Atlas Copco is redefining industrial air compression with energy-efficient, intelligent solutions that help manufacturers cut costs, reduce emissions, and stay competitive. From the GA VSDs series—delivering up to 60% energy savings—to oil-free and centrifugal compressors, every product is built for performance and sustainability.

SmartLink and AIRPlan offer real-time insights and hassle-free ownership, while containerised AIRCUBE systems provide flexible, plug-and-play solutions. With advanced control, heat recovery, and 24/7 support, Atlas Copco delivers compressed air solutions that works harder and smarter.

Efficiency. Reliability. Innovation.

That’s the Atlas Copco advantage.

manmonthly.com.au

Chairman: John Murphy

CEO: Christine Clancy

Managing Editor: Mike Wheeler

Editor: Jack Lloyd jack.lloyd@primecreative.com.au

Design: Alejandro Molano

Head of Design: Blake Storey

Sales/Advertising: Emily Gorgievska Ph: 0432 083 392 emily.gorgievska@primecreative.com.au

Subscriptions

Published 11 times a year

Subscriptions $140.00 per annum (inc GST) Overseas prices apply Ph: (03) 9690 8766

Copyright Manufacturers’ Monthly is owned by Prime Creative Media and published by John Murphy.

All material in Manufacturers’ Monthly is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. The Editor welcomes contributions but reserves the right to accept or reject any material. While every effort has been made to ensure the accuracy of information, Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published.

The opinions expressed in Manufacturers’ Monthly are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

© Copyright Prime Creative Media, 2024

Articles

All articles submitted for publication become the property of the publisher. The Editor reserves the right to adjust any article to conform with the magazine format.

Head Office

379 Docklands Drive Docklands VIC 3008 P: +61 3 9690 8766 enquiries@primecreative.com.au www.primecreative.com.au

Sydney Office Suite 11.01, 201 Miller St, North Sydney, NSW 2060

Printed by: The Precision Group

83-89 Freight Drive. Somerton Vic 3062 Ph: (03) 9794 8337

Welcome to the September edition of Manufacturers’ Monthly

This issue sees the release of IBISWorld’s Top 100 Manufacturers List, a definitive ranking of Australia’s highest-revenue manufacturing companies across 62 industries. For this issue’s cover story, we explore Atlas Copco’s energyefficient industrial air compressors that help manufacturers cut costs, reduce emissions, and stay competitive in a changing landscape. Finally, RSM Australia’s Manufacturing Playbook, experts Rebecca Barnes and Tim Linke reveal how strategic guidance and prepared applications are enabling manufacturers to secure vital funding for innovation, resilience, and expansion.

It’s that time of year again for Australia’s manufacturing sector with the release of IBISWorld’s 2025 Top 100 Manufacturers List. Showcasing the highest-revenue earners across 62 industries, the list represents a combined $376 billion in revenue and offers a clear snapshot of the sector’s performance. It’s a rare opportunity to focus on key trends and shifts without the cloud of negative commentary that too often overshadows manufacturing’s successes.

This year’s list reinforces what we, and many others have highlighted before: manufacturing in Australia is not “dying” – it’s evolving. That evolution brings both highs and lows, with some industries poised to drive the sector forward while others require policy reform or stronger sovereign support.

Leading the charge in the past year is pharmaceutical product manufacturing, which has grown exponentially. The sector’s momentum is clear from the volume of stories

in Manufacturers’ Monthly this year alone, with companies such as Vaxxas, Baxter Healthcare and Recce Pharmaceuticals featuring. With targeted R&D investment enabling expansion and global partnerships, companies like CSL are lifting capacity and strengthening Australia’s reputation as a leader in healthcare manufacturing.

Unfortunately, not all sectors have shared in the gains. Iron and steel manufacturing has taken a hit. Global forces – including China’s shift toward high-grade green steel to meet its 2060 carbon neutrality goal – have increased the pressure on local producers.

For a deeper analysis of these dynamics, the dedicated IBISWorld Top 100 Manufacturers section in this month’s issue is essential reading. Behind the scenes of the industry, a range of services and technologies continue to help manufacturers navigate today’s complex market environment.

Targeted government grants remain critical, enabling innovation, resilience and expansion in

the face of unstable supply chains and geopolitical tensions. In this issue, RSM Australia experts Tim Linke and Rebecca Barnes share advice on navigating the grants landscape, emphasising the importance of building robust business cases and financial models.

Technology also plays a central role in enabling growth. Compressed air solutions, often considered manufacturing’s “fourth utility” alongside electricity, gas and water, are powering tools, machinery and production processes. They underpin operations from material handling and assembly to cleaning and equipment control. This month’s cover story spotlights Atlas Copco’s, with CAPS, Pulford Air & Gas and Boge insights also featured.

Australia’s manufacturing sector continues to try to redefine itself – fuelled by innovation and targeted support. By embracing advanced technologies and strategic guidance, local manufacturers are building the means needed to compete on a global stage.

rely on gas for their round-the-clock operations. Developing a renewable gas sector could help to provide additional sustainable energy solutions for being used successfully overseas, in places like

Atlas Copco is redefining industrial air compression with energy-efficient, smart technologies that help manufacturers cut costs, reduce carbon emissions, and stay competitive in a changing landscape.

In today’s manufacturing environment, energy efficiency is no longer a luxury – it’s a necessity. With rising energy costs, tightening environmental regulations, and increasing pressure to meet sustainability targets, manufacturers are turning to smarter technologies to stay competitive.

Atlas Copco, a global name in compressed air solutions, is at the forefront of this transformation with its portfolio of energy-efficient air compressors designed for smarter manufacturing.

Atlas Copco has been pioneering compressed air technology for more than a century. Its latest generation of air compressors continues this legacy, combining cutting-edge engineering with sustainability-driven design.

The company’s Variable Speed Drive (VSD) technology, particularly the GA VSDs series, has redefined energy efficiency in industrial air compression – delivering up to 50-60 per cent energy savings compared to traditional fixedspeed compressors.

“Our GA VSDs compressors are engineered to adapt to real-time demand,” said Roshan Kumbla, product manager at Atlas Copco Australia. “This means they only use the energy required – nothing more, nothing less. It’s a game-changer for manufacturers looking to cut costs and carbon emissions.”

Atlas Copco offers a range of air compressors tailored to the diverse needs of the manufacturing industry. Here’s a breakdown of the key product segments:

Models are available from 5 kW up to 500 kW, making these compressors the backbone of many manufacturing operations. With a compact vertical design, integrated Variable Speed Drive (VSD), and low noise levels, they are well suited to spaceconstrained environments. They deliver up to 50–60 per cent energy savings, operate as quietly as 62 dB(A), and can be equipped with integrated dryer and controller options. In addition, smart connectivity via the Elektronikon Touch controller

ensures efficient monitoring and optimisation of performance.

“The GA VSDs is not just efficient – it’s intelligent,” Kumbla said. “It learns from your usage patterns and optimises performance automatically.”

2. Oil-Free Compressors (Class 0 Certified)

The ZR/ZT Series and AQ Series are designed for industries where air purity is critical, such as food and beverage, pharmaceuticals, and electronics. Atlas Copco’s oil-free compressors deliver ISO 8573-1 Class 0 certified air, ensuring the highest standard of quality and safety. They provide 100 per cent oil-free air, reduce the risk of contamination, and help lower maintenance costs. Additionally, energy recovery options further enhance efficiency and sustainability for manufacturers.

3. Centrifugal Compressors

This ZH Series are designed for high-capacity applications and are suited to large-scale manufacturing plants that require a continuous supply of compressed air. They deliver high flow rates with reliable oil-free operation, ensuring product integrity while keeping running costs low. With advanced control systems and a low total cost of ownership, they provide an efficient and dependable solution for demanding industrial environments.

