Italy leads the way in innovative design

Getting started in self storage

The self storage evolution

The importance of building compliance

124 MAGAZINE OF THE SELF STORAGE ASSOCIATION OF AUSTRALASIA Insider APRIL / MAY 2022 INDUSTRY NEWS | COMMUNICATION | HUMAN RESOURCES | OH&S | LEGAL | TRADE DIRECTORY

together design, construction, technology and customer experience

design & construction Bringing

Wanting to feature a product of the month?

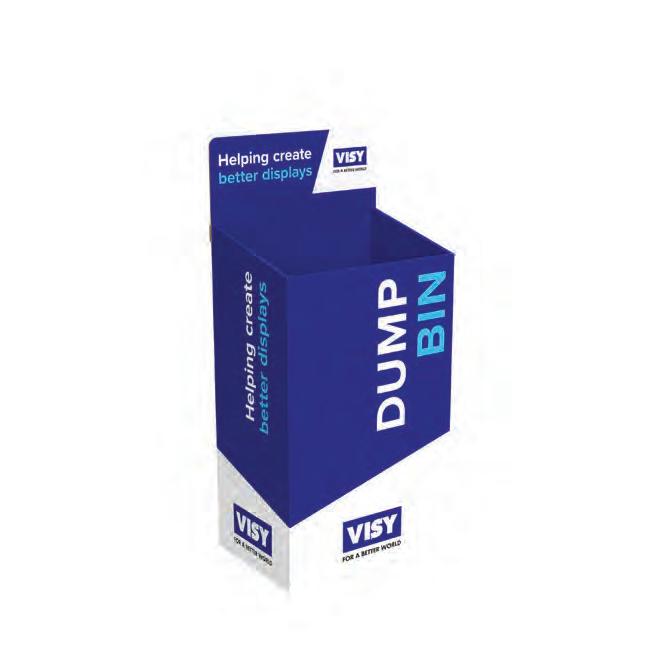

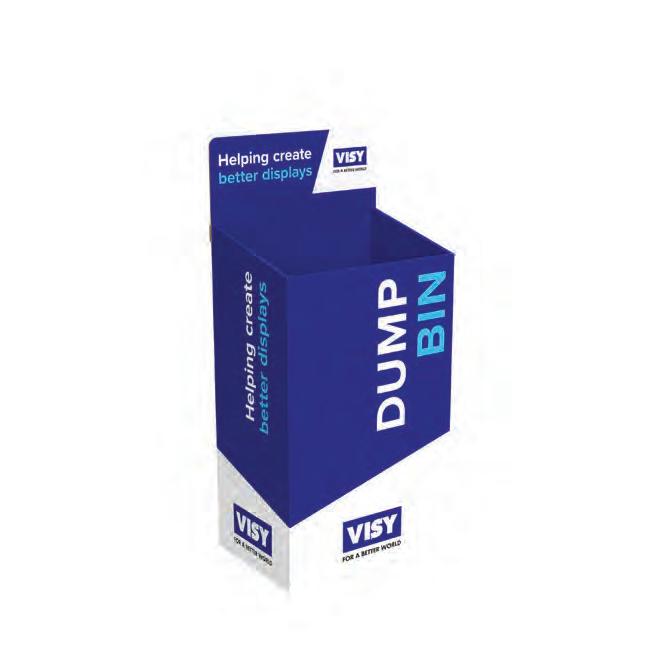

Promote a product in store using Visy Boxes & More

FEATURES OF DUMP BINS

The header is removable and can be custom printed

For custom printing, the base has a large print area to maximise branding potential

Drive brand recognition and consolidate mixed or loose product into one central point in store through eye-catching dump bins

Dump bins are perfect for getting product visible in high traffic areas of stores and can be used as temporary displays for retail applications, impulse sale items or promoting a Product of the Month campaign.

Visy Boxes & More has available standard plain and custom printed dump bins. Customised display units to meet the specifications of your projects are available on request (pending quantity and budget requirements).

For expressions of interest, please call 0419 560 022 or email sonja.becke@visy.com.au

Dump Bins are easy to assemble and do not require tape to close

Partitions are included to ensure your product is fully supported in the unit

1 2 3 4 Max weight 20kg Artwork for illustrative purposes only 115mm 455mm 316mm 800mm 220mm 170mm

SSAA BOARD OF DIRECTORS

Chairman – Michael Alafaci Storage King Group, New South Wales

Shaun Bain

Keepsafe Storage, Western Australia

Ryan Coom

National Mini Storage, New Zealand

Martin Coote

Lock Distributors, New South Wales

Ned Coten

City West Storage, Victoria

Wayne Dade

Glenelg Self Storage and Western Self Storage, South Australia

David Daddow

Able Self Storage, South Australia

Ivor Morgan

Jim’s Self Storage, Victoria

Thomas Whalan

Rent A Space, New South Wales

LIFETIME MEMBERS

Mark Bateman

Frank Cooney

Elaine Coote

Liz Davies

Dallas Dogger

John Eastwood

Simone Hill

Neville Kennard

Sam Kennard

Bob Marsh

Jim Miller

Jon Perrins

Phil Robbie

Mark Snooks

Richard Whalan

www.selfstorage.org.au

TOLL FREE – AUS:

1800 067 313

TOLL FREE – NZ:

0800 444 356

T: +61 3 9466 9699

Address:

Unit 4/2 Enterprise Drive, Bundoora Vic 3083

E: admin@selfstorage.com.au

Connect to our Social Media via our website

Insider magazine (Insider) is published bi-monthly by the Self Storage Association of Australasia Limited (ABN 23 050 341 725). This publication may not be reproduced or transmitted in any form, in whole or in part, without the express, prior written permission of the publisher. While every care has been taken in the preparation and publication of Insider, none of the Insider’s publisher, editor nor any of the publisher’s employees, subcontractors or contributors give any warranty as to the completeness or accuracy of the publication’s content, nor do any of them assume any responsibility or liability for any loss, damage or expense which may result from, or arise in connection with, any inaccuracy or omission in the publication. The views or opinions expressed in Insider are not necessarily those of Insider’s publisher or editor. Furthermore, Insider has the right to accept or reject any editorial and advertising material. All letters addressed to Insider will be regarded as ‘for publication’ unless clearly marked ‘Not for Publication’. All submissions to Insider may be edited for reasons of space or clarity and opinions expressed in letters published in Insider are those of the author, not of Insider’s publisher or editor.

APRIL / MAY 2022 INSIDER 124 8 TIPS TO GET STARTED Getting started in self storage 12 STORAGE DESIGN Italy leads the way in innovative design 14 ARCHITECTURE Architects and self storage developments 15 TECHNOLOGY TRENDS Latest technology for modern design techniques 16 CONSTRUCTION Storco’s take on the evolution of self storage 20 INVENTIVE STORAGE SPACES TAXIBOX creates local storage in St Kilda, Melbourne 24 INNOVATIVE MIXED-USE SITE National Storage Moorooka 26 THE LAY OF THE LAND The construction landscape, Regis Built 28 RESEARCH Work wellbeing 30 INTERNATIONAL NEWS SSAA Asia Annual Industry Survey shows growth, opportunities 33 NEW MEMBER DEBTplacer 34 SECURITY Experience counts when it comes to security

Insider is published and edited by: Social Ties / E: vforbes@socialties.com.au Designed by: Keely Goodall / E: keely@itsallgood.net.au Printed by: Homestead Press / E: printing@homesteadpress.com.au SSAA STAFF Makala Ffrench Castelli CEO Sandra Evans Office Manager REGULARS 4 CEO’s Report 6 Chairman’s Report 11 Industry News 22 MEMBER SPOTLIGHT Hayden Gage, Steel Storage 23 Membership Desk 36 OH&S Planning to extend or build a new storage facility? 38 LEGAL To comply or not to comply 40 Trade Directory 24 CONTENTS 3 12 16

Some of the most visible and significant changes to the self storage industry over the past 10 years have been in facility design and construction.

When we surveyed our design and construction providers in 2020, already more than 60% of facilities being built were more than two levels and operators were trending towards staging developments in line with occupancy growth.

Makala Ffrench Castelli CEO SSAA

In 2021, the SSAA Industry Snapshot highlighted the unprecedented amount of supply forecast over the next few years, underpinned by strong industry fundamentals. More than 75 facilities were proposed or under development in metro markets last year and we understand the count continues to climb as we push into 2022.

