July 2023

COMPRESSORS TO TARGET THE ENERGY TRANSITION

TRI-TOP FOR LNG APPLICATIONS

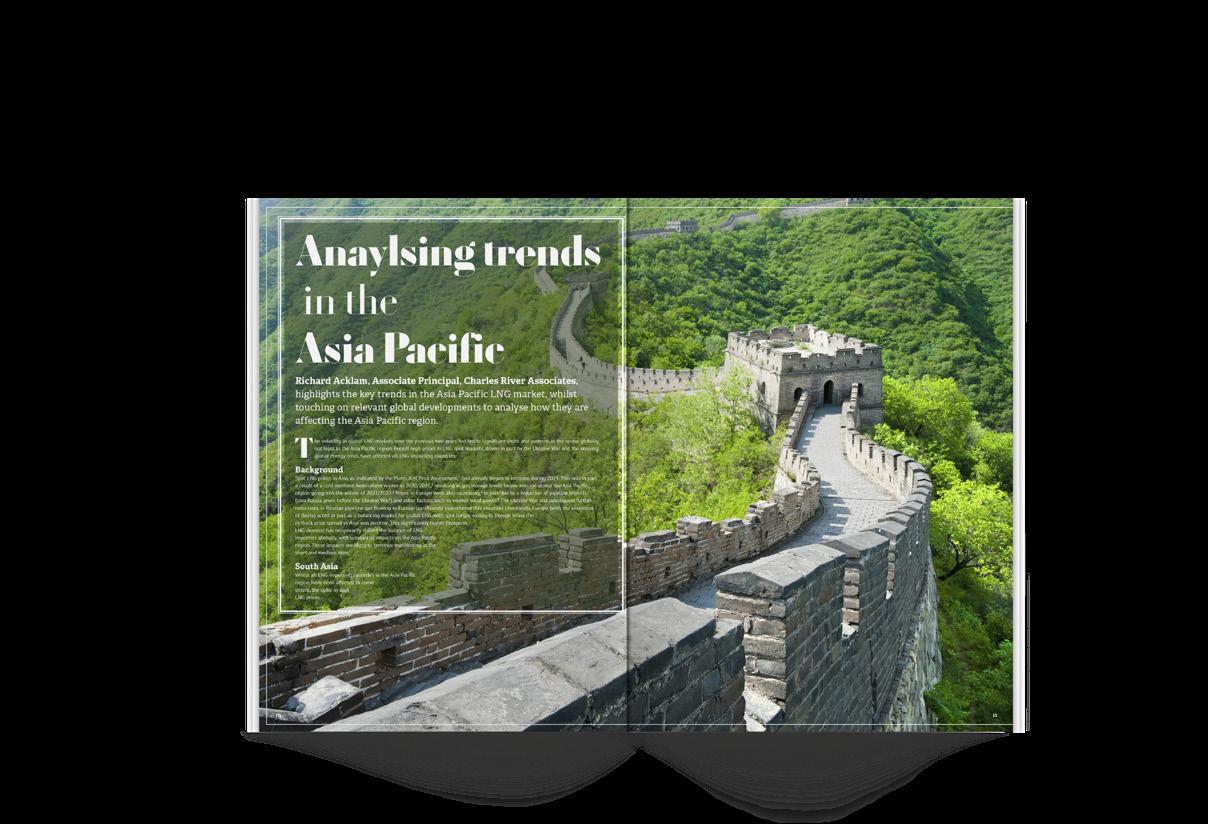

10 Analysing trends in the Asia Pacific

JULY

34 Compressors to target the energy transition

Takashi Niiyama, Mitsubishi Heavy Industries Compressor Corporation, Japan, looks at how compressor solutions for LNG can help the industry navigate the energy transition.

39 Banishing biofouling during outfitting

Catherine Austin, I-Tech, Sweden, explains how to tackle the problem of barnacle biofouling for both the LNG-powered fleet and LNG carriers.

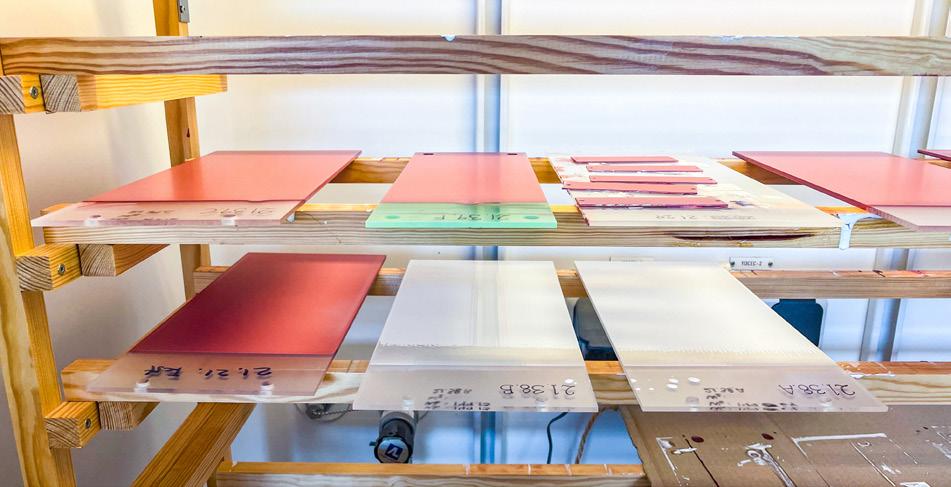

42 Counteracting LNG carrier challenges with marine coatings

LNG carrier fleet must implement energy efficiency measures to meet global and regional regulations, says Ariana Psomas, PPG Segment Director, Protective and Marine Coatings.

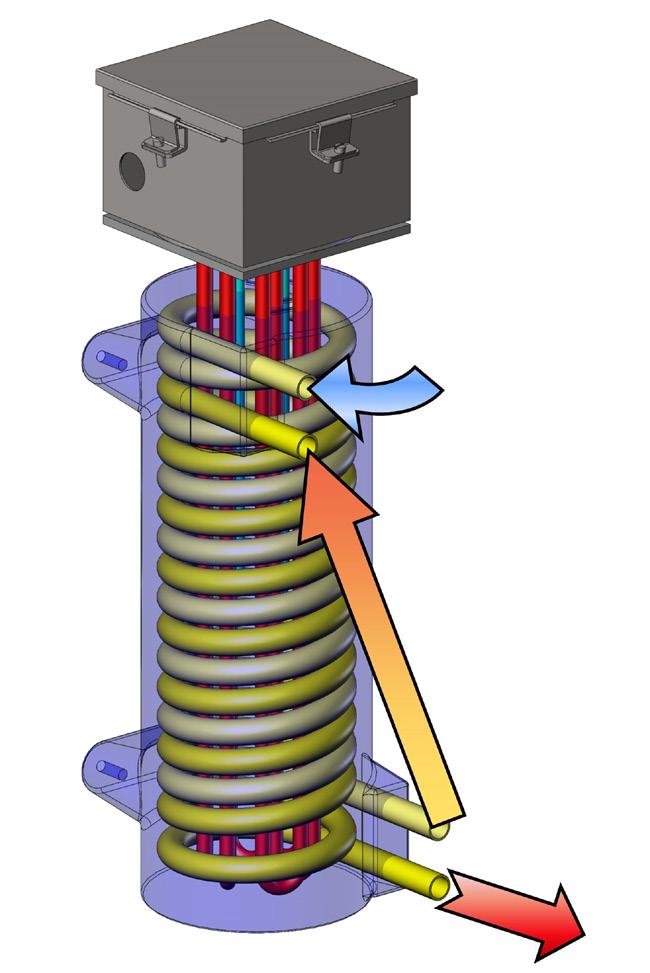

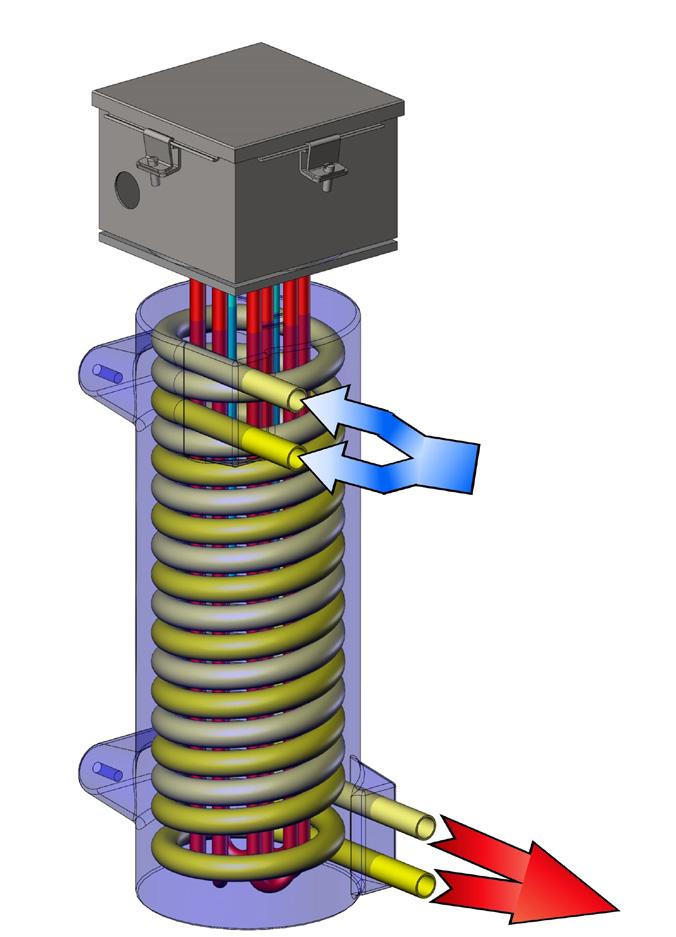

46 Meeting the gas heater and vaporiser needs of tomorrow, today

Jeff Awe, Cast Aluminum Solutions, USA, provides insight into the efficient heating and vaporising of natural gas and other process media.

51 More than a pipe dream

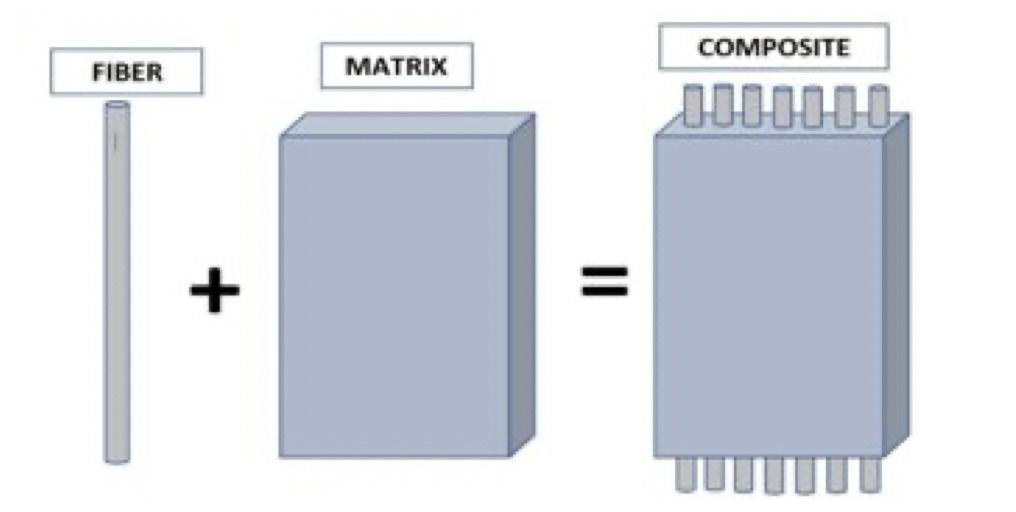

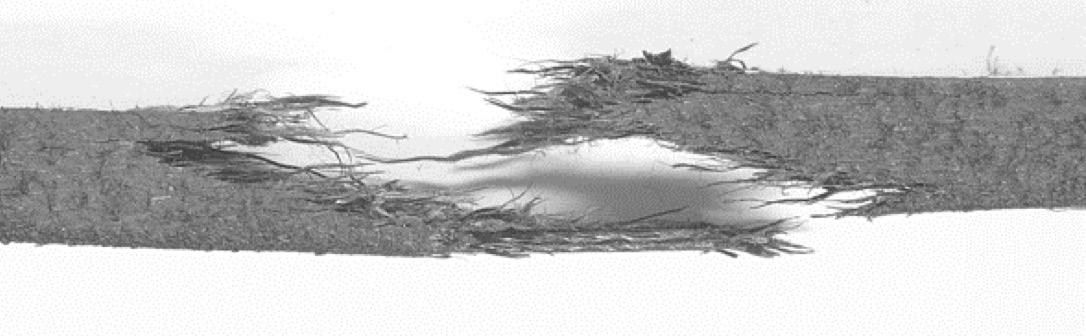

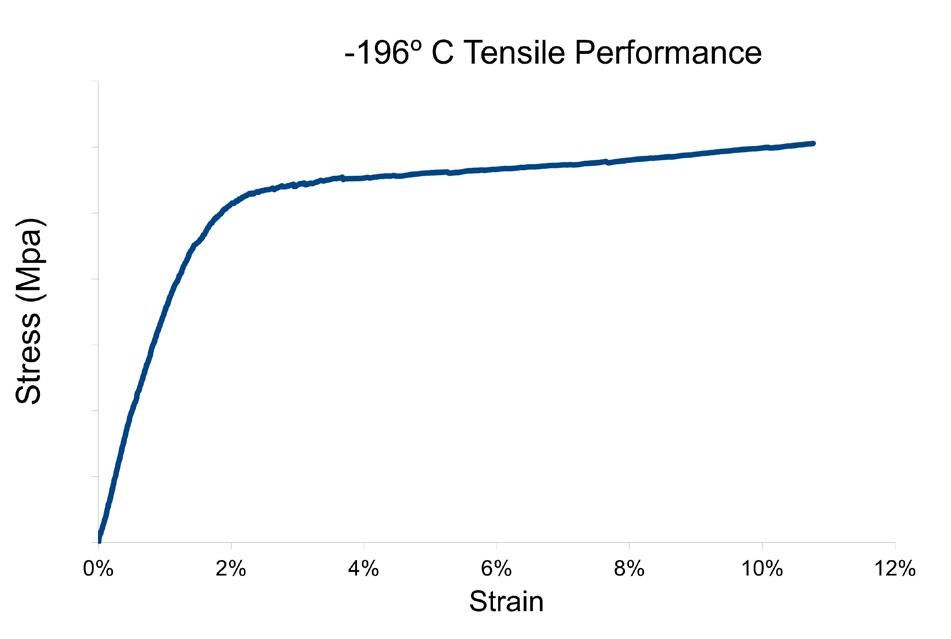

Dr Jonathan Wilkins, Enoflex Ltd, UK, details the development journey for a non-metallic, cryogenic pipe technology for use in regasification terminals.