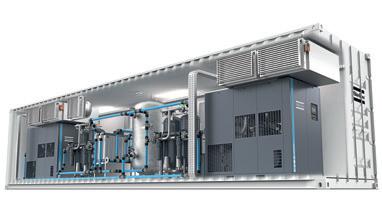

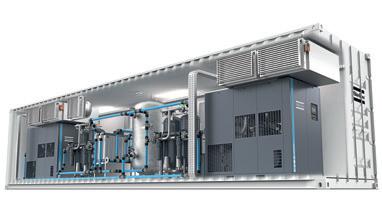

4. Containerised Solutions – AIRCUBE

For manufacturers needing flexibility or rapid deployment, the AIRCUBE provides a plug-and-play compressor room in a containerised format. This integrated system allows for quick installation and is well suited to remote or temporary sites. With customisable configurations, the AIRCUBE delivers a practical, scalable solution that meets a range of operational needs.

Atlas Copco’s SmartLink and AIRPlan solutions are transforming how businesses manage compressed air. SmartLink gives users real-time insights into system performance, helping reduce energy use, prevent downtime, and plan maintenance proactively. AIRPlan takes the hassle out of ownership by offering a complete compressed air package – including equipment, service, and upgrades – for a fixed monthly fee. No upfront investment, no surprises. Together, these solutions

deliver reliability, transparency, and peace of mind, so users can focus on what matters most: running operations efficiently.

The Elektronikon Touch Controller is a smart, user-friendly interface that gives full control over a compressor system. It offers real-time monitoring, advanced scheduling, and energy-saving features – all accessible through a responsive touchscreen. Designed for reliability and efficiency, it helps optimise performance and reduce operational costs. Also, the Optimizer 4.0 is a central controller that manages multiple compressors, ensuring optimal load distribution and minimising energy use.

There are also key energy recovery systems, with up to 94 per cent of the energy used in compression can be recovered as heat and reused in other processes, such as water heating or space heating.

“One of our clients in the food sector now uses recovered heat from their compressors to preheat water for cleaning processes,” said Kumbla. “It’s a perfect example of circular efficiency.”

Atlas Copco backs its products with a robust service network across Australia 24/7. From preventive maintenance to emergency repairs, customers benefit from local expertise and global standards. Service highlights include:

• Genuine parts and lubricants.

• Remote monitoring and diagnostics.

• Tailored service plans.

• ISO-certified quality and safety standards.

• Real-World results.

Whether it’s a small workshop or a largescale production facility, Atlas Copco offers a tailored, energy-efficient air solution to meet customers’ needs.

For more info, please visit this QR Code or contact Atlas Copco Compressors Australia at 1800 023 469

With Australia’s manufacturing sector under pressure, RSM Australia explores how strategic advice and well-prepared grant applications are helping manufacturers access critical funding for innovation, resilience and expansion.

Australia’s manufacturing sector is at a critical juncture, but rising demand for sovereign capabilities and decarbonisation is creating strong opportunities for manufacturers to innovate and expand.

Government grant funding can be a powerful tool to help businesses seize this momentum, offering support for growth, modernisation and long-term resilience. While the funding landscape can be complex, those who navigate it successfully are unlocking advantages.

“There’s never really a bad time to act, but the manufacturing sector is in decline, and that needs to be addressed,” said Tim Linke, partner, Financial Modelling, RSM Australia.

“Government support is out there – businesses should be taking advantage of it to expand manufacturing lines rather than continue down the path of contraction.”

This view is shared by Rebecca Barnes, RSM’s director of National Grants, who believes targeted funding programs designed to build resilience in the sector have never been more important.

“We’ve seen international supply chains become

less stable and geopolitical tensions increase, and all of that points to the need for stronger onshore manufacturing,” she said.

Navigating the funding landscape

Australian State and Federal Governments collectively offer billions of dollars across thousands of grant programs. According to Barnes, the grants targeted at manufacturers have increasingly become focused on specific subsectors – specifically critical minerals processing, medical technologies, ag-tech, defence, transport, energy and renewables – rather than supporting traditional manufacturing more broadly.

A major trend in recent years has been the focus on decarbonisation. Grant funding is now frequently used to help high-emitting manufacturers reduce their environmental impact, while simultaneously supporting innovation in low-carbon technologies. However, identifying the right grant opportunity is only the beginning. According to Barnes, a good grant application does more than tick eligibility boxes; it aligns with the strategic intent of the funding body and presents a clear, compelling case.

“It’s a minefield out there. The government offers thousands of programs and billions of dollars, but figuring out what’s relevant is incredibly difficult,” she said. “My full-time job is staying across the grants landscape, understanding the details of the eligibility criteria and the intent behind each funding body’s program.

“Even if you meet the eligibility criteria, that doesn’t always mean you’re likely to be competitive. It’s about knowing what kind of ribbon the funding body wants to cut.”

To help manufacturers navigate this “minefield,” RSM has built a specialised grant advisory service that supports businesses through every stage of the process, from initial scoping to post-grant reporting and commercialisation. Rather than trying to navigate that minefield alone, manufacturers who are unsure can contact RSM, ask questions and get options and possibilities in return.

“This is a key service line that RSM has invested in and built specifically to support clients through the complexity of the grants landscape,” said Linke. Strategic preparation is critical. Grants are rarely awarded retroactively, and businesses must demonstrate how the funding aligns with broader growth plans. Linke says that the correct process starts with having a clear plan and demonstrating

how the grant will be used to support that plan.

RSM’s approach involves helping clients build robust business cases, develop financial forecasts, and use ‘what-if’ scenario modelling to understand the potential impact of grant funding.

“We help clients develop models and forecast tools to perform ‘what if’ analysis, essentially providing a crystal ball for potential outcomes,” said Linke. “This analysis helps them decide the right course of action based on current micro and macroeconomic conditions.”

To help address the rigorous and multifaceted grant application process, Barnes outlined a multi-step approach, starting with a realistic assessment of the implications of grant funding.

“It’s important to consider whether a grant works commercially for your business,” she said. “For example, if applying means you can’t start your project for another four months, is that delay going to harm your commercial interests?”

Next comes project definition, developing a win theme, preparing documentation – such as project plans, governance frameworks and financial modelling – and finally, lodgement. Very often, grant applications involve large numbers of stakeholders, contributors and deliverables which need to be coordinated to a hard deadline.

Barnes said that helping businesses achieve this level of preparedness is one of the qualities of a good grants consultant, but an excellent grants consultant “will be passionate about your success”.

“They will work and push and communicate and sacrifice as though your success were their own,” she said.

One example is a minerals processing company that approached RSM Australia with a decarbonisation project. Unsure of where to start, they relied on RSM to connect the project with the right funding stream.

“ We set up a workshop to fully understand the project, the business and their trajectory, then mapped it against the funding landscape,” Barnes said. “Ultimately, we helped them secure more than $30 million for their decarbonisation project.”

Importantly, RSM’s support doesn’t end once the grant is approved. The firm views funding as part of a broader business growth lifecycle where grants, financial modelling, auditing and strategic advisory services work together to scale a company sustainably. All these elements support a growing business beyond just securing grant funding.

“The grant process is just one part of a broader business support system,” Linke said. “RSM has teams that can support a range of business requirements, including audit, business advisory, and preparing for potential M&A or divestments down the track.”

With interest rates expected to fall, Linke believes now is an opportune time to consider blending public and private capital to support growth initiatives.

“It’s probably a good time to be brave – to take advantage of both public and private funding opportunities and invest in growth,” he said. Looking ahead, the pair believe manufacturers should keep an eye on key state and federal programmes such as the Industry Growth Programme, CRC Projects, the National Reconstruction Fund, Defence Industry Development Grants and ARENA’s suite of decarbonisation incentives.

“There are different categories of grants depending on what you’re looking to achieve, such as funding for new IP development or manufacturing expansion,” Barnes said. “When it comes to capital facility establishment, the National Reconstruction Fund is a key program – though it’s not a grant, but rather debt finance or investment.”

Government grants are not merely helpful addons – for many businesses, they are enablers of future growth. In many cases, grants play a critical role in enabling businesses to take the next step.

“At the highest level, grants can be a decision breaker on potential acquisitions or expansions – essentially the next evolution of the business,” said Linke.

With the right preparation, guidance, and strategic thinking, government grants can unlock transformational opportunities – and with RSM Australia’s support, manufacturers are increasingly turning this complex process into a powerful growth engine.

