September 2025

September 2025

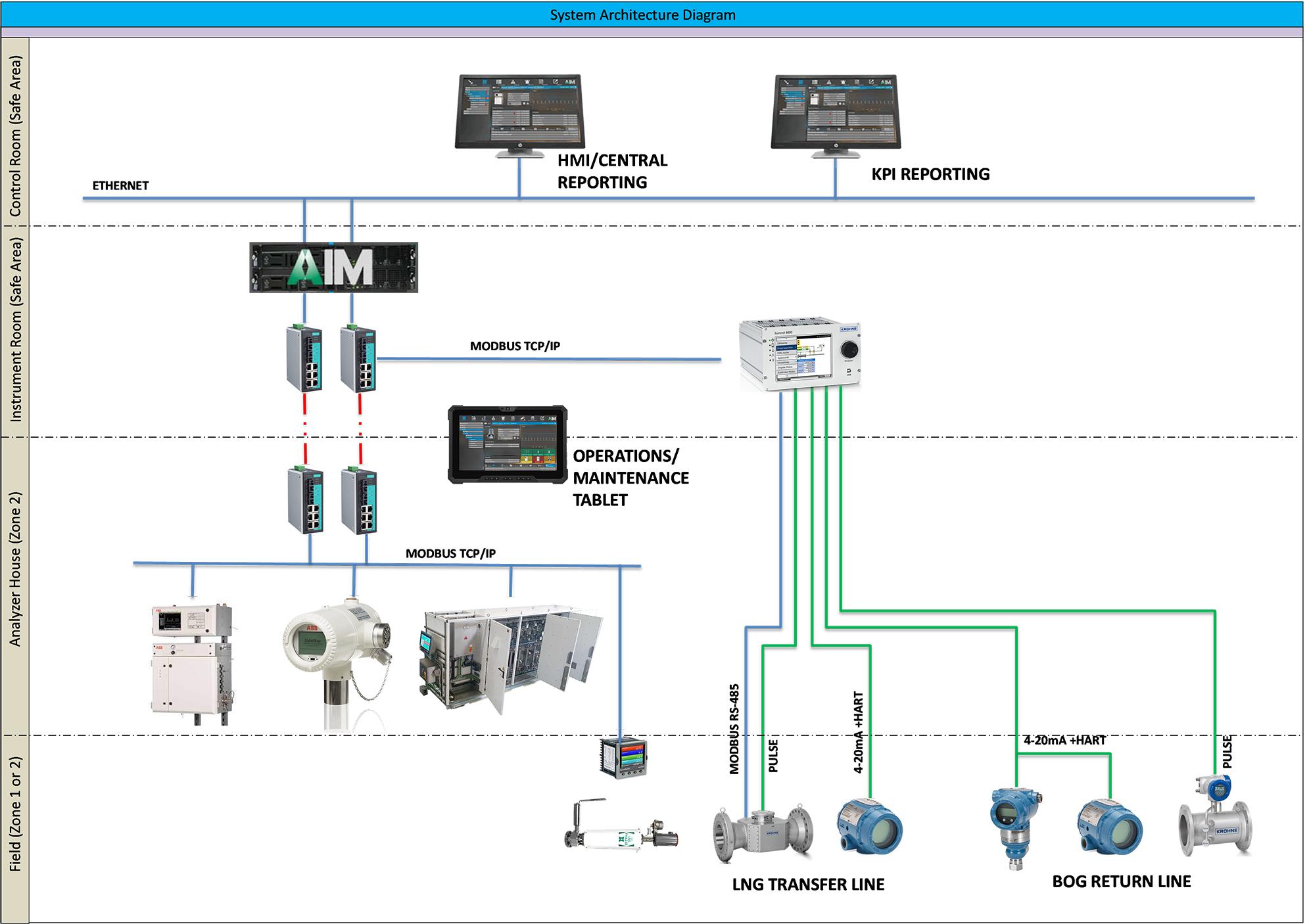

Hans-Peter Visser, Analytical Solutions and Products B.V., the Netherlands, argues the need for fully automated LNG custody transfer measurement systems.

81 The critical role of gas detection in

16 Navigating the turbulent waters of global gas and

Kateryna Filippenko, Research Director, Global Gas Markets, Wood Mackenzie, provides an insight into the future of global gas and LNG within a transitioning energy market.

Chuck Blackett, Chief Engineer, Niche Cryogenic Services, and Eric Ford, Vice President of Marketing, Graphite Metallizing Corp., compare the demands placed on pumps handling LNG and anhydrous ammonia.

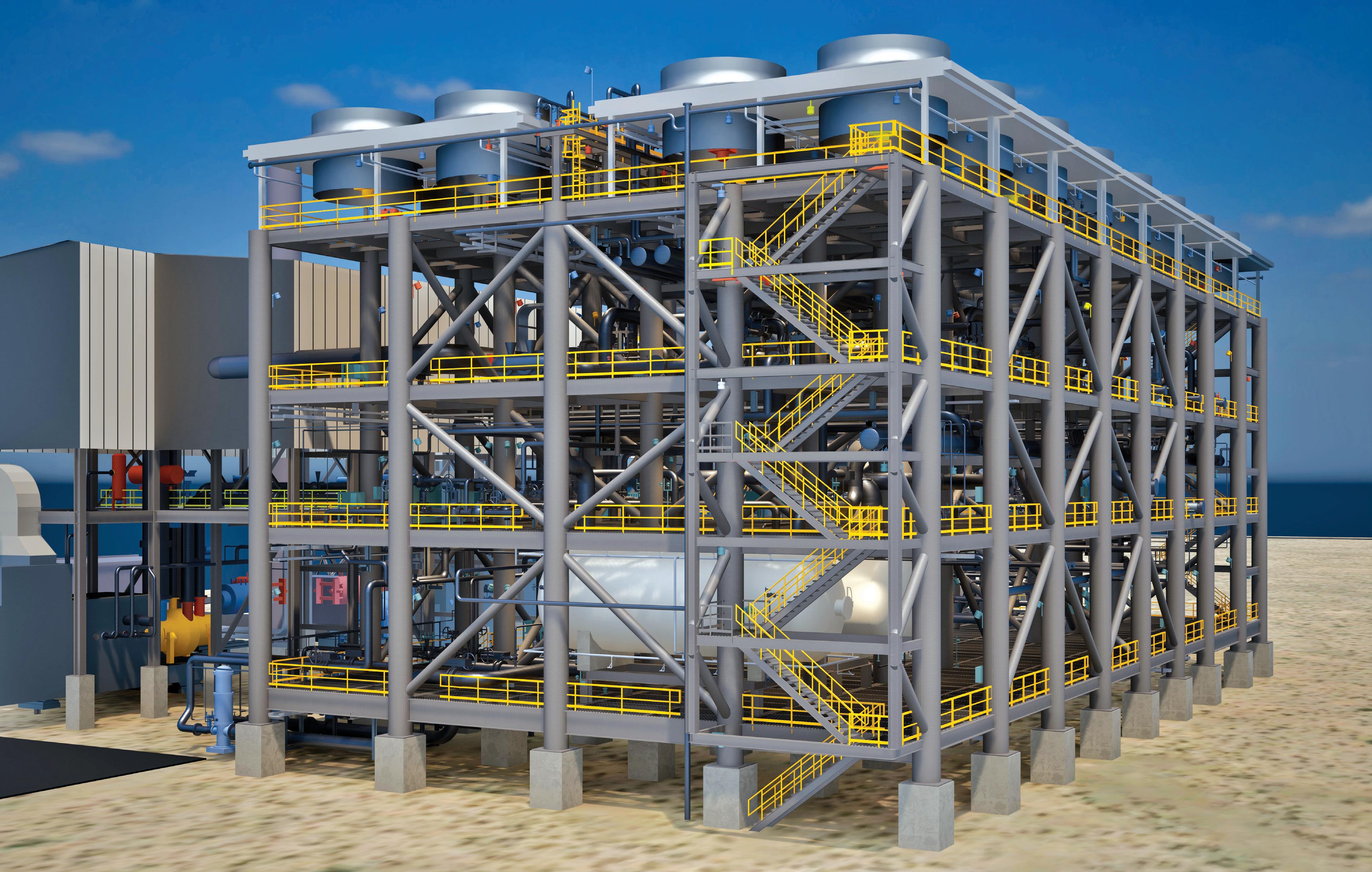

27 The next (modular) step

Mark Butts, Alex Cooperman, and Yogesh Meher, CB&I, assess mid scale modular LNG tank technology as a tool for reducing costs and scheduling.

35 A cooler approach: Part one

In the first part of a two-part article, Andreas Knoepfler, Director Product Management, Wieland-Werke AG (Business Unit Thermal Solutions), and Dr Lotfi Redjem Saad, Head of Heat Transfer Department, Technip Energies, describe the use of enhanced heat transfer technologies for LNG pre-cooling heat exchangers.

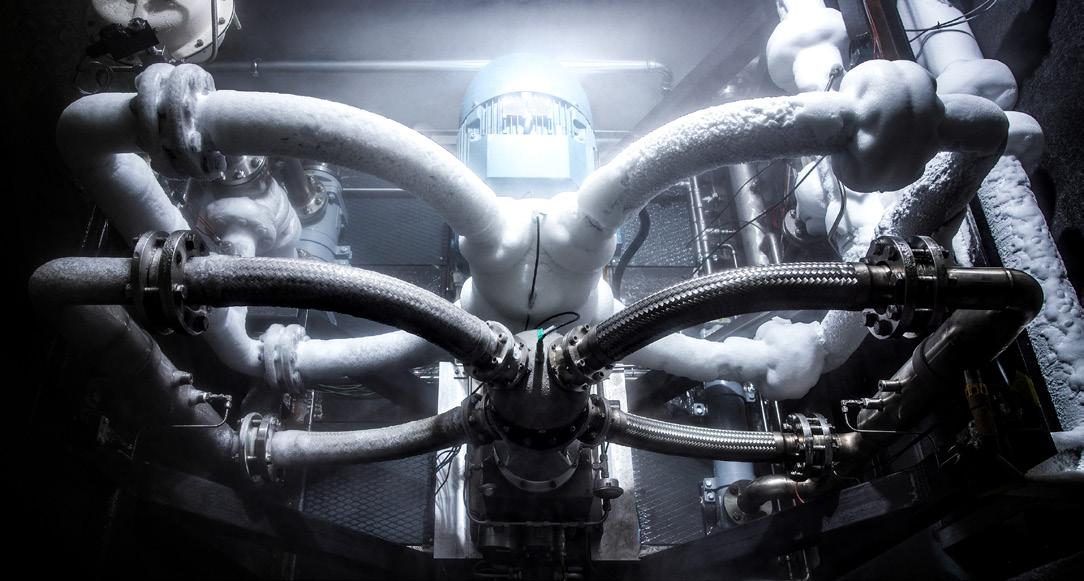

41 Balancing the cost, reliability, and performance of LNG compressors

Christian Gemperli, Business Development Manager, Services Division at Burckhardt Compression, considers the factors affecting compressor maintenance and how they impact the wider business.

48 Bridging operations, people, and progress

Frano Zivkovic and Daniel Perianu, STS Marine Solutions, discuss the role of the LNG Superintendent – and the impact they can have on efficient and safe LNG operations.

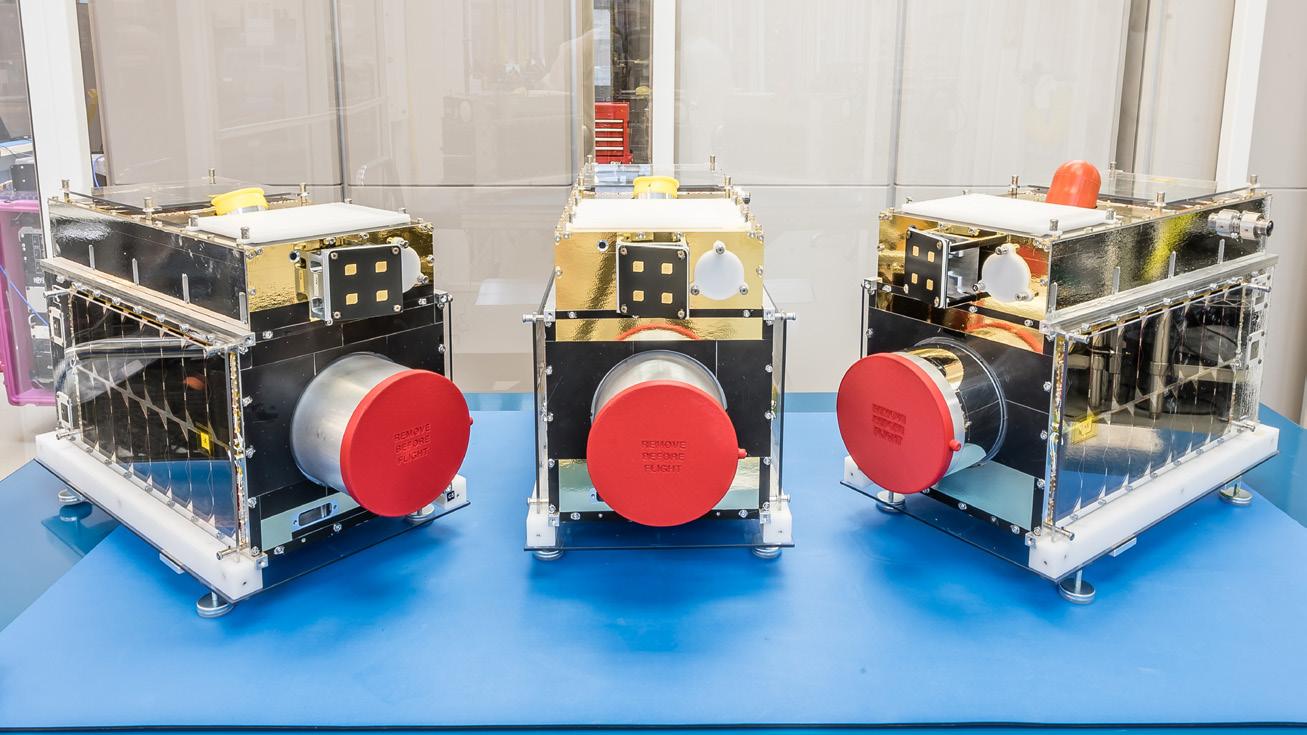

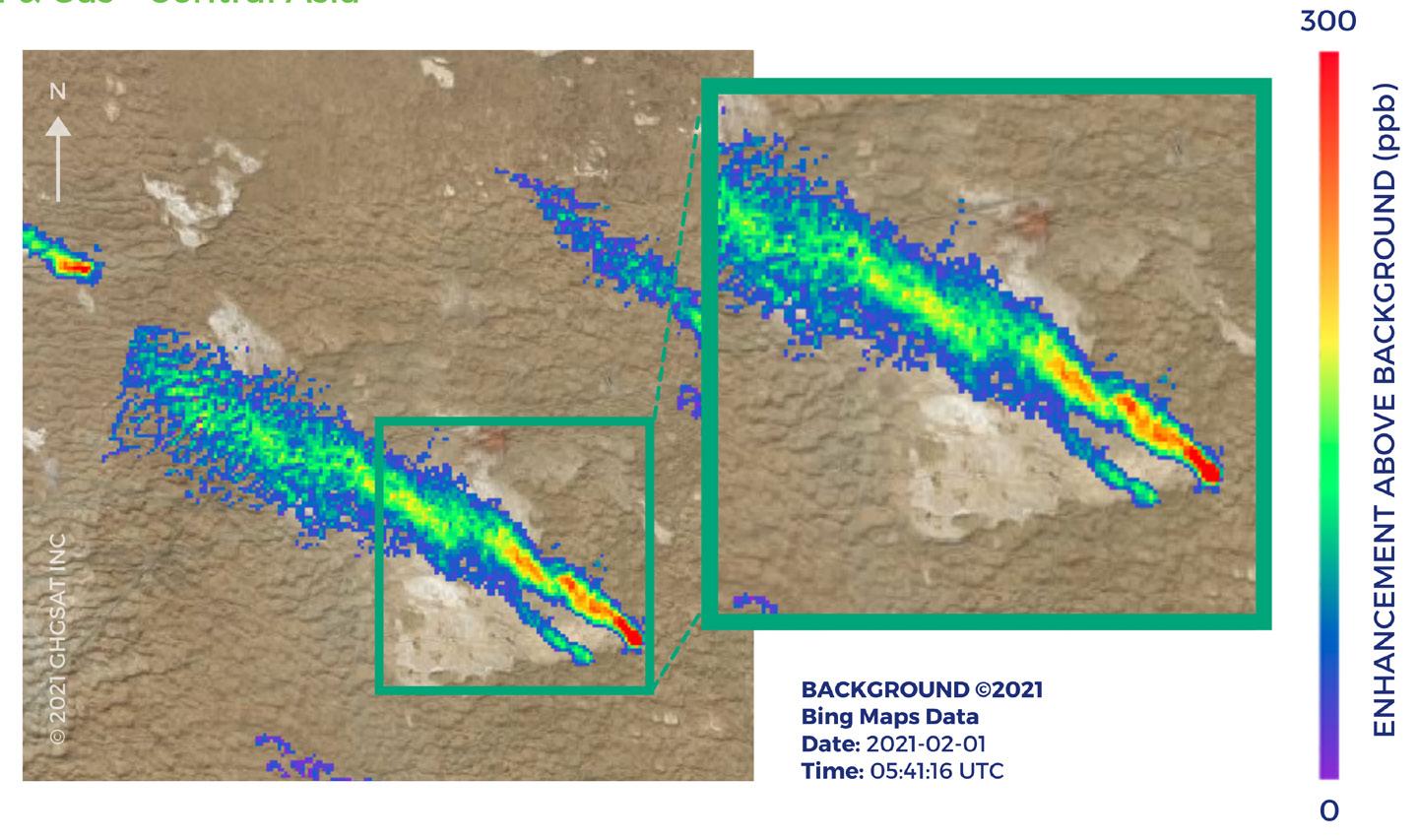

52 Making the methane link

Ryan Mattson, Vice President, Oil & Gas, and Alison Boyer, Director, GHGSat, look into the link between methane reduction and the ability to meet soaring LNG demand.

59 Shining a renewed spotlight on methane emissions management

Julien Boulland, Sustainability Strategy Leader at Bureau Veritas Marine & Offshore, France, outlines the challenges that may be highlighted by new methane regulations, and the importance of overcoming them in order to meet net-zero targets by 2050.

62 Delivering energy security and reshaping global markets

Justin Bird, Executive Vice President of Sempra and CEO of Sempra Infrastructure, USA, provides an overview of how LNG projects in America are building the infrastructure needed today to help power the future.

