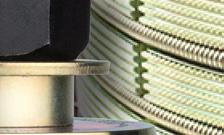

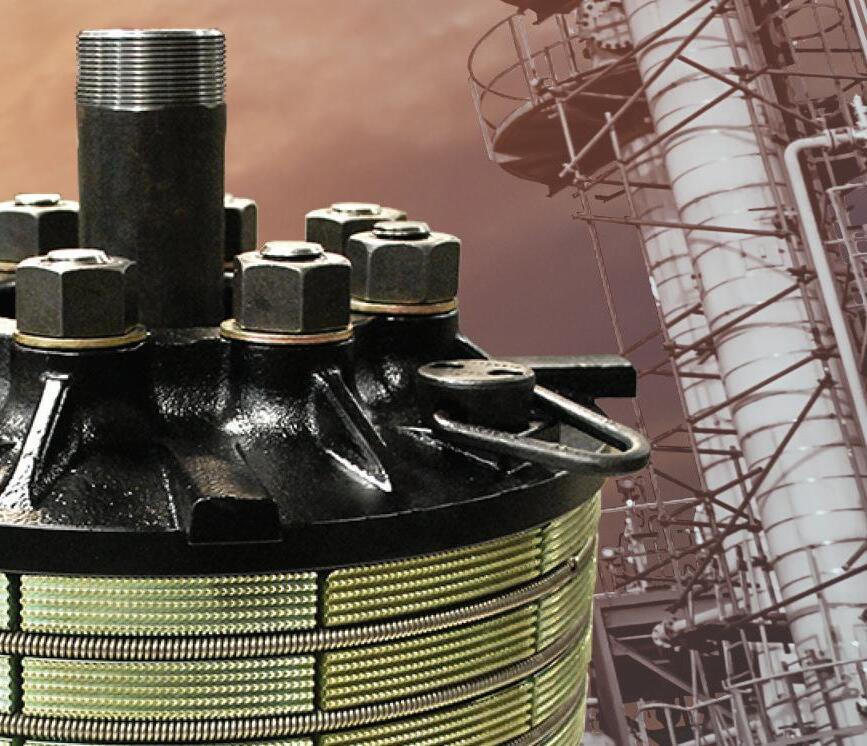

Three kilometres of pipe.

Two outstanding Denso™ systems.

One corrosion prevention solution.

SCAN TO VIEW OUR LATEST DENSO BORE-WRAP™ AND DENSO™ BUTYL TAPE SYSTEM (S43-R23) CASE STUDY. A MEMBER OF WINN & COALES INTERNATIONAL

® Volume 23 Number 10 - October 2023

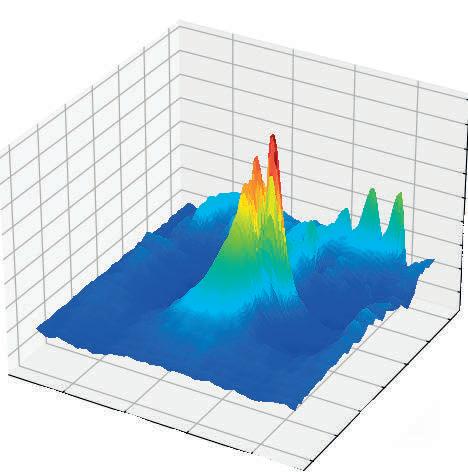

Artificial intelligence solutions are driving life extension, the energy transition, and zero-incidents in the pipeline industry. Combining decades of in-line inspection results, metadata for tens of thousands of pipelines worldwide, and a dedicated team of experts, ROSEN’s Integrity Analytics initiative is the future. As partners we deliver unique insights that enable reliable decision-making for the safety, lifetime, and performance of your assets.

Integrity Analytics

www.rosen-group.com

Editor's comment 05. Pipeline news

With news on the Chevron subsea pipeline row in Cyprus, new proposed rules from PHMSA, AI for the energy transition, and more.

KEYNOTE ARTICLES: AFRICA AND THE MIDDLE EAST

09. Much potential, many pitfalls

Contributing Editor Gordon Cope offers a comprehensive guide to the pipeline sector in Africa and the Middle East.

14. Advancing pipeline infrastructure in Africa

MS Prakash, Vice President and General Manager, Africa - Emerson Automation Solutions, outlines some key challenges faced by pipeline operators in Africa.

18. Africa's time to shine

Arun Behl, Head of Business Development – Middle East & Africa, and John Downer, Senior Project Manager, Penspen, UK, describe how energy producers in Africa can benefit from Europe’s shift in energy policy.

