MAGAZINE | MAY/JUNE 2023

BERNDORF PROCESS EQUIPMENT FOR THE PRODUCTION OF PREMIUM PASTILLES FOR THE FERTILIZER INDUSTRY

Euromel® Melamine The state-of-the-art HP technology

Euromel® Melamine - the leading and most advanced technology for the production of high-quality melamine used in wood-based products, laminates, moulding compounds and fire-extinguishing foams in the last 40 years.

Delivers high purity, high consistency melamine with total zero pollution (TZP) with extremely lower energy consumption using 30% lesser steam import and 20% lower fuel utilisation than the closest competitor.

Euromel® Melamine Process is now used in 28 plants worldwide, accounting for more than 8 million tonnes of melamine produced cumulatively, making it the most traded and widely used melamine worldwide.

CONTENTS

27 A Crash Course On Conveyors

Robert Fitzpatrick, Ag Growth International (AGI), outlines the different methods for conveying and handling fertilizer materials, and describes best practices for safety and efficiency.

31 Cracking Up

Leslie David, Dunlop, UK, explains how both ozone and ultraviolet light can dramatically shorten the working life of conveyor belts, and considers how fertilizer manufacturers can protect against these effects.

36

A Return To Conveyor Safety

Dan Marshall, Martin Engineering, USA, outlines how fertilizer producers can avoid unscheduled downtime, mitigate cleanup, improve efficiency, and reduce the cost of operation through proper belt return maintenance.

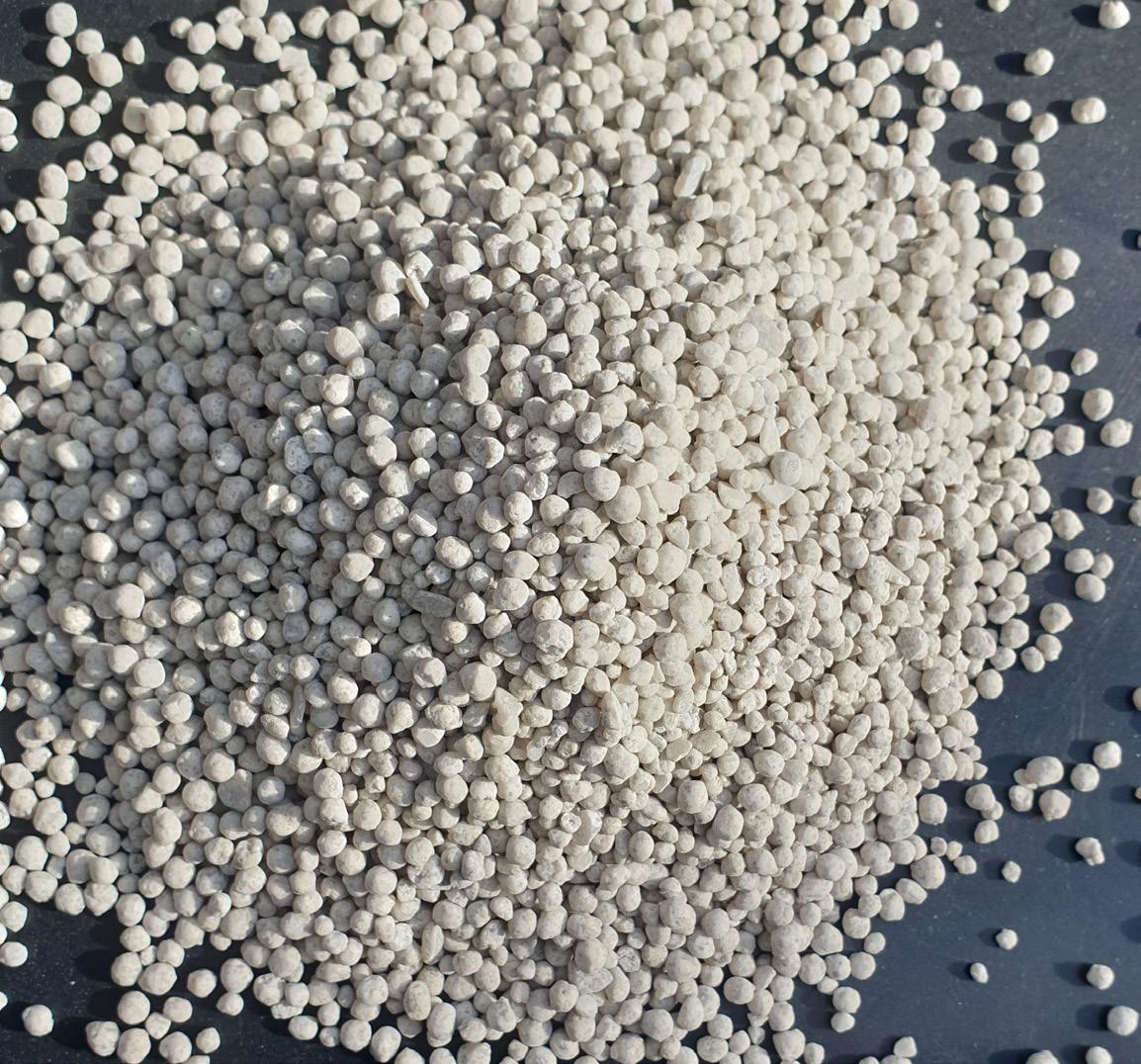

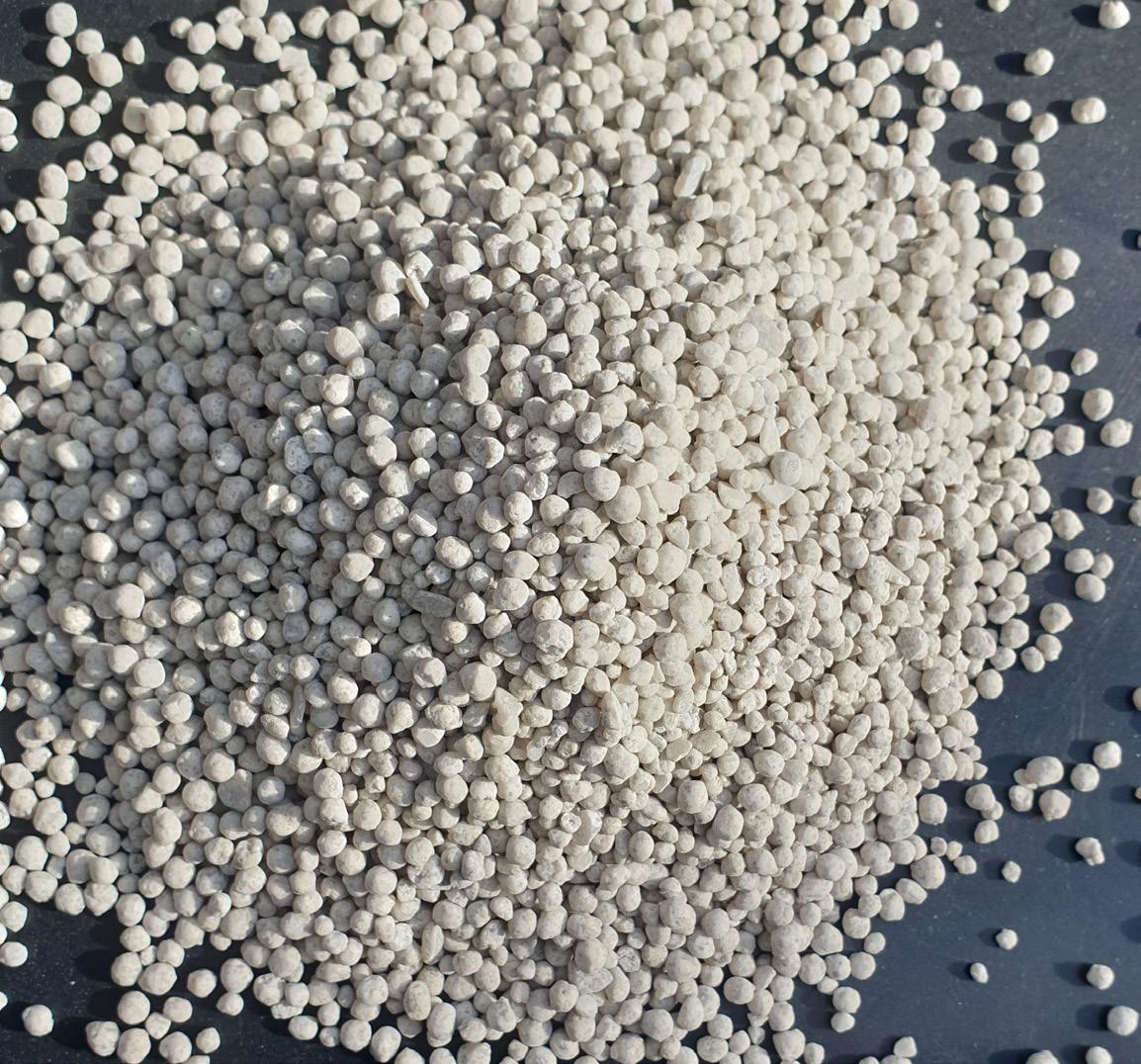

41 Gains From Granulation

Jacco Korver, INSTRAL B.V., and Lucas van der Saag, ICL Fertilizers Europe C.V., The Netherlands, describe the intricacies of the granulation process and consider its benefits for the storage and transportation of the end fertilizer product.

44 Developing Egypt’s Sulfuric Acid Industry

AK Tyagi, Nuberg, India, explains the contributing factors that are influencing the current conditions of the sulfuric acid market, and examines the development of a sulfuric acid plant in Egypt.

48 Less

Is More

Dr. Metodi Zlatev, Haver & Boecker Niagara, Germany, considers the role of efficient and high-quality equipment and fertilizer processing solutions in boosting efficiency, improving product quality, and producing more with less.

