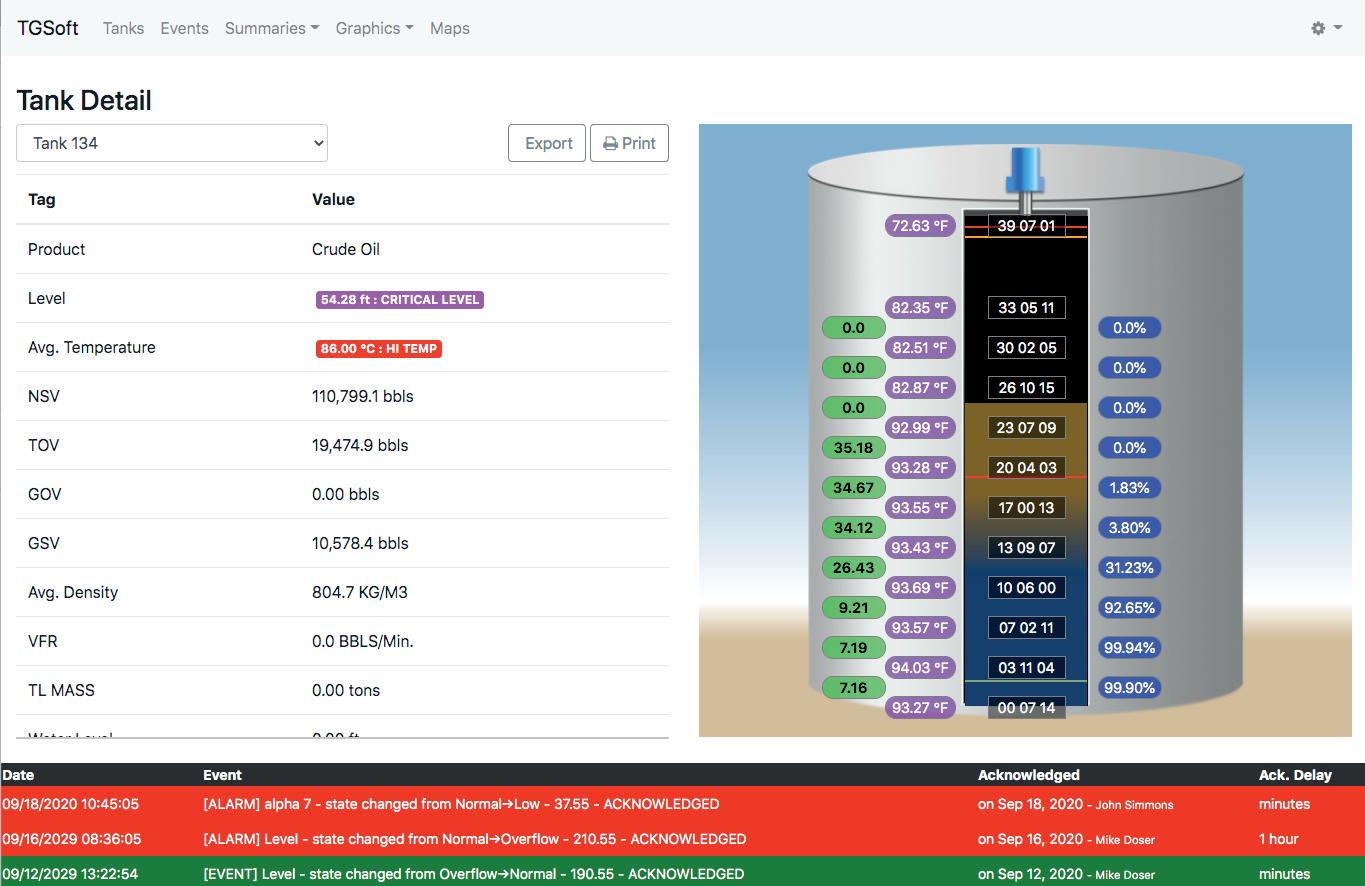

• From a tank gauge (It’s not Radar, Servo, Magnetostrictive, etc.) Bottom referenced (Innage)

• Provides the most accurate product volume (Inventory) (Transfer Ticketing)

• Provides Overfill Protection beyond API 2350 Standard, 5th Edition

• Provides Rupture Protection for Over Pressure & Vacuum on CRT’s

• Provides Leak Detection (Tank tightness, Historical) and Unauthorized Movement

• Provides Vapor Monitoring (Optional ambient vapor monitoring)

• Provides Product Quality by continuous monitoring of product stratification over the height of the liquid (Water, Density, & Temperature) (Blending, De-watering, Sampling Top-Middle-Bottom in real-time, etc.)

• And provides this data to any system via a closed server with OPC/UA, PI, SAP, MQTT, Back Office, etc. connectivity (Real-time or Scheduled)

• TG Soft Server supports multiple applications that are tailored to providing a payback and profit from your gauging technology. What data do you need?

21 The new old-fashioned

and energy security in Asia

Ng Weng Hoong, contextualises the push for energy security and stockpiling in major Asian energy storage markets.

11 Final revisions to industry air regulations

Harold Laurence, Trinity Consultants Inc., USA, discusses the implementation and ramifications of the US EPA’s finalised proposed revisions to emission standards for the gasoline distribution industry.

17 Venting the vapour

Bernat Sala, Tecam, Spain, explores the necessity of gas venting emissions treatment and vapour recovery

Thomas Kemme, AMETEK Level Measurement Solutions, USA, discusses how traditional level measurement techniques can be enhanced.

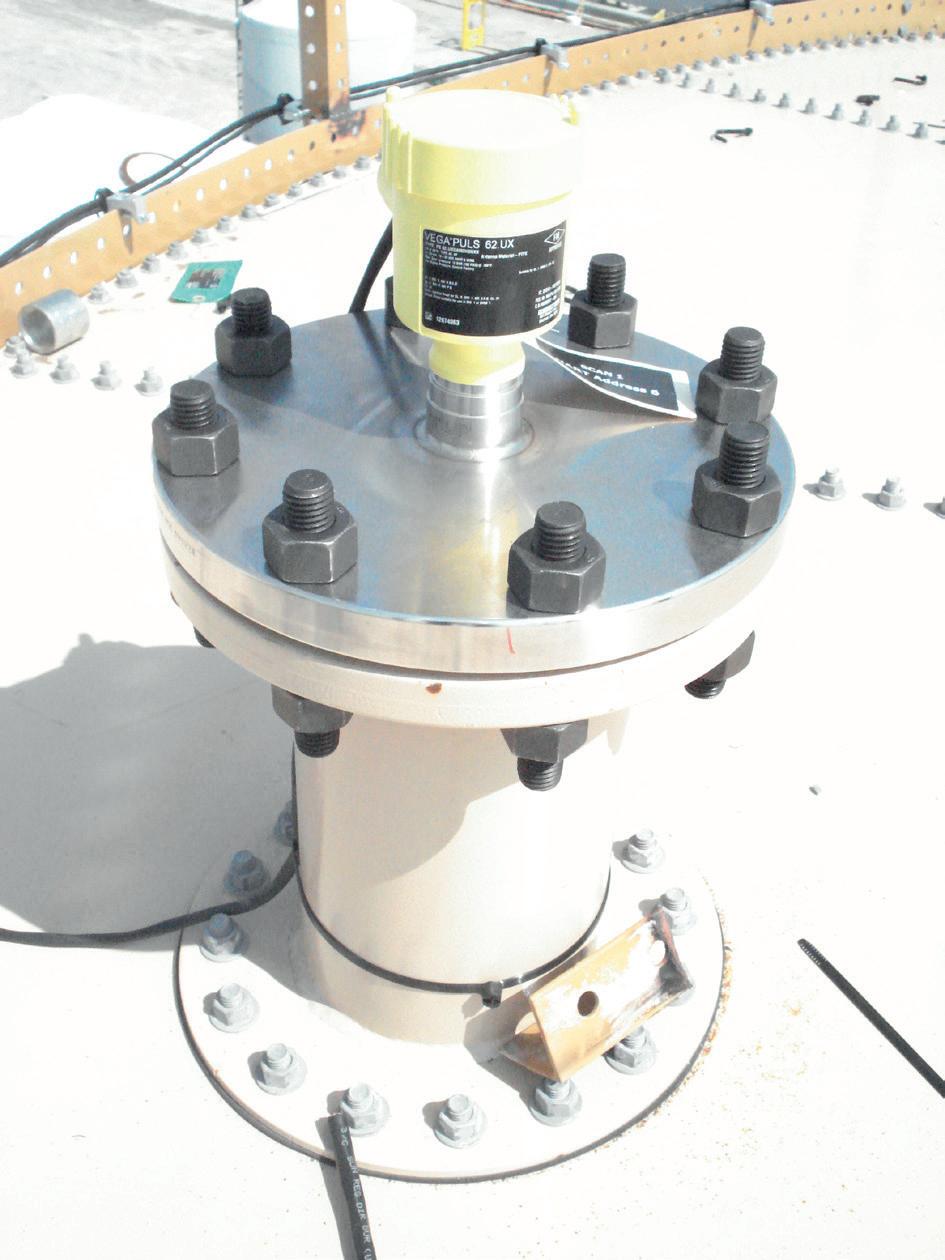

25 Finding the right frequency

Gregory Tischler, VEGA Americas, USA, examines how a tank farm can benefit from the installation of modern radar level sensor solutions.

