INDIVIDUAL RUNNING GEAR SOLUTIONS FOR SPECIAL TRANSPORT TASKS.

With our running gears and special axle solutions, there is nothing that can’t be transported. Your requirements motivate us to create new things. They inspire us to use our entire engineering expertise and decades of experience to develop innovative and reliable solutions together with you – customised for the type of vehicle and intended use.

The vehicle concepts for low-loaders are as varied as the transportation tasks. The use of air-sprung modules with rigid and steering axles is just one solution from our uniquely wide range of running gear systems for low-loaders. Challenge us!

As with many edgling companies, Seri Zenith started out as a big dream of one man, who wanted to change the world. In his case it was the world of trailers in an evolving Malaysia.

Hyva

A quick glance through trade publications and online sources will quickly reveal that this time of year is a bumper period for trade shows, forums and exhibitions. Across the globe, in a diverse range of cities and hi-tech venues, there are a plethora of these events covering all aspects of transport, manufacturing logistics and materials.

We’ve enjoyed some major events and exhibitions, such as the 34th edition of Bauma in Munich, the biennial Brisbane Truck Show, Road Transport Expo and Multimodal in the UK, Transport Logistic 2025 in Munich, Break Bulk Europe in Rotterdam and LogisMed in Casablanca. e list goes on.

While we see the European and North American markets almost saturated with industry events, it’s pleasing to see more of these industry conclaves being hosted in places such as Morocco, Oman, Pakistan, South Korea, Armenia, Indonesia and more.

Imagine attempting to attend these events – exhausting and probably impossible. Or improbable. You would have to be running from venue to venue, country to country burning up innumerable CO2 emissions and creating a massive carbon footprint. But you would come away with a huge network of new friends and contacts and it would certainly be an interesting way to see the world and experience how other countries do business and operate. e burgeoning event management sector

is an incredibly huge and lucrative eld in its own right.

It’s interesting to note that the range and geographical spread of industry-related events now re ects the growth of the global truck and trailer markets in the African, APAC and LATAM sectors.

e mushrooming of these events is also indicative of how vital the transport and logistics sectors are globally. e common saying that a nation moves on its trucks (and trailers) is very true, and relevant, today. We all need food, clothing, resources, building materials and more to live and ourish. Only so much can be provided locally, particularly in places that face extreme weather conditions, or have underdeveloped industries, or are subject to geopolitical tensions.

Naturally, there is a heavy reliance on the transportation of goods to keep society moving, alive and functioning, as is seen in estimates that the global cold chain logistics industry will be worth about $372 billion USD (€344 billion) by 2029.

e global logistics industry highlights the importance of trade events and the need to be able to constantly share innovations, technologies, concerns and successes on a global basis for the betterment of society. We have the rest of 2025 to visit so many global events. Time to plan and go!

CEO John Murphy john.murphy@primecreative.com.au

COO

Christine Clancy christine.clancy@primecreative.com.au

INTERNATIONAL SALES

Ashley Blachford ashley.blachford@primecreative.com.au

MANAGING EDITOR

Luke Applebee luke.applebee@primecreative.com.au

EDITOR

Paul Lancaster paul.lancaster@primecreative.com.au

HEAD OF DESIGN

Blake Storey

DESIGN

Laura Drinkwater

CLIENT SUCCESS MANAGER

Maria Afendoulides maria.afendoulides@primecreative.com.au

COVER

Image: Seri Zenith.

HEAD OFFICE

Prime Creative Pty Ltd

379 Docklands Drive Docklands VIC 3008 Australia

+61 3 9690 8766 enquiries@primecreative.com.au www.globaltrailermag.com

SUBSCRIPTIONS

+61 3 9690 8766 subscriptions@primecreative.com.au

Global Trailer is available by subscription from the publisher. e rights of refusal are reserved by the publisher.

ARTICLES

All articles submitted for publication become the property of the publisher. e Editor reserves the right to adjust any article to conform with the magazine format.

COPYRIGHT

Global Trailer is owned by Prime Creative Media and published by John Murphy. All material in Global Trailer is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. e Editor welcomes contributions but reserves the right to accept or reject any material. While every e ort has been made to ensure the accuracy of information, Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published. e opinions expressed in Global Trailer are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

FOLLOW US

Global Trailer Magazine

coupling –

Push-button trailer coupling

For anyone already using it, it’s a match made in heaven: The KKS allows you to automatically control and monitor the entire coupling and uncoupling process via remote control from the cab. And this includes the air, electrical and brake connections– with simple and intuitive operation. The future of logistics is now on the streets.

www.kks-successstories.com

DP World has opened of its first ever warehouse in Singapore.

The 13,000 square metre facility is the latest addition to the company’s warehousing network in the Asia Pacific region.

As a result, DP World now manages more than 800,000 square metres of warehousing space, including facilities in Incheon, South Korea and Hong Kong. Within the last 12 months, the logistics

giant acquired leading Asian logistics firms Legend Global Logistics, based in Singapore, as well as Savan Logistics and Cargo Services Far East.

DP World in Asia Pacific CEO and Managing Director, Glen Hilton, said:

“This new addition will better fortify our offerings across the entire spectrum of logistics services, backed by our network of ports and terminals in the region.

“With these new facilities in Singapore, Hong Kong and South Korea

complementing the existing network of assets we manage, we are now better positioned than ever to deliver agile, efficient, and reliable logistics solutions.

“We will continue to make strategic investments in key markets to give the best possible service to our customers.”

Since relocating its APAC regional office to Singapore in 2021, DP World has more than tripled its employee numbers in that nation state, approximately 10 per cent of its global workforce.

A state of the art, upgraded and fully integrated global manufacturing centre of trailer systems and On/Off highway systems. Expertly designed and engineered with worldwide accessibility, offering you private label and OEM manufacturing solutions.

Drawing upon decades ofexpertisespanning Asia, Australia US, and in Europe,Fuwastandsasa globalmanufacturing powerhouse, unrivalled astheforemostnetwork ofspecialists intruckand trailer componentsacross the globe.

Germany’s famous Nürburgring will echo to the sounds of trucks racing efficiently on 10 July 2025, as Krone Trailers hosts the Truck Efficiency Run, a new feature of the Truck Grand Prix 2025.

The Efficiency Run, held in conjunction with the Goodyear FIA European Truck Racing Championship (ETRC), is an open competition for truck drivers in which the most efficient and professional driving style, not speed or horsepower, is the deciding factor.

“The competition makes efficiency tangible - beyond technical specifications,” said Krone Trailer’s Head of Marketing, Simon Richenhagen.

“We want to show how big an influence the driver has - and how real savings potential can be achieved through conscious, anticipatory driving.”

In the Efficiency Run, drivers from Germany will compete against each other operating different tractor units, trailers and drive types, as they seek to achieve the lowest fuel consumption under real-life conditions.

Polish trailer OEM, Wielton, has launched a new company specifically for the recycling and up-cycling of semitrailers and components.

ReTrailer Sp. z o.o., has at its core mission the sustainability of the transport industry.

It will focus on the second life cycle, or factory refurbishment, of semi-trailers, together with the sale and rental of used trailers and the responsible recycling and disposal of trailers beyond repair.

Its goal is to effectively manage the

full life cycle of semi-trailers - from production, through the operational phases to withdrawal from the market and proper disposal.

ReTrailer’s full refurbishment of semitrailers will enable transport companies to optimise the costs associated with fleet management, while complying with ESG principles and actively contributing to sustainable development and environmental protection.

This circular economy approach to trailers is aligned with the Wielton Group’s core strategy adopted for 2023-2027.

CEVA Logistics, a subsidiary of the Francebased CMA CGM Group, has strengthened its footprint in Türkiye after signing an agreement to acquire Turkish logistics provider, Borusan Tedarik.

The deal, worth $440 million USD (€387 million) will nearly double CEVA’s footprint in the strategic market as it agreed to acquire 100 per cent of Borusan Tedarik’s shares.

The agreement, which includes Borusan Tedarik’s subsidiaries in Germany, Bulgaria, Hong Kong and China, was subject to customary closing conditions and regulatory approvals.

Borusan Tedarik’s roots extend more than 50 years and it recorded a 2024 gross revenue of $567 million USD (€499 million). It offers logistics solutions in Turkey and globally, including contract logistics, finished vehicle logistics (FVL), full truckload (FTL) and less than truckload (LTL) ground transport, as well as air and ocean freight and customs.

