Services (pg 20):

Services (pg 20):

By Brandi Smith

Chicago’s property managers are juggling more than tenant calls and rent checks these days. Rising expenses, volatile taxes, tight lending conditions and a flood of new tech tools have reshaped the job into something closer to air traffic control. The fundamentals — keeping buildings full and tenants happy — haven’t changed, but how managers get there is shifting fast. For some firms, that means doubling down on proven strengths. Others are expanding into new asset classes or geographies. Either way, the balancing act between efficiency and personal touch has never been trickier.

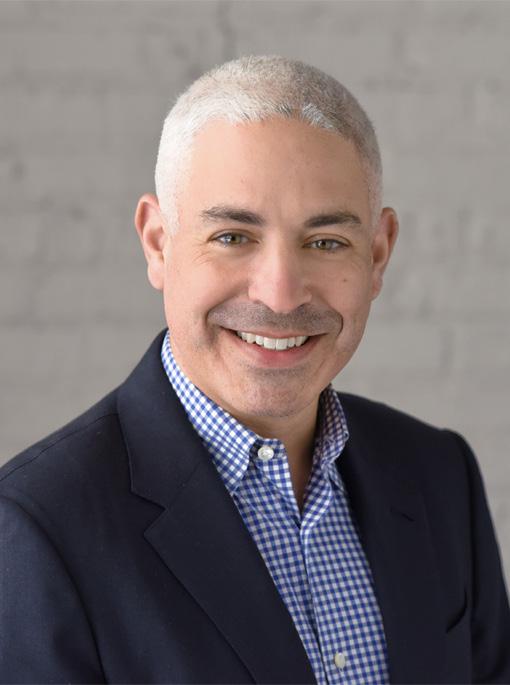

Roger Daniel, founder and president of Daniel Management Group, says Chicago’s multifamily market continues to outpace expectations, even as operations grow more complex.

“It’s not for the faint of heart,” Daniel said. “Property management in Chicago comes with unpredictable taxes, politicized interest rates and plenty of regulatory gotcha moments.”

Multifamily remains the workhorse of his portfolio. He credits both steady renter demand and Chicago’s surprising rent growth compared with peer cities.

“The multifamily asset class has been on an incredible run; If it were baseball, we’d be in inning 15 and still going strong,” Daniel said. “Chicago has had the highest yearover-year rent growth of any city in the country. I can’t remember the last time that was the case.”

At Xroads Advisors, Chief Operating Officer Suzanne Hendrick oversees medical office, general office, retail and flex industrial properties, most of them outside the city’s core.

FROM ROOFTOPS TO RISK MANAGEMENT: INSIDE CHICAGO’S EVOLVING PROPERTY PLAYBOOK Chicago’s property managers are juggling more than tenant calls and rent checks these days. Rising expenses, volatile taxes, tight lending conditions and a flood of new tech tools have reshaped the job into something closer to air traffic control.

CONSTRUCTION IN CHICAGO: BETTING BIG AMID FINANCING HEADWINDS

Chicago’s construction market is living in two realities at once. Developers are chasing some of the biggest adaptive reuse and infrastructure projects the city has seen in years while also struggling to get deals financed in an era of high interest rates and volatile costs.

STRONG DEMAND, WEAK SUPPLY: CHICAGO’S MULTIFAMILY MARKET AT A CROSSROADS Chicago’s apartment market is running hot — just not in the way developers would like. Demand is outpacing supply, rents are climbing faster than in many Sunbelt cities and occupancy remains tight.

TURF TALK: COMMERCIAL LANDSCAPING & SNOW REMOVAL STRATEGIES

An Evidence-Based Snow Management Guide for Property Managers

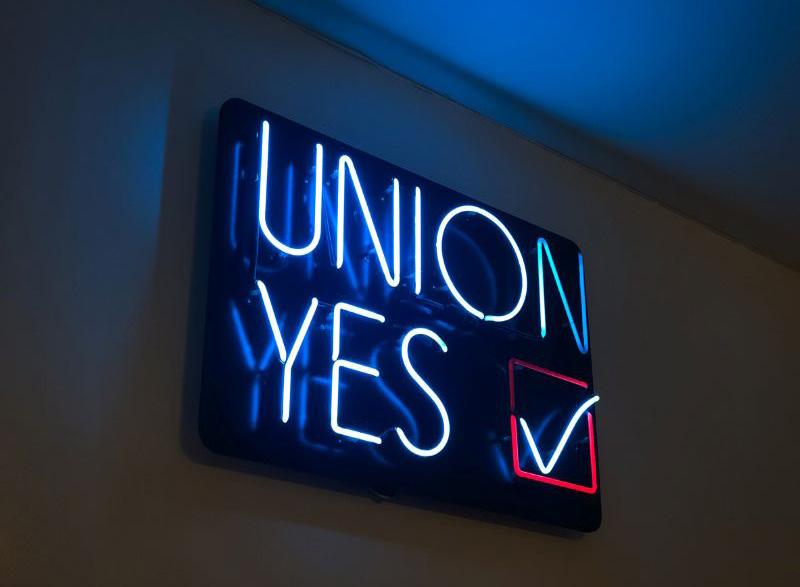

THE CONTINUING IMPORTANCE OF UNION MEMBERSHIP: AN INTERVIEW WITH THE INTERNATIONAL UNION OF BRICKLAYERS AND ALLIED CRAFTWORKERS’ HECTOR ARELLANO Union membership has always been important for workers in the construction industry.

CHECKING THE PULSE OF CHICAGOLAND OFFICE MARKETS: BRADFORD ALLEN RELEASES MID-YEAR OFFICE REPORTS The vacancy rate in Chicago’s downtown and suburban office markets rose slightly in the second quarter.

SAFETY AND COMPLIANCE MUST GUIDE CHICAGO’S SHIFT TO RENEWABLE ENERGY

The City of Chicago recently celebrated a major sustainability achievement as all of its municipal buildings are now powered by clean energy.

DEPAUL UNIVERSITY MID-YEAR REPORT: NUANCED INDUSTRIAL NUMBERS, BUT SECTOR STILL STRONG

The perceived investment strength of industrial segments in the Chicago market was down in 2025 compared to previous years.

COMMERCIAL SERVICES

PUBLISHER Mark Menzies menzies@rejournals.com

EDITOR Dan Rafter drafter@rejournals.com

VICE PRESIDENT OF SALES & MW CONFERENCE SERIES MANAGER Ernie Abood eabood@rejournals.com

VICE PRESIDENT OF SALES Frank E. Biondo frank.biondo@rejournals.com

CLASSIFIED DIRECTOR

Susan Mickey smickey@rejournals.com

MARKETING & EVENTS COORDINATOR Allison Kim Allison.kim@rejournals.com

312.933.8559 Website: www.rejournals.com

EDITORIAL

ALISSA ADLER Colliers

GEORGE KOHL Savills

Jeff Krusinski Krusinski Construction Co.

