Market Report.

APARTMENT & RESIDENTIAL

Part of the group with a family factor.

CITY REALTY GROUP CREATE RECOGNISE GROW

Part of the group with a family factor.

CITY REALTY GROUP CREATE RECOGNISE GROW

04.

Market CommentPause for Breath 06.

Auckland Central Sales & Statistics - June 2025

10.

Grafton & Eden Terrace Sales & Statistics - June 2025 16.

Auction Update with Cameron Brain

18.

Article – Tony Alexander: What the OCR hold means for homeowners and house prices

20.

Our month in Review Top Stories & Events from the City Realty Group 24.

26.

Article – Ray White Group: Housing Recovery Pivots to Premium. 28. Our Awards & Accolades 30. Ray White Auckland Central & Wynyard Quarter

LoanMarket Update: OCR on Hold – But Have We Seen the Last Cut (For Now)?

The Reserve Bank of New Zealand held the Official Cash Rate (OCR) at 3.25% on 9 July, as widely expected. According to Interest.co.nz, the Monetary Policy Committee opted to pause while it assessed persistent inflation pressures and the pace of the country’s economic recovery.

While a rate cut was discussed, the consensus was to delay any adjustment until the August meeting, given the uncertain near-term outlook. Policymakers acknowledged the value in waiting, particularly as inflation risks remain elevated.

BNZ Chief Economist Mike Jones recently revised the bank’s annual house price inflation forecast down from 5–7% to 2–4%, citing “a general uncertainty” and global factors that continue to weigh on domestic demand. “We’re in a recovery phase, but recent speed bumps have complicated the narrative,” Jones said.

Green Shoots of Confidence

Daniel Horrobin, Director of City Realty Group, says that while rate cuts may still be on the horizon, the market is unlikely to see deep reductions from here. “What we’re hoping is that buyers recognise this is likely as good as it gets, and the window of opportunity to secure favourable conditions may not be open for long.”

There are already signs that confidence may be returning. “Our group-wide open home attendance was up 25% in the week ending 13 July,” Horrobin said.

“In one standout example, a central city

property had its auction brought forward due to an early offer. Competitive bidding on auction day led to an even stronger result for the vendor — a great signal that urgency is returning.”

Steady Performance, Limited Listings

Despite broader market challenges, Horrobin says the Auckland central apartment sector has held steady over the winter months.

“Sales volumes have remained consistent through June and July, though new listings are increasingly tight. Once again, the number of central city apartments listed on Trade Me has dipped below 600.”

“With buyer activity showing early signs of lifting, we anticipate seller confidence will follow.”

Challenges Remain — But So Does Optimism

Economist Tony Alexander, writing in OneRoof on 17 July, noted that households are still navigating pressures from tight business margins, job insecurity, rising living costs, and soft migration numbers.

“Despite that,” Horrobin adds, “we believe the fundamentals are tilting in a positive direction. As the country dries out from a very wet winter, we’re cautiously optimistic that momentum will build heading into spring.

There are already signs that confidence may be returning. “Our group-wide open home attendance was up 25% in the week ending 13 July,”

Total Sales

June 2025

51

June 2024

85

There was a -40% decrease in the total number of sales year on year.

Total Sales Value Median Sales Price Median Days On Market

June 2025

$19,203,980

June 2024

June 2025

June 2024

$47,612,086 $300,000 57

There was a -59.6% decrease in the total sales value year on year.

Source: REINZ

There was a -5% decrease in the total median sale price year on year.

June 2025

$285,000 57

June 2024

There wasno change in the total median days on market year on year.

RECENT SALES

EDEN TERRACE MARKET STATISTICS. JUNE 2025

2

$892,500

Total Sales Value 421 Median Days on Market

$1,785,000

JUNE 2025

EDEN TERRACE - RECENT SALES.

