A MEMBER OF WINN & COALES INTERNATIONAL SCAN TO VIEW OUR LATEST DENSO BORE-WRAP™ CASE STUDY ® Volume 23 Number 8 - August 2023

The leading innovator supplying cutting-edge integrity solutions. Together we can ensure sustainable decision-making. Our combination of advanced inspection systems and expert consultants delivers a comprehensive understanding of asset safety, lifetime, and performance.

Comprehensive Asset Integrity Management

www.rosen-group.com

KEYNOTE ARTICLES: PROJECT

10. Proactive risk planning

MANAGEMENT

Brad Barth, Chief Product Officer, InEight, USA.

PAGE 10

14. The modern management of pipeline projects

John Downer, Senior Project Manager, Penspen, UK.

19. Defence against a Trojan horse

Gerald Caponera, Product and GTM Leader, ThreatConnect, USA.

25. Simulation software ecosystems

Paul Dickerson and Dr. Jon Barley, Emerson.

31. Managing regulator station risk

Tony Alfano, Pipeline Product Line Director, DNV.

35. Work within the water

Elizabeth Cleveland Wakefield and Kelly Hardman, Fragomen.

CONSTRUCTION BEST PRACTICE

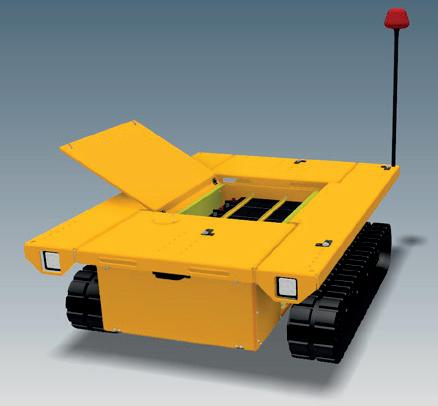

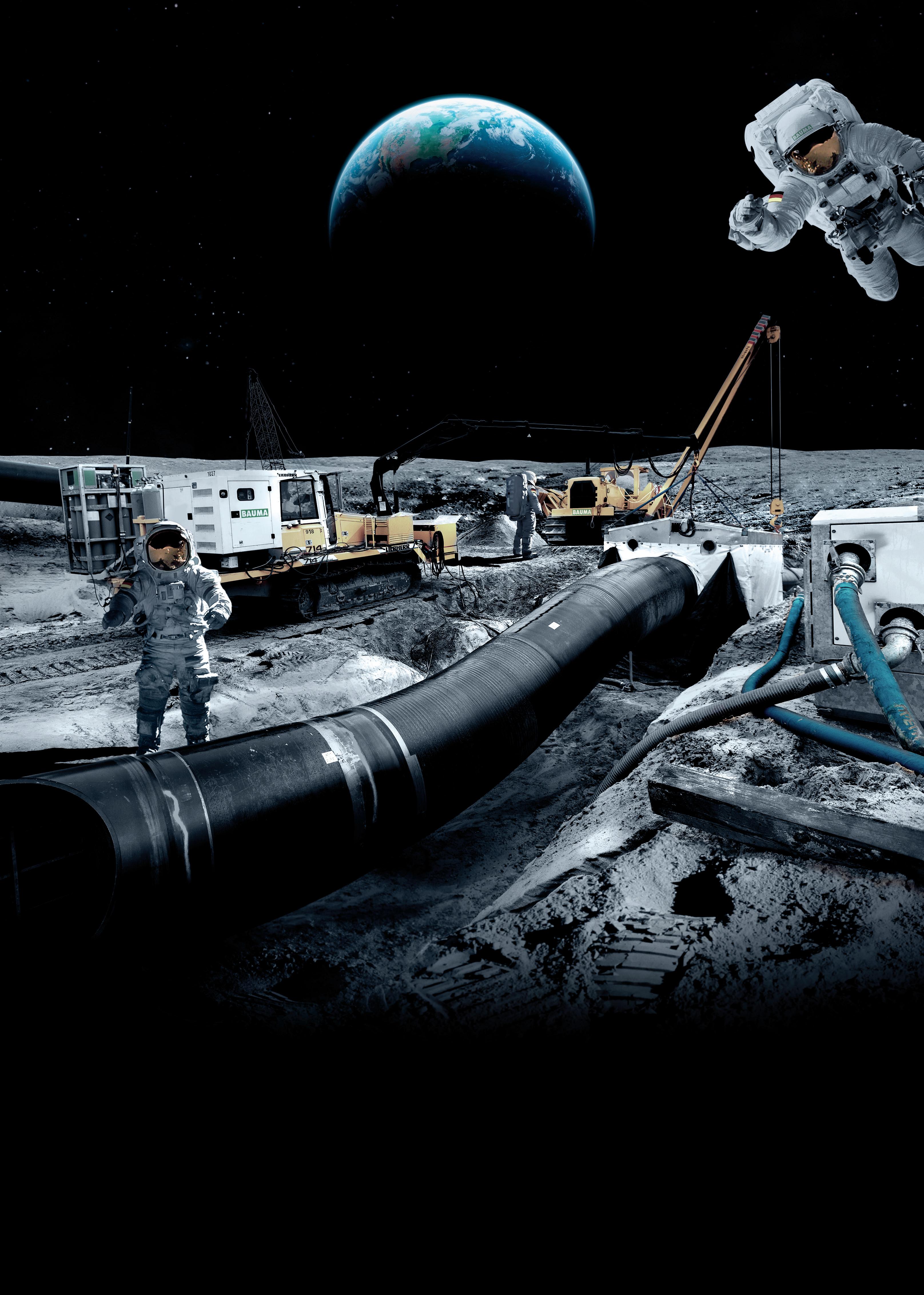

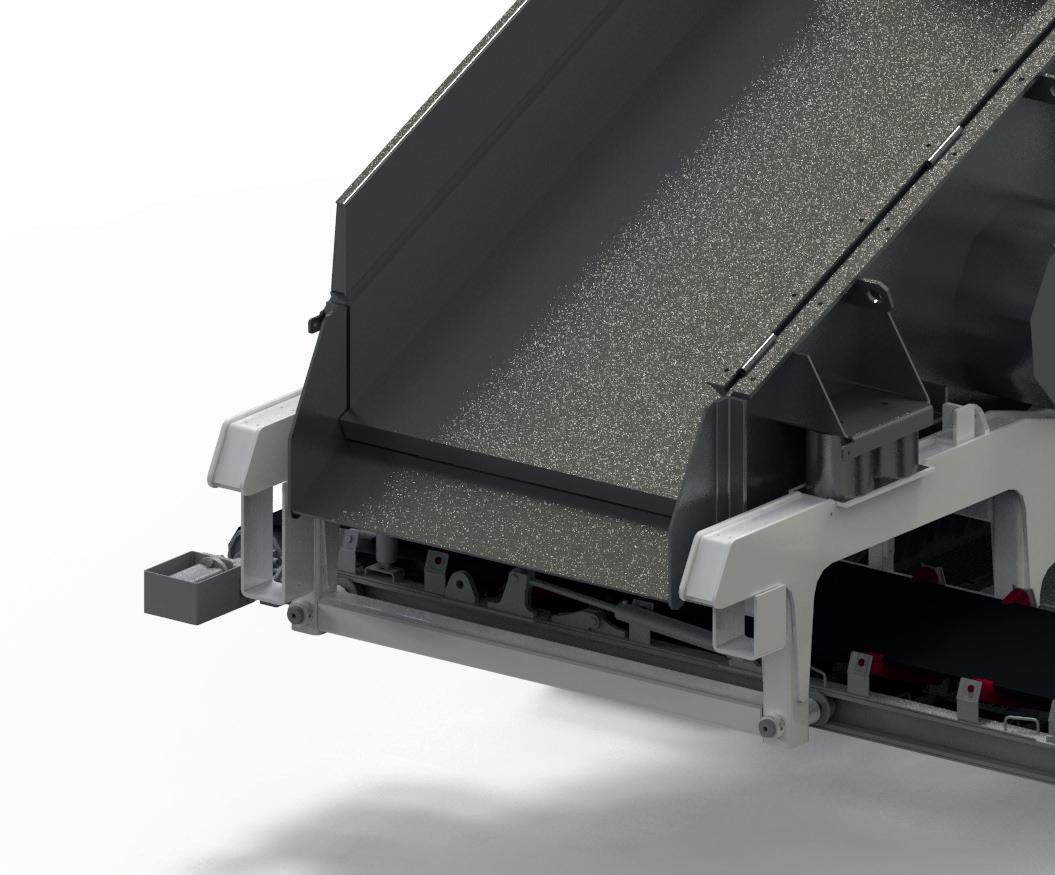

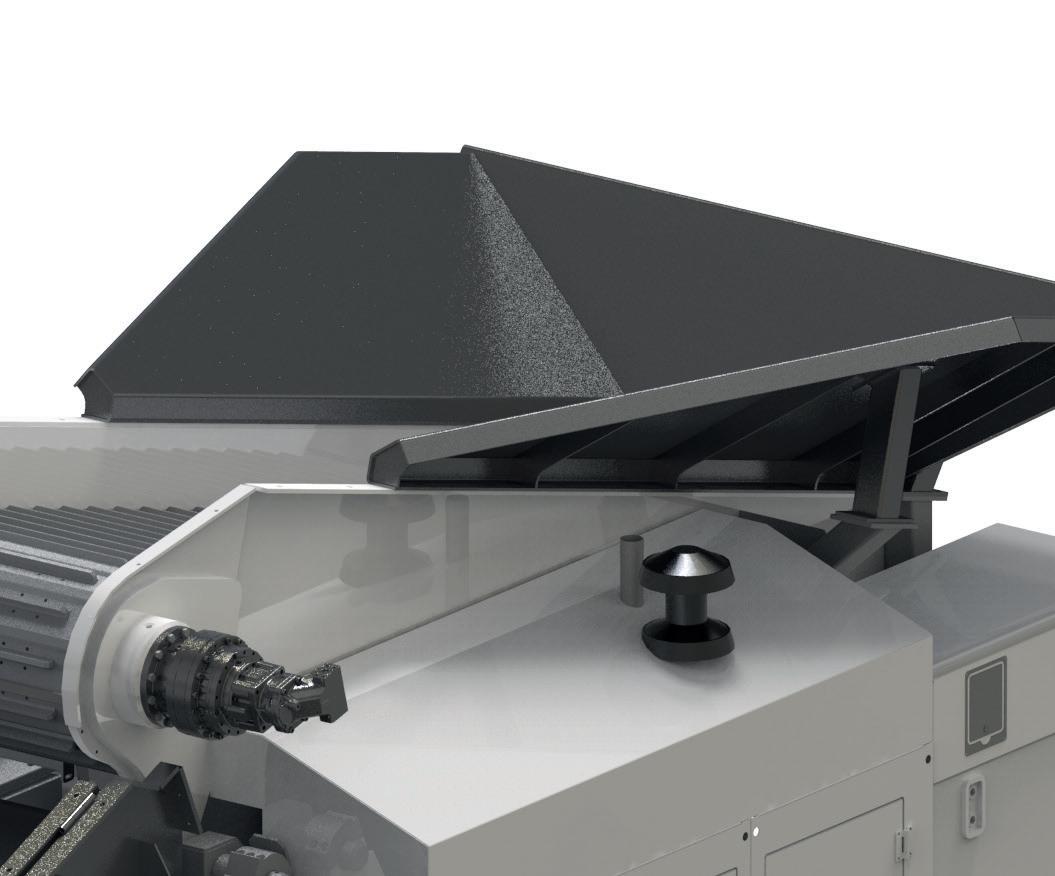

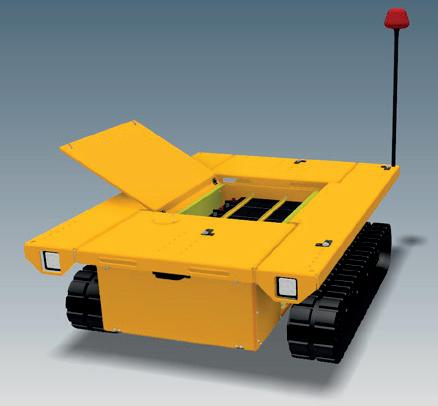

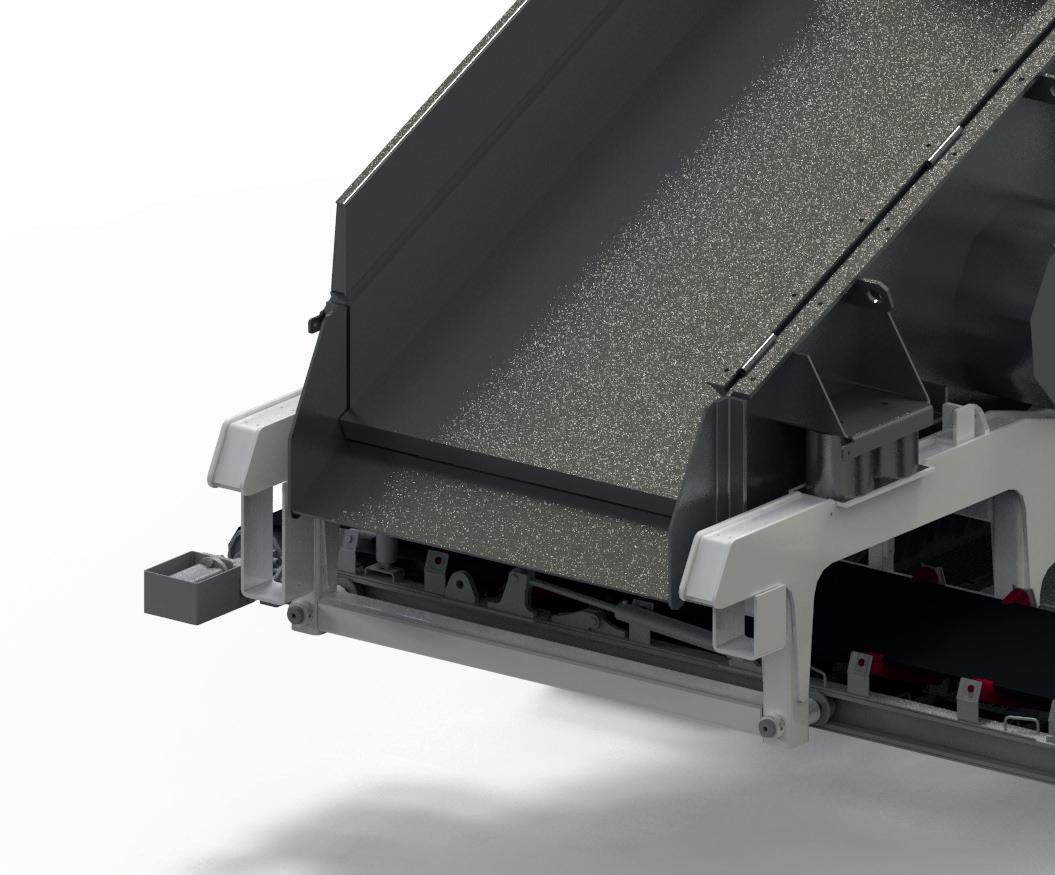

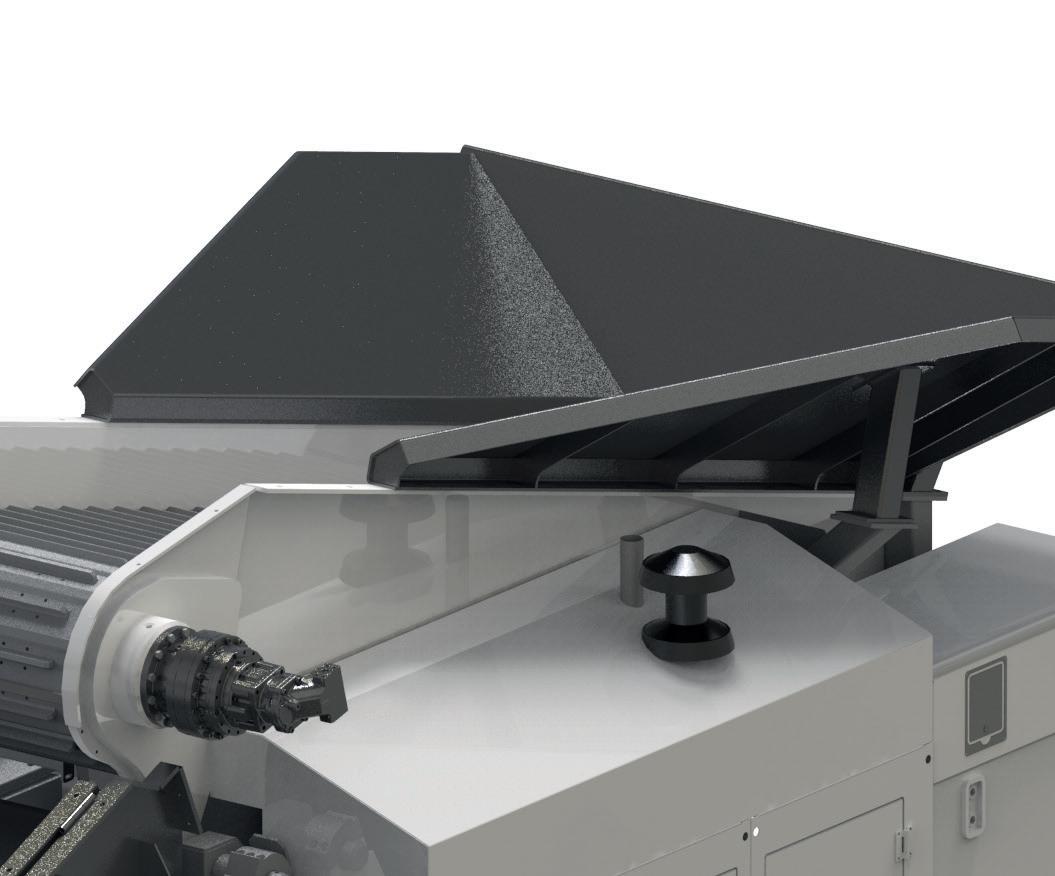

39. Purpose-built pipeline machinery

Todd Razor, on behalf of PACCAR Winch.

