January 2025

January 2025

Kunal Sawhney, Kalkine Group, Australia, examines various strategies for decarbonising LNG production, including carbon capture and storage, renewable energy integration, and methane emissions reduction, across major LNG-producing nations.

Pumps and

Justin Hair, Key Account Manager, Sherwin-Williams Protective & Marine, addresses how to shore up specifications to combat corrosion under insulation, safeguard storage tanks, and protect pipelines. 27 Barnacles beware!

Per Svensson, Sales Director, I-Tech AB, outlines the not-so-secret agents protecting the LNG carrier fleet from biofouling.

31 Off the back-foot

Stavros Sklavounos, Hull Performance Solution Manager, Hempel, directs attention towards how companies can get off the back-foot in the race to reduce emissions from LNG carriers.

35 Wise valve selection improves performance

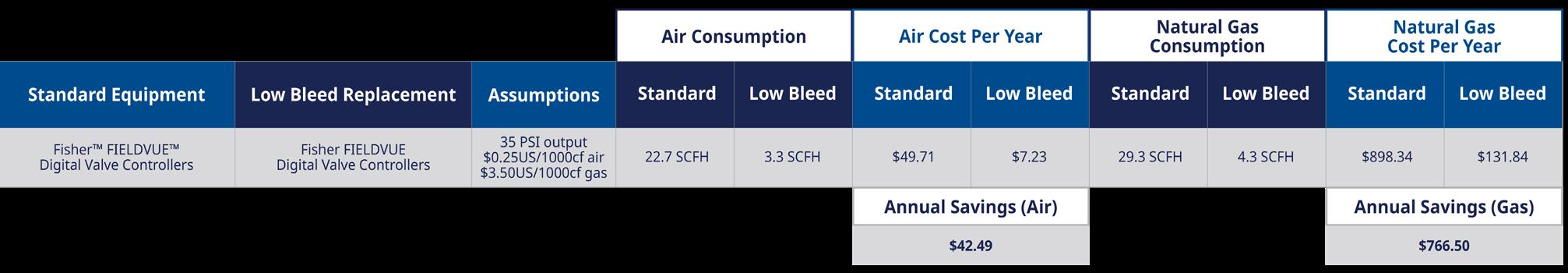

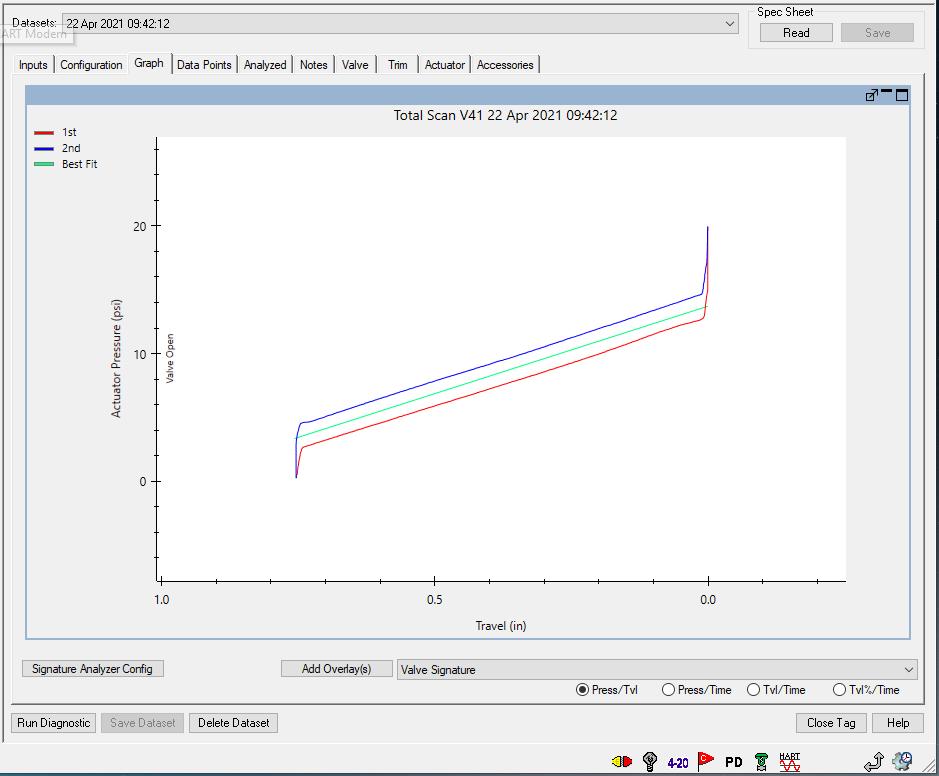

Riyaz Ali, Emerson, USA, explains how a properly specified valve positioner reduces maintenance, increases uptime, and cuts operational costs, especially instrument air consumption.

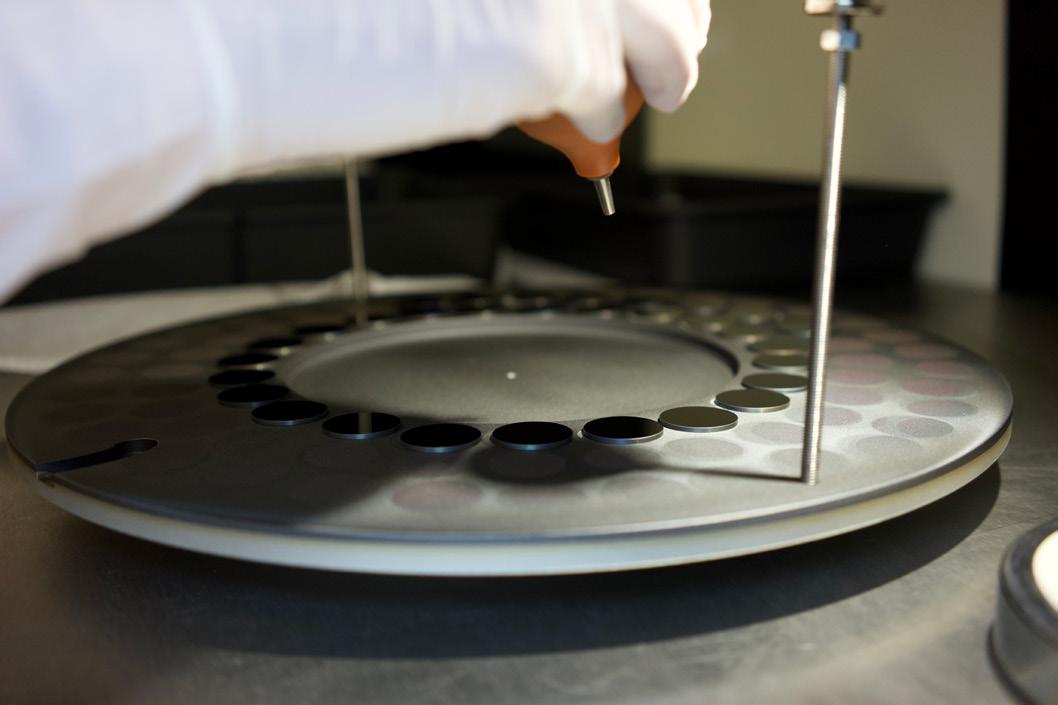

Mark Naples, Managing Director, Umicore Coating Services, provides insight into how infrared filters can unlock the next level of LNG maintenance.

LNG Industry recently spoke to Adam Prestidge, Executive Vice President and Head of Business Affairs at Glenfarne Energy Transition, about the company’s latest projects and the growing importance of LNG.

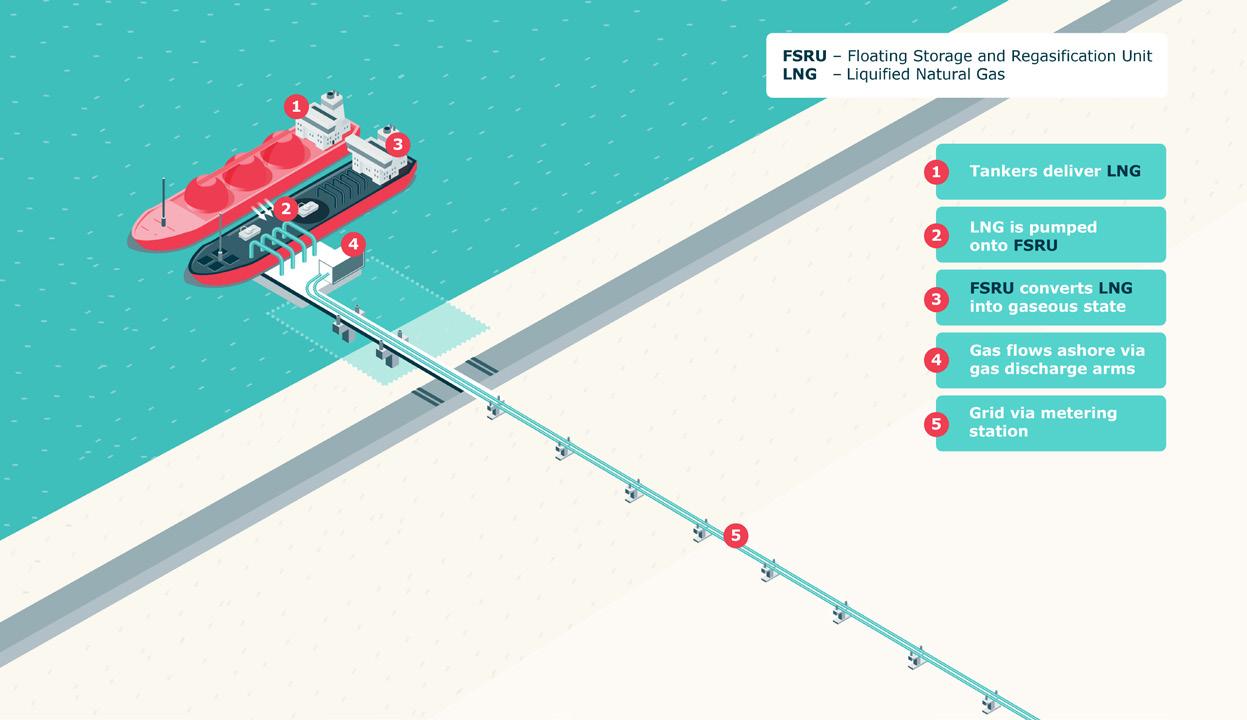

Paul Hughes, Project Delivery Vice President, and Andy Loose, Vice President for LNG sector, Worley, detail how an FSRU was operationalised in less than nine months to help secure Germany’s LNG supply and reduce dependency on Russia.

Francesca Serra and Filippo Perricone, HIGAS, Italy, delves into boil-off gas management at small scale LNG terminals.

Sherwin-Williams Protective & Marine delivers world-class industry subject matter expertise, unparalleled technical and specification service, and unmatched regional commercial team support to customers around the globe. The company’s broad portfolio of high-performance coatings and systems excel at combatting corrosion and helps customers achieve smarter, time-tested asset protection. The company serves a wide array of markets across its rapidly growing international distribution footprint, including the energy market where its latest coatings technologies enable greater durability, lower costs, and additional advantages.

With over 60 years of experience, we seek creative solutions for a more sustainable business and our mission is to serve our clients with safety and operational excellence. We have the ability to provide innovation and solutions to our clients by understanding their specific challenges on the path to decarbonization, establishing strategic alliances with the best designers and tugboat builders, and allocating the necessary resources for the implementation of their sustainable projects.

Managing Editor

James Little james.little@palladianpublications.com

Senior Editor

Elizabeth Corner

elizabeth.corner@palladianpublications.com

Editor Jessica Casey jessica.casey@palladianpublications.com

Assistant Editor

Oliver Kleinschmidt oliver.kleinschmidt@palladianpublication.com

Sales Director Rod Hardy rod.hardy@palladianpublications.com

Sales Manager Will Powell will.powell@palladianpublications.com

Production Designer Amy Babington amy.babington@palladianpublications.com

Head of Events

Louise Cameron louise.cameron@palladianpublications.com

Event Coordinator

Chloe Lelliott chloe.lelliott@palladianpublications.com

Digital Events Coordinator

Merili Jurivete merili.jurivete@palladianpublications.com

Digital Content Assistant

Kristian Ilasko kristian.ilasko@palladianpublications.com

Junior Video Assistant

Amélie Meury-Cashman amelie.meury-cashman@palladianpublications.com

Digital Administrator

Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Administration Manager Laura White laura.white@palladianpublications.com

Happy New Year!

