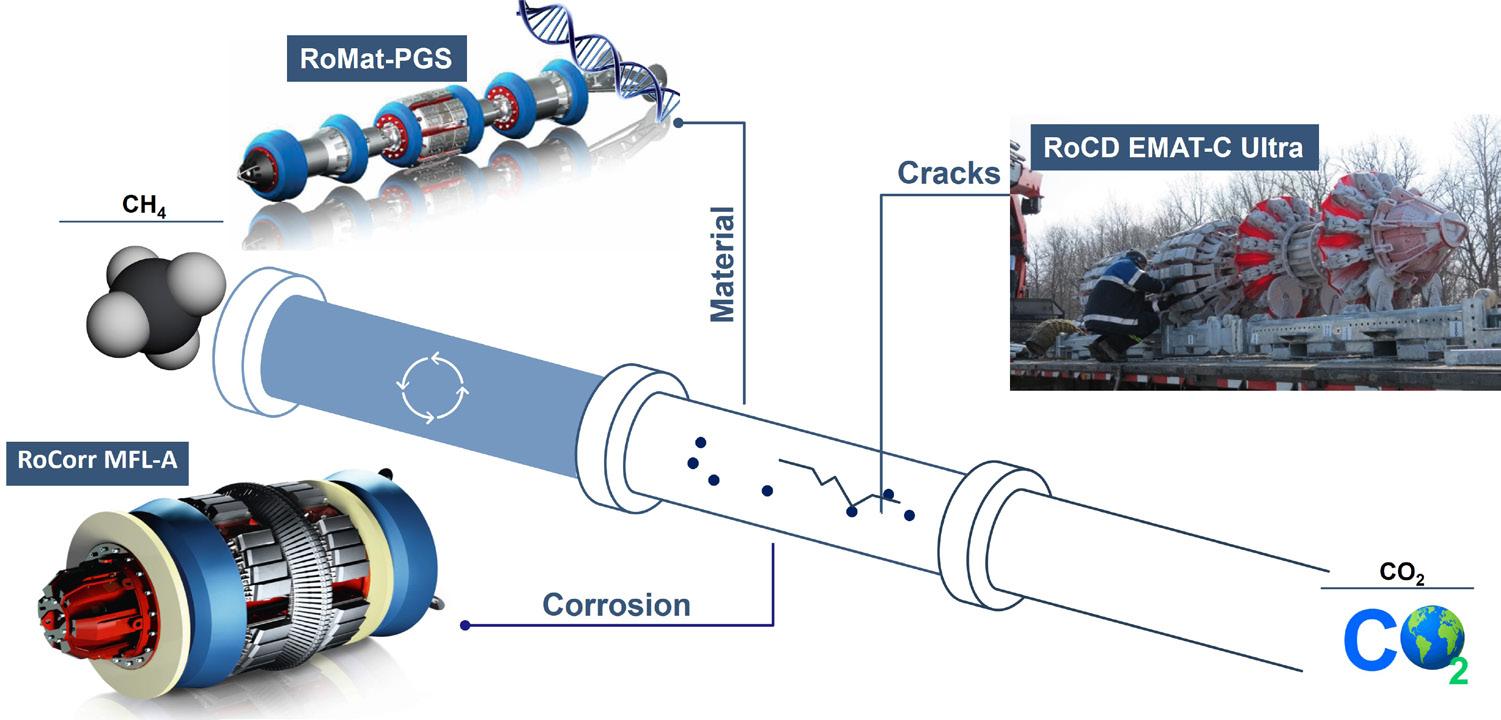

Elevate your asset integrity with unmatched data accuracy and unparalleled expertise

Our unique synergy of advanced inspection systems, cutting-edge analytics and human expertise allows us to transform data into knowledge. Knowledge enables smarter decision-making and delivers a comprehensive understanding of asset safety, lifetime, and performance.

03. Editor's comment

05. Pipeline news

News from Equinor, PHMSA, TotalEnergies, EPIC, Vallourec, and more.

10. Building pipelines: the key to achieving CCS success in Asia

Kevin Pang, Gourab Mondal, and Pushan Pal, FutureScaleX.

HYDROGEN PIPELINES

17. An energy balancing act

Boryana Nedyalkova, Researcher, EMIS.

ILI CASE STUDIES

24. Precision under pressure

Jijo George, STATS Group.

29. Cracking the code

Brian Kerrigan, Frontline Integrity, UK.

35. Pipeline repair that delivers under pressure Robert J. Smyth, P. Eng., and Harold Lee, C.E.T., Technical Support Manager, T.D. Williamson.

INTEGRITY STRATEGY

43. Repurposing pipelines for a carbon-conscious future Kerry Cole of the Association for Materials Protection and Performance (AMPP).

