NORTH AMERICA A supplement to LNG Industry

For over 60 years we have only had one thing in mind: making measured values ever more precise. But we also never lost sight of the need for human values, too. By combining these it makes a remarkable radar level sensor possible. The best value there is: VEGAPULS 6X.

WE LOVE RELIABLE VALUES. JUST LIKE OUR RADAR LEVEL SENSOR. THE

®. OUT NOW!

6X

VEGA. HOME OF VALUES. www.vega.com/radar

NORTH AMERICA 2023

05 Comment

16 Pathways to decarbonisation

Rostom Merzouki, Director, Global Gas Development at ABS, discusses how North America is tackling shipping’s climate challenge ambition and reinventing itself in the energy transition to cleaner sustainable fuels, alongside the US’ endeavour to responsibly drive technology initiatives that help to lower fuel consumption while still managing the increasing demand for goods and services transported by ships.

23 LNG leads the race to net-zero emissions bunkering

Steve Esau, COO of SEA-LNG, addresses the important role the LNG industry can play in decarbonising shipping – from its leading position in the race to net-zero emissions bunkering, to how it can leverage bio-LNG and e-LNG to further reduce greenhouse gas emissions and meet future climate targets.

28 Ensuring energy security with small scale LNG

Paul Shields, Chart Industries, explains how small scale LNG could be the answer to achieving energy security and independence.

31 Small scale, big benefits

Christopher Elko, Daniel Harajda, and Amanda Witmer, Air Products, assess the flexibility and versatility of small scale LNG in the future LNG industry.

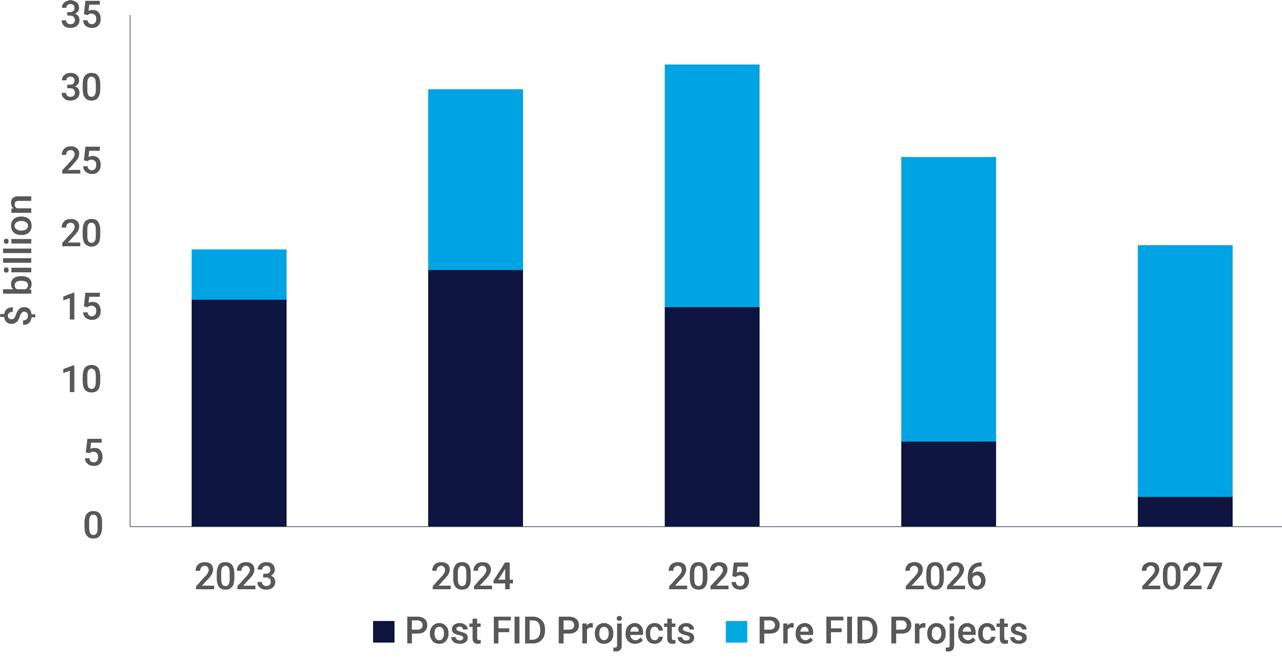

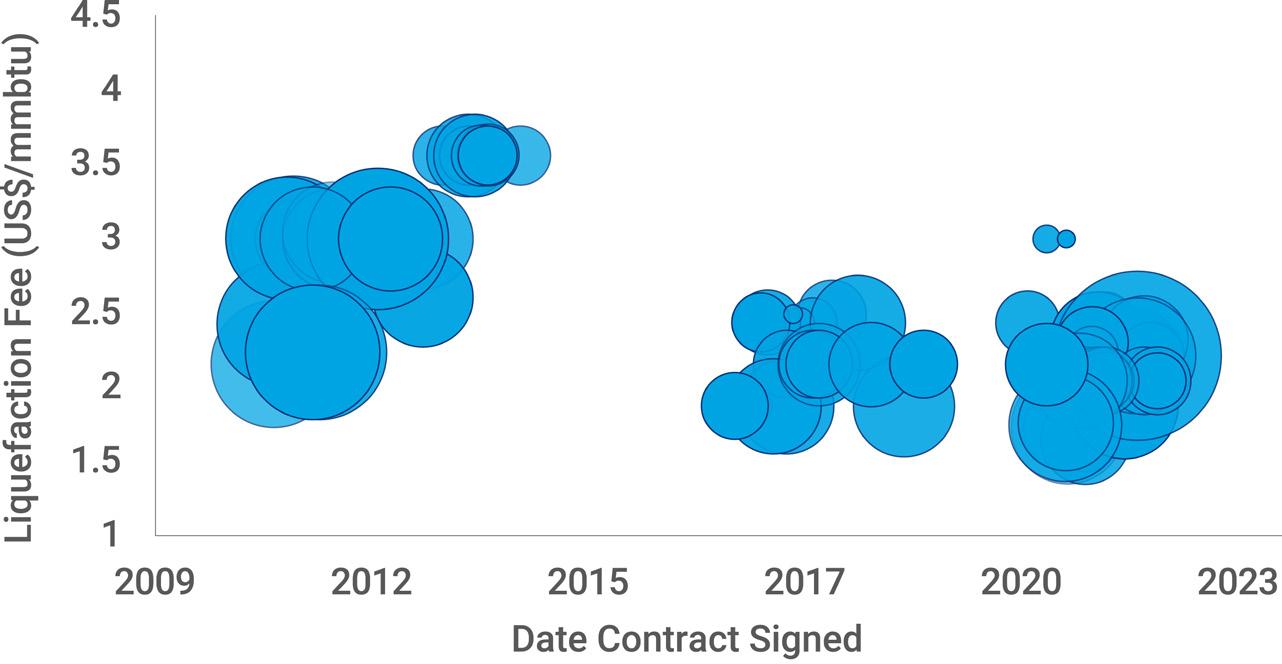

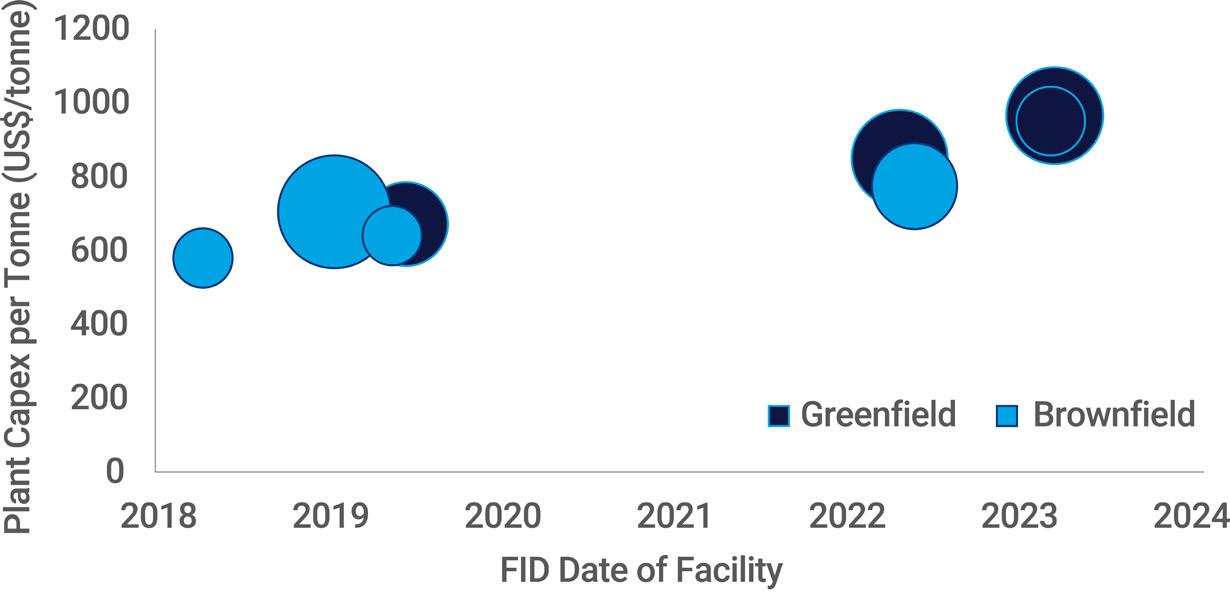

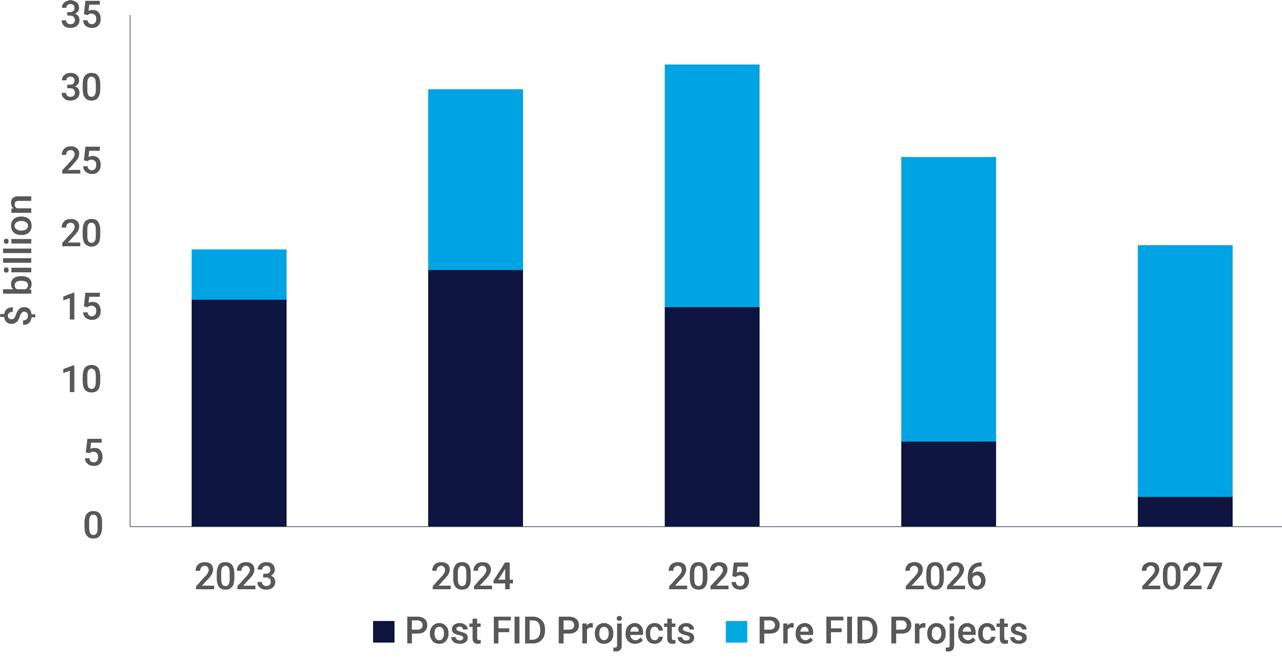

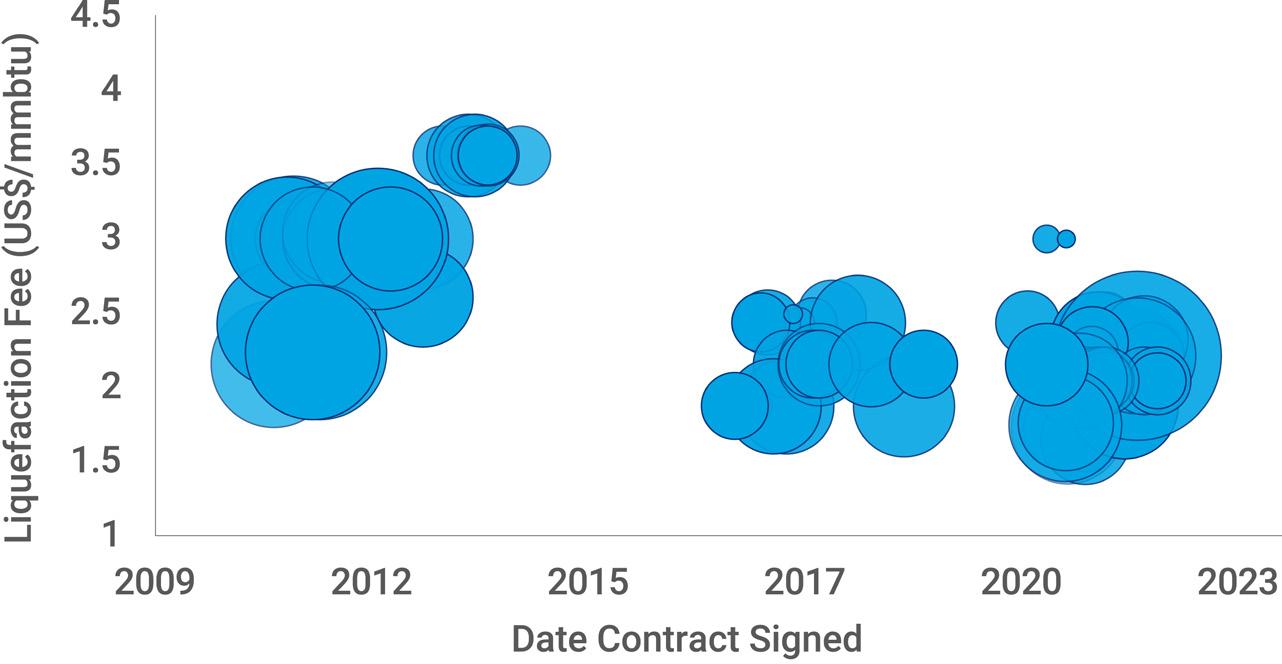

35 Maintaining the flow in the North American LNG project pipeline

Record prices and the need for energy security have created strong momentum in North American LNG. Kristy Kramer, Vice President Gas & LNG Research, and Sean Harrison, Research Analyst Gas & LNG, Wood Mackenzie, explore why a focus on addressing potential issues with the contracting, financing and construction of projects will be important to keep the healthy project pipeline on track.