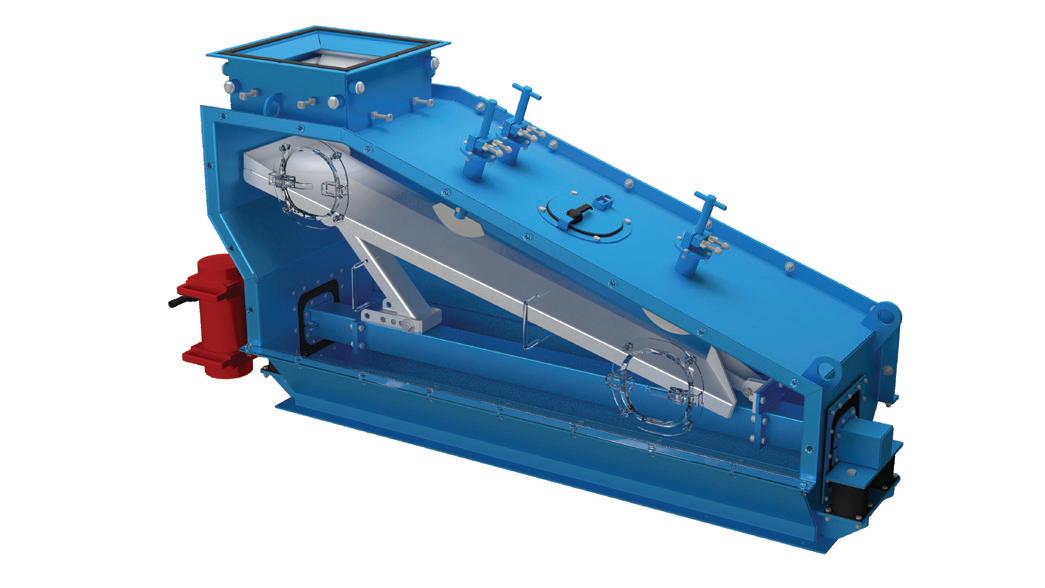

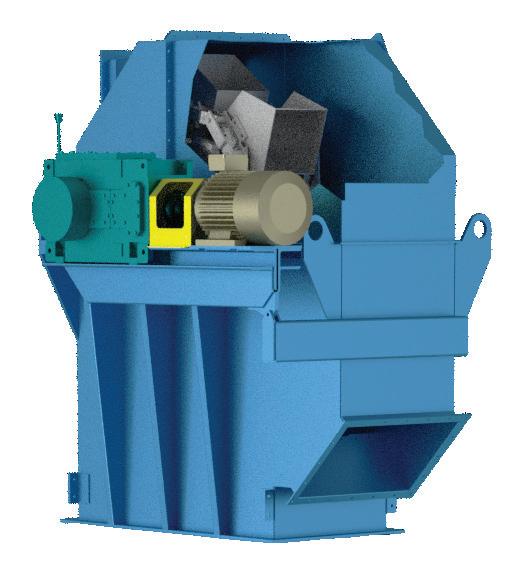

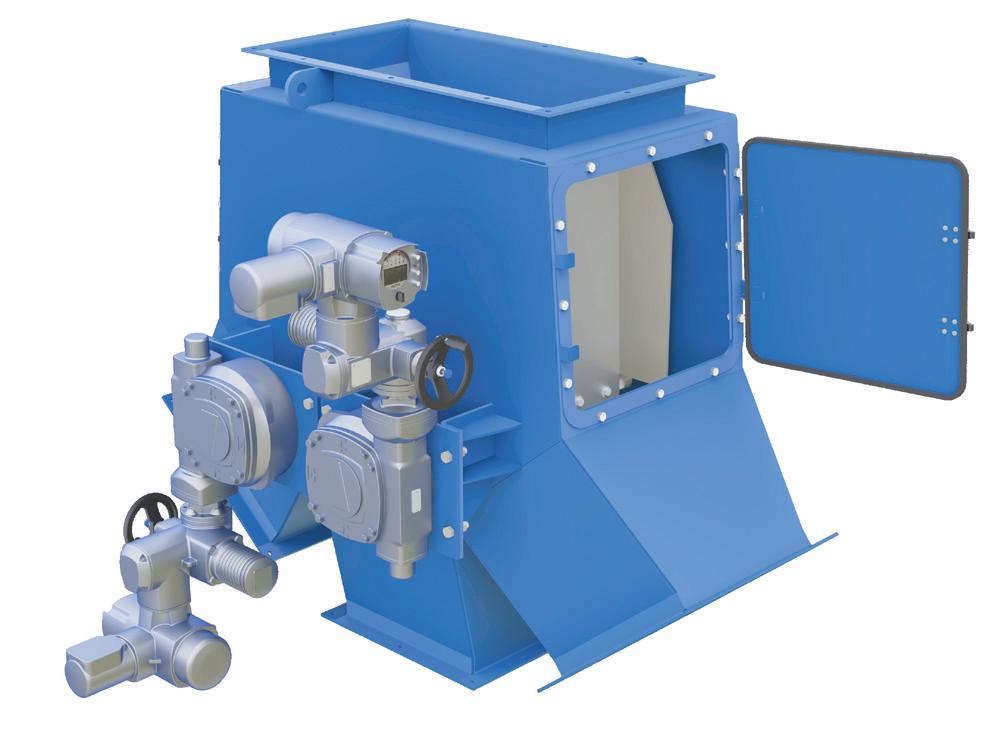

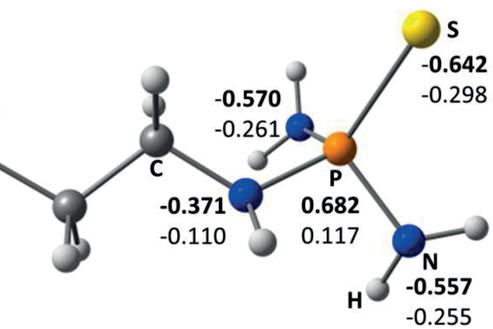

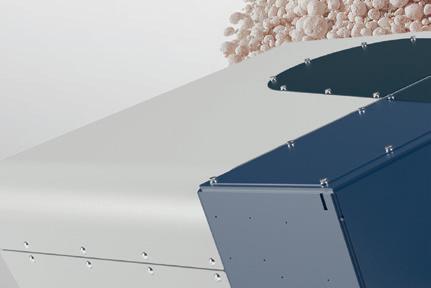

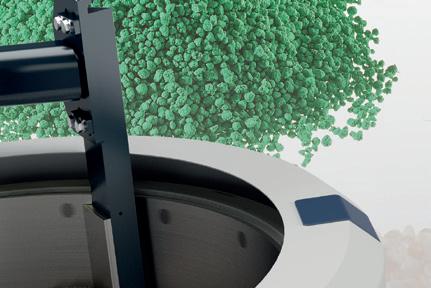

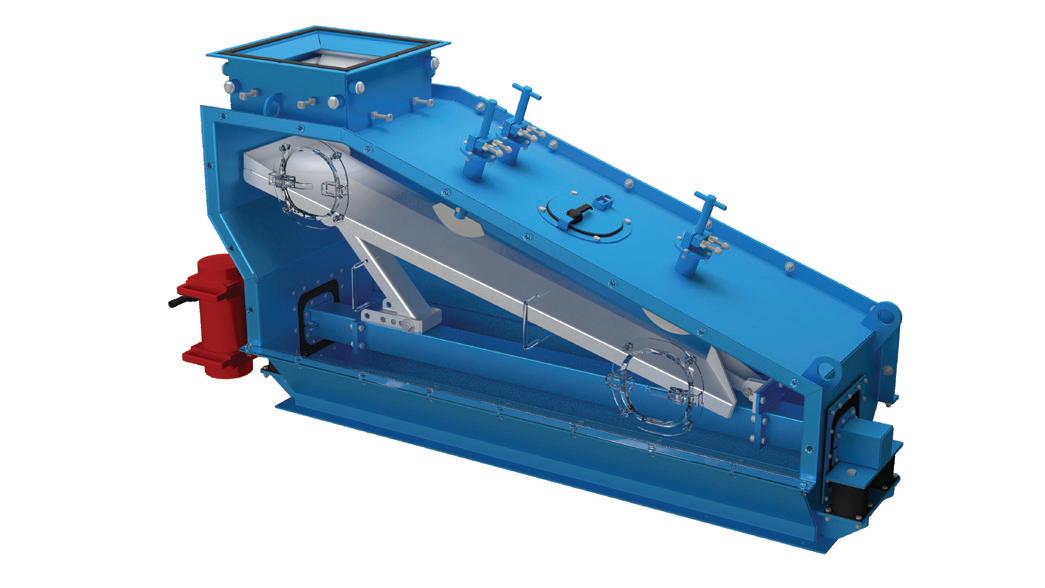

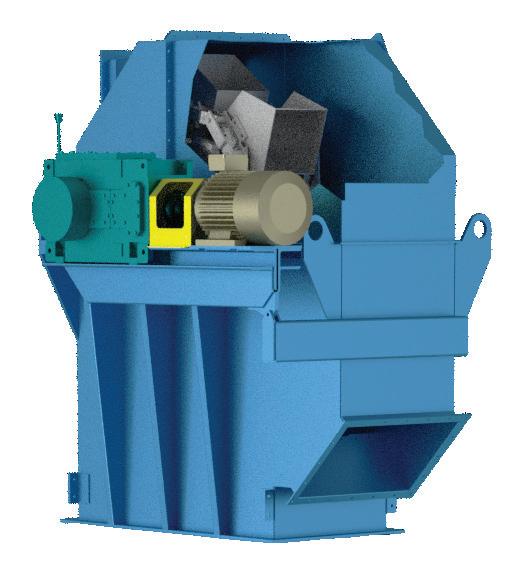

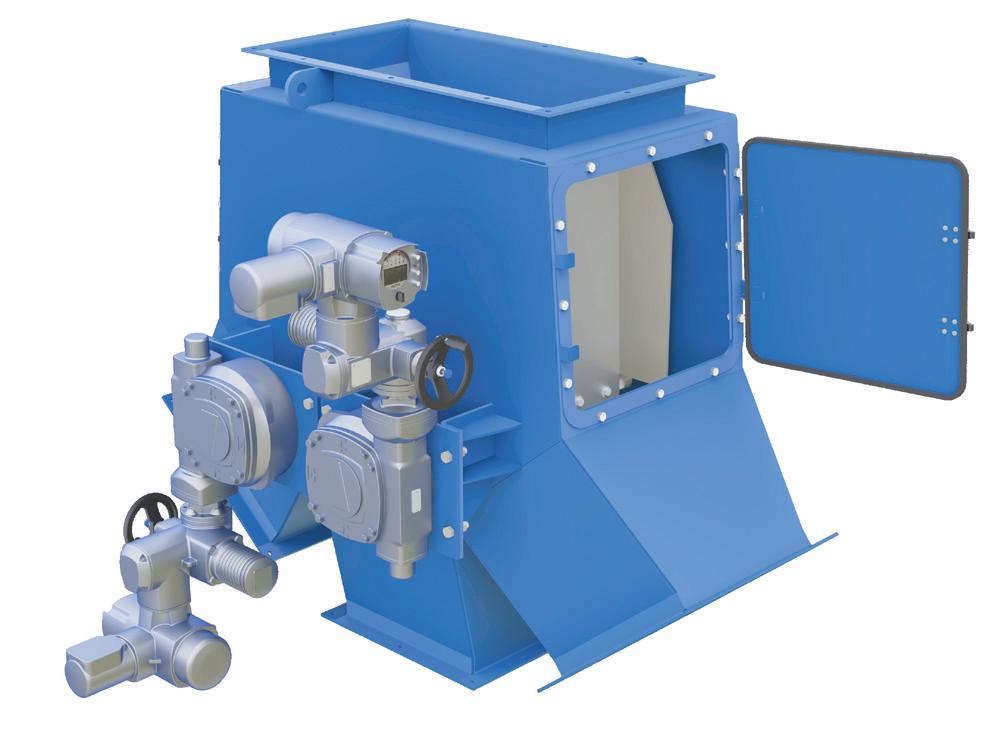

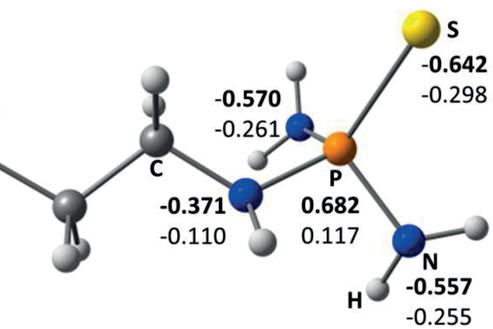

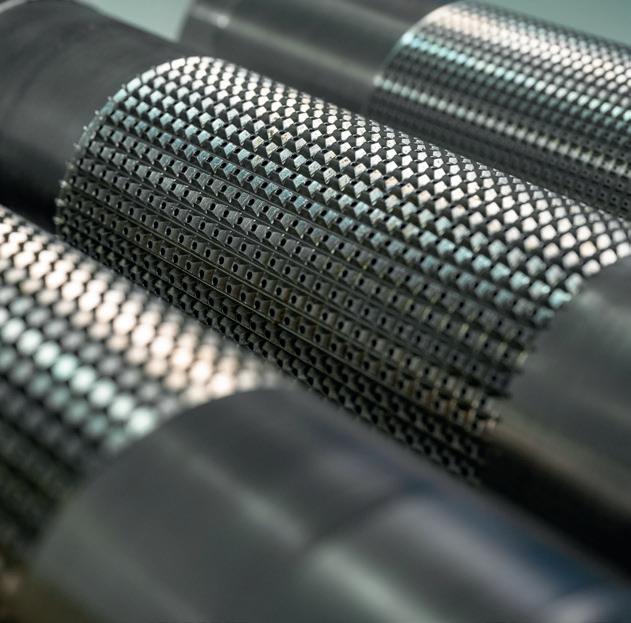

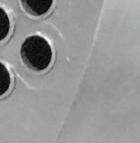

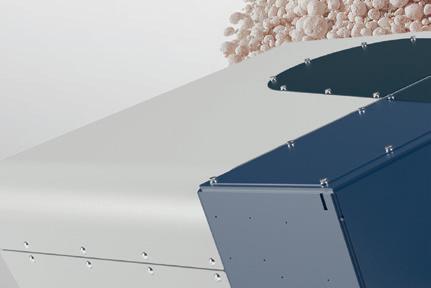

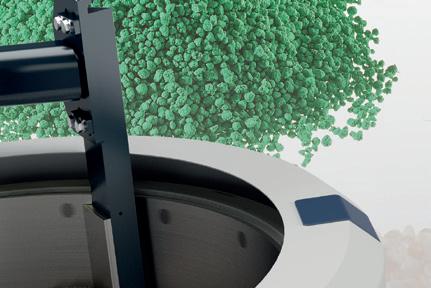

Berndorf Band Group provides equipment for the entire production process of fertilizer pastilles, from upstream equipment to steel belt cooling and solidification systems, as well as pastille handling, bagging and/or truck/rail loading. Advanced feeders, environmentally-friendly cooling systems and Berndorf’s worldwide service network help to ensure the high quality of pastille production.

ON THE COVER 03 Comment 05 News 10 Adapt And Prosper Contributing Editor, Gordon Cope, considers how Europe will eliminate its dependency on Russian natural gas and navigate the challenges of fertilizer and food security. 15 Dried And Tested Shane Le Capitaine, FEECO International, Inc., USA, discusses how rotary dryers operate and why they are favoured for phosphates, as well as the challenges and considerations involved with drying phosphate ores. 19 Keeping A Close Eye On Corrosion Luiza Esteves, Alleima, USA, considers the design, cost, and reliability of corrosion-resistant alloys for use in the phosphoric acid industry. 23 A Question Of Scale James Byrd and Elton Curran, JESA Technologies, LLC., USA, discuss the advantages of larger plant capacities and consider how economies of scale could benefit phosphoric acid producers. follow @WorldFertilizer like World Fertilizer join World Fertilizer Copyright© Palladian Publications Ltd 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither does the publisher endorse any of the claims made in the advertisements. Printed in the UK. CBP006075

BERNDORF PROCESS EQUIPMENT FOR THE PRODUCTION OF PREMIUM PASTILLES FOR THE FERTILIZER INDUSTRY 2023-05 World Fertilizer_May 210x297_cover.indd MAGAZINE MAY/JUNE 2023

and

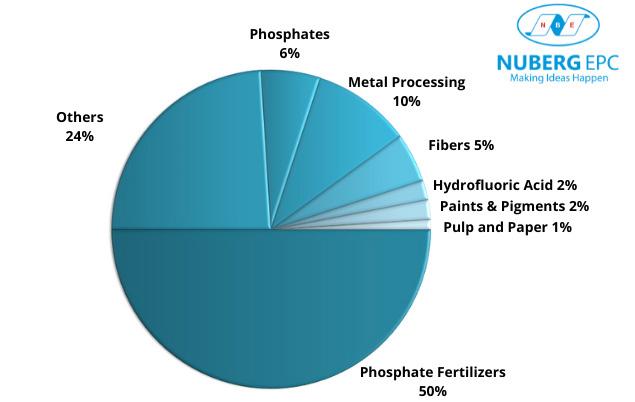

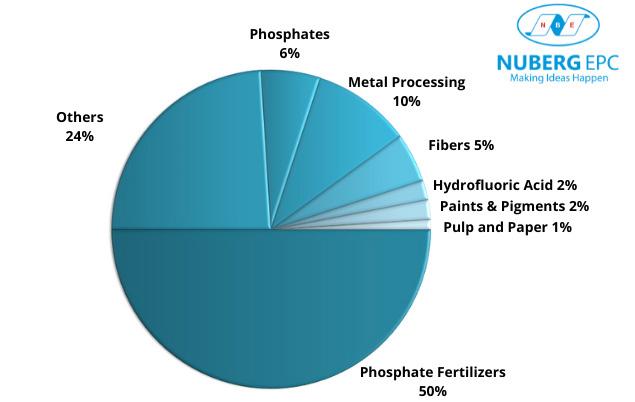

Contributing Editor, Gordon Cope, considers how Europe will eliminate its dependency on Russian natural gas and navigate the challenges of fertilizer and food security. T o everyone’s relief, Europe weathered the energy storm. conservation, and demand destruction, EU member countries managed to reduce gas consumption by 19%, well above the 15% goal it set But longer, more serious challenge remains; fertilizer and food security. At the start of the 2023 World Economic Forum in Davos, expressed concern over Russia’s “weaponisation” of food: “Russia is the world’s largest exporter of fertilizer, so it will have global implications. We’ve seen some of that from the disruptions already and there a need for Russian fertilizer in order to maintain global food production. But my message here is next phase to reduce, to avoid the dependency on Russia. Because when that is being used as weapon in war, we cannot go to be.” Developing Egypt's Sulfuric Acid Industry AK Tyagi, Nuberg, India, explains the contributing factors that are influencing the current conditions of the sulfuric acid market, and examines the development of a sulfiric acid plant in Egypt. Tbeen steadily growing as one of the primary suppliers of raw materials for various chemical and industrial applications. The fertilizer industry is also driving market expansion. Major sulfuric acid suppliers across the world are projected to enhance their already booming exports in the near future as worldwide demand for sulfuric acid continues to grow. Sulfuric acid is one of the global chemical industries’ most important molecules and products. So far, the majority has been utilised to manufacture various types of fertilizers. Sulfuric acid is also in high demand in other chemical and industrial areas, such as metal processing, pigment, petroleum, paper and pulp (Figure 1). China is currently the world’s greatest producer of largest exporter. Grand View Research’s (GVR) industry analysis reveals that the global sulfuric acid market was worth US$10.1 billion in 2016, and is predicted to grow to US$13.45 billion by 2025, reflecting robust compound annual growth rate (CAGR) of 3.3%. The market is predicted to be driven primarily by rising phosphate fertilizer production capacity and tightening environmental rules to regulate emissions, which will lead to increased use of smelters to capture sulfur dioxide products. According to GVR, the global market is predicted to grow due to rising demand for the product from the fertilizer, chemical manufacturing, paper and pulp, petroleum refinery, metal processing and automotive industries for use as a catalyst, dehydrating 45 10 44

Adapt

prosper

Pop-A-Plug ® Tube Plugs

ASME PCC-2 Compliant Heat Exchanger Tube Plugging System

Trusted by fertilizer plants around the world as their go-to solution for heat exchanger tube leaks, Pop-A-Plug Tube Plugs from CurtissWright are engineered for optimal performance throughout the life cycle of equipment. Controlled hydraulic installation eliminates welding and time-consuming pre-/post-weld heat treatments that can cause damage to tubes, tube sheet ligaments, and joints.