MIDSTREAM ANALYSIS

47. Bridging boarders Dynamic Risk.

OFFSHORE AND SUBSEA

53. From lagging to leading Nassima Brown, Strategy Director at Fennex.

DIGITALISATION AND AUTOMATION

57. Three priorities for achieving midstream excellence Andrew Weatherhead, Chief Technology Officer, Sensia.

SYSTEMS AND SOFTWARE

61. From desktop to cloud Natalia Plewniok, Meirik, Poland.

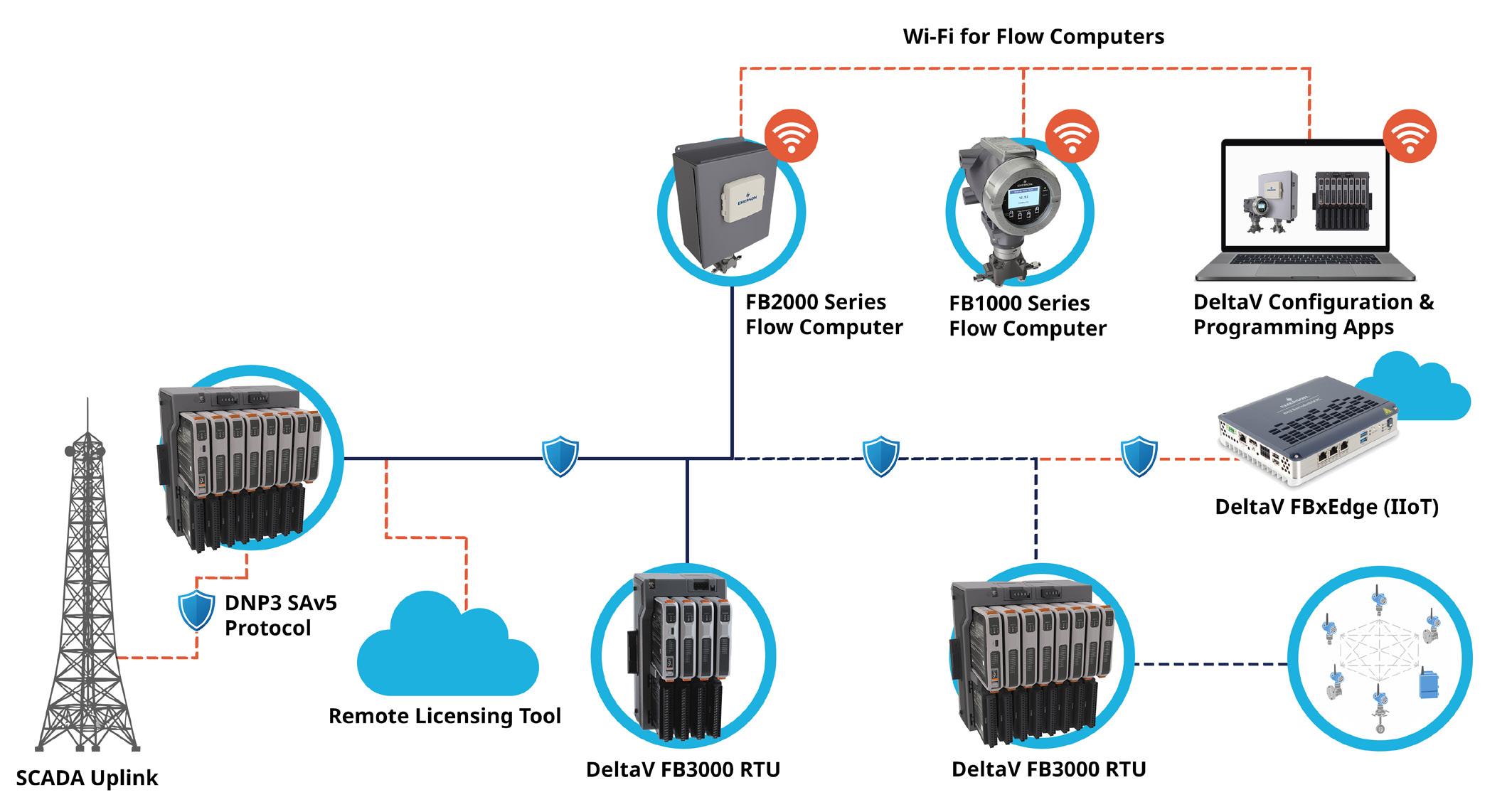

65. Beyond obscurity: building cybersecurity resilience Emerson.

FUTURE OF PIPELINES

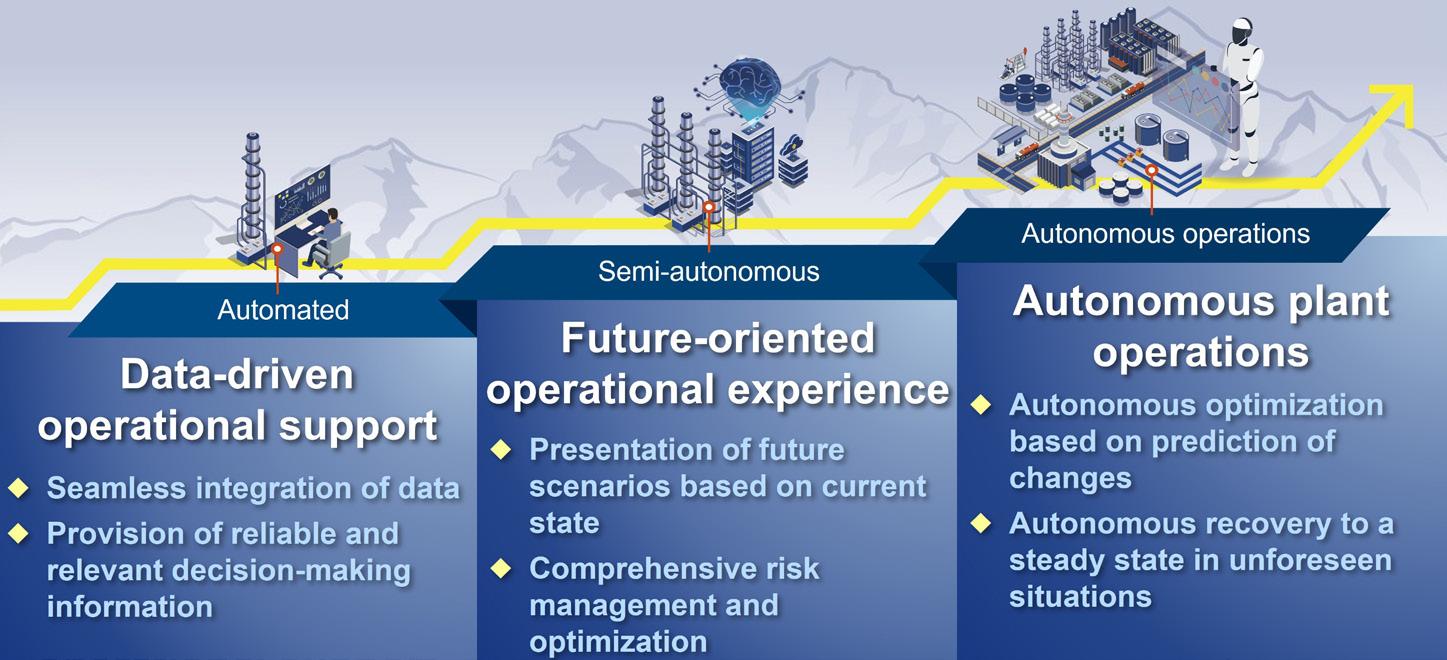

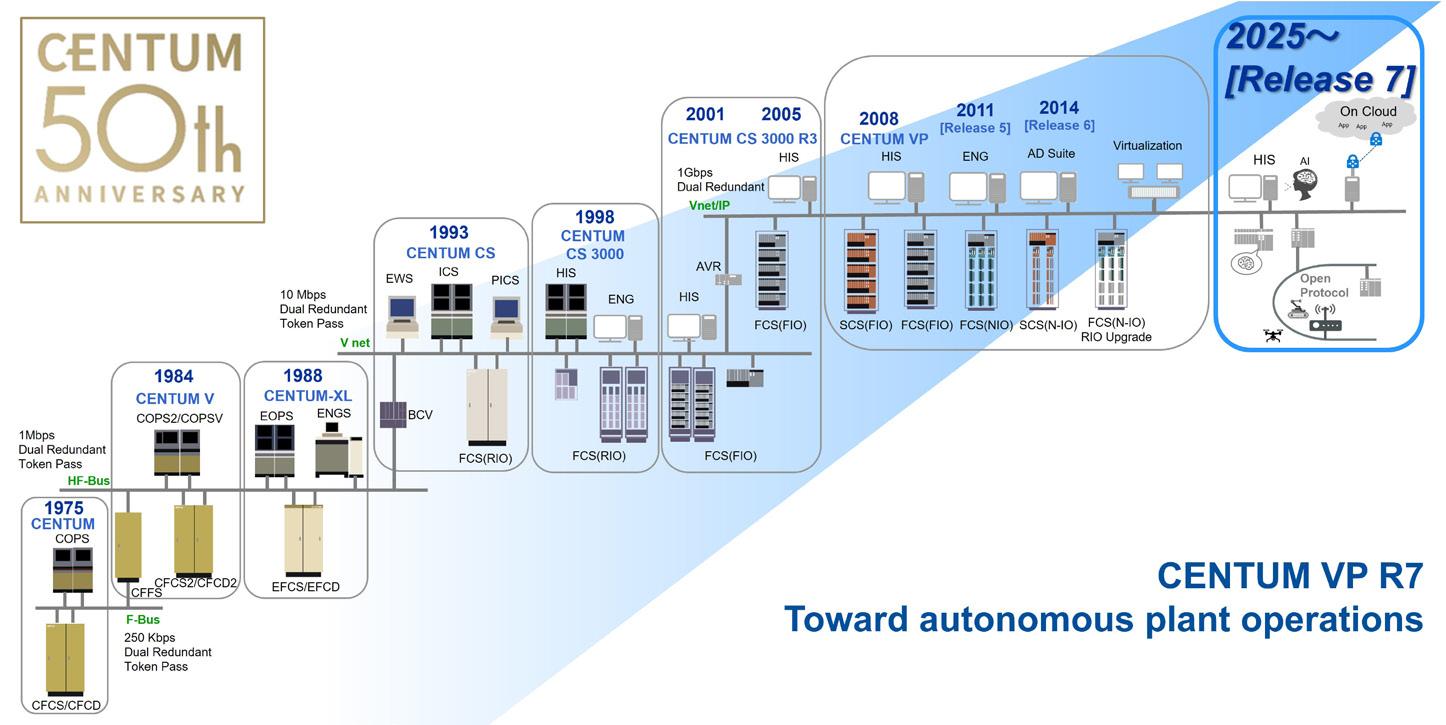

67. Realising sustainable autonomous operations Toshiyasu Shiono and Takuya Yokosuka, Yokogawa Electric Corp.

MANAGING EDITOR

James Little james.little@worldpipelines.com

ASSISTANT EDITOR

Emilie Grant emilie.grant@worldpipelines.com

SALES DIRECTOR

Rod Hardy rod.hardy@worldpipelines.com

SALES MANAGER

Chris Lethbridge chris.lethbridge@worldpipelines.com

SALES EXECUTIVE

Daniel Farr daniel.farr@worldpipelines.com

PRODUCTION DESIGNER

Siroun Dokmejian siroun.dokmejian@worldpipelines.com

HEAD OF EVENTS

Louise Cameron louise.cameron@worldpipelines.com

EVENTS COORDINATOR

Chloe Lelliott chloe.lelliott@worldpipelines.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL CONTENT COORDINATOR

Kristian Ilasko kristian.ilasko@worldpipelines.com

JUNIOR VIDEO ASSISTANT

Amélie Meury-Cashman amelie.meury-cashman@worldpipelines.com

SENIOR WEB DEVELOPER

Ahmed Syed Jafri ahmed.jafri@worldpipelines.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@worldpipelines.com

ADMINISTRATION MANAGER

Laura White laura.white@worldpipelines.com

Palladian Publications Ltd, 15 South Street, Farnham, Surrey, GU9 7QU, UK

Tel: +44 (0) 1252 718 999 Website: www.worldpipelines.com Email: enquiries@worldpipelines.com

Annual subscription £60 UK including postage/£75 overseas (postage airmail). Special two year discounted rate: £96 UK including postage/£120 overseas (postage airmail). Claims for non receipt of issues must be made within three months of publication of the issue or they will not be honoured without charge.

Applicable only to USA & Canada: World Pipelines (ISSN No: 1472-7390, USPS No: 020-988) is published monthly by Palladian Publications Ltd, GBR and distributed in the USA by Asendia USA, 701C Ashland Avenue, Folcroft, PA 19032. Periodicals postage paid at Philadelphia, PA & additional mailing offices. POSTMASTER: send address changes to World Pipelines, 701C Ashland Avenue, Folcroft, PA 19032.

SENIOR EDITOR Elizabeth Corner elizabeth.corner@worldpipelines.com

Anew report from GlobalData highlights how oil and gas contractors are increasingly becoming the force pushing the sector towards decarbonisation. “Contractors”, says the report, “have become central to the industry’s decarbonisation push, with their engineering decisions and technology portfolios now determining the speed and feasibility of low-carbon developments.”1 The report outlines how Technip Energies, Wood, McDermott, Saipem, SLB, and others, are developing and offering technologies for emissions reduction, and acting as intermediaries, translating corporate decarbonisation strategies into practical outcomes. GlobalData notes a trend in which contractors are expanding their portfolio offerings to include CCUS, energy recovery, flaring reduction, and methane monitoring.

This is happening against a backdrop of the fastest clean-energy take-up in history. Rystad Energy’s ‘Global Energy Scenarios (GES) 2025’ provides modelling that suggests we are now firmly in a “hybrid energy era”, where clean electricity is a structural force reshaping investment decisions.2 The report states that renewables are expanding faster than any previous energy technology, with total global wind and solar capacity additions for 2024 - 2025 set to exceed 700 GW. Rystad’s analysts therefore believe that a 1.9˚C global warming trajectory by 2040 is becoming the more probable outcome, driven by the cumulative acceleration of renewables, electrification, and systems gradually bending toward lower-carbon configurations.

If this is the next energy era, then oil and gas contractors are certainly helping to build it, and their expanded portfolios are proof of the work already underway. The Rystad report outlines three tasks that the transformation of the global energy system requires: clean up and grow the power sector; electrify almost everything; and address residual emissions. Contractors pursuing CO2 pipeline transport and storage, repurposing pipeline assets, hydrogen blending, methane monitoring, and integrity upgrades, are an important part of the picture here.

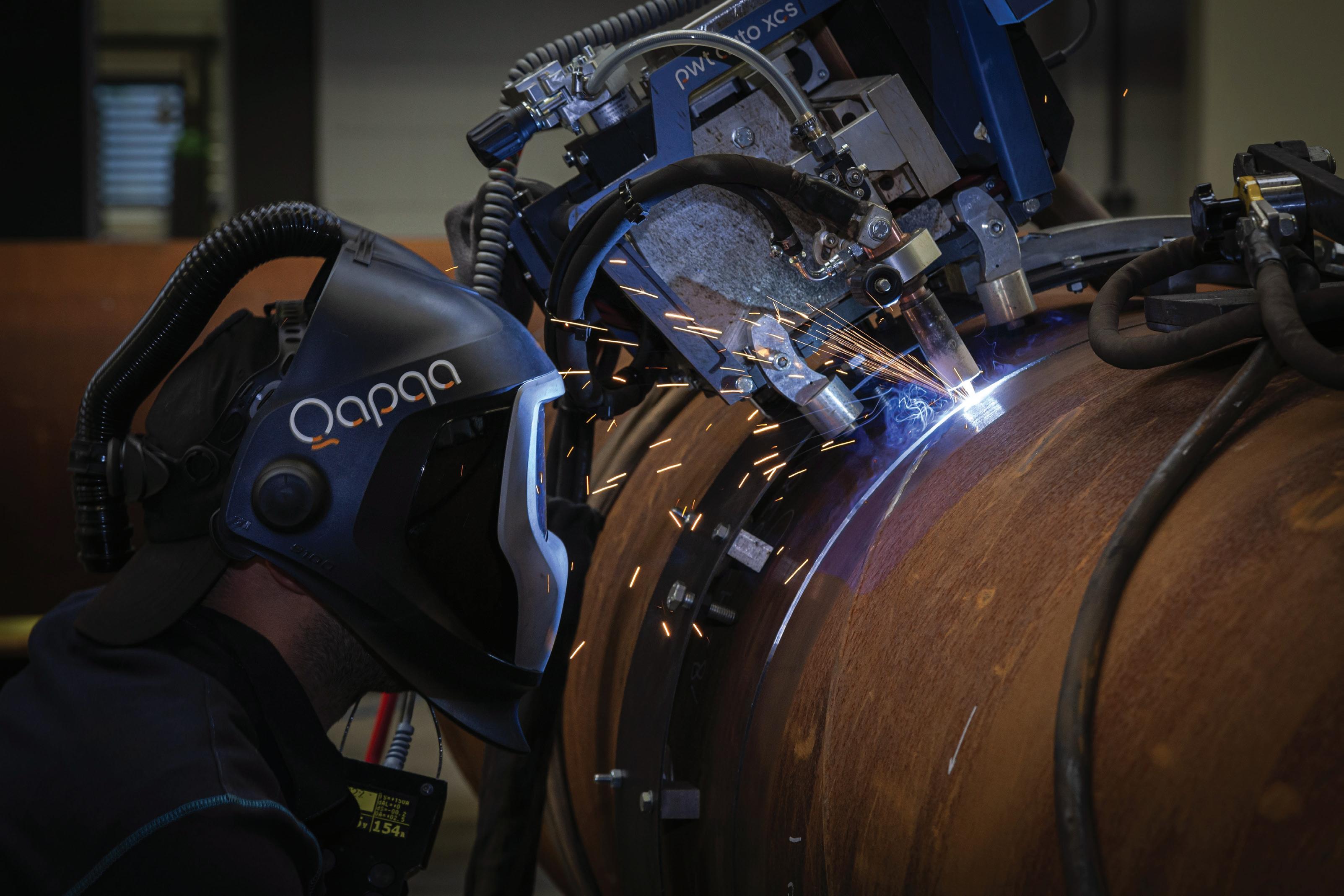

Beyond technology and project delivery, contractors are also overhauling workforce systems in an effort to better enable their businesses for the future. CRC Evans is investing in skills that it hopes will service global future energy and infrastructure markets. Its recent decision to welcome 13 new apprentices across the UK and Brazil is a good example of how the sector is futureproofing its talent base. The company is training a new generation of welders and technicians to work across a far broader portfolio: from conventional oil and gas to renewables, nuclear and emerging CO2 transport infrastructure. Four-year apprenticeship frameworks, specialist academies, and hands-on learning at CRCE highlight something important: as the energy system hybridises, the contractors delivering the physical work are making sure their people have the skills and versatility to operate at the cutting edge.

Similarly, the Connected Competence programme – an industry-led initiative supported by the Engineering Construction Industry Training Board (ECITB) – provides a common, standardised way to check and maintain technical competence across the workforce.3 By using the same baseline tests and assessments across companies such as Worley, nexos, Wood, and Aker, contractors can move people between sites, and between sectors, far more easily. The programme makes workforce transitions smoother as the industry shifts between conventional and low-carbon projects.

These contractor developments echo the conversations we are hearing across the sector, especially as operators, consultancies, and EPCs prepare for a faster build-out of CO2 transport and storage infrastructure in 2026. They also align with the broader themes underpinning next year’s World Pipelines CCS Forum in London, where the interplay between operators, technology providers and contractors will be front and centre.4

1. https://www.globaldata.com/store/report/oil-and-gas-contractors-in-energy-transition-theme-analysis

2. https://www.rystadenergy.com/flagship-report-energy-scenarios-2025

3. https://connectedcompetence.co.uk/

4. https://www.worldpipelines.com/ccsforum2026

Across energy and critical infrastructure, we bring expertise where complexity is highest, partnering with globally local teams and leveraging unrivalled proprietary technologies. Like the M-500 Single Torch External Welding System, seamlessly integrated with Data 360 our cloud-based digital platform that analyses, and visualises your project performance data in real time. We move projects forward, no matter the challenge.

We’re here to partner on how our specialist welding and coating solutions can help you power tomorrow.

ExxonMobil announces investment to increase the capacity of the Enterprise Products Bahia natural gas liquids pipeline

ExxonMobil is investing in the expansion of the Enterprise Products Bahia natural gas liquids (NGL) pipeline, increasing its throughput by 400 000 bpd to bring total capacity to 1 million bpd.

The investment also includes an extension to connect NGL production from ExxonMobil’s Cowboy Central Delivery Point in Eddy County, New Mexico.

Operating under the name ‘Cowboy Connector Pipeline’, the project connects ExxonMobil’s growing production in the Permian Basin to US Gulf Coast refining and chemical facilities and enables access to export logistics to serve markets around

the world. The strategic investment is expected to deliver longterm value for shareholders, strengthening ExxonMobil’s value chain and improving logistics flexibility associated with our growing Permian production in the Delaware and Midland basins. Furthermore, it helps ensure reliable access to the raw NGL mix that will be distilled into component products needed predominantly to support chemical manufacturing and produce essential materials like plastics that benefit everyday life.

The transaction is subject to regulatory approvals and is targeted to close by early 2026, with our expanded capacity scheduled to come online by late 2027.

UK oil sits at the heart of Europe’s integrated energy system as second-largest producer, Wood Mackenzie analysis reveals

The UK operates as a critical component of Europe’s integrated oil system. It exports 86% of its crude production to European refineries while importing 288 000 bpd of refined products back from northwest Europe. This reveals a symbiotic relationship between UK crude production and European refining capacity, according to new independent analysis from Wood Mackenzie.

The study, commissioned by Ithaca Energy and endorsed by Offshore Energies UK (OEUK), positions the UK as Europe’s second-largest oil producer after Norway. The UK exports 370 000 bpd to northwest Europe alone. This represents nearly three-quarters of total UK crude exports.

“The UK’s importance in the European energy system is too often overlooked,” said Malcolm Forbes-Cable, Vice President of Energy Consulting at Wood Mackenzie. “Europe depends on imports for 80% of its crude oil supply. The UK is the second biggest producer of oil in Europe with almost 90% of production consumed domestically or in Europe.”

He added: “The UK and Europe operate as an integrated energy system, not as independent markets. As UK refining capacity declines, it increasingly depends on European refined oil product imports. The UK sits at the heart of the continent’s energy security.”

Europe’s energy reality drives integration

The research demonstrates that 89% of UK crude oil production is refined somewhere in Europe. Crucially, 65% of volumes produced in the UK ultimately serve the UK market. This occurs either directly through domestic refineries or indirectly via the northwest European refining and trading network.

