Give Them Options UV Flatbed Printing for Custom Products

by Cassandra Balentine

For small print businesses versatility is critical to success. Thankfully, the latest print technology delivers solutions that handle a range of applications.

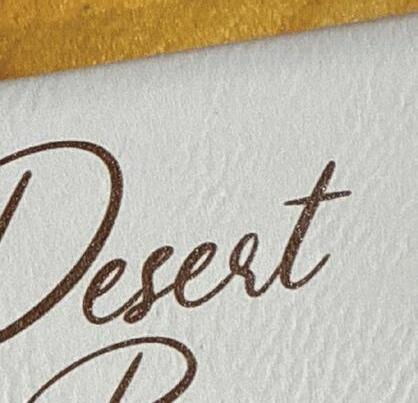

What started out as a side venture for Tammy and Eric Tallman, co-owners, Desert Breeze Custom, is now a bustling business that produces a range of custom products with no minimums. Two employees operate out of a 400 square foot room in San Tan Valley, AZ, a suburb of Phoenix.

Business to Business

Desert Breeze Custom is a small business that serves other small businesses in its local community, the wider Phoenix area, as well as a nationwide audience online.

“Our typical customer is a small business owner with less than 15 employees seeking gift items for their staff, or small affordable items of

great quality to give away or include with marketing options,” shares Tammy Tallman.

“We have no minimum requirements to place an order, which means we are more accessible for businesses that want gifts for their staff but only employ 20 people, or if they have a smaller budget for marketing they don’t have to order 1,000 keychains to start with,” she explains.

The promotional print shop provides discounts for bulk orders at lower quantities. Tallman points out that its competitors often require orders of an item in quantities of 200 to get the best bulk price, but clients only need to order 50 of that item to get the best price with Desert Breeze Custom.

We love the variety of items that we can direct print on with this machine, and we are so impressed with all that it can do.

— Tammy Tallman, co-owner, Desert Breeze Custom

Expanding Applications

Desert Breeze Custom’s business began when COVID-19 was in full swing. It initially sold t-shirts

and vinyl decorated items created with a sublimation printer.

The sublimation printer could do full color on some items, but it was limited when it came to clothing or hardboard-type items that are either white or very light colored. “Our hands were tied when our customers wanted a full-color design on a black tumbler, a dark colored key ring, or if they wanted their full-color logo on a jewelry box,” admits Tallman.

The Tallmans knew they needed to expand, so the company purchased a FusionEdge laser engraver from Epilog Laser and jumped right in.

The laser engraver presented the capability to do engraved cutting boards, coasters, and bottle openers. “Those items are great, and we really enjoyed doing them, but we wanted to do so much more,” says Tallman.

Eventually, the shop purchased a Mutoh America, Inc. XpertJet 661UF UV LED flatbed printer in 2024 to further expand its offerings. “We wanted to explore some other options that could give us full-color solutions for a large variety of items. UV printing had the greatest versatility and this flatbed printer could print on much larger scale items than we could even do before

with our sublimation printer,” explains Tallman.

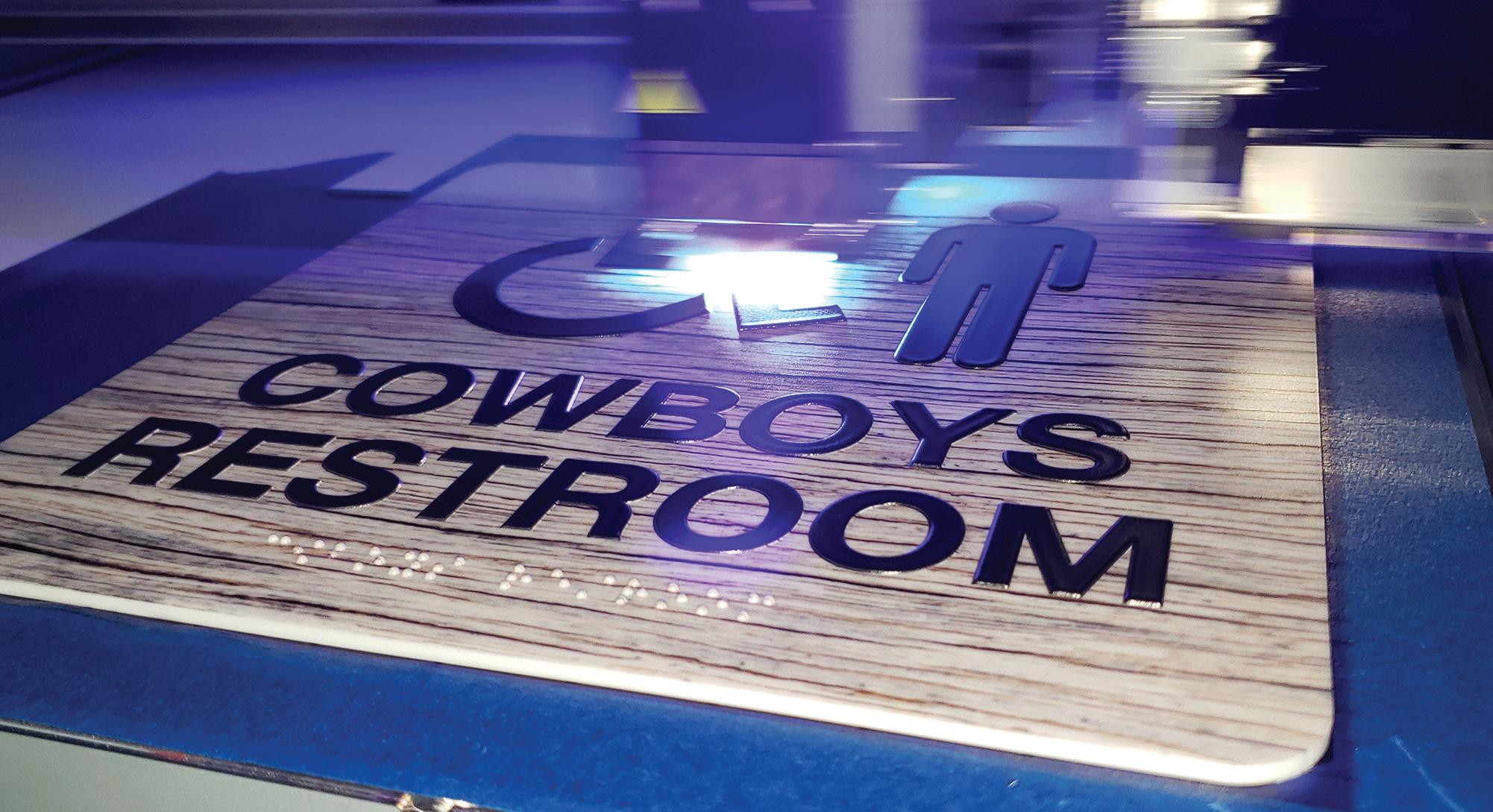

Another Pivot

Tallman admits that the XpertJet 661UF was initially purchased with the intention to output braille signage, however the plan shifted when they realized its potential. “We have done some signage for small businesses, however they never included braille, and we have learned we can actually make so much more with this machine that we went in a totally different direction.”

