ENERGY GL BAL

ENERGY GLOBAL

CONTENTS

03. Comment

04. Africa's energy paradox

Prakash Sharma, Vice President, Head of Scenarios and Technologies, and Roshna N., Research Analyst, Energy Transition, Wood Mackenzie, explore the various pathways for Africa’s energy future as it attempts to power development in a climate-restrained world.

10. Magnetic gears: A game changer for wind turbines

The global expansion of renewable energy is accelerating the search for solutions that are efficient, resilient, and sustainable. Among the range of emerging technologies, magnetic gears are increasingly attracting attention. Gary Rodgers, CEO of Magnomatics, explains the benefits of magnetically-geared systems for the wind industry.

14. A transformative tool

Matteo Saglia, Flyability, Switzerland, answers the question: How can drones help maintain critical energy infrastructure?

20. Enabling next-generation mega turbines with innovations in offshore floating wind platforms

Jon Salazar, CEO, Gazelle Wind Power, addresses the growing need for larger turbines, and considers the challenges and opportunities that come with them.

24. When the ocean delivers the current Although commercial exploitation of wave energy is still in its infancy, it has the potential to contribute substantially to a stable and reliable electricity grid based on renewable energies

being attained within just a few years, argue Michael Kocher and Frank Fladerer, Bachmann electronic GmbH.

30. Taking centre stage in the energy transition

Fernando Gimenez, Product Manager, Sulzer, examines current developments in geothermal energy plants and how the company is supporting the growth of enabling technologies.

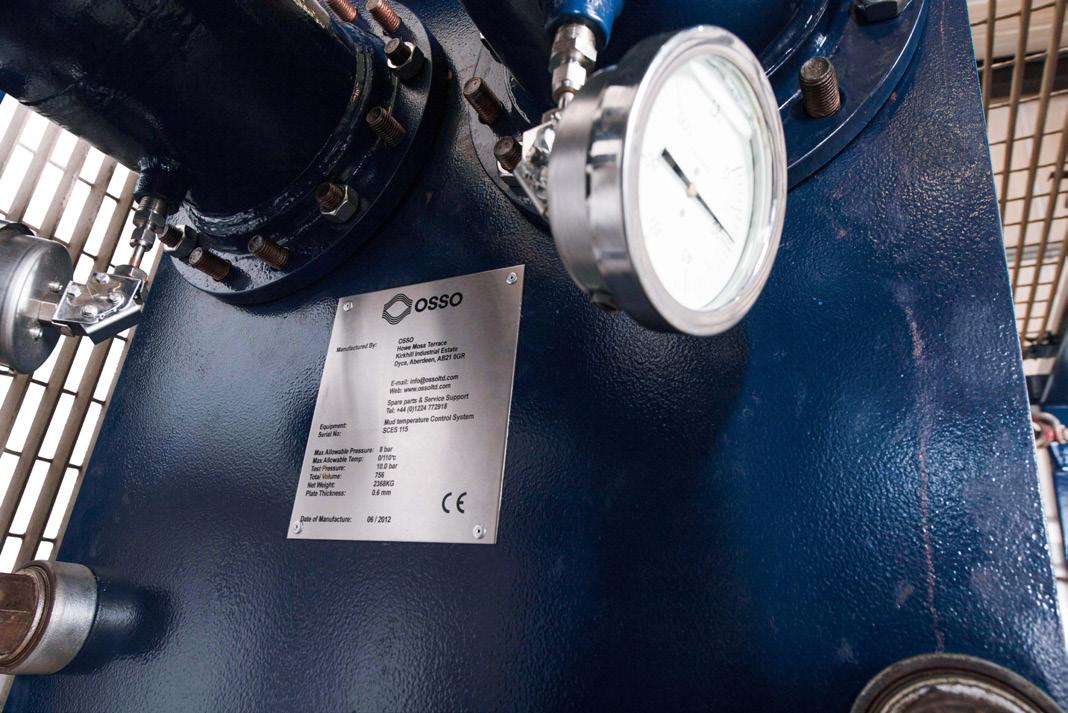

34. Keeping fluids cool in the hottest wells

Michael Adams, Mark Canlas, and Ted Moon, NOV, highlight groundbreaking temperature management technologies that improve drilling efficiencies in the deepest, hottest geothermal applications.

40. Preventing water wastage in the geothermal energy industry

To reach its full potential, the geothermal energy sector cannot afford to be wasteful – especially with water.

Alasdair Carstairs, Business Unit Manager, OSSO, identifies the changes that must be made within the geothermal energy industry to achieve progress.

44. Charging ahead

Dr Dustin Bauer, Associate, Reddie & Grose, provides an overview of the race to innovate battery energy storage systems.

50. The economics of electrification

Paul Cairns, Charge Offshore and MJR Power & Automation CEO, discusses the economic case for electric operations and maintenance fleets and explores the need for robust charging infrastructure to support the transition.

54. Global news

Thermal runaway of a lithium-ion battery within a battery energy storage system (BESS) is an extremely dangerous hazard that can strike at any time. To protect nearby people, property, the environment, and meet UL9540A compliance, Fike is the only organisation in the world that offers comprehensive BESS consultancy, testing, system design, explosion control, gas detection, and thermal management solutions, including Fike Blue: the first third-party tested system proven to suppress battery fires and cascading thermal runaway. Learn more: fike.com/battery-protection

Still pioneers.

Across energy and critical infrastructure, we bring expertise where complexity is highest, partnering with globally local teams and leveraging unrivalled proprietary technologies. Like the M-500 Single Torch External Welding System, seamlessly integrated with Data 360 our cloud-based digital platform that analyses, and visualises your project performance data in real time. We move projects forward, no matter the challenge. We’re here to partner on how our specialist welding and coating solutions can help you power tomorrow.

MANAGING EDITOR

James Little james.little@palladianpublications.com

SENIOR EDITOR

Elizabeth Corner elizabeth.corner@palladianpublications.com

EDITOR

Jessica Casey jessica.casey@palladianpublications.com

EDITORIAL ASSISTANT

Abby Butler abby.butler@palladianpublications.com

SALES DIRECTOR

Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER

Will Powell will.powell@palladianpublications.com

PRODUCTION DESIGNER

Siroun Dokmejian siroun.dokmejian@palladianpublications.com

HEAD OF EVENTS

Louise Cameron louise.cameron@palladianpublications.com

EVENT COORDINATOR

Chloe Lelliott chloe.lelliott@palladianpublications.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@palladianpublications.com

JUNIOR VIDEO ASSISTANT

Amélie Meury-Cashman amélie.meury-cashman@palladianpublications.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

DIGITAL CONTENT COORDINATOR

Kristian Ilasko kristian.ilasko@palladianpublications.com

ADMINISTRATION MANAGER Laura White laura.white@palladianpublications.com

Editorial/Advertisement Offices: Palladian Publications Ltd

15 South Street, Farnham, Surrey, GU9 7QU, UK +44 (0) 1252 718 999 www.energyglobal.com

COMMENT

Jessica Casey Editor

Winter is finally here in the Northern Hemisphere. As we wind down towards the end of 2025, the days are darker, shorter, and colder. With this comes a higher demand for energy and grid stability.

The EU’s primary energy consumption (total energy demand within a country, including losses) in 2024 is estimated to have increased by 1.3% compared to 2023.1 The share of renewable energy in the EU has more than doubled since 2005,1 with one-quarter of all final energy consumed in the EU obtained from renewable sources in 2024.2 However, meeting the new minimum EU target for renewable sources of 42.5% by 2030 will still require a vast expansion of renewable deployment,2 despite the progress and additional capacity that has been actualised in recent years.

According to the European Environment Agency, solid, liquid, and gaseous biomass formed the largest category in 2024, with wind, hydropower, and solar photovoltaics (PV) accounting for the other three largest sources of renewable energy. However, with the population growing and no indication that electricity demand will decrease anytime soon, the energy mix will have to be diversified even more in order to ensure that this is met, sustainably.