29 Keeping operations flowing

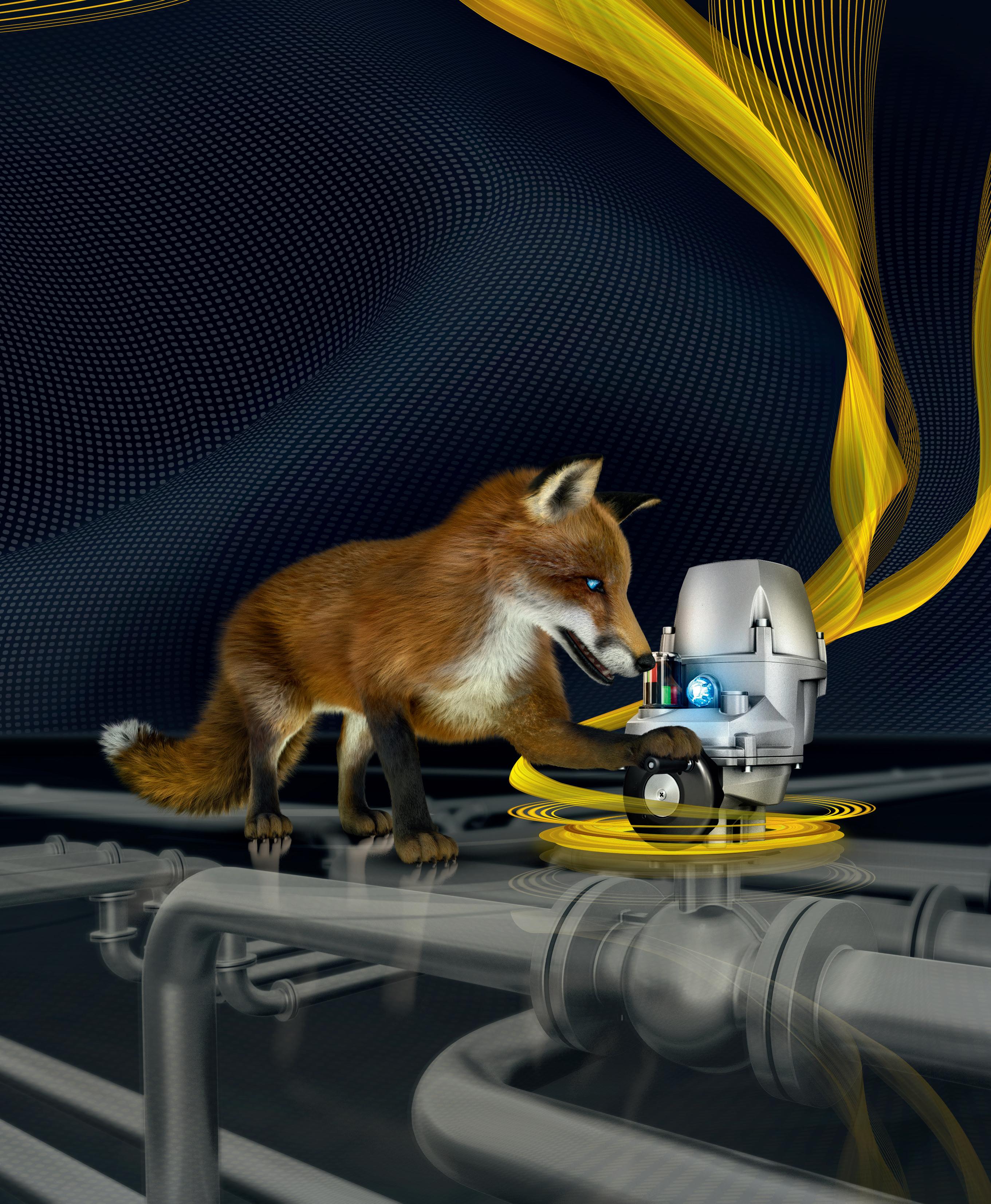

Dave Godfrey, Rotork, UK, explains why maintaining actuators should be a top priority for terminal operators.

33 Standing strong with VCIs

Ted Huck, Matcor, proposes how vapour corrosion inhibitors (VCIs) can be used to combat corrosion damage on tank bottoms.

37 From tanks to tankers

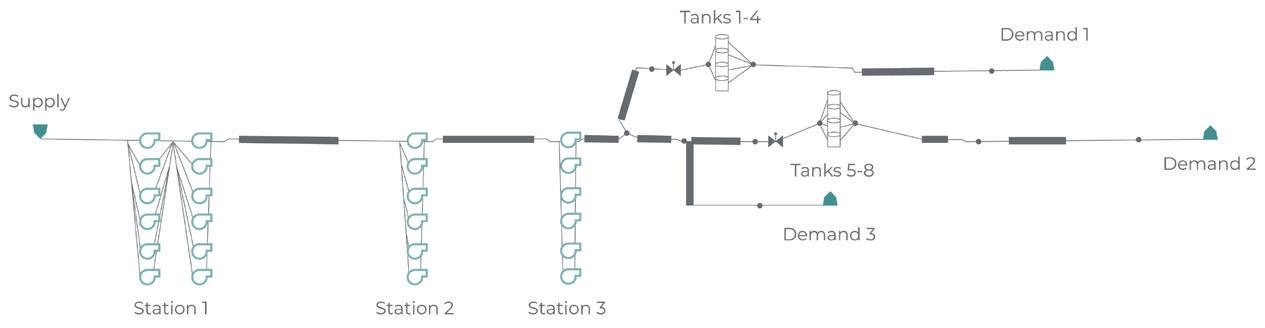

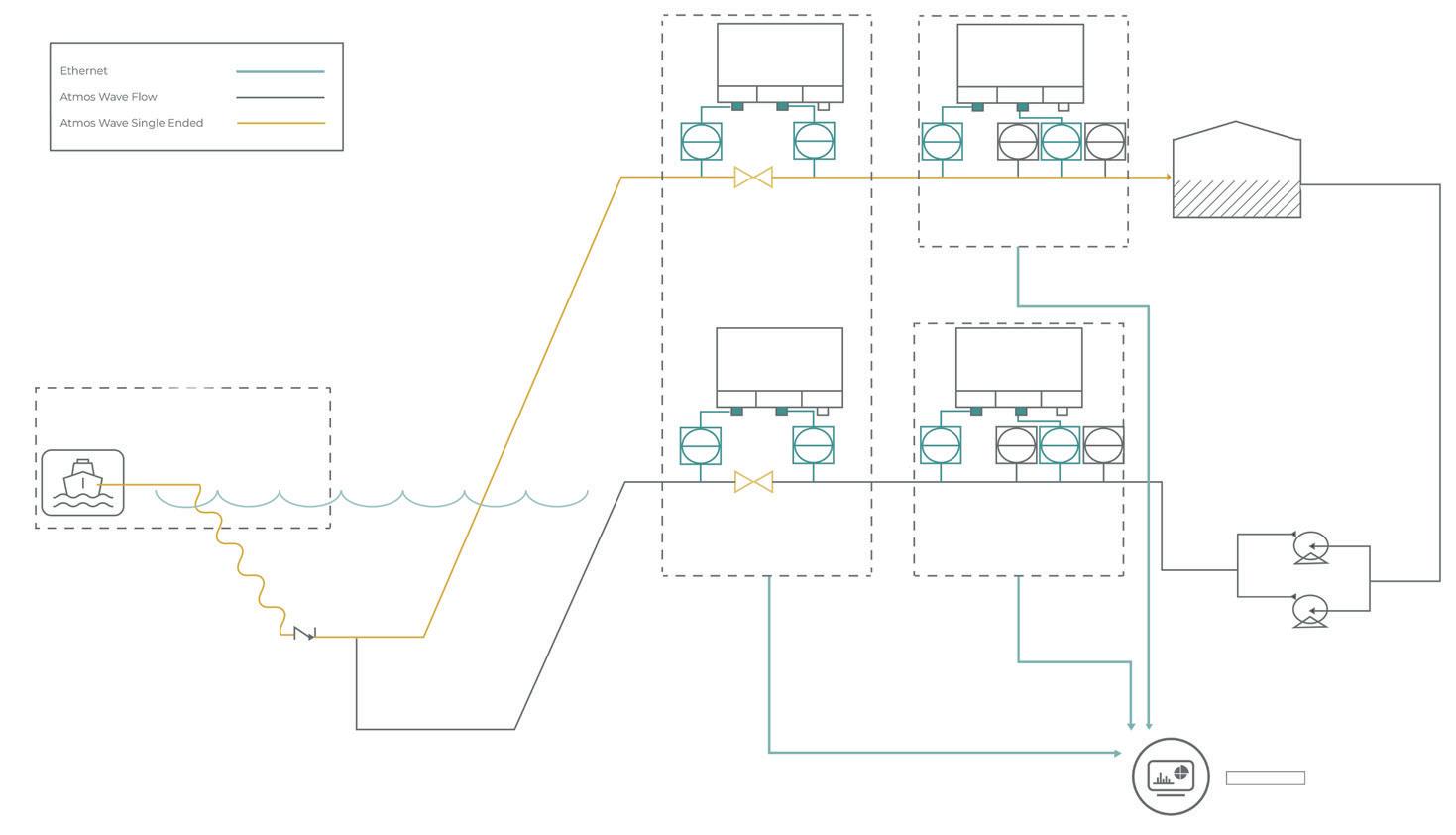

Harry Smith, Atmos International, UK, discusses how to improve storage operations with pipeline technology.

41 Ensuring safety and efficiency

Mark Naples, Umicore Coating Services, considers the benefits of infrared gas detection in the oil and gas storage sector.

45 A step change in risk reduction

Chris Platt, Re-Gen Robotics, discusses how the adoption of a robotic tank cleaning philosophy can significantly reduce safety risks

48 Industrial strength solution

Roger Simonsson, Aquajet, Sweden, explains the benefits of robotic hydrodemolition equipment for oil and gas tank cleaning.

53 Comprehending cybersecurity

Tim Gale, 1898 & Co., emphasises the importance of implementing an effective cybersecurity programme.

Eddyfi Technologies offers advanced non-destructive testing solutions designed to ensure the integrity and safety of tanks and vessels. From comprehensive ultrasonic inspections to state-of-the-art robotic systems, the company’s technology delivers precise, reliable data to meet rigorous inspection demands, securing storage across industries. Discover more at eddyfi.com.

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O’Reilly callum.oreilly@palladianpublications.com

EDITORIAL ASSISTANT Oliver Kleinschmidt oliver.kleinschmidt@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES MANAGER Will Powell will.powell@palladianpublications.com

SALES EXECUTIVE Ella Hopwood ella.hopwood@palladianpublications.com

PRODUCTION MANAGER Kyla Waller kyla.waller@palladianpublications.com

EVENTS MANAGER Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL CONTENT ASSISTANT Kristian Ilasko kristian.ilasko@palladianpublications.com

DIGITAL ADMINISTRATOR Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITOR Gordon Cope

SUBSCRIPTION RATES

Annual subscription £110 UK including postage /£125 overseas (postage airmail). Two year discounted rate £176 UK including postage/£200 overseas (postage airmail).

