ABB DEMO TRUCK RETURNS IN SUMMER 2023

SUPPLIERS: ANDRITZ; DE IULIIS; HOTTER; JOHN CRANE; TOSCOTEC

TECHNOLOGY: AUTOMATED CLEANING; ELECTRIC HOODS; HEADBOX DESIGN; SEAL TECHNOLOGY; STEEL DRYERS CANS

FEATURES: BIOREFINERIES; FABRIANO MUSEUM; GOLD AWARDS/MEDAL; PAPERCYCLE; WEARABLE TECH

COLUMNS: CPI; LETTER FROM INDIA; NEWS; ORDERS; PEOPLE; STANDARDS

VOLUME 64, NUMBER 2 SUMMER 2023

THE JOURNAL OF THE BIOFOREST PRODUCTS SECTOR

For over 100 years, ABB has developed products and services that help papermakers realise higher levels of productivity and profitability. From electrification and advanced control systems to state-of-the-art quality control and lab testing and process measurements, ABB brings together deep industry knowledge, world-class solutions

expertise to make mills more efficient.

Features 10 Switching to Steel Dryer Cylinders (De Iuliis) 14 Automated Cleaning of Paper Machines (Hotter) 18 TT Headbox Delivers Superior Performance (Toscotec) 20 Strategies to Improve Pump Reliability (John Crane) 22 ........ PEFC Stakeholder Meeting 24 ........ Paper Industry Gold Awards 2023 (CPI) 28 Papercycle Recyclability Assessment Tool 30 Paper and Watermark Museum (Fabriano) 32 Investment (CPI) 36 Paper Gold Medal Award Essay 40 Introduction to Biorefineries 43 Wearable Tech Solutions for Health & Safety 44 The PrimeDry Hood E (Andritz) 1 Volume 64 Number 2 Summer 2023 Contents Published by PITA PO Box 721, Bury, BL8 9UZ, United Kingdom Tel: 0300 3020 150 Tel: +44 161 746 5858 (from outside the UK) Fax: 0300 3020 160 email: info@pita.co.uk website: www.pita.co.uk

Daven Chamberlain St Johns House Spring Lane Cookham Dean Berks SL6 9PN Tel: 0300 3020 159

editor@pita.co.uk UK Advertising Sales Contact the PITA Office Tel: 0300 3020 150

info@pita.co.uk European Representative Nicolas Pelletier RNP 16 Rue Bannier – 45000 Orleans, France Tel: +33 6 82 25 12 06

+33 2 38 42 29 10 email: europe@pita.co.uk Designed and typeset by Upstream Ltd, Deepcar, South Yorkshire Printed by Mixam UK Watford, Herts

Editor

email:

Email:

Fax:

and

© PITA reserves all copyrights for the contents of this Journal. Technical papers may also carry first-authors’ copyrights jointly with the Association. None of the contents may be extracted, circulated, or re-published without permission. Registered Number*2928961 England Limited Liability. ISSN (Print) 0 306-252X ISSN (Online) 2632-5799 2 ........ Comment 4 Industry News 6 ........ News Bytes 23 People in the News 34 A Letter from India 38 Exhibition Reports 46 Compendium of Recent Orders 48 Standards Update Advertising List ABB OFC, 1, 3 DITP 33 MIAC 9 Paper Middle East 17 Paper Week Symposium 13 Paperex OBC PITA LinkedIn 42 PITA Training Calendar 31 PRIMA IFC PRO PAPER Africa IBC PRO PAPER Dubai 45 Specialty Paper Europe 35

Environmental Perception of Paper and Packaging

Most of us employed in the pulp and paper sector labour under the belief that we are working in an environmentally friendly industry using a sustainable raw resource. In particular, when compared with other materials, such as plastic, or to a lesser extent glass and metal, we are well placed for the future. However, we are not the sole arbiters of what is considered sustainable or environmentally friendly; governments, pressure groups and ultimately the general public all have influence.

Hence the interest when last month Two Sides Europe published the latest of their Biennial surveys – ‘Trend Tracker Survey 2023’ – which seeks to understand changing consumer perceptions towards print, paper, paper packaging and tissue products. This is pulled together from interviews held across Europe, and as usual it finds multiple misconceptions being held by the general public.

Starting with forestry, 60% of respondents to the survey believed that the European forest coverage is decreasing, whereas it is actually increasing. Although there is some variation between countries, even in the Nordic region which has huge tree-coverage, almost 50% of respondents believe the deforestation trope.

Turning to recycling, again there are misconceptions and misunderstandings about the recyclable nature of paper. Across the EU, only 18% of consumers knew that the paper recycling rate exceeds 60%. However, 41% believe that paper and paper packaging is positively wasteful. Furthermore, 67% of consumers believe that only recycled paper should ever be used.

One final statistic of interest; 56% of respondents believe that e-communications are more environmentally friendly than paperbased communication. This is despite the ICT industry global greenhouse gas emissions being the same as for air travel (>2% of global emissions) where paper and print products are much lower, at 0.8%.

A second survey published this year, on eco-responsible packaging, by IntoTheMinds consultancy, also reveals some interesting, and contrary, opinions. When packaging was made from paper in combination with other materials, its eco-friendliness was deemed 42% higher than for plastic alone. However, with packaging consisting solely of paper, it is only 33% higher than for plastic alone. So, the higher the proportion of paper relative to plastic in a package, the greater are its perceived environmental benefits. But in and of itself, paper still has an image problem!

The survey also reveals that presence of an eco-label exerts a very significant effect on consumer preference, which the survey found was enough to help orient perception. We should never underestimate the ‘validity’ that such a label confers on the packaging, which is in part why the Papercycle tool (pages 28 & 29)

Supplier Index

has been devised, since it is planned to help in the UK Government’s aim that by 2026 all packaging producers will be mandated to label their goods with the simple instruction “recycle” or “do not recycle”. (This is because the current labelling system is deemed far too confusing for the general public, where items may be labelled as “check locally” because not all authorities accept this material or material combination, and “not yet recycled” even though some authorities do indeed recycle the material.)

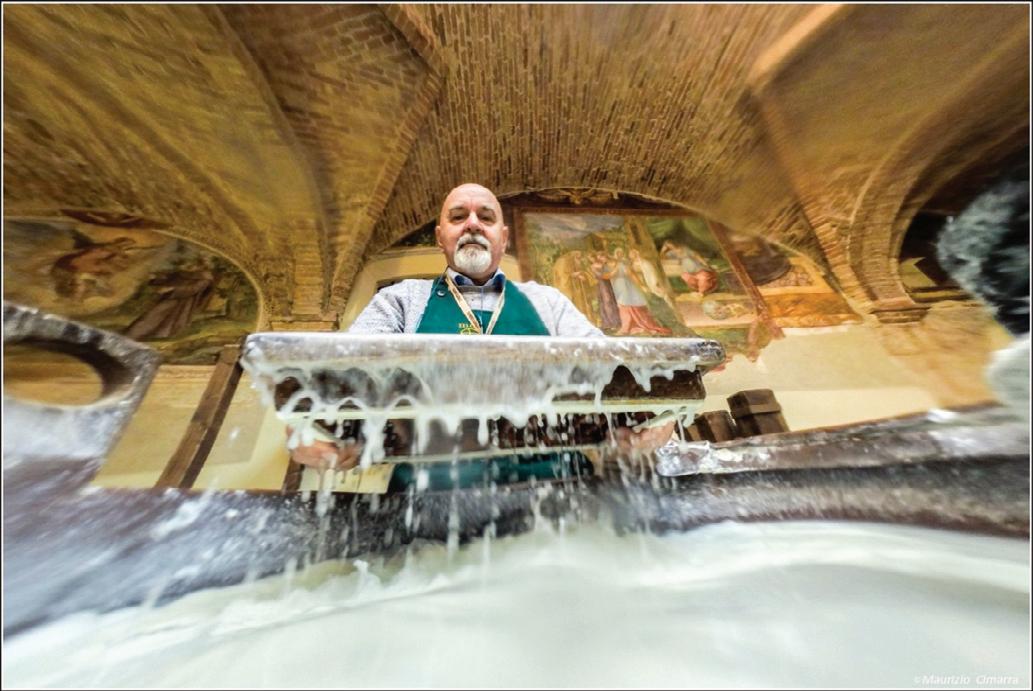

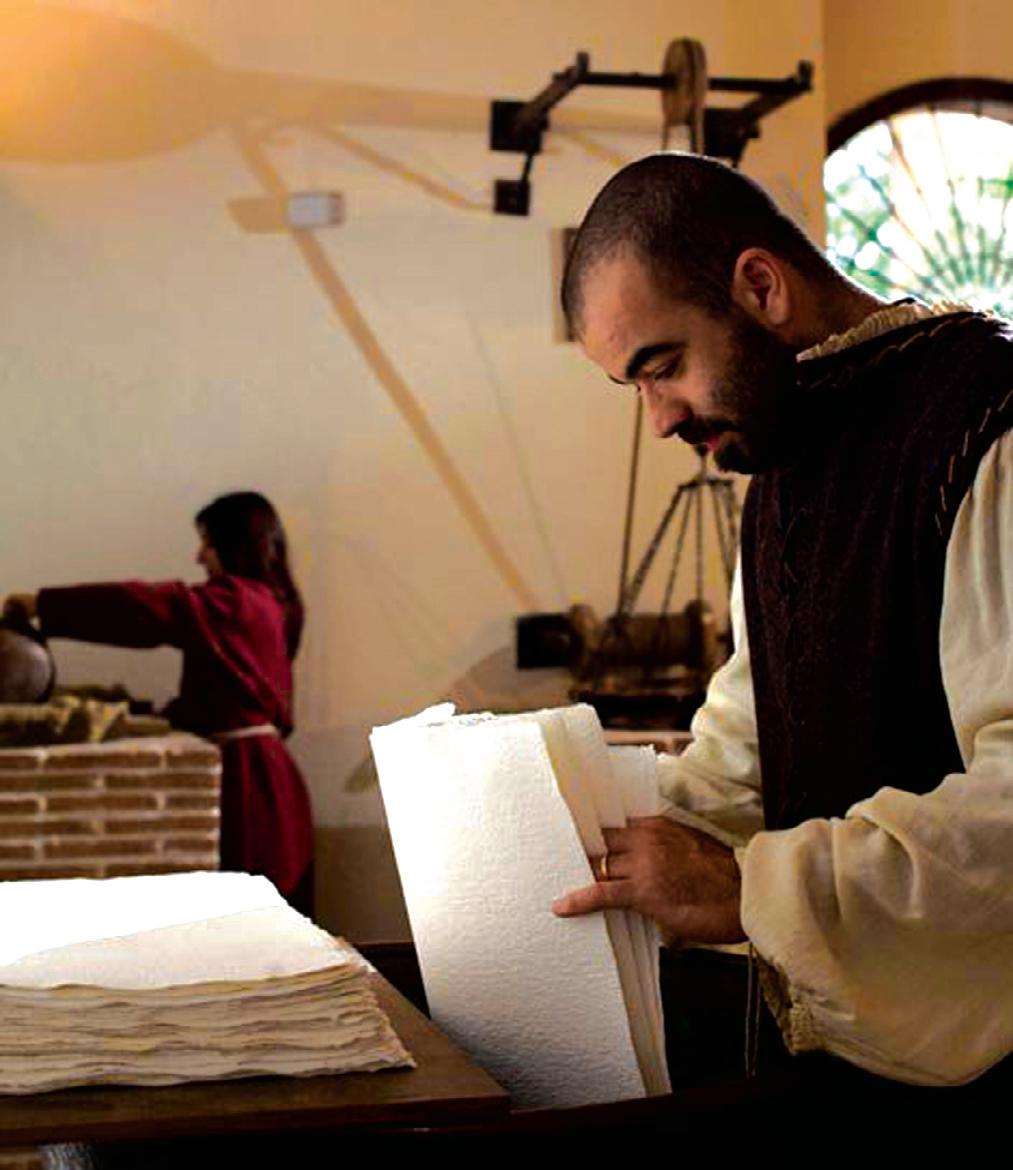

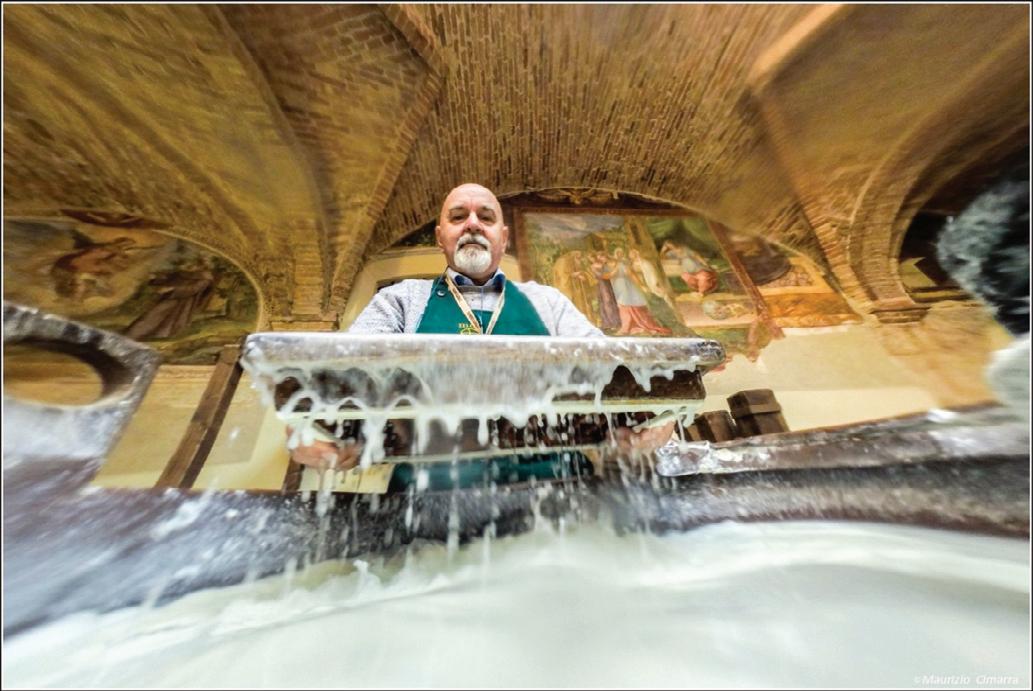

We must always bear in mind that all studies have their limitations: the socio-economic and demographic chosen, and way the questions are framed are obvious influences. But what is most striking from the Two Sides research is that this is a propaper body, yet the general sway of the answers cannot be considered entirely “pro paper”. This gives the research findings much more validity that those produced by a consultancy charged by an interested party with surveying perception in their business area.

