March 2024

•Cracked Gas • Ethane Feed Gas

•LPG, Naphtha, & Light Condensate Feed Liquid

•Regen. Gas from Cracked Gas Driers

•Light Olefin Gas from FCC Units

PROVEN PROCESS – PROVEN PRODUCTS

•AntiMercure® Process Engineering

•MERSORB® mercury adsorbent pellets

AntiMercure® is a Registered Trademark of Selective Adsorption Associates, Inc. for its Process Engineering Services

MERSORB® is a Registered Trademark of NUCON International, Inc. for its mercury adsorbent pallets

With MERSORB® mercury adsorbent pellets

•PROVEN RELIABLE – EVEN IN CRACKED GAS

•HIGH MERCURY CAPACITY – HOT, COLD, WET or DRY

•MORE PELLET SIZES – MORE PROCESS DESIGN FLEXIBILITY

•LOW MOISTURE – FAST START-UP

•40 YEARS EXPERIENCE – ADSORPTION PROCESS DESIGN

MERSORB®

www.mercuryadsorbents.com

Optimized Mercury Removal

Inc.

mercury adsorbent pellets – a Trademark of Nucon International,

(NUCON®)

Mercury Removal

Your Experts for

–in Ethylene Plants

03 Comment

05 Guest comment

07 News

12 US markets: unseen recovery

Nancy Yamaguchi, Contributing Editor, discusses US economic recovery, the gradual control of fuel prices and the long-term oil market outlook.

21 Facilitating and quantifying industry improvements

Colin Frazier, American Petroleum Institute (API), explains how the API’s Process Safety Site Assessment Program (PSSAP®) can help hydrocarbon processing plants improve the safety of operations.

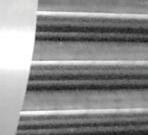

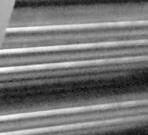

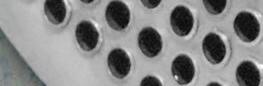

26 Revolutionising performance

Richard Caulkin, Tim Michalec and James Esteban, UNICAT Catalyst Technologies LLC, explore how revolutionary scientific modelling allows tailored optimisation of filtration grading and loading profiles to deliver 50% improvements in catalyst bed life.

33 Meeting enhanced quality demands

Ashley Ashford and Rahul Singh, Topsoe, explain the importance of hydrocracking based technologies in producing high quality, sustainable lubricants.

