® Volume 24 Number 3 - March 2024

05.

08.

Shaun Reardon, Principal Cyber Security Consultant, DNV,

gas industry, drawing on DNV’s latest research into the changing attitudes towards cyber threats. PAGE

Building cyber resilience

HYDROGEN PIPELINES

15. Transition trends in hydrogen

Steve Biagiotti, Jr. P.E., Chief Engineer and Gary P. Yoho, P.E., Principal Consultant, Dynamic Risk.

22. Europe's highway to hydrogen

Kimberly Sari and Simon Roth, ILF Consulting Engineers, Germany.

REPAIR AND REHABILITATION

29. Flexible forward thinking

Håvard Høydalsvik, Head of Business Unit O&G, Rädlinger Primus Line, Germany.

INTEGRITY AND INSPECTION

33. Advancing integrity through NDT Brent Moulton, ASNT.

39.

Heavy Equipment focus

World Pipelines' annual heavy equipment focus, featuring Proline, BAUMA, Suxxesion, and Laurini.

PIG LAUNCHERS AND TRAPS

53. Pushing pig designs into the future

Dave Forster, Propipe, UK.

PIPELINE INTEGRITY TECHNOLOGY

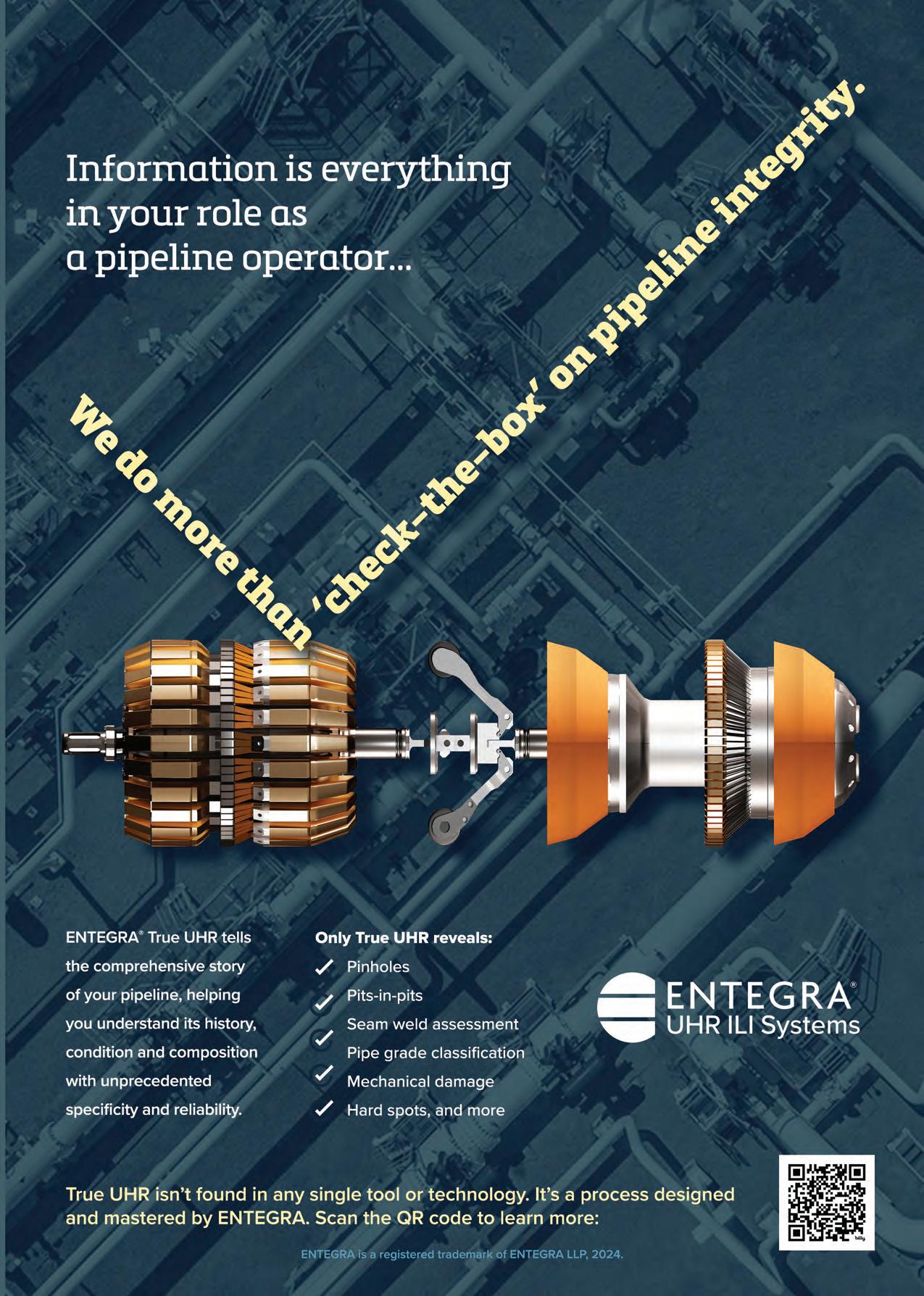

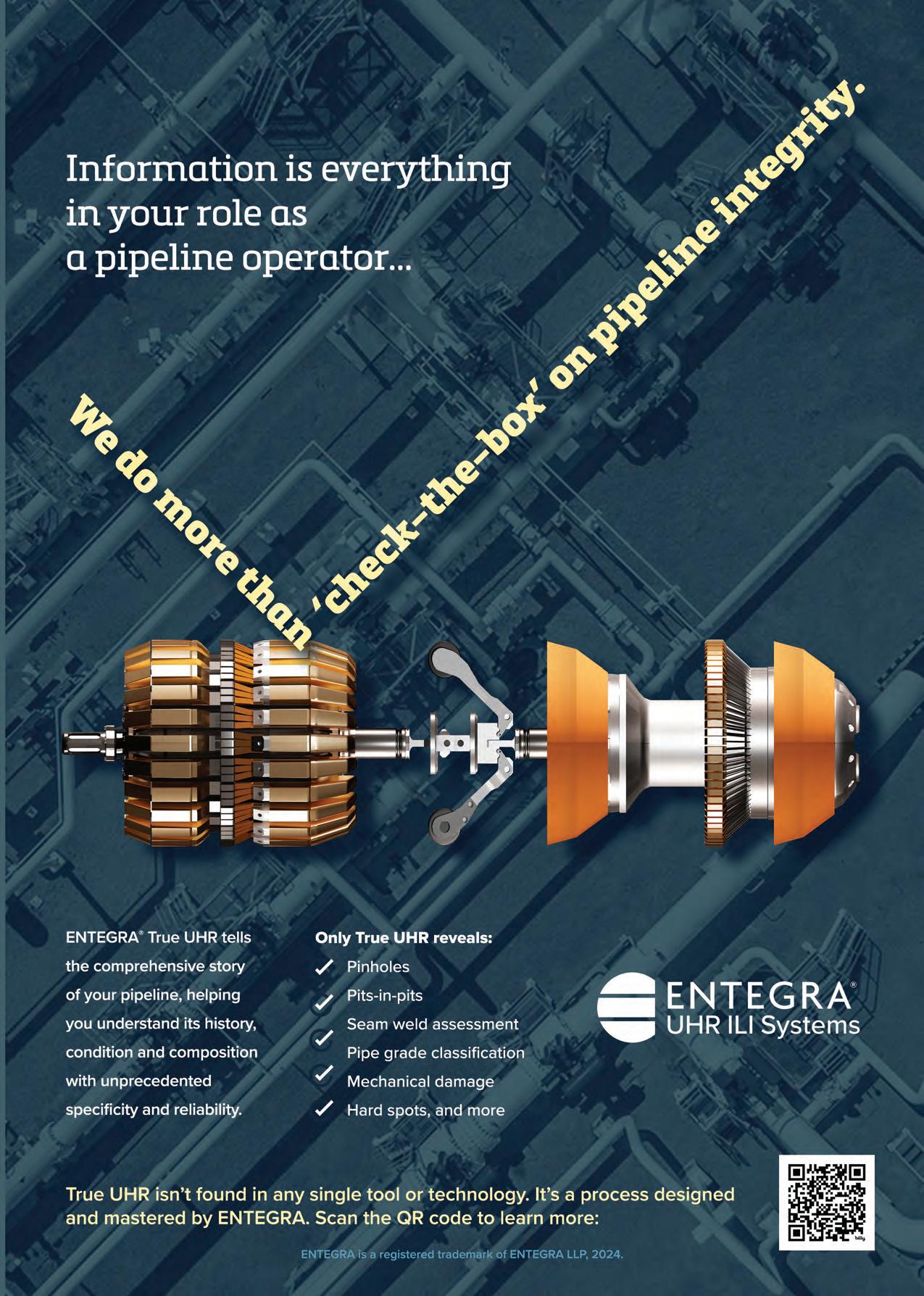

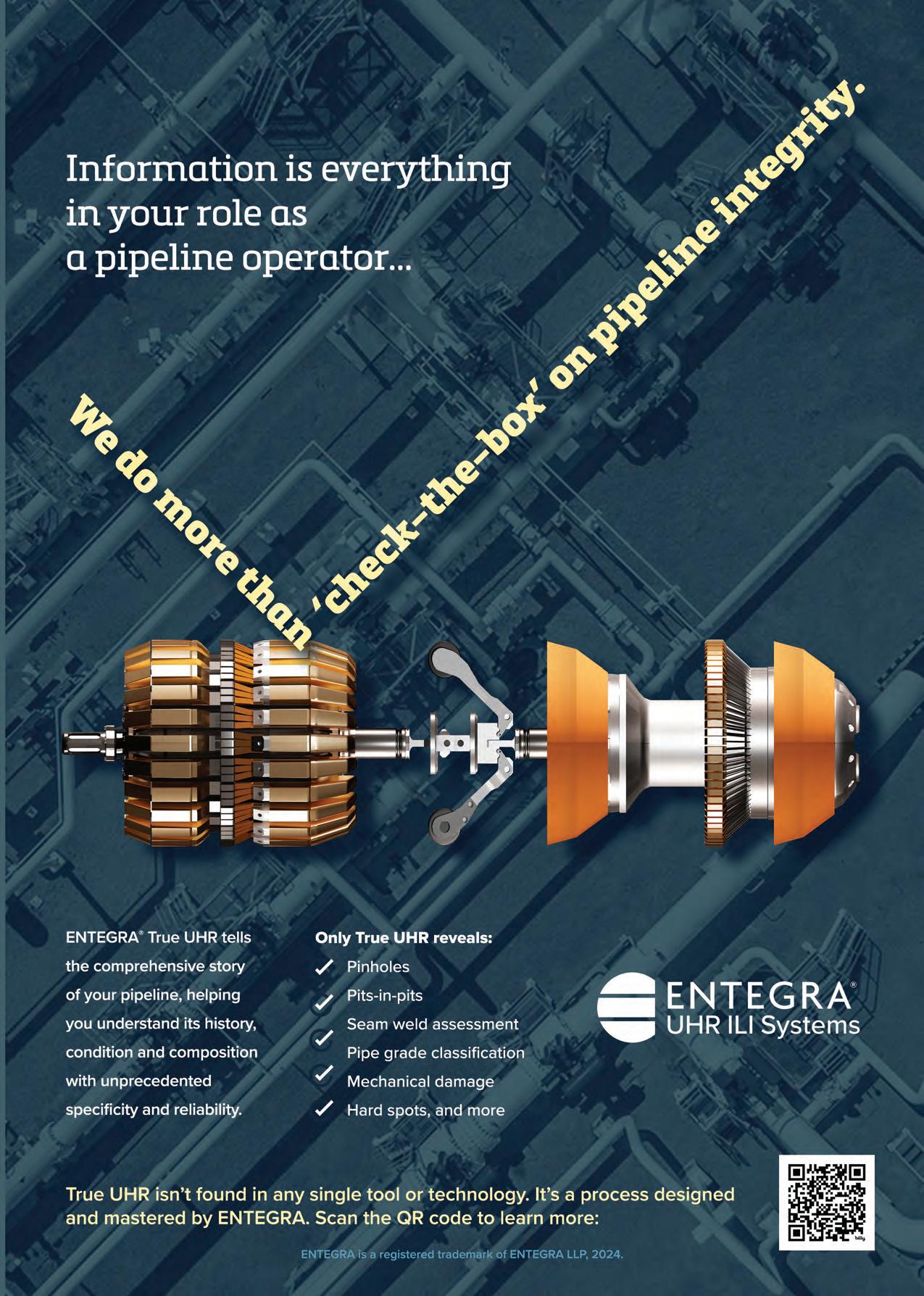

59. It's all about the process

Dr. Chris Alexander, PE, President and Founder of ADV Integrity, Inc., USA.

64. Taking action on methane Mark Naples, Umicore Coatings Services, UK.

PIPELINE MATERIALS

68. Raising the bar for onshore pipelines

Jeff Shorter, Portfolio Director, Eugene Boakye-Firempong, Product Manager and Ronald Panti, Operations Manager, Baker Hughes.

ISSN 14727390 PIPELINE CONSTRUCTION 50. Covering a lot of ground UAVOS, USA. Member of ABC Audit Bureau of Circulations ON THIS MONTH'S COVER Reader enquiries [www.worldpipelines.com] C O NTENTS Copyright© Palladian Publications Ltd 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK. WORLD PIPELINES | VOLUME 24 | NUMBER 03 | MARCH 2024 SCAIP pipelayer SPX-460RC working in Argentina. SCAIP is an Italian headquartered company that designs and manufactures a large variety of pipeline equipment. In the past our products were branded as SUPERIOR, but more recently are all gathered under our company name SCAIP.

Editor's comment

03.

Pipeline news

updates on Mountain Valley pipeline, TMX, and offshore contract news. 39 CBP019982 29 ® Volume 24 Number 3 - March 2024

With

KEYNOTE: CYBER SAFETY

Building

cyber resilience

makes the case for

security

seriously as safety in the oil and

08

treating cyber

as

Shaun Reardon, Principal Cyber Security Consultant, DNV, makes the case for treating cyber security as seriously as safety in the oil and gas industry, drawing on DNV’s latest research into the changing attitudes towards cyber threats. P ipeline security is high on the agenda globally, as attacks on critical energy infrastructure have increased in recent between Finland and Estonia is still offline following damage in October of last year. The year before, in September explosions at pipes A and of the Nord Stream pipeline and pipe A of the Nord Stream 2 pipeline. However, it’s not just physical attacks that threaten critical 8 9

53

PAGE 64 A of pipelines in place in the oil and gas sector, methane leaks are too governments worldwide grapple with the climate crisis, energy The sector collectively operates vast pipeline infrastructure, and as these networks age, the problem In the US alone, 2.6 million miles of pipelines carry natural gas destinations each year. Many of these are approaching retirement years old, and some were installed most of this network buried out of Mark Naples, Umicore Coatings Services, UK, discusses using data to tackle methane leaks in the oil and gas sector. other damage can be easy to ignore This ageing network is already the planet. Worldwide, more than 1000 ‘super-emitting’ events were atmosphere every hour with the largest recorded event releasing Combined, the global energy sector was responsible for an estimated 135 million of methane role as one of the largest sources of greenhouse gas emissions. clear understanding of where they are occurring. Unfortunately, this can feel impossible to achieve. The ineffective at best, and alternatives such as satellite monitoring are emissions from the energy sector Without clear picture of where leaks are occurring, the oil and gas sector cannot begin taking 64 65

HOW ABOUT COATING A SWEATING PIPE CAUSED BY A HOT ENVIRONMENT?

