LEADING POWER SECTION TECHNOLOGY COMPLETIONS 1-11/16” thru 3-3/4” DRILLING 4-3/4” thru 11-3/4” MAGAZINE | AUTUMN 2023

Moving big things to zero with five key technologies

After 250 years engineering complex systems, we are ready for our biggest challenge: reducing emissions for essential industries. Our solutions are based on five technologies: producing green fuels in large volumes, making new engines to run on green fuels, retrofitting existing engines, capturing and processing CO2, and decarbonizing heat generation with heat pumps. Moving big things to zero is a big task but we have the experience, the technology, and the passion to get the job done.

www.man-es.com

Rudranil Roysharma, Frost & Sullivan, India, provides an overview of the upstream oil and gas sector in the Middle East, Africa and South Asia regions.

15 The Rewards Of Reservoir Simulation

Yamal Askoul, Baker Hughes, UK, explores the past and present of dynamic reservoir simulation, and details the benefits it is offering the oil and gas and energy transition sectors.

20 A Step Change In Stimulation

Thomas Jørgensen and Wissam Chehabi, Fishbones, Norway, discuss how operators are utilising the latest stimulation technology to enhance sustainability and efficiency.

25 Embracing Uncertainty

Atila Mellilo and Philip Neri, Halliburton Landmark, Denmark, explain how ensemble-based reservoir modelling is being used to maximise reservoir recovery.

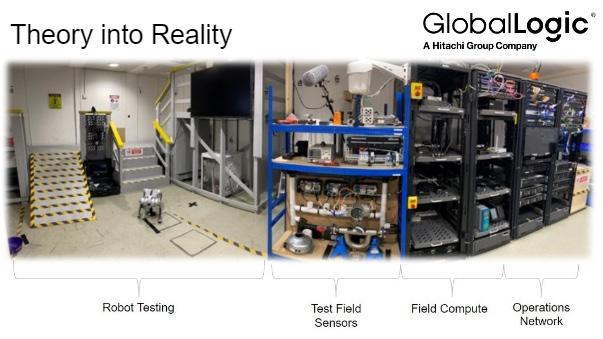

28 Easing Hostile Relations

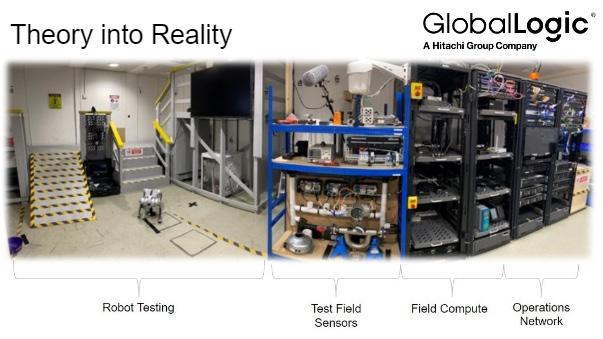

Gaurav Rohella, GlobalLogic, UK, explains how innovative technologies can help the upstream sector overcome challenges associated with hostile and hard-to-reach environments.

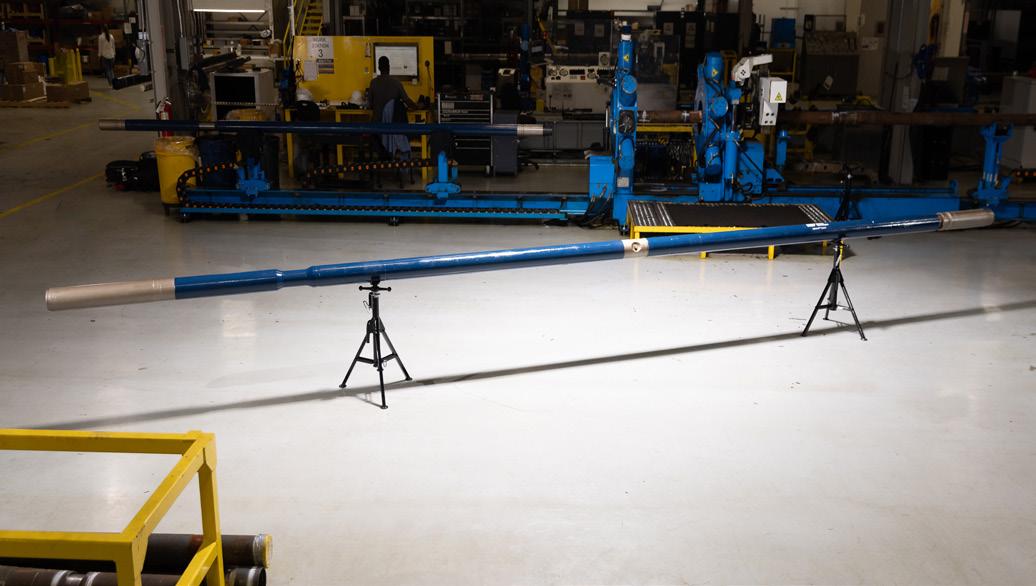

Front cover

With the worldwide oil and gas industry going deeper, faster, and farther, the need for specialised power section technology is clear. Abaco’s portfolio of elastomer technology extends the life of the power sections in diverse drilling and completion operations. Specialised power section diameters ranging from 1 – 11/16 in. – 11 – 3/4 in. deliver power, durability and maximised performance in corrosive, high temperature, high torque or high wear environments. Abaco delivers ‘nothing but power’ by offering customers an excellent drilling experience.

32 For Good Measure

Ming Yang, TÜV SÜD National Engineering Laboratory, UK, discusses the different methods used to measure oil-in-water, and the rise in online analysis techniques.

35

The Path Forward

Megan Pearl, Locus Bio Energy, USA, examines the role of biosurfactants and advanced testing in shale completions and explains why a multifaceted approach is vital in maximising oil recovery.

39

The Importance Of Advanced Engineering

Uday Godse, Wild Well Control, USA, discusses how advanced engineering can be used to optimise design and operations that augment well control engineering.

42 No Pressure

Danny Perez, Roman Che, Khoi Trinh, Chigozie Emuchay and Souhail Bouaziz, NOV, USA, discuss how new developments in friction reduction technology can widen horizons for operators.

Taking The Sting Out Of Splicing

Joachim Åkesson, Ace Well Technology, Norway, explains how the upstream industry can optimise splicing and reduce rig time.

Maintaining The Flame

Chris Addison, Advanced Energy, USA, and Michael Li, Wonder Engineering, Singapore, explain the key to ensuring a successful flare monitoring system.

ISSN 1757-2134 Copyright © Palladian Publications Ltd 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Like us on Facebook Oilfield Technology Join us on LinkedIn Oilfield Technology Follow us on Twitter @OilfieldTechMag Autumn 2023 Volume 16 Number 03 Contents 03 Comment 05 World News

10 Mapping Out The Future Of MENA

us on Facebook Oilfield Technology Join us on LinkedIn Oilfield Technology Follow us on X @OilfieldTechMag LEADING POWER SECTION TECHNOLOGY COMPLETIONS 1-11/16” thru 3-3/4” DRILLING 4-3/4” thru 11-3/4” MAGAZINE AUTUMN 2023 The upstream oil and gas industry has long recognised and embraced the benefits of friction reduction tools (FRTs), which have facilitated reaching previously unattainable lateral lengths and achieving unprecedented drilling efficiency. These cutting-edge technologies have revolutionised the directional drilling sector and have improved performance of motor and rotary is important to acknowledge that implementing friction reduction tools necessitates operational adjustments and changes to drilling practices. Friction reduction tools generate friction breaking force, but this breaking force comes with price. As per the law of conservation of energy, energy cannot be created or destroyed; it can only be as drilling fluid flows through these tools, the internal components move relative to each other, altering the total flow area (TFA). Essentially, the hydraulic energy of the drilling fluid is transformed into axial mechanical energy, which used to break friction and improve weight transfer. The variation of the internal TFA within the tool translates into pressure drop, which each FRT will produce depending on the tool type and set up. Typically, the higher the pressure drop, the more up to a certain point to break friction. Theincreasedpressuredrop by FRTs undesirable for several reasons. It puts additional stress on pumps and surface equipment, and can limit the rig’s capacity to maintain desired flow rates during the drilling process total depth (TD). This pressure drop can also impact the ability to maximise downhole motor output, achieve optimum RSS hole cleaning capabilities. As operators drill longer lateral sections, they must, steadily, and over hundreds of feet, dial back on flow rates to maintain the system within the operational range of the surface pumping equipment. It is not feasible to include an FRT in the string to improve performance at the expense of lower differential at the motor, or hole cleaning long lateral sections (over 2.5 miles) opt to take the FRT out of the string for the last 1000 3000 of the lateral so that they can reach As a solution to this challenge, NOV developed new FRT that generates friction-breaking axial forces downhole without the need to produce pressure pulses or additional pressure drop to the drilling system. The AgitatorZP features tool design that enables operators to maintain optimal and maximum operational flow rates in the deepest parts of the lateral sections while getting maximum output represents a significant step change in operational improvements for operators in long lateral sections, as they can maximise motor as hole cleaning. An FRT that generates no pressure drop can also be useful in scenario where operators PRESSURE NO Danny Perez, Roman Che, Khoi Trinh, Chigozie Emuchay and Souhail Bouaziz, NOV, USA, discuss how new developments in friction reduction technology can widen horizons for operators. 42 43 42

Like

In 2022, TETRA treated and recycled over eight billion gallons of produced water for reuse in well operations. TETRA helps ensure consistent water quality and supply throughout completion operations—from automated water recycling systems, including our patented automated blending controller, to our on-the-fly treatment technologies that economically process diverse types of water to eliminate bacteria and sulfides prior to completion activities.