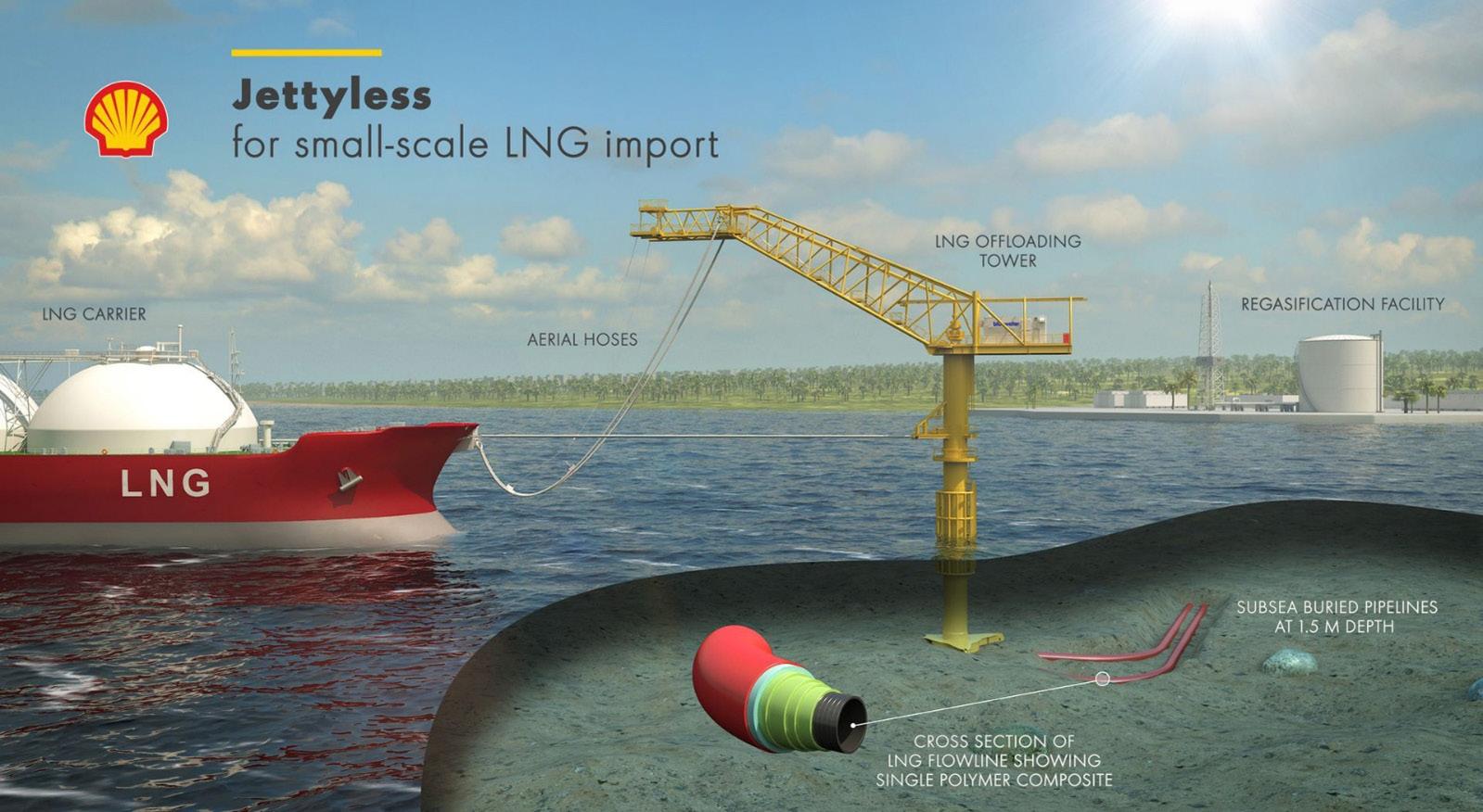

55 Making regasification technology flexible

ECOnnect Energy examine how LNG regasification technology is evolving to meet the needs of today’s energy market.

and Dr Annemarie Ott Weist, Air Products, explore how to prevent unpleasant surprises during mixed refrigerant condensation.

19 A clean fuel to rule the truckstop forecourt

Dover Fueling Solutions, Europe, consider the benefits of using LNG as an alternative fuel.

22 A bridge to alternative fuels

Stefano Calandri, Vanzetti Engineering, Italy, describes how pumps can be used to help the LNG market transition to a cleaner future.

25 Compressors Q&A

LNG Industry asked several companies to discuss some key topics regarding compressors in the LNG industry.

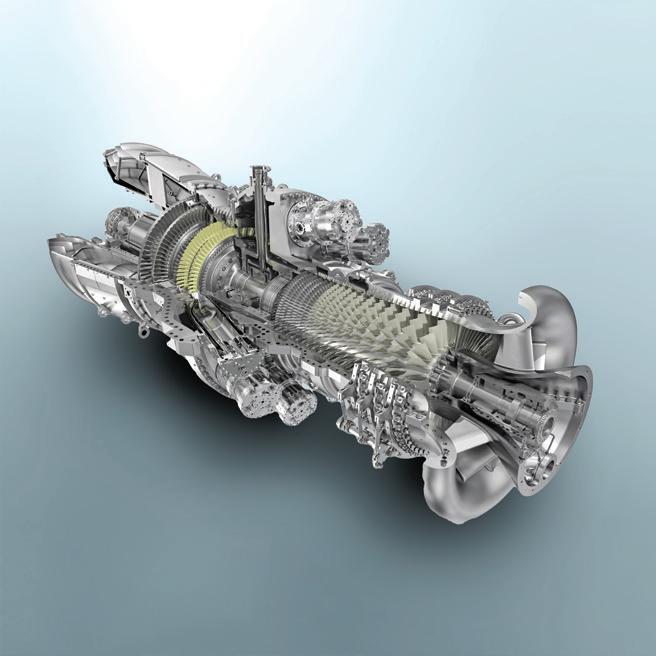

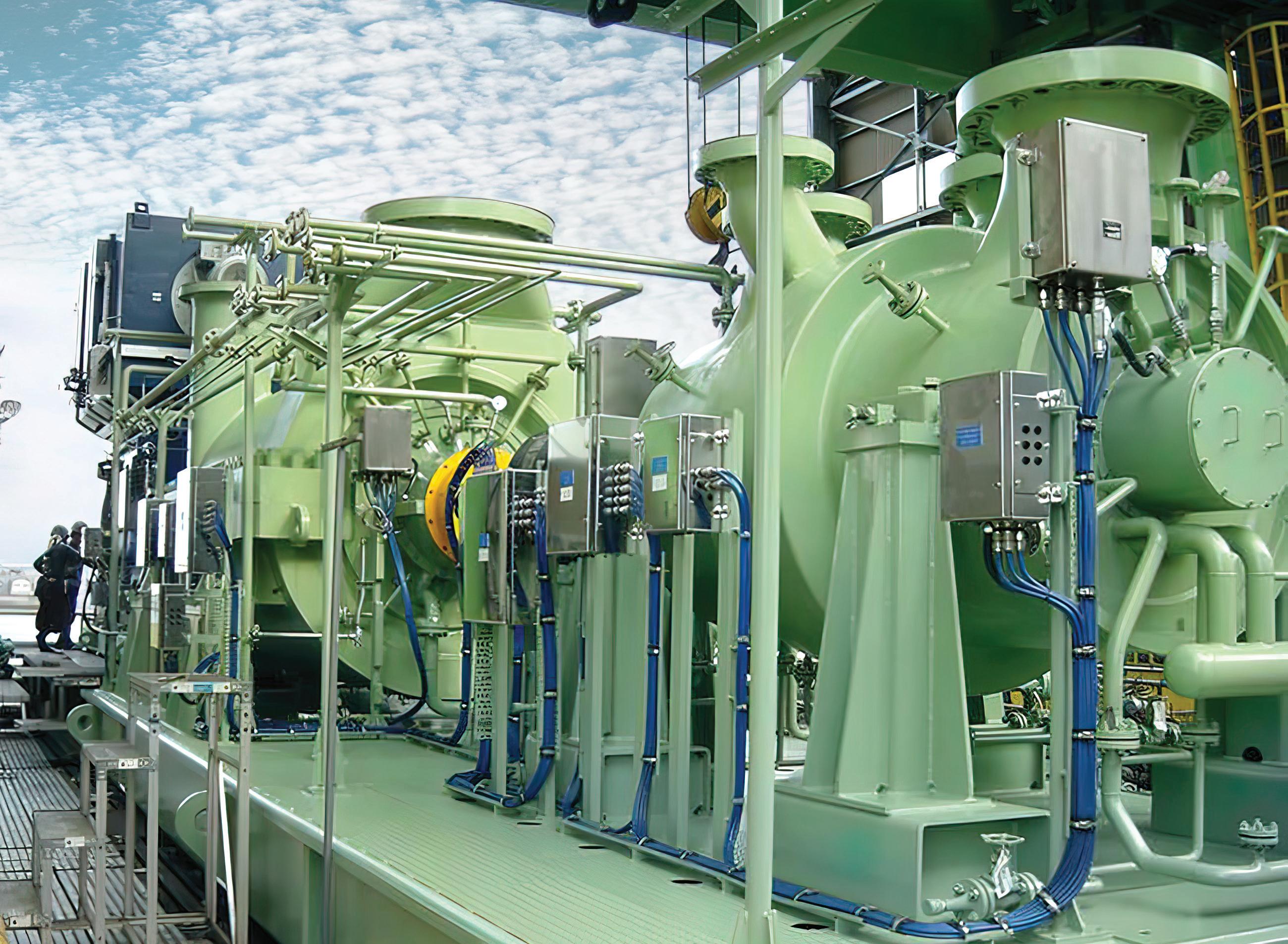

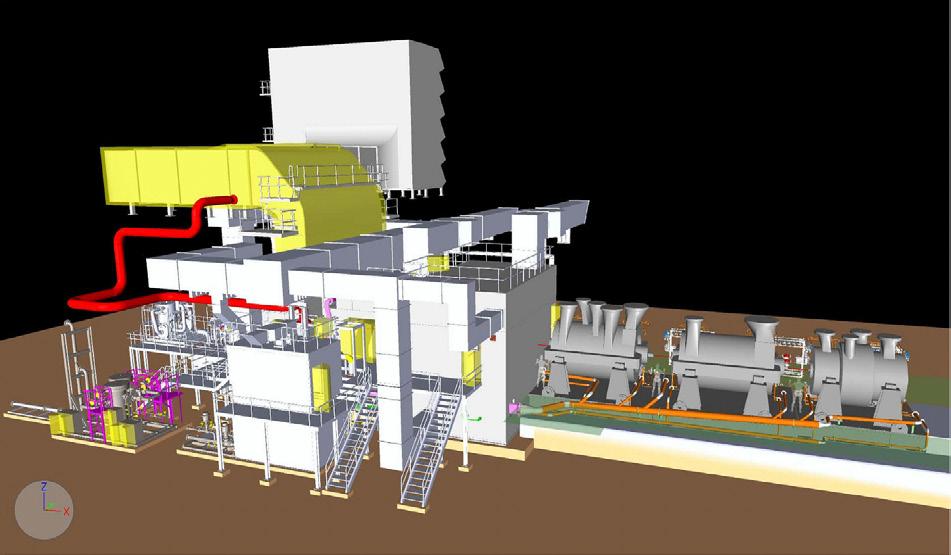

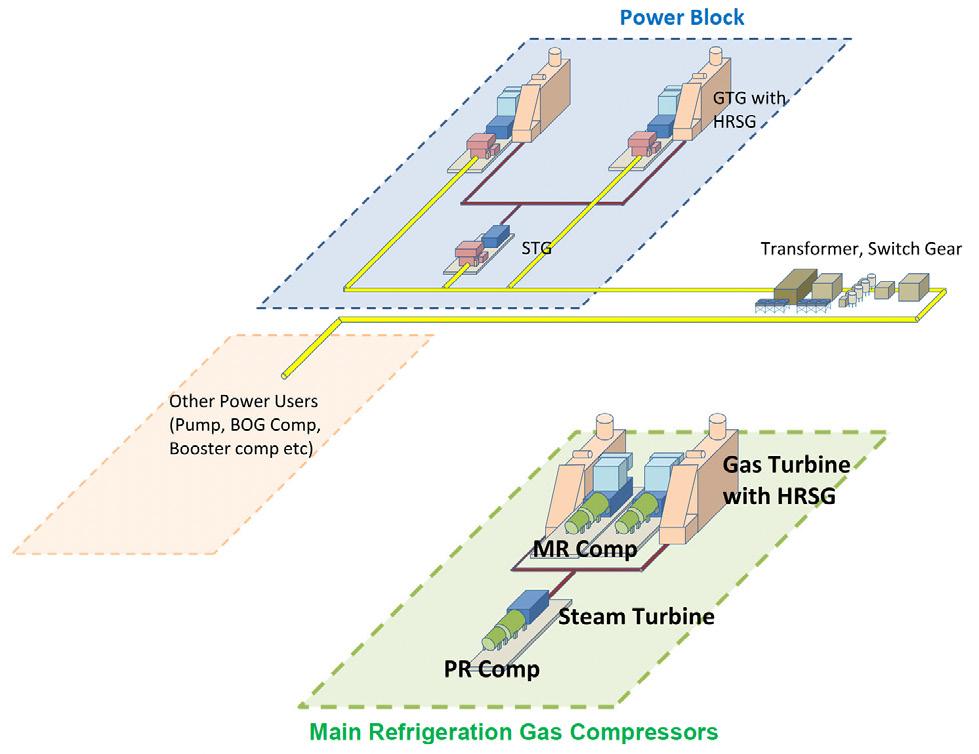

Mitsubishi Heavy Industries Compressor Corporation (MCO) is a global provider of refrigeration compressors, specialising in LNG projects. MCO aims to improve plant efficiency, reduce costs, and address market demands for shorter construction times and lower carbon emissions. Its main compressors, powered by a 120 MW gas turbine, offer variable speed operation and cost-effective startup. MCO ensures system reliability through load string tests and utilises the modular Mitsubishi Compressor Smart Packaging (MCSP) scheme to minimise on-site work and labour expenses. Additionally, the company's Hybrid Combined Cycle (HCC) LNG concept enhances thermal efficiency, capacity and reduces carbon intensity.

Bringing clean energy from Texas to power the world.

COMMENT

We’ve made it to July, and this can only mean one thing: sports. On offer this year is the FIFA Women’s World Cup 2023. Ahead of the tournament, which is going to be co-hosted by Australia and New Zealand, the World Cup is forecast to reach 2 billion viewers worldwide – nearly one-quarter of the population. This would represent an increase of approximately 79% on the 2019 tournament,1 which was watched by more than 1.12 billion people.2

The matches will be taking place in various stadiums across Australia and New Zealand. In Australia, these matches are spread out across Brisbane (Queensland), Adelaide (South Australia [SA]), Melbourne (Victoria), Perth (Western Australia), and Sydney (New South Wales).

Despite recently being overtaken by the US and Qatar as the world’s largest LNG exporter, Australia is still one of the top exporters of LNG. It is geographically well positioned to serve Asia in its quest to reduce its reliance on fossil fuels, and replace this with LNG. In 2022, Australia supplied 40% of its LNG exports to Japan, 15% to South Korea, 10% to Taiwan, 3% to Singapore, and 2% to both Malaysia and Thailand.3

There is also a fair amount of recent news being released in relation to Australian LNG. A joint study by South Australian LNG import terminal developer, Venice Energy, and SEA Gas, the owners of a 680 km pipeline between Victoria and SA, has confirmed that the pipeline can be reconfigured to facilitate bi-directional flow between the states. As a result, the proposed LNG terminal in the Outer Harbor at Port Adelaide will ensure that both states can secure their gas supplies, particularly during the peak winter period.4

Elsewhere in Australia, Tamboran Resources Ltd has been awarded exclusivity by the Northern Territory government for over 170 ha. on the Middle Arm sustainable development precinct for a proposed LNG development,

Northern Territory LNG (NTLNG). The site is expected to host an LNG development with an initial capacity of 6.6 million tpy, with first production targeted by 2030.5

Not long after this announcement, it was declared that Tamboran has signed two memorandum of understandings with BP Singapore Pte. Limited and Shell Eastern Trading (Pte) Ltd for each company to purchase up to 2.2 million tpy from the proposed NTLNG project over a 20-year period, which Tamboran’s CEO, Joel Riddle, believes further emphasises the importance of LNG demand growth in the Asia Pacific region.6

For more on the Asia Pacific region, make sure to read Charles River Associates’ regional report which looks at key trends in the Asia Pacific LNG market, and considers how relevant global developments are affecting the region.

