Delivering More Source Emission Data in the Cloud New Software Coming Soon!

BREEZE ESP+ is the leading cloud-based software (using AP-42 Ch.7 methods) that enables terminal customers to easily calculate, track, store, and report on air emissions from tanks and other sources commonly found at their facilities, such as:

f Catch pans

f Combustion units

f Control devices

f Equipment leaks

f Line/vessel openings

f Sumps/oil-water separators

f Tanks

f Trucks

In addition, we offer our customers a wide range of EHS services to help ensure compliance with applicable environmental rules and regulations, including:

f Permitting and compliance assistance

f Environmental Justice assessments and assistance

f NSPS and NESHAP/MACT support

f Transportation fuel compliance

Contact us today!

amid superpower rivalry

Ng

Ramping up energy security

Neil Wragg, Joao Vasques and Joe Nichols, DNV, UK, discuss how digitalisation is vital to ensuring that FSRUs are operating as efficiently as possible.

Kevin

drive dramatic improvement

of AI

As artificial intelligence (AI) brings unparalleled change to the storage sector, Danny Constantinis, EM&I Group, Malta, outlines the importance of accountability at all levels within the sector.

27

Tanks turn to the future for cleaning

Chris Platt, Re-Gen Robotics, UK, discusses how terminal operators are profiting from the use of robotic cleaning in their storage tanks.

31 Tank inspection and beyond

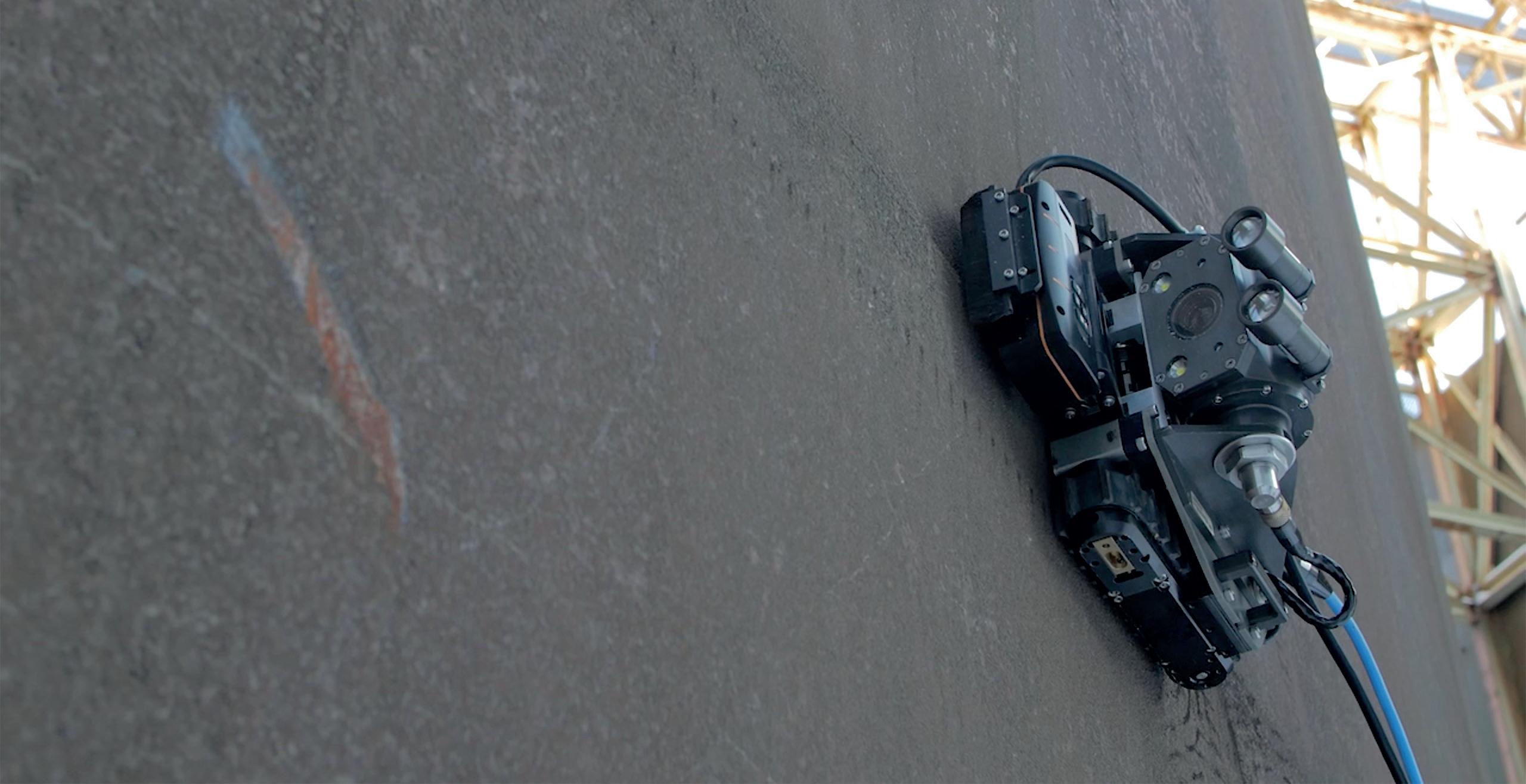

Craig Senych, Eddyfi Technologies, Canada, outlines how the integration of robotic inspection crawlers in the tanks and terminals industry offers advantages in safety, efficiency, and cost-effectiveness.

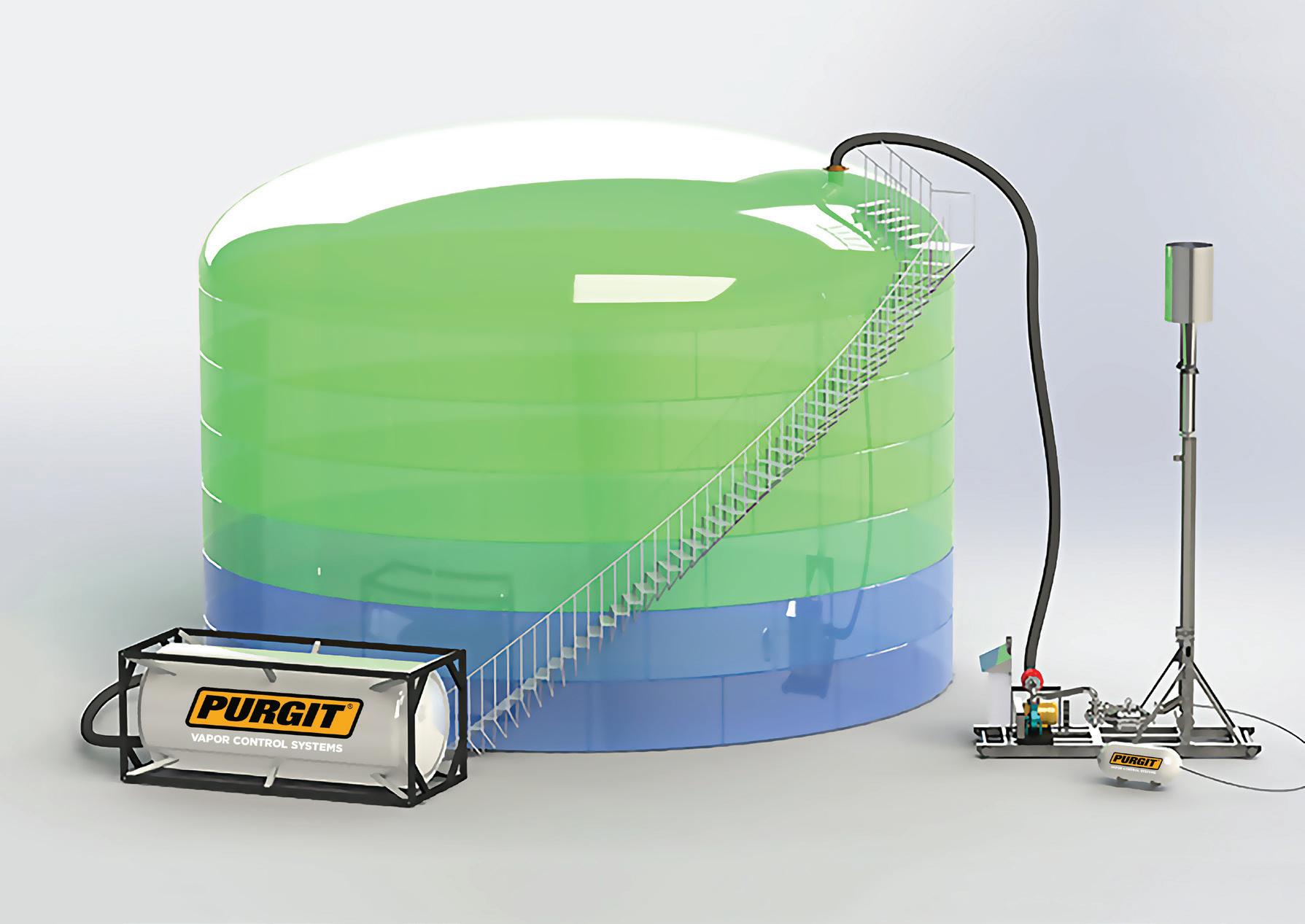

35 Managing emissions in the tank storage industry

Borja Maestro, Tecam, Spain, explains how the tank storage industry is tackling environmental issues, particularly the treatment of venting gas emissions.

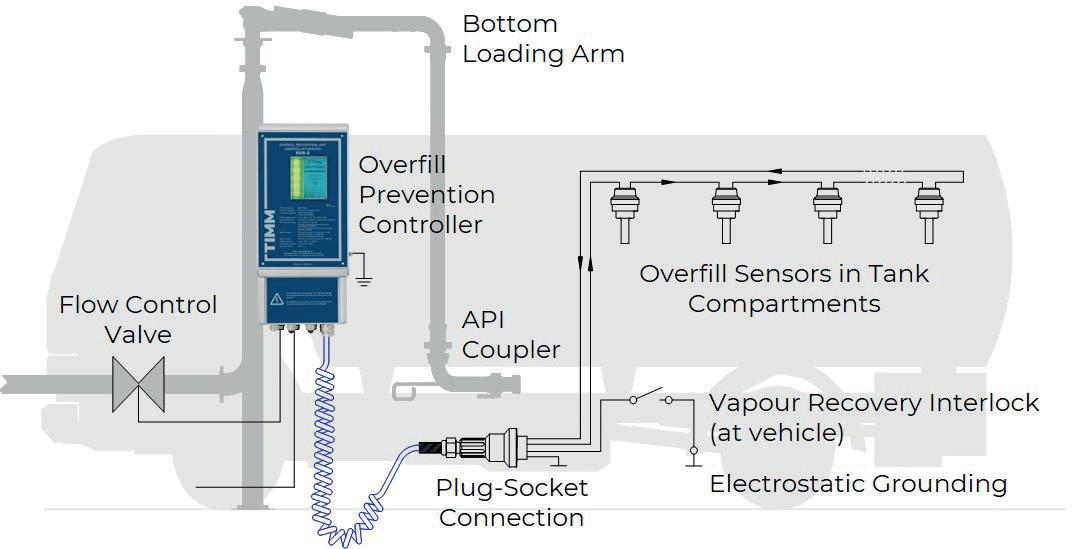

39 Learnings from a bottom loading overfill incident

Dr. Alexander Zelck, Timm Technology, Germany, provides a case study of a bottom loading overfill incident and explains what can be learnt from the experience.

43 Protecting tanks from the ground up

Jente Quintens, Owens Corning, explains why storage tank owners should adopt the practice of insulating tank bases and the criteria that should be considered when designing insulation systems for such purposes.

