The Scottish Mortgage Investment Trust seeks out the world’s most exciting growth companies and invests in them for the long term. We believe this is the best way for you to enjoy strong returns for decades to come.

We explore a number of exciting themes on our mission to find these world-changing businesses. Transport is just one of them. Why not discover them all?

Capital is at risk. A Key Information Document is available. Explore the future at

How much are staycations really saving you?

32 INDEX

Shares, funds, ETFs and investment trusts in this issue

How can global brands remain relevant in an ever-changing world?

Some companies have the knack of continually delighting their customers while others have struggled to maintain interest. We weigh up winners and losers in the battle for mind share as well as market share.

What climate change means for our spending habits

Hotter, drier summers and other natural events are affecting how (and where) we consume certain goods and services, and these trends look likely to continue.

Why Allianz Technology Trust is on a winning streak

Having less exposure than the market to Mag7 stocks has turned from a headwind to a potential tailwind for this actively-managed fund.

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

A strong earnings season across the Atlantic has shifted the debate a touch

The curtain is about to come down on the US quarterly earnings season. As we wrote last week, for the most part companies have impressed – with the caveat that Nvidia (NVDA:NASDAQ) will provide a pretty big full stop on proceedings next week (you can read more on what to expect here).

The beats we have seen potentially reflect the impact of analysts attempting the complicated task of gauging the impact of tariffs. Nonetheless, the resilience of US corporate earnings is notable.

It’s why some observers think talk of an end to US exceptionalism is premature. Sharmin MossavarRahmani, head of ISG (Investment Strategy Group) and chief investment officer at Goldman Sachs Wealth Management, states that US equities tend to align with the long-term trend of US corporate earnings, making being underweight US equities challenging.

She also notes that missing the strongest trading days can impact returns when attempting to time the market, which supports the idea of remaining invested over the long term – an idea we have talked about frequently in these pages.

‘Don’t try to time the market, because it’s very rare that anybody can do that,’ Mossavar-Rahmani says. According to Goldman Sachs, missing just the 50 best trading days since the global financial crisis reduces the S&P 500’s annualised returns from approximately 17% to around 3%.

Her colleague at Goldman, Brett Nelson, head of tactical asset allocation for ISG, also points out some technical pointers which suggest the US market might continue to perform: ‘When we look at the fact the market has recovered all its losses from April, reached new all-time highs, and participation in the rally expanded significantly off the April lows… all of these factors are historically consistent with ongoing momentum.’

Whether this optimism is justified or not is likely to become clearer in the third quarter when the impact of tariffs may be more visible, with October looking

Source: LSEG

set to provide another acid test for US stocks.

The US is certainly home to some of the world’s leading brands and in this issue we look at the power of brands in more detail. We also examine what happens when a brand’s value starts to fade, and highlight one up and coming and one established brand which look interesting from an investment perspective. We also take a delve into leading technology investment trust Allianz Technology Trust (ATT) and how it has managed to outperform while being underweight Microsoft (MSFT) and Nvidia.

Increasingly, it seems there is no fundamental case for a cut

No doubt as Fed chair Jerome Powell heads for Jackson Hole, Wyoming, to deliver his annual speech on 22 August, the White House will be back on its favourite hobby horse ramping up calls for the central bank to cut interest rates when it meets in September.

The question is, does the US economy actually need lower rates at this particular point in time?

Increasingly, the answer looks like no because the current picture and the short-term outlook are clouded by the effect of president Trump’s tariffs on a range of important data.

Take GDP, or gross domestic product, the broadest measure of economic growth.

In the first quarter, imports soared as companies stocked up to avoid paying tariffs, so the domestic side of GDP shrank, and the US economy contracted by 0.5% compared with the previous quarter.

In the second quarter, however, economic growth was 3% higher than the first quarter, or roughly the same rate of growth as the second and third quarters of 2024.

Consumer spending, which makes up more than two-thirds of US GDP, was unusually weak in the first quarter, which is seasonally weak anyway, but growth in the fourth quarter of 2024 had been unusually strong at 4%.

Plus, spending recovered in the second quarter, and consumer sentiment surveys suggest people are still reasonably upbeat about the economy (although Republicans tend to be more bullish and Democrats more bearish).

On these broad measures, there would seem to be no need to cut interest rates.

Inflation, which is central to the Fed’s mandate, increased from 2.4% on an annual basis in May to 2.7% in June, but has yet to show the full effect of tariffs for two reasons.

First, many of the most-affected products are bigticket items which people don’t buy every day, so the data isn’t coming through, and second, so far

Source: LSEG

US companies have ‘eaten’ most of the increase in prices (leading to a surge in wholesale prices).

However, that is likely to change in the second half of the year with analysts at Goldman Sachs predicting consumers will end up paying 70% of the increase.

Where inflation is showing up already is in high-frequency purchases such as food, but core inflation – which is food and energy – is being kept down by low petrol prices which are subdued to low oil prices.

In deciding whether or not to lower rates, the Fed has to weigh up all these factors, and even though the market seems convinced it will cut by 0.25%, for better or worse, we suspect Jerome Powell will stick to his mantra of being ‘led by the data’. [IC]

Warren Buffett’s conglomerate has underperformed the S&P 500 since the legendary investor announced his retirement

According to Berkshire Hathaway’s (BRK.B:NYSE) latest 13F regulatory filing with the SEC (Securities and Exchange Commission), Warren Buffett and his two investment officers Todd Combs and Ted Weschler bought more than five million shares in UnitedHealth (UNH:NYSE) during the second quarter. Besides initiating a new position in the struggling healthcare insurer worth $1.6 billion, the period also witnessed sales in two of the cashed-up conglomerates largest positions, namely Apple (AAPL:NASDAQ) and Bank of America (BAC:NYSE)

Evidently, Berkshire Hathway sees recovery potential at troubled healthcare insurer UnitedHealth under returning CEO Stephen Hemsley, and the conglomerate is in good company. Also making the same bet are hedge fund billionaire David Tepper of Appaloosa Management and ‘Big Short’ investor Michael Burry, whose have also disclosed meaningful stakes.

UnitedHealth’s shares have been hammered this year by rising medical insurance costs, disappointing earnings, a Department of Justice investigation and the sudden departure of CEO Andrew Witty. And Berkshire’s investment is a big vote of confidence in UnitedHealth from a company that knows the insurance business inside out, even if the stake hardly puts a dent in Berkshire’s gargantuan $344 billion cash pile. UnitedHealth was the only stock to receive a ‘Buffett Bounce’ after the latest 13Fs hit the wires, with Berkshire’s filing also revealing new stakes in housebuilders DR Horton (DHI:NYSE) and Lennar (LEN:NYSE), as well as the US’ biggest steel producer Nucor (NUE:NYSE) and billboards operator Lamar Advertising (LAMR:NASDAQ). Buffett’s firm sold 20 million of its 300 million Apple shares in the second quarter, although the iPhone designer remains Berkshire’s largest holding. Meanwhile, Berkshire topped up holdings in several recent purchases including Pool Corp (POOL:NASDAQ), Constellation Brands (STZ:NYSE) and Domino’s Pizza (DPZ:NASDAQ). Arguably the world’s most famous investor, Buffett rocked the investing world in May by announcing he will step down as Berkshire’s CEO at the end of 2025, with longtime Berkshire executive Greg Abel set to take over on 1 January 2026. After a strong start to 2025, Berkshire’s shares have been in a downtrend since this seismic news, which prompted stockpicker Michael Crawford to reappraise his view of Berkshire’s prospects.