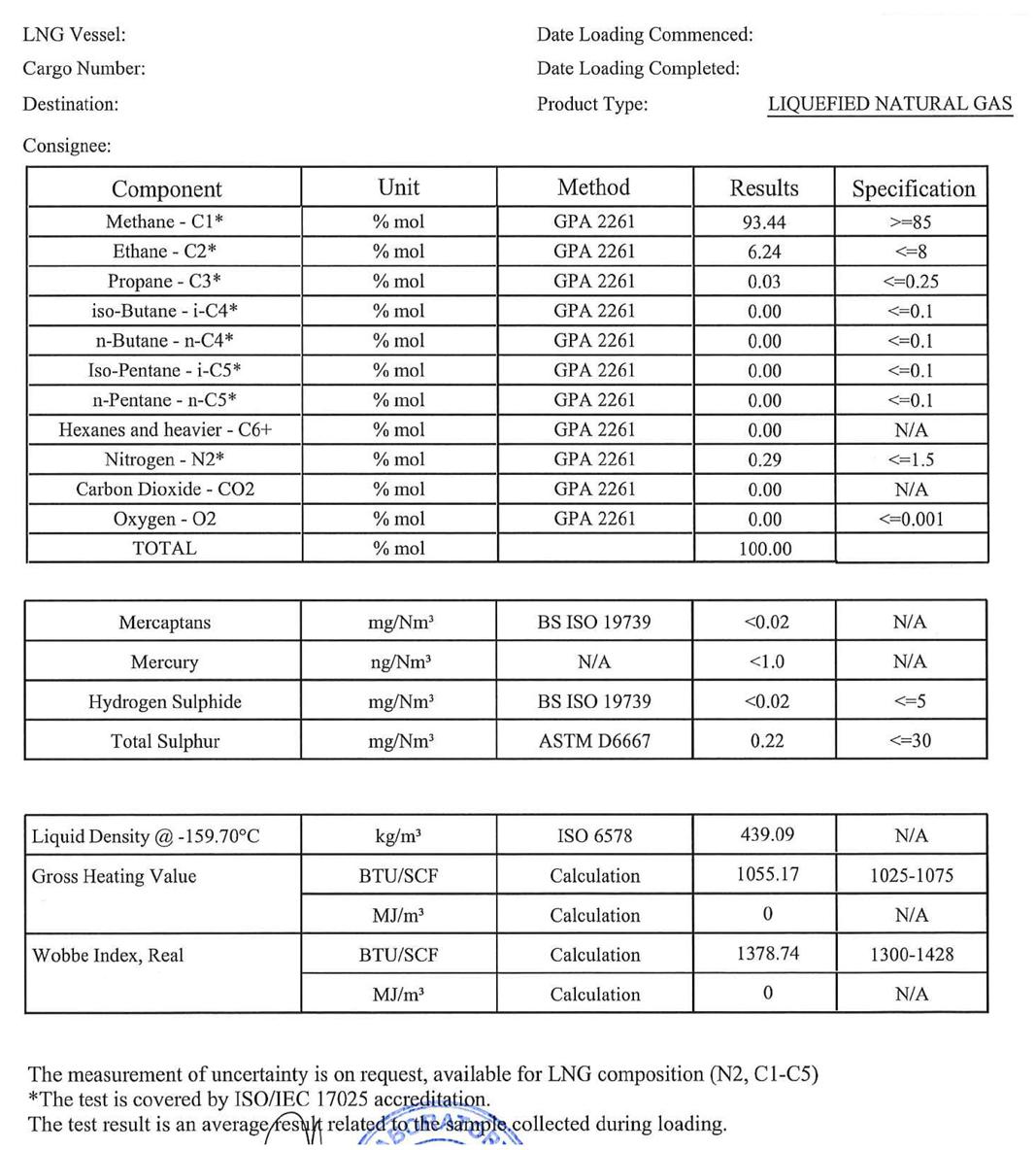

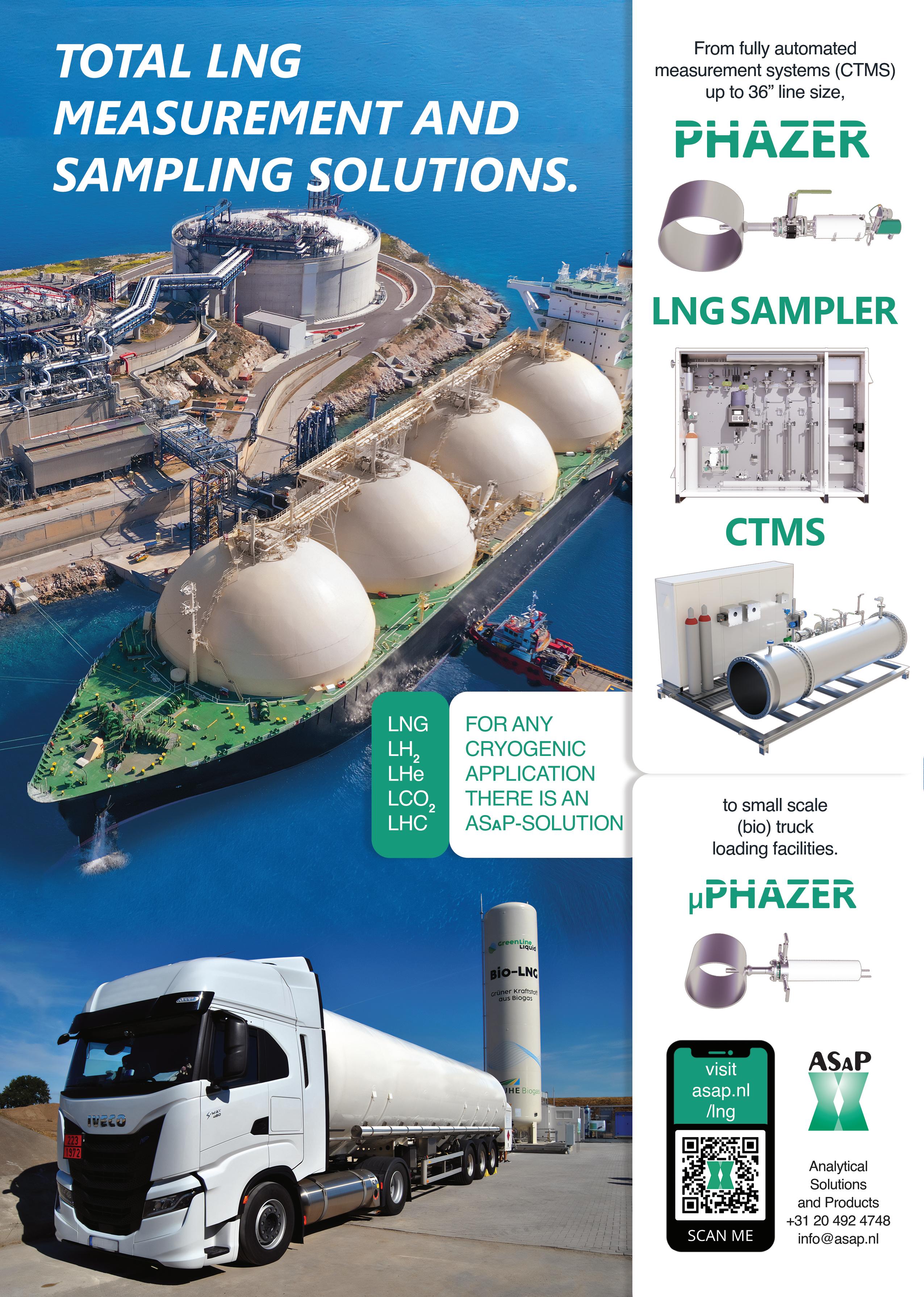

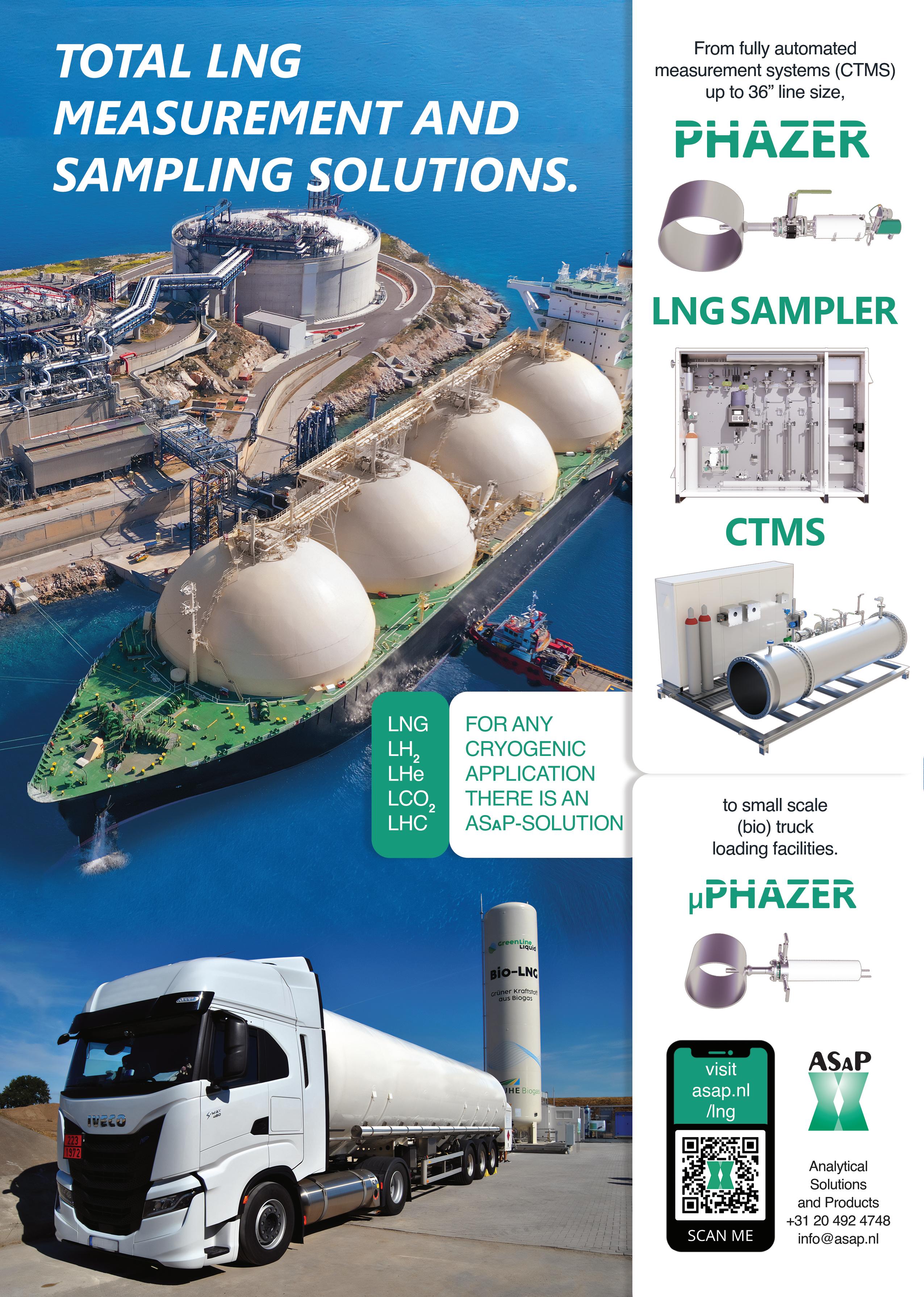

39 Made to measure

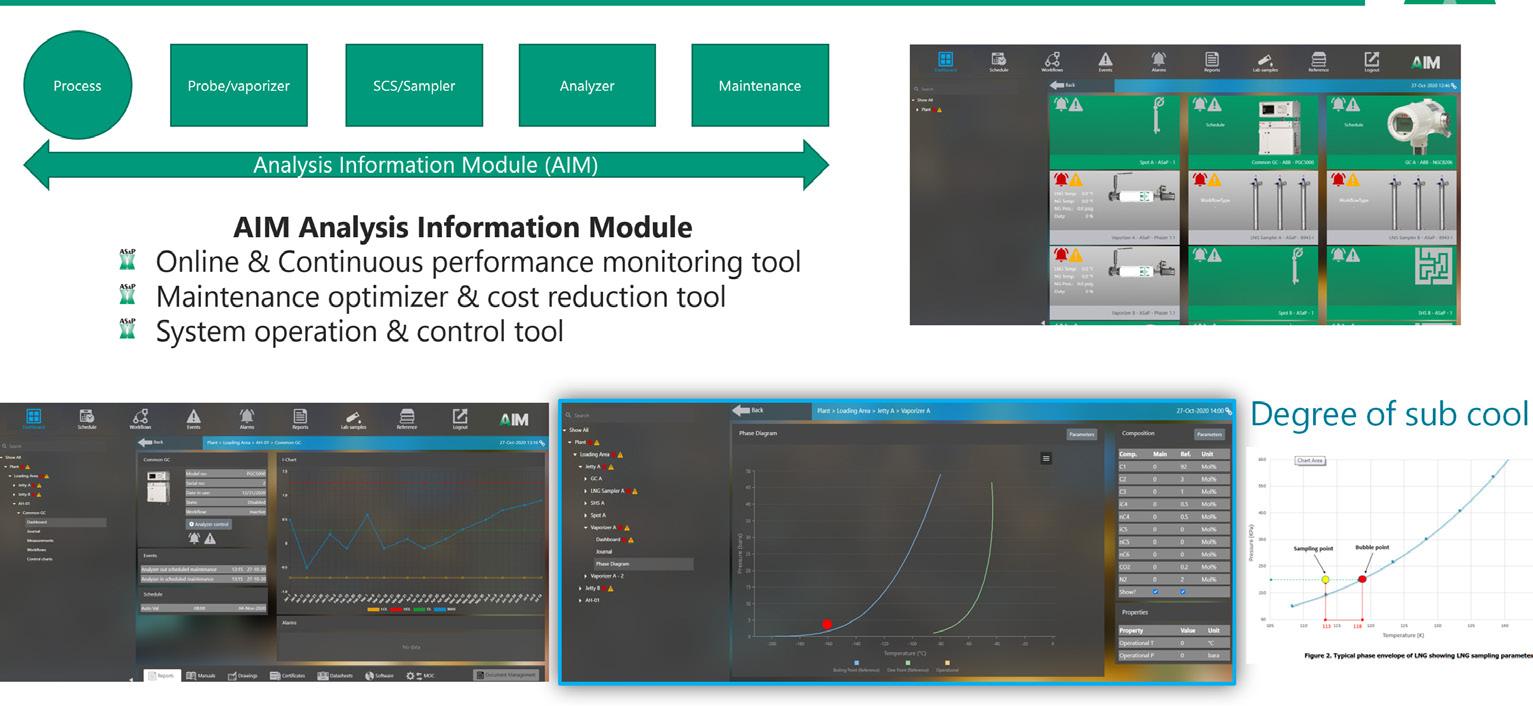

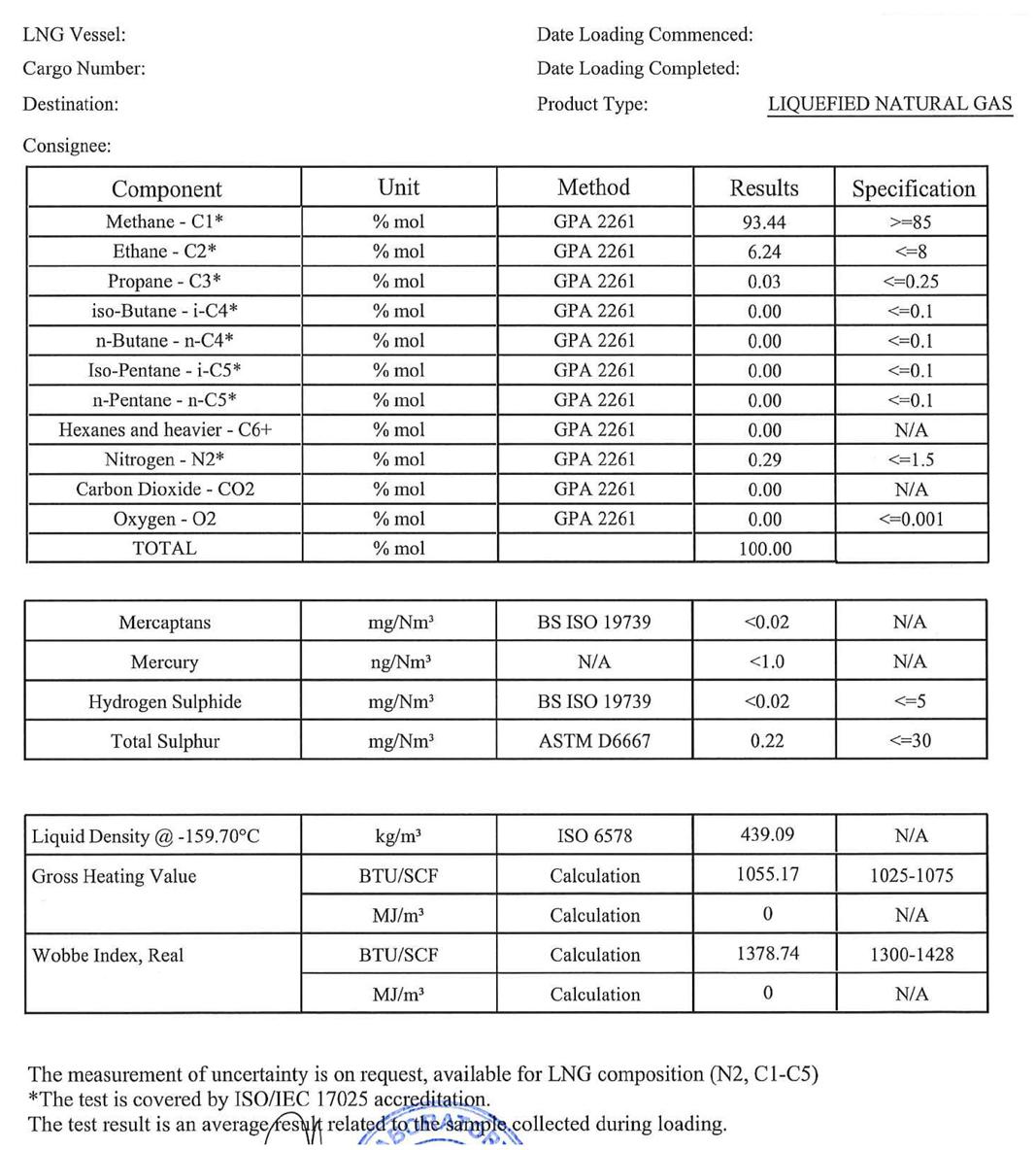

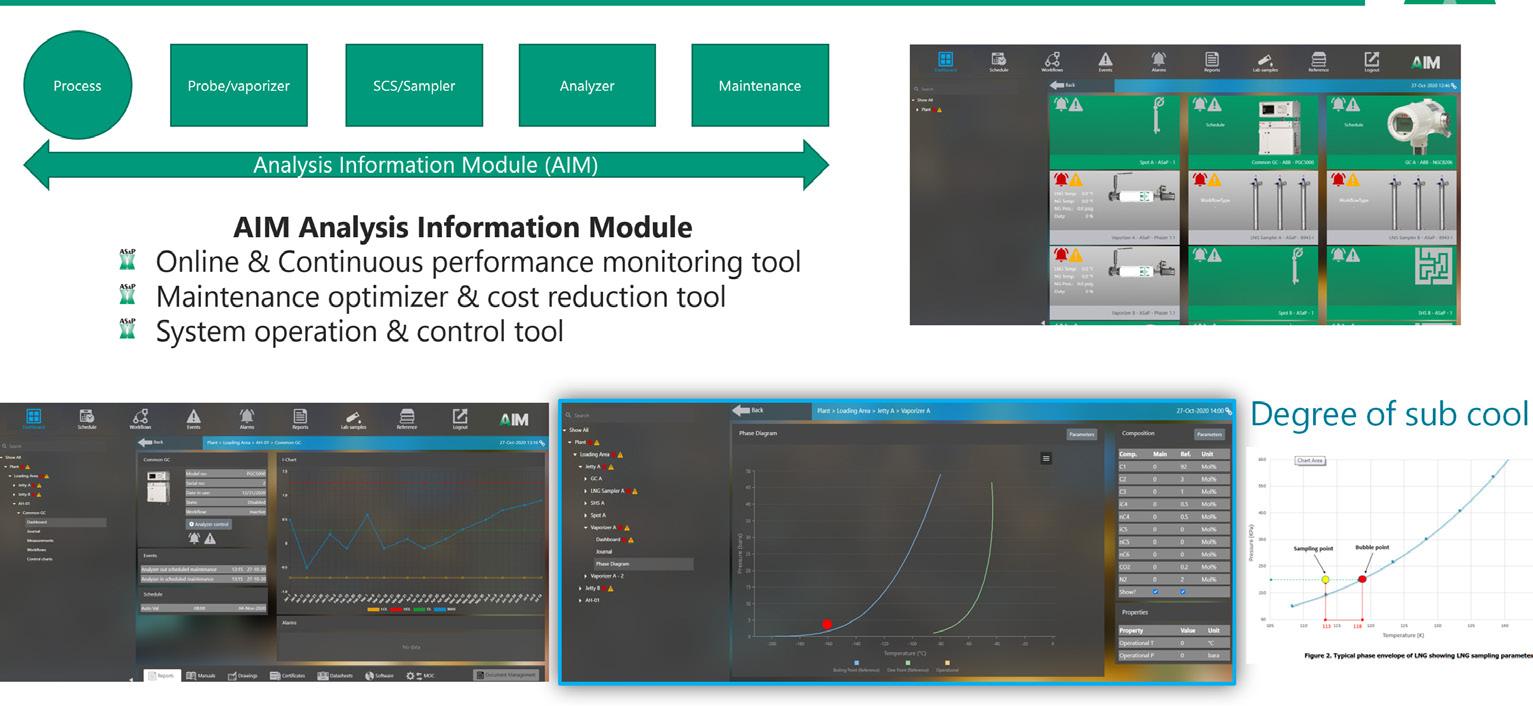

Hans-Peter Visser, Analytical Solutions and Products B.V., the Netherlands, outlines the needs for fully-automated LNG custody transfer measurement systems.

42 Building an LNG facility and a legacy

Lyle Hanna, Commonwealth LNG, USA, details the creation of the Commonwealth LNG project, and the benefits it can deliver to the local and wider communities.

47 Advancing Alaska LNG

Timothy Fitzpatrick, Alaska Gasline Development Corporation, looks at how shockwaves from Russia’s invasion of Ukraine propelled the Alaska LNG

the history of the Woodfibre LNG project, and how the company is working

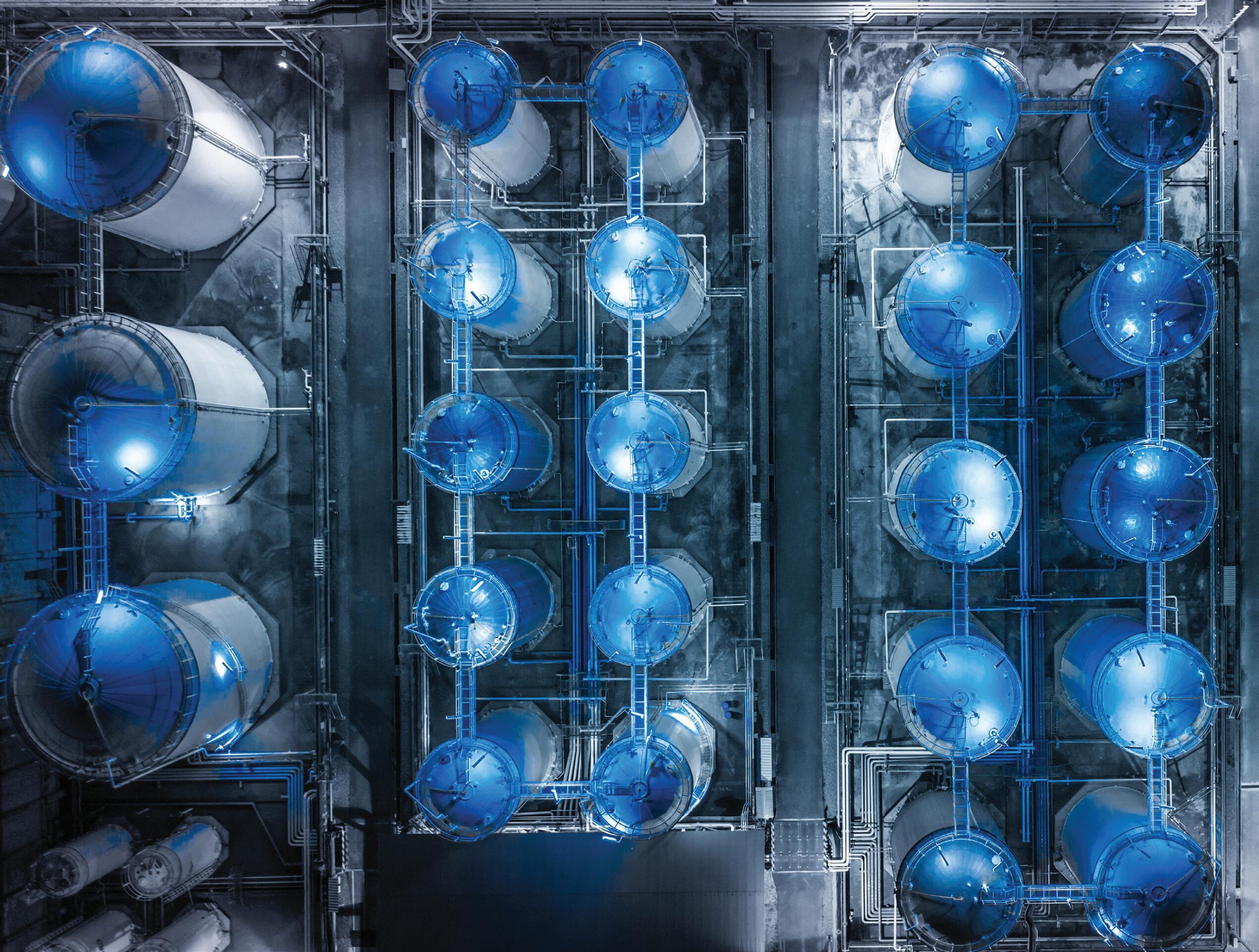

CONTENTS ON THIS MONTH’S COVER

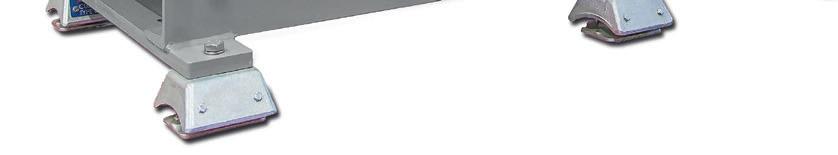

Chart's deep cryogenic expertise and proven track record makes the company an ideal project partner to deliver LNG and hydrogen as secure, clean, safe, and affordable fuel alternatives. At the cornerstone of the company's business is a broad portfolio of complementary products, and it is the integration of these products to deliver highly engineered solutions, used from the beginning to the end in the liquid gas supply

ISSN 1747-1826

LNG Industry is audited by the Audit Bureau of Circulations (ABC). An audit certificate is available on request from our sales department. CBP006075

Noam Ayali, Lindsey Swiger, and Jessica Rodríguez, Norton Rose Fulbright US LLP, outline considerations for project developers in the US looking to integrate carbon capture facilities in LNG projects.

JESSICA CASEY DEPUTY EDITOR

JESSICA CASEY DEPUTY EDITOR

COMMENT

Welcome to LNG Industry’s first North America supplement.

Following the conflict in Ukraine and the subsequent supply-demand imbalance throughout the world, and particularly in Europe, the aim of this magazine is to bring you insights into the recent changes, trends, and developments in the North America LNG industry, as well as updates on some of the current and proposed projects across the region.