RONALD C. LUNT Hamilton Partners

JOHN M. MOYSEY Avison Young

NANCY A. PACHER CBRE

JONATHAN STEIN Inland Real Estate Group

GREGORY T. WARSEK Associated Bank

CHRIS WOOD Cushman & Wakefield

www.rejournals.com

By Brandi Smith

Chicago’s construction market is living in two realities at once. Developers are chasing some of the biggest adaptive reuse and infrastructure projects the city has seen in years while also struggling to get deals financed in an era of high interest rates and volatile costs. Optimism is there, but it comes with caveats.

“Our opportunities in 2025 compared to 2024 are up about 50 percent,” said Damian Eallonardo, regional president of W.E. O’Neil’s Chicago and Texas divisions. “We’re pretty bullish on opportunities in Chicago compared to last year.”

Not everyone is quite as upbeat.

“Commercial construction in recent years has been robust and we enjoyed the benefits of the growth in construction, but recently due to interest rates and the uncertainty of taxes, tariffs and the economy things slowed down drastically,” said Sandya Dandamudi, president of GI Stone. “Currently we are still on a hold pattern, but things seem to be loosening up a bit.”

While office construction remains “pretty dead,” according to Eallonardo, other asset classes are carrying the market.

“Multifamily, retail and industrial are all seeing robust activity,” he said. “The most robust area we’re seeing right now is adaptive reuse: the redevelopment of existing building inventory in Chicago.”

Hospitality upgrades and office-to-residential conversions are top drivers.

“What’s driving this is need,” Dandamudi said. “Hotels need to update and there is still a strong demand for residential units. I believe the current vacancy rate is 1.5 percent, which is one of the lowest in recent times.”

Major projects show the momentum. W.E. O’Neil in a joint venture with GMA Construction is working with the development team of Riverside Investment & Development, Amtrust Realty and DL3 Realty to renovate 135 South LaSalle, also known as the Field Building, in a conversion that will deliver more than 700,000 square feet of residential space, both market-rate and affordable. The firm is also teaming with Clark Construction on a three-year overhaul of O’Hare International Airport’s Terminal 3.

On the horizon for GI Stone are projects like The 78, new stadiums for the Chicago Fire and Bears, Bally’s Casino, and expansions tied to Moody Bible Institute, the South Side, Fulton Market and River North.

Opportunities may be growing, but translating them into groundbreakings is tougher than ever.

“Interest rates, financial conditions and rising construction costs are affecting project feasibility as these pro formas are done a couple of years ahead of project commencement and that’s how loans are secured, so rising costs that are out of normal margins means financ-

ing is lost and it’s back to the drawing board,” Dandamudi said.

“Union wages in Chicago make the cost of labor predictable, which is not the case in some other regions,” added Eallonardo. “The real challenge here is capital and financing.”

Dandamudi noted that uncertainty itself may be the bigger risk. Tariffs in particular have an

outsized impact on specialty contractors like GI Stone.

“It is difficult to bid projects when the needle keeps moving,” Dandamudi said. “We recently lost a project because additional 25 percent tariffs were imposed on the very day we were prepared to make a deal and that fell through.”

The volatility creates opportunities for bad actors.

“When there is uncertainty and chaos there is also predatory pricing,” Dandamudi said. “I caution our industry to be more mindful of these concerns.”

Public incentives are playing a bigger role in getting projects off the ground, according to Eallonardo, who pointed out that even complex deals can pencil out when city support is in play.

“When the city inserts funding or guarantees, it changes everything,” Eallonardo said. “That’s what allows developers to get their head around deals and make them work.”

Contractors are also leaning on innovation to keep projects feasible.

“We can’t be caught sleeping at the wheel,” Dandamudi said. “For example, we can pair stone with other materials – lower cost stones or manmade materials – to achieve the desired aesthetic at a lower price point. Creative solutions like this can help to alleviate some of the hit we’re taking with new tariffs.”

Despite the challenges, Dandamudi and Eallonardo agree that the fundamentals of the market remain strong.

“It’s certainly slowed down a little bit, but it’s better than it was — and that’s a positive,” Eallonardo said.

Dandamudi argued that the city’s story is less about fundamentals and more about how it markets itself to investors.

“Chicago is a stable market and while I believe that Chicago needs to change its narrative to attract outside money, we have the demand and we have the skills,” she said. “Unless something crazy happens we will soon be building robustly again.”

For now, Chicago’s construction scene is defined by tension: projects are ready, but financing remains tight and costs unpredictable. Firms that can adapt through creativity, incentives and careful risk management will be the ones still standing when the cycle turns.

By Brandi Smith

Chicago’s apartment market is running hot — just not in the way developers would like. Demand is outpacing supply, rents are climbing faster than in many Sunbelt cities and occupancy remains tight. But the same conditions that should be spurring construction are running headlong into the realities of costs, taxes and policy hurdles that make new projects a tough sell.

“There’s a big undersupply of multifamily units,” said Maxwell Jacobson, vice president of development for S.R. Jacobson Development Corporation. “There’s strong occupancy, but with the undersupply of units, there’s a lot of demand out there for new units.”

Jacobson’s numbers tell the story: “deliveries are down 61 percent year over year and the pipeline is more than 50 percent below the 10-year average, but rents are up more than 5 percent in the past year.”

“The Chicago MSA is one of the highest in the country in terms of rent growth,” Jacobson said.

“It’s been in the top three the past year.”

Recent stability has eased some of the anxiety generated over the past few years.

“You had this period after COVID between ’22 and ’24 where interest rates rose and were just overall volatile and it kills confidence in buying buildings,” said Andy Friedman, partner with Kiser Group. “Whereas today you’ve got the five-year treasury sticking under 4 percent and very high odds of a rate cut in September, so the interest rate backdrop is far better than it was.”

“I’m starting to sense that people are realizing that we’ve likely hit the peak of the interest rate environment,” said Max Grossman, director at Interra Realty. “Rate changes will be slow and steady, but they should be moving in the real estate community’s favor. I think that the marketplace is going to see more transaction

volume toward the end of this year into next year as things have really normalized.”

Even as financing conditions improve, local tax policy has become the bigger sticking point. Reassessments in 2024 lifted multifamily valuations, increasing tax burdens and shaking underwriting models.

“A city government that isn’t hostile towards property owners, specifically apartment owners, would spur more building,” Friedman said.

He pointed to mandates tied to rezonings as another obstacle.

“Any multifamily development that requires re-zoning mandates that 20% of the units must be kept affordable. You can buy units out of that requirement but If you keep 15 percent of them affordable you get a tax break,” Friedman said. “If not for that, you might have killed any new construction at all. Add in the fact that you have a good deal of anti-development aldermen

that scale back or outright block development and the result is a city where very little multifamily supply comes online.”