Not only is recycling water more sustainable and effective, it’s also cost efficient and a smart business practice, especially in water-scarce regions.

VISIT TETRATEC.COM/RECYCLE TO LEARN MORE.

2023 © TETRA Technologies, Inc. All Rights Reserved. TETRA WATER MANAGEMENT SOLUTION OFFERINGS Automation and Monitoring • Sourcing • Fresh and Produced Water Transfer • Pipeline Construction • Storage and Pit Lining • Treatment and Recycling • Oil Recovery • Blending and Distribution • Flowback and Testing

How do you save one billion gallons of water? RECYCLE.

Left: produced water; right: recycled produced water by TETRA.

Comment

Emily Thomas, Deputy Editor emily.thomas@palladianpublications.com

The ‘golden age of gas is over’ according to the The International Energy Agency (IEA). The company recently forecast that global oil demand will have peaked by 2030 as a result of the growing popularity of heat pumps, electric cars and buses, and the success of renewables in producing electricity. Europe’s deliberate move away from gas following the Russia/Ukraine conflict has also fuelled the notion that renewable technologies and low emissions fuels will be sufficient to meet future energy needs. Writing in The Financial Times, the agency warned of the economic, climate and financial impacts of new oil and gas projects.1

The article has divided opinion, with oil and gas producers in particular having criticised the IEA’s approach towards the energy transition. According to Reuters, the CEOs of oil giants Aramco and Exxon Mobil have expressed the importance of continued investment in oil and gas as a key factor in the transition to cleaner energy.2 OPEC Secretary General, HE Haitham Al Ghais, has echoed these sentiments in a statement following the release of the forecast, claiming that the global energy system has been “set up to fail spectacularly.” The statement continued: “[This narrative] does not take into account the technological progress the industry continues to make on solutions to help reduce emissions. Neither does it acknowledge that fossil fuels continue to make up over 80% of the global energy mix, the same as 30 years ago, or that the energy security they provide is vital.”3 Considering that many net zero technologies are still in their infancy, it is no surprise that a number of political figures are inclined to agree that the energy transition should not be rushed.

Prime Minister of the United Kingdom, Rishi Sunak, recently made the decision to ease UK climate targets, pushing back on a range of measures, from taxing meat consumption, to discouraging foreign travel by raising air fares. A nine-year delay has also been placed on the ban of fossil fuels being used to heat off-gas-grid homes, whilst a ban on new petrol-only cars has been suspended, with Sunak claiming that net zero will be met in “a proportionate and pragmatic way.”4 This follows the UK government’s recent announcement that new licences would be granted for oil and gas exploration in the North Sea. Sunak defended this decision, claiming that using the energy we have at home is consistent with a transition to net zero.5 The subseqeuent approval of the controversial Rosebank project, therefore, was to be expected.

Acquired by Equinor in 2019, Rosebank is the largest undeveloped oil and gas field in the UK, located west of the Shetland Islands, with an estimated 300 million bbl of potentially recoverable reserves. The development of the field is highly contentious, yet the proposed advantages in terms of UK energy security cannot be ignored. Furthermore, Equinor plans for the field to be developed with a redeployed, refurbished Floating Production Storage and Offloading vessel (FPSO) tied to a subsea production system, which will be electrification-ready and able to be powered from shore. The operator claims that this has the potential to reduce production emissions from the field by over 70%. The North Sea currently produces oil at around 20 kg CO2/bbl; post-electrification, it is believed that Rosebank could produce oil at 3 kg CO2/bbl. An estimated £8.1 billion of direct investment into UK businesses is also an undeniable advantage of Rosebank, as is the promise of 1600 jobs created for highly-skilled oil and gas workers.6

While the world continues to battle over the right approach to net zero, and fossil fuels continue to represent a large percentage of the global energy mix, the best thing oil and gas producers can do is aim to provide energy security whilst decarbonising their operations. For now, this can help to bridge the gap between a climate disaster and a rush towards renewables.

*References are available upon request.

Autumn 2023

Contact us

Editorial

Managing Editor: James Little james.little@palladianpublications.com

Senior Editor: Callum O’Reilly callum.oreilly@palladianpublications.com

Deputy Editor: Emily Thomas emily.thomas@palladianpublications.com

Editorial Assistant: Jack Roscoe jack.roscoe@palladianpublications.com

Design

Production: Kate Wilkerson kate.wilkerson@palladianpublications.com

Sales

Sales Director: Rod Hardy rod.hardy@palladianpublications.com

Sales Manager: Chris Lethbridge chris.lethbridge@palladianpublications.com

Sales Executive: Daniel Farr daniel.farr@palladianpublications.com

Website

Digital Administrator: Leah Jones leah.jones@palladianpublications.com

Digital Content Assistant: Kristian Ilasko kristian.ilasko@palladianpublications.com

Events

Events Manager: Louise Cameron louise.cameron@palladianpublications.com

Digital Events Coordinator: Merili Jurivete merili.jurivete@palladianpublications.com

Marketing

Administration Manager: Laura White laura.white@palladianpublications.com

Reprints: reprints@palladianpublications.com

Palladian Publications Ltd, 15 South Street, Farnham, Surrey GU9 7QU, UK Tel: +44 (0) 1252 718 999

Website: www.oilfieldtechnology.com

Autumn 2023 Oilfield Technology | 3

Always victorious.

Drilling challenges are becoming tougher, and the demands on drill bits are rising.

ReedHycalog’s new premium Pegasus™ series drill bits combine industr y-leading technologies to overcome the harshest and most challenging drilling applications, including geothermal. Where existing fixed-cutter, hybrid, and roller cone bits have fallen short of their target, Pegasus drill bits are here to eliminate the competition and deliver next-level bit performance.

NOV Pegasus Series Drill Bits

© 2023 NOV Inc. All Rights Reser

ved.

World news

Rystad Energy: North Sea oil and gas industry booms with increasing production and investments

Norway and the UK have overcome recent challenges and are on course to achieve significant milestones due to notable increases in investments, exploration success and production, according to Rystad Energy. Solid oil and gas production from the region is also providing indispensable resources to Europe and the rest of the world navigating through the energy transition.

Investments in Norway’s oil and gas industry are expected to reach a record-high of about US$21 billion in 2023. This comes as several key projects have been approved in recent years, driven by the country’s temporary tax regime, which was introduced to incentivise spending on the Norwegian continental shelf.

“With an impressive growth rate this year, the total investments in the Norwegian oil and gas industry are projected to surpass the record set in 2013, when total investments reached about US$19 billion. The investments in 2023 are expected to reach a new all-time high, and this significant increase in investment would mark a new milestone in the oil and gas sector in Norway,” affirms Emil Varre Sandoy, Upstream Vice President at Rystad Energy.

This increase in investment is a positive development after several lean years in the industry and will be particularly welcomed by the oilfield service sector. This investment in the sector is essential for maintaining a strong service industry while it undergoes a gradual transition towards alternative energy sources.

Despite a decline of almost 15%, from a peak of nearly 4.6 million boe/d in 2004, Norwegian oil and gas production is set to rise again. By 2025, production might rise back towards peak levels as a result of increased focus on gas production and new projects in the pipeline. These volumes will be produced with one of the world’s lowest CO2 footprints and reduce Europe’s dependency on Russian hydrocarbons.

BP signs MOU with Subsea Integration Alliance to enhance integrated subsea project performance

BP has signed a Memorandum of Understanding (MoU) with Subsea Integration Alliance aimed at developing a framework to enhance integrated subsea project performance. The agreement with the alliance, which comprises Subsea7 and OneSubsea™, an SLB company, will combine the three companies’ skills, knowledge and experience across a global portfolio of projects.

