GET SOME MARKET REASSURANCE

THE FUNDS WHICH LOOK TO PROTECT YOUR MONEY

05 EDITOR’S VIEW

It’s crystal ball gazing time again as 2024 draws to a close

07 How the latest developments in French politics are rattling bond markets

08 Shock departure of Intel CEO Gelsinger leaves struggling chip maker rudderless

09 TI Fluid Systems finally bows to pressure from ABC

09 Facilities by ADF warning sends shares to new post-IPO low 10 Why Moonpig’s shares are flying high

11 Can Costco beat earnings expectations again?

GREAT IDEAS

12 Why consumer healthcare innovator Kenvue can come good for investors

14 How to get a double discount on UK growth companies

16 Why recent Kingfisher sell-off looks an overreaction

17 What two pizzas ordered more than a decade ago tell us about Bitcoin

20 COVER STORY

Get some market reassurance The funds which look to protect your money

27 The funds which invest in Indian small- and mid-cap companies

33 Finding genuine growth stocks: what the experts are buying

38 DAN COATSWORTH

What plans for a new stock market called ‘Pisces’ mean for investors

40 ASK RACHEL

How are my different pensions affected by inheritance tax changes?

Three important things in this week’s magazine

1

Why this could be a good time to hedge your market bets

Find out about ‘capital preservation’ trusts and how they can help your performance when markets become less predictable.

Which stocks are expert growth investors tipping for 2025?

In the second part of series on growth investing, discover which stocks managers believe will outperform the market.

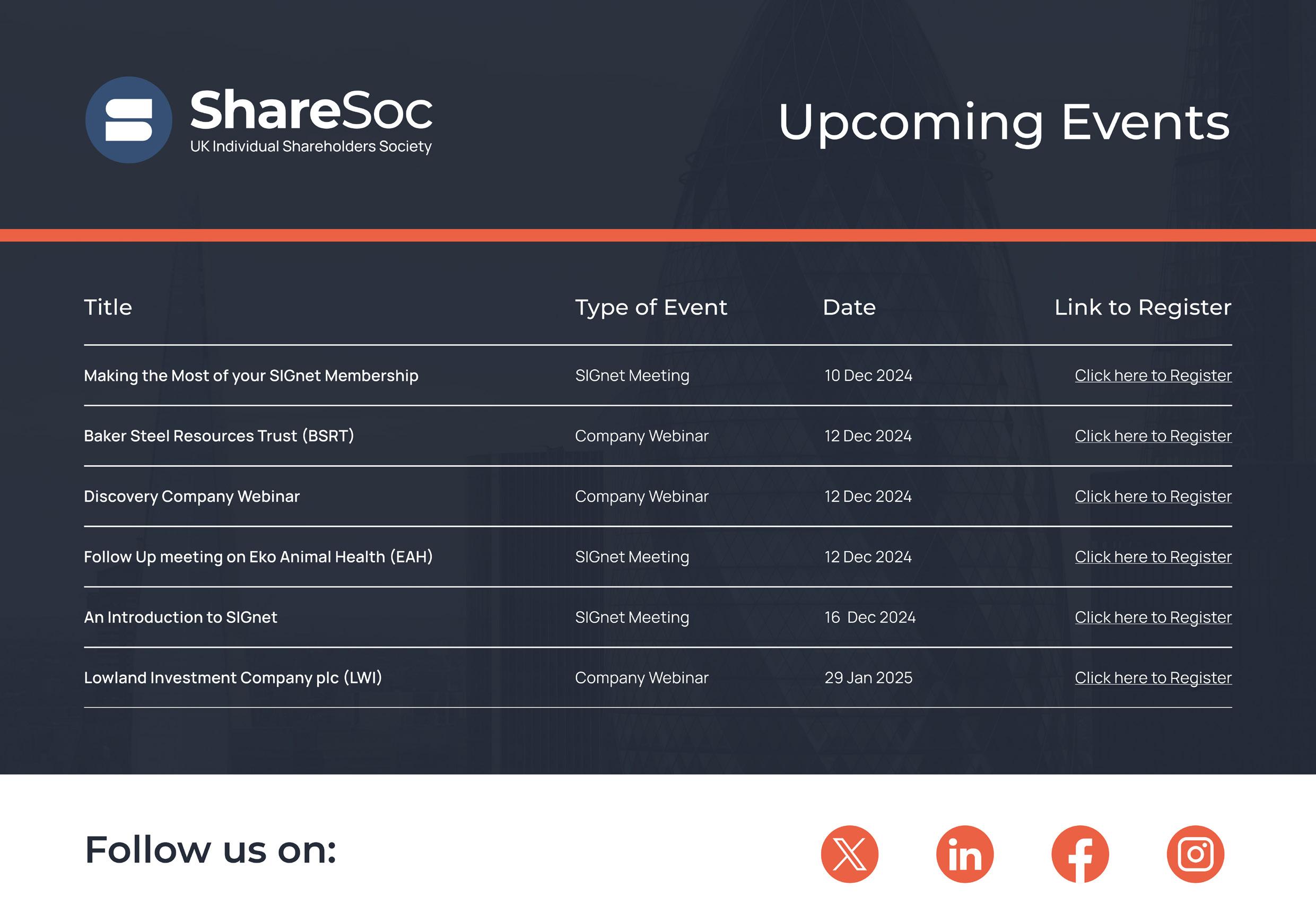

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

3

Is the current mania for Bitcoin healthy or sustainable?

We look at the history of the cryptocurrency and discuss whether there should be a place for it in your portfolio.

Investors cheer Marston’s strong fullyear performance and positive outlook

Topps Tiles’ major shareholder slates management’s ‘costly blunders’

Arbuthnot and Johnson Matthey executives buy while Halma director offloads shares | Directors Deals

It’s crystal ball gazing time again as 2024 draws to a close

The Shares team have got their thinking caps on, and could Microsoft help propel Bitcoin to $100,000?

In next week’s Shares, we face the unenviable task of getting out our crystal ball and attempting to work out what will happen with the markets in 2025.

This time last year we were doing the same for 2024 and our resulting hit rate is reasonable looking back.

We definitely got some things spot on. We flagged a wave of consolidation in the investment trusts space which has certainly materialised and correctly predicted more incoming M&A for the UK market.

We said growth would outperform value, and that was right, at least judging by the MSCI World Growth index, up 19.3% versus 14.5% for the MSCI World Value index in the year to 31 October. We were also right that AI and the big tech names would continue to lead global equity markets in 2024.

We were too positive on China and, although we flagged the potential appeal of Donald Trump as a presidential candidate, we didn’t predict the impact his victory, and the anticipation of him securing a second go at the presidency, would have on the dollar.

Interest rates in general have also remained higher than we and the experts we canvassed thought they would this year.

Trump continues to be the wildcard heading into 2025. Will he introduce the promised tariffs on day one of his presidency, as threatened, or are they just a negotiating tactic? Read next week’s issue to find out the potential implications of an unpredictable policy agenda.

Given some of the uncertainty around the outlook for 2025, it feels like a useful juncture to examine the grouping of funds which look to protect investors’ money – read Martin Gamble’s excellent feature inside to get a feel for the leading capital preservation funds.

Bitcoin has run out of steam of late as it teeters on the edge of hitting the $100,000 mark. However, in a reminder that, as discussed in a recent edition of this column, it is becoming more difficult to ignore, a vote is looming on 10 December at Microsoft (MSFT:NASDAQ) over whether it should follow the likes of Tesla (TSLA:NASDAQ) and MicroStrategy (MSTR) by investing in the digital currency.

The board are opposed, although the proposal had an unsurprising advocate in the form of Michael Saylor, chair of MicroStrategy, which itself owns 2% of all the Bitcoin that will ever be created.

In this week’s issue, Laith Khalaf takes a closer look at cryptocurrency and what two pizzas ordered nearly 15 years ago can tell us about it today. He makes the salient point that, while it is entering the investment mainstream, it is still not used widely as a means of payment.

BECOME A BETTER INVESTOR WITH

SHARES

MAGAZINE HELPS YOU TO:

• Learn how the markets work

• Discover new investment opportunities

• Monitor stocks with watchlists

• Explore sectors and themes

• Spot interesting funds and investment trusts

• Build and manage portfolios

How the latest developments in French politics are rattling bond markets

Months of uncertainty could be a big issue for investors in Europe

Since French president Emmanuel

Macron’s surprise decision to call a snap election in the summer, French politics has effectively been stymied with an unworkable parliament split between the parties of the far-right Marine Len Pen, Macron and a weak left-wing coalition.