STOPAQ is purpose designed and is always challenging the rules in order to comply with reality.

Our reality in this case, was re-coating a section of a buried pipe in a hot environment. The surface condensed due to cold media, resulting in ‘sweating’ of the pipe. Switching to our Wet Substrate applied Wrappingband (WSH) ensured continuation of the project.

Without the need for primers or specialty tools, STOPAQ is simple and easy to apply and immediately forms an impermeable barrier to moisture and air.

Learn from the past Think of the future

Designing coatings for the versatile conditions we apply in.

You can find this application and other challenges in practical situations on: www.stopaq.com/challenges

Self Healing Corrosion Prevention & Sealant Technology

EDITOR’S COMMENT

CONTACT INFORMATION

MANAGING EDITOR

James Little james.little@palladianpublications.com

EDITORIAL ASSISTANT

Isabel Stagg isabel.stagg@palladianpublications.com

SALES DIRECTOR

Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER

Chris Lethbridge chris.lethbridge@palladianpublications.com

SALES EXECUTIVE

Daniel Farr

daniel.farr@palladianpublications.com

PRODUCTION DESIGNER

Kate Wilkerson kate.wilkerson@palladianpublications.com

EVENTS MANAGER

Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL CONTENT ASSISTANT

Kristian Ilasko kristian.ilasko@palladianpublications.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

ADMINISTRATION MANAGER

Laura White laura.white@palladianpublications.com

Palladian Publications

15 South Street, Farnham, Surrey, GU9 7QU, UK

Tel: +44 (0) 1252 718 999

Website: www.worldpipelines.com

Email: enquiries@worldpipelines.com

On TikTok in February there was a trend where women pranked their families by calling to announce they had landed high paying jobs working in the oil and gas sector. Videos were called things like: ‘Telling my little brother (who’s a pipeline welder) I got an underwater welding position with ExxonMobil’, or ‘Telling my dad I got an offshore drilling job for the summer’. Typically, the women call their dad, or brother, and play dumb about what the jobs would realistically entail. As the New York Post explained it: “It usually begins with the woman asking her mark if they know of the energy giant ExxonMobil, then explaining she applied for and received an apprenticeship as underwater welder — for which she’ll be paid a six figure salary.”1

The male relatives in the videos express disbelief that the (mostly young) women could fulfil the requirements of an offshore job: “That’s not anything you’d want to do”, one dad responds after a shocked, six-second pause. “Did they tell you what you’d be doing?”2

Another response goes: “You’re out in the middle of the ocean, the wind is blowing, it’s probably one of the most dangerous jobs in the world,” a dad says in response to the prank, pointing out his daughter “may die” in the role. The same dad calls the idea that the company would hire his daughter “insanity”.

The TikToks are tongue-in-cheek, and it’s funny because the viewer recognises that these calls home are a prank. The women making the videos have jobs or qualifications in unrelated fields, and their relatives are probably rightfully concerned and perplexed about their new career choice.

But it does make me think about what assumptions the general public makes about working in oil and gas. As evidenced in the trending TikTok videos, I’d say that the average person on the street sees oil and gas jobs as: well-paid and highly skilled, but also dangerous and hard to obtain.

Showcasing what it’s actually like to work in the sector is a 20 year old oil rig apprentice from Norway. Thea Uglum Håland (@theauglum) is an apprentice offshore material coordinator for Aker BP, who chronicles her daily life offshore on TikTok. She posts videos showing the everyday tasks of working offshore, and her feed is a mixture of the sublime and the mundane. Håland documents the darkness of the sea at night and stunning views from the helipad, alongside details of her 12 - 16 hour work days, the safety gear she bundles into, the glamour of laundry day, and the cramped conditions of her cabin. Her followers seem to appreciate the full picture she offers of life offshore. She’s enthusiastic and passionate about her burgeoning career and all that it entails.