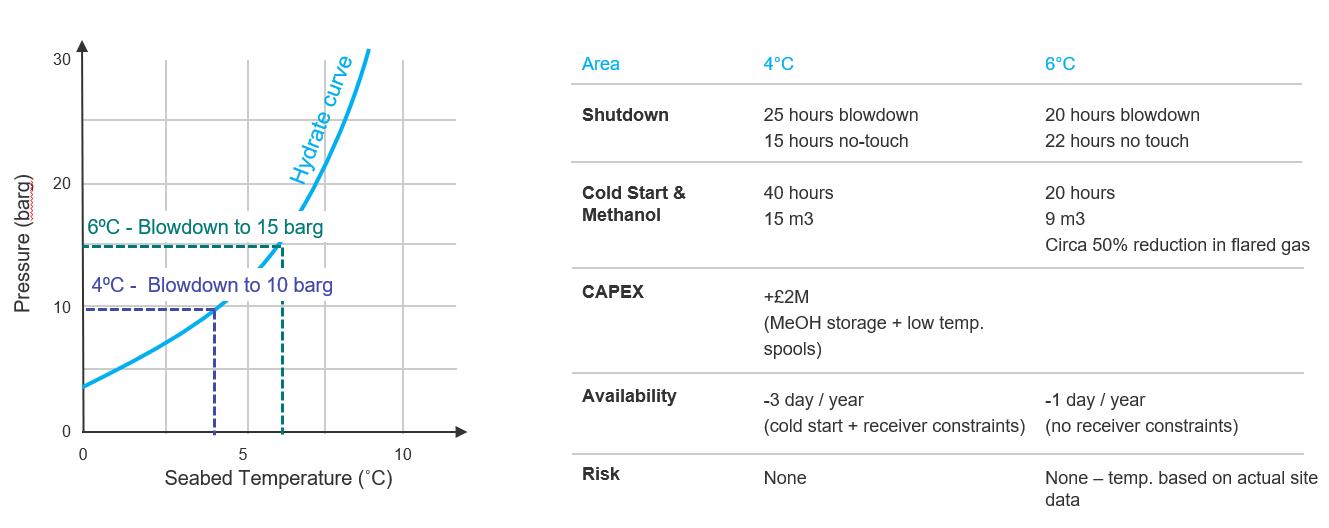

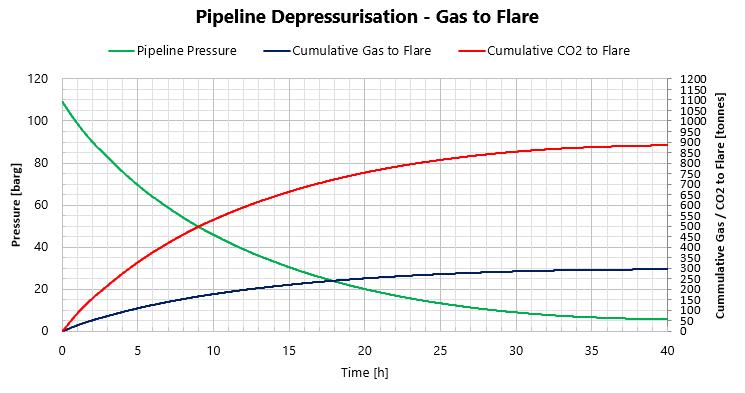

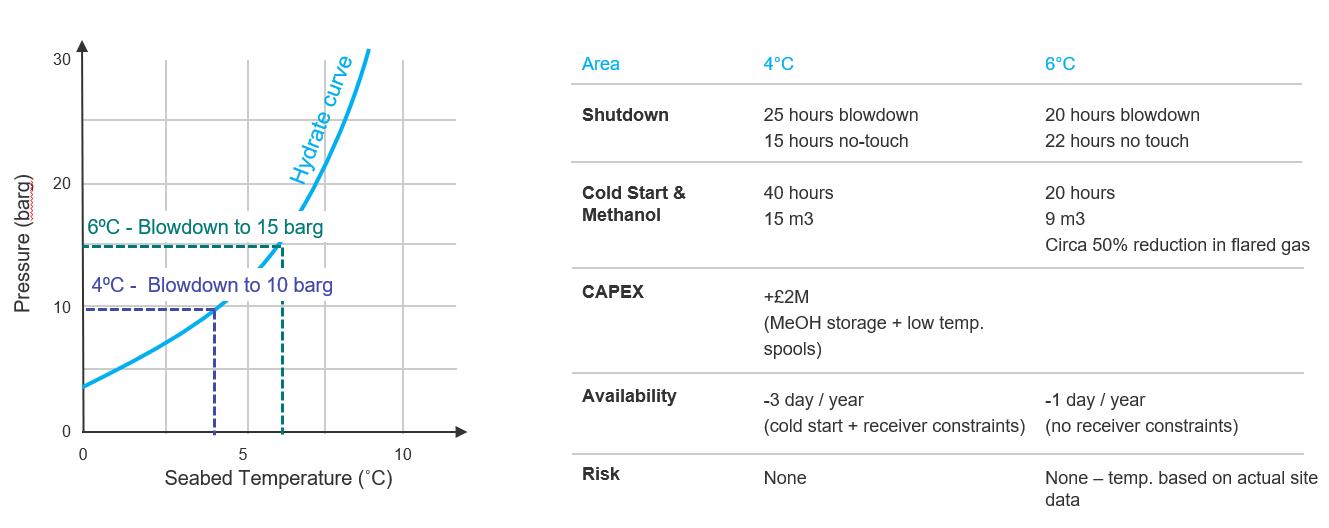

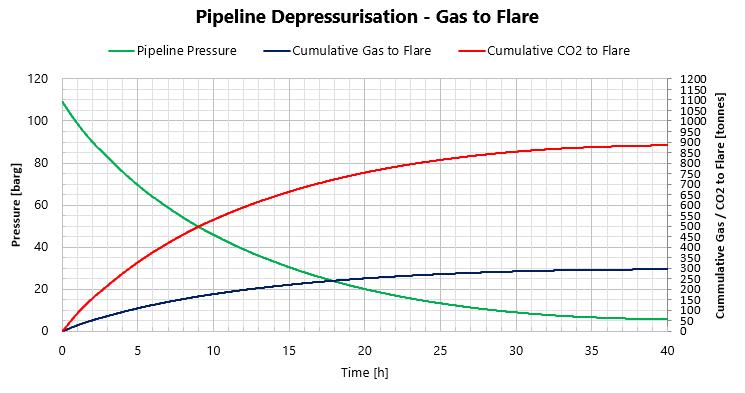

43. Reducing your emissions footprint

Steve Hamilton, Chief Technical Authority, and Paul Wiseman, Flow Assurance Technical Authority, Xodus, UK.

- Featuring: Cappline B.V.; Ledcor Pipeline; Lincoln Electric; Michels; MONTI; Seal For Life; Vietz.

PIPELINE OPERATIONS SOFTWARE

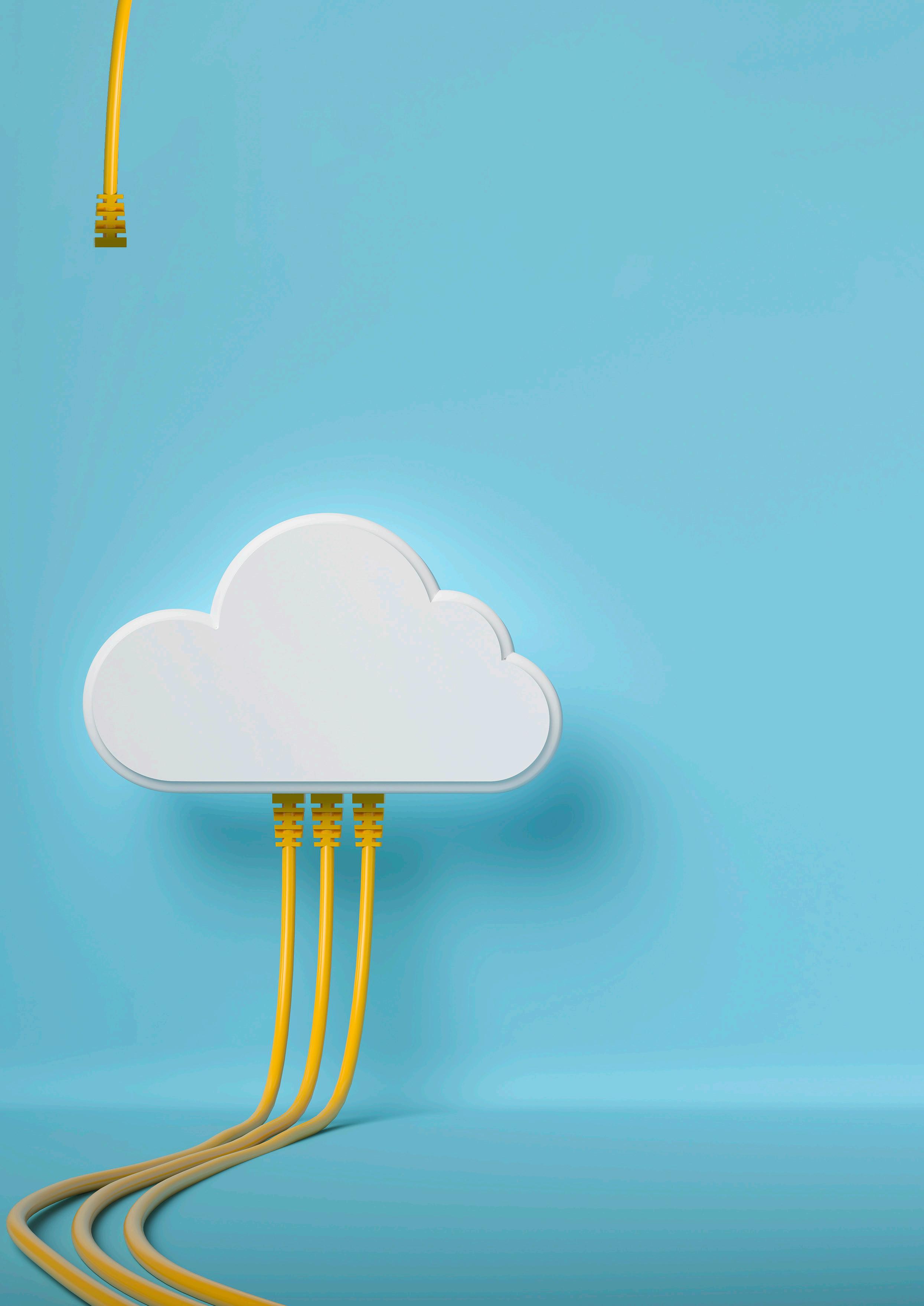

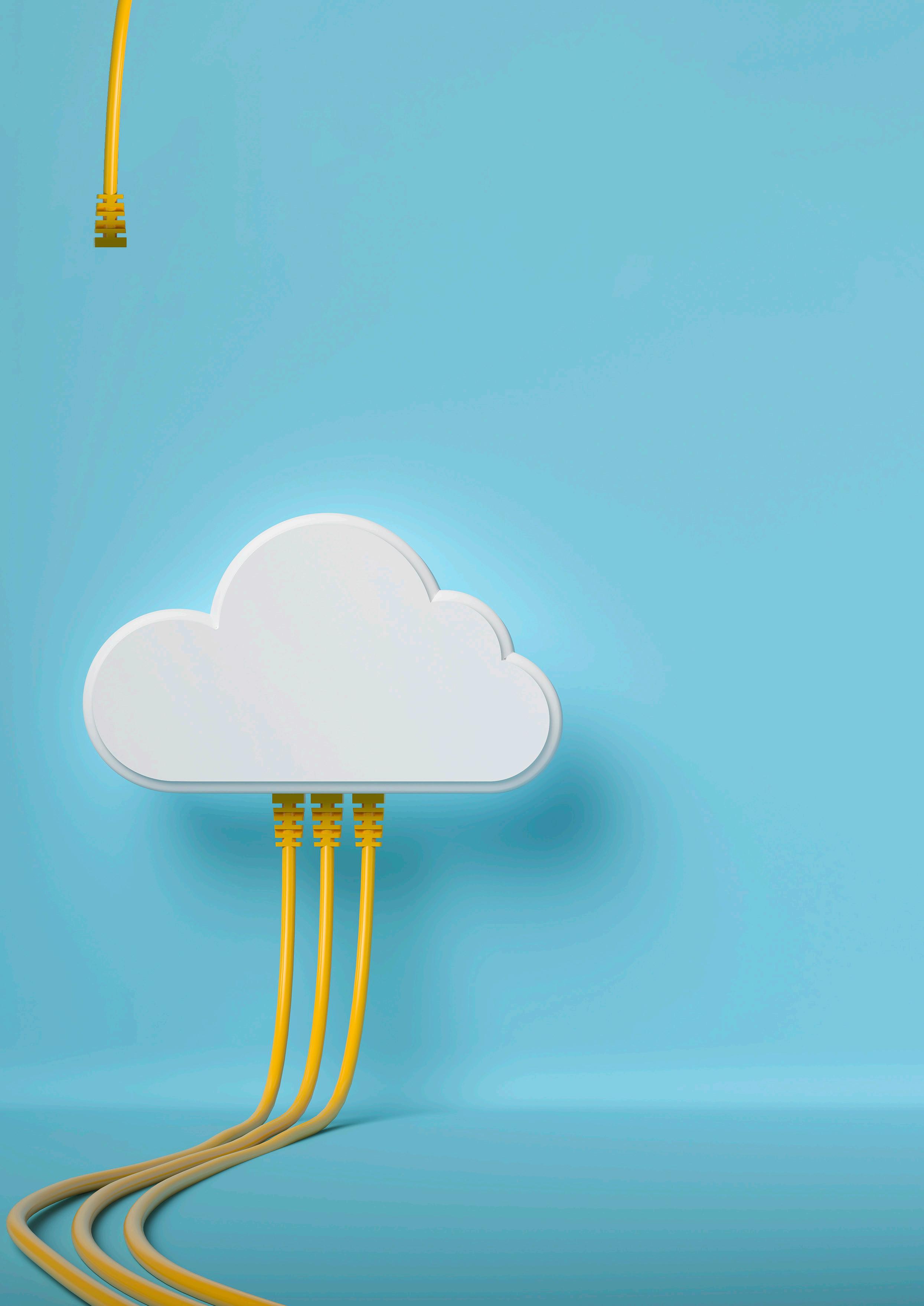

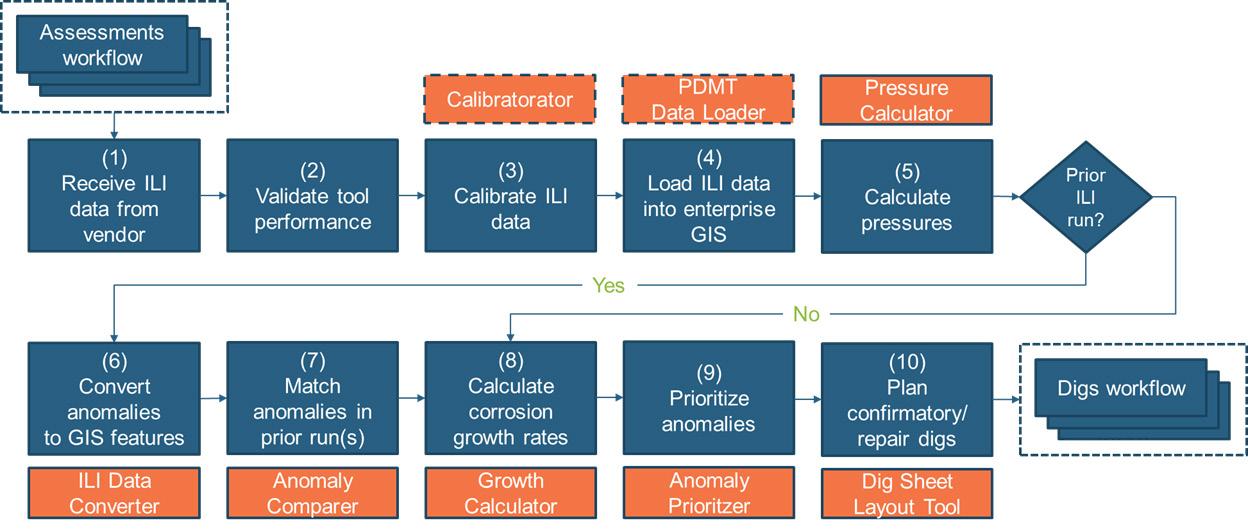

59. Putting pipelines in the cloud

Stacey Hensley, Group Product Manager, Quorum Software, USA.

63. Embracing digital transformation

Febin Jose, Product Manager, Technical Toolboxes, USA.

PIPELINE SERVICES

69. Unlocking pipeline potential

Shaun Walker, Victor Ng and Jeremy Summers, Kent, UK.

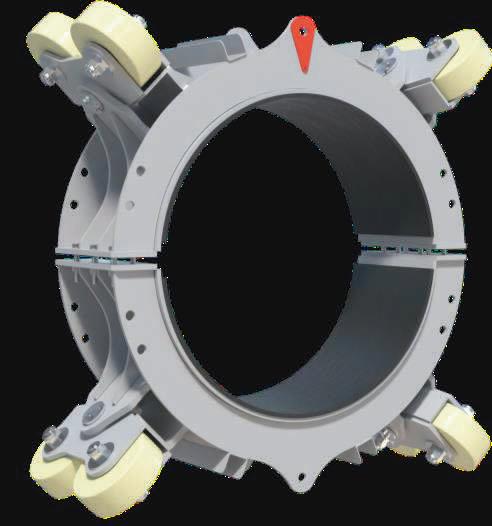

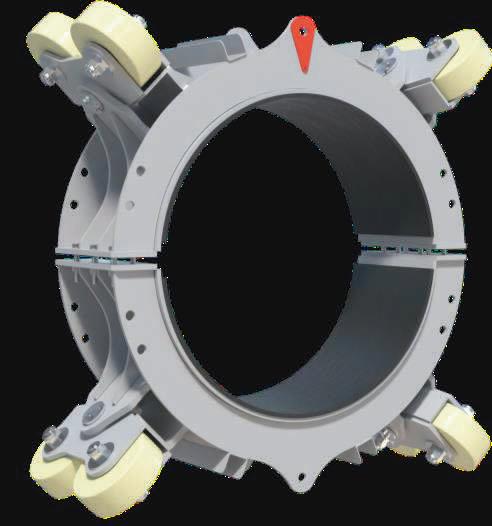

INLINE INSPECTION TOOLS

73. Where energy challenges meet innovation

Tracy Thorleifson, ENTRUST, USA.

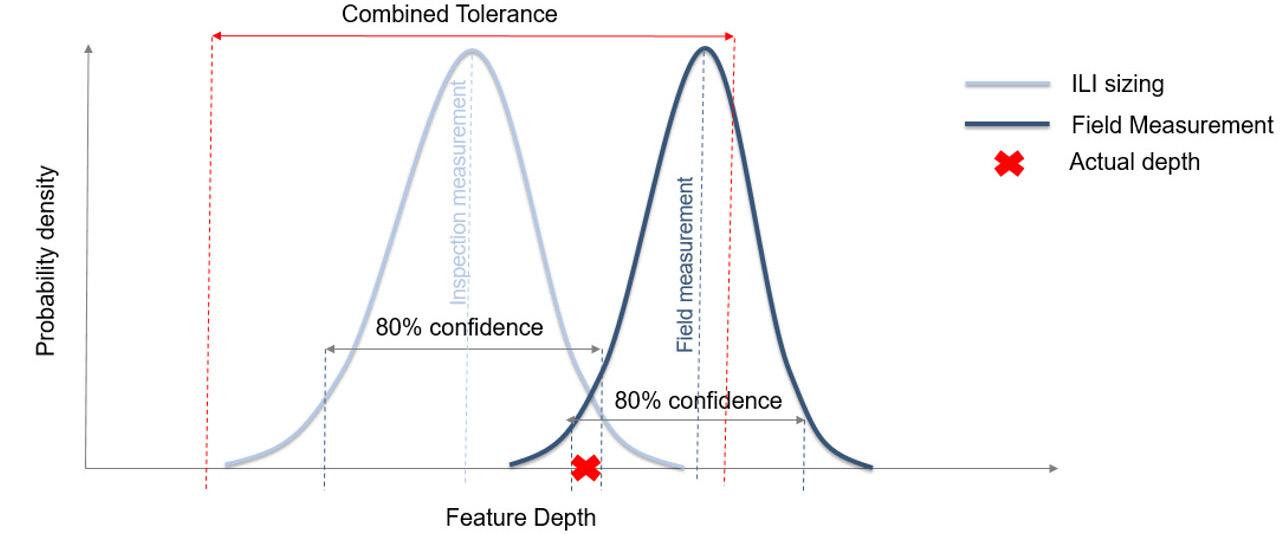

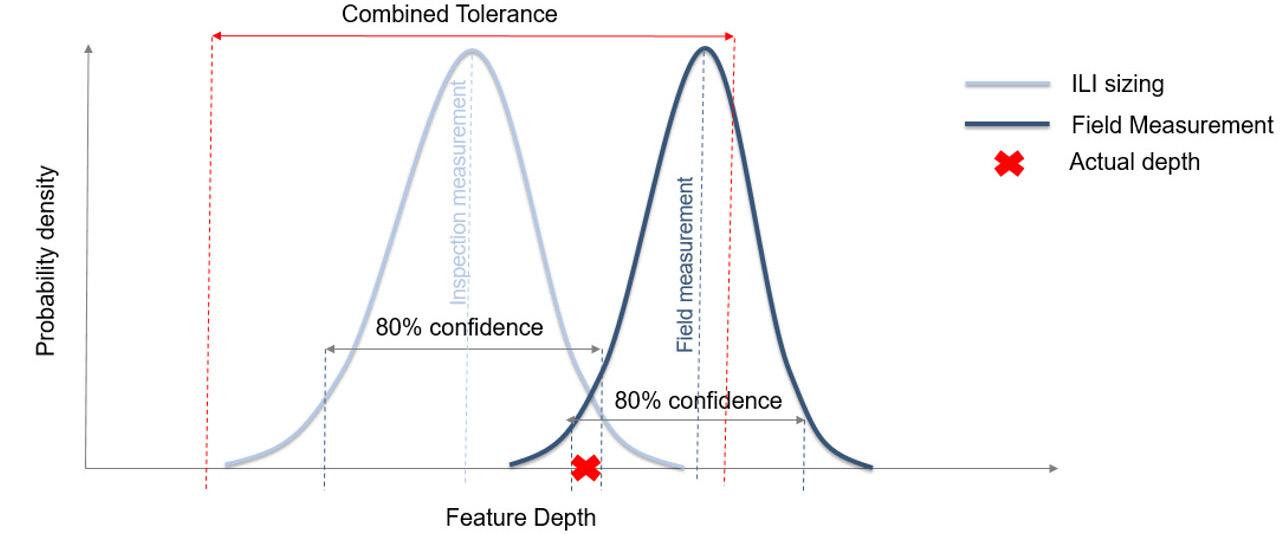

81. In-field crack validation data: can we trust it?

Tom Oldfield, Service Manager – Field Verification, ROSEN, UK.