The U.S. Energy Information Administration expects natural gas production to rise to 42.1 trillion ft 3 by 2050, largely driven by US LNG exports, which are expected to rise to 10 trillion ft 3 by 2050, as per its Annual Energy Outlook 2023 1

There are three export projects currently under construction that will expand US LNG export capacity by 5.7 billion ft3/d by 2025: Golden Pass LNG (Texas), Plaquemines LNG (Louisiana), and Corpus Christi Stage III (Texas).2 All of these projects are close to the Haynesville Formation and Permian Basin, meaning the amount of natural gas produced can grow along with the demand for LNG.1 There are also many proposed projects in the US that are waiting for final investment decisions before construction can begin. As well as the increased demand for US LNG from Europe, Asia is a potential new market following the continent’s efforts to move away from fossil fuels. Alaska Gasline Development Corporation explain how they are well positioned to serve this market in its article.

In a recent webinar by Poten & Partners, 3 Sergio Chapa, Senior LNG Analyst, explores the potential for Mexico as an emerging LNG export powerhouse. The country has four existing import terminals, with three export projects under construction, and another eight proposed projects

totalling 50.2 million tpy. However, these Mexican exports depend on the U.S. Department of Energy’s non-free trade agreement permits, an uncertain regulatory environment, and US-sourced natural gas. 3

Canada only has one LNG terminal in operation –St John LNG’s regasification import terminal located in New Brunswick, but 18 LNG export facilities have been proposed in Canada, with a total proposed export capacity of 216 million tpy of LNG. 4 Woodfibre LNG’s project case study outlines how the company is working to produce the lowest-emissions LNG from their project in Canada. As McKinsey & Company discussed in its regional report in the June issue of LNG Industry (which will also be distributed at LNG2023), Canada is in a promising position to take advantage of the current LNG market and become a major LNG exporter. 5 It is therefore a fitting location for LNG2023 to take place.

I hope you enjoy this special edition of LNG Industry, and I look forward to seeing you in Vancouver for LNG2023.

References

1. ‘Annual Energy Outlook 2023’, U.S. Energy Information Administration, (16 March 2023), www.eia.gov/outlooks/aeo/

2. ‘U.S. LNG export capacity to grow as three additional projects begin construction’, U.S. Energy Information Administration, (06 September 2022), www.eia.gov/todayinenergy/detail. php?id=53719

3. ‘Latin America: Net LNG Exporter of Importer by 2030?’, Poten & Partners, (24 May 2023).

4. ‘Canadian LNG Projects’, Government of Canada, https://natural-resources.canada.ca/energy/energy-sourcesdistribution/natural-gas/canadian-lng-projects/5683

5. BRICK, J., AGGARWAL, P., DI FIORI, L., DEDIU, D., and PARSONS, J: McKinsey & Company, ‘Capitalising on Canada’s LNG’, LNG Industry, (June 2023).

Managing Editor James Little james.little@palladianpublications.com

Senior Editor Elizabeth Corner elizabeth.corner@palladianpublications.com

Deputy Editor Jessica Casey jessica.casey@palladianpublications.com

Sales Director Rod Hardy rod.hardy@palladianpublications.com

Sales Manager

Will Powell will.powell@palladianpublications.com

Production Manager

Calli Fabian calli.fabian@palladianpublications.com

Digital Events Manager Louise Cameron louise.cameron@palladianpublications.com

Digital Events Coordinator Stirling Viljoen stirling.viljoen@palladianpublications.com

Digital Administrator Leah Jones leah.jones@palladianpublications.com

Digital Content Assistant Merili Jurivete merili.jurivete@palladianpublications.com

Administration Manager Laura White laura.white@palladianpublications.com

Editorial/Advertisement Offices, Palladian Publications Ltd 15 South Street, Farnham, Surrey, GU9 7QU, UK Tel: +44 (0) 1252 718 999 Website: www.lngindustry.com

LNG Industry Subscription rates: Annual subscription: £50 UK including postage £60 overseas (postage airmail) Two year discounted rate: £80 UK including postage £96 overseas (postage airmail) Subscription claims: Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge. Applicable only to USA & Canada. LNG Industry (ISSN No: 1747-1826, USPS No: 006-760) is published monthly by Palladian Publications Ltd, GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to LNG Industry, 701C Ashland Ave, Folcroft PA 19032.

Nikhil Kaitwade, Future Market Insights, India, considers the impact of emerging technologies on the North American LNG industry.

6

As a result of the war in Ukraine, demand for LNG is increasing and prices are at their highest level in the last 14 years. To shift away from Russian petrol, European buyers have looked to North American suppliers, while Chinese purchasers are now signing long-term agreements after a lull. Supplementary gas-export plants are being built across various North American countries, such as the US. Nations such as Mexico and Canada are also prepared to join as important gas exporters, with plants planned for their West coasts.

Developers and producers of LNG in North America have agreements to sell approximately 48 million t of LNG this year, which would eventually increase exports by 60%

from present levels. By the end of 2023, there might be more than a dozen LNG export facilities in North America, including the eight that are now under development. These advancements are intended to increase the LNG’s present efficiency. This calls for the use of several cutting-edge technologies, including robots and automation, artificial intelligence (AI), cloud computing, and many more.

According to Future Market Insights, an ESOMAR-certified market intelligence firm, the LNG liquefaction market in the North American region is expected to grow with a significant CAGR from 2023 to 2033 as a result of the rising offshore and onshore construction activities in the US and Canada. 1 Due to

7

growing resource availability, technical developments, and new demand sources, LNG business models are shifting. While the majority of today’s trade gas-on-gas pricing is still determined by long-term, spot cargos, oil-indexed contracts, and price transparency are growing, providing possibilities along the whole North American value chain.

Thus, this article will discuss how the autonomous LNG fuelling system can be used to automatically fuel trucks and ships, how the LNG tank management systems can offer better efficiency and safety to the entire refining process of LNG, and how LNG giants use AI to maximise efficiency and production.

Autonomous LNG fuelling system – an automated way to fuel vehicles

The LNG robotic refuelling system was created to provide LNG to moving vehicles in self-contained filling stations along the roadways. The technology is flexible enough to work with both pressurised as well as non-pressurised fuels. The authorisation for the payment is also put into practice.

The LNG fuelling system is entirely self-contained. With this robotic fuelling system, the truck and other LNG-driven vehicles are driven into a target region, where the robotic system uses RFID to identify the truck as a client and begin the fuelling process. Live cameras allow the driver to monitor and, if necessary, halt the fuelling process.

The lifespan of the LNG fuelling products is extended by the robotic LNG system. The hose’s wear is being decreased since the robotic LNG fuelling mechanism keeps it from hitting the ground. Also, the robotic system’s motions are engineered to reduce mechanical stress to a minimum. The LNG nozzle within the instrument of the LNG refuelling system is exactly aligned with the receivers on the vehicle during connection and disconnection. This significantly lessens the amount of wear on the LNG nozzle’s front-facing components.

The primary benefit of the robotic LNG fuelling system is that it allows users to remain a safe distance away from the fuel dispenser as well as the dispenser itself as the LNG is supplied to the vehicle. The gasses in LNG are quite combustible. To reduce the likelihood of an accident, these LNG fuelling systems have received ATEX certification.

The North American company, Wärtsilä’s LNGPac TM, for example, is a fully automated fuel gas supply system for

LNG-fuelled ships that contains numerous modules such as the bunker station, the storage LNG tank, the process equipment, and the monitoring and control system. For every type of ship, Wärtsilä may provide custom or standard LNG systems that are connected with the rest of the Wärtsilä range and include features that maximise energy efficiency on board. Some of the main advantages of this method include:

z The systems’ high level of automated and remote operability.

z Patent for cold recovery to further reduce energy consumption on board lifecycle services.

z Analysing data locally or remotely.

z Connectivity with other Wärtsilä devices is seamless.

z Solutions that have been approved using various storage technologies and set-ups.

z Extensive familiarity with the main classification societies as well as numerous minor classification societies.

Such developments in the North American region are expected to take regional growth to new heights by 2033.

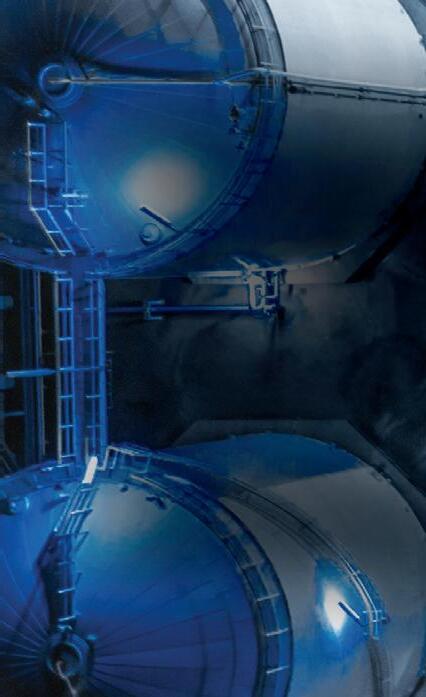

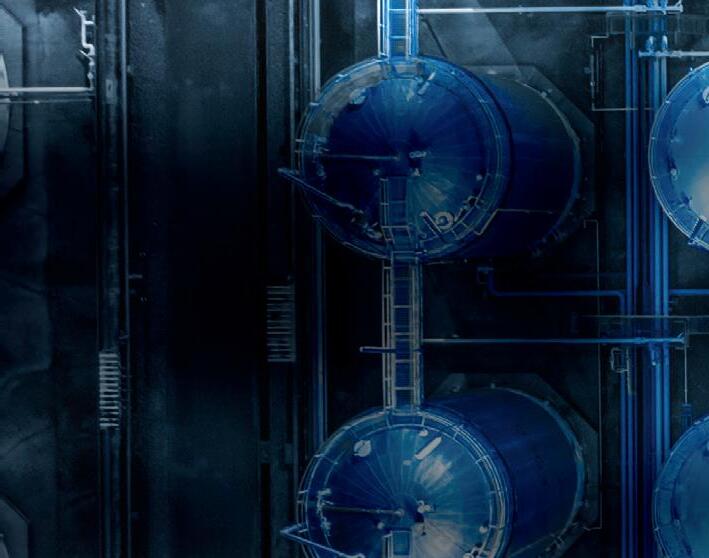

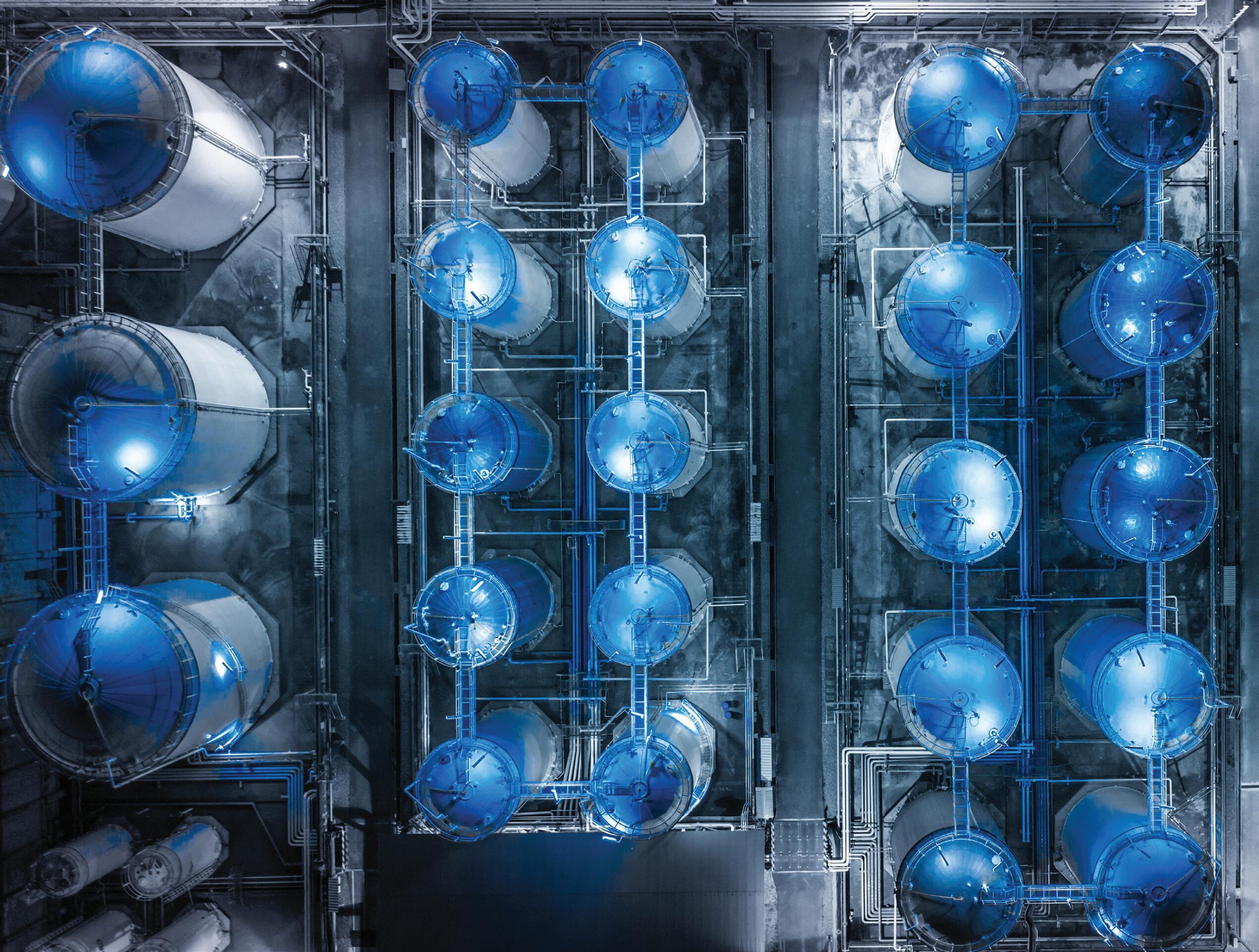

LNG tank management system for enhanced safety

The main goal of the LNG tank management and storage system is to deliver essential LNG tank data via a web-based and user-friendly user interface. To accommodate any plant architecture, the LNG tank management system has several interface choices for communicating with different tank gauging devices and systems. Via the online interface, all necessary information, including gauge setups, interface settings, and type configurations, may be quickly set up.

Depending on the needs of the company, LNG tank management systems show a wide variety of real-time data values and accurately compute inventory characteristics in a graphical or even raw data format. A high degree of safety along with alarm presentation is ensured by a highly sophisticated alarm management system that can be tailored to suit all site needs. A clever, integrated archive system makes all past data instantly accessible. To boost dependability, such systems might be implemented with complete redundancy.

Such emerging LNG technologies enable operations to respond early in a layered tank to minimise a potential rollover and assure terminal safety by delivering precise information on every layer in the LNG tank. A stratification detecting module based on the measurements of level, density, and temperature is incorporated in several advanced versions of such tank management solutions in addition to the regular LNG tank management system.

For instance, a third generation of cutting-edge LNG tank management systems is now being offered by North American company, Scientific Instruments. The most trustworthy option for level, temperature, and density

8 North America 2023

Figure 1. LNG Titans will employ AI to boost productivity and efficiency.

monitoring in LNG and LPG storage facilities is the SI-7000 LTD. Scientific Instruments’ third-generation LTD, the SI-7000, was created to comply with today’s strict safety rules.

With a reduced footprint as well as an intuitive keypad display integrated into the design, accuracy, performance, and dependability have all been improved. The SI-7000 probe is equipped with specialised sensors for measuring level, pressure, and LNG density. These sensors are all housed in a sturdy stainless-steel enclosure. All parts that are exposed to zones 0 and 1 are made of stainless steel, which offers the best corrosion resistance. With the addition of a sturdy stainless-steel chain and a completely jam-proof redesigned vertical gear drive mechanism (VGD), the SI-7000 now offers the most hassle-free and dependable profiling capability in LNG and LPG storage tanks. Such improved safety measures will take care of the safety standpoint in addition to improving overall productivity.

AI to drive the future of LNG – how LNG giants use AI to maximise efficiency and production

Owing to its complexity and operational difficulties, LNG facilities have a limited capacity for production and reduced energy efficiency. For instance, seasonal changes can be seen in ambient temperatures and feed quality. Just a small portion of the data produced is made to effective use. Traditional process-control systems frequently fail to optimise the intricate, non-linear connection between inputs and outputs. Last but not least, current process optimisation systems require too much manual work to adapt to changing real-time conditions.

The liquefaction process may benefit greatly from the combination of AI and domain knowledge since it will result in higher output, less unpredictability in production rates, and reduced emissions intensity. The key to bridging that production gap is teamwork. The domain expertise is combined with machine learning techniques and a thorough understanding of the machines and the environment in which they function, thanks to the contributions of data scientists, process and control engineers, and optimisation specialists.

Enterprise AI software may be created to give these insights and integrate them into the LNG process optimisation procedure based on the convergence of the domain as well as the data. Herein lies the role of the BHC3 coalition. Baker Hughes is one of the major LNG companies in North America, with over 30 years of expertise, and technology present in more than 50 LNG facilities globally, and a team of specialists developing, producing, and maintaining LNG equipment to provide more than 99.8% dependability. The strength of C3 AI, the industry leader in corporate AI software with more than 5 million active AI models along with 1.9 billion predictions generated daily, combined with this to create a powerful new potential.

In the end, the company hopes to establish a continuous improvement loop in which the LNG process feeds data to AI suggestions, the operator acts on the suggestions, and the cycle is improved further. They will use an AI-optimised machine-learning technique to

gradually optimise LNG output through collaboration. They want to achieve that.

The Shell Process Optimiser for LNG, an LNG module developed on top of BHC3 AI software, is one instance of how this may operate in practice. To improve asset performance, the Shell Process Optimiser for LNG integrates machine learning, operational insights, and domain knowledge. It enables engineers to reduce the difference between current and ideal production by modifying operating conditions. As a result, LNG output has increased by 1 – 2%. Similar reasons have encouraged other LNG businesses operating in the North American market to implement AI into their systems to increase the long-term productivity and effectiveness of these systems.

Conclusion

Over 27 LNG liquefaction projects throughout the world are now awaiting permission and are anticipated to begin operations between 2023 and 2026. The other two significant project stages are construction and feasibility, with 16 and 10, respectively. Globally, North America is in the lead with 31 liquefaction projects set to begin operations by 2026. By 2026, the US would have the most project starts internationally (21) compared to other nations. There would be eight projects that would begin operating in Mexico. To increase efficiency and satisfy the growing demand for LNG, several significant firms in the North American area are aiming to integrate innovative technology into their operations.

The US had previously been an LNG importer, but after 2016 the country switched to being an LNG exporter as a result of natural gas discoveries as well as production from the shale revolution. With 10.6 billion ft 3/d of LNG exports in 2022, the US will soon overtake Australia as the world’s second-largest LNG exporter. After just six years of export operations, the US solidified its position as the leading exporter of LNG in the world, even as Russia reduced its natural gas supply to Europe. The use of automation and cloud services across different LNG industry segments is being driven by such potent drivers.

Liquefaction facilities, storage tanks, coolers, and similar cryogenic equipment, as well as regasification plants, are critical technological elements and infrastructure in the conventional LNG value chain. This technology has been around for a very long time. Yet, rather than completely redesigning components, technical advancements continue to focus on increasing energy efficiency. For the upstream and downstream thermodynamic components of the gas cycle, such as gas turbines, heat exchangers, and compressors, higher efficiency and lower losses are sought via research and development.

Hence, in the forthcoming energy period, when environmental effects, investor mistrust, and growing competitiveness will be defining elements, new technology will be the main star, particularly in the North American LNG sector.