Applicable

In its May 2023 report, ‘Creating the workforce for an oil and gas industry in transition’, Bain & Company addresses the challenge of recruiting and keeping talent in the sector. The report states that “Progress will require company-level actions such as strategy-informed workforce planning and radical transparency, as well as industrywide coalitions to change perceptions and drive progress.”3 The report continues: “Individual companies will need to make meaningful investments in shaping their cultures toward greater inclusion, redesigning employee value propositions, and creating equitable career paths”. Employee advocacy (when a company employee acts as a spokesperson or advocate for their employer’s brand) is part of that picture, and I’d say that Håland, and others like her, perform a valuable service to the industry by interpreting the reality of oil and gas jobs to millions of young people online.

1. https://nypost.com/2024/02/24/lifestyle/tiktok-trend-women-tell-families-theyre-offshore-oil-rig-workers 2. https://cheezburger.com/494599/18-year-old-oil-rig-apprentice-goes-viral-for-sharing-her-day-to-day-life-in-the-middleof-the-ocean

3. https://www.bain.com/insights/creating-the-workforce-for-an-oil-and-gas-industry-in-transition

SENIOR EDITOR Elizabeth Corner elizabeth.corner@palladianpublications.com

Ltd,

Annual subscription £60 UK including postage/£75 overseas (postage airmail). Special two year discounted rate: £96 UK including postage/£120 overseas (postage airmail). Claims for non receipt of issues must be made within three months of publication of the issue or they will not be honoured without charge.

only to USA & Canada: World Pipelines (ISSN No: 1472-7390, USPS No: 020-988) is published monthly by Palladian Publications Ltd, GBR and distributed in the USA by Asendia USA, 701C Ashland Avenue, Folcroft, PA 19032. Periodicals postage paid at Philadelphia, PA & additional mailing offices. POSTMASTER: send address changes to World Pipelines, 701C Ashland Avenue, Folcroft, PA 19032

The experts you can trust CRC Evans’ market-leading welding and coating services, technologies and equipment ensures efficient, on-time delivery of your global onshore and offshore energy projects. Americas Europe Middle East Africa Asia Pacific crcevans.com enquiries@crce.com @crcevansglobal

WORLD NEWS

Equitrans delays Mountain Valley pipeline to 2Q24 US energy firm Equitrans Midstream, has delayed the estimated completion of its Mountain Valley natural gas pipeline from West Virginia to Virginia to the second quarter from the first quarter, due in part to adverse weather in January, according to Reuters.

The company also boosted the projected cost to complete the project to around US$7.57 billion - US$7.63 billion, up from a prior estimate of about US$7.2 billion. Equitrans spoke about Mountain Valley in its fourth earnings report, which beat estimates.

Mountain Valley is the only big gas pipeline under construction in the US Northeast. It has encountered numerous regulatory and court fights that have stopped work several times since construction began in 2018.

The pipe, which is key to unlocking gas supplies from Appalachia, the nation’s biggest shale gas-producing region, needed a bill from the US Congress that was signed into law by

the President and help from the Supreme Court before it could restart construction.

In its earnings release, Equitrans CEO Diana Charletta said “construction crews encountered adverse weather conditions, including precipitation well above 20 year averages.”

“These conditions were far worse and longer in duration than anticipated, imposing a significant impact on productivity, which, in turn, impeded our ability to reduce construction headcount,” Charletta said.

When Mountain Valley started construction in February 2018, Equitrans estimated the 2.0 billion ft3/d project would cost about US$3.5 billion and enter service by late 2018.

The 303 mile (488 km) Mountain Valley project is owned by units of Equitrans, the lead partner building the pipe with a roughly 49% interest, NextEra Energy, Consolidated Edison, AltaGas and RGC Resources. Equitrans will operate the pipeline.

Occidental explores US$20 billion+ sale of Western Midstream

Occidental Petroleum is exploring a sale of Western Midstream Partners, a US natural gas-focused pipeline operator that has a market value of close to US$20 billion, including debt, according to people familiar with the matter (Reuters reports).

The divestment would help Occidental, which is backed by Warren Buffett’s Berkshire Hathaway, slash the US$18.5 billion debt pile it has accumulated because of acquisitions.

Occidental signed a deal in December 2023 to acquire oil and gas producer CrownRock for US$12 billion, an acquisition which would add further borrowing, four years after its

US$54 billion purchase of peer Anadarko Petroleum.

Western Midstream shares closed 5.7% higher at US$30.81 on the news, their highest finish since July 2019. Occidental shares dropped 1.6% to US$59.56, along with broad declines among energy producers.

Occidental owns 49% of Western Midstream and controls the company’s operations by also owning its general partner. Western Midstream is structured as a tax-advantaged master limited partnership, and a general partner is its controlling entity.

Bernhard Capital to buy natural gas assets from CenterPoint for US$1.2 billion

Services and infrastructure-focused private equity manager Bernhard Capital Partners is acquiring US$1.2 billion (€1.1 billion) Louisiana and Mississippi natural gas assets from US utility CenterPoint Energy.

Bernhard Capital’s portfolio company Delta Utilities has agreed to buy CenterPoint Energy’s Louisiana and Mississippi natural gas local distribution businesses which include around 12 000 miles of main pipeline in Louisiana and Mississippi

serving approximately 380 000 metered customers.

Jeff Jenkins, Founder and Partner at Bernhard Capital Partners, said the acquisition builds upon the firm’s recent announcement to acquire Entergy’s New Orleans and Baton Rouge natural gas distribution businesses, adding that “once both transactions are complete, Delta Utilities will be a leading natural gas utility in Louisiana and Mississippi and among the top 40 providers in the US”.

Enbridge: pipeline congestion may continue even once TMX starts

Growing Canadian oil production means shipper volumes may still be rationed on the Enbridge Inc. Mainline pipeline system even once the Trans Mountain Expansion (TMX) project is operating, an Enbridge executive said in February.

Calgary-based Enbridge shipped a record 3.2 million bpd of crude on the Mainline in 4Q23, helping it report quarterly profits of CAN$1.73 billion, compared to a loss of CAN$1.07 billion a year earlier.

Last year Enbridge warned the start-up of the 590 000 bpd TMX project would likely cause Mainline volumes to fall, but that notion has become a “bit of a stale concept”, said Colin Gruending, Executive Vice President of liquids pipelines.

“(TMX) has been delayed materially and in that multi-year

period of delay, supply has structurally and permanently grown,” Gruending told an earnings call.

He said those delays were a “slight tailwind” for the Mainline, which ships the bulk of Canada’s crude exports to the US.

“We may still have apportionment once TMX comes in, depending on the month or day or crude slate,” Gruending added.

Apportionment refers to rationing how much crude each shipper can move on a pipeline, and high apportionment tends to weigh heavily on Canadian crude prices.

Gruending estimated Canadian producers would add around 750 000 bpd of supply in a four year period up to the end of 2025.

MARCH 2024 / World Pipelines 5

EVENTS DIARY

CONTRACT NEWS

ASCO secures contract with bp for its Trinidad and Tobago operations

3 - 7 March 2024

AMPP Annual Conference + Expo 2024

New Orleans, USA

www.ampp.org

8 - 11 April 2024

Pipeline Technology Conference (ptc) 2024

Berlin, Germany

www.pipeline-conference.com

15 - 19 April 2024

TUBE Düsseldorf 2024

Düsseldorf, Germany

www.tube-tradefair.com

6 - 9 May 2024

Offshore Technology Conference (OTC) 2024

Houston, USA

www.2024.otcnet.org

11 - 13 June 2024

Global Energy Show 2024

Calgary, Canada

www.globalenergyshow.com

26 - 29 August 2024

ONS 2024

Stavanger, Norway

www.ons.no

9 - 13 September 2024

IPLOCA convention

Sorrento, Italy

www.iploca.com/events/annual-convention

17 - 20 September 2024

Gastech 2024

Houston, USA

www.gastechevent.com

24 - 26 September 2024

International Pipeline Conference & Expo (IPE) 2024

Calgary, Canada

www.internationalpipelineexposition.com

Material management and logistics provider ASCO has secured a five year contract with bp Trinidad and Tobago (bpTT).

Under the contract, which came into effect at the start of the year, ASCO will provide supply base and pipeyard management services for the Operator across all 16 offshore locations in Trinidad. bpTT has operated in Trinidad and Tobago since 1961, and is the country’s largest hydrocarbon producer, accounting for more than half of the nation’s gas production.

The award cements ASCO’s presence in the region, with its in-country headcount set to grow by 30%. The company is also making a significant investment in equipment and infrastructure to deliver this work to the highest international

ROVOP announces long term global partnership with Boskalis Subsea Services

ROVOP, a global supplier of ROV services, and the Aberdeen-based Boskalis subsidiary Subsea Services, a leading subsea provider of IRM, construction and decommissioning services, have announced a global partnership.

The partnership provides five diving support vessels (DSV) and one construction support vessel (CSV) of the Boskalis fleet, with dedicated ROV services to maximise service delivery, efficiency, flexibility and capability.

The partnership will see the placement of seven ROVOP ROV systems across these DSVs and CSV for a minimum three year period on an international basis. ROVOP will also mobilise additional ROV systems on an ad hoc basis as required.

ROVOP’s diverse fleet of vehicles allows for varying configurations onboard the Boskalis Subsea Services fleet depending on the end client requirements. This partnership is an extension of an existing relationship, which sees significant cooperation between both companies both on and offshore.

Driven by increased demand and limited supply in the subsea market, this agreement enhances supply chain reliability. Being enabled with the right ROV, operated by the right skilled offshore personnel, is key in delivering efficiency and consistency across projects.

standards.

