2024

March

Our North American supplement is returning soon!

This special issue will focus on LNG activity in the US, Canada, and Mexico, with keynote articles, case studies, and more.

supplement to

NORTH AMERICA A

LNG Industry Distributed at

03 Guest comment

05 LNG news

10 Considering China's role in LNG

Jessica Casey, LNG Industry, UK, provides a brief overview of China’s LNG industry.

14

AI sentinels

Rotem Battat, Chief Product Officer, Captain’s Eye, Singapore, establishes how artificial intelligence surveillance can improve safety in the LNG maritime industry.

19 Decarbonising LNG

Tommaso Rubino, LNG Strategic Development Manager, Enrico Calamai, LNG Strategic and Growth Manager, Rossella Palmieri, LNG Decarbonisation Manager, Baker Hughes, Italy, outline the delivery of LNG facilities for low-carbon operations.

23 Considerations in designing floating LNG assets

Keith Hutchinson, Head of the Professional Technical and Engineering Services and Senior Consultant in Whole Ship Design and Naval Architecture, Safinah Group, UK, discusses the key drivers and safety aspects to be considered in designing floating LNG assets for exploiting stranded gas reserves worldwide.

MARCH 2024

30 Putting the Elbehafen terminal on the fast-track

Eric Farrell, Head of Commissioning at EnerMech, summarises how experience, expertise, and the right company ethos are key to safely and efficiently delivering fast-track projects.

34 The impact of rapid LNG growth

Since February 2022, LNG has become an even more vital component in the global energy mix as energy security climbs the agenda. Jose Navarro, Lloyd’s Register’s Global Gas Technology Director, addresses some of the pressures being put on safety as a result of the rapid expansion of LNG.

39 Vessel efficiency bubbling up for LNG carriers

The LNG carrier segment is recognising the need for improved vessel and fuel efficiency – clean technology can meet those needs today and in the future, says Alistair Mackenzie, Chief Commercial Officer at Silverstream Technologies.

43 A new standard of BOG management

With its increased focus on environmentally-friendly designs and operations, the global LNG carrier fleet has accepted boil-off gas management systems as the de-facto standard for today’s LNG carrier designs. Pål Steinnes, Heads of Sales and Business Development for Midstream and LNG, Wärtsilä, Norway, examines developments that have been made for enhanced flexibility and efficiency of cargo management on LNG carriers.

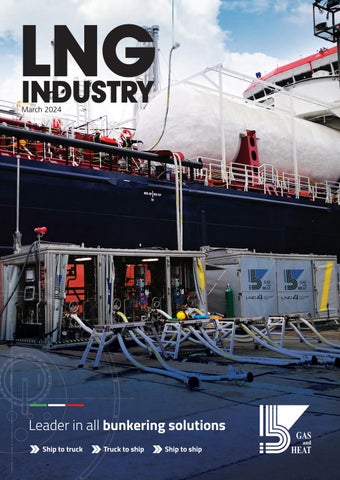

Gas and Heat is an Italian company with 75 years of experience and a strong vocation to the future.

Through a custom-made approach, the company provides its clients with solutions tailored to their specific needs.

Gas and Heat designs, builds, and delivers highly-engineered solutions for LNG and bio-LNG-fuelled systems, both in marine, inland waterway, and land-based areas, as well as an energy source for small-sized onshore plants. Its R&D department researches and proposes solutions for the use of alternative fuels, such as ammonia and hydrogen.

The design and manufacturing cycle of the tanks is completely carried out in the Tombolo Plant, in the heart of Tuscany.

1747-1826 CONTENTS Copyright © Palladian Publications Ltd 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK. ON THIS MONTH’S COVER LNG Industry is audited by the Audit Bureau of Circulations (ABC). An audit certificate is available on request from our sales department. CBP019982

ISSN

10

DOMINIC MCKNIGHT HARDY MANAGING DIRECTOR, MIS MARINE

JOE ANDERSON LEAD DATA SCIENTIST, MIS MARINE

Recently, the challenges of the energy and digital transitions have been dominating and competing for attention. The combination of ongoing attacks on vessels in the Red Sea, the rise of the ‘dark fleet’ due to the Ukrainian-Russian conflict, and the prolonged drought in the Panama Canal have added another layer of complexity to global shipping.

One significant but often-overlooked consequence of the Red Sea attacks is the impact on a vessel’s Carbon Intensity Indicator (CII) grade when rerouting around the Cape of Good Hope. Providing vessels with an annual score, CII letter grades indicate the operational efficiency of a vessel over a 12-month period. Recent data from MIS Marine reveals that vessels tend to sail around the Cape approximately 10% faster compared to the Red Sea route, in what could be an attempt to mitigate the impacts to commercial schedules. For a 100 000 DWT gas tanker, this increase in speed translates to an additional fuel consumption of 291 t and a consequent increase of emissions of 920 t of carbon dioxide, compared to transiting the Suez Canal. Consequently, this would result in a 17% increase in carbon intensity under the CII framework, posing a considerable risk of a negative change in the vessel’s annually calculated letter rating.

A vessel’s CII letter rating is determined annually for a calendar year based on its operational performance. Therefore, any temporary changes in a vessel’s performance caused by external factors, especially if

Managing Editor

James Little james.little@palladianpublications.com

Senior Editor

Elizabeth Corner elizabeth.corner@palladianpublications.com

Editor Jessica Casey jessica.casey@palladianpublications.com

Editorial Assistant

Théodore Reed-Martin theodore.reedmartin@palladianpublications.com

Sales Director Rod Hardy rod.hardy@palladianpublications.com

these alterations persist for several months, could lead to a revision in the vessel’s calculated CII grade during the annual assessment. With the potential for widespread impacts, ongoing deterioration of CII is a worry for the whole supply chain.

The current Cape scenario emphasises the need for solutions that calculate carbon performance based on known values, providing a real-time assessment of carbon intensity within an actual voyage.

MIS is leading the way in applying relevant sources of vessel data, especially engine characteristics, along with operational information from geospatial data and weather/tide data, to calculate a carbon intensity value for a given voyage. This allows charterers to determine their expected carbon accountability and associated costs for the period of a voyage.

While still at a relatively early stage of CII’s rollout, it is vital that the industry recognises the importance of addressing these issues early on and implementing effective solutions to ensure the long-term success and sustainability of shipping’s carbon goals. In forgoing this functionality, CII is at risk of failing the industry, pricing players out of the market based on temporary situations that arise beyond their control.

As the initial wave of CII ratings now begin to play a part in chartering decisions, it will be interesting to observe how the industry responds to this additional layer of decision-making complexity, and the changes it will warrant.

Sales Manager Will Powell will.powell@palladianpublications.com

Production Designer

Kate Wilkerson kate.wilkerson@palladianpublications.com

Events Manager

Louise Cameron louise.cameron@palladianpublications.com

Digital Events Coordinator

Merili Jurivete merili.jurivete@palladianpublications.com

Digital Content Assistant

Kristian Ilasko kristian.ilasko@palladianpublications.com

Digital Administrator

Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Administration Manager

Laura White laura.white@palladianpublications.com

Editorial/Advertisement Offices, Palladian Publications Ltd 15 South Street, Farnham, Surrey, GU9 7QU, UK Tel: +44 (0) 1252 718 999 Website: www.lngindustry.com

LNG Industry Subscription rates: Annual subscription: £50 UK including postage £60 overseas (postage airmail) Two year discounted rate: £80 UK including postage £96 overseas (postage airmail) Subscription claims: Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge. Applicable only to USA & Canada. LNG Industry (ISSN No: 1747-1826, USPS No: 006-760) is published monthly by Palladian Publications Ltd, GBR and distributed in the USA by Asendia USA, 701C Ashland Avenue Folcroft, PA 19032. Periodicals postage paid at Philadelphia, PA and additional mailing offices. POSTMASTER: send address changes to LNG Industry, 701C Ashland Ave, Folcroft PA 19032. COMMENT

Our valve solutions are meticulously engineered and field-proven to ensure your seamless LNG operations. PERFORMANCE, ENGINEERED. trilliumflow.com/lng SARASIN-RSBD® 76 Series Pilot Operated Relief Valves BLAKEBOROUGH® BV500 & 990 Series Cryogenic Control Valves

Global Chevron, Seapeak, and TotalEnergies join MAMII initiative

TotalEnergies, Chevron, and Seapeak have joined the Methane Abatement in Maritime Innovation Initiative (MAMII), led by SafetyTech Accelerator.