Currently, it uses the XpertJet 661UF to print custom logo items like tumblers, jewelry

boxes, compact mirrors, passport covers, and memorial plaques. “We love the variety of items that we can direct print on with this machine, and we are so impressed with all that it can do. It has opened up a whole new level of creativity in us as well,” offers Tallman.

She feels the biggest advantage of the machine is the reduced odor it emits during printing compared to other devices, but the advantages don’t stop there. “We are also getting better adhesion of the inks to the substrates than what we have seen other companies get with their machines.”

Recent Creations

Today, Desert Breeze Custom can customize everything from drinkware to electrical panel labels, hats, office accessories, and gifts.

Finishing Simplified: KalaXY Automatic XY Cutters from Supply55

Engineered and manufactured in Europe, the KalaXY cutter/trimmer reduces labor and increases profits by eliminating the time-consuming task of manually cutting printed digital images. Our line of automatic XY cutters are the ideal solution for processing a range of media including wallpaper, paper, direct to film, canvas, laminated/ encapsulated films, banner material, polycarbonate, and other non-woven roll goods. Increase your output while reducing operation costs with KalaXY cutters. Contact by calling 734-668-0755, visit supply55.com, or email sales@supply55.com for more information. INFO# 9

Self Install panoRama TwoWay Vision Continental Grafix USA, Inc. now offers panoRama TwoWay Vision to a wider range of customers. This revolutionary translucent PVC window film delivers privacy without sacrificing light and stunning double-sided graphics day to night. Now, added is an air egress liner for self installation so more users and applications will be reached than ever before. The new air egress liner allows company employees and workers to install panoRama TwoWay Vision dry without the need for wet installation or professional installers, ideal for customers with retail or service storefronts. Learn more by visiting cgxusa.com.

Recently, the shop created room identifier signs for a chiropractor. “The office has a really bright and vibrant color scheme, so we used our laser to cut out a few different pieces of acrylic in a couple different colors,” shares Tallman.

It then printed on the different layers using first and second surface printing to give an extra level of dimension. The total order included 35 signs for one office.

Promotional Domination

What’s next for Desert Breeze Custom? It is currently working on pairing the UV printer with its laser engraver as much as possible and expanding its line of products made in house, such as NFT tags, acrylic signs, and hat patches. D

See page 14 for more info.

SUPPLY55,

uffice to stay 2025 has been a year filled with turbulence and uncertainty. What we do know is that the graphic arts is thriving—maybe not in ways we had hoped—but there is certainly a bevy of latest and greatest applications that if print service providers (PSPs) choose to take advantage of, will reap the benefits.

by Melissa Donovan

Annually we poll marketshare leaders on where the industry stands, and the range and quantity of commentary in terms of content was vast. So much so, we include part of the reflections in this piece, and much more online at digitaloutput.net.

Here, we look at market segments where growth is current if not imminent, pain points for PSPs and what they can do to

combat them, and finally, future projections for the industry.

Segments with Growth

Applications with potential for growth include décor, direct to film/garment, packaging, and vehicle graphics.

Above) WrapSesh from AZ used Mutoh printers for this car wrap application.

According to Thomas Giglio, segment manager, large format Latex production business in NA, HP Inc., emerging markets with continued growth are those that “require higher value, image quality, and capabilities.”

Erik Norman, president, swissQprint America, agrees that there is an increased interest in those applications that are considered higher value print. “PSPs seek more opportunities for embellishments and new ways to drive more profit to print.”

Other reasons for growth listed by Adam J. Tourville, channel manager, Fluid Color, stem from market demand for faster turnaround, personalized products, and greater substrate versatility.

Décor

Applications that fall under the category of décor are profitable,

they project high quality and value. These include home furnishings to wallpaper or wall murals, even window graphics that are used for a design aesthetic instead of a promotional purpose.

“Décor has compound annual growth rate numbers above ten percent and a total addressable market that gives PSPs a longer runway than common applications such as banners, posters, and decals. It is important to note that décor applications also deliver opportunity to capture printing with white ink—something that many of our customers note adds up to 40 percent of gross margin to their offerings,” explains Giglio.

Tobias Sternbeck, CEO, Beaver Paper & Graphic Media, Inc., says that “in 2025, growth is in soft signage, interior décor, and textile applications, especially in customized home furnishings and fashions.”

Alex Wixted, commercial innovation platform manager, Avery Dennison Graphics Solutions,

notices growth in the decorative and window film space in a range of building types such as hospitals, schools, and hotels.

“Segments like interior décor are thriving due to increasing demand for bespoke, short-run production—something traditional analog methods struggle to deliver cost effectively,” adds Patrick Donigain, senior manager, LFP business planning and strategy group, Canon U.S.A., Inc.

Direct to Film/Garment

They seem like buzzwords, but everyone interviewed for this article made it clear that is not the case. Direct to film (DTF) and direct to garment (DTG) is here to stay.

Touring trade shows this year, Lieven Bertier, CMO, Summa, says it was apparent that DTF in particular is experiencing significant momentum. “The sheer number of vendors showcasing DTF solutions and the consistent interest from attendees underline its rapid growth. The rise in DTF is driven by its flexibility and cost effectiveness, especially for short runs and customized apparel.”

“As a RIP software company, we are experiencing significant growth in demand for DTF and DTG printer drivers and color profiles. The number of new entrants in this segment of the printing industry is remarkable, reflecting a strong market trend,” agrees Bobby Cagle, NA sales director, SAi.