Deborah Benjamin, Managing Director of Trinidad & Tobago, said: “Securing this contract, from the largest operator in the region is a huge achievement for the team and will be a strong foundation to further expand ASCO’s presence in the Caribbean region.

“Following this award, we have made substantive, seven figure (US$) investment to position us to deliver exceptional service standards to bp. Not only do we comply with all international standards, but we are also committed participants to the Trinidad and Tobago Safe to Work (STOW) accreditation standard. Safety Excellence is a fundamental obsession for ASCO globally and our Trinidad operations fully embrace this.”

• Pioneering Spirit completes GTA infield pipelay scope

• ABL completes German subsea pipeline installation project

• US regulators approve Saguaro connector pipeline

• Henkel signs agreement to acquire Seal for Life Industries

• Bilfinger secures contract from INEOS

• Sonatrach to supply Germany with pipeline gas for the first time

6 World Pipelines / MARCH 2024 Follow us on LinkedIn to read more about the articles linkedin.com/showcase/worldpipelines

OUR WEBSITE

ON

HEAT SHRINKABLE SLEEVES

DENSO™ are leaders in corrosion prevention and sealing technology. With 140 years’ service to industry, our mainline and field joint coating solutions offer reliable and cost effective protection for buried pipelines worldwide.

CORROSION

United Kingdom, UAE & India USA & Canada

Australia & New Zealand Republic of South Africa

www.denso.net

www.densona.com

www.densoaustralia.com.au

www.denso.co.za

PROTECTIVE OUTERWRAPS

LIQUID EPOXY COATINGS

PETROLATUM TAPE WRAP SYSTEMS

SOIL-TO-AIR INTERFACE

BUTYL TAPE WRAP SYSTEMS

INTERNAL PIPE LININGS

A MEMBER OF WINN & COALES INTERNATIONAL

BITUMEN TAPE WRAP SYSTEMS

FOR

PREVENTION

VISCO-ELASTIC COATINGS

Building cyber resilience

8

Shaun Reardon, Principal Cyber Security Consultant, DNV, makes the case for treating cyber security as seriously as safety in the oil and gas industry, drawing on DNV’s latest research into the changing attitudes towards cyber threats.

Pipeline security is high on the agenda globally, as attacks on critical energy infrastructure have increased in recent years. In Europe, the strategic Balticconnector gas pipeline between Finland and Estonia is still offline following damage in October of last year. The year before, in September 2022, Danish and Swedish authorities reported a number of explosions at pipes A and B of the Nord Stream 1 pipeline and pipe A of the Nord Stream 2 pipeline.

However, it’s not just physical attacks that threaten critical infrastructure. A cyber-attack in May 2021 caused the temporary shutdown of the Colonial Pipeline in the US, disrupting the flow of oil and leading the US Government to declare a state of emergency.

DNV’s latest Cyber Priority research looked at the changing attitudes to cyber security in industrial sectors. It finds that pipeline operators and the wider oil and gas industry are increasingly aware of the risk from cyber threats, and the sector is becoming more mature in its response as it builds cyber resilience.

9

Cyber security: The safety risk of the decade?

Oil and gas companies have been tackling IT security for decades but securing operational technology (OT) – the control systems that manage, monitor, automate and control industrial operations – is an increasingly urgent challenge. The modern hacker can do more than just steal data. They could take control or physically sabotage a pipeline or oil and gas platform. In industrial sectors cyber security risks are safety risks. Life, property, and the environment are at stake.

Among the oil and gas professionals which responded to DNV’s Cyber Priority research, three quarters said that their organisation takes cyber security as seriously as they do physical health and safety. This is a welcome sign of awareness of the threat and that the industry is taking action to address it, but more work is still required before energy companies can confidently say they treat cyber as seriously as safety. If you walked onto an oil and gas site without the relevant safety equipment, you would be stopped from working immediately. The question is whether a business would react the same if it identified a vulnerable application affecting OT. Despite increasing awareness, the answer is often ‘no’.

When compared with physical safety risks, we can look to the development of safety standards following Piper Alpha and Seacrest incidents. Before such incidents forced leaders to adopt standard protocols in the late 20th century, energy operators took an inconsistent approach to health and safety. Businesses should avoid a similar ‘wait and see’ approach to their cyber security, especially with respect to OT. It should not take a safetycompromising cyber-attack for energy companies to prioritise security protocols and standards.

Many oil and gas companies appear to be taking the risk seriously. More than six in ten oil and gas professionals say that cyber security has become a regular fixture on their organisation’s boardroom agenda, and three quarters report that cyber security is treated as a business risk within their organisations. Our study also showed that a majority (62%) of oil and gas professionals say their organisation invested more in cyber security in 2023 compared with the previous 12 months. This is positive overall, but it also suggests that a sizeable minority of the industry may still be taking a wait and see approach.

Cyber security is essential to the energy transition

Oil and gas decarbonisation and the energy transition rely on digitally connected assets, many of which are being connected to the internet for the first time, having not been designed with interconnectivity in mind. This has the potential to reduce costs, increase efficiencies, as well as support transitions such as from natural gas to hydrogen in pipelines.

Oil and gas professionals overwhelmingly (91%) believe cyber security is a pre-requisite for the digital transformation initiatives that are making the future of the energy industry possible. Among digitally advanced companies in the wider energy industry, some 79% say that digital technologies are enabling the energy transition for their organisation.

Investment is key to building defences in the face of a changing game

While digital interconnectivity presents new opportunities, it also brings new risks for asset owners. Two thirds (69%) of oil and gas professionals globally worry that their organisation is

Figure 1. The view from energy professionals on cyber security investment.

Figure 2. Levels of energy industry concern about threat actors.

Figure 1. The view from energy professionals on cyber security investment.

Figure 2. Levels of energy industry concern about threat actors.

10 World Pipelines / MARCH 2024

Figure 3. Views on supply chain oversight and security-by-design across the energy industry.

more vulnerable than ever to cyber-attacks on their assets and infrastructure.

Only half (52%) of oil and gas professionals believe their company is investing enough in building the cyber resilience of operational technology of assets and infrastructure. This is higher than for professionals in the power and renewables sector (47%) and companies providing services across the energy industry (38%), but it still leaves half of the oil and gas industry believing they need to invest more in cyber security.

Geopolitics driving awareness

Russia’s invasion of Ukraine in 2022 marked a notable step change in cyber-attacks in the energy sphere, as prominent attacks on the sector began soon after the start of the invasion. The most prominent early example affected the renewables sector. A Russian cyber-attack on satellite internet operator ViaSat in early 2022 affected customers in Ukraine, but it also deactivated thousands of wind turbines in Germany when their satellite-dependent monitoring systems were taken offline. This is on top of the physical attacks on pipelines in the Baltic Sea following the invasion.

The oil and gas industry is paying attention. Some 79% of oil and gas professionals say geopolitical uncertainty has made their organisation more aware of the potential vulnerabilities in its operational technology. And two thirds (69%) say that their organisation’s focus on cyber security has intensified as a result of geopolitical tensions.

Our research also shows how the profile of cyberattackers in the energy industry has changed since early 2022. Following Russia’s invasion of Ukraine, the perceived threat posed by all forms of threat actors increased in the two weeks following the invasion in February 2022. Our research found that a year later, executives across the energy industry were still paying significant attention to the threat of hacktivists and hostile states, but had returned to previous levels of concern about criminal gangs and malicious insiders.

We should not forget insider threats and physical sabotage. And while OT is a newer challenge with potentially greater risk to life, property, and the environment, it is still oil and gas companies’ IT networks that face most attacks.

The industry should continue to take an integral approach to security – including both cyber and physical, and both IT and OT.

More broadly, recent geopolitical developments have brought energy security – not just cyber security – into sharp focus with the disruption of energy supplies and price shocks for energy importers.

For the first time in DNV’s power sector forecasts, for example, we now factor in the willingness of governments to pay a premium of between 6% and 15% for locally sourced energy to ensure security. This hints at the advantage that oil and gas companies could gain from greater cyber security resilience.

Regulation driving investment

Regulatory requirements are the greatest driver for the oil and gas industry to invest in cyber security, ahead even of a cyber incident or near miss.

In the EU, for example, organisations providing essential services, including in the oil and gas sector, face tougher regulation in the form of the revised Directive on Security of Network and Information Systems (NIS2), set to be transposed into national laws in 2024.

As well as widening the scope of organisations covered by regulation, this Directive increases the required standards of executive oversight and imposes new reporting requirements.

In the US, the Department of Energy is continuing to work on the National Cyber-Informed Engineering Strategy, and there is focus – including an executive order – driving vendors to provide a software bill of materials – which itemises the components in software and enables better third-party assurance.

Building a supply chain for the future

Supply chain security is a growing priority for the oil and gas industry and across industrial sectors more broadly. Oil and gas professionals rate inadequate oversight of supply chain partners’ vulnerabilities as the greatest challenge to enhancing OT cyber security, followed by disruption to ongoing operations while strengthening cyber security. Across the wider energy industry, lack of in-house cyber skills is perceived the greatest challenge, followed by oversight of their own vulnerabilities and the cost of investing in new solutions.

This suggests potential greater maturity in supply chain cyber security in the oil and gas industry, as the sector places greater focus on the challenge. But there is still some way to go, as more than a third of oil and gas professionals say their organisation does not have good oversight of supply chain vulnerabilities. Indeed, each year a huge number of vulnerabilities are discovered in products supplied to oil and gas operators.

In contrast, oil and gas professionals report that the sector lags the wider energy industry in incorporating cyber security in the early phases of infrastructure projects, following what is known as security by design. This places cyber security at the centre of newbuild projects and has been slowly gaining ground in the past decade.

