PROVEN IPSC SOLUTIONS

MMD remains at the forefront of In-Pit Sizing and Conveying (IPSC) technology, developing ground breaking sizing systems that optimize efficiency, improve safety, and delivers high productivity.

The Twin Shaft MINERAL SIZER™ sits at the heart of every IPSC system. To cater for today’s variety of modern mining methods, MMD has deployed successful modular Sizing stations and systems worldwide to take advantage of cost effective long haul by conveyor. High throughputs and short relocation times enable mines to achieve their efficiency and productivity goals.

MMD’s worldwide structure, technical expertise and service excellence will ensure your system always delivers optimum performance. Discover how we can deliver the complete IPSC solution for your specific needs.

31 Revolutionising The ERS With Technology

Flor Rivas, Caterpillar, USA, discusses the importance of technology advancements in driving electric rope shovel efficiency and longevity.

35 The Right Connection

Paul Badeau, Applied Fiber, USA, examines the advantages of utilising fibre pendants as a connection point technology, and how they can be used as an effective alternative to steel wire.

38 Coal Processing With Screen Media

Serge Raymond, MAJOR, Canada, explains how it is possible to solve the three biggest coal screening challenges.

Productivity With Dust and Erosion Control

Lee Gailer, RST Solutions, Australia, considers how utilising advanced technologies for dust and erosion control is essential for keeping mines running during the wet season.

22 Going Back To Basics With Dust

Liam Sheeder, Belt Tech Industrial, USA, reflects on the problems associated with excess dust in coal mining operations and provides some solutions to mitigate this.

26

Cutting, Crushing, And Loading

Dr. Erik Zimmermann, Wirtgen, Germany, explores how cutting technologies can be used to optimise coal mining operations, and how they play an important role in reducing emissions.

43 Relying On Resin

Benjamin Mirabile, Jennmar, USA, reviews the critical role that resin plays in coal operations and how it is essential to all modern ground support systems.

46 The Importance Of Clean Coal Technologies

Nikhil Kaitwade, FMI, India, outlines how clean coal technologies can help reduce emissions within the industry.

Trust Your Separation Needs To Tabor Vibrating Screens

Trust Your Separation Needs To Tabor Vibrating Screens

Tabor Vibrating Screens

For over 60 years, Tabor vibrating screens have been the trusted choice in meeting industry’s most challenging separation needs. Our industry leading Tabor vibrating screens provide:

• Design Flexibility that provides rugged construction at a competitive price

• Dependable sizing for wet or dry applications

• Efficient screening of metallic/nonmetallic minerals, aggregate, sand, gravel, crushed stone, coal and recycled materials

• Wide selection of repair parts

• 24x7 emergency service

• Application assistance

Our full line of Tabor vibrating screens include Vibrating Incline, Multi-Slope, Horizontal and Fine Dewatering Screens to meet a wide range

of demanding applications. Screens are available in single, double, triple or multi-slope decks in sizes ranging from 3’ to 12’ wide and 6’ to 28’ long.

Elgin Separation Solutions uses the latest technology and manufacturing techniques to provide service and repair parts to mining, chemical, industrial and recycling screening and separation facilities around the world. We are committed to delivering performance excellence and earning your trust in meeting your separation needs with Tabor vibrating screens.

Fine Dewatering Screen Incline Screen TMS Multiple Slope Horizontal ScreenMANAGING EDITOR

James Little james.little@worldcoal.com

SENIOR EDITOR

Callum O’Reilly callum.oreilly@worldcoal.com

EDITOR

Will Owen will.owen@worldcoal.com

EDITORIAL ASSISTANT

Isabelle Keltie isabelle.keltie@worldcoal.com

SALES DIRECTOR

Rod Hardy rod.hardy@worldcoal.com

SALES MANAGER

Ryan Freeman ryan.freeman@worldcoal.com

PRODUCTION MANAGER

Kyla Waller kyla.waller@worldcoal.com

ADMINISTRATION MANAGER

Laura White laura.white@worldcoal.com

EVENTS MANAGER

Louise Cameron louise.cameron@worldcoal.com

EVENTS COORDINATOR

Stirling Viljoen stirling.viljoen@worldcoal.com

DIGITAL ADMINISTRATOR

Leah Jones leah.jones@worldcoal.com

DIGITAL CONTENT ASSISTANT

Merili Jurivete merili.jurivete@worldcoal.com

World Coal (ISSN No: 0968-3224, USPS No: 020-997) is published four times per year by Palladian Publications Ltd, GBR, and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals postage paid New Brunswick, NJ, and additional mailing offices.

POSTMASTER: send address changes to World Coal, 701C Ashland Ave, Folcroft PA 19032.

Annual subscription (quarterly) £110 UK including postage, £125 overseas (airmail). Two-year discounted rate (quarterly) £176 UK including postage, £200 overseas (airmail). Claims for non-receipt of issues must be made within four months of publication of the issue or they will not be honoured without charge.

Palladian Publications Ltd, 15 South Street, Farnham, Surrey, GU9 7QU, UK

t: +44 (0)1252 718999 w: www.worldcoal.com

As 1Q23 draws to a close, some might characterise the global coal industry as a poker player running low on chips. Despite its status as a veteran player, with much time and capital invested over the years, the feeling that coal’s ‘luck’ has turned for the worse has failed to dissipate with the dawn of the new year.

Indeed, large scale public opinion remains stoically opposed to the continued use of coal for power. This was apparent in January, as protests in Germany – backed and attended by climate activist Greta Thunberg – over the expansion of the RWE-operated Garzweiler coal mine made headlines across international mainstream media.

Furthermore, as illustrated by a recent presentation by Fitch Ratings, major financial institutions around the globe are continuing to withdraw from financing coal ventures. The writing on the wall seems particularly clear for Australia: “as part of the net-zero banking alliance, all of the big four banks in Australia have committed to stop financing new thermal coal mining projects, and to exit financing the thermal coal sector entirely, by 2030.”1 (For more information regarding the state of the Australian coal industry, make sure to read Fitch Solutions’ regional report on pp. 8 – 13).

This being said, coal has not been without its victories of late. For example, while UK environmental groups expressed dismay at the opening of a new coal mine in Cumbria – the first to be approved in over 30 years – in the town of Whitehaven, where the mine is being developed, the feeling is reportedly very different. According to The Guardian, the local community has shown strong support for the mine across the political spectrum, with a desire to see renewed economic growth and community spirit playing a key role in swaying opinions.2

Additionally, on the other side of the planet, China continues to ‘double down’ on coal. As reported by Reuters, in January-February the world’s largest coal miner and consumer increased its coal output to 734.23 million t, a 5.8% increase compared to the same period in 2022 (686.6 million t).3 Likewise, during this period the country also re-established trading relations with Australia, ending its unofficial ban on imports from Down Under, which has been in place since the end of 2020.4 With increases in global coal prices, as well as energy supply chain disruption resulting from Russia’s invasion of Ukraine, China has continued to favour coal as it prioritises its energy security.3

Moreover, ‘clean coal’ continues to gather momentum. As spoken to by many of the articles in this issue, technology is offering coal a viable way to ‘buy in’ into an extended period of viability. For example, FMI (pp. 46 – 48) discusses how as countries, such as the US, introduce new initiatives demanding lower emissions, clean coal technologies offer definitive ways to improve the efficiency of power plants. Likewise, this month’s cover advertiser, Wirtgen (pp. 26 – 30), outlines how cutting technologies can optimise coal mining operations and reduce emissions.

Fundamentally, coal is not out of the game yet. The UK switching to emergency backup coal plants to supply almost 5% of its energy during a cold snap this past winter, in addition to the positive trends mentioned above, is clear evidence of the critical role coal continues to play, in the absence of a truly fit-for-purpose alternative fuel source.5

The question of how many hands does coal still have left to play remains, however so does the industry’s consistent answer. As long as coal has chips left in its stack, it will not cede its seat at the table.

REFERENCES

1. ‘Insights On: APAC Coal Sector Outlook amidst the Green Transition’, Fitch Ratings, (16 February 2023)

2. ‘Why this town wants its coal mine back amidst the climate crisis’, The Guardian, (7 March 2023), www.theguardian.com/environment/ video/2023/mar/07/why-this-town-wants-its-coal-mine-back-amidst-the-climate-crisis-video

3. ‘China coal output up 5.8% in Jan-Feb as new capacity comes online’, Reuters, (15 March 2023), www.reuters.com/world/asia-pacific/chinacoal-output-up-58-jan-feb-new-capacity-comes-online-2023-03-15/

4. XU, M., and AIZHU, C., ‘China boosts Australian coal imports on hopes for more easing of curbs’, Reuters, (22 February 2023), www.reuters.com/markets/commodities/china-boosts-australian-coal-imports-hopes-more-easing-curbs-traders-data-2023-02-21/

5. ‘Britain fires up back-up coal plants for first time ever’, The Telegraph, (8 March 2023), www.telegraph.co.uk/business/2023/03/07/ftse-100markets-live-news-halifax-house-prices/

WORLD NEWS

USA American Resources expands Carnegie 2 production

American Resources Corp., through its subsidiary, American Carbon Corp., a leading producer of high quality metallurgical and specialty carbon, has announced that it has expanded production at its Carnegie 2 metallurgical carbon mine in Pike County, Kentucky, by adding a second operating section. It is expected that the production from this section will initially ramp up to approximately 9000 – 12 000 additional tpm.

