UNDER THE RADAR

Uncovering less well-known funds with strong track records

Aberdeen Investment Trusts

If you’re keen to capture the potential offered by global investment markets, take a look at Aberdeen Investment Trusts. Managed by teams of experts, each of our trusts are designed to bring together the most compelling opportunities we can find to generate the investment growth or income you’re looking for.

Tap into Aberdeen’s specialist expertise across a wide range of different markets and investment sectors – both close to home and further afield. There’s plenty of choice to target your specific investment goals, whichever stage of life you’re at.

Please remember, the value of shares and the income from them can go down as well as up and you may get back less than the amount invested.

Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future.

Eligible for Individual Savings Accounts (ISAs) and Self-Invested Personal Pensions (SIPPs).

Invest via leading platforms. Find out more

Three important things in this week’s magazine

UNDER THE RADAR

Under the radar funds

The smaller collectives which are putting some of their larger counterparts to shame.

Dividend heroes

Discover the investment trusts which have increased their payouts year after year for decades.

What to expect from US banks

Financial stocks have done well across the Atlantic in 2025 – will the upcoming quarterly earnings season for the sector change that?

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

Will there really be no more rate cuts from the Fed?

It’s that time of year when those of us who are following the markets day-to-day take stock of the first six months of 2025 and, in turn, look ahead to what we can expect from the remainder of the year.

There are plenty of moving parts to consider, one of which is the future trajectory of interest rates. This was probably the biggest single obsession for markets before the Trump administration took office and, while tariff turmoil has pushed central bank decision making somewhat into the shade, it is still central to the relative attractions of different asset classes.

After all, higher rates normally increase the appeal of bonds and cash compared with stocks and viceversa.

With that in mind, there was a striking observation in some recent commentary from investment bank Berenberg. Economist Atakan Bakiskan noting he expects no further reductions in US rates.

Consensus forecasts still have rates dropping to a 3.5% to 3.75% range by the first quarter of 2026 from the current 4.25% to 4.5%. However, if Bakiskan is right then Trump is unlikely to be happy given the very public and unsparing criticism he has aired about Federal Reserve chair Jerome Powell. Attacking him for being too slow to ease monetary policy.

Notably, having gone harder and faster on rates than its counterparts at the European Central Bank and Bank of England in 2022, the Fed has been slower to retreat than either since the current ratecutting cycle began last year.

As my colleague Martin Gamble observes in this week’s News section, the better-than-expected jobs numbers released on 3 July make any kind of cut unlikely at the next policy meeting at the end of this month. Might this move Trump to announce Powell’s successor ahead of the end of his current term in May 2026, as has already been speculated.

The prospect of a shadow Fed chair, with investors looking for clues as to their future intentions on rates, is one which may heighten uncertainty and provide another source of volatility in financial markets.

Elsewhere in this issue, Ian Conway tees up the upcoming US earnings season with a sideways glance at the American banking sector, whose big names are always among the first to report.

There is also a really interesting look at some of the under-the-radar funds with performance track records which would put some of their more prominent peers to shame.

Stock markets react with relief as tariff deadlines extended

A 4.1% unemployment rate suggests little need for rate cuts from the Fed

An extension to the 9 July deadline for a previous pause on ‘Liberation Day’ tariffs, now shifted until the beginning of August, is overshadowing the threat of new levies on US trading partners.

Investors seem to be back on the TACO (Trump Always Chickens Out) train for now.

One driver of the latest threats on trade appears to have been prompted by the BRICs trading block condemning unilateral tariffs at a recent summit in Rio de Janeiro.

So far only a handful of trade agreements have been secured. That leaves hundreds of countries yet to declare their hands.

US secretary of commerce Howard Lutnick has confirmed that the smorgasbord menu of trade tariffs would not come into effect until 1 August, giving countries more negotiating time.

The other knock-on effect of this extension to the deadline, with noises from the administration suggesting it may not be set in stone, is it just prolongs the uncertainty for markets.

Ahead of the latest tariff turmoil, the narrow passage of the ‘Big Beautiful Bill’ through the House of Representatives and its signature on the White House’s South Lawn raised concern about the potential impact on the US deficit. While elsewhere the release of June’s non-farm payrolls revealed the economy added 147,000 jobs, exceeding consensus forecasts of 110,000.

In a note to clients Goldman Sachs Asset Management said: ‘Today’s stronger jobs report confirms a still resilient US labour market, defying, at least for now, the signs of weakness seen in some leading indicators.’

The strong report reflected robust demand in the state government and healthcare sectors. Underscoring the strength, both April and May’s reports were revised upwards by a combined 16,000 jobs.

The closely watched rate of unemployment fell to 4.1% from 4.2% in May, although the headline

Today’s stronger jobs report confirms a still resilient US labour market, defying, at least for now, the signs of weakness seen in some leading indicators”

rate was helped by a fall in the labour participation rate to 62.3% from 64.4%.

Bond yields moved higher across the maturity spectrum with the yield on 10-year treasuries rising to 4.4% from 4.2% before the payroll report was released.

Any hopes of a July interest rate cut were immediately dashed as traders pushed out implied cuts by the Fed to late 2025. The odds of a September rate cut reduced to 64% from 75% at the end of June according to the CME FedWatch tool.

With the S&P 500 trading at all-time highs investors clearly remain in optimistic mood. One way to measure this is CNN’s ‘Fear and Greed’ index which flashed ‘extreme greed’ on 7 July, its highest reading in a year. [MG]

Fear and greed index

Musk risks alienating supporters with new political intervention

Could board’s hand be forced to ask entrepreneur to stand down?

Elon Musk could face boardroom revolt if the Tesla (TSLA:NASDAQ) chief executive presses ahead with plans to launch a new political party, and analysts are worried.

Shares in the embattled electric vehicle maker fell sharply as investors fear that the move will likely further divert his attention away from the company. The stock plunged nearly 7% on 7 July, wiping out a large chunk of the recovery gains made since April.

It leaves the share price down 22.5% year to date and the best part of 40% off $480 all-time highs (adjusted for share splits) as the company continues to grapple with enormous challenges. It also puts hard decisions in front of the Tesla board, led by chair Robyn Denholm.

Intense competition from China and pressure on margins has been well documented. It has seen Tesla results miss growth expectations time and again, yet it is Musk’s activities away from Tesla that is cranking up the pressure.

Tesla sales have taken a hefty hit from a brand crisis that can be traced back to Musk’s position with the Department of Government Efficiency, or DOGE, an alleged effort to cut waste and fraud in the US government that split opinions among potential

Source: LSEG

Tesla buyers.

Musk’s political aims are now igniting another face-off with president Trump that could have severe ramifications for Tesla shareholders. William Baird analyst Jed Dorsheimer has warned that the Republican tax and spending bill has eliminated the $7,500 tax credit for new electric vehicle purchases or leases, posing a significant challenge for Tesla.

The analyst pointed out that while the removal of the tax credit may affect demand, the dual pressures of diminished demand and more than $2 billion in regulatory credit revenue at risk may become unbearable for investors.

Dan Ives, tech analyst at Wedbush, is worried that Musk’s launch of his ‘America Party’ could exert pressure on both the Republicans and Democrats by influencing the outcome in a dozen hotly contested races. ‘There is a broader sense of exhaustion from many Tesla investors that Musk keeps heading down the political track,’ Ives told clients.

It marks the return to political activism that many Tesla investors had hoped was firmly behind them. ‘Very simply Musk diving deeper into politics is exactly the opposite direction that Tesla investors want him to take during this crucial period for the Tesla story,’ warned Ives.

There is a growing sense that investors are growing weary of Musk’s political activities, and it could force the board to face the prospect of demanding he stand down from day-to-day operations, a prospect that would previously have been unthinkable. [SF]

Frasers targets Hugo Boss dividend policy and treasury shares

German firm needs to focus on improving its share price performance Hugo Boss

Having finally decided last month not to make an offer for Revolution Beauty (REVB:AIM) – in which it owns a minority stake via its 29% holding in online fashion firm Boohoo – retail brand owner Frasers (FRAS) has turned its attention to German luxury brand Hugo Boss (BOSS:ETR).

According to the Financial Times, the Mike Ashley-controlled group, which owns over 25% of the voting rights in the German firm, has waded into the debate about capital allocation, issued a statement last week saying Boss ‘should not pay a dividend at this time’.

While Frasers said it supported the senior management team of Stephan Sturm, chair, and chief executive Daniel Grieder, it urged them to priorotise ‘other value-enhancing measures’ in order to bolster long-term growth and increase the share price in the short term.

Frasers also called on Hugo Boss to redeem all the 1.4 million shares it acquired between 2004 and 2007, and which it has held in treasury ever since, to free up further capital.