SUBSCRIPTION CLAIMS

Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

APPLICABLE ONLY TO USA & CANADA

Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032

15 South Street, Farnham, Surrey GU9 7QU, UK

Tel: +44 (0) 1252 718 999 Fax: +44 (0) 1252 718 992

CALLUM O’REILLY SENIOR EDITOR

As we approach the end of another summer here in the northern hemisphere, thoughts are turning to the darker (and colder) nights ahead (I have already spotted Christmas decorations in some of my local shops – in August!). Thankfully, there is little concern about the lights going out here in Europe during the winter 2024/25 season, as the continent sits in a comfortable position in terms of its energy storage. In its ‘Europe gas and LNG markets short-term outlook Q2 2024’ report, Wood Mackenzie forecasts that European gas storage will reach 100% by the end of September and remain full until the end of October.1 The data and analytics company expects an additional 4 million tpy of floating storage to also be accumulated.

The report states that low European demand for gas has kept storage levels at record highs this year, despite the fact that the continent has imported 11 million tpy less LNG through May 2024, compared to the same period in 2023. This lower demand depressed prices and pushed LNG into Asia, with imports to China up 22%. Wood Mackenzie anticipates an increase in gas demand of 7 billion m3 in 2025 compared to 2024, if there is a return to normal weather dynamics over the coming winter, and due to a strengthening macroeconomic outlook across Europe.

Wood Mackenzie expects Asia to absorb most of the new LNG that is coming online, although Europe is likely to import an extra 4.2 million tpy compared to 2024. More than 40 million tpy of LNG supply growth is expected in 2026, with Asian demand once again expected to account for a significant amount of this new supply, but Europe will absorb almost 20 million t of additional LNG in 2026, which will put downward pressure on prices.

This issue of Tanks & Terminals takes a deeper dive into Asia’s oil and gas storage sector. Contributing Editor, Ng Weng Hoong, guides us through the latest developments in the region, shining a spotlight on a number of countries including India, China, Singapore and Papua New Guinea. This issue also includes detailed technical articles and case studies on a number of interesting topics. Starting on p. 11, Trinity Consultants considers the implementation and ramifications of the US Environmental Protection Agency (EPA)’s finalised proposed revisions to emissions standards for the gasoline distribution industry. Other articles cover the importance of gas venting emissions treatment and vapour recovery technology, level measurement techniques, actuator maintenance, corrosion protection, pipeline technology, robotics, cybersecurity, and much more. I hope you enjoy this issue, and if you are picking up a copy at the AFPM Summit or the NISTM’s 17 th Annual National Aboveground Storage Tank Conference & Trade Show, I invite you to register for a free subscription to the magazine by scanning the QR code.

1. ‘Higher LNG prices to limit Asian demand and turbocharge European gas storage levels’, Wood Mackenzie, (12 June 2024), https://www.woodmac.com/press-releases/higher-lngprices-to-limit-asian-demand-and-turbocharge-european-gas-storage-levels/

At the Gate terminal in Rotterdam, the Netherlands, Uniper has become the first shipper to start using the BioLNG production capacity to convert biomethane into BioLNG. The underlying commodity is biogas produced in one of the EU member states, upgraded to biomethane to remove substances such as carbon dioxide, hydrogen sulfide and fed into the Dutch natural gas grid.

In its latest ‘Short-Term Energy Outlook’, the US Energy Information Administration (EIA) forecast that US working natural gas inventories will be 3954 billion ft3 by the end of October 2024, the most natural gas in US storage since November 2016.

Neste has commissioned terminal capacity at ONEOK’s terminal in Houston, Texas, US, for blending and storing Neste MY Sustainable Aviation FuelTM. The new capacity at ONEOK’s terminal provides Neste with storage capacity of up to 100 000 t (around 33.5 million gal.) and is directly connected to the energy pipeline infrastructure in the eastern part of the US.

GAS Entec, with its group company AG&P and local partners Issa Haddadin, have been awarded a contract to build the Sheikh Sabah Al-Ahmad Al-Jaber Al Sabah onshore regasification LNG terminal at Port of Aqaba in the Kingdom of Jordan. The project’s scope encompasses full engineering, procurement, construction, installation, and commissioning (EPCIC) of a 720 million ft3/d onshore LNG regasification facility, marine works, jetty topside work and other associated components.

To keep up-to-date with the latest news and developments in the storage sector, visit www.tanksterminals.com and follow us on our social media platforms

17 20 September 2024

07 10 October 2024

Storage Tank Conference & Expo Fort Lauderdale, Florida, USA events.api.org/2024-api-storage-tank-conference-expo

20 November 2024 Global Hydrogen Conference Virtual www.accelevents.com/e/ghc2024

10 12 December 2024 17th Annual National Aboveground Storage Tank Conference & Trade Show The Woodlands, Texas, USA www.nistm.org

11 12 March 2025 StocExpo Rotterdam, the Netherlands www.stocexpo.com

23 25 April 2025 27th Annual International Aboveground Storage Tank Conference & Trade Show Orlando, Florida, USA www.nistm.org

09 11 June 2025

ILTA 2025 International Operating Conference & Trade Show Houston, Texas, USA www.ilta.org/events-training

Ng Weng Hoong, Contributing Editor, contextualises the push for energy security and stockpiling in major Asian energy storage markets.

The International Energy Agency (IEA) has reiterated its prediction that global oil demand will peak by the end of the 2020s. But it is falling on deaf ears in Asia, with India and China continuing to invest in the entire oil supply chain covering exploration, production, refining, distribution, trading, and stockpiling. While the crude oil price has stabilised in the US$80/bbl range with no immediate threat to supply, India and China are beefing up their stockpiling capabilities as if to prepare for severe shortages in the coming years.

India will likely lead Asia’s expansion of liquid storage capacity over the next five years under the government of Prime Minister Narendra Modi which recently won re-election for a third term in office.

Between 2024 and 2028, India will add 22 million t of capacity to account for 42% of the region’s storage project start-ups, according to GlobalData. Furthermore, S&P Global suggests the Modi government will prioritise investment in the oil and gas sector to support the country’s economy and quest for energy security.

Oil storage and logistics will be priority projects, with the government responsible for 47% of the increase in India’s stockpiling capacity through the state-owned strategic petroleum reserves (SPRs), as suggested by GlobalData Analyst, Bhargavi Gandham. State agency ISPR Ltd (ISPRL) has been tasked to add 4 million t of capacity in Odisha state, 4 million t in Rajasthan, and 2.5 million t in Karnataka under the second phase of the SPR expansion programme.

Located in Chandikhol town, the US$1.1 billion Odisha terminal will be the country’s largest and most sophisticated after its slated start up in 2028. The terminal will be located 85 km from the north-eastern deep-water port of Paradip.

A proposed inland terminal at Bikaner town in Rajasthan, located 465 km from the India-Pakistan border, will be India’s fourth official crude oil storage site. State-owned Engineers India Ltd (EIL) has enlisted a German firm to help build a salt-cavern facility in the hilly rocky geology of the country’s arid north-western state.

While the idea of storing oil in man-made caverns has been around for decades, India lacks the technology to extract salts embedded in the rocks to eliminate the risk of fuel contamination. At the same time, engineers must ensure the caverns are completely stabilised after the salts are removed.

The world’s third largest oil consuming country is also building its first commercial crude

stockpiling terminal in Padur in Karnataka, located near ISPRL’s existing SPR facility. The underground rock cavern will be served by a dedicated single-point moor, and a set of onshore and offshore pipelines to be constructed on a budget of Rs.55.1 billion (US$1 = Rs.84).

While India has made progress in its stockpiling efforts, it is still a long way from meeting international standards for achieving energy security.

In a special report in early 2024, the IEA praised the Indian government for planning to bolster its SPR while promoting biofuels and energy efficiency measures to reduce domestic oil use and imports.

But the Paris-based agency is also urging India to hasten the pace of oil stockpiling to meet the international standard of 90 days of imports. It wants the Modi government to do more to prepare for “possible oil supply disruptions by implementing and strengthening its SPR programmes and improve its oil industry’s readiness.”

India had oil stocks to cover just 66 days of imports at the start of 2024, said the agency. This includes 26 million bbl stored in ISPRL sites and 218 million bbl in privately-owned terminals. India’s stockpiling efforts are not keeping pace with the rapid growth of its 5.6 million bbl/d market. The IEA projects the country’s oil consumption to rise by 1 million bpd over the next six years to 2030.

In response, the Modi government could ask Indian refineries to set up strategic sites to stockpile up to three days of net imports at up to six different locations.

“This could rapidly boost India’s overall strategic oil stock holdings by between 10 – 18 days of imports,” said the IEA.

India established the ISPRL in 2005 to launch the country’s strategic stockpiling programme. The first phase was completed with the construction of a total of 5.33 million t of storage capacity in 2018. The tanks are in the ports of Visakhapatnam (1.33 million t) on the south-eastern state of Andhra Pradesh, and in Mangaluru (1.5 million t) and Padur (2.5 million t), both in Karnataka on the west coast.

India is seeking to join the IEA, which wants members to comply with its 90-day stockpiling guideline.

Meanwhile, China has issued an unexpected order for state-owned firms to add 8 million t

(58.8 million bbl) of crude to their strategic stockpiles from July to March 2025, said oil and gas intelligence provider Vortexa. This translates to approximately 220 000 bpd of additional crude demand, equal to about 2% of China’s seaborne imports, said Vortexa’s Senior Analyst Emma Li. The additional buying is expected to be shared by the country’s leading state companies – China National Petroleum Corp. (CNPC), Sinopec, China National Offshore Oil Corp. (CNOOC), Sinochem, and Zhenhua Oil.

China’s stockpiling appears to have picked up recently after a lull from late 2023 to mid-May 2024. In June, its onshore crude inventories built “a moderate 8 million bbl month-on-month to 954 million bbl,” said Li.

By end-June, PetroChina, Sinopec, CNOOC, and Sinochem, informally known as the ‘Big Four’, had stockpiled a total of 665 million bbl of crude oil in aboveground oil tanks to add to the 100 – 110 million bbl in underground reserves.

According to Vortexa’s estimate, the combined tank utilisation rate has recently exceeded 60%, suggesting the companies have room to restock in the July-to-March window.

Until Beijing’s latest stockpiling order, China’s slowing oil demand was weighing on its crude buying.

