FUND MANAGERS’ FOREVER STOCKS

THE NAMES THE PROFESSIONALS WANT TO HOLD INDEFINITELY

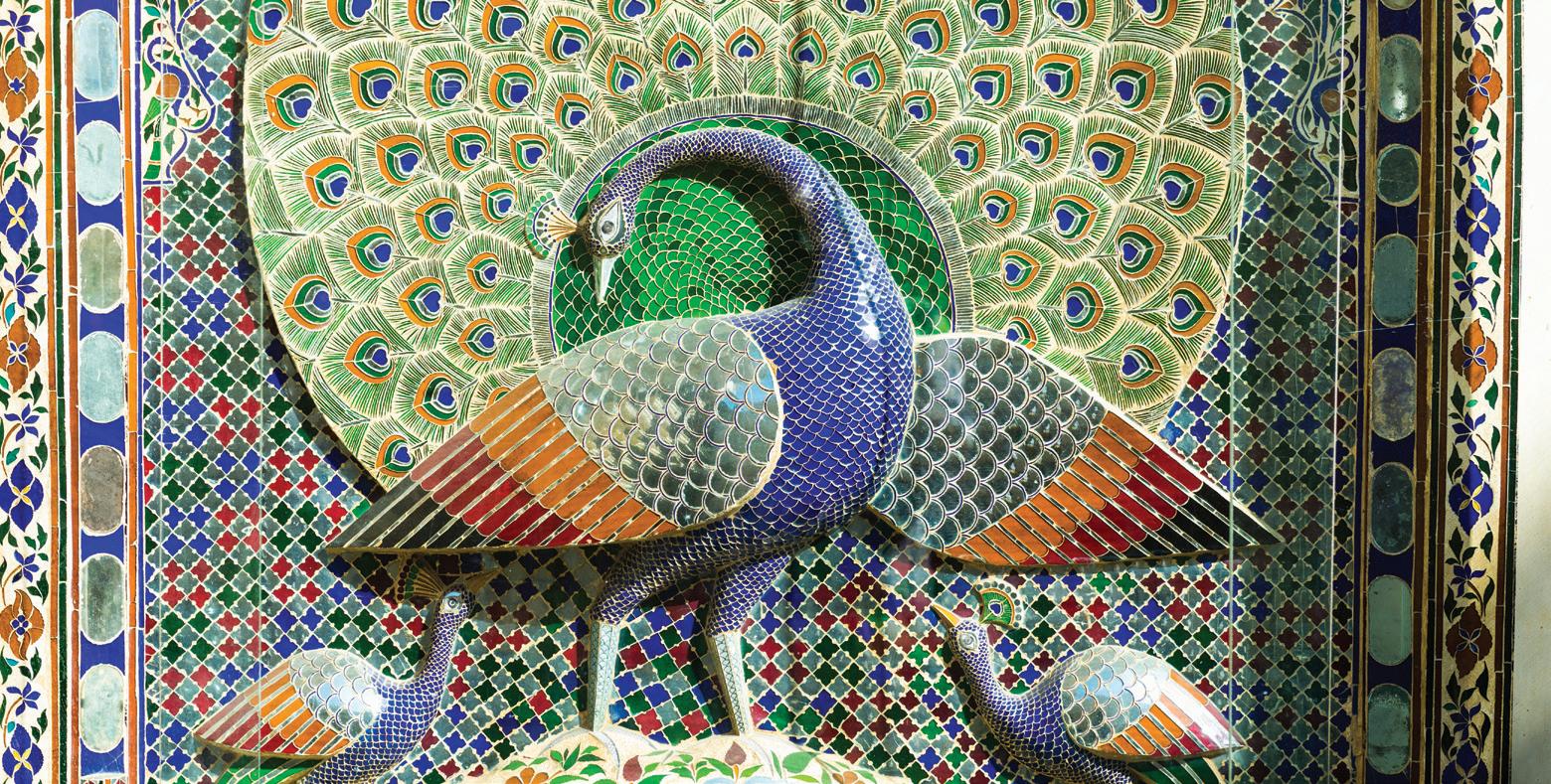

abrdn New India Investment Trust

managed by Aberdeen

India: a vibrant investment opportunity

India’s vibrant economy is fast evolving, with remarkable demographics: the largest population in the world, a growing and aspirational middle class and increasing integration into the global economy.

The Indian growth story is an exciting one, with a wealth of opportunities, but not without risk. So, if you’re keen to explore this market’s promise, quality matters. That’s why at abrdn New India Investment Trust we’re always on the lookout for world class, well governed companies that operate in attractive industries and sectors.

For a portfolio that’s at the heart of India’s growth and potential, take a look at abrdn New India Investment Trust

Tax efficient investing

Please remember, the value of shares and the income from them can go down as well as up and you may get back less than the amount invested.

Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future.

Eligible for Individual Savings Accounts (ISAs) and Self-Invested Personal Pensions (SIPPs).

Invest via leading platforms.

the new UK market addition which is set to join the FTSE 100 soon

Bellway brings a ray of light to the housebuilders with its half-year

Fresnillo up 180% year-to-date after latest strong results

Eli Lilly shares under pressure after disappointing clinical trial results

Recruiter Hays set to update expectations with shares at decadelow

Twenty-five years after the first one launched in the UK how have ETFs changed?

Three important things in this week’s magazine

What do long-term ‘intrinsic’ investors want from a company?

Investors with a long-term view tend to gravitate towards certain types of companies, with mutually beneficial results. We ask several leading managers which would be their ‘forever’ stocks.

We look at the past, the present and the future of ETFs

The first ETFs or exchange-traded funds are now 25 years old, so what does the UK landscape look like and what new products can investors look forward to?

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

What do analysts’ buy and sell recommendations mean for investment returns?

Discover whether recommendations actually make a difference to a stock’s performance, and what you should look for behind the scenes.

Meet the new UK market addition which is set to join the FTSE 100 soon

Metlen Energy & Metals moved its primary listing from Athens to London at the start of this month

Amid the understandable hand-wringing about the future of the UK market, the addition of a new company which could soon be joining the ranks of the FTSE 100 has rather slipped under the radar.

Greek outfit Metlen Energy & Metals (MTLN) moved its primary listing from Athens to London at the beginning of this month (4 August). It appears some investors at least are cottoning on to the potential in the story with the shares up by double digits in a matter of days as I write.

This new listing may do little for the diversity of the ranks of London-listed firms given its focus on energy and commodity markets, which are already well represented.

However, these old-world economy sectors appear to be coming to the fore again – helping the FTSE 100 to its recent record highs.

Plus, in an environment dominated by high-profile exits, it is refreshing to see a business of scale head in the other direction.

Headquartered in Athens it may be, but Metlen is a global business which produces electricity from assets encompassing solar and wind farms and gas-fired power plants. It also has an aluminium, alumina and bauxite mining business.

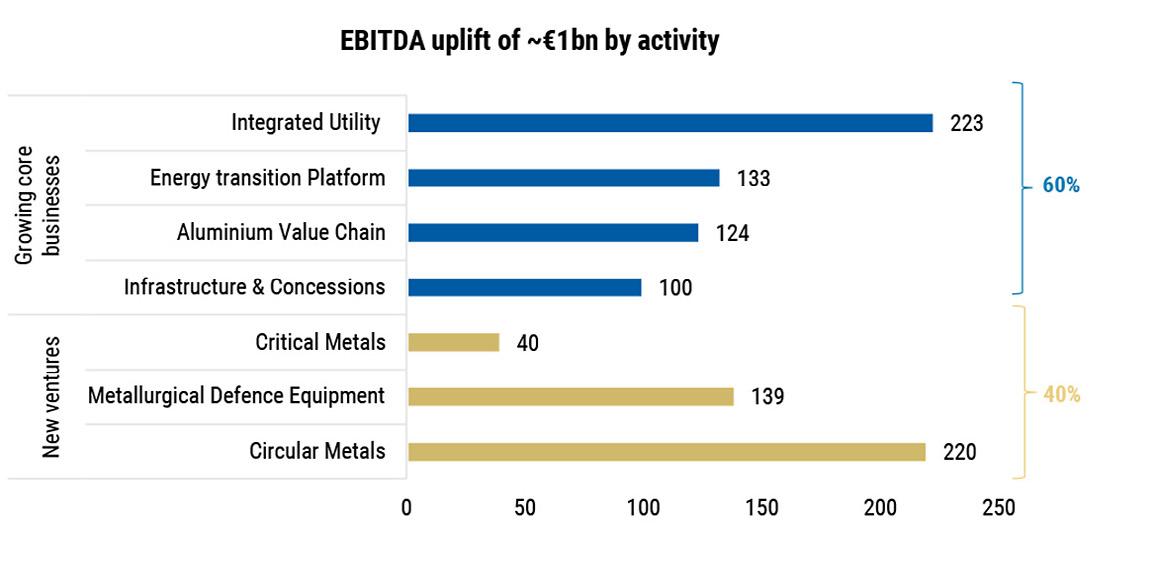

New ventures account for 40% of the ~€1bn targeted EBITDA uplift at Metlen

Source: Company presentation, Morgan Stanley Research

Morgan Stanley analyst Ioannis Masvoulas says: ‘Metlen’s target to double mid-term EBITDA (earnings before interest, tax, depreciation and amortisation) to €1.9 to €2.1 billion (before M&A) offers a unique growth narrative and is broad-based: (1) around 60% via expanding Energy, Metals and Infrastructure/Concessions; (2) around 40% via new ventures in Defence, Circular Metals and Critical Metals (gallium).’

