April 2025

with

We’re powering carbon-neutral shipping

April 2025

with

We’re powering carbon-neutral shipping

Global shipping is advancing towards a sustainable future. And we’re developing new engines to run on climate-neutral fuels. We already offer fuel-flexible engines that can operate on green methanol, green hydrogen, and synthetic natural gas. Our world-first methanol dual-fuel engine will be followed in 2024 by the first green ammonia engine. Working together with the marine industry, we can move big ships with zero carbon emissions. www.man-es.com

ISSN 1747-1826

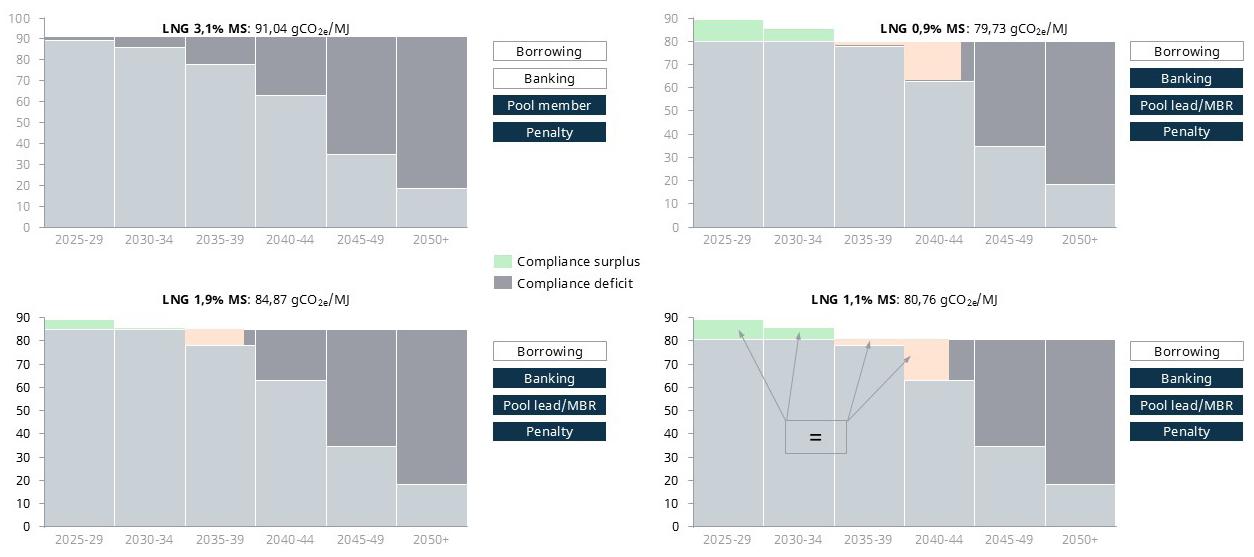

Albrecht Grell, Managing Director, OceanScore, assesses how current EU regulations can produce tangible commercial benefits for shipping companies bunkering LNG.

Sam Reynolds, LNG/Gas Research Lead, Institute for Energy Economics and Financial Analysis (IEEFA), Asia, examines the competitive landscape for China’s LNG market and evaluates LNG’s future in the region.

20 Tanks: Thinking globally to build locally

Neville Stokes, Global Chief Tank Engineer, and Robert Hurd, Performance Manager, Bechtel Energy, explore the benefits and challenges of constructing LNG tanks set for global distribution in house.

25 Seismic resilience

Yogesh Meher, Vice President Global Engineering, and Alex Cooperman, Senior Principal Plate Structural Engineer, CB&I, consider effective measures for seismic safety in LNG tank projects.

29 Software solutions: The optimisation essentials

Noelle Garza, Chemstations, a Datacor company, USA, explains how modern process simulators are an invaluable tool for optimising procedures, such as liquefaction, in LNG.

33 New technologies for sustainable and efficient

Davide De Bacco and Luca Davide Inglese, Saipem, Italy, showcase innovative solutions for reducing the power consumption and carbon dioxide emissions of LNG import terminals, to be applied in lieu of (or in parallel with) conventional technologies for LNG vaporisation.

39 Managing methane slip

Figosta Zhou, General Manager of Decarbonisation and Co-Creation for Power Supply, Wärtsilä Marine, outlines how the introduction of carbon pricing in shipping means that fugitive methane comes with an increasing cost.

47

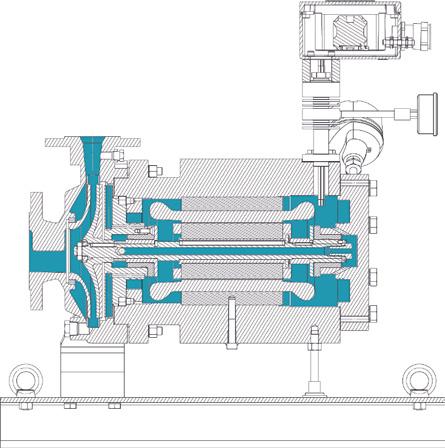

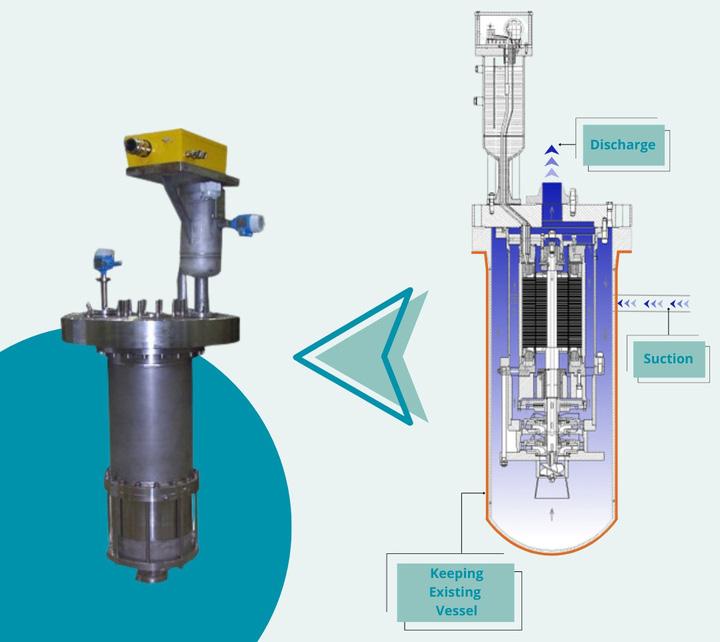

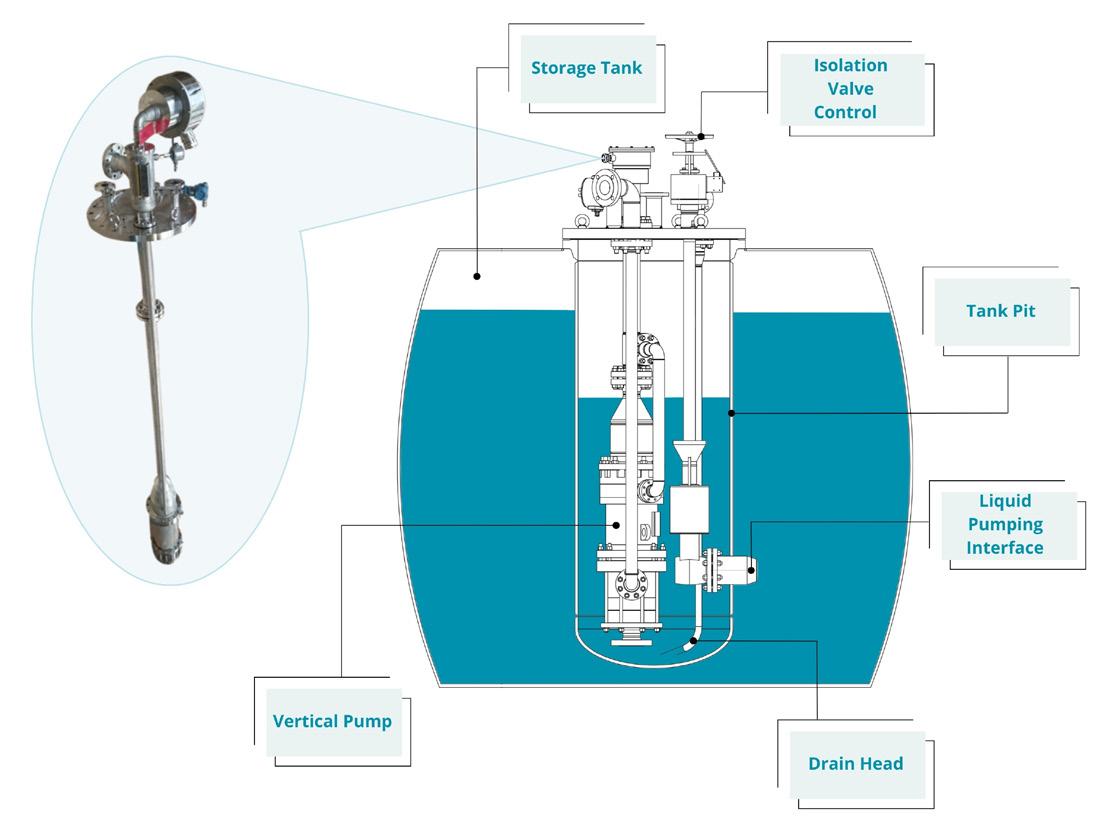

Thomas Damon and Blandine Billet, Optimex Pumps, France, review how crucial cryogenic pumps are to the LNG industry and explore how advanced pump technology and maintenance can benefit production and transportation processes.

51

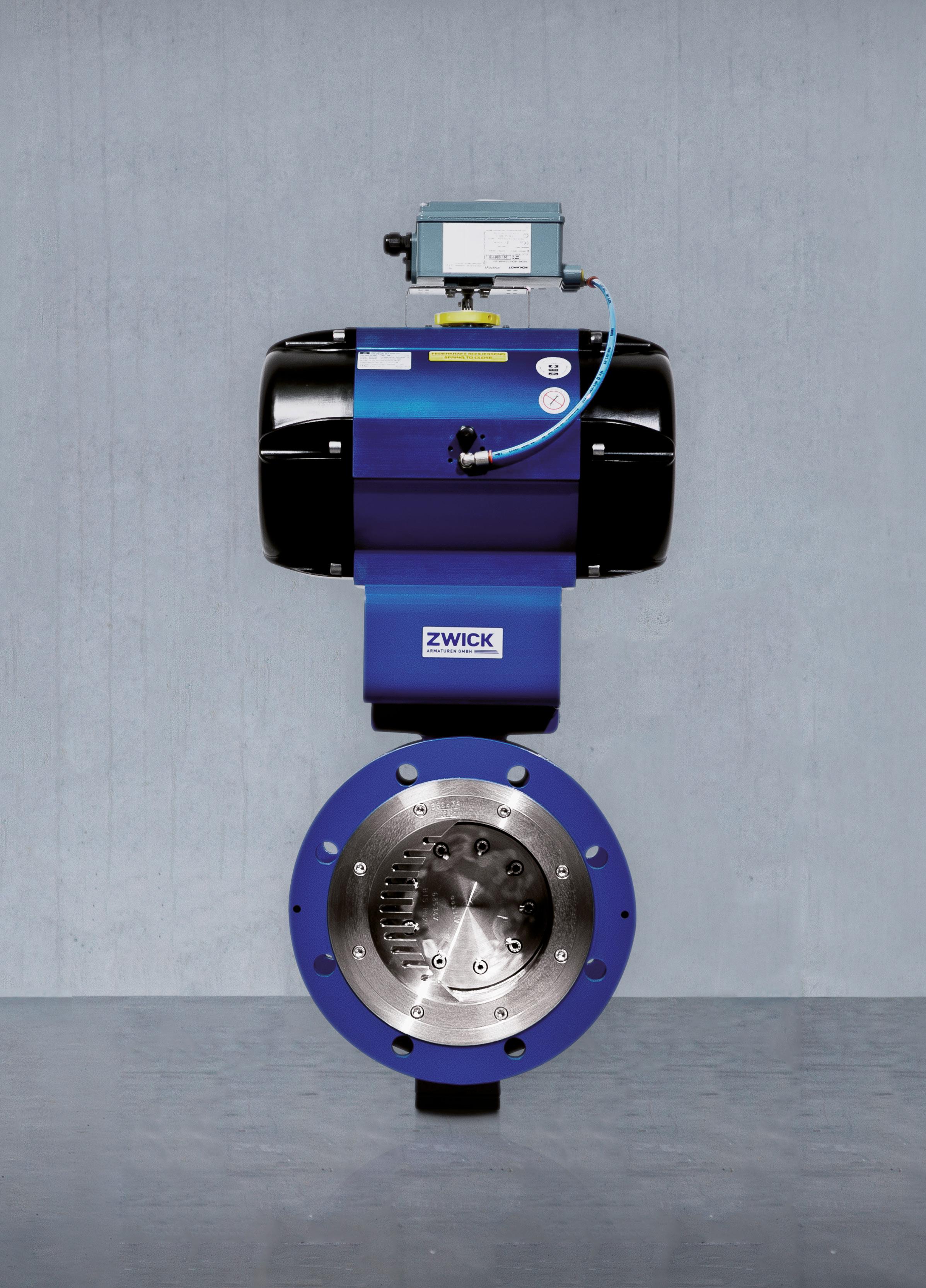

With many LNG plants still using older valve designs, technological advances have helped address issues such as fluctuating temperatures and flow velocities. Fabrizio Delledonne, IMI Process Automation, highlights these innovations and how they are being applied in real-world scenarios.

55

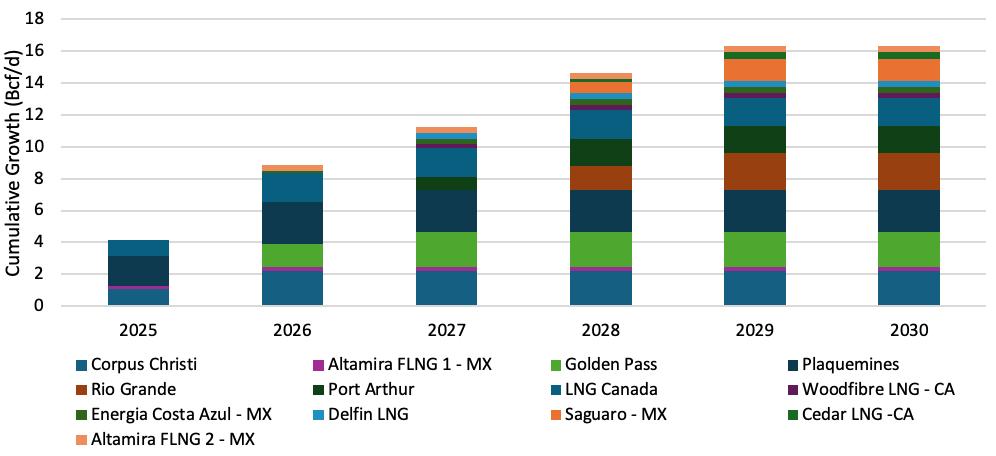

Josephine Mills, Senior Analyst, Enverus Intelligence Research, summarises current market trends in LNG supply and demand, infrastructure growth, and export facilities.

Kristof Adam, W&O, Belgium, details how supplier partnerships drive sustainability when it comes to designing LNG systems and components for LNG vessels.

62

MiQ addresses the importance of methane emissions transparency across the LNG supply chain.

LNG Industry previews a selection of companies ahead of this year’s World Gas Conference in Beijing, China, 19 – 23 May 2025.

