The leading innovator supplying cutting-edge integrity solutions. Together we can ensure sustainable decision-making. Our combination of advanced inspection systems and expert consultants delivers a comprehensive understanding of asset safety, lifetime, and performance.

Comprehensive Asset Integrity Management

C O NTENTS

03. Editor's comment

05. Pipeline news

PIPES Act proposal; ONEOK to buy Magellan Midstream Partners; construction updates from India, Africa, and the Middle East.

10. Delivering green hydrogen

The task of creating a green hydrogen economy is complicated by financial, technical and regulatory hurdles, says Gord Cope.

METERING AND MONITORING

38. Low-cost, low-orbit David Celine, Managing Director, Omniflex, Australia.

15. Natural gas vs hydrogen

Vicki Knott, CEO and Co-Founder, CruxOCM, USA, explores the similarities and differences between natural gas and hydrogen, as well as their energy potential in our existing transmission and distribution systems.

17. Rising to the challenge

Natural gas blended with hydrogen is increasingly being seen as an important solution in the move toward a net-zero economy, says Rodrigo Quintero Bejarano, Expert Industry Manager, Endress+Hauser, Switzerland.

23. Optimising sustainability

John Anderton, Senior Simulation Consultant, Atmos International, UK, explores overcoming the sustainability challenges of hydrogen fuel transportation with leak detection.

INLINE INSPECTION

27. Monitoring pipeline movement

Daniel Bahrenburg and Roland Palmer-Jones, ROSEN, UK.

31. Detecting and sizing pinhole features

Alejandrino Ruiz, John Healy and Bradford Edwards, Pipecare US LLC, USA.

PIPELINE SENSING

43. High fidelity fibre optic monitoring

Ehsan Jalilian and Mike Hooper, Hifi Engineering, Canada.

SYSTEMS AND SOFTWARE

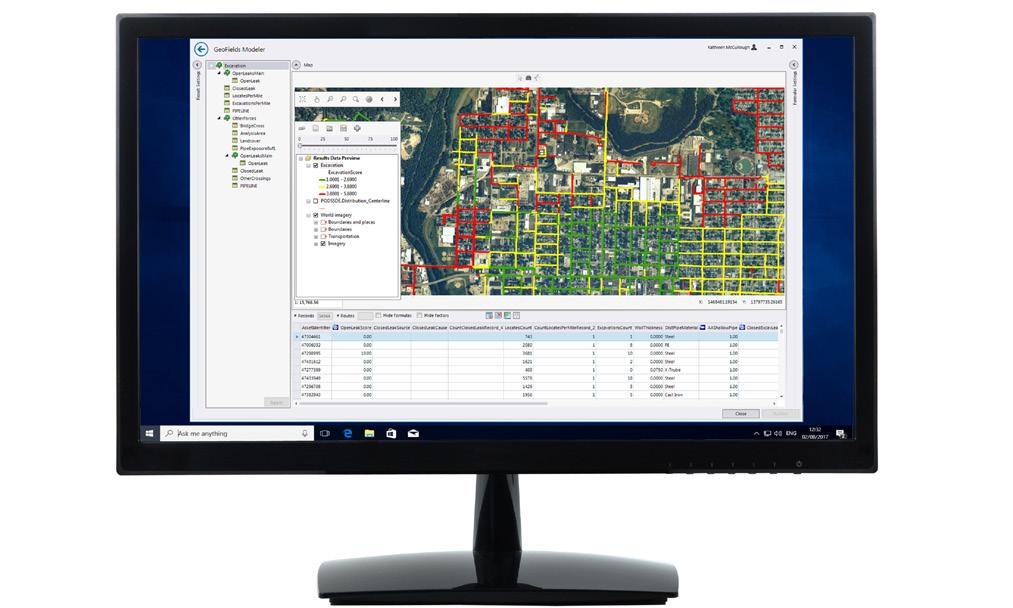

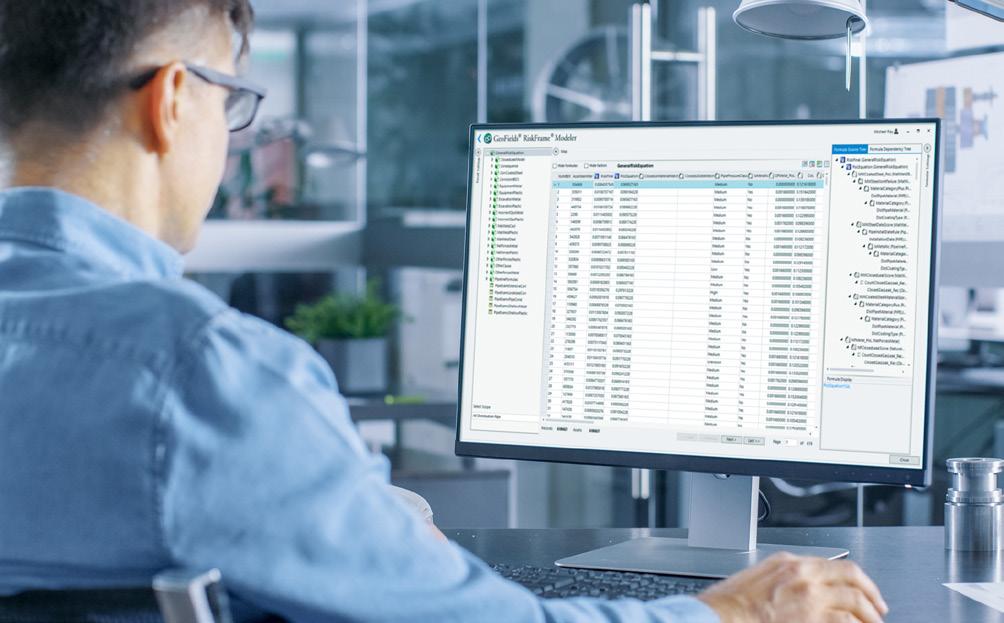

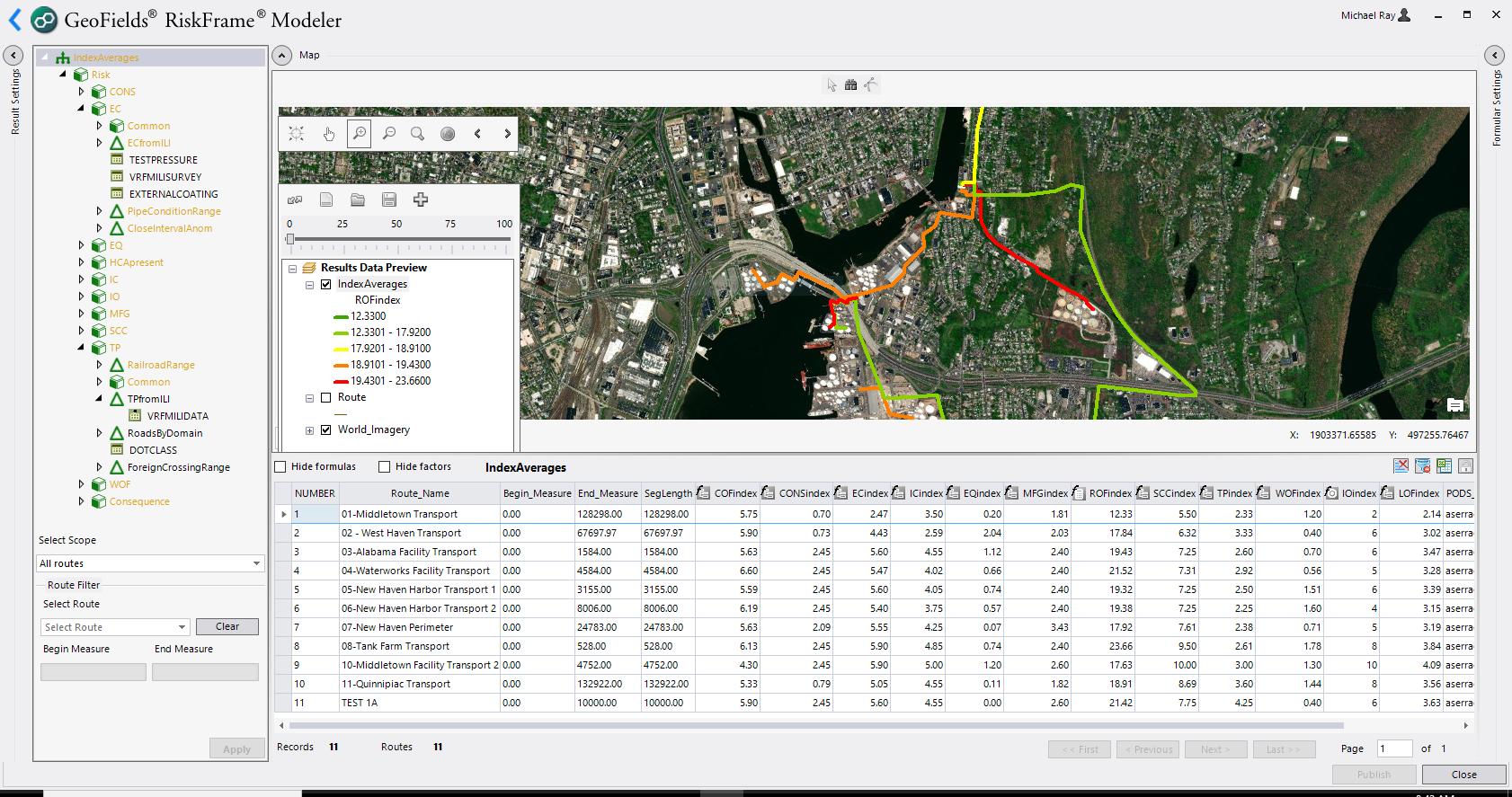

49. Before it breaks

Michael Ray and Greg Cameron, Emerson, USA.

COMPOSITE COATINGS

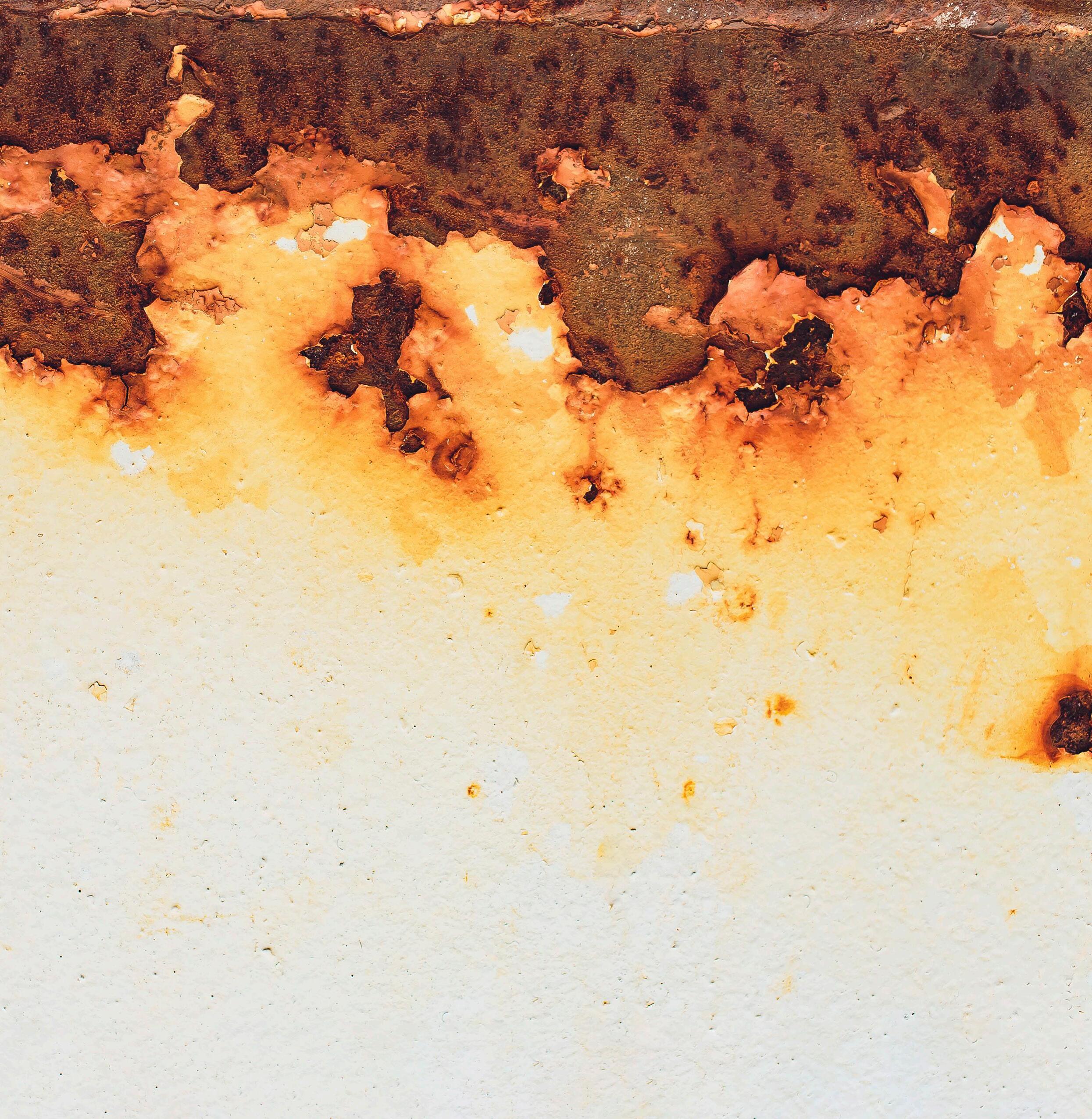

53. Eradicating external pipe corrosion

Hani Almufti and Yulman Flores, Cogbill Construction, USA.

57. Resin reinforcements

Yusuke Nishi, Senior Technical Service Engineer, Belzona, Thailand.

SUBSEA PIPELINES

61. Illuminating acoustic resonance technology

Pedro Rincon, Nathan Oliveira, Peter van de Camp, Mark Mateer, and Sean Legg, Shell, and Paul Chittenden, TSC Subsea.