SURFACE PREPARATION AND COATINGS

87. Meet the conditions

Dinko Cudic, Business Line Director, Seal For Life Industries, the Netherlands.

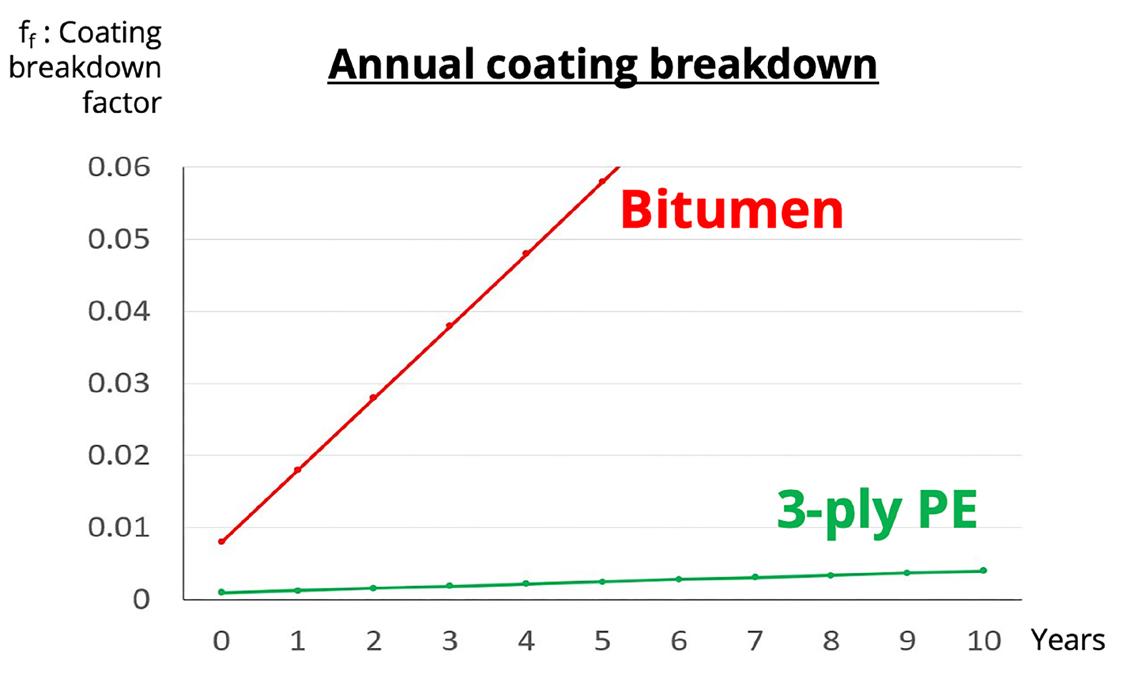

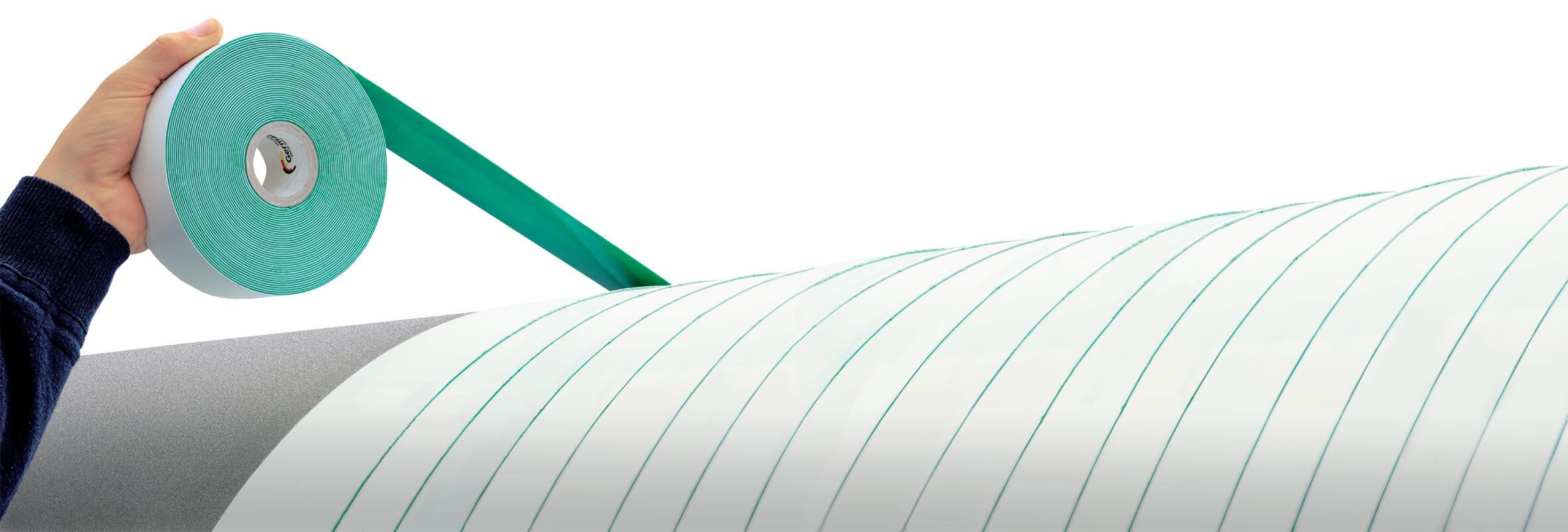

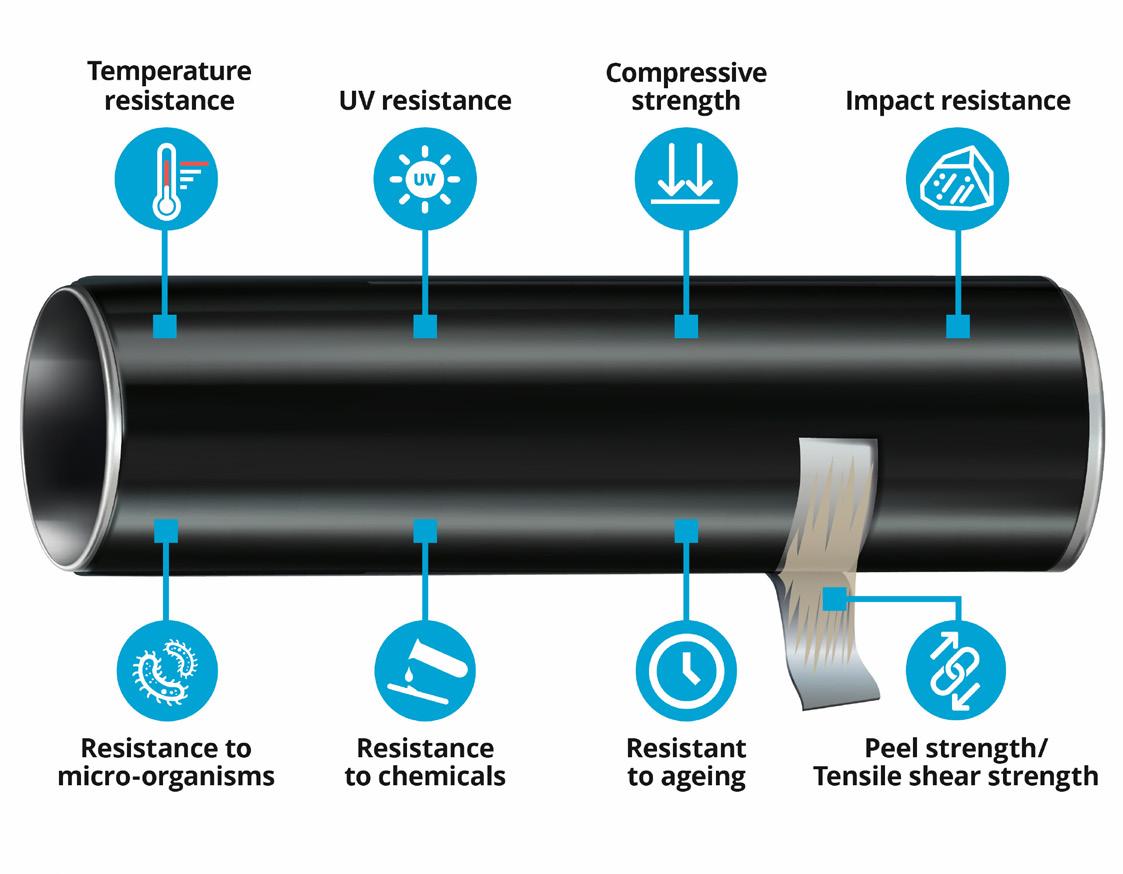

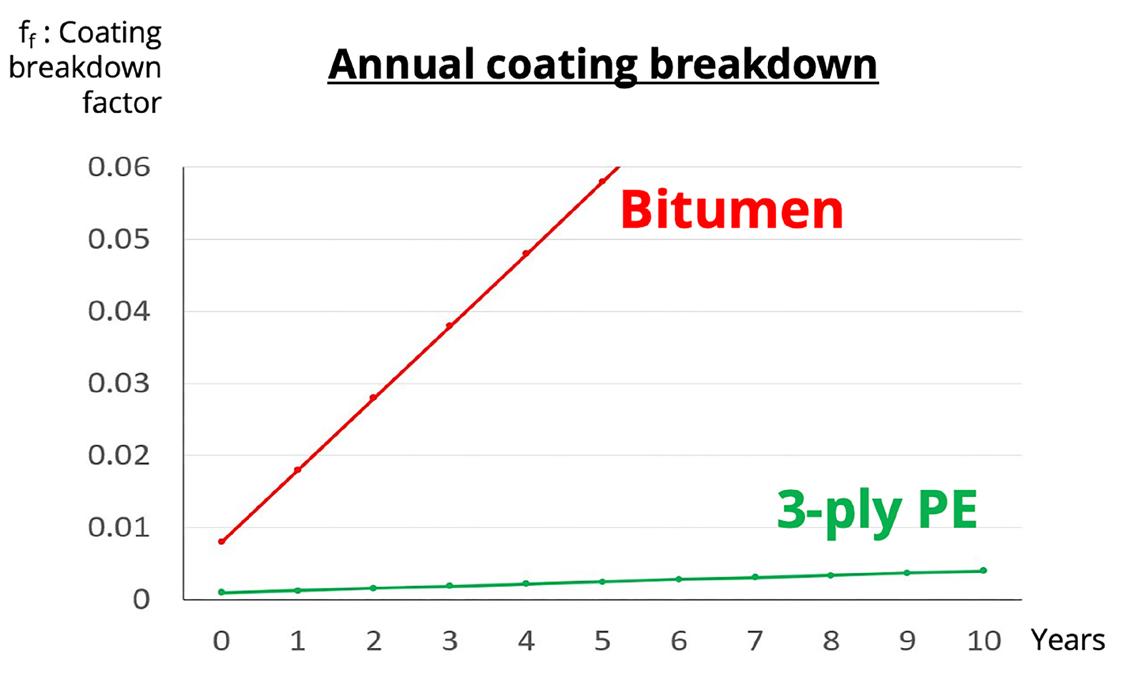

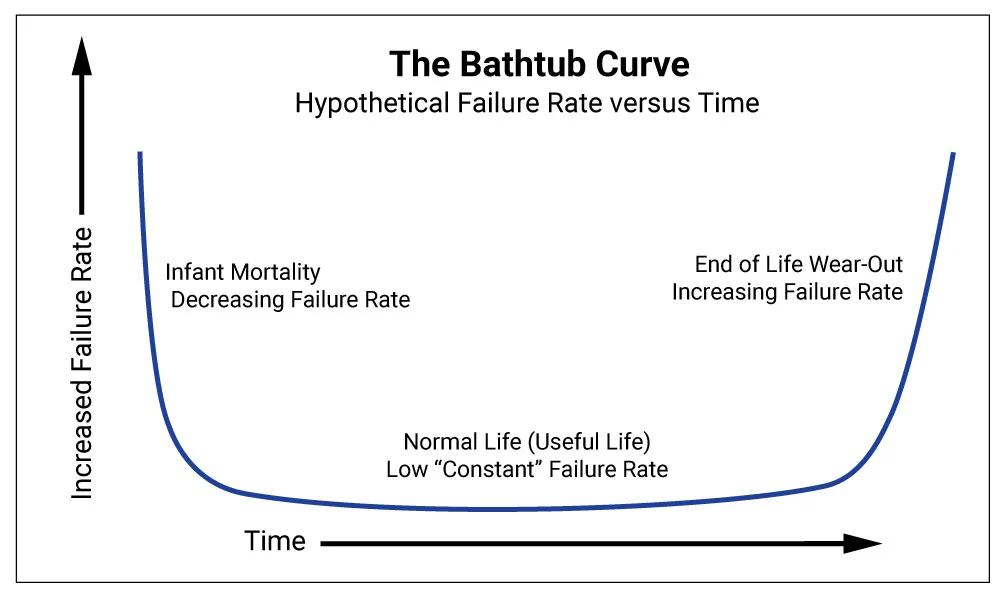

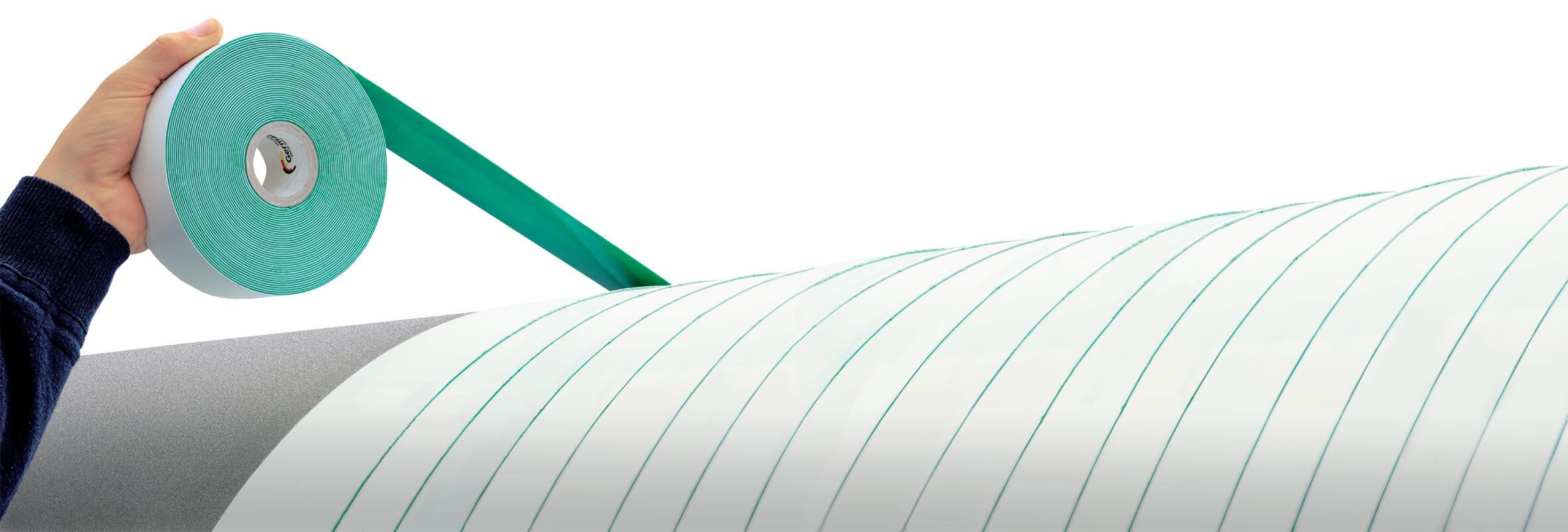

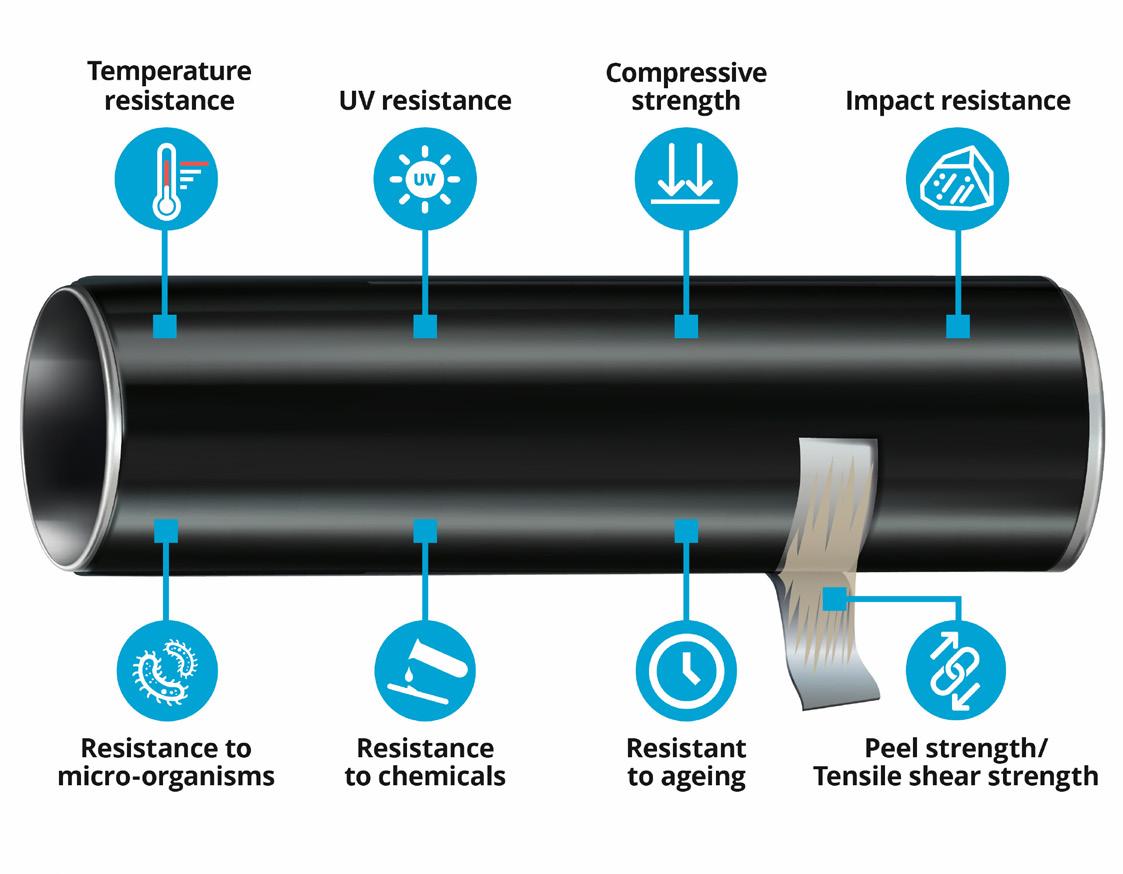

95. Bitumen vs butyl: which is superior?

Thomas Kaiser, Managing Director, DENSO Group Germany.