“The stock build rate dropped from 1.2 million bpd to less than 150 000 bpd in the second half of May, as crude imports slowed by 1.1 million bpd in the three consecutive weeks ending on 2 June, compared to the preceding three weeks,” wrote analyst Li.

China’s onshore crude inventories rose throughout May, but the stockpile buying lasted just four weeks, compared to the typical duration of 10 – 14 weeks in previous years.

Crude demand remains weak as refiners have reduced throughput, reflecting the country’s slowing demand for refined products. This is linked to the state of China’s economy which has become a subject of speculation given the lack of reliable information flow. Beijing reported that the economy grew by 5.3% in the 1Q24, exceeding its targeted growth of 5% as well as the average 4.6% expectations of analysts polled by Reuters.

The Chinese government has been boosting spending and talking up the country’s economic prospects, but consumer confidence remains weak and foreign investors have been heading for the exit while the real estate and technology sectors are mired in gloom.

The oil markets are not supporting Beijing’s narrative that the economy is fully recovering. According to Vortexa’s calculations, China’s implied refinery runs have declined for the third straight month to 14.5 million bpd in May, marking a year-on-year contraction for four consecutive months.

“This suggests that current run cuts are deeper than the scheduled capacity offline for turnarounds, and post-maintenance crude demand is unlikely to rebound to last year’s [2023] levels in the coming months,” observed Li.

Significantly, China’s three largest refiners, Sinopec, PetroChina and CNOOC, slowed down their stockpiling of crude in 2023. While adding a total of more than 120 million bbl of tank storage capacity, they increased crude stockpiles by only 85 million bbl at the end of 2023.

In February 2024, CNOOC added a crude oil reserve storage base in the coastal city of Dongying in eastern Shandong province alongside tanks that have long supported offshore production. The new tank farm has been receiving Russia Far East’s Eastern Siberia Pacific Ocean (ESPO) crude blend, reaching a record 910 000 bpd in March, said Vortexa. According to Chinese state media, the new farm comprises 50 crude oil tanks with a combined capacity to store 4.25 million t of crude oil. Located on a 1.2 million m² site, it has direct access to the Bohai Sea, the main source of China’s domestic offshore oil production.

Connected by pipelines to the offshore oilfields, the expanded terminal will store and distribute the crude to nearby refineries. CNOOC plans to more than triple the terminal’s capacity to 15 million t at a cost of CN¥20 billion (US$1 = CN¥7.25).

The company is also investing CN¥3 billion to build an underground commercial oil terminal in Ningbo port in Zhejiang province. When completed in 2026, the Daxie terminal will have the capacity to store 3 million m³ of crude oil for distribution to nearby refineries.

Singapore may have to reckon with how much more oil, gas, and chemicals it can store, trade, blend, and ship on its increasingly congested waterways.

With little room to increase land-based storage capacity, Singapore’s traders have been expanding their oil and gas trading and supply activities in the waters around the Southeast Asian island state since the turn of the century.

Now, even the waterways are feeling the strain of runaway growth. On 14 June, some 400 t of oil spilled after an accident involving a Dutch dredging boat and a stationary bunker tanker off southern Singapore. Residents and tourists in the polluted parts of the island’s beaches and coastal waters experienced breathing difficulties while businesses complained they suffered heavy losses. The government stated the island’s farmed fish and water supply remained safe for consumption even as it denied that the incident was the result of port congestion.

Coming on the back of another year of record shipping and bunker activity in Singapore, the industry has been eyeing opportunities for storage expansion. But it also raises the risk of more shipping accidents and liquid spillages.

Early in 2024, Vopak announced its plans to expand its range of services in Singapore. In March, it signed an agreement with Air Liquide to develop and operate infrastructure for serving the ammonia and hydrogen trade. The companies stated that they will explore the potential joint development of ammonia cracking, storage, and handling infrastructure at Vopak’s Banyan terminal, and the distribution of low-carbon hydrogen through a hydrogen pipeline network.

Located on Jurong Island, Vopak Banyan is an integrated oil, chemical, and gas hybrid storage terminal. Its 112 tanks have a total storage capacity of 1 452 163 million m³.

In February, Vopak announced the commissioning of 40 000 m³ of storage capacity at its Sebarok terminal for blending biofuels into marine fuels. The company said it converted the terminal’s existing pipeline system to specially

ZEECO® ViZionTM remotely measures, monitors, and controls flare performance to achieve 98% DRE or better. Approved by the EPA for measuring and quantifying NHVdil and NHVcz parameters – ViZion complies with OOOOb/c and AP 42 regulations utilizing simplified video imaging spectro-radiometry (VISR) technology. Because ViZion directly verifies the flare flame and heat release, there is no need for pilot flame confirmation, calorimeters, gas chromatography, mass spectroscopy, or canister sampling. Zeeco – Redefining Flare Monitoring and Control.

handle biofuel blending. Sebarok is located close to the eastern anchorage, where much of Singapore’s bunkering activity takes place.

Vopak said its decision to venture into biofuels storage and blending in Singapore came at the end of a two-year trial to provide the service in response to rising demand. It said it could ‘repurpose’ part of the terminal’s 1 339 579 m³ capacity to support the biofuels trade.

Rob Boudestijn, the company’s President in Singapore, said: “Our vision for the Sebarok terminal is to be a sustainable multi-fuels hub to strengthen Singapore’s position as the top bunkering hub. As a storage and critical infrastructure services provider, this development can facilitate the entry of more biofuels companies to diversify the supply chain for marine biofuels and accelerate the decarbonisation of the shipping industry.”

Another global trading and storage player, Vitol, has taken delivery of its first barge in Singapore dedicated to storing and transporting biofuels for bunker use. The barge is equipped to store and supply biofuel blends of grades ranging from B24, B30 to B100.

Biofuels are being touted as a solution to reduce greenhouse emissions in the shipping industry. Citing the Maritime and Port Authority of Singapore (MPA), Vitol said biofuel sales in Singapore reached 520 000 t in 2023, compared with 140 000 t in 2022.

Papua New Guinea has been seeking investments in oil refining and storage facilities to help solve its multi-year fuel supply crisis that is threatening the country’s political stability and economic prospects.

Prime Minister James Marape believes the projects will create jobs and boost the economy while improving fuel supply security for the nation’s 26 million people living on some 600 islands across the Pacific Ocean.

Acute fuel shortages over the past 18 months have contributed to the economy’s sharp slowdown and rising inflation that led to deadly riots in several cities including the capital of Port Moresby in January. At least 22 people were killed.

In March, Marape and Petroleum Minister Jimmy Maladina flew to Singapore to meet oil executives from Chinese state firms Sinopec and Petro China.

“We are in initial discussions with reputable global fuel traders who are in the business of refining fuel, bunkering, and retail distribution. Papua New Guinea can be a strategic hub to supply the Pacific,” said Marape.

“We want to open the market and remove monopoly. The government’s role is to ensure that the country gets the correct price, quality and reliability into the future to avoid the predicament we are experiencing with Puma Energy.”

Singapore-based Puma Energy, which has a near monopoly of Papua New Guinea’s downstream oil markets, has been at loggerheads with the government over the fuel supply crisis that has severely disrupted transportation services across the country. The frequent disruption to vital air links between the islands has led to shortages of goods and services.

The government has been pushing for greater fuel supply competition that could see increased participation from

Chinese and American companies. Marape believes their involvement could also turn his country into an oil refining and storage hub to serve the economies of the islands in the Pacific Ocean.

ExxonMobil has emerged as a key player, with Marape personally thanking the company’s Singapore operations for providing emergency supplies over the past year.

In May, Mobil Oil Guinea, a subsidiary of ExxonMobil, commissioned a new 3.5 million l storage tank at its Idubada terminal in Port Moresby to increase fuel imports from Singapore. The PGK10 million tank’s launch has had an immediate impact in easing the country’s supply shortages of gasoline, diesel and jet fuel (US$1 = PGK3.85).

While Papua New Guinea’s fuel crisis is far from over, the government will be heartened by Mobil Oil Guinea’s decision to expand the Idubada terminal as part of an PGK80 million investment programme.

BW LPG has been aiming for growth in Asia on the back of its first venture in fuel import and storage in India, a secondary listing on the New York Stock Exchange, and the relocation of its headquarters to Singapore.

The Oslo, Norway-listed company, the world’s leading owner and operator of LPG vessels, has begun implementing a multi-pronged strategy to tap into India’s growing demand for the fuel.

In November 2023, it paid US$30 million for an 8.5% stake in Confidence Petroleum India Ltd, an LPG company with exposure to India’s industrial, automobile, and domestic retail sectors.

The two companies also agreed to establish an equal joint venture, BW Confidence Enterprise Private Ltd, to explore investment opportunities in onshore infrastructure in India to store and import LPG. Based in Mumbai, BW Enterprise will collaborate with BW LPG’s trading division and its India subsidiary, BW Product Services, and BW LPG India to source and import LPG to meet the country’s growing fuel demand.

Separately, BW LPG also announced that it had invested US$10 million to jointly develop and operate a new LPG onshore import terminal at Mumbai’s Jawaharlal Nehru Port Association (JNPA) Port with Ganesh Benzoplast, a Mumbai storage tank builder and operator. The Norwegian firm will be represented by BW Confidence which will hold a 55% stake in a cryogenic LPG storage terminal facility currently being developed at JNPA’s facility.

Due to start up in 2026, the terminal will be equipped to fully offload the latest fourth-generation very large gas carriers (VLGC) of 93 000 m³ capacity in a single discharge operation. The partners are planning to link the terminal to the Uran Chakan pipeline to ensure competitive and efficient supply of LPG into India.

India is the world’s second largest LPG consumer with the potential for rapid growth with the support of improved infrastructure to import, store and distribute the fuel. BW LPG will be better positioned to service India from its new headquarters in Singapore following relocation from Bermuda. The company will also have improved access to funding following its listing on the NYSE in April to tap the world’s largest capital markets.

Harold Laurence, Trinity Consultants Inc., USA, discusses the implementation and ramifications of the US EPA’s finalised proposed revisions to emission standards for the gasoline distribution industry.

On 8 May 2024, the US Environmental Protection Agency (EPA) finalised proposed revisions to emission standards for the gasoline distribution industry.¹ The final rules became effective on 8 July 2024.² These standards affect storage tanks, loading racks, and equipment components at thousands of gasoline distribution terminals, bulk plants, pipelines, and refinery logistics assets.³ The revisions include several important increases in stringency, such as lower numeric emission limits, additional monitoring, and shorter averaging periods.