The three companies join the now more than 20 members of MAMII, emphasising its role in addressing methane abatement within the maritime sector.

Chevron, a global energy company, Seapeak, an owner-operator of liquefied gas vessels, and TotalEnergies, the world’s third-largest LNG player, will bring their valuable insights and commitment to MAMII's mission: tackling the critical challenge of ‘methane slip’.

The initiative has selected four providers to produce feasibility studies on the technologies which will reduce methane emissions from ships.

The release of unburnt methane is a key obstacle to unlocking the full environmental potential of LNG as a maritime fuel. Now in its second year, MAMII was launched in September 2022 by Safetytech Accelerator, bringing together industry leaders, technology innovators, and maritime stakeholders to advance technologies for measuring and mitigating methane emissions in the maritime sector.

MAMII is currently focussed on ‘on-ship’ trials, expanding the range of pilots, and starting to address fugitive methane emissions covering the entire spectrum of methane emissions on LNG-fuelled vessels.

Germany

Australia

First

modules arrive for Scarborough Energy Project

The first three Pluto Train 2 modules for the Scarborough Energy Project have arrived in Karratha, Western Australia, marking an important stage of the project. The modules, fabricated by Bechtel in Indonesia, weigh a combined total of more than 4000 t.

The modules are three of a total of 51 that will be shipped to site from the module yard to form Pluto Train 2.

Pluto Train 2 will be the second LNG production train at the existing Pluto LNG onshore facility and will process gas from the offshore Scarborough development.

The Scarborough Energy Project will contribute significantly to the Australian economy and create thousands of job opportunities during its construction phase.

Bechtel was selected by Woodside Energy to execute the EPC of Pluto Train 2, with construction activities beginning in November 2021.

Pluto Train 2 will have an LNG processing capacity of approximately 5 million tpy. Additional domestic gas infrastructure will be installed at the Pluto LNG facility to increase domestic gas capacity to approximately 225 TJ/d.

Up to 3 million tpy of LNG will be processed at the existing Pluto Train 1 following modifications to accommodate Scarborough’s lean gas. The project, will help meet the growing demand for the low-cost, lower-carbon, reliable energy the world needs today and into the future.

The Scarborough Energy Project is targeting its first LNG cargo in 2026.

DET receives provisional approval for operation of Brunsbüttel FSRU

The State Office for the Environment of Schleswig-Holstein (LfU), Southwest Regional Department, has granted Deutsche Energy Terminal GmbH (DET) provisional approval to operate the regasification terminal (FSRU) at the Brunsbüttel site. The LfU thus approved an application from DET dated 20 December 2023.

A building permit that had already been issued by the city of Brunsbüttel to operate the FSRU at the Brunsbüttel location expired on 14 February 2023. The new application by the DET was submitted because the planned relocation of the FSRU to a

newly-built jetty could not yet be carried out.

After evaluating the application, it was approved by the LfU. This means that the continued operation of the FSRU in Brunsbüttel at its current berth is formally approved until 15 February 2026, but an earlier relocation of the terminal to the new jetty is necessary due to the complex berth situation in the port. The provisional approval of the operation was subject to conditions in accordance with the BImSchG, including those relating to pollution control, building, fire protection, water, and nature conservation law.

March 2024 5 LNGNEWS

LNGNEWS

Singapore

Pavilion Energy concludes first ship-to-ship LNG bunkering operation to Rio Tinto

Pavilion Energy has deployed the newbuild LNG bunker vessel, Brassavola, for her maiden ship-to-ship LNG bunkering operation, delivering 1970 t of LNG to Rio Tinto-chartered dual-fuelled bulk carrier, Mount Api. This follows the recent delivery of Brassavola to Pavilion Energy at the end of January 2024.

Equipped with dual-fuel engines, the Singapore-built Brassavola – also the nation’s first membrane LNG bunker vessel – has loading and bunkering rates of up to 2000 m3/h, offering customers high operational efficiency and faster bunkering turnover.

Conducted in the port of Singapore, the operation marks a pivotal moment in Pavilion Energy’s commitment to advance the maritime sector’s decarbonisation goals.

Brassavola is chartered by Pavilion Energy to supply LNG bunker in the Port of Singapore. It was built by Seatrium Limited and delivered to owner, Indah Singa Maritime Pte. Ltd, a wholly-owned subsidiary of Mitsui O.S.K Lines.

Canada

Cedar LNG provides project update

Cedar LNG and its partners, the Haisla Nation and Pembina Pipeline, have provided an update on project development milestones and timelines.

Cedar LNG has substantially completed several key project deliverables, including obtaining material regulatory approvals, advancing inter-project agreements with Coastal GasLink and LNG Canada, signing a heads of agreement with Samsung Heavy Industries and Black & Veatch, and executing a lump sum EPC agreement.

Though numerous milestones have been achieved, a number of schedule-driven, interconnected elements require resolution prior to making a final investment decision, including binding commercial offtake, obtaining certain third-party consents, and project financing. A final investment decision is now expected in the middle of 2024.

USA

Galveston LNG Bunker Port joins SEA-LNG

Galveston LNG Bunker Port (GLBP), a joint-venture between Seapath Group, one of the maritime subsidiaries of the Libra Group, and Pilot LNG, LLC, a Houston-based clean energy solutions company, has joined SEA-LNG – further enhancing the coalition’s LNG supply infrastructure expertise and global reach, while giving GLBP access to the latest LNG pathway research and networking opportunities.

GLBP was announced in September 2023 and will develop, construct and operate the US Gulf Coast’s first dedicated facility supporting the fuelling of LNG-powered vessels, expected to be operational late-2026.

The shore-based LNG liquefaction facility will be located on Shoal Point in Texas City, part of the greater Houston-Galveston port complex, one of the busiest ports in the US. This is a strategic location for cruise ship LNG bunkering in US waters, as well as for international ship-to-ship bunkering and cool-down services. GLBP will offer cost-effective turn-key LNG supply solutions to meet growing demand for the cleaner fuel in the US and Gulf of Mexico.

THE LNG ROUNDUP

X Armada Technologies announces contract with CoolCo for a hull air lubrication installation

X QatarEnergy to increase country's LNG production capacity to 142 million tpy by 2030

X GTT receives tank design order from Samsung Heavy Industries for 15 LNG carriers

6 March 2024 Follow us on LinkedIn to read more about the articles www.linkedin.com/showcase/lngindustry

Decarbonization Solutions for the Full Supply Chain

LNGNEWS

Africa

11 – 12 March 2024

10th International LNG Congress (LNGCON 2024)

Milan, Italy

https://lngcongress.com

12 – 13 March 2024

StocExpo Rotterdam, the Netherlands www.stocexpo.com

03 – 05 April 2024

26th Annual International Aboveground Storage Tank Conference & Trade Show Florida, USA www.nistm.org

30 April – 02 May 2024

2024 AGA Operations Conference

Washington, USA

www.aga.org/events/2024-aga-operationsconference-spring-committee-meetings

07 – 08 May 2024

ITLA 2024 Annual International Operating Conference & Trade Show

Texas, USA

https://ilta2024.ilta.org

07 – 09 May 2024

Canada Gas Exhibition & Conference Vancouver, Canada

www.canadagaslng.com

11 – 13 June 2024

Global Energy Show Canada 2024

Calgary, Canada

www.globalenergyshow.com

17 – 20 September 2024

Gastech 2024

Texas, USA

www.gastechevent.com

Allseas completes GTA infield pipelay scope

Allseas’ Pioneering Spirit has completed the infield pipelay scope for BP’s ultra-deepwater GTA LNG project offshore Mauritania and Senegal. Two months after arriving in the field, production crew welded, scanned, and field joint coated the final piece of pipe for the second 16-in. export gas line.

Safely landed in a 2-m target box at 2400 m water depth, the pipeline will be recovered in J-mode configuration to install the termination assembly. To make this happen, the vessel aft has been fitted with a bespoke J-mode frame with a 1000-t load capacity. It was designed, built, and installed onboard in only eight weeks.