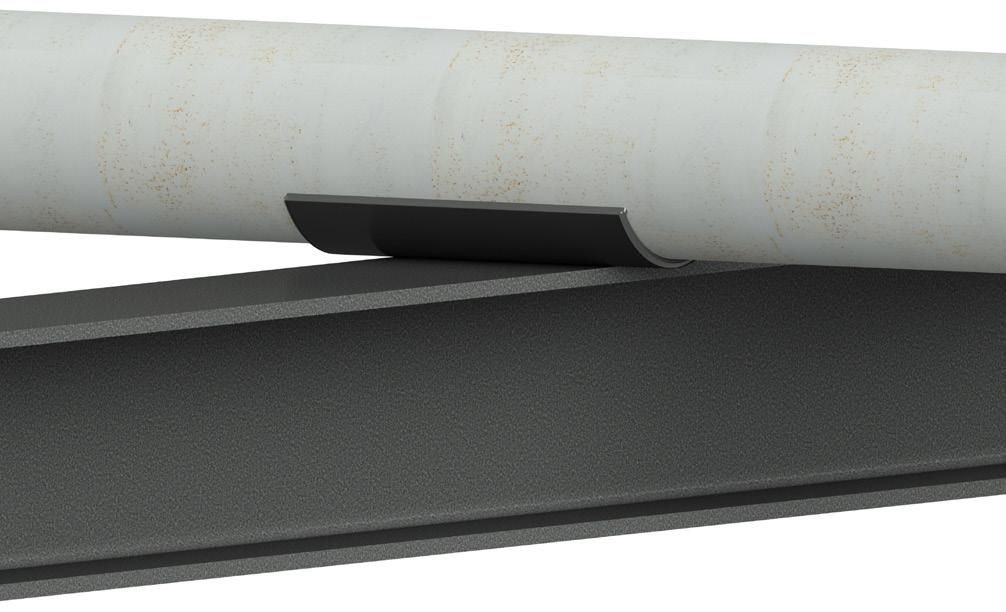

Seal For Life are home to the most comprehensive liquid epoxy line up in the industry. Combining industry-leading abrasion resistance with unmatched flexibility, our range of epoxy solutions are built tough, easy to apply and designed to last. Whether its HDD or field joint coatings, we’ve got the solution. For more information please visit www.sealforlife.com

EDITOR’S COMMENT

CONTACT INFORMATION

MANAGING EDITOR

James Little james.little@palladianpublications.com

EDITORIAL ASSISTANT

Sara Simper sara.simper@palladianpublications.com

SALES DIRECTOR

Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER

Chris Lethbridge chris.lethbridge@palladianpublications.com

SALES EXECUTIVE

Daniel Farr daniel.farr@palladianpublications.com

PRODUCTION MANAGER

Calli Fabian calli.fabian@palladianpublications.com

EVENTS MANAGER

Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR

Stirling Viljoen stirling.viljoen@palladianpublications.com

DIGITAL CONTENT ASSISTANT

Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL ADMINISTRATOR

Leah Jones leah.jones@palladianpublications.com

ADMINISTRATION MANAGER

Laura White laura.white@palladianpublications.com

Palladian Publications Ltd, 15 South Street, Farnham, Surrey, GU9 7QU, UK

Tel: +44 (0) 1252 718 999

Website: www.worldpipelines.com

Email: enquiries@worldpipelines.com

Annual subscription £60 UK including postage/£75 overseas (postage airmail). Special two year discounted rate: £96 UK including postage/£120 overseas (postage airmail). Claims for non receipt of issues must be made within three months of publication of the issue or they will not be honoured without charge.

Applicable only to USA & Canada:

World Pipelines (ISSN No: 1472-7390, USPS No: 020-988) is published monthly by Palladian Publications Ltd, GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to World Pipelines, 701C Ashland Ave, Folcroft PA 19032

At World Pipelines we’re paying close attention to pipelines for hydrogen transport, with the view that a hydrogen economy cannot be made a reality without sufficient infrastructure. One kilogram of hydrogen gas contains a lot of energy: you get a lot of bang for your buck. Hydrogen gas has a high gravimetric energy density and a low volumetric energy density: this means that it weighs almost nothing and is very energy dense but, per volume, the energy content of hydrogen is a lot lower than that of most other fuels and energy carriers. Storing or using hydrogen at atmospheric pressure and temperature requires a substantial amount of space. This means that hydrogen pipelines will be far more effective than vessels at moving hydrogen gas over short to medium range distances. In cases where hydrogen will be shipped (as hydrogen or its derivatives), it will eventually be distributed on land using hydrogen pipelines, which makes transport via pipelines a critical transportation mode for the gas.1

Over 4300 km of pipelines already exist for hydrogen transportation, with over 90% located in Europe and North America. Rystad Energy estimates that there are about 91 planned hydrogen pipeline projects in the world, totalling 30 300 km and due to come online by around 2035.2

A lot of talk about the subject centres around the idea of being ‘hydrogen-ready’. In mid-May, Italy’s Snam, Trans Austria Gasleitung (TAG), Gas Connect Austria (GCA) and German-based bayernets announced plans to combine hydrogen pipeline projects to create a 3300 km hydrogen-ready corridor. The SoutH2 Corridor will connect North Africa to central Europe, and could deliver 40% of Europe’s imported hydrogen demand by 2030.3 ‘Build it and they will come’ seems to be the aim here: the pipeline is designed to foster the production of renewable hydrogen in North Africa and southern Europe. It is estimated that Africa could produce 30 - 60 million t of hydrogen annually, and export up to two-thirds of that.

Plans for the H2Med pipeline (between France, Spain and Portugal) are a little further along: it is expected to be Europe’s first major hydrogen corridor, carrying 2 million tpy of hydrogen. Germany recently announced it is joining the project.

German energy firm RWE and Norwegian oil and gas producer Equinor signed an MoU in January to develop large-scale energy value chains between Germany and Norway which include renewable generation, hydrogen, and natural gas. The plans include hydrogen pipelines between the two countries.

Liberty Pipes has successfully passed trials to become the first UK producer of pipelines for the safe transportation and storage of hydrogen. Testing specialist Element Materials Technology has confirmed that Liberty’s 42 in. submerged arc welded (SAW) line pipe meets international requirements for hydrogen piping and pipelines. Liberty Pipes is one of only a handful of firms globally to confirm it can meet hydrogen standards.

Turn to p.10 for the special hydrogen section, which opens with World Pipelines correspondent Gordon Cope offering a broad overview of the task of delivering green hydrogen around the world. Vicki Knott at CruxOCM (p.15) compares hydrogen with natural gas. Endress+Hauser (p.17) considers safe blending of hydrogen and natural gas, and tackles accurate measurement of this tricky element. Finally, Atmos International (p.23) explores the sustainability challenges of hydrogen transportation.

1. www.demaco-cryogenics.com/blog/energy-density-of-hydrogen

2. www.rystadenergy.com/news/building-the-future-hydrogen-pipelines-start-to-materialize-in-europe

3. www.h2-view.com/story/italy-austria-germany-tie-up-on-hydrogen-pipeline-project-that-could-deliver-40-ofeuropes-imported-hydrogen-demand

SENIOR EDITOR Elizabeth Corner elizabeth.corner@palladianpublications.comThe welding and coating experts you can trust

Ensure the efficient, on-time delivery of your onshore and offshore projects with CRC Evans’ market-leading welding and coating services, technologies and integrated solutions, and extensive fleet of pipeline equipment

WORLD NEWS

USDOT announces bipartisan PIPES Act proposal

Following the Biden-Harris Administration’s historic announcement to invest US$196 million in grants for 37 pipeline modernisation projects spread across 19 states, the US Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA) has announced it is proposing a new rule to significantly improve the detection and repair of leaks from gas pipelines.

As directed by the bipartisan PIPES Act of 2020, the proposed rule would create good-paying jobs, deploy pipeline workers across the country to keep more product in the pipe, and prevent dangerous accidents. These actions, if finalised, would boost efficiency, cut harmful pollution and waste, and create an estimated up to US$2.3 billion annually in benefits.

The Notice of Proposed Rulemaking – transmitted to the Federal Register on 5 May – would enhance public safety and lower methane emissions and other air pollution from more than 2.7 million miles of gas transmission, distribution, and gathering pipelines; 400+ underground natural gas storage facilities; and 165 LNG facilities. The proposed rule will update decades-old federal leak detection and repair standards that rely solely on human senses in favour of new requirements that add an additional layer of safety by deploying commercially available, advanced technologies to find and fix leaks of methane and other flammable, toxic, and corrosive gases. These health and safety improvements will advance environmental justice in communities where gas pipeline infrastructure is disproportionately sited.

“Quick detection of methane leaks is an important way to keep communities safe and help curb climate change,” said US Transportation Secretary, Pete Buttigieg. “We are proposing a long-overdue modernisation of the way we identify and fix methane leaks, thereby reducing emissions and strengthening protections for the American people.”

Fixing wasteful and dangerous pipeline leaks is a core part of the Biden-Harris Administration’s US Methane Emissions Reduction Action Plan to cut energy waste and pollution, boost efficiency, and create good-paying jobs. In 2030 alone, this rule has the potential to eliminate up to 1 million t of methane emissions – equivalent to 25 t of carbon dioxide, or the emissions from 5.6 million gas-powered cars. Overall, the

rule would reduce emissions from covered pipelines by up to 55%. The proposal requires pipeline operators to establish advanced leak detection programmes aimed at detecting and repairing all gas leaks by:

) Strengthening leakage survey and patrolling requirements by increasing the frequency of surveys and requiring the use of commercially available, advanced leak detection technology – such as aerial or vehicle surveys, handheld detection devices, and continuous monitoring systems –with flexibility for operators to use a range of approaches to meet a minimum performance standard.

) Reducing the volume of gas released due to unintentional emissions like leaks and equipment failures and revising the reporting minimum threshold to detect smaller leaks sooner.

) Minimising intentional releases, such as those caused by equipment venting or blowdowns, associated with pipeline maintenance, repair and construction, and encouraging operators to consider cost-effective equipment that can capture the methane for later use.

) Establishing explicit criteria and timeframes for the timely repair of all leaks that pose a risk to public safety or the environment.

Section 113 of the bipartisan PIPES Act of 2020 mandated the issuance of a rulemaking requiring the development of advanced leak detection programmes capable of identifying, locating, and categorising natural gas leaks from pipeline infrastructure for timely repair. In June 2021, PHMSA issued guidance to gas and hazardous liquid pipeline operators that operators must update their operations and maintenance plans to minimise emissions, underscoring Congress’ new requirement in section 114 of the PIPES Act of 2020. In 2022, PHMSA fanned out across the country to inspect operations and maintenance plans to ensure compliance. The recently proposed rule builds on these actions by indicating exactly what pipeline operators must do to comply once the rule is finalised in the coming months.

ONEOK to buy Magellan Midstream Partners for US$18.8 billion

ONEOK Inc. agreed on 14 May to buy US pipeline operator Magellan Midstream Partners in a cash-and-stock deal valued at about US$18.8 billion including debt, bringing natural gas-focused ONEOK into transporting refined products and oil, reports Reuters.

ONEOK will pay US$25 and 0.6670 shares of ONEOK common stock for each outstanding Magellan common unit, representing a premium of 22% based on Magellan shares’ closing price on 12 May. The buyer will also assume Magellan’s US$5 billion debt pile.

The deal will give ONEOK, until now a transporter of NGLs

and natural gas, access to Magellan’s refined products and crude oil transportation business. The combined company will have 44% of its business in NGLs, and 21% in refined products, according to a presentation.

The deal, expected to close in 3Q23, should be accretive to ONEOK’s earnings per share beginning in 2024, with EPS accretion of 3 - 7% per year from 2025 - 2027.

The combined company will own more than 25 000 miles of liquids-oriented pipelines, with significant assets and operational expertise at the Gulf Coast and Mid-Continent market hubs.

USA

Tellurian Inc. announced that the US Federal Energy Regulatory Commission (FERC) issued the certificate on 21 April 2023 granting authorisation for Driftwood Pipeline, LLC’s Line 200 and Line 300, a US$1.4 billion natural gas transmission project to be located in Beauregard and Calcasieu Parishes, Louisiana.

CANADA

Pembina Pipeline Corporation has provided an update on the operational impacts of the wildfires in Alberta and British Columbia, Canada: all Pembina facilities previously shut down due to the wildfires have resumed operations.

UK

LIBERTY Pipes Hartlepool has successfully passed trials to become the first UK producer of pipelines for safe transportation and storage of hydrogen.

RUSSIA

Transneft said on Wednesday 10 May that a filling point on the Europe-bound Druzhba pipeline in a Russian region bordering Ukraine had been attacked.

AUSTRALIA

Caroline Cherry has been appointed Western Australian Director of the Australian Petroleum Production & Exploration Association (APPEA).

USA

Percepto has announced receipt of an unprecedented waiver from the Federal Aviation Administration (FAA). The approval allows the company to operate uncrewed aircraft systems (UAS) beyond visual line of sight (BVLOS) in shielded airspace, without humans onsite, and without ground-based or airborne detect and avoid (DAA) systems, for inspection and monitoring operations at critical and non-critical infrastructure sites nationwide.

WORLD

India to dominate upcoming trunk/transmission pipeline length additions in Asia

India is set to dominate the trunk/ transmission pipeline length additions for planned and announced projects in Asia 2023 - 2027, contributing around 46% of the region’s total planned and announced pipeline additions by 2027, according to GlobalData, the data and analytics company.

GlobalData’s latest report, ‘Oil and Gas Pipelines Length and Capital Expenditure (CapEx) Outlook by Region, Countries and Companies including Details of New Build (Planned and Announced) Projects and Forecast, 2023 - 2027’, reveals that India is likely to add a planned pipeline length of 27 543 km (projects that received all necessary approvals) and an announced pipeline length of 2208 km (projects yet to receive approvals) by 2027.

Bhargavi Gandham, Oil & Gas Analyst at GlobalData, comments: “Pipelines are an efficient and cheaper way of transporting oil and gas for large countries such as India. The

growing economy and strong demand for oil and gas are mainly driving pipeline additions in the country.”

Kandla-Gorakhpur LPG pipeline is the largest upcoming oil and gas pipeline project by 2027 in India, with a total length of 2809 km. The pipeline, which is set to begin operations in 2024, would serve LPG bottling facilities in the states of Gujarat, Madhya Pradesh, and Uttar Pradesh to meet the growing demand for the commodity.

Jagdishpur-Haldia Phase II gas pipeline ranks second in India in terms of length among the upcoming transmission pipelines by 2027. With a length of 1900 km, it is scheduled to start operations in 2023. The pipeline is part of the Indian government’s initiative to connect eastern states such as West Bengal with the national gas transmission network. GAIL (India) is the operator as well as the 100% equity owner of the project.

National Petroleum Corporation, Iraq’s Ministry of Oil, India’s Numaligarh Refinery Limited, and France’s TotalEnergies.

The longest pipeline projects under construction are the 1950 km Niger-Benin Oil Pipeline and the Paradip Numaligarh Crude Pipeline (PNCPL) in India, both slated to start operating in 2024. Canada is home to the third-largest pipeline project under construction, the 980 km Trans Mountain Expansion (TMX), expected to start in 2023 as an expansion to the existing Trans Mountain Oil Pipeline.

Half of all oil pipelines under construction are in Africa and Middle East Africa and the Middle East are home to 49% of all oil transmission pipelines under construction globally at a cost of US$25.3 billion, according to new data from Global Energy Monitor. The 2023 annual survey of data in the Global Oil Infrastructure Tracker shows that these regions together are building 4400 km of crude oil transmission pipelines at an estimated CAPEX of US$14.4 billion. An additional 10 800 km are proposed in these regions at an estimated cost of US$59.8 billion.

Globally, there are 9100 km of oil transmission pipelines under construction and an additional 21 900 km of proposed pipelines. These pipelines in development are estimated to cost US$131.9 billion in CAPEX.

The leading five countries in terms of in-development pipelines (proposed and under construction) are the US, India, Iraq, Iran, and Tanzania.