Still, new programs are helping shape some segments of the market. Cook County’s Affordable Housing Special Assessment, which lowers assessed value for qualifying projects, is beginning to make a dent in neighborhoods on the south and west side.

“It’s a strong incentive and I have no doubt that it’ll be something that will be thought about and discussed for every deal going forward for at least the near term,” Grossman said. “That reduction in taxes is freeing up a lot of cash flow, increasing revenues and that’s a strong positive across the board.”

The city’s additional dwelling unit program also has promise, Grossman said, though bureaucracy slows momentum.

“There’s a reason no one talks about how it’s easy to work with the city to do a lot of these projects,” Grossman said. “Just to get a lot of this stuff off the ground can take months. If we could find some way to just be more real estate friendly and not have as much red tape, I think that would be encouraging.”

While obstacles dominate the conversation downtown, neighborhood-level activity is a bright spot. Grossman highlighted projects such as Thrive Exchange in South Shore, Lawndale Redefined in North Lawndale and United Yards in Back of the Yards as proof that transformative development is possible when public and private capital align.

“There’s probably as much excitement about the quantum computing campus as there’s been in quite some time just knowing the job growth and economic engine that’s going to be on the South Side,” Grossman said. “Honestly, we’re in a very transformative time in terms of new development.”

Developers like Jacobson are looking outward, finding fewer hurdles and plenty of demand in the suburbs.

“The reason why we like the suburbs is they have the schools, the easy commute with the Metra system and the lifestyle people enjoy,” Jacobson said. “One strong driver for our rental commu-

nities that we’re seeing is amenities, which you don’t get when you buy a single-family house.”

His firm’s Orland Park project billed as Orland Ridge features 294 build-to-rent townhomes and ranch villas anchored by a clubhouse featuring a pool, gym, pickleball courts and a dog park. That, Jacobson said, reflects what suburban renters are willing to pay for.

“We find that’s a big driver for us and people really appreciate that,” Jacobson said.

Despite the headwinds, long-term investors see Chicago’s fundamentals as an advantage. Unlike Sunbelt markets, where supply surges have cooled rent growth, Chicago’s tight pipeline is propping up values.

“In Chicago there’s no fear that you might buy a building and within the next two years any meaningful amount of new units are added in your vicinity,” Friedman said. “It is just simple supply and demand. So if demand keeps growing and supply stays the same, rent pricing must go up.”

“Looking forward, we’re confident that the marketplace is going to be healthy headed into next year,” Grossman said.

For now, Chicago’s multifamily sector remains a study in contradictions: high rent growth, strong demand, but construction gridlocked by taxes and policy. The opportunity is there if developers, investors and government can find a way to align.

By Tom Marsan

Tom Marsan is a certified snow professional who has been in the landscaping and snow removal industry for about two decades. He is an active member of ILCA and SIMA and is currently the general manager at Beverly Companies in Chicagoland.

Preparing for the snow and ice season isn’t simply a matter of hiring a plow. It’s about crafting a holistic, data-driven approach that safeguards tenants, visitors, and your bottom line. As you would expect, research shows that a property is more than 3 times as likely to have a slip and fall incident if snow is on the ground . By understanding property-specific challenges, evaluating real climatic risks, and partnering with the right vendor, you can have a stress-free winter.

Reading the Terrain: Property‑Specific Risks

Every property, whether it’s a retail center, an office park, or a multi-unit residential complex,

presents unique winter hurdles. In retail settings, high foot traffic demands almost continuous de-icing and prompt clearing of customer pathways. Meanwhile, office parks often require carefully timed plowing to coincide with morning arrivals and evening departures, preserving safe access without disrupting business flow.

Residential complexes bring their own concerns as well. Like ensuring that walkways, driveways, and emergency routes are never obstructed. In each scenario, it’s not just snow removal but snow management. Property managers are tasked with balancing plowing, hauling, salting, and targeted shoveling to maintain both safety and aesthetics.

Before the first flake falls, successful managers assess four critical dimensions. The property’s footprint, local snowfall frequency and inten-

sity, terrain features (shaded areas, corners, inclines), and logistical constraints (narrow alleys, protected landscaping).

A recent survey determined that walking in snowy or icy conditions carried a fall risk of at least 7.8 incidents per 6 miles traveled, which is roughly 32 times higher than other weather incidents. This emphasizes the importance of proactive pre-treatment (brines or liquid de-icers) and targeted attention to accumulation hotspots.

Not all snow contractors are equal. Seek vendors who offer a full suite of services for your property needs. Plowing, shoveling, de-icing, snow hauling, and pile removal might not all be needed for every property, but as portfolios grow, it’s nice to be able to stick with a consistent snow removal partner. It’s also helpful

to employ companies that use GPS-equipped fleets for transparent, verifiable service logs.

Discuss trigger points (for instance, mobilizing crews at 1 inch versus 2 inches of snowfall), and weigh contract options. A seasonal agreement can lock in costs and ensure priority response, while per-event pricing offers flexibility when winters are mild.

As a final note, don’t overlook insurance! Confirm your provider carries liability coverage for slip-and-fall claims or inadvertent property damage. Chuck with a Truck may be cheap for plowing your snow, but if he decides not to show up or damages the parking lot curbs, it can cost a fortune in the long run.

Contract Essentials and Contingency Plan ning

A robust snow removal contract balances firm commitments with needed flexibility. Include clauses for rate adjustments in anomalously severe winters, and consider multi-year agreements to protect against inflation.

At the same time, pre-season site audits like checking pavement conditions, drainage, and potential trip hazards allow you to address vulnerabilities before they become liabilities.

Equip your in-house team with clear emergency protocols and establish backup arrangements with secondary vendors to handle unexpectedly heavy storms.

Even with a contract in place, it’s crucial to stay prepared on-site. Snow contractors can sometimes miss calls or arrive understaffed, so keep shovels, portable snow blowers, and salt within easy reach for rapid touch-ups. Especially at building entrances during a storm.

Finally, successful winter management hinges on communication. Share seasonal plans and parking directives with tenants and residents well before the first storm. Provide clear schedules for when plowing and de-icing will occur.

Internally, ensure that on-site staff know how to report hazards and coordinate with contractors. And always revisit your strategy after signifi-

Building a successful business requires reliable financial support. Heartland Bank has the resources you need to lay the groundwork for success. Scan the QR code below for information regarding commercial lending.

By Dan Rafter

Union membership has always been important for workers in the construction industry. And membership might be more important today as the prices of everything from homes and groceries to healthcare and transportation continue to rise. Powerful unions are important to protect the earning power of workers.

We recently spoke with Hector Arellano, executive vice president, director – pointers, cleaners and caulkers with Administrative District Council 1 of Illinois of the International Union of Bricklayers and Allied Craftworkers. We spoke about the importance of unions, the benefits that union members receive and Arellano’s hopes for future union growth in the United States.