The company is looking to expand into the production of gallium, a critical mineral for the tech sector where the supply is currently dominated by China.

In addition, it is moving into metal recycling and is seeking to gain exposure to a resurgent defence sector as it develops a large industrial site in Greece which will specialise in the construction of armoured vehicles and components for heavy military vehicles.

Assuming Metlen joins the FTSE 100 as expected next month, it is likely to attract the attention of a wider audience and will also benefit from buying by tracker funds which will have to purchase the shares as they look to replicate the performance of the index.

This week’s main feature focuses on the value of attracting long-term investors to the success of listed companies and also canvasses some leading fund managers for their ‘forever stocks’ – names they plan to hold for the foreseeable future. We also take a look at the exchange-traded fund space, a quarter of a century after the first such product was launched in the UK.

Record numbers of US companies are beating revenue and earnings forecasts

is below the five-year average of 9.1% although it tops the 6.9% average of the last 10 years.

Since the end of June, positive surprises from companies in the financial, communications services, information technology and consumer discretionary sectors have been the biggest contributors to the increase in overall earnings growth at the index level.

Coincidentally, 81% of companies have also reported second-quarter revenue above forecasts which tops both the five-year average of 70% and the 10-year average of 64% and if sustained would mark the highest percentage for a quarter since April to June 2021.

As Shares went to print, over 90% of the companies in the S&P 500 index had posted their results for the second quarter with 81% reporting EPS (earnings per share) above consensus estimates according to data from FactSet Insight.

If the same proportion of companies has beaten forecasts by the time the last 10% or so of filings are in, it will not only be above the five-year and 10-year averages of 78% and 75% respectively, but it will mark the best quarterly reporting season since July to September 2023.

While more companies than normal are beating estimates, the average ‘beat’ is 8.4% which

Overall, companies posted revenue 2.4% above the consensus, which once again beats the five- and 10-year averages, with upside surprises from the health care, communications services, information technology and consumer discretionary sectors making the largest contribution to the overall ‘beat’.

Only two sectors reported a drop in EPS, energy and materials, while energy was the only sector to make a negative contribution to revenue growth at the index level.

As we have said previously, all else being equal, companies’ ability to beat earnings – and for that matter revenue – forecasts largely comes down to where those forecasts are pitched, and it seems likely analysts are low-balling estimates due to the unknown impact of tariffs which is allowing more firms to surprise to the upside.

On the subject of tariffs, a new report from Goldman Sachs estimates up to the end of June, US companies had ‘eaten’ roughly two thirds of the impact of higher import duties, with US consumers absorbing 22% and foreign exporters shouldering 14% of the impact.

Although the analysis is still early-stage, the firm believes US consumers will go on to absorb up to 70% of the impact as companies pass on higher prices, which completely contradicts the narrative coming from the White House, so it will be interesting to see how markets react if that is the case. [IC]

Bellway brings a ray of light to the housebuilders with its half-year update

The sector has yet to shrug off its hangover from higher-for-longer interest rates

For the second time this year, Newcastle upon Tyne-based developer Bellway (BWY) has lifted investor spirits in the moribund housebuilding sector with a positive trading update.

Shares in most housebuilders have struggled this year, after a difficult 2024, as interest rates have fallen more slowly than expected and consumer confidence has wilted in the face of increasing prices and job insecurity.

For the year to the end of July, Bellway reported a 14.3% increase in housing completions to 8,749 units and an £8,000 increase in average selling prices to £316,000, both metrics topping its original guidance.

Housing revenue overall increased by 17% to more than £2.76 billion, with an underlying operating margin of around 11% against 10% the previous year.

The private reservation rate, a measure closely watched by investors and analysts as a sign of future sales, was nearly 12% higher than the previous year at 0.57 units per sales outlet per week, including bulk sales, while excluding bulk sales the rate increased by 6% to 0.52 units per outlet per week.

That took the forward order book at the end of July to 5,307 homes against 5,144 a year ago with a value of £1.52 billion against £1.41 billion, although the firm did say it had seen ‘softer’ trading in the final quarter.

Encouragingly for margins, build-cost inflation was in the low single digits throughout the year and the company said there were good levels of building materials and subcontractor availability which should keep input prices steady.

Overall, Bellway ‘delivered a solid performance despite ongoing headwinds for our industry,’ said

Housebuilders

mud

mud

Data correct as of 12 August 2025 Source: ShareScope

chief executive Jason Honeyman.

‘There was good growth in volume output and an improvement in underlying margin which are set to drive a strong increase in profits for FY25. We have entered the new financial year with a healthy forward order book and outlet opening programme and, if market conditions remain stable, we are well-positioned to deliver further growth in FY26,’ continued Honeyman.

Investors will be hoping for an equally upbeat assessment from the rest of the housebuilders when they report earnings in the coming weeks.

As Shares went to press, York-based affordable home developer Persimmon (PSN) was due to publish its first-half trading update.

As with Bellway, the market’s focus will be on net private reservations and the size of the forward order book, as well as comments on the outlook for the rest of this year, where analysts have penciled in an improvement in profits and margins. [IC]

Fresnillo up 180% year-to-date after latest strong results

Company is ramping up shareholder returns as cash flow increases

Silver and gold producer Fresnillo (FRES) is comfortably the best performing share in the FTSE 100 so far in 2025.

year. However, the Mexico-focused company’s latest update showed the company is making significant operational progress too.

The share price received its latest bump as management lifted their gold production forecast for the year alongside its first-half results (5 August).

For the six months running to 30 June, Fresnillo posted a 16% increase in gold output to 314,000 ounces, supported by improvements on the ground at its Herradura mine.

Silver output was down 12% thanks to the planned closure of the San Julián DOB mine and lower grades at several sites. The company also demonstrated a tight leash on costs and generated strong free cash flow which underpinned a big increase in the dividend from $0.064 to $0.208.

Berenberg forecasts the company

Eli Lilly shares under

pressure after disappointing clinical trial results

Rival Novo Nordisk has already submitted its oral obesity pill for US approval

In one sense this is unsurprising given the unprecedented strength in precious metals prices so far this Intensifying competition in the fast-growing weight-loss market and the threat of tariffs on the pharmaceutical industry have taken a toll on Eli Lilly (LLY:NYSE) whose shares are down 27% over the past six months.

Lilly appeared to be pulling ahead of arch rival Novo Nordisk (NOVOB:CPH) due to the better efficacy of its weekly injectable obesity drug Zepbound

versus the 15% weight loss using Novo’s rival treatment Wegovy.

With the battleground moving to daily oral pills, Lilly was expected to maintain its advantage for many years to come. It was a shock, therefore, when Lilly released underwhelming late-stage trial results for its oral pill candidate orforglipron on 6 August.

It offers patients the chance to shred around 23% of their bodyweight

Patients lost an average 12.4% of their bodyweight, falling short of the 15% expected while the side effects were higher than anticipated. The news sent Lilly’s shares down around 14%, while Novo’s shares got a welcome boost.

Lilly’s CEO David Ricks remained

LSEG

could be sitting on $2.2 billion in cash by the end of the year.