The UK group, which has been building its stake in Hugo Boss since 2020 and sells the fashion brand across its stores and online, further indicated it was not averse to increasing its interest over the coming year after chief executive Michael Murray joined the board of the German firm a matter of a few

Source: LSEG

weeks ago.

It certainly has the firepower, having announced last week it had secured a new financing facility allowing it borrow up to £3.5 billion over the next three years.

Hugo Boss declared a €1.4 per-share dividend for 2024, despite the shares losing more than a third of their value from €67.46 to €44.78 while the DAX index gained almost 19% in comparison.

The German firm said it enjoyed ‘an active and constructive dialogue with all shareholders’, and it would present its strategy for profitable growth to investors, along with its capital allocation plans, later this year.

Boss management is currently forecasting group sales of between €4.2 billion and €4.4 billion for this year, compared with €4.3 billion last year, as ‘macroeconomic uncertainty’ is expected to weigh on industry growth.

Group EBIT (earnings before interest and tax) are forecast to be in the region of €380 million to €440 million against €360 million last year and €410 million the year before. [IC]

Currys shares climb to three-year high on resumption of dividends

Analyst calls trading update a ‘seminal moment’ and suggests buybacks may follow

Washing machine, air fryer and laptop seller Currys (CURY) reported a solid set of results for the year to 3 May, sending its shares up as much as 12p or 10% to a three-year high of 130p last week (3 July).

Group sales were up 2% on a like-for-like basis to £8.7 billion, driven by 4% like-for-like growth in the UK & Ireland, while Nordic like-for-like sales were flat in sterling terms despite a tough market and currency headwinds.

Encouragingly, the firm experienced organic growth in both channels, in-store and online, and gross margins grew faster than inflation, recovering towards their historic highs.

Strong cash flow generation resulted in the group sporting its strongest balance sheet in over a decade, leading the board to recommended a resumption of dividend payments after a hiatus in 2024.

Analysts at Panmure Liberum commented: ‘Every part of the business is heading in the right

Scorching weather takes its toll on Hollywood Bowl

The group successfully completed a £10 million share buyback in April

When tenpin bowling operator Hollywood Bowl (BOWL) reported record trading in the first half (29 May) to the end of March, the shares fell by around a tenth reflecting a prolonged period of unprecedented dry and warm weather from March to May.

The scorching temperatures in June appear to have added to the group’s woes with the shares dropping a further 13% over the last month, meaning they are down 20% so far this year and 25% over the last 12-months.

At the half-year update, chief executive Stephen Burns made reassuring noises about how the

business was responding to the shortterm challenges. ‘We’ve responded quickly, managing margins and costs while maintaining strong operational performance, which remains as good as it’s ever been,’ insisted Burns.

Burns also said the firm was well prepared for the key July and August holiday period and he expected it to meet analysts’ full year EBITDA (earnings before interest, tax, depreciation, and amortisation) forecasts.

Consensus earnings per share forecasts for the year to September have drifted down, but analysts at Berenberg remain optimistic about the outlook for operating

direction, the balance sheet has not been this strong in a decade, dividends are back and the prospects for buybacks this year are very real. Positive trading catalysts are building, and there is a change in emphasis in the report towards growth.’ [IC]

Source: LSEG

performance with FY26 estimates implying high single digit EBITDA growth and double-digit EPS growth. ‘Given the elevated level of investment in the business for refurbishments and new openings in recent years, we remain confident in management’s ability to deliver sustained profitable growth.’ [MG]

15 July: Brickability, Sosander

16 July: Cohort

ANNOUNCEMENTS

15 July: Robert Walters, Experian

16 July: Hunting, Barratt Redrow, SSE

Investors to take their direction from leading housebuilder Barratt Redrow

Conflicting messages from smaller players have painted an unclear picture Barratt

It has been a mixed reporting season for housebuilders so far this summer, with Bellway (BWY) reporting better-than-expected completions and pricing while MJ Gleeson (GLE) talked of a housing market ‘lacking confidence’ and with no signs of a short-term catalyst for a substantial improvement.

Just as Shares is published (10 July), Vistry (VTY) is due to update the market, and the market will be looking closely at the firm’s first-half sales rate and order book, as well as progress on reducing its inventory of unsold properties.

However, investors will likely take their steer from Barratt Redrow (BTRW), the sector’s largest player, when it reports on 15 July.

The group’s first-quarter update in mid-April suggested demand for its homes was resilient, with pricing

What does the market expect from Barratt Redrow?

beginning to tick up.

Additionally, the benefits of the merger were just starting to shine through with the company sounding confident its increased scale would keep a lid of cost inflation coming through from suppliers and subcontractors.

UK interest rates are still expected to fall by another 50 basis points or half a percent by the end of the year, despite the recent wobble in the bond market, and estate agents report buyers returning after a short hiatus following the end of the stamp duty holiday.

Therefore new-build demand should improve in the second half, and investors will be hoping chief executive David Thomas strikes a confident tone for the rest of the year.

It may be early days to expect an increase in guidance, but failing that there may be scope for further shareholder returns in the form of more buybacks as the group’s balance sheet is in good order. [IC]

Redrow (p)

Source: LSEG

Netflix could smash second-quarter earnings forecasts

Global streaming giant hopes to become a $1 trillion company by 2030

Global content and streaming service Netflix (NFLX:NASDAQ) is due to report its second-quarter earnings on 17 July after the market close.

Analysts expect the firm to report an adjusted profit of $7.05 per share, up 44.5% from $4.88 per share reported in the same quarter a year ago.

Alicia Reese, analyst at US wealth management firm Wedbush Securities, is upbeat about the stock saying it offers ‘refuge from uncertainty’ due in part to its ‘virtually insurmountable lead in the streaming wars’.

By adding live events and broadening its content, Netflix should be able to add more advertising revenue for the next several years, Reese adds.

Analysts at Swiss firm UBS, UK bank Barclays and broker Canaccord Genuity have all recently upgraded

What does the market expect from Netflix?

What does the market expect from Netflix?

Source: Stockopedia

their price targets for the stock.

Over the past year shares are up 87% to $1,297 (as of 4 July), outperforming the S&P 500 index by some distance thanks to its continued resilience.

In the first quarter of this year, Netflix reported a 13% increase in revenue to $10.54 billion beating Wall Street estimates due to strong subscriber growth.

In 2024, the company added 41 million new users, ending the year with nearly 302 million subscribers.

Netflix has also been able to maintain its leading position in the intensely competitive streaming market capturing 7.5% of total US video viewing time, putting it second only to YouTube.

The company is keen to enhance its capability for advertisers, which is key to its future success and ambitions to become a $1 trillion company by 2030.

In early April, Netflix launched its in-house ad tech platform which it said over time would enable it to offer ‘better measurement, enhanced targeting, innovative ad formats and expanded programme capabilities’. [SG]

QUARTERLY RESULTS

15 July: JPMorgan, Wells Fargo, BlackRock, Citigroup, Bank of NY Mellon, State Street

16 July: J&J, Bank of America, Goldman Sachs, Morgan Stanley, United Airlines, Equifax

17 July: Netflix, GE Aerospace, Abbott Labs, PepsiCo, Marsh McLennan, Travelers, Seagate, US Bancorp, Elevance Health

Building products firm Genuit has great growth potential

The group is placed to benefit from cyclical and structural tailwinds

Genuit (GEN) 373p

Market cap: £928 million

At the beginning of March, we highlighted three mid-cap stocks which for one reason or another were trading well below what we believed was their intrinsic value and therefore had the potential to generate significant gains for investors.

One of these was water, climate and ventilation solutions firm Genuit (GEN), better known to seasoned investors as Polypipe before a name change.

TURNING THE CORNER

As we flagged at the time, expectations for 2024 were low due to a subdued trading environment but we had an inkling an improvement was in the offing with both new-build housing and the RMI (repair, maintenance and improvement) market set to improve this year.

A couple of months later, in mid-May, the firm posted a positive four-month trading update and confirmed its 2025 guidance thanks to ‘encouraging signs of recovery’ in its key markets, sending the shares up 14% in a day.

Chief executive Joe Vorih commented: ‘Each of our Business Units has delivered organic sales growth for the first four months and we have secured some positive share gains in a competitive market. We are also making strong progress on the continued deployment of the Genuit Business System to drive productivity.’

While we the broader macroeconomic backdrop remains uncertain, Genuit isn’t directly exposed to changes in trade tariffs and is ‘well positioned to navigate this near-term environment,’ according to the chief executive.

Over the medium term, Vorih is

confident in Genuit out-performing the market ‘due to our strong exposure to sustainability-linked growth drivers’.