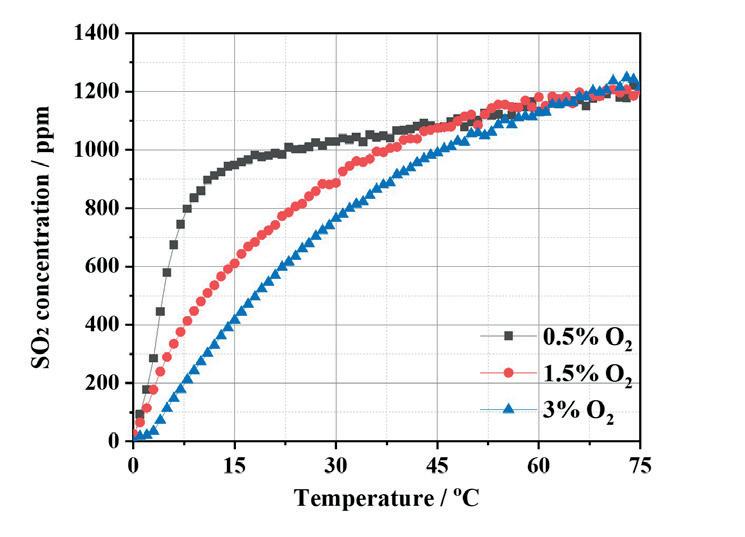

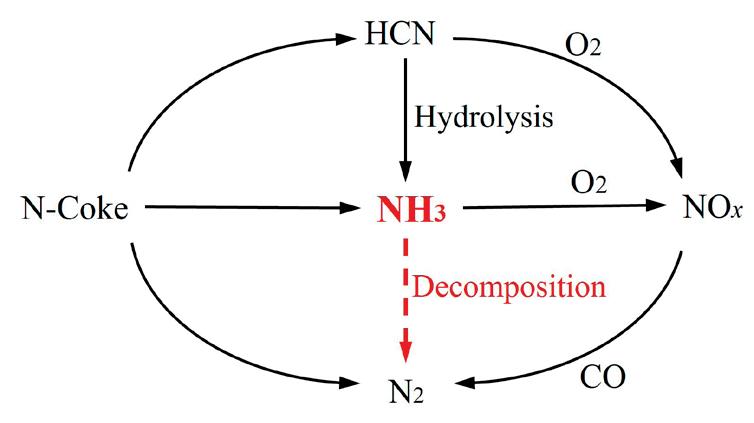

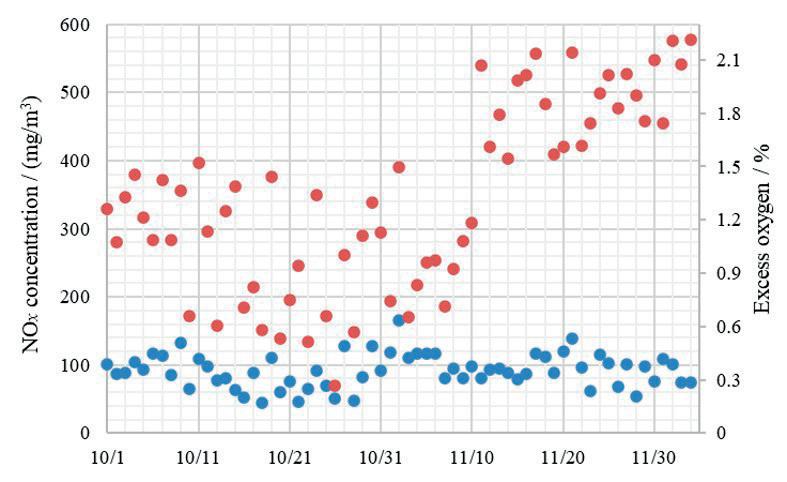

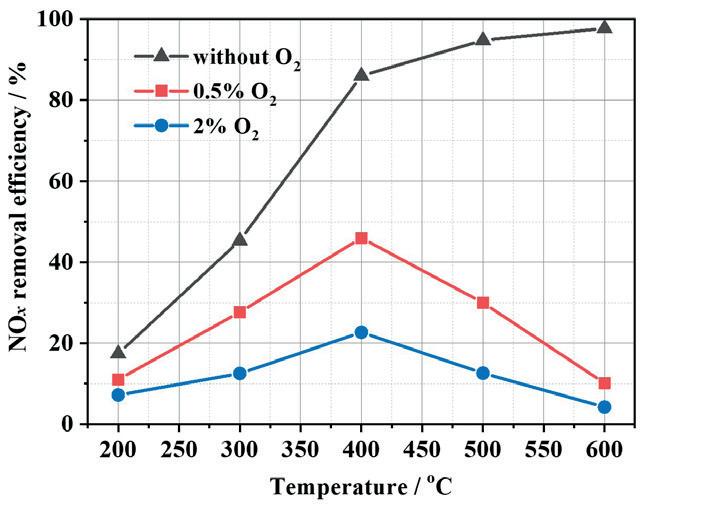

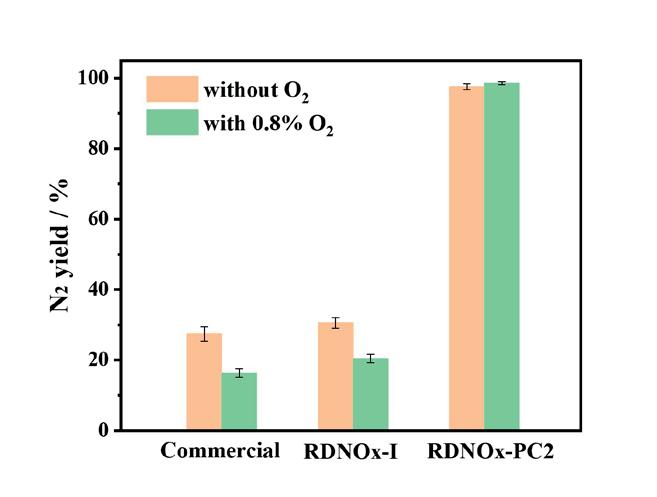

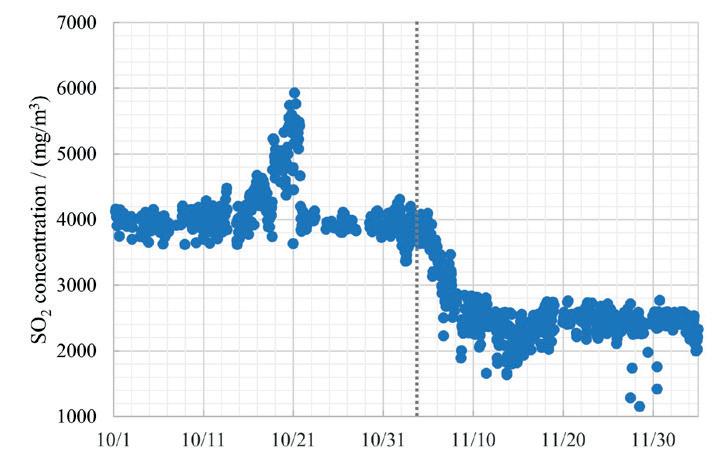

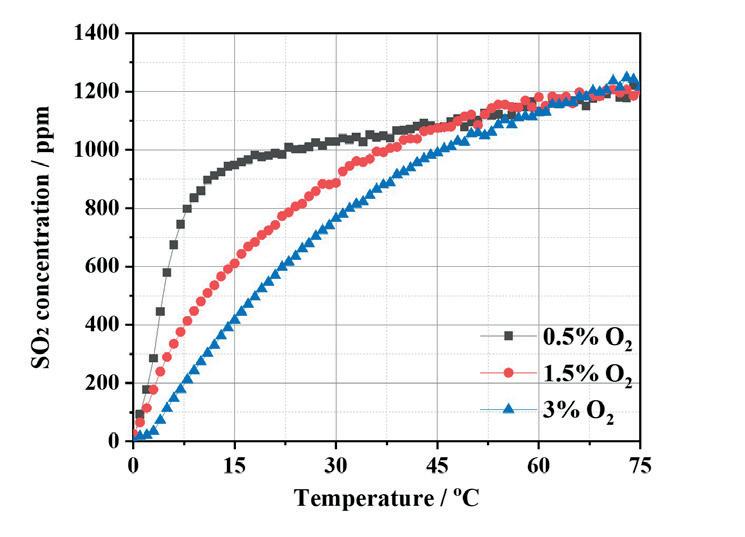

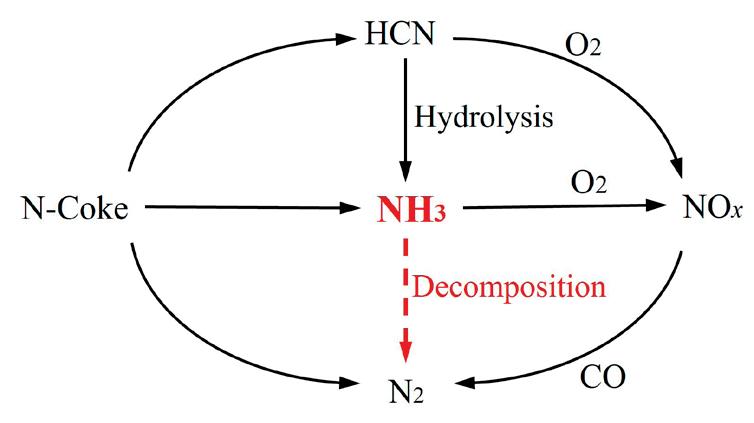

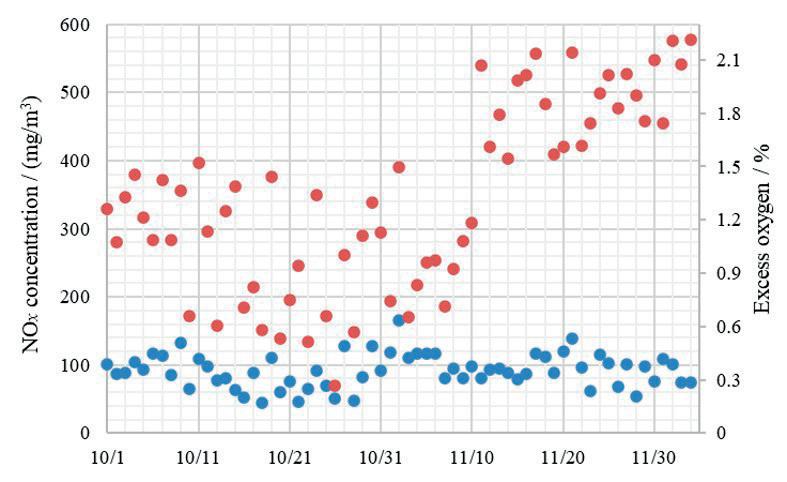

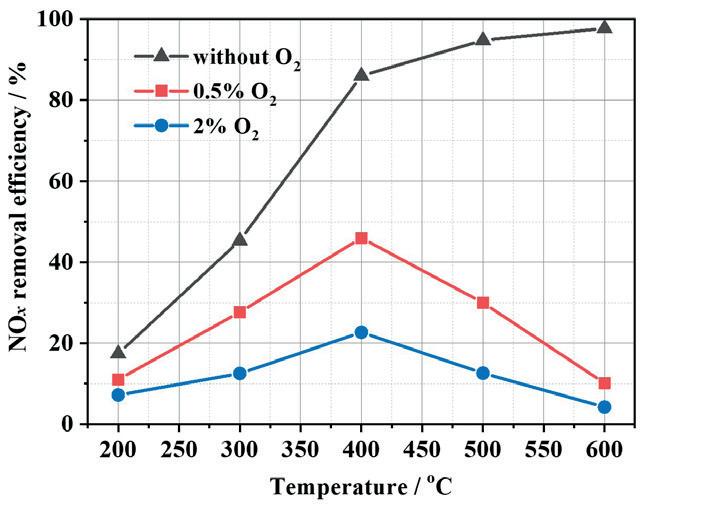

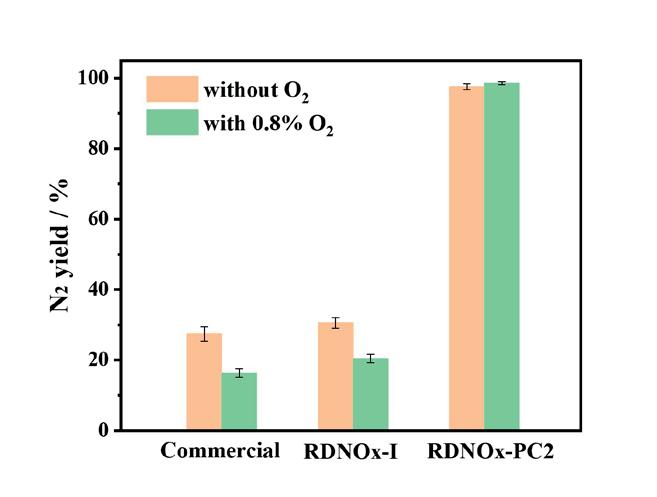

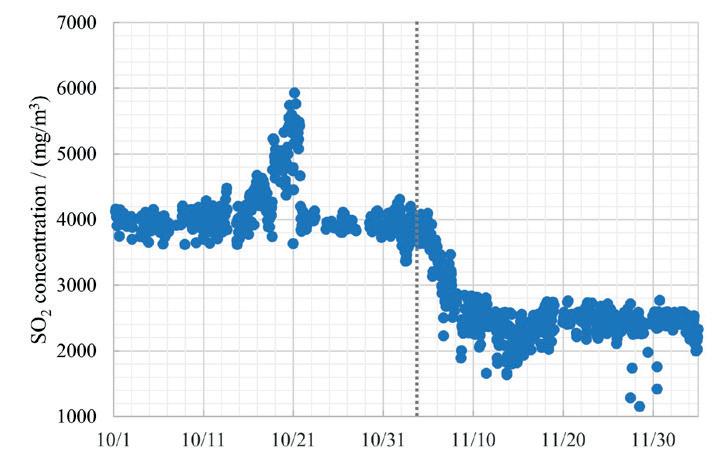

40 Collaborative control of SOx and NOx emissions

Dongyue Zhao, Chunfang Chen, and Haitao Song, SINOPEC Research Institute of Petroleum Processing Co. Ltd, alongside Xianyao Liang and Xianglong Xu, SINOPEC Beihai Refining & Chemical Co., explain how a novel additive can relieve the conflict between NOx and SOx removal efficiency.

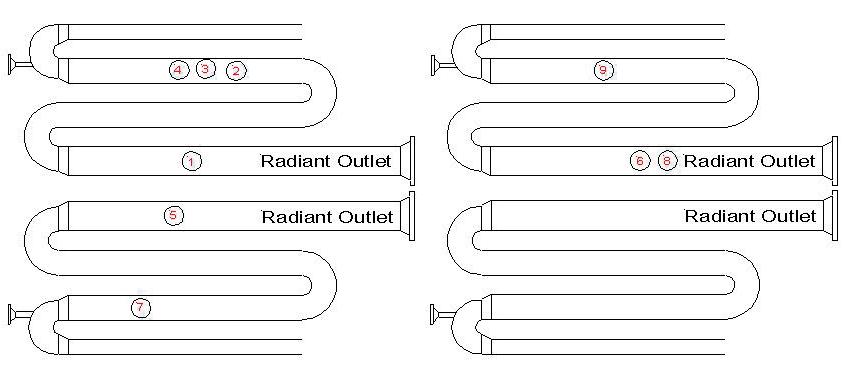

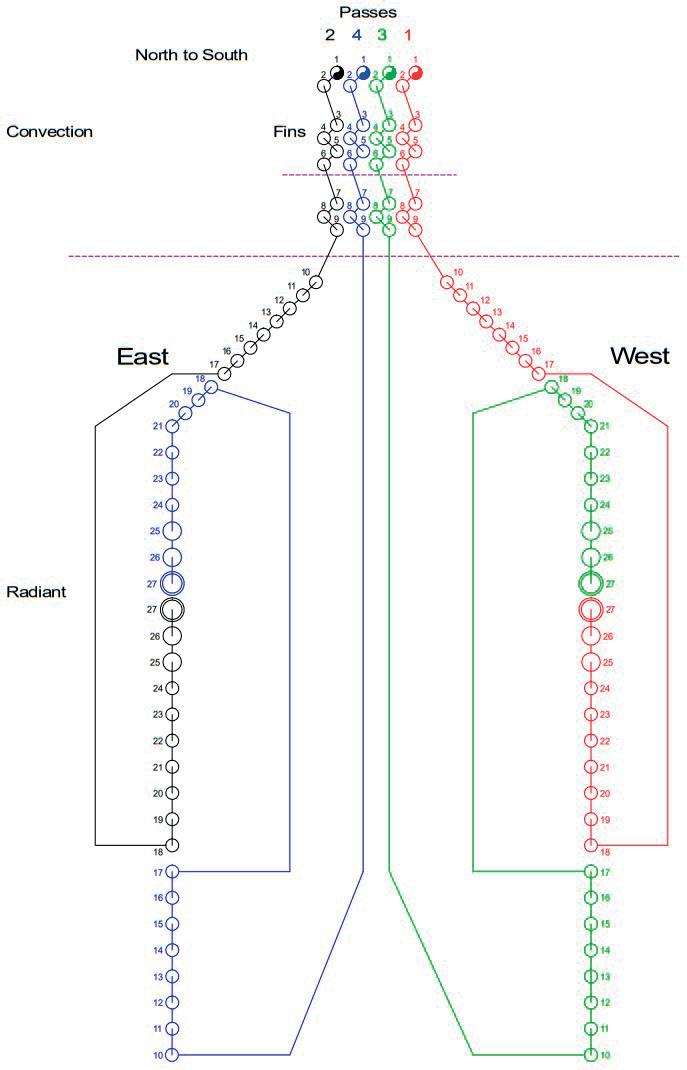

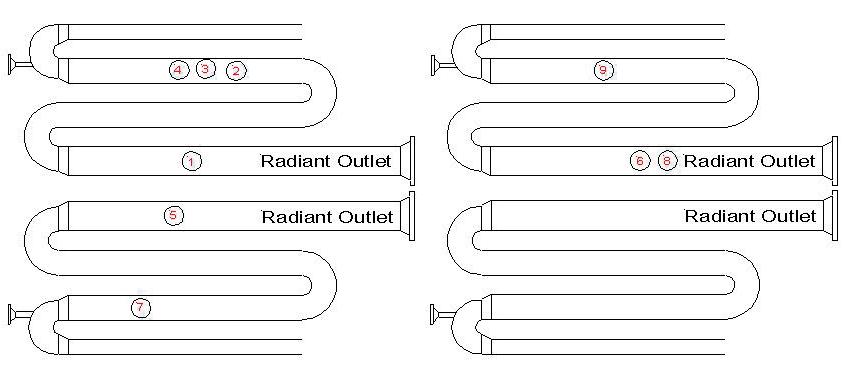

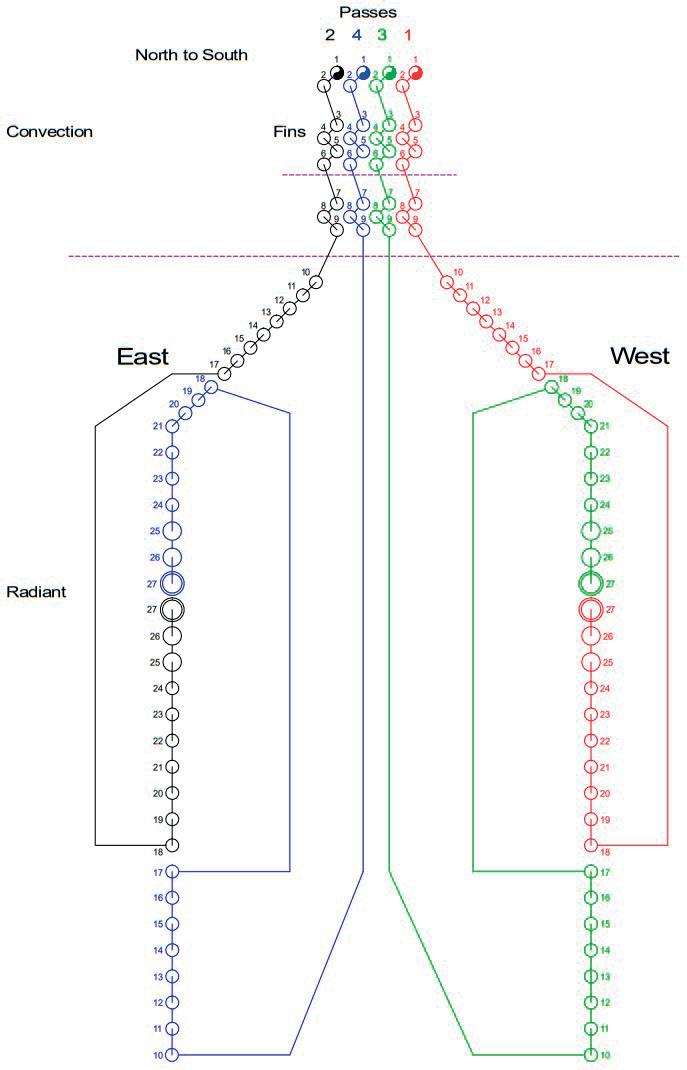

45 Optimising fired heater operations

Tim Haugen, Quest Integrity, explores how advanced coil cleaning and inspection techniques can help plants optimise the performance of their fired heaters.