Cheniere is the largest producer of LNG in the US and the second-largest LNG operator globally. The company provides secure, flexible, and affordable energy to the world. Its full-service LNG capabilities include gas procurement and transportation, liquefaction, vessel-chartering, and delivery.

Cheniere is a Fortune 500 company headquartered in Houston, with liquefaction facilities in Louisiana and Texas and offices in Beijing, London, Singapore, Tokyo, and Washington, D.C. Cheniere’s LNG has reached over 40 markets in five continents, and demand for its energy is expected to grow as countries seek lower-carbon solutions to power their economies. Learn more: www.cheniere.com

Chart’s LNG power generation solutions provide natural gas to hundreds of thousands of homes. This is one way Chart facilitates LNG as a safe, clean-burning fuel for energy, transportation and industry.

Managing Editor

James Little james.little@palladianpublications.com

Senior Editor Elizabeth Corner elizabeth.corner@palladianpublications.com

Editor Jessica Casey jessica.casey@palladianpublications.com

Editorial Assistant

Abby Butler abby.butler@palladianpublications.com

Sales Director

Rod Hardy rod.hardy@palladianpublications.com

Sales Manager Will Powell will.powell@palladianpublications.com

Production Designer Amy Babington amy.babington@palladianpublications.com

Head of Events

Louise Cameron louise.cameron@palladianpublications.com

Event Coordinator

Chloe Lelliott chloe.lelliott@palladianpublications.com

Digital Events Coordinator

Merili Jurivete merili.jurivete@palladianpublications.com

Digital Content Assistant

Kristian Ilasko kristian.ilasko@palladianpublications.com

Junior Video Assistant

Amélie Meury-Cashman amelie.meury-cashman@palladianpublications.com

Digital Administrator

Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Administration Manager

Laura White laura.white@palladianpublications.com

As the global energy landscape evolves, the role of natural gas and LNG in ensuring a secure, sustainable, and affordable energy future has never been more critical. The 29 th World Gas Conference (WGC2025), taking place in Beijing, China, on 19 – 23 May 2025, will gather the global gas industry’s leading voices to explore how gas can continue to play a key role in the energy transition.

With the theme ‘Energising a Sustainable Future’, WGC2025 will offer a platform for leaders, policymakers, and innovators to discuss developments in natural gas, LNG, zero and low-carbon gases, carbon capture, and decarbonisation strategies. As the industry focuses on delivering energy security while decarbonising, collaboration between the industry, government, investment sector, and regulators will be vital to navigating this complex landscape.

LNG has transformed global energy markets, offering flexibility and a pathway to reducing emissions. Recent market volatility has highlighted LNG’s role in energy resilience.

WGC2025 will bring together key stakeholders to explore pressing questions, including:

z What is the future of Global LNG? Assessing global demand, investment trends, and evolving market dynamics.

z Is it time to develop a unified global LNG trading model? Examining key elements needed for a more integrated and efficient system.

z How can the global LNG shipping industry advance in a low-carbon, efficient, and intelligent direction? Innovations in shipbuilding, transportation, and emissions reduction.

z What are the primary challenges for global LNG terminals? Addressing infrastructure expansion, operational efficiency, and sustainability.

z How will China shape the future of LNG? Analysing its role as a major importer and driver of industry innovation.

As the host country of WGC2025, China’s role in the LNG industry will be a focal point. As the world’s largest LNG importer, China is shaping global market dynamics through its advancements in clean energy technologies, LNG storage, and new trading hubs. WGC2025 will offer a unique opportunity to explore how China’s and, implicitly, Asia’s strategies influence industry trends and developments.

We are delighted to collaborate with LNG Industry in the lead-up to WGC2025 to bring key industry conversations to a broader audience. The conference and exhibition will serve as the premier platform for networking, sharing knowledge, and building partnerships that will drive the industry’s next phase of growth.

As WGC2025 approaches, the conversation about LNG’s role in a sustainable energy future will intensify. I invite you to participate in this crucial dialogue, and let’s shape it together in Beijing. See you at WGC2025!

The operator of the Klaipėda LNG terminal, KN Energies, has now completed 500 ship-to-ship LNG transfer operations at the terminal since the start of operations.

The 500th cargo arrived at the Klaipėda LNG terminal from the US. LNG shipments from the US have been delivered to Klaipėda since August 2017. Since then, Klaipėda has received a total of 78 American LNG cargoes.

Out of the 500 transfer operations, more than 100 were related to Ignitis activities. Symbolically, Ignitis was the client for both the first LNG cargo, which arrived in October 2014, and the 500th cargo delivered to Klaipėda on 15 March 2025.

So far in 2025, 24 LNG transfer operations have been carried out in Klaipėda, with a total of 83 in 2024. Since the terminal's launch in October 2014, approximately 205 TWh of LNG have been transferred. The majority originated from Norway (52%) and the US (37%), but Klaipėda has also received LNG from countries like Nigeria, Trinidad and Tobago, Egypt, Algeria, and others. The terminal serves clients from five countries –Lithuania, Poland, Latvia, Norway, and Estonia.

Elengy is launching a new offer for bio-LNG liquefaction by equivalence – a service for loading bio-LNG into tankers and micro LNG carriers – at its terminals in Fos-sur-Mer and Montoir-de-Bretagne, France.

European Regulation 2022/996, voted in 2022, made it possible to decide on the implementation of liquefaction by equivalence of European LNG terminals. The biomethane injected into the gas network can thus be transformed into bio-LNG by equivalence without volume limitation, thus optimising the existing infrastructure.

In November 2024, Elengy terminals obtained an International Sustainability and Carbon Certification as a ‘liquefaction plant’. As a result of the new European regulation and the obtaining of this certification, Elengy can now convert biomethane proof of sustainability (PoS) transmitted by the customer into bio-LNG standard operating procedures by performing equivalence liquefaction for loading of tankers and small scale LNG carriers.

The PoS, valid throughout Europe, carries information on the sustainability of inputs, processes, and carbon content. Elengy will receive proof of biomethane sustainability with the terminal as its destination, and will provide one or more proofs of bio-LNG sustainability up to the volumes loaded into tanks or micro LNG carriers.

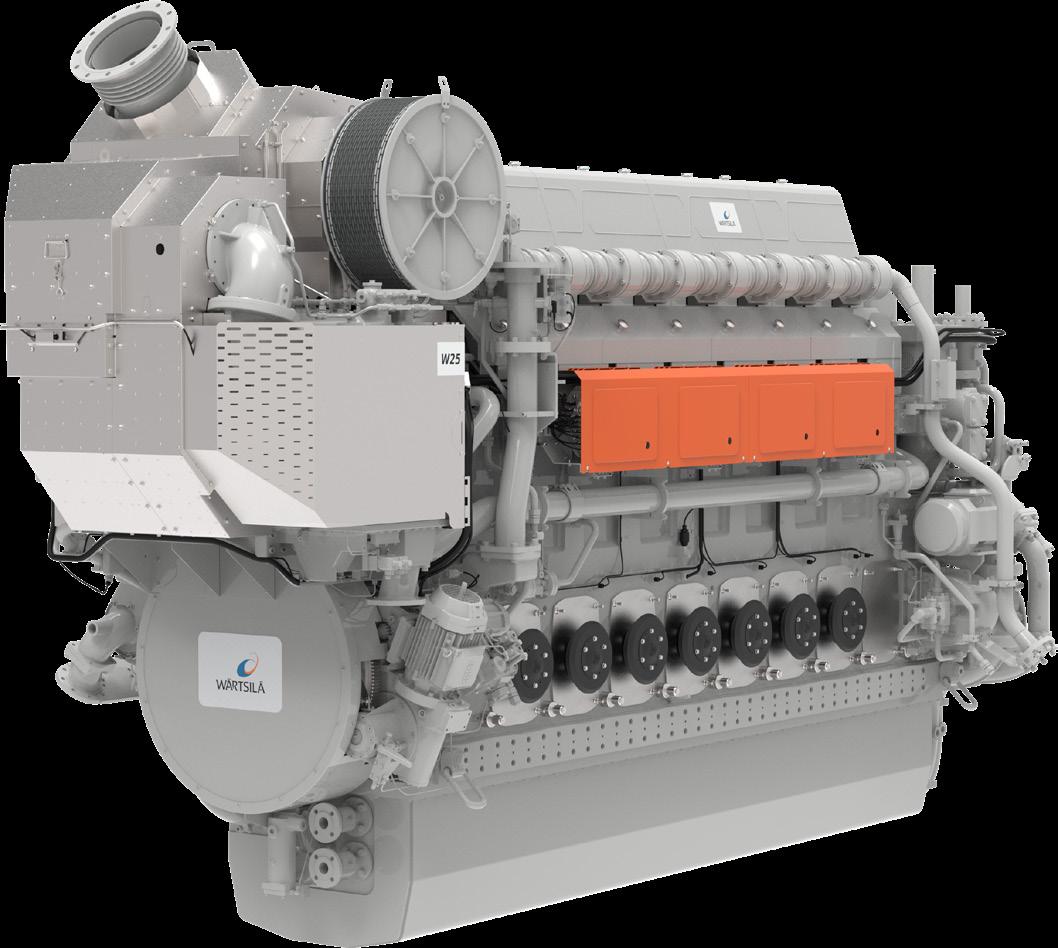

Technology group, Wärtsilä, will supply three Wärtsilä 25DF dual-fuel engines for a new 18 600 m3 capacity LNG bunkering vessel being built for Spanish operator, Ibaizabal. The engines will feature Wärtsilä’s NextDF technology, which reduces methane emissions when operating with LNG fuel. The ship is being built at the Hudong-Zhonghua Shipbuilding yard in China, and the order was booked by Wärtsilä in 4Q24.

The Wärtsilä 25DF engine has already set an industry benchmark for low methane emissions, down to as low as 1.4% at certain load points. The NextDF feature further

reduces methane emissions, achieving as low as 1.1% in a wide load range. What’s more, the nitrogen oxide emissions are lower than on the standard Wärtsilä 25DF engine, which already has low emission levels below IMO Tier III.

In addition to the engines, the scope of supply also includes two Wärtsilä steerable thrusters which will deliver superior hydrodynamic performance for maximum propulsion efficiency and dynamic positioning capability.

The equipment is scheduled for fast-track delivery to the yard, commencing in September 2025. The ship is expected to be delivered before the end of 2026.

Excelerate Energy, Inc. has entered into a definitive agreement with New Fortress Energy Inc. (NFE) under which Excelerate will acquire NFE’s business in Jamaica for US$1.055 billion in cash.

Under the terms of the agreement, Excelerate will acquire the assets and operations of the Montego Bay LNG terminal, the Old Harbour LNG terminal, and the Clarendon combined heat and power co-generation plant. Excelerate expects to assume all material contracts currently in place.

The transaction was unanimously approved by the Excelerate and NFE Boards of Directors and is expected to close as early as 2Q25, subject to regulatory approvals and the satisfaction of other customary closing conditions.

Jonathan Wilkinson, Minister of Energy and Natural Resources, on behalf of Anita Anand, Minister of Innovation, Science, and Industry, has announced a contribution agreement under the Strategic Innovation Fund (SIF) of up to US$200 million for the Cedar LNG project.

Cedar LNG welcomes the government of Canada’s support, which is a key component to advancing an innovative and sustainable project that will result in one of the lowest emitting LNG facilities in the world.

Cedar LNG made a positive final investment decision (FID) in June 2024, making Canada’s first Indigenous majority-owned LNG facility a reality.

Since FID, marine terminal and pipeline right-of-way clearing was initiated and is near completion. Marine terminal and pipeline construction is anticipated to commence in 2Q25, with peak construction expected in 2026. The development of the innovative floating LNG is underway in Korea.

The project’s anticipated in-service date is expected in late 2028.

Each of ORLEN’s newly commissioned LNG tankers can deliver enough gas to power up to 2 million Polish households. A naming ceremony for the two new LNG carriers, purpose-built for the ORLEN Group, was held at the Hyundai Samho Heavy Industries shipyard in Mokpo, South Korea. The vessels were christened Józef Pilsudski and Ignacy Jan Paderewski by their godmothers, Anita Wlodarczyk and Natalia Partyka, who are decorated Polish athletes.

The vessels are named after two key figures in Poland’s fight for independence: Józef Pilsudski and Ignacy Jan Paderewski. Both ships represent the most advanced LNG carriers of their kind globally and were constructed by Hyundai Heavy Industries, one of the leading companies in the global shipbuilding industry.

The vessels are chartered for a period of 10 years, with an option to extend. Each can carry approximately 70 000 t of LNG – equivalent to around 100 million m3 of natural gas in its gaseous state, or roughly the weekly consumption of all Polish households. Their size and specification allow for loading and unloading at nearly all LNG terminals worldwide.

X Glenfarne becomes lead developer for Alaska LNG project

X Shell acquires Pavilion Energy

X Sempra to sell minority stake in Sempra Infrastructure

X Viva Energy seeks expressions of interest for FSRU supply

19 – 23 May 2025

29th World Gas Conference (WGC2025)

Beijing, China

www.wgc2025.com

09 – 11 June 2025

ILTA 2025 Conference & Trade Show

Texas, USA

https://ilta2025.ilta.org

10 – 11 June 2025

Gas, LNG & The Future of Energy 2025

London, UK

www.woodmac.com/events/ gas-lng-future-energy

10 – 12 June 2025

Global Energy Show

Canada 2025

Alberta, Canada

www.globalenergyshow.com

09 – 12 September 2025

Gastech Exhibition & Conference

Milan, Italy

www.gastechevent.com

16 – 18 September 2025

Turbomachinery and Pump Symposia 2025

Texas, USA

https://tps.tamu.edu

SEFE Securing Energy for Europe and Delfin Midstream Inc. have signed a heads of agreement for the long-term supply of 1.5 million tpy of LNG for at least 15 years.

The LNG will be sourced from floating LNG (FLNG) vessels that Delfin is deploying approximately 40 miles offshore near Cameron, Louisiana, on the US Gulf Coast. The free-on-board (FOB) deliveries will commence immediately following the construction and commissioning of the FLNGs, helping SEFE to ensure the security of LNG supplies for its customers.

Cheniere has produced and exported its 4000th cargo of US LNG, loading the Maran Gas Ithaca at the Sabine Pass Liquefaction facility in Louisiana, making it the fastest company to accomplish the feat.

The 4000th cargo has been produced in just over nine years of LNG operations, and has been reached faster than any LNG producer in history, Cheniere exported its first LNG cargo in 2016. Today, Cheniere’s LNG has reached more than 40 markets in five continents and accounts for approximately 50% of US LNG exports.

Noatum Maritime takes delivery of first LNG-powered vessel for United Global Ro-Ro joint venture

Noatum Maritime, part of AD Ports Group’s Maritime & Shipping Cluster, has taken delivery of its first LNG-powered pure car and truck carrier (PCTC) Ro-Ro vessel which will be utilised by the recently formed JV with Erkport, United Global Ro-Ro.

Forming part of Noatum Maritime’s Ro-Ro expansion strategy, the newbuild vessel, named UGR Al Samha, a flagship for the Ro-Ro business, boasts 12 decks covering a total area of 59 331 m2 with a capacity of more than 7000 car equivalent units (CEU).

LNG powered PCTC vessels offer a range of benefits, particularly in relation to addressing environmental concerns and improving operational efficiency, including reduced emissions compared to traditional fuel, cleaner operations due to minimal impact on air quality, and cost efficiencies through fuel economy, performance, and reduced maintenance costs. The use of LNG also aligns with the UAE’s long-term decarbonisation targets and plans to achieve net-zero emissions by 2050 and is a key component of Noatum Maritime’s plans to transition its fleet to alternative fuels.

