THE TEXAS COMMERCIAL REAL ESTATE NEWS SOURCE | AUGUST 2025

NATIONAL ENVIRONMENTAL SERVICES

Houston, Texas • Redlands, California

THE TEXAS COMMERCIAL REAL ESTATE NEWS SOURCE | AUGUST 2025

Houston, Texas • Redlands, California

National Environmental Services, with offices in Houston, Texas and Redlands, California, is an environmental consulting company, established in 1995, that conducts a full range of reliable and cost-effective environmental assessment and corrective services, with competitive pricing and convenient turnaround.

• Phase I Environmental Site Assessments (ASTM E1527-21)

• Transaction Screens (ASTM E1528-22)

• Asbestos & Lead-Based Paint Inspections (Licensed Texas

Asbestos Consulting Agency)

• RSRAs (Records Search with Risk Assessments)

• Phase II Subsurface Investigations*

• Remediation and Corrective Activities*

• Soil, Water, and Air Testing Ser vices

• Indoor Air Quality/Mold Sur veys (Licensed Mold Consulting Agency)

• Underground Ground Storage Tank Testing Ser vices*

National Environmental Services

5773 Woodway Dr, Suite 96, Houston, TX 77057: Phone (281) 888-5266

700 East Redlands Blvd, Suite U618, Redlands, CA 92373: Phone (951) 545-0250

Toll Free: (833) 4-Phase1

www.nationalenv.com • www.gabrielenv.com

THE TEXAS COMMERCIAL REAL ESTATE NEWS SOURCE

PRESIDENT & CEO

Jeff Johnson jeff.johnson@rejournals.com

PUBLISHER

Mark Menzies menzies@rejournals.com

SENIOR VICE PRESIDENT

Benton Mahaffey benton@REDnews.com

TEXAS MANAGING DIRECTOR

April Daniel April.Daniel@rejournals.com

CLASSIFIED DIRECTOR

Susan Mickey smickey@REDnews.com

Texas Brokers: 8,150

Texas Leasing/Tenant Rep: 6,232

Texas Investors: 4,979

Texas Developers: 4,710

Outside Texas Investors, Brokers, Developers etc: 26,387

TOTAL QUALIFIED ONLINE RED news DISTRIBUTION: 50,458

To subscribe to REDnews call (713) 661-6300 or log on to REDnews.com/subscription.

6

Laredo’s logistics surge: Nearshoring boom reshapes city’s industrial landscape Despite high interest rates and development costs, capital is flowing into Laredo, spurred by nearshoring and growing pressure to diversify supply chains away from China.

A new kind of urban core: East River and the future of mixed-use in texas Mixed-use isn’t new. But in Texas, it’s being redefined — not just as a convenient blend of offices and restaurants, but as a full-fledged lifestyle model driven by tenant demands.

Houston Industrial Market Shows Resilience with Increased Leasing and Manufacturing Demand Amid Tariff Concerns Houston's industrial market remained healthy in Q2 2025, driven by an increase in leasing activity and positive net absorption.

14 16 19 20 21 8 12

REDnews Events: Texas REDnews Real Estate Awards

Texas multifamily reckons with oversupply: Developers pivot, investors recalibrate Texas’ major multifamily markets are stabilizing at different paces as developers and investors adjust to higher interest rates, record deliveries and shifting renter preferences.

CRE Marketplace

Scoop/People on the Move

2025 Texas REDnews Awards Houston: Special insert

BY BRANDI SMITH

Laredo isn’t just busy; it’s bursting.

Seventeen-thousand trucks cross the border there every day carrying everything from semiconductors and EV parts to produce and packaged goods. Port Laredo handles more than 40 percent of U.S.-Mexico trade, a staggering figure for a metro area with fewer than 300,000 residents on the U.S. side. While other commercial real estate sectors across Texas have cooled, industrial development in this South Texas city is outpacing expectations.

“Laredo has seen what I would describe as a significant uptick in construction activity over the past year,” said Danny Khalil, associate director of market analytics at CoStar. “That is unusual because there just wasn’t a lot of industrial construction going on statewide.”

Despite high interest rates and development costs, capital is flowing into Laredo, spurred by nearshoring and growing pressure to diversify supply chains away from China. Logistics users are driving much of the leasing activity, but the auto sector remains a key demand engine.

“Automobiles comprise a disproportionate amount of the goods that travel to and from Laredo,” Khalil said. “Primary parts are often built or constructed in the United States. They go to Mexico for assembly and then they come back to the United States, often as final goods.”

The region’s central role in that roundtrip trade has made Webb County a focal point for industrial development. From Laredo, goods head north to San Antonio, a major redistribution node that feeds into I-10 and I-35. The corridor between Monterrey and Dallas-Fort Worth is under increasing development pressure, but Laredo remains its most active node.

“I would imagine that Laredo is going to play an important role in all of that in the future,” Khalil said.

As of Q2 2025, FORUM CRE reports more than 10.5 million square feet of industrial space was under construction in Laredo, a record-setting pipeline. But that boom is outpacing absorption. After a strong first quarter, Q2 recorded just 287,000 square feet of net absorption, pushing the vacancy rate to 6.8 percent.

Most of that vacancy is tied to new deliveries and experts say the slowdown is more about political uncertainty than a drop in tenant demand. Many companies are holding back lease commitments as they wait for clarity on trade policy, particularly tariffs.

“Manufacturers in North America and Asia remain indecisive and unwilling to gamble,” said Carlo Molano, managing principal of brokerage services at FORUM CRE. “They will need to decide between sourcing the raw materials they need locally or importing those materials from Asia if the North American manufacturing market is unable to produce what they need.”

Molano said developers and occupiers alike are looking to the U.S. government to finalize a long-term tariff strategy before moving forward.

“We need a decision for stability to be regained so there is less volatility and industrial development can continue at a consistent pace with steady absorption occupying space,” Molano said.

FORUM CRE is positioning itself to lead that next wave.

“We are building for the future of trade,” Molano said. “Pinnacle Logistics Park is designed with the next generation of industrial users in mind — companies that need proximity to the border, intermodal access and the ability to scale fast.”

The logistics park is located inside Pinnacle Industry Center, the largest industrial park in Laredo with more than 1,200 acres of developed industrial land and totals 985,629 square feet across two identical 492,817-square-foot buildings. Both are scheduled for completion before year-end.

Another five buildings between 300,000 and 500,000 square feet are also under construction in this submarket, allowing for a clustering of manufacturing and distribution operations between the World Trade Bridge and the Colombia Bridge.