ROVS AND UNDERWATER INSPECTION

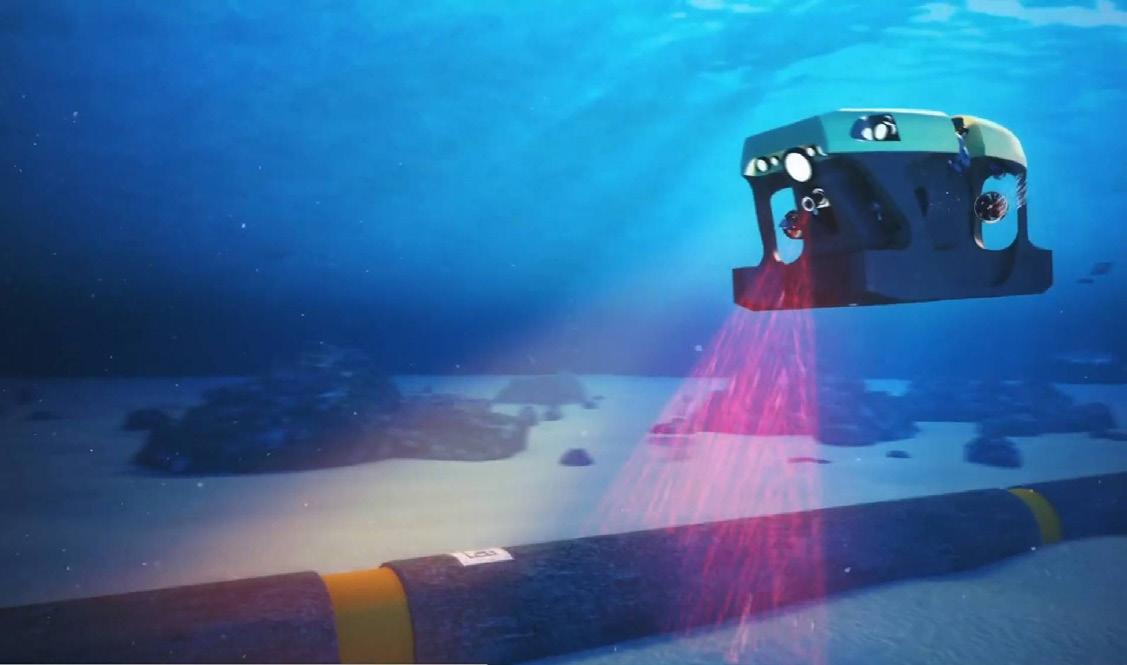

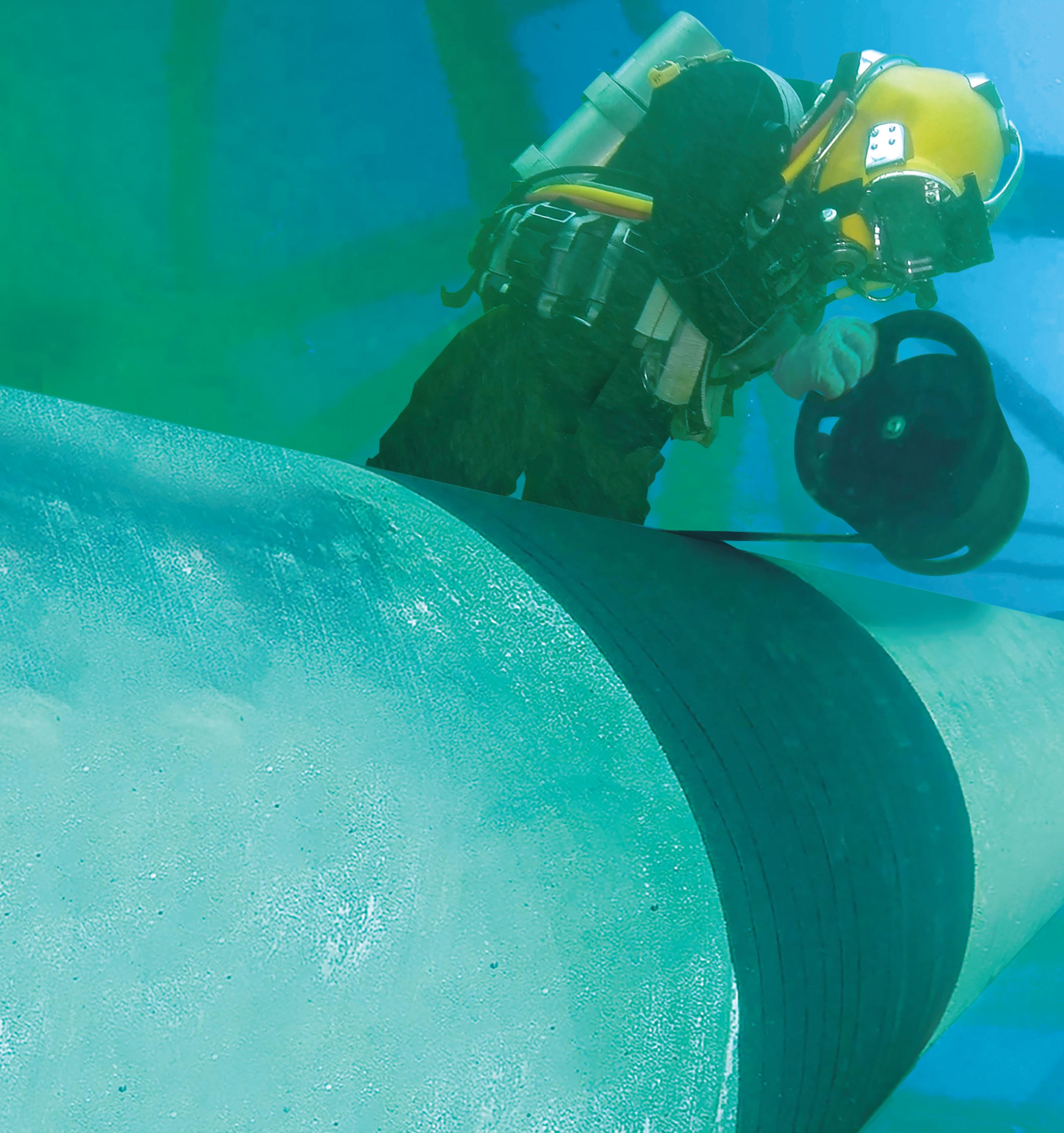

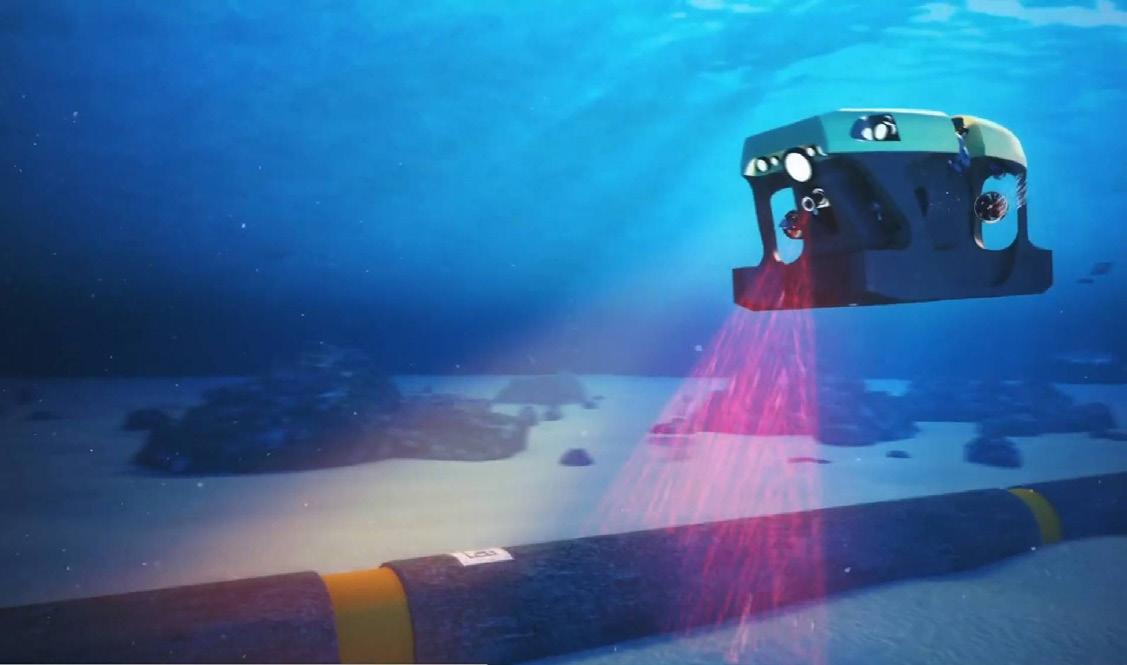

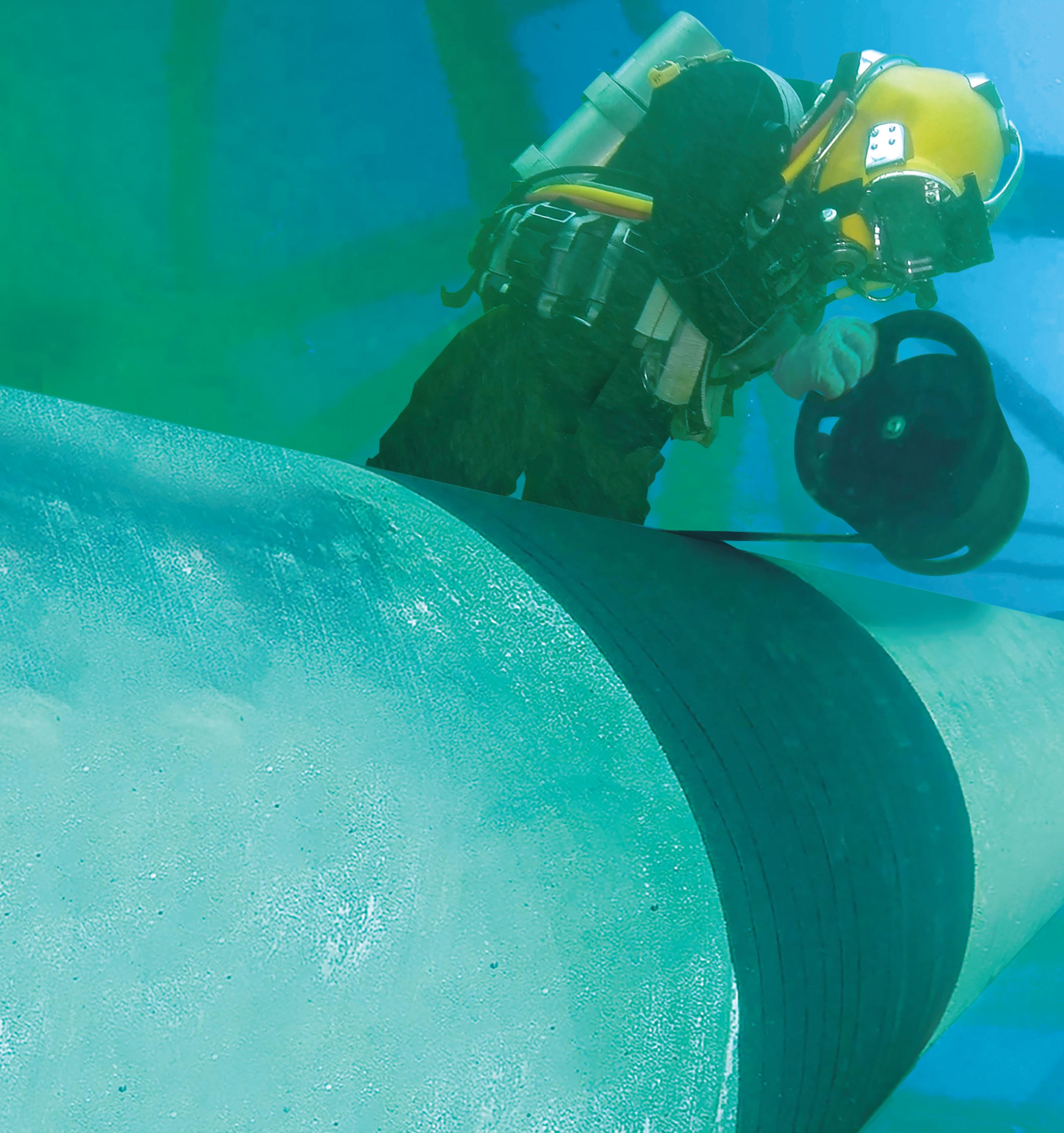

101. Rigorous subsea safety

Andre Rose, Technical Adviser, International Marine Contractors Association (IMCA), UK.

Member of ABC ON THIS MONTH'S COVER Reader enquiries [www.worldpipelines.com] C O NTENTS Copyright© Palladian Publications Ltd 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK. WORLD PIPELINES | VOLUME 23 | NUMBER 8 | AUGUST 2023 Winn & Coales International Ltd has specialised in the manufacture and supply of corrosion prevention and sealing products for over 90 years. The well-known brands of Denso and Premier offer a cost-effective and long-term solution to corrosion on buried or exposed steel or concrete, pipes, tanks and structures. The exceptional mechanical protection offered by their Denso Bore-Wrap system is demonstrated in their latest case study from Northern Ireland, 03. Editor's comment 05. Pipeline news Updates on Mountain Valley pipeline, Trans Mountain expansion, a proposed Barents Sea pipeline, and key contract news. 87 CBP019982 100 39 A MEMBER OF WINN & COALES INTERNATIONAL DENSO BORE-WRAP CASE STUDY WCD WP Cover_Aug 2023.indd 11 14/07/2023 09:13 ® Volume 23 Number 8 August 2023

Gto encompass all project partners across project stages. Pipeline supply chains already face disruption from price volatility for to increased demand and delays in opening new mines. The concentration of supplies for key pipeline ingredients such as copper also leaves them vulnerable to events such as the recent land-use and labour disputes in key With globalised supply chains crisscrossing regions with geopolitical and weather-related risks, there is growing imperative for earlier risk planning from schedule to scope, there is a need for risk planning to encompass all project stakeholders and metrics. siloed and split into linear stages. Even key suppliers are often excluded from risk planning. Risks to budgets or schedules are often assessed separately, ignoring the interdependencies between them. Risk planning is than being done early and holistically. Additionally, the burden of project risks still falls too heavily on contractors, meaning risk management doesn’t This reinforced by the persistence of mutually incompatible project management systems of widely varying quality which cause risk blind spots only increase given the increasing complexity of pipeline projects such as offshore wind and hydrogen that involve increasingly complex partnerships between fossil fuel and renewable sectors. volatile supply chains and escalating costs will require project management teams and their systems to evolve to consider risks earlier. A series of circumstances are driving a significant uptick in pipeline construction. The energy transition and the associated switch from coal to Brad Barth, Chief Product Officer, InEight, USA, explains why we need a sea-change in construction risk management. 10 11

The Best Liquid Epoxy Solutions For Pipelines The Toughest HDD Field Joint Coating contractors’ focus Welcome to the contractors' focus: providing information about the capabilities of oil and gas pipeline engineering contractors. each company also details recent pipeline projects, contract wins and pipeline construction activity of note. OR STATIONS WELDING FINANCE, STRATEGY & ANALYSIS FEASIBILITY STUDIES TERMINALS RESEARCH DEVELOPMENT MAINTENANCE REHAB contractors’ focus

PAGE

49

Max Lift Capacity 98.000 kg - Operating weight 61.000 kg Automatic quick release of the tracks: can be transported with normal open top containers 2 speed hydrostatic transmission - Caterpillar Engine - Full equipped with all safety devices

EDITOR’S COMMENT

CONTACT INFORMATION

MANAGING EDITOR

James Little james.little@palladianpublications.com

SALES DIRECTOR

Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER

Chris Lethbridge chris.lethbridge@palladianpublications.com

SALES EXECUTIVE

Daniel Farr daniel.farr@palladianpublications.com

PRODUCTION MANAGER

Calli Fabian calli.fabian@palladianpublications.com

EVENTS MANAGER

Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR

Stirling Viljoen stirling.viljoen@palladianpublications.com

DIGITAL CONTENT ASSISTANT

Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL ADMINISTRATOR

Leah Jones leah.jones@palladianpublications.com

ADMINISTRATION MANAGER

Laura White laura.white@palladianpublications.com

Palladian Publications Ltd, 15 South Street, Farnham, Surrey, GU9 7QU, UK

Tel: +44 (0) 1252 718 999

Website: www.worldpipelines.com Email: enquiries@worldpipelines.com

Annual subscription £60 UK including postage/£75 overseas (postage airmail). Special two year discounted rate: £96 UK including postage/£120 overseas (postage airmail). Claims for non receipt of issues must be made within three months of publication of the issue or they will not be honoured without charge.

Applicable only to USA & Canada:

World Pipelines (ISSN No: 1472-7390, USPS No: 020-988) is published monthly by Palladian Publications Ltd, GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to World Pipelines, 701C Ashland Ave, Folcroft PA 19032

Fines for oil spills and other pipelinerelated accidents have been rising under the Biden administration in the US, according to a news report from E&E News. 1 The news story states that: “Federal civil penalties for pipeline safety violations topped US$10 million for the first time in 2021 and rose again last year to US$11.6 million. During the Trump administration, fines averaged about US$4.5 million per year.” Not only are fines going up, but money spent on complying with PHMSA orders is also rising. “Companies reported spending US$386 million to comply with PHMSA orders and enforcement actions from 2018 to 2022” (according to experts, this figure is likely to be grossly underestimated). The article quotes Bill Caram, Executive Director of the Pipeline Safety Trust, who said “this administration seems to be taking pipeline safety more seriously than previous administrations, including Democratic administrations.”

Talking of taking pipeline safety seriously, this July saw the fourth annual global lifting awareness day (#GLAD2023), on 13 July. Organised by the Lifting Equipment Engineers Association (LEEA), the initiative seeks to raise awareness about safe and high-quality high load lifting. GLAD prioritises safety over all, bringing together manufacturers, suppliers, and end users to promote safe lifting. Ross Moloney, CEO at LEEA, said: “Remember that LEEA exists to eliminate lifting accidents, injuries, and fatalities; and educate, influence, and enable so that best practice is everyday action. GLAD is how we celebrate buy-in, and evidence movement of the dial towards prioritising safety over cutting costs.”

Moving the dial on safety is something that features prominently throughout this issue of World Pipelines, as we showcase safety in its many forms. Our keynote section presents different facets of project management, with a view to prioritising safe and up-to-standard governance of pipeline assets. The feature includes articles on: adapting to changes in construction risk management (p.10); adopting a modern pipeline management style (p.14); and facilitating network security and calculating cyber risk (p.19). This section also includes insight on how safety factors into pipeline design (p.25); the risks of overpressure in pipelines (p.30); and safe, lawful deployment of personnel offshore (p.35).

We give considerable focus to various aspects of pipeline construction, to honour our longstanding relationship with IPLOCA, which holds its annual convention in September. For the construction best practice feature, PACCAR Winch offers expertise on the current challenges facing the pipeline build space (logistics, inventory, scheduling, supply chain, p.39); and Xodus writes about using benchmarking to optimise design margins and keep a project lean (p.43).

Our contractor focus (p.49) gives a selection of pipeline companies the chance to shine: with space to declare their capabilities and talk about recent projects. And for a closer look at offshore contracting, the International Marine Contractors Association (IMCA) discusses subsea safety (p.100), highlighting the role that ROVs play in pipeline inspection, and how training and competence support a safe, standardised offshore pipeline sector.