Here is some of what Arellano had to say.

Earlier this year, the Economic Policy In stitute reported that interest in union orga nizing was rising in the United States, with public support for unions near 60 year highs at 70%. According to the institute, 16 million workers in the United States were represented by unions in 2024, representing 11.1% of all wage and salary workers. Are you seeing an increase in interest from tuck pointers, clean ers and caulkers in union membership?

Hector Arellano: People are becoming more aware of unions and the value of belonging to a union. More people are looking for stability. They are looking for benefits that might make them feel at ease for the future. We have great retirement plans here. People want that kind of stability. We have strong health and medical plans. Workers need that.

Just look at the challenges that families face today. You can make a lot of money but one visit to the hospital can wipe out your savings. The medical plans that the unions offer can protect you from this.

What kind of benefits, in addition to the retirement and healthcare plans, does your union offer to its members?

Arellano: The Bricklayers and Allied Craftworkers union has been around for more than 150 years. We are the longest continuously existing trade union in North America. One of the things that we have demonstrated over the years is that we are a trade union that provides workers with quality training.

For each of our programs, we have a trade-specific apprenticeship that runs from two to three

Photo credit 400tmax.

“In the Chicagoland area, we have more than 1,200 members active with the pointers, cleaners and caulkers section.”

years, an apprenticeship that you take before you become a journeyman. And the training isn’t just in your craft. We offer safety training, too. We want to make sure that our members and the public are safe out there. With a lot of the work that we do, if you are not safe about it, you could endanger the public. We make sure our members are up on all OSHA and other standards to make sure the public and our members are safe.

For the pointers, cleaners and caulkers, we are involved in the restoration and refurbishing

of buildings, including those in downtown Chicago. We want to make sure our members understand how to keep the facades of the buildings in safe condition. That’s important in a crowded, dense area like downtown.

How strong are your membership numbers today?

Arellano: In the Chicagoland area, we have more than 1,200 members active with the pointers, cleaners and caulkers section. That is a stable number. That is what the market is

supporting. We might get people who retire. If we do, we will bring in more people. If the market gets overheated and creates bigger demand, we’ll try to bring in more people. We always have an open-door policy for people who want to apply for our apprenticeships.

Our apprenticeships are free. The education and training we provide is at no cost to the members. When they leave training, they don’t walk out with a bill. They walk away with a profession and trade that they can use for the rest of their lives.

Are you seeing higher demand from people who want to get into the trades?

Arellano: We are seeing more young professionals who want to transition back into the trades. They see a lack of work or benefits in the professional sector. Then they see the benefits that we offer, a pension and the health and welfare benefits. That pension component is a great attraction for our members. As prices go up and the economy changes, Social Security is not enough to sustain a person. A pension is very important to have.

Then there are the safety classes we offer. We are continually upgrading these classes as new techniques come to our professions, as our members face new city codes. It’s a continuous education that our members must commit to in these industries.

Do building owners and managers under stand how important well trained construc tion workers are to their properties?

Arellano: These buildings will always need maintenance. They need qualified workers to maintain them. The demand for these trades is going to be there under good or bad economies. We will always need these tradespeople to maintain these buildings.

The need for restoration is always going to be there, too. That is why unions like ours are important. Building managers and architects understand that a well-trained workforce is crucial. You can’t just put anybody up there on these buildings. If someone doesn’t do the repairs correctly or up to code, it could be dangerous. No one wants to get sued. Everyone wants to make sure that their buildings are in good shape. That is why it is so important to have a well-trained, safety-oriented workforce.

“Honestly, they are all performing well, including leasing activity,” Hendrick said. “Which isn’t to say that owners aren’t being careful planning capital expenditures, but assets that aren’t over-leveraged are cash flowing.”

Medical office has been the star of that mix.

“I believe that’s due to a growing population of aging people who need out-patient services as well as a greater demand for mental health services across all age groups,” Hendrick said. “I’d add that flex industrial or retail that can accommodate wellness/fitness tenants would be a close second.”

Daniel’s firm has leaned into building community through amenities like rooftop decks and green spaces, but he believes their value comes when they’re activated.

“It’s not just about building a rooftop deck or green space, but activating it with fitness classes and events that create real community,” he said, adding, “Resident satisfaction really comes down to good old customer service — responding to requests, answering questions and making people feel comfortable.”

Hendrick agrees on the importance of personal service, even as technology transforms operations.

“AI capabilities included in software such as Lease Abstraction, property management software platforms and accounting software is creating greater efficiencies for property management professionals,” she said, noting that she sees these tools as time savers, not replacements. “I’m mindful that it doesn’t take away from our ‘personal touch’, hands-on oversight and relationship building but it does take away

the time spent on repetitive and mundane tasks.”

The rapid evolution of technology can be difficult to keep up with, Hendrick admits, noting the abundance of new and enhanced software packages and smart devices that can be deployed.

“All these changes can be a time drain when deciding which tool is the right one to implement and subsequently the training of employees, vendors, tenants to utilize them — not to mention the time spent on the integration of the systems,”

Hendrick said. “It all takes much longer than originally expected!”

For Daniel, technology is also about protection. Fraud prevention has become a growing issue, and his team has invested in AI tools that scan IDs and bank statements to flag problems early.

“It only takes a couple of bad actors to create big problems,” he said.

Automation has further reduced repetitive work, freeing staff to focus on strategy — a shift he argues boosts both efficiency and morale.

Both executives point to data as another double-edged sword. Done right, it helps owners make fast, informed decisions. Handled poorly, it overwhelms.

“Looking at the right data is critical, but just as important is presenting it well,” Daniel said. “We use concise dashboards and narratives instead of dumping raw reports on owners.”

“There is a vast amount of data available to the point where it can delay decision making,” Hendrick said. “Our job as property managers is to summarize the data, give owners accessibility to dashboards and other analytical tools that support decision making to guide and simplify their critical decisions.”

The road forward isn’t all smooth. For Daniel, rising costs and tight supply mean growth depends less on new development and more on capturing market share. Hendrick points to economic uncertainty — “tariffs, inflation, increased vacancies and asset obsolesce” — as another hurdle. And then there are the capital markets.

“It’s no secret that this post-Covid era has led to tightened lending options, which puts stress on owners and has led to loans defaulting or going to special servicing and properties being under more scrutiny,” Hendrick said. “While there are signs the capital markets are opening up for some asset classes, a lot of the properties are in distress right now. All of that has to work its way through the system (foreclosure, bought and adaptive re-use or some other plan to be executed) and then the next real estate cycle will begin.”

Even in a market that can feel more obstacle course than smooth path, both leaders stress that opportunity remains. Daniel points to projects like Aloft in Glenview, The Archer in Chicago’s Gold Coast and Novu in Niles as examples of successful repositioning. His firm has also started expanding outside the region with new assignments in Dallas.