It’s DTF’s simplicity, low equipment cost, and vibrant transfer capabilities that make it attractive, especially to smaller businesses,

suggests Tourville. “DTF is also expanding to include DTF UV films for UV printers. These films can be applied to various items that are not able to be inkjet printed.”

Packaging

Digital print and finishing is ideal for short runs, which is why the packaging segment continues to benefit from the technology.

“There is increasing demand from packaging producers for shorter lead times; smaller, customizable production runs; and smarter production systems that don’t require large-scale infrastructure. Brands today want more variation in lower volumes delivered faster. This is evident in corrugated packaging and point of sale displays, where converters must be able to switch between jobs seamlessly and minimize waste to remain competitive,” notes David Preskett, VP EMEA & APAC, Kongsberg Precision Cutting Systems.

Packaging design also plays a role, as it is “experiencing a significant uptick as brands move away from the minimalist trends of the mid-2010s in favor of more cohesive, creative, and visually engaging portfolios. Packaging offers a unique opportunity to explore bold, three-dimensional (3D) designs that capture attention and reinforce brand identity,” share Emilio Rangel and Tony Simmering, product managers, Mutoh America, Inc.

Vehicle Graphics

A mature application, what’s interesting is the growth many continue to witness in the vehicle graphics space.

One trend is vehicle wraps expanding beyond cars. “More vehicles are being wrapped, not just cars and trucks but planes, boats, trains, and helicopters,” admits Tourville. “Vehicle wraps continue growing due to advertising effectiveness and fleet branding.”

It isn’t just commercial branding. “There is a personalization trend in the consumer market. This segment is thriving thanks to its strong visual impact and versatility,” notes Bertier.

“We also continue to see an uptick in the desire for vehicle customization, both for personal use and advertising with fleet vehicles,” agrees Wixted.

Other

Segments to Note

UV ink advancements push the use of the technology into markets that were once not possible. One of which is ADA braille signage. “The versatility of UV ink on a range of objects and materials is a major driver, enabling creative applications that go beyond traditional signage. One standout area is printable ADA signage, where older production methods are replaced by the speed, efficiency, and design flexibility of UV digital print,” explain Rangel and Simmering.

“Look at unconventional spaces with huge returns on investment. ADA braille signage has insane margins and is required in many of our public buildings and throughout most of our public lives,” they add.

Whether a label or type of outdoor signage, more requests are

made for material that can withstand everything from fluctuation in temperature to heavy traffic. “Durable signage is a big one, with customers requesting materials that hold up outdoors. Industrial labeling is growing too, as companies look for adhesives that can handle heat, moisture, and rough surfaces,” explains Michael Richardson, business development manager – graphics media, Jessup Manufacturing Co.

Shifts in Demand

PSPs want options to grow their business, this is apparent in the type of products they request. More importantly, successful PSPs are those who don’t pigeonhole themselves into one particular application, but are able to offer versatility to customers.

“The most consistent response from print providers is that they’re ‘doing a bit of everything.’

Sign shops and commercial printers alike are pushing forward with creativity and tenacity, exploring every possible avenue for growth. Rather than a single standout segment, we’re seeing companies diversifying to stay competitive and meet evolving customer needs,” notes Jay Kroll, director of product education, General Formulations.

Sustainability is a constant ask when it comes to materials for windows to rigid signage and fabrics. “There is a major shift towards non-PVC, environmentally friendly window films. Brands and retailers are under pressure to reduce environmental impact, and PVC-free options like polyesterbased and olefin films or PETbased optically clear films offer better recyclability and a lower carbon footprint,” shares James Halloran, VP, sales and marketing, Lintec of America, Inc.

“There is continued pressure from the market to produce more but shorter production runs in a wide variety of substrates. This is

definitely trending away from the most toxic, non-recyclable plastics in favor of more sustainable, often paper-based materials,” adds Martin Thornton, executive sales manager, Zund America, Inc.

Sternbeck says “fabric-based solutions, particularly polyester for dye-sublimation, continue to gain ground due to their sustainability profile and compatibility with high-speed printers. Customers are looking for multi-use or ecocertified materials.”

Donigain agrees. “Print buyers are priotitizing unique, eco-conscious solutions that either meet evolving regulations or help brands differentiate visually.”

Michelle Kempf, VP, sales & marketing, Continental Grafix USA, Inc. admits that as of recent, there is a regional market interest and demand for sustainable or “green” alternatives to PVC. “In areas like the Northeast and along the coasts, there is a higher concentration of LEED certified buildings. These buildings often require PVCfree materials be used for interior graphics and signage to maintain compliance with LEED certification. Retailers increasingly prioritize sustainability by demanding recycled or recyclable material for packaging as well as exploring PVC-free and recyclable alternatives for in-store branding and promotions for walls, windows, and floors.”

Brian Buisker, president, Advanced Greig Laminators, Inc., also observes a regional interest in its recyclable media and overlaminates, however, they are not overly

requested. “Customers do value environmentally friendly solutions but only if they don’t have to make big sacrifices in performance and price.” Buisker adds that the ability to provide reliable and consistent pricing on time is a huge benefit right now.

Speaking of performance and price, due to the current economy, Tourville notices PSPs looking to print on to more inexpensive substrates to help cut costs. “With these products there is more of a need to test the surface energy to ensure adhesion of ink to the substrate. These can have an adverse effect of using flame or wipe-on adhesion promoters, which increase the cost of manufacturing due to cost of the primer and the added time for the operator.”

Sales and Usage Impact

Supply chains, lead times, and pricing pressures are challenging for most PSPs.

The recent tariff situation plays a role and at press time it was presumed to impact the print industry. “Tariffs increase the cost of imported goods, such as substrates, inks, and toner; while steel and aluminum tariffs raise the price of offset presses, plates, inkjet printers, digital cutters, and other equipment. This leads to higher input costs, shrinking margins, and print shops adjusting their pricing models to remain competitive,” advises Marc Raad, president, Significans Automation.