As Crawford, manager of YFS Chawton Global Equity Income (BJ1GXX3), observed in the fund’s June factsheet: ‘Following the momentous news in May that Warren Buffett intends to retire as chief executive officer of Berkshire Hathaway, we reluctantly decided to sell our position. Without Buffett’s capital allocation acumen and given the size and composition of the group, we consider it will be difficult for successor, Greg Abel, to materially outperform the S&P 500.’ [JC]

Private equity-owned rivals in particular have struggled this year

UK grocery sales continue to tick along nicely over the summer with the latest data from Worldpanel showing a 4.5% rise in take-home shopping in the 12 weeks to 10 August, with market leaders Sainsbury (SBRY) and Tesco (TSCO) outperforming the market.

However, in the last four weeks at least, all of the increase in value was down to higher prices rather than higher volumes, as inflation remains stubbornly high, eating into household budgets.

Over the 12 weeks to 10 August, Sainsbury’s increased its sales by 5.2% taking its share of the market to 15% while Tesco grew its sales by 7.4% giving it a 28.4% share of the market.

On a year-over year basis, Tesco raised its share by 0.8% while Sainsbury’s gave up 0.3%, but the major loser was Asda which lost 0.8% of its market share to 11.8%, leaving it just one percentage point above Aldi at 10.8% against 10% a year ago.

Asda, which was bought by private equity in 2021 and is now majority-owned by TDR Capital, has registered negative sales growth for more than a year, while Morrison, which is also owned by private equity, has underperformed the market in terms of sales growth for the last 10 months.

Meanwhile, Aldi and Lidl have outpaced the market since the start of the year and now account for 19.1% of grocery spending, up from 17.3% in December 2024, with Lidl the faster growing of the two.

Despite the ‘Big Four’ employing loyalty schemes which offer discounts and ‘Aldi price match’ campaigns across a broad range of everyday items, inflation is a growing issue for shoppers.

Price rises have accelerated from 3.3% in the four weeks to 26 January to 5% in the month to 10 August and topped 5% in the month to 13 July.

According to Worldpanel’s head of retail and consumer insight Fraser McKevitt, one explanation for the increase in average prices may be higher spending on branded goods as opposed to own-label products.

In the four weeks to 10 August, sales of branded grocery items rose 6.1%, outpacing own-label alternatives which increase by 4.1%, with the gap in favour of brands the largest since March 2024.

Overall, branded sales made up 46.1% of grocery spending but they were particularly dominant in areas like personal care, confectionery, hot drinks and still drinks where they made up more than 75% of spending.

12W ENDED 10/08/2025

Source: Worldpanel, data correct as of 19 August 2025

That will be music to the ears of personal care firms like Reckitt Benckiser (RKT) and Unilever (ULVR) as well as soft drinks makers like AG Barr (BAG) and Coca-Cola Hbc (CCH). [IC]

The retail lender has more than recovered from its travails of 2024

Considering how variable UK retail sales and consumer confidence surveys have been since the start of this year, few people would have put money on store card and retail lender Secure Trust Bank (STB) being one of the best-performing stocks in the market.

Shares in the Solihull-based firm

have trounced the FTSE All Share with a 236% advance to a two-year high of £12 as of the time of writing.

Admittedly, this follows a vertiginous fall in the stock price from 800p to less than 400p at the tail end of 2024 after the firm warned it was taking longer than hoped to recover value from excess levels of defaulted loans in its vehicle finance business and it would have to take a £10 million to £15 million provision.

That led to a round of broker

Source: LSEG

downgrades to 2024 earnings, but in the event underlying profit was better than expected, motor finance charges were just £6.9 million and the bank reiterated its medium-term target of a 14% to 16% RoE (return on equity).

The company announced earlier this year it would stop new vehicle lending and put the existing business into run-off to improve its RoE, which gave the shares a further boost. [IC]

Shares in Lloyds of London insurer Beazley (BEZ) fell sharply last week, eradicating their gains for the year, after the firm guided down expectations for premium growth from mid-single-digits to low-singledigits due to concern over market conditions.

Despite posting better-thanexpected earnings for the six months to June, the FTSE 100 firm reported just a 2% increase in written premiums which it said reflected its disciplined approach and was ‘fully aligned with our strategy of prioritising rate adequacy and longterm profitability over short-term income’.

‘The first half of 2025 confirms geopolitical uncertainty remains, technology is transforming business, and the effects of climate change are ever present, all of which are creating new risks and decreasing predictability,’ commented chief executive Adrian Cox.

‘Specialty insurance companies have an important contribution to make during this time of transition and our focus remains on how we can support growth by utilising our powerful expertise, managing the market cycle as pricing conditions normalise,’ added Cox.

Jefferies’ analyst Philip Kett suggested Beazley’s results were

‘perhaps a precursor of what lies ahead more broadly’.

‘On the one hand, investors have been delivered a strong underwriting result which beat consensus. On the other, softening rates have prompted revenue to miss, and management’s prudent cycle management has led them to reduce revenue guidance.’ [IC]

TRADING ANNOUNCEMENTS

27 August: Chesnara, Hunting, JD Sports, Macfarlane, PPHE Hotel Group

Analysts have already pared back their full-year forecasts in readiness

Back in May, sports kit retailer JD Sports Fashion (JD.) posted an impressive set of results for the year to the start of February but cautioned the outlook for the year to February 2026 was clouded by the potential impact of tariffs.

Revenue for the 12 months to 1 February 2025 was up 12%, with organic sales up 6% or more than double the market growth, while the gross margin was steady at 48% as the firm stuck to its full-price strategy in what it described as an increasingly promotional apparel market.

Following the ‘Liberation Day’ tariff announcement, and in the face of slower-than-expected market growth, the firm set out new strategic and capital allocation plans with a focus on improving shareholder returns, starting with a double-digit increase in the dividend and a £100 million share

buyback.

At the time, the company said trading in the first quarter of the year had been in line with its expectations, despite a ‘volatile’ market and uncertainty surrounding US tariffs, and it was confident it could continue to outperform its peers, improve profit margins and create ‘significant’ value for shareholders.

Data

Source:

Therefore, when the company posts its interim trading update on 27 August, investors will be keen to hear how the second quarter has panned out, whether the firm has any clarity on the impact of US tariffs, and if it is sticking with its previous forecast of around £920 million of pre-tax profit for the year to the start of February 2026.

At the time, that forecast was below the middle of the market’s range of expectations (£880 million to £980 million) and it was based on a dollar/ pound exchange rate of $1.31.

Since then, the mid-range of estimates has dropped some 5% to £887 million, while the pound has since risen towards $1.36, which would imply an impact of around £15 million. [IC]

Can the world’s first $4 trillion company continue to deliver blockbuster growth?

Having become the world’s first $4 trillion company in July, shares in Nvidia (NVDA) have stalled slightly of late as the market awaits the company’s second-quarter earnings.

Due out on 26 August, these will cover the three months to 31 July, and investors will be looking for the company to back up the strong performance evident in its first-quarter results when it posted better-than-expected earnings and revenue.

Revenue rose 69% in that quarterly period, from $26 billion a year earlier. Sales in the company’s data centre division, which includes AI chips and related parts, grew 73% on an annual basis to $39.1 billion, accounting for 88% of total revenue, making for a 10th straight quarter of consensus beats.

While the recent and unusual revenue sharing agreement with the US government – allowing the firm to recommence exports of H20 chips to China – came after the end of the period Nvidia is reporting on, the company may still be expected to provide some colour on the arrangement.

In its first quarter update, Nvidia wrote down $4.5 billion worth of inventory as a result of restrictions of Chinese exports. This was $1 billion less than had been flagged in April as chips set for China were repurposed. There will be hope a $8 billion hit flagged for the second quarter can also be mitigated.