There are some renewable sources that are currently being underutilised or are currently being developed. For example, ocean energy (wave and tidal). While currently more expensive than other renewables, tidal is moving towards a cost reduction. Although dependent on location and available landscapes, current statistics suggest a low operational capacity compared to potential. With 25 GW of accessible wave energy capacity and 11 GW of tidal stream energy,3 the UK is one of most promising regions for marine renewables,

and a leader in the wave and tidal sector – it is estimated that tidal could provide 11% of the UK’s electricity by 2050.4 In 2025, the UK government launched the Marine Energy Taskforce (MET) with the aim of unlocking the country’s vast wave and tidal energy potential. The initiative will focus on site development, financing, innovation, and supply chain growth.3 In this issue, Bachmann electronic GmbH outlines wave energy’s potential to contribute to a stable and reliable electricity grid, and looks at some current projects that provide a positive outlook for this energy source.

Another underutilised but abundant resource is geothermal energy. Several technologies exist, with varying degrees of maturity. The overall share in the EU’s renewable energy mix is small in comparison to others (e.g. wind and solar), but it has the potential to grow. However, geothermal has the second-largest potential for electricity-generating capacity after solar PV, and almost three times that of onshore wind and more than five times that of offshore wind. With the energy potential increasing as you reach deeper and hotter resources, almost every region has technically suitable resources once they hit 7000 m.5 Articles from Sulzer, NOV, and OSSO examine current developments in geothermal energy plants, look at temperature management technologies that improve drilling efficiencies in the deepest geothermal applications, and discuss the changes that need to be made within the industry to achieve progress, respectively.

The world is full of renewable resources for us to meet demand without compromising on sustainability and emissions targets; it’s just up to us to figure out how we can best utilise them.

References

References available upon request.

Prakash Sharma, Vice President, Head of Scenarios and Technologies, and Roshna N., Research Analyst, Energy Transition, Wood Mackenzie, explore the various pathways for Africa’s energy future as it attempts to power development in a climate-restrained world.

As Africa’s economy surges towards US$7.7 trillion by 2050, up from US$3 trillion in 2024, the continent stands at an unprecedented energy crossroads. Development imperatives collide with climate urgency. With 42% of the continent’s 1.4 billion people lacking electricity access and abundant untapped resources in gas, oil, and renewable energy, Africa faces a unique challenge: providing energy to hundreds of millions of people whilst contributing to global climate goals.

Wood Mackenzie’s ‘Energy Transition Outlook: 2024 – 25’ reveals four distinct pathways for Africa, ranging from a catastrophic 3˚C delayed transition to an ambitious 1.5˚C net-zero scenario. The continent’s emissions share will nearly double from 3.5% to 6.5% globally by 2050 in the base case. This trajectory makes Africa’s energy choices crucial for a sustainable future.

Improving clean energy access remains a clear priority across the continent. African nations must meet soaring

demand whilst lowering indoor air pollution and mitigating health risks. This dual challenge requires immediate action and long-term strategic planning. The stakes extend far beyond regional boundaries.

Realising Africa’s climate and development objectives requires unprecedented low-cost financing innovation. Strategic deployment of the continent’s vast untapped renewable resources offers one pathway forward. Fossil fuel reserves could also fund the transition through careful management. These resources represent Africa’s competitive advantage in the global energy transformation. This extends beyond an African story alone – it represents the defining energy transition of current times.

Economic development vs climate change

Africa’s energy story defies simple narratives. The continent that holds nearly 10% of global LNG supply also has 630 million people without electricity access. This paradox defines both the challenge and extraordinary opportunity ahead.

Recent trends underscore the complexity. Oil and gas production in Sub-Saharan Africa grew 5% in 2024, driven by Nigeria, Senegal, Congo, Mozambique, and Côte d’Ivoire. Yet renewable installations declined, with solar capacity additions dropping to 3.5 GW from 4 GW in 2023. Most clean energy development remains concentrated in South Africa, highlighting uneven progress.

Africa’s GDP will grow from US$3 trillion in 2024 to US$7.7 trillion by 2050, driven by its service sector and burgeoning working-age population. This economic expansion occurs as the continent’s population increases 1.7 times by 2050, creating massive energy demand precisely when the world demands rapid decarbonisation. However, Africa’s per capita energy consumption remains far below global averages – roughly one-seventh that of China and one-tenth that of the US.

Four pathways to Africa’s energy future

Wood Mackenzie’s integrated analysis presents four distinct scenarios illuminating the complexity of Africa’s energy future. Each pathway reflects different levels of global co-operation, policy ambition, and investment commitment.

Delayed transition scenario

The delayed transition scenario paints a sobering 3˚C warming world where geopolitical tensions and reduced policy support stall decarbonisation efforts for five years. Governments prioritise energy security over global co-operation, driving up technology costs and delaying the transition. Africa reaches net zero only by the early 2080s, with emissions continuing to rise until the early 2030s.

Base case scenario

The base case scenario represents Wood Mackenzie’s most likely outcome, assuming current policies evolve gradually towards a 2.5˚C warming trajectory. Africa achieves net zero by 2080, with emissions beginning to decline around 2027. This scenario incorporates natural policy evolution and

technology advancement, reflecting the inertia inherent in global energy systems.

Country pledges scenario

The country pledges scenario assumes announced net-zero commitments materialise despite near-term challenges. This pathway aligns with below 2˚C warming, with Africa achieving net zero by 2070 through incentive-based policies driving technological innovation and competition.

Net-zero

scenario

The net-zero scenario requires immediate global action to limit warming to 1.5˚C. Africa could potentially achieve net zero before 2060, benefitting from unprecedented global co-operation, rapid technology deployment, and massive investment flows. This pathway demands that sovereignty, security, and sustainability challenges are addressed in time and at the required pace.

The bioenergy transformation imperative

Perhaps nowhere is Africa’s energy complexity more evident than in its relationship with bioenergy. Traditional biomass currently accounts for 81% of residential, commercial, and agricultural energy demand across the continent. Whilst this might appear sustainable, the reality involves significant health risks from indoor air pollution and environmental degradation from unsustainable harvesting practices.

The transition away from traditional bioenergy presents both opportunity and challenge. Moving to electricity offers substantial efficiency gains, reducing primary energy required to meet demand whilst eliminating health risks. However, even in the base case scenario, bioenergy’s share in the residential sector only declines to 70% by 2050, primarily because clean fuel alternatives fail to scale rapidly enough to match population-driven demand growth.

Under the net-zero scenario, more aggressive action reduces bioenergy’s share to 50% by 2050, accompanied by significant deployment of efficient cookstoves. This transition requires not just technology deployment, but fundamental changes in energy infrastructure, financing mechanisms, and consumer behaviour.

Transforming Africa’s mineral potential into prosperity

Africa holds vast reserves of critical minerals including cobalt, manganese, graphite, platinum, and rare earths. These resources are essential for batteries, electric vehicles, and other clean technologies. However, limited local processing capacity has long restricted Africa’s participation in higher-value global supply chains.

The Democratic Republic of Congo (DRC) produces 70% of the world’s cobalt, yet nearly 60% is processed in China. This imbalance limits economic gains and job creation within Africa. The continent exports wealth whilst importing finished products at premium prices.

Several nations are now adopting policies to restrict unprocessed mineral exports. Namibia, Zimbabwe, the DRC, and Gabon aim to capture more value domestically.

Thermal Runaway Solutions

LAB-TESTED, FIELD-APPROVED

Fike delivers complete BESS protection – thermal management, explosion control, custom gas detection, system design, testing, and consultancy – all engineered to perform when it matters most. Our solutions meet UL 9540A requirements and safeguard people, first responders, and the environment from the risks of thermal runaway.

These policies represent a strategic shift towards downstream processing that could transform Africa’s position in global supply chains.

