(pg 18):

©2025

(pg 18):

©2025

By Brandi Smith

The largest recent industrial lease in Chicago didn’t happen in an urban infill market — it happened along I-80. The 1.2 million-squarefoot building in Plainfield, developed by DHL’s real estate group and taken by RJW Logistics before completion, reflects the corridor’s ongoing evolution. Even as national developers pause in other regions, users here are still committing to scale. Momentum has held firm in a market that’s seen nearly every kind of disruption over the past two years including tariffs, rate hikes and supply chain recalibration.

“User activity has been erratic this year as users have navigated a complicated macro-economic landscape,” said Terry Grapenthin, principal with Lee & Associates. “A variety of tariffs and their associated impacts, cost of capital in the event of a relocation and the proposed Fed reduction of the interest rates are just a few of the factors adding to the general uncertainty.”

That caution, said Ryan Earley, principal with Lee & Associates, has kept many tenants focused on renewal instead of relocation.

“Users and investors still have confidence in the overall market and the forward-looking economy, yet decision making is slower and conservative compared to prior years, with many tenants avoiding relocations and the associated capital cost,” Earley said.

For landlords, that pause has translated into more renewals and longer-term commitments — signs of faith in the market’s fundamentals even as money becomes more expensive.

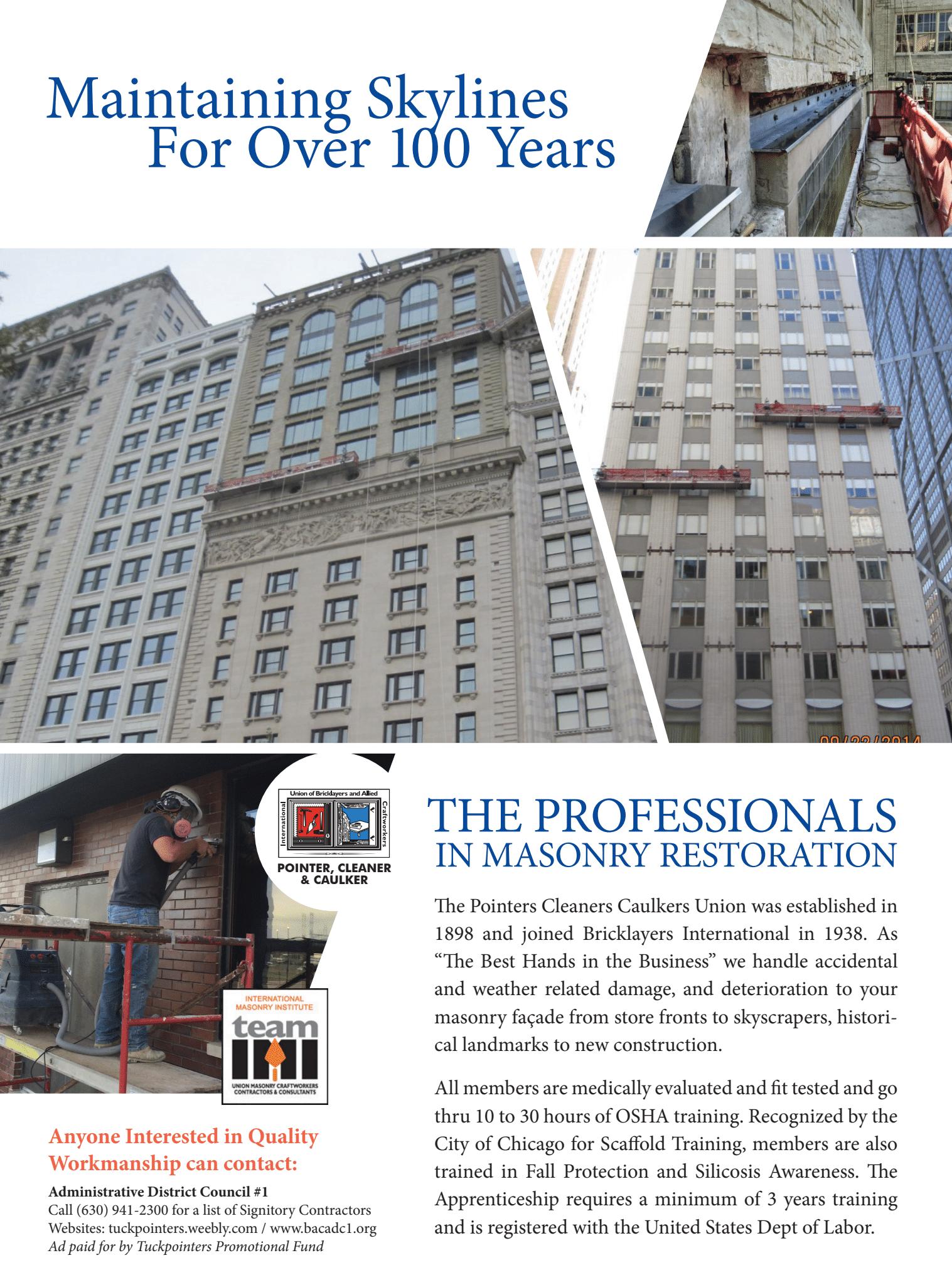

CHARLES PLAZA HOFFMAN ESTATES

PALATINE

Located on Palatine Road join Starbucks, Jewel Osco, Lou Malnati’s and ATI Physical Therapy in the premier community of Hoffman Estates. High visibility for both local and commuter traffic. AVAILABLE

1,275 sq. ft. SALON

3,368 sq. ft. INLINE 2,250 sq. ft. OUTLOT

CRYSTAL LAKE

The central location and visibility of this 137,187 sq. ft. shopping center appeals to Tenants including: Ace Hardware, Pete & Mac’s Pet Resort, Dollar Tree, Sherwin Williams, Dairy Queen, Brown’s Chicken and Elderwerks.

1,475 -1,789 sq. ft. INLINE

NAPER RIDGE PLAZA

NAPERVILLE

This 123,600 sq. ft. center is anchored by Petco, Dollar Tree, LaRosita Fresh Market and Savers located in the heart of retail corridor of the rapidly growing community of Crystal Lake.

AVAILABLE

Established in 1985, Highland Management Associates, Inc. is proud of the high-quality, prime locations, and high-occupancy level of the fifteen properties it developed, owns and manages in Cook, DuPage, Kane, and McHenry Counties. Not Shown:

2,400 -7,600 sq. ft. INLINE 3,000 sq. ft. ENDCAP THE SHOPPES AT STONY CREEK

Rare opportunity to join area retailers, Costco, Amazon Fresh, CVS, McDonald’s, Starbucks and Fifth Third Bank. ANCHOR AND OUTLOT AVAILABLE

Sq. Ft.

