THE JOURNAL OF THE BIOFOREST PRODUCTS SECTOR

VOLUME 65, NUMBER 2 SUMMER 2024 FEATURING: ABB; ANDRITZ; PILZ; SHELL ENERGY; VALMET TECHNOLOGY: AUTOMATION; BARRIER COATING; DIGITALISATION; NANOCELLULOSE; RECYCLABILITY EVENTS: PAPER INDUSTRY GOLD AWARDS; HEALTH & SAFETY; PACKAGING INNOVATIONS COLUMNS: CPI; LETTER FROM INDIA; NEWS; ORDERS; PEOPLE; STANDARDS BARRY READ (1956-2024)

Volume 65 Number 2

Published by PITA PO Box 721, Bury, BL8 9UZ, United Kingdom

Tel: 0300 3020 159

Tel: +44 161 746 5858 (from outside the UK)

Fax: 0300 3020 160 email: daven@pita.co.uk website: www.pita.co.uk

Editor

Daven Chamberlain The Vicarage - Wayside Eldon Place

Cleckheaton

W. Yorks, BD19 5DH

Tel: 0300 3020 159 email: editor@pita.co.uk

UK Advertising Sales

Contact the PITA Office

Tel: 0300 3020 159

Email: daven@pita.co.uk

European Representative Nicolas Pelletier RNP

16 Rue Bannier – 45000

Orleans, France

Tel: +33 6 82 25 12 06

Fax: +33 2 38 42 29 10 email: europe@pita.co.uk

Designed and typeset by Upstream Ltd, Deepcar, South Yorkshire Printed by Mixam UK Watford, Herts

for the contents of this Journal. Technical papers may also carry first-authors’ copyrights jointly with the Association. None of the contents may be extracted, circulated, or re-published without permission. Registered Number*2928961 England Limited Liability.

ISSN (Print) 0 306-252X

ISSN (Online) 2632-5799

and Digitalisation (Valmet / Andritz)

& the Pulp & Paper Industry (Part V)

(PITA)

ABB

Supplier Index

For over 100 years, ABB has developed products and services that help papermakers realise higher levels of productivity and profitability. From electrification and advanced control systems to state-of-the-art quality control and lab testing and process measurements, ABB brings together deep industry knowledge, world-class solutions and expertise to make mills more efficient.

Features 10 The Road Less Travelled

13 End of Waste Criteria for Paper

14 Safety

Industrial Security

16

20

22

26

28

30 Bioeconomy

36 Bio-based

42

1

(ABB)

(CPI)

and

(Pilz)

Accelerated Change for Intensive Energy Users (Shell)

Health & Safety Event (PITA)

Paper Industry Gold Awards (CPI)

Automation

Dispersion Barrier Coatings (Kemira)

Barrier Coatings

Packaging Innovations Show

Summer 2024 Contents

© PITA reserves all copyrights

2 Comment 4 Industry News 6 News Bytes 18 ........ A Letter from India 44 ........ People in the News 46 ........ Compendium of Recent Orders 48 Standards Update Advertising List ABB OFC, 3 CPI Health & Safety 17 DITP 25 MIAC IFC Paper Arabia 19 Paper ME - Egypt 35 Paper ME - KSA IBC Paperex South India 2 PITA Training Courses 13 PRIMA 9 PRO Paper - Dubai OBC PRO Paper - Tanzania 29 Specialty Papers Europe 27 A.Celli 46 ABB 6, 7,

10-12, 46 AFRY 46 AFT 5 Albany 8 Andritz 4, 7, 8, 26, 46 Aquafil 8 Archroma 5 Argynnis 8 AS Drives 8 Bellmer 46 BIM Kemi . . . . . . . . . . . . . . .8 BMH Technology 46 C.G. Bretting 46 Caveron 46 Dieffenbacher 6, 8, 46 DJM . . . . . . . . . . . . . . . . . . . . .7 Enersense 46 Fortum 46 FrontWay 8 GAW 46 IBS Papertech 6 IMA Schelling 46 Jagenberg 6 Kadant . . . . . . . . . . . . . . . . . . .8 Kemira 5, 8, 28, 44 Konecranes 8 MagComp AB 8 Microtec 46 Opturion . . . . . . . . . . . . . . . .46 Pallmann 8 PCF Maintenance 46, 47 Petrofer 44 Pilz 5, 14-15 Powerhouse Controls 8 Protex Chemicals 5 RePlus 8 Runtech 8, 47 Sael 6, 7, 47 Shell Energy . . . . . . . . . . .16-17 Siempelkamp . . . . . . . . . . . .47 Spinnova . . . . . . . . . . . . . . . .47 Tietoevry . . . . . . . . . . . . . . . .47 Toscotec . . . . . . . . . . . . .7,

47 Tronox . . . . . . . . . . . . . . . . . .45 Valmet 5,

44, 45, 47 Voith 8, 44, 47 WEG 47

8,

8,

8, 26,

FRONT COVER PICTURE

Comment

Recycling & Recyclability

These two topics are connected, but are certainly not the same. Also, what is new, especially for our sector?, because, let’s face it, we are the ‘poster boys’ when it comes to recycling!

Let’s start with a couple of definitions. Recycling as it is understood by the general population includes the whole set of connected processes involving collection (or recovery), transportation, sorting, baling, warehousing, selling and ultimately re-processing (which is where the paper mills step in). Meanwhile, recyclability involves assessing the extent to which a material or object can be broken down at the end if its useful life, and re-processed into something new. (Note that this is different from compostability, where the recovered object is broken down by heat, humidity, micro-organisms and invertebrates, to yield low molecular weight organic materials that can be used as soil enhancer. Using this route of processing material at its end of life, the constituent raw materials are lost to the manufacturing sector; however, should the object end up as litter in the environment, it should break down in nature and cause no harm to animals and ecosystems.)

First to recycling. Recently, the UK Government has agreed that the plethora of different recycling operations operated by local government is unacceptable, and that some harmonisation across the country is necessary. So, they propose a ‘commonsense’ approach for England (and presumably Northern Ireland) where all recyclable items (including plastic, metal, glass, paper and card) will be collected from a single bin (so-called co-mingled). This will certainly simplify kerbside collection, although inclusion of glass, from our standpoint, is undesirable! Also, as always, the devil will be in the detail, so we wait to see whether the Government will specify on national scale what can or cannot be classed as ‘recyclable’ such that it can be included in kerbside collection. (Here I note that I live in Kirklees, where I am unable to place used aseptic drink cartons in my recycling bin, yet my local mill, Sonoco Stainland, is the only one in the country set up to take these grades in quantity.) Also, and perhaps most importantly, no start date has been set, so we will have to see whether the next government decides to pursue this proposal.

Of course, the responsibility for waste and recycling is a devolved competence in the UK, so this initiative doesn’t include Scotland or Wales.

Next, the UK Government is also proposing to simplify labelling, so that the public can more easily identify what is or is not recyclable. Under the Extended Producer Responsibility (EPR) scheme, new packaging labelling will be required, although (currently) there are two options that can be used:

1. DEFRA-design: ‘Recycle’ and ‘Do Not Recycle’.

2. OPRL: ‘Recycle’, ‘Don’t Recycle’, ‘Recycle with bags at large supermarket, ‘widely recycled at recycling centres’ etc.

The former is ‘black and white’, the latter gives more nuance, but will in turn lead to confusion, (although whether as much as we have now is debatable: www.recyclenow.com lists over 20 marks that can currently be applied).

Further afield, the EU voted recently to adopt a regulation which aims to harmonise EU rules across all member countries, and boost the circular economy, initially by reducing packaging and in particular banning certain packaging types, notably single-use plastic, as well as encouraging reuse and refill options

for consumers. Since this is a major market for UK producers, we cannot ignore what is proposed ‘across the water’, and so there will have to be some harmony between what we do in terms of labelling and packaging design, and what the EU will accept.

And so we come to the vexed question of ‘recyclability’. Paper and board coming from our mills is, in the main (with a very few exceptions), recyclable. However, once paper or board leaves our mills, it will often be used as a base structure to which other materials are applied to make a finished product. Obvious additives include plastics, glues and adhesives, decorative foils and print; less obvious inclusions include glitter, metallised layers and laminates. What started as a fully recyclable product can quickly become a problem. This is where recyclability testing comes in.