Realising this potential requires substantial investment in mineral processing and battery manufacturing. Related infrastructure development remains equally critical. Strategic co-operation among African leaders will prove vital for success.

Electricity demand: The critical multiplier

Electricity demand emerges as the critical metric across all scenarios. By 2050, demand will exceed 2200 TWh in the base case – double current generation. Under more ambitious scenarios, demand increases three-fold to four-fold, primarily addressing the existing energy deficit whilst supporting economic growth.

This surge reflects Africa’s fundamental development challenge. The continent’s burgeoning working-age population and service sector growth create massive energy needs at a time when rapid decarbonisation is being demanded. Traditional approaches that separate energy access from climate goals are no longer viable.

Gas demand increases from 157 billion m3 in 2024 to 201 billion m3 in 2050 in the base case, mainly due to growing consumption in the power sector. In the net-zero scenario, gas demand peaks around early 2030 and declines long-term as renewables gain prominence in power generation. Oil demand grows in the base case, with internal combustion engine vehicles increasing from 36 million units to 63 million by 2050.

Untapped potential across the energy spectrum

Africa’s renewable energy potential remains largely under-utilised despite abundant solar, wind, and hydroelectric resources. Kenya exemplifies this potential, ranking among the world’s lowest-cost geothermal developers with 90% of electricity generated from non-fossil sources. The country’s estimated 10 000 MW geothermal potential remains largely untapped, with current installed capacity below 985 MW.

Similar opportunities exist across Africa’s diverse energy resources. The continent already accounts for nearly 10% of global LNG supply, with expansion potential in West Africa and Mozambique offering pathways to boost export revenue whilst supporting domestic demand. The challenge lies in creating enabling environments that attract investment whilst ensuring benefits reach those who need them most.

Africa’s future contribution to the global energy transition will increasingly come through hydrogen exports and nature-based solutions. By 2050, the continent has the potential to significantly scale blue and green hydrogen production, positioning it as a key player in the global clean energy economy whilst generating export revenues to fund domestic energy access. However, limited policy support and weak regulatory frameworks risk undermining competitiveness.

The financing bottleneck

The transition’s biggest obstacle remains financing. Africa desperately needs substantial external sources of low-cost capital, yet project costs often reach three times those of

other regions. The continent has received only a fraction of the promised annual US$100 billion in climate finance from OECD countries, creating a critical bottleneck.

This financing gap reflects deeper structural challenges. Energy security concerns highlighted by geopolitical tensions, growing discomfort with Chinese clean technology dominance, and the mounting US$3.5 trillion annual investment requirement for global low-carbon infrastructure all constrain capital flows to African projects.

The interconnected nature of these challenges demands innovative solutions. Fossil fuel and critical mineral revenues could provide the capital needed to finance renewable energy deployment and grid infrastructure. However, this approach requires careful management to avoid carbon lock-in and ensure that hydrocarbon revenues genuinely support rather than delay the energy transition.

The interconnected imperative

For European energy leaders, Africa represents both opportunity and responsibility. Success requires addressing the three critical factors currently holding back the transition discussed above; energy security concerns, discomfort with Chinese clean technology dominance, and the investment requirements for low-carbon infrastructure.

These challenges are deeply interconnected. Energy security concerns drive continued fossil fuel investment, whilst technology supply chain concentration creates vulnerability. The scale of required investment demands innovative financing mechanisms that can mobilise both public and private capital at unprecedented levels.

Africa’s share of global emissions is projected to increase from 3.5% currently to 6.5% by 2050 under current trajectories. Getting the transition right will determine not only the continent’s prosperity, but its contribution to global climate goals. The interconnected nature of today’s energy system demands integrated analysis and co-ordinated action across commodities, technologies, and markets.

Decoding the transformation ahead

More than just hitting climate targets, clean energy can help bring real prosperity to Africa whilst closing the huge energy gap that a reliance on fossil fuels has not solved. At the same time, Africa’s clean energy transition plays a vital role for the world’s path to net zero, from critical minerals and green hydrogen to nature-based carbon offsets.

Understanding how oil and gas revenues can fund renewable deployment, how industrial development affects electricity demand, and how global supply chains impact local energy costs requires an interconnected view of the energy landscape. Only by understanding these connections can Africa’s energy crossroads be navigated and the US$7.7 trillion opportunity ahead unlocked.

The stakes could not be higher. As Africa’s emissions share is projected to nearly double, the continent’s energy choices will play a pivotal role in determining whether climate goals can be achieved. The transition to low-carbon technologies offers Africa an unprecedented opportunity to expand energy access in ways that fossil fuels have failed to deliver.

Figure 1 . Magnetic gears are proving to be a defining technology for wind turbine efficiency, robustness, and sustainability.

The global expansion of renewable energy is accelerating the search for solutions that are efficient, resilient, and sustainable. Among the range of emerging technologies, magnetic gears are increasingly attracting attention. Gary Rodgers, CEO of Magnomatics, explains the benefits of magnetically-geared systems for the wind industry.

The wind industry is experiencing unprecedented growth, cementing its role as one of the cornerstones of the global energy transition.

Across onshore and offshore markets, installed capacity continues to rise y/y, driven by falling costs, government policy, and the urgent need to decarbonise power systems.

As turbines scale ever larger and are deployed in more challenging environments, drivetrain performance has emerged as a decisive factor in the industry’s success. The drivetrain is the beating heart of every turbine: it must transform the relatively slow rotation of blades into usable electrical power with high efficiency, robustness, and longevity. Yet existing solutions present difficult trade-offs.

Mechanical gearboxes can multiply torque effectively, but they remain one of the most common points of failure. Direct-drive systems eliminate gears altogether, but at the cost of very large, heavy machines and an increased reliance on rare-earth magnets. The search for drivetrain technologies that combine efficiency, reliability, and scalability is therefore critical to unlocking the full potential of wind energy.

Magnetic gears, a technology that has matured significantly over the past two decades, are emerging as

a third way – one that blends the compactness of geared systems with the simplicity and reliability of direct drive.

How magnetic gears work

Unlike conventional gears, which transmit torque through physical contact between gear teeth, magnetic gears use magnetic fields to couple input and output shafts. Torque is transferred without contact, eliminating friction, lubrication, and wear. This seemingly simple change offers profound implications for performance, durability, and cost.

Magnetically-geared systems are especially suited to applications where high torque and low speed are required. Their topology maximises the torque capability of the drivetrain, overcoming the limitations of standard direct-drive electrical machines. In practice, the magnetic gear element provides the same uplift in output torque as a single-stage mechanical gear. Furthermore, with the central gear element fully integrated, the dual use of the inner rotor – combined with the relatively modest mass of the pole-piece rotor array and outer magnets – produces a design that

is compact, lightweight, and less prone to failure than its mechanical equivalent.

A magnetic gear typically consists of three key elements: a high-speed rotor, a low-speed rotor, and a modulating pole-piece rotor that sits between them. The arrangement of permanent magnets and pole pieces creates a field interaction that couples the rotors and multiplies torque in much the same way a mechanical gearbox does, yet without direct contact.

This architecture delivers several inherent advantages. Since there is no contact, there is no wear on gear teeth, and no requirement for lubrication systems. Vibration and noise are reduced, improving operational smoothness. Efficiency is typically higher, especially at low speeds.

Reliability is also enhanced by the fault-tolerant nature of magnetic gearing. The coupling behaves as a passively resettable torque fuse, slipping under overload conditions to protect the drivetrain without the need for shear pins or clutches. At the same time, advances in winding design contribute to improved thermal management. Precision wire placement and modular stator construction increase thermal conductivity and minimise eddy current losses, reducing heat rejection requirements and further enhancing overall efficiency.

Advantages for wind turbines

For wind energy applications, these benefits align directly with the industry’s most pressing needs. Reliability is enhanced because the primary failure modes of mechanical gearboxes – gear tooth wear, lubrication breakdown, and bearing damage – are eliminated. As a result, maintenance costs are reduced, which is particularly valuable in offshore settings where intervention is costly and logistically challenging.