PLAZA

73,116 Sq. Ft. 500 Sq. Ft. AVAILABLE

TOWER PLAZA SPRING GROVE COMING SOON 18,000 Sq. Ft. 2,500 Sq. Ft. OUTLOT

BIGGER, SMARTER, FARTHER WEST: THE NEXT CHAPTER OF I-80 INDUSTRIAL GROWTH The largest recent industrial lease in Chicago didn’t happen in an urban infill market — it happened along I-80.

RETAIL RESILIENCE: HOW CHICAGO’S STABILITY CREATES NEW INVESTMENT MOMENTUM Consumers may have traded malls for mobile apps, but in Chicago, the local strip center has never been busier.

1 14 16 18 4 8 10

AMENITY ARMS RACE: LANDLORDS DOUBLE DOWN AS TENANTS REDEFINE SUBURBAN OFFICE DEMAND The next phase of suburban Chicago’s office recovery isn’t being written in square footage or vacancy rates. It’s unfolding in fitness centers, tenant lounges and outdoor terraces.

TURF TALK: SUSTAINABLE SNOW REMOVAL STRATEGIES AZAV Snow removal keeps properties safe and accessible, but it can carry a hefty environmental price tag.

SETTING THE STANDARD: HOW TRAINING EXCELLENCE AND NFPA 70B COMPLIANCE DEFINE ELECTRICAL SAFETY In the electrical industry, safety is a core responsibility that starts well before design plans are drawn or the first wire is installed.

SUBURBAN CHICAGO OFFICE LOANS AT A CROSSROADS: WHAT BORROWERS AND LENDERS ARE DOING FIVE YEARS POST-PANDEMIC

More than five years since the pandemic sent shock waves through the office market, how are office loans faring? A shakeout continues as, after years of lower demand, some properties remain underwater and lenders address the nonperforming loans on their books. COMMERCIAL SERVICES

PUBLISHER Mark Menzies menzies@rejournals.com

EDITOR Dan Rafter drafter@rejournals.com

VICE PRESIDENT OF SALES & MW CONFERENCE SERIES MANAGER Ernie Abood eabood@rejournals.com

VICE PRESIDENT OF SALES Frank E. Biondo frank.biondo@rejournals.com

CLASSIFIED DIRECTOR

Susan Mickey smickey@rejournals.com

MARKETING & EVENTS COORDINATOR Allison Kim Allison.kim@rejournals.com

IL 60301 312.933.8559 Website: www.rejournals.com

EDITORIAL ADVISORY BOARD

ALISSA ADLER Colliers

GEORGE KOHL Savills

Jeff Krusinski Krusinski Construction Co.

RONALD C. LUNT Hamilton Partners

JOHN M. MOYSEY Avison Young

NANCY A. PACHER CBRE

JONATHAN STEIN Inland Real Estate Group

GREGORY T. WARSEK Associated Bank

CHRIS WOOD Cushman & Wakefield

By Brandi Smith

Consumers may have traded malls for mobile apps, but in Chicago, the local strip center has never been busier. From nail salons to neighborhood grocers, service-based tenants are breathing new life into an asset class many once wrote off as outdated. Across the metro area, smaller centers are full, rents are rising and investors are quietly refocusing their attention on necessity retail — the kind that anchors everyday life. In short, neighborhood retail is the city’s quiet outperformer.

According to JLL’s Q2 2025 market report, Chicago’s retail vacancy rate has fallen to a near 30-year low of 4.9 percent — down from 8.6 percent pre-pandemic — underscoring just how tight the market has become. That tightness persists even with year-to-date net absorption in the red, a paradox driven by scarce quality space and minimal new supply.

“Retail continues to be very strong, with leasing activity and renewals remaining on an elevated pace,” said Charles Margosian III, managing principal of Highland Management Associates. “With limited new development and elevated construction pricing making new development difficult to ‘pencil,’ existing

properties with availability have an advantage in the current market.”

New projects that do proceed tend to be smaller, highly pre-leased and strategically located — a sign of discipline rather than exuberance. Legacy properties, meanwhile, are benefiting from tenants who are staying put.

“It’s a very highly occupied leased market,” said Richard Tucker, CEO of Tucker Development. “Rents are stable and growing. Because of limited construction, the existing well located centers with good demographics have high occupancy and a growing income streams, which all generatesl, greater interest on the investment side.”

That interest shows up as tighter bidding for well-located centers and fewer concessions for stabilized assets. That sentiment echoes broader market performance. JLL found that more than 1.7 million square feet of negative net absorption through midyear hasn’t dented landlord leverage: investors still chase high-quality neighborhood centers because there’s so little to buy.

In Chicago’s fragmented landscape, access and demographics often make or break a deal. Tucker said his firm focuses on corridors with both density and convenience — “good traffic corridors with good access to the property.” Each of these plus drive times, daytime population and daily-needs tenants remain critical. Those fundamentals, he said, separate thriving centers from those lagging behind.

Investment, meanwhile, is catching up to a new reality. As interest rates remain elevated, capital has shifted toward properties with predictable performance rather than aggressive growth potential. Margosian noted that “the investment market is still adjusting to the new ‘normal’ of higher interest rates,” but the bid-ask spread is narrowing as sellers reset and trades clear closer to market.

“We are encouraged in that we see more deals transacting at current market price,” Margosian said.

That renewed confidence stems partly from how the definition of “retail” has evolved. E-commerce no longer replaces storefronts; it reinforces them. Click-and-collect, delivery

staging and showrooming push transactions back to the store.

“We have seen e-commerce become a complement to retail bricks and mortar instead of [the] oft-forecasted downfall with good retailers adapting their brick-and-mortar strategy to complement their online offerings,” Margosian said.

The result is a network of smaller, service-based tenants — restaurants, medical users and fitness brands — that meet daily needs and generate consistent foot traffic. These users renew more often, resist pure online substitution and create predictable cash flow.

Reliability is exactly what Tucker’s latest investment strategy is built on. While many developers chase mixed-use megaprojects, he’s leaning into the overlooked workhorses of retail: unanchored strip centers. His firm recently launched a fund to acquire what it calls “necessity-based retail centers” throughout Chicago and the Midwest.

“It’s the services, it’s food, it’s all the basics,” Tucker said. “The key now is using our 40 years of experience in retail to acquire the best cen-

ters with necessity based tenancy and durable cash flow.”

The appeal, he explained, lies in the tenant mix and tenure. Tucker said one factor that’s particularly important is the weighted average lease duration — how long tenants have actually stayed rather than how long they’re obligated to. For investors, actual tenure is a better proxy for durability than credit ratings — longevity matters more than paper credit.