• No Welding Required

• Pressure Ratings Up to 7000 PsiG (483 BarG)

• Simple Hydraulic Installation

• Helium Leak Tight Seal to 1 x 10-10 cc/sec

• 100% Lot Tested to Ensure Unmatched Quality

• ASME PCC-2 Recommended Tube Plugging Repair Methods

• Wide Range of Sizes& ASME/ASTM Certified Materials Available

877.383.1029 l est-sales@curtisswright.com l cw-estgroup.com/wf-23

CONTACT US

MANAGING EDITOR

James Little james.little@palladianpublications.com

SENIOR EDITOR

Callum O’Reilly callum.oreilly@palladianpublications.com

DEPUTY EDITOR

Emily Thomas emily.thomas@palladianpublications.com

SALES DIRECTOR

Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER

Ryan Freeman ryan.freeman@palladianpublications.com

PRODUCTION

Kate Wilkerson kate.wilkerson@palladianpublications.com

ADMINISTRATION MANAGER

Laura White laura.white@palladianpublications.com

DIGITAL ADMINISTRATOR

Leah Jones leah.jones@palladianpublications.com

EVENTS MANAGER

Louise Cameron louise.cameron@palladianpublications.com

EVENTS COORDINATOR

Stirling Viljoen stirling.viljoen@palladianpublications.com

DIGITAL CONTENT ASSISTANT

Merili Jurivete merili.jurivete@palladianpublications.com

COMMENT

EMILY THOMAS, DEPUTY EDITOR

An estimated 9.9 million viewers tuned into the BBC and gathered around their televisions to watch the 2023 edition of the Eurovision Song Contest on 13th May. The contest was welcomed back to the UK for the first time since 1998, hosted in the city of Liverpool on behalf of 2022 Ukrainian winners, Kalush Orchestra. An array of whacky and wonderful musical acts graced our screens, including Austria’s Teya and Salena, whose electropop tune about being possessed by the spirit of poet Edgar Allen Poe served up exactly what we have all come to expect from the annual competition – a celebration of Europe’s most eccentric and diverse talent. However, among the fun and carefree acts were those using the platform to make more politically-driven statements. Despite the fact that the Eurovision Song Contest was conceived in the 1950s to unite countries after World War II, this year’s competition saw Croatia’s Let 3 perform an anti-war track, with reference to the Russian Federation and both the presidents of Russia and Belarus.

Ukraine’s track ‘Heart of Steel’ also touched upon the war, inspired by Azovstal’s steel works, which became one of the most emblematic points of the Siege of Mariupol. It is evident therefore that the impacts of the Russia-Ukraine conflict are still being felt across Europe, 14 months after it began.

Europe’s fertilizer sector is just one area still struggling with the repercussions of the conflict. As our regional report in this issue of World Fertilizer states, Europe’s nitrogen fertilizer market in particular has found itself vulnerable, relying heavily on Russian natural gas as feedstock. In 2021, Russia exported US$13.1 billion in fertilizer,1 and following the country’s invasion of Ukraine, prices of diammonium phosphate and urea also reached record highs;2 while prices are now coming down from these peaks, Europe must explore new ways to become more self-sufficient and reduce its dependence on Russian exports. A prerequisite for this is sourcing raw materials for fertilizer, such as natural gas, from elsewhere in Europe, however other solutions, according to major European fertilizer producer Yara, should inevitably include the decarbonisation of the fertilizer sector.3 By replacing natural gas with sources like green ammonia, the company plans for its own ‘green fertilizer’ to have an 80 – 90% lower carbon footprint. And Yara is certainly not the only producer with plans based on decarbonisation. CF Industries recently reported that it is partnering up with CHS Inc. to accelerate agriculture and food system greenhouse gas emission reductions through the production and distribution of low-carbon nitrogen fertilizer.4

SUBSCRIPTIONS

By leveraging CF Industries’ investments to produce ammonia, as well as carbon capture technologies, lower Scope 1 emissions are hoped to be achieved. It has also been suggested that the encouragement of organic fertilizer use could set Europe on a path away from Russian exports, as well as circular economy practices like nutrient recycling and recovery from waste streams. Overall, it seems that navigating an industry independent of Russia will not be without its challenges, however being forced to explore alternatives to these exports could provide Europe with a real opportunity to develop more sustainable and planet-friendly practices. Turn to P.10 to read the article from Contributing Editor, Gordon Cope, as he explores the topic in further detail.

1. www.oec.world/en/profile/bilateral-product/fertilizers/reporter/rus#:~:text=About&text=Exports%20In%20 2021%2C%20Russia%20exported,most%20exported%20product%20in%20Russia.

2. www.reuters.com/world/europe/have-western-sanctions-russia-impacted-its-fertiliser-exports-2023-05-11/

3. www.yara.com/sustainability/transforming-food-system/green-fertilizers/what-you-need-to-know-about-greenfertilizers/

4. www.cfindustries.com/newsroom/2023/low-carbon-nitrogen-fertilizer

MAY/JUNE 2023 | WORLD FERTILIZER | 3 World Fertilizer (ISSN No: 2398-4384) is published 8 times a year by Palladian Publications Ltd, UK. World Fertilizer Subscription rates: Annual subscription: £50 UK including postage £60 overseas (postage airmail) Two year discounted rate: £80 UK including postage £96 (postage airmail). Subscription claims: Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

Palladian Publications Ltd, 15 South Street, Farnham, Surrey GU9 7QU, UK Tel: +44 (0) 1252 718 999 Website: www.worldfertilizer.com

sales@bdgt.com.au

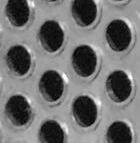

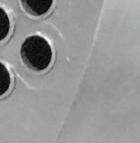

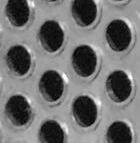

MANUFACTURE OF PRECISION

PRILL SPRAY PLATES

CUSTOM AUTOMATED PROGRAMMING SOFTWARE

Capabilities

PRECISION ENGINEERING COMPONENTS

Hole Size: ≥ 0.70mm (0.030”) Diameter

Plate Thickness: 1mm (0.040”) to 3mm (0.120”)

Material: 304 S/S

Finish: Polished

P R I L L SPRAY P L AT E S PE C I A L I S T S

www.bdgt.com.au

BDGT is knowledgeable about the intricate processes required for the production of Prill Spray Plates, and their direct impact on the quality of premium-grade ammonium nitrate. Several factors contribute to the production of high-quality Prill Spray Plates, including the precise form and concentricity of the Prill blank, as well as the perpendicular alignment of the holes with the plate’s surface. By prioritising the manufacturing of top-tier Prill Spray Plates, BDGT enables you to achieve uniform and consistent results when producing ammonium nitrate. +61 7 3344 5744

WORLD NEWS

US Stamicarbon awarded contracts for green ammonia plant

MAIRE S.p.A. has announced that its subsidiary NextChem Holding, through Stamicarbon, part of the Sustainable Technology Solutions business unit, has been awarded licensing and basic engineering design contracts for a 450 tpd green ammonia plant by a prominent North American fertilizer producer.

The plant, to be built in the US, will produce green ammonia to be used as feedstock for nitrogen-based fertilizers and will be based on the state-of-the-art Stami Green Ammonia technology. It is expected to start operations in 2026.

Stami Green Ammonia, the main building block for green fertilizers, enables environmentally friendly ammonia production from nature’s elements by using water electrolysis to make hydrogen and obtaining nitrogen from the air instead of the steam reforming of fossil fuels. The combination of proprietary technology and engineering requirements to build small-scale green ammonia plants offered by Stamicarbon, NextChem Holding’s nitrogen technology licensor, represents a sustainable and highly competitive alternative to the conventional processes. This proven technology can also be applied in existing plants, as part of a hybrid technology solution to make existing fertilizer production more sustainable.

Alessandro Bernini, Chief Executive Officer of MAIRE, commented: “The global demand for ammonia will continue to grow, requiring efficient and environmentally friendly production methods to effectively reduce the carbon footprint. Stami Green Ammonia technology, using renewable energy instead of fossil fuels, represents an important step forward in achieving the fertilizer industry’s goals of sustainable, carbon-free solutions. This important milestone further confirms MAIRE’s role as a leading technology integrator and enabler of the energy transition globally.”

AUSTRALIA Construction of Perdaman Chemicals & Fertilisers’ urea plant begins

Agroundbreaking ceremony in Western Australia’s Pilbara has marked the start of construction of Perdaman Chemicals & Fertilisers’ (PCF) urea plant which will provide Incitec Pivot Fertilisers (IPF) with a secure, long term supply of Australian urea.

The 20-year offtake partnership with PCF secures up to 2.3 million tpy of urea for IPF and its customers. IPF representatives joined Perdaman leadership in Karratha for a groundbreaking ceremony to celebrate the beginning of construction on the project.

Incitec Pivot Limited (IPL) Managing Director and CEO, Jeanne Johns, said the announcement by Perdaman Chairman and CEO Vikas Rambal is testament to his longstanding vision and determination to support Australian agriculture into the future. The world scale manufacturing plant will use Western Australian natural gas to produce urea fertilizer, an essential input for Australian agriculture.

“I want to congratulate Vikas and his Perdaman team for making this opportunity a reality and bringing together Australian and international expertise. This investment in manufacturing will support highly skilled jobs and deliver security of supply for Australian farmers.”

“Our partnership with Perdaman provides IPF with significant volumes of competitive, long-term, domestic urea supply for its Australian customers and the ability to expand sales into growing global markets,” Jeanne Johns continued.

“Global market conditions and security of supply are growing challenges for farmers and the agriculture sector in Australia and globally.”

Urea supply is expected to be available from mid-2027 when construction is completed. IPF’s strategy is to deliver market-leading products and services that provide farmers with more sustainable plant nutrition solutions, manage input costs, increase productivity, and crop yields and improve the health of their most valuable asset, their soil.

“This is all about IPF executing on its strategy and enables them to grow the long-term strength and scale of the business. It is also another step towards creating two great businesses – Incitec Pivot Fertilisers and Dyno Nobel,” added Johns.

The project has been awarded Major Project Status by both the Australian and Western Australian governments. It is expected to generate around 2000 construction jobs and 200 operational and indirect jobs once production begins.

MAY/JUNE 2023 | WORLD FERTILIZER | 5

US CF Industries to work with CHS Inc. on production and distribution of low-carbon nitrogen fertilizer

The company is working with CHS Inc. to accelerate quantifiable and certifiable agriculture and food system greenhouse gas (GHG) emission reductions through the production and distribution of low-carbon nitrogen fertilizer. This initiative was developed as part of the U.S.-UAE’s Agriculture Innovation Mission for Climate (AIM for Climate) programme that seeks to catalyse global innovation in climate-smart agriculture.

The manufacture of fertilizers, which are essential to crop yields, is a significant contributor to the lifecycle GHG footprint of global food production. For example, one study 1 estimated that nitrogen fertilizer manufacturing accounts for about 30% of the lifecycle GHG emissions associated with the production of a loaf of bread.

To address the GHG footprint of food production, both companies will leverage CF Industries’ investments to produce ammonia, which is the building block of nitrogen-based fertilizer products, with lower Scope 1 carbon dioxide (CO 2 ) emissions. They will also leverage CHS’ extensive distribution network to place low- and zero-carbon fertilizers with growers. The companies expect to work together to promote the use of low-GHG nitrogen fertilizer to help farmers and crop end users, such as consumer product goods companies and ethanol producers, reduce the overall carbon footprint of agriculture.

Bert Frost, Senior Vice President, Sales, Supply Chain and Market Development, CF Industries, said: “Decarbonised fertilizer is the future of how we sustainably supply and produce the goods that humanity needs.”

“The advantage of using decarbonised fertilizer is that we can measure the reduction in greenhouse gas emissions associated with its production and transfer that attribute to the farmer who can then provide crops to their customers that have a quantifiably lower GHG footprint. This will enable us to develop a certifiable decarbonised agricultural value chain.”

“We recognise the importance of helping growers optimise resources as they produce food the world needs,” said Brian Schouvieller, Senior Vice President, Commercial Trade and Risk Management at CHS. “Nitrogen fertilizer is critical to plant growth; zero or low-carbon fertilizer can be an important tool as we pursue solutions that help growers simultaneously achieve their crop production and sustainability goals.”

Since 2020, CF Industries has advanced projects to decarbonise its ammonia production network and position the company to supply a substantial volume of clean ammonia within the next few years. This includes leveraging carbon capture and sequestration (CCS) technologies at its Donaldsonville Complex where CF Industries is constructing a CO 2 dehydration and compression facility to enable the capture and permanent sequestration of up to 2 million tpy of CO 2 , which is expected to begin in 2025. Additionally, CF Industries is constructing North America’s first commercial scale green ammonia capacity at its Donaldsonville Complex, enabling up to 20 000 t of green ammonia production beginning in 2024.

1. www.nature.com/articles/nplants201712

WORLD NEWS 6 | WORLD FERTILIZER | MAY/JUNE 2023 NEWS HIGHLIGHTS Western Resources Corp Potash Phase 1 processing plant moves to commissioning phase African Development Bank approves US$11.7 million to facilitate access to fertilizers for African farmers Kropz Plc provides update on Elandsfontein phosphate project sales Fertilizer Canada welcomes the Standing Committee on Agriculture and Agri-Food’s report on global food insecurity Visit our website for more news: www.worldfertilizer.com

ENABLING THE WORLD TO FEED ITSELF

As a pioneer and market leader in designing, licensing and developing plants for the fertilizer industry and beyond, we go all the way to help the world feed itself and improve quality of life. Our 75 years of expertise, knowledge and experience enables us to overcome any challenge and to grow, together with you, towards a more sustainable future. Looking forward to meeting you at www.stamicarbon.com

Tomorrow. Together.

Today.

WORLD NEWS

DIARY DATES

AICHE 2023 Safety in Ammonia Plants & Related Facilities Symposium

20 – 24 August 2023

Munich, Germany aiche.org/conferences/ annual-safety-ammoniaplants-and-related-facilitiessymposium/2023

ANNA 2023

10 – 15 September 2023

Varna, Bulgaria

anna-eu.com

Turbomachinery & Pump Symposium

26 – 28 September 2023

Houston, Texas tps.tamu.edu

Sulphur + Sulphuric Acid 2023 Conference & Exhibition

06 – 08 November 2023

New Orleans, USA events.crugroup.com/sulphur/ home

US OCI Global and NuStar sign agreement to deliver ammonia into the Midwest

The companies’ affiliates have entered into an agreement for OCI Global to transport ammonia on a new segment of NuStar Pipeline Operating Partnership L.P.’s Ammonia Pipeline System.

Under the arrangement, NuStar will install a new 14-mile pipeline segment that will connect OCI’s Nitrogen facility in Wever, Iowa, with NuStar’s existing 2000-mile anhydrous ammonia pipeline, which originates in Louisiana and flows northbound to various points in the Midwest, including Iowa.

