TRANSPORT & STORAGE

UCO grows to supply HVO market

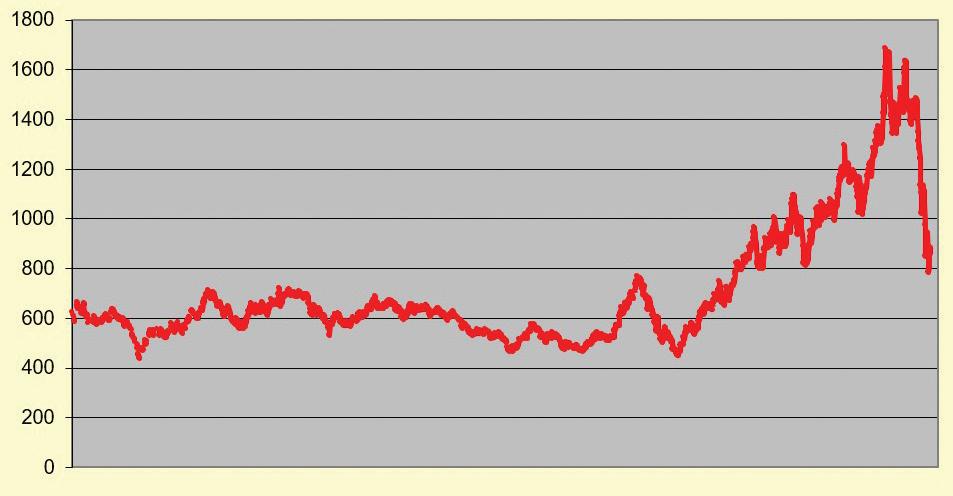

Growing environmental concerns and rising awareness of sustainable energy resources are driving considerable growth in the global used cooking oil (UCO) market. Production is also being boosted by recent technological advancements in UCO processing, expanding supplies from the food service industry, and government to promote UCO for industrial use. The global UCO market is expected to grow from US$6bn in 2021 to US$10.1bn in 2028, equating to a CAGR (compound annual growth rate) of 7.8% over the period, according to a January 2022 report by market research firm Fortune Business Insights. And, although 2020 saw a 12.5% decline in production due to the COVID-19 pandemic, the market began to bounce back in 2021 once consumers resumed eating out and restrictions hampering the collection, processing and transport of UCO were lifted. Industry experts agree that the UCO market growth is being driven by the uptick in its use as biofuel, the main application in recent years. In Europe and the USA, UCO has been used for biodiesel production in the past 15 years to support the decarbonisation of road transport, notes Leonidas Kanonis, director of communication and analysis at the European Waste-based & Advanced 28 OFI – JULY/AUGUST 2022

UCO 2pg.indd 2

Biofuels Association (EWABA). Since 2011, use of UCO for biodiesel (including renewable diesel) has tripled and now represents almost 20% of total biofuel production in Europe, adds Emanuela Peduzzi, spokesperson for the European Federation for Transport and Environment, commonly known as Transport & Environment. UCO is also an important feedstock for renewable fuels for maritime shipping and aviation, while also being used to make animal feed in China, India and the USA. Its use in the oleochemicals industry for producing soap and other products, however, is negligible. The key to the growth of UCO for biofuels is favourable government policy and legislation, says Tenny Kristiana, associate researcher at the fuels programme in the International Council on Clean Transportation (ICCT). As a “low-carbon feedstock for biofuel that is both technologically mature and commercially available,” UCO “is ideal for meeting biofuel mandates in Europe and the United States,” notes a February 2022 report by the ICCT. The European Union’s (EU) renewable energy directive (RED II), for example, incentivises the use of UCO biofuels to meet renewable energy targets in transport, while UCO is “an attractive

Photo: Neste

The used cooking oil (UCO) market is expanding to meet increased feedstock demand from the renewable diesel sector. Correct UCO storage and transport are key but there is potential for fraud related to its collection Kathryn Wortley

option” to help meet California’s Low Carbon Fuel Standard in the USA, the paper continues. According to Transport & Environment, UCO accounted for about 20% or 3M tonnes of the feedstock used in biodiesel production in Europe in 2020. However, the region does not produce enough UCO for its biodiesel consumption. Data from the ICCT shows that Asian UCO imports are crucial, with China, India, Indonesia, Japan, Malaysia and South Korea being the main Asian producers exporting to Europe as well as the USA. There is also intra-Asia trade among these six Asian producers, particularly in exports from China and Indonesia to Malaysia and South Korea and from Japan to South Korea. “The EU is the main producer [of UCO] and the largest buyer of UCO globally,” says Kanonis, pointing out that in 2020, Europe imported around 1.7M tonnes of UCO, mainly from Asia.

Correct storage and transport

With UCO an important global commodity, its correct storage and transport is key, both for the food service industry and households; and relating to country-wide systems or international trade. According to the European Biomass u Industry Association, there are three

www.ofimagazine.com

21/07/2022 14:41:48