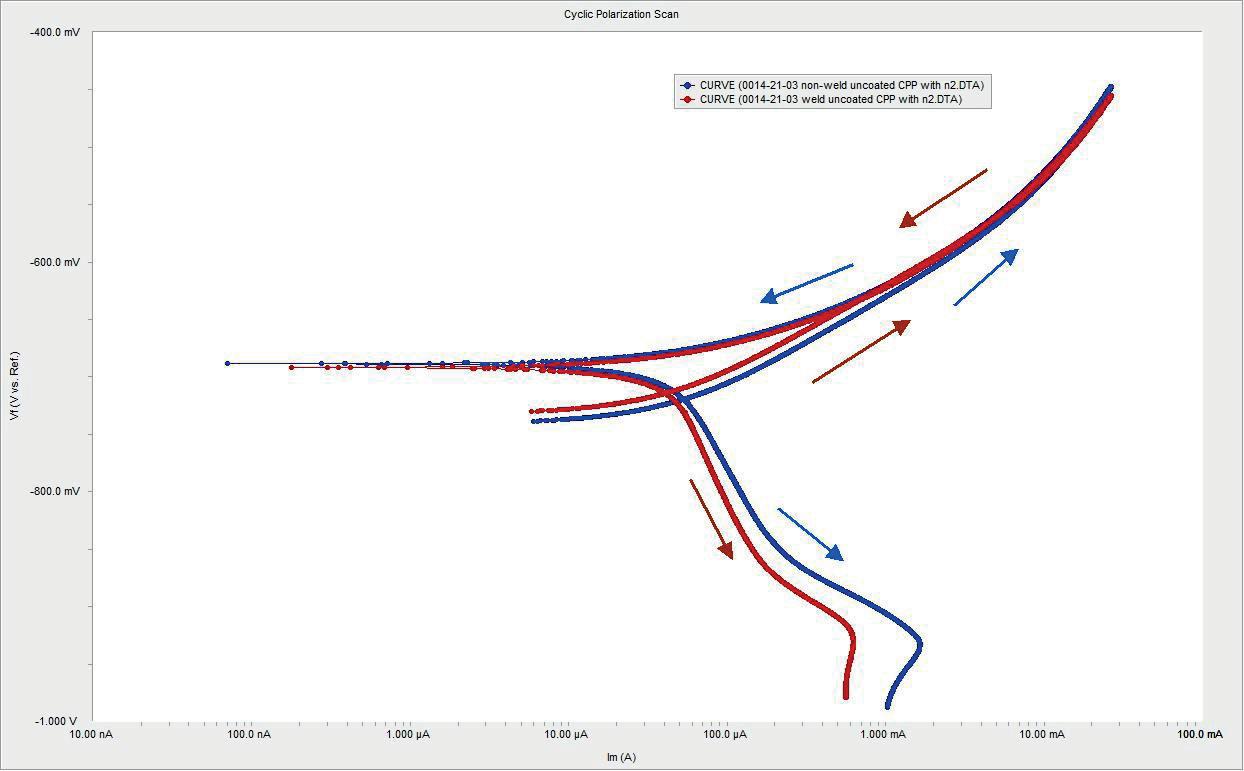

47 Corrosion protection for the soil facing side of tank bottoms

Tony Collins, EonCoat, USA, discusses how the tank industry is evolving to implement more effective corrosion prevention techniques.

51 A ticking time bomb

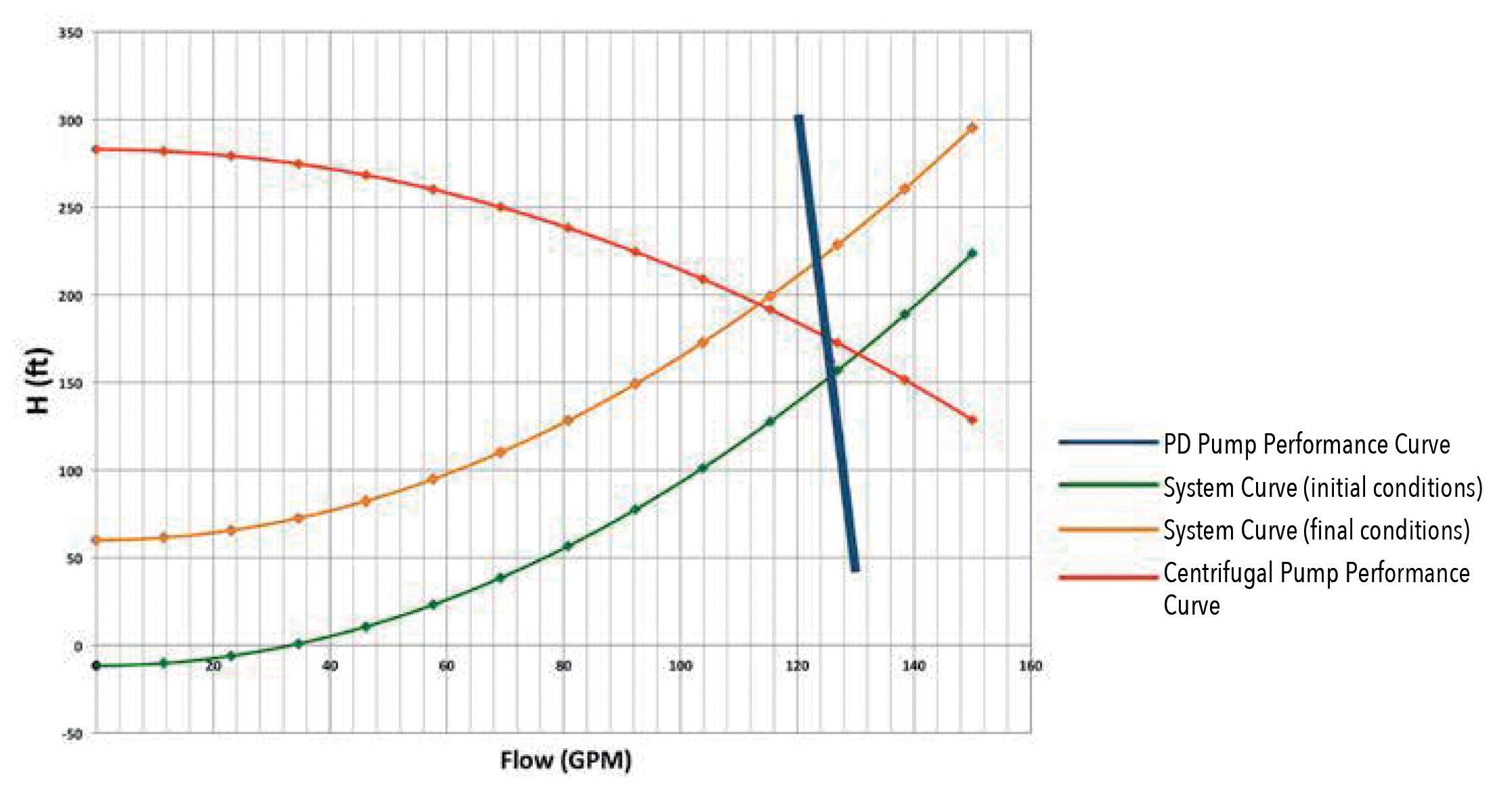

Geoff VanLeeuwen, Blackmer, USA, explains how the liquid terminal industry can save time by ensuring that the right pump is selected.

56 Q&A with...

Tanks & Terminals talks to Edward J. Cass, Technology Manager, Paratherm Heat Transfer Fluids.

Chart provides a complete range of bulk cryogenic storage tanks and solutions delivering proven reliability, reduced maintenance, and lowest cost of ownership for the full spectrum of liquefied gases, including hydrogen and LNG. Chart Vacuum Technology guarantees highest thermal performance and extended hold times. All tanks are shop built and total storage capacities can be modularised, which significantly reduces civil engineering, installation costs and schedule.

COM MENT

CONTACT INFO

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O’Reilly callum.oreilly@palladianpublications.com

EDITORIAL ASSISTANT Jack Roscoe jack.roscoe@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES EXECUTIVE Sophie Barrett sophie.barrett@palladianpublications.com

PRODUCTION MANAGER Kyla Waller kyla.waller@palladianpublications.com

EVENTS MANAGER Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL ADMINISTRATOR Leah Jones leah.jones@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITOR

Gordon Cope

SUBSCRIPTION RATES

Annual subscription £110 UK including postage /£125 overseas (postage airmail).

Two year discounted rate £176 UK including postage/£200 overseas (postage airmail).

SUBSCRIPTION CLAIMS

Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

APPLICABLE ONLY TO USA & CANADA

Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032

15 South Street, Farnham, Surrey

GU9 7QU, UK

Tel: +44 (0) 1252 718 999

Fax: +44 (0) 1252 718 992

CALLUM O’REILLY SENIOR EDITOR

Last winter, LNG was Europe’s knight in shining armour; swooping into its terminals from far flung destinations and saving the continent from the threat of mass energy shortages.

Europe imported over 66% more LNG in 2022 than it did in 2021, bolstering its storage reserves and ensuring that the lights (and heating) stayed on throughout the dark, cold months. In its latest ‘World LNG Report’, the International Gas Union (IGU) noted that during the most turbulent year in the history of gas markets, LNG “demonstrated its essential value as a flexible, reliable and available energy resource for a secure energy transition.”

However, if Europe was under any illusion that LNG provided a cosy (although cryogenically chilled) comfort blanket for its energy needs, it was recently given a nasty shock.

Europe’s newfound dependence on LNG imports has left it susceptible to supply disruptions from around the world, even as far afield as Australia. Despite the fact that Australian LNG rarely makes its way directly into European regasification terminals, the recent threat of strike action at three LNG terminals in Western Australia started a chain of events that saw a dramatic surge in European gas prices. The fear is that if production is halted at the LNG terminals operated by Woodside Energy and Chevron, then their regular buyers from Asia may be forced to look for alternative supplies from elsewhere, putting them into direct competition with Europe.

Kaushal Ramesh, Head of LNG analytics at Rystad Energy, explains: “A lot of US volume […] which [is] currently being sent to Europe, could be taken to Asia, raising the risk of an inter-regional bidding war.”1

We live in incredibly sensitive times, and the markets are easily spooked. The mere whisper of industrial action can lead to significant price volatility. This is the new reality for Europe as it continues to wean itself off Russian gas and increases its reliance upon LNG – a truly global commodity. And although Europe currently sits on a comfortable level of storage reserves, said to be close to 90% full, “the market remains unstable as this winter could still turn out severe and rapidly deplete storage”, according to Ramesh. Even if winter is mild, the continent will need to continue importing huge quantities of LNG throughout the coming months, as storage alone cannot meet demand.

Interestingly, in a bid to bolster its storage reserves, Europe’s energy industry has also started to ship large volumes of natural gas into war-torn Ukraine. The country has more gas storage capacity than any country in the EU, and has the potential to provide an additional 10 billion m3 worth of storage to foreign customers, according to state-owned Naftogaz Group.2 Brussels-based think tank, Bruegel, recently said that Ukraine could increase Europe’s storage capacity by approximately 10%.

Ukraine’s storage tanks are located deep underground in the west of the country, which is far from the front lines. And although traders were initially cautious about using the facilities, there are signs that this is beginning to change. Naftogaz said that the number of non-Ukrainian companies injecting gas into the country had hit 19 this year, up from four in 2021. It seems that Ukraine is offering an unexpected option to help stabilise the market and ensure security of supply throughout winter.

1. TANI, S., ‘Gas price spike underscores Europe’s vulnerability to global energy shocks’, Financial Times, (10 August 2023). 2. TANI, S., SHEPPARD, D., and HANCOCK, A., ‘EU increases gas storage in Ukraine to ease winter shortage’, Financial Times, (8 August 2023).

WORLD NEWS

A selection of the latest news hitting the headlines on www.tanksterminals.com

Stanlow Terminals and Eni ink MoU

Stanlow Terminals Ltd has signed a Memorandum of Understanding (MoU) with Eni UK Ltd to explore the development of carbon dioxide (CO2) collection, transportation, and storage.

Chart Industries celebrates construction progress of its ‘Teddy 2’ facility

The plant is expected to fabricate the largest shop-built cryogenic tanks ever manufactured globally, with manufacturing production set to begin in 1Q24.

Gate terminal starts construction of fourth LNG tank

Gate terminal and its shareholders Gasunie and Vopak have announced that the final investment decision has been taken to expand Gate terminal’s storage and regasification capacity. The expansion consists of a new LNG storage tank of 180 000 m3. The new capacity is already rented out under long-term commercial agreements and is expected to be ready for operation by 2H26.