This year, we’re seeing some new facilities set to reach heights of more than five or six levels, a wide range of expansion projects underway and more mixed-use developments, as featured on pages 16 and 24. I’m looking forward to seeing what other trends the design and development questions in State of the Industry 2022 will unearth later this year.

In this edition we talk to people at the forefront of design, construction and customer experience – three aspects of self storage that are now more connected than ever. From local insights to global ones, it’s clear that customer experience is now top of mind for owners and operators alike.

The industry continues to attract new interest, so for our growing number of provisional members we feature a selection of articles for those contemplating their first facility. There’s much to consider and it’s a delight to be part of an industry that generously shares its experiences.

I hope this edition provides some inspiration for your next self storage project. l

4 CEO’S REPORT

local support facility map online payments online move-ins nance exports extensive reports access control integrations sales & marketing locally secured single or multi site Tomorrow’s self storage software, today!

I’m delighted to be penning my first column to members as Chair and looking forward to delivering on our commitments around advocacy, support and engagement this year. There’s much on our agenda, with the transformation of our industry presenting its fair share of

Michael Alafaci Chairman SSAA

expand their knowledge base across operations, technology, marketing and more.

Insurance remains a significant challenge and we continue our work on a range of potential solutions in this space. We are acutely aware of the importance of insurance for our members and the industry as a whole, which is why we’ve committed to exploring a number of alternatives.

The complex regulatory landscape together with a wide range of stakeholders and recent severe weather events haven’t made it easy, but we’re leaving

the opportunities we should be leveraging to continue to raise the profile of our asset class. As you can see, there’s a lot of opportunity and a great foundation for us to build on. All the Directors are looking forward to our events program later in the year and I look forward to being able to meet many of you in person! l

6 CHAIRMAN'S REPORT

e only self storage so ware you need. Smarter Operations Automate workflows and take customers from lead to lease online with SiteLink’s powerful features. Integrate sales and marketing, payments and reporting to optimise your operations. Local Support, Global Network Our local support team are here to help, in your time zone. Harness the power of experience and insights from our global network of industry and technology partners. Strength In Numbers More than 16,000 facilities use SiteLink worldwide. Feedback from single and multistore operators is transformed into product features. The collective knowledge of the industry is in your hands. On average storage facilities have a 12% vacancy rate How much potential revenue are you losing each month? Let us help you keep your sites full Storage Industry Experts Website Design & Development, Marketing Strategy, Search, Social & SEO. R6digital.com.au Book your demo! sitelinksoft ware.com.au Contact Us Today (07) 3889 9822 sales@sitelinksoftware.com.au Insurance A Challenge? Is your current storage booking process compliant with government legislation? With Sitelink and RapidStor you can be compliant with recent insurance legislation changes through the online self service booking system without extra custom development.

“ There’s much on our agenda, with the transformation of our industry presenting its fair share of opportunities and challenges.

Getting started in self storage?

The SSAA has welcomed many new members recently who are considering embarking on their first self storage project. Based on the combined experience of our members over many years, we share some hard-earned wisdom with those just getting started.

Do your research

Self storage is a local business, so it’s important you understand your local market inside and out. You can engage a range of advisors to help with research and feasibility studies and it is worth seeking out experts in self storage for the task. Don’t underestimate how important these fundamentals will be to the success of your self storage venture.

You should be researching your chosen location and primary target market, including demographics and suburban trends. Keep a keen eye on operators already in market. Insights from surrounding facilities on style, sizes and rates might help you identify a gap in the market or model the potential for your facility.

Location, location, location

Self storage is a real estate business after all. Customers are seeking convenience and accessibility so a great location is key. A high degree of visibility, access to main roads or major thoroughfares and passing traffic all make for great self storage locations. Think about opportunities for branding and signage as you’re assessing your location options.

The 5 Ps

You know the saying. Proper preparation prevents poor performance – or whatever version you’re familiar with. It rings just as true in self storage.

There are three aspects of proper preparation you’ll want to consider when you’re starting out: Business planning – make sure you’ve considered all aspects of your strategic plan, particularly where external investment or funding is concerned. Do the numbers stack?

Project management – an experienced project manager will add value at every step and ensure things run as smoothly as possible. The execution phase of your build will include everything from structural engineering to ventilation and electrical design, fire safety, approvals and much more. If you’re managing the project yourself, make sure your reach out to your service providers to ensure you’ve covered every aspect.

Operational readiness – are you considering operating the facility yourself, engaging a third party management provider or thinking about full automation? Whatever the scenario, consider your operating model ahead of time. There’s insurance, technology, security solutions, marketing and customer experience to consider so don’t leave it all until the build is nearly done.

What’s inside counts

Maximising your available space or net lettable area (NLA), determining the most efficient unit mix (the size, type and layout of units) and choosing the right fit out are all essential for success in self storage. There are a wide range of self storage solutions including different types of partition systems, doors, lockers, modular units and more. If this is your first experience with self storage then engage an expert for valuable advice. What you invest at this stage will return dividends both in operating revenue and if it comes time to divest down the track.

Budget surprises

The 5Ps should help limit any budget surprises. Beyond your initial purchase, design, development and operating costs, don’t forget to consider:

l External building requirements such as parking, signage and landscaping costs

l Internal requirements such as a retail space or box shop and associated fit outs, bathrooms, office furniture and other amenities

l Insurance

l Security setup and any ongoing monitoring costs

l Technology

l Retail merchandise

l Staffing

l Marketing; and

l Maintenance

Looking for support?

The SSAA is here to support new entrants to industry. Check out the SSAA Self Storage Supplier Guide for case studies, resources and a range of experienced industry suppliers. Login to your SSAA Member Portal to learn more. l

8 TIPS TO GET STARTED

INSIDER 124 APRIL / MAY 2022 www.selfstorage.org.au

Southwell Service & Modernisation

Southwell Engineering doesn’t just engineer market-leading lifts and hoists. Our experienced team of technicians can make tired and broken-down hoists work better than they did brand new. We can also add new functionality more cost-effectively than installing a replacement.

Southwell’s expert technicians will bring back ‘as new’ functionality to your lift

Upgrade from goods-only to goods plus personnel and disabled access to meet the latest codes NCC/BCA, WHS Standards at a fraction of the cost of a new hoist

Enhance your lift communication system to GSM standard for better workplace safety

Switch out manual doors to an electric roller door for efficiency and ease of use

Quick turnarounds for reduced downtime

Guaranteed and maintained by Southwell Lifts and Hoists with 100% parts backup

Before After

Southwell Engineering

Southwell is a proud, family owned company. Since 1945 we’ve been engineering and manufacturing high-quality hoists and scissor lift products at Camden, New South Wales, delivering and installing them around Australia, New Zealand and the world. We design registered one of the original Australian hoist designs and we’ve continued to innovate with creations like our Car Lift with Integrated Turntable, adding neatly to our standard range of Car Lifts and Goods Hoists.

36 Edward St, Camden NSW Australia 61 2 4655 7007 southwell.com.au

Sentinel sees alignment between US and Australasian distributors

Sentinel Systems Australasian distributor Sentinel Storage Security has recently undertaken its biggest transformation with alignment and control by its US parent brand Sentinel Systems.

The past 20 years has seen Sentinel products distributed by Sentinel Australasia, and now Sentinel Storage Security, at pace with self storage industry growth throughout Australia, New Zealand and Asia. The marketing of Sentinel Storage Security as a one-stop security shop to also include CCTV, office alarms, gates, as well as other security features in recent years, has been instrumental in accelerating growth which has seen the Australasian team dramatically increase with dedicated local support and operational staff.

The new alignment was paired with a significant investment in the US that saw the Sentinel Systems foundation owners make available their shareholdings to several personal investors with more than 100 combined years of management software, digital marketing and security experience. The new investment, directorship and expansion will see the US and Australasian businesses align and synergise in both regions. This earmarks an evolution for Sentinel across the two regions in product, research and development, and opportunities for future growth. This announcement has created excitement for both businesses and staff in what the future holds.

“Sentinel Storage Security are thrilled with the outcome, as this transition to a wholesaler from a regional distributor of Sentinel products means the US will be playing a more active part in the Australasian market,” said Tony Harvey, sales manager.

“In effect, this means we used to buy Sentinel products from the US, but now we are directly part of the Sentinel family.”

Rest assured Sentinel Storage Security will continue with the same Australasian team in Support and Sales, with the same local passion and same local awareness but with the added might of US backing from Sentinel Systems.