The compactness of magnetic gear systems translates into smaller nacelles, reducing loads on towers and foundations. At the same time, efficiency improvements increase energy yields, contributing to lower levelized cost of energy (LCOE).

From a manufacturing standpoint, magnetic gear systems are cost-effective. However, they do not just

tend to be less expensive to produce, but also more sustainable since they use fewer materials overall.

Case study: The CHEG project

While magnetic gears are conceptually elegant, demonstrating their practicality at utility scale has required concerted research and development. A landmark initiative in this regard was the Compact High Efficiency Generator (CHEG) project, part of the EU Horizon 2020 DemoWind programme funded by the Department for Business, Energy & Industrial Strategy (BEIS).

The project’s aim was to advance generator technology for wind turbines by reducing both capital costs and operating costs. At its heart was the innovative Magnomatics Pseudo Direct Drive (PDD)® generator incorporating the largest magnetic gear ever built, rated at 200 000 Nm of input torque. The previous largest had been just 20 000 Nm.

Building a machine of this scale posed several challenges. Innovative modular assembly techniques were developed for stators, pole-piece rotors, and high-speed rotors, enabling construction at size while remaining scalable for even larger machines. The manufacturing phase, carried out in partnership with Wolong Laurence Scott, required specialist tooling to handle powerful permanent magnets safely and effectively, all under ISO 9001:2015 quality management standards.

Testing took place at the ORE Catapult facility in Blyth, UK, using a 1 MW dynamometer. Results were highly encouraging: the generator delivered high efficiencies, exhibited low vibration, and responded dynamically to torque and speed changes. Independent validation by BVG Associates concluded that at the 10 MW scale, PDD technology could reduce LCOE by 2.6% compared with direct-drive systems and 2.8% compared with mid-speed geared drivetrains.

The project’s success demonstrated feasibility at scale and generated strong interest from turbine manufacturers. For developers and operators, the benefits are tangible. Reduced maintenance requirements directly translate into lower operational costs, particularly offshore where interventions are expensive and logistically challenging. Improved efficiency leads to higher energy yields, while compactness reduces structural demands on towers and foundations. Importantly, these advantages combine to lower the LCOE – a critical metric that underpins project financing and government policy decisions.

Wider applications

While wind energy is one of the leading sectors driving uptake of magnetic gear systems, the potential applications extend far beyond.

In tidal and ocean energy, conditions are harsh: equipment must operate underwater, exposed to

Figure 2 . The PDD generator has an input torque of 200 000 Nm and includes the largest magnetic gear ever made.

saltwater corrosion, fluctuating currents, and difficult access for servicing. Here, the advantages of contactless torque transfer are particularly significant. Magnetic gears require no lubrication and minimal maintenance, reducing the need for expensive offshore interventions. Their ability to deliver torque efficiently at low speeds makes them ideally suited to tidal environments, where currents may be variable and relatively slow. By improving reliability and reducing costs, magnetic gears could help unlock the commercial viability of tidal power.

The push to decarbonise shipping is also creating strong demand for efficient electric drive systems. Magnetically-geared thrusters can provide the compactness, scalability, and reliability required, whether for subsea vehicles, ferries, or larger ocean-going vessels. By eliminating complex mechanical gear trains, they reduce maintenance demands while improving environmental performance.

Additionally, in mobile and off-grid power generation, the compactness and durability of magnetically-geared machines make them well suited to challenging environments which require resilient systems that can deliver power reliably with limited maintenance support. Magnetic gears, with their vibration tolerance and contactless design, provide precisely this capability.

In industrial plants, where continuous operation is essential and downtime is costly, magnetic gears offer high reliability and low maintenance. Industries such

as chemicals, steel, and cement, which rely on high-torque machinery, could benefit from systems that minimise wear and mechanical losses. Contactless torque transmission ensures robust performance even in harsh environments, while improved efficiency reduces energy consumption and emissions.

Across all these sectors, the unifying theme is resilience and sustainability. By reducing wear, eliminating lubricants, and improving efficiency, magnetic gears contribute to more robust and environmentally responsible power generation systems.

Next generation wind turbines

The wind industry’s trajectory is clear: larger turbines, higher capacities, and lower costs. Achieving this will require not only larger blades and taller towers, but also drivetrain technologies that are more reliable, efficient, and sustainable.

Magnetic gears represent a significant step forward. By addressing many of the shortcomings of both mechanical gearboxes and direct drive – and combining efficiency, compactness, fault tolerance, and sustainability – they offer a compelling path for the next generation of wind turbines.

For wind energy, and indeed for a host of other renewable and industrial applications, magnetic gears could prove to be a defining technology of the next generation. June 9-11,

Matteo Saglia, Flyability, Switzerland, answers the question: How can drones help maintain critical energy infrastructure?

The energy sector encompasses many types of power production facilities, whether it is traditional thermal plants, wind farms, or hydropower plants. Although all these facilities are very different in nature, they are all highly complex environments that require constant monitoring and inspection to guarantee their reliability and reduce unexpected downtimes. With growing

demand for energy and a rising strain on the power plants’ infrastructure, inspecting them and making sure any issues are found on time is becoming increasingly important.

Traditionally, people inspecting these areas are required to access many confined, elevated, or hazardous spaces and perform the inspections manually (when this is possible). However, this often exposes workers to

Figure 1 The Elios 3 drone ready to perform an internal blade inspection.

fall risks, asphyxiation, toxic gases, and other risks. Additionally, manual inspections are prone to incomplete data acquisition, human error, and long inspection times, which can result in costly downtime. To reach these areas, scaffolding may require several days or even weeks to be built and dismantled, and carries the risk of dropped or forgotten objects and work at height. For these reasons, many energy companies around the world are looking for new tools to carry out these inspections remotely without having to put people in danger or having to build scaffolding.

An example of someone invested in finding safer and more efficient ways of performing inspections in these types of environments is Joseph Valenzuela, Co-Founder of Pathfinder Optics. He explains that “the benefit of using drones [for an internal wind blade inspection] compared to having a human enter the blade is safety. The biggest thing is safety, but also efficiency. Having a wind turbine down for a full day can be very costly for the owners.” He is one of the many industry experts who identified drones as an ideal tool to collect critical data remotely. Inspection drones, like Flyability’s Elios 3, are designed specifically to address these challenges, providing a safer,

faster, and more efficient alternative for data collection in challenging environments.

Wind turbine blades are just one of the many examples where people put themselves at risk to carry out inspections and make sure energy production remains consistent and reliable. Other examples include thermal power plant assets like boilers, chimneys, steam pipelines, condensers, and cooling towers. Hydroelectric plants also require their penstocks, surge tanks, and water pipes to be inspected. But use cases for remote inspection tools in the energy sector are many more, with new applications for drones being discovered almost daily by unmanned aerial vehicle (UAV) pilots around the world.

Could drones be the future of inspections in the energy sector?

Among several innovative remote inspection tools brought to the energy market, the most effective appear to be drones, and more specifically confined space drones. But why? As mentioned earlier, many areas that require frequent monitoring happen to be very complex environments, which can be enclosed, at height, or filled with pipes or other components, making it difficult for many people and solutions to move around them freely. On the other hand, drones built to inspect confined spaces can easily navigate these environments and also fly at heights where other ground robotic solutions cannot reach. This means they have a high level of versatility that allows them to inspect pretty much any type of asset.