The agreement will combine BP’s experience to frame, build and execute projects with the alliance’s capability to deliver integrated subsea production systems (SPS) and subsea umbilical, riser and flowline (SURF) systems. The team will work together, from concept development through the full field lifecycle to support project delivery through new ways of working and an innovative commercial model.

A new team will be formed to oversee and manage activities across the programme, with a focus on safety, quality and subsea project performance.

Ewan Drummond, BP’s SVP of projects, said: “The members of Subsea Integration Alliance have been a key supplier of BP for decades, and by combining our resources and knowledge, we can bring significant benefits to our customers and our stakeholders. Together we can safely deliver projects with improved project schedules, reducing our total cost of ownership and harnessing synergies through a collaborative one-team mindset. We look forward to getting to work.”

Olivier Blaringhem, CEO of Subsea Integration Alliance, said: “This agreement marks a step change in how our highly collaborative teams will work together to achieve shared objectives for mutual value. Together with BP, we will deliver lower carbon energy to the world through enhancing long-term subsea performance.”

The MoU was signed at an official ceremony in London on 22 September 2023, that was attended by Ewan Drummond, Olivier Blaringhem, Louise Jacobsen Plutt, BP’s SVP of procurement, Kristian Siem, Subsea7 Chairman, John Evans, Subsea7 CEO, Steve Gassen, SLB President of Production Systems, and Mads Hjelmeland, SLB Director of Subsea Production Systems.

Autumn 2023

United Kingdom

Equinor and Ithaca Energy have taken the final investment decision to progress Phase 1 of the Rosebank development on the UK Continental Shelf (UKCS), investing US$3.8 billion.

The North Sea Transition Authority (NSTA) granted consent for the development of the field on 27 September.

“Developing the Rosebank field will allow us to grow our position as a broad energy partner to the UK, while optimising our oil and gas portfolio, and increasing energy supply in Europe. Rosebank provides an opportunity to develop a field within the UK Continental Shelf which will bring significant benefits to Scotland and the wider UK,” says Geir Tungesvik, Executive Vice President Projects, Drilling and Procurement at Equinor.

The Rosebank field is located around 130 km north-west of Shetland in approximately 1100 m of water depth. Total recoverable resources are estimated at around 300 million boe, with Phase 1 targeting estimated 245 million boe.

The field will be developed with subsea wells tied back to a redeployed Floating Production Storage and Offloading vessel (FPSO), with start-up planned in 2026 – 2027. Oil will be transported to refineries by shuttle tankers, while gas will be exported through the West of Shetland Pipeline system to mainland Scotland.

USA

TGS has announced a northern extension to its previously announced Pontiac 3D Survey in the Midland Basin. The extension increases the size of the Pontiac 3D from 167 m2 to a total of approximately 267 m2 and is located in Midland, Ector, Upton and Crane counties, Texas, US.

The northern extension of the Pontiac 3D sits on the western edge of the Midland Basin and encompasses historical production from Sprayberry and Wolfcamp intervals along with significant accumulations in deep-seated structures in the Devonian and Ellenburger formations.

In brief w Autumn 2023 Oilfield Technology | 5

World news

Diary dates

02 - 05 October 2023

ADIPEC 2023

Abu Dhabi, United Arab Emirates adipec.com

16 – 18 October 2023

SPE ATCE 2023 Texas, USA atce.org

20 – 22 February 2024

Subsea Expo

Aberdeen, UK www.subseaexpo.com

Web news highlights

Ì Bozhong 28-2 south oilfield second adjustment project commences production

Ì Norwegian Petroleum Directorate (NPD) and the Petroleum Safety Authority (PSA) to undergo name change in 2024

Ì Arena Energy awarded seven blocks on Gulf of Mexico Shelf

To read more about these articles and for more event listings go to:

www.oilfieldtechnology.com

Shenzi North project has commenced production in the Gulf of Mexico

The Woodside-operated Shenzi North project has commenced production in the deepwater US Gulf of Mexico.

Shenzi North is a two-well subsea tieback that takes advantage of the existing Shenzi infrastructure to increase production capacity of the asset.

The project, on which a final investment decision (FID) was taken in July 2021, achieved production ahead of targeted first oil in 2024. Woodside CEO, Meg O’Neill, said the start-up of Shenzi North further demonstrated the value of Woodside’s US Gulf of Mexico assets, acquired as part of the merger with BHP’s petroleum business in 2022. “First production from Shenzi North shows how we are leveraging existing infrastructure to increase production and provide attractive returns from our Gulf of Mexico business.”

“Taking the project from FID to first oil in 26 months is a great achievement. I commend the project team on safely bringing this resource into production well ahead of schedule,” she said.

Woodside holds a 72% interest in the Shenzi conventional oil and gas field as operator and Repsol holds the remaining 28% interest. The field is located approximately 195 km off the coast of Louisiana in the Green Canyon protraction area. Shenzi was discovered in 2002 and first production of oil and natural gas occurred in 2009.

The Shenzi platform produces both oil and gas with a production capacity of 100 000 bpd. Crude oil and natural gas produced from the field is transported to connecting pipelines for onward sale to Gulf Coast customers.

TWMA secures long-term contract with Equinor

TWMA has secured a long-term contract with Equinor. The 10-year agreement will see TWMA extend its global drilling waste management services to Equinor’s operations, allowing the company to process its drilling waste safely and sustainably.

The contract is inclusive of five scopes of work, including bulk transfer, slop treatment, swarf treatment, skip and ship, and TWMA’s offshore processing technology, the RotoMill®.

Jan Thore Eia, TWMA Business Development Manager in Norway, said: “Our collaboration with Equinor marks a significant milestone for TWMA. This collaboration is a testament to our expertise in providing innovative and sustainable drilling waste management solutions. We look forward to delivering these solutions to Equinor and supporting drilling operations in Norway.”

Halle Aslaksen, TWMA CEO, said: “This contract underlines the impressive growth we have witnessed across our Norwegian operations. We are dedicated to delivering the best environmental practices in drilling operations and I look forward to developing our relationship in the coming years.”

Wood and Harbour Energy agree strategic partnership

Wood and Harbour Energy have entered into a new strategic partnership for UK North Sea operations agreeing a new master services agreement (MSA) and associated contracts valued at around US$330 million.

Under this new agreement, Wood will provide engineering, procurement and construction (EPC) and operations and maintenance (O&M) services, including digital and decarbonisation solutions, for a number of Harbour’s offshore assets critical to UK energy security.

The strategic partnership will run for an initial term of five years, with five one-year extension options covering Harbour’s operated assets, including its J-Area, Greater Britannia Area, Solan and AELE (Armada, Everest, Lomond and Erskine) hubs.

Steve Nicol, Wood’s Executive President of Operations, said: “We are incredibly proud to have been selected and trusted by Harbour Energy to partner with them across their North Sea assets. We share a commitment to ensuring safe, reliable and sustainable energy production and are confident our integrated digital solutions and world-leading engineering, operations and decarbonisation expertise will enable Harbour to maximise their investment and ensure the UK continues to have the energy mix it needs.”

6 | Oilfield Technology Autumn 2023

Autumn 2023

World news

Aker BP awarded Exploration Innovation Prize for its ‘exploration robot’

Aker BP has been awarded the Exploration Innovation Prize for the development of machine learning models for use in exploration work. The company’s exploration department is already using the models, often referred to as the ‘exploration robots.’

The machine learning models that have been developed can assist geologists and geophysicists in reconstructing missing well logs, making lithology predictions, calculating shale content, and mapping potential undiscovered reservoir areas. The solution can also provide an impartial assessment of log quality.

The prize is presented by Geopublishing and is awarded during the NCS Exploration Conference.

The jury was impressed that the team has succeeded in creating a tool that is actually used and streamlines daily work.

Peder Aursand, Value Stream Manager and data scientist at Aker BP, presented the ‘exploration robot’ during the conference. He highlighted three factors that have been crucial to their success.

“Firstly, we have focused on making the models work for the exploration team, not the other way around. Secondly, we have included explanations and quantification of inherent uncertainty as standard in the models. And we have made the models available in tools and software that the exploration team is already familiar with and uses daily,” says Aursand.

He received the award along with several representatives from the team that developed the exploration robot. In addition to Aursand, the team consists of Tanya Kontsedal, Kjetil Westeng, Yann Van Crombrugge, Christian Lehre, Martine Dyring Hansen, Peyman Rasouli, and Etienne Sylvain Peysson.

DNO makes discovery in the Norwegian North Sea

DNO has announced a gas condensate discovery on the Norma prospect in the Norwegian North Sea license PL984 in which the company holds a 30% operated interest.

Preliminary evaluation of the discovery indicates gross recoverable resources in the range of 25 – 130 million boe on a P90 – P10 basis, with a mean of 70 million boe, in a Jurassic reservoir zone with high quality sandstones. Located 20 km northwest of the Balder hub and 30 km south of the Alvheim hub, Norma is situated in an area with extensive infrastructure in the central part of the North Sea, with tie-back options offering potential routes to commercialisation.