References

1. ‘Total television audience of the FIFA Women’s World Cup in 2019, with a forecast for 2023’, Statista, (5 June 2023), www.statista.com/ statistics/1386733/womens-world-cup-total-tv-viewership/

2. ‘2019 world cup watched by more than 1.12 billion’, FIFA, (18 October 2019), www.fifa.com/tournaments/womens/ womensworldcup/france2019/news/fifa-women-s-world-cup2019tm-watched-by-more-than-1-billion

3. ‘Australia’s 2022 LNG exports, by country’, Wood Mackenzie Lens Gas & LNG, www.woodmac.com/news/opinion/japan-australianlng-exports/

4. ‘SA LNG Import Terminal can serve the east coast – study confirms’, Venice Energy, (4 May 2023), https://veniceenergy.com/ wp-content/uploads/2023/05/Media-Release-Pipeline-Study230504-WEB.pdf

5. ‘Tamboran secures land at Middle Arm Sustainable Development Precinct for proposed Northern Territory LNG (NTLNG) Development’, Tamboran Resources, (9 June 2023), www.investi.com.au/api/announcements/tbn/c2224152-5fb.pdf

6. ‘Tamboran signs two MOUs with bp and Shell for supply of 4.4 MTPA of LNG from the Company’s proposed NTLNG development’, Tamboran Resources, (23 June 2023), www.investi.com.au/api/announcements/tbn/23dcafe8-1f9.pdf

Managing Editor James Little james.little@palladianpublications.com

Senior Editor Elizabeth Corner elizabeth.corner@palladianpublications.com

Deputy Editor Jessica Casey jessica.casey@palladianpublications.com

Editorial Assistant

Théodore Reed-Martin theodore.reedmartin@palladianpublications.com

Sales Director Rod Hardy rod.hardy@palladianpublications.com

Sales Manager Will Powell will.powell@palladianpublications.com

Production Manager Calli Fabian calli.fabian@palladianpublications.com

Digital Events Manager

Louise Cameron louise.cameron@palladianpublications.com

Digital Events Coordinator Stirling Viljoen stirling.viljoen@palladianpublications.com

Digital Administrator

Leah Jones leah.jones@palladianpublications.com

Digital Content Assistant Merili Jurivete merili.jurivete@palladianpublications.com

Administration Manager Laura White laura.white@palladianpublications.com

CryoMac® 4 LNG Fueling Nozzle

Maximum safety for LNG fuel technology

Vacuum Jacketed Pipe (VJP)

The most cost-effective way to transfer cryogenic liquids

SAFE

“Safety Stop” for added safety and operator protection.

Stainless Steel Inner Pipe

these advanced features to produce exceptional efficiencies across the

Evacuation & Safety Device

Super-Insulation

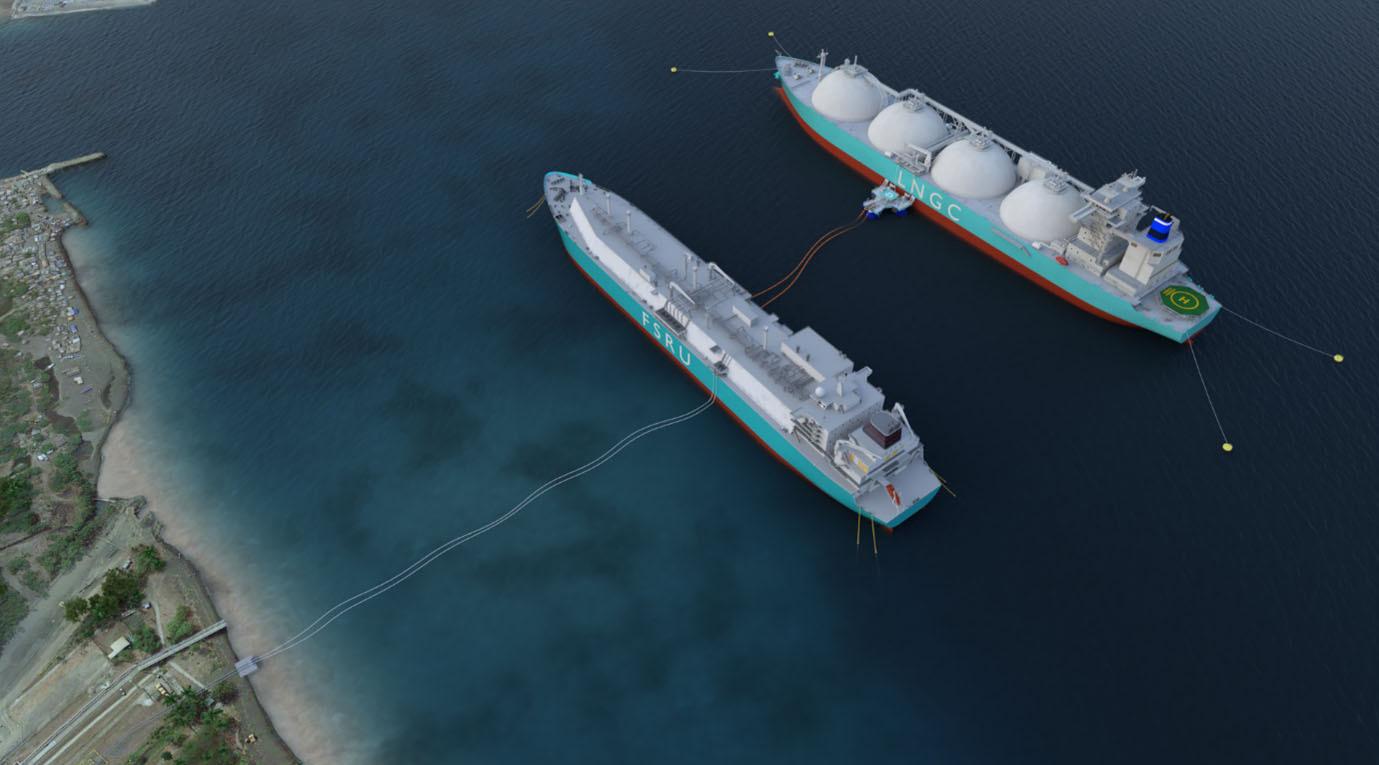

the Philippines First Gen welcomes BW Batangas FSRU in the Philippines

First Gen Corporation has welcomed the arrival of the BW Batangas, in Batangas Bay. The BW Batangas is a FSRU that was chartered by its wholly-owned subsidiary, FGEN LNG Corporation, as part of its interim offshore LNG terminal project.

FGEN LNG and BW LNG, a wholly owned subsidiary of the BW Group, the world's largest gas shipping company, entered into a charter agreement in respect of the BW Batangas in April 2021 to play a pivotal role in securing the country’s energy supply through its capabilities to store and regasify imported LNG to fuel the natural gas power plants located at the First Gen Clean Energy Complex (FGCEC) in Batangas.

The BW Batangas, which was previously identified as the BW Paris, can store 162 524 m3 of LNG and regasify up to 500 million ft3/d of gas to enable LNG to be utilised to supplement the depletion of natural gas reserves from Malampaya.

First Gen chose to rename its FSRU as the BW Batangas because of the Lopez-led company’s desire to acknowledge the consistent support of the Province of Batangas, Batangas City, and the local government units that host the FGCEC where it will be based. First Gen’s decisions to charter the BW Batangas and to construct its LNG terminal project underscore the company’s commitment to supporting the energy security of the Philippines.

Singapore

LNGNEWS

Vietnam

T&T Group to develop LNG and hydrogen projects with Korean companies

T&T Group and Korean partners recently signed and awarded a memorandum of understanding to develop LNG and hydrogen projects in Vietnam.

Specifically, T&T Group and Korea Gas Corporation (KOGAS) will co-operate to develop LNG gas power projects in Vietnam, and convert coal power projects already in the Power Plan VIII to gas power. The two sides will also explore opportunities to participate in hydrogen production projects to meet the high potential demand of power projects in commercial operation. Other power projects will be developed and built and operate in the near future, in line with the orientation and long-term strategy of the Government of Vietnam in the recently approved Power Master Plan VIII.

T&T Group and KOGAS will jointly develop projects using LNG refrigeration from LNG terminals in Vietnam and operate a LNG cold chain business nation-wide; they will also engage in other business activities related to LNG (procurement, importation, transportation, and supply of LNG for power generation and other industrial purposes).

T&T Energy, a member of T&T Group, and SK E&S, an energy company of SK Group (Korea), have also signed a memorandum of understanding on co-operation in the LNG power sector.

Accordingly, T&T Energy and SK E&S will co-operate to develop LNG terminals and gas power plants in accordance with Vietnam's development orientation and legal regulations. Under the agreement, SK E&S will be the unit responsible for finding financial resources to support the project implementation.

Eastern Pacific Shipping celebrates 100th LNG bunkering operation

Eastern Pacific Shipping (EPS) has reached a new milestone for its dual-fuel fleet following the successful 100th LNG bunkering operation in Singapore for its managed 210 000 DWT newcastlemax, M/V Mount Tai

FueLNG, a joint venture between Seatrium Offshore & Marine and Shell Singapore, deployed its latest LNG bunker vessel, FueLNG Venosa, to provide M/V Mount Tai with 4887 m3 of LNG.

This is the first bunkering operation for FueLNG Venosa,

which has a total capacity of 18 000 m3 and is able to simultaneously carry out cargo handling and bunkering operations.

M/V Mount Tai, which is chartered on consecutive voyages with BHP, is equipped with M-type, electronically controlled gas injection two-stroke engines that have negligible levels of methane slip. M/V Mount Tai will be a part of EPS’ low carbon emission fleet, transporting iron ore along the green corridor from West Australia to Northeast Asia.

USA

Equinor signs long-term LNG purchase agreement with Cheniere

Equinor and Cheniere have announced a new 15-year sales and purchase agreement (SPA). This agreement brings the total volumes that Equinor has contracted with Cheniere up to around 3.5 million tpy.

This new SPA with Cheniere will double the volumes of LNG that Equinor will export out of Cheniere’s LNG terminals on the US Gulf coast.

The LNG market is expected to grow significantly because of the role it will play in providing energy security, as well as enabling a transition to a cleaner energy mix in many markets. With more US LNG in its portfolio, Equinor will increase its role as a supplier of natural gas in global markets while maintaining its position as the major supplier of natural gas to Europe.

Under the SPA, Equinor has agreed to purchase approximately 1.75 million tpy of LNG from Cheniere Marketing on a free-on-board basis, for a term of approximately 15 years from the start of the delivery of the total amount of LNG volumes. The deliveries under the SPA will start in 2027 and is expected to reach the full 1.75 million tpy towards the end of this decade.

Australia

Tamboran secures land for LNG development project

Tamboran Resources Ltd, an Australian independent gas company, has secured 170 ha. of land on the Middle Arm sustainable development precinct, near Darwin, for its proposed Northern Territory LNG development (NTLNG).

NTLNG represents the first fully-integrated LNG development in Northern Australia where upstream, midstream, and downstream production and processing are based in the Northern Territory. The site is expected to host an LNG development with an initial capacity of 6.6 million tpy of LNG, with a potential for expansion, dependent on the completion of the concept select study, successful Beetaloo appraisal drilling and flow testing, and government approvals.

Tamboran is aiming to start LNG production by 2030. FEED studies remain ongoing for the proposed 100 million ft3/d domestic pilot development, with volumes contracted to Origin Energy for 10 years.

Colombia SPEC LNG terminal receives LNG delivery

More than 130 000 m3 of LNG, purchased by the main thermal generators in the country as a provision to deal with the El Niño phenomenon in 2H23, has arrived at the SPEC LNG regasification terminal.

This LNG is stored at the Cartagena regasification terminal to be transformed from a liquid to a gaseous state and delivered, when required, to the main thermal plants in the country in order to support the generation of electricity during the period of low hydrology.

In the scheme that supports the generation of electrical energy defined by the Energy and Gas Regulation Commission (CREG), the SPEC LNG regasification terminal has the role of infrastructure agent that provides its services to three thermal generators in the country, which acquire backup LNG through the Marketing Agent that represents them.

The regasification terminal was vital in 2020, when the level of the reservoirs reached 30%, it regasified close to 13 000 million ft3 of LNG for more than 200 days for the thermal plants and received 16 methane tankers throughout the year. In this way, gas-fired thermal generation contributed close to 22% of the national energy demand and a possible shortage of electrical energy was avoided.

THE LNG ROUNDUP

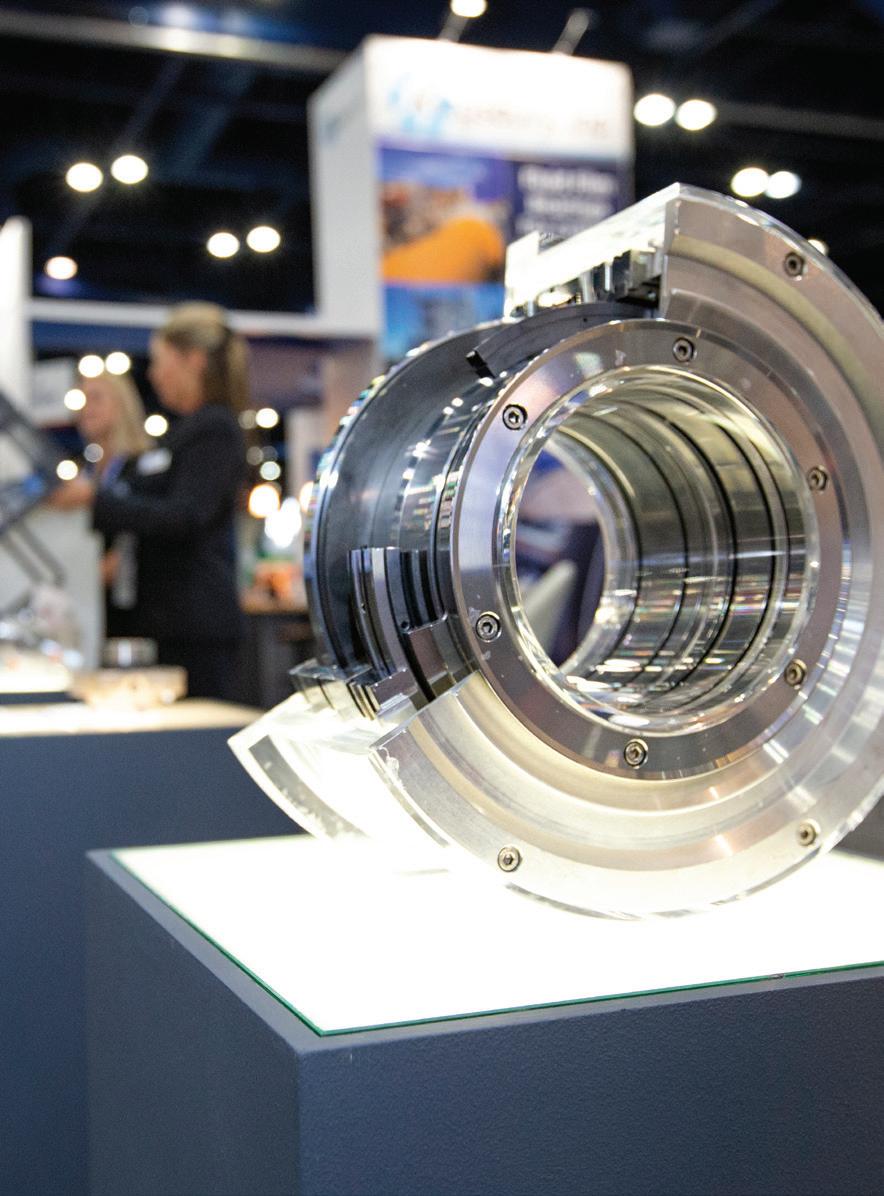

Turboexpanders are NEAT

Nikkiso Clean Energy & Industrial Gases

Turboexpanders are NEAT – Nikkiso Expander Application Technology (NEAT). Our turboexpander team has been designing and engineering turboexpanders for more than 200 (combined) years! We stand ready to help with most any turboexpander need, and support for the hydrocarbon gas processing, petrochemical and hydrogen industries. And our turboexpander performance can be tailored to plant operating demands and to reduce operating costs.