Source: LSEG

The shares trade on 41.7 times 2026 EPS (earnings per share) and 30.5 times 2027 EPS based on consensus forecasts. Earnings have grown at a CAGR (compound annual growth rate) of 91% since 2020, on 64% compound annual growth in revenue. It is these levels of growth that Nvidia will likely need to sustain to maintain its eye-catching share price momentum in recent years. [TS]

QUARTERLY RESULTS

27 August: Agilent, Cooper, Crowdstrike, HP, JM Smucker, NetApp, Nvidia

28 August: Autodesk, Best Buy, Brown Forman, Campbell’s, Dell Tech, Dollar General, Hormel Foods, Lululemon Athletica, Marvell, Ulta Beauty

Source: Zacks

Management remains highly focused on leveraging the company’s high-density UK delivery network

The UK’s leading newspaper and magazine distributer Smiths News (SNWS) has clear value credentials with the shares trading on a miserly 2026 PE (price to earnings) ratio of 5.2 times and a twice covered dividend yield of 10.7%.

Perceptions that the business is in terminal decline are misplaced and fail to take account of growth initiatives to exploit the firm’s unrivalled expertise in warehousing, reverse logistics and early morning last mile capabilities.

We believe investors are being handsomely paid to wait for the payoff from these initiatives by reinvesting the generous dividends.

Meanwhile the core business continues to throwoff increasing amounts of free cash flow, reducing average net debt in the first half to £1.1 million from £12.5 million in 2024.

The company has secured more than 91% of existing publisher contract revenues through to 2029, providing excellent medium-term visibility.

Smiths News has committed to investing £6 million annually over the next three years to optimise warehouse operations and efficiencies in a low-risk way while also supporting growth initiatives.

These include the roll-out of Smiths News Recycle, a waste recycling collection service tailored to retail customers. Headed up by a new hire from one of the largest players in the sector, the business generated a 5% increase in new customers in the first half of the year to 1 March.

The group plans to extend these services to new customers along selected existing delivery routes in the North West region.

Management believes the size of the market is

Source: LSEG

around £230 million, growing at 3% to 5% a year, and capable of generating 10% to 15% EBITDA (earnings before interest, tax, depreciation, and amortisation) margins.

A second initiative is focused on the delivery of additional categories such as books and home entertainment to retail customers including supermarkets and grocers.

In February Smiths News started a trial with global greetings cards expert, Hallmark to deliver cards to independent retailers. The company estimates the total market opportunity from new verticals is worth £160 million.

The final growth initiative is based on leveraging the firm’s high-density network and unique position to offer final mile delivery.

The group has started a small-scale trial with several providers to deliver engineering and manufacturing specialist parts to customers along existing routes.

While still embryonic revenue from the growth initiatives was up 25% in the first half.

In summary, we believe the shares are priced as if this is a completely moribund business and give no credit for the company’s competitive advantages and emerging growth prospects.

Tangible progress from the new verticals, recycling services and final mile initiatives has been encouraging. It seems only a matter of time before the shares start to attract a more realistic rating. [MG]

Progress in the US already this year should lead to further success

Cambridgeshire-based Tristel (TSTL:AIM) is a specialist in infection prevention whose products are used in the high-level disinfecting of medical equipment. While its primary focus is on acute treatments, which typically take place in major hospitals, the trend towards more medical procedures being outsourced to clinics and community healthcare settings mean the market for its products is continually growing.

Due to fact its products are made in-house, the company has a high gross margin on sales (82%), while it is also cash-generative and debt-free, with a 4% dividend yield and a progressive policy policy,

New chief executive Matt Sassone, who arrived last year, has set a target to grow revenue by between 10% and 15% annually from 2024 to 2027,

Source: LSEG

and so far the firm is on track.

Revenue for the year to June 2025 increased by 11% to £46.5 million, but impressively growth in the second half was 15% in line with the top of the target range.

Profit before tax for the year was up 23% to more than £10 million, and the firm had a cash balance of £12.8 million, giving it the flexibility to invest in the business, buy back shares or increase the dividend.

The group’s largest market, and the one which promises the fastest growth, is the US, where it already has a commercial partner in Parker Labs, which supplies ultrasound gels, and where it has already had some notable successes this year.

Both Tristel ULT, the company’s proprietary product for use in ultrasound treatments, and Tristel OPH, for use on ophthalmic medical devices, have received approval from the FDA (Food & Drug Administration) this summer, opening up large markets.

Analysts at Cavendish believe OPH in particular offers a number of advantages over current US disinfectant products, noting the firm has already received approaches from numerous leading eye institutes to become early adopters.

Source: LSEG, data correct as of 19 August 2025

Source: LSEG, data correct as of 19 August 2025

Assuming the company can continue to deliver revenue growth in line with its target, while improving its operating margin and cash generation, which will support its progressive dividend policy, we think Tristel represents an attractive combination of growth and income. [IC]

We believe there is plenty of scope for the firm to keep growing

361p

Gain to date: 27%

When we recommended workplace benefit and health insurance provider Personal Group (PGH:AIM) just over a month ago little did we think it would have gained quite so much in quite so little time.

The stock price is now back to the highs of 2022, which is a great achievement and a ringing endorsement of chief executive Paula Constant and chief financial officer Sarah Mace’s ambitions for the business.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

Just days after we flagged the shares, Personal Group published a trading update for the six months to June showing an 11% increase in revenue to £23.3 million and a 41% jump in adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) to £5.5 million.

More than 90% of revenue came from recurring sources, providing good visibility for the full year

Oct 2024 Jan 2025 Apr Jul

Source: LSEG

and the group enjoyed high retention rates across all areas of the business.

As a reminder, the firm offers affordable insurance, with first-half annualised premium income up 12% to £38 million, and digital benefits and rewards programmes, where annual recurring revenue increased by 10% in the first half to £6.9 million.

Among the roster of existing staff benefit partners are B&Q, British Airways, DHL, Mitie (MTO), Ocado Retail and Royal Mail. Personal Group also counts universities and museums among its clients.

WHAT SHOULD INVESTORS DO NOW?

Momentum is clearly building for the group’s strong proposition, with new client wins including the BMA and the FSCS, with very little churn, while new product offerings and partner programmes are being developed all the time.

We would sit back and let the team do what they do best, which is focus on growing the business towards their medium-term targets of £100 million of annual revenue and £30 million of EBITDA. [IC]

-listed consumer goods giant Unilever (ULVR) is in the middle of a wellpublicised restructuring which involves focusing on the product ranges in its portfolio which it feels resonate most strongly with shoppers.

The decision to focus on these so called ‘power brands’ is just the latest illustration of how much brands matter,

how there is a clear hierarchy for brands, how their fortunes can fluctuate and the impact this can have on the businesses which own them.

In this article we look at brands, what makes them so powerful and what happens when a brand starts to lose its appeal. We also highlight one up-andcoming and one established brand which we think are worth investing in.

Enduring brands play a significant role in driving sales, expanding market share, and increasing shareholder value, and are central to the success of many top-performing businesses. Firms with strong brands create deep connections with consumers: their products foster self-assurance, provide status, or become indispensable everyday staples which foster loyalty.

Because of this, consumers remain willing to spend, even during difficult economic periods, to obtain their trusted brands. This, in turn, grants many brand owners impressive pricing power. Typically, the essential or desirable nature of their products offers companies with popular brands reliable, steady revenues and above-average profit margins, which are sustained through substantial marketing and innovation spending.

Building a compelling brand and continuously investing in its development gives a company a genuine advantage over rivals. This approach establishes ‘barriers to entry’—or what Warren Buffett, famed as the Sage of Omaha, describes as a ‘moat’ around the enterprise.