“The tenants tend not to relocate,” Tucker said. “It’s not so much focused on the credit of the tenants. But it’s more about the operational history and the business.”

Because these centers are made up of smaller, locally owned spaces — often 2,000 to 4,000 square feet — vacancies have a limited ripple effect. One 2,500-square-foot move-out is a reletting exercise, not a thesis-breaker.

“If you had a few of those that happen, it doesn’t impact the portfolio like the larger boxes do,” Tucker said.

The model provides stability, diversification and an opportunity to add value through better management and leasing. Simple fixes — better parking flow, lighting, signage, patio rights — often move the needle more than capex-heavy redevelopments.

Many of these assets have been held by local families for generations and are now coming to market. Tucker called it “a very fragmented industry from the standpoint of the strip cen-

ters,” describing a wave of owners no longer interested in owning and managing their assets or lacking succession plans. That churn has opened the door for well-capitalized operators to modernize tired properties without overspending on construction.

“Construction costs are starting to stabilize, but are much higher than pre-pandemic,” Margosian said. “It makes development returns very difficult and even poses challenges to re-tenanting spaces, especially large boxes.”

Data backs that up: only about 600,000 square feet delivered through the first half of 2025, and roughly 78 percent of projects were preleased before completion — clear evidence of

developers’ caution and tenants’ commitment to physical retail.

Limited new supply, in turn, sustains rents for existing centers — keeping occupancy high and concessions modest in the best corridors.

Retail performance across categories reflects those same consumer habits. Margosian said “service and medtail seem to continue to be strong users,” while the rise of resale and consignment stores shows how younger buyers favor value and uniqueness over labels.

“We believe this trend will continue with Millennials, many of whom are motivated by ex-

periences and unique items vs. ‘brand names,’” Margosian said.

For Tucker, necessity retail isn’t just a shortterm play — it’s a cornerstone of a long-term portfolio strategy. His firm’s past developments — District 1860 in Lincolnwood and The Henry in Skokie — combine multifamily living with essential retail, reflecting how urban convenience now drives suburban design.

“We see it as an exciting place to be,” Tucker said. “It’s one of the pieces of our puzzle that we think is important, and we’re focusing on it.”

As JLL notes, the market is trending toward equilibrium as supply stays muted and occupier demand remains steady — a setup that rewards patient ownership and hands-on leasing. Despite persistent narratives about the city’s fiscal challenges, both leaders share a pragmatic optimism rooted in experience.

“The reality of Chicago vs. the perception will continue to provide opportunities for people who really know the market,” Margosian said. “Chicago remains a major metropolitan center where people want to live, work and play.”

And in that reality, the humble strip center looks less like yesterday’s format and more like tomorrow’s cash flow.

By Brandi Smith

The next phase of suburban Chicago’s office recovery isn’t being written in square footage or vacancy rates. It’s unfolding in fitness centers, tenant lounges and outdoor terraces. Across the metro’s suburban corridors, landlords are racing to reinvent aging buildings into hospitality-driven workplaces — and those who invest are winning.

After several years of contraction, new data from Avison Young and Colliers shows the market may finally be nearing equilibrium. Leasing activity has cooled, but absorption in top-tier buildings remains positive, signaling a deepening divide between properties that have modernized and those still waiting for a comeback. The fight for tenants is no longer about price; it’s about experience.

“Tenant demand is fairly soft throughout the suburban Chicago submarkets with the highest tenant demand in the Oak Brook area, as this submarket continues to be a major draw for tenants seeking Class A space around Oak-

brook Center mall,” said Fred Ishler, principal at Avison Young.

Mid America Plaza is one example of that momentum. Following a sweeping renovation that added a conference center, fitness facility, covered parking deck and on-site restaurant, the two-building complex is now 90% leased.

“This capital investment program has further enhanced the buildings’ positioning at the top of the Oak Brook area office market,” Ishler said.

Across the metro area, the “amenity arms race” is unfolding in similar ways. According to Colliers’ Q3 2025 market report, Class A buildings accounted for the majority of the year’s positive absorption, while Class B product continued to lose occupancy. The O’Hare submarket posted the lowest vacancy rate among suburban peers, while the Northwest corridor achieved its strongest absorption since before the pandemic. The common thread: tenants are gravitating toward modernized, move-in-ready spaces with strong ownership behind them.

“The flight to quality has not only persisted but also widened since the pandemic,” said Melissa Copley, vice chairman at Newmark. “Tenants are concentrating demand in well-located Class A/A+ buildings that have financial stability.”

That divide, she added, extends far beyond lobbies and landscaping.

“Premium amenity packages include collaboration spaces, such as tenant lounges with food and beverage offerings, games, attractive and comfortable seating, flat screens, and excellent connectivity,” Copley said. “Conference centers with hybrid technology are expected. Spa-like fitness and wellness centers and attractive and functional landscaped outdoor space are exciting for tenants.”

Owners without the capital to compete are being forced to make harder choices. Avison Young’s Chicago Suburban Office market Q3 report shows that while leasing volume fell year over year, absorption in Class A and A+ properties turned positive, offsetting losses in lower-quality buildings.

“Class A+ and A buildings are attracting the highest amount of tenant activity,” Ishler said. “The gap between Class A+/A and Class B buildings continues to widen. Landlords need to invest significant capital into these assets to maintain and enhance their quality, particularly because suburban Chicago office buildings tend to be older than those in other markets.”

That reality is reshaping how deals are structured. Jonathon Connor, senior vice president at Colliers, said owners willing to adapt — both operationally and financially — are finding success.

“Creativity has become critical in today’s office leasing environment,” Connor said. “Tenants have diverse needs, not just in terms of physical office space, but also with respect to financial structures. Landlords that are able to be flexible with how rental terms are structured or how concessions are allocated have been more successful in securing new leases and retaining existing tenants.”

Flexibility, Connor said, is becoming just as valuable as amenities. Rising construction costs are prompting tenants to seek longer terms and maximize concessions, often in exchange for committing to better-quality space.

“For those owners that have the patience and capital to hold or reinvest in an asset, we are optimistic that the leasing market will continue to improve and that the investment sale markets will be in a more favorable position for office buildings in 12–24 months,” Connor said.

Copley agreed that liquidity and adaptability remain key.

“Landlords that are flexible in terms of their ability to offer the needed concessions and other desired features of a tenant’s lease, such as space and term flexibility, attractive identity packages, and aggressive economics will likely do better,” Copley said.

Some suburban buildings, she added, are layering lifestyle programming into their amenity mix — from outdoor concerts and food truck events to lobby gatherings designed to foster a sense of community.