STEADY RATHER THAN STELLAR GROWTH

Genuit consists of three divisions: sustainable building solutions (around 40% of group revenue); climate management (30% of revenue) and water management (another 30% or so of revenue).

Sustainable building solutions is focused on domestic and commercial plumbing and drainage solutions, as well as building products such as injection-moulded plastic products for roofing, wall and floor ventilation, and valves for highpressure industrial pipe systems.

Climate management is focused on reducing the carbon impact of heating and cooling systems in the home and the workplace, with products ranging from large-scale ventilation and cooling systems to heat recovery units, filtration units to ensure water quality in heating systems, and heat pumps and underfloor heating.

well positioned to navigate this nearterm environment”

Water management is focused more on civil and infrastructure projects, covering surface water

drainage, sewer systems, pressure systems, cable access and protection, and includes the original Polypipe business.

All three divisions grew their turnover by high single digits in the first four months of this year, highlights being new-build housing, more need for stormwater attenuation solutions due to dry Spring weather and increased demand for residential and commercial ventilation systems.

Management expect to be able to offset increased labour costs – due to the increase in NI contributions and the minimum wage – through productivity gains and cost management, and the Genuit Business System is expected to improve margins over the course of the year.

Meanwhile, thanks to its strong balance sheet, the firm continues to build a pipeline of potential bolt-on acquisitions to increase its market share and add new capabilities.

FUND

MANAGERS SEE UPSIDE

Alex Wright, manager of UK-focused investment trust Fidelity Special Values (FSS), is a contrarian stock-picker with a tremendous track record which includes having beaten the Nasdaq over the last five years.

With a current UK market share of around 20% and exposure to long-term themes such as sustainable construction, water management and infrastructure investment, we believe this is more than a cyclical recovery story”

structural change, and Genuit is a relatively new holding in the early, ‘beginning of change’ category.

‘There are numerous attractive opportunities in the current market, available at low valuations, and we continue to uncover compelling investment ideas, particularly in periods of high market volatility. We believe current market conditions continue to favour our contrarian-value investment style, and this is reflected in our increased exposure to domestically focused businesses, particularly within UK consumption,’ which include housingrelated stocks like Genuit, says Wright.

The trust takes a three-step approach to investing in companies which are undergoing

Source: Stockopedia

Another fan of the stock is Charles Montanaro, manager of Montanaro UK Smaller Companies (MTU), who views it as a high-quality business with strong leadership and a growing ‘moat’.

‘Genuit offers an extensive portfolio of innovative solutions ranging from PVC drainage and plumbing pipes/products to low-carbon heating and cooling systems, clean and healthy air solutions and resilient surface water management – this means identifying ways to reduce the risk of flooding through diverting or managing water flows.

‘With a current UK market share of around 20% and exposure to long-term themes such as sustainable construction, water management and infrastructure investment, we believe this is more than a cyclical recovery story,’ says the manager.

With first-half results due on 12 August, and the price having drifted back from its post trading update high of 420p, we think this is a good time to start accumulating Genuit shares.

Assuming no change to earnings forecasts of 28.5p per share by December 2026, and a gentle re-rating towards its 10-year median valuation of 20 times, we reckon the shares could be trading at 570p or more than 50% higher than today within 18 months. [IC]

Guard your hard-earned wealth with STS Global Income & Growth

This global trust’s capital preservation focus should appeal to investors seeking to protect irreplaceable capital and grow their income

STS

Global Income & Growth Trust (STS) 242p

Market cap: £285 million

Rising market volatility, Donald Trump’s tariffs and US equity valuations at nosebleed levels are among the risks facing patient portfolio builders at present, which suggests to Shares this is a sensible time to invest in a fund with a capital preservation focus that strikes a balance between quality income and growth.

One trust which should steer a steady course through the ups and downs ahead is STS Global Income & Growth (STS), co-managed by Troy Asset Management’s James Harries and Tomasz Boniek.

Since Troy was awarded the mandate in 2020, the trust’s conservative approach has delivered superior risk and downside protection characteristics for shareholders, who’ve also benefited from lower charges following a 2024 merger with stablemate Troy Income & Growth.

With investors warming to its defensive attributes, STS Global Income & Growth is the Global Equity Income sector’s second-best one-year share price total performer and this concentrated portfolio of resilient, cash-generative companies offers an attractive 3.5% dividend yield.

Investors have

done

fantastically well over a very long period of time and the prudent thing to do is to take some of those gains and secure a long-term growing income stream for yourself ”

Global Income & Growth Trust

Source: LSEG

WINDS OF CHANGE

The £285 million cap trust pursues a quality investment approach, seeking to invest in 30 to 50 stocks Harries and Boniek believe are high-quality and holding them for long periods to capture their compounding power.

The quarterly dividend-paying vehicle benefits from Troy’s conservative investment style and is well positioned to offer an attractive, low-risk source of income and capital growth over the longer haul.

STS Global Income & Growth’s strict discount control mechanism is a further attractive feature for investors who dislike to see trust holdings languishing well below NAV (net asset value).

‘I think we are going through a reverse Berlin Wall moment,’ Harries tells Shares. ‘The world is splitting into two blocks, the US and China, we’re now in a more inflationary environment, there are greater concerns about government balance sheets and the world is less secure. So all the things that have been so good for so long in the past are less favourable today.’

For some time, Harries has felt the US market is ‘pretty fully valued and this economic expansion is quite long in the tooth, and we’ve hit quite a fragile

situation with tariffs and geopolitics.’

His key message: ‘Investors have done fantastically well over a very long period of time and the prudent thing to do is to take some of those gains and secure a long-term growing income stream for yourself.’

QUALITY BIAS

That’s where this trust has a role to play. The portfolio includes companies such as Philip Morris (PM:NYSE) and British American Tobacco (BATS), tobacco titans transitioning from the traditional business of selling combustibles to distributing less harmful products.

repeat and non-discretionary nature of spending in this category, often mandated by regulation, which leads to high recurring revenue and solid growth.

Rentokil has temporarily stumbled due to teething problems with the acquisition of US pest business Terminix, yet Harries believes these issues will ultimately be solved and this should boost Rentokil’s rating.

‘Generally, we are pretty sceptical of acquisitions at Troy, but this one is potentially very interesting in the sense that it is the core business of what Rentokil does,’ he explains.

Other top 10 holdings include US software company Paychex (PAYX:NASDAQ), which has proved ‘an excellent long-term investment’ for the trust, as well as Japanese video game giant Nintendo (7974:TYO).

STS Global Income & Growth has typically low portfolio turnover, but Harries has been able to purchase what he considers some exceptional businesses at low valuations of late.

One such recent addition is Rentokil Initial (RTO), the pest control industry player benefiting from the

STS Global Income top holdings

STS Global Income top holdings

top 10: 47.3%

Source: Troy Asset Management

Source: Troy Asset Management

STS Global Income & Growth bought sneakersto-basketballs franchise Nike (NKE:NYSE) during the Liberation Day sell-off. ‘Nike is now under new management,’ enthuses Harries.

‘The business is returning to its previous model of being multi-channel and sports-based, and we were able to buy it on a low double-digit PE with no debt. Our view is either the tariffs won’t come through in quite the way everyone expects, Nike will be able to shift some of its manufacturing, or it can put up prices, but overall this is manageable.’ [JC]

Gaming Realms is on a roll and remains a buy

The number of unique players in content licensing increased by 22% in 2024

Gaming Realms

(GMR:AIM) 52.2p

Gain to date: 59%

It has been just over a year since we flagged AIM-listed games distributor Gaming Realms (GMR:AIM) for its underappreciated growth prospects driven by the expansion of the popular Slingo brand.

For the uninitiated, Slingo games are a mashup of slots and bingo and Gaming Realms has the intellectual property rights to the brand.

Pleasingly, the shares have been on a tear, jumping around 43% over the last six months taking gains since our buy recommendation on April 2024 to 59%.

WHAT

HAS

HAPPENED

SINCE WE SAID TO BUY?

The company revealed another strong year of growth in 2024 with revenue rising 22% to £28.5 million, driven by the release of 12 new unique Slingo games and the launch of 44 new content

Gaming Realms

partners across the globe.

Adjusted EBITDA (earnings before interest, tax, depreciation, and amortisation) grew 30% to £13.1 million representing a margin on sales of 46%, up from 43% in the prior year.

The business ended the year with cash of £13.5 million, up from £7.5 million, and remains debt free.

Reflecting the board’s confidence in the strategy and business model, the company announced an initial £6 million share buyback programme equivalent to around 4% of the firm’s market capitalisation.

