2 minute read

In Financial

GETTING LOAN-READY FOR 2022

Over the past few decades, the Australian property market has continued to grow exponentially, defying all odds in the wake of the global financial crisis (GFC) and a pandemic. Across the ditch in New Zealand, the situation is much the same, with Government recently introducing restrictions to help cool a red-hot property market. Along with historically low interest rates across Australasia, making borrowing money more affordable for many, consumers’ spending habits have changed as a result of restricted choices. At the same time, more people are saving because of concerns around job security, all of which is driving increased demand for property and greater spending power. For those considering buying property in 2022, there’s a lot to grapple with, including the way properties are being bought and sold post-pandemic. While there’s never been a better time to invest in property, having an experienced mortgage professional on your side is increasingly advantageous.

Tips to Help Prepare For a Loan Application

1. Review spending habits Cut back on discretionary spending. Think retail shopping, Uber Eats, AfterPay and subscriptions.

2. Start seriously saving Avoid paying LMI (Lenders’ Mortgage Insurance) and/or LEP(Low Equity Premium) by saving a bigger deposit. Download the Mortgage Express budget tool by scanning the QR code below to check your numbers.

3. Get your story straight Collate all paperwork including details of any Covid support received in 2021.

4. Clear your debt Pay down debt, check your credit report and sort out any issues. Knowing your own credit score gives you confidence; to get your free personal credit check visit: moneysmart.gov.au/managing-debt/credit-scores-and-credit-reports

5.Grow your own knowledge Use these online tools and calculators in Australia and New Zealand to crunch your numbers in a hurry. Read reputable blogs, and talk to a Mortgage Express professional at the start of your property journey. What’s happening in Australia? • Property sales are up post-lockdown • Median house prices continue to rise across all regions • Tight supply not meeting demand • Highest rental growth in over a decade • Historically high auction clearance rates • Historically low interest rates

What’s happening in New Zealand? • Rules introduced around limiting availability of tax deductions for investors • Returning Kiwis investing in property • Rapid house price increases • Starting to see an uplift in interest rates from the historically low levels • Ongoing demand for housing and housing shortages across the region

Download the Mortgage Express budget tool by simply scanning the QR code:

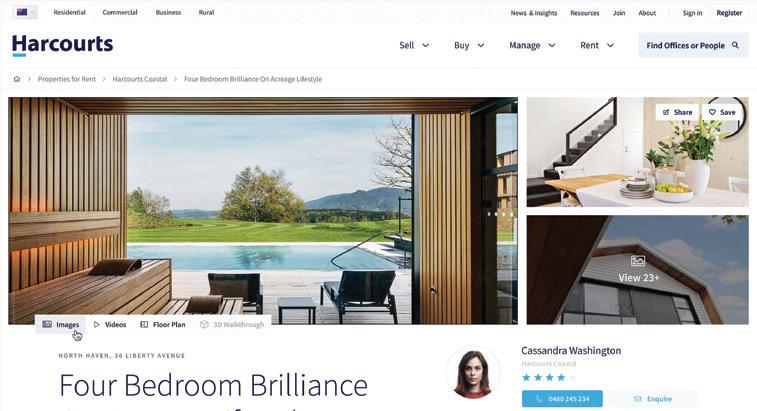

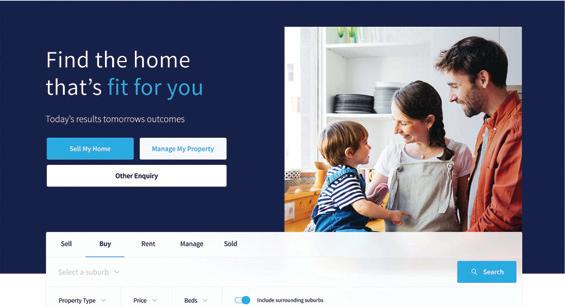

The best real estate websites exclusively for you and your business.

Attract new leads with flawless website designs that are fully customisable and easy to manage.

Built to rank & attract new leads. Designed to stand out. Easy to use and manage. Real-time analytics.