JUNE 2025

Source: REINZ

STATEMENT:

Ray White repeatedly achieves higher sales prices than other agencies, and it’s not just our claim— here are the facts:

301/83 Halsey Street, ‘Lighter Quay’

1 1 0

SOLD WITH RAY WHITE

Sale Price: $150,000 + GST

($172,500 incl GST)

Sale Date: 24th of October 2024

201/83 Halsey Street, ‘Lighter Quay’

1 1 0

SOLD BY ANOTHER AGENCY

Sale Price: $50,000

Sale Date: 6th November 2024

* IMPORTANT NOTE: Both units are identical with just one floor level separating them, yet Ray White sold for $122,500 more than the other agency.

Request an appraisal today.

Ray White Auckland Central is your home for apartments.

305/8 Ronayne Street, ‘The Landings’

SOLD WITH RAY WHITE

Sale Price: $157,500

Sale Date: 1st August 2024

* IMPORTANT NOTE:

803/8 Ronayne Street, ‘The Landings’

SOLD BY ANOTHER AGENCY

Sale Price: $105,300

Sale Date: 7th August 2024

The unit sold by the other agency included a car park, yet it still sold for $52,200 less than the price Ray White achieved for a property without a car park.

110/8 Ronayne Street, ‘The Landings’

SOLD WITH RAY WHITE

Sale Price: $135,000

Sale Date: 12th September 2024

* IMPORTANT NOTE:

205/8 Ronayne Street, ‘The Landings’

SOLD BY ANOTHER AGENCY

Sale Price: $116,500

Sale Date: 21st August 2024

The unit sold by the other agency included a car park, yet it still sold for $18,500 less than the price Ray White achieved for a property without a car park.

There’s an old saying: “You get what you pay for.”

In these case studies, maybe saving a little on commission upfront led to a significantly higher loss in the end.

List with Ray White for the best results and more money in your pocket. And if fees are a concern for you - let’s talk.

3.0

Take advantage of a prime opportunity to get ahead of the anticipated spring listing rush & maximize your property’s exposure to eager buyers. Don’t miss out!

WHEN: August 27 th & 28 th 2025

As we enter the second half of 2025, it’s a timely opportunity to reflect on what has been a strong and encouraging start to the year for Ray White City Realty Group.

In the first six months of 2025, Ray White CRG conducted a total of 220 auctions, comprising 130 apartments and 90 residential properties, achieving a combined clearance rate of 53.18%.

Across our Ray White CRG network, 2,072 properties were opened for inspection, with 3,472 open homes conducted.

Of these, 23.21% were auction campaigns . Buyer engagement remains strong, with 3,961 individual buyers recorded through our open homes—of which auction properties accounted for 44.83% of total attendees

Our data shows an average of 1.14 buyers per open home, and an average of 1.91 buyers per property.

Looking ahead, we anticipate a busy and energised second half of the year. With interest rates showing signs of easing, both investors and first-home buyers are reentering the market, positioning us for an exciting and competitive spring season.

To help vendors get ahead of the anticipated spring listing rush, we are proud to present Ray White CRG Auction Collection 3.0—a multi-office auction event taking place over two days:

Wednesday, 27 August 2025 – Ray White Sandringham will host their Auction Collection event from their in-room auction facility.

Thursday, 28 August 2025 – Ray White Auckland Central and Ray White Wynyard Quarter will hold a joint Auction Event at 12:30pm at the Ray White Auckland Central Auction Rooms. Later that afternoon, Ray White Mt Roskill will host their auction event from their Mt Roskill office at 4:00pm.

No matter where in Auckland you’re located, Ray White CRG has you covered. If you’re considering selling or simply want to learn more about our premium Auction Collection 3.0 marketing packages, please speak with one of our experienced team members or contact me directly.

Wishing you a successful July—I look forward to sharing the results of our August Auction Events in next month’s report.

Warm regards,

Director of Sales & Auctions

The Reserve Bank has put the brakes on its run of rate cuts.