Most standards and requirements of the final rules follow the rules proposed on 10 June 2022. Compared with the proposed rules, the final rules provided additional flexibility on certain matters. The EPA provided alternative, flare-like monitoring provisions for vapour combustion units (VCUs) in each rule;4 loosened the inspection schedule for internal floating roof (IFR) tank lower explosive limit (LEL) enhanced monitoring;5 and provided a continuous emission monitoring system (CEMS) downtime option for vapour recovery units (VRUs).6 The EPA clarified that methane may be excluded when measuring emissions to compare with the standards for loading racks.7 The EPA also separated the applicability of equipment leak detection and repair (LDAR) standards from the applicability of standards for loading operations.8 Under the final rule, projects that increase fugitive emissions from rack equipment (pumps, valves, etc.) without increasing emissions from loading operations would not subject those loading operations to new standards.9

On the other hand, the EPA markedly increased monitoring stringency for VCUs, for open flares, and thus also for VCUs that choose to rely on the final rules’ open

flare monitoring parameters. To comply with the final rule, operators must know the prior loads of each loaded cargo compartment: an unworkable requirement for many terminals. If unworkable, the terminal must treat vapours from every loaded compartment as though they are gasoline.10 If the terminal controls vapours with a VCU, the terminal must maintain high temperature or vapour net heating value (NHV) through the addition of substantial volumes of assist gas.11 Increased emissions of combustion pollutants and substantially increased operational costs are likely outcomes of the final rule.

The EPA has regulated volatile organic compound (VOC) emissions from the gasoline distribution sector under its new source performance standards (NSPS) regulatory programme (40 CFR Part 60) since the 1983 promulgation of ‘Standards of Performance for Bulk Gasoline Terminals,’ 40 CFR Part 60, Subpart XX.12 The NSPS required most gasoline truck loading racks built or modified between 17 December 1980 and 10 June 2022 to meet an emission standard of 35 mg/l total organic compounds (TOC) of gasoline loaded (mg/l TOC).13 The NSPS required monthly monitoring of loading rack equipment for leaks, by audio, visual, and olfactory (AVO), or put more simply, sight/sound/smell means.14 NSPS XX also introduced vapour tightness requirements for gasoline tank trucks.15

In 1994, the EPA promulgated an emission standard regulating hazardous air pollutant (HAP) emissions from HAP major source gasoline terminals and pipeline breakout stations: ‘National Emission Standards for Gasoline Distribution Facilities (Bulk Gasoline Terminals and Pipeline Breakout Stations),’ 40 CFR Part 63, Subpart R (Subpart R).16

This subpart required gasoline truck and rail loading racks to meet 10 mg/l TOC.17 Subpart R required gasoline storage vessels to install an IFR meeting most requirements of 40 CFR Part 60, Subpart Kb,18 and to retrofit certain deck fittings on existing gasoline storage vessels with external floating roofs (EFRs).19

Subpart R required monthly AVO leak inspections, but the scope included all gasoline-service equipment at the terminal or breakout station.

Subpart R only affected larger terminals and breakout stations, those that met the EPA’s HAP major source threshold. By 1999, the EPA had indicated its intent to regulate gasoline distribution facilities that did not rise to the HAP major source threshold – such sources are known as ‘area sources’ of HAP.20

In 2008, the EPA promulgated 'National Emission Standards for Hazardous Air Pollutants for Source Category: Gasoline Distribution Bulk Terminals, Bulk Plants, and Pipeline Facilities,'

40 CFR Part 63, Subpart BBBBBB (Subpart 6B).21 Subpart 6B contained different sets of requirements for four source categories: bulk gasoline terminals, bulk gasoline plants (a throughput of less than 20 000 gal./d), pipeline pump stations, and pipeline breakout stations.

The EPA is required to review NSPS, such as 40 CFR Part 60, Subpart XX, and National Emission Standards for Hazardous Air Pollutants (NESHAP), such as 40 CFR Part 63, Subparts R and 6B, at least every eight years.22 If needed, the EPA must revise the subparts to reflect the best demonstrated system of emission reduction (for NSPS) or to take developments in control technology into account (for NESHAP, a ‘technology review’). Table 1 presents the EPA’s key revisions of the three subparts as they apply to bulk terminals. The EPA adopted new or more

Table 1. Selected 2024 final rule changes from 2022 Proposed Rule for Subpart XXa and Subparts R and 6B, for equipment at bulk gasoline terminals, pipeline pump stations, and pipeline breakout stations

Affected source type

Vapour combustion units (VCUs)b

XX, XXa XX: 35 mg/l TOC for truck racks new/modified after 17 December 1980

80 mg/l existing 6 hr average

Vapour recovery units (VRUs)c

Open flares on loading racksd

• 1 mg/l TOC for new racks. 3 hr average

• 10 mg/l for modified/ reconstructed racks. 3 hr average

R 10 mg/l TOC. 6 hr average 10 mg/l TOC. 3 hr average

6B 80 mg/l TOC for racks > 250 000 gal./d. 6 hr average

XX, XXa Same as VCUs

35 mg/l TOC for racks > 250 000 gal./d. 3 hr average

• 550 ppmv TOC as propane. 3 hr average at new racks

• 5500 ppmv for modified/ reconstructed racks

R 5500 ppmv TOC as propane. 3 hr average

6B 19 200 ppmv TOC as propane. 3 hr average

XX/XXa, R, 6B

General flare standards:

§60.18 (XX) or §63.11(b) (R, 6B)

Gasoline storage tanks subject to Subpart R or 6B standardse R, 6B IFR or EFR

• See subparts for rim seal and deck fitting requirements

XXa: no flares allowed for new racks Racks modified or reconstructed in XXa, or subject to R or 6B, may meet refinery flare rules at § 63.670(b)

• EFR tanks’ deck fittings must fully meet Part 60, Subpart Kb

• IFR tanks must conduct LEL monitoring during annual inspections. LEL threshold is 25%, 5 minute average. LEL data to be collected every 15 sec. for at least 20 minutes

Methane may be excluded from measured TOC in all subparts. Monitoring NHV and NHVdil as though the unit is an open flare was added as an option under all subparts.

Equipment in gasoline servicef (also applies to bulk plants under 6B)

XX/XXa, R, 6B

Monthly AVO leak inspection, with leaks repaired

Method 21 leak monitoring or optical gas imaging

10 000 ppm leak definition for Method 21

• XXa: Quarterly

• R: Semiannual

• 6B: Annual

Methane may be excluded from measured TOC in all subparts. Clarity added, that the rules do not prohibit purge air.

240 hr/yr CEMS downtime alternative added, but the option limits throughput and relies heavily on activity in 10 regen cycles preceding the downtime.

Final rule added requirements to track gasoline load ratio, and gasoline load rate for air-assisted flares, to prevent overdilution.

Flare tip velocity monitoring reduced to a one-time assessment.

LEL required annually, but not necessarily at the same time as a visual inspection. Wind speed limitation of 10 mph revised; OK to use 15 mph if not practicable to make timely measurement during < 5 mph.

Separate XXa affected facility 'collection of equipment' definition. Modifying ‘equipment’ and beginning LDAR does not mean modifying the ‘loading rack’ and applying new mg/l or ppm standards, and vice versa.

a. Subpart XX requirements are not revised in the present rulemaking. Existing loading racks would comply with Subpart XXa after they are modified or reconstructed, and Subpart XX until then.

b. Current: §§ 60.502(a)-(b), 63.422(b), Subpart 6B Table 2 Item 1. New final: §§ 60.502a(b)(1), (c)(1), 63.422(b)(2), Subpart 6B Table 3 Item 1.

c. Current: same as VCU. New final: §§ 60.502a(b)(2), (c)(2), Subpart 6B Table 3 Item 3.

d. Distinct from VCUs. Current: §§ 60.503(e), 63.425(a)(2), 63.11092(a)(4). New final: §§ 60.502a(c)(3), Subpart 6B Table 3 Item 2.

e. Under Part 63, Subparts R and 6B, tanks < 75 m3 (19 800 gal.) are exempt. Under Subpart 6B only, tanks from 75 to 151 m3 (19 800 to 39 800 gal.) are also exempt, if the tank’s throughput is 480 gal./d (annual average) or less. Current rules: §63.423(a)-(b); Subpart 6B Table 1 Item 2. New final: §§ 63.423(c), 63.425(j), Subpart 6B Table 1 Item 2.

f. Current: §§ 60.502(j), 63.424, 63.11086(c), 63.11089; New final: §§ 60.502a(j), 63.424(c), 63.11089.

Strategically located petroleum bulk storage facility. The only deep water platform (64’ operating draft) on the U.S. East Coast

• 20 storage tanks 80 miles East of New York Harbor

• The only deep-water loading/ unloading platform on the U.S. East Coast.

• Total Storage Capacity of 5 Million Barrels

• Easy reloading for distribution of product to U.S., Canada and Europe

(631) 284-2010

stringent requirements for gasoline storage tanks, gasoline loading racks, and gasoline-service equipment. Also, the testing thresholds to determine whether a gasoline cargo tank is vapour-tight are revised.

The Clean Air Act specifies a three-year timeframe to reach compliance with revised Part 63 rules, so existing terminals must comply with the Subparts R and 6B changes before 8 May 2027.23 Performance tests for VCUs and initial performance evaluations for VRUs must be complete before that date. New terminals must comply upon start-up. By contrast, when Part 60 (NSPS) rules are revised, existing facilities come into compliance with the new rule only after the first time they are modified, or reconstructed, after the date on which the rule is proposed. As a summary, most changes to a facility that cause emissions to increase are considered a ‘modification,’ and most changes that cost more than 50% of the cost of an equivalent new facility are considered a ‘reconstruction.’24 There may therefore be some loading racks that are already subject to Subpart XXa, either to the loading rack standards or to the LDAR standards, due to having ‘modified’ or ‘reconstructed’ the loading rack or the gasoline-service equipment since 10 June 2022. Going forward, terminal operators should carefully consider the effects and schedules of capital projects affecting their loading racks, to assess if those projects will cause the racks to be subject to Subpart XXa’s stringent new standards.

Certain aspects of the revisions to 40 CFR Part 60, Subpart XX and 40 CFR Part 63, Subpart 6B merit further discussion.