“These tenants aren’t just looking for space — they’re looking for throughput,” Molano said. “And they need to know their logistics provider and real estate partner can grow with them.”

That strategy extends to Pinnacle Industry Center, the logistics park’s home campus aimed at smaller tenants with fast turnaround needs.

“It’s not all mega-box,” Molano said. “We’re seeing real demand for 30,000- to 100,000-squarefeet with high parking ratios and flexible layouts.”

Killam East Industrial Park and Port Grande are also making largescale plays. Killam offers more than 1.2 million square feet across five buildings with 331 dock doors and nearly 900 trailer stalls. Port Grande is marketing build-to-suit options, dock customization and rail access across hundreds of acres.

Still speculative development is beginning to outpace active leasing. With more space coming online than tenants are ready to absorb, capital markets are approaching the Laredo market more cautiously. In its Q2 report, FORUM CRE noted that “equity groups... have begun to reassess their commitment while lenders have similarly expressed growing hesitation in extending debt financing.”

That concern is amplified by Laredo’s narrow economic base.

“Laredo is driven entirely by trade with northern Mexico,” Khalil said. “What’s happening in Laredo is very unique.”

Unlike Houston, Dallas or San Antonio, which benefit from diversified demand drivers and large metropolitan populations that demand many goods, Laredo's industrial space is built more for international trade that supplies product to major metros and therefore more vulnerable to shifts in cross-border trade and not city specific population or demand shifts. While El Paso and the Rio Grande Valley are also seeing growth from nearshoring, Khalil said no other Texas market shares Laredo’s unique position or exposure.

“Trying to replicate what’s happening in Laredo with the rest of the state is quite difficult,” he said.

Whether that uniqueness proves to be Laredo’s competitive advantage or its vulnerability will depend on how trade policy unfolds. The third and fourth quarters could be a turning point for absorption if manufacturers move forward post-tariff clarity.

Either way, Laredo is on the map — not just as a border town but as a strategic player in the future of U.S.-Mexico logistics.

BY BRANDI SMITH

Mixed-use isn’t new. But in Texas, it’s being redefined — not just as a convenient blend of offices and restaurants, but as a full-fledged lifestyle model driven by tenant demands, urban evolution and some major legal tailwinds. Few places illustrate this transformation more vividly than East River, Houston’s largest urban mixed-use development and one of its boldest bets.

Developed by Midway, East River sprawls across 150 acres along the Buffalo

Bayou less than a mile from downtown and just blocks from the Port of Houston. The first phase includes more than 300,000 square feet of Class A office space, 100,000 square feet of retail and restaurant offerings and 360 multifamily units, all stitched together by greenspace, trails and waterfront access.

“What you see today is just 26 developed acres, so there is so much more goodness to unfold in this development,” said Amanda Nebel, Executive

Director at Cushman & Wakefield, which oversees leasing for the project. “Literally anything is possible.”

Midway is no stranger to game-changing mixed-use. The firm’s CityCentre project in west Houston was once dismissed as too far-flung until it became a gold standard for placemaking in Texas. Now East River offers the same kind of potential on the east side, with sharper focus on flexibility, walkability and adaptive reuse of historically industrial land.

“What makes this place special is it’s simultaneously responding to two of the biggest drivers in commercial real estate right now: office occupiers want new and they want mixed use,” said Eric Siegrist, Executive Managing Director at Cushman & Wakefield. “East River gives them both,”

For many tenants, “new” isn’t just about aesthetics; it’s about signaling value to employees. Post-pandemic office users are increasingly making decisions based on talent attraction, not just lease rates. Amenity-rich environments and vibrant, integrated communities are fast becoming non-negotiables.

“Right as COVID ended, employees started saying, ‘I don’t want to go to a bad office, I won’t go to a dangerous office and I want an office with really good food and coffee nearby,’” Siegrist said.

This shift has changed the conversation around site selection. Today’s topof-mind considerations? Commuting ease, access to public space and what Siegrist calls the “magic” of the tenant experience.

“One of our big tenant CEOs lives in Magnolia — easily the worst commute of anyone involved,” Nebel said. “But he saw the magic of East River and said, ‘This is where my people need to be.’”

The message is clear: true company leaders with vision know the “right place” for their people when they see it.

East River’s vision isn’t limited to tenants. The project also includes The Studios: 10,000-square-foot, two-story commercial office buildings available for purchase. The product is rare in Houston and offers small business owners a chance to build equity in a Qualified Opportunity Zone with the potential for substantial tax advantages over time. Created under the 2017 Tax Cuts and Jobs Act, Qualified Opportunity Zones offer federal tax benefits for long-term real estate investment in underserved areas.

“There’s no other place in Houston where you can buy a brand-new, move-inready commercial structure like that in an opportunity zone – all the others are rehab projects,” Siegrist said.

While the two main office buildings in Phase 1 are fully leased, The Studios remain a live opportunity for firms seeking not just presence but permanence.

“This is for visionary companies,” Nebel said. “We’ve already seen interest from creative firms, architects, residential brokerages and especially maritime companies given the proximity to the Port.”

That kind of targeted growth is now easier to achieve in Texas thanks to a new

law passed in 2023. Senate Bill 840, which took effect in January 2024, gives local governments the right to adopt “housing choice” ordinances that allow mixed-use residential and commercial development by right in commercial zones — sidestepping often arduous zoning approvals.

In effect, SB 840 gives municipalities a powerful new tool for enabling density without endless rounds of variance requests. Combine that with strong demand from Millennials and Gen Z, both of whom prioritize convenience, experience and authenticity, and Texas cities are embracing the allure of mixed-use.

Major relocations and corporate expansions have increased transaction volume and boosted demand for walkable, mixed-use development throughout Dallas-Fort Worth. Frisco Station, part of the so-called “$5 Billion Mile,” spans 242 acres of office, residential, retail, hotel and public space centered on a hub projected to employ 15,000 people. Legacy West in Plano, developed after Toyota relocated its North American HQ, integrates 415,000 square feet of retail, restaurant and office space, 1,300 residential units and a 303-room hotel.

In San Antonio, retail and mixed-use projects are reshaping the city’s periphery and downtown core. On the Far Westside, more than 280 acres are being developed with retail, restaurants, medical offices and housing

targeting newly expanding residential zones. The city’s “Project Marvel,” a plan for downtown revitalization, combines Convention Center expansion, adaptive reuse of historic buildings and new mixed-use construction — projecting nearly $19 billion in economic impact over 30 years.