Tyre-derived material is a scientifically validated, high-performance material driving sustainable manufacturing and proving that recycled content can rival – and even surpass – virgin resources.

For decades, recycled materials were seen by many manufacturers as unpredictable in quality, inconsistent in supply, and best suited for low-value applications.

That perception is shifting. ESG targets, tightening regulations and changing market expectations are pushing manufacturers to integrate recycled content into their products. The real change lies in how these materials are now engineered, tested and validated –making them not just viable, but sometimes superior, alternatives to virgin resources.

Tyre-derived material (TDM) is a prime example. With proven durability and versatility, it’s used in roads, permeable paving, concrete crash barriers and acoustic panels.

“There’s a real drive to do something with the resources we already have,” said Dr Linda Mitchell, science, research and innovation manager at Tyre Stewardship Australia (TSA).

“Materials that were once relegated to basic applications are now being considered for highervalue infrastructure projects – often delivering comparable or better performance while helping meet sustainability targets.”

Overcoming assumptions with scientific validation

If recycled inputs once carried a stigma of being weaker or less safe, TDM is challenging that through rigorous testing. Its durability is one of the most reliably measured traits, stemming from the tyre’s original design to endure extreme conditions.

“Rubber in tyres is made to last. We validate that in lots of studies to ensure its fit for purpose in its next life as TDM,” Mitchell said. “TSA’s Market Development Fund pairs funding with research — from technical studies to lab testing — so manufacturers have the evidence they need that tyre-derived rubber can deliver on durability, safety and performance.”

One focus has been road construction, where TSA partnered with the Southern Sydney Regional Organisation of Councils (SSROC) to compare rubbermodified roads with traditional asphalt. Across projects involving 12 councils, the results were clear.

“Eighty per cent of those roads performed just as well, or even better in terms of durability,” Mitchell said. “This is part of validating TDM to ensure performance requirements are met.”

“These studies range from testing performance properties — such as flexibility, resistance, and cracking behaviour — to assessing environmental benefits including the reduced carbon emissions during production and construction. Together, they create a robust evidence base that gives manufacturers and procurement teams the confidence to specify tyre-derived materials without hesitation.”

The Market Development Fund: de-risking

To accelerate adoption, TSA’s Market Development Fund (MD Fund) supports manufacturers and innovators using TDM– from concept design through to market demonstration.

The MD Fund operates year-round with two streams: a research and development pathway for early-stage concepts, and a demonstration and infrastructure pathway for market-ready products requiring trials or real-world validation. Applications are reviewed by TSA’s Research Advisory Committee and assessed by the TSA Board.

“You don’t need to start with a full application. Get in touch with us to have a chat about your idea – we can point you in the right direction and give you the best chance of success,” Mitchell said.

Several manufacturers have already leveraged TSA’s support to bring TDM products to market.

In Queensland, the Department of Primary Industries developed a particle board incorporating recycled rubber, successfully validated in their laboratory and are now progressing to full scale manufacturing trials.

In Victoria, a university project produced a concrete crash barrier containing rubber, which resulted in better energy absorption, reduced risk to vehicle occupants and increased barrier lifespan. TSA

also worked with Australian manufacturer Coloured Recycled Group to expand the use of their rubber surfacing in sports facilities and into public and private infrastructure.

Permeable paving is another success story. A Melbourne university research project, supported by TSA, evolved into a commercial business, Porous Lane, now supplying councils across several states.

“Sometimes it’s not a matter of ‘does this product work?’ but ‘does it work in this specific environment?’,” Mitchell said. “That’s where the trialling and proof-ofconcept support is so valuable.”

With mounting evidence and case studies, Mitchell’s message to manufacturers is clear: the opportunity is here, and support is available. From reducing environmental impact to enhancing product performance, TDM offers a pathway to meet ESG goals without compromising quality.

“If you’re thinking about using rubber, engage with TSA early,” Mitchell said. “Apply for funding. It’s there to help overcome misconceptions and give you that kick start in an area that might feel a bit unknown.”

Recycled materials are no longer fringe experiments in manufacturing, but reliable, high-performance inputs of the future. For TDM, that future is already rolling out on roads, building sites and industrial projects – proving that waste can be one of manufacturing’s most valuable raw materials.

INDO PACIFIC 2023 DELIVERED:

Royal Australian Navy Sea Power Conference

25,000+ visitor attendances

832 participating exhibitor companies from 21 nations

90 conferences, symposia and presentations

IMC 2023 International Maritime Conference

171 defence, industry, government and academic delegations from 46 nations

FREE TRADE VISITOR REGISTRATION NOW OPEN EVENT.INDOPACIFICEXPO.COM.AU/REGISTER

CAPS deliver locally engineered compressed air and power generation solutions, combining global technology with expert local support.

Efficient and continuous operation are key elements in most industrial and manufacturing processes, so it is important to have a compressed air solution that achieves both.

Creating compressed air and power generation solutions across Australia for more than 45 years, CAPS delivers systems that are designed and configured to the end use application. Whether a reciprocating rotary screw, oil-free rotary screw, portable diesel or centrifugal air compressor is needed, CAPS’ solutions are engineered for local operating requirements, giving best-in-class outcomes, that last.

Any inefficiency or downtime can have a costly impact on operations, so CAPS draws from its

partner brands such as Ingersoll Rand, AIRMAN, Mitsubishi Heavy Industries, Sauer, Pedro Gil, Next Turbo Technologies, in designing a solution.

The right compressor for the job

Safety, quality and hygiene standards that are key across the manufacturing, food and pharmaceutical sectors are all captured, along with operational efficiencies, when specialised ‘Class Zero’ air quality compressors are utilised to supply clean, dry air.

Minimising the initial possibility of contamination by using oil-free compressors, the achievement and maintenance of critical air purity requires fewer ancillary equipment elements. With a reduction in the risk to air quality there is also less equipment

that requires servicing – all boosting the long-term operational benefits for your operations.

Every application is different and the experts at CAPS can help users assess their requirements to find the right match. For larger scale applications, CAPS has a range of oil-free centrifugal compressors as well as rotary screw compressors from 37kW to 355kW in either fixed or variable speed.

On a smaller scale, CAPS can offer scroll compressors in an all-in-one solution with a dryer, storage tank and compressor in a single unit.

Offered as a single phase from 1.5kW – 2.2 kW, or three phase from 3.7kW to 7.5kW, CAPS suggests this integrated solution as suitable for smaller applications requiring oil-free air.

Initial lower costs means that many manufacturing

customers opt to use oil-lubricated compressors with air treatment processes downstream. From 5kW through to a 315kW, there are many technologies and brands to choose from, and it can be challenging to evaluate different compressors to select the best technology for a particular system. CAPS offers a suite of compressed air solutions and has the expertise to help match the right equipment to a customer’s needs.

Founded in Western Australia in 1980, CAPS joined the global Ingersoll Rand family in 2024, expanding its access to Ingersoll Rand’s global offering of innovative and mission-critical air, fluid, energy and medical technologies. Enhancing industrial productivity and efficiency, the company’s delivery of air and power solutions is also underpinned by the financial strength of Ingersoll Rand. With 10 branches nationwide, CAPS’ team brings together great service, with expert advice, support and spare parts. Its 24/7 maintenance and breakdown service ensure customers’ operations run smoothly. Additionally, CAPS Care programs package the service and support experience for clients with a range of diagnostic and maintenance programs to maximise the operational performance of the air compressors.

Manufacturing all but stops when the power goes out and CAPS has been entrusted to provide reliable power solutions for clients of all scales throughout Australia. Sustaining operations across manufacturing, healthcare, data centres, water treatment, landfills and independent power stations, CAPS’ solutions are underpinned by high performance and fuel-efficient equipment.

As Australia’s number one supplier of AIRMAN products, and the official Australian distributor for the Mitsubishi Generator Series (MGS), CAPS can deliver the power generation needed to keep a company operating.

CAPS delivers custom-built systems that are matched to clients’ requirements. Complete solutions are designed and developed by its in-house engineering team, with delivery supported through its Australian ISO9001 accredited manufacturing facility. This expertise also enables CAPS, where possible, to integrate new technology into existing installations, enhancing the operational performance and life of equipment and infrastructure.

