safety always. Innovation first,

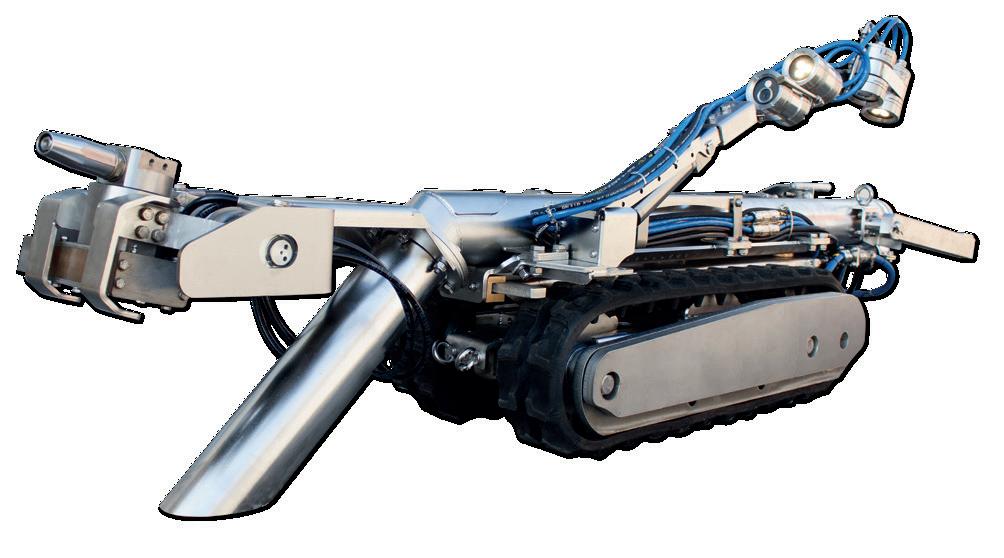

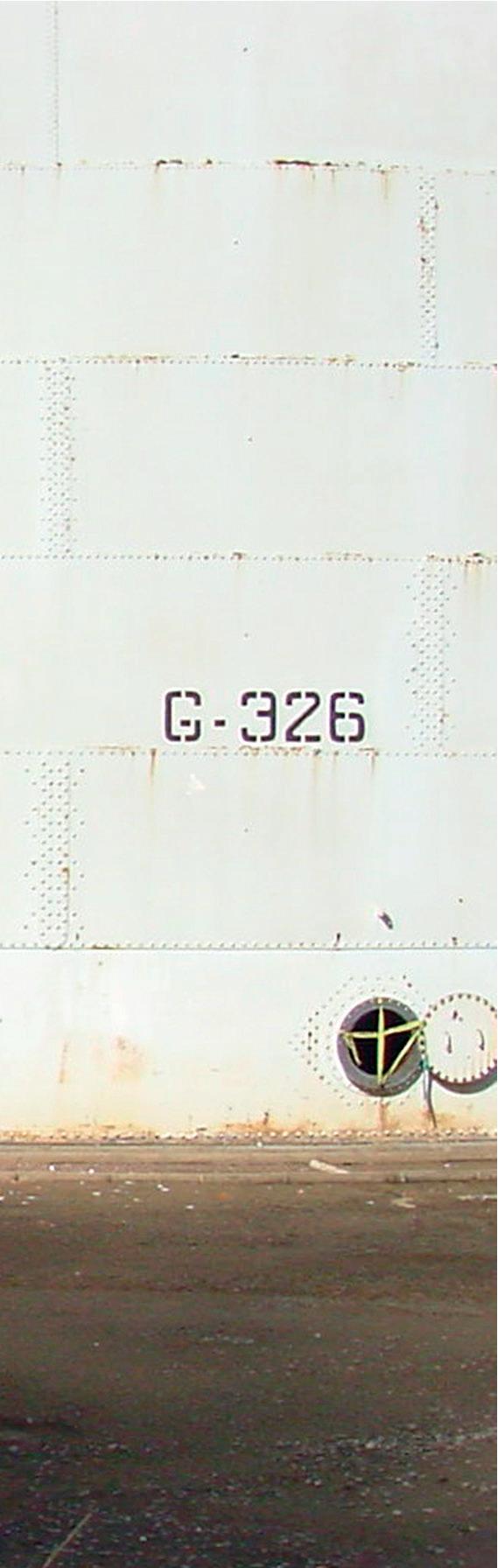

Gerotto has been a pioneer in engineering and manufacturing robotic tank cleaning solutions since 2002. A cutting-edge range of no-man entry robots that helps contractors and asset owner to reach the most demanding performances in explosive environments.

John

Driving increased performance

Ryan Thompson, Emerson, USA, explains how even the most experienced terminal schedulers can increase peak operational efficiency with the help of digital twin-based scheduling and optimisation software.

27 Faster, smarter tank cleaning

Aidan Doherty, Re-Gen Robotics, UK, details how terminal operators can improve safety and cut maintenance costs by applying smart tank cleaning solutions.

31 Rise of the robots

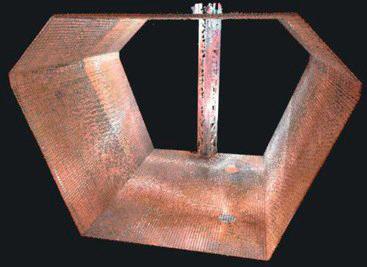

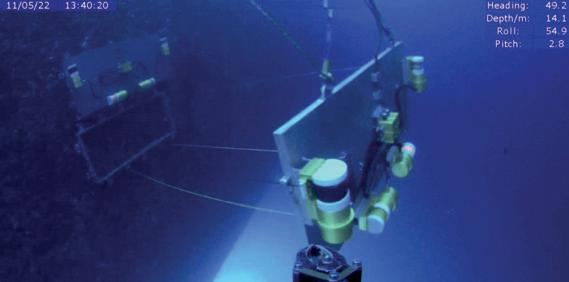

Edoardo Marangoni, Alberto Feletto, Daniel Devò and Alessandro Gerotto, Gerotto Federico Srl, Italy, analyse the genesis of robotic technologies for tank cleaning, and consider various options that are available to the market.

35

Bottoms

up: unfinished business for tank inspection

Danny Constantinis, EM&I Group, Malta, discusses some innovative solutions to the challenge of safe tank inspection.

39 Bunkering

made safe and efficient

Tariq Boussouara, TÜV SÜD National Engineering Laboratory, explains why the use of mass flow meters for fuel bunkering is likely to become increasingly widespread in the future.