Analyst Richard Hatch comments: ‘We have gleaned from management’s comments that it is not focusing on large-scale M&A at this point, instead choosing to focus on its brownfield and greenfield development projects, which all feeds into our view that Fresnillo could once again surprise to the upside from a shareholder-returns basis.’ [TS]

upbeat saying: ‘The goal was to create an oral pill that was convenient and can be made at a huge scale, really, for the mass market, and had weight loss that was competitive with other single-acting GLP-1s, and that’s what we’ve achieved.’ [MG]

UK UPDATES OVER T HE NEXT 7 DAYS

FULL-YEAR RESULTS

19 August: Cambridge Nutritional Science FIRST-HALF RESULTS

19 August: Tribal Group

20 August: Kenmare Resources TRADING ANNOUNCEMENTS

20 August: Celebrus Technologies

21 August: Hays

Recruiter Hays set to update expectations with shares at decade-low

Analysts are throwing in the towel after failed attempts to call the bottom

Staffing stocks have been terrible performers in recent years, and Hays (HAS) is no exception with its shares currently trading at their lowest level in more than a decade.

Therefore, the firm’s full-year results and outlook will be keenly watched when it reports on 21 August.

After the post-Covid ‘great retirement’, which spurred a dash for talent and a corresponding increase in fee income, the market for new hires – in particular for permanent roles – has become increasingly difficult.

In its pre-close trading update in June, Hays warned revenue and earnings would miss forecasts due to lower hiring activity by clients and said it expected current market conditions would

What the market expects from Hays

persist into the financial year ending in June 2026.

‘Activity levels during our fourth quarter (ending 30 June) have reduced sequentially driven primarily by broad-based weakness in Perm markets globally reflecting low levels of client and candidate confidence as a result of macroeconomic uncertainty,’ the firm explained.

Customer confidence in Germany, Hays’ largest market, has been hit by tariffs on the auto sector, which is a major employer, while the UK and Ireland, also key markets, have seen a double-digit decline in net fee income.

UK rival PageGroup (PAGE), which reported first-half earnings last week (12 August), echoed Hays’ comments, blaming lower net fee income on ‘continued subdued levels of client and candidate confidence’ which impacted decision-making.

PageGroup chief executive Nicholas Kirk also revealed the firm experienced ‘a slight deterioration in activity levels and trading in Continental Europe towards the end of the period, particularly in our two largest markets, France and Germany’.

Meanwhile, analysts appear to have given up trying to call the bottom in the staffing market with two prominent brokers cutting their recommendation on the stock. [IC]

All eyes on second-quarter retail bellwether Walmart

Arkansas-based company continues to outperform its peers

The world’s biggest retailer Walmart (WMT:NYSE) is set to report its second-quarter earnings on 21 August.

Investors will be hoping for more of the same from this bellwether stock, which reported steady revenue growth and operating income in the first quarter, even as it drew the ire of the Trump administration for warning of a tariff impact (15 May). Significantly online sales moved into profitability for the period.

Over the past year Walmart shares have gained 50% and are currently trading close to the 52-week high of $105.30 achieved on 14 February this year.

The retailer which sees 270 million customers and members visit more than 10,750 stores each week, has outperformed peers such as Costco Wholesale (COST:NASDAQ), Kroger (KR:NYSE) and Target (TGT:NYSE).

First-quarter worldwide e-commerce sales were up 22%, membership and other income was up 3.7%, including 14.8% growth in membership income.

There was also strong growth in advertising for the company in the first quarter, including a 31% increase in Walmart Connect sales.

The company is expecting net sales to increase 3.5% to 4.5% on a constant currency basis in the second quarter, while keeping its 2026 outlook unchanged.

Source: LSEG

UBS analysts expect the retailer will demonstrate underlying momentum in its second-quarter earnings, despite economic headwinds with strong performance in grocery, health and wellness, and e-commerce. Walmart is also expected to show it is managing tariff-related price increases and managing costs effectively with general merchandise performance being a key focus. A price to earnings ratio approaching 40 times means the group has little margin for error when it reports.

[SG]

US UPDATES OVER THE NEXT 7 DAYS

QUARTERLY RESULTS

18 August: Palo Alto Networks

19 August: Home Depot, Keysight Technologies, Medtronic

20 August: Analog Devices, Estee Lauder, Lowe’s, Salesforce, Synopsys, Target, TJX

21 August: Dollar Tree, Intuit, Marvell, Walmart, Workday

Investing in the AI-era

Seizing tomorrow’s tech opportunities today

Artificial intelligence is reshaping industries and economies, creating extraordinary opportunities for investors.

Polar Capital Technology Trust (PCT) is at the forefront of this transition. Managed by one of Europe’s largest and most experienced technology investment teams, we take a conservative approach in this dynamic sector. We seek to identify and invest in the real drivers and beneficiaries of AI adoption – carefully navigating powerful technologies while positioning for long-term growth.

Forward-thinking. Actively managed. Specialist focus.

Invested in your future: PCT’s continuation vote

Launched in 1996, PCT is proudly committed to shareholders, with a five-yearly continuation vote. At the last vote in September 2020, shareholders voted in favour of continuing the Trust.

The next continuation vote is scheduled for September 2025.

Discover how shareholders can vote

Buy AVI Global to take advantage of its double discount

New Korean leader Lee has vowed to eliminate the Korean discount to the benefit of the trust’s holdings in the country

AVI Global (AGT) 260p

Market cap: £1.1 billion

With stock markets trading near alltime highs, it might seem like there are few bargains to be had. That is rarely the case. We believe the 136-year-old AVI Global Trust (AGT) is a great way to get exposure to undiscovered quality assets, trading at a ‘double discount’ to intrinsic value.

The trust trades at a 7.5% discount to its own NAV (net asset value) while the weighted average discount on the underlying portfolio is more than 40%, near the bottom end of its 10-year range.

This is even more intriguing when considering

Source: LSEG

the trust’s NAV and share price are trading near alltime highs, reflecting several successes within the portfolio.

The trust has been busily recycling some of those successes into new opportunities which sit on big discounts to the managers’ estimate of intrinsic value.

Over the last five years the trust’s total return in NAV has been 98.8% or around 14.75% annualised, comfortably outperforming the MSCI ACWI (All Country World Index) of 80%.

This has been achieved with a big underweight to US assets which represent just 16% of the portfolio, compared with a 65% index weighting. For comparison the MSCI ACWI ex US has a five-year total return of 56.8%.

Since taking over the management of the trust in June 1985 the investment manager, AVI (Asset Value Investors) has delivered an annualised total return of 11.6% a year.

A DIFFERENTIATED APPROACH

For the uninitiated, AVI is focussed on delivering capital growth by investing in a concentrated portfolio of companies and assets which trade at a discount to the managers’ estimate of intrinsic value.

The manager seeks to identify quality assets held through unconventional structures such as holdings companies, closed-ended funds and asset-backed special situations.

Often the holding companies are vehicles for families to control their underlying assets. For example, French fashion house Christian Dior (CDI:EPA) is the family holding for France’s richest man Bernaud Arnault, and his 50% ownership of LVMH (MC:EPA).

Ultimately, AVI is looking to find undiscovered value among high quality assets to drive long-term capital growth. The manager has followed the same approach since 1985.

With so many global portfolios holding similar assets revolving around the large US technology firms, AVI Global offers shareholders a differentiated return profile and high active share (different from the benchmark) relative to global benchmarks.

COULD KOREA BE THE NEXT JAPAN?

AVI Global exposure by assets

Source: AVI Global Trust, Marten & Co

AVI Global has long been an activist in Japan and as of the end of June the country accounted for 18% of the portfolio. The manager is aiming to repeat its Japanese success in Korea, driven by a greater focus on shareholder returns.

Despite being the 13th largest world economy, Korea’s stock markets remain largely irrelevant, accounting for around 1% of the MSCI ACWI. Poor corporate governance and restrictions on the

Source: AVI Global Trust, Marten & Co

convertibility of the Korean won have kept valuations low.

The AVI team estimate that 70% of KOSPI-listed stocks trade below book value with 40% trading at less than half book value. The persistent undervaluation can be traced to the powerful ‘family controlled’ chaebols which exercise control through intricate cross shareholdings.

The manager believes the election of new leader Lee Jae Myung in May was the trigger to unlock shareholder value and he appears to have made progress in improving corporate governance.

New legislation passed in July gave company boards more fiduciary responsibilities and required them to consider the interests of minority shareholders. This has led to more shareholder activism.

It remains early days in the transformation of Korea’s corporate landscape, but the AVI Global team believe it has legs and has initiated new positions equivalent to 3% of the portfolio across a select group of Korean companies trading at an average 51% to estimated intrinsic value.

The trust’s top holdings include private equity investment trust Chrysalis Investments Limited (CHRY), News Corp (NWS:NYSE) and French entertainment and media conglomerate Vivendi (VIV:EPA).