As part of the purchase, CEVA Logistics will incorporate approximately 4,000 Borusan Tedarik employees, strengthening CEVA’s current operations in Türkiye, particularly in its core products of air, ocean and ground transport, contract logistics and FVL.

The acquisition will nearly double the size of CEVA’s domestic warehousing

and distribution operations, adding approximately 570,000 square metres to its existing 620,000 square metres of warehouse space.

The acquisition of Borusan Tedarik is part of CEVA Logistics’ continued growth following its 2019 acquisition by the CMA CGM Group.

At the SAF-Holland Plant 03 at Bessenbach, outside Frankfurt am Main, the production team is celebrating an historic milestonethe three millionth axle to be produced. Bessenbach 03 is regarded within SAFHolland as one of the central building blocks of the axle and suspension manufacturing division since 2000, and a key site or production of the SAF-Holland INTRA premium product.

As such, it underpins the SAF-Holland Group’s reputation as a reliable manufacturing partner in the trailer industry.

The success story of Plant 03 is founded on a continuous improvement process that has significantly increased productivity as well as quality over the years, with the factory’s PPM rate consistently lowered while automation was continuously expanded.

The Carrier Corporation will expand its global operations with the acquisition of its long-term partner Addvolt, S.A., a Portuguese transport electrification technology company.

Addvolt provides patented, non-invasive, low-maintenance electric systems for use with refrigerated vans, trucks, trailers and containers.

The Portuguese company’s plug-in electric systems for refrigerated transportation markets negate the use of fuel and also reduce major emissions, including noise, particulates, nitrogen oxide and carbon dioxide.

“By combining Addvolt’s deep expertise in electric systems and power management with Carrier’s industry-leading solutions, we are well-positioned to drive innovation beyond refrigerated transportation,” said Carrier’s President of Climate Solutions Transportation, Edward Dryden.

“This strategic partnership creates opportunity for new and emerging applications, while also continuing to build on the success we’ve already achieved together.”

The Addvolt acquisition strengthens Carrier’s electrification strategy by

providing advanced electrification technology, integrated power management and power electronics capabilities connected with its energy management software and engineering talent.

The technology has already been implemented by Carrier Transicold customers in Europe utilising the Vector eCool system, the world’s first fully autonomous electric trailer refrigeration system.

Headquartered in Porto, Portugal, Addvolt has approximately 60 employees who will join the Carrier Climate Solutions Transportation segment.

Global logistics provider Rhenus Group has rebranded its subsidiary Blu Logistics LATAM to Rhenus Logistics, enhancing the Group’s Latin American footprint.

The official rebranding follows from the acquisition of Blu Logistics LATAM in 2023, strengthening the Group’s commercial operations across Latin America, particularly in Argentina, Colombia, Ecuador, Mexico, Paraguay, and Uruguay. This transition to Rhenus Logistics also complements Rhenus existing operations in Argentina, Brazil, Chile, Colombia, and Mexico, while expanding its service portfolio in the LATAM region, particularly in the fields of air & ocean services and warehousing solutions.

The Group sees the unified branding of the two family-owned companies as offering its customers greater consistency, connectivity and access to the Group’s global network and service portfolio.

The rebranding is aligned with, and reflects, the Group’s growth in the LATAM region, as well as its strategic focus on expanding its Air & Ocean division in high-growth markets.

In 2024, the combined operations of Rhenus Logistics LATAM and Blu Logistics LATAM handled over 210,000 TEUs in full container load (FCL) shipments, a 16.67 per cent increase compared to the 180,000 TEUs managed solely by BLU Logistics LATAM in 2023.

Due to its strong ranking in ocean freight, Rhenus Logistics is recognised as a leading freight forwarder in the LATAM region. Rhenus Logistics will continue to provide a full suite of solutions in Latin America, including air and ocean freight, customs brokerage, warehousing, and project logistics.

Blu Logistics offices will operate under

the Rhenus brand name and benefit from the Rhenus Group’s global infrastructure, systems, and technology.

Macquarie Asset Management has agreed to acquire 100 per cent of Brazilian toll road company Monte Rodovias S.A.

Under the terms of the agreement Macquarie will acquire a diversified set of five toll roads across three states, totalling 740 km.

Monte Rodovias is comprised of the concessionaires for four toll roads in northeastern Brazil and a toll road in the central Brazilian agricultural state of Mato Grosso.

The existing roads connect the 4th largest city in Brazil with its main airport, one of the largest industrial complexes in the country and popular residential and tourist regions.

It includes Bahia Norte and Litoral Norte in Bahia, and Rota do Atlântico and Rota dos Coqueiros in Pernambuco.

In addition, the deal to purchase Monte Rodovias includes a 30-year concession for

a 344 km road in Mato Grosso, a central agricultural state in Brazil.

“Monte Rodovias is deeply committed to the sustainable development of Brazil — in regions like the Northeast, where efficient service drives local economic growth and social development, and in the CenterWest, where quality infrastructure helps the country’s food belt supply the global economy,” said Monte Rodovias CEO, Fabio Bonini.

“We are proud to be a platform that generates value for our granting authorities, our investors, and the communities we serve — ensuring operational excellence, continuous investment, and sustainable growth.”

Macquarie Asset Management has been operating in Brazil since 1999 and also has investments in the waste management, green energy and data centre sectors in the country.

Its current investments include Corredor Logística e Infraestrutura (CLI) in Brazil, Supervia Poniente in Mexico and the Odinsa Transport Platform in Colombia and Ecuador.

UPS has made a major expansion into healthcare logistics after it agreed to acquire the Andlauer Healthcare Group Inc. for $1.6 billion USD (€1.4 billion).

Andlauer is a North American supply chain management company headquartered in Canada that offers customised third-party logistics and specialised cold chain transportation solutions for the healthcare sector. This transaction will extend the global portfolio of end-to-end cold chain capabilities available to UPS Healthcare customers, who increasingly seek temperature-controlled and

precision logistics solutions.

UPS EVP and President of International, Healthcare and Supply Chain Solutions, Kate Gutmann, said: “Andlauer Healthcare Group will help us deliver expanded capability to our customers, driving best in class patient outcomes while contributing to our overall growth plans across the business.

“This acquisition marks another important step in our declaration to be the number one complex healthcare logistics and premium international logistics provider in the world.”

Under agreement, Andlauer shareholders will receive $55 CAD (€35) per share in

UPS will expand into healthcare logistics with its latest purchase.

Image: KKF/stock.adobe.com

cash, representing the total purchase price of approximately $2.2 billion CAD (USD $1.6 billion, €1.4 billion).

Haldex REMAN, part of the global SAFHolland network, celebrated its 40th anniversary of operations at its Marion, North Carolina base.

The milestone underscores the company’s commitment to quality, sustainability, and longstanding contributions to the local community and the commercial vehicle industry.

In January 2025, SAF-Holland announced the rebranding of its remanufactured brand as Haldex REMAN, replacing the former Like-Nu brand.

This was after SAF-Holland completed its acquisition of Haldex in March 2023. Since opening its doors in 1985, the Marion facility has been at the heart of Haldex’s North American remanufacturing operations.

The REMAN product line includes ABS valves, air disc brake calipers, air dryers, compressors, hydraulic brake calipers, and water pumps.

The Marion site has grown from a small operation into a state-of-the-art facility, employing more than 60 skilled team members, who deliver high-performance, cost-effective solutions to fleets across North America.

“We’re incredibly proud of the people, partnerships, and progress that have shaped the last 40 years, and we’re excited for the future as we continue to support our customers with the quality and reliability they expect from Haldex,” said Haldex Director of Operations, Nathan Duncan.

Family owned and operated logistics company, Leschaco Group, named Michael Kopecky as its new Global Head of Tank Container, effective 1 July 2025.

Previously serving as Head of the Tank Container Competence Center (TCCC) Americas, Kopecky will continue to be based in Houston and assume a dual role until further notice.

Kopecky joined the Leschaco Group in January 2024 as Deputy General Manager for TCCC Americas. Since then, he has led the tank container business in the Americas with ‘outstanding dedication’, successfully driving the unit forward together with his team in Houston. He brings extensive expertise in the tank container segment, gained through more than a decade with the Hoyer Group, where he most recently held the

position of Director of Projects/Financial & Executive Officer.