References

1. ‘LNG Liquefaction Equipment Market’, Future Market Insights, www.futuremarketinsights.com/ reports/lng-liquefaction-equipment-market

10 North America 2023

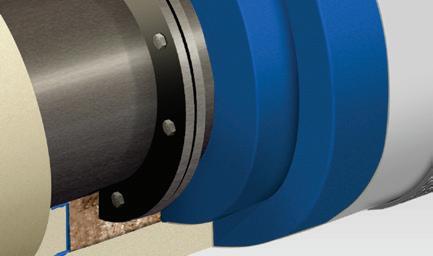

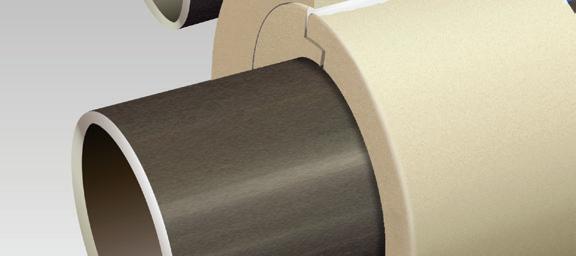

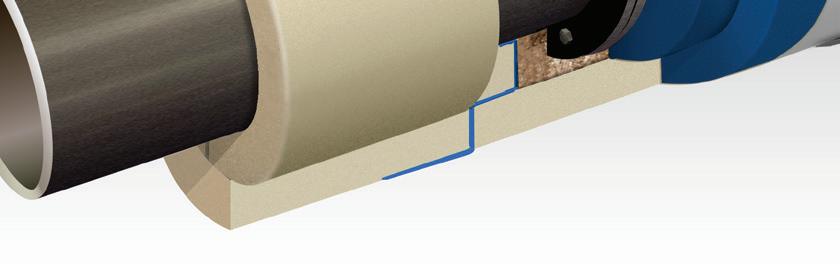

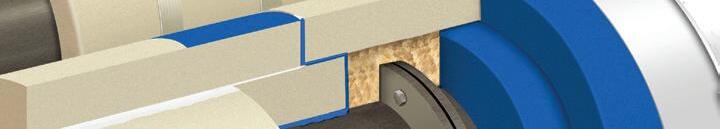

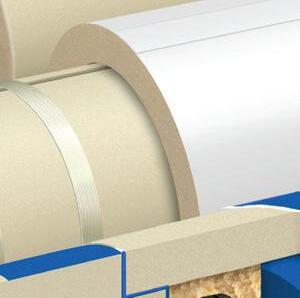

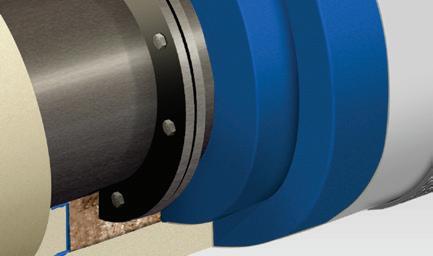

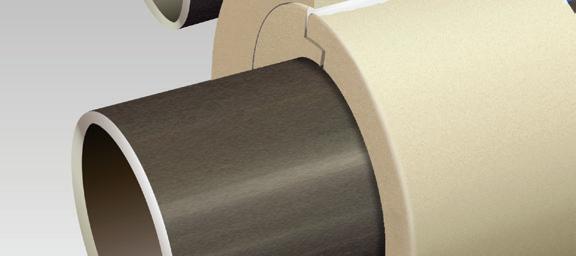

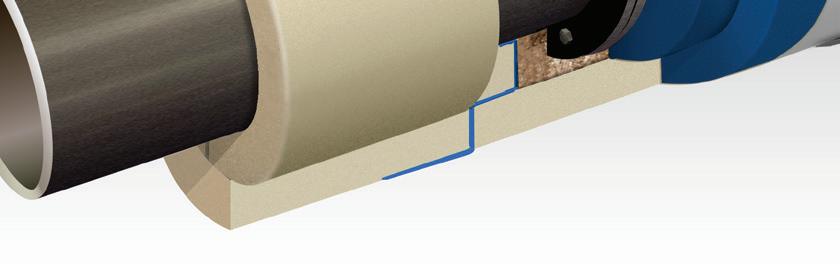

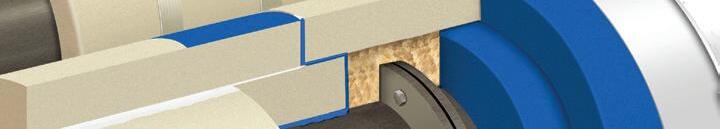

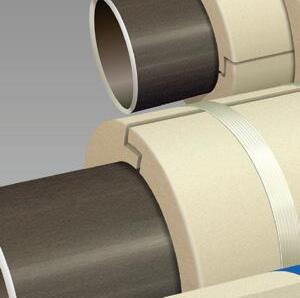

TRYMER® PIR

Guiding You Through LNG Systems

TRYMER® PIR, is a closed-cell, high-performance insulation with a broad temperature range, giving you the perfect insulation solution for not only heated applications but also cryogenic applications, like those found in LNG plants.

• Economical

• Easy to fabricate & install

• Superior thermal performance

• Available in a variety of densities and thicknesses

the LNG

Download

Systems Guide

LNGguidesystems availablenow

NEW!

Noam Ayali, Lindsey Swiger, and Jessica Rodríguez, Norton Rose Fulbright US LLP, outline considerations for project developers in the US looking to integrate carbon capture facilities in LNG projects.

12

The LNG industry is reaching a critical crossroads in its development. Demand for US LNG is surging. Fuelling this surge is the combination of key benefits of US LNG (e.g. inherent flexibility as both a domestic and international commodity, lack of destination restrictions, and pricing pegged to US natural gas hubs, such as Henry Hub) with energy security concerns, heightened in particular by Russia’s invasion of, and subsequent war in, Ukraine, which resulted in Moscow’s cutting of supplies to Europe in response to international sanctions.1,2 With at least 16 new LNG projects planned on the US Gulf Coast, the US is expected to become the world’s largest LNG exporter in 2023.2

Due to its lower emissions output than other hydrocarbon resources, natural gas – and LNG in particular – has long been hailed as a ‘bridge fuel’ “that would connect a period of declining coal usage to a future ruled by renewables.”3,4 However, the push to decarbonise and invest in less carbon-intensive energy sources has called into question whether, despite increasing demand, LNG has a place in the energy transition and the global energy mix. In response, LNG suppliers are seeking ways to decarbonise their LNG. This approach has received support, with John Kerry (who currently serves as the first US Special Presidential Envoy for Climate) recently noting that “[g]as is clearly part of the transitional effort,” “[b]ut if you’re going to head to net-zero by 2050, you’ve really got to have some serious capacity to be able to reduce emissions.”1

Carbon capture and sequestration has recently caught the attention of liquefaction facility developers in the US as a route to decarbonisation in LNG. Decarbonising liquefaction operations through carbon capture may help developers meet their own internal decarbonisation goals and those of their offtakers and also may help developers secure financing, as major banks are seeking to reduce their funding of carbon-intensive investments.5 A number of US LNG facility developers are taking this path, including Cheniere Energy Inc., NextDecade Corp., Sempra Energy, Venture Global LNG, and Freeport LNG.6,7

Notably (although beyond the scope of this article) the integration of carbon capture facilities with LNG facilities is not the only method the LNG industry is using or contemplating in attempts to decarbonise. In addition to optimising existing plant facilities, other methods include carbon credits to offset carbon emissions and ship-based carbon capture (installing and operating carbon capture facilities on board an LNG cargo ship).8,9

This article will explore certain considerations that project developers should consider when looking to incorporate carbon capture facilities at or upstream of their LNG facilities for the purposes of decarbonising, or otherwise reducing emissions from, such LNG facilities.

Regulatory framework

In developing any project, one of the primary considerations is the regulatory framework within which that project must exist. Accordingly, developers must consider the regulatory framework required for developing a carbon capture facility in connection with an LNG facility. The regulatory framework for LNG projects in the US is well developed and well understood. At a very high level, the construction and siting of liquefaction facilities is governed by the Federal Energy Regulatory Commission (FERC), while the export of LNG to both free trade and non-free trade agreement countries is governed by the U.S. Department of Energy. Depending on a number of factors, other federal, state, and local agencies also may have jurisdiction with respect to the construction and operation of an LNG facility.

The regulatory regime for carbon capture facilities (and transportation and storage or sequestration of captured carbon),

however, is less clear. Currently, the U.S. Environmental Protection Agency (EPA) maintains authority over underground injection of carbon (unless the EPA has granted primary enforcement authority to a particular state).10 Otherwise, at the federal level, carbon capture projects may require a number of different regulatory approvals depending on the particular project.11 The states also maintain regulatory authority over carbon capture facilities.10 However, not all states have promulgated carbon capture and storage facility laws, and the laws that have been passed vary in content.11 While there are efforts underway to clarify the carbon capture regulatory landscape, the complexities of the current regulatory environment can complicate development of carbon capture facilities, and regulatory counsel should be consulted early in the development process.11

In addition, although carbon capture facilities alone would not be subject to the FERC’s jurisdiction, when attached to an LNG facility, those carbon capture facilities may then be considered part of the FERC-regulated LNG facility.12 Thus, FERC approval of such facilities may be necessary.12 Accordingly, any application to the FERC may be required to contemplate, or existing FERC approvals may need to be amended to contemplate, carbon capture facilities that will be integrated with an LNG facility.

Timeline

Those looking to incorporate carbon capture facilities with or into LNG facilities should be cognisant that doing so can result in a development timeline longer than what might be expected for an LNG facility alone. As discussed later in this section, various factors can contribute to this delay.

Primary among these factors is the regulatory timeline. As discussed, including carbon capture facilities as a part of an LNG facility may require a FERC application to contemplate those carbon capture facilities or may require amendment of an LNG facility’s already-obtained FERC approval (if the carbon capture facilities were not originally included in the design of the LNG facility). Expanding the scope of a FERC application or amending a FERC order can delay FERC approval of the project from the outset or require additional time for the FERC to consider the amendment application. This is because the FERC will require time to consider the impact of the carbon capture facilities in each case, including thorough review of any public comments that may be submitted to the FERC in response to the carbon capture facilities. Other regulatory agencies with jurisdiction over the carbon capture facilities also may require time for consideration thereof and issuing approvals related thereto.

Any appurtenant delay should be reflected in the development, construction, and commissioning timeline in all agreements and documents (including financing documents) related to the LNG facility and the carbon capture facility. In the case of an LNG facility in which carbon capture facilities are contemplated from the onset, project developers should take care that the development schedule and major milestones for the LNG facility as stated in contracts relating to the facility and elsewhere contemplate the timeline for development of both the LNG facility and the carbon capture facility. In the case of a carbon capture facility added later to an LNG facility already in development, project documents and regulatory approvals (including the original FERC order approving the LNG facility, which often includes a construction deadline) may need to be amended to incorporate any carbon-capture-related timeline extension.

Lastly, incorporating carbon capture facilities may result in delays because a carbon capture facility addition requires development of an entirely new project. A project developer will have to undertake the design and engineering for, and ultimate construction of, the carbon capture facility as well as put into place the commercial and legal

13

infrastructure of the carbon capture facility. Naturally, these activities may lead to a longer development timeline than development of an LNG facility alone.

Project development and financing

Although construction timelines for, and the general requirements for development of, LNG facilities are generally understood in the industry, development of industrial scale commercial carbon capture facilities in the US is relatively untested. While a full description of the requirements for developing a carbon capture project is beyond the scope of this article, US developers must consider that a carbon capture facility requires land on which to be situated, potentially pipeline infrastructure to transport captured carbon, and a means for disposing of captured carbon, either through a location in which to store the captured carbon, a buyer for the captured carbon, or a means of utilising the captured carbon. Supply chain issues and the ability to obtain component parts for construction of the carbon capture facility also could complicate development and construction.

Of particular note regarding difficulties in carbon capture facility development, ownership of pore space for the storage of captured carbon is still a question that has yet to be definitively resolved in many states in the US, making storing captured carbon a legally and commercially complicated process. Further, the market for captured carbon is limited at this time, with enhanced oil recovery being the primary use of captured carbon.13

Parallel to developmental timeline concerns, project developers also must determine where in the financing process the carbon capture facilities will be included, and whether they will comprise part of the larger financing of the LNG facility itself or will be financed separately. For example, developers and their commercial teams should consider the scope of their facilities and whether the opportunity would be attractive to financing sources in different segments of the market, what the implications of a ‘single consolidated’ financing vs separate entities/separate ring-fenced financings are, and ultimately what the market can support in terms of competing facilities or other low-carbon investment opportunities. Further illustrating the complex, interconnected nature of the integration of LNG and carbon capture facilities, the decision with respect to financing may hinge, in part, on the timeline for development and permitting of the carbon capture facility relative to the timeline for development of the LNG facility.

Finally – and arguably most importantly – incorporating a carbon capture facility with an LNG facility will likely also have tax implications for developers, including structuring requirements related to tax credits under the Inflation Reduction Act and Section 45Q tax credits for carbon sequestration.14,15 A nuanced discussion of tax credit qualification is beyond the scope of this article, but US project developers are well advised to carefully review the changing tax landscape as they bring these facilities online. In addition to tax structuring, corporate structuring also will play a key role in the development of the facility. For example, developers must determine whether the carbon capture facility will sit within its own entity, be part of the common facilities, or sit within another, already-existing entity within the project structure. These structuring questions also may impact tax considerations as well as regulatory filings, including those made with the FERC.

Greenwashing claims

Given that environmental considerations are one of the primary drivers for incorporating carbon capture facilities into an

LNG facility, LNG project developers undoubtedly will want to publicise the environmental benefits stemming from such carbon capture facilities. However, advertising the environmental benefits of carbon capture facilities associated with LNG facilities is not without risk, as it could lead to claims that the reported environmental benefits are being overstated or misrepresented, often characterised as ‘greenwashing’ claims.16 A failure to, or even a perceived failure to, accurately represent the environmental benefits of the carbon capture facilities could lead to action against an LNG project developer from project stakeholders, commercial counterparties, environmental groups, or even regulators.

These actions bring to light a variety of factors that complicate how developers report the benefits of carbon capture facilities (or other methods of reducing the environmental impact of LNG facilities). For example, claims may centre on the fact that the LNG delivered is not ‘carbon neutral’ or ‘net zero’ because the carbon reduction method employed at the LNG facility reduces only certain emissions (e.g. Scope 1 and Scope 2 emissions [emissions from sources that are owned or controlled by an organisation and emissions associated with an organisation’s purchase of electricity, steam, heat, or cooling], but not Scope 3 emissions [emissions that result from assets not owned or controlled by an organisation]) and the amount of emissions purported to be offset is inaccurate.8,17,18 The varied and complex landscape of emissions calculation and reporting standards and requirements could create difficulties for developers in ensuring that reporting of environmental benefits correctly represents, or is perceived to correctly represent, the actual environmental benefits that a carbon capture facility affords.

Accordingly, project developers should be thoughtful when describing any environmental benefits of a carbon capture facility associated with an LNG facility, including paying close attention to the substance of public statements and project developer interaction with stakeholders.

Conclusion

Integrating carbon capture facilities with LNG facilities offers US LNG project developers an opportunity to balance competing but urgent needs – the need for secure and reliable energy, as well as the need to continue to decarbonise and meet global climate goals. However, as highlighted above, developing carbon capture facilities together with LNG facilities can be a complex process that requires careful consideration and planning.

References

A comprehensive list of this article’s references can be found on the LNG Industry website: www.lngindustry.com/special-reports

Notes

Noam Ayali, Lindsey Swiger, and Jessica Rodríguez would like to thank Jenelle Tubergen, an Associate in Norton Rose Fulbright’s Houston office, for her assistance with this article.

As legal advice must be tailored to the specific circumstances of each case or matter, nothing provided herein should be used as a substitute for the advice of competent counsel. This article does not constitute legal advice, does not necessarily reflect the opinions of Norton Rose Fulbright or any of its attorneys or clients, and is not guaranteed to be correct, complete, or up-to-date.

14 North America 2023

Rostom Merzouki, Director, Global Gas Development at ABS, discusses how North America is tackling shipping’s climate challenge ambition and reinventing itself in the energy transition to cleaner sustainable fuels, alongside the US’ endeavour to responsibly drive technology initiatives that help to lower fuel consumption while still managing the increasing demand for goods and services transported by ships.

LNG as a marine fuel represents an available and competitive solution that contributes to the International Maritime Organization’s (IMO) long-term strategy of reducing greenhouse gas (GHG) emissions from ships. It uses generally light, small-molecule fuels with high energy content, but more demanding, mainly cryogenic, fuel supply systems and storage. This includes the relatively mature methane (such as LNG) solution leading towards bio-derived or synthetic methane, and ultimately to hydrogen as fuel. On this pathway, if methane slip is discounted, LNG can reduce carbon dioxide (CO2) emissions by 20%; bio-methane can be carbon neutral, while hydrogen is a zero-carbon fuel.

Expanding the operating parameters of marine LNG across North America

Seven years ago, the US exported almost no LNG. Now, as Europe increasingly relies on US gas exports, the US must establish its own strategy for gas.

Imports of LNG are currently concentrated across certain developed nations: just eight LNG importers have absorbed 74% of global LNG trade. US exports were shipped to 36 different countries in 2022, but Europe absorbed the lion’s share of US LNG (64%).

LNG from the US has become the second-largest source of gas imports to Europe, after pipeline gas from Norway, following accelerated Russian pipeline cuts over the summer of 2022. Other nations –including Norway, Azerbaijan, and Qatar – have stepped up their exports to Europe, collectively adding 28 billion m3 in 2022. But the US, supported by its recent increase in liquefaction capacity, added 37 billion m3, more than all other LNG sources combined.

As the Shell LNG Outlook 2023 reveals, 80% of new LNG supply by 2030 will be from Qatar and the US based on new long-term LNG sales and purchase agreements (SPA) showing Europe’s shift to long-term supply commitments towards LNG for its energy security.

16

17

While recent political events have been costly, energy security in Europe rests on US natural gas exports. Europe’s shift from Russian gas to other supplies has dramatically changed global gas trade and energy markets. Leveraging US LNG to deliver lowest-emissions gas, clean hydrogen, and zero-emissions shipping will be key to maintaining momentum in the transatlantic energy trade and securing a clean energy system. Public-private partnerships in Europe and the US could reinforce transatlantic co-operation in securing supply chains.1

Many questions for US policymakers remain: How will LNG export demand be balanced with domestic consumption of gas? How will political leadership capitalise on the economic and geopolitical benefits of LNG exports? How will domestic environmental regulations, infrastructure, and permitting decisions affect the US response to this crisis? Answers to these questions will help Europe understand the strength of the transatlantic energy partnership.

The world is going to have to begin to balance what it is facing today, which is, essentially, how to handle energy security relative to the short-term energy security challenge and the longer-term energy transition. LNG is going to play a leading role in this. However, for such a key fuel for the energy transition, it is important to recognise it is itself a fuel in transition.

Developing economics

According to Clarksons Research’s Shipbuilding Review 2022, more complex ships were ordered – including a record 182 LNG orders worth US$39 billion – and alternative fuel investment increased to a record 61% of tonnage ordered, all supporting a 6% increase in value of orders to US$124.3 billion.

Ordering was dominated by LNG, which represented 36% of total compensated gross tonne (CGT), together with container vessels with 350 ships and 29% of total CGT, which, while down 50% y/y, was still the third largest on record on a TEU basis. Car carrier (69 vessels, 2.4 CGT), FPSO, and ‘wind’ niches also did well.

Increased tanker orders are thought likely for 2023, along with a continued flow of LNG – despite the average price for a 174 000 m3 vessel being US$248 million at the end-2022, up a significant 18% y/y.

The latest ABS Zero Carbon Outlook indicates that significant investments had been made in newbuild tonnage, with a particular focus on containerships and gas carriers. The trends indicated that LNG, methanol, and LPG will have a starting point advantage over the other fuels currently considered, at least until the middle of the decade. Based on the vessel type and applications, the fuel uptake will vary. For example, it is expected that more large bulk carriers will adopt LNG compared to smaller vessels. The tanker sector’s adoption of alternative fuels is expected to lag bulk carriers.

The expected future fuel mix will inevitably involve a rapid reduction in oil-based fuels from close to 80% today to less than 30% by 2050 with LNG, methanol, ammonia, and hydrogen rapidly increasing in adoption. Ammonia and hydrogen will be carbon free if they are produced by the green pathway. The uptake will depend on several factors, availability of fuel being one apart from the readiness of ports and bunkering infrastructure.

Short-term actions making the transition faster

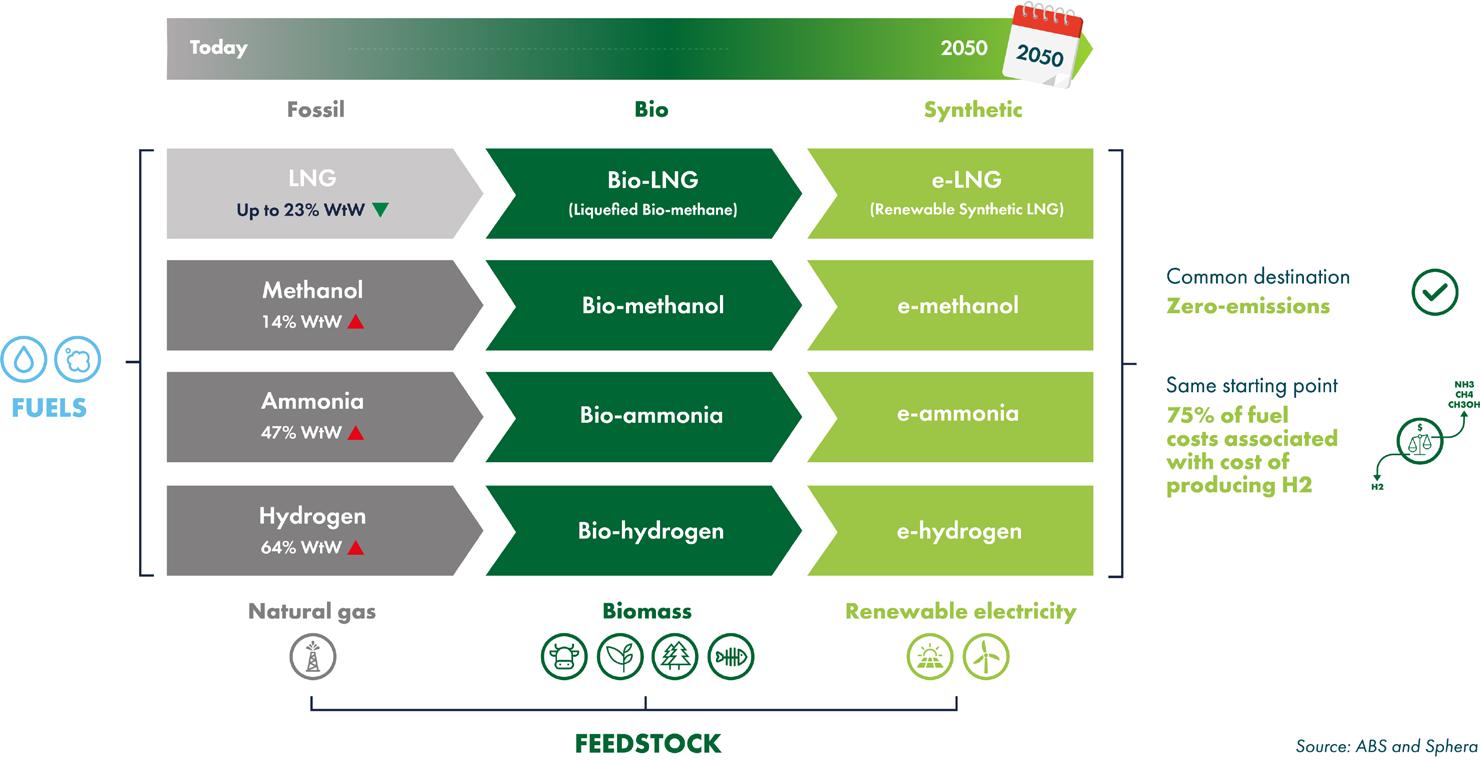

There is growing recognition that decarbonisation will not be a ‘single one-stop fuel’ process where the industry moves in a single step from fossil to zero-emission, renewable fuels. Accelerating decarbonisation efforts in the maritime and shipping industry, marine LNG is known to help to cut sulfur emissions by 99%, fine particle emissions by 99%, nitrogen oxide emissions by up to 85%, and GHG emissions by up to 23% (well-to-wake [WtW]).