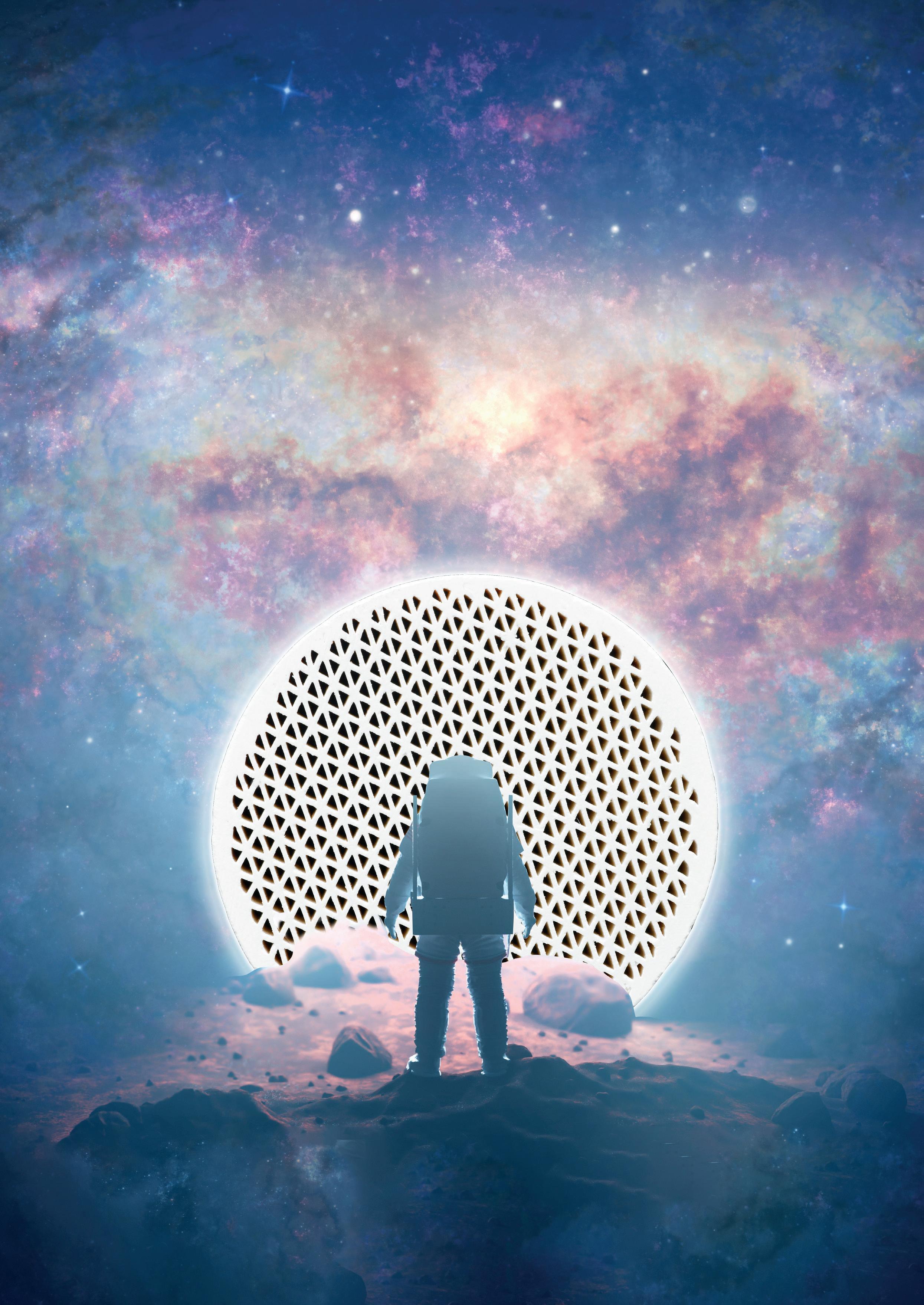

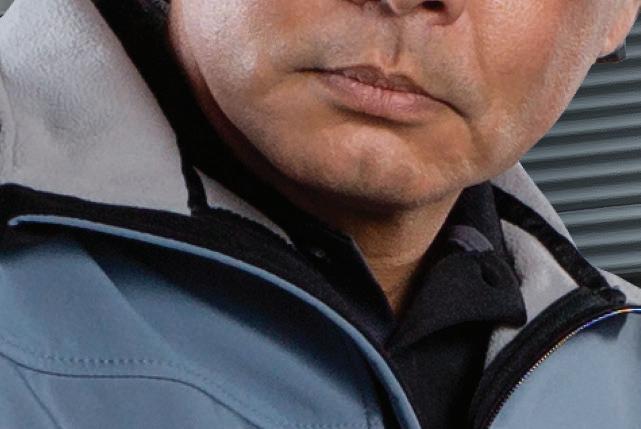

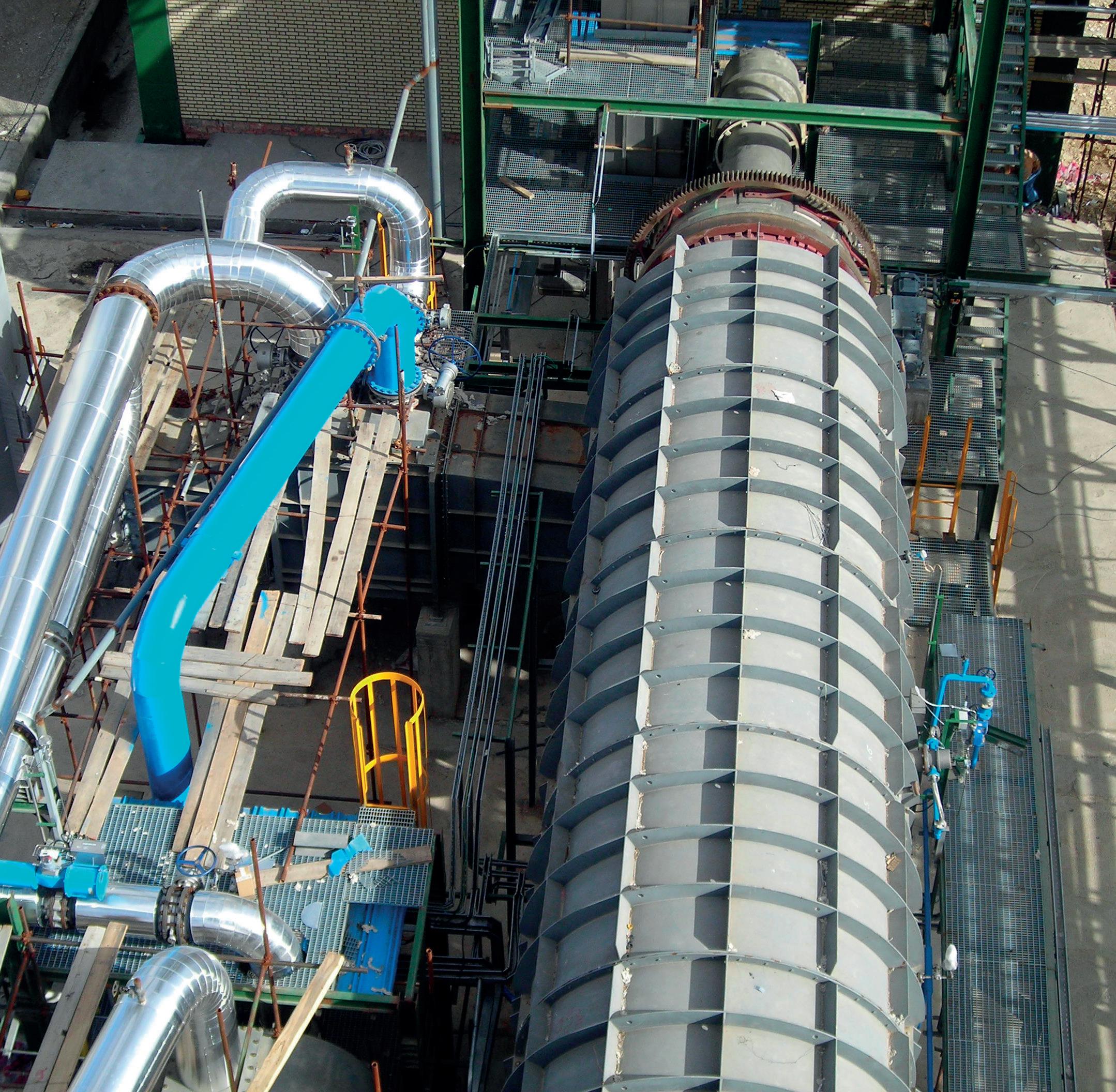

THIS MONTH'S FRONT COVER

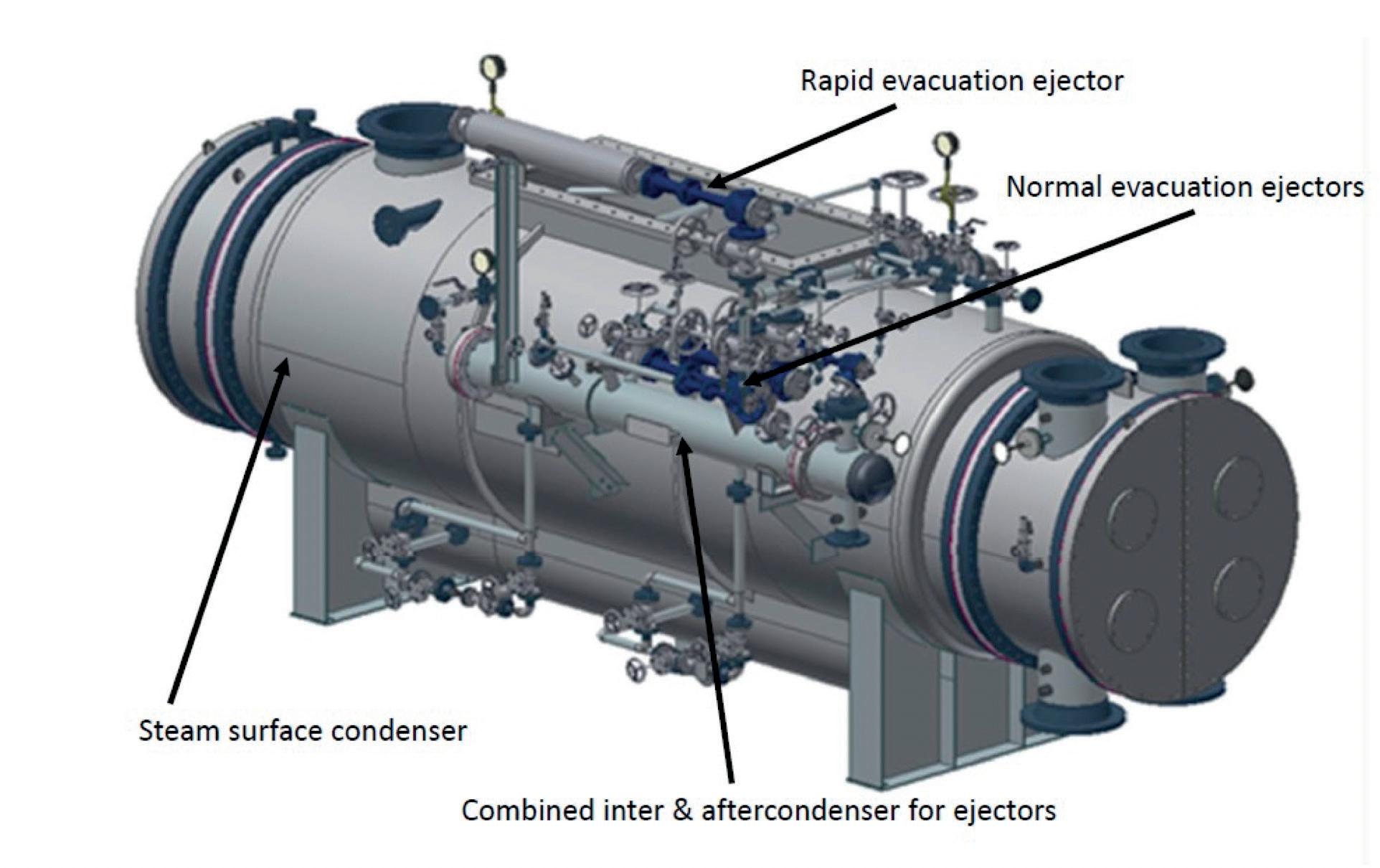