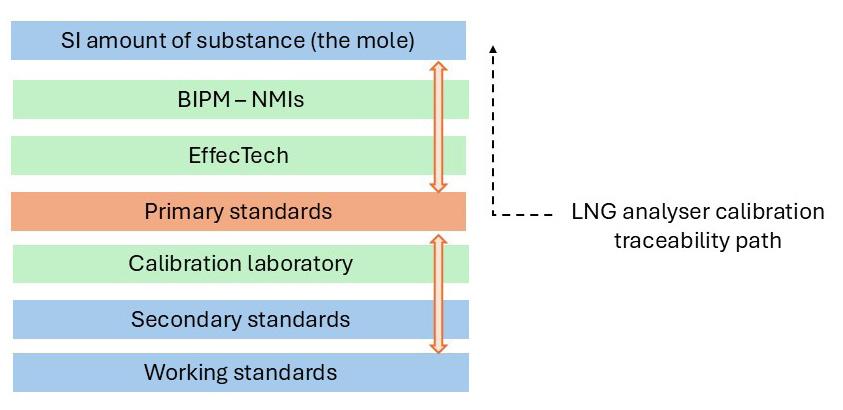

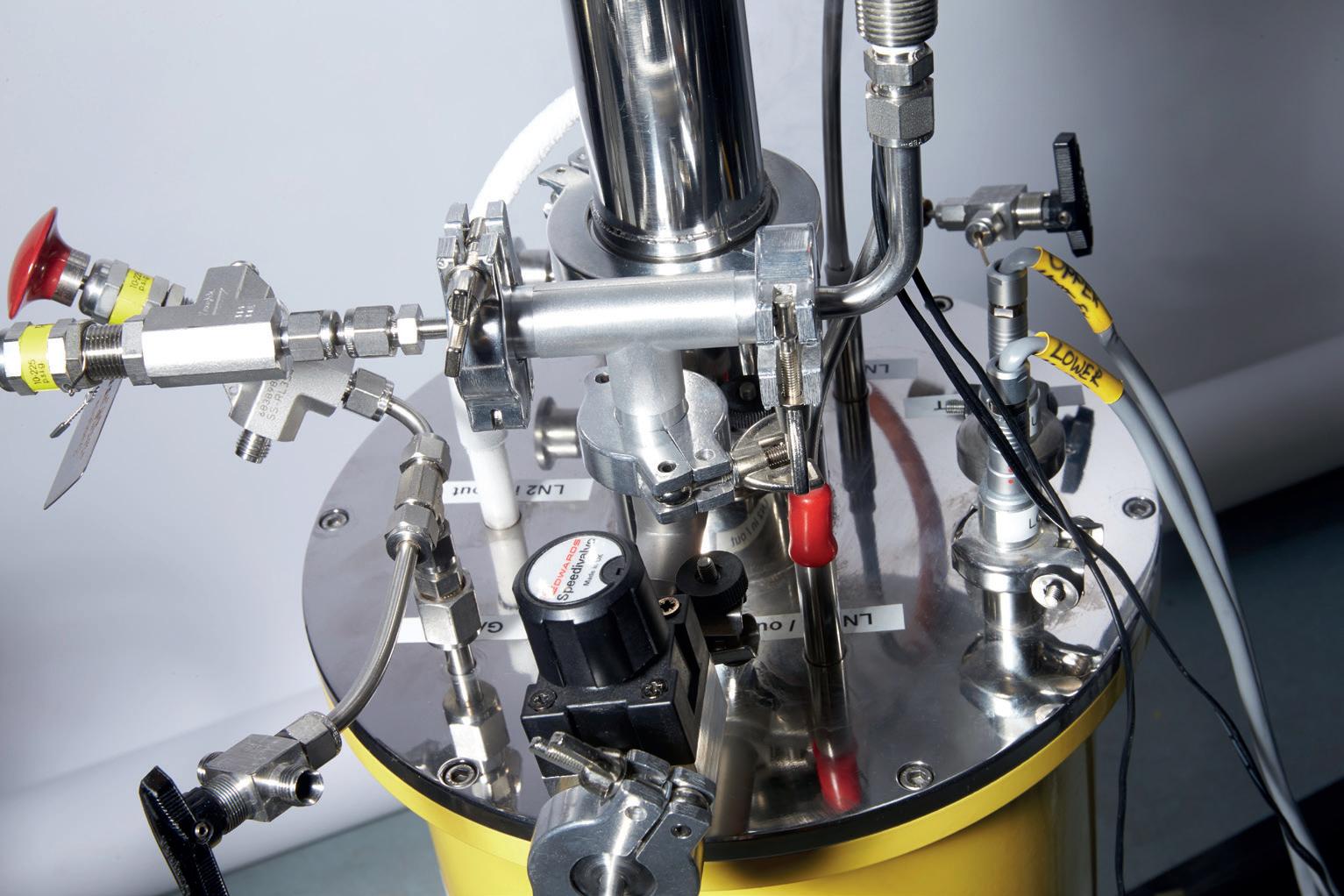

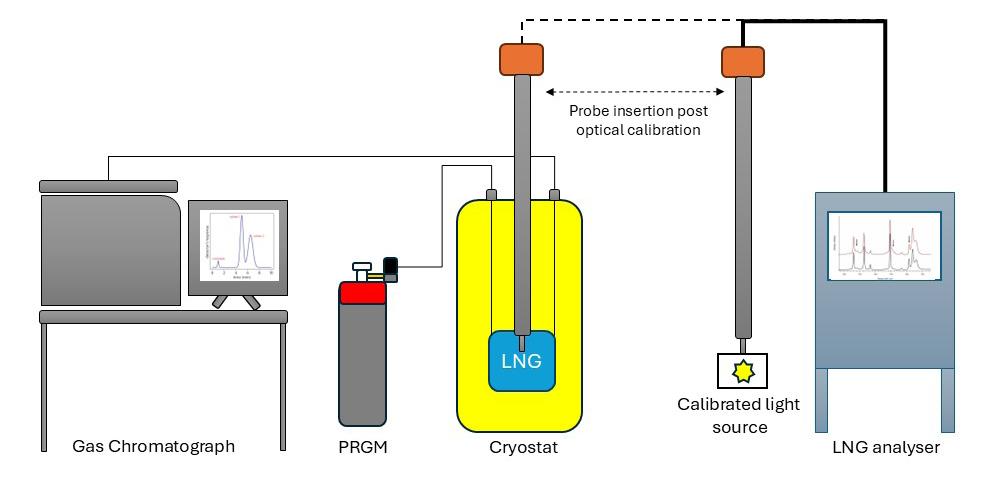

69 Confidence you can measure

Dr Joey Walker, EffecTech, UK, explores the nature of traceability for in-situ LNG analysers.

Alexander Barbashin, Customer Marketing Manager, MSA Safety, advocates for the importance of effective and dependable gas detection systems in LNG operations.

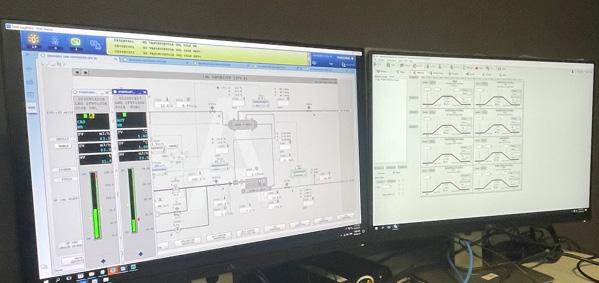

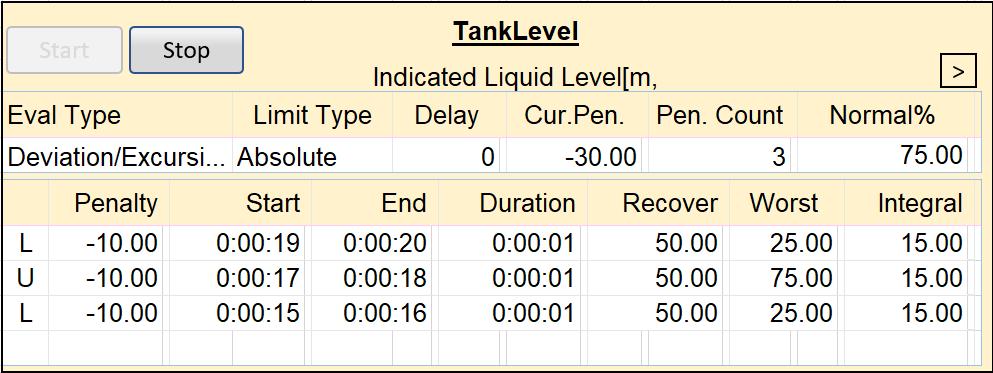

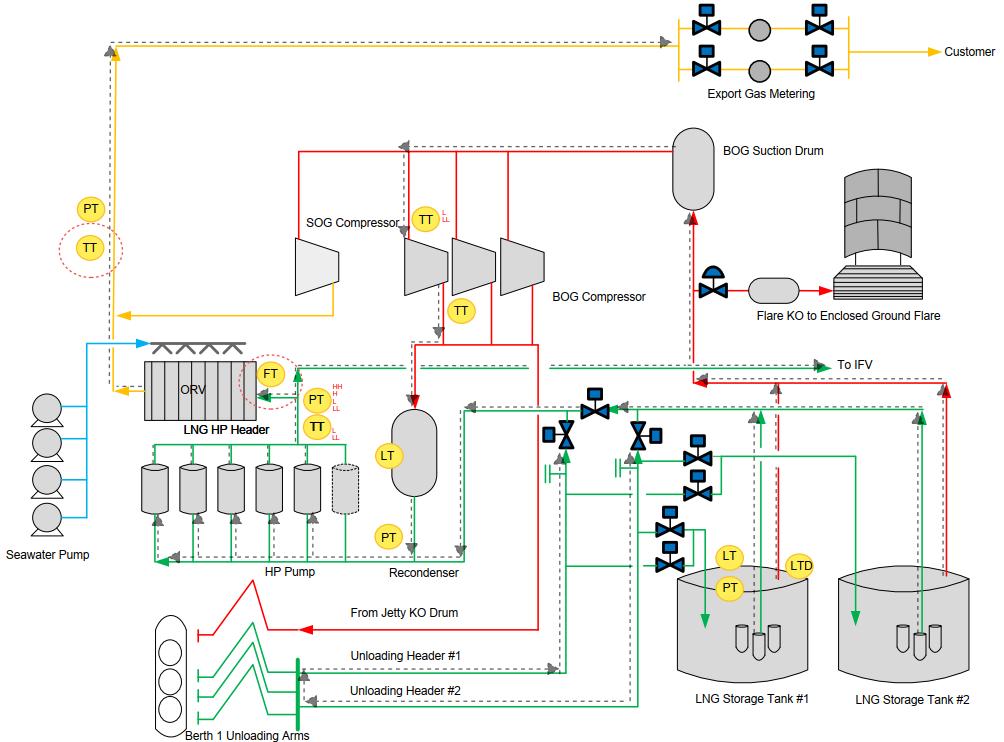

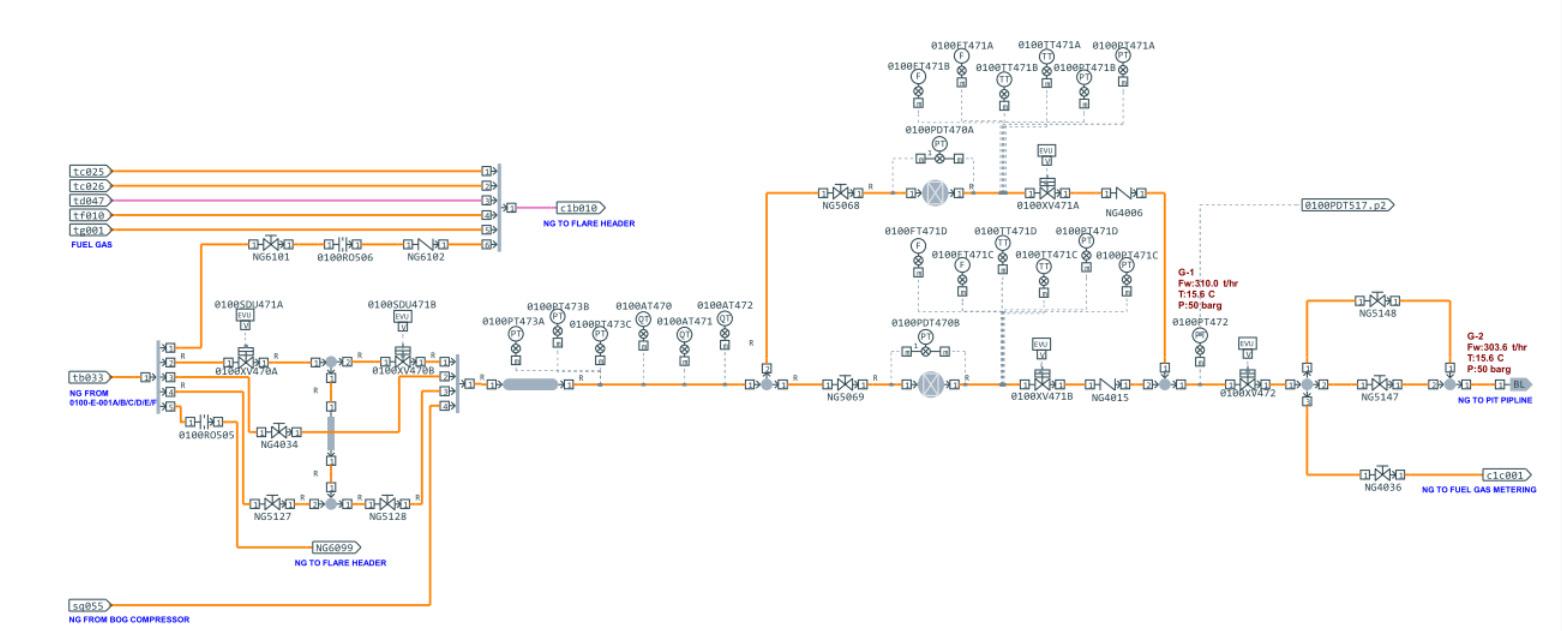

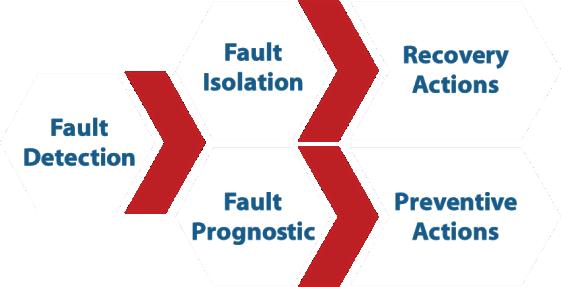

Thitiya Tangtanawit, Lead Instrument Engineer at Engineering Department, CTCI Thailand, establishes the importance of operator training simulations for LNG terminals.

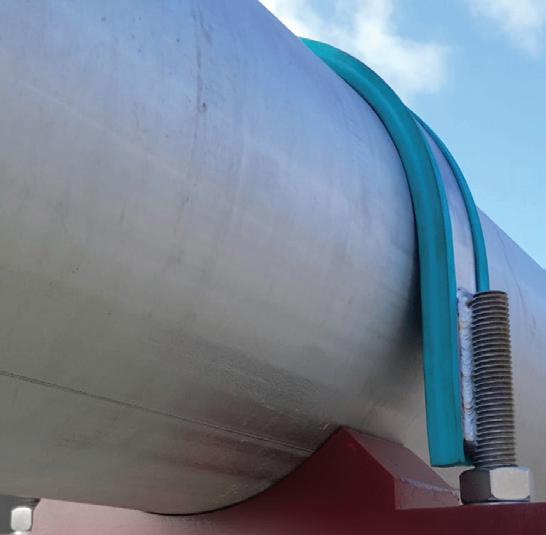

In a recent discussion with Jessica Casey, Editor of LNG Industry, Romuald Machac, Sales Manager Oil and Gas, Hutchinson, maps out the importance of continual innovation in the LNG industry regarding safety solutions.

98 The LNG mobility leap is

In a discussion with LNG Industry, Vijay Kalaria, Global Head of Marketing and Sales, LNG, INOXCVA, evaluates the prospect of LNG expansion in India and beyond.

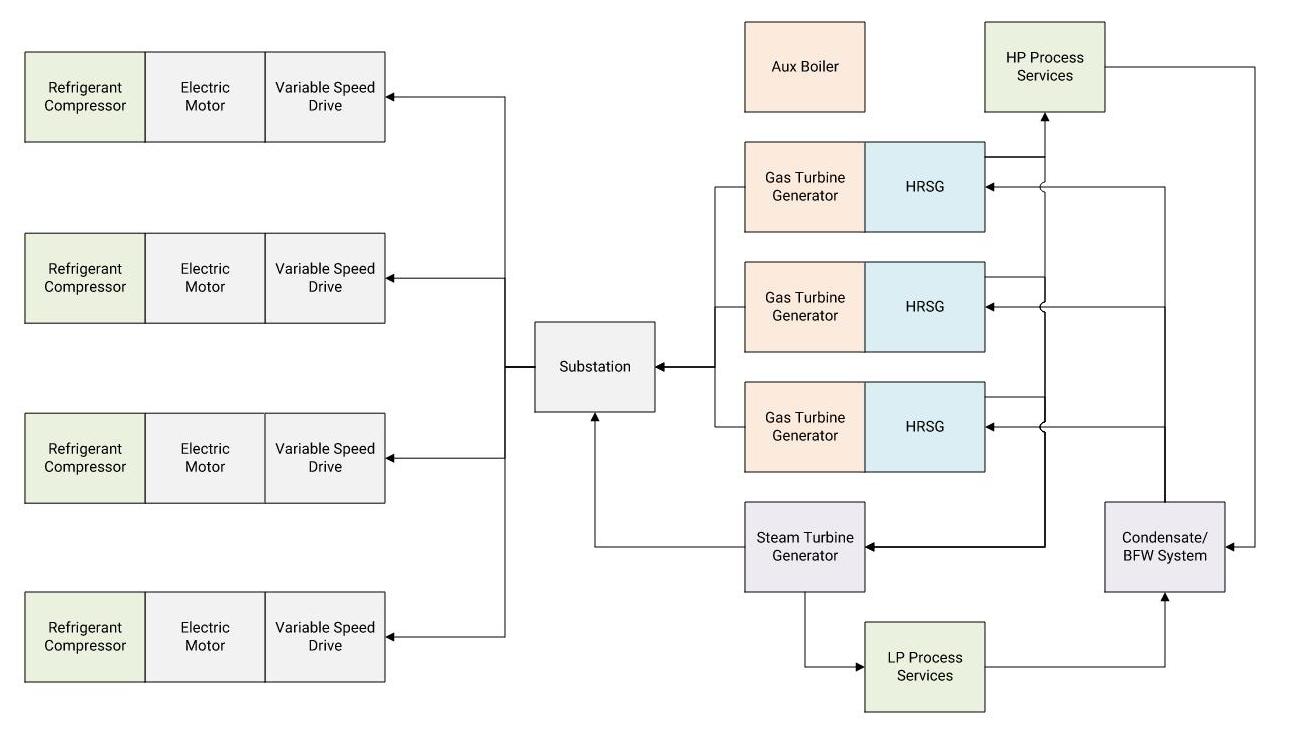

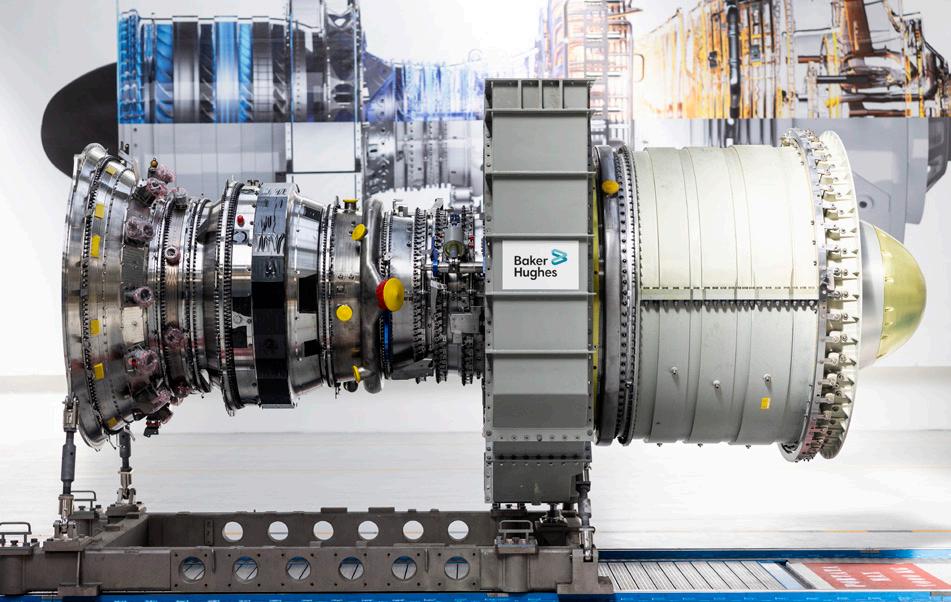

Justin Ellrich, Black & Veatch LNG Technology Manager, details the challenges and solutions for electric drives in LNG projects, now and for the future.