In his new role as Global Head of Tank Container, Kopecky will oversee Leschaco’s global tank container operations. He will focus on further advancing the strategic initiatives of this core business unit, collaborating with global teams and stakeholders to foster operational excellence and ensure customer satisfaction.

Kopecky shared his enthusiasm for the new challenge, saying: “The global tank container market holds tremendous potential, and I look forward to working closely with our talented teams worldwide to drive innovation, deliver exceptional value to our customers, and strengthen our position as a leading player in this dynamic sector.”

Leschaco was founded as Lexzau, Scharbau in Hamburg in 1879. Today, the Bremen-based business operates in more than 24 countries with its dedicated subsidiaries and a close network of selected agents all over the world. It has a total staff of around 4,000 employees and an annual gross revenue of €1 billion.

Alabama-based trailer manufacturer, Pitts Trailers, has promoted a key team member to the role of General Manager.

In his new role as GM, Brandon Fretwell will work to bridge any gaps between the firm’s departments, as well as enhance operational processes and drive improvements in production capacity, quality and safety.

Fretwell has 17 years’ experience at Pitts Trailers, holding key roles as Design Engineer and Engineering Manager.

Fretwell’s appointment recognises and rewards his commitment to innovation and customer-focused development, attributes that will strengthen Pitts Trailers’ leadership in the industry. Pitts Trailers has also appointed

Dustin Preslar as Plant Manager of its Pittsview headquarters.

Preslar brings to the role extensive manufacturing expertise, coupled with his commitment to excellence.

As plant manager, he will play a leading role in maintaining productivity and quality at the trailer company’s facility.

A division of Pitts Enterprises, Pitts Trailers is a top 10 trailer manufacturer in the US.

It is renowned as the world’s largest complete line forestry trailer manufacturer and offers a wide variety of truck trailers, tailor-made for the foresty industry.

Transport temperatured goods more cost-effectively. The vapour diffusiontight FERROPLAST® body together with the efficient S.CU cooling unit and the smart TrailerConnect® telematics system ensure optimised and reliable transportation. Also available fully electric as S.KOe COOL.

AS WITH MANY FLEDGLING COMPANIES, SERI ZENITH STARTED OUT AS A BIG DREAM OF ONE MAN, WHO WANTED TO CHANGE THE WORLD. IN HIS CASE IT WAS THE WORLD OF TRAILERS IN AN EVOLVING MALAYSIA.

What’s in a name?

Choosing a name for your rst business enterprise is no mean feat. e name, which will hopefully be around for many generations, needs to convey the importance of the business, the eld it operates in and be associated with success, good fortune and prosperity.

ink of Apple, Nike, Adidas, Amazon, Mercedes Benz ... ere’s a lot of pressure in the naming process. Choosing the right, and most appropriate, business name that conveys such lo y ideals

is o en the rst achievement of a new venture.

Koh Moi Tee, a man in his twenties, had a bright idea to start his own trailer business – the concept to create an innovative out t of his own had been fomenting in his mind for some years. is was Selangor, Malaysia in 1976, and he needed a little help to get things started.

e 22-year-old Koh wanted a name to embody the power and success of the business he envisioned it would one represent.

His solution?

He asked his youngest, 15-year-old brother, still in high school, to search through an English dictionary for an appropriate word.

A er hours spent searching the dictionary for the best name, the eldest Koh brother ultimately chose the word ‘Zenith’.

Reading the de nition, it was clear to the older Koh the perfect name for his new business was at the end of the dictionary.

Mr. Koh was now ready to set his own path.

But let us rewind a few years to understand how Seri Zenith germinated in the mind of a teenage Koh Moi Tee, as it was to become the realisation of an unshakeable dream.

As the eldest son of a close-knit Teochew family, there was an expectation he would forgo education for gainful employment that could support the large family.

As with many of his generation, Koh Moi Tee le formal education behind a er primary school and trained his eyes rmly on a trade that would give him the skills to support his family.

As the eldest son he did what was expected. Filial duty.

His employment started out small at the British company, Hargill Engineering, based in Selangor, where he was tasked with odd jobs around the workshop.

But he was a young boy with big dreams, rapidly rising from a junior position to supervisor through sheer determination and skill.

Working among highly quali ed and trained engineers instilled in the eager Koh the values of hard work, operational discipline and the knowhow of world-class technical expertise.

By the time Koh was 16, and still working in the workshop, he longed to create something of his own.

He saw rst-hand how skilled men could

transform pieces of metal into working components of valuable machinery.

In a ‘light bulb’ moment, Koh realised he would gain ultimate ful lment by creating something of his own.

Not only did he want to be a source of great pride for his family, but Koh also recalls he had dreamt of revolutionising ‘conventional and standard designs and products’ from his teenage years.

He wanted to do things in a new way. Di erently.

It therefore made perfect sense to the ambitious worker. To achieve his grand plans, he had to open his own business.

Years of perseverance and hard work would eventually turn that dream into his own ‘Eureka’ moment and laid the foundation for the multi-million-dollar company today.

Koh’s roots were always at the forefront of his mind, even through his formative teenage years and early adult period.

As a 22-year-old and shaped by years of physically hard work, Koh was driven by an innate and profound sense of duty to provide his parents and siblings with a better life.

He was able to combine the invaluable training and mentorship he obtained at Hargill Engineering to establish Seri Zenith.

He wanted to make a meaningful impact, step out of his comfort zone and challenge himself to innovate in this eld that was gaining momentum under a forward-thinking government.

He couldn’t ask his high school brother for more assistance, so he convinced another family member to join in his dream.

Koh was joined by his other, younger brother, Koh Yoon Yee at the reigns of the business venture.

‘Koh Brothers’ didn’t quite have the same punch as Seri Zenith. is momentous decision was arrived at on the backdrop of the major transformation of Malaysia, that started in late August 1957, and which was to herald a period of rapid growth and development.

Malaysia’s

On 31 August 1957, the Federation of Malaya gained independence from British rule, becoming an independent member of the Commonwealth of Nations.

is was a major milestone, marking the end of British colonial rule in the region.

e Malayan Emergency was ongoing at this time and the Malayan Communist Party, composed primarily of ethnic Chinese rebels, was trying to overthrow the incumbent British government.

is was the genesis of the post-British government period.

Even in those edgling days of the new nation, Malaya was a multi-cultural country, run by a coalition of various political parties.

e population was a diverse mix, including Chinese, Malays, Indian and other ethnic groups.

is diversity would later shape the nation’s identity and policies.

With the Federation of Malaya unravelling itself from British rule, its economy was soon to be propelled into a new era.

Malaya’s economy was heavily reliant on the agriculture sector, primarily on rubber and tin production, which had been set up by the British.

Grasping on to its independence, Malaya then set about to diversify its economy with a greater focus on industrialisation.

It was to eventually lead to plans for the expansion of the Federation of Malaya to include Singapore, Sabah (North Borneo), and Sarawak. is new conglomerate, to be known as Malaysia, was o cially formed on 16 September 1963.

While the Federation of Malaya, and its heterogenous population, was planning a bright new future, Koh Moi Tee was also planning big things for what would eventually transform into an international enterprise.

A dream comes to fruition

e mid-1970s saw Malaysia developing industry and commerce in its own right.

Growing towns and cities, with residents eager to obtain consumer goods, meant that transport and logistics networks needed to be set up.

Trailers, well-made and of high-quality material, were required to transport the goods to all corners of the burgeoning nation of Malaysia.

Koh Moi Tee and his hard-working partners were inspired to pioneer this industry, contributing to Malaysia’s growing economy while addressing a critical market need.

While hoping to emulate such bold expansion, the older Koh realised he needed to take baby steps before succumbing to the temptation of wanting to run. e initial set up for this trailer company was as humble as one could imagine.

“You couldn’t call it a proper factory,” Mr. Koh recalled.

“We rented a vacant plot of land, about 180 square metres in size in Selangor.

“ at’s all we could a ord.”

at small square of land at Batu 11 Cheras, Selangor may have been the base for Mr. Koh and his team of four, but echoing the growth of Malaysia in those formative years, Seri Zenith would multiply to where it employs a sta of about 200 and operates two sites with a total area of 69,000 square metres. at’s a 4,000 per cent increase in sta and 38,000 per cent increase in operating space over its astonishing 68-year journey.