For these reasons, inspection drones are transforming the way energy facilities monitor and maintain their critical infrastructure. In fact, the energy/utilities industry has the highest use of drones among all major industries, and according to data from Drone Industry Insights, it is estimated that the drone market in this sector will reach US$4.4 billion by 2030. Clearly, drones cannot replace human work and maintenance, but they are able to provide a complete assessment of an area to determine whether human intervention is in fact required and whether an environment is safe to enter before sending in people. For instance, a 50-m-tall boiler may be in perfectly good condition to continue operating; traditionally, the boiler would have to be shut down for weeks, with thousands of dollars spent on scaffolding, and then have people work at height for multiple days just to get that information. Drones, on the other hand, can remotely collect that very same data in hours, record it, and store it for future evaluation and comparison. It allows inspectors to share what they see with anyone around the world in a matter of seconds, reducing risks of human error and miscommunication. Then, only if an issue is discovered, will humans have to be involved to

Figure 2 The Elios 3 drone performing a visual and UT inspection inside a 50 m tall boiler.

Figure 3 . Visual of the data collected by the Elios 3 and visualised in the Inspector software.

perform the repair work, and even then, this can be limited to the specific area where a defect was found.

Experienced drone pilot and power plant inspector, Scott Paul from Dominion Energy, believes that “the biggest benefit [of using drones for inspection] is without a doubt safety! Not putting people at height for inspections is second to none, and not having to secure equipment to perform an inspection means we maintain maximum output for the grid. We also see benefits including time and cost savings, increasing efficiency, and reducing outages.”

Equipped with advanced sensors and protective cages, inspection drones like the Elios 3 by Flyability can navigate tight and complex environments that would otherwise require workers to enter hazardous areas, climb scaffolding, or simply be impossible to reach. Onboard lighting and high-resolution imaging enable detailed visual inspections even in dark or confined spaces, and LiDARs create accurate 3D models (also known as digital twins) of the assets where defects can be precisely localised for better monitoring and maintenance planning. In addition, the integration of UTM payload on board highly specialised drones allows inspectors to collect thickness measurements remotely and localise them inside the very

same digital twin, creating a more comprehensive view of the asset that is being inspected.

“The Elios 3 has been a breakthrough in the inspection of penstocks for the hydro sector. What previously took weeks can now be safely accomplished in a day with far more data acquired than was previously possible,” says Bryce L. Kohler from Cirrus Design. Bryce has been inspecting penstock and other energy assets for several years now and, according to him, there is no other tool able to collect the same quality data as an inspection drone like the Elios 3. Specifically for penstocks, which are extremely confined, dark, and wet environments, people would often have to be lowered hundreds of metres into these pipes via rope access, equipped with only a torch, and try to visually identify any defects. If any were found, they would then have to try to provide an estimation of where they were located within the pipe. Needless to say, these inspections proved to be very complex. A drone can simply fly inside the penstocks, and, thanks to their powerful lighting and high-quality cameras, detect the presence of damage or concerns.

The ability to rapidly inspect confined areas minimises downtime, enhances safety, and supports predictive maintenance strategies, ultimately reducing operational costs and improving asset reliability. As power generation facilities face increasingly stringent safety and efficiency requirements, solutions like the Elios 3 illustrate how inspection drones are becoming an integral part of modern plant management.

What makes a drone fit to perform inspections?

It is important to consider that not every drone is suited for the complex and often dangerous environments found in the energy sector. Consumer-grade drones, for example, may excel outdoors in open spaces but lack the stability, resilience, and sensor payloads required for industrial inspections. Confined space drones, such as the Elios 3, are purpose-built for these environments but are not suited for high altitude outdoor flights. Just like with other tools, for each application, the best UAV should be determined for those specific circumstances.

For any indoor or outdoor complex environment that needs inspecting, key characteristics of an inspection drone should include collision tolerance, allowing drones to bump against structures without compromising flight stability, and the ability to fly in GPS-denied areas (usually LiDAR-based stabilisation). This typically requires a collision-tolerant design or obstacle detection, and live situational awareness for operations beyond the visual line of sight. Equally as important is the data quality that the drone can collect. For purely visual inspections, drones should be equipped with 4K cameras and powerful lighting, and for more complete assessments, drones can now also be equipped with UTM payloads for remote thickness measurements, gas sensors for additional safety and detecting the presence of toxic or flammable gases, LiDAR scanners for digital twinning, and more. Last but

Figure 4 . The Elios 3 drone performing a visual inspection inside a wind turbine blade.

Figure 5 A pilot expertly flying the Elios 3 to perform an internal chimney inspection.

not least, durability is an essential trait for a reliable inspection solution. Drones should be able to withstand dust, temperature variations, elevation, low visibility, and other challenging conditions, making the pilot feel comfortable with the tool they are controlling.

Digital twins are becoming increasingly relevant for energy companies looking to adopt predictive maintenance strategies. By repeatedly scanning the same assets, operators can monitor the progression of defects over time and make data-driven decisions on when to perform maintenance, extending asset lifespan and avoiding unexpected failures. Additionally, an integrated LiDAR on the drone provides the ability to localise defects within the digital twin of the asset, making it much easier for maintenance teams to know exactly where to start. This also enables the possibility to perform accurate comparisons over time to see how a defect evolves and determine the best time to intervene.

Ongoing developments in the tech world are also opening up advanced new possibilities for inspection drones. Innovations like automation and artificial intelligence are proving to be a real game-changer for the inspection world. Additional abilities for drones to fly tethered or untethered give them the flexibility to operate for long periods of time, but also to reach where the tether cannot reach. Additional data management capabilities such as real-time streaming, automated reporting,

and integration with inspection software platforms further increase the value of drones for asset integrity programmes.

Conclusion

As energy infrastructure continues to age and global demand for power increases, ensuring the reliability, efficiency, and safety of energy production facilities has never been more critical. Traditional inspection methods, though still widely used, come with significant drawbacks, from safety risks and prolonged downtimes to incomplete or inconsistent data. On the other hand, drones, particularly those designed for confined and complex environments, are proving to be transformative tools in the inspection space. They drastically reduce the need for hazardous human entry, cut down inspection time and associated costs, and provide high-quality, repeatable data that can be used for predictive maintenance and long-term asset management. With their ability to access hard-to-reach areas, integrate advanced sensors, and create detailed digital twins, inspection drones like the Elios 3 are quickly becoming an essential part of modern energy infrastructure maintenance. As technology continues to evolve, the role of drones in the energy sector will likely expand even further, helping operators meet growing safety, efficiency, and reliability demands with confidence.

Jon Salazar, CEO, Gazelle Wind Power, addresses the growing need for larger turbines, and considers the challenges and opportunities that come with them.

As the world races towards what the International Energy Agency (IEA) has called the “age of electricity”, the potential of wind energy remains strong both in driving the energy transition and enhancing energy security.

As part of this, offshore wind has demonstrated its unique ability to become the main engine for the future growth of wind energy despite several obstacles. The most recent report by the Global Wind Energy Council (GWEC) shows that there is now already 83 GW of offshore wind installed worldwide. There is also currently a further 48 GW of offshore wind under construction worldwide.

What is more, in 2024, a total of 56.3 GW of offshore wind capacity was awarded worldwide. Europe led the way, with 23.2 GW awarded while China awarded 17.4 GW. Other markets also had landmark years, with South Korea awarding 3.3 GW, Taiwan 2.7 GW, and Japan 1.4 GW. Even France, which has historically relied on nuclear energy, is now getting serious about offshore wind, setting an ambitious target of 18 GW of installed capacity by 2035.

Offshore wind energy is gaining recognition not just for its role in delivering clean, renewable power, but also as a vital element in strengthening energy independence and security – especially important in today’s uncertain geopolitical climate. Despite facing hurdles such as supply chain bottlenecks, increased investment costs, and global

political shifts, the sector’s strategic value continues to rise, reinforcing its importance to developers, investors, and decision-makers alike.

The bigger the better: The potential of 15 MW and beyond

One of the sector’s most pressing issues is the need to improve the economic viability of offshore wind projects. Although technological advances have helped bring costs down over time, offshore wind remains capital-intensive compared to other renewables. The logistical demands of constructing and maintaining turbines at sea, in deep waters, and under extreme weather conditions, can sometimes result in higher levelized costs of energy (LCOE) than land-based alternatives.