The pipelay scope comprises approximately 75 km of 16-in. export lines and 10 km of 10-in. CRA infield lines, some of the pipeline infrastructure exceeding 2700 m water depth at the deep end. The main firing line and double jointing facilities on Pioneering Spirit have run in parallel throughout the campaign. Pioneering Spirit will conclude the offshore works by installing the six outstanding flowline termination assemblies.

Australia

Woodside to sell 15.1% Scarborough interest to JERA

Woodside has broadened its strategic relationship with JERA through a transaction that involves three core elements: equity in the Scarborough joint venture (JV); LNG offtake; and collaboration on opportunities in new energy and lower carbon services.

Woodside has signed a binding sale and purchase agreement with JERA for the sale of a 15.1% non-operating participating interest in the Scarborough JV for an estimated total consideration of US$1400 million. This comprises the purchase price of approximately US$740 million, and reimbursement to Woodside for JERA’s share of expenditure incurred from the transaction effective date of 1 January 2022. Completion of the transaction is expected in 2H24.

Woodside and JERA have also entered into a non-binding heads of agreement for the sale and purchase of six LNG cargoes on a delivered ex-ship basis per year for 10 years, commencing in 2026 from Woodside’s global portfolio.

In addition, a non-binding agreement for new energy collaboration including potential opportunities in ammonia, hydrogen, carbon management technology, and carbon capture and storage was signed to support common decarbonisation ambitions.

Completion of the Scarborough equity transaction is subject to conditions precedent including Foreign Investment Review Board approval, National Offshore Petroleum Titles Administrator approvals, Western Australia Government approvals, and satisfaction of requisite financing approvals.

The transaction also includes an option for JERA to acquire a 15.1% non-operating participating interest in the Thebe and Jupiter fields, as well as a non-binding agreement that outlines a long-term collaboration to pursue opportunities for additional feed gas and joint investment in offshore gas fields for future tieback to the Pluto LNG facility via Scarborough infrastructure. A non-binding agreement has also been signed for Woodside to provide carbon management services to assist JERA to meet its obligations associated with its share of carbon emissions from the Scarborough JV.

Following completion of the sale of equity to JERA, Woodside will hold a 74.9% interest in the Scarborough JV, and remain as operator.

8 March 2024

Accelerating Modular LNG Solutions

Invisible. Invaluable.

Sometimes the things you can’t see make all the difference. Our integrated team of consultants, engineers, technicians, and construction professionals leverage our extensive history and expertise in mid-scale LNG technology and pioneering work in FLNG EPC to seamlessly bring our modular designs to life. Our modular LNG solutions enable fast-to-market results, so you can arrive at your destination on your terms, regardless of the technology, processes, or path.

The invaluable difference:

• Minimize interfaces and reduce prolonged onsite installation time and manpower

• Flexibility in compressor driver selection, cooling medium, and capacity from 1–2 MTPA per train

• Utilize the same modular philosophy for gas treating, heavies removal, product and boil-off handling

• Complete modular solutions for onshore and offshore applications between the pipeline and storage tank

Jessica Casey, LNG Industry, UK, provides a brief overview of China’s LNG industry.

The LNG industry in China has witnessed remarkable growth and transformation over the past few decades, reflecting the nation’s evolving energy landscape and its commitment to environmental sustainability. As one of the world’s largest energy consumers and a key player in global energy markets, China has started to strategically prioritise the diversification of its energy sources, with LNG emerging as a pivotal component of its energy mix.

China’s rapid economic expansion and urbanisation have led to surging energy demands, prompting policymakers to explore cleaner and more efficient alternatives to traditional fossil fuels. LNG, with its lower carbon footprint and versatility, has surfaced as a viable solution to meet the country’s growing energy needs while addressing environmental concerns.

The development of China’s LNG industry has been supported by robust investments in infrastructure, including LNG import and regasification terminals, storage facilities, and transportation networks. Government initiatives and the promotion of natural gas as a cleaner alternative to coal have further propelled the growth of the LNG industry in China.

Despite significant progress, challenges have persisted in China’s LNG sector, including infrastructure constraints, supply chain disruptions, and regulatory uncertainties. However, the Chinese government’s commitment to energy security, environmental sustainability, and economic development underscores its determination to overcome these challenges and further strengthen the LNG industry’s role in China’s energy transition.

US pause on LNG exports: How will this affect China?

Following US President Joe Biden’s announcement that there would be a temporary pause on pending decisions for the export of LNG to non-free trade agreement countries, 1 many people questioned how this would affect the world’s energy security. With the US having overtaken Qatar and Australia to become

10

Considering China’s role in LNG

11

the world’s largest exporter of LNG for the very first time in the industry’s history last year, 2 this is understandable.

How much would this threaten energy security elsewhere in the world? In theory, it should not affect this too much; since the pause is just on pending decisions, projects that are already operational or under construction are not affected by the decision. In addition, the US plays only a small role in supply China with LNG; US exports accounted for just 4% of the country’s total LNG purchases in 2023, 3 with most of China’s LNG imports in 2023 coming from Qatar, Australia, and Malaysia. 4 These countries are likely to continue as the dominant suppliers to Asian markets, including China.

A growth in regasification capability

By the end of 2023, China had reclaimed its title as the world’s largest LNG importer, surging to 8.2 million t in December – the highest since January 2021, according to Kpler. 5 It is perhaps no surprise then that China is expected to see a 5% rise in LNG demand, with 4 million t growth in LNG imports, according to Wood Mackenzie’s recent report, Asia Pacific Gas and LNG: 5 things to look out for in 2024 6 The country is likely to dominate LNG demand growth as it aims to continue switching from coal to gas in the hope of reducing carbon emissions and is expected to witness the highest additions of LNG regasification capacity in Asia between 2023 – 2027, accounting for approximately 35% of the region’s total capacity additions by 2027. 7

According to the same Wood Mackenzie report, China alone will add over 50 million tpy of regasification capacity in 2024, including Chinese inland waterway terminals (the first of their kind), along with new build terminals, and the expansion of existing regasification terminals. 7

Proposed and current additions

The announced Zhoushan II terminal will be the largest contributor to the country’s regasification capacity addition by 2027; the terminal is anticipated to begin operations in 2025 with a capacity of 292 billion ft 3 , which is expected to increase to 584 billion ft 3 by 2027. 7

Yantai I will be the second-largest terminal in China in regards to LNG regasification capacity additions by 2027. The terminal is being developed at the Port of Yanti along the Bohai Sea in the Shandong province, and was approved construction in 1Q20 by the National Development and Reform Commission of China. Yantai LNG Group is the proposed operator of the planned terminal, and POLY GCL Petroleum Investment Ltd has a 100% stake in the project. The terminal is expected to start operations in 2024 with an estimated initial capacity of 287 billion ft 3 , increasing to 487 billion ft 3 by 2027. 7

Meanwhile, towards the end of 2023, China Petroleum & Chemical Corp. (Sinopec) put the world’s largest LNG storage tank into service at its Qingdao LNG receiving terminal. The tank added 165 million m 3 of storage capacity to help meet the winter gas demand. The LNG storage tank, with a 100.6 m dia. and height of 55 m, is a key part of Sinopec’s Qingdao LNG receiving terminal’s phase III construction. 8

On the same day (2 November 2023), the company completed the phase II construction at its Tianjin LNG

receiving terminal – three 220 000 m 3 storage tanks were entered into full service, adding over 400 million m 3 of natural gas storage capacity. This brought the terminal’s total storage capacity to 1.08 billion m 3 , the largest in China. 8

Securing the delivery of LNG

To ensure China meets its demand, and in its endeavour to move away from traditional fossil fuels, the key Chinese companies have also signed long-term LNG supply agreements. In September 2023, ADNOC Gas and PetroChina International signed an LNG supply agreement valued between US$450 – US$550 million. 9

Another agreement from the Middle East was signed between QatarEnergy and Sinopec in November 2023. The companies signed a long-term sales and purchase agreement (SPA) for the delivery of 3 million tpy of LNG from QatarEnergy’s North Field South (NFS) expansion project to Sinopec’s receiving terminals in China over a span of 27 years. This SPA follows a previous agreement that was signed in November 2022 for the supply of 4 million tpy of LNG over 27 years, the longest LNG supply agreement in the industry’s history. 10

In addition to this SPA, the two companies signed a partnership agreement that will see QatarEnergy transfer a 5% interest to Sinopec in a joint venture company that owns the equivalent of 6 million tpy of LNG production capacity in the NFS project. This follows a similar agreement that was signed in April 2022 which marked Sinopec’s entry as a shareholder in one of the North Field East joint venture companies that own the project. 10

Moreover, Sinopec has signed a time charter contract with NYK for the transportation of LNG to China for up to 23 years, beginning in 2024 or later. This will support the country’s intent to be carbon-neutral by 2060. 11

LNG exports

Although China is the largest importer of LNG, the country does also export some LNG, although these are mostly re-exports. In fact, China is now the second largest re-exporter, after Spain, re-selling significant shipments to other countries in Asia. 12 According to Wood Mackenzie, some Chinese players are also expected to continue negotiations with LNG suppliers with the aim of building a flexible portfolio to generate trading profits as they compete in international markets with IOCs and traders.