Austin’s ever-expanding skyline includes the Waterline Tower, a 74-story mixed-use tower set to house office, residential and hotel space. Standing more than 1,000 feet tall, Waterline will become the tallest building in Texas upon its planned 2026 completion. Early development in suburbs like Cedar Park includes hotels, entertainment and mixed residential and retail offerings driven by surging population gain.

New Braunfels, south of Austin, is home to Creekside Town Center, which has evolved from vacant Hill Country land into a sprawling 400 -acre mixed-use hub. Now a regional destination anchored by retailers, entertainment venues, Topgolf and a major hotel, it's reshaping regional dynamics along I-35. Elsewhere, the 72,000 -square-foot Neue project in New Braunfels offers condominiums over offices and retail — a perfect example of small-scale mixed-use meeting local demand.

But it’s not just what’s in the buildings that’s important — it’s what’s between them. At East River, a day might start with a run along Buffalo Bayou, continue with a team meeting over coffee and wrap with golf at East River

9, the only nine-hole, par-three, stadium-lit public golf course inside the 610 Loop. The Riverhouse, located on-site, serves scratch-cooked fare and craft cocktails, blurring the line between “after work” and “where you work.”

“East River’s office buildings have the same quality and professionalism as downtown office buildings, but without the congestion and tough parking,” Nebel said. “You’ve got fresh air, access to trails, golf, pickleball and restaurants. The buildings even have showers on every floor because people run or bike to work. It’s a lifestyle center.”

For Nebel and Siegrist, the appeal of mixed-use isn’t abstract. It’s personal: a working model of how business, culture and community can function as one. “There are all different flavors of mixed use, but the kind we love — the kind Midway builds — is walkable,” Siegrist said. “You don’t want to be getting in and out of your car just to grab a coffee. You want to go downstairs, pop outside and have ‘collisions’ with like-minded business people.”

“Mixed use is the cream of the crop in office real estate right now,” Nebel said. “New, walkable, mixed-use projects just crush everything else.”

Midway has already proven its formula for mixed-use success on the west side. With East River, it’s bringing that same placemaking muscle to Houston’s east end — only bigger, bolder and built for the long haul.

BY STEVE TRIOLET, SVP OF RESEARCH AND MARKET FORECASTING

Houston's industrial market remained healthy in Q2 2025, driven by an increase in leasing activity and positive net absorption, despite a slight rise in vacancy and an elevated construction pipeline. Quarterly leasing velocity ticked up slightly by 2.5% to 9.0 million sq. ft. from 8.8 million sq. ft. in Q1 2025, driven by heightened demand for warehouse/distribution space. Warehouse/distribution properties continued to dominate, followed by flex requirements. Manufacturing leasing activity cooled slightly in the second quarter. Flex and manufacturing space recorded negative absorption, while warehouse/distribution space remained the dynamic segment.

Net absorption for the quarter totaled 1.4 million sq. ft., an increase from the 1.0 million sq. ft. in Q1 2025, yet still marking 63 consecutive quarters of positive absorption since 2009. The overall vacancy rate increased slightly to 7.1% from 6.8%, reflecting a balance between demand and new deliveries of 4.0 million square feet. The construction pipeline expanded by 14% quarterover-quarter to 19.1 million sq. ft. However, the lack of entitled properties in the greater Houston MSA continues to limit industrial supply, supporting market stability. Rental rates rose modestly to $0.86 per square foot, a 6.2% increase from Q1 2025 and an 11.7% year-over-year jump, reaching a new record high.

Investment activity remained strong, with industrial sales volume continuing upward. Election trepidation has shifted to concerns over changing tariffs, influencing occupier and investor strategies alike. Houston’s industrial market remains a steady performer, underpinned by robust leasing, controlled supply, and anticipated growing demand for manufacturing.

Houston Economic Update

The Houston unemployment rate increased from 3.9% in April to 4.2% in May, and increased from 4.0% one year ago. Houston’s labor market recorded employment growth of 0.9% year-over-year, adding 29,600 jobs —a slowdown compared to the earlier momentum in the year.

That job growth was uneven across sectors. Oil and gas employment remained a standout, growing 4.6% year over year in 2024 (3,600 jobs), bolstered by increased Texas oil production and rising retail fuel prices into early 2025. Additional sectors also showed resilience, with other services growing at an annualized rate of 2.4% (3,200 jobs), education and health services expanding at a 2.2% annualized rate (9,900 jobs), and leisure and hospitality increasing at an annualized rate of 1.7% (6,400 jobs). Sectors that experienced job loss include Information at -1.7% (500 jobs), professional and business services at -1.3% (7,300 jobs), and construction at -0.6% (1,300 jobs).

Quarterly leasing velocity—comprising new leases and renewals—climbed to 9 million sq. ft. in Q2 2025, a 2.5% increase from 8.8 million sq. ft. in Q1 2025. Warehouse/distribution properties led the way with 8.05 million sq. ft. leased, while manufacturing remained steady at 385,726 sq. ft., reflecting increased requirements due to tariffs and onshoring pressures. Flex space leasing saw an uptick to 588,701 sq. ft. Notable leases signed during the second quarter include Foxconn’s lease of two buildings in the Innerbelt Northwest Logistics Park, totaling more than 601,000 sq. ft. of space at 8188 and 8228 Houston Avenue. JW Fulfillment Inc. leased 353,000 sq. ft in Uplands Twinwood Distribution Center located at 2062 Woods Rd. In addition, JD Logistics leased 259,500 SF of space at Stafford Logistics on Pike Rd.

Net absorption reached 1.4 million sq. ft. in Q2 2025, up 36.9% from 1.02 million sq. ft. in Q1 2025, yet extending Houston’s 16-year streak of positive absorption. Warehouse/distribution space absorbed 1.88 million sq. ft., offsetting a manufacturing decline of -104,207 sq. ft. and a decrease in flex absorption of -376,650 sq. ft. Key submarkets like North (941,520 sq. ft.), Northwest (353,525 sq. ft.), and CBD (350,592 sq. ft.) drove gains, while manufacturing’s dip suggests short-term adjustments amid tariffrelated shifts (specific move-ins to be updated). Notable deals include EDA International taking 374,000 sq. ft. at Mason Ranch, DPR Construction taking 325,219 sq. ft at 26007 Highway 249, and Old World Industries, LLC taking 279,000 sq. ft. at Port 10 Logistics Center.

The overall vacancy rate rose to 7.1% in Q2 2025, up 30 basis points from 6.8% in Q1 2025, but dropped 60 basis points from 7.7% in Q2 2024. Flex space vacancy held the highest vacancy rate at 9.6%, while manufacturing stayed tight at 2.7%, and warehouse/distribution increased to 7.5%. Total availability dropped 10 basis points to 9.5%.