OCI’s facility uses ammonia to make fertilizer and produce DEF (Diesel Exhaust Fluid), which reduces emissions from diesel engines in cars, as well as light and heavy-duty trucks, farming equipment and other heavy machinery.

“We are pleased to partner with OCI to better serve the areas’ agricultural needs by delivering more ammonia to help meet fertilizer demand for local and regional farmers and by providing additional ammonia to serve as feedstock for upgraded products,” said NuStar Chairman and CEO, Brad Barron. “We expect this healthy-return, low-capital project to meaningfully increase utilisation of our system in 2024 and we are excited about the growing interest in ammonia – to reduce emissions and supply the globe –which we expect to generate significant additional opportunities for even greater utilisation of our Ammonia Pipeline System over the next several years.”

The agreement has been executed by both companies and commits NuStar to provide transportation services under a long-term arrangement. To facilitate the project, OCI has committed US$30 million in capital expenditures for new ammonia cooling and storage infrastructure. The proposed infrastructure will allow OCI to economically transport ammonia from the Gulf Coast and capitalise on its existing storage capacity.

OCI, which owns and operates US ammonia production facilities in Wever, Iowa, and Beaumont, Texas, is expected to bring an additional 1.1 million t of blue ammonia capacity online in 2025 in the Gulf Coast.

“We are excited to work with NuStar, a leader in safe and responsible midstream operations. This highly cost-effective project will allow us to safely and sustainably reach new customers, strengthens our position in the premium US Midwest market and is one further step in our ammonia logistics,” said OCI Global CEO, Ahmed El-Hoshy. “As one of the most efficient manufacturing plants in the nation, OCI Nitrogen, Iowa is leading the way in providing US farmers a stable, high-quality source of nitrogen fertilizer products. Our plant in Iowa has been central to our US operations since starting up in 2017 and we look forward to continued investment in the region.”

US Ostara announces new Chief Technology Officer

The company has announced that Dr. Aaron Waltz has been named Chief Technology Officer of the company. Waltz brings over 20 years of experience in the agriculture industry and deep agronomic expertise, having begun his career at DuPont Pioneer in corn genetics and transgenic traits. He has since worked in technology development roles in the adjuvants, biologicals and fertilizer industries.

Kerry Cebul, Chief Executive Officer of Ostara, said: “Aaron’s skills are highly complementary to the existing executive team and will enable Ostara to realise our vision of global expansion as we increase production of our portfolio of Crystal Green phosphate fertilizers.”

“Aaron’s agronomic expertise, diverse science background, and leadership will be critical as we rapidly expand our platform of technologies and significantly increase production to meet grower needs.”

8 | WORLD FERTILIZER | MAY/JUNE 2023

TRUSTED TECHNOLOGIES FOR A SUSTAINABLE FUTURE

GET IN TOUCH WITH THE PHOSPHATE TECHNOLOGIES EXPERTS TECHNOLOGIES.PRAYON.COM

Adapt and prosper

o everyone’s relief, Europe weathered the energy storm. Due to a combination of warmer weather, conservation, and demand destruction, EU member countries managed to reduce gas consumption by 19%, well above the 15% goal it set for itself ahead of winter.

But a longer, more serious challenge remains; fertilizer and food security. At the start of the 2023 World Economic Forum in Davos, Yara CEO, Svein Tore Holsether, expressed concern over Russia’s

“weaponisation” of food: “Russia is the world’s largest exporter of fertilizer, so it will have global implications. We’ve seen some of that from the disruptions already and there is a need for Russian fertilizer in order to maintain global food production. But my message here is that we also need to think about the next phase to reduce, to avoid the dependency on Russia. Because when that is being used as a weapon in war, we cannot go back to how it used to be.” 1

10

Contributing Editor, Gordon Cope, considers how Europe will eliminate its dependency on Russian natural gas and navigate the challenges of fertilizer and food security.

11

Prior to the war, the EU produced approximately 18.1 million t of fertilizer; 13 million t of nitrogen, 2.9 million t of potash and 2.2 million t of phosphate products. Domestic farm consumption amounted to 11.2 million tpy of nitrogen, 2.6 million tpy of phosphates and 2.6 million tpy of potash, for a total of 16.4 million tpy. While on paper, production exceeds demand, the market is complicated by a number of factors (transportation costs, crop needs, etc). As a result, around 8 million tpy is imported and over 3 million tpy is exported.

And there lies the vulnerability. The EU’s agricultural sector has relied on inexpensive and abundant potash, phosphate and nitrogen products from Russia, Belarus and Ukraine, all of which have been significantly decreased by bans, embargoes and logistical disruptions. Over the last year, manufacturers and consumers have been scrambling to find new sources, and figure out ways to pay once they have them.

Nitrogen

The manufacturing of ammonia requires lots of natural gas as both feedstock and energy, and accounts for 80% of variable costs in Europe. Even prior to the war, a gas shortage in the EU resulted in prices at the benchmark Dutch TTF market to rise to the point where major European manufacturers curtailed production. When the Ukraine war drove spot prices at the TTF hub over €300/MWh, as much as 40% of ammonia output was shut-in. Some of the shortfall was made up with imports of urea from Egypt and Algeria, but urea has lower field-yield efficiency and a higher carbon footprint when compared to other nitrogen fertilizer products.

Faced with high costs and unsuitable alternatives, farmers in the EU have been curtailing usage. In the summer of 2022, purchases dropped approximately 20%, which will have a negative effect on yields if the trend continues through 2023. While natural gas prices have recently eased to around €50/MWh, they still remain much higher than other producing jurisdictions. The price spread, for instance, between Henry Hub, Louisiana, and TTF, is approximately US$15 per MMBtu. That translates into an ammonia production margin difference of up to US$500 per t.

In order to help alleviate price pressures on the agricultural sector, the EC earmarked €450 million from its agricultural reserve to offset high-input farming costs. In addition, it announced that it would monitor the market for price gouging, and reduce fertilizer import restrictions. New EU sources for nitrogen fertilizer are in short supply. ANWIL is expanding nitrogen capacity at its complex in Wloclawek, Poland. Three new modules – a 1200 tpy nitric acid unit, an ammonium nitrate solution unit, and a drum granulation unit – will increase total fertilizer capacity from 966 000 tpy to 1.46 million tpy when they come on-stream in mid-2023. The company notes that the new production will offset Polish imports from Russia.

Organic fertilizer is an attractive alternative that has been formally adopted under EU’s Green Deal, a €1 trillion growth strategy designed to transition the continent to a climate-neutral, sustainable economic model.

The Green Deal’s ‘Farm to Fork’ (F2F) strategy calls for decreases in methane emissions (agriculture accounts for over half of anthropogenic emissions), and reductions in pesticides and artificial fertilizers. Actions include establishing 25% of arable land under organic practices. A multi-year study comparing organic and artificial fertilizers in Germany was recently published. Over a period of 10 years, the Weihenstephan-Triesdorf University of Applied Sciences studied 40 organic and 40 conventional farms in order to collect and compare data. They found that several factors made the organic farms more environmentally-friendly than conventional farms, including the lesser usage of nitrogen (an average of 20 kg per ha. compared to 80 – 100 kg for conventional), better carbon absorption in the soil and lesser overall energy usage. Costs to consumers were also an advantage; while inflation associated with the Ukraine war caused prices for conventional foods to rise by an average of 59% between November 2021 and November 2022, prices for organic food rose less than 30%, thanks to more stable organic fertilizer prices. The downside of the comparison, of course, was the 50% lower yield rates; the goal of reaching 25% organic farming in Europe would place significant pressure on conservation lands to maintain levels of output.

Green ammonia

For the last several years, EU regulators have been keen on developing green ammonia. The low-carbon process uses renewable energy from windmills and solar panels to separate hydrogen molecules from water using electrolysis, which can then be combined with nitrogen to form ammonia; the process lowers the carbon footprint of nitrogen fertilizers, and, when combusted in engines, offers a low-carbon transportation fuel. Prior to the Ukraine war, government support was essential; hydrogen produced through the traditional Haber Bosch process costs approximately US$2 – 5/kg, but green hydrogen costs around US$6 – 10/kg. With higher gas prices, however, subsidies for hydrolysis-based hydrogen production become relatively cheaper; the EU recently announced a €300 million green hydrogen funding package aimed at ramping up the current target of 3 million t by 2030, to 15 million t.

Major manufacturers have taken note. Yara, Europe’s largest ammonia producer, has extensive plans to go green. In conjunction with Orsted, a Netherlands-based offshore wind-farm developer, Yara will convert part of its ammonia output at its existing plant in Sluiskil, Holland, to 75 000 tpy of green ammonia using a 100 MW electrolyser.

The company is also planning a green hydrogen stream at its 500 000 tpy ammonia plant, in Herøya, Norway. The project, dubbed HEGRA, will reduce CO 2 emissions by 800 000 tpy, equivalent to 300 000 fossil-fuelled cars. Yara is also modifying its ammonia storage capacity at its import and export terminal in Brunsbüttel, Germany, to handle up to 3 million tpy of clean ammonia.

In September 2022, Danish-based Topsoe, and First Ammonia of New York, formed a joint venture to create a company dedicated to the use of solid oxide electrolyser cells (SOEC) to produce green ammonia. The plan is to build

12 | WORLD FERTILIZER | MAY/JUNE 2023

Lab Scale Test 100 g batch Pilot Scale Test 1000 kg batch Industrial Solution 1 to 100 ton/hr

1.

2.

3.

a total of 10 modular 500 MW plants around the world that would displace up to 5 billion m 3 of natural gas and eliminate 13 million tpy of CO 2 emissions. One of the first plants is planned for Northern Germany, with a commission date in 2025.

In late 2022, Cepsa announced a new green energy corridor between southern and northern Europe. The Spanish firm intends to produce up to 4.6 million tpy of green hydrogen at its San Roque Energy Park near the Bay of Algeciras. The hydrogen will then be converted into ammonia and methanol and shipped to the Port of Rotterdam in Holland. First shipments are expected by 2027.

Phosphate

Except for a small amount of production in Finland, there is no commercial mining of phosphate in the EU. Traditionally, Europe has relied on two main sources; Russia accounts for almost 60%, and Morocco around 40%. While phosphate fertilizer imports from Russia have not technically been banned, complications arising from financial payment restrictions and transportation insurance premiums have greatly impeded their movement, not only to Europe, but to many consuming nations.

Morocco, which has the world’s largest phosphate reserves, has been increasing its production to take advantage of the gap. State-owned OCP has announced that it will boost shipments by 50%, and is building three 1 million tpy granular phosphate units at Jorf Lasfa.

While farmers are calling for increased imports from Morocco, there is a complication. Production from the North African nation is relatively high in cadmium. The toxic trace element and its compounds can cause cancer, attacking the renal, digestive, reproductive, and respiratory systems. Fertilizer is one of the major sources for the build-up of cadmium in soils, and, in 2022, the EU emplaced a cap of 60 mg/kg on cadmium levels in fertilizers. Producers were able to meet the cap by mixing Russian-sourced phosphate (which is significantly lower in cadmium than Morocco’s products), but now that option has largely disappeared. COPA COGECA, a European agricultural industry lobby, has called for the EU to suspend the cadmium limit in order to access more Moroccan imports.

The rising cost of phosphates and the political complications of accessing new sources has renewed interest in recycling. The European Sustainable Phosphorous Platform (ESPP) is a broad-based coalition dedicated to recovering phosphorous compounds. The ESPP calculates that the EU generates over 800 000 tpy of phosphorous in sewage, animal byproducts and food scraps; that waste can be economically converted to recyclable products. When sewage sludge is incinerated, for instance, the fly ash contains up to 11% phosphorous compounds. Since 2019, ICL has been recycling phosphates from waste streams at its Amfert fertilizer plant in the Dutch Province of Noord-Holland. Ashes from Amsterdam’s sewage sludge and bone meal from food waste streams were treated with acid; the recycled mineral displaces approximately 10% of the mined phosphate feedstock at the fertilizer plant.

Potash

At first glance, finding supplies of potash to replace Belarusian and Russian imports may not represent as complicated a challenge as other nutrients. K+S, a German resources company, has extensive potash holdings in eastern Germany; the Zielitz underground mine extracts almost 2 million tpy of potash agricultural products, and authorities in the nearby state of Thuringia note that their region has around 5 billion t of reserves that could be developed.

In February 2023, Anglo American announced it would expand its 10 million tpy Woodsmith polyhalite project in the Yorkshire region of England to 13 million tpy. The underground mine, currently under construction, involves digging 1.6 km-deep mine shafts and a 37 km tunnel to transport raw material to the port of Teesside. The rock will then be milled into sulfate of potash-magnesia (SOPM) for export around the world. The company expects first production in 2027.

Potash mining has significant environmental side-effects, however; Zielitz produces 10 million tpy of waste salts, which worries NGOs concerned about salinisation of nearby rivers. In the face of strict EU guidelines that extend the time required to approve new projects, capacity increases that offset Russian and Belarusian supplies are much more likely to be achieved in other, less-populated jurisdictions. In May 2022, K+S Potash Canada announced that it would expand its Bethune mine, located in Saskatchewan, from the current production of 2 million tpy, to 4 million tpy in gradual increments. Nutrien, the world’s largest potash producer, upped 2022 production from an initial 14 million tpy to almost 15 million tpy. Mosaic said it would add 1.5 million tpy of capacity to its Esterhazy K3 mine in Saskatchewan by mid-2023. BHP announced a startup date of 2026 for its C$7.5 billion Jansen mine, also located in Saskatchewan. Once completed, Jansen’s initial phase will produce 4.5 million tpy, with additional phases planned for the future.

The future

The EU is taking concrete steps to permanently eliminate its dependency on Russian natural gas by building LNG regasification terminals and reducing per capita usage; TTF prices have already decreased to the point where ammonia production is once again economically feasible. The continent is not out of the woods yet, however; the European Central Bank (ECB) warned that a hot summer similar to that experienced in 2022 could also pose a problem. “High temperatures in the summer months would raise gas demand for electricity generation owing to an increased need for air conditioning.”2

In the longer term, the increased use of organic fertilizer and the creation of a green hydrogen economy will reduce reliance on imports. Europe’s fertilizer sector, one of the most innovative in the world, will also continue to find new ways to adapt and prosper.