Buffett, who has shared much investment insight over the years, once noted: ‘In business, I look for economic castles protected by unbreachable moats.’

Here, the ‘castle’ stands for the company, while the ‘moat’ symbolises a robust competitive edge: the broader the moat, the

stronger the long-term defence.

A valuable brand, though an intangible asset in accounting terms, is one of the clearest forms of these economic moats, helping to erect barriers to entry which shield against competition.

Focusing on widening and deepening this moat not only bolsters a company’s pricing power but also equips it to withstand long-term market changes.

Buffett also famously stated: ‘The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10%, then you’ve got a terrible business.’

Conveniently for investors, many of the world’s top brands are accessible through the US stock market which, in turn, is easy to trade on most investment platforms. This includes the likes of McDonald’s (MCD:NYSE) , Visa (V:NYSE) , and Coca-Cola (KO:NYSE) .

The Kantar ‘Brandz’ ranking of the world’s most valuable brands for 2025, presented in the table, shows Apple (AAPL:NASDAQ) at the top – as it has been for several years in these lists – with a brand value approaching $1.3 trillion. Following closely behind are Alphabet (GOOG:NASDAQ) owned Google, Microsoft (MSFT:NASDAQ) , relative newcomer Nvidia

(NVDA) , and Facebook and Instagram (both under the Meta Platforms (META:NASDAQ) umbrella). Investors also have the option of tapping into the brand strength of luxury name Hermes (RMS:EPA) and streaming giant Netflix (NFLX:NASDAQ) on the stock exchange among many others.

A strong brand may give a company a decent underpinning, but it is no guarantee of success. While Apple has the most valuable brand in the world, its shares have slumped 7% year-to-date compared with a 10% advance for the S&P 500 index as it has had to contend with the impact

of tariffs on the business.

The recent struggles of Nike (NKE:NYSE) and Adidas (ADS:ETR) – which dominate the sportswear market – are also testament to the reality that a strong brand still needs careful management.

This can be seen in Nike losing share to specialists in areas like running thanks to a lack of innovation and Adidas enduring an ultimately damaging tie-up with controversial rapper Ye (formerly known as Kanye West). Compounding this, both pursued ill-fated direct-to-consumer strategies which meant their brands were not necessarily as front and centre as they had been in third-party outlets. Both are also currently in different phases of their respective recovery strategies and

are fortunate they can lean on what remain exceptionally strong brands as they look to turn around their fortunes.

Next, we consider what happens when a company’s brand starts to fade and what the potential implications are for investors.

While brands can be valuable intangible assets which support a company’s ability to raise prices and drive customer loyalties, there are many brands of yesteryear which have either lost their lustre or disappeared completely.

Therefore, it is incumbent on companies to continuously assess the effectiveness of their brands to ensure they continue to resonate with customers and drive loyalty.

One risk to watch out for, particularly in areas like casual dining or food-to-go – is cannibalisation. This can happen when a brand is expanded too aggressively, and new stores start to eat into the sales from existing nearby stores. This can lead to lower volume growth, weaker footfall and potentially, declining brand loyalty.

The iconic Greggs (GRG) sausage roll officially became a national treasure after being displayed in Madam Tussauds in the run-up to National Sausage Roll Day on 5 June.

Could that signal a peak in the popularity of the sausage roll? Some analysts believe so following a string of poor trading updates from the food-to-go food retailer.

The company attributed a slowdown in first half like-for-like sales growth to the hot weather, but some analysts have questioned the wisdom of the firm’s expansion strategy and diversification into longer opening hours.

Management insists investments are starting to payoff and investors should be patient. At the first-half update (2 July) CEO Roisin Currie insisted: ‘Through our disciplined estate expansion and focus on innovation, Greggs is evolving its offer further and making the brand more convenient for a wider range of customers.’

Greggs operates from 2,649 outlets and plans to open 140 to 150 net new sites this year, targeting locations in the south of England where it believes it is under-represented. Longer-term the company sees opportunities for ‘significantly’ more than 3,500 shops.

Whichever camp you fall into, the overexpansion narrative is gaining traction with investors who try to make money from short selling. These investors ‘borrow stock’ from a prime broker and sell them with the intention of buying the shares back at a lower price.

According to S&P Global the percentage of shares out on loan has increased from 0.3% to 6.3% over the last five months to the end of July.

However, not everyone agrees with the peak sausage roll narrative with one former shareholder telling the Financial Time s that delivering 3% to 4% like-for-like sales growth would be enough to justify investment in expansion.

Another food retailer potentially feeling the effects of overexpansion is Domino’s Pizza (DOM) which lowered full-year guidance on 5 August and signalled a slowdown in the pace of new store openings, reflecting a more cautious approach from franchisees.

A slower planning environment means the company now expects to open mid-20s new stores form around 50 stores previously.

Domino’s reported a 15% decline in first

Barratts Shoes Evans

Blockbuster HMV

Borders JJB Sports

Bristish Home Stores Maplin

C&A Phones 4u

Comet Safeway

Debenhames Toys R Us

Dixons Woolworths

Source: Google

half pre-tax profit to £43.7 million but insisted it was gaining market share against a weak consumer environment and increased employment costs.

Market share gains have been given a boost by Domino’s trial of a loyalty programme which has performed ahead of expectations in its second phase and is on track for a full roll-out in 2026.

To complement organic growth ambitions Domino’s is actively looking to add another brand to its stable but said it will revert to share buybacks should an acquisition not be found before the end of the year.

forecasts by around 20% over the last year, with no sign of let up, suggesting faltering confidence in Domino’s growth strategy.

Fashion retailer Superdry was founded in 1985 by Julian Dunkerton in Cheltenham and at its peak the brand sold in 157 countries, generating more than £600 million of annual sales, and had a market capitalisation of almost £2 billion.

A decline in the popularity of the brand resulted in the company being delisted from the London Stock Exchange in July 2024 with Dunkerton promising the retailer would shed its ‘dad brand’ image and become ‘cool’ again.

Ted Baker was a fixture on UK high streets in the late 1980s known for its quirky advertising and British fashion heritage.

Starting out as a menswear brand in Glasgow it eventually opened shops across the UK and in the US while also signing licensing agreements in Asia and the Middle East.

A combination of factors, including being slow to establish digital sales channels and a failure to adapt to athleisure trends during the pandemic reduced the appeal of a brand, which had its roots in sought-after products for special occasions.

Operating roughly 1,400 stores, Domino’s believes it can grow to 1,600 stores across the UK & Ireland by 2028, generating £2 billion of system sales and get to 2,000 stores by 2033.

Management sees opportunities in smaller address count territories where competition is less fierce and average sales performance is greater.

Investors appear less enthusiastic about Domino’s growth ambitions if the stock price is anything to go by, with the shares languishing at 10-year lows.

Not helping matters, analysts have revised down their 2025 and 2026 earnings per share

Founder Ray Kelvin stepped down as CEO in 2019 after allegations of inappropriate behaviour, which he denied. A string of profit warnings led to the brand being snapped up by US multi-brand outfit Authentic Brands for £210 million in 2022.

The US firm purchased the brand name while No Ordinary Label ran the UK stores until the company filed for administration in 2024.

Meanwhile, Authentic Brands licensed the brand to United Legwear & Apparel which runs Ted Baker’s online sales and distribution in the UK and Europe.

Authentic brands previously filed for a US IPO in 2021 then later withdrew to raise money privately. The company owns more than 50 iconic brands and generates approximately $32 billion in annual systemwide retail sales. The company was valued at $12.7 billion in its latest funding round.