Each of the final rules includes an LDAR instrument monitoring programme to detect leaks from equipment in gasoline service. None of the current rules for gasoline distribution facilities require instrument monitoring. An LDAR programme may apply already if an existing terminal’s project added equipment in gasoline service since 10 June 2022. At present, it is possible to interpret the rule to mean that it applies after addition of any de minimis number of valves or flanges to an existing gasoline terminal.25 Apart from ‘modifying’ or ‘reconstructing’ the collection of gasoline-service equipment under Subpart XXa, LDAR will apply to the equipment from 8 May 2027 under the other two subparts. The three subparts only differ in frequency of monitoring, as shown in Table 1.

The required programme includes two options. One option is to use EPA Method 21 to detect leaks, as is common at petroleum refineries or chemical plants. The other option is to use optical gas imaging (OGI) to detect leaks. OGI technology creates images of hydrocarbon gases, such as gasoline vapours. Both programmes require specialised equipment, as well as a detailed inventory of components in gasoline service.

First-time implementation of an instrument monitoring LDAR programme requires advance consideration of several factors, especially for terminals in remote locations. Inspection logs required under current rules must be replaced with detailed, individually identified components. A compliance tool must be developed or purchased to record component identifiers and monitoring results. A decision must also be made between selecting a contractor or training a terminal’s staff to provide routine monitoring. This decision would consider the availability of contractors and of monitoring equipment.

The final rules make substantial revisions to emission standards for loading racks and associated vapour control systems at gasoline distribution facilities, as Table 1 illustrates. Key changes include:

n Lower standards for many VCUs, regulated as ‘thermal oxidation systems’: emission standards for VCUs decrease under Subpart XXa and Subpart 6B. The current Subpart 6B specifies that bulk gasoline terminal loading racks with gasoline throughput of 250 000 gal./d or greater must reduce the emissions of TOC to less than or equal to 80 mg/l TOC.26 This standard will be reduced to 35 mg/l TOC. VCUs at loading racks under the new Subpart XXa must meet emission standards of 1 mg/l TOC (new loading rack) or 10 mg/l TOC (modified or reconstructed loading rack), compared with a prior Subpart XX standard of 35 mg/l TOC. The Subpart R standard of 10 mg/l TOC is unchanged.

n More stringent monitoring requirements for VCUs: in the section to follow, details of new VCU monitoring requirements are explained.

n Open flare standards: achieve at least 98% reduction in emissions of TOC by weight, and demonstrate this reduction using rules pulled from the refinery flare rules to Subpart XXa.27

n Vapour recovery system: when complying with any subpart using a VRU, emission standards are now expressed as parts per million by volume (ppmv) as propane, determined on a three-hour rolling average. Since prior subparts relied on a six-hour averaging period for performance testing, existing units should be assessed for suitability under a three-hour rolling average standard.

Monitoring a VCU for compliance with the new rules is perhaps their most challenging compliance aspect. While some VCUs were required to monitor firebox temperature under the pre-2024 Subpart R rule, most VCUs were regulated under the pre-2024 subpart 6B rule. This rule provided monitoring the presence of a pilot flame as an alternative to measuring the firebox temperature.28 Gasoline vapours readily combust in the presence of a flame.

Under the final rules, monitoring requirements for VCUs become much more restrictive. New loading racks built since 10 June 2022 will be subject to Part 60, Subpart XXa and must continuously monitor temperature.29 Loading racks subject to Subpart XXa due to modification or reconstruction after that date, as well as racks subject to Part 63, Subpart 6B and complying by 2027, have an additional option to monitor the NHV of the gases fed to the VCU.30 Such racks would follow rules for open flares at petroleum refineries in several respects.31 These monitoring options are challenging because each option is likely to result in substantial use of assist gas. For the temperature monitoring method, the final rules require determining a VCU temperature set point at the lowest three-hour average temperature during the emission performance test of the unit.32 By rule, the performance test involves a minimum amount of gasoline loaded.33 As gasoline vapours release heat when combusted, the performance test

VOL storage emissions standards are set to change in September 2024.

The market-leading, desktop-based program, that uses emission estimation procedures from AP-42 Chapter 7 to calculate emissions from floating- and fixed-roof tanks.

BREEZE ESP+

Highly-anticipated, cloud-based solution including all TankESP capabilities plus ability to calculate emissions from:

f Catch Pans

f Combustion Units

f Control Devices

f Equipment Leaks

f Line/Vessel Openings

f Loading Operations

f Sumps/Oil-Water Separators

f Vacuum Trucks

Now is the time to prepare for the proposed NSPS changes by investing in tank emissions calculations software today.

When it comes to tank emissions calculations, we have you covered!

time period naturally has bias toward higher temperature than time periods when gasoline and non-gasoline load rates vary with demand. In supporting documents to the final rule, the EPA asserts that during periods of lower temperature, the VCU may be operating in an overdilute manner, reducing its emission control effectiveness.34 In comments on the 2022 rule proposal, industry trade associations asserted that in fact, VCUs maintain high effectiveness at lower temperatures than would be expected during the emission performance test.35 In the final rule, the EPA retained the requirement to set a three-hour average temperature during the test. Therefore, terminals are obliged to maintain this temperature whenever gasoline is loaded. In that many terminals are not able to certify the prior load contents of a given truck’s cargo compartments, this requirement will apply to diesel loading. Accordingly, compliance will require substantial auxiliary fuel.

Some facilities use a VCU as a backup vapour control system to their primary vapour recovery system for when the primary vapour control system is down. If the backup VCU is required to combust additional auxiliary fuel to maintain the firebox temperature, operation of the backup vapour control system may become cost-prohibitive.

The EPA believes that small terminals, for which this requirement is cost-prohibitive, will elect the alternative option, to monitor the NHV and ‘dilution parameter’ (NHVdil) of the VCU.36 The rules require continuous compliance demonstration, either through continuous online assessment of waste vapour composition or NHV, or through continuously tracking the loading rack’s gasoline loading rate and gasoline-to-non-gasoline loading ratio.37 The EPA thereby requires terminals to demonstrate that waste vapours to the VCU maintain an NHV of 270 Btu/ft³, and NHVdil of 22 Btu/ft². Similar to the temperature option, these requirements require substantial use of assist gas if non-gasoline loading operations must be treated as gasoline loading due to unavailable information on prior truck loads.

Facility operators should begin to develop their compliance approaches for VCUs, whether serving as primary or backup controls. From the more limited options available in the rules, facilities should select a vapour control and compliance demonstration approach that achieves compliance in a cost-effective manner.

The final rules also reduce the duration of averaging periods for loading rack emission control devices, creating another potential challenge for facilities subject to the revised rules. For a thermal oxidation system other than a flare, the EPA requires that combustion zone temperature be maintained at or above the level determined during the performance test on a three-hour rolling average basis.38 Similarly, the EPA is finalising a three-hour rolling average monitoring period for the ppmv emission standards for vapour recovery systems. Prior to this rulemaking, the averaging period for performance testing for either type of control device was six hours.39 Changing from a six-hour to a three-hour rolling average impacts the perceived effectiveness of control devices.

In a VCU, actual firebox temperature is related to the volume of gasoline vapours combusted at a given time. At most facilities, loading activities do not occur at a uniform rate throughout the

day but are, rather, characterised by periods of higher gasoline demand followed by periods of lower gasoline demand. Decreasing the window for a rolling average temperature parameter, from six hours to three hours, means greater variability in the VCU temperature. Rises and falls in temperature due to varying gasoline vapour generation rates do not correlate with VCU effectiveness. However, operators now have a compliance need to stay above the required temperature minimum. This need might be met by adding assist gas, shortening periods of higher loading rates, or smoothing periods of peak and low demand. This compliance need could result in more waiting time for tank trucks or delays for delivering gasoline to customers.

In vapour recovery systems, a limit expressed as ppmv on a three-hour basis is more stringent than the same limit expressed on a six-hour basis. Facilities’ existing vapour recovery systems may need to be redesigned to be able to accommodate the final emission limits on a three-hour rolling average basis.

In the final rule, the EPA provided an alternative monitoring option for VRUs, for up to 240 hr/yr in periods when the VRU continuous emission monitoring system (CEMS) is offline for more than 15 minutes.40 The alternative involves establishing the quantity of liquid loaded, vacuum pressure, purge gas quantity, and duration of vacuum/purge cycle length over the prior 10 regeneration cycles of the VRU, and using these values as monitored operating parameter values during periods of CEMS downtime. In practice, the option is likely not workable for many terminals. The option would limit gasoline loading throughput, while the option is in use, to the minimum throughput in the past 10 regeneration cycles of the VRU. As that minimum throughput may be zero, the option is unpredictably unavailable in practice. The option may also impose unworkable values for the monitored parameters, as VRUs use CEMS data to tailor actual cycle length and operations when CEMS data is available. And, it is not typically necessary for a VRU to measure purge gas quantity for operations, so information on purge gas quantity is likely not available to most terminals. For these reasons, terminals should carefully examine whether the alternative monitoring option for VRUs is workable.

The EPA has finalised key changes to air emission standards for the gasoline distribution industry. The revisions include instrument monitoring LDAR requirements, revised monitoring requirements for storage vessels, and substantial changes to emission standards and compliance demonstration methods for loading racks. The new standards may require affected facilities to undertake capital projects, to implement new compliance demonstration programmes, or to conduct internal feasibility studies for compliance planning purposes. Gasoline distribution facilities should begin developing compliance strategies for the revised rules, especially as NSPS Subpart XXa rules apply to facilities modified after 10 June 2022.

Note

For a full list of references, please visit: www.tanksterminals.com/product-news/01072024/ final-revisions-to-industry-air-regulations--references

Bernat Sala, Tecam, Spain, explores the necessity of gas venting emissions treatment and vapour recovery technology in tank storage terminals.

Tank terminals are critical nodes in the global supply chain for hydrocarbons and other bulk liquids. These facilities are responsible for the storage and transfer of vast quantities of hydrocarbons, containing volatile organic compounds (VOCs), which can lead to significant environmental challenges if not properly managed.

Emissions from tank terminals can contribute to air pollution, pose health risks, and lead to regulatory non-compliance. To address these challenges, emission treatment technologies and vapour recovery units (VRUs) have become essential for tank terminal operations.