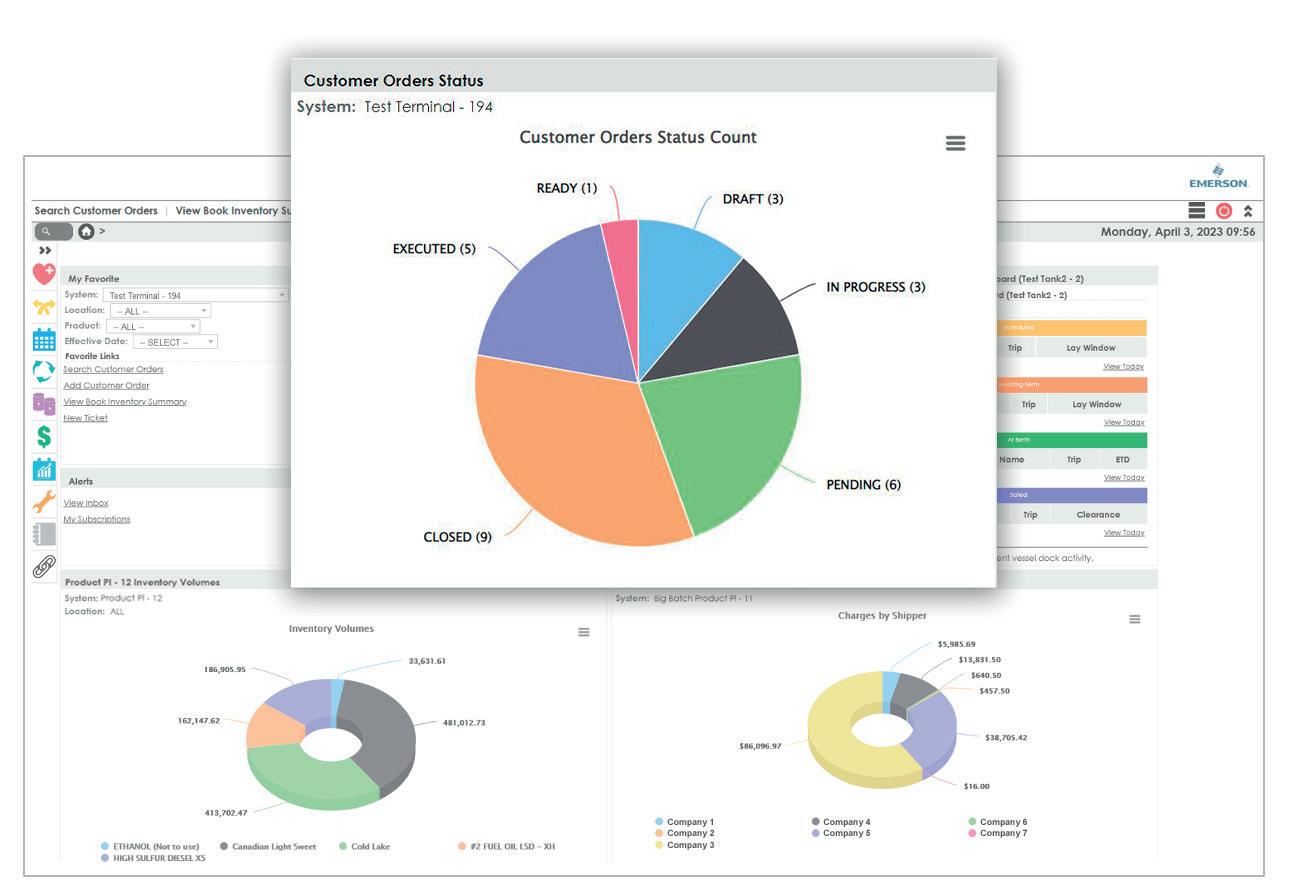

Spotlight interview with Emerson

Tanks & Terminals recently sat down with Ryan Thompson, Senior Manager for Midstream Marketing & Sustainability, as well as Dieter Sticht, Product Owner for Liquids Scheduling Applications at Emerson, about their recent article that featured in the Summer 2023 issue of Tanks & Terminals magazine. Watch the full interview here: bit.ly/3qy7CQR

READ MORE...

To keep up-to-date with the latest news and developments in the storage sector, visit www.tanksterminals.com and follow us on our social media platforms

DIARY DATES

26 28 September 2023

Turbomachinery & Pump Symposia Houston, Texas, USA tps.tamu.edu

02 05 October 2023 ADIPEC Abu Dhabi, UAE www.adipec.com

09 12 October 2023

API Storage Tank Conference & Expo Denver, Colorado, USA events.api.org/2023-api-storage-tank-conference-expo

05 07 December 2023

16th Annual National Aboveground Storage Tank Conference & Trade Show The Woodlands, Texas, USA www.nistm.org

12 13 March 2024 StocExpo Rotterdam, the Netherlands www.stocexpo.com

03 05 April 2024

26th Annual International Aboveground Storage Tank Conference & Trade Show Orlando, Florida, USA www.nistm.org

06 08 May 2024

ILTA International Operating Conference & Trade Show Houston, Texas, USA www.ilta.org

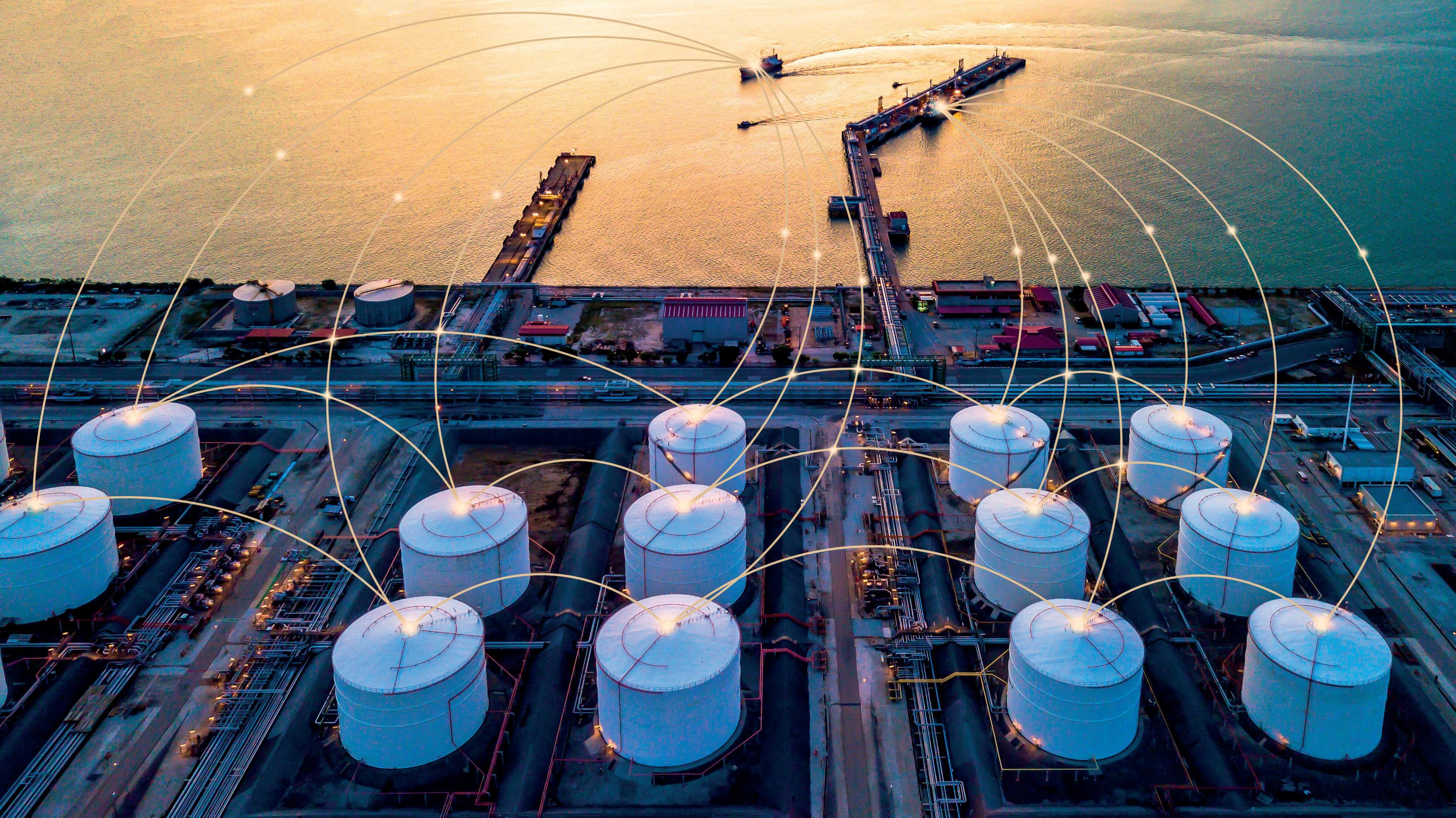

Asia’s oil storage sector is taking on greater geopolitical importance amid rising tensions between the region’s military powers.

The US and China are eyeing each other with increased suspicion, drawing the rest of Asia into their superpower rivalry.

China has been building its oil infrastructure of refineries, pipelines, storage and tankers at a rapid rate, and with increasing secrecy. It has triggered a response from Australia and India, two of the US’ three main allies in the region. Australia has announced the establishment of a fuel council that will jumpstart the country’s oil stockpiling programme. India too has been under pressure to expand its stockpiling programme to improve energy security. Indian officials realise that their inadequate storage facilities are limiting the country’s ability to increase the import of cheap Russian oil. China, Singapore and Malaysia have seen an increase in tanker traffic outside their waters not just for oil delivery, but for stockpiling.

Australia’s proposed fuel council to jumpstart stockpiling efforts

Fuel stockpiling and logistics will play a key role in the military’s protection of Australia’s territories and trade routes in the event of war in Asia, according to a sweeping review of the country’s defence strategy. The Defence Strategic Review (DSR) has recommended that Australia immediately establish a national council to ensure the country’s defence forces are well supplied with fuel owing to “the prospect of major conflict in the region that directly threatens our national interest.”

The government of Prime Minister Anthony Albanese has accepted this and several other recommendations in the DSR jointly written by a former Defence Minister, Stephen Smith, and a former Australian Defence Force (ADF) Chief Angus Houston. Released in April 2023, the report provides a roadmap for Australia’s biggest overhaul of its strategic and military planning in decades. Much of that is in response to China’s growing challenge to the geopolitical status quo in Asia

Ng Weng Hoong, Contributing Editor, discusses the growing importance of the oil storage sector in Asia in light of rising tensions between global superpowers.

and the expansion of its military reach in the region and beyond. “A whole-of-government Fuel Council should be established as soon as possible with representatives from relevant departments and industry to deliver resilient national fuel supply, distribution and storage,” said the report.

With the region’s radically changed security landscape from China’s emergence as a global political and military force, the report said the ADF must have the fuels and logistical support to engage in undersea and maritime warfare, long-range air strikes, integrated amphibious water-land activities, and all-round air operations. Fuel supplies and stockpiles have long been identified as one of Australia’s security vulnerabilities. While the country is blessed with enormous primary energy reserves such as crude oil, natural gas, coal and uranium, it is significantly short on refined fuels that are needed to run engines. For years, the International Energy Agency (IEA) and Australian analysts have been telling Canberra to boost the country’s fuel stockpiles, but to no avail. Writing for the Sydney-based think tank Lowy Institute in September 2022, Security Analyst Victor Abramowicz commented: “Aside from potential future nuclear-powered submarines, every ADF aircraft, vehicle and vessel is useless without fuel.” Citing poor economics, Australia’s oil industry has shut down five refineries over the past decade, leaving the country with just two that supply only a fraction of its 985 000 bpd of liquid fuels demand. As a result, Australia is increasingly reliant on fuel imports from refineries in Asia. “Australia imports 91% of its fuel requirements, supplied by inherently vulnerable oil tankers, and holds only 64% of the recommended 90 days’ worth of reserves – so any war disrupting supply best be conveniently short, or the nation is left defenceless,” said Abramowicz. According to the Australia Institute, the country relies on imports for 71% of its fuels. Australia’s two remaining refineries, Ampol’s 108 000 bpd plant in Lytton, and Viva’s 129 000 bpd Geelong plant, are being kept alive by government subsidies. At more than 50 years old, both are well past their shelf lives. What makes the situation so alarming is that Australia’s fuel stockpiles can only meet about a third of daily consumption, the institute said in a 2022 report. The public policy think tank criticised Canberra for previously understating the dire state of the country’s fuel supply by including in its count of strategic reserves “some 21 days of fuel in transit to Australia or onboard ships in foreign ports.” As many of the ships are foreign owned, the institute warned: “There is no guarantee that this fuel would reach Australia in the event of a crisis. Our strategic fuel supply is particularly vulnerable as our two remaining refineries are set up to produce largely (gasoline) rather than aviation fuel and diesel.”

