap tech stocks in Europe compared to the US, ASML is not a bad choice, and it seems as though hedge funds added to their positions in the second quarter, taking advantage of the initial sell-off.

The next most widely-owned stocks were energy firm Shell (SHEL), health care companies Novo Nordisk (NOVO-B:CPH) and Novartis (NOVN:SWX) and consumer goods giant Unilever (ULVR).

As Klement and Cruz note, the list of most popular stocks is mostly made up of companies which aren’t directly affected by tariffs, such as healthcare, services or commodities.

‘Hedge funds are trying to stay out of the way of geopolitical uncertainties where possible,’ conclude the analysts.

Focusing on the stocks most commonly found in hedge funds’ top 10 holdings throws up three more interesting names, Belgian biotech firm Argenx (ARGX:EBR), Spanish biotech Grifols (GRF:BME) and Irish budget airline Ryanair (RYAAY:NASDAQ).

If we look at the most significant changes in holdings during the quarter, outside of the most popular stocks – which funds are wont to trade in and out of as prices move up and down – there are some notable entries with.

The stock which saw the most buying interest in the second quarter, relative to the first quarter, were Dutch insurer Aegon (AGN:AMS), Swiss industrial equipment and robot-maker ABB (ABBN:SWX), French cosmetics firm L’Oreal (OR:EPA) and two UK media companies, Pearson (PSON) and WPP (WPP).

The last two are a prime example of contrarian thinking, given they are among the worstperforming stocks in the FTSE 100 year-to-date.

On the flip side, stocks with the largest decline in holdings among hedge funds during the quarter include defence contractor BAE Systems (BA.) and medical devices firm Smith & Nephew (SN.), two of the best-performing stocks in the index this year, suggesting managers feel it is time to book some profits.

Also noteworthy is the drop in popularity of Danish diabetes and weight-loss drug maker Novo Nordisk, which although it still appears on the most-held list is owned by fewer hedge funds than previously, suggesting hedge funds are ‘increasingly giving up on a turnaround’ after a 43% fall in the share price year-to-date, muse the analysts.

By Ian Conway Deputy Editor

The UK and China were the best performing markets globally in July 2025, yet fund flow data shows no interest from UK retail investors. What is going on?

The FTSE 100 returned 4.2% in July including dividends, driven by double-digit gains from the likes of vapes-to-cigarette maker British American Tobacco (BATS), consumer goods group Reckitt (RKT), and gambling specialist Entain (ENT). Market heavyweights including drugs company AstraZeneca (AZN), engineer Rolls-Royce (RR.) and oil producer BP (BP.) also delivered in one month the kind of returns you might only expect from UK shares across an entire year.

It is fair to say the FTSE 100 was a fruitful place to make money in July, yet Investment Association data shows that retail investors withdrew £718 million from UK equity funds in the month. Normally you would expect a robust performance from a specific market to attract investors, not turn them away.

The Investment Association suggests there is an element of investors derisking their portfolio ahead of the Budget on 26 November. That makes sense up to a point.

On the one hand, the market is growing ever worried about the state of UK public finances and

how the chancellor is going to fill the black hole. There is speculation about taxes going up, and whether that is still enough to solve the problem.

On the other hand, what is slightly perplexing with the outflows from UK equity funds is the fact that approximately three quarters of earnings from FTSE 100 constituents come from overseas. They are not reliant on the UK economy to do well.

Investors might simply be worried about the economic outlook globally or they might take the view that negative sentiment towards the UK will hold back the FTSE 100 because it is the benchmark for the country’s stock market.

Worries about the outlook for the UK economy and concerns about government policies have been getting louder and louder and exploded in early September when 30-year gilt yields hit a 27-year high.

Bond investors are making their opinions known loud and clear. By dumping long-dated gilts they are effectively saying the UK is now a riskier investment proposition and they will not start buying gilts again until the reward is much higher. When gilt prices fall, the yield rises.