TURBOMACHINERY

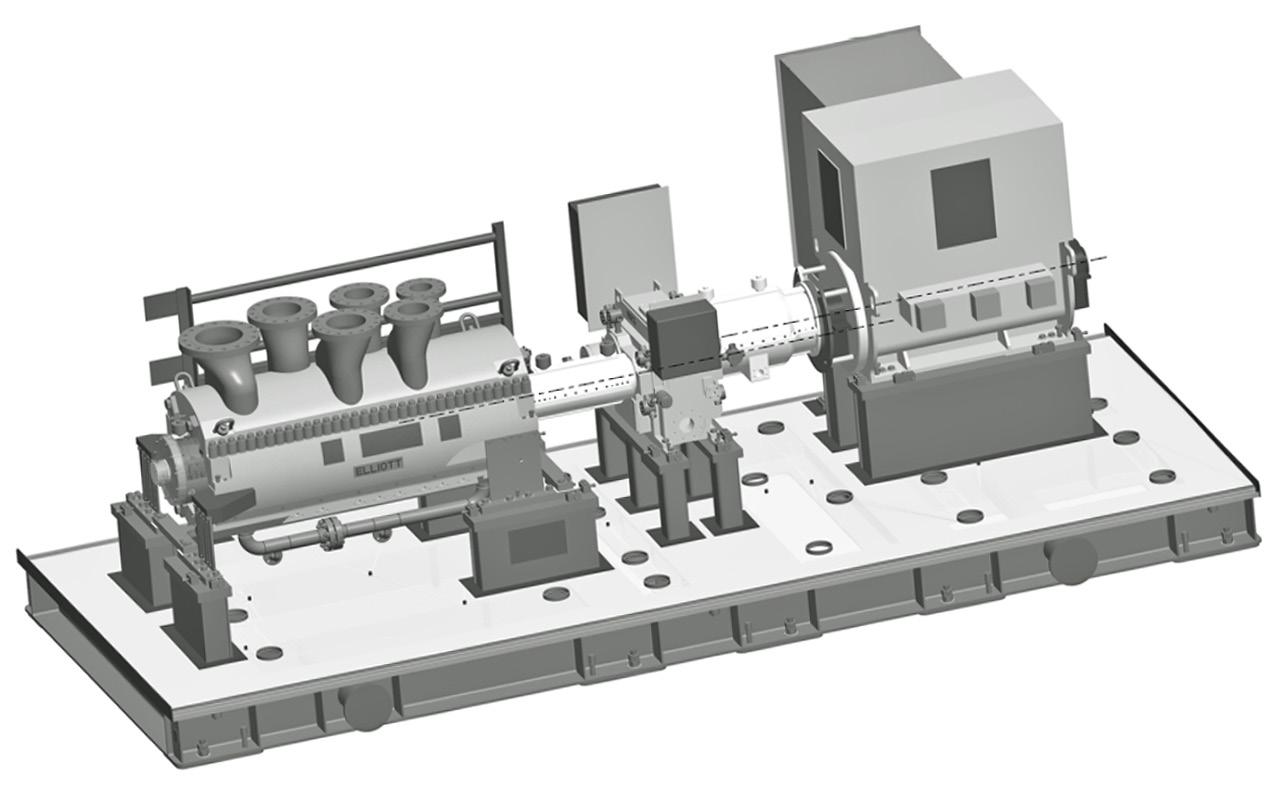

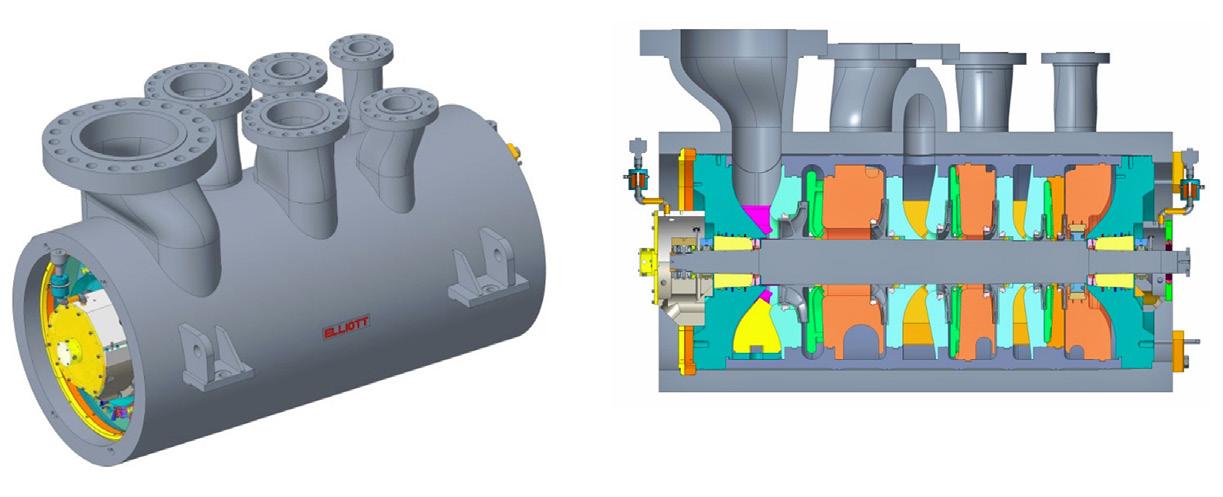

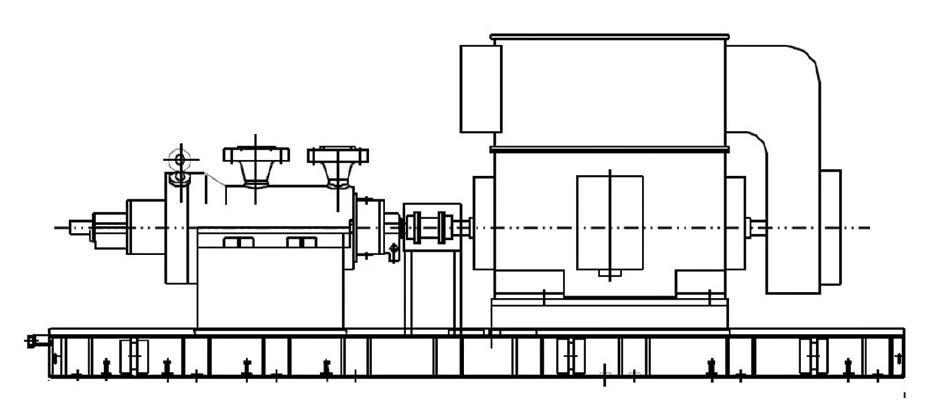

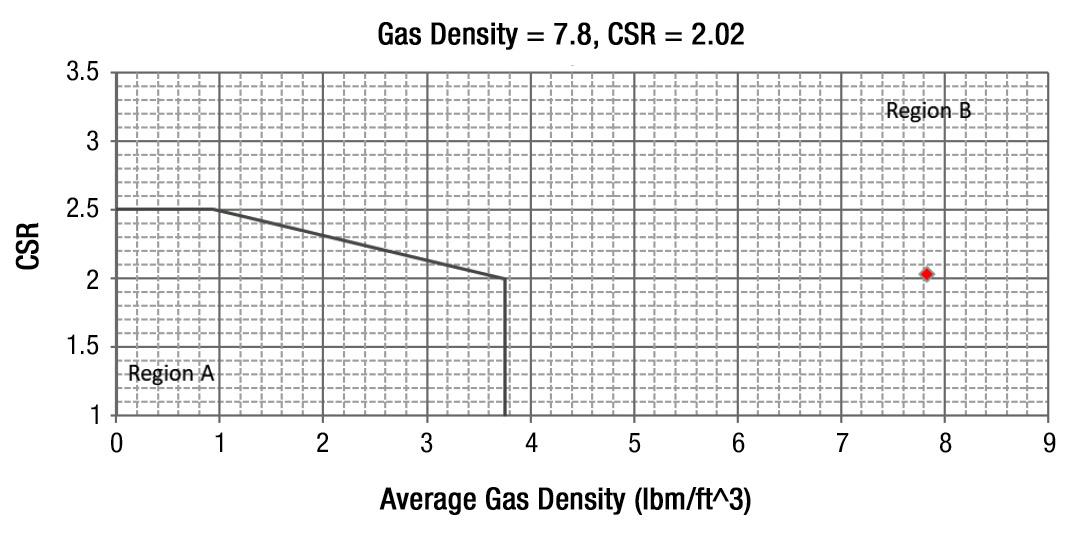

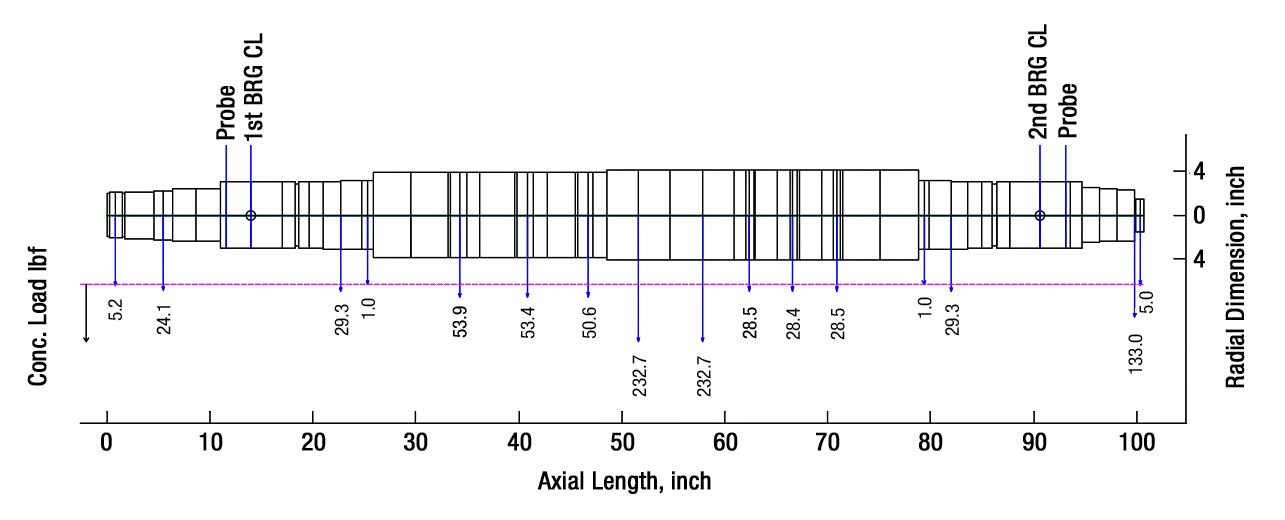

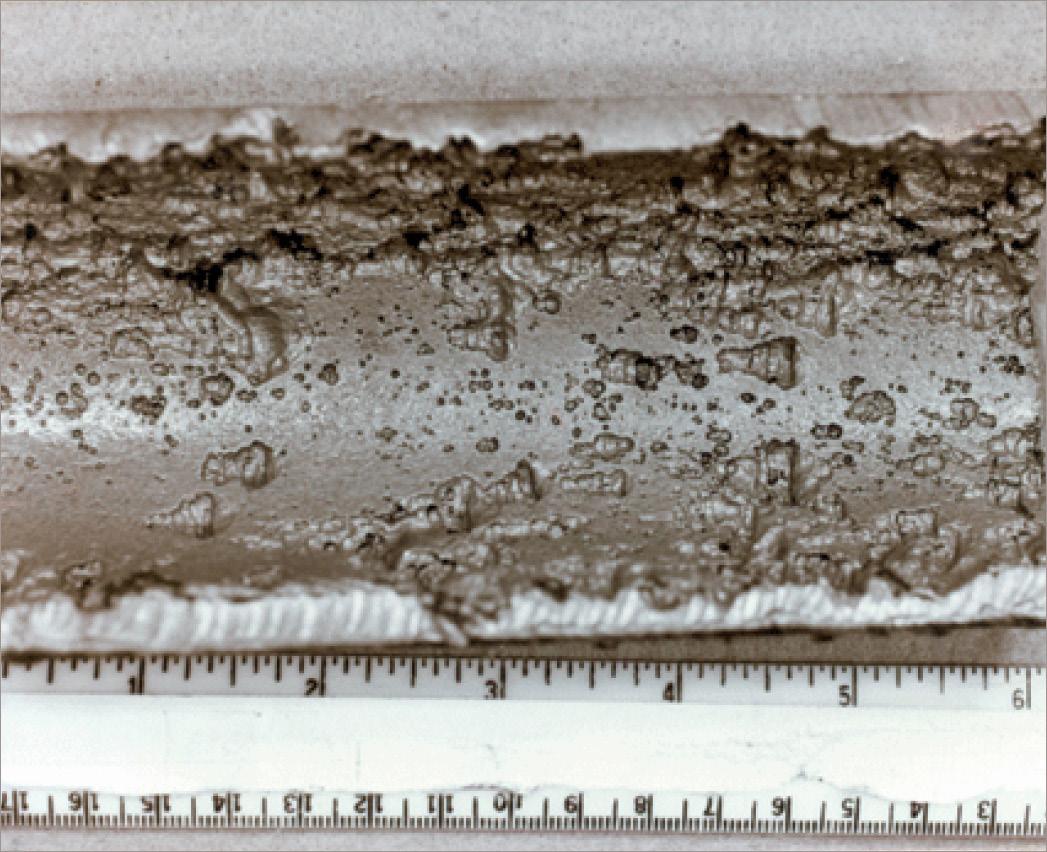

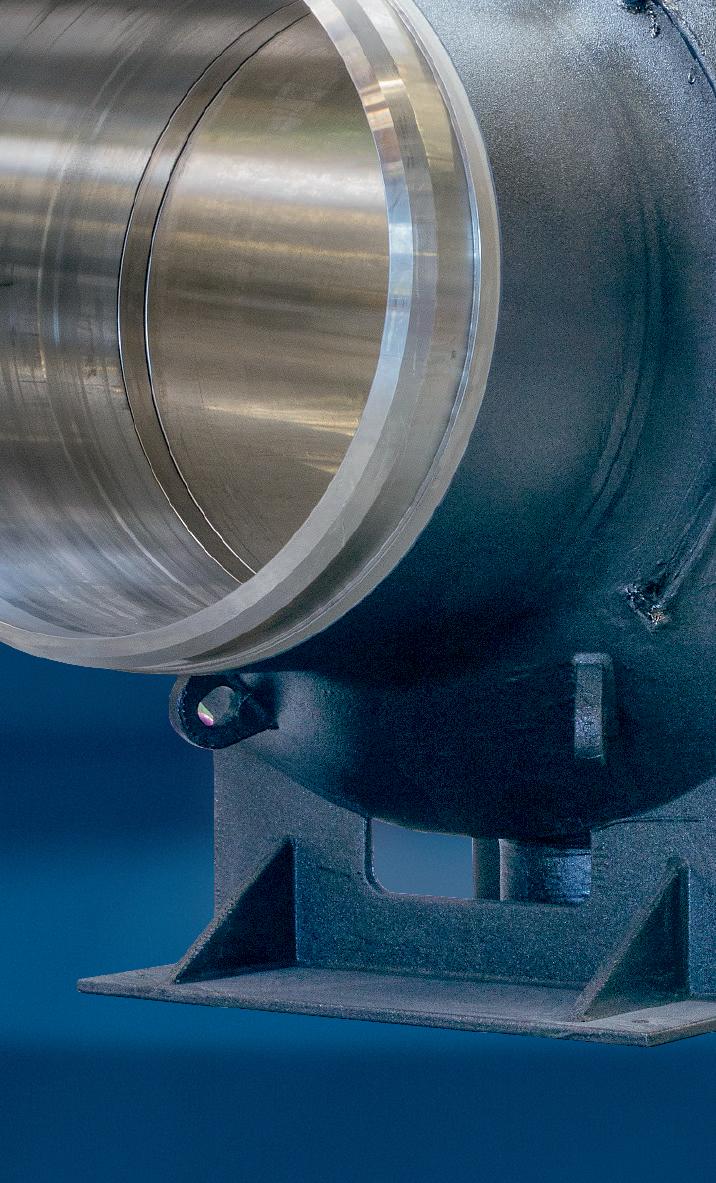

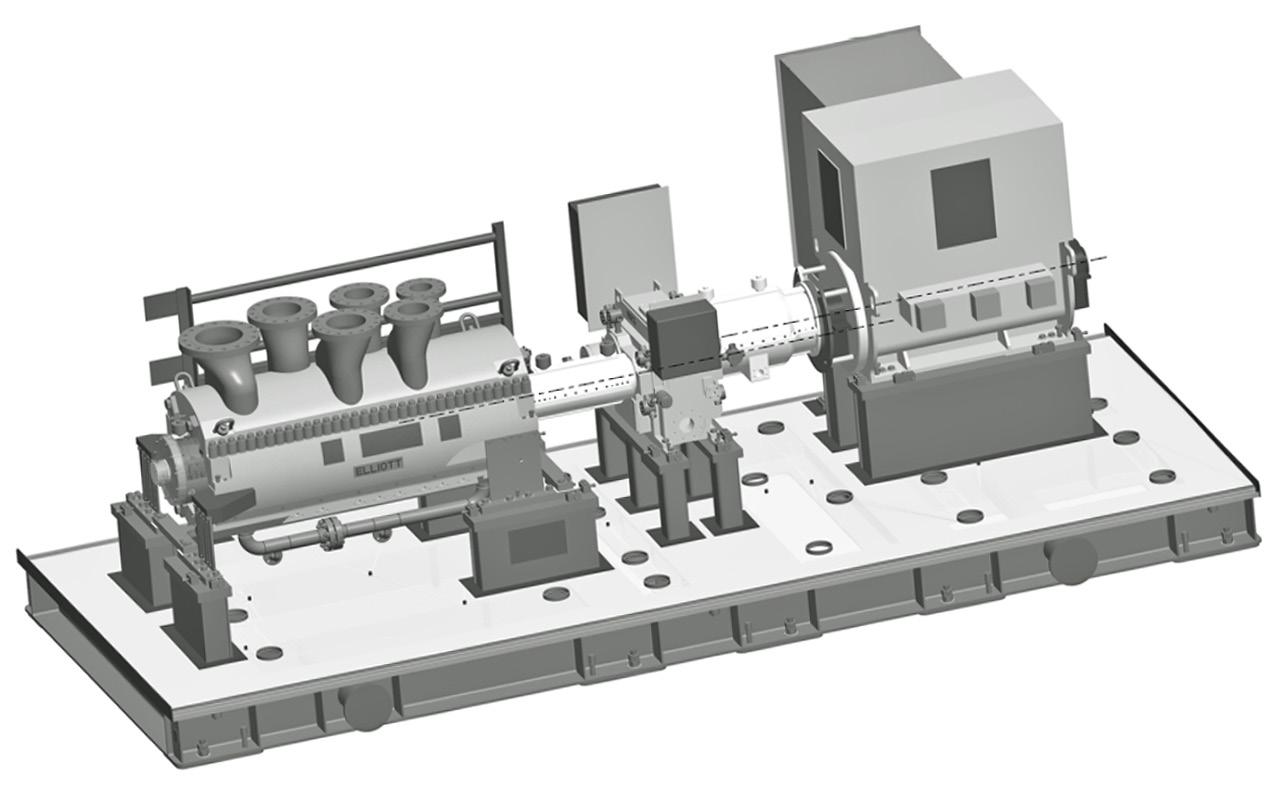

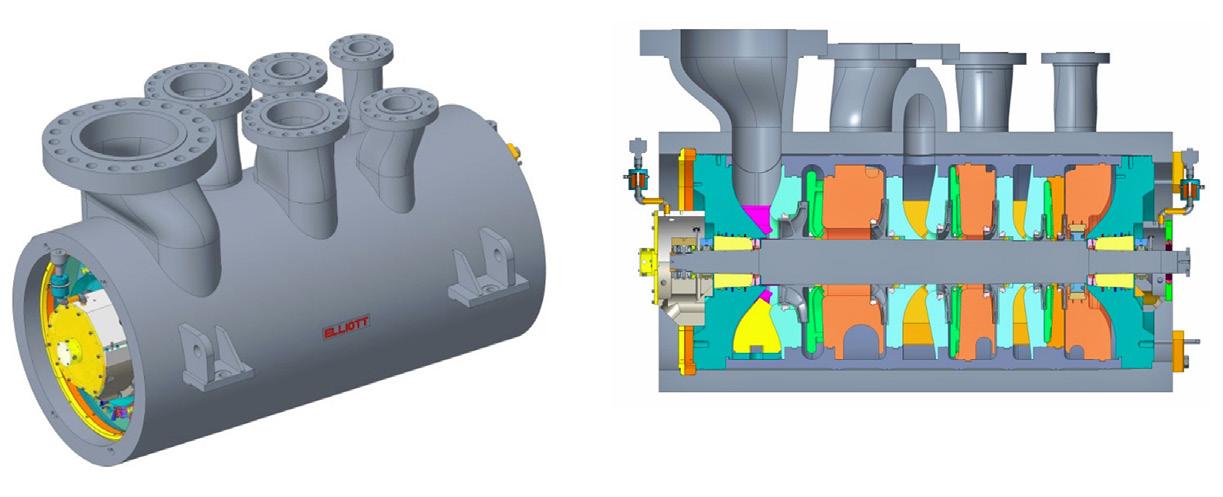

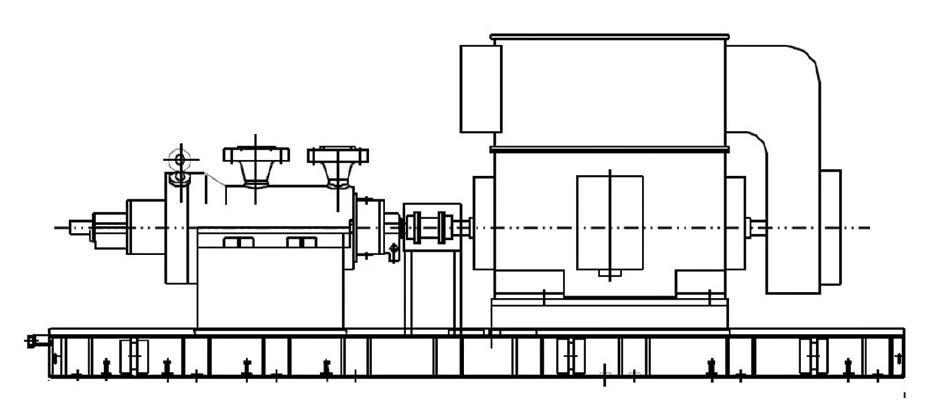

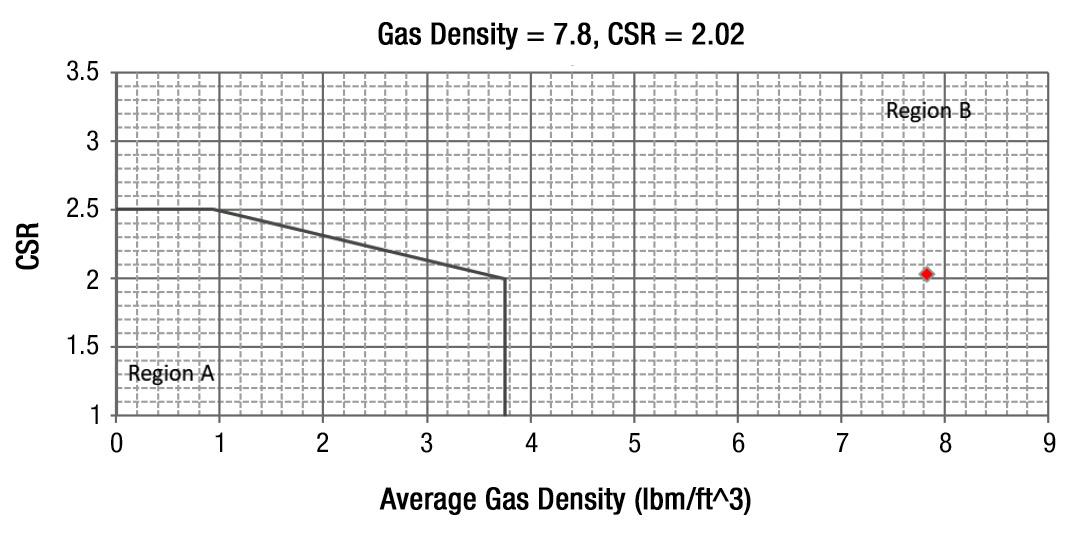

35. CO2 compression challenges

Klaus Brun, Brian Pettinato, Stephen Ross and Todd Omatick, Elliott Group, and Joseph Thorp, Aramco Ventures.

SUBSEA REPAIR

41. Making subsea connections count

Aiden Hardy, STATS Group, UK.

PIPELINE ISOLATION AND INTERVENTION

46. Surge relief in liquid pipelines

Eduardo Zani and Pedro Flores, Celeros Flow Technology, USA.

23. Conquering digital distrust in Nigeria

Adeshina Adebusuyi, Regional Business Development at James Fisher AIS, provides a blueprint for overcoming the gaps in Nigeria’s oil and gas digital transformation journey.

PUMPS

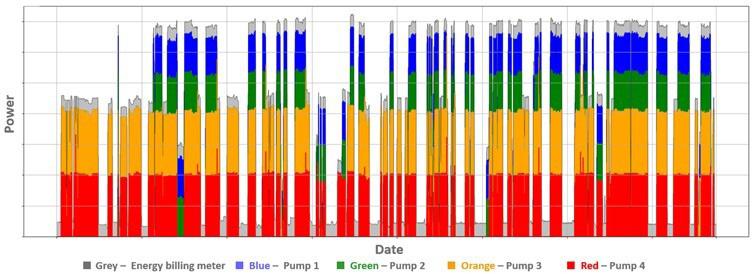

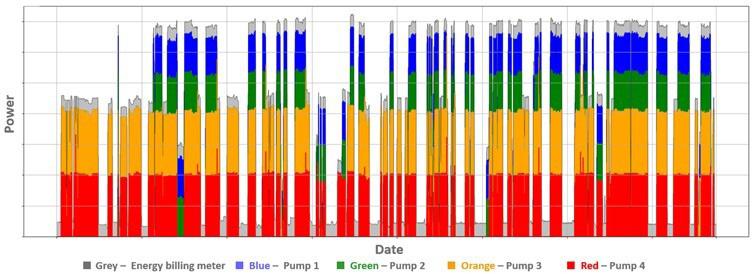

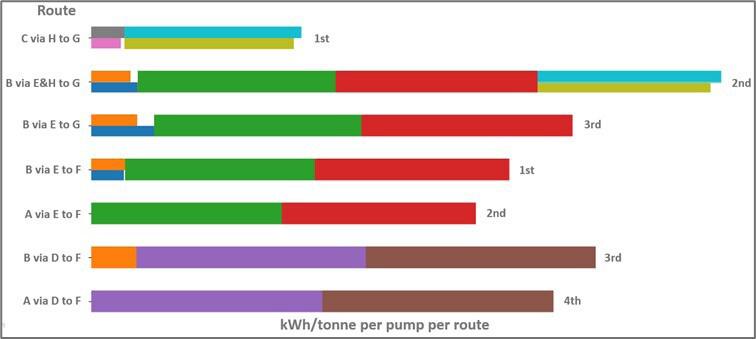

27. Green and lean: data driven asset optimisation for transmission pipelines

Dr Liam Trimby and Robyn Eveson, Klarian Ltd, UK.

31. Lifetime performance assurance

Red Paley and Gary Fitch, Sulzer.

53. Removing the guesswork

Aaron Madden, T.D. Williamson, USA.

TRENCHLESS TECHNOLOGY

57. HDD going green

Simon Herrenknecht, Herrenknecht AG, Germany.

61. Guided boring at its best

John Barbera, Barbco, USA.

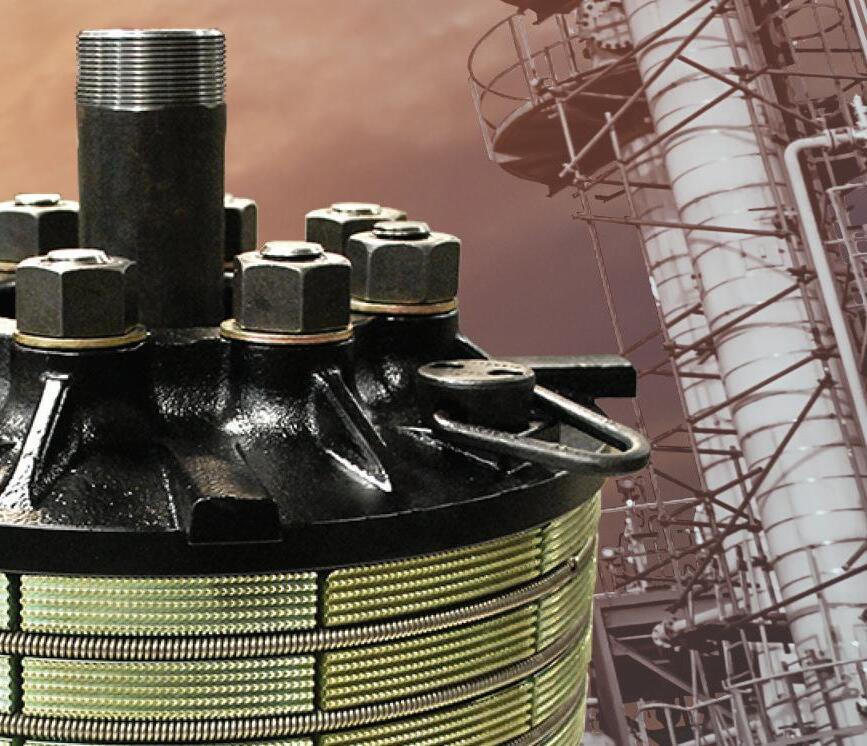

CBP019982

Winn & Coales International Ltd has specialised in the manufacture and supply of corrosion prevention and sealing products for over 90 years. The well-known brands of Denso and Premier offer a cost-effective and long-term solution to corrosion on buried or exposed steel or concrete, pipes, tanks and structures. Their Denso Bore-Wrap™ and Denso™ Butyl Tape System (S43-R23) products feature in the latest case study from their Australian subsidiary, Denso (Australia) Pty Ltd.

ISSN 14727390 Member of ABC Audit Bureau of Circulations ON THIS MONTH'S COVER Reader enquiries [www.worldpipelines.com] C O NTENTS Copyright© Palladian Publications Ltd 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK. WORLD PIPELINES

VOLUME 23 | NUMBER 10 | OCTOBER

|

2023

03.

41

57 23 SCAN TO VIEW OUR LATEST DENSO BORE-WRAP BUTYL TAPE SYSTEM (S43-R23) Three kilometres of pipe. Two outstanding Denso™ systems. One corrosion prevention solution. WCD WP Cover_Oct 2023.indd ® Volume 23 Number 10 - October 2023 PAGE 18 W ith 492 projects expected to commence that oil and gas producers in Africa are in for decidedly busy time would be something phenomenal surge in activity is primarily down to the European Commission’s plans to end Europe’s dependence on Russian fossil fuels following the Kremlin-sanctioned invasion of the succeeding at an all-time high, but there are number of key benefits to producers are to be realised. fuel’ en route to zero emissions target has opened key opportunity for African producers to take up the slack of, supplies. The European Parliament, in response to the energy crisis, also now considers new investments in gas as ‘climate friendly’ change of heart that is already proving an area of Africa currently provides around 20% of Europe’s gas imports. percentage that’s likely to increase considerably with natural gas delivered directly to the EU via pipeline and LNG transported by Why the EU/Africa attraction is mutual climate-neutral economy, with member nations having achieved zero carbon targets by that time. Although African countries don’t have the tapped reserves or extensive infrastructure looking to diversify their suppliers and routes to meet their existing energy needs. Africa can certainly be part of that mix, particularly as home to 13% of global gas reserves, 7% of the Europe’s appeal to Africa as region to export to is its tremendous market size and the creditworthiness of consumers. towards expanding and improving the production, processing and transport capacity of Africa’s energy producers. The EU appetite for imports of petroleum oils from Russia to 15.1% as of 3Q22, with further falls predicted. opportunity for Africa to make more use of its energy reserves, Arun Behl, Head of Business Development – Middle East & Africa, and John Downer, Senior Project Manager, Penspen, UK, describe how energy producers in Africa can benefit from Europe’s shift in energy policy. 19 18