Laboratory tests have been designed to mimic the early part of paper production, namely slushing, screening and cleaning, and by so doing (under controlled conditions), assess the reject levels, and potential problems due to stickies and other contaminants. Sappi has already installed a laboratory in its European R&D to monitor recyclability of its own products, and other paper manufacturers are likely to follow suit. Meanwhile, other independent contract organisations (such as PITA Member ECOL Studio in Italy) offer this service as well; see also CPI with Papercycle in the UK where the whole process is explained in greater depth

Although recyclability testing is probably of more direct interest to packaging producers than paper mills, nevertheless, papermakers will need to have a greater understanding of this area than ever before, because the market is going to get ever stricter in its requirements. Expect scrutiny of what additives go into paper production, and arguments with recovered paper merchants if any consignment causes issues at a mill. Furthermore, expect the test method to alter with time. (Here I note that Barry Read was particularly interested in any unintended deleterious effects that bio-based barrier coatings might have on the wet end chemistry of a mill; only time will tell whether he was right to be concerned.)

So, in terms of ‘Recycling’, changes are afoot, and as regards ‘Recyclability’, we are roughly at the start of what is going to be a long, and increasingly complicated journey.

Daven Chamberlain

2

ABB Ability™ Manufacturing Execution System for Pulp and Paper

Evolving market demands require agility and efficiency for mills to deliver products on spec and on time. Trust ABB and our MES specifically designed for pulp and paper to help you deliver the best operational results. Our comprehensive and modular solution covers all the core MES functionalities across the value chain, helping you achieve new levels of operational efficiency.

For more information contact your Pulp and Paper Account Managers, Paul Clark: +44(0)7803 885700 | paul.d.clark@gb.abb.com Colin Goodchild: +44(0)7562 207605 | colin.goodchild@gb.abb.com

abb.com/pulpandpaper

—

Real-time transparency for easier decision-making

Industry News

UK NEWS

Board24 has produced sheets on the new corrugator installed at its Eurocentral facility in Motherwell. It is the newest corrugator in the country and the latest technologies mean that it is faster, has enhanced capabilities, and can manufacture superior quality materials more efficiently and sustainably. Capable of producing more than 100 million metres squared per annum, it can manufacture a wide range of flute types including B, C, M, E, BC, MB, and EB.

Cullen Packaging has been nominated for the Earthshot Prize for its Fibre Bottle, in the Waste-Free World category. The Fibre Bottle is a patented paper bottle, made from the waste from Cullen’s corrugated facility via a bespoke closed-loop recycling system and is fully recyclable and compostable. Cullen said the bottle is a scalable, sustainable alternative to single-use plastic bottles or plastic pouches containing dry goods.

In a move to combat plastic pollution, the UK government has announced plans to introduce legislation aimed at banning wet wipes that contain plastic. The announcement was made by the Environment Secretary, marking a significant step in the UK’s environmental strategy. The Department for Environment, Food and Rural Affairs (Defra) plans to roll out the legislation for England before the summer recess, with Northern Ireland, Scotland, and Wales expected to follow suit by autumn.

Over the last couple of months, DS Smith has been subject to two rival takeover bids, the first from Mondi and the second from International Paper. Following an all-stock transaction agreeing to pay 0.1285 new shares of International Paper for each DS Smith share, Mondi withdrew, declining to make a counter offer. IP’s agreement on the conditions to buy DS Smith on 16 April, valued the British packaging firm at £5.8bn.

DS Smith has made a £48m investment in a new fibre preparation line at its Kemsley paper mill. The new line will supply recycled fibre to PM3 machine, which is capable of producing white top test liner, plasterboard liner and other corrugated case materials grades. A drum pulping and screening system will also be installed as part of this initiative, to more efficiently separate contaminants such as plastics, barriers and coatings. With this investment, production waste is expected to fall by 39,000tpy and Kemsley’s use of fresh water by more than 50,000 cu m a year.

Ekman & Co has increased its footprint in Britain. The company has announced the acquisition of Allan Morris Recycling (AM Recycling Ltd) of Deeside, Flintshire, North Wales. According to Ekman, AM Recycling operates one of the most advanced paper recovery facilities in the UK. The company will, as a wholly owned subsidiary of Ekman & Co AB, trade as Allan Morris Recycling.

Essity has had the combustion system of its TAD machine in Prudhoe Mill upgraded by Andritz Novimpianti. The new equipment included a new gas valve train as well as a new burner management system for electronic control of the air/gas ratio to optimise the combustion process over the entire burner output range. This will increase burner performance while reducing gas consumption by up to 4%. CO2 and NOx emissions will also be considerably reduced, and safety improved.

Essity has closed one of its two machines at its Oakenholt site in Flintshire. The site makes brand labels such as Quilted

Velvet and Triple Velvet and also private label products for Tesco, Morrisons, Asda, Wilkinson, Lidl and Costco. The action has placed 13 roles at risk and the firm says it will work to relocate affected staff to other Essity sites, which has six bases in the UK.

Fourstones Sapphire Paper Mill has installed a new paper machine at their site in Leslie, Scotland. The paper machine, which is the company’s biggest single investment to date, was delivered to site in September, and is equipped with a Crescent Former, a Fabricated Steel Yankee Cylinder and a High Temperature Drying Hood with a trimmed width of 2.75m and an operating speed of 1700m/min. Once operational, the capacity is 60,000tpy, and it will primarily produce virgin toilet tissue and towel grades for the consumer and away from home markets.

Seventeen organisations, including global manufacturing giants, universities, and innovation experts, are working together in the unprecedented collaboration Flue2chem to examine the potential for using biogenic carbon emissions as an alternative source of carbon in the manufacture of household products. In the project’s first stage, the partners will examine the transformation of biogenic carbon, captured from the flue gas emissions at Holmen’s paperboard mill in Workington, UK, into surfactants – the active ingredient in household detergents. Earlier this year, the mill took delivery of the carbon capture equipment, which has been developed by the University of Sheffield and CCU International

Metsä Tissue launched a three-week public consultation on its plans to develop a new state-of-the-art tissue paper mill in Goole, East Yorkshire, in March. Metsä announced that it had chosen Goole as the site for this landmark investment in September 2023. Subject to planning and environmental permits, the new mill would increase the UK’s self-sufficiency by more than 30% in the production of tissue products. The proposed mill would be the largest of its kind in the UK and create 400+ jobs at the facility, as well as thousands more across the supply chain and the local economy.

Navigator Paper UK Limited has succeeded in acquiring the entire issued and to-be-issued share capital of British tissue converter Accrol Group Holdings plc. Accrol is a leading tissue converter and supplier of toilet tissues, kitchen rolls, facial tissues, and wet wipes to many of the UK’s leading discounters and grocery retailers across the UK.

UPM Caledonian paper mill in Irvine is celebrating its 35th anniversary this year. The plant opened in April 1989, at a cost of £215 million, which at the time was the largest single inward investment in Scotland. More recently, the site has benefitted from a biomass CHP plant, which is now able to produce all of its heat requirements and just over half of its electricity needs.

Ireland-based packaging group Zeus has announced the acquisition of the Weedon Group, one of the UK’s largest independent integrated corrugated manufacturers. The Weedon Group has three business units: Weedon Corrugated Products in Audenshaw near Manchester operates a corrugator and produces sheet board for internal and external conversion as well as industrial and transit packaging; Weedon PSC at Hednesford, Staffordshire produces POS displays and printed packaging for the retail market; and the i2i europe Creative Solutions unit develops packaging solutions for the own brand label market.

4 PAPER TECHNOLOGY SPRING 2016 MONOTIER®: THE MILLION-TONNE DRYER FABRIC

BENELUX NEWS

DS Smith has invested in a new advanced converting machine, designed to produce FEFCO 0201 bespoke boxes and other alternative grades tailored to customers’ requirements, at its Eerbeek plant in the Netherlands. The machine boasts an advanced automatic inline error detection system to ensure the highest quality in printing and glueing. Also, the computer-controlled technology enhances the precision of die-cutting lines in the packaging and folding process.