Also within the same license, DNO has identified additional exploration prospects that have been considerably de-risked by the Norma results.

“Coming on the heels of our six Troll-Gjøa area discoveries since 2021, three of which were made this year including Carmen, Heisenberg and Røver Sør, Norma opens up an exciting new play for DNO in the North Sea,” said Executive Chairman Bijan Mossavar-Rahmani. “At the risk of hoodooing our crack explorationists, the string of recent discoveries validates DNO’s offshore Norway exploration strategy,” he added.

Saipem awarded offshore contracts in Côte d’Ivoire and Italy

Saipem has been awarded two new contracts for offshore activities in Côte d’Ivoire and Italy for an overall amount of €850 million.

The first contract has been awarded to Saipem by Eni Côte d’Ivoire and its partner Petroci. It is a subsea umbilicals, risers and flowlines (SURF) contract for the development of the Baleine Phase 2 project, which takes its name from the oil and gas field, located offshore Côte d’Ivoire at a 1200 m water depth.

The scope of work encompasses the engineering, procurement, construction and installation (EPCI) of approximately 20 km of rigid lines, 10 km of flexible risers and jumpers and 15 km of umbilicals connected to a dedicated floating unit. The installation works will be carried out by Saipem’s offshore construction vessels and will take place in 2024.

With this new award, Saipem brings a further strategic contribution to the history of the Baleine field and strengthens its presence in Côte d’Ivoire. Saipem contributed to the drilling activities of Baleine Phase 1 by deploying the Saipem 10 000 and Saipem 12 000 vessels, followed up by the execution of two contracts for Baleine Phase 1 in fast-track mode.

The second contract has been awarded to Saipem, through a temporary association of companies with Rosetti Marino and Micoperi, by Snam Rete Gas for the construction of the facilities for the new floating storage and regasification unit (FSRU) to be located in the Adriatic Sea offshore Ravenna, Italy.

The project consists of the EPCI of a new offshore facility, linked to the existing one, for the docking and mooring of the FSRU, to be connected to shore via a 26 in. offshore pipeline 8.5 km in length, plus a 2.6 km onshore pipeline and a parallel fibre optic cable. The shore crossing will utilise a microtunnelling system to minimise environmental impacts. Offshore operations will be executed by Saipem’s pipelay barge Castoro 10.

ABB supports Well Done Foundation to tackle orphan oil and gas wells

ABB will provide financial support to the Well Done Foundation, a non-profit organisation that tackles the massive environmental problem of millions of leaking orphan oil and gas wells across the United States. The three-year financial partnership will support the organisation in carrying out their critical work of detecting, plugging and monitoring leaking wells.

The Well Done Foundation works to cap orphan oil and gas wells that have been deactivated and no longer have legal owners responsible for their care. Due to their age and deteriorated condition, the wells can leak methane and other harmful greenhouse gases. ABB’s emissions monitoring technology is central to the work carried out by the foundation as both parties align to help tackle harmful emissions.

“ABB’s partnership brings immense value to our campaign to fight climate change through the plugging of orphaned oil and gas wells,” said Curtis Shuck, Chairman of the Board of the Well Done Foundation. “The financial support is obviously most welcome, and it is ABB’s technology and expertise in emissions monitoring that are helping us to fight climate change one well at a time.”

Autumn 2023

8 | Oilfield Technology Autumn 2023

Learn More

MAPPING OUT

Energy is considered the most critical ingredient for the development of any economy. For decades, the Middle East and North Africa (MENA) region has played a significant role in the global energy ecosystem and has supported industrialisation and economic growth in several countries around the world. The geological framework of the region favours the generation and accumulation of large oil and gas reserves.

The region is home to some of the world’s largest conventional onshore and offshore oil and gas fields. The most prominent fields in the region include Ghawar and the Safaniya oilfields in Saudi Arabia, the Burgan oilfield in Kuwait, the Rumaila oilfields in Iraq, and the South Pars/North Dome gas field, co-owned by Iran and Qatar. The North African oil and gas landscape revolves primarily around three producer countries: Algeria, Libya, and Egypt.

All conventional basins across the world also contain large volumes of shale. It is estimated that the MENA region has 2547 ft3 of shale gas reserves.1 Some Middle Eastern countries such as Saudi Arabia, UAE, Bahrain, and Oman are developing shale oil and gas fields in the region, such as Khazzan, South Ghawar, Jafurah, and Rub’ Al Khali.

Regulations and NOCs

The energy and resources sector is the cornerstone of economic growth and development for Middle Eastern and North African countries. Since oil and gas related activities are the primary source of revenue for the government, it is a strictly regulated sector. National oil companies (NOCs) are responsible for developing the oil and gas sector in their respective countries. A few of the prominent NOCs within the region are:

Ì Saudi Aramco.

Ì National Iranian Oil Company.

Ì Iraq National Oil Company.

Ì Kuwait Petroleum Corporation.

Ì Qatar Energy.

Ì Sonatrach Algeria.

Ì OQ Oman.

Ì National Oil Company Libya.

Ì ADNOC.

NOCs enter strategic partnerships with international oil companies (IOCs) such as BP, Chevron, Shell and Exxon Mobil, to name a few, to develop oil and gas fields within the MENA region. While IOCs get access to the country’s oil and

10 |

Rudranil Roysharma, Frost & Sullivan, India, provides an overview of the upstream oil and gas sector in the Middle East, Africa and South Asia regions.

THE FUTURE OF MENA

| 11

gas reserves, NOCs benefit from IOCS’ technological prowess and financial capabilities.

Another important stakeholder in the value chain is the oilfield service (OFS) providers. These companies provide necessary products and services to explore and develop wells and further production of oil and gas from those wells. Notable international OFS companies in the region are Schlumberger, Baker Hughes, Halliburton, and Weatherford. When doing business with the Middle East NOCs, suppliers and service providers need to demonstrate compliance with the in-country value addition requirements that have been introduced by Aramco (IKTVA), ADNOC (ICV), and Oman’s Ministry of Oil and Gas (ICV), with Kuwait and other producer nations likely to follow suit.2

MENA as a backbone for the world’s energy ecosystem

Oil and gas producers in the MENA region have been the backbone of the global energy system. The MENA region holds about 57% of the world’s proven oil reserves and about 41% of natural gas resources.3

Historically, the region has contributed to about 37% of the world’s total oil supply and approximately 35% of the world’s total gas supply.4

Crude oil production in the MENA region was approximately 33 million bpd in 2022, amounting to about 33% of the total oil produced in the world. Natural gas production in 2022 was about 963 billion m3, roughly 23% of the total gas produced globally.5,6

Currently, the region accounts for approximately 50% of oil exports and 15% of natural gas exports worldwide.7 Major oil producers within the region include Saudi Arabia, Iraq, UAE, Kuwait, and Iran. Gas production in the MENA region is dominated by Iran, Qatar, Saudi Arabia, Algeria, Egypt, and UAE.

Strong outlook for the upstream sector in the MENA region

MENA’s five-year (2022 – 2026) energy investment portfolio is comprised of a total investment of US$879 billion, which is a 9% increase over the investment projection for 2021 – 2025.8 Of all the projects in the pipeline for implementation, about 30% are in the execution phase. The increase in project expenditure is spearheaded by the Gulf Cooperation Council (GCC), with committed projects making up more than 45% of the Gulf States’ total energy investments. National oil companies in the region have committed investments in the upstream sector to increase the country’s oil and natural gas production in the coming years:

Ì Saudi Aramco aims to increase its crude oil production capacity to 12.3 million bpd by 2025,9 thereby bringing additional output to meet global energy requirements. The plan is to further raise the production capacity to 12.7 million bpd by 2026 before reaching 13 million bpd by 2027. The kingdom plans phase-wise expansion of the nation’s production capacity – the Dammam field is forecasted to yield an additional 75 000 bpd by 2024, and the offshore Marjan and Berri fields are set to provide another 300 000 bpd and 250 000 bpd by 2025. The Zuluf field expansion is projected to add 600 000 bpd by 2026 and the Safaniyah development is set to increase production by 700 000 bpd by late 2027.

Ì The ADNOC board recently endorsed plans to bring forward the company’s 5 million bpd oil production capacity expansion to 2027 from a previous target of 203010 to meet rising global energy demand. The ADNOC board has approved a five-year business plan and a capital expenditure of 550 billion AED (US$150 billion) to enable the firm’s growth strategy for the period 2023 – 2027. Further, ADNOC will introduce low-carbon solutions and an international division centered on new energies, gas, LNG, and chemicals.