One must think about the physical processes and mechanisms we have for safety in the oil and gas industry. They are embedded in projects and practice from the design stage. The same should be the case for cyber security. For the oil and gas industry, this is perhaps more of a challenge than in the wider energy industry as it operates a large amount of legacy infrastructure and assets, more than the renewables sector, for example. Compensating controls should be introduced as soon as possible to counter this, as security should always be the standard. The oil and gas industry is slowly moving in this direction.

Manage risk, but also view cyber security as an enabler

The oil and gas industry often considers five key areas of risk related to cyber-attacks:

) Financial.

12 World Pipelines / MARCH 2024

) Reputational.

) Impact on people and safety.

) Damage to assets.

) Effects on the environment.

Operational excellence is key to organisations working in the sector and every day that passes without incident and impact on these risks is a successful one. While criminals may find success with easy targets, companies with robust cyber arrangements are able to enjoy the many benefits of safe, secure and continuous operations.

Companies should remain vigilant and continually evaluate what impact an attack could have on their operations and primary business processes. Would an attack shutdown production? Would customers, clients and partners be inconvenienced or harmed? Would there be a trickle-down effect on the consumer? And even what happens if critical infrastructure is shut and the pipeline providing much of a country’s gas supply is shutdown?

When so much is at stake, it’s good practice to regularly focus on raising standards and evaluating readiness. Having an approach that prepares for the worst while hoping for the best will produce operational excellence that will allow a company to resume operations as quickly and smoothly as possible. And companies will be judged all the better for it by their customers, suppliers, staff and other stakeholders.

Building resilience as an ongoing process

Oil and gas companies should know their assets well. But do they know exactly what they are connected to, what digital technologies are present, and what the attack surface looks like from a cyber security perspective? This sort of internal questioning is essential to prioritise activities to build cyber resilience.

Oil and gas companies should evaluate how they are measuring the strength of their defences and recovery plans and how they are benchmarking performance. Have they identified the improvements they need to make? Once they have systematically identified the gaps in their defences, they can put plans in place to close them.

Taking a proactive approach to cyber security can increase competitiveness, and this can be a persuasive argument in budgetary conversations. Cyber security is essential to reap the benefits of digitalisation and to deploy the technologies needed to decarbonise the world’s energy system, better positioning companies that invest in cyber security to secure their future in the energy transition.

Energy firms need to invest to ensure compliance with tightening regulation. This requires not just greater budget, but also the right mindset, company culture, and access to skills to ensure regulation-driven investment translates into greater cyber resilience. Oil and gas companies should go further than what is stipulated in regulation, focusing on resilience alongside compliance, and looking for new opportunities that may arise from managing cyber security effectively.

Awards will be presented during the IPLOCA Annual Convention TOGETHER - DELIVERING SUSTAINABLE ENERGY INFRASTRUCTURE www.iploca.com/awards 2024 IPLOCA Awards Submit your entries by April 2024

TRANSITION TRENDS IN HYDROGEN

Steve Biagiotti, Jr. P.E., Chief Engineer and Gary P. Yoho, P.E., Principal Consultant, Dynamic Risk, discuss the evolution of hydrogen adoption in the pipeline industry and the role it will play in reaching global net-zero goals.

The deadline to achieve the 50% reduction target set by the UN Climate Change Committee is rapidly approaching. It’s only six years away. Targets will not be achieved without substantial infrastructure changes. Europe is much further ahead than most of the 195 partner nations that have voluntarily approved the Paris Agreement. 1

Meeting ambitious climate goals will require substantial and aggressive investments in infrastructure, technology development, and regulatory frameworks to ensure efficient and sustainable production, distribution, and utilisation. Greenhouse gas emission (GHG) targets of +40% below 2005 levels by 2030 and net-zero emissions by 2050 will be virtually unattainable without incorporating hydrogen as an

15

element in the global energy strategy. Hydrogen, especially when produced through low-carbon methods, offers a versatile and clean alternative to fossil fuels.

The broader society accepts that climate change is occurring and that something needs to be done to slow the rate of change. Governments appear to be struggling with how to integrate hydrogen into CO 2 reduction targets within their broader energy and environmental policies. More specifically, the acceptable form of hydrogen generation continues to be a stumbling block. This pace in adopting hydrogen strategies is too slow to meet even the minimum emissions targets: more prompt and determined action is necessary.

Trends in hydrogen adoption

In the early 2000s, some forward-thinking countries, particularly those with a focus on renewable energy and sustainability, began considering hydrogen as a key component of their energy transition strategies. Initial discussions and exploratory studies on hydrogen as a clean energy carrier took place during this period. By the mid-2000s, several governments started to formalise their commitment to hydrogen by including it in their energy policy frameworks. 1, 3 Countries with a strong emphasis on reducing carbon emissions and diversifying their energy mix began setting preliminary targets for hydrogen development.

The 2010s witnessed a significant increase in the number of governments worldwide setting explicit targets and incorporating hydrogen into their long-term energy plans. Targets often included specific goals for hydrogen production, infrastructure development, and integration into various sectors, such as transportation and industrial processes. Towards the end of the 2010s and into the

early 2020s, the momentum for hydrogen targets further accelerated. Several countries announced ambitious strategies and commitments, emphasising hydrogen as a crucial element in achieving carbon neutrality goals. These targets were often aligned with international climate agreements, such as the Paris Agreement, reflecting a global push toward sustainable and low-carbon energy solutions. 2

In parallel, collaborations and partnerships between countries and international organisations aimed at advancing hydrogen technologies gained prominence. These efforts contributed to the sharing of best practices, research findings, and the establishment of global standards.

Overall, the setting of hydrogen targets by governments has evolved over the past two decades, mirroring the increasing recognition of hydrogen’s role in addressing climate change, enhancing energy security, and fostering a more sustainable energy landscape. The specific timing and nature of these targets depend on each country’s unique energy policy priorities and commitments to environmental stewardship.

Meeting the challenge

The path to lowering CO 2 emissions requires replacement of fossil fuels with renewable energy sources and carbon capture. This transformative transition will require innovation and investment. These changes require the retirement and replacement of equipment, modifications to processes to maintain safety levels, and public education on the global benefits. However, change takes time.

To meet the voluntary initiative the US Greenhouse Gas Emissions targets are 50 - 52% reduction below 2005 levels by 2030 and net-zero emissions by 2050. 14 Canadian targets are 40 - 45% reduction below 2005 levels by 2030 and

16 World Pipelines / MARCH 2024

Figure 1. Industry reaction to hydrogen adoption.

IT IS MY DEDICATED PASSION

for pipelines that compels me to partner with others in the industry, share best practices and collaborate on ideas for future innovations and advanced applications.

It is who I am. I am a pipeliner.

We are pipeliners too.

We share this passion and, like you, we are committed to keeping pipelines running safely and reliably. By providing top-of-the-line tools to address your threats, and applying the most advanced assessment techniques, we ensure you get the best return on your pipeline asset, both economically and environmentally.

The world counts on you. You can count on us. ©2024

Scan here to learn more about our Integrity Engineering Solutions.

T.D. Williamson

net-zero by 2050. 13 The European Union targets are based on 55% reduction below 1990 levels. 15 More governments must support and establish policies soon if the world is to meet the Paris Agreement goals. Industry Think Tanks 5 are suggesting that hydrogen must make up at least 15% of the global energy mix by 2050 to meet the goal.

However, the adoption of hydrogen into the gas delivery mixture has been slow. Companies are still evaluating projects to better understand the nuances of transporting and delivering hydrogen utilising existing infrastructure. Key technical questions to answer include:

• What is the ‘sweet spot’ with respect to the level of hydrogen that can be blended and transported with natural gas?

• What is the demand for transportation of a 100% stream of hydrogen?

Educating stakeholders

It is a logical desire to want hydrogen included in the energy network. Some assume that since it is a combustible gas, like natural gas, it can be easily blended and transported in the existing transmission and distribution pipeline network. Although this belief is partially correct, hydrogen introduces different safety, operational, tariff, liquified storage, and pipeline integrity concerns. Unlike the long successful history the industry has with natural gas, only a few specialised operations (e.g. feedstock into petrochemical processes, fertiliser production) have been working historically with hydrogen gas. However, the transportation of hydrogen in steel pipelines has had a long and successful history over the last century, albeit with limited mileage. This means there is a need to educate a large population of engineers and pipeline technicians.

The industry has responded with webinars, short courses, workshops, and conferences to help share experience and knowledge gaps. The rise in industry events that include hydrogen-related topics and symposia noticeably peaked around 2022. It is unclear whether recent activities by AGA 2 and others are meaningfully reducing the operational and integrity concerns of transporting blended hydrogen. Contrary to the general increase in hydrogen-related seminars, it appears that pipeline company operations related to pilot projects have been delayed or slowed somewhat.

An informal survey of companies at a recent industry event revealed that only a limited number of pipeline companies have established dedicated teams to focus on hydrogen projects. These are the larger operators, who typically are early adopters of new technologies and processes. Concerns are that North American operators are still taking a ‘wait and see’ approach.

In addition to educating the workforce, educating the public and local regulators will be critical. Regulators and the public are requesting risk assessments for projects to demonstrate any change associated with the new (i.e., hydrogen blended) gas composition. Regulators and the public are seeking lower risk exposures.