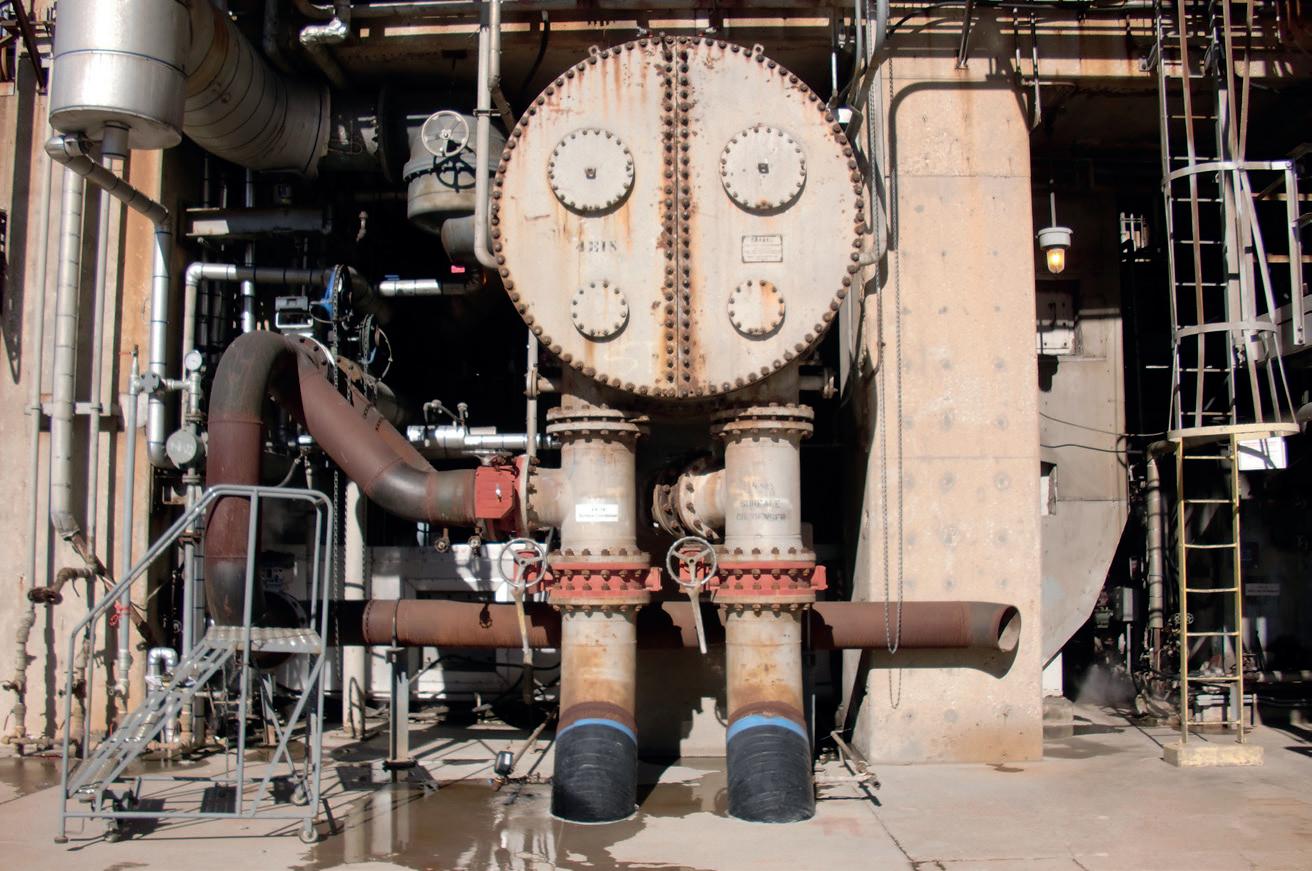

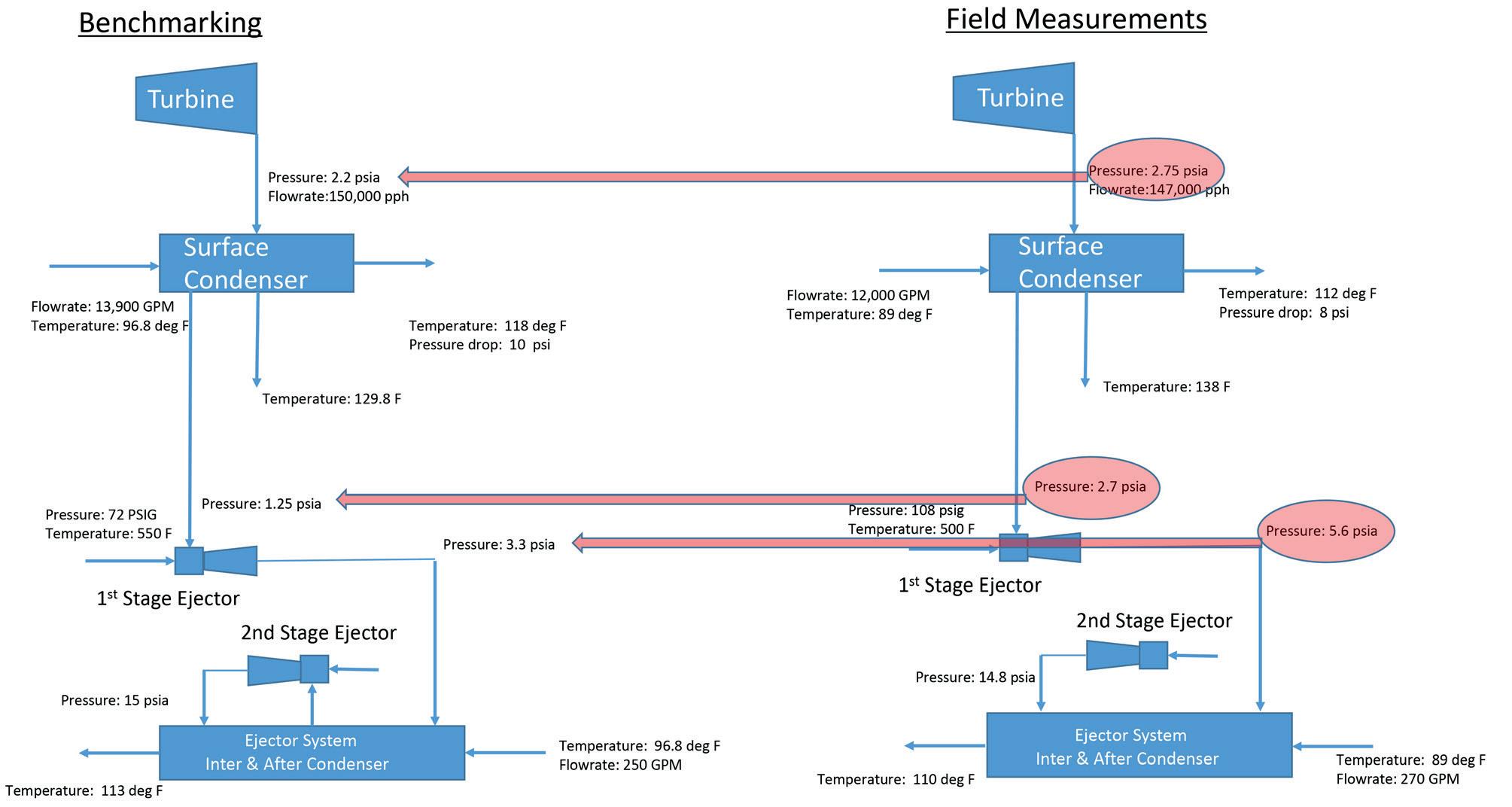

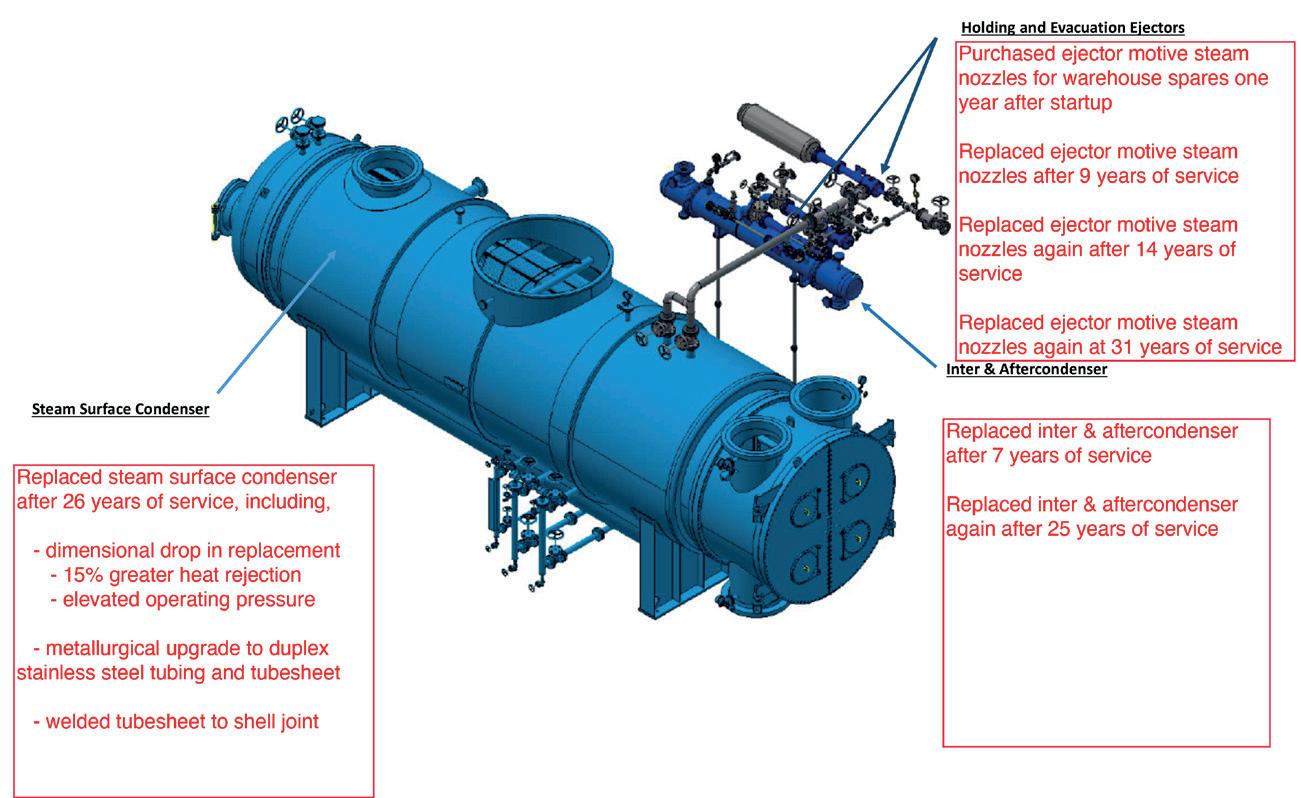

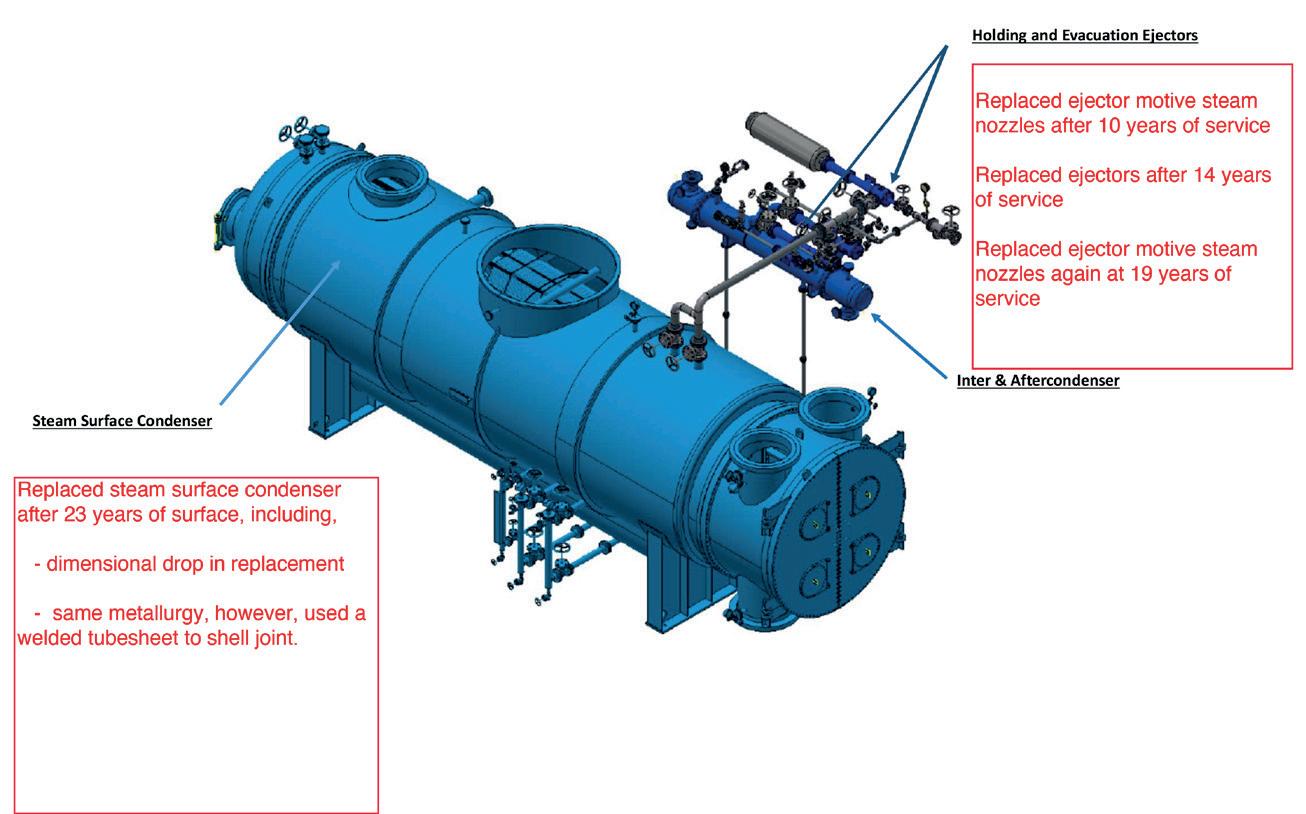

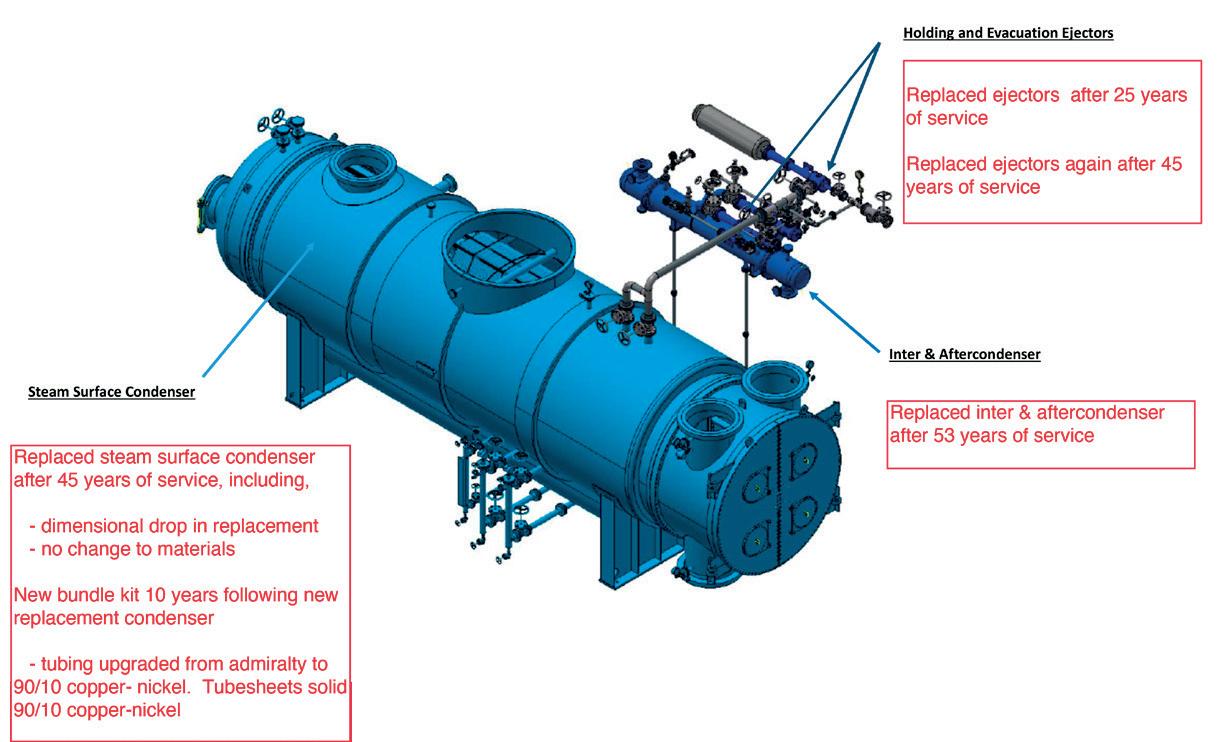