It has taken months for Macron to appoint a prime minister which eventually came in the shape of centre right technocrat Michel Barnier. Barnier’s decision to force through a budget seemed set to prompt a collapse of the government as we went to press. This could be the precursor to months of uncertainty as Macron seeks a replacement. A stable government looks almost impossible to achieve and new elections cannot be called until July.

Stock and bond markets appear to be increasingly worried about the impact all this chaos is having on the economy.

French bond yields have widened to a spread of more than 0.9% over German bunds, the highest since 2012 shortly after the European debt crisis spurred then ECB (European central bank) president Mario Draghi to declare to do ‘whatever it takes’ to protect the euro.

Today’s crisis is not of the same magnitude, and it is worth pointing out that spread widening is happening while bond yields are falling this time around.

Stocks are also feeling the pain with the CAC-40 index down around a tenth since the summer, clearly underperforming the German benchmark DAX index which is up 7% over the same period and climbed to a new high on 3 December.

French shares have significantly underperformed their German counterparts

These tensions are happening at a time when the European economy remains sluggish as confirmed by the latest manufacturing PMI (purchasing managers’ index) reading which sank to 45.2 in November from 46 in the prior month. A sub-50 reading indicates activity is contracting and the headline reading has been under 50 since the middle of 2022.

While no one is yet talking about a sequel to the euro crisis of 2012, as discussed a vote of no confidence in the current administration would mean a lame duck administration for the next few months at least.

It therefore looks unlikely France can set a budget within agreed Eurozone parameters which may increase pressure on the euro, which has lost 5% of its value since the summer and languishes close to parity against the US dollar. [MG]

Shock departure of Intel CEO Gelsinger leaves struggling chip maker rudderless

Silicon Valley giant Intel (INTC:NASDAQ) is facing more upheaval after announcing the unexpected retirement of chief executive officer, Pat Gelsinger. Effective immediately, the decision marks a significant shakeup for the chip maker as it grapples with ongoing challenges and competitive pressures in the semiconductor industry.

Gelsinger returned to Intel in February 2021, having previously been its chief technology officer between 2001 and 2009, and was immediately thrust into a debate about its foundry business, which manufactures semiconductors. Several analysts have been calling on Intel to separate its chip design and foundry businesses for years as a way to realise greater shareholder value, but Gelsinger disagreed.

That debate has re-emerged now that Gelsinger has departed, with some reports suggesting he

was forced out by the board, which had become disillusioned with his business strategy and execution. Under Gelsinger’s leadership, Intel stock has lost around 60% of its value, wiping more than $150 billion off the firm’s market cap.

In response to Gelsinger’s departure, Citi analysts said it would be ‘in the best interest of Intel shareholders’ if the company ceases its attempts at being a merchant foundry and sells off the business. The bank sees a higher chance of this scenario, given that Gelsinger was a champion of the ailing foundry unit.

But Citi also noted that Gelsinger was a driving force of improving Intel’s overall manufacturing, and that the company could face ‘long-term pain’ if the new CEO did not share his technical expertise. Uncertainty ahead for Intel is presumably why, after an initial bump the stock gave back those gains.

‘It’s always going to rattle investor sentiment when the person at the helm of a company announces they’re stepping down, but when it’s done seemingly without warning and only a few years into what was expected to be a lengthy turnaround plan, that news is seismic,’ said AJ Bell head of financial analysis Danni Hewson.

‘The chipmaker should have been right out in front of the AI boom but somehow ended up on the back foot and attempts to claw back lost ground seem to have been beset with problems. Perhaps a new broom rather than an old hand is what’s needed to really to get to grips with the scale of the issues facing Intel right now.’

DISCLAIMER: Financial services company AJ Bell referenced in this article owns Shares magazine. The author of this article (Steven Frazer) and the editor (Tom Sieber) own shares in AJ Bell.

TI Fluid Systems finally bows to pressure from ABC

Canadian rival seals the deal with its third takeover offer

Automotive fluid storage and delivery specialist TI Fluid Systems (TIFS) became another statistic last week in the seemingly unstoppable wave of UK M&A (mergers and acquisitions).

Having spurned two lower bids from Apollo-backed ABC Technologies, the auto parts-maker finally agreed a 200p per cash offer which valued the company at just over £1 billion.

share price prior to the offer period.

The board of TI Fluid Systems said the deal gave shareholders ‘an immediate and certain’ cash value for their investment

The offer represents a 21% premium to ABC’s initial pitch and a 55% premium to the company’s

‘at a level which may not be achievable until the execution of TI Fluid Systems’ strategy is delivered over the medium to longer term, with that execution subject to a number of factors outside of TI Fluid Systems’ control’.

The Oxford-based business has faced a ‘challenging’ market this year, with revenue down around 6%

Facilities by ADF warning sends shares to new post-IPO low

Sadly it’s been less a case of ‘lights, camera, action’ and more ‘brace for impact’ lately for shareholders in Facilities by ADF (ADF:AIM), the firm which provides on-set serviced production facilities to the UK high-end TV and film industry.

Floated in 2022 with hopes of bringing a touch of Hollywood glamour to the AIM market, the firm soon found itself under the spotlight as a result of the Hollywood writers’ and actors’ strike which paralysed production schedules.

Even though it took mitigating

action by securing shorter-duration domestic productions and cutting the use of agency drivers to reduce costs, the impact of the strikes is still being felt through lower levels of activity.

As a consequence of taking on shorter productions there will be lower levels of ‘addons’, which will impact revenue this year, and customers are increasingly cost-conscious which means the market has become more competitive.

To compound matters, a ‘significant number’ of productions

in the third quarter due to customer delays, and has been implementing self-help measures in order to prop up the bottom line.

The shares have struggled in the last couple of years, trading on a single-digit PE (price to earnings) ratio, so although the take-out price of 200p is well below the 2021 highs investors aren’t about to turn it down. [IC]

the firm had in its sales pipeline for this year have had their start dates pushed out to next year while some have been scrapped altogether.

On a brighter note, the 2025 pipeline has been building steadily since the summer and many in the industry believe there will be a full return to previous activity levels so there may yet be a happy ending to the story. [IC]

UK UPDATES OVER T HE NEXT 7 DAYS

FULL-YEAR RESULTS

12 Dec:

Benchmark, RWS

FIRST-HALF RESULTS

10 Dec:

Moonpig, Solid State

11 Dec:

Cohort, Optima Health

12 Dec:

4Global, Currys, De La Rue, Gore Street Energy Storage Fund

Why Moonpig’s shares are flying high

The greeting card-to-gifts platform aims to return to double-digit revenue growth

Still some way off 2021’s 450p IPO (initial public offering) price, Moonpig’s (MOON) shares have rallied 63.5% to 248.9p year-to-date amid debt reduction progress and some reassuring trading updates as it puts the unwind of the Covid sales bump in the rear-view mirror.

More recently, the stock surged following a well-received capital markets day (16 October), where the online greeting cards-to-gifting platform set out its ambition to return to double-digit annual sales growth. Investors were also delighted as the cash generative company, rapidly deleveraging since 2022’s Buyagift acquisition, outlined plans to return surplus cash to shareholders, starting with an inaugural £10 million dividend for the year to 30 April 2025 and a maiden share buyback programme of up to £25 million now underway.

With the Christmas season in full swing, investors will be hoping for positive noises on

current trading when Moonpig trots in with first half figures on 10 December. Management should reiterate current year guidance for mid-to-high single digit revenue growth, underpinned by order growth at the Moonpig brand famed for its earworm of a jingle. Investors will also be looking for evidence of an upswing in fortunes at the Experiences business. Guided by CEO Nickyl Raithatha, Moonpig sees the opportunity for a return to double digit growth despite already boasting leading market shares in the UK and Netherlands, as greetings card volumes shift online, active customer numbers grow, purchase frequency increases and the company capitalises on exciting growth opportunities in both gifting and overseas markets. [JC] What the market expects of

Table: Shares magazine • Source: Berenberg Note: 30 April year end

Chart: Shares magazine • Source: LSEG

Can Costco beat earnings expectations again?