References

1. www.bbc.com/news/business-64288792

2. www.businessinsider.in/stock-market/news/europe-is-now-stuckwith-a-huge-stockpile-of-natural-gas-after-hoarding-it-last-year-fora-brutal-winter-that-never-came/articleshow/97947533.cms

14 | WORLD FERTILIZER | MAY/JUNE 2023

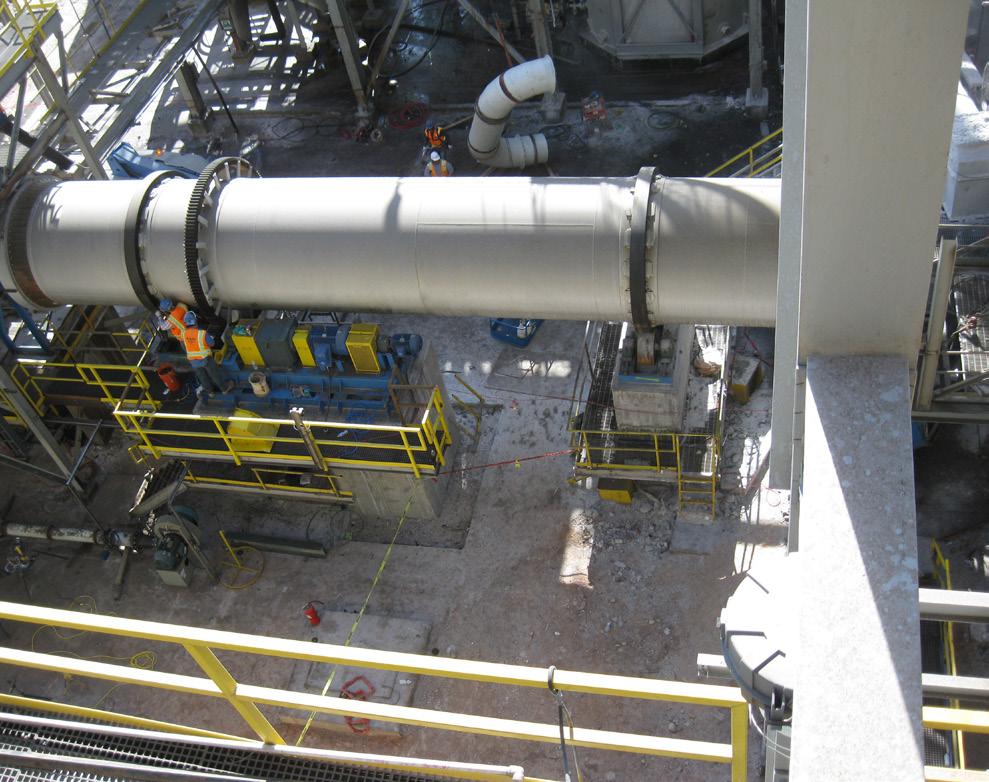

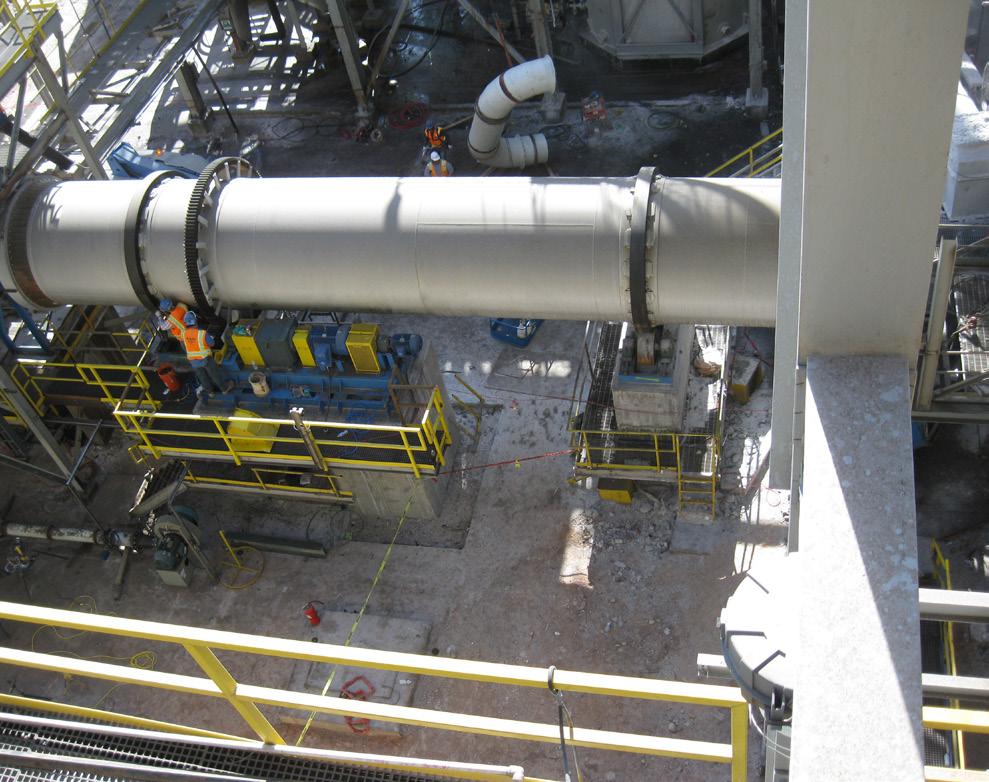

Shane Le Capitaine, FEECO International, Inc., USA, discusses how rotary dryers operate and why they are favoured for phosphates, as well as the challenges and considerations involved with drying phosphate ores.

Whether drying phosphate ore or finishing a fertilizer product, drying plays a pivotal role in bringing phosphate fertilizers to market. To accomplish this, producers continue to rely on the rotary dryer, thanks to the many advantages this type of industrial dryer can offer.

Rotary dryer operation

Rotary dryers are based on time-tested rotary drum technology. Solids are passed through a rotating drum, along with products of combustion and hot air to dry the material. Flights, or lifters, pick up the material and drop it through the air flow as the drum rotates. This cascading action creates a ‘curtain’ of material in the drum’s cross section that helps to maximise heat transfer via convection. The drum is set at a slight angle

to allow gravity to assist in moving material through the drum as it turns.

It is important to note that this method of drying is considered direct drying, because the material and products of combustion are in direct contact. While indirect rotary dryers are available, they are typically not employed in processing phosphates.

Direct dryers can be either of the counter-current or co-current (parallel) configuration, referring to the directional flow of the solids in relation to the process gases; in a co-current dryer, the material and products of combustion are fed into the same end of the unit, putting the hottest air in contact with the material in its wettest state. In a counter-current configuration, the solids and process gases are fed into opposing ends, putting the material in contact with the hottest gas while in its driest state, just before discharge.

15

When drying phosphates, the co-current configuration offers the best approach. In drying phosphate rock, a co-current design helps to ‘flash off’ initial surface moisture and dry the rock through to its core as the material moves down the length of the drum. In drying granular fertilizer products, the co-current design prevents over-drying of the product, which would otherwise result in the generation of fines and attrition.

Most phosphate dryers are also equipped with a combustion chamber. This refractory-lined, cylindrical vessel houses the combustion reaction to prevent direct contact

between the burner flame and the solids being processed. In the case of phosphates, the use of a combustion chamber ensures that material will not break down due to contact with the flame.

Why rotary dryers for phosphates?

Rotary dryers have been the dryer of choice among phosphate producers since the dawn of modern fertilizer, and for good reason. Rotary dryers are extremely reliable, thanks to a robust build and their considerable opportunity to design the dryer according to a material’s unique characteristics. They also accommodate the high feed rates required by the industry, processing anywhere from 1 to 200+ tph.

Further, their tolerance to slight fluctuations in feed characteristics makes them ideal for handling the variation across deposits of phosphorus ores. In finishing fertilizers from a granulation process, rotary dryers yield a premium product thanks to the added polishing of the granules caused by the tumbling action as the drum rotates.

Challenges in drying phosphates

Phosphate-based materials present some challenges for producers, which must be considered in the dryer design process to yield a reliable and efficient system. The primary challenges phosphate producers experience are outlined below.

Corrosion and abrasion

Both phosphate rock and fertilizer granules can exhibit varying levels of corrosion and abrasion. For this reason, selecting proper materials for construction and reinforcing high-wear areas such as the material inlet is often essential.

Buildup

Phosphates can also have a tendency to clump and build up on equipment during processing. If not properly managed, this can result in clogged and even damaged equipment, as well as inconsistent product quality and yield. Combatting buildup is often a matter of selecting proper materials for construction, while also implementing additional components such as knockers to dislodge any material that begins to stick to the dryer’s interior. A trommel or grizzly can also be incorporated onto the discharge end to break up any clumps that may have formed during drying, while also assisting in size separation.

Dust

Phosphates, particularly phosphate rock, can also present dust problems, which can result in a dusty atmosphere around the dryer, lost product, and even liability risks. A well-designed dryer from a reputable manufacturer will reduce the amount of dust generated but will not eliminate it entirely. As such, all rotary dryers will need to include some type of exhaust gas handling equipment to capture the dust. Options include cyclones, baghouses, and scrubbers. The recovered dust can then be incorporated into the subsequent granulation process or transported to the dryer discharge conveying system as product.

Variability

Producers often find phosphate ore deposits challenging due to the significant variation they can exhibit in both physical and chemical properties. Depending on the specific ore source,

16 | WORLD FERTILIZER | MAY/JUNE 2023

Figure 1. FEECO rotary dryer.

Figure 2. Interior view of a FEECO rotary dryer showing flights.

Figure 3. Rotary dryer with trommel screen/grizzly.

CONVERTING C U S T O M E R S INTO BELIEVERS ASME - S and U STAMP Authorized Manufacturer Fabrication: Brad Varnum bvarnum@cmw.cc 813-650-2271 Field Services: Ian Legg ilegg@cmw.com 813-365-2085 For more info go to: www.cmw.cc

producers may benefit from carrying out testing on their material to ensure a fitting solution.

Considerations in phosphate dryer design

In addition to accommodating challenging material characteristics, a few other factors should be considered when designing a rotary drying system for phosphates.

Equipment quality

The harsh conditions characteristic of the phosphate industry demand high-quality equipment tailored to the specific challenges associated with processing phosphates. Standardised and low-quality designs may seem like an economical choice, but typically end up costing more in the long run. As part of this, consideration should also be given to the drive assembly. The gear and pinion drive assembly type is generally best for the high capacities and rugged build required of phosphate producers. For these reasons, it is best to work with an OEM that is familiar with the rigors of phosphate processing to ensure a system that is not only designed for optimisation, but that is also constructed for long-term reliability.

Process development

As mentioned, the considerable variation associated with phosphate rock can require some process development work such as that carried out in the FEECO Innovation Center. Through testing trials, engineers are able to evaluate how the material responds to the drying process and gather critical process data to use in scaling up the process to design a commercial-size unit.

Automation and controls

Automation and control systems are powerful tools in optimising dryer efficiency, performance, and long-term reliability. In addition to assisting in start-up and shutdown, these systems can help operators to ensure key performance indicators stay within specification, even alerting operators when a parameter falls out of spec. They can track and trend data, providing reports that increase process transparency and assist in maintenance planning, making their value immeasurable.

Operating environment

It is important to note that the operating environment can influence dryer performance and therefore must also be considered during the design stages. Factors such as elevation, ambient air temperature, and humidity can all have an impact on drying and must be factored into the design.

Existing dryers

Phosphate producers working with an existing dryer have nearly as many options in tailoring their system according to process and material goals, with numerous retrofits and upgrades to improve overall performance and longevity available. This might include reinforcing high-wear areas or replacing shell sections with more appropriate materials of construction, as well as incorporating add-ons to improve performance and efficiency, such as knockers, seals, a combustion chamber, or more appropriately designed flights.

FEECO recommends those struggling with the performance of an existing dryer bring in an expert to conduct a process audit and evaluate their options.

Concluding remarks

From drying phosphate ores to finishing fertilizers, drying is integral in helping phosphate producers bring their product to market. The rotary dryer, with its high throughput, capability for customisation, heavy-duty build, and reliability, continues to be the industry’s industrial dryer of choice.

While phosphates can be challenging, presenting issues such as corrosion, buildup, variation, and dust, working with an experienced rotary dryer manufacturer to tailor the dryer design around the material’s unique characteristics can result in a dryer that will last for decades to come. Similarly, equipment quality is paramount to withstanding the harsh conditions often associated with phosphate operations. As such, dryer design may best be determined through process development testing. The help of an automation and control system can further optimise the system for performance and efficiency.

Bleed area: 216mm x 78mm

Trim area: 210mm x 72mm

Safe area: 190mm x 52mm

Figure 4. Rotary dryer with a gear and pinion drive assembly (ring gear can be seen).

Luiza Esteves, Alleima, USA, considers the design, cost, and reliability of corrosion-resistant alloys for use in the phosphoric acid industry.

KEEPING A CLOSE EYE ON

he corrosiveness of phosphoric acid during the wet process concentration will depend on the source of the phosphate rock and the presence of impurities. In this article, a detailed comparison between graphite and metallic tubes in the heat exchangers used in evaporators and their advantages in terms of design, cost, and reliability will be provided. The corrosion resistance of Sanicro® 28 which has been used for the past couple of decades under varying phosphate acid compositions and temperatures will also be discussed.

The wet process phosphoric acid (dihydrate)

In general, the wet-process phosphoric acid plant has four sections: rock grinding, reaction, filtration, and evaporation. The feedstock,

calcium phosphate, is ground to improve digestion, mixed with dilute phosphoric acid, and reacted with dilute sulfuric acid. A certain temperature is required to dissolve the phosphate calcium ore before it goes through a filtration process. The filtered acid, 28 – 35% phosphorous pentoxide (P 2 O 5 ), is evaporated to higher concentrations. 1 The concentration for commercial grade is 54% P 2 O 5 and the acid known as superphosphoric is 70%.

19

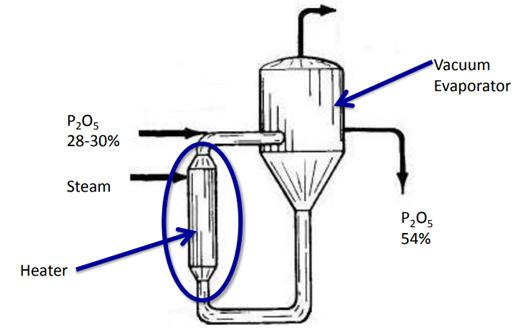

Phosphoric acid evaporation

The phosphoric acid evaporation can be done in one or several steps, where each loop contains a phosphoric acid heater.

The first stage is usually not as corrosive as the last stage. As the acid moves through the different evaporation stages, a higher temperature is needed and as such, the corrosive species become more concentrated through the evaporation process. For the shell and tube heat exchangers, the process fluid is inside of the tubes. Possible issues with the heater

Group Corrosivity of

1 Low South Africa (Phalaborwa), Nauru, Senegal (Taiba), Florida (Tampa, Pebble), Brazil (Araxa).

2 Medium North Carolina, Kola, Morocco (Khouribga, Youssoufia), Sahara (Bu Craa), Tunisia (Gafsa), Togo.

3 High* Syria, Jordan, Israel, Mexico. *High-chlorine

include erosion from solid particles, formation of deposits, and aggressive corrosion conditions. Phosphate rock contains large amounts of impurities that are found in different mixed ores, some of which are activating (chlorides, fluorides, fluorosilicates, dilute sulfuric acid, calcium, and sodium), and corrosion inhibitors (soluble silica, aluminum, ferric, and magnesium ions). The source and potential contamination of the phosphate rock will influence the corrosiveness of the acid as can be seen in Table 1.

