OIL'S SLIP

WHAT LOWER CRUDE PRICES MEAN FOR THE MARKET

The future. Imagining what’s next, not what’s now.

Scottish Mortgage is a global portfolio investing in companies driving progress. To find them our managers work with entrepreneurs and academics who help us imagine what’s next.

We believe that transformative change delivers transformative returns. If you want to discover what possibilities the future holds, invest with us today.

06 EDITOR’S VIEW

What the latest twist in tariff turmoil means for markets

07 Bank shares under pressure after think tank proposes ‘windfall’ levy

08 Magnificent Seven’ continue to beat earnings forecasts (mostly) 09 Carnival shares cruise to new multi-year high on record results 09 Victorian Plumbing plan to revive homewares brand raises serious doubts

10 Is the bad news baked-in at Associated British Foods?

11 Can Chewy impress with second-quarter earnings?

12 A globally diversified portfolio has been the ‘winning formula’ for Murray International 14 Take advantage of silver playing catch-up to gold with this vehicle

15 The Property Franchise Group goes from strength to strength

17 Three crucial things to think about with your Nvidia exposure 20 COVER STORY Oil’s slip What lower crude prices mean for the market

American

‘Bear steepener’ starts to stalk the chancellor

Three important things in this week’s magazine

What would cheap oil mean for markets?

The US administration has made clear it wants a low oil price, and thanks to global oversupply it looks like prices are going to keep going down, so what would $60 or even $50 oil mean for investors and world markets?

The ‘Magnificent Seven’ beat forecasts once again

Big Tech earnings continue to exceed market expectations, partly due to artificially low forecasts, although the rate of increase has slowed. We look ahead to the next few quarters.

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

Why all eyes are on the gilt market

Inflation and interest rates are falling, slowly, so why aren’t gilts behaving better, or are they trying to send us a message?

Jump

growth

What the latest twist in tariff turmoil means for markets

US companies and (to an extent) the economy have proved resilient this year

The latest twist in the tariff saga is a conundrum for investors. Broadly speaking, anything which reduces barriers to global trade is likely a positive for markets.

Therefore, a ruling by the US Court of Appeals for the Federal Circuit that most tariffs issued by the current US administration are illegal has some potentially positive long-term implications.

However, said ruling will not take effect until 14 October. This is to allow time for the White House to request an intervention from the Supreme Court which it seems almost certain to do.

Whatever the ultimate outcome, in the short term this just creates more uncertainty for businesses and investors who may well delay decisions as they wait to see exactly how the chips fall.

In its latest global outlook, investment bank Berenberg acknowledges the damage wrought by the trade war but does offer some reasons for optimism.

It notes: ‘Resilient labour markets and healthy balance sheets should partially offset the downward pressure on growth from elevated levels of uncertainty and tariffs.

‘So long as the US government sticks to the trade deals that it is making now and hands tariff revenues back to US consumers in the form of tax cuts, we think the US economy will slow significantly but not enter recession.’

Its forecasts imply GDP growth of 1.8% in 2025

moderating to 1.7% in 2026 and 1.5% in 2027. Berenberg does also note the looming fiscal risk in the US.

It adds: ‘Yet larger government deficits can raise the government debt-to-GDP ratio and borrowing costs to extreme levels. Unsustainable policies cannot go on forever, and President Trump’s erratic policymaking has caused investors to lose some patience. The risk of a buyers’ strike in the bond market that forces the US into a major fiscal adjustment is growing.’

It is worth acknowledging that despite a somewhat chaotic backdrop, at a corporate level, the US continues to excel. In this vein Ian Conway looks at how the Magnificent Seven are faring in this week’s News section and there’s a detailed examination of Nvidia’s (NVDA) latest earnings report by our technology expert Steven Frazer.

By now you may have seen communications about the end of Shares in its current format. On a personal note, it has been a real pleasure to be part of the team for the last 18 years and to have edited the magazine over the last 18 months or so. Expect more insights, ideas and analysis over the next few weeks as we build up to our final issue on 25 September and in the meantime a big thank you to all of you for your feedback, input and support over the years.

Bank shares under pressure after think tank proposes ‘windfall’ levy

‘QE’

Shares in UK banks dropped last on 29 August after the publication of a report by the IPPR (Institute for Public Policy Research) recommending the government introduce a new tax on ‘excess’ profits generated since the pandemic.

Shares in Barclays (BARC) fell 2.2% to 360.4p while Lloyds (LLOY) fell 3.4% to 79.5p and NatWest (NWG) fell 4.9% to 510.6p at the close.

The IPPR report centres on the fact the Bank of England is making significant losses, due to the unintended consequences of QE (quantitative easing), by selling government bonds below their purchase price and on interest rate losses, with an estimated cost to the Treasury of £22 billion per year during the current parliament.

it describes as ‘windfall profits’ for the banks, the IPPR estimates the Treasury would save between £35 billion and £40 billion of taxpayer losses over the course of this parliament, boosting fiscal headroom against the current budget by £5 billion to £7 billion, with the proceeds used for ‘supporting households and growth’.

The IPPR argues the proposed levy does not interfere with the Bank of England’s operations but would more or less match the interest-rate losses made and would be time-limited, so if interest rates fall below 2% or QE is finally unwound it would be lifted. [IC] Cash

The think tank suggests a two-pronged approach to tackling the issue: introducing a ‘QE reserves income levy’ on all domestic and foreign commercial lenders in the UK with assets of more than £25 billion, to raise between £7 billion and £8 billion per year; and slowing the pace of undoing QE by ending the ‘fire sale’ of government bonds, saving more than £12 billion per year. By taxing reserve returns in excess of 2%, which

‘The UK taxpayer is spending £22 billion a year compensating the Bank of England for losses on its QE programme, public money which is partly being funnelled to commercial bank shareholders,’ says the think tank. ‘This subsidy of commercial banks, at the expense of public services, is boosting bank profits while millions face the cost-of-living crisis. Since interest rates began rising in December 2021, the four largest UK banks have seen their annual profits more than double, up by £22 billion compared to pre-pandemic. Some of this is a direct transfer of funds from the taxpayer to shareholders.’

‘Magnificent Seven’ continue to beat earnings forecasts (mostly)

Now that Nvidia (NVDA:NASDAQ), the world’s largest company by market cap, has reported earnings, we can weigh up how well the ‘Magnificent Seven’ did in terms of delivering on forecasts (you can read Steven Frazer’s in-depth look at Nvidia’s earnings further on in this week’s mag).

On average, earnings per share growth for the group was 26.6% in the second quarter compared to the previous year.

That was well ahead of the 13.9% forecast on 30 June, but below the average of 31% for the same seven stocks over the previous four quarters according to information provider FactSet. By comparison, average earnings growth for the other 493 companies in the S&P 500 was just 8.1% in the second quarter.

only outlier although it missed forecasts by just 7% this time compared with a whopping 57% the previous quarter.

The biggest ‘beat’ was at Amazon (AMZN:NASDAQ), which topped earnings estimates by more than 26% thanks to strong sales growth in North America and overseas along with rising demand for its AWS cloud services.

‘Our AI progress across the board continues to improve our customer experiences, speed of innovation, operational efficiency, and business growth, and I’m excited for what lies ahead,’ said president and chief executive Andy Jassy on the results call.

Six out of seven companies beat forecasts, with electric vehicle-maker Tesla (TSLA:NASDAQ) the

Source: Zacks Investment Research

According to FactSet, four of the ‘Magnificent Seven’ – Amazon, Meta Platforms (META:NASDAQ), Microsoft (MSFT:NASDAQ) and Nvidia – were among the top six contributors to overall S&P 500 earnings growth in the second quarter.

The other two companies making a major contribution were pharmaceutical firm Vertex (VRTX:NASDAQ) and media group Warner Bros. Discovery (WBD:NASDAQ), both of which benefitted from easy comparisons due to weak earnings in the same quarter last year after each took a large provision.

As we have written previously, one of reasons so many companies are able to beat forecasts is analysts tend to set the bar artificially low.

Looking ahead to the next four quarters, the average growth forecast for the ‘Magnificent Seven’ ranges from 14.5% to 16.8% which would suggest most of them should keep beating expectations.

Excluding these seven stocks, the average growth forecast for the other 493 companies in the S&P 500 index is around 5% for the next two quarters of 2025 and around 10% for the first two quarters of 2026.

Once again, this seems fairly undemanding and should ensure the majority of companies are able to post better-than-expected earnings. [IC]

Carnival shares cruise to new multi-year high on record results

Record bookings at high prices mean smooth sailing into 2026

They say good things come to those who wait, and that appears to be the case for investors in cruise line operator Carnival (CCL) as the shares hit a post-pandemic high last week. In mid-June, the firm posted a

strong second-quarter trading update showing better-than-expected revenue ($1.51 billion against a consensus of $1.37 billion) and earnings per share ($0.35 against Wall Street’s $0.25), suggesting the cruise industry is more resilient than analysts expected.

In its statement, Carnival said it had hit its end-2026 targets 18 months early, with its adjusted return on invested capital and adjusted operating profit per lower berth reaching the highest level in almost two decades.

The firm also raised its thirdquarter operating profit and earnings per share forecasts, along with its full-year outlook, saying its advanced booked position for 2026 was in line with the record levels it reached last year and at ‘historical high prices’ in constant currencies.