1. www.eenews.net/articles/is-biden-cracking-down-on-pipeline-violators

SENIOR EDITOR Elizabeth Corner elizabeth.corner@palladianpublications.com

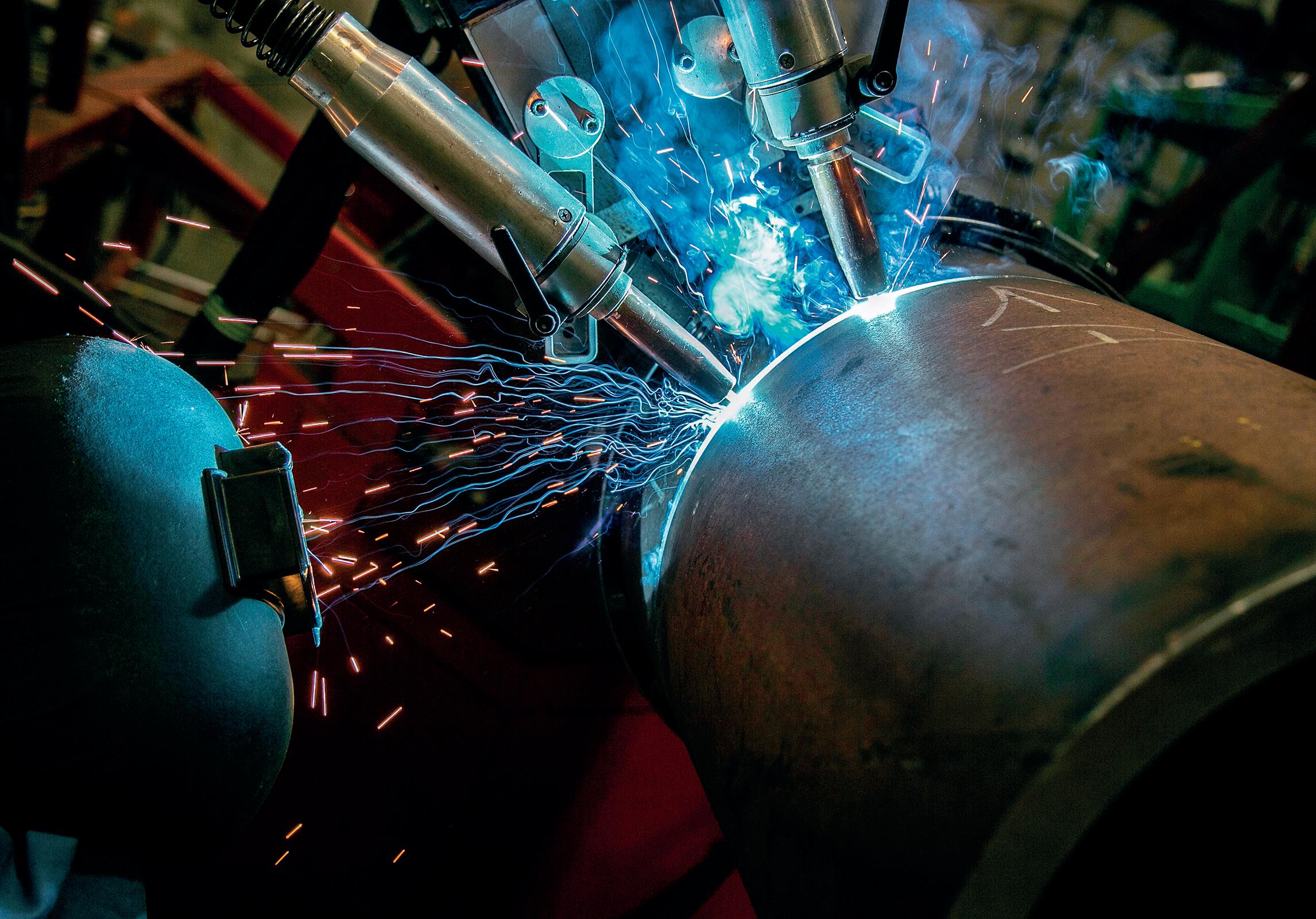

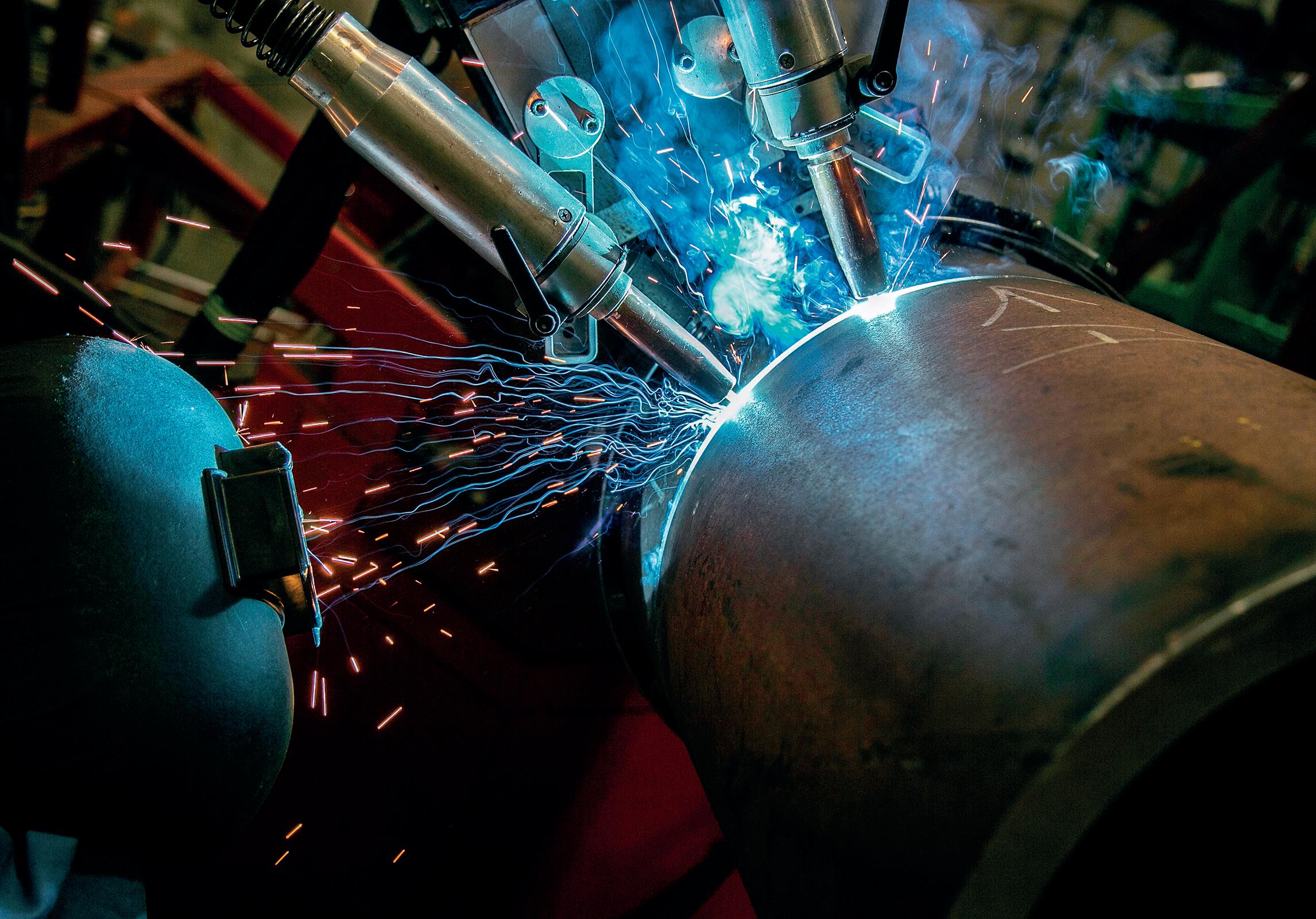

The welding and coating experts you can trust

Ensure the efficient, on-time delivery of your onshore and offshore projects with CRC Evans’ market-leading welding and coating services, technologies and integrated solutions, and extensive fleet of pipeline equipment

americasEuropeMiddleEastAfricaAsiaPacific crcevans.com enquiries@crce.com @crcevansglobal CONNECTWITH CRC EVANS

WORLD NEWS

Appeals court orders temporary halt to construction of Mountain Valley pipeline

A federal appeals court has again blocked construction on the Mountain Valley natural gas pipeline being built through Virginia and West Virginia.

The stay, issued on Monday 10 July by the Fourth Circuit Court of Appeals in Richmond, comes after Congress passed legislation in June requiring all necessary permits be issued for construction of the pipeline.

The law greenlighting the pipeline was passed last month as part of a bipartisan bill to raise the debt ceiling. The provision that deals exclusively with the Mountain Valley Pipeline was included after negotiators failed to reach an agreement on broader regulatory reform. This law also stripped the Fourth Circuit from jurisdiction over the case

The stay issued focuses on a 3 mile (5 km) section of the right-of-way that cuts through the Jefferson National Forest. Environmentalists say the construction plan will cause erosion that will ruin soil and water quality. The court has also issued a similar stay in connection with parallel litigation alleging the pipeline would violate the Endangered Species Act.

Mountain Valley Pipeline says the project is already substantially complete and that only 3 acres (1 hectare) of trees need to be cleared, compared to more than 4400 acres (1700 hectares) already cleared.

The US$6.6 billion, 300 mile (500 km) pipeline is designed to

TMX likely to send more oil to US than Asia

The Trans Mountain pipeline expansion (TMX) was meant to unlock Asian markets for Canadian oil, but analysts and traders say those barrels will now probably land on the US West Coast, as Asia gobbles up Russian oil that is cheaper due to sanctions from Western countries after Moscow’s invasion

meet growing energy demands in the South and Mid-Atlantic by transporting gas from the Marcellus and Utica fields in Pennsylvania and Ohio.

Equitrans Midstream Corporation has released a statement related to the decision regarding construction in the Jefferson National Forest:

“We are disappointed with the US Court of Appeals for the Fourth Circuit’s remarkable decision to grant a onesentence stay halting all construction in the Jefferson National Forest with no explanation. The Court’s decision defies the will and clear intent of a bipartisan Congress and this Administration in passing legislation to expedite completion of the Mountain Valley Pipeline project, which was deemed to be in the national interest. We believe the Court also exceeded its authority, as Congress expressly and plainly removed its jurisdiction. Further, the fact that the Court issued the stay prior to receiving full briefing from the federal government and Mountain Valley is particularly telling and demonstrates why Congressional intervention was appropriate. We are evaluating all legal options, which include filing an emergency appeal to the US Supreme Court. Unless this decision is promptly reversed, it would jeopardise Mountain Valley’s ability to complete construction by yearend 2023.”

of Ukraine.

Asia’s heavy crude refining market is roughly nine times the size of California’s, but the geopolitical upheaval means Canada will struggle to reduce its reliance on its number one oil customer, the US (reports Reuters).

Norway’s 800 km Barents Sea gas pipeline back on agenda

A proposed US$5 billion export route linking gas fields in the Barents Sea in Northern Norway to European markets could help alleviate the continent’s dependence on LNG imports, according to a new report by Wood Mackenzie.

The report – ‘Can the Norwegian Barents Sea help solve Europe’s gas crisis?’ – concludes that after spending years in the doldrums, Russia’s invasion of Ukraine brought a potential Barents Sea gas export route back onto the agenda in Norway. However, the report added there are several hurdles the 800 km, 15 million m2/d would have to overcome before it was green lit by Oslo.

“The Barents Sea basin has enough existing resources to fill the pipeline, but the costs involved would make developing the gas more expensive than alternative imports from new LNG developments,” Daniel Rogers, Senior Analyst at Wood Mackenzie says. “However, gas from the area offers a cleaner alternative to LNG, and any proposed development would be carried out under strict Norwegian environmental controls.”

The report adds that state-funding of the pipeline, or the

introduction of a Carbon Border Adjustment Mechanism (a tool designed by the EU to encourage cleaner industrial production in non-EU countries) on gas imports to Europe would increase cost competitiveness.

“The carbon and socioeconomic argument for a pipeline – and further development of the basin – is strong, but it won’t happen without government support,” Rogers says. “However, if long-term European gas demand and prices fall faster than expected, this would put further pressure on the viability of the project.”

The report also states that while Barents Sea gas would help alleviate Norwegian production decline, it won’t be a gamechanger. A bigger pipe would be required to incentivise high-impact exploration and realise the basin’s full potential. Currently, gas in the Barents Sea is produced from the Snøhvit Area subsea fields and is sent via pipeline to the Hammerfest LNG facility. The facility is expected to be at full capacity until the 2040s. There is currently no direct pipeline route connecting Barents Sea gas resources to the main Norwegian pipeline network.

AUGUST 2023 / World Pipelines 5

GREECE

Greek gas grid operator DESFA wants to build a €1 billion (US$1.12 billion) hydrogen pipeline that will connect Greece to Bulgaria.

UK AND IRELAND

Schneider Electric has announced the launch of a new partner programme in the UK and Ireland.

GERMANY

German oil refinery, PCK Schwedt has applied to the economy ministry for €400 million in state aid to help it upgrade the RostockSchwedt pipeline.

INDIA

Ace Energy Infrastructure Pvt. Ltd. has completed a vital link in the Barauni-Guwahati natural gas pipeline being executed by GAIL (India) Limited as part of Pradhan Mantri Urja Ganga project, by completing tunnelling under the confluence of Kanamakra, Aie and Manas River.

BELGIUM

Fluxys Belgium recently welcomed the EU Commissioner for Energy, Kadri Simson, at the construction site of its first dual-purpose pipeline. Initially, the pipeline between Zeebrugge and Brussels will substantially increase the capacity for the security of supply of Belgium and neighbouring countries. In addition, this pipeline is ready for use to transport hydrogen.

HUNGARY

Hungary will ask the EU for a oneyear extension of an exemption from sanctions against Russia that allows refiner Slovnaft, part of MOL, to export products refined from Russian oil to the Czech Republic.

WORLD NEWS

Argentina inaugurates key gas pipeline to reverse energy deficit

Argentina inaugurated on Sunday 9 July the first stage of a gas pipeline that will carry natural gas from the Vaca Muerta formation in western Argentina to Santa Fe province by way of Buenos Aires province, an essential work to reverse the country’s significant energy deficit.

Vaca Muerta, a massive shale formation the size of Belgium located in Patagonia, is seen as key to boosting the South American country’s gas supplies and lessening the need for pricey imports. It has the second unconventional gas reserves worldwide and the fourth in oil.

Argentina registered a US$5 billion deficit in the energy trade balance in 2022 because it needs to import energy during the highest consumption months.

The completion of the first stage of the gas pipeline, which starts in Neuquen province and reaches Buenos Aires province, adds 11 million m3/d of gas. This will double when the compression plants are installed in Tratayen, in Neuquen province, and in Salliquelo, in Buenos Aires province.

The inauguration comes as the ruling Peronist party aims to cling to power in

upcoming October elections with the country reeling from 114% inflation. Economy Minister, Sergio Massa, who often touts the economic benefits of the pipeline, is seeking the presidency in what pollsters predict to be a tight race.

“This work [...] is the beginning of change in the economic and energy matrix of Argentina,” Massa said at the inauguration ceremony. “We are no longer going to import gas in ships because we are going to use the gas from our subsoil.”

The President of state energy company Energia Argentina, Agustin Gerez, told reporters after the event that the call for tenders for the second section of the gas pipeline reaching San Jeronimo in Santa Fe province would be made in September, with expected completion between March and April 2024. This will increase transportation capacity by 44 million m3/d, allowing for imports of diesel and LNG.

With the new pipeline up and running, the country expects to reach net-zero in its energy balance in 2024 and achieve a surplus in 2025, according to official estimates.

Exxon Mobil buys pipeline operatory Denbury

Exxon Mobil Corporation has entered into a definitive agreement to acquire Denbury nc., an experienced developer of carbon capture, utilisation and storage (CCS) solutions and enhanced oil recovery.

The all-stock deal valued at US$4.9 billion puts Denbury’s capabilities related to carbon capture front and centre.

Denbury is the beneficiary of changes in US climate policy that intend to reduce the amount of emissions released into the atmosphere (the Associated Press reports).

Carbon capture and storage involves removing carbon dioxide (CO2), either from the source of pollution or from the air at large, and storing it deep underground. In some instances, the CO2 is transported across states through pipelines and stored at facilities and used for other things.

Plano, Texas-based Denbury specialises in using CO2 to extract oil from old wells and thus is seen as an attractive asset for oil majors and other large-cap energy companies that are starting to make bigger

bets on the environmental, social and corporate governance strategy.

Exxon Mobil Corp. said that the acquisition gives it the largest owned and operated CO2 pipeline network in the US at 1300 miles, including nearly 925 miles of CO2 pipelines in Louisiana, Texas, and Mississippi – located within one of the largest US markets for CO2 emissions, as well as 10 strategically located onshore sequestration sites.

“Acquiring Denbury reflects our determination to profitably grow our low carbon solutions business by serving a range of hard-to-decarbonise industries with a comprehensive carbon capture and sequestration offering,” Exxon CEO, Darren Woods said in a prepared statement.

The acquisition includes Gulf Coast and Rocky Mountain oil and natural gas operations. The operations consist of proved reserves totaling over 200 million boe, with 47 000 boe/d of current production.

IN

6 World Pipelines / AUGUST 2023

BRIEF

GripTight ® Test & Isolation Plugs

Confidently test open-end pipe, pipelines & pressure vessels without welding, and isolate & test flange-to-pipe weld connections with GripTight Test & Isolation plugs from Curtiss-Wright.

• Standard pressure ratings up to 15,000 PsiG (1034 BarG)

• Patented gripper design for increased safety in high-pressure applications

• Eliminate welding end caps for pressure testing pipe spools and piping systems

• Test flange-to-pipe welds without pressurizing entire systems

• Isolate & monitor upstream pressure and vapors during hot work

• ASME PCC-2 Type I, III & IV Testing Devices

877.503.0768 l est-sales@curtisswright.com l cw-estgroup.com/wpl-23

CONTRACT NEWS

EVENTS DIARY

8 - 10 August 2023

Rio Pipeline 2023

Rio de Janeiro, Brazil www.riopipeline.com.br

5 - 8 September 2023

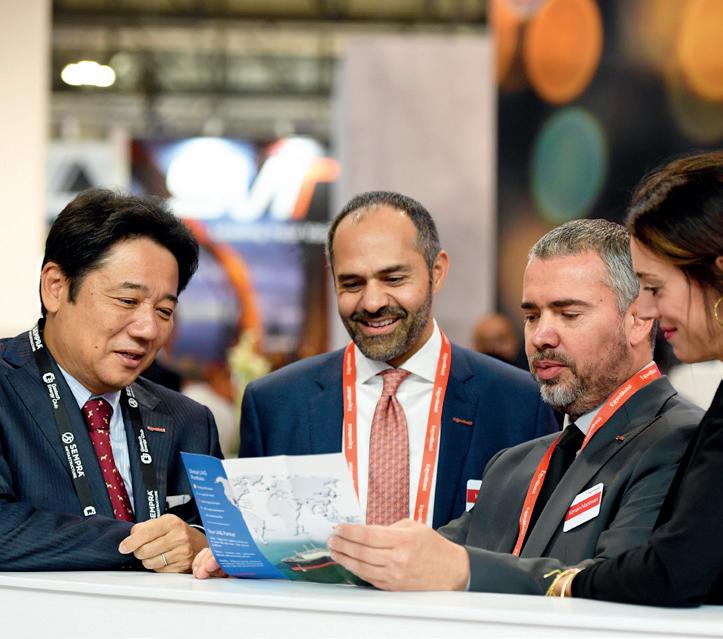

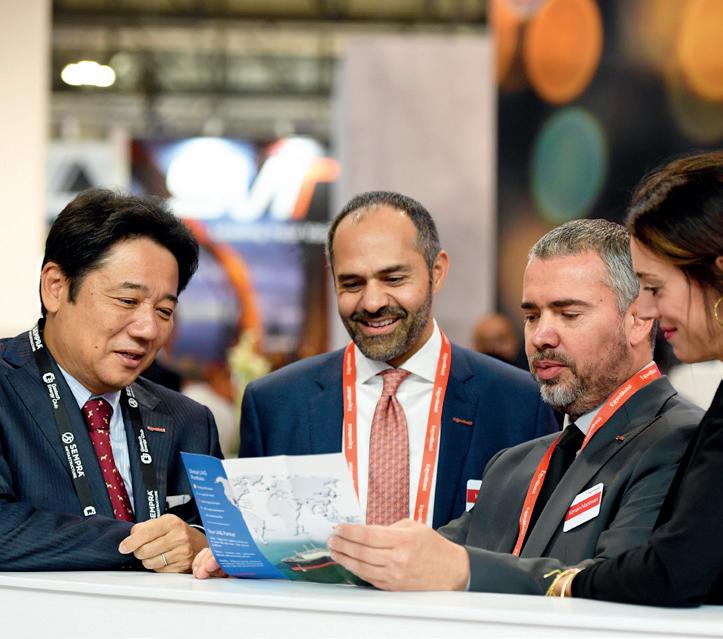

Gastech 2023 Singapore www.gastechevent.com

5 - 8 September 2023

SPE Offshore Europe 2023 Aberdeen, Scotland www.offshore-europe.co.uk

11 - 15 September 2023

IPLOCA 2023 Convention Vancouver, Canada www.iploca.com/events/annualconvention/2023-convention

17 - 21 September 2023

World Petroleum Congress 2023 Calgary, Canada www.24wpc.com

21 - 22 September 2023

Subsea Pipeline Technology Congress (SPT 2023) London, UK www.sptcongress.com

2 - 5 October 2023

ADIPEC 2023

Abu Dhabi, UAE www.adipec.com

24 - 26 October 2023

OMC 2023

Ravenna, Italy www.omc.it/en

NTS selects Atmos International for natural gas network simulation

Nova Transportadora do Sudeste (NTS) has become the latest Latin American pipeline company to select Atmos International, the simulation experts, for its natural gas transmission network.

The NTS network is made up of more than 2000 km of pipeline, and has the highest capacity of all pipelines in Brazil, with a transport contractual capacity of 158.2 million m3/d of gas. NTS transports natural gas through a pipeline system that crosses Brazil’s most industrialised region and has links to the states of Rio de Janeiro, Minas Gerais and São Paolo.