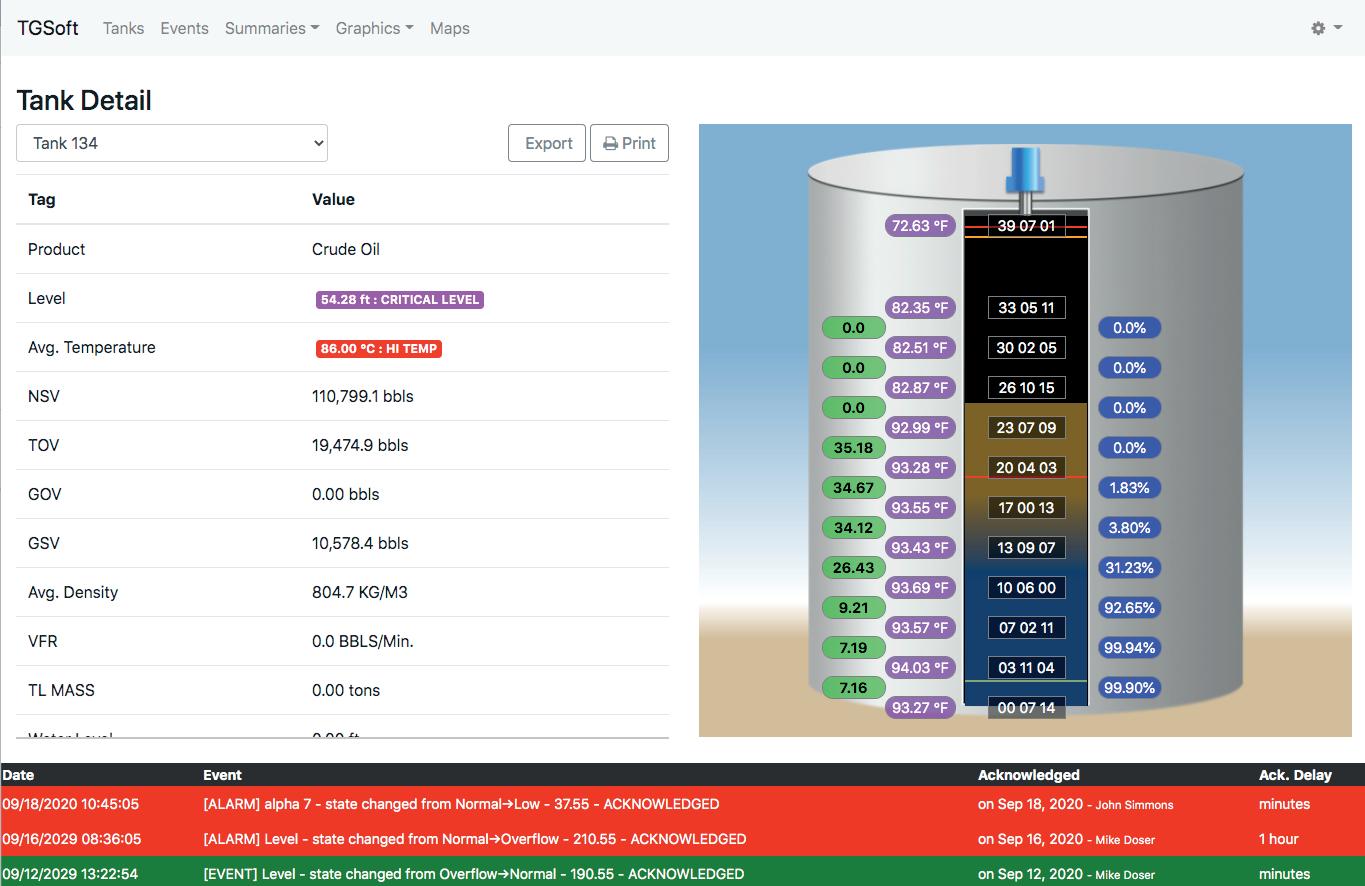

42 Predict and prevent rollover events

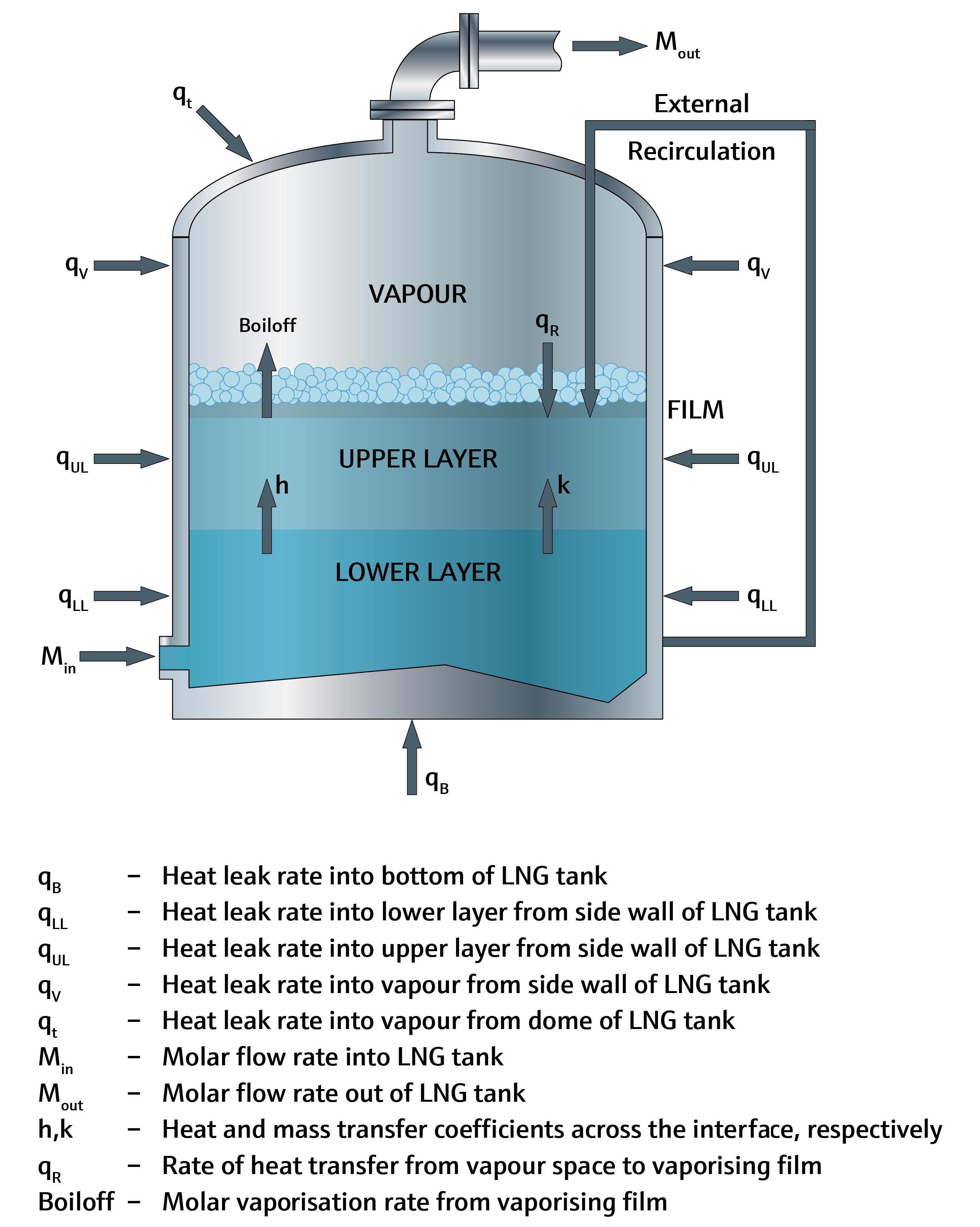

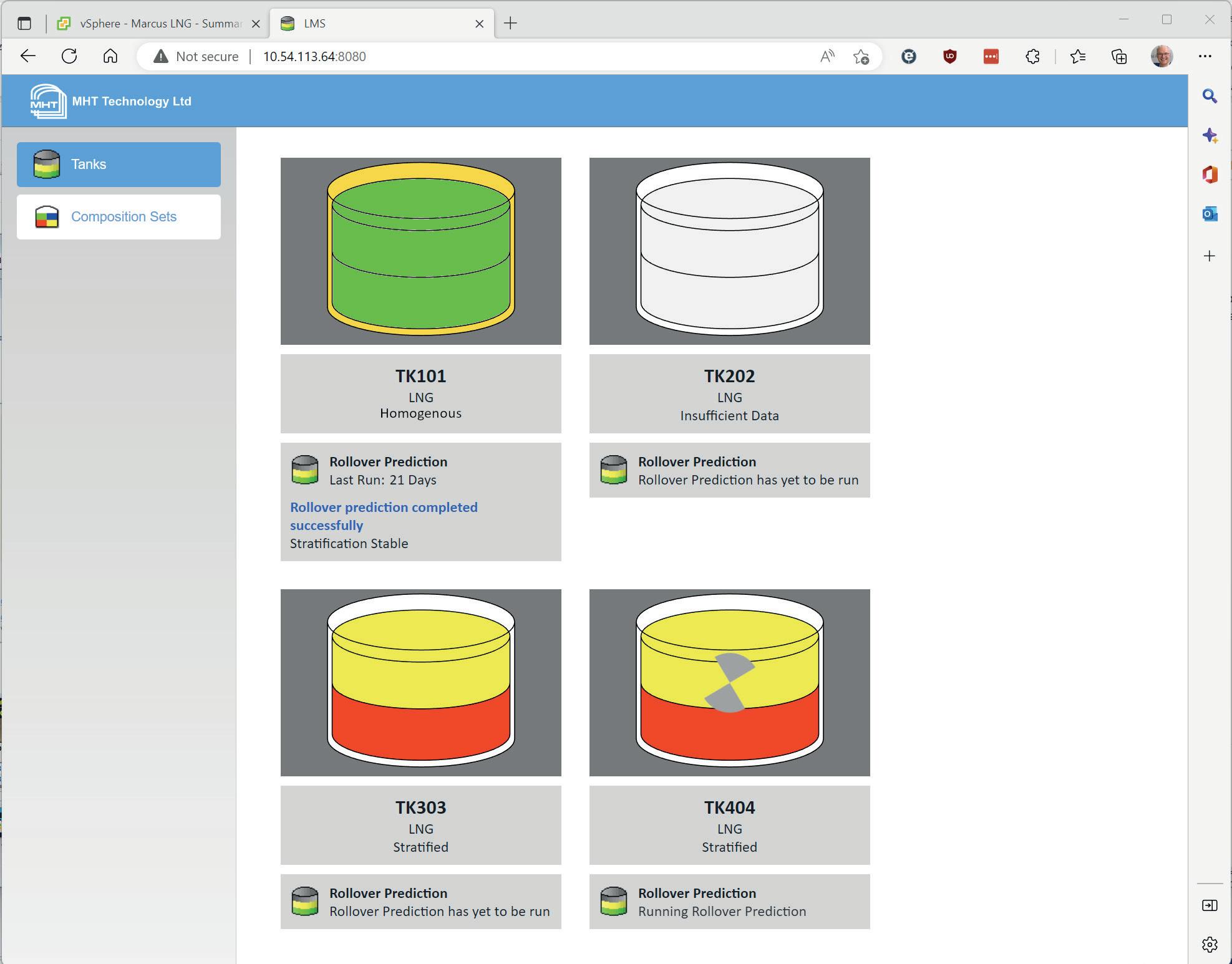

Dandee Bacani, Endress+Hauser, Japan, examines how efficient instrumentation can help predict rollover events and minimise potential damage.

45 Leak detection for LNG tanks

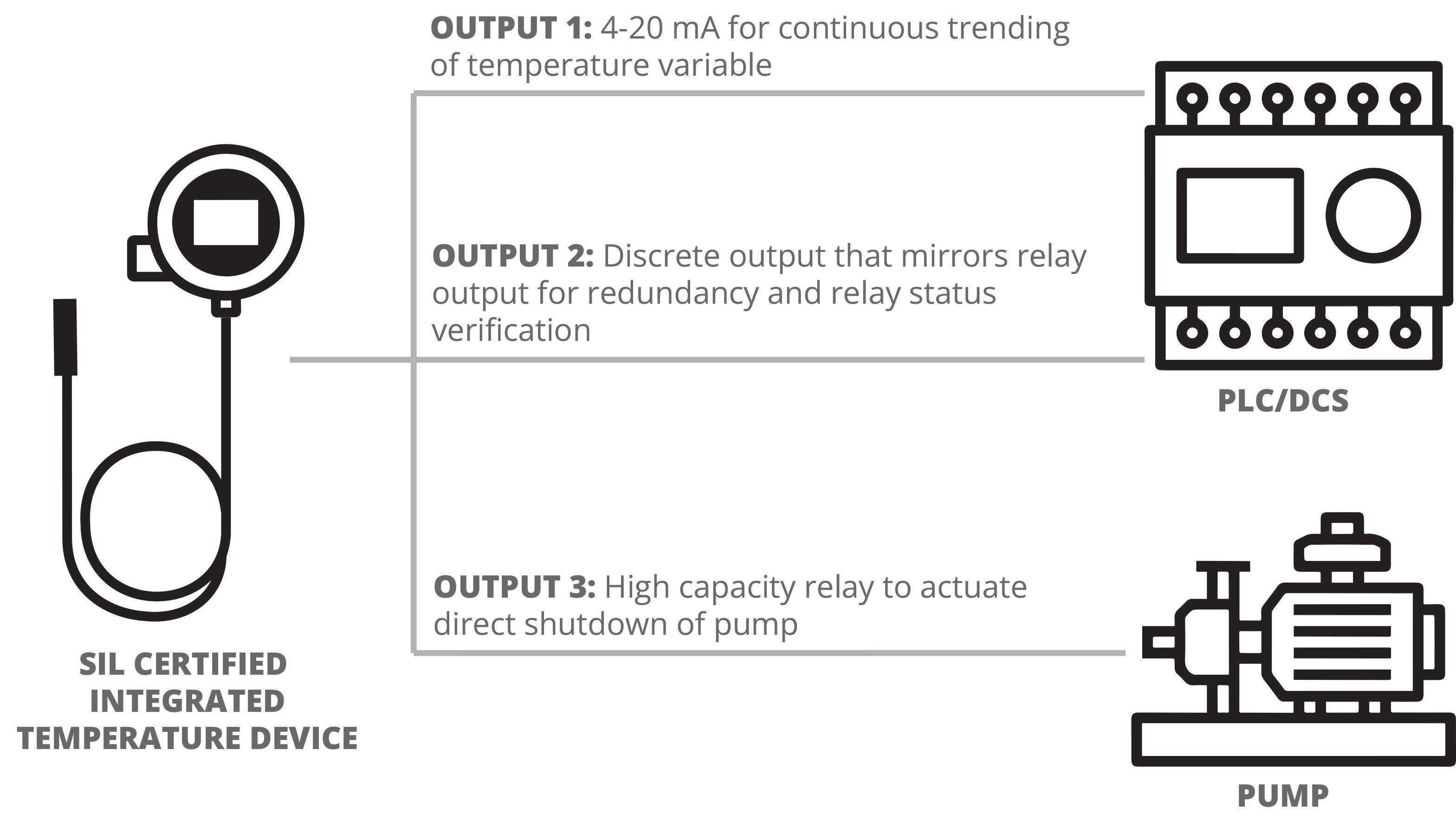

Julian Yeo, United Electric Controls, USA, considers how it is possible to learn lessons from past incidents in the LNG sector to create a systematic approach towards leak detection.

49 The tank breather valve conundrum

Ewart Cox, Assentech, UK, outlines the importance of accurately measuring and reporting on the volume of leakage from tank breather valves.

53 Battery powered

Anthony Vangasse, Rotork, UK, explores how modern battery technology improvements within electric valve actuation can help a site to maintain an optimum level of operations.

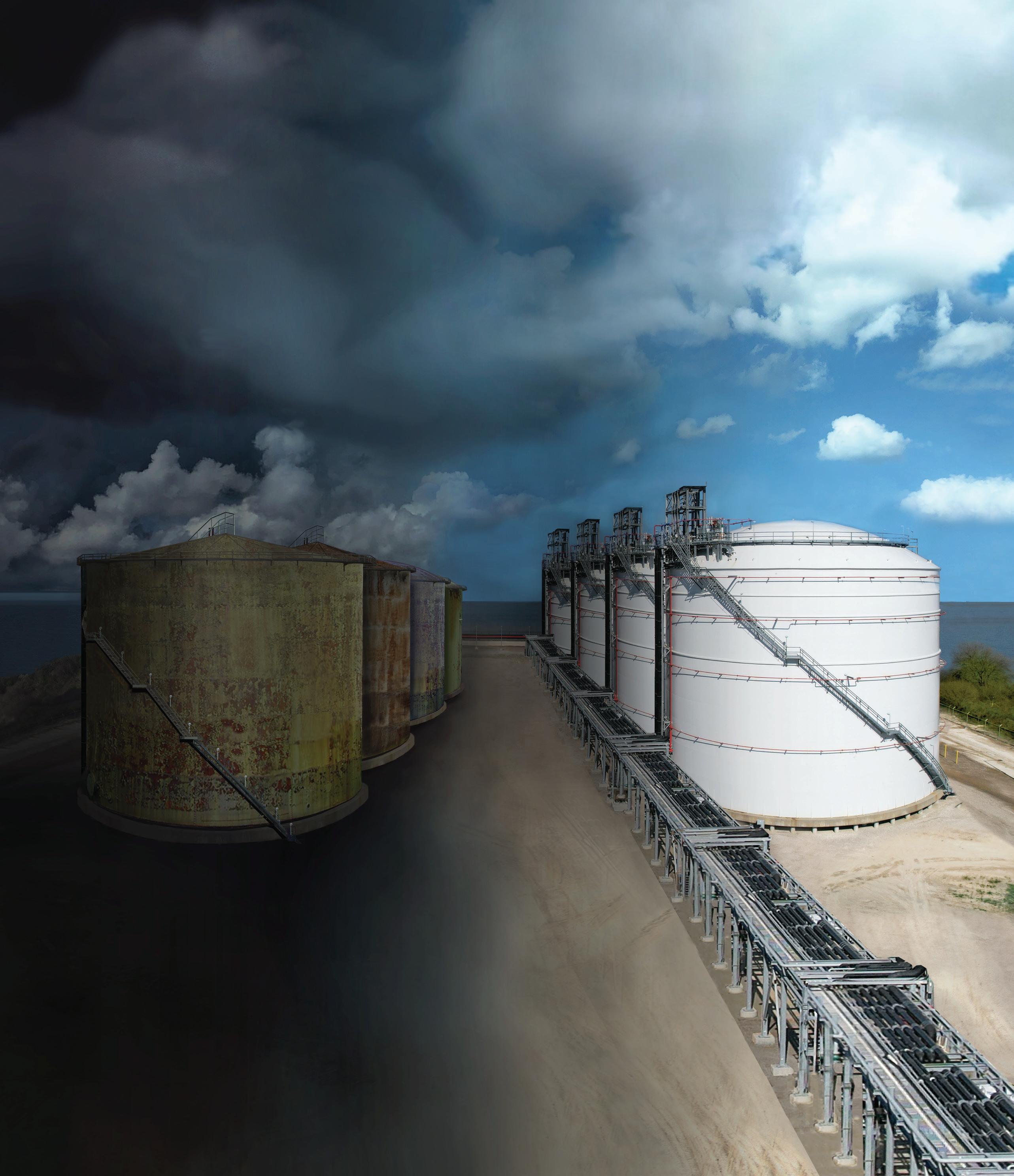

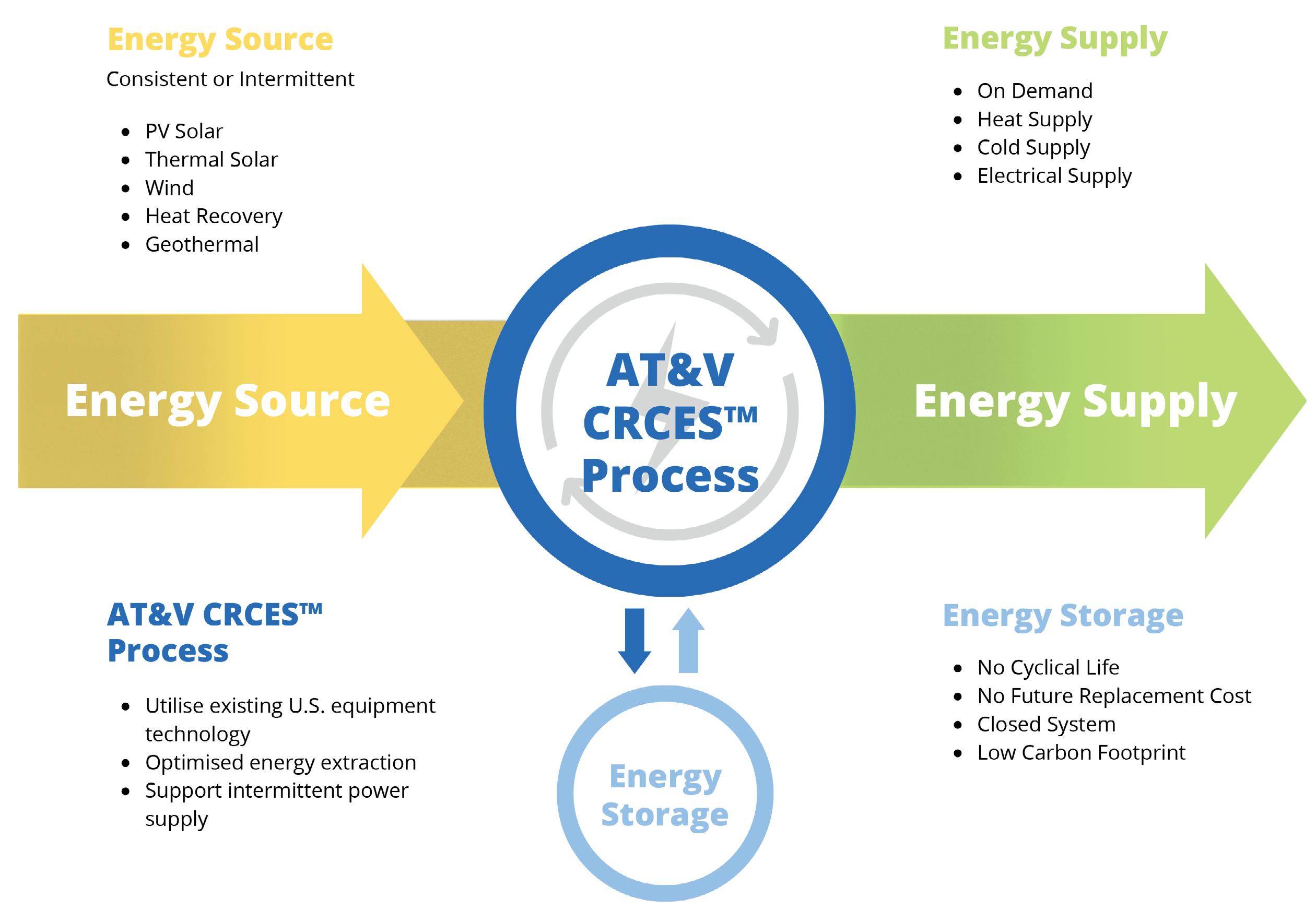

Gale force winds from the energy trilemma are bearing down on the liquid hydrocarbon terminal industry. American Tank & Vessel Inc. (AT&V) believes these winds possess the energy to propel the industry into a profitable transition. For more information, please refer to the article ‘A clean energy future for liquid terminals’ on p. 14 of this issue.