The CAPS Engineering team manages the total design, development and manufacturing of specialised compressor, generator and blower

packages. This unique capability includes calibration and testing, helping to fast-track site installation, so users can plug and play.

CAPS can also get clients operational without big capital costs with its turnkey air and power rental solutions. Keeping operations running smoothly all year round, CAPS offers short- and long-term rental of compressors and generators across Australia. They are suitable for special projects, seasonal peak demand requirements and covering any operational breakdowns.

The national footprint of CAPS means the team is working in the same time zones as clients. It is on hand to support customers through the process, from understanding their requirements, offering suggestions and providing advice, to ultimately delivering the solutions they need. Utilising quality products with proven reliability, CAPS delivers global solutions, suited to Australian conditions and backed by local service.

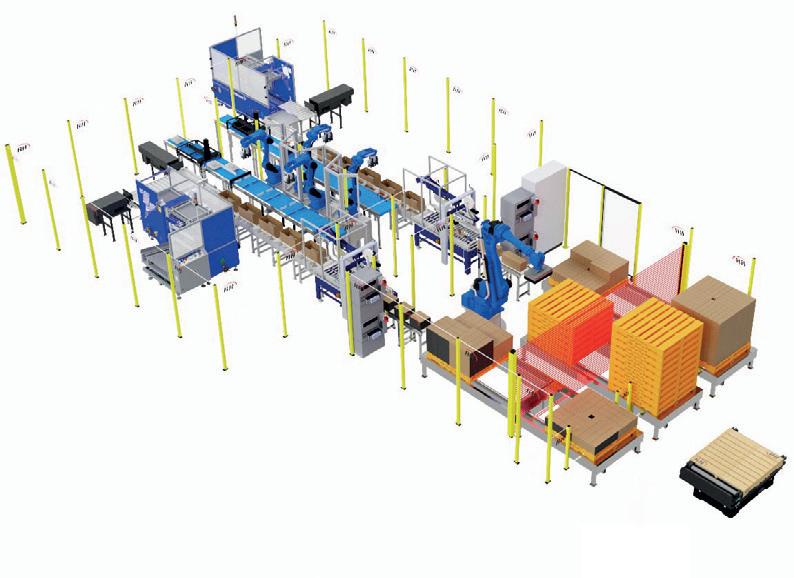

Colin Wells of Robotic Automation™ reflects on nearly 40 years of industry experience and how lessons learned are guiding the company’s future.

In 1988, after his first 10 years in the robotics industry in Europe and Australia, now group managing director Colin Wells founded his own company, Robotic Automation. The experienced team now design, supply, and integrate advanced automation and robotic systems in Australia –including turnkey robotic cells for palletising, welding, materials handling, and AGV and AMR mobile robots. The company’s solutions have helped thousands of local manufacturers in sectors like food and beverage, packaging, logistics, and heavy industry to improve safety, reduce operational costs, and boost productivity.

Reflecting on Robotic Automation’s role in a rapidly evolving industry, Wells said the company has thrived by staying true to its core strengths.

“One of the most enduring lessons we’ve learned over nearly four decades is that our greatest successes have come from leveraging our core expertise – understanding our strengths, refining our capabilities, and delivering consistent value to our clients,” said Wells.

While Robotic Automation explores new markets and technologies, it does so cautiously, as the temptation to chase trends or adopt emerging tools without proper evaluation can lead to costly detours and damaged relationships. The most recent

example of this being the misinformation leading the introduction of Cobots. This honest approach has been key to both sustainability and building client trust.

“We’ve found that progress comes from a balanced approach: staying grounded in proven knowledge while remaining open to innovation – but only after rigorous assessment,” Wells said. “This philosophy has helped us grow sustainably, build trust with our partners, and stay resilient through industry shifts.”

Equally important is the company’s willingness to turn down projects it believes are not sustainable. However, Wells said when a commitment is made, delivery is essential.

“When you have committed to achieve a result then you had better deliver it, even at considerable cost–as it’s your reputation that’s on the line,” he said.

Wells believes evolving customer needs and new technologies will continue to shape the future of robotic and automated systems. He recalled how, when Robotic Automation started in 1988, there were very few off-the-shelf options available. Anything the company needed to add or use to build a robotics-based system for a client, it had to design and make itself.

“This was tough, expensive, and therefore very risky – but no other options were available,” he said. “The robots available back then were not as friendly and nowhere near as smart or flexible as they are today.”

Now, the variety and sophistication of robotics technology is far greater, making it unnecessary to use unproven tools when more affordable, proven options are available. Yet despite that, Wells said clients still require guidance to select the right system and keep up with trends such as machine learning, flexible automation, energy efficiency and sustainability.

“Examples include AI-driven capabilities like machine learning through Yaskawa’s MOTOMAN NEXT. Adaptive robots equipped with AI use sensors and cameras to perceive situations, adapt, and complete tasks autonomously,” he said.

“Sustainability goals are also key, demonstrated by systems like MOTOMAN Yaskawa Energy Recovery, which enables robots to feed kinetic braking energy back into the grid.”

“Clients also need to keep driving industries like manufacturing, healthcare, logistics, warehousing, and agriculture in the front of their minds.”

Wells emphasised that combining different robotic technologies – such as those mentioned above – will be essential to the competitiveness of Australian manufacturing. Flexibility, he said, is the foundation of the industry’s future.

“In the not-too-distant future, AGVs, AMRs, conventional robots and cobots will just be known as automation,” Wells said. “No need to explain their differences – they are all just automation tools.”

Wells also believes that automation must not only be flexible, but simple to use, and applied within its limitations.

“We have an old saying – ‘don’t ask the robot to make the tea as well’ – which is when we believe we are asking too much from the robot. That inevitably results in lower output as the system is forever being edited to accommodate, instead of working and reducing the clients’ costs” he said.

The robotics and automation industry has had its fair share of challenges, often in the form of misconceptions and a lack of adequate support. According to Wells, many clients still

This end-of-line packaging system is a great example of how combining robots and AMRs to work in unison produces a highly flexible product.

misunderstand what robots, AGVs, AMRs, and cobots can and cannot do. This reality is often professionally overcome by the company’s long history of proven experience that can’t be brought to the table elsewhere.

“If Robotic Automation is apprehensive about supporting an unviable project, it’s for good reason, and we can often knowledgeably guide our customers to a more effective and efficient solution,” he said.

Another challenge facing Australian industry, according to Wells, is the lack of meaningful government support, particularly in research and development, where emerging consulting firms seem to be more prevalent each year, siphoning what little governmental initiatives remain for little return.

“While there is much talk of driving industry back to Australia, there are still very few initiatives actually being offered,” he said.

Wells believes this must change for Australia to compete and allow technologies like robotics to help local manufacturing thrive again. He said automation will be crucial to reviving Australian industry in the face of labour shortages, rising costs, and a growing need for efficiency.

“Many industries that were lost to offshore production can only be brought back if we embrace automation at scale,” he said. “Automation offers a way to rebuild smarter – enabling high-quality, costeffective, flexible production while remaining globally competitive.”

Looking ahead, Wells believes robotics will become not just a tool, but a vital component of national industry strategy.

“Without it, reshoring and revitalising Australian industry simply won’t be viable,” he concluded

Investing in front office technology is a critical driver for manufacturing growth, with AI tools from companies like Paperless Parts delivering impact alongside shop floor equipment and talent.

For Jason Ray, co-founder and CEO of cloudbased quoting platform Paperless Parts, investing in front office operations is as vital as spending on the factory floor. While often overlooked, quoting technology enables faster, more consistent estimates that keep customers engaged and operations flowing.

“You can have the most advanced equipment on your floor, but if your quoting process is slow or inconsistent, you’ll never reach your full potential,” he said. “Growth in this industry starts with the first customer interaction, not the first cut. Front office operations are the engine behind predictable, profitable growth.”

A major challenge, Ray said, is the lack of centralised, accessible data in quoting. Disconnected information leads to errors, delays and lost revenue, as quoting is high stakes: a bad estimate can lose the job or win it at a financial loss.