Victorian Plumbing plan to revive homewares brand raises serious doubts

Bathroom seller is already facing stiff competition in its core market

Sometimes reviving an old brand can be fun – like Starburst sweets being rebranded as Opal Fruits for the summer – but there’s usually a good reason why brands vanish into obscurity and stay there.

So, when Victorian Plumbing (VIC) announced it was reviving the MFI brand – which collapsed into administration in 2008 because it could no longer compete effectively – with a relaunch planned for the first half of 2026, the question on everyone’s lips was ‘why?’

That was followed by ‘how much? ‘as the firm revealed bringing MFI back from the dead would cost it £6 million in profits over the next two years. Had Victorian Plumbing been winning the battle for market share against firms like B&Q and Wickes (WIX), then maybe investors might have given it the benefit of the doubt, but according to analyst Wayne Brown at Panmure Liberum the opposite is true.

Brown believes the firm needs to ramp up its spend on paid search in order to defend its territory ‘at a time

Source: LSEG

‘Our amazing team delivered yet another phenomenal quarter, more than tripling adjusted net income driven by record net yields and strong close-in demand,’ commented chief executive Josh Weinstein.

‘We continue to set ourselves up well for 2026 and beyond, with so much more potential to take our margins, returns and results even higher over time’, added the CEO. [IC]

when margin tailwinds unwind and marketing efficiency has worsened’.

With revenue rising by less than 5% per year and pre-tax profit growing by just 2.5% per year, on 14 times current forecasts ‘there seems very little upside and too many risks on the downside’ says Brown. [IC]

OVER T HE NEXT 7 DAYS

RESULTS

5 Sep: Ashmore Group FIRST-HALF RESULTS

8 Sep: Concurrent Technologies, Norman Broadbent, Sigmaroc

9 Sep: Computacenter, Gamma Communications, Likewise Group, Midwich

10 Sep: Gym Group, Vistry

11 Sep: Heath (Samuel) & Sons, Lords Group Trading, Playtech

Is the bad news baked-in at Associated British Foods?

Primark’s performance and the merits of a sliced bread merger will be pored over by analysts when the conglomerate reports

Trading trends at cut-price clothing chain Primark and the synergies promised by a planned merger of Kingsmill-owning Allied Bakeries and Hovis will be in focus when Associated British Foods (ABF) updates the market on 10 September. The FTSE 100 foodsto-fashion conglomerate’s shares are down 13% on a one-year view with discount fashion arm Primark finding life tougher on home turf and its sugar business also struggling.

However, Associated British Foods continues to address loss-making businesses and has decided to close UK bioethanol unit Vivergo after the UK Government refused to fund a rescue; the plant was dealt a killer blow by Keir Starmer’s trade deal with the US which scrapped tariffs on American ethanol imports. In time, Vivergo’s closure should benefit the profitability of the currently loss-making sugar arm.

10 Sep: Associated British Foods

Primark has continued to generate good growth in Europe and the US, but continued consumer caution drove 4% sales declines in both the UK and Ireland in the first half ended 1 March 2025. As such, investors will want

What the market expects from

market expects from

Source:

Associated British Foods

(p)

2,000 2,500

Oct 2024 Jan 2025 Apr Jul

Source: LSEG

reassurance that Primark’s operating margin outlook hasn’t deteriorated and that the value-oriented retailer remains on track to deliver low-single digit sales growth for the full year.

Associated British Foods’ management is also likely to outline how it plans to get the best out of sliced bread businesses Kingsmill and Hovis, having agreed to buy the latter from private equity player Endless for an undisclosed sum in a deal which faces regulatory scrutiny.

On 15 August, Associated British Foods insisted the Hovis acquisition will ‘combine the production and distribution activities of the two businesses, driving significant costs synergies and efficiencies, to create a profitable UK bread business that is sustainable over the long term’. Panmure Liberum says a transaction ‘would likely attract regulatory scrutiny’, but the broker expects the regulator to ‘take the view that, in the absence of a merger, only one of the two companies would survive, thereby reducing competition in any case.’ [JC]

Can Chewy impress with second-quarter earnings?

US specialist retailer Chewy (CHWY:NYSE) is a pretty similar beast to UK-listed Pets at Home (PETS), selling pet food, treats and toys while also offering grooming and veterinary services.

Like Pets at Home, the shares have come back to earth having gone somewhat stratospheric during the pandemic when many people on both sides of the Atlantic introduced a new furry or feathered friend into their household.

Today the stock trades at around $40 compared to more than $100 in early 2021. However, one area where a comparison with Pets at Home does not match up is valuation.

Chewy trades on 50.9 times forecast earnings for the 12 months to 31 January 2027, Pets by contrast is on a PE (priceto-earnings) ratio of around 12 times.

Chewy’s first-quarter numbers (12 June) got a mixed reception, albeit following a strong run for the shares heading into the results.

Adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) came in at $192.7 million, an increase of 18.3% from $162.9 million reported a year earlier.

The adjusted EBITDA margin increased 50 basis points year-on-year to 6.2%,

Source: LSEG

while revenue and earnings per share were ahead of expectations.

Yet a soggy outlook did little for sentiment, and when the firm posts second-quarter earnings on 9 September investors will be looking at just how much lower the adjusted EBITDA margin is versus the first three months of the year after the company warned of a modest decline.

The group also said it expected second-quarter net sales to be between $3.06 billion and $3.09 billion, representing year-over-year growth of around 7% to 8%.

Beyond the numbers, the focus is likely to be on commentary around current trading and whether pet owners are proving as willing to spend lavishly on their animal companions as they have been historically. [TS]

QUARTERLY RESULTS

5 Sep: Kroger

8 Sep: Caseys

9 Sep: GameStop, Synopsys

11 Sep: Adobe, Chewy

Source: Panmure Liberum, Bloomberg

A globally diversified portfolio has been the ‘winning formula’ for Murray International

The trust has delivered solid returns to investors and is a ‘Dividend Hero’

Murray International (MYI) 295p

Market cap: £1.75 billion

Investment trust Murray International (MYI), part of the Aberdeen Asset Management stable, delivered a solid set of half year results on 15 August, cementing itself in the eyes of investors as delivering income and long-term capital growth.

Over the six months to 30 June, the company delivered an NAV (net asset value) total return of 6% and a share price total return of 11.6% compared to just a 1% increase in the benchmark the FTSE All World index (although note that from 1 July the benchmark changed to the MSCI ACWI High Dividend Yield index).

The trust also declared two dividend distributions for the period of 2.6p per share each and said it

remained ‘committed to a progressive dividend policy.’

This commitment to growing the dividend has earned the trust recognition from the AIC (Association of Investment Companies) as a ‘Dividend Hero’, having raised its total payout in 2024 by 2.6% to 11.8p for a 20th consecutive year.

WHAT’S IN THE PORTFOLIO?

Managed by Martin Connaghan and Samantha Fitzpatrick, after the departure of long-serving manager Bruce Stout in June 2024, the fully diversified global portfolio of around 50 companies avoids ambitiously-valued growth stocks and focuses on cash-generative firms with durable business models, strong management teams and ESG (Environmental Social and Governance) credentials.

This globally diversified strategy has historically helped the trust navigate periods of volatility, maintaining consistency in income and returns.

Connaghan told Shares the Aberdeen team reviews stocks on a daily ongoing basis due to the global nature of its portfolio, taking into consideration macro, geopolitical risk, company earnings and news flow.

Fitzpatrick explained there was always a danger of being too reactive when it comes to reviewing a portfolio, and due to the tumult in the first half of the year there was a great deal of discussion among the team, but in the end turnover of assets was just 8.3% which was in line with other periods.

‘Most of our conversations didn’t result in

Murray International - top 10 holdings

Data as of 30/06/2025

Source: AIC/Morningstar

immediate action. We paused and took a view on what it might mean for companies. The last thing to do is to have a knee-jerk reaction,’ adds the manager.

The pair have moved away from investing in the so-called ‘Magnificent Seven’ but are not shy of technology or chip-focused stocks, with Broadcom (AVGO:NASDAQ) and TSMC (2330:TPE) among their top 10 holdings.

Mel Jenner, analyst at research firm Edison, says of the duo: ‘While the managers invest for the long-term, sharp moves in stock prices [during the first half of 2025] provided several opportunities; during the first half of 2025, there were three new purchases and seven complete disposals, along with a selection of top-ups and top-slicing of portfolio holdings.

‘Connaghan and Fitzpatrick are mindful of the macroeconomic background but are fully focused on bottom-up stock selection, seeking good businesses at good prices across the globe.’

The sector diversification across the portfolio emerged in the key drivers of performance, which included international tobacco company Philip Morris International (PMI:NYSE), global exchange group Hong Kong Exchanges and Clearing (0388:HKG), Central American airport operator, Grupo ASUR (ASURB:BMV), Asian communication services business Singapore Telecommunications (Z74:SGX) and European utility company Enel (ENEL:BIT) as the top five best-performing stocks.

Despite the success stories, co-manager Fitzpatrick told Shares there were stock-specific challenges in the first half of the year.

A couple of alcohol producers, Diageo (DGE) and French spirits company Pernod Ricard (RI:EPA) were ‘in the eye of the storm of tariff uncertainty’ along with two healthcare stocks the trust owns, Merck (MRK:NYSE) and Bristol Myers Squibb (BMY:NYSE).