GUEST COM MENT

CLAY PRESIDENT,KATHRYN

INTERNATIONAL LIQUID TERMINALS ASSOCIATION (ILTA)

CONTACT INFO

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O’Reilly callum.oreilly@palladianpublications.com

ASSISTANT EDITOR Bella Weetch bella.weetch@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES EXECUTIVE Sophie Birss sophie.birss@palladianpublications.com

PRODUCTION MANAGER Kyla Waller kyla.waller@palladianpublications.com

EVENTS MANAGER Louise Cameron louise.cameron@palladianpublications.com

EVENTS COORDINATOR Stirling Viljoen stirling.viljoen@palladianpublications.com

DIGITAL CONTENT ASSISTANT Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL ADMINISTRATOR Leah Jones leah.jones@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITORS

Nancy Yamaguchi Gordon Cope

SUBSCRIPTION RATES

Annual subscription £110 UK including postage /£125 overseas (postage airmail).

Two year discounted rate £176 UK including postage/£200 overseas (postage airmail).

SUBSCRIPTION CLAIMS

Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

APPLICABLE ONLY TO USA & CANADA

Tanks & Terminals is a supplement of Hydrocarbon Engineering. Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831.

Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032

15 South Street, Farnham, Surrey

GU9 7QU, UK

Tel: +44 (0) 1252 718 999

Fax: +44 (0) 1252 718 992

Many of the bulk liquid products handled by ILTA member companies demand special precautions due to their flammable properties. While significant fire events at terminals are rare, responsible facility management demands that terminal operators maintain capabilities to respond quickly and effectively to fire events when they do occur. For decades, the tank storage industry has relied upon aqueous film-forming foams (AFFF) to protect communities, workers, commodities, and infrastructure from potentially dangerous fire hazards and environmental risks from fire events or spills, such as air pollution. The effectiveness of these foams was attributable to the unique characteristics of the perfluoroalkyl and polyfluoroalkyl substances (PFAS) they contained.

ILTA firmly supports a safe, strategic, well-managed transition to fluorine-free, or PFAS-free, firefighting foams, while ensuring public and worker safety. We also recognise that significant barriers must be addressed before we can achieve a complete, industry-wide transition to safer alternatives.

Transitioning the liquid terminal industry’s existing stocks of firefighting foam to fluorine-free foams will require collaboration between regulators and industry stakeholders, including terminal owners and operators, firefighters, foam manufacturers, and disposal vendors. Alternative foams are not a drop-in substitute for AFFF. There are important research, development, deployment, training, disposal, and other activities that should be strategically thought through in developing a transition timeline. For example, to be effective, the replacement foams may require higher foam volumes, additional labour, and different application techniques and equipment. And we must allow time for coordination between these stakeholders for testing, training, equipment replacement, disposal, and other critical activities.

Terminal operators rely on the principle of mutual aid to ensure that they can provide adequate responses to incidents. During an event, neighbouring facilities may provide foam, equipment, or fire-fighting personnel. Importantly, due to the foam flow rates and potential contamination concerns, equipment prepared to deliver PFAS-containing foams cannot be used to deliver fluorine-free foams, and vice versa. For the largest fires, foam may be provided from other facilities across the region or even from across the country. This interdependence of terminals means more time is needed to eliminate PFAS-containing foams from our sector.

There are still challenges. We must ensure we do not introduce regrettable substitutes. Certification programmes, such as Green Screen, provide vital information about new alternatives. Moreover, there is no universally accepted method of safe disposal of PFAS-based firefighting foams. Incineration of PFAS chemicals is banned in several states, and a moratorium on PFAS incineration is in place at Department of Defense facilities. While new technologies to destroy PFAS in firefighting foams have recently entered the marketplace, more work is needed to validate these technologies for all legacy foams.

A coordinated transition to fluorine-free firefighting foams is essential to safe incident response across the liquid terminal industry. ILTA will continue working with a coalition of industry, firefighters, and environmental stakeholders to advocate for a national phase-out of fluorine-free foams on a practical, achievable timeline. It is vital that we avoid a piecemeal approach across different states.

A selection of the latest news hitting the headlines on www.tanksterminals.com

Vopak and AltaGas form joint venture

Royal Vopak and AltaGas Ltd have announced the execution of definitive agreements for a new 50/50 joint venture (JV) to further evaluate development of the Ridley Island Energy Export Facility (REEF), a large-scale LPG and bulk liquids terminal with marine infrastructure on Ridley Island, British Columbia, Canada. REEF will have the capability to facilitate the export of LPGs, methanol, and other bulk liquids that are vital for everyday life.

First cargo delivered to the Dhamra LNG terminal

TotalEnergies has announced the delivery of the first LNG cargo to the Dhamra LNG terminal, located in Odisha, India. The terminal is owned and operated by Adani Total Private Ltd (ATPL), a 50/50 joint venture (JV) between TotalEnergies and Adani.

Hyphen signs LOI with Koole Terminals

Hyphen Hydrogen Energy has signed a Letter of Intent (LOI) with Koole Terminals, covering the proposed import of green ammonia into northwestern Europe. Hyphen plans to supply its customers using the import terminal being developed by Koole Terminals, which is located in the Port of Rotterdam, the Netherlands.

Sacyr Proyecta selected as engineering company for liquified gases terminal

Sacyr Proyecta has been confirmed as the engineering company for a new liquified gases terminal that is currently being developed by Hanseatic Energy Hub (HEH) in Stade, Germany. The terminal will have a regasification capacity of 13.3 billion m3, and two LNG storage tanks with a capacity of 240 000 m3.

READ MORE...

To keep up-to-date with the latest news and developments in the storage sector, visit www.tanksterminals.com and follow us on our social media platforms

DIARY DATES

10 13 July 2023

LNG2023

Vancouver, British Columbia, Canada www.lng2023.org

05 08 September 2023

Gastech Singapore www.gastechevent.com

26 28 September 2023

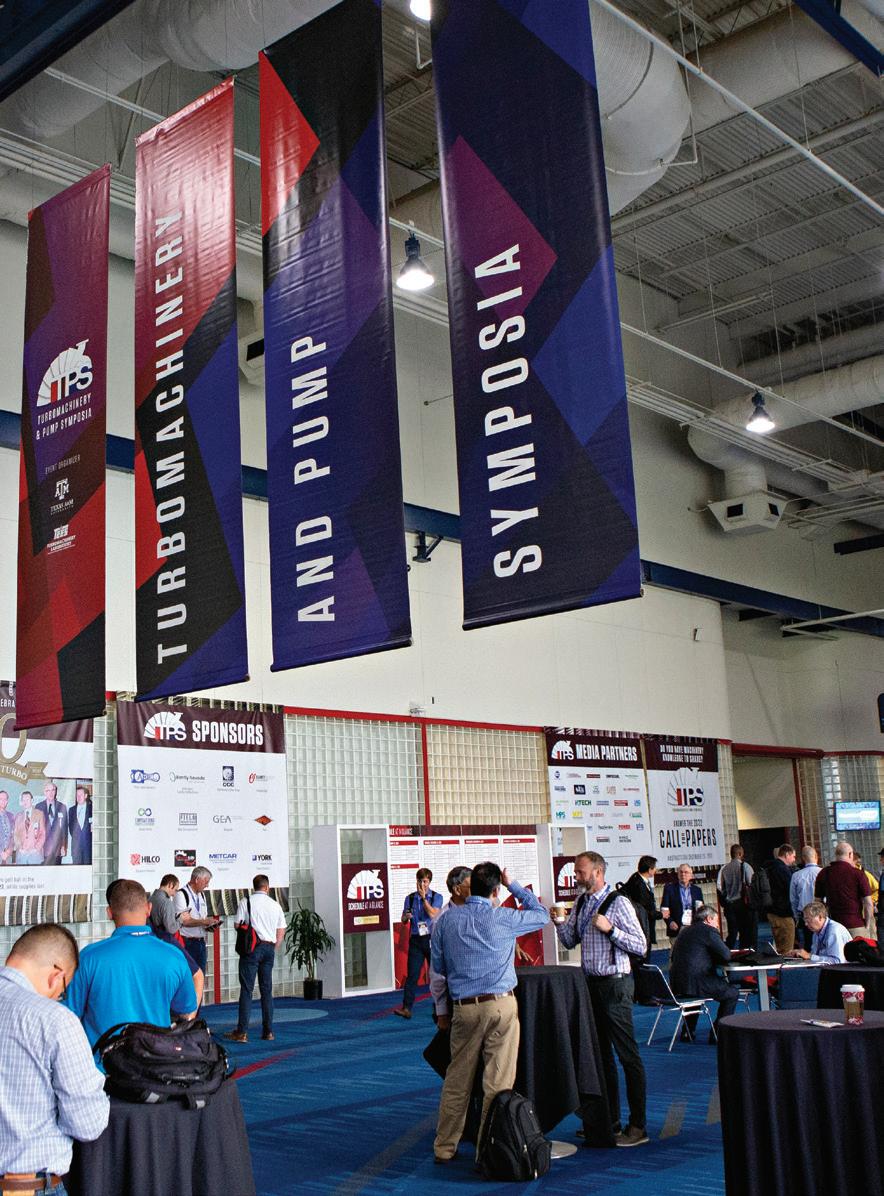

Turbomachinery & Pump Symposia Houston, Texas, USA tps.tamu.edu

02 05 October 2023

ADIPEC Abu Dhabi, UAE www.adipec.com

09 12 October 2023

API Storage Tank Conference & Expo Denver, Colorado, USA events.api.org/2023-api-storage-tank-conference-expo

05 07 December 2023

16th Annual National Aboveground Storage Tank Conference & Trade Show

The Woodlands, Texas, USA www.nistm.org

12 14 March 2024

StocExpo Rotterdam, the Netherlands www.stocexpo.com

Contributing Editor, Gordon Cope, considers how recent geopolitical events have opened up a range of opportunities for the tanks and terminals sector in North America.

Although the Ukraine conflict is thousands of kilometers away from North America, its consequences are reverberating throughout the continent. Traditional international markets for crude and refined products are being upended, and LNG has been given a new lease of life. Investments in renewable fuels, such as green hydrogen and ammonia, are also experiencing exponential growth. And the consumption of energy in major markets such as China has fully recovered from the COVID-19 pandemic. All of this spells new opportunities for the tanks and terminals sector.

Canada

Canada’s total crude production exceeds 5 million bpd. The oil sands of Alberta are the largest single source, with 3.3 million bpd, and output is expected to rise to 3.6 million bpd over the next decade.

Several major crude terminals exist in Alberta to store production that is destined for

export to the US. The largest is in Hardisty, which sits astride several major crude pipelines. Crude producers, pipeline companies, and infrastructure firms operate at the site, including Enbridge (16 million bbl), Husky (4.9 million bbl) and Gibson Energy (13.5 million bbl). Gibson alone is looking to spend up to CAN$125 million on tank-related expansions in 2023, and CAN$150 million – 200 million/yr for the foreseeable future.

Canada exports approximately 4 million bpd to the US, which is expected to rise to 4.2 – 4.4 million bpd by 2026. Pipeline expansions that are in progress will add almost 1 million bpd capacity by 2025, and crude-by-rail capacity is continually growing. In order to develop alternate export markets in Asia, the Trans Mountain pipeline, which runs from Alberta to tidewater in Burnaby, British Columbia (B.C.), is being expanded from 350 000 bpd to 890 000 bpd, with completion expected in 2024. The Burnaby tank terminal and nearby Westridge marine terminal are also undergoing expansion. Formerly, the Burnaby terminal had 13 tanks with a capacity of 1.6 million bbl; the expansion will add 13 more tanks, and double capacity. The Westridge marine terminal was able to handle one Aframax tanker (approximately 600 000 bbl); a new dock complex will allow the facility to load up to three Aframax tankers. When completed in 2024, the new infrastructure will be able to handle around three dozen vessels per month.

For over a decade, various developers have been promoting LNG projects in B.C., which is thousands of kilometers closer to Asia than the Gulf of Mexico. LNG Canada, led by Shell, is building a plant in Kitimat. The first phase of 14 million tpy is scheduled for completion in 2025. Construction of the 2.1 million tpy Woodfibre LNG plant near Squamish is set to begin in late 2023, with a completion date in 2027. In March 2023, the B.C. government approved the construction of the Cedar LNG project, also near Kitimat. The CAN$2.4 billion floating LNG (FLNG) facility, which is majority-owned by the Haisla First Nations, is expected to produce up to 4 million tpy.

US

Energy infrastructure in the US Gulf Coast (USGC) is undergoing a transformation. During the latter half of the 20th century, an immense refinery/petrochemical complex arose, stretching from Texas to Louisiana. Oil tankers delivered crude from Mexico and Venezuela via Aframax tankers; refined products were then shipped by tankers, rail and dedicated pipeline systems to consumers on the Eastern Seaboard.