Beverages business Coca-Cola Company (KO:NYSE) is a shining example of enduring profitability and sustainable growth, having thrived for well over a century, yet arguably it is still only at the foothills of its prospective global growth journey.

The value of its brand may not be at the level of the global tech giants but its longevity is, in itself valuable. It’s hard to imagine circumstances in which Coca-Cola would lose its dominant position in the soft drinks market.

Coca-Cola’s franchise model has built an immense network, enlisting six million people, 120,000 suppliers, and 3,000 production lines to serve its interests.

The company’s product portfolio extends beyond its flagship soda, including brands like Costa Coffee, Sprite, Fanta, and Dasani, boasting some 30 brands which generate upwards of $1 billion in sales on their own among its 200-strong lineup. Globally, CocaCola leads in the water, juice, and international sports drinks categories.

According to its own data, Coca-Cola commands around 14% of beverage volumes in the developed world, but a modest 7% in developing and emerging markets—a primary target for expansion.

These territories, representing 80% of the world’s population, still have enormous untapped potential, with most prospective customers yet to embrace commercial beverages.

As such they offer Coca-Cola a huge runway for future growth backed by an extremely strong portfolio of brands.

The company’s asset-light approach supports robust operating margins, superior returns on invested capital (ROIC), and abundant free cash flow. In 2024, Coca-Cola posted operating margins of 30%, ROIC of 23%, and nearly $11 billion in free cash flow.

This financial strength enables the company to maintain a dominant presence in marketing and advertising, reinvest in the business, and reinforce its competitive advantages—creating a self-sustaining growth engine.

It also leaves plenty of cash left over to pay dividends and the company promises a yield of 3% based on consensus forecasts for 2026, a level which is generous relative to the wider US market.

UK investors should note they may not get those dividends in full unless they hold the shares in a SIPP. To hold Coke in another account you’ll need to complete a W-8BEN form. As well as allowing you to deal in US shares, this form lets you benefit from the US Internal Revenue Service (IRS) treaty rate, which lowers the withholding tax for qualifying US dividends from 30% to 15%.

For more than 60 years, Coca-Cola has achieved consistent annual earnings per share growth of 8% to 9%. Looking ahead, management is aiming for 4% to 6% organic revenue growth and 7% to 9% comparable

earnings growth, excluding currency effects.

Currently, the company trades at a cyclically adjusted price-to-earnings ratio that is below its historical average, which, considering its quality and resilience, looks an attractive opportunity. [TS]

Although it might seem to be an overnight success story after sales rocketed during Covid and successive lockdowns, SharkNinja (SN:NYSE) actually traces its roots back over 20 years ago.

Initially, it sold humdrum household goods like cordless sweepers, steam mops and irons, but today it has two multi-billion-dollar brands – Shark, which is the US market leader in cleaning, ‘home environment’ and beauty appliances, and Ninja, the US market leader in kitchen appliances, grills and outdoor cooking equipment.

As chief executive Mark Barrocas likes to say, the company works for one person, the consumer, and it does it one product and one five-star review at a time.

In the last three years the group has expanded into 19 different categories, with the Shark brand now operating in 14 categories, having diversified from vacuum cleaners into items like air purifiers, fans and hair straighteners, while the Ninja brand operates in 20 categories such as juice makers, ice cream makers, coffee machines, cookware and even knives, and Barrocas believes there are still plenty of areas where the two brands can expand and take market share.

Since coming to the stock market the company has built a formidable reputation for beating estimates, and on 7 August it blew past second-quarter forecasts and raised guidance for the sixth quarter running.

The rise of home cooking during lockdown generated a tsunami of demand for gadgets like air fryers and bread-making machines, which SharkNinja was ideally placed to serve, but it has since gone on to carve out a bigger and bigger slice of the global appliance market.

Fundamental to the firm’s success is its ethos of setting out to solve problems faced by consumers either due to lack of suitable products or just poorly-designed products.

Having its products featured in the Apple (AAPL:NASDAQ) film F1: The Movie hasn’t hurt, as it has helped cement the brands in the mainstream, and the company is working on launching a unified DTC (direct to consumer) website which will give it greater control over pricing and margins.

Finally, with more than 90% of products for the US market manufactured outside China and a target of 100% by the year-end the firm is largely unaffected by trade tariffs. [IC]

9

Some of us are already changing our spending habits and our travel plans

We have already recently looked at the potential impact of climate change and warmer weather on the financial system, but what could it mean for consumer behaviour and are we already seeing signs people are changing how and where they spend their money?

In fact, from our weekly shop to our annual getaway, we are already starting to make subtle changes, and if hotter weather is here to stay it could have big implications for some businesses.

It’s hard to think of a product whose sales are more dependent on the seasons than ice cream, and right now both at supermarkets and on the seafront as temperatures head into the 30s again sales are booming.

According to broker Jefferies and data provider Nielsen, ice cream sales across Western Europe were up by 16% in volume terms and more than 22% in value terms in the four weeks to 13 July against a 4%

increase in value across all food categories.

Higher sales by value of ice cream and yoghurt, both of which have seen big price rises, helped disguise the fact sales were down in seven of the nine categories surveyed as lower volumes offset higher prices.

The big losers were chocolate, where volume sales fell 19%, and savoury snacks, where volumes were 9% lower than the same period last year.

All of which makes Unilever’s (ULVR) decision to create a standalone ice cream business containing Magnum, Ben & Jerry’s and Walls under the banner of The Magnum Ice Cream Company, so as to demerge it later this year, all the more interesting.

The business, which will be the biggest ice cream company in the world, is expected to list in London, New York and Amsterdam at the end of this year with a valuation of between £12 billion and £15 billion.

If there was any doubt the sector is hot, look no further than Goldman Sachs’ reported interest in buying into Froneri, the European ice cream joint venture formed by Swiss food giant Nestle (NESN:SWX) and French private equity group PAI in 2016.

In 2019, Froneri acquired Nestle’s US ice cream operations for $4 billion, giving it control of HaagenDazs and other Nestle brands, so the business as a whole is now valued at north of $17 billion.

Another winner from the hot weather, not unreasonably, is the soft drinks sector, according to Nielsen.

Sales by value in the four weeks to mid-July were up by 7.9% in value terms, marking an acceleration on the 7.7% rise recorded in the preceding four-week period.

As with ice cream, price was one driving factor with price and mix driving 5.2% of the 7.9% increase against 3.9% in the previous period.

UK-listed companies like Coca-Cola Europacific Partners (CCEP), Coca-Cola HBC (CCH), Fevertree (FEVR:AIM) and Britvic, now owned by Danish brewer Carlsberg (CARL-B:CPH), as well as US giants CocaCola (KO:NYSE) and PepsiCo (PEP:NASDAQ), have been making hay while the sun shines this summer.

Data from Nielsen shows strong growth in France, Italy, Spain and the UK in the period to mid-July, with Germany the only major market to disappoint.

In contrast to soft drinks, sales of beer dropped by 2.1% in value terms over the same four-week period, according to Nielsen, although in fairness in 2024 the UEFA European Football Championship took place at almost the exact same time so comparisons are somewhat distorted, and we would need to trawl through more datasets to get a clear picture.

Within household and personal goods, sales of deodorant typically increase in hot weather, as do sales of laundry care products, and this summer has been no different with Nielsen showing back-to-back growth for both categories during mid-May to midJune and mid-June to mid-July.

On the other hand, sales of cosmetics seem to have slowed sharply this summer, although skin care products and in particular items such as cooling sprays and body wipes have been strong sellers.

While one summer’s takeaways obviously doesn’t establish a trend, if climate change means longer, hotter summers and wetter winters, as seems to be the case, then we would expect these shifts to become even more pronounced as time goes on.