Despite uneven progress across submarkets, most brokers and researchers agree the market has stabilized. Avison Young’s latest figures show overall suburban absorption just shy of breakeven — a remarkable recovery from the

deep losses recorded a year earlier. The North and Northwest corridors lead that rebound, posting lower availability rates and steady leasing from midsized tenants. Taken together, the data and commentary suggest a selective but strengthening recovery across the region.

At the same time, capital markets activity is slowly resuming, with Colliers projecting that suburban office transactions will accelerate through early 2026 as investors recalibrate pricing expectations and pursue value-add op-

portunities. Repositioning and redevelopment are expected to play major roles in that cycle.

“Assets that lack [location or capital improvements] are increasingly exploring alternative uses or redevelopment strategies to remain viable,” Connor said.

The message across firms is clear: suburban Chicago’s office recovery is selective but strengthening. The buildings that are thriving are those that feel alive — where capital in-

vestment, amenities, and community activation intersect.

“Landlords who expect to succeed in the next 12 to 24 months need to make sure that their buildings are as up to date and as amenitized as possible,” Ishler said. “Tenants are drawn to buildings where the landlord’s capital investments are visible, current and appealing.”

In today’s suburban office landscape, survival isn’t about waiting for tenants to return — it’s about giving them a reason to stay.

By Tom Marsan

Tom Marsan is a certified snow professional who has been in the landscaping and snow removal industry for about two decades. He is an active member of ILCA and SIMA and is currently the general manager at Beverly Companies in Chicagoland.

Snow removal keeps properties safe and accessible, but it can carry a hefty environmental price tag. Gas powered equipment emits pollution, salt contaminates waterways, and inefficient routing burns fuel and money. The good news is, modern sustainable practices not only reduce environmental harm, but also improve operational efficiency and cut long-term costs.

There are many practical ways for property managers to make snow operations more environmentally responsible this winter. If you’re hiring a snow removal contractor, be sure to discuss their sustainability initiatives and equipment choices as well.

Older snowblowers and plow trucks are surprisingly dirty. A two-stroke snowblower can emit as much pollution in one hour as a car driving up to 300 miles, according to the U.S. EPA. Newer four-stroke, hybrid, or fully electric models slash those emissions dramatically by 70–90% while also using less fuel.

Electric snow equipment is becoming viable for sidewalks, campuses, and tight spaces. Larger contractors are investing in Tier 4 diesel plows and hybrid trucks. Some states, like California, are even phasing out small gas engines entirely.

Choosing vendors who upgrade their fleets can significantly lower your facility’s wintertime carbon footprint and improve reliability. Ask snow contractors what percentage of their fleet uses low-emission or electric equipment, and how old their average machines are.

Plow trucks burn a lot of diesel, especially when they drive inefficient routes. GPS-based route optimization can reduce both fuel use and labor hours by minimizing backtracking and idling. Real-time tracking also ensures no area is missed and allows managers to reroute crews quickly during storms.

Efficient routing isn’t just sustainable. It keeps your lots and walkways clear faster, reducing slip-and-fall liability. Look for vendors using modern fleet management or GPS routing systems, and ask how they plan for emergencies to avoid wasted trips.

Traditional rock salt (sodium chloride) is cheap but environmentally costly. It runs into soil and

waterways, increasing salinity and harming ecosystems. Over decades, chloride pollution has risen in more than 80% of urban streams, and salt corrosion costs U.S. infrastructure billions annually.

Brine pretreatment can be a better option for properties. Spraying salt brine before storms can cut salt use by 20–30% while preventing ice from bonding to pavement.

Alternatives to rock salt also include calcium magnesium acetate (CMA), potassium acetate, or beet-based additives that are less harmful to plants and waterways.

Over-salting is common and wasteful. Calibrated spreaders ensure only the needed amount is applied.

Every extra trip to refill salt or fuel burns time and emissions. Storing materials on-site or at nearby satellite yards can dramatically reduce travel. Pre-positioning salt bins, brine tanks, or fuel during storms speeds up response and minimizes idling.

For larger properties or portfolios, this can be a game-changer. Especially during regional storms when supply chains are strained. Ask your snow provider if they stage materials or equipment on-site to reduce travel and improve response times.

Well-maintained machines run cleaner, use less fuel, and break down less. Regular tune-ups, proper tire inflation, and prompt repairs all matter. Spreaders should be calibrated at least once a season. Poorly set units can apply two to three times the necessary salt.

Operator behavior counts, too. Training crews to reduce idling, avoid over-application, and plow efficiently can significantly lower environmental impact. Verify that your contractor has a maintenance schedule and crew training program focused on efficiency and sustainability.

6. Leverage Standards and Certifications

Sustainability in snow removal is gaining structure. Programs like the Sustainable Winter Management (SWiM) standard offer clear best practices for salt reduction, equipment maintenance, and record-keeping. Certified

contractors often reduce salt use by 20–40% while maintaining service levels.

Green SnowPro (used in some states) and similar programs teach contractors how to protect water quality through smarter practices. Working with certified vendors can support your facility’s ESG goals and reduce liability.

Sustainable snow removal isn’t just good PR, it’s practical risk management and cost control. Cleaner equipment and routing reduce your winter carbon footprint. Less salt means less damage to soils, plants, and infrastructure. And finally, Efficient operations cut fuel, material, and maintenance costs over time.

Property managers don’t have to choose between safety and sustainability. By modernizing equipment, optimizing operations, and rethinking de-icing strategies, you can make winter maintenance cleaner, more efficient, and often cheaper in the long run.

Sustainable snow removal is no longer a niche idea, it’s quickly becoming the industry standard.

Despite restraint at the capital level, activity remains broad-based. Logistics firms continue to anchor absorption, while manufacturing and data center users drive diversification.

The I-80 corridor’s energy and transportation infrastructure — already robust — now serves as its biggest growth lever.

“We are experiencing an uptick in tenant demand for newer construction, which in turn is increasing investors’ interest in the submarket,” said Jerry Sullivan, principal at DarwinPW Realty/CORFAC International.

Energy access has become one of the corridor’s most important differentiators. Grundy County’s three nuclear plants and a forthcoming connection to Lake Michigan water have made western submarkets newly viable for power-intensive operations. For high-consumption users, reliable utilities can make or break a deal — and that reliability has become I-80’s calling card.

“We’ve got the people, we’ve got the power and soon we’ll have the water,” said Keith Stauber, Managing Director, JLL Ports Airports & Global Infrastructure. “The Grand Prairie Water Commission that’s been formed by six communities in the

region will have Lake Michigan water by about 2030. I think that’s a really intriguing kind of new infrastructure that will make the sites even more attractive.”

Stauber said the corridor’s appeal is also tied to its balance of infrastructure and labor access — a rare combination in today’s industrial landscape.