‘Healthcare stocks by their nature are largely resilient, however after the Liberation Day announcement and subsequent worries about price changes, some of our healthcare stocks suffered tariff uncertainty.’

WHAT IS NEXT FOR THE TRUST?

As for new portfolio additions, the co-managers have bought shares in Indian IT service company Infosys (INFY:NSE) and Italian financial services group Intesa Sanpaolo (ISP:BIT).

‘Intesa Sanpaolo is well capitalised and is the number one bank in Italy. And although Infosys has had a bumpy ride this year, revenue growth has been great over the past five years and the company provides a different type of IT exposure in our portfolio,’ says Connaghan.

Looking forward, Fitzpatrick sees the biggest threat to the trust’s performance being the possible threat to income from an extreme event, such as it experienced during the Covid years when companies struggled to pay out dividends or went into ‘panic mode’ and withheld dividends.

But lessons have been learned, Fitzpatrick says reassuringly. ‘We have a fantastic safety net. Over the bumper years the trust has squirreled away cash for exactly that type of pandemic scenario or another type of scenario, like currency fluctuations. The trust has over a year’s worth of income reserves to dip into to maintain a steady dividend to our shareholders.’ [SG]

Take advantage of silver playing catch-up to gold with this vehicle

The precious metal benefits from many of the same drivers as bullion

iShares Physical Silver (SSLN) £28.79

Assets: £1.54 billion

Gold is often seen as a useful source of diversification – with a returns profile which is genuinely uncorrelated to that of other asset classes.

We have written about gold’s attractions several times this year, including a look at what it might take for the gold price to hit $4,000.

In a nutshell, its enduring status as a store of value stems from its scarcity, resistance to manipulation, and its appeal in times of uncertainty. In recent years, central banks – especially in Russia and China – have increased gold holdings to reduce reliance on their US dollar reserves.

Weaker demand for traditional safe havens like US government bonds, driven by concerns over US deficits and trade policy, has further boosted gold’s attractiveness.

The US dollar’s weakness and geopolitical tensions, including conflict in the Middle East and Ukraine, continue to support demand and anticipation of a US interest rate cut in the near future also enhances gold’s relative appeal versus income-generating assets.

However, with the yellow metal currently trading at fresh record highs, silver may offer investors a useful

iShares Physical Silver

Source: LSEG

way to diversify their precious metals exposure given it benefits from many of these same trends.

The exchange-traded commodity vehicle iShares Physical Silver (SSLN) tracks the spot price of silver in US dollars and is backed by physical holdings of the metal with just a 0.2% ongoing charge.

In fairness, silver is also elevated, currently trading at a 14-year high and not too far off the all-time highs seen in April 2011 when it nearly breached the $50 mark, but on valuation grounds it looks relatively attractive compared with gold.

The so-called gold-silver ratio, which shows how many times the silver price goes into the gold price, has fallen from a peak around 100 this April but, in the mid-80s, is still significantly higher than the average of around 67 times over the last 30 years.

Even if gold were to remain at its current levels, and there are reasons to think it could trade higher still, then a return to this average would see silver advance nearly 30% from here.

Historically, silver has been more popular with retail than sovereign and institutional investors and this has contributed to greater levels of volatility. However, there are some signs of a shift here. Regulatory filings from the Saudi Central Bank show it invested in two silver vehicles during the second quarter of the year.

Unlike gold, silver also benefits from industrial demand with growing usage in areas like photovoltaics (materials converting light into electricity used in solar energy) and electronics. [TS]

The Property Franchise Group goes from strength to strength

The stock is a great way to play growth in the UK residential market

When we recommended multibrand lettings and estate agency franchising firm The Property Franchise Group (TPFG:AIM) on 24 April, we said it represented a more attractive way to play growth in the UK residential property sector than buying traditional housebuilders.

Our call has played out nicely, with the shares up more than a third while most of the major developers are still nursing hefty losses for the year.

WHAT HAS HAPPENED SINCE WE SAID BUY?

When we spoke with chief executive Gareth Samples back in April, he was appreciably upbeat about the success of the Belvoir takeover which, in his own words, had transformed TPFG into something akin to a new business thanks to the scale it has brought.

That step-change in the business was evident when the firm posted its half-year trading update at the start of August, with group revenue increasing 50% to £40.3 million while like-for-like revenue was 8% ahead of last year.

Management service fees from lettings rose 24% to £10.4 million, with underlying growth of 5% and an additional two months of Belvoir revenue, while franchising revenue rose 22% to £12.2 million.

Financial services revenue increased by 54% to £12.2 million, thanks to a ‘strong upturn’ in property sales and lower mortgage rates on the back of Bank of England rate cuts, while underlying growth was a still respectable 14%.

WHAT SHOULD INVESTORS DO NOW?

In August, the firm said it saw a slight softening

The Property Franchise Group (TPFG:AIM) 567p

Gain to date: 37%

Property Franchise Group

in new instructions but thanks to its strong sales pipeline reiterated its confidence in meeting its second-half revenue targets.

With the first-half results themselves scheduled for 10 September, we think investors should stick with The Property Franchise Group as it continues to benefit from and build on its newly-attained scale. [IC]

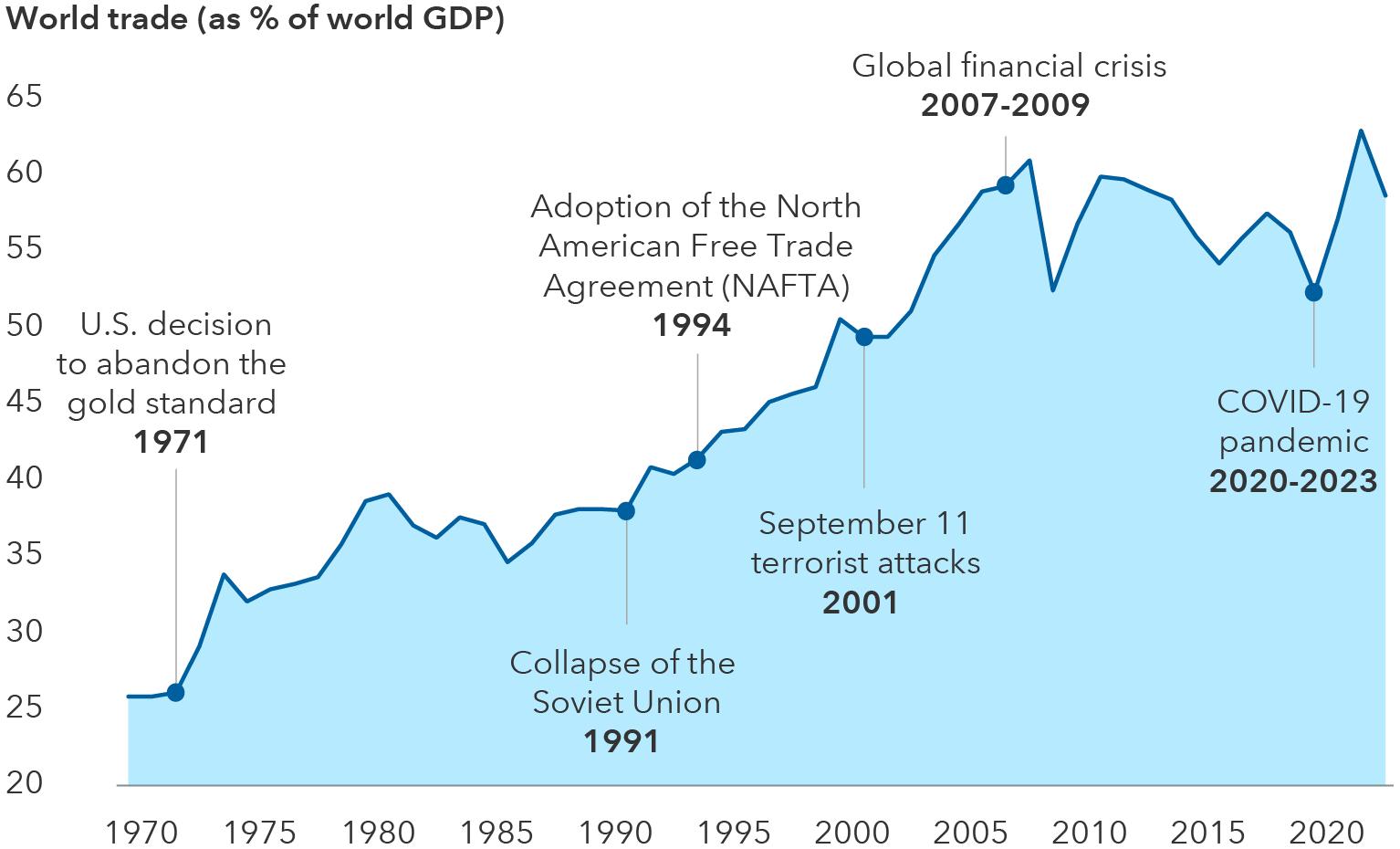

Globalisation isn’t dead. It’s changing

Tariffs launched by the US government in early April prompted a wave of criticism from world leaders, including some who say globalisation is now dead. As a global investor for over four decades, Steve Watson portfolio manager in Capital Group UK – New Perspective Fund respectfully disagrees. Globalisation isn’t dead. It is, however, changing in a significant way. Could it take a step back? Yes, he thinks it will. There are valid reasons for globalisation to go through a policy refresh — at least, the type of globalisation that started in the early 1970s when trade expansion started a meteoric rise.