As we welcome 2025, the 82nd Golden Globe Awards kicked off awards season in Beverly Hills, California, where Emilia Pérez won the most awards for motion picture and television series (four), with The Brutalist coming in second (three).1

After its success last year, eyes will be on the US to see if America can retain its crown as the world largest LNG exporter. However it plays out, the US will remain in the spotlight, with Trump’s inauguration only bringing potential for further momentum.

President Trump’s election will likely help this endeavour, having pledged to lift the Biden Administration’s pause on approvals for new LNG projects on his first day in office. However, as Wood Mackenzie has stated in its new report, it believes new final investment decisions for new US LNG projects might happen more slowly than the administration might want.2 In addition, as Reuters has reported, Advisers to Trump are urging him to be patient regarding restarting approvals for LNG export licenses so as to avoid any decisions being overturned in court.3

Nevertheless, with many projects starting production, construction, or having already signed guaranteed contracts (such as Venture Global’s CP2 LNG project, Cheniere Energy’s Corpus Christi facility, and Mexico Pacific’s Saguaro LNG),4 the US remains in a strong position, and Glenfarne Energy Transition’s interview later in this issue highlights the US’ growing importance.

Another topic of discussion that may impact the LNG industry is EU methane regulation. Wood Mackenzie predicts that limited clarity will emerge on how these regulations will be framed. The first date in the diary for LNG importers is 5 May 2025, by which time importers will need to provide information such as whether the producer/exporter of the gas is monitoring methane emissions, carrying out leak detection surveys, and the gas emission’s methane intensity.2 This could either trigger the potential for low-carbon LNG that could transform LNG trade, or cause more complications –it all depends on the clarity and execution of the regulations.

Kalkine Group has also forecasted the decarbonisation of LNG production as a key trend for 2025. In their keynote report at the beginning of this issue, Kalkine examines various strategies such as carbon capture and storage, the integration of renewable energy, and methane emissions reductions as ways for major LNG-producing nations to achieve this. As discussed in various articles throughout the issue, valves, coatings, and boil-off gas management are all things companies can consider to reduce the environmental impact of their operations.

Whatever 2025 may hold, LNG Industry will again be here to bring you the latest on any updates, developments, new projects or regulations, with each issue helping to keep you up-to-date and well informed. We look forward to seeing how it plays out.

1. ‘The 82nd Golden Globe Awards – Winners’, Golden Globes, (6 January 2025), https://goldenglobes. com/articles/the-82nd-golden-globe-awards-winners/

2. ‘Global Gas and LNG: 5 things to look for in 2025’, Wood Mackenzie, (January 2025), www.woodmac.com/news/opinion/gas-lng-2025-outlook

3. GARDNER, T. and RENSHAW, J., ‘Trump promised swift action on LNG exports, but advisers preaching patience’, Reuters, (7 January), www.reuters.com/business/energy/trump-promised-swiftaction-lng-exports-advisers-preaching-patience-2025-01-07

4. WILLIAMS-DERRY, C., ‘IEEFA comments to DOE on LNG export terminals and permitting’, Institute for Energy Economics and Financial Analysis, (8 January 2025), https://ieefa.org/ resources/ieefa-comments-doe-lng-export-terminals-and-permitting

bp has begun flowing gas from wells at the Greater Tortue Ahmeyim (GTA) Phase 1 LNG project to its FPSO vessel for the next stage of commissioning.

GTA, offshore Mauritania and Senegal, is one of the deepest offshore developments in Africa, with gas resources in water depths of up to 2850 m. Once fully commissioned, GTA Phase 1 is expected to produce around 2.3 million tpy of LNG.

Gas from GTA Phase 1 is being introduced to the GTA FPSO approximately 40 km offshore, where water, condensate, and impurities are removed. From there, it will be transferred via pipeline to a floating LNG vessel located 10 km offshore, where it will be cryogenically cooled, liquefied, and stored before being transferred to LNG carriers for export. Some of the gas will be allocated to help meet growing energy demand in the two host countries.

GTA construction activities have generated more than 3000 local jobs, and the project has engaged with around 300 local companies across Mauritania and Senegal. bp and partners have invested in local workforce development and started a multi-million-dollar social investment programme that aims to enhance local quality of life and create long-term opportunities for local development.

ADNOC Gas plc and its subsidiaries, a world-class integrated gas processing company, has announced the awarding of three enabling contracts worth US$2.1 billion for an LNG pre-conditioning plant (LPP), compression facilities, and transmission pipelines to supply feedstock to the Ruwais LNG project.

The LPP and compression facilities will be located within ADNOC Gas’ Habshan 5 plant, part of one of the world’s largest integrated gas processing complexes. The five plants of the Habshan Complex have a combined capacity to process 6.1 billion ft3/d of gas. The newly awarded transmission pipelines will connect the Habshan Complex with the Ruwais LNG facility.

The largest contract, valued at US$1.24 billion for the LPP, was awarded to a consortium consisting of Engineering for the Petroleum and Process Industries (ENPPI) and Petrojet. A US$514 million contract for transmission pipelines was awarded to the China Petroleum Pipeline Engineering Company, while Petrofac Emirates LLC will develop the new compression facilities under a US$335 million contract.

The three contracts will establish the key infrastructure needed to supply feedstock to the Ruwais LNG export facility. This investment is part of the US$15 billion CAPEX plan through 2029, as outlined in ADNOC Gas’ recent strategy update.

D TEK, Ukraine’s largest private energy company, has taken delivery of its first cargo of LNG from the US, after the LNG shipment docked in Greece.

The consignment of approximately 100 million m3 of gas, or 1 TWh of energy, onboard the Gaslog Savannah arrived at the Revithoussa LNG terminal on the morning of 27 December 2024.

D.TRADING, DTEK’s pan-European trading subsidiary, has purchased the entire cargo. Working with Greek and other partners, the LNG will now be regasified and exchanged through EU and Ukrainian gas networks.

The shipment is part of broader efforts to enhance Ukraine and Europe’s energy security by reducing reliance on Russian

supplied gas. Its arrival comes just days before Ukraine ends an arrangement transporting Russian gas to the EU via its territory.

D.TRADING expects the consignment to be the first of a number of such shipments from the US, and is looking to expand its LNG activities into northern Europe and the Baltics.

D.TRADING is bringing in this first cargo via Greece due to restrictions on LNG transits into the Black Sea and Ukraine directly. Instead, it will use regasification terminals like Revithoussa together with cross-border pipelines such as the Vertical Corridor initiative, which transmits gas between Greece, Bulgaria, Romania, Hungary, Slovakia, Moldova, and Ukraine.

Chart Industries, Inc., a global leader in clean energy and industrial gas solutions, has signed a global master goods and services agreement (enabling agreement) with ExxonMobil.

This enabling agreement sets the terms, conditions, and commercial framework for Chart to provide LNG equipment, technology, and services for ExxonMobil’s global portfolio of projects. Specifically, the agreement includes the supply of cold boxes, as well as Chart’s proprietary IPSMR® process technology.

Under the agreement, ExxonMobil and Chart will deploy a design once, and then build many concepts to optimise cost, schedule, and quality for LNG projects globally.

CB&I has been awarded a substantial lump sum contract by TJN Ruwais JV for EPC of two cryogenic tanks and associated civil, structural, mechanical, and piping works for its Ruwais LNG project, Abu Dhabi, UAE. Once complete, the Ruwais LNG project will be the first net-zero LNG facility in the Middle East. TJN Ruwais JV is a joint venture between Technip Energies France-Abu Dhabi, JGC Corp., and NMDC Energy.

Under the contract, CB&I will deliver two 180 000 m3 full containment concrete LNG tanks, including all piping and civil infrastructure. Project delivery will be led from CB&I’s UAE office for tank construction, the Plainfield office (Illinois) in the US for engineering, and CB&I’s Saudi Arabia and Thailand offices will provide fabrication and modularisation support, respectively.

CB&I’s construction activities are expected to commence in November 2025, with project completion targeted in early 2028.

Seaboard Marine has announced the arrival of the Seaboard Victory, the second vessel in its cutting-edge LNG-powered V-Class fleet. The Seaboard Victory recently made its inaugural calls at the ports of Callao and Pisco, Peru, enhancing Seaboard Marine’s ability to provide sustainable and efficient maritime transportation.

With a capacity of 3500 TEU, including over 1000 refrigerated container plugs, the Seaboard Victory brings added reliability and increased capacity to key trade routes across the Americas. This state-of-the-art vessel is powered by LNG, significantly reducing emissions while improving operational efficiency and aligning with Seaboard Marine’s ongoing commitment to environmental stewardship.

The Seaboard Victory has joined a strategic rotation of ports in the Caribbean Basin, Central America, and South America. Its advanced features and increased capacity are already positively impacting trade routes, especially for perishable and high-demand cargo.

The Seaboard Victory is one of eight LNG-powered vessels set to be integrated into Seaboard Marine’s fleet by the end of 2025.

X Excelerate Energy completes 3000th LNG ship-to-sip transfer operation

X Venture Global ships first cargo from Plaquemines LNG

X Cheniere achieves first LNG at the Corpus Christi Stage 3 project X Samsung Heavy Industries picks TMC Compressors for 15 LNG carriers

Our LNG projects under construction and development are designed to meet rising global energy demand, improve energy security for American allies and advance environmental stewardship – all while creating new jobs and supporting the local community.

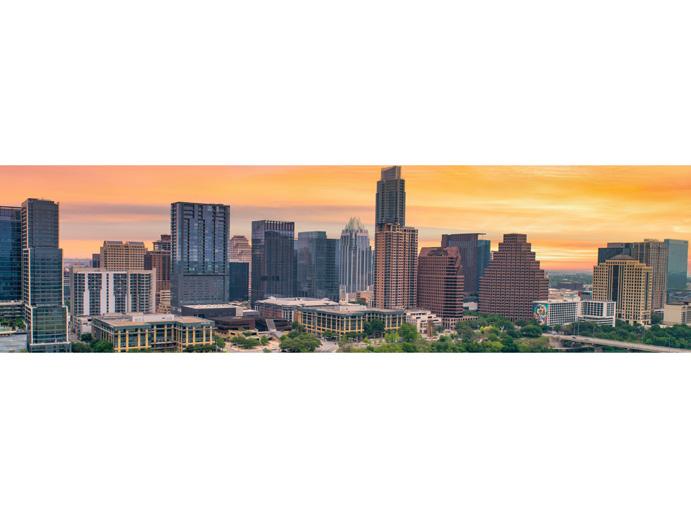

10 – 11 February 2025

6th American LNG Forum

Texas, USA

https://americanlngforum.com

10 – 12 March 2025

The 11th International LNG Congress (LNGCON) 2025

Amsterdam, the Netherlands

https://lngcongress.com

11 – 12 March 2025

StocExpo 2025

Rotterdam, the Netherlands www.stocexpo.com

07 – 08 April 2025

7th Global LNG Forum

Barcelona, Spain

https://lng-global.com

19 – 23 May 2025

29th World Gas Conference (WGC2025)

Beijing, China

www.wgc2025.com

10 – 11 June 2025

Gas, LNG & The Future of Energy 2025

London, UK

www.woodmac.com/events/ gas-lng-future-energy

09 – 12 September 2025

Gastech Exhibition & Conference

Milan, Italy

www.gastechevent.com

Baker Hughes, an energy technology company, has announced an order from Bechtel Energy Inc. to supply gas technology equipment for two liquefaction plants with a total capacity of approximately 11 million tpy for Phase 1 of Woodside Energy Group Ltd’s Louisiana LNG development opportunity. The order marks a significant milestone as Woodside targets final investment decision (FID) readiness from 1Q25.

The award, which includes eight main refrigeration compressors driven by LM6000PF+ gas turbines and eight expander-compressors, leverages Baker Hughes’ LNG technologies to support Bechtel and Woodside. Baker Hughes’ history of working with Bechtel and Woodside will support the delivery of Phase 1 of the project.