LNG Industry previews a selection of companies that will be exhibiting at this year’s Gastech in Milan, Italy, from 9 – 12 September 2025.

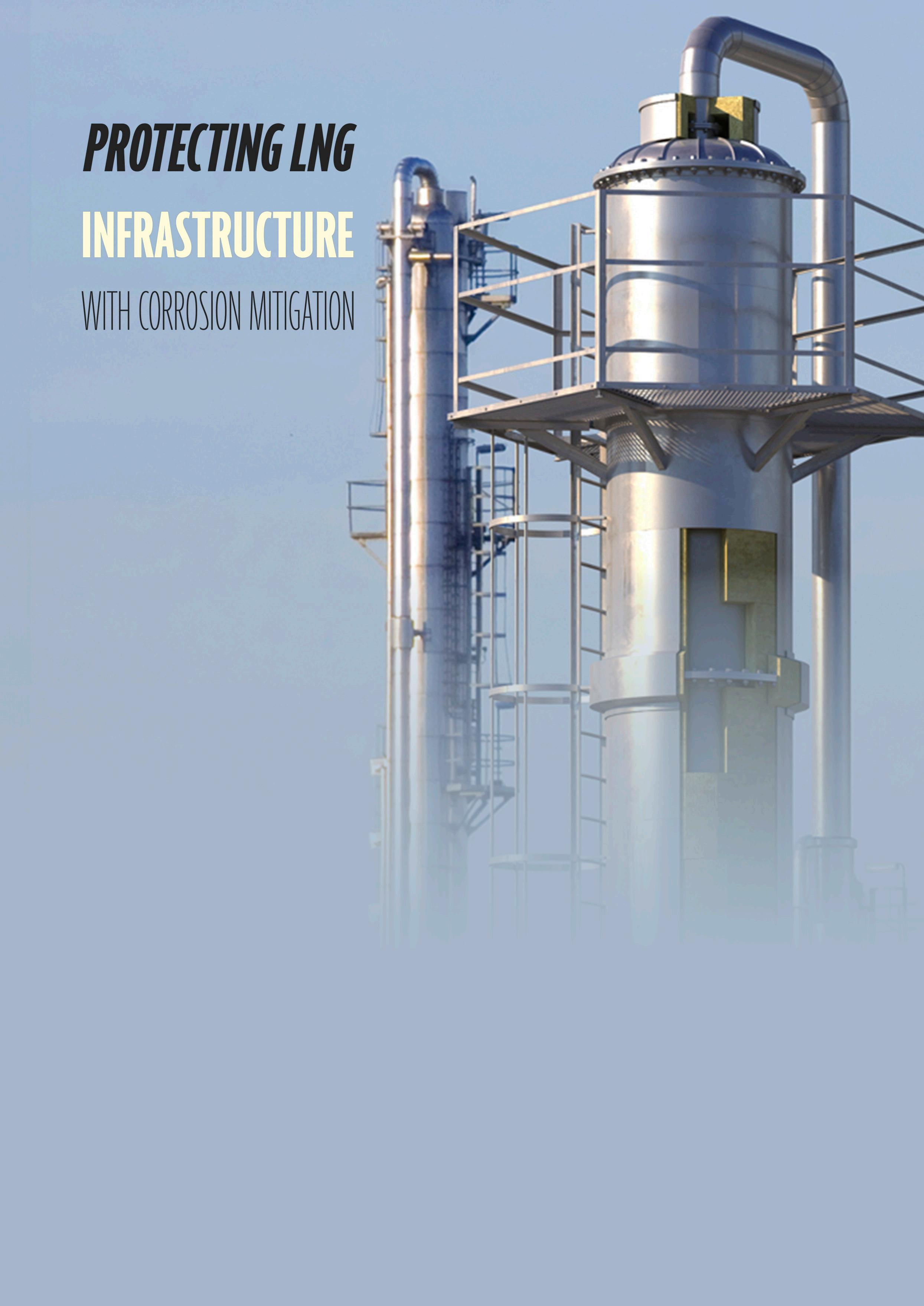

Ricky Seto, ROCKWOOL Technical Insulation, highlights the importance of advanced corrosion under insulation mitigation and the role it plays in optimising LNG tank maintenance.

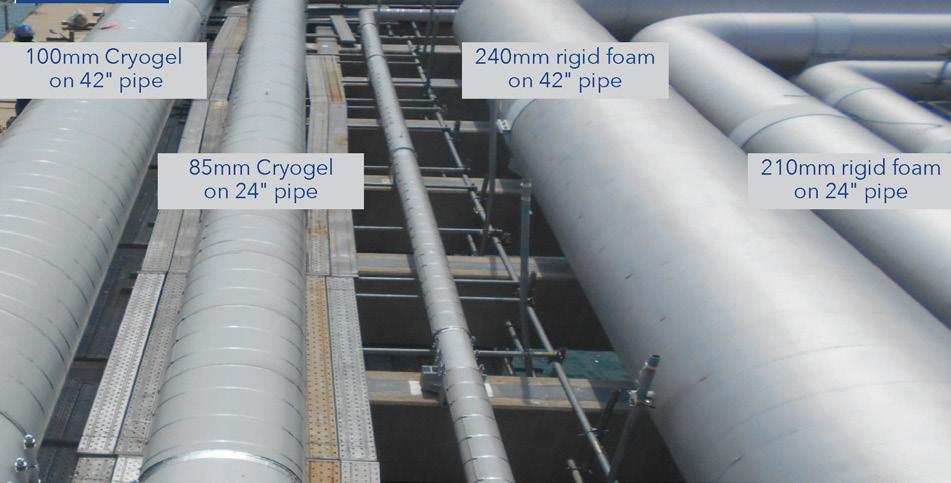

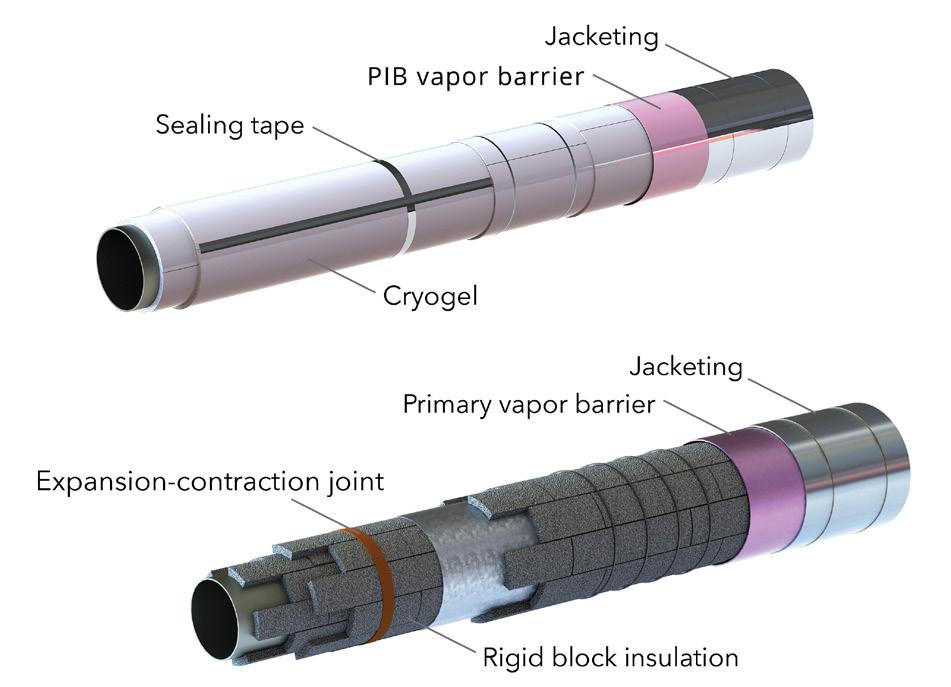

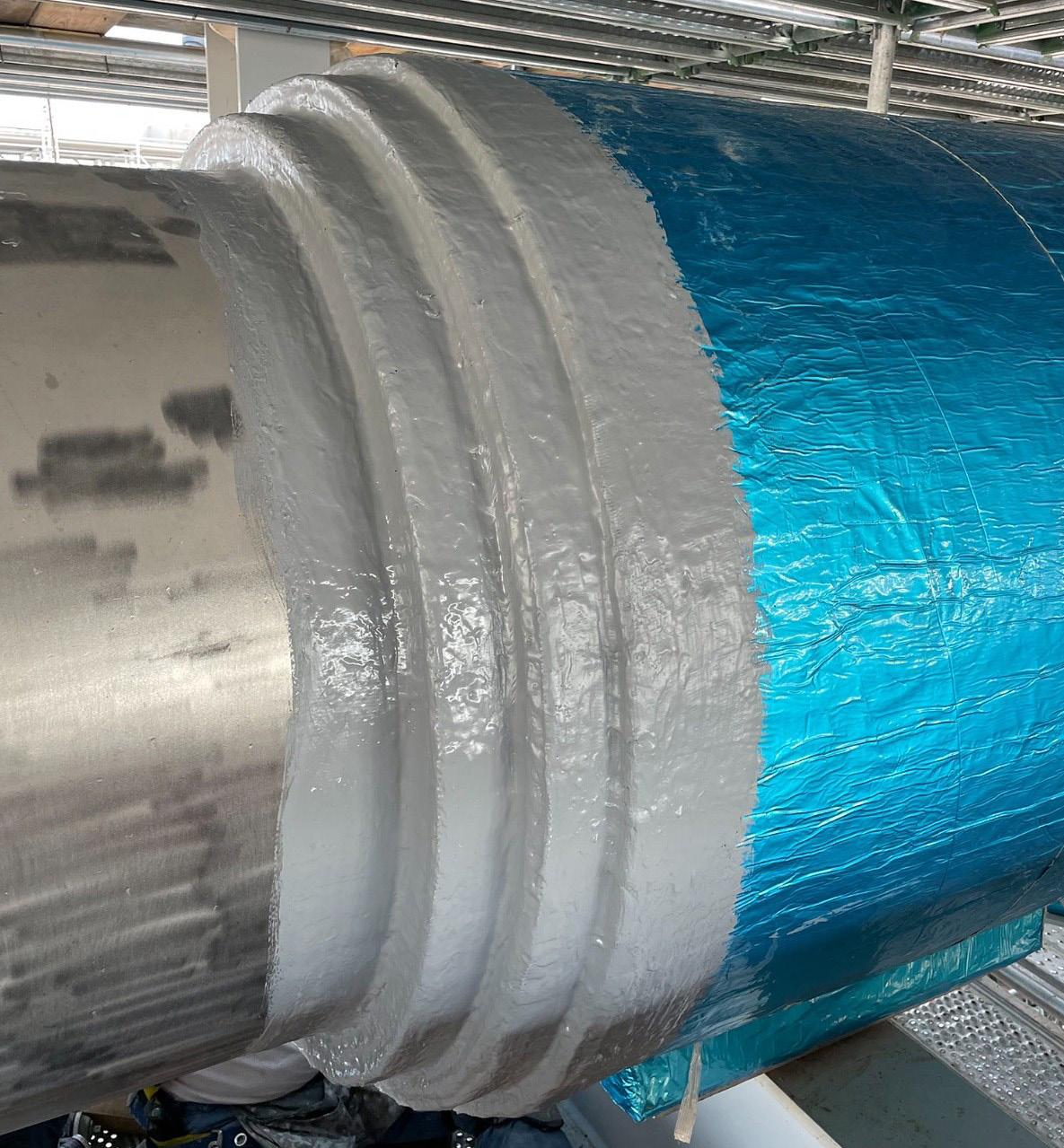

, Mario Silvestro, Product Manager, Seal for Life, and Mark Krajewski, Senior Director of Technical Services, Aspen Aerogels, examine the benefits of using aerogel insulation and polyisobutene systems for LNG new builds

Sempra Infrastructure, headquartered in Houston, is focused on delivering energy for a better world by developing, building, operating, and investing in modern energy infrastructure, such as LNG, energy networks, and low-carbon solutions that are expected to play a crucial role in the energy systems of the future. Through the combined strength of its assets in North America, Sempra Infrastructure is connecting customers to safe and reliable energy and advancing energy security.

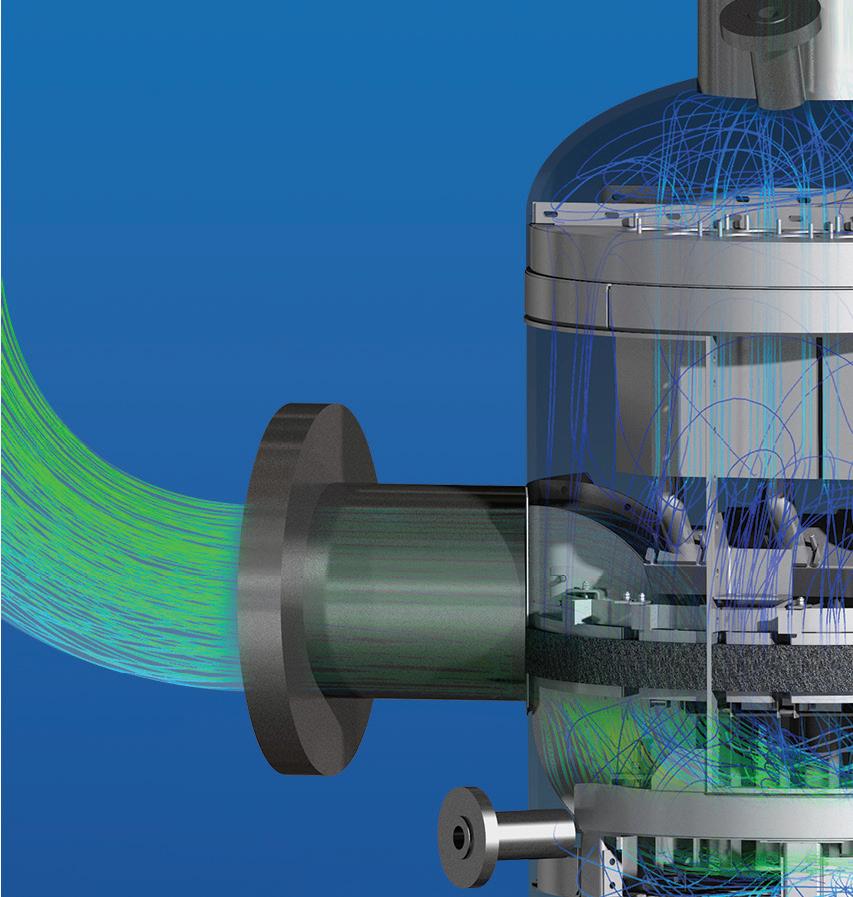

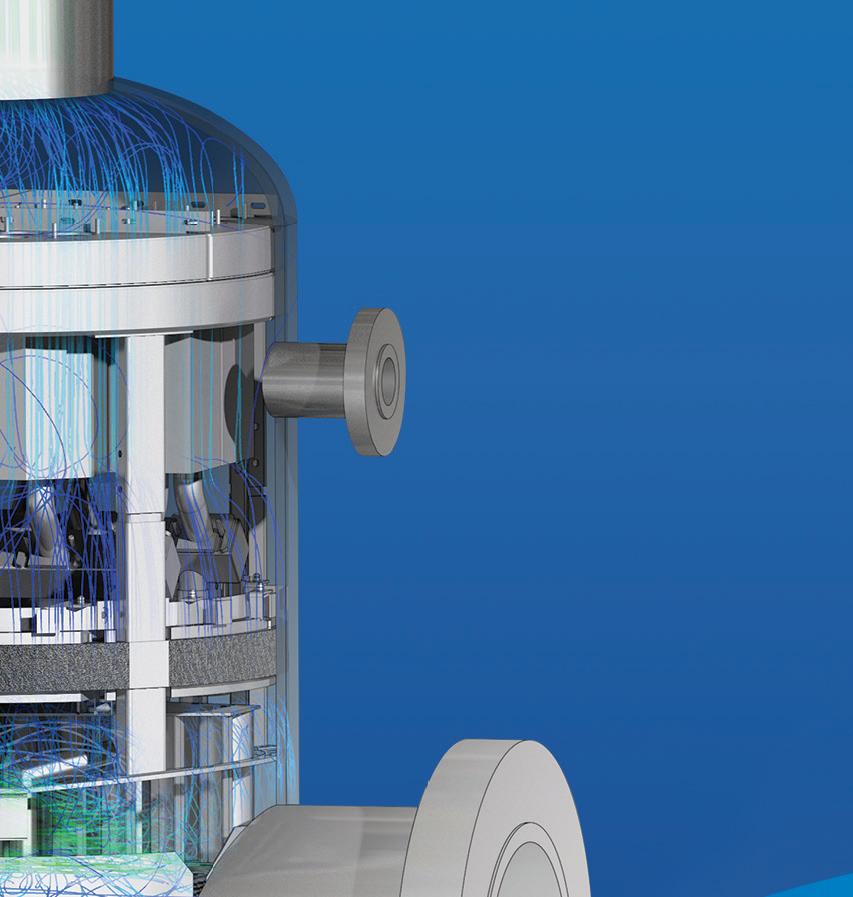

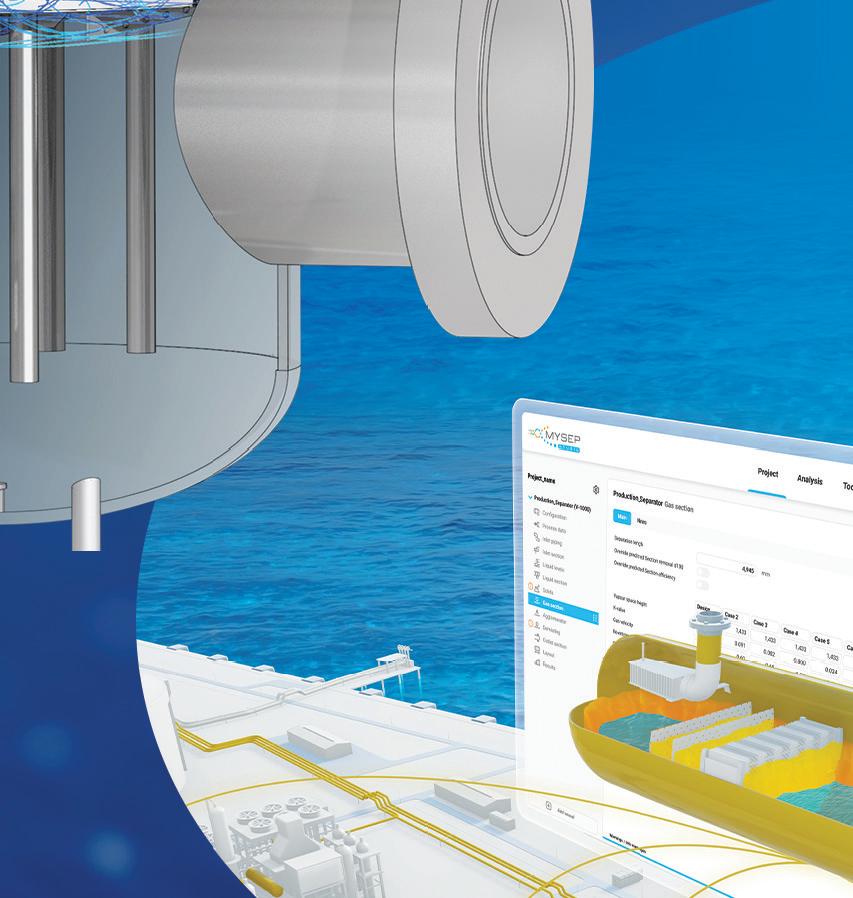

Burckhardt Compression offers a complete portfolio of compressor solutions for BOG management.

Our cutting-edge compressor solutions are designed to effectively manage and utilize BOG, ensuring optimal performance and compliance with stringent industry standards. Explore our comprehensive range of products and services tailored to meet the unique demands of BOG onshore applications. From innovative compressor solutions to expert maintenance and support: we are your trusted partner in maximizing the value of your LNG operations.