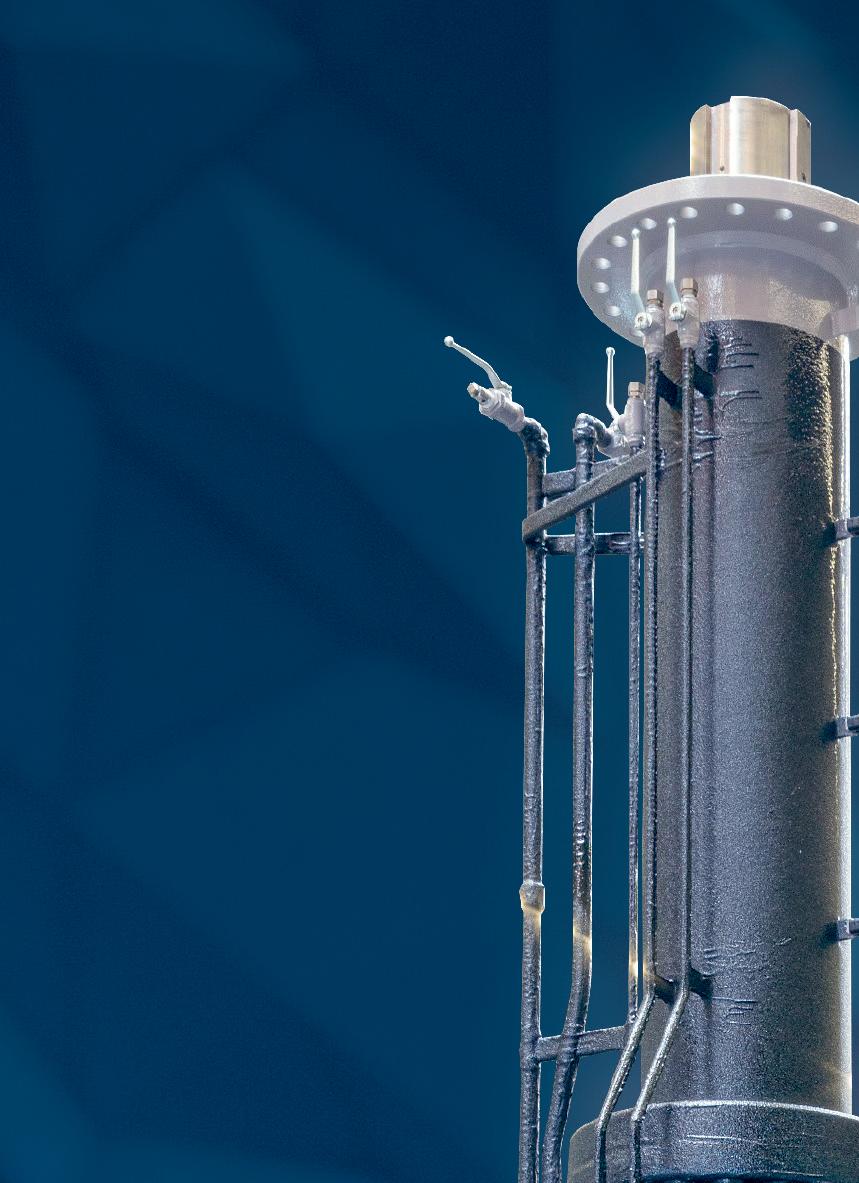

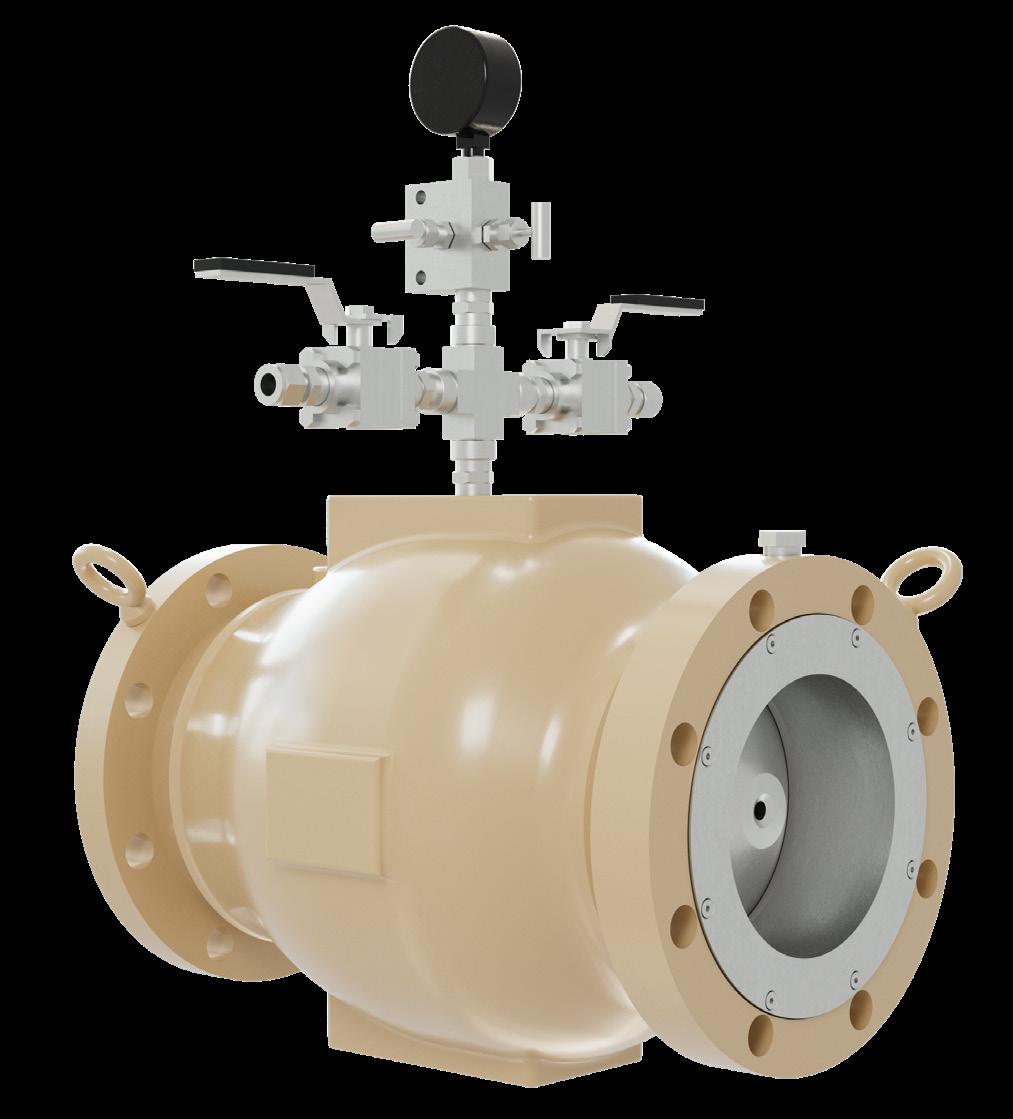

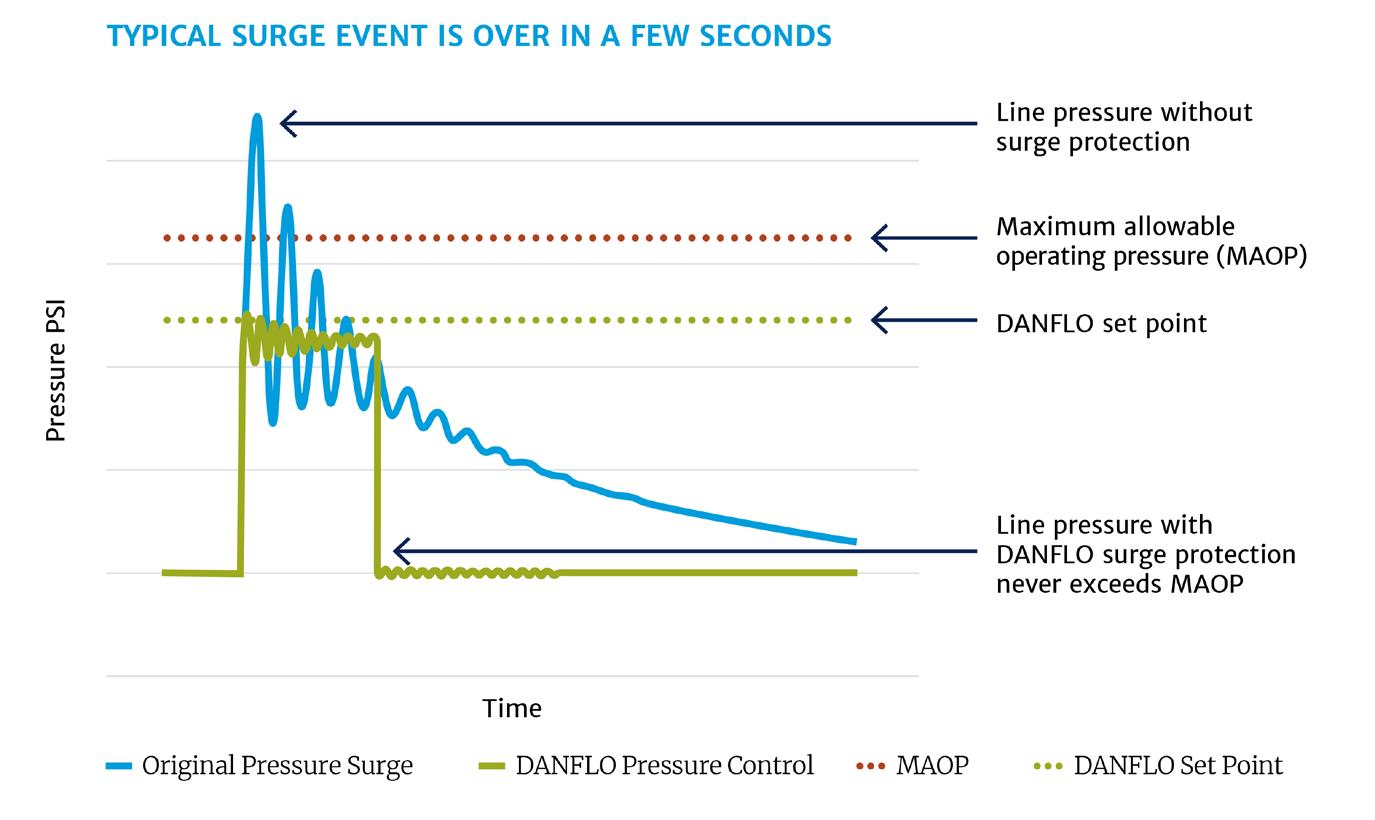

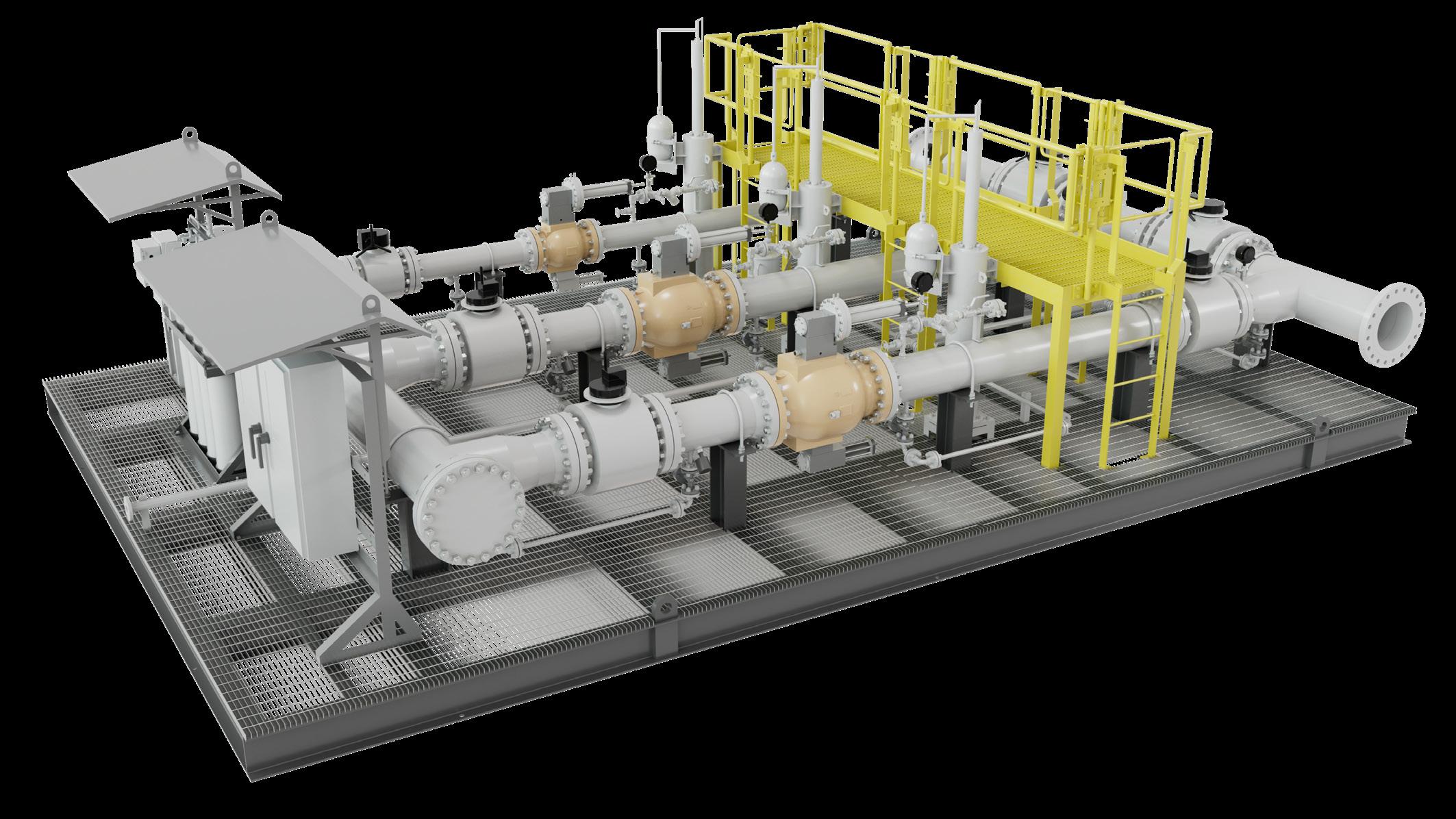

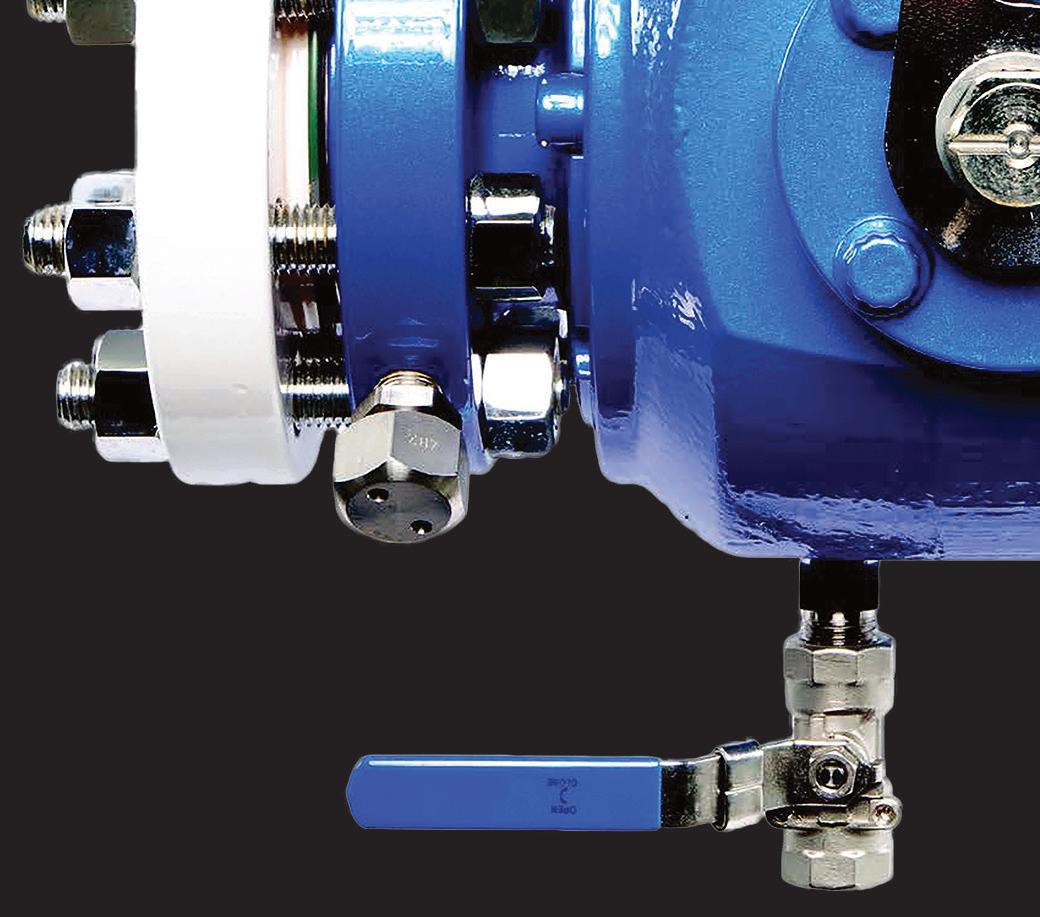

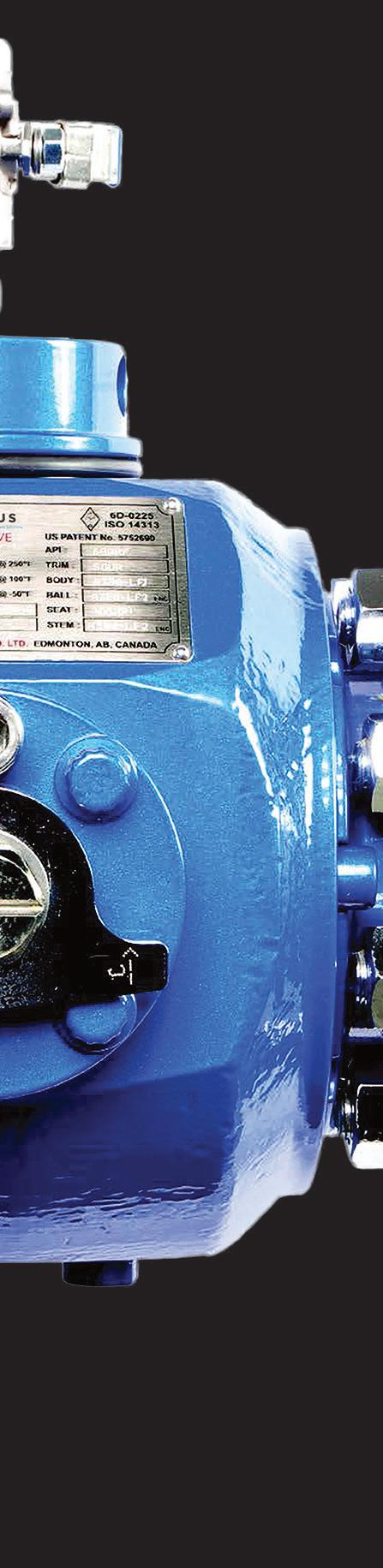

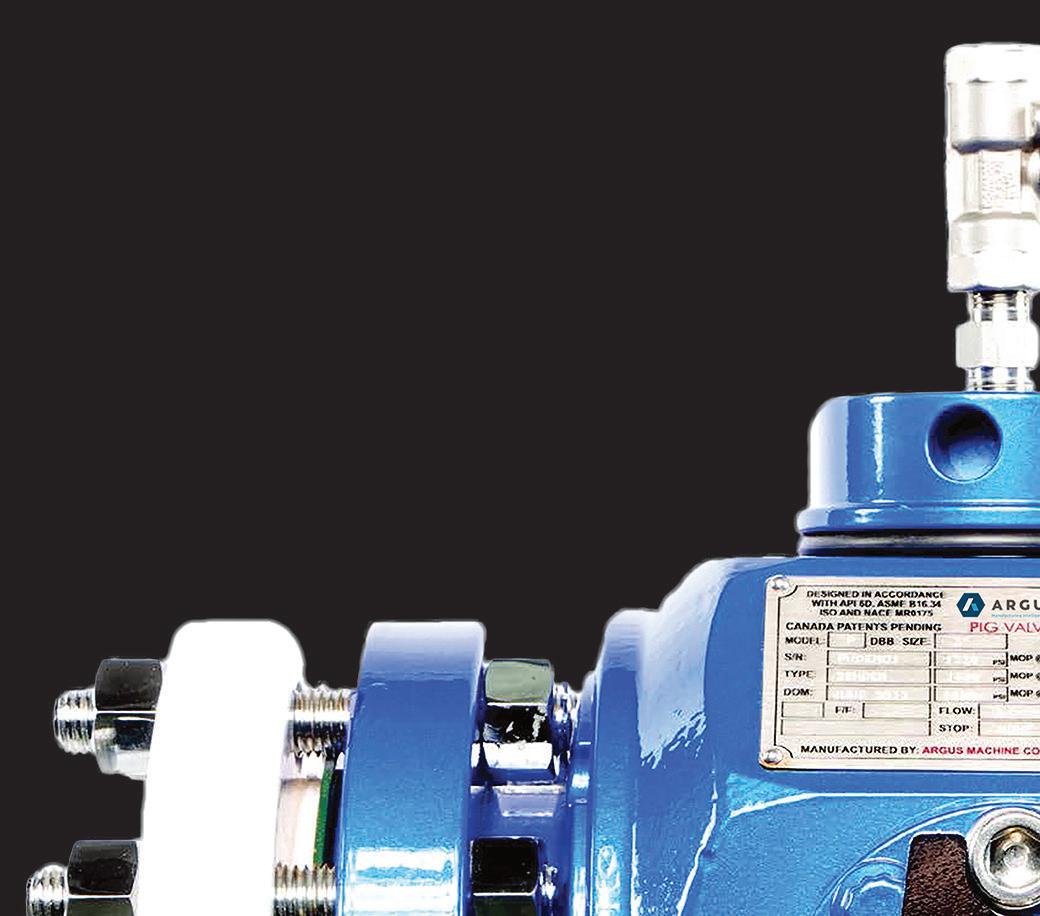

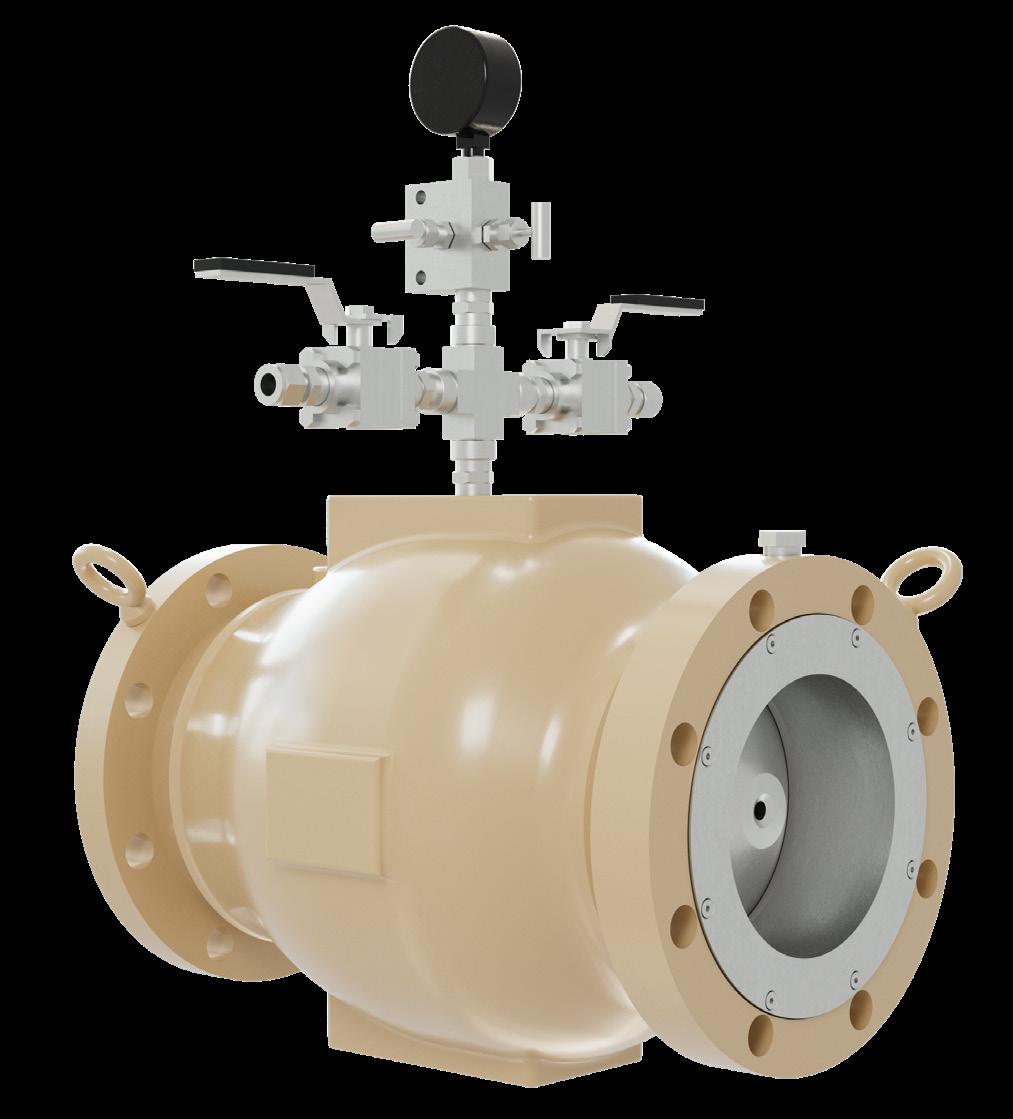

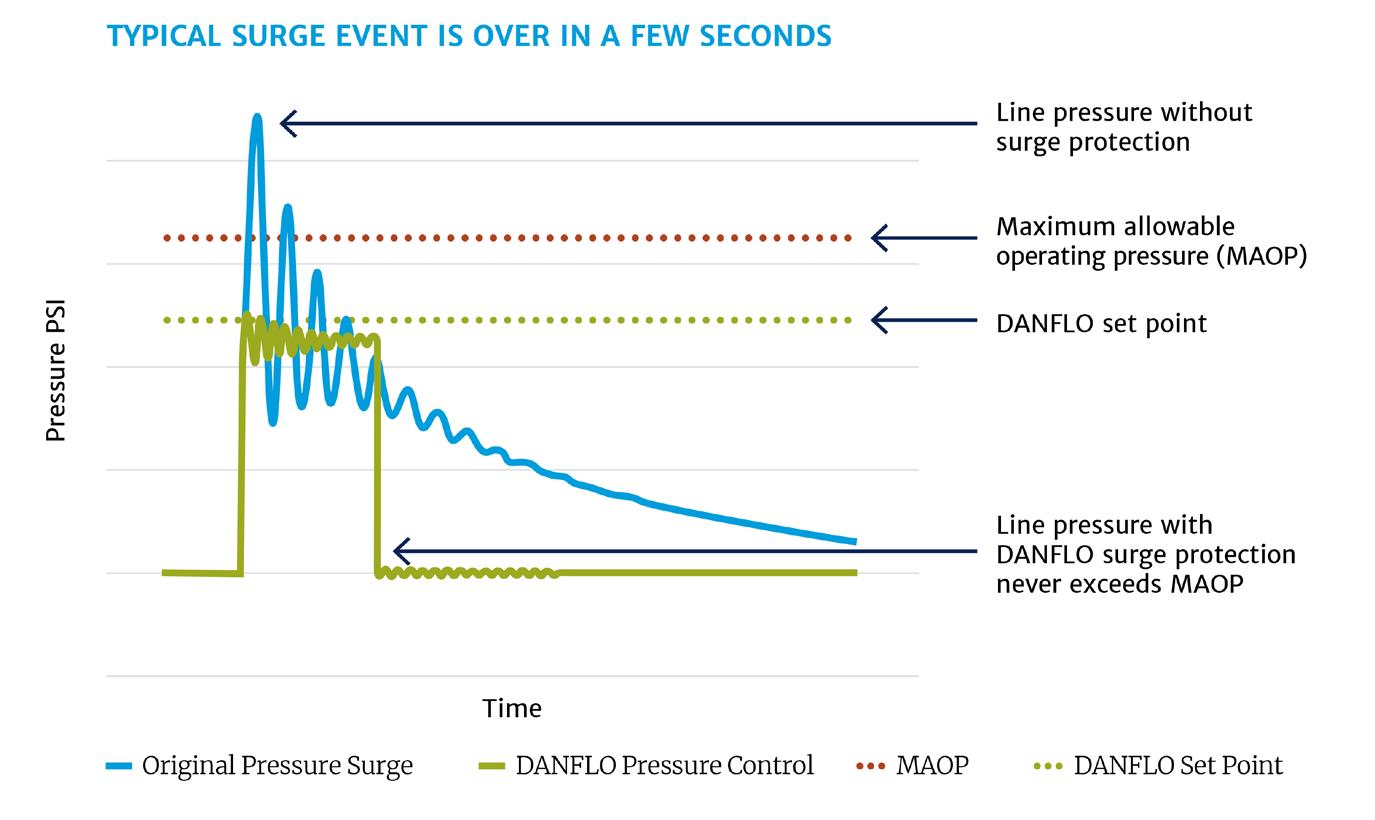

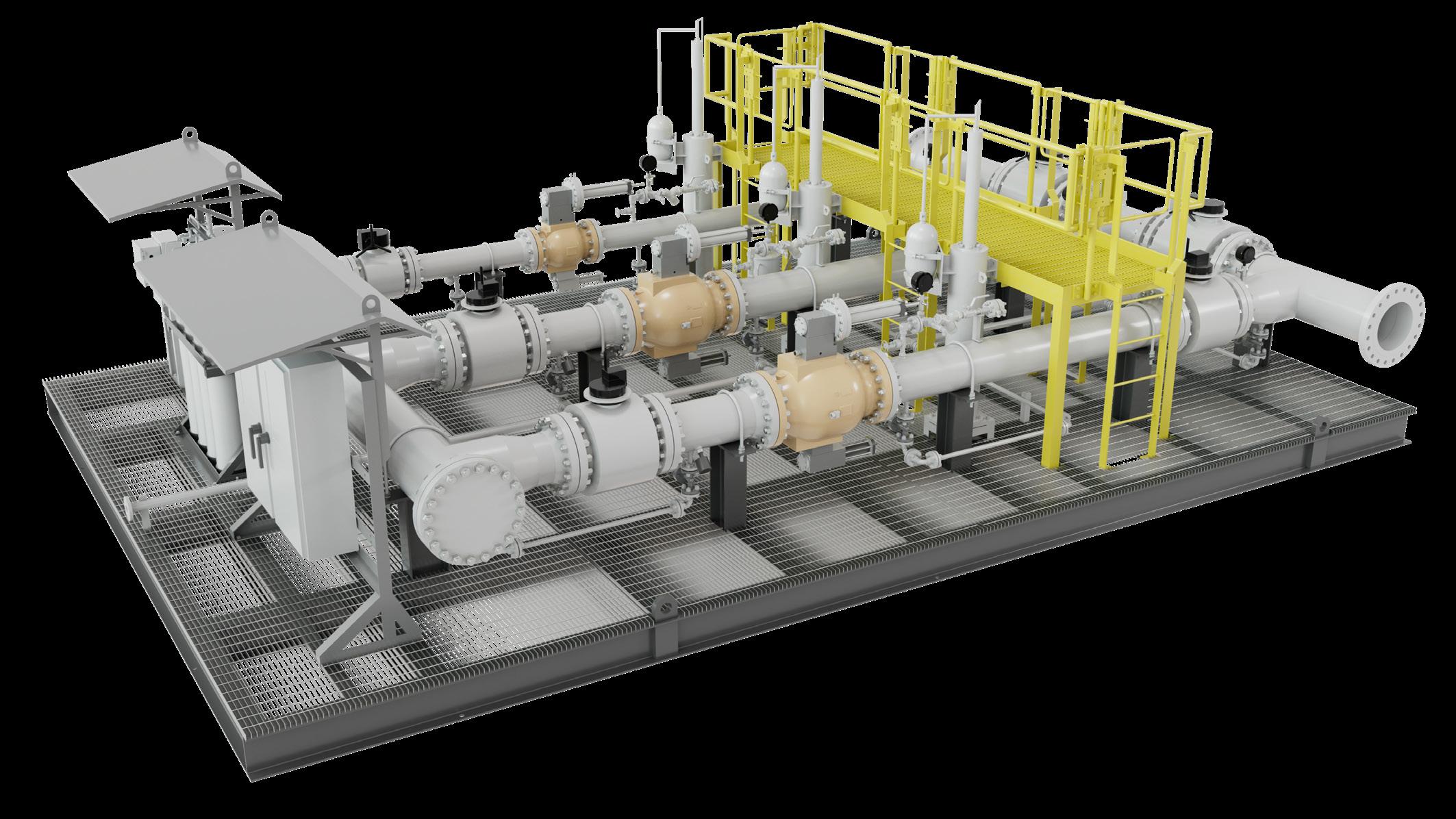

PAGE 46 Surge relief in liquid pipelines urge relief in liquid pipelines reducing the pressure surge in pipeline system due to sudden fluid velocity or flow rate that travels through the pipeline and can cause damage to the system, such as pipe ruptures, leaks, or Consequences of high-pressure pipeline surge may include fatigue at welds, or longitudinal splits of the pipe. Pumps can be knocked out of alignment, piping and piping supports, as well as specialised components such as hoses, filters, bellows, result in unplanned downtime and product loss or spoilage, impacting consequences, too, ranging from environmental pollution and clean-up costs to injury or loss of Surge relief devices are typically installed at strategic points the pipeline system to protect against include relief valves, surge tanks, or other specialised equipment the surge energy and reduce the pressure spikes that can occur. The selection and design of various factors, including the type of fluid being transported, the length and diameter of the of the area, and the operational conditions of the pipeline system. of liquid pipelines and ensuring reliable and efficient transport of Anyone responsible for the design, operation, and maintenance of fluid handling systems must transient pressure surges and ensure adequate mitigation measures are Causes of surge Any hydraulic system, from a complex petrochemical process network, will be subject to surge pressures operational changes pressures may vary from being virtually undetectable to having catastrophic failure leading to major disaster. Many of us have experienced our garden hose. This effect often referred to as ‘water surge causes the sound. When an appliance’s low pressure and small larger piping and high-pressure arrangements commonly found in tanker terminals, oil and gas plants, that little thump can become big problem. The noise alone terrifying, and its surge is Rapid changes in pipeline flow rate are usually caused by generating pressure waves, which travel upstream and downstream from the point of origin. The these propagating waves rapidly increases or decreases. Typical propagation velocities can range pipeline to 3300 ft/sec. for typical crude oil line. as line pack, where pressure slowly builds. Due to frictional losses in higher discharge pressures to move the liquid column downstream. Pump flow maintained as the pump packs the pipeline. Using the IoT to capture pressure data in real-time adds further functionality and analysis of surge events, says Eduardo Zani and Pedro Flores, Celeros Flow Technology, USA. s 46 47

ONSHORE /OFFSHORE OIL & GAS POWER STRUCTURAL

EDITOR’S COMMENT

CONTACT INFORMATION

MANAGING EDITOR

James Little james.little@palladianpublications.com

EDITORIAL ASSISTANT

Isabel Stagg isabel.stagg@palladianpublications.com

SALES DIRECTOR

Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER

Chris Lethbridge chris.lethbridge@palladianpublications.com

SALES EXECUTIVE

Daniel Farr daniel.farr@palladianpublications.com

PRODUCTION DESIGNER

Kate Wilkerson kate.wilkerson@palladianpublications.com

EVENTS MANAGER

Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL ADMINISTRATOR

Leah Jones leah.jones@palladianpublications.com

ADMINISTRATION MANAGER

Laura White laura.white@palladianpublications.com

Palladian Publications Ltd, 15 South Street, Farnham, Surrey, GU9 7QU, UK

Tel: +44 (0) 1252 718 999

Website: www.worldpipelines.com

Email: enquiries@worldpipelines.com