Conclusion

In summary, the LNG industry in China represents a dynamic and evolving sector that plays a crucial role in the nation’s energy security, economic development, and environmental sustainability efforts. With continued investments, innovation, and policy support, China is poised to solidify its position as a major player in the global LNG market, while advancing towards a more sustainable energy future.

References

A comprehensive list of this article’s references can be found on the LNG Industry website at: www.lngindustry.com/special-reports

12 March 2024

Through the strength of our North American assets, we are dedicated to helping enable the global energy transition, thoughtfully pursuing avenues to lower the carbon intensity of our LNG, and developing low carbon solutions to meet the market demand for clean, reliable energy.

At Sempra Infrastructure we develop, build, operate and invest in the infrastructure critical to meet the world’s energy and climate needs.

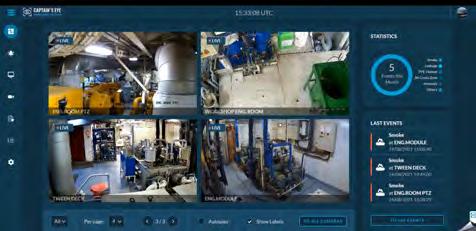

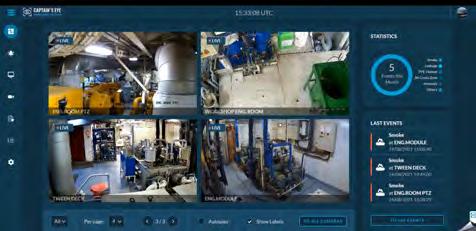

AI sentinels

Rotem Battat, Chief Product Officer, Captain’s Eye, Singapore, establishes how artificial intelligence surveillance can improve safety in the LNG maritime industry.

14

In the vast expanse of the maritime industry, where the open seas hold both adventure and challenge, ensuring safety, security, and operational efficiency is a constant quest. This exploration delves into the depths of maritime challenges, and focuses on the prevention of catastrophic accidents in the LNG industry.

The perils of LNG waters

LNG vessels sail through treacherous waters, laden with the potential for disasters like leakage, fire, and human errors that can lead to catastrophic consequences. Accidents in the LNG industry can result in massive financial losses, environmental damage, and, most critically, loss of life.

According to industry reports, LNG leakage or spillage incidents pose a significant threat. LNG is highly flammable in its vapour form, and a leak can result in a flammable cloud. The consequences of such incidents can range from environmental pollution to severe safety hazards, making the prevention of these events paramount.

A sentry against disaster

Captain’s Eye offers a line of defence against potential disasters in LNG waters. The system’s primary focus lies in the early detection of smoke, leakage,

15

and human errors, providing a proactive approach to safety and accident prevention.

z Smoke and fire prevention: the system is designed to swiftly identify the first signs of smoke, enabling the crew to pinpoint the source before it escalates into a full-blown fire. In LNG vessels, where the cargo is highly flammable, early detection is not just a matter of operational efficiency but a critical component in preventing catastrophic accidents.

z Human error detection: the company acts as an extra set of vigilant eyes, capable of detecting various human behaviours that could lead to accidents. Whether it is entering restricted zones or neglecting personal protective equipment, the system provides real-time alerts, allowing for immediate corrective actions.

Annually, the industry faces a staggering number of incidents that result in significant financial losses, environmental damage, and human casualties. The proactive approach facilitated by the

company could alter this landscape, turning the tide in favour of safety and prevention.

In incidents involving leakage or spillage, the system’s early detection capabilities can make the critical difference between a controlled event and a full-blown disaster. The Captain’s Eye system has the capacity to enhance safety by mitigating risks associated with LNG waters, potentially saving lives, preventing environmental pollution, and minimising financial losses.

The human factor: an overlooked risk

While the industry acknowledges the technical challenges and potential hazards posed by LNG, the human factor remains a critical, and often overlooked, element in accident prevention. Statistics from maritime safety databases indicate that a considerable number of accidents in the LNG sector can be attributed to human factors, ranging from procedural lapses to communication breakdowns.

Captain’s Eye addresses this dimension of risk by monitoring human behaviours in real time. The system’s ability to detect deviations from safety protocols, such as entering no-cross zones or neglecting personal protective equipment, provides a proactive layer of defence against accidents triggered by human error.

Navigating the evolution of maritime security

As the maritime landscape evolves, so do the challenges faced by vessel operators. New vessels come equipped with CCTV systems, offering a foundation that makes integrating Captain’s Eye into existing setups both easy and straightforward. With vessels growing larger and crew sizes diminishing, a technology-driven solution becomes imperative to bridge this safety gap effectively.

Captain’s Eye compliments these existing CCTV systems, adding a layer of advanced artificial intelligence (AI) that transforms passive surveillance into an active and intelligent safety net. The system’s adaptability to various CCTV setups ensures a smooth integration process, making it an accessible and practical solution for both new and existing vessels.

The landscape of maritime accidents

Statistics from global maritime safety databases paint a concerning picture. Accidents in the maritime industry, ranging from fires to human errors, contribute to substantial financial losses and environmental damage. As vessels become more sophisticated, the need for advanced safety solutions becomes paramount.

The data behind maritime safety

Data from maritime safety organisations indicates a persistent challenge in preventing accidents at sea. Collisions, groundings, and fires rank among the top incidents, each carrying the potential for catastrophic consequences. The financial toll of these accidents is substantial, with repair costs, environmental fines, and insurance claims reaching unprecedented levels.

The company’s system offers a proactive solution to prevent accidents before they escalate. The system’s real-time monitoring capabilities provide an early warning system, allowing crews to take immediate corrective actions and

16 March 2024

Figure 1. Captain’s Eye dashboard with overview of the cameras, events, and statistics.

Figure 2. No cross zone detection for safety and security reasons.

Figure 3. Early detection of smoke from an oil leakage in the main engine.

prevent incidents that could result in financial losses, environmental damage, and human casualties.

The staggering reality of LNG accidents

In the realm of LNG, where the stakes are even higher due to the volatile nature of the cargo, the consequences of accidents are particularly severe. Statistics indicate a concerning number of LNG leakage incidents annually, each carrying the potential for disastrous outcomes. Delayed responses to such incidents can result in catastrophic explosions, causing extensive damage to vessels and posing significant risks to the surrounding environment.

The financial toll of LNG accidents is astronomical, with repair costs, environmental fines, and insurance claims reaching unprecedented levels. The company offers a solution to detect LNG leakage in its early stages, mitigating the risks and averting the catastrophic consequences associated with delayed responses.

Human-caused accidents

While the focus often leans towards technical challenges, accidents caused by human factors remain a silent and persistent threat in the maritime industry. Human errors, miscommunications, and procedural lapses contribute significantly to incidents that could have been prevented with heightened awareness and real-time intervention.

Captain’s Eye serves as an advocate for improved safety culture, actively monitoring human behaviours to detect deviations from established protocols. By providing real-time alerts and visual evidence of non-compliance, the system empowers crews to address potential risks promptly, thereby reducing the likelihood of accidents caused by human factors.