Learn more: https://www.burckhardtcompression.com/applications/ boil-off-gas-bog-onshore/

Visit us at Gastech Milan, Booth no. M10

JESSICA CASEY EDITOR

Managing Editor

James Little james.little@palladianpublications.com

Senior Editor

Elizabeth Corner elizabeth.corner@palladianpublications.com

Editor Jessica Casey jessica.casey@palladianpublications.com

Editorial Assistant

Abby Butler abby.butler@palladianpublications.com

Sales Director

Rod Hardy rod.hardy@palladianpublications.com

Sales Manager Will Powell will.powell@palladianpublications.com

Production Designer Siroun Dokmejian siroun.dokmejian@palladianpublications.com

Head of Events

Louise Cameron louise.cameron@palladianpublications.com

Event Coordinator

Chloe Lelliott chloe.lelliott@palladianpublications.com

Digital Events Coordinator

Merili Jurivete merili.jurivete@palladianpublications.com

Digital Content Assistant

Kristian Ilasko kristian.ilasko@palladianpublications.com

Junior Video Assistant

Amélie Meury-Cashman amelie.meury-cashman@palladianpublications.com

Digital Administrator

Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Administration Manager Laura White laura.white@palladianpublications.com

Senior Web Developer

Ahmed Syed Jafri ahmed.jafri@palladianpublications.com

We’ve reached September, which may mark the beginning of a new school year for some, studies at university, or the start of work after the summer break. Other’s might have a chance to go on holiday, taking advantage of cheaper prices once kids return to school, while some (like us at LNG Industry), might be dusting off their passports to travel to Milan.

Of course, I’m talking about Gastech. It’s that time in the oil and gas calendar again where experts gather in one place to discuss current trends, recent developments, and plans for the future. As mentioned, Gastech is returning to Milan for 2025. As the finance and fashion capital of Italy, it acts as a great backdrop to unlock business growth opportunities and explore the latest solutions, technologies, and services to drive the energy transition.

A new specialised industry area at Gastech 2025,AI::Energy offers a chance for attendees to discover how the sector is responding to the twin challenges of artificial intelligence (AI) revolutionising energy systems while simultaneously increasing global power demand, for example through the rapid rise of data centres.1 The industry area will provide insight into how digital innovation across the energy chain – from automation and predictive analysis to grid optimisation and emissions tracking – is driving the next energy era.

The articles in the September issue of LNG Industry also offer various examples of how digital developments can help LNG companies and operations meet the requirements of customers, and the world at large.

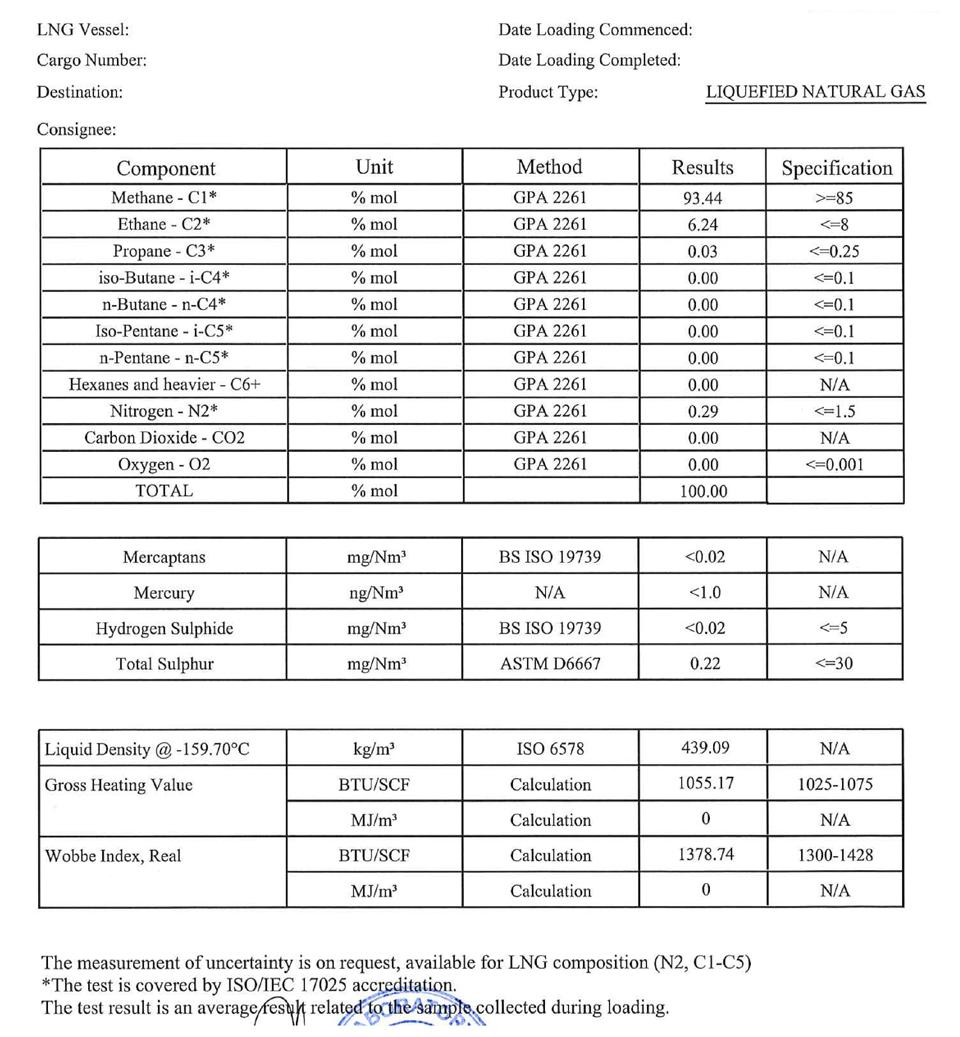

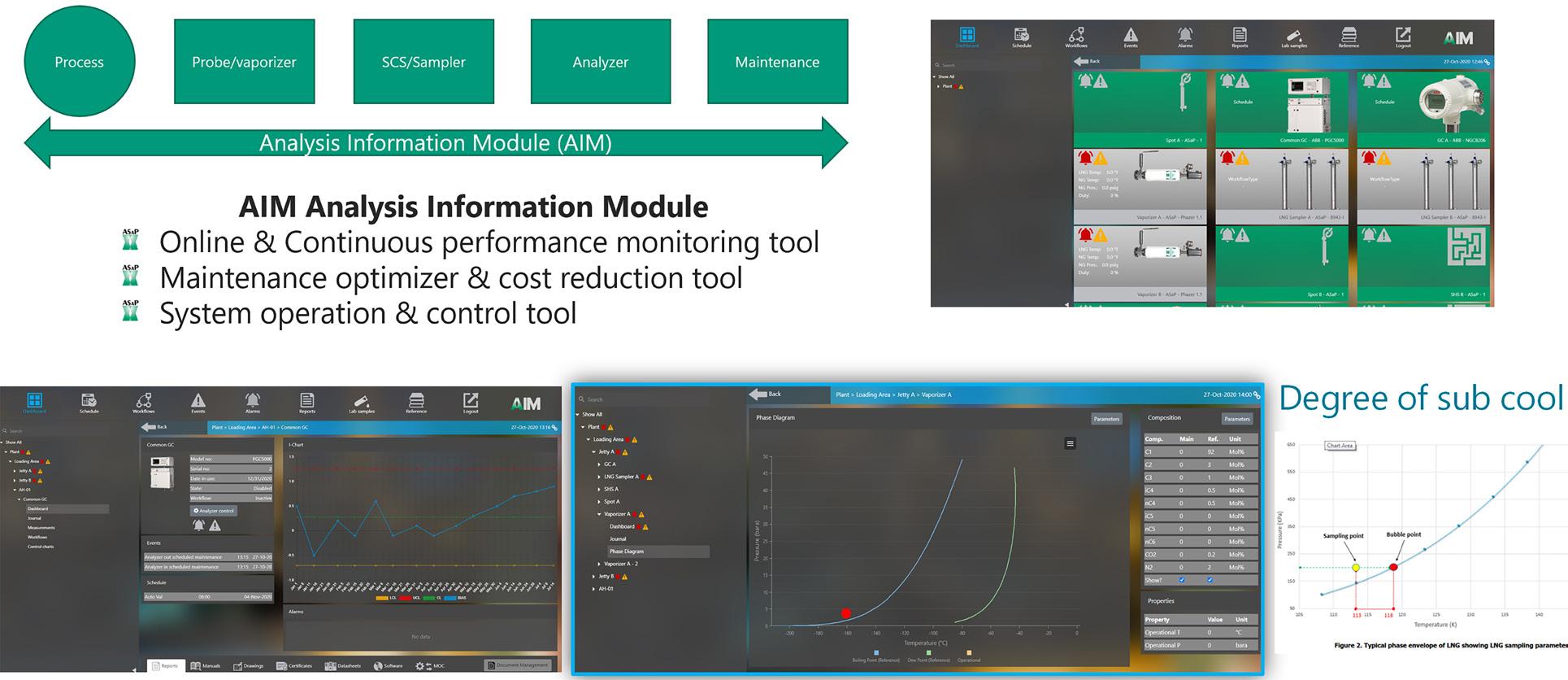

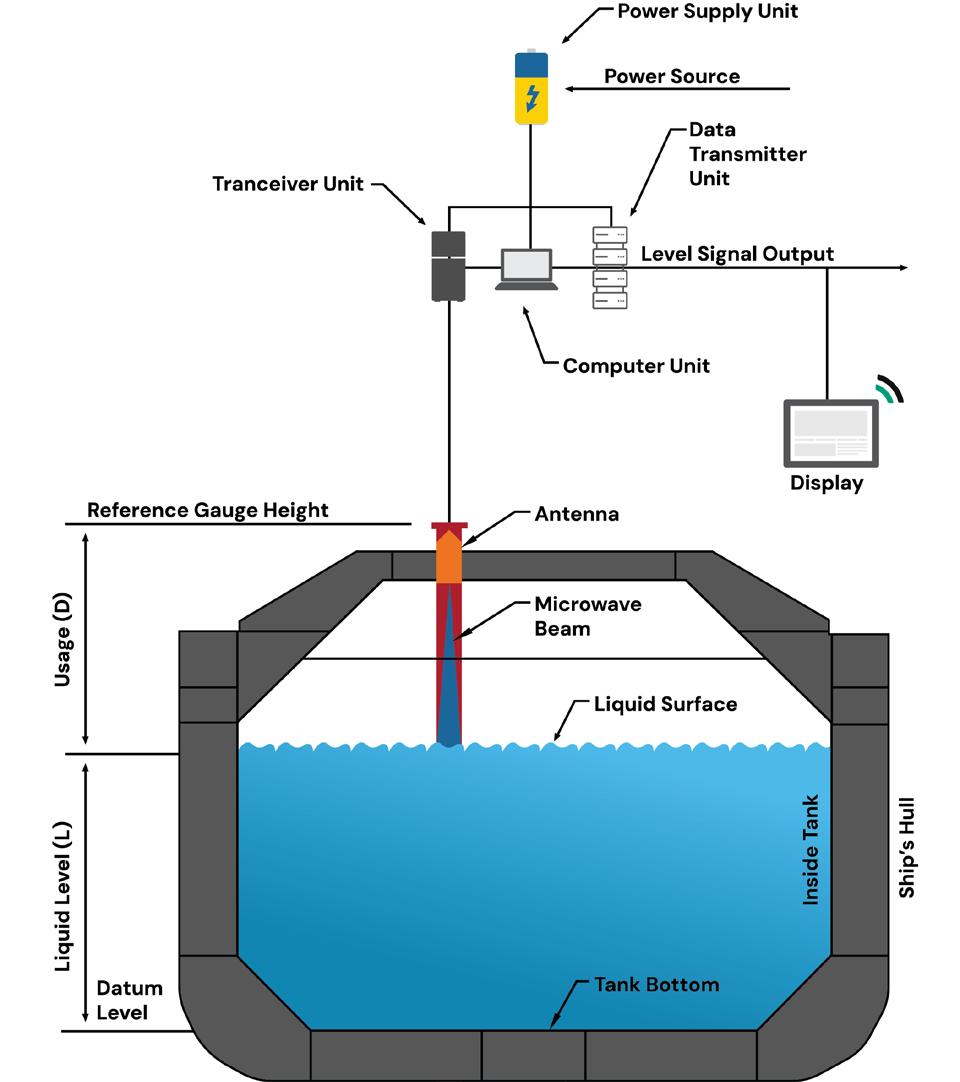

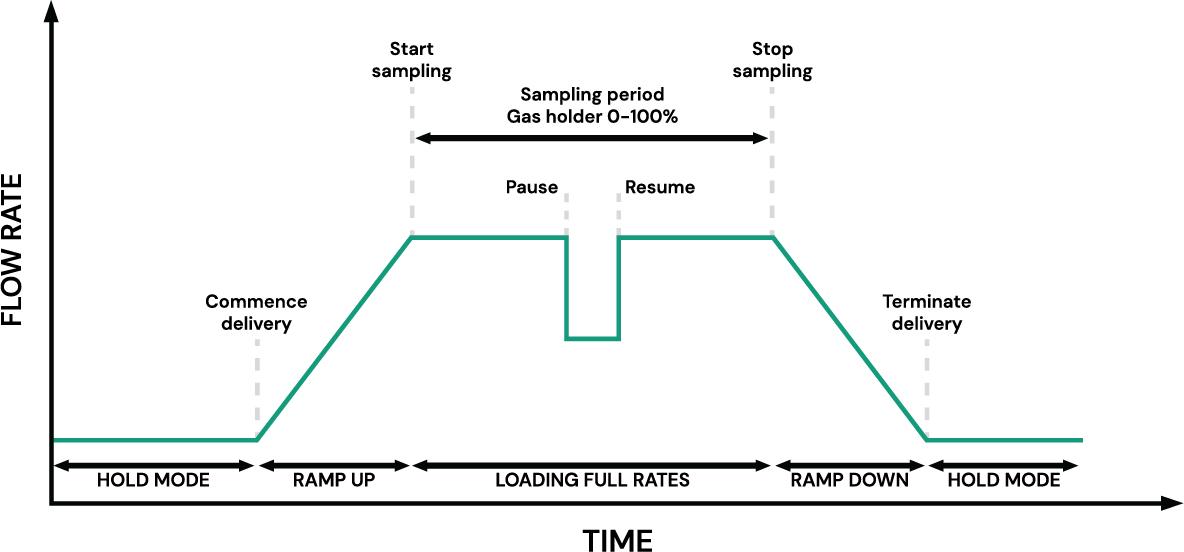

GHGSat’s article considers the link between methane reduction and the ability to meet LNG demand, and how the use of technologies such as drones and satellites can help detect and quantify methane at a previously unavailable and unimaginable scale and accuracy. ASaP look at fully automated LNG custody transfer measurement systems, which are crucial for ensuring accuracy, transparency, and efficiency in the transfer of LNG and meeting the evolving needs of the industry, ultimately contributing to the growth and sustainability of the LNG market. Meanwhile, CTCI considers the importance of operator training simulations for the LNG industry, making the case for these high-fidelity platforms that combine process control logic, safety systems, and human performance into one seamless example (including digital twin integration and AI for adaptive learning paths) as a way to allow operators to practice hands-on skills without risk to personnel or assets.

The LNG Industry team will be exhibiting at Gastech in Milan from 9 – 12 September. Feel free to pick up a copy of the September issue or have a chat with us at Booth M112.

While we wait to see how AI will help and transform the LNG industry, here’s an ode to LNG, written by AI:

In steel-bound tanks so cold and tight, A gas becomes a liquid light.

They cool it down to minus cries, So vapour bends and liquefies.

In ships it sails the open blue, A quiet force, both old and new.

To warm our homes, to light the night –LNG, the silent might.

References

1. ‘Optimising energy transformation through innovation’, Gastech, (2025), www.gastechevent.com/ visit-aienergy

Few companies have the scale and expertise to handle a project’s full range of needs—from design to dismantlement. But as an engineering, procurement, construction, and project management leader, Bechtel delivers excellence throughout every phase.

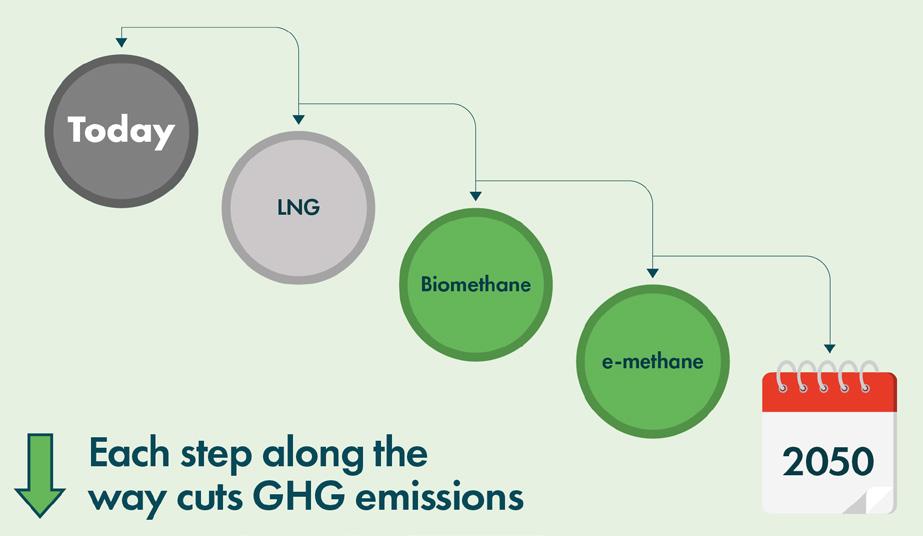

As the industry accelerates its efforts to achieve net zero, the LNG pathway continues to prove its capabilities as the most practical and realistic marine fuel solution available for deep-sea shipping today.

And it is a solution global shipping is increasingly adopting. Not just to cut carbon, but to reduce local air pollution too, improving the health of those living and working closest to international shipping. Amid tightening regulations, market volatility, and shifting public expectations, LNG and its pathway has moved beyond the ‘alternative fuel’ label and firmly into the mainstream – marked by its impact and potential.

The start of the year demonstrated a continued trajectory for LNG as a marine fuel. 87 new LNG dual fuel vessels were ordered from January – June 2025, up from 53 in the same period in 2024. According to DNV, the total number of such vessels (in operation or on order) is now over 1360. Critically, the majority of 2025 orders have been for large, emissions-heavy container ships, signalling strong confidence in LNG’s emissions reduction capabilities and long-term potential.

LNG bunkering volumes are also seeing notable growth. Volumes in Singapore rose by 18% in the first five months of 2025; Shanghai experienced a 60% increase; and Rotterdam grew by 7%.

These figures go beyond simply LNG, as liquefied biomethane (bio-LNG) bunkering accelerated in the early parts of 2025, with operations taking place in key ports across Europe. The use of bio-LNG is reaching the cruise sector, container liners, ferries, OSVs, car carriers, tankers, bulkers, and small scale LNG carriers over the past 12 months.

Increasingly stringent regulations – such as MEPC83’s Net Zero Framework and FuelEU Maritime – present significant challenges for shipping. In an analysis conducted by SEA-LNG using Z-Joule’s POOL.FM evaluation model comparing ammonia, methanol, and methane, LNG pathway dual-fuel vessels were found to provide the lowest cost option due to their lower carbon intensity, with a 4.5 – 5-year payback vs VLSFO. The analysis also suggests that the high FuelEU Maritime penalty price will incentivise the demand for bio and e-fuel versions of LNG, which is something we are already seeing with the rapid growth in bio-LNG bunkering in north-western Europe.