The tectonic plates of world trade have been shifting for some time, trade as a percent of world GDP has moved roughly sideways since the global financial crisis between 2007 and 2009. A decade later, the Covid-19 pandemic and

the Russia-Ukraine war exposed the vulnerabilities of global supply chains that rely too heavily on single trade routes. Since then, countries and companies have sought to diversify supply chains and bring some manufacturing back home, or closer to home, so everyone can get what they need to keep their economies thriving

THE NEW PATH OF GLOBALISATION

Realistically, Steve doesn’t think the US will re-emerge as a manufacturing powerhouse. It gave up that capability a long time ago. But he does think the US will become more self-reliant, particularly in critically important products, such as computer chips, medical supplies and pharmaceuticals. The actions of the current US administration are reinforcing that message, taking us down rockier terrain than many investors would like. But there’s no mistaking the goal: The US is seeking to reshape the path of global trade, not end it. You might call it “Globalisation 2.0” — a more robust, diverse and multi-faceted form of globalisation.

GLOBALISATION MARCHES ON - AT A DIFFERENT PACE Sources: Capital Group, OECD, World Bank. World trade is calculated as the sum of exports and imports of goods and services and represented as a share of global gross domestic product (GDP). Latest data available is to 2023, as at 17/04/2025.

LONG-TERM INVESTMENT OPPORTUNITIES

Against this backdrop, Steve remains optimistic. He has lived through more than twenty market shocks in his 37-year career. In hindsight, most of those challenging periods turned out to be attractive entry points for patient investors.

Globalisation isn’t coming to an end. It is adapting to a changing set of circumstances. The road ahead may be bumpy, and financial markets may convulse with every news headline. It could take a few years to reach the destination. But the key question is: Can we get to a better place?

As long as the goal remains Globalisation 2.0 and not isolationism, Steve thinks we can.

Key Investor Information Document(s) (KIID). These documents are available free of charge at www.capitalgroup.com/gb/en Investment objective: To provide long-term (i.e., a period of over 5 years) growth of capital. There is no guarantee that this will be achieved over that specific, or any, time period and the capital of the fund is at risk. If you act as representative of a client it is your responsibility to ensure that the offering or sale of fund shares complies with relevant local laws and regulations. This communication is not intended to provide investment or other advice, or to be a solicitation to buy or sell any securities. Fund manager: Capital Group UK Management Company Limited, registered at 1 Paddington Square, London, W2 1GL, authorised and regulated by the Financial Conduct Authority. © 2025 Capital Group. All rights reserved.

Capital Group UK – New Perspective Fund

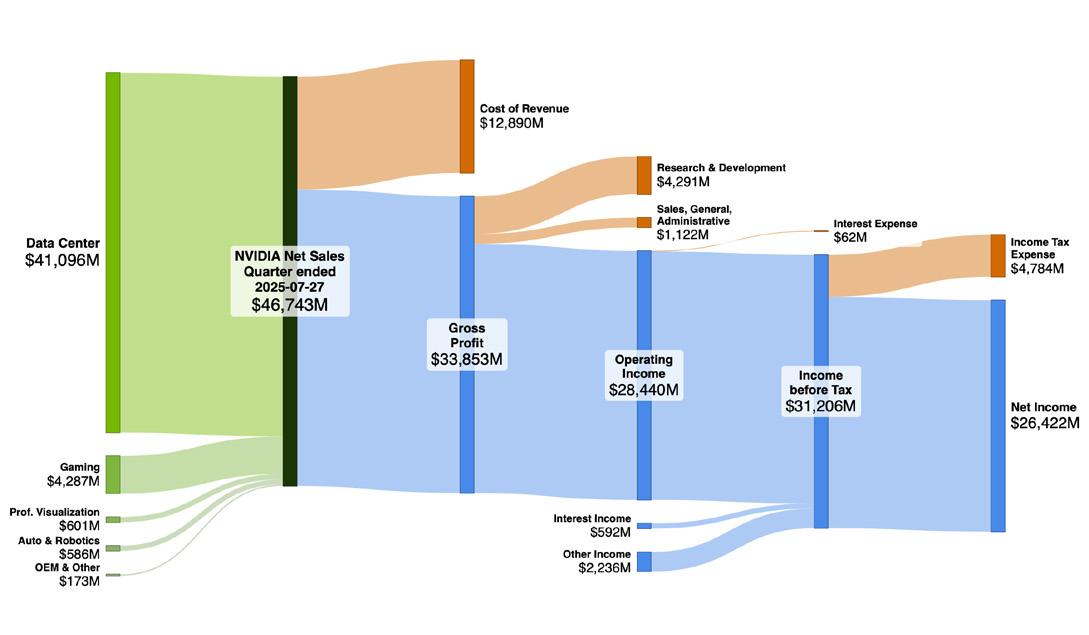

Three crucial things to think about with your Nvidia exposure

Investors have come to expect Nvidia (NVDA:NASDAQ) to beat forecasts and up guidance as the AI chip tech leader, but it is things outside of its control which give investors cause for caution.

The outlook on China remains murky, a market where the US company has struggled with export restrictions and pressure from Beijing. This could clear in the future but in the meantime, it is putting a dampener on data centres revenue growth, its largest and most critical division.

This saw the stock limp about 2% lower in afterhours trading directly post the results (27 August). This is hardly anything to tremble about given the share price is less than 5% off record highs, and it may simply have been a case of investors taking some chips off the table ahead of a long weekend in the US for the Labor Day holiday.

NVIDIA’S CHINA TRAP

Putting some colour on the China issues, Nvidia said data centre revenue, its largest and most critical division, came in at $41.1 billion, missing analysts’ projection of $41.34 billion. Of that, $33.8 billion of Nvidia’s data centre sales were for Nvidia’s GPU chips, down 1% from the first quarter because of $4 billion fewer H20 sales because it sold none of these chips to China in the quarter to end July.

Nvidia expects to generate $54 billion in revenue in its fiscal third quarter, plus or minus 2%, a fraction above the $53.5 billion anticipated by analysts. Any relaxation of export controls could see Nvidia sell between $2 billion and $5 billion of H20 chips this quarter (to end October), although these potential sales are not included in revenue guidance.

Spun positively, it implies there’s room for upside to Q3 sales if it gets the green light from Washington. ‘If their sales to China are able to surprise next quarter, that could be a huge catalyst moving forward,’ wrote one analyst in a note to clients.

Another big issue discussed by Nvidia chief financial officer Colette Kress, is that the widely reported arrangement Trump struck with Nvidia,

under which the government would get a 15% cut of the company’s China revenues, hasn’t been codified in regulations, making that agreement not quite as set in stone as Trump has implied.

GROWTH STILL HUMMING

Nvidia chief executive Jensen Huang’s comments about the top four cloud computing hyperscalers totalling $600 billion in capital expenditures in 2026 came alongside his projection that $3 trillion to $4 trillion could be spent on AI infrastructure by 2030. But the reality is that growth was bound to moderate from rampant levels of recent years. The company has averaged 64% and over 90% a year in revenue and earnings growth since 2020. A crucial question going forward is, by how much will this

NVIDIA Q2 FY26 income statement

Source: appeconomyinsights.com

ease, especially considering persistent questions over how quickly clients can extract value from AI investments.

Chief executive Jensen Huang says China alone could be a $50 billion revenue opportunity for Nvidia this year, with the potential for 50% annual growth if it were able to sell its technology unhindered by regulations, but those rules mean it cannot fully exploit this opportunity.

For now, not including any H20 sales into forward earnings guidance is a sensible thing to do, opening the potential for upside surprises while allowing lower expectations to get baked into the current valuation.

Where does this leave Nvidia’s growth expectations? According to Koyfin’s consensus data, the market is forecasting EPS of $1.24 on $54.6 billion revenue in the fiscal third quarter to end October, and $1.41 on $61.1 billion in Q4, implying 50% to 55% growth. That would be impressive for most companies, but it is unheard of for a multitrillion dollar market cap business.

For the full year to January 2026, the consensus is pitched at $4.48 EPS on roughly $207 billion of

revenue, both increased since June and implying new records both. Koyfin consensus projects sales growth to moderate to approximately 32% and 18% in fiscal 2027 and 2028, lowish bars that look likely to be gradually raised as the months tick by.

So where does this leave investors? We all know the company as the chip designer which has captured early leadership in the emerging AI race. Over five years, Nvidia stock has amassed 1,280% gains from about $12, or 67% a year on an annualised basis. That’s nearly five times the annualised return of the Nasdaq Composite (14.4%, according to Morningstar data).

LOOK THROUGH THE VALUATION

The obvious conclusion is Nvidia shares must be on a scorching valuation after such phenomenal success, but that’s not the case. Stockopedia calculates Nvidia’s 12-month forward PE (price to earnings) multiple at 31.3 times, about on par with Microsoft (MSFT:NASDAQ), another perceived AI winner, and less expensive than other AI hot stocks like Broadcom (AVGO:NASDAQ) and Palantir (PLTR:NASDAQ) (see table).