Mondi has improved the circularity of material flows in a release liner production site in Heerlen, the Netherlands, in partnership with Veyzle, a Dutch specialist in the recycling of paper and plastics, and the Dutch site of the WEPA Group, an expert for sustainable hygiene paper production. Veyzle collects Mondi’s production waste and sorts, shreds and bails the different papers before transporting them to WEPA. 95% of the production waste is now used as secondary raw material for other industries, thanks to its strategic partnerships.

Prezero has started a new paper and board processing plant in Alphen aan den Rijn in the Netherlands, that can process 40,000tpy of recovered paper and board in a newly built hall on an existing site, located midway between Amsterdam and Rotterdam.

PITA CORPORATE MEMBERS

The Aikawa Fiber Technologies (AFT) MaxEdge™ refiner family has a new member: the MaxEdge600, capable of handling process capacities over 600 t/d. With this latest design, AFT is expanding its product range to higher production rates, offering energy efficient refining technology combined with patented Finebar® segments. Since launching the MaxEdge refiner, AFT has been continuously developing the refiner series by integrating more control and IoT features. With AFTLinx™ service, they are providing more comprehensive and faster support to ensure efficient and optimised refiner operation.

Aikawa Fiber Technologies (AFT) and Islet Group have collaborated to improve AFT’s IoT data processing and reporting. Islet’s team created a modern data and analytics platform using Microsoft Fabric, able to meet AFT’s current needs and expandable for the future. AFTLinx™ Service was developed as a diagnostic service that collects equipment-specific operating data to improve its productivity and performance - with assistance from AFT specialists who analyse the instrument information. AFT’s data platform and reporting will be expanded in stages by bringing in data from other operational systems. The architecture was implemented using specific Microsoft models, which have become industry standards.

Archroma announced the launch of the latest innovation in their Cartaseal® portfolio, Cartaseal® OGB F10, which is a superior water-based oil and grease resistant barrier coating that enables papermakers to provide high-quality and sustainable packaging by replacing fluoro-based substances and polyethylene with a recyclable and repulpable coating. It is FDA and BfR compliant, making it suitable for the manufacturing of paper and board for food and non-food contact. In addition to its functionality, it is recyclable and repulpable.

Kemira and PA Consulting have formed a strategic collaboration aimed at accelerating the development of a new renewable coating technology, supporting transformation into more sustainable food packaging. This builds upon the recent announcement of a new contract manufacturing facility by Kemira and IFF under their exclusive partnership, which will be able to supply entry-level industrial scale volumes for Kemira’s strategic markets. The collaboration with PA focuses on bringing an in-

novative polysaccharide-based renewable barrier coating material to market by leveraging its inherently strong sustainability profile, including recyclability and compostability, combined with excellent barrier properties for sustainable flexible food packaging applications.

Kemira has expanded its renewable products portfolio by launching two new ISCC PLUS certified biomass balanced polymers for the papermaking industry, wet strength resins and polyamines. The wet strength resins reportedly are ISCC-certified PAE-based chemistries (polyamideamine epichlorohydrin), derived from renewable feedstocks. In the biomass balance approach, fossil-based raw materials such as oil and gas are replaced by renewable resources at the beginning of the production value chain. A corresponding amount of renewable raw materials is attributed to the products sold as biomass balanced. Kemira’s biomass balanced products reportedly contain at minimum 50 percent renewable carbon, through either partial or full mass balance attribution.

Pilz has launched an Operation element PIT oe ETH with activatable Ethernet port. The compact control and signal devices are versatile to use when operating your plant, enabling you to switch and display digital inputs and outputs. The operation elements are intended for 22.5 mm diameter mounting cutouts in accordance with EN 60947-5-1 with anti-rotation protection. As an industrial Ethernet interface, PIT oe ETH can be fully activated and deactivated electrically and works like an expanded Ethernet interface of an industrial PC. The interface elements can be activated via any controller. In combination with the PITreader output, activation is only possible with corresponding permission. This ensures that only authorised personnel are allowed access.

Valmet is introducing new low-friction doctor blades to respond to customers’ energy savings and decreased doctor blade usage sustainability requirements. The new low-friction doctor blades are suitable for dryer sections in all paper and board machines regardless of the original equipment manufacturer. The new doctor blades are made of epoxy resin with glass and/or carbon glass fibre reinforcements. Special attention in research and development was paid to functional fillers for low friction. Valmet has conducted a series of successful customer trials with the new blades, and data from one European customer found that the new blade reduced absolute electric consumption of the dryer section motors by more than 26%. Valmet’s doctoring offering includes a complete portfolio of doctor blades, holders and other accessories.

Valmet is taking process automation further by introducing the next-generation distributed control system (DCS), the Valmet DNAe. The fully web-based process control system comes with a new cybersecure system architecture, control software and hardware, engineering and analytics tools, helping customers improve efficiency, productivity, sustainability and safety of their operations. The system provides a common user interface for controls, analytics, configuration, and maintenance. Intuitive workflows simplify operations and enable users to manage larger process areas with less effort.

And finally, we welcome Protex Chemicals, part of Protex International, as our latest PITA Corporate Member. Founded in 1932, Protex International is an independent French industrial group which develops, manufactures and markets speciality chemicals. Their UK operation is based in Morley, just outside Leeds, and the company’s offering includes process additives, flame-proof reagents, products for tissue manufacture and coated paper applications, and materials for speciality packaging (including food-grade papers) such as barrier products.

5 PAPER TECHNOLOGY SUMMER 2024 INDUSTRY NEWS

News Bytes

HEALTH & SAFETY

A pipefitter died after being electrocuted at Canfor Intercontinental Pulp Mill in Prince George, Canada. The man was operating an electric hoist attached to an overhead monorail in the mill when he was electrocuted; according to WorkSafeBC, “the worker was holding the control pendant and leaning on a metal guardrail to view the area of the lift when he collapsed. An exposed 347-volt conductor was subsequently found on the electric hoist power cable in close proximity to where the worker had been.”

Officials with the Domtar Corporation in Johnsonburg have confirmed that two contractors were injured at their mill in Elk County while working on a chip conveyor tunnel.

An employee at the Georgia-Pacific box-making facility in Camas died after becoming entangled in packing machinery.

Metsä Group announced an extended (2-3 month) shutdown of its Kemi bioproduct mill due to a gas explosion in the evaporation plant that occurred during welding work. Three people were slightly exposed to hydrogen sulphide and were referred for a health check.

A contractor working at the Resolute sawmill in Thunder Bay, Canada, was killed in an incident involving a log loader vehicle.

A worker died after becoming trapped in a machine at the WestRock Niagara County facility; the site manufactures corrugated containers.

One man died following a forklift accident at a Weyerhaeuser sawmill facility in North Carolina.

Fires occurred at: Georgia Pacific facility in Emporia, Virginia, following an explosion; International Paper Company on Wells Road and Halifax Drive, Petersburg, in a tractor-trailer attached to the facility in the loading dock area; NORPAC in Longview, Washington, in a conveyor belt system, probably due to overheating equipment or a malfunctioning roller bearing in contact with combustible materials; Pixelle Specialty Solutions paper mill in Spring Grove, Pennsylvania, in the hardwood digester; Resolute Forest Products, Calhoun Mill, Tennessee, in part of the building’s power distribution system; Sappi Somerset Maine mill, on a conveyor belt carrying

shredded wood chips – the wood silo also caught fire; UP Paper LLC mill in Manistique, Michigan, in a storage area containing bales of OCC; Weyerhaeuser location in West Eugene, Oregon, reportedly in a press section.

EUROPE - EASTERN

Arctic Paper is constructing a new production unit for moulded fibre trays at the paper mill in Kostrzyn, Poland; production is due to start in Q3, 2024.

Lithuanian cardboard maker Grigeo has completed its takeover of a Polish paper mill, from Głuchołaskie Zakłady Papiernicze sp. z o.o.

Mondi expanded its professional printing and converting papers portfolio at its Slovak mill in Ružomberok, with a new slitting and rewinding unit.

Pehart Group, a Romanian tissue paper producer, has invested in a new conversion line.

Vrancart, a Romanian tissue paper and corrugated cardboard maker, is investing in renewable energy and installing 20.5MW of photovoltaic panels.

EUROPE - WESTERN

Ahlstrom has launched a consultation process with employee representatives at its facility in Bousbecque, France, about the possibility to divest or close the plant and to centralise parchment paper production to its Saint-Séverin plant in France.