From the very outset, the vision of the Seri Zenith company was a straightforward one - to create a ‘one-stop custom solution’ – seamlessly integrating manufacturing and transportation services to deliver e ciency, reliability, and convenience to customers.

e steadfast adherence to this approach not only supported the nation’s industrial

“WE RENTED A VACANT PLOT OF LAND, ABOUT 180 SQUARE METRES IN SIZE IN SELANGOR. THAT’S ALL WE COULD AFFORD.”

KOH MOI TEE SERI ZENITH FOUNDER

development but also set the foundation for the company’s enduring success.

Despite the Malaysian economy in the 1970s starting to establish its foothold on the global scale, the local trailer industry was very much in its infancy – market demand for large rigs was limited and the country’s infrastructure wasn’t yet developed enough to support growth. at wouldn’t strike until the late ‘80s.

Good times ... and bad Koh Moi Tee was not going to give up on his teenage dream of running his own empire of trailers across Malaysia.

He was one tigerish man and would not bow to external pressures, such as cash ow struggles, lack of basic facilities, manpower shortages, and even working in the rain without proper shelter.

He held tightly on to his dream, adamant that Seri Zenith would be the success he envisioned.

A er battling, and overcoming, nancial issues, shortages of quali ed workers and Malaysia’s monsoon climate Koh’s business hit pay dirt.

Seri Zenith enjoyed strong growth in the 1990s, eventually becoming the market leader for trailers in Malaysia.

During this period, the company even received approval for listing on Malaysia’s stock market. Times were good for the Koh brothers and their team.

However, the 1997 Asian nancial crisis struck, severely impacting the market and forcing the business to shut down.

A er su ering such a signi cant setback, the founding Koh, now a seasoned operator at 45, had no intention of reviving the company.

He had enough of the stress from running a big corporation only to see it all collapse.

However, the Zenith company was to have its

own phoenix moment, when, in 2000, former suppliers and clients rallied behind him, o ering their support and encouragement.

Buoyed by such overwhelming response, a reenergised Koh was ready to restart the business. is marked an exciting new chapter in Seri Zenith’s journey - one that would see it ourish nationally and internationally.

Since its ‘rebirth’, the company has innovated and transformed itself from solely being a trailer manufacturing company to now producing, trading and engineering transport equipment, as well as providing a er-sales services.

It has also found itself manufacturing, customising and modifying prime movers in ‘head-to-toe, all-in solutions’, while exploring the commercial air, rail, and water transportation equipment rental and leasing sectors.

Today, Seri Zenith now stands out in the market with a diverse portfolio of over 20 semi-trailer models, customising and manufacturing a variety of medium to heavy-duty semi-trailers, including car transporters, skeletal containers, general cargo, telescopic poles, step frame extendable

trailers, low-loaders, lowbed trailers, palm oil tankers, bulk cement tankers, side/front tipping trailers, curtainsider trailers, our tankers, timber jinker semi-trailers, and v-shaped bulk cement tankers.

Continuously in production, its two sites, employing about 200 sta , serve a diverse range of clients from eet owners, manufacturers for their own use, to crane operators and local authorities.

It also covers a broad market space, spanning from Peninsular Malaysia and parts of Borneo (East Malaysia- Sabah and Sarawak), to ailand, Papua New Guinea, Vietnam, Indonesia, Brunei and Singapore.

Seri Zenith also works with the highest quality original equipment manufacturers, including Axalta coating, Binotto, Bridgestone Tyre, Contili , FUWA, Hella, Hyva, Jost, Jost-Tridec, Linde Gas, PPG Paints, SSAB, Structur ex Curtain, Toa Paints and ZF.

e company’s growth strategy focuses on establishing it as a recognised leader in semitrailer manufacturing across Southeast Asia through strategic regional partnerships.

e can-do approach and dedication to quality has now seen Seri Zenith reach about $16 million USD (€14 million) in its latest trading gures, while in 2024 the company reported a net sales revenue increase of 15.34 percent.

e next generation of the Koh clan has now taken hold of Seri Zenith’s reigns.

Koh Moi Tee, now 72 years old, has formally passed leadership responsibilities to the next generation but continues to contribute his expertise as Technical and Strategy Advisor.

His son, Pei Jia (‘PJ’) Koh, is con dently steering Zenith through the current landscape of issues a ecting a globalised industry, from tari s to supply of materials and competition from global OEMs.

PJ was educated at Michigan Technological University, in the US, and has been a director of Seri Zenith since 2013.

He still has a rm grasp on his father’s legacy and the family tradition, while keeping a steady gaze on the future and all challenges and opportunities it brings, from AI, steady expansion of the business and its markets, to ensuring the Seri Zenith continues to run smoothly and e ciently.

“Transport and logistics are always essential in the old and a modern world, they can never be forgotten,” said Pei Jia Koh.

“We see the moving trend in transport and logistics in term of higher in ation, higher operating cost, lack of eets operator, so e ciency and technology on a semitrailer will play a very important roles in transport and logistics.”

His approach to the company’s future is also seen in its vision.

“We want to lead the transportation industry forward through innovation, safety, and education – delivering smarter technology, superior comfort, and uncompromising road safety,” said PJ Koh.

e younger Koh continues to carry the torch of the company’s commitment to customer satisfaction, utilising the highest quality raw materials and people and forging successful long-term partnerships.

“We strive to deliver exceptional quality services to our customers,” said PJ Koh.

“Customer satisfaction is the core value of the business, and we treat them like partners.

“We have managed to sustain good business relationships with our customers locally and across Southeast Asia.”

While it prides itself on its exemplary customer service, Seri Zenith sets itself apart in the market is its exible production approach.

“We continuously adapt to shi ing economic trends and evolving customer demands,” PJ Koh said.

“ is agility allows us to serve a wide range of industries with tailored solutions, ensuring we meet the unique needs of every client while staying ahead of market changes.”

Today, the company still maintains a rm grasp on teamwork – internally and externally.

“In transportation, real progress happens when we work together,” said PJ Koh.

“Safety, innovation, and sustainability are challenges no single company can solve alone –that’s why we actively seek partnerships across our industry.

“Better roads, better technology, and better standards bene t us all.”

A need to be agile and proactive has resulted in Seri Zenith gaining a reputation for manufacturing customised trailers, such as its custom-made four-axles line vessel bridge semi-trailer with detachable gooseneck.

This trailer is also extendable, allows for widening, and features large, 600mm suspension and minimal tyre wear.

e trailer has 20T capacity per axle-line and up to 40T per axle-line at slow speed.

roughout the design and manufacturing process, the company ensures that the customer is an inclusive member of each step.

“With our trailer orders, we co-create solutions tailored to each of our customers’ needs,” said PJ Koh.

“Our team is often excited for new technologies such con guring advance ABS systems for mixed eets and we believe in

shared success by providing the right education and training to drivers to ensure we get insights directly from them and this help us sharpen our solutions better.”

e company’s latest innovative o ering to the trailer market will be a custom-designed Vessel bridge semi-trailer with detachable gooseneck equipped with Jost-Tridec TPO system and Fuwa custom made axle.

Dedication to customer needs, technology innovation and maintaining high standards in production has seen Seri Zenith recognised as Southeast Asia’s rst OEM semi-trailer manufacturer certi ed by ZF as an o cial WABCO Service Partner and ZF ProService provider.

“Being the rst to achieve this distinction re ects our dedication to bringing world-class service standards and cutting-edge solutions to our customers, ensuring their eets operate at peak performance with factory-approved maintenance expertise,” said PJ Koh.

Its broad-based approach to the trailer industry has seen Seri Zenith showcase its products to a wider audience, such as MCVE 2024 (Malaysia Commercial Vehicle Exhibition).

at saw its industry- rst Vessel Bridge Semi-Trailer with Detachable Gooseneck receive favourable responses from attendees.

Seri Zenith also hosted a carnival-style event at its facility to demonstrate the WABCO EBS System through live, interactive demos.

“These events allowed customers to

• Started in 1976

• Closed in 1997

• Relaunched in 2000

• Manufactures 20 trailer models

• Operates two sites

• Employs 200 sta

• Market share in Malaysia, SE Asia & PNG

• 2024 revenue – $16 million USD (€14.1 million)

experience our innovations rsthand, rather than just seeing them online,” said PJ Koh.

“ e hands-on approach helped build deeper trust and understanding of our cutting-edge solutions.”

A er those successes, the company now plans to showcase its latest innovations at MCVE 2026, through strategic collaborations with industry leaders such as Allegiance Malaysia, Jost-Tridec, Hella and ZF.