“You can reach nearly half the U.S. population within a day’s drive, but you’re also tapping into one of the Midwest’s strongest labor pools,” Stauber said. “That connectivity is what keeps this market resilient, even when capital tightens.”

That combination of infrastructure and utility reliability is attracting not just distribution users, but manufacturers rethinking site selection. Many are looking to the I-80 corridor as a hedge against volatile energy markets in other states.

The shift aligns with Illinois’ broader manufacturing resurgence: JLL projects manufacturing will represent 25 percent of U.S. industrial demand by 2028, supported by more than $3 billion in state-level investment from firms such as Rivian, Gotion and Avina Clean Hydrogen.

Sullivan said the former Caterpillar plant at 2200 Channahon Road in Joliet illustrates how legacy manufacturing sites are being reimagined for modern users. The 220-acre property, now marketed by DarwinPW

and owned by IRG, has been repositioned to attract manufacturers drawn to its abundant utilities and existing infrastructure. Continued interest from production-oriented tenants underscores how electricity, water and natural gas availability remain decisive location factors for this part of the state, Sullivan argued.

The same logic — access and adaptability — is driving speculative development nearby. Northern Builders continues to see strong demand at Cherry Hill Business Park in Joliet and New Lenox, where tenants value access to I-80, I-355 and I-55 without the congestion surrounding the intermodal.

Four new Northern projects broke ground there last year, which included a mix of both build-to-suit and speculative product. Two state-of-the-art speculative facilities — an 802,440-square-foot cross-dock expandable to 1.2 million square feet and a 183,300-square-foot single-load building — are nearing completion and available for lease or purchase.

“Leasing velocity has increased considerably over the past year, fueled by continued demand from national 3PLs and food distributors as supply chains continue to stabilize,” said Matthias Trizna, Northern’s Vice President of Development.

Infrastructure improvements have multiplied those effects. The Houbolt Road

bridge and I-80 reconstruction have reduced congestion, cutting dray times and opening previously overlooked sites to new development.

“The Houbolt Road bridge extension was a significant improvement to the market,” Sullivan said. “Allowing truck traffic from within the intermodals to move further west along I-80 assisted in easing traffic flow along I-80.”

As improved access encourages expansion west, Earley said developers are taking a more measured approach to speculative construction.

“While many blame lack of confidence from developers and overall demand for lack of new construction, it’s actually more a conversation about capital partners and the cost of doing business,” Earley said.

That westward expansion continues into Wilmington, Morris and Minooka — long considered value markets but historically limited by labor supply.

“Developers have long looked at areas like Morris and Minooka but demand has been a bit stagnant,” Sullivan said. “Lately, interest in these areas has increased and the addition of the Brisbin Road interchange has only enticed developers to investigate well-positioned tracts of land.”

As users move west, design standards are advancing. Developers are preparing for tenants whose operations rely on automation, robotics and electrified fleets.

“We will continue to see more build-tosuit activity as the impact of technology drives a different sort of building need,” Grapenthin said. “Some users will be coming out of a 30’ clear building or some facility that was ‘state-of-the-art’ a decade ago but won’t meet the businesses’ future functional or operational objectives. We see this continuing to ignite the need for new development to satisfy the needs of today’s modern industrial tenant.

The race to modernize is also reshaping capital strategy: owners are now underwriting for electrical redundancy, not just location.

“Over the next few years, automation, electrification and sustainability will continue to shape the next generation of industrial product along I-80,” Trizna said. “Many new facilities are being designed with higher clear heights, redundant power sources and EV charging infrastructure to accommodate robotics and fleet electrification.”

Stauber said those shifts reflect a new era for the corridor — one defined less by square footage and more by sophistication.

“This market has evolved from moving goods to powering industries,” Stauber said. “Between the intermodal network, the utilities and the labor, you’re looking at one of the country’s most complete industrial ecosystems.”

That progression from logistics to hightech manufacturing mirrors Illinois’ broader industrial transformation. According to JLL Vice Chair Meredith O’Connor, Illinois’ strength lies in its alignment of

“people, place and power,” a formula that continues to attract domestic and international investment.

With the Canadian National Railway preparing to break ground on its new +800 acre Chicago Logistics Hub intermodal facility in Channahon and Minooka, the corridor’s westward reach is still expanding.

Stauber called the project “yet another catalyst for growth along the I-80 corridor,” reinforcing its position as the Midwest’s logistics spine.

By Elbert Walters III, Executive Director of Powering Chicago

In the electrical industry, safety is a core responsibility that starts well before design plans are drawn or the first wire is installed. Every project, from a small commercial upgrade to a large-scale municipal infrastructure build, carries potential risks that must be addressed through training, preparation, and strict adherence to safety standards.

One of the most effective ways to ensure that electrical systems operate safely and reliably is through compliance with NFPA 70B, the standard for electrical equipment maintenance. This framework outlines how to maintain electrical assets to prevent failures, reduce hazards, and extend equipment life. For facility managers, business leaders, and property owners, understanding and implementing NFPA 70B has become essential to protecting both people and property.

Electrical failures remain a leading cause of building fires and costly downtime. NFPA 70B provides comprehensive guidance for creating and maintaining an electrical maintenance program (EMP). It covers everything from periodic inspections to testing protocols, helping ensure that systems continue to perform as designed.

For municipalities and commercial property owners, following NFPA 70B is not simply about checking a compliance box. The standard reduces operational risk, prevents unplanned outages, and safeguards investments in building systems. By proactively maintaining electrical equipment, organizations can avoid incidents that compromise safety and disrupt business continuity.

Safety in electrical work begins with the professionals responsible for installation, maintenance, and repair. The most effective electricians complete multi-year apprenticeship programs that combine thousands of hours of classroom education with hands-on field experience. Leading programs require approximately 8,500 hours of combined training, with 200–300 hours dedicated specifically to safety instruction. This includes arc flash prevention, lockout/tagout procedures, hazard recognition, and other critical skills. Continuing education after the apprenticeship is equally essential, ensuring electrical contractors stay current with evolving technologies, updated codes, and emerging safety practices that directly impact system reliability and workforce protection.

Such extensive preparation equips union electricians with both technical expertise and situational awareness. This training enables

them to meet NFPA 70B requirements in real-world conditions, where adaptability and problem-solving are just as important as technical knowledge.

Preventive maintenance and testing are central to NFPA 70B, which establishes best practices to keep electrical systems safe, efficient, and dependable.

One example of these standards in action can be seen at the Algonquin Wastewater Treatment Facility. Electrical maintenance ensures system reliability and safety, as demonstrated at the facility, where up to four million gallons of water are processed daily. Jamerson & Bauwens Electrical Contractors performed NFPA 70B compliance work using infrared and ultrasonic testing to identify potential issues before they caused disruptions, protecting both worker safety and critical water-treatment operations.