The vessel will join the existing fleet being operated by United Global Ro-Ro and will be deployed mostly on routes within the Middle East, Asia, and the Mediterranean, with the aim of connecting global hubs and enhancing vehicle logistics and high and heavy cargo transportation in a sustainable manner.

ANorwegian consortium has teamed up to develop a new solution for decarbonising maritime transport by capturing and storing carbon dioxide (CO2) from LNG-fuelled solide oxide fuel cell (SOFC) power trains.

The project is called LNGameChanger and is led by HAV Group, plus Havila Voyages, Molgas Norway, and SINTEF.

The LNGameChanger project’s primary objective is to design an innovative, decarbonised maritime LNG-fuelled power train combining SOFC and high-efficiency onboard CO2 liquefaction and storage. Secondary objectives are to confirm energy efficiency and emission targets for the SOFC power train with CO2 capture in standalone mode. In addition to the required onboard processes, LNGameChanger will also address the infrastructure needs related to decentralised CO2 collection and transport in port. This includes the potential for combining this logistically with LNG distribution.

The Norwegian Research Council has awarded a grant of approximately NOK 5 million over the project’s two-year duration.

Axpo has concluded its first delivery of LNG to MSC in the port of Málaga. It is the first operation carried out via Axpo’s chartered small scale LNG vessel in Spain. There is growing demand for LNG as a cleaner and more cost-effective alternative to the traditional fuels used by the maritime sector.

In Axpo’s first delivery to MSC, roughly 2800 t of LNG has been supplied, using a small scale LNG vessel which allows ship-to-ship fuel transfers (known as bunkering).

Axpo’s new small scale LNG offering in Spain will be facilitated by two vessels – a 7500 m3 and a 12 500 m3 ship – both equipped with cutting-edge technology. In addition to bunkering, Axpo will be able to offer small scale break-bulk deliveries and gas up and cool down services. Whilst commencing operations in the port of Málaga, a well-known destination for commercial maritime traffic, Axpo will also offer its services in other Spanish terminals such as Algeciras, Valencia, and Barcelona.

The delivery marks the first ship-to-ship LNG bunker undertaking for the port of Málaga.

Crowley has raised the US flag on American Energy, commencing operations of the first domestic LNG carrier to transport US-sourced natural gas to Puerto Rico. The milestone will provide Puerto Rico with increased access to the reliable supply of US-produced LNG, helping address the island’s ongoing power demands.

Crowley and Naturgy have entered into a multi-year agreement that provides for the regular delivery of the US mainland-sourced LNG to Naturgy’s operating facility in Penuelas, Puerto Rico.

The Crowley-owned carrier American Energy, which has capacity of 130 400 m3 (34.4 million gal.) per voyage, will operate in accordance with the U.S. Coast Guard Authorization Act of 1996. The vessel has a CAP 1 rating, certifying its top rating for safety and vessel condition, and its compliance with all

regulatory requirements.

The 900-ft-long (274 m) LNG carrier builds on Crowley’s 70+ years commitment to Puerto Rico. The company also operates the full-service marine Isla Grande cargo terminal in San Juan for its container and roll-on/roll-off vessels, including two LNG-fuelled ships, and logistics services. Crowley annually delivers more than 94 million gal. of LNG through its LNG loading terminal in Penuelas, as well as provides ocean delivery and land transportation using ISO tank containers.

At capacity, each delivery of LNG aboard American Energy provides enough energy to power 80 000 homes for a year. LNG is also a lower-carbon fuel emitting less greenhouse gas emissions compared to diesel and other traditional energy sources.

American Energy will be crewed by US mariners and provide regular service from the U.S. Gulf Coast to Puerto Rico.

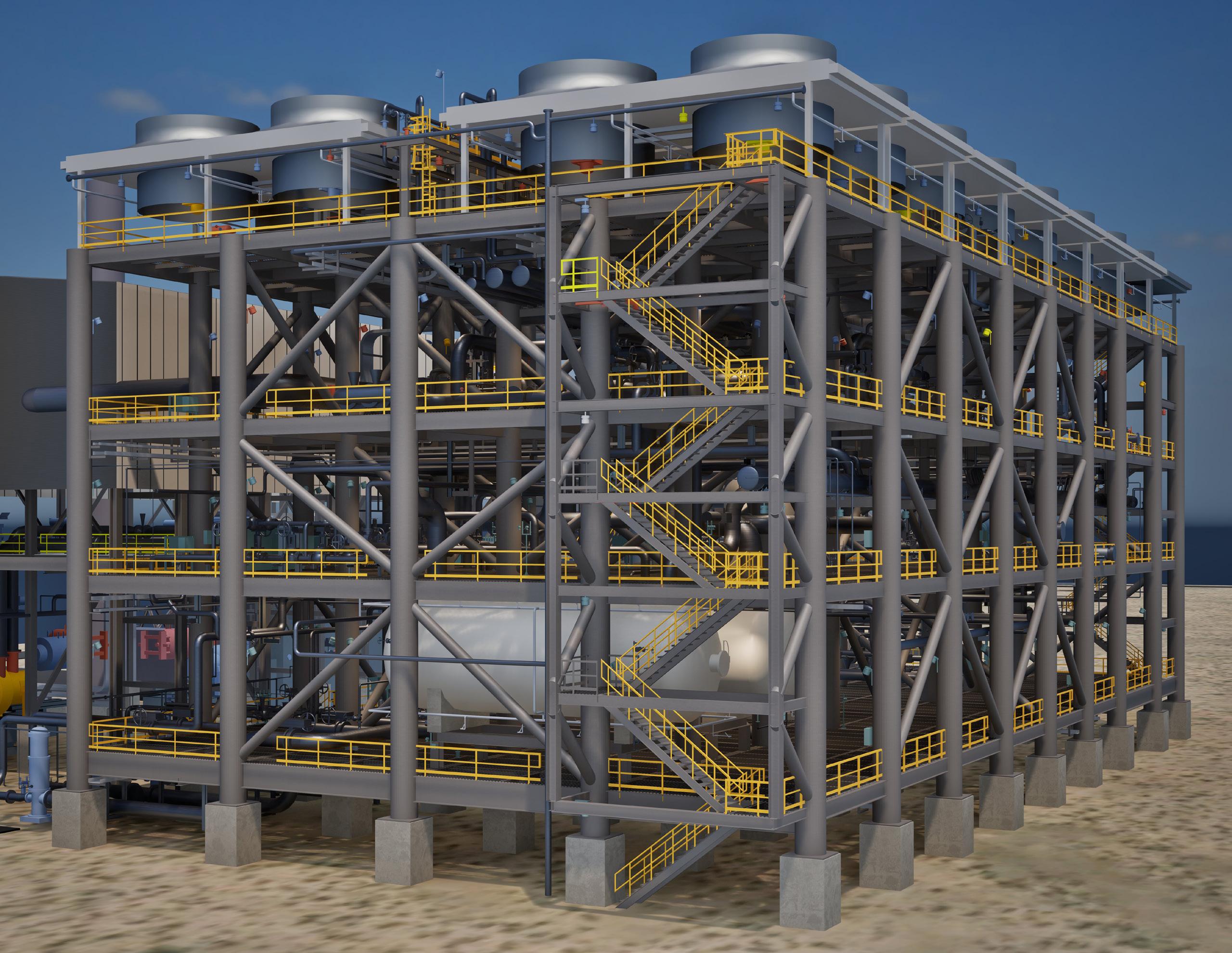

Black & Veatch’s Modular LNG solution produces more LNG in a smaller footprint, bringing improved capital efficiency and an expedited schedule to your project.

Built on the long history of our industry leading PRICO® liquefaction process and our engineering expertise, our modular LNG solution ensures operational certainty to your entire facility from pipeline to tank.

Maintaining a standardized design while integrating motor or turbine drivers, our solution can handle a range of gas compositions and site conditions, bringing the most economical and flexible modular LNG product to the market.

Learn more

Sam Reynolds, LNG/Gas Research Lead, Institute for Energy Economics and Financial Analysis (IEEFA), Asia, examines the competitive landscape for China’s LNG market and evaluates LNG’s future in the region.

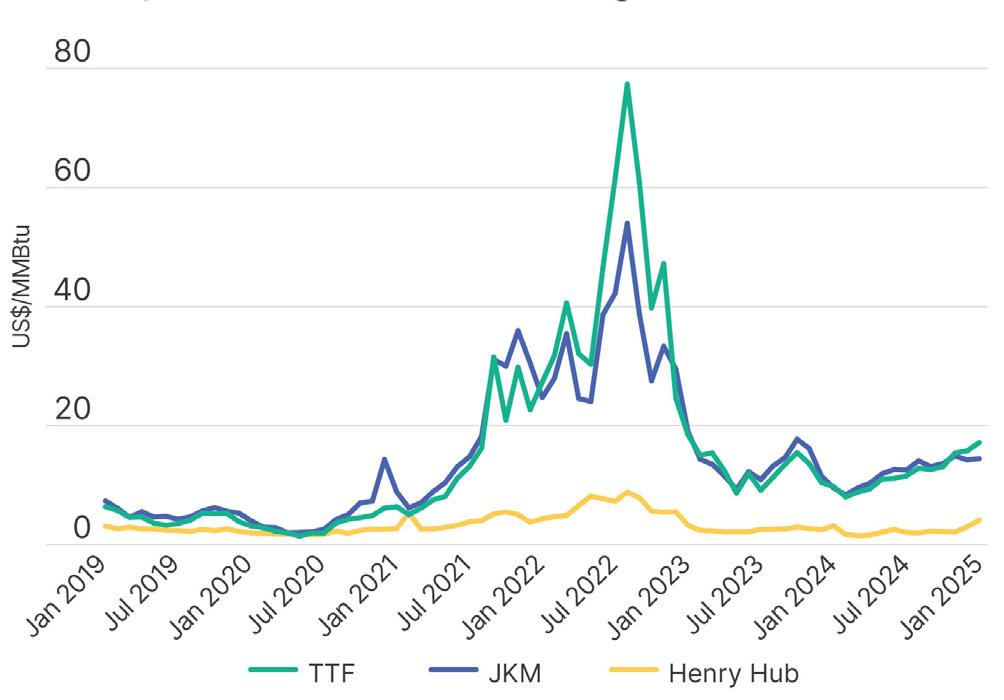

Over the last decade, China has been a shining star in the LNG industry. When markets waned in 2016 due to global oversupply, China jumpstarted LNG purchases to become the world’s largest importer in 2021. Following Russia’s invasion of Ukraine, Chinese companies signed a flurry of LNG deals while European buyers hesitated to commit to long-term contracts.

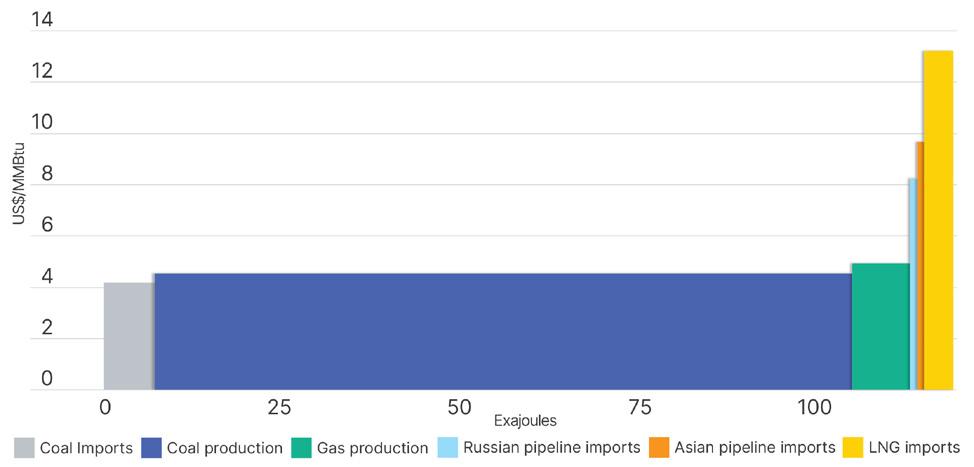

Gas exporters have also touted LNG’s potential to replace coal and reduce emissions in China. A US gas producer recently suggested that since China’s electricity mix is similar to that of Ohio and Pennsylvania in 2005, China might use LNG to pursue a similar coal-to-gas switching model. Certainly, when viewed as a simple substitute for coal, China’s LNG demand appears limitless.

However, the role of LNG can only be understood in relation to its alternatives. LNG faces intense competition from coal, renewables, and other gas sources in terms of both cost and energy security. In the power sector, for example, LNG has yet to make a dent in China’s coal usage due to high costs and the rapid growth of cheaper renewables. As a result, many expect the rate of China’s gas demand growth to slow, curtailing the need for LNG.

Ongoing volatility in global markets and escalating tensions with suppliers, such as the US, have only weakened the case for LNG in China. If the country’s demand stagnates and remains price-responsive, Chinese companies may increasingly look to

resell contracted LNG abroad, exacerbating the global market oversupply set to emerge later this decade.

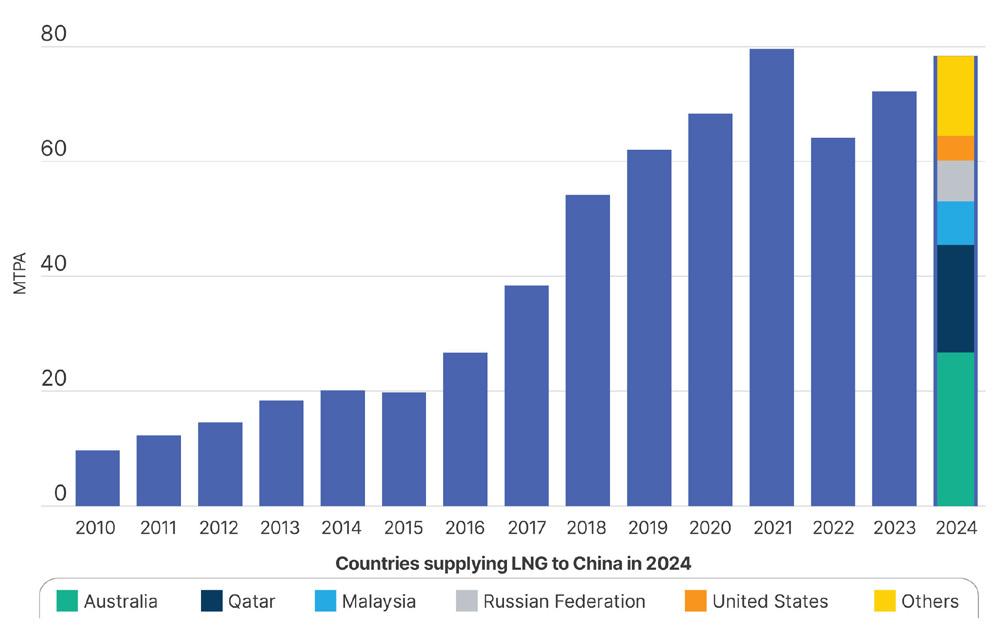

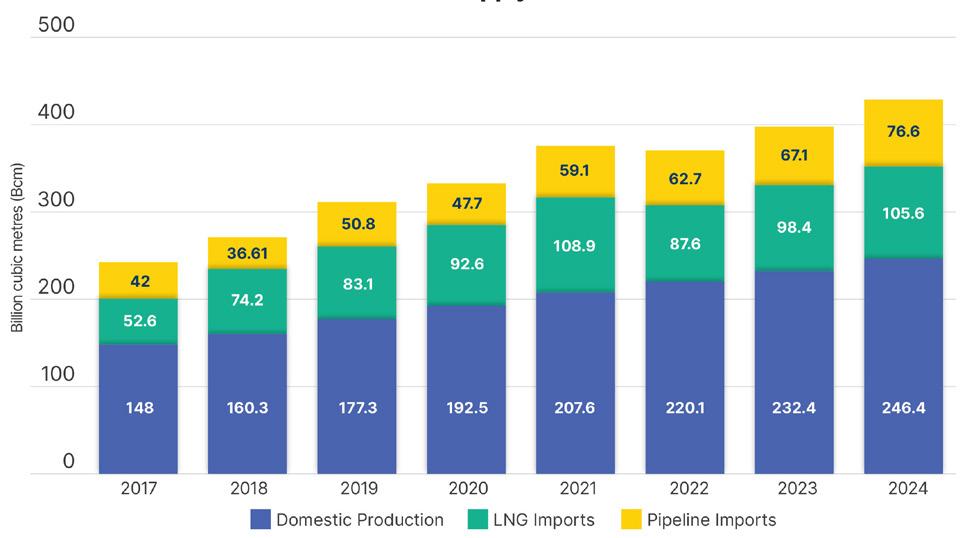

At first glance, China’s LNG market appears to be booming. Imports jumped nearly 9% in 2024 to 106 billion m3 or 78 million t, according to kpler’s data. The country’s supply came from Australia (34%), Qatar (24%), Malaysia (10%), Russia (9%), and the US (6%).

