JUNE 2025

Market Report.

APARTMENT & RESIDENTIAL

Part of the group with a family factor.

CITY REALTY GROUP CREATE RECOGNISE GROW

Contents.

04.

Market CommentCause for Optimism. 06.

Auckland Central Sales & Statistics - May 2025 10.

Grafton & Eden Terrace Sales & Statistics - May 2025 16.

Auction Update with Cameron Brain

18.

Article – Tony Alexander: OCR drops again, but who’s winning and who’s missing out?

20.

Our month in Review Top Stories & Events from the City Realty Group 24.

Article – Diana Clement: ‘Man, it’s a big drop’: New CVs spark confusion 28.

26.

LoanMarket Update: No Sudden MovesRBNZ’s Deliberate Strategy Continues...

Our Awards & Accolades 30. Ray White Auckland Central & Wynyard Quarter

Cause for Optimism.

Despite ongoing uncertainty globally, positive momentum is returning to New Zealand’s property sector — and the signs are encouraging.

“Despite the chaos playing out internationally, we’re seeing strong indicators of renewed confidence at home,” says Daniel Horrobin, Director of City Realty Group. “There’s a noticeable shift — both in buyer sentiment and market activity.”

This outlook is backed by national commentary:

REINZ (Mid-June): “Cautious confidence returns to the property market.”

Realestate.co.nz: “The days of dramatic highs and lows appear behind us, with steady activity in the property market.”

Trade Me Property (via Gavin Lloyd): “A plentiful supply of properties, coupled with more affordable loan repayments, is giving buyers a sense of renewed confidence and motivation.”

Ray White: “The auction market sees further confidence — strong buyer engagement lifted the average number of registered bidders to 2.0 per auction.”

Auction Activity Surges

“Speaking of auctions,” says Horrobin, “our highly anticipated Big Auction Day on 29 May was a standout success. Of the 23 properties listed, over 50% sold either prior or under the hammer on the day, with several more sold shortly after. The energy in the room was electric — a real confidence booster for everyone involved.”

Momentum continued two weeks later when 4 out of 5 properties sold under the hammer — an 80% clearance rate. “That event saw 9 active bidders and over 100 bids placed. The lineup featured two leasehold properties sold at $23,500 and $30,000 respectively, with a freehold new-build in between fetching $845,000 — a snapshot of the diversity and competitiveness in Auckland’s apartment market,” says Horrobin.

Open Home Engagement Up

Open Home figures also reflect this surge in interest. Across City Realty Group: Property openings were up 12% in May compared to April

Total Open Homes conducted rose 24.3%

A total of 729 attendees were recorded across all sites

This increase in foot traffic has no doubt been buoyed by the Reserve Bank’s decision on 28 May to lower the OCR by 25 basis points to 3.25%, with further announcements anticipated in July.

“Right now, both buyer activity and seller motivation are rising in tandem,” Horrobin adds. “If this trajectory continues, the second half of 2025 is shaping up to be much more promising than expected.

Realestate.co.nz:

“The days of dramatic highs and lows appear behind us, with steady activity in the property market.”

Auckland Central Market Statistics.

Total Sales

May 2025

63

May 2024

There was a -36% decrease in the total number of sales year on year.

Total Sales Value Median Sales Price Median Days On Market

May 2025

May 2025

$27,688,279 $300,000 51.5

May 2024

May 2024

99 $46,272,750 $349,000 55.5

There was a -40% decrease in the total sales value year on year.

Source: REINZ

There was a -14% decrease in the total median sale price year on year.

May 2025

May 2024

There was a -7% decrease in the total median days on market year on year.

Recent Sales.

AUCKLAND CENTRAL

Eden Terrace

EDEN TERRACE MARKET STATISTICS. MAY 2025

3

EDEN TERRACE - RECENT SALES.

STATEMENT:

Ray White repeatedly achieves higher sales prices than other agencies, and it’s not just our claim— here are the facts:

301/83 Halsey Street, ‘Lighter Quay’

1 1 0

SOLD WITH RAY WHITE

Sale Price: $150,000 + GST

($172,500 incl GST)

Sale Date: 24th of October 2024

201/83 Halsey Street, ‘Lighter Quay’

1 1 0

SOLD BY ANOTHER AGENCY

Sale Price: $50,000

Sale Date: 6th November 2024

* IMPORTANT NOTE: Both units are identical with just one floor level separating them, yet Ray White sold for $122,500 more than the other agency.