Europe faces significant energy security challenges with 80% of its crude oil supply coming from imports. The region consumes 12.6 million bpd against domestic production of just 2.5 million bpd. This creates an 80% supply deficit that persists even under net zero scenarios through to 2050.

The North Sea accounts for 90% of indigenous oil supply across the EU, Norway and UK. Norway commands 67% of regional production while the UK contributes 20%. This

concentration underscores the strategic importance of North Sea resources to European energy security.

Refined products flow demonstrates market interdependence

The analysis reveals sophisticated UK-European oil trade relationships. While the UK exports significant crude volumes, it maintains a refined product deficit of approximately 275 000 bpd. This stems from declining domestic refinery capacity.

Northwest Europe operates as a global trading and refining hub with significant capacity reliant on oil imports. UK crude export destinations show 86% flowing to European refineries and returns 288 000 bpd of refined oil products to British shores. This two-way flow demonstrates the integrated nature of the regional energy system.

Wood Mackenzie’s analysis highlights how the UK’s position creates strategic interdependencies extending beyond simple trade relationships. The integrated system ensures efficient utilisation of regional refining capacity. It provides the UK with access to refined products that domestic facilities cannot supply.

“The UK is not merely a participant but a critical node in Europe’s energy infrastructure,” adds Yaniv Friedman,” Executive Chairman, Ithaca Energy. “The Wood Mackenzie report underlines the vital importance of the North Sea, not only to the UK but to wider Europe, for regional energy security. As Europe’s second largest crude supplier, not only does UK production support a major energy market, 65% of it ultimately returns to serve us here in the UK. We have a more secure and robust UK and European economy with a healthy and thriving oil industry in the UK.”

The study utilised Wood Mackenzie’s proprietary market analysis and data from multiple tools. These included the Upstream Service, Energy Transition Service, Global Oil Supply Tool, and Refinery Evaluation Model. They provide comprehensive insights into UK oil flows and European market dynamics.

Equinor and the Capital City of Prague’s gas and electricity company Pražská plynárenská have signed a long-term agreement for 10 years of gas supplies into the Czech Republic. Deliveries have started and will last until 2035.

PHMSA implements new datadriven framework for hazmat transportation inspection and enforcement standards. These new priorities support the Department’s core mission of upholding the highest of safety standards.

TotalEnergies commits US$100 million to Climate Investment in support of the OGDC community. The announcement was made at the United Nations Climate Change Conference (COP30) in Belém, Brazil.

Enbridge approves US$1.4 billion expansion across its Mainline and Flanagan South systems. Enbridge is adding Canadian egress to key US refining markets.

Representatives of the German and European CCUS community, convened in Berlin for the CCSA Country Spotlight Series, to explore the challenges and opportunities of CCUS technologies in driving industrial decarbonisation in Germany and Europe.

Kongsberg Discovery welcomes the Joint Declaration of Baltic Sea Security for protecting critical infrastructure.

GlobalData: contractors emerge as strategic catalysts advancing lowcarbon transition in oil and gas Contractors, that traditionally focused on oil and gas project installations and allied works, have become central to the industry’s decarbonisation push, with their engineering decisions and technology portfolios now determining the speed and feasibility of lowcarbon developments. By advancing carbon capture, utilisation, and storage (CCUS), lowcarbon hydrogen, bioenergy, and efficiencyfocused design, they are reshaping project economics and guiding operators’ transition pathways across the energy value chain, says GlobalData.

GlobalData’s Strategic Intelligence report, “Energy Transition Strategies in Oil and Gas Contractors,” notes that several oil and gas contractors, such as Technip Energies, Wood, McDermott, Saipem, and SLB are developing and offering technologies for emission reduction. They act as intermediaries, which translate corporate decarbonisation strategies into practical operational and technological outcomes.

The role of contractors spans from advisory to technical execution and regulatory compliance, acting across upstream, midstream, and downstream operations. They also foster innovation, set up resilient supply chains, and drive efficiency to streamline project costs while ensuring optimum quality levels from the

end product.

Ravindra Puranik, Oil and Gas Analyst at GlobalData, comments: “Contractors are expanding their portfolio offerings to include core technologies, such as CCUS, energy recovery, flaring reduction, and methane monitoring to detect leaks, measure emissions, mitigate and utilise them for productive purposes. Several of these have also ventured into the power generation and utilities sector to diversify their offerings in line with their traditional oil and gas clientele. Nevertheless, this market is still dominated by power contractors, including Vestas and Siemens.”

According to GlobalData, many contractors are specialising in specialised engineering and construction across diverse low-carbon initiatives to support oil and gas operators in mitigating emissions. Their engineering choices and cost curves materially affect the project viability and speed to market.

Of late, low-carbon energy developments have faced some setbacks due to technical, regulatory and financing challenges. Inflation has compounded cost volatility, forcing companies to reconsider projects even when binding offtake agreements exist. Developers essentially relying on government subsidies and grants have had to rethink their project plans, causing delays and even cancellations.

Greece advances US$4.2 billion carbon capture and pipeline project

Greece is moving forward with a series of large-scale carbon capture and storage (CCS) investments valued at up to €3.6 billion (approximately US$4.2 billion), as the country positions itself to build a national CO2 management network connecting heavy industry with offshore storage under the Aegean Sea.

Energean subsidiary EnEarth has launched a tender for drilling two wells at the Prinos site near Kavala, marking a key step toward establishing Greece’s first offshore CO2 storage facility.

The €1.2 billion (approximately US$1.4 billion) project, supported by €270 million (US$313 million) from the EU Innovation Fund, is expected to begin drilling in early 2026 pending environmental and permitting approvals from the Ministry of Environment and Energy.

Meanwhile, DESFA, Greece’s gas network

operator, is advancing its ApolloCO2 project, which will capture, liquefy and transport CO2 from industrial sites to Prinos for permanent storage.

The project secured €169 million in EU Innovation Fund grants, with an initial €700 million (US$810 million) investment and future expansion planned. DESFA is developing the system alongside Ecolog, a subsidiary of GasLog.

DESFA is additionally seeking €30 million (US$35 million) from the Connecting Europe Facility to build a 35 km (22 mile) CO2 pipeline connecting refineries and industrial hubs in Elefsina, Boeotia, and Aspra Spitia. Together, these efforts signal Greece’s emergence as a regional CCS hub, with infrastructure designed to serve both domestic emitters and potentially overseas customers.

PROTECTIVE OUTERWRAPS

19 - 23 January 2026

PPIM 2026

Houston, USA

https://ppimconference.com/

10 - 11 February 2026

EPIC Midstream Holdings (EPIC) has announced that it has completed the sale of its 45% operated interest in EPIC Crude Holdings, LP (EPIC Crude) to Plains All American Pipeline (Plains).

Plains had already completed the purchase of 55% of EPIC Crude’s non-operated interest from Diamondback Energy and Kinetik Holdings, Inc.

AMI Pipeline Coating 2026

Vienna, Austria

https://www.ami-events.com/event/d7ee7978d036-4457-a67b-78d5343495b9/home

11 - 15 February 2026

78th Annual PLCA Convention Phoenix, Arizona

https://www.plca.org/annual-convention-events

03 March - 07 March 2026

CONEXPO-CO/AGG 2026

Las Vegas, USA

https://www.conexpoconagg.com/conexpo-conagg-construction-trade-show

10 March - 11 March 2026

StocExpo 2026

Rotterdam, The Netherlands

https://www.stocexpo.com/en/

15 - 19 March 2026

AMPP Annual Conference + Expo Houston, USA

https://ace.ampp.org/home

18 March 2026

World Pipelines CCS Forum - London London, UK

https://www.worldpipelines.com/ccsforum2026

27 - 30 April 2026

Pipeline Technology Conference (PTC) Berlin, Germany

https://www.pipeline-conference.com/

04 - 07 May 2026

Offhore Technology Conference (OTC) Houston, USA

https://2026.otcnet.org

EPIC Crude owns long haul crude oil pipelines and associated oil terminal/logistics facilities that serve both the Permian and Eagle Ford basins.

The completion of the sale of EPIC Crude marks the third divestiture by EPIC in the last 10 months. The three transactions have collectively driven gross transaction value of approximately US$5.25 billion.

“Over the last several years, EPIC has transformed its Crude business, and this transaction underscores the strength of our team, strategy, and execution,” said Brian Freed, Chief Executive Officer of EPIC. “We developed a

strategic footprint in Corpus Christi with downstream interconnectivity to our export facility and third-party terminals and refineries, as well as multiple interconnections in the top US oil basin, the Permian. We believe Plains will be a great owner to steward these assets into their next phase.”

“Ares is pleased to have supported Brian and the EPIC team through its evolution and recent achievements,” said Robert Kimmel, Partner in the Ares Private Equity Group. “We believe as the EPIC businesses move forward in their respective next chapters, they are well-positioned to meet the needs of customers.”

Freed continued, “I am incredibly proud of the entire EPIC team’s leadership and dedication in helping us reach these milestones. I also want to thank Ares for their partnership and support in positioning the EPIC businesses for the long-term,” said Brian Freed.

Vallourec announces multi-million dollar investment in a new premium threading line in Youngstown, Ohio

Vallourec, a world leader in premium tubular solutions, announced today a US$48 million investment to expand its operations in Youngstown, Ohio.

This strategic initiative is part of a broader commitment to US manufacturing, with over US$1.5 billion invested in the US over the past 15 years.

The investment will support the creation of a new Premium Threading Line within Vallourec’s existing steel making, rolling and finishing operations. This addition will offer a competitive, fully integrated domestic manufacturing route and strengthen Vallourec’s position in the Oil Country Tubular Goods (OCTG) market in the US. This new line will increase capacity to thread VAM® hightorque connections, which are increasingly used in onshore wells with long laterals. This development marks a major milestone in Vallourec’s ongoing commitment to US manufacturing excellence and energy innovation.

Construction began in July 2025 and is expected to be completed by early 2027, with no disruption to current operations. Once operational, this new line will create 40 full-time-equivalent positions, expand the local supply chain, and support the regional energy industry, further reinforcing Ohio’s industrial ecosystem.

Vallourec North America is a fully integrated supplier of 100% Made in America seamless tubes. The company delivers best-in-class tubular

solutions capable of withstanding the most extreme environments across the energy and industrial sectors. At the core of Vallourec’s US operations lies a strong circular economy approach: its seamless tubes are manufactured entirely from recycled scrap metal.

Vallourec’s North American headquarters are located in Houston, Texas, and its main production facility is based in Youngstown, Ohio. With nearly 2000 employees in North America, the United States represents Vallourec’s largest market globally.

• COP30: Oil & Gas Decarbonisation Charter sustains momentum

• Williams secures key permits for Northeast Supply Enhancement project

• Pembina and PETRONAS enter long-term agreement for Cedar LNG capacity

Follow us on LinkedIn to read more about the articles linkedin.com/showcase/worldpipelines

integrated bypass maintains production during isolation

Dual Leak-Tight Seals

Double Block & Bleed Isolation

Isolated Pipeline

Monitored Zero-Energy Zone

The BISEP® has an ex tensive track record and provides pioneering double block and bleed isolation while

dual seals provide tested, proven and fully monitored leak-tight isolation, ever y time, any pressure.

Kevin Pang, Gourab Mondal, and Pushan Pal, FutureScaleX, examine the role of CO2 transport infrastructure as the critical missing link for effective, largescale carbon capture and storage (CCS) deployment in Southeast Asia (SEA) and the wider Asia-Pacific (APAC) region.

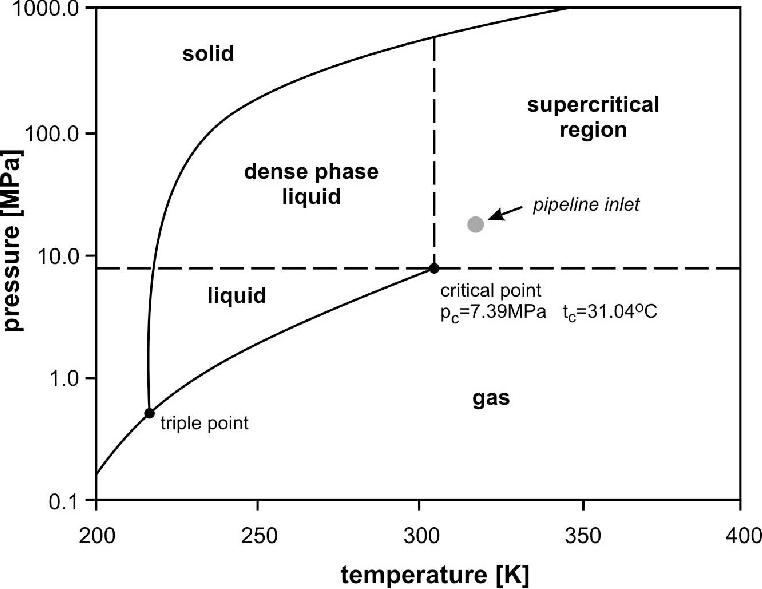

Carbon capture and storage (CCS) requires three connected components for success: capture, transport, and storage. While capture and storage receive the most media attention, transport infrastructure is the critical bottleneck to making large-scale CCS deployment truly work. Without robust CO2 pipeline networks that connect industrial carbon emissions to long term storage sinks, capturing carbon at scale becomes untenable. Southeast Asia (SEA) as a region is rapidly growing along with its energy demands. With a population estimated to top 720 million by 2030,1 with rapidly rising living standards, the IEA is forecasting the region to contribute to more than 25% of the expected growth in global energy demand by 2035 based on stated policies by countries in the region.2 Today, more than 80% of supplied energy in SEA is accomplished through use of fossil fuels. So in addition to needing to manage its manufacturing carbon footprint, SEA’s larger per capita energy carbon footprint than many other regions in the world also needs aggressive management.