So what do we as a sector need to do? Well one area where the general public needs greater understand is the area of forestry and wood. As I have pointed out previously, we are seen as contributors to deforestation, which is just not true. In the same way, the UK Government has been keen to promote planting of trees in the UK, but has shied away from the idea that some may be felled for industrial uses.

People want wooden furniture, decking and even cutlery, certainly in preference to plastic, but there is a disconnect between this and protesting the felling of trees.

As a world we must plant more trees, some of which should be considered as woodland which is the purview of nature (although again, this does not mean that nature does everything –even woodland needs to be managed!). But we should also be sowing trees as plantations, for felling (and replanting) after a defined time for use in a variety of industries – including power production. (It is a little-known statistic which is worth repeating here: FAO data show that approximately 50% of trees felled worldwide are used as fuel: not for timber or construction (which accounts for around 21%) and certainly not for paper (around 13-15%) – so wood is being burnt already, although we should probably try and reduce the amount in favour of other, better uses, as other environmentally-friendly power sources such as solar and wind grow in size.)

In conclusion, the paper (and forest) industry has a good environmental story to tell. But we are still not reaching the public, and we are in danger of others ‘simplifying’ the message for them in a way that controls the narrative.

Daven Chamberlain

2

Comment

A.Celli 8, 46 ABB 5, 46 AFRY ..................................8, 46 AFT 5 Andritz 6, 7, 8, 44, 46 Archroma ...............................23 Aurorium 8 BASF 8 Bellmer 46 Bodytrak 43 BTG 6, 46 Byworth 4 De Iuliis 10-13 Dieffenbacher 46 DustCanary 43 E.ON 4 GAW 46 Greycon 46 HAVSco ..................................43 Hergen 7 Hotter 14-16 Howden...................................47 Industrial Physics 8 ISRA Vision 23 John Crane 20-22 Kadant 8, 47 Kemira 8 Kuraray 8 MākuSmart 43 Modjoul 43 Omya 8 Pesmel .....................................47 Petrofer 24 Projet 8, 47 Reactec ...................................43 Runtech 47 Sael 6, 47 Siempelkamp 8, 47 Smartech 47 Solenis 8 Soter Analytics 43 Stanley Handling 43 Sulzer Chemicals 8 TietoEVRY 47 Toscotec ...............7, 8, 18-19, 47 Valmet 7, 8, 23, 47 Valutec 47 Vertellus....................................8 Voith 7, 8, 46, 47

See you at the mill Book a stop on the 2023 ABB Pulp and Paper tour

Due to popular demand, the ABB Pulp and Paper European tour is coming back to the United Kingdom this summer, and we still have a few spots left. Your team can see, try and learn about the latest digital technologies and industry solutions that will help enhance your process and bottom line – all in a mobile unit that we bring to your site. No travel required!

To book a visit, contact one of the United Kingdom Pulp and Paper Account Managers: paul.d.clark@gb.abb.com or colin.goodchild@gb.abb.com

Learn more at: abb.com/pulpandpaper

—

Industry News

UK NEWS

Cepac has broadened its offering, with the acquisition of specialist microflute corrugated tray producer EW Cartons Ltd. Located in Altham, Lancashire, EW Cartons Ltd is now being rebranded under the name Flutepac, as it is brought under the umbrella of Cepac Group. Adam Clifton, the previous owner, remains a shareholder and is appointed as Flutepac’s General Manager. Flutepac’s portfolio of microflute corrugated packaging is entirely food safe, with its products being fully BRCGS AA accredited. The packaging solutions are utilised extensively for fresh produce, bakery items, ready meals and ‘food-to-go’ containers.

Cepac is set to start production this summer on the first Koenig & Bauer ChromaCUT X Pro to be sold to the British market. The high board line rotary die-cutter will boost productivity for the corrugated packaging specialist at its Rawcliffe Bridge, East Yorkshire site. Koenig & Bauer will handle the supply and installation of the entire line, including full integration of the associated third-party peripherals such as the pre-feeder and palletiser, into the control system of the ChromaCUT X Pro. Along with the active air management system at the dryer, which allows higher production speeds to be achieved when printing coated sheets, the machine is also equipped with the patented die-cutting contour control. This allows any waste sheets to be ejected and makes zero-defect production possible.

The Compostable Coalition UK has kicked off a large-scale composting trial, currently underway in Cambridgeshire, UK. Millions of compostable tea bags, coffee pods, catering disposables, caddy liners and bags are in the spotlight – will they compost as expected? A group of compostable packaging and materials producers have teamed up with industrial composting facility EnVar, with expert advice from REA Organics. The trial is aiming to address whether even if an item may hold compostability certification, does that mean it can successfully break down in a real-world composting environment? The multi-stakeholder initiative is aimed at ensuring compostable packaging is effectively collected and organically recycled via existing UK biowaste infrastructure. Partners include Biome Bioplastics, behaviour change experts from the University of Sheffield and Hubbub, and waste industry partners EnVar Composting, Recorra, REA and Recoup. The ‘Closing the Loop for Compostable Packaging’ project is funded by Innovate UK’s Smart Sustainable Plastic Packaging Challenge fund.

DS Smith has invested in corrugated printing capabilities at its factory in Ely, Cambridgeshire, with an investment in digital printing technology: a Nozomi C18000 Plus was purchased from digital printing technology specialists Electronics For Imaging and prints directly onto board at fast speeds. DS Smith says the award-winning printer advances its high-end 3D corrugated display capabilities in the UK and is designed to deliver superior quality and productivity. The seven-colour printer has a configuration that gives DS Smith the ability to match 97% of Pantone Colours and also features inspection system technology that allows for rapid identification and correction of inkjet nozzle issues or other defects.

The University of Exeter has partnered with DS Smith to launch a circular design challenge. Students have been tasked with creating reusable packaging system solutions focusing on the reuse of e-commerce and white goods secondary packaging.

They will receive mentoring from DS Smith experts to support the development of their ideas and understanding of the industry. DS Smith is a corporate sponsor of the University of Exeter’s MBA, Circular Economy Corporate Challenge.

DS Smith and E.ON unveiled a new state-of-the-art combined heat and power (CHP) plant at DS Smith’s paper mill in Kent, the largest mill for recycled papers in the UK. Work on the CHP plant began in 2019 with E.ON financing, building and operating the plant. The new plant produced its first energy in 2022, and to commemorate the plant’s official opening, a ribbon-cutting ceremony took place on 25 April. E.ON IQ Energy has been deployed at the new CHP plant, an intelligent, energy supply solution that has been specially developed for energy-intensive industries. It features an automated, self-controlled power plant based on patented hardware and a digital control concept that uses artificial intelligence to optimise the supply in real time. Data from the operation of the power plant and production facilities, the grid, and commodity markets help make the energy supply efficient and flexible.

James Cropper received delivery of a new energy-efficient boiler to its Burneside mill. The new boiler was delivered, under police escort, on a low loader up the A66 in the early hours of 29 April and lifted into its new home at James Cropper. Taking the place of the two old boilers which had been in place for fifty years, the 18-tonne Byworth Yorkshireman is extremely efficient and will deliver a reduction in environmental emissions as well as energy usage. It is fitted with an ‘economiser’ which hoovers up every last drop of heat from the flue gasses.

4 PAPER TECHNOLOGY SPRING 2016 MONOTIER®: THE MILLION-TONNE DRYER FABRIC

James Cropper Group is investing in the James Cropper brand by reorganising itself from three separate divisions (James Cropper Paper, Technical Fibre Products and Colourform) into

four market-facing segments, unified under the Group name: James Cropper Creative Papers; James Cropper Luxury Packaging; James Cropper Technical Fibres and James Cropper Future Energy. A consequence of these changes will be reduction of production of its paper segment as the group focuses on value rather than volume; this will mean loss of one machine, and operating only two out of three machines at any one time. Therefore, some job losses are inevitable.

Kimberly-Clark has announced three of the UK-based green hydrogen projects it is developing with energy partners have won places on the UK government’s Hydrogen Business Model Strategy (HBMS) shortlist. The three hydrogen projects selected by The Department for Energy Security and Net Zero (DESNZ) include K-C’s green hydrogen hub in Barrow-in-Furness, developed in partnership with Carlton Power, which will power K-C’s Cumbria manufacturing facility. The other two projects are being developed in partnership with HYRO, a joint venture between Octopus Energy Generation and renewable energy company RES, and will see green hydrogen supplied to K-C’s manufacturing facilities in Flint, North Wales, and Northfleet in Kent. In total, the three schemes are expected to provide a total of 50MW of green hydrogen. The shortlisting of all three green hydrogen projects submitted by Kimberly-Clark’s partners coincides with the switch-on of a new purpose-built onshore wind farm expected to generate around 80% of Kimberly-Clark’s UK electrical power needs. Located in Cumberhead in South Lanarkshire, Scotland, the 12-turbine wind farm has taken just 18 months to build. Kimberly-Clark will take 160MWhr annually from the site.

Omni-Pac, a manufacturer of moulded fibre products based in Lincolnshire, is building a second factory with a single production line a short distance away from its main site in Flixborough. This is part of a strategy to double its turnover to £40m. The 60,000 sq.ft. facility is based on the Normanby Enterprise Park in Scunthorpe.

Smurfit Kappa Chelmsford has invested £5.5m in a Gopfert HBL machine to boost its print capability along with material handling for its conversion production areas; the die-cutter has seven flexo units. The corrugated packaging specialist said the machine’s highly productive, “state-of-the-art” quality control systems, auto print registration, and colour control features enable high-quality repeatability job to job. It will also reduce environmental footprint at the site. Furthermore, it will shorten lead times, allow for an increase in customer supply collaboration in the group’s print division, and offer both reliability and repeatability throughout the process.

Transcend Packaging has secured an £8m investment from Japanese moulded fibre pioneer Itochu. The deal, which Transcend called “the cornerstone” of its latest funding round, will see the Welsh manufacturer ramp up its expansion plans in the UK, Europe, Asia and North America. Transcend, which specialises in food-safe moulded fibre packaging for the retail and catering industries, currently has installed capacity to produce several billion straws per year, and will be investing to ramp up its capacity for straws, lids, and other moulded fibre products.

BENELUX NEWS

The planned sale of three mills by Sappi to Aurelius Group, a pan-European multi-asset manager group, has collapsed because it was not finalised within the agreed timeframe of the contractual agreement. Therefore, the Maastricht Mill (capacity 260,000tpy of coated woodfree paper and paperboard for printers and packaging converters) will remain within the Sappi group.

While the UK Government still dithers about recycling pro-

jects in general, imposition of Extended Producer Responsibility (EPR), Deposit Return Schemes etc, the Dutch and Belgium Governments are moving ahead. In the Netherlands a new deposit return system for aluminium and steel drink cans, with collection points including supermarkets and staffed petrol stations, has been introduced. According to the new concept, all metal beverage containers with a capacity of up to three litres and a deposit of €0.15 will be eligible for recycling. This expansion plan comes after the number of metal drink cans in the environment increased by 27% in 2020, according to information posted on the TOMRA website. (TOMRA is the world’s leading provider of reverse vending machines, where consumers return drink containers for recycling in deposit return systems. TOMRA’s reverse vending technology is capable of accepting all types and materials of drink containers.)

Turning to Belgium, the Dutch recycler Morssinkhof-Plastics has announced the construction of a recovery plant in Lommel, Belgium. The production facility, which is to go into operation in October 2024 and is projected to have a recycling capacity of 40,000 tonnes (input), will recycle polypropylene and polyethylene (HDPE) packaging, including milk, shampoo, detergent, and shower gel bottles.

CORPORATE MEMBER NEWS

ABB opened a multi-million-dollar R&D centre to drive technological advancements in pulp and paper in Dundalk, Ireland. The new R&D Centre is at the heart of ABB’s automation and digital offering for the sector and will be home to the ongoing evolution of the ABB Quality Control System (QCS). New ideas and products will be piloted and managed into the suite of applications for improved quality in the complex world of papermaking, where manufacturers often struggle to balance ever-changing variables to produce paper to customers’ particular specifications. This will include solutions for measuring, adjusting, optimising and controlling quality as the paper web makes its way through the paper machine to form the end-products, including paper and board.

AFT has appointed Salvtech Machinery and Services as their UK agent with direct responsibility for mills in England. Salvtech is a specialist process engineering and paper recycling company located in North Wales. It is a family run business focused on supplying a wide variety of machinery and services for paper and tissue manufacturing and for energy from waste industries. Their experience includes the installation and servicing of pressure screens.

5 PAPER TECHNOLOGY SUMMER 2023 INDUSTRY NEWS

News Bytes

HEALTH & SAFETY

Over thirty mill workers contracted a fungal infection (Blastomycosis) and one died at the Billerud Paper Mill in Escanaba, Michigan. The fungus grows in moist soil and decomposing wood and leaves. The mill was subsequently closed to a month during which it was subjected to a deep clean before being reopened.

A worker was injured at the Pratt Industries Mill in Travis on Staten Island; he was pulled into the paper machine by his right arm while working at his station and sustained extensive injuries to the face and chest areas.

Fires occurred at: Cascades Recovery Inc. at the site in Kelowna, British Columbia, Canada, on a conveyor filled with recycled materials; Inland Empire Paper Co. in Millwood, Washington, after the bleaching agent sodium hydrosulphide leaked out of an over-pressurised container and reacted with another chemical; Kruger in Memphis, in a facility that produced tissue (no cause reported); Kruger in Gatineau, Quebec, Canada, cause unreported; Neenah Paper Mill in Brownville, New York, after a machine overheated; Pro-Gest in Mantua Mill, Italy, in the recovered paper stockyard; Renewcell textile recycling facility in Sundsvall, Sweden, in the shredding area; Resolute Forest Products facility in Talladega County, Alabama, on a chip conveyor; Soundview Paper Co. at Putney, Vermont, due to ‘caked on’ dust which covered, among other things, the sprinkler heads!