Despite the y/y increase in 2024, China’s LNG imports fell 2% shy of record purchases in 2021 and grew at a slower pace than in 2023. The country’s multi-year demand recovery demonstrates the prolonged consequences of market volatility and geopolitical uncertainty on LNG demand.

Lower imports compared to three years earlier reflect the country’s slower economic growth, COVID-19 lockdowns, and unaffordable LNG prices exacerbated by Russia’s invasion of Ukraine. As prices started to jump in late 2021, Chinese buyers were forced to withdraw from spot markets entirely. In 2022, Chinese LNG demand plummeted 19%.

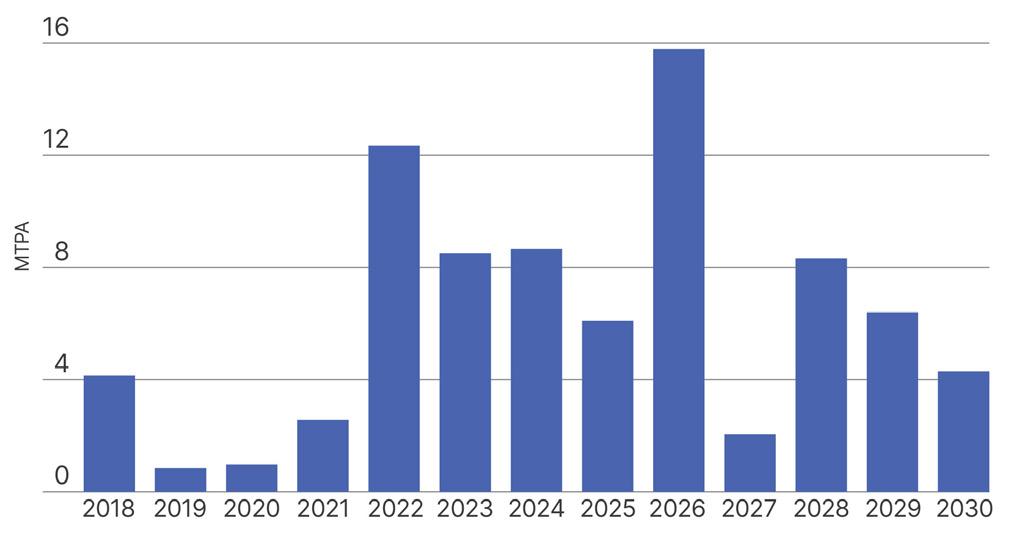

At the same time, Chinese companies dramatically reduced their future spot market exposure by signing long-term contracts. In 2021 and 2022, China signed a combined 44 million t of LNG contracts, four times the volume signed in the two years prior. Most of those contracts were signed with the US, followed by Qatar, and the largest share will begin deliveries in 2026.

China may have sufficient LNG purchase agreements to satisfy LNG demand through to 2030, which means Chinese buyers will likely sign fewer contracts in the future. However, this does not necessarily imply that contracted volumes will land in China. Since the majority are with US suppliers offering flexible destination terms, Chinese companies, many of which are active LNG traders, can resell volumes abroad if fundamentals at home favour other energy resources.

Although new LNG purchase contracts will begin in the coming years, China has met a growing share of its overall natural gas demand from cheaper, more reliable gas sources, namely domestic production and pipeline imports.

Preliminary figures indicate that China’s overall gas consumption increased by 30.7 billion m3, reaching 428 billion m3 in 2024. Since 2017, China’s apparent gas demand (production and imports) has increased at an average rate of 8% annually. The largest share of natural gas is consumed in the industrial and city gas segments — which account for 42% and 33%, respectively — followed by the power and fertilizer sectors.

Domestic gas production contributed to nearly half of China’s incremental demand in 2024. In the last decade, the country has accelerated the development of unconventional and ultra-deep resources, particularly in the Sichuan, Ordos, and Tarim gas basins. China produces 23.8 billion m3/y of shale gas, but is estimated to have 20 trillion m3/y of reserves.

In 2021, President Xi Jinping emphasised the importance of domestic energy self-sufficiency and investment in domestic oil and gas production then spiked 19% the following year. In 2023, the China National Petroleum Corp. began extracting gas from ultra-deep shale formations in the Sichuan Basin, then completed 14 ultra-deep gas wells in Xinjiang’s Tarim Basin to supply an additional 1 billion m3 to eastern provinces.

Higher pipeline imports from Russia and Central Asia also contributed to a large share of incremental demand. In particular, flows through the Power of Siberia-1 pipeline from Russia are set to increase from 22.7 billion m3 in 2023 to the pipeline’s full capacity of 38 billion m3 in 2025. In January 2024, China and Russia began constructing the Far East Pipeline (10 billion m3/y), extending an existing Russian pipeline system to northeastern China by 2027.

Larger projects from Russia and Central Asia have been discussed for years but may not come to fruition until the next decade, if at all. A second Power of Siberia pipeline with Russia could add 50 billion m3 of annual capacity and the

Line D pipeline from Turkmenistan would add 30 billion m3 of annual capacity to China. In both cases, Beijing holds the upper hand in negotiations due to the diversity of its gas supply sources, demanding low prices that remain untenable for counterparties in Russia and Turkmenistan.

Kazakhstan also aims to significantly increase gas exports to China by building an additional pipeline to feed the Central Asia-China network by 2027.

These new pipeline connections and higher domestic output could rein in China’s LNG demand over the long term on cost alone. In 2024, the IEEFA estimated that the average cost of domestically produced gas was roughly US$5/million Btu, compared to US$8 – US$10/million Btu for pipeline imports and over US$13/million Btu for LNG. Competition between Central Asian and Russian suppliers enhances China’s ability to negotiate cheaper pipeline imports.

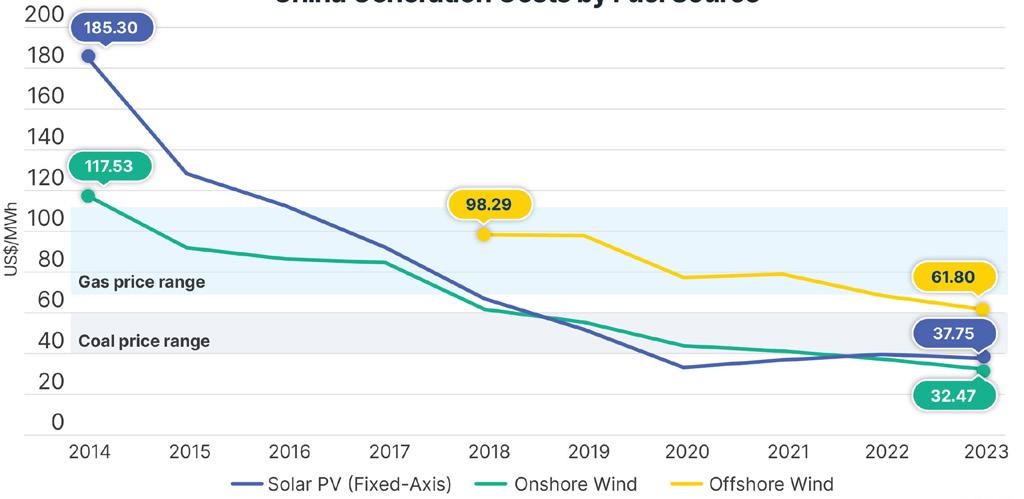

A closer look at China’s power sector shows how less expensive options are squeezing the role of gas. Between 2015 – 2023, the share of gas-fired power generation in the country’s electricity mix remained just 3%, while wind and solar quadrupled to 16%. Wind and solar generation increased by 1250 TWh while gas generation grew by 140 TWh.

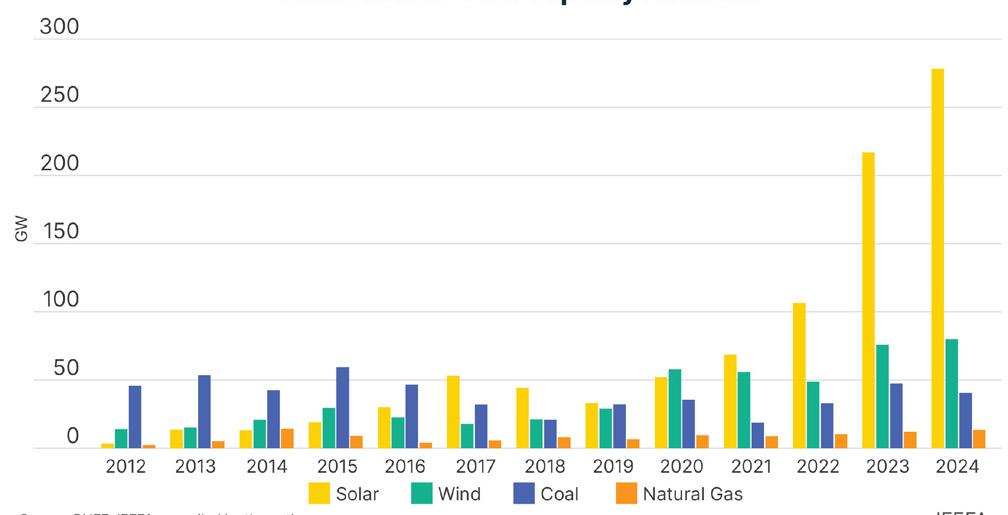

In 2024, China’s renewable energy deployment continued at an unprecedented rate. Solar capacity jumped 277 GW, a 46% increase, alongside nearly 80 GW of new wind projects. Total wind and solar capacity reached 1408 GW, surpassing the country’s 2030 target of 1200 GW, six years ahead of schedule. Solar and onshore wind are the cheapest sources of power in China, ranging from US$30 – US$90/MWh lower than gas generation.

PetroChina’s Global Head of LNG and New Energies, Yaoyu Zhang, believes that the cost of solar and wind falling beneath that of natural gas has “severely hindered the large scale coal-to-gas switch.”

China continues to approve large capacities of coal power, adding 40 GW in 2024. While coal generation is increasing in absolute terms, its market share has steadily declined from 70%

Pipeline recently connected to the West-East network, allowing it to reach full capacity. Delivered 22.7 billion m3 in 2023, with a projected increase to 38 billion m3 in 2025.

25-year sale and purchase contract signed in February 2022, immediately following Russia’s invasion of Ukraine. Construction officially began in January 2024.

Negotiations ongoing mid-2030s Discussions have stalled due to disagreements over pricing and volume commitments.

Central Asia-China Pipline (lines A, B, C) Turkmenistan, Uzbekistan, Kazakhstan 55 Operational 2009

Central Asia-China Pipeline (line D) Turkmenistan 30 Negotiations ongoing 2030s

Sino-Myanmar Pipeline Myanmar 12 Operational 2013

In 2023, China imported 37.8 billion m3 through the pipeline, down from 43.2 billion m3 in 2022.

Construction suspended in 2017. China renewed interest in the project in 2023 – contractual negotiations continue to delay progress.

Underutilised due to upstream challenges in Myanmar, with 2022 deliveries to China at 3.8 billion m3, according to Chinese customs.

With over 55 years of LNG design and operating expertise, ConocoPhillips has licensed the Optimized Cascade Process (OCP®) for 120 MTPA of LNG production capacity around the world.

in 2015 to 61% in 2023 due to the growth of renewables. The average utilisation of China’s coal fleet has fallen 20% since 2005, while government plans position coal as a flexible energy source to support wind and solar integration.

Meanwhile, the push for gas power pales in comparison. Estimates indicate that China added 13.5 GW of gas capacity in 2024. In 2023, the government said it would “strictly control the expansion of projects to replace coal with natural gas.” In 2024, the country’s Natural Gas Utilisation Policy designates gas usage as “restricted” for baseload electricity in 14 coal-producing regions.

Analysts often point to Guangdong province, one of China’s largest gas-consuming regions and industrial powerhouses, to demonstrate LNG growth potential. In 2023, however, gas-fired power generation provided less electricity than coal, imports, and nuclear. Meanwhile, Guangdong recently slashed power tariffs by 16%, likely hurting margins for power producers using costlier LNG. While subsidies are in place for gas plants to bear high fuel costs, a push toward market-based electricity pricing could see large buyers opt for cheaper power.

Moreover, provincial energy plans suggest the share of non-fossil fuels in the energy mix could reach 32% in 2025 (towards a goal of 35%) while prioritising domestic gas production, solar, wind, nuclear, and battery storage.

Given the challenging pathway for LNG growth in China’s power sector, some hope that other sectors, such as industry and transportation, will face better prospects. The industrial sector consumes the largest share of China’s gas, particularly in manufacturing and petrochemical segments. However, industries like iron and steelmaking primarily use coal as a non-combustible feedstock, so switching to gas would require newbuild production capacity.

From 2017 – 2023, there were proposals for 389 million t of new or replacement coal-based blast furnace capacity, compared to just 4.3 million t of non-blast furnace capacity. Even if all 4.3 million t uses gas, coal-to-gas switching in these sectors would remain limited. Much like the power sector, industries may encounter similar cost and energy security incentives favouring coal and renewables.

China’s transportation sector has garnered global attention for its rapid uptake of LNG as a replacement for diesel in heavy-duty trucking. This development is not new, but the LNG truck fleet has nearly tripled in size since 2019. In 1H24, gas and LNG trucks comprised 35% of heavy-duty truck sales compared to 9% for battery electric trucks. LNG trucks consumed roughly 22 million t of LNG in 2024, though some of this came from China’s fleet of domestic liquefaction plants for pipeline or domestic gas, not exclusively from LNG imports.

However, LNG truck sales remain highly susceptible to volatile fuel pricing dynamics. The increase in LNG-fuelled trucks in 1H24 was driven by falling LNG prices relative to diesel. When LNG prices rose in 2H24, LNG vehicle registrations slowed. In 2025, a combination of high LNG prices and falling diesel demand in China could threaten the rapid growth of LNG trucks.

Battery electric truck sales have also risen sharply in China, presenting a longer-term structural risk for LNG and diesel vehicles. Heavy-duty electric and fuel cell vehicle sales increased from roughly 3000 in 2020 to 35 000 in 2023. Amidst rapidly declining global battery prices – Goldman Sachs expects an additional 50% decline by 2026 – some suggest that electric trucks are already cheaper than diesel in certain regions of China. Wood Mackenzie expects the LNG trucking surge to be temporary, with battery-electric technologies evolving as the main long-term diesel displacer.