The EU Member States are implementing the Fit For 55 package, the umbrella regulation that includes the FuelEU, the EU’s ETS extension to the maritime transport sector, an update Energy Taxation Directive, and initiatives on the deployment of Alternative Fuels Infrastructure. The expansion of the EU ETS to the maritime transport sector will bring the cap-and-trade approach to an industry level. For each individual vessel, the implementation will be more like carbon taxation with a payment obligation for each tonne of carbon emissions from the vessel. In this instance, the tank-to-wake emissions and the fuel consumption as reported within the EU monitoring, reporting, and verification (MRV) framework are only considered. The FuelEU Maritime mechanism expands carbon-output calculations beyond present tank-to-wake estimates to include well-to-tank emissions, which better reflect energy lifecycles. The initiative aims to incentivise the use of low-carbon fuels, as well as the shore power connection of specific vessel types (containerships and passenger vessels) and thereby escalate the transition to carbon-neutral shipping. The FuelEU Maritime initiative makes use of the lifecycle approach on a well-to-wake basis to derive the carbon footprint of fuels including CO2, nitrous oxide (N2O), methane slip, and the carbon dioxide equivalent (CO2-e) emissions from electricity used during port stays. Future developments in carbon trading schemes around the world and regulations show a trend in using WtW data.

Bio-LNG, produced from sustainable biomass resources, is also commercially available today and output is rising. SEA-LNG indicates there are 78 production plants set to be up and running within the EU alone in the next two years, and output should expand ten-fold by 2030.

The US has the capacity to produce the most LNG globally. Traction in developing LNG bunkering infrastructure is expanding, with several leading ports and LNG bunker suppliers having established key initiatives and made significant progress in support of these developments. As the World LNG Report for 2022 highlights, the US’s bunkering operations currently take place primarily at the Port of Jacksonville in Florida and Port Fourchon in Louisiana. Jacksonville has conducted truck-to-ship operations since 2016 for two containerships and added ship-to-ship (STS) bunkering services to the facility with the delivery of the Clean Jacksonville bunker barge in 2018. The Clean Canaveral, a 5500 m3 bunker barge, was also delivered to Jacksonville in late 2021. Port Fourchon completed the bunkering of its first LNG-fuelled vessel in 2016 and has plans to become a central LNG terminal in North America. With the arrival of the 4000 m3 Q-LNG 4000 ATB unit and its dedicated tug Q-Ocean Service in early 2021, Port Canaveral in Florida is on track to become the US’ first LNG cruise port. The Q-LNG 4000 vessel will operate from Port Canaveral to provide LNG fuel to

18 North America 2023

Serving the future with years of experience.

DSC offers over 30 years of experience in repairs and services spanning all types of vessel operating in the natural gas arena, from LNG carriers and FSRUs (Floating Storage and Regasification Units) to servicing LNG-fueled vessels.

Damen Shiprepair Brest offers one of the largest docks in Europe (420x80m) with tunnel access enhancing logistical flexibility. In combination with the size of the shipyard and adjacent port terminal facilities, deep water quay side possibilities and specialised LNG services (GTT license), Brest is a perfect location for servicing LNG vessels.

Additional location is Damen Shiprepair Verolme, capable of servicing this type of vessels with its large dock (400x90m), quayside availability as well as surrounding infrastructure.

Our reference list is growing by day, tackling a wide range of our Clients’ demands: from complexity of the GTT certified cargo tanks and sub-cooler installations to standardised BWTS installations and regular hull surveys.

With the new demands emerging from the EEXI and CII regulation, we are there to serve our Clients’ needs further on their pathway towards compliance.

Find out more on Damen.com

Pictured here:

Damen Shiprepair Brest

cruise ships after loading LNG from a fuel distribution facility on Elba Island, Georgia.

Projects set to go live include Sempra Energy’s Port Arthur plant in Texas, Energy Transfer LP’s Lake Charles in Louisiana, and NextDecade Corp’s Rio Grande in Texas. Recently, ExxonMobil agreed two 20-year deals with Mexico Pacific Ltd from the planned 14.1 million tpy Saguaro Energía LNG project on Mexico’s Pacific coast. Others include Brownsville LNG, Golden Pass, Freeport, Cheniere, and Tellurian.

The US can export around 11.8 billion ft3 this year and 12.6 billion ft3 next year, according to estimations by the U.S. Energy Information Administration. The seven export plants already in service, including Freeport LNG, can turn approximately 13.8 billion ft3 of gas into LNG each day.

Shipping as the enabler of the clean, green energy transition

For shipping, the challenge and opportunity lies in two pathways: shipping for shipping, which is the decarbonisation of the industry and shipping for the world, which highlights shipping’s role as an enabler of the global green energy transition.

Industry will be fundamental in supporting the emerging value chains in shipping which is complex and with unique challenges to navigate. It is a multi-dimensional lifecycle hybrid solution with numerous boundary conditions impacted by technology and infrastructure readiness timelines. Complex integrated energy management systems, new materials and processes, improved ship connectivity, increased application of autonomous functions, and real-time performance optimisation are some of the challenges today.

Any selection of the most appropriate fuel pathway and related technology is certainly a challenge for both vessel operators and their owners, which includes considerations of the vessel’s size and design, as well as evaluation of whether lower or higher energy content fuels will best match its operational profile.

Pushing the technology parameters in the evolution of green shipping corridors

The U.S. Department of State (DOS) has provided high-level guidance on green shipping corridors and the current administration has promulgated several climate related laws that have created a supportive regulatory and policy framework which the shipping industry could take advantage of over the next decade.

Formation of a green corridor is a techno-regulatory-commercial undertaking and will require comprehensive expertise. Typically, most corridors announced are between two ports, but there are more being developed which focus on a business case that is at the centre of the corridor development, e.g. the Australia-Japan Irzdor and the Chile Green Corridors focus on green hydrogen. Forming a consortium based on a pre-feasibility assessment followed by a top-down approach analysing each part of the value chain and their individual criteria will help to make decisions based on solid quantitative backing.

From a fuel perspective, LNG, ammonia, hydrogen, and methanol seem to be the front runners from a decarbonisation viewpoint, and from a technology standpoint, battery-powered and fuel cell vessels could play a role, at least for short-range applications.

Dual-fuel engine technology is also making the transition to alternative low- and zero-carbon fuels much easier, and are technologies that can be factored into the design of new vessels, especially fuel tanks. ABS classed the Harvey Energy, which features a dual-fuel (LNG/diesel) engine equipped with a battery-converter system. A 1450 kW battery was installed as part of a hybrid energy solution that was designed to reduce the ship’s exhaust emissions, fuel consumption, and noise levels. In February 2022, Harvey Gulf International Marine announced that it has begun to operate one of its ‘tri-fuel’ vessels exclusively on battery power and renewable LNG (RLNG), with diesel fuel as backup. RLNG is recaptured swine and dairy farm gas from pigs and cows. The use of RLNG enables the dual and tri-fuelled RLNG vessels to carbon neutral.

20 North America 2023

Figure 1. ABS map identifying locations of green shipping corridors.

BRIGHTER FUTURE COOLER BY DESIGN ®

Chart’s LNG power generation solutions provide natural gas to hundreds of thousands of homes. This is one way Chart facilitates LNG as a safe, clean-burning fuel for energy, transportation and industry.

Learn more at www.ChartLNG.com LNG@ChartIndustries.com

Onboard carbon capture will be a useful technology to help bridge the gap between traditional fuels and alternative fuels. Carbon capture utilisation and storage will begin to play an important role in reducing emissions in both carbon-intensive processes and in the growing use of low-carbon fuels, such as LNG, methanol, or biofuels. Carbon capture is also essential to the production of fuels such as blue hydrogen and ammonia, which could also help to power the next generation of maritime assets. Nuclear vessels are a possibility but the public relations issues may prevent usage despite being technologically sound and proven.

Increased electrification through advanced energy storage systems (ESS) may serve an essential role in the path to decarbonisation. ESS such as batteries, kinetic ESS, or supercapacitors offer broad application potential. They could be used in a hybrid arrangement, improving the efficiency of hydrocarbon-burning vessels. ESS could also be used in the small scale production of green alternative fuels for powering various systems. Use of advanced ESS is expected to see increased use on board marine vessels and offshore assets as 2050 approaches.

In the future, a third generation of biofuels, such as lignocellulosic or algae-based fuels, could potentially provide the industry with almost 500 million tpy of fuels, more than the current annual bunker demand. This group includes electro/synthetic gas-to-liquid (GTL) fuels produced though either carbon capture and electrolysis, or from converting biomass to syngas and then to liquid fuels, such as methanol or diesel.

According to ABS’ future fuel mix forecast, alternative fuels will take off post-2030. This means construction of those vessels should start in the next 2 – 3 years and even in 2050, there will be enough vessels which will still operate with traditional fuels. When vessels with alternative fuels begin operating, they will find a natural home in the announced green corridors assisting with viable operations despite the higher expected fuel costs.

Green shipping corridors are a nascent conceptual idea which will need to be tested in the physical world. If there is an industry that can make this work, it is the shipping industry with its rich history of co-operating with numerous stakeholders in a supply chain. Co-operation and collaboration are at the bedrock of any green shipping corridor.

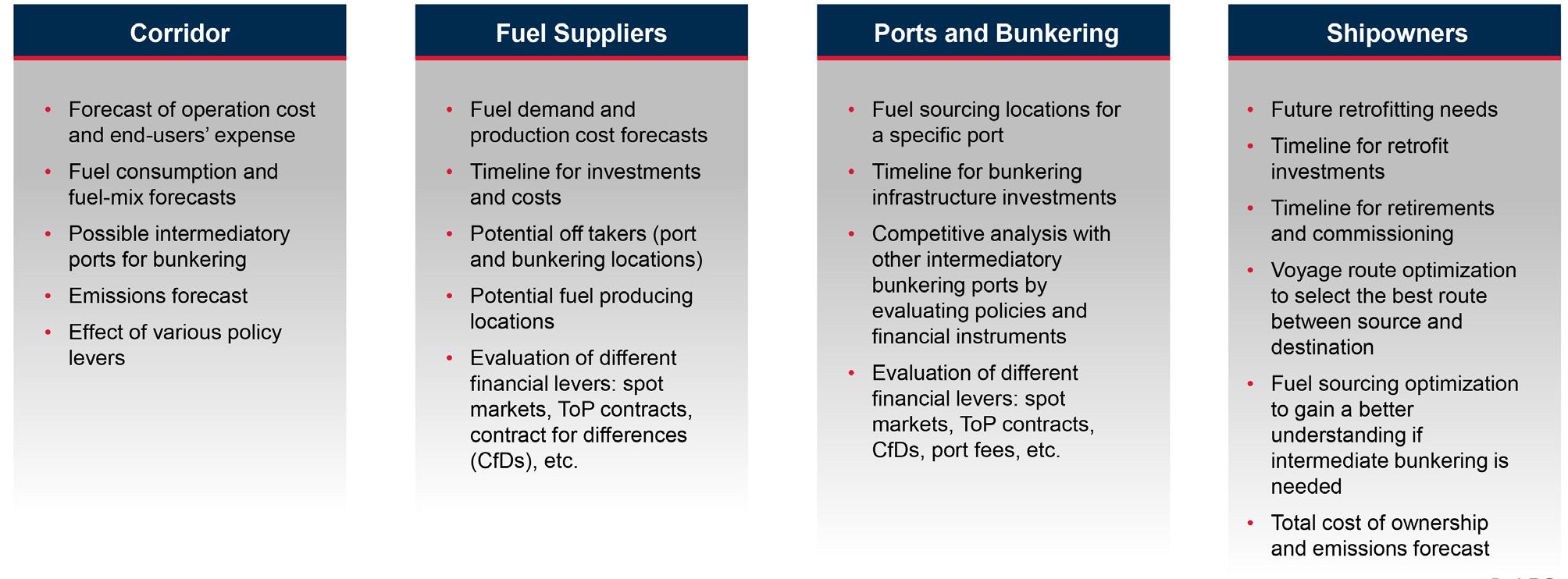

Creating an integrated model with all stakeholders in the marine ecosystem to understand and evaluate the potential, feasibility, and profitability of green corridors is subjected to variations in operating conditions, policies and financial instruments.

Collaborating with industry

Developments in digital twins, modelling and simulation, generative design, alternative fuels, green ecosystems, and the blue economy are technologies that represent significant industry paradigm shifts: future fuels and energy sources, approaches to design and construction that reflect digital processes, software that empowers people and analysis that feeds back into the design and production phases. These shifts demand they are approach with a fresh mindset and new tools, prompting the elevation to a new performance level and leverage new technologies.

ABS is leveraging on its organisation’s low-carbon expertise to provide industry-leading services and solutions, as well as guidance to assist vessel owners in selecting alternative fuels such as LNG. It is committed to working closely with industry partners and customers to intensify investigation into these technologies and future fuel solutions.

In the shorter term, retrofitting vessels with LNG and biofuels (both seen as good transitionary fuels) appears to be the most viable option. New vessels, on the other hand, could be designed to incorporate the likes of ammonia, methanol, hydrogen, and fuel cells and represent more of a longer-term strategy that ABS expects to see investment into over the coming decades. As marine and offshore transitions away from the combustion of hydrocarbons, fuel-cell technologies are also drawing careful attention from shipowners.

While everyone has a part to play in not just the ‘here and now’ of cleaner marine fuels, but in the sustainable development of tomorrow’s carbon-free future of shipping, it is clear not a single industry participant can deal with this decarbonisation challenge alone. Collaboration with stakeholders across shipping’s value chain is essential to accelerate the speed of R&D and commercialising sustainable fuels of the future – and at scale.

References

1. Center for Strategic & International Studies, www.csis.org

22 North America 2023

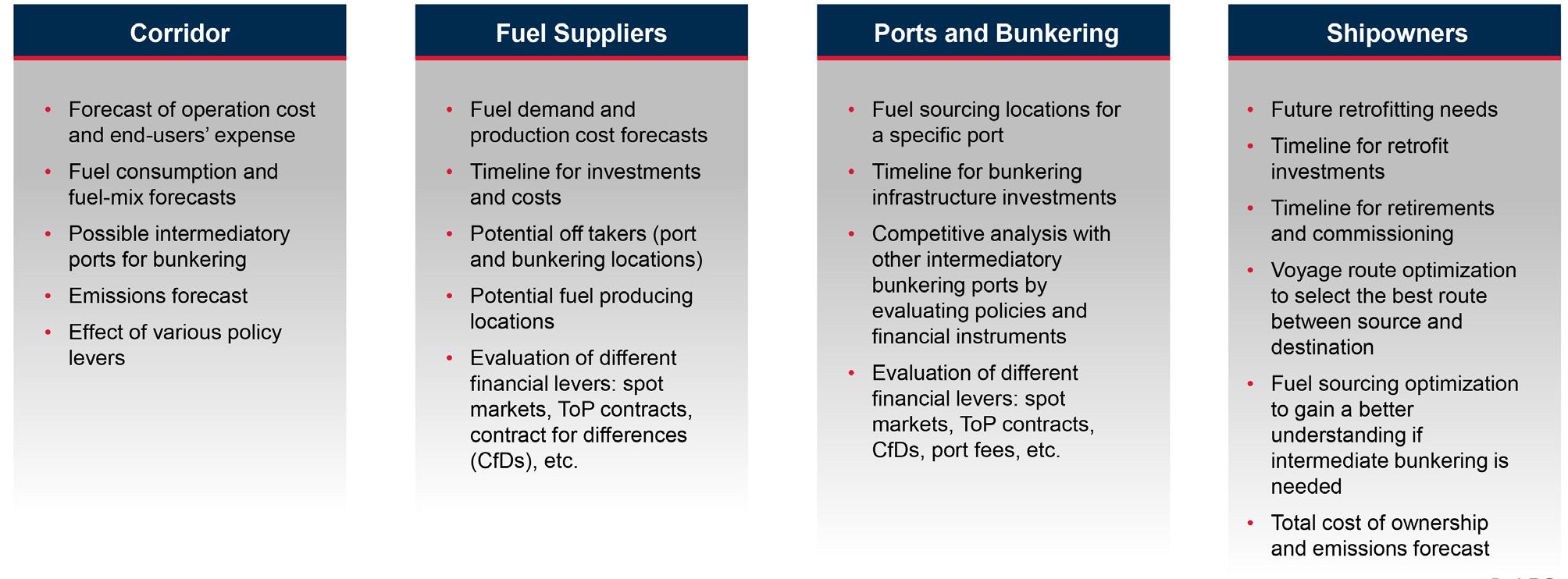

Figure 2. Key outcomes by stakeholder from the ABS Green Corridors Simulation, a service designed to support international design and development of clean energy initiatives.

Steve Esau, COO of SEA-LNG, addresses the important role the LNG industry can play in decarbonising shipping – from its leading position in the race to net-zero emissions bunkering, to how it can leverage bio-LNG and e-LNG to further reduce greenhouse gas emissions and meet future climate targets.

LNG is already a clean shipping fuel success story because of its unparalleled reduction in harmful local emissions and the fact that it offers cuts to greenhouse gas (GHG) emissions of up to 23% on a full lifecycle, or well-to-wake basis, compared with traditional oil fuels. This provides a firm foundation for further emissions reductions as LNG transitions from a fossil fuel as growing volumes of bio-LNG and e-LNG become available.

The story so far

The shipping industry currently represents approximately 3% of total global emissions. According to the

Fourth International Maritime Organization (IMO) GHG Study 2020, these emissions are projected to increase from about 90% of 2008 emissions in 2018 to 90 – 130% of 2008 emissions by 2050. The marine fuels and shipping industries therefore need to encourage demand for lower carbon fuels and supporting the demand with commercial supply.

Changes in local emissions regulations in the shipping industry in the past decade – for example the introduction of the IMO’s Sulphur Cap in 2020 and Emission Control Areas in Northern Europe, North America, and the Caribbean – have driven the uptake of LNG as a marine fuel. LNG offers a well understood solution –

23

over 60 years’ experience of using and transporting LNG gives it a structural advantage over other alternative marine fuels in areas such as safety, handling, infrastructure, and supply chain organisation.