“The instability in global trade and the uncertainties regarding U.S. tariffs are definitely on everyone’s mind. While this translates

2) Jessup TenaciousTac is a great example of the rise in demand for durable, pressure-sensitive materials with adhesives that can handle heat, moisture, and rough surfaces.

into a ‘wait-and-see’ attitude for some, others use it as a negotiating tool in the hope of locking in more favorable pricing before the fallout begins to manifest itself. All in all, it seems like a continuation of the near-constant turmoil in recent years brought about by the pandemic and its aftermath,” suggests Thornton.

According to Norman, “the tariff situation has given some pause to capital spending decisions, yet market leaders are still moving forward. This disruption, while frustrating for many of us, is still just a speed bump—it only slows you down for a brief moment.”

With the situation in flux, it seems there is a “growing effort to reshore manufacturing and reduce reliance on overseas materials, which is influencing substrate choices and planning,” notes Kroll.

“Regionally, focusing on the local market—specifically within a four hour radius of production facilities—can significantly enhance competitive advantage. This proximity allows for faster turnaround times and stronger client relationships, which are increasingly important as lead times and pricing pressures fluctuate due to ongoing supply chain adjustments,” admits a representative from Flexcon.

There is a growing interest in U.S.made materials, as this reduces supply chain risk, explains Richardson. With products available at a local/regional level, faster turnaround times are met. “Lead times are more stable, but customers are still being cautious—keeping more inventory and prioritizing vendors who can deliver consistently. And while pricing pressures persist, there’s a clear understanding that quality materials save time and money in the long run.”

Indeed, working with well-made, quality hardware and substrates is an important element. Preskett believes PSPs are adapting to the

uncertainty of the market “by seeking more resilient, futureproof technology and systems that are modular, upgradeable, and reduce downtime. They also require greater flexibility from equipment providers to support a wider range of applications, helping them stay agile in response to fluctuating material availability and customer demand.”

Another way for PSPs to manage this disruptive point in time is to analyze and capitalize on specific occurrences where profitability can occur. “It’s essential to recognize the cyclical nature of certain market segments. For instance,

advertising on public transit for the film industry ramps up between Memorial Day and Labor Day, aligning with movie release schedules. Understanding these seasonal patterns enables providers to better allocate resources and anticipate demand,” recommends the representative from Flexcon.

Brian Buisker, president, Advanced Greig Laminators, Inc.

aglinc.com

Labor Shortage

Impacted by lack of qualified workers, PSPs try and rely on automated systems to combat this loss. However, some human-type of “intervention” is needed.

“The industry faces a shortage of skilled labor, exacerbated by ‘the

Nick Dinunzio, director of business development, Alpina Manufacturing, LLC 116 fastchangeframes.com

Alex Wixted, commercial innovation platform manager, Avery Dennison Graphics Solutions

graphics.averydennison.comTobias

Tobias Sternbeck, CEO, Beaver Paper & Graphic Media, Inc.

beaverpaper.com

Patrick Donigain, senior manager, LFP business planning & strategy group, Canon U.S.A., Inc.

usa.canon.com

Michelle Kempf, VP, sales & marketing, Continental Grafix USA, Inc.

cgxusa.com

Flexcon

flexcon.com

Adam J. Tourville, channel manager, Fluid Color

fluidcolor.com

Jay Kroll, director of product education, General Formulations

generalformulations.com

Thomas Giglio, segment manager, large format Latex production business in NA, HP Inc.

hp.com

great resignation’ and an aging workforce. Attracting younger generations to the printing profession remains a significant hurdle. To address labor shortages and improve efficiency, businesses are investing in automation and artificial intelligence (AI) tools. These technologies streamline workflows, reduce errors, and enhance productivity,” shares Nick Dinunzio, director of business development, Alpina Manufacturing, LLC.

In tandem with the current economic uncertainty, print shops are trying to do more with less. For example, “they are currently focusing on doing more with the staff and equipment they already have—rather than making investments in new equipment or hiring additional staff. They meet these challenges head-on by

Michael Richardson, business development manager

jessupmfg.com

David Preskett, VP EMEA & APAC, Kongsberg Precision Cutting Systems

kongsbergsystems.com

James Halloran, VP, sales and marketing, Lintec of America, Inc.

digitalwindowgraphics.com

Emilio Rangel and Tony Simmering, product managers, Mutoh America, Inc.

mutoh.com

Bobby Cagle, NA sales director, SAi

thinksai.com

Marc Raad, president, Significans Automation

significans.com

Erik Norman, president, swissQprint America

swissqprint.com

Lieven Bertier, CMO, Summa

summa.com

Martin Thornton,executive sales manager, Zund America, Inc.

zund.com

implementing customized workflow automation solutions and full, end-to-end integration of all their business-critical processes, from order intake to final delivery,” explains Raad.

Kempf says finding and retaining experienced, skilled operators, installers, and color management experts is a pain point for PSPs. This, coupled with faster, shorter turnaround times, means “PSPs have a greater need to invest in automation and rely on vendor expertise as well as invest in faster, more versatile printers and leaner workflows to reduce turnaround times. The investments needed to stay competitive can be daunting.”

“The talent shortage is real, and it’s pushing the industry to prioritize ease of use and intuitive machinery. Equipment that requires less specialized training but delivers high-quality output is valuable,” agrees Bertier.

It’s all about remaining lean. “Print providers are increasingly challenged by the rapid pace of technological change. They actively seek innovative software and equipment solutions that enable greater automation, allowing them to operate more efficiently with leaner teams. Selecting the right printing technology and software is essential to achieving these operational goals,” admits Cagle.

Preskett brings up a good point, that in “investing in automation

3) Avery Dennison DOL 7460 with ADReva Technology is a digital overlaminate film using PVC-free and solvent-free technology with superior conformability and durability paired with its PVC-free digitally printable film MPI 1405 for walls and tough, textured surfaces.

INDUSTRY LEADER PARTICIPANT

WEBSITE

and smart finishing systems to maintain productivity with fewer manual steps, this also means skilled labor can be used in other areas of the business to add value.”

PSPs Across the Board

From the one to five person momand-pop shop to the multi-million dollar in revenue corporation with five different locations, PSPs across the board remain active in a volatile economy. There are investments in technology, growth in profitability, and staff and income changes no matter the business size.

According to Giglio, “smaller PSPs are more active in looking at investments, whereas larger PSPs would like to extend their capital investments while at the same time keeping their current hardware relevant. It’s much easier for a smaller PSP to increase its offering by implementing innovative hardware solutions that drive application growth.”