Air Force’s upgraded fuel storage tanks in Tindal

Canberra is completing a AU$1.6 billion upgrade of the Royal Australian Air Force (RAAF) base in Tindal in Northern Territory state. The upgrade includes the design and construction of bulk liquid fuel storage tanks in Katherine, including two that can each hold up to 4 million l of aviation fuel. The project started in 2020 under then Prime Minister Scott Morrison who said the enhanced base will be integral to Australia’s military alliance with the US. It will also increase the

reach of RAAF fighter planes in the Indo-Pacific region.

“As part of these upgrades, RAAF Base Tindal will be able to deliver enhanced air-to-air refuelling and air support capabilities, ensuring we can support critical ADF operations […] both at home and throughout our region,” he said.

Minimum stock levels to be raised

The Australian government has ordered oil companies to raise their minimum fuel stockpile levels from 1 July 2023. The refineries in Ampol and Geelong will have to hold stockpiles to meet the national demand for at least 24 days of gasoline, 20 days of diesel, and 24 days of jet fuel. Importers will have to maintain stockpiles for at least 27 days of gasoline, 32 days of diesel, and 27 days of jet fuel.

Energy Minister, Chris Bowen, said: “The guaranteed minimum stock levels of traditional transport fuels will improve domestic fuel reserves to protect motorists, businesses and industries from future market turmoil.” The industry will also have to report stock levels fortnightly from July 2024. Bowen said these ‘transitional arrangements’ will give industry enough time to prepare for the full implementation of the minimum stockholding obligation scheme in 2024.

China steps up oil stockpiling as US talks naval blockade

China’s economy is rapidly slowing but there has been no let-up in its drive to import as well as produce more oil, gas and coal, the country’s main energy sources. Unlike in the past when the country needed increased energy consumption to sustain its breakneck pace of economic growth, the current phase of supply expansion is driven mostly by strategic and military considerations. Much of the additional crude import will likely be stockpiled into the country’s strategic petroleum reserves. Some of it is being refined and exported as finished products. According to Italian shipbroker, Banchero Costa, China accounted for 22.4% of the world’s imported crude oil at the start of 2023, giving it the top spot ahead of the EU, which had a 22.1% share.

While the Middle East remains China’s main crude supplier, Russia’s sales to its Asian neighbour surged 30.7% to 42.2 million in 2022. Partly to continue taking advantage of Russia’s heavily discounted oil, China recently raised the crude import quotas for its private refiners by 20%. According to Reuters, Beijing permitted the refiners to import a total of 194.1 million t of crude oil for 1H23, up from 161.75 million t for the same period in 2022. Bloomberg counted some 125 supertankers with the capacity to deliver 250 million bbl entering China in April, the most in over two years.

China’s oil demand growing faster than the economy

China’s rush to buy oil is starting to have an effect on its macro-economic picture. In its June 2023 report, OPEC forecast China’s oil consumption to rise by a hefty 5.69% in 2023, significantly higher than the country’s projected economic growth of 5.2%.

But China is unlikely to be consuming that much oil. Its famed export machinery has slowed down rapidly, while its real estate, construction, tourism, and technology sectors

have slumped. In fact, for the first time in more than five decades, the Chinese economy has become one of Asia’s worst performers. Its economic growth of 3% in 2022 and 2.2% in 2020 were the slowest recorded since 1976. Growth could rebound to a modest 5% this year, and to 4.5% in 2024, according to the Asian Development Bank.

For China, these numbers represent a new era of slow growth that contrasts with the golden period between 1980 – 2020 when its economy powered ahead by an average annual rate of 11.4%, according to the World Bank. In 1980, China opened to the world when it adopted economic reforms, while COVID-19 forced a near three-year closure from early 2020.

US to plan naval blockade

China’s increased stockpiling of both crude and products are likely driven by its worsening bilateral ties with the US.

In June, members of the US House of Representatives began openly discussing a naval blockade against China. This was contained in a proposed amendment to the next US defence budget submitted by Republican congressman, Ronny Jackson. In a statement, the Texas representative said his submission for increased defence priorities under the National Defense Authorisation Act (NDAA) for FY24 was approved 58 - 1 by the House Armed Services Committee’s (HASC). His foreign policy priorities included developing “a concrete plan to create a naval blockade for fossil fuel shipments to China”, and an evacuation plan for Taiwan. So far, China has not commented, but there are concerns about how the US’ actions may be perceived.

Myanmar’s oil storage terminal

Human rights campaigners have raised concerns that Myanmar’s military government is using the country’s largest and most modern oil products terminal to support its operations in the civil war.

Amnesty International, Global Witness and Burma Campaign UK are jointly demanding oil companies, especially in nearby Asian countries, to stop shipping fuels to the storage terminal at the port of Thilawa, located 16 km south of Yangon, the country’s main city. Jet fuel imported and stored in Thilawa has increased the regime’s ability to fuel fighter planes.

Myanmar has been wracked by violent ethnic conflicts for decades. Despite their control of the government, the dominant Burmans, who comprise two-thirds of the population of the resource-rich country, have been unable to live peacefully with the Kachin, Kayah, Karen, Chin, Mon, Rakhine and Shan groups. The country has plunged into civil war over the past two years. In December 2022, the government gained an upper hand when it took full control of the Thilawa terminal following the exit of owner Puma Energy Asia Sun (PEAS). The company is a wholly-owned subsidiary of Puma Energy, which is majority-owned by the Singapore-based Swiss commodity trader, Trafigura.

In 2017, PEAS said it invested US$92 million to develop the terminal to store and supply aviation fuel, gasoline, diesel, heavy fuel oil and bitumen with an eye to supporting the country’s long-term economic growth.

Myanmar’s Asia Sun Energy (ASE) took a minority stake in the project, which Chairman Win Kyaw said would set the standard for fuels logistics and distribution in his country.

At the terminal’s start-up in May 2017, he said: “We are proud to set a standard in the industry with our infrastructure, modern quality control processes and independent onsite lab. We are confident that these unique features will establish Puma Energy Asia Sun as a reliable provider of high-quality fuels in Myanmar.”

Instead of economic progress, the project has become a symbol of the country’s descent into failed statehood.

Montse Ferrer, an Amnesty International Researcher, said: “We have traced new shipments of aviation fuel that have likely ended up in the hands of Myanmar’s military, which has consistently conducted unlawful air strikes. These attacks regularly kill civilians, including children, and destroy civilian property, yet planes can only take off if they have fuel. Since the military’s coup in 2021, it has brutally suppressed its critics and attacked civilians from the ground and the air. Supplies of aviation fuel reaching the military enable these war crimes. These shipments must stop now.” He also criticised Puma Energy for selling the terminal and other assets to the Myanmar company. According to the Myanmar Institute for Peace and Security, the military conducted 104 air strikes in 2021, and 243 in 2022. That number is expected to increase now that the government fully controls the Thilawa terminal.

In response to the Amnesty and Global Witness report, Wilhelmsen and Korean Pan Ocean said they would cease providing shipping services and vessels delivering aviation fuel to Myanmar. Thailand’s refining company, Thai Oil, said it would also join the boycott.

Salt cavern crude storage project in India

With the help of its new German alliance partner, state-owned Engineers India Ltd (EIL) is looking to build India’s fourth official crude oil storage site in Rajasthan state.

The rocky geology of India’s hilly arid northwestern state provides for natural caverns to be carved out to store petroleum crude and products. While the idea of storing oil in man-made caverns has been around for decades, India does not have the technology to extract the salts embedded in the rocks to eliminate the risk of fuel contamination. At the same time, engineers must ensure the caverns are stabilised after the salts are removed. EIL announced its intention to build the cavern in landlocked Rajasthan after recently signing a Memorandum of Agreement with German engineering firm DEEP.KBB. In a joint statement, the companies announced: “The alliance shall jointly pursue basic design, detail engineering, project management and construction supervision services for underground and aboveground salt cavern storage facilities for hydrocarbons and other products like hydrogen and CO2.” DEEP.KBB’s expertise is in building deep underground oil storage tanks and extracting brine and salt from rock formations. EIL is currently working on two terminals for storing LPG for Hindustan Petroleum Corp. Ltd. Rajasthan will need storage terminals to serve the new integrated Barmer refinery-petrochemical complex that is due for completion in 2024. Jointly owned by

Hindustan Petroleum and the Rajasthan state government, it has the annual capacities to refine 9 million t of crude and produce 2 million t of petrochemical products. India’s existing three state-owned storage terminals are all granite rock caverns located near the seaports of Mangalore in the western state of Karnataka, Padur in the eastern state of Tamil Nadu, and Visakhapatnam in eastern Andhra Pradesh.

Oil storage poised for further expansion

As part of its plan to improve the country’s energy security, the Indian government is encouraging private companies to expand their oil storage and logistical infrastructure. Earlier in 2022, Adani Ports became the sole owner of Indian Oiltanking Ltd (IOTL) when it acquired the 49.38% stake that it did not previously own. Subsidiary Adani Ports and Special Economic Zone Ltd (APSEZ) said it bought out its partner Oiltanking India GmbH. IOTL owns and operates a network of six terminals in India with a total storage capacity of 2.4 million kl for crude and petroleum products. India’s oil storage sector will also be boosted by the development of a new deep-sea port on Nicobar Island located at the junction of the Bay of Bengal and the Andaman Seas off the southern coast of Myanmar. The island has a front row view of the Straits of Malacca through which oil, gas and other goods flow from the Middle East to East Asia. With China in mind, India is proceeding with plans to invest US$9 billion to build a new city port with a container trans-shipment terminal, an

airport, power plant and oil storage facilities. The port is expected to also support India’s naval operations in that region as the government of Prime Minister Narendra Modi prepares for further escalation in tensions with China.

Fuel storage in Singapore

Finland’s leading energy firm, Neste Corp., has bought a minority stake in a firm specialising in the storage and distribution of aviation jet fuel at Singapore’s Changi international airport. Neste said it bought into Changi Airport Fuel Hydrant Installation Co. Pte Ltd (CAFHI) as part of an expansion of its Singapore sustainable fuels refinery at a total cost of €1.6 billion. The plant, which started up in November 2010, now has the capacity to produce 2.6 million tpy of fuel. Neste did not disclose the value of its investment or the size of its stake in CAFHI, a private company jointly owned by the main oil companies in Singapore that has the lucrative monopoly of supplying fuel and fuelling services to the country’s bustling airport.

Neste’s stake in CAFHI marks its admission into the elite club of Singapore’s oil industry, which includes ExxonMobil, Shell, Chevron, PetroChina and BP. Neste said 38% of its plant’s capacity is dedicated to producing sustainable aviation fuel (SAF) from recycled waste products. Finland became NATO’s newest member when it joined the western military organisation in April. NATO is looking to expand into Asia with the proposed opening of an office in Japan.

Consolidating on the historical increase in worldwide energy demand, which is forecast to continue until 2050, natural gas has played and will continue to play an essential role in meeting the world’s energy requirements.