All of that changed with the advent of unconventional oil and gas. Operators began to pump millions of barrels of crude and billions of cubic feet of natural gas from the shale formations in Texas and Louisiana, upending traditional supply and demand. The Ukraine conflict has also spurred changes. According to the US Energy Information Administration (EIA), USGC (PADD 3) exports averaged 2.48 million bpd in 2021; by late 2022, that number had grown to over 4 million bpd, with the majority of the increase going to Europe to offset the ban on Russian seaborne crude.

The need for new infrastructure in the USGC can be roughly broken into three aspects. First, the light, low-sulfur crude being produced from the Permian Basin is unsuited to the heavier slates being used by domestic refineries, but is in demand in other jurisdictions, including China. Normally, US crude travelling to China is loaded aboard 2 million bbl very large crude carriers (VLCCs), which then take a seven-week journey around the Cape of Good Hope. Due to the fact that USGC ports are configured for Aframax, they cannot load VLCCs at dockside, and must rely on ‘reverse lightering’, in which smaller tankers top up VLCC cargoes offshore. As a result, exporters have been angling for new port infrastructure to handle VLCCs.

In November 2022, the Biden Administration approved the development of the Enterprise Products Partners’ Sea Port Oil Terminal (SPOT) in Freeport, Texas, approximately 30 km south of Houston. The new 2 million bpd offshore terminal will be able to accommodate VLCCs. Enbridge subsequently announced that it was proceeding with the Enbridge Houston Oil Terminal (EHOT) at the southern end of its Seaway Pipeline. The first phase of the new facility will have up to 2.5 million bbl of crude storage, with the potential to expand to 15 million bbl. Plans are underway to connect EHOT to SPOT.

Second, finished petroleum products from the USGC are growing in demand worldwide. According to the EIA, in 2021, prior to the Ukraine war, gasoline, diesel and jet fuel exports

from the region averaged 2.34 million bpd. By late 2022, they had exceeded 3 million bpd, and are expected to increase further this year as ExxonMobil’s 250 000 bpd expansion of its Beaumont, Texas refinery ramps up to full production of 619 000 bpd.

The majority of the refined product export increases are going to Mexico, Argentina and Brazil, which do not have sufficient refining capacity to meet increased domestic demand. Most of the exports are handled by mid-size tankers which fit into current USGC terminals, but the increased traffic requires greater clean tank capacity dockside.

Third, the immense quantities of natural gas being produced in association with unconventional crude became an inexpensive feedstock and energy source for the development of LNG. USGC-area LNG projects are currently consuming over 13 billion ft3/d, placing the US in the running as the world’s top LNG exporter. The Ukraine war has motivated European utilities to seek long-term LNG contracts, sparking North American firms to announce new projects. Over the next three years, capacity is expected to increase by a combined 5.7 billion ft3/d as new major capacity comes onstream. Projects that are underway or planned include the following:

n Sempra is developing the Port Arthur LNG project, located on the Sabine-Naches ship channel (which marks the border between Texas and Louisiana). Phase 1 foresees two trains with a capacity of 10 million tpy (1.3 billion ft3/d). ConocoPhillips has taken a 30% stake in the project and a commitment to take 5 million tpy, as well as supply feed gas through its regional pipeline system.

n Qatar Energy and ExxonMobil are currently constructing the Golden Pass LNG project, located at an existing LNG import terminal at Sabine Pass, Texas. The US$10 billion complex could eventually have up to 18 million tpy capacity. Start-up is expected in 2024.

n Energy Transfer plans to build the Lake Charles LNG project at its current LNG import site in Louisiana. The company intends to build three LNG trains with a total capacity of 6.45 short tpy.

n Venture Global has announced plans to build the Plaquemines LNG terminal in Louisiana, 30 km south of New Orleans. Phase 1 will include 18 modular mini-trains with a total of 11.3 million short tpy capacity. Phase 2 will almost double capacity to 20 million t. The total cost of both phases is estimated at US$20 billion.

Greenfield LNG projects typically require extensive tank and terminal infrastructure. The Plaquemines project, for instance, envisions two 200 000 m3 LNG storage tanks and berthing facilities capable of handling three tankers simultaneously. New demand in the projects cited above will cost several billion dollars. While most existing terminals can handle standard 150 000 m3 LNG tankers, a new generation of 250 000 m3 tankers (similar in size to VLCCs) is on the drawing boards; ports will have to make extensive draft and pier improvements to accommodate them.

In addition, regional storage infrastructure needs to be added to handle the billions of cubic feet of additional

Go Manage.

Emerson’s inventory management software provides instant insight to tank operations worldwide. No matter the time or place, management can always stay on top of critical assets, leading to better and faster decision making.

Learn more at www.emerson.com/rosemounttankmastermobile

gas requirements. In March 2023, Enbridge announced that it was purchasing the Tres Palacios gas storage facility, located 50 km southwest of Houston, for US$335 million. The facility currently has the capacity to store up to 35 billion ft3 of gas in three salt caverns, with a request before the US Federal Energy Regulatory Commission (FERC) to expand capacity by a further 6.5 billion ft3 by building a fourth cavern. In a statement, Enbridge said the purchase would aid its customer’s LNG exports.

While critics warn that US LNG facilities might find themselves stranded in the coming decades as the world converts to renewables, staunch environmental proponents are investing heavily in the sector, regardless. For instance, Germany, which is highly vulnerable to dependence on Russian gas, is busy commissioning FLNG regasification terminals and signing long-term contracts that allow LNG companies to finance construction. “Energy supply will no longer be taken for granted,” said Simon Flowers, Chairman and Chief Analyst at Wood Mackenzie, a consultancy. “No country can ever again allow itself to become reliant on imported energy from a single supplier. In future, energy security will be about the diversity of fuels and sources, and the primacy of domestic resources.”1

Green potential

Net zero regulations in Canada and the US are also incentivising companies to invest in environmentally-friendly projects that create renewable fuels in North America. In February 2023, German-based RWE formed an alliance with LOTTE Chemical, of South Korea, and Japan’s Mitsubishi, to build a clean ammonia production and export facility in the Port of Corpus Christi, Texas. The plan is to build a series of units with a final capacity approaching 10 million tpy by 2030. Output will be in the form of both blue and green ammonia, and will be exported to Asia and Europe for use as both fuel and a source of renewable hydrogen.

In February 2023, EverWind, based in Nova Scotia, Canada, received approval from the provincial government to build a 300 MW hydrogen electrolysis and green ammonia plant in Port Hawkesbury. The CAN$6 billion project is intended to supply the German market by 2025.

Nutrien, a Canadian fertilizer company, is working in collaboration with Belgian shipping company EXMAR to develop an ammonia-powered shipping vessel. In late 2022, the company announced that it has plans to build the world’s largest clean ammonia facility at its existing complex in Geismar, Louisiana, near tidewater ports in New Orleans. Currently undergoing FEED, the 1.2 million tpy plant would permanently remove up to 90% of CO2 emissions using carbon capture and sequestration (CCS) technology. A final investment decision (FID) is expected by 2023; full production could commence by 2027.

ExxonMobil is advancing plans for a massive, low-carbon hydrogen and ammonia production facility, located in its Baytown, Texas complex. In January 2023, it contracted with Technip Energies to conduct FEED in order to make an FID by 2024. When construction is finished in 2028, the new facility will produce up to 1 billion ft3/d of blue hydrogen by capturing and sequestering up to 98% of CO2 emissions.

The output allows ExxonMobil and third-party customers to produce low-carbon fuels and products.

Cresta Fund Management, a private equity firm, purchased the idled Come-by-Chance refinery in Newfoundland, Canada. The 135 000 bpd refinery, to be called Braya Renewable Fuels, will focus initially on producing 14 000 bpd of sustainable aviation fuel (SAF). Further plans include doubling capacity to 27 000 bpd. Braya is currently in discussions with ABO Wind to supply 35 000 tpy of green hydrogen.

Yara, a fertilizer company based in Norway, is teaming up with Enbridge to build a blue ammonia plant in Corpus Christi. The US$2.9 billion facility will produce up to 1.4 million tpy using carbon capture. The output will be used for low-carbon fertilizers, shipping fuel and utility power. Salt dome structures are widespread throughout sedimentary formations in Texas. Researchers at the University of Texas have determined that the large underground caverns are suitable for both temporarily storing hydrogen and permanently storing CO2 captured during blue hydrogen production.

Problems

Environmental complications surrounding energy terminals remain an issue. In early 2021, Phillips 66 and Trafigura received a permit to build the Bluewater Texas Terminal (BWTX) in the Port of Corpus Christi. The proposed terminal would be located 20 miles offshore from the Corpus Christi Ship Channel in water deep enough to allow up to 21 VLCCs to be loaded each month, with a total annual capacity of almost 400 million bbl. As part of the development, the US Environmental Protection Agency (EPA) issued a Clean Air Act permit allowing BWTX to emit approximately 19 000 short tpy of pollutants – primarily volatile organic compounds (VOCs). Environmental groups protested, arguing that the project should fall under National Emission Standards for Hazardous Air Pollutants (NESHAP) for marine tank vessel loading operations, which calls for a 95% reduction in VOC emissions. The EPA agreed, and in September 2022 it revoked the permit and instructed Phillips 66 to withdraw and resubmit its application. Phillips 66 complied, including new equipment to reduce VOCs. The revised application is currently under review.

Future

The future of the energy sector in North America is difficult to predict; one only has to see how an unexpected event such as the war in Ukraine can significantly impact plans. The conflict has, however, accelerated many of the energy-related changes already underway in North America, including growth in exports and new markets. When the potential for new renewable fuels is added into the mix, significant opportunities for tanks and terminals will abound through the coming decade.

Reference

1.

Global ammonia production is being affected by surges in natural gas feedstock prices and the halt of ammonia supply shipments due to the war in Ukraine. On the other hand, demand continues to grow to support food production, along with an increasing number of applications that can use ammonia to meet decarbonisation goals.

In 2022, the worldwide ammonia market was US$78 billion, with expected growth to almost US$130 billion by 2030.1 The US ammonia market is tracking this growth, with more than 621 000 t exported in the last six months of 2022 alone.2 This market growth presents a unique opportunity for terminal operators to explore the development of ammonia export terminals. However, balancing capital investment with the logistical factors of ammonia handling will be essential for export terminal project success.

Upfront planning considerations

Upfront planning and decision making are critical to terminal project development, and can directly shape project efficiency while lowering risk.

At the start of a project, operators should evaluate the location of upstream assets, existing terminal facilities, pipeline location, and water access. Whether planning for a new terminal or revamping an existing facility, deciding plant capacity and vessel class early will serve to guide the site selection strategy.

Export terminals also require an assessment of site topography, storm surge risks from hurricanes and flooding, levees, terminal equipment elevation requirements, and more. There are many different stakeholders interested in export terminal development. It is important to consider the required environmental, wildlife, water, safety and security rules and permits at the start of a project in order to help guide the scope and schedule.

Design to deliver

The operating infrastructure, energy needs, and export volumes of an ammonia terminal are enormous. Refrigeration systems will commonly require tens of thousands of horsepower, with ships typically loading 40 – 55 million t of product at a time. Therefore, an ammonia export terminal must be engineered to precise

ChrisNiemeyer

andCaitlin

Geisinger, Burns & McDonnell, USA, explain how growth in the ammonia market presents a unique opportunity for terminal operators.

standards in the upfront design phase in order to safely and cost-effectively handle this toxic and highly flammable chemical.

Once the decisions have been made on plant capacity and vessel types, operators and designers must focus on essential operational requirements. These must be determined early due to the large volumes of energy, water and refrigeration that ammonia demands. In this conceptual design phase, each decision aims to strike a balance among the total installed cost of assets, operational efficiency, and safety.

Water and power

Ammonia must be transported and stored in refrigerated environments. Therefore, at the outset, the terminal design must identify the availability, location and reliability of power and water needed for industrial refrigeration.

As part of the cooling system, operators must determine whether wet surface air coolers, cooling water condensers, or air coolers will be used. Considerations include evaluating efficiency, process temperatures achieved, space for assets, and energy requirements. For example, using condensed air instead of water for cooling could require up to 20% more electrical energy.

Ammonia export terminals demand consistent, round-the-clock electrical power. Evaluation of the site should consider proximity of grid interconnections and available voltage capacity. It is important to determine options to tap into the grid, as well as the potential for a full loop tap for higher reliability. If the site is remote, operators must determine the available energy sources, and whether onsite electrical power generation may be required. A holistic approach with the design firm and service provider is essential for an effective outcome.

Tank storage and tank type

Determining whether a terminal will use tank storage or direct load will have a cascading effect on decisions, cost and efficiency. Tank storage presents a large upfront investment but can help a terminal to manage inventory and cope with scheduling uncertainties. With steady ammonia supply into the tank, load swings can be better managed, and the set-up needs smaller supply pipelines and lower refrigeration requirements.

Direct load is limited by pipeline and refrigeration capacity, which can slow loading and increase dock time. A direct load design simplifies terminal design but requires large-diameter pipelines and higher horsepower refrigeration.

For projects that use tank storage, full containment tanks are preferred for ammonia storage. Although this will require a larger capital investment than for single-wall tanks, full-containment tanks take up less plot space and meet safety considerations and permitting regulations. This double-walled tank design, however, requires submersible loading pumps, which present certain considerations for engineering and maintenance. For example, tanks with capacities in the range of 300 000 – 900 000 bbl must be drained and inspected every 5 – 10 years.

Refrigeration and compression

Due to the critical nature of refrigeration for terminals, several design decisions must be made. Open-loop refrigeration (without heat exchangers) using the ammonia as the cooling medium allows for simpler design and lower power consumption. Closed-loop refrigeration can also be used with multiple refrigerant options; the process requires more equipment than an open-loop approach but can often better handle light ends or contaminants that end up at the terminal. An experienced design contractor can evaluate refrigeration options as well as compressor types, configuration and boil-off gas (BOG) management in order to identify the optimum solution.

Safety and site layout

With its high oxygen concentration, ammonia is a flammable gas that can create a jet flame if released. There is flexibility in many terminal design decisions, but the safe handling, storage and containment of ammonia must be the catalyst upon which design decisions are made.

Safety and site layout planning can go hand-in-hand. Because of the size of assets, power requirements, and safety mandates of ammonia export facilities, the layout of a terminal is critical.