“There is interest in new technologies from both large and small print providers, but the approach often differs,” agree Rangel and Simmering. “Smaller print shops show a growing willingness to invest in ‘like-new’ technologies— those that have been proven and adopted by larger players first. With today’s market conditions, many prefer to wait until new solutions are battle tested before fully committing.”

Norman believes the common denominator isn’t the size of the shop, but its growth mindset in ownership. “We see those printers who believe in their teams, and

their ability to grow, continually invest in new technology.”

How a small versus a large shop operates in its media acquisitions differ and yet are also similar.

“Smaller shops want versatile substrates that can work across a range of applications. Bigger shops are going more specialized. In both cases, they’re looking for ways to boost efficiency and stand out,” says Richardson.

“We see many examples of smaller print shops thriving by focusing on customer service and product quality. These businesses are growing alongside their clients— often moving from roll cutters to flatbeds and expanding their capabilities incrementally, but strategically. At the same time, larger companies, particularly

those built around ecommerce and personalization, continue to invest. Their scale allows them to explore automation, workflow integration, and mass customization more aggressively—setting benchmarks that smaller providers can also learn from,” notes Bertier.

For Kroll, he sees growth and decline at both ends of the spectrum, but it is innovation and adaption that is essential to succeed no matter the size of the print shop.

“I recently saw a post from a 70 year old shop owner whose thriving business collapsed when his main client—accounting for 60 percent of his work—shut down. He tried to pivot and diversify, but the foundation of his business was too tied to that one relationship. The takeaway—diversify early. A narrow focus can make

any business vulnerable to disruption, but excessive diversification can also lead to inefficiency and a loss of identity. The key is finding the right balance—one that aligns with the business’ strengths and customer base.”

Thoughts into the Future

Pinpointing the trajectory of the industry and what it will look like in five years forces reflection on the current state of affairs. Studying the segments/applications where PSPs are currently succeeding and where demand is generated from are good benchmarks.

Kroll foresees continued growth in short-run, high-customization verticals like vehicle wraps, décor, and experiential graphics, as well as expansion in durable film applications beyond signage.

“Customers are moving toward high-performance, weather-resistant materials. Substrates that pair well with UV-curable inks are in demand, especially as large format printing continues to grow. Print providers want materials that deliver strong adhesion and clean, high-resolution results with minimal waste,” adds Richardson.

A strong push in luxury packaging is a segment where Bertier sees additional growth. “Premium materials and sophisticated designs are in high demand, driving innovation and value. Mass customization is another area. From personalized sportswear to bespoke labels and stickers, small-batch, high-impact

production is resonating with modern consumers who want uniqueness and immediacy.”

“Other verticals to watch include interior décor and custom home textiles, sustainable fashion using pigment and sublimation on demand models, 3D textile applications, and wearable tech integrations,” foresees Sternbeck.

“As digital signage continues to displace some traditional print, success will hinge on offering tactile, high-value applications such as textured wallcoverings, soft signage, and interior décor that are difficult to replicate with screens,” adds Donigain.

1 Avery Dennison Graphics Solutions 9 graphics.averydennison.com/dol7460 13 Budnick Converting/Banner Ups 15 bannerups.com

2 Canon U.S.A., Inc. 2 usa.canon.com

3 Colex Finishing, Inc. 11 colex.com

14 Delivery Signs 15 yardsignsresellers.com

4 Flatbed Tools 17 flatbedtools.com

5 Fluid Color 13 fluidcolor.com

6 Mutoh America, Inc. 27 mutoh.com

7 Newlife Magnetics LLC 19 newlifemagnetics.com

8 Signs365 28 signs365.com

9 Supply55, Inc. 6 supply55.com

Emerging technologies also include solutions “that combine efficiency and personalization through product and service offerings, with sustainability becoming more of a priority,” says Wixted. In addition, she sees AI and even augmented reality (AR) being creatively used in signage and graphics for both advertising and customization.

“Automation will continue to revolutionize print shop workflows. The integration of digital marketing with print will grow, leveraging quick response codes, AR, and near-field communication in print materials to create more engaging interactive experiences. Finally, AI, arguably the most disruptive technology in our lifetime, will continue to revolutionize almost every aspect of printing businesses worldwide,” attests Raad.

As for PSPs in the thick of it, recommendations on how to ride out the current state of affairs include adopting automation tactics and embracing ecommerce. “The market is shifting toward models that empower customers to design their own artwork and submit graphics directly to print providers for production. Organizations that adopt automation, leveraging advanced software and AI, are well positioned to support print providers in maintaining a competitive edge,” stresses Cagle.

A representative from Flexcon shares that “as consumer buying habits favor online convenience and personalization, print providers who invest in ecommerce platforms or marketplace integrations will be better positioned to capture new revenue streams.”

“While the impact of AI is still emerging in the large format industry, companies that have already implemented automation in their infrastructure are the ones most likely to benefit from enhancements that are set to completely redefine customer experiences,” stresses Giglio.

This is automation across the entire print production process, from real-time performance monitoring and predictive analytics to solutions that enhance material handling and contribute to higher throughput—all of which reduce downtime and extend equipment life, explains Preskett.

Strong into the Next Decade

Down the road, Buisker hopes the next three to five years “bring a lot of promise. By continuing to innovate and listen to what our customers are asking for, I believe the industry will remain strong, successful, and profitable.”

Thornton suggests that “print providers, and especially the equipment they invest in, need to be prepared to keep growing and adapting to changes—whatever those may be.”

“The next three to five years will continue to reward those who stay agile—able to pivot between markets, experiment with new media, and integrate emerging technology into their workflow,” concludes Kroll.

Hear more about what these industry leaders have to say about the current state of the industry in our July webinar. Visit digitaloutput.net to access the archived broadcast. D

Pressure-Sensitive Adhesives

Printing Floor Graphics

Modern Corrugated Finishing

Vehicle Wraps

Artificial Intelligence for Workflow

#12

#10

#11

latbed printers featuring smaller format print areas and laser engravers are two versatile technologies attracting a lot of interest among print service providers (PSPs). These devices are capable of speciality printing and engraving for braille signs, awards, and smaller promotional or personalized items like golf balls and drinkware.

by Cassandra Balentine

Smaller format flatbeds, which max out at approximately 50 inches, allow shops to diversify beyond signage into higher margin segments, including unique and personalized products, industrial components, and compliant braille signage.