These examples demonstrate how skilled training and the consistent application of NFPA 70B standards lead to safe, reliable electrical systems that safeguard both personnel and operations.

Why Experienced Professionals Make the Difference

Electrical safety depends on more than correct installation. Systems must operate safely and consistently over their entire lifespan. That level of performance requires professionals trained

“As facilities become increasingly complex and electrical systems assume a greater role in powering transportation, infrastructure, and advanced technologies, NFPA 70B will continue to serve as a foundation for electrical safety. ”

to design, build, maintain, troubleshoot, and optimize complex electrical infrastructure in accordance with NFPA 70B guidelines.

Engaging experienced, well-trained teams helps reduce downtime, lower maintenance costs, and provide confidence that systems are operating at peak safety and efficiency.

As facilities become increasingly complex and electrical systems assume a greater role in powering transportation, infrastructure, and advanced technologies, NFPA 70B will contin-

ue to serve as a foundation for electrical safety. Combined with rigorous training, it helps ensure that systems remain dependable, efficient, and ready to meet future demands.

About the Author:

Elbert Walters III is Executive Director of Powering Chicago, leading 100+ annual community initiatives and daily operations. A former IBEW Local 134 representative and journeyman electrician, he brings decades of experience in union labor, electrical construc-

tion, and workforce development, advancing safer job sites, skilled careers, and stronger communities across Chicagoland.

References:

1. National Fire Protection Association (NFPA). NFPA 70B: Recommended Practice for Electrical Equipment Maintenance.

2. Jamerson & Bauwens Electrical Contractors – Project Documentation (Algonquin Wastewater Treatment Facility).

Building a successful business requires reliable financial support. Heartland Bank has the resources you need to lay the groundwork for success. Scan the QR code below for information regarding commercial lending.

By Steven F. (“Sonny) Ginsberg

More than five years since the pandemic sent shock waves through the office market, how are office loans faring? A shakeout continues as, after years of lower demand, some properties remain underwater and lenders address the nonperforming loans on their books.

Yet while valuations are lower, a lack of new construction and uptick in return-to-office policies mean more investors are starting to look at suburban offices again. The market is moving forward, if at a lower basis, setting the stage for future recovery and growth.

The suburban Chicago office market has stabilized since the pandemic, but persistently high vacancies, depressed rents and lower property values mean some office loans continue to be underwater. Nationwide, 11.13% of CMBS office loans are distressed, per Trepp. As much as absorption has improved in Chicago’s suburban office market – with 935,000 square feet of positive net absorption in the first half of 2025 – vacancy rates were still 26% at mid-year, according to Newmark.

As someone who has worked in CRE law for decades, I can say there have been times in the past when values declined. And, of course, specific assets have struggled. But the office market in general has not seen a crash of this type since, perhaps, the Depression era. Moreover, there is no certainty that the office market, and office culture, will return to pre-pandemic levels in the near future. Still, after hitting bottom about 18 months ago, valuations have reset, renewing buyer interest at more “real” market values. Lenders that had been waiting for an exit are now seeking solutions to the nonperforming loans that remain on their books. What steps they take depend on whether the guarantor has money and is willing to cooperate.

Lenders have five primary paths forward with nonperforming loans: restructuring, negotiating with guarantors, executing a lender-controlled sale, conducting a straight-loan sale or initiating a foreclosure.

With this solution, the lender and borrower restructure the loan – for example, extend the repayment period, reduce the interest rate or change the payment schedule – to avoid foreclosure.

“A market reset is well underway in the suburbs, ultimately leading to a healthier long-term outlook.”

Workouts are effective for lenders when there is hope of a payoff. Where there has been such a shock to the system, however, workouts are a form of “extend and pretend.” Permanently reduced demand and valuations can make it impractical for borrowers to meet the terms of any extension, or refinance within a forbearance period.

Loan modifications often include a form of deed-in-lieu agreement, whereby the parties agree in advance that they will avert the foreclosure process if the borrower fails to satisfy the restructure conditions. Sometimes this will take the form of extensive modification agreements, including pre-signed closing documents, sometimes termed a “deed-in-the-box.” In other cases, the parties will merely agree to enter into deed transfer documents if and when a restructure default occurs.

In conjunction with a restructuring, lenders may require borrowers and/or guarantors to deposit additional reserves and/or make principal repayments as a condition to any loan modification. Guarantors will often negotiate to have additional equity coming from them offset against guarantor liability under the guaranties. For ex-

ample, guarantors under a limited guaranty may be willing to fund continued carry costs, but only to the extent that such funding counts against their guaranty cap. For both lenders and guarantors, this type of negotiation allows the project to remain funded while a restructure, refinance or sale is pursued and averts later litigation to enforce the guaranteed obligations. Lenders may agree to cap future guarantor liability in exchange for current payments and reserve deposits.

Lender-Controlled Sale (Preferred Method)

Especially in the circumstance where a guarantor’s liability may be capped, lenders have an interest in selling the property prior to reserves running dry. If the guarantor has already funded into reserves, as a downstrike on the loan, all of its liability, then it will have essentially converted a recourse loan into a non-recourse loan. In such scenarios, or where a loan is nonrecourse from the outset of a loan, borrowers and/or guarantors may have no economic incentive to fund additional carry costs.

Lenders may elect to accept a deed-in-lieu from borrowers at such point, but they may also reach an agreement with the borrower that allows the borrower to operate the property while the lender directs a sale process. This allows the borrower to own the property during the marketing period and collect such management and/or asset fees generated from leasing revenue as may be available. It also averts a foreclosure showing up on the borrower’s record. The lender becomes the sole party that determines when and how a sale shall occur, which is fair since the lender both funds the carry costs and suffers the detriment of any short sale. The borrower will still need to execute sale documents, including responsibility for limited representations and warranties thereunder. Thus, this becomes a somewhat sophisticated negotiation between lenders and borrowers, but the result can benefit both parties. Note that a lender-controlled sale is often the best solution for underwater properties, as it averts protracted guarantor litigation and foreclosure and may increase sale value, since there is often more value in a sale by deed versus the sale of a note.

For a straight loan sale, the lender generally decides not to work with the borrower at all and sells the loan to another party, such as another lender, avoiding direct responsibility for the property. Some restrictions may apply for eligible transferees; for example, some loans do not allow the lender to sell to a competitor of the borrower or guarantor. However, many banks will not limit too broadly their right to sell a loan.