“Too often, critical details live in someone’s head, a random spreadsheet, or buried in emails,” he said. “That leaves the shop floor guessing, trying to reverse-engineer what the quote was based on. Solving it starts with breaking down silos and standardising information flow from quote to production.”

Quoting often falls on the most experienced team members, who juggle admin tasks like sorting files, interpreting RFQs, and entering data. This diverts time from more valuable activities.

“A modern quoting platform takes that burden off their plate so shops can move faster, respond with confidence, and compete at a higher level,” Ray said. “Manufacturing is more competitive than ever, and quoting can either be a growth engine or a bottleneck.”

Paperless Parts modernises and automates the quoting process for custom manufacturers. By eliminating spreadsheets and manual workflows, it enables faster, more accurate quoting through automation, CAD integration, and data-driven tools.

“With tools like Paperless Parts, you can automate the admin and make it easier to delegate, so experts aren’t stuck with paperwork, and teams can focus on driving revenue,” Ray said.

The platform reduces quoting time, lowers costs, and improves win rates. Many customers report ROI matching or exceeding investments in machinery.

Hundreds of shops across North America, and now in Australia and New Zealand, use the software.

“A lot of shops have been burned by big, complicated software deployments that overpromised and underdelivered,” said Ray. “But when prospects see a shop down the road transforming its business with Paperless Parts, they know we’re delivering real results.”

Rather than replace expertise, the system enhances it. Paperless Parts uses AI to extract key data from RFQs, CAD files, and drawings, identifying material specs and details like threads or welds. This reduces manual work while speeding up quote preparation.

These capabilities are now bundled as Wingman – an AI-powered quoting assistant that extracts hundreds of data types and flags sensitive information. Coupled with the file-agnostic BOM Builder, which can cut bill of materials setup time by up to 90 per cent, estimators work from a single, searchable platform that slashes repetitive tasks.

Quoting requires dozens of decisions. “Paperless Parts uses AI to automatically extract answers

for the first 80 easy decisions and then gives you a head start on the last 20 most complex questions,” Ray said.

Brisbane-based sheet metal fabricator Metal-Tech Industries (MTI) was the first Australian business to adopt Paperless Parts. The team moved from a fragmented quoting process to a centralised system that could scale with demand.

“We’d modernised every other part of the business – this was the missing link,” said director Glen Langford.

Co-director Nathan Hockey said the platform felt purpose-built for manufacturers like MTI. After implementation, RFQs were pulled from shared inboxes, files centralised, and quotes handled from a unified dashboard.

The system allowed MTI to quote 30 per cent more work and respond to most RFQs within 24 hours, allowing sales to grow by 25 per cent.

“We’re not spending less time quoting – we’re just quoting more and finally keeping up,” Hockey said.

International users also report major efficiency gains: Axis Fabrication cut a four-hour quoting task to 45 minutes; M3 Fabrication compressed weeks-long BOM cleanups into regular quoting timelines; and; Reata Engineering reduced turnaround from weeks to a day.

The adoption of AI in manufacturing has brought both excitement and scrutiny. Paperless Parts’ success reflects a grounded approach – assisting human decision-making rather than replacing it.

Jason Luce, the company’s CTO, said AI must meet strict standards for reliability, security, and transparency – especially for projects involving Controlled Unclassified Information (CUI) or ITAR regulations.

“If you’re quoting sensitive or confidential work, data security isn’t optional,” said Luce. “The best filter for AI hype is hearing how real shops are using it – what’s working, what’s not.”

Looking ahead, Ray predicts AI will soon interpret older 2D drawings and complex 3D models, evaluate risk, and recommend optimal production strategies.

Indo Pacific 2025 will bring together defence, industry and academic leaders to tackle the latest opportunities and challenges in naval capability, uncrewed systems and maritime engineering.

While the Royal Australian Navy Sea Power Conference highlights strategy and capability desires at this year’s 2025 Indo Pacific International Maritime Exposition in November, Australia’s industry and peak bodies in uncrewed systems and maritime engineering will deliver their own specialist conferences on opportunities and challenges in their fields.

In addition, The Hub, Indo Pacific’s own curated presentation opportunity, is back for 2025 with a new line up of sessions designed to spark ideas and build connections.

Set for November 4-6 at Sydney’s International Convention Centre, Indo Pacific 2025 is the region’s commercial maritime and naval defence exposition, connecting Australian and international defence, industry, government, academia and technology leaders, in the national interest. The event creates engagement opportunities through:

• Specialist conferences and symposia, including the International Maritime Conference (IMC) and Royal Australian Navy Sea Power Conference.

• A world-class industry exhibition showcasing innovative companies from prime contractors to start-ups.

• Business-to-business (B2B) and business-togovernment (B2G) networking programs.

• Delegation engagement programs with senior defence, industry, and government representatives.

• Small-business and export development initiatives.

• A prestigious innovation awards program.

• Careers and skilling programs.

Indo Pacific is supported by the Royal Australian Navy, Australian Government Department of Defence and the New South Wales State Government. As a platform for engagement, the event provides a venue for the conferences of major Australian industry and defence organisations.

As part of Indo Pacific 2025, a brace of Australia’s engineering and commercial shipping experts will cover challenges in ship design, fuels and safety in the IMC International Maritime Conference.

Delivered by the The Royal Institution of Naval Architects, The Institute of Marine Engineering, Science and Technology and Engineers Australia, the IMC International Maritime Conference has been a pillar of the Indo Pacific event, renowned as the source of innovation and research across naval architecture, marine engineering and maritime technology in both defence and commercial shipping. The headline conference subjects reflect today’s

changing maritime world, including nuclear propulsion, uncrewed surface vessel development, shipyard capability, margins as design metrics and cyber security for vessels at sea.

Keynote speakers will include the chief of the Platforms Division of the Department of Defence Australia, Professor Scott Tyo, ASC’s chief nuclear and capability officer Alex Walsh and Australian Maritime College principal Mal Wise.

But IMC is also known for delving into detail on lesser known, but often critical subjects. This year’s conference will cover test analysis of corroded flight deck tie-down fittings, stern tube sacrificial sleeve inserts and the hydrodynamic loads on an underwater vehicle operating in a shallow channel. It will investigate evaluation of hydrodynamic impacts of aft control surface positioning in submarine design, additive manufacturing in defence and numerical simulation of ship dynamic motion and structural response.

Engineers Australia CEO Romilly Madew (AO FTSE HonFIEAust EngExec) will open the IMC conference on Tuesday 4 November. Prior to her appointment as Engineers Australia CEO in 2022, Madew was CEO of Infrastructure Australia where she was responsible for overseeing the organisation’s role in helping governments prioritise projects and reforms to serve communities. Madew served as CEO of the Green Building Council of Australia (GBCA) for 13 years. In acknowledgment of her contribution to Australia’s sustainable building movement, she was awarded an Order of Australia in 2019.

She will be followed by keynote speaker Walsh from ASC, which has been selected as Sovereign Submarine Partner in Australia’s conventionally

armed, nuclear-powered AUKUS submarine program. Walsh is a degree-qualified nuclear engineer who brings close to 40 years’ experience in the nuclear submarine and power sectors to his role. With senior expertise in engineering, project management and managing nuclear commissioning, safety and licencing, Walsh has worked in the UK, France and Australia. At BAE Systems his roles included Head of Nuclear Construction (leading the team constructing the reactors for the UK’s Astute class submarines) and Head of Nuclear Safety Engineering, leading nuclear authorisation and the safety case for Astute fuelling, commissioning and power range testing.

While engineers cover the gamut of vessels and systems, the Australian Association for Uncrewed Systems (AAUS) will concentrate on autonomous and remotely operated air and sea vehicles. This is becoming a hot topic for naval operations from cargo delivery to covert surveillance and long-range strike.

With a wide-ranging brief, the AAUS Autonomy in the Maritime Domain conference will pursue three main themes: operations (demand), technologies (enablers) and assurance (Capability integrity). These headline themes will encompass a range of discussion on air, surface, subsurface technologies and applications, the challenges and opportunities for uncrewed systems and safety considerations. They will explore the continuous evolution of operational concepts for autonomous maritime platforms, including Intelligence, Surveillance and Reconnaissance (ISR), adjunct missile magazines, drone motherships, modular mission packages, counter-mine operations and electronic warfare.