“Additionally, they print directly onto rigid and dimensional objects with precision, opening doors to

new revenue without sacrificing space or major workflow modifications,” shares Josh Hope, director of marketing, Mimaki USA, Inc.

Similarly, incorporating a laser engraver enables print shops to tap

Above) Mimaki offers two flatbed solutions in the range of 55x27-inch format range, the JFX200-1213 EX and UJF-7151 Plus II, both capable of printing directly to smaller objects like this business card case.

into new markets and types of work that may currently be out of reach. “These devices open the door to custom fabrication, intricate product personalization, and high-end finishing services that go far beyond traditional printing,” offers Derek Kern, president, Kern Laser Systems.

Laser systems facilitate detailed cutting and engraving on substrates like wood, acrylic, leather, and coated metals—materials often used in industries such as architectural signage, awards and recognition, branded merchandise, and interior décor.

Scaling Down

Flatbed printers offer a variety of advantages to PSPs. While we often focus on those in the 64-inch-plus range, smaller format options also play a significant role in the wide format print landscape.

“Smaller format printers can complement wider format machines by offering a development or proofing platform and the ability to produce short-run jobs without taking cycles away from the larger format machines,” shares Lon Riley, founder/CEO, The DPI Laboratory.

When turning out low-volume jobs, smaller scale flatbeds tout cost efficiency. “Instead of cutting into the production on a wide format or large format UV flatbed, smaller format options allow shops to profit on smaller quantity jobs without disrupting larger production runs,” offers Michael Perrelli, sales director, Innovative Digital Systems (IDS).

One advantage of smaller format flatbed printers is the potential for a strong return on investment (ROI). According to Emilio Rangel, UV and VerteLith product manager, Mutoh America, Inc., smaller format UV printers are versatile, enabling shops to handle a range of applications and meet diverse customer needs with a single solution.

“Small flatbed printers are a compact and relatively low-cost solution that provide wide format print shops the ability to easily produce smaller production runs of highly customized orders that can be inefficient to produce on large format printers,” echoes David Bistrovic, product manager, Professional Imaging, Epson America, Inc.

Chances are high that a wide format print shop may become tight

on floor space. “Small format printers pack a lot of versatility into a much smaller footprint, making them a logical option to set up in a cellular layout or in areas where space is limited,” asserts Perrelli.

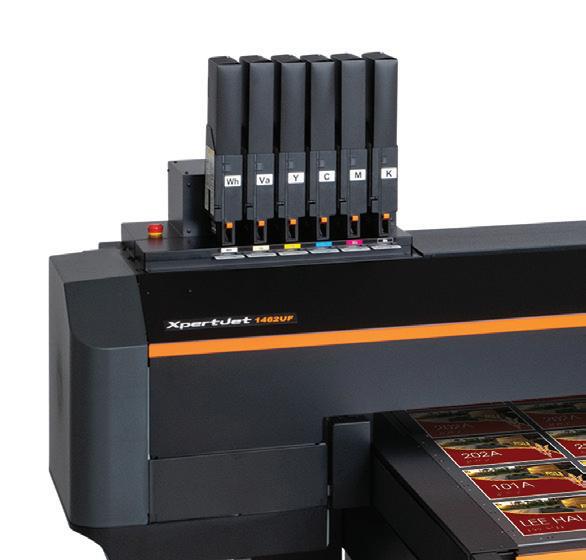

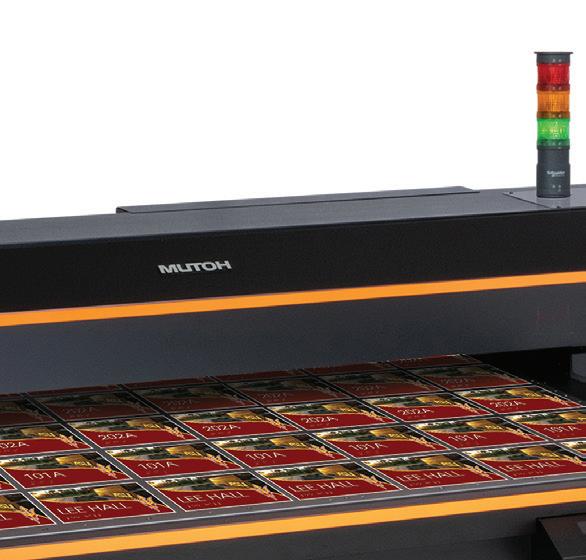

Braille is one essential application these devices handle thanks to a compact offering. For example, the Mutoh XpertJet 661UF and XpertJet 1462UF are well known for their legally ADA-compliant braille output capabilities.

“This allows shops to bring ADAcompliant production in house, eliminating the need for expensive outsourcing or bulky, spaceconsuming appliqué workflows— ultimately enhancing operational efficiency,” notes Rangel.

Randi Kerkaert, product manager, Summa, says a compact

flatbed cutter provides an ideal bridge for shops scaling up from vinyl cutters. “While wide format equipment can represent a significant investment, smaller format models allow businesses to expand more gradually, aligning capital expenditure with customer demand and growth.”

By expanding beyond vinyl, Kerkaert points out that small format flatbeds open the door to new applications—including short-run packaging, rigid signage, and textile prototyping. “The added versatility allows shops to diversify their offerings and respond to more complex or custom client requests.”

Some smaller format wide format flatbed printers offer technologies like rotary devices for

printing on cylindrical objects, UV direct to film compatibility for oddly-shaped objects, or support materials that are not sufficiently compatible with direct print from a durability standpoint, adds Riley.

Laser Engraving

Laser engravers also open up opportunities to work with a variety of materials beyond traditional printing. By combining wide format printing with laser engraving technology, shops deliver customized, high-quality products with faster turnaround times—positioning themselves as one-stop solutions in a competitive market.

“Adding a laser engraver and/ or cutter to a wide format print business allows you to diversify services, increase revenue streams, and enhance the value you provide to clients,” explains

Harris, marketing communications specialist, Epilog Laser.

Applications include rubber stamps, wooden coasters, engraved tumblers, personalized photo puzzles, and many other items that go beyond standard print jobs, which are ideal for laser engraving. “This expands the service portfolio and attracts new business opportunities,” says Devin Huang, deputy manager, marketing, GCC.