DNV’s 2022 ‘Energy Transition Outlook’ estimates that natural gas will be the single largest energy source by 2048. LNG, due to its storage and portability characteristics, in addition to its lower environmental impacts in relation to coal or oil, is an attractive long-term solution in providing a proportion of the world’s heating and electricity generation requirements.

As the LNG market continues to grow, ensuring that new and existing storage and transport facilities are fit for purpose will be key. With energy security now a priority for many nations, floating storage and regasification units (FSRUs) are seen as a rapid response strategy. In the European Union (EU) in particular, where security of supply is high on the agenda following the Russian invasion of Ukraine, several projects have been accelerated to ensure a diversified supply of gas from different sources. This year alone, policymakers are determined to slash the bloc’s dependence on Russian gas by two-thirds.

Neil Wragg, Joao Vasques and Joe Nichols, DNV, UK, discuss how digitalisation is vital to ensuring that FSRUs are operating as efficiently as possible.

As such, to achieve a secure and greener future, ensuring the robustness of LNG supply chains is essential. For that to happen, digitalisation in support of the FSRU market can play a key role in streamlining efficiencies across both design and operational phases of new and existing LNG assets.

Supporting projects through digital methodology

While FSRUs may be situated offshore, countries are increasingly seeing the benefits of essentially constructing/retrofitting them for use as permanent floating facilities as an alternative to land-based terminals. They are quicker to build/implement than onshore facilities and with the demand for energy security being so immediate, expediency is a priority.

However, for the successful deployment of FSRUs, there are several operational parameters that need to be considered, which include the following examples:

n Wind levels, wave height, weather conditions and visibility, including seasonal variations.

n Equipment reliability.

n Sea water temperature.

n LNG tanker size, demurrage conditions, sloshing potential and berthing restrictions.

Through statistical analysis, the risk associated with each of the individual factors can begin to be understood.

However, effective risk management of FSRU operations can only be fully achieved when both the stochastic variation of all risk factors and their potential interdependencies are jointly considered. At DNV, the RAM (Reliability Availability and Maintainability) analysis software TARO (Total Asset Review and Optimisation) uses Monte-Carlo simulation-based tools in support of the LNG sector. More specifically, TARO is used to produce fully dynamic probabilistic models of FSRU operations to substantiate the robustness of proposed commercial operating model(s). This highlights risks associated to production, reliability and demurrage to the selected model and alternative options.

As a quantitative digital forecasting tool, TARO enables the creation of a true risk profile. Tangible benefits include being able to support LNG tanker delivery schedule design and aiding in pre-FEED and FEED stages from a process design perspective. This can be achieved through optimisation of berthing design and operation, buffer storage provision and/or quantification of the effect of different equipment and process system configurations via sensitivity cases. In addition, TARO can also be used to de-risk any changes/updates that operating assets might be considering in relation to their current operations, which is of particular relevance within the ongoing LNG market movements that seek to address security of supply concerns.

The Wilhelmshaven LNG terminal

On the northern coast of Germany, the Wilhelmshaven LNG terminal is an example of the benefits that digital RAM tools provide to the sector. Opened in December 2022, it is the country’s first facility of its kind, with its introduction accelerated due to geopolitical issues.

Rather than an onshore terminal, an FSRU was chosen as it can be quickly built and there is low impact from construction operations and noise. Its space saving characteristics and its location in Germany’s only deep-water port allows for it to be approached at any time by LNG transport ships of any size.

A study was undertaken to assess the risk and benefits of possible operating models for the FSRU terminal to ensure a viable model that provided sufficient flexibility to the shippers and an efficient terminal operation.

The dynamic model assessed various scenarios to determine operating conditions. It considered, amongst other factors:

n Reliability of FSRU equipment.

n Variable number of shippers and shipper entitlement.

n Planned maintenance days on the terminal.

This allowed for the development of a detailed understanding of the drivers for terminal performance and the optimisation of inventory management rules. It mitigated the impact of delays in cargo arrivals as it provided

Figure 1. OLT’s FSRU Toscana.AMMONIA STORAGE TANKS

Maximize Reliability and Efficiency with a Comprehensive Solution to your Ammonia Tank Inspection Program

Ammonia storage systems carry significant consequences, making thorough inspections crucial. Determining the right inspection strategy for a particular tank can be difficult when balancing inspection techniques with any identified damage to date and potential damage mechanism propagation. With E²G | The Equity Engineering Group, Inc., you can gain confidence in your ammonia tank inspection strategy and frequency. Our comprehensive approach enhances confidence in inspection results, empowering you to make informed decisions.

E²G delivers a multi-disciplinary approach that leverages API 581 risk-based inspection (RBI), European Fertilizer Manufacturer’s Association (EFMA) qualitative RBI, advanced probabilistic analysis, and finite element analysis (FEA) to offer a better understanding of the expected probability of failure.

Choose E²G for an optimized ammonia tank inspection strategy that is focused on safety and reliability.

SERVICE AREAS

⊲ Risk-Based Inspection (RBI)

⊲ Tank Fitness-for-Service (FFS)

⊲ Damage Mechanism Reviews

⊲ Finite Element Analysis (FEA)

⊲ Structural Analysis

BENEFITS

REDUCE RISK OF UNEXPECTED FAILURE INCREASE

an understanding of how best to handle them. Other benefits included determining the operating rules for small-scale LNG.

Offshore LNG Toscana

Another example of an FSRU where digital RAM tools have been introduced is Offshore LNG Toscana’s (OLT) development in Italy. In April, it was announced that the facility would be at 100% capacity until 2027. The regasification capacity of 3.75 billion m3/y, which is currently authorised, was offered in LNG slots of 155 000 m3 (per cargo).

For the Italian energy system, it is one of the country’s most important infrastructure developments for the import of LNG. It is permanently moored around 22 km from Tuscany, on the coast between Livorno and Pisa.

To assess the risks and challenges faced by OLT’s FSRU, a range of parameters that have an impact on the overall system performance over its lifetime were assessed. This enabled all stakeholders to agree on terminal performance guidelines and associated contingency plans.

The relationship between terminal send-out efficiency and gas import volumes was quantified, where it was demonstrated that efficiency is heavily reduced with increasing import requirements, mainly due to lower levels of equipment sparing at the FSRU as throughput increases. The design configuration of the LNG topside facilities was optimised and overall performance improved as key

performance drivers and bottlenecks in the terminal were identified and addressed.

The TARO models were also used to identify the significant operational and financial risk posed by LNG delivery schedule congestion, as a result of berthing slot disruption and tanker delays. As mitigation, the proposed ship sizes and storage volumes on the terminal were optimised to find acceptable trade-offs between demurrage hours, zero send-out time and efficiency.

Securing our energy future

In the last 12 months, DNV has applied its digital RAM tools in support of numerous FSRU projects, working with vessel designers, owners and grid operators to improve performance and maximise the value of their LNG assets. These essential projects are expected to contribute significantly towards their nations’ future energy needs: 8.5% of Germany’s future gas requirements will be met via the Wilhelmshaven import terminal, whereas the regasification capacity provided by multiple FSRU developments in Italy will represent around 20% of their demand.

Security of supply is the overarching aim but to get there, challenges must be understood and de-risked.

LNG supply chains are subjected to numerous potential hurdles, including terminal accessibility, coordination between shippers, equipment reliability issues, etc. However, RAM digital tools enable risk management decisions to be taken to foster a sustainable and resilient energy future.

The liquid commodities market is in a state of rapid growth. Exporters are expanding their operations to send LNG, as well as new types of low-carbon refined products and biofuels, from countries such as the US and Europe into South America and Asia.

Simultaneously, crude oils are being imported to and exported from the US, while other critical feedstocks are imported to the US, Europe, and many other countries. As the market increases, the demand for terminals is growing. Large companies are acquiring existing terminal facilities, and venture capitalists are supporting greenfield projects by building new facilities around the globe.

Rapid growth and expansion can bring massive returns, but it can also present problems if organisations are not prepared. As companies introduce new products into their terminals and acquire new assets – or even attempt to do more with what they already have – they must find ways to optimise those assets to expand operations without needing to grow or overtax their workforce. To accomplish this, forward-thinking organisations are turning to digitalisation by using software to increase throughput and efficiency –ultimately increasing standardisation, safety, and performance while simultaneously delivering higher profitability.

Cultivating a cohesive digitalisation vision

In large ports around the world, the many vessels coming and going can choose a wide variety of terminals. The companies operating those vessels make decisions based on their own business objectives. They will select facilities that have a reputation for efficiently offloading their product, protecting it, and moving it through the terminal as quickly as possible. Doing so means more sales for their product, whether it comes from their own refineries, pumping stations, or other sources.

If one terminal can turn a vessel around in 12 hours and another takes 18, this time difference will be a significant factor in facility choice, as customers can use the extra time to turn their vessel around, get more product into it, and send it elsewhere. Increasing business often means capturing that time deficit, because terminal efficiency helps customers meet their own objectives.

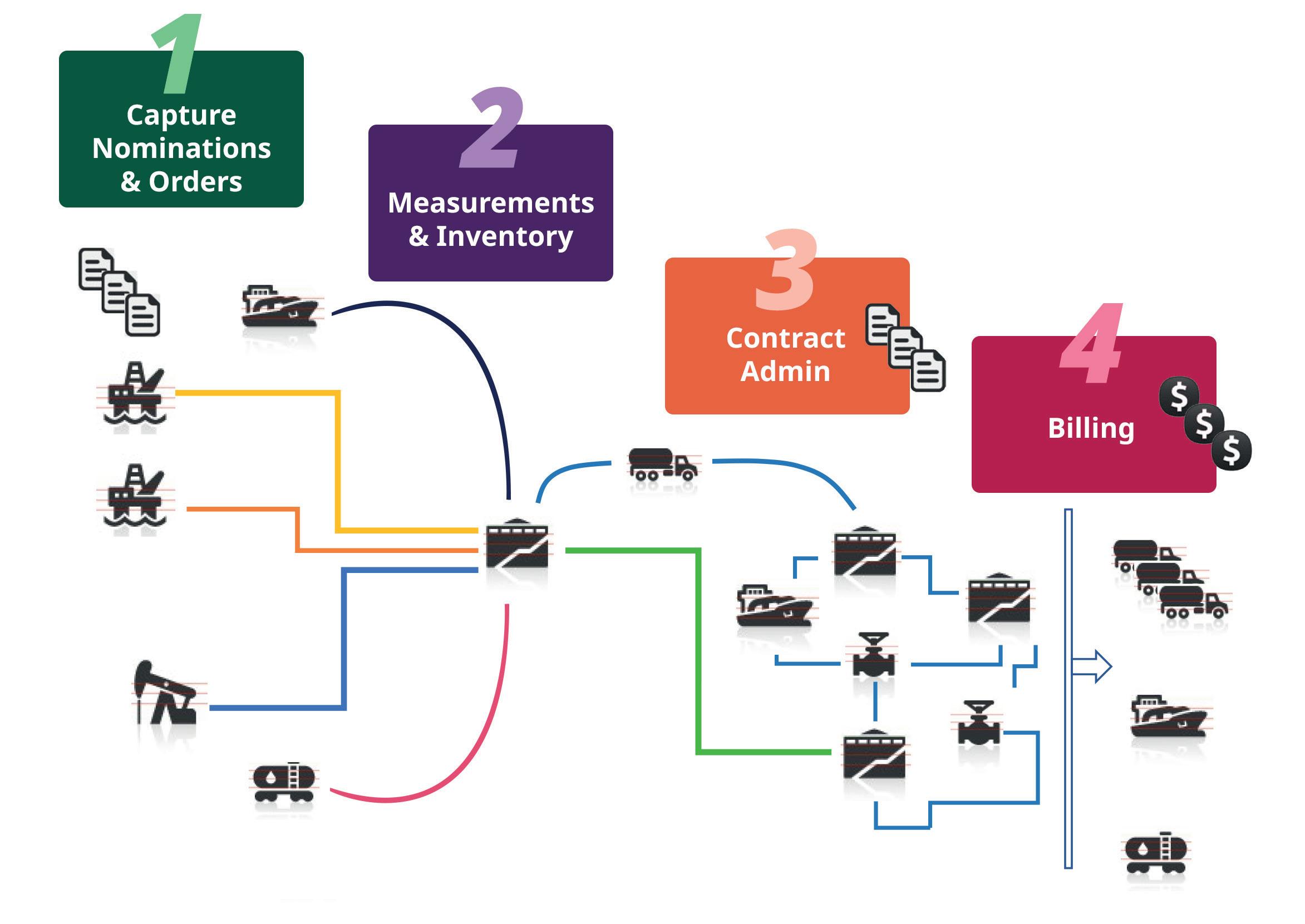

To capture that difference, a facility needs to maximise its known throughput capacity. Downtime or slow time in operations leads to decreased throughput, making a facility far less competitive. Today, many organisations are eliminating downtime and slow time by implementing order-to-cash software, which digitalises operations by collecting the information surrounding a customer’s order for the movement of product into, out of, or within the facility.