Interestingly, climate change is already influencing when and where we go on holiday.

According to the Financial Times, ‘hotter weather is prompting rising numbers of British tourists to shun classic summer hotspots and travel later in the year’.

It appears we aren’t alone, as ‘Germans, and others, are showing signs of doing the same,’ says the report.

The latest survey of 6,000 holiday-goers for the European Travel Commission, which represents 36 national tourism organisations, found three quarters of respondents had made at least one change to their travel habits as a result of climate change.

The top three adjustments were choosing milder destinations, avoiding those with extreme heat and monitoring weather plans before booking.

Europe’s largest travel operator TUI (TUI1:ETR) has extended its autumn booking season and is now offering flights to Crete until mid-November instead of October previously, as well as offering year-round vacations in destinations such as southern Turkey as the travel season stretches.

Another shift is where we are choosing to go on holiday, with over half of respondents in the survey avoiding major hot spots – some of which, such as Venice and Barcelona, have seen popular demonstrations against ‘over-tourism’ – in favour of less popular locations.

‘Nordic and Baltic countries have experienced rising summer demand, with marketing campaigns promoting themselves as “coolcations”,’ says the report, noting if global temperatures continue to rise then northern European coastal regions could experience significant gains in summer tourism demand as visitors flee traditional southern European destinations.

For those willing to travel out of season, and to less popular locations, there could be savings to be had.

And if the weather here is going to be as hot as the weather abroad in future, it raises the possibility the UK could become even more of a tourist hot-spot not just for foreign visitors but for those who have yet to experience the joys of a ‘staycation’.

That could boost the fortunes of the hospitality and hotel industries with chains such as JD Wetherspoon (JDW) and Premier Inn, owned by Whitbread (WTB), enjoying bumper summer takings.

By Ian Conway Deputy Editor

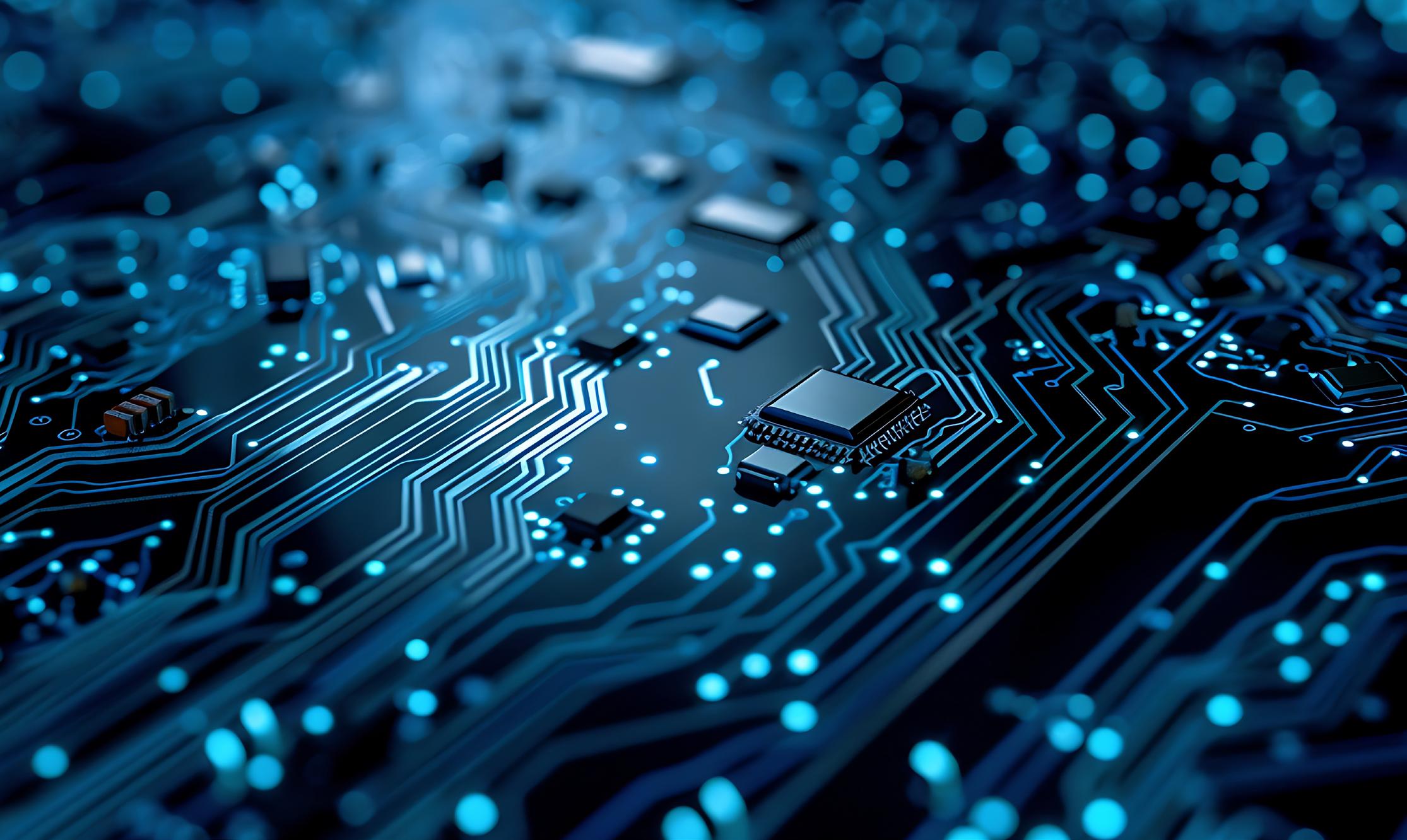

Recent volatility may play to manager Mike Seidenberg and his team’s stock picking strengths

Once again the big US tech names have been a significant driver of returns in the technology sector and the wider markets in 2025. This has not applied across the board, but certainly the likes of Nvidia (NVDA:NASDAQ) and Microsoft (MSFT :NASDAQ) have been to the fore.

Which makes it all the more impressive that Allianz Technology Trust (ATT) has been able to outperform despite effectively having no choice but to be underweight (i.e. have a lower weighting in its portfolio than these stocks do in broad technology indices) both Nvidia and Microsoft this year.

That’s because both businesses are now so large that if the trust’s manager Mike Seidenberg were to hold them at their market weighting then they would breach maximum position size limits.

OUTPERFORMING AS RETURNS START TO DISPERSE

The company’s recent results for the six months

Allianz Technology Trust (p)

to 30 June showed a total return in net asset value terms of 2.9% versus -0.2% for the Dow Jones World Technology Index (total return in sterling). Not spectacular but solid enough and there are signs that the market environment is moving in the trust’s favour.

As we hinted at the start, there has been greater

dispersion between the so-called Magnificent Seven in the last eight-and-a-half months from impressive, to decent, to disappointing to frankly pretty disastrous for Tesla (TSLA:NASDAQ).

Allianz Technology Trust has benefited from being underweight Apple (AAPL:NASDAQ) – which has been badly hit by tariff uncertainty – and fellow

Source: Sharescope, data to 18 August 2025

underperformer Tesla, where Seidenberg scaled back exposure almost as soon as he took over running the trust in 2022.

As Winterflood analyst Shavar Halberstadt observes, ATT should ‘benefit from any sustained dispersion in equity markets, given the concentration of returns in Mag7 ‘super-megacaps’ was a challenge for its diversified portfolio with a mid-to-large cap bias’.

The analyst adds: ‘ATT commendably managed to roughly keep pace with the benchmark even through that environment, but there are signs that now a more hospitable moment has arrived.’