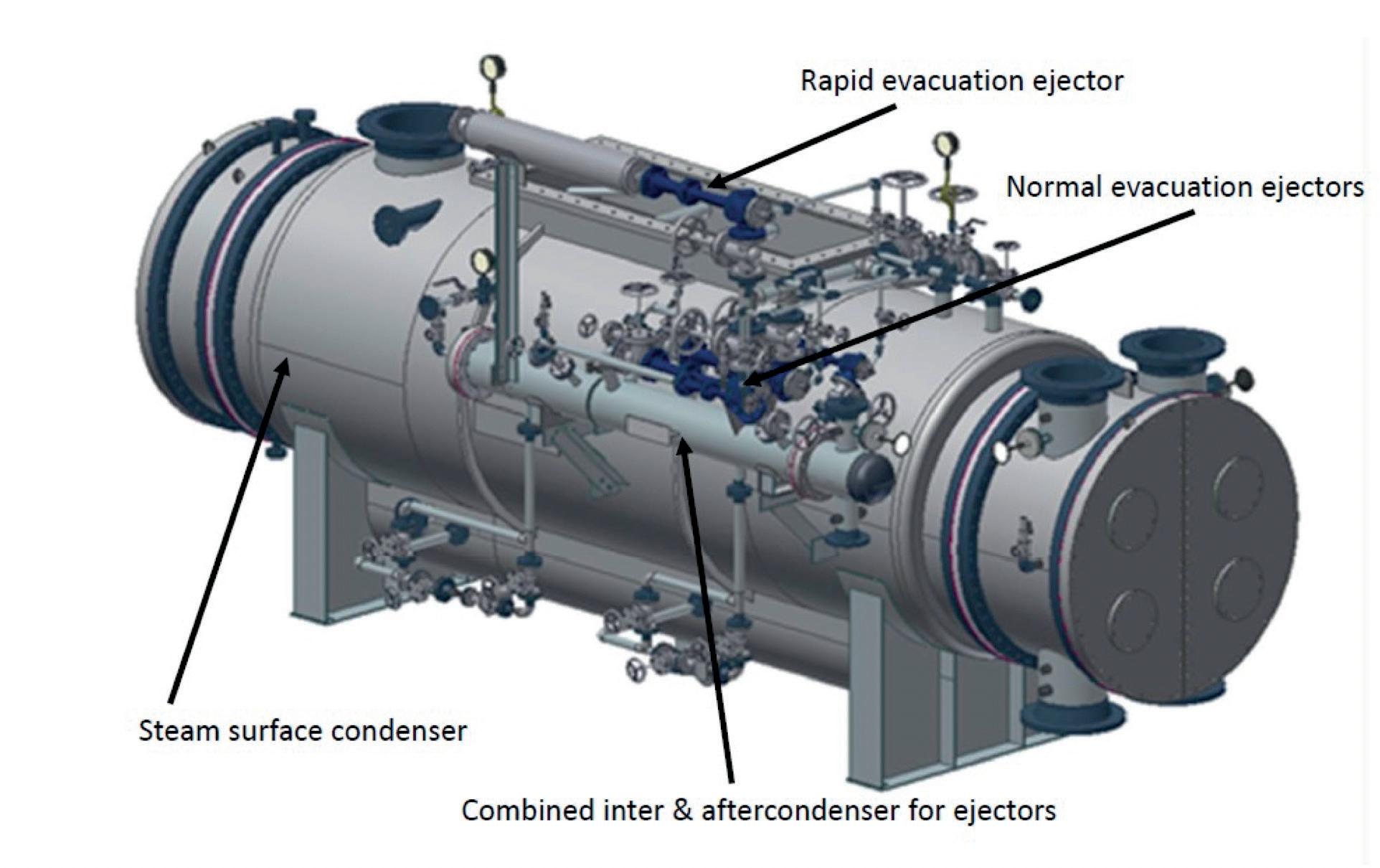

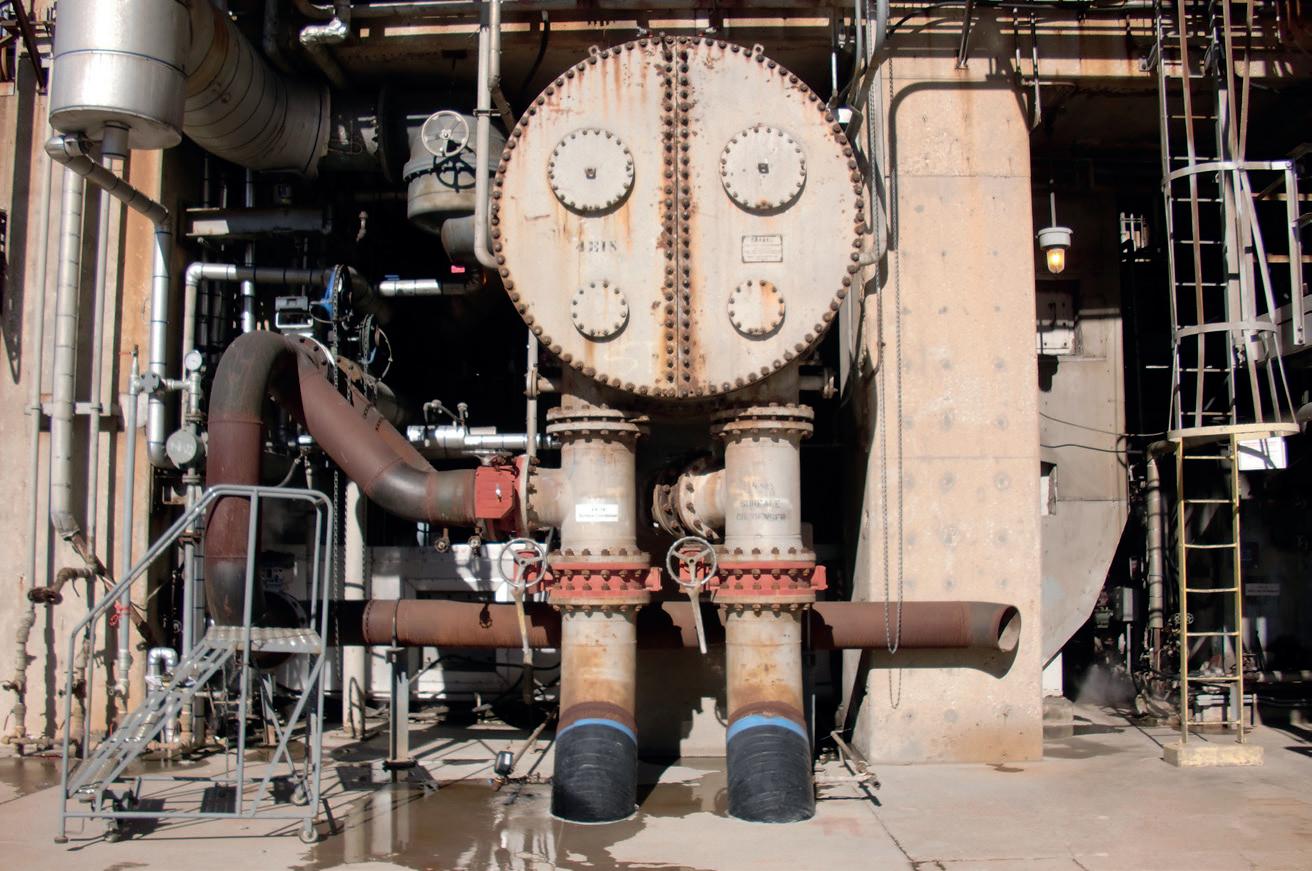

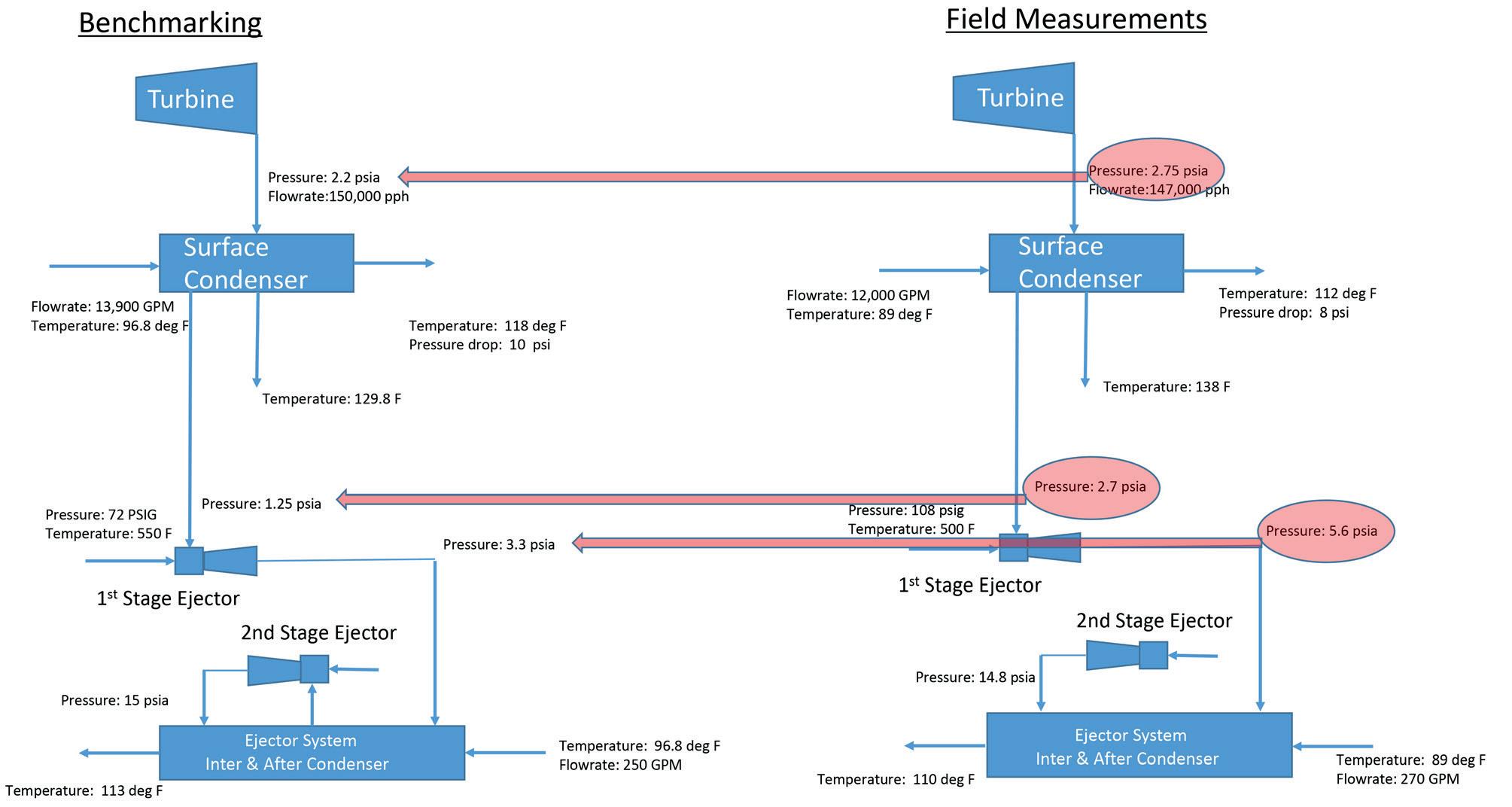

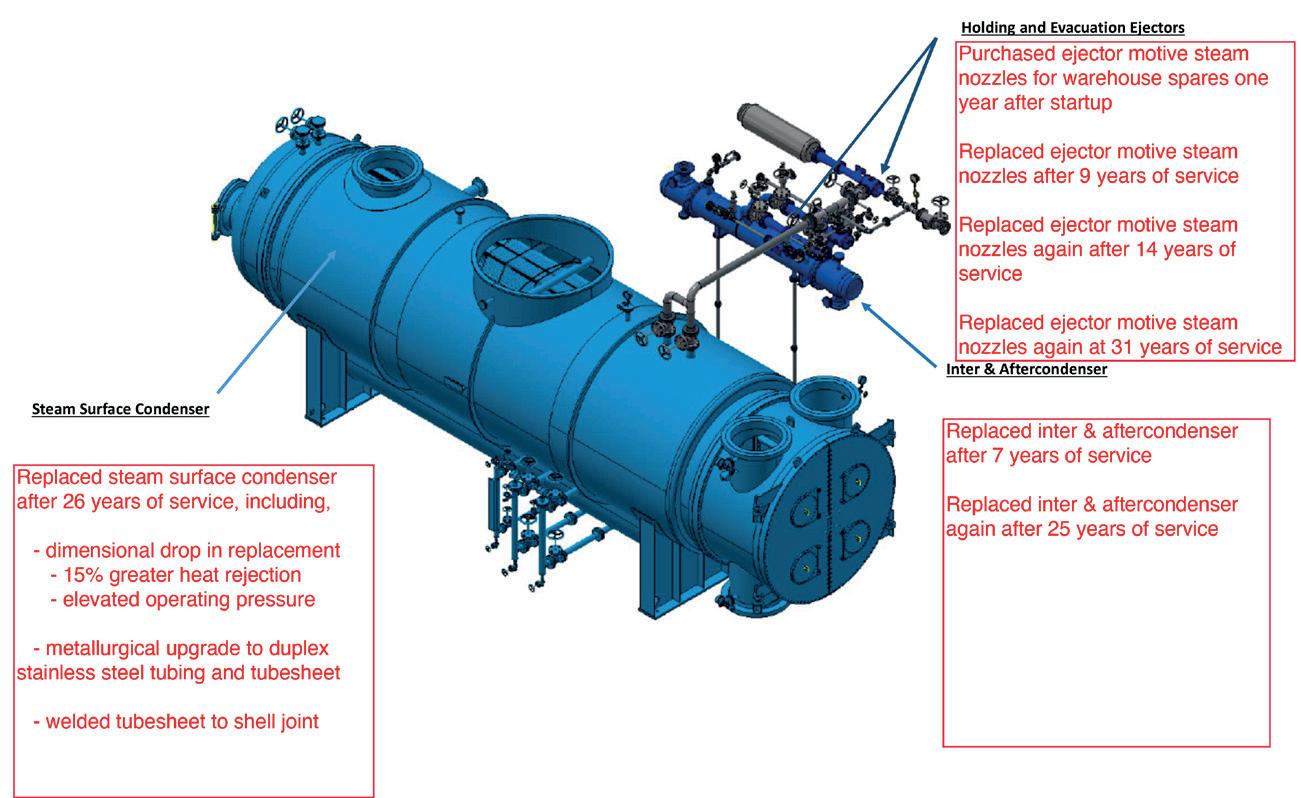