The top five parent companies developing oil pipelines are state-owned enterprises and private companies, including Iran’s Ministry of Petroleum, the China

Baird Langenbrunner, Project Manager for the Global Oil Infrastructure Tracker, said: “The crude expansion in Africa and the Middle East is pumped as a panacea to the chaos of global energy demand, which is driven in large part by Europe’s scramble for oil and gas outside of Russia. But the approach might entrench these regions to costly infrastructure that will in time need phasing out, saddling them with stranded assets. The solution is not to build more crude oil pipelines but to use that money and plan reliable, low-carbon energy systems and transmission networks.”

PROTECTIVE OUTERWRAPS

HEAT SHRINKABLE SLEEVES

SOIL-TO-AIR INTERFACE

INTERNAL

DENSO™ are leaders in corrosion prevention and sealing technology. With 140 years’ service to industry, our mainline and field joint coating solutions offer reliable and cost effective protection for buried pipelines worldwide.

United Kingdom, UAE & India

USA & Canada

Australia & New Zealand

Republic of South Africa

FOR CORROSION PREVENTION

www.denso.net

www.densona.com

www.densoaustralia.com.au

www.denso.co.za

LIQUID EPOXY COATINGS PETROLATUM TAPE WRAP SYSTEMS BUTYL TAPE WRAP SYSTEMS PIPE LININGS BITUMEN TAPE WRAP SYSTEMSCONTRACT NEWS

EVENTS DIARY

13 -15 June 2023

Global Energy Show 2023

Calgary, Canada www.globalenergyshow.com

8 - 10 August 2023

Rio Pipeline 2023

Rio de Janeiro, Brazil www.riopipeline.com.br

5 - 8 September 2023

Gastech 2023 Singapore www.gastechevent.com

5 - 8 September 2023

SPE Offshore Europe 2023

Aberdeen, Scotland www.offshore-europe.co.uk

11 - 15 September 2023

IPLOCA 2023 convention

Vancouver, Canada www.iploca.com/events/annualconvention/2023-convention

17 - 21 September 2023

World Petroleum Congress 2023

Calgary, Canada www.24wpc.com

21 - 22 September 2023

Subsea Pipeline Technology Congress (SPT 2023)

London, UK www.sptcongress.com

2 - 5 October 2023

ADIPEC 2023

Abu Dhabi, UAE www.adipec.com

Major contract win in East Coast Hydrogen Pipeline project

Fisher German, infrastructure consultancy, has won a contract to provide land services and initial consultation for the construction of a major hydrogen cluster scheme which will help the UK reach its net-zero targets.

Fisher German will work as part of a multi-disciplinary team including Worley, J. Murphy & Sons, SLR and Camargue to support the pre-FEED and FEED of Cadent’s East Coast Hydrogen Pipeline (ECHP), which will connect hydrogen plants to end users and other strategic networks in the east region. The multi-disciplinary team will be identifying the consenting regime and developing the consenting strategy in preparation for FEED.

The project, led by East Coast Hydrogen (ECH2), will connect 10 GW of hydrogen production from Humber and Teesside industrial hubs to the gas network. If completed, the project is set to convert up to 39 000 businesses over a 15 year timescale. It is also estimated to create tens

of thousands of jobs in the future hydrogen economy.

Mark Gilkes, Partner at Fisher German and its DCO Land Strategy Lead, said: “We are delighted to have been awarded the project to assist Cadent and the team with identification of landowners, land constraints and, in the future, to secure land rights for the East Coast Hydrogen Pipeline. Before any potential NSIP like this can make progress, landowners along the route of the pipeline must be consulted extensively and their views considered by the Planning Inspectorate.

Adam Knight, Cadent Project Director, said: “This is a major milestone not only in the commencement of the first stage of design, but setting down another marker in Cadent’s ambitions and efforts to transition from natural gas to low carbon hydrogen, supporting UK economic growth and playing an integral role in the decarbonisation of our networks.”

Corinth Pipeworks awarded contract for deepwater pipeline

Corinth Pipeworks has been awarded a contract to manufacture and supply approximately 15 km of 23 in. and 26 in. longitudinally submerged arc welded steel pipes for Equinor’s IRPA field development project.

The IRPA gas discovery is located in the Vøring Basin, the deepest field development on the Norwegian continental shelf (1350 m deep), and will be developed as tie-in project to Aasta Hansteen platform. This offshore tie-in project will contribute to increased gas supply to Europe and extend the lifetime of the platform.

The pipes will be manufactured at Corinth Pipeworks’ facilities in Greece, and offshore installation work will commence according to schedule within 2025.

Ilias Bekiros, General Manager of Corinth Pipeworks, commented “CPW has had a huge impact in offshore pipeline markets in recent years, and we are proud to have successfully delivered our pipes to 20 major projects in the North Sea region over the last 5 years. We are particularly delighted to be working with Equinor, one of the pioneering global IOCs, and their frame agreement partner Mitsui, on this project.”

THE MIDSTREAM UPDATE

• Wood and SGN accelerate UK hydrogen plans

• China continues to lead midstream project starts in Asia

• Sir Jim Ratcliffe: “I fear for the future of the North Sea”

• IMCA announces new CEO

• Pembina Pipeline reports 1Q23 results

• PHMSA proposes vital standards to enhance safety

• DTEK Oil&Gas digitises base fields

Green hydrogen is hot. The ubiquitous element can be made anywhere using renewable power, water and electrolysis. Unlike conventional hydrocarbon energy, consuming nations cannot be held hostage by a belligerent producing country. Hydrogen is also energy-dense, and can be burned in fuel cells or converted to ammonia and used in internal combustion engines (ICE), similar to gasoline diesel and jet-fuel. When consumed as fuel, it emits nothing but water. Best of all, it can be economically transported by pipeline; Rystad Energy, a consultancy, estimates that there are over 90 projects with a total exceeding 30 000 km of new hydrogen pipelines planned by 2035. 1

But the infrastructure to create and deliver green hydrogen to industry, utilities and consumers is not cheap, with estimates quickly exceeding trillion of dollars. Governments around the world are therefore kick-starting the move to green hydrogen with a combination of subsidies and regulations.

Europe

The EU has set a goal of reducing greenhouse gases (GHGs) by at least 55% below 1990 levels by 2030. In the aftermath of the energy crisis related to the Ukraine war, it is being generous with green hydrogen subsidies, including €5.4 billion for Hy2Tech (an initiative that aims to perfect hydrogen technology), and €5.2 billion for Hy2Use (which will invest in applications in hard-to-decarbonise sectors such as cement, steel and glass). A further €3 billion subsidy, dubbed the Hydrogen Bank, will help stimulate demand.

While onshore windfarms face uphill permitting battles on the populated continent, the EU has vast swaths of sea in which to install renewable power assets. DNV, a consultancy, is a leading advocate for developing green hydrogen in the

North Sea. It recently released a study in which it estimated that a ‘North Sea hydrogen backbone’ consisting of 4200 km of pipelines could be built using existing technology at a cost of US$15.9 billion to US$23.3 billion. Offshore wind farms could generate an estimated 300 terawatt hours (TWh) of power, enough to create up to 15% of the estimated hydrogen consumption in 2050.

GASCADE and Fluxys, transmission system operators based in Germany, are working to develop the AquaDuctus project, an offshore green hydrogen pipeline running from wind farms in the North Sea’s Dogger Banks to an energy hub on the Heligoland archipelago 60 km north of Schleswig-Holstein (Germany). In early 2023, they submitted their project to the European Commission to have it declared a project of common interest (PCI). PCIs link energy systems in the EU, and the official designation can benefit projects with accelerated permitting procedures and funding from the Connecting Europe Facility (CEF).

In February 2023, OX2, based in Sweden, and the Bank of Aland announced a major green hydrogen project, located in the Port of Långnäs, Finland. Two offshore wind farms with a total of 8 GW will be connected to facilities in the Mega Grön Hamn complex where electrolysers will be used to create hydrogen and shipping fuels. (1 GW of capacity equals about 160 000 tpy of green hydrogen production). A dedicated pipeline is also planned for exports.

In March 2023, the Dutch government officially designated a site for the world’s largest offshore hydrogen production project; the Ten noorden van de Waddeneilanden (the North of the Wadden Islands). The site, which has the potential for 700 MW of generation, will be connected to Gasunie’s proposed offshore hydrogen pipeline network. The announcement is part of the Dutch government’s

The task of creating a green hydrogen economy is complicated by financial, technical and regulatory hurdles, says Gord Cope.

contribution to the Esbjerg Declaration that commits the Netherlands, Belgium, Denmark and Germany to achieve 20 GW of green hydrogen offshore capacity by 2030.

In December 2022, Spain and France announced H2Med, a €2.5 billion initiative to build a 450 km undersea hydrogen pipeline between the two countries. The pipeline, which had previously been intended to carry natural gas until hydrogen technologies had matured, will run from Barcelona to Marseille and deliver up to 10% of Europe’s expected hydrogen consumption by 2030. The hydrogen is expected to be produced by wind and solar facilities in Portugal and Spain, and be transported to Barcelona by land pipelines.

Most of the green hydrogen is initially slated to replace conventional usage in refineries and industry, but around 20% of energy consumption is used to heat homes. Because conventional gas distribution networks can handle up to 25% hydrogen without serious complications, it can piggy-back its way into homes. In late 2022, the UK’s Department for Business Energy and Industrial Strategy announced proposals to introduce hydrogen-ready domestic boilers, starting in 2026. The modifications would allow technicians to easily convert fuels from natural gas to hydrogen, or a mix of the two. The British Energy Security Strategy currently aims for 10 GW of domestic hydrogen production by 2030.

USA

The White House under the Biden administration has set out an ambitious target of promoting hydrogen as a clean fuel source, ear-marking billions of dollars to subsidise the cost of green hydrogen and develop infrastructure.

The US has approximately 1600 miles of existing hydrogen pipelines, most of which are located in the refinery and petrochemical corridor along the US Gulf Coast (USGC) in Texas and Louisiana. The majority of hydrogen is created using traditional, carbon-intensive processes, but the following plans are underway to create green hydrogen:

) Renewable fuels developer HIF Global has plans for a US$6 billion green hydrogen fuel plant in the Bay City area of Texas. When completed in 2026, the plant will produce 200 million gal./yr of green fuels.

) Air Products and partners are building a US$4 billion plant in Wilbarger County, Texas, to produce 200 tpd of green hydrogen.

) OCI N.V., based in the Netherlands, is constructing a US$1 billion blue hydrogen plant in Beaumont, Texas.

While output from the new hydrogen facilities will primarily flow through the dedicated lines currently servicing refineries, petrochemical and fertilizer plants, opportunities for pipeline expansion will arise as new facilities seek low-carbon feedstock and energy inputs.

Southern California Gas (SoCalGas) and San Diego Gas & Electric (SDG&E), have announced plans to experiment

with blending hydrogen and natural gas for customers in California. The US$35.3 million demonstration project would see a 5% hydrogen mix used by residential and commercial buildings.

SoCalGas is also developing Angeles Link, a dedicated, green hydrogen pipeline system that could deliver up to 25% of the company’s current gas capacity. Potential customers include electric utilities, heavy transportation and industry. The system has the potential to displace the equivalent of 3 million gal./d of diesel. The pipeline system would likely originate in the desert east of Los Angeles (LA) where contracted firms would generate hydrogen using abundant wind and solar power and electrolysers. The pipeline would terminate within the LA basin near current utility plants or the port of LA, where approximately 20 000 heavy-duty loading trucks could be converted to hydrogen fuel.

Asia

China is the world’s largest producer of hydrogen, with approximately 33 million tpy made from coal and natural gas. There are also several hundred km of existing dedicated pipelines that primarily supply refineries and petrochemical plants.

In March 2022, China’s government announced a multi-decade national plan to develop a hydrogen energy sector. The plan, which runs to 2035, seeks to coordinate a complete hydrogen value chain to support a green energy transition, including regulatory framework, production, distribution, fuel cells and vehicles; an initial goal of 100 000 tpy has been set for 2025.

While international investors are welcome to contribute in most aspects of the plan, many of the initial pilot phases will be met by state-players, including oil companies, utilities and regional governments. In November 2022, Sinopec announced that it was building a green hydrogen project in the Mongolian city of Ulanqab. The US$2.8 billion project is designed to produce 100 000 tpy of hydrogen from wind power: the output will be shipped by a 400 km dedicated pipeline to the company’s petrochemical complex in Beijing. The project is part of its massive US$15 billion investment in hydrogen.

In August 2022, Shanghai unveiled ambitious plans to become China’s leading city in clean hydrogen. The proposals include the manufacture of electrolysers, fuel cells and storage tanks, the production of hydrogen, filling stations for hydrogen-fuelled trucks and buses, a hydrogen trading platform and a dedicated pipeline network. No funding details have been announced, but the city is scheduling demonstration projects in its industrial zones to aid in planning.

Japan, which is heavily dependent on energy imports, announced plans in April 2023 to boost hydrogen supplies from 4 to 12 million tpy by 2040. The push will involve spending US$113 billion of private and public money over the next 15 years. In late 2022, Tokyo unveiled plans to supply the 14 million residents of the capital with a dedicated pipeline network that would deliver green

hydrogen from the port of Kawasaki to residential and industrial customers throughout the metropolitan area. Studies are currently underway to gauge costs and scope of the project.

Problems

Hydrogen tends to make conventional steel crack and fail. In March 2023, investigations by the US Bureau of Safety and Environmental Enforcement (BSEE), revealed that the cause of an offshore leak at an oilfield in the Gulf of Mexico was due to hydrogen embrittlement. The 2020 incident occurred after the studs on a connecting flange failed due to contact with minute traces of hydrogen in the crude being pumped.

Norway-based DNV is coordinating H2Pipe, a jointindustry project to develop a new code that governs the safe design, construction and operation of offshore pipelines that carry pure and blended hydrogen. The first phase of the project was initiated in 2021, with a test programme to fill gaps in current knowledge regarding the degradation of mechanical properties in steel pipe. The results narrowed down the number of key variables for the main test programme in Phase 2. In March 2023, DNV launched Phase 2, which will involve greater in-depth testing in order to create a detailed guideline in the design and repurposing of offshore pipelines for hydrogen transport. DNV expects to publish its set of standards in 2025.

A dedicated hydrogen gas or liquid network might also be superseded by a new technology; liquid organic hydrogen carrier (LOHC). Molecules such as benzyltoluene, which has similar properties to diesel, can repeatedly absorb large volumes of hydrogen, which can then be transported in the existing systems used for crude and refined fuels. The technology is currently being commercialised.

The biggest hurdle is capital investment. Creating a new energy sector based on green hydrogen is reckoned to be exceedingly expensive when compared to other green alternatives. A 100 000 m 3 storage tank for green ammonia, for instance, costs approximately US$50 million, while a liquid hydrogen tank is close to US$200 million. The EU has estimated that it would cost US$430 billion to achieve a 14% hydrogen share of the continent’s energy demand in 2050. DNV calculates that global spending on producing green hydrogen will reach almost US$7 trillion, from now until 2050, with an additional US$180 billion on hydrogen pipelines.