EUROPE - EASTERN

MG TEC Industry successfully started its second complete tissue production line supplied by Andritz at its mill in Dej, Romania.

MM Group has approved investment at MM Kwidzyn in Poland, including a new recovery boiler and a new steam turbine, a second pulp line and a pulp dryer. In parallel, PM1 is to be converted from copy paper to sack kraft paper.

Natron Hayat in Bosnia and Herzegovina has successfully completed a cooking control project thanks to instruments supplied by BTG

Rottneros and Arctic Paper have established a JV to produce moulded fibre trays in Poland.

Smurfit Kappa has installed a new high-tech corrugator and a range of ultramodern converting machinery at their Pruszków corrugated plant.

Tex Year Group recently established a new factory in Poland in a JV with Minima Technology, Taiwan’s largest compostable tableware and food packaging manufacturer.

UPM has completed withdrawal of its businesses from Russia by selling all its Russian operations, including the Chudovo plywood mill, to Gungnir Wooden Products Trading

EUROPE - WESTERN

Ahlstrom has launched a consultation at its Stenay paper mill (capacity 55ktpy of one-side coated speciality papers) in France about the possibility to divest the mill, and if a buyer cannot be found, closure.

Recycled cartonboard producer Buchmann Karton has been taken over by fellow German rival Weig Karton

Corex, part of VPK Group, has entered into a binding agreement to acquire Arteche Paper, a leading player in the production of coreboard, cores and edge protectors in Portugal and Spain.

DS Smith announced an upgrade program to its kraft paper mill in Viana, Portugal, which will include rebuilding the existing paper machine and installing a new recovery boiler.

Essity concluded a two-year pilot study at its tissue paper production plant in Mainz-Kostheim, Germany, where the company became the first in the industry to produce tissue using renewable hydrogen.

A French partnership of bio-resin producer Evertree and wood-based panels manufacturer Seripanneaux has launched what they claim is the first 100% Made-in-France bio-based particleboard, produced in Saint-Vincent-De-Tyrosse, South West France.

Fedrigoni Paper Mill in Verona, Italy, has restarted PM3 after Sael rebuilt the sectional drive.

Heinzel Group plans to convert an idled graphical paper machine at the Steyrermühl mill in Austria to the production of kraft papers (capacity 150ktpy).

ICT Group has completed a number of energy efficiency measures on PM2 and PM4 at the Italian plants in Piano

della Rocca and Piano di Coreglia. One intervention involved the installation of a system blowing hot air, recovered downstream from other processes, onto the paper sheet before it reaches the nip area between the suction press and the Yankee dryer. By heating the paper sheet, the viscosity of water it contains is reduced and thus drainage is more effective.

Koehler Group has successfully converted the power plant at the Greiz site in Germany from lignite to biomass.

Lucart has signed a 10-year Corporate Power Purchase Agreement with the Eni Group company, which covers the entire production of the 10MW wind farm in Abruzzo.

MM Board & Paper, Austria, has successfully restarted KM3 at the Frohnleiten mill after Andritz completed a major rebuild.

Model Group is to convert a graphic paper mill in Eilenburg, Germany, from newsprint to packaging papers; the PM will be shut and rebuilt between August 2023 and February 2024.

Mondi is to refocus operations at its Neusiedler mill, Austria, on the strategic growth markets of Luxury Packaging, Professional Print, and Technical & Converting Papers, and as a result one paper machine will be closed, and the capacity of the finishing lines will be streamlined.

Norske Skog has started its rebuilt containerboard machine at Bruck mill in Austria, introducing 210ktpy of recycled testliner and fluting capacity to the market.

RDM Group officially inaugurated a new boiler house at the Ovaro mill, Italy.

Sappi Europe has invested in a new plant to produce innovative high-barrier papers, including an all-new type of barrier coating machine. Recently put into operation at the company’s Alfeld site in Germany, the in-house solution will produce high-barrier papers for recyclable packaging for food and non-food applications.

Sappi Limited announced that its plan to sell three paper mills to the Aurelius Group has failed; the intended sale of the Kirkniemi, Stockstadt and Maastricht facilities was not completed within the agreed timeframe of the contractual agreement.

Smurfit Kappa is investing in a new waste management and recovery facility at its Nervión paper mill in Iurreta, Spain.

6

The lime kiln and gas treatment system will have a production capacity of 120tpd.

Sofidel signed an agreement with Hakle GmbH for the acquisition of the Hakle trademark and other brands. The transaction structure allows Hakle GmbH to continue to produce and process paper under a new name at the DüsseldorfReisholz site.

Suominen Corporation is to close its nonwoven wipes plant in Mozzate, Italy.

UPM plans to permanently close PM6 at Schongau mill in Germany, reducing the annual capacity of uncoated publication papers by 165ktpy. Production on PMs7 and 9 will continue.

NORDIC REGION

Holmen is to rebuild PM52 at Braviken mill in Sweden, for higher CCM capacity and to strengthen its position in the book paper market.

To reduce the climate footprint of board production, IKEA is switching from fossil-based to bio-based glues.

Metsä Board inaugurated its renewed bleached chemical pulp mill in Husum, Sweden, on 3 May.

Metsä Tissue is to modernise and expand Mariestad tissue mill in Sweden. After the expansion the mill will have a new tissue machine (capacity 70ktpy), and three new converting lines; also a fully automated warehouse for finished goods and raw material handling will be built as well as a new office facility.

Mondi is upgrading its Dynäs pulp and paper mill in Sweden. The project includes the installation and upgrade of machinery and equipment such as a new cooking plant and bark boiler.

Norske Skog Skogn AS is investing in a new TMP line, to increase the production capacity by 100ktpy. The investment will replace the use of expensive recycled paper fibre with fresh wood fibre.

PA Consulting, and PulPac (the Swedish R&D and IP company behind the proprietary production process of Dry Moulded Fibre), have launched the Bottle Collective. The Collective will create a fibre bottle alternative to help minimise the use of single-use plastic bottles in food, drink, consumer health and FMCG industries.

RDM Group is to acquire Fiskeby, a producer of packaging board made from 100% recovered fibre, with one manufacturing facility in Sweden (capacity 170ktpy).

Rottneros is to invest in renewable electricity at Rottneros mill in Sweden. The investments include a solar park (capacity 3GWh annually) and battery stor-

age. The company is also to expand the production capacity of CTMP from 125ktpy to approximately 165ktpy; the additional capacity will come on-line in 2024.

SCA announced that the new kraftliner machine (PM2) at its Obbola pulp and paper mill in Umeå, Sweden, is ramping up production. The new machine was supplied by Voith

SCA inaugurated its new pulp mill at its Ortviken industrial site in Sundsvall, Sweden, on 16 May. The upgrade project increased CTMP capacity by 90ktpy to 300ktpy.

Stora Enso and Valmet have started collaborating on next-generation lignin product and process development to drive Stora Enso’s lignin-based businesses and further improve the performance of the Valmet LignoBoost technology.

Stora Enso has started a lime cooling system at Imatra Pulp Mill in Finland, supplied by Andritz

Stora Enso is to permanently close a paper machine at Anjala Mill in Finland, reducing capacity of uncoated mechanical printings by 250ktpy. A second machine on the site will continue, and will focus upon book paper production.

Stora Enso will invest in its Heinola Fluting site in Finland to renew the energy set-up and process equipment.

Tetra Pak has commenced groundbreaking research towards advancing fibre-based sustainable food packaging, in collaboration with MAX IV synchrotron radiation laboratory. The research aims to uncover fresh insights into the nanostructure of fibre materials, with the first application being to optimise the composition of materials used for paper straws.

UPM is replacing the use of fossil fuels with electric boilers in heat and steam production at its mills in Finland and Germany. A total of eight boilers will be installed, mainly to replace the use of natural gas. UPM Tervasaari paper mill has already commissioned its first 50MW electric boiler, which was transferred to Valkeakoski from UPM Kaipola mill. In the autumn, a new, more efficient 60MW electric boiler will be installed at the mill. The remaining electric boilers will be installed at the Finnish and German mills by the end of 2023.

electric truck to transport pulp.

Canfor Pulp is to close the Taylor Pulp Mill, which was curtailed temporarily in September 2022 (capacity 60kpty).

Cascades Inc. announced that it has produced its first roll of 100% recycled containerboard at its Bear Island, Virginia mill. Cascades also announced the permanent shutdown of PM2 at its Niagara Falls, New York mill; the old machine had a production capacity of 90ktpy. Finally, the company is to close its tissue plants in Barnwell, South Carolina, and Scappoose, Oregon, as well as the virgin paper tissue machine at its St. Helens plant, also in Oregon.

Cipel has restarted PM3 after Hergen installed a new Steel Yankee Dryer and replaced the press frames.

Domtar Corporation plans to divest the Dryden NBSK pulp mill in Canada to US tissue and personal care products company First Quality Enterprises Dryden mill runs one fibre line (capacity 330ktpy).

Georgia-Pacific is commencing three upgrade projects: at Monticello Mill in Mississippi, the corrugated plant in Owosso, Michigan, and at the Port Hudson mill in Zachary, Louisiana.

GrandBay Papelera Internacional started PM7, a double-width tissue machine (capacity 60ktpy) supplied by Toscotec at its Rio Hondo Zacapa site in Guatemala.

Kruger Packaging plans to modernise its Place Turcot Containerboard Mill in Montréal, Canada, making it the first in North America to manufacture 100% recycled saturating kraft board, a product that is used to make high-pressure laminates for furniture, countertops and decorative panelling.

Omnia Advanced Materials has started PM1 at its Beaver Falls facility following a successful rebuild by Toscotec of the drier section.

Pactiv Evergreen plans to shut down operations at its pulp and paper mill in Canton, North Carolina, during Q2, 2023.The converting facility in Olmsted Falls, Ohio is also affected. The company also continues to explore strategic alternatives for its Pine Bluff, Arkansas, mill and Waynesville, North Carolina, facility.

Pixelle ceased production at the Androscoggin Mill in Jay, Maine, on 8 March (capacity of 425ktpy of speciality grades).

BiOrigin Specialty Products started up PM2 at its Menominee site in Michigan after the successful completion of a wet section rebuild supplied by Toscotec.

Bracell is starting a project to use an

Resolute Forest Products Inc inaugurated its new commercial-scale plant for the production of cellulose filaments (capacity 21tpd) at its Kénogami paper mill in Saguenay, Quebec.

Sonoco closed Hutchinson Paperboard

7 PAPER TECHNOLOGY SUMMER 2023 NEWS BYTES

N

NORTH / SOUTH AMERICA

Mill in Kansas, capacity 90ktpy on two pressure-former paper machines, in early March.

UPM started pulp production at its new mill in Paso de los Toros, Uruguay, in mid-April. After ramp-up, the mill’s output will amount to 2.1Mtpy of bleached eucalyptus kraft (BEK) pulp.

WestRock plans to close its paper mill in North Charleston, South Carolina, by late August. The North Charleston mill produces containerboard, uncoated kraft paper and unbleached saturating kraft paper, with a combined annual capacity of 550ktpy. The Company intends to exit the unbleached saturating kraft paper business when the mill shutdown is completed.

REST OF WORLD

ABC Tissue commissioned A.Celli to modernise the DCS system on PM1 at the Wetherill Park, Sydney (Australia) plant.

Dongguan Jianhui Paper Co., Ltd. has successfully started a new mechanical pulping line from Andritz.

Essity has initiated a strategic review of the company’s ownership of the Asian hygiene company Vinda

Metro Ply Group has produced the first board on its new Siempelkamp particleboard plant at the Surat Thani site, Thailand.

Nippon Paper Industries Corp, Sumitomo Corp and Green Earth Institute Corp agreed to jointly study bioethanol production made from woody biomass. The project, if it succeeds, would aim to produce bioethanol from Nippon Paper’s mills to be used as a feedstock for sustainable aviation fuel production.

Opal, the Australian subsidiary of Nippon Paper, closed its Maryvale Mill in Victoria, Australia, after their main wood supplier, VicForests, lost a court case with various environmental groups regarding timber harvesting.

Following its expansion into Asia, PulPac announced HZ Green Pulp as its first licensee in Malaysia. HZ Green Pulp is one of the APAC market’s largest moulded paper pulp groups.

Rengo Co., Ltd. announced that it has acquired 70% of the shares issued by Nitto Danboru Co., Ltd., a corrugated packaging manufacturer.

Saudi Paper Group has started the new tissue machine (PM2), supplied by Toscotec, at its Dammam mill in Saudi Arabia (capacity 30ktpy).

Siam Kraft Co. Ltd. in Thailand successfully started two press felt cleaners on PM1, supplied by Projet BV

Starwood Orman Urunleri Sanayi

A.S., an MDF producer in Türkiye, has successfully produced fibres with its new fibre preparation system supplied by Andritz

Zhejiang Shanying Paper Mill in Jiaxing, China, has restarted PM16 after Kadant Fiberline (China) Co. Ltd. supplied two OCC Systems and a UKP System.

SUPPLIERS

A.Celli Group has acquired Sadas Srl, a Lucca-based company specialising in system integration and automation solutions and electrification for industrial plants.

AFRY acquired KSH, a Canadian engineering company focused on the process industries sector such as pulp & paper, chemicals and biorefining, as well as in energy, water and environment sectors.

AFRY has divested its Russian subsidiary to local management. The local ownership and operations will secure a good solution for both employees and customers.

Andritz launched PrimeDry Hood E, an electrically heated hood for reduced carbon emissions and increased tissue production. In addition, the system offers increases in energy efficiency and production rates compared to conventional fossil-fuelled systems. An order has already been placed, with start-up by the end of this year.

Andritz Nonwoven has set up a technical centre in Cours, France, equipped with a pilot line.

BASF extended its portfolio for extrusion coating on paper and board by adding a certified home as well as industrial compostable grade for cold and hot food packaging: ecovio® 70 PS14H6.

Kemira has divested most of its colorants and dye business to ChromaScape. The scope includes one Kemira manufacturing site at Goose Creek, Bushy Park in South Carolina. Kemira will keep its APAC-related colorants business.