With NTS transporting gas to areas

that are responsible for around 50% of gas consumption in Brazil, it’s understandable that they want to better understand the pipeline’s behaviour, improve operations and maximise efficiency.

Working with Atmos, NTS has opted for the full Atmos Simulation Suite (SIM). Atmos SIM has proven compatibility with pipelines transporting liquid and gas, and supports industries ranging from chemical, oil and gas to mining and slurry. The software is in operation in over 20 countries, supporting approximately 45 000 km of pipelines globally.

Express Engineering acquires QA Weld Tech

Express Engineering, the manufacturing, assembly, and testing specialist, has further expanded its offering in the global subsea engineering market after acquiring the assets of QA Weld Tech Limited.

LDC-backed Express Engineering has secured the site and the plant and equipment of QA Weld Tech, a leading provider of flow spools, crossovers and technical welding services based on Riverside Industrial Park, Middlesbrough (UK).

Express Engineering, which is a Gateshead-based global turnkey supplier for subsea actuator assemblies, connection

systems and subsea production systems, intends to retain the current site in Middlesbrough and continue to offer fabrication and welding services under the QA Weld Tech brand. The acquisition has also supported the transfer of 39 staff to the new entity within the Express Engineering group, which now employs more than 230 staff. The investment expands Express Engineering’s technical capabilities, and adds flow loops and spools to the specialist product range, giving access to additional markets and customers.

Thordon Bearings selected for SUMED pipeline service boats

Egypt’s SUMED pipeline operator, Arab Petroleum Pipeline Company, has completed the tailshaft conversion to Thordon’s SXL seawater-lubricated bearing system for seven special purpose single point mooring (SPM) service boats.

SUMED’s fleet of service boats assist

tankers in loading shipments from the SUMED oil pipeline. The pipeline, which runs from the Ain Sokhna terminal in the Gulf of Suez to Sidi Kreir port in the Mediterranean Sea, provides an alternative to the Suez Canal for transporting oil from the Arabian Gulf region to the Mediterranean.

THE MIDSTREAM UPDATE

• Kinder Morgan and Howard Energy Partners announce expansions

• Equitrans Midstream releases statement related to Mountain Valley Pipeline

• WPC undertakes comprehensive review

• Zambia and Tanzania enhance security on oil pipeline

• PetroTal sets production record despite sabotaged pipeline

• DNV acquires Enviroguide Consulting

• STATS Ltd acquired by Mitsui

8 World Pipelines / AUGUST 2023

us on LinkedIn to read news articles and more linkedin.com/showcase/worldpipelines

Follow

10

Growing demand for pipeline construction amid a fluctuating risk landscape has highlighted the need for proactive risk planning to encompass all project partners across project stages. Pipeline supply chains already face disruption from price volatility for key commodities such as steel and the potential for copper shortages due to increased demand and delays in opening new mines. The concentration of supplies for key pipeline ingredients such as copper also leaves them vulnerable to events such as the recent land-use and labour disputes in key mines. The challenge is compounded by labour shortages.

With globalised supply chains crisscrossing regions with geopolitical and weather-related risks, there is a growing imperative for earlier risk planning encompassing key suppliers and project designers. And with risks such as commodity shortages increasingly affecting multiple suppliers and metrics from schedule to scope, there is a need for risk planning to encompass all project stakeholders and metrics.

Yet traditional project delivery models such as design-bid-build are siloed and split into linear stages. Even key suppliers are often excluded from risk planning. Risks to budgets or schedules are often assessed separately, ignoring the interdependencies between them. Risk planning is often late or limited to certain scenarios or individual stakeholders rather than being done early and holistically. Additionally, the burden of project risks still falls too heavily on contractors, meaning risk management doesn’t include owners and key suppliers or involve early project stages such as design.

This is reinforced by the persistence of mutually incompatible project management systems of widely varying quality which cause risk blind spots and gaps in communications across complex projects. These blind spots only increase given the increasing complexity of pipeline projects such as offshore wind and hydrogen that involve increasingly complex partnerships between fossil fuel and renewable sectors.

A combination of booming demand for pipeline construction, and more volatile supply chains and escalating costs will require project management teams – and their systems – to evolve to consider risks earlier.

The pipeline boom

A series of circumstances are driving a significant uptick in pipeline construction. The energy transition and the associated switch from coal to

11

Brad Barth, Chief Product Officer, InEight, USA, explains why we need a sea-change in construction risk management.

gas across Asia, and Europe’s search for alternatives to Russian gas, is driving demand for gas exports from regions such as North America to Africa. Oil pipeline construction is also rising in Africa and the Middle East with 4400 km (2734 miles) of crude oil transmission pipelines already being built. North America will lead the world in pipeline investment and expansion, while China and India are also investing heavily.

Yet, project certainty is being undermined by volatile supply chains. The concentration of copper production in South America leaves pipelines vulnerable to disputes and delays involving new mining projects. A clash over a tax agreement forced a suspension of copper processing at the world’s largest mine in Panama while disputes with community activists have stopped production at Peru’s La Bamba mine. We have also seen volatile and escalating prices for key pipeline ingredients such as steel since the COVID-19 pandemic.

Meanwhile, the globalisation and diversification of supply chains means that risks are no longer confined to individual places or project partners. Everything from geopolitical instability to price volatility can now disrupt multiple suppliers and contractors, and have a knock-on effect across all project metrics from scope to speed. A contractor may compensate for delays of key materials by pouring extra resources into accelerating other areas of the project, therefore increasing spend or sometimes reducing scope to stay on schedule.

Yet, while risks to supply chains are increasingly farreaching, risk management remains fragmented. Traditional siloed, sequential project delivery methods mean risks are considered in isolation by separate stakeholders such as individual partners or owners. Contractors often shoulder most of the burden of risk which means that they also do most of the planning. When rewards and responsibilities are unequally apportioned among project partners, this can also create an irrational incentive for some suppliers or partners to hide vulnerabilities from each other.

The design and build stages often happen in isolation so that risk planning is not built into the FEED stage in adequate measures. Despite the impact of supply chain volatility on project targets, even critical suppliers are often not treated as project partners, so they are also frequently excluded from risk planning. This fragmented approach is worsened by incompatibility between the various paper-based project management systems, point solutions and proprietary project management platforms in use across the industry. Incompatibility between various project management tools impedes joined-up risk planning and collaboration to help mitigate common threats such as vulnerabilities in a supply chain for critical materials.

Early-stage planning

The industry needs to adopt proactive, predictive risk planning baked into project management at an early stage, encompassing all project stakeholders and stages. Risk management should start at the pre-planning stage and encompass the entire project lifecycle and all project partners. Tier 1 suppliers should be involved so that every risk from vulnerability to extreme weather and geopolitical instability to commodity price volatility is factored in upfront. For

example, some recent LNG projects with a focus on modular construction have adopted supplier-centric planning and therefore included suppliers as critical stakeholders involved in risk planning. Shared-risk delivery models from design-build to integrated project delivery methods can further incentivise partners to share resources and data, and collaborate on risk management.

Interoperable project management systems form the foundation for holistic risk planning by enabling data integration to enable shared visibility and responsibility among all stakeholders. Joining the data dots drives collaborative risk planning; data visualisations such as digital dashboards and executive-level project analytics drawing on data from all project partners can give funding approvers an integrated picture of risk to enable integrated planning. By highlighting common vulnerabilities, such as how suspended production in a copper mine could disrupt both key logistics and critical material sources, this democratised approach to risk assessment can help spur smarter mitigation measures.

Connected data and cloud technology can create a single source of truth on major systemic risks to inform holistic mitigation measures. Open, interoperable tools can encourage and enable more open and collaborative project management models where all partners work together on risk management throughout the project lifecycle. For example, a recent collaborative alliance delivery model for a rail project in Canada forced all delivery partners to integrate risk data for regular risk assessment exercises through a single cloud-based platform from InEight.

Looking at future projects, the rapid evolution in the world of AI is driving interest in capturing historic project outcomes consistently across projects, creating an incredibly valuable knowledge base from which to train AI systems. Lessons learned from past projects can serve to inform risk planning on future projects, with less reliance strictly on the prior experience of individual planners. Such ‘collective knowledge’ can drive smarter and more realistic project cost and schedule targets, creating more predictable project outcomes and reducing capital set aside for contingency.

A new project management model

Demand for new pipeline construction is growing faster than the construction industry’s ability to deliver, forcing inevitable changes in approach to keep up. Simply put, the industry must do more with less, meaning efficiency gains must be found, and risks and other friction must be removed from the process.

Future risk management must encompass all metrics from cost, time, and scope, and involve all capital project stakeholders including key suppliers. This will naturally support the trend toward more iterative and shared-risk delivery models such as design-build, progressive designbuild, and IPD, bringing along with it the ongoing digital transformation of construction. The key is to move towards shared visibility and accountability, underpinned by shared data. This will ultimately drive a significant change in project certainty and performance, and lead to more agile, adaptive, and predictable construction.

12 World Pipelines / AUGUST 2023

14

n the past, projects were managed by engineers or technical experts who had little to no formal training in project management. Often a project team came together to define a pipeline in engineering terms, did a bit of external consulting to understand a few factors and issues to be considered, and then the focus was on just getting the thing built. As a picture of management style, an image of a fortified city with strong walls and limited ways inside via guarded entry gates comes to mind.

Projects of the past needed far less to engage with external stakeholders, and the advent of environmental and social impact assessments that came in during the 1980s seemed novel to those concerned with doing the engineering work and getting it built. Extending the analogy of a fortified city, there came a time when the walls were no longer needed and free access into and out of the conurbation became the norm, where responding to external project parties became a major part of project management alongside the engineering part.

The energy sector has been around for centuries, but project management of pipelines as we know it today is facing another need that requires new thinking and responses from new skills and tools, says John Downer, Senior Project Manager, Penspen, UK.

The present

As the complexity of projects increased over the years, project management techniques evolved to become more sophisticated and comprehensive. Modern projects are now much more like today’s cities, with a regular flow of information from all angles and entry points, which involve multiple stakeholders, complex supply chains, and regulatory compliance requirements.

The management of pipeline projects flexes with the demands made so that now there is an increasing need to engage with the widest audience of project stakeholders whilst utilising systems that provide an audit trail of decision-making and demonstrable evidence of the engagement. Additionally, there has been an increased call for managing the non-technical parts of engineering projects to reflect the wider changes in society where what was once accepted is now more prone to challenge, debate, and revision.

15

The role of pipeline project management

Without proper management, the project will simply be unmanaged. The core tenets of successful project management services are delivering success at every level of the project. Macro issues may include the public perception of the project and a well-managed project these days can go a long way to engaging more effectively with the public to explain the reason for the project and its benefits. It can show it is serious about the environment by its actions in taking appropriate mitigation measures to minimise disturbances and perhaps include within the project some direct community engagement that might include local support or education.

Modern projects are inherently complex with a requirement in law to be responsive to external parties and conform to regulations. This has meant that the current role of pipeline project management is a complex amalgam of sometimes competing forces over and above which there is a business objective to deliver the project concept in line with budget, quality, time, and safety criteria. At a technical level, there is a need to ensure that the project is appropriately engineered to modern standards of design, the concept is optimal and reflects a judicious approach to ensuring good value for the investment but also takes account of wider concerns from stakeholders that are reflected in the design.

There has been a raising of the bar with time over what a project must achieve in terms of meeting a much broader, deeper set of criteria imposed by external stakeholders and regulatory systems overseen by a more alert public and pressure group audience. For companies, there is shareholder pressure to be an acceptable operator in the modern world – not to mention external investors assessing environmental, social, and governance (ESG) merits.

Decision-making practices

Project management for engineering projects can gain much from the assimilation of practices from areas such as operational research (OR), which is the science of decisionmaking. Techniques within OR lend themselves naturally to managing situations that are uncertain, unclear, and multifaceted. The application of the techniques allows decisions to be made and for the project to progress taking account of a much wider and more realistic set of inputs and constraints, albeit sometimes with necessary attenuation. OR contains practices such as robustness analysis, rich pictures, strategic choice approach (SCA) and soft systems methodology that are likely to become a part of the project managers’ toolkit in the next decade.

Mingers and Rosenhead’s seminal work Rational Analysis for a Problematic World is a good place to start.1 Also derived from OR techniques, multi-criteria decision-making is referenced by the UK government, which recommends the use of the technique for local government as it promotes a visible record of using a wide range of inputs, constraints, and options to deliver a justified selection.2 In addition, SCA as referenced, was used by the Dutch government in the early 1980s to devise new policy responses for the safe handling of LPG that could meet competing departmental constraints and resulted in a new policy being accepted unopposed in 1984.1

Integrating digital technology with operational research

The growth of modern digital technologies integrates with the wider use of OR practices seamlessly, creating means and helpful tools for visualising multiple data inputs and viewpoints. This allows for complexity to be imagined by a dispersed team or larger group in real-time, and interrelationships to be mapped and contextualised. Document management systems have now expanded to the point where quality control is ensured with revisions and document issues fully recorded and auditable. For the project manager, the potential of digital information overload is remedied by the development of dashboards now highly configurable to elevate critical project management information for constant visibility.

Appropriate responses to business requirements

Demonstrating that the project has delivered appropriate responses to issues raised by stakeholders affected by the project, whilst also delivering the engineering concept required by the client for its business objectives is key to effective modern management of pipeline projects. Certain modern methodologies derived often from OR, as outlined previously, lend themselves for use where there are a multiplicity of options, issues and constraints, and allow the orderly management of deciding whilst providing an audit trail of how the choice has been made. In this way even an aggrieved party, maybe whilst not accepting the decision, can understand how it’s been made and the process of making that decision. Other demonstrated business benefits include:

) Managing scope, budget, and timescale requirements against changing requirements.

) Identifying project objectives, and ensuring management of those objectives.

) Making decisions and progress in times for a project where uncertainty is very high.

) Providing an objective record of decision-making and outcomes.

Top-down

or collegiate management of projects?

So how can lessons from the past alongside experiences from today ensure further progression in the field? Providing two fictive gas pipeline projects to act as examples of management of the past with the techniques of the present might give us an indication of the factors in play.

Project A: top-down management

A dirigiste promoter with a top-down approach for all aspects of a multi-stakeholder project, one that is stretching many thousands of kilometres across several countries. Political imperatives are playing a significant part in determining the selection of engineering options. In terms of project management, the retention of control within the promoter unit means that there is a lack of a project management vehicle to share comprehension of how the project should respond to the changing external environment. The effects of

16 World Pipelines / AUGUST 2023

PE ISOLATION has changed for the better.

Part of the comprehensive gas distribution systems offering from TDW, the revolutionary POLYSTOPP® Quick Connect system makes it easy to safely perform tapping, plugging and branching on polyethylene (PE) pipelines — faster than other methods of isolating and using significantly less excavation space.

One person lift. | For 4-inch through 8-inch pipelines. Pressure rated to 10 bar (150 psi). | Covers multiple standard dimension ratios. 2-inch bypass capable. | Plugging or branching fittings available.

SAFE. QUICK. RELIABLE.

How much faster is it?

Watch the speed comparison video:

©2023 T.D. Williamson

the top-down decisions reverberate within the consultancy team and appropriate responses are not conditioned by interactions with stakeholders directly. To help bridge the gap, more modern project management techniques could facilitate an open dialogue between the promoter and consultant to reduce the risk of adverse outcomes.

Project B: collegiate management

A trusting promoter with an open approach to the project, one that is highly political and stretching across two continents. The consultancy team has built a rapport with the promoter unit catalysed by project management techniques such as open workshops for key decision-making at project gates, where the vortex of technical and political forces can be laid out, allowing the techniques to be honestly debated. Decisions, even with occasional dissensions on issues, can be accepted since the mode of reaching the choice is open and visible. As a result, the technique contributes to the achievement of all project objectives.

The future

Likely to be shaped by several factors, the future of energy projects will include advances in technology, changes in policy, and an increasing focus on sustainability and renewables. Projects that are associated with fossil fuels may need a precursor stage of justification before moving forwards. This can be seen as a useful step as for many parts of the world the use of fossil fuels in areas of energy deprivation is non-negotiable.

The Western focus on decarbonisation obscures the deep energy poverty of continents such as Africa, where finding any energy source is the focus and where fossil fuel projects may still be the best way to get new energy sources to the greatest number of people. A precursor stage may as a statement of need act as a manifesto for the project to defend against possible objections, where the desperate need for energy can justify a hydrocarbon project.

The energy sector is one of the most complex and rapidly changing industries in the world. As new technologies emerge and environmental concerns continue to increase, the need for effective project management is becoming more important than ever before. Project management will need to adapt to ensure that projects are delivered on time, within budget, and to the highest standards of quality and safety. To progress, whilst delivering on time and to budget is often at strong odds with the need and pressure to consult, so how can project management navigate a wider plethora of requirements and aspire to keep key stakeholders’ content? Whilst this article hints at some of the main areas to consider, how can we prepare our management teams adequately to give them the right skills and techniques to progress the evolution of pipeline projects?

References

1. ROSENHEAD, J., MINGERS, J., Rational Analysis for a Problematic World Revisited: Problem Structuring Methods for Complexity, Uncertainty and Conflict (2001).

2. www.gov.uk/government/publications/multi-criteria-analysis-manual-formaking-government-policy

55th IPLOCA Annual Convention, ‘Together - Delivering Sustainable Energy Infrastructure’ 11-15 September 2023 - Vancouver, Canada Visit www.iploca.com to find out more

high

in the pipeline industry

Encouraging

standards

here are a couple of common sayings in the security industry. One is that compliance is not equal to security. Another (less common but equally relevant) is that all defensive activity is good activity. Most know that the first statement isn’t true, but many companies think that the second is – that if they’re doing something to be more secure, they are more secure. Such a strategy can lead to creating a false sense of security around how well-defended an organisation actually is. Companies often find themselves with a false sense of security because they often equate activity with security. Yet, the cost of

cybercrime is expected to be US$8 trillion dollars in 2023 and is expected to grow to US$10.5 trillion by 2025. Increased spending, and thereby, activity, does not guarantee more security.

The industry

The risk in the oil and gas industry is even higher than in others. Oil and gas companies are a critical part of our nation’s infrastructure and economy; companies in this sector manage operational technology (OT) – the technology that powers the pipelines, pumps, and controllers, for example – and IT networks that power

19

Gerald Caponera, Product and GTM Leader, ThreatConnect, USA, explains how cyber risk management and quantification can be applied to pipeline safety and risk management.

other parts of the business like accounting, shipping, and inventory management.

Risks for IT and OT environments are different. Key risk areas on the IT side can include cloud transition and usage, access to business and marketing data, and identity management. Key risk areas on the OT side include industrial control systems (ICS) such as supervisory control and data acquisition (SCADA), programmable logic controller (PLC), and physical zones and assembly lines.

Even when key risk areas appear on both a business’s IT and OT networks, such as vulnerability scanning, the process differs greatly. Active vulnerability scanning that can be done on IT networks is often too risky to attempt on OT networks. Although some overlaps exist between IT and OT environments, the environments differ significantly enough that oil and gas companies are forced to double their workload to defend the two environments.

Assessing risk – one and done?

The aforementioned risks to the IT and OT networks are not static. An organisation’s OT and IT environments constantly change, its

supplier environment constantly changes, and the attackers’ capabilities evolve. Therefore, organisations must continuously measure potential risk.

Often companies will perform a risk assessment and slowly implement changes without realising that the risks change rapidly. An example of this is the Log4j vulnerability that caused chaos in the company’s security plans. With the increase in cyberattacks on OT networks, new vulnerabilities appearing in software supply chains, and persistent news coverage of the risks, companies can wrongly believe that ‘all activity is valuable activity’.

Breaking out of the trap

Principally, organisations must understand that cyber risk is a business risk and needs to be treated in the same way other company risks are evaluated, quantified, and managed.

Secondly, organisations must ensure they have the ability to prioritise where their cyber investments are going. Spending money on cyber investments without understanding the financial risk reduction is not a wise long-term strategy.

Ultimately, the solution to understanding and managing cyber risks well is to have a strong cyber risk management programme in place. Those cyber risks need to be communicated in financial terms so that the business can see both the potential impact – in terms of what they can consume – while also choosing which risks to accept, transfer, and mitigate.