“In my 35 years in commercial real estate, these past five years have been the most

challenging of times; however, it can also be a time of great opportunity,” Hendrick said. “We all need to think outside the box and be tenacious in our pursuit of the highest and best use of the assets we lease and manage.”

If one lesson stands out from today’s property management environment, it’s that resilience alone isn’t enough. Chicago firms are learning that adaptability — marrying tech efficiency with hands-on service — is the real key to staying competitive. For

Daniel and Hendrick, success comes down to this: keep tenants and owners confident, no matter how volatile the market becomes.

By Neil Bouhan

Although the vacancy rate in Chicago’s downtown and suburban office markets rose slightly in the second quarter, continued sales and new leases suggest a market that’s continuing to find balance and healthier than some might realize based on recent headlines.

As detailed in Bradford Allen’s newly released research reports, “Q2/25 Office Market Report: Downtown Chicago” and “Mid-Year 2025 Office Market Report: Suburban Chicago,” the CBD vacancy rate rose to 24.7%, up from 23.4% in the first quarter, and average gross asking rates declined to $41.54 from $42.56 in the same period. Meanwhile, the suburban vacancy rate reached 25.1%, up from 24.6% at the end of 2024, and gross asking rents declined

to $24 per square foot from $27.53 per square foot at the end of 2024.

Still, companies continued to sign large leases and investors acquired more distressed and obsolete properties, whether to recapitalize or convert to new uses. Move-in-ready office suites, which comprise built-out and speculative spaces, remained popular, accounting for almost one-third of downtown leases and more than a third of suburban leases. Those between 3,000 and 12,000 square feet are leasing the fastest.

As conversions take obsolete product off the market and distressed properties find new owners and tenants, vacancy will decline further and better reflect current market conditions, according to Bradford Allen’s in-house research team.

“Well-capitalized landlords with no debt and the ability to provide updated, built-out space in Class A buildings are doing well in this market,” said Dan Fernitz, executive managing director and suburban market leader for Bradford Allen. “In the suburbs, there has been historic opportunity for companies to get into top space, to the point where Class A space is now getting harder to find. The market has evolved since the pandemic and will continue to do so.”

Tenants signed approximately 1.9 million square feet of leases in downtown Chicago in the second quarter, with about half of that in the West Loop. Golub Capital’s 205,450-squarefoot lease at 225 W. Randolph St. was the quar-

ter’s largest. Throughout downtown, direct net absorption was negative 1.5 million square feet for the quarter, making second-quarter 2025 among the weakest periods for overall demand since first-quarter 2024.

Investment sales totaled $118.3 million in the second quarter, down from $156.7 million in the first quarter, a 24.5% decrease. Kohan Retail Investment Group’s purchase of 311 S. Wacker Drive for $45 million was the quarter’s largest investment deal. The purchase price equated to $34 per square foot, down significantly from the $230 per square foot paid in 2014 but a low enough basis for the new owners, who are considering converting some of the office space into a hotel, to pursue a strategic repositioning.

Other conversion deals are expected to add a combined total of 734 residential units to the market, including:

• The Primera Group secured $67 million in TIF funding to convert 105 W. Adams St. into 400 residential units.

• WindWave Real Estate and Path Construction bought a portion of 111 W. Illinois St. for $17 million for conversion into 153 residential units.

• Concord Capital bought 223 W. Erie St. for $6.85 million and plans to convert it into 66 residential units.

Additional conversion projects announced were 1500 N. Halsted St. near Goose Island (31 units) and 309 W. Washington St. (84 units).

Suburban office leasing activity was 2.9 million square feet at mid-year, ahead of the pace for 2024, which saw a total of 5.7 million square feet. Net absorption was negative 5,639 square feet, an improvement over the net negative 770,000 square feet of absorption in the first half of last year.

Investment sales totaled $121 million through June, well below the pace for last year, when $368 million in sales were recorded at year-end.

Market conditions continue to present opportunities for patient capital looking to acquire quality assets in prime suburban locations, according to Bradford Allen. For example, GTZ Properties acquired the 327,000-square-foot Oak Brook Office Center for just under $9 million, a significant discount from the 2013 purchase price of $33 million. GTZ plans to

“In the suburbs, there has been historic opportunity ... The market has evolved since the pandemic and will continue to do so.”

maintain 100,000 square feet of upgraded office space while exploring retail and entertainment conversions for the remainder of the property, located about 3 miles from the Oakbrook Center mall.

Fortune Brands Innovations leased two of three buildings at 1 Horizon Way in Deerfield, the

former Horizon Therapeutics campus. The deal was backed by Illinois EDGE tax credits in exchange for creating 400 new jobs by late 2027. Vantive, the kidney care spinout from Baxter International, took 390,000 square feet at 510 Lake Cook Road in Deerfield, bringing 200 employees and 50 new jobs to the former Caterpillar site.

Principle Construction Breaks Ground on State-of-the-Art Facility in Bedford Park. We’re building a 140,000 sq ft

Class A industrial building at 65th & Laramie, featuring 36-foot clear height, 14 docks, and 2 drive-in doors. This six-acre site, part of Bridge Industrial’s Midway Airport Business District, will also include ample power, ESFR sprinkler system, enhanced office facades, and 120 parking spaces.

Principle Construction is proud to deliver this cutting-edge project, revitalizing Chicago’s Midway Airport area.

9450 West Bryn Mawr Avenue

Suite #120 • Rosemont, IL 60018 (847) 615-1515

By Elbert Walters III, Executive Director, Powering Chicago

The City of Chicago recently celebrated a major sustainability achievement as all of its municipal buildings are now powered by clean energy.

As Chicagoland accelerates its transition to renewable energy, this progress brings significant opportunities for a greener future while also introducing new challenges, namely in workplace safety and regulatory compliance. It’s up to local government officials and village trustees to ensure that critical energy infrastructure updates are handled safely and responsibly.

According to the National Fire Protection Association (NFPA), electrical distribution, lighting, and power transfer contributed to the second leading cause of structure fires in the industrial and manufacturing setting. Prioritizing safety in electrical work is essential not only to prevent fires but also to safeguard workers. Highlighting the importance of workplace safety, the National Fire Protection Association recently upgraded NFPA 70B from recommended guidelines to the Standard

for Electrical Equipment Maintenance to help protect workers from electrical hazards. All this serves as a stark reminder that as we push for technological advancement, we must never compromise on safety.

The key to navigating this complex landscape lies in partnering with experienced electrical contractors who understand the intricacies of cutting-edge technology and time-tested safety practices. Qualified contractors bring not just technical expertise but a comprehensive understanding of local electrical codes, permit processes, and inspection requirements.