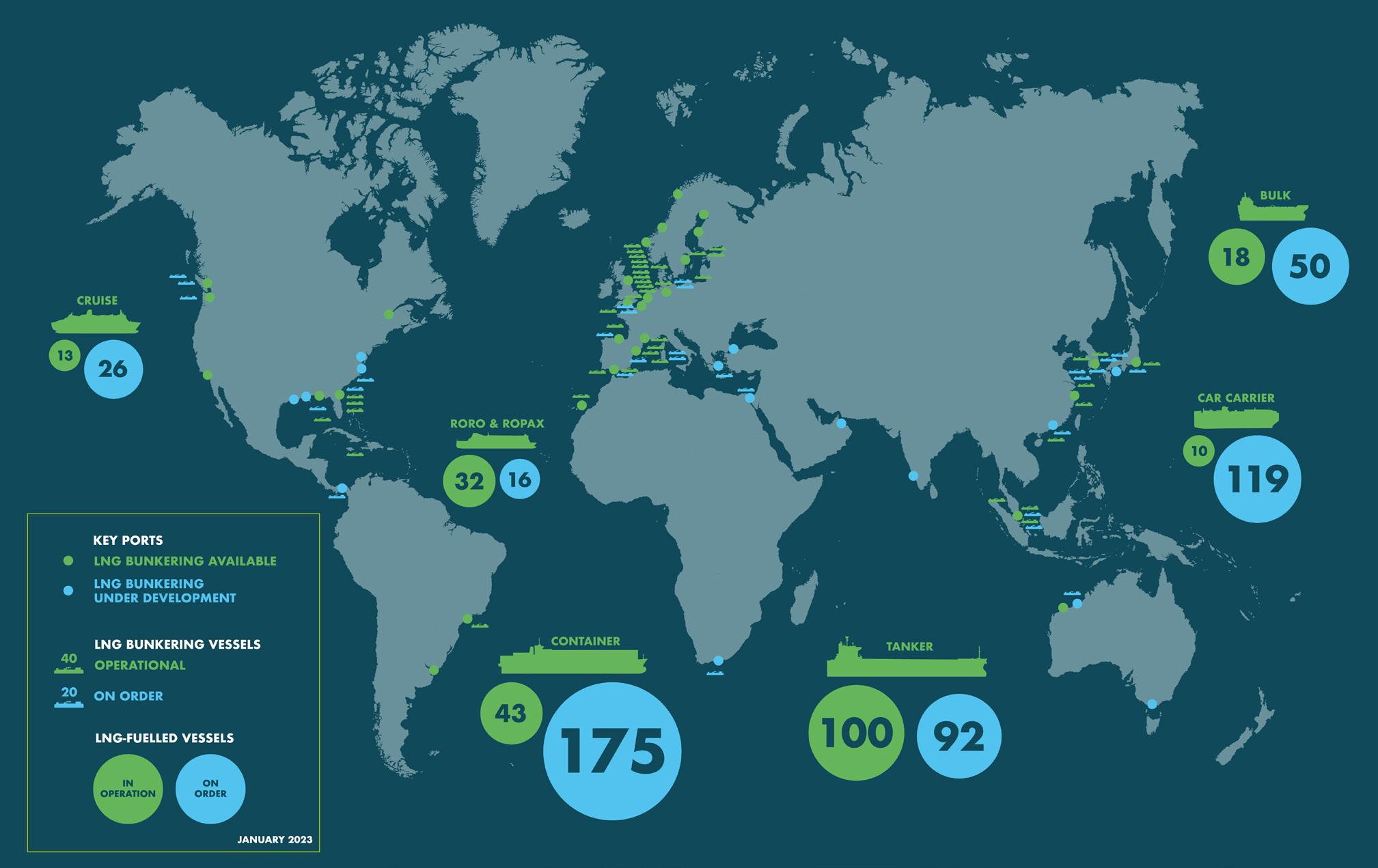

In recent years, LNG has been the fastest-growing alternative fuel option among orders of newbuild deep-sea vessels. Based on the current confirmed newbuild order book, the LNG-powered fleet is forecast to grow from fewer than 200 vessels in 2020, to close to 900 by 2030. If current trends continue, several thousand LNG-powered vessels could be in operation by the end of the decade.

The potential market for a clean marine fuel is huge and diversified. The shipping industry is unlikely to rely on a single solution; it is likely to need a basket of fuels to support different vessel types and shipping routes. LNG and its pathway to net-zero carbon is a viable solution for many. Future net-zero carbon-based marine fuels will recycle existing carbon in the atmosphere without releasing fossil carbon, and some may help reduce carbon through post-combustion carbon capture and storage.

Today’s challenges

Today, no zero emissions fuels exist in the quantities necessary to satisfy the demand from shipping.

Different fuels have different levels of technology readiness and investment needs across vessels and engines, fuel production, supply infrastructure, and for regulatory and safety requirements.

Shipping’s basket of fuelling options will likely include a mixture of bio-derived and synthetic, or electro-fuels, such as bio-LNG (also called liquefied biomethane [LBM] or renewable natural gas [RNG]), bio-methanol, e-LNG, e-methanol, e-ammonia, and e-hydrogen. All synthetic fuels are derived from the same building block: hydrogen produced via electrolysis. The capacity for producing synthetic fuels will rely on the build out of electrolysis capacity to produce sufficient hydrogen feedstock. To be net zero, these fuels need to use renewable electricity in their production.

Crucial to filling the basket with truly net-zero fuels will be assessing and understanding, for each fuel choice, the full lifecycle carbon emissions of the fuel from production to combustion. Tracing fuel pathways allows for comparing not just the emissions impact of a particular molecule, but the overall environmental impact of a molecule’s pathway to net zero. It is crucial that decision making is guided by accurate information that assesses the alternative fuel pathways on a like-for-like and full lifecycle (well-to-wake) basis.

Bio-LNG is already meeting the industry’s requirements for an environmentally friendly fuel and is being used in as a drop in fuel in North-West Europe and the US. Bio-derived fuels produced from waste streams can be effectively net zero and, given certain conditions in their supply chain, they can even be carbon negative.

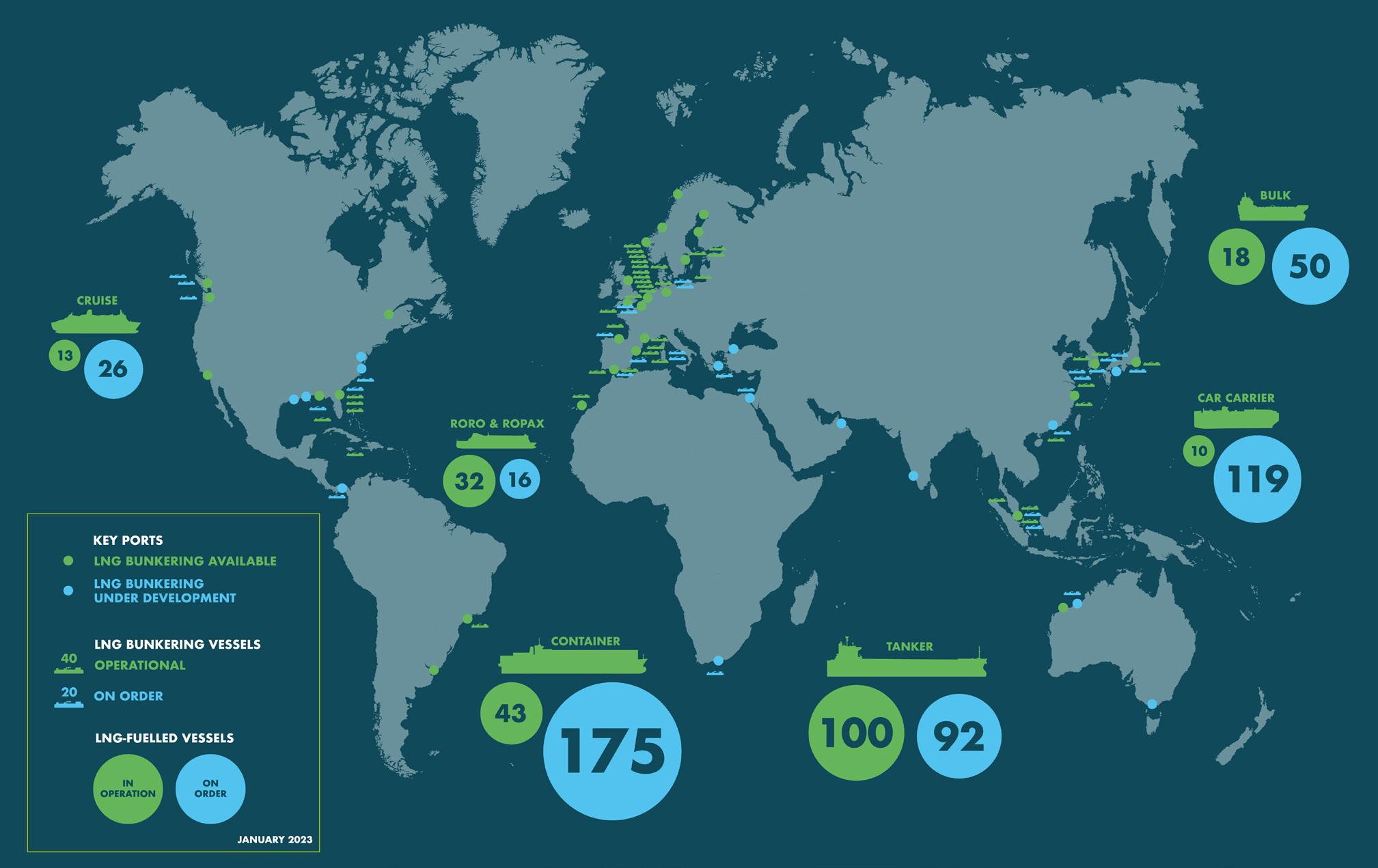

Decarbonisation in action

By the end of 2022, there were 40 LNG bunkering vessels operating around the world in northern Europe, the Mediterranean, the US, Canada, South Korea, Japan, Malaysia, China, Singapore, Brazil, and Australia. 2022 saw commercial ship-to-ship bunkering of LNG taking place for the first time in China, the Caribbean, and Russia. The year also saw the number of ports where LNG was available increase by nearly one-third, from 141 to 185, with further expansion anticipated to bring the number of ports offering LNG bunkering to more than 230 by mid-decade.

24 North America 2023

Figure 1. Growth of LNG-fuelled fleet.

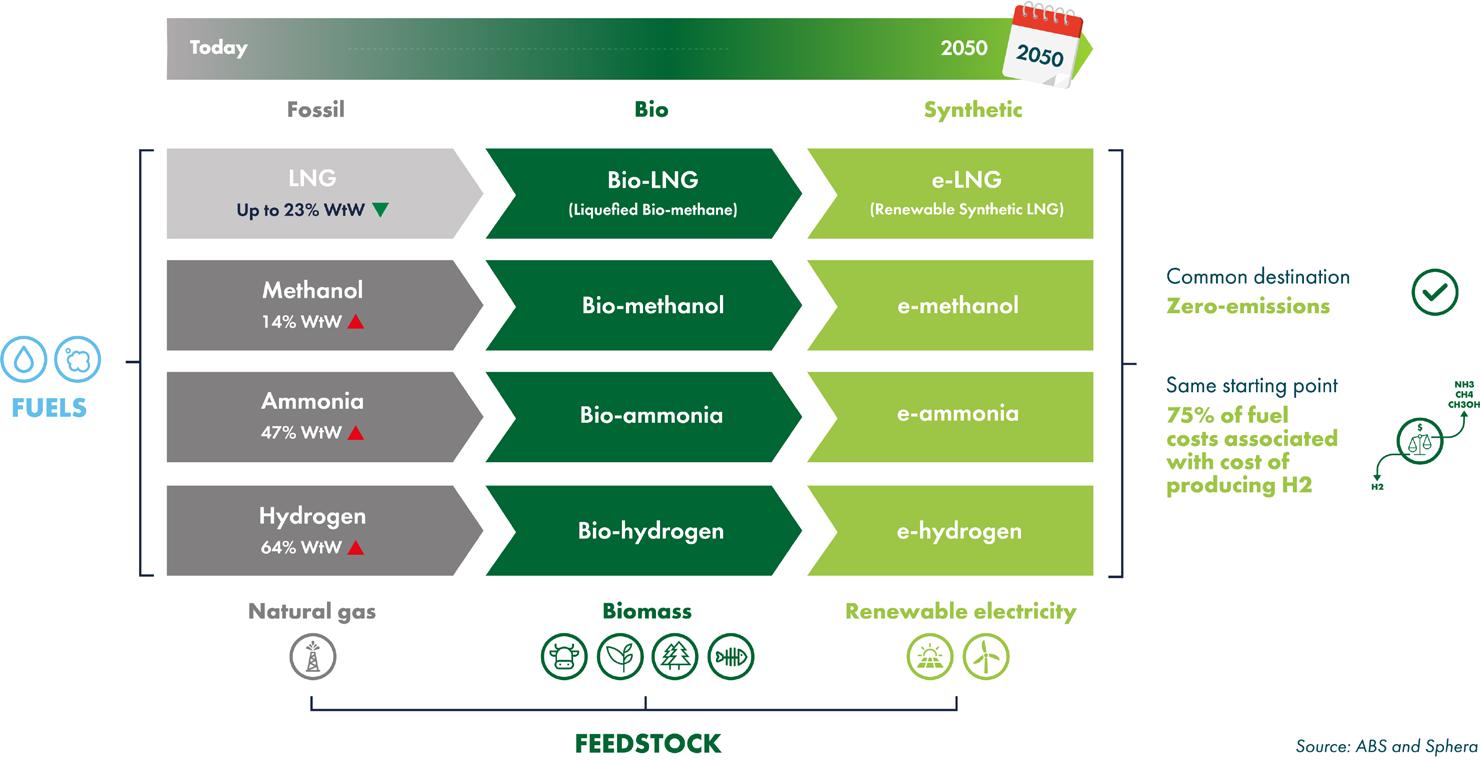

Figure 2. Alternative marine fuel pathways must be assessed on a like-for-like basis.

Florida is a thriving location for LNG bunkering for the shipping industry, with the pioneering TOTE Group working with a number of other businesses to develop significant commercial experience in the region. For example, TOTE’s Orca class of vessels, which sail between North-West US and Alaska, have been converted to run on LNG.

Seaside LNG operates the largest fleet of LNG barges in the US, including Clean Jacksonville and Clean Canaveral (the largest LNG bunkering vessel in the country), and is expecting delivery of a sister bunker barge, Clean Everglades, by the end of 2023. Seaside LNG supplies LNG through JAX LNG, North America’s first small scale liquefaction plant serving the maritime sector, located in the Port of Jacksonville.

The LNG bunkering vessel, Clean Jacksonville, completed its 300 th fuelling operation at the JAXPORT Blount Island Marine Terminal in Jacksonville, Florida, just four years after it was commissioned.

Canada-based Seaspan Maritime Transportation is expanding LNG bunkering operations in the Pacific Northwest, with orders for two 7600 m 3 LNG bunker vessels. The first vessel is expected to be delivered and in operation in 2024.

Most recently, in March 2023, Shell and ZIM announced an LNG supply deal, which was inaugurated in Jamaica, as ZIM’s latest container vessel Sammy Ofer bunkered LNG at Shell’s new location in Kingston.

In November 2022, major carriers including NYK, CMA CGM, and Carnival all underlined their commitment to the LNG pathway and called for more bunkering infrastructure to maintain LNG’s central position in the basket of fuels.

From grey to green

All future alternative fuels, including LNG, ammonia, methanol, and hydrogen, share a similar pathway from ‘grey’ fossil feedstocks to ‘green’ electro or synthetic fuels. To be successful in meeting climate goals, the shipping industry will need to address issues associated with these new fuels such as safety (toxicity and flammability), technology maturity, energy density, fuel supply infrastructure, and fuel availability.

Some fuels, such as LNG and methanol, will have a bio-phase, with bio-LNG and bio-methanol produced from human or agricultural waste. Others, such as ammonia and hydrogen, are only likely to be produced from fossil fuels (mainly natural gas) or renewable electricity. While bio-derived fuels are about double the cost of their fossil counterparts, they are significantly cheaper than their electro-fuel equivalents.

LNG’s pathway to net-zero for bunker fuels, through the use of bio-LNG and synthetic LNG, is clear and well defined. These fuels can be blended with fossil LNG, providing an incremental, lower-cost transition towards low-carbon LNG fuels for industries along the entire value chain. They can be dropped into existing infrastructure and fuel systems without need for expensive modification.

The bio and synthetic pathways are not exclusive and can run concurrently. This means, for example, that applications that use LNG today can reduce emissions and tackle decarbonisation while lower-carbon alternatives are becoming available. The cost of e-LNG will be on a par with other e-fuels, as 70 – 80% of the cost of producing these fuels depends on the cost of producing hydrogen from renewable energy.

26 North America 2023

Figure 3. Worldwide growth in LNG use and infrastructure.

2030 and 2050 solutions

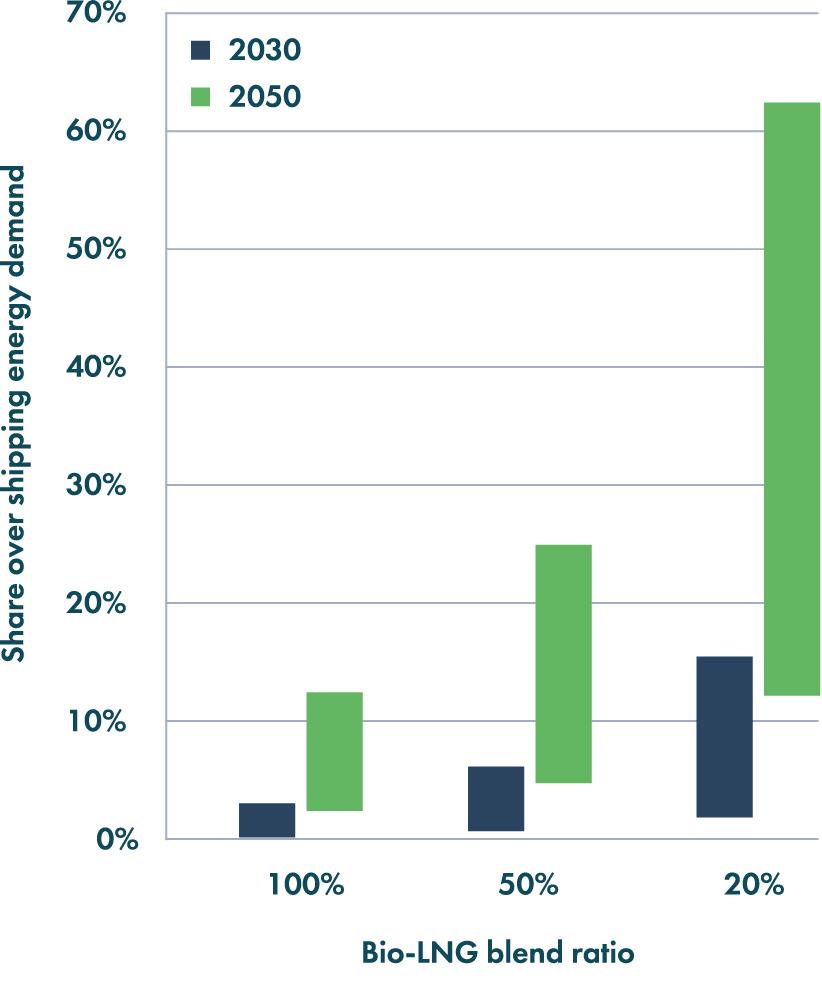

Bio-LNG produced from sustainable biomass resources has the potential to meet a significant proportion of future shipping energy demand, even taking into account growing demand for biomass feedstocks from other sectors, such as wood and paper production, industrial processes, heat and power generation, aviation, and heavy-duty road transportation.

Bio-LNG is already available for bunkering in north-west Europe and North America. For example, energy major, Shell, has announced an agreement with the container shipping company, Hapag Lloyd, to supply liquid biomethane to 12 cargo vessels operating between Europe and Asia.

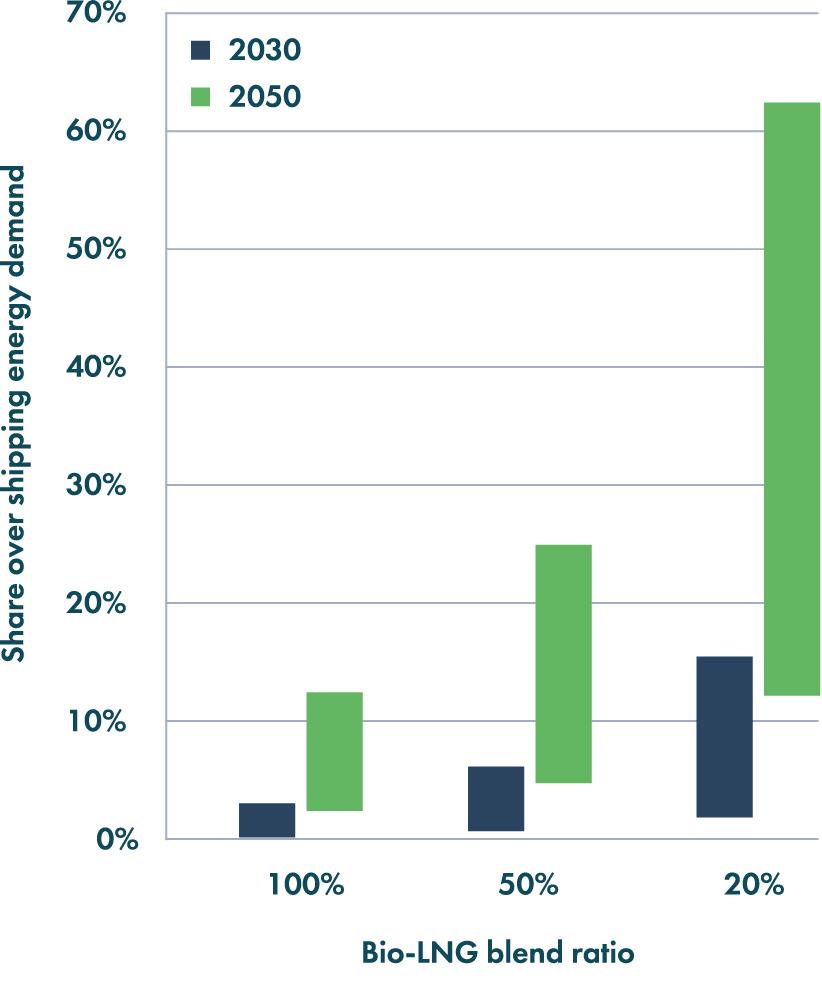

This fuel can be blended in relatively small amounts, meaning it can help the industry hit key milestones in 2030 and beyond. Pure bio-LNG could cover up to 0.4 – 3.1% of the total energy demand for shipping fuels in 2030 and 2.4 – 12.6% in 2050. Blended at 20% with fossil LNG, bio-LNG could cover up to 15.7% of total shipping energy demand in 2030 and 62.9% in 2050 and meet decarbonisation targets.

Longer term, e-LNG is likely to play a more important role. This process will be a gradual one, as renewable energy sources, electrolysis plants, and fuel production capacity is built out.

The overall transition is likely to be incremental, utilising drop-in fuels and existing infrastructure to keep risks and costs as low as possible – this makes the LNG pathway a highly attractive option for ship owners.

What can the LNG industry do?