Tank terminals face several environmental challenges due to the nature of the substances they store. Hydrocarbons, for instance, are highly volatile and can easily vaporise into the atmosphere, leading to VOC emissions. These emissions are not only harmful to the environment but can also present significant health risks to workers and nearby communities. Furthermore, the release of VOCs can result in substantial economic losses due to the evaporation of valuable products.

The primary sources of emissions at tank terminals include:

n Tank breathing: the natural evaporation of liquids during storage, particularly when temperatures fluctuate.

n Tank filling and emptying: the displacement of vapours as tanks are filled or emptied.

n Loading and unloading operations: the transfer of liquids between storage tanks and transport vehicles.

Emissions treatment technology plays a crucial role in mitigating the environmental impact of tank terminals. These technologies are designed to capture, control, and eliminate the emissions so that they are not released into the atmosphere.

Some of the key emissions treatment technologies include:

n Thermal oxidisers: these systems use high temperatures to oxidise VOCs into less harmful substances such as carbon dioxide and water vapour. They are highly effective but can be energy-intensive.

n Catalytic oxidisers: similar to thermal oxidisers, these systems use a catalyst to lower the temperature required for oxidation, making them more energy-efficient.

n Activated carbon adsorption: this technology involves passing emissions through activated carbon, which adsorbs VOCs onto its surface. Once saturated, the carbon can be regenerated or replaced.

n VRUs: they are specifically designed to capture and recover vapours that would otherwise be lost to the atmosphere. VRUs are essential for tank terminals as they not only reduce emissions but also allow for the recovery of valuable hydrocarbons.

n Condensation systems: these systems cool vapours to condense them back into liquid form. They are highly effective for high-concentration VOC streams and can recover a significant portion of the hydrocarbons.

n Absorption systems: in these systems, vapours are passed through a liquid solvent that absorbs the VOCs. The solvent is then regenerated to recover the hydrocarbons.

n Adsorption systems: similar to emissions treatment, vapours are passed through an adsorbent material such as activated carbon. The adsorbent can then be regenerated to recover the hydrocarbons.

Regenerative thermal oxidation (RTO) is currently the most suitable technology for gas venting emissions abatement, and is one of the solutions recommended for that goal by the European Commission in its reference document on best available techniques (BREF) on emissions from storage, together with technologies such as adsorption, absorption, condensation, and membrane separation.

The implementation of emissions treatment technology and VRUs in tank terminals offers several significant benefits.

Firstly, it ensures environmental compliance by adhering to stringent regulations, thereby avoiding fines and penalties. This compliance is crucial for maintaining operational legitimacy and preventing legal and financial repercussions.

Secondly, these technologies protect the health and safety of workers and nearby communities. By effectively controlling and reducing harmful emissions, the risk of respiratory issues and other health problems associated with VOC exposure is significantly minimised. This not only fosters a safer working environment but also enhances the quality of life for those living in proximity to the terminals.

Thirdly, vapour recovery leads to substantial economic efficiency by reducing product losses. By capturing and reprocessing vapours, tank terminals can recover valuable hydrocarbons that would otherwise be lost to the atmosphere. This recovery translates directly into cost savings and improved profitability for the terminal operators.

Lastly, the adoption of these technologies reflects a strong sense of corporate responsibility. Companies that invest in advanced emissions control and recovery systems demonstrate their commitment to environmental stewardship. This commitment enhances the company’s reputation as an environmentally responsible entity, which can lead to better stakeholder relationships, customer loyalty, and competitive advantage in the market.

Koole Tankstorage Minerals (KTM) needed to eliminate the vapours and odours generated while barge and ship offloading for tank farm filling purposes with fuel oil, vacuum gasoil, and class-3 blend components. These vapours contained highly polluting particles, mainly: VOC, CO, SOx, NOx, MVP2, and PM10.

Once the problem and all its variables were analysed, Tecam proposed a custom-made RTO as the optimal solution taking into account the volume, nature, and characteristics of the emitted vapours:

n Polluted air to be treated: 40 000 Nm³/h of air flow.

n Low concentration of VOCs.

n VOC 2g C/Nm³.

n Very variable air flows.

During this RTO equipment life cycle, more than 13 860 t of VOCs will be eliminated and not emitted into the atmosphere, providing a safe, clean solution for tank terminals in regards to emissions abatement.

As the tank storage sector continues to grow, the need for effective emissions treatment and vapour recovery technology becomes increasingly critical. By implementing these technologies, tank terminals can mitigate their environmental impact, ensure regulatory compliance, and recover valuable hydrocarbons.

Tecam is committed to providing innovative and efficient solutions to help tank terminals achieve these goals and maintain sustainable operations.

Ideally arranged, the proper amount of Jet Mixers produces a three-dimensional flow that mixes the entire contents without creating a rotating motion in the tank. Delivering high efficiency, operational safety, resistance to fouling and little wear & tear thanks to its simple and robust construction Download our catalog

www.accelevents.com/e/ghc2024

Thomas Kemme, AMETEK Level Measurement Solutions, USA,

discusses how traditional level measurement techniques can be enhanced.

For generations, process industries have relied upon traditional level measurement techniques often stemming from mechanical principles. And why not? Trusted, reliable techniques that have proven themselves through decades of field use in the most demanding applications deserve user confidence. Traditional technologies include displacer level transmitters and sight glass level gauges, found in large installed bases throughout the energy sector to this day. However, significant improvements have been made to innovate around these core principles to create something far more efficient for processes while decreasing total cost of ownership.

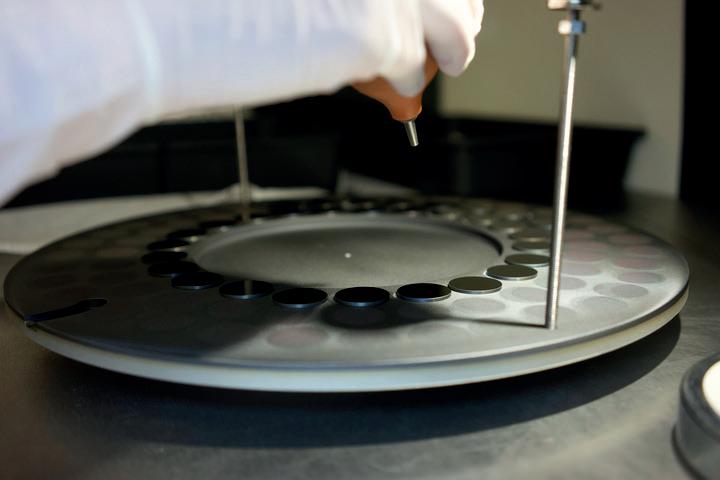

Starting with buoyancy-based products, floats and displacers have long held their place in demanding applications including high pressures, temperatures, and corrosive environments. Many tank farm and terminal operators deploy displacer switches on storage tanks as fail-safes for

hydrocarbon liquid overfill prevention and floating roof detection due to their versatility and durability in these applications earned through decades of service. With a similar operating principle, displacer switches are transformed into continuous transmitters using torque tubes and linear variable differential transformer (LVDT) based technologies. These transmitters provide users with continuous visibility into their desired level span, most often

through measuring an analogue output (current/4-20 mA) proportional to their 0 - 100% level range.

Torque tubes represent the majority of displacer transmitters found in the field. While the traditional torque tube uses a torsion bar that rotates relative to the weight of the displacer in liquid to correspond to a level change, a more seamless design was innovated using an LVDT and range spring combination. The latter design has an LVDT core that moves as the spring is unloaded, which occurs as the liquid level covers the displacer. This core movement induces voltages across the LVDT secondary windings located in the transmitter enclosure and these voltages are then converted to a level output measured through the 4-20 mA current loop. The technology can be top mounted directly into the vessel or installed into an external chamber mounted to the outside of the vessel.

Compared to torque tubes, the LVDT/range spring technology has proven to be more resistant to vibration, providing a more stable output resulting in better linearity and repeatability. Other factors contributing to the success of LVDT/range spring displacer transmitters include the linear structure of the physical design as opposed to the rotational torque tube. This design creates multiple benefits, including reduced long-term maintenance costs; a smaller installation footprint for facilities with confined spaces; and the ability for the transmitter to be removed without de-pressurising the tank.

The last factor, being able to perform maintenance or replacement of the transmitter without shutting down the process, results in increased uptime and plant profitability. The transmitter itself is an important element in the system, capable of advanced diagnostics while providing extreme ease-of-use through an intuitive user interface with quick-start menus to get processes up and running in a timely fashion. Make no mistake, these old displacers are ‘smart’ transmitters built upon years of feedback and experience in the field.

Another basic, yet important, traditional method for level measurement has been through visual indication of the liquid level. Providing visual indication becomes more complex in process industries where extreme properties and corrosive environments come into play. Nevertheless, visually inspecting the level is a technique that is still often used during walk-throughs, process start-ups, or to provide a degree of redundancy alongside other level instrumentation in applications such as storage tanks, separators, and boilers.

Whether it be petroleum refineries or power plants, sight glass gauges are the most prevalent method of visual indication. However, users familiar with sight glass gauges may encounter problems such as breakage, leaks, or bursting, particularly at high pressures

and temperatures. In addition, the visibility of sight glasses can be poor and often affected by moisture and corrosion.

An alternative technology used in place of sight glasses and now commonly specified in greenfield and brownfield projects is the magnetic level indicator (MLI) or magnetic level gauge. MLIs utilise a magnetised float inside of a chamber, which is isolated from a visual indicator and mounted to the outside of the process or storage vessel. The indicator has enclosed flags or a shuttle that is magnetically coupled to the magnets inside the float. The float follows the liquid level inside of the chamber, providing a clear representation of the liquid level as the indicator flags flip or the shuttle moves with the float.

One of the biggest differentiators with MLIs from sight glasses is the isolation of the visual indicator from the chamber and therefore the application media, eliminating the ramifications of these fluids coming into direct contact with the indicator. The viewing window of the indicator is often produced using a polycarbonate, providing better shatter/impact resistance compared to glass as well as reduced UV sunlight exposure. There will be process temperature limitations when using polycarbonate, where glass is still required at extreme high temperatures. Other parts of the MLI can be provided in various plastic constructions for chemical compatibility purposes including the chambers and floats. When adding up these differences and evaluating typical repair costs of sight glass gauges, including the seals/gaskets, glass kits and labour for removal and replacement, it amounts to thousands of dollars in maintenance compared to MLIs. This does not include the negative impact to plant revenue and profitability due to process downtime during sight glass repair.