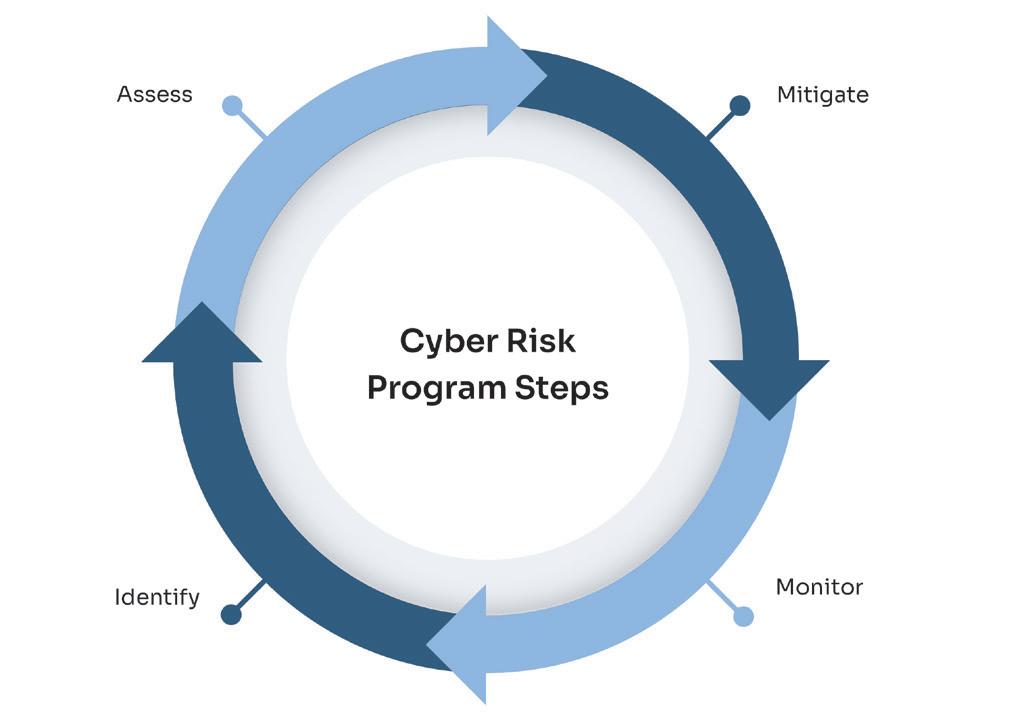

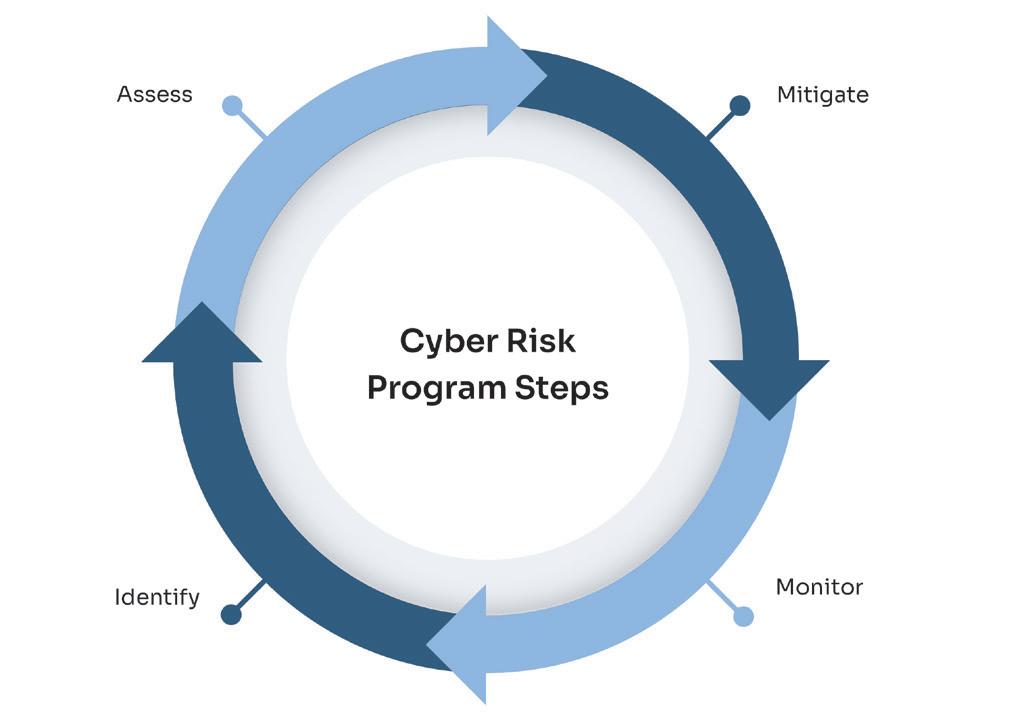

Good cyber risk management is continuous

A good cyber risk management programme is critical to success and not hard to implement. There are four key steps that are required including assessing risk, measuring risk, controlling risk, and identifying risk. It’s also critical to understand that this process is a continual process. Attackers don’t stop after you finish one cycle – they continuously attack, thus you need to continuously run your process.

Figure 1. Lifecycle of risk management.

Figure 2. IT and OT overlap.

20 World Pipelines / AUGUST 2023

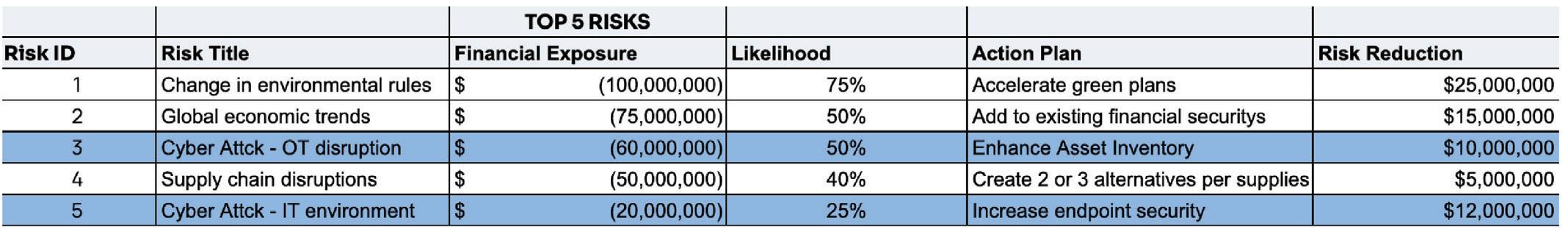

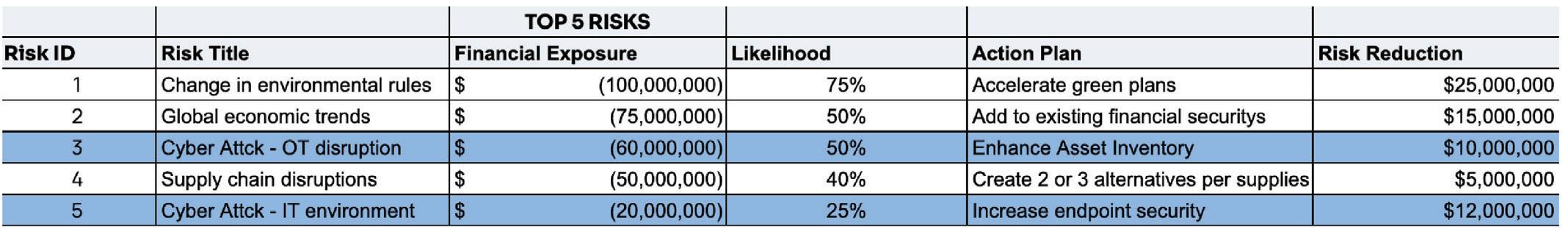

Figure 3. Sample risk register.

Master your next job with productive equipment solutions from SUPERIOR Manufacturing and Worldwide Machinery. We have the project-proven solutions and new innovations to tackle any job. +1 800 383 2666 sales@wwmach.com worldwidemachinery.com/SUPERIOR SUPERIOR Manufacturing is a trademark of Worldwide Machinery SUPERIOR RESULTS

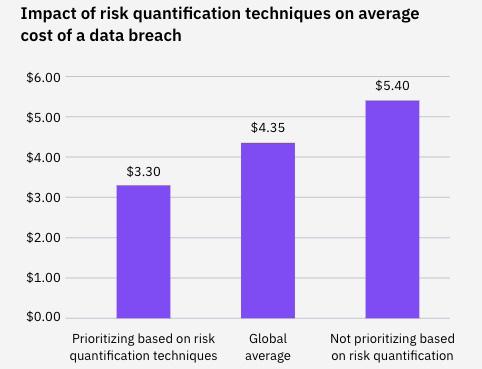

This process isn’t unique. The piece that needs to be added for oil and gas companies, and arguably all companies, is adding quantitative rather than qualitative measurements to assessments.

Risk assessments are typically done a few times a year (at best), and most assessments are qualitative – not quantitative. Businesses run on financial data and cyber risk assessments need to be quantitative to ensure they’re understood, adopted, and implemented.

An example

Cyber risk is a business risk and needs to be treated accordingly. Whilst some oil and gas companies are managing cyber risk in that way, unfortunately, some are not.

In a hypothetical example, Company X is in the oil and gas industry. The company manages both IT and OT environments and has carefully and wisely segmented the networks so that an attack on one does not metastasise to the other. Company executives have been reading about the increasing risks in their industry and are getting worried about statements like the following:

) The oil and gas industry uses a variety of complex systems and technologies that are becoming increasingly vulnerable to cyberattacks.1

) Threat actors, state actors, cybercriminals, and others could potentially conduct cyberattacks against offshore oil and gas infrastructure. The federal government has identified the oil and gas sector as a target of malicious state actors.2

) According to Dragos research, between 2018 and 2021 the number of ransomware attacks on ICS entities increased over 50%, with 5% of attacks impacting ONG entities.

After reading these, and other similar postings, the business commits to a 20% increase in spending securing their OT environment and is under the false impression that its business is secure and that its key risks are mitigated. Invariably, the company receives the news it has been dreading and has attempted to defend against – a ransomware attack has forced a shutdown of the pipeline. However, the attack did not materialise on the OT network – it was initiated on the IT network.

Deception is a standard adversary tactic

A standard military tactic is to try to convince the enemy an attack will occur in one place while then attacking another. Infamously, during WW2, the Allies expertly utilised deception by inflating hundreds of ‘dummy tanks’ to give German intelligence the impression an attack would occur on faraway Pas-de-Calais, France, as opposed to the Allies’ true and eventual target, Normandy. In the case of this oil and gas company, the deception used was that the OT networks were the only critical vulnerabilities the company faced. Note that the term ‘critical’ vulnerability is not a technical measure, but a qualitative business measure. As Company X learned, deception leads to a false sense of security which ultimately leads to a breach.

How do you prevent deception?

Not only are cyberattacks staying, but the frequency and magnitude is only likely to increase. Oil and gas and other critical infrastructure will continue to be vulnerable and those industries are in the unfortunate position of having to secure both their IT and OT networks. The only way to ensure companies in those industries are not deceived by a false sense of security is to ensure

Figure 4. Cyber risk taxonomy.

Figure 5. Investment based on ROI.

22 World Pipelines / AUGUST 2023

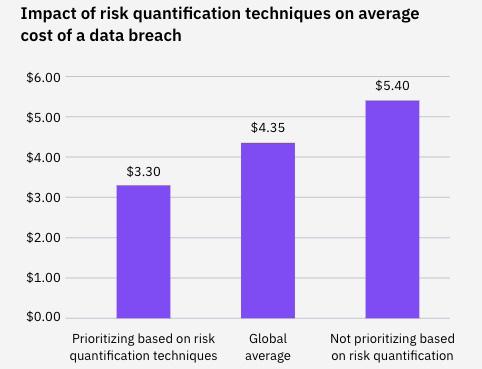

Figure 6. ROI using risk quantification.

they identify, measure, and manage risk in a way the business truly understands.

All companies have a risk register where they track the biggest threats, yet most companies are missing a few key pieces – a sense of the potential loss magnitude for cyber risks and the risk reduction actions plans would provide, for example.

The two most important columns in the spreadsheet in Figure 3 are financial exposure and risk reduction. Cybersecurity is now a major business risk (one of the top five risks companies face, according to the World Economic Forum), and only by managing cyber risk in financial terms can companies ensure they are on the right track.

Companies that measure risk in financial terms – and are experiencing growth – would have seen a different approach. Rather than implementing a blanket cost increase, they would have targeted their spend in the area that provided the greatest risk reduction. This could have resulted in the ransomware attack being prevented or contained quickly enough to cause much less disruption.

What’s the right way to see cyber risk?

Company X – like most companies – focused on what it perceived were its biggest risks. However, the company should have assessed its entire risk landscape and better understood how its IT assets provide business value.

Traceability is important because material cyber risk is realised when an IT asset – which is part of a business application like shipping or accounting that is part of a key process – gets breached.

n L i g h t w e i g h t , o n e - p i e c e e r g o n o m i c d e s i g n p r o v i d e s c o m f o r t a b l e a l l - d a y u s e

O n e w a n d c o v e r s t h e e n t i r e v o l t a g e r a n g e f r o m 0 5 t o 3 0 k V

n U p t o 1 6 h o u r s o f b a t t e r y l i f e p o w e r f u l L i - i o n b a t t e r i e s f i t n e a t l y w i t h i n t h e c o m p a c t w a n d h a n d l e e l i m i n a t i n g t h e n e e d f o r a s e p a r a t e b a t t e r y b o x

n B u i l t - i n C e r t i f i e d Vo l t m e t e r a n d Vo l t a g e C a l c u l a t o r f e a t u r e

n I n d u s t r y s t a n d a r d c o n n e c t o r s a n d a d a p t o r s p r o v i d e c o m p a t i b i l i t y w i t h n e a r l y a l l e x i s t i n g e l e c t r o d e s

If our hypothetical company had mapped and combined the mapping with cyber risk quantification (CRQ) in order to calculate the financial risk to cybersecurity, it would have seen the risk register outlined above. Additionally, the analysis that the risk register shows is the ROI for investing in IT is greater than investing in OT.

But does cyber risk quantification really help?

A question that we frequently encounter is whether QRC is genuinely effective in reducing risk. According to an IBM report, companies that implement QRC reduce the cost of a breach by 48.3%.3

No shoulder bag required!

Also available with Pulsed DC

High voltage Holiday Detector

Conclusion

This hypothetical use case was drawn from past customer engagements in the oil and gas industry. The recommendation is not where to invest in cyber defence, but rather to fully know the breadth of the problem and to create meaningful metrics around cyber risk by using financial terms and balancing risk vs reward in a defensible way.

Wand-style with Continuous DC

Stick-type with Pulsed DC

References

1. www.weforum.org/impact/cyberresilience-oil-and-gas

2. www.gao.gov/products/gao-23-105789

3. www.ibm.com/downloads/cas/3R8N1DZJ

Detects holidays, pinholes, and other discontinuities using continuous DC NEW High voltage Holiday Detector D e Fe l s k o C o r p o r a t i o n l O g d e n s b u r g , N e w Yo r k U S A Te l : + 1 - 3 1 5 - 3 9 3 - 4 4 5 0 l w w w d e f e l s k o c o m