Mark Jensen, CEO of American Resources, comments: “Our McCoy Elkhorn complex is a showcase operation that possesses a significant opportunity for growth from our internal portfolio of assets. We applaud the hard work that the men and women onsite have put forth and the effort to achieve this growth safely and efficiently and to capitalise on the strength of the metallurgical carbon market. Adding a second operating section at this already producing mine is one of the highest margin growth opportunities we can execute upon as a company, given no additional fixed costs and minimal additional variable costs are needed to achieve

the incremental growth of production. Now that this has been achieved, we look forward to focusing on additional growth expansion at the McCoy Elkhorn complex, while we continue to minimise capex costs and maximise speed to market.”

Over the years, American Resources Corp. has acquired a significant fleet of underground and surface equipment that it can utilise to expand production. This new expansion at Carnegie 2 is utilising almost entirely owned equipment that the company has been able to acquire over the years. The company is still in possession of over three additional full operating sections of equipment that it intends to use for Carnegie 1 expansion, the company’s upcoming Mine #15A expansion, as well as its Wyoming County Coal LLC complex that it is currently developing. In the current market, owning quality assets and equipment for efficient growth offers a significant competitive advantage, given the current tightness in the equipment and infrastructure marketplace.

ZIMBABWE Contango completes pilot coke plant construction at its Lubu Project

Contango Holdings Plc has advised that the construction of a small-scale coke battery has been completed at the Lubu Coal Project in Zimbabwe. The pilot coke plant has been constructed to provide onsite capability to manufacture coke from washed coking coal produced at Lubu for testing by future offtake partners, and for the company’s internal studies and quality control. The ultimate coke batteries to be installed at Lubu for future production and sales will be considerably larger and a different specification.

To date the manufacture of coke and subsequent studies from washed coking coal from Lubu has taken place remotely, with highly encouraging results. The ability to now manufacture coke onsite is a significant step, providing accurate in the field results, a crucial step in securing partners in the company’s coke manufacturing strategy.

Following completion of the pilot plant, the company has subsequently produced approximately 4 t of coke, from a sample of washed coking coal from Lubu. A significant portion of this production will be delivered to the

multinational company that entered into a memorandum of understanding with Contango in December 2022. This is part of the ongoing due diligence process to confirm suitability for their requirements ahead of a potential transaction.

Carl Esprey, CEO of Contango, comments: “Whilst the expected margins on our coking coal production are very attractive, we have always maintained the highest margin business stems from the manufacture of coke at Lubu. Accordingly, we have already completed numerous small-scale tests remotely to assess the coke characteristics from Lubu, with highly encouraging results.

“The completion of the pilot coke plant will now enable us to generate larger coke production for testing, something required to enable us to conclude discussions under our MOU and, as required, provide additional samples to other parties who have expressed interest in coke produced from Lubu.

“This is a notable step in the evolution of the Lubu Project and I look forward to providing further updates with respect to the planned manufacture of coke in due course.”

DIARY DATES

Expomin

24 – 27 April 2023

Santiago, Chile

www.expomin.cl/registro-expomin

Mines & Money Connect

25 – 26 April 2023

London, UK

https://minesandmoney.com/connect

China Coal & Mining Expo 2023

25 – 28 October 2023

Beijing, China

www.chinaminingcoal.com

International Mining, Equipment, & Minerals Exhibition (IME 2023)

06 – 09 November 2023

Kolkata, India

https://miningexpoindia.com

To stay informed about the status of industry events and any potential postponements or cancellations of events, visit World Coal’s website: www.worldcoal.com/events

WORLD NEWS

CANADA Teck Resources to spin off steelmaking coal business

Teck Resources Ltd. has announced the reorganisation of its business to separate Teck into two independent, publicly-listed companies: Teck Metals Corp. and Elk Valley Resources Ltd (EVR). The separation will create two world-class resource companies and provide investors with choice for allocating investment between two businesses with different commodity fundamentals and value propositions. Teck Metals will be growth-oriented, with premier, low-cost base metals production, a top-tier copper development portfolio, and a disciplined capital returns policy. EVR will be a high-margin Canadian steelmaking coal producer, focused on long-term cash generation and providing cash returns to shareholders, with significant equity value accretion potential. Both companies will remain committed to strong environmental and social performance.

Jonathan Price, Teck CEO, commented: “This transformative transaction creates two strong, sustainable, world-class mining companies committed to responsibly providing essential resources the world needs.”

SOUTH AFRICA Canyon Coal develops new mine in Mpumalanga

Canyon Coal, a subsidiary of private investment company Menar, is constructing a new coal mine in Hendrina, Mpumalanga, South Africa, with production expected to start in 2H23.

The first phase of the Gugulethu project, on track to be completed in 8 – 10 months, is expected to produce 1.2 million tpy of 5500 kc NAR coal.

Jarmi Steyn, Gugulethu Colliery GM, commented: “We are in the development phase and have already done the tenders for the civils and the processing plant. Our mining equipment has started to arrive.”

Formerly known as De Wittekrans, Gugulethu is a greenfield project located southeast of Hendrina that Canyon bought out of business rescue. Phase 1 of the project holds an economically mineable reserve of 14.3 million t of run-of-mine (RoM) coal. It is comprised of three pits, one of which has been specifically designed to gain access to the underground reserve, as part of Phase 2.

This fully licensed project has a life of mine of over 20 years based on a RoM production of approximately 2.4 million tpy from the opencast section. The underground sections, which will commence operations in 2028 after the completion of the open cast reserve, will sustain production of 2.4 million tpy.

The commissioning of the processing plant is scheduled towards the end of 2023. The transfer of the plant from the depleted Hakhano mine – Canyon’s first opencast colliery – for reassembly at Gugulethu has begun.

Total investment earmarked to develop the mine is over R1.4 billion. Canyon Coal will invest R600 million in Phase 1 of the project. The development of the underground mining section will require a further R890 million.

Gugulethu’s product will be trucked some 43 km to the Rietkuil siding for transportation to the Richards Bay Coal Terminal in KwaZulu-Natal.

WORLD NEWS

TANZANIA Edenville Energy releases Rukwa Coal update

Edenville Energy Plc has provided an update on its Rukwa Coal Project in Tanzania.

The company has been focused on stockpiling run of mine coal to mitigate, as far as practicable, impact from the Tanzanian rainy season. A substantial stockpile of run of mine (ROM) coal was accumulated, but this stockpiled ROM coal has proven difficult to wash due to its moisture content. The production of washed coal is therefore expected to be reduced for as long as the rains continue, which could be for several more months.

The company continues to explore further opportunities in the Tanzanian coal market as they are presented, with efforts being increased given the robustness of the global coal markets and opportunities currently available within Tanzania.

Edenville is in discussions with the Mining Commission in Tanzania in relation to its Rukwa mining licence, having been advised by the Commission that the company had historically failed to perform certain tasks required under its licence and that the licence could

technically be in default of these requirements.

Edenville’s senior management have held constructive discussions in Tanzania with the Commission and both parties have agreed to work on resolving any outstanding issues, whilst also ensuring the company is in full compliance with local regulations.

The company is continuing to run the day to day operations at Rukwa, while continuing discussions with the Commission, and looks forward to remedying the outstanding matters concerning the licence in consultation with the Commission on a timely basis.

For the period from 1 January to 27 March 2023, the company has sold 948 t of washed coal, generating revenue of approximately £34 500.

Noel Lyons, CEO of Edenville, comments: “We remain focused on resolving any legacy issues at Rukwa and remain confident that the challenges can be overcome. However, in conjunction with this, we are also focused on securing potential new and exciting coal opportunities.”

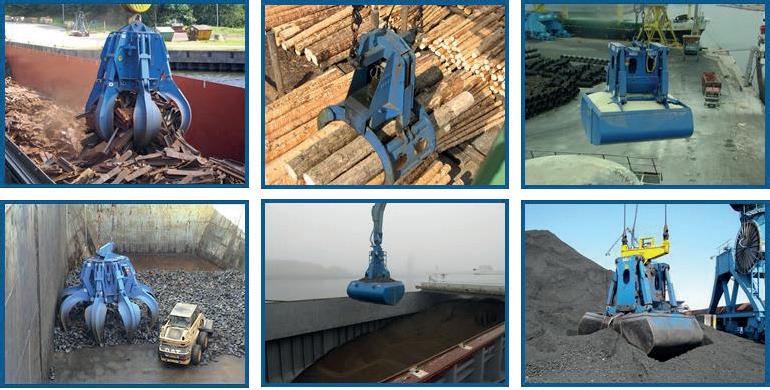

CHINA Siwertell shipunloaders commissioned at new Chinese power station

Bruks Siwertell has completed the commissioning of two large scale Siwertell ST 790-D-type shipunloaders for a newly developed ultra-supercritical power station in southern China, ensuring clean and efficient coal handling for their new owners.