Setting industry standards

Hand in hand with educated stakeholders are the industry controls and best practices needed to ensure that operations limit impact to the public and the environment. As mentioned earlier, the transportation of 100% hydrogen is a more mature application and standards such as ASME B31.12 and CGA 5.6 include notably conservative design requirements for conventional storage and pipeline transportation, which can limit options and increase costs. 7, 8 However, many pipeline transportation and distribution operators are considering blending hydrogen into natural gas, at concentrations up to 30%. Low levels of blended hydrogen are not currently addressed in most North American pipeline integrity management guidelines. The Canadian Standards Association (CSA) Z662-23 standard has a newly developed section dedicated to the design of pipeline systems to transport hydrogen. 9

What’s driving implementation?

One significant change in the pipeline transmission industry is the increased awareness of incorporating hydrogen-compatible materials and technologies in the design and construction of pipelines. Procedural adjustments have become imperative to accommodate the distinct characteristics associated with transporting hydrogen. This encompasses modifications in inspection technologies, assessment techniques, maintenance practices, and risk assessment methodologies.

The regulatory landscape has also evolved to address the challenges and opportunities presented by the transport of hydrogen in pipelines. Regulators are demonstrating a willingness to adopt revised standards, such as NFPA 2 and CSA Z662, to provide enhanced frameworks for the safe transport and utilisation of hydrogen in pipeline systems. 6,9

Costs vary based on the mode of production (i.e. green, blue, purple, grey), the availability of water and lowcost electricity, plus the cost of equipment/infrastructure. The question of ‘decarbonisation at what cost?’ is raised to address the holistic evaluation of costs and benefits. A 2022 estimate of US$200 billion was made with only US$35 billion announced for investment in transportation and distribution. 12

Advances in research and development to make the technology more affordable and efficient will lead to greater adoption and lower hydrogen production costs. However, these improvements will have to come at a much faster pace to meet the global targets.

Regulations and subsidies

Another barrier to rapid hydrogen adoption has been assurance of commercial demand. Producers may be willing to generate hydrogen when they have plentiful resources, but they may not have access to a distribution market. Similarly, pipeline operators may be willing to accept hydrogen into the network but need reliable demand from consumers willing to receive the differential in gas price and BTU value.

18 World Pipelines / MARCH 2024

How government regulations respond to these challenges is influencing adoption. Subsidies and investment backing in hydrogen production facilities are being observed in Europe and the US. The lack of subsidies appears to be stalling projects moving from concept or pilot stages to commercial in Canada.

The US has gone one step further by introducing ‘Regional Clean Hydrogen Hubs’, or regional pipeline networks that will gather, transport, and deliver blended hydrogen to the market. 10 These hubs are expected to provide the stability the market seeks so that when hydrogen is produced, there will be a carrier to transport and deliver to consumers.

Engineering assessments

As production methodologies and locations evolve and the need for pipeline infrastructure develops further, pipeline operators will likely turn to standards such as CSA Z662:23 to guide the engineering assessments (EAs) required to demonstrate the reliability of pipeline systems. A Gas Technology Institute initiative, the Net Zero Infrastructure Programme (NZIP), used statistics from the US Pipeline and Hazardous Materials Safety Administration that indicated more than 50% of the natural gas transmission pipe in the US were installed before 1970. 11 This vintage pipe typically has lower toughness that could be exacerbated by the introduction of atomic hydrogen into the pipeline steel under certain conditions and needs evaluation.

EAs must satisfy stakeholders by addressing:

) Project threats and risks.

) Dissociation rates of molecular hydrogen (H 2) during transport.

) The effect of atomic hydrogen (H+) on existing anomalies within pipelines that are otherwise acceptable for continued operation.

) Methodologies for determining the suitability of in situ toughness values for existing pipelines.

Material verification activities will be crucial to determining if pipeline assets are suitable for hydrogen transportation. Liquid pipelines lend themselves to

ultrasonic technologies aimed at identifying anomalies that could be susceptible to hydrogen impact. Gas pipelines have fewer options.

Operators are also considering the use of ‘carrier fluids’ such as anhydrous ammonia (NH 3) to move hydrogen molecules to production facilities where the hydrogen would be extracted. Chemically, ammonia is 82% nitrogen (N) and 18% hydrogen (H). However, even these methods are not without integrity concerns.

Conclusion

Making the industry goal of net-zero by 2050 will require acceleration of current programme efforts. The pipeline transmission industry requires modifications that extend across infrastructure, material selection, procedural considerations, and regulatory framework changes. Actions will need to be addressed in parallel and in a prioritised manner to maintain the safe and efficient integration of hydrogen into the energy mix that stakeholders expect, and that the industry has proudly demonstrated for decades. But the pace needs to improve which may include:

) Governments must drive funding support (i.e., backed loans, incentives and reduced regulatory permitting barriers).

) Rapid industry consensus through standards development to guide the technical and consistent means to address blending hydrogen.

) Increase stakeholder training and certification programmes for working with hydrogen.

) Increase the pace of technology development (equipment, materials, inspection and risk analysis) to support hydrogen transport.

) Set Engineering Assessment criteria to drive safe operations for the benefit of the public and environment.

References

1. US Dept of Energy, Hydrogen Posture Plan: An Integrated Research, Development and Demonstration Plan, December 2026.

2. Paris Agreement, UN Climate Change Conference (COP21), Paris, France, 12 December 2015.

3. American Gas Association, Impacts of Hydrogen Blending on Gas Piping Materials, June 2023.

4. IEA Greenhouse Gas R&D Programme, Impacts of Hydrogen Blending on Gas Piping Materials, Report PH4/24, October 2003.

5. PARKES, R., ‘World “won’t hit Paris climate goals” without policies to speed hydrogen take-up’: DNV, Recharge News, 14 June 2022.

6. NFPA 2, Hydrogen Technologies Code, 2020.

7. B31.12, Hydrogen Piping and Pipelines, ASME, 2023.

8. CGA 5.6, Hydrogen Pipeline Systems, Compressed Gas Association, Chantilly, VA, EIGA Doc. 121/04.

9. CSA Z662, Oil and gas pipeline systems, CSA Group, 2023.

10. Regional Clean Hydrogen Hubs, US Office of Clean Energy Demonstrations (OCED).

11. Net Zero Infrastructure Program (NZIP), GTI.

12. Five Charts on Hydrogen’s Role in a Net-Zero Future, 25 October 2022, McKinsey Sustainability.

13. Canadian Government Website.

14. The Long-Term Strategy Of The United States: Pathways to Net-Zero Greenhouse Gas Emissions by 2050 US Government website.

15. European Commission 2030 climate targets.

20 World Pipelines / MARCH 2024

Figure 2. Data Variability used in the Engineering Assessment.

Whether you're dealing with short or extremely long pipelines, or you require ultra-high resolution, or high inspection speed. intero-integrity.com Meet the top-notch UT ILI family Explore what our ILI technologies can do for you Helix Phasix Matrix

Kimberly Sari and Simon Roth, ILF Consulting Engineers, Germany, discuss navigating the future of sustainable green molecule bulk transport, offering some analysis of transport options from the MENA region to Europe.

In the coming decades, a transformative shift awaits the global energy market, transitioning from its current state to an emission-free landscape. The European Union’s (EU) ambitious objective of achieving climate neutrality by 2050 is anticipated to advance the continent in achieving secure, emission-free, lowest cost energy supply with local benefits, however the path to reach the objective is still evolving. In the White Paper titled “Bulk Transport Options for Green Molecules”,1 prepared by ILF Beratende Ingenieure GmbH (ILF) in collaboration with Dii Desert Energy, a comprehensive analysis of the transportation avenues available for green molecules from the Middle East North Africa (MENA) region to Europe was conducted.

Industry stakeholders are proactively anticipating this transition, working to align their operations with the EU’s objectives by adopting their own decarbonisation targets. Noteworthy enthusiasm is evident among industry stakeholders, with the development of green molecule supply projects; meticulous consideration being given to transportation routes for optimal efficiency; comprehensive discussions on distribution instruments; and a commitment to ensuring that the demand for green molecules is met with a commensurate supply, all amongst a gradually evolving EU-wide policy and regulatory landscape.

The intricacies of a vast value chain comprising supply, demand, transport, storage, and conversions must harmonise for the successful execution of strategic green molecule initiatives both in Europe and globally.

While the overarching vision of a climate-neutral European continent is well-defined, the identification of specific pathways to achieve these objectives remains a complex task. Consequently, stakeholders are concentrating on their respective target objectives, strategically positioning themselves to adapt to the evolving landscape. Facilitating the development of this market could be enhanced by the establishment of a comprehensive framework led by the EU, offering a transformative opportunity for accelerated progress.

The development of the market should substantially consider the concentration of physical conditions of the commodity,

22

23

ensuring a robust and scalable economy. Simultaneously, the absence of a unified global context for energy trading poses a significant challenge, as the majority of countries currently lack carbon trading mechanisms and impose no restrictions on carbon emissions.

In the context of energy transportation from MENA to Europe, ILF’s experts identified three distinct possibilities in their report. These include pipelines, designed for the direct transport of hydrogen in molecule form; offshore transport of ammonia as a hydrogen carrier via ship; and electron-based subsea cable transport of electricity.

Each option is characterised by unique transport capacities and associated costs. For a more in-depth exploration of these alternatives, please refer to the report.1

During ILF’s discussions with prominent developers in the field, including ACWA Power, AMEA Power, CWP Global, and Masdar, it is evident that their commitment to delivering green molecules to Europe is not only robust but also clearly expressed. These developers, recognised as established energy providers, exhibit active involvement throughout the MENA region. Despite common challenges in securing funds for capital-intensive and long-term infrastructure projects to bring commodities to Europe, they leverage their extensive experience and engage in collaborative efforts with stakeholders across the value chain, in addition to governments and ministries, partners, and others to successfully achieve project milestones by developing equity partnerships.