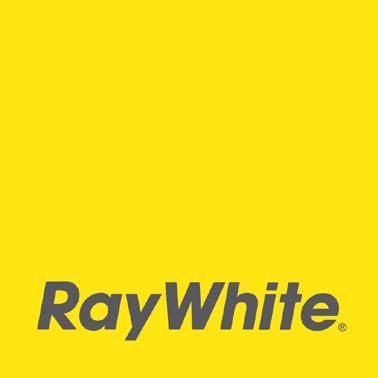

ANALYSIS: As had been widely anticipated, the Reserve Bank has just left its Official Cash Rate unchanged at the 3.25% rate they took it to at the previous meeting of the Monetary Policy Committee late in May. They didn’t provide any updated forecasts at this review but noted that if things pan out as they expect then there is scope for interest rates to go lower as they outlined back then.

What they have pencilled in is a cut in the cash rate to 3% before the end of the year with a small chance of a cut to 2.75%. Why not cut now when it is clear to many people that the economy is not strong?

RBNZ Holds Official Cash Rate At 3.25%

Partly it is because in the next six months the annual rate of inflation is widely forecast to rise from the current 2.5% to 3% if not a tad higher. This will reflect things like higher power prices and food prices in particular. We will get the inflation number for the year to June on July 21.

The problem here is that despite the economy having spare capacity (as in the unemployment rate being 5.1%), there have recently been increases in some key gauges of what inflation might do down the track.

The ANZ’s Business Opinion Survey showed a year ago that a net 35% of businesses planned raising their selling

The graph shows the OCR since its introduction in 1999.

Chart: OneRoof.co.nzSource: Reserve Bank of New Zealand

prices in the coming year. Now that proportion is 49% driven probably substantially by a net 79% expecting their costs to rise through to mid-2026 and margins currently being exceptionally tight.

We have also seen a slight lift in household inflation expectations and the risk I’ve been highlighting for some time is that once consumers start spending a bit more over 2026 businesses will take advantage of that to raise prices and recover lost margins.

Throw in uncertainty related to the global environment for inflation and growth, where our export prices might be headed, how easing fiscal policies offshore may affect things, and how long wages growth in New Zealand remains restrained and get a very clouded picture.

The things I focus on substantially are high business pricing plans for a year from now, loosening fiscal policy in the United States and upward pressure on global medium to long-term interest rates, plus the lesson our Reserve Bank recently learnt from easing policy too much during and after the pandemic.

For borrowers the situation looks like one in which tossing a coin between fixing, one, two, or three years for the remainder of the year may be the optimal tactic. Actually, one is incentivised in this environment to

fix for two or maybe three time periods in order to spread risks out and buy time to adjust one’s budget should shocks up or down come along.

For the housing market there was nothing in today’s cash rate review from the Reserve Bank to justify any change in view for where the market is headed. Buyers remain cautious with minimal feelings of FOMO. Listings are at a 10-year high, issuance of consents for more dwellings to be built are unusually strong, some older investors are selling because of higher costs, and levels of job security remain low.

We are in a very solid buyer’s market, and we can see from various measures that first-home buyers recognise this and are taking advantage of the situation to make a purchase. Frankly, much as some people may bemoan the lack of rising house prices currently and the associated lack of extra household spending from perceptions of higher paper wealth, this is a very good development.

The back of exceptionally poor housing affordability in New Zealand may finally have been broken. But a return to the pre-1990s scenario of prices averaging just three times average income is not on the cards – not with construction costs having skyrocketed in the past three decades.

@raywhiteaucklandcentral

@raywhitewynyardquarter

@raywhitesandringham

@raywhite.mtroskill

The Ray White Wynyard Quarter team brought home the CRG Cup!

We’re proud of all the hard work, collaboration, and dedication that made this victory possible. Here’s to many more wins!

Check out the latest production on tvnz featuring our very own Luke Crockford and Cameron Brain.