Valuations of popular AI stocks

Source: Koyfin, Stockopedia

Put it another way, investors have had only a handful of opportunities since 2020 to buy the stock below its current valuation. Nvidia’s average threeyear PE is under 30, a metric that many growth stock fund managers believe is more instructive than a single year or 12-month PE. It is also worth noting that Nvidia’s current PEG (price to earnings growth) ratio sits at an attractive one times.

This valuation is being supported by a huge $60 billion share buyback programme, announced alongside its latest earnings results. Rather than a sign of growth fatigue, as some market commentators have suggested, this looks to us like sensible use of its $25 billion-plus quarterly free cash flow and near-$57 billion cash reserves to counter stock dilution from employee options and underpin shareholder value over the medium term while its hands are tied in China.

In the meantime, most Wall Street analysts agree that Nvidia has more room to run both operationally and in share price terms. Koyfin’s consensus price target over the next 12-months sits above $205, versus $174.18 now (1 September), while 89% of the 65 analysts covering Nvidia are still have ‘buy’ recommendations on the stock.

Given the popularity of index ETFs, most investors will own some exposure to Nvidia – it represents 13.9% of the Nasdaq 100 and 7.3% of the S&P 500. For those that own Nvidia shares directly, hopefully this feature will help crystallise your thoughts about what you should do next.

By Steven Frazer News Editor

OIL'S SLIP

WHAT LOWER CRUDE PRICES MEAN FOR THE MARKET

Who would want to be an oil analyst, having to forecast where prices are likely to be in a month or even 12 months’ time?

In the last five years alone, Brent crude futures have collapsed to below $20 per barrel – and infamously actually went negative at one point during mid-2020 – before soaring to more than $130 per barrel following the Russian invasion of Ukraine.

Since their 2022 peak, however, they have been on a steady downward path, with very little in the way of volatility despite rising geopolitical uncertainty and increasing tensions in the Middle East, a key oil-producing region, and the long, drawn-out conflict in Ukraine.

Today, Brent crude trades around half the level it reached in 2022, and it’s anyone guess where the current downtrend will end.

By Ian Conway Deputy Editor

Therefore, we thought it worth asking what would $60 or possibly $50 oil mean for stock markets and the world economy?

COULD PRICES KEEP FALLING?

Volatility has always been a characteristic of oil markets, yet one of the most striking features of the oil market over the past three years has been precisely the lack of volatility despite rising geopolitical tensions.

When Hamas attacked Israel in October 2023, markets braced for a spike in the oil price which never happened.

When Israel and Iran came to the brink of conflict this June, with each side firing salvoes at the other’s energy infrastructure, there was a brief spike in oil prices, but it was over in a matter

Global energy market forecasts (EIA

August 2025)

of days and the downtrend quickly resumed.

Javier Blas, senior energy correspondent at Bloomberg, pondered at the time whether the oil market was ‘pushing its luck’.

‘The biggest risk is sleepwalking into believing that just because two years of violence hasn’t disrupted flows, the physical market would never be disrupted. Particularly in the Middle East, it’s always the last straw that breaks the camel’s back,’ wrote Blas.

The reason oil prices can’t go up is because there is too much of the stuff – put simply, everyone is over-producing.

The US, now the world’s largest producer of crude, is pumping a near-record 13.3 million barrels per day, while Saudi Arabia, which had held output back for years in an attempt to support prices, has now ramped up production as it races to reclaim market share.

On 3 August, OPEC+, which includes Saudi Arabia, agreed to accelerate its scheduled production increase meaning the 2.2 million barrels per day of cuts announced in November 2023 which were due to unwind by September 2026 will now be unwound by this month.

In its Short-Term Energy Outlook published on 12 August, the US EIA (Energy Information Administration) forecast global liquid fuel production would rise by two million barrels per

day on average in the second half of this year with OPEC+ contributing half the increase and nonOPEC producers such as the US, Brazil, Norway, Canada and Guyana providing the other half.

At the same time, demand is forecast to rise by only 1.6 million barrels per day meaning every day 0.5 million barrels will be added to inventories.

On top of the 1.4 million barrel per day buildup in the first half, that means inventories will increase by 1.9 million barrels per day in the second half of 2025 and 2.3 million barrels per day in the first half of 2026.

This will inevitably put ‘significant downward

Source: LSEG

pressure’ on oil prices, says the EIA, which is forecasting an average Brent crude price of $58 per barrel in the fourth quarter of 2025 and $49 in March and April next year.

As inventories build, the cost of storing oil will rise, which means crude prices will have to fall to reflect the higher marginal cost of storage, predicts the EIA.

Assuming prices do dip below $50 next year, and there are no major disruptions, both OPEC+ and non-OPEC countries – including the US – will eventually be forced to reduce supply, to the point where inventory build slows and a small increase in demand could lift prices back to an average of $54 in the end of 2026.

This bearish view on supply, demand and prices is backed up by the International Energy Agency, which has revised up its production forecast for this year and next year and has repeatedly downgraded its demand growth forecasts.

In its mid-August Oil Market Report [end], the IEA corroborates the EIA’s view that most of the increase in output over the next two years is likely to come from non-OPEC+ countries, in particular the US and Canada, while consumption has been weaker than expected with demand forecasts for Brazil, China, Egypt and India all revised down from the previous month.

‘While oil market balances look ever more bloated as forecast supply far eclipses demand towards year-end and in 2026, additional sanctions on Russia and Iran may curb supplies

from the world’s third and fifth largest producers,’ says the report, more in hope than in expectation.

WHO BENEFITS FROM CHEAPER OIL?

While President Trump has repeatedly moved the goalposts when it comes to global trade, raising tariffs one month only to reduce them weeks or months later, he has at least been consistent about wanting lower oil prices, and in the EIA’s scenario he will get what he wants.

Lower oil prices are unquestionably good for US consumers and businesses as they reduce inflation expectations and provide leeway to increase spending on other items through higher income.

According to the American Automobile Association, retail gasoline prices could drop from their current average of around $3.70 per gallon to below $3 per gallon next year which would be the lowest price since the pandemic.

Psychologically, gasoline prices have a huge impact on US consumers’ willingness to spend, and with tariff-induced inflation now starting to come through in food and services, keeping energy prices down would be convenient both politically and economically.

Low energy prices could help keep core inflation (food and energy) down, disguising to some extent the nascent impact of tariffs, and allow the White House to continue pressuring the Federal Reserve

Industry 'beta' or sensitivity to oil prices

Source: Shares

to lower interest rates, which would be another spur to consumption.

According to Raphael Olszyna-Marzys, international economist at J. Safra Sarasin Sustainable Asset Management, a 10% rise in oil prices typically lifts headline inflation in both advanced and emerging economies by about 0.4% after a few months, although the effect is larger for net importers, so if we assume a 10% fall could knock 0.4% off inflation we probably wouldn’t be too wide of the mark.

As the US is a net exporter of oil, and oil is priced in dollars, it’s also not unreasonable to assume a weak oil price would feeds through into a weak dollar, which is positive for other US exporters but raises the price of imports.

For emerging markets, where energy has a relatively high weighting in consumer price indices compared with developed markets, lower crude prices not only give central banks more wiggle room to lower interest rates, should they need

to, they also save governments having to use subsidies to smooth input costs.

Countries like India, South Korea, Thailand, Taiwan and Vietnam are heavily dependent on imported oil and therefore likely to benefit, whereas Brazil, as a net exporter, would lose out from lower oil prices. Although India faces, for now, the challenge of 50% tariff on exports to the US as a punishment for buying Russian oil.

For companies, lower oil prices obviously reduce input costs, but the effect may be less pronounced than in the past because in general businesses are becoming more energy-efficient than they used to be.

The biggest winners would be energy-intensive industries like those making steel, chemicals, cement, cars, trucks and large industrial equipment, while those using oil by products as feedstocks, such as industrial gas companies, would also benefit. Travel stocks could also get a boost as the cost of fuel goes down.

IS IT BAD FOR ENERGY STOCKS?

On the face of it, a lower oil price wouldn’t be great news for companies like BP (BP.) and Shell (SHEL), but ironically it could be good news for shareholders, especially if they are looking for income.

A new report by BloombergNEF suggests with long-term commodity prices determined by the cost of producing the marginal unit to satisfy demand, higher-cost greenfield E&P (exploration and production) sites will require a long-term real oil price of $63 per barrel to generate a ‘reasonable’ return.

At that price, the oil industry can bring online many major new resources like deepwater projects in the Gulf of Mexico, off the coast of Angola and Nigeria, in the icy hinterland of Alaska and in land-locked countries in East Africa, as well

as higher-cost US shale.

A higher oil price is also necessary to stop depletion – US firm Exxon Mobil (XOM:NYSE) estimates existing oilfields decline at an average rate of 4% per year after investment, but that figure would be as much as 15% if the company didn’t maintain a high level of ongoing investment.

As we said, forecasting oil prices is tricky, especially with the state of geopolitics today, but if companies need Brent crude to be $63 per barrel to make it worthwhile continuing to ‘drill, baby drill’, yet prices drop to $50-something because there is still plentiful supply – which BloombergNEF, the EIA and the IEA are all forecasting – then shareholders could be in line for higher returns in the form of increased dividends or more share buybacks as companies redeploy their cash flow.

Investing in the AI-era

Seizing tomorrow’s tech opportunities today

Artificial intelligence is reshaping industries and economies, creating extraordinary opportunities for investors.