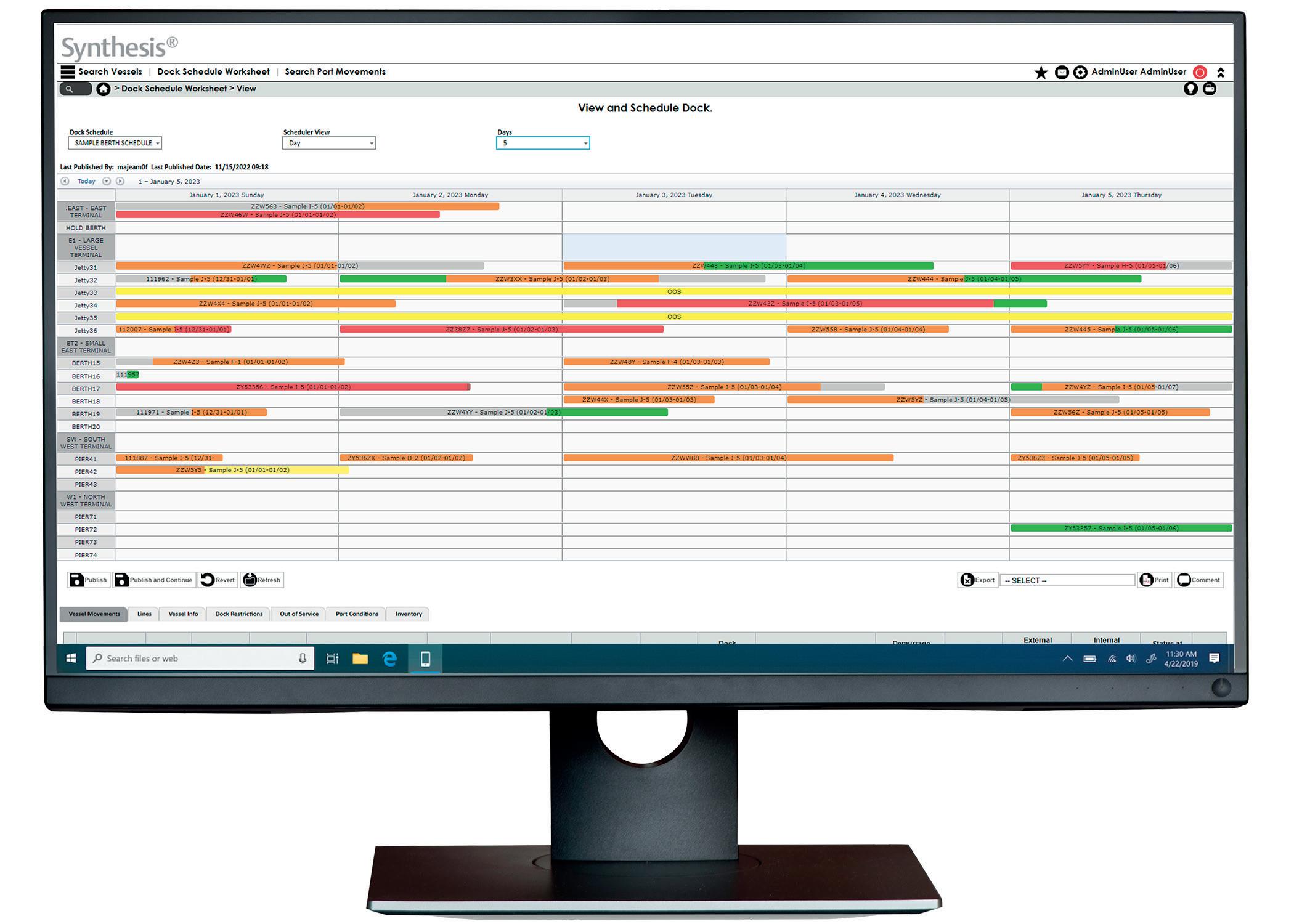

As the movements occur, the software automatically creates a movement ticket, providing visibility of the entire process, while tracking customer inventory by terminal, tank, or product. Following the completion of the movement, the software updates the contractual service charges, including leasing of tanks, the throughput itself, and even ancillary services, such as heating tanks and line flushes (Figure 1).

Kevin Niles and Sandy Tiu, Emerson, USA, explain how choosing the right software can drive dramatic improvement in terminal operations, increasing efficiency and delivering return on investment.

Although software tools, such as order-to-cash applications, have existed for some time, many organisations are just getting started on their digitalisation journey. The value of traditional investments, such as those into hardware and safety equipment, are easy to understand, as they are necessary to move product and protect personnel and the environment.

However, software investment is just as important. Once a team has a vision and an automation software solution in place, the terminal – or even a series of terminals - can operate as a cohesive, interconnected ecosystem for increased efficiency. With order-to-cash software in place, teams know what to move, where to move it, and how to do so, while minimising contamination and time-consuming line flushes. The terminal will increase throughput and optimise facility operations so that product moves faster for customers.

Embracing such a digitalisation vision leads to dramatic improvements across the facility and, potentially, across the enterprise.

Improved visibility and efficiency

At its most basic level, order-to-cash software helps an organisation improve visibility across the facility. A complex network of pipes, valves, and tanks dominates any terminal, and finding a way to navigate that web takes time and expertise –two things that are often in short supply. In fact, scheduling these transactions is one of the leading causes of excessive downtime and slow time in terminal facilities. Teams scheduling transactions manually often take too long to stop one process and start the next.

For example, teams often must flush lines to facilitate product movement without contamination. The flushing process can easily take hours, which is downtime where the terminal is not generating revenue.

Order-to-cash software can automatically plan movements so that they pass through the most efficient routes without mixing products. Built-in algorithms track the products, bringing in a batch, splitting it into different pieces, and moving those pieces through different tanks – avoiding mixing where necessary, and automatically mixing where desirable. Movements are optimised to make the most of every hour of each day, and they are automatically tracked all the way back to the original batch, so that operators have a complete, reliable paper trail for auditing.

Because actions are recorded in near real-time, operators have continuous visibility of what is happening across the facility, helping them to make better decisions. With cloud connectivity, these reports can be made available securely and remotely, helping members of a lean staff monitor their critical activities from anywhere, empowering them with more mobility and easier collaboration (Figure 2).

However, improved visibility does not stop at the facility level. Easy scalability enables an organisation owning a series of terminals in different parts of the world to still view them within a single instance, hosted in the cloud or on premises. Digitalisation tools support a boundless automation vision where teams eliminate data siloes and enterprise personnel can see everything that is happening across their fleet from a single view, from anywhere. Enterprise teams can monitor inventory or follow up on problems as they occur. Transactions are updated in real time in the system, from ordering and processing, all the way to invoicing, and everywhere in between.

With the most advanced order-to-cash software and the required connectivity, organisations can even extend visibility to their customers’ customers. A customer can instantly see how much inventory it has and where it is, so that business decisions can be made about how and where to ship product.

Efficiently navigate external hurdles

Every region has unique elements to its operations, and fit-for-purpose digitalisation solutions will take these nuances into account. For example, European operations must navigate the complexity of customs clearance as products are exported and imported between countries.

Using manual processes, customs delays are a common occurrence. Between phone calls, faxing and emailing,

BRIGHTER FUTURE COOLER BY DESIGN ®

Chart’s LNG power generation solutions provide natural gas to hundreds of thousands of homes. This is one way Chart facilitates LNG as a safe, clean-burning fuel for energy, transportation and industry.

documents can easily get lost, thus causing delays. If customs processes are delayed, vessels are stranded. Those stranded vessels block other vessels trying to move in or perform operations, ultimately creating a chain reaction that leads to missed deadlines and confused schedules for both the terminal and its customers. In the worst scenarios, that chaos can lead to demurrage that can generate tens of thousands of dollars in fees.

Order-to-cash solutions streamline the customs process through business-to-business connections with the customs authority. As a batch is processed through a terminal, order-to-cash software can process the customs application and automatically submit the data to the proper customs authority.

Customs can then digitally return clearance, at which point the order-to-cash software automatically updates status and documentation, allowing the vessel to depart whether clearance was granted in the middle of the afternoon or the dead of night.

Other complexities can be tied to product types. For example, transporters of LNG need the flexibility to track product in different ways, including both volume and calorific value. The most advanced software solutions can convert from mass to volume to British thermal units in support of liquefaction and regasification.

Improved safety

In any terminal, when product is moving from tank to tank, or moving out of the facility, teams need to follow essential safety precautions. In fact, any time the team operates a pump or opens a valve, a series of safety protocols must be followed. Safety procedures typically consist of a checklist of operations to perform critical tasks safely, and those checklists must be monitored by supervisory personnel, often needing sign-off. Many operators are still performing these tasks on paper, which not only leads to inefficiencies in the process, but also risks creating safety hazards due to oversights.

Terminals can dramatically improve their safety and efficiency through digitalisation, taking advantage of the automated safety tools built into order-to-cash software.

Using a supported and intrinsically safe handheld device, operators and technicians can perform safety checks in real time, and those checks – and their results – will be instantly available to others in the facility.

Supervisors can oversee operations from anywhere, and they can sign off digitally to ensure operations are not interrupted because a critical person is off duty or hard to find, for example. Moreover, those same safety reports can be instantly and automatically transferred to the enterprise, where personnel can use the data to track and trend safety and reliability issues across the whole fleet.

Digitalisation in action

One terminal operator needed to improve visibility and efficiency for servicing a customer that was sending hundreds of trucks into the terminal each day to lift petrochemical products. The company only had two customer service representatives, and needed a way to streamline the transaction process to move product more efficiently and effectively.

Using its order-to-cash software, the terminal was able to use application programming interfaces to connect directly to the customer’s enterprise resource planning software to create a round-trip business-to-business software system for faster transaction processing. Today, the customer simply submits hundreds of truck lifting orders electronically on a daily basis.

The automation software at the terminal then schedules and executes the process. Once the operation is complete, an invoice automatically goes back to the customer to let them know what was moved and how much it cost. The entire process is hands-off, and the terminal operator can easily complete all operations with their lean staff.

Such an automation configuration is advanced but is also entirely possible – especially when terminal organisations work closely with a trusted automation partner to select and implement order-to-cash solutions. Even after the software is live, a trusted partner can continue to support customers, for example by helping a terminal operator set up new contracts, along with automation that has never been attempted before, helping customers to stay nimble and efficient, even as operations change (Figure 3).

Moreover, software and cybersecurity continuously evolve. The best automation suppliers will regularly update their order-to-cash software with new features to improve cybersecurity and functionality.

Moving to the digitalisation mindset

Digitalisation of a terminal’s processes is about more than simply implementing software and technology; it requires a mindset change. A terminal can continue to run the traditional way –emailing records, manually scheduling transactions, and keeping individual terminals siloed from each other. However, the organisations that will best compete as the industry evolves with newer products and increased economic pressures will be those that implement software solutions to help them better manage efficiency and maximise throughput.

Just as with operational and safety equipment, software is an investment, but it is one that will pay significant returns in the decades that a terminal operates, not only through increased revenue, but also in improved goodwill and loyalty from customers.