After spinning off its media assets including pay tv group Canal+ (CAN), the bulk of Vivendi’s value lies in its 10% stake in Universal Music (UMG:AMS).

AVI believes Vivendi now has little reason to exist and with company trading at half AVI’s estimate of intrinsic value, activist intervention may signal a wind up of the company or a ‘take private’ transaction at a premium. [MG]

Anpario can nourish portfolios with growth and income

Small cap feed additive play has enjoyed earnings momentum of late and we think this can be extended

Anpario (ANP:AIM) 384.6p

Market cap: £79.2 million

Consistently beating analysts’ expectations is usually a recipe for share price gains and it is a trend which has been in evidence for some time at Anpario (ANP:AIM). Yet the natural sustainable feed additives specialist has seen its shares ease back in recent months. A 19 June trading update referring to geopolitical uncertainties despite also flagging strong first-half sales. We think this has created an enticing buying opportunity for risk tolerant investors.

In our view the company has the ability to navigate any future headwinds. Anpario, whose additives support animal health, hygiene and nutrition, is well diversified by geography and species, winning market share and widening its moat through investment in innovation, since competitors struggle to replicate its science-backed products.

The company is benefiting from a trend which sees food producers around the world transition to natural feed solutions and away from banned or toxic feed chemicals and antibiotics and the safety and sustainability of global food production increases against a backdrop of population growth.

Source: LSEG

The company is well-placed to limit US tariff impacts following the acquisition of Bio-Vet, which brought Anpario a modern US production facility from which to expand and shift UK production should the need arise; Bio-Vet’s unique technology helping dairy cows recover quicker from the impact of avian influenza is currently in big demand.

Anpario’s forecast-beating results (31 March) for the year to December 2024 revealed a 76% surge in pre-tax profit to £6.1 million on revenues up 23% to a record £38.2 million. Balance sheet strength

is another plus at Anpario. While the cash balance slipped from £10.5 million at the start of the year to £9 million as at the end of May, that should still give the company plenty of capacity to expand its international footprint, explore complementary acquisitions and boost earnings through share buybacks.

Shore Capital forecasts a rise in pretax profit to £6.4 million on £44.7 million revenue this year, building to £6.8 million and £47 million respectively in 2026. Based on the broker’s 31.5p earnings estimate for 2026, and a forecast dividend hike to 12.4p, Anpario trades on a forecast price to earnings ratio of 12.1 times.

This represents a significant discount to where it has been historically. It also offers a wellunderpinned dividend yield of 3%. We would expect to see a substantive uplift from here, on the basis the company can deliver on its well thought out strategy and continue to surprise to the upside with earnings. First-half results on 10 September offer a potential near-term catalyst. [JC]

Why we believe investors should stay invested in Oracle

$252.68 Gain to date: 52.3%

Markets were slow to pick up on Oracle’s (ORCL:NYSE) cloud computing growth opportunity but investors are making up for it now.

WHAT HAS HAPPENED SINCE WE SAID BUY?

The stock has doubled since April, including a 22% jump in the wake of impressive fourth-quarter earnings (11 June), with cloud revenues surging 50%, and Oracle expects it to jump 70% in the current financial year (to end May 2026), as the company put up what CEO Safra Catz called ‘dramatically higher’ revenue growth rates. Those growth rates are sensational compared to those of Oracle competitors like Amazon Web Services, which saw its revenue increase 19% in 2024. But Oracle remains a pipsqueak in cloud computing, with only about a tenth of AWS’ annual revenue.

Oracle’s business is fundamentally sound, with revenue growing by double digits annually

Source: LSEG

and supported by a robust pipeline of new opportunities, such as its partnership with Digital Reality to help accelerate digitisation and AI adoption, potential for a new deal with SkydanceParamount, and expanded demand for the Stargate Project, a massive, $500 billion AI infrastructure initiative spearheaded by OpenAI, SoftBank, Oracle, and MGX.

WHAT SHOULD INVESTORS DO NOW?

Let the opportunity run. Some investors might prefer to take a profit and cut and run but that could mean missing out on significant further upside. Interestingly, forecast revisions from Wall Street analysts have been shifting higher, according to Koyfin consensus data, and a series of higher target prices have begun filtering through.

The catalyst for further moves higher will, of course, be earnings, with eyes fixed on first quarter 2026, due 15 September. Koyfin consensus predicts 13% and 7% year-on-year revenue and earnings growth, but progress is widely seen accelerating through the rest of fiscal 2026 and beyond. Consensus estimates revenue and earnings growth of 20% or more through full years 2027 and 2028. [SF]

WATCH RECENT PRESENTATIONS

Aram Advisors/ Scotch Corner

Richard Croft , Director & Simon Waterfield, CEO

Aram is a newly launched segment of the Aquis Stock Exchange Growth Market, a dedicated marketplace for real estate and infrastructure investment, offering investors access to the world’s largest asset class through a fully regulated and liquid public market.

Schroder Japan Trust (SJG)

Masaki Taketsume, Portfolio Manager

Schroder Japan Trust (SJG) aims to achieve longterm capital growth by investing in a diversified portfolio of 50-60 of the best quality but undervalued companies in Japan.

Poolbeg Pharma (POLB)

Jeremy Skillington, CEO & Ian O’Connell, Chief Financial Officer

Poolbeg Pharma (POLB) is a clinical-stage biopharmaceutical company focussed on the development of innovative medicines to address unmet medical needs. The Company’s clinical programmes target large addressable markets including, cancer immunotherapy-induced Cytokine Release Syndrome (“CRS”) and metabolic conditions.

FUND MANAGERS’ FORE VER STOCKS

THE NAMES THE PROFESSIONALS WANT TO HOLD INDEFINITELY

By Ian Conway Deputy Editor

Arecent report from consultants McKinsey explored the subject of what long-term ‘intrinsic investors’ want from companies and how in return companies can benefit from the presence of a strong a stable shareholder base.

The bottom line is a strong, stable shareholder base tends to lead to higher

returns, not just for businesses but for their investors too, creating a kind of virtuous circle. In this article we look at this phenomenon in more detail and hear from leading fund managers about their ‘forever stocks’

First though, how can companies encourage ‘intrinsic’ long-term shareholders to join the register and generate higher returns, and are there any useful UK examples?

ENGAGEMENT IS KEY

Most executives know they need to communicate early and often with long-term intrinsic investors, say the report’s authors Tim Koller and Prateek Gakhar.

‘Compared with, for instance, mechanical investors and traders, intrinsic investors are paying closer attention to companies’ performance metrics, potential to create value over the long term, and strategic decisions—and making their investment decisions accordingly,’ say Koller and Gakhar.

Long-term intrinsic investors are also the ones most likely to champion a company’s prospects in the market, influencing other investor segments to follow suit, they argue.

They are also the ones who provide valuable guidance and feedback to management, and who will likely ride out volatility with a company, claim the authors.

The report analysed data for some 320 of the largest US companies by market value between 2012 and 2022 and found those which experienced an increase in ownership by long-term intrinsic investors also saw an increase in total shareholder return).

The analysis shows companies with increased intrinsic ownership also grew their revenue faster and improved their return on invested capital

Companies with increased intrinsic-investor ownership delivered higher excess TSR (2012 to 2022)

Companies with increased intrinsic-investor ownership delivered superior performance (2012 to 2022)

Source:

Source: McKinsey & Co, S&P Capital IQ

(excluding goodwill), while trading at a higher multiple of operating earnings.

The report concludes there is a virtuous circle whereby companies which engage with long-term shareholders tend to perform better, not just operationally but also in stock market terms, which in turn attracts more long-term ‘intrinsic’ investors.

WHAT DO SHAREHOLDERS WANT?

The authors argue the companies which demonstrated increased ownership by intrinsic investors tended to do three things well.

First, they were able to increase their market share using ‘commercial excellence (including doubling down on digital channels), geographic expansion and product innovation, among other actions’.

Second, they ‘consistently and effectively’ allocated capital well, both to grow their business and operate more efficiently, a trait which many great investors value highly and which makes them loyal supporters of the management.

Third, some of the companies underwent fullscale transformations and were able to sustain higher returns over time. In some cases, the transformation was led by external factors, such as an activist investor campaign, while in others it

was a change of leadership which brought about operational change.

Conversely, companies with decreased intrinsic-investor ownership were either ineffective allocators of capital, particularly in the case of M&A; facing secular decline, meaning growth was decelerating; or they were valuation outliers, meaning their stock prices were discounting the best of all possible worlds.