The European Commission has approved, under EU State aid rules, an estimated €4.06 billion German measure to support the operation of four FSRUs for the import of LNG by Deutsche Energy Terminal (DET). The measure contributes to the achievement of the objectives of the REPowerEU Plan, by enabling the diversification of energy supplies and ensuring security of gas supply.

In December 2022, Germany had chartered four FSRUs and created the state-owned company DET, tasked with operating the terminals. The FSRUs are located in Brunsbüttel, Wilhelmshaven (two locations), and Stade.

The measure aims to address energy market disruptions caused by Russia's invasion of Ukraine and the halt of pipeline gas supplies from Russia to Germany. The FSRUs, two of which started operating quickly, provide an additional import route to replace part of the lost Russian gas and are a temporary solution until permanent onshore LNG terminals are completed in Germany to ensure long-term gas supply.

The aid, in form of a direct grant, covers the losses incurred by DET for operating the FSRUs until the end of their charter period. As they were chartered at the peak of the energy crisis when demand and costs were very high and their limited operating time frame does not allow for full cost recovery, these terminals were expected to operate at a loss from the outset. The total net contribution between 2023 – 2033 is expected to amount to €4.06 billion. In case of higher losses than expected, the total net contribution could amount to €4.96 billion.

Germany has committed to stop operating the Brunsbüttel and Stade terminals once the planned onshore LNG terminal at those locations become operational, preventing market overlap. Once the onshore LNG terminals are active, the FSRUs will be sub-let at market rates, following worldwide calls for interest open to all bidders and locations, until the lease contracts expire.

Going forward, the capacity of the terminals will be auctioned in three different products: (i) a minimum technical capacity, subject to a delivery obligation, needed to ensure that the terminals remain operational in steady regime, therefore available at all times to ensure gas security of supply; (ii) medium term (3 – 4 years); and (iii) short term (one year). Germany has also introduced safeguards to address possible undue distortions to competition.

The Commission assessed the scheme under EU State aid rules, in particular Article 107 (3)(b) of the Treaty on the Functioning of the EU (TFEU), which enables Member States to remedy a serious disturbance in the economy.

Chart’s LNG power generation solutions provide natural gas to hundreds of thousands of homes. This is one way Chart facilitates LNG as a safe, clean-burning fuel for energy, transportation and industry.

Kunal Sawhney, Kalkine Group, Australia, examines various strategies for decarbonising LNG production, including carbon capture and storage, renewable energy integration, and methane emissions reduction, across major LNG-producing nations.

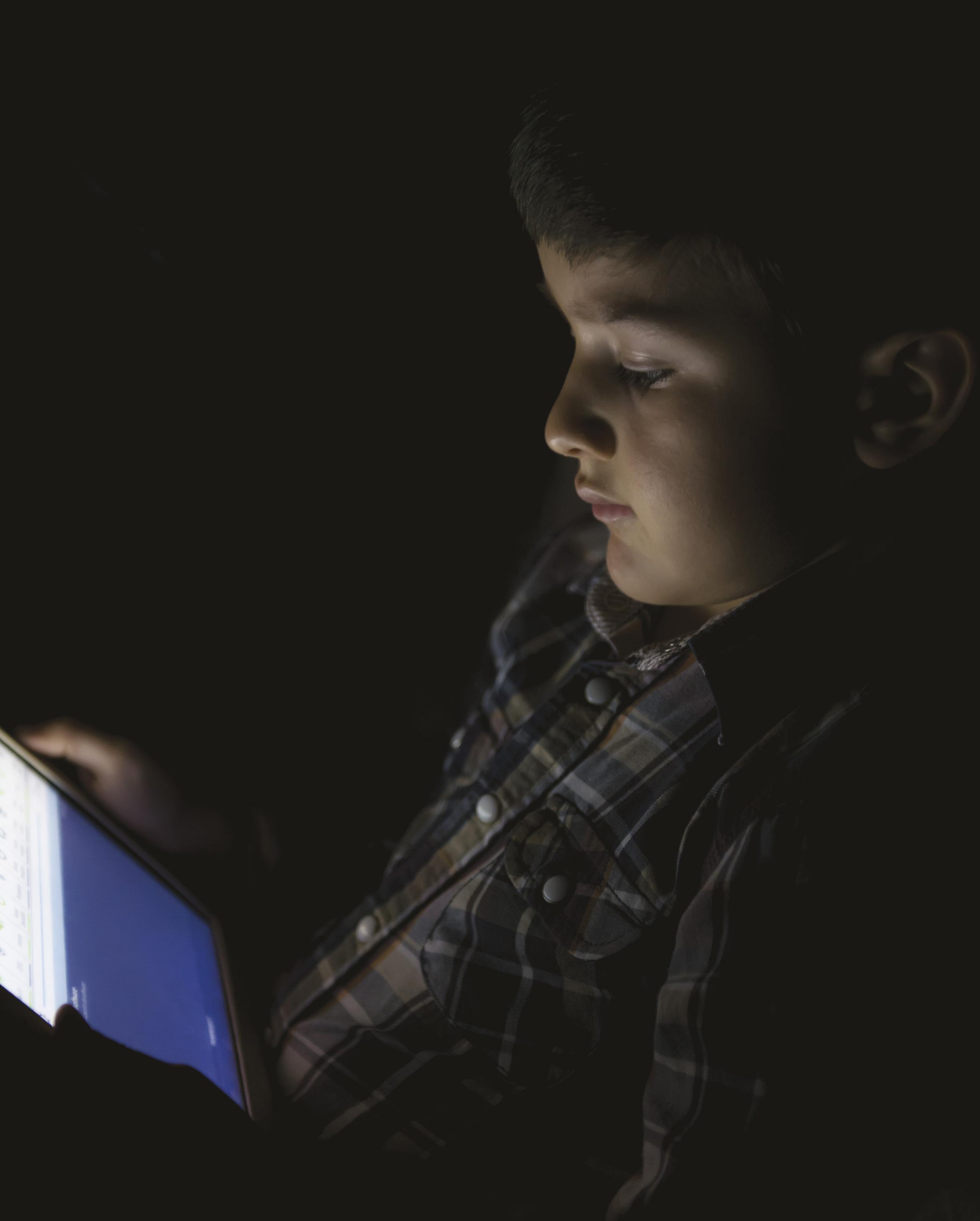

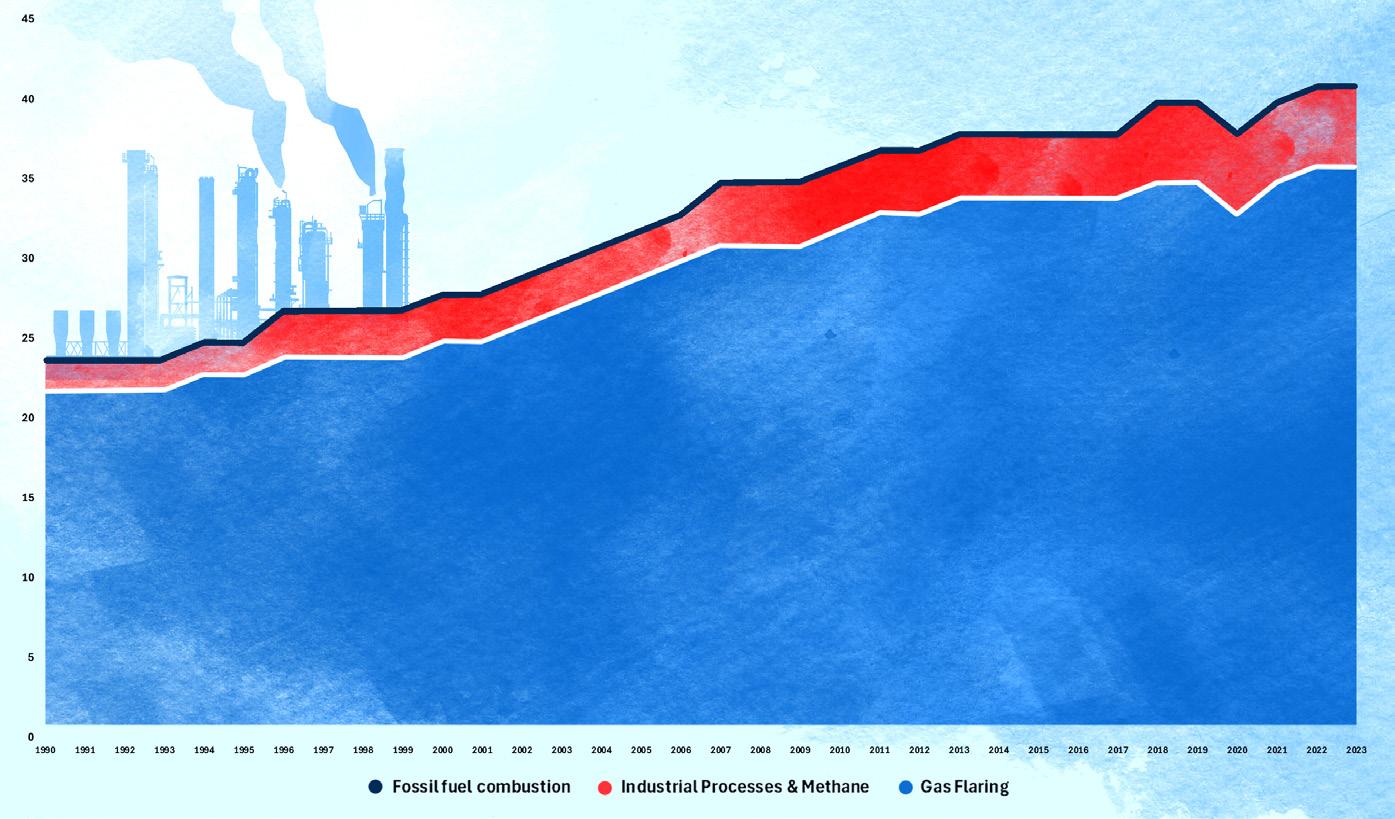

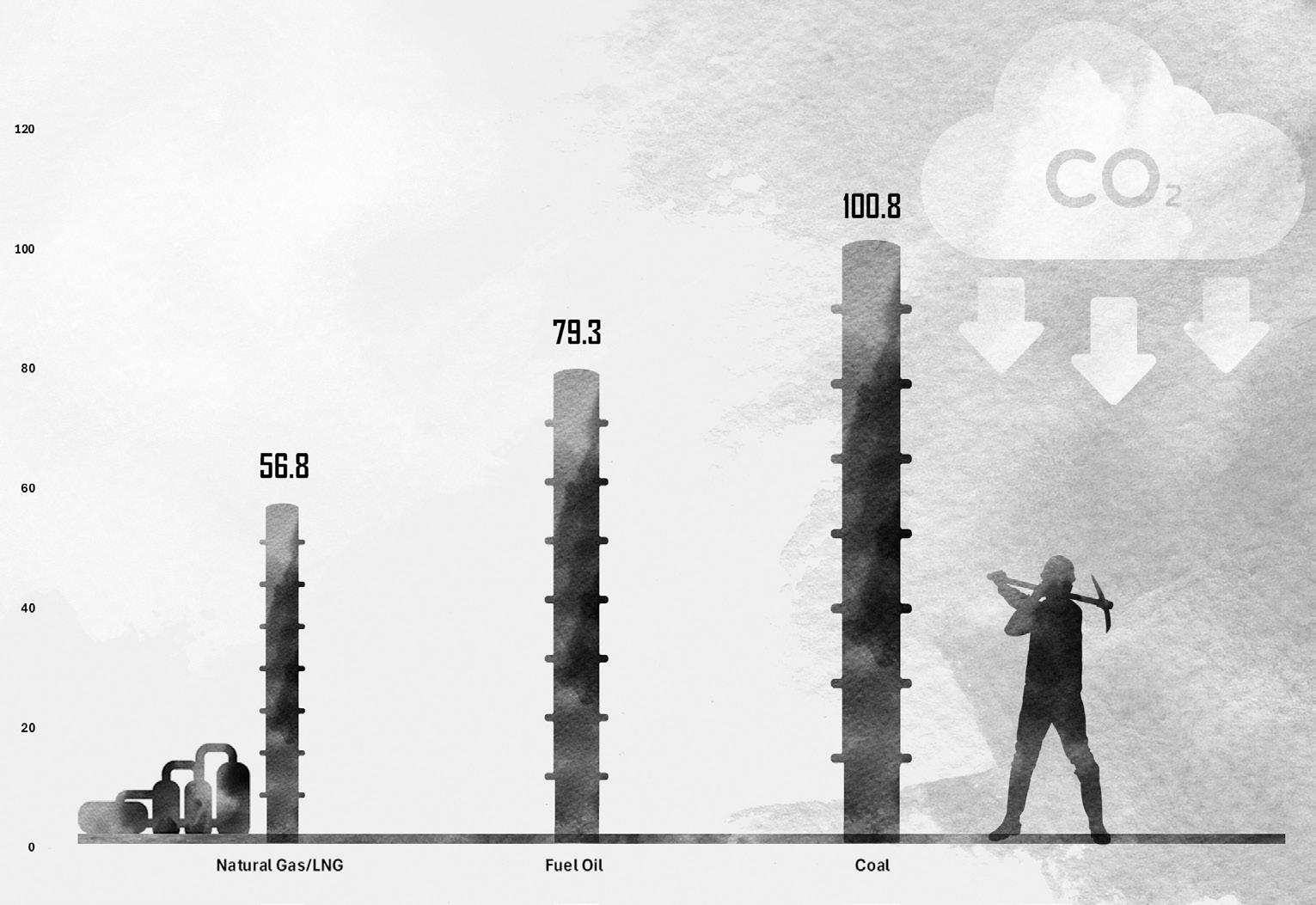

s global energy consumption surged in 2023, so did greenhouse gas (GHG) emissions, reaching unprecedented levels. LNG, a relatively lower-carbon fossil fuel, has emerged as a critical transition energy source. However, significant emissions from the LNG supply chain necessitate urgent decarbonisation efforts to align with global climate targets.