According to Kern, one of the most compelling benefits is the laser’s ability to quickly process a variety of materials, many of which are already commonly used in print environments, such as acrylic, wood, paperboard, and coated metals. “This versatility allows PSPs to expand offerings without needing to source unfamiliar substrates.”

Huang admits that for wide format printing, most finished products typically require no additional

laser processing. “However, introducing a laser engraver opens up a broader range of applications and materials that printing alone cannot cover.”

The ability to add engraving to printed materials expands a print shop’s product line into high-value applications such as personalized signage, branded packaging, awards, and promotional items, enhancing both aesthetics and functionality, offers Kern.

To streamline integration, registration marks can be printed alongside the artwork. “These marks are then read by the laser system’s vision camera to automatically align the CAD file with the printed piece. This ensures precise, repeatable results without the need for manual adjustments,” continues Kern.

ROI

While ROI varies based on many factors, Rangel offers a potential

example. “A single 6x9-inch ADAcompliant sign printed on the Mutoh XpertJet 1462UF can generate a gross profit of over $55. With consistent orders, shops can recover their investment in a relatively short time frame.”

Similarly, Hope says the Mimaki JFX200-1213 EX can produce approximately 35 ADA-compliant 6x9-inch braille signs in just 90 minutes with an average ink cost of under $2 per sign. In comparison, retailers set their prices above $50 each for custom colors and graphics. “Low running costs and rapid throughput contributes to strong profitability,” adds Hope.

Perrelli agrees, pointing out that producing ADA/braille signage for schools or hotels typically yields a much higher profit margin than printing on items like golf balls or notebooks. “In fact, some of our customers have been able to cover the cost of their machine after just a few signage jobs. For accurate ROI calculations we always encourage shops to request custom sample prints if they are seriously considering a small format printer. This allows them to gather valuable data such as ink usage and print time that can be used to create realistic, relevant ROI projections tailored specifically to their business.”

PSPs can expect to see ROI through the ability to take on new small-batch orders, whether for new customers or expanding services for existing clients. “If a print shop was previously outsourcing small-batch orders, they can now bring those services in

Amy

1) The Mutoh XpertJet 661UF is well known for its ADA-compliant braille output capabilities. 2) The Mutoh XpertJet 461UF is 19x13 inches and can print to such things as golf balls.

house and see the ROI. These capabilities not only increase profit margins but also help attract niche and repeat business that may have previously been out of reach,” comments Bistrovic.

With the right plan and product, Riley has seen small format UV machines return original investment in 90 days. “That was with established operations and required the right planning, product mix, and marketing/sales approach. Six to eight months is more typical with a good plan. I would encourage startups or smaller shops to take a very conservative approach to modeling return and productivity and be realistic about their capabilities.”

The ROI for a laser engraver can be both rapid and substantial for PSPs, especially when the equipment is integrated into existing workflows and marketed effectively. “Because laser systems dramatically expand a shop’s capabilities, they open the door to higher margin, value-added services such as engraving, cutting, and personalization—services that command premium pricing and attract new clientele,” attests Kern.

In many cases, shops begin to see ROI within the first year, especially if they actively promote their new capabilities to existing customers and explore new markets like custom signage, packaging, awards, and promotional products. “By offering complete, finished products rather than just printed sheets, shops can move up the value chain and become indispensable partners to their clients,” adds Kern.

Huang agrees, noting that custom products like personalized signage, awards, and promotional items can command higher prices and increase profit margins. Additionally, offering these diverse services helps the print shop stand out from competitors, attracting more customers and enhancing market competitiveness. “With long-term durability and minimal maintenance costs, a laser engraver can generate consistent revenue, ultimately leading to a positive ROI.”

Learning Curve

Before ROI is realized, PSPs must be well versed on how to operate the machine.

In general, small format UV flatbed printers are user friendly, thanks to improved software interfaces, automated features, and improved maintenance routines, says Hope. “For inexperienced users, there may be an initial learning curve around

artwork preparation and creating special effects like those made with layering techniques, especially for direct to object applications. However, most

systems are designed to help operators with intuitive layouts and workflows that will go from intuitive to production promoting with practice.”

FLATBED INK SETS

Multiple ink options are available with smaller format flatbed printers. “In the UV flatbed printing industry, having access to a variety of ink types is a major advantage, as different applications demand different performance characteristics,” says Josh Hope, director of marketing, Mimaki USA, Inc.

Michael Perrelli, sales director, Innovative Digital Systems (IDS), says the advancement and availability of these inks have really shaped the versatility of small format printers. “Units that we offer at IDS have rigid and semi-flexible inks that continue to expand the range of printable items and materials. Add wipe-on and jettable primers to the ink options and operators have more tools to ensure proper printability than they have ever had.”

Hope says rigid inks are commonly used for items that require high scratch and chemical resistance ideal for functional applications like ADA signage or industrial labeling where durability is critical. “These inks can withstand frequent touch or cleaning with solvents like alcohol without degrading the print.”

Flexible UV inks are also widely used, especially for applications that involve flexible materials or applications that require post processing, like packaging. “Advanced flexible inks are engineered to stretch significantly up to 350 percent in certain cases while maintaining ink integrity and color saturation,” notes Hope.

Emilio Rangel, UV and VerteLith product manager, Mutoh America, Inc., explains that Mutoh’s rigid UH21 UV ink and flexible US11 UV ink have both passed the Consumer Product Safety Improvement Act or CPSIA and California Proposition 65 compliance testing, making them suitable for regulated

If shops are already operating digital wide format equipment, the learning curve is minimal for smaller format flatbeds. “Regardless of current UV experience, IDS provides onsite training and installation with all the printers we sell and that has been a

applications—including products intended for children. Additionally, US11 UV ink is GREENGUARD GOLD certified, ensuring low chemical emissions for use in sensitive environments. Both ink sets are available in 220 and 800 milliliter cartridges.

Lon Riley, founder/CEO, The DPI Laboratory, points out that the typical ink configuration for smaller format UV printers is CMYK with white and varnish. “The varnish can be used as a protective layer or to provide special effects and embellishment. For ink delivery, you will usually see ink bags, cartridges, bottles, or bulk systems. Bulk systems will typically require less in terms of startup time and have lower ink cost with virtually no waste factor.”