Automation and control systems used in terminal facilities have evolved to keep up with asset owner and operator requirements to ensure facilities operate reliably and at full capacity. Over the years, systems have migrated from pneumatic control to single loop control, to vendor proprietary systems, to current systems running standard off-the-shelf hardware and operating systems that resemble information technology (IT) systems yet have a completely different mission. Current operational technology (OT) systems are now susceptible to cybersecurity attacks. Data sharing between IT and OT has increased as companies have strived to optimise their systems and increase profit. A strong dependency now exists between IT and OT, where pipelines, tank farms, and terminals rely upon business IT applications for inventory and accounting to ensure molecules are tracked and billed accordingly. When IT is impacted, the business may not have the capability to fall back to manual tracking methods to operate their OT systems. A recent example of these dependencies was highlighted in February 2022, when OilTanking in Germany, SEA-Invest in Belgium, and Evos in the Netherlands all suffered a cybersecurity attack on IT systems

that impacted their ability to operate their OT systems at a normal capacity.1

Cybersecurity events can devastate corporate profits, especially when organisations are unprepared to react. The public perception of a company that falls victim to an attack can be impacted, but more importantly, it is the loss of revenue, impact to employee safety, and damage to the environment that are of the utmost concern. As an example, the shipping company Maersk lost an estimated US$200 - 300 million in the NotPetya ransomware attack alone, not including unknown upstream and downstream supply chain losses.2

Colonial Pipeline suffered a ransomware attack in 2021 on its IT systems. To save its OT environment from a similar fate, it performed an IT to OT disconnect, isolating the pipeline SCADA from the business accounting systems. This decision eventually led the company to stop its US east coast pipeline operation due to the inability to account for product ownership along the pipeline and in tank farm inventories and customer billing. To resume operations, Colonial paid nearly US$5 million to the threat actors to recover its ransomed IT systems, but the effects could be felt nationwide with finished product prices increasing.

Mike Hoffman, Dragos, USA, examines the different cybersecurity threats that face the tank industry, and what actions can be taken to mitigate this.

However, this was felt the most on the eastern seaboard as fuel stations quickly ran out of supply.

Governmental response to these cybersecurity attacks has brought about regulation and cybersecurity baseline practices, such as the US Transportation Security Administration’s Pipeline Security Directive (SD02C), requiring pipeline owners and operators to establish a cybersecurity implementation plan, assessment plan, and develop and test an incident response plan.3 Similarly, asset owners and operators of essential services in EU Member states under the NIS2 Directive have several baseline security controls and policies, including incident reporting requirements.4

The cyber challenges

Resources, budgets, and outage time constraints are universal limitations at terminal facilities. Therefore, security controls cannot be applied to all systems in the same way or at the same frequency. Given an increase in cyber threat to the landscape, cybersecurity should be viewed as a business enabler to ensure safe, reliable, and optimised operations. Therefore, critical systems that need security controls include but are not limited to:

n Inventory tracking.

n Distributed control systems (DCS) or programmable logic controllers (PLC).

n Terminal management systems.

n Tank measurement and tank strapping tables.

n Custody transfer flow meters and meter factor numbers.

n Online/offline analytical measurement (methods and calibration data).

n Electrical switchgear and motor variable frequency drive (VFD) controllers.

How to secure OT environments

Whether organisations are just starting on their cybersecurity journey or have a mature cybersecurity posture, knowing how to focus efforts and monies appropriately is the topic of many leadership conversations. SANS, an IT and OT security training provider, recently outlined the five critical controls that organisations should focus on to secure their OT environments.5

The controls are:

n Incident response plan.

n Defensible architecture.

n OT network monitoring.

n Secure remote access.

n Risk-based vulnerability management.

Incident response plan

The first and most important thing that organisations can do is to be ready for cyber-attacks against their company’s critical automation and control systems. When ransomware strikes, or equipment begins to misoperate, operations, engineering, and technicians often struggle to understand what is happening. In today’s adversarial cyber landscape, companies must have a documented incident response (IR) plan. This should be the first call to action if an organisation does not have an IR plan in place. To start, a documented plan for a ransomware attack scenario should be included. Focus should be placed on when an IT/OT disconnect would take place, understanding what systems would be affected, who would need to respond, who would need to be notified, could the OT systems work while IT systems are

disconnected, etc. The IR plan should answer these questions and be a guiding light in the dark hour if the company does fall victim to an attack.

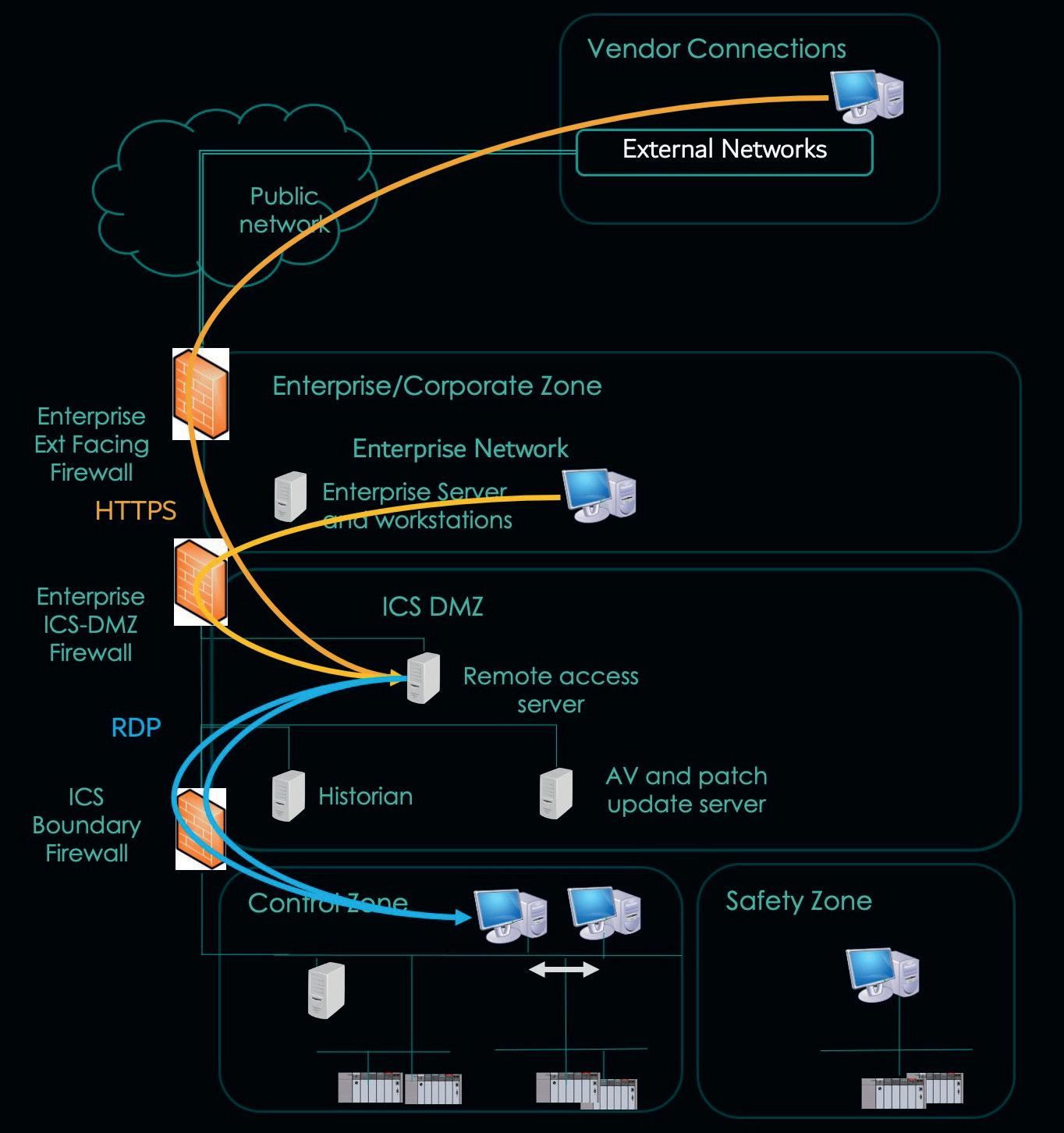

Defensible architecture

The next area that a tank farm/terminal facility should focus on is ensuring that the network architecture is designed to protect critical OT assets from IT networks and then further segment the OT systems into areas of trust or security zones. If a system does not need to communicate with another system, then technical controls (e.g., firewalls) should be in place to prevent those communications from occurring. OT systems are commonly classified based on the type and relative process data timing needs from real-time to aggregated time, and then the systems are segmented according to zones. Sitting between the OT and IT networks is a demilitarised zone (DMZ) construct that acts as a traffic gateway to ensure that user-to-system and system-to-system communication crossing the OT to the IT environment, or cloud, is brokered and tightly controlled. The DMZ also provides a logical area to isolate the automation systems in the event of a cybersecurity event on the IT side. DCS and PLC systems logically reside within the OT environment. Still, terminal management systems and quality measurement systems (online and laboratory analysers) are often overlooked and reside on IT networks in many organisations. These systems are critical and should be in a secure zone on the OT side.

OT network monitoring

Setting up a well-architected network not only prevents cybersecurity attacks from occurring but allows for security monitoring solutions to be leveraged in the environment. Unlike IT systems, where software agents can be deployed on all workstations and servers, OT systems are engineered and often restricted by vendors as to what security software solutions can be deployed. OT systems have many devices, such as DCS controllers, PLCs, remote terminal units (RTUs), flow computers, analysers, and instrumentation, that cannot run conventional security software. Nevertheless, asset owners and operators must understand the activities that are occurring on the networks. Deploying continuous network security monitoring (NSM) solutions provides valuable insights into the overall operation of automation and control systems. For example, NSM can detect workstation-to-server or server-to-controller traffic and further see commands being sent to devices, such as when a variable frequency drive (VFD) motor driving a product pump is commanded to increase flow into a pipeline. They will also be able to detect malicious behaviours, such as an adversary trying to jump the IT to OT boundary to move down into the OT environment further to compromise systems with the end goal of system disruption or damage. Detecting at the IT/OT boundary and near PLC or DCS traffic is critical to a holistic security programme. NSM also dramatically assists with identifying device and network misconfigurations or leading indicators to failures, thereby simultaneously providing operational reliability and security benefits. Figure 1 shows a high level NSM deployment diagram.

Secure remote access

Many terminal facilities do not have sufficient size or complexity to warrant onsite control systems engineers, instrumentation and

electrical (I&E) technicians, or OT security staff. Often these individuals cover a region encompassing many terminal facilities. However, these distributed roles still need access to the automation and control systems to support operational troubleshooting and even make small changes in logic or control strategy (onsite presence is still advised or required to make process impactful control system changes). Remote access solutions provide the necessary technical means to allow these workers to access the plant. These solutions must reside within a secure zone between the IT/OT DMZ and ensure a network protocol break occurs between network communications coming into and out of the remote access server to the facility system being accessed. As Figure 2 shows, an initial connection occurs over HTTPS to the remote access server from the IT side. Then the remote access server establishes a remote desktop protocol (RDP) connection to a terminal OT server or workstation.

The remote access solution should enforce a second form of authentication, often called 2FA, that leverages a token or one-time password. 2FA drastically raises the difficulty bar for an adversary to break in and should always be used in remote access solutions. This solution can be used for both in-house and vendor-supported remote access.

Risk-based vulnerability management

Automation and control systems are comprised of firmware, operating systems, and applications. Unfortunately, they are susceptible to many of the same vulnerabilities on IT systems. For OT servers and workstations running Windows, these devices need to be patched on a determined frequency. Other systems, such as the DCS or PLCs, also need to be kept updated, but often less regularly due to the operational impact of applying a patch or firmware that requires rebooting the systems. A recommended approach is to inventory systems to know what you have and to understand what needs attention. The NSM solution mentioned previously will significantly help this effort. It is also important to apply patches and firmware based on factors such as the interconnectedness to the IT environment, operational risk, and operational impact of the patch itself. Other mitigating controls also play a part here, such as restricted network access through segmentation or disabling vulnerable functionality. For example, if a PLC sits alone on a skid with no network connection, it will fall into a very low-risk category. Increasingly, however, automation systems are networked to support remote monitoring and control. Requirements for increased patching frequencies grow for remote access, data, and file transfer servers or those interacting with the IT and business systems.