Lastly, following the achievement of air quality targets, coal-to-gas switching in the building sector is likely to slow in favour of electric systems. For example, Beijing recently prohibited newbuild, independent gas heating systems, prioritising the use of some electric heating systems.

LNG faces serious economic competition from various alternative fuels, but its implications for China’s energy security may be even more important. China has delicate trading relationships with some of the largest global producers of LNG – namely the US and Australia – adding incentives to develop domestic energy resources and trade with nearby allies. The recent US-China trade war reflects these geopolitical realities and may cause Chinese companies to resell US cargoes overseas rather than absorb them at home.

This does not bode well for the global LNG industry. Demand from key regions such as Europe and Northeast Asia is falling, so exporters and traders will compete to secure emerging market buyers amidst a record increase in LNG supply this decade. Ultimately, slower LNG demand in China and more aggressive reselling by Chinese traders may only exacerbate oversupply and margin erosion for LNG investors.

1. REYNOLDS, S., DOLEMAN, C., and PEH, G., ‘LNG is not displacing coal in China’s power mix.’, IEEFA, (25 June 2024), https://ieefa.org/ resources/lng-not-displacing-coal-chinas-power-mix

2. ALAM, S., DOLEMAN, C., et al., ‘Global LNG outlook 2024 – 2028’, IEEFA, (25 April 2024), https://ieefa.org/resources/global-lngoutlook-2024-2028

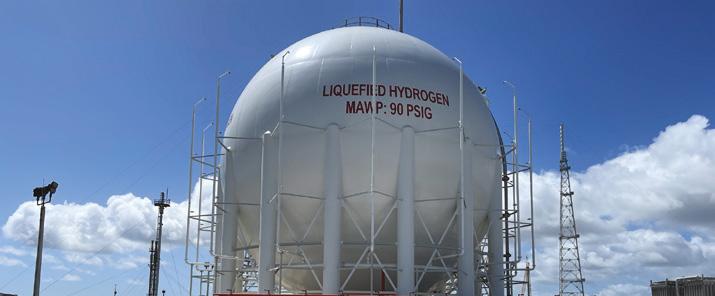

NG has become an integral part of today’s energy landscape while the world continues to seek a more stable supply of energy and aims to reduce carbon emissions on the path to a lower carbon world. Critical to LNG operations, especially for import and export facilities, are its storage tanks, which act as a buffer between the demand and supply of the gas. As these tanks are some of the biggest and most complex storage facilities in the industry, they require a capable team to design and engineer them.

Bechtel has designed and built over one-third of the world’s LNG capacity to date, making up half of the US Gulf Coast’s LNG capacity, and, so far, is the only EPC company that builds its own LNG tanks. Bechtel started its tanks business in 2012 with the decision to self-perform field-erected LNG storage tanks. This fully integrated construction model is used for the company’s projects from the US Gulf Coast to Australia and leverages functions across its business, such as project controls, procurement,

and engineering. Adopting this approach has given Bechtel increased control over the project delivery schedule and costs. It takes approximately 30 – 36 months for the company to self-perform the construction of a full concrete

containment LNG tank, from the start of the base slab to nitrogen purging, ready for cooldown, depending on the size and location of the project. The self-perform scope includes engineering to mechanical completion, commissioning, and cooldown, after which the tank can start operations.

The company typically designs and builds at least two tanks per project site to be able to manage unexpected capacity, shutdowns, and other sudden changes. The capacity and design of an LNG tank is determined by the plot site, LNG production, and the number of LNG trains on site, as well as minimum inventory requirements, costs, and shipping studies of carrier sizes and delivery frequencies.

To date, Bechtel has self-performed the construction of eight cryogenic LNG storage tanks and is in the construction phase of eight more. The tanks have been ranging in size from 46 000 m³ in Canada to 235 000 m³ tanks in Louisiana, which, when completed, will be North America’s largest. The trend is towards bigger tanks. Bechtel is increasingly looking at projects with tanks of more than 200 000 m³. Bigger tanks can lower customers’ costs per stored cubic metre of LNG and reduce their footprint on site.

The EPC of concrete and steel plate structures in their entirety requires technical expertise in concrete structural analysis, a detailed understanding of engineering plate structures, as well as knowledge of American Petroleum Institute (API) codes and field-erection methods to satisfy an overall EPC design.

The tanks are designed to be manufacturable and constructible using existing supply chains and repeatable processes to minimise costs and avoid dependence on one particular supplier or technology.

As regulatory requirements continue to evolve, more safety systems have become necessary for large tank structures. For example, many projects now require a full containment design with a concrete outer structure providing an additional layer of protection. In the unlikely event of an inner tank failure, the outer wall is capable of containing the liquid while retaining vapour tightness.

Bechtel uses high strength 9% nickel steel for its tanks as this type of steel remains ductile at the cryogenic temperatures required for LNG storage. However, with such specific material requirements, challenges do arise. Usually, Bechtel tries to source materials locally for all of its projects. For its LNG tanks, however, as only a limited number of suppliers in Europe and Japan can deliver 9% nickel steel, the company has had to reach out further afield.

The challenges that come with the construction of LNG tanks differ from project to project. A common concern is the conditions of the ground on site, which determine whether the tanks need to be built on piles or on improved soil, as well as what type of heavy equipment can be supported.

Seismic conditions are an additional hurdle. Designs must ensure that the soil will maintain

structural integrity and not liquify during a seismic event. Due to the tanks’ size and large soil loading, substantial earthwork piling is needed for their construction, which requires more soil stabilisation to spread the foundation loading. This is often achieved by using larger engineered piles, reduced spacing, and other soil improvements, such as sand columns. At times, it is necessary to add sand piles and gravel layers in addition to large piling.

Another challenge for LNG projects in general, and LNG tanks in particular, is the current shortage of skilled workers, including field craft professionals. While this is a global challenge, demand for skilled workers has been especially high in the US Gulf Coast region, where Bechtel is working on four LNG projects simultaneously, namely at the Port Arthur, Rio Grande, Corpus Christi, and Louisiana LNG sites.

Several hundred people are required for the construction of an LNG tank, covering everything from concrete work to mechanical craft. At Corpus Christi, about 50% of the direct craft population contributed to the LNG tank build over the entire construction duration to take advantage of the common craft professional pool of talent. Each month, LNG tank builders represented about 15% of the overall craft population, peaking at 30% nearing mechanical completion, with more than 20 crew disciplines working together to complete construction. Many craft professionals from Corpus Christi are now working on other US Gulf Coast LNG tanks for Bechtel.

One particularly sought-after craft professional is the 9% nickel welder to ensure the tanks are leak-tight and structurally sound. The welding work required on tank projects is substantial. For example, on Bechtel’s Corpus Christi Phase 1 project, which included two LNG storage tanks and 13 small field-erected tanks, the welding required for the tank plate structures was 200% more than all the piping of LNG Phase 1 combined.

As a result, Bechtel’s LNG business had to triple its field-welding scope. Incorporating this into its EPC self-perform model has allowed the company to optimise its overall EPC synergies and reduce the project’s risk profile.

Additionally, the company has been investing in upskilling and training initiatives. The company has been collaborating with technical colleges across the US Gulf Coast, equipping students with the tools and skills required to go straight from learning the craft into the field.

The Bechtel apprenticeship scheme gives high school students and local residents the opportunity to take part in a fast track programme at a community college. After classroom and job site training are completed, apprentices are hired once they pass the final assessments. In 2024, through Bechtel’s Port Arthur LNG workforce and education initiatives, the company hired close to 100 locals who graduated from Bechtel-supported programmes.

In Taiwan, Bechtel initially needed to import labour to perform the welding on tanks but has since also started training locals through its welding engineers.

The EPC execution of LNG facilities requires a complex system of people working together. The contract model, builder network, overall governance, and execution plan will largely determine how a team self-organises, optimises, and performs. Experience has shown that the quality of the people, their relationships, and a one team mindset are critical. Field teams’ skills and expertise must be tailored to each project’s specific demands. Teams must integrate services spanning a diverse range of expert knowledge and capabilities – from geotechnical expertise to civil and structural engineering – to provide comprehensive and innovative solutions. This can be achieved by leveraging vertically integrated work streams, proprietary digital tools and data, in-house supply chains for vital components, and capturing opportunities to reduce cycle times on repeatable work. This allows the execution teams to make improvements and increase overall productivity on the project.

One of the keys to Bechtel’s success has been its one team execution process, which helps replicate performance across tanks and trains on an LNG project, from the supply chain to engineering and construction.

Constructability of LNG tanks – the optimum use of construction knowledge and experience in planning, design, procurement, and field operations to achieve overall project objectives – has also greatly improved. A well-implemented constructability programme, according to the Construction Industry Institute (CII), has historically yielded a 4% reduction in project cost and a 7% reduction in project duration.

As a result of its replication programme, the duration of the delivery schedule of Bechtel’s LNG tanks has improved by 10% on costs and 15% on schedule vs the respective CII benchmarks.

z Each tank has top entry submersible in-tank pumps.

z Each in-tank pump is supported by a pump column with a foot valve.

z Boil-off gas (BOG) is directed to the BOG compressors.

z Each tank has a jib crane for maintenance.

z Often the tank includes foundation base heating.

z Primary governing codes: API 620, API 625, ACI 376, NFPA 59A.

z Material: Inner tank – 9% nickel steel; outer tank –concrete and carbon steel vapour barrier.

z Insulation: Perlite, foamglass blocks, glass fibre blanket.

Cheniere’s over 1000-acre Corpus Christi Liquefaction (CCL) facility is located in the Texas coastal bend, where energy infrastructure and estuaries coexist. The facility’s two berths have the capacity to receive the world’s largest LNG carrier, the Q-Max, which stands at 344.4 m long, with a cargo capacity of 266 000 m3 of LNG.

Bechtel self-performed the facility’s LNG storage tanks over two phases between 2007 and 2021 – each with a capacity of 160 000 m3 – following FEED and front-end loading (FEL) studies as part of its EPC work.

Tanks A and C were built in Phase 1, making them the first self-performed EPC tanks on the US Gulf Coast, while a third – tank B – was erected in Phase 2.

Bechtel made improvements to schedules, costs, and technology during the execution of the tanks, and, in Phase 2, put in place a constructability programme. The company was able to drive down costs by applying the lessons learned from the first phase to the second. It implemented its proprietary patented technology when constructing the tank wall and improved its 9% nickel welding capabilities.

The company brought in interdisciplinary teams for the LNG tanks’ structural steel, electrical, instrumentation, piping, mechanical, cooldown, and commissioning scopes to ensure optimal synergies with regard to equipment, tools, and people. This division of labour between EPC teams, together with teamwork, value engineering, and the nickel-welding improvement programme, improved the delivery schedule by five months or 15% (vs the 7% industry benchmark set by the CII) and increased labour efficiency across EPC teams resulting in cost reductions of 10% (vs the 4% CII benchmark) for tank B in Phase 2.

Being fully integrated and self-performing the design, construction, and commissioning of the LNG tanks has helped ensure project certainty of outcome. With three fully operational trains, CCL produces around 15 million tpy of LNG and exports more than 200 cargoes/y. The facility has the ability to run above installed capacity, which gives it greater flexibility in its operations.

Yogesh Meher, Vice President Global Engineering, and Alex Cooperman, Senior Principal Plate Structural Engineer, CB&I, consider effective measures for seismic safety in LNG tank projects.

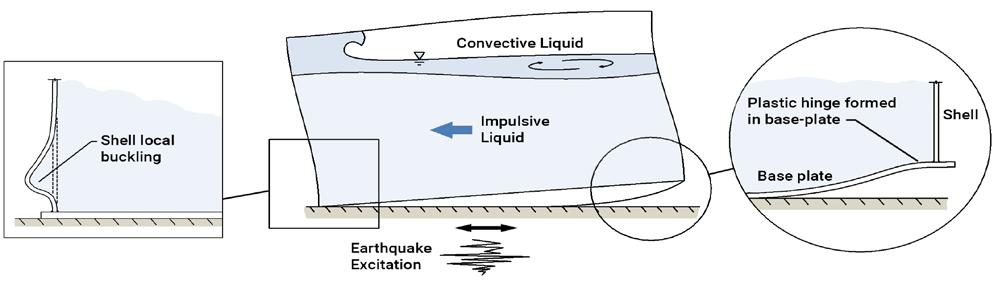

eismic resilience of critical infrastructure, such as LNG storage tanks, is essential to the safety and economic well-being of the general population. Seismic design of LNG tanks is very important and often controls the design and configuration of the tank structure, especially in high seismic areas.

The LNG industry and tank design standards1,2,3,4 define general requirements for seismic design of LNG tanks. The current industry practice in both US and European standards is to design LNG tanks for two main seismic levels. At a lower seismic level, defined as operating base or operating level earthquake (OBE or OLE), the LNG tank must remain fully operable, and as a result the structure must remain completely elastic. At a high seismic level, defined as safe shutdown or contingency level earthquake (SSE or CLE), the LNG tank may sustain damage, but no product release can occur. The standards allow some reduction in seismic load due to structure inelastic behaviour and energy absorption via damage without loss of containment or structural integrity.

In addition, US standards recommend consideration of aftershock level earthquake (ALE), assuming all the LNG stored in the primary liquid container is released into the secondary

liquid container.1,3,5,7 The ALE is defined as 50% of SSE.1,3 European regulations do not require consideration of an ALE case.

NFPA 59A1 defines OBE as a seismic event associated with a return period of 475 years and SSE as an event associated with a return period of 2475 years. European regulations specify the same return period for OBE and a 4975-year return interval for SSE.4

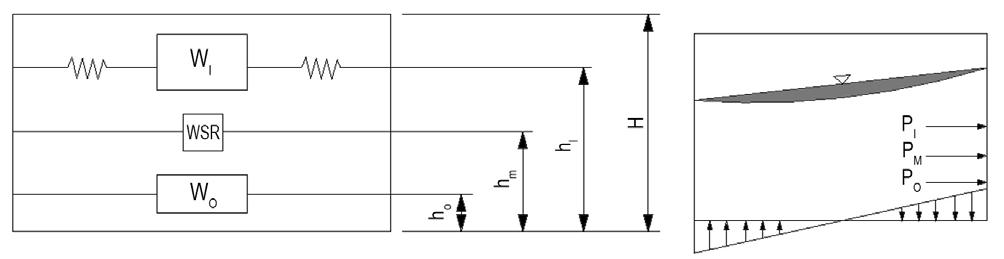

LNG steel tank design procedures for seismic loads are defined in API620 Annex L5 and EN 1998-4.6 A portion of liquid mass in the tank will respond to the horizonal component of seismic excitation as a rigid body (impulsive mass) while the other portion of the liquid will respond in a sloshing wave mode (convective mass). The typical tank seismic design model is shown in Figure 1. Concrete tank design recommendations for seismic activity and guidance for seismic modelling are provided by ACI376, which includes finite element analysis.7

Both NFPA 59A and EN 1473 provide for a site-specific seismic study to be conducted for all LNG facilities. The study includes both OBE and SSE site-specific seismic spectra based on the specific local geotechnical conditions and proximity to seismic faults. Furthermore, to avoid underestimation of OBE and SSE seismic levels based on site-specific analysis, NFPA 59A applies minimum OBE and SSE seismic levels based on seismic load specified by ASCE/SEI 7-22 for the site geographical location.8

Because impulsive and convective seismic masses do not respond in unison to ground excitation, the effects due to responses of impulsive and convective horizontal seismic components are combined using the square root of the sum of squares (SRSS) method. In addition to horizontal seismic activity, vertical seismic excitation may also significantly affect the tank design. Vertical seismic acceleration increases the effective product specific gravity due to excitation pointed in the upward direction. The same vertical seismic effectively reduces product specific gravity and tank structure weight when pointed in the downward direction. In the latter case, it results in reduction of tank stability due to reduction of the tank structure weight and liquid product weight contribution in both overturning and sliding resistances.