Annual subscription £60 UK including postage/£75 overseas (postage airmail). Special two year discounted rate: £96 UK including postage/£120 overseas (postage airmail). Claims for non receipt of issues must be made within three months of publication of the issue or they will not be honoured without charge.

Applicable only to USA & Canada:

World Pipelines (ISSN No: 1472-7390, USPS No: 020-988) is published monthly by Palladian Publications Ltd, GBR and distributed in the USA by Asendia USA, 701C Ashland Avenue, Folcroft, PA 19032. Periodicals postage paid at Philadelphia, PA & additional mailing offices. POSTMASTER: send address changes to World Pipelines, 701C Ashland Avenue, Folcroft, PA 19032

The EU Commission has named six major technology companies as gatekeepers of the digital economy under the Digital Markets Act (DMA). Five American companies (Alphabet, Amazon, Apple, Meta, and Microsoft) and one Chinese company (ByteDance) will face stricter rules due to their substantial market dominance. The DMA aims to rein in their power, promote competition, and protect user choice and privacy. The rules will take full effect in six months, with very high fines for non-compliance.

The European Commission announced that:

“These are the first six companies designated as ‘gatekeepers’ under the Digital Markets Act. This status will prevent them from imposing unfair conditions on businesses and end users, and ensure the openness of crucial digital services. From social networks to operating systems, they have six months to ensure their core platform services comply with the Digital Markets Act, including: allowing users to unsubscribe and remove pre-installed services; allowing users to download alternative app stores; banning tracking outside of their services without consent, and banning ranking their products and services more favourably.” 1

The new EU law speaks to the phenomenon of ‘digital distrust’: a growing sense of mistrust in technology and the cyber-verse. Some recent reports characterise digital distrust as: information scepticism, mistrust of tech giants, surveillance fears, and a rise in cybercrime. 2 Until now, the way in which gatekeepers conducted their businesses has been either largely unregulated or based on sets of rules that, in the majority, pre-date the digital economy. The DMA will work towards making markets in the digital sector fairer and more contestable.

Digital distrust is a topic in this issue of World Pipelines: in an article starting on p. 23, Adeshina Adebusuyi, from James Fisher AIS, offers a blueprint for success for Nigeria’s oil and gas digital transformation journey. The article acknowledges that, while Nigeria is home to the highest number of technology hubs in the continent, it has a long way to go to fulfil its digital potential. One of the hurdles it faces is digital distrust, with the article explaining: “most [Nigerian] oil and gas decision makers will have at least one story to tell of how they were sold a vision of digital transformation, only to be left with an inferior product and no support to assist with implementation.” Adebusuyi lays out some steps to overcome this digital disillusionment and ensure Nigeria reaches its target of being a gas-powered economy by 2030.

Adebusuyi’s article sits alongside three others in our keynote section, which focuses on pipelines in Africa and the Middle East. On p. 9, World Pipelines’ Contributing Editor Gordon Cope offers information on pipeline capacity and projects in Iraq, Iran, Algeria, Egypt, Nigeria, Mozambique, Angola, and Uganda. On p. 14, Emerson Automation writes about the key challenges faced by pipeline operators in Africa, focusing on how best to manage infrastructure and assets. Finally, Penspen outlines how energy producers in Africa can benefit from the recent shift (away from Russia) in Europe’s energy policy, offering some regional case studies (p. 18).