Forecasts may need to be bettered if the momentum which has driven shares to all-time highs is to continue

Shares in US retail titan Costco Wholesale (COST:NASDAQ) have been on an astonishing run, not just over the last 12 months but for several years before that and the shares are now trading at alltime highs.

The company has consistently reported earnings ahead of expectations in recent quarters and, given the elevated share price, it may need to do so again if it is to sustain its red-hot momentum when it posts numbers for its fiscal first quarter on 12 December. The shares currently trade at nearly 50 times 2025 consensus forecast earnings.

The business operates a chain of membership-only, warehousestyle retail stores across the US, Asia and Europe, and also has an accompanying e-commerce website.

By selling a limited range of cheap items, Costco has demonstrated its ability to pass on price increases to the customer and makes additional money through the annual membership fee.

Areas of focus when the market digests its latest earnings

release are likely to include revenue performance, which came in just short of expectations for the year to 31 August.

Another facet of the results which is likely to be under the microscope is e-commerce performance, after online sales saw a recent rebound following a fallow period in the immediate aftermath of the pandemic. [TS]

6 Dec: Genesco, Johnson Outdoors, Kirklands, SigmaTron

9 Dec: MongoDB

10 Dec: AutoZone

11 Dec: Adobe, Lennar, Nordson

12 Dec: Broadcom, Costco, Oracle

Why consumer healthcare innovator Kenvue can come good for investors

This quality company owns iconic brands with global growth potential and activist Starboard is helping to shake things up

Kenvue (KVUE:NYSE) $24.30

Market cap: $46.6 billion

Investors looking to add a resilient company with healthy global growth potential to portfolios should consider Kenvue (KVUE:NYSE). The $46.6 billion cap stands behind a variety of self-care, beauty and essential health products. Formerly Johnson & Johnson’s (JNJ:NYSE) consumer healthcare division, Kenvue was spun out as a standalone in 2023 via a separation that is allowing management to focus on consumer health sector opportunities without the constraints previously imposed by the erstwhile parent’s umbrella.

Shares believes Kenvue can capitalise on broader health and wellness trends by launching innovative, premium products, while key initiatives including brand investments and cost savings are laying the groundwork for profitable growth in the years ahead. Shares in Kenvue are up 18% over one year, in part reflecting the appearance of Starboard Value on the shareholder register; this activist helps companies focus on operational efficiency and margin improvement, has pushed management to pep up the performance of the Skin Health & Beauty business which is now seeing early signs of recovery.

WHAT DOES KENVUE DO?

Guided by CEO Thibaut Mongon, Kenvue is in fact the world’s largest pure-play consumer health company by revenue, with three business units Self Care, Skin Health & Beauty and Essential Health.

Rooted in science, Kenvue’s iconic brands include Listerine mouthwash, Tylenol pain reliever, Band-Aid adhesive bandages and the Neutrogena skin care label, not to mention the

likes of Nicorette, Aveeno, Benadryl and Johnson’s Baby; erstwhile parent Johnson & Johnson has agreed to shield Kenvue from baby power-related legal costs in the US and Canada, although one risk to weigh is the fact the spin-out is facing claims relating to sales in other countries.

Kenvue

around the world, Kenvue’s brands are trusted by consumers and as such, are especially tough for cheaper private-label alternatives to unseat as a result. These everyday staples confer a good deal of resilience and pricing power upon Kenvue, which operates in markets with structural tailwinds including the increasingly health-conscious consumer and the burgeoning emerging market middle class, while recognisable brands including Neutrogena, Listerine and Aveeno in growth categories such as Skin Health & Beauty and oral care are now getting the reinvestment dollars they deserve.

GREEN SHOOTS

Candidly, Kenvue’s third-quarter results (7 November) were nothing to write home about. They revealed another period of subdued top line progress, with organic sales up just 0.9% in the period ended 29 September 2024 as price increases impacted volumes and the New Jerseyheadquartered company also posting a year-onyear earnings per share decline.

However, this earnings decline reflected heavy reinvestment to prepare Kenvue for long-term growth and market share gains, while gross margins expanded by 100 basis points to 58.5% as productivity initiatives began to bear fruit.

In the results statement, CEO Mongon said this reinvestment is enabling Kenvue to ‘continue to drive share gains in Self Care, deliver broad-based growth across the Essential Health categories, and build the right foundation in Skin Health & Beauty, where we are seeing early signs of recovery. As we continue to advance our new Kenvue playbook, our team is making strong progress toward transforming into a leaner, more efficient and agile consumer health organisation driving

Kenvue's profit is forecast to improve

How the portfolio performed in the third quarter

sustainable and profitable growth.’

Jefferies observed that ‘key initiatives (brand investments, cost savings) are on track, laying necessary groundwork to drive balanced growth in the future’. The investment bank expects ‘early green shoots to emerge’ in 2025, setting the stage for ‘accelerating results’ in 2026.

Consensus estimates from LSEG show pre-tax profits falling from $3.1 billion to $2.9 billion for the year to December 2024, ahead of a recovery to $3.1 billion and $3.3 billion in 2025 and 2026 respectively.

According to Stockopedia, Kenvue trades on a prospective price-to-earnings ratio of 19.9 for 2025, broadly in line with London-listed consumer health peer Haleon (HLN), but a significant discount to competitors such as Procter & Gamble (PG:NYSE) and L’Oreal (OR:EPA) that implies significant rating catch-up scope, so long as Kenvue’s organic growth and profit performances improve. [JC]

How to get a double discount on UK growth companies

Baillie Gifford UK Growth is a great way to play this investment style domestically

Baillie Gifford UK Growth Trust (BGUK) 180p

Market cap: £251 million

While 2024 has been a reasonable year for growth investors generally, for those looking just at the UK it has still required patience and a need to stay focused on the fundamentals.

As Baillie Gifford director James Budden put it at the firm’s latest private investor forum, inflation, rising interest rates and geopolitics have had the effect of ‘shrinking’ the market’s time horizon, creating headwinds for the performance of growth stocks.

The result is, especially in the case of the UK, there are plenty of opportunities for those prepared to take a long-term view.

‘GROWTH ON SALE’

Iain McCombie, co-manager of the Baillie Gifford UK Growth Trust (BGUK), admits some investors see the UK as lacking innovative growth companies, yet ‘if you think share prices follow fundamentals, UK growth stocks look cheaper than they have for a long time’.

The trust’s aim is to maximise capital growth by buying UK companies which have the potential to generate a total return in excess of the FTSE All-Share.

Managers McCombie and Milena Mileva describe the portfolio as ‘a high-conviction, concentrated selection of our best ideas in the UK with a bias to mid- and smaller-cap growth companies, where we intuitively believe the growth spot for UK equities to be’.

After beating the index conclusively in the two years to September 2021, the trust struggled in 2022, but performance improved in 2023 and in the year to September just gone the company

Baillie Gifford UK Growth Trust

Annual performance to 30 September

streaked ahead, posting a 19% share-price return and an 18% NAV (net asset value) return against a 13% gain for the benchmark.

Despite this return to form, the trust still trades at a 15% discount to NAV, which means investors can now get a double discount on a selection of innovative, and in some cases disruptive, UK companies.

DIFFERENT APPROACHES

The UK is no different to any other market globally, in that the fastest-growing companies tend to be the best performers.

McCombie cites Auto Trader (AUTO), the trust’s second-largest holding, which is an established FTSE 100 company yet is a good example of a business which is growing faster than the market appreciates.

Not only is it the number one player in the used car market by a factor of 10, which gives it tremendous network effects, but management are driving new ways of increasing turnover, such as the new ‘Dealbuilder’ service which allows customers to get pre-approval for finance, with the company taking a small slice of the revenue.

–for their ability to continue exploiting their IP (intellectual property) yet keep their customers onside.

PRIVATE AND OTHER HOLDINGS

Finally, in common many other Baillie Gifford trusts, UK Growth has the flexibility to invest a proportion of its assets in unlisted companies.

The limit on unquoted stocks is 10%, but at present the trust is well below that level with just one holding, Wayve Technologies, an earlystage autonomous driving company developing ‘Embodied AI’, which makes up 1.1% of the portfolio based on its initial valuation.