Establishing a long-term service and maintenance relationship with a reputable electrical contractor offers multiple benefits. It ensures consistent quality of work, proactive identification of potential issues, and swift resolution of any problems that may arise. This approach not only enhances safety but also proves cost-effective in the long run. That’s because proper preventative maintenance can extend the life of electrical systems, representing significant savings for municipalities and taxpayers alike.

For local government officials, the stakes are high. An accident or compliance issue during a renewable energy project can have far-reaching consequences, from public safety concerns to financial implications and damage to public trust. By partnering with a qualified contractor, you gain access to a wealth of experience in

handling complex projects, navigating regulatory landscapes, and maintaining the highest safety standards.

As we stand on the cusp of a green energy revolution, the decisions made today will shape the safety and efficiency of our electrical infrastructure for decades to come. By choosing to work with experienced professionals who understand the importance of both innovation and safety, you’re not just avoiding potential pitfalls – you’re actively investing in the long-term well-being and prosperity of your communities.

Safety and compliance must guide Chicagoland’s transition to renewable energy. As you consider your options for upcoming renewable energy projects, remember that the true measure of success lies not just in the technology implemented, but in the safety, reliability, and longevity of the installation. Powering Chicago and its member contractors stand ready to partner with you in this crucial endeavor, ensuring that our path to a greener future is paved with safety.

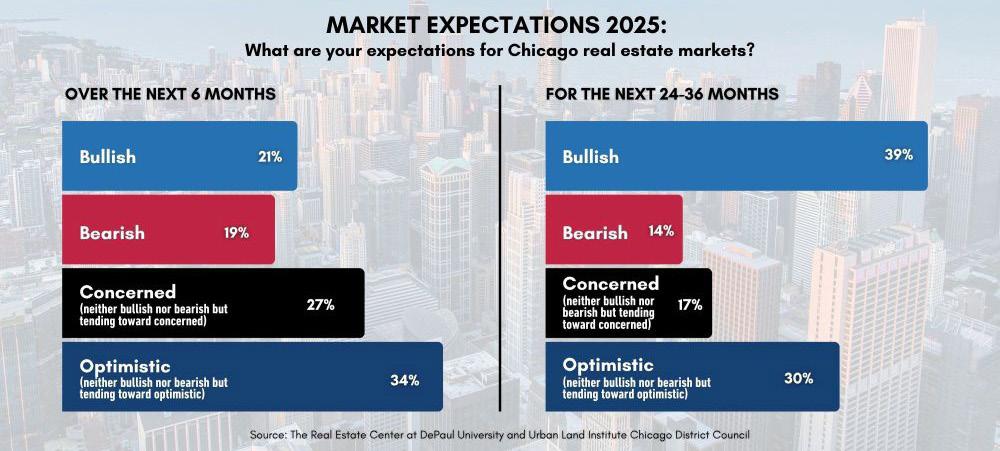

By The Real Estate Center at DePaul University

The perceived investment strength of industrial segments in the Chicago market was down in 2025 compared to previous years as the perceived impact of tariffs is stronger in that segment than many others.

This further speaks to a level of parity in the Chicago real estate market, according to the recently released Chicago Mid-Year Sentiment report from the Real Estate Center at DePaul University.

Data centers, a recent investment darling, led the 2025 rankings, scoring a 3.83. But in 2024, data centers led all other choices with a score of 4.25. industrial, a perennial favorite, dropped from 3.7 to 3.5 and slipped to fifth place behind downtown multifamily.

While the clear interpretation is there are no longer any slam dunks for investors, the 2025 Chicago Mid-Year Sentiment Report by the Real Estate Center at DePaul University in collaboration with ULI Chicago found the Chicago industrial marketplace remains strong, locally and nationally.

Emi Adachi, Heitman, said one of the compelling storylines is how strong fundamentals are in the Chicago market.

“Chicago is outperforming the national averages in the industrial market,” Adachi said. “That continues to be a real positive for Chicago.”

Fundamentals keep local market strong

Among the reasons for the sector’s strength in Chicago as well as across much of the country is the fact that while new supply has been elevated over the past few years, speculative development has not been excessive to the point of tremendous overbuilding.

Laura Hyde, Managing Director of Investments, Central Region, Link Logistics, says the broader industrial market enjoys a healthier position compared to some coastal markets, a position that was evident even before tariffs entered the equation.

“The dynamics on the ground feel really positive,” she said. “There are opportunities for an attractive basis, strong yields and runway to grow.”

She also noted that average rents continue to escalate, at least for now. That is not to say that the macroeconomic backdrop is not impacting current market conditions. Perhaps more than most sectors, tariffs are impacting the industrial sector, at least until there is more data and direction on their impact.

“We’ve seen decision-making uncertainty,” Hyde acknowledged. “Tenants aren’t backing out of deals, but they are delaying decisions. That could set the market up for a strong third and fourth quarter of activity.”

Just as the pandemic mandated a change to supply chain strategies, tariffs could have the same

impact. For example, if tariffs result in a greater level of onshoring by US companies it may be good for industrial demand. Many tenants, depending on their size and line of business, are assessing what’s best for their inventories and supply chains with some contemplating stockpiling products and materials to avoid negative consequences of the tariffs.

On balance, industry professionals are bullish on Chicago industrial in the long run. Still, Hyde cautions, much remains to be seen about the level and impact of tariffs.

Because of the size and geographic diversity of the Chicago marketplace, it’s hard to paint a broad-brush picture of the sector. Different markets and submarkets cater to different users many of whom have distinct leasing requirements.

Link’s Hyde noted that in the 100,000 to 200,000-square-foot range, the I-55 market has softened, despite its historical appeal to bulk distribution users. At the same time, the market for space less than 100,000 square feet has been strong with those tenants, that typically are more locally focused.

Notably investment activity is also picking up in Chicago for the $3 billion national industrial outdoor storage segment.

Tom Barbera, CEO, Industrial Outdoor Ventures, described Chicago’s IOS market as strong with low vacancy, robust tenant demand and narrowing bid-ask spreads, particularly when compared to coastal markets. Like the broader industrial market, pricing in the IOS sector— rental rates and sale prices—have held up better in Chicago than in tier-one coastal markets that have experienced more dramatic peaks and subsequent declines.

“The current trajectory of investment in IOS exceeds expectations,” Barbera said. “It’s exciting to see the sector gain scale and credibility.”

He noted that the sector’s increasing popularity is also evident in the debt markets. It has been

buoyed, nationally and in Chicago, by increasing institutionalization. Barbera, one of the early investors in the space, isn’t surprised by its growing popularity.

“An increasing number of lenders are entering the space, as debt tends to follow equity,” Barbera said. “Although debt sources are not as abundant for IOS properties as for generic industrial properties, debt is available, especially for experienced operators.”

But here too, the outcome of tariff negotiations is a significant concern.

“My greatest concern for potential setbacks in the marketplace is a negative outcome in tariff negotiations which could lead to a recession,” Barbera said. “However, I am optimistic that a favorable outcome can be reached.”