Enhancing safety culture

A robust safety culture is not just a set of procedures but a collective mindset that permeates every level of an organisation. Captain’s Eye contributes to the enhancement of safety culture by fostering a sense of accountability and awareness among the crew. The system’s real-time monitoring acts as a continuous reminder of the importance of adhering to safety protocols, creating an environment where safety is not just a rule but a shared commitment.

A case for early detection – the unseen danger of oil leakage

Imagine a scenario where a small oil leakage occurs in the main engine of an LNG vessel. This leakage is invisible to the cameras installed onboard, and as the oil heats up, it starts creating smoke. However, this smoke is slow to rise, making it virtually undetectable by traditional smoke detectors.

In a situation where reliance is solely on traditional detectors, minutes could pass before the system signals an alarm. Meanwhile, the unseen danger continues to escalate. The severity of such a situation is immense — a small oil leakage, if left undetected, can lead to a full-blown fire in the main engine.

Here is where Captain’s Eye becomes a game-changer. Its AI algorithms can swiftly detect the initial signs of smoke, providing a real-time alert to the crew. Within seconds, a short video is generated, allowing the crew to visually inspect the situation. In a scenario where smoke is slow to rise, these crucial seconds can make all the difference.

The crew can now efficiently distinguish between a small fire and a potentially catastrophic event. This level of early detection, coupled with visual evidence, empowers the crew to take immediate and targeted actions. The potential disaster is averted, showcasing the instrumental role of Captain’s Eye in preventing accidents and ensuring the safety of both the vessel and its crew.

Connectivity to shore

The company’s technology provides connectivity to shore. This feature enables supervisors and fleet managers to access a comprehensive suite of tools for enhanced monitoring, analysis, and communication.

Captain’s Eye facilitates real-time and recorded video access from on-board cameras, allowing shore-based supervisors to have a continuous, vigilant eye on vessel operations. This feature proves invaluable for assessing situations, responding to alerts, and conducting remote inspections, as well as post-incident investigations.

The system offers advanced statistical tools accessible from shore, providing supervisors with insights into operational patterns, incident frequencies, and safety trends. This data-driven approach empowers decision-makers to implement targeted improvements and preventive measures across the fleet.

Incorporating robust operational communication tools facilitate online and offline communication between on-board crew and shore-based personnel. This ensures efficient coordination, timely response to incidents, and streamlined operational workflows.

Recognising the significance of satellite connectivity in maritime operations, Captain’s Eye is optimised for minimal data consumption. This ensures that even in remote areas with limited satellite bandwidth, supervisors and fleet managers can access critical information without compromising the efficiency of other vessel communication systems.

This connectivity feature not only enhances the overall efficiency of fleet management but also establishes a dynamic link between on-board activities and onshore decision-makers, fostering a collaborative and proactive approach to maritime safety and operations.

Beyond standard monitoring: unveiling anomaly alerts

In a stride towards maritime safety, Captain’s Eye extends its vigilance with anomaly alerts. These alerts encompass scenarios like forgotten hardware and potential fall hazards, such as leaving a power cabinet open or materials too close to the main engine. This proactive approach not only addresses standard risks but also identifies unforeseen circumstances that could compromise both crew well-being and vessel integrity.

Conclusion

The early detection of LNG leakage, smoke, and human errors is a useful tool when navigating the waters of the LNG industry. By providing a proactive approach to safety and accident prevention, the system reshapes the narrative, ensuring that vessels sail through waters that are not just navigable but safe and secure. In the realm of maritime safety, where every moment counts and the consequences of oversight are profound, the system’s ability to prevent accidents, minimise financial losses, and, most importantly, save lives, shows its importance.

18 March 2024

Tommaso Rubino, LNG Strategic Development Manager, Enrico Calamai, LNG Strategic and Growth Manager, Rossella Palmieri, LNG Decarbonisation Manager, Baker Hughes, Italy, outline the delivery of LNG facilities for low-carbon operations.

Decarbonising L NG

The outlook for global LNG demand is bullish. Given the current LNG price environment and the quickly changing dynamics, global LNG capacity is believed to likely exceed 800 million tpy by the end of this decade to meet growing demand forecasts. Despite some scepticism over the depth of demand long term, the industry is actively engaged in developing many new projects in the near term.

In every net-zero scenario that does not involve choosing lower living standards, half or more of the total energy demand will still be met by fossil

fuels in 2050, primarily natural gas. Baker Hughes sees natural gas as not only key to the energy transition, but also a ‘destination’ fuel.

While the IEA World Energy Outlook report projects a significant drop in demand for unabated natural gas, it also forecasts that natural gas will remain a major source of energy. The success of shared net-zero ambitions therefore depends on company’s capabilities to produce and supply natural gas in more efficient, decarbonised ways.

Focusing on the LNG value chain, real opportunities exist today to improve efficiency, reduce greenhouse

gas (GHG) emissions, and lower costs. This requires installing emissions reduction technology into existing plants and designing future plants with even more powerful emissions reduction technologies at the core.

There is no single leap to realise this objective. Multiple technologies, including those developed by Baker Hughes, either exist today or are in development that help to create low carbon emissions operating environments, including for liquefaction.

Two clear routes present the best short-term opportunities to achieve more sustainable operations:

19

z First, emissions can be further reduced by improving the efficiency of turbomachinery and optimising these complex systems. In addition, there are several promising avenues being explored that may unlock greater reductions in time-to-market.

z Second, electrification is providing an attractive avenue for emissions abatement. While speaking of electrification, it should be clear there is no silver bullet, no unique approach – on the contrary, there are different (and necessary) possible paths towards electrification and carbon reduction in the LNG industry, for both greenfield and brownfield projects.

Electrified LNG trains for new and brownfield projects

To maintain their license to operate, LNG operators need solutions today. For brownfield projects, electrification is one option to be considered to help reduce emissions while producing more efficiently.

For example, in the case for a brownfield project, by substituting the gas turbine for an electric motor, significant emissions reductions can be achieved – as long as the power to feed the electric motor is obtained through renewable or other net-zero emission sources.

Varying shaft-line sizes and configurations, methods of delivering electrical power, and technical constraints inherent to specific sites are some of the reasons why there are multiple solutions and approaches to electrification.

In any scenario, a consistent benefit is the tangible and quantifiable reduction in emissions. For every unit of mechanical-drive power that transitions from a gas turbine to an electric motor, the potential carbon dioxide (CO2) equivalent emission reduction amounts to:

z 20 – 40% if the electricity is sourced from a combined-cycle gas turbine (CCGT) power generation plant. The exact reduction depends on the comparative efficiency of the CCGT plant and the original mechanical drive gas turbine.

z 100% if the electricity is sourced from renewable or other net-zero emission sources.

State-of-the-art electric motors can run large scale LNG operations. When paired with renewable energy and/or nuclear power, net-zero power can be achieved.

A seminal e-LNG project is ADNOC Gas’ Ruwais LNG project, a 9.6 million tpy facility being developed to run on a combination of renewable and nuclear power. Baker Hughes is set to provide two all-electric liquefaction trains for the project that will utilise the company’s 75 MW BRUSH electric motor technology, complemented by advanced compressor technology. While this LNG project will inaugurate operations with net-zero power, existing LNG terminals can also make the shift to electrification combined with lower emissions power.

Modular option with lower emissions drivers

The expansion of the LNG market has created demand for medium-to-large projects, which can be developed relatively quickly and scaled with a turnkey option that contains the liquefaction train in modular form (1 – 1.5 million tpy).

This requires a compact yet powerful driver, such as the Baker Hughes LM9000, a simple-cycle efficiency, aeroderivative gas turbine designed with up to a 65 MW+ driver. This provides high-power density with reduced fuel use and emissions. This turbine design also allows for start-ups without venting process gas. It can operate with emissions below 15 ppm for NOX and 25 ppm for CO at ISO condition. Such modular projects can reduce CO2 emissions up to 30% compared to a traditional LNG plant based on a large size train with heavy duty gas turbines.

The turbine’s high-power density results in a smaller footprint than traditional LNG plants, making it suitable for offshore settings, which will be critical to increasing the supply of low emission natural gas. Its compact design and features that enable quick and straightforward maintenance —

20 March 2024

Figure 1. BCL centrifugal compressor for LNG applications.