The relative location of equipment, tanks, docks and thermal oxidisers should be based on spacing guidelines and project-specific operability and maintenance analysis. Refrigeration terminal decisions should use consequence-based modelling for toxic releases, fire, radiation, and potential blast contours.

Site layout options should be considered as process design and equipment decisions are made. Deciding on asset placement, electrical power, water access and dock unloading will adversely affect the efficiency of the terminal and unnecessarily drive up cost.

Conclusion

Early decisions on process choices, equipment preferences, safety strategies, and plot plan will greatly determine the project cost. Engaging with field-proven engineering resources that offer planning and design best practices and deliver credible cost estimates will help drive good decisions and, ultimately, savings. Not unlike a large tank ship, once an ammonia terminal project gets going, any course changes are complex and expensive.

References

1. 'Ammonia Market (By Product Form: Liquid, Gas, Powder; By Application: Fertilizers, Refrigerants, Pharmaceuticals, Textile, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2022-2030', Precedence Research, (November 2022).

2. MULLINS, C., 'Viewpoint: EU demand to bolster US ammonia exports', Argus Media, (3 January 2023).

3. TULLO, A. H., 'Is ammonia the fuel of the future?', Chemical & Engineering News

The new ammonias

As ammonia processes and technologies change, so does the carbon intensity of production. An informal colour scheme has been adopted for ammonia (and also applies to hydrogen) to communicate both the process used and the environmental impact.3

Grey

Conventional ammonia production, known as grey ammonia, uses the traditional Haber-Bosch process, and currently accounts for almost all ammonia output today. The method reacts atmospheric nitrogen and hydrogen, which is often generated from steam reformation of methane.

Blue

Conventionally-produced ammonia, where the carbon dioxide (CO2) byproduct is captured and stored, is called blue ammonia. While its carbon intensity is reduced, a range of opinions exist concerning the overall environmental benefit of blue ammonia.

Green

Green ammonia is produced with hydrogen from water electrolysis that is powered by renewable or alternative energy. Investment and improvements in the technique for ammonia production are beginning to be widely adopted.

Turquoise

Not as well known, turquoise ammonia is produced by converting methane into pure carbon and hydrogen that then reacts with nitrogen.

can tailor to your requirements, produce 1 - 12 page formats, print colour or mono and more

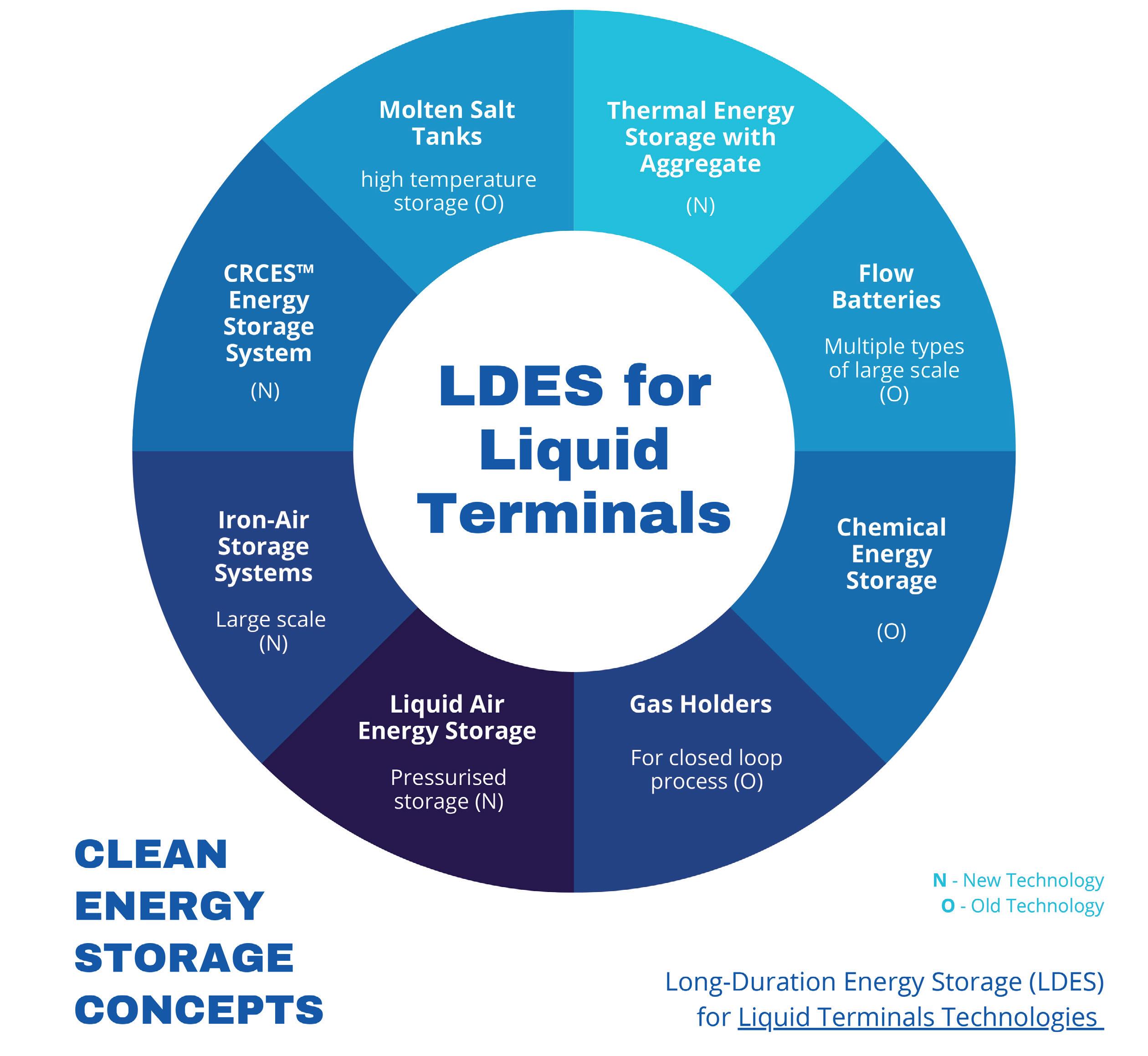

Almost everyone in the liquid terminal industry would agree that resolving the energy trilemma (affordability, energy security, and environmental sustainability) may take up to 20 years. At the same time, investors are starting to distance themselves from the hydrocarbon industry, and publicly traded companies are faced with the challenge of satisfying a broad range of investors on the path forward. Therefore, the liquid terminal industry needs a plan to support positive economic results during the energy transition.

The good news is that there are many opportunities to reformulate existing hydrocarbon liquid storage terminals in order to profit from a clean energy future. The solutions incorporate emission reductions, storage of products generated through renewable efforts, optimisation, and new technologies that take advantage of existing terminal infrastructure, systems, and locations. The top eight technologies are listed in Figure 1, but the most obvious technology for liquid terminals to embrace is flow batteries, utilising bulk storage with low or no emissions, and supporting electrical energy storage (EES). Flow batteries would truly be a windfall for the tanks and terminals industry if they were economical today. However, even with an efficient flow battery solution, the equation is not complete without energy

generation. The complete solution needs to harness the terminal assets that are already in place, store energy, and at the same time capture a renewable means of power generation. The combination of these efforts paints a picture of transition success accepted by the industry and the most aggressive investors.

As a reference point for terminal storage competition, one need not look any further than lithium-ion batteries for EES. When it comes to power generation, solar and wind are the systems to beat. The liquid terminal industry can surpass the use of photovoltaic (PV) solar with batteries for reasons such as long-duration energy storage (LDES), lower EES cost, lower carbon footprint, etc.

Embracing new technology

From an investor perspective, there are plenty of selling points, but the big challenge is favourable economics. The solution lies in relatively new technology formulated to fit the liquid terminal industry. Taking advantage of the location of many terminals and their proximity to industry and power grids are key elements of success.

American Tank & Vessel Inc.’s Carbon Reduction Clean Energy Storage (CRCESTM) technology is as simple as waste heat recovery and clean bulk energy storage, and can compete with

W.T. Cutts, American Tank & Vessel Inc. (AT&V), USA, outlines the opportunities available for existing liquid storage terminals to benefit from the energy transition.

solar, wind and batteries. It offers unlimited life cycles, no cost of future battery replacement, a smaller area requirement for energy storage, and efficient LDES. The technology also has faster project timelines, and provides more local jobs compared to deploying batteries. The unit also has a lifespan of 20+ years.

Moving forward

The realisation of these benefits requires a commitment to working with the power community and industries in the vicinity of the existing liquid terminal. One source of energy is low-quality waste heat. Most industries have already utilised waste heat in a variety of manners but still have low-quality waste heat within their operations. Typical operations consume water, power, chemicals and land area to expel this low-quality waste heat. Technologies are available today to utilise low-quality waste heat, as well as convert tanks and systems to act as energy storage. A level one front end engineering design (FEED) study can identify the resources that can be utilised for energy acquisition, storage and distribution. Terminal companies that embrace the concept are underwriting their future by:

n Promoting a path to clean energy storage with investors.

n Adding long-term sources of revenue.

n Reducing local industries’ consumption of water.

n Expanding relationships with local industries.

n Stabilising the power grid with clean energy.

Utilising terminal assets

Storage of clean energy in liquid hydrocarbon terminals can be accomplished through a number of applications that incorporate technology that has been around for 30 years, and others which promote technology that is still incomplete. A review of these applications shows that many do not take advantage of the traditional hydrocarbon terminal’s assets. For applications to have a good fit, the projects need to utilise current physical assets, support deployment, leverage existing staff and systems, acquire low-cost energy, incorporate good economics, show flexibility for future transitions, and minimise the land required for new equipment.

Most clean energy storage is either burdened with incomplete technology or limited by rare materials. The CRCES technology is available for commercialisation, and has the benefit of storing energy from low-quality waste heat sources. CRCES storage technology can utilise the traditional storage tanks found in liquid terminals with modifications, while full utilisation of most tanks can be realised. Not only are the assets of the liquid terminal utilised, but the terminal’s current management systems are appropriate to operate the facilities described. Many liquid terminals operate propane facilities or blending, which is of similar complexity to operating the facility supported by CRCES. In addition, most liquid terminals are located in areas where it is easy to tie into the electrical grid, support a substation, generate behind the meter, or work through an electrical broker to sell power.

Conclusion

Transitioning liquid terminals to support clean energy will start with aggregating low-quality waste heat from local operators for clean energy generation, storage of energy from renewable sources for grid stabilisation, and storage of electricity from the grid to support peak shaving and/or back-up systems. Other key factors will include supporting ammonia for bunker fuel demand, and establishing a path to the hydrogen economy.

Whether the terminal is driven to have a green initiative or generate additional revenue streams, the solution is at hand.

CRCES™ supports:

• 100% US materials and labor

• Lower cost versus Li-ion batteries

• Smaller carbon footprint versus Li-ion batteries

• Long Duration Energy Storage (LDES)

John Colpo and Sudhakar Bhooramoorthy, Honeywell, discuss how an enterprise-wide approach to managing multiple oil products terminals offers a number of benefits to companies.

Oil products terminals are essential infrastructures that serve as storage and transfer hubs for petroleum products such as gasoline, diesel and jet fuel, as well as midstream and upstream products. Companies that operate multiple terminals often face the challenge of marginal economics and resistance to efficiency improvements, while also needing to ensure compliance with ever-growing health, safety and environment (HSE) regulations. One way to address these challenges is company adoption of an enterprise-wide approach that integrates all terminals into a cohesive system, rather than operating each terminal based on its individual legacy.

Running a terminal is becoming tougher

Today, there are fewer terminals than in previous decades. Early terminals handled logistics in localised precincts, dealt with fewer and simpler products, and pre-dated third-party access (TPA) or

Figure 1. An integrated and enterprise-wide approach provides significant value at each level of terminal operations and business processes, and covers all aspects of custody transfer, including safety, security, operational excellence and regulatory compliance. Once a holistic system is implemented, all sectors of the business will benefit.

other modes of sharing terminal and product capacity. Workflows involved several manual procedures and paper-based order and audit trails. Gate-to-gate times were typically over an hour, and tank turns were low.

Today’s terminals are fewer, but larger and more complex and costly to operate; increasingly tightly regulated for HSE protocols; and must respond to the needs of a number of stakeholders and customers. Bottom-line impact for today’s complex oil and gas terminals is driven by load-out efficiency and the ability to quickly react to market dynamics and trends in order to capture market and overdrive on tank turns.

Any lack of visibility into terminal performance adds to the day-to-day challenge of optimising the asset’s investment. The uncertainty associated with forecasting demand or identifying where the next interruption will occur – whether it is an equipment malfunction, safety incident, or out-of-spec product – can also reduce the opportunity to operate at maximum efficiency.

Constantly evolving fiscal and HSE regulations challenges terminals owners to invest capital, implement additional sub-systems, and interrupt operations. Additional challenges for terminal owners and operators include:

n A fractured view of inventory and operations across multiple terminals.

n Difficulty benchmarking performance of each terminal.

n Fewer qualified personnel due to an aged workforce set to retire.

n Geographical distribution of terminals.

n Increasing complexity needed to handle multiple-product mixes and rebranding.

n Limited collaboration across the supply chain.

The right approach for productivity and profits

Now more than ever, all categories of multi-terminal owners need to combine the operations of multiple storage terminals, applying consistent and standardised work practices across facilities to lower IT, OPEX and maintenance costs. This is true for national oil companies (NOCs), independent bulk storage operators, and all other owners.

An enterprise-wide approach provides several benefits to companies that operate multiple oil products terminals. Firstly, it allows for centralised management of all terminals, enabling better coordination of skilled activities and scarce

resources across different locations. This approach also facilitates real-time monitoring of operations, such as tank levels, temperature and pressure, which enables better decision making and reduces the risk of accidents or product loss.

Secondly, it enables the standardisation of processes and procedures across all terminals, which simplifies training, improves consistency, and enhances compliance with regulations. This standardisation also enables companies to implement best practices and continuous improvement programmes across all terminals, improving overall operational efficiency, and reducing costs and dependence on individual staff.

Thirdly, the approach enables the use of advanced technologies such as automation, artificial intelligence (AI) and predictive analytics, which can improve operational efficiency, reduce downtime, and enhance safety. These technologies can be used to optimise inventory management, predict maintenance needs, and improve energy efficiency across all terminals, providing a competitive advantage for the company.