A key advantage of LNG lies in its pathway to decarbonisation through bio-LNG in the short term and then liquefied e-methane. Bio-LNG is chemically identical to LNG, and fully compatible with existing LNG engines and bunkering infrastructure, negating the need for new transportation and storage infrastructure, as required for ammonia and methanol. But, because of its composition, it can reduce greenhouse gas (GHG) emissions by more than 100% compared to marine diesel on a full well-to-wake basis.

Bio-LNG is currently the lowest cost ‘green’ fuel for shipping and is growing in use and popularity. In August, SEA-LNG member, Gasum, and Finnish shipping company, Wasaline, agreed that Gasum will provide only bio-LNG to Wasaline’s ferry, Aurora Botnia, going forward. In June 2025, Molgas conducted the first biomethane bunkering from the Dunkerque LNG terminal. In July 2025, another SEA-LNG member, Titan Clean Fuels, supplied 100% bio-LNG to UECC’s car carrier fleet as part of the company’s ‘Green Gas Month’. And in April 2025, the 7500 m3 vessel, Avenir Ascension, began operating on 100% biomethane for 2025 to reduce emissions by more than 3500 t.

Additional investment in renewable hydrogen energy infrastructure is required for all marine e-fuels. However, e-methane can also utilise the existing global energy network for LNG and existing LNG bunkering infrastructure afloat and ashore. e-methane has the potential to achieve full emissions reduction capabilities and achieve the IMO’s net-zero goal by 2050.

The LNG pathway offers a safe and scalable, pragmatic, and practical solution for an industry increasingly under pressure to decarbonise. And to do so quickly. The fuel’s immediate emissions reduction capabilities offer a viable method to achieve the IMO’s 2030 goals, while the adoption of bio-LNG can reduce GHG emissions by more than 100% – all while using existing infrastructure and technology. Furthermore, e-methane’s scaling potential, offering owners and operators the opportunity to fully decarbonise, only incentivises the industry (and its financiers) to invest in the assets needed to produce the fuel.

Recent newbuilding decisions have demonstrated LNG’s growing influence amongst key players, underpinned by extensive operational experience, safety record, and commercial viability. This is no longer a ‘what if’ solution, but a mainstream option for owners and operators to drastically reduce emissions and achieve compliance. Figure 1. The LNG pathway.

Hanwha Aerospace has signed a memorandum of understanding with Hanwha Energy and Korea Southern Power to strengthen co-operation in the global LNG sector and advance the development of an integrated LNG value chain.

The signing ceremony, held at The Plaza Hotel in Seoul, marks the start of a new public–private collaboration to secure competitive LNG procurement and diversify supply sources. The agreement is designed to strengthen Korea’s access to US LNG in a more favourable trading environment and to address the need for stable energy supply chains amid heightened geopolitical risks and global market uncertainty.

Under the agreement, the three companies will collaborate on joint procurement of US LNG, enhance domestic supply stability through LNG swaps, and expand information sharing in the global LNG market. Hanwha Aerospace and Hanwha Energy will leverage Hanwha Ocean’s LNG carrier fleet to create an integrated LNG value chain from sourcing to transportation and delivery, with the aim of strengthening order potential and generating synergies across the Hanwha Group.

Centrica plc has acquired the Isle of Grain LNG terminal (Grain LNG) in partnership with Energy Capital Partners LLP (ECP) from National Grid Group for an enterprise value of £1.5 billion.

National Grid and Garden Bidco Ltd (Bidco), which is owned 50:50 by Centrica and ECP, have entered into a sale and purchase agreement pursuant to which National Grid has agreed to sell and Bidco has agreed to acquire the entire issued share capital of National Grid Grain LNG Ltd and Thamesport Interchange Ltd, which together comprise National Grid’s LNG terminal business at Isle of Grain. Centrica and ECP will hold the investment in Grain LNG through a jointly controlled entity with customary governance provisions,

Crowley’s latest Avance Class ship, Torogoz, has made its inaugural commercial service, departing from Port Everglades, Florida, to serve Central America. The vessel’s commencement is a capstone on the company’s initiation of the four-vessel, Avance Class containership fleet.

With a capacity of 1400 TEUs (20-ft equivalent units), including 300 refrigerated containers, the ship is specifically designed and equipped to quickly and frequently deliver cargo, including apparel, fresh produce, food products, pharmaceuticals, and textiles, between the US and El Salvador, Guatemala, Honduras, and Nicaragua.

Torogoz, like the other Avance class vessels, is powered by lower-emission LNG.

The Torogoz follows the operation of its sister ships: Tiscapa, Quetzal, and Copán. All four of the Avance Class ships are named to honour the cultural aspects of Central America, where Crowley has operated shipping and logistics services for more than 60 years.

Torogoz, also known as a turquoise-browed motmot, is the national bird of El Salvador. Revered by Mayan and other Mesoamerican civilisations, the bird has likely lived on the continent for thousands of years and has long held spiritual significance in the region.

including reserved matters.

Completion is expected to occur in 4Q25, conditional upon certain regulatory approvals being received, including approval under the National Security and Investment Act and certain mandatory anti-trust approvals.

The Grain LNG management team will continue to operate the terminal as an independent company. Supporting the operation, Centrica can leverage operational knowledge and experience from its existing Barrow and Easington gas processing terminals. In the longer term, there are options to develop projects in hydrogen and ammonia and a combined heat and power plant, areas in which Centrica is already active across its broader portfolio.

Furui Energy Service has held a kick-off meeting for Brazil’s first bio-LNG project. The event was attended by Li Huaibing, General Manager of Furui Energy Service, along with representatives from the company’s Overseas Sales Department, Overseas Project Department, Technology Department, Procurement Department, Furui Do Brazil, and executives from one of Brazil’s leading large scale agricultural companies.

The project is designed to process 200 000 m3/d of biogas, with the core objective of efficiently converting abundant organic waste resources into high-purity bio-LNG. Leveraging Furui Energy Service’s advanced biogas purification and liquefaction technology, the project ensures that the final product fully complies with local standards in Brazil.

The LNG carrier Al Zuwair has been completed and delivered at the HHI Ulsan Shipyard of HD Hyundai Heavy Industries Co. Ltd. The vessel will be deployed under a time-charter contract with QatarEnergy, one of the world's largest LNG producers.

Al Zuwair is the third of 12 new LNG carriers being built for QatarEnergy by a joint venture comprising NYK, Kawasaki Kisen Kaisha, Ltd., MISC Berhad, and China LNG Shipping (Holdings) Ltd. This delivery marks the first of these vessels built at HHI. Al Zuwair also represents the first instance in which the NYK Group will provide ship-management services for the consortium.

The ship is powered by two X-DF 2.1 iCER engines, highly fuel-efficient dual-fuel engines capable of using fuel oil and boil-off gas as fuel. Additionally, the vessel is equipped with an air lubrication system and a reliquefaction device that effectively uses surplus boil-off gas. These innovations promote efficient navigation and help reduce greenhouse gas emissions, thereby minimising environmental impact.

Asyad Group, Oman's global integrated logistics provider, has completed a high-precision breakbulk operation, transporting an ultra-heavy LNG cryogenic tank for Gas Lab Asia, moving the cargo from Northern India to Dammam, Saudi Arabia.

The operation involved transporting a 115 t pressurised tank, 28 m in length and 5.5 m in height. The cargo was hauled overland for 1500 km from Northern India to Mumbai Port over a period of three weeks before being shipped across the Arabian Sea to its final destination in Dammam, Saudi Arabia.

The challenges of this operation stemmed from the sensitive nature of cryogenic gas storage tanks, which demand precise temperature and pressure control. Specialised equipment and custom handling were essential throughout the entire process. The entire move was executed through detailed engineering assessments, route planning, compliance checks, and last-mile co-ordination to ensure safety, integrity, and efficiency at every stage.

X Van Oord completes first bio-LNG bunkering

X Gasum provides bio-LNG to Wasaline for carbon-neutral shipping route X Latham advises on acquisition of Grain LNG X Havila Voyages secures new LNG agreement

09 – 12 September 2025

Gastech Conference & Exhibition Milan, Italy

www.gastechevent.com

16 – 18 September 2025

Turbomachinery and Pump Symposia 2025 Texas, USA

https://tps.tamu.edu

19 – 21 October 2025

Americas LNG Summit & Exhibition Louisiana, USA www.americaslngsummit.com

03 – 06 November 2025

ADIPEC

Abu Dhabi, UAE

www.adipec.com

02 – 05 December 2025

World LNG Summit & Awards

Istanbul, Türkiye www.worldlngsummit.com

02 – 05 February 2026

21st International Conference & Exhibition on Liquefied Natural Gas (LNG2026)

Ar-Rayyan, Qatar

https://lng2026.com

09 – 10 March 2026

LNGCON 2026

Barcelona, Spain

https://lngcongress.com

Seaspan Energy and Anew Climate have entered into a strategic agreement to offer delivery of renewable LNG (R-LNG) to customers on the North American West Coast.

As part of the service offering, Anew will supply renewable natural gas (RNG) certified by the International Sustainability and Carbon Certification (ISCC) and provide pre-audit services to Seaspan required for ISCC certification. The RNG will comply with global standard frameworks like the International Maritime Organization’s (IMO) Net-Zero Framework and the FuelEU Maritime Regulation in the EU.

The initiative aligns with emerging guidance from the IMO, which has preliminarily approved measures to encourage emissions reductions like those associated with the use of alternative fuels such as R-LNG.

Vanguard Renewables, a leading provider of environmental services and renewable natural gas (RNG), has announced a commercial partnership with the CMA CGM Group, a global leader in sea, land, air, and logistics solutions, designed to support the decarbonisation of its shipping activities.

Under the terms of the agreement, CMA CGM will make a strategic minority investment in Vanguard Renewables through its energy fund PULSE, ensuring access to significant volumes of RNG to be delivered on a long-term basis. The agreement highlights the critical role that Vanguard’s RNG is poised to play in the decarbonisation of the maritime industry.

Vanguard Renewables offers a leading network of solutions to divert organic waste from landfills and collaborates with food and beverage manufacturers and retailers seeking organic waste disposal options. The company produces RNG through proprietary anaerobic digesters that are powered by farm and organic waste. Vanguard Renewable will dedicate up to four projects to CMA CGM production. With this option, CMA CGM can access high-quality, low carbon intensity RNG produced by Vanguard Renewables’ large scale facilities across the US.

The company’s investment in Vanguard Renewables comes as the International Maritime Organization (IMO) recently announced its Net-zero Framework. Under the draft regulations, shipowners must reduce greenhouse gas (GHG) emissions or face financial penalties if they exceed a GHG fuel intensity threshold. This partnership highlights the potential of LNG vessels as a transitional solution toward bio-LNG, playing an active role in advancing the decarbonisation of the shipping industry.

Vanguard Renewables’ position as a producer of RNG from both dairy and food waste gives customers the opportunity to optimise the cost of GHG abatement.

Guggenheim Securities, LLC served as financial advisor to Vanguard Renewables in connection with this transaction.

- Mission-critical equipment manufactured in-house

- Nitrogen cycle & proprietary IPSMR® process technology

- Liquefaction capacities from 10,000 to >20MM tonnes per annum

- Modular design & construction minimize project cost, schedule & risk

LNG is crucial to meeting the world’s increasing energy demands and improving energy access, independence and security. By choosing Chart, you gain a reliable and trustworthy project partner with a proven, solution-driven track record who will accompany you through the entire project lifecycle.

Cong Thanh Thermal Power Joint Stock Company and the Doosan Enerbility (Korea) and Power Construction Consulting Joint Stock Company 2 (PECC2) joint venture have signed an agreement in principle to implement the 4500 MW Cong Thanh power plant project (Phase 1: 1500 MW; Phase 2: 3000 MW).

Attending the signing ceremony was Nguyen Cong Ly –Chairman of Cong Thanh Group (on behalf of Cong Thanh Thermal Power Joint Stock Company); Yeonin Jung – Vice Chairman of Doosan Enerbility Group; and Nguyen Chon Hung – Chairman of the Board of Directors of PECC2, along with representatives of the Board of Directors from the three parties.

Cong Thanh thermal power project is located in Nghi Son Economic Zone, Thanh Hoa Province, with imported LNG as the main fuel and using combined cycle gas turbine technology. The conversion to LNG fuel has elevated the project, helping to increase value and open up prospects in the energy development process in Vietnam.

The operation of the project not only ensures the supply of electricity to Thanh Hoa province, but the project also supplies electricity to the Northern load centre area. With the increasing load demand, the operation of the 4500 MW Cong Thanh LNG power project is of great significance in providing electricity for the socio-economic development needs of the country.

Axpo has completed Spain's first ship-to-ship bio-LNG bunkering operation at the Port of Algeciras in the large container shipping industry. A volume of over 4000 m3 of ISCC-certified bio-LNG was delivered to the CMA CGM FORT BOURBON. This operation builds upon Axpo's recent LNG bunkering successes in key ports, including Málaga, Algeciras, and Sines.

The bio-LNG was sourced via virtual liquefaction at the Enagás regasification plant in Cartagena.

The bio-LNG service at the Cartagena regasification plant has been certified by the EU’s International Sustainability and Carbon Certification (ISCC EU) since July 2024, guaranteeing that the facility meets all the environmental, social, and traceability criteria established by the European Commission. Cartagena is a critical LNG infrastructure hub in the Mediterranean, playing a key role in supplying next-generation marine fuels and supporting broader European decarbonisation goals. This innovative sourcing strategy underscores the growing flexibility of LNG infrastructure that allows it to accommodate sustainable alternatives.

The standard proof of sustainability certificate for this delivery was issued at the beginning of August 2025 by Enagás.

Nikkiso Clean Energy & Industrial Gases Group has been contracted by NPG (a joint venture to be formed by Shell and a subsidiary of FOCOL Holdings Ltd) to provide LNG regasification and cryogenic equipment for the New Providence gas project in Nassau, the Bahamas. The project involves an LNG receiving terminal in support of additional power generation at Clifton Pier. It aims to deliver lower-carbon infrastructure by using LNG to feed new and retrofitted gas turbines which previously used diesel. Nikkiso CE&IG will manufacture and deliver the LNG

packaged regasification system which includes high-pressure submerged centrifugal pumps installed in a modular pump skid; a gas-fired water bath vaporiser and associated power distribution and control systems; an insulated pipeline featuring Nikkiso CE&IG's vacuum jacketed system; and site critical ancillary equipment. The group will also provide engineering services in support of the project.

The packaged regasification system, with capacity of 55 million ft3/d, features a modular, standardised design which will reduce system integration time and cost.

We build: Cryogenic Storage Tanks, Intermodal ISO Tank-Containers, Marine Cargo Tanks, Peak-Shaving Plants, LNG Terminals, and LNG-Cooled AI Data Centers.

Royal Caribbean International’s Star of the Seas, the world’s largest cruise ship, has been refuelled with LNG for the first time at Port Canaveral ahead of her maiden voyage.

The LNG fuelling was completed by JAX LNG and Seaside LNG, which dispatched bunker vessel Clean Everglades to supply Star of the Seas with enough fuel to last a few weeks. The entire operation took approximately seven hours, and was monitored by Canaveral Fire Rescue’s Fireboat2, the specially outfitted marine firefighting rescue vessel, Brevard County Sheriff’s Office Marine Unit, and the U.S. Coast Guard.

Star of the Seas set sail on her maiden voyage from Port Canaveral 16 August 2025 and launched week-long cruises to the Caribbean and the Bahamas from the end of August 2025.

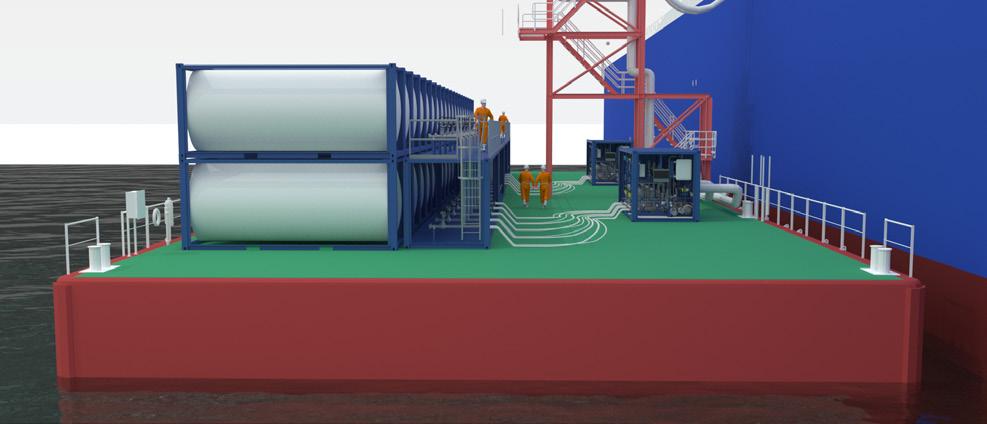

Seatrium Ltd has announced the signing of a letter of intent (LOI) with Karpowership.

Under the LOI, Seatrium will carry out the integration of four New Generation Powerships (floating power plant), with an option for two additional units. Karpowership will deliver the hulls and key equipment for the four Powerships to Seatrium Singapore, where integration works will begin in 1Q27. Seatrium’s scope of work includes mechanical and electrical, equipment integration, mechanical completion, and pre-commissioning.

The agreement also includes the conversion, life extension, and repairs of three LNG carriers into FSRUs. This involves the installation of regasification modules, spread-mooring systems, and the integration of critical supporting systems such as cargo handling, offloading, utility, electrical, and automation systems.

ADNOC Gas plc and its subsidiaries has announced the signing of a heads of agreement with Hindustan Petroleum Corp. Ltd (HPCL) to supply 0.5 million tpy of LNG for a 10-year term.

The agreement underscores ADNOC Gas’ expanded global footprint, particularly across the high-demand Asian LNG market, reinforcing its role as a reliable global supplier of LNG. The long-term contract strengthens ADNOC Gas’ partnership with key Indian players as it continues to support India’s energy security, building on recent agreements with Indian Oil Corp. and GAIL India Ltd.

The LNG will be supplied from ADNOC Gas’ Das Island liquefaction facility, which has a production capacity of 6 million tpy. As the world's third longest-operating LNG plant, Das Island has shipped over 3500 LNG cargoes worldwide since starting operations.

X Sempra and ConocoPhillips sign offtake agreement for Port Arthur LNG Phase 2

X SAMSUNG E&A secures FEED contract for Abadi LNG project

X Coastal Bend LNG and Solvanic announce carbon capture FEED study

X Venice Energy signs sale agreement for Australian LNG terminal project

Kateryna Filippenko, Research Director, Global Gas Markets, Wood Mackenzie, provides an insight into the future of global gas and LNG within a transitioning energy market.

As the midpoint of the 2020s approaches, the global gas market stands at a critical juncture. The world now faces a new energy era shaped by geopolitics, technology, and environmental imperatives. This article, drawing on data from Wood Mackenzie’s Lens Gas and LNG platform, explores the key trends reshaping global gas and LNG markets through 2050.

From Europe’s evolving energy strategy to the impact of new LNG investments, these factors are not only driving market changes, but delivering wider implications for the future of global gas and LNG markets. As the industry navigates this period of transformation, understanding these dynamics will be crucial for stakeholders aiming to position themselves effectively in the changing energy landscape.

The global gas and LNG markets are poised for significant transformation over the coming decades. Wood Mackenzie’s analysis reveals two distinct growth phases leading up to 2050, with varying trajectories across different regions:

z The expansion era (2025 – 2035): Global gas demand is projected to grow by 15% through 2035, supported by a 33% growth in Asia and 15% increase in North America – and despite an 8% reduction in Europe. LNG demand will grow faster, expanding by 56% or 230 million tpy through 2035. This surge is primarily driven by new LNG supply sources reducing prices and consequently boosting demand.

z The transition phase (2035 – 2050), post-2035: Global gas demand is expected to peak and then begin a gradual decline as the energy transition accelerates. However, LNG demand will keep growing – albeit at a much slower pace – as domestic gas supply declines in key LNG importing regions. The period after 2035 marks a shift, with Northeast Asian and European LNG demand declining, while South and Southeast Asia become the only source of growth, alongside LNG bunkering demand.