Request an appraisal today.

Ray White Auckland Central is your home for apartments.

305/8 Ronayne Street, ‘The Landings’

SOLD WITH RAY WHITE

Sale Price: $157,500

Sale Date: 1st August 2024

* IMPORTANT NOTE:

803/8 Ronayne Street, ‘The Landings’

SOLD BY ANOTHER AGENCY

Sale Price: $105,300

Sale Date: 7th August 2024

The unit sold by the other agency included a car park, yet it still sold for $52,200 less than the price Ray White achieved for a property without a car park.

110/8 Ronayne Street, ‘The Landings’

SOLD WITH RAY WHITE

Sale Price: $135,000

Sale Date: 12th September 2024

* IMPORTANT NOTE:

205/8 Ronayne Street, ‘The Landings’

SOLD BY ANOTHER AGENCY

Sale Price: $116,500

Sale Date: 21st August 2024

The unit sold by the other agency included a car park, yet it still sold for $18,500 less than the price Ray White achieved for a property without a car park.

There’s an old saying: “You get what you pay for.”

In these case studies, maybe saving a little on commission upfront led to a significantly higher loss in the end.

List with Ray White for the best results and more money in your pocket. And if fees are a concern for you - let’s talk.

Auction Spotlight: Mount Eden Villa Sells for $3.29 Million

The standout auction of the day came courtesy of Ray White Sandringham agent Diane Goer, who brought to market 7 Horoeka Avenue, Mount Eden—an original villa on 1,105sqm, offered for the first time in 89 years.

11 Registered Bidders

08 Active Bidders

92 Bids placed

Sold Under the Hammer for $3.29M

“The property attracted a mix of builders and families, and it was a lovely result with a young family securing it for generational living,” — Diane Goer

In Review..

As we move into the mid-year mark, May has delivered a notable lift in market momentum across Ray White City Realty Group, with increased stock volumes, healthy open home activity, and a renewed sense of confidence—particularly from investors.

Looking Ahead...

Although May’s Budget didn’t introduce any major housing initiatives, the signals for the second half of 2025 are promising.

“While average open home numbers dipped slightly, bidder activity is strengthening— which is a key indicator of genuine buyer intent,” — Cameron Brain

Interest rates will remain a determining factor, but the market is showing early signs of recovery—particularly in price-sensitive segments and investor activity.

May 2025 Open Home Performance

Despite a modest dip in overall buyer numbers, open home volumes surged in May, reflecting strong campaign momentum and growing vendor confidence:

Total Open Homes Conducted:

787 (↑ 24.33% from April)

Total Properties Opened:

448 (↑ 12% from April)

Total Buyers Engaged: 729 (↓ 8.76% from April)

Breakdown by Method of Sale:

Auction: Private Treaty 25.4 % 74.5 % of all open homes

Auction Private Treaty Buyers Buyers 62.5 % 37.4 %

Market Segment Breakdown: Apartments: 484 215 0.44 open homes attendees attendees/OH Residential: 303 514 1.70 open homes attendees attendees/OH

While buyer turnout softened slightly, the sharp lift in auction campaign engagement continues to highlight the value of structured auction marketing in driving urgency and participation.

Investor Confidence Returns at CRG’s Second Major Auction Event for 2025

Ray White City Realty Group hosted its second collective auction event for 2025, with strong results reinforcing a positive shift in investor sentiment.

Auction Event Snapshot: 25

Properties scheduled 2 9 6 Sold Sold Under Under Prior Hammer Negotiation

Total Sales Value: $2,198,000

Average Sale Price: $199,818

Registered Bidders: 51

Total Bids: 196

Investor Purchases: 90% of all properties sold

“It was pleasing to see bidding on every property within the order of sale—many with three or more active bidders,”

Investor re-engagement is being driven by the reinstatement of interest deductibility, and the return of confidence is particularly evident in the apartment sector—historically a mainstay for investment buyers

Tony Alexander: OCR drops again, but who’s winning and who’s missing out?

Real estate agents now say they are seeing fewer people at auctions and open homes.

ANALYSIS: Last week we had the Budget, today we had the OCR. Both are unlikely to substantially change the course of the housing market. On the Budget, the many attempts by some real estate agents to talk the market up by saying they had inside information regarding the Government removing the ban on foreign buying have been revealed as baseless.