“The COVID pandemic presented a number of challenges for the commissioning process as it was impossible to send personnel from Sweden,” explained Björn Ohlsson, Contract Manager, Bruks Siwertell. “We had to get creative, developing a unique set-up that saw our local personnel carry out the commissioning and performance tests with remote support from Sweden.

“The whole process required us to be very flexible, not only with our approach, but also with our working hours. The result is two shipunloaders that are meeting their new owner’s expectations,” Ohlsson added.

The new unloaders secure the delivery of fuel to a two-unit 1000 MW power plant development.

Siwertell screw-type shipunloaders are designed to handle coal and other dry bulk materials in the most environmentally-friendly way possible, with totally enclosed conveying lines from start to finish, providing an operation free from spillage, and reducing dust emissions to a minimum.

“The proven performance of Siwertell unloaders was an important element in them being selected for this new development,” commented Ohlsson. “Our technology is also much lower in weight than any equivalent capacity equipment, which minimised the load on the jetty, delivering significant cost savings in jetty construction.”

In addition to their low weight, the Siwertell shipunloaders deliver market-leading through-ship capacities, which minimise berth occupancy. These new units are rail-mounted and offer a continuous rated coal handling capacity of 1800 tph, with a peak capacity of 2000 tph, discharging vessels of up to 100 000 DWT.

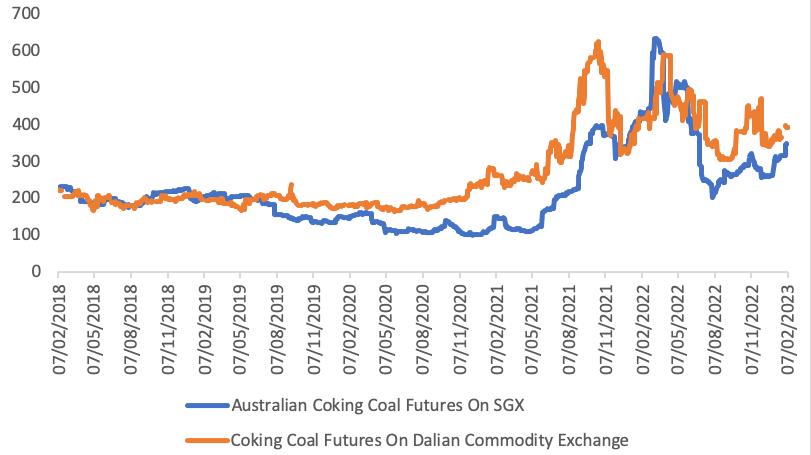

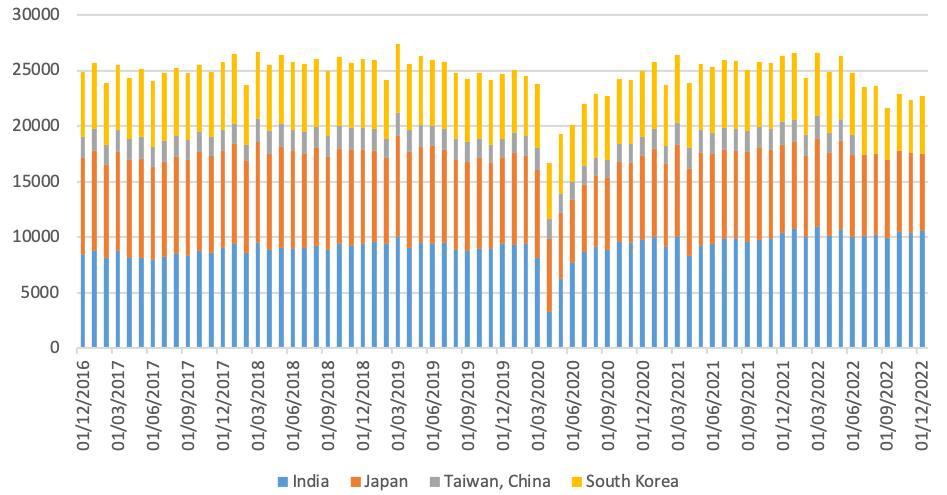

The Australian coking coal market is expected to receive some upside from China’s reopening, but weak global steel production will restrict coking coal’s demand outlook in 2023. Australian thermal coal will also experience limited growth in 2023 following milder winters, easing LNG prices, and increased domestic production from major importers. On the whole, Australia’s coal mining activity will continue to face domestic environmental opposition, while the

global focus on renewable power will edge out coal mining in the longer term.

Coking coal supply and demand

Fitch Solutions expects a modest 0.5% y/y growth for coking coal production in Australia this year, reaching 196 million t. After a two-year ban, mainland China has finally eased its stance towards Australian coal imports. China sourced a sizable portion of its coking coal

needs from Australia prior to the ban, due to its high quality. A reintroduction of Australian exports to China would mean a tighter supply in the market, translating to higher prices. However, weak global growth and poor steel consumption from importing countries will place a cap on Australian coking coal prices and, consequently, its production outlook. Prior to the ban, China imported 72.27 million t of coking coal in 2020, with 34.97 million t sourced from Australia.

Johann Tan, Fitch Solutions, Singapore, presents some of the latest analysis of the Australian coal market.

China’s 2019 imports followed a similar trend, with imports reaching 74.49 million t and 30.77 million t imported from Australia, according to Chinese customs data. After the ban, coking coal from cheaper countries – such as Russia, Indonesia, and Mongolia – gained significant Chinese market share. Mongolia replaced Australia and supplied 40% of the China’s total imported 63 million t of coking coal in 2022. Russia was a close second at 33% of 2022 imports. As for Australia,

it turned to other countries to diversify the gap left by China. Exports went to markets such as India, Korea, Japan, and the EU.

Australian prime hard coking coal is still highly sought after in China due to its high quality. With increased efforts being made to reduce carbon emissions, higher quality coal produces less carbon and is more efficient in the steelmaking process.

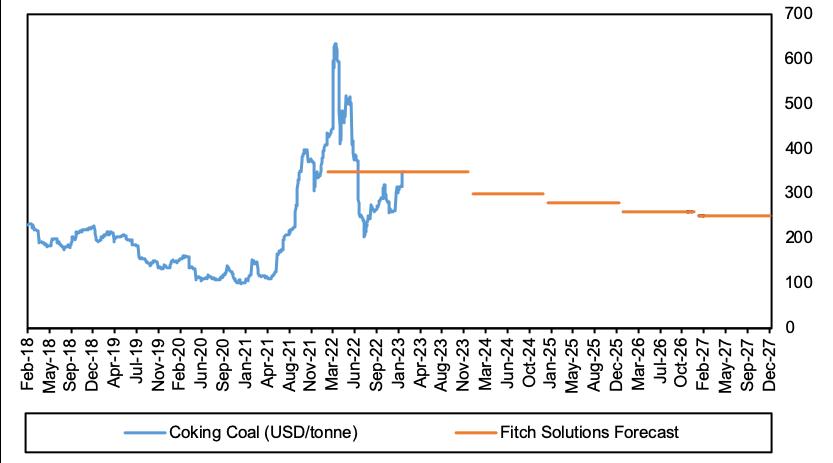

That said, competing coking coal exporters will still be strong competition for Australia’s exports in China’s market, limiting sharp demand spikes from Australia and consequently production as well. Hence, it is likely that the reintroduction of Australian exports will see modest demand from China. The diversified markets will also continue importing Australian coking coal together with China in 2023. As such, Fitch Solutions forecasts that the Australia origin coking coal price will average US$350/t in 2023. Prices will remain elevated around current levels throughout 2023, in response to Chinese demand and increased market tightness.

On the production front, better mining conditions from drier weather and revitalised Chinese demand will incentivise production for miners. Wet weather conditions have plagued Australian miners for most of 2022 –floods and rain reduced operational outputs and disrupted mining operations. However, in 2023, the La Niña event is expected to ease earliest by March 2023, based off forecasts from Australia’s Bureau of Meteorology. Drier mining conditions will support miners in their production outlook.

Moreover, coking coal mining will see some growth as it is expected to experience greater export volumes to China. Orders have already started coming in for deliveries in February 2023; two vessels carrying both coking and thermal coal arrived in China on 9 February. Three state owned utility firms and Baowu Steel were granted permission for coal imports and Fitch Solutions expects China to allow more companies to follow suit.