Concentrators: Metallic heater vs graphite heat exchangers

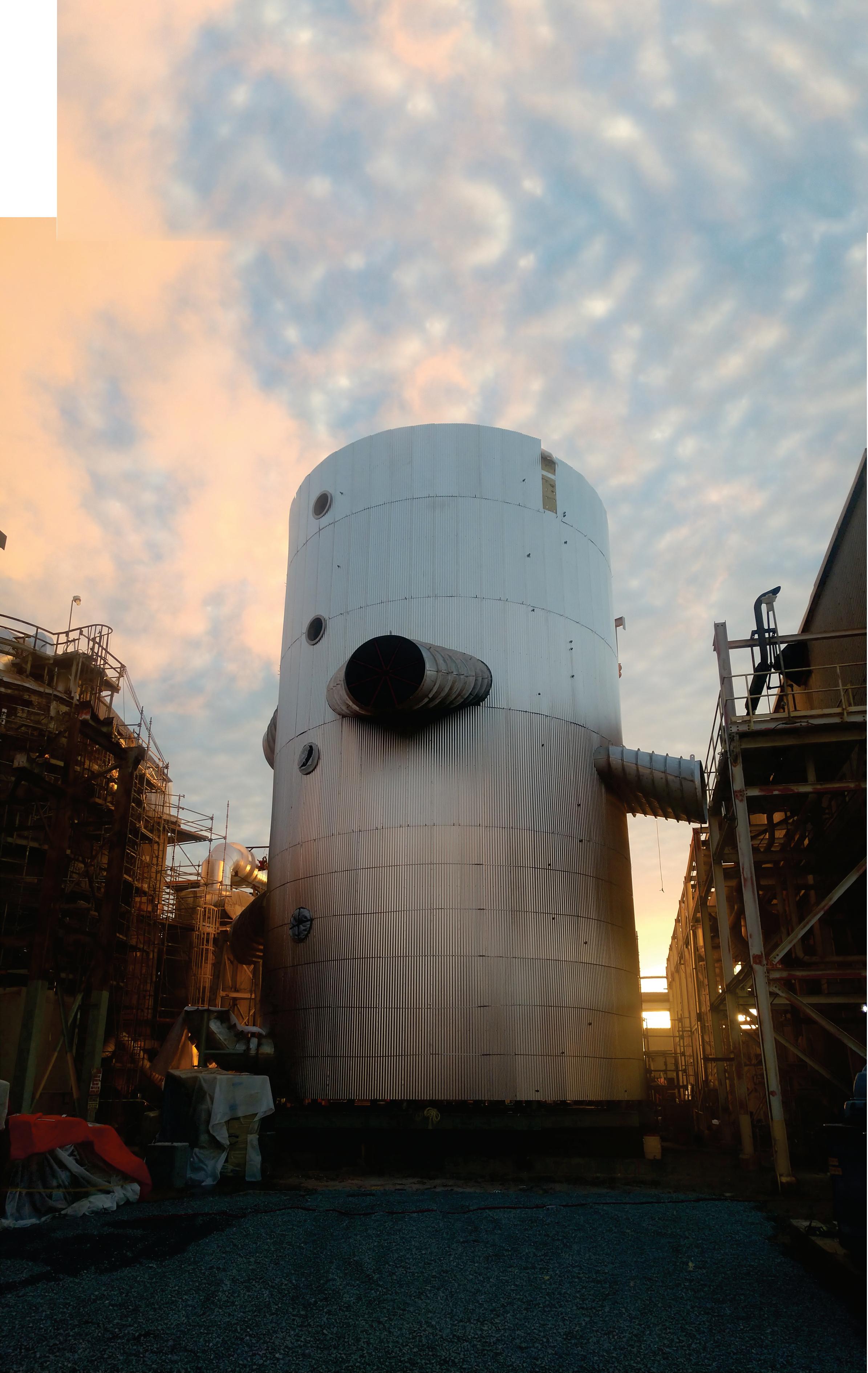

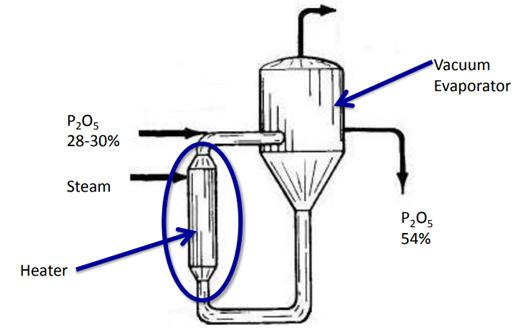

The most frequent system used to concentrate phosphoric acid in the wet process is forced-circulation evaporation, heated by low-pressure steam (Figure 1). The heat exchangers used in forced-circulation evaporators are typically impervious graphite tube-and-sheet, block heat exchangers, or high alloy stainless steel tube heat exchangers. Graphite has excellent corrosion properties; however, it is brittle. 2 Graphite has weak bonds between the atomic layers and therefore breaks easily. These types of heat exchangers are highly vulnerable to cracking during water blasting, a common method of cleaning tubes. Cleaning is required to remove deposits inside the tubes to restore heat transfer. This brittle material can easily fracture during cleaning, start up or shut down. The service life of these types of equipment is typically around three to six years. Metallic heat exchangers, on the other hand, have proven to be robust and resistant to the shocks associated with thermal cleaning. Some advantages of metallic heaters include easier maintenance and cleaning, as full pressure of hydro jets can be used. Repairing metallic tubes is less challenging than repairing graphite tubes. Excellent weldability allows tubes to be easily plugged or replaced, reducing the amount of down time.

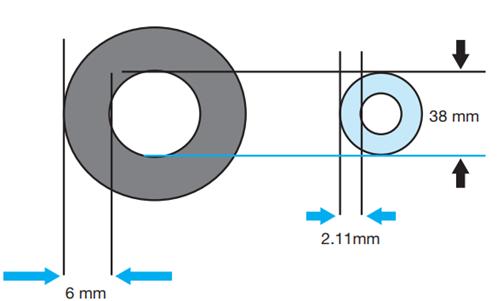

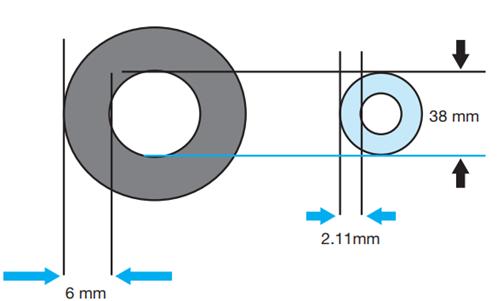

Graphite has around a three times higher thermal conductivity than stainless steel, however, the high yield strength of the metal allows the tubes in metallic heat exchangers to be manufactured with similar heat transfer using thinner walls and smaller outside diameter where more tubes can be accommodated in the same size of tubesheet to maintain the level of efficiency (Table 2 and Figure 2). 1

Overall, the maintenance of the metallic heater is lower and easier than the graphite heaters, resulting in a cost-effective alternative to graphite heat exchangers.

20 | WORLD FERTILIZER | MAY/JUNE 2023

Figures 1 & 2. Schematic of forced-circulation evaporator3 (left) and comparison of the diameter and wall thickness of graphite and metallic tube (right); typical sizes of graphite tubes (50.8 x 6.35 mm) and Sanicro® 28 (38.1 x 2.11 mm).

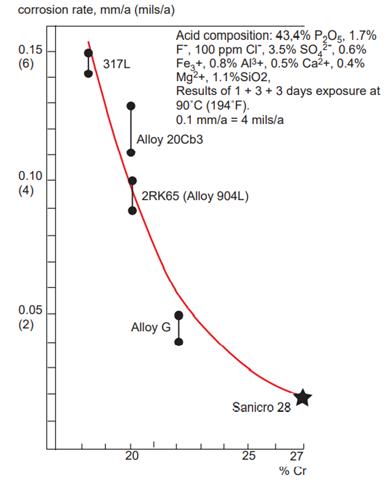

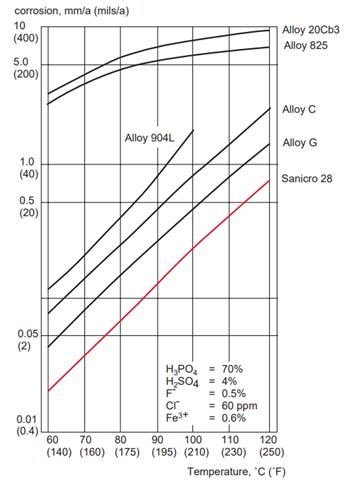

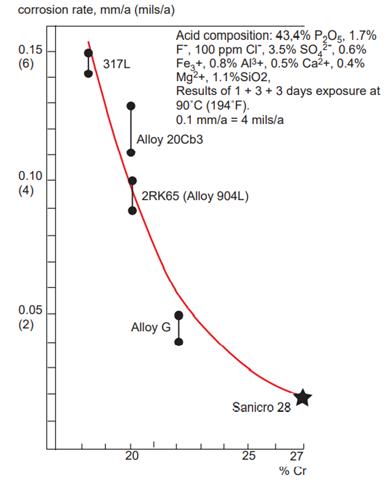

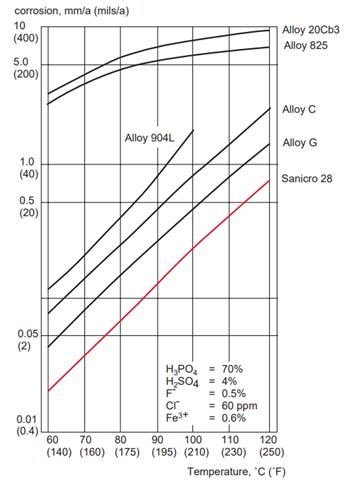

Figures 3 & 4. Corrosion rate of certain alloys with respect to chromium content in the simulated Florida acid1,4 (left), and corrosion rate in contaminated phosphoric acid at different temperatures for Sanicro 28 and some other alloys3 (right).

Table 1. Corrosivity of phosphoric acid obtained from different phosphate geographic regions.3

phosphate Countries

phosphates.

WORLDWIDE SERVICE & SPARE PARTS for your local support

Steel Belts | Belt Systems | Worldwide Service

INDUSTRY

www.berndorfband-group.com/PE-fertilizer SOLUTIONS FOR PRODUCING PREMIUM PASTILLES FOR THE FERTILIZER

SPECIAL FEEDING DEVICES WITH RAISED SHELL for high production output & optimal pastille quality

ENVIRONMENTALLY FRIENDLY due to closed water circuit

HIGH QUALITY STEEL BELTS for optimal heat transfer & belt run

Metallic alloys for phosphoric acid plants

Chromium is important to increase the corrosion resistance of alloys in phosphoric acid services due to its highly oxidising nature. It is important to consider that the corrosivity of the phosphoric acid depends on the source of the phosphate rock. 1,2 Therefore, phosphates

from different groups are often mixed to keep the corrosiveness of the acid at a controlled level.

Figure 3 shows the effect of chromium content on the corrosion performance of some alloys using a synthetically produced 'Florida Acid.' 3,4

Table 3 shows the chemical composition of some advanced high-performance alloys (nickel-chromium-molybdenum alloys) that are used in phosphoric acid plants. Sanicro 28 was developed for phosphoric acid and has proven its performance under severe conditions of the phosphoric acid evaporators (steam temperatures of 120 – 130 ˚C ). 1,4 In addition, this material has high corrosion resistance in strong acids, resistance to pitting and crevice corrosion, and good weldability.

The temperature changes in a different stage of phosphoric acid production affects the corrosion parameters. The influence of the temperature is shown in Figure 4. 1 Laboratory tests were carried out in simulated phosphoric acid solutions with impurities such as chlorides and fluorides. Sanicro 28 showed a high level of corrosion resistance. An increase of 10 °C results in approximately double the corrosion rate. The importance of a high chromium content is also visible. 4,5 This material is a cost-effective solution in contrast to G-type alloys that offer excellent corrosion resistance to phosphoric acid applications but are more expensive with long lead times. 1

Figure 5 shows the combined effect of chlorides and fluorides on the corrosion of the high alloyed superaustenitic stainless steel in a superphoshoric acid. The results showed that Sanicro 28 offers acceptable corrosion resistance up to 0.8% fluorides. 1,3,4,5

Summary

Sanicro 28 is an austenitic stainless steel that shows high corrosion resistance to this demanding process. It offers easier fabrication and maintenance as compared to graphite heat exchangers which results in lower cost and down time. Graphite tubes have problems during mechanical cleaning as this material is brittle and easily damaged during cleaning or maintenance. In addition, Sanicro 28 has a lower cost than most traditional higher alloyed materials used in phosphoric acid production.

References

1. DILLON C.P., MS-7 Material Selection for Phosphoric acid, 1st Edition, 2004: 91 pp.

2. Technical article no. S-TU229-TA-TA. Corrosion resistance and cost-effective alternative to graphite heaters and low corrosion resistance pipes in phosphoric acid production – metallic heaters and pipes in Sanicro 28 (2014).

3. VIERIA B.S., GULLBERG D., PERROT V., Recent Experience with Metallic Heaters for Phosphoric Acid Evaporation. Procedia Engineering 138, 2015: 437-444 pp.

4. AB Sandvik Steel S-52-90, BERGLUD G., TERSMEDEN K. Materials of Construction for Phosphoric Acid Plants Duty. Sandvik AB, Sweden,1999: 1-9 pp.

5. AB Sandvik Steel, S-52-69, Tersmeden, K., Nicolio C., Sweden, 2001:1-8

22 | WORLD FERTILIZER | MAY/JUNE 2023

pp.

100°C. 3

Figure 5. Combined effect of chloride ion content and free fluoride ion content on the corrosion resistance at

Material Thermal conductivity W/m ˚C Thickness of the tube wall (mm) Graphite 45 6.35 Wrapped graphite 28 6.35 Sanicro 28 15 2.11

Table 2. Thermal conductivity of graphite and metallic Sanicro 28.3

Material UNS Cr Ni Mo Cu Others Sanicro 28 N0828 27 31 3.5 1Alloy 904L N08904 20 25 4.5 1.5Alloy 20Cb3 N08020 20 34 2.5 3.3 Nb Alloy 825 N0825 21.5 42 3 2.3 Ti Alloy G-3 N06985 22 45 6.5 2 W, Co, Nb Alloy C N10276 15.5 54 16 - W, Co

Table 3. Chemical composition of stainless steel used in phosphoric plants.3

James Byrd and Elton Curran, JESA Technologies, LLC., USA, discuss the advantages of larger plant capacities and consider how economies of scale could benefit phosphoric acid producers.

conomies of scale can mean many things depending on context. For the purposes of this article, the phrase references the size of greenfield phosphoric acid plants, and refers to a cost advantage in production in terms of capacity. Because the phosphate industry is a mature industry, improvements to the process are measured in fractions. Small improvements can have significant impacts on plant economics as the scale of production is large. The processes are well known and many talented engineers through history have helped make modern plants highly efficient, compared to the early days. Finding new stones to overturn now is a continual challenge.

23

Trends over time

The goal of being the lowest cost producer has evolved. Initially in the phosphate industry, there were many ways to improve plant economics. Trends have included switching to wet rock processing, the integration of co-generation, predictive operation and maintenance models, DCS implementation with automation, advancing equipment technologies, better understanding of process chemistry, synergies with adjacent plants, and taking advantage of site-specific conditions. These trends have brought the industry to a continual state of improvement. Operators that are not looking forward and optimising unit operations are falling behind in terms of the unit cost per ton of P2O5 produced.