Current US LNG tank standards recommend considering 100% horizontal seismic activity in combination with 40% vertical seismic for stability verification and both 100% horizontal and 40% vertical, and vice versa, for tank component design, including the tank shell, roof, and platforms.

Figure 1. Tank seismic design model. Wl = liquid convective mass; Wo = Liquid impulsive mass, WSR = mass of the tank structure; ho, hm and hl = respective elevation of each mass.

High seismic load may affect the design of LNG tank as follows (Figure 2):

z Result in increase of the tank shell plate thickness due to hydrodynamic liquid pressure and vertical excitation.

z Affect overturning stability of the tank.

z Affect sliding stability of the tank.

z Result in increase in the tank height to accommodate seismic sloshing wave height.

The impulsive tank mass has a period of vibration in the range of 0.2 – 0.5 seconds, which typically puts the impulsive mass acceleration at the peak of the response spectra. The convective period is dependent on the tank diameter and typically ranges between approximately five seconds for a small tank to 12 seconds for a large tank. Therefore, the seismic accelerations associated with the convective period are much smaller than those associated with the impulsive period.

The most economical solution to handling high seismic exctiation depends on several factors, including the magnitude of seismic activity, real estate availability, and soil type. Re-proportioning of the LNG tank, such as making the tank shorter in height and larger in diameter, changes the percentage of the liquid mass associated with both impulsive and convective components by decreasing the mass of the horizontal impulsive component and increasing the mass of the horizontal convective component. However, because the convective component is associated with much lower seismic acceleration, the overall response is reduced, sometimes significantly. A simple re-proportioning of the tank can help make the tank stable and reduce the base shear to help mitigate any sliding issues. If the real estate is available, then re-proportioning the tank may be the simplest and most economical solution to handle high seismic levels up to a certain limit.

Another effective option to reduce the tank seismic response is accounting for soil-structure interaction (SSI). Due to soils flexibility, SSI allows increasing:

z The effective period of the tank impulsive mass.

z The system damping due to additional soil damping.

Due to increases in the effective period and damping ratio, the effective acceleration applied to the impulsive mass, which typically is a controlling acceleration, may be reduced significantly.

While consideration of SSI may be very effective to reduce seismic loads applied to the tank, it should be noted that SSI is effective only for soft soils. The industry standards also limit the maximum increase in the damping ratio due to SSI.

API620 Annex L limits the maximum damping ratio due to SSI to 10% for OBE and 20% for SSE.

In very high seismic locations, tank re-proportioning and SSI may not be able to provide the required reduction in seismic load, in which case the only remaining option is to add base isolation to the tank system. Seismic isolation is the most effective option to reduce seismic loads and handle very high seismic activity. The cost of seismic isolation should be accounted for the overall tank system cost.

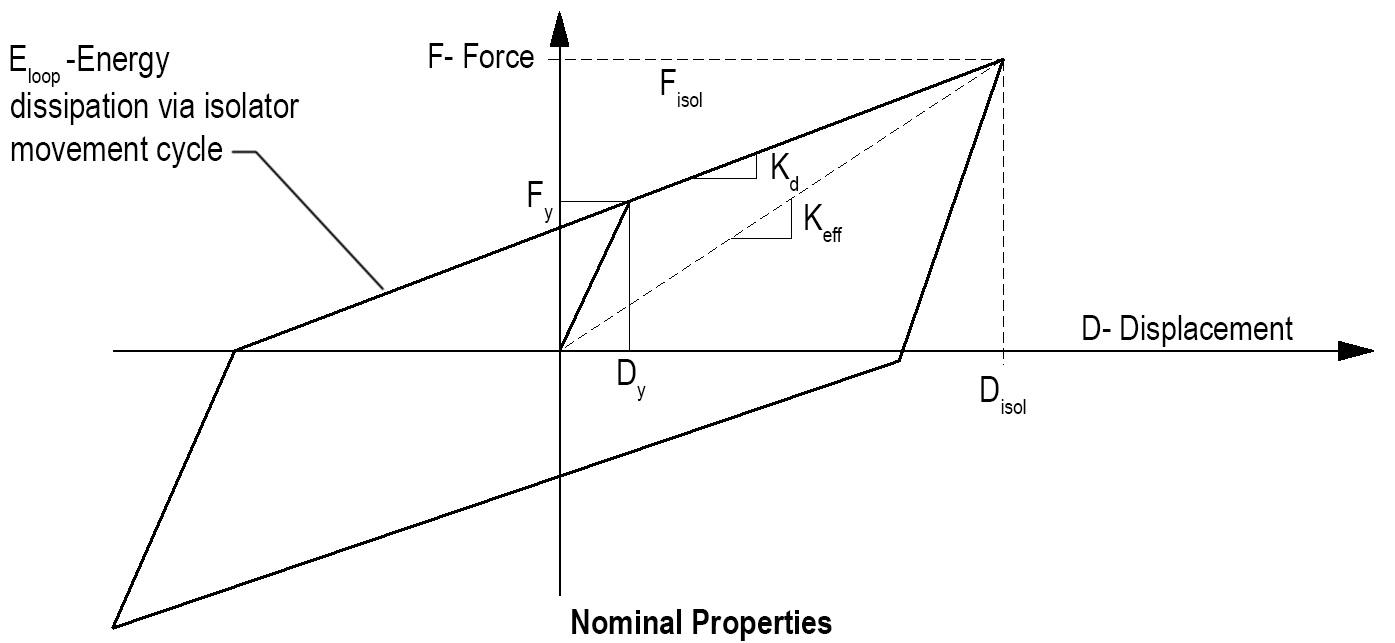

Seismic isolation devices allow a very significant reduction in the horizontal impulsive seismic acceleration due to a large increase in both the effective period of vibration and the effective damping. The isolators allow an increase in the effective impulsive period from a typical 0.2 – 0.5 seconds to 3 – 5 seconds following the vibration period of the isolation device. Seismic isolators are also very efficient in seismic energy absorption, resulting in an effective damping ratio of more than 30%. A typical energy dissipation curve for this seismic device is shown in Figure 3. Both the increase in the impulsive period and the effective damping dramatically reduce the seismic acceleration applied to the horizontal impulsive seismic mass, reducing hydrodynamic pressure, overturning moment, and base shear. However, isolation devices have little effect on seismic wave height, as a typical convective period for a midsize or a large tank is much longer than the period provided by isolators, and the liquid convective mass damping ratio stays at 0.5%.

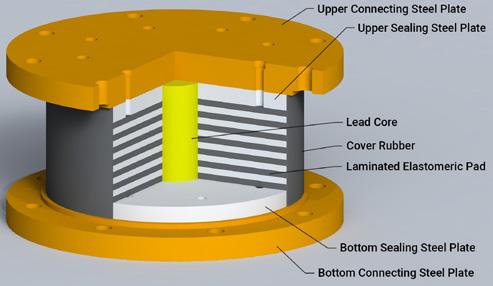

Both lead-rubber and friction pendulum seismic isolators shown in Figure 4 are efficient seismic isolation devices and allowed by the existing standards. High damping rubber isolators are not recommended by ACI376 due to inconsistencies in performance.

The period shift in a lead-rubber isolator is achieved due to flexibility of the rubber, while yielding of the lead core allows for high damping performance.

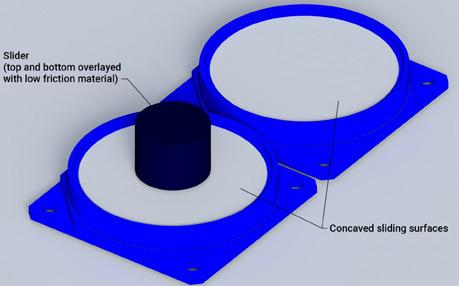

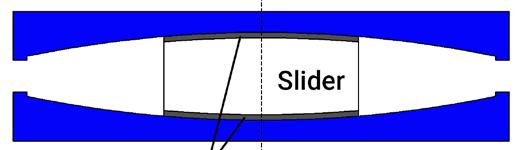

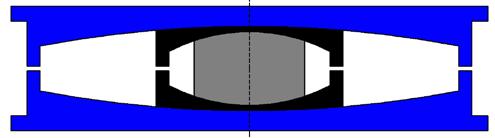

A friction pendulum isolator provides a large increase in both effective period and damping via curvature of the components and friction on the sliding surfaces. Various types of friction pendulum isolators are schematically shown in Figure 5. Double and triple pendulum isolators accommodate the same level of seismic excitation as a single pendulum with significantly less displacement. Furthermore, a triple pendulum system allows a very soft start, eliminating an initial spike in acceleration due to static

3. Isolator movement (energy dissipation) loop. Kd = isolator post-yield stiffness; Keff = isolator effective stiffness; Fisol = maximum force; Disol = maximum displacement.

friction being higher than dynamic friction. This is achieved by using a sliding coating material with much lower friction coefficient for the inner sliders than that used for the outer sliders.

While seismic isolation helps in significantly reducing horizontal impulsive acceleration, it comes at the expense of high displacement. All connections and attachments external to the tank, such as piping or connections to a free-standing access system, must be designed to have sufficient flexibility to accommodate the isolated tank displacement, which in high seismic regions may be as high as 1000 mm. Because the behaviour of seismic isolation devices is highly non-linear, standards including ACI376 recommend that the seismic isolation system be designed using non-linear response-history design procedure. Guidance for the design of the seismic isolation systems is provided in Chapter 17 of ASCE/SEI 7-22.

CB&I has vast experience in designing and constructing seismically isolated storage tanks for refrigerated liquefied gases, including LNG. Seismically isolated LNG storage tanks have been constructed by CB&I in Turkey, Peru, Chile, the Philippines, and the West Coast of the US.

In conclusion, the seismic loading on an LNG tank has a direct impact on the dimensions of the LNG tank (proportioning diameter and height), liquid sloshing height, and need for anchorage. In locations with very high seismic activity, it can be beneficial to add base isolation to the tank system in the form of lead-rubber or friction pendulum isolators. Use of seismic isolation often results in an economical tank design with a reduced footprint, while providing the most reliable mechanism for accommodating the large seismic displacements that occur during an earthquake. The implementation of a base isolation system allows a significant reduction (as much as 80%) of the earthquake forces on the tank. The company’s project delivery model ensures high-quality and cost-effective solutions for projects. Many customers draw on the company’s deep knowledge and extensive LNG experience early in a project’s development, allowing CB&I to provide input, recommendations, and project-specific solutions that enhance the long-term value of the facility. Its integrated EPC resources enable CB&I to self-perform all aspects of the project, from conceptual design to tank commissioning.

The standards referred to throughout the article are:

1. NFPA 59A-2023 Standard for Production, Storage, and Handling of Liquefied Natural Gas (LNG).

2. EN 1473:2021 Installation and equipment for liquefied natural gas – Design of onshore installations.

3. API 625 Tank Systems for Refrigerated Liquefied Gas Storage, 1st ed., including addendum 4.

4. EN14620-1:2024 Design and manufacture of site built, vertical, cylindrical, flat-bottomed tank systems for the storage of refrigerated, liquefied gases with operating temperatures between 0˚C and -196˚C – Part 1: General.

5. API620 Design and Construction of Large, Welded, Low-pressure Storage Tanks, 12th ed., including addendum 3.

6. EN 1998-4:2006 Design of structures for earthquake resistance –Part 4: Silos, tanks and pipelines.

7. ACI 376-2023 Refrigerated Liquefied Gas Containment for Concrete Structures.

8. ASCE/SEI 7-2022 Minimum Design Loads and Associated Criteria for Buildings and Other Structures.

Noelle Garza, Chemstations, a Datacor company, USA, explains how modern process simulators are an invaluable tool for optimising procedures, such as liquefaction, in LNG.

According to the U.S. Energy Information Administration’s short-term energy outlook, demand for North American LNG exports is forecast to rise by 17% in 2025 and is expected to continue increasing throughout 2026. This demand is driven by recent shifts in political strategy and ongoing geopolitical turmoil.

For those in the LNG industry — and anyone providing essential equipment and technology — staying competitive requires technological innovation and the ability to optimise processes for greater efficiency.

While process ‘optimisation’ is a frequent buzzword used in engineering consulting and promotional content, it is less common for engineers to rigorously set up and solve an optimisation study. Instead, the focus is concentrated on designing a process that is safe, reliable, and capable of meeting demands. Each design decision involves trade-offs, but, once the initial goals are met, the process is considered optimised.

However, there are many situations, such as the need to discover cost or energy savings, that will require more thought and effort in design considerations and optimisation. This is especially true with growing regulatory pressure to reduce energy usage and emissions in order to work towards achieving net-zero targets. LNG plant design and expansion in 2025 and beyond requires re-thinking longstanding design practices and looking into innovative solutions to meet growing demand.

Setting up optimisation problems involves minimising or maximising an objective which represents the engineer’s goals for the process investigation. To carry out an optimisation, the objective is expressed as a function of process variables which are limited by constraints. These constraints can be physical relationships, as would be expected from engineering knowledge about the physical world, or design limitations

such as requirements from regulatory codes. Constraints are important to successful optimisation as, when calculations are performed, calculated values are compared to the specified constraints and the optimisation rejects any solution that falls outside of these.

When selecting the constraints for optimisation, it is important to choose these as targeted variable conditions to achieve the best objective. Under-constraining the calculation can lead to unbounded solutions which could be unrealistic for processes. Additionally, over-constraining a problem could create a situation where no solution exists.

Formulating a good objective function begins with focused goals. While broad goals such as lowering costs may sound straightforward, complexity arises when it comes to the process of defining variables and constraints.

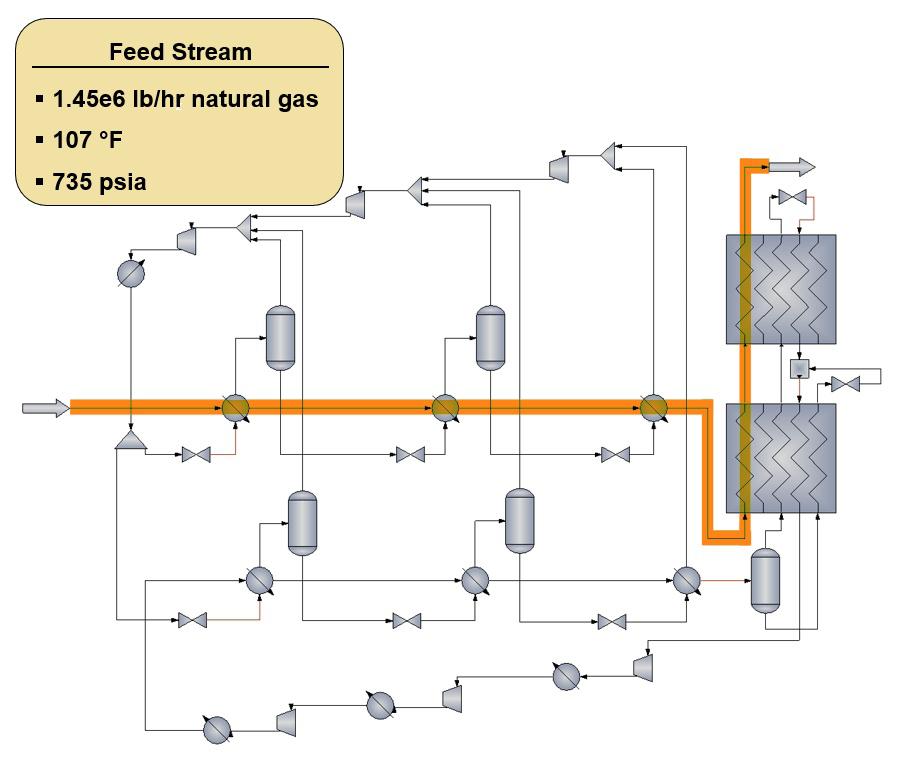

A good procedure can be illustrated by searching for potential areas for cost savings in a liquefaction process. This process involves multiple pieces of equipment, each with its own variables and uncertainties, requiring the use of software to solve a complex optimisation problem. Most modern process simulators are equipped with analysis tools that can

be used to set up and solve rigorous optimisation problems. For example, Figure 1 shows how the CHEMCAD NXT process simulation software is used to simulate a natural gas stream entering at 107˚F and 735 psia, with cooling loops pre-cooling the natural gas stream. The pre-cooled natural gas is then liquefied in a multi-stream heat exchanger.