Lastly, weak global steel production will put a ceiling on coking coal prices, preventing them from hitting 2022 highs. Steel import nations are expected to pose weak economic growth due to global conditions, while China’s share of infrastructure growth is not expected to recover as quickly. Fitch Solutions’ macro teams forecast a mild global growth of just 2.13% in 2023. Weaker economic conditions will slow industrial activity and steel demand. According to Fitch Solutions’ estimates, steel production in coking coal import nations were weak throughout most of 2022. Likewise, the World Steel Association forecasts a flat global production outlook for 2023, at 1% y/y growth to 1.814 billion t.

Infrastructure activity is vital to steel production and coking coal demand too, making up more than 50% of the world’s steel demand, according to World Steel Association. Market signals for China’s infrastructure activity still remain downbeat, new floor sales are down 31.5% y/y, while floor space of new housing starts slid 43.7% y/y in December 2022. The sector’s contribution to GDP fell to 6.1% in 2022, down from 6.8% in 2021. China’s real estate sector is not poised for a sharp recovery since real estate cycles are lengthier in nature. Stimulus measures and liquidity provided by the government will take time before it addresses issues of struggling developers. A recovery in the Chinese market will still come this year, but it is very unlikely to drive a sharp rebound in steel and coking coal needs.

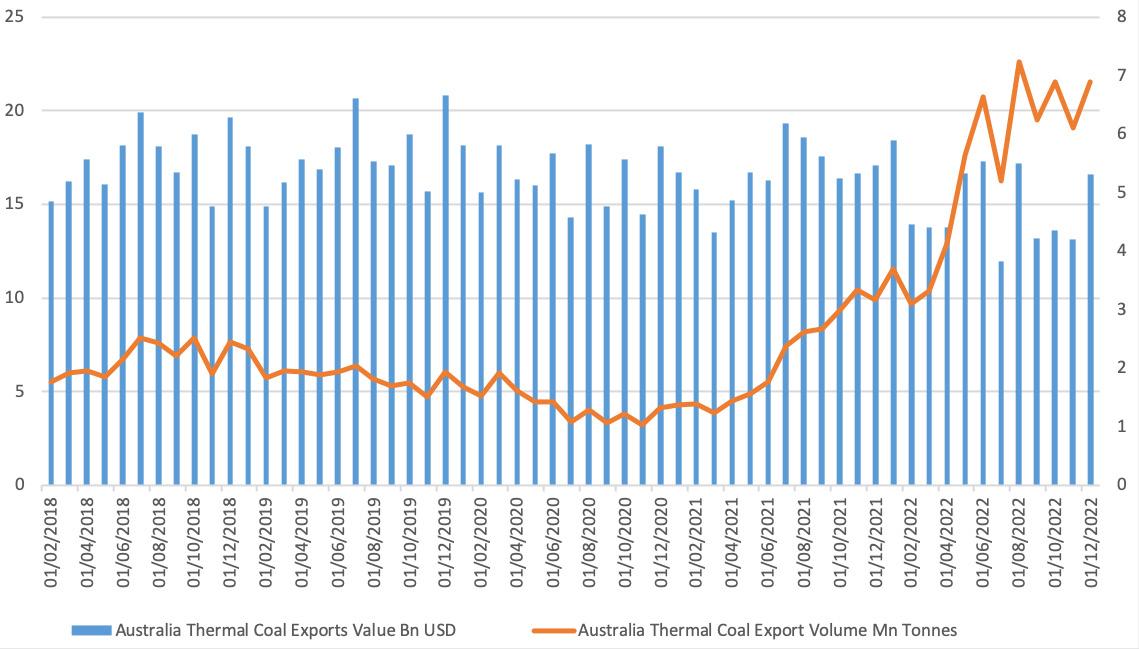

Thermal coal supply and demand

Australian thermal coal will face similar conditions to coking coal, with limited production growth in 2023, even as countries renew their perspectives on coal as an energy source. Drier mining conditions and reduced flooding at mine pits will alleviate production woes. However, higher levels of domestic coal production in importing countries and waning natural gas prices will reduce the need for coal imports, and, consequently, place a limit on production growth. Fitch Solutions’ expects thermal coal production in Australia to grow by 1% y/y this year, reaching 303 million t. Global need for thermal coal spiked after Russia’s invasion of Ukraine. Many countries in the EU turned to thermal coal for energy in view of intermittent natural gas supplies from Russia. Outright coal power generation in the EU increased by 7% y/y to 28 TWh in 2022, according to reports by Reuters. However, exports from Australia still fell in 2022 to a 10-year low, at 178 million t, a 10.3% y/y drop from 199 million t in 2021, according to reports from SXCoal. Persistent wet weather affected thermal coal supply chains, flooded mine pits, and disrupted freight rails reduced overall production in Australia throughout 2022, subsequently reducing exports.

As mentioned earlier, an easing of the La Niña cycle is expected in 2023, prompting better mining conditions for the smoother output of coal.

On the other hand, factors that created the price surge in the mid-2022s have begun to unwind and demand pressure is expected to ease this year, thereby reducing the need for coal. A warmer winter has translated to reduced demand from European countries, while a rise in coal inventories from higher domestic production in importing countries will help alleviate supply build up for next winter. Moreover, a fall in natural gas prices would relieve some demand from coal as an energy source. In 1Q23, natural gas prices in Europe dropped significantly compared to its

prices last year. Benchmark Dutch 3-month gas futures dropped to just €53/MWh as of 8 February, compared to €150/MWh two months earlier in December. In view of such trends, Fitch Solutions forecasts Newcastle thermal coal (6000 kcal/kg) to average US$280/t in 2023. This implies that prices are likely to get an increment from current levels in the coming months, as seasonal energy needs increase later on in the year, but remain significantly below the highs reached in 2022.

Compared to coking coal, many major importers have local production of thermal coal on top of imports. Hence, robust domestic production growth in countries like China and India, to ensure energy security needs, will restrict demand and production growth of Australian thermal coal. China and India accelerated thermal coal production after gas and thermal coal prices reached unprecedented highs last year. Imports are still essential, but are not expected to rise sharply given their higher domestic output. Specifically, India mandated power plants to import at least 10% of its coal needs to build coal inventories. However, most buyers sourced their imports from heavily discounted Russian coal.

For 2023, China and India will lead global production growth, with authorities driving such initiatives through planned increases in coal plant permits and directly advising state-owned miners to ramp up production. Already, coal production in China is estimated to have surged by 9% y/y in 2022, reaching 4.45 billion t, while India’s production from April 2022 to January 2023 has risen 16% y/y to 693 million t. India’s Ministry of Coal has requested the Ministry of Environment, Forest, and Climate Change to allow coal mines to increase production, as of February 2023. Furthermore, India’s state-run Coal India, accounting for 80% of coal production, is expected to supply 620 million t to its power sector across FY23/24, as compared to a projected 580 million t in FY22/23. Meanwhile in China, Reuters reported that an additional 260 million t of coal mining capacity was approved in 2022, bringing total capacity to 5.05 billion t. Additionally, China’s National Development and Reform Commission advised electric utility firms to extend term contracts with local miners in 2023, translating to a definite rise in coal production. The increased self-sufficiency in markets from domestic sources and imports from cheaper sources creates headwinds for Australian thermal coal exports, restricting growth. Australian production will therefore likely suffer from a similar effect.

Other considerations

Besides supply and demand factors impacting Australia’s coal outlook, Fitch Solutions believes domestic environmental regulations will continue creating headwinds for coal production. Moreover, the overall global shift in the green transition to green steel and renewable power will inevitably drive miners away from coal in the long term. Global thermal coal use will remain robust in the short term, as a direct result of the Russia-Ukraine war and the pivot away from Russian energy. Energy issues will continue to make coal a priority for energy generation, but this also brings about an accelerated shift to alternative power, such as the EU’s REPowerEU plan to increase renewable energy targets from 40 to 45% by 2030. Elsewhere in Asia, India’s latest budget pledged INR350 billion to fund energy security and energy transition. India’s target is to reach 500 GW of clean energy by 2030. Meanwhile, China has committed itself to maintaining coal use for energy generation, however it insists that it is still on target with strict coal controls, pledging to start cutting its use by 2026 and peaking emissions before 2030.

As for coking coal, Fitch Solutions expects demand to decrease in tandem with global blast furnace steel production’s decline. As the global economy makes its shift to a greener future, the shift away from fossil fuels and highly polluting methods of production will see steel producers slowly transition to cleaner steelmaking processes. These include a greater adoption of electric arc furnaces, as well as the use of green hydrogen in steelmaking. Green steel’s rising adoption across EU steelmakers is underway, with pilots and plants currently under construction. That said, it will take some time before such steelmaking plants reach industrial scale, hence the continued need for coking coal in the near term. These trends mark an inevitable decline for coal, not just in Australia, but globally in the longer term.