The Hub: offering something different

Once again Indo Pacific 2025 will feature The Hub, a platform for subject matter experts to present their vision, insights and solutions to the questions currently being posed by the region’s maritime community. With a three-day program of speakers, The Hub is integrated into the wider conference program and curated to ensure relevance to the audience. It is open to all trade day attendees. From maritime drones to nuclear submarine infrastructure, The Hub will tackle pressing topics facing the Indo Pacific region. Hear directly from industry leaders, global experts and defence insiders as they unpack real-world challenges and opportunities across land, sea, air and space. Session highlight presentation topics include:

• Industry and allies – beyond the pact (expanding market presence and forging strategic alliances in AUKUS and beyond).

• Joint seabed awareness at mission speed: advancing interoperability through secure data integration.

• Complexities in building and supporting nuclear submarine dock facilities.

• Unleashing the potential of maritime drones to optimise maritime security.

• Agile defence technology to address emerging threats in the Indo Pacific.

• No tender, no delay: your gateway to the U.S. Defence market in the Indo Pacific.

• Navigating the rising threat of spoofing in maritime.

• Dual use tech in AUKUS pillar one.

Whether you’re focused on capability, innovation, workforce or partnerships, The Hub delivers the conversations that matter.

The Royal Australian Navy (RAN) is undergoing its greatest capability expansion in decades, with investments in nuclear-powered submarines, advanced surface combatants, long-range strike capabilities, and autonomous maritime systems.

Therefore, Indo Pacific 2025 will be a focus for conversation on and around these issues, and the ability of Australian industry to maximise local provision of the required capability.

“It’s promising to be a great event,” said Justin Giddings, CEO of Indo Pacific organiser AMDA Foundation. “Sydney is a great venue. It was a sell out last time and it will be a sell out this time.

“It’s a great opportunity for not just Australian exhibitors, but others from around the world, to really get in front of the people who are really making some big capital investment decisions.

“Indo Pacific is by far the largest maritime event in the Southern Hemisphere and one of the largest in the world. And when you look at the investment the Australian government is making in maritime, industry needs to be here.”

For more information see www.indopacificexpo.com.au

When a servo drive fails, replacing it might seem simple – but repair can often be the smarter, less complicated solution according to Datafactory.

An electronic servo drive is a complex box controlling high performance electric motors. Industrial systems are dependent on electronic servo drives. They are everywhere. For example, they can be used to power up a CNC router or a robotic arm. They can drive a conveyor in a warehouse. They can even make the Mars Rover move around.

Despite the crucial role they play no one pays much attention to them until they fail.

But a failed servo drive is not really a problem, is it? There is no point of repairing it. You simply contact the drive maker and order a new one, right? Well not exactly. Very often an attempt to replace a failed servo drive is the start of a long journey full of surprises, however not always pleasant ones.

Firstly, you discover that the failed servo drive is obsolete. What’s more it has been obsolete for a few years and the company that used to make them does not hold any of them in stock anymore. They have a new model of course but it is not compatible with your control system.

Nor is it compatible with your servo motor. In fact, you would have to buy a new servo motor, new gearbox and employ a fitter to make a plate to mount the new gear required. But that is not all. A new drive comes with entirely different firmware (the software DNA of your servo unit).

Therefore, even if you successfully negotiate the servo motor issues, control system interface issues and quite often networking issues, you would still have to transcribe the servo drive

Products made with TDM helps you:

Maximise value with long-lasting, high-performance products.

Deliver on your sustainability goals by sourcing circular, lower-emission alternatives.

application program, by for example re-writing all parameters in the manner that your new servo drive can understand.

You have to read the manual of the old servo drive. You also have to read the manual of the new servo drive. You might even have to employ a specialist to do it for you.

It finally occurs to you that if you decide to repair the old servo drive rather than source a new one, then you would not have to deal with any of the above outlined issues at all.

But who could repair it? This is the question you should have asked yourself in the first place.

Contact Datafactory:

26/41-49 Norcal Road, Nunawading, Victoria 3131, Australia

Telephone: 03 9874 7737

E-mail: sales@datafactory.com.au Servo drives power CNCs, robots, conveyors –even the Mars Rover – making them vital to industrial systems.

Strengthen local procurement outcomes by choosing reliable, Australian-made products.

Support local innovation and industry by reducing reliance on imported material.

Support local industry and circular outcomes by choosing products made with Australia’s used tyres. Visit our website to find recycled tyre products near you.

MaXXlink is an intelligent solution that unites CAD and ERP systems, closing the critical integration gap that slows manufacturing output and creates risk.

Unlike generic connectors, MaXXlink is purpose-built for manufacturing and engineered to integrate disparate or siloed environments—such as SolidWorks, Inventor, Epicor, and MYOB Advanced—without disrupting established workflows. It transforms engineering BOMs into fully validated manufacturing BOMs with precision, speed, and complete traceability.

Visual BOM Interface — Restructure assemblies with drag-and-drop speed

CAD to E-BOM Conversion — Native compatibility with SolidWorks and Inventor

E-BOM to M-BOM Mapping — Get from design to production-ready structures in minutes

Pull non-modelled parts from your ERP — Drag and drop these parts with full traceability

Local ERP Integration — Works with Epicor, MYOB Advanced, and custom systems

Full Change Control — Built-in version tracking, approval workflows, and audit trails

BOGE and INMATEC’s two-stage nitrogen and hydrogen generation system enables manufacturers to produce ultra-pure nitrogen on-site for laser cutting, cutting process costs while improving quality and sustainability.

Laser cutting has become established as a precise procedure in industrial metal processing. Maximum material quality requires a stable inert gas atmosphere in the form of pure nitrogen. INMATEC provides a solution that allows an energy-efficient and economical nitrogen selfsupply on-site that suits a company’s requirements: a combination of the PNK nitrogen generator and the H2KAT hydrogen catalytic converter. This solution, the INMATEC Duo, helps save up to 70 per cent during metal processing using nitrogen and hydrogen.

Laser cutting is indispensable in many branches –especially in areas where metals and other materials are cut, shaped or processed precisely and flexibly. The process is used in the automobile industry, mechanical engineering, aerospace and electronics manufacturing. The increasing demand for laser cutting is based on advancing machine technologies, which allow faster and more precise processing of materials. During the cutting process, a stable inert gas atmosphere is essential to guarantee highquality processing.

Typically, nitrogen is used as an inert gas during laser cutting. The colourless and odourless gas prevents the metal from encountering oxygen along the cutting edge, thus ensuring delicate contours and clean cutting edges. If the purity of the nitrogen used is too low, the material will oxidise, creating

annealing colours, which subsequently must be removed with great effort. Cutting systems therefore require nitrogen with a high purity level of 5.0, i.e. 99.999 per cent.

The gas quality has a major influence on the processing result. The purer the nitrogen, the lower the effort during subsequent re-working and therefore also lower energy consumption during processing.

The combination of PNK nitrogen generator and H2KAT hydrogen catalytic converter uses a twostage procedure to generate nitrogen on-site. First the IMT PM LASER PSA system (Pressure Swing Adsorption) filters nitrogen from the surrounding air. Then, the H2KAT hydrogen catalytic converter removes the residual oxygen by converting it into water vapour.

This creates the aforementioned nitrogen purity of up to 99.999 per cent – at up to 50 per cent lower energy consumption compared with conventional methods. This solution forms the basis for numerous industrial uses and can be expanded purposefully with specific applications, depending on the industry.

On-site nitrogen generation reduces operating costs. In addition to saving money on transport and storage, costs during the cutting process reduce by up to 70 per cent. This is a benefit for manufacturing companies requiring a substantial gas supply.

Companies that use nitrogen generators on-site benefit from a steady gas supply and an improved carbon footprint, while keeping quality standards high. Those who supply their own power can save up to 90 per cent of costs with an INMATEC nitrogen generator.