Polar Capital Technology Trust (PCT) is at the forefront of this transition. Managed by one of Europe’s largest and most experienced technology investment teams, we take a conservative approach in this dynamic sector. We seek to identify and invest in the real drivers and beneficiaries of AI adoption – carefully navigating powerful technologies while positioning for long-term growth. Forward-thinking. Actively managed. Specialist focus.

Invested in your future: PCT’s continuation vote

Launched in 1996, PCT is proudly committed to shareholders, with a five-yearly continuation vote. At the last vote in September 2020, shareholders voted in favour of continuing the Trust.

The next continuation vote is scheduled for September 2025.

Discover how shareholders can vote

BlackRock American Income: the trust using AI to manage its portfolio

This North America-focused fund offers investors a unique way of gaining access to US stocks

Investment trusts have a history of more than 150 years and over that time, have constantly reinvented themselves to meet investors’ needs. The first ever trust, F&C (FCIT), was launched back in 1868 and in the intervening 157 years, the sector has survived wars, recessions and myriad market crashes. In a clear demonstration of the sector’s ability to move with the times, BlackRock American Income’s (BRAI) board recently adopted a systematic active equity investment process that combines big data, artificial intelligence, and human expertise.

The goal of this approach is to enhance returns and pep up the performance of a trust which lags its AIC North America sector peers on a one-year share price total return basis and is the second worst performer on a fiveyear view.

With the introduction of the new strategy, which has helped to narrow the NAV (net asset value) discount since March to 4.9% at the time of writing, the trust has changed its fee structure so that ongoing charges are expected to fall from 1.06% to a much more competitive 0.8%.

90 investment professionals who benefit from a multi-million-dollar annual data budget as well as significant technological resources’.

INNOVATIVE & DIFFERENTIATED

Talking Shares through the rationale behind the changes approved by shareholders in April, the trust’s chair David Barron says: ‘The challenge for the board was we’d gone through a period of difficult performance. And we wanted to offer active US equity management at a lower, more competitive fee through a strategy that we thought gave us good potential to get to greater scale through being innovative and differentiated.’

Barron continues: ‘But we wanted to keep the exposure to the value part of the US market, and we also wanted to keep something that used the flexibility, the integrity of the investment trust structure, namely the ability to use smooth income and pay regular dividends.’

Travis Cooke and Muzo Kayacan, the new managers of a £113.5 million cap trust targeting long-term capital growth and an attractive level of income, seek to deliver consistent outperformance of the Russell 1000 Value Index on an annual basis and in a risk-controlled manner at that. To achieve this, they aim to build a portfolio with characteristics closely aligned to the benchmark, with ‘alpha’ being generated through a large number of small active positions.

Cooke and Kayacan are supported by BlackRock’s Systematic Active Equity team, which as Kepler analyst Alan Ray points out, includes ‘more than

In the run up to the trust’s continuation vote, BlackRock put forward a proposal to move to its systematic strategy which had great appeal to Barron and the rest of the board. ‘This is a very well-established approach in many investment markets, but was not one that had been particularly offered to UK investors in the retail and wholesale market,’ explains Barron.

Source: The AIC, data as at 27 August 2025

Top 10 holdings as at 30 June 2025

Source: The AIC, data as at 18 August 2025

‘But it is something that BlackRock has been doing for a long time and does very well. We got through our continuation vote, the portfolio changes were put through efficiently, and since April, Muzo and the team have been running our portfolio on the new approach. We hope it is something that will catch on in the broader UK market. The board’s view is this is a very modern active investment strategy.’

Though BlackRock American Income’s strategy and management team have changed, the trust remains focused on value and has retained its income mandate. In fact, it has adopted a new enhanced dividend policy, tied to quarterly NAV, which offers the potential for increased income so long as NAV grows.

Cooke and Kayacan from BlackRock’s Systematic Active Equity team have taken over the management of the fund, replacing Tony DeSpirito, David Zhao, and Lisa Yang from BlackRock’s Fundamental Active Equity team.

Kayacan informs Shares that this is not a brand new approach, since the systematic active equity team at BlackRock have been around for 40 years. ‘But I think what’s new is that are we are bringing this to investment trusts. Why is it exciting? Well

more and more, people recognise that technology makes humans more productive, and technology is amazing at filtering things and narrowing things down,’ enthuses the portfolio manager.

‘Systematic investing is not brand new. Even artificial intelligence is not brand new. Investing always starts off with gathering information, whether you are flying somewhere to look at a mine, talking to company management, reading some broker research or the news in the morning, you are gathering information. And now more and more systematic investors can do that systematically.’

Kayacan and his team use computational techniques, such as natural language processing and machine learning, that enable them to process vast amounts of data on a daily basis. Among other inputs, this includes data from news, broker research, social media activity and consumer transactions related to more than 1,000 US companies, a task that would be nigh-on impossible for humans to carry out at such scale.

The AI-driven model then generates insights, suggesting potentially actionable investment ideas for the team, which are referred to as signals. But while technology plays a critical role in the investment process, human input remains important and ultimately, the portfolio managers select which stocks go into the portfolio.

DIGITAL TRACES OF HUMAN BEHAVIOUR

Kayacan says the approach also enables the managers to examine the ‘digital traces of human behaviour.

‘People interact with brands on social media, people buy stuff online, companies put details of new products or new jobs on their website, so there’s a vast amount of data that enables you to “nowcast” company fundamentals,’ says the BlackRock manager.

He continues: ‘If a company has just posted a load of jobs on its website, it is probably gearing up to sell more stuff, if it has pulled a load of jobs off its site, the company is probably seeing a slowdown in its business. If a brand sees strong year-on-year growth in interactions on Instagram around its products, we tend to find that is correlated with traffic to that company’s website and ultimately the revenue. So you’ve also got different data sources that let you nowcast fundamentals and you can do this across hundreds or even thousands

Share price total return (%) - AIC North America

Source: The AIC, data as at 18 August 2025

of companies.’

He continues: ‘More and more what we do is use technology or AI tools to gather all of the important information on companies, synthesise it together and then just predict which stocks will outperform or underperform the market. As a portfolio manager, it is like being an architect, you design the system that picks the stocks, and you do that in a very rigorous way so that you have a very high degree of confidence.’

What does Kayacan see as the team’s edge

THE KEPLER VIEW

Kepler’s Alan Ray believes that BlackRock American Income’s focus on the value factor is a key differentiator, and one that ‘could complement a more typical US equity growth strategy by offering a different performance profile. Historically, US value equities have tended to outperform their growth counterparts during challenging market conditions – such as in 2022, when inflation and interest rates surged. Value stocks’ earnings tend to be nearer term and less speculative than those of growth stocks, which can make them more resilient to shifts in interest rates or macroeconomic uncertainties. In addition, value stocks often pay dividends, while many growth stocks do not, providing a cushion during periods of volatility.’

in a super-competitive market, wonders Shares aloud? ‘It is probably our ability to be a bit more dynamic. Our holding period is typically six to 12 months. And we are trying to get ahead of the market consensus over like the next two to four quarters. For a human investor, it is hard to keep incorporating new information. But a model that reads everything, captures shorter term sentiment as well as long term fundamentals, that dynamic approach means that when the market keeps pivoting, we’ve got a better ability to capture that changing investment opportunity set.’

Kepler’s Alan Ray stresses that risk control is also reflected ‘in the number of stocks Travis and Muzo aim to hold - between 150 and 250 names.

‘The rationale for holding a large number of stocks is to diversify risk, ensuring that no single position has the potential to severely impact the portfolio’s overall performance.’ Albeit backwardlooking, the trust’s top 10 holdings as at 30 June 2025 included Jamie Dimon-led JPMorgan Chase (JPM:NYSE), Google-to-YouTube owner Alphabet (GOOG:NASDAQ) and Walmart (WMT:NYSE), the world’s largest retailer. Other top positions included retailer-to-cloud computing titan Amazon (AMZN:NASDAQ), Bank of America (BAC:NYSE) and Pfizer (PFE:NYSE).