The construction pipeline expanded to 19.1 million sq. ft., a 14% increase from 16.7 million sq. ft. in Q1 2025, with 3.99 million sq. ft. delivered, up 12% from the prior quarter’s 3.6 million sq. ft. However, year-over-year deliveries dropped 45.6% from 7.3 million sq. ft. in Q2 2024. The lack of entitled properties in the greater Houston MSA continues to constrain supply growth, maintaining market equilibrium despite rising demand.

Rates Climb to Record $0.86 per Sq. Ft.

The average monthly rental rate (NNN) reached $0.86 per sq. ft., up 6.2% from $0.81 in Q1 2025 and 11.7% from $0.77 in Q2 2024. Flex space led at $0.99 per sq. ft., surprisingly followed by manufacturing, which jumped from $0.73 to $0.92 per sq. ft over the quarter. Warehouse/distribution space has an average lease rate of $0.79 per sq. ft. The Southwest submarket posted the highest rental rate at $0.99 per sq. ft., with Northeast and North close behind, both at $0.87 per sq. ft.

In the second quarter of 2025, 160 Industrial and Flex properties sold for a total 7.1 million sq. ft. of aggregate volume. The average price per sq. ft. was $149 and had a 7.0% average cap rate. Notable sales transactions in the second quarter include Foxconn’s purchase of Fairbanks Logistics Park from Dalfen Industrial. The four-building portfolio totaling 1 million sq. ft was 32% leased at the time of sale. The property sold for a rumored price of $141 per sq. ft. Lineage Logistics LLC purchased a 315,100 sq. ft. cold storage facility located at 7500 Uvalde Rd. from Boomerang Industrial for $90 million or $286 per sq. ft. At the time of sale, Lineage Logistics LLC occupied 100% of the building.

BY BRANDI SMITH

Texas’ major multifamily markets are stabilizing at different paces as developers and investors adjust to higher interest rates, record deliveries and shifting renter preferences. Across Dallas, Austin, Houston and San Antonio, the fundamentals are recalibrating — sometimes painfully — in a landscape still shaped by the development surge of the past several years.

While deal activity has slowed in some cities, brokers say buyers are beginning to re-engage, sellers are adjusting expectations and demand continues to flow into the state’s fastest-growing metros. But the pressure of oversupply, particularly in Class B and C product, is weighing on performance in several markets.

DFW is still leading, but not unscathed

DFW has remained a national leader in multifamily deliveries. And while that pipeline is still working its way through the system, investors are seeing signs of renewed activity.

“The market has largely adjusted to current conditions and we're seeing the gap between buyer and seller expectations narrow,” said Kevin Diener, first vice president at Matthews Real Estate Investment Services. “We are only a small margin off.”

Operators are increasingly willing to sell assets at a loss according to Diener, but DFW has avoided a wave of distress so far.

“While some groups are still walking a fine line to keep deals afloat, there hasn’t been a notable uptick in foreclosures,” he said. “Overall, the DFW multifamily market has held up remarkably well given the broader economic factors and the volume of new supply.”

That supply is forcing owners to compete, especially at the top of the market.

“A-class properties have begun reducing move-in concessions and are seeing occupancy improve,” Diener said. “However, B- and C-class assets are facing more challenges. Tenants are taking advantage of concessions to move into A-class buildings for only a marginal increase in rent, which has negatively impacted occupancy — especially in C-class properties.”

Urban core submarkets are proving more resilient.

“Properties in central Dallas and Fort Worth proper are performing well, particularly as more companies are calling employees back to the office,”

“Inventory levels are rising and we anticipate a significant increase in transaction volume over the next six to 18 months.”

Diener said. “Young professionals want to be where the action is and areas like Uptown Dallas are seeing strong occupancy and rent growth.”

With population and job growth continuing, Diener expects more activity ahead.

“Inventory levels are rising and we anticipate a significant increase in transaction volume over the next six to 18 months,” he said. “Groups that have been on the sidelines for the past few years are starting to re-enter the market.”

Location and basis define winners and losers in Austin

Few cities have seen a more dramatic swing than Austin, where development exploded during the pandemic-era tech boom and is now forcing deep recalibration.

“At this point in the market, I would generally say it’s bad,” said Richard Waterhouse, a multifamily investment specialist with Matthews. “Transaction velocity is down between 80 and 90 percent from where it was eight quarters ago in the private client space.”

Waterhouse tracks everything from traditional trades to pref equity takeovers and said Austin’s challenges stem from a potent mix: higher rates, a glut of supply and the end of remote work-fueled migration.

“There are developers who built garden deals expecting to trade at $270,000 or $280,000 a door,” he said. “Today, those same deals are trading in the high $100s or low $200s and that’s very location-specific.”

For Waterhouse, everything comes back to two fundamentals: location and basis.

“The only thing that makes a 300-unit garden deal special is basis,” he said. “We’ve built 60 or 70 of them with minor changes — a nicer clubhouse, a bigger pool — but at the end of the day, what matters is location and basis.”

Downtown towers are struggling to meet pro forma rents, but Waterhouse said renters are still willing to pay top dollar for desirable locations.

“They’ll get to $3,500 one-bedroom rents eventually,” he said. “When you own the nicest product in a Tier 2 city, you get to set the price.” Renter preference is pushing older properties out of the picture.

“Class A product is close to market occupancy,” Waterhouse said. “But we still have 20,000 more Class A units to lease in the next year and those renters are coming from somewhere — mostly Class B and C.” Houston remains volatile, but is stabilizing

In Houston, market volatility is gradually giving way to more confident underwriting even if sentiment remains uneven.

“The Houston multifamily market is still quite volatile, but we’re starting to see stability return — and that’s the most important thing,” said Luke Matthews, a multifamily investment associate with Matthews. “When buyers can reasonably project expenses like insurance and taxes, that brings confidence back into underwriting.”

Sellers are adjusting their pricing expectations, he said, and buyers are inching back in.

“Rates have held steady for a while now and that’s helped fundamentals come back,” Matthews said. “Buyers are starting to put numbers on paper again and sellers are realizing that pricing just isn’t where they want it to be.”

Submarket dynamics are playing a big role in Houston’s resilience. Matthews pointed to Northwest Houston, Katy, Cypress and Montgomery County as pockets of activity.

“There’s still strong activity in pockets like Webster, League City and that southeast I-45 corridor,” he said. “It’s all part of that natural growth path.”