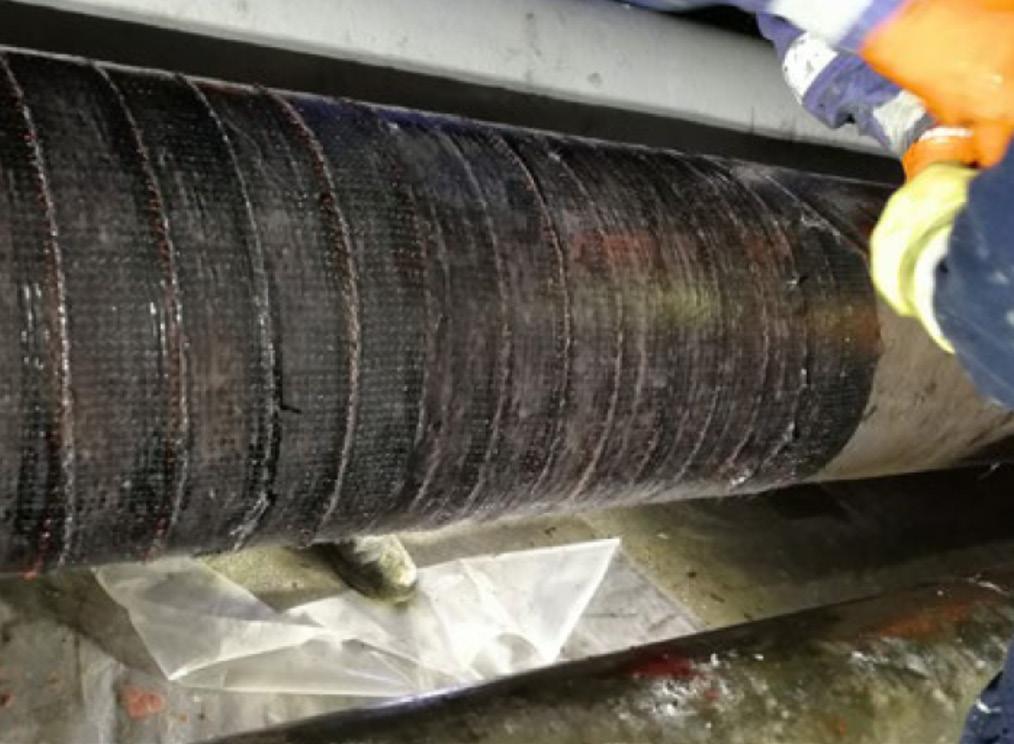

Researchers are looking for ways to cut costs. Studies have shown that using existing gas grids for hydrogen transport is four times more cost-effective than constructing new pipelines. Lines made of unsuitable materials can be repurposed through relatively cheap reinforced thermoplastic pipes (RTP). In the UK, for instance, over 60% of the existing gas distribution ironpipe network has been upgraded by inserting an RTP lining; most of these networks are now considered suitable for future hydrogen use.

The future

Currently, electrolysis can produce hydrogen at a cost of US$5/kg; the goal is to reduce it to under US$2/kg, similar to conventional production. Research is focusing on commercially-available electrolysers to reduce capital costs and increase efficiency. Proton exchange membrane (PEM) electrolysers cost approximately US$1400 - 1700/kg of production, and use 52 kWh of electricity to produce 1 kg of hydrogen; developers are looking at ways to replace expensive platinum catalysts. Liquid alkaline electrolysers use less expensive nickel-based catalysts and cost roughly US$800 - 1000/kg output, but use 55 kWh of electricity; efforts are underway to increase electrode efficiency. Solid oxide electrolysers, currently in the development stage, essentially reverse the operation of fuel cells, leading to significantly lower energy input per kg of produced hydrogen.

Scientists at the US Department of Energy’s National Renewable Energy Laboratory (NREL), are also examining the potential for solar thermochemical hydrogen (STCH) production, which has the potential for being much more efficient than electrolysis. The process relies on focusing the sun’s rays to heat metal oxides to 1400˚C (2552˚F), which are then quenched with steam to split the water atoms into oxygen and hydrogen. Currently, research is underway to find the most efficient metal oxides.

Researchers at RMIT University in Melbourne, Australia have devised a method of separating hydrogen directly from seawater. Using a new catalyst compound called nitrogendoped porous nickel molybdenum phosphide, the process breaks down water into hydrogen and oxygen molecules using very little energy, and under room temperature conditions. The method also eliminates the byproduct of toxic chlorine gas, a problem with using seawater in electrolysis. The academics estimate that the process will produce hydrogen for under US$2/kg, making it competitive with conventional hydrogen.

Further down the road, natural sources might obviate the need for production entirely. Scientists are studying the formation of pure hydrogen deep in the mantle of the Earth, where temperatures approach that of the sun. This ‘white’, or naturally-derived hydrogen then percolates up to the near-surface, where it can be acquired using wells drilled into the substrate. Under certain geologic conditions, it can be captured as easily as natural gas and shipped directly to consumers.

In conclusion, the task of creating a green hydrogen economy is complicated by financial, technical and regulatory hurdles. But the potential benefits are also immense, and great strides are already being made around the world. The prospect holds out tremendous opportunities, and the energy transportation sector is well positioned to significantly participate and benefit over the coming decades.

s the world is moving towards a more sustainable future, the energy sector is at the forefront of the transition. The shift from traditional fossil fuels towards renewable sources of energy is well underway, and this has put natural gas and hydrogen in the spotlight. Both of these energy sources are gaining attention, but how do they compare?

Size of the molecules

When comparing natural gas and hydrogen, one key difference is the size of their molecules. In terms of molecular weight, hydrogen (H2) is much lighter than methane (CH4), the primary component of natural gas. The molecular weight of hydrogen is 2 grams per mole, while the molecular weight of methane is 16 grams per mole. This means that the hydrogen molecule is eight times lighter than the methane molecule.

In terms of diameter, the van der Waals radius of a hydrogen molecule is about 120 picometers, while the van der Waals radius of a methane molecule is about 200 picometers. This means that

the hydrogen molecule is about 40% smaller in diameter than the methane molecule.

Lower and upper explosive limits

The lower explosive limit (LEL) is the lowest concentration of a gas or vapour in the air that can catch fire or explode if there is an ignition source. The LEL is an important safety consideration when handling and transporting flammable gases like natural gas or hydrogen.

The LEL of hydrogen is 4%. This means that if the concentration of hydrogen in the air is less than 4%, it is too lean to ignite and support combustion. However, if the concentration of hydrogen in the air is 4 - 75%, it is within the explosive range and can ignite and cause a fire or explosion if a spark or flame is present.

The LEL of natural gas can vary depending on the specific composition of the gas mixture. Typically, the LEL of natural gas is 4 - 5% by volume in air, and the upper limit is around 15 - 15.5%. In short, the explosive range of pure hydrogen is significantly greater

Vicki Knott, CEO and Co-Founder, CruxOCM, USA, explores the similarities and differences between natural gas and hydrogen, as well as their energy potential in our existing transmission and distribution systems.

than that of natural gas, which is why safety precautions are so critical when handling hydrogen.

How natural gas and hydrogen combust to create heat energy

When hydrogen gas is burned, it reacts with oxygen gas in the air to create water vapour and releases heat energy. Methane, the primary component of natural gas, combusts with oxygen in the air to produce carbon dioxide, water vapour, and heat. The combustion of natural gas releases CO2 emissions, which is why hydrogen as an energy source is so appealing – it produces no CO2 emissions.

Energy density

Energy density is a measure of the amount of energy that can be stored in a given volume or mass of fuel. The energy density of hydrogen is higher in its liquid phase compared to its gas phase. At standard temperature and pressure (STP), the energy density of hydrogen gas is about 0.010 M per litre (L). However, when hydrogen is cooled to its boiling point of -252.87 °C and compressed to its liquid phase, its energy density increases to about 8.5 MJ/L. This means that liquid hydrogen contains significantly more energy per unit volume compared to hydrogen gas.

The energy density of natural gas can vary depending on its composition and pressure, but on average, the energy density of natural gas is about 38 MJ/m³ or 38 000 MJ/L. If you consider the energy density in MJ/kg, then the combustion of hydrogen produces about 141.8 MJ of energy per kg of hydrogen. A common range for the energy density of natural gas is around 50 - 55 MJ/kg.

Technically, hydrogen has a much higher energy density than natural gas; however, the global distribution systems and our household appliances are built for gas, meaning that the apples-toapples comparison of hydrogen energy density to natural gas energy density is in the gas form and as such, the energy density of natural gas is much greater.

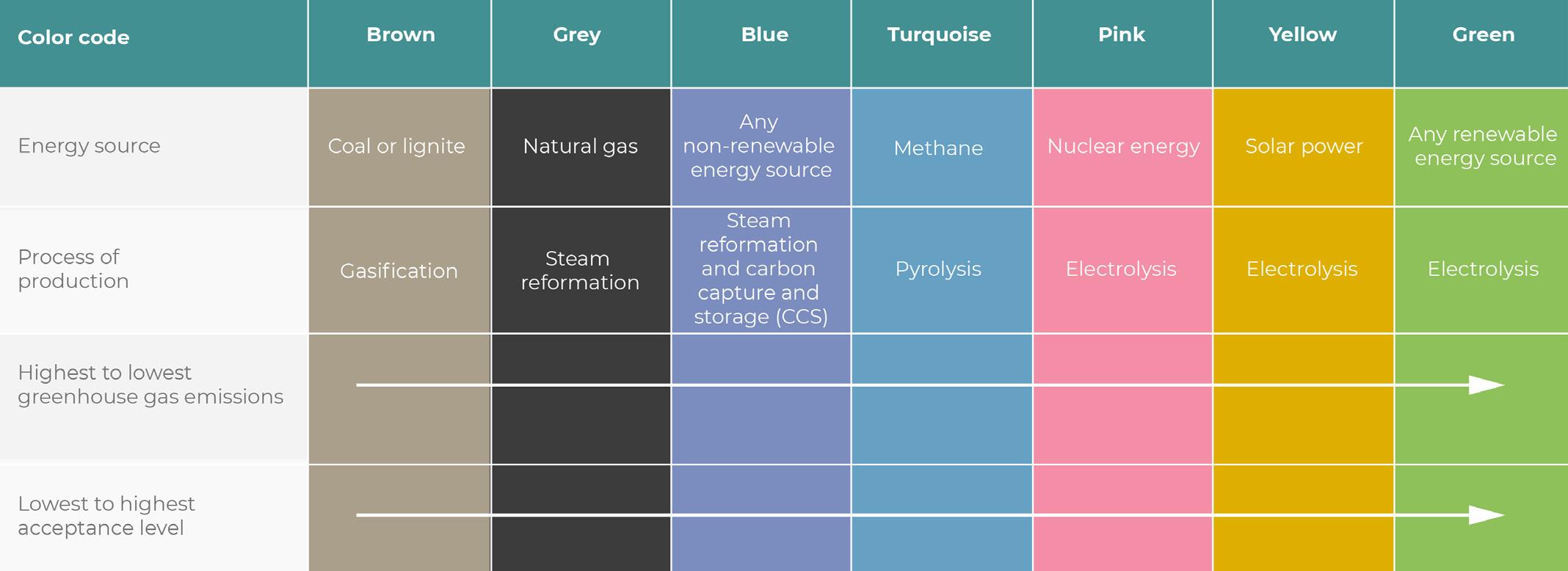

What are the types of hydrogen and why is it important?

Hydrogen has long been touted as a potential solution to our energy challenges, with its ability to produce electricity cleanly and efficiently without harmful emissions. However, not all hydrogen is created equal, and understanding the different types of hydrogen is crucial to unlocking its full potential.

One type of hydrogen that has been gaining attention in recent years is green hydrogen, which is produced using renewable energy sources like wind, solar, or hydropower. Unlike other types of hydrogen, green hydrogen production does not emit greenhouse gases (GHGs), making it a truly sustainable source of energy. While it is currently more expensive to produce than other types of hydrogen, the promise of this clean energy source has spurred efforts to reduce its cost and increase its adoption.

Another type of hydrogen is blue hydrogen, which is produced using fossil fuels like natural gas, coal, or oil. However, to mitigate the environmental impact of this production method, the carbon dioxide emissions are captured and stored underground, a process known as carbon capture and storage (CCS). Blue hydrogen offers a cleaner alternative to grey hydrogen, the most commonly produced type of hydrogen worldwide, which does not include CCS and therefore contributes to GHG emissions.

Understanding the different types of hydrogen and their environmental impact is crucial to developing a sustainable energy future. While grey hydrogen remains the most affordable option for now, the development and adoption of green and blue hydrogen technologies will be instrumental in reducing carbon emissions and mitigating climate change. As we move towards a more sustainable future, the classification of hydrogen will play a critical role in determining whether or not burning hydrogen as fuel can truly reduce CO2 emissions.

Hydrogen as an alternative to natural gases

Hydrogen is often seen as a promising alternative to natural gas, such as methane, due to its high energy density per kilogram, combined with the fact that it can be transported as a gas. At first glance, it appears to be an excellent alternative to the current CO2-emitting energy source of natural gas, assuming the hydrogen source is green or blue. However, the feasibility of hydrogen as a primary energy source is currently hindered by various factors.

Transporting hydrogen gas through existing natural gas transmission and distribution systems to homes for use as a primary energy source seems like an excellent solution in an energy utopia. Unfortunately, the size of the hydrogen molecule, explosive limits, and the energy density of the gas phase indicates that it is not feasible. The molecule is so small that it leaks more from existing infrastructure than natural gas does, and if it does leak in a home and is trapped, it is much more likely to explode than natural gas. It’s been a while but I’m sure folks can remember the Hindenburg Blimp; we want to avoid that at all costs in our homes. The energy density in the gas form is also much less than natural gas, requiring a lot more of it at higher pressure (or in liquid) to achieve the same results for heating homes or cooking. Blending in hydrogen gas is an option that has been proven to be safely transported in existing natural gas systems up to 10 - 15%, but this raises the question of whether it is reducing carbon emissions at the endpoint where the energy is created.

As a thought exercise, if adding 10 - 15% hydrogen into existing natural gas systems (assuming it’s green or blue hydrogen), imagine yourself as a hydrogen molecule and there are only 10 of you for every 100 natural gas molecules, you’re already at a disadvantage. On top of that, you’re 40% smaller than the natural gas molecules, so you tend to escape more easily through valves and other fittings. By the time you reach your destination to be burned on the stove, there may be only one of you left, and you’ll need to be backfilled by natural gas molecules to produce enough heat to boil water for dinner. As a result, the CO2 emissions reduction you thought you were getting by adding 10 - 15% hydrogen at the injection point isn’t what you’ll actually get by the time the water is boiled. With most of the hydrogen molecules escaping and the low energy density of hydrogen in gas form, it won’t effectively help mitigate climate change or contribute significantly to cooking dinner when utilised in our existing natural gas systems.

While green or blue hydrogen may have promise in other applications, unfortunately, it doesn’t seem to be a viable option as a reliable energy source for our homes through existing natural gas transmission and distribution systems. It’s unlikely to produce the desired results for reducing CO2 emissions when blended into natural gas, except perhaps to give a false sense of contribution to mitigating climate change to the people blending it at the source.