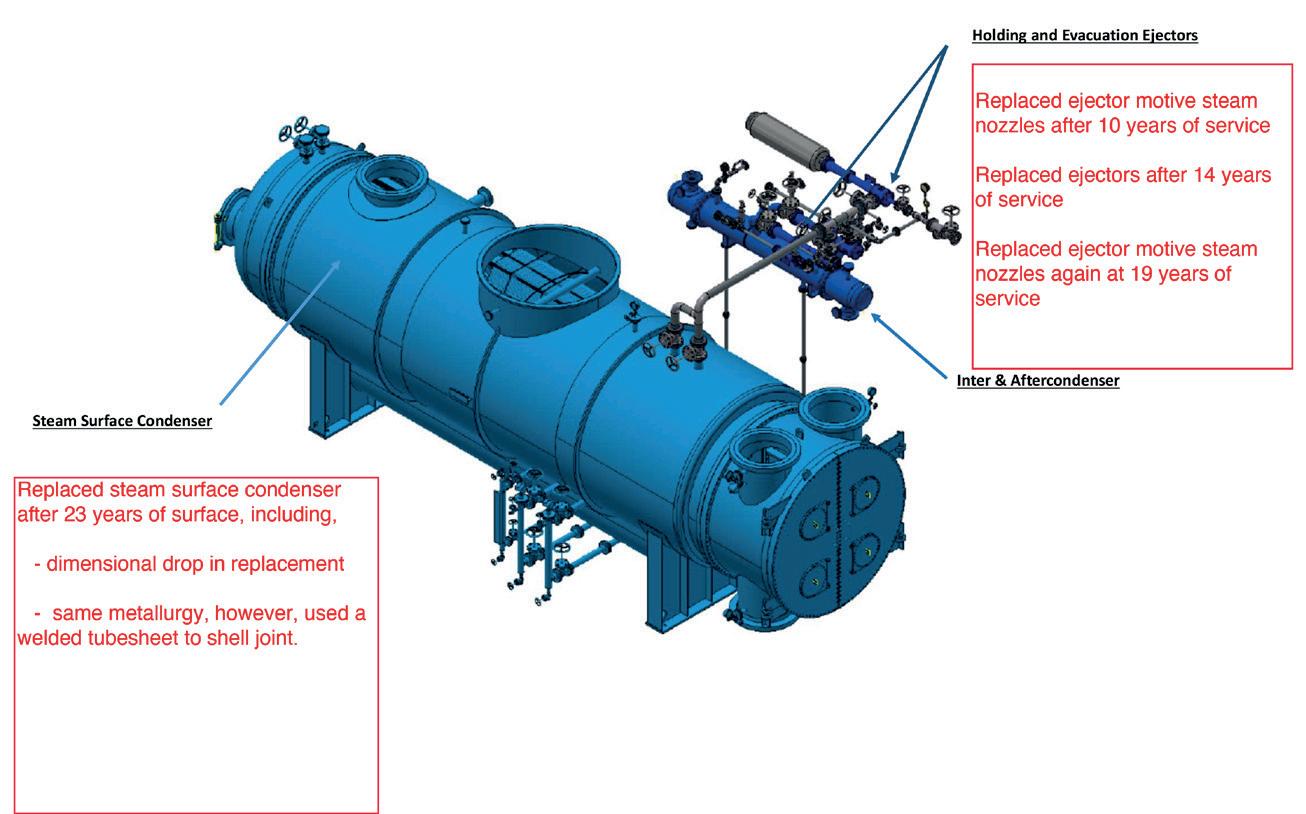

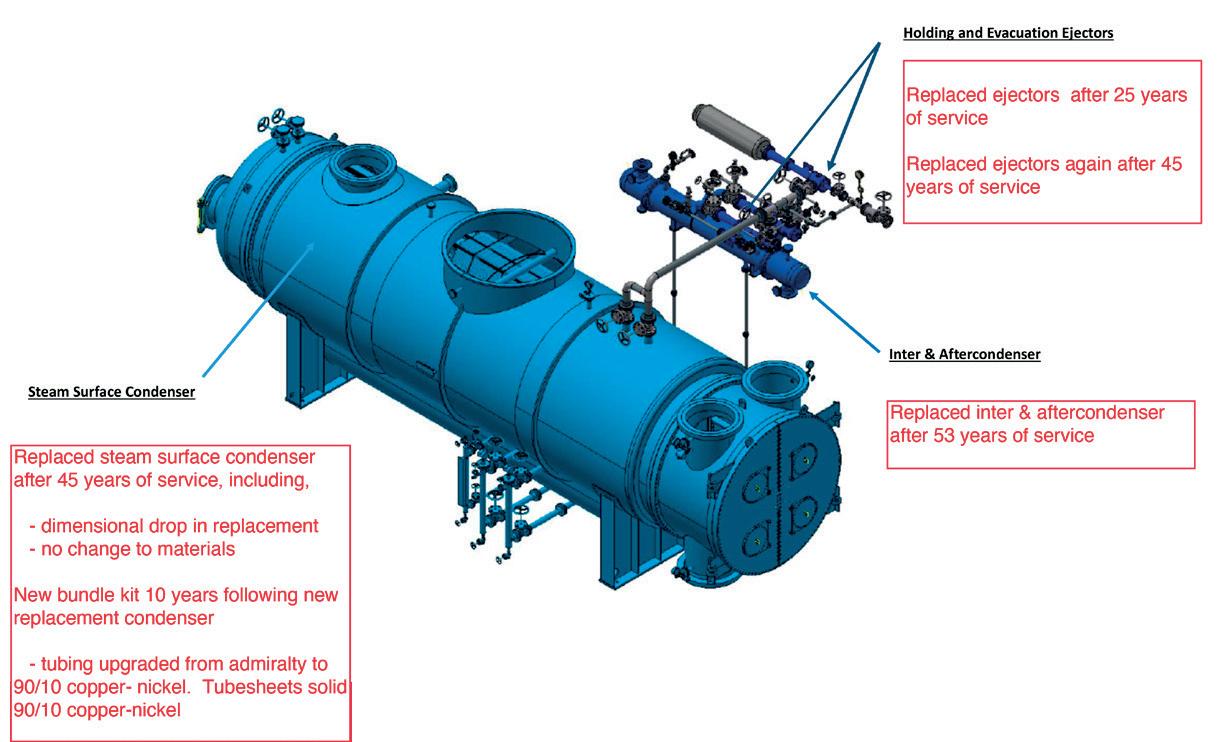

49 Reliability and longevity

Jim Lines, Graham Corp., USA, explains how the life of steam surface condensers can be maximised.

