BP vs SHELL

Amid merger speculation which one should you invest in?

04 EDITOR’S VIEW

Inflation is back – what does it mean for markets?

05 Nvidia poised to resume H20 sales to China with Washington’s blessing

06 Supermarket sales show households continuing to tighten spending

07 Diploma shares make new alltime high on stronger sales outlook

07 B&M continues to slump despite return to like-for-like growth

08 Can Next deliver yet another upgrade?

09 Visa seen posting 18% increase in third-quarter earnings

GREAT IDEAS

11 Why it is time to look at L’Oreal

13 Kainos is an underappreciated AI play at an attractive valuation

14 Wise maintains 2026 outlook and eyes US listing

COVER STORY BP VS SHELL

As merger speculation rumbles on which one should you invest in?

22 Could climate change trigger a financial crisis?

25 US bank profits top forecasts but shares fail to make headway

How are people managing inheritance tax amid prospect of pensions inclusion?

28 RUSS MOULD

Which chancellors of the exchequer have been best for the UK stock market?

Should I move

payers out of my SIPP to take the

Three important things in this week’s magazine

BP vs SHELL

The UK’s two ‘oil majors’ both trade at a discount to their US peers but which is the better business and which one should you own?

Why climate change could cause a financial crisis

When the US banking system cracked in the mid-2000s, regulators and policymakers stepped in to prevent a global meltdown, but if extreme weather events trigger a similar crisis, it is questionable whether anyone will be able to intervene.

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

What the changes to inheritance tax mean

for financial planning

The decision to bring pensions under the IHT umbrella from 2027 raises questions over how to pay the increased costs and has spurred some to start planning for the deadline already.

GSK shares down on news Blenrep unlikely to get US approval

Oxford Nanopore makes new 12-month high on strong first-half results

MONY

Inflation is back – what does it mean for markets?

Inflation has returned as a live topic for markets as consumer price indices creep up on both sides of the Atlantic.

The June reading for UK inflation came in at 3.6% against the 3.4% penciled in, while the US number was 2.7% versus the 2.6% anticipated. The latter was only a smidge ahead of the forecast, so why the fuss and how did the release prompt suggestions it offered evidence of the impact of tariffs?

Berenberg’s Holger Schmieding explains: ‘The June headline CPI print alone does not reveal tariffinduced price increases, but a closer look shows clear signs. Excluding car prices and volatile food and energy costs, goods prices rose 0.55% monthon-month in June – the highest increase since November 2021.

‘At this time last year, core goods excluding vehicles subtracted 10 basis points from headline annual inflation. Now, however, they add 10 basis

points – a complete reversal. This marks only the start of tariff effects.

‘Although goods make up only around 35% of the CPI (after all, the US economy is servicesdominated), with effective tariff rates near 15%, with the potential to reach 25% if US President Donald Trump follows through on his recent threats, a spike in core goods inflation could push headline inflation high enough for the Fed [Federal Reserve] to avoid considering rate cuts.’

This is probably the biggest implication for markets of renewed inflationary pressures and the Federal Reserve will have to unpick whether the impact of tariffs on inflation will be sustained or a one-off, as businesses pass on the associated costs in one go.

The uncertainty around where exactly tariffs are going to land, with the US administration’s trade policy seemingly shifting on a regular basis, makes it less likely this will be a ‘one and done’ situation.

We plan to return to the topic of inflation, how it impacts on investors and ways of seeking protection from its effects in future issues. In this week’s News section we look at how prices are moving higher in the grocery sector.

Achange of chair at BP (BP.) shows the company is responding to the volley of criticism which has come its way but as we explore in this article it is unlikely to be sufficient on its own to address problems which are more than a decade in the making.

Also in the digital magazine we look at how the US banks’ quarterly earnings were received and whether climate change could result in a financial crisis.

Nvidia poised to resume H20 sales to China with Washington’s blessing

Chip firm warns customers that bottlenecks will take time to clear

Artificial intelligence chip designer Nvidia (NVDA:NASDAQ) hopes to resume sales of its H20 processing chips to China with Washington’s blessing in what would be a major boon for a company that has suffered from US export curbs.

The H20 is a less-advanced semiconductor designed for AI workloads that comply with US export restrictions to China introduced during the Biden administration in 2023. Released in early 2024, the H20 was the top chip used by Chinese tech firms for AI training before Washington blocked its sale in April.

Nvidia is perhaps the most high-profile tech company to be caught in the crosshairs of US-China tensions over trade and technology. The tech giant has faced several rounds of restrictions that have forced it to restrict access of its most advanced chips to China. Nvidia took a $4.5 billion write-down on unsold H20 inventory in May 2025 and said sales in its last financial quarter would have been $2.5 billion higher without any export curbs.

Nvidia CEO Jensen Huang launched a recent charm offensive in China during a trip to Beijing, as the US chip giant navigates the volatile tech war between the world’s two largest economies, praising China’s open-source AI developments.

Huang also stressed the importance of the Chinese market for Nvidia in an interview with state broadcaster CCTV, noting Huawei Technologies as a formidable competitor.

Source: LSEG

The sales resumption of Nvidia’s H20 chips in mainland China will clear a hardware bottleneck and boost the country’s ambitions in AI despite lingering supply uncertainties about the highly sought-after processor, according to Morgan Stanley.

The lifting of US export restrictions on the H20 ‘removes a key near-term headwind’ for China’s

AI development’, the analysts wrote in a report that also predicts a 60% investment increase by Chinese cloud computing providers this year to an estimated 380 billion yuan, or approximately $53 billion.

However, clearing supply bottlenecks will take time and Nvidia has warned Chinese customers that it has limited supplies of H20 chips, including tech giants Alibaba (BABA:NYSE), Tencent (0700:HKG), Baidu (BIDU:NASDAQ), and ByteDance.

The lack of advanced GPUs (graphics processing units) had already led to delays in upgrades to China’s latest large language models, such as DeepSeek’s highly anticipated model R2, according to Morgan Stanley.

Despite the tech curbs, Nvidia reported record first-quarter earnings and revenues in May, catapulting the share price to $173 all-time highs and making the company the first in history to command a market cap above $4 trillion. The Santa Clara-based firm is set to report second-quarter results on 27 August. [SF]

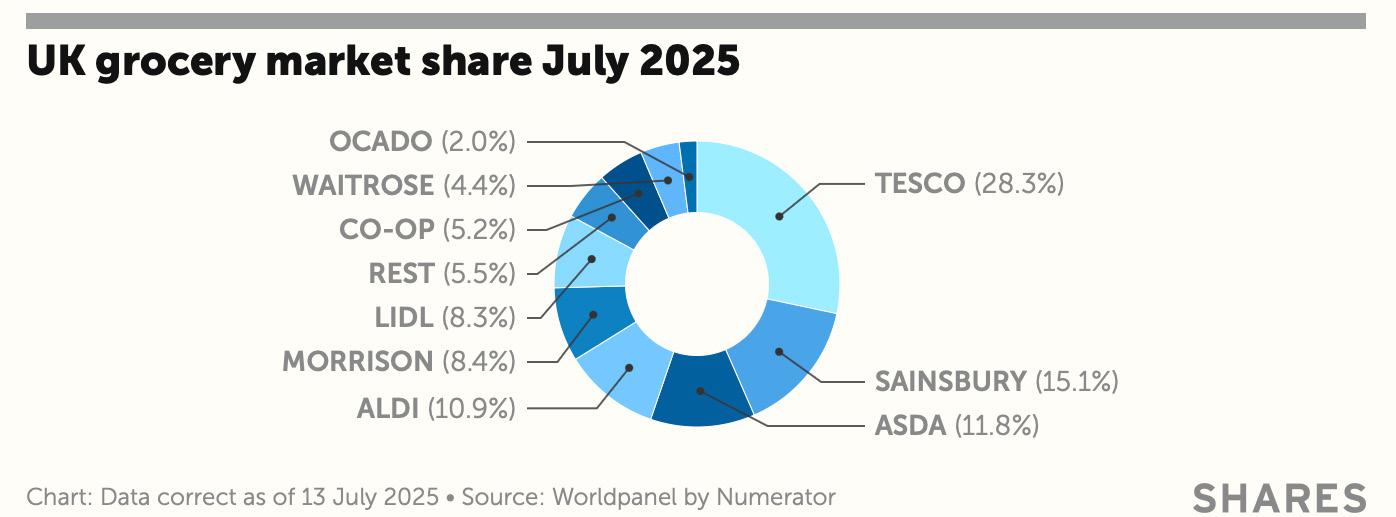

Supermarket sales show households continuing to tighten spending

Grocery prices are rising at twice the rate of six months ago, pressuring budgets

The uptick in UK CPI (consumer price index) to 3.6% in June from 3.4% in May – and just 2.5% in December – was largely attributed to a sharp increase in housing and energy costs, which are growing at an annual rate of 7.5% according to the ONS (Office for National Statistics).