Hence, a robust, coordinated CCS policy throughout the region is needed to build the necessary partnership ecosystem to make CCS a reality. This partnership system needs to focus on robust buildout of CO2 transport systems throughout the region that connect energy and manufacturing sites to viable long term storage sites to await the time when viable utilisation pathways are developed and the stored CO2 monetised.

Today CCS pipelines exist and are being built, the majority in the US and EU, with nascent buildouts in Brazil and China. The US leads the globe in total pipeline with approximately 5345 miles of pipeline,3 but these are used to link natural sources of CO2 for use in enhanced oil recovery (EOR) predominantly in the southwestern oil fields of the US, so the carbon storage is intentionally indirect. A 2020 Princeton University study estimates that up to 66 000 miles of new CO2 pipeline purpose built for CO2 transport to storage would be needed as part of a US net zero 2050 scenario.4

However, much needed policy guidelines on CO2 pipeline safety were withdrawn in February of 2025, leaving doubt on future progress. Further, in May of 2025, more than US$3.7 billion in Department of Energy awards for CCS projects were cancelled as part of a larger US$11.3 billion cut in energy projects. Momentum and progress are difficult to see at the time of writing.

The EU however, is moving ahead with multiple transnational cooperation and projects. In November 2023 the European Commission included 14 CO2 network projects as part of its list of 166 infrastructure projects of common interest, “to create a market for carbon capture and storage.”5 The EU Joint Research Commission estimates that up to 19 000 km (12 000 miles) of pipeline will be needed at a cost between €9 - 23 billion to transport for storage a minimum injection of 50 megatons (Mt)/year.6

Two of the ongoing projects are worth examining to create a benchmark of what a CCUS pipeline might look like in APAC. This is because it has similar nearest neighbour advantages, as well as short to long geographical challenges to construct coherent transport strategies, both short and long term, to accomplish their individual and shared cross country CCS strategies.

The Port of Rotterdam’s Porthos project is the template for CCS hub formation. Designed to carry up to 2.5 Mt of CO2 annually, the recently completed 20 km offshore pipeline enables Rotterdam operators such as Shell, ExxonMobil, Air Liquide, Air Products, and others in industrial hubs to transport their CO2 for injection 3 km under the North Sea into the 37 Mt storage capacity P18 depleted gas field.7 Constructed at an estimated cost of approximately €1.3 billion, this backbone infrastructure allows for future expansion and ties into other hubs, to address 17% of targeted industrial CO2 emissions reduction by 2030.8

Coming on the initial success of Porthos, the government of Norway driven Northern Lights project with operators Shell, TotalEnergies, and Equinor, is a 110 km pipeline from Øygarden terminal into the North Sea for subsea bed injection. Phase 1 cost of US$700 million designed to transport 1.5 Mt CO2/year was completed this year. First injection was accomplished in August with liquified CO2 from Heidelberg Materials’ Brevik, Norway factory first transported via ship to Øygarden. Phase 2 expansion has now commenced to increase pipeline capacity to 5 Mt/year at an expected cost of another US$700 million. This is to accommodate anticipated future growth and expected maritime shipping of CO2 from other industrial centres from the UK, northern Netherlands, Germany, and Eastern Europe.9

Key to system scaling is the total cost and capacity of the hybrid ship to pipeline system. The current hybrid approach of combining maritime to pipeline transport is limited as each designed ship today has only a CO2 carrying capacity of 8000 t at an estimated CAPEX of US$150 million/ship.10 Thus, lower cost pipelines are clearly needed to achieve scale and cost targets. FSX analysis using carbon credits estimates that a suitable breakeven point occurs at US$100/t of CO2. According to cited IEA and Wood Mackenzie analyses, current cost/t might be in the realm of US$175/t of CO2 11

In contrast to the EU and the US, APAC lags significantly behind North America and Europe in CO2 transport infrastructure. Yet its needs and opportunities are no less significant. Home to 4.3 billion people and 60% of the world’s population, the calculated t of CO2e load exceeds as a region (including China) that of the US, EU, and UK combined (Table 1).

The APAC and the EU regions share similarities in having diverse coastline geographics for connecting ports, robust offshore oil and gas exploration along with depleted wells for potential CO2 storage, and strong maritime commerce dependencies. An advantage for APAC is that the top nine busiest seaports in the world are in APAC, number 10 being Rotterdam. Another unique advantage that APAC countries have is that many of their manufacturing bases are built for export, and hence are newer and closer to seaports, making hub and spoke infrastructure potentially more feasible and interconnectable at lower cost.

A key challenge and a stumbling block to APAC progress however is the lack of tight policy integration between nations like that of the EU, which through its European Commission and PCI programme which creates and funds large cross border energy infrastructure projects. A closer look at APAC policy making activity reveals increasing efforts to create cross

border interactions (Table 2). These public-private partnerships are laying the groundwork for storage siting, and hence transportation and eventual pipeline routes.

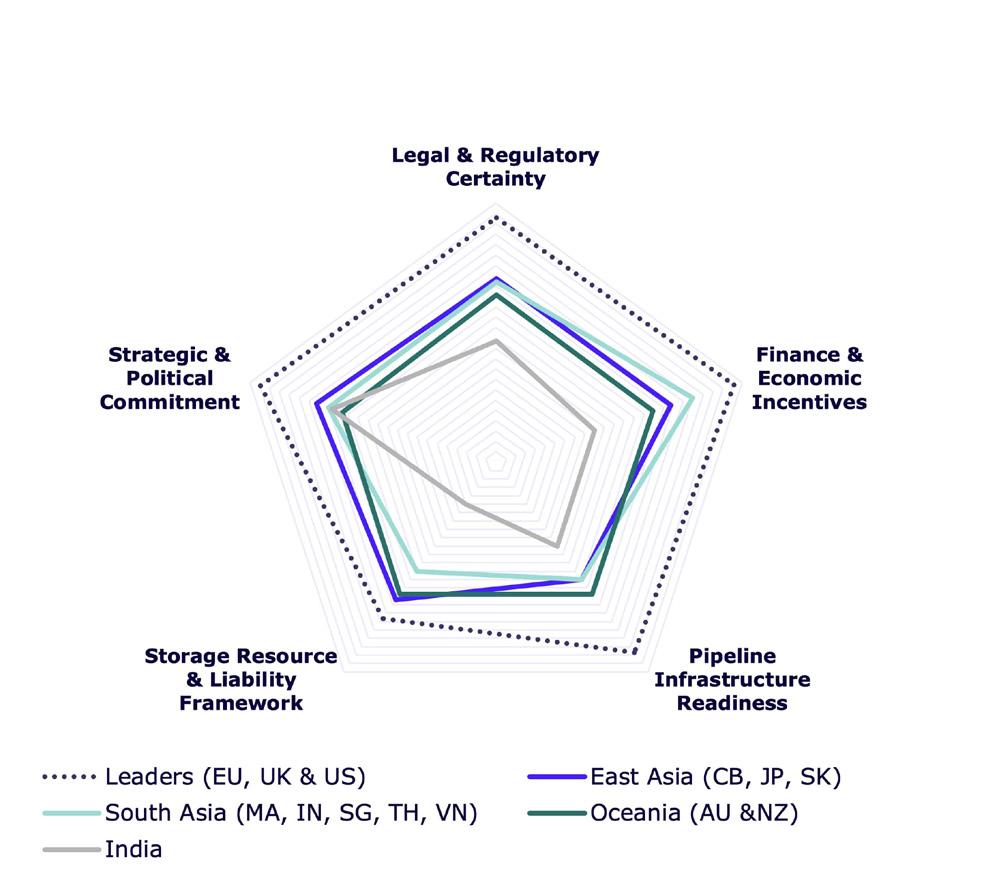

Figure 1 compares the APAC region and subregions against the leaders; the US, UK, and EU, along five critical dimensions for CCS ecosystem maturity and action. While the ASEAN region clearly lags in these dimensions, we see emerging strength in creating new financial and economic incentives for cross border CCUS cooperation via increasing private-public partnerships.

These cross border interactions, while still relatively early in formation, have the potential to create US$220 billion in annual GDP and 300 000 jobs across the region by 2035 according to the Asia Natural Gas & Energy Association (ANGEA).12 The foundation for creating CO2 hubs rests on a combination of geologic mapping, interoperability guidelines to connect pipelines, technology harmonisation, and mechanisms to ensure auditing, tracking, and carbon credit generation and sharing.

Analysis of the geographic distribution profile of CO2 generation across Southeast Asia and Oceania makes evident the opportunity for synergy, as well as competition, between countries like Australia, Indonesia, and Malaysia that have tremendous geological and spent well assets to become

Table 2. A closer look at APAC policy making activity revealing increasing efforts to create cross border interactions Entities When What Significance

Singapore, Indonesia Jun-25

Singapore, Japan Aug-24

Singapore, Malaysia Jan-25

Australia, Japan, Korea, others Dec-23

Japan, Malayasia, Indonesia Jun-23

Japan, Australia, ASEAN Aug-24

ExxonMobil, Shell, Singapore Mar-24

ExxonMobil, Petronas, Malyasia Jul-23

ExxonMobil, Pertamina, Indonesia Jul-23

Woodside Energy, Australia

BHP, Arcelor Mittal Nippon

Steel India, JSW Steel, Hyunday Steel, Chevron, Mitsui & Co.

Aug-25

Importation of up to 2 megatons (Mt)/y CO2 for storage from Singapore to Indonesia

CCS collaboration for adoption

MOU on cross border CCS transport

Multiple bilateral treaties for cross border CO2 transport

CO2 export for sub seabed storage

Formation of Asia Zero Emission Centre

Cross border value chain set up for CCS

Map and assess CO2 storage fields and create commercial frameworks

Study of Java Sea for CCS hub feasibility

CCS offshore basin storage, northwest Australia

Pre-feasibility study for CCUS hub formation across Asia

Indonesia has cleared up to 30% of 600 gigatons (Gt) of CO2 storage capacity for cross border use.1

Creation of standards for interoperable CCS markets, technology and innovation sharing.2

Carbon credit generating project cooperation. Note in March 2025 Malaysia passed their Carbon Capture, Utilisaiton, and Storage Bill to catalyse formation of a new growth industry.3

Australia seeking to capitalise on estimated 20 Gt onshore and 400 Gt offshore storage capacity to become storage hub. Japan creates a carbon storage permitting system to enable 120 - 240 Mt annual storage by 2050.4, 5

Japan seeks to secure up to 13 Mt/y storage by 2030 offshore Malaysia. Tentative budget of ¥4 trillion (US$27 billion) over 10 years for value chain build.6, 7, 8

Innovation hub for 11 partner countries hosted by the Economic Research Institute for ASEAN and East Asia (ERIA).9

Codeveloping a 2.5 Mt/y onshore/offshore storage capacity in Singapore by 2030. 10, 11

MOU in 2021, in 2023 partnership agreement signed to storage and local transport infrastructure.11, 12

Potential US$2.6 billion CCS project to explore up to 3 Gt of storage capacity across Asia Pacific.13, 14

Onshore pipeline gathering system and international CO2 ship based transport for injection; 5 Mt/y; targeting SEA customers.15

Define enablers for cross border transport and hub formation.16

Example public and private cross border interactions regarding CCS. With the exception of China who appears to be charting its own course, North Asia and South East Asia countries are increasingly working on cross border collaborations.

Key activities is regulations and policies setting up interoperability, accounting, and value chain formation and support to drive down CCS costs.

Transport will likely be first phase through specialised shipping followed by pipeline formation. Both Indonesia and Malaysia with significant geographic and depleted reserve space, are angling along with Australia, to become carbon storage hubs, taking CO2 from neighbouring countries.

Figure 1. Comparison of the APAC region and subregions against the leaders; the US, UK, and EU, along five critical dimensions for CCS ecosystem maturity and action.

storage hubs. These in turn create the opportunity to become innovation hubs as the world seeks to find ways to not just store but utilise CO2. These massive stores then become feedstock assets for future chemical and biotechnology industrial usage. Hence the cross-border agreements must contain not just technology interoperability agreements but also future carbon credit and access rights.

The outlook for CO2 pipelines in APAC

APAC’s reliance on fuel combustion for energy means that CO2 emissions grew by 8% in 2024 to 19 gigatons (Gt),13 up from 17.5 Gt in 2022,14 which demands a robust and coordinated cross border capture, transport, and storage response to abate. Given the terrain, large distances, and fixed asset locations, a combination of shipping and pipeline transport will be needed. A recent study by Xodus Group envisions a possible scenario of up to 90 storage hubs across Asia connected by 8000 km of pipeline utilising 80 specialised CO2 carriers.15 Others are calling for up to 150 such vessels to ply the 6800 km of various expanses of ocean between Japan to Australia.16 But clearly pipelines are needed from shore to subsea storage and for high volume continuous cross border CO2 transport if APAC is to hit its ambitious >100 Mt/y capture and storage targets by 2050.

From the European Northern Lights initiative, we see that the upfront CAPEX for pipelines is high but the learning curve is steep. The initial 1.5 Mt/y pipeline cost US$700 million to deliver, but the follow-on Phase 2 pipeline is slated to cost the same US$700 million for 5 Mt/y, or US$1.3 million/km/Mt/y of CO2. This learning curve estimate is complicated by recent changes in trade and tariffs which have lifted material and labour costs for pipelines by more than two times in some regions.17 However, given APAC regional cooperation this may be less of a consideration, and the technological and engineering aspects of pipeline delivery costs should continue to decrease. Given the current 8000 t CO2 carrying capacity limitation per US$150 million

specialty ship; clearly a biphasic ship to pipeline, hybrid operating solution connecting Northern Asia to Southeast Asia is needed.