KKR, a global investment firm, will acquire Industrial Physics, a leading manufacturer of testing and measurement instruments, from Union Park Capital Headquartered in New Castle, Delaware, Industrial Physics is a global provider of testing and inspection equipment used across food and beverage, packaging and other diversified markets.

Kuraray America, Inc., a world leader in performance-based polymers and special materials technology, announced a new grade of PLANTIC™, the

company’s sustainable, high-performance barrier material. A plant-based resin designed specifically for converters who perform extrusion coating, PLANTIC™ EP can be used to develop sustainable gas and aroma-barrier solutions with paper, paperboard or traditional film substrates.

Omya will invest in seven onsite plants for ground and precipitated calcium carbonate at paper and paperboard mill locations in China and Indonesia. The new plants in China include 3 ground calcium carbonate (GCC) plants in Guangxi, Guangdong, and Shandong, 2 precipitated calcium carbonate (PCC) plants in Shandong, and 1 more PCC plant in Fujian. The new plant in Indonesia will be for GCC in Sumatra.

Solenis has agreed to merge with Diversey, a leading provider of hygiene, infection prevention and cleaning solutions based in Fort Mill, South Carolina.

Sulzer Chemtech has signed an agreement with JTC Corporation, the master planner and developer of Singapore’s industrial infrastructure, to build and operate a new research centre for its separation technology solutions.

The Forest Stewardship Council (FSC) announced withdrawal of the remaining forest management certificates in Russia by the respective certification bodies.

Valmet has decided to further strengthen its press felt production capabilities in Tampere, Finland, by investing in a new weaving machine and a new heat-setting machine in addition to the ongoing press felt investment announced in August 2022.

Vertellus announced the acquisition of CENTAURI Technologies. In addition to the acquisition, the company announced that it has changed its official name from Vertellus to Aurorium. CENTAURI’s specific expertise in hydroformylation and hydrogenation processes, including high pressure, high melt, and other complex capabilities, is highly complementary to Aurorium’s strategy and strengthens its position as a provider of speciality ingredients and performanceenhancing materials.

Voith inaugurated its newly refurbishment workshop in Karlstad, Sweden. The new workshop and office space significantly increases capacity for refurbishment services of screw presses and screens; it also presents the opportunity to refurbish other equipment, such as rotary valves, vacuum pumps and rolls.

Continued on page 18

8

PAPER TECHNOLOGY SUMMER 2023 NEWS BYTES

Why to switch from cast iron to steel dryer cylinders?

De Iuliis C&A, www.deiuliis.it

Introduction

The drying phase in the paper machine is the most energyconsuming process of a paper mill. Therefore, it is essential to invest in the optimisation of the drying section consumption, which constitutes one of the principal direct costs of every paper mill. In the past, drying cylinders were generally built in cast iron because it was an easy to find low-cost material and above all easily machinable.

Currently, the demand for higher machine speeds and wider paper size imposed by the market, requires a proportional increase in the number of drying cylinders to maintain the same level of drying capacity of the machine.

The use of modern steels and modern manufacturing techniques, made cast iron cylinders disadvantageous and their replacement can bring great benefits in terms of machine management, especially regarding energy saving. In this short technical excursus, we will try to demonstrate the reasons.

The factors that most influence the heat exchange through the drying cylinder are:

diameter, thickness and material of the cylinders; operating pressure and temperature; condensate drain system.

Given the limits on maximum operating pressure and on maximum condensate that can be extracted with current technologies, it is logical to invest to improve the efficiency of the drying by replacing the cast iron cylinders with steel ones.

In fact, the change from cast iron to steel brings four fundamental advantages:

Greater thermal efficiency, since thinner thickness of the shell leads to a significant increase in heat exchange;

Greater useful drying surface, due to the enlargement of the working width, consequent to the smaller size of the heads;

Faster reaching of the working temperature, given by the increased heat exchange;

Increase of safety standards, linked to the higher safety coefficients used for steel.

Heat exchange

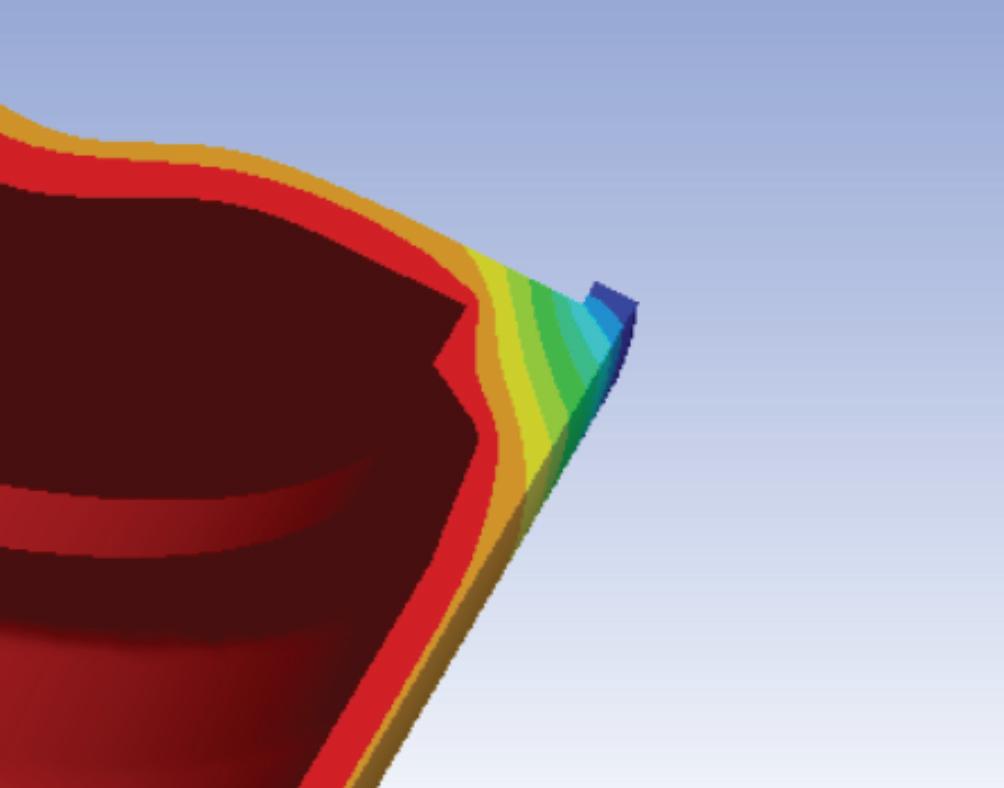

A drying cylinder can theoretically be treated as a thin-wall pressure vessel (s << 2R). It is therefore possible to schematise the heat exchange between the steam and the sheet of paper with the simplified model schematised in Figure 1 and based on the following hypotheses:

the shell of the cylinder may be dealt as a flat plate (s << 2R);

the global heat transfer shell-paper also includes the transfer of heat through the thin layer of air between the shell and the sheet of paper.

Therefore, starting from the previous hypotheses, the equation that represents the thermal flow affecting the surface of the cylinder is given by:

Where:

q = thermal flow, W m-2;

t1 = steam temperature inside the cylinder, °C;

t2 = external temperature of the sheet of paper, °C;

a1 = steam thermal conductance - internal shell surface, W m-2 K-1;

s = wall thickness, m;

a2 = thermal conductance; outer surface of the shell - outer surface of the sheet of paper, W m-2 K-1;

λ = thermal conductivity of the shell, W m-1 K-1

Assuming the value of the sum constant for both cast iron and steel cylinders and equal to 1.35x10-3 m2 K W-1, the only parameter that we can modify in order to increase the heat flow is the thickness of the drying cylinder shell, which must be sized according to the standards (ASME / UNI), that define the minimum thicknesses to be used.

In the following discussion we have chosen to use the UNI EN 13445-3:2019 standard, which allows us to arrive at the following formulation of the thermal flow transmitted by the steam to the sheet of paper.

��=( 1 ��1 + �� �� + 1 ��2)(��1−��2) (1) ��= 1 1 ��1 + �� �� + 1 ��2 (��1−��2) = 1 1 ��1 + ������ 2(����) ⁄ ��+�� �� + 1 ��2 (��1−��2) (2) 10 PAPER TECHNOLOGY SUMMER 2023 NEW INSIGHTS ON APPLICATION OF HIGH-YIELD PULP

Figure 1: Qualitative trend of the temperature in the system. (Anello liquido acqua = Liquid water ring; Interno cilindro = cylinder internal; Carta = paper; Strato aria = air layer; Mantello = shell)

Where:

p = steam pressure inside the cylinder, Pa;

De = outer diameter of the shell, m;

f = material yield stress, N mm-2;

i = safety factor, according to UNI EN 13445-3:2019 adim.;

z = joint coefficient, according to UNI EN 13445-3:2019, adim.

From (2) it can be deduced that, for the same pressure and diameter of the cylinder, the heat exchange depends on λ and f, so, on the characteristics of the material used. The values of λ and f for steel P275NH and cast iron G25, used for the construction of drying cylinders, are shown in Table 1, from which it is evident that, even if they have similar thermal characteristics, the best mechanical characteristics play in favour of steel, that allows a thinner shell.

Working Width

The second factor to consider when choosing the drying cylinders to be used in the drying section of the paper machine is the maximum width. In fact, the paper market is pushing its trends towards wider paper size, so that paper mills, in order to be competitive, must expand their paper size. As we will see, the steel drying cylinders, with the same overall dimensions, can have a bigger useful width, thus allowing a precious recovery of centimetres of paper size and an increase in the thermal energy transferred to the sheet of paper, without necessarily modifying the external frames of the machine.