Dollar Match Day campaign raises $80,000+

Queensland’s iconic Mater Foundation received an additional $82,951.36 thanks to National Storage’s Self-Donation Dollar Match Day campaign. The money matched the funds raised from RACQ International Women’s Day Fun Run held earlier this year. National Storage is proud to continue to support the Mater Foundation and women with breast cancer – a disease that has touched the lives of so many of their staff, family and friends.

CBRE has bolstered its Valuation & Advisory Services – Alternative Assets business by recruiting a leading self storage specialist valuation team led by Dylan Adams, National Director. Dylan is joined by Emily Quick, Associate Director and Jack Seymour, Assistant Valuer as experts in self storage valuation and advisory throughout Australia and New Zealand.

New partnership with Storage Investments Australia

The Maras Group, a successful property development group, has entered into an exciting new partnership with Storage Investments Australia (SIA), to roll out a number of new storage facilities in New South Wales and Victoria.

SIA manages one of the largest national portfolios of self storage assets in Australia. The first project for Maras Group and SIA will be in Oran Park, south-west Sydney, within the Macarthur Region and in the Camden Local Government Area (LGA), and will comprise some 6500sqm of NLA over four levels.

Con Tragakis, Chair and Director – said “Self storage continues to strongly outperform in the property sector and we are excited to partner with Maras Group to build, own and operate a portfolio of high-quality self storage facilities”.

INDUSTRY NEWS 11

APRIL / MAY 2022 INSIDER 124 www.selfstorage.org.au

Italy leads the way in. innovative design.

Have you ever thought about making a storage facility look a lot different than just roller doors? It is possible, and Casaforte Italy leads the way.

By Casaforte Self Storage.

By Casaforte Self Storage.

Casaforte is the biggest self storage operator in Italy, with more than 20 facilities located in the peninsula. The first facility opened in 2000, and it has continued its expansion ever since. Casaforte is always trying to find new and innovative self storage solutions, first in Italy and then in Switzerland with its facilities in Lugano, Bedano and Basilea.

It has been able to profoundly innovate the self storage industry, doing something no one had done before, so how did they do it?

Casaforte has always focused on people, with its motto “Our people come first ”. It invests in its employees with ongoing training and courses, both professional and personal, as well as ensuring customers receive dedicated (obsessive) attention. This ensures attention to people’s needs is its primary mission.

INSIDER 124 APRIL / MAY 2022 www.selfstorage.org.au

Embracing people and their needs fosters innovation and ideas. This extreme attention and desire to understand the needs of its customers has pushed Casaforte to conduct specific studies to find ways to better support them.

Casaforte decided to break the golden rules of self storage that advocated the opening of large facilities and introduced a small plant in the heart of the beautiful city of Milan, kicking off a new era of self storage: the Casaforte Express. l

Cesare Carcano, president of Casaforte Self Storage, said: “For some time, we were wondering if it could be possible to realise something different, a full of beauty and cosy facility which could meet the needs of our customers.”

Casaforte did it. It created a beautiful and pleasant environment, setting up majestic trees in the facility’s centre, complete with electrical sockets for mobile phone recharging.

The facility’s corridors are decorated with evocative images of mountains, sea, cities, spaces where people live that may remind them of the objects they will deposit in the store.

This facility is entirely new and innovative, rich in beautiful murals and art that transforms a sterile environment into -one of colour and emotion.

The most fascinating and attractive part of this innovation is that Casaforte reserved an entire wing for modern art, including the character Valentina by Guido Crepax, an Italian cartoonist known around the world for his beautiful and evocative drawings. The new Casaforte Express has brought value to customers and the environment by restoring old structures instead of starting afresh, therefore saving land and redeveloping the city districts. Casaforte has brought self storage closer to the people by creating a pleasant, unique and more reassuring environment that helps customers relax and meet their needs.

www.casaforte.it

email: info@casaforte.it

FOR SALE

35KM SOUTH OF

STORAGE DESIGN 13

APRIL / MAY 2022 INSIDER 124 www.selfstorage.org.au

FOR FURTHER INFORMATION ON THIS PROPERTY CONTACT MATT WALSH ON 0411 880 054 HIGHWAY FRONTAGE ARE SSAA MEMBERS FREEHOLD AND SELF STORAGE BUSINESS for sale on walk-in walk-out basis

“ Casaforte has always focused on people, with its motto “Our people come first ”.

BUSINESS

PERTH CBD SECURE INCOME WITH STRONG OCCUPANCY 64 STORAGE UNITS OF 822 SQM NLA APPROX. LAND AREA 1,797 SQM APPROX. EXCELLENT SECURITY REMOTE MANAGEMENT: WEBSITE, SECURITY AND SOFTWARE ALL IN PLACE MATES RATES STORAGE MINIMAL OWNER INVOLVEMENT 14 Hurrell Way, Rockingham Perth WA

Architects and self storage developments

By David Cahill Director | Architect at MCHP Architects.

Architects are often involved in projects from the early design stages through to the completion of a project. They can work with a client to help investigate the feasibility of a property from a functional design perspective and potential floor space yield. They can then develop building and site concept designs and layouts, architecturally design and document submissions for authority approvals, whether council, state authorities or certifiers. Other architectural services include documenting for construction and assisting during the construction process.

As well as architects, there may be various other design and consulting professionals involved in a project. They may include town planners, civil and structural engineers, mechanical, hydraulic, electrical, energy, access, traffic, ecology, arborist, bushfire, flood and National Construction Code consultants. An architect will generally assist to coordinate these consultants as part of developing the project design.

The design of a self storage centre is generally based on financial drivers, the unique opportunities and constraints of a site, council or state planning codes and authority approvals, and then the building function to create a centre that meets the needs and demands of customers.

Developments may be one completely new building, or there may be several buildings in a development where a masterplan is developed and the centre is developed in stages. A self storage centre design may need to work with an existing building or sometimes it may just be alterations and additions to an existing centre to adjust to changing customer demands.

Designs need to consider traffic flow, functional use of the centre, security, what amenities are required and how it appeals to the customer and the local community. Branding, customer understanding and the feel of a centre is also of consideration.

Site opportunities and constraints have particular impacts on design. City properties generally demand high values and accordingly, a financial return on those properties will likely require a multi-storey

storage centre. It may be located on a smaller site, vehicle access and movement may be more compact, lifts required, consideration given to the building appearance and various council and authority constraints. There are different requirements under the National Construction Code, including fire resistance and protection, fire isolated egress stairs, etc plus construction access may be more difficult. These factors all influence the design and construction of a centre and increase the build cost per square metre.

Alternatively a self storage site may be on a non-city site. Council requirements and functional and financial requirements of the development will often create a lower scale and more spread-out development. There may be different issues, such as flooding, bushfire and other environmental considerations. It may have one- or two-storey self storage buildings surrounded by driveways. The construction of up to two storeys has different demands under the National Construction Code and are generally developed with a more generic style of self storage industrial building to keep the build cost per square metre lower.

An architect can work with a client to assist to create an appropriate development for a particular site. l

INSIDER 124 APRIL / MAY 2022 www.selfstorage.org.au 14 ARCHITECTURE

“ Designs need to consider traffic flow, functional use of the centre, security, what amenities are required and how it appeals to the customer and the local community.

Latest technology for modern construction techniques

By Javier Rezzonico, Managing Director | Storcad Self Storage Design.

It’s no secret that retrofitting a self storage facility into the worst building on the best street is one of the most cost-effective ways to get into the market. However, unlike a greenfield development, a retrofit can come with some risks. Older buildings generally have a poor documentation history, leading to costly variations once onsite construction has commenced.

Luckily, technology is starting to catch up in the construction industry to reduce the risk of these types of developments. One of the best ways to prepare for a retrofit is to conduct an onsite 3D laser scan.

What is a 3D laser scan?

3D laser scanning is a technology breakthrough in surveying a building and its surroundings. Within minutes, a 3D laser scanner can fully capture in 3D the shape of existing buildings, structural elements, fire services, landscapes, and large objects. It does this by collecting thousands of 3D coordinates or points, resulting in a tightly packed point cloud

‘constellation’ that creates a supremely accurate output that can be used for a range of purposes to help manage the design process of your development.

This point cloud is then overlaid into Storcad’s architectural software to ensure accuracy when modelling the facility. The point cloud ensures that the proposed self storage design will not clash with existing building elements such as structural columns or reduced roof heights.