Countries like Australia, Qatar, and the US are leading in technological innovations and regulatory policies aimed at reducing LNG emissions. While decarbonisation presents challenges such as high energy demands,

regulatory uncertainty, and added operational costs, advancements in low-emission technologies and carbon-neutral LNG are reshaping the industry. Decarbonising LNG is essential to maintaining its role as a viable transition fuel in the global shift toward a sustainable energy future.

In 2023, global primary energy consumption reached a record high for the second consecutive year, growing by 2% to a total of 620 EJ. While fossil fuel consumption hit an

absolute record, its share in the energy mix declined slightly from nearly 81.9% in 2022 to 81.5% in 2023. Demand for natural gas, a relatively low-carbon fuel, remained stable. However, increased reliance on more carbon-intensive sources like oil and coal pushed energy-related GHG emissions to a new peak, exceeding 40 Gt of carbon dioxide equivalent (CO2-e) for the first time. Notably, CO2 emissions from fossil fuel combustion accounted for about 87% of total energy-related GHG emissions, remaining the largest contributor.

With energy-related GHG emissions reaching a new high, one of the pressing issues of the global energy industry is its decarbonisation. However, it is impossible to make such a transition overnight; therefore, a transitional fuel is needed – for example, natural gas as it has the lowest carbon emissions rate of all hydrocarbons fuels.

However, the global LNG market is undergoing a rapid evolution to meet the growing demand for cleaner energy,

particularly in emerging markets, while adapting to shifting geopolitical, regulatory, and environmental dynamics.

As LNG infrastructure expands and technology advances, the market diversifies, with an increasing number of players and innovations reshaping the industry. Challenges such as regulatory pressures, infrastructure limitations, and environmental concerns introduce uncertainty and complexity. In response, LNG operators are focusing on decarbonisation – an essential strategy to reduce emissions across the LNG value chain, from upstream production to downstream distribution.

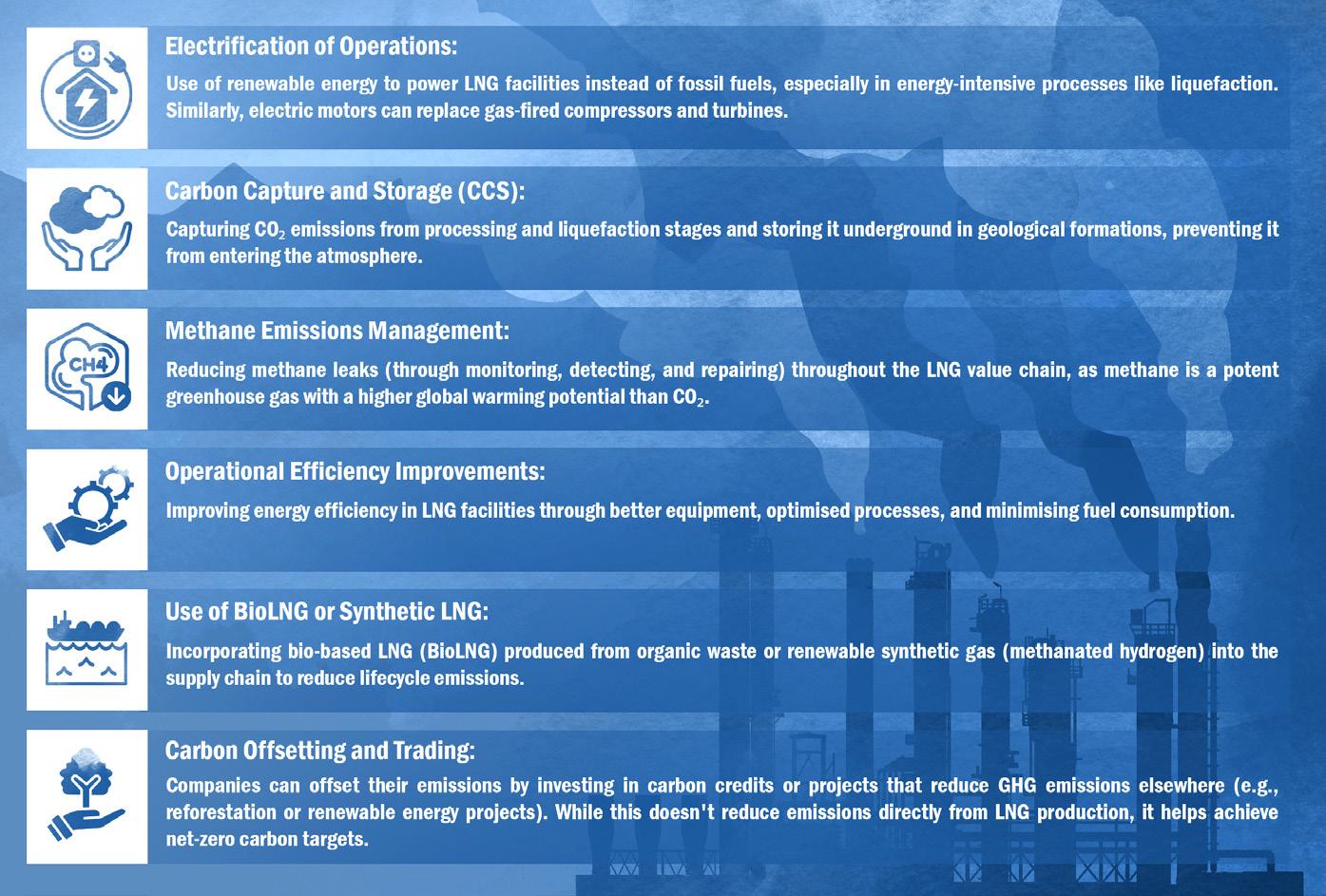

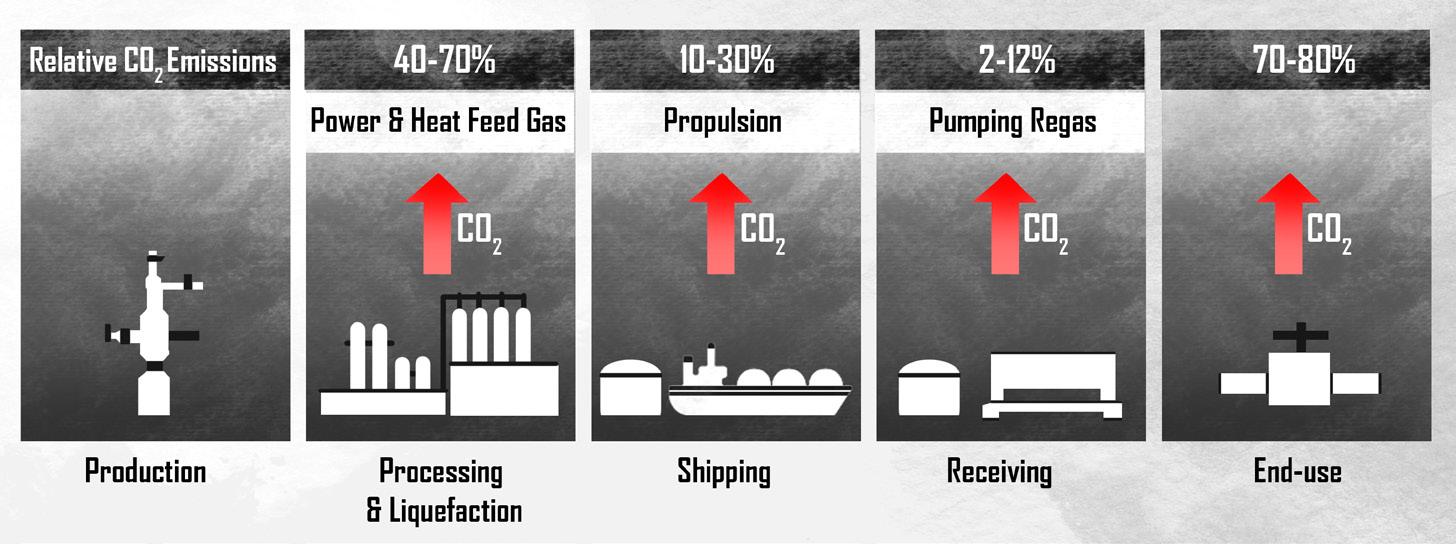

Decarbonisation of LNG production refers to reducing or eliminating the GHG emissions generated throughout the LNG value chain – from extraction and processing to liquefaction, transport, and regasification. As shown in Figure 3, 40 – 70% of total CO2 emission in the LNG value chain occurs in the processing and liquefaction stage.

This process is part of the broader effort to make LNG production more sustainable and aligned with global climate targets by reducing its carbon footprint.

Steps taken by countries to decarbonise LNG production

Countries are adopting various policies, infrastructure investments, and technologies to decarbonise LNG production. Some notable approaches from major LNG producers include:

z Carbon capture and storage (CCS): Australia is advancing CCS projects, such as Chevron’s Gorgon LNG project, designed to store up to 4 million tpy of CO₂.

z Renewable energy integration: Some facilities are trialing solar power to meet part of their energy needs, aligning with national climate goals.

z Government support: Australia provides subsidies for low-emission technology, including CCS and hydrogen, under its Technology Investment Roadmap.

OUR LATEST COATINGS BREAK CONVENTION. YOURS.

It’s common to reuse coatings specs from previous projects – especially coatings that performed well. But our newest coatings may o er even greater durability, lower costs or additional advantages, like insulating without the need for an exterior system. So don’t pick up the same old specs until you know what our latest coatings technologies can do for you.

Scan to upgrade your specs for complete asset protection.

z Efficient technologies: Qatar is investing in high-efficiency equipment, such as in the North Field East project.

z Carbon offsetting: LNG producers are offering carbon-neutral cargoes via carbon credits and renewable energy.

z CCS expansion: Qatar aims to increase CCS as part of its National Vision 2030.

z Electrification: Producers like Venture Global LNG are incorporating renewable energy, such as solar, to power operations.

z Policy incentives: Tax credits under the 45Q provision encourage CCS investments.

z Methane emission regulations: The U.S. Environmental Protection Agency (EPA) has implemented stringent methane rules for oil and gas, including LNG.

z Carbon pricing: Canada’s carbon pricing mechanism incentivises emission reductions.

z Hydroelectric power: Projects like LNG Canada in British Columbia use hydroelectricity to cut emissions.

z CCS and methane reduction: Federal and provincial funding support cleaner LNG operations.

z Electric LNG facilities: Equinor’s Hammerfest LNG plant uses hydroelectric power, reducing fossil fuel reliance.

z Strict regulations: Norway enforces strict emission rules for LNG production.

z Carbon pricing: Norway’s carbon pricing and offset initiatives push companies toward carbon-neutral solutions.

z Carbon-neutral LNG imports: Japan is signing carbon-neutral LNG contracts, spurring exporters to reduce carbon footprints.

z Investments in CCS and hydrogen: Japan supports CCS and green hydrogen as part of its energy transition.

z Carbon border adjustment mechanism (CBAM): CBAM imposes costs on carbon-intensive imports, motivating exporters to cut emissions.

z Demand for carbon-neutral LNG: European buyers’ preference for low-carbon LNG drives suppliers toward cleaner production.

z Methane standards: The EU proposes strict methane standards for energy imports, encouraging global LNG producers to reduce leaks.