In essence, the authors conclude, companies get the investors they deserve: if they focus on their operating performance, in time the ‘right’ investors will follow.

'FOREVER' STOCKS

When asked what his ideal holding period was for companies in Berkshire Hathaway’s (BRK.B:NYSE) portfolio, Warren Buffett famously replied ‘forever’. In case of point Buffett has owned (and consumed) Coca-Cola (KO:NYSE) for decades.

But what about those steering portfolios on this side of the Atlantic? We asked several leading UK fund managers which stocks in their portfolios they regard as ‘forever’ holdings, with some surprising results. In practice these stocks might not be held indefinitely but, at the very least, these names are ones which the managers in question are happy to hold for the foreseeable future.

TAPPING INTO TESCO

Tom Matthews, Vish Bhatia and Mark Costar, comanagers of the JO Hambro UK Dynamic Fund (B4T8552), identified grocery giant Tesco (TSCO)

as a ‘forever’ stock, and the fund’s history with it provides a good example of why companies should reach out and engage with ‘intrinsic’ investors.

‘While several companies have been long-term holdings, Tesco (TSCO) is a standout’, say the team. It was first purchased at the fund’s inception in 2008 and is still a top 10 position today.

Its presence in the portfolio ‘perfectly illustrates our investment philosophy: a great long-term investment requires not just a great business model but also a strong culture of generating recurring equity value and an attractive share price’, add the managers.

Despite being a great business, in the late 2000s Tesco management took a ‘growth-at-any-cost’ approach, say the team, destroying value with investments in restaurants and expansion in the US at the expense of the UK business, which became uncompetitive.

With the company’s eye off the ball, Aldi and

Source: LSEG

Tom Matthews, Vish Bhatia and Mark Costar –JO Hambro UK

Lidl seized the opportunity and carved out market share at Tesco’s expense, leading the team to sell the shares before its price halved in 2014.

Following the arrival of new management and a renewed focus on Tesco’s core UK market, price leadership and reducing debt, the fund rebuilt its position in 2017, and while another new team has taken over at Tesco the core strategy remains the same.

The company has regained market share and now has the biggest ever lead over its main rival, Sainsburys (SBRY), while free cash flow reached £3 billion last year compared with almost zero a decade ago.

In addition, new management has leveraged the firm’s scale by focusing on ‘capital-light’ growth platforms like expanding the market-leading finest* premium range and Retail Media services.

‘Tesco is once more a great business, but this time it’s matched by a culture of creating recurring equity value for its investors. With the current share price implying a 7% free cash flow yield, Tesco remains a great investment and is a core holding we intend to own for the long run,’ say the managers.

TRUSTING IN TRUSTPILOT

Karan Singh, manager of the Fidelity UK Opportunities Fund (BH7HNZ8) and Fidelity UK Select Fund (BFRT394), expects to be a longterm holder of online ratings platform Trustpilot (TRST).

Singh explains his reasoning: ‘Trustpilot operates in a large, underpenetrated market, with over four million company domains

but only 27,000 paid customers. The average customer spends over $9,000 annually, supporting a potential high teens growth runway over the medium term. While the UK is its mature market, where it launched in 2013, revenue is still growing at over 15% per year.’

As he observes the value for businesses is material given the impact a Trustpilot score can have on the effectiveness of marketing spend.

‘Trustpilot also provides valuable customer insights and analytics that enhance business performance. For large enterprises, a paid subscription is a Karan Singh – Fidelity UK Opportunities Fund and Fidelity UK Select Fund –Trustpilot

Source: LSEG

Source: LSEG

logical choice,’ Singh adds.

‘The company economics are highly attractive. Trustpilot is a software as a service (SaaS) business, with retention rates above 100%, strong cash flow generation and low capital intensity. As the company grows, margins are expected to expand. Management run the company prudently with a net cash balance sheet and have demonstrated good capital discipline.’

The manager of Latitude Horizon (BDC7CZ8), Freddie Lait, has been a long-term holder of US

Value

Managers who put the emphasis on value are less likely to hold stocks for a very long time as they will often sell when a company reaches a certain valuation threshold.

Simon Gergel, who steers The Merchants Trust (MRCH), doesn’t think about ‘forever stocks’ per se, but when he buys a company for

automotive parts and accessories specialist AutoZone (AZO:NYSE). He says: ‘I have owned it for 16 years. The business has generated a 23% annualised return, supported by a 17% annual growth in EPS.

‘The runway for growth remains strong with 50% of the US auto parts market still highly fragmented, susceptible to AutoZone’s superior operating model over time. The business is defensive, predictable, and highly cash generative, growing at twice the rate of the market yet trading around a market multiple.’

the fund, he does like to think ‘that we would be willing to own this for a very long time, but we are value driven’. Gergel recently sold the trust’s entire holding in retailer Next (NXT) following a stellar run for the stock.

‘I think Next is a great business,’ says Gergel. ‘But it’s not necessarily a great investment opportunity if the shares have re-rated, so I wouldn’t want to say that these companies (in the trust) are forever stocks, that’s not the way we approach it. There are companies that have been in the portfolio a very long time like Shell (SHEL), where the position size has moved a lot over the last 10, 15 years, but it is a big stock in the market and we’ve generally had a positive view on it. We wouldn’t own it if we didn’t have a positive view.’

Freddie Lait –Latitude Horizon

managers and ‘forever stocks’

How to exploit analysts’ least loved stocks using earnings revisions

Direction of travel is far more important when looking for stock ideas

Behavioural biases affecting the way analysts change their earnings forecasts and stock recommendations can be exploited to unearth potential investment opportunities.

The key idea is to find discrepancies between what analysts are doing to their earnings forecasts and what they are saying through their recommendations. We start by identifying the least loved UK stocks as seen through the lens of analyst buy recommendations. You might be thinking, why not screen for the most popular stocks?

Well, the sad fact is, most studies show analyst recommendations by themselves are of little value in terms predicting future stock performance. However, changes in recommendations can be powerful signals.

By drilling down on the least favoured companies among analysts, we can be reasonably confident that sentiment towards these firms is already relatively depressed, and expectations are low. Next, we introduce the idea of earnings revisions. These are simply the changes analysts make to their forecasts following company results and trading updates.

POSITIVE EARNINGS REVISIONS HELP COMPANIES OUTPERFORM

Many studies have shown that stocks with persistent positive earnings revisions tend to outperform the market. Companies which are receiving positive earnings revisions are more likely to see revisions in the same direction and these cycles can last many months.

To understand why EPS (earnings per share) revisions move in cycles we need to understand how analysts respond to new information and the action of other analysts. In a perfect world analysts are rational and informed about the companies they cover, undertaking independent research and gathering information to conclude a view and weave it into a persuasive investment narrative.

In practice analysts know in advance of doing research where the consensus earnings forecast

sits and what his or her peers think of a particular company. This brings ‘group-think’ and ‘herding’ into play. Research shows analysts tend to take ‘baby steps’ when making revisions, leaving room for further moves in the same direction. This suggests not all good news is immediately priced into earnings forecasts. (Note, this is not true for bad news).

This dynamic explains why earnings revisions move in cycles, lasting many months and why they are a key driver of share price outperformance. Outperforming stocks are more likely to see buy ratings slapped on them as analysts do not want to appear to be out of sync with the herd, creating a virtuous circle.

Group-think means that, at some point, after one analyst is brave enough to ‘break cover’ and move to a buy recommendation, others are more likely to

Companies with least broker buys

Companies with least broker buys

follow suit.

In summary, the opportunity here is to spot companies where analysts are sitting on the fence with a ‘hold or ‘underperform’ rating while simultaneously nudging up their earnings forecasts.

The key message is, watch what analysts are doing, not what they are saying.

PUTTING IT INTO PRACTICE

Using Stockopedia software, we screened for stocks where less than 10% of the analysts covering them (with a coverage of at least three) have a buy recommendation.

We then analysed the change in consensus EPS revisions over the prior three-months to identify discrepancies between what analysts are saying (buy, hold etc) and what they are doing to their earnings forecasts.

For context, over the last three months earnings revisions across the UK market have been roughly flat, which means, those companies with a positive revision are seeing better than average upward revisions.

Fund management group Jupiter Fund Management (JUP) has seen analysts ratchet-up

their 2025 EPS estimates by a whopping 43% to 9.4p since early May when downward EPS revisions troughed at around 6.5p.