Finally, in a foreclosure, the lender takes the title and then stabilizes or sells the asset. It is generally less preferred due to costs and delays but sometimes unavoidable. Costs include loss of interest, foreclosure proceedings and property dispositions. An office property foreclosure in Chicago’s suburbs can take more than 18 months, longer when contested.

While the last five years have been painful for many office property owners, loan workouts, sales and foreclosures are critical to achieving market stability for the long haul. Already, the office sector appears to be rebounding, with suburban office ranked No. 5 on a list of greatest opportunities for real estate owners and investors over the next 12 to 18 months, per a recent Deloitte report. A market reset is well underway in the suburbs, ultimately leading to a healthier long-term outlook despite the short-term pains some may experience.

Steven “Sonny” Ginsberg is co-founder and partner of Ginsberg Jacobs LLC. He has 30 years of experience in real estate and finance law, assisting clients from both the lending and development side. He works with financial institutions and national funds to develop lending forms and guidelines, and has vast knowledge in structuring complex debt and equity vehicles. Sonny also assists owner and operator clients in the acquisition, zoning, development, leasing and financing of commercial real estate, with a particular emphasis in hospitality and telecommunications. Additionally, Sonny speaks regularly at local and national real estate and finance conferences.

Sonny began his career at Sonnenschein Nath & Rosenthal and was formerly a partner at Katten Muchin Zavis, and Levenfeld Pearlstein, LLC.

One Parkview Plaza, 9th Floor

Oakbrook Terrace, Illinois 60181

Key Contacts:

Jean Zoerner-Illinois, JMZoerner@midamericagrp.com; Brad Lefkowitz-Michigan, blefkowitz@midamericagrp.com; Brandon O’ Connell-Minnesota, boconnell@midamericagrp.com; Jim Vaillancourt-Wisconsin, jvaillancourt@midamericagrp.com;

Services Provided: Mid-America provides strategic consulting services that maximize net operating income, net cash flow, and accelerate property appreciation. We provide property and construction management, leasing, due diligence, and market analysis. Additionally, we offer MA Building Services, a self-performing porter and maintenance company offering our clients cost savings and improved accountability for related services.

Company Profile: Mid-America Real Estate is #1 in retail real estate services in the Midwest, with full service offices in Illinois, Michigan, Minnesota, and Wisconsin. Our exclusive focus on retail property, combined with cutting-edge technology and unsurpassed service, distinguishes Mid-America within the industry and provides clients with a competitive edge. For more information, visit www.midamericagrp.com.

S74 W16853 Janesville Road

Muskego, WI 53150

P: 414.369.3511 | F: 414.435.0251

Website: outlookmgmt.com

Key Contact: Ray Balfanz, President/Partner, ray@outlookmgmt.com

Services Provided: Full service property and asset management services, financial analysis and reporting; budget preparation and expense reconciliations; lease administration; construction management; preventative maintenance and consulting services.

Company Profile: Outlook Management Group, LLC AMO provides comprehensive property and asset management services for all asset classes in multiple states and markets.

Notable Properties Managed: Washington Corners, Naperville, IL; Ironwood Office Park, Glendale, WI; Wood River Condominiums, West Bend, WI; Seven 10 West Luxury Apartments, Chicago, IL; MDJD Aesthetic MOB, Rockford, IL, Ascension Health MOB Milwaukee, WI; Henry Ford Health Systems Pharmacy Services Bldg. in Rochester Hills, MI; Henry Ford Medical Center in West Bloomfield, MI.

MERIDIAN DESIGN BUILD

9550 W. Higgins Road, Suite 400 Rosemont, IL 60018

P: 847.374.9200 • F: 847.374.9222

Website: meridiandb.com

Key Contact: Paul Chuma, President; Howard Green, Executive Vice President

Services Provided: Meridian Design Build provides construction and design/build construction services on a national basis with a primary focus on industrial, office, medical office, retail and food and beverage work.

Company Description: With a team of in-house professional project managers, Meridian has extensive experience coordinating the design and construction of new buildings, tenant improvements, and additions/renovations from 15,000 square feet to 1,000,000+ square feet. Meridian Design Build has been a Member of the U.S. Green Building Council since 2007.

Notable/Recent Projects: Venture Park 47, Huntley, IL - 729,800 sf speculative industrial facility for Venture One Real Estate. Lion Electric, Joliet, IL - 928,500 sf electric bus / medium duty truck assembly plant for Clarius Partners. Greenwood Truck Terminal, Greenwood, IN - 125 door truck terminal on 43 acres for Scannell Properties

PRINCIPLE CONSTRUCTION CORP.

9450 West Bryn Mawr Ave., Suite 120 Rosemont, IL 60018

P: 847.615.1515 | F: 847.615.1598

Website: pccdb.com

Key Contacts: Mark L Augustyn, COO, maugustyn@pccdb.com, James A. Brucato, President, jbrucato@pccdb.com

Services Provided: Since 1999, Principle Construction Corp. has been a leading design-build general contractor serving the industrial markets of Chicago Metro, Southern Wisconsin, and Northwest Indiana. We specialize in designing and constructing exacting solutions for our clients, including:

• Built-to-Suit Facilities • Speculative Facilities • Warehouse and Distribution Centers

• Logistics and Cross-Dock Facilities • Industrial Outdoor Storage • Industrial and Manufacturing Plant • Tenant Improvements • Expansions and Additions • Food Processing Facilities • Specialty Projects

Recently Completed Projects include:

• 8,205 SF animal shelter for Heartland Animal Shelter, at 586 Palwaukee Dr., in Wheeling, IL.

• 12,560 SF showroom and outdoor pool park for Doheny Enterprises, at 5307 Green Bay Rd., in Kenosha, WI

• Phase 1 renovation project for SMW Autoblok, at 285 Egidi Dr., Wheeling, IL

2000 Center Dr., Suite East C219 Hoffman Estates, IL 60192

P: 847.392.6900

Website: victorconstruction.com

Key Contact: Zak Schuttler, President, ZakS@victorconstruction.com

Services Provided: Victor Construction Co., Inc. manages projects from ground-up site developments to interior buildouts, specializing in retail, industrial, and commercial markets.

Company Profile: Established in 1954, Victor Construction Co., Inc. is a third generation general contractor that specializes in commercial, industrial, and retail construction. Victor Construction is known as one of the most efficient and dependable general contractors in the Chicago metropolitan area and has earned the reputation due to meticulous project management, cost-effectiveness, budget awareness, and prime first-rate workmanship. Commitment to the clients’ goals is what keeps satisfied customers returning to Victor Construction for all of their construction needs—We Build for Your Success!

Notable/Recent Projects: Owens + Minor Distribution – 600K SqFt distribution facility that involved a full LED lighting upgrade, new HVLS fans, 200K SqFt section that required new cooling for medical distribution, an office renovation of 20K SqFt, and a new exterior employee pavilion.