1. https://www.linkedin.com/company/european-commission

2. https://www.sld.com/blog/digital-experiences/how-fake-news-scams-and-trolls-could-cause-digital-disruption

SENIOR EDITOR Elizabeth Corner elizabeth.corner@palladianpublications.com

The experts you can trust CRC Evans’ market-leading welding and coating services, technologies and high-performance equipment ensures efficient, on-time delivery of your global onshore and offshore energy projects. Americas Europe Middle East Africa Asia Pacific crcevans.com enquiries@crce.com @crcevansglobal 2-5 October - Abu Dhabi, UAE Visit us at Stand 8350, UK Pavilion, Hall 8

WORLD NEWS

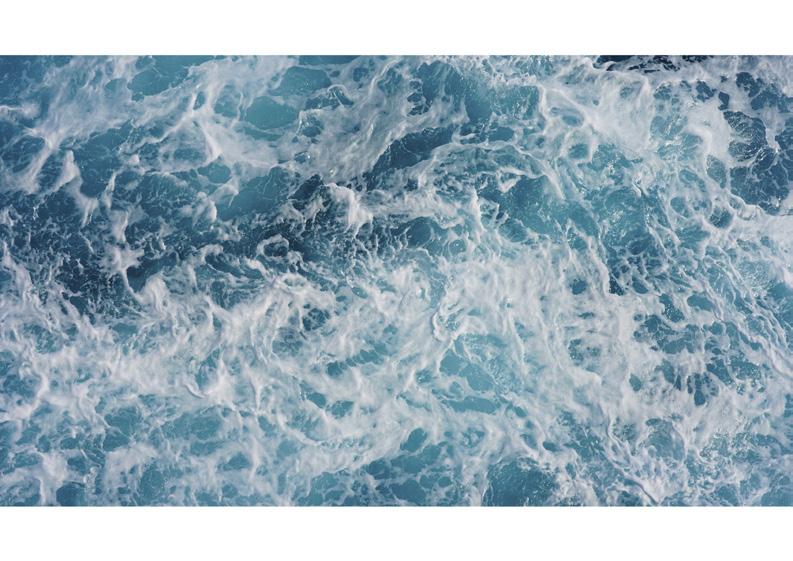

US backs Chevron-led consortium in Cyprus subsea pipeline dispute

Washington has weighed into a dispute between Cyprus and international companies led by Chevron over how to develop a giant offshore gas field, backing the US company’s plan to link it to neighbouring Egypt, Reuters reports.

Reuters reports: The Chevron-led consortium proposed connecting the Aphrodite gas field via a subsea pipeline and existing infrastructure to Egypt, where the gas can be sold in the domestic market or liquefied and shipped to Europe, which has largely been cut off from Russian supplies.

Cypriot Energy Minister George Papanastasiou confirmed that the government had rejected the latest plan, which omitted a previous proposal to build a floating gas processing plant at the field which lies 160 km (100 miles) southeast of Cyprus. “The modification has been rejected. The expectation of the Republic of Cyprus is (that) the consortium honours what was mutually agreed by the parties in 2019,” Papanastasiou told Reuters.

The partners have engaged in a new round of talks with the Cypriot government, Israel’s NewMed, which is a partner in the Aphrodite field, said earlier this week.

The US is backing Chevron’s plans, which it believes will help to get gas to the market faster and with a lower carbon footprint as it does not involve building large infrastructure, according to a US source.

“Connecting (Aphrodite) to Egypt will help them with peak domestic consumption in the summer, add stability and reduce tensions in the region, and allow exports for Europe,” the US

source said.

The Biden administration is “making the distinction between expensive and unnecessary infrastructure projects” and less work-intensive interconnections that are necessary as economies transition to cleaner forms of energy, the source said.

Aphrodite, discovered more than a decade ago, holds an estimated 124 billion m3 of gas. Chevron is a partner in the field with NewMed and Shell.

Its development would give a vital boost to the Eastern Mediterranean gas basin which has attracted huge investment in recent years, particularly in the wake of Russia’s invasion of Ukraine as Europe sought to replace Russian fossil fuel.

According to two industry sources, Nicosia objected to Chevron’s plans to drill three production wells rather than five and avoid the construction of a floating production unit above the field.

A Chevron spokesperson said the consortium was working to progress the Aphrodite project. “We have submitted a modified development plan to the Cypriot Government, which we hope will lead to the development of the Aphrodite field and delivery of gas to Egyptian and global markets via existing LNG plants on the north coast of Egypt.”

“We believe it is important that Aphrodite is expeditiously developed for the benefit of Cyprus, the Eastern Mediterranean region and European and other international markets,” Chevron said.

AGA and others recommend improvements to PHMSA proposed rule

The American Gas Association (AGA) has filed joint comments together with the American Public Gas Association (APGA), Interstate Natural Gas Association of America (INGAA), American Petroleum Institute (API), GPA Midstream, American Fuel & Petrochemical Manufacturers (AFPM), and Northeast Gas Association (NGA) with the Pipeline and Hazardous Materials Safety Administration (PHMSA) regarding PHMSA’s Notice of Proposed Rulemaking, ‘Pipeline Safety: Gas Pipeline Leak Detection and Repair.’

These comments make substantive suggestions for improving the implementation of the proposed rule. As stated in the comments, “The Associations support the intent of the proposed rule and share PHMSA’s goal of addressing methane emissions. However, the Associations have significant concerns with PHMSA’s proposed rule, its proposed implementation of the Congressional mandates… and its expanded interpretation of its regulatory reach in the NPRM which is far beyond Congress’ mandate.”

Among the issues identified in the proposed rule is flawed accounting of the costs and benefits by PHMSA, unrealistic timeframes for implementation, mandates for leak detection methodologies that do not necessarily yield tangible improvements in public or environmental safety, and the presumption that all leaks must be managed as hazardous

leaks. One major goal of these comments is to help align the proposed rule with the Environmental Protection Agency’s (EPA) anticipated final rule, “Standards of Performance for New, Reconstructed, and Modified Sources and Emissions Guidelines for Existing Sources: Oil and Natural Gas Sector Climate Review”, and other regulations aimed at reducing methane emissions.

This objective is reflected in the comments. “Based on the proposed rule, it is the perception of the Associations that PHMSA has shifted its primary focus from pipeline safety to pursue environmental goals. Both goals – improving pipeline safety and reducing emissions – can be accomplished. However, extensive changes must be made to PHMSA’s proposed rule in order for it to be consistent with Congress’ intent in the PIPES Act of 2020 and for it to be technically and economically feasible.”

“Our industry has made and continues to make a sincere commitment to leak detection and repair” said Karen Harbert, AGA President and CEO. “We support improving pipeline safety and reducing emissions and are confident these goals can be met. However, extensive changes to this proposed rule are necessary to ensure that the final rule is viable and not contradictory to other federal guidance. Our comments provide a roadmap for these essential changes.”

OCTOBER 2023 / World Pipelines 5

UK

Wood, a global consulting and engineering company, and Harbour Energy, the UK’s largest oil and gas producer, have entered into a new strategic partnership for UK North Sea operations agreeing a new master services agreement (MSA) and associated contracts valued at around US$330 million.

SAUDI ARABIA

ABB has signed a framework agreement with Samsung Engineering in Saudi Arabia to collaborate in engineering and procurement activities in the Kingdom. With this agreement, ABB becomes a single-source vendor for gas analyser system integration for Samsung in Saudi Arabia.

GUYANA

Strohm’s first deepwater/high pressure thermoplastic composite pipe (TCP) Jumper in South America has been successfully installed, commissioned and is up and running for ExxonMobil Guyana at its Liza field.

USA

Building on the oil and natural gas industry’s commitment to ensuring safe operations, the American Petroleum Institute (API) and the Liquid Energy Pipeline Association (LEPA) has released a carbon dioxide (CO2) pipeline safety tactical guide for pipeline operators and emergency response personnel.

GLOBAL

Exploration spend (excluding appraisal) will recover from historic lows to average US$22 billion/yr in real terms over the next five years, according to a new report from Wood Mackenzie.

USA

PHMSA announces new social equity mapping tools, allowing viewers to visualise pipeline accidents and incidents across the US.

WORLD

DNV: Artificial intelligence can accelerate the energy transition, but must gain the trust of the sector

The energy sector must overcome a lack of trust in artificial intelligence (AI) before the technology can be effectively used to accelerate the energy transition, a DNV report has found. Based on interviews with senior representatives from energy companies across the UK, DNV’s research determined that while AI is already being used across the sector, companies are largely cautious of its new and unestablished uses. Interviewees include industry personnel from the Centre for Data Ethics and Innovation, EnQuest, National Gas, National Grid Electricity System Operator (ESO) and the Net Zero Technology Hub, among other organisations.

‘AI insights: Rising to the challenge across the UK energy system’ outlines how AI can contribute to the energy transition and that an industry-wide approach to standards and best practices is required to unlock its potential. While AI can be key to advancement and innovation in energy supply chains, the research found that putting in place the foundations for trust in the providers of AI solutions and the outputs of those solutions must be prioritised in light of recent geopolitical events highlighting the need for countries to have energy sustainability, security and affordability – in effect, a parallel trilemma for AI as it is increasingly democratised and utilised. It was also found that data policies

and industry culture present significant barriers to its widespread adoption.

At industry level, data sharing has been identified as the area which requires the greatest improvement. In terms of culture, it was found that the engineering community has a high level of risk aversion and low tolerance to error.

Hari Vamadevan, Executive Vice President and Regional Director UK and Ireland, Energy Systems at DNV said: “To truly harness the benefits of AI in the energy sector, it’s critical this technology is trusted.”

The emergence of artificial intelligence also poses cyber security risks in the sector, with heightened geopolitical tensions and the accelerating adoption of digitally connected infrastructure sparking concern over industry’s vulnerabilities to cyber threats.

Shaun Reardon, Head of Section, Industrial systems, Cyber Security at DNV said: “Accurate, accessible, reliable, and relevant – digital technologies and AI tools must be all these things if we are to trust them. But they must also be secure. Digital technologies – set to be enhanced by AI –are being connected to control systems and other operational technology in the energy industry, where safety is critical. The industry needs to manage the cyber security risk and build trust in the security of these vital technologies.”

EQT completes acquisition of Tug Hill and XcL Midstream

EQT Corporation announced in August that it has closed its previously announced acquisition of THQ Appalachia I Midco, LLC and THQ-XcL Holdings I Midco, LLC.

Final consideration after purchase price adjustments was comprised of approximately US$2.4 billion of cash and 49.6 million shares of EQT common stock. EQT funded the cash portion of the consideration with US$1.25 billion of term loan borrowings, US$1 billion of cash on hand and the US$150 million cash deposit previously held in escrow.

Toby Z. Rice, President and CEO, said, “We are excited to complete this strategic transaction and welcome the Tug Hill and XcL Midstream teams to EQT. These assets have among the lowest breakeven prices in

Appalachia, and should reduce our pro forma NYMEX free cash flow breakeven price by approximately US$0.15/MMBtu, providing greater resiliency to our business moving forward. We also see the potential for more than US$80 million/yr of synergies, which could drive additional reductions to our corporate cost structure over time.”

Tug Hill’s upstream assets are currently producing approximately 800 million ft3/d of gas equivalent with a 20% liquids yield. XcL Midstream’s gathering and processing assets add 145 miles of owned and operated midstream gathering systems that connect to every major long-haul interstate pipeline in southwest Appalachia. The company plans to provide pro forma financial guidance with its Q3 earnings results.

6 World Pipelines / OCTOBER 2023

NEWS IN BRIEF

GripTight ® Test & Isolation Plugs

Confidently test open-end pipe, pipelines & pressure vessels without welding, and isolate & test flange-to-pipe weld connections with GripTight Test & Isolation plugs from Curtiss-Wright.

• Standard pressure ratings up to 15,000 PsiG (1034 BarG)

• Patented gripper design for increased safety in high-pressure applications

• Eliminate welding end caps for pressure testing pipe spools and piping systems

• Test flange-to-pipe welds without pressurizing entire systems

• Isolate & monitor upstream pressure and vapors during hot work

• ASME PCC-2 Type I, III & IV Testing Devices

877.503.0768 l est-sales@curtisswright.com l cw-estgroup.com/wpl-23

CONTRACT NEWS

EVENTS DIARY

2 - 5 October 2023

ADIPEC 2023

Abu Dhabi, UAE www.adipec.com

24 - 26 October 2023

OMC 2023

Ravenna, Italy www.omc.it/en

2 November 2023

3rd Global Hydrogen Conference VIRTUAL EVENT https://www.accelevents.com/e/3rdghc2023

14 - 15 November 2023

Gas, LNG & The Future of Energy Conference

London,UK

https://www.woodmac.com/events/gas-lngfuture-energy/

30 January - 3 February 2024

76th annual PLCA Convention 2024

Nassau, Bahamas

https://www.plca.org/annual-convention-events

12 - 16 February 2024

PPIM 2024

Houston, USA

https://ppimconference.com/exhibition/

13 - 15 February 2024

AMI Pipeline Coating

Vienna, Austria

https://www.ami-events.com/

3 - 7 March 2024

AMPP Annual Conference + Expo 2024

New Orleans, USA

https://www.ampp.org/

ROVOP secures new long term contract award from Energean PLC

ROVOP has secured a new five year contract with Energean PLC, the leading independent, gas-focused E&P company in the Eastern Mediterranean.

This milestone contract is ROVOP’s first dedicated field support award for an E&P company. The ROV system had been strategically placed in the region to support scopes such as this contract.

ROVOP will deploy a work class ROV onboard Energean’s owned field support vessel, the Energean Star. The Star is a newly converted platform supply vessel (PSV) designed to carry out a range of support tasks for Energean.

Following a safe and successful mobilisation in Cyprus, the vessel has transited to the strategically important Karish gas field, located approximately 75 km offshore Israel in 1750 m water depth. The ROV system and offshore team will carry out a range of tasks from general ROV support to subsea survey and intervention works to support the maintenance and further development of the field.

Mark Gilmartin, ROVOP’s Business Development Director, said: “We are

thrilled to have been awarded this contract, highlighting our capability to support our clients no matter their location, task or scopes. The award is a real milestone contract and reflects our strategic approach to breaking into the field support ROV market. It has been an outstanding start to the year for ROVOP. It is a testament to our people’s expertise and professionalism, our global reach and unrivalled capability across the complete project lifecycle that we continue to go from strength to strength.”

Lenas Mylonas, Energean Head of Subsea said: “We are delighted to be working with ROVOP on this long-term contract. ROVOP’s dedicated focus on standalone ROV services was a key reason behind our decision to award this contract. Energean expect a high quality, responsive contractor able to quickly change priorities, in a safe manner, and we believe ROVOP are the best positioned company to be able to do this and support us in our operations. We’re looking forward to a long and successful relationship with the team as we both maintain and grow the Karish Gas field.”

EnerMech and TSI form strategic joint venture to accelerate Asia Pacific growth

EnerMech has entered a strategic joint venture (JV) with PT. Titian Servis Indonesia (TSI), an integrated turn around services firm with deep local expertise in Indonesia’s oil and gas sector. This collaboration marks an important milestone in EnerMech’s expansion strategy and underscores its commitment to establishing a strong presence in the Asia Pacific market.

The two businesses have worked together on various projects since early 2022. The new entity (‘EnerMech Titian JVA’) will leverage EnerMech’s extensive global expertise across its specialist service lines, cutting-edge technology and equipment fleet, combined with TSI’s intimate understanding of the Indonesian market, its local capabilities, and industry experience.

THE MIDSTREAM UPDATE

• Dominion Energy announces agreements to sell gas distribution companies to Enbridge

• Celeros Flow Technology launches new valve packing system to reduce fugitive emissions from pipelines

• New pipeline to accelerate Scotland’s green hydrogen export potential

• Comment: MVP Southgate; the next domino to fall

• PHMSA proposes new safety requirements for gas distribution pipelines

• Report – Bridging the gap: storage and distribution in the hydrogen value chain

Follow us on LinkedIn to read news articles and more linkedin.com/showcase/worldpipelines

8 World Pipelines / OCTOBER 2023

AFRICA AND MIDDLE EAST KEYNOTE SECTION

Welcome to the Africa and Middle East keynote section, providing information about oil and gas pipeline activity in this important region. Read on for a country-by-country guide, along with insight into pipeline infrastructure, energy policy, and digital transformation.