For example, the system can store excess energy generated by a photovoltaic system. It then uses the energy in the form of nitrogen during the laser cutting process if needed. This allows virtually free production and more efficient use of selfgenerated power.

With its systems for the onsite generation of gases, INMATEC GaseTechnologie GmbH has a global presence with its headquarters in Herrsching. The company has been developing, manufacturing and delivering nitrogen and oxygen generators since 1993, and has been part of the BOGE Group since August 2023.

Reliable, clean compressed air has been BOGE’s trademark for more than 115 years. The quality and efficiency of the company’s compressors and compressed air solutions have led it to enjoy the trust of more than 100,000 users in 120 different countries.

BOGE Australia imports and distributes BOGE high-quality German machines, spare parts and all ancillary equipment through a network of trained sales and service partners throughout Australia, New Zealand, Papua New Guinea and Fiji.

By combining INMATEC’s gas generation technology with BOGE’s proven compressed air systems, manufacturers can achieve precise, costeffective and sustainable laser cutting at the highest quality standards.

APS Industrial has unveiled the new Siemens SIMATIC S7-1200 G2 – a compact PLC aimed at modernising automation for the manufacturing sector.

In Australia’s growing industrial automation landscape, APS Industrial and Siemens are solidifying their long-standing partnership with the launch of the next-generation SIMATIC S71200 G2, designed to meet the rising demand for efficient control systems. The S7-1200 G2 is a nextgeneration programmable logic controller (PLC) that automates machinery and processes by receiving inputs, executing logic-based instructions, and controlling outputs.

The S7-1200 G2 builds on more than a decade of success with the original S7-1200 “shoebox PLC” by introducing advancements while reducing the overall footprint by twenty fi ve percent. The updated platform is suited to industries where space, precision, and safety are key. This includes food and beverage production, pharmaceuticals, packaging, and material handling.

“The S7-1200 G2 brings additional value with enhanced communications and efficient motion control, plus pre-set function libraries that customers can download and use to get up and running much faster,” said Automation and Drives business manager at APS Industrial, Steven Sischy. “The focus will be on industries where you have conveyors, packaging lines or filling capabilities.”

For manufacturers considering an upgrade from earlier models, the S7-1200 G2 notable benefits in speed, connectivity and space efficiency emerging from a smaller footprint. Siemens has overhauled the PLC’s architecture, also offering benefits in system integration and programmed with TIA Portal.

“We’re moving from seven different CPUs to just four – two standard CPUs and two safety versions –which makes stocking and customer support much simpler,” said Sischy. “Expandablity is increased and we can handle more PROFINET I/O. Cybersecurity is native to the system, and for the first time we’ve introduced NFC, so with the right credentials you can walk up to a machine with your iPhone or Android and diagnose faults instantly – it’s a major step forward in efficiency.”

The advancement of the S7-1200 G2 is a targeted approach, with the system aligned with the four pillars: performance scalability, flexible machine safety, efficient motion, and increased data

transparency. One of the most important pillars of the S7-1200 G2 is improvements in performance and scalability, with new units being 25 per cent smaller than the current range.

“This means a reduced footprint, allowing us to address up to 31 PROFINET devices across the network, compared to just 16 previously,” said Sischy.

Flexible safety features have also received a boost. The G2 has doubled its support for system boards and now includes dual PROFINET channels – separating machine communication from IoT or cloud connections. This helps support a clearer division between IT and OT systems.

“With flexible machine safety, we’ve gone from supporting one system board to two, giving customers more options,” said Sischy. “On the communications side, the previous generation only supported one PROFINET channel, but now one can connect to IoT or cloud-based systems, while the other links directly to devices on the machine.

“Another important change is that customers no longer need to pay for additional software licences if they have a fail-safe CPU – it’s now included as standard in the base software package.”

Perhaps the largest enhancement of the S71200 G2 is in motion control. Where the earlier generation lacked integrated motion capabilities, the new system brings this functionality directly into the CPU, improving real-time control and synchronisation.

“Power dissipation reduced by 20 per cent for CPU 1212 and 30 per cent for CPU 1214 compared to predecessor products. Product performance increased by more than 100 per cent

with a comparable weight (avg. increase <15 per cent) for all variants of CPU 1212 and CPU 1214 compared to its predecessor” said Sischy. The new system also improves data visibility. With integrated Near Field Communication (NFC), operators can instantly access diagnostics wirelessly, reducing downtime and allowing quicker maintenance interventions.

Alongside the introduction of the S7-1200 G2, APS Industrial and Siemens have committed to helping manufacturers with a smooth transition. This includes the offering of standard functions, motion control libraries and detailed application notes.

“From start to finish, we provide everything – how to get started, how to connect, the configurations, and even the program – so the whole experience is much smoother and more user-friendly,” said Sischy.

While the technology is newly launched, APS Industrial has already seen early adoption in food and beverage applications and is working on a large water industry Remote Terminal Unit project. Sischy said that alongside these cases, the new system represents a journey into uncharted waters for APS Industrial and Siemens.

“Our key focus going forward remains on market segments where we haven’t been strong before –particularly OEM liquid filling applications. We now have the capability to pursue those opportunities,” said Sischy.

With the S7-1200 G2, APS Industrial and Siemens aim to empower manufacturers with a smarter, faster, and more transparent automation platform, ready for Industry 4.0 and beyond.

Exclusive insights into the top manufacturers in Australia.

The Top 100 Manufacturers List, based on 2024 financials, highlights Australia’s leading producers and how they’re navigating growth, volatility and global supply challenges.

IBISWorld’s 2025 Top 100 Manufacturers List showcases Australia’s leading producers across 62 manufacturing industries: from food and beverage to building materials, chemicals and transport equipment. Together, these manufacturers generated approximately $376 billion in revenue in 2024, up 5.3 per cent on the previous year’s $357 billion.

This growth was underpinned by strong pharmaceutical exports, surging demand from defence and infrastructure projects, and price-driven gains across key commodities like cement, fertiliser and meat.

Key takeaways

• IBISWorld’s 2025 Top 100 Manufacturers List comprises the highest-revenue-earning enterprises from across 62 industries within Australia’s manufacturing sector, with a combined revenue of $376 billion.

• Pharmaceutical product manufacturing in Australia prospered through targeted R&D spending, with manufacturers like CSL expanding their biologics capacity and forging global partnerships.

• Iron and steel manufacturing slumped and is set to continue slowing down as the top iron oreexporting nation, China, tends towards high-grade green steel as part of its efforts to reach carbon neutrality by 2060.

• Investments in AI and automation in the meat processing industry helped lift revenue by enhancing operational efficiency.

The Pharmaceutical Product Manufacturing industry once again reaffirmed its dominance, remaining the most represented industry in this year’s list, with six companies placing in the top 100. CSL Limited rose to third place, benefiting from strong patient demand for immunoglobulin (Ig) products through its CSL Behring segment.

While pharmaceutical manufacturers saw gains, some of the list’s largest petroleum producers moved in the opposite direction. Although Ampol Limited (1st) and BP Australia Investments Pty Ltd (4th) held their spots in the top 4, both experienced revenue declines, down 7.5 per cent and 4.1 per

cent, respectively. Falling crude oil prices and ongoing domestic supply disruptions weighed down their performances, and maintenance at Ampol’s Lytton refinery also hampered its performance, contributing to a 12 per cent drop in its production volumes to 5.3 billion litres.

This year’s list highlights how commodity price swings, automation advances and other economic headwinds continue to shape Australia’s manufacturing landscape.

Pfizer Australia Holdings Pty Limited (67th) achieved the most growth of industries across Australia’s manufacturing sector, with its revenue skyrocketing 164.4 per cent from the previous year. The transfer of assets from its related party, Pfizer PFE Australia Pty Ltd, boosted its sales revenue, driving this growth.

The company’s expansion of its product portfolio and digital capabilities through acquisitions of various pharmaceutical assets, particularly ResApp Health Limited in late 2022, propelled it forwards. These acquisitions supported its disease prevention initiatives and the development of new and improved medicines and vaccines.