This coincided with the group announcing a further £15 million of cost savings and, importantly, revealing that fund outflows had virtually ground to a halt, raising the prospect of fund inflows.

Jupiter confirmed this change in fortunes at the 25 July first-half results when the group reported net positive inflows in second quarter. The same trend appears to have happened across the sector with other fund groups reporting positive or less negative fund flows in recent weeks.

Beady-eyed investors who spotted the uptick in earnings revisions in early May would have been rewarded with a 63% rally in Jupiter’s shares.

Telecommunications and mobile money services provider Airtel Africa (AAF) operating across Nigeria and East Africa gets no love from the analyst community.

Not even one brave sole believes the shares are a ‘buy’, yet as a group analysts have quietly revised up their 2026 EPS estimates by 17% over the last quarter.

The shares are up an impressive 80% so far in 2025, making them one of the best performing in the FTSE 100 index, demonstrating once again the value in keeping close tabs on what analysts are doing rather than what they are saying.

A REVERSAL IN THE TREND FOR BP?

There is almost universal disinterest in energy giant BP (BP.) from analysts with just two out of 22 sticking a buy rating on the shares. That might have something to do with the fact that 2025 EPS estimates have been slashed by more than half over the last 18-months.

That cycle is looking long in the tooth, so it is interesting that the shares reacted positively to news this week (4 August) of a new oil discovery in Brazil, the oil major’s biggest in a quarter of a century.

The company also revealed better than expected quarterly results the following day, so it may be worth keeping a close eye on those earnings revisions for early signs of a reversal in trend.

Martin Gamble Education Editor

Twenty-five years after the first one launched in the UK how have ETFs changed?

Discover the top recent performers as thematic products come to the fore

This year marks the 25th anniversary of the first ETF (exchange traded fund) launched on the London Stock Exchange. The ETF market has grown rapidly in the quarter of a century since the first such product iShares Core FTSE 100 UCITS (ISF) was listed in April 2000.

Now the UK markets hosts more than 2,350 ETPs

KEY FEATURES OF ETFS

DIVERSIFICATION. An ETF can include hundreds of securities thus reducing risk through diversification.

LIQUIDITY. ETFs can be bought and sold through the trading day just like stocks. Funds are typically priced once a day at a level investors usually only find out after they have submitted their trade.

LOW FEES. Most ETFs have lower ongoing charges compared to funds.

(exchange-traded products) with more than £1 trillion in AUM (assets under management). In 2024 270 ETPs joined the London Stock Exchange.

2,350 ETP listings

There are now 1,856 ETFs (available as 2,763 lines through multi-currency offerings) and 457 ETCs/ ETNs (available as 854 lines) on the London market

Source: LSEG

Jane Sloan, Europe Middle East Africa head of shares and global product solutions at BlackRock observes: ‘ETP trading now makes up 20% of the London Stock Exchange’s daily trading turnover, with trading spread across 19 market makers.

‘Advances in technology, particularly the rise of ETF algorithms for trading, could lead to the creation of even more sophisticated ETF products and trading strategies.

‘In April 2025, we also recorded our highest trading day in ETPs, with £2.6 billion traded on the LSE order book,’ Sloan adds.

WHAT ARE ETFS?

An ETF tracks a basket of assets consisting of stocks, bonds and commodities that you can buy and sell through a broker or investment platform.

ETFS TRACKING THE DEFENCE BOOM

The recent ‘boom’ in defence ETFs is difficult for investors to ignore. According to quarterly data from Ark Invest Europe (as of 6 May) defence ETFs accounted for 72% of European thematic net flows for the first quarter of this year – amounting to $4.18 billion.

Ark Invest cites ‘the demand for next-gen military and aerospace technology’ and ‘defence-tech firms benefiting from increased procurement budgets globally.’

Back in June, the UK government announced its SDR (Strategic Defence Review) aimed at moving the UK to a position of ‘war fighting readiness,' the UK government has already committed to increase military spending to 2.5% of GDP (gross domestic product) by 2028, on the 1 June this will be increased to 3% during the next parliamentary term (2029-2034).

This enthusiasm has led to several ETF providers launching defence-related ETFs.

In May, Global X ETFs Europe

launched the Global X Europe Focused Defence Tech UCITS ETF (EDEF).

In March ETF provider WisdomTree launched its WisdomTree Europe Defence ETF (WDEF), as of 27 June, AUM surpassed $3 billion, as investors keen to gain exposure to Europe’s long-term defence transformation piled into the ETF.

Adrià Beso, head of distribution, Europe at WisdomTree, said: ‘The NATO (North Atlantic Treaty Organisation) summit has made it clearer than ever: European

Best performing defence ETFs over one-year

countries are stepping up their defence commitments, with increased spending now a top priority.

‘For investors, this marks the next phase of a long-term shift. As governments channel more funds into the defence space, we see strong potential for sustained growth across the sector. Companies that support modern military capabilities and critical infrastructure are well-positioned to benefit, making European defence an increasingly important area for capital allocation.’

Source: Morningstar 4 July 2025

Most ETFs are passive and aim to replicate the performance of a specific index, benchmark or sector rather than beat it.

HOW HAVE ETFS CHANGED?

270

ETP listings 2024 214 new ETFs and 43 new ETCs/ETNs were listed in 2022

77 new ETFs listed with an ESG methodology

The ETFs sector has evolved over the past 25 years and one big development is the emergence of thematic products –enabling investors to tap into emerging trends.

Source: LSEG

Mobeen Tahir, director of macroeconomics and thematic research at WisdomTree tells Shares that thematic investing has gained significant momentum over the past decade: ‘For Europedomiciled ETFs and open-ended funds combined, thematic AUM have grown from around $71 billion 10 years ago to $593 billion as of the end of June.

‘We group the thematic universe into four broad categories: demographic and social shifts, environmental pressures, geopolitical forces, and technological advancements. Based on AUM, the two largest clusters are technology and environmental themes, reflecting investor focus on innovation and sustainability.

‘More recently, the geopolitical category has gained ground, particularly within ETFs. Rising global tensions have driven strong interest in defence. In the first half, the “rise of tension” theme – a subset of our geopolitical category that includes defence – has seen around $8.3 billion in net inflows.’

THE RISE OF ACTIVE ETFS

In the last few years active ETFs have started to become a bigger component of the ETF universe. According to State Street’s ETF Impact Report 2025-2026 active ETFs secured $166 billion in global inflows in 2023, and $330.7 billion in 2024 – 22.2% of all ETF inflows globally.

including increased product innovation, the continued migration of assets from funds to an ETF wrapper, and international investor demand.

69% equity trading

23% fixed income trading (orderbook turnover breakdown by underlying asset class)

Source: LSEG

Robert Selouan, senior research strategist at State Street says in the report: ‘Since the global financial crisis and the 2020 pandemic sell-off, investors are looking for more stability and protection from those kinds of events, especially as they near retirement.

‘Active ETFs have started to answer that call, as they’ve evolved beyond their traditional role of benchmark outperformance or alpha.

19 registered Market Makers Provide continous pricing and high-quality pool of liquidity on the London Stock Exchange's orderbook

Year-to-date tells a similar story, with this category of product pulling in $94.3 billion and representing 32% of all ETF flows in 2025.

Multiple factors are behind the inflows,

Source: LSEG

‘Increasingly, they’re now being used to target specific outcomes or improve portfolio risk management - and potentially provide more predictable risk/reward trade-offs, better downside protection, and greater risk-adjusted returns.’

However, for now active ETFs are less numerous, prominent and popular in the UK and Europe. That may change but it is worth remembering in this context that UK investors are unable to trade US-listed ETFs.

The 10 best-performing ETFs for second quarter 2025

Source: Morningstar 4 July 2025

WHICH ETFS HAVE PERFORMED WELL RECENTLY?

According to data firm Morningstar, the best performing UK ETF in the second quarter of this year was the £389 million VanEck Crypto & Blockchain innovators UCITS ETF (DAPP) which returned 71.4%.

The second and third best performing ETFs have been from the uranium and nuclear technologies sector. Both passively managed.

The £205 million Global X Uranium UCITS ETF (URNU) returned 62.5% and the £575 million VanEck Uranium and Nuclear Technologies UCITS ETF (NUCL) returned 56.4% to investors.

Other ETFs that have performed well include the actively managed Ark Innovation UCITS ETF (ARKK) which returning 39% in the second quarter. The product launched in April 2024 and invests in disruptive technologies.

WHAT NEXT FOR ETFS?