Lastly, an enterprise-wide approach provides a holistic view of the company's performance, enabling better decision making and resource allocation. This approach allows companies to identify trends and patterns across all terminals, providing insights into areas that require improvement or investment. It also facilitates benchmarking against industry standards, enabling companies to identify areas where they can improve their competitiveness.

An enterprise-wide approach will integrate disparate inventory management, blending and loading systems to provide a complete picture of performance. It also manages the paper stream associated with operations. It is important to see how each terminal is performing relative to other sites, and to determine which terminals have spare capacity, experience bottlenecks, or have room for improvement.

Comprehensive solutions for optimising operations

It is important to employ a holistic and integrated solution across the enterprise, from the field to the control room, and up to the business level – all delivered by a single trusted supplier. Merely finding solutions for individual sub-systems will hinder the terminal from working efficiently as a whole. An integrated approach seamlessly integrates processes, assets and people, and helps turn data into actionable insight so that a business can optimise operations, predict asset performance, and reduce unplanned downtime.

The key elements to consider are the following:

Integrated pipelines

Terminals can benefit from solutions that track batches of product being transported through pipelines or transferred between tanks, and provide movement monitoring so that product moved from one location can be accounted for at its destination. These solutions also offer a range of leak detection options to monitor product as it flows through pipelines.

Automated terminal management

Control and supervisory software combined with work stations can be used to automate all operations at a bulk liquid terminal, including all key monitoring and controlling functions such as product receipt, gate access control, and loading. This approach also controls the flow of information from inventory management systems, and delivers detailed process insights via an intuitive analytics dashboard.

Secure cloud technology

Cloud hosting for enterprise-wide visualisation and analysis makes it possible to leverage insights found at one terminal across all terminals, which allows for more informed decision making. This solution reduces IT costs while guaranteeing high reliability, flexibility and scalability. Furthermore, faster turnaround for troubleshooting and applying fixes can be achieved, and new applications can be more easily developed, tested and deployed. Cloud-based solutions also enable business process outsourcing (BPO) of both non-core and core work functions.

Integrated cybersecurity

Terminals have often been targets of organised crime. Cyber is the new frontier, and if not fully implemented, there can be devasting results. Fallout from a cyber incident can result in operational disruption, loss of product, non-compliance, ransom payments, or fines. An industrial-grade cybersecurity system defends the availability, reliability and safety of control systems and terminal operations to protect the entire enterprise.

Equipment health monitoring (EHM)

Maintenance departments often have one of the largest payrolls, but they can reduce costs and increase equipment availability by switching to preventative maintenance regimes. EHM applications allow operators to build an asset-centric model of their terminal equipment that can predict outages of reliability and availability. Standard models for common equipment such as tanks and pipelines are readily available, while various terminal-specific models can also be developed.

Precision tank monitoring

With a precision tank monitoring solution, multiple standard tank views are available for each terminal. Personnel can be alerted by audible and visual alarms based on the inventory position in each tank.

Inventory management

Terminal control systems can be integrated into a wide range of servo, radar tank gauges, and associated field instruments. The gauges are tied into tank inventory systems, which perform advanced monitoring and alarming of storage inventories.

Loading automation

An integrated system of loading, additive and blending controllers can be utilised to optimise loading automation capabilities. Not only do controllers manage straight

loading, but they can also handle ratio and side stream blending.

Fire and gas safety

Advanced systems are essential in tank and storage areas, where protection is the highest priority. Gas detection technologies can be combined with terminal control systems to ensure better situational awareness and improved response times, helping to save lives in an emergency.

End-to-end physical security systems

Site security, including perimeter-intrusion detection, video surveillance, and access control can be integrated with the terminal control system. Security systems can be augmented with an advanced wireless network, which enables better operator efficiency and improved situational awareness.

Advanced wireless network

This solution enables wireless applications such as tank gauging, overfill alarming and floating roof monitoring to be natively integrated into the control platform. A wireless solution could reduce costs by up to 50% compared to traditional wiring, while expediting project execution.

Benefits across the business

An integrated and enterprise-wide approach provides significant value at each level of terminal operations and business processes, and covers all aspects of custody transfer, including safety, security, operational excellence, and regulatory compliance. Once a holistic system is implemented, all sectors of the business will benefit.

Senior staff can accurately compare terminal performance across multiple, geographically-dispersed locations, and implement company-wide strategies to keep operations safe, quality high, and customers satisfied.

Planners can precisely determine terminal consumption and inventory distribution patterns, identify and predict product allocation for different stakeholders, monitor inventory availability at individual or multiple facilities, and plan shipments and orders from a centralised location.

Terminal managers can minimise project risk, maintain on-time production schedules, and drive business performance with scalable solutions that improve safety, efficiency and profitability.

Terminal operators can accurately monitor and maintain bay efficiency, manage terminal inventory, respond to alarms and alerts, and track and execute loading plans and shipments.

Conclusion

In conclusion, an enterprise-wide approach to managing multiple oil products terminals offers a number of benefits to companies, including centralised management, standardisation of processes, adoption of advanced technologies, and a holistic view of the company's performance. By adopting this strategy, companies can improve their operational efficiency, reduce costs, enhance safety, and gain a competitive advantage in the industry.

Ryan Thompson, Emerson, USA, explains how even the most experienced terminal schedulers can increase peak operational efficiency with the help of digital twin-based scheduling and optimisation software.

In the increasingly competitive liquid storage business, high customer satisfaction is paramount. A seemingly small delay can have multiple cascading impacts, as terminals frequently run very tight schedules to satisfy the needs of their customers. Therefore, terminal operators poised to deliver outstanding service are well-positioned to increase market share while retaining their existing customer base.

Traditionally, good service simply meant a deep bench of expert personnel who could effectively manage the tank farm with its spider webs of pipe, complex vessel schedules, and vehicle loading. Today, however, these highly skilled employees are becoming hard to find, and even harder to retain, as many of the most experienced operators are retiring. New personnel, while potentially easier to find, do not have the expansive knowledge or skill set that comes from years of experience at a specific facility.

Furthermore, even experienced human schedulers tend to be conservative in their use and operational deployment of the terminal’s physical assets. Tried-and-true asset line ups are preferred, which means that the full operational capacity of the

existing assets may remain unexplored. The ability to squeeze in one or two additional tankers a month, for example, would represent a significant increase in revenue and profit margin, but this would require running closer to constraints.

Without a paradigm shift, basic terminal operation in the future will become increasingly difficult, and possibly non-competitive against more efficiently run terminals.

Closing the inevitable skill gap while simultaneously improving customer satisfaction will require the employment of advanced technology. One of the most impactful new pieces of terminal-centric technology is digital twin-based terminal scheduling and optimisation software. Implementing scheduling software moves specialised data and esoteric scheduling processes onto a standardised and easy to use platform.

Moving product is complex

Unsurprisingly, the more complex a terminal, the more difficult it becomes to schedule the product movements, define movement interdependencies, and plan related operational activities efficiently and accurately. Operators are trying to satisfy the competing requests of multiple customers to ensure that they receive the level of service dictated by their contracts, without unexpected delays, all while avoiding unintentional transmix or contaminations.

Consider the complexity of a large multi-modal terminal facility: many dozens of tanks, scores of products, complex spaghetti webs of interconnected pipes, vessels of varying sizes whose arrival is highly dependent on weather, connections to major international pipelines, fleets of trucks moving through the terminal daily, railcar loading and storage, and inter-tank transfers. Creating a schedule for such an intricate orchestration is no simple task.

Additionally, routing a movement through the terminal’s complex of pipe headers is just the beginning, because the product portions already in those pipes must also be displaced or flushed in many cases. Each one of these displacements becomes a scheduling concern in its own right. Even after a schedule is set, circumstances can change the plan, sometimes leading to all-hands-on-deck scrambles, resulting in losses in efficiency at best, and mistakes or safety incidents at worst. Even the best prepared operators can fall victim to changes that are out of their hands. For example, operators often attempt to expedite operations by prefilling lines going to a certain jetty. But when a ship is late, operations can become complicated very quickly.

Beyond the spreadsheet

Necessity is the mother of invention, and some incredibly complex scheduling spreadsheets have been created to support this statement. Typically, scheduling spreadsheets were built by a small group of experienced users, or, in some cases, even a single expert engineer. Many terminals pin their entire operations on spreadsheets to track and schedule product movements in granular detail.

While these spreadsheets are often powerful, the inherent risk lies in the ability to maintain and adjust them when a terminal no longer has a deep bench of

expert personnel to support such bespoke solutions. If nobody else on staff understands the macros and the programming of that complex spreadsheet, the terminals quickly find themselves in a bind. Moreover, even the best, most well-supported spreadsheets are subject to human error. Improper data entry, unverified changes, and security gaps also pose a serious risk to the long-term viability of these well intended solutions. Finally, spreadsheets are simply not designed for this type of task, and are hard to create, maintain and change as a result.