VILLAGE OF HOMER GLEN ECONOMIC DEVELOPMENT

14240 W. 151st Street Homer Glen, IL 60491

P: 708.301.0632

Website: HomerGlenIL.org

Key Contact: Janie Patch, Economic Development Director, jpatch@homerglenil.org

Services: Resource center for brokers, developers, site selectors and businesses providing space and property inventory, trade area demographics, site selection assistance, custom tours, coordination through entitlement process, business opening process guidance and retention services.

Demographic Info: Strategic Will County location 25 miles southwest of Chicago with two I-355 interchanges between I-55 and I-80. Average household income of $154,800. Trade area population of 83,000. Prime commercial corridors include Bell Road, 143rd Street and 159th Street (State Route 7). 159th Street is improved with 4 lanes and access to Lake Michigan water and sanitary sewer.

Recent CRE Activity: The Villas of Old Oak (46 ranch duplexes) completing full build out. New food specialty and restaurant openings include South Viet, OneZo Boba Tea, Sultan Sweets and Cervantino’s. Restaurant with drive-thru position available at Homer Glen Bell Plaza with Pet Supplies Plus, Dollar Tree and Taco Bell, SWC 143rd/Bell.

ECONOMIC DEVELOPMENT CORPORATION

OF MICHIGAN CITY

Two Cadence Park Plaza

Michigan City, IN 46360

P: 219.873.1211

Website: www.edcmc.com

Key Contacts: Clarence Hulse, Executive Director, chulse@edcmc.com

Karaline Cartagena Edwards, Economic Development Manager, kcedwards@edcmc.com

Services/Demographic Info: Up-to-date inventory of commercial buildings, site selection and orientation tours

Incentives: Tax-Increment Financing, Façade Improvement Grants, Property Tax Abatements, Enterprise Zones, Job Training Programs

Recent CRE Activity: Double Track Northwest Indiana: $1.6 Billion development reducing train travel to Chicago to 60 minutes; The Franklin at 11th St. Station: $100 Million Development with Residential & Retail Space; “You are Beautiful”/ SoLa: $311 Million Mixed-Use Multi-Family Development with 235 boutique hotel rooms & 174 Luxury Condos; Burn ‘Em Brewing: $3 Million Expansion project with 30 new jobs.

DEIGAN & ASSOCIATES, PLLC

28835 N. Herky Drive Lake Bluff, IL 60044

P: 847.682.7381

Website: http://www.deiganassociates.com

Key Contact: Michele Brady, Director Business Development & Real Estate Services, mbrady@deiganassociates.com

Services Provided: The Deigan Group provides client responsive, results oriented environmental consulting and remediation services, with a focus in land-based work, including Brownfield Redevelopment, Power Plant Decommissioning/Redevelopment, Strategic Environmental Planning, Property Assessments and Site Remediation, Compliance/Permitting, Employee Exposure Testing/Safety Monitoring Asbestos Surveys/Mold/Indoor Air Quality, Waste Minimization/ Recycling/ Sustainability Plans, Successful Grant Writing. Company Profile: A full-service environmental consulting organization specializing in defining environmental business risk and removing environmental uncertainties for property development sites. Our wide range of experience within the environmental industry helps us provide realistic cost-saving strategies for our clients with the goal of reducing their overall environmental liability and obstacles to redevelopment.

MARQUETTE BANK

1628 W. Irving Park Road, Unit 1D Chicago, IL 60613

P: 708.873.8639

Website: emarquettebank.com

Key Contact: Patrick Tuohy, Senior Vice President, ptuohy@emarquettebank.com

Services Provided: Multifamily/apartment building lending for all Chicagoland. Fast, local decision making. Dedicated local servicing staff. Simple, no-hassle paperwork. Quick close. Flexible terms. All clients enjoy ZRent – an automated, hassle-free, nocost way to collect monthly payments from tenants.

Company Profile: Marquette Bank has 20 branches, loan office and $2 billion in assets. Independently owned/operated since 1945. Offering clients full-service, banking, financing, insurance, trust and wealth management services.

REINHART BOERNER VAN DEUREN S.C.

1000 N Water Street, Suite 1700 Milwaukee, WI 53202

P: 414.298.1000

Website: reinhartlaw.com

Key Contact: Joseph Shumow, Shareholder, jshumow@reinhartlaw.com

Services Provided: Reinhart is a full-service, business-oriented law firm that delivers innovative, value-added solutions for today’s most important real estate needs, including land use and zoning; tax-incremental financing; tax credits; leasing; construction; and condemnation and eminent domain issues.

Company Profile: With the largest real estate practice in Wisconsin and offices throughout the Midwest and across the country, Reinhart’s attorneys offer clients customized real estate insight rooted in broad knowledge and deep experience to help you capitalize on opportunities no matter where you do business.

100 N. LaSalle St., 10th Floor Chicago, IL 60602

P: 312.782.8310

Website: sarnoffpropertytax.com

Key Contact: James Sarnoff, jsarnoff@sarnoffpropertytax.com P: 312.448.5337

Services Provided: Since 1986, Sarnoff Property Tax has been a leading and recognized law firm concentrating solely in the field of property taxation. We help client’s secure favorable taxes in Illinois through property tax appeals, incentives and consulting.

Company Profile: Sarnoff Property Tax’s clients include Owners, Developers, Managers, REIT’s, Fortune 500 Companies, Private Equity Firms, etc., in connection with commercial property, high-rise and low-rise apartment buildings, condominium associations and single-family home portfolios.

180 North LaSalle Street, Suite 3010 Chicago, IL 60601

P: 312.917.2307 P: 312.917.2312 | F: 312.596.6412

Website: wvproptax.com

Key Contacts: Francis W. O’Malley, Managing Partner fomalley@wvproptax.com; Jessica L. MacLean, Partner jmaclean@wvproptax.com

Services Provided: Worsek & Vihon, LLP represents tax payers in Illinois by limiting their property tax liabilities through ad valorem appeals. We have over 40 years of experience and can handle basic to the most complex assessment issues while offering the dependable, personalized attention our clients deserve. We have experience representing owners of all property types. In addition to filing thousands of appeals with the Cook County Assessor, we have been involved in numerous proceedings before various Boards of Review, the Illinois Property Tax Appeal Board, and the Circuit Court of Illinois, and have appeared before the Illinois Appellate and Supreme Courts. Company Profile: Worsek & Vihon LLP, is a team of experienced attorneys singularly focused on real estate tax law. The firm is dedicated to minimizing property tax liabilities through strategic tax portfolio management, well-researched, creative appeal preparation and aggressive advocacy.