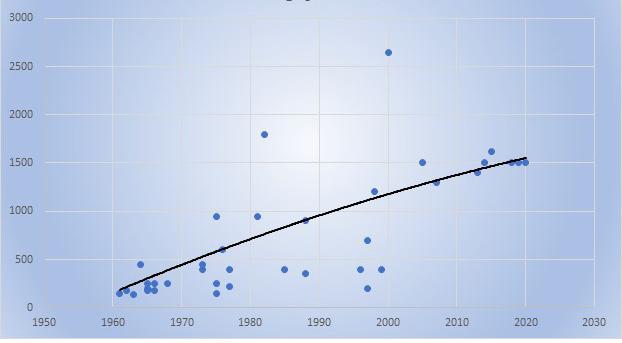

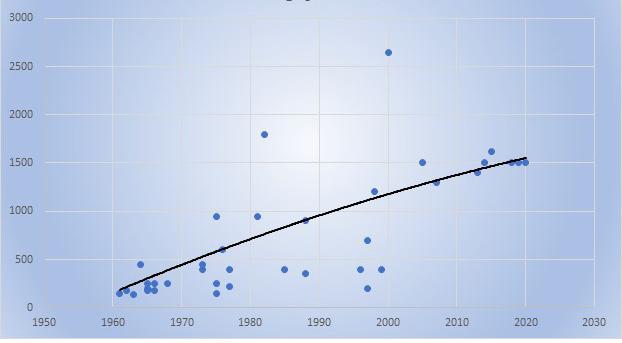

One area in which producers building greenfield phosphoric acid plants can claim an advantage, in terms of cost per ton of product, is in larger plant capacities. The concept is not new and is not limited to greenfield projects. As the price for fertilizer increases, most producers try to increase production rates. Often, a debottleneck exercise can have more favourable economics than a greenfield plant. However, these studies will have production limitations and the increase will be incremental. In a greenfield plant, the targeted production is a matter of design. As can be seen in Figure 1, new plant design capacities have increased over time. The chart is limited to JESA Technologies, and Jacobs’ legacy installations over the past 60 years and does not include plants currently in design nor improvements to increase site capacities.

Project economics of larger over smaller plants are easy to quantify and many precedents have been set in many other industries. JESA Technologies performed a study which determined that a 3000 tpd plant vs two 1500 tpd plants will net CAPEX savings of approximately 20% when converted to a cost per ton basis. OPEX also nets savings but to a lesser degree, since the primary driver for OPEX is raw material costs.

Capacity step changes

A 3000 tpd plant will look remarkably like a 1500 tpd plant. The primary difference revolves around the reactor design. The largest plant in the world has a capacity design of

2650 tpd. That plant, operated by IFFCO, has set a world record of daily production at 3600 t in one day, although it is likely that record could have been surpassed by the time of publication. So, there is evidence that a 3000 tpd design reactor is feasible. Since that installation, over 20 years ago, advancements have been made in flash cooler design; now only two coolers would be necessary at 3000 tpd. The use of two flash coolers on one reactor has been proven throughout the past four or five decades and is not an issue. Depending on the ore source, as few as two filters could be used, which is standard for a world class plant today. The rest of the plant would remain largely unchanged, although with added throughput in rock handling, there are potential technical improvements in both CAPEX and OPEX, over traditional methods. Another hidden advantage herein is an inherently integrated design for the larger plant which allows for higher utilisation factors for all unit operations in the plant. This, in turn, increases annualised production compared to smaller plants totalling the same daily capacity.

The reason that such large CAPEX savings can be realised is the simple fact that the reactor is the most expensive piece of equipment in the plant. What is less apparent is that there are also process benefits for larger reactors. The wetted surface to throughput ratio is lower when comparing a larger reactor to a smaller one. This means there are fewer nucleation sites for scale formation which means scale rates should be lower. This enhances crystal habit since the path of solubility favours the crystal surface area to attack vs wetted surfaces of equipment. Further, sulfate control is better with the larger volume mitigating the inherent variability of chemical constituents in the feed. The specific reactor volume (SRV) can also be reduced, further improving the CAPEX advantage. Additionally, with lower scale rates, a higher degree of forgiveness and multiple filters, a higher asset utilisation factor with the reactor can be achieved. This results in higher relative annualised production per cubic metre of reaction volume.

Not only is the most expensive piece of equipment utilised to a higher relative degree, the fact that it should have longer on-stream time also inhibits scale rates. Any time a reactor is shut down and the slurry is allowed to cool to any degree, a layer of scale occurs on the wetted surfaces. All producers in all technologies are encouraged to keep their reactors running no matter the circumstance, as additional layers of scale reduce both the SRV and times between required cleanings. Reduced SRV decreases sulfate control (efficiencies), and increased frequencies of cleaning reduce annualised production. A producer that can clean every three years with a higher relative SRV has a distinct advantage over other producers that must clean annually with high scale rates. The value of higher asset utilisation of the reactor cannot be underestimated nor simply quantified by an

24 | WORLD FERTILIZER | MAY/JUNE 2023

Figure 1. JESA Technologies installed reactor size: Tpd P2O5 vs time.

Unlocking your green fertilizer goals with CORE-SO2TM sulphuric acid technology

Better-integrated, more efficient and cleaner production of CO2-free phosphate fertilizers

SO2

Reduced stack emissions

It’s the same, but better.

• No fossil fuels required

• 98% lower emissions

• 60% less plot space

Decreased CAPEX

• 55% fewer construction materials

• 50% decrease in CAPEX

Lowest construction cost

Produce CO2free power

By leveraging oxygen from water electrolysis and ammonia production, CORE-SO2TM decreases acid plants’ environmental footprint and greenhouse gas emissions, recovers clean energy and enhances plants’ profitability. LEARN

Green ammonia/ hydrogen O2 use

chemetics.info@worley.com

chemetics.equipment@worley.com worley.com/chemetics

Get in touch with

MORE

our experts!

increase in annualised production; yields and OPEX are also improved.

Questions looking forward

Logically, the question to ask is: “Why haven’t more new plants taken advantage of economies of scale?” The answer is complex; from a design perspective, the technology exists, the precedence exists, the benefits are real and there should be no reason that more large scale plants have not been built. Whether the owner’s position is one of familiarity, market constraints, phased investments or simply replicating what other producers are doing, these decisions reside with financial leaders. But from a process perspective, this area is ripe for the next producer to take advantage. The definition of world class phosphoric acid plants will change over time.

The next logical question is: “What is the limit on reactor capacity?” To answer the question properly, some engineering will need to be done. Certainly, there should be some hydraulic limitations at some production rate, although JESA Technologies has not seen that limitation in the current expansion scheme. The next step change is likely somewhere in the 4500 – 5000 tpd range. A third flash cooler and additional filters can be added. The hydraulic question must be addressed, but at a preliminary glance, this step change appears feasible.

An industry trend over time has been the consolidation of producers. Will the trend in plants follow suit, where a producer has only one site versus multiple sites? There are advantages to this too. Environmental constraints have not

been addressed in this paper, but as time moves forward, this point is getting more attention. As well as this, managing one site vs many could have monetary advantages.

Of course, producers’ circumstances are as varied as the ores they process, so blanket statements will always have exceptions. Certainly, custom plants will result in better project economics than simply keeping to the status quo, but this point also applies to environmental issues.

What is the next step change past 5000 tpd? The answer to that will have to do with the timing of the next two step changes. It has been a long time since the 3000 tpd reference plant was designed and built, and the next step change to 3000 tpd has yet to become mainstream. The next step change to 5000 tpd could take another couple of decades. By then, there could be disruptive technologies addressing the cooling and filtration equipment that could change everything. That said, with the precedence set and the technologies available, the first step change to 3000 tpd could be coming very soon, or one producer may want to take on the challenge of designing and operating the largest plant in the world by moving the bar to 5000 tpd.

Conclusion

It is certain that plant capacities will continue to increase over time. Where and when this will take place is uncertain, but economics dictate that it will occur. In a mature industry, where small advantages result in large benefits, future owners of new plants will need to evaluate all potential opportunities to maximise investments. Certainly, application of economies of scale will be one such variable.

The Doyle and EMT Alliance

Can provide you with all the Blending, Bagging and Transport equipment you need.

High Speed Bagging Line

* For big bags - jumbo bags.

* Capacity 50 to 70 ton m³ per hour.

* 120 kg to 1250 kg bags.

* Suitable for granular and powder materials.

* Available with dust reducing system.

Weighcont Blender

* Capacity of 20 to 200 ton per hour.

* Unlimited number of hoppers.

* Computer controlled.

* Custom built.

Fertilizer Inhibitor Treating Unit

* Portable.

* Stainless steel.

* Computer controlled.

* High Capacity120 m³ per hour.

EMT

Molenpad 10, 1756 EE ‘t Zand The Nederlands.

Tel.+31 (0) 224 591213

email: emt@emt.tech

www.emt.tech

Shamrock Blender

* Capacity of 25 to 70 ton/m³ per hour.

* Machine size 4,5-5,4-7-9-11,5-14 ton.

* Easy and gentle blending process.

* Blending and weighing are separated.

Equipment Manufacturing

Jack Doyle Industrial Drive, Palmyra, MO. 63461 USA. Tel. +1(217) 222-1592 & +1(573) 300-4009