Our team had the pleasure of visiting the Risland Meadowbank development — an inspiring afternoon of learning, connection, and collaboration.

From exploring the layout and design to diving deep into key features and insights shared by the developer team, the tour was packed with valuable knowledge that empowers us to serve our clients with even greater confidence.

Plenty of buyer’s turning up, this time at Ray White Mt Roskill.

Our CRG Auction Manager Cameron Brain.

In celebration of Matariki, Tracey Potter from Ray White Sandringham embraced the season of reflection and community by launching a special colouring-in competition for local schools.

Working alongside Rosebank School and Owairaka District School, Tracey invited students to take part in the initiative, the response was heartening, with more than 250 colourful entries received by the closing date.

This brand new seriers was all about Vendor Communication & Reporting — and what a session it was!

We heard from three of our high performers: Hugh Free – Ray White Sandringham, Gabriella Galateanu – Ray White Wynyard Quarter and Dominic Worthington – Ray White Auckland Central

Big thanks to our panel for kicking off the CRG Training Series with real insight and value.

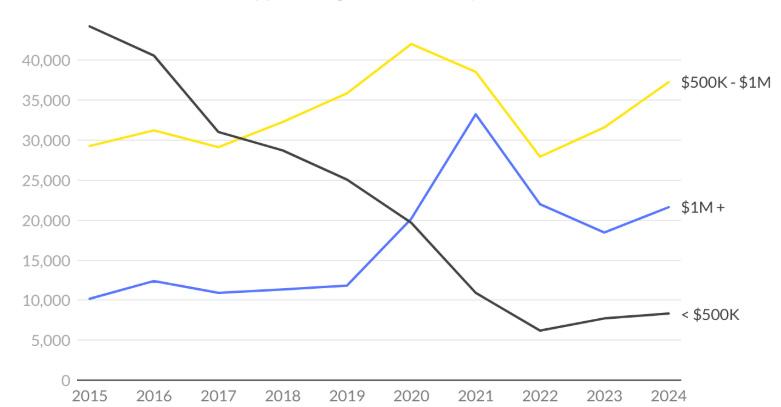

The housing market is emerging from its 2022 trough with renewed momentum.

Total transactions climbed 20 per cent from the 2022 low of 56,133 to 67,202 in 2024, signaling a return of buyer confidence and market activity after a challenging period.

The most striking aspect of the recovery is how the market has reorganized around premium pricing. The $500K-$1M price range has become the market’s backbone, demonstrating exceptional resilience throughout recent volatility. This segment now commands more than half of all transactions, with 37,259 sales in 2024 representing 55 per cent of total market activity. What was once considered midrange pricing has become the new center of gravity for the entire market.

Meanwhile, the luxury segment above $1M has found its rhythm after the dramatic

Distribution of house sales by price segment

volatility of 2020-2022, when high-end sales surged to 40 per cent of the market before contracting. This segment has now settled into a sustainable 30-32 per cent share, with 21,620 transactions in 2024, suggesting affluent buyers have adjusted to current conditions and are participating at predictable levels.

The recovery’s most concerning aspect is the continued weakness in affordable housing. The sub-$500K segment, which represented more than 50 per cent of transactions in 2015, now accounts for just 12 per cent of the market. While this segment showed a modest increase from 6,191 transactions in 2022 to 8,323 in 2024, this represents stabilization at a dramatically reduced scale rather than meaningful recovery.