Natural gas blended with hydrogen is increasingly being seen as an important solution in the move toward a net-zero economy, says Rodrigo Quintero Bejarano, Expert Industry Manager, Endress+Hauser, Switzerland.

s the world looks to accelerate the transition to a low-carbon future, many renewable energy sources are being developed to replace their more carbonintense predecessors. One such rising star in the new energy arena is clean hydrogen; a powerful, versatile alternative capable of producing electricity, power and fuel for transportation. When burned, its only byproduct is water – a significant advantage over traditional greenhouse gas emitters.

With such great potential for the decarbonisation of our society, producing and storing hydrogen safely and effectively is one of the challenges Endress+Hauser is currently helping its partners to solve. As the lightest element on earth, measuring hydrogen accurately is no easy feat, but, using the Coriolis effect or thermal mass, our flowmeters can achieve this; and now we have the tried-and-tested applications to show for it.

Experience in low pressure hydrogen flow

Over the last decade, Endress+Hauser has shipped over 750 thermal mass meters calibrated on low, laminar hydrogen flows for gas and steam turbine generators. The flow totaliser is used to monitor the hydrogen cooling loop that is critical to keep the generators working efficiently. For low pressure applications, this measurement principle will be able to measure hydrogen

better than other higher performance measurement principles, like a Coriolis flowmeter which relies on a minimum density of the fluid to make a good and reliable measurement.

With very few global facilities positioned to test flowmeters in hydrogen, third-party calibration data was tricky to source. Given the growing interest in the production, transfer, and storage of hydrogen, higher pressure applications are around the corner as new infrastructure is being built to support decarbonisation. Now, with several hydrogen measurement success stories across different applications and industries, we are able to share exciting results for higher pressure applications with the Coriolis flowmeter.

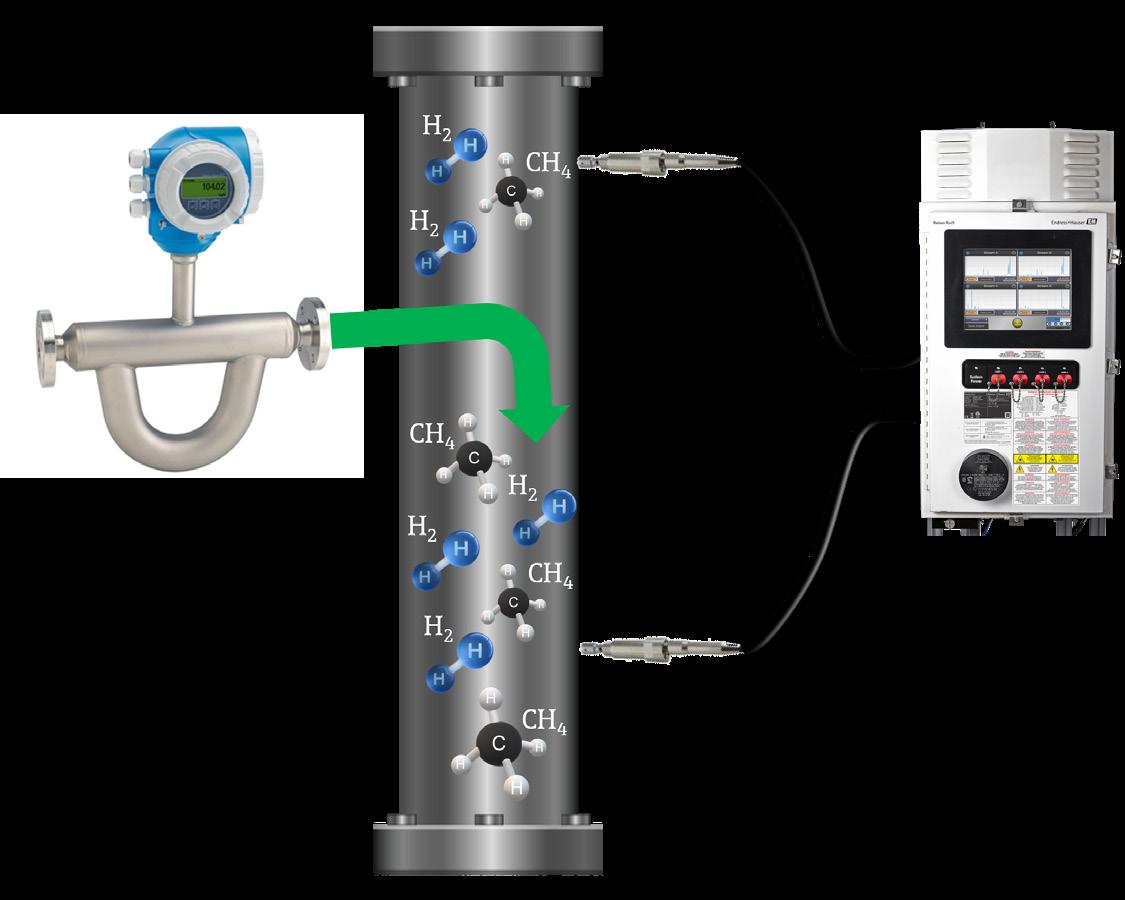

A measured approach: testing Promass Q onsite

At DNV’s H2 Loop in the Netherlands, we were able to test the Promass Q Coriolis flowmeter for a customer project within the scope of a qualification requirement. At the facility, we tested the sensor first using nitrogen and then later with hydrogen at 30 and 40 bar.

For hydrogen applications, these pressures are still considered low because the gas density is between just 2.3 and

3.1 kg/m3. So, the mass flowrates achieved by the facility were low compared to the maximum sensor capacity. This happens very often in hydrogen applications; sensors are operated at very low mass flowrates due to hydrogen’s exceedingly low density.

This was also the case during these tests, and yet, Promass Q performed excellently – even when all flow points fell within the trumpet part of the sensor’s error curve. All results were well within our specification. What’s more, we calibrated the sensor in our factory with water as standard, and the calibration factor did not need any adjustment during the tests. This shows that the Coriolis flowmeter water calibrations are also transferable to any gas type.

With the success of the application, we were able to prove the very high mass flow sensitivity of the Promass Q allows it to master hydrogen’s challenging low-density conditions. The tests gave the customer confidence that this flowmeter is highly suitable and a reliable component in their project.

Adding more to the mix: measuring H2 gas blends

Natural gas blended with hydrogen is also increasingly being seen as an important solution in the move toward a net-zero economy. But blending hydrogen with natural gas poses an increased risk of explosion, and presents challenges around fire management as well as environmental impact. We were able to partner with our customer, Long Ridge Energy (LRE), to provide the instrumentation to facilitate safe and effective H2 blend production.

Tackling complexity with collaboration

Before injecting hydrogen into its existing natural gas grid infrastructure, LRE had to carefully mitigate the risks. At the same time, the company needed to find ways to reduce waste and increase efficiency, while making its fuel source more environmentally friendly. LRE stakeholders teamed up with Endress+Hauser to benefit from the breadth and depth of industry knowledge. Expert advice and reliable measuring instruments are essential to safely control the sensitive hydrogen-natural gas blend. By obtaining its hydrogen for injection from a local chemical manufacturer’s byproduct and relying on the process automation expertise of Endress+Hauser, LRE was able to accomplish its primary objectives.

The company has since completed four successful tests of injecting and controlling 5% blends of hydrogen into natural gas.

Equipped with industry-leading instruments

The Promass Q can measure natural gas or pure hydrogen, and now, a mixture

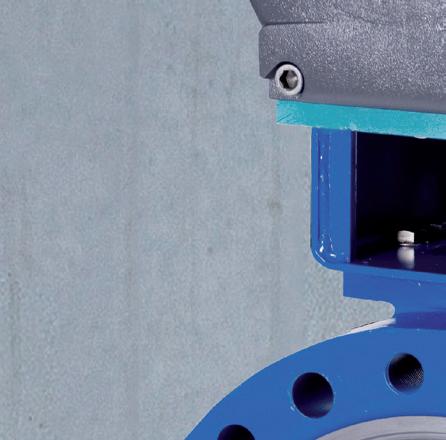

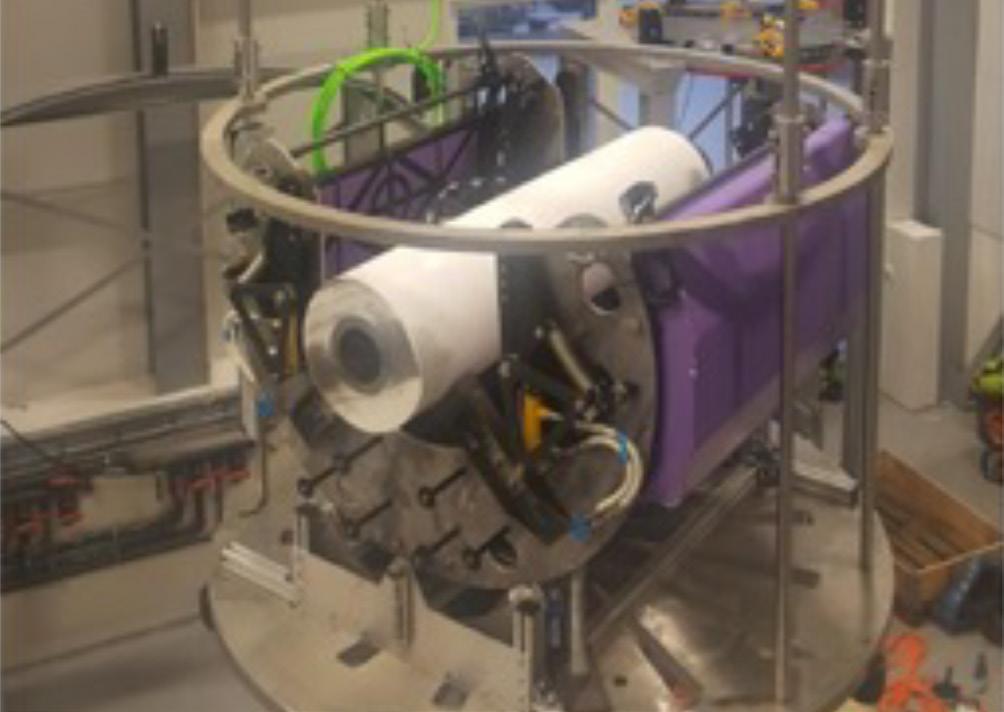

Figure 1. Promass Q flowmeter at Long Ridge Energy (LRE).

Figure 1. Promass Q flowmeter at Long Ridge Energy (LRE).

SAFE. RELIABLE. CERTAIN.

D2000 Quick-actuating closures with the

ProSeries™ advantage:

Opened or closed in a single motion while the operator stands safely to the side, the D2000 is the quick-actuating closure the industry depends on. Now, with the ProSeries™ advantage, the same features you trust are available for a broader range of applications, with shorter lead time, greater standard code compliance and, as always, the consistent quality you expect from T.D. Williamson.

THE MOST TRUSTED CLOSURE ON THE MARKET – MADE EVEN BETTER

tdwilliamson com

For the life of your pipeline. Shop online for pigs, closures and accessories. Scan the code and register to get started:

of both. Implemented with the latest software update, the commissioning for customers who will be supplied with a mixture for their combustion processes has been simplified.

In this instance, LRE needed 316/316L wetted parts as well as best-in-class repeatability for an accurate injection rate of the hydrogen.

In mixtures like H2 and natural gas, Raman spectroscopy can also be used for effective and accurate measurement. Simple molecular gases (e.g. CO, CO2, H2, N2 and NH3) have simple Raman spectra, often a single peak. Raman scatter from each type of molecule present in a different wavelength (colour)

Product notes

H2 material compatibility is critical according to ASME B31.12.

316L and 904L

H2 is 100% compatible with any sensor made of 316L and 904L, e.g. Promass F, Promass Q, Promass E, Promass A, Cubemass, etc.

C22 and Super Duplex

H2 reduces the ductility of nickel-based alloys like C22 steels enough to cause concerns about its application in this service. Promass sensors made of C22 should be handled with caution, e.g. high pressure applications require explicit request and approval by customers.

Endress+Hauser’s online application wizard includes these recommendations and warnings, especially for ASME B31.12 pipeline applications.

of light emitted from the sample. The Endress+Hauser Raman Rxn5 process analyser measures all these gases simultaneously, separating them ‘by colour’. Simple spectra allow for the use of simple ‘method-based’ analysis of mixtures.

Raman spectroscopy: advanced optical analysis technology

In the last 50 years, a variety of gas analyser technologies have been developed around the ability of lasers to produce highly specific wavelengths of light across a wide spectrum. Various gases affect this radiation or are affected by the radiation, in characteristic and measurable ways, making it possible to detect and quantify gases of interest. Raman spectroscopy is one such technique. It utilises laser radiation to produce light in the visible or near-infrared wavelength regions to excite the vibrational modes of different gases in the sample. The resulting scattered radiation changes colour based on the type of chemicals in the gas.

A Raman analyser measures these scattered colours to determine the components in the gas, and the intensity of each colour to determine component concentrations. What started out as a single laser-generated colour now becomes its own rainbow since different gases in the sample produce specific wavelength spikes indicating their presence, and the relative intensity indicates relative concentration. The analyser looks for these specific spikes to create a chemical profile of the gas. When this concept is applied to an industrialised analyser, it uses a probe inserted into the gas stream that allows the gas to flow through a passage. Perpendicular to the gas passage is a miniature optical system. The green laser light shines through a lens and across the passage, where it strikes a reflector and passes back through the passage a second time. It now enters a detector where the resulting individual wavelengths are identified and quantified by the analyser. This approach has several critical advantages over other technologies such as mass spectrometers or gas chromatographs:

) The probe is located remotely from the analyser, so no sample is transported to the analyser therefore enhancing operator safety.

) The probe can handle pressures up to 70 bar and temperatures to 148˚C, with higher temperature solutions available.

) The output from the probe changes in real-time, and the analyser can take a snapshot in 15 - 30 sec.

) Both laser and detector are housed within the analyser and the light is carried to and from the probe via fibre optic cables over distances of 50 - 150 m with response times closer to 60 sec. The probe is designed for installation in Class 1, Division 1, or Zone 0 environments.

) A single analyser can support up to four probes, reading each simultaneously, so readings can be taken at multiple

locations in the process stream for feedforward and feedback control loops.

) In addition to hydrogen content, a Raman analyser can also handle many of the commonly measured natural gas components.

Joined forces for safe blending pipelines

At present, the blending limit for hydrogen into pipeline gas is capped at 20%. However, since so much of the energy industry is currently in transition, there is little reason to believe this is a permanent limit.

But for the time being, let’s consider the case of a facility with a sizeable photovoltaic array which often finds itself with a surplus of power for much of the day. The facility installs a modest electrolyser with the intent of feeding the hydrogen it produces into the local gas pipeline. If the facility can measure the volume of pipeline gas moving through the local system, it can program its blending unit to feed in hydrogen such that it will not exceed 20% by volume. By using an Endress+Hauser

Proline Promass Coriolis flowmeter, it is a simple matter to measure, and ultimately control, the flow of hydrogen into the pipeline appropriately.