Australia’s growing emphasis on environmental issues will also play a part in reducing Australia’s coal production. Carbon emissions from coal are the most pollutive form of emissions relative to other forms of fossil fuels. Across a historical period of 1850 – 2021, coal contributed to 46% of total fossil fuel emissions according to data from Global Carbon Project’s 2022 report. Environmental regulatory developments are creating headwinds for Australian coal. New projects and coal developments are increasingly being scrutinised and scrapped due to environmental concerns. Most recently on 8 February, a thermal coal project by Central Queensland Coal was rejected by Australia’s environment minister, citing potential adverse environmental impacts. Glencore also announced several downturns to its coal assets in Australia. In December 2022, Glencore scrapped a new application of its Valeria Coal project, with a capacity of 16 million t of metallurgical and thermal coal. It adds that it would progress brownfield extensions

at existing mines, however its Liddell, Newlands, and Integra mines in Australia will close and undergo rehabilitation within the next four years.

For miners, as investors become wary of climate change issues and global energy consumption patterns shifting away from coal in the long term, established players will increasingly leave the high cost Australian coal market.

Anglo American, Peabody Energy, and Vale have all started liquidating their Australian coal portfolios, with Rio Tinto having completely exited the coal market and BHP exiting thermal coal production. These headwinds will only increase over time, hampering mine development and project pipelines for Australian coal. Fitch Solutions expects an increasing trend of blocks and scrutiny to hinder coal outlook in the country as long as environmental concerns continue, slowly enveloping the decline of coal mining activity.

There is no question that coal dust is more highly scrutinised and regulated compared to other bulk handling operations, due to the health of workers and a high risk of explosions. Ask any coal family and they would agree that the safety and longevity of workers should be a top priority. Controlling dust also makes sense from an operational aspect, as it can foul rolling components, machinery, and equipment air intakes – requiring extra parts and labour for cleaning and maintenance. All of these factors unnecessarily raise the cost of operations when there are methods

and technologies designed to control and suppress dust emissions before they become airborne and create these risks.

While obvious that one way to reduce coal dust emissions is to reduce the amount of dust created in processing, it is not always practical or easy to accomplish. There are many dust sources that have to be managed depending on the extraction, haulage, and storage methods. Most of the dust contained in bulk materials is from crushing or grinding, in order to reduce particle size, and from transfers from one step in the production

R. Todd Swinderman, Martin Engineering, USA, highlights the importance of controlling dust emissions in coal operations.

process to another, such as at conveyor transfer points or discharge onto a stockpile. The hydrophobic properties of coal also make it harder to control dust emissions using water without the addition of expensive surfactant additives.

Surface vs underground operations

In surface operations, control of dust is difficult because it happens in the open air, and the fracturing of the in-situ material creates dust. Typically, the bulk material is loaded into haul trucks at the point of extraction and taken either

to a conveyor transfer point or a crusher. As the material is dumped and crushed, the most effective dust control is the use of water, or if water addition to the material is a problem, foam is used. Water is not as effective as foam, but is often preferred due to the cost of foaming chemicals. There are some residual effects of water, but they are usually short-lived.

In underground extraction, water is often used at the face and conveyor transfer points to control dust. When water cannot be used, methods such as in mining salts, ventilation, and modular dust collection are options.

Conveyors

Conveyors are a major source of dust emissions, but they can also aid in reducing fugitive dust. For example, in pit crushing and overland conveying in a surface coal mine, there is reduced total site dust generation compared to truck haulage. Coal is easily windswept and, in some cases, may require an enclosed conveyor belt system, such as a fold belt, pipe conveyor, or air-supported conveyor.

When the haulage involves a conveyor belt, dust generation is a function of the loading and discharge, as well as how it is managed. Closed conveyors are very useful for preventing contamination and protecting the cargo from the elements, but they still have to be opened and closed for loading and discharge. Passive dust reduction strategies include:

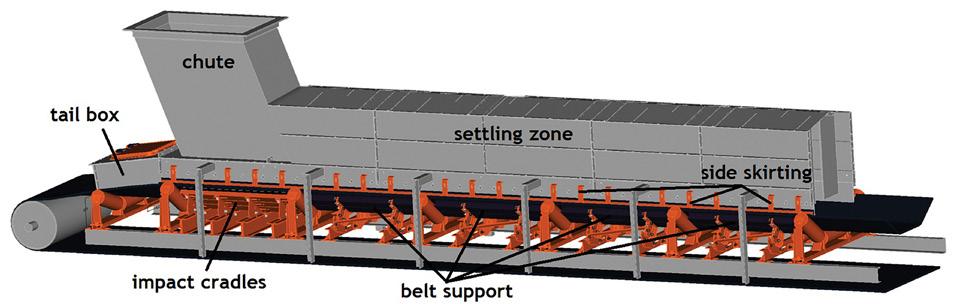

Shorter or directed drops: Transfer chutes (Figure 1) over loading zones that decrease the impact of cargo on the belt below reduce the amount of turbulence within the loading zone, lowering the amount of dust released.

Managing the flow: Although rock boxes can work, they can also be prone to clogging, so experienced engineers recommend a sloping system that slows material to minimise impact and induced air, as well as loads in the centre of the belt for less shifting and improved belt training.

Preventing belt sag between idlers: The belt can dip slightly between idlers, creating gaps between the belt and skirting, causing the release of dust and

fines in the loading zone. Using an impact cradle with shock-absorbent polyurethane bars reduces impact strain on the belt, and creates an even belt plane with no gaps between the skirting and belt. Cradles can extend along the entire length of the stilling zone.

Fully enclosed transfers: By completely enclosing the loading and settling zone, dust is contained. Items such as dust curtains and dust bags can then be added to control airflow and capture dust.

Lower belt speeds

There are many suggestions for belt speeds based on the properties of the bulk material. The ANSI/CEMA 550-2003 Classification and Definitions of Bulk Materials lists miscellaneous properties of bulk materials that would contribute to a decision to use a lower belt speed and may be windswept as part of its classification code system, and includes:

B-1 Aeration-Fluidity.

B-6 Degradable-Size Breakdown.

B-8 Dusty.

B-20 Very Light and Fluffy.

With lower belt speeds, the belt width has to increase to convey the same tph, creating a capital cost vs operating cost dilemma. Many sources suggest belt speeds of 2 m/s (394 fpm) or less for reducing dust generation.

If a conveyor is being designed for an extended lifetime, then it is worth the effort to closely compare the capital savings from a higher-speed belt to the long-term costs of maintenance, cleanup, and safety. There are clear relationships between increased cleanliness, fewer safety incidents and more reliable production, so the tradeoffs should be examined closely. Foundations™ for Conveyor Safety – a comprehensive textbook for safe conveyor operation written by Martin Engineering – provides a detailed methodology and data sources for including direct and indirect costs in the financial analysis in section six.

Coal dust and belt tension

Similarly, at a critical speed, the bulk material loses contact with the belt at the idler and is launched into the air, falling back onto the belt at a slightly lower speed than the belt. This splashing action opens the profile, creating induced air flows that can release dust, creating turbulence, impact, and degradation as the material lands and returns back up to belt speed. Keeping the belt sag to 1% between idlers is a frequent specification. Usually, the concerns in conveyor design from these belt sag phenomena are the added belt tensions required to overcome the frictional losses.

Often overlooked in a dust reduction strategy are design choices that can minimise dust creation from the undulations of the bulk material on the belt as it is transported. Managing belt tension so the sag between idlers is minimised reduces the effects of material trampling and splash. Material trampling is the

Worldwide

Subscribe online at: www.globalminingreview.com/subscribe

15 South Street, Farnham, Surrey, GU9 7QU, UK

Subscribe online at: www.globalminingreview.com/subscribe

Subscribe online at: www.globalminingreview.com/subscribe

T: +44 (0)1252 718999 F: +44 (0)1252 821115

E: info@palladian-publications.com

15 South Street, Farnham, Surrey, GU9 7QU, UK

T: +44 (0)1252 718999 F: +44 (0)1252 821115

15 South Street, Farnham, Surrey, GU9 7QU, UK

E: info@palladian-publications.com

T: +44 (0)1252 718999 F: +44 (0)1252 821115

E: info@palladian-publications.com

particle-to-particle movement created by the change in the bulk material profile as it goes over the idlers. Trampling and splash can be a source of dust generation, given the large number of times the cargo passes over idlers every hour. The higher the belt tension, the lower the trampling loss.

Coal storage

Controlling dust at the storage location is another challenge. Large stockpiles are impractical to enclose in buildings and are often stacked out and reclaimed by machinery that generates additional fines.

Open stockpiles are subject to the weather, where some bulk materials degrade upon exposure to the atmosphere, and some materials will revert to a solid state when exposed to humidity or rain. Those materials that can be wetted often use water sprays to reduce windblown dust. Other strategies include wind fences and compacting the pile.