On the OCR, the cut of 25 basis points was as expected, but the fact that the committee only discussed a 25-point cut and no change from 3.5% suggests scope for further cash rate reductions may be less than the markets have been factoring in.

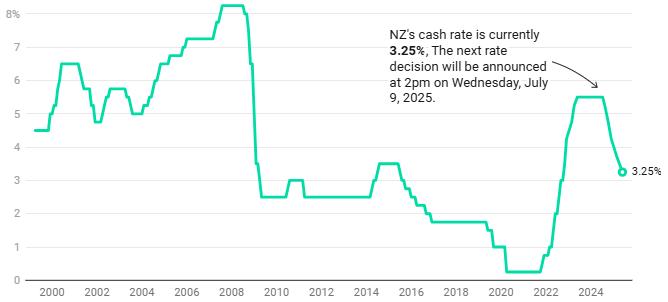

NZ’s Official Cash Rate Drops To 3.25%

For now, the housing outlook remains one of high supply of new and existing properties and buyers feeling no need at all to hurry and make a purchase.

My five regular surveys of businesses, consumers, and various groups in the residential real estate sector point to ongoing challenges.

First, a net 18% of consumers say they intend to cut spending in the next 3-6 months versus a +10% result in December, so retailers should not anticipate good trading conditions in the months ahead. People are concerned about the many developments they are seeing around

The graph shows the OCR since its introduction in 1999.

Chart: OneRoof.co.nzSource: Reserve Bank of New Zealand

them, including weak jobs growth and a US-centred tariff war. Times look tough for operators in the hospitality sector for the rest of this year, and domestic travel operators may also be challenged.

Second, businesses are hopeful of stronger revenue in the coming year and plan to invest in capital equipment. The 20% depreciation allowance contained in the Budget is likely to provide extra encouragement to boost productivity and capacity.

But businesses are disappointed with the country’s political climate, worried about whether customers really will show up as economic concerns continue, and still feel compliance costs are a drag on their operations.

Third, mortgage brokers are reporting that banks are becoming more willing to lend money for home purchases. But bank mortgage application processing times have become appallingly long and new enquiries about financing from first-home buyers and investors have slowed down.

Fourth, real estate agents now say they are seeing fewer people showing up at auctions and open homes, that prices are generally falling around the country, and few new investors are entering the market.

They strongly feel that it is a buyer’s market throughout the country and knowing this there are very few of those buyers feeling

FOMO – a fear of missing out. The results strongly tell us that the housing market for the moment has stalled and it is vendors who are going to have to change their stance if they want to get a transaction over the line – not the buyers who can pick and choose from almost the highest number of properties listed for sale since 2015.

Finally, residential property investors remain deeply concerned about rising costs and getting a good tenant has become extremely difficult. Investors are net sellers of property, not buyers, and fewer and fewer landlords feel that they can raise rents in the current climate.

Therein lies the trap for young buyers. The rental market is in their favour, so many may feel incentivised to keep renting for as long as possible. But with few other buyers competing to acquire property currently, this remains a very good time to make a purchase if one’s deposit and employment outlook are good enough to make it financially feasible.

Young buyers have been the key driving force in the housing market since the mild recovery started early in 2023 and remain so. At this stage, given that the bulk of mortgage rate declines this cycle have already happened and that investors are struggling to make cash flows work, the market is likely to remain dominated by first-time buyers until next year at least.

@raywhiteaucklandcentral

@raywhitewynyardquarter

@raywhitesandringham

@raywhite.mtroskill

City Realty Group Auction Action.

Auction action at our Auction Collective 2.0 last month.

What an incredible day under the hammer! With 52% of properties sold at our Auckland Apartment Auction event, it’s clear the market is gaining momentum.

Key Highlights:

• 51 active bidders

• 196 bids placed across all apartments

• Investors returned in full force, engaging in competitive bidding on nearly every property

Community Event Recap –Brainobrain

What an incredible day it was at the Brainobrain event! It was a pleasure for, Yuhei Umezaki, and Lakhbir Singh to attend and proudly sponsor the amazing kids who took part.

We had the honour of presenting awards on stage to some truly talented young achievers. It was heartwarming to meet so many local families and share in such a positive community atmosphere.