The surge taking place, nationally and in Chicago, is attributed to the rapid rise of AI, high-performance computing and cloud services. While exciting announcements such as CRG/Related Midwest’s Quantum project provide headlines, there is a lot of activity region wide:

• Estates, Compass Datacenters is transforming the former 200-acre Sears headquarter campus into a five-building data center campus development.

• CyrusOne is developing a 230-acre complex in Yorkville, and

• Microsoft acquired a 500-plus acre site for a new development in Plano.

Despite impressive activity, the data center segment in Chicago and Illinois is at a crossroads, and an imbalance between land sites with reliable access to power and outdated legislation.

The Biometric Information Privacy Act (BIPA) is creating real hesitation. Some suggest that

if the state doesn’t modernize its laws, it risks losing out on the enormous capital investment, innovation, and job creation potential.

“Some argue the sector is overhyped and overbuilt. I disagree,” said Shawn Clark, CEO, CRG. “I believe AI adoption is progressing faster than most people realize, and the demand for computing, storage and additional use cases will continue to accelerate over the long term.”

Chicago has been a key market for data center users thanks to its central location, access to

fiber, and strong infrastructure. “The collaboration between public entities, academia, and private industry exemplifies how states and cities can adapt and thrive in the evolving technological landscape,” Clark said. The hope is that the Quantum project will breathe new life into a site that once symbolized industrial might and is now reimagined as a hub for cutting-edge technology. Nationally, it positions Chicago as a leader in quantum research and development and is expected to attract top talent, significant investment, and innovative ideas.

One Parkview Plaza, 9th Floor

Oakbrook Terrace, Illinois 60181

Key Contacts:

Jean Zoerner-Illinois, JMZoerner@midamericagrp.com; Brad Lefkowitz-Michigan, blefkowitz@midamericagrp.com; Brandon O’ Connell-Minnesota, boconnell@midamericagrp.com; Jim Vaillancourt-Wisconsin, jvaillancourt@midamericagrp.com;

Services Provided: Mid-America provides strategic consulting services that maximize net operating income, net cash flow, and accelerate property appreciation. We provide property and construction management, leasing, due diligence, and market analysis. Additionally, we offer MA Building Services, a self-performing porter and maintenance company offering our clients cost savings and improved accountability for related services.

Company Profile: Mid-America Real Estate is #1 in retail real estate services in the Midwest, with full service offices in Illinois, Michigan, Minnesota, and Wisconsin. Our exclusive focus on retail property, combined with cutting-edge technology and unsurpassed service, distinguishes Mid-America within the industry and provides clients with a competitive edge. For more information, visit www.midamericagrp.com.

S74 W16853 Janesville Road

Muskego, WI 53150

P: 414.369.3511 | F: 414.435.0251

Website: outlookmgmt.com

Key Contact: Ray Balfanz, President/Partner, ray@outlookmgmt.com

Services Provided: Full service property and asset management services, financial analysis and reporting; budget preparation and expense reconciliations; lease administration; construction management; preventative maintenance and consulting services.

Company Profile: Outlook Management Group, LLC AMO provides comprehensive property and asset management services for all asset classes in multiple states and markets.

Notable Properties Managed: Washington Corners, Naperville, IL; Ironwood Office Park, Glendale, WI; Wood River Condominiums, West Bend, WI; Seven 10 West Luxury Apartments, Chicago, IL; MDJD Aesthetic MOB, Rockford, IL, Ascension Health MOB Milwaukee, WI; Henry Ford Health Systems Pharmacy Services Bldg. in Rochester Hills, MI; Henry Ford Medical Center in West Bloomfield, MI.

MERIDIAN DESIGN BUILD

9550 W. Higgins Road, Suite 400 Rosemont, IL 60018

P: 847.374.9200 • F: 847.374.9222

Website: meridiandb.com

Key Contact: Paul Chuma, President; Howard Green, Executive Vice President

Services Provided: Meridian Design Build provides construction and design/build construction services on a national basis with a primary focus on industrial, office, medical office, retail and food and beverage work.

Company Description: With a team of in-house professional project managers, Meridian has extensive experience coordinating the design and construction of new buildings, tenant improvements, and additions/renovations from 15,000 square feet to 1,000,000+ square feet. Meridian Design Build has been a Member of the U.S. Green Building Council since 2007.

Notable/Recent Projects: Venture Park 47, Huntley, IL - 729,800 sf speculative industrial facility for Venture One Real Estate. Lion Electric, Joliet, IL - 928,500 sf electric bus / medium duty truck assembly plant for Clarius Partners. Greenwood Truck Terminal, Greenwood, IN - 125 door truck terminal on 43 acres for Scannell Properties

PRINCIPLE CONSTRUCTION CORP.

9450 West Bryn Mawr Ave., Suite 120 Rosemont, IL 60018

P: 847.615.1515 | F: 847.615.1598

Website: pccdb.com

Key Contacts: Mark L Augustyn, COO, maugustyn@pccdb.com, James A. Brucato, President, jbrucato@pccdb.com

Services Provided: Since 1999, Principle Construction Corp. has been a leading design-build general contractor serving the industrial markets of Chicago Metro, Southern Wisconsin, and Northwest Indiana. We specialize in designing and constructing exacting solutions for our clients, including:

• Built-to-Suit Facilities • Speculative Facilities • Warehouse and Distribution Centers

• Logistics and Cross-Dock Facilities • Industrial Outdoor Storage • Industrial and Manufacturing Plant • Tenant Improvements • Expansions and Additions • Food Processing Facilities • Specialty Projects

Recently Completed Projects include:

• 8,205 SF animal shelter for Heartland Animal Shelter, at 586 Palwaukee Dr., in Wheeling, IL.

• 12,560 SF showroom and outdoor pool park for Doheny Enterprises, at 5307 Green Bay Rd., in Kenosha, WI

• Phase 1 renovation project for SMW Autoblok, at 285 Egidi Dr., Wheeling, IL

2000 Center Dr., Suite East C219 Hoffman Estates, IL 60192

P: 847.392.6900

Website: victorconstruction.com

Key Contact: Zak Schuttler, President, ZakS@victorconstruction.com

Services Provided: Victor Construction Co., Inc. manages projects from ground-up site developments to interior buildouts, specializing in retail, industrial, and commercial markets.

Company Profile: Established in 1954, Victor Construction Co., Inc. is a third generation general contractor that specializes in commercial, industrial, and retail construction. Victor Construction is known as one of the most efficient and dependable general contractors in the Chicago metropolitan area and has earned the reputation due to meticulous project management, cost-effectiveness, budget awareness, and prime first-rate workmanship. Commitment to the clients’ goals is what keeps satisfied customers returning to Victor Construction for all of their construction needs—We Build for Your Success!