The LNG industry has responded well to meeting the demand from the growing LNG-fuelled fleet. The main challenge to be addressed is the fact that the maritime industry is accustomed to buying its fuel on the spot market, while the LNG industry is underpinned by long-term deals which support its large capital investments on the supply side.

The uptake of bio-LNG and e-LNG will require continued investment by the LNG industry in the traditional supply chain and potentially new investments in bio-methane and e-methane production. It will also demand the industry’s traditional expertise in operations, supply, and trading.

New challenges will need to be met, for instance, maximising bio-LNG’s role in decarbonising the shipping industry will require a supportive regulatory framework. This will include robust certification schemes, clear mass-balance and Guarantees of Origin systems enabling bio-LNG supply and trading operations to capitalise on the existing infrastructure built up over decades for LNG and natural gas.

In summary, there is a clear role for the LNG industry to support the maritime energy transition with opportunities for first movers to develop new markets, new services, brand recognition, and technology leadership.

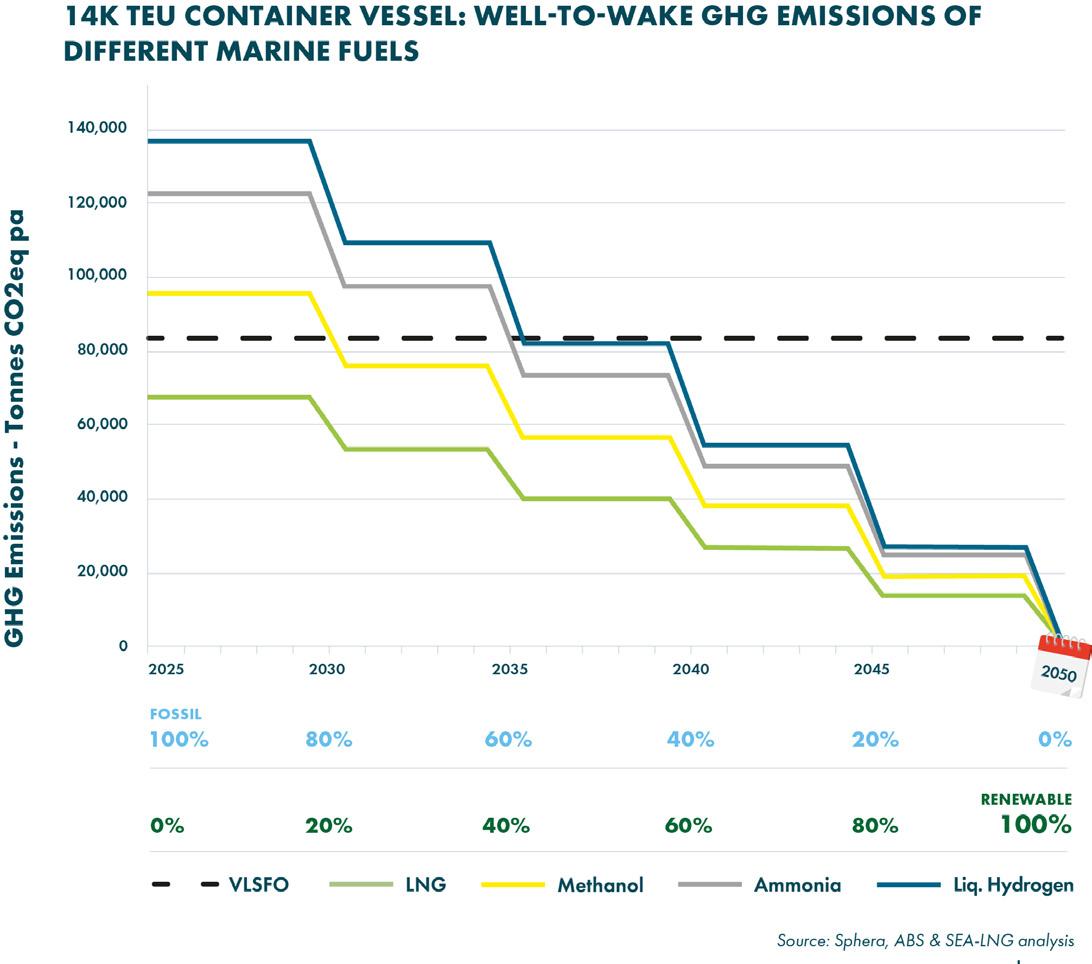

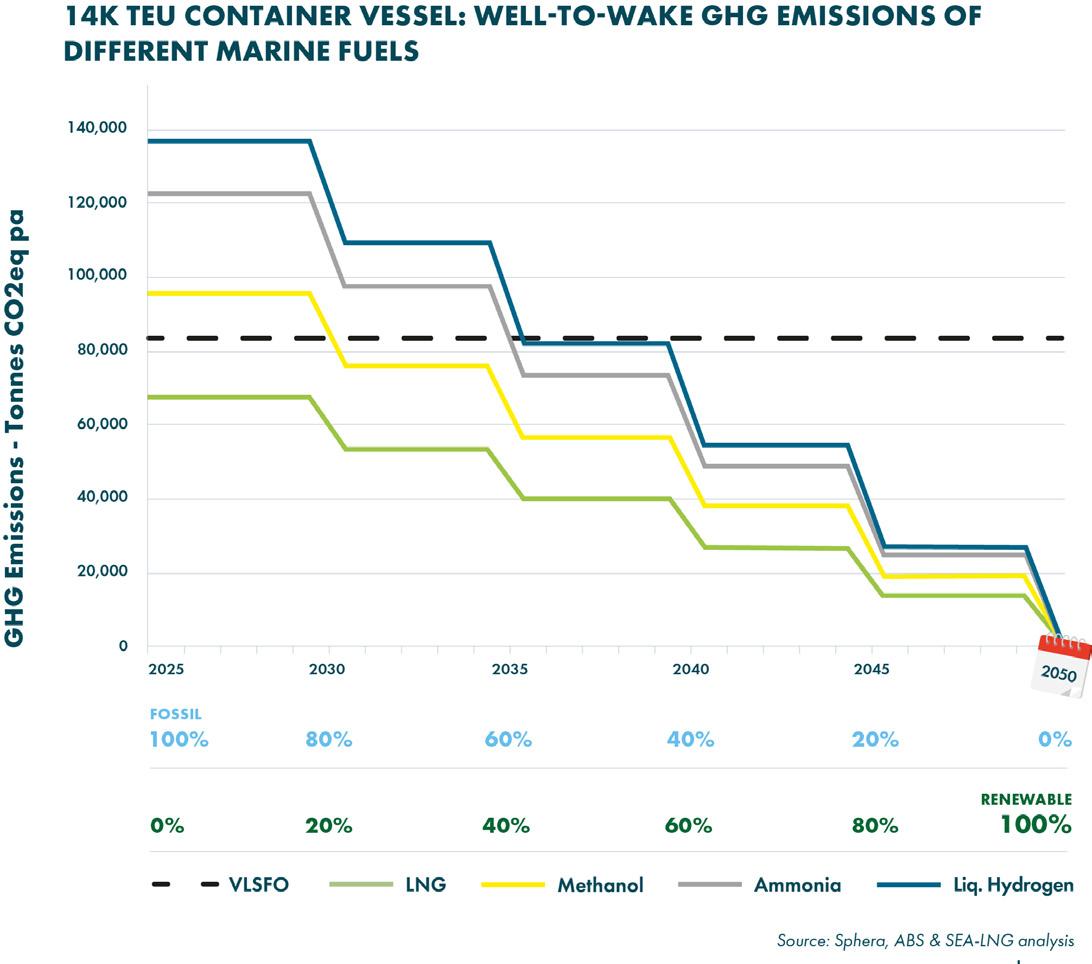

benefits of the LNG

pathway are illustrated using simple calculations of GHG emissions over the lifetime of a mid-sized container vessel. The vessel comes into operation in 2025, is dual-fuelled with a 25-year lifespan, and renewable fuels are assumed to become available at increasing scale from about 2030 onwards. The graph illustrates how LNG offers immediate GHG reductions decreasing to zero-emissions by 2050. Note, the example of a single container vessel is used for simplicity, whereas the insights obtained apply at a fleet level.

North America 2023 27

Figure 5. Potential availability of bio-LNG for shipping sector in 2030 and 2050 over total shipping energy demand, with different blending rates with fossil LNG.

Figure 4. Comparison of decarbonisation pathways: The

decarbonisation

28

Paul Shields, Chart Industries, explains how small scale

With natural gas viewed as the gateway fuel to a lower carbon energy future, and Europe committed to transitioning away from imported pipeline gas, North American LNG is viewed as a near-term solution for many, with new liquefaction capacity coming online and other liquefaction terminals moving toward final investment decisions. However, as well as replacing pipeline gas, LNG also affords the opportunity to provide gas to regions and enterprises that are not connected to the pipeline grid and provide energy security during peak times, curtailment of pipeline supply, and to supplement renewables when unfavourable climatic conditions do not generate sufficient supply.

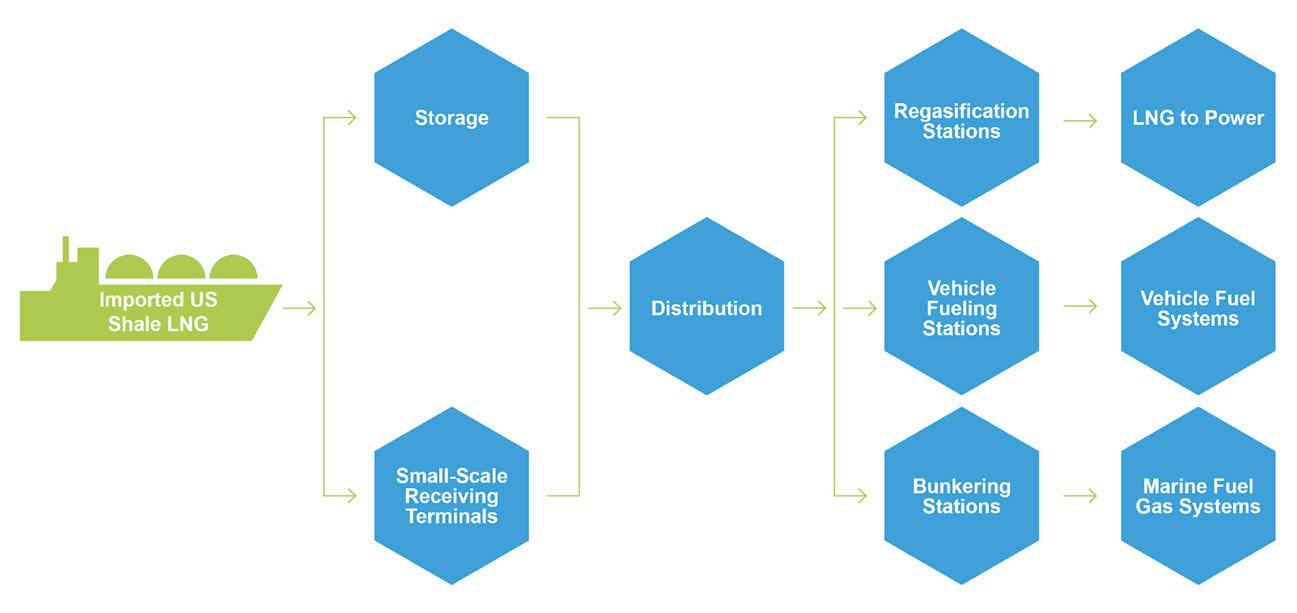

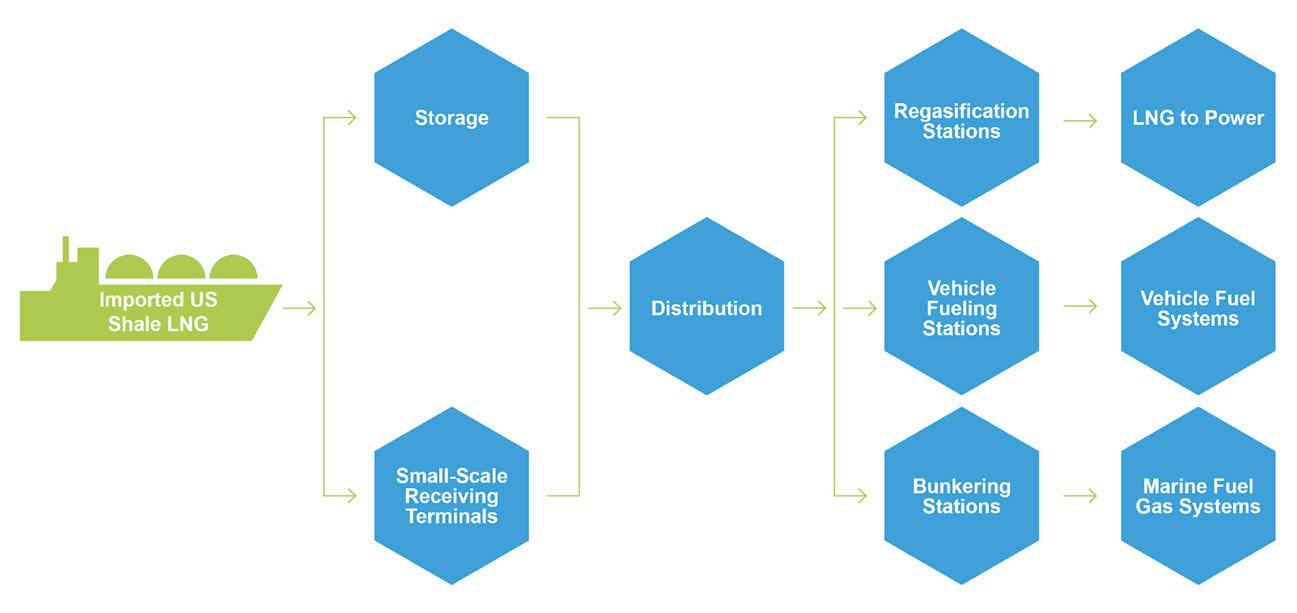

LNG virtual pipelines and the small scale value chain

The process of bringing LNG from its source to the point of use is called the virtual pipeline and typically covers four stages; liquefaction, distribution, storage, and end-use, collectively known as the value chain.

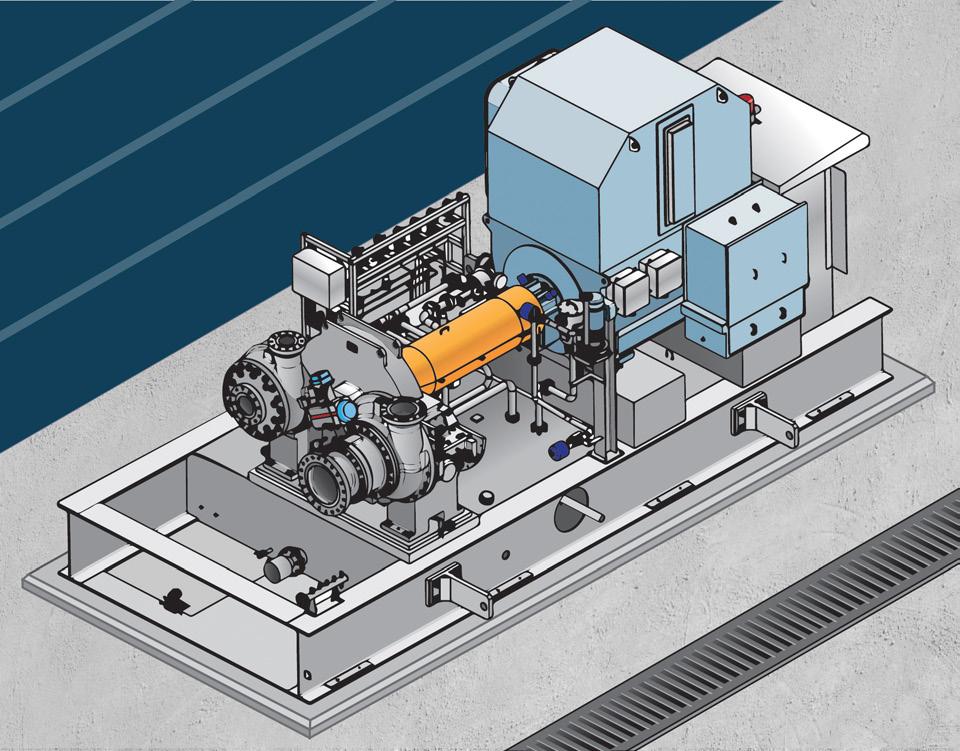

Liquefaction reduces natural gas to 1/600th of its gaseous volume, making it economical to transport and store. Traditionally, liquefaction plants were defined as peak shaving or baseload depending upon their function and capacity. Regardless of size, a single custom plant design was used to achieve

total capacity; hence, as technologies and manufacturing capabilities improved (particularly for the baseload model), the trend has been towards ever larger capacities to realise economies of scale. However, particularly in the US, modular mid scale has gained significant traction. Here, total plant capacity is achieved through multiple identical liquefaction modules instead of a single custom plant. By utilising proven, standard equipment packages, shop build is maximised, which reduces on-site construction and results in significant cost and schedule savings. Other advantages of the modular approach included an overall reduced risk profile, the option for trains to be brought online and operated independently for earlier revenue recognition, and operators being able to have greater opportunity to respond to demand fluctuations.

At the other end of the scale, it is now possible to economically liquefy much smaller quantities of LNG and plant capacities nominally between 10 – 725 tpd (3000 – 450 000 gal./d) of LNG are available. This means that as well as liquefying pipeline gas to create the source for a regional virtual pipeline, captured methane (biogas) can also be liquefied and added to the energy mix, reducing carbon emissions further.

From liquefaction to end use, LNG is transported and stored in cryogenic containers. Cryogenic storage tanks are available in a range of sizes, nominally from 6000 l to > 1 million l, and can be orientated horizontally or vertically. Each tank is specially constructed to keep the LNG at temperature and provide safe and effective extended storage. Tanks are shop-built with a high degree of standardisation, making them much smaller than a site built alternative – this means far less site-work, civils, and permitting during the installation phase. Standardisation also facilitates modularisation so, just like modular liquefaction, total storage capacity is made up of multiple identical storage modules rather than a single large tank.

The same tank technology is also applied to vehicles used to transport LNG. Readers will be familiar with seeing trucks delivering liquefied air gases and the solutions for LNG are basically identical. Cryogenic ISO containers facilitate multi-modal transportation, for example road and sea. A perfect example of this solution in action is the megawatt power station on Madeira Island, which has been operating successfully for many years. LNG is loaded at the import terminal in the Port of Sines and transported to the island in a fleet of ISO containers. A full for empty swap system, where empty ISO containers are collected and returned to Sines for refilling, makes the whole process highly efficient and sustainable.

End-use

This section will demonstrate how the small scale model operates in practice for two key applications: gas to power and natural gas vehicle fuelling.

LNG could be the answer to achieving energy security and independence.

29

A regasification station, also referred to as an LNG satellite station, incorporates storage, vaporisation, pressure regulation, and control systems to deliver natural gas exactly as if it were from a physical pipeline. They can be configured for any demand requirement and enable businesses, regions, and municipalities to transition from diesel, heating oils, and other sources to natural gas. There are hundreds of examples where this has been applied to single businesses and many larger scale examples, including the 80 MW power station at Gibraltar that powers the territory and a series of five regasification stations

Standardisation and modularisation are again key features. All equipment is shop built, standard production, and already proven in the field, which minimises engineering and production costs, schedule, and risk. Total capacity is achieved by connecting multiple storage modules. Smaller capacity stations are typically supplied skid mounted to facilitate simplified transport and installation. Even the larger megawatt stations use shop-built equipment that can be transported by road and installed with significantly reduced site-work, civils, and permitting vs a site built alternative. Modularisation also means that planned facility expansions can be incorporated into the base design.

Providing flexibility

The virtual pipeline and LNG regasification can also benefit users who are connected to a grid but looking to supplement insufficient or unreliable pipeline capacity to meet additional load and seasonal variations or provide emergency fuel back-up during outages. Using LNG is far more efficient than diesel or LPG back-up, as the model simply mimics their current supply solution; liquid fuel is delivered to the site where it is off-loaded and stored for use, except they are using stored natural gas to augment pipeline natural gas and can utilise the same delivery system.

The small scale LNG model is also an effective supplement to renewable resources for when the sun does not shine or the wind does not blow.

LNG vehicle fuelling

Earlier this year, the NGVA announced Europe’s 500th fuelling station for LNG powered heavy haulage trucks. Stations are available in a range of sizes, from private relocatable ones through to stations with multiple dispensers and open to the public. Larger stations are typically located in strategic locations, such as ports and major motorway intersections and can also be equipped with compressed natural gas modules to provide a refuelling service for all natural gas-fuelled vehicles.

LNG is loaded at source, which can be an import terminal, storage/distribution hub and/or liquefaction plant, and delivered to the individual fuel stations in exactly the same way as discussed.

Summary

LNG helps with what is referred to as the ‘energy trilemma’, finding the balance between affordability, security of supply and driving down emissions. The small scale model is an excellent vehicle for increasing natural gas penetration enabling LNG to go beyond simply replacing imported pipeline gas and is an important tool in the journey towards a low carbon future.

30 North America 2023

Figure 4. The small scale LNG value chain enables natural gas to penetrate beyond simply replacing imported pipeline gas.

Figure 3. Storage and revaporisation plants are an integral part of the virtual pipeline, bringing natural gas to businesses and regions not connected to the pipeline grid.

Figure 2. Modularised cryogenic storage reduces project complexity, lead time, permitting, and civil engineering.