Most developers are hitting pause, Matthews added, with new supply trailing behind Dallas and Austin.

“Most groups are sticking to the more typical value-add approach,” he said. “Construction costs are still high, even though they’ve started to level off.”

San Antonio’s steady growth matched by cautious capital

Unlike its larger neighbors, San Antonio’s multifamily market is marked by steadier growth and a more measured investment climate.

According to Matthews’ Q1 2025 market report, both rent growth and occupancy ticked upward for the first time since 2022. The metro recorded an 88.8% stabilized occupancy rate with net absorption of 2,804 units.

Population growth continues to outpace national trends, driven by domestic migration and robust job creation in healthcare, defense and finance. The metro’s unemployment rate sits below the national average at 3.9%.

Roughly 11,000 units were delivered over the past 12 months, with another 5,600 still under construction. Most new Class A product is concentrated in Midtown, Downtown and Far West San Antonio, while build-to-rent offerings are expanding in surrounding areas like New Braunfels and Alamo Ranch.

Still, the transaction pace has slowed. The market saw only three sales of 25 units or more in Q1, down from a quarterly average of 10.5 in 2024. Elevated interest rates have widened cap rates, particularly for older product.

With lower price points and resilient in-migration, San Antonio remains an attractive long-term bet, but capital is still moving cautiously.

KDS de stijl interiors, LLC

2006 E Cesar Chavez St. Austin, TX 78702

P: 512.457.1332

Website: kdsaustin.com

Key Contacts: Jill Laverentz, Owner, jill@kdsaustin.com; Clark Kampfe, Principal, clark@kdsaustin.com

Services Provided: Programming & Client Process Analysis – Due Diligence & Building Analysis – Schematic Design – Test Fit & Pricing Notes – Project Scheduling Goals – Consultant Team Formation – Cost Analysis & Value Engineering – Design Development – Construction Documentation – Racking, Commodity, & Equipment Coordination – Permit Processing – Project Management – Construction Administration – Project Budgeting & Cost Tracking – As-Built Documents

Company Profile: KDS is a full-service commercial design firm with 30+ years of experience including 25,000,000+ SF of Industrial/Flex and 3,000,000+ SF of Office Projects. We are committed to responsiveness and to providing well designed and implemented solutions. Our extensive knowledge base and adept management of critical milestones creates consistently successful projects.

Notable/Recent Projects: American Canning – Austin, TX – 101,000 SF –Manufacturing & Distribution

FlightSafety International – TX & OK – 186,000 SF Combined – Manufacturing GT Distributors – Pflugerville, TX – 58,000 SF – Retail, Office, Fabrication, Storage & Distribution

280 E. Levee Street Dallas, TX 75207

P: 469.498.0998

Website: lgedesignbuild.com

Key Contact: Ray Catlin, Regional Vice President, rcatlin@lgedesignbuild.com

Service Provided: LGE Design Build provides comprehensive design and construction services, including architecture, engineering, and interior design. LGE specializes in commercial, industrial, retail, healthcare, and tenant improvement projects. Utilizing a client-centric, design-build model, LGE ensures streamlined processes, reduced costs, and sustainable building practices for customized, high-quality results.

Company Profile: LGE, with dual headquarters in Phoenix and Dallas, provides full-service architecture, design, engineering, budget control, permits, and construction. Renowned for integrity and craftsmanship, LGE has completed over 1,200 projects across industries like industrial, office, hospitality, medical, and more, delivering award-winning designs. Notable/Recent Projects: LGE Dallas Headquarters, Mesquite 635, Fort West Commerce Center, Houston Point 290, Cypress Creek Distribution Center, McKinney Trade Center II, Sunridge Industrial Park, Park West Phase III, Bottled Blonde / Backyard Fort Worth.

CMI BROKERAGE

820 Gessner, Suite 1525

Houston, TX 77024

P: 713.961.4666

Website: cmirealestate.com

Key Contacts: Trent Vacek, tvacek@cmirealestate.com; James Sinclair, jsinclair@cmirealestate.com

Services Provided: Central Management, Inc. is a full-service commercial real estate firm providing Brokerage Services; Property, Facility, Construction and Asset Management Services; Landlord and Tenant Representation; Land Sales; Receivership and Real Estate Recovery. Services are available for Industrial, Land, Multifamily, MOB, Office and Retail. Licensed in Oklahoma and Texas.

Company Profile: Central Management, Inc. (CMI) was founded by Houston real estate professional Vic Vacek in 1978. Our team understands the intricacies of the markets that offer investors an edge both from a leasing and an asset management perspective. Certified AMO® 1984, IREM, CPM, CCIM, NAR, HAR, NALP, ICSC, and TREC. Notable Transactions/Clients: Armada Big Springs Ptnrs, Barbour Invts., Baytown ISD, Core Real Estate, Hoffpauir Estate, JLC Properties, KBR, Prudential, Rawson Blum & Leon, Subway, Texas Hearing Institute, Triple Crown Invts., US Oncology, Vigavi Realty, Walgreens.

ROOFING COMPANIES

HIGHUP ROOFING

6620 Isabelle Dr. Austin, TX 78752

P: 512.566.9989

Website: highuproofingllc.com

Key Contact: Nasir Hussain, Owner, highuproofing94@gmail.com

ALSTON CONSTRUCTION COMPANY

HOU: 1300 W. Sam Houston Pkwy S

Suite 225, Houston, TX 77042

DAL: 10440 North Central Expressway

Suite 720, Dallas, TX 75231

Website: alstonco.com

Key Contact: HOU: Nick Dwyer, Director of Business Development, ndwyer@alstonco.com

DAL: Brittany Schneider, Director of Business Development, bschneider@alstonco.com

Services Provided: Alston offers a diverse background of design-build experience, general contracting and construction management of industrial, commercial, healthcare, retail, and municipal projects.

Company Profile: Alston Construction’s success begins and ends with our approach to planning, scheduling, and choosing the right team. We have been adhering to an open and collaborative approach since our founding more than 35 years ago.

Notable/Recent Projects: Innovation Ridge Logistics Park, a 1.1 million SF 3 building industrial business park in Forney; 610 Business District, a 388,795 SF industrial park located in Houston; 1.2 million SF logistics facility located in Conroe.

98 San Jacinto Blvd, 4th Floor

Austin, TX 78701

P: 512.872.6698

Website: summitdb.com

Key Contacts: Adam Miller, President, amiller@summitdb.com; Doug Hayes, Project Executive, dhayes@summitdb.com; Amber Autumn, Business Development, aautumn@summitdb.com

Services Provided: Summit Design + Build, LLC is a provider of full service general contracting, construction management and design/ build construction services for the commercial, industrial, multifamily residential, office/tenant interiors, hospitality and institutional markets.