Notable/Recent Projects: Owens + Minor Distribution – 600K SqFt distribution facility that involved a full LED lighting upgrade, new HVLS fans, 200K SqFt section that required new cooling for medical distribution, an office renovation of 20K SqFt, and a new exterior employee pavilion.

VILLAGE OF HOMER GLEN ECONOMIC DEVELOPMENT

14240 W. 151st Street Homer Glen, IL 60491

P: 708.301.0632

Website: HomerGlenIL.org

Key Contact: Janie Patch, Economic Development Director, jpatch@homerglenil.org

Services: Resource center for brokers, developers, site selectors and businesses providing space and property inventory, trade area demographics, site selection assistance, custom tours, coordination through entitlement process, business opening process guidance and retention services.

Demographic Info: Strategic Will County location 25 miles southwest of Chicago with two I-355 interchanges between I-55 and I-80. Average household income of $154,800. Trade area population of 83,000. Prime commercial corridors include Bell Road, 143rd Street and 159th Street (State Route 7). 159th Street is improved with 4 lanes and access to Lake Michigan water and sanitary sewer.

Recent CRE Activity: The Villas of Old Oak (46 ranch duplexes) completing full build out. New food specialty and restaurant openings include South Viet, OneZo Boba Tea, Sultan Sweets and Cervantino’s. Restaurant with drive-thru position available at Homer Glen Bell Plaza with Pet Supplies Plus, Dollar Tree and Taco Bell, SWC 143rd/Bell.

ECONOMIC DEVELOPMENT CORPORATION

OF MICHIGAN CITY

Two Cadence Park Plaza

Michigan City, IN 46360

P: 219.873.1211

Website: www.edcmc.com

Key Contacts: Clarence Hulse, Executive Director, chulse@edcmc.com

Karaline Cartagena Edwards, Economic Development Manager, kcedwards@edcmc.com

Services/Demographic Info: Up-to-date inventory of commercial buildings, site selection and orientation tours

Incentives: Tax-Increment Financing, Façade Improvement Grants, Property Tax Abatements, Enterprise Zones, Job Training Programs

Recent CRE Activity: Double Track Northwest Indiana: $1.6 Billion development reducing train travel to Chicago to 60 minutes; The Franklin at 11th St. Station: $100 Million Development with Residential & Retail Space; “You are Beautiful”/ SoLa: $311 Million Mixed-Use Multi-Family Development with 235 boutique hotel rooms & 174 Luxury Condos; Burn ‘Em Brewing: $3 Million Expansion project with 30 new jobs.

DEIGAN & ASSOCIATES, PLLC

28835 N. Herky Drive Lake Bluff, IL 60044

P: 847.682.7381

Website: http://www.deiganassociates.com

Key Contact: Michele Brady, Director Business Development & Real Estate Services, mbrady@deiganassociates.com

Services Provided: The Deigan Group provides client responsive, results oriented environmental consulting and remediation services, with a focus in land-based work, including Brownfield Redevelopment, Power Plant Decommissioning/Redevelopment, Strategic Environmental Planning, Property Assessments and Site Remediation, Compliance/Permitting, Employee Exposure Testing/Safety Monitoring Asbestos Surveys/Mold/Indoor Air Quality, Waste Minimization/ Recycling/ Sustainability Plans, Successful Grant Writing. Company Profile: A full-service environmental consulting organization specializing in defining environmental business risk and removing environmental uncertainties for property development sites. Our wide range of experience within the environmental industry helps us provide realistic cost-saving strategies for our clients with the goal of reducing their overall environmental liability and obstacles to redevelopment.

MARQUETTE BANK

1628 W. Irving Park Road, Unit 1D Chicago, IL 60613

P: 708.873.8639

Website: emarquettebank.com

Key Contact: Patrick Tuohy, Senior Vice President, ptuohy@emarquettebank.com

Services Provided: Multifamily/apartment building lending for all Chicagoland. Fast, local decision making. Dedicated local servicing staff. Simple, no-hassle paperwork. Quick close. Flexible terms. All clients enjoy ZRent – an automated, hassle-free, nocost way to collect monthly payments from tenants.

Company Profile: Marquette Bank has 20 branches, loan office and $2 billion in assets. Independently owned/operated since 1945. Offering clients full-service, banking, financing, insurance, trust and wealth management services.

REINHART BOERNER VAN DEUREN S.C.

1000 N Water Street, Suite 1700 Milwaukee, WI 53202

P: 414.298.1000

Website: reinhartlaw.com

Key Contact: Joseph Shumow, Shareholder, jshumow@reinhartlaw.com

Services Provided: Reinhart is a full-service, business-oriented law firm that delivers innovative, value-added solutions for today’s most important real estate needs, including land use and zoning; tax-incremental financing; tax credits; leasing; construction; and condemnation and eminent domain issues.

Company Profile: With the largest real estate practice in Wisconsin and offices throughout the Midwest and across the country, Reinhart’s attorneys offer clients customized real estate insight rooted in broad knowledge and deep experience to help you capitalize on opportunities no matter where you do business.

100 N. LaSalle St., 10th Floor Chicago, IL 60602

P: 312.782.8310

Website: sarnoffpropertytax.com

Key Contact: James Sarnoff, jsarnoff@sarnoffpropertytax.com P: 312.448.5337

Services Provided: Since 1986, Sarnoff Property Tax has been a leading and recognized law firm concentrating solely in the field of property taxation. We help client’s secure favorable taxes in Illinois through property tax appeals, incentives and consulting.

Company Profile: Sarnoff Property Tax’s clients include Owners, Developers, Managers, REIT’s, Fortune 500 Companies, Private Equity Firms, etc., in connection with commercial property, high-rise and low-rise apartment buildings, condominium associations and single-family home portfolios.

180 North LaSalle Street, Suite 3010 Chicago, IL 60601

P: 312.917.2307 P: 312.917.2312 | F: 312.596.6412

Website: wvproptax.com

Key Contacts: Francis W. O’Malley, Managing Partner fomalley@wvproptax.com; Jessica L. MacLean, Partner jmaclean@wvproptax.com

Services Provided: Worsek & Vihon, LLP represents tax payers in Illinois by limiting their property tax liabilities through ad valorem appeals. We have over 40 years of experience and can handle basic to the most complex assessment issues while offering the dependable, personalized attention our clients deserve. We have experience representing owners of all property types. In addition to filing thousands of appeals with the Cook County Assessor, we have been involved in numerous proceedings before various Boards of Review, the Illinois Property Tax Appeal Board, and the Circuit Court of Illinois, and have appeared before the Illinois Appellate and Supreme Courts. Company Profile: Worsek & Vihon LLP, is a team of experienced attorneys singularly focused on real estate tax law. The firm is dedicated to minimizing property tax liabilities through strategic tax portfolio management, well-researched, creative appeal preparation and aggressive advocacy.