Strategic investments in mRNA vaccine platforms, digital health tools and high-demand respiratory products enabled Pfizer Australia to secure a strong position as a major performer in this year’s edition of the list.

Looking ahead, Pfizer Australia’s growth trajectory will likely be shaped by the commercial rollout of new products, like its RSV vaccine, and its expanding network of digital health partnerships. This forward momentum is reflective of broader trends across the pharmaceutical sector.

Australia’s pharmaceutical product manufacturing industry continues to be shaped by strong demand for high-value therapies, particularly in immunology and blood products. In 2024, the industry benefited from rising patient demand, ageing demographics and sustained investment in research and development.

Backed by the Federal Government’s R&D Tax Incentive, firms are intensifying their focus on clinical trials and biologics development. These efforts are paying off – the industry’s six top-ranked companies generated a combined $26.7 billion in revenue. CSL was a standout performer in 2024, placing third overall on the Top 100 list.

Pharmaceutical companies in Australia have benefited from two structural trends: surging R&D investment and demand driven by an ageing population. By 30 June 2024, Australians aged 65 and over comprised approximately 17 per cent of the population, up from 12 per cent three decades earlier. This demographic trend is projected to intensify, with that share forecast to reach 24 per cent by 2064-65. An ageing population is fuelling demand for treatments targeting age-related conditions, immunodeficiencies, neurological disorders and cardiovascular diseases, reinforcing R&D-driven growth in the pharmaceutical product manufacturing industry.

The Federal Government’s Research and Development Tax Incentive (RDTI), introduced in 2020, continues to drive innovation across Australia’s pharmaceutical product manufacturing industry. The scheme encourages eligible companies to undertake clinical trials and other R&D activities by offering

generous tax offsets, which help improve profit margins and accelerate product development.

CSL Limited, one of Australia’s largest biopharmaceutical companies, has benefited from this environment. The company spent US$1.4 billion towards Research and Development in 2023-24. CSL’s focus on R&D has enabled it to develop innovative medicines like immunoglobulin products, which treat various immunological and neurological diseases. Heightened global demand for the immunoglobulin (Ig) therapies produced by its CSL Behring division led to a 14 per cent uplift in the segment’s sales revenue, contributing to the 11.9 per cent revenue growth CSL recorded in 2024. This positive performance reflects CSL’s ongoing investment in R&D, which remains central to its strategy of addressing unmet medical needs and advancing treatments for complex immunological and neurological conditions.

The pharmaceutical manufacturing industry has increased its spending towards Research and Development activities, which accounted for 31 per cent of the total expenditure during 2022-23. This R&D intensity reflects the industry’s reliance on innovation to develop high-value therapies and maintain strong profit margins across patented, specialty products.

In contrast to more commodity-exposed industries, pharmaceutical product manufacturers benefit from stronger pricing power and robust export opportunities. The industry’s consistent growth is underpinned by rising demand for biologics, vaccines and therapeutic treatments, along with structural drivers like an ageing population and Australia’s focus on sovereign medical capability. A continual commitment to innovation, particularly in biologics, is likely to support both CSL’s performance and the pharmaceutical product manufacturing industry’s ongoing growth in the years ahead.

Iron and steel revenue slides amid global shifts

Weakened global demand, falling iron ore prices and a shift towards green steel have hit Australia’s iron smelting and steel manufacturing industry, with many companies experiencing an overall revenue decline. BlueScope Steel Limited (6th), Liberty InfraBuild Limited (19th) and Liberty Primary Metals Australia Pty Ltd (31st) recorded revenue drops of 6.2 per cent, 12.3 per cent and 2.4 per cent, respectively.

China is Australia’s major exporting nation for iron ore, accounting for approximately 84 per cent of the total exports. Export volumes to China rose two per cent in the first nine months of 2024, reaching 514 million tonnes. However, this increase masks a broader shift in China’s demand away from Australia’s lower-grade iron ore as China increasingly favours higher-grade ore from competitors like Brazil and Guinea. This transition supports the Chinese Government’s ‘dual carbon goals,’ which aim to peak steel industry carbon emissions before

2030 and achieve carbon neutrality by 2060. The effects of slowing demand from China have, in turn, impacted iron ore prices, which were down 10 per cent during 2024 and sit at US$96.16 per tonne as at 1 June 2025.

Australia’s iron smelting and steel manufacturing industry felt the negative impacts of stagnant demand from China, its top export destination, as part of the shift towards green-steel practices. This led to falls in sales revenue, particularly in international segments across companies like BlueScope Steel and Liberty Primary Metals Australia.

Australia’s producers have also come under pressure from the United States, with President Donald Trump reinstating and expanding Section 232 tariffs in mid-2025. Steel import duties doubled from 25 per cent to 50 per cent, while aluminium tariffs also surged. BlueScope Steel’s US subsidiary

benefited as local prices rose, but Australian-made exports were caught in the crossfire. The Australian Government has so far failed to secure an exemption, raising concerns for manufacturers like Liberty Primary Metals Australia and InfraBuild, which have operations or supply chains exposed to the US market. These trade tensions are just one part of a broader wave of geopolitical instability that’s reshaping global supply chains and pricing dynamics for Australian manufacturers.

Ongoing conflicts have driven unprecedented swings in prices for commodities, particularly steel, aluminium and energy feedstocks. Meanwhile, USChina tech and trade disputes continue to disrupt semiconductor and electronics supply chains, forcing Australian manufacturers to contend with longer lead times and higher landed costs.

These dynamics have fed directly into revenue volatility among the top 100 metals, machinery

and chemical manufacturers. Caterpillar Holdings Australia Pty Ltd (73rd), a supplier of heavy industrial equipment, recorded a 16.1 per cent drop in revenue in 2024, while Southern Steel Group Pty Ltd (57th), exposed to steel price fluctuations, saw its revenue fall 13.5 per cent over the year.

Australia’s ramp-up in defence procurement under AUKUS and broader force modernisation programs has buoyed homegrown contractors. BAE Systems Australia Holdings Limited (40th) and Thales Australia Holdings Pty Ltd (55th) feature in the Top 100, both posting double-digit growth as contracts for submarines, ship patrol vessels and electronic warfare systems flowed through. Given the multidecade nature of Australia’s defence investment pipeline, including the AUKUS nuclear submarine program and expanding sovereign shipbuilding targets, growth in this segment is set to be sustained well into the next decade.

While external demand drivers like defence spending continue to shape some manufacturers’ performance, internal efficiency strategies (especially automation) are becoming just as critical.

Various enterprises across Australia’s manufacturing sector have invested in AI and automation initiatives, aiming to optimise their operations and reduce expenses associated with employee wages. In particular, the meat processing industry has capitalised on automation within its operations, including two well-performing manufacturers, Industry Park Pty Ltd (9th) (trading as JBS Australia) and Thomas Foods International Consolidated Pty Limited (26th), which achieved revenue boosts of 5.6 per cent and 18.2 per cent, respectively.

Adopting automation to improve effi ciency while reducing operational expenses has been a common trend in the meat processing industry, and this has been the case for top meat processors like Thomas Foods

International. The company’s new Murray Bridge processing plant, completed in May 2023, features Dematic’s Multishuttle Meat Buffer and Pallet Automated Storage and Retrieval System, enabling stock transfer using automated guided vehicles that can navigate frozen and chilled environments.

By streamlining operations and creating a sustainable local supply chain method through automation, Thomas Foods International, along with other similar meat processing entities, has gained momentum in the industry, helping to lift profi t margins by cutting costs and mitigating labour risks.

As automation and AI implementation ramp up across the meat processing industry, companies pursuing cost-cutting efforts will continue to benefi t from improved effi ciency by streamlining operations, leading to higher throughput. Companies like JBS Australia and Thomas Foods International are beginning to see tangible benefi ts from their investments in automation.

Broader industry adoption remains uneven

Looking across the industry, JBS Australia is trialling automated beef-boning systems under the LEAP4Beef program at its Brooklyn facility in Victoria, marking a step towards robotic precision in meat processing. Similarly, Teys Australia Pty Ltd (29th) has invested in automated inventory management and robotics at its $100 million Port of Brisbane distribution centre.