When the trust initially invested in Wayve in 2022, alongside Microsoft (MSFT:NASDAQ), it was estimated to be worth around $1 billion making it a so-called ‘unicorn’. Earlier this year, however, US mobility firm Uber (UBER:NYSE) signed a strategic partnership with Wayve and invested in another fundraising round, which valued the business significantly higher than in 2022 although the figure wasn’t published.

McCombie also holds smaller stocks such as Kainos (KNOS) and Softcat (SCT), both relatively new holdings for the trust.

There is a strong focus on management with a vision for their business, and McCombie lauds the team at fantasy miniatures maker Games Workshop (GAW) – which has been such an outperformer it is being promoted to the FTSE 100

Also, the managers have taken advantage of the discount to NAV to buy back their own shares, with the result that as of the end of November 15% of the outstanding share capital is now held in treasury stock.

These shares could be issued once the price rises to a premium to NAV, or they could be cancelled in which case NAV per share would automatically rise due to there being fewer shares in circulation. [IC]

Table: Shares magazine • Source: Baillie Gifford UK Growth

Why recent Kingfisher sell-off looks an overreaction

Kingfisher

13.6%

We added Kingfisher (KGF) to our list of Great Ideas in February at 223.5p arguing the valuation afforded the B&Q and Screwfix owner did not reflect the self-help levers being pulled by the company and the potential for an improvement in the consumer backdrop.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

For a time, our call looked like a particularly good one as the company announced reassuring firstquarter performance in May and then robust first-half numbers in September which allowed the company to increase its outlook for free cash flow and pre-tax profit.

However, a strong run for the share price came to an abrupt halt with a third-quarter update on 25 November. Sales missed guidance, with the retailer suffering a 6.4% revenue plunge in its second largest market, France, prompting the group to lower the top end of its full year 2025 profit guidance.

The DIY group also warned rising national insurance costs on both sides of the channel, combined with a higher finance bill, will crimp full year 2026 earnings.

Although trading has picked up in the fourth quarter to date, Kingfisher said it now expects adjusted pre-tax profit of between £510 million and £540 million for the year to January 2025.

That represented a trimming of the previously guided £510 million to £550 million range. Free cash flow guidance of £410 million to £460 million was left unchanged and Kingfisher is on track to complete its £300 million share buyback programme in March 2025.

WHAT SHOULD INVESTORS DO NOW?

In hindsight it might have been prudent to book profit in Kingfisher ahead of this announcement but given the relatively modest impact on full-year guidance, we think the reaction to a slightly offcolour quarterly update is overdone.

We will keep a close eye on the company’s fullyear results, likely to be released in March, and hope a more encouraging picture then can get the shares moving in the right direction again. [TS]

What two pizzas ordered more than a decade ago tell us about Bitcoin

The cryptocurrency trades at record levels but predicting its future trajectory is very tricky just as it was in 2010

Spare a thought for Laszlo Hanyecz. You may not have heard of him, but in 2010 he spent 10,000 Bitcoins on two pizzas, in one of the first ever ‘real world’ crypto transactions. The market value of those Bitcoins is now $950 million. Hanyecz is pretty stoic about it, but deep down he must know that no amount of melted cheese can make up for the vast fortune he might have had. Hanyecz, a computer programmer from Florida, reckons he actually spent in total around 100,000 Bitcoins over the course of 2010 on pizza, which would currently have a value of £9.5 billion. He is now part of the foundation myth of Bitcoin, and his lunch bill from 14 years ago still prompts a sharp inhale of breath normally reserved for three-star Michelin eateries.

Hanyecz’s story first and foremost tells us about what a rocket-fuelled price escalator Bitcoin has been bounding up. When he bought his two pizzas with 10,000 coins, each coin was worth around $0.004. The cryptocurrency is now trading at $95,000 per coin. There have been a number of way stations along this breakneck journey, if you haven’t blinked at the wrong moment. It may be convenient for the crypto industry to gloss over it, but much of Bitcoin’s early usage came down to drug dealing.

The Silk Road was an early website on the darknet, a bit like eBay, but for illicit drugs and murder for hire. In 2020 US law officials seized $1 billion in Bitcoin as part of its investigation into the digital marketplace. Criminality has never been far from Bitcoin’s story. The anonymity it can provide still makes it ideal for darknet transactions, and crypto more generally has been a hotbed of scam activity and fraud. The nadir (so far) has probably been the FTX scandal, in which the crypto exchange’s founder, Sam

Bankman-Fried, was sentenced to 25 years in jail for stealing $8 billion from customers.

PROSPERING DESPITE MURKY BEGINNINGS

And yet, Bitcoin has prospered. The arrival of crypto exchanges and platforms opened up trading beyond the tech bros who know what to do with a command prompt. More recently institutions have started to get in on the act, with the likes of Tesla (TSLA:NASDAQ) and MicroStrategy (MSTR:NASDAQ) holding Bitcoin on their balance sheets. Earlier this year, the US financial regulator approved Bitcoin ETPs (exchange-traded products); essentially Bitcoin tracker funds. This was a hugely significant step for the cryptocurrency, opening up the market even further to retail and professional investors alike, and providing a regulatory halo around the asset class.

This may just be the beginning, seeing as the next president of the US wants to make the country ‘the crypto capital of the planet’. Other competitors in this event include El Salvador, which has legalised Bitcoin as legal tender and announced plans to construct a Bitcoin city in the shape of a giant coin.

All of this has of course contributed to the rapid price ascent of Bitcoin, against a backdrop of increasing global digitalisation and the

manipulation of major currencies through quantitative easing, which added fuel to the Bitcoin fire. Such extreme price appreciation is itself a cause for concern as previous buyers of tulips (17th century), South Sea companies (18th century), railroad stocks (19th century) or technology stocks (20th century) will attest. But Laszlo Hanyecz’s story doesn’t begin and end with the price explosion of Bitcoin. It also prompts us to ask, why didn’t he hold onto his Bitcoin holdings to become a multibillionaire today?

HARD TO PREDICT THE TRAJECTORY

It’s clear from his pizza-buying spree, that even as an early adopter of Bitcoin, Hanyecz had no idea where the cryptocurrency was headed. With the price of Bitcoin closing in on $100,000, that remains the case today.

It might be helpful to think about Bitcoin in terms of three groups of potential users: investors, businesses, and consumers. Bitcoin does seem to be stepping more into the mainstream of the investment world. The launch of Bitcoin ETPs in the US is undoubtedly a meaningful event, because it makes it super easy for investors to buy Bitcoin in their normal trading accounts, provided by highly regulated brokers. These tracker funds aren’t available in the UK yet, but it wouldn’t be a surprise if they were in due course.

Papa John’s… using dollars.

And then to add insult to injury, converted the Bitcoin he received back into dollars to pay for travelling expenses. So rather than being the first real world crypto transaction, this encounter could equally be characterised as two computer geeks transacting in crypto, while the outside world trundled on oblivious, using its conventional forms of currency.

NOT IN MAINSTREAM USE YET

While there are more outlets which accept Bitcoin today, including Subway which is experimenting with the cryptocurrency, the vast majority do not. And why would they? Consumers can already buy products by flashing their mobile phone at a payment terminal using conventional currencies. Even those which accept Bitcoin almost certainly convert it into conventional currencies immediately. Subway won’t pay its staff in crypto, or its suppliers, so by holding something as volatile as Bitcoin, it could quickly find itself out of pocket if it didn’t convert it back into ‘real’ money immediately.

Meanwhile the first UK pension scheme has reportedly invested in Bitcoin, and back in 2020, the conservative asset manager Ruffer bought a slice. But, overall, there hasn’t been a groundswell of professional investors running diversified portfolios trying to get in on the cryptoverse. There is a high degree of scepticism around Bitcoin, and for professional money managers, its extreme price volatility will undoubtedly lead to both joyous and uncomfortable meetings with clients.

Consumers and businesses likewise haven’t on the whole embraced Bitcoin instead of pounds, dollars and euros. This again brings us back to the two pizzas bought by Hanyecz. Who exactly did he buy them from? The answer is a 19-year-old student called Jeremy Sturdivant, who responded to Hanyecz’s request for pizza on a Bitcoin chat room. Sturdivant, in turn, bought the pizzas from

Consumers face the same issue. Their bills and expenditure are in pounds, euros, dollars, yuan, yen or rupees. Holding large sums of spending money in Bitcoin might well leave consumers unable to buy the M&S Christmas turkey they have their eye on, or even some essential winter underclothes in ‘Primani’.