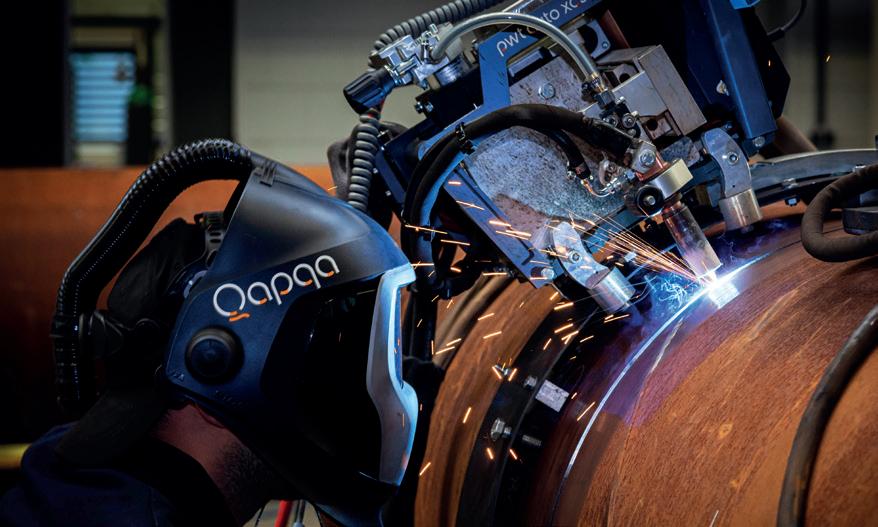

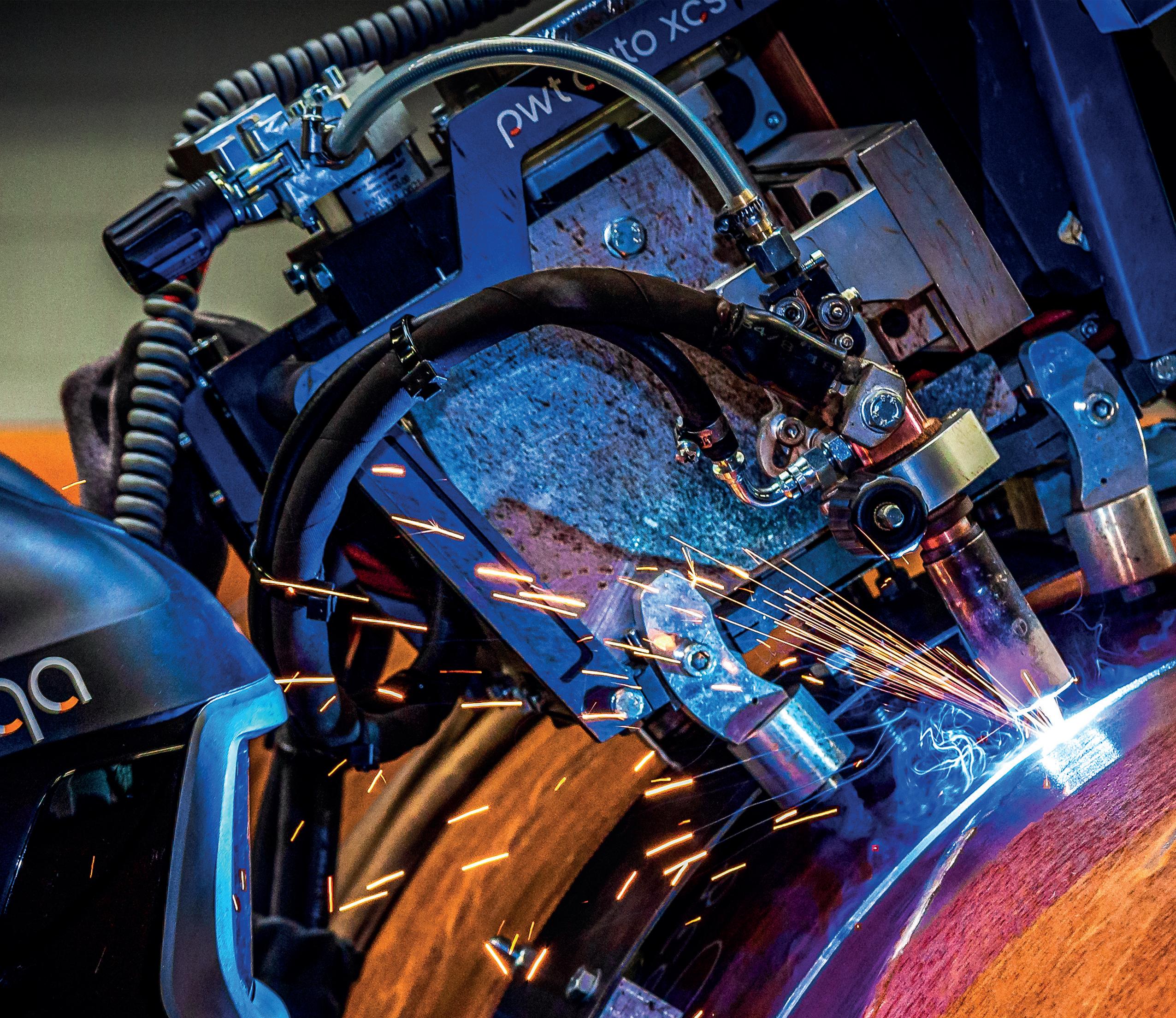

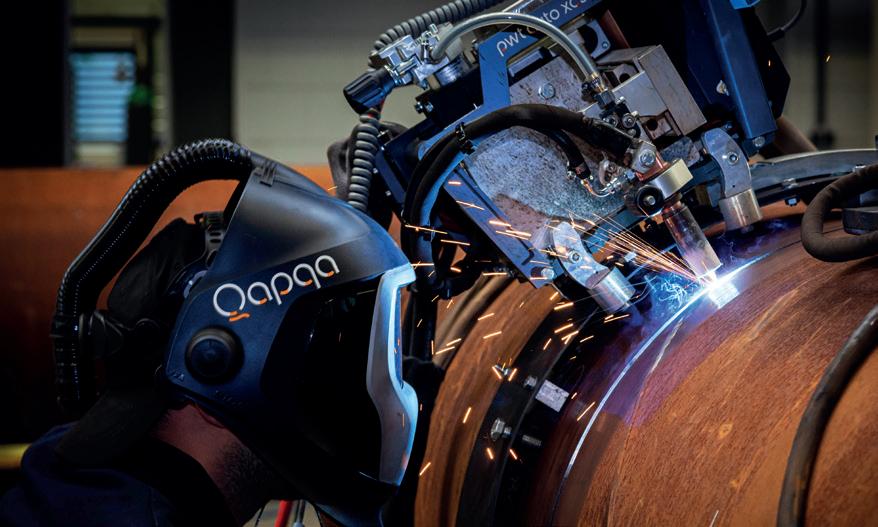

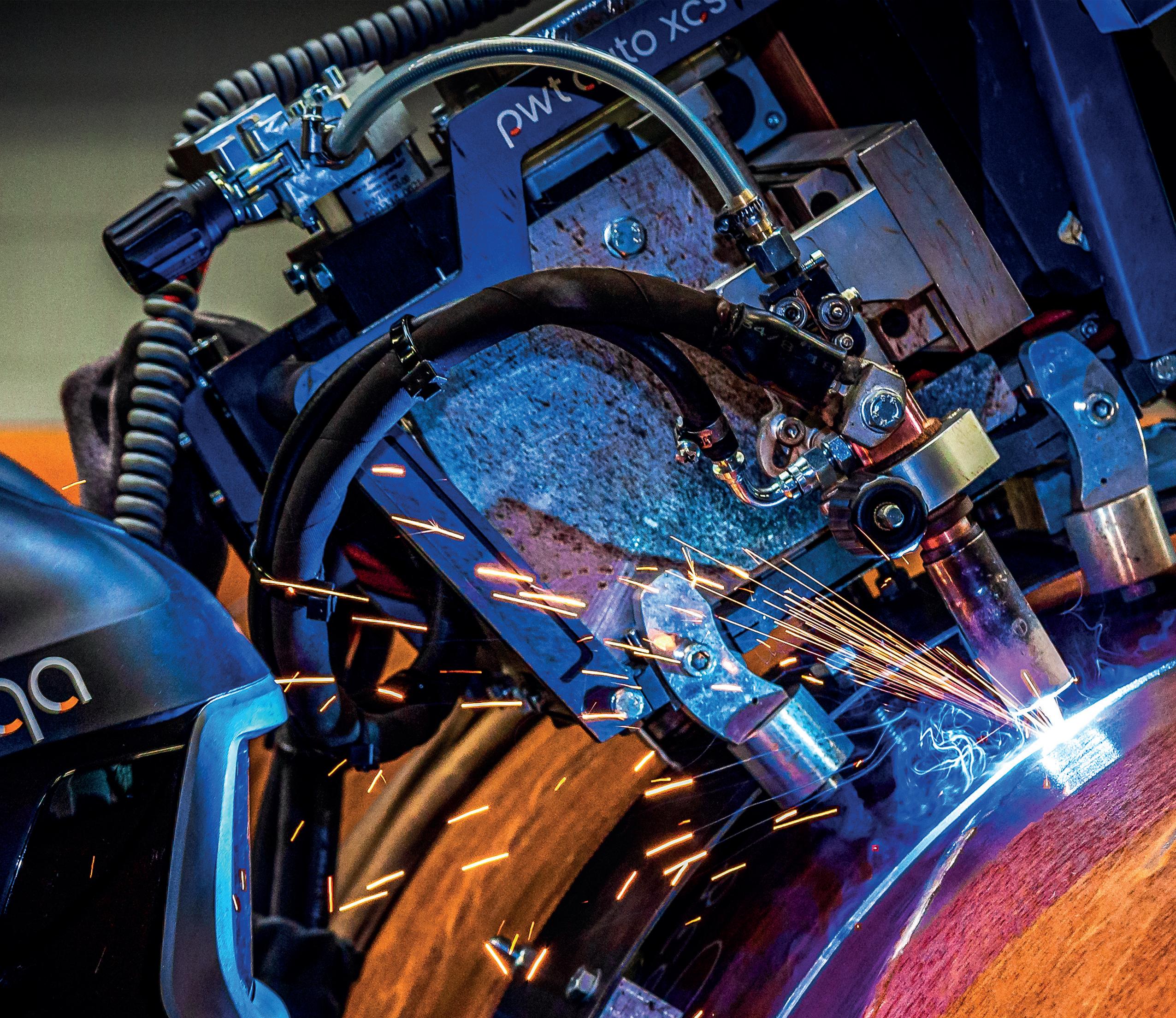

IN EVERYTHING WE DO, WE MAINTAIN THE HIGHEST STANDARDS. OR AS WE CALL IT: THE QAPQA PROMISE.

www.qapqa.com

• Increase productivity • Increase quality • Lower repair rates • High level of support www.qapqa.com PWT AUTO XCS WELDING SYSTEM THE

OPERATOR’S CHOICE

Much potential, many pitfalls

Africa and the Middle East are blessed with some of the largest reserves of oil and gas in the world. They are also beset with internal strife, regional conflicts, geopolitical machinations and the fallout from the Ukraine war. The wide spectrum of challenges compels each jurisdiction to find unique solutions, many of which involve the building and expansion of midstream assets to meet domestic needs and lever export opportunities.

Middle East

Iraq

Geopolitical flare-ups are a constant source of uncertainty in Iraq. For several decades, Kurdistan has been shipping 450 000 bpd of crude through the Iraq-Turkey pipeline that runs to the port of Ceyhan, obviating the need to pass through Iraq territory. Iraq had filed a complaint with the International Chamber of Commerce, arguing that the flow through Turkey should not occur without Baghdad’s approval. In March 2023, the Chamber ruled in favour, which resulted in operators shutting down production in Kirkuk oilfields as local storage tanks reached their limits. The sudden disruption, coming on the heels of a banking crisis, temporarily roiled international

markets; although regional crude trade has since compensated for the loss, Iraq has shown little desire to reach any agreement with Kurdistan regarding resumption of exports, and the situation remains in stalemate.

High level negotiations between Jordan and Iraq continue as the latter seeks a tidewater outlet in the Red Sea for its crude production. The project involves a 1700 km pipeline that would run from Iraq’s oil producing region in Basra to the Jordanian port of Aqaba, located on the northern end of the Red Sea. The US$9 billion line would carry up to 1 million bpd; Jordan would have the right to buy 150 000 bpd as feedstock for the Jordan Petroleum Refinery Company in Zarqa.

Iran

For several decades, Iran has been seeking ways to circumvent the vulnerability of shipping energy products through the contentious Strait of Hormuz. In 2021, it commissioned the Goreh Jask crude pipeline, which runs overland for 1000 km from producing fields near Goreh to the port of Jask in the Gulf of Oman. The US$2 billion project, which took two years to complete, has a capacity of 1 million bpd.

Gas exports have proved more problematic. In 2009, Iran and Pakistan agreed to build the Iran-Pakistan (IP) pipeline

9

Contributing Editor Gordon Cope offers a comprehensive guide to the pipeline sector in Africa and the Middle East.

to service customers in the latter’s populated regions; Iran subsequently constructed the 750 million ft3/d line to the border. But Pakistan’s Inter-State Gas Systems has not built its portion, a 781 km stretch running from the border to the densely populated corridor of the Indus River valley, partly due to complications arising from US sanctions against Iran’s nuclear development program. In early 2023, Iran warned Pakistan that it could be liable for penalties amounting to as much as US18 billion for not holding up its end of the agreement. In August, 2023, Pakistan officially served Iran with a notice of ‘Force Majeure and Excusing Event’ under the Gas Sales and Purchase Agreement (GSPA), essentially cancelling the deal until US sanctions are lifted.

With the Iran-Pakistan project essentially dead in the water, plans for other new pipelines connecting the Middle East to Asia are rising to the fore. Oman is promoting a 2000 km line that would run offshore through the Arabian Sea to India. Other schemes call for Iranian gas to pass through the Oman Sea in an offshore pipeline to Oman, where it would be converted to natural gas for export to Asia.

Africa

Algeria

Algeria is Europe’s largest North African gas exporter. The country’s conventional gas reserves are approximately 140 trillion ft3. Gas production has remained steady at 9 billion ft3/d; major gas lines include the 1620 km MaghrebEurope line (from Algeria to Spain via Morocco), the 2475 km TransMed line (running from Algeria via Tunisia to Sicily and mainland Italy), and the 575 km MedGaz line from Algeria to Spain.

In light of the Ukraine war and subsequent Russian gas disruptions, Spain, France and Italy have been making strong political and business inroads to the North African country, seeking guarantees for increased supplies. In 2022, Paris and Algiers signed a declaration of renewed cooperation marking the 60th anniversary of the former French colony’s independence; one of the key goals was to augment Algerian imports by 50%. Italy’s ENI stated in late 2022 that its gas flows from Algeria are expected to double from 9 million m3/yr to 18 million by 2024. Spain’s ENAGAS is hoping to increase volumes through the Medgaz line, which has a capacity of 10 billion m3/yr.

But EU hopes for greater imports could be misplaced. Algiers’ government is facing internal pressure to force France to pay for its colonial-era misrule and to ease visa requirements; talks between France’s ENGIE and Algiers’ Sonatrach are also stalled over contract length and prices. Spain is in a dispute with Algeria over Morocco’s claims to the Western Sahara. Algeria and Morocco recently cancelled diplomatic relations; the former closed the Maghreb-Europe pipeline, cutting off supplies to both Morocco and Spain (Spain subsequently reversed flows to Morocco, further irking Algeria). Russia is also a strong military partner with Algeria, holding frequent joint military exercises and supplying arms. The former has a clear interest in limiting Algerian gas exports to Europe; Algeria can fruitfully play both sides of the fence to achieve financial, political and military goals.

Egypt

Over the last decade, exploration and drilling have uncovered vast natural gas reserves in the Levant. Egypt is home to the supergiant Zohr field, holding an estimate 30 trillion ft3 of non-associated gas. Israel lays claim to the Leviathan field (22 trillion ft3), and Tamar field (10 trillion ft3). Cyprus holds ownership of the Aphrodite field (7 trillion ft3), and the Calypso discovery region (10 trillion ft3). The Eastern Mediterranean now has the potential to produce almost 30 billion m3/yr, well in excess of regional needs.

In January, 2020, Greece, Israel and Cyprus signed the final agreement for the Eastern Mediterranean (EastMed) project, an 1800 km gas pipeline designed to connect the participating country’s gas reserves to Europe. The ROW will start in Cyprus and connect to Greece, and then to Italy, running roughly 1200 km offshore and 600 km onshore. Italy’s Edison, a subsidiary of France’s EDF and Greece’s DEPA International Projects, are promoting the project through their joint venture IGI Poseidon. The US$6.7 billion line will have a capacity of 10 billion m3/yr in the first phase, with the potential to double capacity in the second phase.

Prior to the Ukraine war, the project faced several challenges. Turkey opposed EastMed because it ignores its rights over natural resources in Cypriot territorial waters and that the cost of transport would make the gas comparatively costly to Russian sources. The subsequent scramble to wean Europe off Russian gas has given the project renewed vigour. The pipeline, which has the potential to transport hydrogen, is on the list of EU Projects of Common Interest, and the EC has announced it would be interested in partially funding the project. In March, 2023, Edison announced that it planned to make an FID by the end of 2023, with a tentative start-up date set for 2027. In the meantime, Cyprus officials expressed doubts regarding the viability of EastMed, citing the cost and challenges of laying pipe in the deep waters west of the island, preferring instead to build only the 300 km link between Israel and Cyprus, then constructing an LNG plant to deliver gas to Europe.

Nigeria

In September, 2022, Nigeria and Morocco signed a memorandum of understanding (MOU) to build the NigeriaMorocco gas pipeline (NMGP). Although the project has been touted for several years, the Ukraine war, higher gas prices (and Morocco’s desire to eliminate Algeria’s stranglehold on supplies), has given the National Nigerian Petroleum Company (NNPC) and the Moroccan Office of Hydrocarbons and Mines (ONHYM) new impetus. The 6000 km line would travel through 13 African countries and deliver up to 5 billion m3/yr of gas to Morocco, where it would hook up to the (currently) inactive Maghreb Europe line and the European gas network. The project, which would cost an estimated US$23 billion, does not have a construction or completion timetable. Algeria, in turn, is promoting a competing line, the Trans-Saharan Gas Pipeline (TSGP), that would link Nigeria to Algeria’s Mediterranean coast via the Sahara desert, and hence to Europe. The 4130 km gas line would cost an estimated US$19 billion. Critics have questioned the viability of both projects, citing the

10 World Pipelines / OCTOBER 2023

complexities of negotiating ROWs, vulnerabilities to jihadists, and financing.

The theft of crude from pipelines remains a significant problem in Nigeria. In October, 2022, Nigerian authorities uncovered a sophisticated crude pipeline network in the Niger Delta region that was being used to siphon off state crude. The 4 km line diverted oil to the Atlantic Ocean, where it was loaded onto barges and vessels. It was part of the US$3.3 billion worth of petroleum products that are stolen annually, and a contributing factor to the decrease in domestic production, from 2.5 million bpd in 2011 to approximately 1 milllion bpd in 2022.

Mozambique

Mozambique possesses significant gas reserves in its offshore waters in the Indian Ocean. In late 2022, ENI’s Coral Sul Floating LNG (FLNG) plant celebrated its first shipment. The 3.4 million tpy plant, under construction since 2019, uses 450 million ft3/d of gas derived from the ultra-deep Coral reservoir. Unfortunately, the region is located in a disputed region of the country, creating security and social problems that have complicated the development of two other projects, ExxonMobil’s Rovuma plant and TotalEnergies’ Mozambique LNG.

Angola

Angola produces approximately 1 million bpd of crude, primarily from offshore oilfields. In 2022, state-owned Sonangol revitalised a project to build a pipeline to transport fuels to land-locked Zambia. The line, which is estimated to cost US$5 billion, would stretch over 2000 km from the Angolan coast to a storage hub near the urban region of Lusaka. From there, branch lines could be extended to the seven other countries that border Zambia. The region, which traditionally relies on Middle East countries to supply its fuels, would benefit from regional proximity and commercial advantages. Angola, which currently has 60 000 bpd of refining capacity, has plans to expand output to 425 000 bpd through greenfield projects.

Angola also has 11 trillion ft3 of gas reserves, primarily associated with its oilfields. While most associated gas production is either flared or re-injected, a 500 km network of pipelines with a capacity of up to 1 billion ft3/d was built to feed gas to the 5.2 million tpy Soyo LNG terminal. Due to insufficient gas flow, the LNG plant has been operating well under capacity; in 2022, Sonongol announced that the Quiluma and Maboqueiro gas fields would be connected to the network to add up to 4 billion m3/yr of gas feed by 2026.

Uganda

Land-locked Uganda has approximately 1.4 billion bbls of recoverable oil located in the complex graben-structures that bisect the country. Several fields are now reaching production phase. Operator CNOOC expects to produce 40 000 bpd from the 560 million bbl Kingfisher oil field. TotalEnergies’ Tilenga oil field is eventually expected to add an additional 190 000 bpd.

In late 2022, Uganda and Tanzania finalised an agreement to build the East Africa Crude Oil Pipeline (EACOP). The US$4 billion line, which is being promoted by TotalEneries and partners, will run from Uganda’s Lake Albert district to the Tanzanian port at

Tanga, a distance of 1443 km. The 24 in. line, which will have an initial capacity of 216 000 bpd, will be insulated to keep the waxy crude from solidifying en route. The line can be ramped up to 246 000 bpd as production increases come on-stream.