Ì Qatar Energy has planned expansion of the North Field to ramp up its liquefaction capacity from 77 million tpy to 126 million tpy by 2027.11 The project will boost Qatar’s position as the world’s top LNG exporter and help guarantee long-term supplies of gas to Europe as the continent seeks alternatives to Russian flows.

Ì The Middle East oil and gas landscape has always been the focal point of global energy dynamics.

12 | Oilfield Technology Autumn 2023

Figure 1. Distribution of the world’s proven oil and gas reserves in 2020. Source: BP statistical review of World Energy, 2021.

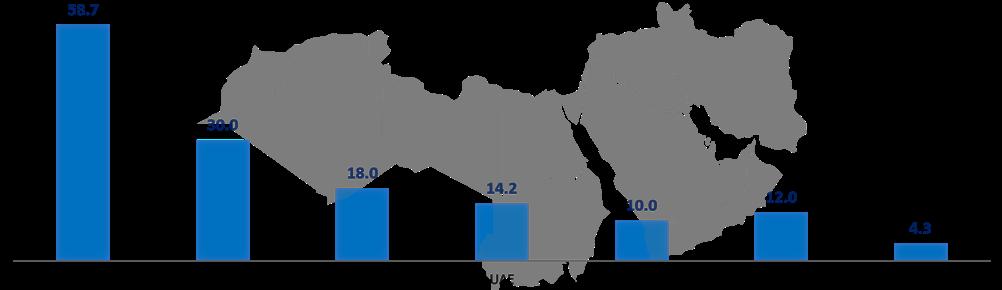

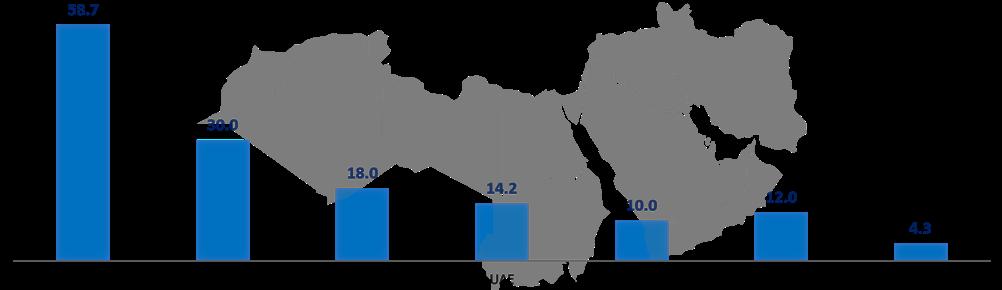

Figure 2. 2022 revenue (US$ billion) of the MENA NOCs. Note: Revenue numbers are for 2022 except for National Iranian Oil Company and Iraq National Oil Company. * 2017 revenue; 2019 revenue.

Figure 3. Oil production of key producer countries in MENA in 2022 (million bpd). Source: International Energy Agency.

Mastering Well Control Challenges:

Where Advanced Engineering Ensures

Safe Solutions

Wild Well Control is at the forefront of cutting-edge engineering and well control services within the oil and gas industry. Prioritizing safety and ingenuity, our experienced professionals promptly handle wellbore complications, demonstrating expertise in intricate situations.

Our distinguished rapid response encompasses sealing maneuvers in the harshest of circumstances. Moving beyond conventional drilling, Wild Well's skilled engineering unit partners with clients to reinstate standard drilling conditions. Our proficient well control staff guarantees the secure management of well control occurrences, drawing upon extensive proficiency in both established and innovative methodologies.

Contact us for all your well control needs. +1 281.784.4700 / WILDWELL.COM

The sector has recently gone through significant challenges and changes, and, as a result, future investment commitments in the region have become more diverse, with a focus on LNG, more complex offshore projects, renewables, and decarbonisation. The trend aligns with the energy transition plan for most global economies.

Energy security and low-carbon investments may pose a threat to the MENA upstream sector

The ongoing Russia-Ukraine tension may pose a threat to the MENA upstream sector. The European Commission has announced plans to make the continent independent of Russian fossil fuels through the widespread adoption of renewable energy (RE) and diversification of natural gas supplies. Frost & Sullivan identified five growth opportunities that will shape the global energy landscape in the coming years:

Ì Energy security will be the foremost priority for most nations.

Ì Renewables adoption will no longer be by choice but out of necessity.

Ì Fossil fuel prices will become a key geo-political lever for the energy-supplying nations.

Ì Coal and oil will be reduced to regional fuels.

Ì Demand for natural gas, a transitioning fuel, will depend on its affordability.

Fossil fuel importers are always vulnerable to supply disruption and price volatility; therefore, tapping into a country’s indigenous resources for energy needs will become a priority in the coming decades.

As countries reduce dependence on energy imports, the upstream sector, which is dominated by the MENA region, may be affected as supply may outstrip demand. Further, a demand reduction would create a stagnant low-price environment in the oil market that could impact the upstream operators and the producing nations.

Energy transition and integration of renewables

Blue and green hydrogen

Hydrogen is gaining significance as a clean energy vector. Both blue hydrogen (produced from natural gas with carbon capture) and green hydrogen (produced via electrolysis using RE) are seen as key pillars

of the energy transition within the region. Initiatives of select MENA countries towards the implementation of a hydrogen-enabled economy12 are outlined below:

Ì Saudi Arabia: in 2021, Saudi Arabia launched the Saudi Green Initiative that aims to develop substantial green hydrogen and green ammonia production around Neom. When completed, the project would encompass the world’s largest utility green hydrogen facility. Further, the Green Initiative includes thirteen RE projects with total capacity addition (GW) targets of 11.3 GW that could reduce around 20 million tpy of carbon emissions.

Ì Oman: Oman recently introduced a new Green Hydrogen Strategy, envisioning US$140 billion in investment by 2050. The goal is to produce 1 – 1.25 million tpy of green hydrogen by 2030, increasing production to 3.25 – 3.75 million t by 2040, and 7.5 – 8.5 million t by 2050. Oman is also working on a project for a green steel plant powered by hydrogen, with a yearly production of 5 million t. The products from this plant would be exported to other Middle Eastern countries, Europe, Japan, and Asia.

Ì Qatar: Qatar has initiated a project to establish the largest blue ammonia facility worldwide and is actively acquiring international renewable companies. Qatar Investment Authority (QIA) is also exploring the possibility of providing support for projects involving green ammonia and fuel for navigation in Egypt.

Focus on renewable energy capacity additions

Several MENA countries are incorporating renewables, particularly solar and wind energy, into their power generation mix. Some of these countries have set ambitious RE capacity addition targets by 2030,13 – 16 which is driven by decreasing renewable technology costs and the global shift towards cleaner energy sources. A large part of this RE would be used in green hydrogen production which would then be exported to various parts of the world and also be used in the production of green ammonia, green steel, green methanol, and so on.

Energy storage solutions

The integration of energy storage solutions, particularly battery storage, is gaining momentum. Energy storage helps in managing the intermittency of renewable sources, enhances grid stability, and facilitates the dispatchability of power.

Electrification of industries

There is a growing interest in electrifying energy-intensive industries such as petrochemicals and refining, which are heavily reliant on fossil fuels.

Conclusion

The global energy industry is going through a huge transformation, and the future of the MENA oil and gas sector is one to watch. It will be interesting to see how the regional NOCs navigate these interesting and challenging times and usher in a low-carbon environment.

References

For a full list of references please visit: https://bit.ly/3sV7M5l

14 | Oilfield Technology Autumn 2023

Figure 4. Natural gas production of key producer countires in MENA in 2022 (billion m3). Source: International - US Energy Information Administration (EIA). Note: The figures for Bahrain, Libya and Iraq are 2021 production values.

Figure 5. Renewable energy capacity addition (GW) targets of select MENA countries by 2030. * long-term renewable energy capacity addition target.

The rewards of reservoir simulation

Yamal Askoul, Baker Hughes, UK, explores the past and present of dynamic reservoir simulation, and details the benefits it is offering the oil and gas and energy transition sectors.

Anumber of industries rely heavily on technological advancements that lay the foundation for future developments. The oil and gas and energy transition sectors are no exception. Dynamic reservoir simulation in the oil and gas industry dates back to the 1960s when computer-based modelling first gained traction. Initially, these simulations were limited to simple models that provided basic insights into process behaviour. However, advancements in computing power and software capabilities propelled dynamic reservoir simulation to evolve into a sophisticated tool capable of replicating real-time operational scenarios.

In the 1970s, companies in the energy sector recognised the potential of dynamic reservoir simulation, leading to a race in its development and investigation. This era witnessed the introduction of comprehensive process simulation software packages that offered dynamic modelling capabilities. Engineers and operators were now able to simulate complex conditions and predict reservoir behaviour, specifically in terms of production output. As computer technology continued to advance in the 1980s and 1990s, dynamic reservoir simulation became increasingly sophisticated, with integrated advanced

| 15

control systems, real-time data acquisition, and more accurate modelling techniques. These advancements empowered operators to optimise process performance, evaluate safety measures, and improve operational efficiency.