Figure 1. The standard plant model has enabled the cost effective liquefaction of natural gas for smaller quantities of gas, including liquefaction of bio-methane.

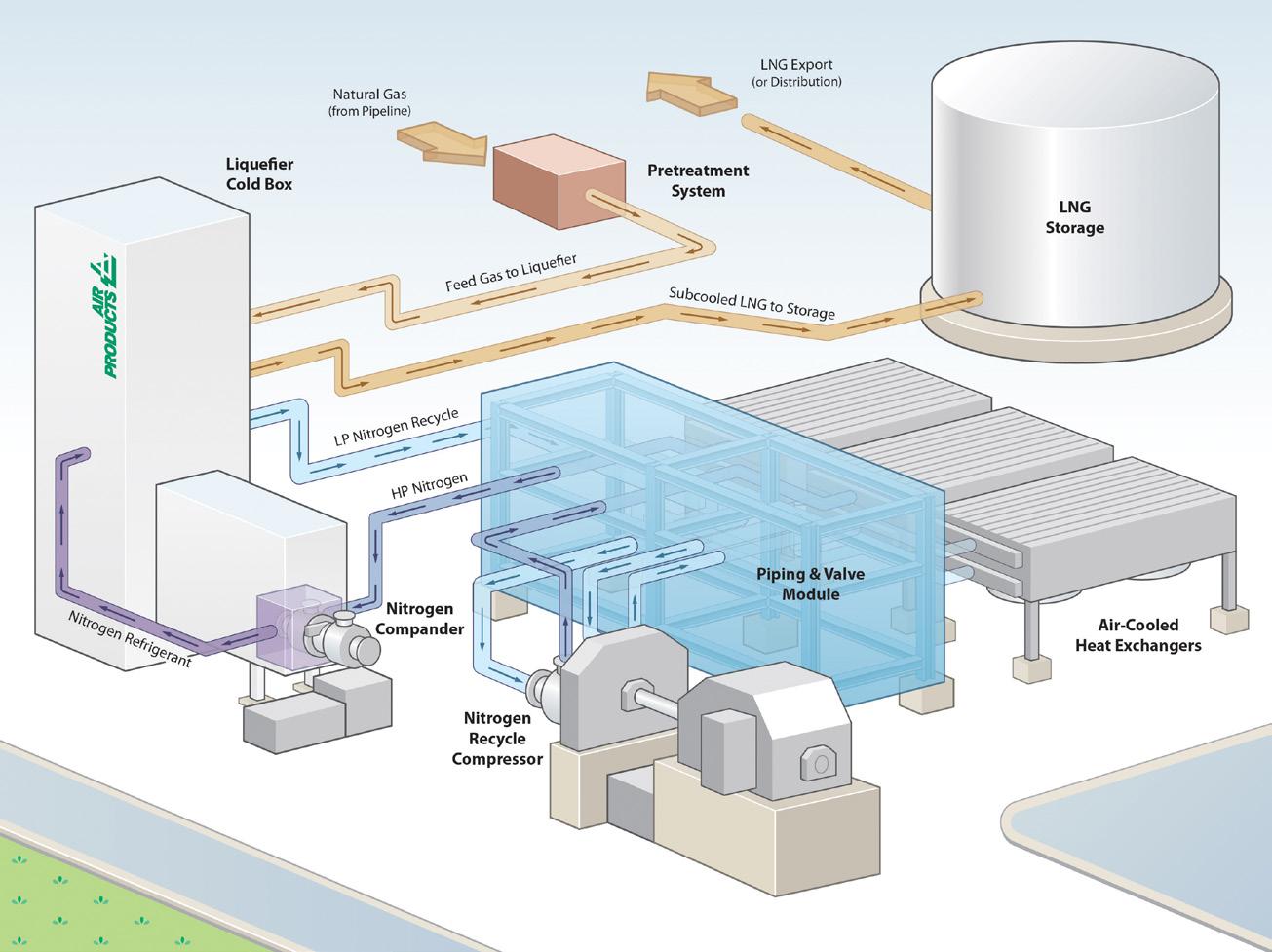

As the world seeks energy security in the face of the energy transition and geopolitics, demand for clean fuels, such as LNG, continues to rise. Safe and reliable energy supply to an ever-widening consumer base remains critical, while increasingly stringent environmental regulations have mandated tighter control over fugitive emissions and reduced carbon intensity. The LNG industry has risen to the occasion to meet this need, offering production that ranges from large scale export facilities to small scale facilities that support local pipeline distribution. Even the smallest of these facilities leverage world-class technology that is tailored for the highest efficiency, superior performance, and lowest total overall cost of ownership.

31

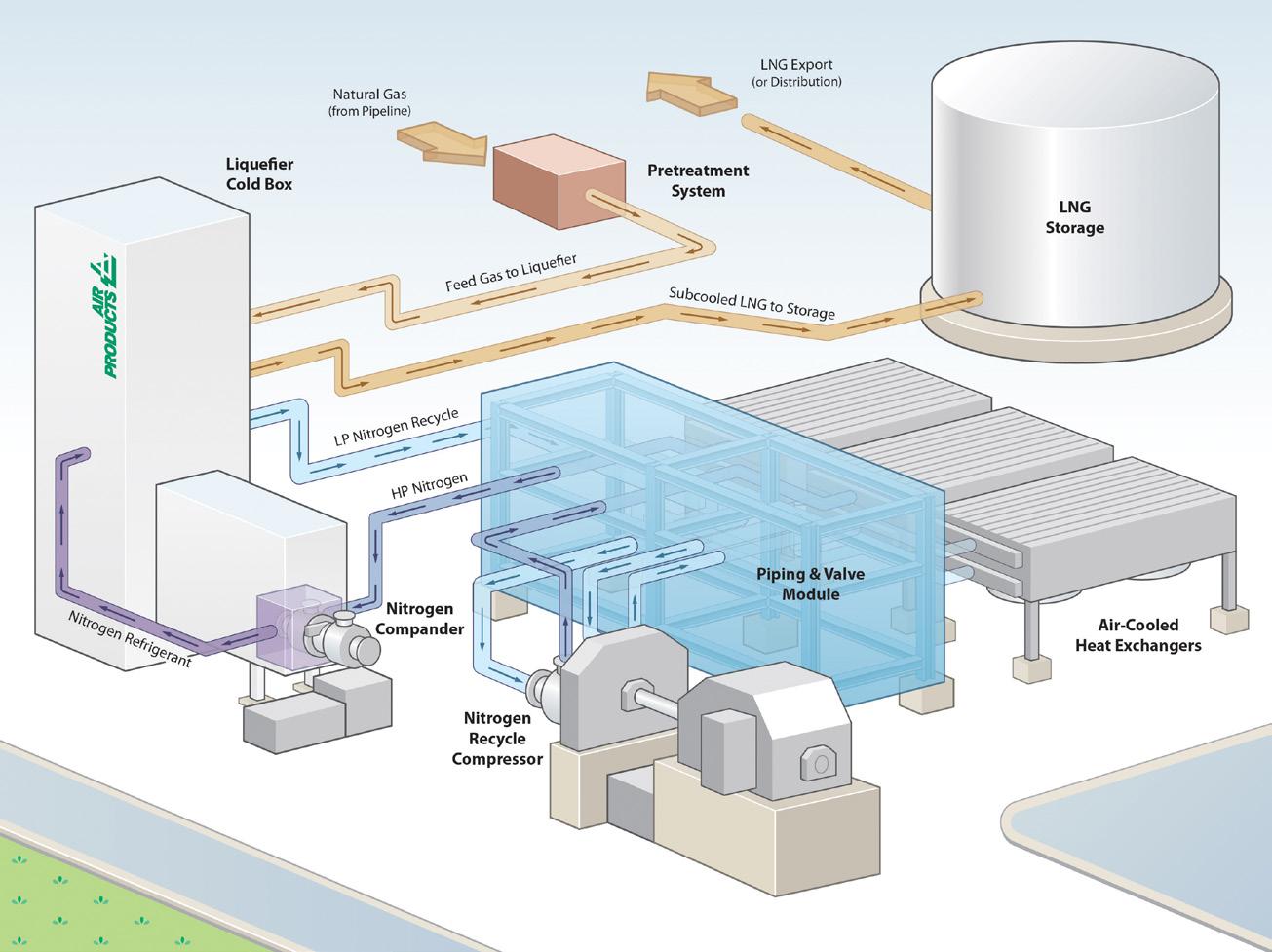

Christopher Elko, Daniel Harajda, and Amanda Witmer, Air Products, assess the flexibility and

versatility of small scale LNG in the future LNG industry.

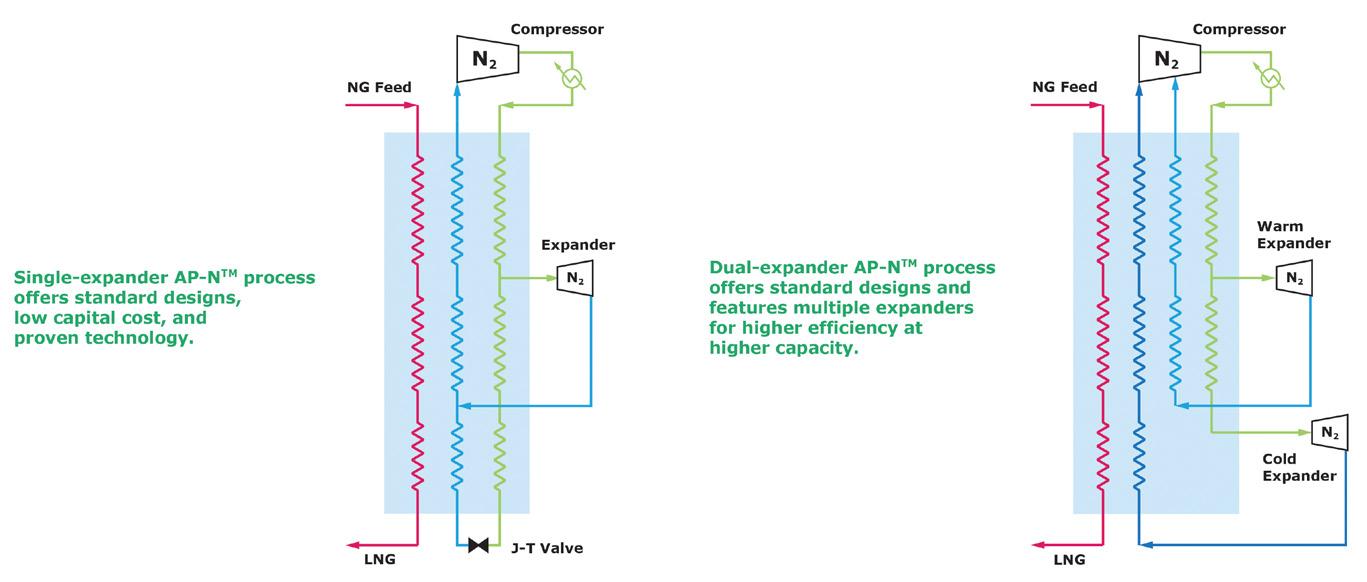

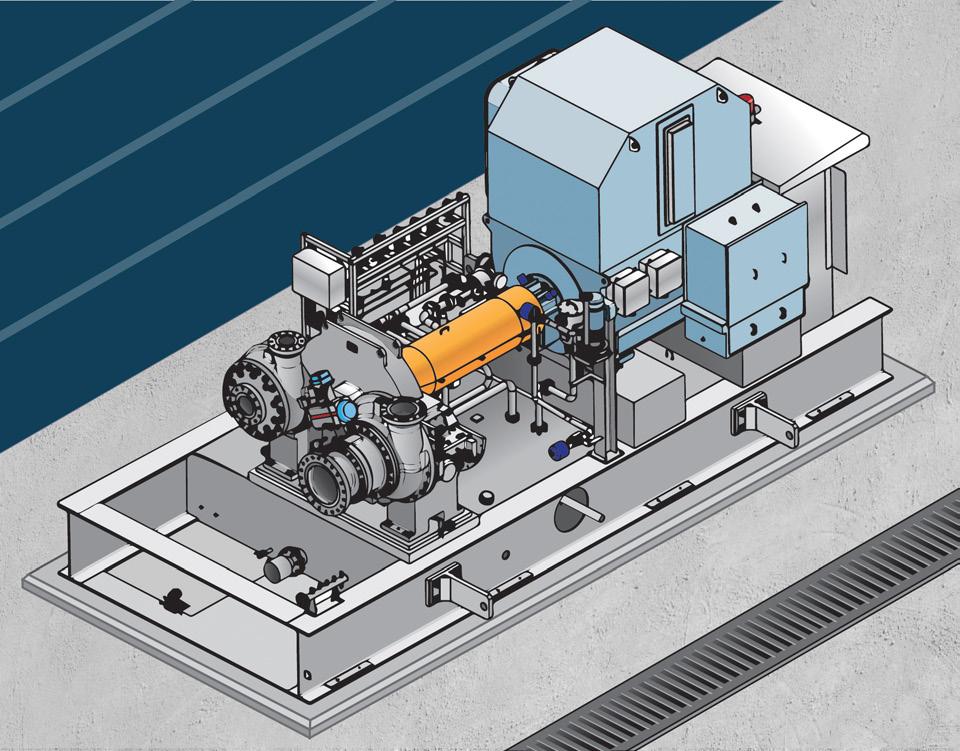

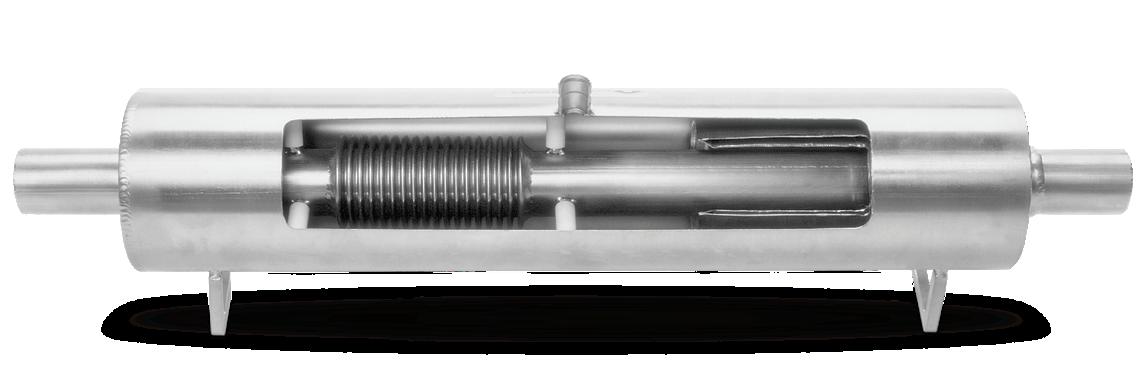

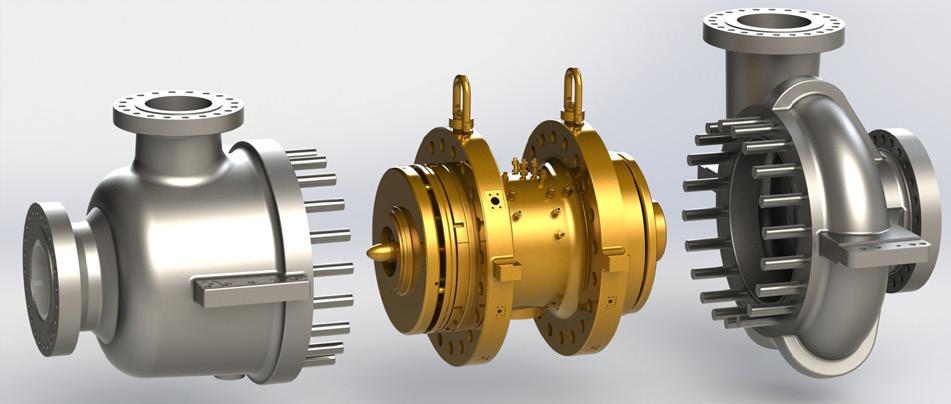

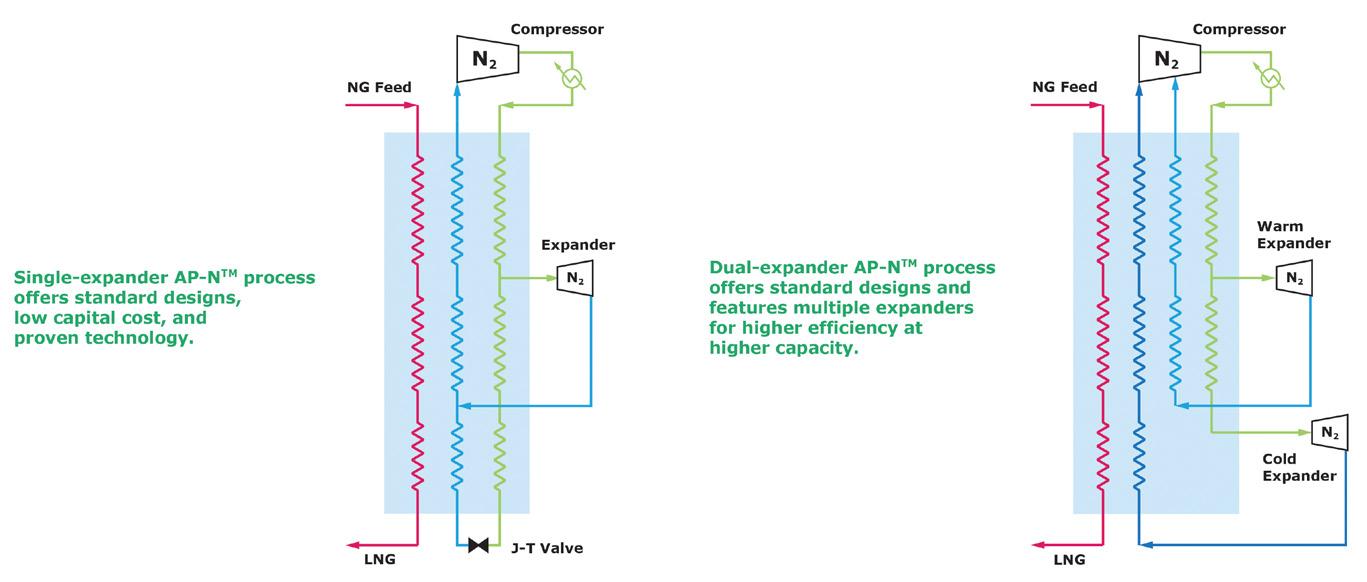

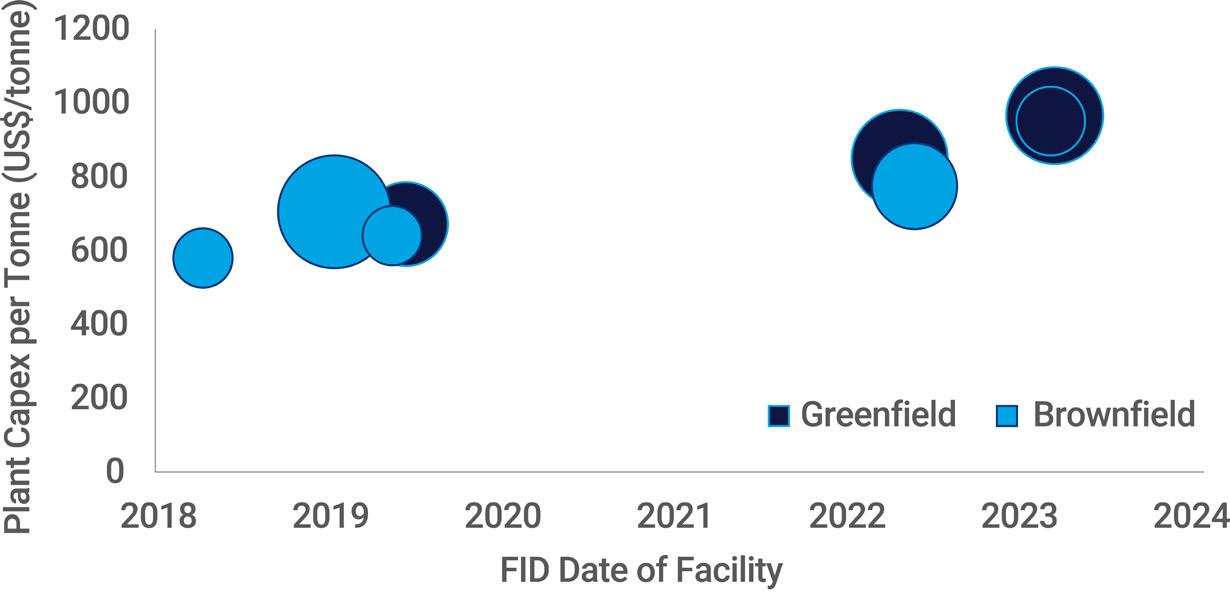

Small scale LNG plants are a versatile solution for optimising a facility’s geographic location to better serve consumers. Whether located at a wellhead, the end of a pipeline, or even used within an existing facility to reliquefy boil-off gas, small scale LNG plants feature a small footprint, thus making them suitable for greenfield or brownfield installations. Although smaller in scale, the plants utilise proven process technologies. For example, Air Products’ nitrogen-based refrigeration cycles are derived from well-referenced liquefaction technology spanning decades of operating experience in the industrial gas industry:

z Brazed aluminium heat exchangers (BAHX) housed within an insulated cold box.

z Packaged, integrally geared refrigerant compressors with robust, cost-effective performance.