However, food price inflation has also increased since the start of the year, so whereas at the end of 2024 supermarkets were charging around 2.6% more than the previous Christmas, last month prices were rising at 5.2% or double that rate.

This was confirmed by the latest till roll figures from Worldpanel by Numerator (formerly Kantar), which showed grocery prices increased by 5.2% in the four weeks to 13 July.

Given total sales grew by 5.4%, that means we bought roughly the same amount of goods we did a year ago but almost all of the increase in sales was down to inflation.

are very concerned about the cost of their grocery shopping, and people are adapting their habits to avoid the full impact of price rises,’ adds McKevitt.

Customers are heading to the supermarket more frequently, but the average basket size is shrinking and spending on promotions has risen toward 30% of the total.

Also, sales of own-label goods are growing faster than branded goods and we are cooking simpler meals with fewer ingredients to keep costs down.

The discount, or ‘limited-assortment’ chains, are naturally benefiting as more customers switch their allegiance, with sales at Aldi and in particular Lidl outpacing the market.

If people’s shopping habits stay the same, the increase in inflation could add £275 to the annual shopping bill says Worldpanel’s head of retail and consumer insight Fraser McKevitt.

‘Just under two-thirds of households say they

Over the last three Worldpanel reports spanning mid-May to midJuly, Aldi has grown its sales by an average of 6.5% against 4.6% for the market while Lidl has racked up 11.1% growth.

As a result, the two chains now account for almost one pound in every five spent in the UK on groceries, more than Sainsbury’s (SBRY) but still less than Tesco (TSCO), which accounts for just under one pound in every three.

The main losers in the battle for customers’ wallets appear to be Asda and Morrisons, both of which were taken over by private equity and both of which have lost market share this year. [IC]

Diploma shares make new all-time high on stronger sales outlook

Organic growth and acquisitions drive top-line acceleration

We have said it before, but there’s nothing better than a ‘boring’ company which quietly goes about its business and compounds earnings at a higher rate than the market, and once again specialist distributor Diploma (DPLM) has proved our point.

The group, which makes and distributes seals, controls and life sciences equipment to customers across the globe, posted a short third-quarter trading update revealing organic sales growth had hit 10% over the

nine months to June and it was raising its full-year guidance.

For the second time this year, the firm increased its like-for-like revenue growth forecast, this time from 8% to 10%, while maintaining its 22% operating margin target. Diploma also said it had made two ‘quality’ acquisitions during the year, a Danish seals business and a UK in vitro diagnostics company, signaling its entry into a new market.

Acquisitions are key to the longterm growth of the business – last year the company acquired US-

B&M continues to slump despite return to like-for-like growth

Market remains unimpressed with retailer’s inability to capitalise on its value credentials

Warmer weather and soft comparatives helped embattled shopkeeper B&M (BME) return to likefor-like growth in its core UK business in the first quarter to 28 June 2025.

However, this growth came in at the lower end of market expectations and the variety goods discounter warned of lower margins in some general merchandise categories, raising fears of a potential margin reset.

with the retailer’s inability to deliver meaningful like-for-like growth and new chief executive Tjeerd Jegen has his work cut out in turning the company around.

With consumers counting the pennies, business should be booming at a value-focused chain like B&M, so the market is clearly losing patience

Group revenue rose 4.4% in the first quarter driven by growth from new space and positive quarterly like-for-like performances in both the B&M UK and B&M France chains.

While UK like-for-like sales rose 1.3%, improving from a 1.8% decline in the fourth quarter, this was shy of the 2% to 3% increase analysts were expecting.

based Peerless Aerospace Fastener for £236 million with the assurance it would deliver a high-single-digit lift to earnings in its first year. Fast-forward to May this year and the firm reported a 14% increase in first-half revenue, driven by 9% organic growth at the group level and 16% in Controls, where the firm said Peerless had ‘excelled’. [IC]

Source: LSEG

B&M’s statement noted negative like-for-like sales in FMCG (fast moving consumer goods), where further work to ‘strengthen the proposition’ continues, while the retailer warned ASP (average selling price) deflation had led to ‘a lower trading gross margin year-on-year in some general merchandise categories’. [JC]

UK UPDATES OVER T HE

NEXT 7 DAYS

FULL-YEAR RESULTS

29 July: Altitude, IG Design

30 July: Hargreaves Services, Ondo Insurtech

FIRST-HALF RESULTS

25 July: Jupiter Fund Management, Rightmove

28 July: RTC, Science Group

29 July: AstraZeneca, Canal+, Convatec, Croda International, Essentra, Greggs, Inchcape, Morgan Sindall, Restore, Shaftesbury Capital, Staffline, SThree, Unilever

30 July: BAE Systems, Franchise Brands, Greencoat UK Wind, Hostelworld, HSBC, Rathbones, Rio Tinto, Taylor Wimpey

31 July: Abrdn, Anglo American, Elementis, Endeavour Mining, Haleon, Hammerson, London Stock Exchange, Melrose Industries, Mondi, Rentokil Initial, Robert Walters, Rolls Royce, Schroders, Segro, Standard Chartered

TRADING ANNOUNCEMENTS

25 July: Airtel Africa

31 July: Next

Can Next deliver yet another upgrade?

We’ll soon discover if heatwaves have been a help or a hindrance to the clothing giant

Best-in-class retailer Next (NXT) has delivered 11 upgrades to earnings forecasts in the last three years, the latest (8 May) driven by warm spring weather in the first quarter to 26 April. Consequently, there is pressure on the fashion-to-homewares seller to raise guidance for a 12th time with its second-quarter update on 31 July.

Investors will want to learn if Next has benefited from Marks & Spencer’s (MKS) cyber-attack and sustained its strong overseas performance, and to hear CEO Simon Wolfson’s thinking on the share buyback, paused following a share price surge which meant the economics of buying back stock were

no longer so compelling.

Balmy temperatures helped send full-price sales 11.4% higher year-onyear in the first quarter, way ahead of management’s expectation of a 6.5% increase, as the better weather coaxed consumers to its retail outlets.

As a result, Next nudged its year-toJanuary 2026 pre-tax profit guidance up by £14 million to £1.08 billion, implying 6.8% year-on-year growth.

However, the notoriously conservative company refrained from upgrading sales guidance for the rest of the year, warning the warm weather may have pulled forward sales. There is also the risk the recent run of heatwaves kept cash-strapped British consumers indoors, sapping second-quarter sales.

The FTSE 100 company’s run of upgrades demonstrates that retailers can thrive, regardless of what the weather does, if they sell the right product at the right price point in the right format for the target customer base.

Next has the knack of getting this right, but in common with retail rivals, is grappling with frail consumer confidence as well as higher wage and national insurance costs. [JC]

Source: LSEG

Visa seen posting 18% increase in thirdquarter earnings

Results from other credit card issuers suggest spending remains resilient

The message from Wall Street so far this earnings season seems to be the US economy and the consumer are doing all right.

Jamie Dimon, head of JPMorgan Chase (JPM:NYSE) and someone who has warned of investors being complacent about the market and the risks to the economy, even admitted things were better than predicted as the global bank comfortably beat second-quarter earnings estimates.

‘We’ve basically been in this soft landing now for some time period,’ said Dimon, adding: ‘It’s been resilient. Hopefully that will continue.’

Spending at JPMorgan’s credit card business rose 7% during the second quarter, while at Citigroup (C:NYSE) spending rose by 4% over the period and customers increased their outstanding balances, increasing the bank’s revenue.

‘The consumer basically seems to be fine,’ added JPMorgan’s chief financial officer Jeremy Barnum.