Green hydrogen

Major consuming regions in Asia, North America and Europe have instituted regulatory initiatives to evolve their energy infrastructure away from fossil fuels to the benefit of solar, wind and green hydrogen. The latter, especially, has attracted the attention of Middle East countries, who see the switch as an opportunity to transition away from oil and gas toward renewable hydrogen.

Saudi Arabia’s ACWA Power Corporation and US-based Air Products & Chemicals are constructing a US$5 billion plant in the desert city of Neom to produce 220 000 tpy of green hydrogen through the use of solar-powered electrolysis. The output will then be converted into up to 1.2 million tpy of green ammonia by mixing the hydrogen with nitrogen. Green ammonia, which has a higher energy density than hydrogen, is much easier to transport to market. A comprehensive dedicated infrastructure will be needed to service domestic and export markets, however.

In March 2023, Dubai invited bidders to participate in the sixth phase of the Dubai Electricity and Water Authority (DEWA) Rashid Al Maktoum Solar Park. The park, which uses solar photovoltaic power to produce hydrogen, just completed its third phase, and now has the capacity of 2 GW (1GW of capacity is roughly equivalent to the production of 160 000 tpy of hydrogen). The Solar Park, which is to reach 5GW of clean energy output by 2030, is the cornerstone of the country’s strategy to provide 100% of its total power production capacity from clean energy sources by 2050.

Oman is moving aggressively to become an international leader in hydrogen production. Its national oil company, OQ, and the state hydrogen company Hydrom recently signed binding agreements for six green hydrogen projects with a total cost estimated at US$20 billion. The Sultanate’s goal is to produce 1 million tpy of hydrogen by 2030, and up to 8 million tpy by 2050.

In early 2021, Helios Industries announced plans to build a green ammonia production facility in the Khalifa Industrial Zone Abu Dhabi. The US$1 billion plant will produce 40 000 tpy of green hydrogen using an 800MW solar photovoltaic grid and electrolysis. Output will be converted into 200 000 tpy of green ammonia for export and domestic use.

The future

While Africa and the Middle East have tremendous energy potential, their future prospects are complicated by many factors, including geopolitics, corruption, financing, political will and domestic needs. Many jurisdictions are successfully navigating their countries toward success, focusing on leveraging conventional midstream assets and investing in new forms of clean energy, while others struggle with conflicting goals and impediments. For good or bad, they offer both intimidating challenges and tantalising opportunities for the midstream sector.

12 World Pipelines / OCTOBER 2023

AdvAncing pipeline infrAstructure IN AFRICA

14

The African continent is diverse with vast energy resources and diverse economies – each with their unique opportunities and challenges. While some nations are energy producers and exporters, others have to depend on imports to meet their energy needs. Export, cross country and intra country pipelines are critical infrastructure that support the transfer of energy from producers to consumers. As a global leader in automation solutions, Emerson supports pipeline operators to safeguard operations, enable efficient product transfer and support energy security across Africa.

A few of the key challenges faced by pipeline operators in Africa, where pipelines stretch across vast distances and traverse diverse landscapes, are issues around challenges to meet customer demands and maximise pipeline profitability. With ageing infrastructure and an evolving regulatory environment, maintaining the integrity of assets is becoming more difficult, and the potential consequences of pipeline failures are becoming more and more severe. Pipeline leaks can result in substantial economic losses and even pose risks to human and environmental safety.

On the project front, intra-African pipeline development relies on cooperation between multiple nations in which policy, legal and sectoral differences may cause challenges. Political will and regional regulatory alignment are essential to the realisation of Africa’s regional pipelines. The process also involves securing adequate funding, since the high costs of infrastructural developments often prevent project take-off.

To combat these challenges, Emerson offers a comprehensive suite of integrated systems designed to enhance the efficiency and reliability of pipelines. These solutions cover planning, operations, asset management, and more, ensuring optimised pipeline performance while minimising integrity concerns. From advanced leak detection to asset maintenance, Emerson provides a holistic approach for streamlined operations, from field devices to enterprise management. With these solutions, pipeline operators can achieve greater throughput and operational excellence.

15

MS Prakash, Vice President and General Manager, Africa - Emerson Automation Solutions, outlines some key challenges faced by pipeline operators in Africa.

A few ways that automation can support pipeline operators meet these goals are listed below.

Integrate operational and commercial activity to maximise pipeline throughput

Integrated solutions spanning from intelligent field devices and instrumentation to automation and control systems, operations management and enterprise management along with a range of lifecycle services options to ensure peak performance and maximum uptime.

Leak detection systems

Leak detection systems use an array of cutting-edge technologies – including ultrasonic, acoustic, and fibreoptic sensors – to promptly identify leaks in pipelines. By providing early detection, these systems play a crucial role in averting significant spills and mitigating potential environmental harm.

Corrosion protection systems

Corrosion protection systems help to prevent pipelines from corroding, which can lead to leaks and other problems. Employing an array of advanced technologies, including cathodic protection, insulation, and specialised coatings, these systems effectively mitigate the risks from corrosion and erosion of pipelines.

Pumping station, compressor stations, and block valve station controls

Pumping and block valve station controls help to ensure that pipelines are operated efficiently and safely. These advanced controls monitor the pressure, flow, and temperature of the fluid in the pipeline, and can deploy appropriate pump or compressor controls to ensure optimal operation of the pipelines.

Custody transfer metering skids: ensuring accurate transactions

Once energy resources such as crude oil or natural gas reach their destination, ensuring precise custody transfer becomes paramount. Emerson’s custody transfer metering skids offer the most advanced and accurate solutions for measuring and transferring oil or gas from one company to another. These skids ensure transparency and fairness in transactions, fostering trust between trading partners.

Emerson’s flow metering technology guarantees high accuracy, minimising discrepancies and disputes in the measurement of transferred resources. This not only bolsters the financial wellbeing of the businesses involved but also promotes a stable and reliable energy market across the continent.

Supporting Africa’s internal gas networks

Apart from inter-country pipelines, Africa’s internal gas networks play a crucial role in delivering energy to various sectors of society. LPG-powered vehicles and compressed natural gas vehicles are prevalent in many African countries, necessitating gas filling stations throughout cities. To ensure the safe and uninterrupted distribution of gas, natural gas pressure regulating skids are deployed.

Emerson’s pressure regulating skids are highly favoured by many African countries for their effectiveness and reliability. These skids protect gas distribution networks from potential spikes in pressure, minimising risks and ensuring consistent supply to end-users.

Emerson’s commitment to local partnerships

In addition to providing pipeline automation solutions, Emerson also partners with local businesses in Africa to help them develop their own automation capabilities. Embracing a strong belief in fostering sustainable growth and development in the regions it operates, Emerson actively engages with and empowers local businesses across Africa. Through knowledge transfer, skill development programs, and technology partnerships, Emerson aims to create a positive impact on African economies.

By collaborating with African enterprises, Emerson provides training and support to equip local talent with the expertise required to manage and maintain the advanced automation solutions. This not only enhances employment opportunities but also stimulates economic growth by encouraging innovation and entrepreneurship. Emerson also works with local businesses to develop customised solutions that meet the specific needs of their customers. This tailored approach further enhances the relevance and effectiveness of the automation industry in the region. The company’s solutions are helping to improve the safety, efficiency, and reliability of pipeline operations in Africa, and they are also helping to create jobs and economic opportunities in the region.

The future of pipeline infrastructure in Africa

The demand for energy in Africa is growing rapidly, and the pipeline industry is playing a key role in meeting this demand. Emerson is committed to providing the products and services that African countries need to build and maintain safe, efficient, and reliable pipeline infrastructure.

As Africa continues to evolve in its pursuit of energy security and economic prosperity, pipeline infrastructure remains a critical factor. Emerson’s automation portfolio has emerged as a key enabler, empowering the safe and efficient transportation of energy resources across diverse landscapes. Through cutting-edge leak detection systems, custody transfer metering skids, and pressure regulating solutions, Emerson has solidified its position as a reliable partner in Africa’s energy journey.

What sets Emerson apart is its dedication to empowering local businesses through knowledge transfer and technology partnerships, demonstrating a commitment to sustainable growth on the continent. The company’s solutions are helping to improve the safety, efficiency, and reliability of pipeline operations in Africa. Moreover, these advancements have contributed to the creation of job opportunities and economic development in the region. As Africa and the Middle East face unprecedented challenges and opportunities, Emerson’s role as a driving force in pipeline automation and a catalyst for socioeconomic development is poised to create a lasting impact on the region’s energy landscape.

16 World Pipelines / OCTOBER 2023

IT IS MY DEDICATED PASSION

for pipelines that compels me to partner with others in the industry, share best practices and collaborate on ideas for future innovations and advanced applications.

It is who I am. I am a pipeliner.

We are pipeliners too.

We share this passion and, like you, we are committed to keeping pipelines running safely and reliably. By providing top-of-the-line tools to address your threats, and applying the most advanced assessment techniques, we ensure you get the best return on your pipeline asset, both economically and environmentally. The world counts on you. You can count on us.

©2023 T.D. Williamson

18

Arun Behl, Head of Business Development – Middle East & Africa, and John Downer, Senior Project Manager, Penspen, UK, describe how energy producers in Africa can benefit from Europe’s shift in energy policy.

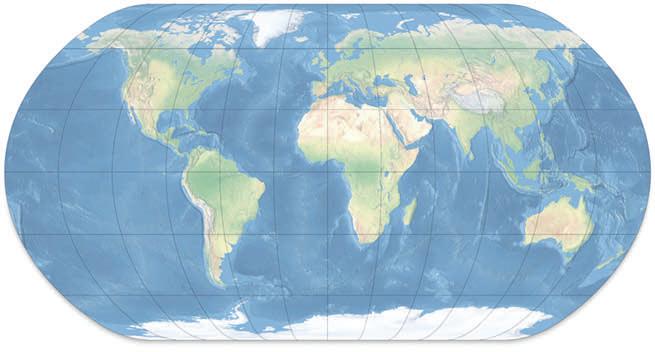

With 492 projects expected to commence operations between 2023 and 2027, to say that oil and gas producers in Africa are in for a decidedly busy time would be something of an understatement.1 Of course, the trigger for this phenomenal surge in activity is primarily down to the European Commission’s plans to end Europe’s dependence on Russian fossil fuels following the Kremlin-sanctioned invasion of the Ukraine. Positive sentiment in the energy market towards Africa succeeding is at an all-time high, but there are a number of key considerations that will need to be taken into account if the benefits to producers are to be realised.

The decision by the EU to label natural gas as a ‘transitional fuel’ en route to a zero emissions target has opened a key opportunity for African producers to take up the slack of, the now banned, Russian gas that provided around 30% of EU supplies. The European Parliament, in response to the energy crisis, also now considers new investments in gas as ‘climate friendly’ – a change of heart that is already proving an area of investment interest for European banks and other financiers. Africa currently provides around 20% of Europe’s gas imports.2 It’s a percentage that’s likely to increase considerably with natural gas

delivered directly to the EU via pipeline and LNG transported by ship from now until 2050.

Why the EU/Africa attraction is mutual

The 2050 line in the sand is the EU’s aim to be the world’s first climate-neutral economy, with member nations having achieved zero carbon targets by that time. Although African countries don’t have the tapped reserves or extensive infrastructure to replace Russian supplies entirely, European countries are looking to diversify their suppliers and routes to meet their existing energy needs. Africa can certainly be a part of that mix, particularly as it is home to 13% of global gas reserves, 7% of the world’s oil and has boundless green-energy potential.3

Europe’s appeal to Africa as a region to export to is its tremendous market size and the creditworthiness of consumers. The capital generated by serving the EU also goes a long way towards expanding and improving the production, processing and transport capacity of Africa’s energy producers.

The EU appetite for imports of petroleum oils from Russia has now dropped markedly from 27.6% as recently as 3Q21 to 15.1% as of 3Q22, with further falls predicted.4 Here the opportunity for Africa is to make more use of its energy reserves,

19

to earn hard currency export income to the EU and in parallel to develop energy for its own continental use – making a hugely transformative difference to the region’s economic growth and people’s lives. For an economy to develop you need energy.

European consumer and business perception that gas pipeline projects also bring key benefits to Africa, and the transited countries, by the dropping off of gas en route (to bring new energy to energy poor regions) is also a big attraction. In short, it gives rise to an element of altruism that is a happy by-product.

Key considerations – it’s all in the delivery

As you would expect, delivering oil and gas resources from African producers to Europe involves several key considerations to ensure smooth and efficient operations. Encompassing various aspects of the supply chain, logistics, regulations, and geopolitical dynamics, some of the essential factors to be taken into account include:

Infrastructure and transportation

Establishing robust and reliable infrastructure is crucial. This includes pipelines, ports, terminals, and storage facilities to transport oil and gas from production sites to European markets. Also, incorporating a degree of future proofing within the design of new systems so that they can transition to products such as hydrogen will ensure alignment with future EU energy demands and prolong asset life and usefulness.

Political and regulatory stability

Nigeria has the tenth largest gas reserves in the world. However, the gas is dispersed in various fields – many of which are offshore – and a network to collect and treat the gas in sufficient quantities for all the various projects has yet to be developed. Although stalled for 17 years since it was initiated in 2005, Nigeria’s Brass LNG Project presents the perfect opportunity for Africa to interact with the world LNG market if it can overcome the pre-FID hurdles that have affected its completion. The post Ukraine situation is again reviving interest in the project, whetted by the estimated US$400 million gas sales each week to the EU that could have occurred since 2022.6 Also stemming from Nigeria, the West African Gas Pipeline (WAGP) was commissioned in 2006 and was the first regional natural gas transmission system in sub-Saharan Africa.

With regard to areas attracting potential finance injections, Energy Capital & Power, the Africa-focused energy investment platform, identified the top 10 African countries with the largest natural gas reserves in 2021 as: Nigeria (206.53 trillion ft3), Algeria (159.1 trillion ft3), Senegal (120 trillion ft3), Mozambique (100 trillion ft3), Egypt (77.2 trillion ft3), Tanzania (57.54 trillion ft3), Libya (53.1 trillion ft3), Angola (13.5 trillion ft3), Congo (10.1 trillion ft3), and Equatorial Guinea (5 trillion ft3).7

All eyes are on the Nigeria-Morocco prize August 2021 saw the announcement from Nigeria’s Petroleum Minister, Timipre Sylva, that the government of Nigeria would look at supplying Europe with natural gas via the NigeriaMorocco Gas Pipeline (NMGP).

A key issue for any energy supply is the security

and

reliability of that supply. African pipelines, particularly in the Niger delta, have made headlines from attacks and supply interruptions which, if they occurred to a contracted EU supply, would evoke deep questions over the continued reliance on such a supply with possible contractual penalties applied.

Investment and financing

Development finance institutions and multilateral development banks have long been the go-to sources for investment in all types of energy projects throughout Africa. A growing network of African-based lenders has emerged to take advantage of the boom. Blended finance initiatives, specialist funds and other innovative international lending mechanisms are providing private investors with a more secure platform, shored up by attractive rates for financing and guarantees from DFIs and MDBs. For the European market though, price competitiveness and end-to-end contractual agreements are the certainties that backers look to have locked in place from the outset to ensure maximum return on investment.

Some regional cases in point

Keeping the key considerations listed above in mind, let’s take a look at some of the major players in African country terms. Algeria is one of the region’s largest natural gas exporters and its gas connectivity infrastructure with Europe is well developed. On the good news front, April 2022 saw Italy strike up a new gas supply agreement with Algeria that would increase its gas imports by close to 40%.5 This was a major move for Italy as it sought to cut ties with Russian supplies.

A 5660 km long regional onshore and offshore gas pipeline, starting from Nigeria and ending at the Moroccan port of Tangiers on the Strait of Gibraltar, the NMGP is planned to deliver natural gas to 13 countries in the West and North Africa as a continuation of the existing WAGP pipeline and will be extended to Europe through Spain.8 To be completed in phases over a 25 year period, the completion date is expected to be in 2046 at a cost that was estimated pre-COVID-19 to be US$25 billion.9

A remarkable feat of engineering, the NMGP promises to be a life-changing achievement for all of the countries it serves, and a triumph of cooperation.

The value of knowhow shared

It’s important to acknowledge that Africa isn’t going it alone when it comes to developing and optimising the energy infrastructure required to improve access to its resources for the benefit of communities, economies and export. Penspen has been a leading, independent provider of engineering (FEED, feasibility study, detailed engineering), project management services (PMS) and asset integrity services to the oil and gas industry for over 70 years. The company’s influence extends across major cross-country pipeline projects in Europe, the Middle East, Africa, the Americas, and the Asia Pacific region.

The experience and expertise of western companies is evident in the large-scale compressor technology needed for the systems being developed. Project governance, asset integrity and management, and feasibility and engineering studies are typically the purview of western companies too, while Asian contractors – including Indian and Chinese contractors – are most heavily

20 World Pipelines / OCTOBER 2023

Wax-Tape® #2

Self-Firming Anticorrosion Wrap:

A unique, microcrystalline-wax-saturated wrap that slowly firms up to provide excellent above and belowground protection. Comes in a variety of colors and usually requires no outerwrap.

Temcoat™ 3000 Primer

Temcoat™ 3000 is a high-temperature microcrystalline waxbased coating compound that will not melt and can be applied at ambient temperatures up to 110°C (230°F).

Wax-Tape® HT-3000

High-Temperature Anticorrosion Wrap:

Designed for operating temperatures up to 110°C (230°F), Wax-Tape® HT-3000 wrap can be used on high-temperature oil and gas piping, on compressor station discharge piping, beneath thermal insulation and in high ambient temperature conditions.

High-quality, easy-to-apply wraps that protect irregularly shaped fittings and require minimal surface preparation.

Only Trenton offers Wax-Tape® brand anticorrosion wrap systems, with primers, wraps and outerwraps.

Wax-Tape® #2 wrap was applied to large mooring chains on a platform off the west coast of Africa.

A customer in the Middle East chose Temcoat™ 3000 primer and Wax-Tape® HT-3000 wrap to apply to a 30” pipeline before insulation was applied.

involved when it comes to construction. Together, the skills and insight of businesses from many nations are bringing projects of a massive scale to fruition in Africa.

The future looks bright, and renewable…

If you take ‘beneficial, affordable and reliable’ as the hallmarks of success for African oil and gas producers to aspire to over the years to 2030, then the not-too-distant future will be in great shape as well given North Africa’s enormous renewable energy potential. Solar and wind power are the obvious winners, especially with regard to exporting the surplus to Europe. But it is the production of green hydrogen that is most likely to prove vital to the EU and its goals to decarbonise industrial sectors across the board.

The opportunity to construct pipelines today that can be adapted to transport green hydrogen 20 to 30 years from now when the market for oil and gas has diminished should be incorporated into current project thinking. Far from a pipe dream, the ideal scenario would be to have future proofing designed and built in. The presence of critical raw materials essential to the energy transition, and an up-and-coming young, welleducated workforce in North Africa that could help take R&D and manufacturing technology to the next level, also bodes well for the future.