Finance challenges

Historically, the financing of oil and gas pipelines was instigated by major players in the oil and gas industry, recognising pipelines as a crucial means to bring their commodities to market to satisfy a substantial demand. In the current landscape, developers of green molecules seeking to build a business case for their product perceive an uncharted market, heightening the risk associated with an already costly infrastructure development. This contrasts with the past scenario in the mature oil and gas market, where a substantial market value and fossil-fuel financial subsidies made project financing less risky for developers and banks.

Despite common challenges, the enthusiasm and interest of green molecule developers, remain palpable. Their innovative expertise, coupled with a strong commitment to decarbonisation, propels them to address the challenges through novel approaches. This involves, amongst others, close collaboration with value chain stakeholders, and engaging in discussions with financial institutions and experienced equity partners, potentially spanning major sectors such as oil and gas, steel, and shipping.

Developing resilient transport infrastructure

Robust network infrastructure is essential for establishing a thriving hydrogen market. Insights gained from the interviews ILF held with stakeholders in the transport and distribution infrastructure, including SNAM, Westenergie and Baker Hughes,

Existing Gas Pipelines with Repurposing Plans

Existing Gas Pipelines

Planned Pipelines

Hassi R'Mel Gas Field

European Hydrogen Backbone 2030

24 World Pipelines / MARCH 2024

Figure 1. Cross-continent pipelines.1

Secure coating

for 3,000 weld seams. One thing will do.

DENSOLEN® with DENSOMAT®-11

50 years of DENSOLEN® The leading standard.

Only DENSOLEN® protects like DENSOLEN®. The only corrosion prevention tape with 40 years’ proven durability. And for working on a major project – the DENSOMAT®-11 wrapping machine. Precise wrapping with maximum productivity. denso-group.com

DENSOLEN® Protection for Eternity

covers 25 EU member states plus Norway, the UK, and Switzerland. Furthermore, the significance of import security is underscored by the application for the ‘Southern Import Corridor’, a project of common interest (PCI), highlighting the strategic importance of ensuring a reliable and secure supply chain within the context of the broader EHB initiative.

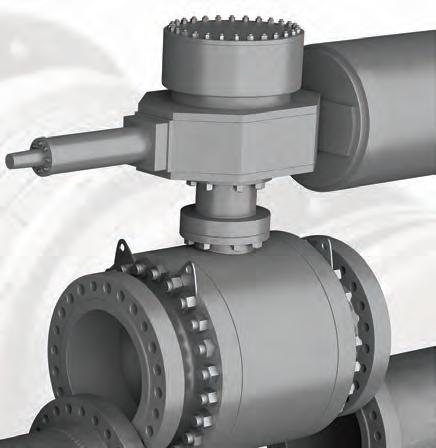

highlight a growing industry commitment to developing resilient transport and distribution infrastructure equipment. This dedication plays a pivotal role in ensuring the smooth evolution of interconnected infrastructure. While transport system operators – together with technical design and certification bodies – are working on harmonised standards and regulations for a hydrogen transport grid, industry players like Baker Hughes demonstrate notable technological advancements in gas compression technology. In the realm of hydrogen compressors, Baker Hughes has introduced a groundbreaking solution with the high-pressure ratio compressor (HPRC). This centrifugal compressor, featuring a stacked rotor design architecture, can achieve a higher tip speed in the future. This innovation facilitates the efficient transport of substantial quantities of hydrogen.

Repurposing pipelines

In exploring the transition from natural gas to hydrogen in both onshore and offshore pipelines, the technical feasibility and potential advantages of repurposing existing infrastructure become evident, as highlighted by SNAM’s considerations of pipeline compatibility, standards, and the potential for high repurposing rates.

The importance of a clear regulatory framework

A consistent theme echoes among emerging infrastructure project developers: the imperative need for clear, EU-level regulations that foster investments in the supply chain and facilitate the development of both new and retrofitted transport infrastructure. Additionally, a clear understanding of the expected demand for green molecules in Europe by 2030 and 2040 is crucial for determining viable transportation routes. This is especially pertinent for meeting import targets throughout the European Hydrogen Backbone (EHB) initiative, encompassing 33 European transmission system operators whose infrastructure

Given the expansive territory, questions arise surrounding resource allocation, guarantees of origin (GoO) for renewable (green) energy, and carbon credits or carbon content information comprising virtual attributes of the green molecules within the establishment of a hydrogen backbone. Additionally, the level at which power transmission system operators (TSOs) and natural gas TSOs will cooperate in aligning both sets of infrastructure is to be determined.

ILF’s report displays that currently, the reliability of transport and distribution infrastructure relies on strategic investments, often funded through research and development (R&D) projects. Stakeholders, especially TSOs and distribution system operators (DSOs), anticipate that regulatory frameworks will eventually recognise and endorse their investments as a means for future cost recovery.

The absence of harmonisation in EU-level regulations presents a challenge to the seamless integration of the EHB infrastructure’s advancement. It is evident that the future green molecule market will be policy-driven, necessitating governmental intervention to undertake substantial groundwork before a commercial market can materialise. A coordinated initiative to align regulatory frameworks is crucial for the effective deployment of developed infrastructure within the emerging industry.

Supply and demand

Offtakers, such as EnBW, have demonstrated commitments in producing and procuring green molecules, accompanied by efforts in infrastructure preparations. Despite these strides, uncertainties persist regarding the specific availability of molecules at potential offtake sites, particularly in scenarios where high-flexibility demands, crucial for power plants, become prominent. To ensure supply security, a swift scaling up and down of power is imperative, mirroring the functionality observed in underground gas storage, which currently fall short of meeting the required demand. In contrast, industries with relatively flat and less variable energy profiles exhibit less pronounced imperative for flexibility. Addressing nuanced flexibility requirements for diverse offtake

26 World Pipelines / MARCH 2024 Morocco 6 Hydrogen: 0.03 Mtpa Ammonia: 0.18 Mtpa Algeria 2 N/A Jordan 1 N/A Saudi Arabia 3 Hydrogen: 1.2 Mtpa Ammonia: 1.2 Mtpa 2 Bahrain 1 N/A Qatar 1 N/A Mauritania 4 Hydrogen: 8 Mtpa Ammonia: 10 Mtpa Tunisia 2 N/A Egypt 21 Hydrogen: 2.2 Mtpa Ammonia: 3 Mtpa UAE 10 Hydrogen: 1.2 Mtpa Ammonia: 1.2 Mtpa 1 Oman 10 Hydrogen: 1.2 Mtpa Ammonia: 1.2 Mtpa 1 Green H2 Projects Blue H2 Projects Production Capacity

Figure 2. Hydrogen project announcements in the MENA region.1,2

Maintenance / Operational Pigging

Once a pipeline is in production, debris within the system can be more extreme, with sand or scale or wax deposits. This can require more specialist pigs to be used, where designs are more focused and offer the ability to be adjusted as part of a progressive cleaning programme.

Propipe pigs are designed specifically for each pipeline and offer optimum performance to maintain maximum production pressures and flow.

Standard Pigs - No Bypass

Propipe Pigs with Bypass

Full testing facilities and the Trident pig tracking range are available.

Propipe Limited

Queens Meadow Business Park

Hartlepool UK, TS25 5TE

groupsales@propipe.co.uk

Propipe North America

302 Bluewater Road

Bedford, Nova Scotia Canada, B4B 1J6 sales@propipenorthamerica.com

www.piggingsmarter.com

scenarios, especially in contexts where high-flexibility is imperative, becomes paramount for optimising the deployment of green molecules across varied industries.

Creating a competitive environment

Advocating for an EU-wide approach is considered optimal for creating a competitive environment. However, interviews conducted for ILF’s report indicate that infrastructure planning encounters obstacles due to the absence of a holistic view across the supply chain.

For example, the current focus on transport routes should expand to encompass flexibility instruments, aligning with the nature of power production profiles. When stakeholders – including TSOs concentrating exclusively on their grids, and storage system operators individually exploring the new frontier of hydrogen storage – transition from this isolated approach to a coordinated and collective strategy, it would reveal aspects pertinent to each value chain participant. This shift contributes to a more cohesive and efficient transition into this emerging market and the future EHB.

While supporting the ambitious EHB development, the need for enhanced coordination is paramount. The current focus on transport routes should expand to include flexibility instruments, also considering the nature of power production profiles. Many questions remain unanswered, such as the locations of major import and production sites, offtake centres, and the timeline and nature of developments. Achieving clarity on these critical aspects is essential for promoting a harmonised and efficient industry transition, particularly in the context of advancing the green molecule market in Europe.

Strategy

In 2020, the EU articulated an ambitious hydrogen strategy through the European Commission’s, ‘A hydrogen strategy for a climate-neutral Europe’.3 The EU is actively developing a hydrogen and decarbonised gas market package to help curb greenhouse gas emissions in the EU in line with plans for climate and internal energy market objectives. Rules that ensure sufficient cross-border capacity, fostering the creation of an integrated European hydrogen market and facilitating the unimpeded movement of hydrogen across borders, are also being negotiated.

These coordination efforts, among others, mark significant progress. However to substantiate the green molecule market in Europe and meet 2030 targets, there is a pressing need for an approved comprehensive policy. This policy must encompass the specific requirements of each value chain member, spanning the expansive territory of the EU. It should articulate clear demand projections for 2030 and 2040, accounting for the intricacies of power and electricity consumption and restrictions within each country.

Despite strides made, the lack of synchronised regulations hampers the rapid transition to the green molecule economy in Europe. The imperative regulations necessary to facilitate and finance the transition to green molecules have yet to achieve synchronisation, prompting stakeholders throughout the value chain to recognise this as a pivotal issue necessitating

global attention. Presently, national interests exert a significant influence on the trajectory of development. This divergence is evident in the varying perspectives on red hydrogen: it is a non-issue in France, where nuclear power production is predominant, but as of April 2023, it has been phased out in Germany.