Figure 2. BRUSH Power Generation, 2-pole generator.

Figure 3. Centrifugal compressor driven by an electric motor assembled in the manufacturing site in Florence.

Designed for efficiency enthusiasts: LM9000

With 44% efficiency in simple cycle, our LM9000 is the most efficient gas turbine in the 65+ MW power range. It also helps reduce CAPEX in LNG because it doesn’t need a helper motor, and its longer maintenance intervals help reduce OPEX.

LNG capacity up, carbon intensity down.

bakerhughes.com/LM9000

2024 Baker Hughes Company. All rights reserved.

Copyright

including an engine swap capability within 24 hours — position the LM9000 as a practical choice for both mechanical drive and power generation applications.

Packaging power in modular liquefaction also provides plant capacity flexibility by operating multiple units in parallel to respond to market demand volatility. A power island configuration based on mid-size high efficiency gas turbine in a building block architecture couple perfectly with the modular liquefaction approach.

The LM9000 gas turbine technology has been chosen for a number of prominent global LNG developments, such as the 2 million tpy nearshore LNG project of PETRONAS in Sabah, Malaysia, and the 9.3 million tpy LNG project of Commonwealth in Cameron Parish, Louisiana, the US.

A configuration with multiple LM9000 aeroderivative gas turbines in a combined heat and power plant (CHP) provides 99+% availability. For additional flexibility and emissions reduction, renewable power can be integrated as well. For example, a 5 million tpy LNG plant that utilises electric motor machines to drive its refrigeration trains – potentially composed by 3 NMBLTM modules, working together – and is equipped with a 300 MW power generation unit, can decrease its CO2 footprint up to 15% when 120 MW of renewable power is incorporated.

Driving the energy transition

Natural gas is key to the energy transition, and the industry is now seeing a reversal of the under-investment in gas projects experienced in recent years.

57% of 555 executives from leading energy and hard-to-abate industrial firms across 21 countries claim to be investing or planning to invest in natural gas/LNG as a result of the energy security crisis, according to a survey commissioned last year by Baker Hughes and FT Longitude.

The sector has clear demand and therefore ambition to improve efficiencies and reduce emissions, along with costs. Contracts are no longer simple transactions for equipment, but long-term strategic partnerships with operational efficiency and emissions reductions at the core.

Incorporating advanced emissions reduction technologies into existing plants is imperative, ensuring even long-standing facilities align with contemporary sustainability standards. Whether the design is large scale, stick-built or for modular LNG projects, net-zero objectives can be met with a variety of viable options.

Natural gas is not the inherent issue; the primary challenge is preventable emissions. Industry needs to support burgeoning energy demand while actively reducing emissions with the technologies available today.

Powering liquefaction trains with electricity sourced from clean energy reduces emissions and – depending on location – is a readily available option. The integration of renewables can also be considered for powering further the terminal, presenting a holistic approach to cleaner energy. These exciting developments also include hydrogen as an alternative fuel source. As example, replacing natural gas with hydrogen in heavy duty gas turbines equipped with a diffusive combustion system, blending with nitrogen, can help to lower CO2 and NOX in exhaust emissions.

In addition, carbon capture and storage are critical to remove CO2 in LNG operations. By leveraging on existing technologies, like CO2 compression and pumping, and continuing fostering innovation of capture technology, the gas industry will be able to move toward a sustainable development while ensuring the safe supply of energy.

To orchestrate the integration of various configurations, equipment types, and technologies, digitalisation is essential for optimising efficiencies and further lowering emissions. Asset performance management software is becoming increasingly important to improve efficiency and achieve the global 2030 agenda.

An integrated approach combining advanced design and digital intelligence can reduce carbon emissions from the gas supply chain, including LNG.

Bibliography

1. ‘Baker Hughes Announces Milestone Electric-LNG Award for ADNOC Ruwais LNG Export Terminal, Baker Hughes, (4 October 2023), https://investors.bakerhughes.com/newsreleases/news-release-details/baker-hughes-announcesmilestone-electric-lng-award-adnoc-ruwais

2. ‘Baker Hughes to Supply Super Efficient LM9000 Gas Turbine for PETRONAS Sabah LNG Project’, Baker Hughes, (19 April 2023), www.bakerhughes.com/company/news/bakerhughes-supply-super-efficient-lm9000-gas-turbine-petronassabah-lng-project

3. ‘Commonwealth LNG and Baker Hughes Sign Strategic Agreement’, Commonwealth LNG, (21 August 2023), https://commonwealthlng.com/commonwealth-lng-and-bakerhughes-sign-strategic-agreement/

4. ‘Baker Hughes 2023 Energy Transition Pulse: Confidence to Hit Net-zero Emissions Goals Stable Despite Energy Trilemma’, Baker Hughes, (24 January 2023), www.bakerhughes.com/ company/news/baker-hughes-2023-energy-transition-pulseconfidence-hit-netzero-emissions-goals

22 March 2024

Figure 4. LM9000 gas turbine at the manufactuirng and testing site in Massa, Italy.

Figure 5. LNG module under construction in Avenza, Italy.

Floating LNG (FLNG) technologies have been proposed and solutions developed for all regions of the world, from the arctic to the tropics. It is interesting to note that the first FLNG was actually built over six decades ago and became operational in 1959. The vessel in question was a small inshore barge moored in a ‘notch’ on Lake Calcasieu close to Lake Charles in Louisiana, the US. It produced the first 2020 t of LNG shipped – to the UK’s Canvey Island terminal on 20 th February 1959, in the first LNG carrier Methane Pioneer, which was a converted Liberty ship with 5088 m 3 of storage. However, it was only in May 2011 that the first offshore FLNG project, namely Shell’s 3.6 million tpy Prelude, gained final investment decision (FID). Currently, there are five FLNGs in service (one a conversion), with a further six (one a conversion) under construction.

An FLNG is, usually but not exclusively, located over a stranded offshore natural gas reserve. The field can be either lean or rich (i.e. with associated condensate or petroleum gasses) and usually, but not necessarily, without significant associated oil reserves. As with most traditional offshore oil FPSO vessels, an FLNG is typically permanently moored.

The FLNG receives the multi-phase well fluids to the inlet treatment facilities via either flexible, or possibly steel catenary, risers. As with a FPSO, an FLNG separates the multi-phase well fluids and stabilises any associated condensate, etc. for storage within the hull. However, following separation instead of the gas being compressed and exported via pipeline, it is further processed onboard into marketable liquefied

Keith Hutchinson, Head of the Professional Technical and Engineering Services and Senior Consultant in Whole Ship Design and Naval Architecture, Safinah Group, UK, discusses the key drivers and safety aspects to be considered in designing floating LNG assets for exploiting stranded gas reserves worldwide.

__________ 23

gas products. This typically uses mature and proven marinized-based natural gas liquefaction technologies in order to minimise overall solution risk and, dependent upon the field characteristics and process/number or trains, LNG production rates range from 1 – (a proposed) 10 million tpy. Typically, the gas is treated to remove the acid gas (carbon dioxide [CO2] hydrogen sulfide [H2S]), water, and any mercury (Hg). It is then cooled to extract heavier petroleum gases and then the remaining gas, mainly methane (CH4) and ethane (C2H6), is further cooled and liquefied in the cryogenic heat exchanger before any excess nitrogen (N2) is removed. The LNG, and any liquefied petroleum gas (LPG), is stored in cryogenic cargo tanks located in the hull, and any condensate also stored in dedicated tanks within the hull.

The LNG, LPG, and condensate are offloaded, at required intervals, to suitable trading LNG carriers, LPG carriers or shuttle tankers respectively. The FLNG supply chain typically basically consists of three elements:

z An FLNG offshore moored over the gas field.

z LNG carriers for transhipment to market.

z Either a standard onshore LNG reception terminal, or an FSRU vessel moored near-shore/inshore.

Note that there are alternatives to ‘in field FLNGs’, i.e. ‘pipeline FLNG’ assets which are designed receive pipeline gas from, typically, the shore and are moored near-shore or

on jetties, as with FSRUs but export LNG to LNG carriers, and are less complex.

Once the field development strategy has identified an FLNG as a possible exploitation option, certain fundamental aspects will influence the selection of an appropriate hull design with the operational life dictating corrosion margins, fatigue life, etc.