Dynamic reservoir simulation at present

In the 21st century, dynamic reservoir simulation applications in the oil and gas industry experienced a rapid expansion, supported by improved computing performance and high-fidelity models. Companies are able to simulate complex phenomena such as multiphase flow, heat transfer, and fluid dynamics, with greater accuracy. This enables the combination of real-time data integration and dynamic simulation, resulting in the creation of powerful predictive models.

Building a model

The time required to build a dynamic reservoir model in the oil and gas and energy transition sectors can vary significantly due to various factors. These factors include data collection and preparation, data analysis and interpretation, reservoir characterisation, reservoir simulation model construction, model calibration and history matching, and model validation and uncertainty analysis. Additionally, considerations such as software capabilities, computational resources, and the expertise of the team involved play a crucial role. In general, the time required to build a dynamic reservoir model can range from several weeks, to months or years depending on these factors.

This is a general timeline and actual project durations can vary significantly based on the specific circumstances of each reservoir and project.

The process of building a robust dynamic reservoir model begins with reservoir characterisation. This involves building a geological model that accurately represents the subsurface reservoir.

Geoscientists employ seismic interpretation, well-log analysis, and reservoir rock characterisation techniques to unravel the geological structures and rock properties, and engineer support to understand fluid properties within the reservoir.

Seismic interpretation entails mapping subsurface structures using seismic data, enabling the identification of fault lines, stratigraphic layers, and hydrocarbon-bearing formations. Well-log analysis assists in evaluating porosity, permeability, lithology, and fluid saturations at different depths. Additionally, reservoir rock characterisation involves laboratory testing of core samples to determine essential rock properties like porosity and permeability that can be contrasted against log analysis results to have a calibration.

These characterisations play a vital role in building a detailed representation of the reservoir by capturing its complexity and heterogeneity, which are essential for an accurate and dynamic reservoir model.

After the completion of the geologic model, the next step involves constructing a static model, which discretises the reservoir into a grid or cell system, enabling numerical simulation of fluid flow. Each cell within the grid system represents a small volume within the reservoir. Properties such as porosity, permeability, and fluid saturation are assigned to each cell based on the reservoir characterisation data.

The grid blocks can be either uniform or non-uniform, depending on the desired resolution and computational efficiency. In some cases, upscaling techniques are employed to represent the reservoir at a coarser scale, while maintaining the critical flow behaviour. The static model acts as the initial representation of the reservoir’s properties and forms the foundation for dynamic simulations.

The required equation and data for dynamic reservoir simulation

The heart of dynamic reservoir modelling lies in fluid flow simulation, which involves governing equations for fluid flow through porous media. These equations are typically derived from Darcy’s law and mass conservation principles. Major laws used in reservoir simulation include:

Ì Conservation of mass: flow equations for flow in porous materials are based on a set of mass,

16 | Oilfield Technology Autumn 2023

Figure 1. Multilateral well location.

Figure 2. Improvement in oil production total and reduction of unwanted fluid.

Optimum Strength elastomer formulated for high torque and designed for increased reliability in high solids drilling applications

Maximum Wear elastomer designed to deliver increased durability and high torque in high performance drilling applications

High Temperature elastomer for applications requiring high power output and excellent fatigue life at elevated downhole temperatures

Elastomers that deliver nothing but power

No matter what you are drilling through, or what well you are completing, we have the right elastomer compounds for the job. Specifically formulated to deliver the power, durability and maximized performance you demand.

See how we deliver nothing but power sections at Abacodrilling.com

© 2023 Abaco Drilling Technologies. All rights reserved.

LEADING POWER SECTION TECHNOLOGY

momentum and energy conservation equations, along with constitutive equations for the fluids and the porous material involved.

Ì Conservation of momentum: the governing equations for momentum, usually described by the Navier-Stokes equations, are simplified for low-velocity flow in porous materials, and are instead described by the semi-empirical Darcy’s equation. This equation is used in the case of a single-phase, one-dimensional, horizontal flow.

Ì Conservation of energy: referred to as the first law of thermodynamics, this principle states that energy can neither be created or destroyed; it can only be transformed from one form to another. This principle serves as the cornerstone of dynamic reservoir simulation, ensuring the preservation of energy throughout the simulation process.

In addition, a dynamic reservoir model needs accurate and reliable input data such as fluid properties, rock properties, pressure differentials, and production/injection rates. Numerical algorithms discretise the reservoir grid and iteratively solve the equations, predicting fluid flow behaviour over time. The simulations provide valuable insights into pressure distributions, fluid movement patterns, and production/injection rates over time. By simulating different scenarios, engineers can assess the reservoir’s response to various production strategies and optimise field development plans.

Implementing dynamic reservoir simulation

Dynamic reservoir simulation is particularly beneficial in the following scenarios:

Ì Real-time decision making: dynamic reservoir simulation enables engineers to make informed, real-time decisions by providing up-to-date reservoir performance data. It allows for better prediction of fluid movement, pressure changes, and production behaviour, leading to more accurate and timely decision making.

Ì Production optimisation: by simulating different production scenarios, engineers can identify optimal well placements, well configurations, and production strategies. This optimisation can maximise hydrocarbon recovery while minimising costs, leading to improved reservoir management and increased profitability.

Ì Risk reduction: dynamic reservoir simulation facilitates risk analysis and mitigation. It helps identify potential challenges such as water breakthrough, gas coning, or reservoir compartmentalisation, enabling engineers to design effective mitigation strategies and reduce uncertainty during field development.

Ì Geothermal reservoir assessment: thermal dynamic simulation plays a vital role in predicting crucial information related to heat extraction (enthalpy per day) and recharge rates between producers and injectors. By understanding pressure and thermal fronts, as well as cooling fronts, the simulation provides valuable insights into the reservoir’s energy capacity and performance limits. This essential data helps in planning the design of heat exchangers, surface facilities, and commercial strategies more effectively, ensuring optimal utilisation of the geothermal resource and sustainable project development.

Ì Carbon capture, utilisation, and storage (CCUS) dynamic simulation: dynamic reservoir simulation plays an important role to understand the behaviour of CCUS processes and their implications for long-term carbon management. For carbon capture and storage (CCS), the process consists of injecting carbon dioxide (CO2) into geological formations, such as

depleted oil and gas reservoirs or saline aquifers. The simulation helps to understand reservoir pressure changes, migration of CO2 within the formation, and potential risks like induced seismicity and leakage. Understanding these dynamics is crucial for assessing storage capacity and ensuring the long-term stability of the storage site. On the other hand, the process for CCUS also considers capturing CO2 emissions from fossil power generation and industrial processes for storage and utilisation in underground oil reservoir. Dynamic reservoir simulation also helps to predict the interaction between the injected CO2 and liquid hydrocarbon over time and understand whether injecting CO2 will have any benefit to recover more oil.

Ì Enhanced reservoir management: through dynamic reservoir simulation, engineers can monitor reservoir performance and evaluate the impact of operational changes in real time. This information assists in reservoir management, ensuring long-term sustainability and prolonged production life.

Ì Complex reservoirs: when dealing with complex geological structures, heterogeneous reservoirs or challenging fluid behaviour, dynamic reservoir simulation offers valuable insights into the behaviour of the reservoir, helping optimise production strategies and recovery.

Ì Enhanced oil recovery (EOR): for reservoirs undergoing EOR techniques, such as water flooding, gas injection, or chemical flooding, dynamic reservoir simulation is crucial for assessing the efficacy of these methods, optimising injection rates, and predicting incremental oil recovery.

Ì Long-term field development: when planning long-term field development strategies, dynamic simulation enables engineers to evaluate reservoir performance under various scenarios, optimising well spacing, production rates, and infill drilling plans.

Case study: dynamic models

An operator recently wanted to increase production by drilling new multilateral wells that could reach a section of the reservoir that would aid in maximising the recovery factor.

The project encompassed a set of background factors and challenges that needed to be addressed effectively. One significant aspect involved dealing with a complex reservoir and well completion, which had posed difficulties in previous modelling attempts. Therefore, seeking expert advice on autonomous inflow control device (AICD) modelling became crucial for overcoming such obstacles. Another essential requirement was to generate accurate forecasts for all mother bores and laterals within the system. Such forecasts would help provide valuable insights into the reservoir’s behaviour and aid in making informed decisions. Lastly, it was imperative to assess the potential benefits that could be derived from implementing AICD technology, as this would enable a comprehensive understanding of its impact on reservoir performance (Figure 1).

