Provenir AI for Fraud Analytics

Challenge

The first interaction with the customer is always the riskiest, with a very high potential for fraud. Traditional policy-based approaches often fail to identify potential fraud and/or produce large volumes of false positives, which then require manual review.

Our Solution: Provenir AI

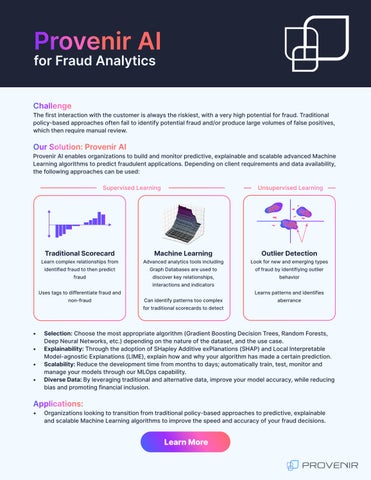

Provenir AI enables organizations to build and monitor predictive, explainable and scalable advanced Machine Learning algorithms to predict fraudulent applications. Depending on client requirements and data availability, the following approaches can be used:

Supervised Learning

Traditional Scorecard

Learn complex relationships from identified fraud to then predict fraud

Uses tags to differentiate fraud and non-fraud

Machine Learning

Advanced analytics tools including Graph Databases are used to discover key relationships, interactions and indicators

Can identify patterns too complex for traditional scorecards to detect

Unsupervised Learning

Outlier Detection

Look for new and emerging types of fraud by identifiying outlier behavior

• Selection: Choose the most appropriate algorithm (Gradient Boosting Decision Trees, Random Forests, Deep Neural Networks, etc.) depending on the nature of the dataset, and the use case.

• Explainability: Through the adoption of SHapley Additive exPlanations (SHAP) and Local Interpretable Model-agnostic Explanations (LIME), explain how and why your algorithm has made a certain prediction.

• Scalability: Reduce the development time from months to days; automatically train, test, monitor and manage your models through our MLOps capability.

• Diverse Data: By leveraging traditional and alternative data, improve your model accuracy, while reducing bias and promoting financial inclusion.

• Applications:

• Organizations looking to transition from traditional policy-based approaches to predictive, explainable and scalable Machine Learning algorithms to improve the speed and accuracy of your fraud decisions.

Learns patterns and identifies aberrance Learn More