An additional benefit of MLIs is the ease of implementing level transmitters or switches if an output proportional to the liquid level is required in addition to the visual indication. This can be beneficial as a measure of redundancy or if it is simply desirable to output the tank levels into a programmable logic controller (PLC) or distributed control system (DCS). The most common level transmitters supplied through MLI designs are guided wave radar (GWR) and magnetostrictive.

Both GWR and magnetostrictive technologies can be deployed using a dual chamber design, which has the advantage of isolating the level transmitter from the MLI if maintenance must be performed on the transmitter. Alternatively, single chamber designs are available which allows both visual indication and continuous level output. This can be accomplished by externally mounting a magnetostrictive probe to the outside of an MLI chamber (utilising the same float for measurement) or installing a GWR probe directly into the chamber. In the case of GWR, a probe is installed parallel to the MLI float and separated by a baffle plate inside the chamber. The use of GWR provides an additional degree of redundancy, as the GWR transmitter operates independently from the float (if the float gets stuck or damaged) and conversely there is no effect on the MLI if the level transmitter signal becomes lost.

Alternatively, or in addition to level transmitters, level switches can be clamped to the side of the MLI or directly installed into the chamber (also operating off the float) or installed into the chamber using ultrasonic switches. Of course, switches provide an on/off detection for low and/or high levels as opposed to continuous level measurement from a transmitter.

The prevalence of these mechanical-based technologies still in use today prove not only their reliability at the outset, but their continued refinement through the years to keep them in a competitive position against many newer level instrumentation technologies. And based on the comfort and familiarity they provide users all over the world in some of the most demanding process industry applications, chances are the industry will continue to see these instruments specified in the next generation of industrial facilities to come.

Gregory Tischler, VEGA Americas, USA, examines how a tank farm can benefit from the installation of modern radar level sensor solutions.

Tank farms have long employed level measurement solutions to ensure optimal operations. One of the premier technologies used in these applications is radar. Radar sensors that are used for tank level measurement are mounted at the top of the tank, pointed downwards. These sensors operate by transmitting electromagnetic energy to the surface of the material being measured. The electromagnetic energy is reflected off the surface and returns to the radar. The time of flight of the

electromagnetic energy is used to determine the distance to the surface. This distance measurement is converted to a level measurement by the sensor’s electronics.

A major operator of a large-scale tank farm faced significant challenges in preventing overfills. Its existing methods of obtaining measurements – float systems and tilt switches–were prone to inaccuracies and mechanical failure, requiring

frequent maintenance and leading to operational inefficiencies and potential safety hazards. Seeking a more reliable solution, the operator explored the potential of using advanced radar level measurement technology.

Radar level measurement in the tank farm can be separated into two broad categories: tank gauging systems and overfill prevention systems.

Initially, the tank farm operator in this case study integrated radar sensors into its tank gauging systems. For nearly 50 years, radar has been used as a means to provide level measurement for tank gauging systems. These custody transfer radars are extremely accurate (+/- 0.5mm). Furthermore, some form of digital communication is usually employed to ensure that accuracy is not lost during the transmission of the level information.

In recent years, radar level sensors have experienced an increase in usage as part of overfill prevention systems.

These sensors are not affected by changing process conditions; changes in temperature, pressure, or product density do not affect the radar’s ability to detect the overall level of the material in the tank.

Another major benefit of using radar sensors in overfill prevention systems is that they are solid state devices. There are no moving parts, and there is no maintenance or calibration required. Once a sensor is installed, the operator does not have to do anything to keep it running reliably.

After learning of the additional benefits of radar, the tank farm operator expanded its use of sensors beyond tank gauging and into the overfill prevention systems. One standout feature for the operator was the active nature of radar sensors. With the radar sensors constantly measuring the level, the sensors’ output could be compared with inventory management sensors, allowing the client to monitor performance continuously. Discrepancies between sensors could indicate potential issues, giving operators ample warning to address problems before an overfill condition occurred.

Radar sensors constantly run diagnostics and monitor their own performance. If proof tests are required, radar sensors can be tested by remotely activating a function test. In this scenario, the operator sends a command to the radar sensor to perform its diagnostic function. The tool used to send these commands, usually a computer connected to the sensor via a form of digital communication (HART, Modbus, etc.), will produce a report documenting the results of the test.

Radar used for overfill prevention has the added benefit of mounting capability; it can be mounted on the vessel and deployed in a variety of methods. For example, radar level measurement sensors are typically mounted on the roof of the tank and measure the liquid directly below. In tank farms, it is also common for radar level sensors to be mounted over a floating roof or measuring the liquid surface in a stilling well.

The aforementioned tank farm operator deployed radar sensors in various configurations; one of these configurations was floating roof mounting. When mounted over a floating roof, a radar sensor actually measures the surface of the roof as it travels up and down with the surface of the liquid. The metal roof is highly reflective, thus returning a high amount of radar energy back to the sensor. The construction can be an internal or external floating roof. When it is an external floating roof, the radar sensor is mounted in a fixed location on a bracket, usually near the wall of the tank that is easily accessible for maintenance.

On a tank with an internal floating roof, the mounting is the same as when measuring the liquid directly on a fixed roof tank. The difference is that the radar energy is reflected off the roof instead of the liquid. If a casual observer were to see it from outside of the tank, they may not know if the radar sensor was measuring the liquid directly or measuring the metal roof.

Measurement in a stilling well is another common method of measuring liquid level in tank farms. A stilling well in a tank farm is usually constructed using a pipe that is between 4 in. and 10 in. dia., with 8 in. being the most common size. The stilling well is permanently installed in the tank, encompassing the entire measurement range. The measurement takes place entirely within the confines of the stilling well. Stilling wells can be on both fixed roof and floating roof tanks. The advantage to using a stilling well to take a measurement is that nothing outside of the stilling well can impact the measurement signal.

Most modern radar sensors utilise frequency modulated continuous wave technology (FMCW) for making the distance measurement to the product surface. FMCW technology can be both low-powered and very accurate. Alternatively, pulse radar has been used in the past, but manufacturers of radar level sensors have not introduced a radar that employs pulse technology in more than five years. Leading suppliers of radar level sensors are utilising FMCW technology.

The Federal Communications Commission (FCC), US, has allocated three frequency bands for Tank Level Probing Radar: C-band (5.925 – 7.250 GHz), K-band (24.05 – 29.00 GHz), and W-band (75 – 85 GHz). All three have been used throughout the years in tank farms and are still used today.

The W-band offers some unique differences compared to C-band and K-band. For radar signal transmissions using the same size antenna, the higher the frequency, the smaller the beam angle. 80 GHz radar (W-band) has the narrowest beam angle of the three available frequencies. This means that it focuses the most energy directly below the antenna onto the surface of the product being measured. The result is that, with all things being equal, W-band receives the strongest and most reliable measurement signal when compared to the other frequencies.

A narrow beam also translates to more choices of mounting location for the radar sensor. It can be closer to the sidewall, avoiding false signals from weld seams or other mechanical obstruction along the wall. It can also be recessed in a tall mounting nozzle when measuring directly to the liquid surface or to the floating roof.

Another advantage of using the W-band frequency range is that 80 GHz radars can be offered with smaller antennas than the other frequencies. For example, a 3 in. dia. antenna (either a horn or lens antenna) from a K-band radar sensor has the same beam angle as a W-band radar sensor with a 1 in. dia. antenna.

The result is that smaller antenna systems can be used for W-band radar sensors, making them easier to install. The tank farm operator in this scenario found that this afforded them the ability to be creative in how they deployed the sensors. They could mount radar sensors on the same process connection as other devices, such as a sounding or sampling port, without degrading performance.

80 GHz radar sensors can be small enough that it is possible to mount multiple on the same process connection, with process connections as small as a 6 in. dia. flange. This allows for redundancy while utilising a single process connection. Alternatively, instead of using two radar sensors, it is possible to have a sounding or sampling port and a single radar sensor on a single process connection.

The use of radar level sensors for overfill prevention in tank farms offers numerous benefits, including reliability, accuracy, and versatility in deployment. With advancements in 80 GHz radar technology, operators can achieve more precise measurements and greater flexibility in sensor installation. As the industry continues to evolve, radar level sensors remain a crucial component in ensuring the safe and efficient operation of tank farms.

As for the tank farm operator featured in this article, it continues to reap numerous benefits through the use of radar level measurement. Radar is low maintenance: there are no moving parts, and the sensors do not need to be recalibrated. The operator no longer has to work with the frequent inaccuracies of floats. Radar is always active and performing diagnostics, informing the user of any issues in the system. With 80 GHz radar, the tank farm operator realises safer, more reliable, and more efficient processes.

Dave Godfrey, Rotork, UK, explains why maintaining actuators should be a top priority for terminal operators.

Hundreds of intelligent electric actuators manage the flow of liquids and gases at the Pengerang Deepwater Petroleum Terminal in Malaysia. Like many oil and gas terminals across the world, it relies on precise electric actuation to ensure safety and efficient operations while limiting environmental impact.

Optimum flow performance is essential and Rotork’s PakscanTM system controls hundreds of IQ intelligent actuators at the site on the Johor Peninsular. The system can support the full automation of a complex plant and link up 240 actuators on a single two-wire loop. It also enables operators to override automatic settings and operate any individual actuator if the need arises, to control flows and levels.

The system is designed to work with Rotork actuation products and is backed up by a worldwide service and support network. Rotork Site Services (RSS) provides field support at Pengerang for repairs, commissioning, upgrades, and maintenance. It is part of a maintenance option for customers that ranges from basic repairs to a premium package for actuators on critical processes.

Tank terminals like Pengerang house some of the greatest concentrations of actuators anywhere in the industry and these must be maintained to avoid expensive downtime. The aftermarket offering from RSS addresses the need to monitor and maintain this critical equipment. It includes a lifetime management service that proactively maintains actuators with the aim of reducing downtime and keeping tanks in optimum operational condition.

Engineers work with companies to consider each actuator and the likely consequences if they were to fail. These engineers aim to understand which would be the costliest, cause the most problems or the most severe process interruption. In a facility with 100 actuators that might well come down to just 10 that require the highest level of maintenance to avoid serious impacts if they were to fail.