In Halberstadt’s view the current volatility is a good fit for the trust’s active, bottom-up approach which is made possible by its on the ground presence in Silicon Valley.

Halberstadt’s counterpart at Deutsche Numis, Gavin Trodd, agrees: ‘A greater dispersion of market returns favours an active approach, and we believe the manager is well-placed to capitalise on the widening opportunity set.

‘ATT takes a bottom-up stock picking approach driven by exposure to key themes,’ continues Trodd, ‘with relatively high turnover in a dynamic, fast-moving sector, and we believe this approach and the flexibility to invest lower down in the

market cap spectrum in mid- and large-caps should serve it well in this market environment.’

As both analysts make clear, Seidenberg has chalked up solid performance since his tenure began in June 2022 with NAV total returns of 111% or 27.2% per year compared with 108% for the index (26.5% a year) and in line with rival trust Polar Capital Technology (PCT).

Included in the list of names outside the Mag7 which really contributed to performance in the first half were cloud services firm Cloudfare (NET:NYSE) and music streaming platform Spotify (SPOT:NYSE).

Among those added to the trust were Advanced Micro Devices (AMD:NASDAQ) – bought to increase the semiconductor and AI footprint in the portfolio – and Robinhood Markets (HOOD:NASDAQ). The trust sees the latter as benefiting from a strong underlying client base.

The company also took a position in business software group Intuit (INTU:NASDAQ), noting the company’s favourable execution across its suite of products and strong demand drivers as well as the introduction of AI-related features.

Exits included cloud-based monitoring and analytics platform Datadog (DDOG:NASDAQ), cloud-based relationship management outfit HubSpot (HUBS:NYSE) and cybersecurity firm Palo Alto Networks (PANW:NASDAQ).

The company also bought shares in Microsoft through period, even if for the reasons mentioned above it remains underweight the software giant.

Despite continuing to buy back its own shares, Allianz Technology saw its discount widen through the first six months of the year, although it has subsequently narrowed a touch to -8.8% currently.

Mike Seidenberg remains effusive about the impact of AI and its strength as a theme: ‘Artificial intelligence is the single most important emerging technology and has the potential to disrupt every sector,’ he says.

‘It is a horizontal technology, thus it cuts across all the various vertical industries (health care, industrial, energy, retail, etc.) and is changing corporate workflows globally.

‘Every business we interact with is testing/trialing multiple use cases due to the potential inherent power it has to offer. It has the potential to touch the three most important drivers businesses care about – sell more things, create happier customers and decrease costs – and this makes it unique.’

Seidenberg notes this is reminiscent of the move to the cloud and wider digitisation and he believes it still has greater potential than other emerging technologies like quantum computing and blockchain.

The trust has an ongoing charge of 0.64% which is lower than its close competitor Polar Capital Technology at 0.77% and the wider 1%-plus trust average.

By Tom Sieber Editor

Unquoted assets have already performed strongly over the last decade

They say that mood follows price, and in this respect, it is easy to see why private markets, and private equity in particular, are garnering so much attention, from Downing Street downwards. Even as the FTSE 100 crosses the 9,000 mark for the first time and flirts with new all-time highs, the capital return from the UK’s leading index over the past five years is 50%. By contrast, the S&P 500 Listed Private Equity Index has ripped higher by more than 130%.

Granted, the FTSE 100 has been a happy hunting ground for income seekers over that time, and the total return is far more pleasing. The ‘Leeds Reforms’ proposed by chancellor Rachel Reeves do focus on public markets, as part of a wider plan to promote investment, deregulate and boost overall economic growth, but the bigger changes may lie in

S&P Listed Private Equity index FTSE 100 (rebased)

Source: LSEG Refinitiv data

the prospect of permitting greater access to private markets, especially for retail investors.

The idea is that retail investors will be able to buy Long-Term Asset Funds, open-ended funds that offer exposure to long-term private markets, including private credit and private equity. The question now is whether this is an opportunity to embraced or spurned.

Again, the performance of private equity asset class explains why it looks such a beguiling option and potential portfolio diversifier beyond the standard options of equities, fixed income, commodities, property and cash.

The S&P Listed Private Equity index is a good benchmark for that, and it shows how investors can get access to the asset class through some of the index’s constituents, including Brookfield (BN:TSX), Blackstone (BN:NYSE), KKR (KKR:NYSE), EQT (EQT:ST) and the UK’s very own 3i (III), should they feel they fit with their overall strategy, target returns, time horizon and risk appetite.

And there are risks to consider, including the following:

● Private equity is an inherently illiquid asset class. It is not easy to buy and sell whole businesses quickly. The funds offer limited windows for redemption, if any at all, and involved lengthy holding periods as a result. It seems odd for

there be a stampede in this direction when a lot of the fall-out from the Woodford funds farrago surrounded the issue of liquidity and the needs for retail-oriented investment products to provide it.

● Private equity is long only. The funds own companies. It just happens to be all of them rather than a shareholding. In the event of a market or economic dislocation, they cannot go short or hedge. Given the use of debt, they are in some ways a leveraged play, even allowing for the diversification provided by the range of companies and assets within their portfolios. What was the largest ever private equity deal at the time, 2007’s $45 billion swoop for the Texan power utility TXU led by KKR and TPG, ended in disaster. The Great Financial Crisis hit home shortly after, to warn of the dangers of illiquidity, opacity and leverage. TXU itself went bankrupt in 2014, crushed by the debts shovelled on to it as part of the leveraged buyout.

● The lack of liquidity can mean there is also little immediate transparency on asset valuations. Private equity firms are not obliged to mark their assets to market in the way that a vanilla equity or fixed-income fund, investment trust or tracker would be.

equity firms’ shares were not immune to prior equity market bouts of volatility

● The relatively limited number of initial public offerings on global stock markets means it is currently difficult for private equity to sell and realise gains. There is a danger that newfound buyers of the asset class could simply be providing exit liquidity to shrewd sellers

● Most pressingly, private equity as an asset class has already done well, for five, ten years or more. To expect it to do as well in the next five or 10 years is therefore inherently a bold assumption (and a reflection of how mood follows price), not least because valuations are higher, particularly for the assets they wish to buy. This takes us back to the TXU example, struck just as a bull market was about to give way to a bear one.

This final point is particularly pertinent because the environment is now different from the one in which private equity’s strong, historic returns lie. Private equity’s use of debt to leverage returns looks great when interest rates are zero, but perhaps less so now benchmark borrowing costs are something vaguely akin to ‘normal.’

The debt piled onto acquired businesses now comes with a cost and could start to smother them, as the interest bills suck away cash that could otherwise be used to invest in the competitive position of the acquired company. A couple of UK supermarkets could be potential examples of this, after the acquisitions of Morrisons and Asda, as Aldi and Lidl (not to mention Tesco (TSCO)) continue to eat their lunch.

Falling interest rates could yet provide a fresh tailwind for private equity so it may not pay to be too cynical. An onrush of inflation, thanks to the Trump growth agenda of a lower energy prices, lower interest rates, lower energy prices, lower direct taxes and deregulation, coupled with central banks keeping borrowing costs down, could force investors to spurn cash and seek multiple hide-outs, including the real assets and businesses owned by private equity. But in that instance, portfolio builders may have to bear in mind the Swiss investor and publisher Marc Faber’s dark assertion that: ‘When things are really broken, the price of everything goes up.’

The type of accomodation, when you travel and what you do when you’re there makes a more significant difference

As an American living in the UK, having continental Europe on your doorstep and not hopping over for holidays seems borderline sacrilegious.

Unfortunately, my budget has other ideas. And one of the most common suggestions for enjoying a holiday on the cheap is to ‘staycation’ instead. For those unfamiliar, a ‘staycation’ is a holiday in your own country. For an American, this would just be called ‘a vacation’, but I suppose in the UK, staying in country considerably slims down the options.