Financial

fragmentation is

accelerating blockchain adoption. From tokenisation to stablecoins, digital finance is becoming a tool of strategic competition”

£173bn

Total ETP orderbook value traded in 2024

including: European defence autonomy, nuclear energy, cybersecurity, critical minerals and blockchain infrastructure.

ADVT*: £681.1m, 29% higher YoY

*Average Daily Value Traded

Source: LSEG

WisdomTree’s Tahir sees five key themes gaining prominence for ETF investors in the future

Tahir says in relation to the theme blockchain infrastructure: ‘Financial fragmentation is accelerating blockchain adoption. From tokenisation to stablecoins, digital finance is becoming a tool of strategic competition.’

By Sabuhi Gard Investment Writer

02 SEPTEMBER 2025

COMPANIES PRESENTING

ABERDEEN ASIAN INCOME FUND (AAIF)

3 CLOTH ST

LONDON EC1A 7LD

Registration and coffee: 17.15 Presentations: 17.55

During the event and afterwards over drinks, investors will have the chance to:

• Discover new investment opportunities

• Get to know the companies better

• Talk with the company directors and other investors

Limited targets the income and growth potential of Asias most compelling and sustainable companies. It does this by using a bottom-up, unconstrained strategy focused on delivering rising income and capital growth by investing in quality Asia-Pacific companies at sensible valuations.

JPMORGAN CLAVERHOUSE INVESTMENT TRUST (JCH)

Helping investors tap directly into the long-term growth potential of UK large cap stocks since 1963. The trust focuses on attractively valued, high quality stocks with the ability to generate consistent and growing dividends.

SCHRODER ORIENTAL INCOME FUND (SOI)

Targets total returns by investing in Asia Pacific companies that offer attractive yields. Focusing on Asian companies that offer long-term growth potential.

STRATEGIC EQUITY CAPITAL (SEC)

A specialist alternative equity trust. Actively managed by Ken Wotton and the Gresham House UK equity team, it maintains a highly concentrated portfolio of 15-25 highquality, dynamic, UK smaller companies, each operating in a niche market offering structural growth opportunities.

Why volatility isn’t just a mental drain but a money drain too

be achieving a decent gain, because you’d end up being up 5% overall right? Unfortunately for investors it doesn’t work that way.

Ayear of tariff drama and currency concerns have led many investors to start to look outside the US to boost their market returns. And while some have steered towards calmer waters, with a boost in European investments, others have turned towards emerging markets.

While both can offer their own set of perks to a portfolio, those looking at rockier markets have an extra consideration to factor into returns: Even when high highs and low lows seem to average out, what are these peaks and troughs actually doing to the value of the investment?

If you have £100 in the stock market and it loses 5% in a year, at the end of that year you’d be left with £95. The next year, if your investment gains 10%, your money will not increase to £105. Instead, it will be a 10% gain on £95, which is £104.50.

In this example, there’s a very minimal difference between the amount that an annual average would assume your investment has grown to, and the amount it actually is. But this 50 pence difference can become significant quickly.

THE TORTOISE AND THE HARE: UK VS BRAZIL

It seems intuitive enough to think that if an investment goes down by 5% one year, and then up by 10% the next, then you would still

The effects of volatility drag become much more apparent when looking at the long-term outcome in different markets. Take two very different economies, the slow-but-steady UK and the

Feature: Volatility drag

volatile Brazil.

In the past 10 calendar years, the annual return from each year of the FTSE 100 averages out to 6.7%, while the MSCI Brazil averages to 8.8% in sterling. Based on these averages, £1,000 put into the FTSE 100 would increase to £1,950.60 while in MSCI Brazil, this would become £2,403*. That’s almost a £500 difference.

But how did money in these markets perform in reality, not when using averages? The £1,000 in the FTSE 100 turned into £1,825, still a drop from the averaged-out gains, but within the same range. However, the £1,000 in MSCI Brazil turned into £1,347*. Not only a £1,000 difference from the starting amount, but less of a gain than the FTSE 100, despite having a significantly higher annual average gain.

When looking at the percentage changes year by year, the numbers begin to add up. While the FTSE 100 still had some volatility, losing 1.3% in the first year to a gain of 11.95% in the second year, this was nothing compared to the range of MSCI Brazil, which plummeted 38% in the first year, to increase by 98% in the second year.

This 98% gain dragged the average annual return up significantly, but because it happened right after the investment had lost over a third of its value, the gains were on a much smaller pot of money than that initial £1,000.

MODELLING RETURNS

Fortunately, when many fund managers show annualised returns, they use a geometric mean,

rather than a typical arithmetic mean, to reach the percentage. This allows for a much more representative value of what has happened to the investment. Instead of summing the values and dividing by the number of values, for a geometric mean the values are multiplied together, and then this figure is taken to the root of the amount of numbers in the set.

So, to take the geometric average of values A, B, and C, you would multiply A*B*C, and then take the cube root of that result, since there are three values in the set. Notably, you cannot use negative numbers when calculating a geometric mean. Instead, you must create a proportion.

In the case of the decrease of 38% for Brazil, instead of multiplying by negative 38, you would subtract 0.38 from 1, to reach a value of 0.62. Then, you would multiply by 0.62 in your calculation.

FACTORING VOLATILITY DRAG INTO PORTFOLIOS

When creating a portfolio, it’s a common practice to attempt to build a return that is relatively stable overtime. This strategy is often chalked up to peace of mind: If the return on a portfolio is smooth, investors can remain calm and are less likely to pull money out of the market, which can lead to large losses. This is certainly an important factor, but it’s not the only benefit of steady returns.

The other advantage is the mathematical upside. If a portfolio has a large downside risk, the returns it will need to create to make up for those market falls are extreme. It’s impossible to find a market that will not have some negative periods but minimising how extreme those troughs are can make achieving strong returns significantly easier.

A helpful way to create a clear picture of how a market has actually performed is looking at the return of an actual amount of money, like £1,000, over a period, instead of relying on averages. While this will not capture elements such as fees, it will give a decent impression of how an investment has performed in reality.

*Figures do not factor in investment or platform fees, data from FE Analytics

Hannah Williford AJ Bell Content Writer

How to cope with a cruel summer of speculation

Why it is important not to panic about possible changes in the upcoming Budget

The next Budget won’t be held until the end of October or early November, but the jungle drums have been beating pretty much since the chancellor sat down after the last Budget in March. There is some chanting alongside the drumming, and you don’t have to listen too hard to make out the words ‘tax rises’. As the shadow chancellor Mel Stride said in June, we all now face a ‘cruel summer of speculation’ ahead of the Budget about which taxes will rise, and I’d confidently go further and say it won’t stop when the kids go back to school either.

REEVES NEEDS TO FIND MONEY FROM SOMEWHERE

The Labour government has U-turned on measures like restricting the Winter Fuel Allowance and changes to benefits payments, which means Rachel Reeves will have to find some more money to balance the books. The economy’s not looking too sharp either. And the OBR, which provides the all-important financial projections for the chancellor, has said it’s been too optimistic in its previous predictions, so it may now seek to

be more Eeyore and less Tigger when it comes to forecasting future economic growth. Again, that means the chancellor having to find more money to keep the public finances ticking over.

We don’t know how much money the chancellor will need to conjure up in the autumn Budget. There are a lot of moving parts which determine how much financial pressure she will be under, and many of the variables which feed into the OBR’s forecasts will be collected in the weeks before the Budget itself. There’s a lot of time between now and then for those factors to improve or deteriorate. The latest guess from the think tank NIESR suggests Reeves might have to find £40 billion from somewhere. Not an amount which is just lying down the back of the sofa at Number 11.

GOVERNMENT BOXED IN BY PREVIOUS PLEDGES

The Labour government has boxed themselves in somewhat by saying they won’t raise the personal rates of income tax or national insurance, or VAT. These are the three biggest which can be pulled to bring in some money and so excluding them means yanking on some of the smaller levers even

harder. This presents an opportunity for politicians and ex-politicians (if there is such a thing) to lob some grenades into the mix. Neil Kinnock has suggested looking at a wealth tax. Gordon Brown thinks we should raise gambling taxes.

Beyond that you can be expected to be bombarded with plenty of media speculation around which taxes the chancellor will raise. Don’t be surprised to find AJ Bell mentioned in there. We respond to media questions on potential tax changes, but we try to do so in a balanced way which seeks to inform people, without overegging the pudding. That’s not always the case with the stories you will read in the press, and there can be negative consequence for your finances.