Looking ahead, the company said it expects to deliver further growth in new and existing markets. So far in 2025 Gaming Realms has launched with five new partners and three new Slingo games.

Chief executive Mark Segal commented: ‘Building on the momentum, we have made an excellent start to 2025 with our recent launch in Brazil, a newly regulated iGaming market, which expands our global presence to 21 markets.’

WHAT SHOULD INVESTORS DO NOW?

The company continues to deliver on its threepronged strategy to grow the number of Slingo games, launch with new partners and enter new territories.

Earnings are expected to grow by mid-doubledigits over the next few years, while the growing cash pile presents further opportunities to reward shareholders.

Gaming Realms is a unique business, and the long-term potential remains exciting. [MG]

UNDER THE RADAR

By Steven Frazer News Editor

Uncovering less well-known funds with strong track records

Acouple of weeks ago, Shares took a look at a handful of ‘under-theradar’ stocks held by some of the most popular funds readers would be familiar with, such as Fundsmith (B41YBW7), JPMorgan Growth & Income (JGGI) and Fidelity Special Situations (B88V3X4)

In this feature, we are investigating ‘under-theradar’ funds, little-known gems which in their own right could make a useful addition to any portfolio. We’ll be looking at how they invest, what’s in their portfolios and how they have managed to put up such impressive performance numbers in recent years.

IS BIGGER BETTER?

Investors tend to gravitate towards larger funds as they tend to have longer track records, greater liquidity and, often because of the

economies of scale, lower charges, but that doesn’t always mean their performance is top-notch.

Smaller funds run less money, so managers can be nimbler and invest in stocks lower down the market scale ladder, giving them a much larger investment field in which to forage.

Larger funds, by contrast, are often unable to invest in smaller opportunities because they would be forced to either take an overly large stake in the company or establish a position which is too small to make a difference to the fund’s overall return, or ‘move the needle’ in fund manager-speak.

These contrasts mean smaller, more agile funds can outperform their larger cousins, sometimes over many years.

Take the Blue Whale Growth Fund (BD6PG78), for example. Launched in September 2017 with a £25 million cheque from Peter Hargreaves, it invests in high-quality businesses with long-run

growth scope, at attractive prices.

Blue Whale eschews research from third party brokers, instead relying on its own inhouse team of analysts to come up with great investment opportunities, then robustly tracking them in detail once they make it into the concentrated portfolio.

With typically with between 25 and 35 stocks, current holdings include Nvidia (NVDA:NSASDAQ), Visa (V:NYSE) and Paddy Power-owner Flutter Entertainment (FLTR), plus lesser-known ones like chip equipment maker Lam Research (LRCX:NASDAQ), German biotech kit designer Sartorius (SRT:ETR) and Danaher (DHR:NYSE), the US lifesciences powerhouse.

Performance has been impressive, returning more than 180% since inception (to 3 July 2025), beating its Investment Association Global Sector benchmark every year bar 2022 and often by a wide margin. That is why, today, Blue Whale Growth manages more than £1.3 billion of investor funds.

Matching that performance is a high bar, but we believe that these (largely) sub-£100 million funds have the potential to do so.

IFSL Meon Adaptive Growth Fund (BMQ8V53)

Price: 150p

Ongoing charge 0.82%

IFSL Meon Adaptive Growth Fund

Proving that bigger isn’t always better when it comes to global portfolios is Meon Adaptive Growth (BMQ8V53), a £48 million minnow punching above its weight.

Over three years, the Robert Hale-managed fund has delivered roughly double the cumulative return of the IA Global sector through a systematic approach which is delivering for investors.

The fund is up 62.1% versus 31.8% for the sector, ranked first-quartile over three years and one year, and boasts a five-star rating from Morningstar

Hale uses computer modelling to assess numerous financial measures of companies and can also invest in ETFs (exchange traded funds) to bring exposure to shares, bonds and commodities, but he reserves the right to use his judgement to override the output of the computer model.

While the fund is skewed towards UK, European and US-listed large caps, it doesn’t currently hold any ‘Magnificent Seven’ names.

Notable successes from positions closed over the past 12 months include Royal Caribbean Cruises (RCL:NYSE) and Leonardo (LDO:BIT), while winners within the current top 10 include ACS (ACS:BME) and Kongsberg Gruppen (KOG:OSE)

‘Perhaps one of the greatest advantages of a systematic approach to the management of a global equity portfolio is that you don’t get hung-up on style,’ says Hale.

‘Many managers set out their stall with a bias toward value, whereas others are more adept at a growth approach. Convincing a value stalwart to jump ship to growth and vice versa doesn’t always end well. The market is currently rather split upon which side of the divide to invest.’

the fact that our style-agnostic, systematic approach, which ignores the confusing noise from around the globe, has navigated a successful path, providing worthwhile outperformance, with lower levels of volatility and a globally diversified portfolio that has adapted along the way.’ [JC]

10 holdings

Shares magazine • Source: Meon Capital Management

With interest rates apparently heading lower, ‘growth could be where to head, but bond yields are remaining stubbornly high and therefore value could still prevail’, explains Hale.

‘And so it is that we at Meon rejoice in

Table: Shares magazine • Source: Meon Capital Management Cumulative performance

Chart: Shares magazine • Source: Meon Capital Management

Ninety One Global Special Situations (B29KP10)

Price: 496p

Ongoing charge 0.82%

Ninety One Global Special Situations

Performance of Ninety One Global Special Situations fund

Chart: Shares magazine • Source: LSEG

The Ninety One Global Special Situations fund (B29KP10) has delivered solid returns to investors over the past 10, five and three years on an annualised basis, outperforming its benchmark, the MSCI All-Countries World index.

The fund, managed by Alessandro Dicorrado, aims to provide capital growth and income to investors over at least five years by investing in companies from around the world which he believes are undervalued by the market.

‘We employ a value strategy, focusing on uncertainty rather than solely low multiples when identifying companies to invest in,’ explains the manager.

‘The recent markets’ turmoil after the US trade tariff news in April created opportunities for us to buy companies with a cheap valuation. We are particularly interested in how markets overreact to events as this presents buying opportunities.’

To identify potential investments, the fund employs a quantitative screening tool to analyse companies undergoing special situations. These can be defined as company going through a turnaround, spin-off, postbankruptcy or re-capitalisation.

Dicorrado adds: ‘The fund focuses on the likelihood of being right eventually, rather than precisely timing the bottom.’

There are several notable names in the fund’s top 10 holdings, including aircraft engine maker Rolls Royce (RR.), Facebook owner Meta Platforms (META:NASDAQ) and airline and holiday packages provider Jet2 (JET:AIM).

‘Rolls Royce and Meta have performed well for the fund,’ says Dicorrado and ‘may well be trimmed or sold [in the future].’

In terms of new holdings, the fund is looking to Brazil’s investment management company XP Inc (XP:NASDAQ) as a potential recovery story, and warship builder Huntington Ingalls (HII:NYSE), which Dicorrado believes is an undervalued stock.

Surveying the current market backdrop, Dicorrado thinks uncertainty will remain elevated: ‘Geopolitical tensions, shifting trade dynamics, and persistently high borrowing costs demand caution. In this environment, a passive approach won’t cut it. An active approach is essential-targeting alpha through quality and value, two distinct yet complementary styles that offer diverse and uncorrelated return potential within UK equities.’ [SG]

VT Holland Advisors Equity (BMW26L0)

Price: 143p

Ongoing charge 1.24%

VT Holland Advisors Equity

Set-up and run by Andrew Hollingworth’s Holland Advisors just over four years ago, the VT Holland Advisers Equity Fund (BMW26L0) is a tiny sub-£40 million gem with a track record which would put many much bigger funds to shame.

Benchmarked, like Blue Whale Growth against the IA Global Index, it has put up a highly impressive performance from day one, outperforming 38.9% versus 22.4% from its inception up to the end of May 2025.

Yet, it is over the past three years that it has really shone, more than doubling its benchmark return (77.8% versus 33.3%, based on Trustnet data), making it among the best in the sector.

Hollingworth has done this by investing in good businesses which can generate returns on capital and allocate any extra cash well.

The team are effectively looking at the fastest way possible to compound returns, but without loosening the risk reigns too much. The way they do this is by owning shares in businesses which can grow their own intrinsic value at a faster but sustainable rate.

As the fund’s literature states, ‘we want to find great companies run by great managers available at great prices’.

Current holdings stand at 27, so it’s a

Chart: Shares magazine • Source: LSEG

VT Holland Advisers has smashed its benchmark performance

‘If people think it is best to invest with us, that is what they will do. Worrying about the industry structure and how it should or shouldn’t be different isn’t my job and isn’t going to make it any easier. If we are destined to succeed, then we will,’ the manager said in a recent interview with Trustnet.