Configuration and dimensions

The upper deck area within the cargo region is typically made available for locating the topsides modules. It is good practice to site less hazardous utilities, power generation/switching, etc. modules between the more hazardous processing and liquefaction modules and the accommodation block. The principal dimensions, regulatory compliance, and safety of an FLNG are directly governed by the overall topsides layout as this determines the required ‘real-estate footprint’. Drivers include:

z Location of accommodation, topsides modules, flare, etc.

z Separation (safety) areas/gaps between groups of modules to prevent jet fires propagating and to dissipate blast, etc.

z Process deck elevation requirements to afford suitable separation of the process deck from the hull’s upper deck regarding blast, etc.

z Appropriate blast protection.

z Suitable thermal protection on the upper deck, etc. in way of cryogenic modules, etc.

z Mooring and offloading.

z Main power generation and process cooling water system philosophies.

z Provision of craneage and maintenance ways.

z Incorporation of workshops and laydown/storage areas.

z Access and escape routes.

The accommodation block cannot be sited over spaces contiguous with cargo tanks. Hence, on FLNGs and FPSOs, accommodation blocks are invariably sited over machinery spaces. Obviously, the size, layout, orientation, and location of the accommodation block will influence the design significantly.

If a turret mooring system is chosen, then this is best sited forward of the process plant if a naturally weather vaning swivel solution is adopted. If a spread mooring system is applicable, then this is incorporated on the forward and aft decks and, if moored to a jetty, then a mooring arrangement based on a standard marine one can be adopted, which will impinge little on the upper deck.

Offshore, the offloading solution for LNG and LPG is, currently, side-by-side due to the predominant application of ‘hard-arms’. However, this is not the case for condensate where a tandem arrangement with the offtake shuttle

24 March 2024

Figure 1. 2016 newbuild 177 000 m3 membrane 1.2 million tpy nitrogen cycle FLNG.

Figure 2. 2009 147 600 m3 spherical IMO Type B SS ST LNG carrier.

NATIONAL INSTITUTE FOR STORAGE TANK MANAGEMENT NISTM 26th Orlando, Florida APRIL 3-5 2024 FREE TRADE SHOW www.NISTM.org | 800.827.3515 International 011.813.851.1700 • AST Conference Sessions • Free Trade Show • Golf Tournament • Co-Located Events • Free EPA SPCC & FRP Course • Welcome Reception • Network Mixers on the Trade Show Floor

tanker in line astern of the FLNG is typically adopted; hence, the offloading system needs deck space at the aft end of the FLNG for turret moored designs – for spread moored designs it is possible that a buoy system may be utilised.

Topsides liquefaction and process

Only the N 2 cycle and the mixed refrigerant (MR) liquefaction processes, both single (SMR) and dual (DMR), have been currently utilised offshore due to the inherent footprint limitations of an FLNG compared to a land-based development. The MR process offers the greatest liquefaction efficiency and lower space requirements due to using liquid rather than gas refrigerant(s). However, such liquid refrigerants are flammable and hence a potential source of vapour clouds. Practically, the SMR process and the N 2 cycle, even with pre-cooling, can only produce up to approximately 1.5 million tpy of LNG per train; amounts above this requires application of the DMR process.

Specific aspects of the topsides that drive the hull design from the earliest stages are:

z Relative layout and separation requirements of modules.

z Footprint of individual modules.

z Weight (dry and wet), extents, etc. of individual modules.

z Longitudinal and transverse centres of gravity of individual modules.

z Vertical centre of gravity of individual modules and elevation of the process deck.

Due to the large footprint required for LNG topsides modules, it may be advantageous to site non-hazardous process utilities, such as sea water cooling pumps and heat exchangers, power generations/transformers/switchboard rooms, etc. below the upper deck within the hull rather than in modules on the process deck.

Containment system

The selection of the containment system is governed the metocean environment, cost, and preference, etc.

It fundamentally drives the structural arrangements and scantlings, together with the principal dimensions and configuration. The common choices of containment system are:

z Self-supporting spherical IMO Type B – converted LNG carriers only.

z Self-supporting prismatic IMO Type B (SPB).

z Membrane – typically GTT’s Mk.III variants and No.96 systems.

Storage capacity and configuration

A model of the production rate together with offloading frequency/parcel size(s) and required buffer storage for weather, and to a lesser degree tank inspection and maintenance requirements, will determine the minimum required LNG, LPG, and condensate cargo storage capacity. In addition, the regulatory regime, chemical requirements, refrigerant (for liquefaction process) requirements, etc. must also be determined and accommodated within the hull. Depending upon the required cargo storage, together with the selected containment system and tank sizes, etc. then the configuration of the cargo region can be significantly affected as it may force cargo tanks to be ‘in-line’ or ‘wrapped’, etc.

Environment

The environment has many facets, such as: whether the location is offshore or near-shore; waves categorised as benign to harsh with unidirectional or bi-directional seas; wind; currents, etc. Even sea areas with ice can be exploited using FLNGs provided suitable hull forms, construction materials, scantlings, and moorings are applied. The environment imposes an upper and a lower limit on FLNG dimensions – too small and motions will be too extreme to provide a stable platform for the operation of the topsides, too large and the mooring system will be unduly affected. Other aspects which must designed for include acceptability of motions regarding safe personnel operations, extreme wave, loads, etc.

The wave environment can introduce large bending moments and shear forces into the hull girder. In the more extreme and harsh environments, actual site-specific longitudinal wave bending moments can significantly exceed the classification societies rule values from the worldwide service. This therefore necessitates a new-build specially-strengthened hull with extensive additional longitudinal and other material compared with trading LNG carriers designed for standard worldwide service. For more benign locations utilising small-to-medium FLNGs, conversion of existing LNG carriers' tonnage can be advantageous but requires incorporation of significant hull sponsons due to the large deck area required for the topsides process and liquefaction trains and associated equipment, not to mention their weight.

Mooring and heading control

Selecting the most appropriate mooring system is dictated by the environment, water depth, and riser solution being employed – in fact selection of the mooring and riser

26 March 2024

Figure 3. 2018 newbuild 26 000 m3 IMO Type C jetty moored 50 million ft3/d mini-FSRU.

2024

Conference & Trade Show

May 6-8

HOU TX

ILTA 2024, the leading conference and trade show for the bulk liquid terminal industry, is set to be our biggest yet!

Join thousands of terminal industry professionals from around the world for:

Inspiring keynotes plus in-depth educational sessions featuring expert speakers

The ILTA exhibit floor packed with hundreds of industry solution providers

World class networking including a special celebration of ILTA’s 50th anniversary

All in Houston, TX—the Energy Capital of the World!

ilta.org

Register Now!

solutions are directly linked, and the number and type of risers can drive the selection of the mooring system. For offshore locations a either a multi-leg spread mooring system, yoke, external turret, or internal turret (which could be and disconnectable and the FLNG self-propelled) could be employed. If employed in sheltered waters an FLNG can be pier/jetty moored or even located in a shoreline ‘notch’.

In moderate to harsh wave climates FLNGs must weathervane into the predominant wave direction to control roll motion and reduce mooring loads, motion induced process and offloading downtime, etc. hence a turret must be incorporated. In more benign environments, an FLNG can be spread moored so that it is aligned into the predominant swell in the knowledge that non-aligned environments will not significantly increase mooring loads or impact on motion induced downtime. If extreme environmental events such as hurricanes, typhoons, or floating ice are possible then a disconnectable mooring system and installed propulsion system to facilitate the FLNG to steam away (or possibly be towed dependent on size the attendant ships) may be a desirable solution.

Thrusters can be an integral part of the mooring solution or only be used to improve the operability of the FLNG by, for example, maintaining best heading for low motions or providing heading control during offloading operations. If they are an integral part of the mooring solution then classification society rules require high levels of redundancy in the power generation, control and thruster components. Thruster installations must consider access for maintenance at sea, as the FLNG will remain on station throughout its operational life.

Regulatory framework

Most of the major IACS classification societies now have rules governing the design of FLNGs.