Ahlstrom announced that it is implementing a refined strategy focused on global trends for sustainable materials and is simplifying its divisional structure from five to three business units, being (1) Filtration and Life Sciences, (2) Food and Consumer Packaging, and (3) Protective Materials.

Cartiere Saci S.p.A. in Italy has successfully completed the start-up of its monitoring systems for stock activity and formation, supplied by IBS Papertech GmbH

CPH Group, the parent company of Swiss newsprint and magazine paper producer Perlen Papier, intends to focus on the growing chemicals and packaging business in the future. Therefore, the paper and the real estate business will be separated from the group and subsumed under Perlen Industrieholding AG Drewsen Spezialpapiere is to con-

struct a photovoltaic system, with a generation capacity of 24,600 kWp, close to the mill. This project is being realised by the EPC service provider Iqony Solar Energy Solutions GmbH. The expected annual generation will cover about 22% of the annual electricity requirements for paper production at the mill.

Drewsen Spezialpapiere started a new film press on PM1 at their mill in Lachendorf, Germany; this replaced an existing size press.

DS Smith Contoire-Hamel Mill in France had their motors upgraded by ABB, using award-winning SynRM motors technology.

DS Smith has invested in two Austrian packaging plants. At their plant in Margarethen, new palletising robots and transfer carriages have been installed. At the Kalsdorf facility a new folder gluing machine (Masterfold) and a high-performance die-cutter (Masterline) were put into operation. In addition, the conveyor system has been modernised and the warehouses expanded at both sites.

The EcoReFibre consortium has met at the Dieffenbacher Eppingen base to demonstrate and discuss interim results of the research project which aims to recycle waste fibreboards and use the material in the manufacture of new fibreboards.

Ence (Energía y Celulosa) has commenced the execution works of the project that will allow the Navia biofactory to supply cellulose fluff pulp.

Ermolli paper mill in Italy commissioned Sael to upgrade their Jagenberg Varidur rewinder/slitter.

Heinzel Group may discontinue operations at Raubling Papier mill in Germany.

Turkish company İŞ Holding A.Ş. has confirmed plans to build a new paper machine at the Ober-Schmitten speciality paper mill (SPO) in Nidda, Germany.

Koehler Group has signed a Power Purchase Agreement with Koehler Renewable Energy, to use the power produced from two wind turbines for paper production at its mill.

LEIPA plans to concentrate the production of graphic papers on PM4 and discontinue operation of the older PM1 at Schwedt, Germany. This decision is part of a comprehensive approach to site optimisation, which is also being pursued in Schrobenhausen, Germany.

6

PAPER TECHNOLOGY SUMMER 2024 NEWS BYTES

Mayr-Melnhof in Austria has started marketing its “latest eco-friendly breakthrough”, thermoformed wet-moulding technology, a fibre-based, moulded pulp product.

Omnia Advanced Materials, a company producing absorbent media, industrial filters and gasket materials, has taken delivery of an induction heated calender from DJM at its facility in Italy.

Pavatex, a member of Soprema Group, has started a second fibre production line at the Golbey facility in France. Andritz supplied the equipment, which is used for production of insulation board.

Pirinoli Papermill, Italy, has upgraded the press section of PM3, with new drives from Sael; in addition, Toscotec installed a shoe-press.

Progroup has set a world record at the paper mill in Eisenhüttenstadt. Containerboard machine PM2 produced WS 80g paper at more than 1801m/min over a 25hour period on 21 February.

Progroup plans to build a new containerboard machine in Stockstadt by the end of the decade. Dismantling of the former idled Sappi Stockstadt pulp and mill began in May.

RDM announced the closure of its Blendecques paper mill (capacity 117ktpy of recycled grades) in Pas-de-Calais region, Northern France, and is withdrawing from the French market.

Sappi has established inhouse capacity to test recyclability of its own products, within the R&D Department at its European Technology Centre.

Schilliger Holz AG started the construction works for its new fibre insulation board factory in Küssnacht am Rigi, Switzerland.

French containerboard mill Papeterie Saint-Michel, part of French industrial group Thiollet, has found itself in receivership due to the plant’s long-term financial trouble.

Unipak Hellas Central S.A. has taken delivery of ABB KPM KC7 microwave consistency sensors at their new paper mill in Pelasgia, Greece. This is the first time a customer has opted to use highquality microwave only, rather than a combination of different measurement technologies, throughout an entire facility.

NORDIC REGION

Infinited Fiber Company, based in Espoo, Finland, has developed a 100% circular technology for converting textile waste or other cellulose-rich waste into their proprietary “Infinna” fibres. The company has just raised €40 million as it looks to finance future growth.

Metsä Board has made an investment decision to renew the folding boxboard machine at Simpele, Finland; this will increase the mill’s production capacity by around 10ktpy.

Metsä Board announced on 15 September 2022 that it will start pre-engineering for a new folding boxboard mill in Kaskinen, Finland. The pre-engineering has now been completed and Metsä Board has decided not to proceed with the investment.

Metsä Fibre Kemi bioproduct mill in Finland has successfully commissioned a state-of-the-art 270 MW steam turbine supplied by Doosan Škoda Power

Metsä Group announced plans for its Mänttä tissue mill in Finland to develop the sustainability of the operations and to modernise and extend the lifecycle of the mill.

Metsä Group will construct a demo plant for lignin refining in connection with its Äänekoski bioproduct mill in Finland. The equipment will be supplied by Andritz. Construction will begin in summer 2024, and the plant’s daily capacity will be two tonnes of the lignin product.

Södra is to invest in a new condensing turbine in the pulp mill at Mörrum, which will increase the county of Blekinge’s electricity generation by 20%.

Soilfood, a Finnish circular economy company, is processing the fibre-based side streams generated in the production of paperboard from manufacturer Metsä Board, into various soil improvement fibres for local farms. Soilfood has previously used these side streams from Metsä Board’s board mills at Kemi and Äänekoski. Now the cooperation has been extended to the Tako mill, located in the centre of Tampere.

NNORTH / SOUTH AMERICA

Ahlstrom completed a paper machine conversion project at its Thilmany Mill in Kaukauna, Wisconsin. The machine now produces stretchable creped base papers for masking tape, capacity 30ktpy.

Berry Global Group and Glatfelter Corporation have entered into definitive agreements for Berry to spin-off and merge the majority of its health, hygiene and specialities segment to include its Global Nonwovens and Films business with Glatfelter, to create a leading, publicly-traded company in the speciality materials industry. The new combined company will become a global leader in the growing speciality materials industry.

Billerud has reached terms with the Capital Recovery Group, LLC for the sale of the Wisconsin Rapids Mill and related assets; the mill had been idled since July 2020.

Canfor aims to reduce reliance on natural gas with a hydrogen power project in Prince George, B.C. Chilliwack-based Teralta Hydrogen Solutions plans to take byproduct hydrogen from Chemtrade Logistics’ sodium chlorate plant in Prince George and refine it for use as hydrogen power at the pulp and paper mill.

Cascades Inc. is closing three facilities as part of changes to its containerboard operations; the corrugated medium mill in Trenton, Ont., that is currently idled will not restart operations, while converting plants in Belleville, Ont., and Newtown, Conn., closed.

According to CMPC, the process for building a new $4bn pulp mill project in the municipality of Barra do Ribeiro, Brazil, has been launched with the signing of a protocol of intentions with the federal government of Rio Grande do Sul.

Colombian tissue manufacturer C.Y.P. Del R. S.A. has started a complete tissue line supplied by Toscotec at its mill in Risaralda.

Fedrigoni Group acquired ‘certain assets’ from Mohawk Fine Papers; the company did not acquire the whole legal entity, but did acquire production assets in Waterford and Cohoes mills and the Albany Warehouse.

Georgia-Pacific is to rebuild a paper machine at its mill in Wauna, Oregon. This investment will transform a 1965vintage paper machine into a world-class machine to make paper for Angel Soft® and strategic private label bath tissue.

Godfrey Forest Products is to open a new OSB production facility in Jay, Maine, located at the premises of the Androscoggin paper mill where production activities ended in 2023.

Graphic Packaging is to sell Augusta mill in Georgia, which produces solid bleached sulphate (SBS) paperboard, to Clearwater Paper

Holmen is set to merge its paperboard and paper business units into a new unit, Holmen Board & Paper. The company said that the decision is part of a continuing development of its business.