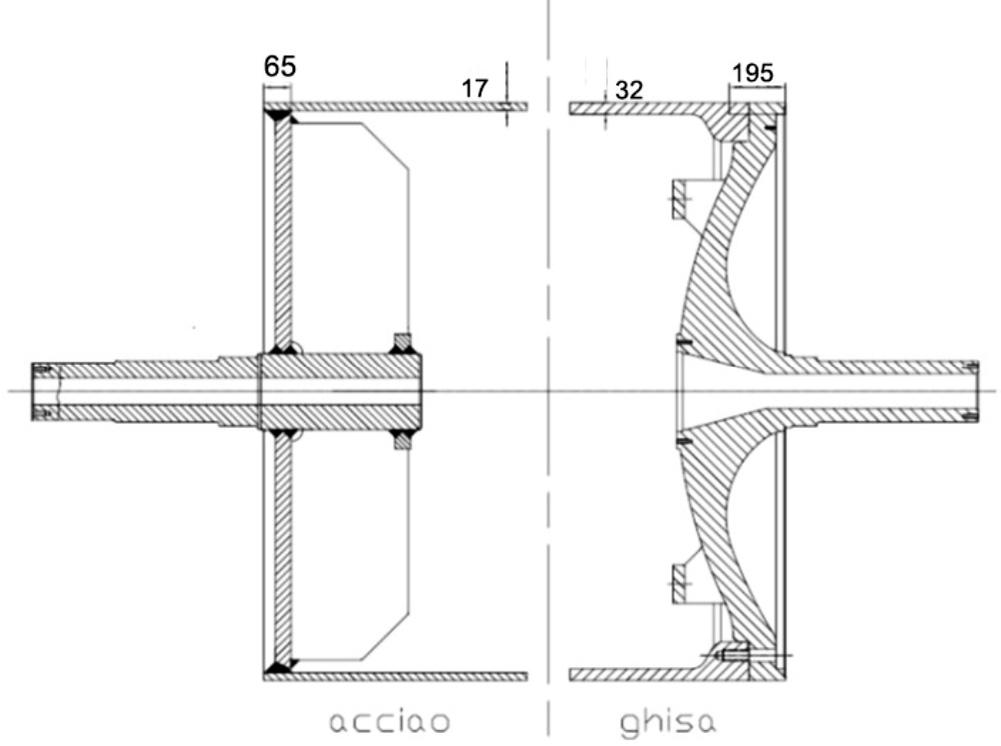

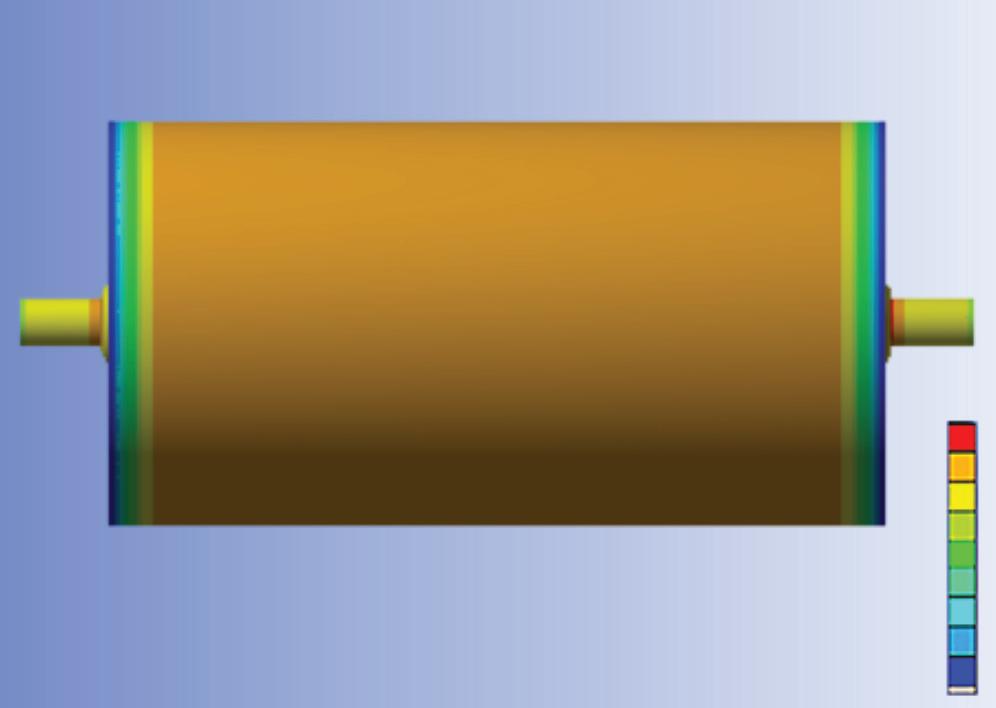

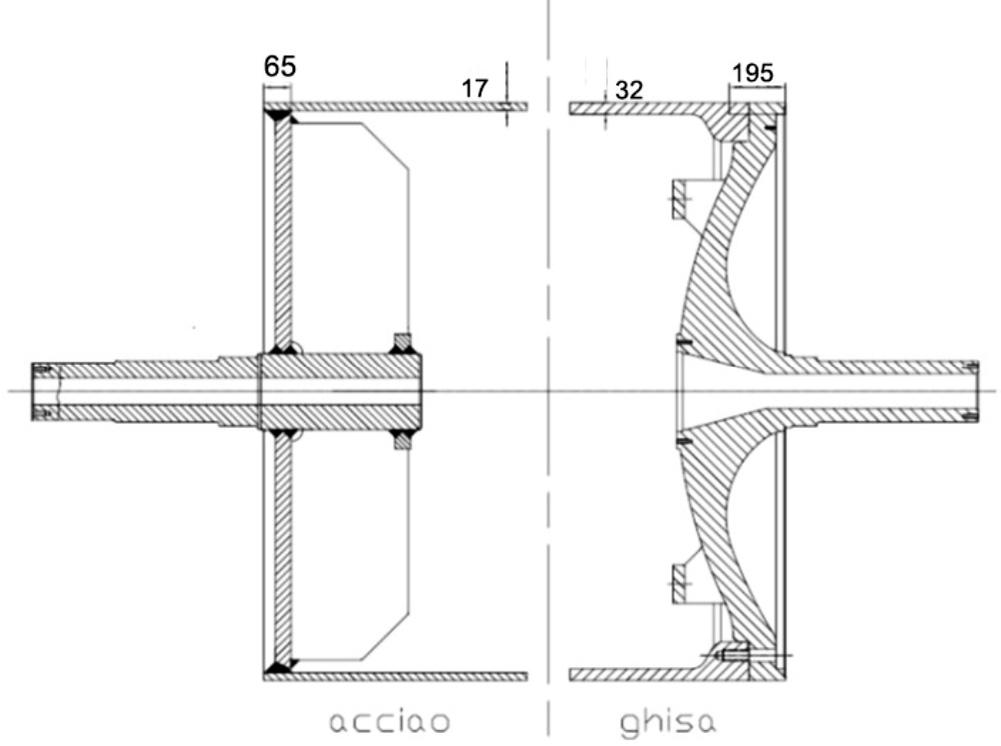

Figure 2 shows the construction drawing of two drying cylinders, one in steel and one in cast iron. It is evident that steel cylinder’s heads, thanks to the weldability of the material and the better mechanical characteristics, has smaller dimensions compared to cast iron ones.

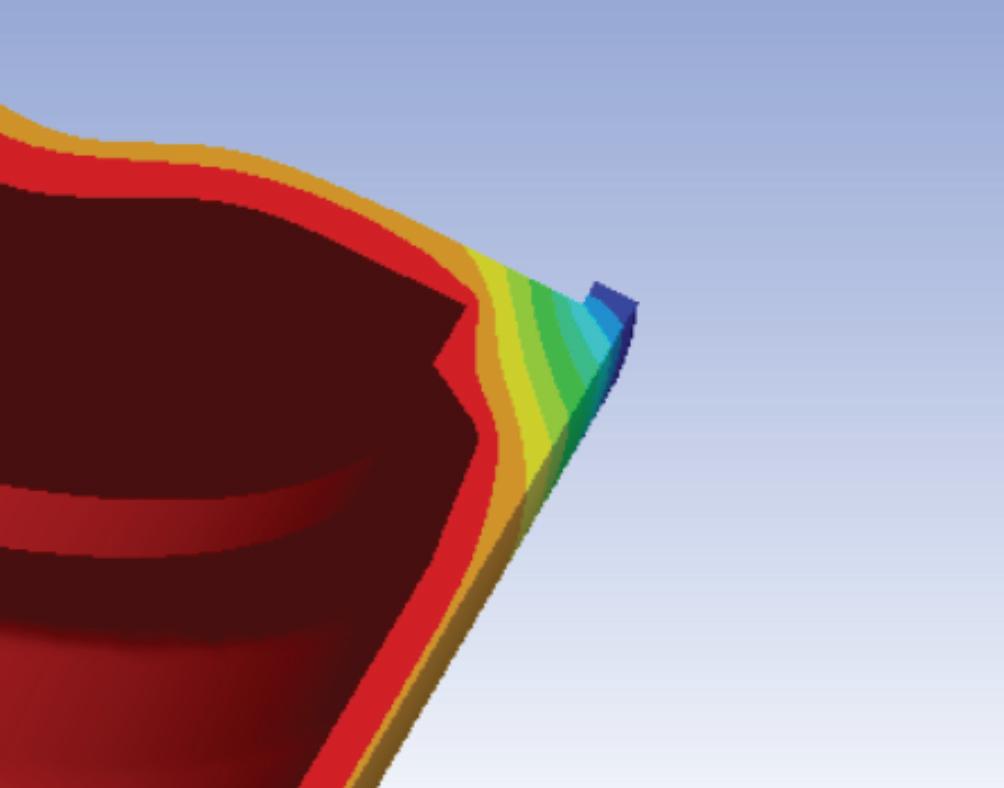

Figures 5 & 6 show that the cast iron cylinder, as mentioned, has the head slightly more recessed and it has a variation in thickness on the extreme sides of the shell.

For that reason, the temperature trend is not uniform and doesn’t allow to obtain a perfect drying process of the sheet.

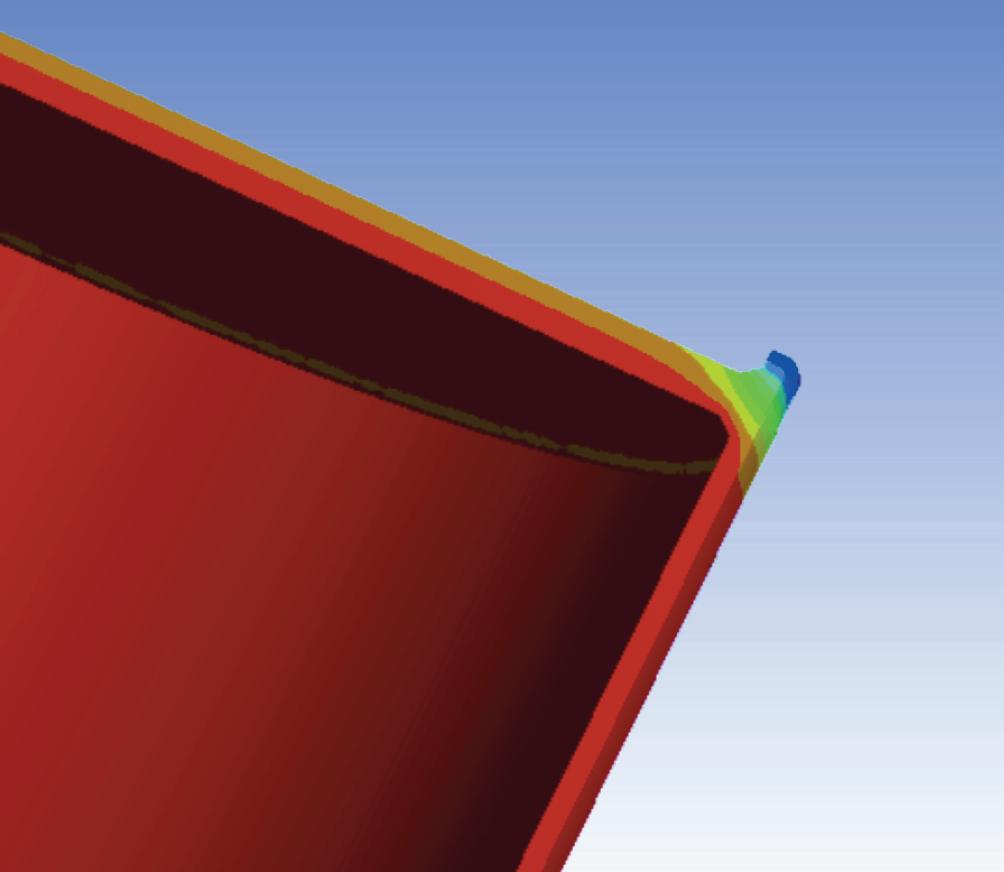

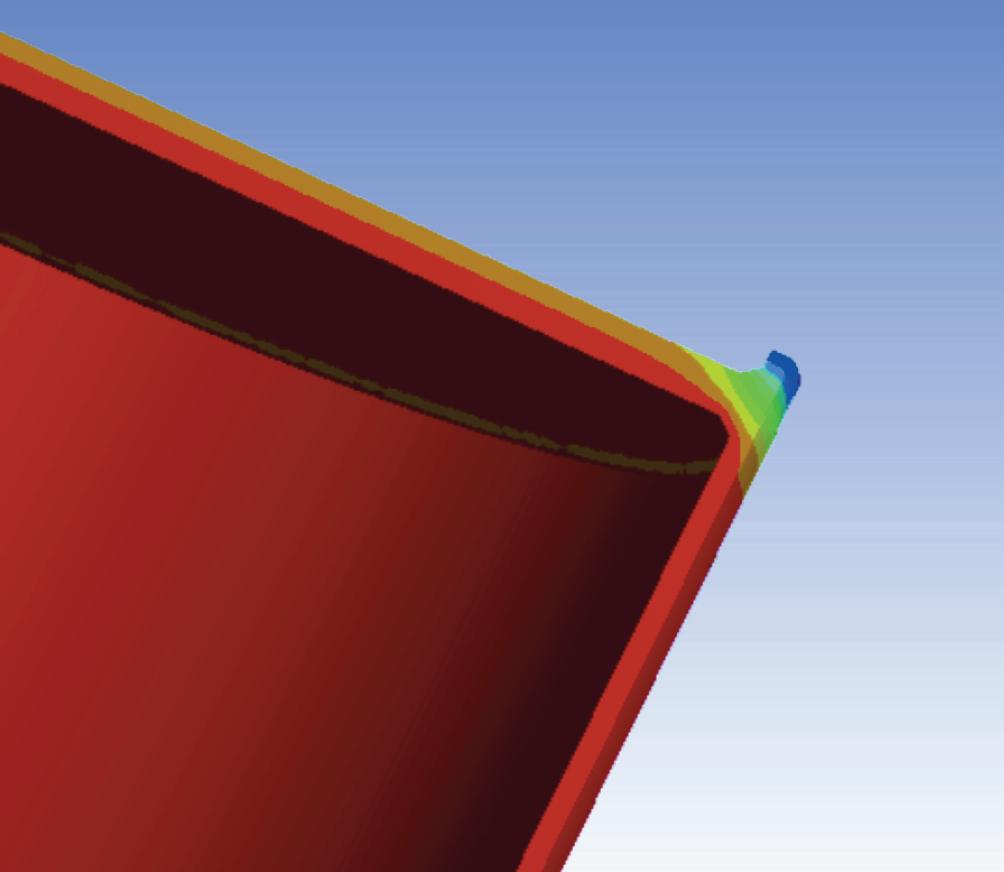

Furthermore, due to the different type of design and construction technique, steel cylinder’s shell maintains a constant thickness up to the head, which determines the temperature trend

shown in Figures 3 & 4, with a uniform heat distribution in the shell up to the ends of the cylinder.

shown in Figures 3 & 4, with a uniform heat distribution in the shell up to the ends of the cylinder.

11 PAPER TECHNOLOGY SUMMER 2023 SWITCH FROM CAST IRON TO STEEL DRYER CYLINDERS

Table 1: Values of λ and f for steel P275NH and cast iron G25.

Figure 2: Construction drawing of steel (left) and cast iron (right) drying cylinders.

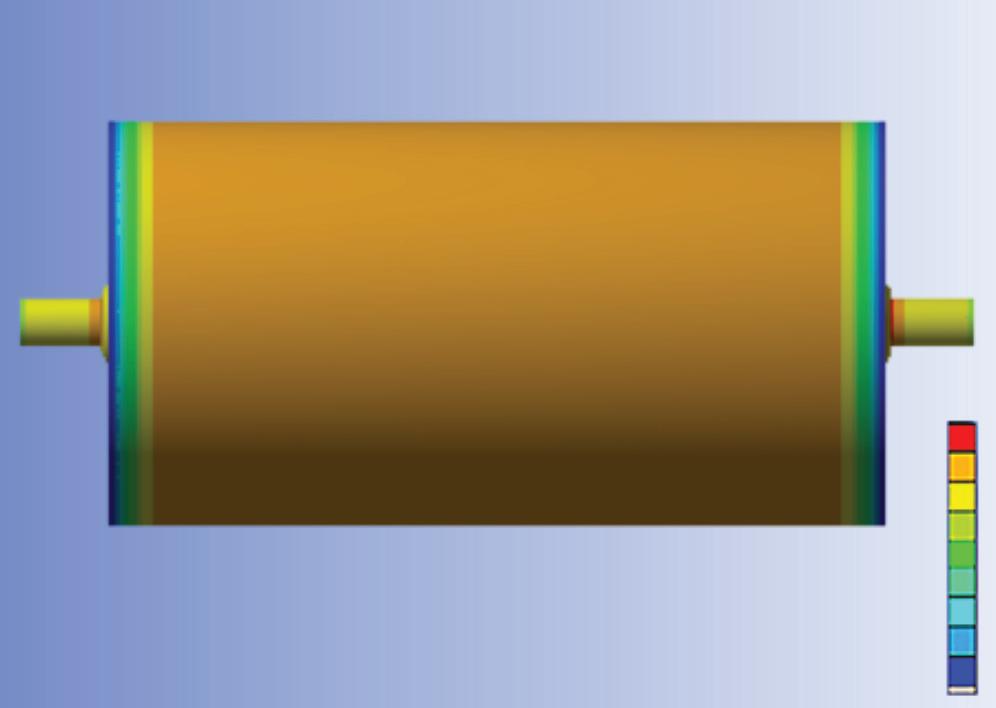

Figure 3: Trend of temperatures on the shell of the P275NH steel dryer cylinder.

Figure 5: Trend of temperatures on the shell of the G25 cast iron dryer cylinder.

material λ [W m-1 K-1] f [N mm-2] steel P275NH 49 275 cast iron G25 46 110

Figure 4: Trend of temperatures in the thickness of the P275NH steel dryer cylinder.