It is noteworthy that money market fund

Source: LSEG

demand has soared. The Investment Association recorded £1 billion inflows in July into these products which offer cash-like returns. They are popular with people who want to keep money inside an investment tax wrapper such as an ISA or SIPP (self-invested personal pension) and potentially get a better return than their investment platform provider might pay on straight cash. The alternative is to park money in a standard savings account and that brings income tax into the equation.

The jump in demand for money market funds implies investors are in a holding pattern until there is more clarity on how Rachel Reeves’ updated plans at the Budget might impact the economy.

The amount going into money market funds in July was half of the total amount of inflows in the whole of 2024, to illustrate the scale of recent demand. The previous high for net inflows for this investment type over the past 10 years was £3.3 billion in 2017 – we are already at £4.8 billion net inflows for the first seven months of 2025.

Like the UK, China enjoyed a strong period on the stock market in the summer and has continued to push higher. The SSE Composite index delivered a 3.7% total return in July and 12.4% in the year to 5 September 2025. Surprisingly, that performance has

not led to a wave of UK money going into Chinese funds.

The Investment Association data reveals that China equity funds have seen net outflows from UK retail investors in every month bar two over the past 12 months. Even July 2025 saw a modest net outflow of £1 million despite the rise in Chinese equity markets.

Domestic investors in China have driven the rally in Chinese stocks amid greater liquidity, and lower interest rates on cash leading individuals to seek a better return via equities.

Foreign investors including those in the UK might lack confidence in the region. Recent Chinese economic data has not been supportive of the stock market rally, with retail sales, corporate investment, credit, and activity numbers more representative of a downturn.

So, what could change the situation? There is one factor that unites both the UK and Chinese stock markets – attractive valuations. Both markets are much cheaper than investment hotspots like the US and Germany.

The next time markets experience a sharp pullback, it is fair to suggest certain investors might decide they are no long willing to pay high multiples of earnings, and we see a de-rating in the most expensive parts of the market. In that situation, investors could go on the hunt for cheaper places, and it is clear where two of them lie.

Aberdeen Asian Income Fund (AAIF)

Isaac Thong, Portfolio Manager

Aberdeen Asian Income Fund (AAIF) Limited targets the income and growth potential of Asias most compelling and sustainable companies. It does this by using a bottom-up, unconstrained strategy focused on delivering rising income and capital growth by investing in quality Asia-Pacific companies at sensible valuations.

JPMorgan Claverhouse Investment Trust (JCH)

Anthony Lynch, Portfolio Manager

JPMorgan Claverhouse Investment Trust (JCH) has been helping investors tap directly into the long-term growth potential of UK large cap stocks since 1963. The trust focuses on attractively valued, high quality stocks with the ability to generate consistent and growing dividends.

Strategic Equity Capital (SEC)

Ken Wotton, Fund Manager

Strategic Equity Capital (SEC) is a specialist alternative equity trust. Actively managed by Ken Wotton and the Gresham House UK equity team, it maintains a highly concentrated portfolio of 15-25 high-quality, dynamic, UK smaller companies, each operating in a niche market offering structural growth opportunities.

You can now get a better return on a product offering a fixed income for life than you could for years but there are drawbacks

The bond market has got a nasty case of the jitters, thanks in part to Donald Trump launching an attack on the independence of the US central bank. The waves of concern from this unprecedented political interference in monetary policy can also be felt on this side of the Atlantic, as the UK’s longterm borrowing costs reached their highest level since 1998.

A rise in borrowing costs isn’t good for companies or individuals looking to take on debt. Or indeed the chancellor, who is in a tight spot when it comes to balancing the public finances. But it is pretty good news for those who are thinking about drawing on their pension, because annuity rates go up when bond yields do.

The basic premise of an annuity is that if you hand over your pension pot, or part of it, to an insurance company, they will provide you with an annual income for life in return. They do this by investing in bonds; hence the fact gilt yields have a big impact on annuity rates.