Once the design is completed using the point cloud as the base point, you will be comfortable knowing that the risk of onsite structural challenges has been eliminated. It is then time to finalise the visual aspect.

This type of design documentation is then enhanced with real-time rendering.

Real-time rendering is an exported version of your 3D model that gives you the visual check that you have selected the correct colours and materials. It is the most accurate representation of what your design will look like as a completed project. It is the perfect solution for those who have trouble visualising what your 2D drawings will look like. It is also a handy tool to assist with council approvals as it is a standard requirement across all council areas to have an attractive façade.

Using the latest surveying and design techniques is the best way to reduce your future retrofit development risk. l

APRIL / MAY 2022 INSIDER 124 www.selfstorage.org.au

TECHNOLOGY TRENDS 15

“ Technology is starting to catch up to the construction industry to reduce the risk of these types of developments. One of the best ways to prepare for a retrofit is to conduct an onsite 3D laser scan.

Example of project Point Cloud with roof removed.

Javier Rezzonico.

Member Survey Results & Roadmap

Storco’s take on the. evolution of self storage.

Storco’s story dates back to 1980, when the Layton family-owned business opened its doors in Orange, New South Wales. With more than 20 years in the business, Managing Director Jonathan Layton has seen many changes.

INSIDER 124 APRIL

MAY

www.selfstorage.org.au

/

2022

16

CONSTRUCTION

Rent a Space - Brookvale

One of the most significant changes has been in facility design. In years gone by, Jonathan remarked that self storage facilities were much more industrial. In contrast, the current desire is to make facilities much more commercially appealing. He believes it is essential to keep up with trends worldwide. For example, innovation from the United States has played an important part in design trends, as it has generally been a more mature market than Australia. The Laytons regularly attend trade shows and visit storage facilities in America and then take that knowledge, adapt it, and improve it to meet Australia and New Zealand requirements. As self storage builds change, Storco has evolved its product too, by seeing the potential and bigger picture. Jonathan and the team are always

looking at ways to improve existing models and regularly take on feedback and ideas from installers, staff, clients, and owners.

Jonathan said the current evolution of self storage has seen an increased number of floors in self storage facilities. The recent trend with regional facilities is changing from exclusively single level to a mix of single and two-level buildings, and city sites that, in the past, were developed as two- to three-level sites are now as high as seven. He believes this change is primarily due to rapidly increasing land prices.

Another change in recent years has been in the materials used to construct self storage developments. Storage facilities are now fitted out with customised products developed specifically for the self storage market. Storco take great pride in developing many of these products locally, which is one of the drivers behind the decision to build a new stateof-the-art factory. The factory will increase from 3500 square metres to 7000 square metres and is due for completion mid-year . It will house equipment unique to Australia, which will create significantly more advanced products than what is currently available across the self storage industry.

One thing that hasn’t changed over the years is the benefits that great partnerships deliver. Jonathan emphasises that partnerships built over time with developers, designers

APRIL / MAY 2022 INSIDER 124 www.selfstorage.org.au

“ One thing that hasn’t changed over the years is the benefits that great partnerships deliver.

Storage King - Woonoona

and construction companies such as Patterson Building Group, Mettle (who delivered Woonona Storage King) and Total Construction Group have all helped evolve the industry to the high quality storage solutions we see today. Ninety per cent of Storco’s work is repeat or referral business which is testament to the relationships formed right across the industry. The trust that forms over time, knowing that people will do what they say, take the time to understand needs and work together to achieve them is what sets projects up for success. It’s enabled Storco to deliver projects for all major operators and independents alike - in metro markets, the regions and right out into rural areas.

Advice for new entrants

If you are considering building or renovating, Jonathan’s advice is to ensure you have the necessary funding, and allow a financial buffer as the process can be drawn out . You will also need to be patient. Councils can now take up to 12 months for approvals, materials costs have increased, and there are delays in shipping.

Terry King from Safeguard Self Storage in New Zealand seconds this advice. Terry has been in the industry for 13 years, and Storco has built all of Safeguard’s facilities. Due to this close relationship, the process has become seamless. Storco is in the process of building 10 new sites for Safeguard across the North and South Island. Terry said three years ago, the planning process was a lot simpler. The builder came in, the product

came in, and it was built. In the past 12-18 months, there have been delays, and they are spending more time sourcing materials, arranging deliveries and labour. Terry has had to spend a lot more time upfront, planning and establishing timelines to minimise delays. This has helped significantly, and Terry recommends everyone to do the same. Even though it can be a laborious process up front, it is well worth the effort.

Storco currently has 70 projects underway in Australia and New Zealand. Looking ahead, Jonathan predicts that the current growth of self storage will continue for the next couple of years and then potentially reduce to the levels seen before COVID-19. l

For more information: Storco.com.au

18 CONSTRUCTION INSIDER 124 APRIL / MAY 2022 www.selfstorage.org.au

Safeguard Self Storage – Gisborne

TAXIBOX. creates local storage. in St Kilda, Melbourne.

Providing flexible and convenient solutions has always been at the top of the priority list for TAXIBOX. For many years, the team have been working behind the scenes to continuously innovate in the industry, finding ways to expand on the mobility of TAXIBOX services and therefore extend its capabilities and reach as a business.

With this in mind, it identified an opportunity to launch hyper-local storage locations. Premised on using TAXIBOX’s existing infrastructure to create 24/access, these self storage centres use smart-access technology, allowing them to operate unmanned. Unlike traditional storage locations, the capital costs required to get a facility up and running are particularly low as all that’s required is space and leveraging TAXIBOX’s existing metal units.

Due to the mobility and flexibility of their units, TAXIBOX can occupy underutilised space to create local

storage sites, including inactive lots, corporate car parking spaces, unused car parking space in large format retail, etc. This opportunity exists in both metropolitan as well as regional areas.

The most recent acquisition was a joint venture with the landlord of a vacant block of land in St Kilda, Melbourne. This site is a flagship proving ground and an example for any future projects for TAXIBOX. It was an opportunity to step forward by refining the model, technology, and processes.

The site offers local flexible services to residential customers and commercial services (i.e. nearby retail, e-commerce delivery network, and local businesses).

As this concept rolls out to other areas, the plan is to provide hyper-local 24/7 storage to residential customers, local retail and commercial operators. It has also identified opportunities for providing a flexible solution as a mid-step in consumer logistics

such as delivered goods, food and beverage, etc as TAXIBOX also provides cool rooms.

A lot of hard work behind the scenes was required to make this happen. Local storage by TAXIBOX is something of a technological world first using mobile storage in this capacity, fully equipped with impressive innovation to run an unmanned, yet secure storage centre.

The key benefits of this type of storage offers:

l Low capital outlay for set-up and quick set-up time

l Hyper-local storage with 24/7 access offered at competitive pricing without fixed contracts

l Digital bookings and onboarding

l Smart-access technology for units, security, gates, cameras.

l Unmanned facilities

l Ability to move units between local centres

l E xpands TAXIBOX’s network to interstate and regional areas

www.selfstorage.org.au INSIDER 124 APRIL / MAY 2022

St Kilda (and particularly Grey St) is known for its ‘colourful’ demographic and there have been some operational challenges in administering unmanned facilities. TAXIBOX has found that most of these issues have been overcome with surveillance and active monitoring. Since setting up operations in September last year, the site has reached nearly 95% occupancy. According to TAXIBOX, the response has been tremendous with cross-sharing of leads taking place between the existing mobile storage and local storage side of the business.

The next step in the journey for TAXIBOX is to continue to refine the model and work with strategic partners to identify and secure properties within major Australian cities and regionally. l

APRIL / MAY 2022 INSIDER 124 www.selfstorage.org.au INVENTIVE STORAGE SPACES 21

“ Local storage by TAXIBOX is something of a technological world first using mobile storage in this capacity, fully equipped with impressive innovation to run an unmanned, yet secure storage centre.

Insider : You've been in the industry for just over a year nowtell us about your background?

Hayden Gage:I have been working in the construction industry for the past 15 years. Starting as a carpenter-joiner apprentice before progressing through to project management within corporate commercial fit-outs. This has provided me with experience across a broad array of projects and clients throughout Australasia. I fell into sales approximately seven years ago. By understanding the endto-end challenges faced in fitting out onsite and not carrying the car salesman mindset helps me consult with clients to deliver projects.

IN: What surprised you most about self storage?