Given a recent policy and patent analysis showing that the APAC region is now out innovating the US and even the EU in CCS technology development, we see this as strong commitment to the industry and anticipate increasing market acceleration and opportunity throughout APAC as the region races to catch up and surpass the rest of world in CCUS deployment.18

For table references, please visit https://www.worldpipelines. com/special-reports/01112025/futurescalex--buildingpipelines-the-key-to-achieving-ccs-success-in-asia/

1. World Population Review, https://worldpopulationreview.com/continents/ southeast-asia

2. IEA, Southeast Aisa Energy Outlook 2024, https://www.iea.org/reports/ southeast-asia-energy-outlook-2024/executive-summary

3. US Department of Transport, Pipeline and Hazardous Materials Safety Administration, Annual Report Mileage for Hazardous Liquid or Carbon Dioxide Systems, October 1, 2025. https://www.phmsa.dot.gov/data-andstatistics/pipeline/annual-report-mileage-hazardous-liquid-or-carbon-dioxidesystems

4. Princeton University, ‘Net-Zero America: Potential Pathways, Infrastructure, and Impact’, October 29, 2021. https://netzeroamerica.princeton.edu/img/ Princeton%20NZA%20FINAL%20REPORT%20SUMMARY%20(29Oct2021).pdf

5. European Commission, ‘Commission proposes 166 cross-border energy projects for EU support to help deliver the European Green Deal’, November 28, 2023. https://ec.europa.eu/commission/presscorner/detail/en/ip_23_6047

6. Tumara, D., Uihlein, A. and Hidalgo Gonzalez, I., Shaping the future CO2 transport network for Europe, Publications Office of the European Union, Luxembourg, 2024, doi:10.2760/582433, JRC136709. https://publications.jrc. ec.europa.eu/repository/handle/JRC136709

7. Port of Rotterdam, Porthos CO2 pipeline laid on seabed and entrenched, August 14, 2025. https://www.portofrotterdam.com/en/news-and-pressreleases/porthos-co2-pipeline-laid-seabed-and-entrenched

8. Porthos and Beyond: The Critical Importance of Carbon Capture and Storage Projects for Dutch Climate Goals. https://cdn.catf.us/wp-content/ uploads/2023/02/20091740/CATF_PorthosFactsheet_English_02.27.23.pdf

9. Mr. Sustainability, ‘Equinor Moves Ahead with CCS’, https://www. mr-sustainability.com/stories/2021/equinor-moves-ahead-with-ccs

10. Thunder Said Energy, ‘Liquefied CO2 carriers: CO2 shipping costs?’, https:// thundersaidenergy.com/downloads/liquefied-co2-carriers-co2-shipping-costs/

11. Euro News, ‘Can CCS meet Europe’s climate targets? Three projects beset with problems suggest not’, By Sam Edwards, May 26, 2025. https://www.euronews. com/green/2025/05/26/can-ccs-meet-europes-climate-targets-threeprojects-beset-with-problems-suggest-not#:~:text=Today%2C%20there%20 are%20only%20five%20operational%20CCS,which%20is%20outside%20of%20 the%20EU.%20Related.

12. Asia Natural Gas & Energy Association, Cross-Border CCS for Asia Pacific, https://angeassociation.com/policy-areas/cross-border-ccs-for-asiapacific/#:~:text=Malaysia%20and%20Indonesia%20have%20both%20signed%20 MOUs,Summit%20in%20South%20Korea%20in%20late%202025.

13. Statsia, Energy & Environment, Emissions, ‘Carbon dioxide emissions from energy worldwide from 1965 to 2024, by region’, https://www.statista.com/ statistics/205966/world-carbon-dioxide-emissions-by-region/

14. IEA, Asia Pacific, Total CO2 emissions, https://www.iea.org/regions/asiapacific/emissions

15. XODUS, ‘Forecasting the APAC CCUS Infrastructure’, https://www.xodusgroup. com/media/z3opky0q/forecasting-the-apac-ccus-infrastructure.pdf

16. Asian Power, Sailing the Future of Asean Carbon Shipping, By Suwanto and Lintang Ambar Pramesti, https://asian-power.com/environment/commentary/ sailing-future-asean-carbon-shipping

17. Oil & Gas Journal, ‘Pipeline construction costs reach record $12.1 million/mile’, https://www.ogj.com/pipelines-transportation/pipelines/article/55322093/ pipeline-construction-costs-reach-record-121-million-mile

18. Energy Sudies Institute, ‘What the Trump Presidency Means for CCS: Policy Shifts and Opportunities for Asia’, Pardeep Pal, Sita Rahmani, Chew Shee Jia, and Kevin Pang, July 29, 2025. https://esi.nus.edu.sg/docs/default-source/ esi-policy-briefs/esi-pb-82_what-the-trump-presidency-means-for-ccs. pdf?sfvrsn=16a49808_1

Boryana Nedyalkova, Researcher, EMIS, highlights the crossroads that Central and Eastern Europe (CEE) is at regarding its energy landscape and the careful balancing act between hydrogen vs methane.

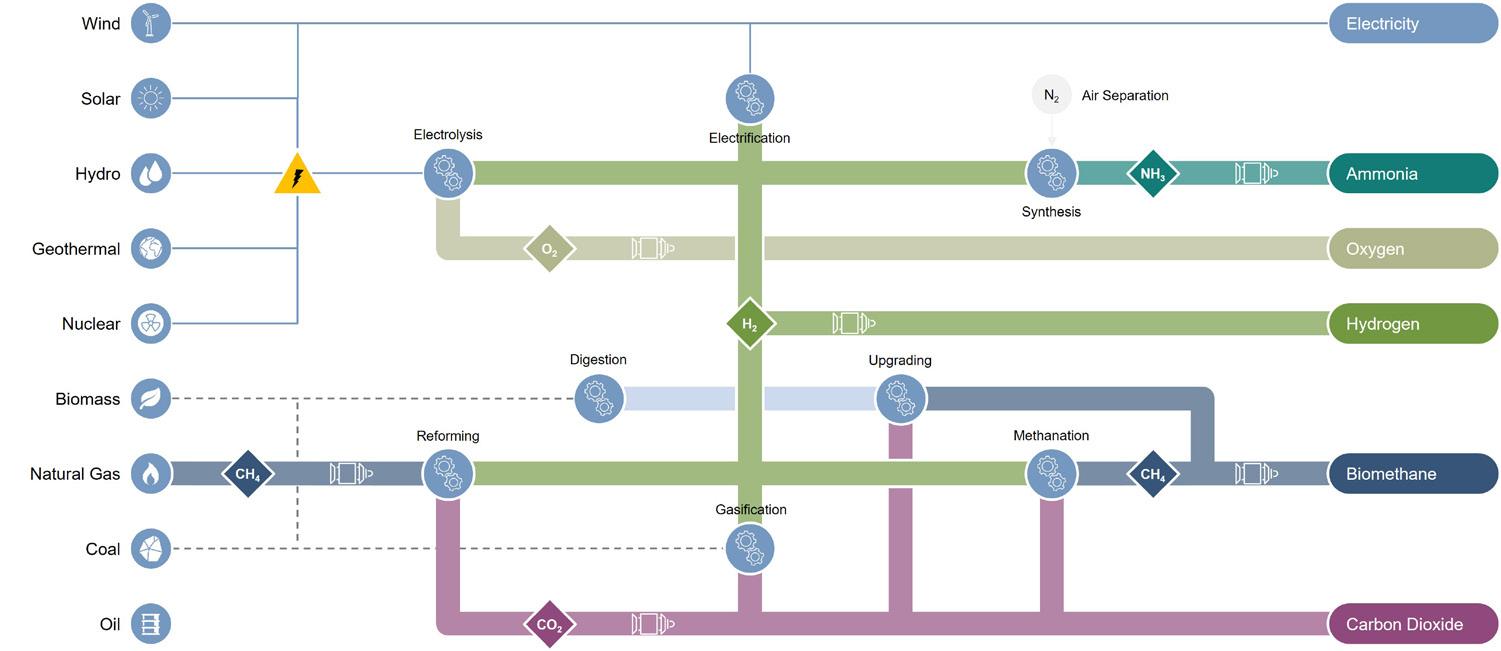

The Central and Eastern Europe (CEE) region is at crossroads as it reshapes its energy landscape in the aftermath of severed ties with Russian gas. Recent infrastructure investments have diversified gas flows and boosted access to LNG, but the EU’s long-term decarbonisation agenda also demands a parallel shift toward hydrogen. This has stretched the CEE countries between managing the immediate challenges of energy security and preparing for a hydrogen-driven future.1

Natural gas supply diversification is triggered by the EU announcing plans to phase out Russian fossil fuel imports by 2027, pushing a ban on new pipeline contracts starting 1 January 2026, and ending imports under existing short-term contracts by 17 June 2026.2

Working towards a gradual shift to green hydrogen is, in turn, mandated by the EU Hydrogen Strategy that has set binding targets for 10 million t of domestic electrolyser capacity, used for green hydrogen production, and 10 million t of renewable hydrogen imports by 2030.3

As a result, hydrogen projects have slowly been gaining momentum across the 27-nation bloc. While more than 90% of low-emissions hydrogen projects in Northwestern Europe remain in early phases of development,4 on 1 August 2025, the European Commission (EC) launched its third auction in support of renewable and low-carbon hydrogen projects that demonstrate technical and financial readiness.5

CEE countries successful in aligning their technical, regulatory, and financial planning with the Brussels-driven pace of development, will be in position to achieve a strategic place within this new ecosystem, while laggards will risk losing funding,

alongside remaining locked into carbon-intensive infrastructure while EU incentives and focus shift to alternative sources of energy.

Yet, the EU’s visionary hydrogen policy is complicated to say the least. On one hand, it strictly defines green hydrogen as one obtained from renewable energy and not fossil fuels, and prioritises the financing of such projects, also planning the construction of an EU-wide hydrogen transportation infrastructure. On the other, it envisages a transition period where hydrogen is to be obtained from fossil fuels and mixed with natural gas; and transported on the current gas pipeline network, following costly upgrades to technically accommodate the hydrogen-methane mix.

This makes EU’s hydrogen plans a challenge to implement in the CEE context of legacy energy systems and other structural, economic, and institutional constraints. Issues range from regulatory complexity and lack of infrastructure readiness against tight deadlines, to lack of national industrial hydrogen targets, and alleged disconnect from market reality against high implementation costs.

Uneven midstream hydrogen readiness

Technical compatibility

One aspect of hydrogen readiness is the technical compatibility of the gas networks of CEE countries (Poland, Czechia, Slovakia, Hungary, Croatia, and Romania) for handling hydrogen blends

(allowed until the end of 2029)6 or pure hydrogen safely and efficiently. This is because the countries have been mapped along the future routes of the five EU hydrogen corridors, made up of both repurposed and newly built pipelines, and defined by the European Hydrogen Backbone (EHB) in May 2022.7 However, as of mid-2025, the CEE countries’ plans related to corridor implementation remain vague, risking stalling project progress if other EU member states advance on schedule. Slovakia’s Transmission System Operator (TSO) Eustream,8 Hungary’s FGSZ,9 and Romania’s Transgaz10 have reported testing hydrogen blending against a lack of set EU standards on the proportion between natural gas and hydrogen in the required blend.11 In March 2024, Poland’s Polska Spółka Gazownictwa (PSG) obtained the country’s first technical certificate for up to 20% blended hydrogen transportation, on the Jelenia Góra-Piechowice pipeline.12 Czechia and Croatia have not publicly disclosed blending trials yet. Not all existing infrastructure (pipelines, valves, and compressors, amongst others) can handle any blend proportion, which adds a further level of uncertainty to the technical compatibility required.13

The Clean Hydrogen Joint Undertaking has helped draft projects for hydrogen valleys across the EU, including in Poland, Croatia, and Slovakia.14 Hydrogen valleys are key nodes in the future corridors because they integrate hydrogen production, storage, transportation, and end-use applications within a defined geographic area, fostering a sustainable hydrogen

economy. Construction of the EastGate H2V in Slovakia’s Košice region, for example, started only in April 2025.15

According to an October 2024 Bankwatch Network report called ‘Looking Beyond the Hype, Public Funding of Hydrogen in Central and Eastern Europe’, the EU’s cross-border hydrogen infrastructure assumes very high levels of production, consumption, and trade, which may be based on speculative demand scenarios.16 Furthermore, green hydrogen is associated with substantial production and efficiency losses, an IRENA publication stated in 2020.17

Against this backdrop, the July 16, 2025 publication of Joule magazine makes the case for a more robust European green hydrogen strategy, suggesting raising the 10 million t production target to 25 million t by 2040, given that the EU has not officially committed to a 2040 target yet.18 In February 2025, Daniel Fraile, Chief Policy Officer at Hydrogen Europe highlighted that the EC should not give preference to electrification-only scenarios and should be working towards parallel developing of electricity and hydrogen infrastructure, alluding to a considered scenario of only 3 million t hydrogen production by 2030, instead of the 10 million t target announced in 2020.19

In a July 2025 interview with CEE Energy News, Veronika Vohlídková, executive director of the Czech Hydrogen Technology Platform (HYTEP), said Czechia will not be ready for hydrogen import via pipelines by 2030, so the country’s goal is to develop local production sites. Specifically, the country

was considering transforming coal regions into hydrogen hubs, reducing energy dependence on other countries.20

According to Vohlídková, the EU rules on green hydrogen production are too strict and are suitable for countries with large renewable energy generation capacities, not Czechia. She also noted that production costs under the current rules make green hydrogen uncompetitive without subsidies.21

A similar appeal was launched by German Chancellor Olaf Scholz who, at the beginning of 2025, called on EC President Ursula von der Leyen to modify the excessively strict green hydrogen definition, HydrogenInsight.com reported.22

The EU prioritises the production of certified renewable (green) hydrogen, as it has the highest potential to reduce greenhouse gas (GHG) emissions. This is allegedly so only if EU member state authorities can make sure the pipelines carrying hydrogen – the smallest molecule – will not leak through microfractures in repurposed pipelines for example. Released into the atmosphere, hydrogen has up to 37 times greater global warming potential compared to carbon dioxide, as it slows down the decomposition of methane.23

Nevertheless, green hydrogen – produced via electrolysis using renewable energy such as wind, solar, or hydropower – is considered a good solution for the decarbonisation of carbonintensive sectors that cannot be feasibly electrified (e.g. steel, cement, chemicals, shipping, transportation, aviation).24

3. Renewable energy generation in CEE countries (share of total renewable EU generation). Diverging renewables bases across the CEE region are a key constraint for green hydrogen readiness. Poland and Romania dominate CEE’s renewables generation share, while lower output countries like Croatia, Slovakia, and Czechia, will face greater challenges in meeting EU-certified green hydrogen production targets without rapid renewable capacity growth.