By James Crux Funds and

Baillie Gifford US Growth

‘Bear

steepener’ starts to stalk the chancellor

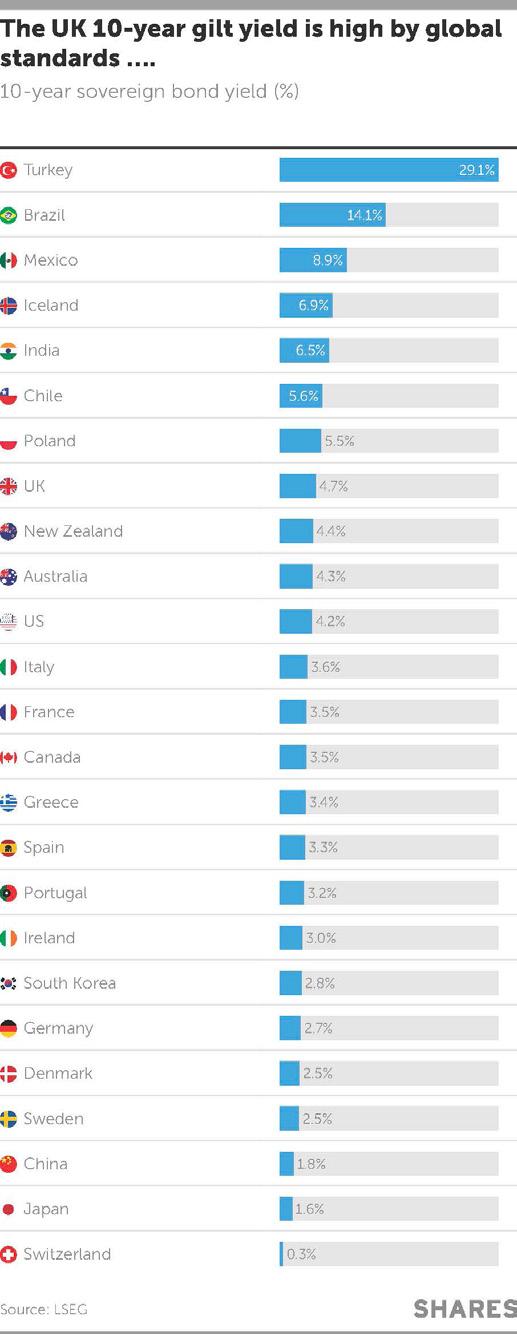

Sovereign bond yields are ringing some alarm bells about the UK’s economic and fiscal outlook

At the time of writing, no date is set for the second Budget of this Labour Government, but investors – or at least bond market vigilantes – seem to be getting edgy, at least if the yields on UK sovereign bonds, or gilts, are a reliable yardstick (and they usually are).

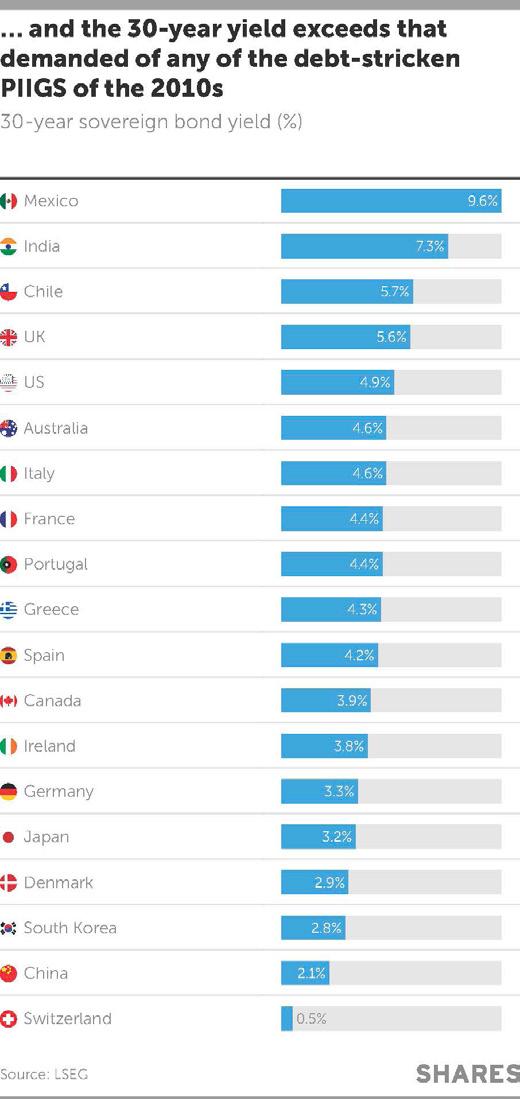

Gilt yields are starting to crawl higher again, and thus prices are going lower. At 4.73% at the time of writing, the yield on the benchmark 10-year gilt is within touching distance of the 4.84% sixteenyear high reached back in January. At 5.6%, the 30-year instrument’s yield is nearing a mark not seen since 1998.

The result is that it is costing the UK government more to issue 10-year debt than any of Portugal, Ireland, Italy, Greece and Spain, the so-called PIIGS whose sovereign borrowings caused such angst in the early 2010s.

The same applies to 30-year paper. None of this, alas, looks like a vote of confidence in the UK’s economic outlook or Labour’s ability to stick to its carefully laid-out fiscal rules, at least without some politically unpalatable tax increases, spending cuts, or both.

BAD COMPANY

Back in 1998, Tony Blair was prime minister and Gordon Brown chancellor. Inflation was subdued, at below 2% based on the consumer price index, but annual GDP growth that year was 3.4%, a far superior rate of growth to that of 2025. The Bank of England base rate therefore exceeded 7% all the way through to November 1998, when rapid cuts were deployed by the then governor Eddie George, as part of a globally co-ordinated response to the Asian debt crisis and subsequently LTCM hedge fund failure.

Healthy GDP growth, ‘Cool Britannia’ feel good and financial market volatility were thus the order of the day in the late 1990s. This time around, however, inflation, tariffs and government debt seem to be the key issues that are niggling bond vigilantes.

Interest rate cuts from the Bank of England have made no difference, either. Benchmark gilt yields have gone up in the UK since the first reduction in headline borrowing costs of this cycle sanctioned by Governor Bailey and the Monetary Policy Committee a year ago.

It will be scant consolation that the UK is keeping company here with America, where the Trump administration continues to run policies designed to stoke growth, generate tax revenue from tariffs and keep interest rates low, in an attempt to manage a galloping Federal debt and interest bill. Nor will the Labour Government, treasury or Bank of England take comfort from how France is in the same situation, especially as efforts to impose any kind of fiscal order have led to public unrest, while coming to nought. Next week’s vote of confidence in the current prime minister, François Bayrou, may only heighten worries about France’s ability to manage its borrowing.

French, American and British sovereign yields have risen even as central banks have cut interest rates

Source: LSEG

LEARNING CURVE

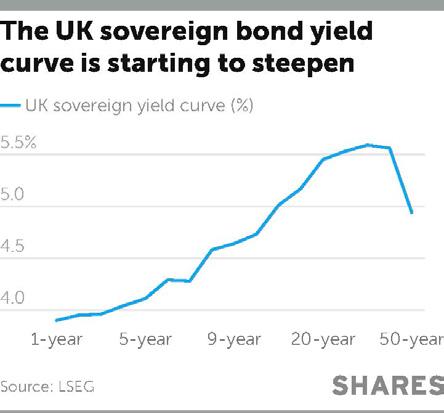

Over the last month, the UK two-year gilt yield is up by seven basis points (0.07%), the 10-year by 15 (0.15%) and then 30-year by 23 (0.23%).

As a result, the yield curve shows something a little more akin to a ‘normal’ yield curve, where lenders (or bond buyers) demand a higher return from longer-dated paper to compensate themselves for the increased scope for something to go wrong during the additional life time of the gilts, such as changes in interest rates, higher inflation or, at worst, a default by the issuer (or borrower).

However, this also means the UK is offering a socalled ‘bear steepener,’ when both short- and longterm yields are rising but long-term ones are rising faster to widen the gap between the two.

This can be bad news for bonds in particular, as prices fall when yields rise, and it can be a sign inflation is on the rise. It could be a challenge for share prices, too, as it combines higher discount rates (that lower the theoretical value of the longterm cash flows of long duration sectors like tech and biotech) with tighter monetary policy that hits the earnings power of short-duration, cyclical industries.

This means it is not just bond vigilantes, but equity investors as well, who will have keep tabs on the rumour mill regarding possible policy interventions from chancellor Rachel Reeves ahead of the Budget as she looks for a way to keep financial markets, her own backbenchers and voters happy, while sticking to her own ‘fiscal rules’ and the Government’s growth agenda.

The of cost university tuition is on the rise – how can

Options to help meet the growing expense of higher education

This year, university tuition fees will be kicked up another 3.1% to £9,535, meaning heftier loans for students footing the bill. In the circumstances both students and parents may be inclined to do some forward thinking on how to save for their studies most effectively.

The increased charges associated with university tuition represent a significant departure from how older generations were able to handle the costs of higher education. The parents of students now heading off to university might have paid closer to £1,000 per year, which was the cost in 2000. While inflation has made most things more expensive in the past 25 years, goods costing £1,000 in 2000 would cost just under £2,000 today. That’s a fair way off from the £9,535 students are expected to pay today, not factoring in the cost of housing, food, and (let’s be honest) a few trips to the pub.

A MORE FORMIDABLE OBSTACLE

Because tuition fees used to be relatively manageable, it was common for students to repay them as they began their careers. But now, the mounting fees present a much more formidable obstacle. Now, more parents are pitching in.

According to a survey by the Association of Investment Companies, run by Opinium, over 70% of parents are helping out with their children through university, with an average contribution of £8,723 per year.

Ultimately, it’s up to you to decide if you’d like to help your child out while they are at university. But if you do, it may be better to get started saving sooner rather than later. About half of parents are using some or all of their savings to help their children through university, and 64% are using cash to save for their children.

However, a bit of savvy investing instead could make savings go a lot further, especially if you’re able to start early. One of the easiest ways to save

you keep up?

for children is through a Junior ISA. As a bonus, grandparents or family friends can also contribute to this account, which can put a boost on the savings.

HOW MUCH TO SET ASIDE?

If parents invested £50 per month for their child from when they were born until their 18th birthday, and the investment grew by an average 8% each year, they could have £21,536 in the account as they were heading off to university. Equally, if a parent maxed out the £9,000 limit for yearly contributions in a Junior ISA, this pot could turn into nearly £313,000.