Card issuer and Visa (V:NYSE) rival American Express (AXP:NYSE) also posted strong second-quarter

earnings thanks to resilient spending by its more affluent customers.

Total revenue rose 9% to $17.9 billion, topping the $17.7 billion consensus, while earnings per share of $4.08 were also above the $3.89 forecast by analysts, although the company did increase its provision for loan losses slightly to $1.4 billion from $1.3 billion a year ago.

While it may not present a picture of the whole economy, due to its focus on high-end cardholders, AmEx does give some insight into how more credit-worthy customers are behaving.

Visa, which has beaten estimates for the last four quarters in a row, is expected to post an 18% increase in earnings per share to $2.86 from $2.42 a year ago when it reports its third-quarter results on 29 July. [IC]

What the market expects from Visa

US UPDATES OVER THE NEXT 7 DAYS

QUARTERLY RESULTS

25 July: Aon, Centene, HCA, Phillips 66

28 July: Brown&Brown, Cadence Design, Cincinnati Financial, Hartford, Nucor, Principal Financial, Waste Management, Welltower

29 July: American Tower, Boeing, Booking, Corning, Ecolab, Electronic Arts, Merck&Co, Mondelez, PayPal, P&G, Royal Caribbean Cruises, Seagate, Starbucks, UnitedHealth, United Parcel Services, Visa

30 July: Albermarle, Arm, DexCom, Ford Motor, Garmin, Hershey Co, Meta Platforms, Microsoft, MGM, Prudential Financial, Qualcomm

31 July: AbbVie, Air Products, Amazon. com, Apple, Biogen, Bristol-Myers Squibb, Comcast, Eastman Chemical, First Solar, Mastercard, MercadoLibre, MicroStrategy, Moderna, Motorola, Norwegian Cruise Line, Paramount Global, S&P Global, Willis Towers Watson

WATCH RECENT PRESENTATIONS

Aram Advisors/ Scotch Corner

Richard Croft , Director & Simon Waterfield, CEO

A newly launched segment of the Aquis Stock Exchange Growth Market, a dedicated marketplace for real estate and infrastructure investment, offering investors access to the world’s largest asset class through a fully regulated and liquid public market.

Manx Financial Group (MFX)

Douglas Grant, Group CEO

A diversified financial services listed entity offering a customer-focused range of deposit, lending, insurance, and wealth management products. The Group includes an established independent bank with both a UK and Isle of Man deposit taking licence, as well as market leading lenders in their field.

Rome Resources (RMR)

Paul Barrett, CEO

A critical minerals exploration company active in the DRC. Its main project is Bisie North, a tin and copper deposit some 8km from the world’s highest-grade tin mine. The Company has been drilling since Admission to AIM in 2024 and is approaching the end of its programme which will lead to the posting of a maiden resource estimate.

Why it is time to look at L’Oreal

The French personal care powerhouse is a high-quality, cashgenerative business with beautiful long-run growth prospects

L’Oreal (OR:EPA) €361.30

Market cap: €193 billion

An 11.5% one-year share price decline at French cosmetics giant L’Oreal (OR:EPA) presents investors with a beautiful opportunity to buy a high-quality global business, with a track record of solid organic growth and smart acquisitions, trading at a substantial valuation discount.

A core beauty pick rewarding investors with progressive dividends and share buybacks, L’Oreal faces short-term challenges in China and North America and tariff worries weigh on sentiment toward the stock.

Yet L’Oreal’s gross margins are wide enough to absorb tariff hikes, and the €193 billion cap remains well-placed for long-term growth driven by price increases and premiumisation, and offers a play on the rapidly-growing dermatological beauty market too, since consumers are eager to slow the effects of ageing on their skin.

2025’s beauty industry slowdown is priced in and Shares sees scope for a re-rating, possibly starting with L’Oreal’s first-half results (29 July), should analysts feel sufficiently confident to upgrade fullyear estimates, perhaps drawing confidence from improving trends in North America and China.

YOU’RE BEAUTIFUL

Paris-listed L’Oreal is the world’s largest cosmetics and beauty company with a focus on hair colour, skincare, sun protection, make-up, perfumes and haircare.

Backed by the Bettencourt family, the beauty behemoth’s investment attractions are spearheaded by its flotilla of strong brands including L’Oreal Paris, Yves Saint Laurent and Maybelline New York, not to mention Garnier and luxury beauty brand Aesop, the latter with significant growth potential in China and travel retail.

These powerful brands confer pricing power on a business with a successful innovation pipeline which delivers high returns on equity and has a record of outperforming global beauty market rivals.

Bulls believe L’Oreal’s marketing excellence – the

Regional and category sales breakdown - 2024

Regional and category sales breakdown - 2024

(%)

(%)

Latin America (8)

Latin America (8)

SAPMENA - SSA* (9)

SAPMENA - SSA* (9)

North Asia (24)

North Asia (24)

Europe (33)

Europe (33)

personal care products along with a burgeoning global ageing population.

Rising financial independence among women and increasing beauty awareness among men are additional drivers, and there are long-run growth opportunities for cosmetics leaders like L’Oreal in emerging markets including China.

Another market driver is social media, where influencers on Instagram and TikTok can boost demand for new cosmetics products.

North America (27)

North America (27)

Led by chief executive Nicolas Hieronimus, L’Oreal has a track record of best-in-class execution and should continue to deliver organic sales growth above the household and personal care average over the medium to long term.

*SAPMENA - SSA is South-Asia Pacific, Middle East, North Africa, Sub-Saharan Africa

*SAPMENA - SSA is South-Asia Pacific, Middle East, North Africa, Sub-Saharan Africa

Source: L'Oreal annual report

Hair colouring (8)

Source: L'Oreal annual report

Fragrances (14)

Haircare (16)

Skincare and sun protection (39) Makeup (19) Other (4)

*SAPMENA - SSA is South-Asia Pacific, Middle East, North Africa, Sub-Saharan Africa

Source: L'Oreal annual report

company is the largest advertiser in the beauty industry by some stretch - and unrivaled brand portfolio will drive accelerating market share gains and higher profitability over time.

PRETTY RESILIENT

While the global beauty market has undergone a post-pandemic normalisation, consumers continue to set aside cash for affordable luxuries such as cosmetics which make them feel good about their appearance and add a little glamour to their lives.

One reason for this is the resilience cosmetics tend to exhibit through economic cycles, often referred to as ‘the lipstick effect’, based on the evidence consumers are willing to treat themselves to little luxuries during tough times.

Growth drivers for cosmetics include the widespread increase in the use of skincare and

Results for the first quarter of 2025 (publsihed 17 April) showed solid 3.5% like-for-like growth with the group ‘moderately’ outperforming a tougher global beauty market.

‘In what has been a particularly challenging and volatile operating environment, L’Oreal has started the year with growth in line with our projections,’ said Hieronimus.

‘There were some good and some less good surprises: the US was more challenging than anticipated, while China was slightly better than expected. Europe was, once again, our single largest growth contributor and emerging markets remained dynamic.’

AND LOOKING CHEAP

L’Oreal has suffered a de-rating with growth slowing due to a tougher consumer backdrop and the market worried about continued weakness in China as well as the impact of Trump’s tariffs on the business.

Risks to consider include a delayed or smallerthan-expected recovery in the Chinese beauty market, or the potential for trade tensions to escalate in Asia and for Western beauty brands to become less desirable as a result, which could have a negative effect on growth forecasts.

For the current year to December, the consensus calls for a slight dip in earnings per share from €12.90 to €12.80 ahead of a rebound to €13.90 in 2026.

Based on next year’s estimates, L’Oreal shares are cheap relative to their own history on a forward multiple of 26 times, significantly below the stock’s 35-year mean valuation of 37 times, reversion to which would imply a share price of €514, more than 40% above current levels. [JC]

Kainos is an underappreciated AI play at an attractive valuation

Investors should buy this quality business as it emerges from a difficult period

Kainos (KNOS) 720p

Market cap: £873.3 million

After a difficult period for the business, not helped by uncertainty around government spending, we think software and digital transformation specialist Kainos (KNOS) is on the road to recovery.

What’s more, weakness in the share price over the last 12 months has created an attractive entry opportunity with the rise of artificial intelligence likely to act as an underappreciated driver for the group.