HG: The biggest shock I had coming into the industry was the industry's size and just how many facilities. When casually driving through the streets, what I had been blind to previously started to stand out and around every fifth corner seems to be a storage facility or marketing to one close by. It is amazing to see how tight-knit the self storage community is, with everyone being incredibly welcoming.

IN: Where do you see the opportunities in design and construction?

HG: The various types of construction is dependent on location, current demand and proposed growth and development of local areas. With the growth in the current market,all areas of design and construction are surging due to the demand for self storage. There is definitely an opportunity for owners and operators to shape the future of self storage during this wave of growth

Member Spotlight Hayden Gage

This issue of Insider Member Spotlight is with Hayden Gage, National Sales Manager of Steel Storage Australia. We asked him a few questions on where he sees the industry going from a design and construction perspective.

and demand. There’s exciting new offerings too, that we'll be bringing to market in the next year or so.

IN: Given your background, how do these opportunities compare to what you've seen across other industries?

HG: The hotel industry, evolves every five to ten years with a standard of room or expectations from guests to be modern and fresh. Office space is the same, due to lease terms requiring a new fit-out out or to be attractive to new staff or tenants, with vibrant, welcoming environments. The self storage industry hasn't seen this happen, it is a massive opportunity that could revolutionise the industry and help owners think outside the box.

IN: What are some of the current challenges you see the industry facing?

HG: The industry faces many supply chain challenges that have been impacted by the current global climate. All playoff against each other as a knock-on effect from reduced shipping due to the pandemic to steel availability. One of the major suppliers closed down its manufacturing mill, leaving a major gap in the market. It has led to increased prices globally over the past 18 months. We have helped clients minimise the impacts as much as possible by working closely with them from the earliest point possible to procure early and source material/transport needs.

Another pressing challenge the industry will shortly face will be around fire code and compliance. It will become a pressing issue/ question for all owners and operators. The number of incidents locally and globally, has raised a few eyebrows from various agencies.

IN: Your role involves talking to both existing and prospective owners/operators – what kind of questions are they asking? Any key themes?

HG: The number one question is always "How much does it cost to build a storage facility?" Closely followed by "Is there technology that enables me to manage a site remotely?". Luckily, I can answer yes and tell them about the Nokē smart access system (sorry for the sell).

IN: We are often focused on what is happening here in Australasia – what is it like being part of a global self storage team?

HG: Exciting and insightful. Reaching out to some of the greatest minds in the industry and gain in-depth insight into different global markets is valuable. Australia is welldeveloped market, closely with the leading USA markets, with are a lot of similarities. The markets in Asia and Europe that are still relatively young are very different due to many factors (government regulations, living conditions, lease of space, size and market requirements).

IN: What does innovation mean to you? How do you think this will play out in self storage?

HG: Innovation is a word that is getting thrown around a lot in all industries. I feel the relevance and opportunity are not as substantial as what we are currently seeing in the self storage market. Looking to the future, I think the technological innovations in the self storage market will bring a massive shift from what the previous standard self storage facility has offered, moving towards an in-person and online shopping, retail and premium experience. l

22 MEMBER SPOTLIGHT

INSIDER 124 APRIL / MAY 2022 www.selfstorage.org.au

2022 EVENTS U PDATE

We've planned a range of events in an effort to offer something for everyone, covering different event styles, topics, formats and locations.

Whilst we are looking forward to travelling and getting together once more, we understand that health advice and guidelines will continue to change so we'll be working to tighter timeframes and taking a more flexible approach. We're committed to delivering our major events in a hybrid format, so if you're unable to join us in person you'll be able to join via the live stream online.

Our convention has moved to later in 2022 to give us the best chance of having both Australian and New Zealand members together once we're out of winter, and hopefully travel will have become a little easier for us all. ––––––

Wednesday 24 August –

Thursday 25 August 2022

SSAA SKI in Queenstown

Start the day with early morning speaker sessions followed by afternoons on the slopes. Share stories over a trade showcase and networking dinner. ––––––

Wednesday 21 September –

Friday 23 September 2022

Australasian Study Tour –UK into Portugal

Pending international travel, join us as we tour the best in storage and business in the UK before heading to Portugal to join the FEDESSA conference from 27 - 29 September 2022. ––––––

Tuesday 8 November –

Thursday 10 November 2022

Convention!

Explore the next normal over a three day format including the launch of State of the Industry 2022, the return of the SSAA Awards for Excellence and our 30th(ish) Anniversary Celebrations. Location TBC. ––––––

SSAA Online Industry Training

12 modules with two complimentary introductory modules now available. Each module takes approximately 15 to 30 minutes to complete and is accompanied by handy Quick Reference Guides.

Visit the Member Portal to sign up today!

National Storage Moorooka.

construction, technology

By Sophie Catsoulis, National Storage

Situated in the southern suburbs of Brisbane City, you’ll find National Storage’s brand-new Moorooka build on Ipswich Road near the BP Service Station and Moorooka Train Station.

Open since December of last year, the centre offers a range of convenient and affordable self storage options with units featuring lighting, individually alarmed doors, and receipt and dispatch services. Focusing on both safety and convenience, the centre also boasts 24/7 access, driveway units, an undercover loading bay, and a goods lift.

As leaders in the innovation space, Bluetooth Smart Access is the most recent addition to National Storage’s tech arsenal. First implemented at their new build at Robina on the Gold Coast in 2020, this new technology takes the highly topical contact-free sales process to a whole other level. Their new Moorooka facility is the second centre to feature Bluetooth Smart Access.

With the touch of a button, customers can access their units via keyless entry or digital key sharing, all available through an app.

Particularly suited to the business’ increasing commercial customer base, many of whom will be drawn to the Moorooka site due to its main road location, this technology enables a higher degree of much-desired outside operating hours usage. As the second cab off the rank in this new technology roll out, the closely aligned development and IT teams enjoyed added confidence in the efficiency of the technology stating their desire to continue to keep up with industry trends, and even discussing the possibility of retrofitting older centres within the National Storage portfolio.

When it comes to the site’s design approach, General Manager Development Nick Crang spoke of the many challenges the site presented. Ranging from difficult ground conditions and complex

24 INNOVATIVE MIXED-USE SITE

The best of design,

and customer experience on a mixed-use site.

“Their new Moorooka facility is the second centre to feature Bluetooth Smart Access. With the touch of a button, customers can access their units via keyless entry or digital key sharing, all available through an app.

demolition, to the site’s interface with Queensland Rail, state roads and the inclusion of a fuel station, the National Storage development team faced several parameters in their planning process.

“As a team we were able to leverage our previous mixeduse experience to counter some of the negative offsets of those preconditions,” Nick explains.

“We carried forward all of our successful recent tests with respect to access controls, the Bluetooth system, and all of our security and lift control learnings. Material

selection was the same rationale, we carried forward our solar initiatives, we chose sustainable, long-lasting durable materials that have a low ongoing repair and maintenance component.”

When it comes to the inclusion of the fuel station, Nick says that despite the corresponding design limitations, its inclusion actually increased the viability of the entire project. “There’s an obvious, noncompeting synergy between some land uses such as this, and we’ve got strong partnerships, and that where it’s relevant, we will continue to look

at those moving forward for our development projects,” he says.

The result is a lightweight, mixed-use design that utilises as much of the site as possible, and is empathetic to the catchment and wider area, while still being able to successfully capture prior learnings from recent successful flagships and accommodate an alternate use within the site.

“I’m happy with what we achieved there,” says Nick. “It’s the right development for the right location, and we’re expecting a very successful outcome”. l

APRIL / MAY 2022 INSIDER 124 www.selfstorage.org.au

CREDIT: LUCY RC PHOTOGRAPHY

The construction landscape.

Regis Built works predominantly on medium to large scale self storage projects, generally contracted under a “design and construction” process. The team currently have fifteen projects under construction across three states of Australia.

Anthony shared that in his 20 years of operation, he’s never seen demand for self storage construction so high. This demand, combined with the past two years’ global and local impacts, presents some challenges.

“The availability of consultants with the capacity to facilitate the design phase is critical to a successful self storage project. We are experiencing delays with architects, engineers, other consultants, certifiers and planning consultants,” said Anthony.

“There has been very little migration into Australia in the past two years. There are emerging trends of shortages of workers across all facets of skills/trades in the Australian construction industry. So far, this has primarily caused project delays and

wage pressure within the industry, and this is expected to continue throughout 2023”.

