COMMODITY PRICES

Record highs in 2022

Implications of invasion

Mistry said that damage to ports and infrastructure in Ukraine meant a lag of at least four to six weeks before exports could resume. There were also problems with Russian exports, meaning supply from the rest of the world had to increase. The most bullish agricultural commodities would be wheat and corn, and sunflower oil would also be very buoyant in the vegetable oil market. Meanwhile, energy prices would fuel biodiesel profitability, while fertiliser prices and availability would be a problem. The Russian economy would almost certainly be driven into a recession. “All bets are off while the conflict

2012/13 1,090 8,240 980 –

2020/21 2,880 8,210 1,950 450

2021/22 3,600 6,950 2,200 250

10,670

13,490

13,000

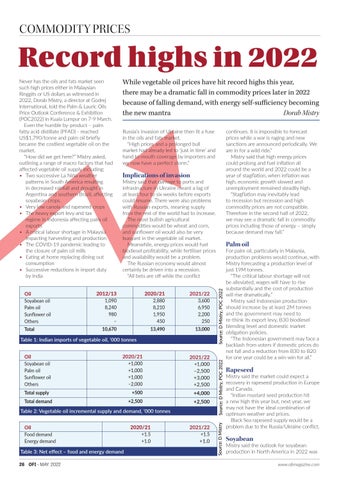

Table 1: Indian imports of vegetable oil, ‘000 tonnes Oil Soyabean oil Palm oil Sunflower oil Others

2020/21 +1,000 +1,000 +1,000 –2,000

2021/22 +1,000 –2,500 +3,000 +2,500

+500

+4,000

+2,500

+2,500

Total supply Total demand

Table 2: Vegetable oil incremental supply and demand, ‘000 tonnes Oil Food demand Energy demand Table 3: Net effect – food and energy demand 26 OFI – MAY 2022

Commodity prices 2022.indd 2

continues. It is impossible to forecast prices while a war is raging and new sanctions are announced periodically. We are in for a wild ride.” Mistry said that high energy prices could prolong and fuel inflation all around the world and 2022 could be a year of stagflation, when inflation was high, economic growth slowed and unemployment remained steadily high. “Stagflation may inevitably lead to recession but recession and high commodity prices are not compatible. Therefore in the second half of 2022, we may see a dramatic fall in commodity prices including those of energy – simply because demand may fall.”

2020/21 +1.5 +1.0

2021/22 +1.5 +1.0

Palm oil

Source: D Mistry, POC 2022

Total

Russia’s invasion of Ukraine then lit a fuse in the oils and fats market. “High prices and a prolonged bull market had already led to ‘just in time’ and hand to mouth coverage by importers and we now have a perfect storm.”

Source: D Mistry, POC 2022

Oil Soyabean oil Palm oil Sunflower oil Others

While vegetable oil prices have hit record highs this year, there may be a dramatic fall in commodity prices later in 2022 because of falling demand, with energy self-sufficiency becoming the new mantra Dorab Mistry

Source: D Mistry

Never has the oils and fats market seen such high prices either in Malaysian Ringgits or US dollars as witnessed in 2022, Dorab Mistry, a director at Godrej International, told the Palm & Lauric Oils Price Outlook Conference & Exhibition (POC2022) in Kuala Lumpur on 7-9 March. Even the humble by-product – palm fatty acid distillate (PFAD) - reached US$1,790/tonne and palm oil briefly became the costliest vegetable oil on the market. “How did we get here?” Mistry asked, outlining a range of macro factors that had affected vegetable oil supply including: • Two successive La Niña weather patterns in South America resulting in decreased rainfall and drought in Argentina and southern Brazil, affecting soyabean crops. • Very low canola and rapeseed crops • The heavy export levy and tax regime in Indonesia affecting palm oil exports • A critical labour shortage in Malaysia impacting harvesting and production • The COVID-19 pandemic leading to the closure of palm oil mills • Eating at home replacing dining out consumption • Successive reductions in import duty by India

For palm oil, particularly in Malaysia, production problems would continue, with Mistry forecasting a production level of just 19M tonnes. “The critical labour shortage will not be alleviated, wages will have to rise substantially and the cost of production will rise dramatically.” Mistry said Indonesian production should increase by at least 2M tonnes and the government may need to re-think its export levy, B30 biodiesel blending level and domestic market obligation policies. “The Indonesian government may face a backlash from voters if domestic prices do not fall and a reduction from B30 to B20 for one year could be a win-win for all.”

Rapeseed

Mistry said the market could expect a recovery in rapeseed production in Europe and Canada. “Indian mustard seed production hit a new high this year but, next year, we may not have the ideal combination of optimum weather and prices. Black Sea rapeseed supply would be a problem due to the Russia/Ukraine conflict.

Soyabean

Mistry said the outlook for soyabean production in North America in 2022 was

www.ofimagazine.com

04/05/2022 11:12:00