Company Profile: Located in downtown Austin and with offices in Tampa, FL, Chicago, IL and North Carolina, Summit Design + Build has been involved in the design and construction of over 400 buildings and spaces totaling more than 10 million square feet over the firm’s 18 year history.

Notable/Recently Completed Projects: Montage – 2323 S. Lamar (Multifamily), Congress Lofts at St. Elmo (Multifamily), UpCampus Student Housing Tallahassee (Multifamily), WeWork (Office TI), Eli’s Cheesecake (Industrial), Lockheed Martin (Industrial), Stadium Lofts North Carolina (Multifamily).

PUREFYT COMMUNITY CARE

14205 N MoPac Expy, Suite 570 PMB #565290

Austin, TX 78728

P: 512.775.3704

Website: purefytcc.com

Key Contact: Ge'O-Vanna Smith, Owner, mobileivtherapyaustin@gmail.com

Services Provided: Mobile Medical Services; emergency medical services; medical service company; emergency medical services; family health medical services; behavioral health services; behavioral mental health; behavioral healthcare services; behavior health services; behavior health service; advanced behavioral health services; mobile iv therapy; mobile iv therapy near me; mobile iv therapy austin; community medical services.

Services Provided: Flat Roof Coating, Roof Repair, Roof Installation, Roof Maintenance, Torch Down Roofing, Commercial Roofing, Residential Roofing.

Rhonda Noell hired at Texas Capital

Rhonda Noell is Managing Director, Healthcare at Texas Capital, where she focuses on healthcare lending in cashflow, asset-based lending and real estate. She brings over three decades of experience and is responsible for strategy, new products, originations, credit prescreen review and portfolio consultation.

Steve Farabaugh hired at Hill & Wilkinson

We’re excited to welcome Steve Farabaugh as Vice President at Hill & Wilkinson. With over $670M of experience in mission critical construction, including one of the nation’s largest third-party data centers at time of award, Steve brings deep technical knowledge and leadership in complex, large-scale builds. He also serves on the Board of Governors for the 7×24 Lone Star Chapter. Steve will be a valuable addition to our growing mission critical team.

Mariam Ghoul, recognized at Dalfen Industrial

Mariam Ghoul, Managing Director of HR & Operations at Dalfen Industrial, plays a key role in driving Dalfen’s continued growth and operational success. She consistently demonstrates strategic leadership in her role as she provides guidance to management on critical areas such as staffing plans, compensation strategy, benefits design, and professional development initiatives.

Beyond HR leadership, Mariam drives resource planning and operational efficiency across the organization. She collaborates closely with department heads to streamline workflows, implement scalable processes, and align daily operations with long-term business goals. Her ability to balance strategy with execution makes

her an indispensable asset to the team and a driver of organizational performance.

Mariam oversees operations for more than 100 employees across nine offices and supports a company managing over $5 billion in assets under management.

David Yeagy promoted to President, Austin Commercial at Austin Commercial

Austin Industries has promoted David Yeagy to President of Austin Commercial, based in Dallas. He first joined Austin in 1995, and served most recently as Sr. Vice President, overseeing operations across Austin Commercial’s Southeast, Austin (TX), and Los Angeles regional offices. Under his leadership, the company has realized success across key construction markets, including advanced technology, aviation, healthcare, higher education, hospitality, corporate office, and themed entertainment.

Reese promoted to Vice President at Moss

Moss has promoted Andrew Reese to Vice President in its Dallas office. With a career focused on large-scale commercial construction in the DFW market, Andrew specializes in high-rise projects and leads both operations and project pursuits. He is known for delivering complex builds with precision and for his commitment to developing high-performing teams. Andrew holds a degree from Texas Tech University and is a LEED Accredited Professional.

CBRE names market leader, senior managing director for Austin, San Antonio and El Paso

CBRE added Ryan Kasten as the Market Leader and Senior Managing Director for Austin, San Antonio and El Paso, Texas. Kasten will be based in the firm’s Austin office.

In his role, Kasten will oversee the market’s business operations and drive their growth strategies for all

Advisory Service lines, including leasing, sales, debt and structured finance, valuation and property management.

With nearly 20 years in commercial real estate, Kasten most recently served as Partner and Managing Director for Partners Real Estate overseeing the firm’s brokerage services for Austin and San Antonio. Prior to that, he spent eight years in Cushman & Wakefield’s Austin office, most recently as Managing Principal for the firm’s Austin and San Antonio markets where he increased the company’s revenue and market share along all service lines.

Kendra Gouge hired at Harmony Bank

We are delighted to welcome Kendra Gouge as Senior Vice President, Commercial Loan Officer at our Midlothian branch. With over 20 years of experience, her expertise in managing diverse loan portfolios spans C&I, SBA, and Commercial Real Estate projects. She is a dedicated wife, mother, and community leader. Serving as President of DFW Professional Women’s Networking Group and actively supports Make-A-Wish North Texas.

Laura Vargas, AIA, NCARB, LEED AP BD+C promoted to Principal/ Academic Director at Page, now Stantec

Laura Vargas, AIA, NCARB, LEED AP BD+C, has been named Academic Director at Page in Houston. A Principal with nearly 20 years of experience, she leads complex higher education, science & technology, healthcare, and research projects. Laura brings a collaborative, missiondriven approach to delivering innovative environments that advance performance by design.

Education & Daycare

WINNER! CONROE ISD NEW JUNIOR HIGH

School of Science and Technology Sugar Land High School

Texas A&M University System Nuclear Engineering

Education Building

Green / LEED Development of the Year

Technip Energies Relocation

WINNER! VIVA CENTER

Industrial / Manufacturing / Science

6600 Longpoint

Beltway 66 Logistics Park

WINNER! EMPIRE WEST BUSINESS PARK

Port 99

Interior Design

Cyclone Anaya’s - Westheimer

Fluor

Schenider Electric | Round Up

WINNER! THE KENNEDY

Tomball Early Excellence Academy

Medical / Mixed-Use Property

Retina Consultants of Texas The Woodlands

WINNER! 1023 STUDEWOOD

2910 McKinney

Office - Suburban

Telios Corporation Office

Nurix Therapeutics

WINNER! CIVE HEADQUARTERS

Office - Urban

Fuse Workspace

Galleria Park

MaRS Culture Offices

WINNER! NORTON ROSE FULBRIGHT

PhiloWilke Partnership

Shipley Snell Montgomery LLP

Redevelopment / Reuse / Historic

2910 McKinney

K9 Resorts

Late August

Maven Sawyer Yards

WINNER! TEXAS A&M UNIVERSITY SYSTEM

BORLAUG CENTER ADDITION

ViVa Center

Retail / Restaurant

Azumi

Chardon

ChòpnBlọk

Credence & Sidebar

MaRS Mercantile

WINNER! TALYARD BREWING CO.