One step at a time

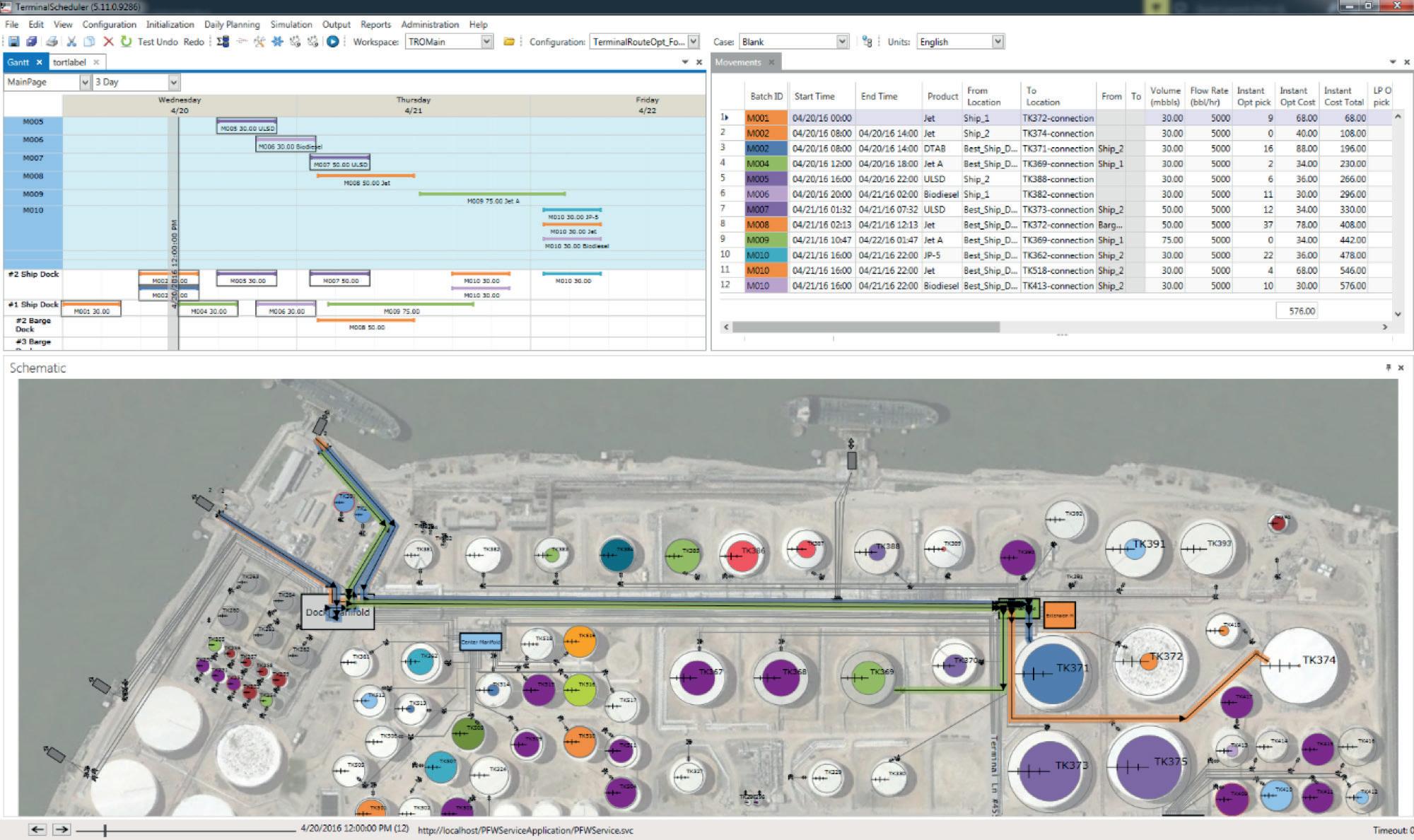

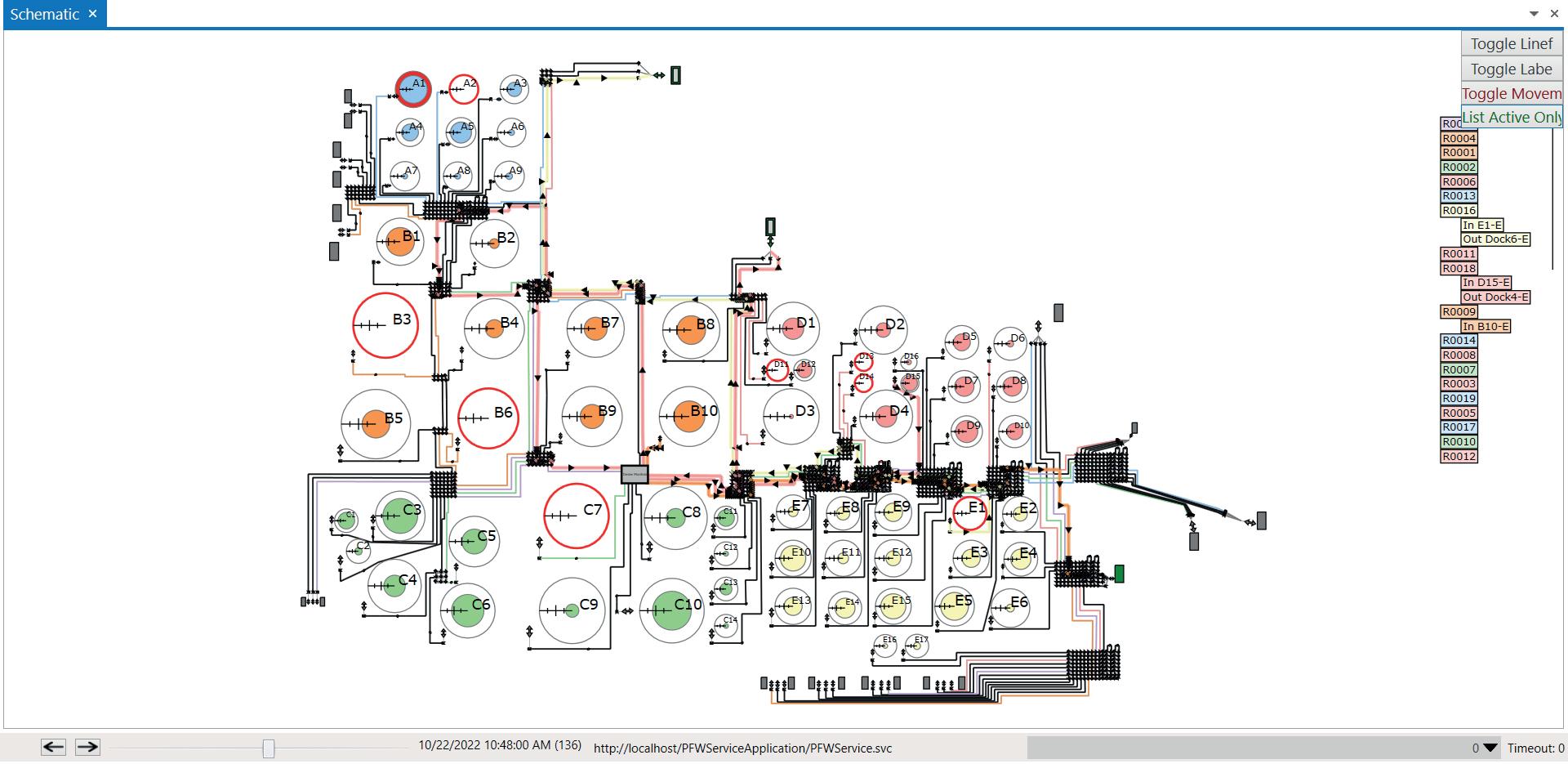

To avoid these and other problems, forward-thinking terminals are employing standardised fit-for-purpose terminal scheduling software. The leading solutions rely on simulation based on a digital twin – an exceptionally detailed replica of the facility, with digital representations of the critical physical elements needed to create an actionable schedule, including all the tanks, lines, valves, pumps, interconnections, manifolds, jetties, gantries, and more (Figure 1).

Prior to any new simulation, a few precursor activities are required:

n The period of the simulation must be set. Due to the fluid nature of terminal operations, most simulations are

run for a period of two to three days, but the length of time can vary from terminal to terminal.

n All relevant movement requests (orders or nominations for product entering, leaving or moving within the terminal, etc.) must be captured in the scheduling tool.

n The digital twin starting point needs to match the physical reality, i.e., tank levels, line fill status, equipment status, etc.

Once precursor activities are complete, the simulation can begin. The first stage is a general inventory check to ensure that the terminal will either have enough pumpable volume to go out, or will have enough ullage to bring product in. For smaller terminals with simple path routing, this may be all that is required to schedule the terminal adequately.

In more complex operations, the simulation should employ a customer-driven weighting system to determine the optimal path for movements from origins to destinations. Given that a typical terminal’s profit is heavily based on throughput, path routing cannot be left to chance.

Weight-driven optimised routing automates the process of deciding which routes products must not take, as some may be out of service, a pump on one route might not be big enough to provide the right flow rate, or some other constraint may be in place.

What seems like a small difference becomes a critical variable when that flow rate could mean filling a holding vessel in two days rather than three. Scheduling software tracks and incorporates all of these variables so that humans do not need to perform this complex task. This type of software application will avoid line conflicts, pipeline/tank contamination, and other scheduling complications (Figure 2).

Once complete, the simulation will either successfully pass, or produce errors. With the right software, all product movements (tank, pipeline, marine and truck/rail) can be displayed in graphical, tabular, and Gantt-style views. Using these and other tools, a passing simulation can then be approved, with the software creating a schedule and supporting line-ups.

The schedule can be sent to internal and external (connecting carrier) parties, and the line-ups can be used by operators to carry out the product movements. With the appropriate level of automation within the terminal, scheduling software can send line-ups directly to the automation systems for digital execution.

At the end of the scheduled period, or sooner if off schedule, the plan and actual movements must be reconciled in the scheduling software before a new schedule can be created.

Plan, pivot, replan

Operators using terminal scheduling software create a schedule, including all product movement activities, for the desired length of time. The software then runs the simulation to see whether the plan is feasible. If a problem is predicted in the physical world, such as an overfilled tank, the software will return an error, letting the user know what would happen and why. Armed with that knowledge, the schedule can be easily adjusted and run through the simulation again, without the risk of real-world safety or efficiency impacts. Once the

Figure 1. Digital twins provide terminal operators with the necessary insight to deliver outstanding service, leading to more satisfied customers and increased market share.

simulation runs without error, the schedule can be published to interested parties, including external parties such as connecting pipeline operators (Figure 3).

However, whilst having a perfect plan is the ideal scenario, what happens when a ship reports that it will be coming in eight hours early or late? It does not matter how good a model looks or how detailed the schedule is if it cannot easily accommodate minor or major changes. With scheduling software, an operator can easily modify the ship movement and re-run the simulation to identify new conflicts, see how any changes will cascade down the line, and identify which elements – such as truck and rail loads – may need to be rescheduled. Schedule upsets will still need to be remedied, but scheduling software makes it far faster and easier to get the terminal back on track.

Flexibility in handling real-world situations also benefits the planning stage. Terminal schedulers can use the power of digital twin technology to test an infinite number of scheduling ‘what-ifs’ against their operations strategies. What if a supplying refinery ramps up production? What if a tank or line segment needs to go out of operation for service? With a few adjustments, the simulation can report back the outcome of the change in a matter of minutes. The options to tweak and optimise the schedule are truly endless.

Technology empowers personnel

In today’s competitive landscape, companies are running leaner, and terminals are no exception. The challenges of reduced staff are compounded by a general decline in overall experience due to the retirement of more experienced workers. Terminal scheduling software can help ease the burden on these small teams while simultaneously closing the knowledge gap, making it easier for less experienced operators to perform their work, and with more confidence.

Traditionally, setting a terminal schedule could easily take hundreds of clicks in a spreadsheet or other software program, each one essential to getting the process right. Data entry throughout the process leaves room for errors, as critical information is manually transcribed from multiple source systems.

Today’s terminal scheduling software solutions automate most of the process. Operators can typically complete a schedule in far fewer clicks, cutting time out of the scheduling

process. Additionally, scheduling software can connect directly to external systems such as enterprise resource planning packages and order-to-cash software. Data from these systems can be automatically pushed down to the scheduling software, simplifying the process of defining and creating movements, while eliminating the risk of human error in data entry from source systems.

The personnel benefits of automated scheduling go well beyond simple time savings. Partial automation and support of the asset line up validation lends a higher level of certainty to that process. The software can also provide close to real-time capabilities to monitor and verify that the schedule is being executed as planned.

Time saved leads to opportunities to work on other high-value tasks, such as reviewing data trends for additional efficiency gains.

Build a foundation for the future

Adopting terminal scheduling software will provide immediate benefits to the day-to-day operations of the facility, and it is also a critical step in securing future success.

Traditional scheduling methods only provide the terminal’s owners with general knowledge and inexact certainty as to what was in each pipe, and what the exact state of the terminal is at any particular time. In contrast, a digital twin can exactly identify the state and content of all assets and volumes in the terminal.

Companies in every industry are realising the massive value of their data, and are looking to a more connected and data-centric future where granular field-level data is aggregated to make key business decisions – both for individual facilities and for the enterprise. Analytics can be applied to this data, with the insights used to find trends in deltas between the terminal’s schedule and actual results.

For example, a diverging trend may only be seen on one segment of pipe within the terminal. It could be that a valve is not opening completely, causing a reduction in actual vs expected flow rate. Quickly identifying and resolving such issues is critical for a fully optimised terminal operation.

Top performers focus on customer satisfaction

Today’s sophisticated terminal customers expect more than a functioning terminal; they want an efficient terminal that provides insights that help them to manage and optimise their own businesses. Terminal scheduling software can provide these capabilities through the easy and automated transfer of data, forecasting at different levels – such as inventory and individual tank levels – and notifications of delays as early as possible, whether due to product movement disruptions or equipment downtime. Operators are finding that scheduling software not only helps them operate more efficiently and effectively, but also gives their personnel more time to focus on facility safety, gain competitive advantage through customer service, and achieve top performance among their competitors.