These steps reflect a combination of regulatory pressures, technological advancements, and market demand shaping LNG decarbonisation across the globe. While progress varies by country, these actions collectively help to drive lower-emission practices in LNG production and align the sector with global climate targets.

Decarbonisation is having a profound impact on the gas and LNG industry, reshaping its operations, economics, and role in the global energy landscape. There are some key ways in which decarbonisation is influencing this sector.

Increased capital in low-carbon technologies

To meet decarbonisation targets, companies are redirecting investments toward low-emission technologies. This shift in investment means more capital allocation toward research, development, and implementation of sustainable solutions.

There is a growing trend in ‘carbon-neutral’ or ‘green’ LNG contracts, especially from buyers in Europe and Asia, who are willing to pay a premium for LNG with offset or low-carbon options.

Decarbonisation is pushing gas and LNG operators to adopt new technologies adding

complexity to traditional operations, requiring significant modifications to existing facilities and supply chains.

Technologies such as CCS and electrification require additional CAPEX and OPEX, making LNG production more costly. Maintaining competitiveness may become challenging, especially for projects in regions with lower-cost fossil fuel operations.

Market demand shift and competitiveness

As renewable energy and green hydrogen gain traction, there is a risk that LNG may lose its status as a ‘transition fuel’ and face declining demand over time. Some buyers view LNG as a temporary solution, and this long-term demand uncertainty affects investment decisions and the overall strategic direction of the industry.

Customers are beginning to demand detailed carbon footprint information on LNG cargoes, prompting companies to improve emissions tracking and reporting. Complying with these requirements adds operational complexity and can create competitive pressure among producers.

Profitability concerns

The higher costs of decarbonisation initiatives, coupled with potential carbon taxes and the expense of purchasing carbon offsets, can reduce margins for LNG producers. Companies without the resources to invest in decarbonisation could struggle to compete, potentially leading to consolidation in the industry.

Decarbonisation efforts may enable producers in regions with access to renewables, CCS infrastructure, or carbon-neutral LNG contracts to gain a competitive edge. This could shift market leadership towards countries with strong decarbonisation policies and resources.

and social license to operate

Enhanced public and investor scrutiny

Decarbonisation aligns the LNG industry with climate action goals, which is increasingly important for securing investment and public support. Companies prioritising decarbonisation are better positioned to attract capital, satisfy stakeholders, and improve their reputations.

Environmental, social, and governance (ESG) standards are becoming critical for many investors. By decarbonising, LNG companies can appeal to ESG-conscious investors

and stakeholders, which is particularly important as global capital shifts toward sustainable investments.

Decarbonising LNG production presents several significant challenges, as the process is complex, energy-intensive, and often relies heavily on fossil fuels.

Energy-intensive processes

LNG production, especially the liquefaction stage, requires a vast amount of energy, which is typically supplied by natural gas itself. Switching to renewable sources is challenging due to the scale of power needed and the continuous operation requirements of LNG plants.

Limited renewable integration

In remote locations, renewable energy infrastructure may not be available or reliable enough to fully power LNG facilities, limiting opportunities for electrification.

Technical and economic feasibility

While CCS is a potential solution for capturing CO2 emissions from LNG production, the technology is still costly and not yet widely implemented at scale. Significant investment and infrastructure are required for capture, transportation, and storage of CO2.

Site-specific constraints

Not all LNG production sites have nearby suitable geological formations for CO2 storage. Transporting CO2 to distant storage sites can be cost-prohibitive and logistically complex.

Detection and prevention

Methane is a potent GHG, and its unintentional leaks (fugitive emissions) throughout the LNG value chain are challenging to monitor, detect, and repair. Effective methane management requires advanced monitoring technology, which can be costly and is not yet widespread in industry.

Industry-wide standards and best practices for methane emissions control are still developing, making consistent reductions challenging across different operators and regions.

Transitioning LNG facilities to lower-emission operations, such as integrating renewable energy or implementing CCS, requires substantial upfront capital. Many LNG projects operate on thin profit margins, making large investments in decarbonisation difficult.

Funding and incentives

Government incentives or carbon pricing mechanisms are often necessary to make these projects economically viable, but such mechanisms are inconsistent globally, with varying levels of support for LNG decarbonisation.

and policy uncertainty

Inconsistent policies

Regulations for emissions control and incentives for decarbonisation vary widely by country and region. LNG producers operating globally must navigate different environmental regulations, some of which may lack clear guidance or enforcement, slowing the adoption of decarbonisation measures.

Carbon pricing and compliance

Not all regions have carbon pricing in place, and where it exists, the rates may not be high enough to incentivise decarbonisation fully. Uncertainty in future carbon pricing also affects long-term planning for LNG producers.

Market pressures and demand uncertainty

Market demand for ‘green’ LNG

While some buyers prioritise low-carbon LNG, many consumers still prioritise cost over emissions profiles. As a result, there may be limited demand for decarbonised LNG, creating an uncertain return on investment for producers.

Long-term demand uncertainty

LNG is often viewed as a ‘transition fuel’, and there are questions about its long-term role in a net-zero future,

especially as renewable energy adoption increases. This uncertainty can make companies hesitant to invest heavily in decarbonisation.

Supply chain and operational challenges

Complex LNG value chain

Decarbonising the entire LNG supply chain is challenging because emissions come from multiple stages, including extraction, transportation, and liquefaction. Co-ordinating decarbonisation efforts across all stages and stakeholders in the supply chain requires substantial collaboration.

Decarbonisation technologies such as CCS or electrification can complicate LNG facility operations, potentially leading to increased downtime, maintenance requirements, and risk of operational disruptions.

Public perception and stakeholder pressure

Skepticism toward LNG as a ‘transition fuel’

Environmental groups and some governments question LNG’s role in a net-zero future, given the methane emissions associated with natural gas. LNG companies face pressure to reduce emissions significantly to justify their product as a viable transition fuel.

Increased reporting and transparency requirements

Investors and stakeholders are demanding more detailed emissions reporting and transparency, putting additional pressure on LNG producers to adopt verifiable decarbonisation measures.

Despite these challenges, LNG companies are exploring ways to reduce emissions, but overcoming the economic, technical, and logistical barriers requires co-ordinated efforts from industry players, governments, and technology providers. Addressing these challenges is crucial to aligning LNG production with global decarbonisation goals and maintaining its role as a cleaner alternative to coal and oil in the energy transition.

Pumps and valves are an important component in the LNG process. LNG Industry asked several companies to discuss key topics regarding these pieces of equipment.

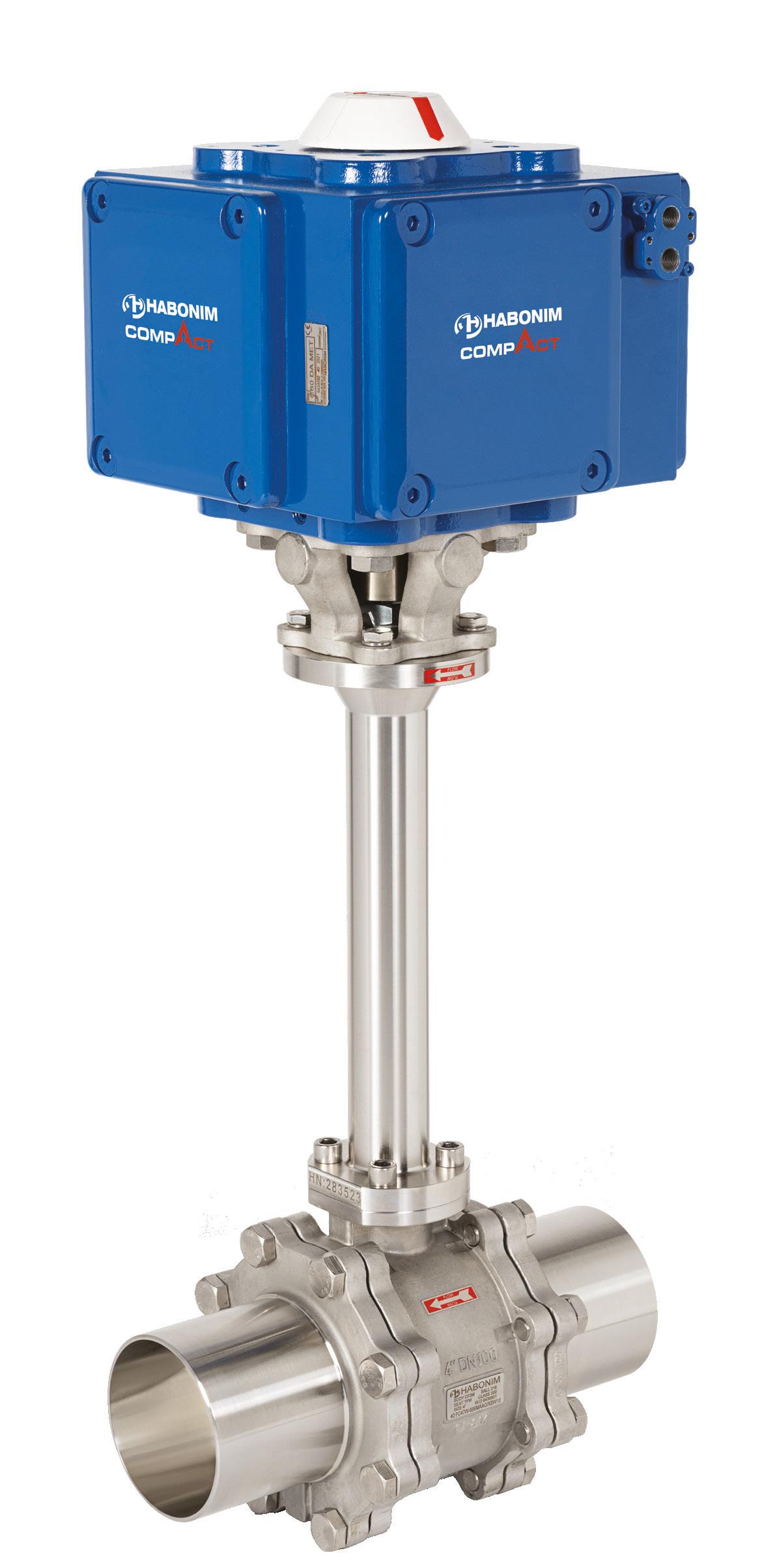

Tzur Layish is leading Habonim’s strategy and market focus in the LNG market, a rapidly growing market for Habonim in valves and valve automation, bringing innovation based on close co-operation with leading LNG system builders and equipment manufacturers around the globe. Tzur started his career at Habonim in 2018 and has 18 years of experience in industrial processes and instrumentation.