n

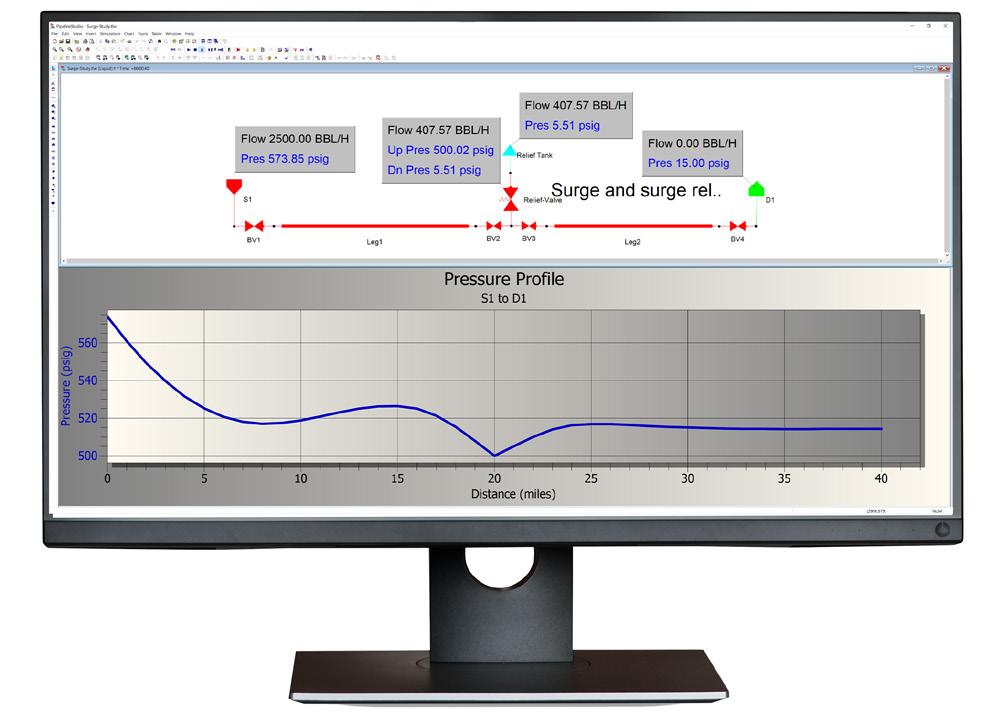

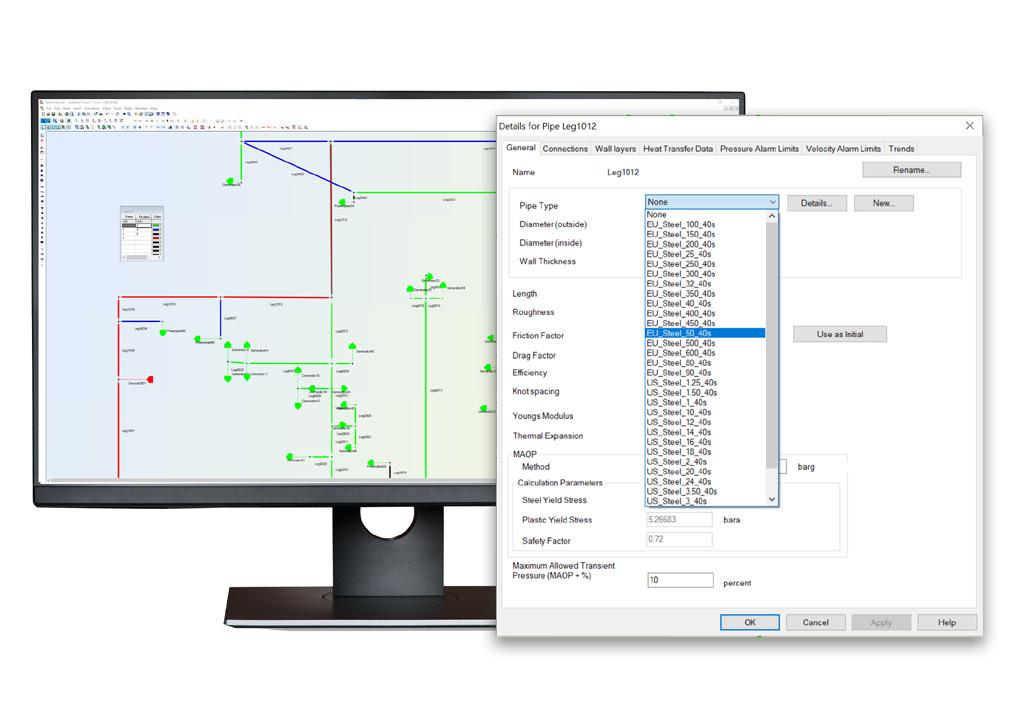

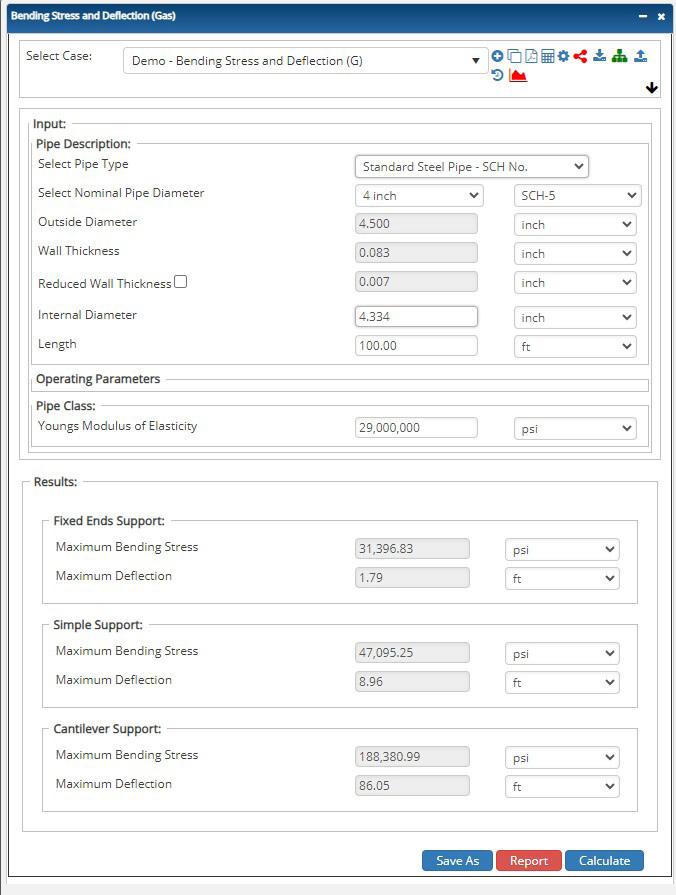

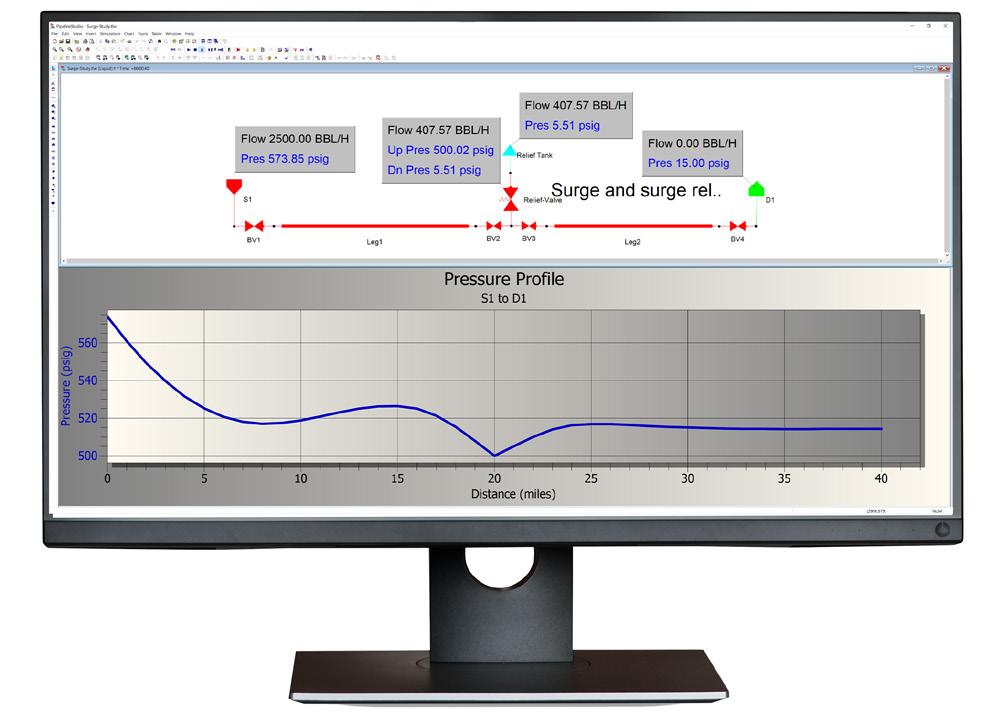

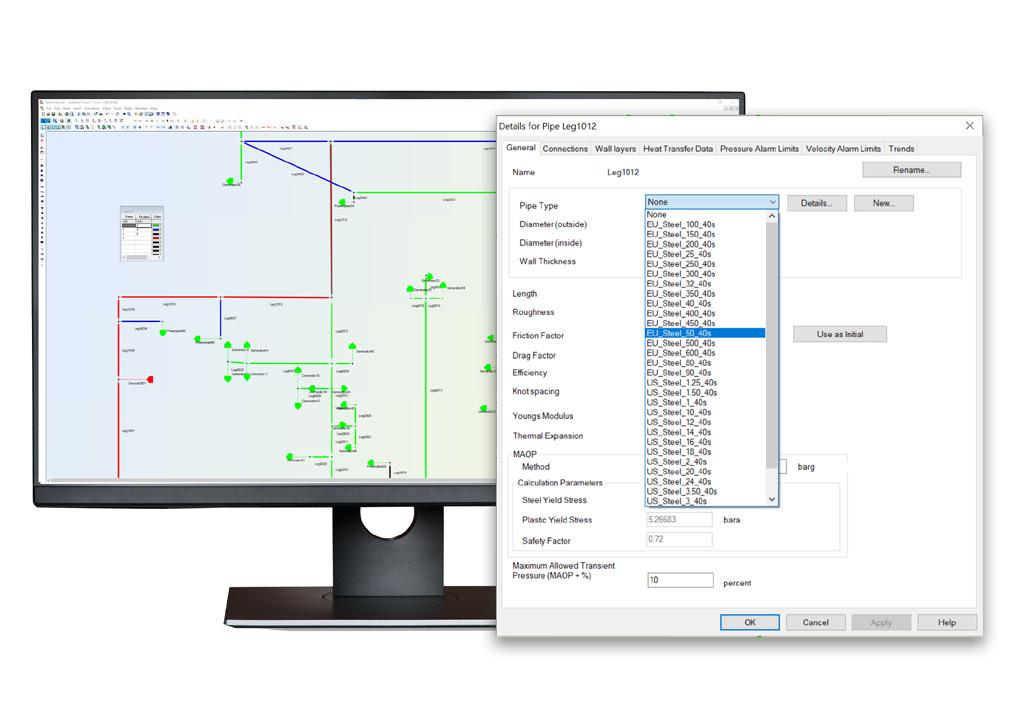

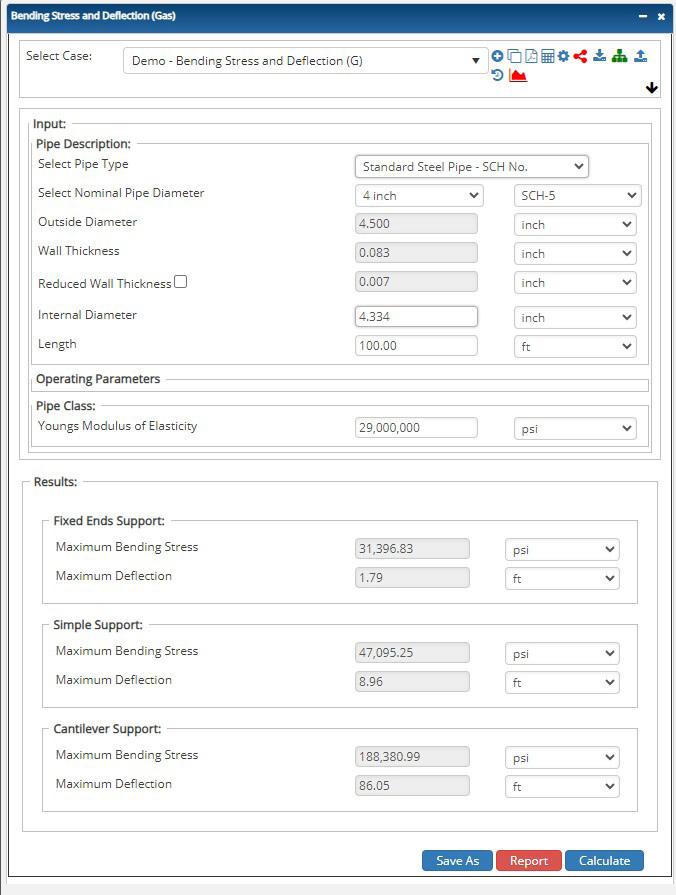

Whether used for traditional products or emerging energy transition solutions, pipeline design and analysis software provides value from engineering to operations, says Paul Dickerson and Dr. Jon Barley, Emerson.

The world is rapidly trying to adjust to an era of uncertainty. Supply chain snags, personnel shortages, and the need for more sustainable operations are impacting nearly every industry, including pipeline operators. Ensuring that pipelines operate at peak efficiency is no longer a goal; it is a requirement to stay competitive.

Operating a pipeline at peak efficiency requires the right digital tools, including pipeline design and analysis software. Using a robust software tool helps teams design, prepare, evaluate, and adapt their pipeline operations to meet the shifting needs

25

of a new era of pipeline use and development. But not all tools are created equal; choosing the right solution to help meet the needs of modern operations means finding one that is designed for ease of use and provides value at every stage.

Making a move to modern operations

Today’s most innovative pipeline solutions are neither built nor operated as they would have been twenty years ago. Modern pipeline operators have a variety of needs, and the tools they use should offer corresponding capabilities. Engineers require reliable tools to model the way the pipeline will react to specific changes. For example, their software should be able to simulate a flow decrease in one part of the pipeline to show how that change will impact pressures and flow in other areas.

For liquid transport systems, engineers also need systems capable of performing surge analysis to ensure they are designing safe networks. Their simulation software should be able to demonstrate what happens if a valve is closed

suddenly, and it should offer tools to help the engineer size the surge relief valves.

In addition, many engineers will need access to models for tracking batches of different products moving through the pipeline. Using these tools, the team can model batch schedules to help determine the sequencing of offtake and routing valve opening and closing, which is required to deliver the right quantity of product to the right location.

But those functions are just the basics. Today, as markets are moving toward more sustainable products, many engineers need extended functionality in their digital tools. For example, as operators introduce hydrogen into natural gas, this change can significantly impact pipeline operations. Hydrogen has different physical properties than natural gas, and pipeline pressures must change to achieve the correct flow rates. Moreover, consumers taking gas out of the system are likely calculating their requirements based on energy content rather than volume of gas. Because the volumetric energy content will be lower with hydrogen, teams will need best-in-class design and analysis software to identify the correct increase, and to automatically determine the correct flow and pressure needed to meet those energy contracts.

Carbon capture operations also need simulation software to help design systems for transport to depleted reservoirs for sequestration, or to storage tanks for reuse. These operations collect captured carbon dioxide (CO2) from various plants and transport it to the designated sequestration sites. Transporting CO2, however, is different from transporting gas. CO2 transporters must keep the pressure and temperature at a level to maintain the fluid in a single phase, and this and other requirements present unique challenges. The solutions chosen must help these teams build the models they need to keep the pressure high and the temperature low from endto-end.

Some carbon capture groups are even collecting CO2 from many different sources. As the CO2 from different facilities is combined, contaminants can become an issue. Due to environmental and operational risks, there may be limits regarding how much of each contaminant is present in certain parts of the network. Modelling software provides tracking of contaminants – such as nitrous oxides, sulphur oxides and methane – and it then computes the comingling at junctions in the network to provide the analysis needed for staying within necessary limits.

Successful organisations are finding these digital tools within fit-for-purpose pipeline design analysis and simulation software ecosystems. Today’s most effective pipeline simulation software solutions contain everything engineering teams need, often all from a single provider to help ensure seamless operation.

Pipeline design and analysis software

Pipeline design analysis and simulation software is used by engineers to design pipeline systems, and to help them perform short and medium-term planning for their pipelines before they start operations. The software enables steady state and transient hydraulic analysis of pipelines for both

Figure 1. The safe design of liquid pipeline networks requires software capable of accurately modelling surge to ensure relief valves are properly sized.

Figure 1. The safe design of liquid pipeline networks requires software capable of accurately modelling surge to ensure relief valves are properly sized.

26 World Pipelines / AUGUST 2023

Figure 2. Problematic contaminants in CO2, such as methane, can be accounted for in pipeline design software, allowing for safer transport of the gas.

• Increase productivity

• Increase quality

• Lower repair rates

• High level of support

Together, we create the most distinctive and integrated welding solutions for the construction of reliable and sustainable pipelines.

Whether it’s oil, gas, or any other fluid, we are here to ensure reliability and make projects run smoothly. Quality is top priority, we settle for nothing less than perfection.

No matter location, challenges, or circumstances, Qapqa is your go-to partner for exceptional welding solutions. From remote deserts to high altitude environments, we deliver our expertise to every corner of the globe.

Qapqa. Joining solutions.

Oilserv - Nigeria

Oilserv - Nigeria

liquids – such as crude oils, refined products, biofuels, and LNG – as well as for gases, such as dry and enriched natural gas, regasified LNG, CO2, and hydrogen.

During greenfield design, engineers use pipeline design and analysis software to determine how much piping and other material is needed, how much product volume they need to move through a system to meet contractual obligations, and the required pipe sizes needed to meet specific shipping volumes.

Pipeline simulation software can also be used for pipeline systems already in place. Engineers can enter the specifications for an existing pipeline into the software to identify bottlenecks in the system, determine how the system will respond to specific upsets, or identify where they may need additional compressor stations.

Advanced users also turn to pipeline simulation tools for planning and analysis of their existing systems. Using powerful modelling tools, they can plan and analyse activities, such as the best ways to shut down their pipelines, and the safest and most efficient ways to start them back up again.

Select for ease of use

Pipeline design can be a complex and time-consuming process. Today’s engineers are busy, however, and few have the spare time to spend learning, navigating, and transitioning between software packages to get the reliable results they need. The best solutions are feature-rich but also easy to use. To find such a solution, organisations should look for a few key features that set the most user-friendly and intuitive systems apart from the pack.

First, users should be able to go from zero to design in a single software package. The best pipeline simulation software allows users to go directly from steady state simulation to transient simulation without having to move to a different application or purchase additional modules.

The most obvious benefit to such a solution is that it saves the user the time of exporting and importing files between software packages. However, another more critical value is consistency of the user interface. When a software package

handles the full spectrum of simulation, users only need to learn one system to accomplish all their tasks. Working within a single package dramatically cuts training time with consistent, logical input at every stage.

The single interface should also be designed with the user in mind. Pipeline engineers need accurate answers quickly, and the more clicks they must perform to get to needed data, or to move data between solutions, the more time they spend on low-value tasks. Simulation software must therefore be intuitive to navigate and use. Typically, that user friendliness comes in software solutions that have been developed over many years, and tested and tweaked in the field to meet the needs of actual users.

Another key differentiator for best-in-class pipeline design applications is the presence of sensible default values. Often, pipeline engineers have scant data available for new builds. When their software solution contains well-designed defaults, they can avoid the complexity of starting from a blank page. Instead, engineers can use a starter configuration with sensible values to quickly begin the process of design and create a workable simulation, and they can then gradually refine from there as they gain access to more details.

Best-in-class software also offers parametric studies, which provide the ability to run sequentially through a set of different models with ranges of parameter values – such as different pipe diameters – to quickly identify the correct value to optimise the system, or to provide a range of operational scenarios. These parametric simulations can be performed for a whole pipeline system or individual pipes. Users simply create a matrix of parameters, and the software runs thousands of simulations against those parameters, outputting a matrix of optimal results. Automated parametric studies save significant time, often completing in just hours a process that takes days to perform manually.

Deliver value at every stage

Modelling a pipeline is typically a multi-stage project. In the earliest stages of design, an engineer might not have or need all the granular details. At that early stage, the goal is often to quickly rough-in an idea to see if it is even feasible. That type of simple model should be scalable and easy to create. Bestin-class design and analysis software provides the tools to use early models as a springboard to more complex engineering.

For example, an engineer starting a project might not be worried about temperature distribution across the network, so they simply perform a draft configuration to make sure pipe lengths and volumes look accurate but use isothermal simulation while testing those parameters. Instead of taking the time to set up detailed thermal parameters for the pipe, they simply set an average temperature for the whole system. However, once the lengths and volumes are settled, the engineer will need to come back and go into more detail, setting up detailed thermal parameters for the pipe and adjusting the thermal environment.

That same engineer might temporarily use generic compressors as placeholders in the first levels of configuration. When the system is coming together, they can add more detail around compressor modelling, such as head and efficiency

28 World Pipelines / AUGUST 2023

Figure 3. Pipelines can be quickly configured with minimal mouse clicks using the sensible default data in Emerson’s PipelineStudio modelling software.

maps. The best tools do not force engineers to model every detail from the very first moments of design. Instead, they allow the engineer to easily jump right in, and to then begin refining and adding complexity where it is needed.

Best-in-class design and analysis software also instils value into operations, as was the case with a gas operation company serving a large area with varying natural gas demand. The company used a pipeline simulation system for short-term day-to-day planning. The simulation helped the operations team model how much gas they needed, how they were going to move it, and where it would be needed to satisfy customer demands in the face of fluctuating environmental factors, such as the weather.

The team now uses the models to quickly and easily decide how much to buy, how much to put into storage, and how much to put into the system. The team even does some load forecasting, taking information from load forecasting tools and entering them into the simulation to run tests. With the test results in hand, the team knows it is always prepared with enough gas in storage, even as extreme weather events occur and population centres change.

Critical evaluation is key

Whether a pipeline is designed to transport traditional materials or is navigating the uncertainty of the future with the addition of emerging energy solutions like hydrogen and carbon capture, utilisation and storage, its engineering team will need powerful design and analysis tools. But with a wide variety of available

features and capabilities in different products, it is worth the time to carefully examine each application to determine if a given solution will deliver value across the entire chain.

Best-in-class software has typically been designed over decades and tested in the field by thousands of users over that time, an evolution that adds value at every step. Taking the time to properly evaluate design and analysis software adds the speed and flexibility teams need to make the fast decisions that lead to competitive advantage – a critical success metric in a constantly changing marketplace.

Figure 4. Mapping systems can be integrated into Emerson’s PipelineStudio software to achieve advanced GIS modeling capabilities.

Creating today the energy network of tomorrow

Corinth Pipeworks, a prominent steel pipe manufacturer, is committed to support the energy transition by providing solutions that facilitate the transportation of hydrogen through high pressure pipeline networks and up to 100% in content.

www.cpw.gr

Our position at the forefront of the new hydrogen era is strengthened by our the Research and Development efforts, an in-house hydrogen laboratory and the successful execution of multiple hydrogen pipeline projects.

ipelines have long been the safest way to transport gas, but what are crucial components of modern energy infrastructure still have weaknesses. Safety has always been the main priority for the natural gas sector, with an understanding that any accident could have a significant impact on public safety and the environment.

This was certainly the case in 2018 when a series of gas explosions shook Merrimack Valley, Massachusetts (USA). One person died because of the fires, another 21 were injured, and 8000 were forced to evacuate their homes following the accidental over-pressurisation of a low-pressure natural gas distribution system. Any natural gas incident is one too many, but unfortunately, incidents such as Merrimack Valley have increased in frequency over the last decade, according to research by the Pipeline Safety Trust.

While the incident in Massachusetts was rare in its scale and such events are unlikely to be commonplace, it led to pipeline operators forcing through change to drastically improve safety standards in the sector. Two years after the Merrimack

Valley incident, the United States Congress passed the ‘Protecting Our Infrastructure of Pipelines and Enhancing Safety Act of 2020’ (PIPES Act 2020). For operators, it means that they must now assess the risks that could lead to or result from the operation of a distribution system at a pressure, too low or high, that makes the operation of any connected lowpressure gas burning equipment unsafe.

Ensuring safe pressure levels

Gas utilities have relied on pressure regulator stations for over 200 years to maintain constant pressure across their distribution networks. With downstream distribution networks designed to operate at lower pressures, regulating pressure to appropriate levels is essential to avoid catastrophic overpressure events or costly gas outages, either of which would impact thousands of customers.

However, challenges such as differences in the station and regulator types and their configurations, site-specific differences compounded by limited data and multiple failure mechanisms in regulator stations mean traditional risk management methods and models are often inadequate.

Tony Alfano, Pipeline Product Line Director, DNV, discusses mitigating overpressure and outage risks in pipelines.

Tony Alfano, Pipeline Product Line Director, DNV, discusses mitigating overpressure and outage risks in pipelines.

31

Figure 1. Valve at pig launcher.

Understanding regulations

The safe and reliable operation of gas pipelines and management of over-pressurisation or network outages is not only important for the industry and the communities they serve, but it is also heavily regulated by governments worldwide. There are several regulations in place to manage over-pressurisation in gas pipelines. Regulations vary by country and region, and pipeline operators must be aware of and comply with all relevant regulations in their area.