Geometrically speaking, using a steel instead of a cast iron cylinder, bring generally to an increase of up to 130 mm of useful width per side, therefore 260 mm of width difference, simply because of the different construction design. As consequence steel cylinders are able to achieve a larger width, and to reduce heat loss through the walls of the cylinder, with a general increasing of efficiency.

Case study

Two possible models of dryer section are compared below, one with cast iron cylinders and one with steel cylinders, to understand the differences between the two materials. We start from the hypothesis of cylinders of the same diameter and the same operating pressure, therefore under the same working conditions, which are interchangeable with each other without modifications of the machine frames; the only variation will be due to the different thickness of the shell, linked to the different resistances of the two materials. The data relating to the two models are shown in Table 2

equal to 13%, with the important benefit of eliminating the problems of lateral humidity at the edges of the sheet. With reference to the heat exchange, considering the same values of the temperatures t1 and t2 of Figure 1, the change to steel cylinders guarantees an increase equal to 18%, due to the lower thickness of the shell, while maintaining a higher safety coefficient. Considering the contribution due to the different characteristics of the materials and the widening of the useful width, the use of the steel cylinders increases the heat exchange of 33%, an increase that is immediately translated into a saving of the quantity of steam needed by the dryer, and therefore in less drying cylinders necessary to obtain the same performance obtainable with the cast iron ones.

A second type of analysis concerns the more drastic situation in which a paper mill wants to carry out a deeper upgrade of its own dryer section, varying not only the material of the drying cylinders, but also their diameter and their operating pressure.

The useful drying area of the two cylinders is obtained with the equation:

Where:

L = cylinder width, mm;

b = useful width reduction, mm.

From (3) therefore it results:

A(P275NH) = 12.98 m2

A(G25) = 9.42 m2

Using the relationships (1) and (2), the transition to the steel cylinders in this case allows an increase in the useful drying area

The data relating to the cylinders and the operating pressure values pre and post intervention are shown in Table 3

In the first analysis it is clear that the larger diameter and the larger useful width of the steel cylinders entail a much higher drying surface, which can be calculated with (3) and is equal to 38%. For that reason, the steel shell, while maintaining a high safety coefficient, will have a smaller thickness than the cast iron shell, and this will generate an increase in the steam-paper heat exchange equal to 14% in advantage of steel. Ultimately, the heat exchange obtainable with the steel cylinder is 57% greater than the one that occurs with the homologous cast iron cylinder. Obviously, the basic hypothesis is that the temperature difference between the inside of the hood and the steam introduced into the cylinder is the same for the two types of cylinder.

Conclusions

The transition from cast iron to steel cylinders appears to be a winning choice for all paper mills that want to modernise their drying section and improve their efficiency by reducing their management costs. Of course, the increase in efficiency from the point of view of heat exchange does not correspond to a proportional increase in the water extracted from the paper, which also depends on other physical factors not explained in this review. In any case, already from this first partial analysis, the advantages linked to the use of steel in drying process emerge, and that will certainly represent the future of all paper mills.

Bibliography

a) Kawka W. & Reczulsky M.: The optimalization of heating steam pressure on thermal effectiveness of drying cylinders. Technical University of Lodz 2011.

b) Karlson M.: Papermaking Part Drying. Fapet Oy, Helsinki 2000.

c) Keranen J.: Increasing the drying efficiency of cylinder drying. University of Jyvaskyla 2011.

d) Holik H.: Handbook of paper and board. Wiley-VCH.

e) UNI EN 13445-3:2019 Recipienti a pressione non esposti a fiamma - Parte 3: Progetta.

��=2����

12 PAPER TECHNOLOGY SUMMER 2023 SWITCH FROM CAST IRON TO

(��−��) (3)

STEEL DRYER CYLINDERS

Figure 6: Trend of temperatures in the thickness of the G25 cast iron dryer cylinder.

material Diameter [mm] Shell thickness [mm] Width [mm] Pressure [bar] steel P275NH 1500 17 2400 3 cast iron G25 1500 32 2400 3

Table 2: Data relating to the two models of dryers considered.

material Diameter [mm] Shell thickness [mm] Width [mm] Pressure [bar] steel P275NH 1830 20 2400 10 cast iron G25 1500 32 2400 3

Table 3: Data relating to the cylinders and the operating pressure values at the pre and post intervention dryers.

8TH PAPER WEEK SYMPOSIUM

18-19-20 SEPTEMBER 2023

5 STAR RESORT HOTEL, ÇEŞME - İZMİR,TÜRKİYE

PAPER WEEK SYMPOSIUM

Paper Week participants consist of the best companies from Europe, USA, Türkiye, the Middle East, and Africa.

Our target for this edition is 14 companies as sponsors, consisting of senior management and technical experts who will come together on a professional networking platform and make their presentations for their products and services in a 5 Star Resort Hotel in Türkiye.

In total, 150 participants who are the top potential customers and all decision makers representing their companies.

WHY YOU SHOULD PARTICIPATE

Enjoy 3 days with a relaxing atmosphere. A perfect chance for all attendees to get together, socialize and network, and have pleasure & business all together.

Present your products or services, have B2B meetings expand, business networks with friendly relations.

7th PAPER WEEK SYMPOSIUM 2022 ANALYSIS

43 PAPER MILLS57 CONVERTERS 19 COUNTRIES 142 PARTICIPANTS 110 COMPANIES +90 (212) 916 17 31 info@paperoneshow.net www.paperoneshow.net

Automated Cleaning of Paper Machines – An Outlook

Robert

This article deals with the cleaning of paper, board and tissue machines. Due to the use of water as a carrier medium for fibres, fillers and chemicals of process chemistry, these machines inevitably become dirty. As long as there is no waterless web formation, it will be necessary to clean. The big challenge for plant operators lies in the long production runs from one planned shutdown to the next. Furthermore, sharply increased energy costs require precise analyses of how to prevent web breaks caused by contamination.

1. INTRODUCTION

Why is it necessary to clean? What types of deposits are there and what do closed water circuits or waste paper have to do with machine efficiency? These questions and many other thoughts on the subject of cleaning concern us as a developer and manufacturer of cleaning chemicals for paper, board and tissue machines.

Web breaks are uncontrolled events that at best only cause an interruption in production, but in the worst case can lead to damage to machine clothing or press rolls. In any case, they cause high costs, because the system runs with full drive power and heated drying cylinders without producing paper. The trend towards ever wider and faster machines is exacerbating the situation. The web breaks can be triggered by falling chunks or holes in the web coming from the wet end.

Deposits are formed in several ways. Mineral encrustations originate from the water, fibre chunks collect above high-pressure showers in the wire section, bacterial slime forms due to water mist. Closed water circuits allow the water hardness to rise to astronomical heights of up to 1000 degrees German hardness. Therefore, mineral deposits are formed very easily. With waste paper, a wide variety of undesirable substances get into the paper web. Hydrophobic microstickies, macrostickies, colloidal stickies and their negative effects are well known among paper technologists.

2. CURRENT CLEANING METHODS

For understandable reasons, thorough cleaning can only be carried out during the planned shutdown. You can quickly spray the water hose into the machine at any short, unplanned shutdown, but thorough cleaning simply requires more time.

In most planned shutdowns of a year, the wires and felts of the wet section and all dryer fabrics of the dryer groups are still installed. This means that cleaning can only be done from the tending or drive side. Cleaning systems for fabrics that work during production are expressly excluded. Water hoses are used for cleaning in every factory, but in the end they are not very thorough and the detached dirt is sprayed mainly to the drive side. There it remains on cardan shafts and electric motors, walkways, stairs and handrails (Figure 1). Bacterial slime then often forms on these deposits.

2.1 High-pressure water

The use of high-pressure cleaners with 200 bar is only possible to a very limited extent when the fabrics are not removed. In the case of fourdrinier machines with pressure-sensitive drainage foils,

it is not even allowed to walk on protective felts or Styrofoam plates laid on top of the table. It is a pity, as the combination of chemical foams and 200 bar high-pressure water would be particularly effective. In the centre of the machine, deposits in the wet section are virtually inaccessible when the fabrics are installed.

2.2 Foamed cleaning chemicals

Alkaline and acidic cleaning chemicals are very effective means of loosening deposits; for descaling, oil removal and loosening organic dirt, they work very well. However, it also requires mechanical energy from high-pressure water to thoroughly remove the deposits and rinse the chemicals from the wet end of the machine.

In the dryer groups alkaline foams can be used with installed dryer fabrics and the oily deposits can be flushed out with water hoses.

2.3 Mechanical cleaning

Especially very old, mineral deposits must be removed with grinding wheels or chisels. Since this work requires electrically operated, hand-held equipment, the cleaners have to climb directly into the machine. This is not possible with installed fabrics.

3.

In case of short, unplanned downtimes, almost always only in-house workers are involved in cleaning. Planned downtimes of more than 6 hours allow the use of external cleaning companies. Huge machines with a sheet width of 10m or more require a workforce of up to 10 external cleaners who block the wire or

14 PAPER TECHNOLOGY SPRING 2023 NEW INSIGHTS ON APPLICATION OF HIGH-YIELD PULP

CLEANING PERSONNEL

M. Hotter, Hotter GmbH, Inkobastrasse 14, 4730 Waizenkirchen, Austria. phone: +43-664-88622872. email: robert.hotter@hotter-care.at

Figure 1. Dirt on the drive side of the wet end.

press section for several hours. They bring in their own personal protective safety gear and tools like foam pumps, hoses and highpressure water units.

3.1 Chemicals and cleaning personnel

Especially in the wet end sometimes cleaning chemicals are used which are not accepted by in-house workers. Odours, corrosive effects and extensive personal protective equipment make the work unattractive. Therefore, cleaning jobs are often left to external companies, so the use of chemicals is only possible during longer downtimes.

3.2

Effects of the Corona measures

More than once it has happened that ordered external cleaning companies were not allowed into the paper mill because Coronainfected persons were present. So long-planned cleaning jobs could not be carried out.

3.3 Supply chains and energy costs

Due to supply chain issues, energy costs and market turbulence, extended shutdowns of several days or weeks have become more common since 2022.

The available time can be used by the company’s own staff for thorough cleaning. This requires excellent cleaning chemicals, adapted personal protective equipment, training by external cleaning experts and supervision during cleaning. Most of the time, external equipment is also provided by the suppliers of the cleaning chemicals.

4. AUTOMATION

In more and more areas of our daily life, automated processes are being used to relieve workers, eliminate dangerous work and to defuse the issue of lack of workers. Also, in the production and processing of paper a large number of robots are already being used.

4.1 First stage of automated cleaning – Hotter Solution ACSF System

In the wet end, currently it is necessary to bring IBCs with chemicals to the cleaning area. Furthermore, mobile foam pumps must be connected to the IBCs and air hoses must be run to the cleaning equipment. After cleaning, all IBCs and all equipment must be removed.

As the first stage of automated cleaning, we have developed a system that enables the machine personnel to use even the shortest unplanned downtimes for the use of cleaning chemicals.

The ACSF system consists of a mother-daughter IBC unit, which is coupled with a foam unit. This foam unit is connected to the plant’s process control system. Permanently installed piping for compressed air, water and foam eliminates the work required to provide foam. One click of the mouse in the control room and foamed cleaning chemicals are available at a central coupling point in the wet section; or three primary sorters can be foamed at the same time; or two suction rolls at the same time.

The prerequisite for this solution is, of course, a cleaning chemistry that is accepted by the machine personnel.

4.2 Second stage of automated cleaning – Hotter Solution ACSD System

The basic principle of the ACSF system can also be applied in the dryer section. We have developed the alkaline cleaner CCS 100 for oil removal and cleaning the dryer fabric. CCS 100 can be used in dryer groups without traversing cleaning heads.

Again, a mother-daughter IBC unit with foam unit is connected to the plant’s process control system. With a click of the

mouse, the alkaline oil remover can be distributed in one or more dryer groups at the same time. Permanently installed piping distributes the foam evenly and is then used for rinsing with water.

4.3 Third stage of automated cleaning – Hotter Solution ACSM System

The objective for the development of ACSM was as follows: no longer allow humans to climb into the machine, no direct contact of humans with chemicals, cleaning at the click of a mouse in the control room, and use of cleaning chemicals only selectively in places that are essential for machine operation.

Advantages: significantly lower consumption of cleaning chemicals, no risk of injury to humans, cost savings and use of available personnel for other, equally important work.

4.3.1. Don’t let people climb into the machine anymore

The first point is already a hot issue. Safety is a top priority in every paper mill, and before entering the factory premises, safety training must first be completed and the test passed. However, it is very often not possible to reach the internal surfaces of the wet section from the safe walkways. The external cleaning companies then have to make a decision. Thorough cleaning, as requested by the client, is only possible if you climb into the machine (Figures 2 & 3). If the occupational safety regulations are adhered to, the walkways must not be left. Thus, the work order cannot be fulfilled at all.

15

Figure 2: Man inside tank spraying foam cleaner.

PAPER

Figure 3. Man under machine spraying foam cleaner.

TECHNOLOGY SUMMER 2023 AUTOMATED CLEANING OF PAPER MACHINES

A way out of this dilemma is not so easy to find. Creating secure access is difficult because the existing structures of the paper machine do not allow this at all. The deposits are also hidden in particularly inaccessible niches above wires or felts. Above pulpers, it is not possible to clean thoroughly at all without scaffolding or a mobile walkway.

Especially in the case of large machines with sheet widths of more than 10m and a gap former (Figure 4), it is critical to keep the lips free of incrustations. However, since damage to the lips or a separating strip is absolutely not acceptable, it is obvious not to let workers walk on the gap former.

4.3.2. No direct contact with chemistry

Direct contact between foaming chemicals and workers is unacceptable. Although unhealthy chemicals are avoided in the development of acidic or alkaline foam products, the workers should not be contaminated. Astronaut suits with bottled breathing air protect against chemicals, but hinder mobility and visibility very much. Thus, the goals of the third stage of automation are clear. Cleaning at the click of a mouse from the control room. Automated, mechanical systems remove the deposits without human labour.

4.3.3. Spot cleaning

Incidentally, during the expert discussions on the subject of acidic foams in the wet end, it became clear that there are individual areas in each wet section that must be kept clean at all costs, as they have a major influence on the sheet break numbers. Most of the rest of the cleaning job may well be called cosmetic.