These projections paint a picture of a market in flux, presenting both challenges and opportunities. From technological advancements and environmental policies to geopolitical shifts and changing consumer preferences, the industry must navigate a multifaceted and often unpredictable terrain. In an era where adaptability and

foresight will be key differentiators, companies that can anticipate and respond to these shifting dynamics will be better positioned to thrive in this evolving landscape.

As European decarbonisation targets are proving more difficult to achieve, the region’s gas demand is showing resilience in the near term. Current trends indicate that European gas consumption will remain relatively stable through the end of this decade, with demand projected to reach approximately 454 billion m 3 by 2030. This stability reflects a slower-than-anticipated electrification of non-power sectors and highlights increasing headwinds for meeting Europe’s 2030 decarbonisation targets.

However, the long-term outlook still points to a gradual decline. Beyond 2030, more stringent decarbonisation policies and technological advancements are expected to take effect, initiating a downward trend in gas consumption. Nevertheless, natural gas will continue to play a significant role in Europe’s energy mix for decades to come. Wood Mackenzie’s analysis suggests that even by 2050, European gas demand will still stand at a substantial 241 billion m 3 . As research delves deeper into these issues, it becomes clear that the European gas market is entering a new era. While the immediate future suggests stability, the longer-term outlook points to significant changes that will reshape the industry. Understanding these trends and their implications will be crucial for anyone operating in or observing the European energy sector.

The LNG market is gearing up for a significant shift in pricing dynamics. While geopolitical tensions continue to drive price volatility in the near term, a wave of new supply from 2026 will put downward pressure on prices.

Both European benchmark Transfer Title Facility (TTF) prices and Japan-Korea Marker (JKM) spot delivered ex-ship (DES) prices are expected to soften in late-2020s and early-2030s as the new supply wave arrives to the market – bolstered by the new US LNG projects.

As LNG demand continues to grow, new supply will be required in the long term, pushing the prices to the level defined by the cost of developing new LNG projects. These are expected to increase on the back of higher liquefaction fees and stronger US benchmark Henry Hub prices supported by higher US domestic demand. Interestingly, the Asian spot price premium for LNG over European TTF prices is projected to widen over time, reflecting growing demand for US LNG in Asia.

As the market enters this new era, adaptability to both short-term volatilities and long-term structural changes will be key to success in the global LNG market.

Trade tensions pose a significant risk to the future of gas and LNG markets. While Wood Mackenzie’s

NMBL™ modular LNG is Baker Hughes nimble pre-engineered liquefaction solution to get you from inception to operation fast. Relying in 30+ years of LNG experience, the range of production is up to ~2.0 million-ton LNG per annum. It is digitally native for improved reliability, availability and process performance optimized by the iCenter™ services, powered by Cordant™.

NMBL™—a nimble, modular and cost-effective way for LNG, ready to go.

current outlook does not include tariffs imposed since 2 April 2025, the potential for an all-out trade war presents considerable downside risk to GDP growth assumptions.

The company anticipates the most likely outcome to be comprehensive trade agreements between the US and its partners, with some US tariffs remaining at a weighted average of 7.5 –10%. This scenario would likely result in a short term lowering of global GDP growth, with negative effects on the US economy, though avoiding recession.

In the gas and LNG sector, European demand would likely soften, while the anticipated surge in Asian LNG demand would be more muted. US gas requirements, however, would find support from growing LNG supply needs.

LNG supply growth will remain limited in 2025, but a new wave of LNG projects is about to hit the market with supply growth averaging over 34 million tpy in the period from 2026 to 2029. With the U.S. Department of Energy (DOE) pause now lifted, players are positioning for a new wave of US LNG investments, adding to investments in the Middle East, Canada, and elsewhere. Wood Mackenzie anticipates 108 million tpy of new LNG supply will take final investment decision (FID) through to 2027, ensuring a continuous flow of LNG supply growth throughout 2035. However, with LNG demand growth slowing down after 2030, the market is poised for a period of excess supply – there is a risk US LNG cargo cancellation might be required to balance the market, particularly in the 2030 – 2032 period.

For industry stakeholders, it presents both opportunities and risks, emphasising the need for careful market analysis and flexible business strategies.

While natural gas has established itself as a vital bridge from traditional high-carbon fossil fuels such as coal and oil to renewable energy sources, the global gas market of 2050 will be vastly different from today’s.

Ripe with opportunities for those prepared to navigate its challenges, success in this more complex, interconnected, and volatile landscape will hinge on strategic foresight, operational flexibility, and innovation. By addressing the following challenges and seizing opportunities, the gas industry can secure its position in the evolving energy landscape of 2050 while playing a vital role in the global energy transition.

z The gas and LNG industry must prioritise reducing greenhouse gas emissions across the value chain, particularly tackling methane, which is a relatively cost-effective measure, and Scope 3 emissions, particularly post-combustion emissions, which account for the majority of gas-related emissions. Collaboration with consumers to develop carbon capture and storage (CCS) solutions will be crucial. While policies in some regions offer incentives for such initiatives, the gas industry needs to take more decisive action and deploy significant capital, especially in regions like Asia where carbon-pricing policies lack impact.

z Maintaining LNG’s competitiveness is fundamental, with additional supply needed by 2030 to meet growing demand. Governments must balance net-zero aspirations with security of supply, ensuring LNG availability as a backup for other low-carbon technologies. Governments must strike a balance between net-zero aspirations and security of supply, ensuring LNG availability as a backup if other low-carbon technologies fall short. Japan’s pragmatic approach to energy planning, which considers various scenarios, serves as a model for other nations to follow.

z The LNG industry must support a diverse range of buyers and import countries, adapting to their specific needs and market conditions. This includes offering flexible pricing and contract terms for mature markets and providing support for infrastructure development in emerging markets. Clear, consistent, and co-ordinated advocacy is essential to convince stakeholders of the benefits of gas as a transition fuel. The industry must demonstrate its commitment to long-term sustainability, even at the expense of short-term profits. Collaboration with renewable energy developers can strengthen messaging around the role of gas as a reliable backup power source.

With the choices made today shaping the energy landscape for decades to come, the question for industry leaders is not whether change is coming, but how best to position themselves to thrive in this new energy landscape. For those with the ability to transform silos of disparate data and deliver the interconnected insights required to navigate these turbulent waters, the opportunities are immense.

PRICO® LNG modules up to 2 MTPA per train

The Black & Veatch Modular LNG solution produces more LNG in a smaller footprint, bringing improved capital efficiency and an expedited schedule to your project.

Built on the long history of our industry leading PRICO® liquefaction process and our engineering expertise, our modular LNG solution ensures operational certainty to your entire facility from pipeline to tank.

Maintaining a standardized design while integrating motor or turbine drivers, our solution can handle a range of gas compositions and site conditions, bringing the most economical and flexible modular LNG product to the market.

Chuck Blackett,

Chief Engineer, Niche

Eric Ford, Vice President

of

Marketing,

Cryogenic Services, and

Graphite Metallizing Corp., compare the demands placed on pumps handling LNG and anhydrous ammonia.

Anhydrous ammonia’s primary use is in agriculture as a fertilizer, but it is also used in the clothing, pharmaceutical, and refrigeration industries. Since it is anhydrous, meaning it contains no water, it has enhanced fertilization qualities.

There are many similarities in the cryogenic pumps used for anhydrous ammonia and LNG as they both utilise submerged motor in-tank retractable designs that operate at

low temperatures. However, there are differences that those operating and maintaining this equipment should become familiar with.

Like LNG pumps, in-tank ammonia pumps have the motor and pump submerged in the process fluid through a tank column via a retraction system that utilises a foot valve at the bottom. The most significant difference in the in-tank pumps for ammonia vs LNG is that the ammonia duty machine is split

in half. In an ammonia application, the bottom half of the unit (wet end) is similar to an LNG pump with product-lubricated bearings. The upper half of an ammonia pump (dry end) contains the vibration instrumentation and the motor, which are sealed from the ammonia and under pressure from a nitrogen purge system. With the motor and pump being isolated from each other in the ammonia application, the design relies on two shorter shafts that are magnetically coupled. In an LNG application, on the other hand, the lower pump end and the upper motor end share a common shaft and all components are open to the process fluid.

Several of the properties of anhydrous ammonia make life challenging for pump operators. These include a low net positive suction head (NPSH) available and a low level of viscosity, which can lead to fluid slippage and poor pump efficiency. Low lubricity paired with warmer fluid temperatures can contribute to a higher frequency of bearing and bushing failures, as well as other mechanical issues.

Perhaps the biggest difference with LNG is temperature. Whereas LNG pumps deal with fluids in the -162˚C range, ammonia pumps typically deal with fluids at temperatures around -35˚C. This permits the use of a wider range of materials. As a result, tanks and vessels are often made of carbon steel, as are other components upstream of the machines. One consequence of this is that there is usually far more debris found in those fluids than in LNG applications. Another difference relates to manufacturer clearances for ammonia pumps. In-tank cryogenic pump original equipment manufacturers (OEMs) typically use running clearances that are tighter than the guidelines contained in API 610. The result of this is that much higher rates of wear are typically found in warmer fluid pumps than on LNG pumps.

Galling is another issue commonly encountered in the pumps that operate in ammonia and LNG service. The typical aluminium and bronze bushings and wear rings deployed by pump OEMs can lead to galling due to operating at such tight clearances. Under high pressure, metal-on-metal contact occurs with resultant adhesion, surface roughening, and material transfer. Frictional damage can precipitate component failure.

The ball bearings used in anhydrous ammonia and LNG service are not designed to deal with high thrust loads.

The main ball bearing is the most common point of catastrophic failure in ammonia and LNG pumps. During steady state operation, thrust loads are mitigated with a thrust balancing system. A properly functioning thrust balancing system relies on tight running clearances that are often well outside of API 610 guidelines. OEMs use bronze and stainless steel in these tight running clearance areas. Due to this, the balance system often fails due to excessive wear. Once the thrust system no longer functions, the main ball bearing fails under high thrust loads. The use of graphite-metal alloy products in these tight running clearance areas of the thrust balancing system can extend equipment life. Additionally, thrust loads are present during start-up. If the machine’s main bearing is failing before the thrust balancing system wears out, it is best to upgrade the machine with bearings rated for the loading conditions at start up.

Bushings, too, are a weak spot. In normal plant operations, bushings used in anhydrous ammonia and propane pumps have been found to fail after little more than 50 hours. One plant reported bushing failures after an average of 84 hours. Another facility experienced the failure of a new bushing during a one-hour factory performance test. The factors contributing to the poor performance of bushings include the tendency to use bushings made from metals such as bronze and aluminium, poor lubricity, fluid temperature, and tight manufacturing clearances. Graphite-metal alloy bushings solve these performance issues with their self-lubricating and non-galling features. These should be utilised instead of bronze or aluminium whenever these pumps have maintenance challenges.

Perhaps the biggest challenge in the servicing of anhydrous ammonia pumps is safety. Whenever a unit must be removed or installed, there is ammonia gas present. Exposure to ammonia gas brings with it risk of serious injury or death. Explosive risk is very real, too. To make matters worse, the work is often done under demanding deadlines – the cost to the plant for having these pumps offline is very high so they need to be fixed or upgraded rapidly. Nevertheless, the opportunity presented by a pump repair to upgrade should be used to bring both the operation and maintenance procedures and the machines into full compliance with the latest safety standards and industry best practices. A machine that lasts longer reduces owner exposure to environmental issues, explosive atmospheres, and risk.

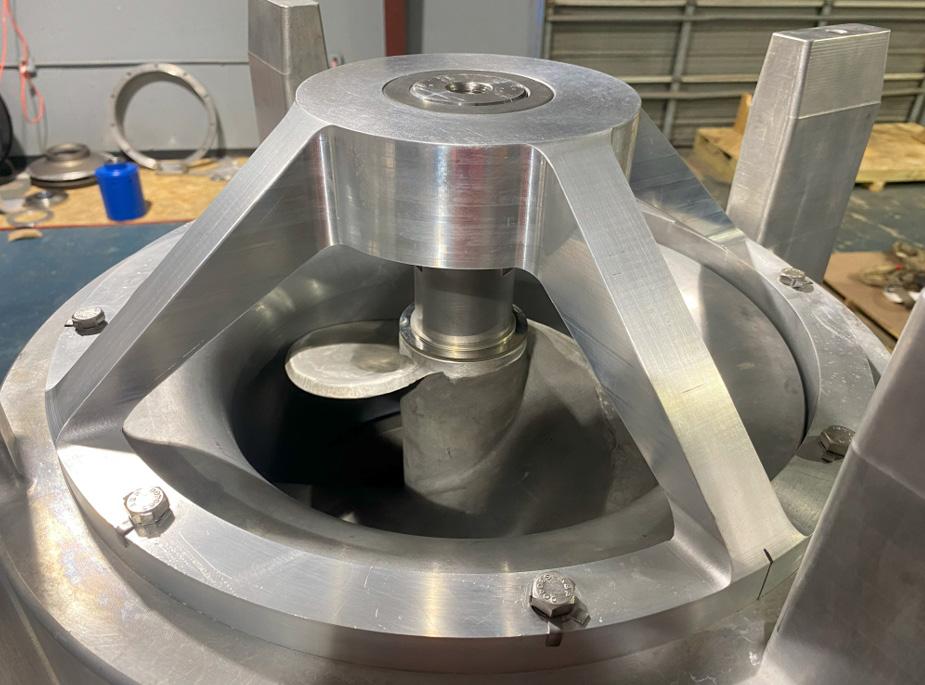

At one site, a retrofit was needed for an Ebara Elliott Energy in-tank vertical pump in liquid anhydrous ammonia service at an ammonia manufacturing plant. The single stage wet-end of the pump unit was designed with two product-lubricated 6317 bearings, with the dry-end utilising two greased 6320 bearings.

The specifications for the pump in service at the manufacturing plant are shown in Table 1.

The pumps operating in the ammonia production plant are critical assets with specific reliability requirements. Without the pumps, the facility cannot contractually meet its obligations or export ammonia to the market. These pumps deliver the plant’s final product. Further, if the pump outage is long enough (16 days if the tank is empty when the

With over 55 years of LNG design and operating expertise, ConocoPhillips has licensed the Optimized Cascade Process (OCP®) for 120 MTPA of LNG production capacity around the world.

Learn more at lnglicensing.conocophillips.com . Liquefied Natural Gas

outage occurs), the entire production plant must be shut down as there is no further storage room in the tank that these pumps operate in.

When the pumps were initially commissioned, the vibration on both units was extremely high, reaching peaks of 0.8 in/s-rms. A new cryogenic pump of this size should vibrate at 0.2 in/s-rms or less. Additional data collection and spectrum analysis showed the vibration was at the operating frequency (1x). After the units were returned to the OEM, no mechanical failures were noted, and the balance of all components was verified.

After failed attempts by the OEM to meet the owner’s requirements by adding an additional ball bearing, the owner released the spare pump to Niche Cryogenic Services (NCS) to be completely redesigned. In reviewing the as-found conditions of the machine, the bearing housing design and bearing spacing in the wet-end, along with the bearing clearances in the dry-end were found to be contributing to heavy levels of 1x vibration. The shaft in the wet-end needed to be lengthened, and two extra bearing areas were required

to stabilise the wet-end’s rotating assembly. Instead of bronze, aluminium, or rolling bearing components, NCS installed graphite-metal alloy bushings, given that:

z Similar bushings in ammonia service elsewhere have operated for tens of thousands of hours without issue instead of failing after an average of 84 hours.

z The new components were available in custom sizing, allowing for the lowest L/D ratio and were available in less time than other solutions explored.

z The replacement bushings are self-lubricating, non-galling, and help improve pump efficiency and longevity.

Several design changes were part of the project. Initially, the wet-end pump shaft concluded within the bore of the inducer. The inducer was thru-bored, and a new retaining method was used. The new shaft retained the same diameter through the inducer but extended out past the inlet housing’s suction bowl 5 in. into the available foot valve area. A custom housing was designed to hold the new bushing to support the bottom of the shaft out past the suction of the machine and provided the support needed in that area.

In addition, the 6317 pump bearings were originally spaced 6 in. from each other. The use of a spool piece and longer shaft allowed for these bearings to be spaced out to 37 in. by moving the upper 6317 bearing from its original position into the top of the spool. A custom upper bearing retainer in the wet-end was designed to house a new bushing at the top end of the pump’s shaft between the upper 6317 bearing and the over-hung magnetic coupling at the top of the shaft. In the dry-end of the machine, the bearing retention, bearing housing clearances, and housing registers were modified to ensure better axial alignment of the motor shaft and female magnetic coupling to the wet-end’s rotating assembly.

The repair shop co-ordinator asked for the graphite-metal alloy bushings to be supplied undersized so that they could finish machining them to an exact clearance, after installation in the housing. The inside diameter of the graphite-metal alloy bushing will close in about the same amount as the interference fit on the outside diameter of the bushing. These bushings were machined in place with a spiral groove design on the inside to allow more fluid flow and prevent the accumulation of debris.

Due to the critical nature of the work being done on the anhydrous ammonia pumps, extra bushings were ordered in case they experienced any issues with installation or machining that might need to be quickly corrected due to the time sensitive nature of returning the pump to service. If any mistakes were made, they had backup spares immediately available. However, the spare components were not needed.

After the modifications supported by the installation of the two graphite-metal alloy bushings, the vibration levels fell to between 0.01 – 0.03 in/sec. rms, down from 0.8 in/sec. rms prior to the upgrade. The pump has been in operation since December 2024 without any issues. After this success, the owner elected to retrofit another two units with the same design, including the graphite-metal alloy bushings, to increase uptime while reducing future maintenance costs and risks.

Efficient and cost-effective construction of LNG storage tanks is vital for the global energy landscape. The growing demand for natural gas, coupled with the need for energy security, makes optimising LNG storage a priority. Streamlining the construction process of LNG tanks can lead to faster project completion, reduced costs, and increased LNG availability, ultimately benefitting both producers and consumers. Remote locations present significant challenges for on-site construction due to limited accessibility, lack of infrastructure, difficulties with transportation of materials and personnel, potential environmental constraints, and increased logistical complexities, often leading to higher costs and potential safety concerns. Construction in harsh climates can be unpredictable and costly. Additionally, high labour cost areas pose a significant challenge to the economics of a project. All these issues and concerns can be mitigated by applying modular tank technology.

As CB&I continues to innovate LNG tank designs and product delivery models to help reduce risks, improve construction schedules, and optimise overall project economics, the company has developed a comprehensive mid scale modular tank design and execution plan.

Mark Butts, Alex Cooperman, and Yogesh Meher, CB&I, assess mid scale modular LNG tank technology as a tool for reducing costs and scheduling.

Although this article focuses on the application of modular tank technology to LNG storage, this technology and delivery model can be applied to any refrigerated product that is typically stored in double-walled tanks. Many countries are implementing stricter regulations for LNG storage, making full containment tanks a more attractive option for compliance. Full containment tanks provide enhanced safety, as the secondary liquid container is designed to both contain cryogenic product liquid and provide controlled product vapour release in case of excessive boiling. Steel full containment tanks are allowed by current LNG industry regulations (NFPA 59A-2023) and have both the primary and the secondary liquid container constructed from cryogenic grade steel. Full containment tanks are superior from a siting and real estate utilisation perspectives compared to single or double containment tank systems.