David Bistrovic, product manager, Professional Imaging, Epson America, Inc., suggests that the addition of varnish supports gloss or matte embellishments and finishes to highlight specific areas of the print and create textures. “The use of varnish also enables the creation of braille signage, expanding the market for wide format print providers.”

The Epson SureColor V1070 leverages six-color UltraChrome UV ink that includes CMYK plus white ink and varnish. “The addition of white ink supports printing on substrates that are not white, as well as clear and acrylic substrates by printing a white base layer prior to the color ink to make prints stand out,” comments Bistrovic.

“The availability of white, clear, and jetted primer ink expands creative and material versatility, allowing for high-opacity underlays, textured effects, and improved adhesion on challenging substrates while keeping a simplified workflow,” adds Hope.

proven way to ensure customers are comfortable with the operation, art set up, and maintenance of the unit,” offers Perrelli.

Mutoh minimizes the learning curve with the StartRight Kit—a comprehensive onboarding tool

designed to guide users from setup to production with ease. The kit includes video-guided lessons, downloadable stepby-step tutorials, printed UV samples, and blank substrates, helping printer owners transition smoothly from design to final output. “When paired with VerteLith RIP software and proprietary preloaded Mutoh Print Environments, which require little to no user adjustment, shops can be up and running in no time,” according to Rangel.

Bistrovic confirms that the Epson SureColor V1070 is designed for minimal maintenance, with

several automated features that keep operation simple and efficient. “The printer is also equipped with a fabric wiper that maintains the printhead. After each cleaning cycle, UV light cures the ink on the wiper, allowing for clean, hassle-free disposal.”

Mimaki also supports ease of use with intuitive features like RasterLink7 Jig Print layouts and multi-layer printing features like 2.5D Texture Maker and Braille App. “We also feature automated, semi-maintenance systems, and built-in tools like Nozzle Check Units and Recovery Functions that reduce downtime. Combined with Mimaki’s training resources and consistent workflows across models, our flatbeds help shops maximize uptime and focus on high-value output,” says Hope.

The machines themselves are typically straightforward when it comes to maintenance. “With a good quality machine from a reputable vendor, initial setup should be straightforward and well supported. Definitely look at the software and get a feel for production capabilities. The simpler software is less expensive and easy to get up and running to make a few prints, but the investment in a good quality RIP—in terms of cost and learning curve—is worth every penny when you begin to scale,” suggests Riley.

When it comes to laser engraving, the learning curve is also relatively manageable, particularly for operators already familiar with digital design and print workflows. “Most modern laser systems are designed with

intuitive software interfaces and integrate easily with common file formats and CAD/CAM programs. For users with experience in vector design or RIP software, the transition is often seamless,” claims Kern.

Harris says most users get tripped up learning how to design for the laser, however if already familiar with design software like Adobe Illustrator or CorelDRAW, the process is easier.

For ongoing use, laser systems are built for reliability and daily operation. “Once operators are familiar with the workflow, running jobs becomes a streamlined process. Barcode or quick response (QR) code workflows further simplify operation by automating file loading and material settings, which helps minimize user error and improve consistency,” adds Kern.

Maintenance is generally straightforward and includes tasks such as lens cleaning, filter replacement, and checking beam alignment. Kern Laser’s systems are engineered for industrial use, so they’re built with durability and ease of upkeep in mind. “With routine maintenance and proper handling, shops can expect years of dependable performance with minimal downtime,” notes Kern.

Huang argues that compared to printers, laser engravers are relatively easier to operate. “For example, printing requires color calibration and fine-tuning CMYK

profiles, which demand experience and expertise. In contrast, laser engravers can produce quality results by simply following standard operating procedures. As for maintenance, daily routines like lens cleaning are straightforward and easy to perform, ensuring long-term machine durability with minimal effort.”

Software Support

In the digital printing space, RIP software plays a key role in maintaining order accuracy throughout production. “RIPs support features like job labeling, barcoding, and hot folder automation to reduce manual entry errors and ensure each file is printed as intended,” explains Hope.

Therefore, compatibility with workflow and order management systems—such as those used for tracking production status or batching print jobs—helps ensure smooth coordination from intake to output. “Industry-standard RIPs offer robust support for these workflows, helping print providers integrate seamlessly with job tracking systems and minimize production errors across both single-piece and high-mix, short-run environments,” says Hope.

Most quality RIP software have some essential workflow capabilities built in, such as hot folders, design templates, and configurable workflows, says Riley. “As companies scale and require components such as API connections to web stores, art workflows, quality assurance, and pick and pack, in addition to

customization, sometimes they require more horsepower. In this case, there are more enterprisegrade packages such as DPI’s KFLOW software, that can integrate with these systems, and help direct traffic with the customization operation.”

Kern believes precision and efficiency are critical when it comes to delivering high-quality printed products. “To support accurate order processing from file submission to the finished product, we utilize barcode workflow software as a key part of our automation strategy. This technology plays a vital role in streamlining the laser cutting process. Barcodes or QR codes are printed directly onto the material, alongside registration marks. These codes carry essential data, including the appropriate CAD file and laser parameters specific to that job. Once the printed sheet is placed on the laser table, our integrated barcode scanner and vision camera system take over.”

Kern points out that with this process, the system automatically identifies the job through the barcode, loads the correct CAD

file, and applies the predefined laser settings. This eliminates the need for manual file selection and parameter input, significantly reducing the chance for human error and ensuring consistency from start to finish. “By leveraging barcode-driven workflows, Kern delivers a seamless transition from digital design.”

Huang adds that common graphic design software, such as Adobe Illustrator and CorelDRAW, are widely compatible with laser engravers. “Print shops are generally familiar with these programs, which make the file preparation process intuitive and efficient, ensuring a smooth and accurate workflow from file submission to final production.”

New Capabilities

Small format flatbed printers and laser engravers are two technologies that allow PSPs to bring in new business with a minimal upfront investment, compact footprint, and negligible learning curve. However, ROI and success is largely related to how a PSP strategizes and promotes the new products and capabilities afforded by these devices. D

3) The Epson SureColor V1070 is an A4-size printer that includes six-color UltraChrome UV ink to print directly to objects like this bottle opener.