Significant price increases and longer supplier lead times are impacting projects at supplier and sub-contractor levels. “Steel price increases over the last eighteen months have made it challenging even to quote projects accurately. The volatility of the raw steel and timber prices have made the expected increase in dollar values and the time of the increase impossible to predict. We have had to build escalation clauses into

contracts to cover the potential rises from suppliers as it reaches levels the industry cannot absorb,” said Anthony.

Regis Built is navigating the labour shortage, though it is difficult and is expected to remain so for some time. However, it’s not just the labour market that has been a challenge.

“Material shortages are not a major issue though the lead time is. We typically tend to procure materials in a “just in time” approach but have had to change this approach as material supply times are at an all-time high”, said Anthony.

Mr Regis expects if there is a change in government at the federal level, the industry could see further change, particularly around regulation and the nature of the Australian Building and Construction Commission. This could increase blue-collar wages in the construction industry, increasing building labour costs.

Regis Built currently build conversions and purpose-built

INSIDER 124 APRIL / MAY 2022 www.selfstorage.org.au

26 THE LAY OF THE LAND

Anthony Regis of Regis Built took time out of his busy schedule to share some thoughts on the current construction landscape across Australia and New Zealand.

“ Regis Built currently build conversions and purpose-built designs on greenfield sites and regularly engage with architects as part of the process.

designs on greenfield sites and regularly engage with architects as part of the process. Anthony sees increased pressure on developers to use façade architecture for the external fabric of buildings, especially elevations located on the streetscape. He says it’s important to understand your local environment and requirements.

Engaging an experienced planning company and/or architect to design and develop your facility is some of Anthony’s most sage advice. “In the current market, when advising on building a new facility, we suggest allowing at least four weeks more than the expected time for your facility’s planning, permits, design and engineering phase. Using a building company that is experienced in self storage and has a history in delivering projects on time and within budget will set you up for success,” said Anthony.

Anthony remains optimistic despite the sector’s current challenges and is looking forward to growing and upskilling his team. l

Insurance. Uncomplicated. midlandinsurance.com.au Comprehensive and tailored insurance solutions to help protect you and your self-storage facility. SSAA_InsiderMagazine_HalfPage_2022.indd 1 30/01/2022 9:38:54 PM

Work wellbeing

Wellbeing in the workplace

A third of Australians’ waking hours are spent in the workplace and more than half of an individual’s years of life are spent at work7. With the magnitude of time an individual spends in the workplace, it is essential for leaders to create an environment that helps their workers thrive.

Our research into work wellbeing important elements of a workplace are:

The hybrid workplace

The experience of work has radically shifted throughout COVID-19, with the pandemic causing the greatest transformation to work in a century. As the global workforce continues to adopt changes brought about by the work from home (WFH) era, it is important to understand workers’ experiences and expectations for how they can do their best work in the future.

When considering their ideal working conditions, three in five Australian workers (62%) see a hybrid model as their ideal arrangement, incorporating a mix of working from home and the workplace. One in four (25%) want everyone working from the workplace all the time, while just 14% see their ideal as everyone working from home all the time.8

70%

of Australian workers say the workplace is where they experience meaningful and regular social connection and community

As leaders think about the future of the workplace it is important to understand that the workplace is so much more than an environment where productive work is done. For 70% of Australian workers, work is the place they experience meaningful and regular social connection and community. This is higher than the proportion who experience connection in their households (54%) or local neighbourhood (32%), highlighting the significance of the workplace in building meaningful social connections.9

Publisher:

LEADER INSIGHT

Australia towards 2031 04 trends, they are able to see things not just as they are, but as they will be.

THE

FUTURE OF WORK WILL BE HYBRID EVERYONE WORKING FROM THE WORKPLACE ALL THE TIME

EVERYONE WORKING FROM HOME ALL THE TIME A HYBRID OF WORK FROM HOME AND THE WORKPLACE

14% 62% 25%

McCrindle Research Pty Ltd Authors: Mark McCrindle, Sophie Renton, Kevin Leung. Excerpts from the document titled: Australian towards 2031: The demographic, consumer and behavioural trends shaping the nation. mccrindle.com.au

INSIDER 124 APRIL / MAY 2022 www.selfstorage.org.au

EMPLOYEE ENGAGEMENT = CULTURE + PURPOSE + IMPACT

THE WELLBEING TREE Culture and value

To some work is simply a job, but to many more it's a lifeline to social interaction, purpose and a place of belonging.

Expectations of the future workforce

By 2031, 31% of the workforce will be Gen Z workers who bring a unique set of values and perspectives to their work. As a generation they are looking to have a work experience that is for purpose, aligns with their values and has a positive impact on the world around them. The trends that are already being seen in Gen Z are likely to continue in Gen Alpha, signalling an opportunity for leaders to take steps now to prepare their business for the workforce of the future. l

To find out more head to www.workwellbeing.com.au

Those whose workplace has a commitment to staff wellbeing are:

Chapter 5 Chapter 6 Retention Engagement Employer of choice L Command & Control Collaboration & Contribution 58% Conditions and earnings 42%

5

5

workplace flexibility

workplace flexibility

64% workplace flexibility

64% workplace flexibility COMPETENCE what we do CAUSE why we exist CULTURE how we do it Rapidly

64% workplace flexibility

workplace flexibility

Fear of sedentary lifestyle

Australia towards 2031 33

Australia towards 2031 33

Australia towards 2031 33

Australia towards 2031 33

Australia towards 2031 33

Australia towards 2031 33

Australians are aware of the benefits of an active lifestyle with more than three in four (76%) making an effort to avoid a sedentary lifestyle. More than two thirds (64%) believe they are doing enough exercise to stay healthy but three in five (61%) are still worried their life is too sedentary.

The active nature of work in self storage facilities could be a real benefit to your workforce and a reason for prospective employees to consider self storage as an ideal career. Consider presenting employment offerings as an opportunity to embrace an active work day.

APRIL / MAY 2022 INSIDER 124 www.selfstorage.org.au

Australia towards 2031 33

Work Wellbeing applied

The success of a leader is measured not by what they achieve in their life, but by what they set in motion.

more likely to be working in their current workplace in 2 years 3.1x4.3x 2.6x more likely to be engaged at work more likely to recommend their place of work to others

When looking for a place of employment, these matter the most:

SSAA Asia Annual Industry Survey shows growth, opportunities

Self storage around the world has outperformed every other real estate asset class. Asia is no exception. The Self Storage Association Asia (aka ‘the other SSAA’) surveys its members every year in partnership with JLL and crafts a report based on its analysis of the results. The report, The Self Storage Association Asia Annual Survey 2021, can be summarised in four words: The future is bright.

The 2021 report gets into the metrics that matter and also gives some sense of momentum when compared to the 2020 results. With strong support from the Rental Storage Association of Japan and a Japanese language version of the survey, Japan’s participation in the report dramatically increased. Japan has the biggest and most mature national self storage industry with a range of service niches in addition to traditional storage of all sizes.

Growing through COVID

It hasn’t been all smooth sailing for the past few years as COVID hit different countries at different times and with varying levels of ferocity. Likewise, the way in which self storage was affected differed from country to country, but the overall story was one of growth. Across Asia, operator members of all sizes expanded. Smaller operators in Hong Kong grew single-location businesses, doubling their floor space. Indian firms made plans for second, third, and fourth locations. One operator in Vietnam had a hugely successful turn on the Vietnamese version of the global TV sensation, Shark Tank. Judges showered the valet and self storage concept with praise and made opening offers of investment during the show.

Operators from Jordan to Japan renovated old facilities and planned new ones. On the technology front, AI for dynamic pricing came to Asia (starting in Japan). Space calculators, common in Australia, are being tested by market leaders looking for an edge. Energy-saving technology used in German self storage is now available through the SSAA. Solar energy panels on rooftops are spreading from Dubai to Singapore. Biometric electronic locks are about to make their debut in Asia, perhaps becoming the industry norm for high-end self storage operations.

The big picture

The use of self storage for business versus personal use is still heavily weighted in favour of personal use. The highest levels of business use as a percentage of total use occur in Malaysia and Thailand. In Malaysia, up to 40% of self storage is used by business customers. A culture of small-scale e-commerce retail has seen savvy young operators target their age peers who are often still in university when they start their own businesses.

Special services such as climate control can vary greatly from country to country. For example, Hong Kong, Mainland China and Vietnam have around 80% of facility space in climate-controlled environments. But this could be as low as 30% in markets such as Malaysia and Thailand, even with their humid, tropical environments. Even equatorial Singapore is only about 50% climate controlled.