Shore Capital analyst Martin O’Sullivan says: ‘Often overlooked in the hyperbole around AI chatbots and innovation, IT services specialists play a crucial role in turning AI ambitions into reality.

‘These firms provide the essential expertise, infrastructure and project management skills needed to integrate AI solutions seamlessly into existing systems and workflows across diverse industries. They act as the vital bridge between cutting-edge AI technologies and practical, scaleable deployment.’

The Belfast-based business is a FTSE 250 constituent which essentially does three things.

Digital Services helps typically large organisations reshape their processes and operations for a 21st century digital world, and is a key supplier to UK government departments, often writing bespoke tools and software.

As Canaccord Genuity analysts observe, the recent Treasury spending review is a positive development for Kainos and its peers.

‘After a bleak 2024 for most UK government digital transformation/IT services suppliers, the spending review by the UK chancellor creates funding and planning certainty for central government departments as well as the NHS for the next four fiscal years. In addition, it emphasises

Kainos

Source: LSEG

digital transformation as a key tool to drive government efficiency.’

Then there is Kainos’ Workday (WDAY:NASDAQ) practice. This is delivered in partnership with the $71 billion US enterprise human resources and financial planning software platform, which provides clients with testing, training, installation and audit for the platform, as well as designing new products to enhance the Workday platform.

Analysts estimate the UK’s digital services market will expend to £5.2 billion by 2027, while Kainos’ two Workday divisions are positioned to benefit from the performance of the software giant’s own rapid growth.

Kainos itself observes its enhanced partnership with Workday underpins a £100 million 2026 annual recurring revenue target and its new 2030 target of £200 million.

Kainos cut its global workforce by 7% at the start of the year as it responded to subdued market conditions, which should help support margins.

The shares trade on 17.9 times forecast earnings for the 12 months to 31 March 2026 and, underpinned by strong cash generation, offer a forecast yield of 3.8%. The company also unveiled its latest share buyback programme, worth £30 million, alongside May’s full-year results. [TS]

Wise maintains 2026 outlook and eyes US listing

Wise had 9.8 million customers in the first quarter, up 17% year on year and 5% quarter-on-quarter

Gain to date: 6.6%

In late April, we highlighted Wise Group (WISE) as a major winner in the circa $14 trillion cross-border payments industry given its laser-like customer focus and strong technology offering.

To give a sense of scale, in the year to March 2025 Wise helped around 15.6 million individuals and businesses process over $185 billion in cross-border transactions, saving customers around $2.6 billion.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

On 5 June, Wise revealed revenue and profit growth for the year to 31 March ahead of market expectations and reiterated its 2026 and mediumterm guidance.

To recap, Wise expects 2026 underlying income to grow between 15% and 20% and a pre-tax margin at the upper end of its 13% to 16% target range. In the medium-term, the company also expects income growth in the 15% to 20% range and a pre-tax margin range of between 13% and 16%.

The company also announced plans to move its primary listing to the US, while retaining a secondary UK listing.

Wise believes the move will provide the company with access to a wider pool of investors, generate greater liquidity, provide a pathway to index inclusion, build brand awareness and accelerate growth in the US.

Source: LSEG

B’ shares, criticised the company for extending its dual-class status for a further 10 years as part of its plan to list in the US.

Shareholders are due to vote on the plan on 28 July.

In a surprise turn of events (21 July), co-founder Taavet Hinrikus, who owns around 5% of the ‘Class

First-quarter results (17 July) came in shy of consensus with income growth of 14% undershooting the firm’s guidance, caused by a combination of foreign exchange headwinds, tough comparables and a price reduction impact.

Despite the miss, Wise maintained its full-year guidance as comparables are expected to get easier and there are no further planned price reductions.

WHAT SHOULD INVESTORS DO NOW?

Wise continues to deliver on its growth plans and has only just scratched the surface of the global opportunity, while its competitive advantages continue to build. Stick around for the longterm [MG] Wise (WISE) £10.21

BP vs SHELL

As merger speculation rumbles on which one should you invest in?

By Tom Sieber Editor

The divergence in fortunes between Shell (SHEL) and BP (BP.) in recent times has been striking and arguably reached its apotheosis with reports in June 2025 the former was set to make a bid for the latter.

Shell has consistently poured cold water on this speculation but, if nothing else, the fact a rumour

which has done the rounds multiple times over the years actually had a ring of credibility on this occasion reflects the relative standings of the two businesses.

This article aims to unpick how we got here and how the investment cases for both businesses stack up today.

vs Shell

year comparison chart

SHELL’S ADVANTAGE A DECADE IN THE MAKING

In our view, Shell’s stronger position is more than a decade in the making. Looking at the relative performance of their shares over the last 20 years, it is evident that, after briefly outperforming in the mid-noughties, BP has not kept pace ever since the Deepwater Horizon disaster and resulting oil spill in the Gulf of Mexico in April 2010.

That crisis and its fall-out consumed a significant amount of the company’s resources and management time which could have been directed towards developing a long-term strategy for the business.

The company finally agreed a $20.7 billion fine – the largest environmental damage settlement in US history – in April 2016, and also paid out billions of dollars in damages to affected individuals and businesses while incurring hefty clean-up costs.

BP is still paying off the fine agreed nearly 10 years ago, with payments set to be made up until 2034 under the terms of said agreement.

Its market valuation, which at one point before the disaster was higher than Shell, is now just 40% of that of its domestic rival, though whether this genuinely makes it an easier-to-swallow target is a subject we will return to later.

BP AND SHELL 101

Both companies are global integrated energy firms which means they operate worldwide across the entire oil and gas ecosystem from upstream (exploration and production) to downstream (refining, marketing and distribution to end-users) and midstream (transportation and storage). They also have modest investments in clean energy. BP employed more than 100,000 people in 2024, while Shell’s headcount is above 90,000. Shell is the third largest company and BP the ninth largest company in the FTSE 100 by market valuation.

In more recent years, BP has been dogged by issues with management – CEO Bernard Looney leaving under a cloud after failing to disclose personal relationships with colleagues – and a poorly-received and subsequently abandoned energy transition strategy.

NEITHER PERFORMING NOR TRANSFORMING

When first announced in February 2020, the ‘performing while transforming’ plan revealed ambitious goals around reducing the firm’s reliance on oil and gas production and shifting into renewables.

The problem was that said oil and gas production generated most of the cash flow which paid the bills and, crucially, facilitated returns to shareholders.

The pandemic obviously did not help as energy prices crashed, with both BP and Shell using this as an opportunity to reset their dividends (Shell cutting its payout for the first time since the Second World War), but what really shifted the calculus was the invasion of Ukraine by Russia in early 2022. As well as boosting energy prices, it also pushed the focus from the energy transition to energy security.

Both BP and Shell, which had its own transition strategy, subsequently dialed back on their green push. The former has been under particular pressure to do so from activist investor Elliott since it joined the shareholder register at the beginning of 2025.

BP vs Shell

Dividends per share (Rebased to 100)

Current BP chief executive Murray Auchincloss unveiled a renewed focus on hydrocarbons at an investor day in February, but most parties, including Elliott, seemed to feel what had been announced did not go far enough.

The departure of chair Helge Lund, who is set to be replaced by former CRH (CRH:NYSE) CEO Albert Manifold, reflects the perception he is a key architect of BP’s recent problems.

One of the concrete measures unveiled by the company was a series of disposals – including the Castrol lubricants business – but the suggestion is Auchincloss and his team are struggling to achieve the price tags they are looking for from potential suitors.

It doesn’t help that BP’s problems, including a stretched balance sheet, are well known, which puts it in a less-than-ideal negotiating position.

The company at least made some progress on this front in July 2025 when it divested its US onshore wind business for an undisclosed sum.

MOVING FURTHER AND FASTER

Shell has moved further and faster under CEO Wael Sawan, who took the helm in January 2023 having served time in the company’s gas operations.

Sawan has adopted a hard-nosed attitude as he looks for Shell to play catch up with US peers, with any investments in green energy having to pay their way, and Shell has outperformed the S&P 500 Energy sector over the course of Sawan’s tenure.

That is not to say it has always been smooth sailing for Shell either but, free from the sort of legacy created by the Macondo disaster and with a more stable management in place, the company has had a more coherent long-term strategy.