VT Woodhill UK Equity Strategic Fund (BMTRT64)

Price: 96p

Ongoing charge 1.28%

concentrated fund which includes Irish budget airline Ryanair, global money transfers business Wise (WISE), chip manufacturing giant TSMC (TSM:NYSE) and Wall Street-listed homes builder and land development firm Green Brick Partners (GRBK:NYSE)

VT Holland Advisors’ small scale does present issues. For one, it is not the cheapest: investors are asked to pay ongoing charges of 1.24% a year. Size also makes it difficult to grab the attention of wealth managers who tend to want to throw multi-million pound cheques at funds, something this one would find difficult to handle. Yet Hollingworth hopes that will change in time, which makes retail investors so important.

It’s not impossible that VT Holland Advisors could, one day, manage £1 billion of funds, but Hollingworth is determined not to change the ethos too do it.

VT Woodhill UK Equity Strategic Fund

The all-weather, £32 million VT Woodhill UK Equity Strategic Fund (FUND:BMTRT64) aims to provide investors with a positive return over a 12-month period regardless of market conditions, and will lower volatility than the market.

VT Holland Advisers IA Global

Top 10 holdings

Table: Shares magazine • Source: FE Analytics. Data at 31 May 2025

Fund managers Paul Wood and Michael Bedford, who have over 50 years of markets experience between them, have blown the lights out over the last three and five years, delivering total returns of 33.5% and 50.3%, respectively.

That makes the fund the best performer in the IA’s (Investment Association) absolute return category, more than doubling the sector’s 21.5% return over five years.

The managers have achieved this with annualised volatility of just 4%, which means investors have had a much smoother ride than the underlying market.

As Paul Wood explains: ‘At Woodhill, we aim

to protect investors from substantial market declines when risk is high. We are about capital growth when the risk/reward is favorable and capital preservation when it is not.’

Recent market gyrations driven by tariff uncertainty have produced three periods when equities have dropped between 8% and 9% in a matter of weeks.

The fund has protected shareholders’ capital each time, demonstrating the capital preservation skills of the managers.

‘We do not believe investors should put up with seeing dramatic declines in the value of their portfolio. An investment manager should, in our view, do all he or she can to act to both grow and protect investors’ money,’ insists Wood.

That does not mean losing sight of the upside, however, as the performance over the last few years shows. Wood and Bedford populate the portfolio with around 50 large-cap, high-quality companies which are solidly financed and are expected to grow.

Top holdings include pharmaceutical giant AstraZeneca (AZN), global bank HSBA (HSBA), aerospace and defence group BAE Systems and data analytics firm RELX (REL)

The managers assess overall market risk using economic, fundamental and market-related data sets. The fund is hedged around two thirds of the time on average.

The fund has an ongoing charge of 1.28% a year and dividends are paid in March and September. [MG]

DISCLAIMER: Steven Frazer has a personal investment in Blue Whale Growth and Fundsmith Equity.

Dividend heroes: the investment trusts with the longest track records of consistent dividend growth

Ten of the AIC’s ‘heroes’ have demonstrated their durability by increasing payouts for over half a century

Rates are starting to come down on cash savings accounts driving income-hungry individuals back into equities and bonds in search of better yields at a time when tariffs and volatile geopolitics are expected to keep inflation high.

In a scenario where central banks continue to cut rates, savers will be offered less generous interest on their cash in the years ahead. In contrast, equity income-focused investment trusts offer the potential for attractive yields for many years as well as a growing stream of dividends.

Shares has consistently championed the unique advantage investment trusts have when it comes to paying regular and progressive dividends.

For the uninitiated, these funds are able to hold back up to 15% of the income they receive from their portfolios and tuck it away in revenue reserves which can be used to boost dividends during lean spells when businesses they own may be cutting payouts.

This structural benefit has enabled many investment companies to pay consistently-rising dividends through both good and bad years for

many decades, a record unrivaled by other funds such as unit trusts.

You may have heard of the AIC’s (Association of Investment Companies) ‘Dividend Heroes’, classified as trusts which have increased their dividends for 20 or more years in a row.

Impressively, 10 of these dividend heroes have over half a century of unbroken annual increases under their belts and the AIC also maintains a list of the ‘next generation’ dividend heroes, trusts with more than 10 years of consistently rising dividends but less than 20 years.

WHY DIVIDEND HEROES DESERVE YOUR ATTENTION

Annabel Brodie-Smith, communications director of the AIC, says: ‘The dividend hero investment trusts offer income seekers a consistently-rising income, with 10 dividend hero investment trusts increasing their dividends for more than half a century. Of course, dividends are never guaranteed but these track records demonstrate their durability.’

Josef Licsauer, investment trust research analyst at Kepler Partners, insists: ‘The AIC’s Dividend

Heroes list is a timely reminder of the strength and resilience investment trusts can bring to an income strategy. Trusts on this list have increased their dividends every year for over two decades, with half boasting 50-plus year streaks, a remarkable achievement through inflation shocks, recessions and global crises.’

Brodie-Smith adds: ‘It’s important to do your

Holding out for some heroes

research on the dividend heroes so you find an investment trust which meets your investment needs and risk profile. The dividend heroes and next generation of dividend heroes cover a wide range of sectors from the equity income and global sectors to UK smaller companies, infrastructure and private equity.

‘The AIC’s website is a good place to start

A selection of 'next generation' heroes

your research as there’s lots of useful dividend data including the yield, the five-year dividend growth, dividend cover, revenue reserves and a full dividend history. There’s also a wealth of additional data including discounts, gearing, performance and charges.’

HEROIC ACHIEVEMENTS

In recent years, the concept of dividend heroes has really taken off with qualifying investment trusts eager to retain their position within the AIC’s list. After all, dividend hero status is a valuable marketing tool.

At the time of writing, 20 trusts qualify for dividend hero status, with City of London (CTY), Bankers (BNKR), Alliance Witan (ALW) and the Cayzer family-controlled Caledonia Investments (CLDN) sporting 58 consecutive years of dividend hikes apiece.

These trusts started paying their shareholders higher dividends in the same year Bobby Moore held the World Cup aloft for England and have grown distributions in every year since.

Only one of this quartet currently trades at a

popular City of

Five-year annual dividend growth

Alliance Witan

The Global Smaller Companies Trust

BlackRock Smaller Companies

Scottish Mortgage Investment Trust

F&C Investment Trust

Bankers Investment Trust

Scottish American JPMorgan Claverhouse

Caledonia Investments

Brunner Investment Trust

Data as at 26/06/25

Source: theaic.co.uk/Morningstar

Over the past decade, City of London Investment Trust has delivered a solid 92.6% share price total return, but the Job Curtis and David Smithmanaged trust is the top-performing ‘hero’ year-todate with a 15.8% return.

City of London traded at a premium to NAV (net asset value) for most of 2021 until 2023 but last year slipped to a 3% approximate discount; it now trades at a 1.8% premium as investors warm to the UK stock market again.

CALEDONIA JOINS THE CLUB

In contrast, the newest entrant to the 58-year club, Caledonia, trades on a wide 30%-plus NAV discount which likely reflects the self-managed trust’s significant exposure to private capital besides public companies and funds.

Originally a shipping company, founded by Sir Charles Cayzer in 1878, this global multi-asset investment company remains 49% owned by the Cayzers, making it less an investment trust and more a ‘family office’ whose job is to create and protect wealth for generations to come. Nothing demonstrates that long-term view quite like the fact Caledonia has now raised its payout for

10-year dividend growth

Scottish Mortgage Brunner Investment Trust

Alliance Witan

F&C Investment Trust

Scottish American Bankers Investment Trust

Murray International

Caledonia Investments

Merchants Trust

JPMorgan Claverhouse

Data as at 26/06/25

Source: theaic.co.uk/Morningstar

pushing on six decades.

The biggest of the four by total assets is Alliance Witan, which boasts the second-longest dividend growth track record among investment trusts. ‘With a distributable reserve of £3.7 billion, including a £55.6 million revenue reserve (as at 31 December 2024), there appears little reason to doubt the board’s ability to maintain this progressive dividend policy,’ notes QuotedData.

Hot on their heels with 54 years of consecutive payout growth to crow about is The Global Smaller Companies Trust (GSCT), which has one of the fastest five-year dividend growth records among the heroes at 11.2% and will reach the 55-year milestone on 20 August.

Paul Niven-steered F&C (FCIT), the ‘one-stopshop’ global fund invested in more than 350 companies in 35 countries, with a formidable 10year share price total return approaching 200% and a five-star Morningstar rating, also sports 54 years of dividend growth.