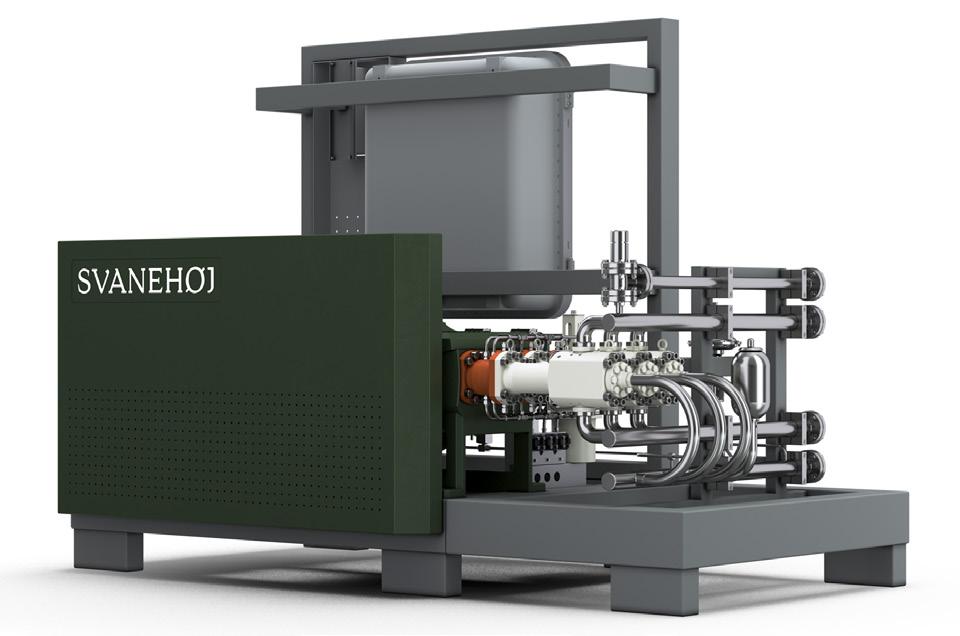

Johnny has been with Svanehøj for nearly 15 years, and since 2019 has been CSO with the overall responsibility for sales and projects. Over this period, Svanehøj has established itself as a specialist in LNG pump solutions, starting with deepwell (DW) cargo pumps in 2009, followed by DW fuel pumps in 2016, and most recently cryogenic submerged (CS) fuel pumps in 2022 and high-pressure piston (HPP) pumps in 2023.

Q1. Why are pumps and valves considered fundamental to the LNG process?

Tzur Layish, Habonim, An ITT Company

The LNG process involves piping systems connecting the equipment and devices along them. Valves are essential to any piping system and in many of the devices involved. They allow, block, or regulate the flow of LNG in the system, both in regular operation and in emergencies. As such, the reliability of valves is of high importance. As LNG is in extreme cryogenic temperatures and has risks of flammability and explosion, valve safety is critical.

Johnny Houmann, Svanehøj

From a maritime perspective, fuel pumps are considered critical equipment due to their essential role in delivering LNG from the storage tanks to the main engine. Fuel pumps are vital not only for the basic operation of an

LNG-fuelled vessel, but also for ensuring safety, efficiency, and compliance with environmental regulations. High-quality pumps specifically designed for cryogenic conditions are crucial for maintaining stability, optimising performance, and ensuring high reliability in vessel operations.

Q2. How can the right pumps and valves improve cost-efficiency, and overall efficiency of the LNG process?

Tzur Layish, Habonim, An ITT

Valve quality affects system efficiency by preventing leaks, energy loss, and downtime. Moreover, as the valve flow-rate capacity is one of the bottlenecks in piping systems, selecting valve technology with higher flow-rate capacity, like ball valves, can allow designers to maintain the overall system flow rate while using smaller pipes. Such designs can cut the overall piping system costs by half.

Using a floating ball valve technology with bi-directional sealing capability for the LNG system allows even greater savings in CAPEX and OPEX, as this quarter-turn valve technology is the most cost-effective.

Based on ball valve technology, LNG flow control is significantly more cost-effective than alternative cryogenic valve technologies.

Johnny Houmann, Svanehøj

Keeping LNG in its liquid form requires cryogenic conditions of at least -162˚C. LNG pumps must therefore be highly reliable, durable, and constructed from materials that function optimally under cryogenic conditions. The greater the efficiency of a fuel pump, the more energy is converted into mechanical power, resulting in energy savings and the prevention of gas loss caused by heat generation and boil-off gas (BOG). A main design criterion at Svanehøj has been to ensure optimised energy performance and extended service intervals for all pumps in our portfolio, thereby shifting the focus in the industry from initial investment cost to lifetime cost. A comprehensive lifetime study, including tests and thorough calculations of the mechanical components, has concluded that a Svanehøj DW pump only requires servicing every five years during regular docking. In fact, all maintenance until 10 years/50 000 hours does not require access to the tank.

Q3. What are some of the recent developments for pumps and valves in the LNG industry, if any?

Tzur Layish, Habonim, An ITT Company

The development of Cryogenic Bi-Directional Flushing Ball valve technology, which is a recent innovation in valve technologies, opens a new way to design LNG piping systems with significantly lower costs and simplicity.

Johnny Houmann, Svanehøj

The growing adoption of LNG as a ship fuel has driven an increase in demand for high-pressure engines in specific maritime applications, owing to their lower emissions, higher efficiency, and superior fuel economy. In response to the need for leak-free components supporting high-pressure LNG ship engines, Svanehøj has developed the HPP Triplex Pump Unit, a complete high-pressure pump unit designed exclusively for maritime purposes. With this design, the company has introduced an innovative low-pressure sealing arrangement for the cold end that reduces friction, ensuring longer service intervals. Additionally, Svanehøj has incorporated a new inlet valve design to ensure high efficiency and low-pressure drop.

Q4. As LNG becomes more popular and new gas sources are utilised, will this require changes in how pumps and valves are designed or used?

Johnny Houmann, Svanehøj

From a maritime perspective, it is crucial to ensure that cryogenic pumps can effectively handle impure LNG. Traditionally, fuel pumps have faced challenges with clogging, leading to reduced efficiency, operational disruptions, and excessive wear. Svanehøj has addressed this issue, designing both its DW fuel pumps and submerged fuel pumps for LNG to manage impurities in liquefied gas without compromising performance or reliability.

Q5. What component of a pumps and valves is most prone to failure and thus requires the most maintenance?

Layish, Habonim, An ITT Company

Valve sealing elements are prone to get worn out with cycling and time as operating the valve most affects the valve’s steam-sealing arrangement. Unique steam-sealing technologies for LNG provide emission-free operations, fire-safe capabilities, and durability that allows no sealing maintenance for long periods or cycling.

Johnny Houmann, Svanehøj

Traditional filters in submerged cryogenic pumps are prone to clogging due to impurities in the LNG. This leads to pump downtime and excessive wear on bearings and motor components. In response, Svanehøj’s new series of submerged LNG fuel pumps, launched in 2023, features a redesigned filtering system. The primary gas flow circulates around the

LNG filter at very high speed, effectively dislodging particles and preventing clogging.

Q6. Numerous types of pumps and valves exist. Describe the technology behind one of your most popular pumps and valve products.

Tzur Layish, Habonim, An ITT Company

Habonim’s patented Bi-Directional Floating Ball valve technology is based on releasing any potential ‘in cavity’ overpressures without the traditional use of a ‘pressure relief hole’ in the valve ball, which, in turn, turns the valve into a unidirectional valve.

This bi-directional sealing capability allows the use of quarter-turn floating ball valves to replace alternative valve technologies and achieve higher performances with lower costs.

Johnny Houmann, Svanehøj

The Svanehøj DW fuel pump is a long-shaft, multistage centrifugal pump that has achieved remarkable success, with over 1000 units sold since its introduction in 2016.

Svanehøj. Svanehøj has been developing pumps for LNG since 2009. A main design criterion has been to ensure optimised energy performance and extended service intervals for all pumps in the portfolio, thereby shifting the focus in the industry from initial investment cost to lifetime cost.

Svanehøj. In response to the need for leak-free components supporting high-pressure LNG ship engines, Svanehøj has developed the ‘HPP Triplex Pump Unit’, a complete high-pressure pump unit designed exclusively for maritime purposes.

All sensitive components (the electric motor, seals, and bearing systems) are positioned outside the tank. This design not only ensures easy access during service, but also prevents motor heat from contributing to increase in BOG and pressure inside the tank. The pump is equipped with a unique hermetically sealed MagDrive coupling, which eliminates the risk of gas leaking, enhancing safety and reliability in LNG applications.

Svanehøj DW pumps are designed for 5 years/25 000 hours service intervals and 10 years/50 000 hours between overhauls. Two patented design features – a static seal and a foot valve system – significantly enhance the ease of pump maintenance. When the static seal is activated, the inner magnet coupling, the main pump bearing, and the oil filter can be accessed, dismantled, serviced, or replaced without having to extract the pump from the tank. When installed in a caisson pipe, the unique foot valve system enables the pump to be fully extracted and serviced regardless of the tank’s contents or the liquid level. For many of the company’s customers, the foot valve system is a decisive factor, as it allows for immediate pump servicing without the need to empty the tank, significantly reducing downtime and operational disruption.

Q7. Outline a short case study on the use of pumps and valves at an LNG operation.

A common use of ball valve technology in LNG trailers and ISO tanks is the fire-block valve (FBV). This safety device shuts off LNG flow in case of fire. FBV is usually required in LNG transportation equipment and systems and is installed on the main LNG supply line.

LNG transportation systems usually require a high level of safety certification for inland transportation, like TPED or marine type approval for shipping.

Svanehøj’s DW pumps are equipped with a patented foot valve system that enables complete servicing of the pump –regardless of the tank’s contents or liquid level.

This feature proved invaluable when Svanehøj was called to an offshore installation vessel in Germany after the crew discovered a leak in a fuel pump during bunkering. By activating the foot valve system, Svanehøj’s service engineer identified the issue and began repairs within just three hours. Without the foot valve system, the fuel tank would have needed to be emptied and rendered gas-free before the pump could be extracted – a process that could have taken several days instead of hours and incurred substantial financial costs.

The foot valve system operates by utilising the tank’s internal pressure to keep the valve closed, as the surrounding pressure in the tank exceeds that in the pump caisson. The system is activated from outside the fuel tank. In the event of a leak or pump malfunction, the service engineer injects nitrogen to displace LNG from the pump caisson via the foot valve. Once the valve is securely closed and any remaining gas vented, the fuel pump can be safely extracted for a full overhaul or minor maintenance.

At Svanehoj, we are dedicated to developing the best and most comprehensive range of future fuel pump solutions to meet the need for carbon-neutral fuels, whether we talk LNG, LPG, ammonia, or methanol.

Our leading technology is developed based on our extensive background and knowledge from the maritime industry, and our proven and reliable pump technology is already part of more than 1000 Svanehoj Fuel Pumps operating in vessels around the world to advance the green transition.

Justin Hair, Key Account Manager, Sherwin-Williams Protective & Marine, addresses how to shore up specifications to combat corrosion under insulation, safeguard storage tanks, and protect pipelines.

atural gas takes a complicated journey from inland extraction sites to LNG plants and coastal exporting terminals. Along the way, the infrastructure that moves and stores the material in either a gaseous or liquid state faces numerous corrosive threats that can create maintenance headaches for owners at best, or lead to dangerous leaks and catastrophic events at worst.

Such threats exist from upstream fracking sites to midstream pipelines and storage facilities to downstream processing facilities and distribution terminals. At every stage, owners must determine the best ways to stave off corrosion for as long as possible on pipelines, compressors, process vessels, storage tanks, and numerous other infrastructure assets. The longer those assets can perform, the better for the owner’s bottom line.

Specifying high-performance coatings is the optimal solution for buying extra time on the corrosion clock. Better performing coatings lead to longer asset service lives, plus longer-term cost savings

due to fewer planned and emergency maintenance shutdowns needed over the life of an asset. However, determining which solutions offer the best results can be difficult. This article will review some considerations for choosing the most appropriate coatings for various assets associated with LNG production and transmission, as well as reinforce the importance of having informed coating specifications for those assets.

Steady LNG market growth has spurred the need for additional infrastructure – including pipelines, compressor stations, storage tanks, and peak shaving facilities – to enable

continued progress. This activity is keeping global EPC firms on their toes as they manage various logistics associated with LNG infrastructure. Because many such projects involve an array of international suppliers, a logistical nightmare could materialise if various plug-and-play assets are not compatible when connecting everything together –particularly if the coatings do not meet strict international standards, such as ISO 12944 and NORSOK M-501.

The success of installing those assets, and ensuring everything will function as planned, hinges on having solid

specifications in place. Such protocols hold each supplier to the same standards, enabling a process vessel that is fabricated and coated in North America to connect seamlessly to piping produced in Latin America, that connects to a storage tank made from steel produced and coated in Asia. Each coating system used on those assets must be compatible with the ones used on any connected assets. In addition, asset owners will want the colours to be uniform for aesthetic purposes. Clear specifications should ensure both outcomes, particularly when using a coating supplier that offers uniform products that are available at the same quality and performance standards anywhere in the world. Such universal coatings ensure compatibility, colour matching, and performance on projects spanning multiple regions.