Discharge onto the pile is a source of dust release as the material flows from the delivery equipment, often a conveyor, onto the pile. Cascading or telescoping chutes can be used to reduce the release of dust in these cases. If the material is easily broken, the drop height from discharge to the pile, or between cascade shelves, can create additional dust from impact degradation. One unexpected source of dust emissions can be the site layout. For example, if a slope conveyor going from the stockpile into a storage bin or building is orientated in line with the prevailing winds in a high wind locale, the wind flowing up the conveyor will overwhelm dust control strategies by creating positive pressure throughout the conveyor enclosures.

Best practices: Enclose the system

If the material stream can be constrained so that it does not open up when discharged, the amount of air induced into the transfer point is reduced. As the material particles spread out, it creates a low-pressure area in the spaces which induces airflow into the transfer point.

The amount of dust that can become airborne is directly proportional to the volume and speed of the airflow through the transfer point. If the openings in the chute work are restricted to the practical minimum, the inward airflow is restricted. A useful dust control strategy is to capture the material shortly after discharge and keep the stream coalesced as tightly as possible to reduce induced air.

There are a number of discrete element modelling (DEM) software programmes specifically designed for the design of material flow through chutes, and there are specialty chute manufacturers that specialise in these techniques. These chutes work best with materials of consistent size and adhesive and cohesive properties, such as coal. Wear on the chute surfaces may be accelerated, but this can be offset with a maintenance-friendly design for quick and easy change-out of wear surfaces.

Conclusion

Much emphasis is placed on planning the mine to maximise profitability, but little attention is placed during the initial feasibility studies on how the layout can affect dust creation and emissions. Conveyor transfer points have a history of being drafted rather than designed. Design tools are now readily available to address these critical details. How the conveyor is operated and maintained also has a significant effect on dust generation and release.

Lee Gailer, RST Solutions, Australia, considers how utilising advanced technologies for dust and erosion control is essential for keeping mines running during the wet season.

Australian mines have been stepping up their mitigation strategies to reduce the potential for large infrastructure and production losses during a ‘wetter than usual’ wet season, following the country’s ninth wettest year on record.

Fine particle management specialist Reynolds Soil Technologies (RST Solutions) has been assisting mine site operators with advanced technologies to help keep roads open and operations

running during wet seasons.

Many mining operations globally that use RST Solutions’ technologically advanced dust suppressants are unaware that the team started out 30 years ago as a chemical soil stabilisation company, and is now well known throughout Asia as a leading supplier of chemical soil stabilistion products, which treat the region’s highly reactive road construction materials in an extremely wet environment.

Advancing Australia’s road network

RST Solutions’ chemical soil stabilisers are used to improve and maintain the structural integrity of road materials, regardless of the change in moisture content, by modifying the unfavourable interactions between water and soil that cause road and material failure.

These high-performance road stabilising chemicals assist in managing the challenges and risks presented by extreme wet weather conditions around the globe, so it has been easy for RST Solutions to step up and offer Australian mining companies advanced solutions for wet weather operational strategies.

At the beginning of 2023, just a third of the way through Australia’s wet season, Western Australia and Northern Territory experienced a one-in-100-year flooding event, while severe flooding inundated parts of Queensland.

Curtin University transport and logistics expert, Liz Jackson, spoke to ABC News about Australia’s road network being the veins that held the country’s

cultural and financial economy together.

Associate Professor of Supply Chain Management and Logistics, Ms Jackson, called for desperate attention to upgrading the nation’s roads, in order to better withstand more extreme weather events, as well as heavier freight, pointing out that cut roads impacted the ability for major mining sites to ship their goods.

Solutions for unsealed roads

RST Solutions says high quality, rain resistant roads can be achieved without the need for bitumen or cement, through using advanced treatments that permanently change the unfavourable interactions between water and the reactive soil particles in the road materials.

By treating the road materials with advanced stabilising solutions, the road maintains its design strength when saturated during heavy rain events, with only minimal delays, as haul truck drivers must still drive to the conditions.

Further compaction happens as the road is being used, with the huge haulage tyres acting like massive filters, compressing the water out of the mud and removing void spaces.

As part of an ongoing management plan of unsealed, stabilised haul roads, RST Solutions strongly recommends the implementation of a haul road management system (HRMS), incorporating a compatible advanced dust control product continually through the watercarts at ultra-low dosage rates.

This provides a continued stabilising and tightening effect of the haul roads wearing surface, delivering many benefits including reduced roll resistance and road maintenance, faster road recovery after rain and significantly reduced haul road watering requirements, in order to achieve the desired dust control efficiency (DCE).

The combined implementation of soil stabilisation and dust suppression in an HRMS offers autonomous mining operations enormous benefits, as it minimises the interaction time between autonomous vehicles and secondary equipment (water carts and graders) operated by people.

Road quality improves in both the short and long term, reducing the requirements for road maintenance activities to treat both dust and erosion. The use of water carts will also decrease by up to 50%, and haul road grading requirements can drop by as much as 30%.

Targeting onsite materials

RST Solutions has developed a range of high-performance products that target a variety of issues associated with the construction of high-quality, unsealed roads and hardstand areas to withstand wind and rain erosion.

Advanced dust suppressants, Avenger and Guardian, were developed as both long-term and instant solutions, that continue to add value over time by improving haul road structure after rain and with heavy vehicle traffic compression.

Haul roads built from quality road base materials with this type of treatment have proven over time to demonstrate a cumulative effect, as the material compacts more after each wetting and drying event, reducing permeability and increasing in strength.

By adjusting the chemistry to target the specific materials being used onsite – which could be anything from high plastic clays to very low plastic silt – the whole road construction process is significantly improved, resulting in more durable, weather resistant haul roads that help keep productivity at an optimum level.

Red soils and other challenges

RST Solutions has recently developed advanced soil binding and stabilising chemistry specifically for Pindan and red soils to improve the quality of bulk material being used. The results include increased moisture control throughout the road construction process, resulting in material being more friable and less likely to clump, speeding up compaction rates to improve pavement strength and densities.

‘Titan’ is a new chemical road stabiliser designed for the construction and reconstruction of strong, durable unsealed roads using pindan and red soils that will withstand extreme wet weather and support high volumes of heavy vehicle traffic.

Immediate results have been reported as “remarkable”, with Titan’s strengths including the unique ability to form mechanically high-resistant road pavements that remain flexible and in good condition during wet weather.

By adding a high-quality chemical soil stabiliser to the structural layers during road construction works, as well as in water cart applications for ongoing surface maintenance, the road quality is greatly improved, helping to keep them safe, with minimal dust, and open to traffic during extreme wet weather.

Compaction aids

High quality compaction aids also increase the stabilisation capacity of all material types in earthworks, in order to achieve higher levels of compaction with much higher densities and strengths than the usual substandard, natural surface-building materials.

When the material is ripped or laid out, it contains an open framework of particles with the pore or void space usually filled with air and water. Advanced compaction aids such as RST Solutions’ CompaK, keeps working long after application to reduce void spaces between

individual soil particles.

This occurs primarily through a lubricating and dispersive action, which results in a more efficient packing of the particles to deepen the effect of the mechanical compaction.

Conclusion

RST Solutions develops advanced technology in response to mines seeking more project optimisation strategies, particularly for the construction of unsealed roads and infrastructure, in order to achieve higher levels of dust control and strengthening against rain and wind erosion.

By selecting the most appropriate solutions and adjusting for compatibility with site-specific material types, infrastructure forms, and seasonal changes, RST Solutions assists mine sites to manage unexpected shifts in construction and weather patterns.

Liam Sheeder, Belt Tech Industrial, USA, reflects on the problems associated with excess dust in coal mining operations and provides some solutions to mitigate this.

Dust is a fact of life. If homes can indicate anything, it is that dust will make an appearance anywhere and everywhere. It is a war that will never be won – but one that needs to be fought nonetheless.

Obviously, the dust issue facing a coal mine or material handling operation in general is not just average everyday dust. According to the Mine Safety and Health Administration, dust is defined as: “finely divided solids that may become airborne from the original state without any chemical or physical change other than fracture.”

Put another way, dust is the material that becomes airborne when disturbed and lands on surfaces when it is at rest. It becomes a problem when it flies or lands where it is not wanted.

Effects of dust

It is easy to get used to things over time and develop ‘blind spots’. This happens gradually in the same way that dust accumulates over time. The daily demands of an operation can cause a rush from one issue to the next, while other problems quietly go about their business of making life harder.

For this reason, it is a good idea to reflect on the ill effects of excess dust and look for ways to manage it at the source.

Failure to do so effectively can have very real legal and financial consequences, not to mention the impacts on the health and safety of workers. Dust inhalation can lead to potential respiratory and other problems, such as: pneumoconiosis (black lung disease), silicosis, and eye and skin irritation. Long-term exposure to dust can also increase the risk of lung cancer and other disease variants.