Much of this has centred around natural gas which appears to have a role to play as countries slowly wean themselves off more polluting fuels like coal and oil.

The £36 billion acquisition of BG, which completed in 2016, substantially bolstered Shell’s footprint in LNG (liquefied natural gas). In 2024 the company’s Integrated Gas division, which incorporates LNG, accounted for more than 50% of its earnings.

It is also a key driver of cash flow for the group and, while returns are heavily tied to oil

Shell vs S&P 500 Energy

BP and Shell key metrics and financials

Source: Stockopedia, data as at 16 July 2025

WHAT IS RECENT TRADING LIKE AT BP AND SHELL

Looked at through the lens of their most recent comments on trading BP is actually outshining Shell.

On 11 July, in its usual teaser ahead of quarterly results, BP stated it expected secondquarter upstream output to be higher than in the first three months of 2025. The Customers & Products segment is projected to benefit from increased refining margins, estimated between $300 million and $500 million, alongside a higher level of turnaround activity. The oil trading result is also anticipated to remain strong. However, BP’s second-quarter results are likely to reflect the impact of lower oil and gas prices, following a decrease in crude prices attributed to OPEC+ countries unwinding self-imposed production cuts in April. According to the company, average crude prices were $67.77 per barrel in the second quarter, compared to $75.73 in the first quarter.

Shell issued an updated outlook for its Integrated Gas unit production in its own preresults announcement on 7 July. The company forecast output of 900,000 to 940,000 barrels of oil equivalent per day (boepd) in Integrated Gas, relative to the previous range of 890,000-950,000 boepd reported in its first-quarter results. Expected LNG volumes are now 6.4 million to 6.8 million metric tonnes, with the upper end reduced from 6.9 million and the lower end raised from 6.3 million.

Shell indicated second-quarter trading and optimisation results in Integrated Gas and Chemicals & Products would be significantly lower than those posted in the first quarter. For Upstream, Shell’s second-quarter output forecast is 1.66 million to 1.76 million boepd, with the lower end revised upward from the previously stated 1.56 million in the first-quarter outlook.

price linked contracts, the scale of the business means it can operate profitably against most market backdrops.

WHY SHELL IS A BETTER INVESTMENT THAN BP

Despite BP’s bombed-out share price, with the stock trading at its lowest level in more than three years, we would regard Shell as a much more attractive investment – on the important condition it does not take the plunge and actually pursue a deal with BP.

One big sticking point we would have with any merger is the borrowings Shell would have to absorb.

Berenberg analyst Henry Tarr observes: ‘BP is significantly more geared than Shell, with gross debt at end-2024 of $71 billion including leases, and $88 billion including hybrids, and this leverage eats into free cash flow generation.’

Tarr adds: ‘While we can see a path to significant cost savings and synergies on paper, in practice such a merger is always complicated. The culture of the two organisations has historically been quite different, which could prove challenging in achieving the synergies quickly.

‘A deal of this size would inevitably be the defining moment for Shell’s management team, which are only two years into shaping Shell into a more competitive business.’

AVOIDING A POTENTIALLY MESSY DEAL

This is a key point for us, Shell should stick to its knitting and Sawan should not budge from his stance that the best use of excess capital is buying back the company’s own shares.

Assuming it does so, then Shell could represent a useful addition to portfolios, as long as investors are comfortable with the inherent volatility in the company’s business, the longerterm risks around the energy transition and any ethical qualms about the company’s impact on the environment.

On valuation grounds, while Shell has a slightly lower dividend yield than BP, 4.5% versus 5.4%, it actually trades on a lower earnings multiple. Catalysts for the share price include new upstream developments in Latin America and further LNG projects which should help to grow free cash flow growth and thereby underpin returns to shareholders.

Emerging markets: a game of two halves

Gabriel Sacks , Co-Manager of abrdn Asia Focus plc

Emerging markets (EMs) are no longer routinely regarded as the investment arena’s equivalent of the Wild West. Once readily associated with risk, volatility and even the unknown, they are increasingly acknowledged as home to a remarkable range of opportunities.

Even so, they continue to give rise to some intriguing questions. One is whether EMs are better accessed through local investment managers rather than through managers based outside a specific country or region.

This consideration recently came to mind when I read about Carlo Ancelotti’s appointment as coach of the Brazilian national football team. An Italian, Ancelotti is the first foreigner to take the reins of the Seleção since Argentina’s Filpo Núñez oversaw a single friendly in 1965.

It ought to be a match made in heaven. Brazil are the most decorated side in the history of the World Cup, while Ancelotti is the most decorated manager in the history of European football. Logically, trophy after trophy should follow.

Yet many fans are dismayed. They see Ancelotti’s recruitment as a betrayal of Brazilian culture. They claim his success elsewhere does not automatically mean he understands the unique and cherished elements ofojogobonito – “the beautiful game”.

I should make clear at this juncture that I am Brazilian and a life-long

Seleção fan. Yet I am firmly in the pro-Ancelotti camp – and not just because Brazil’s form of late has been so abysmal that it seems any idea, however outrageous it might prove, must be worth a whirl.

I should also make clear that I co-manage an Asia-focused fund yet spend much of my time in the UK. You may therefore be unsurprised to learn I am also in favour of accessing EMs through non-local investment managers.

There are two points I ought to stress without further delay. The first is that I am certainly not aligning my own achievements with those of Carlo Ancelotti. The second is that

there are important nuances at play here, as I will attempt to explain next.

PROS AND CONS

It is useful to first reflect on why non-local managers could be disadvantaged. The most obvious potential drawback is a lack of indepth knowledge of the businesses and markets in which they invest.

The less you know about a company or a country, of course, the more vulnerable you are to unpleasant surprises. Unfamiliarity with the “terrain” could lead to a manager being mistaken, misguided or even misled.

As with Brazil and Ancelotti, cultural

aspects may also enter the reckoning. These can differ not only from nation to nation but from business to business, not least in a region like Asia.

Take South Korea, where corporate life is rooted in a blend of extraordinary politeness and rigid adherence to hierarchy. As in so many EMs, the country’s past, attitudes and even eccentricities can play a significant role in investment choices – which is why it is vital to be aware of them.

So what about the flip side? A key benefit of being non-local is often that a manager is not consumed by the dominant domestic narrative.

For example, imagine an EM is in the midst of a political crisis. Most local managers would likely be depressed about the outlook for the economy, as the prevailing mood music would drown out almost everything else.

As a result, they might miss evidence of cycles or fail to discern the ways in which their own market retains an edge over others. In effect, “noise” could blind them to

opportunity.

By contrast, non-local managers may recognise circumstances they have already encountered in other EMs. They could be better able to draw useful parallels and comparisons. Maybe above all, they might be sufficiently detached to appreciate an EM’s place in the wider investment world.

ON-THE-GROUND KNOWLEDGE AND GLOBAL INSIGHT

By now it ought to be apparent that there is something to be said for a “best of both worlds” approach to EMs. Ideally, a balance should be struck between local expertise and a “bigger picture” perspective.

You may recall I mentioned spending much of my time in London. Crucially, I do not spend all of my time there.

Our team specialises in Asian smaller companies, which means we want to identify the brightest hidden gems across the region. In our view, we can fulfil this objective only if we have an on-the-ground presence and genuinely global resources at our

disposal.

Accordingly, we use an investment process that is centred on in-depth research and direct engagement. We carry out both quantitative and qualitative analysis – some at first hand, some from afar.

To put it another way: our stockpicking is driven from the bottom up and from the top down. We see merit both in “being there” and in adopting a broader view.

Ultimately, it is a matter of combining micro and macro factors in an effort to arrive at fully informed investment decisions. This might be particularly useful in times of uncertainty and volatility.

Speaking on Brazilian TV shortly after his appointment was officially confirmed, Ancelotti said he would “love to get to know Brazil in general”. “I want to see Rio,” he said. “I want to see the beach…”1

Football fandom is notoriously fickle, but to me such a sentiment sounds very much in the “best of both worlds” vein. Perhaps a few more trophies really are on the horizon. Vamos, Carlo!

1 See, for example, Forbes: “Carlo Ancelotti confirms he will live in Brazil”, May 27 2025 –https://www.forbes.com/sites/josephosullivan/2025/05/27/carlo-ancelotti-confirms-he-will-live-in-brazil/#

Important information

• The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

• Past performance is not a guide to future results.