10/10

at Ray White Mt Roskill

The Ray White Mount Roskill team have had a busy month celebrating success and birthday’s at their weekly team catch up’s.

Growth, performance, and industry leadership

Ray White New Zealand proudly hosted its annual Business Leaders Symposium last week at Takina, Wellington, bringing together more than 170 of the network’s most ambitious and forward-thinking leaders.

Calls, Connections & Croissants..

The Ray White Sandringham team took a well-deserved break to enjoy a special team brunch, celebrating their recent calling efforts.

It was a great chance to recognise the energy, teamwork, and dedication that went into connecting with clients and driving momentum in the market.

Diana Clement: ‘Man, it’s a big drop’: New CVs spark confusion as Auckland Council braces for barrage of calls.

Auckland Council is gearing up for a barrage of inquiries and objections following the release of the city’s new CVs last week.

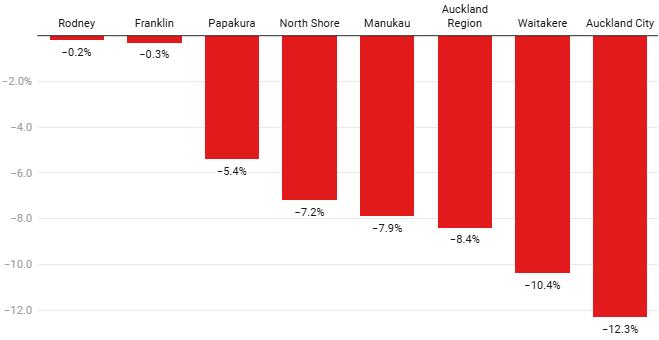

CVs dropped an average of 9% across the city since the last valuation, although some homeowners saw their valuation drop by as much as 20%.

The council anticipated increased inquiries at the beginning of every rate valuation period. Those unhappy with their new CV had until July 25 to object.

The online objection process requires property owners to supply supporting information for their objection, such as the value of work done at their property, recent comparable sales in the area, property features, and anything else that might affect the property’s value.

“We’re keen for them to realise that this is a robust process, it’s a transparent process. It can be challenged.”

Auckland Council received 9000 objections (about 1.55% of the total valuations) to the CVs it assessed in June 2021, with about 50% of objectors complaining their CV was too high and 50% complaining it was too low. “Those times were very different to times now. We [had] residential property increasing on an average of 30%. Now we’re talking an average [drop] of 9% across Auckland.” Heath said one of the common misconceptions people had about CVs was that it was reflective of today’s sales prices and that was “absolutely not the case”, with the latest valuations taken in May 2024. She told OneRoof that the sole purpose

Auckland’s New CVs: Percentage Change Since 2021

The graph shows for each district and the region as a whole, the percentage change in the average CV since the last valuations were completed, in 2021, at the height of the market.

Chart: OneRoof.co.nz Source: Auckland Council

of CVs was to assess the rates bill. They helped the council split the cost evenly and fairly, so someone whose property was valued at $895,000 did not pay the same rates as someone with a $2m or $10m property.

CVs were calculated using a “mass appraisal” method where a third-party valuation companies analysed sales data, property features, and location electronically to reach a figure. The ValuerGeneral then independently audited the results before they were finalised and released to property owners.

The CVs represented the likely selling price of a property at the date of valuation (May 2024), which meant by the time they were released to homeowners, they were 13 months out of date. It assessment process did not look at every house individually and excludes chattels such as curtains and appliances, which could boost a sales price.

Cotality NZ’s head of research Nick Goodall told OneRoof that he felt the Auckland CVs were a pretty accurate representation of the value of the city’s homes at the time they were taken.

“Of course, they’re not perfect, like any valuation done without seeing the property.” He added that the price a property would sell for was only what someone was willing to pay. “But as a guide, they’re certainly pretty accurate for the time.”

Goodall said that based on the latest sales data, Auckland’s CVs might have been hit even harder than the average 9% drop if they had been carried out this month.

“The other key thing here is that they’re very old now. Have property values changed much since May last year? I think the Auckland figure has seen a further 2.7% decline since last year. People are going, ‘Man, it’s a big drop’, but in many cases, people might find that their property would sell for less than CV right now.”

Goodall pointed out that the 9% fall in CVs on average is for the entire Auckland region, and some suburbs have fared better and others worse.