This is the main point for the automated, mechanical systems. Selective use of chemicals at crucial locations makes it possible to limit the number of such systems (Figure 5). It also makes it possible to reduce the use of chemicals; and the available ma-

chine personnel is freed up for other work. Thus, the cost/benefit calculation is extremely positive.

4.3.4. Automated, mechanical-chemical cleaning systems

Now, what does such an automated, mechanical cleaning system look like? This question cannot be answered so simply and universally.

The basis for the selection of suitable systems is the thorough analysis of the wet end by an expert audit. In this process, the spots with an influence on sheet break numbers are identified and existing, useable machine components are identified.

Water showers, for example, can also be used for distributing acidic foams, and existing traversing cleaning systems can be upgraded. However, robotic arms reach much larger areas around the trusses than simple, traversing cleaning heads. Even the underside of the trusses can be cleaned by robot arms. So, the idea of having robot arms traversing is obvious; at least if there are no interferences with existing structures. Priority targets are places that have a major impact on the number of sheet breaks and the quality of the paper web and/or are particularly sensitive to damage. If such damage could result in extreme interruption of production, one should seriously consider the use of robot arms for cleaning.

4.4 Outlook

Robot technology, artificial intelligence, camera systems and processing speeds are changing rapidly. The same applies to the possibilities of keeping steel structures permanently free of dirt due to changed surface properties.

As of today, it is already possible to use cameras to determine the type of contamination and select the appropriate chemicals. It is already possible to mechanically achieve the dirt repelling effect on steel structures and to maintain it permanently.

Additionally, it is already possible today to use artificial intelligence to decide whether cleaning is necessary or not, no matter how short a shutdown is. And if so, to carry the cleaning job out autonomously. Sensors can detect any movement or a person within the danger zone and stop the robotic cleaning system.

The development of future paper machines will take into account the questions raised about humane cleaning of the wet end and wherever possible, bring us automated mechanical systems for cleaning with highly specialised chemicals.

16

PAPER TECHNOLOGY SUMMER 2023 AUTOMATED CLEANING OF PAPER MACHINES

Figure 4. Encrusted debris around the lip of a gapformer, before cleaning.

Visit

PITA website www.pita.org.uk

Figure 5. Cleaning a gapformer using a robot spraying acid foam.

the

Toscotec’s TT Headbox delivers superior performances in tissue

Luca Ghelli, R&D Director Toscotec, Luca.Ghelli@toscotec.com

An old and popular advert promoting efficient, reliable, and user-friendly household equipment ended with the vigorous claim “Facts, not just words.” The underpinning message being the guarantee of “actual results, not only promises.”

While elaborating the list of Toscotec’s TT Headboxes – 32 units since 2020, of which 23 in operations and 9 undergoing manufacturing – we were reminded of that popular ad.

Over the last 16 years, Toscotec has sold over 130 TT Headboxes to be installed on tissue machines, of which 32 have been in the last three years. The majority of these units were part of complete tissue line orders (23 units), some were part of major rebuilds (4 units), and the rest (5 units) were sold as replacements of existing headboxes. The latter replaced headboxes manufactured by other machinery suppliers with the aim of improving paper quality and production performance. Since headboxes are normally sold with the complete tissue machine, the fact that paper producers are willing to replace only the headbox testifies to its importance, as it affects the machine’s production both in terms of paper quality and energy performance.

Toscotec’s TT Headboxes sold since 2020 vary in size, characteristics, and performance:

15 TT Headboxes have a pond width lower than 3,000 mm, while 17 units between 3,000 and 5,800 mm

The majority are designed for high-speed machines (up to 2,200 m/min)

5 TT Headboxes are equipped with paper profile dilution control (connected to QCS), while 5 units are designed for its future installation

21 units are single-layer TT Headboxes and 11 are multilayer units

26 TT Headboxes are installed on crescent former machines and 6 units on twin wire former machines

3 TT Headboxes are installed on TAD machines and the rest on DCT machines.

Toscotec’s headboxes produce high quality products – from facial and low basis weight toilet tissue (below 12 gsm) to towel tissue (up to 32-35 gsm) – processing different furnishes, including virgin fibres, de-inked pulp, and 100% wastepaper.

All TT Headboxes feature high flexibility in terms of: flow out of the headbox and into the forming section through precise slice opening control jet landing on the first dewatering part of the former

In order to ensure a proper and uniform feed, they are equipped with best-in-class instrumentation for the control of process parameters such as pressure, temperature, and consistency.

Actual Results: superior performances

After a short period of optimisation and fine-tuning following start-up, all TT Headboxes have met the guaranteed figures and customer requirements, as high quality formation was always reached on all applications and on all grades. In several cases, the headboxes have set a new benchmark for paper formation, which was subsequently adopted also in other mills of the same group, and on various occasions also led to repeated orders.

TT Headboxes – those without dilution control and only the basic configuration of the slice lip controlled with manually operated micro jacks or micrometric screws have always met bone dry profile guarantees within 1.5% of mean bone-dry value when averaged over the control window corresponding to the adjusting spindle spacing.

For TT Headboxes equipped with automatic Cross Direction (CD) dilution system, the main operating parameters are: dilution flow accounting for 7 to 10% of the flow out of slice

18

PAPER TECHNOLOGY SUMMER 2023 BIOECONOMY AND THE PULP & PAPER INDUSTRY PART 1

Photo 1: Toscotec’s TT Headbox

pressure ratio (pressure in dilution header divided by pressure in headbox header) normally in the range of 1.3-1.4 standard control window of 82 mm

bone dry profile 2 sigma values below 0.8-0.9% (ratio of bone dry 2 sigma CD gsm/average bone-dry gsm*100) for all products

The accomplished 2 sigma figures are based on the control window of the profiling system. Even when all scanner readings are used to calculate the 2 sigma figures, the variability never exceeds 1.5% of the average bone-dry value.

Why is bone dry profile uniformity so important? Because after paper formation is completed, it is a crucial property as it normally translates into:

better control of the Yankee coating

avoid over-drying to compensate for lack of moisture profile uniformity with significant energy saving in the Yankee and hood area

better moisture profile at the pope reel better runnability in the converting less complaints from final customers

TT Headbox: a successful technology

Optimal headbox performance and high-quality paper production require an optimised control of stock injection and a proper selection/operation of the equipment in the approach system. A good control of the water recovery circuit is also key for smooth, clean, and efficient operation of the headbox, especially for furnishes such as wastepaper and de-inked pulp.

Toscotec has developed a deep knowledge of the approach system design and best practices to avoid process disturbances, which could affect TT Headbox’s operations, enhancing both Machine Direction (MD) and CD profile control. As a result, it offers all the necessary support for the control of the complete process both upstream and downstream of TT Headbox.

The success of TT Headboxes derives from: extensive experience and deep product knowledge effective and precise manufacturing specifications optimal quality control of the final product stricter and more accurate quality control procedures of sub-suppliers.

Based on the increasing knowledge of the product, Toscotec has developed standard headbox specifications, which are then applied and customised for each customer based on the specific need in terms of flow, control capacity, and geometry of the application.

Besides quality and profile control results, the TT Headbox is close to 100% free of internal build up issues or the need of special cleaning requirements.