Conclusion

A foundational target is the initiation of the hydrogen market development with a primary focus on carbon reduction. This approach accelerates the timeline to achieve economies of scale. However, refining this objective is equally crucial, evolving towards the overarching goal of attaining a net-zero carbon footprint. This progressive approach not only addresses immediate environmental concerns but also aligns with longterm sustainability objectives. It showcases a comprehensive and adaptable strategy for the evolution of green molecule technologies across diverse national contexts.

“Through interviews with various stakeholders within the green molecule sector, a clear observation emerged, that each participant is impacted by the constraints of other parties involved. It became evident that a unified approach to realise the overarching strategy is lacking, one that would articulate the requirements and challenges faced by each sector member” says Simon Roth, Business Area Director, ILF Beratende Ingenieure GmbH.

“To underscore the challenges confronting the sector members and facilitate a collaborative effort to overcoming constraints, Dii and ILF have embarked on preparing an additional report. This report aims to delve deeper into the perspectives of a broader spectrum of companies within the burgeoning green molecule sector, serving as a mutual aid by articulating each company’s perspective. By providing a comprehensive understanding of these perspectives, the report intends to foster a collective approach in addressing challenges in a mutually beneficial manner.”

References

1. ILF Beratende Ingenieure GmbH/Dii Desert Energy, Bulk Transport Options for Green Molecules | Focus Area: Europe and MENA Region, January 2024.

2. Dii Desert Energy/Roland Berger, Hydrogen Project Tracker, November 2023.

3. European Commission, A hydrogen strategy for a climate-neutral Europe, July 2020 .

Notes

With thanks to Paul Van Son, President, Dii Desert Energy; Dr. Jan Frederik Braun, Head of Hydrogen Cooperation (MENA Region) Fraunhofer Cluster of Excellence Integrated Energy Systems CINES; Gustavo Beneitez, Executive Manager Business Development, ACWA Power; Hussein Matar, Sr. Director Business Development, AMEA Power; Giulia Maria Branzi, Head of Climate Policies & Decarbonization Market Design, SNAM; Riccardo Bernabei, Director Hydrogen Project Development, SNAM; Richard Streitboerger, Trading Green Molecules Senior Originator, EnBW; Florian Lindner, Business Development, Westenergie; and Mark Crandall, CEO CWP Global.

The full study Bulk Transport Options for Green Molecules, which takes a look at global hydrogen trade, cross-continental pipelines and the economy and features selected interviews, is available for download.

28 World Pipelines / MARCH 2024

Håvard Høydalsvik, Head of Business Unit O&G, Rädlinger Primus Line, Germany, discusses the material and cost benefits of composite pipe solutions and introduces two flexible pipe systems, one for trenchless rehabilitation and the other for aboveground installation.

When ageing pipelines reach the end of their service life, the operators traditionally tend to replace them with new steel pipes that require open trenches. The situation is similar for the above-ground transport of potentially hazardous fluids: conventional high-density polyethylene (HDPE) pipe is used. But more and more pipeline operators are thinking outside the box. Flexible, fabric-reinforced pipes increasingly find market acceptance as well as international standards and guidelines have been

established to secure safe and reliable operation. In addition, a volatile oil and gas price environment has made engineers more open to implementing new technologies.

Such innovative composite pipe solutions offer several material and cost benefits to pipeline operators. This article provides an overview of these benefits as well as an introduction to two products made in Germany. While Primus Line® Rehab is designed for the trenchless rehabilitation of pressure pipelines, Primus Line® Overland Piping is suitable for the temporary above-ground transport of potentially

hazardous fluids. The text also explains why the manufacturer relies on highquality materials for safety and quality aspects.

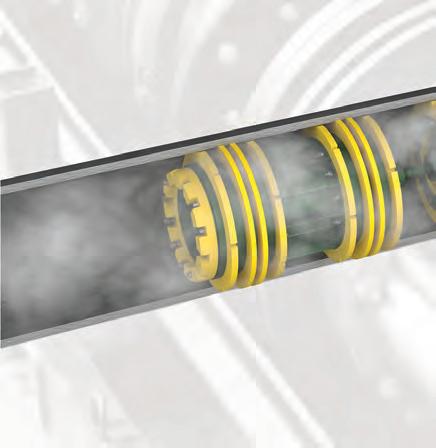

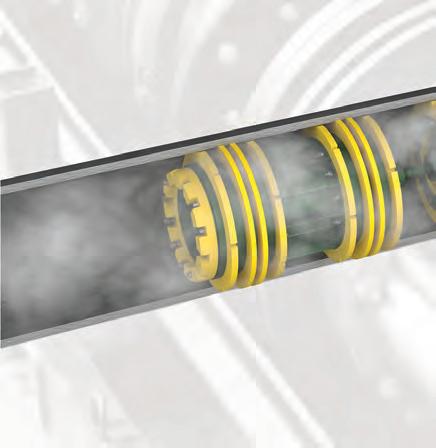

The Primus Line® flexible pipe –structure and products Composition

The Primus Line flexible pipe for both rehabilitation and above-ground installation consists of a liner and a connection technology developed specifically for this system. The liner itself is composed of three layers. The inner layer is adapted to the respective

29

medium to be transported and, like the outer layer, is made of abrasion-resistant polyethylene (PE) or thermoplastic polyurethane (TPU). The latter has a high chemical resistance that withstands contact with highly corrosive hydrocarbon compounds which is important for surface applications.

The outer layer protects the fabric in the middle from external influences during transportation and installation. For aboveground applications, TPU provides maximum protection from UV light and abrasion, as well as the flexibility required for repeated installations and rewinding of the reusable system.

The middle layer, the reinforcement, is a seamless woven aramid fabric. For pipeline rehabilitations, this layer absorbs all tensile forces and operating pressures without relying on the existing host pipe. For above-ground installations, it allows complete stand-alone absorption of even very high operating pressures. For higher pressure levels in the medium- and highpressure range of rehabilitations, only Kevlar® is used. The lowpressure system consists of an aramid/polyester hybrid fabric for a cost-benefit optimised and economical rehabilitation solution. All types are both strong and flexible.

To complete the Primus Line flexible pipe and provide a pull-tight connection, purely mechanical and resin-tightened connectors are available, either flanged or welded. For aboveground applications, there are also specialised quick couplers compatible with Victaulic notches. These are used to connect several flexible pipelines. They can also be connected to pumps or other piping equipment.

Primus Line Rehab

The Primus Line system was originally developed as an innovative technology for the trenchless rehabilitation of pressure pipelines for various media such as water, gas and oil. Now called Primus Line Rehab, it is suitable for the transport of different fluids and is also approved for drinking water in many countries like the US, Canada, Australia, Spain, France or Germany.

Primus Line Rehab has ideal flow characteristics due to the extremely smooth inner coating. The system is optimised for high-, medium- and low-pressure requirements. It is available in diameters from DN 150 to DN 500 and can pass bends up to 90°.

Preferred fields of application are, for example, pipelines for the transport of drinking water, fire water, industrial water, process water, crude oil, refined petroleum products, diesel, natural or coke gas and more.

Primus Line Overland Piping

This product, available in diameters from DN 150 to DN 350, is specifically designed to create leak-free above-ground pipelines for demanding and potentially hazardous media such as raw water, process water, flowback water, fire water, industrial or treated wastewater.

The fact that it is a spoolable and reusable solution that can be deployed up to 500 times not only simplifies its installation, but also makes it an environmentally friendly solution compared to commonly used alternatives such as trucking and HDPE piping. In addition, Primus Line Overland Piping can be installed quickly.

Benefits of both flexible pipe systems

The three-layer structure of the pipe is the basis for both its strength and its flexibility, resulting in the following benefits for the operator:

Figure 1. Primus Line®’s three layered composition.

30 World Pipelines / MARCH 2024

Figure 2. All-terrain: due to its flexibility, Primus Line Overland Piping naturally adapts to the ground.

Safety

The flexible pipe is reinforced with seamless woven Kevlar fabric. This synthetic fibre is up to ten times stronger than steel and twice as strong as glass fibre or nylon. This para-aramid core gives the pipe a very high factor of safety (FoS), leading to a burst pressure at least 2.5 times the allowable working pressure, depending on the medium being transported.

The installation teams do not have to work with hazardous materials on site: standard machinery equipment is used for assembly. Another advantage for above-ground applications is that there is no need for hot work such as welding or butt fusion. Instead, the aforementioned connectors or quick couplers are used.

A further safety aspect is that the entire production process is closely monitored. In addition, a sample of every pipe produced is pressure-tested in-house before delivery to the construction site.

Cost advantage

In contrast to an open trench rehabilitation, Primus Line Rehab saves time in terms of implementation time and installation speed: up to 10 m/min. and up to 2500 metres per pull reduce installation time to a minimum, allow for quick re-commissioning and only short service interruptions. The standard equipment used for installation is not only reducing the footprint at the construction site, but also secures a low up-front investment for installation companies. And the

rehabilitation with Primus Line extends the service life of the pipeline by at least 50 years.

In the case of temporary above-ground transport applications, the Primus Line flexible pipe scores with low storage space requirements: depending on the diameter, up to 4 km of the pipe can be transported on a single transport reel. Therefore, on-site storage space is reduced to one tenth of that required for HDPE pipes. In addition, the flexible pipe is fully reusable which has been proven in long-term bending tests.

Figure 3. Primus Line Rehab can also be used for subsea pipelines. Here the flexible pipe is coming ashore.

Figure 3. Primus Line Rehab can also be used for subsea pipelines. Here the flexible pipe is coming ashore.