We provide Turboexpander-Compressors; energy storage systems; liquid air, carbon dioxide, liquid hydrogen solutions; pressure letdown energy recovery systems and Organic Rankine Cycle systems for geothermal and waste heat applications. To support all these, we offer global aftermarket service and support.

Want to know more? Ask Nikkiso.

LNGNEWS

Germany

10 – 13 July 2023

LNG2023

Vancouver, Canada www.lng2023.org

05 – 08 September 2023

Gastech Singapore www.gastechevent.com

05 – 08 September 2023

Offshore Europe

Aberdeen, Scotland

www.offshore-europe.co.uk/en-gb.html

25 – 28 September 2023

Turbomachinery and Pump

Symposia 2023

Texas, USA https://tps.tamu.edu

02 – 05 October 2023

ADIPEC 2023

Abu Dhabi, UAE www.adipec.com

31 October – 03 November 2023

Americas Energy Summit & Exhibition 2023

Louisiana, USA

www.americasenergysummit.com

28 November – 01 December 2023

The 23rd World LNG Summit & Awards

Athens, Greece www.worldlngsummit.com

Alternoil and GrønGas to expand value chain for sustainable fuel alternative

Alternoil GmbH, based in Germany, and biogas plant operator, GrønGas A/S, from Denmark, have signed a long-term and exclusive supply agreement for waste-derived bio-LNG to further increase the availability of Alternoil's renewable fuel, REEFUEL. Together, the companies aim to master the transformation to a climate-friendly transport sector.

Alternoil has set itself the goal of making an important contribution to the decarbonisation of heavy-duty transport. Since the end of 2020, the company has been providing the transport industry with the climate-friendly fuel alternative REEFUEL (bio-LNG and e-LNG) through its nationwide network of filling stations. The 100% renewable fuel is produced from green hydrogen generated by wind energy and biomethane from certified organic waste processes.

Alternoil's exclusive annual purchase of the total production volume of bio-LNG from GrønGas will further increase the availability of REEFUEL throughout Alternoil's filling-station network. According to Alternoil GmbH, this is a scaling measure that is a clear response to the market developments. By using Alternoil's renewable fuel, companies can significantly reduce their carbon dioxide emissions in the transport of heavy goods and thus demonstrably improve their company's carbon footprint.

In the coming years, the purchasing volume of REEFUEL will be further expanded in line with the growth of the market in Germany. Alternoil already provides the renewable fuel alternative through a network of filling stations in Germany. By 2030, Alternoil and its partners plan to achieve climate neutrality for over 50 000 heavy-duty trucks by developing additional waste-to-energy projects.

To save even more carbon dioxide along the value chain in the near future and in response to market developments, Alternoil GmbH is currently participating as a joint venture partner in the construction and operation of the REEFUELERY, one of the world's largest liquefaction plants for biological and synthetic fuels, located in the heart of Germany. The plant is scheduled to commence operations in 2024.

Qatar

QatarEnergy and China strike LNG deal

QatarEnergy has signed definitive agreements with China National Petroleum Corporation (CNPC), covering the long-term supply of LNG to China and a partnership in the North Field East LNG expansion project (NFE).

The two parties signed an LNG sales and purchase agreement (SPA) for the delivery of 4 million tpy of LNG from the NFE project to CNPC’s receiving terminals in China over a span of 27 years, marking the industry’s longest-term SPA commitment.

Pursuant to this agreement, QatarEnergy will transfer to CNPC a 5% interest in the equivalent of one NFE train with a capacity of 8 million tpy. This transfer will see CNPC become a partner in the NFE project and will not affect the participating interests of any of the other shareholders in the project.

The agreements were signed by Saad Sherida Al-Kaabi, the Minister of State for Energy Affairs, the President and CEO of QatarEnergy, and M Dai Houliang, the Chairman of CNPC, during a special ceremony held at QatarEnergy’s headquarters and attended by senior executives from both companies.

BRIGHTER FUTURE COOLER BY DESIGN ®

Chart’s LNG power generation solutions provide natural gas to hundreds of thousands of homes. This is one way Chart facilitates LNG as a safe, clean-burning fuel for energy, transportation and industry.

he volatility in global LNG markets over the previous two years has led to significant shifts and patterns in the sector globally, not least in the Asia Pacific region. Record-high prices in LNG spot markets, driven in part by the Ukraine War and the ensuing global energy crisis, have affected all LNG-importing countries.

Background

Spot LNG prices in Asia, as indicated by the Platts JKM Price Assessment,1 had already begun to increase during 2021. This was in part a result of a cold northern hemisphere winter in 2020/2021,2 resulting in gas storage levels below average across the Asia Pacific region going into the winter of 2021/2022.3 Prices in Europe were also increasing,4 in part due to a reduction of pipeline imports from Russia (even before the Ukraine War5) and other factors, such as weaker wind power.6 The Ukraine War and subsequent further reductions in Russian pipeline gas flowing to Europe significantly exacerbated this situation. Historically, Europe (with the exception of Iberia) acted in part as a balancing market for global LNG, with spot cargos sailing to Europe when the netback price spread vs Asia was positive. This significantly higher European LNG demand has temporarily shifted the balance of LNG importers globally, with substantial impacts on the Asia Pacific region. These impacts are likely to continue manifesting in the short and medium term.

South Asia

Whilst all LNG-importing countries in the Asia Pacific region have been affected to some extent, the spike in spot LNG prices

Richard Acklam, Associate Principal, Charles River Associates, highlights the key trends in the Asia Pacific LNG market, whilst touching on relevant global developments to analyse how they are affecting the Asia Pacific region.

has had a much more critical effect on some countries than others. South Asia (Pakistan, India, and Bangladesh) has been one of the regions hardest hit by the energy crisis, in no small part stemming from high LNG prices.

In India, as with many Asia Pacific countries, natural gas has been promoted as a transition fuel7 – cleaner than coal for power generation and for use in industrial applications, but also able to mitigate the intermittency of renewables, such as wind

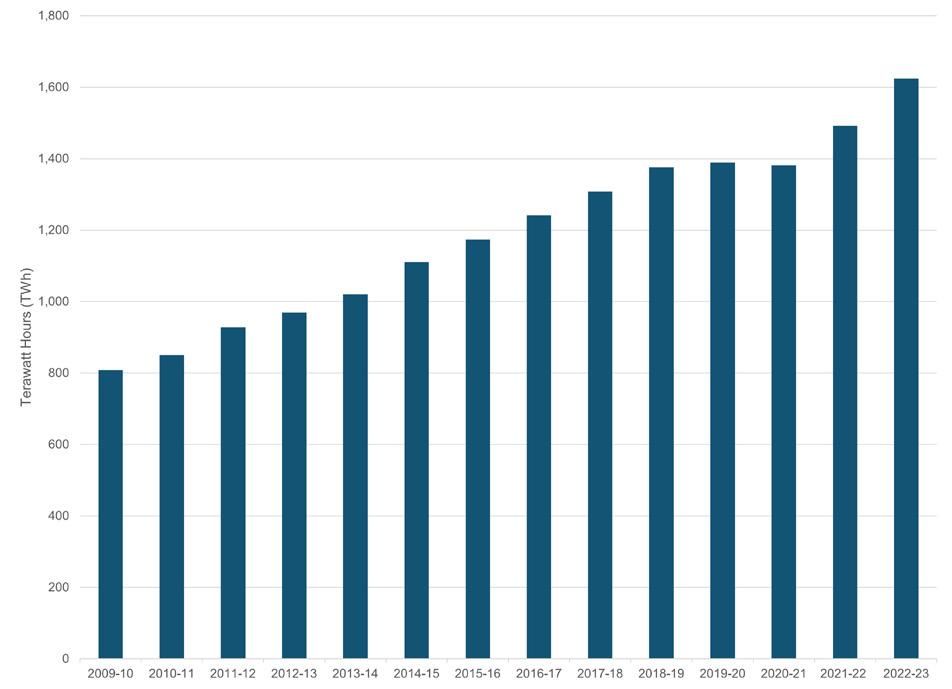

and solar. Furthermore, these are often markets where electricity consumption is rapidly increasing in absolute terms, and natural gas also plays a role in this expansion. Indeed, electricity generation in India has more than doubled since 2010, as shown in Figure 1.8

However, a high level of dependency on imported LNG (which accounts for around 50% of natural gas consumption in India9), coupled with high global gas prices, has decreased the attractiveness of gas as a transition fuel in the power generation sector. Imported LNG cannot currently compete with either coal or renewables in the power generation sector; in the 12 months to March 2023, electricity generated from coal increased by 12.4% y/y, with gas-fired power generation falling by 28.7%.10 This has resulted in a corresponding fall in LNG imports, which were 16.3% lower during 2022 than the previous year, and 21.6% lower than the peak in 2019, as illustrated in Figure 2.

Similarly, Pakistan and Bangladesh have faced significant problems. Neither country has sufficient volumes contracted on a long-term basis to meet demand, so both rely on the spot market. With the increase in spot LNG prices, importing the required volume of the fuel has not been possible, as high-priced gas becomes uncompetitive in downstream sectors. Both countries have suffered from repeated blackouts due to a lack of LNG; Pakistan relies on gas for one-third of its power generation needs.11 Bangladesh is even more reliant with almost three-quarters of its power generated from imported LNG.12 Pakistan is also turning back to coal for its power generation needs, looking to domestic coal. Indeed, Pakistan’s Energy Minister, Khurram Dastgir Khan, recently stated that Pakistan would look to quadruple its domestic coal-fired capacity and would not build any more gas-fired power plants.13 Similar dynamics are seen in Bangladesh, with coal-fired generation favoured over imported LNG.14

From the perspective of the LNG market, there is a risk that persistent high prices will incentivise the South Asia region to skip the wholesale adoption of natural gas as a transition fuel (at least in the power generation sector) and instead either burn more coal, despite the associated negative environmental effects, and/or substantially increase deployment of renewable energy generation technologies as a more economical alternative to natural gas. Whilst gas demand in these countries could still increase over time, a lack of a return to the growth rates seen prior to the COVID-19 pandemic could contribute to an LNG supply-demand imbalance in the latter half of this decade.

China

Whilst Chinese LNG imports also fell in 2022, the reasons for this, and in particular the trends and implications going forward, are very different from the situation in South Asia. LNG imports to China fell by approximately 20% in 2022.15 Natural gas demand fell by approximately 2% in China from 2021 to 2022 – although pandemic lockdowns extended throughout most of 2022, this was similar to the situation in 2021. However, 2022 saw an increase in both domestic gas production (6% y/y16) and pipeline imports (an additional 5 billion m3 from Russia17,18 and 5 – 6 billion m3 from Central Asia17), largely offsetting the reduction in LNG imports.

Natural gas demand in China is expected to rebound to at least 2021 levels this year. However, whether this translates into a rebound in LNG imports in the short term will largely depend on prices in the spot market. JKM prices fell from their historic

highs during the last four months of 2022 (albeit rising slightly in December1), and the downward trend continued into 2023 as the European winter remained mild, reducing that region’s demand for natural gas. If JKM prices continue to fall, or even if they stabilise at a level around US$10 – US$12/million Btu (levels not seen since mid-2021), Chinese importers may return to the spot market.

A different picture is being painted in the long-term LNG market as it pertains to China. Having relied to an increasing extent on the spot market (in 2021, spot and short-term imports accounted for almost 50% of imports19), Chinese companies are now signing large numbers of long-term contracts, with around 20 signed during 2021 alone, accounting for approximately 50% (in volume terms) of all contracts signed that year.20 That pace has been maintained, with further large-volume deals in 2022 and 2023, such as those between QatarEnergy and Sinopec (4 million tpy for 27 years20) and ENN Group’s agreement with Energy Transfer (2.7 million tpy for 20 years21). This drive for Chinese companies to lock in long-term gas contracts is due to several factors. Natural gas demand in China is likely to continue rising, with more LNG required to maintain this. Whilst historically, Chinese companies were willing to rely on the spot market, recent high (and highly volatile) prices seem to be driving importers back to long-term contracts. Finally, security of supply is also a factor – during 2H21, numerous Chinese provinces experienced widespread power outages. As well as affecting people living in these provinces, these blackouts significantly impacted China’s economic activity, with Goldman Sachs estimating as much as 44% of China’s industrial activity being affected.22 Whilst other factors apart from natural gas supplies contributed to this (such as temporary coal shortages and a lack of wind power generation), signing large numbers of long-term LNG contracts generally improves security of supply relative to spot purchases.

Japan and South Korea

The current trend elsewhere in East Asia is somewhat different. Japanese imports only fell by 3.1% in 202223 and rose very slightly in South Korea.24 This led to Japan once again becoming the largest importer, overtaking China. However, based on the recent long-term contracting trends this looks unlikely to be more than a temporary situation.

In contrast to the contracting spree being undertaken by Chinese companies, only two contracts with a duration of five years or more were signed for import to Japan in 2021 (with one of those covering only 0.5 million t in total over five years). Similarly, only one long-term contract was signed for import to South Korea.20

There is also potential in the medium-term for a recovery and increase in nuclear power generation for both Japan and South Korea. Japan has 16 nuclear reactors in the process of acquiring approval to restart post-Fukushima, and the government plans for nuclear to account for at least 20% by 2030, compared to around 6% currently.25 In South Korea, the new government elected last year saw a turnaround in policy, with nuclear power generation expected to slightly increase to account for a minimum of 30% of electricity generation in 2030 (as opposed to the previous policy of phasing out nuclear power completely). These policies could potentially create lower LNG demand in both countries.