As evidenced by silo explosions in the grain-handling industry, dust explosions are very powerful and a very real risk. Consequently, extreme care must be taken to minimise this risk. For many dusts, a settled layer as thin as the thickness of a paper clip – only 1 mm (1/32 in.) – is enough to create an explosion hazard. A 6 mm (1/4 in.) layer is a bigger problem – it is big enough to destroy a plant.

That being said, the following outlines the problems and solutions.

Determining if there is a problem

A certain amount of dust is to be expected, so taking some measurements can go a long way towards determining if the dust is perfectly usual, or a sign of something else.

Personal dust sampling with a small vacuum pump that is worn by a worker is one method. The dust captured at the end of the shift is weighed, and that number is divided by the total amount of air the pump has pulled in for the duration of the shift. This can help to determine the amount of dust in the air.

Basic location-specific dust sampling involves placing many containers in a dusty area for a designated amount of time. The amount of dust collected is then weighed.

More sophisticated methods exist, such as a microwave opacity tester, but the main point is that having raw data can help to put a number on something that could seem very abstract.

If these tests determine that there is in fact a problem, then the actual work of tracking it down and fixing it starts. Thankfully, controlling dust is not rocket science when the focus is on doing the basics well, and that means finding the source.

Transfer points

Transfer points are a usual suspect when it comes to the generation of dust, and for good reason. They have all the ingredients for creating dusty conditions.

Material separates as it falls, exposing smaller particles to greater airflow. In turn, the falling material itself creates vortices which convince the now free particles to make a home elsewhere.

Taking a closer look at both the drop and the landing zone can help. Shortening the drop between conveyors can reduce the velocity of the material. Directing the material onto the receiving belt in the

same direction that the belt is moving avoids drastic changes in material trajectory.

All of this is a lot easier to consider in the initial design stage, but much can also be accomplished by retrofitting existing systems. For instance, installing custom chutes, hood and spoon systems, settling zones, and even using old belting as a curtain for the entry and exits of transfer points.

These are all methods of controlling air movement which is a primary ingredient for controlling “finely divided solids that may become airborne from the original state.”

Belt support in the load zone

While a ‘soft landing’ may be nice for a plane touching down on a runway, too soft is not the ideal situation for a load zone.

Belt sag places unnecessary stress on the belt, adds resistance to the entire system, and – more to the point of this article – breaks the seal between the skirted area and the belt. This lets air in, which should be avoided, and lets dust out, which is the exact opposite of what is trying to be achieved.

And it does not take much. A small amount of sag, which may not even be apparent to the naked eye, is enough to let fines out.

Increasing the number of idlers in the load zone is one option. Another is to dispense with idlers altogether and install a belt support cradle. These impact cradles are composed of a steel framework with a set of impact-absorbing bars.

Using low-friction bars instead of rollers means belt sag is minimised, while belt seal is maximised. Providing good support for the entire length of the loading zone provides the best results.

Hybrid designs are also available which employ rollers under the centre of the belt and bars, in order to maintain a continuous seal at the belt edge.

In any case, having a solid foundation will keep the material flowing, protect the belt, and reduce the amount of escaped dust.

Belt scrapers

When material clings to the belt after being discharged at the head pulley, it dries out on the return, releases from the underside of the belt, and can become airborne.

Belt scrapers play a key role in reducing the levels of dust in an operation. When properly installed and maintained, they effectively reduce the amount of carryback.

Carryback is often a more cumbersome and costly problem than transfer-point spillage. It can drop off at any point all along the conveyor return, which requires cleaning crews to work along the full length of the conveyor.

Depending on the consistency of the material being conveyed, a primary, secondary, or even tertiary scraper may be necessary.

Belt washers

Some studies have shown that the oversized material is more easily removed through scraping, but the smaller respirable-sized particles tend to remain adhered to the conveyor. When this occurs, a belt wash can be installed.

A belt wash sprays the conveyor belt with water, while simultaneously scraping it to remove the product. In a number of published studies in this area, this technique has been shown to increase the cleaning effectiveness by approximately 14%.

Belt maintenance

Proper maintenance should not be overlooked. Worn or cracked belt covers, seized rollers, belts miss-tracking, and inadequately or over-lubricated components all contribute to a poorly operating conveyor system. In turn, those deficiencies add to a dusty environment.

Properly maintaining the belts is one of many vital operating practices necessary to keep respirable dust levels low along the belt entry.

Conclusion

The war on dust should be fought with a multi-faceted approach. Further forms of dust control can involve collectors, water sprays, fog suppression, foams, and so on.

However, the hierarchy of control that applies to mitigating hazards and the use of PPE applies to managing dust. First, look to remove the source, manage what is left, and finally use additional equipment if needed.

Neglecting the small things may create large quantities of dust. However, the opposite is also true. Small consistent improvements produce a much cleaner system. And, a cleaner system is not just nicer to work around, or better for relationships with neighbours, it is more efficient. Dust may be a fact of life, but excessive, harmful levels can be controlled by recognising the problem and doing the basics well.

References

1. SWINDRMAN, T., MARTI, A., GOLDBECK, L., MARSHALL, D., and STREBEL, M., ‘Foundations™’, Martin Engineering, www.martin-eng.com/sites/default/files/Fo21undations/ Book%20Downloads/f4-2012.pdf

2. The National Institute for Occupational Safety and Health (NIOSH), ‘Best Practices for Dust Control in Metal/Nonmetal Mining’, Centers for Disease Control and Prevention, (18 November 2018), www.cdc.gov/niosh/engcontrols/ecd/ detail79.html

3. COLLINET, J., RIDER, J., LISTAK, J., and ORGANISCAK, J., ‘Best practices for dust control in coal mining’, Information Circular, (January 2010), www.researchgate.net/ publication/283924262_Best_practices_for_dust_control_in_ coal_mining

Dr. Erik Zimmermann, Wirtgen, Germany, explores how cutting technologies can be used to optimise coal mining operations, and how they play an important role in reducing emissions.

The drilling and blasting process is common practice and problem-free on many construction sites. However, there are opencast mines with conditions that make blasting operations very difficult, if not impossible. Problems include the vibrations caused by the blasting process, and the complicated storage and handling of the explosives.

Coal mining using the cutting technology of surface miners is an option that is attracting increasing interest. These miners achieve in one working pass what would otherwise require several operations; cutting, crushing, and loading – all in a single working pass.

Surface miners are cost-effective, environmentally friendly, and reliable in coal mining applications. At the beginning of a mining project, all key factors are taken into consideration. The most important of these include the required mining volume, the geological characteristics of the area, and the logistical conditions at the operating site, all of which determine the right choice of machine.

For decades, Wirtgen has been renowned as a manufacturer of machines for cutting rock in opencast mining. The company can look back on more than 30 years of experience in this particular field and can optimally incorporate its know-how

into the production of its machines. Wirtgen experts provide advice on selecting the right machine and the appropriate cutting tools for the given conditions, ultimately resulting in optimum implementation onsite. To cover the entire performance range in mining, earthworks and rock construction applications, machines are available in different weight and performance classes.

Continuous progress

Wirtgen gains a great deal of insight from discussions with customers and uses this in the further development of its machines, in order to offer them

optimal solutions. After all, surface miners are also continuously progressing.

Wirtgen sold the first machine of this type in 1983, successfully entering the market with what was then the Surface Miner 1900 SM. A mere six years later, Wirtgen presented the prototype of the 2600 SM, which was used specifically for mining coal and limestone. The machines have not only changed in appearance since then, new technology has also brought with it various advantages, progressively resulting in more efficient processes and an enhanced end product. This is confirmed by a study from 2014 involving various tests conducted by

Wirtgen in cooperation with RWTH Aachen University, Germany. The basis for this study was a coal mine in Queensland, Australia. The advantages of the Wirtgen surface mining technology include, in particular:

Selective mining.

Avoidance of blasting.

Cutting, crushing, and loading in a single working pass.

Maximum deposit exploitation.

Reduced transport costs.

The study focused on the use of the 4200 SM, performing particularly well due to the selective mining, increased process efficiency, and reduced dust emissions. This miner in the 200 t class has a cutting width of 4200 mm and a cutting depth of up to 830 mm. When mining with Wirtgen surface miners, the cutting depth can be individually adjusted to reach the desired layer and ensure the purity of the material. The continuous cutting operation increases process efficiency compared to conventional discontinuous methods that use rippers and wheel loaders. Unlike these machines, which produce considerable quantities of dust, the surface miner has very low dust emissions. The miner

collects what dust is produced in its cutting drum housing, before an integrated water system sprays water into this housing, thereby reducing the quantity of dust even further.