International Paper Vicksburg containerboard mill has been selected for Carbon Capture Pilot Program by the U.S. Department of Energy (DOE) Office of Clean Energy Demonstrations (OCED). A first-of-its-kind for the pulp and paper industry, the pilot project aims to capture 120ktpy of CO2 and direct it to a site for permanent geologic storage.

International Paper Riegelwood Mill was closed temporarily following a cyberattack. The attacker accessed International Paper’s system through a third-party vendor “and did not directly

7 PAPER TECHNOLOGY SUMMER 2024 NEWS BYTES

target our company or mill.”

Irving Pulp & Paper in west Saint John, New Brunswick, is upgrading its woodyard, including installation of a new automated stacker reclaimer that is the tallest of its kind in the world.

Mondi plc has completed the acquisition of Hinton Pulp mill in Alberta, Canada, from West Fraser Timber Co. Ltd

Paperera Reyes, has started a new vacuum system supplied by Runtech, at their mill in in Callao, Peru. TM2 was supplied by RePlus Tissue, and can produce 130tpd.

ProAmpac acquired UP Paper, a leading producer of 100% unbleached recycled kraft paper for packaging applications located in Manistique, Michigan.

US wood-based panel Roseburg closed the Missoula works in Montana during May, and has permanently withdrawn from particleboard production.

Sofidel America produced its first parent roll of tissue at its newly acquired mill in Duluth, Minnesota (USA) on 1 Feb.

Sonoco Products Company announced that it will permanently close its uncoated paperboard (URB) mill operations in Sumner, Washington (capacity 40ktpy), effective immediately.

Twin Rivers Paper has sold Pine Bluff unbleached kraft paper mill to American Kraft Paper Industries.

UPM Paso de los Toros pulp mill in Uruguay has taken control of a 2.1Mtpy eucalyptus pulp mill from the supplier, Andritz

West Fraser and Mercer announced dissolution of its Cariboo Pulp and Paper joint venture; West Fraser will continue as the sole owner/operator of the mill, doing business as Cariboo Pulp and Paper Company

Hangzhou Huawang New Material Technology, a Chinese decor paper manufacturer based in Ma’anshan Huawang (Anhui province), is to commission its fourth paper machine in June.

Hengan International Group has launched structured tissue products on the Chinese market from its Xiaogan mill, following start-up of a new machine supplied by Toscotec

Middle East Paper Company (MEPCO) has approved 1.78 billion Saudi riyals ($474.56 million) for the construction of a fifth paper line (PM5), which will have a production capacity of 450ktpy.

PT Riau Andalan Paperboard International, part of APRIL Group, has initiated the commissioning of its new paperboard manufacturing plant, capable

of producing 1.2Mtpy of recyclable and biodegradable paperboard annually.

Shandong Huatai Paper and Voith Paper successfully started PM11 in the eastern Chinese province of Shandong. PM11, a former newsprint machine, was successfully rebuilt by Voith for the production of high-quality graphic paper.

Societé Industrielle Des Papiers Tissues (Sipat S.A.), a manufacturer of premium tissue mill in Morocco, has started ABB QCS on two machines.

SK Leaveo, a subsidiary of South Korean chemical giant SKC specialising in biodegradable materials, has reportedly partnered with paper product manufacturer KleanNara to create a line of biodegradable hygiene products, starting with eco-friendly wet wipes.

Thai MDF producer Wisewoods Co. Ltd. is expanding its production capacity at the company’s headquarters in Khao Yoi in the province of Phetchaburi, with the new CEBRO MDF plant delivered by Dieffenbacher

Xuong Giang Paper in Song KhêNội Hoàng Industry Park, Bắc Giang Province, Vietnam, has successfully started a new 72ktpy tissue machine supplied by Andritz.

Yuen Foong Yu Consumer Products started a new Andritz tissue production line at Chingshui mill in Taiwan.

SUPPLIERS

Albany International Korea, Inc., an affiliate of Albany International Corp. is to discontinue manufacturing at its operations in Chungju, South Korea, and to transfer production to other Albany International manufacturing facilities.

Andritz and Powerhouse Controls, a leading provider of drive systems, have entered into a partnership to address the need of North American paper mills to modernise their paper machine drive systems while minimising production downtime. The partnership combines Powerhouse Controls’ drive solutions with Andritz’s extensive paper machine engineering expertise to provide customers with a tailored and comprehensive solution to their coordinated drive system challenges.

Andritz and AS Drives are partnering in the field of innovative direct drive solutions for the pulp and paper industry. Since more than 30 years, AS-Drives has offerred a range of products in the drive and lubrication technology sector.

Argynnis announced the acquisition of MagComp AB, whose non-contact drying systems will complement the company’s other technology.

Kadant Inc. has acquired Swedish simulation software company FrontWay

AB. Founded in 2004 with a focus on pulp and paper industries, the company is headquartered in Norrköping, Sweden and will become part of Kadant’s Industrial Processing reporting segment.

Kadant Solutions, a division of Kadant Inc., announced the launch of the VeriFlex™ oscillation system which provides compact and reliable oscillation for the VeriLite™ roll cleaner assembly. The VeriFlex oscillation system enhances roll cleaning effectiveness and extends blade life in a variety of industrial processing applications.

Kemira has strengthened its product portfolio in Brazil’s growing pulp market with an exclusive distribution agreement with BIM Kemi.

Konecranes launched its flagship Konecranes X-series industrial crane, the successor to its popular CXT model with a new compact design and safe, reliable wireless technology that is upgradable.

Pallmann Maschinenfabrik, located in Zweibrücken, Germany, has acquired the business operations of the Slovakian company Febs SK s.r.o. in Mytne Ludany.

Toscotec has successfully launched a new generation design of its TT Brain DCS, which offers a whole breadth of innovative functions and add-on customised tools.

Valmet has introduced sustainable low-friction doctor blades to reduce energy consumption at the dryer section of board and paper machines.

Valmet introduced their next-generation Distributed Control System (Valmet DNAe).

Valmet plans closure of its exhaust air purification system in Kaiserslautern, Germany (previously EWK Umwelttechnik GmbH, which it purchased in 2021).

Valmet is to invest in filter fabric manufacturing in Belo Horizonte, Brazil, in order to better respond to the growing demand of high-performing filter fabrics in both the mining and pulp and paper industries in South America.

Voith Paper has introduced the “Design for Recycling” concept. In cooperation with partners such as Aquafil S.p.A., Voith has succeeded in an initial pilot phase in collecting used press felts from customers at the end of the product life cycle and successfully recycling them at Aquafil S.p.A through its regeneration process.

Voith introduced OnView.Energy, an innovative digitalisation solution for energy monitoring that enables paper manufacturers to visualise, monitor and reduce energy consumption to lower their operating costs while minimising environmental footprint.

8

REST OF WORLD

PAPER TECHNOLOGY SUMMER 2024 NEWS BYTES

9 PRIMA 2024 STRATEGICALLY FOCUSED ONE-DAY EVENT PRIMA has established a reputation as the go-to network hub for the entire fibre value chain. Register Now: www.prima-paper.com/home 2 SEPTEMBER 2024 A MUST ATTEND EVENT FOR ANYBODY IN THE FOREST FIBRE & PAPER INDUSTRY PART OF SMITHERS PAPER WEEK 2024 USE CODE PRIM2410 FOR 10% OFF YOUR TICKET!

The road less travelled in papermaking Navigating known challenges when scaling operations

Stefano Cinquina, Global Business Line Manager for Pulp and Paper, ABB Process Industries

Stefano Cinquina, Global Business Line Manager for Pulp and Paper, ABB Process Industries

The pulp and paper industry represents a large and growing portion of the world’s manufacturing economy. As more businesses and consumers opt against single use plastics, demand for paper and sustainable packaging solutions is growing. This is driving an expected compound annual growth rate of 3.8% between 2024 and 20281 for the pulp and paper industry.

With increasing demand for paper products and new innovations on the horizon, such as bags, bottles and battery components made from paper, the industry needs to achieve consistent, high levels of productivity to capitalise on these abundant opportunities. However, paper mills are struggling with uptime, mainly due to the time-old challenge of outdated equipment and subsequent low standards of process control and measurement.