However, both Japan and South Korea still have a significant proportion of electricity generated from coal, which may be

replaced first by continuing or growing nuclear generation, supporting demand for LNG. Indeed, recent long-term deals have been signed by Inpex (1 million tpy for 20 years26) and Itochu (1 million tpy for 15 years27), as well as by South Korean importers (albeit for smaller volumes).28,29 Particularly in Japan, in order to avoid long-term LNG imports declining substantially in the next few years, companies will have to sign more long-term contracts or increase reliance on volatile spot markets, as volumes contracted in 2030 are only 70% of those contracted on a long-term basis in 2023.30

Southeast Asia

There are also several countries in Southeast Asia which are new (or expected) entrants to the LNG market, such as Cambodia, the Philippines, and Vietnam. All three had plans for new LNG regasification terminals delayed by the COVID-19 pandemic and related supply chain issues. The Philippine terminal and one of two Vietnamese terminals have, or will shortly, import their first cargos (Cambodia’s project is still ongoing, with a second Vietnamese terminal expected to start operations later this year).31,32 LNG demand in these countries will be driven by both increasing power demand and a transition away from coal, but particularly in Vietnam this may be disrupted by rapid buildout of renewable energy capacity. Vietnam and the Philippines have not as yet been able to secure long-term volumes, bringing both price stability and volume certainty, and as such are reliant on volatile spot markets. If spot prices remain high and/or volatile for the medium-term, a switch (at least partially) from coal to renewables in these markets may occur, dampening the outlook for long-term LNG demand.

Conclusion

The LNG-importing countries of the Asia Pacific market are at various stages in terms of LNG demand development, as reflected in the current trends explored in this article. Existing markets with high growth potential in South Asia have recently been hit by spot LNG prices which render gas too expensive for many applications. Mature markets, such as Japan and South Korea, look to be unwilling to replace long-term contracts at the same previous rate as a result of potential long-term demand concerns. Chinese importers have taken advantage, dominating the long-term contracting market in the previous two years. These trends, in conjunction with high spot prices, have led to doubts about demand in new growth markets in Southeast Asia.

One of the fundamental questions for these markets currently is the direction of spot prices in the short and medium term. Whilst this is, in part, dictated by demand in Europe, another major factor is supply. Significant new capacity is slated to come online from 2025 – 2027, primarily from Qatar and the US. Qatar’s major North Field expansion project will result in additional capacity totalling 49 million tpy, although only 6 million tpy of that is currently contracted.33 Whether or not the additional capacity is eventually sold under long-term contracts (as is expected by Qatar33), importers in the Asia Pacific region look likely to benefit from lower prices in the medium term.

References

A comprehensive list of this article’s references can be found on the LNG Industry website at: www.lngindustry.com/ special-reports

Dual mixed refrigerant (DMR) and single mixed refrigerant (SMR) LNG processes require partial or total condensation of mixed refrigerants using an ambient air or water heat sink. To ensure optimal performance, it is essential that liquid and vapour phases remain intimately mixed as condensation occurs. Substantial performance impacts may result from improper design. 1 The ability to ensure optimal performance depends not only on the heat exchanger design used to condense the mixed refrigerant, but also on the liquefaction process employed.

Effect of heat exchanger design

For some DMR and SMR processes, the mixed refrigerant that needs to be condensed enters the ambient cooled heat exchanger as a two-phase mixture. The refrigerant is divided among the multiple flow paths (tubes, passages, or channels) of the heat exchanger and cooled by the air or water on the other side of the exchanger. Non-uniform distribution of the refrigerant vapour and liquid phases will result in each path having a different condensation curve (temperature vs duty) which will cause internal pinching with the overall performance of the heat

Mark Roberts, Katherine Wells, and Dr Annemarie Ott Weist, Air Products, explore how to prevent unpleasant surprises during mixed refrigerant condensation.

exchanger falling short of design. In addition, the type of heat exchanger used, and the cooling medium (air or water) can further impact the ability to achieve optimal performance.

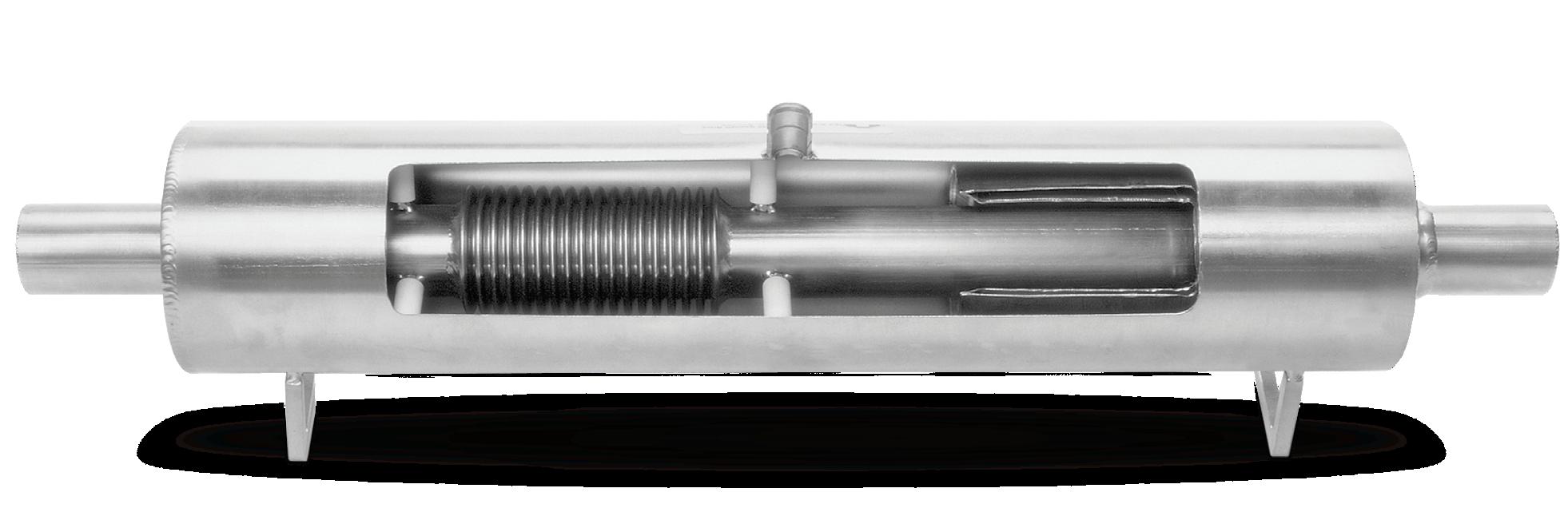

Water-cooled LNG plant

Water cooling is commonly employed for floating LNG plants. Typically, either shell-and-tube or diffusion bonded exchangers are used.

For diffusion bonded exchangers (also known as printed circuit heat exchangers), the dominant concern is uniform distribution of mixed refrigerant liquid and vapour phases into each passage. There have been several studies focusing on even distribution of phases into these exchangers. 2,3 Vendors have developed methods to achieve good distribution, often by performing phase separation before the heat exchanger and separately introducing the vapour and liquid into a special mixing zone at the entrance to the heat transfer passages.

For shell-and-tube exchangers it is critical that the condensing mixed refrigerant is in the tubes with cooling water in the shell. Otherwise, it is difficult (if not impossible) for the designer to ensure that the phases remain in equilibrium as mixed refrigerant is incrementally condensed, resulting in negative performance impacts. 1 Introduction of mixed refrigerant liquid and vapour phases into each tube can be accommodated using injection tubes, as shown in Figure 1.

Air-cooled LNG plant

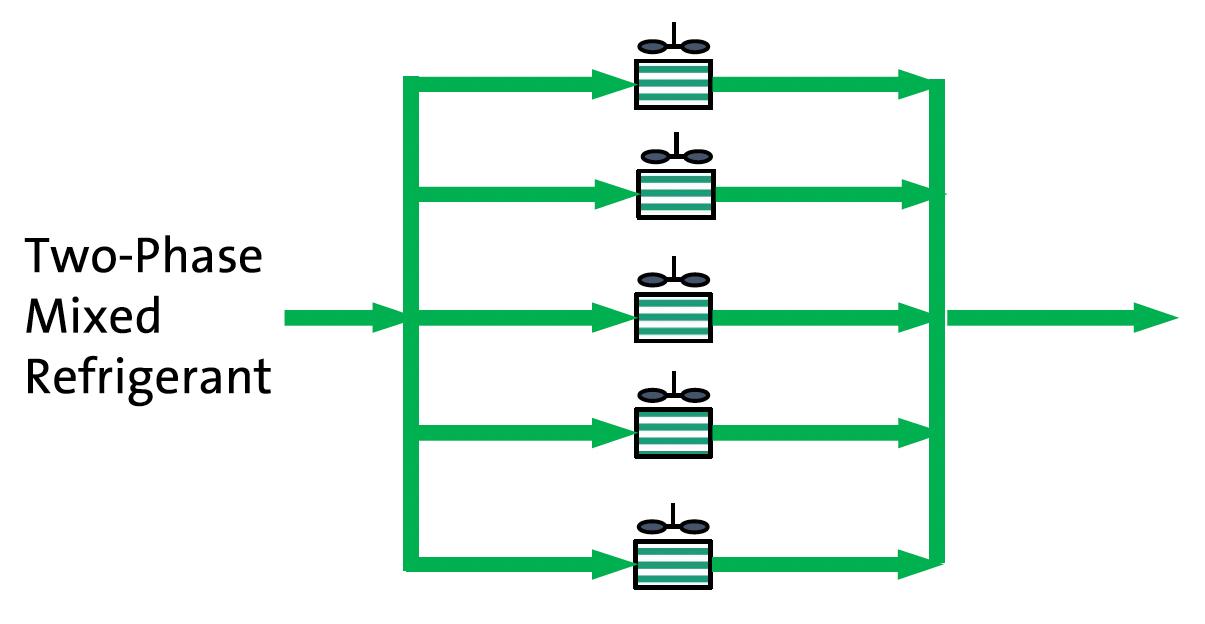

Many more tubes are required for an air-cooled mixed refrigerant condenser than for a water cooled one due to the lower heat transfer coefficient. For a mid scale or large scale DMR or SMR plant, multiple air-cooled exchanger bays in parallel with finned tubes and fans are required to accommodate the high tube count (Figure 2). For an air-cooled plant, distribution of equal proportions of mixed refrigerant liquid and vapour phases into each tube among several parallel air-cooler bays is challenging and cost-effective solutions have not been identified.

Example: Single bundle pre-cooler option

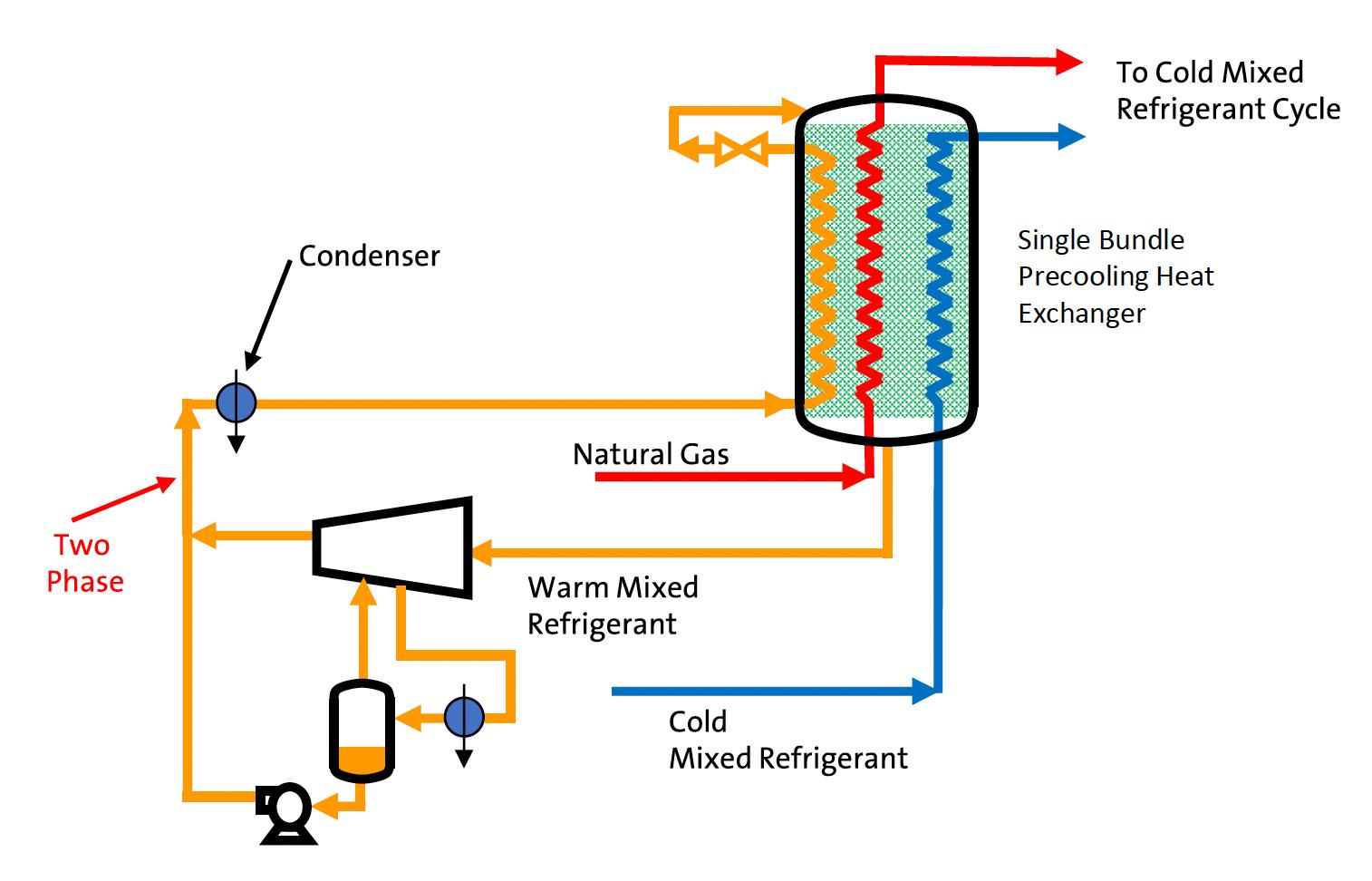

Figure 3 shows the pre-cooling section of the AP-DMRTM LNG Process employing a single bundle coil-wound heat exchanger for pre-cooling.

In this process, low pressure warm (pre-cooling) mixed refrigerant (WMR) is compressed in the first compressor stage, partly condensed in the WMR intercooler and phase separated. The vapour is compressed in the second stage and combined with the liquid before being totally condensed. This cycle has been successfully employed in the Coral Sul floating LNG plant. 4

Due to a small footprint and easily modularisable pre-cooling section, there has been increasing interest in the AP-DMR LNG Process for air-cooled land-based LNG plants. To assess the potential performance impact of introducing two phase WMR into multiple parallel air-cooler bays, Air Products performed a parametric

MHI’S HYBRID COMBINED CYCLE LNG SOLUTION

PROVIDING LOWER CARBON LNG WITH HIGH EFFICIENCY COMPRESSORS

MHI is the leading OEM to provide the highest efficiency compressors and dual-shaft industrial gas turbine driver to help meet the demand for lower carbon footprint and overall plant costs. By offering the smallest footprint and lowest CAPEX cost, MHI rotating equipment benefits LNG production to both brownfield and greenfield LNG plant developers. Learn more at mcoi.mhi.com.