Chasing these names down are Brunner (BUT) on 53 years and JPMorgan Claverhouse (JCH) on 52 years, followed by Murray Income (MUT) and Scottish American (SAIN) with 51 years of payout growth apiece.

The heroes list also includes high-yielders

The City of London Investment Trust

Caledonia Investments

Source: LSEG

Merchants (MRCH), the Simon Gergel-steered fund boasting over forty years of dividend growth, and Aberdeen Equity Income (AEI) whose dividend growth streak extends to nigh-on a quarter of a century, not to mention Murray International (MYI), a global equity income trust with a defensive approach and value bias which was recently granted hero status after raising the 2024 dividend by 2.6% to 11.8p for a 20th consecutive year of rising payouts.

Managed by Martin Connaghan and Samantha Fitzpatrick, Murray International’s distinctive style and avoidance of frothily-valued growth stocks means it brings something different to the table.

A diversified portfolio of quality companies, the managers’ focus on cash-generative firms with durable business models, wide economic moats, strong management teams and ESG credentials is reassuring at this time of geopolitical uncertainty.

WHY CLAVERHOUSE STANDS OUT

Kepler’s Licsauer notes JPMorgan Claverhouse has delivered 52 consecutive years of dividend growth. ‘That’s not just consistency, but growth with substance: since 1972, JCH’s dividend has compounded at 9% per annum, well ahead of inflation and the broader UK equity market,’ observes Licsauer.

‘Like others on the list, JPMorgan Claverhouse has drawn on one of the trust structure’s key advantages: the ability to use revenue reserves to maintain payouts in more difficult years. But rather

Source: LSEG

than rely on this indefinitely, the management team has evolved the portfolio to support future dividend growth and rebuild reserves.’

He continues: ‘Today, it blends high-yielders with dividend growers and compounders, notably increasing its exposure to opportunities across the UK market. This includes small- and mid-caps which currently offer better yield and growth potential

JPMorgan Claverhouse

BlackRock Smaller Companies Trust

Source: LSEG

than many large-caps, and hold the potential to support dividend growth for years to come.

With a 4.5% yield and a forward-looking strategy, Claverhouse’s place among the Dividend Heroes feels well-earned, and a reminder that sustainable income often comes from trusts willing to adapt, not just endure.’

Licsauer adds: ‘Investors might also want to keep

Source: LSEG

an eye on the next generation of Dividend Heroes, like Fidelity Special Values (FSV), which has raised its dividend for 15 consecutive years and grown it at nearly 12% per annum since 2009, faster than inflation and with strong reserve cover to support future growth.’

Liscauer’s Kepler colleague Ryan Lightfoot-Aminoff says: ‘BlackRock Smaller Companies (BRSC) is interesting in itself due to it being focused on UK smaller companies, an asset class not typically known for its income credentials.

‘This dividend is largely an output of the process rather than a goal of manager Roland Arnold, although his focus on high-quality, cash-generative companies means that the portfolio often generates a good amount of income. Following a 22nd consecutive increase of the trust’s dividend, the historic yield is circa 3.4%, with the latest dividend a 4.7% increase on the previous year. This required a small contribution from revenue reserves, although these stand at over 90% of the most recent dividend paid.’

DISCLAIMER: James Crux has personal investments in The Scottish American Investment Company, The Merchants Trust and Fidelity Special Values.

By James Crux Funds and Investment Trusts Editor

Why big US bank stocks are on a roll again

The S&P sector index is making new alltime highs

Three months ago everyone was fretting over the impact of ‘Liberation Day’ tariffs on the US economy, the consumer, and the financial system.

The S&P 500 Banks index fell more than a quarter, and JPMorgan Chase (JPM:NYSE) chief executive Jamie Dimon was warning of long odds for a ‘soft landing’ for the US economy.

Fast-forward and the same index is powering to new highs, up more than 35% in the space of three months. So, what has changed to drive this performance?

As analysts at S&P Global Market Intelligence explain: ‘Heightened tariff-related anxiety will weigh on loan growth and credit quality, and could threaten earnings growth in 2025, but the worstcase fears in the investment community appear to have subsided and banks still expect to benefit from deregulation.’

And, while interest rates haven’t been cut as much as the market expected, funding costs are set to move lower which will help the banks increase their net interest margins, ‘while earning assets mature and are replaced with higher-yielding loans and securities,’ say the analysts.

Another factor driving performance has been the expectation of higher payouts in the form of dividends, after the Federal Reserve’s annual ‘stress test’ showed all 22 banks surveyed had enough capital to withstand a hypothetical economic downturn.

The stress test was softer than in previous years, as the Fed’s economic downturn scenario was less severe, resulting in theoretical loan losses of around $550 billion, but the market never lets the truth get in the way of a good story, and the fact the major lenders sailed through was a big win.

As a result, all the big Wall Street banks hiked their dividends for the coming quarter, with Goldman Sachs (GS:NYSE) raising its payout by 33% or $1 per share.

JPMorgan Chase nudged its payout up by 10c

from $1.40 to $1.50 but made up for it with a new $50 billion share buyback, while Morgan Stanley (MS:NYSE) upped its payout from $0.925 to $1.00 and authorised a multi-year $20 billion buyback.

In terms of regulation, the Fed announced plans to lower the enhanced supplementary leverage ratio, which requires banks to hold a certain level of cash relative to their assets, which could prompt some banks to increase total shareholder returns further if they find they can’t deploy their excess capital.

The bank reporting season gets under way on 15 July with updates from Citigroup (C:NYSE), JPMorgan Chase and Wells Fargo (WFC:NYSE), among others.

By Ian Conway Deputy Editor

How do I rework my financial future after divorce?

Here are some simple steps to help you towards independence

After the dust has settled in a separation, it can be daunting to face building a new future which looks different from the one you planned. Part of this may include getting by on a different budget than you are accustomed to or had expected.

However, there are steps you can take to secure your financial future and allow you to focus on building your life instead. Making sure any remaining ties are unknotted can allow you to begin this process with more certainty about your position.

TAKE ACCOUNT OF YOUR ASSETS

Two of the main assets discussed in divorce are pensions and property. When it comes to pensions, depending on your settlement, this was likely either split through ‘pension sharing’ or ‘pension offsetting’.

If you opted for pension sharing, your pension pots were divided and you may have had some money added or taken out of your pot in the split. If you opted for pension offsetting, the amount in your pension would stay the same as before, with other assets, such as property, being used as an equaliser.

Regardless, it’s a good time to get an accurate picture of how much you have in your pension.

If you’ve had multiple jobs, you may have multiple pension pots. By combining these into one, you can get a more straightforward picture of how prepared you are for retirement.

When it comes to other assets, such as property, you will need to ensure everything you now own solely is listed just in your name.

In addition to the big-ticket items such as pensions and homes, you likely opened a variety of smaller accounts during your marriage which need to be accounted for.

If you have joint bank accounts, you will likely need to close them and reopen a new account owned only by you.

Once you have a good idea of what assets you own, you will also need to establish your insurer is aware of these changes. This way, you can make sure you are only insuring the assets still in your possession.

Personal Finance: Fresh start after divorce

CREATE A NEW RETIREMENT PLAN

Once you have a clearer understanding of what you have in your pension, you can start to form an idea of how your retirement will look, and if you need to start making additional contributions to keep it on track.

You will now be planning your future with one state pension instead of two, so the amount you need to save independently may rise.

In the most recent report from the Pensions Lifetime and Savings Association, estimates for a one-person household in retirement were £13,400 per year for a minimum lifestyle, rising to £31,700 per year for a moderate lifestyle, and £43,900 for a comfortable lifestyle.

Currently, the full state pension allowance sits at £11,973 per year, so the rest of that income would need to come from your own savings.

BUILD YOUR BUDGET

Starting your new life as a single person will likely mean adjusting how you spend. If you have children at home, you will need to have clear guidelines in place for how costs will be split, but you will also need to ensure your own lifestyle fits the budget you need to work with.

Some of these may be easy wins: if you have subscriptions or memberships your ex-partner was a fan of, but you can do without, remove them from your budget and make new space for other hobbies and interests. You may also be able to cut back on grocery bills or pay less in utilities for a

smaller living space.

Keep a close eye on your expenses in the first few months, so you can get an accurate picture of how much to budget and where you can cut back. Whether it’s a spreadsheet, an app, or just a pen and paper, taking a visual account of this information can create a clearer idea of your finances.

If you need to start contributing more to your pension, or if you have plans to save for a home, ensure that you make these savings a priority. This can allow you to start building an independent life.