To address this issue, developers and manufacturers have embraced a strategy of scale. By deploying increasingly larger turbines capable of producing more energy per installation, project developers can reduce the overall number of installations needed, simplify supporting infrastructure, and improve overall project economics.

The latest frontier in this race is the deployment of 15 MW+ turbines. Indeed, DEC recently unveiled a prototype 17 MW floating offshore wind turbine and, in 2024, the company also announced a 26 MW fixed bottom wind turbine. This new class of larger turbines are gargantuan

Figure 1 . Innovative platform technology can simplify manufacturing, speed up assembly, and streamline installation.

machines that can generate enough electricity to power tens of thousands of homes each, dramatically increasing the output of individual offshore wind farms.

However, while the energy-generating potential of these machines is clear, their size and weight pose new challenges. Transporting, installing, and operating 15 MW+ turbines in offshore environments is not an easy task. The turbines are taller than structures like the Shard or the Eiffel Tower, with some blades now exceeding 150 m in length. The logistics involved in port assembly, at-sea installation, mooring, and long-term maintenance become increasingly complex as turbine sizes grow. The harsh marine environment only adds to the difficulty, with powerful waves, strong currents, and saltwater corrosion exerting continuous pressure on both the turbines and their foundations.

Fixed-bottom foundations, which have historically supported offshore turbines in relatively shallow waters, quickly become uneconomical or physically unviable in deeper sites. This constraint limits where offshore wind farms can be located, often excluding areas with the highest wind resources – typically found farther offshore, in water depths beyond 60 m.

As a result, the industry is increasingly turning towards floating wind platforms, which can unlock these deepwater zones and bring offshore wind to regions previously

considered inaccessible. Floating wind is not a new concept, but until recently it remained a niche application. That is now changing.

Unlocking 15 MW+ through innovative floating technology

Early floating wind projects served as test beds rather than commercial scale power producers, and high costs limited their wider adoption. However, recent years have seen a shift. As engineering knowledge increases and supply chains become more experienced, floating wind is edging closer to commercial competitiveness. Industry projections suggest that global floating wind capacity could reach 21 GW by 2035, potentially transforming the offshore wind map and expanding its reach to new coastal geographies.

Additionally, according to WindEurope, floating foundations could have a transformative impact on the European market, where 80% of offshore potential lies in waters deeper than 60 m.

Key to this evolution is the development of floating platform technologies that can support larger turbines, including the 15 MW+ class, while remaining cost-effective and scalable. Platform design, though often less visible than turbine technology, plays a crucial role in floating wind success. A well-designed platform must provide the necessary stability to ensure turbine performance and longevity, while also being logistically viable to manufacture, transport, assemble, and maintain. At the same time, it must meet increasingly stringent environmental requirements and minimise disruption to marine ecosystems.

Achieving all these goals simultaneously is a formidable engineering challenge. However, recent technological progress in floating offshore wind has opened the door to turbine installations in deeper waters, supported by cutting-edge anchoring methods and enhanced stability frameworks. As the industry moves to deploy ever-larger turbines in harsher offshore conditions, new designs are emerging that seek to reconcile the limitations of previous generations.

Portugal: The perfect test bed for new floating offshore wind technology

One illustrative example of this innovation can be found off the coast of Aguçadoura, Portugal, where a next-generation floating wind demonstrator is currently under development. The project, known as Nau Azul, is spearheaded by Gazelle Wind Power, which is working to validate a new floating platform. Though the demonstrator will initially support a 2 MW turbine, its underlying design is intended to serve as a blueprint for much larger deployments, including those in the 15 MW+ range.

What sets this technology apart is the way it achieves stability. Instead of relying only on buoyancy, it separates flotation from stability using what is known as the Gazelle principle. This involves a counterweight connected to levers or balancing arms, which are attached to outer mooring lines.

Figure 3 Floating wind moves towards commercial competitiveness.

Figure 2 New platform technology is being developed for floating offshore wind.

This method is both flexible and reliable. Whether the user swaps out the arms for pulleys, changes the shape of the platform, or comes up with new ideas, the core principle still works well. Unlike older systems, which have struggled to scale affordably over the past 20 – 25 years, this design offers strong potential for improvement and efficiency. Its ability to be refined and improved is what makes it a potential game-changer in the industry. The focus is on reducing the LCOE, primarily by lowering CAPEX, especially through minimising steel usage. Less steel means lower CAPEX through reduced transport and installation costs. The ability to assemble the platform in shallow ports also means greater deployment flexibility, making it suitable for regions without specialised deep-water port infrastructure.

This approach is also notable for its focus on environmental integration. By minimising seabed disturbance and offering a smaller physical footprint, the platform design seeks to reduce the impact of offshore wind development on marine life and ecosystems, an issue of growing concern as more projects are sited in previously undisturbed ocean areas.

In essence, this technology retains the strengths of traditional offshore wind systems while eliminating many of their limitations. The Gazelle principle is the foundation of these improvements, which simplifies manufacturing, speeds up assembly, and streamlines installation, all essential in reducing the cost of clean energy.

Although still in its early stages, the platform’s development underlines a broader shift in how the industry approaches the deployment of large scale offshore wind turbines. Rather than focusing solely on turbine efficiency or energy output, there is a growing recognition that the infrastructure beneath the turbine, the floating platform and the mooring systems, will play a decisive role in determining the economic and technical feasibility of offshore wind in the next decade.

A successful demonstration could pave the way for commercial scale projects that deploy 15 MW+ turbines in deeper waters, far from shore, where wind speeds are more consistent and capacity factors are higher. Such projects would not only increase energy yields, but also reduce visual impact and competition for nearshore space, a consideration that is becoming more important as public resistance to large coastal infrastructure grows.

How to scale floating offshore wind to enable bigger turbines and more energy

Engineering breakthroughs on their own are not enough to drive the integration of larger turbines with floating platforms. Success will also depend on improvements in infrastructure. Ports, installation ships, and power grid connections will need to handle bigger parts and more complex operations. At the same time, regulations must be updated to make permitting easier and give developers more long-term clarity. Financing models will also need to reflect the higher upfront costs of floating wind, while recognising its potential to provide higher returns over time.

Individual countries are also making positive changes. The UK has launched dedicated funding streams for floating wind manufacturing and port upgrades, while countries like Portugal and Spain are integrating floating wind into their broader maritime spatial planning frameworks.

Despite recent challenges in the industry, installed offshore wind is constantly growing as the industry seeks to make good on its enormous potential. However, in order to do so, developers must continue to deliver greater scale – which means bigger, 15 MW+ turbines on floating platforms, in windier environments. The innovations in floating platform technology that will enable this scale are being developed right now. These innovations will allow countries around the world to truly harness the full potential of this vast source of zero-carbon electricity and guarantor of energy security.

Figure 4 Floating platforms enable turbines in deeper waters.

Figure 5 . New designs use the Gazelle principle.

Although commercial exploitation of wave energy is still in its infancy, it has the potential to contribute substantially to a stable and reliable electricity grid based on renewable energies being attained within just a few years, argue Michael Kocher and Frank Fladerer, Bachmann electronic GmbH

Ocean wave movements contain hydrokinetic energy. The magnitude of this energy is considerable: according to the U.S. Ocean Energy Council, a wave breaking along a mile of coastline releases almost 36 000 kW of power. It can be captured by means of wave energy converters, which are anchored to the seabed. These convert the energy into electric current, which is then transported to the coast by cable.

The global potential of wave energy is estimated at 29 500 TWh/y, which approximately equates to current global electricity consumption. Wave energy is also more constant and predictable than other forms of renewable energy. Furthermore, the production profile of wave energy is countercyclical to that of wind and solar energy.