Conclusion

In the current heightened cybersecurity threat landscape, terminal facilities and tank farm operators can fall victim to ransomware or even worse. Organisations must prioritise

protecting their critical assets with attacks focused on damaging equipment, employees, and the environment. This includes having a plan that allows OT systems to operate and generate revenue when IT systems are taken offline. Critical systems need to be defended, and by applying five critical controls, owners and operators will be in a much better position to take the higher ground against adversaries trying to bring the company down and stop the transfer of molecules.

References

1. TIDY, J., 'European oil facilities hit by cyber-attacks', BBC, (3 February 2022), https://www.bbc.com/news/technology-60250956

2. LORD, N., 'The Cost of a Malware Infection? For Maersk, $300 Million', Digital Guardian, (7 August 2020), https://www.digitalguardian.com/ blog/cost-malware-infection-maersk-300-million

3. https://www.tsa.gov/sites/default/files/tsa_sd_pipeline-2021-02july-21_2022.pdf

4. https://eur-lex.europa.eu/eli/dir/2022/2555/oj

5. LEE, R. M., and CONWAY, T., 'The Five ICS Cybersecurity Critical Controls', SANS Institute, (7 November 2022) https://www.sans.org/whitepapers/five-ics-cybersecurity-critical-controls/

Figure 1. OT network security monitoring deployment.

It is unlikely that Tacitus, one of the great Roman historians, had the future ‘inspectability’ of production hydrocarbon tanks in mind when in 110 AD he stated: “Truth is confirmed by inspection and delay; falsehood by haste and uncertainty.”

But his comment is just as apposite in 2023. And just as this article is focused on the floating offshore production environment, and the inspection of tanks, then so too is its applicability to other safety-critical asset integrity areas of operation.

In many ways the disruptive technology environment in which regulators and inspection companies operate today exacerbates rather than solves the challenges faced by those interested in ‘inspection’, seeking the ‘truth’ and reducing both ‘falsehood’ and ‘uncertainty’.

Assessing what is new

Artificial intelligence (AI) brings, and will continue to confer, truly game-changing and welcome technology benefits. It does, however, have the demonstrable propensity to be used unethically to project fake information, to promote inaccurate data, and to amplify false insights. The wise must pause to reflect on its application, especially where safety and the integrity of assets might be at stake. Ironically, the rise of autonomous and thinking robots may undermine the crucial human interface; where trusted human teams underpin the integrity of data and where the strong and binding relationships between clients, suppliers and the regulators assumes an even greater importance than it does today.

Ownership and accountability

The COVID-19 pandemic was a truly terrible period for humankind, in which the ripples extended way beyond the suffering, death and disruption. As industry sought to find ways to continue to trade and to be productive, remote working and associated technologies came to the fore, providing a key boost to innovation in so many areas including remote inspection technology (RIT).

The changes also had unwelcome and unintended consequences. For many, remote working brought positive changes to the balance between work and life. But many employees now appear reluctant to change or to return to the former status quo. ‘Quiet quitting’, where staff do just enough to retain their jobs, is on the rise. ‘Overemployed’ workers secretly maintain two remote jobs at the same time, ensuring their employers remain unaware. These phenomena are on the rise, and evidenced by the plethora of support groups and online apps that support this new way of working.

All of this has increased the notion of ‘distance’, added uncertainty, and consequently made true accountability and responsibility all the more opaque. Workplace remoteness appears to have brought with it increased managerial remoteness with many seemingly reluctant to take accountability for the integrity and safety of the assets for which they are responsible.

Assemble these factors and influences and a picture begins to emerge. Paradoxically, RIT and all that it does and can do to dramatically improve safety, reduce risk, and reduce human exposure in dangerous confined spaces, may increasingly have its effectiveness reduced by the enabling technologies that are underpinned by AI.

As artificial intelligence (AI) brings unparalleled change to the storage sector, Danny Constantinis, EM&I Group, Malta, outlines the importance of accountability at all levels within the sector.

The presence of ‘trust’ could be eroded by a growing lack of accountability arising from the pernicious effects of remote working and the growing distance between those accountable for safety and those responsible for it.

Accessibility and RIT technology

If the tanks and terminals industry is to realise its desire to reduce accidents and improve safety, especially in dangerous confined spaces, it might appear there are four options:

Improving physical access for RIT

This would reduce the challenge faced by those seeking to deploy RIT systems. One obvious way to achieve this is to design-in ‘inspectability’ early in an asset’s design life cycle where it is practically possible to do so, and where significant cost benefits may accrue. It is becoming ever easier to design and develop high performance components with little regard for their inspectability. As an example, EM&I has worked with a number of clients seeking to realise the cost and safety benefits of installing its ODIN access ports during FPSO conversion projects. These access ports are fitted inside the hull during operations (without disrupting operations) to perform a range of tasks that previously required a risky, expensive and time-consuming intervention by dive teams. The ODIN access ports permit valve inspection and, frequently, valve isolation and repair, as well as sea chest inspection.

There are self-evident benefits to using an ODIN access port to facilitate diverless inspection and repair scopes of mission-critical valves and sea chests. Inspections are carried out from inside the hull so there is no dependency on weather or sea state and associated costly downtime. It is significantly safer than using divers and a far lower cost than using either divers or remotely operated vehicle operations. The high-definition video and still imagery provides excellent inspection output for Classification Society (class) approval,

including close-up inspection of the valve sealing faces. The benefits are amplified significantly when the ports are designed-in early, and installed in the shipyard; rather than retrospectively and while on station.

Applying the ‘rules of preparatory tank cleaning’ to promote access

The advent of reliable sensors that are capable of seeing through the sludge and dirt inherent in a production oil tank remains a vital aspiration. Until that time, RIT will continue to require that tanks are prepared for inspection. It is crucial that tanks are cleaned to the standard defined by the Classification Societies if RIT or a Class Inspector is to be able to effectivley inspect bottom plating. It must be incumbent on those Classification Societies to insist that the cleaning standard is maintained.

Embracing RIT

Owners and operators should embrace the possibilities offered by RIT from the outset. Companies that pride themselves on understanding the needs of their clients, and seeking innovative solutions to those challenges, depend crucially on the willingness of owners, operators and regulators to adapt. Recently, for example, EM&I has extended its RIT capability within the dangerous confines of offshore cargo oil tanks. Early versions of EM&I’s high-definition camera systems for general and close visual inspection, and its laser sensor for assessing deformation coating condition, and corrosion, depended on the use of robotic quadpods to be delivered vertically through small deck openings such as Butterworth hatches. Its recent deployment of an innovative ‘bridge system,’ delivered through the same small openings, now permits robotic lateral movement of sensors inside the tank so that the spread of the inspection footprint now fully matches that which a Classification Society might want inspected, including the vulnerable under deck area.

Form trusting partnerships

AI is being seen in some quarters as one of the most significant global threats to national security and global stability through its unethical use to portray situations that in reality do not exist. Those promoting this theory believe the solution lies in trusted teams of humans in each country that know each other well and trust equivalent teams in other nation states to broker stability between nations. There may be a parallel in our industry where there will be merit in promoting and providing organisational structure to the human interface at key levels in clients, owners, operators and regulators to promote the reliable passage of reliable, accurate and timely asset integrity data.

Conclusion

Rightly, advances in AI will and should prevail; they will bring unparalleled and welcome change. For those whose responsibility includes safety, inspection and asset integrity of high-risk assets in challenging environments, AI does bring a raft of concerns which need to be addressed sooner rather than later. Before that, a return to insisting on true accountability at all levels in the industry will go a long way to providing the safe environment that we all see.

Chris Platt, Re-Gen Robotics, UK, discusses how terminal operators are profiting from the use of robotic cleaning in their storage tanks.

Tanks are built to operate for many years and need to be inspected, maintained and repaired periodically to be safe and efficient. Every storage tank will accumulate sludge over time and this is especially true for petroleum storage tanks at terminal facilities. Contaminants such as wax residues, organic matter, shells, aggregates, and water can affect the quality of the product in the tank and can corrode its floor and inner walls. It can also cause damage to floating roofs and prevent them from providing a tight seal. If residues or sludges are not removed for a considerable period, they can occupy significant space in the tanks, therefore reducing capacity

within the tank and altering the quality of the product stored within the tank.

The solution to this issue is the extraction of this sludge and the cleaning of the tank itself.

When deciding on the cleaning method to be applied, terminal operators will take into consideration the most efficient, safe, economical and environmentally friendly cleaning process available to them.

Up until recently this process would have involved personnel manually cleaning the interior of the tank. Manual tank cleaning involves a team physically scrubbing the contaminants from the surface of the tank. These workers are exposed to a multitude of hazards that have historically led to injury and even death when control of activities has been lost.

With the advance of remotely-operated, explosion proof robotic cleaning equipment, the presence of people inside the tank is unnecessary.

Closed loop cleaning circuit

In terms of cleaning cost and environmental impact, ATEX Zone 0 robots are economical and environmentally friendly because of their closed loop cleaning circuit, leading to the potential to reclaim precious oil from the sludge.

Robotic cleaning methods are highly efficient as tank downtime can potentially be reduced by 40% up to 70%, due to the short time it takes to assemble the equipment and the fact that staff are not required to enter the confined space of the tank.

As the industry embraces change and introduces innovative technology onto sites to replace dated methods, terminal operators are profiting from major operational benefits in safety and a significant reduction in the downtime of the tanks. There is a focus on employing cleaning methods that consider personnel safety, cleaning efficiency, time and money savings, as well as the protection of the environment.

Oil terminal operators are focusing on recovering the oil contained in the sludge residue as the revenue generated from the recovered oil could go some way to

cover the cost of the cleaning operation, and robotic sludge removal promotes this.

Before cleaning a tank, the composition of the sludge must be considered, to determine the cleaning process required. It is important to understand the composition for the recovery of oil, the treatment of the wastewater, and the solid residues and toxic substances to be removed and disposed of.

Planning process

When a tank is scheduled to be cleaned, terminal managers create a planned schedule for the scope of work. The main parts of the plan relate to the safety of staff, the environment and the terminal assets. The project, cost, scope of work and execution time is planned and agreed before any activity occurs so that the safest, most efficient process can be adopted.

Should a terminal manager choose to have the tank cleaned manually, there is a major body of work to be completed before anyone enters the tank. Tasks including confined space entry plans, updates on the methodology of the project, safety lessons for personnel, and the organisation of construction around the tank all must be completed.

Prior to a manual clean, the tank must be gas free, for the safe entry of staff. Gas must be extracted from the tank and all manholes, cleaning doors and apertures on the roof are opened. The process can be accelerated using fans which are fitted to increase the supply of fresh air.

Manual tank cleaning can be criticised because of a multitude of disadvantages, including the following:

n Tank downtime is significant.

n System installation time and auxiliary cleaning equipment is required, such as water jetting, pumps, vacuum trucks, shovels, cranes, tool warehouses, containers, portable dressing rooms, toilets, restaurants, and offices.

n Time taken to ventilate the interior complicates the job further, thereby adding to the cost and the demad of resources.

n Time taken to be certified by the appropriate department can also be significant.

n A large water supply is required.

n Quality of the cleaning is low.

n Cleaning efficiency is low.

n Open circuit to the environment, which presents a high risk of petroleum wastes contamination.

n Cost due to the number of cleaning staff, observers, rescue teams and safety officers.

n Workers must wear heavy personal protective equipment (PPE) with breathing apparatus.

n The job requires the manual removal of toxic sludge.

n High amounts of waste (water, oil, and sludge) are generated and need to be disposed of.

n Significant use of equipment and manpower is required.

Health and safety regulators’ concerns also apply during the execution of manual tank cleaning, downtime can be considerable, and skilled workers for the job are limited

and difficult to find due to the ageing of the workforce in this sector.