Over time, more businesses, consumers, and investors may embrace Bitcoin. But it’s by no means certain, and there are plenty of obstacles, not least the potential launch of central bank digital currencies which may usurp many of the functions crypto prides itself on. It goes without saying that if you are buying crypto, do so with a small amount of money which you are able to lose without it having a dramatic effect on your overall wealth. And for goodness sakes, if you’re buying a takeaway this weekend, make sure you don’t pay too much for it.

By Laith Khalaf AJ Bell Head of Investment Analysis

GET SOME MARKET REASSURANCE

THE FUNDS WHICH LOOK TO PROTECT YOUR MONEY

Martin Gamble Education Editor

With US stocks trading close to all-time highs, valuations looking stretched and one of the narrowest markets on record, this could be an opportune moment to consider adding some defensive qualities to your portfolio through capital preservation funds and trusts.

These products aim to protect your capital during periods of heightened volatility and equity market drawdowns as well as growing capital ahead of inflation over time.

However, strong equity market returns appear to have driven investors away from capital preservation funds leading to consistent outflows across the sector over the last three years.

Despite many managers actively buying back their own shares, valuations in the sector have drifted out to a discount to NAV (net asset value) instead of their usual premium showing how out of favour the sector has become. In this article we profile the leading capital preservation names and identify one fund which we think is worth adding to a diversified portfolio.

LOW FUTURE RETURNS

Freddie Lait, founder of Latitude Investment Management and investment manager of the Latitude Horizon Fund (BG1TMR8), believes based on current valuations the implied forward return for the S&P 500 over the next one to 10 years is between 1% and 3% per year.

Similarly, investment bank Goldman Sachs issued a report in October suggesting their basecase forecast for the S&P 500’s total return was an average of 3% per year over the next decade.

‘Our forecast would be 4 percentage points greater than our baseline if we exclude a variable for market concentration that currently ranks near the highest level in 100 years’, added the investment bank.

High market concentration is expected to lead to higher market volatility, and one of the benefits of investing in capital preservation funds is they have historically provided returns with far less volatility than the market indices.

As the charts show, these trusts have successfully protected investors capital during the biggest bear markets over the last 24 years.

HOW DO THE TRUSTS WORK?

Troy Asset Management, which manages Personal Assets Trust (PNL), says it aims to ‘protect investors’ capital and increase its value over time’.

Capital Gearing’s (CGT) manager Peter Spiller explains the trust’s primary objective is not to lose money.

‘Our portfolio is invested so investors are able to participate in some upside from the stock market and bonds but are protected from steep downturns.’

Fund Manager Duncan MacInnes at Ruffer Investment Company (RICA) says the trust focuses on keeping clients safe.

‘Over a full market cycle, we have demonstrably added a smoothing or volatility dampening effect to our investor portfolios,’ says MacIness.

Freddie Lait sees the Latitude Horizon fund’s role as providing investors a steady return over time while allowing clients to ‘get a good night’s sleep’.

DIFFERENT APPROACHES

While these principles all sound very laudable, they also sound rather similar, so the question is how do the trusts differ in terms of their approach and investment style and how they are currently positioned?

Having spoken with each of the managers, there are important differences in investment style and portfolio construction which investors may not be aware of at first glance.

Personal Assets Trust is focused on investing in high-quality businesses which can compound their earnings sustainably over time.

The team also likes companies with strong balance sheets and a competent, well-aligned management team.

Its top equity holdings include consumer goods firms Unilever (ULVR) and Nestle (NESN:SWX), software giant Microsoft (MSFT:NASDAQ) and Google owner Alphabet (GOOG:NASDAQ)

In contrast, the team at Capital Gearing takes its inspiration from the father of value investing, Benjamin Graham, and invests almost exclusively in investment trusts trading at a discount to NAV.

Latitude Horizon’s Freddie Lait is also a fan of Graham’s value approach and has built the ‘margin

Total returns from the capital preservation trusts

of safety’ principle into his investment process.

Lait looks to invest in companies which can sustainably grow earnings per share faster than the market average, which has helped the fund deliver strong returns since launching eight years ago.

Ruffer is more difficult to pin down in terms of investment style, although today it is more contrarian and value-driven.

In the past, the manager has owned the ‘Magnificent Seven’ stocks, and one of its bestperforming individual equity positions was grocery

retail technology group Ocado (OCDO), which it held from 250p to more than £20.

However, the trust’s exposure to Chinese and UK stocks speaks volumes about how the team view the current opportunities and risks – at a time when global managers struggle to allocate the UK even a market-neutral 3.5% weighting, Ruffer currently has 12% of the fund invested in UK equities.

As well as different philosophical approaches to investing, the investment managers construct their overall portfolios differently too.

PERSONAL ASSETS TRUST

Troy Asset Management employs the same capital preservation strategy in the closed-end vehicle Personal Assets and its open-ended equivalent the Troy Trojan Fund (BZ6CNS3).

The managers start the investment process with a focus on finding ‘high-quality companies at the right price’ and then try to diversify the portfolio with lower-risk assets such as bonds, gold, inflation-protected

Personal

bonds and short-term gilts.

The amount of diversification and protection they deploy depends on the level of risk that founder and investment manager Sebastian Lyon and assistant portfolio manager Charlotte Yonge perceive there to be in capital markets at any given time.

Currently, the managers are positioned more defensively than usual because of worries over the high valuations of US stocks and

rising geopolitical risks.

The proportion of the fund in equites is currently a lowly 28%, compared with an average of 43% since inception in 1994, but it is important to understand the allocation process is dynamic.

In 2008 to 2009, the equities proportion of the fund was over 70% as the managers sought to take on more equity risk during a time when markets were reeling from the global financial crisis.

CAPITAL GEARING TRUST

Capital Gearing Trust is managed by CG Asset Management, founded by Peter Spiller who has managed the trust since 1981 and remains actively engaged in the day-to-day management of the business.

The trust has a particular client profile in mind when investing – typically one with a long-term horizon, an aversion to significant short-term losses and a desire to grow their wealth ahead of inflation.

The trust has only suffered two down years since 2001 (-4% in 2022 and -2% in 2014), and has generated an annualised total NAV return of 8.3% per year, easily outpacing inflation of 2.5% a year.

These returns have been achieved with much lower volatility than the FTSE-All Share index, providing investors a smoother return.

The employee-owned firm has been built on the three core

Capital Gearing

principles of ‘the client comes first, don’t be greedy, and have fun’.

A distinguishing feature of Capital Gearing is that, unlike the others in the sector, gold does not feature heavily in the portfolio as the managers prefer to use inflation-protected bonds as a hedge against inflation.

The managers expect inflationlinked bonds to continue to outperform nominal bonds as investors underestimate nearterm inflation.

The portfolio is split into three distinct buckets, comprising, equities, index-linked bonds and dry powder in the form of cash and short-dated bonds.

Its current positioning is very defensive with dry powder representing around a third of the portfolio as the managers are concerned over the high valuations of US stocks.

Where the managers cannot get exposure to a market via investment trusts they use ETFs

(Exchange traded funds) for exposure, with the Japanese market being a good example.

The focus on investment trusts means the portfolio is very diversified considering the number of positions it holds indirectly.

Current positions include Smithson Investment Trust (SSON) and Finsbury Growth and Income (FGT), which are trading on double-digit discounts to NAV and buying back shares.

An interesting counter-cyclical holding is Brevan Howard’s BH Macro (BHMG), which trades at a large discount to NAV.

The hedge fund has a strong track record of delivering positive returns during market downturns. During the stock market rout of 2022, the fund delivered a 20% return and the trust then traded at a premium to NAV.

Capital Gearing is competitively priced with a 0.4% management fee and 0.47% ongoing charge.

LATITUDE HORIZON

The Latitude Horizon fund invests roughly half the portfolio in a concentrated selection of large-cap, global stocks at modest valuations, and the other half in lower-risk assets like index-linked bonds, gold, currencies and cash.

This means the fund looks to embrace volatility at the individual stock level while endeavouring to reduce it at the portfolio level.