I enjoy exploring the rest of the UK, but it doesn’t have the same feel as going abroad. I can’t justify buying wine because it’s cheaper than water and then there’s the weather.

In some circumstances, like visiting a family member, saving by staying in country is more or less guaranteed. But if you’re taking your own trip, and paying for a hotel, food and transport, is it really that much more to look abroad?

The obvious conditions of this question are that it depends on when and where you’re going, and where you’re going from. I’ve decided to go with the most popular choices for Brits (according to TimeOut). Starting in London and going abroad to Spain or staying in country for a trip to Cornwall, for a family of four at the end of August.

It’s also worth noting that my fake trips are being planned slightly last minute, to fit into the summer holidays. This might make the prices a little bit more than they would be otherwise, but still in the range of normalcy.

It’s no secret that traveling by rail in the UK has gotten expensive, but each time I book a ticket, it surprises me all over again.

To avoid the most expensive rates, I chose to travel on a Thursday and return on a Tuesday. For a trip to Cornwall, going from London to Penzance, it would cost a single person about £162. For a family

of four, provided the children are between five and 15, getting a 50% discount, this would mean a total price of £486.

Or, you could fly to Spain (Menorca, specifically), for about £155. Since planes are not so keen on child discounts, this would mean £620 for flights. One point for the staycation.

But what about once you get there? Most places, if you’re willing to rough it, you can find affordable places to stay. A search of Cornwall accommodations found many of the economical options are caravan parks. In Menorca, the penny pinchers would have several alternatives resplendent in 80s decor. For a once-a-year holiday, I decided to splash out a bit more with my fake budget.

So instead, I took a look at places in the four-star

range. In Menorca, I found a variety of apartments around the £1,000 mark for five nights, including amenities like a pool and... well... it really seems to be mostly about the pool and a nice ocean view.

Searching the same site for places in Cornwall, the options I found in the £800 to £1,000 range looked to be mostly homes available to rent (no pool in sight). Notably, more affordable properties were in towns that were further inland, which somewhat defeats the purpose of a beach holiday. When I narrowed down my search to waterfront properties, the price jumped considerably, to closer to £1,400 for the inexpensive options. Others breached £3,000.

To get a more accurate average, I filtered by waterfront properties with a four star rating for both locations, from lowest price to highest. The 10 lowest listed in Cornwall averaged to £2,047, while the 10 lowest listed for Menorca averaged £1,477.

It seems a waste to go to Cornwall without enjoying a little time on the waves, so factoring in a surf lesson may also be on the docket. Airbnb experiences offer a variety of options here, for

about £45 per person, board included. For a family of four, this means £180 extra pounds.

Menorca is less of a surf destination (they are apparently more into wind surfing), but for comparison’s sake, there were a few options. A surf lesson was around €40, which as of 14 August, is £34.40. However, Cornwall likely wins out on the better waves.

Like almost all of these categories, food and drink prices come down to where you pick. For a beach holiday, a nice restaurant on the bay seems like a staple choice for a night out. Many restaurants had options for entrees of about £23, with a bottle of wine ranging from £28 to £82.

In Menorca, meals were priced about the same due to the currency conversion: while many main courses sat around €28, it converts to £24. Wine by the bottle ranged from £16 to £47, although there’s always the option to save with a trip to the grocery before.

Remember, you can help yourself save on currency exchanges by using a card with low or no exchange fees and choosing the euro option when paying instead of pounds. Usually, the set pound rate is higher on the card readers.

The obvious asterisk to this article is that each location can be done far more affordably. My coworker is heading to Cornwall this weekend and staying in a campsite that costs £7 per night, and this would be a hard rate to beat abroad.

But it is worth asking if staying closer to home really helps for the type of holiday you’re looking for and having a look at where currency exchange rates sit. The devil is in the detail. Choosing the right accommodation, flight times and restaurants could be a far better determiner of trip costs than the location.

I took a trip to Menorca this spring on a £60 flight, and stayed in a reasonably priced local hotel, looked after by an enthusiastic owner named Pedro. It was worth a little extra searching.

Hannah Williford AJ Bell Content Writer

Visit the Shares website for the latest company presentations, market commentary, fund manager interviews and explore our extensive video archive.

Custodian Property Income REIT (CREI)

Richard Shepherd-Cross, Investment Manager

Custodian Property Income REIT (CREI) aims to be the REIT of choice for private and institutional investors seeking high and stable dividends from well diversified UK real estate.

Brunner Investment Trust (BUT)

Julian Bishop, Co-lead Portfolio Manager

Brunner Investment Trust (BUT) Come rain or shine, the expertly managed Brunner Investment Trust aims to thrive in all market conditions. It has stood firm in the face of changing economic seasons, volatility and market fluctuations to protect, nurture and grow shareholders’ investments. With a track record spanning more than five decades of increasing dividend payments, we’ve earned recognition as a dependable ‘dividend hero,’ steadfast in our commitment to long-term wealth creation.

abrdn Equity Income Trust (AEI)

Thomas Moore, Investment Manager

abrdn Equity Income Trust (AEI) The aim of the abrdn Equity Income Trust is to deliver equity income using an index-agnostic approach focusing on best ideas from the full UK market cap spectrum. Evaluate changing corporate situations and identify insights that are not fully recognised by the market.

EDITOR: Tom Sieber @SharesMagTom

DEPUTY EDITOR: Ian Conway @SharesMagIan

NEWS EDITOR: Steven Frazer @SharesMagSteve

FUNDS AND INVESTMENT

TRUSTS EDITOR: James Crux @SharesMagJames

EDUCATION EDITOR: Martin Gamble @Chilligg

INVESTMENT WRITER: Sabuhi Gard @sharesmagsabuhi

CONTRIBUTORS:

Dan Coatsworth

Danni Hewson

Laith Khalaf

Russ Mould

Laura Suter

Rachel Vahey

Hannah Williford

Shares magazine is published weekly every Thursday (50 times per year) by AJ Bell Media Limited, 49 Southwark Bridge Road, London, SE1 9HH. Company Registration No: 3733852.

All Shares material is copyright. Reproduction in whole or part is not permitted without written permission from the editor.

Shares publishes information and ideas which are of interest to investors. It does not provide advice in relation to investments or any other financial matters. Comments published in Shares must not be relied upon by readers when they make their investment decisions. Investors who require advice should consult a properly qualified independent adviser. Shares, its staff and AJ Bell Media Limited do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

Members of staff of Shares may hold shares in companies mentioned in the magazine. This could create a conflict of interests. Where such a conflict exists it will be disclosed. Shares adheres to a strict code of conduct for reporters, as set out below.

1. In keeping with the existing practice, reporters who intend to write about any securities, derivatives or positions with spread betting organisations that they have an interest in should first clear their writing with the editor. If the editor agrees that the

reporter can write about the interest, it should be disclosed to readers at the end of the story. Holdings by third parties including families, trusts, selfselect pension funds, self select ISAs and PEPs and nominee accounts are included in such interests.

2. Reporters will inform the editor on any occasion that they transact shares, derivatives or spread betting positions. This will overcome situations when the interests they are considering might conflict with reports by other writers in the magazine. This notification should be confirmed by e-mail.

3. Reporters are required to hold a full personal interest register. The whereabouts of this register should be revealed to the editor.

4. A reporter should not have made a transaction of shares, derivatives or spread betting positions for 30 days before the publication of an article that mentions such interest. Reporters who have an interest in a company they have written about should not transact the shares within 30 days after the on-sale date of the magazine.