Such events help to strengthen its network within the commercial vehicle ecosystem, said Koh.

With its latest innovations heralding a bright future, Seri Zenith continues to plan ahead by looking to combine operational e ciencies with innovative trailer builds, sustainable practices and market/customer responsiveness.

Its future plans therefore combine the delivery of superior trailer solutions while achieving predictable growth.

It is also keeping a close look at local trailer market movements, which the company sees as undergoing a signi cant transformation, driven by rising demand for road safety, operational e ciency, and smart technology integration.

“Customers are increasingly adopting intelligent systems – such as WABCO I-EBS – to enhance performance,” said PJ Koh.

“Semi-trailers are no longer just standalone hardware; they now function as integrated so ware-driven solutions that work seamlessly with prime movers.”

Meanwhile, the company is tackling industry-wide issues, such as rising commodity prices, head on, providing Seri Zenith with the niche opportunity to meet customer demand for higher-quality semi-trailers.

“ is allows us to showcase our superior engineering and dispel the ‘all trailers are equal’ myth,” said PJ Koh.

“We’re responding to the key challenges, such as global economic uncertainty, through customer education on long-term value and developing more e cient designs.”

roughout the years, the company has weathered the ups and downs, going from a humble backyard operation to multi-million-dollar enterprise, and everything in between, thanks largely to the unwavering determination and commitment to his vision of founder Koh Moi Tee.

is led to a reciprocal market recognition, acknowledging his and the company’s innovative approach to trailer building.

Not bad for a quiet boy with a primary school certi cate and a big dream.

What began as a family mission has evolved into an industry benchmark, re ecting Koh senior’s resilience and leadership.

Today, his children proudly carry forward this legacy, upholding his values of excellence and cooperation, imbued in the company.

“At Seri Zenith, we believe progress thrives on collaboration, not competition,” said PJ Koh.

“Whether partnering with peers in our industry or innovators worldwide, we’re committed to working openly to advance global transportation.

“Because safer roads, smarter technology, and sustainable mobility aren’t just our goals – they’re a shared responsibility for all.”

For Koh Moi Tee, his son, their legion of Seri Zenith employees and customers, the company’s strength is continually re ected in its name.

www.serizenith.com

SINCE IT WAS OPENED IN 1914, THE PANAMA CANAL HAS ALWAYS BEEN A FOCUS OF COMMERCE, TRANSPORT AND INCOME, CREATING WEALTH FOR ITS OWNERS AND USERS. MORE THAN 110 YEARS LATER, IT IS STILL VERY MUCH A BAROMETER FOR THE GLOBAL ECONOMY, BECOMING A SYMBOL OF THE ONGOING TUSSLES BETWEEN NATIONS SEEKING TO STAKE A PLACE ON THE WORLD STAGE.

Leonardo da Vinci once wisely stated that “water is the driving force of all nature.” It is a commodity that is fast becoming more precious and sought-a er than lithium, gold and other metals.

Nations, corporations, investors and market speculators are all looking to water as a viable source of income.

One 82-kilometre stretch of water in Central America has come to symbolise the driving force that water is in commerce, industry, transport and people’s daily lives today – the Panama Canal.

O en called the ‘Big Ditch’, the Panama Canal has been the focus of great attention in 2025, as its waters continue to drive the life of logistics industries in the Americas and the Asia Paci c region, as well being a source of fresh water and livelihoods for millions of people.

It has come under greater scrutiny since the Trump administration took o ce in January 2025.

Little wonder, given that each year, about 40 per cent of all US container tra c travels through the Panama Canal. is equates to the annual value of goods shipments being in the realm of $270 billion USD (€236 billion).

With Panama Canal toll charges totalling $100,000 USD (€88,000) and more for a

single crossing, the Canal has become something of a cash cow, earning almost $5 billion USD (€4.4 billion) in total pro ts for 2024.

A Forbes report stated that the Canal, through which nearly 10,000 supersized ships carrying about 423 million tons of cargo passed through its locks in 2024, contributes about three-to-six per cent of Panama’s annual GDP, or $2.5 billion – $5 billion USD (€2.2 billion - €4.4 billion).

Forbes also calculated that if the Panama Canal was to be leased for a 50-year term, that would place its commercial purchase value at between $125 billion and $250 billion USD (€109 billion – €218 billion).

e US Government, understandably sees the strategic waterway as indispensable – the goose that laid the golden egg.

Today, the US and the Panama Canal are

intrinsically tied up in a business relationship that is increasingly being tested as it balances sovereign national interests with commercial gain – a highly lucrative business conduit, but also a natural source of water for millions of residents.

In 2024, more than 50 per cent of the commercial vessels, and three-quarters of cargo, transiting the Canal were either bound for, or leaving, American ports.

Shipments through the Panama Canal have gone from about 800 transits in 1916 to 11,240 transits of deep and small commercial vessels in 2024, with the latter year seeing 213 million metric tons of cargo carried through the waterway.

Today, roughly 13,000 ships, or anywhere between ve and seven per cent of global trade, traverse the Canal.

With such volumes of water tra c, the Canal is vital to the US and Panamanian economies, with the former still being the canal’s biggest user.

In 2024, revenue from the Canal made up about four percent of Panama’s gross domestic product.

Approximately 40 per cent of all US container tra c ply its waterways annually.

Other major users of the waterway include Chile, China, Japan, and South Korea.

So how did the Panama Canal become such a prominent tool in the global economy – the subject of a tug-of-war involving several nations, primarily the United States, China and Panama? e issue of trade and commerce is the most obvious reason for the Canal’s prominence, but there is another key component to its vaunted status – the power of water and water security.

The UN Environment Programme has estimated the economic value of water and freshwater ecosystems, is valued at more than $50 trillion USD (€43.7 trillion) annually, describing water as “our most valuable resource, more precious than all the gems and metals in the world. We must protect it.”

A recent MoneyWeek report found that only about 2.5 per cent of the planet’s overall water stock is freshwater.

To further compound the issue, the report, based on ndings from the US Geological Survey, reported that only one percent of global freshwater is surface water.

However, the majority of that (70 per cent) is

locked in ground ice and permafrost, meaning that only 0.0075 per cent of the world’s total water supply is found in rivers, lakes, swamps, soil and the atmosphere. is places the Panama Canal, a source of daily fresh water for about two million Panamanians, at the very centre of a tussle between economic gain and sustainable living.

While it is responsible for generating up to seven percent of global trade, the Panama Canal relies heavily on rainfall to keep its locks operating and supply fresh drinking water.

Naturally occurring climate conditions, such as droughts – as happened in 20232024 – have resulted in fewer ship transits per day, while drinking and farming water is substantially diminished.

In 2024, rainfall in the canal’s watershed catchment area was 20 per cent below the historical average of 2,660 millimetres during the eighth-driest year in the Panama Canal records, dating back to 1951. is follows drastic action by the Panama Canal Authority in December 2023, when it was forced to limit the number of daily transits to 22, compared with 36 to 38 usual crossings, because too little freshwater was available.

According to the Panama Canal Authority’s 2024 Annual Report, nearly two-thirds of the Panama Canal watershed’s freshwater used in 2024 went to the canal’s locks, with water used as follows – canal locks (65 per cent), drinking water (17 per cent), evaporation (13 per cent) and other uses (5 per cent).

With the global demand for water at a peak, the 2030 Water Resources Group found that an estimated $150 billion USD (€131 billion) is needed each year to deliver universal safe water and sanitation – great potential for water sources to be the focus of major investment.

With the Panama Canal being under the microscope for trade and water, a proposed new dam to be built by the Panama Canal Authority in 2027 has caused additional controversy.

While the dam’s capacity is believed to be enough to provide water for the Canal, thus ensuring its longevity, it is predicted to submerge farming communities and displace over 2,000 people from their homes.

Representing a signi cant income source for the US, the Panama Canal has come under intense scrutiny by the Trump administration in 2025.

Nothing new, as the Canal’s rich history is marred by controversies, interspersed with international claims and counterclaims for this liquid gold.

Canal’s history

e narrow stretch of land in Panama, separating the Gulf of Mexico and the Paci c Ocean, interspersed with a natural water, has been seen as a strategic transit route for centuries.

e Canal was built between 1904 and 1914, mostly by the US a er a failed attempt by French interests.