4. Renewable energy capacity in CEE countries. Poland boasts the highest renewable energy generation capacity of all CEE countries. This puts the country, in theory, in a good place for renewable hydrogen production, provided it can afford CAPEX costs of €3.28/kg (€3.81/kg in 2023), alongside electricity costs of €2.93/kg (€3.22/kg in 2023), according to 2024 data by the European Hydrogen Observatory.

As much as 96% of hydrogen currently produced in the EU is fossil-based, a February 2025 European Parliament briefing stated.25 The EU hydrogen funding framework such as IPCEI and the Hydrogen Bank, allows support for low-carbon hydrogen, which may include blue hydrogen (made from natural gas with carbon capture), and other transitional ‘low-carbon’ forms.26

This creates space for ambiguity and greenwashing at the national level, essentially meaning that EU public funds might be used to build fossil hydrogen infrastructure. Another risk is that in the early stages of their functioning, the hydrogen pipelines might carry hydrogen produced with grid electricity that includes fossil fuel inputs.27

These concerns are especially valid for the CEE countries where green hydrogen production is immature, national strategies allow grey or blue hydrogen (e.g. Hungary,28 Poland,29 Czechia30), and certification or enforcement is weak.

As proof of this, not a single EU member state, including none of the CEE countries, has fully transposed the EU’s Renewable Energy Directive III (RED III) by the deadline of 21 May 2025, the EC said on its website in September 2025.31 RED III creates a legally backed market demand from sectors like aviation steel or chemicals, mandating that member states use at least 42% renewable hydrogen in industry by 2030, and at least 5.5% of green hydrogen or e-fuels in transportation by 2030. The directive, passed in October 2023, also stipulates that only hydrogen certified under its mechanisms counts towards national targets. However, the document does not fix national targets, creating uncertainty and reluctance from industry to engage in long-term hydrogen contracts, S&P Global said in a June 2025 article.32

Without improvements in policy, funding, and demand-side requirements to address high costs and weak demand, less than 20% of the EU’s hydrogen production projects may become operational by 2030, said an April 2025 report by the Westwood Global Energy consultancy titled ‘Europe’s Hydrogen Future: How Much is Realistically Achievable?’33

Storage for flow flexibility

CEE countries have substantial gas storage,34 but most of it is not certified or technically fit for (pure) hydrogen storage, which has stricter technical requirements.35 CEE countries have been conducting studies estimating the feasibility and safety of converting natural gas storage into hydrogen storage as well as developing new hydrogen storage capacity. For example, in July 2024, Poland announced plans to set up a large-scale hydrogen storage facility in Kosakowo to utilise energy surpluses in Pomerania, CEE Energy News reported.36

Poland is EU’s third-largest hydrogen producer by capacity after the Netherlands (second-largest) and Germany (the largest),37 so the low level of maturity of its hydrogen storage infrastructure can be used to gauge the general lack of preparedness of the CEE region. Yet CEE should have operational hydrogen storage infrastructure well ahead of the 2030 deadline, if storage specifications are to be consistent with a gradual transition from blended to pure hydrogen. To help address this, the Annual Work Programme 2025 of the Clean Hydrogen Joint Undertaking has stated it will invest in development of lined rock caverns for hydrogen storage alongside other infrastructure vital for enabling cross-border hydrogen flows and storage trials.38

Varying progress towards green hydrogen Poland has been making substantial green electrolyser investments backed by EU funds.39 Croatia has also reported that important green hydrogen infrastructure is scheduled to become operational in 202640 and 2027.41 Romania has pilot projects for green hydrogen in progress, but its midstream network is not hydrogen-ready yet.42

The November 2024 Learnbook for hydrogen infrastructure by the European Clean Hydrogen Alliance, describes Czechia, Slovakia, and Hungary as still being in early planning stages, with few production projects launched, dedicated infrastructure funding, or engineering and retrofitting timelines.43

To avoid the risk of being sidelined from the emerging hydrogen economy, CEE should prioritise pipeline retrofits, clarify regulatory frameworks, and invest in regional transit and storage hubs. The EU, in turn, could provide clearer national guidelines, more flexible funding, and certification, as well as targeted technical support, ensuring that CEE becomes an integral part of the EU’s decarbonised future.

Parallel to its hydrogen concerns, the CEE region must navigate the overlapping but often conflicting priority of reshaping and sustaining its energy landscape in the aftermath of severed ties with Russian gas.44

Shifting from long-term supply contracts with Russia to spot LNG and pipeline imports from western European countries has made CEE a participant in a highly competitive global market with fluctuating prices and little to no political accountability to the local governments.45

Under EU regulations, CEE countries must fill their natural gas underground storage to at least 90% by 1 November each year.46 For the region, import timing is vital for preventing potential disruption caused by cold spells earlier in autumn coupled with delayed storage fill. On 1 October 2025, the EU system was at about 83% full, which is considered a healthy level for the coming winter, the EC said on its website.47

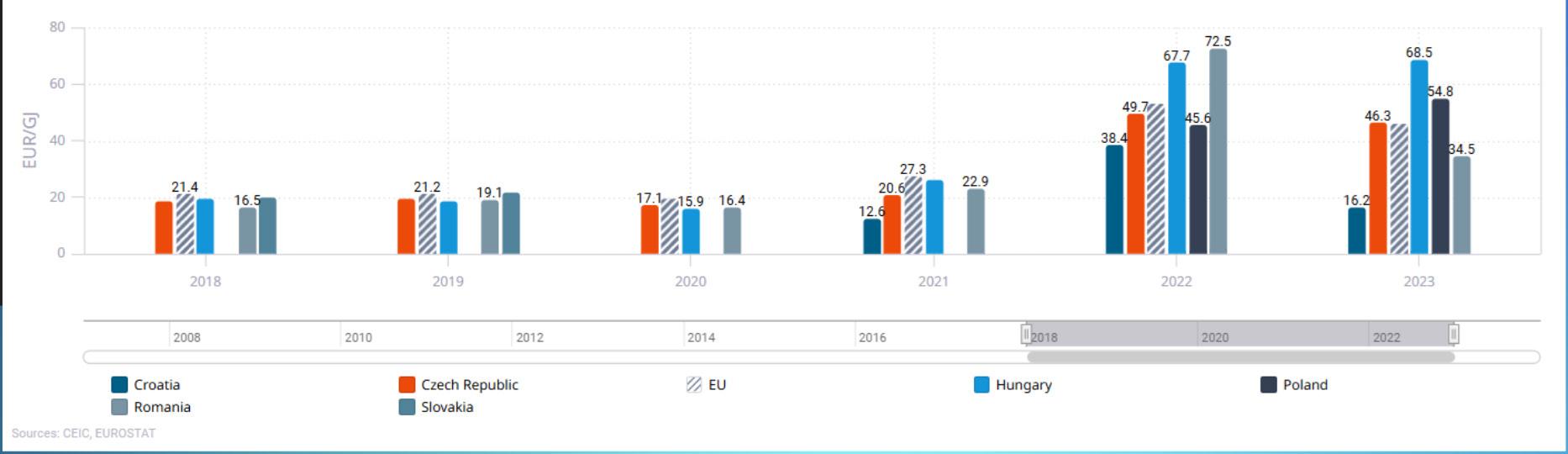

Backhaul deliveries from Germany, Austria, and Italy are associated with transit and/or storage costs that make gas more expensive than when deliveries came from Russia.48 The bidirectional flow of gas on already available infrastructure was achieved through costly equipment upgrades, which contributed to an increase in domestic gas prices in CEE countries.49 However, not all gas can be injected into storage smoothly because of pipeline congestion along the SlovakiaAustria and the Czechia-Germany routes and pipeline bottlenecks and regasification limits at plants crucial for CEE, such as Krk FSRU in Croatia and Świnoujście in Poland.50 Debottlenecking of pipeline infrastructure in the South-North and West-East directions will be crucial for CEE countries to succeed in the quest for energy security from 2025 onwards.

LNG imports, heavily dependent on enough interconnection capacity, are a mainstay of supply diversification and energy security in CEE. Countries operating regasification facilities (LNG terminals) like Poland and Croatia, are key in supplying gas to landlocked countries in the region. Croatia is adding new export capacity to neighbouring countries in late 202551 and beyond,52 boosting the country’s support of the region’s energy needs.

According to global trade analytics company Kpler, Poland’s potential for exports into other CEE countries limited, especially in the event of a colder winter. This is because most of the capacity available at Świnoujście is booked by the national heavyweight Orlen and its subsidiaries. Another factor is its poor connectivity with Czechia, limiting the opportunity to send gas there in the short term.53

In addition, the CEE countries are not a single natural gas market but are home to different capacity reservation rules, tariff regimes, and storage access frameworks, complicating regional cooperation.

Overall, CEE countries possess sufficient flexibility to manage the loss of Russian gas and LNG will be central to maintaining supply security. Its effectiveness, though, will depend on how rapidly additional pipeline interconnection capacity comes online.

With multiple alternatives to Russian supplies now operational or coming up, CEE’s midstream networks have successfully

a marginal transit route, but a key node in a resilient European gas architecture, combining LNG, pipeline, storage, and hydrogen-ready infrastructure. For this, however, the region needs to show political will, regulatory discipline, and strategic consistency. Without a clear course to rigorously green hydrogen, however, the transition to this new energy source risks recasting CEE’s natural gas dependency under a new name. The success of this transition, though, can reshape CEE’s energy sovereignty and redefine its strategic role in Europe’s energy future.

EMIS is a leading curator of multi-sector, multi-country research for the world’s fastest-growing markets. We provide a unique combination of research from globally renowned information providers, local and niche specialist sources, our own proprietary analysis, and powerful monitoring and productivity tools. EMIS delivers trustworthy intelligence covering more than 370 industry sectors and 16 million companies across 197 markets. EMIS is part of ISI Markets.

Note

Graphs courtesy of the CEE Natural Gas Sector Report 2025 - 2026, an EMIS Insights Industry Report, and the CEE Renewable Energy Sector Report 2025 - 2026, an EMIS Insights Industry Report. For references, please visit https://www. worldpipelines.com/special-reports/01112025/emis--an-energy-

Jijo George, STATS Group, examines how to safely execute critical valve replacement without halting production.

Pipeline isolation during maintenance or modification activities remains among the most critical operations in the oil and gas sector. Conventional methods such as full depressurisation and venting, while reliable, have drawbacks including significant downtime, environmental emissions from flaring or venting hydrocarbons, and the potential formation of hydrates in subsea systems. In addition, operators often encounter difficulties isolating sections of their pipeline to facilitate essential maintenance activities when appropriate valves are absent from the line or not functioning adequately.

As an alternative, inline isolation plugs that provide double block and bleed (DBB) capabilities offer a safe and efficient approach by providing two independent sealing barriers separated by a zero-energy zone. This approach ensures the safe breaking of containment on pressurised systems in compliance with the highest industry standards. Achieving DBB in operational high-pressure pipelines without depressurising the system or section of pipeline requires specialised isolation tools.

The Tecno Plug® inline isolation tool, developed by STATS Group, addresses this challenge by providing DNV

Type Approved double block and bleed isolation through a combination of mechanical fail-safes, hydraulic actuation, and energised seal technology.