Lait deploys a rigorous investment process and takes a genuine long-term approach to unearthing companies he believes can sustainably grow earnings per share at doubledigit rates yet are trading at a discount to his estimate of intrinsic value.

This discount provides a margin of safety against unforeseen events and can reduce volatility during market drawdowns, a strategy which proved particularly effective in 2022 when stock markets fell in response to aggressive interest rate increases by central banks to combat inflation.

Since inception, the equity portfolio has grown at an average compound annual growth rate of around 14% per year, which is in line with the growth of the intrinsic value of the companies in the portfolio supporting Lait’s view that share

prices follow earnings over the medium term.

Top equity holdings include credit card company Visa (V:NYSE) , UK grocer Tesco (TSCO), US auto parts and accessories retailer AutoZone (AZO:NYSE) and investment firm Bank of America (BOA:NYSE)

The top 10 holdings represent a quarter of the overall value of the equity portfolio, while long-dated inflation-linked bonds are 10% of the portfolio and shorter-dated gilts and bonds make up the rest, which reduces the equity risk while paying a steady income of just over 5% at current prices.

Bonds also have the potential to perform well when equity market fall as investors rush into safer assets.

In his latest investment commentary Lait notes: ‘We are still fearful of the market more broadly which implicitly assumes that Goldilocks is here to stay, and inflation will not return.’

It is worth noting the Horizon Fund has bucked the trend of outflows in the capital preservation sector, with inflows equivalent to 47% of NAV over the last three years reflecting the fact it has outperformed its peers since its launch eight years ago.

RUFFER INVESTMENT COMPANY

Ruffer is different to the other capital preservation vehicles in that it actively uses derivatives to manage risk and it has, in the past, successfully invested in bitcoin.

Investment manager Duncan MacInnes told Shares that to achieve its long-term objectives the team thinks differently about risk.

‘We start our investment process from the perspective of risk minimisation. We believe the key to long-term sustainable returns is avoiding the points of material capital loss in financial markets. If you avoid the drawdowns – the upside looks after itself,’ explains MacInnes.

While other managers build the portfolio they want, then try to add hedges to protect against the downside, Ruffer starts by seeking capital protection first.

The trust offers retail investors access to some strategies they might not be able to do directly themselves, particularly derivative protection or more non-traditional assets like commodities or the Japanese Yen.

The investment team is led by Henry Maxey and Neil McLeish, who act as co-chief investment officers, supported by an asset allocation team of senior fund managers and partners, such as MacInnes, alongside chairman Jonathan Ruffer.

MacInnes points out that very few other firms made money in each of the past bear markets, including the dotcom bust, the credit crisis, the covid crash and market fall of 2022.

Similarly, very few firms made money in both 2008 and 2009, which demonstrates the value of having the ability and the conviction to

pivot from bearishness to bullishness when the circumstances change.

Ruffer invests across a wide range of securities including stocks, bonds, currencies and commodities as well as a small allocation to derivatives.

MacInnes says most of the trust’s returns have come from asset allocation to the most liquid markets in the world.

Often, outperformance derives from not owning particular assets. Examples include not owning dot-com stocks in 2000, not owning banks, commodity, or property stocks in 2008 and not owning profitless tech companies in 2022.

In terms of the investment outlook, Ruffer believes recent events including the Trump victory strengthen the case for a second wave of inflation.

While the market seems convinced of a soft landing, Ruffer sees an opportunity to take the other side of the trade believing US equities and credit spreads look unfavourable from a risk to reward perspective, with high valuations and ‘extended’ positioning.

Therefore, the company owns a combination of downside protection via equity index put options (bets that prices fall) whilst holding a ‘significant’ proportion of the portfolio in cash assets yielding between 4% and 5%.

In addition, the company has

assembled a collection of assets where bad news is perceived to be already priced in such as commodities and cheap equity markets such as the UK and China.

This so-called ‘ugly duckling’ portfolio showed its mettle over the summer, demonstrating the potential of the portfolio to deliver powerful returns, says McInnes.

Near-term, the company’s positioning differs from the other vehicles in the space as the portfolio balance has been adjusted to reflect an increase in risk appetite following the ‘marketfriendly’ outcome of the US elections.

Net equity exposure is around 40% with a further 10% allocated to commodities and precious metals, which represents the highest allocation to risk assets since early 2022.

The funds which invest in Indian small- and mid-cap companies

In October foreign institutional investors pulled an estimated $11.5 billion from Indian stocks as one of the world’s top performing markets of recent years hit a bit of a speed bump.

Up until that point, small and mid-cap stocks had performed particularly strongly during the latest leg of the Indian rally, so Shares has canvassed some UK-based fund managers which focus on this area of the market to see how they are managing the risks and opportunities they are facing into.

Over the past year the MSCI India Mid Cap index has returned 33.5% to investors compared to 26% from the broad-based MSCI India index.

The mid cap grouping includes 65 constituents and covers approximately 15% of the free floatadjusted market capitalisation in India.

The Nifty Smallcap 250 Index (which consists of 250 small-cap companies listed on India’s National Stock Exchange) returned 35.1% to investors over the past 12 months.

The dust has settled for India politically with prime minister Narendra Modi being elected for a third term in June 2024, albeit with a narrowed majority

which could impact his ability to deliver reform.

James Thom and Rita Tahilramani investment managers at Abrdn New India Investment Trust (ANII) say: ‘India remains one of the world’s fastestgrowing major economies, supported by a resilient macro backdrop. Growth momentum is driven by supportive central government policies following a decade of painful, but necessary economic reforms.

‘In July 2024, the new coalition government’s first budget indicated fiscal consolidation was on track, with robust capex allocation for infrastructure development, while efforts were made to address consumption, rural demand, and employment.’

term enterprises), start-ups and early-growth stage businesses.

Also in October, Indian equity markets experienced inflows of $12.8 billion from domestic institutional investors, according to data from Ashoka India Equity Investment Trust (AIE) ‘Investors must not be distracted by the issue of high valuations’ says Ayush Abhijeet, investment director at Ashoka India.

Thom and Tahilramani acknowledge the recent volatility: ‘We have seen a pullback in the equity market, driven by various factors including a rotation into China and the outcome of the US presidential election. We expect the softness to remain for the next couple of quarters, but our base case is that the growth returns sometime in 2025.’

DOMESTIC INFLOWS FROM INVESTORS AND HIGH VALUATIONS

While overseas money has been moving out of India, domestic investors are ploughing cash back in and investing in local SMEs (small and medium-

Ashoka’s Abhijeet says: ‘When thinking about investing in India [it is important] to look at the company’s earnings growth, and whether [the company’s earnings growth] support the valuations.’ Abhijeet goes on to contextualise the outflows of foreign investors’ cash in October and early November saying this sum is relative if taking into consideration historic outflows, for example $15.4 billion at the time of the global financial crisis or $10.6 billion at the time of the Covid pandemic.

Guarav Narain is principal adviser to the fund, he told Shares: ‘Many small and mid-caps are growing faster than large caps. The number of new companies listing in India is growing so there is plenty of investment choice for professional portfolio managers.’

India Capital Growth Fund (IGC) is a fund primarily weighted towards small cap stocks at 41.6%, mid-caps at 39.5% and finally large caps at 15.3%.

Market cap breakdown of India Capital Growth Fund

Ashoka’s Abhijeet sees potential in the consumer discretionary, healthcare, technology, industrials, and financial services sectors.

‘We tend to pick companies which have strong governance and are not heavily regulated. We also pick companies with less exposure to macro variables, for example, the oil price. That’s not to say we don’t pick these companies, but we may just be underweight in them.’

Top contributors to Ashoka’s performance for the year ending 30 June are Azad Engineering (AZAD:NSE) which makes highly engineered precision and machined components for companies in sectors such as defence and energy; the private sector bank ICICI (IBN:NYSE) and CG Power (CGPOWER:NSE).

For Ewan Thompson fund manager at Liontrust India Fund (B1L6DV5), which does not have a much of a small and mid-cap skew but still invests in this part of the market, ‘the most attractive sectors would be industrials and consumer/ healthcare. The former often allows for well-run companies that have developed a niche in the market or have specific technology to grow rapidly and capture share.’

Among the names held by the fund is ASK Automotive (ASKAUTOLTD:NSE), India’s leading manufacturer of advanced braking systems and precision-engineered components for the twowheeler auto market in India.