• Emerging markets tend to be more volatile than mature markets and the value of your investment could move sharply up or down.

• Movements in exchange rates will impact on both the level of income received and the capital value of an investment.

Other important information:

The details contained here are for information purposes only and should not be considered as an offer, investment recommendation, or solicitation to deal in any investments or funds and does not constitute investment research, investment recommendation or investment advice in any jurisdiction.

Issued by abrdn Fund Managers Limited, registered in England and Wales (740118) at 280 Bishopsgate, London EC2M 4AG. Authorised and regulated by the Financial Conduct Authority in the UK.

The abrdn Asia Focus plc Key Information Document can be obtained here

Find out more at www.Aberdeen.com/aas or by registering for updates

You can also follow us on social media: Facebook, X and LinkedIn.

Could climate change trigger a financial crisis?

Extreme weather is having an increasingly significant impact

As anyone who has been watching the news will know, droughts, wildfires and floods are no longer one-in-a-hundredyear or one-in-a thousand-year events, they are becoming more widespread, they are happening more regularly, and their effects are becoming more devastating.

California, Texas, New York, Switzerland, Spain, Italy, South Korea, China, Japan and Dubai have all experienced extreme weather events recently, with little or no warning, and the climate is becoming more unpredictable.

The UK isn’t exempt, either – a drought has been declared across Yorkshire after the driest spring since 1893 and the Scottish Fire and Rescue Service has warned of an extreme risk of wildfires this month after a 30,000-acre blaze in Perthshire.

So, could climate events contribute to the next financial market crisis?

‘THE FIFTH RISK’

As the world heats up, some countries are rolling back policies to combat global warming and energy companies are abandoning their promises to invest in renewables.

Meanwhile, the Trump administration is scaling down government agencies such as NOAA and

FEMA (the Federal Emergency Management Agency), the bodies which prepare Americans for disasters and distribute aid.

In his 2018 book ‘The Fifth Risk’, author Michael Lewis warned of the dangers of a US administration responding to long-term problems with short-term solutions and ‘hollowing out’ the state agencies which quietly underpin everyone’s lives.

By dismantling agencies like NOAA (the National Oceanic and Atmospheric Administration) and FEMA (the Federal Emergency Management Agency), which respectively warn of disasters and manage the distribution of aid, the White House appears to some to be heading in this direction.

Of all the long-term problems facing the planet, climate change is perhaps the largest and the most difficult to solve and it is already having a direct impact on the insurance industry and the real estate

European cities at high risk from extreme heat this summer

Figures represent deaths from 23 June to 2 July 2025

Source: Imperial College London, Grantham Institute; Bloomberg

sector in the US.

In June, the temperature topped 40C across a large swathe of the US as a ‘heat dome’ took hold across eastern and central states affecting tens of millions of people. This led to power emergencies as extreme temperatures put strain on the electricity grid.

According to NOAA, heat domes – which occur when a high-pressure system traps heat – and related atmospheric events behind extreme weather have almost tripled in strength and duration since the 1950s.

The problem is, heat domes and similar phenomena are difficult to forecast, and can happen at any time of year, but they are especially

dangerous – and costly – during the summer. Plus, forecasting where they might occur is just as hard as knowing when they might occur.

Take the example of Lytton, British Columbia, which in the summer of 2021 recorded temperatures as high as 49.6C before the town literally burned to the ground.

As Bloomberg’s Eric Roston explains: ‘When a team of climate scientists assembled days later to analyse the heat wave, they found the local historical weather data offered a paradox: their standard approach for estimating a heatwave rarity concluded the new records were too extreme to occur in the region where they did. They were, in a sense ‘impossible’, even though they actually occurred.’

COMPUTER SAYS ‘NO’

Due to the risk of wildfire, in some areas of the US, mainly Florida and California, insurance has not only become more expensive but fewer companies are willing to offer cover.

In January this year, the US Treasury’s Federal Insurance Office released a study of nearly 250 million policies issued between 2018 and 2022 which showed the average cost of premiums for people living in areas where climate-related risk was ‘high’ was over 80% more than in the least risky areas.

Those in high-risk areas also faced much greater likelihood of their insurer refusing to renew their policy, according to the FIO, whose role includes

Economic losses from natural catastropes - and the 'protection gap'are

Source: Swiss Re

‘monitoring the extent to which traditionally underserved communities and customers have access to affordable non-health insurance products’, making it another casualty of Trump’s agenda.

In another report, also issued in January, the US Financial Stability Board – which was set up following the global financial crisis to watch over the banking system – acknowledged climaterelated vulnerabilities in the financial system, when triggered by climate shocks, ‘could threaten financial stability through various transmission channels and amplification mechanisms’.

The report went on to say, ‘These shocks raise concerns over financial institutions’ ability to manage their risks and to continue to provide financial services in certain segments and geographical areas’ as they can ‘interact with existing vulnerabilities in the real economy or in the financial system and threaten financial stability’.

A ‘STAGGERING’ LOSS IS COMING

In his final shareholder address, in February of this year, legendary investor Warren Buffett claimed that at some point the insurance industry – which includes Berkshire Hathaway (BRK.B:NYSE) – would face an outsized loss due to climate change.

Discussing insurance premiums, Buffett wrote that ‘pricing strengthened during 2024, reflecting a major increase in damage from convective storms. Climate change may have been announcing its arrival.’

While he admitted no ‘monster’ event had occurred during 2024, he warned: ‘Someday, any day, a truly staggering insurance loss will occur –and there is no guarantee that there will be only

one per annum.’

It’s possible Buffett’s decision to hold off from buying stocks and build up significant cash reserves at Berkshire was a contingency against a big hit to the insurance business, which has historically provided the ‘float’ to the investment business.

While reinsurance prices rose during 2024, as they typically do after a year of heavy claims, they have been falling this year, which means there is a particularly keen focus in the industry on the coming US hurricane season.

TRILLION-DOLLAR DAMAGES

A study published in the journal Nature earlier this year forecast climate disasters could cost the global economy $38 trillion per year by 2050 compared with an estimated $417 billion in economic losses incurred by natural catastrophes last year.

At the same time, a report by the World Economic Forum in December 2024 titled ‘Business on the Edge’ forecast that any company which fails to adapt to climate risks like extreme heat – not just insurers – could lose up to 7% of their annual earnings by 2035.

‘Without resilience strategies, especially increasing heat will cause $560 billion to $610 billion in annual fixed asset losses for listed companies, with telecommunications, utilities and energy companies most vulnerable,’ warned the report.

By Ian Conway Deputy Editor

The 'protection gap' is the amount of losses not covered by natcat insurance

US bank profits top forecasts but shares fail to make headway

Reaction suggests investors may no longer swayed by earnings ‘beats’

After a big build-up and a near-50% rally in the US bank sector index from its April low, the second-quarter earnings season has been something of a damp squib.

Granted most banks beat forecasts, but there was none of the usual buying frenzy.

First out of the gate, as always, was Wall Street giant JPMorgan Chase (JPM:NYSE), which smashed estimates led by a strong performance at its global markets business due to market turbulence.

Meanwhile, if there are any tariff concerns, they aren’t being felt by JPMorgan’s well-heeled retail clients, as loan growth and credit card borrowing continued to grow apace with low default rates, yet the firm’s shares ended the day in the red.

for all three firms powered by their trading desks, which like JPMorgan benefitted from volatile markets.

Non-investment banks State Street (STT:NYSE) and Wells Fargo (WFC:NYSE) fared even worse, with shares dropping 7% and 5% respectively on concerns over costs and top-line growth.

It was the same story for Wall Street rivals Bank of America (BAC:NYSE), Goldman Sachs (GS:NYSE) and Morgan Stanley (MS:NYSE), whose shares also finished lower on the day despite blow-out results

Best of the bunch was Citigroup (C:NYSE), whose shares hit their highest since 2008 on strong earnings and a $4 billion buyback, although they gave back some of their gains a day later.

Blended EPS (earnings per share) for the S&P 500 index are predicted to grow by 4.8% in the second quarter, but according to Factset senior earnings analyst

John Butters they are likely to grow by 9% or almost double that rate.