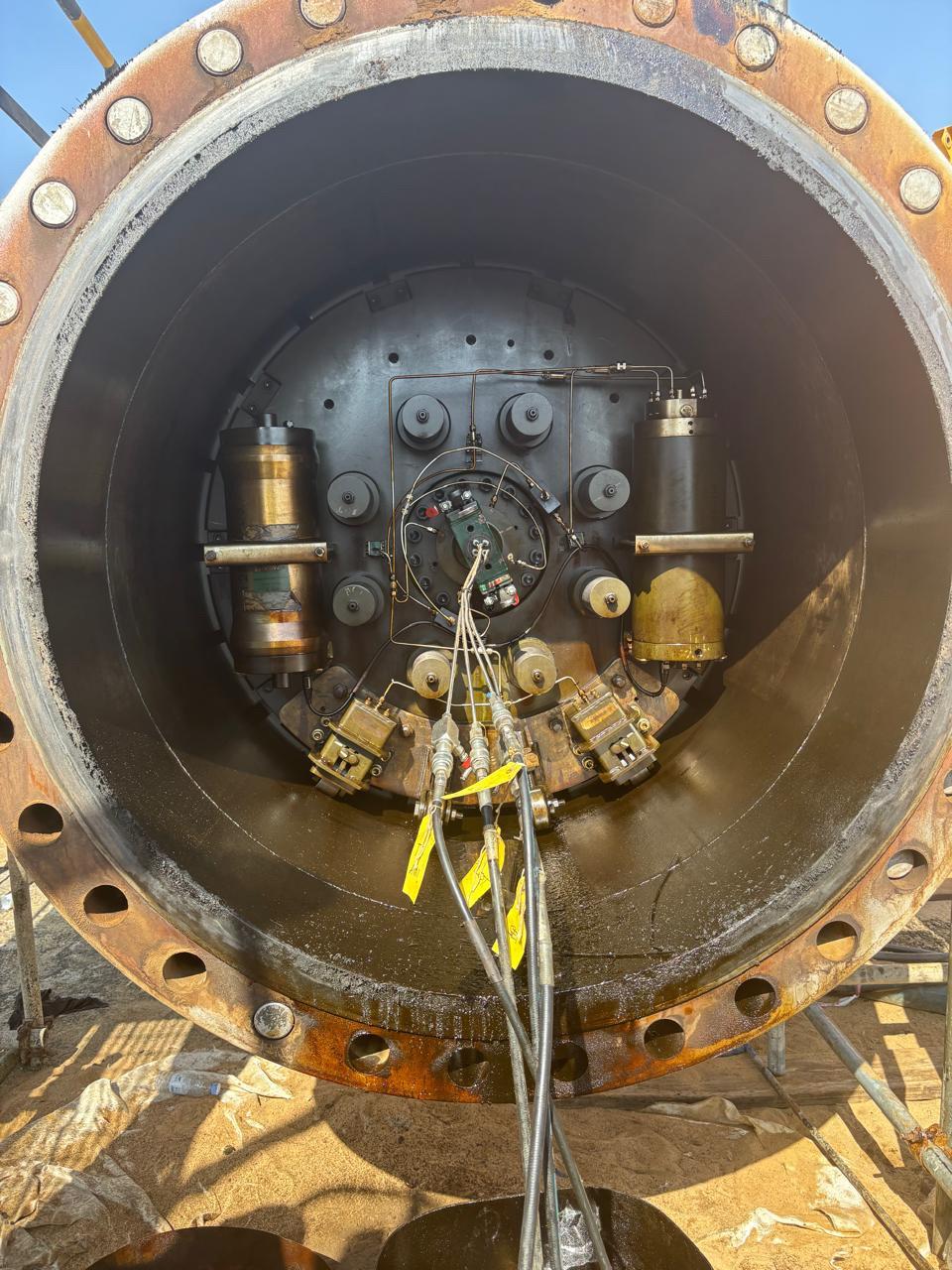

A recent isolation project completed on a 56 in. crude oil pipeline in Saudi Arabia highlights the advantages that inline isolation tools can provide, enabling the safe replacement of a 56 in. scraper trap valve while production was maintained throughout the entire operation.

STATS was approached by a major client in Saudi Arabia requiring the replacement of a 56 in. scraper trap valve, with the critical condition that the work be completed without shutting down, draining, purging, and flushing the entire pipeline.

Following a detailed site survey and comprehensive engineering study, STATS proposed a custom-designed 56 in. Tethered Tecno Plug, tailored specifically for this application and designed to overcome challenges associated with nonstandard scraper trap features.

Mark Gault, Vice President, Middle East at STATS Group, said: “This is the largest Tecno Plug in the history of STATS,

highlighting a remarkable milestone in our capability to deliver safe, innovative, and large-scale isolation solutions for critical pipeline infrastructure. This successful project provided a safe and cost-effective double block isolation, resulting in no

interruption to production and preventing a costly shutdown. The safe and efficient workscope was the result of advanced planning, dedication, and teamwork between STATS and client personnel.”

STATS Tethered Tecno Plug isolation system features two integrated isolation modules, both designed to deliver a failsafe double block and bleed isolation. The first module is the Tecno Plug isolation tool, which features dual seals and taper locks. This plug is pushed with stem bars to the exact isolation location, in this case, the short pipe spool between the scraper trap valve to be replaced and the production tee.

The second module, known as the Door Plug, also features dual seals and taper locks. However, this plug replaces the scraper trap door and includes a bore through the centre of the plug that allows the stem bar to travel. Dual seals in the centre of the Door Plug maintain leak-tight isolation of the scraper trap while allowing the stem bar to travel forward and backward, moving the isolation Tecno Plug through the pipeline.

Each isolation plug (Tecno Plug and Door Plug) features dual elastomer seals separated by an annulus ring and a set of taper locks. The annulus void between the seals is used to independently test the seals with full pipeline pressure to verify that both are leak-tight before STATS issues an Isolation Certificate allowing safe breaking of containment. The annulus is also used to monitor the isolation and ensure the seals remain leak-tight throughout the duration of the work. The locks, which embed into the inner pipe wall, provide the grip required to secure the tool in place.

The fail-safe design of the Tecno Plug uses differential pressure acting on the plug to energise the locks and seals – a process referred to as self-energisation. When the isolation plug is self-energised, the isolation is maintained independently of the hydraulic control system. It is, however, backed up by the hydraulic control system, which maintains pipeline isolation if the differential pressure falls below the self-energisation threshold.

Once the isolation plug is activated, the hydraulic pressure circuits are locked in by pilot-operated check valves. In the unlikely event that the control system is compromised, the tool actuation mechanism will unset only when differential pressure is equalised. This feature ensures pipeline integrity is maintained and that the isolation plug is always recoverable upon job completion. The Tecno Plug is DNV Type Approved and fully certified, ensuring compliance with industry standards.

Prior to mobilisation, a comprehensive Factory Acceptance Test (FAT) was carried out on all 56 in. equipment at STATS’ Abu Dhabi facility. The test replicated site conditions and validated equipment performance under maximum isolation pressure. To further ensure integrity, an additional leak test was conducted at STATS’ operational facility in Dammam, Saudi Arabia, before final deployment to site. Both test phases were witnessed by

when you switch to PipePillo® engineered pipeline supports, the trusted quick and easy replacement for cribbing, foam, sandbags, and pad dirt to keep crews working faster and safer away from the trench.

Whether in or out-of-trench, PipePillos® support your team and your pipe, so your team can stay focused on the job, and not worry about their safety. Contact PipeSak Inc. for engineered pipeline supports, impact protection, saddle bag weights, and all around protection

Fast, safe & easily stacked

Reliable, versatile, permanent

Won’t float & supports fully loaded pipelines

Proven long-term ovality prevention

Eliminates the need for cribbing, foam, sandbags, and pad dirt

Reduces labor & speeds up your project Call

client representatives, ensuring full alignment with stringent operational and safety standards.

Once on site and following thorough pre-deployment inspections, the deployment tray holding the isolation plugs was positioned in front of the pipeline scraper trap door. The client then depressurised the scraper trap and opened the door, enabling the safe loading of the 56 in. Tethered Tecno Plug and Door Plug.

Using stem bars, both isolation plugs were pushed on wheels into the scraper trap and advanced into the pipeline until the front isolation plug was in the minor barrel. Once in position, the rear Door Plug was hydraulically activated, causing the taper locks and dual seals to radially expand against the pipe wall. Seal testing was performed to verify the integrity of the primary and secondary seals, with both independently tested and monitored.

The Door Plug replaces the scraper trap door and allows access for the tether (hydraulic control and monitoring lines) to pass through, enabling the pipeline to remain pressurised and operational without replacing or modifying the original scraper trap door.

After confirming the double block isolation, a leak test of the scraper trap was performed, and the 56 in. scraper trap valve was opened, allowing the Tethered Tecno Plug to be pushed downstream of the valve location. The compact design allowed the isolation plug to be set in the short section of pipework upstream of the production tee, maintaining uninterrupted production during valve replacement activities. With primary and secondary seal tests completed and double block isolation verified, the Isolation Certificate was issued and the client unbolted the existing scraper trap valve. The stem bar was hydraulically disconnected and retracted back into the scraper trap, allowing the old valve to be removed.

During valve replacement operations, a remote monitoring module attached to the rear of the Tecno Plug maintained continuous surveillance of the dual seals, relaying pressure

readings in real time to a laptop monitored by a STATS isolation technician. The Tecno Plug and Door Plug remained leak-tight and stable throughout the valve replacement activities, safely isolating 55-bar pipeline pressure without halting production.

Following installation of the new 56 in. scraper trap valve, the stem bar was repositioned and reconnected hydraulically to the back of the Tecno Plug while the valve bolts were fully torqued. Upon reconnection, communication systems were verified, and the scraper trap pressure was increased to perform a flange joint leak test of the new valve. The Tecno Plug remained fully isolating the pipeline while the leak test was conducted. Upon successful testing, the Tecno Plug Isolation Certificate was withdrawn.

Pipeline product was then reintroduced into the section between the Tecno Plug and the Door Plug to equalise pressure and prepare for the isolation plug removal sequence. The Tecno Plug was then hydraulically unset and retracted to its initial deployment position.

After closing the new scraper trap valve, a pressure build-up test confirmed valve integrity.

Finally, the scraper trap was depressurised, the Door Plug was unset, and both the Tecno Plug and Door Plug were recovered into the deployment tray, marking the successful and safe completion of the valve replacement operation.

The 56 in. scraper trap valve replacement project in Saudi Arabia represents a benchmark achievement in the application of STATS’ tethered Tecno Plug technology for large-diameter, high-pressure pipeline systems. This operation successfully demonstrated that essential remedial and replacement works can be executed safely and efficiently without the need for full system shutdowns or depressurisation.

By maintaining continuous production throughout the valve replacement, the project safeguarded both revenue streams and supply security while avoiding costly production outages. The use of the Tethered Tecno Plug provided a verified double block and bleed isolation, ensuring personnel safety and complete containment integrity throughout the workscope. The operation also eliminated the need for draining, purging, or extensive fluid-handling activities, significantly reducing project complexity and overall timescales.

Inline isolation tools such as the Tecno Plug offer operators a proven, non-intrusive method of achieving double block and bleed isolation in pressurised pipelines. These tools are pigged or pushed to location and are adaptable for a wide range of maintenance applications, from launcher and receiver valve replacements to the isolation of pipeline sections for integrity repairs or facility modifications.

Through precise engineering, rigorous testing, and close collaboration with the client, STATS 56 in. Tethered Tecno Plug isolation delivered a safe and efficient solution. The successful completion of this project sets a new benchmark for largescale, live pipeline intervention and reinforces the value of advanced isolation technologies in maintaining production continuity and operational excellence.

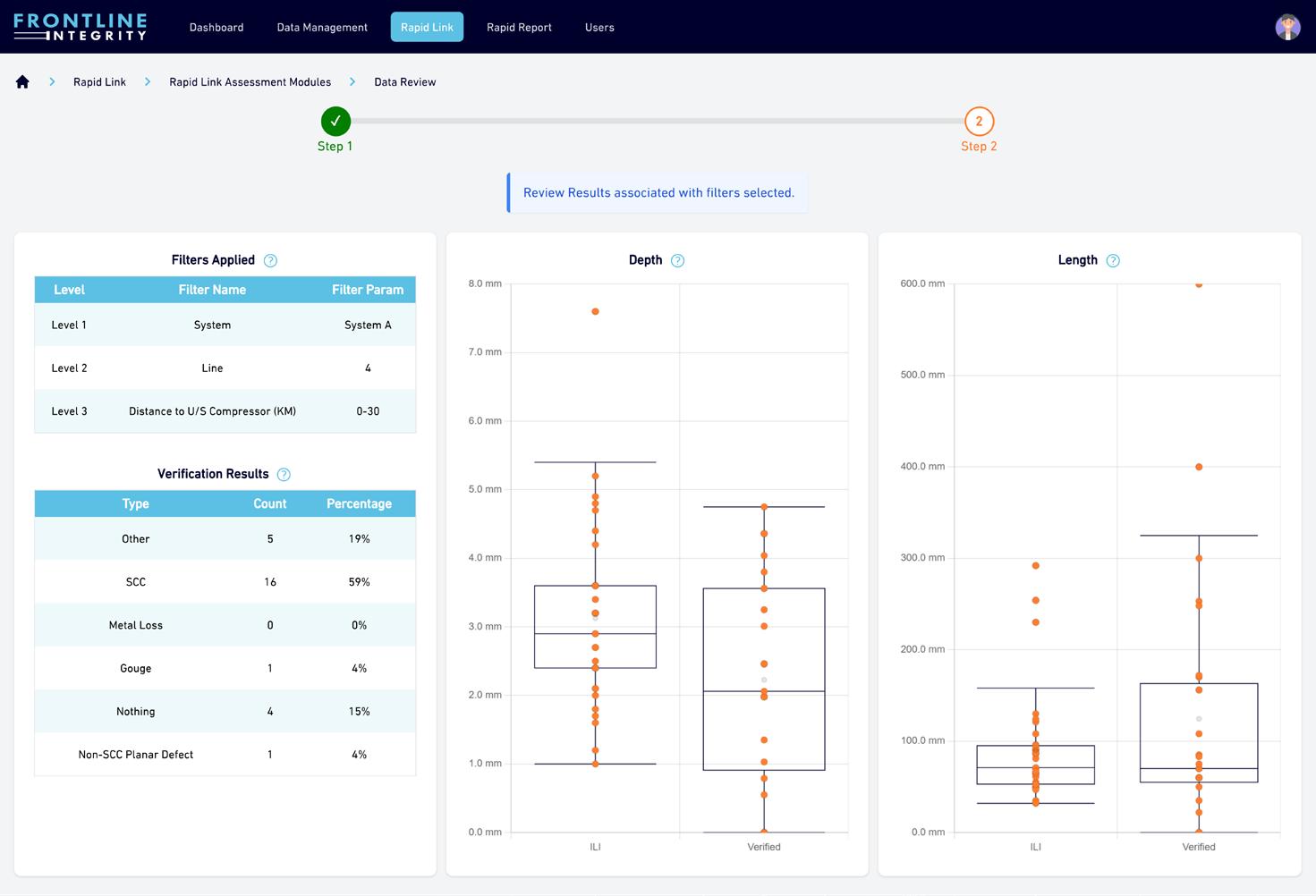

Brian Kerrigan, Frontline Integrity, UK, explores how stress corrosion cracking (SCC) is being managed more effectively, specifically through the use of data-driven technology to transform crack management.