“People will be looking at [their new CVs] and saying, ‘It doesn’t seem right to me’ and they might want to challenge it. They want to have a serious think about whether they want to do that because if they’re trying to lift the property value, it is going to mean higher rates. Unless they’re trying to sell it, it’s probably not a worthwhile exercise.:

Homeowners who wanted a truer picture of what their home is worth now were better off looking at online automated valuation models.

Ray White Mt Eden owner Jared Cooksley said several of his agents had done an exercise to compare the new CVs to what clients’ houses were actually selling for and most were well off.

“We’ve run it for Mount Albert, where Rachel Berry sells. She’s a market leader there. We just analysed her last 20 deals. Across those, the most recent ones had about 15% over the new CV. It’s a bit of an indication, really, of where [the new CVs are] sitting on average.

“We ran the same trial with Dean Tuffley in Green Lane. They’re all selling for over. A CV is just an indication.”

Cooksley said his agents’ phones had been ringing hot since the new CVs had been released. “People are 100% checking what that means, looking at their CV and, rightly or wrongly, comparing that to the value of their house.”

He encouraged homeowners who were concerned about their CV to talk to an agent. “The actual improvement value and what they’ve done and the style and the features can be quite different. Again, that’s why you need someone to actually visit the house and appraise it properly.”

027 742 5227 jamie.maclennan@loanmarket.co.nz Jamie

No Sudden Moves: RBNZ’s

This cut was widely expected as the Reserve bank indicated another 0.25% drop earlier in the year, but a lot has happened since then so all eyes were on whether this would hold up in the current global environment.

Gone are the days of the 50 basis point rate cuts as the Reserve Bank cut the OCR by just 0.25% to 3.25%, sticking to their cautious and controlled approach of bringing rates down.

Ironically it is the same global uncertainty that has made rates so hard to predict recently, which the Reserve bank has now indicated may help to keep inflation (and the OCR) lower over the medium term. The impact of international tariffs and policy uncertainty is expected to restrict global growth, New Zealand economic recovery and reduce the pressure on inflation. This is good news for interest rates, but

not so good for the New Zealand economy which has just started to show signs of recovery.

What this means for home loan interest rates:

With another 0.25% cut we can expect to see more rate drops, however we expect these to be minimal and focused across the shorter term rates. Both BNZ and ANZ dropped their rates ahead of the announcement and we expect the other banks to follow with a 4.89% for 1 year and 4.92% for 2 years over the next week. There has been a bit of scrutiny on the banks recently after taking a number of weeks to pass on the last rate cuts to clients, so we

expect these rate drops to be quicker this time and reflecting across all major banks before the end of next week.

What rate terms to pick:

At the moment, our advice is still to look at the 1-2 year fixed rates with the expectation that the fixed rates will hit a bottom point in the mid 4% ‘s which we are now not that far from. For the longer term certainty the 3 year rate is a competitive option, but you will be paying slightly more for the certainty at around 5.09%. As the rate drops slow down, now is the time to start looking at these longer term rates.

Rate My Agent Awards

RAY WHITE AUCKLAND CENTRAL ARE PROUD TO BE ACKNOWLEDGED BY RATE MY AGENT FOR THE BELOW AWARDS

CURRENTLY PLACED

#1

Auckland Central

Agency of the Year 2025

#1

Agency of the Year 2025 Grafton

#1

Eden Terrace

Agency of the Year 2025

RateMyAgent is Australia’s leading real estate ratings and reviews website. It collects and verifies reviews from buyers, sellers, and landlords to provide an accurate and reliable assessment of real estate agencies. RateMyAgent Awards are independently judged based on verified customer reviews and sales data.

Our appraisals are on the house.

Are you considering selling your home, or simply curious about your property’s current market value?

Our expert appraisal team is here to help!

With an award winning team and years of experience, we understand the local market and provide insights that matter.

Never has there been so much data publicly available about what is happening in the property market. Are you ready to get started?

Request a no obligation appraisal today!

Meet the team.

SALES TEAM - AUCKLAND CENTRAL OFFICE

SALES TEAM - WYNYARD QUARTER OFFICE

OUR LOANMARKET MORTGAGE ADVISOR

WE CAN NEGOTIATE A LOWER RATE. WORK WITH A QUALIFIED AND COMPETENT MORTGAGE ADVISER

LoanMarket Mortgage Adviser