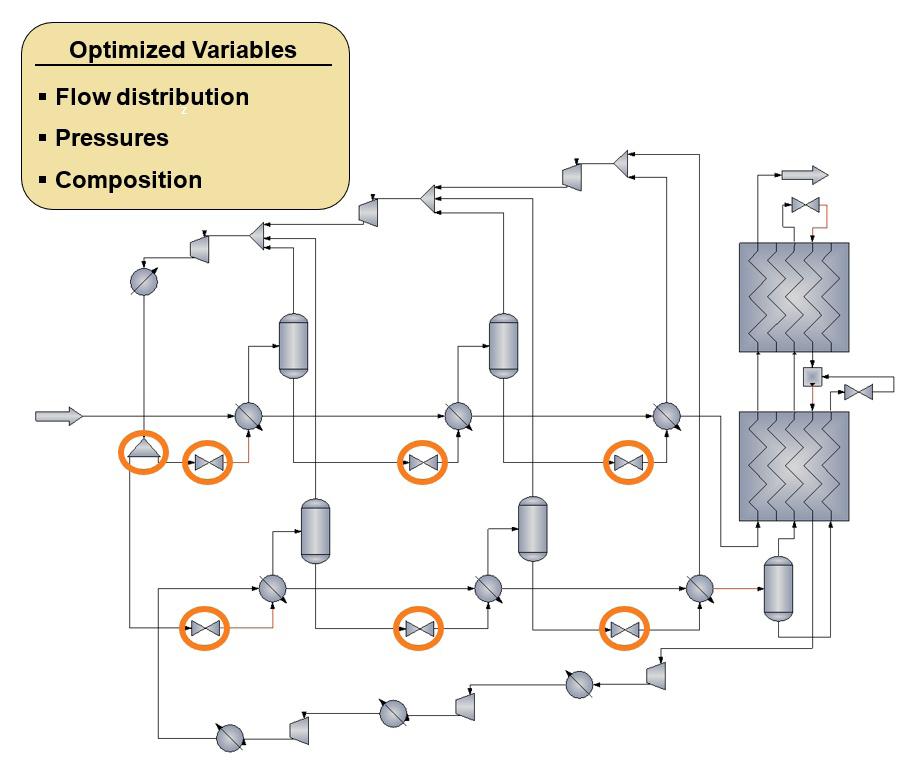

Due to the high energy demands of liquefaction, optimising this part of the LNG production process can lead to significant cost savings. By reducing energy consumption in the cooling process, OPEX can be lowered. For instance, compressors are particularly energy-intensive. Their optimisation will involve minimising the compression train power requirement by adjusting refrigerant flow, flow distribution, refrigerant pressures, and refrigerant composition (Figure 2).

In the CHEMCAD NXT optimisation tool, engineers can define one or more objective functions. For the example shown in Figure 2, the objective function was defined as the minimisation of the total power requirement for the compressors. Engineers can also choose one or more variables to adjust (independent variables). In this simulation, the adjusted values were selected as the flow rate of the incoming refrigerant stream, pressures at the valves, refrigerant split at the stream divider, and the composition of the refrigerant stream – variables were bounded using engineering judgement.

Engineers are also able to choose one or more variables as constraints for the solver in CHEMCAD NXT. A good constraint for this objective function is to limit temperature or phase split just upstream of the compressor suction to protect the compressor trains from liquid carryover, a potential cause of damage.

By thinking carefully about how to define an optimisation problem, from setting up one or more targeted objectives to selecting independent variables and imposing constraints, it is possible to achieve significant energy efficiency and save on operating costs for LNG processing, storage, and regasification.

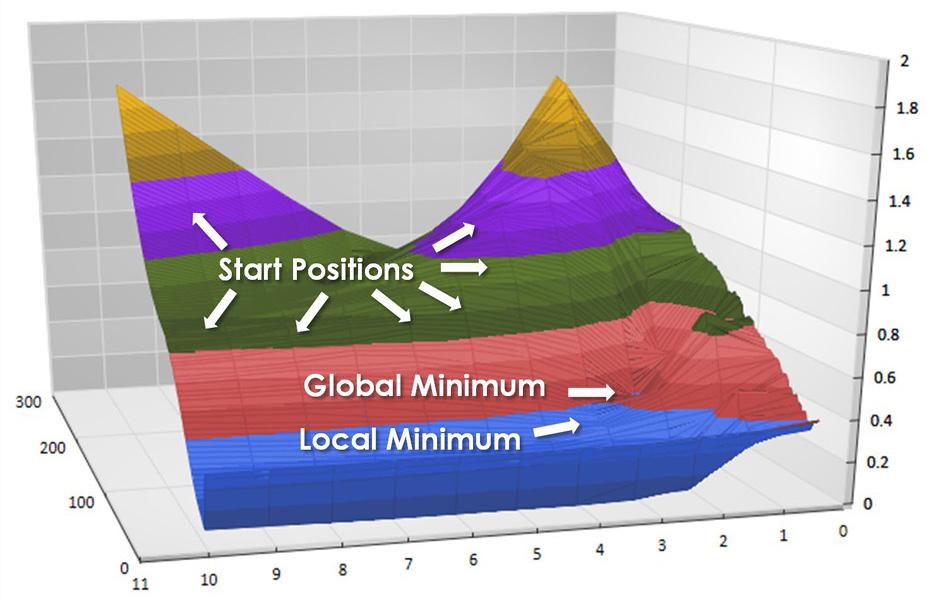

Optimisation solvers can sometimes get trapped in local optima. This phenomenon occurs when there could be more than one minimum or maximum found within the bounded solution region. Using a contour plot (Figure 3) helps when it comes to understanding and visualising the presence of local optima vs global optima.

The best approach for finding the global optimum is to restart the optimisation solver, usually at randomised starting points, to find a new solution. This needs to be done multiple times to search across multiple solutions. CHEMCAD NXT handles this by automatically parallelizing a large number of starting positions so that the solution has the best chance to converge to the global optimum. If a spreadsheet calculator or a different commercial simulator is being used, code may need to be manually written to program multiple restarts, but this is the recommended practice to ensure convergence to the global optimum.

In the past, complex optimisation problems similar to this required leaving the computer running overnight in the hope

In over 40 markets, across 5 continents, Cheniere is providing the energy people need. In 2024, we produced more than 640 tankers of liquefied natural gas and supplied enough energy to help power economies and keep hundreds of millions of people warm through the winter months. At Cheniere, we’re energizing a more secure future.

that it would arrive at a solution by the next day. Fortunately, the computational time required for optimisation has significantly improved since modern process simulators gained the ability to use parallel computing. Finding the global optimum for an optimisation, such as the one demonstrated in Figure 2, is completed in seconds or minutes (depending on computation performance related to number of CPU cores, available memory, etc.) using CHEMCAD NXT.

A universal part of engineering involves making assumptions about process variables that may change over time, necessitating the exploration of different scenarios. Using sensitivity studies to explore the relationships between these variables is an analytical approach from the Six Sigma playbook and most modern process simulation software includes sensitivity analysis tools to support this need.

By systematically varying one or more aspects of a model using sensitivity analysis tools and observing the trends in response, engineers can clarify the path to isolating the most influential variables for the objective function. While it may seem like another hurdle in getting started with optimisation, this extra step will ultimately enhance the efficiency and success of optimisation objectives. This is because there is always variability in a complex system and the impact to the response variables is not always clear.

Selecting the variables to manipulate and the variables to observe through a sensitivity analysis is relatively straightforward. Generally, selection is based on the engineer’s understanding of which variables either carry the most uncertainty in their process or which carry a likelihood for variation, meanwhile considering the objectives for the process optimisation. Selecting the number of variables for a sensitivity study also requires some consideration as varying too many conditions simultaneously can be computationally expensive. Additionally, omitting influential variables may result in unrealised opportunities for effective optimisation and cost savings.

As important as it is to select good variables to visualise the response, it is also helpful to recognise how the right distribution methods can affect sensitivity analysis. The most common distribution methods for process simulation will fall into two categories:

z Uniform distribution methods are best for testing variables that are likely to appear spread evenly across a range. Using the liquefaction example from Figure 1, it is possible to explore the variations in feed gas temperatures, pressures, compressor power, or refrigerant flow rates which are expected to vary across a uniform range.

z Gaussian, or normal, distribution methods are used to describe data which tends to centralise around an average value, but which also has the potential to fall into extremes or outliers from the average values. This is usually the case for variables such as compositions, which are expected to have a normal formulation with some slight variations and the expectation that outliers may occur. Using Figure 1’s example, it is possible to explore feed gas composition, refrigerant composition, and temperatures if impacts from ambient temperatures, which tend to fall into averages yet sometimes have unexpected highs and lows, are expected.

Engineers can better understand data and identify trends when they are visualised using tables and charts, such as the bell curve shaped histograms that can be plotted after running a sensitivity analysis with a normal distribution. Performing sensitivity studies with process simulation helps users comprehend complex, interrelated data to reveal unrecognised effects in processes.

With the future of the LNG industry headed towards growth amid rising equipment and operating costs and regulatory pressure around energy usage and emission reduction, it is a good time to use optimisation solvers to recover costs and enhance energy efficiency in LNG processes. Fortunately, modern process simulators like CHEMCAD NXT are equipped with tools that can accelerate a detailed optimisation analysis.

Best practice for setting up a successful optimisation requires some extra effort in identifying key variables using sensitivity studies. Selecting the appropriate independent variables and constraints is a critical step in setting up an effective optimisation. It is also important to define a targeted objective function (the goal of the optimisation) so that a clear direction for manipulated variables can be provided to achieve specific performance targets. By methodically setting up and solving optimisation problems, engineers can achieve multidimensional goals, ensuring that processes are efficient, cost-effective, and compliant with regulatory demands.

References

1. ‘Short-term Energy Outlook’, U.S. Energy Information Administration, (February 2025), www.eia.gov/outlooks/ steo

2. TOWLER, G. and SINNOTT, R., Chemical Engineering Design: Principles, Practice and Economics of Plant and Process Design, 3rd ed., (2021).

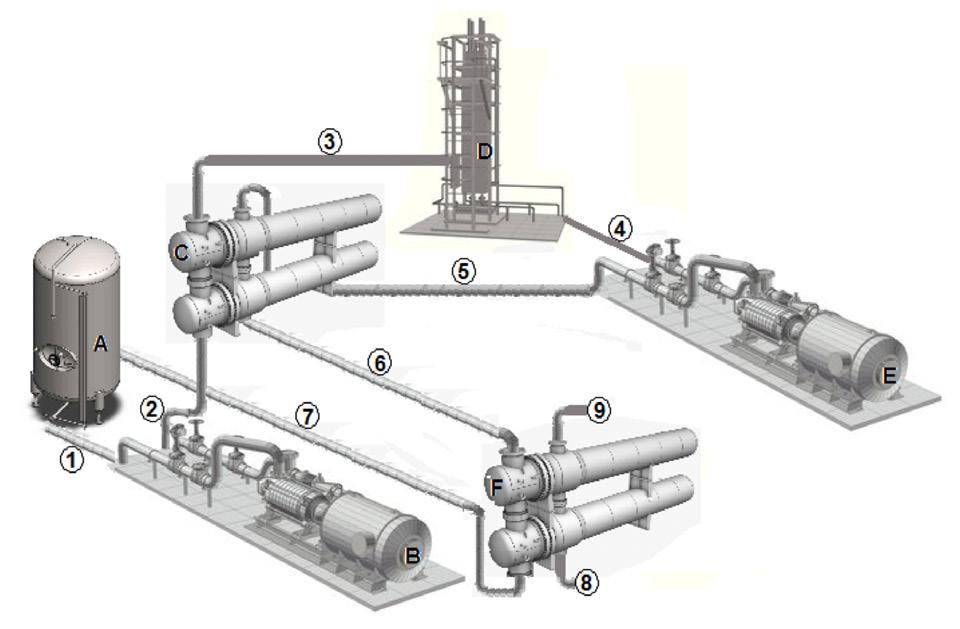

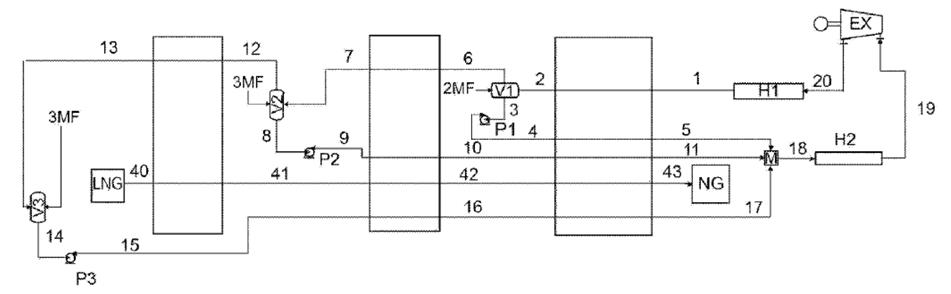

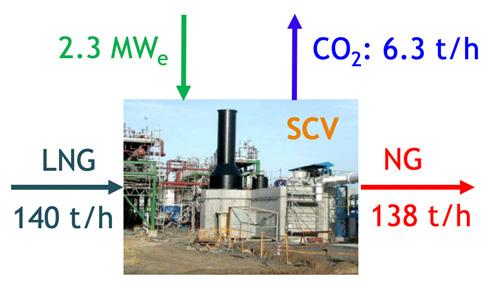

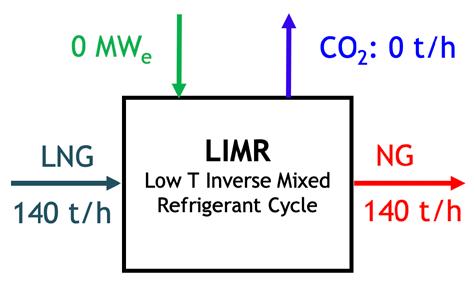

Davide De Bacco and Luca Davide Inglese, Saipem, Italy, showcase innovative solutions for reducing the power consumption and carbon dioxide emissions of LNG import terminals, to be applied in lieu of (or in parallel with) conventional technologies for LNG vaporisation.