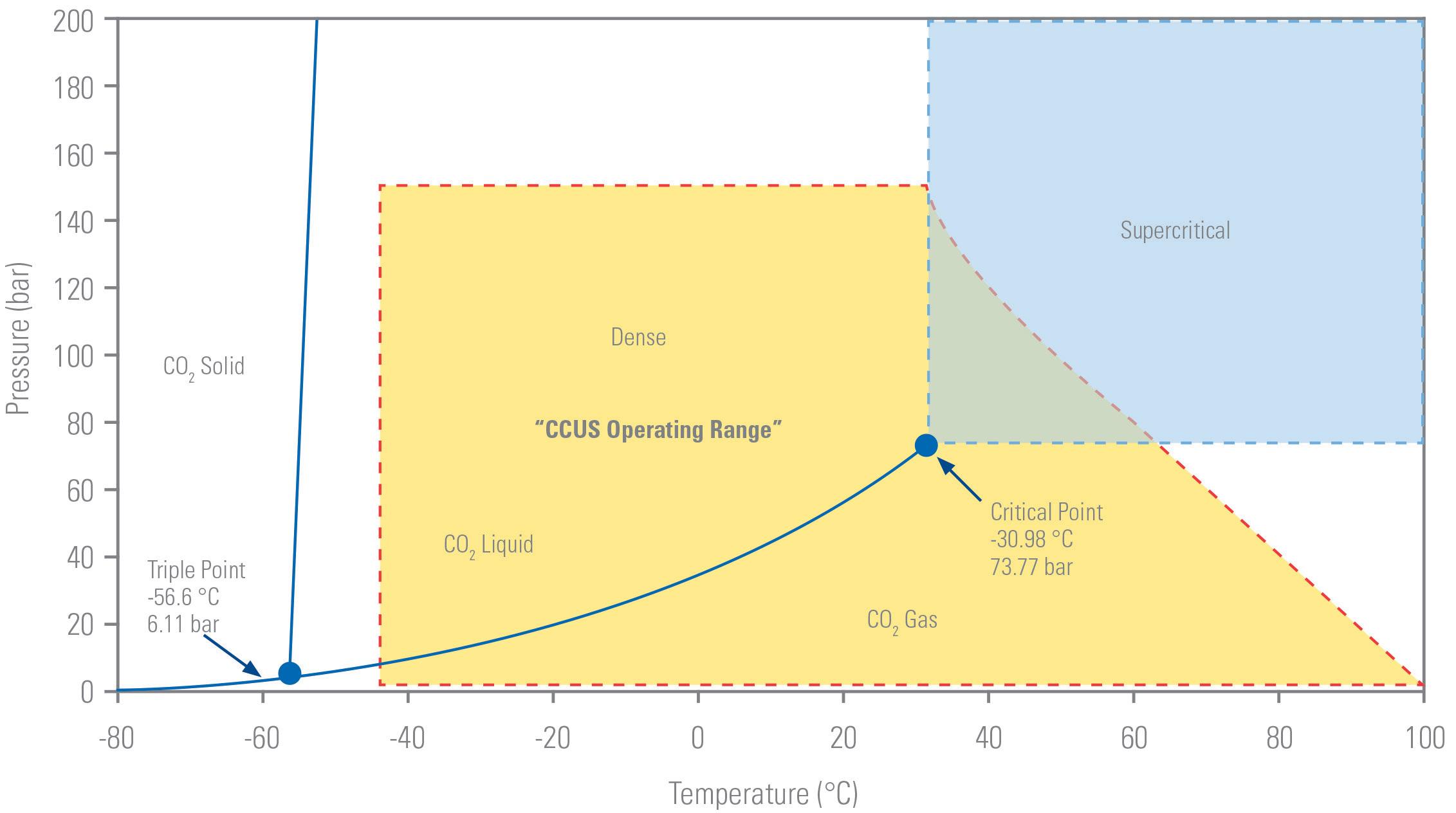

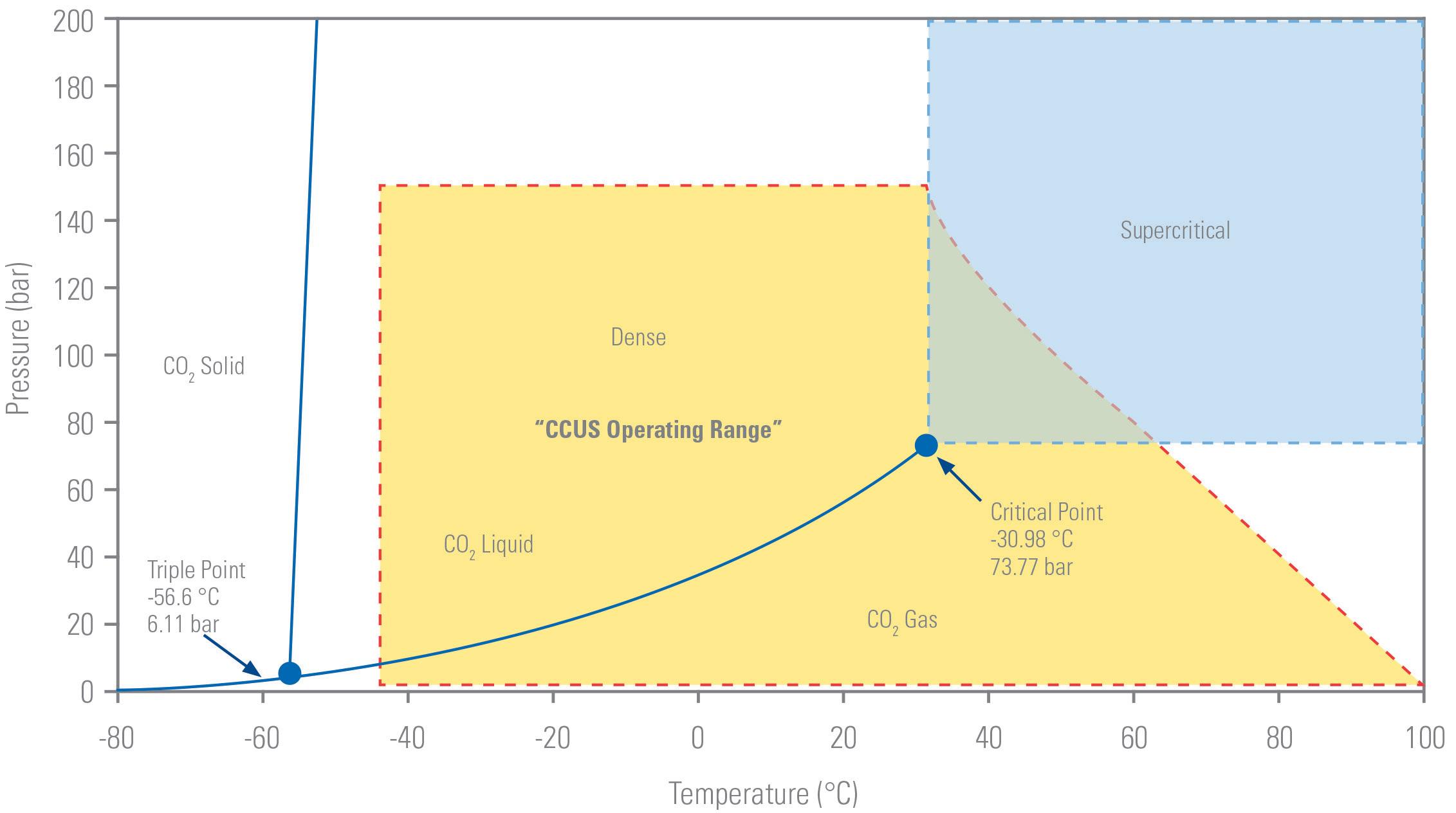

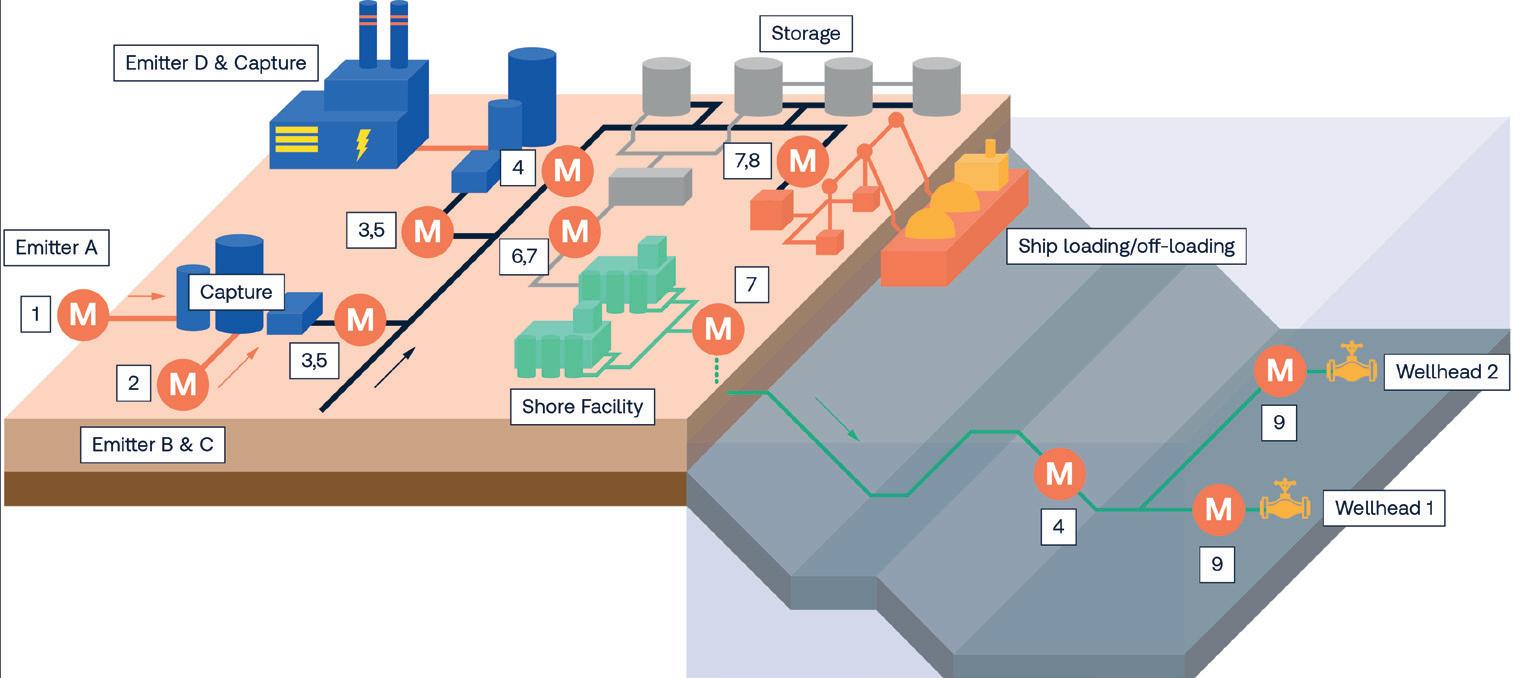

56 The path forward: capitalising on decarbonisation opportunities

Dr. Cecilia Mondelli and Stephen Shields, Sulzer Chemtech, look at the most promising CCUS technologies, which offer multiple benefits that go further than compliance with environmental regulations.

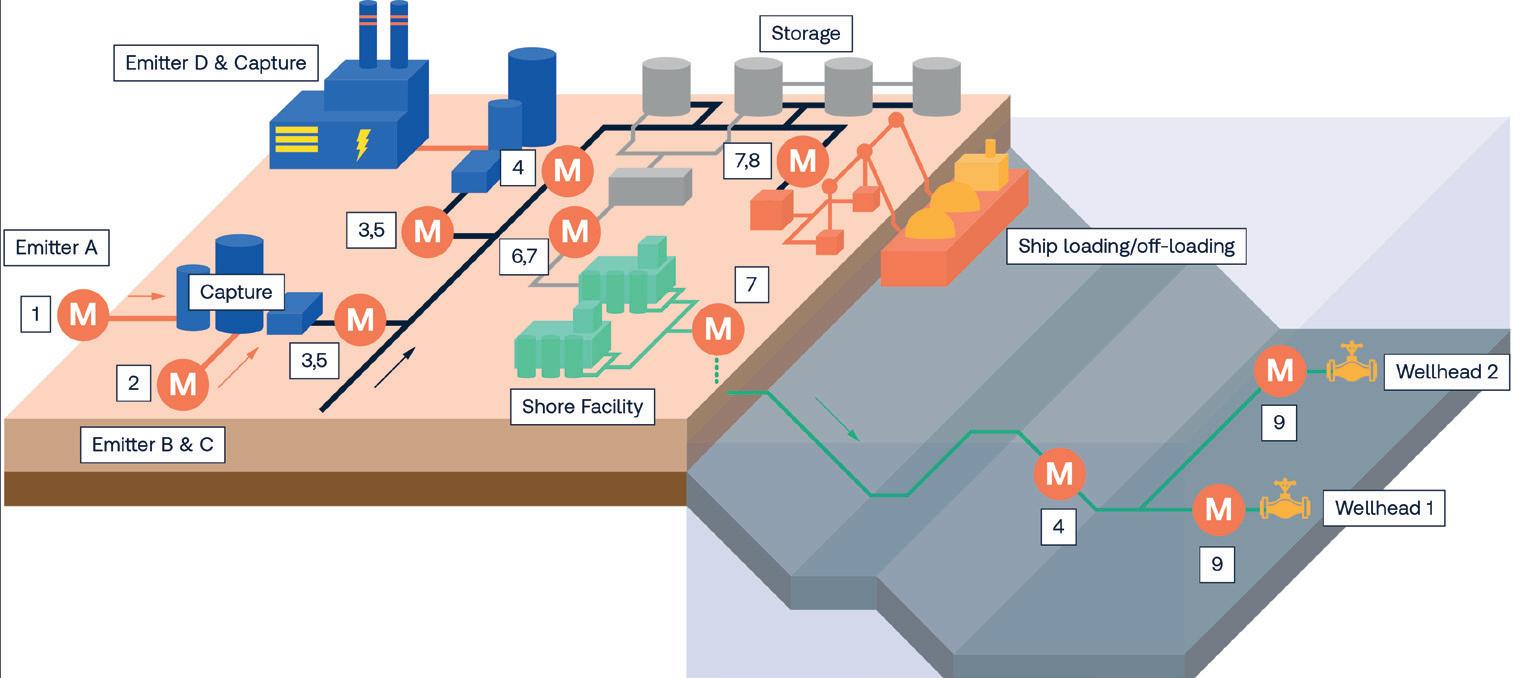

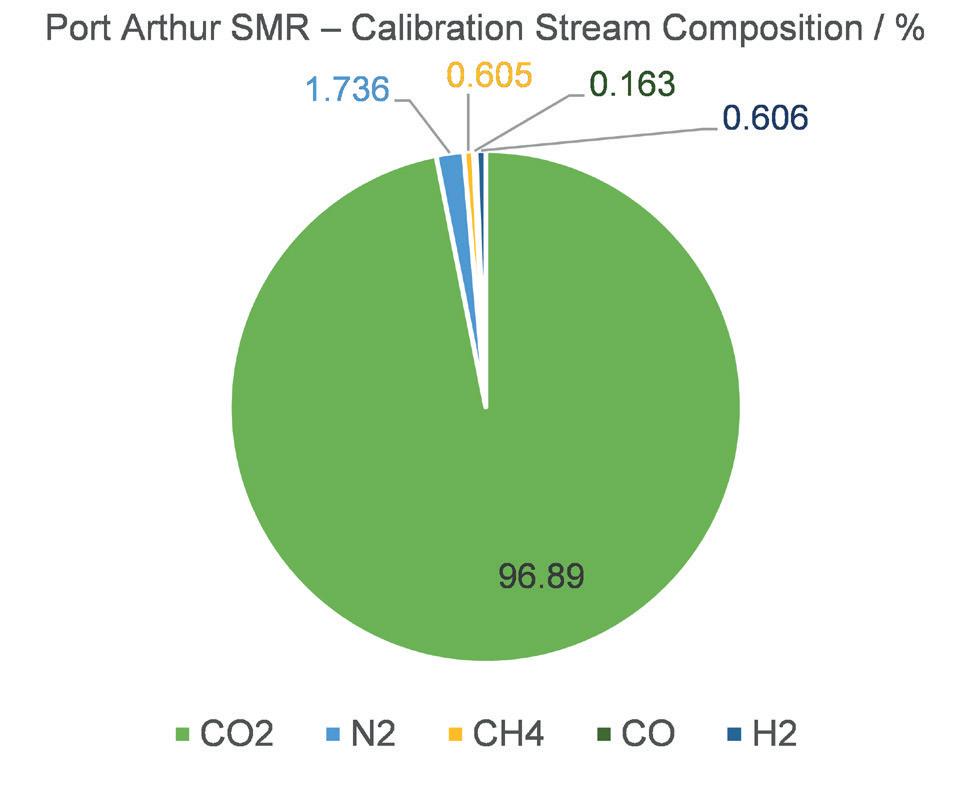

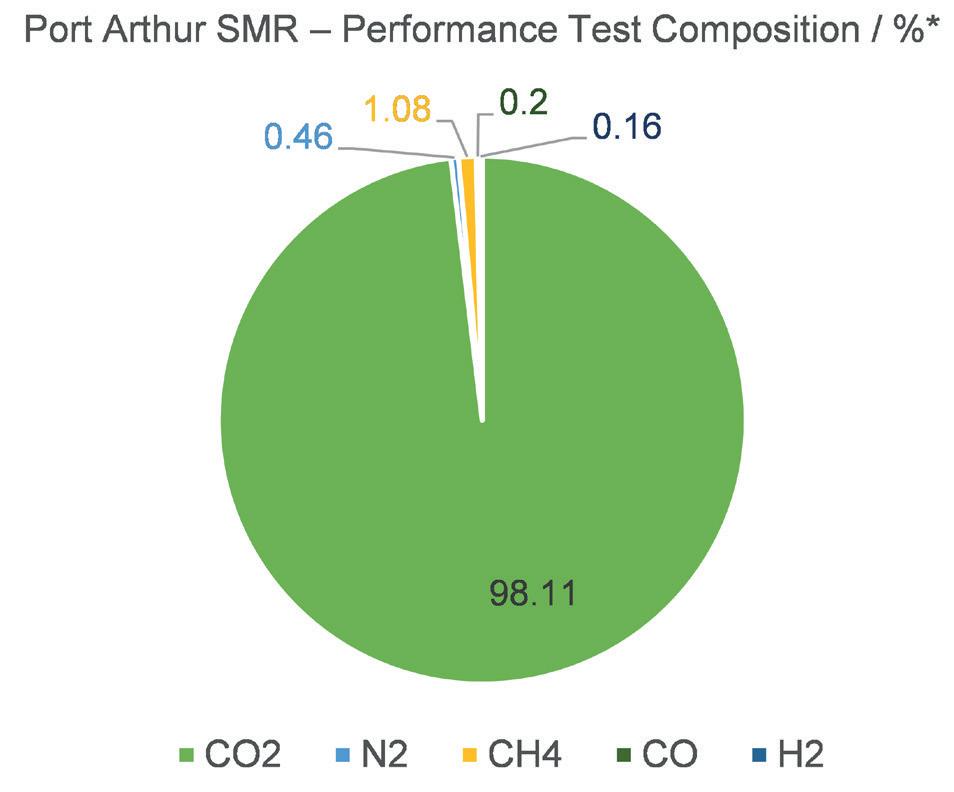

61 Facilitating the transition

Dr Chris Mills, TÜV SÜD National Engineering Laboratory, UK, discusses how flow measurement will play a fundamental role in carbon capture, utilisation and storage (CCUS).