www.doylemfg.com

Doyle

1

doyle@doylemfg.com,

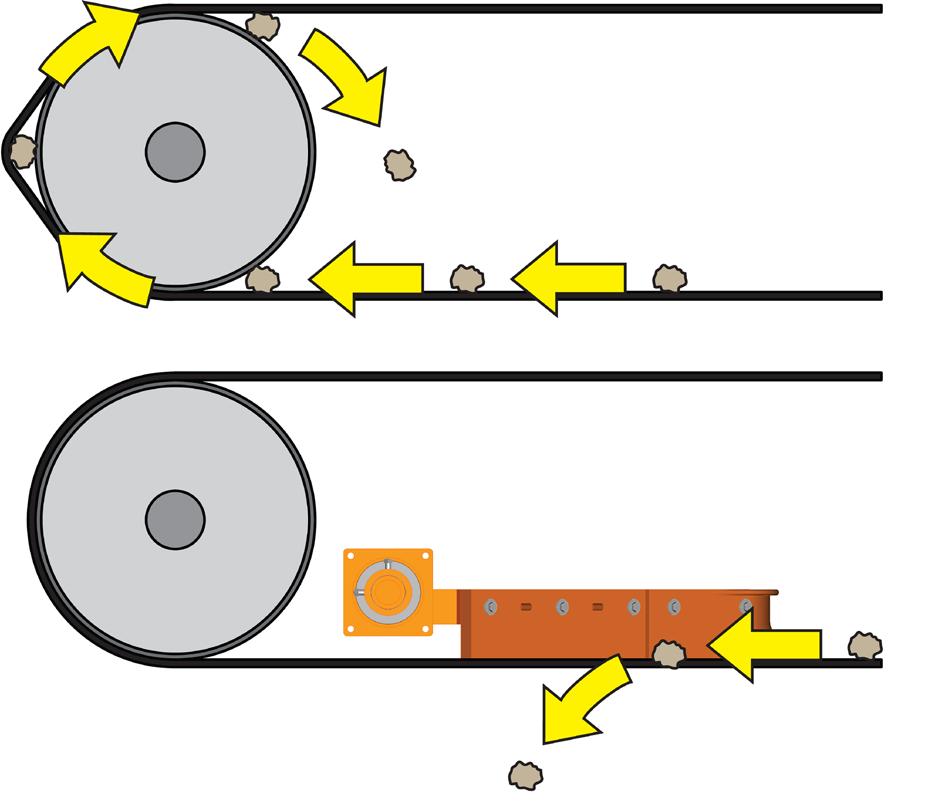

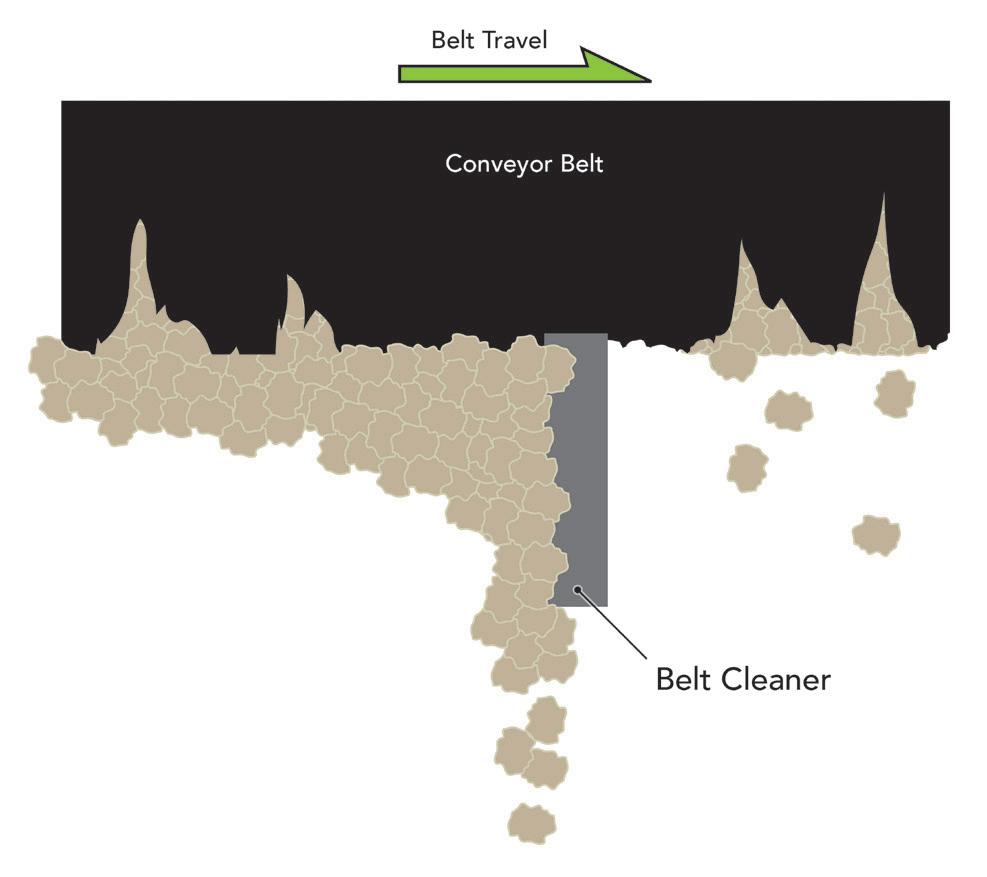

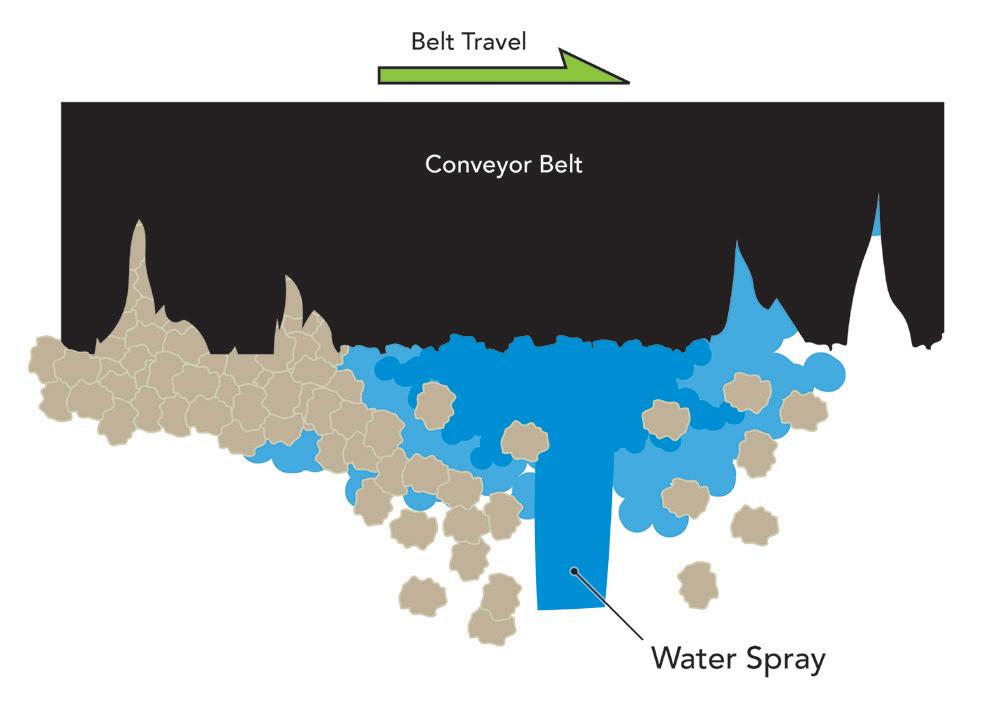

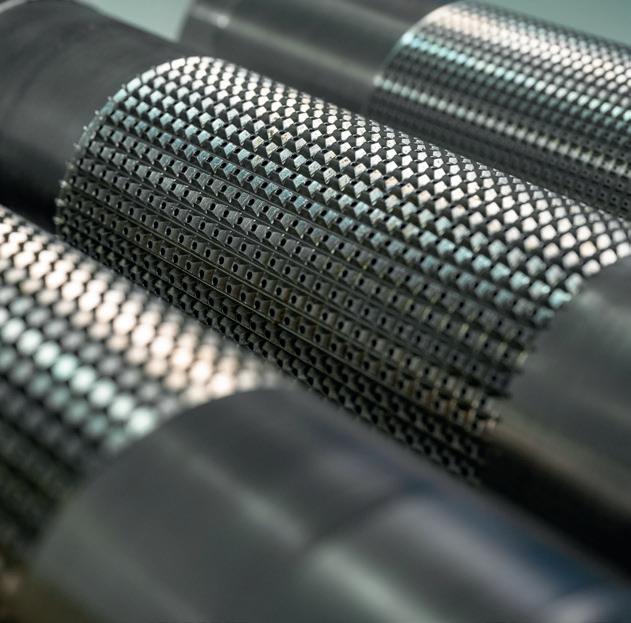

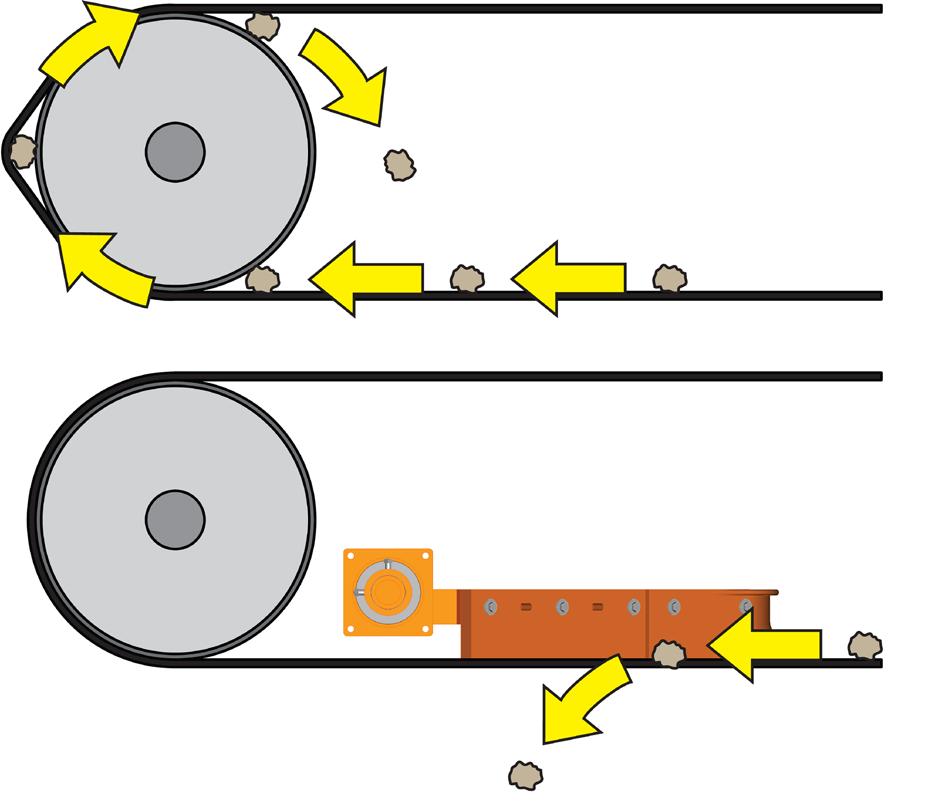

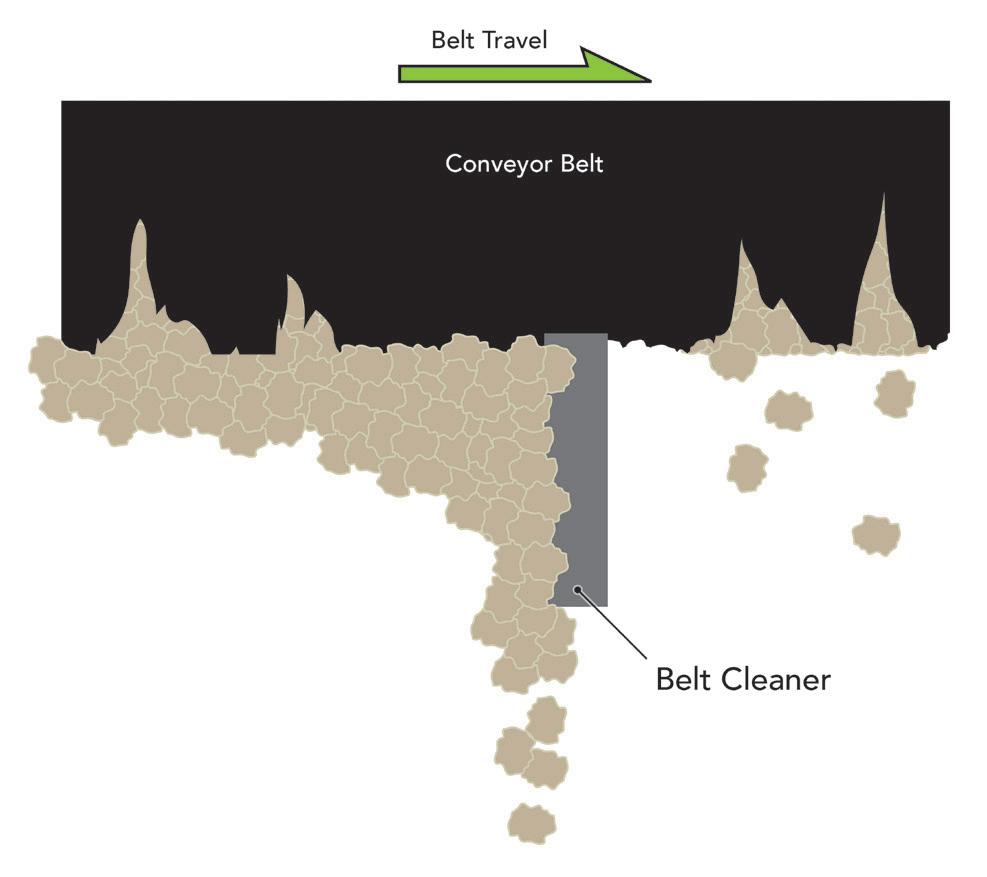

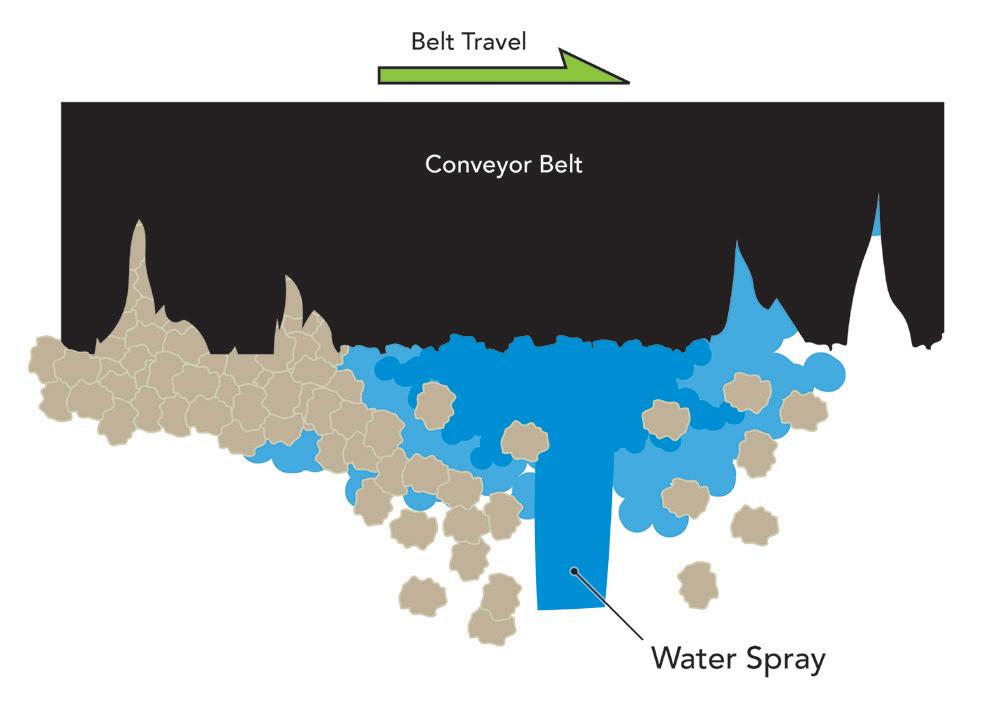

Robert Fitzpatrick, Ag Growth International (AGI), outlines the different methods for conveying and handling fertilizer materials, and describes best practices for safety and efficiency.

Fertilizer is a critical component of agricultural production. It helps to increase crop yields and improve soil fertility. However, the effectiveness of fertilizer depends on its proper use, which includes the efficient and safe conveying and handling of fertilizer materials. This article will discuss the different methods of conveying and handling fertilizer materials, the importance of proper conveying and handling procedures, and best practices to ensure safety and efficiency.

Fertilizer material conveying and handling is a crucial part of the production process in agricultural and industrial applications. It is essential to ensure that the fertilizers are moved quickly and safely from one location to another, while also avoiding damage or contamination. As such, it is important to understand the various types of fertilizer material conveying and handling systems available, as well as the design considerations that need to be made when selecting an appropriate system for the job.

There are several types of fertilizer material conveying systems available, each with their own advantages and disadvantages. These systems can be broadly divided into two categories: pneumatic and mechanical.

Pneumatic systems use a combination of compressed air and vacuum to move the fertilizer material between locations. They are often used in applications where the fertilizer material needs to be moved quickly and efficiently, for example, in large-scale production facilities. These systems are less common in the fertilizer industry.

Mechanical systems, due to their simplicity and low cost, are much more common. Mechanical systems use a variety of methods to move the fertilizer material, including belts, rollers, chain paddles and screws or augers.

The type of equipment used for conveying and handling fertilizer materials depends on the size and type of the operation as well as the distance that materials need to be moved. For example, augers and belt conveyors may be used to move large quantities of fertilizer materials over long distances.

27

Proper fertilizer conveying and handling design: Safety, shrinkage, cost impacts, and maintenance

The importance of proper conveying and handling of fertilizer materials cannot be overstated. Without this, material loss and contamination can be experienced, resulting in decreased crop

yields and soil fertility as well as large cost impacts to the operation.

It is extremely important to consider the operating environment and duty cycle of the process and equipment needed for an application. The number of hours used per day and per year determines the equipment design duty and can optimise efficiencies. An operation utilising equipment less than 2000 hours per year could get by with standard or even light duty cycle designs. These would be typical farm and farm retail equipment designs. Above 2000 hours per year, it would be best to invest in equipment designs for medium and heavy-duty cycle. These decisions affect maintenance and overall operating costs and can impact equipment longevity. Proper choice of duty cycle in equipment and system design, based on system utilisation, significantly affects return on investment.

AGI’s fertilizer conveyor and handling solutions are designed to provide high quality products and meet the needs of farmers, ranchers, and other agricultural businesses. They are also designed to be durable, so they can withstand the harsh conditions of the agricultural industry.

Expert material handling begins with using the right equipment for the application. In addition to using the right equipment, a variety of techniques can be used to reduce material spillage. Experts use their extensive knowledge of material handling and storage to develop innovative ways to reduce material loss. This includes utilising flow control designs to ensure that the material is moved in a steady flow.

Different types of conveyers

Fertilizer conveyors are an essential piece of equipment for any agricultural business. They are used to transfer fertilizer from one location to another, and can be used in a wide variety of applications. There are several different types of fertilizer conveyors available, each with its own unique features and benefits.

The most basic type of fertilizer conveyor is a belt conveyor. These are the most common type of conveyors used in the agricultural industry. They are composed of a continuous belt, typically made of rubber or other durable and flexible material. The belt is driven by an electric motor, and the speed and direction of the belt can be adjusted to suit the job. Belt conveyors are most often used to move granular materials, like fertilizer, from one location to another. Several different types of belt conveyors, such as slider, tri-roller and industrial troughing roller belt conveyors, can be used.

The slider belt conveyor includes a ridged frame and pulleys to drive a belt. Supports along the length of the belt are rigid, low friction frame members; there are typically no support rollers on these designs. Slider belt conveyors can be used for material loadout and transfer, can be stationary or portable, and are typically the lowest cost, lowest maintenance design. Material tripper units can be included in a slider belt design.

Tri-roller conveyors are used to convey heavier loads at higher outputs. The tri-roller design allows the belt to fall into the roller profile, providing a trough for material to sit in. This design reduces material fall-off and allows for higher belt speeds and material flow rates. These conveyors can also be ordered with material trippers.

Troughing roller belt conveyors are similar to the tri-roller belt conveyor but with heavier duty rollers and structure. The troughing roller conveyor includes a heavier frame as well as

28 | WORLD FERTILIZER | MAY/JUNE 2023

Figure 1. Iowa, USA: Hopper to conveyor transition.

Figure 2. Chain paddle conveyor.

roller design and can be included with a tripper for material placement. These conveyors are used in heavier industrial applications with high material flow rates and long material runs.

Tripper units are carts that travel along the length of a conveyor and move material off the belt at a specific location while the belt is running.