This works conceptually but with the assumption that no other gas blender is already adding hydrogen somewhere upstream. If the pipeline is already carrying 10% hydrogen, our hypothetical facility cannot add 20%. Additionally, it cannot

tell if the present content is changing as different blenders go online and offline.

Similarly, a gas turbine must operate differently for low heating value (LHV) conditions during start-up, so knowing the composition of the incoming fuel from the gas pipeline is critical, especially if there is additional H2 injection downstream within the fuel system of the power plant. To address these and other issues, a Raman analyser can be used to create a real-time signal indicating hydrogen content, which can then be used for regulating blending rates, monitoring Btu/Wobbe Index, or adjusting air-to-fuel mixture for combustion optimisation. When used in a closed-loop control strategy, the system can respond automatically to changing conditions.

With up to four-channel availability and fibre optic lengths up to 150 m, a Raman analyser can also monitor hydrogen composition over a long length of pipeline after being injected. This data can be used to monitor the mixing quality or be used to corroborate predictive models of how H2 will behave in the gas grid at scale. This is especially useful for gas utilities looking to meet renewable gas portfolio standards in their distribution networks, without compromising safety or quality for their customers and other stakeholders.

When combining Raman spectroscopy with a comprehensive control strategy, companies can maximise the injection of hydrogen into fuel systems and pipelines without compromising safety or efficiency, ultimately reducing overall carbon emissions.

The Best Liquid Epoxy Solutions For Pipelines

Combining industry-leading abrasion resistance with unmatched flexibility, our range of epoxy solutions are built tough, easy to apply and designed to last. Whether its HDD or field joint coatings, we’ve got the solution.

The Toughest HDD Coating on the Market HBE - The Best Performing Field Joint CoatingJohn Anderton, Senior Simulation Consultant, Atmos International, UK, explores overcoming the sustainability challenges of hydrogen fuel transportation with leak detection.

In an effort to accelerate decarbonisation and map out a route to net-zero emissions, hydrogen became a prominent conversation topic at the recent COP27 summit. With a focus on the introduction of a hydrogen economy to the developing world, hydrogen (and green hydrogen production in particular) has been suggested as the solution to stunted economic growth and trade relations. 1

Financial costs vs environmental savings

Just as there’s no shortage of hydrogen itself (it accounts for at least 70% of all atoms in the universe), there’s been

no shortage of literature on hydrogen following the COP27 summit. Whether it be in discussions about hydrogen’s role in the creation of nuclear fusion as an energy source, engineers in Australia identifying a process that uses soundwaves to boost green hydrogen production, or Rolls-Royce testing green hydrogen as jet fuel for the aviation industry, hydrogen can already be proven as a netzero substitute for conventional fuel. But do the financial challenges of hydrogen fuel production and transportation offset its environmental savings? 2,3,4

As mentioned at COP27, hydrogen is a sector that isn’t fully established, requires financing and has a complex

value chain, which raises questions about whether the energy industry is ready to start producing and transporting hydrogen fuel. 1 Additionally, the process for producing certain types of hydrogen, such as brown or grey hydrogen (Figure 1) can ultimately overshadow the net-zero emissions promised by the end product. 5 Pair this with the fact that there is debate surrounding the feasibility of hydrogen to heat UK homes, for example, and it raises questions into how sustainable hydrogen is as a universal carbon neutral fuel. 6

However, there are a number of uses for which hydrogen has already been identified as a suitable fit and, when it comes to new ways of producing energy, hydrogen remains one of the key areas gaining momentum. Part of the European Commission’s REpowerEU plan, for example, has an expectation that 20.6 million t/yr of hydrogen will be imported along pan-European pipeline corridors by 2030. 7

Taking this into consideration, I will work with an understanding that a transition to hydrogen fuel is inevitable, and look at how the sustainability challenges of hydrogen can be optimised through effective leak detection.

Sustainability challenges

While hydrogen energy has distinct advantages as a netzero solution, there are still risks involved in hydrogen fuel transportation.

Hydrogen molecules are smaller than natural gas molecules, for example, so hydrogen fuel can not only leak more easily but potentially leak more product. 8 It’s worth noting that the intended goal of hydrogen fuel can be partially counteracted in the event of leaked product too.

A recent study by the UK government’s Department of Business, Energy and Industrial Strategy (BEIS) details the implications on global warming if hydrogen fuel leakage occurs. Hydrogen not only becomes an indirect greenhouse gas (GHG) when it reacts with other GHGs, but it affects the composition of the atmosphere by way of climate warming and impacting air quality. A key finding in

this BEIS study suggests hydrogen is twice as powerful a GHG as was initially thought. 9

For this reason, those handling hydrogen fuel should consider the previously mentioned sustainability risks when considering how to transport the product, and look to the following as prerequisites to overcome those challenges.

What’s the safest way to transport hydrogen?

When it comes to transporting any gas or liquid, there exists a whole host of options for getting the product from A to B. Barges, tankers, and tugboats can transport fuel across a range of water sources, while railroad tankers utilise the existing railroad infrastructure to deliver product. Ultimately, pipelines consistently remain the safest means of transporting any gas or liquid due to their infrastructure that often uses the shortest and most economic route.

Pipeline infrastructure’s role

As hydrogen gas blends are introduced to gas pipelines, it’s important to consider what, if any, repurposing needs might be required to an existing network’s infrastructure. As previously mentioned, hydrogen has a significantly different molecular makeup to a natural gas and because hydrogen’s atoms are so small, they can be absorbed by the metal interior of the pipeline transporting it, causing cracks to emerge in the pipeline through a process called hydrogen embrittlement. For these reasons and many more, it’s vital that pipeline operators receive training to understand what impacts the shift to hydrogen will have on the pipeline.

Hydrogen has a much lower energy density than natural gas, so repurposing pipelines previously used for natural gas to transport hydrogen is not straight-forward as pipeline capacity will be impacted. Using simulation tools for both design and operation can mitigate the risks associated with the transition from natural gas to hydrogen.

Simulation software like Atmos SIM enables operators to model all aspects of the pipeline’s infrastructure, providing

TRIDENT MULTI-HIT SMART GAUGE

Reduces vessel costs and saves time during pipelay and operations

Gauging multi-diameter pipelines

• Hinged multi-hit gauge plate system

• On-board logging and multiple gauging records

• Allows mainline gauging where reduced-bore PLET / PLEM

• Thru-wall comms and download

• Use as part of pre-ILI cleaning programme for scale and wax check

• Part of the Propipe Trident SMART range

927

FOREFRONT INNOVATION SERIES

A new, virtual, technical series from AMPP!

Forefront Innovation Series is a new and innovative web-based series from AMPP. Filled with the latest insights and technical developments, Forefront brings together subject matter experts from a wide variety of industries and professional backgrounds to discuss hot-button materials protection and performance related technical topics. Utilizing best practices, case studies, and lessons learned, these engaging sessions will shed light on challenges faced by different industries.

Top 5 reasons to attend:

• Gain insights to the New & Emerging Technologies

• Participate in Open Discussions about Future Innovations and Theories

• Engage with Subject Matter Experts to get your questions answered

• Network with peers & discuss hot-button materials protection and performance related technical topics

• Earn up to 6 Professional Development Hours per series

View our Calendar for Upcoming Events!

Visit www.ampp.org/events/forefront-innovation-series

them with a better understanding of how the pipeline network will cope with the introduction of hydrogen fuel blends.

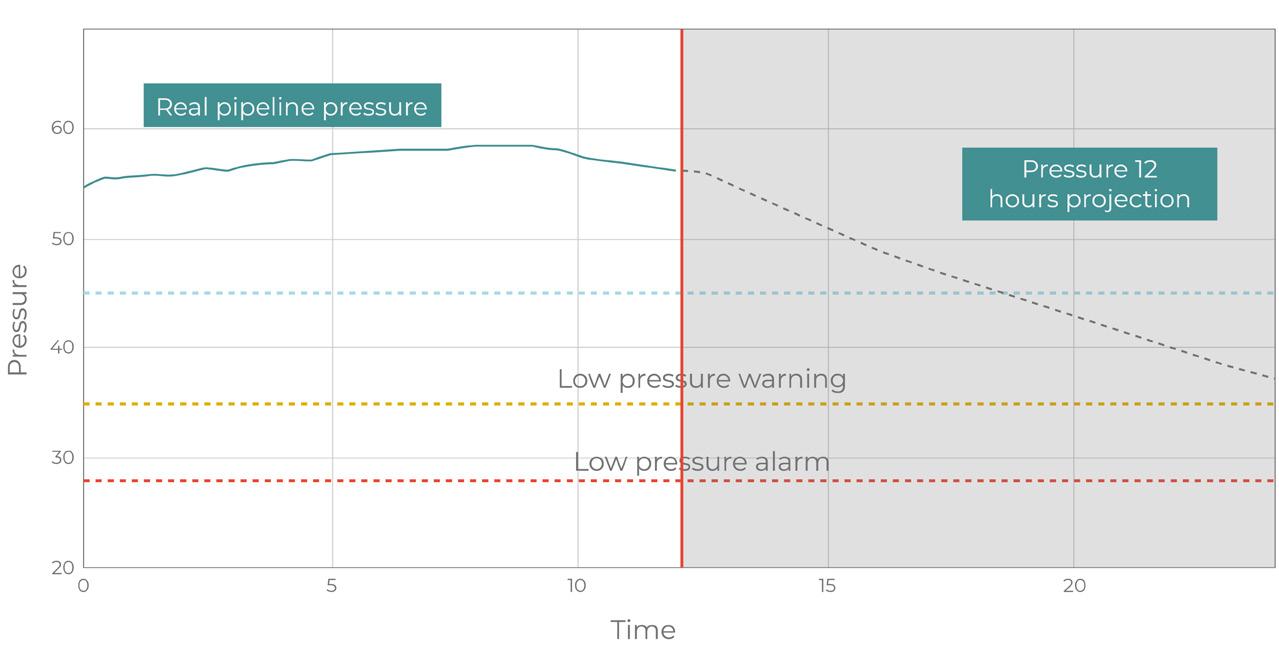

If we look to Figure 3 as an example, capacity for this pipeline network is restricted by supply locations, network topology, and demand pressure requirements. Capacity will also be affected by the transition from natural gas to

hydrogen, but simulation software can accurately predict future capacity for hydrogen and hydrogen blends.

The same simulation model can be used as an online decision support tool to accurately predict the current or, by using look-ahead models, the future state of the network.

Figure 4 illustrates what would happen to the demand pressure on a pipeline if there is a supply interruption: the pressure continues to fall but hasn’t triggered any pressure warnings or alarms after 12 hours. If actions are taken before the alarm level is reached, the pipeline can continue to deliver gas to the customer without pressure violation.

Leak detection

A multitude of factors can cause a leak on a pipeline. There’s the possibility of corrosion (which has already been mentioned in the context of hydrogen embrittlement), excavation and outside force, operational causes, natural causes, and more.

Many leaks are identified by people on a liquid pipeline where the spilled products can be seen by the naked eye. In the case of hydrogen gas, it is odourless, colourless and flammable which, if left undetected during a leak event, can have catastrophic effects on the surrounding area and the atmosphere itself. For this reason, a real-time leak detection system made of advanced hardware and software is vital for safe hydrogen fuel transportation.

Leak detection software such as Atmos Wave can use negative pressure waves to detect leaks accurately and with a minimal false alarm rate during steady-state, transient and shut-in conditions. Additionally, simulation software like Atmos SIM can detect leaks effectively by incorporating the statistical algorithms used by Atmos Pipe, the world’s first statistical volume balance system.

References

1. hydrogencouncil.com/en/hydrogen-high-on-the-cop27agenda-hydrogen-council-reflects-on-sharm-el-sheikhconference

2. edition.cnn.com/2022/12/12/us/common-questions-nuclearfusion-climate/index.html

3. interestingengineering.com/innovation/sound-waves-boostgreen-hydrogen-production

4. arstechnica.com/cars/2022/11/rolls-royce-tests-hydrogenfueled-aircraft-engine-in-aviation-world-first

5. www.nature.com/articles/d41586-022-03693-6

6. www.thetimes.co.uk/article/hydrogen-too-costly-andinefficient-to-heat-homes-vlcf2wrkn

7. ehb.eu/files/downloads/ehb-report-220428-17h00interactive-1.pdf

8. www.atmosi.com/en/resources/technical-papers/differentways-to-reduce-greenhouse-gas-emission-in-pipelines

9. www.gov.uk/government/publications/atmosphericimplications-of-increased-hydrogen-use

Figure 4. A 12 hr forecast from a what-if look-ahead of a decrease in pressure in the event of a supply interruption. Figure 3. A theoretical gas transmission network.The recent atmospheric river events in California that have been in the news across the world brought widespread flooding, scour and landslides.1 In 2022, exceptionally heavy monsoon rain and glacier melt caused devastating floods and landslides in Pakistan.2 According to the US Environmental Protection Agency, it is likely that climate change is resulting in an increase in extreme rain events.3 The UK Meterological Office points out that warmer air can hold more water; so, as the climate warms, rainfall is increasing on average across the world.4

These increases in extreme rainfall, and the associated scour, landslides and floods, create more and more challenges for the pipeline industry. Geohazards are however, not a new phenomenon. As an industry, we have built and safely managed pipelines in geotechnically

difficult terrain such as the Andes, Rocky Mountains, or Caucuses, in areas of subsidence caused by historic coal mining and in geological fault zones for decades. Good practice in design, construction and integrity management can prevent failures. An example is the recent massive strike-slip earthquake in Turkey and Syria, which was devastating for the population with many buildings destroyed and lives lost. While there were pipeline failures where design and integrity management actively consider geohazard threats, TANAP and BTC survived with no loss of containment.