‘The actual earnings growth rate has exceeded the estimated earnings growth rate at the end of the quarter in 37 of the past 40 quarters for the S&P 500,’ says Butters. The only exceptions were Q1 2020, Q3 2022, and Q4 2022.

Over the last decade, S&P 500 earnings have beaten the estimate by an average of almost 7%, adds Butters, with beats outnumbering misses three to one.

This suggests analysts repeatedly low-ball forecasts, not just for the banks but across the market, in order for companies to beat expectations and their shares to go up – except this time round, in the case of the banks at least, this dynamic seems to have faltered.

Faced with what are already demanding valuations, investors appear to have gone on a ‘buyers’ strike’ raising the question of whether on aggregate share prices will be higher or lower at the end of this earnings season.

By Ian Conway Deputy Editor

How are people managing inheritance tax amid prospect of pensions inclusion?

The main considerations as changes to the regime announced in 2024 Budget get closer

Inheritance tax has been in the spotlight over recent months as pensions are poised to come under its purview in 2027.

Inheritance tax rates are set to stay the same until 2030, and adding pensions under the umbrella has brought a flurry of questions on how to pay for the costs. It’s led some people to turn to more unconventional methods to pay the tax, including life insurance policies.

Currently, Brits owe inheritance tax on any assets they plan to pass down above a £325,000 threshold. If you have a spouse, each of you have an entitlement of £325,000, which can transfer to each other.

For example, if your spouse passes away before you, and you are the sole beneficiary of their estate, you will now be able to pass £650,000 down tax free. If you are passing down a home to your children or grandchildren, this adds an exemption of £175,000 for each person.

After this point, there is a tax of 40% on all other parts of their estate, which can include property, assets, cash, and soon, pensions.

For many people, this will not be a problem, as they struggle to make their pensions last throughout their own lifetime. But for some in the

UK, this could add to the burden of inheritance tax, with pensions being taxed as income as well.

GIVING ASSETS AWAY AS GIFTS

With some foresight, there are steps that can be taken to soften the blow of inheritance tax. If assets are given away before death as gifts, it may not be subject to any tax or could be taxed at a lower rate.

If gifts are given seven years before the death of the giver, there will be no tax due. From there the amounts charged are tiered, so if a gift is given four to five years before death, for example, it will be taxed at 24%, while three to four years before death it will be taxed at 32%. Additionally, you can give away a total of £3,000 each year with no tax due, which can carry over for one tax year. You can give as many gifts of £200 as you like to separate people with no tax.

Importantly, if you give a gift but still benefit from it, like gifting your home to a relative but continuing to live there, you will receive no inheritance tax break on this gift. The trouble with giving assets as gifts is ensuring that you keep enough money for yourself to stay comfortable throughout your retirement. If you give away too

much, you could end up in a situation of being unable to support yourself. Currently, men aged 65 are anticipated to live the best part of two decades, where women are expected to live another near 25 years, according to the Office for National Statistics.

If you choose to donate your inheritance to charity, those assets will not be subject to inheritance tax. And, even if you choose to donate just a portion of your inheritance, you can receive some benefits to the remaining amounts. As long as the donation makes up at least a net 10% of your estate (calculated based on the value before your inheritance tax exemption amount), you will be eligible for a reduction in your inheritance tax to 36% instead of the full 40%.

PAYING INHERITANCE TAX

If you inherit an estate that is subject to tax, you will have six months to make this payment to the HMRC, after which they will begin to charge interest. Some choose to take out a loan at this point to make the payment, allowing for an additional period to liquidate assets.

For those passing down an estate, you can choose to cover inheritance tax bills through taking out a life insurance policy. It can be an effective method because the policies are often held in trust, which means that they aren’t subject to inheritance tax themselves. This is because the trust itself is the owner, and the inheritor would simply be the beneficiary.

Typically, whole-of-life policies are used in this case. But they are often expensive and involve

a long period of payments. However, for large estates, it can be a way of avoiding leaving the inheritors with the burden of the bill. This can be particularly useful when inheriting assets that aren’t very liquid, such as houses and property.

WHAT WILL IT MEAN FOR PENSIONS TO BE ENCOMPASSED IN IHT

Under the current plan, pensions will be subject to both inheritance tax and income tax beginning in 2027. So, if you pass down a pension that is outside the exemption limit, the inheritor will pay the 40% tax on the pension pot and then income tax dependent on their tax band. AJ Bell has calculated that this will mean a marginal tax rate of at least 64% for higher rate taxpayers.

This may incentivise people to use more of their pension rather than pass it down. In some situations, people decide to first live off of their ISA savings, which are not subject to income tax. But if pensions are taxed twice once they’ve been passed on, it may be more efficient to use up the pension and leave more assets in an ISA. ISAs are subject to inheritance tax, but they aren’t subject to income or capital gains tax, so they would not suffer from the same double taxation.

AJ Bell owns Shares magazine. The editor (Tom Sieber) of this article own shares in AJ Bell.

Hannah Williford AJ Bell Content Writer

Which chancellors of the exchequer have been best for the UK stock market?

The impact the occupant of Number 11 has had on domestic shares

Winston Churchill was chancellor of the exchequer from 1924 to 1929, and he presented five Budgets to Parliament during its term in office. He targeted pension reform, the protection of wages from inflation and growth above all else, in uncanny echoes of the current chancellor’s programme.

He also endured a torrid time thanks to the General Strike and his legacy was tarnished by the Bank of England’s decision to withdraw from the Gold Standard in 1931, just six years after Churchill oversaw the UK’s return to it. As a result, the future prime minister later noted: ‘Everybody said that I was the worst chancellor of the exchequer that ever was. And now I’m inclined to agree with them. So now the world’s unanimous.’

It is too early to judge whether Rachel Reeves can succeed in her goals of stoking growth and meeting her own fiscal rules on government borrowing, but the strain already seems to be telling, judging by her tearful appearance in the House of Commons amid a backbench rebellion over welfare reforms. The UK government bond market does not seem convinced, either, given how the yield on the benchmark 10year gilt is higher than it was at the time of Labour’s election victory in July 2024, even though the Bank of England base rate is down by a full percentage point over the same period.

Bond vigilantes continue to stalk the chancellor of the exchequer

Bank of England Base Rate (%) UK 10-year gilt yield (%)

Source: LSEG

Investors will ultimately look to their portfolios to gauge the effect of Reeves’ policies, and, in this respect, she is off to a decent start, despite President Trump’s tariffs, war in the Middle East and turgid UK economic growth figures. The chancellor’s ‘Leeds Reforms’ package generally drew praise, albeit of the lukewarm variety, and the FTSE All-Share is up by nearly 9% since Labour took office, a gain that has outpaced inflation.

BOOM AND BUST

Rachel Reeves is the 21st chancellor of the exchequer since the inception of the FTSE All-Share index in 1962 and the sixth member of the Labour Party to hold the post during this period. She has already outlasted four of her predecessors, all of whom were Conservatives – the ill-fated Ian MacLeod, Kwasi Kwarteng, Nadhim Zahawi and Sajid Javid.

Stability is always welcomed and the chancellor’s first year in office represents a steady one for equity investors, despite some signs of unrest in the bond market and on the backbenches.

Chancellor Reeves’ first year was a steady one for UK equity investors

Party Chancellor Term of office

*To 4 July. 8.7% in nominal terms and 4.3% in real terms as of 21 July and time of writing. ** Adjusted for RPI as CPI only introduced in 1989 in current format Source: LSEG, www.gov.uk.

office

FTSE All-Share real change

Party Chancellor Term of office

*To 4 July. 8.7% in nominal terms and 4.3% in real terms as of 21 July and time of writing. ** Adjusted for RPI as CPI only introduced in 1989 in current format Source: LSEG, www.gov.uk.

Investors – and chancellors – must always beware inflation

Adjusts nominal return by change in the retail price index (RPI) as CPI data only goes back to January 1989 in current format

Source: LSEG, www.gov.uk

Cooler inflation is helping here, both in nominal and real terms, and the rate of change in prices could yet define Reeves’ term as chancellor, especially if external events take a hand.

The gap between nominal and real, inflationadjusted returns from the FTSE All-Share index under some chancellors is truly glaring, and this is company that the current incumbent of 11 Downing Street will not wish to keep.