HOW

DO MANAGERS MITIGATE THE RISKS?

Investing in emerging markets is typically seen as being towards the higher end of the risk spectrum, thanks to issues around governance, the ability to

buy and sell shares and political risks, and arguably these risks are even higher the further down the market value spectrum you go.

Companies are likely to be early stage and therefore lack long-term performance history and they could have a lack of transparency in the way they do their accounting.

For Liontrust India’s Ewan Thompson balance sheet weakness is a big risk for him which can either ‘leave companies vulnerable to short-term economic volatility or leave them unable to invest appropriately to capture the market and grow to significant scale’.

‘Over the long-term, small cap stocks offer one of the most direct routes to access India’s exceptionally strong economic growth profile over the next decade – providing an opportunity to benefit from significant increases in market share across huge and rapidly expanding end markets,’ adds Thompson.

Ashoka’s Abhijeet says [with his investment trust] he has a system in place to mitigate risk which means he doesn’t operate a concentrated portfolio or single large stock position.

‘We also carry out our due diligence on each company we decide to invest in. We have a team of 32 on the ground professionals in India.

‘Last year we carried out over 3,000 meetings with companies we were likely to invest and met with suppliers, distributors, and factories.’

By Sabuhi Gard Investment Writer

Schroder Japan Trust plc: making sense of Japan’s economic and political developments

Exploring the recent volatility in Japanese equities

Japanese equities have been very volatile in recent months. Initially this was driven by the diverging monetary policies of the US (interest rates down) and Japan (rates up). This prompted a rapid unwind of Japanese yen ‘carry trades’ (where investors borrow in yen and invest in higher yielding foreign assets) and a sharp currency appreciation. More recently, uncertainty around Japanese politics and the announcement of a snap general election exacerbated this volatility.

We spoke to Masaki Taketsume, portfolio manager of Schroder Japan Trust plc, about these short-term challenges and how they may impact the long-term outlook for Japanese equities.

The market has seesawed during the process of electing a new prime minister and the general election – can you give some context for these moves?

Markets were initially unnerved by the unexpected victory of Shigeru Ishiba in the run-off with Sanae Takaichi to become the next leader of the ruling Liberal Democratic Party (LDP) and Japan’s next prime minister (PM).

This prompted a reversal of the so-called ‘Takaichi Trade’, in which we had seen a weakening yen and rising stock prices in the last few days of September. Takaichi had been viewed very much as a continuation candidate that had long been aligned with the ‘Abenomics’ policies and ideals of former PM Shinzo Abe.

By contrast, Ishiba is known as a fiscal reformist and had been considering an increase in capital gains tax, so his victory was initially greeted more cautiously by the market.

Subsequently, the announcement of a snap general election added to the political uncertainty, as did (at the time of writing) the absence of a clear election outcome.

Japan has previously been well-known for its political stability. How should investors react to these unexpected political developments? History has shown that positioning portfolios around who you think is going to win an election is extremely difficult. We believe it is more important to remain focused on the economic outlook and on stock specific opportunities. In this regard, the fundamentals of Japanese economy are robust and corporate earnings remain strong and have shown continued progress in recent months. We are confident there is enough momentum in the domestic economy to withstand recent political developments.

The Bank of Japan’s (BoJ) unexpected July rate hike contributed to the sharp appreciation in the yen and equity market volatility. How should longterm investors view a stronger yen?

The BoJ’s rate hike reflected confidence in Japan’s macroeconomic development, including wage growth. It also mitigated the risk of further yen weakness, which could have driven higher inflation. Overall, therefore, it should be viewed as a positive for long-term investors.

That said, a stronger yen will exert downward pressure on the earnings of export-related companies. This is one of several reasons why our strategy for the Schroder Japan Trust portfolio favours exposure to domestically-oriented companies.

What are the key aspects of the outlook for Japanese equities that long-term investors should hold in their mind?

There are many reasons to be positive about the outlook for Japanese equities currently and three of them in particular stand out very clearly. These are robust corporate fundamentals, improved governance standards and increasing demand from foreign and domestic investors.

From the perspective of corporate fundamentals, many domestically-oriented companies are demonstrating strong demand and signs of regained pricing power (the ability to raise prices in response to inflation) for the first time in decades. When coupled with improved consumer purchasing power through

wage increases, this should drive healthy levels of corporate earnings growth.

Meanwhile, due to the ongoing efforts of the Tokyo Stock Exchange, corporate governance reforms aimed at improving shareholder returns and increasing the valuations of Japanese businesses, have continued. Although these initiatives were initially conceived as part of Abenomics, they are now driven more by regulators and institutional investors than they are by politicians. This should provide them with enough momentum to continue uninterrupted by the current political uncertainty.

Indeed, as evidence of the success of the corporate governance revolution in Japan has accumulated, we have seen growing interest from the global investment community, after years of overseas apathy towards Japanese equities. In addition, there has been an increase in the level of domestic retail participation in the equity market as a result of a new tax-efficient savings scheme, known as NISA.

Importantly, these three factors should not be negatively impacted by Japan’s recent political developments. They look capable of driving continued progress from the Japanese stock market in the years ahead.

Some parts of the market look better positioned to benefit than others, however, so a disciplined, valuation-oriented, active investment approach, such as the one we adopt for Schroder Japan Trust, is wellplaced to add further value for investors.

• Concentration risk: The company may be concentrated in a limited number of geographical regions, industry sectors, markets and/or individual positions. This may result in large changes in the value of the company, both up or down, which may adversely impact the performance of the company.

• Currency risk: The company can be exposed to different currencies. Changes in foreign exchange rates could create losses.

• Derivatives risk: Derivatives, which are financial instruments deriving their value from an underlying asset, may be used to manage the portfolio efficiently. The fund may also materially invest in derivatives including using short selling and leverage techniques with the aim of making a return. A derivative may not perform as expected, may create losses greater than the cost of the derivative and may result in losses to the fund.

• Gearing risk: The company may borrow money to make further investments, this is known as gearing. Gearing will increase returns if the value of the investments purchased increase by more than the cost of borrowing, or reduce returns if they fail to do so. In falling markets, the whole of the value in that investment could be lost, which would result in losses to the fund.

• Liquidity risk: In difficult market conditions, the fund may not be able to sell a security for full value or at all. This could affect performance and could cause the fund to defer or suspend redemptions of its shares,

IMPORTANT INFORMATION

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory

meaning investors may not be able to have immediate access to their holdings.

• Operational risk: Operational processes, including those related to the safekeeping of assets, may fail. This may result in losses to the fund.

• Performance risk: Investment objectives express an intended result but there is no guarantee that such a result will be achieved. Depending on market conditions and the macro economic environment, investment objectives may become more difficult to achieve.

• Counterparty risk: The fund may have contractual agreements with counterparties. If a counterparty is unable to fulfil their obligations, the sum that they owe to the fund may be lost in part or in whole.

• Market risk: The value of investments can go up and down and an investor may not get back the amount initially invested.

Important information

For help in understanding any terms used, please visit www.schroders.com/en-gb/uk/individual/glossary/

We recommend you seek financial advice from an Independent Adviser before making an investment decision. If you don’t already have an Adviser, you can find one at www.unbiased.co.uk or www.vouchedfor. co.uk. Before investing in an Investment Trust, refer to the prospectus, the latest Key Information Document (KID) and Key Features Document (KFD) at www.schroders. co.uk/investor or on request.

system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Finding genuine growth stocks: what the experts are buying

We reveal the markets, sectors and growth names that are exciting professional money managers

In last week’s magazine, Shares focused on the methods by which leading fund managers identify genuine long-term growth opportunities, covering everything from the need for a growth mindset to bottom-up stock picking and the need to factor in top-down considerations.

Now we turn the spotlight on the regional markets, themes and stocks which have some of the market’s most admired investors salivating.

HERE, THERE AND EVERYWHERE

Lawrence Burns, manager of Scottish Mortgage (SMT), runs the trust with an unconstrained remit, which gives him the opportunity to invest in the most exceptional growth companies both public and private worldwide, and a number of the trust’s new names have been in Asia.

‘There is every possibility this will become the “Asian Century” given the young, dynamic and growing populations across the continent,’ says Burns.