In culturally similar places such as Taiwan and Mainland China, wide variations in industry structure can arise. Almost 70% of unit sizes in Taiwan are under 20 sq. ft. In China, extra-large (>61 sq ft) and medium-sized units are much more common.

Occupancy levels have improved in recent years, climbing to over 70% in all measured jurisdictions except Mainland China. Hong Kong, Japan, Singapore and Malaysia all reported over 80% occupancy, a marked increase from previous years.

INSIDER 124 APRIL / MAY 2022 www.selfstorage.org.au 30 INTERNATIONAL NEWS

Source: Transport Intelligence, 2Q21

Profitability outlook remains

resilient as well

Profitability outlook remains resilient as well

Occupancy levels in APAC

Occupancy levels in APAC

The 2020 survey was conducted in the midst of the pandemic. Prior to COVID-19, 72% of respondents expected rental growth in 2020. However, only 58% expected rental growth in 2020 after the pandemic; roughly a modest 14 percentage point decline. Overall, this illustrated the defensiveness of the sector compared with many other sectors and industries that are in more negative territory. As the survey is based on 2019 performance, the next annual survey will likely provide deeper insights into the actual impact.

In a similar vein, 78% of respondents expected profitability growth in 2021, while 89% expect profitability growth in the longer term. Again in line with those rental outlooks, these findings reaffirm a positive prospect for the sector.

The 2020 survey was conducted in the midst of the pandemic. Prior to COVID-19, 72% of respondents expected rental growth in 2020. However, only 58% expected rental growth in 2020 after the pandemic; roughly a modest 14 percentage point decline. Overall, this illustrated the defensiveness of the sector compared with many other sectors and industries that are in more negative territory. As the survey is based on 2019 performance, the next annual survey will likely provide deeper insights into the actual impact.

2021 profitability expectations Figure 25

2021 profitability expectations

Monthly rental rates needed some deep analysis in this year’s report. While a first glance at the numbers suggested that monthly rental rates were steady or declining in some markets, much of the dip arose from the appreciation of the USD against local currencies. Sampling also increased the number of reporting facilities beyond the more premium part of the industry. This may have depressed the average for stores while a careful look by analysts suggested rental rates strengthening when same-store rental rates were compared.

Room for improvement (with a little investment)

Some findings suggested that operators could have scope for increased profitability by adopting measures common in Australia and other markets. Value-add services (for example, insurance, co-work services or retail) make up less than 2% of total revenue for 50% of operators. This compares to over 12% in the UK. Asian

In a similar vein, 78% of respondents expected profitability growth in 2021, while 89% expect profitability growth in the longer term. Again in line with those rental outlooks, these findings reaffirm a positive prospect for the sector.

One item to raise is that respondents with positive rental growth view tend to show an even more positive view vis a vis their profitability outlook which is a textbook example of industry with high operating leverage. In other words, given self storage’s high proportion of fixed costs to variable costs, operators expect to earn more per unit rented as they improve occupancy.

One item to raise is that respondents with positive rental growth view tend to show an even more positive view vis a vis their profitability outlook which is a textbook example of industry with high operating leverage. In other words, given self storage’s high proportion of fixed costs to variable costs, operators expect to earn more per unit rented as they improve occupancy.

3 to 5 years profitability expectations

3 to 5 years profitability expectations

operators are increasing their use of these revenue drivers but can do more with their sites in the future.

While different operators had different plans for expansion, most are bullish on rental growth expectations. Around 79% of operators expect positive growth in the near- to medium-term. This is an increase from 58% the year before, demonstrating improved morale regarding market prospects. Even better, 84% had expectations of rental growth over a five-year horizon.

Likewise, profitability expectations are rising. The data reveals that those “with positive rental growth view tend to show an even more positive view vis a vis their profitability outlook which is a textbook example of industry with high operating leverage. In other words, given self storage’s high proportion of fixed costs to variable costs, operators expect to earn more per unit rented as they improve occupancy.”

Source: SSAA Annual Survey 2021

Source: SSAA Annual Survey 2021

APRIL / MAY 2022 INSIDER 124 www.selfstorage.org.au

17 | The Self Storage Association Asia Annual Survey 2021

Source:

Transport Intelligence, 2Q21

Figure 16

Source: SSAA Annual Survey 2020 and 2021, FEDESSA 2020 and 2021. Excluded facilities opened in 2021

2020 2025 2019 2020 Average occupancy (%) 90 80 70 60 50 30 10 40 20 0 100 ChinaHong KongTaiwanJapanSingapore MalaysiaIndia Thailand Overall Asia Asia (Major

6) Europe

17 | The Self Storage Association Asia Annual Survey 2021

Figure

Source: SSAA Annual Survey 2020 and 2021, FEDESSA 2020 and 2021. Excluded facilities opened in 2021

16

2020 2025 20192020 Average occupancy (%) 90 80 70 60 50 30 10 40 20 0 100 ChinaHong

MalaysiaIndia Thailand Overall Asia Asia

KongTaiwanJapanSingapore

(Major

6)

Europe 25

| The Self Storage Association Asia Annual Survey 2021

Figure 24

Figure 25

Expect to decrease By 16-20% By less than 5% I don’t know/prefer not to answer By 5-10% By 11-15% By more than 20% ChinaHong KongIndiaJapanMalaysiaSingaporeTaiwanThailandVietnam APAC 33% 67% 33% 33% 50% 50% 22% 11% 17% 33% 33% 33% 50% 50% 17% 17% 17% 17% 17% 2% 9% 13% 30% 33% 6% 8% 40% 20% 20% 20% 41% 10% 3% 41% 3% 50% 50% Expect to decrease By 16-20% By less than 5% I don’t know/prefer not to answer By 5-10% By 11-15% By more than 20% ChinaHong KongIndiaJapanMalaysiaSingaporeTaiwanThailandVietnam APAC 67% 33%33% 44% 100% 11% 11% 33% 17% 33% 33% 33% 50% 50% 50% 11% 8% 3% 36% 27% 11% 5% 40% 20% 20% 20% 28% 7% 10% 45% 10% 100% 03 | 01 | 04 | 02 | 05 | 25 | The Self Storage Association Asia Annual Survey 2021 Source: SSAA Annual Survey 2021 Source: SSAA Annual

Survey 2021

Figure

24

Expect to decrease By 16-20% By less than 5% I don’t know/prefer not to answer By 5-10% By 11-15% By more than 20% ChinaHong KongIndiaJapanMalaysiaSingaporeTaiwanThailandVietnam APAC 33% 67% 33% 33% 50% 50% 22% 11% 17% 33% 33% 33% 50% 50% 17% 17% 17% 17% 17% 2% 9% 13% 30% 33% 6% 8% 40% 20% 20% 20% 41% 10% 3% 41% 3% 50% 50% Expect to decrease By 16-20% By less than 5% I don’t know/prefer not to answer By 5-10% By 11-15% By more than 20% ChinaHong KongIndiaJapanMalaysiaSingaporeTaiwanThailandVietnam APAC 67% 33%33% 44% 100% 11% 11% 33% 17% 33% 33% 33% 50% 50% 50% 11% 8% 3% 36% 27% 11% 5% 40% 20% 20% 20% 28% 7% 10% 45% 10% 100% 03 | 01 | 04 | 02 | 05 |

find more the proportion matures.

expectations rise. Owner occupation is most accretive to value and also enables the operator to find more favourable debt terms. As such, we expect the proportion of self-owned facilities to rise as the market matures.

favourable debt terms. As such, we expect the proportion of self-owned facilities to rise as the market matures.

this sector with a strong focus on Hong Kong, Australia and Japan. Hence, the share of organized funds and corporate funding will gain ground going forward.

favourable debt terms. As such, we expect the proportion of self-owned facilities to rise as the market matures.

Blackstone and Japan’s Mistuuroko deploying money in this sector with a strong focus on Hong Kong, Australia and Japan. Hence, the share of organized funds and corporate funding will gain ground going forward.

and Japan. Hence, the share of organized funds and corporate funding will gain ground going forward.

and Japan. Hence, the share of organized funds and corporate funding will gain ground going forward.

Figure

Ownership versus lease

40% of respondents to seek external funding

40% of respondents to seek external funding

Ownership versus lease

Ownership versus lease

For two consecutive years, respondents have expressed a cautious view with regard to funding. This year, the share of operators seeking external funding over the next 2 years declined to 40% from 50%, the result observed in the prior year. Nonetheless, given the current uncertain economic climate, we still view this as a positive result, as 40% of operators are planning to form new relationships and prepare for new business growth going forward.