Mitsubishi Heavy Industries Compressor International

14888 Kirby Drive Houston, Texas 77047

Mitsubishi Heavy Industries Compressor International

14888 Kirby Drive Houston, Texas 77047

study evaluating the effect of varying levels of liquid-vapour maldistribution.

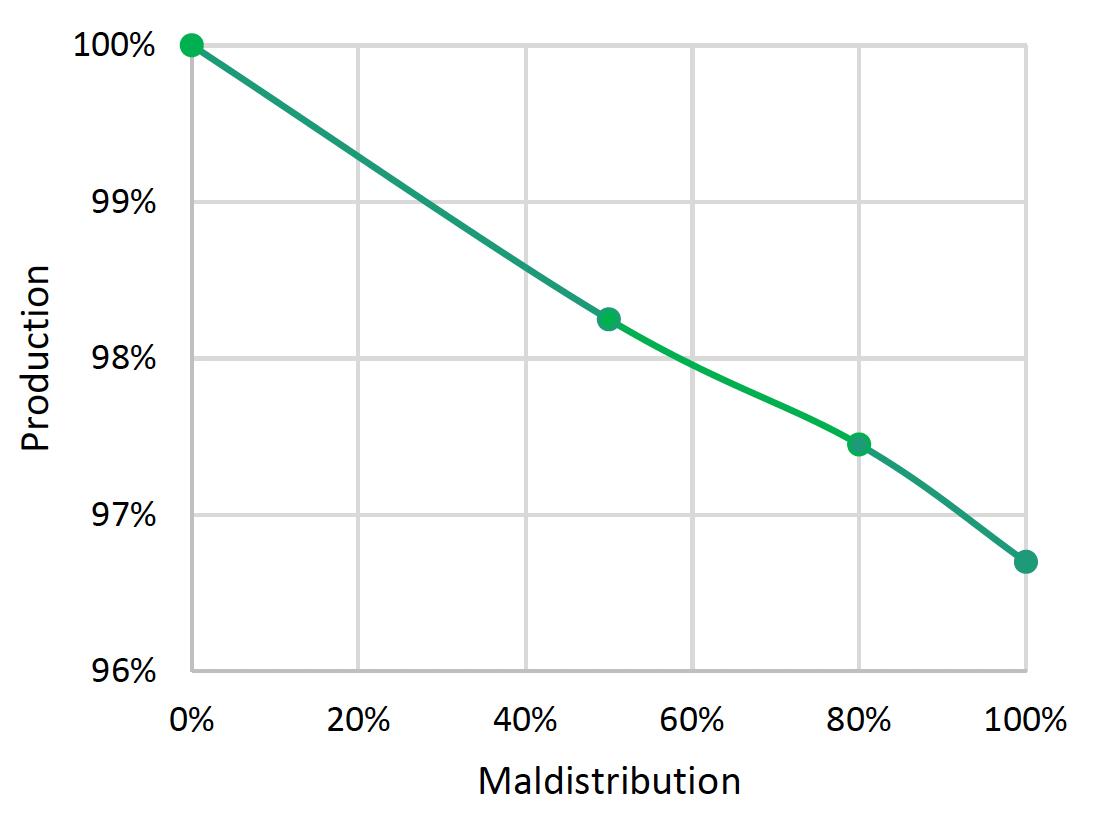

Figure 4 shows the results of this study. LNG production assuming fixed compressor driver power is plotted as a function of condenser inlet maldistribution. The maldistribution varies from 0% to 100%, with 0% representing perfect distribution of equal proportions of mixed refrigerant liquid and vapour phases into each tube among several parallel air-cooler bays, and 100% representing complete separation of the phases with liquid and vapour in separate tubes.

If maldistribution is small the resulting small production penalty would be acceptable; however, predicting the maldistribution is problematic. The two-phase flow through header piping between exchanger bays and between tubes within each exchanger bay is complex, making it difficult, if not impossible, to predict maldistribution and the resulting performance impact. One could design the plant with the assumption of 100% maldistribution, requiring 3.5% additional power to overcome the lower performance, but this is a significant impact to OPEX.

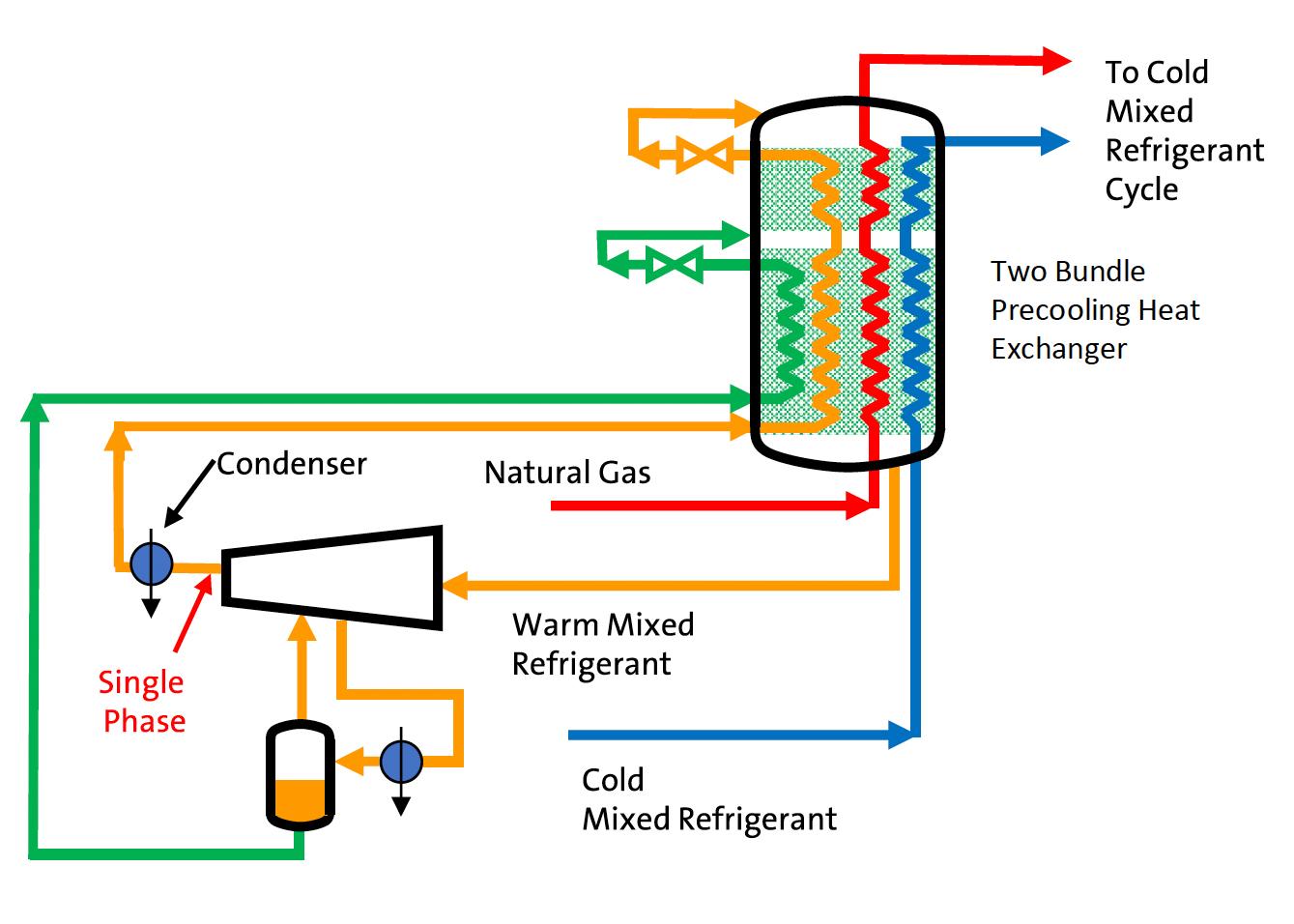

Example: Two bundle pre-cooler option

Figure 5 shows the pre-cooling section of the AP-DMR LNG Process employing a two-bundle coil-wound heat exchanger for pre-cooling. Air Products has developed this process in part to address concerns regarding the WMR condenser in a land based air-cooled plant.

In this process, WMR is partly condensed in the WMR intercooler then phase separated, with the resulting liquid sent directly to a dedicated circuit in the precooling heat exchanger rather than to the WMR condenser, thereby eliminating the pump used in the single bundle option. In this process, single phase fluid enters both the WMR compressor intercooler and aftercooler, eliminating the concerns about maldistribution in air-cooled condensers.

The liquid mixed refrigerant produced from the WMR intercooler is used to provide refrigeration to the warm (lower) bundle of the precooling exchanger, while the lighter liquid mixed refrigerant produced from the condenser is used to provide refrigeration to the cold (upper) bundle of the pre-cooling exchanger. Use of two different WMR compositions in the two zones of the pre-cooling exchanger provides an efficiency benefit, particularly at a 50:50 warm mixed refrigerant to cold mixed refrigerant (CMR) compression power split.

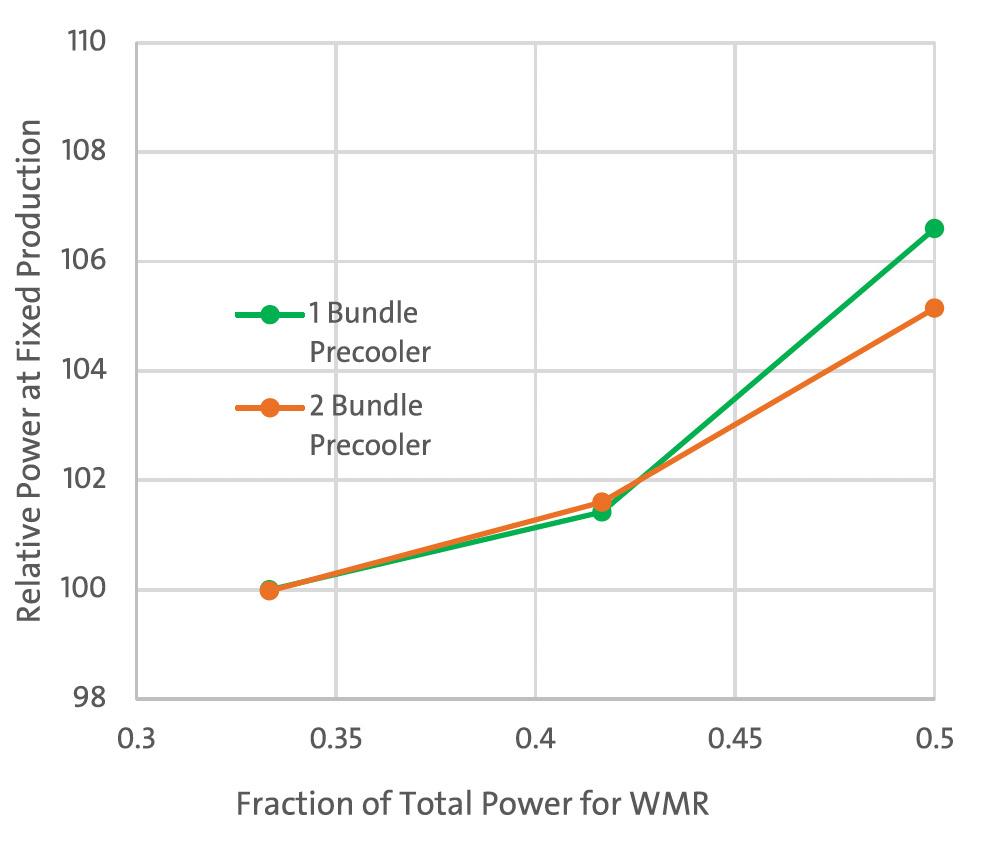

Figure 6 shows the relative power consumption of both AP-DMR LNG Processes as a function of power split, defined as WMR Power/(WMR+CMR) power. At a 0.33 power split, for example with one gas turbine driver for WMR and two gas turbine drivers for CMR, the relative power is the same. At a 0.5 power split, for example with one gas turbine driver for WMR and one gas turbine driver for CMR, the two-bundle precooler version has an efficiency advantage of around 1.5%. For both cycles, optimal efficiency occurs at around a 0.33 power split.

Summary

Air Products has developed efficient dual and single mixed refrigerant LNG processes that are suitable for both floating LNG production using water cooling, and land-based LNG production using air cooling. Unlike pure refrigerants, condensation of mixed refrigerants against an ambient heat sink presents unique challenges. Care must be taken in both the condensing heat exchanger design and liquefaction process selection to ensure that both liquid and vapour phases remain in equilibrium as the mixed refrigerant condenses.

References

1. PETTERSEN, J., and FREDHEIM, A. O., ‘Experience with water cooled mixed refrigerant condensation’ IGT International Liquefied Gas Conference Proceedings, (2010).

2. KE. H. et. al., ‘Analysis Exploring the Uniformity of Flow Distribution in Multi-Channels for the Application of Printed Circuit Heat Exchangers’, Symmetry, Vol. 12, No. 314, (2020).

3. BAEK, S. et. al., ‘Microchannel heat exchanger for two-phase Mixed Refrigerant Joule Thomson process’, AIP Conference Proceedings 1573, pp.612 – 617, (2014).

4. ‘Mozambique’s first LNG cargo departs from Coral Sul FLNG, offshore the Rovuma basin’, Eni, (13 November 2022), www.eni.com/en-IT/media/pressrelease/2022/11/eni-coral-first-cargo.html

s the world moves towards decarbonisation, the benefits of LNG are widely apparent. It is clean and quiet burning, abundant, and easily stored. Its simple dispensation is convenient for truck-refilling, with the most traditional familiarity.

Why then, are there only 635 fuelling stations across Europe?

Despite almost doubling in size in the last two years, LNG still significantly trails behind compressed natural gas (CNG), which boasts 4159 stations across the continent.1 The bulk of LNG stations are concentrated in Germany, which hosts 162 stations, followed by Italy with 130, and Spain with 90.

Dover Fueling Solutions, Europe, consider the benefits of using LNG as an alternative fuel.

So, what is contributing to this slower uptake and why are more new LNG-powered vehicles not being registered by fleet owners? Can LNG become the odourless, colourless, non-toxic, clean fuel of the future, and what infrastructure will be required to enable this?

Seemingly, soaring gas prices and economic uncertainty have been the main barriers to adoption thus far. Fuel retail businesses and fleet owners appeared reluctant to invest in new, clean fuels until the market settled and prices started to reduce to current levels.

One company facilitating this transition to cleaner fuel is Dover Fueling Solutions (DFS). The company offers fuelling retailers a highly-effective total cost of ownership (TCO) model with its LNG dispensers and LNG fuelling technology,

in addition to its innovative boil-off gas treatment unit (BTU) management solutions. This is all supplemented by a comprehensive ‘after-care’ package which means the company remains involved, through its LIQAL brand, in the project to keep the station up and running for customers.

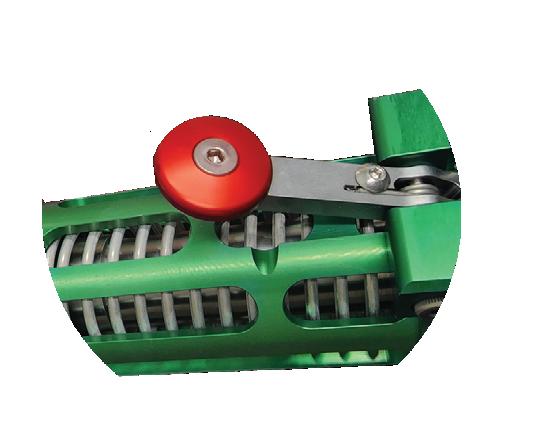

Boil-off gas: cost-effective solutions

One of the challenges of storing LNG is the accompanying boil-off gas (BOG). When heat enters the cryogenic storage vessel, BOG is continuously evaporated. Releasing this into the atmosphere must be avoided at all costs.