Technical approaches

Several different technical approaches to harnessing wave energy are being trialled around the world. Those currently most significant are described in this article. Point absorbers, such as Carnegie Clean Energy’s CETO system, are floating devices that generate electricity from the vertical movements of waves. Unlike other systems for this purpose, they function independently of the wave’s direction

of propagation and can absorb energy irrespective of it. A rod-shaped buoy or ring-shaped float converts the oscillating up-and-down movement directly into electrical energy. Point absorbers are primarily used at sites near the coast.

In oscillating water columns (OWCs), air is compressed and decompressed. OWCs feature a chamber, with a submerged opening through which water flows into and out of the chamber. The air trapped in the chamber serves as a medium for driving a turbine. A key advantage of this design is the use of special turbines which generate electricity during both ingress and egress of the water into and from the chamber (compression and decompression of the air respectively). These ‘pneumatic chambers’ are used primarily on steep coasts where strong waves occur.

Attenuators are elongated devices oriented in the axis of wave propagation. They exploit the rising and falling motion of the waves. They typically consist of several interconnected segments that float parallel to the axis of wave propagation and can move relative to each other. The movement at the joints between the segments is used to activate hydraulic cylinders, whose energy is used in turn to generate electricity. The modular design of the attenuators enables them to be scaled easily for high power classes, making them ideal for large offshore projects.

Overtopping devices are power generators that exploit the flow of water over a ramp into a reservoir. The difference in elevation is used to generate electricity, in much the same way as in small hydroelectric power plants. This technology resembles that of pumped storage power plants, and is particularly suitable for locations with high tidal ranges.

Some companies have opted for oscillating attenuator technology: one of these is CalWave in California. Converters of this type are fully submerged and exploit the pressure differential created by the wave motion. The platforms are anchored to the seabed. The wave movements, which also occur below the surface, give rise to changes in their buoyancy. Drivetrains convert the constant movement into electrical energy. Their submerged location protects the systems against storms, and their impact on the environment is lower than that of wave energy converters above the surface.

Wave energy converters are currently being tested and developed further worldwide, primarily on a small number of test and pilot farms. However, the production of electric power that has been attained is increasing with each new generation of converters, and suppliers are now attaining magnitudes of economic significance.

Besides economic viability, the issue of grid integration must be resolved, and the systems’ impact on marine ecosystems has also not yet been fully researched. Finally, many countries have extremely complex approval procedures and far-reaching regulatory frameworks.

Control: A success factor

All these issues are made critical by the harsh environmental conditions; wave energy systems must withstand storms and the corrosive effects of salt water. The components are subject to temperature fluctuations, shock, and vibration. Difficulties of access require the systems to exhibit high operational reliability and a long service life. The development of robust and low-maintenance designs is therefore essential.

Figure 1 Point absorbers, such as Carnegie Clean Energy’s CETO system, are floating devices that harness the vertical movement of waves to generate electricity. Source: Carnegie Clean Energy.

Figure 2 . Companies such as CalWave in California rely on the principle of oscillating attenuators. These converters are fully submerged, and exploit the pressure differential created by the wave motion. Source: CalWave.

Figure 3 CorPower Ocean’s C4 has a diameter of 8 m, a height of 40 m, and a weight of 70 t. As a result, the wave energy converter can withstand even extreme storm waves. Source: CorPower Ocean.

JOIN US IN LONDON!

A full day event dedicated to the UK’s CO2 pipeline build-out: uniting pipeline operators, engineers, contractors, and decision-makers.

The programme will cover the UK’s rapidly evolving CCS infrastructure plans, proposed and confirmed projects, safety codes, technical challenges, international case studies, and the technologies enabling safe, efficient CO2 transport.

WITH SUPPORTING ASSOCIATION

Delegate takeaways from this exclusive one day conference:

Learn

Hear from industry leaders on planning, safety, design, construction, and environmental considerations for CO2 pipelines.

Be informed

Updates on key UK CCS projects, with sessions on buildout and delivery, integrity, and international insight.

Understand

Understand government support, regulatory frameworks, and permitting processes.

Network

Meet the companies driving the UK’s CCS pipeline future.

One particular technical aspect is the control systems used. These are crucial in wave energy converters, for the energy yield to be maximised and, at the same time, the mechanical stresses presented by the weather conditions to be reduced to a minimum. Control algorithms enable the converters to be adjusted dynamically to different wave heights and frequencies, thereby always delivering the optimum yield. In addition, intelligent control protects the systems from overload, for example during storm surges, and extends their service life.

Successful test in California

CalWave, a US provider, has conducted an initial long-term trial 0.5 km off the coast of San Diego, California.

Thomas Boerner, Chief Technology Officer at CalWave Power Technologies, Inc., explained: “The Bachmann team considered the automation requirements in detail in consultation with us and gave us sound advice on the optimum configuration of the systems.”

The system operated autonomously round the clock during the 10-month pilot project, which was conducted under real-world conditions. The control system mastered the challenges and contributed significantly to an availability of over 99% being attained for the system as a whole. No intervention was necessary during the project.

Multiple drivetrains converted the energy from the waves into electricity. In addition, the system was able to change the geometry of the absorber body. The aim here was to exploit each wave to the full. “By means of these mechanisms, we were able to keep not only the drive within the optimum operating range, but the whole unit – very similar to the approach used in wind energy,” said Boerner.

The xWave system, with its rated output of 15 kW, was controlled through a Bachmann main device with an MC220 processor module. Several subdevices of the controller, connected to the main device over FASTBUS, assumed the complex task of drive control. The wave energy converter also featured load management: xWave could be raised or lowered relative to the seabed according to the instantaneous wave propagation, thus exploiting the wave energy at the ideal depth for absorption.

Within the control system, the control tasks were shared between the four available processor cores. This allowed loads such as sensor data processing, control, or communication with peripheral devices to be processed simultaneously and in parallel rather than sequentially.

The elegant distribution of tasks increased the response speed of the controller – already very powerful – still further. This is important for optimum energy yield in complex applications such as the adaptive control of wave energy converters under dynamic sea conditions. Although over 1000 variables were exchanged between the application programs running in parallel during completion of the complex control tasks, the system load of the four available processing cores never exceeded 50%, even when only a single processing core was in use at a given time.

The task of providing CalWave with a full picture of the instantaneous status of its pilot plant always fell to the Scope 3 software oscilloscope. In contrast to a conventional hardware oscilloscope, the signals are recorded by hardware but are displayed, analysed, and saved in a software application. A major advantage here is the close integration with the control software, which permits simultaneous visualisation of process data, storage of large data volumes, and the use of complex evaluation logic. The use of webMI pro to visualise the data permitted comprehensive system diagnostics and selective control of all-important parameters – from any location. 12-hour data sampling of all relevant signals enabled the company to track the processes on the platform conveniently and without post-processing.

Complex development

CalWave opted for a model-based approach for development of the pilot plant. The complexity of the drivetrain and controller, and organisation of signalling and data, posed particular challenges in this process.

Model-based development enabled the

Figure 4 . A study by the International Renewable Energy Agency (IRENA) estimates the global potential of ocean energy at around 80 000 TWh/y. The potential of wave energy alone could cover global electricity demand.

Figure 5 . Visualisation with webMI pro enabled comprehensive system diagnostics and selective control of all important parameters, from any location.

company to use the simulation model itself to study the mutual influences between the waves and the mechanical and electrical components precisely. Parallel to this work, the MATLAB Simulink development tool was used for design of, for example, the required control algorithms and signal processing. As part of this process, the wave energy specialists generated new, tailored control programs automatically using M-Target for Simulink.

This architecture proved to be of crucial benefit as the project progressed and during field testing. It enabled CalWave to replace the existing control core with an optimised version, for example, by loading new software at any time. The remaining software components were not affected by the update; operation of the system was uninterrupted, as a controller restart was not required.

Another major advantage was that the Bachmann controller supports the C++ programming language. In demanding applications such as wave energy, where real-time processing and hardware access are crucial, this enables engineers to implement powerful control strategies, tailored to the application and surpassing the capabilities of traditional PLC programming.