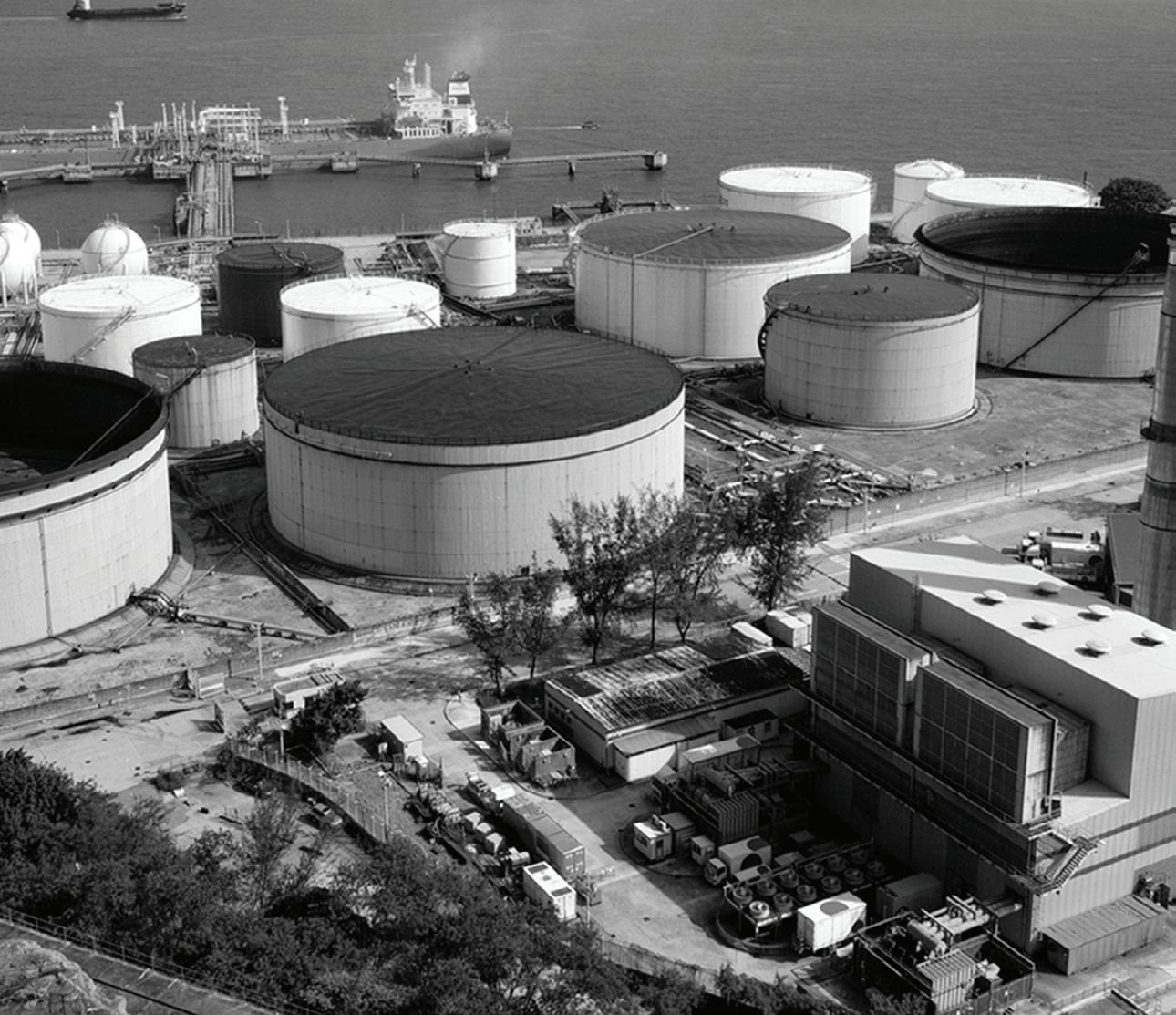

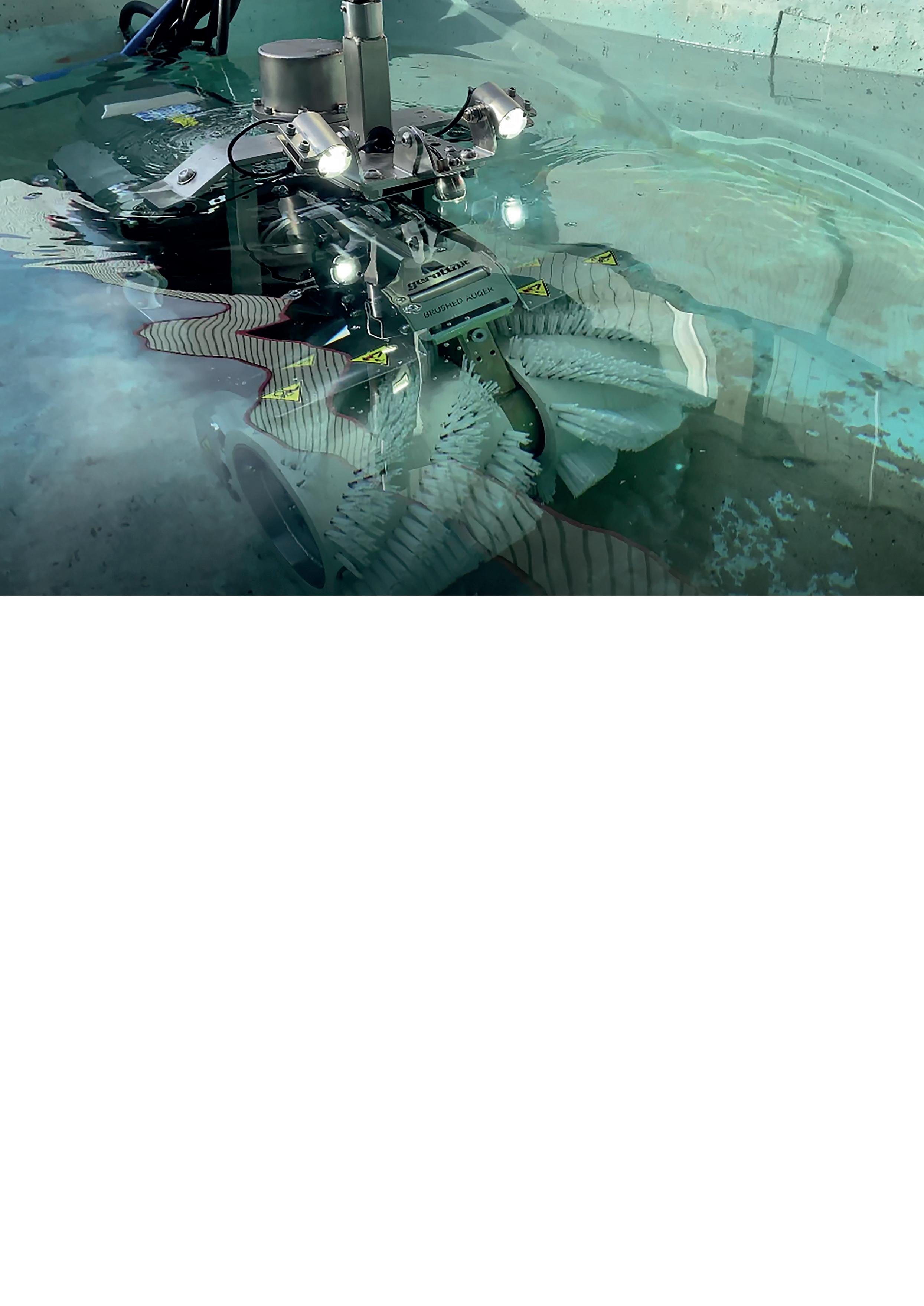

Oil and gas terminal operators are looking for the safest, most cost-effective and ecologically-friendly tank cleaning service to maintain their storage tanks. There are several key requirements when carrying out internal cleaning of tanks. In addition to removing hazardous products for safe disposal and ensuring that the risk to personnel during tank inspection procedures is reduced, it is also important to ensure that there is no cross-contamination of product, should the tank usage change.

Sediment and sludge residue take up considerable volume in the bottom of oil tanks, limiting their storage and affecting the quality of the products held within. Contaminants can corrode the floor and inner walls of the tank, and the residue can add stress to the integrity of the structure of the tank, as the weight of the sludge and sediment is sporadically dispersed across the tank floor. This can also cause damage to floating roofs and prevent them from providing a tight seal.

Terminal operators have the primary responsibility of ensuring operational and process safety, and the personal health of the operating staff. Safety guidelines have mandated periodic inspections and operating standards, with the purpose of protecting people and the environment against industrial accidents. These are devised to help prevent accidents from happening, to reduce the frequency and severity of incidents, and to mitigate their effects – should they occur.

Incidents can have major consequences on the environment and workers’ health, and can lead to oil terminal facilities paying dearly in terms of repairs, loss of share value, cost of closure, remediation, and claims.

Shifting the focus

Tank cleaning methods that focus on safety procedures, cleaning effectiveness, time and money reduction, and ecological preservation have all been highlighted by oil majors in recent years. Additionally, the desire to cut maintenance costs while still improving safety has shifted the focus to automated systems. This involves no man entry that can replace an entire human crew and can run on continuous shifts without downtime. This solution also allows oil majors to get their asset back up and running up to 60% faster than if conventional cleaning processes were being used.

The gauntlet has been thrown down to tank cleaning companies to employ the latest health and safety standards and environmental guidelines while planning, managing and administering a faster, smarter, no man entry service.

Oil industry bodies are signalling an end to confined space entry by 2025. In response,

Aidan Doherty, Re-Gen Robotics, UK, details how terminal operators can improve safety and cut maintenance costs by applying smart tank cleaning solutions.

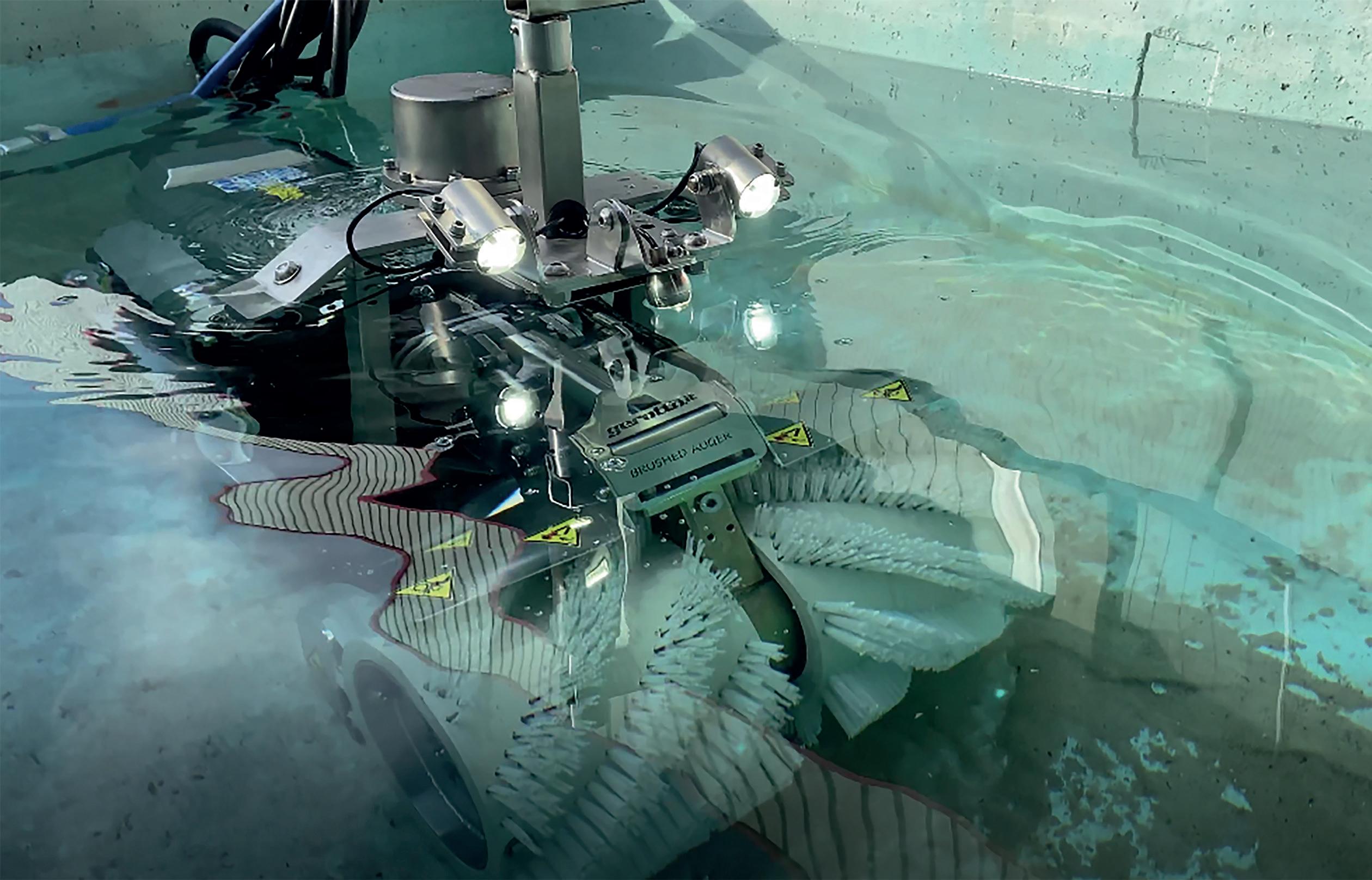

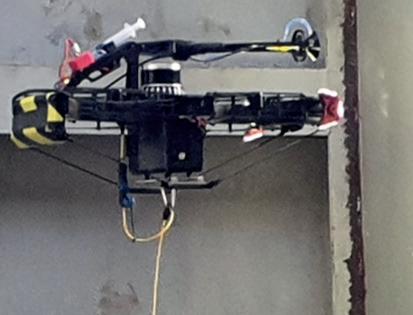

no man entry robotic tank cleaning systems can eliminate the risk to human safety in hazardous environments and confined spaces. Re-Gen Robotics has developed a Zone 0, Ex certified, remote controlled cleaning system. The cleaning systems were created to tackle crude oil, black oil, white oil and distillate tanks, and feature closed looped cleaning circuits and a highly-efficient hydrocarbon recovery system to protect the environment.

Tank cleaning process

When conducting no man entry robotic tank cleaning, it is important to begin by compiling detailed information on the tank(s) to be cleaned, including size, type, location, contents, volume, and nature of material contained within. A formal assessment of the risks associated with the cleaning task should then be performed, and the operational history of the tank, with information on the products that have been stored within the tank, established.

A proposed cleaning methodology should then be presented to the clients, who should be given the opportunity to ask any questions regarding equipment and processes. At this stage, a timeline and next steps can be completed, and a sample proposal on timings and costs of the proposed tank clean should be provided. This will be indicative if exact details of the volume of the tank material is unknown; otherwise, a final proposal can be prepared if all elements are up to date.

This is followed by a site visit to assess the tank(s) and meet the team to gain a comprehensive understanding of the scope of work. Once all of the details have been specified, a final proposal outlining method, timeframe and cost can be

submitted, and the detailed responsibilities of everyone involved throughout all stages of the cleaning and reinstatement process are agreed. The highest levels of health and safety and environmental and quality procedures must be observed at all times.

Re-Gen Robotics’ self-contained system is comprised of robotics, vacuum, jetting and cranage, so there is no capital outlay for terminal operators. The clean begins with the mobilisation and installation of equipment, according to a thorough installation plan that has been approved by the tank owner.

The ADR tanker is stationed alongside the tank bund, and the self-contained cranage system lifts the robot over the bund wall and positions it in front of the tank manhole. This is particularly useful for tank farms and terminals situated in remote locations.

The certified robotic operator manages all aspects of the tank clean from a dedicated, air-conditioned control room through a series of ATEX cameras and gas monitoring equipment. This ensures that every clean, no matter what category of tank, is uncomplicated, as the operation is remotely controlled with permanent visual connection.

The tank does not need to be gas-free to enter when using no man entry robots. As a result, all equipment installed on the robot is anti-explosive and hydraulically propelled to remove any danger of fire or explosion. Paperwork and permits are also reduced, and there is no requirement for capital outlay or spading of tanks.

The tank cleaning robotic system has been designed to fit through a standard 600 mm manway, using externally fitted hydraulic ramps, and begins the process of extracting sludge from the internals of the tank. Each robot is fitted with an auger system capable of breaking down heavy sludge without using water, meaning that it produces less waste. Sludge and sediment are extracted by the ADR-certified jet vac tanker, which has a vacuum capacity of 4800 cm3/hr, using high-pressure, low flow jetting systems, and the powerful vacuum.

The system has an offset suction head to allow for precise cleaning underneath heating coils, and the low-profile tool can access underneath pipes and remove waste from below the heating coils. It can also operate offset on the left, right, and straight-ahead positions. This tool can decrease tank cleaning time by approximately 10 – 12%.

The self-contained system simplifies the entire tank cleaning process. Productivity is enhanced, and tanks are brought into operation more quickly.

Robotic tank cleaning systems can be set up by two workers in two hours, which saves time in comparison to that taken for human crews to prepare to enter a tank.

Clients can also be provided with a recording of the tank cleaning operation, and the truck telemetry system provides real-time information to clients so that they can monitor energy consumption and waste generation.

Case study: Vermilion Energy

Re-Gen Robotics was commissioned to clean three 15 m tanks at Vermilion Energy’s gas terminal, which refines and purifies gas from a gas field on the west coast of Ireland.

The first tank scheduled to be cleaned contained methanol, and the remaining tanks contained condensate,

a low-density mixture of hydrocarbon liquids present as gaseous components in raw natural gas.

The tanks were resin lined and contained a large amount of internal furniture including aluminium legs, skim arms and floating pontoons. The entry manholes were raised slightly higher than standard tanks, and there was manifold piping situated on the ground around the tanks’ exteriors.

Upon initial inspection, it was discerned that a portable raised platform would be required to allow the robot to pass freely over the exterior pipework, in order to meet the manhole entry ramp. The platform was supplied by the client and was also used for the other tank cleans.

It was also noted that the height of the tank was considerably lower than most tanks and that it would therefore be necessary to restrict the height of the telescopic camera bracket attached to the tank cleaning robot. Rubber stoppers were fitted around the ATEX camera that would restrict the height of the camera bracket with a length of chain.

The ADR tanker was stationed 10 m from the tanks and the robotic equipment was craned into position. Scaffolding

equipment was not required as Re-Gen Robotics supplied the crane system to lift the robot into position. Full magnetic tracks were fitted to the robot in order to maintain the integrity of the resin lined floor.

At no time during the entire cleaning process was there a requirement for human presence in the confined space. The operator remained in the Zone 1 control unit where they could monitor activity through a series of ATEX cameras and gas monitoring equipment fixed to the robot.

The unique features of the large robot made it ideal for cleaning the storage tanks. The combination of specially designed 3500 psi jetting water nozzles, powered by a high-pressure low flow pump, were critical to the cleaning process.

Sludge was then extracted by the ADR certified jet/vac tanker, and by using a fully-contained waste removal and a 360˚ cleaning process, the waste material was transported offsite with an ADR tanker and safely treated in an authorised, licensed facility.

The entire tank cleaning operation was recorded on CCTV by the ATEX cameras, and was made available to the client upon completion of the works. All files are date and time stamped to ensure that the process is traceable for auditing purposes.

On completion of each vessel cleaning, final readings were confirmed, the tanks were handed back to the client, and the robots were demobilised.

By engaging Re-Gen Robotics’ team, who meticulously planned the project, the tanks were cleaned faster than anticipated (reducing tank shutdown duration by half).

Re-Gen Robotics has maintained an exceptional work record throughout every tank cleaning contract. To date, all jobs tendered have been accepted and completed on time and to budget.

The speed and efficiency of the tank cleans exceeded the client's expectations, by finishing ahead of schedule and by significantly reducing the amount of tank downtime.

Conclusion