Inflation had a withering effect upon investors’ returns from the stock market under Labour chancellor Denis Healey in the mid-to-late 1970s, even if his supporters would argue his record was tarnished by the need to tackle the mess left behind by the crack-up Barber boom and oil price spike of the early seventies. Inflation also chewed up the nominal gains made by the FTSE All-Share under the Tory chancellors Geoffrey Howe (1979-83) and the aforementioned Tony Barber (1970-74).

UNFORESEEN EVENTS

Not all of the inflation that tore through the British economy in 1973-74 could be laid at the door of Barber’s policies, as the 1973 oil price shock had a huge amount to do with it, and this highlights the importance of factors which are beyond the control of any chancellor, no matter how diligent or skilled.

Alastair Darling could hardly have expected to inherit the Great Financial Crisis which prompted a deep recession and a wicked bear stock market. Norman Lamont inherited British membership of the Exchange Rate Mechanism, fought to defend the pound and a policy in which he did not believe and oversaw a devaluation of sterling which actually helped the FTSE All-Share to rally. Sunak had to contend with Covid-19 and the worst recession for three centuries, so perhaps he got the worst hand of all.

Even so, investors, looking at the world through the narrow perspective of their portfolios, will be wanting Rachel Reeves to think back to Barber and Healey. Her desire for growth is totally understandable, especially as rapid nominal growth could help to shrink the debt-to-GDP ratio, if borrowing and base rates are kept under control.

But that is a big ‘if,’ should the backbench rebellion on welfare reforms be any sort of guide, and failure to rein in spending could raise fears of fiscal profligacy and – in a worst case – a situation where suppressed interest rates and even money printing come into play as tools to make the aggregate debt manageable. Further increases in 10-year gilt yield, and perhaps the gold price, may give investors a clue as to the likelihood of such a scenario.

Kwarteng

Sunak

Ask Rachel: Your retirement questions answered

Should I move dividend payers out of my SIPP to take the income?

Answering a question about the rates of tax on payouts inside and outside a pension pot

I have a question about SIPPs and dividends. My SIPP is geared to generate significant dividend income in retirement, but are the dividends classed as income, so rather than 8.75% tax I’d be liable for the 20% basic rate of income tax (as long as I don’t breach the £50,270 limit)?

I don’t want to sell my dividend payers, so the fact they are currently in a tax wrapper is irrelevant because I’m not intending to realise any capital gains. Is the solution to sell my holdings, move the cash into a trading account, buy the holdings back and then take the dividends? If so, how much can I move in a year, and will I have to pay tax?

Alan

Rachel Vahey, AJ Bell Head of Public Policy, says:

When thinking about how to build an investment portfolio to provide an income, many people turn to dividend stocks. These – held on their own or as part of a fund – will pay out a steady stream of dividends, allowing investors to share in the profits of the company.

If you receive these dividends through a trading account or general investment account, then you will pay dividend tax on anything over the tax-free allowance of £500 a year.

If you’re a basic-rate taxpayer you’ll pay 8.75% tax on your dividends, and if you’re a higher-rate taxpayer you’ll pay 33.75%. It’s 39.35% if you’re an additional-rate taxpayer.

However, the taxation is different if you hold these dividend producing shares within a pensions tax wrapper. To take them out to give you an income you will have to access or ‘crystallise’ the SIPP.

You can access a pension from 55 (rising to 57

from April 2028). Of any money you take out, up to 25% will be tax-free and the remaining 75% will be taxed as income.

You can choose whether to take some or all that 75% out immediately, move it to drawdown so you can access it how and when you want, or use it to buy an annuity (a guaranteed income for life).

If you are doing a simple comparison between a general investment account and a SIPP, then it’s easy to see how you can conclude that 8.75% dividend tax is ‘better’ than 20% income tax and so you may want to move the shares outside the SIPP to take advantage of that lower tax rate.

However, it’s not a direct comparison, because of the other tax advantages that SIPPs offer.

The first difference is you will have received tax relief on your pension contributions when you paid them into the SIPP. This would have increased the amount of money in the pension pot by 20%, allowing you to buy a bigger share holding, so you have held more shares and therefore received more dividends.

A second difference is the tax treatment in the SIPP wrapper. Up to now the dividends paid out have remained within the SIPP wrapper (I am

Ask Rachel: Your retirement questions answered

assuming you haven’t yet accessed your SIPP), and you haven’t paid any tax on dividends or capital gains, which may not have been the case if these had been held outside the tax wrapper and you had exceeded the tax-free dividend allowance of £500 or the capital gains tax-free allowance of £3,000.

Third, you are able to take 25% of your withdrawal from the SIPP as tax-free cash. This will bring the effective tax rate down from 20% to something closer to 15%. The income tax-free allowance – the personal allowance of £12,570 –should also be factored in.

And finally, if you did decide to withdraw the dividend stock holdings from the SIPP wrapper, you would initially have to sell the shares in the pension. You could then withdraw the sale proceeds from the SIPP and use them to buy the shares in a dealing account.

However, remember you may have to pay tax on part of that withdrawal (25% would be tax free) which would mean you would be able to buy back

fewer shares.

You can take out as much money as you want from your pension, but a higher withdrawal may mean paying more tax and could even push you up into a higher tax bracket.

Comparing tax treatments through different accounts can be complicated, but it’s best to remember that pensions can be a very tax-efficient way of growing, and then taking, a retirement income.

DO YOU HAVE A QUESTION ON RETIREMENT ISSUES?

Send an email to askrachel@ajbell.co.uk with the words ‘Retirement question’ in the subject line. We’ll do our best to respond in a future edition of Shares Please note, we only provide information and we do not provide financial advice. If you’re unsure please consult a suitably qualified financial adviser. We cannot comment on individual investment portfolios.

Money & Markets podcast

featuring AJ Bell Editor-in-Chief and Shares’ contributor Dan Coatsworth

LATEST EPISODE

Inflation on the rise, FTSE hits 9,000, and the Chancellor announces sweeping reforms to financial services

WHO WE ARE

EDITOR: Tom Sieber @SharesMagTom

DEPUTY EDITOR: Ian Conway @SharesMagIan

NEWS EDITOR: Steven Frazer @SharesMagSteve

FUNDS AND INVESTMENT

TRUSTS EDITOR: James Crux @SharesMagJames

EDUCATION EDITOR: Martin Gamble @Chilligg

INVESTMENT WRITER: Sabuhi Gard @sharesmagsabuhi

CONTRIBUTORS: Dan Coatsworth

Danni Hewson

Laith Khalaf

Russ Mould

Laura Suter

Rachel Vahey

Hannah Williford

Shares magazine is published weekly every Thursday (50 times per year) by AJ Bell Media Limited, 49 Southwark Bridge Road, London, SE1 9HH. Company Registration No: 3733852.

All Shares material is copyright. Reproduction in whole or part is not permitted without written permission from the editor.

DISCLAIMER

Shares publishes information and ideas which are of interest to investors. It does not provide advice in relation to investments or any other financial matters. Comments published in Shares must not be relied upon by readers when they make their investment decisions. Investors who require advice should consult a properly qualified independent adviser. Shares, its staff and AJ Bell Media Limited do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

Members of staff of Shares may hold shares in companies mentioned in the magazine. This could create a conflict of interests. Where such a conflict exists it will be disclosed. Shares adheres to a strict code of conduct for reporters, as set out below.

1. In keeping with the existing practice, reporters who intend to write about any securities, derivatives or positions with spread betting organisations that they have an interest in should first clear their writing with the editor. If the editor agrees that the

reporter can write about the interest, it should be disclosed to readers at the end of the story. Holdings by third parties including families, trusts, selfselect pension funds, self select ISAs and PEPs and nominee accounts are included in such interests.

2. Reporters will inform the editor on any occasion that they transact shares, derivatives or spread betting positions. This will overcome situations when the interests they are considering might conflict with reports by other writers in the magazine. This notification should be confirmed by e-mail.

3. Reporters are required to hold a full personal interest register. The whereabouts of this register should be revealed to the editor.

4. A reporter should not have made a transaction of shares, derivatives or spread betting positions for 30 days before the publication of an article that mentions such interest. Reporters who have an interest in a company they have written about should not transact the shares within 30 days after the on-sale date of the magazine.