High environmental sustainability

Lowering dust emissions is just as important today as minimising CO2, noise, and vibrations. At the same time, of course, construction machines should continue delivering the same high mining performance and productivity. Conservation of resources and environmental awareness are the keywords in the development department at Wirtgen. Here, experts implement these principles with innovative technologies that can be found, for instance, in the Surface Miner 280 SM(i). This newcomer, among the miners, can be equipped with different cutting drum units. For coal mining, for example, there is a cutting drum unit that has been optimised for high material throughput in soft rock. The miner has a low specific fuel consumption, boasts an integrated water management system, and it minimises dust emissions during the cutting process.

Material removal in the cutting process, without drilling and blasting, results in an almost vibration-free operation and low dust generation. There is not as much noise as in a conventional opencast mine, where many other machines have to be used for mining in addition to the main extraction equipment. Alongside the low environmental impact, maximum exploitation of the deposit is also ensured. This is due to the highly selective mining process when using a surface miner, and the ability to produce steep slopes that are very stable.

Innovative machine technology for efficient extraction of primary resources

Wirtgen surface miners extract primary resources such as coal, gypsum, iron ore, salt, phosphate, bauxite, limestone or granite, achieving high degrees of purity in the process. The selective mining method reduces equipment, personnel, and time requirements in equal measure. Hundreds of machines are in use to date. The operating sites are spread all over the world and include the USA, India, China, and Australia. In addition to the widely used 220 SM(i) 3.8 and 4200 SM(i) models, the 280 SM(i) – launched in 2022 – also cuts a fine figure in coal mining applications. The machines are used both in newly developed opencast mining areas, as well as in extensions of existing mines. The 220 SM(i) 3.8, with its extra-wide drum, is particularly well represented in opencast coal mines. This model achieves its maximum mining performance in soft rock, such as coal, chalk, or gypsum.

The cutting drum, which is fitted with picks, rotates against the direction of travel, cutting layers of material from the rock formations. In the cutting

drum housing, this material is then crushed to the desired size. Depending on the machine and the requirements, the material can now either be discharged – cut-to-ground process – or loaded. For loading, the material is brought via the primary conveyor to the discharge conveyor. The discharge conveyor can be adjusted in height and slewed to either side to adapt to the discharge position. From there, the material is either discharged to the side of the machine – sidecast – or loaded onto lorries or dumpers. The customer can decide on this based on efficiency considerations and the prevailing conditions.

Four steerable and height-adjustable crawler units ensure reliable propulsion and accurate control of the surface miner. An automatic levelling system guarantees precise adherence to the cutting depth, thereby enabling even thin seams or layers to be mined selectively and with maximum accuracy.

Level surfaces suitable for direct use as roads

The precise and level surfaces produced are particularly valuable in mining, earthworks, and rock applications. This is because the processed surface behind the surface miner can be used directly as a road for other mining vehicles. Due to

the excellent evenness of the surface, it can also be used by road-legal trucks. This increases the transport capacity of the entire truck fleet, as the quality of the road surface is a decisive factor affecting the wear on the tyres, frame, and suspension of the transport vehicles. For mining companies, this is a compelling argument, as not only are transport costs reduced, but also the overall production costs per tonne of material used. The excellent evenness of the cut surfaces can also be used for other application scenarios. Tunnel floors, for example, can also be produced or lowered with the surface miner.

Maximum efficiency

Cutting, crushing, and loading – Wirtgen surface miners carry out these processes in a single working pass. Pre-crushing the rock, as is common in conventional mining, is also rendered unnecessary, making the surface mining method a cost-efficient option. At the same time, it is important to take the mined material itself into account.

The use of surface miners, and the selective mining process made possible with them, enables the reduction of CO2 emissions during subsequent conversion of the coal into electricity at the power plant. The mined coal has fewer contaminants and therefore a higher purity, so that ‘better’ coal is converted into power.

Coal seams are generally of varying thickness and separated from each other by layers of interburden. The different materials have to be separated from each other. In conventional mining methods, this operation is associated with high processing costs. When using a surface miner, the coal can be mined more cost-effectively, thereby reducing the processing costs. Overall, Wirtgen surface miners reduce mining losses and the dilution of the extracted coal in the mine, leading to an increase in the quality and purity of the primary resource, and, ultimately, in the revenue generated. Exploitation of the deposit is maximised, and an improved overburden-to-coal ratio is achieved.

Greater onsite safety

The fact that extraction is carried out without the need for drilling and blasting leads to additional advantages in opencast mining. For example, by not having to store and handle explosives, employees benefit from increased safety. Furthermore, the slopes created are extremely stable and rockfall occurs less frequently than when conventional mining methods are used. Opencast mine operators not only benefit from enhanced safety, but their work is also made easier. This is because closures of the mine are no longer necessary, the relevant permits and documentation do not need to be obtained, and no certified blasting personnel are required.

Flor Rivas, Caterpillar, USA, discusses the importance of technology advancements in driving electric rope shovel efficiency and longevity.

The iconic electric rope shovel (ERS) is the stalwart overburden and ore material loader for the mining industry. From the Panama Canal shovels weighing 63 500 kg (140 000 lb) to today’s shovels weighing in at more than 1.36 million kg (3 million lb), these massive machines have loaded mining equipment with dipper capacities up to and in excess of 100 t for more than 140 years.

While some of today’s ERS models have distant relatable appearances to those of the 20th century, the shovels currently operating at mine sites are much more efficient. As a matter of fact, the quest to drive machine efficiency has never stopped over the decades. Steam power gave way to diesel engines and finally to electric power in the 1930s. DC motors evolved to much less complicated AC drives. Analogue systems evolved into digital gate turnoff (GTO) systems with the introduction of insulated gate bipolar transistor (IGBT) fuseless technology, pushing drive system availability upward to 99%. All along, OEMs have advanced the durability and reliability for structures and mechanical items to extend the target design life for these massive machines.

In the hands of a skilled and experienced operator, the ERS loads haul trucks smoothly and efficiently with some of the lowest costs per tonne of material moved. However, as operator experience wanes, loading efficiency can suffer – causing cost increases and decreases in uptime availability.

For years, the mining industry, like many others, has had difficulty replacing retiring highly skilled ERS operators, and mounting evidence is showing that even the most skilled operator can be more efficient when loading trucks.

The era of technology

Over the last decade or so, the ERS design has undergone a technological revolution of sorts. Supplementing proper operator training and machine operation, OEMs and third-party suppliers have introduced a number of operator-assist software supplements to simplify machine operation and reduce occurrences of some of the most common operating miscues.

For Caterpillar, the first technology advancement came in the form of Operator Assist – Enhanced Motion Control (EMC) for the Cat® 7495 shovels, introduced in 2016 after studying the operating habits of numerous operators with varying skill levels. Protecting the machine from inadvertent misuse has led to significant benefits for ERS components, such as crowd and hoist ropes, brakes, gears, and the swing rack.

The new technology offered machine protection and simplified machine operation. Some of the best examples of the software’s powerful capabilities included detecting and automatically limiting swing forces when the operator attempted to swing the dipper through the bank. This prevented the added side-loading forces that can damage shovel components.

Machine protection software also helps to safeguard the crowd ropes and the brake. When the dipper hits the bank with high inertia, the resultant impact produces high crowd rope stresses and potential shock loads if the crowd motor continues to apply force. To avoid this, the software automatically adjusts motor output.

When the command speed is exceeded, a crowd overspeed occurrence takes place, which requires the brake to automatically apply. This interrupts the digging cycle and causes unnecessary wear on the crowd brake. Available software for ERS models provides more braking power to prevent over-speed situations, in order to improve crowd brake life.

Another common miscue with these shovels, boom jacking occurs when the ERS crowds against the bank floor and lifts the boom with the dipper handle, triggering faults that adversely affect cycle times and machine productivity. The technology exists to prevent this situation by automatically adjusting the hoist and crowd to maintain proper rope tension, so the operator experiences fewer digging interruptions.

The benefit of these technology features is evidenced in a copper mine in Chile, which installed the EMC technology on its electric rope shovels and analysed the data collected by the software. In one year, it detected an astonishing 779 309 anti-swing

in-bank events across the mine’s shovel fleet. Additionally, anti-boom jack year-over-year comparisons showed 60% fewer incidents when using the motion control technology. Crowd overspeed incidents were reduced by 80%.

The mine also experienced longer lasting crowd and hoist running ropes, which led to fewer rope changeouts that put maintenance people in harm’s way, reduced costs, increased reliability, and elevated production per set of ropes. The mine also realised hoist stall protection, crowd anti-impact, and hoist rope slack prevention. Ultimately, over the analysis period the site saw overall production increase by 25%.

An easier tech installation

Mining operations now realise the significant benefits offered by the expanded use of technology with a range of equipment at mine sites, and they are requesting that ERS manufacturers expand technology offerings. This has led to third-party suppliers and OEMs expanding software capabilities to include anything from bearing temperature and vibration monitoring, to payload management and cycle segmentation.