Digital transformation is part of the answer to existing production optimisation and holds significant promise for reducing energy consumption, however, despite it being essential for the future, connectivity brings its own unique set of challenges. The convergence of operational technology (OT) with information technology (IT) has created new vulnerabilities in mill cyber security which, if not managed correctly, can cause even greater inefficiencies if a cyberattack is successful.

Many of ABB’s clients are struggling in the face of these conflicting challenges. They recognise the copious opportunities for growth but find the road to realising them is plagued with hazards. As a result, mills find themselves at a crossroads. They must find a way to increase uptime and productivity, while doing so safely, securely, and sustainably. In this article, we investigate the approaches and technologies that can give the pulp and paper industry the boost it needs to reach its destination.

Unleashing productivity

Most pulp and paper mills are aware of the pressing need to

modernise and invest in their operations, yet some sites have not upgraded key technologies in over 20 years. The culminating result is unexpected failures and hidden inefficiencies, costing time and money while losing out on key growth opportunities.

It is critical to see and measure results in real time. If you can’t measure quality, the consumption of raw materials such as fibre, chemicals and energy is often not optimal for the paper products produced, which has a significant impact on overall productivity and profitability. Quality Control Systems (QCS), such as ABB QCS, enable mills to have greater control over their paper machines, including functions such as third-party dilution actuators in headbox and profilers, which can optimise production based on basis weight and moisture measurements. This level of control ensures production quality is higher with less downtime, empowering operators to implement faster production changes while maintaining a high-quality output.

Effective data management also has the potential to revolutionise productivity in paper mills. By analysing historical data and identifying patterns and trends, mills can forecast when a component is likely to require maintenance or a replacement, allowing them to schedule interventions during planned downtimes, rather than responding reactively to faults and having to shut down at inconvenient times.

ABB Ability™ System 800xA® distributed control system (DCS) integrates operations across the mills to provide data and analysis to support maintenance engineering decisions. This helps pulp and paper manufacturers to optimise maintenance strategy procedures, while ABB Ability™ Asset Condition Monitoring observes all pulp and paper mill’s assets in real time. This includes field devices, control systems, automation elements and other major assets.

One of ABB’s key clients in Asia demonstrates the value that

10 PAPER TECHNOLOGY SPRING 2024 NEW INSIGHTS ON APPLICATION OF HIGH-YIELD PULP

ABB Control Room Solution for Pulp Mills

digital technologies can deliver for increasing productivity. One of its major paper mills runs a complex, 13-paper machine operation which needed to maintain high production while being able to correctly predict service costs and constantly improve process performance. They turned to ABB’s remote monitoring and predictive analysis technologies. This helped the mill harness the tremendous amount of data needed to complete bump tests to address production, quality and cost issues — one step at a time — and reduce both the time spent doing so by 70% and the overall loop tuning effort by 75%. This contributed to increased production, lower chemical costs, accelerated grade changing, fewer sheet breaks, reduced unplanned downtime and machine direction ash variability.

Keeping security in check

The advent of new technologies to reduce downtime and foster greater productivity is changing the pulp and paper industry significantly. However, excitement regarding these innovations must be balanced with a constant eye on security.

These technologies place a greater emphasis on connectivity as real-time data and insights are often crucial to realising productivity gains. If not managed correctly, the increased integration of operational assets onto corporate networks can expose industrial control systems, process control systems and operational technology to malware attacks, hacktivism and other security threats.

A cyber security breach on a mill can bring production to a halt with potentially widespread consequences, even from just a minor breach. One day of lost production or downtime could cost millions of dollars. There are also many potential sources of indirect loss in the immediate wake of a breach. In the long term, mills must contend with the costs to validate that their systems are back to normal, manage regulatory reporting and invest additional time into rebuilding trust with customers.

With the instances of cyberattacks on the rise – in 2023, over 72 percent of businesses2 worldwide were affected by ransomware attacks – mill operators can’t afford to be passive about cyber security.

So, how can mills rise to the challenge of growing demand without compromising the security of their operations?

A dual faceted solution

Digital transformation should be built on a strong foundation of cyber security. All digitalisation initiatives must actively pursue an appropriate combination of technology, people, and process – including integrating IT and OT. A defence-in-depth approach is a great way to achieve this, meaning addressing cyber security at multiple levels.

Working with mills worldwide, ABB has found it’s never too late to begin implementing a cyber security strategy. Mills can, and should, upgrade and implement practices across existing platforms if they don’t already have an established cyber security architecture. New technologies now make it easier than ever to collect and analyse security data.

ABB recently supported DS Smith to build a bespoke cyber security system to ensure the highest level of security across existing technologies. The two organisations worked together to upgrade legacy systems and establish enhanced cyber security architecture.

DS Smith case study: Combining safety with automation

DS Smith is a leading provider of sustainable fibre-based packaging worldwide, supported by recycling and papermaking operations. The company’s Kemsley Paper Mill in Kent, UK, has been in operation for 99 years and is today the second largest recycled paper mill in Europe with an annual production capacity of over 820,000 tonnes.

As it edges towards its centenary, the DS Smith Kemsley team

11 PAPER TECHNOLOGY SUMMER 2024 NAVIGATING KNOWN CHALLENGES WHEN SCALING OPERATIONS

ABB Ability™ System 800xA® Distributed Control System

faces a new generational challenge to create highly automated, increasingly connected and more secure operations. As a technology leader with decades of history and many industry firsts in pulp and paper, ABB is embedded in the mission. For the Kemsley mill, cyber security is an important part of its license to operate. The team wanted to maintain their security but recognised the importance digitalisation plays now and in the future.

For the last decade, an older version of System 800xA distributed control system (DCS) was used successfully, but it did not lend itself to effectively supporting the latest technology and hardware. The time had come for a full system upgrade with enhanced cyber security architecture to meet modern requirements.

Together with a QCS, drives and machine control across all three paper machines on the 1.1km² site, the DCS touches every area of the mill. At such a scale, the idea of a seamless upgrade may have seemed impossible to many.

The mill scheduled shutdown on all three paper machines, beginning with PM3 and PM4 simultaneously, followed by PM6 and their effluent and freshwater plant. The team recognised the importance of the project and timed it for minimal disruption to normal operations. Having three paper machines on one site isn’t common within the industry and added to the complexities and logistics of such a project – raising the stakes significantly.

It became one of the largest system upgrades that ABB has supplied into the industry, taking over 6,000 hours in advance and 12 days on site. The team completed a full upgrade of the DCS, QCS and paper machine drives, with mill-wide integration.

Mapping out a complex architecture to deliver cyber security at every level of operations, ABB had the expertise and power of both local and coordinated resources to deliver a close-toseamless upgrade.

System 800xA is a key control system for DS Smith and with enhanced integration and more secure options, visibility of operations mill-wide have improved significantly – aiding DS

Smith on their digitalisation journey and laying the ground for the future of their operations.

The home stretch

ABB firmly believes that the future of the pulp and paper industry is sustainable. But, to succeed, mills need to keep moving forward with a phased approach that takes advantage of data. While the industry is increasingly embracing digitalisation, knowing how best to utilise and secure it is key.

It is important not to shy away from adopting new technologies just because of the elevated security risk. Thousands of companies around the world have embraced new productivity-boosting technologies and haven’t experienced devastating cyberattacks. This is because they secured against threats by considering and implementing security as part of the overall transformation plan.

As exemplified by DS Smith’s Kemsley Mill, digitalisation presents a roadmap for a more secure, efficient, and sustainable future for the pulp and paper industry. By embracing these advancements and fostering collaborative partnerships with industry leaders like ABB, manufacturers can unlock the true potential of digital transformation and secure their competitive edge in the years to come.