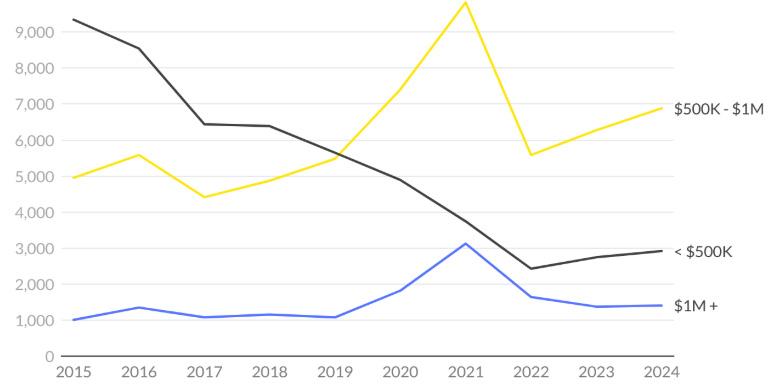

The unit market tells a similar story of

Count of house transactions by price range for the last 10 years,

Source: Ray White

constrained recovery. Unit sales declined 37 per cent from 15,303 in 2015 to 9,654 in 2022, then partially rebounded 16% to 11,207 in 2024. However, this recovery leaves unit volume 27 per cent below 2015 levels, and the unit market continues to mirror the broader pattern of strength in higher price segments while affordable options remain scarce.

As the unit market finds its footing, the same dynamic emerges: the $500K-$1M segment dominates, while sub-$500K options have become increasingly rare. This parallel pattern across both houses

and units reinforces that the post-2022 recovery is occurring primarily in higher price tiers, fundamentally altering housing accessibility and market structure rather than restoring broad-based affordability.

Methodology: The analysis draws from the REINZ (Real Estate Institute of New Zealand) dataset, focusing specifically on residential house and unit transactions across New Zealand from 2015-2025. To ensure data quality, transactions under $10,000 were excluded to remove outliers and non-market sales.

027 742 5227 jamie.maclennan@loanmarket.co.nz Jamie Maclennan

Since August 2024, the OCR has been slashed by a total of 225 basis points – from a peak of 5.50% to its current 3.25% level. While the cuts to date have provided much-needed relief to the economy, particularly for borrowers, the RBNZ is now pausing to assess how these lower rates are flowing through to households and businesses.

The Reserve Bank of New Zealand (RBNZ) has decided to keep the Official Cash Rate (OCR) on hold at 3.25%, as widely expected. This follows the Reserve Bank of Australia’s decision to pause further rate cuts, highlighting a regional wait-and-see approach to monetary policy.

Many of you who fixed your mortgage in the high 6% or 7% range have either recently rolled off or are due to do so soon. This delayed impact on households is a key reason why the Reserve Bank is holding steady for now.

It’s important to remember that

the RBNZ has a singular focus: maintaining inflation within its 1–3% target band. Broader economic or employment concerns are secondary to this mandate. The Bank noted that while annual inflation may lift toward the upper end of the band by mid2025, it is still forecast to ease back to around 2% by early 2026 due to weakening domestic inflation and spare capacity in the economy.

Despite calls from some economists for further cuts to support the slowing economy, the central bank is staying cautious. Most analysts now expect the next rate cut to come on August 20, barring any major surprises in economic data between now and then.

Financial markets took the decision in their stride. The New Zealand dollar nudged up slightly by 10 pips to around US60.1c, while interest rate markets were largely unchanged.

For now, the Reserve Bank is in watchand-wait mode – and so are we.

Should I fix long or short term now?

A lot depends on your circumstances, if you want certainty, we wouldn’t expect to see rates drop much further in the near term.

However if you have strong servicing capability you could either stick with short term rates or split the difference and do some short term some longer term.

RAY WHITE AUCKLAND CENTRAL ARE PROUD TO BE ACKNOWLEDGED BY RATE MY AGENT FOR THE BELOW AWARDS

CURRENTLY PLACED

#1

Auckland Central

Agency of the Year 2025

#1

Agency of the Year 2025 Grafton

#1

Eden Terrace

Agency of the Year 2025

RateMyAgent is Australia’s leading real estate ratings and reviews website. It collects and verifies reviews from buyers, sellers, and landlords to provide an accurate and reliable assessment of real estate agencies. RateMyAgent Awards are independently judged based on verified customer reviews and sales data.