The solution involved several key steps and yielded significant results. First, the operator requested to build a dynamic model that helped to understand the advantage of a lower completion technology. Once the dynamic model was complete, it was used to build standalone screen (SAS) wells and AICD completions using dynamic reservoir simulation. This step enabled the visualisation and integration of the completion designs into the reservoir model.

Next, in-house software was employed to generate performance characteristics for AICD. This allowed for a detailed analysis of the AICD configurations, flow rate resistance (FRR), and other sensitivities. By comparing and assessing these various factors, the

18 | Oilfield Technology Autumn 2023

model helped to evaluate the effectiveness and efficiency of different AICD set-ups.

The implementation of AICD technology offered numerous benefits for the project. The results obtained from the analysis indicated that the deployment using AICD had a positive impact on production performance. Specifically, it demonstrated an increase in oil production while simultaneously reducing water and gas production. This outcome signifies the effectiveness of the AICD system in optimising reservoir production and enhancing hydrocarbon recovery (Figure 2).

Furthermore, the project provided valuable technical guidance on AICD modelling, both in steady-state and dynamic scenarios. The insights gained from the modelling exercises facilitated a better understanding of the behaviour and performance of the AICD system under varying conditions.

Overall, the dynamic reservoir simulation analysis showed the benefit that could be gained in production performance, enhanced technical understanding through modelling, and increased operator confidence. These outcomes highlight the potential and value of dynamic reservoir simulation in optimising reservoir production and achieving greater hydrocarbon recovery.

Conclusion

The process of building a dynamic reservoir model involves reservoir characterisation (where a geological model accurately represents the subsurface reservoir) and constructing a static model that discretises the reservoir into a grid system to numerical simulation. The heart of dynamic reservoir modelling lies in solving the governing equations for fluid flow through porous media (derived from Darcy’s law), mass conservation principles, and accurate input data.

Dynamic reservoir simulation offers numerous benefits in various scenarios, including real-time decision making, production optimisation, risk reduction, enhanced reservoir management, analysis of complex reservoirs, enhanced oil recovery, and long-term field development planning. By simulating different scenarios, engineers can make informed decisions, optimise production strategies, mitigate risks, monitor reservoir performance, and plan for long-term sustainability.

The case study presented in this article highlights the effectiveness of dynamic reservoir simulations in optimising reservoir production through the implementation of AICD. By building a dynamic model and analysing various AICD set-ups, the project achieved increased oil production, reduced unwanted fluid production, and enhanced technical understanding. This demonstrates the tangible benefits of dynamic reservoir simulation and its potential in maximising hydrocarbon recovery and supporting the energy transition.

In conclusion, dynamic reservoir simulation enhances reservoir engineering analysis related to oil and gas fields and the energy transition sector. Over time, it has evolved into a powerful tool to optimise production, enhance hydrocarbon recovery, and assist in decision-making. The advancements in computing power, high-fidelity models, and the integration of machine learning have further improved the accuracy and capabilities of dynamic reservoir simulation. The essential role it plays in the oil and gas industry and the energy transition sector is profound, as it contributes to better operational efficiency, reduced costs, and improved resource management. Through dynamic reservoir simulation, new opportunities can be unlocked, and the changing landscape of the energy industry can be navigated.

TRUST RESPONSIBILITY INTEREST MOTIVATION OBJECTIVITY STABILITY Your partner in OIL & GAS / Geothermal Industry since 2003 www.trimos-sro.eu ISO 9001:2015 Mrs.

Lenka@trimos-sro.cz Mr.

trimos@trimos-sro.cz TRIMOS, s.r.o. Prosečská 4541 468 04 Jablonec nad Nisou Czech Republic EUROPE

Lenka Sîrghi

Petru Sîrghi

A STEP CHANGE IN STIMULATION

20 |

Operators worldwide are facing increasing pressure to enhance the efficiency and sustainability of their production operations. While conventional stimulation methods, such as acid matrix stimulation, continue to be used with success, they tend to be less effective in tightly layered formations and often lead to uneven wellbore stimulation. Large-scale pumping or fracturing operations are very resource-intensive (in terms of both energy and water), resulting in a large carbon footprint.

Using Fishbones’ Stimulation Technology (FST) as a case study, this article examines how technology is helping operators overcome the limitations of traditional stimulation techniques. This technology enables access to multiple zones of the pay-stack via the creation of laterals/tunnels (10 – 12 m in length) that branch

off from the main bore. Key advantages include increased reservoir connectivity, improved distribution, improved production/injection rates, enhanced recovery efficiency, and a reduced carbon footprint when compared to high-pressure pumping operations.

The technology has been deployed in numerous wells both onshore and offshore on four continents. On several projects it has been adopted as the base case solution for early-stage development.

Technology overview

FST can be deployed with an open hole liner as part of a standard rig operation and comprises subs at selected intervals, each containing four needles up to 12 m in length that penetrate

| 21

Thomas Jørgensen and Wissam Chehabi, Fishbones, Norway, discuss how operators are utilising the latest stimulation technology to enhance sustainability and efficiency.

the sub-layers of the formation. The needles are equipped with either 0.5 in. drill bits or jetting nozzles (depending on the formation type). Multiple subs can be spaced out along the liner.

In the case of jetting in carbonate formations, acid (typically 15% HCl) is pumped in a bullhead operation. Due to the differential pressure created across the jetting nozzles, the needles jet and extend into the formation in a curved trajectory simultaneously. The jetting operation is performed after setting the liner hanger packer through the work string, with the rig in place.

When drill bits are used, the laterals are created in one single circulation operation and are drilled out simultaneously. In both the drilling and jetting configurations, the end result is the same: a well containing numerous 10 – 12 m laterals, which increases reservoir exposure and connectivity. The maximum number of needles deployed in one well to date is 224.

The drilling system is normally installed in combination with blank liner pipe or in combination with standalone screens, in case of sand control requirements. The subs for blank liner pipe applications are equipped with production valves, which provide pressure integrity during circulation of drilling fluids for the laterals’ drilling operation. The valves open and allow for hydrocarbons to enter the liner during the production phase. When installed in combination with standalone screens, the subs have no production valves, as the hydrocarbons will need to flow through the screens and inflow control devices (ICDs). The ICDs are equipped with a check functionality in the drilling application, similar to the standard production valves.

FST can be deployed in any type of field. However, it is especially beneficial in naturally fractured and layered formations. The system provides several advantages over conventional stimulation techniques including:1

Ì Connection of multi-layered reservoirs with poor vertical permeability: the 12 m long needles penetrate the formation, establishing a connection to layers located above and below the wellbore.

Ì Larger reservoir exposure and reduced drawdown: while the increased connection length can reduce drawdown, the laterals

also create access to higher reservoir pressures in previously isolated layers.

Ì Connections to naturally producing fractures: the needles intersect with the present fractures, allowing production from much deeper points in the reservoir’s natural fracture network.

Ì Bypass near wellbore damage: the laterals created by needles will allow a flow pathway to bypass any skin and effectively eliminate the contribution of the near wellbore damage to choking the flow.

Ì Improved conformance: with laterals spaced along the entire wellbore, FST helps to improve conformance along horizontal sections.

Ì Reduced risk: in hydraulic fracturing operations, control on fractures is limited and there is a risk of percolating the fracture to the water and gas-bearing zone. With FST technology, the lateral length can be customised, which significantly reduces the risk of penetrating unwanted zones.

Ì Need to drill fewer wells: in many cases, by increasing reservoir connectivity, FST can eliminate the need to target different sublayers with multiple drilled wells. This can drastically reduce field development costs, improving sustainability and hydrocarbon recovery factor.

Reduced environmental impact

Another notable advantage of FST technology is a reduced environmental footprint.

An independent study performed by THREE60 Energy found that carbon dixoide (CO2) emissions from a FST deployment were 88% lower with jetting, and 95% lower with drilling (when compared to hydraulic fracturing).

Total CO2 emissions generated by FST jetting were calculated to be 6.7 t per completion, compared to 53.3 t generated by acid-fracturing. Similarly, the calculated FST drilling CO2 emissions were calculated at 35.4 t per completion, with propped-fracturing techniques generating 651 t of emissions by comparison.

The report noted that FST offers a more sustainable alternative for well enhancement than conventional techniques, and in some cases, a more cost-effective solution as well. The findings also suggested that through its unique, controlled pumping operation, FST technology was able to connect wells with faults and fractures, bypass any damaged formations, and target so-called reservoir ‘sweet spots’.2

North Sea – conglomerate formation application

Although FST is still viewed as a novel stimulation technique by many across the industry, the first jetting application occurred a decade ago in 2013. Shortly after, in 2015, the first FST drilling installation was completed. With installations in both clastic and carbonate reservoirs showing positive results, it is gaining traction in many regions of the globe. The technology was installed for the first time in two conglomerate formation wells in the North Sea’s Edvard Grieg field in 2021 for Lundin Energy (now Aker BP).