References

1. Pulp & Paper - Worldwide | Statista Market Forecast (https:// www.statista.com/outlook/io/manufacturing/materialproducts/pulp-paper/worldwide)

2. 2024 Cyberthreat Defense Report, CyberEdge Group, LLC (https://cyberedgegroup.com/cdr/)

12 PAPER TECHNOLOGY SUMMER 2024 NAVIGATING KNOWN CHALLENGES WHEN SCALING OPERATIONS

DS Smith Kemsley Paper Mill in Kent, UK

End of Waste Criteria for Paper – Position Paper

Dimitra Rappou, Executive Director - Sustainable Products, Confederation of Paper Industries

Dimitra Rappou, Executive Director - Sustainable Products, Confederation of Paper Industries

Setting the bar high has long been fundamental for progress and innovation in the paper sector and instrumental in its long-term credibility and growth. Today, with the UK recycling rate for packaging paper and cardboard exceeding 80%, and a remarkable 78% reduction in carbon emissions since 1990, the importance of standards in driving such achievements cannot be ignored. Paper, as a sustainable, renewable, and recyclable material, stands as a testament to the potential of setting the bar high. However, as packaging evolves to meet consumer demands, it is crucial that these innovations also prioritise recyclability.

The Confederation of Paper Industries (CPI) recently published the 4th edition of the Design for Recyclability Guidelines Since its first publication in 2019, it was evident that the supply chain needed clear, simple but comprehensive guidelines that provide design parameters which, if generally adhered to, should deliver recyclable fibre-based packaging. This revised version both seeks to offer guidance on efficient paper recycling, but also gives a direction of travel for future packaging design within the context of the upcoming regulatory changes.

But why do these guidelines matter beyond being a set of recommendations? They define the very essence of sustainable packaging design by setting clear design recommendations, such as limiting non-paper components to 5% of pack weight. They challenge industry professionals to push boundaries and develop environmentally friendly and efficient solutions. Moreover, with the prevalence of commingled recycling collections, the need to improve the quality of upstream materials has never been more timely. As more materials are mixed together in the recycling process, the level of undesired contaminants in the paper recycling stream will increase significantly. This trend poses a serious challenge to the recycling process, as contaminated materials impact significantly on the quality of recyclate and increase processing costs. In response, initiatives aimed at enhancing the

quality of materials entering the recycling stream have gained importance.

In an era where corporate responsibility is increasingly scrutinised, these standards demonstrate a commitment to sustainability. By setting clear benchmarks for recyclability and resource efficiency, companies are urged to make more responsible decisions regarding their packaging materials and processes. They signal a commitment to sustainability, demanding accountability at every stage of the packaging process.

Right from the start, these Guidelines have been shaped through collaboration, gathering insights from a wide range of stakeholders. This inclusive approach ensures that the guidelines are thorough and reflective of the industry’s collective commitment to sustainability and innovation. As new technologies emerge and policy takes shape, CPI will continue to review these guidelines through a cross-sectoral CPI committee. The more recyclability testing is conducted via Papercycle, the richer the insights we gather to inform these Guidelines. Additionally, we’re inviting contributions on any technological advancements through an open call for evidence, which will influence future revisions. At the same time, as pan-European efforts to provide guidelines for paper and board packaging intensify, the CPI Guidelines will be as closely aligned as possible with the work being undertaken in Europe.

The time for action is now. As consumers become increasingly conscious of their environmental footprint, businesses must rise to the occasion and embrace sustainable practices. As we navigate through uncertain times, with impending reforms and regulatory changes on the horizon, the CPI Guidelines remain a trusted resource and supportive mechanism for designers of fibre-based packaging. They provide future direction, guiding towards a future where sustainability is not just a goal, but a standard practice.

PITA TRAINING COURSES

PITA organises a wide range of courses in partnership with a host of top trainers, covering important managerial and technical subjects, including:

• EPR Compliance

• Fundamentals of Papermaking

• Introduction to Food Contact

• Introduction to Tissue

• Introduction to Wet End Chemistry

• Modern Papermaking

• Wastewater Treatment

For more information about any of these courses, see the PITA website (www.pita.org.uk ¦ E: daven@pita.co.uk ¦ T: +44 0300 3020 159)

13 PAPER TECHNOLOGY SUMMER 2024 INDUSTRY NEWS

Safety and Industrial Security - One-stop shop

Security incidents no longer affect just IT systems, but increasingly the production environment (OT) also. Industrial Security incidents include not only targeted attacks but also unintended manipulations. The mission of Industrial Security in production is to guarantee the availability of plant and machinery, as well as the integrity and confidentiality of machine data and processes. Ultimately, if companies are not in control of their data, then both the company and employee safety are at stake: there’s no Safety without Security, and without Safety, people are not protected!

The EU legislator has reacted to the rising threat level: at corporate level, the Directive for Network and Information Security NIS 2 requires the overall implementation of an Information Security Management System.

The new Machinery Regulation 2023/1230 now stipulates protection against corruption for plant and machinery and demands security measures for parts of the machine that influence functional safety.

The Cyber Resilience Act (CRA) requires security measures for products with digital elements. These include controllers, IO systems and other components used in machinery.

Companies, machinery and products – at every level, machine builders and operators face different challenges and different legal frameworks.

Irrespective of the fact that the legislator is making Industrial Security mandatory, there are a number of good reasons for dealing with the subject early and getting some advice. That’s because many procedures and factors for the operation of machinery encourage manipulations, and should be scrutinised and modified urgently. For example, a long service life for machinery often leads to a situation where the corresponding systems become outdated, and at some point no longer meet the current security standards. These systems have security gaps that can no longer be closed, because the supplier has stopped providing security updates. Often, protection against malware cannot be implemented on end devices, as some are too old and their performance would suffer as a result, potentially leading to production downtimes.

Comprehensive service package from Pilz

The ultimate goal is to protect business operations, but to do this companies need to overcome a variety of challenges: this ranges from identification of the valid legal requirements and detection and rectification of weak points in systems, to raising

awareness of and training employees, and to subsequent enforcement of controls. Because Security is a goal that is constantly changing, a regular check of the Industrial Security status of machinery is also necessary.

The automation company Pilz has prepared itself for these requirements and developed a service package for machine builders and users around the world that holistically incorporates all aspects for the protection of human and machine. The services range from basic information, orientation guides and training, through to the Industrial Security Consulting Service (ISCS), in which actual projects are implemented.

Pilz launches its Industrial Security Consulting Service, helping companies to make their plant and machinery secure. (© Westend61/[westend61] via Getty Images, © Pilz GmbH & Co. KG)

With the qualification “CESA • Certified Expert for Security in Automation”, since last year Pilz has offered a two-day expert course, which gives delegates concise Security knowledge in line with the current status of the standards. What’s more, the training covers practical risk reduction measures, such as access control, increase of network security using technical means and organisational measures to avoid security risks. When delegates pass the test, they receive the TÜV NORD certificate for “CESA • Certified Expert for Security in Automation”, which is recognised worldwide.

With the new Industrial Security Consulting Service (ISCS), Pilz is expanding the safety-related inspection of machinery to create a holistic approach to Safety and Security. Pilz has developed the service package, building on the proven methodology for functional machinery safety services and based on the security standard series IEC 62443. Once companies have used this service, they will be well equipped in terms of Industrial Security and will meet the current legal requirements.

One-stop Safety and Security: Pilz offers a comprehensive solution package with services and products for Industrial Security on machinery. (© Pilz GmbH & Co. KG)

14 PAPER TECHNOLOGY SUMMER 2024 INDUSTRY NEWS

Four modules for greater Industrial Security

ISCS consists of four modules: Protection Requirements Analysis, Industrial Security Risk Assessment, Industrial Security Concept and Industrial Security System Verification.

In the Protection Requirements Analysis, experts from Pilz visit the company to identify the protection requirement of the individual “assets” in the plant or machinery, and their protection goals. Step two is the Risk Assessment, where all risks are considered along with the likelihood of them occurring, for each subsection over the system’s complete lifecycle. Then the Pilz experts meet with the customer to discuss solution approaches to mitigate the identified risks and potential hazards.

In step three, experts from Pilz create an Industrial Security Concept with strategies and measures to defend against and mitigate risks arising from attacks, manipulations and misuse. In addition, policies, rules and guidelines are created for the continued secure operation or structure of the system. The final step, the Industrial Security System Verification, checks the effectiveness of the implemented countermeasures.

Secure machine availability

Industrial Security Consulting Service helps to mitigate or prevent cyber attacks. The number of security incidents triggered unintentionally also falls. In turn this increases machine availability and ultimately brings cost savings and maintains economic efficiency.