19 PAPER TECHNOLOGY SUMMER 2023 SUPERIOR PERFORMANCES IN TISSUE

Photo 2: Toscotec’s TT Headbox

Photo 4: Toscotec’s TT Headbox: bone dry profile and dilution system

Photo 3: Toscotec’s TT Headbox

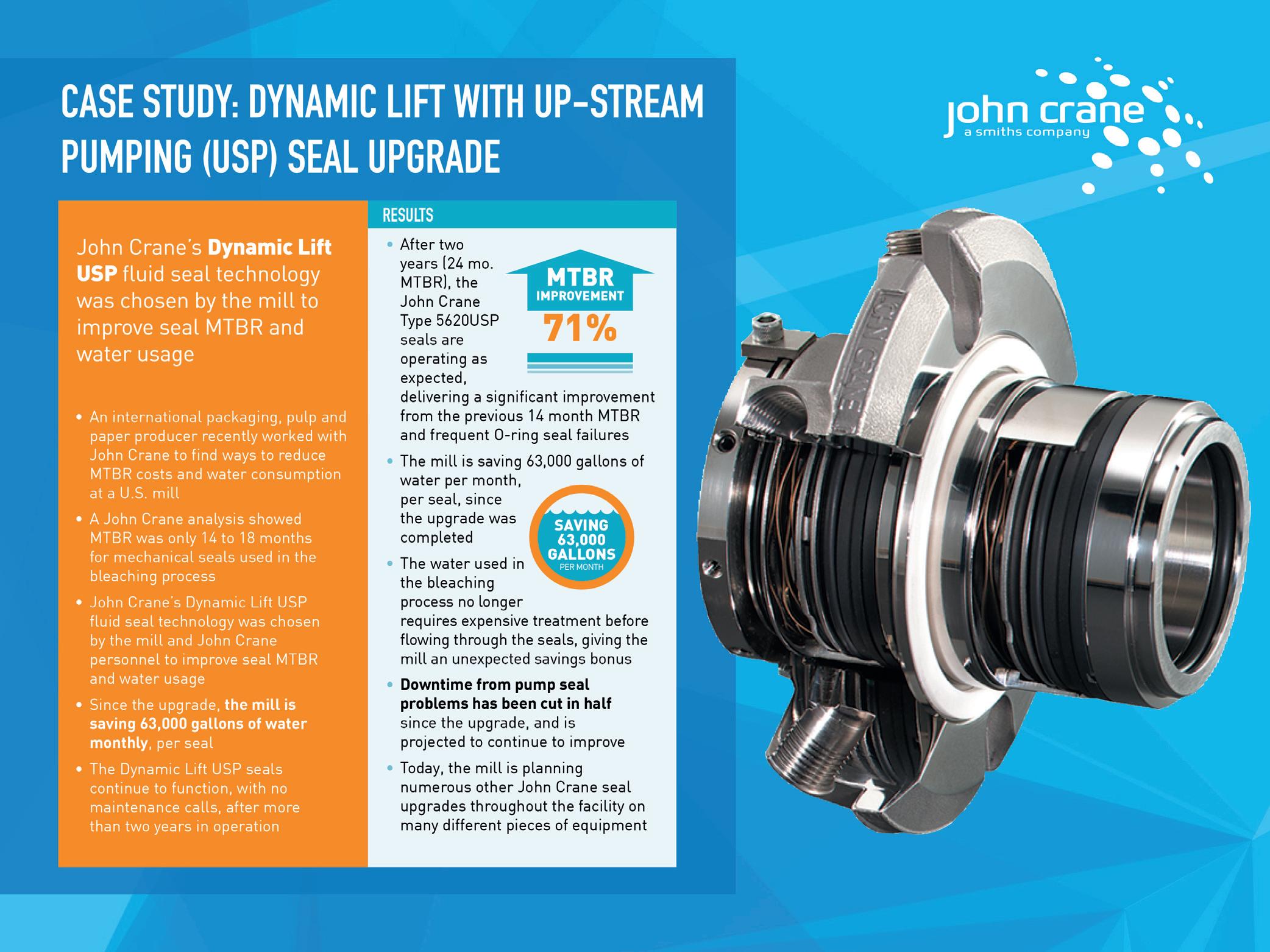

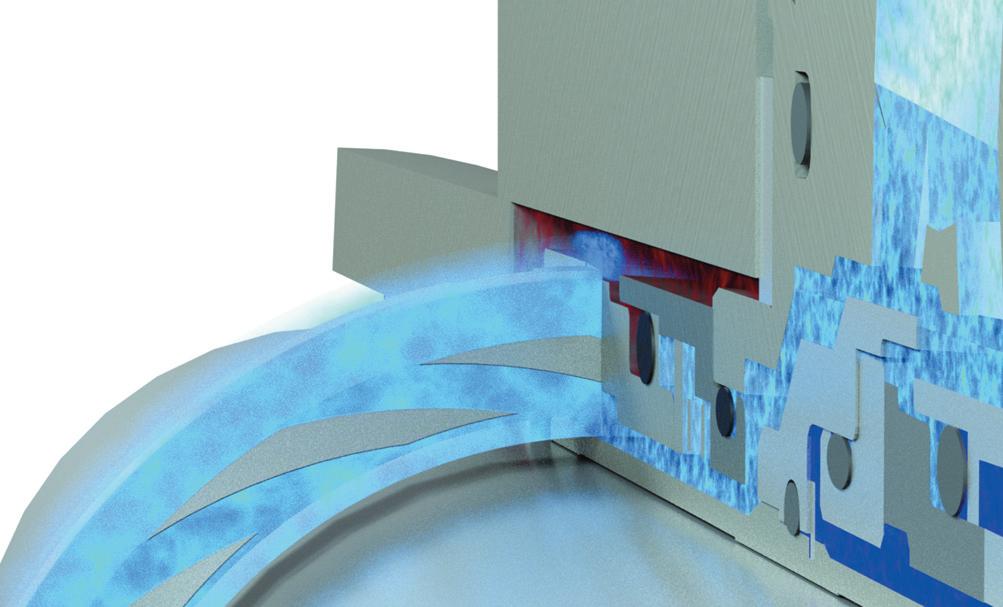

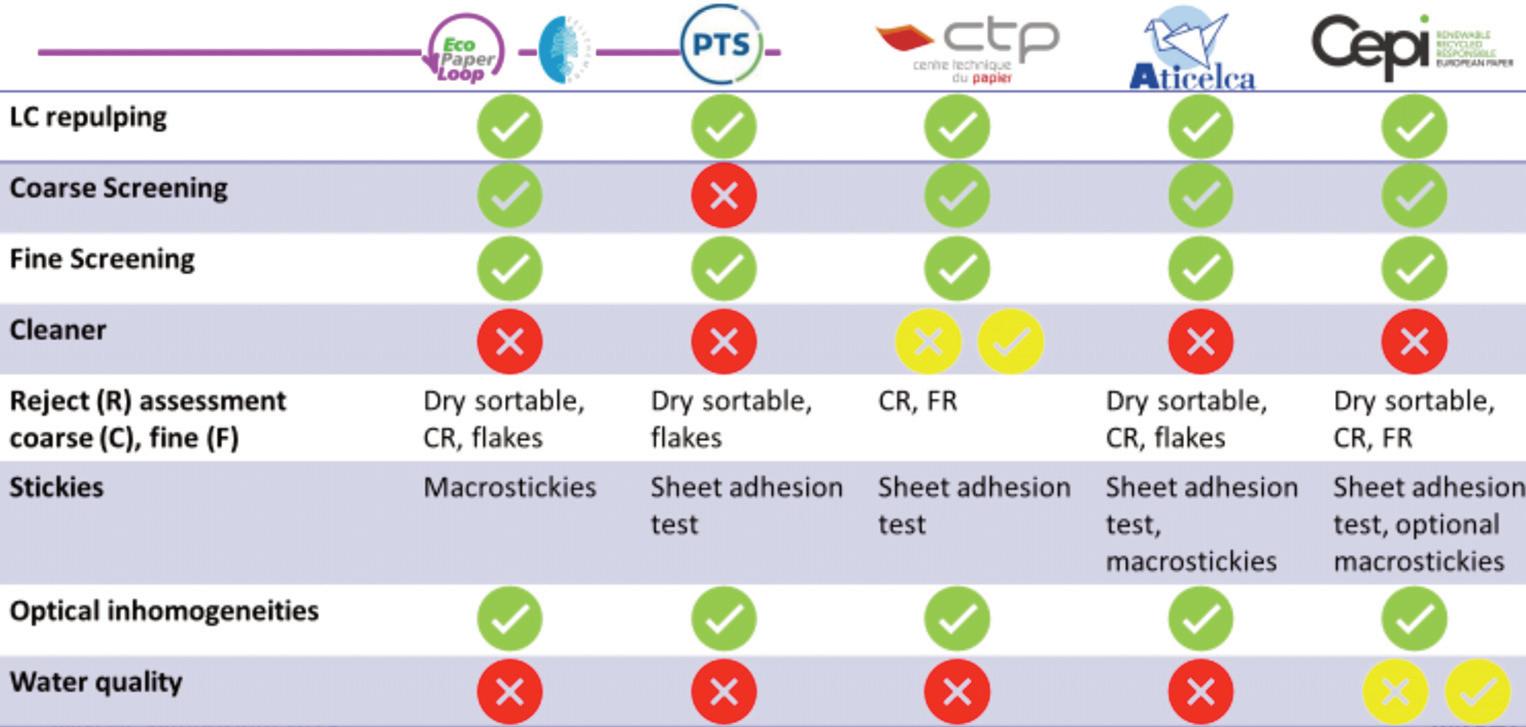

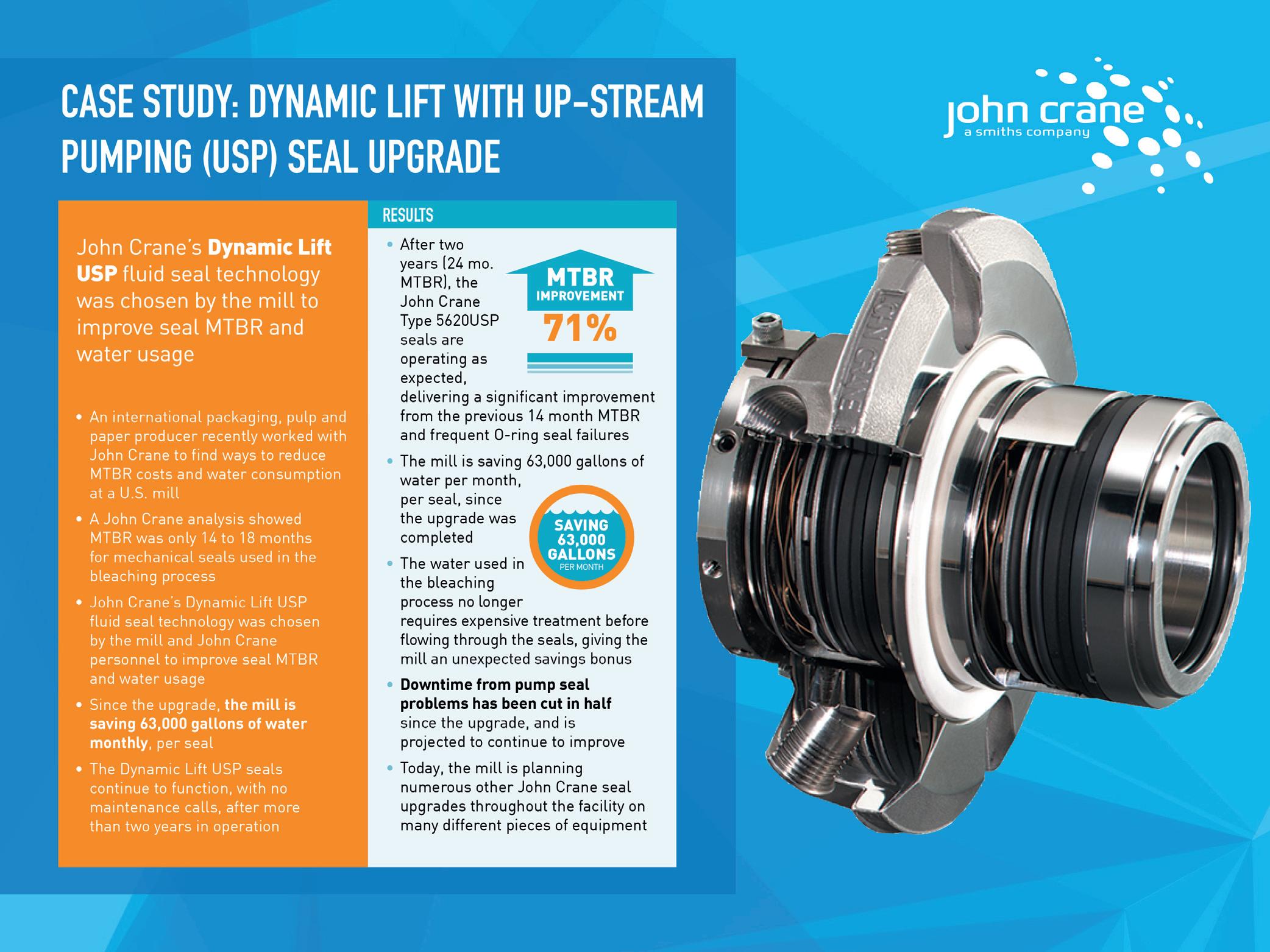

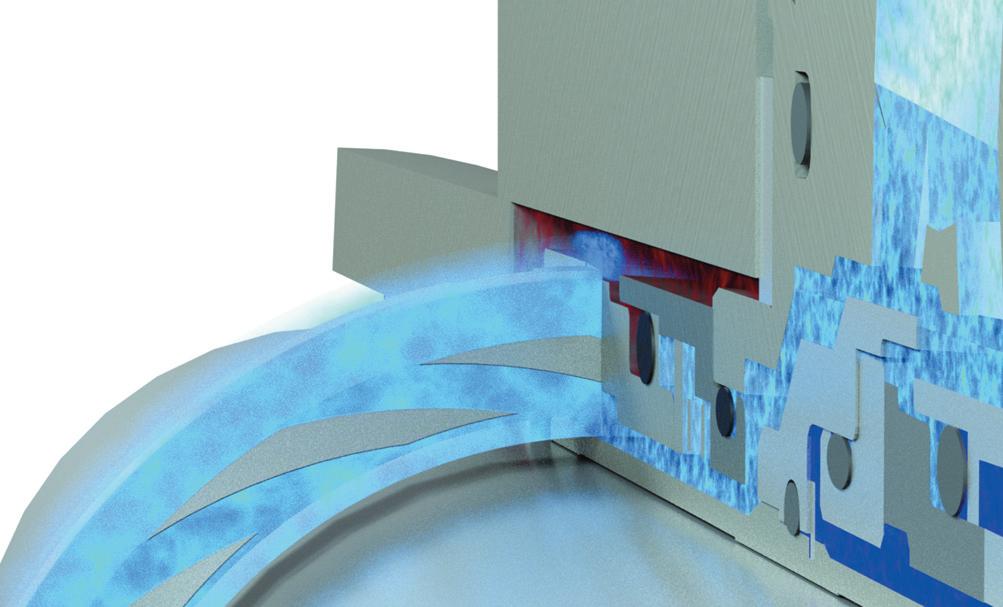

Water Waste Reduction in Pulp & Paper Mills: 8 Strategies to Improve Pump Reliability

The world’s population is expected to reach 8.5 billion by 2030, and the conservation of critical resources, such as water is a crucial societal goal. The United Nations estimates that water scarcity currently affects 40% of the population, making it a significant concern.

Processes in pulp and paper production plants, among other industrial processing, rely on slurry movement that use high volumes of water. Regions, where pulp and paper mills operate, are coming under increasing scrutiny for water use and effluent and wastewater disposal. With expectations for tighter legislation on water consumption targets, and many companies making public declarations of their water and energy savings targets, water conservation in the pulp and paper processing industry has never been more important than it is today.

Water is used in almost every paper production process, from moving slurries and paper stock to steam creation for heat transfer in cooking and dehydrating pulp by-products and creating concentrated liquors and waste products. Mechanical seals are used in heavy-duty centrifugal process pumps that move liquids, including black liquors, water, chemicals, or sludge, to support the manufacturing process. The variations encountered with process water and waste liquids make pump and seal selection vital to plant productivity and process reliability.

Today, virtually all paper mills face challenges in reducing water consumption and increasing water reuse and recycling to reduce the mill’s environmental footprint. Specifying the correct mechanical sealing technology can dramatically improve system reliability, greatly reduce water consumption and significantly impact the parasitic losses of sealed shafts.

Modern, well-designed mechanical seals will:

Limit leakage from rotation shafts

Reduce power losses associated with compression packing

Lower the frictional heat associated with packing

Minimise water consumption

Reduce maintenance hours associated with rotating equipment

Recycle process water and eliminate harmful solids using self-clearing filtration technology

Consider these eight water-waste reduction strategies to achieve dramatically improved results in your pulp and paper mill:

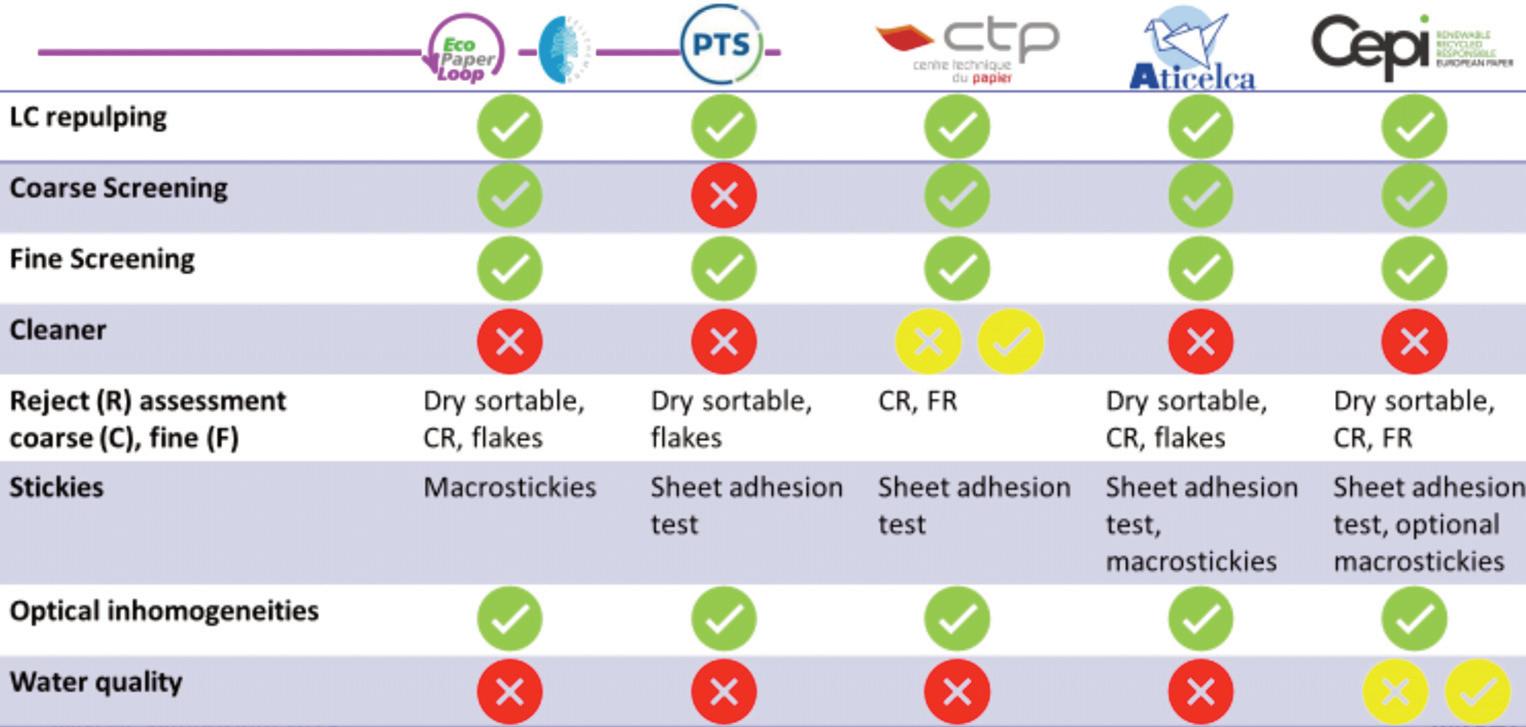

1. Convert compression packing to single mechanical seals to reduce water consumption and eliminate leakage. The proper operation of mechanical shaft packing requires a constant water flow to cool and lubricate the sealed shaft. More than a century old, this technology amounts to a balancing act of radial compression exerted by the packing, a constant flow of pressurised water used to cool the pump sleeve and process leakage required to lubricate the packing rings. Replacing packing with a mechanical seal will reduce water consumption by at least half and eliminate the need for daily or weekly maintenance activities to tighten packing.

2. Where mechanical packing cannot be easily upgraded to a mechanical seal, consider using a CPR bushing. This device meters and distributes flush water while excluding solids from spoiling the inboard packing ring.