The Sylvie

James “Jim” Furr’s journey began in a small Louisiana town, later moving to Monroe, where he graduated from high school. He pursued his passion for architecture at LSU, earning a Bachelor of Architecture degree in 1969, and served in the US Army Reserves. In 1967, Jim married his high school sweetheart, Jo, and they relocated to Houston in 1970. There, he joined Neuhaus+Taylor, which evolved into 3D/I. At 3D/I, Jim led the Interiors team and eventually the entire office. In 1987, he co-founded Hoover & Furr Architects, a subsidiary of 3D/I.

In 1994, Jim was recruited by Gensler, where he served as Managing Principal of the Houston office and the South Central Region for over two decades. His leadership was instrumental in establishing the Houston office as the largest design firm in the city, significantly shaping the Houston skyline.

Promoted to Regional Managing Principal, Jim oversaw the growth of the Houston office and the opening of new offices in Dallas and Austin,

forming the South Central Region. He also represented his region on Gensler’s Board of Directors and Management Committee. Jim’s leadership and vision laid the foundation for the region’s success, bringing in major projects and fostering lasting client relationships, including:

• Houston Museum of Natural Science

• Reliant Energy Tower at 1000 Main

• ExxonMobil Campus Project

• Anadarko Petroleum Headquarters

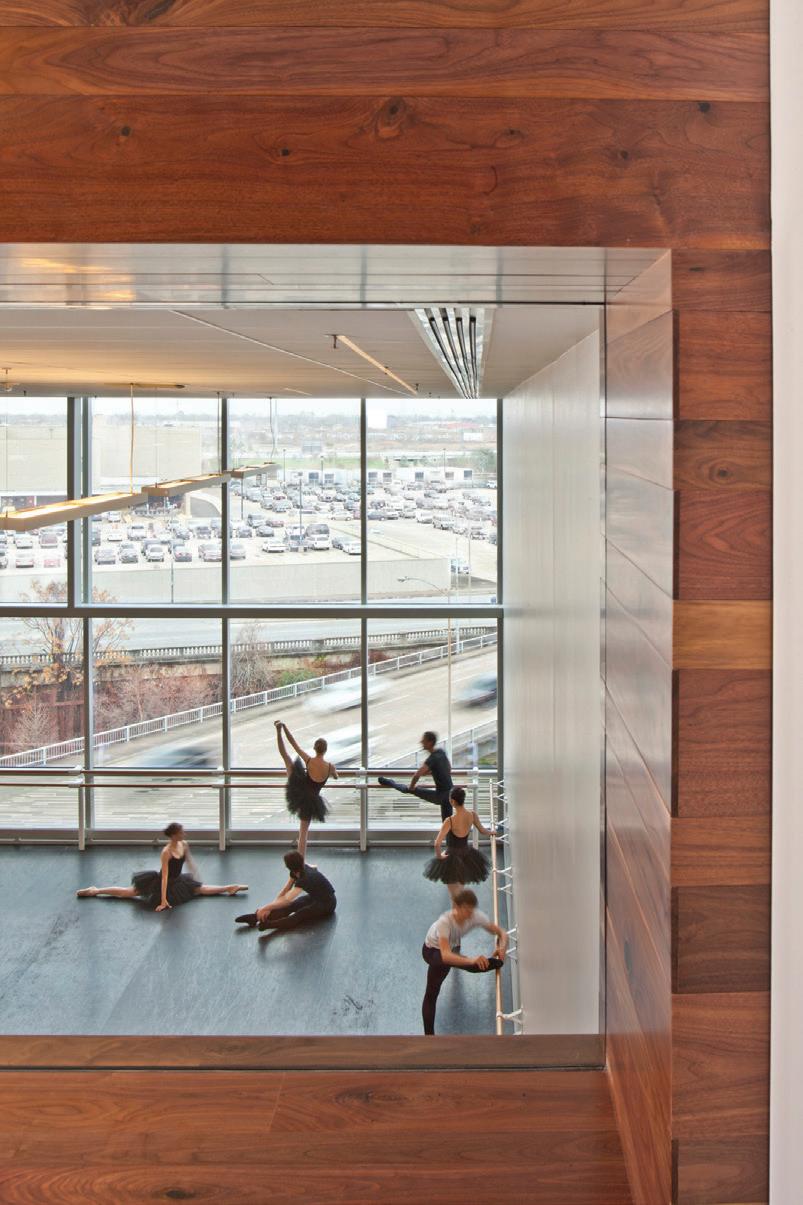

• Houston Ballet Center for Dance

• City Centre Mixed-Use Development

• Hess Tower at Discovery Green

• Kinder High School for the Performing & Visual Arts

• Hilton Americas Hotel

• Alkek Tower for Biomedical Science at Baylor College of Medicine

Jim’s dedication to his profession earned him election to the AIA College of Fellows in 1987. He served as President of AIA Houston in 1994, Vice President of the Texas Society of Architects in 1996, and President of the Rice Design Alliance. With over 43 years of professional experience, Jim is licensed in more than 14 states.

Beyond his professional achievements, Jim has been a pillar of the Houston community, serving on numerous boards, including The Heritage Society, Houston Arts Fund, Greater Houston Preservation Alliance, Contemporary Arts Museum, Blaffer Art Museum, Central Houston, Inc., University of Houston School of Architecture Leadership Council, and New Hope Housing. For over 20 years, he was a senior lecturer at the Rice University School of Architecture.

Jim and Jo celebrated 58 years of marriage in June. Reflecting on his life, Jim once remarked that his greatest project was his two children, now including his five stellar grandchildren.

His daughter, Dr. Erin Furr Stimming, a Neurologist and Professor of Neurology at UT McGovern Medical School, lives in Houston with her husband, Chris, and their sons, Hopson, Eason, and Wells. His son, O’Neal Furr, an architect and Senior Associate at Gensler, resides in Houston with his wife, Grace, and their daughters, Josephine and Juliette.

Since retiring, Jim holds the title of Managing Principal Emeritus at Gensler, focusing on client and community service and mentoring the firm’s next generation of leaders.