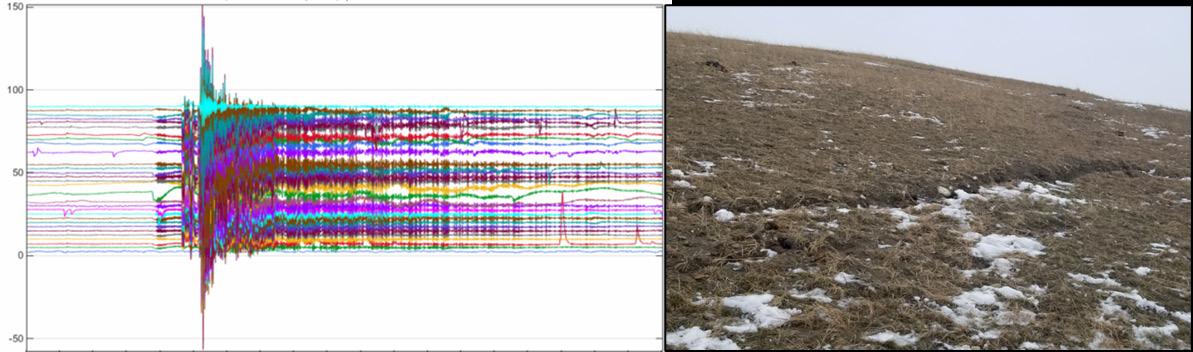

It is now widely recognised in the pipeline industry that good practice in the integrity management of pipelines subject to geohazard threats includes a combination of remote sensing (e.g. LiDAR), ground survey, internal geometry and mapping inspection, and site assessment.5,6

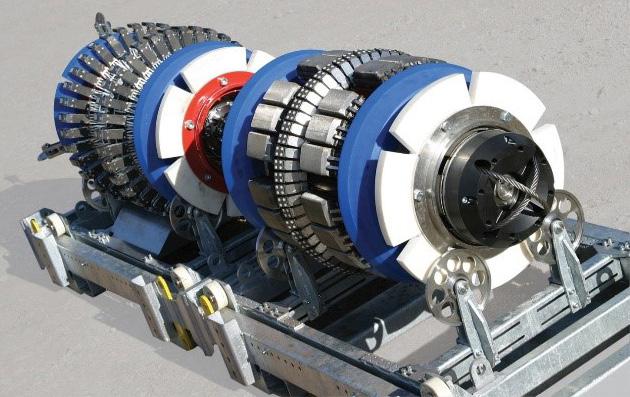

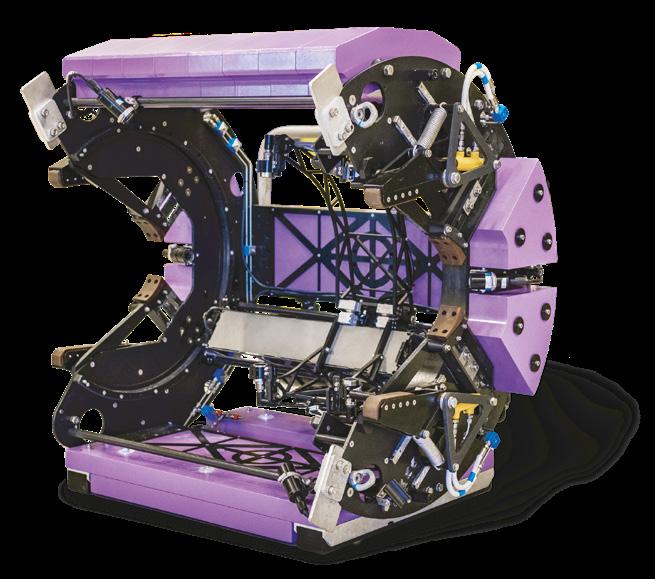

In recent years the inline inspection (ILI) tool equipped with an inertial measurement unit (IMU) has proven itself to be indispensable for the detection and monitoring of geohazardinduced bending strain and pipeline movement. Typically, IMUs are integrated into ILI systems that include magnetic flux leakage sensors for detecting and sizing metal loss, and calipers for geometry measurement. The combination of these ILI technologies provides relevant information for geohazard threat evaluations; however, complex tools and expert resources are required for deployment. Utilising a dedicated

IMU platform offers a simple efficient option for monitoring geohazard threats at high frequency and short notice.

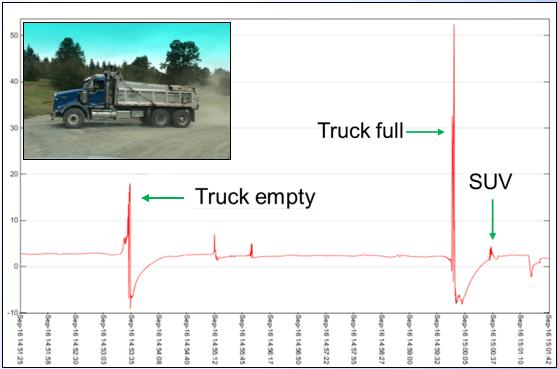

To make pipeline movement monitoring easier, ROSEN has developed the RoGeo PD (PipeDrift) system. This system integrates an IMU with a robust utility tool designed for excellent run stability and tolerance to high speeds, allowing an operator to deploy an IMU inspection with much less effort than would be required for a typical MFL/Geometry combination set-up, or even a stand-alone geometry inspection. The PipeDrift system was run multiple times in 2021 and 2022, proving the reliability and benefits of the approach, and has since been adopted as the primary platform for routine geohazards monitoring of a high-visibility natural gas pipeline system.

How it works

A baseline inspection with a minimum of high-resolution geometry and IMU technologies, together with accurate differential GPS surveyed above ground marker points is required for reference. This gives the most reliable picture possible of the position and shape of the pipeline. Subsequently, the dedicated IMU system can be deployed and, using the start and end points, along with characteristic patterns produced by inertial responses of pipeline features, the two datasets (baseline and IMU-only) can be distance aligned. This is needed as the IMU-only tool does not have odometer wheels and above ground markers will not be in place.

With the two datasets aligned, the rate of change of pitch and azimuth can be reviewed. Where there has been no movement between the two inspections, these rates of change will be consistent. There will of course be some variations due to noise in the data, typically caused by vibration of the tools as they travel through the pipeline. If there has been any movement, the rate of change of pitch and azimuth will not be the same between the baseline inspection and the following IMU-only run. In these cases, it is possible to calculate the new trajectory where it deviates from the original, typically considering a limited length of pipe, possibly 150 m (500 ft).

Case study

ROSEN has been working with multiple operators around the world helping them to identify active or incipient geohazard threats, and develop appropriate monitoring and mitigation plans. In one particular case, numerous combined geometry and IMU inspections were completed and a few locations of active pipeline movement were being monitored.7 The maximum strain levels in the sections being monitored remained low, and movement was slow. Sections with higher strains and faster movement had been mitigated by either stress relief and slope stabilisation, or re-routing away from the areas of active movement. The repeat inspection frequency for monitoring the pipeline was approximately every 2 or 3 months. PipeDrift was implemented as a trial with the aim of increasing the efficiency

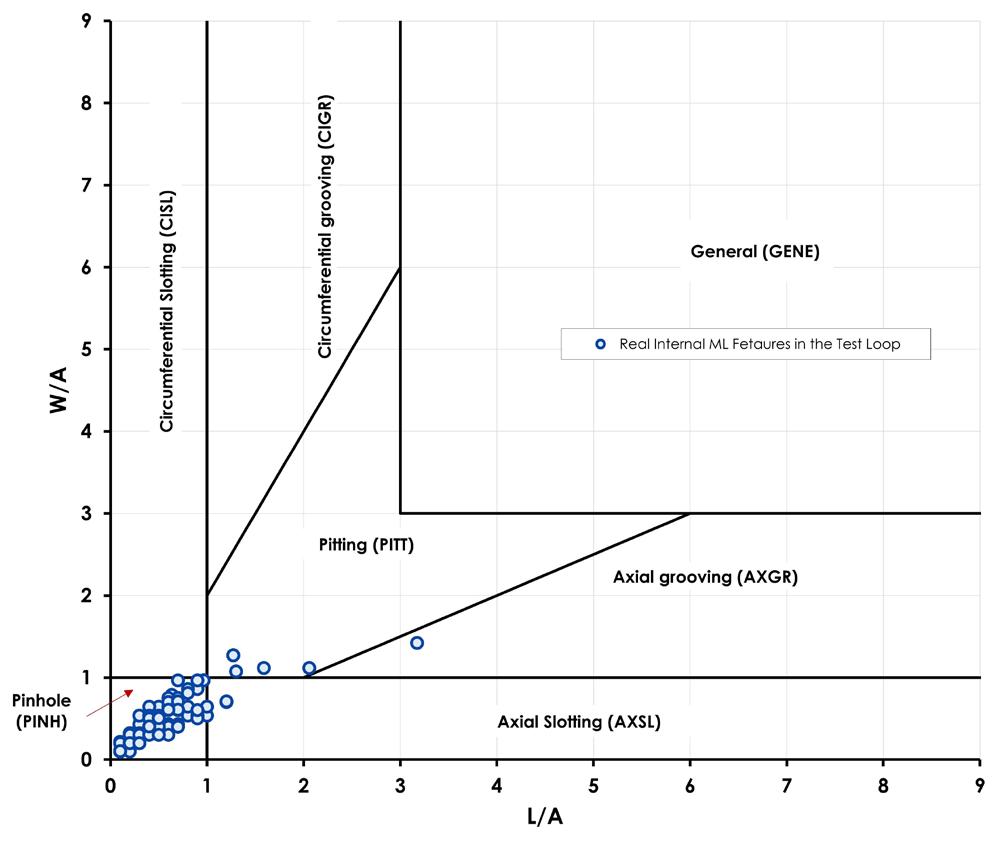

Figure 2. Landslides may affect pipeline integrity, making monitoring or stresses essential. Figure 1. XT tool.of monitoring and allowing an increased monitoring frequency if required. A geometry and IMU combination service (RoGeo XT) was performed first, immediately followed by an inspection with the dedicated PipeDrift IMU system. The post-processed datasets were analysed and compared to assess the accuracy of the PipeDrift monitoring system.

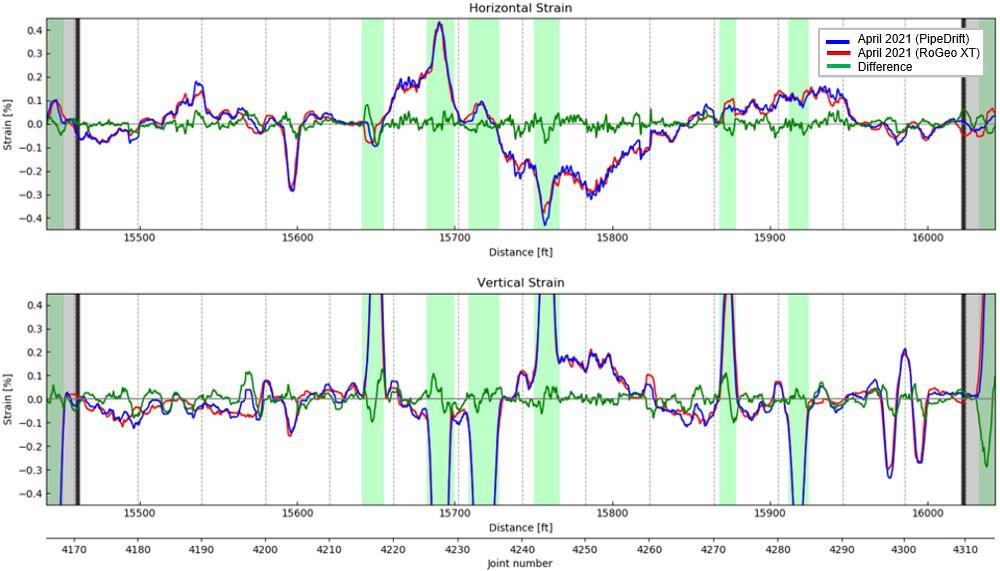

High quality IMU, when deployed in a geometry tool or MFL/ geometry combination, has been shown to deliver very consistent results with high repeatability.8 Some reduction in accuracy was considered likely when using a less sophisticated tool, without distance measurement. However, the results were very reassuring, showing a close correlation with minimal differences in horizontal and vertical bending strain, as illustrated in Figure 3.