Next step and the digital twin

In the next step, CalWave is working on construction of a 100 kW version of the xWave architecture. This is to be operated for two years in ‘PacWave South’, the first accredited, grid-connected, and approved test facility for wave energy

in the open sea off the US coast. The expectation is that from mid-2026 onwards, 20 MW of power will be fed from there over pre-installed cables into the local grid on the mainland.

Besides increasing the output, CalWave also plans to use a digital twin: a simulation model trained on data from the real system. Control and simulation are then to run in parallel in real time, and the results of the real system are to be compared with those of the simulation. The long-term goal is to develop wave energy converters rated at over a megawatt per system. However, platforms with lower rated outputs, such as those in the pilot project, are also important for the utilisation of wave energy; for example, they could be used in the future to supply energy to offshore measuring stations.

Industrialisation requires stable framework conditions

The present course of wave energy exploitation is promising. However, it will continue to require considerable research and development effort in the years to come. Some island countries and territories, such as the Faroe Islands, Orkney, and Tahiti, have already set their own goals, putting an end to the expensive imports of fossil fuels by ship and intending to have their power needs met entirely by renewable ocean energy by 2030. This creates a major incentive for manufacturers to scale up wave energy to industrial levels soon.

LNG Industry magazine

Fernando Gimenez, Product Manager, Sulzer, examines current developments in geothermal energy plants and how the company is supporting the growth of enabling technologies.

As the world accelerates its transition away from fossil fuels, attention is increasingly turning to the vast, untapped energy beneath our feet. Geothermal power, long viewed as a niche renewable energy source, is now emerging as a critical component of global decarbonisation strategies. According to the International Energy Agency (IEA), global geothermal capacity had a utilisation rate over 75% in 2023, compared with less than 30% for wind power and less than 15% for solar photovoltaic (PV).1 Now, more regions can take advantage of geothermal energy and deliver significant

growth for an industry traditionally overshadowed by solar, wind, and hydropower.

With more fossil fuel-powered generating plants coming out of service, maintaining national grid stability and meeting peak demand is crucial – a task that geothermal can now support in more areas than it has in the past. The fact that geothermal power plants can operate flexibly also means that they can enable the further integration of variable renewables such as solar PV and wind, supporting the decarbonisation of the energy sector.

Geothermal energy, derived from the natural heat of the Earth’s interior, offers continuous, stable power generation, unlike many other renewables that are intermittent by nature. Yet the path to scaling geothermal is complex, requiring not only advanced drilling and thermal technologies, but also innovative engineering solutions to ensure plant efficiency and long-term reliability.

Developing technology in geothermal power

One of the most significant technological trends in the geothermal sector is the increasing use of the Organic Rankine Cycle (ORC). Unlike conventional geothermal plants, which operate using high-temperature steam, ORC systems can function at lower temperatures ranging from 105˚C – 185˚C. This makes them ideal for regions without extreme geothermal gradients.

In an ORC system, geothermal fluid is used to heat an organic working fluid with a lower boiling point via a heat exchanger. This fluid vaporises, drives a turbine connected to a generator, and then condenses back into liquid form, completing a closed-loop cycle. Due to the ability to use lower temperature resources, these systems are unlocking vast new areas for geothermal development. With more flexible siting and a lower environmental impact, ORC systems offer a number of advantages.

Enhancing efficiency and reliability

As a typically modular design, ORC plants are scalable, enabling operators to tailor the capacity to local demand and expand incrementally, which reduces the initial capital investment. These plants can also be integrated with existing power generation facilities to recover waste heat and supply local district heating systems, enhancing overall efficiency.

Furthermore, as ORC systems operate at lower temperatures and pressures, they experience less thermal stress and corrosion. This leads to longer equipment life, lower maintenance requirements, and a better return on investment (ROI).

The challenge with ORC systems lies in their technical complexity, particularly regarding fluid handling. The organic fluids used (while non-corrosive) have high vapour pressures and low boiling points, making them difficult to seal and contain during operation. Pumping systems must be both precise and robust to handle the unique thermodynamic properties involved.

Engineering precision

These challenges are most prominent for the pumps that are deployed in the heat transfer processes. Multi-stage, vertical pumps are commonly used to pressurise the organic working fluid, and their design needs to be precisely engineered to achieve long-term reliability and efficiency. These pumps have some interesting characteristics. The fluid is constantly trying to escape the pump, and the design engineers need to engage

Figure 1 Geothermal power is now emerging as a critical component of global decarbonisation strategies.

Figure 2 . Geothermal fluid powers an organic turbine by heating a secondary organic fluid (like brine) via a heat exchanger.

technologies and expertise accordingly to overcome these unique challenges. Original equipment manufacturers (OEMs), such as Sulzer, engineer their pumps to operate with high efficiency and exceptional reliability.

These attributes are critical for geothermal projects, which face high capital costs and require uninterrupted operation to maximise ROI. OEM pump testing facilities provide customers with assurance that the units meet strict performance criteria before deployment.

In addition to technical excellence, OEMs need to deliver complex solutions under tight project timelines. Geothermal plants, particularly those using ORC technology, are typically smaller in scale than conventional thermal power stations. This results in compressed development cycles and response time becomes critical.

However, for the operators, the benefits are numerous. Producing a reliable and continuous source of energy with zero emissions, regardless of the weather or time of day, ORC plants complement intermittent renewable sources, such as wind and solar PV. As such, they offer an excellent addition to baseload power supplies.

Case study: Retrofitting a Turkish geothermal plant

In addition to new facilities, assets in existing geothermal facilities can be upgraded, enabling them to benefit from modern technologies too. During a recent retrofit of an ORC geothermal facility in Türkiye, the customer wanted to enhance energy efficiency without modifying the existing infrastructure. The performance bar was set high; the pumps had to achieve a minimum of 82% efficiency, while conforming to specific mechanical constraints like flange dimensions and pipeline pressure limits.

In a brownfield project like this, the challenge is in adapting a pump to the existing dimensions while ensuring that the equipment meets the required operational conditions.

Sulzer delivered customised VS6 pumps that met all specifications, revitalising the plant’s performance and extending its operational life. This project exemplifies how modern engineering solutions can breathe new life into older facilities, reducing emissions while improving output.

Expanding the net-zero energy mix

While retrofits are crucial for legacy systems, new build geothermal projects are increasingly gaining momentum. Sulzer recently secured a contract to supply VS6 pumps to several carbon-free energy installations in the US. These projects integrate wind, solar, and geothermal power into hybrid systems that produce zero emissions, serving as blueprints for future renewable energy ecosystems.

ORC systems also hold potential beyond the power sector. In Canada, Sulzer participated in a project to capture and reuse waste heat from a refinery using ORC technology. This not only reduced energy consumption, but also contributed to the facility’s broader sustainability goals. Such applications highlight geothermal’s role in industrial decarbonisation.

Global scale

Scaling geothermal power is not just a technical challenge, it is a global endeavour. Nowhere is this more evident than in Indonesia,

a country rich in geothermal potential thanks to its location along the Pacific Ring of Fire. With a national goal of achieving net-zero emissions by 2060, geothermal energy has become central to Indonesia’s energy strategy.

Sulzer is playing a key role through a five-year strategic service agreement with PT Pertamina Geothermal Energy Tbk. The agreement covers maintenance and technical support for rotating equipment across multiple geothermal facilities, which collectively generate 330 MW, enough to power more than 600 000 homes.

Sulzer’s field services provide everything from outage optimisation and turbomachinery overhauls to advanced repair technologies. These services are essential to ensure improved uptime and efficiency, both of which are crucial in meeting Indonesia’s climate targets.

Regulatory challenges

Despite promising trends, the geothermal industry faces challenges on its growth journey, particularly around regulation. Each country pursuing geothermal development has unique technical codes, safety standards, and environmental regulations. However, as a global supplier, Sulzer is able to customise each solution to meet local requirements, including ATEX certification, specific material standards, and pressure ratings.