Architecture/Engineering Firm of the Year

DLR Group

Heights Venture

WINNER! WGA

Brokerage Firm of the Year

Junction

Marcus & Millichap

Matthews Real Estate Investment Services

Northmarq

Oxford Partners

WINNER! STREAM REALTY PARTNERS

Colliers Houston

Lee & Associates

Developer of the Year

Dhanani Private Equity Group

Junction

WINNER! PROVIDENT REALTY ADVISORS

Stream Realty Partners

General Contractor of the Year

Angler Construction

WINNER! ARCO DESIGN/BUILD HOUSTON

DPEG Construction

JNT Construction

Right Choice Construction

Owner / Landlord

WINNER! DHANANI PRIVATE EQUITY GROUP

Elevate Commercial Investment Group

Professional Service Company of the Year

Hiffman National Project Services

Lane Property Tax Advocates

WINNER! MARS CULTURE

Property Management Company of the Year

Emerge Living

Haswani Investments

Hiffman National

WINNER! LEE & ASSOCIATES

Real Estate Law Firm of the Year

WINNER! PORTER LAW FIRM

Sultanali Law, PLLC

LANE FIGHTS UNFAIR COMMERCIAL PROPERTY TAXES AND WINS.

Overinflated commercial property valuations can cause stress and strain budgets. Lane Property Tax Advocates protests for you. Trust the experts to unburden your business.

Architect/Engineer of the Year

Paul Kweton, DLR Group

WINNER! ROCKY GONZALEZ, LEE & ASSOCIATESHOUSTON

Broker of the Year - Investment

Gus Lagos, Marcus & Millichap

WINNER! JP HAYES, JUNCTION

Ryan Hartsell, Oxford Partners

Sameer Haswani, Haswani Investments

Stefan Galagaza, Junction

Taylor Snoddy, Northmarq

Broker of the Year - Leasing

Brad Fricks, Stream Realty Partners

Garret Geaccone, Stream Realty Partners

WINNER! JOHN NICHOLSON, COLLIERS HOUSTON

Jon Dutton, Granite Properties

Matt Asvestas, Stream Realty Partners

Stephen Kuper, Lee & Associates

Broker TEAM of the Year

Colliers Broker Team

Junction Broker Team

Marcus & Millichap Broker Team - Retail Group

WINNER! NEWMARK BROKER TEAM - MULTIFAMILY CAPITAL MARKETS

Newmark Broker Team - Tenant Representation

Economic Developer of the Year

Devon Rodriguez, City of Sugar Land

WINNER! KELLY VIOLETTE, TOMBALL ECONOMIC DEVELOPMENT CORPORATION

Emerging Leader of the Year -Brokerage/Management

Eric Stockley, Northmarq

Imtiaz Ali, Alison Commercial Group @ KW Commercial Signature

WINNER! MASON ALSBROOKS, LEE & ASSOCIATESHOUSTON

Megan Hutson, Hiffman National

Emerging Leader of the Year - Investment

Ali Wadhwani, Dhanani Private Equity Group

WINNER! MATHEW VOLZ, PAGEWOOD

Sameer Haswani, Haswani Investments

Emerging Leader of the Year - Development/Design

Ash Harley-Majic, DC Partners & Houston EB5

Francesca Sosa-Alkhoury, Inventure

WINNER! NIKHIL DHANANI, DHANANI PRIVATE EQUITY GROUP

Tina Khatri, TDK Construction Company

Scan the QR code for more information.

Executive of the Year - Development/Management

WINNER! CHRISTEN VESTAL, PROVIDENT

Jorge Abreu, Elevate Commercial Investment Group

Kelie Mayfield, MaRS Culture

Reed Vestal, Junction

Tom Murphy, Hiffman National

Executive of the Year - Investment

Ash Shah, Impex Capital Group

Ben Suttles, Disrupt Equity

Feras Moussa, Disrupt Equity

Nick Dhanani, Dhanani Private Equity Group

WINNER! PAUL COONROD, PAGEWOOD

Sameer Haswani, Haswani Investments

Navigating property taxes can be challenging, but the right approach uncovers savings that strengthen your bottom line.

Houston’s top real estate owners and developers rely on Ryan to uncover hidden tax savings, cut costs, and redirect capital where it drives the most value. We deliver more than compliance—our strategic tax solutions fuel profitability, accelerate growth, and drive long-term asset performance.

Uncover savings that fuel long-term growth.

Interior Designer of the Year

Catherine Bellshaw, Inventure

WINNER! GIN BRAVERMAN, GIN DESIGN GROUP

Jesus Guerrero, DLR Group

Kelie Mayfield, MaRS Culture

Stephanie Fallon, PhiloWilke Partnership

Project Manager of the Year

Alex Morales, Cushman & Wakefield

Blake Berg, DC Partners

Brianna Kushner, Hiffman National WINNER! ERIC OLIVER, JUNCTION

Johnathon Jordan, Wan Bridge Group

Ruby Mares, Corvus Construction Company

Property Manager of the Year

Anna Broussard, TBDM, a Wan Bridge Company

WINNER! CHRISTINA CRUZ, STREAM REALTY PARTNERS

Lillie Norton, Lee & Associates - Houston

Sarvin Mohammadi, Stream Realty Partners

Real Estate Lawyer of the Year

WINNER! BRAD PORTER, PORTER LAW FIRM

Rahila Sultanali, Sultanali Law, PLLC

Woman of the Year - Design/Operation

Dawn Arcieri, KT Ventures / Sparrow Studio

Kelie Mayfield, MaRS Culture

Landrie Tribble, Inventure

Mary Roder, Heights Venture

Michelle Mitchell, Hiffman National

WINNER! QETURAH WILLIAMS, DLR GROUP

Woman of the Year - Development/Investment

WINNER! BECKY DUBNER, PAGEWOOD

Lucy Singh, Dhanani Private Equity Group

Taylor Beakey, Pagewood

Woman of the Year - Brokerage/Advisory

WINNER! LAURA HARVEY, STREAM REALTY PARTNERS

Rahila Sultanali, Sultanali Law, PLLC and Commonwealth Title of Houston, Inc.

Most Significant Investment Sale Transaction in 2024

Fairbanks Logistics Center

WINNER! VIRAGE ON MEMORIAL

Most Significant Lease Transaction in 2024

WINNER! GULF INLAND LOGISTICS PARK

Oliva Gibbs |11750 Katy Freeway

Based out of Houston, Texas, Dhanani Private Equity Group (DPEG) is a $2 billion familyowned real estate syndication specializing in high-performing investment opportunities across multifamily, retail, office, land, hotels, and convenience stores.