BOG contains methane – a harmful greenhouse gas. This will soon become illegal as part of the European green deal. Typical practices, such as venting or flaring methane, are also soon to be banned.2 Evaporated BOG – which is simply vented away – will also result in stock loss, which can hurt businesses fiscally too.

To combat this, DFS has a BOG treatment unit that converts BOG back to its harmless liquid form and keeps it, for an unlimited amount of time, in the storage tank – the LIQAL BTU System.

The benefits of this system are threefold: the process is environmentally friendly, it ensures unlimited shelf life of LNG in the tank, and it also has a low TCO. Environmentally, the LIQAL BTU system eliminates the venting of BOG in a cost-effective way that does not impact LNG deliveries or demand active management from forecourt owners. Furthermore, its components are built to last, field-proven, and require fewer maintenance interventions.

Moreover, it has the ability to provide cold LNG to trucks. Ultimately, the temperature of the LNG will affect the range output of the vehicle. Excessive LNG temperatures will cause shorter vehicle ranges, so it is important for forecourt owners to install solutions that can help keep LNG as cool as possible. The LIQAL solution avoids the high operating expense, possible carbon dioxide (CO2) release, and site risk that comes with the alternative BOG solution – cooling with liquid nitrogen.

Station after-care

One main concern for station owners, amidst fluctuating market forces, is staying informed of day-to-day operations through key performance indicators (KPIs) and other metrics. This can include availability, sales info, fuelling process data, and dispenser usage. LIQAL’s aftercare solutions can enable this.

The advanced SCADA system offers real-time, user-friendly dashboards with strong functionality for station KPI report generation. This can help station owners access real-time information with an intuitive overview of the station, right at their fingertips. This includes monitoring storage tanks, and controlling unloading and refilling. In-keeping with modern working patterns, this can be accessed via web browser from anywhere at any time.

Remote performance is managed by a skilled team of engineers, with customer support keeping an eye on fuelling performance to ensure a reliable and consistent fuelling experience. This service means that station owners do not need to be actively involved at all times and can rely on experts to manage operations.

Physical station after-care training sessions can include on-site station inspections, maintenance, and service activities.

Everything is in order to ensure maximum station availability during the years of commercial operation.

Case study: creating a consumer-centric model

If – like its benefits would suggest – LNG is going to play a big part in the future of commercial transport, dispensing needs to be intuitive and consumer friendly. As demand for greener energy grows higher every day, so will the need for bespoke LNG service stations. This includes standard LNG and the fully sustainable variant, bio-LNG – renewable LNG made from waste materials.

But what could this LNG model look like in practice?

Well, it is clear that, much like its traditional petrol and diesel counterparts, LNG has the potential to become a mainstream retail fuel. This would, however, require a very consistent and reliable fuelling performance.

DFS can help to facilitate this. Through its LIQAL brand, DFS can design a completely, bespoke and integrated LNG station with advanced LNG technology.

At the heart of this new LNG forecourt should be the state-of-the-art fuel dispenser. These should be reliable for everyday use, assembled from corrosive-proof materials to withstand even the harshest weather conditions and suited to all extremities of the European climate. Their modern design should be compatible with the customer able to choose their own filling conditions – namely, cold or saturated LNG fuel.

This should be coupled with a user-friendly, modern interface at the pump. This can include a euro-centric, touchscreen display where truck drivers can select their preferred language and pay quickly at the pump for ease of convenience.

Modern problems require modern and safe solutions. This is especially true of the LIQAL LNG dispenser which has been engineered with safety in mind. This model includes a patented nozzle docking bay, heated and purged for tension-free connectivity, and a long hose and nozzle life, limiting the occurrence of leakages.

The inherent robustness of these materials will also enable use in the most demanding of environments, which should mean a low TCO for the fuelling retailer.

Is this the future of commercial transport?

Clearly, from the advent of this cutting-edge technology, it is apparent that LNG will be a part of the decarbonisation mix alongside fellow market leaders, electricity and hydrogen.

The market has been buoyed recently by the launch of Volvo’s new bio-LNG truck,3 which it claims can reduce CO2 emissions by 100%. The vehicle also boasts a 10% larger gas tank that makes it up to 4% more fuel efficient and contributes to a longer range. This has enormous potential for the commercial transport sector.

Clearly, the forecourt will have to be prepared for this new model to roll onto the market with ‘Volvo ready’ functionality to handle venting and filling through the same connection.

To make it mainstream, LNG infrastructure needs to improve. For forecourt owners looking to make the switch, they need to look to partner with experts who can construct the ideal station – laying the foundation for development of this infrastructure. From the highest safety specification to the

most advanced technology, companies such as DFS can help aid this transition.

References

1. ‘Europe now has 635 LNG fueling stations’, LNG Prime, (24 January 2023), https://lngprime.com/europe/europenow-has-635-lng-fueling-stations/71712/

2. ‘Member States agree on new rules to slash methane emissions’, Council of the European Union, (19 December 2022), www.consilium.europa.eu/en/press/ press-releases/2022/12/19/member-states-agree-on-newrules-to-slash-methane-emissions/

3. ‘Volvo launches new bio-LNG truck’, LNG Prime, (2 February 2023), https://lngprime.com/europe/volvolaunches-new-bio-lng-truck/72615/

Stefano Calandri, Vanzetti Engineering, Italy, describes how pumps can be used to help the LNG market transition to a cleaner future.

In terms of emissions, LNG used in maritime transport allows for zero sulfur oxide, 85% less nitrogen oxides, 95% less particulate matter, and also a containment, in the order of 20%, of carbon dioxide emissions. Even though it is still a fossil fuel, LNG represents a hypothetical bridge to new alternative fuels because it can be integrated with bio-LNG, thus paving the way for further developments in this field.

As for LNG, the energy security aspect must also be considered: the recent increase in demand is also related to the choice of European governments to drastically reduce dependence on Russian gas. The increasing use of LNG in the naval sector is possible due to rising trade flows to Europe. LNG carriers aim to progressively replace the gas previously transferred via pipelines between Russia and Europe. Therefore, in the short term, LNG is confirming itself as the only viable solution for shipping and is likely to lead to a further increase in LNG-fuelled ships in the coming years.

All of this represents a high-impact technological transition. The entire supply chain of methane transport using ships as an alternative to pipelines is essentially based on cryogenic systems and applications.

The marine LNG market

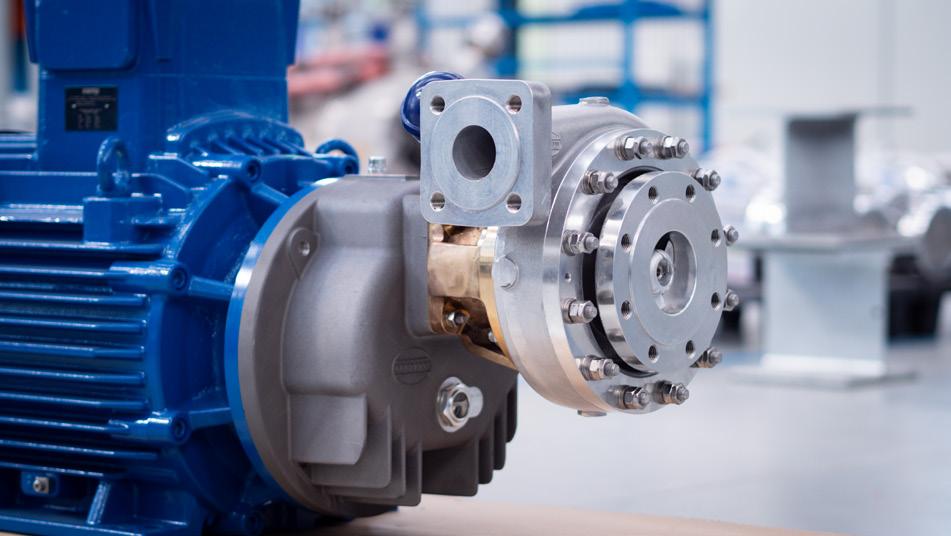

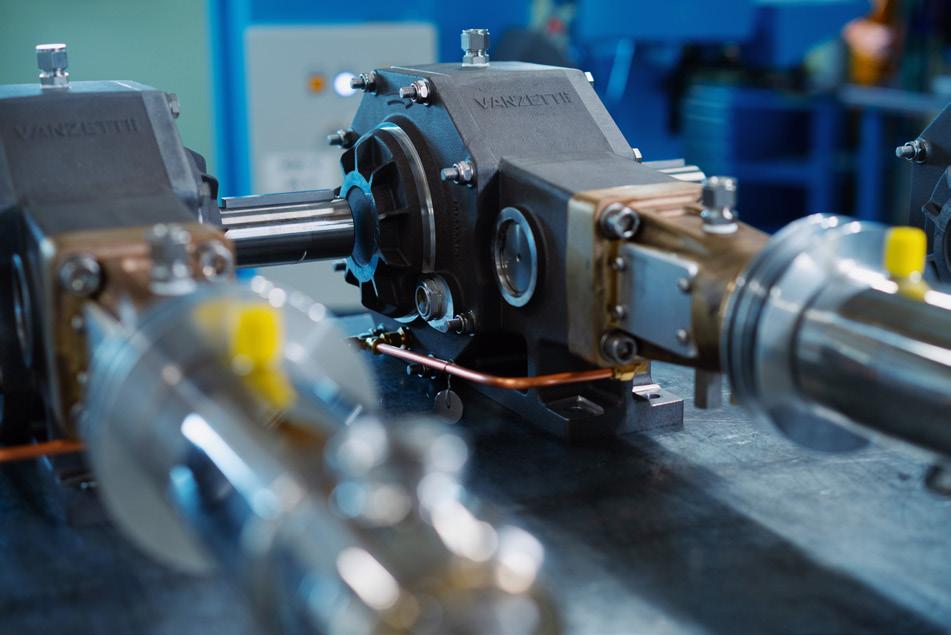

Vanzetti Engineering has developed a complete range of pumps and cryogenic components for the main areas of LNG use: automotive, industrial, and marine.

In particular, the company’s core business is naval applications – there has been a significant increase in demand in this sector, from shipowners and shipyards, especially from the Far East, for example China and South Korea.

This trend shows that a major path of the energy transition is at hand. What is driving the change is first and foremost the environmental need, as methane is generally less polluting than traditional hydrocarbons.

The company’s pumps are able to address the two main areas of technology relating to liquid methane engines, both high and low pressure. Depending on the case, there are different pump types, as they must be able to meet different requirements. For example, there are reciprocating pumps (VT-3) or low-pressure pumps (from the Artika series), as well as centrifugal pumps, or even a combination of the two.

In the equipment of a ship, what differs the most is not so much the operating pressure, which normally follows standard parameters, but the flow rate, which can vary greatly depending on the size of the engine and the speed the ship can reach.

Consultancy, design, and certification: a long journey

When dealing with certain installations, especially those that are used in the marine environment, not everything is 100% defined at the time of contracting. There are several details that have to be finalised later, and, in addition, a number of documents have to be produced for validation not only by the customer, but also by certifying bodies, which in the marine sphere are in charge of class certification. These bodies are third-party organisations that guarantee the conformity of the design, as well as the performance of functional pressure tests and everything related to the completion of each individual project. Certifications are mandatory in each sector; in the marine sector, it is a fundamental aspect that customers would expect as part of the contract.

The customer’s requests usually involve a specific performance requirement that may entail pressure and/or flow values, depending on the liquid gas used; methane or other cryogenic gases, such as nitrogen and oxygen. Once the customer’s needs are understood, Vanzetti Engineering proposes the best technical solution, also considering the context in which the customer plans to use it.

With particular reference to the marine sector, the initial requirement is the one set by the shipyard or the shipowner that requires a certain type of product that, again, takes pressure and/or flow values into account. An important factor is redundancy, since the systems must have this requirement on

ships in order to guarantee safe navigation, even on the high seas. In fact, each type of on-board service always requires more than a single pump, i.e. a system consisting of at least two twin pumps.

The company pays particular attention to understanding how it is being contextualised. This practice is highly diversified, depending on the context and substantially based on the experience it has developed over the years in the various application areas where it has been operating.

Once the right solution has been identified to fulfil the customer’s requirements, the order is placed. At this point, the design stage begins, which includes the generation of a whole series of documents, such as the general assembly drawing, the BOM, etc., which are submitted to the certification bodies and, of course, to the customer for approval.

Once approvals and certification have been obtained, the task passes to the logistics department, which enters the list of parts required for the construction into the company’s management system, showing the relevant construction specifications. This is a highly critical aspect from the point of view of the production process, as it is at this stage that the basis is laid for determining the product’s production time. For example, a component may also include sub-cycles as well as a painting process; thus, suppliers can be identified. All of this information, together with the specifications described, is passed on to the purchasing department in charge of selecting suppliers, and the order is placed so that the project deadlines are met.

The time factor is crucial since it represents not only the delivery date, but an entire flow consisting of numerous stages. In fact, the delivery date is the reference with which one proceeds backwards to first determine a date for acceptance, which is often carried out in the presence of the customer or alternatively via remote connection.

A project, scheduling, and production Gantt is used to check schedules, which includes all phases: order acquisition, design, procurement, manufacturing, testing, and shipping.

Other endeavours

On the horizon for Vanzetti Engineering is not only the market, but also the spirit to take the opportunity to make its own contribution to scientific research, as demonstrated by its collaboration with the Aria Project, promoted by the National Institute of Nuclear Physics (INFN). The aim of this project is the direct detection of dark matter.

The project involves the construction of the distillation column for liquid nitrogen. In this particular project, Vanzetti Engineering provided two liquid nitrogen booster pumps that are used to move the liquid nitrogen from the bottom to the top of the column.

Conclusion

The LNG sector is constantly changing as the world undergoes an important phase of energy transition. Furthermore, storage facilities, as well as regasification units, are increasingly proliferating. The growth in the use of LNG in the marine sector is also opening the door to new development opportunities in terms of both a new transport concept, and the technical and fuel supply chain that has been created. Vanzetti Engineering, through its technology and its products, is part of the change and aims to make its own contribution by working alongside the customer to find the best solution, which allows LNG to be used in all its forms, advantageously and safely.

Joseph C. Fernandez, P.E., Manager, Application Engineering, Ariel Corporation

Joe Fernandez manages the Applications Engineering Department at Ariel Corporation. He has been with Ariel Corporation for over 26 years, and in the energy industry for over 38 years, responsible for engineering compression systems in the upstream, midstream, and downstream markets. This experience has included compressors used for feeding and offloading LNG terminals, as well for gathering, pipelines, storage, acid/sour gas carbon capture, utilisation, and storage, and vehicle fuelling.

Andrea Masi, Compression Product Platform Manager, Baker Hughes

Andrea Masi leads Baker Hughes’ Compression Product Platform team, to define and execute the multi-generational product plan for centrifugal compressors, reciprocating compressors and turbo-expanders solutions. His career spans 21 years in strategic marketing product management and R&D advanced technology engineering across energy and industrial sectors. He graduated in Electronic Engineering at the University in Florence (IT).