A £100,000 pension pot will now buy a 65-yearold a level annuity of around £7,600 a year, according to MoneyHelper. That compares with somewhere in the region of £5,000 five years ago. So, things are definitely looking a lot better for annuity buyers than they did for a long time in the era of ultra-low interest rates.

Given the big jump in annuity rates, we might well see more people buying an annuity instead of the risker option of keeping their pension invested and drawing an income from it (commonly known as drawdown). Indeed, we’ve already seen evidence of this happening, and that’s probably going to be exacerbated by the chancellor’s introduction of inheritance tax on pensions.

WHY DRAWDOWN MAY REMAIN POPULAR Annuities are undoubtedly a great option for

those who want a secure income for life, taking minimum risk. But I suspect that keeping your money invested in a pension will remain the more popular option for pension savers for a number of reasons.

First, most people will already be on course to receive annuities, albeit in a different guise. Both the State Pension and Defined Benefit schemes (better known as final salary schemes) provide pension savers with a secure income for life, just like an annuity. Buying an annuity with a pension pot effectively doubles up on this strategy which may be appropriate for some, but by no means all.

Second, annuities aren’t flexible. They pay out an income year in, year out, irrespective of whether you need it or not. For many people this won’t fit their retirement income needs. For example, they may be stepping back from work gradually or have especially high expenditure in the first few years of retirement as they travel and make the most of their free time. The inflexibility of annuity income also means pension savers can’t manage their tax liabilities easily if they have

income from other sources. There may be years they wish to minimise pension income to avoid being pushed up into a higher tax bracket. They can do this with a drawdown plan, but not with an annuity.

Third, protecting an annuity from inflation comes at a hefty cost. Understandably so over such a long time frame. Whereas £100,000 would buy you a level income (staying the same every year) of around £7,600 a year, if you wanted the income to rise in line with inflation, that would fall to a starting income of about £5,000, again according to MoneyHelper.

Given you can get a 4% yield on an equity income fund while also retaining control of your capital, and some inflation protection from stock market growth over the long term, the pendulum looks like it’s swinging back towards a drawdown plan, though of course, remaining invested comes with its own risks attached.

Fourthly, and this is a big one, people really don’t like annuities. Perhaps this is because some don’t understand them. Others might underestimate their chances of living to a ripe old age and still getting payments from their annuity provider, even at age 100. But mostly I think, people don’t like the idea that if they get run over by a bus, their income stops and all those years of saving into a pension were for nothing. There are of course

protections you can build into an annuity, such as a guarantee period or a spouse’s pension, but these also reduce the starting income you get and hence soften the dazzle of the high rates available on the market at the moment.

There was a time 90% of pension savers bought an annuity with their pension. But that’s because the rules around drawdown were extremely restrictive, rather than because annuities were perceived to be appealing. Those rules were washed away by George Osborne’s pension freedoms, and as a result, annuities aren’t likely to see such glory days again, even if rates stay high.

Nonetheless they are still an important option for savers to have at retirement. It’s also worth keeping in mind that you don’t have to choose an annuity or drawdown, you can use some of your pension for each. This mix and match approach means you can secure the income you absolutely need from an annuity and also keep some invested for growth in a drawdown which provides a more variable, flexible income. In a way, this is the best of both worlds.

By Laith Khalaf AJ Bell Head of Investment Analysis

Pension contributions are taken from earnings automatically, so if you had unexpected extra income during the year (bonus, overtime), contributions would increase.

What would happen if too much had then been put into a SIPP? I assume the employer’s pension scheme would take precedence, and the excess in the SIPP then not given a tax credit. But that tax credit could have made gains by the end of the tax year, when you know exactly what your earnings were, and what pension contributions were made. Who calculates how much is discounted? Seems quite complicated.

David

Rachel Vahey, AJ Bell Head of Public Policy, says:

How much you can save tax-efficiently into a pension is a complicated area.