Ahead of the last Budget, there was rampant speculation that the chancellor was going to abolish or reduce the amount of tax-free cash you could take from a pension. Many people were understandably frightened about the money they had spent their lives building up and pulled it out of their pension ahead of the Budget.

PREVIOUSLY CHANGE DIDN’T COME AS EXPECTED

The chancellor didn’t change the tax-free cash rules, and these savers ended up with a load of cash parked outside the tax protection of a pension, which couldn’t go back in. That’s part of the reason why at AJ Bell we have called for the chancellor to announce a pensions tax lock: committing to no changes to pensions taxfree cash or tax relief for the remainder of this parliament, to provide some stability for investors to build their retirement plans.

So, you do need to be careful about taking action on the back of media reports about tax rises. Be sure to check the source for the information quoted in the article. Some are official, some less so. Many commentators and think tanks have political views which inform their contributions to the debate. And be particularly wary of stories built on the back of a cabinet minster refusing to rule out such and such. No minister is going to predict what the Budget will hold ahead of it happening. Not least because if you’re not chancellor, it’s not your job.

STAY INFORMED BUT DON’T ACT IN PANIC

It’s definitely important to keep informed, and press coverage around the Budget can help you

do that, though do keep your critical faculties to the fore when reading. Having a stock take of your finances ahead of the Budget can also put you in a position to take action if necessary. And if you do make changes to your savings and investments ahead of the Budget, make sure that you will be happy with them even if the chancellor doesn’t raise taxes where you expect her too. Ultimately, nobody knows where the axe will fall. While that is undoubtedly a frustrating position, so is living with the consequences of a poor financial decision made in a pre-Budget panic.

DISCLAIMER: AJ Bell owns Shares magazine. The author (Laith Khalaf) and editor (Tom Sieber) of this article own shares in AJ Bell.

By Laith Khalaf AJ Bell Head of Investment Analysis

Ask Rachel: Your retirement questions answered

How can I avoid falling foul of HMRC recycling rules?

Helping with a query about withdrawals and subsequent contributions to a pension pot

I’m planning on withdrawing around £28,000 from my SIPP around January 2026 but don’t want to fall foul of HMRC’s tax recycling rules with my pension contributions during this tax year.

I think I get the idea of not increasing my cumulative contributions (triggering tax relief) ‘significantly’ (30% more than would be expected) over five years (so in my case from 2023/24 to 2027/28).

But what I’m not sure about is exactly which year’s past contributions are considered to be ‘expected’. Is it just the one year preceding the five-year ‘test’ period (so 2022/23 for me)? Or maybe they’d be looking at the average of, say, the previous three or four years (going back to 2020/21 or 2019/20 in my case)?

Or would they go back even further than that, when my contributions were much lower? The figures come out differently in each case, as my contributions in each tax year have varied quite widely since 2017/18.

Does it help if I decide not to contribute anything at all to my SIPP for the next two years or so (thus reducing the cumulative ‘increase’ over whatever is ‘expected’ and therefore being ‘on the safe side’)?

Anonymous

Rachel Vahey, AJ Bell Head of Public Policy, says:

I’ll start by explaining what is meant by ‘HMRC’s recycling rules’.

These rules aim to combat the potential issue of people ‘double dipping’ on tax relief by taking their tax-free cash and then immediately ploughing it back into their pension to gain more tax relief.

HMRC obviously want to prevent this from happening so it has devised a set of conditions to determine whether the tax-free cash (or pension

commencement lump sum (PCLS) to give it its technical name) should be considered as ‘recycled’. Broadly these are:

• the PCLS (and any other PCLSs received in a 12-month period) must be more than £7,500;

• the cumulative amount of additional contributions is over 30% of the amount of the PCLS; and

• the contributions for the member are significantly above what they would normally be.

When judging whether the rules have been broken, HMRC isn’t just looking at whether the contributions have increased after the PCLS has been taken, it also looks at the period before. In fact, the increase in contributions is tested on a cumulative basis over five years; two years before the PCLS is taken, the tax year the PCLS was made and the two years following the payment.

You are planning on taking a PCLS which is more than £7,500, meeting the first condition. As you are taking it in this tax year – 2025-26 – HMRC will look at the contributions paid in the period from 2023-24 to 2027-28.

It will be looking for a significant increase. For example, if you weren’t contributing anything in the first two years but then started paying £20,000 in the third year when you took your PCLS and for the next two tax years, that might pique HMRC’s interest. But there are no hard and fast rules.

However, if your contributions naturally fluctuate over the five-year period – say because you were

Ask Rachel: Your retirement questions answered

self-employed – then that could probably be explained.

Stopping contributions altogether after taking the PCLS isn’t necessarily going to mean ruling out recycling if contributions increased significantly just before you accessed the pension.

Even if there is a sudden spike in contributions this may not raise any flags if the pension saver has been following a consistent trend of pension saving. This condition is more likely to catch those who contribute minimal amounts, take a PCLS and markedly increase their contributions afterwards.

HMRC is also looking for evidence that the increase in contributions is a direct result of the PCLS. If you have a specific use for the PCLS then you may want to keep a written record of that to justify your actions.

But there is also a final condition that has to be satisfied before a PCLS can be said to be recycled. And that is whether the recycling was planned – in other words was it a conscious decision?

It sounds like in your case this is a no, especially if

you have a specific use for the PCLS. As the barrier between accumulation and decumulation blurs even further, it’s likely there are going to be many more of these cases where it could be argued that recycling has taken place, as people take tax-free cash at the same time as contributing to their pension.

This could mean a combined effective tax rate of 52% if they are a basic rate taxpayer, 64% if they are a higher rate taxpayer or 67% if they are an additional rate taxpayer.

DO YOU HAVE A QUESTION ON RETIREMENT ISSUES?

Send an email to askrachel@ajbell.co.uk with the words ‘Retirement question’ in the subject line. We’ll do our best to respond in a future edition of Shares

Please note, we only provide information and we do not provide financial advice. If you’re unsure please consult a suitably qualified financial adviser. We cannot comment on individual investment portfolios.

Money & Markets podcast

featuring AJ Bell Editor-in-Chief and Shares’ contributor Dan Coatsworth

LATEST EPISODE

US trade deal with Japan as earnings season kicks off, pensions and IHT plans confirmed, and 24-hour trading on the LSE

WHO WE ARE

EDITOR: Tom Sieber @SharesMagTom

DEPUTY EDITOR: Ian Conway @SharesMagIan

NEWS EDITOR: Steven Frazer @SharesMagSteve

FUNDS AND INVESTMENT

TRUSTS EDITOR: James Crux @SharesMagJames

EDUCATION EDITOR: Martin Gamble @Chilligg

INVESTMENT WRITER: Sabuhi Gard @sharesmagsabuhi

CONTRIBUTORS:

Dan Coatsworth

Danni Hewson

Laith Khalaf

Russ Mould

Laura Suter

Rachel Vahey

Hannah Williford

Shares magazine is published weekly every Thursday (50 times per year) by AJ Bell Media Limited, 49 Southwark Bridge Road, London, SE1 9HH. Company Registration No: 3733852.

All Shares material is copyright. Reproduction in whole or part is not permitted without written permission from the editor.

Shares publishes information and ideas which are of interest to investors. It does not provide advice in relation to investments or any other financial matters. Comments published in Shares must not be relied upon by readers when they make their investment decisions. Investors who require advice should consult a properly qualified independent adviser. Shares, its staff and AJ Bell Media Limited do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

Members of staff of Shares may hold shares in companies mentioned in the magazine. This could create a conflict of interests. Where such a conflict exists it will be disclosed. Shares adheres to a strict code of conduct for reporters, as set out below.

1. In keeping with the existing practice, reporters who intend to write about any securities, derivatives or positions with spread betting organisations that they have an interest in should first clear their writing with the editor. If the editor agrees that the

reporter can write about the interest, it should be disclosed to readers at the end of the story. Holdings by third parties including families, trusts, selfselect pension funds, self select ISAs and PEPs and nominee accounts are included in such interests.

2. Reporters will inform the editor on any occasion that they transact shares, derivatives or spread betting positions. This will overcome situations when the interests they are considering might conflict with reports by other writers in the magazine. This notification should be confirmed by e-mail.

3. Reporters are required to hold a full personal interest register. The whereabouts of this register should be revealed to the editor.

4. A reporter should not have made a transaction of shares, derivatives or spread betting positions for 30 days before the publication of an article that mentions such interest. Reporters who have an interest in a company they have written about should not transact the shares within 30 days after the on-sale date of the magazine.