The first well was drilled in the southern part of the field (1100 m), targeting low permeability conglomerate. Two nearby wells had shown low productivity and were not able to drain the area. To address this, a 5.5 in. FST drilling system was used in combination with standalone ICD screens (53 subs and 159 laterals).

The well came online in June 2021 and demonstrated excellent performance, with productivity significantly higher than the pre-drill prognosis. The initial production rate was approximately 1200 m3/d at moderate drawdown, with a liquid PI of approximately 30 m3/d/bar, more than five times higher than seen from

22 | Oilfield Technology Autumn 2023

Figure 1. Visualisation of FST technology. (Image courtesy of Aker BP).

Figure 2. Depiction of well with FST jetting system installed in lower sub-layers.

Decarbonising. Faster. Together.

ADIPEC, the world’s largest energy exhibition and conference, brings together the ideas, ambition, technology and capital needed to accelerate the urgent, collective and responsible action that can decarbonise and future-proof our energy system. Under the Patronage of H.H.

of the United Arab

2-5 October 2023 Abu Dhabi, UAE ADIPEC

Numbers 160,000 Energy

15,000

delegates 54 NOCs, IOCs, NECs and IECs 350 Conference

30 Country pavilions Conferences 10 2,200 Exhibiting companies 1,600 Conference speakers Register as a visitor Register as a delegate www.adipec.com Strategic insights partner Host City Venue partner Official travel partner Official hotel partner Official local media partner Sport & recreation partner ADIPEC brought to you by Technical Conference organised by Knowledge partner Official English news partner Official broadcast partner International news partner Partners Supported by Platinum sponsors Gold sponsors

Sheikh Mohamed Bin Zayed Al Nahyan, President

Emirates

in

professionals

Conference

sessions

the nearby well. The well was produced at a stabilised liquid rate of approximately 1000 m3/d after the clean-up.3

The second well (61 subs) began operation in December 2021 and also demonstrated high productivity. The flow rate and pressure response exceeded expectations and provided a good drainage point in what was likely to be an area with stranded resources.

Fishbones’ activity with Aker BP on the Edvard Grieg field is an example of the success that can be achieved by working closely on field development. Due in part to this close partnership approach, Aker BP announced in 2022 that a successful infill well campaign had contributed to a reserve increase of 17%.4

Middle East – tight carbonate productivity enhancement

Another successful application of FST technology took place in the Middle East, where it was used to improve productivity in a heterogeneous tight marginal field operated by an ADNOC joint venture (JV). The reservoir has a low permeability ranging from 0.2 – 5 md and is comprised of several sub-layers, with porosity of 10 – 15%.

FST technology was installed as part of a pilot implementation in two lower sub-layers in combination with the production sub for matrix acidising in an upper sub-layer. FST jetting was used to create 80 laterals (from 20 subs). The result was a 4.5 times productivity increase compared to the initial estimate of 1.5 times. Production was also increased to 2000 bpd, which was roughly double that of a normal well with conventional stimulation during initial testing.5

The pilot implementation proved the applicability of the FST system for tight reservoir development with low permeability and poor vertical communication. The technology is now expected to

further reduce drilling and tie-in costs, as it can achieve the same objective of drilling two or more wells to target different sub-layers.

Conclusion

Dozens of applications and long-term testing have shown that FST demonstrably and sustainably increases production rates and recovery in challenging wells. First time use of FST in conglomerate formation creates a platform for productivity enhancement in tight heterogeneous reservoirs.

In addition to increased productivity, the technology also reduces rig time compared to conventional stimulation techniques, which results in a lower carbon footprint. In offshore applications, the need for stimulation vessels is also reduced, further mitigating emissions.

References

1. RACHAPUDI, R.V., AL-JABERI, S. S., AL HASHEMI, M., PUNNAPALA, S., ALSHEHHI, S. S., TALIB, N., LOAYZA, A. F., AL NUIMI, S., ELBEKSHI, A., QUINTERO, F., YULIYANTO, T., ABD RASHID, A. BIN, ALKATHEERI, F. OMAR, GUTIERREZ, D., CHEHABI, W., AND ALI BA HUSSAIN. “Fishbone Stimulation a Game Changer for Tight Carbonate Productivity Enhancement, Case Study of First Successful Implementation at Adnoc Onshore Fields.” Paper presented at the Abu Dhabi International Petroleum Exhibition & Conference, Abu Dhabi, UAE, November 2020. doi: https://doi.org/10.2118/202636-MS

2. Fishbones’ technology significantly reduces carbon emissions compared to conventional practices. September 2021. url: https://www.fishbones.as/news-21-9-22

3. FLIKKA, T., EEK, A., SOLHAUG, K., and THOMAS J., “World’s First Installation of a Revolutionary Multi-Zone Stimulation Technique in Conglomerate Formation, Unlocking Reserves and Proving Significant Productivity Increase.” Paper presented at the SPE Annual Technical Conference and Exhibition, Houston, Texas, USA, October 2022. doi: https://doi.org/10.2118/209953-MS

4. Lundin Energy announces total resource additions of 200 percent of 2021 production. January 2022.

5. LI, RONG & GONG, HAO & AL-SHAMSI, MOHAMED & FENG, PEIZHEN & ELBARAMAWI, MOHAMED & AL-NEAIMI, AHMED & AL-MENHALI, HELAL & CHEHABI, WISSAM & ABDELHAMED, WAEL & LOOBARI, SULTAN & ALI, AHMED & OBEID, AHMAD. (2022). A Novel Approach by Needles in the Payzone of Heterogeneous Tight Carbonate: A Case Study for Offshore Marginal Field. International Journal of Petroleum Technology. 9. 14-25. 10.54653/2409-787X.2022.09.3.

requires a global publication Global publication Subscribe online at: www.oilfieldtechnology.com/subscribe

Embracing Uncertainty

In the oil and gas industry, the maximisation of hydrocarbon recovery can present a significant challenge. Often, optimal production hinges on the ability to understand and model the subsurface and its associated uncertainties. Advancements in ensemble-based reservoir modelling and data conditioning techniques have helped develop reservoir management, enabling the industry to better predict, plan, and optimise operations.

Traditionally, reservoir modelling has revolved around deterministic methods, with a focus on delivering ‘best estimate’ models. However, this approach can often fail to capture the inherent uncertainties associated with subsurface characteristics. Deterministic methods are ill-suited to sparsely sampled reservoirs which are often rife with unknowns, from the precise distribution of hydrocarbon-bearing formations to the extent of variations in reservoir parameters such as permeability or porosity. Today, the oil and gas industry is actively embracing an uncertainty-centric approach, and ensemble-based modelling is helping to enable this transformative shift.

Ensemble-based modelling facilitates the creation of multiple, equally probable subsurface models, capturing a range of uncertainties inherent in the subsurface data. Each model within the ensemble honours both static and dynamic data while portraying variability and capturing uncertainty. This offers a

more robust understanding of the reservoir and sets the stage for efficient, fact-based production optimisation.

Ensemble-based modelling and data conditioning

Generating plausible subsurface representation requires reservoir models that incorporate a wide range of data. The data, which spans from well logs and seismic data to production history and 4D seismic surveys, can be of varied quality and resolution. Data conditioning plays an important role in the often challenging task of integrating such a disparate set of information. When properly implemented, an ensemble smoother with multiple data assimilation (ES-MDA) technique helps ensure that the models generated honour all available static and dynamic data simultaneously.

Once seen as a strategy for history-matching brownfields with many years of production, the use of multiple data assimilation in an ensemble-based modelling technique has delivered value to operators for many years in all stages of the reservoir’s lifecycle.

For instance, in the Johan Sverdrup field in Norway, ensemble-based modelling was instrumental in improving volume estimates at an early stage in the field’s appraisal. Here, the technique helped create a robust understanding of the reservoir formation’s permeability and thickness uncertainties. This led to

| 25

Atila Mellilo and Philip Neri, Halliburton Landmark, Denmark, explain how ensemble-based reservoir modelling is being used to maximise reservoir recovery.

more accurate forecasts of reservoir performance, even though only DST data was available as dynamic data.

1

Best practices in ensemble-based modelling

Implementing ensemble-based modelling to help optimal oil and gas production management involves following several best practices to ensure the desired results.

The creation of the ensemble of reservoir models must ensure that the ensemble members honour all the available static and

dynamic data, as well as the regional and local knowledge across all the disciplines in the asset team. This involves the simultaneous curation of geospatial, geophysical, and geological data into a multi-disciplinary modelling workflow to provide a consistent view of the reservoir’s characteristics.