Above all, ISCS ensures that appropriate security measures are used to protect people on the machine. Because a security incident can obstruct safety measures. For example, a light curtain in front of machinery ensures that operators do not enter a danger zone. However, if an attacker can influence the relevant controller and mechanism, the protective function of the light curtain may no longer be guaranteed. Security protects Safety!

Thus machine builders and users receive a service package from Pilz, which takes into account all aspects for the protection of human and machine.

For the actual implementation of the machine, therefore, it makes sense to consider Safety and Security together. Because: there’s no Safety without Security, and without Safety, people are not protected!

Comprehensive Identification and Access Management controls access to the application, thereby ensuring the integrity of the safety functions and measures – including Safety and Industrial Security. (© Westend61/[Westend61] via Getty Images, © Pilz GmbH & Co. KG)

The Industrial Security Consulting Service from Pilz consists of four modules: Protection Requirements Analysis, Industrial Security Risk Assessment, Industrial Security Concept and Industrial Security System Verification. (© Pilz GmbH & Co. KG)

Clearly controlled: who can do what on the machine?

The safety of a machine and its operators stands and falls with the control of access – whether that’s for people or the network. Entry points must be protected against unauthorised access, so that nobody is inside the danger zone when the machine is in operation, for example. If an authorised machine operator is in this danger zone for maintenance purposes, it is essential to ensure that nobody else accesses the plant at the same time. Otherwise, even well-intentioned plant operation or maintenance – whether on site or via a network – could have fatal consequences.

An important element is Identification and Access Management (I.A.M.), which clearly regulates permissions and access to plant and machinery in companies. These include organisational measures and specifications, as well as the appropriate Safety and Security functions. An access permission system such as PITreader from Pilz represents an appropriate product component. It means that users can meet the requirements with regard to employee protection, liability protection, maximum productivity and data protection.

With the operating mode selection and access permission system PITmode fusion, Pilz offers functionally safe operating mode selection and the control of access permissions on plant and machinery. Each operator is given an RFID-coded transponder, which contains the machine enables that match their responsibilities and qualifications. So the plant can only be operated and controlled by authorised personnel in defined operating modes. This provides a high degree of protection against unintended actions and manipulations.

Add the components of a modular safety gate system to the operating mode selection and access permission system and the result is a coherent machine access concept – from Safety and Security perspectives.

The best safety gate guarding is worthless if data, know-how and operations are not sufficiently secured against unauthorised access and manipulation and an external attacker is able to penetrate the control system.

Industrial firewall protects against external access

The mission of the SecurityBridge industrial firewall from Pilz is to safeguard against external access to automation networks. It monitors the data traffic between the PC and controller and thus reduces the attack surface for hacker attacks and manipulation. SecurityBridge not only protects Pilz controllers but also third-party controllers from manipulation.

Pilz is convinced that only a holistic approach to Safety and Security can guarantee the comprehensive protection of human and machine. It is no longer at the company’s discretion whether, and to what extent, it wishes to grapple with Security. It is now a legal requirement. In engineering, security in the form of Industrial Security is not solely a task for IT, but is an integral part of the design and construction. To implement security retrospectively is complex, and usually means reductions in user friendliness, functionality and productivity.

15 PAPER TECHNOLOGY SUMMER 2024 SAFETY AND INDUSTRIAL SECURITY - ONE-STOP SHOP

Accelerated change on the cards for intensive energy users in 2024

Jodie Eaton, CEO of Shell Energy UK

Jodie Eaton, CEO of Shell Energy UK

From government plans to unlock access to grid connections, to updates on support for major energy users, the focus on driving efficiency and supporting decarbonisation is set to continue in 2024. In this article, Jodie Eaton, CEO of Shell Energy UK, digs deeper into what’s ahead and considers how major energy users can take advantage of the opportunities available.

For many major energy users, rising costs and pressing decarbonisation targets mean that energy is already firmly on the board room agenda. Recent research from Shell Energy1 found that two of the top five strategic priorities for UK businesses are related to decarbonisation – considered more important than other critical issues such as financial stability and retaining employees.

It is now nearly two years since it became mandatory for more than 1,300 of the largest UK-registered businesses to disclose climate-related financial information, aligned with the UK Government’s drive to reach net-zero by 2050.2

The disclosure regime was endorsed by 60% of global businesses and has helped to frame decarbonisation strategies among some of the UK’s largest companies.3

Increasing support for companies looking to decarbonise

For those looking to diversify their supply and explore onsite generation, government plans to halve power line construction time to accelerate homegrown, renewable energy will help create

up to 100GW of capacity – equivalent to around a quarter of the electricity needed to power the UK economy in 2050.4

The plans will remove the first come, first served queuing system for connection and, via the Green Industries Growth Accelerator, commit £960m of investment in green industries in a bid to boost energy security.5 The Accelerator package, announced by the government in mid-November 2023 as part of a £4.5bn boost for UK manufacturing, is targeted at expanding homegrown, lower carbon supply chains across the UK, including carbon capture, utilisation and storage, electricity networks, hydrogen, nuclear and offshore wind.

Powering the future

Resilience is business critical and in its Statutory Security of Supply Report 20236, the Department for Energy Security and Net Zero (DESNZ) reminds us that we can expect a significant increase in peak electricity demand - 26-51% by 2035, versus 2022. The government’s Net Zero Strategy7, British Energy Security Strategy8, and the Powering Up Britain: Energy Security Plan9 aims to meet this demand with a diversification of energy sources, with a significant emphasis on accelerating the transition to renewable energy sources such as wind, solar, and hydroelectric power.

This shift aims to reduce dependence on fossil fuels as well as mitigate the risks associated with volatile global energy mar-

16 PAPER TECHNOLOGY SUMMER 2024 INDUSTRY NEWS

kets. The plan cautions that while demand for oil, gas, and other fossil fuels will decline, they will continue to play a role in ensuring secure energy supplies and as an important part of the future economy.

So, what’s in store for major energy users?

The goals of efficiency, performance, risk management, resilience and cost management are likely to remain, but will continue to be supported by advances in technology and artificial intelligence (AI). Every industry faces unique challenges, but collaboration can accelerate progress towards overcoming them.

The government has already committed to providing more than £500m of energy bill support for energy-intensive industries10, including £122m waived emissions trading costs under the Energy Intensive Industries Compensation Scheme. In addition, more than £400m of reduced electricity costs were delivered through exemption from green surcharges in 2020. The compensation scheme was extended for another three years in April 2022.11

Another incentive offered by the government is the Industrial Energy Transformation Fund12, which is set to run until 2028. The initiative helps businesses undertake feasibility studies and introduce technologies that can help to reduce their fossil energy use. Two competition windows will be opened in 2024, with major energy users able to apply for funding. Grants are available for a number of initiatives, including energy efficiency technologies, or more innovative solutions, such as those enabling the use of electricity or hydrogen in industrial heating processes.

The plans for the British Industry Supercharger scheme aim to bring energy costs of the UK’s energy intensive industries in line with those charged across the world’s major economies. Specifically, support will be made available to sectors particularly exposed to the cost of electricity.

The scheme intends to build on the government’s Energy Security Strategy, published in 2022, which aims to deliver decisive action in addressing the UK’s industrial electricity prices, which are higher than those of other comparable countries.

In October 2023, the Government announced more detailed plans13 for its British Industry Supercharger Network Charging Compensation (NCC) Scheme, which is designed to benefit eligible14 businesses from April 2024. The NCC Scheme will offer Energy Intensive Industries (EIIs) 60% compensation on eligible network charging costs. Meanwhile, the final changes to the wholesale market set out in the Review of Electricity Arrangements (REMA) are still subject to consultation.

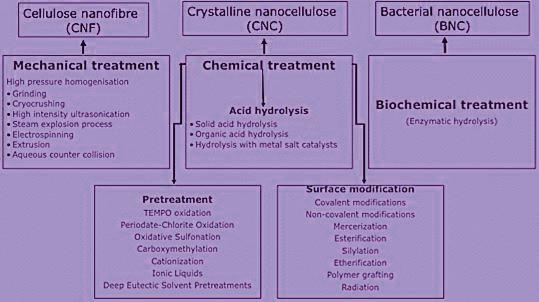

For businesses, the closure of the Energy Bill Discount Scheme at the end of March 202415 is a reminder that short, medium and long-term strategies must be regularly re-examined to ensure that sustainable decarbonisation and energy security goals are met.