In nearly all regions of the world, some form of process to permit the operation of an FLNG exists, which involves audit of the design solution as well as its means of operation. This is heavily regulated by some national governments, while others simply accept classification society approval. The regulations of some countries are prescriptive in nature whereas others are ‘goal-setting’ in approach and lay down requirements and require an operator to demonstrate that the risks to the operators,

third parties, and the environment are as low as reasonable practicable (ALARP).

While the hull designer may refer to classification society rules to demonstrate the safety of their solution, this must be documented in design and operations safety cases. Specifics relating to the field environment, mooring solution and topsides, and subsea interfaces must be addressed in the hull design safety case documentation.

Safety

As with the design of any marine artefact the primary goals in designing an FLNG are personnel safety (including possible de-manning) and asset operability. It is imperative that the naval architect comprehensively explores the design space in an efficient manner to arrive at the safest and near-optimal FLNG design with respect to integrity and operability, redundancy, etc. Specific safety considerations include:

z Emergency shutdown.

z Survivability/stability.

z Blast and spill protection.

z Firefighting and protection.

z Access and escape routes.

z Lifesaving and evacuation.

It is imperative that the maintenance and inspection strategies, etc. are inherent within the design from the concept phase onwards. To ensure that a coherent and near-optimal design is developed it is crucial that the design team (process, marine, mooring, subsea, operations, etc.) is fully integrated with an open communication culture in which lessons learnt are freely communicated and adopted and driven by an experienced design authority with the skill sets to understand and rationalise all aspects of the asset.

Summary

Just as that FPSOs enabled the development of remote and deep-water oil reserves from the 1970s onwards, it is obvious that due to their relatively low capital costs and rapid project realisation FLNG solutions are the technology catalyst for the successful development offshore stranded gas fields. Given the recent financial climate growth has been restrained over the past few years, however, given the current energy market, FLNG is back in vogue with five projects sanctioned in the past couple of years and hence FLNG liquefaction capacity is set to double from the current 12 million tpy to almost 25 million tpy by 2026, and a further 16 FLNG projects in pre-FEED.

Disclaimer

The views expressed in this article are those of the author and do not necessarily represent those of the organisations with which he is affiliated and the professional institutions of which he is a member.

28 March 2024

Figure 4. Author’s design of a condensate and 275 000 m3 SPB 5.1 million tpy DMR FLNG for an extremely harsh remote location, offloading to a 137 500 m3 spherical IMO Type B SS ST LNG carrier.

A

global industry requires a global publication

Register for free at: www.lngindustry.com Worldwide Coverage

In an era characterised by swift transformations in the energy sector, the demand for a varied and flexible work ethic within the supply chain has become more critical than ever before. It is imperative for the supply chain to showcase its agility and adaptability in meeting client requirements. This emphasis on responsiveness has now evolved into the necessity that can expedite and execute projects with both efficiency and safety.

This trend is particularly evident in the way countries are proactively addressing global developments. They are not only diversifying their energy sources, but also placing significant focus on reducing carbon emissions.

30

Eric Farrell, Head of Commissioning at EnerMech, summarises how experience, expertise, and the right company ethos are key to safely and efficiently delivering fast-track projects.

PUTTING THE ELBEHAFEN TERMINAL ON THE FAST-TRACK

Germany, for example, has embarked on a major undertaking to reduce reliance on Russian gas imports through the development of its Elbehafen LNG import terminal at the port of Brunsbüttel.

This underscores the increasing need for a supply chain that can swiftly navigate these shifts in the energy landscape.

The commissioning strategy EnerMech OTS has devised places strong emphasis on early involvement, ensuring that a team of experienced engineers are engaged, if able, from the very beginning of each project. This approach enables the company to work in close co-operation with its client and all stakeholders, from conceptualisation to execution, ensuring a

comprehensive understanding of project goals and responsibilities. Integrating skilled experts at the outset maximises efficiency, helps anticipate challenges, and enhances the overall quality of the commissioning process.

Q. What does the Elbehafen project involve?

A. The purpose is to enable the import of large amounts of LNG as quickly as possible to a country that had no direct access to the LNG market. The long-term establishment of the LNG import terminal will help Germany reduce its dependence on Russian energy.

31

Phase one involved the construction of necessary technical infrastructure at an existing jetty at the port of Brunsbüttel to accommodate an FSRU commissioned by German multinational energy company, RWE, on behalf of the country’s government. Work on a dedicated new LNG import jetty is also proposed and expected to begin between 2Q24 –3Q24.

Phase two will see the new state-of-the-art jetty, which will accommodate the FSRU on a longer-term basis, come into operation. The third phase will see gas being fed into a newly constructed gas pipeline which will have the capacity to carry 7.5 billion m3 of gas, generated from 12.5 million m3 of LNG/y.

Q. What is EnerMech OTS’ workscope on the Elbehafen project?

A. EnerMech OTS – a strategic partnership alliance between EnerMech and Offshore Technical Services (OTS) – was awarded a contract by Worley for the provision of precommissioning and commissioning planning and execution services, plus specialist services across the project, such as nitrogen (N2) leak testing, flange management, boroscopic inspection for pipeline cleanliness, and strength testing of the newly built temporary oil pipeline (the original oil offloading facility is now being used for LNG import).

At the client’s request, EnerMech OTS was involved in all the main areas in phase one, including design and engineering assistance, turnover, construction and commissioning, handover, start up, and operations – meeting the requirement for this to be completed within a timescale that was ‘as short as possible’.

Prior to the contract award, acting on a verbal agreement only, EnerMech OTS demonstrated its competence and trust by performing the following:

z Early systemisation and scoping of the project.

z Development of completions management system database, complete with construction and commissioning completion inspection test records (ITR).

z Commissioning schedule and detailed plan.

A full commissioning team at Elbehafen has taken the project from the construction/mechanical completion stage through to operations handover, delivering enhanced continuity of planning execution, interface reduction and the project delivery.

Q. What experience and expertise did EnerMech OTS bring to the table?

A. EnerMech OTS has global experience in servicing the LNG industry that has seen the company work across 20 different facilities in a growing geographical spread which includes Australia, Africa, the Americas, the Middle East, Caspian, Europe, and Asia – and, as announced in 2023, Canada.

The Canadian project was a strategically important win for EnerMech OTS as it looks to increase its foothold as a specialist services provider for LNG production, storage, and loading projects. This award further highlights the company’s growing reputation for its capabilities to deliver specialist and integrated mechanical, electrical and instrumentation services, and equipment to clients in different geographies around the world.

EnerMech’s track record of work spans the asset lifecycle from early engineering to pre-commissioning, commissioning and start-up, to operations and maintenance and specialist shutdown and turnaround scopes.

The company’s experience and the broad range of services it provides has expanded over the years, equipping us with the scope to deliver a broader level of expertise and capability than ever before.

Having this as a solid foundation was key to the industry-leading project delivery of this strategically important project for Germany.

Q. Where did the EnerMech OTS LNG story begin?

A. Our legacy as a premier provider of integrated specialist services in the LNG market stretches back over the last 15 years and has its roots in Australia, which led the way in large scale global LNG projects.

The Gorgon and Wheatstone LNG developments offshore Western Australia were two early flagship projects which continue to supply gas to Australia’s domestic market and exports to China, India, Japan, and South Korea.

The company’s legacy from working on Australian mega-projects helped introduce its services and expertise to the global LNG market, and this has continued to thrive due to EnerMech’s toolbox of speciality services and integrated approach, allied to its ability to quickly ramp up activity as required by the Market Tier 1 contractors.

Q. What needs to be taken into consideration when fast-tracking projects?

A. Fast-tracking a project requires much more than just pulling the timeline forward. Fast-track projects require specific advance planning followed by detailed execution to avoid problems regardless of the reduced timescales and teamwork is essential to ensure project delivery at a safe, accelerated pace.

This means the ability to mobilise quickly with a team that has the specialist skills required, who can be

32 March 2024

Figure 1. Elbehafen LNG import terminal is being fast-tracked with EnerMech’s help.

adaptable and flexible in responding to emerging needs and demands of clients and the ability to fulfil a wide variety of requirements through a broad range of specialist capabilities. The partnering and trust though EPC is led by leadership commitment and action, setting the tone for the company’s can-do approach, common purpose and shared motivation.

Q. What is the EnerMech OTS approach to fast-tracked projects?