A common practice for EPC firms and asset owners alike is to base new coating specifications on previous ones that have worked well in the field over years of asset use. That certainly makes sense. However, there is a good reason to question even a specification with a sound performance history, as legacy specifications likely do not include newer materials now on the market. Those materials may offer better longevity, cost, maintenance, and performance, but they could be left out of consideration if no one speaks up.

Knowing this, it is important for EPCs and asset owners to connect with coating suppliers well ahead of finalising project specifications and before any infrastructure assets are created. Working together to understand the operating logistics and challenges of the project will help all parties consider every potential solution. With the longevity of assets being a primary goal, many newer coating formulations are likely to displace older specified materials.

Since older specifications are often used for new projects, it may be helpful to examine a particular category of coatings to demonstrate why considering newer solutions is advisable.

A good example are the coatings used to stave off the troublesome and potentially dangerous condition of corrosion under insulation (CUI) (Figure 1). This bane of many energy-related operations occurs underneath the insulation and cladding that is wrapped around storage tanks, piping, and other assets operating at hot or cold temperatures to insulate them. Moisture inevitably becomes trapped within those insulation systems and works its way down to the steel substrates underneath, accelerating corrosion potential.

Hidden from view, CUI can be very corrosive in nature due to moisture and condensation intrusion, varying pH ranges that occur based on the type of insulation materials used, and the intrusion of chlorides that is likely to occur due to the harsh coastal environments in which many LNG plants are located.

Consider stainless steel piping used to move process gas or fluid through an LNG facility. Covered in insulation, the piping is likely to encounter CUI at some point during its lifespan. In the coastal environments where LNG plants are typically located, that corrosion is likely to come in the form of chloride stress corrosion cracking (CSCC), which can cause cracking, pitting, and even leaks.

An EPC using an older specification could miss the fact that better CUI-mitigation coatings have entered the market and would therefore miss out on the improved outcomes a newer technology would deliver. Some enhanced options in that realm include newer spray-applied organic liquid coatings such as high-temperature epoxy phenolics, high-temperature, high-solids alkylated amide epoxies, and ultra-high-solids novolac amine epoxies.

Among the newer liquid CUI-mitigation coating options EPCs may not know are formulations featuring a high concentration – at least 25% – of micaceous iron oxide (MIO) pigment, which reinforces the coating for greater durability against impacts, chemicals, and corrosion (Figure 2). In addition, an ultra-high-solids advanced epoxy novolac with a functional chemical enhancement for CUI mitigation is available that performs even better than the MIO-enhanced formulations per heat cycling, CUI, UV erosion, DFT tolerance, and ISO testing.

EPCs may also not know they can eliminate CUI altogether by skipping the traditional insulation systems used on storage tanks, piping, and process vessels. Newer thermal insulative coatings that provide an advanced energy barrier to curb the transfer of heat rival the thermal retention capabilities of traditional insulation. They enable asset owners to forgo traditional insulation and cladding in favour of a few layers of coatings (Figure 3). Doing so literally eliminates the threat of corrosion forming underneath insulation because the insulation is no longer there.

Protecting the massive storage tanks that hold processed LNG for distribution is also critical. However, coatings play less of a role on certain tanks. For example, the double-walled carbon steel tanks that are insulated with concrete and referred to as full containment tanks typically remain uncoated (Figure 4), even when located in coastal regions. They may be coated for purely aesthetic reasons, using an acrylic-based coating due to its compatibility with concrete and its long-term gloss retention.

The story is different for storage tanks used for peak shaving facilities. Such tanks may be located in coastal regions where they require a robust protective coating system to combat the corrosive forces of the C5M environment. They may also be located inland where they face a less harsh C2 or C3 environment. In either case, EPCs would typically specify a zinc/epoxy/polyurethane or a zinc/epoxy/polysiloxane protective coating system for increased performance.

For tanks that will be coated, builders will typically prime steel plate in a shop before shipping it to the installation site for assembly. Primers should be specified with durability in mind, as plate loading and shipping damage, extended on-site storage, and on-site construction damage can all be issues. Using such primers can help dramatically with on-site construction schedules because if the shop primer fails during the construction process, complete removal is often required. That is a major problem that adds man hours – and costs – to the schedule.

At the fabrication shop, tank builders typically specify inorganic zinc coatings for shell plates due to their high zinc load and excellent corrosion protection. Their extended recoat windows also help. Once the tank has been constructed, coating applicators will address any damaged

Figure 3. Using a thermal insulative coating system with an advanced energy barrier to curb the transfer of heat on process vessels and other assets can help LNG producers forgo the use of traditional cladded insulation systems while eliminating CUI altogether.

Figure 4. Most full containment tanks made from double-walled carbon steel and insulated with concrete remain uncoated unless the owner prefers a coating for aesthetic purposes. Source: Getty Images, Westend61.

areas and field welds first, coating them with an organic zinc or an epoxy primer/intermediate product before applying a finish coat.

That topcoat should offer high performance and may take the shape of a polyurethane material. Alternatively, a polysiloxane that meets the ISO 12944-6 Rev 4 standard for very harsh C5M environments may be used as a finish coat on these large scale assets. Polysiloxanes combine the properties of a high-performance epoxy and polyurethane to deliver effective long-term corrosion protection and weatherability. Robust zinc/epoxy/polyurethane systems have proven to have excellent long-term performance in multiple service environments, but an upgraded zinc/epoxy/polysiloxane coating system can potentially add an additional five years of coatings performance.

Between inland gas extraction sites, peak shaving facilities and coastal import/export terminals, raw and processed natural gas requires a lengthy system of pipelines to transport supplies often hundreds of miles. These underground pipes require significant protection from

corrosion to avoid deterioration that could lead to reduced pipe wall thicknesses and the potential for catastrophic leaks. That includes the corrosion protection applied to pipes in a shop environment, as well as the coatings used in the field to cover the girth welds that are made as installers fasten pipes together.

Today’s natural gas pipelines face more challenging soil environments with even harsher, rockier, and wetter terrain than before. As such, the pipes can benefit from using better performing coating materials than the conventional fusion-bonded epoxies (FBEs) that have typically been used. The more robust coatings offer improved damage prevention and moisture tolerance.

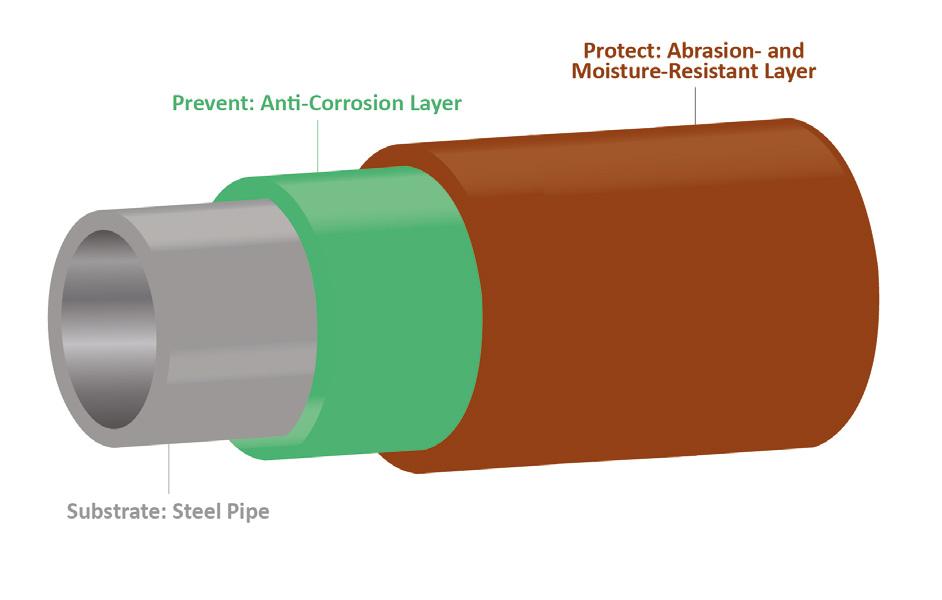

As an example, a moisture-resistant overcoat (MRO) applied over top of a conventional FBE exhibits exceptional damage prevention and moisture tolerance for challenging installations (Figure 6). The dual-layer coating system offers a combination of corrosion prevention from the first layer and protection of that coating by the second layer. The topcoat creates a moisture barrier that discourages water from penetrating through the coating to reach the anti-corrosion layer. This damage-resistant layer also resists abrasion, helping the coating avoid many of the scrapes a pipe may encounter from handling to installation, including the rigors of horizontal directional drilling (HDD) and backfilling.

This newer MRO coating is a perfect example of why EPCs and owners need to continue working with their coatings

suppliers to stay abreast of new technologies and update specifications accordingly.

For coating the girth welds that occur at every joint where new pipeline sections are connected together, installers have the option of using a powdered FBE that matches the native coating already applied to the pipe or a liquid epoxy that is made from the same chemistry (Figure 5). Powder from materials can be optimised according to the service condition required, including using a dual-layer system with an anti-corrosion layer and a moisture and abrasion-resistant layer. There are also powdered FBEs with low application temperature characteristics that make them ideal for cold-weather installations. On the liquid side, two-component, ultra-high-solids, amine-cured epoxies are available that provide outstanding resistance to impact damage, abrasion, chemical immersion, and cathodic disbondment.

With corrosion a constant threat along the entire pathway from extraction sites to terminals, ensuring safety and longevity in LNG operations means choosing the optimal coating solutions to enable better outcomes. Doing so will help LNG asset owners and operators realise the longest lifespan possible for their investments.

Success begins by shoring up specifications. Owners, EPCs, and coating suppliers should all convene early in the project planning process to review all the operating variables associated with each asset to be coated. They can look to legacy specifications for guidance, but they should also consider newer solutions that could offer better long-term performance. New specifications should include universal coatings that ensure quality, colour, and performance consistency, so modular parts built in different areas of the world can be assembled successfully on site with no obvious signs the components were produced elsewhere. Consistency enables uniformity – which are both key characteristics owners are looking for when operating around the globe.

Following the guidelines discussed in this article will help LNG asset owners and specifiers select the optimal high-performance protective coatings for their operations as they work diligently to combat CUI, protect massive storage tanks, and safeguard pipelines and other infrastructure assets.

Per Svensson, Sales Director, I-Tech AB, outlines the not-so-secret agents protecting the LNG carrier fleet from biofouling.

n the past Century, the international shipping industry has undergone several evolutions. The energy sources used by ships have progressed through sail to steam to diesel engine, and now renewable energies are starting to come into the fuel mix. Ship designs have been modified in the quest for achieving greater efficiency and competitiveness and clean technology use by the industry has grown significantly.

Alongside these changes, in the past decade, the LNG carrier fleet has grown rapidly to meet increasing demand. With LNG trade volumes reaching 549 billion m3 in 2023, a higher number of tankers have hit the water to satisfying growing consumer demand in recent years. In fact, the number of LNG storage vessels worldwide has more than doubled from a total of 360 vessels in 2010, to 772 vessels in 2023.1

However, one thing that has not changed in several millennia is the risk that ships face from biofouling. This is the well-known and much encountered global community of biological marine invaders that settle and grow on the submerged surfaces of ships.

For the LNG carrier fleet, biofouling, particularly barnacle fouling, is not only bumping up fuel bills when vessels are in operation, but it is also a growing issue for many shipyards located in warmer waters that construct and fit out LNG carriers.

What the ships of the past have in common with the ships of today is that they spend their working lives sailing through, or sitting in, a watery soup of aquatic organisms. The composition of this watery soup varies from area to area on a global scale. The strength of the biofouling is determined by several varying factors including light levels, water temperature, and pH. However, one thing is certain: with global water temperatures increasing, the biofouling soup is only getting more flavoursome as species flourish under increasingly favourable conditions and the outer limits of ‘biofouling hotspots’ expand.