Francesco Cangioli, Compression R&D Engineering Manager, Baker Hughes

Francesco Cangioli is New Product Development Manager, leading a team focused on compressors and expanders. Following a Masters Degree in Mechanical Engineering and a PhD in Reliability and Availability in Industrial Engineering at the University in Florence (IT), he has been part of Baker Hughes since 2012, covering multiple roles innovating on gas turbines, pumps, expanders, and compressors.

Serge Staroselsky, Chief Technology Officer, Compressor Controls Corporation

Serge Staroselsky has been with Compressor Controls Corporation (CCC) in various roles for over 25 years, assuming his current position in 2014. He works in product and technology development and has extensive experience in designing and implementing control systems for turbomachinery, specialising in antisurge control and protection and compressor capacity control, covering a variety of applications. He has a B.S. degree in Mechanical Engineering from the University of California at Berkeley and an M.S. in Mechanical Engineering from the University of Minnesota.

Jens Wulff, Managing Director, NEUMAN & ESSER Deutschland

Jens Wulff has extensive experience in compressor technology. He started as a Project Manager, became Area Sales Manager, and later Managing Director of the compressor production companies at NEUMAN & ESSER. Today, he is Managing Director of NEUMAN & ESSER Deutschland, the new machine company in Germany. Wulff has successfully managed several sales projects of LNG compressor systems over the years, including the first LNG boil-off gas compressor with innovative stepless reflux power control in 2016.

Arnd Viets, Managing Director, NEUMAN & ESSER South East Asia

Arnd Viets has held various positions at NEUMAN & ESSER. Among these, he supported the Asian branches in India and Thailand with technical support. Since 2014, he has been Managing Director for the first-class compression equipment at NEUMAN & ESSER South East Asia and is responsible for the Asia Pacific region. The high demand for LNG terminals worldwide and his strong technical background led him to develop highly efficient LNG terminal solutions.

LNG Industry asked several companies to discuss some key topics regarding compressors in the LNG industry.

Q1. How do compressors improve the efficiency of the LNG process?

Joseph C. Fernandez, Ariel Corporation

The flexibility provided by reciprocating compressors allows for the reduction in offloading pressures prior to being put into sales lines (inlets at storage facilities prior to the liquefaction), thereby improving the overall efficiency of the LNG plant. Another area where reciprocating compressors are used and help improve overall efficiency is as vapour recovery units, also due to the wide range of operating pressures under which they can run.

Andrea Masi and Francesco Cangioli, Baker Hughes

Compressors are the technological heart of the LNG process, playing a key role in performance and overall total cost of ownership (TCO). Improvements in compressor efficiency reduce power consumption, leading to a reduction in fuel or electricity consumption – depending on the driver adopted, and whether it is a gas turbine or electric motor. A compressor’s higher efficiency is achieved through new technology injection, new impellers profile, and new seals: this is key for new LNG projects and also allows for upgrading existing assets to maximise output. Improving compressor efficiency (average +4% in the last three years through aerodynamic improvements) does not impact only consumption, but also directly abates emissions, providing a double benefit to the plant operator.

Serge Staroselsky, Compressor Controls Corporation

From the point of view of a control system, first of all, capacity control of compressors should be a part of the overall LNG process control strategy; secondly, optimising loadsharing for parallel compressors; thirdly, minimising recycling with small antisurge margins; and, lastly, simplifying start-up and shutdown operations, reducing start-up time. For example, for some types of LNG processes, the control system typically maintains inlet header pressure for each refrigeration service, where the setpoints for the pressures can be derived by the overall plant optimiser. For other processes, different process parameters can be used as PVs for capacity control and integrated within overall optimisation scheme. Often, it is assumed that given the desire to produce maximum LNG rates, all refrigeration compressors operate far from the surge region. However, this is not always the case, particularly in climates where the design has to cover wide range of ambient temperatures. A compressor control system that is a part of the overall optimisation scheme must be able to operate in a stable manner while recycling and maintaining margins of <=10%, reliably preventing process upsets resulting in surging of the machines.

Jens Wulff, NEUMAN & ESSER Deutschland, and Arnd Viets, NEUMAN & ESSER South East Asia

By using efficient compressors, the LNG process can be improved significantly. For boil-off gas (BOG) management, efficient piston compressors are the best choice.

NEUMAN & ESSER uses contact ring type machines with low internal leakage for these processes. As the BOG flow rate varies a lot, we also use efficient capacity control methods to save energy and reduce carbon dioxide (CO2) emissions.

Q2. What factors are considered when deciding which compressor technology is needed for an application?

Joseph C. Fernandez, Ariel Corporation

The primary considerations in compressor selection are inlet and discharge pressures and required throughput. These will determine the best technology for the project, as well as the size and number of units required. Positive displacement compressors, such as reciprocating compressors, are good for high-discharge pressures and moderately high throughputs, and can accommodate a wide range of operating pressures; while rotary screws are well suited to low inlet pressures and very high throughputs, at lower discharge pressures. Dynamic compressors, such as centrifugals, are designed for very high throughputs and moderately high discharge pressures, with axial compressors providing the highest throughput capabilities and considerably lower pressure capabilities. Another consideration is the type of prime mover needed. Natural gas engines and electric motors are well suited for driving reciprocating and rotary screw compressors, whereas a turbine being used as a centrifugal compressor is a better solution.

Andrea Masi and Francesco Cangioli, Baker Hughes

Multiple factors are considered when selecting the most appropriate compression technology for the application, and usually include efficiency and availability. Indeed, the main drivers are flow and pressure that typically identify the most relevant technologies, such as compressor size and impeller types, then footprint, particularly for floating LNG (FLNG) applications. Typically, key decisions are driven by specific customer needs and by TCO, balancing CAPEX and OPEX of the solution. For example, the same service could be delivered with a larger compressor and higher efficiency to increase the diffusion ratio, or a smaller compressor with slightly lower efficiency (-2%) but with a weight benefit of about 20%.

Serge Staroselsky, Compressor Controls Corporation

From a control system vendor’s perspective, it appears that the process design and capacity requirements play a dominant role in compressor technology selection. Up until recently, it seemed that improvements in process efficiency demanded larger capacity centrifugal compressors, up to 100 MW in a single casing, often driven by single-shaft gas turbines with limited rotating speed operating range. Today’s trend seems to be toward smaller capacity centrifugal units, and with the plant having multiple trains to meet overall capacity requirements. It seems that the trend is also toward simplification of the control system and avoidance of compressors operating in parallel due to perceived complexity. However, in CCC’s

COMPRESSION YOU CAN COUNT ON

For our customers, compression is critical – always. So when they need us, we spring into action. Ariel works to build and maintain a trusting relationship that grows stronger with time. We look at everything from our customers’ perspective, so we can truly understand the best ways to make their operations more successful.

Compression you can count on, now and always.

www.arielcorp.com

experience, compressors can be reliably operated in parallel, especially for units having an operating range of at least 85 – 105% of rotating speed, and the complexity of parallel operation should not influence the design toward reducing overall efficiency per train, that is, increasing process and compressor efficiency should take precedence over the complexity of controls.

Jens Wulff, NEUMAN & ESSER Deutschland, and Arnd Viets, NEUMAN & ESSER South East Asia

Determining factors include flow rate, flow and pressure fluctuations, and available space. Turbomachinery is best suited to high-flow scenarios under constant conditions, whereas reciprocating compressors are very well suited to variable flow rates and pressures from low to high. The available space influences the choice of whether a horizontal, vertical or V-type compressor is used.

Q3. How are compressors helping to reduce emissions (e.g. carbon dioxide) from the LNG process?

Joseph C. Fernandez, Ariel Corporation

Reciprocating compressors within the LNG process rely on a pressure packing case which seals around the reciprocating piston rod. Ariel employs solid ring technology in the packing cases which contains processed gas by eliminating the leak paths of conventional segmented ring sets. The company’s packing cases typically reduce fugitive emissions to meet or exceed Environmental Protection Agency (EPA) regulations. This packing design is also very reliable, providing improved time between maintenance cycles. Reciprocating compressors are also being considered to collect flare gasses, reducing carbon dioxide emissions. Reciprocating compressors are also proving to be the solution of choice for carbon sequestration trains associated with LNG export facilities.

Andrea Masi and Francesco Cangioli, Baker Hughes

The main driver to decarbonise the LNG process is compressor efficiency. With a history of 30 years in LNG installations, Baker Hughes brings a track record of continuous efficiency improvement, with plants that have seen an efficiency increase of up to 5 – 6% when duplicating trains over a 5 – 10-year timeframe. At the same time, the company has seen a trend in power density, around maximising throughput while reducing the compressor size – up to the recently developed high pressure ratio compressor (HPRC) that unlocks a dramatic reduction in the number of casings (allowing to compact up to three casings in one). The impact is a reduction in emissions from dry gas seals, along with overall lifecycle impact.

In some cases of a smaller size, hermetically sealed electric technology, such as the Baker Hughes’ integrated compressor line (ICL) is an effective solution. ICL is a zero-emissions compressor during operation and pressurised standby. Being an electrical driven compressor, emissions are proportional to electrical grid power generation emissions. In case of green

electrical power, ICL is removing up to 99% of emissions compared to gas-fired solutions.

Serge Staroselsky, Compressor Controls Corporation

Again, from the perspective of a control system for compressors, the main factors in reducing emissions are avoidance of trips and large pressure fluctuations, which can lead to flaring and result from the inability of the control system to handle disturbances. In addition, optimal loadsharing between units and reduced recycling can lead to reduced power consumption and thus reduced emissions. Loadsharing and well responding control system are very important for BOG compressors where inlet conditions can rapidly change due to various modes of operation, with incoming gas of widely different temperatures. Observing operations at a large plant with multiple trains, it appears that disturbances occur fairly often, due to maintenance activities on various trains, so the response of a control system plays an important role in maintaining stable operation. Technological advancements may further reduce emissions, however, there is still a lot that can be done today to reduce emissions through better controls.

Jens Wulff, NEUMAN & ESSER Deutschland, and Arnd Viets, NEUMAN & ESSER South East Asia

Compressors can be used to re-liquify the BOG or make use of it as a fuel. This avoids flaring the BOG without a use and saves a lot of CO2. As the compressors are mostly electrically driven, a higher compressor efficiency saves electrical power which also has a specific CO2 footprint.

Q4. What component of a compressor is most prone to failure and thus requires the most maintenance?

Joseph C. Fernandez, Ariel Corporation

Valves. Valves consist of a sealing element, often with damping plates and damping from the gas. As a spring mass damped system, the valve motion is optimal at one condition, with fair motion across a small range. The factors defining the range include operating pressure, both suction and discharge, operating speed, gas composition, temperature, and valve design. Gas cleanliness also plays a role in valve reliability. Valve reliability can be optimised through upfront design and monitoring for changes in conditions.

Andrea Masi and Francesco Cangioli, Baker Hughes

Unlike other applications such as those in upstream, the LNG mission profile is usually characterised by stable operations and clean gas. Compressor failures are quite rare and tend to be due to the wear on components, such as dry-gas seals. These components require dedicated preventive maintenance and advanced prognostic services to monitor their operating performance and identify potential failures in advance. Through advancements in the 24/7 remote monitoring of LNG compression trains worldwide, Baker Hughes has reached 99+%

A whole new way of thinking about compression technology

Backed by 60 years of industry-leading compression design, our High Pressure Ratio Compressors (HPRC) provide significant improvements in overall H2 plant footprint. They're 50% smaller and 30% lighter than traditional centrifugal compressors, and can reach 3:1 pressure ratio—with high reliability and availability.

Get the higher pressure you need in the smaller package you want.

bakerhughes.com

Copyright 2023 Baker Hughes Company. All rights reserved.average availability, enabling LNG players to maximise their production and reduce operating costs.

Jens Wulff, NEUMAN & ESSER Deutschland, and Arnd Viets, NEUMAN & ESSER South East Asia

For reciprocating compressors, the valves at the cylinder inlet and outlet are the most failure prone component. Monitoring their behaviour, e.g. via temperature, vibration, and sound measurement, is key for avoiding unplanned shutdowns.

Q5. With new LNG markets arriving and others expanding, how is compressor changing/adapting?technology Are there any limitations?

Joseph C. Fernandez, Ariel Corporation

A major area of advancement in reciprocating compressors is the incorporation of smart technologies, such as machine monitoring, and predictive maintenance. These enhancements allow for better planning of shutdowns, and ensuring that critical parts are on hand when needed, thereby minimising downtime. Another area is automation in particular where measured process data is used with a programmable logic controller (PLC) to control compressor performance based on plant needs. Examples of automation include electric motor-driven units utilising variable frequency drives to control speed, and automated compressor unloading devices, such as Ariel’s eVCP, providing efficient and effective methods to control throughput and fuel usage.

Andrea Masi and Francesco Cangioli, Baker Hughes

LNG demand is growing, and additional projects FIDs are needed shortly. Analysing the technical requirements, the company can see an increase of electric motor and high-efficient aeroderivative gas turbines (such as the Baker Hughes’ LM6000PF+ or the LM9000) driving compressors instead of traditional heavy-duty gas turbine – mainly in operation in mature projects. Looking at the entire refrigerant train size, the preferred choice is a multiple number of mid-size trains modularised vs traditional large trains stick built.

Baker Hughes’ mid scale solution is the perfect fit for those projects where time-to-LNG, lower production costs and project de-risks are key priorities. Combining electric motor compressors with more efficient power generation island, operators are able also to reduce plant carbon footprint. The company’s compression technology can be tailored to different approaches, traditional and modularised, providing the best compromise between performance optimisation and standardisation.

Serge Staroselsky, Compressor Controls Corporation

There seems to be a trend for new plants toward electric-driven packages, and generally, toward pre-packaged modular solutions, with trains of approximately

0.5 –1.5 million tpy capacity. Whether this trend will stay and expand depends on the performance of some of the newly commissioned plants using the modular approach with multiple trains. For control systems the general trend is toward more autonomous operation, which is particularly important for remote locations, where experts can access the system, or at least information from the system, without having to be on site. Building a safe communication infrastructure remains a challenge at some locations and places limitations on the availability of remote access.

Jens Wulff, NEUMAN & ESSER Deutschland, and Arnd Viets, NEUMAN & ESSER South East Asia

There are currently no real limitations. Progress is made on controllability and online-monitoring for predictive maintenance. With the digital NEA|XPLORE system, NEUMAN & ESSER has its own platform for data collection and analysis for machine health, maintenance planning, and corrective measures.

Q6. Detail the process and design behind one of your most popular compressors.

Joseph C. Fernandez, Ariel Corporation

Ariel Corporation continuously improves designs and uprates the capabilities of our compressors. New designs and improvements start with input from its customers. The design engineers develop the concepts taking into account the company’s vast field experience and what it has learned in its state-of-the-art R&D facility. Multi-department teams work together to make sure the new products meet the demands of the markets, and provide good value to the customer and exceed equipment uptime expectations.

Andrea Masi and Francesco Cangioli, Baker Hughes

Baker Hughes is always active in technology development, investigating frontier technologies and developing solutions that can meet the market’s requirements. It is continuously working on improving and enhancing thermodynamic stages, materials, and internal sealing and bearings, as well as on digital solutions.