‘Companies there can be less well-known but address large market opportunities, have visionary management and formidable competitive advantages.’

In contrast, Odyssean Investment Trust’s (OIT) Ed Wielechowski says he is finding the best opportunities closer to home in a UK market which remains undervalued compared to international peers and its own historic ratings and whose smallcaps sit on a ‘double discount’.

Also lending his view is respected venture investor Tim Levene, chief executive of Augmentum Fintech (AUGM), who is excited by the momentum in fintech companies leveraging advancements in AI (artificial intelligence) to redefine industries such as wealth management, capital markets, and compliance.

‘AI-powered solutions are transforming previously constrained markets, unlocking enormous potential,’ he enthuses.

BAILLIE GIFFORD – ALL ABOUT THE GROWTH

No discussion centred on growth would be complete without input from Baillie Gifford, the Edinburgh-based house behind growth big beast Scottish Mortgage and investment trust

stablemates Monks (MNKS) and Baillie Gifford US Growth (USA), whose managers think in terms of years and decades rather than months and quarters.

Baillie Gifford US Growth’s manager Gary Robinson highlights two recent additions to the portfolio.

The first is Block (SQ:NYSE), a collection of financial services businesses linked by a common mission: to advance economic empowerment and inclusion.

Its two most important businesses today are Square, which enables merchants to accept card payments and provides ancillary software services, and Cash App, a personal payment app.

‘Square can continue to drive penetration in merchants, offer more software services, and expand internationally, which should be helped by the company’s acquisition of buy-now-pay-later firm AfterPay.

‘Cash App is still in its infancy, and we think Block’s efforts to grow merchant acceptance for its nascent card service will drive rapid growth,’ says Robinson.

The second is SharkNinja (SN:NYSE), known for manufacturing and selling popular vacuum cleaners, kitchen appliances and other home products under the Shark and Ninja brand names.

‘A mixture of product innovation, efficient supply chain, strong distributor relationships

and innovative marketing gives SharkNinja the opportunity to grow substantially, and much more than the current share price implies,’ insists Robinson.

Recent additions to Monks, whose portfolio includes stocks with a range of different growth profiles, have been ‘eclectic’ according to manager Spencer Adair, ranging from Dutch Bros (BROS:NYSE) and Nexans (NEX:EPA) to Norwegian Cruise Line (NCLH:NYSE).

He notes Norwegian Cruises, which is emerging from a cyclical downturn following the pandemic, has ‘ambitious plans to grow its fleet to supply growing demand for its premium cruise holidays in the years ahead.’

WHAT’S EXCITING THE SMALL CAP SPECIALISTS?

An investor in quality global small- and mid-cap companies, Smithson (SSON) manager Simon Barnard highlights several areas of strong growth, including datacentre construction, AI development, industrial automation and renewable energy, but while opportunities here are attractive, valuations can be high, so he remains selective.

At the other end of the scale, there are ‘some great companies supplying industries which are currently going through a low point in their economic cycles, such as biotechnology, semiconductor manufacturing and consumer products, often with impressive long term track records but trading at depressed multiples’.

WHAT HAS SCOTTISH MORTGAGE BEEN BUYING?

Scottish Mortgage has been topping up its position in Taiwan-based semiconductor chip maker TSMC (2330:TPE). ‘We view TSMC as a diversified royalty on both compute and AI that will benefit regardless of which specific types of semiconductor technologies win out over the next decade,’ says Burns.

Another recent purchase is Warren Buffettbacked Nu Holdings (NU:NYSE), the owner of the world’s largest digital bank outside of China, which operates in Brazil, Mexico and Colombia.

‘The banking industry in Latin America has been simultaneously terrible for customers and yet one of the world’s most profitable, making it ripe for disruption,’ says Burns.

There exists a significant greenfield opportunity with most of the region’s population underbanked.

Nu has been able to address this with a radically lower cost to serve, given it does not operate physical bank branches, has a fraction of the employees and is not weighed down by expensive legacy IT infrastructure, argues Burns.

Among the recent additions to UK smaller companies trust Odyssean’s portfolio is Genus (GNS), a leading provider of genetics and related services to global porcine and bovine markets which are cyclical but growing well above GDP driven by increasing penetration of genetics and the improving benefits of the company’s genetics to farmers.

‘Genus is well-positioned to drive a multiyear growth story through continued share gain in its growing markets, self-help driven margin improvement and break out potential from transformational new products,’ says Wielechowski.

‘With the shares trading near a 10-year low on an enterprise value-to-sales basis, and recent private equity activity in the sector we see an attractive long-term story from here.’

OPPORTUNITIES IN AI

Mike Seidenberg, who manages Allianz Technology Trust (ATT), continues to find interesting opportunities in sectors including cyber security, internet products and the AI supply chain.

Spotify (SPOT:NYSE) is a recent addition to the trust, with Seidenberg excited about the

management team and the multi-generational power of music.

‘Music has been an important part of my life for at least four decades and many of Spotify’s customers could have a similar monetisation trajectory,’ observes Seidenberg.

James Cook, co-manager of JPMorgan Global Growth & Income (JGGI), says right now the fund’s managers are ‘balancing exposure to high-growth, cyclical sectors such as semiconductors, with attractively-priced defensive stocks.

Cook points out that AI processes require more powerful memory, as well as associated hardware. In response to these trends, the popular trust has added exposure to companies providing memory capacity for computers and smartphones.

Within the AI sector, Blue Whale Growth’s (BD6PG78) Stephen Yiu is particularly focused on infrastructure as opposed to applicationsinvesting in the ‘picks and shovels’ of the industry.

He highlights Vertiv (VRT:NYSE), a provider of cooling solutions for data centres, as being wellpositioned to benefit from the growing adoption of GPUs.

‘As GPUs become essential for high-performance data centres, the demand for advanced cooling solutions rises,’ he explains. ‘Vertiv exemplifies this dynamic and has performed well since our investment earlier this year.’

Stephen Tong, a portfolio manager for Mid Wynd International (MWY), says the trust’s recent purchases include customer relationship management software titan Salesforce (CRM:NYSE)

‘The data that’s input can help businesses attract customers methodically and then upsell,’ stresses Tong. ‘Once embedded it’s a lot of hassle

for clients to switch, so Salesforce is good at keeping business.’

The company has been investing in AI to enhance its offering under the Einstein label, which should enable its clients to make better data-driven decisions.

‘It can help automate some tasks and identify the hottest leads for sales teams to follow,’ explains Tong.

Marylebone Partners’ chief investment officer Dan Higgins, whose firm manages Majedie Investments (MAJE), believes the most compelling equity-centric investments looking ahead lie outside the most obvious areas. ‘US markets have already anticipated monetary easing and the rally has been concentrated in a small number of mega cap companies,’ explains Higgins.

‘AI-related stocks have outperformed almost everything else over the past two years, but looking ahead, growth stocks are not usually considered the greatest beneficiaries of lower policy rates and steeper yield curves.

‘As short rates come down, we expect a portion of the trillions of dollars that have been earning attractive income from short-dated government bonds and money market funds to flow back into riskier assets.’

Given the divergence in valuations which has occurred while this capital has been on the sidelines, a disproportionate amount of the flow may find its way into smaller cap stocks, value plays and international equities, suggests Higgins.

By James Crux Funds and Investment Trusts Editor

BUYER BEWARE

WATCH RECENT PRESENTATIONS

Investment Evolution Credit (IEC)

Marc

Howells, CEO

Investment Evolution Credit is a United Kingdom group of fintech companies whose main business activities are online consumer loans. The IEC group has been operating in the consumer finance industry in the United States since 2010 via licensed subsidiary MRAL US Corporation which provides online personal loans.

Pulsar Helium (PLSR)

Tom Abraham James, Co Founder and CEO

Pulsar Helium is a dedicated helium exploration and development company listed on London’s AIM exchange, the TSXV and American Over the Counter exchange. Pulsar is at the forefront of a new industry, the production of helium without the co-production of hydrocarbons – focusing on deposits where helium is the primary economic driver

Ashoka India Equity Investment Trust (AIE)

Prashant

Khemka, Portfolio Manager

Ashoka India Equity Investment Trust is a diversified, long-only equity investment trust. The investment objective is to achieve long-term capital appreciation, mainly through investment in securities listed in India and listed securities of companies with a significant presence in India.