For the LNG-carrying fleet, managing the effect of hull biofouling on vessel performance when in active service is a significant challenge and an expensive problem. A biofouled hull increases the fuel used by a ship due to creating hydrodynamic drag on the hull, and this introduces the needs for a ship to burn more fuel to maintaining a set speed or, if a ship is operating on fixed shaft power, it will lose speed.

LNG carriers spend long periods of time in waters with a high intensity of biofouling organisms. Once in active service, their typical trading routes are through warmer waters posing a high biofouling risk. LNG carriers also spend periods of time static in high-risk biofouling hotspots off the west coast of Africa, the Middle East, Southeast Asia, and Australia during gas up and cooldown periods necessary when loading the cargo, which increases their biofouling risk significantly.

However, the type of biofouling that accumulates on the hull can determine the severity of the fuel penalty. Hard fouling species exert the greatest negative influence on bunker fuel consumption and can create a higher level of speed penalties when a vessel is in service. This is because hard-shelled species attached to the hull create greater hydrodynamic drag compared to soft fouling marine species.

Although barnacle fouling can only occur when a ship is idle or operating at low speeds, as soon as larvae have the chance to attach, they glue themselves to the surface and create a calciferous bottom plate using one of the strongest glues in nature. From this glued baseplate they build up walls around their soft body to form a volcano-shape shell.

However, it is not just when vessels are idle in or around ports during their day-to-day operations that they are exposed to the risk of accumulating barnacle biofouling on the hull. It is also a problem that is extremely prevalent in shipyards, particularly for vessels with long outfitting periods, such as LNG carriers.

As global water temperatures increase and global ‘biofouling hotspots’ intensify, newbuildings at the world’s major shipyards in hotspot areas will be exposed to a greater risk of biofouling during the outfitting process. Since LNG carriers have extended outfitting times more than 12 – 18 months and are often built in yards located in warmer waters, such as those off the coast of South Korea, this vessel type is often at a high risk of biofouling, particularly barnacle fouling. These newbuild vessels during outfitting are effectively barnacle magnets.

During the outfitting period, a significant area of the underwater hull and niche areas are exposed to biofouling species. This can have a significant impact on a newly applied hull coating and on a vessel’s performance in sea trials, with barnacle biofouling having the greatest negative effect.

Readers may think, but surely, a vessel that has a good antifouling coating applied at the newbuild stage is already protected?

It is well-known that liquid antifouling coatings are used across most of the global shipping fleet for the purposes of biofouling prevention. So, it would be entirely sensible to think that the in-situ antifouling coating that was applied before the vessel was floated would already be working to protect the hull from biofouling, but this is not the case.

The antifouling coatings that are usually applied on a newbuild ocean-going vessels are designed to last for 60-months. However, they are designed to work under dynamic conditions. The complex chemistries and biocide release mechanisms (or slippery surface in the case of foul

release coatings) of these coatings do not work so well when a vessel is static, particularly when a vessel is sat idle for months at a time. For example, biocidal coatings used on 95%+ merchant vessels are designed to dissolve or ‘polish’ away over time, delivering the biocide when water flows across the hull surface.

Without the flow of water, those coatings are likely not able to offer the superior hard fouling prevention performance required for long static conditions in warmer waters with high concentrations of biofouling species.

Therefore, if a vessel does not have adequate protection from an antifouling coating layer that can release biocide with little or no water flow, when the vessel goes for its speed trial, the hull may be full of biofouling and the speed trial is affected.

This is a significant challenge for shipyards, particularly those located in warmer waters. The vessel needs to undergo speed trials and be delivered to the owner with a foul-free hull.

Cleaning the hull before the speed trial and delivery to the owner is one option; however, cleaning practices can deplete the thickness of the antifouling system. This is not ideal since liquid antifouling coatings are applied to a specific thickness related to the specifics of the vessel’s operations such as design speed and activity. Therefore, loosing layers of antifouling coating will shorten the performance life of that coating.

Also, for vessels with barnacle fouling, more abrasive cleaning techniques are required since there is a risk that over a period of time a barnacle’s shell could cut through the

coating down to the steel hull. Therefore, undertaking cleaning to remove established barnacle fouling could pose a risk of significant damage to the coating where areas of the coating are left exposed to biofouling more than others. This can be the case when barnacle fouling is partially removed but the barnacles calciferous base plate remains attached to the vessel hull where biofouling can flourish.

When it comes to biofouling, control protection for vessels that have long outfitting periods requires further protection in the form of an extra protective layer of antifouling coating, applies as a final layer.

The type of antifouling coating used for this purpose would have the characteristics of a high polishing rate so that biocide would be continuously released when in static conditions, without the need for the flow of water to polish away coating layers exposing fresh biocide.

This additional layer is designed to protect against fouling during the entire outfitting period. By the end of this period, the one-layer coating should be almost polished away in its entirety, exposing the main antifouling system for when the vessel enters service.

For barnacle fouling prevention, the antifouling technology Selektope is used in many antifouling coatings intended for outfitting biofouling prevention. This is due to its highly selective precision, efficiency at extremely low concentrations and sustained performance under static conditions. For this reason, it is being adopted by many of antifouling coating manufacturers as a technology that acts as barnacle fouling insurance.

It protects the hull in long static periods during outfitting, but also, when included in the 60-month antifouling coatings, provides insurance that a vessel can idle for long periods of time without suffering the negative consequences of barnacle fouling. Which is very important for LNG carriers and their trade patterns.

Selektope is an organic, non-metal active agent that prevents barnacle fouling by temporarily activating the swimming behaviour of barnacle cyprid larvae, repelling them from the hull surface. As it is an organic compound, it is metabolised by the barnacle larvae, and they return to normal function after a few hours.

This first-of-its-kind antifouling technology caught the attention of coatings suppliers in the early stages of its research and development. To-date, several products have been launched onto the market and the number of Selektope-containing coatings being sold by different manufacturers is increasing y/y. Selektope is playing a vital role at shipyards to protect LNG carrier hulls from barnacle fouling during extended outfitting periods. As such, the use of the technology in this application has significantly expanded in the past five years.

For vessels in operation, with over 95% of vessels using biocidal antifouling coatings these form the first line of defence against biofouling and will continue to do so into the future.

As the first line of defence against biofouling for most marine vessels, biocidal antifouling coatings play an integral role in the decarbonisation challenge of the global shipping industry and in mitigating biosafety risk from commercial vessels, in the short and mid-term future.

The not-so secret agents contained within marine antifouling coatings are keeping biofouling at bay and, in doing so, mitigate high costs that would otherwise be incurred from excess fuel use, carbon taxes and maintenance costs.

Currently, there is increasing regulatory pressure to reduce the use of biocides in antifouling coatings. As such, great innovative strides are being made by coatings manufacturers to meet this challenge using the limited number of marine biocides that are approved for use and at the lowest concentration possible while ensuring that coatings continue to deliver the biofouling prevention protection that the global shipping industry requires. Selektope, since it is used in extremely small concentrations in the paint, helps antifouling coating manufacturers to meet this challenge and helps keep ships free from barnacle fouling, no matter the biofouling soup strength and no matter the time spent static.

As one of the not-so-secret antifouling agents below the waterline, Selektope is part of a highly regulated crew of biofouling banishing biocides – without them, LNG carriers would be much more fouled that they are today, both in the shipyards during outfitting and when in operation, sailing in and out of biofouling hotspots.

1. ‘Number of liquefied natural gas storage vessels worldwide from 2010 to 2023’, Statista, (19 August 2024), www.statista. com/statistics/468412/global-lng-tanker-fleet

Stavros Sklavounos, Hull Performance Solution Manager, Hempel, directs attention towards how companies can get off the back-foot in the race to reduce emissions from LNG carriers.

or steam turbine LNG carriers, which represent a sizeable proportion of the existing global LNG fleet, slow steaming as a strategy to reduce vessel emissions simply is not an option due to the technical constraints of their propulsion systems. These behemoths pose a challenge for owners and operators because they are amongst the oldest, least efficient, and therefore most expensive gas carriers to operate – they are both too young to scrap and too old to justify significant retrofitting. Crucially, given that this class of vessels

makes up around 27% of the global gas fleet, they are needed to meet the still insatiable global demand for LNG, which shows no sign of abating within their lifespan.

All LNG carriers use boil-off gas (BOG) from their cargoes to help propel them. However, compared to newer designs, steam turbine LNG carriers produce significantly more BOG, and the boil-off rate remains constant regardless of operational speed. This means that slowing down – a strategy that can reduce fuel consumption and emissions for other ship types – extends the journey time

for steam turbine LNG carriers, which causes more BOG to burn.

In other words, while slow steaming typically reduces fuel consumption in most vessels, for steam turbine LNG carriers, the longer the voyage, the more gas is lost to BOG. This in turn has to be burned to maintain propulsion or led to a gasification unit for safety purposes and wasted as a potential energy source. This means that

even though the ship is moving slower, it is consuming more gas over a longer period or wasting it. Because these vessels consume more gas as the voyage time increases, slow steaming paradoxically leads to higher emissions.

For charterers, who ultimately foot the bill, the result is counterproductive: increased emissions and operating costs, which stand in direct opposition to the goals of the International Maritime Organization’s (IMO) Carbon Intensity Indicator (CII) and Energy Efficiency Existing Ship Index (EEXI) regulations.

With the EU’s Emissions Trading System (ETS) now also expanded to cover maritime shipping and the FuelEU Maritime regulation requiring ships to reduce the carbon intensity of energy used on board which came into force in early 2025, many charterers are now forced to account for these increased operational costs too. These regulatory requirements will further impede the competitiveness of older, less efficient vessels, and steam turbine LNG carriers are under particular scrutiny, even though LNG-fuelled vessels face lower penalties than ships burning conventional fuel oils.

For charterers and operators of these vessels, then, focusing not just on EEXI and CII performance but on the impact of emissions reductions solutions on the vessel’s reference speed (Vref) specifically may be the trick to keeping up with the pack, according to hull coatings manufacturer Hempel.

It all sounds quite complicated, but through extensive analysis and testing with customers, it is clear that operators of steam turbine LNG carriers have little choice but to apply propeller shaft power limitation (ShaPOLi) in order to reduce their emissions in line with EEXI. Applying a propeller shaft limitation cap (and therefore a cap on its emissions) does ensure compliance, but the trade-off is a speed loss of around 2 – 2.5 knots. This quickly adds up to additional transit days, increased operational costs and potential failure to meet charter party requirements.

A vessel’s Vref is the speed it can reach under specific conditions, such as a certain draft or engine load. Vref is used to calculate an EEXI, the IMO’s framework for assessing a vessel’s designed energy efficiency. It takes into account a vessel’s engine and auxiliary engine power, transport capacity, and reference speed.

Owners and operators need to consider innovative solutions that minimise the increase in power required due to hull and propeller deterioration over time. A high-performance hull coating can partially offset the impact of ShaPOLi in a single dry-docking and ensure that it maintains its performance throughout the drydocking cycle. This can reduce the sailing times and subsequently the reduce the absolute BOG amount on a given voyage route.

There is a critical need for shipowners to maintain commercial viability while achieving compliance with

In the oil and gas industry, ensuring highest safety and plant availability is crucial, while achieving decarbonization goals has also become a critical imperative. Our comprehensive portfolio and expertise enable process improvements that increase operational reliability and move us towards net zero targets.

environmental regulations. Hull coatings offer one of the most effective ways to improve a ship’s operational performance, reduce emissions and mitigate the effect of ShaPoLi in a vessel’s Vref without propulsion retrofitting. Advanced silicone-based hull coatings in particular, such as Hempel’s Hempaguard, deliver immediate performance benefits. This is because the surface properties of silicone coatings significantly reduce frictional resistance as the vessel moves through water, thereby reducing the amount of energy required to propel the ship. At the same time, this specific coating type optimises biofouling management on the hull throughout the whole service period between mandatory dry dockings. This results in lower fuel consumption, fewer emissions, and improved speed-to-power ratios.

Hempaguard in particular offers a 2% increase in Vref following application in dry dock, providing immediate operational improvements. The company’s coating has been applied to more than 4000 applications and is market validated for its performance claims and decarbonisation efforts by a classification society — specifically, DNV.

Importantly, for vessel operators, as well as charterers, the impact of a hull coating on emissions performance can be measured and monitored.