In the world of pipeline integrity management, few threats are as persistent and costly as stress corrosion cracking (SCC) along buried transmission pipelines. In the past two years, Frontline Integrity have been involved in SCC related pipeline incidents in North America, South America, Europe and Australasia.

Many regions document, report and share key information associated with pipeline incidents related to

materials, operation, mechanism, and consequence. Pipeline and Hazardous Materials Safety Administration’s (PHMSA’s) open-source database has been documenting USA incidents since 1970 and provides an extensive overview. Our recent analysis concluded that since 2005, there have been 81 incidents attributed to cracking in the USA and 57 of these were specifically attributed to SCC.1

These 81 incidents are reported to be split evenly between gas (51%) and liquid pipelines (49%). Notably, 16% of the incidents resulted in an ignition.

SCC is a time-dependent threat and can present itself as axial, circumferential, or ‘off-axis’ external cracking. The uncertainty of whether it is present on a system is a widespread concern and, once identified, the cost associated with managing it has long plagued pipeline operators.

Typical options for managing a system with SCC consist of recoating sections, reducing pressure, targeted direct assessment, or

in-line inspection (ILI) using crack detection technology. These ILI tools offer broad coverage and convenience, but this comes with a significant caveat: not every reported planar reflector is likely to be the target threat you are chasing, in this instance SCC.

After running a crack detection ILI tool, operators frequently find themselves with a significant list of planar reflectors located in challenging locations. In order to perform field verification and possible repair, some sites may require road closures, the removal of protective slabs, or the diversion of waterways to enable direct pipeline access. All of which carry significant costs for the pipeline operator.

Given that crack detection technologies report planar reflectors, many of the calls verified in a standard population will be anomalies with planar characteristics such as sharpedged corrosion which may not pose a significant integrity threat. Many operators would consider these sites ‘dry holes’ when chasing the real cracking threat and, considering the excavation cost, may get frustrated that resources are being diverted away from the primary threat.

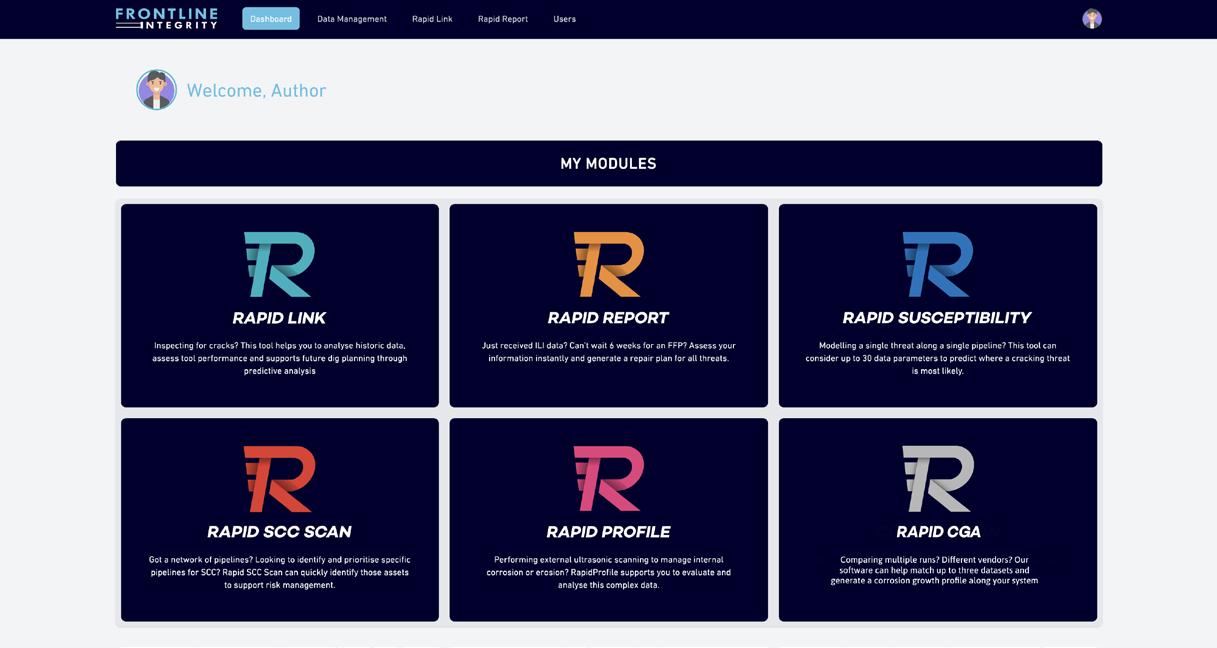

Considering feedback from pipeline operators, Frontline Integrity (an independent pipeline integrity consultancy based in the UK) have developed RapidLink™, a cloud-based software platform designed to help pipeline operators target the actual threat and minimise unnecessary excavations.

The software gathers and aligns a number of key datasets for an entire network in its secure DataHub. This typically consists of crack detection ILI datasets (reported anomalies and pipe tallies), historic field verification data and SCC susceptibility profiles, where available.

Rapid Link is built on three core assessment pillars: ) Data analysis.

) Predictive analysis (API 1176 Assessment).

) Tool performance review (API 1163 Assessment).

The data analysis pillar allows the operator to perform forensic analysis on their network, system or individual pipeline section. The key features include the ability to:

) Interrogate crack detection ILI signal characteristics and SCC hit rates.

) Assess and calibrate current SCC susceptibility parameters.

) Identify new or existing parameter combinations which result in the highest SCC hit rate across the system.

The data analysis pillar enables the identification of recurring characteristics linked to verified SCC, forming the basis for predictive modelling.

By utilising advanced analytics and machine learning, the predictive analysis pillar allows the user to assess

March 15–19, 2026 | Houston, Texas

600+ Hours of Technical Content | Breakthrough Corrosion Research | Global Connections

AMPP Annual Conference + Expo 2026 brings together the leaders shaping the future of materials protection and performance. Discover real-world innovations and solutions that drive safer, stronger, sustainable, and more resilient infrastructure. Join thousands of professionals for the industry’s largest global event, filled with technical insights, hands-on solutions, and opportunities to collaborate with experts from around the world.

Act now to secure early registration savings. Don’t miss our best rate!

a new crack detection ILI dataset and predict which of the planar reflectors are ‘likely’, ‘possible’, or ‘unlikely’ to be a real cracking threat in line with API RP 1176, supporting operators to develop an optimised verification plan and minimise unnecessary excavations.

1163)

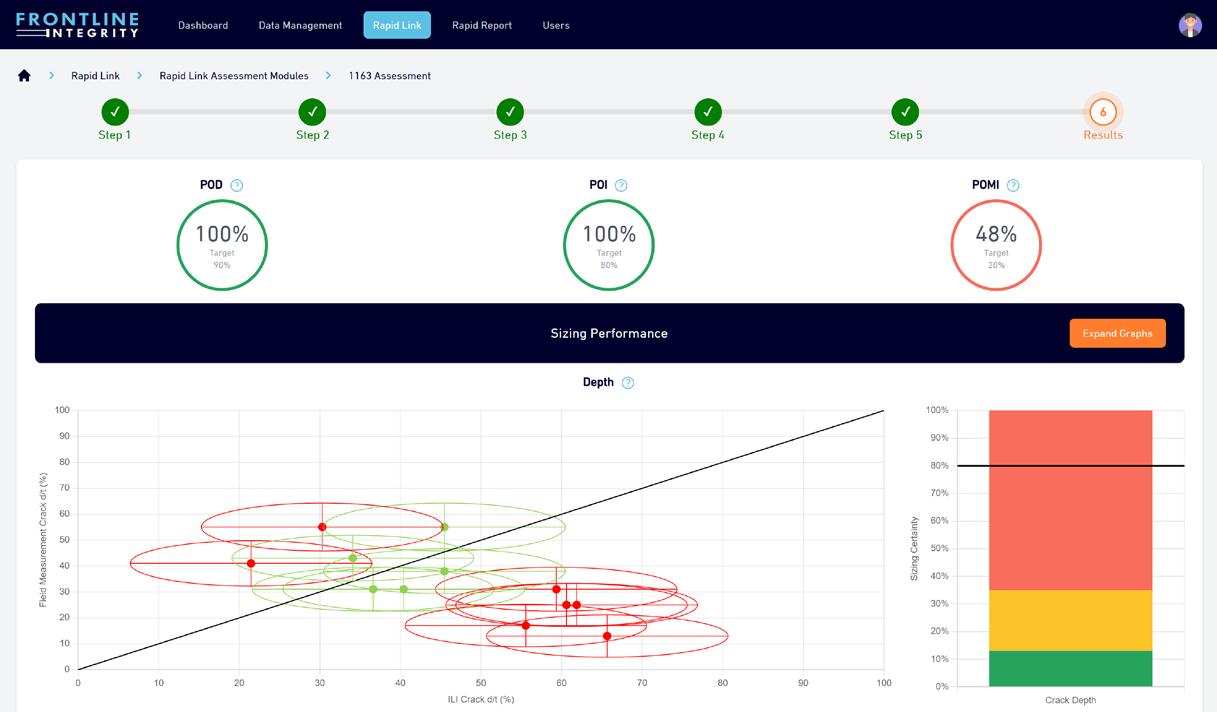

Using verified ILI data, Rapid Link allows the user to quickly formally assess the tool performance for any pipeline or ILI dataset in line with API 1163. This considers Probability of Detection (POD), Probability of Identification (POI), Probability of Misidentification (POMI), and sizing accuracy.

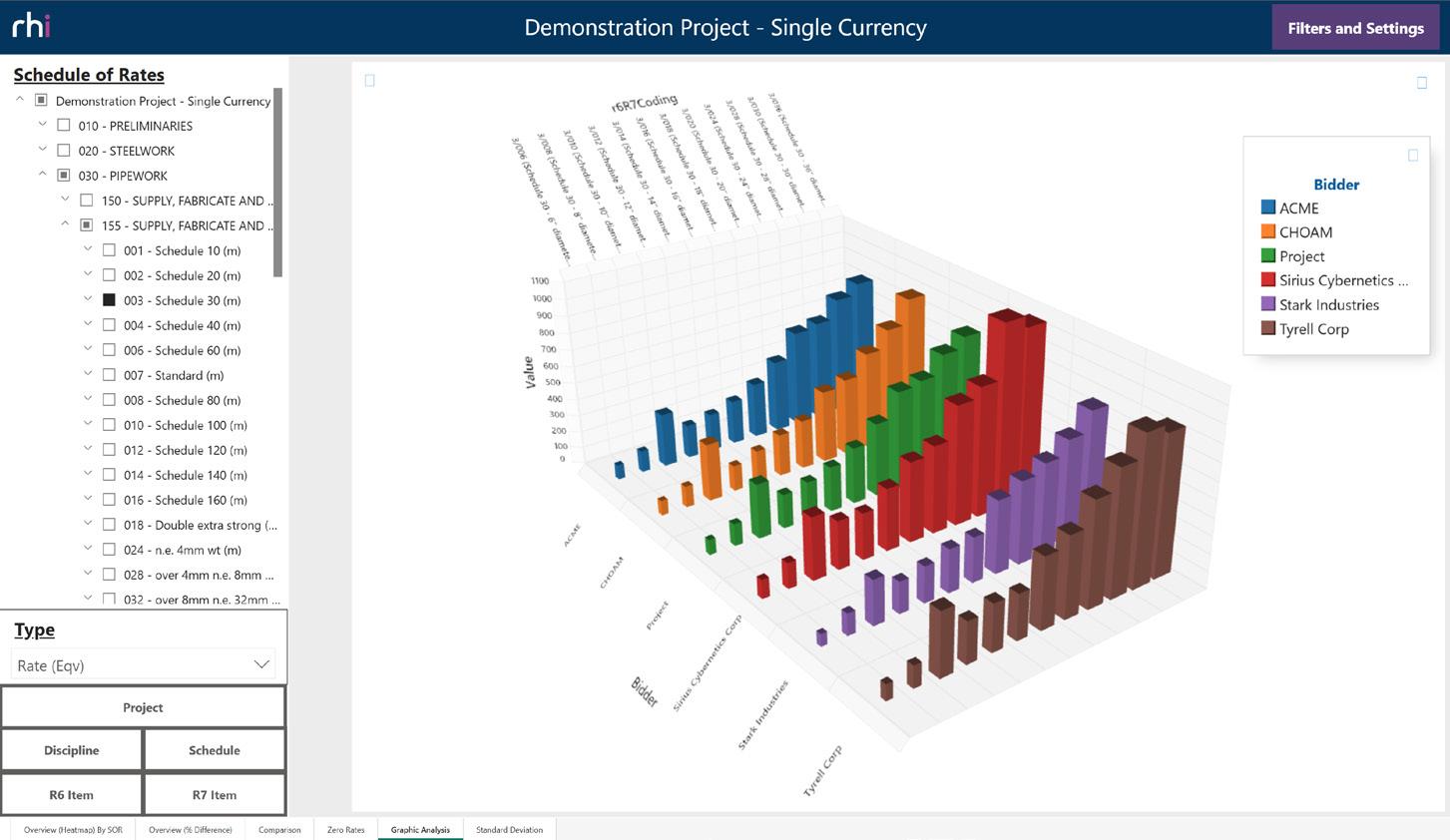

study: a data-driven transformation in crack management2

A natural gas transmission operator managing a vast multi-diameter pipeline network faced a familiar challenge: despite deploying EMAT-based crack detection ILI tools across 17 inspections, only 23% of the 426 verified anomalies were confirmed as SCC. With over 400 anomalies still unverified, the operator sought a more effective way to prioritise digs and minimise unnecessary excavations.

The operator began by uploading five EMAT datasets and their corresponding field verification results into Rapid Link. The platform analysed common characteristics among verified SCC and non-SCC anomalies, utilising advanced analytics to group calls based on common susceptibility parameters and signal characteristics.