President eodore Roosevelt oversaw the Canal’s construction at the narrowest point of the country and in the heart of its population centre.

e route was historically used by the Spanish colonies and later for a rail line between the oceans.

e US acquired the rights to build and operate the Panama Canal in exchange for $10 million USD (€8.7 million) and annual payments of $250,000 USD (€218,000).

roughout the 1800s, American and British leaders and businessmen had longed for a route where they could quickly and cheaply ship goods between the Atlantic and Paci c, rather than having to travel to the southern tip of South America.

e 1977 Torrijos-Carter Treaty, signed by US President Jimmy Carter laid the

path for the US to hand over ownership and control of the Canal to Panama, which it duly did on 31 December 1999.

Under the 1977 treaty, President Carter agreed to return the 10-mile-wide (16 kilometre) Canal Zone to Panama in 1979, followed by the Canal 20 years later.

e treaty contained a proviso in favour of the United States – that the US could use military force to defend and protect the neutrality of the Canal, as well as giving it the authority to maintain and operate the waterway.

However, the 1977 document did not contain a clause allowing the US to take ownership of the Canal.

Today, ships traversing the waterway go through three sets of locks – the Gatún, Pedro Miguel, and Mira ores locks.

e narrowest portion of the Canal is almost 13 kilometres long and contains the Pedro Miguel and Mira ores locks.

A $5.2 billion-plus USD (€4.5 billion) government expansion project, the ird Set of Locks Project, completed in 2016, enabled the Canal to handle larger ships, which in turn let to increased revenues for Panama (approximately 56 per cent) between 2019 and 2024.

at project controlled the Chagres River basin so that three di erent sets of locks could be operated, thus making allowances for the di erence in water levels between the Paci c and Atlantic oceans.

e Canal’s locks were constructed in pairs to enable two-way tra c and the three locks project, from 2007-2016, resulted in the Panama Canal’s capacity double due to the addition of a new tra c lane, as well as wider and deeper lanes and locks.

Two lock complexes also were built to allow a new generation of supersized vessels, called ‘neo-Panamax’ ships, to use the Canal.

e Canal can now accommodate ships that are up to 50 meters wide, 365 metres long and 15 meters deep.

To complete the extensive project, the Canal’s designers changed the shapes of the region’s mountains and rivers to create a massive watershed of 3,435 square kilometres, enabling water to drain into the man-made Gatun and Alajuela lakes.

ese expansive lakes ensure the locks are supplied with water and are supported by dams across the Chagres River.

e Panama Canal Authority, Authoridad del Canal de Panamá (ACP), is an autonomous legal entity that has responsibility for the administration, operation, conservation, maintenance, and modernisation of the Canal, ensuring its e ciency and long-term sustainability.

While the ACP is charged with the operation and maintenance of the Canal, its tasks have not been without controversy and problems stemming from issues with shipping and water usage and conservation.

With 65 per cent of the region’s watershed being used for operating the Panama Canal locks, the majority is ushed into the Paci c or Atlantic oceans.

Approximately 40 per cent of water used in the locks completed in 2016 is ushed out so as to prevent saltwater intrusion into the watershed.

Furthermore, located in the wet tropics, Panama is at the mercy of prevailing weather and wind conditions.

Records have shown that average rainfall in the region, usually the highest from May to November, has been dropping since 1950.

Hit by the drought in 2023-2024, the ACP estimated it could lose $100 million USD (€87 million) each month as a result of lowering water levels in its locks.

To combat these nancial losses, the ACP increased the transit fees, limited the daily number of vessels that could traverse the system, as well as auctioning passage rights to the highest bidder.

While water levels have risen, climate experts believe new investments and upgrades to water use and management systems are urgently needed.

e drop in water levels resulted in the Panama Canal experiencing a decrease in shipping tra c by almost 30 per cent.

Between October 2023 and September 2024, 9,944 vessels crossed the Canal, compared with 14,080 in the previous year.

With uncertainty surrounding water levels and economic repercussions from trade tari s and a slowing global economy, there is speculation that the ACP will again have to increase fees for shipping.

Moreover, in January of this year, the ACP agreed to proceed with plans to build a new dam on the Indio River, so as to boost water levels in the Canal.

While this is seen as a necessity to preserve the canal’s viability, the e ect on local inhabitants cannot be underestimated, with more than 1,000 homes in the direct path of the proposed dam.

To compound issues of shipping costs and viability, in late 2024 the UN Trade and Development (UNCTAD) reported that freight rates had risen sharply due to factors, such as geopolitical tensions, rerouted vessels, port congestions and higher operational costs.

It found that disruptions in routes through the Red Sea, Suez Canal and Panama Canal signi cantly increased freight rate volatility.

It said that disruptions due to climate-induced low water levels in the Panama Canal contributed signi cantly to a rise in shipping costs from October 2023 to January 2024.

Similar, and even more deleterious, e ects were experienced in the Red Sea crisis and Suez Canal, as a result of geopolitical tensions in those regions.

e resultant sharp rise in freight rates led to a natural, but profound, ripple e ect on global trade and economic stability, the UNCTAD said.

It is clear the Panama Canal is a source of great income and that it will remain an important transport route – the proverbial goose that laid the golden egg.

is status will see the relationship between Panama and the US continue as the Canal to be a primary conduit for the transit of goods in a mass, creating a vital route between the Americas and the Asia-Paci c region, and beyond.

According to the ACP’s gures, in 2024, 52 per cent of transits through the Canal had ports of origin or destinations in the United States, making the Canal a signi cant driver of those countries’ relationships.

e ACP also found that over three-quarters of cargo travelling through the Canal was headed to, or departing from, the US.

The current issue will be whether the simmering international tensions continue, or whether they will escalate into a multi-player trade war.

As a multi-billion-dollar trade route that involves many international stakeholders it is understandable the Canal is a pawn in a series of tussles and di erences between nations, focused on the ‘tari wars’ between the US and China.

e Panama Canal became the focus of the

incoming Trump administration as early as December 2024, when Donald Trump said the US should take the Canal back, saying President Jimmy Carter “foolishly gave it away.” is was rejected by Panama’s President Jose Raul Mulino, who posted on his X account that: “Every square metre of the Panama Canal and the surrounding area belongs to Panama and will continue belonging [to Panama].”

In February 2025, during a state visit by US Secretary of State, Marco Rubio, the ACP shared its intention to work with the US Navy to optimise transit priority of US naval vessels through the Panama Canal.

In April 2025, the US’s intentions over the Panama Canal became more evident when Secretary of Defence, Pete Hegseth visited the area where he declared that the US would take the Canal back from Chinese in uence.

In a sign of exing its military might, the US said it would increase the security agreement with Panama, so as to prevent China from ‘weaponising’ the Panama Canal by using China’s commercial presence in the area for spying, according to Hegseth.

e US Defence Secretary’s comments about China were not unexpected given that approximately $270 billion USD (€236 billion) of goods goes through the Panama Canal annually through one of the world’s busiest waterways.

e Trump administration has held a contentious stance with respect to China, alleging that it somehow covertly manages the Panama Canal through the guise of Chinese businesses operating there.

It appears the US was gravely concerned that China, through could exert untold economic pressure on the US in the form of high transit fees if China was to obtain great in uence in the operation of the Panama Canal. Up to 13,000 ships traverse the Canal yearly. Image: Pumapala/stock.adobe.com

ere was also concern that China could obtain intelligence on US shipping, naval routes and various shipments with such a strong in uence in the Canal.

It is clear that China has established establish economic relations with many Latin American countries, including Panama, particularly through its adventurous Belt and Road Initiative - a global infrastructure strategy started in 2013, where China seeks to invest in more than 150 countries and international organisations.

In early 2024, more than 140 countries had joined BRI, which accounted for close to three-quarters of the world’s population and more than half of the world’s GDP.

As a result of such assertive growth strategies, China has become South America’s top trading partner.

In Panama, China invested $1.4 billion USD (€1.2 billion) in 2023, quadrupling its investment there since 2017. In addition, shipping to or from China accounted for 21 per cent of the cargo going through the Canal, from October 2023 to September 2024.

Chinese companies are also investing heavily in infrastructure projects in and around Panama itself. A new fourth bridge, connecting Panama City to West Panama, worth approximately $1.42 billion USD (€1.25 billion) is under way, as well as the Amador Cruise Terminal on the Canal’s Paci c side and an extension to the Panama City Metro.