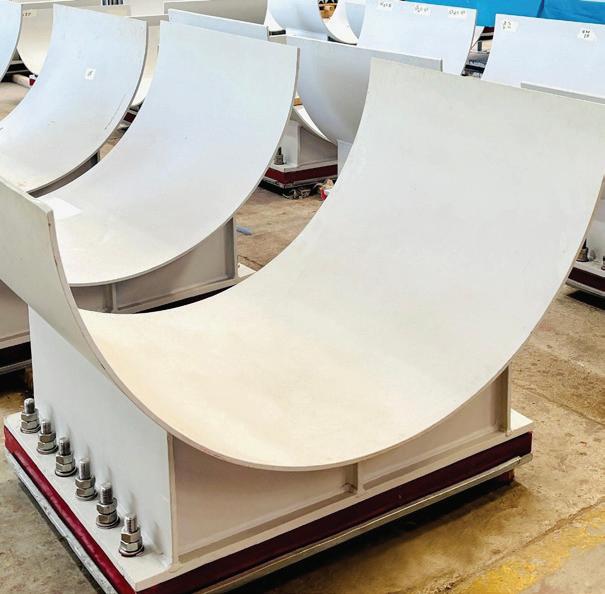

Double wall steel full containment modular LNG tanks made at the fabrication facility include the following components:

z Elevated foundation base slab with pedestals.

z Primary and secondary liquid containers with cryogenic grade steel shell and bottom (normally 9%Ni material).

z Non-brittle bottom insulation.

z Suspended deck with insulation.

z Resilient blanket wall insulation.

z All internal components including pump wells.

z Tank umbrella roof.

z All top side components, including pump platform with all piping and valving.

z Tank access system including stairways and ladders.

z Electrical, instrumentation, and fire protection systems.

Since ground and marine transportation expose the transported module to both dynamic and vibration loads, brittle materials and those sensitive to vibration should not be included. For example, cellular glass and perlite concrete should not be used for bottom insulation due to their brittleness. Additionally, perlite insulation, which is sensitive to excessive vibration, should also be excluded from the transported module.

Once the modular tank is delivered to its destination, the remaining work at the site is minimal and should be limited to activities, such as:

z Installation of insulation components sensitive to dynamic loads and vibrations that occur during shipping, such as loose-fill perlite.

z Tank hydrotest is a mandatory field operation, as the main purpose of the hydrotest is to verify performance of the foundation and reliability of the underlying soil.

z Tank final commissioning and connection to the facility piping and electrical power systems.

The design of the modular tank and traditional field erected tank are similar. However, appropriate changes are to be made to the design, materials, and details to facilitate transportation of the modular tank to its destination.

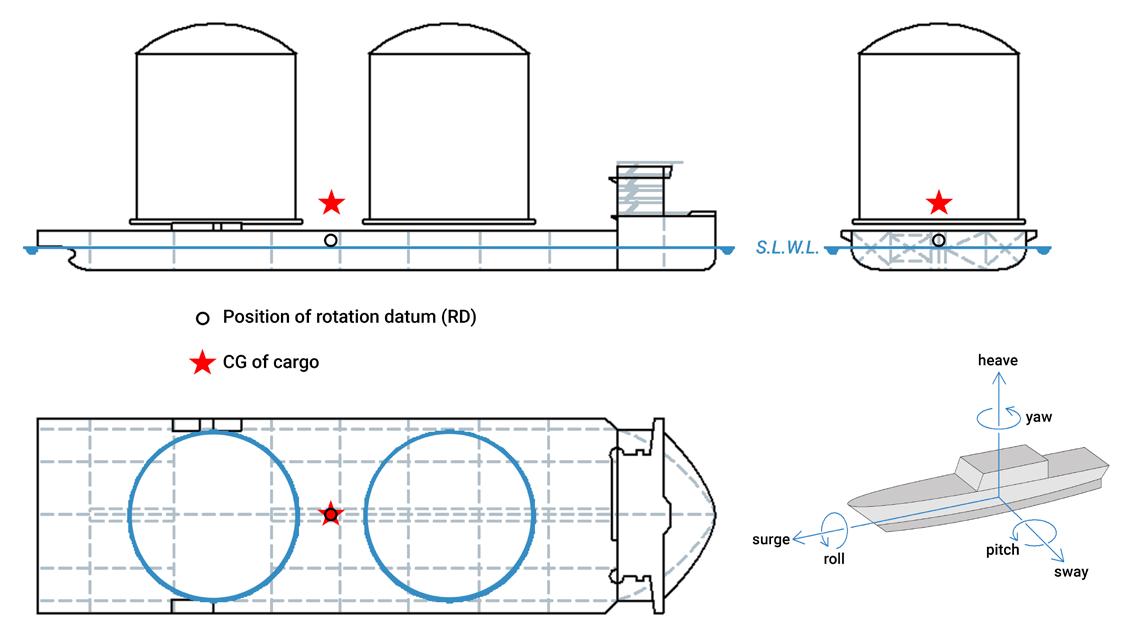

Transportation of a modular tank typically includes both ground and marine components. Ground transportation of the complete module may be performed using several self-propelled modular transporters (SPMTs). Special vessels with adjustable deck elevation are normally required for module loading and marine transportation.

A comprehensive transportation study is essential for modular tank execution, encompassing both ground and marine transportation components. This study is crucial, as transportation restrictions typically determine the size and configuration of the modular unit.

To fit within the transportation restrictions from either ground or marine transportation or both, modular tanks have a higher aspect ratio when compared to conventional field-erected tanks of similar capacity. This higher aspect ratio makes modular tanks more sensitive to seismic overturning. However, because an elevated foundation with pedestals is necessary for transportation of a modular tank, seismic isolation is a natural solution in cases of high seismicity where isolators can be easily installed beneath the pedestals.

Loads from ground transportation may impose dimensional restrictions on either the diameter or height of the module. The restrictions on the tank diameter are dictated by width of the transportation route, including roads, bridges, and railway crossings, as well as by obstructions on the sides of the road such as power lines, ditches, and walls. The module height may be restricted by overhead power lines, height of overpasses, or other restrictions applied by local regulations. The tank footprint should allow for a sufficient number of SPMTs to be placed under the base slab to lift and move the module.

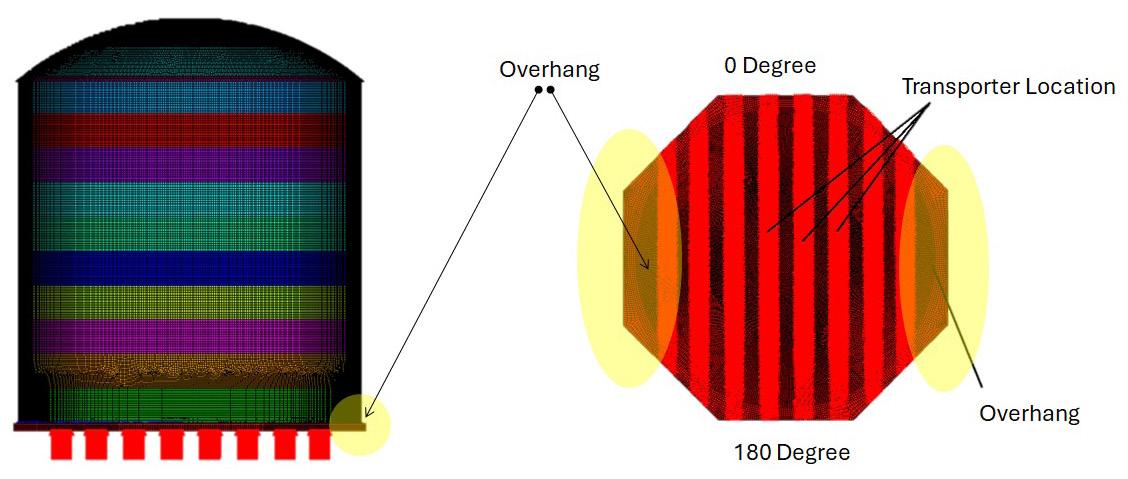

Selecting the optimal SPMT arrangement is a significant consideration for ground transportation of the modular tank. Enough SPMTs must be placed underneath the slab to lift and move the module, particularly when the road width is much narrower than the tank footprint. Additionally, in cases of narrow roads, parts of the base slab and the steel tank that overhang the

transporters may remain unsupported, potentially leading to overloading during transportation.

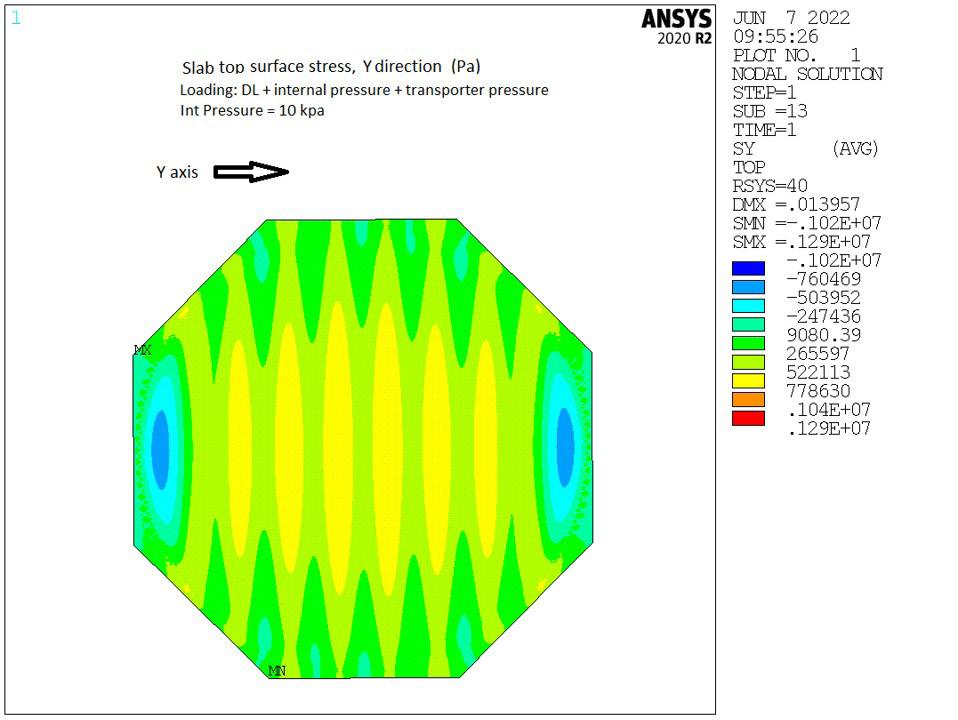

To illustrate this challenge, Figure 1 shows the base slab of a 41 m diameter modular tank transported on a 32 m wide road. The stresses in the base slab are shown on Figure 2. The base slab and the tank structure above are deformed, as the overhanging portions of the unit have no support. To avoid failures of the outside SPMTs, the centre SPMTs apply more pressure to the underside of the base slab to pick up more load and relieve the load from the outside SPMTs. This results in further deformation of the base slab, causing tensile stresses in the base slab to significantly exceed its concrete tensile strength. Furthermore, excessive downward deformation at overhanging portions may cause distortion and buckling of the steel tank superstructure.

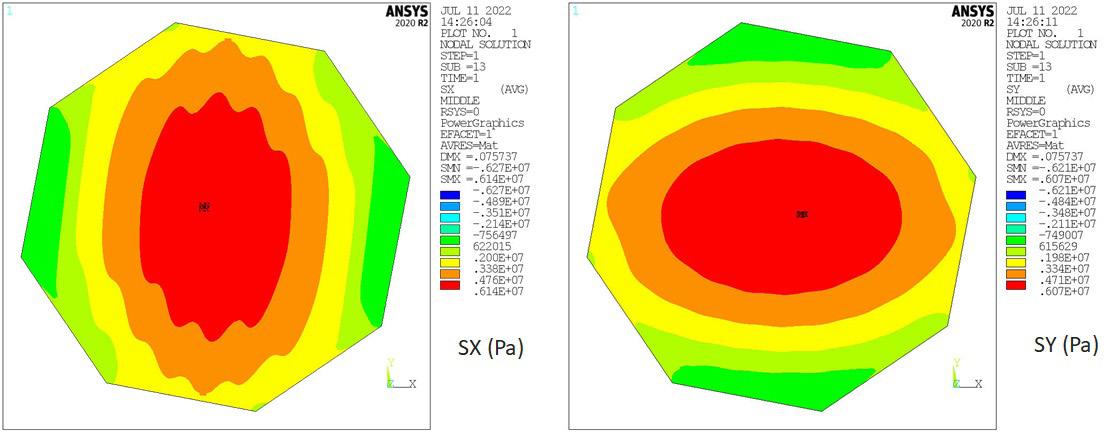

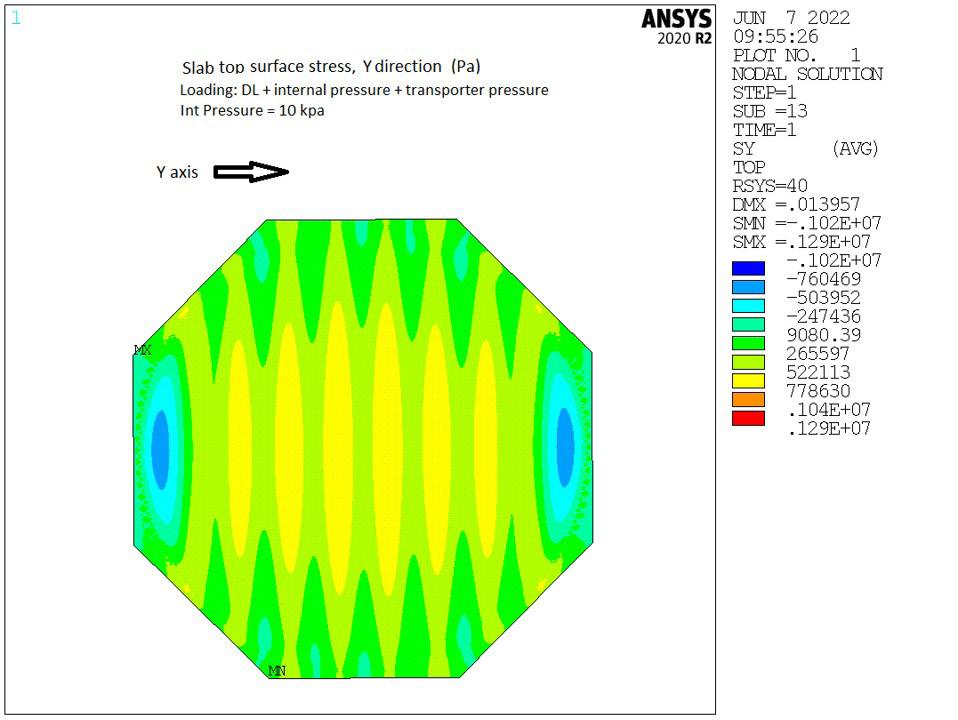

Roads narrower than the tank footprint may present a significant transportation challenge. CB&I addressed this issue by developing a proprietary (patent pending) method of transporting the modular tank under pressurised conditions, generating internal pressure in the tank module using dry air. Shell uplift due to internal pressure relieves loads on the overhanging portion. At the same time, pressure adds more load to the inside SPMTs and allows distribution of the module weight more evenly among all transporters. The base

slab deformations, loads on transporters, and stresses in the base slab are all within the acceptable limits, as shown in Figure 3. Also, the steel tank superstructure is not distorted or buckled.

It should be noted that while there are no physical limits on the modular tank size, both ground transportation restrictions and marine vessel availability make tank capacities up to 60 000 m3 with diameters smaller than 45 – 50 m the most viable configurations for modular execution.

Larger modules will require extra wide roads for ground transportation, large marine loading/unloading facilities, and extra wide deck vessels, which, while they exist, are of very limited availability and higher freight costs. On the other hand, a significant number of vessels are available with a deck width up to 50 m and sufficient length to transport up to three tank modules. Transportation of multiple tank units on a single vessel minimises the number of sea voyages and reduces overall transportation cost.

A marine transportation study should select the most optimal shipping route considering the time of the year, weather patterns, shelter ports, etc. The study should determine maximum horizontal, vertical, and angular accelerations

that can be applied to the shipped module during its sea voyage. The modular unit, along with its restraints on the ship deck, should be designed to accommodate the expected loads. Similar to ground transportation, marine transportation may have an impact on the size and geometry of the tank module. The factors affecting configuration of the module are the shipping loads and availability and freight cost of the appropriate size vessel.

The tank module should be designed for accelerations applied during maritime transportation. As the vessel has all six degrees of freedom, all credible load combinations due to ship motions should be considered. Also, the location of the module on the ship deck in relation to the ship’s centre of gravity and rotation datum needs to be accounted for in the design of both the module and the module-to-deck restraints, since additional eccentricity loads are to be applied to the modules located closer to the bow or the aft of the vessel. Figure 4 shows an example of marine transportation of multiple modules.

Also, it is beneficial to keep the modules under low pressurisation with dry air to minimise the possibility of moisture ingress during the sea voyage. Appropriate pressure controls and pressure/vacuum-relieving devices should be included.

Cost reduction due to the use of mid scale modular tanks can be realised based on the following factors:

z Construction in a controlled environment in low-labour cost locations.

z Year-round construction with mitigated weather-related interruptions.

z Repetitive processes for multiple tanks utilising benefits of the established facility.

Overall project schedule reduction can be achieved based on the following:

z Site preparation and foundation construction are no longer on the critical path – tank construction can start in the fabrication facility even before the site earth work has begun.

z Reduction in dependency on weather-related interruptions and site conditions.

z Repetitive nature of work in the off-site fabrication facility.

z Minimising the amount of field work.

In order to evaluate the benefits of mid scale modular tanks when compared to traditional field-erected execution in challenging areas, a cost and schedule evaluation was performed on six modular full containment LNG tanks of 37 500 m3 fabricated in southeast Asia and delivered to a site located on the west coast of North America. This was then compared against a single field-erected 225 000 m3 full containment LNG tank, having a concrete secondary container constructed at the same site. The comparison showed more than 30% reduction in cost and approximately one year reduction in schedule.

The comparison of four 32 500 m3 modular tanks fabricated in southeast Asia and shipped to a site in Australia against two 65 000 m3 full containment field-erected tanks at the same site, having both primary and secondary liquid containers made from steel, showed approximately 10% reduction in cost and two months reduction in schedule.

The company’s project delivery model ensures high-quality and cost-effective solutions for projects. Many customers draw on the company’s deep knowledge and extensive LNG experience early in a project’s development, allowing CB&I to provide input, recommendations, and project-specific solutions that enhance the long-term value of the facility. The company’s integrated EPC resources enable CB&I to self-perform all aspects of the project, from conceptual design to tank commissioning.

Modular tanks are most beneficial for projects in remote locations or harsh climate areas or in regions with high labour costs, especially when multiple identical tanks are required.

In making the decision on the use of modular tank technology, both ground and marine transportation studies are very important to ensure that the modules can be safely and economically delivered to their destination.

For marine transport, the availability of suitable vessels that can accommodate the size, weight, and quantity of modular tanks is crucial. Freight costs, which can fluctuate significantly, also need careful evaluation. Ground transportation requires meticulous route planning to comply with road restrictions, including height and width. Both ports and inland transportation networks need to have the capacity to handle the movement of these modular tanks.

The use of brittle materials should be avoided. Vibration sensitive material should not be included in the transported tank modules.

Finally, field activities should be limited to vibration-sensitive tasks, such as installing tank perlite insulation material, conducting the tank hydrotest to verify the adequacy of the foundation and soil, and performing commissioning activities, including tank purge and cooldown.

Premium workforce acommodations for the most challenging locations.

Bridgemans is the driving force behind your most ambitious marine projects. With deep industry experience and a hands-on approach, we provide a fully integrated system with three divisions: Bridgemans Floatels, Marine Services and Marine Construction.

With relentless attention to detail, Bridgemans Floatels are elevated in every aspect, customized to client specifications and held to the standards of a premium hotel. To expand our ability to deliver in even the most remote and challenging environments, our Marine Services and Marine Construction divisions provide marine transportation as well as construct docks, berths, breakwaters, and more. Bridgemans brings precision and an unwavering commitment to every project - Turning your ambition into real-world results.

With 30–40 + years of demonstrated service life, TRYMER ® PIR is the insulation solution relied on for long-term performance in cryogenic environments.

Learn more about how Trymer compares in LNG applications.