The European Commission’s Green Deal of 2019 views tackling climate and environmental-related challenges as ‘this generation’s defining task’.10 The EU and its member states can leverage the sentiment of the deal’s energy transformation

Connecting pipelines to populations

strategy to stimulate investment in Africa in support of clean energy.

The EU’s pledge to give Nigeria US$1.4 billion (€1.3 billion) in climate funding to support 60 projects focused on agriculture, climate and digital technology through to 2027, also speaks to the aspect of altruism we mentioned earlier in this piece.11 It’s not just about the energy crisis in Europe, it’s about improving the fortunes and wellbeing of the people of Africa on the road to achieving economic growth through low carbon, resource efficient and climate resilient development.

For European energy consumers this is Africa’s time to shine.

References

1. “Africa Oil and Gas Project Market Overview”, GlobalData, April 2023.

2. “Europe’s energy switch may boost African producers”, GIS Reports, January 2023.

3. “Why Africa is poised to become a big player in energy markets”, The Economist, July 2023.

4. Europe’s ‘energy war’ in data: How have EU imports changed since Russia’s invasion of Ukraine? euronews.green February 2023

5. “Ukraine crisis: Can Africa replace Russian gas supplies to Europe?”, BBC,May 2022.

6. “Nigeria misses millions of dollars on failed Brass, Olokola LNG projects”, BusinessDay, November 2022

7. “Top 10 African countries sitting on the most natural gas”, Energy Capital & Power, July 2021.

8. “A timeline of the Nigeria-Morocco Gas Pipeline Project”, Further Africa, August 2021.

9. “Unlocking Africa’s gas riches: Nigeria-Morocco gas pipeline”, Further Africa, July 2022.

10. “Communication from the Commission – The European Green Deal”, EUR-Lex, December 2019.

11. “EU pledges US$1.4billion in climate funding to Nigeria”, Further Africa, July 2022.

in remote locations Visit www.iploca.com to find out more

Conquering digital distrust in Nigeria

Adeshina Adebusuyi, Regional Business Development at James Fisher AIS, provides a blueprint for overcoming the gaps in Nigeria’s oil and gas digital transformation journey.

Digital transformation in Africa is advancing in leaps and bounds, with Nigeria leading the charge as home to the highest number of technology hubs in the whole continent. This advancement, coupled with global initiatives such as the Biden Administration’s ‘Digital Transformation with Africa’, will see the continent’s digital infrastructure grow significantly.

Despite this technology spike, Nigeria’s energy industry is lagging behind its global peers, putting its big ambition –to be a gas-powered economy by 2030 – at risk.

23

Is Nigeria’s decade of gas in jeopardy?

Nigeria is on the cusp of a big oil and gas infrastructure boom, which could see the country finally unlock the economic prosperity residing in its abundant natural resources. This could lift millions out of energy poverty by augmenting domestic supply as well as boosting exports.

Historically, Nigeria has been severely hampered by a lack of oil and gas infrastructure, however progress is finally being made as a result of President Buhari’s ‘Decade of Gas Initiative’, alongside the long-awaited reforms delivered through the Petroleum Industry Act (PIA).

Although the pace has been slow, there are large infrastructure projects happening, such as the Dangote Refinery, the 614 km long AKK natural gas pipeline, and several LNG plants that are anticipated to be commissioned over the coming months and years. In addition to this, the state-owned refineries in Port Harcourt, Warri, and Kaduna are also being rehabilitated, which will be another boost to the Nigerian economy.

Despite the planned projects, Nigeria’s chequered history with the use of digital technology within the oil and gas industry is in danger of jeopardising this potential success story, with many companies becoming disillusioned by digital transformation.

The pitfall of digital distrust

impact, whether on production, maintenance, resourcing, construction etc. For some workers in the industry, this has created an element of doublethink: many have ambitions to mirror their global peers when it comes to digital innovation but are hesitant to do so based on their past experiences.

While industry leaders elsewhere are benefiting from the latest innovations in digital twins, data analytics and preventive and predictive maintenance, many Nigerian workers are still struggling to piece together their maintenance schedules from incomplete plant plans and records kept in Excel. Employees waste a lot of their time looking for data that has been siloed into several systems and documents or, worse, has not been captured at all, residing solely in colleagues’ memories.

Diverless Systems working off DP vessels

This frustration is only amplified when, year on year, they attend the same industry conferences but are left out of conversations for being no further along in digitally transforming their Nigerian operations. This deflated feeling is particularly acute for the globally mobile portion of the workforce who have benefitted from digital transformation first-hand in the United States, Middle East and Europe, and previously gained satisfaction from using digital tools to amplify their decision making.

Land make-up andBottom TowInstallation

Most oil and gas decision makers will have at least one story to tell of how they were sold a vision of digital transformation, only to be left with an inferior product and no support to assist with implementation. These purchases not only failed to contribute any productivity or financial improvements; but in many cases, did not solve the issues that they were bought to resolve. It’s become an all-too-common pitfall, engineered by unscrupulous salesmen that are only in it for the win.

Understandably, this has led to distrust and hesitance in adopting new innovations that would have a positive

Overcoming digital disillusionment

Trench

Without digital transformation, Nigeria will continue to trail its global peers. Although domestic supply and exports will rise, economic prosperity would not be unlocked to the fullest potential. To mend the rift created by digital disillusionment, a new approach to digital transformation is needed.

Collaborative partnerships with an innovative ethos offer a compelling alternative to previous digital transformation attempts. Built on mutual trust and understanding, they can wash away the hesitance and disenchantment of the past, revealing the almost limitless opportunity of a digital future.

Cable TrenchingSled

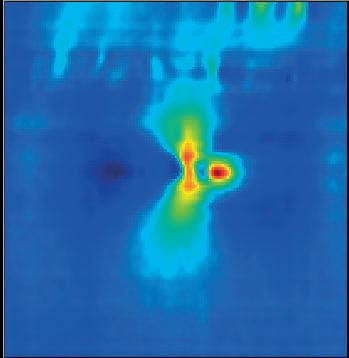

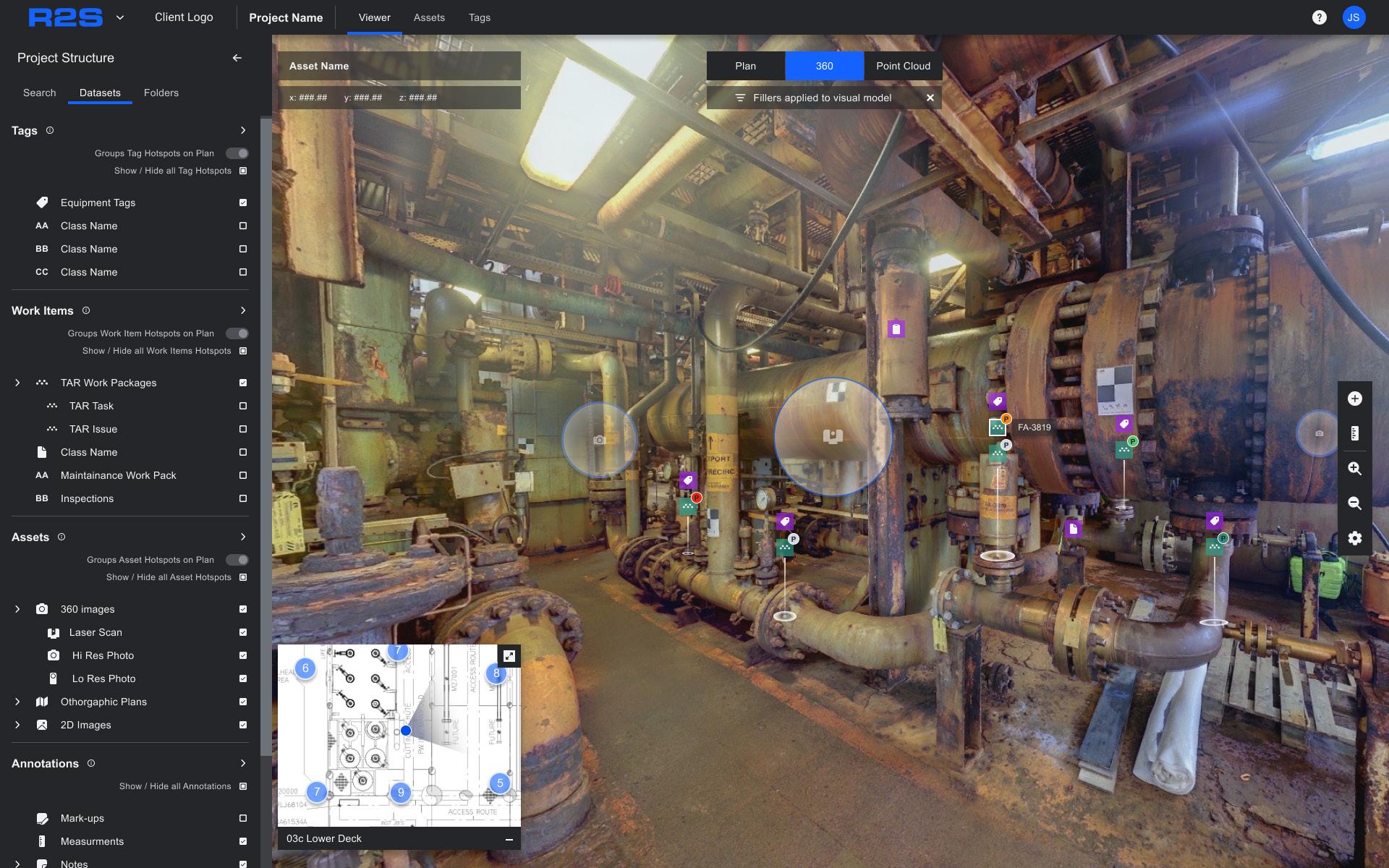

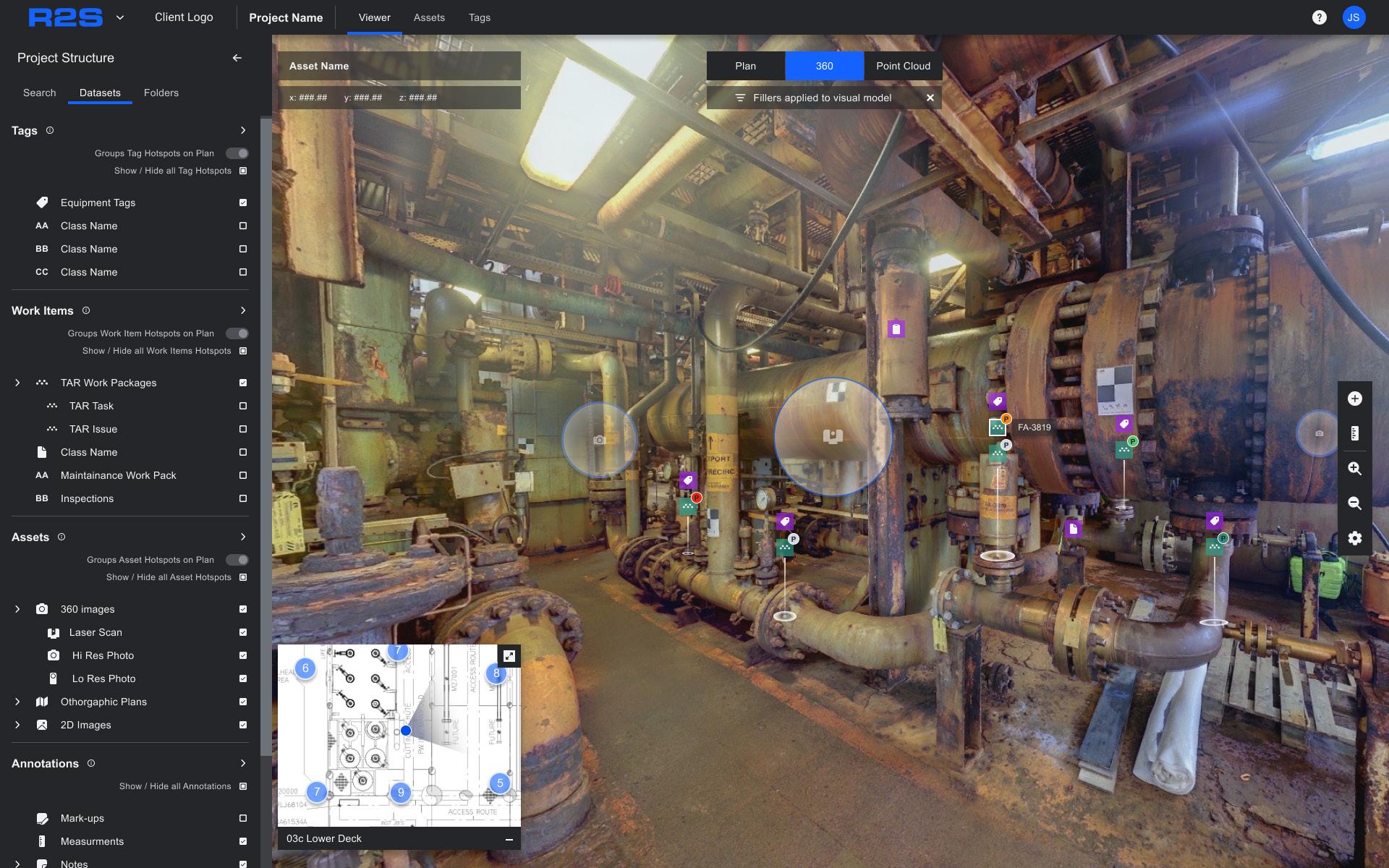

James Fisher AIS’s rollout of its R2S digital twin technology is one example of how Nigeria is benefitting from a different approach.

Digital twins are commonly used in upstream and downstream projects, but they can also be used to simulate and manage midstream operations. From transportation to storage, there is huge value in having ‘eyes’ on these facilities, particularly when they are prone to safety risks, ranging from aging pipelines to corrosion or cracks in tanks.

There is even the risk of attacks on pipelines, particularly as large stretches of pipeline can be found in more remote areas. However, technologies, such as digital twins

OESPtyLtd Lincoln Consulting

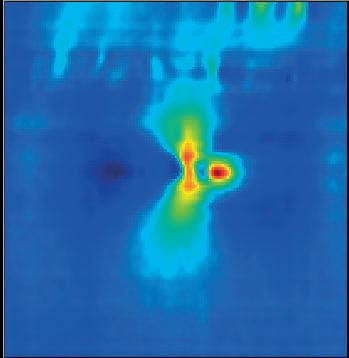

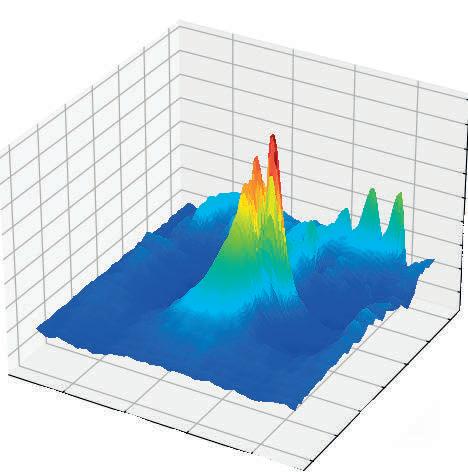

Figure 1. James Fisher AIS’ R2S digital twin software.

Floatation

Shore Crossing Cofferdam Diverless Systems working Diverless Systems working Diverless Systems working off DP Diverless Systems working off DP vessels

24 World Pipelines / OCTOBER 2023

Above and below - Indonesian Buaya Besar Barge 1.2 m to 20 m depth.

Brasil Post Trenching Rough Shore Approach (Lead Keel Machine)

Above and below—Ultra shallowwater system 0.6 m to 3 m depth.

Typical Deck Layout On DP Vessel for Deep Water Trenching 80 to 400 meters

Post Trenching in rough swells off Brazil. Cutter Suction

TRENCHINGCAPABILITES

Above and below - Indonesian Buaya Besar Barge 1.2 m to 20 m depth. Above and below—Ultra shallowwater system 0.6 m to 3 m depth.

OES INTERNATIONALLOCATIONS

Above and below - Indonesian Buaya Besar Above and below—Ultra shal system 0.6 m to 3 m depth.

Above and below - Indonesian Buaya Besar Above and below—Ultra shal system 0.6 m to 3 mdepth.

First Trenching by Dynamic Positioned Vessel 1992 New Zealand

• Trenching in largest Seas 28 ft 1992 New Zealand

• Trenching Hardest Soils with proprietary high pressure system 150 kpa shear strength Thailand 1993

First and only Post Rock Trencher ‘Tiger Shark’ 1994 to 2008

•

• Trenching Deepest Pipelines 400 meters 1999 Bass Strait

Trenching Deepest trench 7 meters 2000 Indonesia

• Trenching in strongest water current 11 knots China 2004

Busan, Korea

Trenching Stress Relieving of Directional drilled pipelines by others Australia 2004

• Trenching Live Gas Pipelines Indonesia 2006

Singapore

•

• Trenching roughest shore approach with pumps on beach Ghana, Africa 2018

Rio

. •

• •

Balikpapan, Indonesia

Also laid 7 kilometers of 150 NS 110,000 Volt cables including directional drilling shore approach through rock cliffs

Salvaged six projects where pre dredging, directional drilling and jet sleds failed

• •

Melbourne, Australia Corporate Headquarters

Equipment Includes: 45 20 ft sea freight containers with 8 x 1600 hp 350 psi pumps, 2 x 1000 psi booster pumps, 3 hydraulic hose reels with 90 to 120 meters of 4 x 4 inch hose, interconnecting piping and suction strainers, 6 x subsea pipeline lead k eel type jet machines for 6 inch to 52 inch pipelines, 1 Tiger Shark cuts 600 mm deep trench per pass x 1200 mm wide in 30 mpa ucs rock, 2 cable trenchers that simultaneously backfill to 1.5/3 meters cover. An eight point mooring system 20 tonne, 20 tonne heave compensator, 3 Hydraulic power packs including 1 300 HP for tiger Shark, 1 Tiger Shark Hose reel with 2 x 500 meters of 5000 psi hydraulic hose and a 10 tonne clump weight and deployment system. A 10 tonne hydraulic cable tensioner.

Company Value 1995 to 2014 $100 million. Sell now $5 million or best offer. Ask for photos, specs, container lists and completed project references.

1 305 304 6452 www.oes.net.au lincolnoes@aol.com

De

Largo, USA

Janeiro, Brazil Key

Seychelles Islands INTERNATIONAL OIL, GAS AND POWER EPC CONTRACTOR

working off DP vessels

Diverless Systems

working off DP vessels

Post Trenching in rough swells off Brazil. Cutter Suction

DP vessels

Cutter Suction Dredge

vessels

Post Trenching in rough swells off Brazil.

Above and below - Indonesian Buaya Besar Above and below—Ultra shallowwater system 0.6 m to 3 m depth.

OES World Leader in Subsea Pipeline Trenching Is For Sale (all assets tangible and proprietary intangible) Track Record since 1992 includes the successful trenching of over 250 pipelines and cables including the following world’s firsts:

• Largest Pipeline 54 inch 1995 India

World’s deepest water post trencher sled 1200 ft

Typical Dynamic Positioned Vessel during Trenching (Lead Keel Machine)