Self storage sector to continue to grow

Self storage sector to continue to grow

For two consecutive years, respondents have expressed a cautious view with regard to funding. This year, the share of operators seeking external funding over the next 2 years declined to 40% from 50%, the result observed in the prior year. Nonetheless, given the current uncertain economic climate, we still view this as a positive result,

Optimism is rising compared to expectations expressed in last year’s survey. Bar Malaysia and Taiwan, operators in the rest of the region are willing to expand at a brisker pace (compared to previous years) over the next two years, again reflecting growth prospects and optimism within the industry. Given the confidence in driving expansion, we believe this emerging sector is well placed to attract more institutional capital, leading to boosted liquidity and scalability.

Optimism is rising compared to expectations expressed in last year’s survey. Bar Malaysia and Taiwan, operators in the rest of the region are willing to expand at a brisker pace (compared to previous years) over the next two years, again reflecting growth prospects and optimism within the industry. Given the confidence in driving expansion, we believe this emerging sector is well placed to attract more institutional capital, leading to boosted liquidity and scalability.

Desire to seek external funding

Desire to seek external funding

Figure 29

Figure 29

Sources of funding

Sources of funding

Source: SSAA Annual Survey 2021, FEDESSA 2021

Note: Owned includes freehold and leasehold titles. Leased refers to building lease.

Source: SSAA Annual Survey 2021, FEDESSA 2021 Note: Owned includes freehold and leasehold titles. Leased refers to building lease.

Source: SSAA Annual Survey 2021, FEDESSA 2021 Note: Owned includes freehold and leasehold titles. Leased refers to building lease.

Sources of funding

40%

Investment: ownership vs leasing

Overall, leasehold is still common in Asia. Japan, in particular, has high rates of leasing, often of small spaces, skewing Asia-wide results. China has some of the highest rates of ownership alongside Singapore and Taiwan. But in many markets, owned premises are in the minority of operator sites.

Desire to seek external funding over the next 2 years Venture Capital

While most companies are currently self-funded, local and international sources of funds have caught on to the promise of self storage and are getting in on the action.

60% Yes No

Private Equity

Joint Venture Strategic Partnership

This may be changing as more professional investors enter the market. Deals done by Blackstone, Warburg Pincus and others are changing the face of the industry. Even in Hong Kong, where the purchase of whole buildings was considered prohibitively expensive, deals are being done with the aforementioned major players and self storage operators such as Storefriendly and Storhub, respectively.

Plans for new facilities

The report reveals much more detail but it all points in one direction: up. Self storage in Asia is on a strong positive trajectory and funding sources are diversifying as the industry professionalises, moves up the value chain, and benefits from an increasingly aware consumer base eager for self storage. l

Visit www.selfstorageasia.org for more information and to access the full report. The SSAA also has the Survey Presentation seminar available. Please contact Ms Heily Lai at heilylai@selfstorageasia.org for details.

Source: SSAA Annual Survey 2021

Source: SSAA Annual Survey 2021

Part of a corporate groupOrganised funds: Family o ice, private equity, investment manager, pension fund, etc. High net worth individual /private individual Self funded by owner/operator

Part of a corporate groupOrganised funds: Family o ice, private equity, investment manager, pension fund, etc. High

Figure 31 Plans for new facilities

Source:

| The Self Storage Association Asia Annual Survey 2021

| The Self Storage Association

31 | The Self Storage Association Asia Annual Survey 2021

Source:

Source: SSAA Annual Survey 2021

Source: SSAA Annual Survey 2021

Sources: SSAA

2021

Sources: SSAA Annual Survey 2021

INSIDER 124 APRIL / MAY 2022 www.selfstorage.org.au 32 INTERNATIONAL NEWS

Figure 29

Figure 28

OwnedLease China Japan Hong KongIndiaMalaysiaSingaporeTaiwanThailandVietnam APAC with JP APAC without JP UKEurope 86% 40% 57% 46% 75% 43% 57% 82% 23% 14% 60% 43% 54% 25% 100% 57% 90% 10% 50% 50% 18% 43% 77% 23% 77%

China IndiaJapan Hong Kong MalaysiaSingaporeTaiwanThailandVietnam APAC 25% 25% 25% 25% 63% 14% 9% 14% 60% 40% 67% 17% 67% 33% 17% 33% 33% 33% 60% 20% 20% 50% 25% 25% 100% 60% 6% 17% 17%

31

SSAA Annual Survey 2021

to value and also enables the operator to find more

this sector with a strong focus on Hong Kong, Australia

28

OwnedLease China Japan Hong KongIndiaMalaysiaSingaporeTaiwanThailandVietnam APAC with JP APAC without JP UKEurope 86% 40% 57% 46% 75% 43% 57% 82% 23% 14% 60% 43% 54% 25% 100% 57% 90% 10% 50% 50% 18% 43% 77% 23% 77% Part of a corporate groupOrganised funds: Family o ice,

manager,

High net worth individual /private individual Self funded by owner/operator China IndiaJapan Hong Kong MalaysiaSingaporeTaiwanThailandVietnam APAC 25% 25% 25% 25% 63% 14% 9% 14% 60% 40% 67% 17% 67% 33% 17% 33% 33% 33% 60% 20% 20% 50% 25% 25% 100% 60% 6% 17% 17%

private equity, investment

pension fund, etc.

31

Asia Annual Survey 2021

Figure 28

OwnedLease China Japan Hong KongIndiaMalaysiaSingaporeTaiwanThailandVietnam APAC with JP APAC without JP UKEurope 86% 40% 57% 46% 75% 43% 57% 82% 23% 14% 60% 43% 54% 25% 100% 57% 90% 10% 50% 50% 18% 43% 77% 23% 77%

China IndiaJapan Hong Kong MalaysiaSingaporeTaiwanThailandVietnam APAC 25% 25% 25% 25% 63% 14% 9% 14% 60% 40% 67% 17% 67% 33% 17% 33% 33% 33% 60% 20% 20% 50% 25% 25% 100% 60% 6% 17% 17% Survey 2021

net worth individual /private individual Self funded by owner/operator

SSAA Annual Survey 2021

includes

Leased

to

lease. OwnedLease KongIndiaMalaysiaSingaporeTaiwanThailandVietnam APAC with JP APAC without JP UKEurope 46% 43% 57% 82% 23% 54% 57% 90% 10% 50% 50% 18% 43% 77% 23% 77% Family o ice, private equity, manager, pension fund, etc. High net worth individual /private individual Self funded by owner/operator MalaysiaSingaporeTaiwanThailandVietnam APAC 60% 40% 33% 33% 33% 60% 20% 20% 50% 25% 25% 100% 60% 6% 17% 17%

Source: SSAA Annual Survey 2021, FEDESSA 2021 Note: Owned

freehold and leasehold titles.

refers

building

40% of operators

planning to form new relationships and prepare for new business growth going forward.

as

are

Figure 30

Yes

Desire to seek external funding over the next 2 years Venture Capital Private Equity Joint Venture Strategic Partnership 2021 – 2022 2022 – 2023 ChinaHong KongIndiaJapan Singapore Malaysia TaiwanThailandVietnam APAC 7 6 5 4 3 2 1 0 04 | 03 | 01 | 02 | 05 | 32 | The Self Storage Association Asia Annual Survey 2021

40% 60%

No

Annual Survey

Figure 31

Figure 30

2021 – 20222022 – 2023 ChinaHong KongIndiaJapan Singapore Malaysia TaiwanThailandVietnam APAC 7 6 5 4 3 2 1 0 04 | 03 | 01 | 02 | 05 |

New Member

Debtplacer is an online platform enabling businesses with overdue invoices to list debts and compare fee proposals from a verified network of collection partners.

Through reduced administration, Debtplacer makes it easy for businesses to recover their unpaid invoices by streamlining the process of engaging with collection agencies and ensuring that companies receive competitive collection rates and improved collection outcomes.

How Debtplacer helps

For self storage operators, chasing tenants for outstanding rent can be time-consuming and an unnecessary distraction, often resulting in the business writing these debts off. It makes sense to engage a collection agency to handle these trickier collections.

Collection agencies are typically equipped with the systems and expertise to manage any collection size on a contingent collection basis – meaning you only pay them if they are successful in recovering your unpaid debt. Whether you are engaging a collection partner for