Realistically, putting £9,000 aside each year on top of childcare costs is not possible for most parents. In addition, if you have multiple children, this can become quite a lot to save. But thinking ahead can save a lot of money in the long run. For a parent that is able to put away that £50 per month discussed above, at a 7% return rate, over half the money that’s been added to the account would be a result of compound interest, instead of out of your pocket.

Assuming tuition prices stay put; to cover three years, you would need an end pot of a little under £30,000, not factoring in housing and food costs. If your investment returned 7%, this would mean you could reach that pot in 18 years with investments of around £70 per month.

£50 per month adds up

BREAKING DOWN THE JUNIOR ISA

if you choose to invest for your child through a Junior ISA, there’s a few rules that are helpful to keep in mind. While a typical stocks and shares ISA has a cap of £20,000 per year in contributions, a junior ISA has a cap of £9,000. Until the child turns 18, anyone can contribute to their Junior ISA. But once the child turns 18, it’s automatically converted into a regular ISA. For example, a Junior ISA invested in stocks and shares would just become a Stocks and Shares ISA.

Notably, once the Junior ISA holder turns 18, they also have access to the money just like they would with a regular ISA. So, it does require some degree of trust in your child. Once the holder is 16, they can also start to make investment decisions, even though they can’t withdraw the money yet.

If you want to ensure that funds you save will go to your child’s tuition rather than other expenditures, you can also choose to save the money within your own ISA. This will eat into your ISA allowance however, and it will also mean that you can withdraw it. So, if you think you may be tempted to use the money for other reasons, a Junior ISA could be the more suitable option.

Unless you’ve saved money in a Lifetime ISA account, you have the ability to spend the money on what you please. This means that if your child decides to learn a trade, or go straight to work instead of university, they can also put the money in their Junior ISA towards these efforts instead.

WHEN IS IT TOO LATE?

If there’s just a few years before your child heads off to university, you may not be as comfortable taking risks with the savings. When there’s 18 years ahead of you, there’s plenty of time for market volatility to even out. But when this is closer to two or three years, you may want to have more security in what you’ve saved.

There are still investments that could be helpful at this point, such as bonds or money market funds, to help those returns possibly boost a bit above the cash savings rate. Ultimately, any money that a child doesn’t need to loan can be a big help for the future.

Hannah Williford AJ Bell Content Writer

Will beneficiaries be able to retain a SIPP after paying inheritance tax?

Answering a question about pension pots being passed on when someone dies

As you know SIPPs may be liable for Inheritance tax of 40% from 6th April 2027. Will beneficiaries be able to retain the passed over SIPP after paying 40% inheritance tax?

Say, if I specify in my will that my SIPP is to be divided into four beneficiaries, can all four beneficiaries keep the investment under their own SIPP after paying 40% inheritance tax? Of course, they will pay income tax after they withdraw money from the passed over SIPP. Is this possible?

Ashwani

Rachel Vahey, AJ Bell Head of Public Policy, says:

It seems inevitable that IHT (inheritance tax) will apply to any unused pensions on death after 6 April 2027. HMRC recently shared more information on how they see this working in practice, although many unanswered questions remain.

It’s important to remember, that although pensions will be brought into the estate when working out how much (if any) IHT is due, they won’t always have to be paid to the people set out by the will.

At the moment, most pension schemes pay death benefits under the trustees ‘discretion’. This means the trustees of the pension, most pensions are set up under trusts or trust-like structures, decide who should inherit the pension. The pension saver can complete a nomination or expression of wish form saying who they would like the pension to go to, but the trustees have the final decision.

So, the pension won’t necessarily be paid to the same people who will receive assets through the will.

EXECUTORS ARE RESPONSIBLE FOR WORKING OUT IHT DUE

When the pension saver dies, the executors of their

will or personal representatives are responsible for working out what, if any, IHT is due. The personal representatives usually have to pay the full IHT and can do so using other assets in the estate – for example a bank account.

Once the IHT position has been finalised they will tell the pension scheme, and the pension scheme will then pay out the pension benefits to the pension beneficiaries. If the personal representatives pay the IHT, no IHT will be deducted from the pension before it’s passed to the beneficiary.

The beneficiary can take the pension either as a lump sum or they may be able to set up a drawdown plan and withdraw money when they want.

If the pension saver dies aged 75 or over then

Ask Rachel: Your retirement questions answered

the beneficiary will have to pay income tax on the lump sum or on any withdrawals from drawdown. If the pension saver was younger than 75 then there usually is no income tax to pay.

Alternatively, the beneficiary of the pension may be able to ask the pension scheme to deduct the IHT owed from the pension directly from the pension scheme. In this situation, the pension scheme will deduct the IHT before paying any lump sum or setting up a drawdown plan.

Where it can get more confusing is where the beneficiaries of the pension are different to the beneficiaries of the will, as steps will need to be taken to make sure each party pays a fair share of IHT.

OTHER CONSIDERATIONS

A few other things. Remember that any assets passed to a spouse or civil partner are free from inheritance tax. And only assets over and above the nil rate band (and residence nil rate band where applicable) are subject to inheritance tax. If the IHT

is to be paid from the pension scheme, then any remaining nil rate band will be split proportionately between each pension scheme and the remaining assets in the estate.

Bringing pensions into the estate for IHT is a complex approach, and I still very much hope the Government changes its mind and chooses a different way to treat pensions on death. It will certainly save personal representatives and pension beneficiaries a lot of administrative headaches.

DO YOU HAVE A QUESTION ON RETIREMENT ISSUES?

Send an email to askrachel@ajbell.co.uk with the words ‘Retirement question’ in the subject line. We’ll do our best to respond in a future edition of Shares Please note, we only provide information and we do not provide financial advice. If you’re unsure please consult a suitably qualified financial adviser. We cannot comment on individual investment portfolios.

Money & Markets podcast

featuring AJ Bell Editor-in-Chief and Shares’ contributor Dan Coatsworth

US trade deal with Japan as earnings season kicks off, pensions and IHT plans confirmed, and 24-hour trading on the LSE

WATCH RECENT PRESENTATIONS

Aram Advisors/ Scotch Corner

Richard Croft , Director & Simon Waterfield, CEO

Aram is a newly launched segment of the Aquis Stock Exchange Growth Market, a dedicated marketplace for real estate and infrastructure investment, offering investors access to the world’s largest asset class through a fully regulated and liquid public market.

Rome Resources (RMR)

Paul Barrett, CEO

A critical minerals exploration company active in the DRC. Its main project is Bisie North, a tin and copper deposit some 8km from the world’s highestgrade tin mine. The Company has been drilling since Admission to AIM in 2024 and is approaching the end of its programme which will lead to the posting of a maiden resource estimate.

Poolbeg Pharma (POLB)

Jeremy Skillington, CEO & Ian O’Connell, Chief Financial Officer

Poolbeg Pharma (POLB) is a clinical-stage biopharmaceutical company focussed on the development of innovative medicines to address unmet medical needs. The Company’s clinical programmes target large addressable markets including, cancer immunotherapy-induced Cytokine Release Syndrome (“CRS”) and metabolic conditions.

WHO WE ARE

EDITOR: Tom Sieber @SharesMagTom

DEPUTY EDITOR: Ian Conway @SharesMagIan

NEWS EDITOR: Steven Frazer @SharesMagSteve

FUNDS AND INVESTMENT

TRUSTS EDITOR: James Crux @SharesMagJames

EDUCATION EDITOR: Martin Gamble @Chilligg

INVESTMENT WRITER: Sabuhi Gard @sharesmagsabuhi

CONTRIBUTORS:

Dan Coatsworth

Danni Hewson

Laith Khalaf

Russ Mould

Laura Suter

Rachel Vahey

Hannah Williford

Shares magazine is published weekly every Thursday (50 times per year) by AJ Bell Media Limited, 49 Southwark Bridge Road, London, SE1 9HH. Company Registration No: 3733852.

All Shares material is copyright. Reproduction in whole or part is not permitted without written permission from the editor.

Shares publishes information and ideas which are of interest to investors. It does not provide advice in relation to investments or any other financial matters. Comments published in Shares must not be relied upon by readers when they make their investment decisions. Investors who require advice should consult a properly qualified independent adviser. Shares, its staff and AJ Bell Media Limited do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

Members of staff of Shares may hold shares in companies mentioned in the magazine. This could create a conflict of interests. Where such a conflict exists it will be disclosed. Shares adheres to a strict code of conduct for reporters, as set out below.

1. In keeping with the existing practice, reporters who intend to write about any securities, derivatives or positions with spread betting organisations that they have an interest in should first clear their writing with the editor. If the editor agrees that the

reporter can write about the interest, it should be disclosed to readers at the end of the story. Holdings by third parties including families, trusts, selfselect pension funds, self select ISAs and PEPs and nominee accounts are included in such interests.

2. Reporters will inform the editor on any occasion that they transact shares, derivatives or spread betting positions. This will overcome situations when the interests they are considering might conflict with reports by other writers in the magazine. This notification should be confirmed by e-mail.

3. Reporters are required to hold a full personal interest register. The whereabouts of this register should be revealed to the editor.

4. A reporter should not have made a transaction of shares, derivatives or spread betting positions for 30 days before the publication of an article that mentions such interest. Reporters who have an interest in a company they have written about should not transact the shares within 30 days after the on-sale date of the magazine.