Notwithstanding such investment, the US is still Panama’s largest investor and prime user of the Panama Canal, with a yearly foreign direct investment in Panama is close to $4 billion USD (€3.5 billion).

Hence, its in uence in the strategic nation remains highly signi cant in a period of economic and geopolitical turbulence.

China’s FDI was just under one percent in 2023, covering logistics, construction, infrastructure and energy; compared to almost 20 percent FDI by the US.

Despite having close economic arrangements with the Chinese, the Panamanian government has denied any under-handed arrangements, or control by Chinese operatives.

Panamanian President José Raúl Mulino has denied any Chinese involvement in operating the Canal while also rejecting Donald Trump’s claims to reclaim it.

However, President Mulino still sees the value of American naval and commercial support in the Canal, as evidenced by US military personnel at three local bases, while the US view it as a strategic asset economically and for security purposes.

future con ict in Asia, enabling fast transit from the Atlantic to the Paci c Ocean.

• China cargo (Oct 2023 – Sept 2024) = 46 million tonnes Map

e US sees the Panama Canal is critical for the passage of its warships during any

e US’s recent actions and claims over the Canal have been seen as part of its strategy to reduce China’s sphere of in uence in the region.

is was evident when Panama announced, in February 2025, that it would formally exit from China’s BRI.

ere is also controversy over CK Hutchison Port Holdings’ proposed sale of its port interests in the region.

e company is a Hong Kong-based shipping conglomerate that operates major ports at both entrances to the Canal.

It is a leading global port investor, with more than 50 ports around the world and has operated the Ports of Balboa and Cristobal, respectively situated at the Paci c and Atlantic ends of the Panama Canal, since 1997.

Its $22.8 billion USD (€19.9 billion) agreement with the BlackRock-TiL Consortium to sell a 90 per cent interest in the Balboa and Cristobal ports, caused an uproar in China, leading to a diplomatic stand-o with the US.

A stalemate developed when the deal didn’t proceed in early April 2025. However, in midMay 2025, CK Hutchison announced at its AGM that the Aponte family-operated MSC (Mediterranean Shipping Company) is the

• Built and operated by US

• Opened in 1914

• Returned to Panama in 1999

• Approx. $5 billion USD pro ts (2024)

• 3-6 per cent of Panama GDP

• Approx. 13,000 supersized ships (2024)

• 5-7 per cent of global trade

• 40 per cent of US container tra c

• US investment (2023) = $4.5 billion USD

• China investment (2023) = $1.4 billion USD

• US cargo (Oct 2023 – Sept 2024) = 163 million tonnes

primary investor in a consortium looking to purchase its 43 ports around the globe.

Apart from Panama leaving China’s BRI , there are more signs of waning Chinese in uence in the Latin American country, with some estimates saying that about half of the Chinese-funded projects in Panama have been stopped since it le the BRI.

Panamanian authorities have shuttered a number of Chinese-led projects, including shelved several other high-pro le Chineseled projects, a development of a port on Isla Margarita, as well as a high-speed rail link from Panama City to the city of David.

e Panama Canal now clearly stands as a pawn in a tug-of-war between the US and China, as the US tries to limit China’s in uence in the region while China seeks to consolidate and even remain relevant to Latin America.

is is occurring at a time of increasing uncertainty revolving around it and the two other key shipping routes around the world – the Suez Canal and Strait of Hormuz.

Despite the posturing, allegations and trade escalations between the US and Chinese governments, the future of the Panama Canal seems assured, provided the trade route remains viable for industries and governments.

In the absence of an alternate shipping route being created, at a potential cost of $6 billion USD (€5.3 billion) or more, it is apparent the Panama Canal will remain of signi cant geo-strategic importance for years to come.

ere is also the issue of supply of fresh water for inhabitants in the region, as well as for use in the Canal’s locks.

is may prove to be more of a pressing issue than trade relations between the two global economies.

e ‘Big Ditch’ will continue to hold its paramount position as a conduit between the US, South America and the Asia Paci c, linking the two great oceans and the nations that depend on sea transport.

It will also be a critical route by which China can maintain regional economic and political links.

While its waters ow and container ships continue to ply their trade, this liquid gold will remain the centrepiece of the global economy.

However, as nations and corporations continue to utilise its waters for commerce and industry, the stretch of water will continue to be dogged with controversy, as it has since the rst vessels crossed its waters in 1914.

www.globaltrailermag.com

BILLED AS THE WORLD’S LEADING TRADE FAIR FOR LOGISTICS, MOBILITY, IT AND SUPPLY CHAIN MANAGEMENT, TRANSPORT LOGISTIC 2025 DIDN’T DISAPPOINT.

From 2-5 June 2025, about 2,500 exhibitors from more than 70 countries showcased their solutions and products at Messe München’s 150,000 square meters of exhibition space, which included 12 halls and an outdoor area with track areas.

In addition, approximately 150 specialist events were convened during the four-day event on topics from logistics, mobility, IT and supply chain management.

Specific topics included sustainability, stakeholder cooperation, latest developments, AI, cybersecurity, infrastructure and human capital in the industry, re ecting that markets and technologies are changing rapidly due to factors, such as geopolitics, digitalisation and sustainability.

e eld of logistics saw discussion points, such as ‘Global supply chains in transition’, ‘My Nation First – Antiglobalisation, trade wars, hot wars’ and ‘Future of Air Freight and Freighters’.

Other subjects relevant to the current logistics industry included discussions and panels on the continuing wave of insolvencies in transport SMEs and ‘How freight forwarders are mastering change’.

ese saw participation by key players from

business and research, including major brands such as IKEA, Alfred Kärcher, Andreas Schmid Logistik and VDO/Continental.

A major discussion point related to the digitalisation of the transport and logistics industries, as stakeholders across all modes of those markets continually seek to achieve maximum e ciency with minimum emissions.

AI was a hot topic of discussion among delegates, as they considered its application scenarios and its ubiquity.

e well-attended discussion on ‘Cybersecurity in logistics: How supply chains remain secure in the digital age’ revealed some major issues for logistics companies around the globe.

The all-important topic of sustainability across many industries was raised through various avenues, including research projects, electric mobility, ESG, emission calculations, and technologies and applications.

e last day of the trade fair was dedicated to HR topics, featuring interactive four-hour sessions focused on employer branding, developments in the world of work with a focus on women.

Delegates also examined the best strategies to combat the shortage of trainees and skilled workers, tackling the shortage of professional drivers and how to motivate drivers.

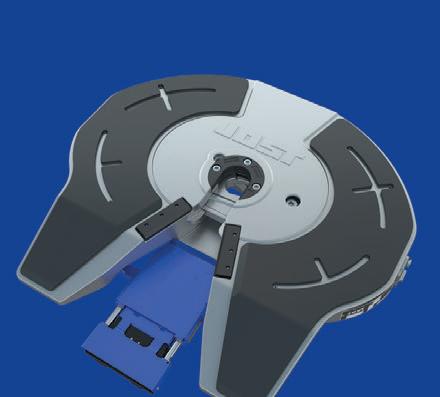

At this year’s trade fair, JOST, for the rst time, presented its KKS solution for on-yard use with the specially developed JSK80 – a major step forward in automation and e ciency.

The global supplier of safety-critical commercial vehicle systems is continuously

improving its KKS automatic coupling system. Already across road and refrigerated transport JOST is now expanding its application to yard logistics.

e JOST KKS aims to set new benchmarks for performance and reliability in the transportation industry.

e KKS enables drivers to couple and uncouple semi-trailers via remote control without leaving the driver’s cabin, automatically, safely and quickly.

e driver is guided through the entire coupling process, with sensor technology providing live information on the KKS remote control throughout every step of the process.

Time, comfort and safety gains are made possible with just one product.

“With the KKS Terminal Tractor JSK80, we are enabling fully autonomous and hands-free coupling in distribution yards and port terminals,” said JOST Head of Sales Trailer Europe, Dietmar Franke.

“ is is a game changer for modern logistics – e cient, safe, and a key solution for tackling logistics challenges like the ongoing driver shortage.

“Additionally, we are proud to contribute to emissions reduction through innovations, such as our e-axle, which supports sustainable resource management.

“Our mission is to support technological change towards better connected, environmentally friendly and intelligent commercial vehicles – on the road with tomorrow’s technology.”