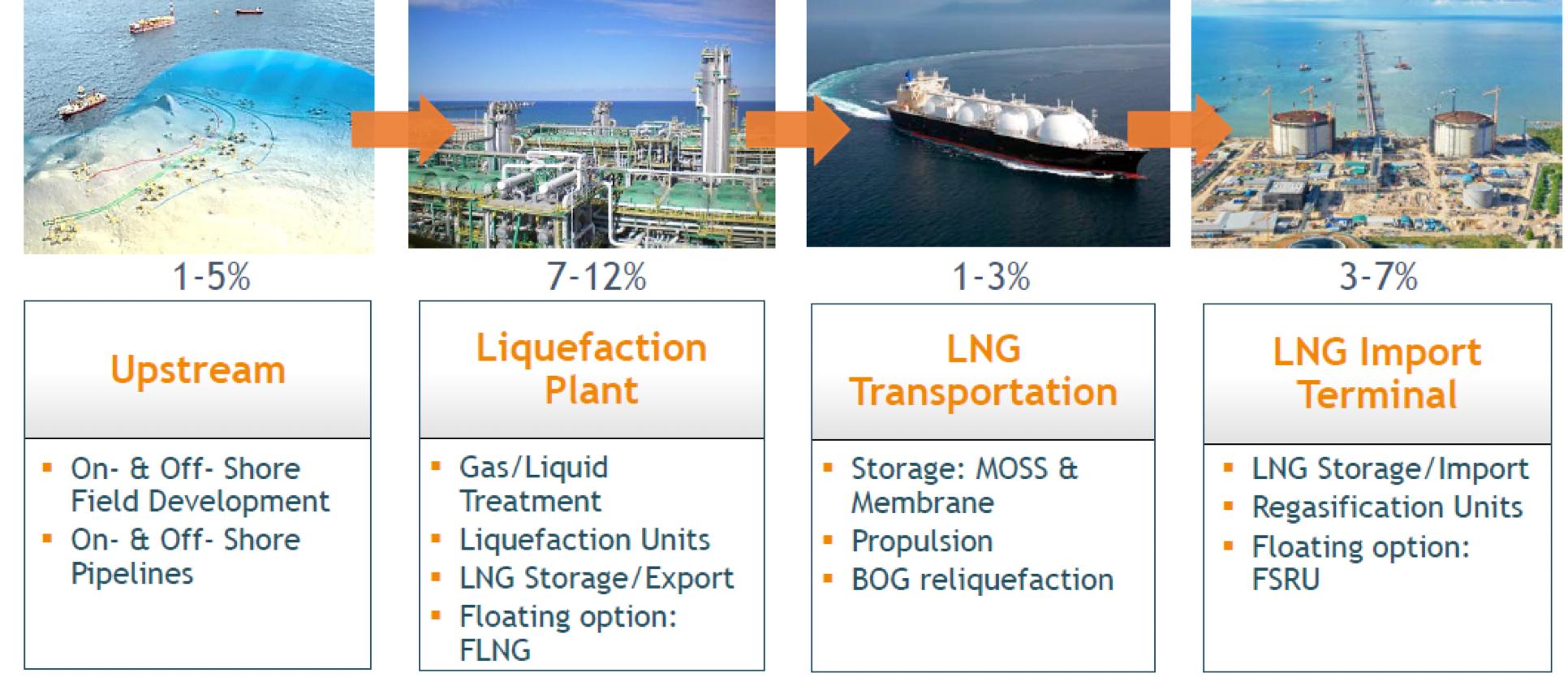

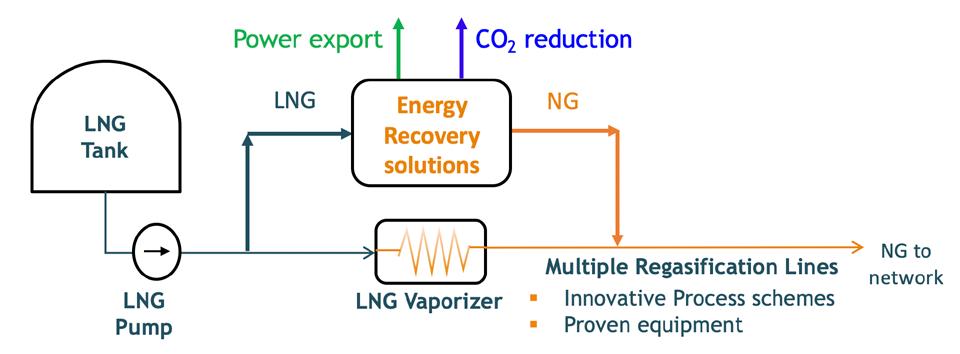

he LNG value chain is inherently energy-intensive, characterised by significant consumption of natural gas for the energetic requirements and inefficiencies of the processes involved in each step of the chain (Figure 1).

This article explores innovative solutions for the efficient recovery of cold energy from the final step of the natural gas value chain, i.e. regasification.

In an LNG regasification terminal, LNG is pumped at high pressure, vaporised, and then

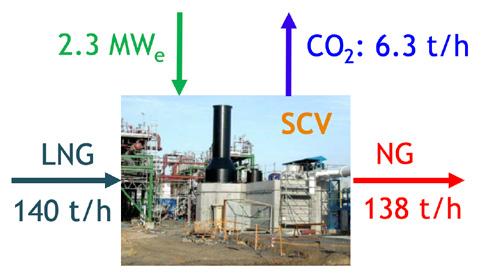

delivered to gas pipelines for distribution. Several technologies for LNG regasification are available on the market, among which the most common ones are the open rack vaporisers (ORV), the submerged combustion vaporisers (SCV), and the intermediate fluid vaporisers (IFV).

All these technologies consume electrical power and/or fuel gas, and the selection process is the result of a trade-off between CAPEX and OPEX, depending on several site-specific factors.

Although the energy consumption of base load regasification terminals (mainly due to LNG pumping and boil-off gas [BOG] compression or vaporisers thermal duty) is significantly lower than that of a base load liquefaction plant, it is not negligible. This is especially important in countries where the energy unit cost and carbon tax rate are high.

These plants often operate with a considerable variability in the LNG regasification capacity, providing gas supply in the periods of high demand and a spare capacity during the periods of lower request; it is important to note that, when the lower capacity usage occurs, it exacerbates the LNG regasification plants power cost to income ratio.

Another factor to consider is that adding energy recovery facilities can help in obtaining authorisations to build new LNG import terminals or in expanding the regasification capacity of existing facilities, which might be challenging with standard technology.

Conventional solutions to improve the energy efficiency of an LNG import terminal focus on minimising the boil-off rate (BOR), thereby reducing the loss of valuable LNG.

High-performance insulation materials for storage tanks and associated pipes (recirculation and unloading) are available on the market, such as vacuum insulated pipes (VIP). State-of-the-art LNG storage tanks are also increasing in size to reduce the surface-to-volume ratio and consequently the BOR.

Nowadays, these solutions should be considered the bare minimum for a profitable LNG import terminal. Attention should be directed towards the core of the regasification plant, which is the LNG vaporiser.

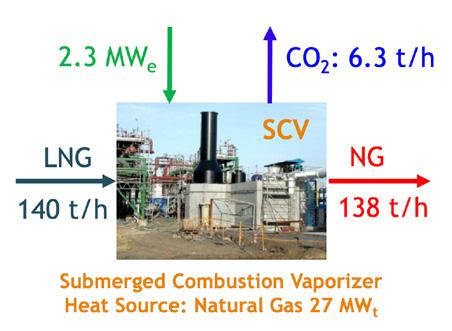

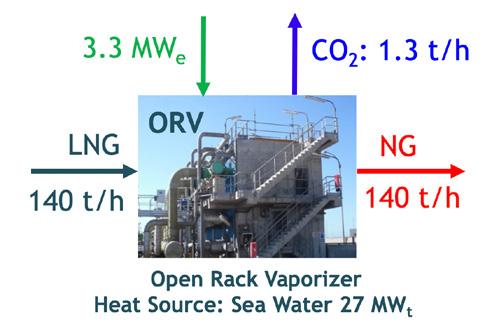

In a conventional terminal, LNG is pumped from the atmospheric pressure inside the storage tank up to about

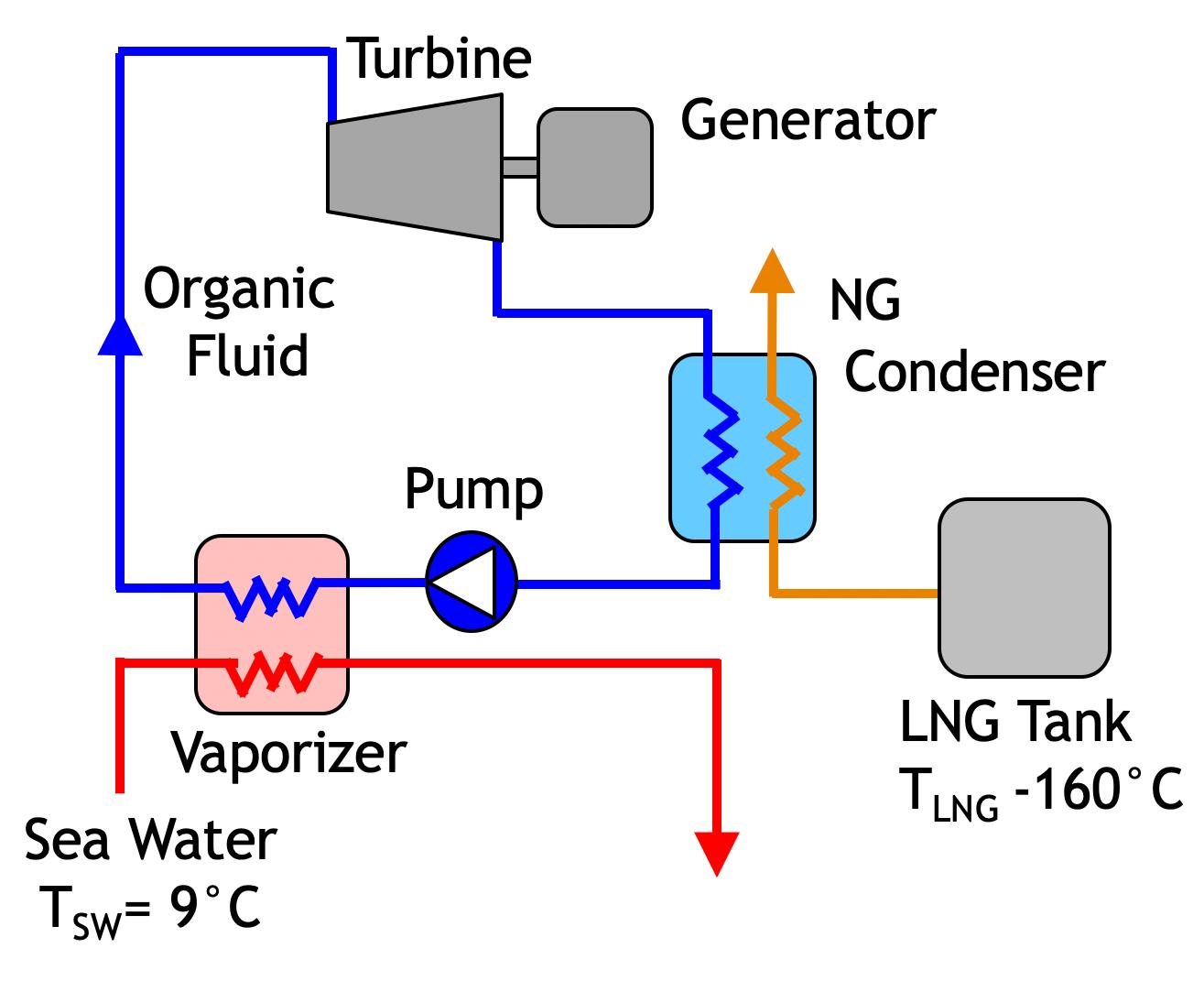

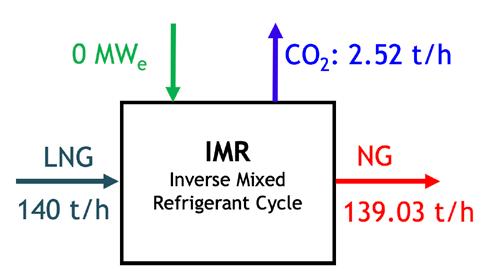

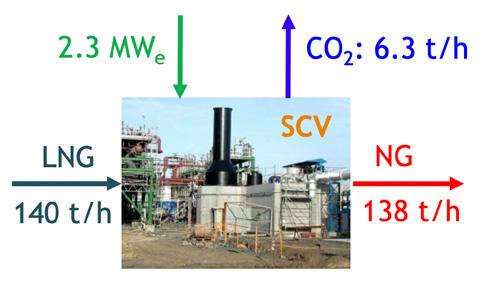

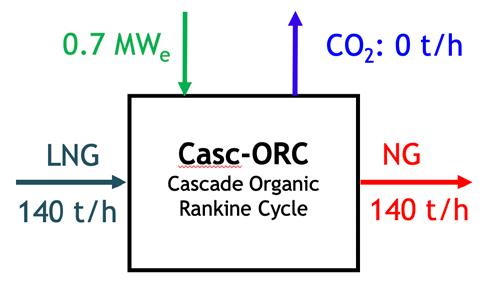

80 bar. As baseline, it has been considered a reference scenario of a base load facility with four parallel regasification lines, with each line that vaporises 140 tph of LNG up to a temperature of 3˚C, requiring a thermal load of 27 MWth (Figure 3). Depending on the regasification technology, the heat for the LNG vaporisation can be provided by seawater (ORV), by fossil fuel combustion (SCV), or by organic fluid condensation (IFV and organic Rankine cycle [ORC]).

Regardless of the regasification technology, the plant needs electrical power to run the LNG pumps (1500 kWe) and the BOG compressors duty (345 kWe) for each regasification line. Additionally, about 9000 kWe of fixed plant requirements shall be considered, including utilities, control systems, lighting, and building air conditioning. For ORV technology, extra electrical power is needed for the seawater pumps, whereas SCV technology implies also the consumption of fuel, resulting in higher carbon dioxide (CO2) emissions.

Therefore, the reference plant requires about 16 MW of electric power if SCV based or 20 MW if ORV based; the CO2 emissions of the ORV based terminal are only the indirect ones associated to the power plant that provides the electric power for the plant needs, while the ones of the SCV based terminal include also the direct emissions related to fuel consumption.

Most of the recent LNG regasification plants deploy systems to provide ‘free’ cold energy, recovered from the regasified LNG, for air conditioning purposes and/or for efficiency increase of power generation gas turbines (if present at site) by means of inlet air chilling. In this case, chilled water closed loops integrated with IFV provide the cold energy to the aforementioned users.

Other LNG import terminals establish instead synergies with neighbouring facilities to exploit the cold energy of the LNG for CO2 liquefaction, sea water desalination, food conservation, etc.

In this context, Saipem has invested over the last decade to develop, optimise, and promote innovative energy recovery solutions to achieve carbon neutral, self-sustaining, and profitable LNG regasification terminals. These solutions are based on well-established technologies and referenced equipment already applied to different industrial fields.

They can be integrated as an energy bypass (Figure 4) within an LNG import terminal, whether newly built or as a retrofit application, either in parallel with or replacing one or more conventional vaporisation lines.

In the oil and gas industry, ensuring highest safety and plant availability is crucial, while achieving decarbonization goals has also become a critical imperative. Our comprehensive portfolio and expertise enable process improvements that increase operational reliability and move us towards net zero targets.

Saipem’s portfolio of patented technologies includes solutions which exploit:

z Very hot heat sources like CO2 power cycles that produce electric power using CO2 as primary working fluid,

not subject to high temperature degradation and very compact, in combination with other fluids at lower temperature.

z Warm heat sources like cogeneration/heat pumps that produce electric and thermal power burning a fraction of the vaporised LNG.