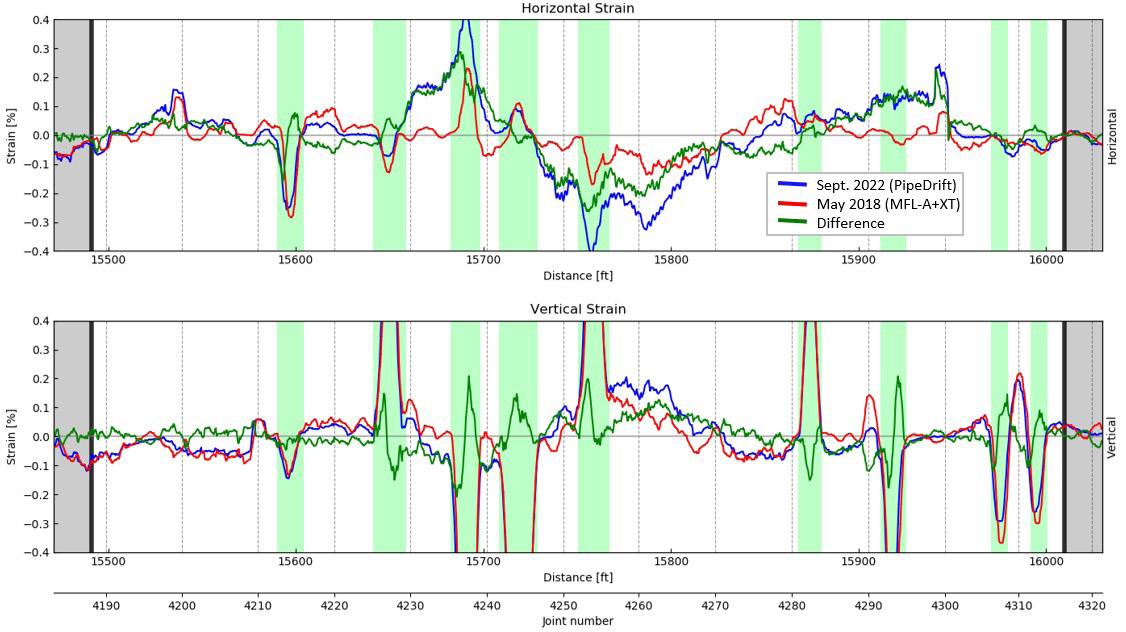

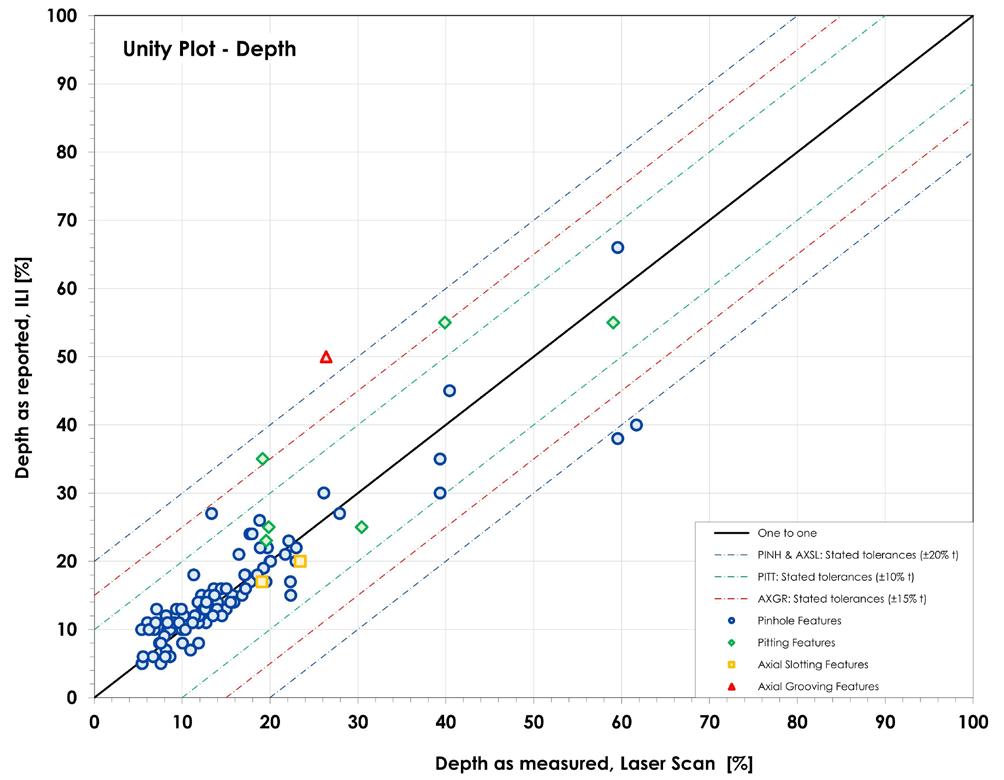

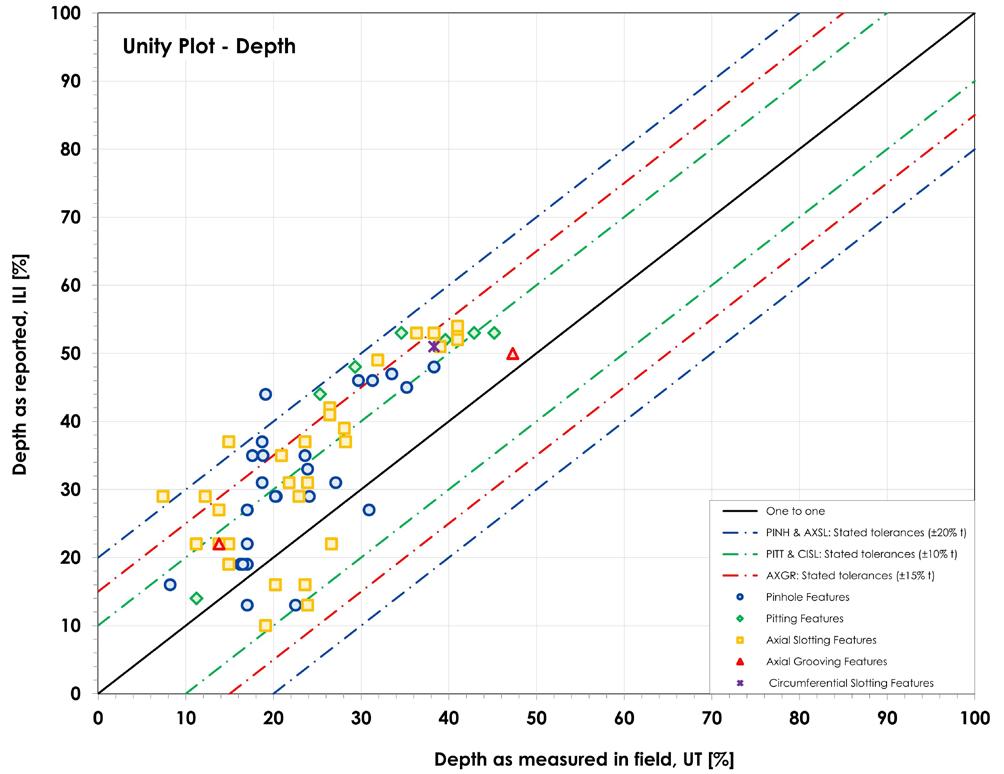

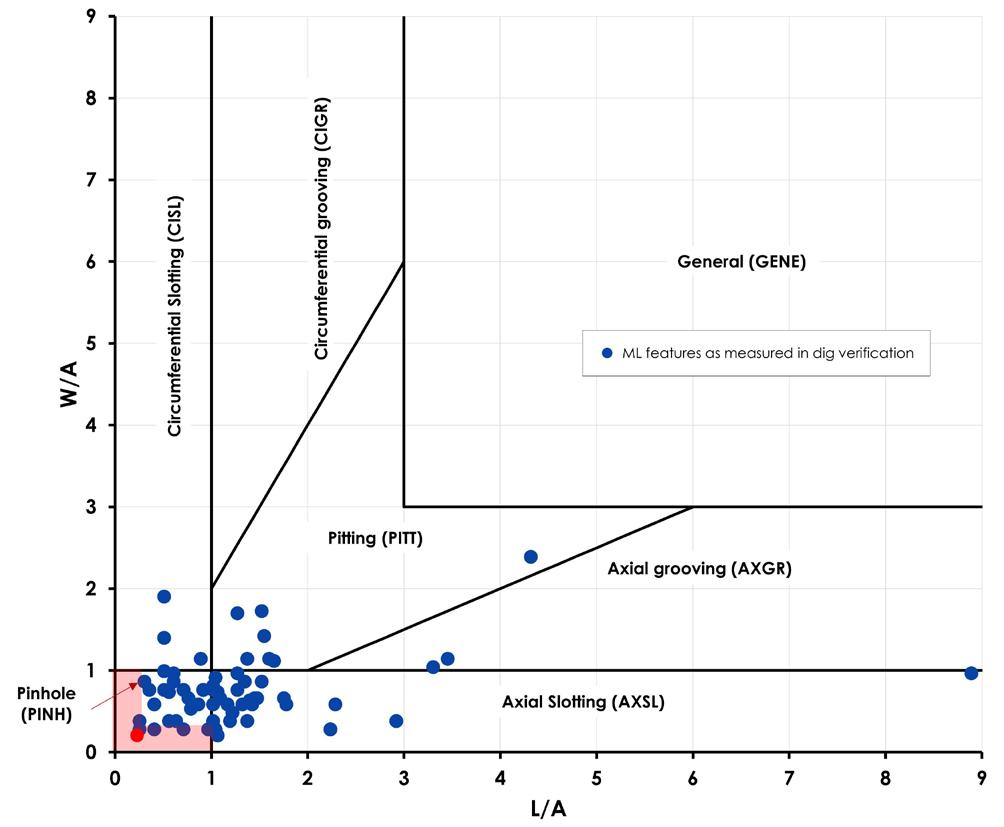

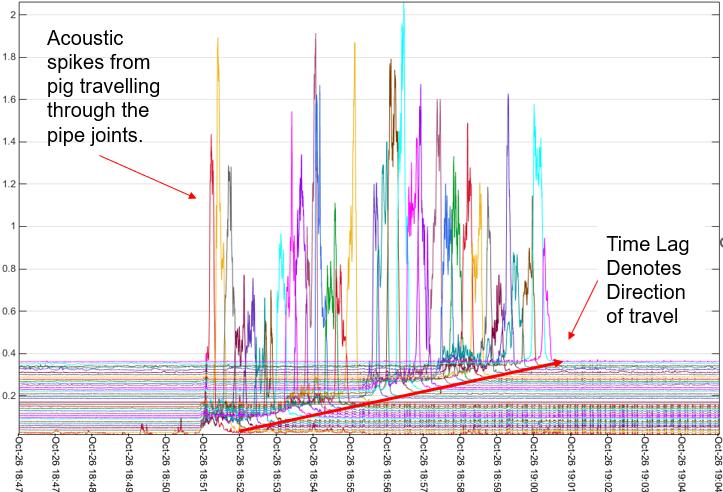

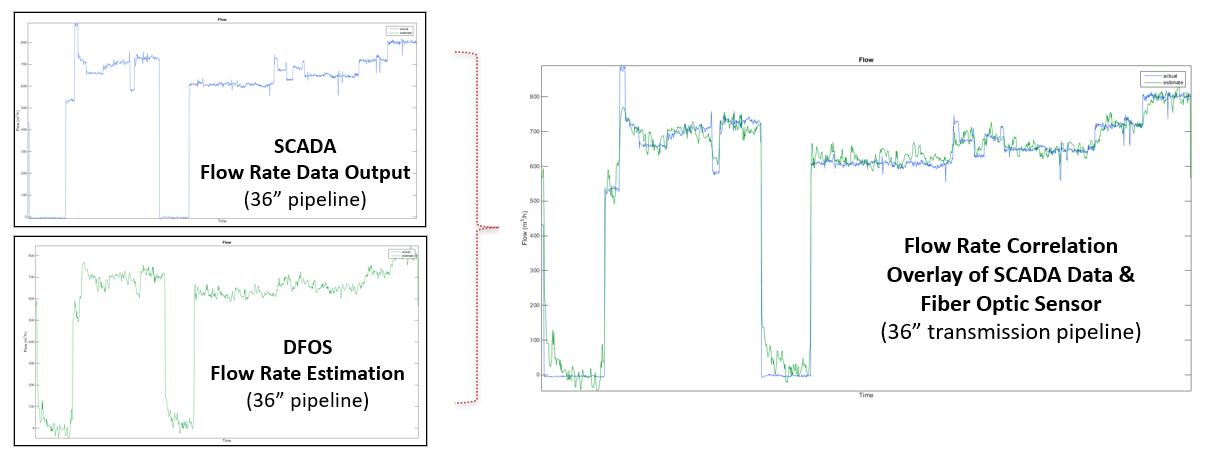

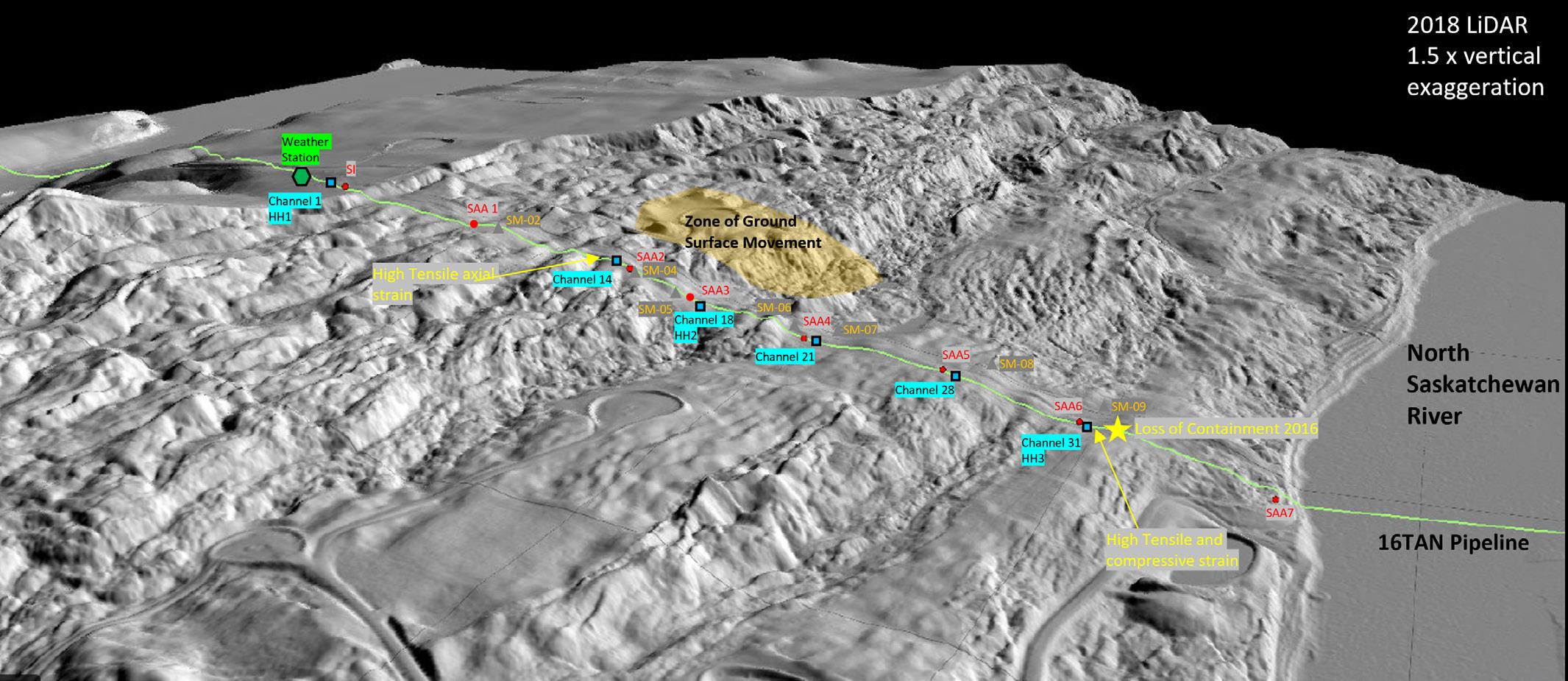

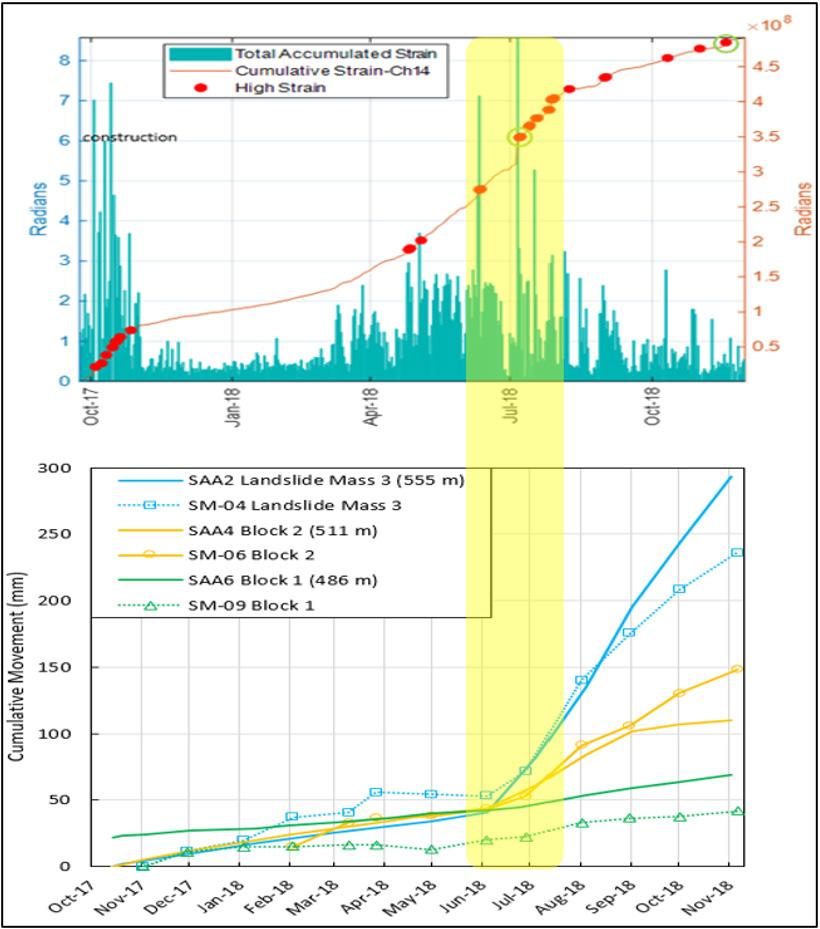

Since confirmation of the system’s feasibility, several additional PipeDrift monitoring inspections have taken place to observe this area of historical movement. Each inspection has consistently detected the displacement occurring between the first IMUequipped inspection of the pipeline and the most recent ILI. This is clear to see in Figure 4, which reflects a total maximum strain change of 0.26% (corresponding to 5.2 ft of total movement) between a combined MFL-A/XT inspection and a PipeDrift inspection.