In addition to the live demonstrations of the JOST KKS system at its stand, visitors also witnessed the automatic coupling process in action every day at the Transport Logistics outdoor area.

German trailer OEM, Kässbohrer showcased prime examples of its ‘Enginuity’ (Engineering and Ingenuity) at Transport Logistic, as part of its 360-degree portfolio.

e range of Kässbohrer commercial transport vehicles on display included general cargo to bulk and liquid goods transporters, as well as intermodal, heavy and abnormal goods carriers.

Showcased vehicles included Kässbohrer’s longer and higher capacity (SEC) curtainsider, box, container chassis combinations, its award-winning light-weight intermodal product range and its electri ed cold chain vehicles.

A highlight was the award winning Kässbohrer Octagon-on central frame chassis design, which won a Trailer Innovation award (Chassis category).

Kässbohrer also presented Europe’s lightest 20 tank container chassis, manufactured with S 700 MC steel.

Kässbohrer’s next generation electri ed K.SRI E reefer, equipped with BPW and ermo King refrigeration units, showcased the company’s emphasis on green technologies and sustainable practices.

e e-Reefer technology enables fuel savings of up to 4,000 litres annually, reducing CO2 emissions by up to 10 tonnes, the company said.

Kässbohrer is making a big push into the electric trailer market, utilising the EUfunded ZEFES (zero emissions) project.

It is developing the e-curtainsider powered by a ZF recuperation axle system that provides traction support for both combustion engines and electric trucks.

Transport Logistic 2025 also saw the unveiling of the new standardised Wielton EVO curtainsider semi-trailer, together with Wielton’s Langendorf-branded Flexliner SDT double-deck inloader, as well as its Aberg Service, Aberg Connect and ReTrailer solutions.

Wielton Group CEO, Paweł Szataniak said Transport Logistic was a valuable opportunity to showcase its latest innovations in road transport to a broad professional audience.

“We are also gaining insight into the evolving needs and challenges faced by transport companies,” said Szataniak.

“ e Wielton Group o ers more than just a wide range of semi-trailers, trailers, and truck bodies – it delivers a comprehensive ecosystem of solutions.”

Paweł Szataniak said Wielton’s ecosystem included proprietary telematics, TPMS systems and an expanding suite of vehicle services.

“As part of our growth strategy, we have recently enhanced our o ering with factoryrefurbished semi-trailers and launched the standardised Wielton EVO curtainsider,” he said.

“Combined with a digital purchasing platform and intelligent service package, it forms an integrated ecosystem that delivers e ciency, quality, and innovation in one complete solution.”

e Transmec Group showcased its latest developments in transport and logistics at the Munich event.

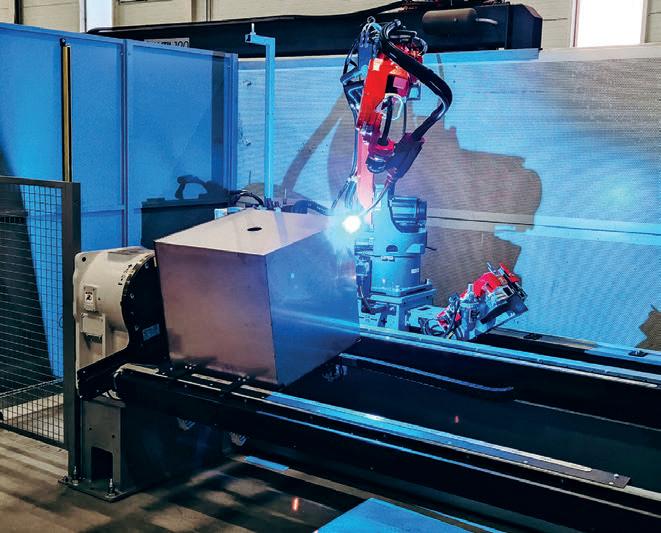

Its spotlight was on the Group’s ecosystem, which includes 800,000 sq metres of warehouses and yards across eight European countries, while it showcased its foray into innovations, with Transmec’s newly inaugurated robotic area.

In the lead-up to Transport Logistic, the organisers conducted a far-reaching survey of 1,851 exhibitors and visitors as to their views on the current state of the logistics industry.

Topics covered by the survey included cost pressure and bureaucratic hurdles, shortage of skilled workers, emissions and cyber-attacks.

Furthermore, nine out of ten respondents said they were con dent about the future of trade and the industry in general.

Despite the conditions, the exhibitors and visitors surveyed tend to be optimistic overall. One in two (52 per cent) expect the market situation to improve in the next two years. Germany (46 per cent) is somewhat more cautious than other countries (60 per cent), while Asians (80 per cent) are particularly con dent.

www.transportlogistic.de

We stand right in the middle of every project realization.

HIGH QUALITY GRP FOR COMMERCIAL VEHICLES.

KRONE TRAILERS’ PROVEN TRACK RECORD OF SUCCESSFUL INNOVATIONS IS DUE TO ITS LONG-HELD VALUES OF EXEMPLARY PRODUCT QUALITY AT A FAIR PRICE, INNOVATIVE PROWESS, A SERVICE PROVIDER MENTALITY AND PROXIMITY TO ITS CUSTOMERS.

In a constantly evolving globalised economy, Krone is something of an anomaly. A rare breed among multinationals.

A er 119 years of operation, Krone is still owned and operated by the Krone family, with the corporate entity Bernard Krone Holding SE & Co. KG, the parent company of the Krone Group. The family business, with interests in electri ed and refrigerated trailers, semi-trailer combinations, axles, agricultural harvesting equipment and more, is currently under the stewardship of the fourth generation of Krones.

It is truly a family concern, with four generations of ‘Bernard Krones’ having been at the company’s helm throughout its rich history.

e latest iteration was in 2010 when Dr Bernard Krone handed over the management of the company to his son Bernard.

While it has modernised over the decades, embracing up-to-date technological advances, Krone is still intrinsically bound to its agricultural roots, harking back to the days of the early 1900s when it started out as a smithy’s workshop in Spelle, tucked away in Germany’s Lower Saxony farming region, near the Dutch border.

It was borne of an era when a man’s word was his bond and customer satisfaction was paramount, providing a quality product for a fair price.

e edgling company was forged on the ‘olde world’ values of taking care of the customer, the employee, the company – values, which today, are still rmly embedded in the Krone DNA.

At the turn of the 20th century, founder Bernard Krone understood that to adhere to these values, while maintaining a healthy business that meets customers’ needs, you had to adapt with the times. at meant innovating.

e ethos of ‘tradition meets innovation’ is still practised today.

e company’s dedication to innovating to meet customers’ needs, and to be ahead of the curve, has manifested itself throughout Krone’s history.

Krone developed agricultural trailers in 1948 to meet the demands of the burgeoning agricultural sector, with which the company had close links.

Its steady growth saw Krone develop its rst coil liner trailer in 1973, tted with a special trough for the safe transport of steel rolls. is was followed in 1981, when Krone developed the short coupling that signi cantly increased transport capacities, and a rst for Krone when, in 1990, it launched its Mega Trailer with a clear internal height of 3,000mm.

More innovations were to come, with it being the world’s rst trailer manufacturer in 1997 to introduce cathodic dip coating plus powder processing for long-term rust protection.

e 2000s saw Krone advance R&D endeavours in sustainable practices, acknowledging its historic ties to the agriculture sector of northwest Germany.

e decade resulted in Krone setting new standards for the transport industry with innovations such as its Safe Liner, the fuel-e cient, long-distance goods transporter, the Euro Combi (2004), the aerodynamic Pro Liner ECO semitrailer (2008) that reduced fuel consumption and CO2 emissions.

ese were followed by Krone’s Aero Liner project study in 2012, where it explored developments in energy-e cient trailers, and the Krone Surface Centre in 2018.

e company’s growth stemming from its innovations, saw it undertake a number of mergers and acquisitions between 2013 and 2019, expanding its base as a trailer OEM and industry innovator.

e adherence to R&D saw it open its Krone Validation Centre Future Lab in Lingen in 2021, followed the next year by the development of its innovative Krone e-Trailer, equipped with powerful electric axles that allow for CO2 emissions to be reduced by 20 to 40 per cent.

e company’s laser focus on improving products for customer bene t has extended to the development, manufacture and sales of commercial vehicles, where it has implemented a certi ed environmental management system.

is system ensures that emissions, noise and odours are reduced, while the company minimises the amount of waste produced, and water used.