*Inquire with JM for project references.

In the first part of a two-part article, Andreas Knoepfler, Director Product Management, Wieland-Werke AG (Business Unit Thermal Solutions), and Dr Lotfi Redjem Saad, Head of Heat Transfer Department, Technip Energies, describe the use of enhanced heat transfer technologies for LNG pre-cooling heat exchangers.

Global natural gas liquefaction capacity reached about 495 million tpy in 2024.1

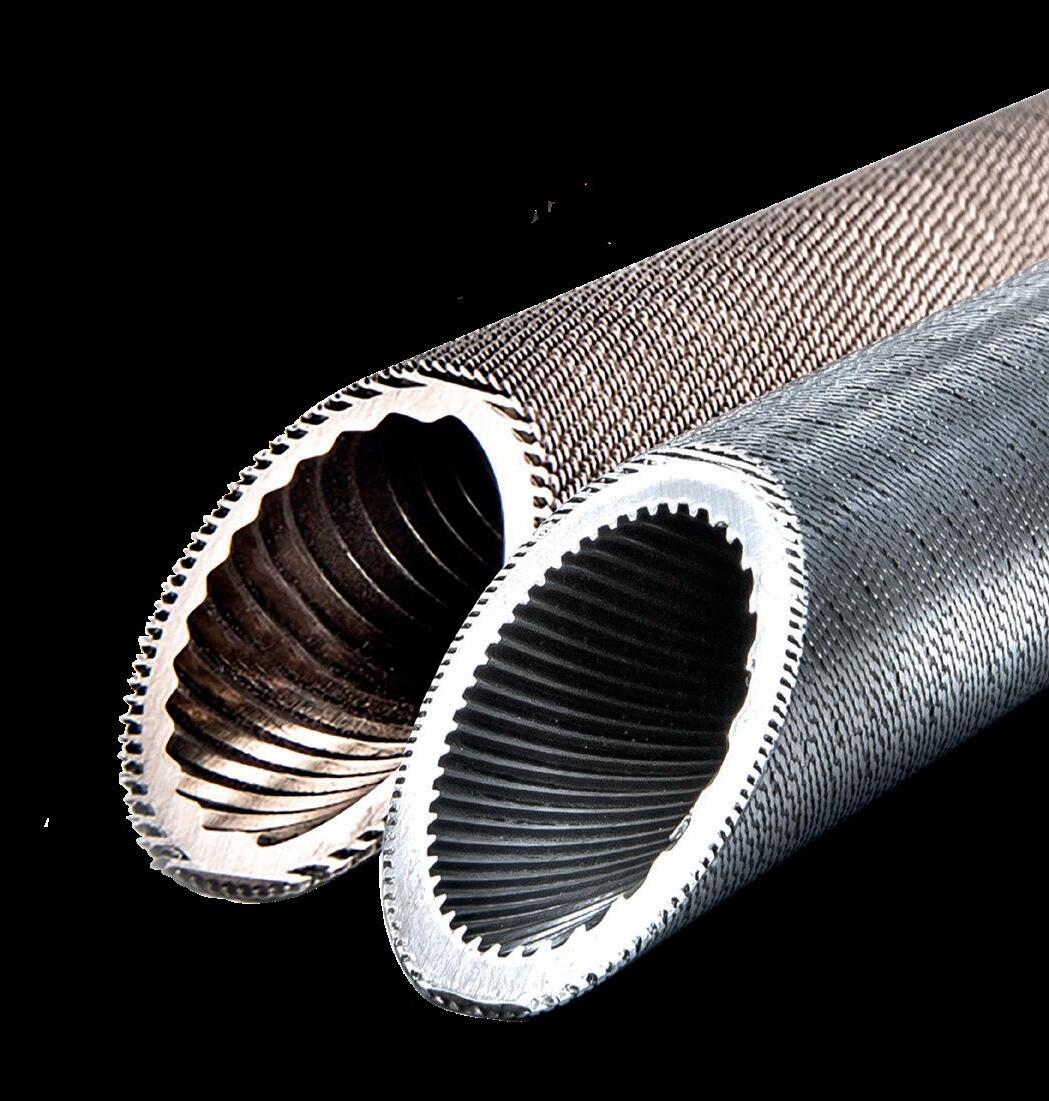

Since the first greenfield deployment of GEWA-PB (process boiling) technology for Qatargas debottlenecking in 2003, the authors’ dual enhanced tubes have gone on to equip the pre-cooling heat exchangers of more

than about 185 million tpy of LNG capacity in operation or under construction, demonstrating the highest level of reliability and outstanding performances. All applications to date have been on Honeywell’s (formerly Air Products) propane pre-cooled MR processes. In preparation of a world which suddenly became thirsty for LNG,

existing and new facilities are looking for any opportunity to push further efficiency, offering highest production rates at lowest power consumption while decreasing carbon footprint and achieving attractive investment decisions (CAPEX).

To reach this level of expertise, Wieland Thermal Solutions and Technip Energies (T.EN) have engaged in a state-of-the-art development programme that includes scientific work and dedicated product development, highly accurate test equipment with specifically adapted procedures in combination with feedback from existing operations in the field of LNG, and other industrial size facilities, such as ethylene plants.

Part one of this article will describe the test equipment used, and achievements made in developing dual enhanced tubes with its enhanced heat transfer surfaces, which are in the meantime widely used in the liquefaction process of LNG plants.

Part two will focus on heat exchanger design aspects and the enormous potential of optimising heat transfer equipment, reducing greenhouse gas emissions (GHG) and demonstrating the advantageous impact on LNG production capacity and beneficial operations efficiency by minimising the approach temperatures in the associated heat exchangers.

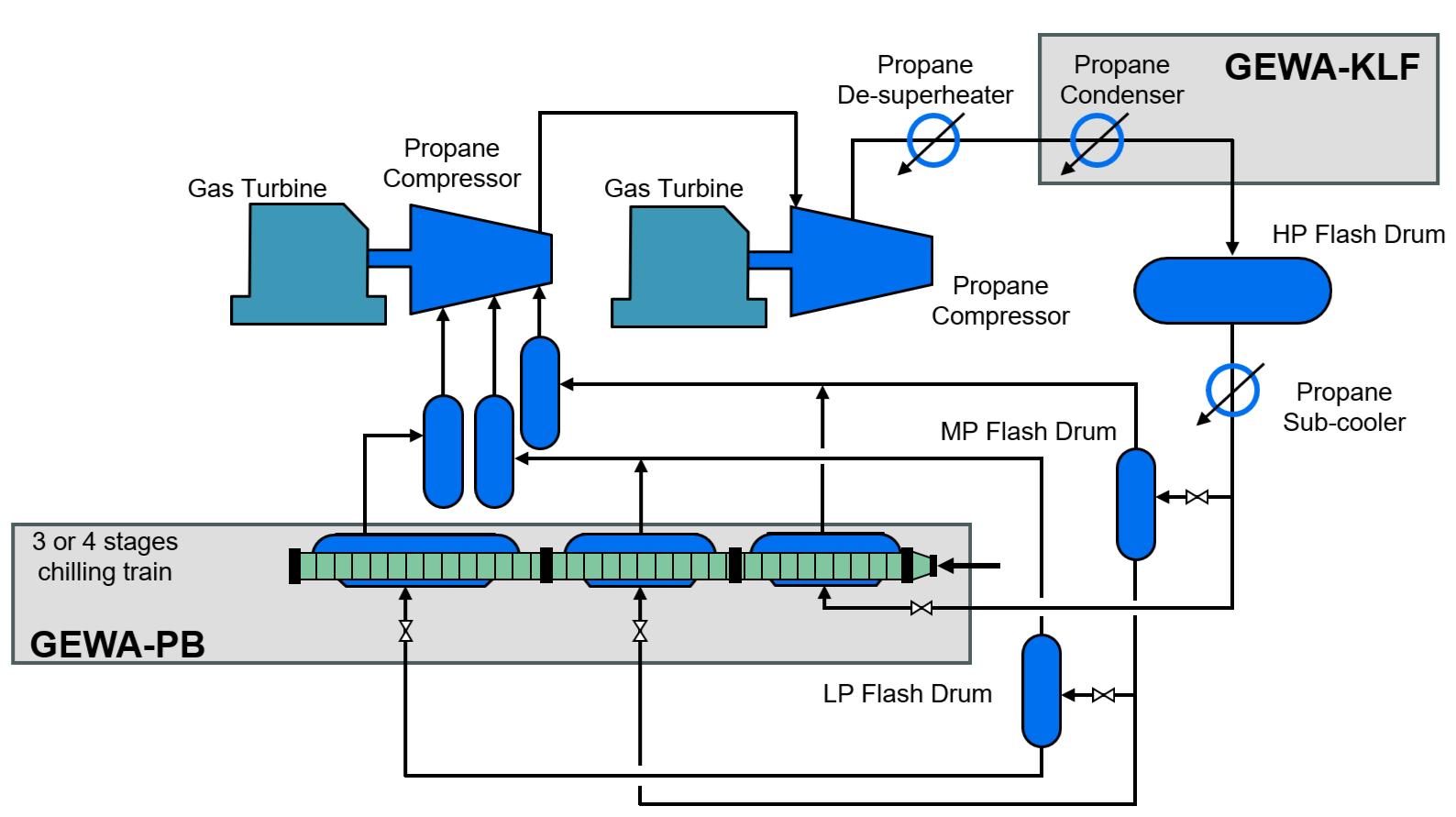

The C3/MRTM liquefaction process (Figure 1) from Honeywell combines a pre-cooling section using propane (C3) as refrigerant followed by a mixed refrigerant (MR) for liquefaction. The pre-cooling cycle ensures natural gas cooling down to approximately -35˚C while liquefaction operates from -35˚C down to -160˚C. The pre-cooling cycle represents about 30 – 35% of the total refrigerant compressor shaft power

and any kind of increase in efficiency would be of interest.2 One major portion of this pre-cooling equipment are large propane evaporators (often referred to as chilling trains), removing heat from the natural gas and from the condensing MR, which will be used in the liquefaction part. Typically, a chilling train is composed of three or four kettle type heat exchangers installed in series. This equipment can be very large and heavy. Every action to achieve a more compact or more efficient process will be beneficial for all actors: to the manufacturer by proposing a lighter heat exchanger with a reduced need of steel reducing the equipment carbon footprint; to the EPC company by delivering a more compact heat exchanger reducing all surrounding weight (piping, concrete, steel structure, etc.), resulting in cheaper transport and installation and lower overall carbon dioxide (CO2) emissions; and finally, to the operator by proposing a more economic and efficient process scheme, i.e. a lower carbon footprint per tonne of LNG.

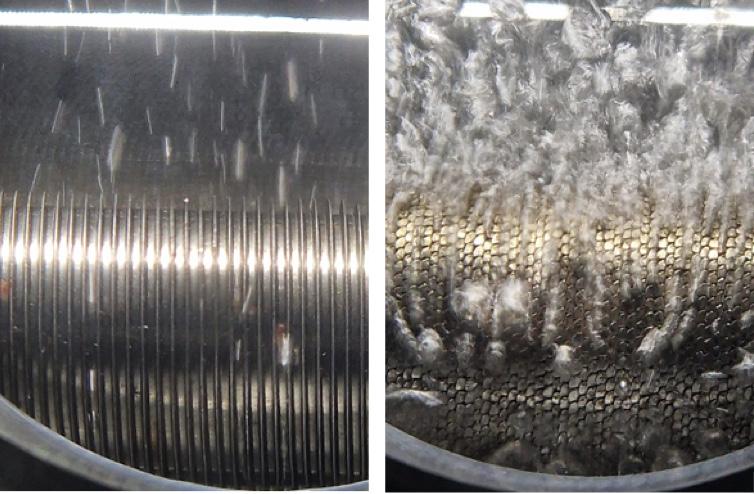

The application of optimised heat exchanger technology, using dual enhanced nucleate boiling tubes GEWA-PB (Figure 2) by T.EN and Wieland, has proven successful since the first installation in 2003. Once Qatar North Field East (NFE) and North Field South (NFS) and other ongoing new installations move to operation, the global LNG capacity will be more than about 185 million tpy of natural gas that will be pre-cooled as a result of this technology.

In collaboration with T.EN, a unique test bench has been designed, built, and commissioned at Wieland Thermal Solutions in Germany to carry out shell side heat transfer measurements with hydrocarbons, called ‘KoMeT-1’ (Figure 3). This hydrocarbon evaporation and condensation test facility is used for pool boiling measurements at very low heat fluxes, particularly tuned to the operating range of C3/MR pre-cooling conditions. Since it is not easy to receive feedback from the field, this equipment allows for an additional source of information.

The purpose of carrying out boiling tests and collecting measurement data with hydrocarbons is:

z To describe fundamental heat transfer characteristics of enhanced nucleate boiling surfaces.

z To incorporate know-how in specific heat transfer correlations.

z To benefit from the use of heat transfer correlations in the design of heat exchangers for LNG pre-cooling heat exchangers.

By designing and building a unique test equipment like ‘KoMeT-1’, several challenges had to be met. First, the safety requirements of handling explosive fluids in a factory environment had to be considered in the test rig design, building, and construction, and in all test procedures. Second, with the highly enhanced surfaces and the corresponding high heat transfer coefficients, measurement accuracy became more challenging than ever. In this case, electrical heating was evaluated, installed,

We are pioneers, engineering and delivering transformative LNG solutions worldwide. Through cutting-edge technologies and unmatched project execution, we enable clients to decarbonize the entire gas value chain — from field to power generation. Our electrification and CO₂ reduction innovations drive the energy transition forward.

www.ten.com

and used, which has been proven to be a reliable and practical way of heating.

To comply with actual operating conditions in LNG and ethylene production, KoMeT-1 has been setup to handle the test range as displayed in Table 1.

Fluids available

Pure fluids (C2 to C5) and mixtures with two of these components

Temperature range -30˚C < T < 70˚C

Operating pressure

Maximum of 50 bar

Based on many years of experience with pressurised test facilities using synthetic refrigerants, the new challenge was to deal with flammable and potentially explosive atmospheres. For that reason, the test concept has been designed to a fluid volume of less than 500 g of hydrocarbons. The entire test facility is positioned in a dedicated room with additional precautions, e.g. an encapsulated ‘bell’, which covers the test chamber and is working under vacuum conditions. Additional equipment is in accordance with the European Directive to work with equipment for potentially explosive atmospheres (ATEX). If there is an issue with any kind of leakage or the system pressure is too high, the safety procedures will immediately release an acoustic alarm, and an emergency programme will be initiated. Amongst other aspects, this includes a controlled release of the test fluid and purging with nitrogen before opening the test chamber. The equipment and test procedures have been certified by an independent third party, TÜV Süd in Germany.

To achieve accurate test data, it was mandatory to work on a dedicated procedure for preparing test specimen and to ensure repeatability regarding all operating conditions, particularly when measurements at low wall to saturation temperature differences are conducted. To support this, measurements have been fully automated and the data acquisition and software has been tailored to the necessary requirements. Thus, the following parameters are safely collected for boiling tests:

z Wall temperature (PT-100) in several locations.

z Liquid and gas phase bulk temperature (PT-100).

z Pressure in gas phase.

z Electric power to calculate heat flux.

The following paragraph will briefly describe propane shell side boiling characteristics of plain and enhanced surfaces.

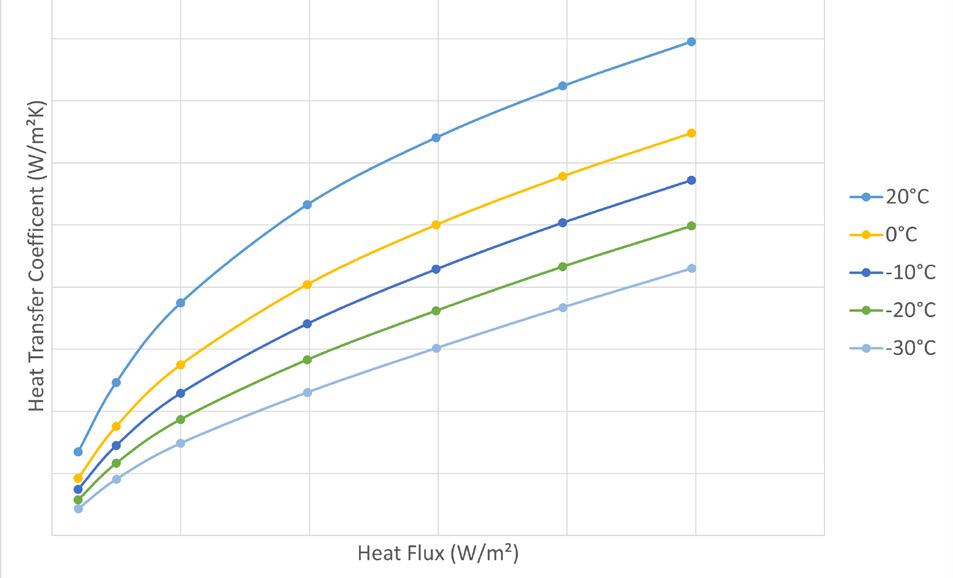

Initial measurements have been carried out with plain tubes and results have been thoroughly reviewed and compared with literature, confirming proper functioning of KoMeT-1 test facility. An important lesson has been that experimental data and available correlations from literature vary significantly. One main reason for this is the tube surface roughness, which depends on the material and on the manufacturing process. The heat transfer performance measured for plain tubes met expectations and it has been proven that the shell side pool boiling heat transfer coefficient (ho) vs heat flux is dependent of the saturation temperature – test results are shown in Figure 4. It has been confirmed that ‘ho’ increases steadily with increasing heat flux. When the saturation temperature is increasing, the curve shifts to higher levels. This behaviour agrees with experimental data and correlations from literature.

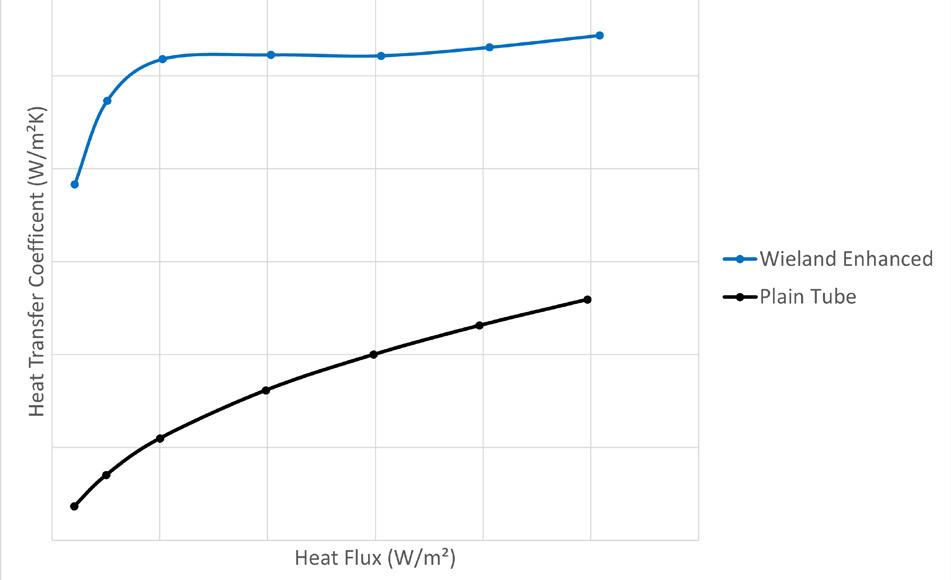

Figure 5 compares propane pool boiling heat transfer coefficient of a carbon steel plain tube to a carbon steel dual enhanced nucleate boiling tube (GEWA-PB) at the same test conditions. With specific enhancements for boiling, the shell side heat transfer can be substantially increased. One key advantage

of Wieland enhanced surfaces is the specific improvement of the boiling heat transfer coefficient at low heat fluxes

(respectively wall superheat temperatures). This is very important for the design of most compact and efficient refrigerant chillers and reboilers.