KEEP AN EYE ON CREDIT

If you held joint accounts, there’s a good chance your credit score is intertwined with your expartner’s. Depending on your credit scores, delinking those accounts may hurt or help your own score.

You can check your own score as often as you want without harming the number, and you are required to be offered a free credit score check by each of the three major credit bureaus every year.

Having a gauge on this number can be essential for your planning, especially if you would like to buy a home independently in the future.

UPDATE YOUR BENEFICIARIES

Even once your separation has completed, your will does not automatically change. If you would no longer like that person to receive assets in the event of your passing, you will need to update this paperwork.

It’s also important to check if they are the guardian or executor of your assets, not just the beneficiary, and decide if this is something you’d like to change.

Bear in mind when your assets are not inherited by a spouse, they can become subject to inheritance tax even if being passed down to children.

While sorting out your finances is likely one of the last things you’d like to be doing during a sensitive time, it can provide you with a large amount of protection and comfort in the future.

Hannah Williford AJ Bell Content Writer

What should investors do about the dollar’s dive?

Taking a proactive approach may mean exploring different asset classes

There are two ways to look at the second Trump presidency.

The first is, there are already only threeand-a-half years to go, while November 2026’s mid-term elections will have a big say in how much, or how little, Trump can get done.

Even a modest swing towards the Democrats would hand them control of Capitol Hill and perhaps force the Republicans to start looking ahead to November 2028’s presidential election and to reassess their political priorities. In sum, ‘this too shall pass,’ as the old saying goes.

The other view is his ‘America first’ policies could have a major impact upon the US, and dollardenominated assets, and how attractive they are (or otherwise) for investors.

There will be those who stay loyal, in view of the rich rewards gleaned since the Great Financial Crisis ended in 2009 (and frankly beyond then, given America’s rise to global political, economic and military dominance over the past century or so).

Those who harbour doubts may have to ponder how to diversify to best effect, given the US stock market still represents around 60% of global market capitalisation and the greenback is the world’s reserve currency.

US equities still dominate global equity market capitalisation

Source: LSEG

A clear choice between those potential scenarios will at least provide investors with a framework for deciding whether current portfolio allocations are sufficiently well balanced to protect, and have the scope to augment, their savings and wealth.

DOLLAR DILEMMA

It is not hard to see why the dollar, as benchmarked

by the trade-weighted DXY index, nicknamed ‘Dixie,’ is losing ground in the second Trump presidency.

The White House does not seem wedded to a strong currency, and a weak one could help the plan to onshore industry by rendering exports from local manufacturing more competitive.

Trump continues to call for lower interest rates, even though inflation is still running above the US Federal Reserve’s 2% target more than four years after policymakers argued this was a ‘transitory’ issue.

Some owners of dollar assets may simply be put off by Trump’s use of executive orders, arbitrary decision making and the implications of his proposed Big Beautiful Bill, which looks set to add to a Federal deficit that is already expected to gallop higher.

The dollar continues to slide

Further dollar declines therefore are not impossible, especially as the DXY sits a lot nearer the top of its 20-year trading range than the bottom.

That said, currencies do have a habit of selfcorrecting, as a decline can help exports, drive growth and increase inflation, and thus force higher interest rates which should, by rights, serve to attract capital once more.

Investors must also be aware that the bear case usually seems most compelling at or near the bottom.

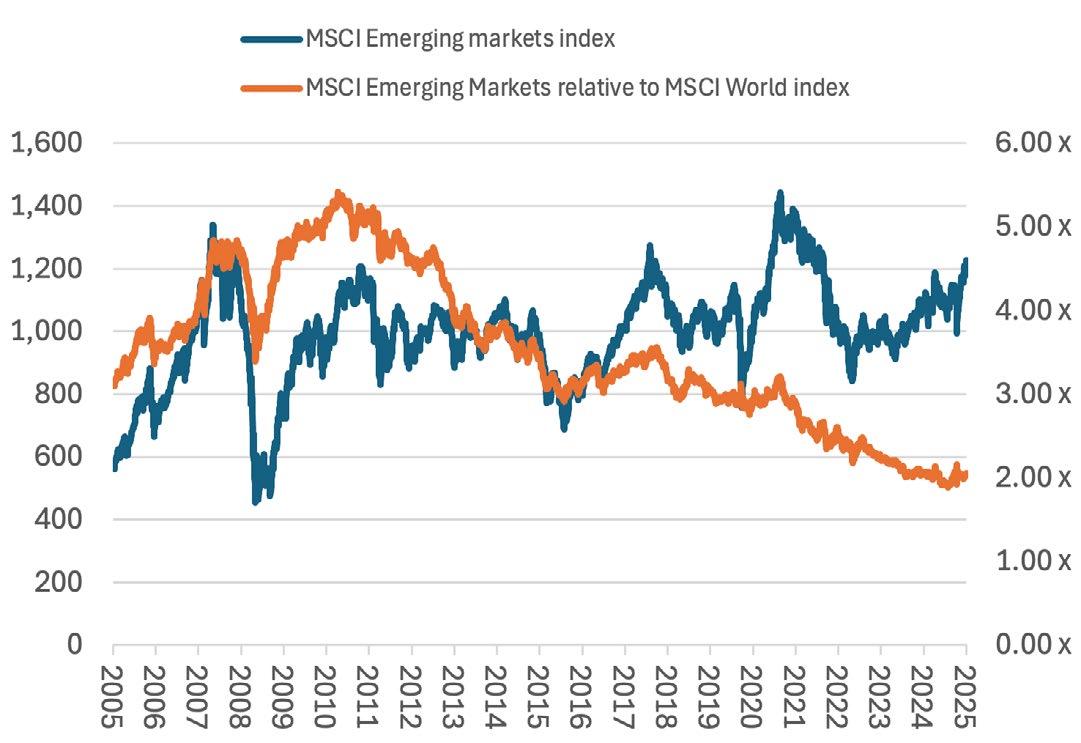

EMERGING OPTIONS

Those who do fear, or expect, a weaker dollar, or believe the post-Financial Crisis era of American

exceptionalism is ending, may therefore be left looking for alternatives .

Can emerging markets finally turn the corner after fifteen years of underperformance?

Source: LSEG

2025

2010 2015 2020 2025

It may not therefore require a huge leap of imagination to see why China and Hong Kong, Brazil (and the UK and Europe) sit above the US in terms of stock market performance in 2025 date.

Emerging markets in particular have been in the doldrums for so long and they still offer long-term growth potential.

Research from GaveKal and Aubrey Capital Management shows 69 of the world’s 100 biggest cities lie within a four-hour flight of Hong Kong, a circle which holds half the world’s population.

Demographic trends are favourable, income trends are positive and technological innovation is evident in everything from China’s excellence in electric vehicle batteries to Indian prowess in software development.

Those with a keen sense of market history will also be aware of the historical inverse relationship between the dollar and emerging market equities.

The past is no guarantee for the future, but a softer greenback has tended to help emerging markets in the past, as it eases the burden on developing economies’ overseas debts and enables them to spend the money on themselves rather than on interest for lenders.

Russ Mould: The dollar’s decline

RAW DEAL

Another asset class which has tended to do well during times of dollar weakness is commodities, not least because they are priced in the US currency. They become cheaper to non-dollar users and lower prices tend to fuel higher demand, though again, there is no certainty this pattern will repeat itself even if the dollar does go lower.

Gold’s all-time high may be no coincidence, but it may also deter contrarians from getting heavily involved now.

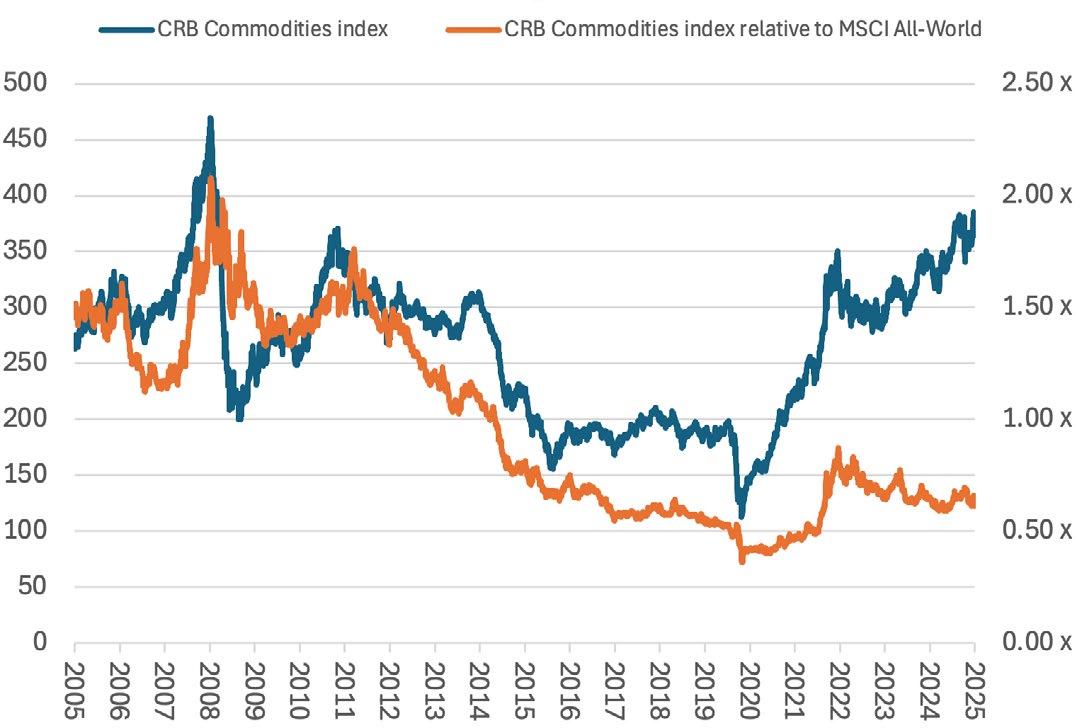

Silver, oil and platinum, to name but three, look cheap relative to gold on a historic basis, and the wider CRB Commodities index continues to

outperform equities almost unnoticed, some five years after forming a bottom relative to the FTSE AllWorld equity benchmark.

Was 2020 the bottom for commodities’ performance relative to equities? Was 2020 the bottom for

Source: LSEG

Money & Markets podcast

featuring AJ Bell Editor-in-Chief and Shares’ contributor Dan Coatsworth

WATCH RECENT PRESENTATIONS

Schroder Japan Trust (SJG)

Masaki Taketsume, Portfolio Manager

Schroder Japan Trust (SJG) aims to achieve longterm capital growth by investing in a diversified portfolio of 50-60 of the best quality but undervalued companies in Japan.

Schroder Income Growth Fund (SCF)

Sue Noffke, Head of UK Equities

The Schroder Income Growth Fund (SCF) is an AIC Dividend Hero with a 28 year track record of delivering an increasing dividend achieved by investing primarily in above average yielding UK equities.

Poolbeg Pharma (POLB)

Jeremy Skillington, CEO & Ian O’Connell , Chief Financial Officer

A clinical-stage biopharmaceutical company focussed on the development of innovative medicines to address unmet medical needs. The Company’s clinical programmes target large addressable markets including, cancer immunotherapy-induced Cytokine Release Syndrome (“CRS”) and metabolic conditions such as obesity with the development of an oral encapsulated glucagon-like peptide GLP-1R agonist.

Can I cash in my pension and invest the money myself?

Performance has tailed off recently and I think I can do better, but I’m worried about the tax situation if I change

I am seeking help regarding cashing in a pension plan completely to invest the money myself, or withdrawing some money from the plan to invest myself.

As I have no plans to spend the money and simply want to invest it, is there a way to do so with as little tax liability as possible?

While the pension has more than doubled compared to the money I put into it, recently its performance has stagnated. As I have become more knowledgeable about investing, I feel I can safely get better returns myself.

While there are lots of adverts about putting all your pensions from different jobs into one pot, when you look at the returns, the performance of many of these companies often isn’t great.

Dave

Rachel Vahey, AJ Bell Head of Public Policy, says:

One of the reasons to invest for later life using a pension is the fabulous tax advantages it offers. Not only can you get tax relief on the money you put in, but you don’t pay tax on any gains or on investment income.

Sometimes, however, the chosen pension may not be the right one for you, but if you want to move your pension money you have to be careful not to confuse ‘cashing in’ your pension with ‘transferring’ your pension.

You can take money out of your pension once you reach age 55 (rising to age 57 from 2028), but if you do take money out you lose the taxadvantageous growth, so you may want to keep the funds invested in the pension wrapper, especially if you have no immediate need for them. If you take the money out, then think carefully about your options. You can take up to 25% of it as

a tax-free lump sum, and with the remaining 75% you can move it into ‘drawdown’, meaning it remains invested, and take an income from it should you want.

Alternatively, you can use the remainder to buy an annuity, or guaranteed income for life, or you could cash it in completely, but any money you withdraw in these ways will be subject to income tax.

If you take money out of your pension – either by cashing it in completely, partly or by taking an income – and you later change your mind, you may encounter issues reinvesting it in a pension as contributions are subject to maximum limits.

You may also run into problems if you significantly increase your pension contributions roughly at the same time you take a tax-free lump sum from it, as HMRC’s ‘recycling rules’ are designed to stop people taking tax-free lump sums from pensions and then immediately reinvesting them to gain tax relief on the contributions.

If you don’t need the money straight away and want to leave it in the tax-advantaged pension plan, then you may want to think about where it’s invested.

When you get a new job, most employers will enrol you in a company pension plan, and your contributions will automatically be invested in the default fund, unless you provide alternative instructions.

The default fund’s investment strategy is probably designed to meet the needs of several thousand pension scheme members, and therefore it will almost always be set as ‘cautious’.

Some default funds may adopt ‘lifestyling’ strategies, which mean they are automatically moved into lower-risk funds as people near retirement age, so savers don’t experience much growth in their pension pot.

You can always decide not to use the default fund and instead choose different investment

Ask Rachel: Your retirement questions answered

options offered by the pension scheme, although depending on the scheme these can be limited, and you may want to take fuller control over the investment.

This is where transferring comes in. In other words, you can move money from one pension wrapper to another pension wrapper, but it doesn’t leave the pension ‘environment’.

If you transfer your pensions into a SIPP (selfinvested pension plan), for example, you can usually access a wide range of investments, giving you the flexibility to choose the right investment strategy for you – the SIPP provider won’t pick the investments.

It’s generally accepted people have an average of 11 jobs in their lifetime, so you may have several neglected pension plans from previous jobs. You could consider transferring these into a SIPP, but before doing so you may want to make sure the employer is no longer contributing, otherwise you could lose that valuable contribution.

Before you transfer, you may also want to check

these pension plans don’t offer any special deals such as a guaranteed price if you buy an annuity. You may also want to compare the charges under the old pension and any new SIPP.

Transferring should be a simple process. Once you have consolidated your pensions into a SIPP you can then decide on an investment strategy which meets your needs and objectives, as well as start to plan when and how you want to take money out of your pension for income in later life.

DO YOU HAVE A QUESTION ON RETIREMENT ISSUES?

Send an email to askrachel@ajbell.co.uk with the words ‘Retirement question’ in the subject line. We’ll do our best to respond in a future edition of Shares Please note, we only provide information and we do not provide financial advice. If you’re unsure please consult a suitably qualified financial adviser. We cannot comment on individual investment portfolios.

15 JULY 2025

NEW VENUE FARMERS AND FLETCHERS IN THE CITY

3 CLOTH ST

LONDON EC1A 7LD

Registration and coffee: 17.15

Presentations: 17.55

During the event and afterwards over drinks, investors will have the chance to:

• Discover new investment opportunities

• Get to know the companies better

• Talk with the company directors and other investors

COMPANIES PRESENTING

STRATEGIC EQUITY CAPITAL

A specialist alternative equity trust. Actively managed by Ken Wotton and the Gresham House UK equity team, it maintains a highly concentrated portfolio of 15-25 highquality, dynamic, UK smaller companies.

ROME RESOURCES

A critical minerals exploration company active in the DRC. Its main project is Bisie North, a tin and copper deposit some 8km from the world’s highest-grade tin mine.

ARAM

A newly launched segment of the Aquis Stock Exchange Growth Market, a dedicated marketplace for real estate and infrastructure investment, offering investors access to the world’s largest asset class through a fully regulated and liquid public market.

MANX FINANCIAL GROUP

A diversified financial services listed entity offering a customer-focused range of deposit, lending, insurance, and wealth management products. The Group includes an established independent bank with both a UK and Isle of Man deposit taking licence, as well as market leading lenders in their field.

WHO WE ARE

EDITOR: Tom Sieber @SharesMagTom

DEPUTY EDITOR: Ian Conway @SharesMagIan

NEWS EDITOR: Steven Frazer @SharesMagSteve

FUNDS AND INVESTMENT

TRUSTS EDITOR: James Crux @SharesMagJames

EDUCATION EDITOR: Martin Gamble @Chilligg

INVESTMENT WRITER: Sabuhi Gard @sharesmagsabuhi

CONTRIBUTORS:

Dan Coatsworth

Danni Hewson

Laith Khalaf