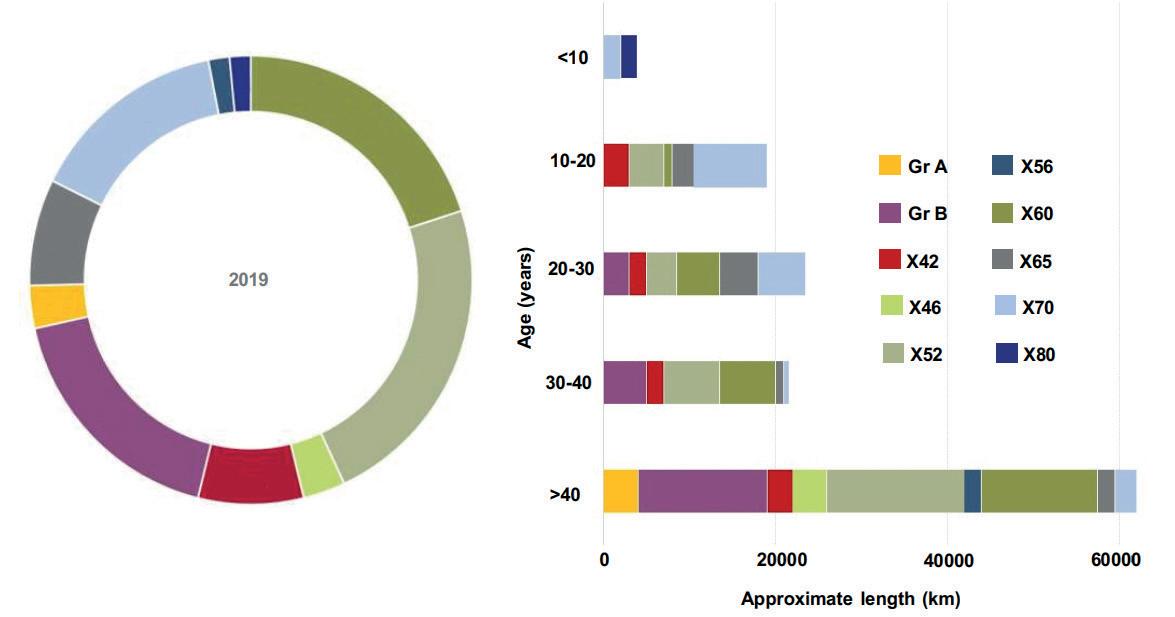

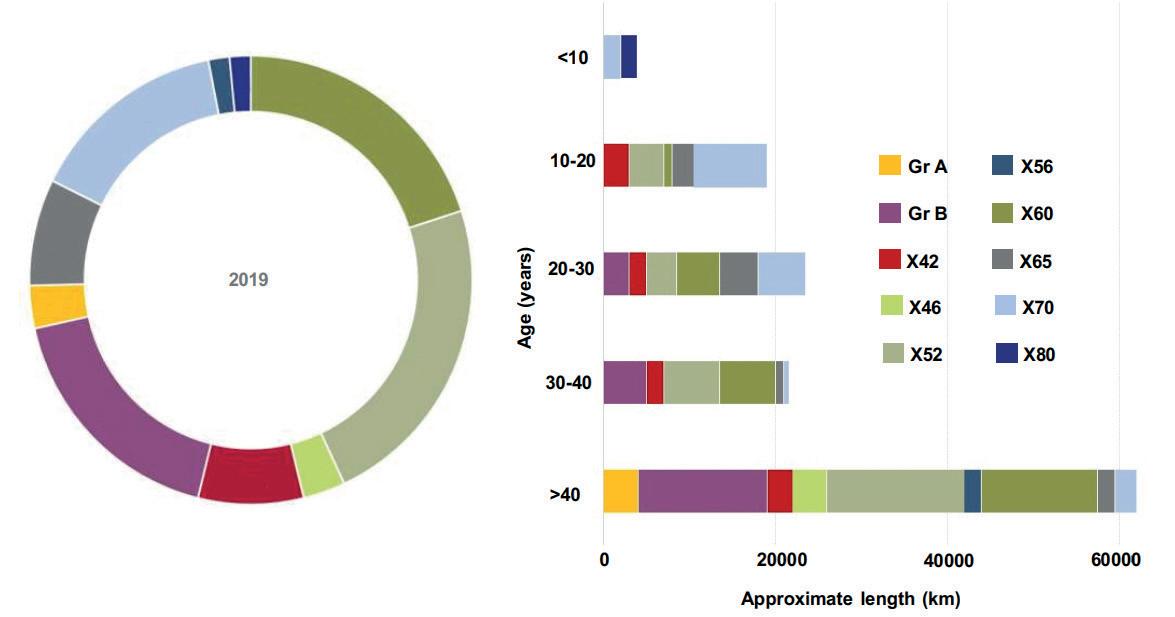

65 CO2 pipelines: challenges and threats

Dr. Sameera Naib and Dr. Daniel Sandana, ROSEN, evaluate the challenges and threats to consider when deciding whether to repurpose existing pipelines or build new pipelines for the transportation of carbon dioxide.

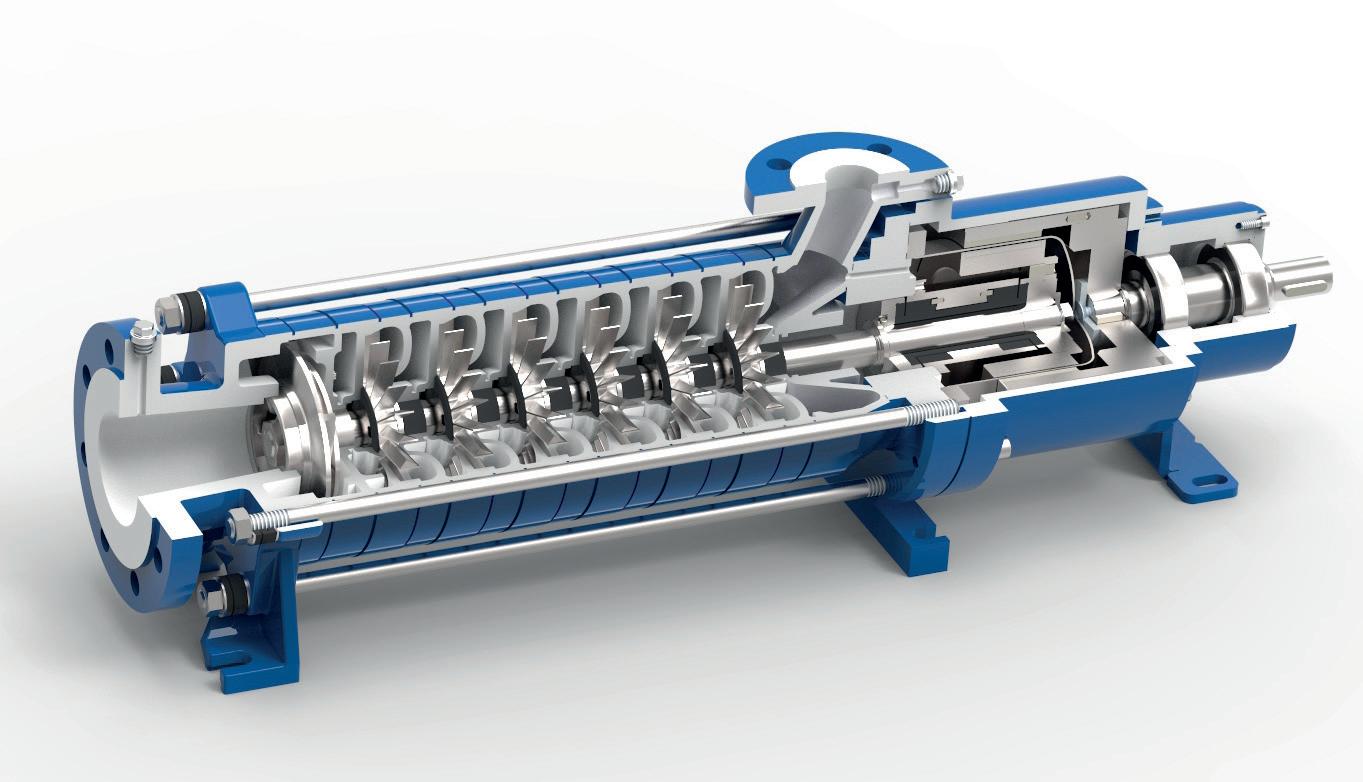

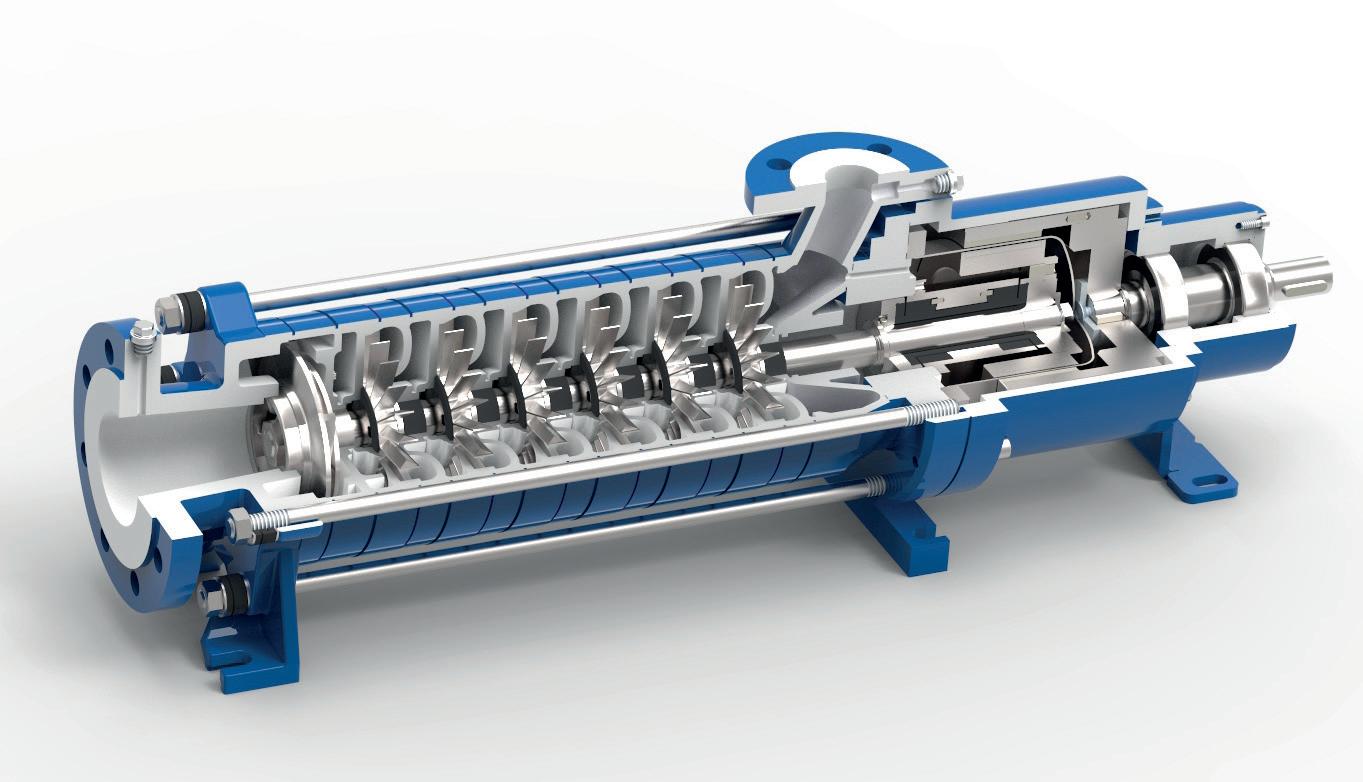

71 Playing a pivotal role

Klaus Reischl, SERO PumpSystems GmbH, Germany, highlights the important role played by side channel pumps in carbon capture and storage (CCS) processes.

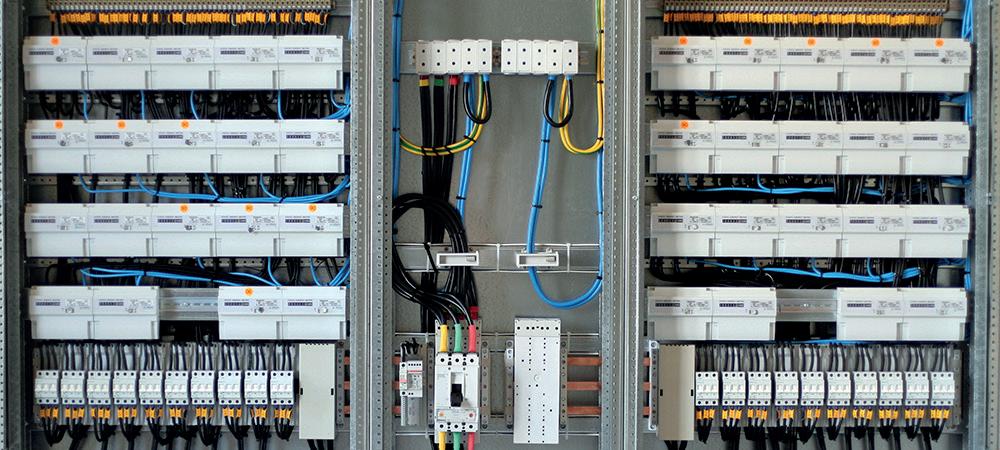

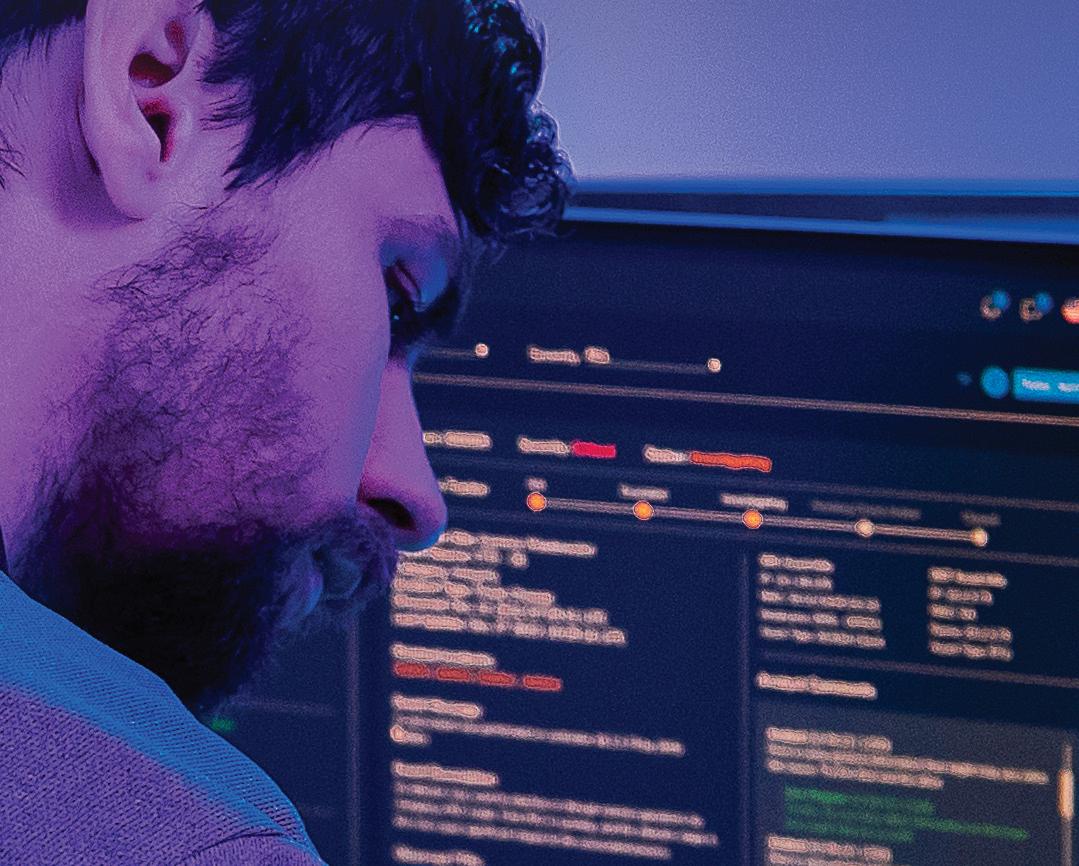

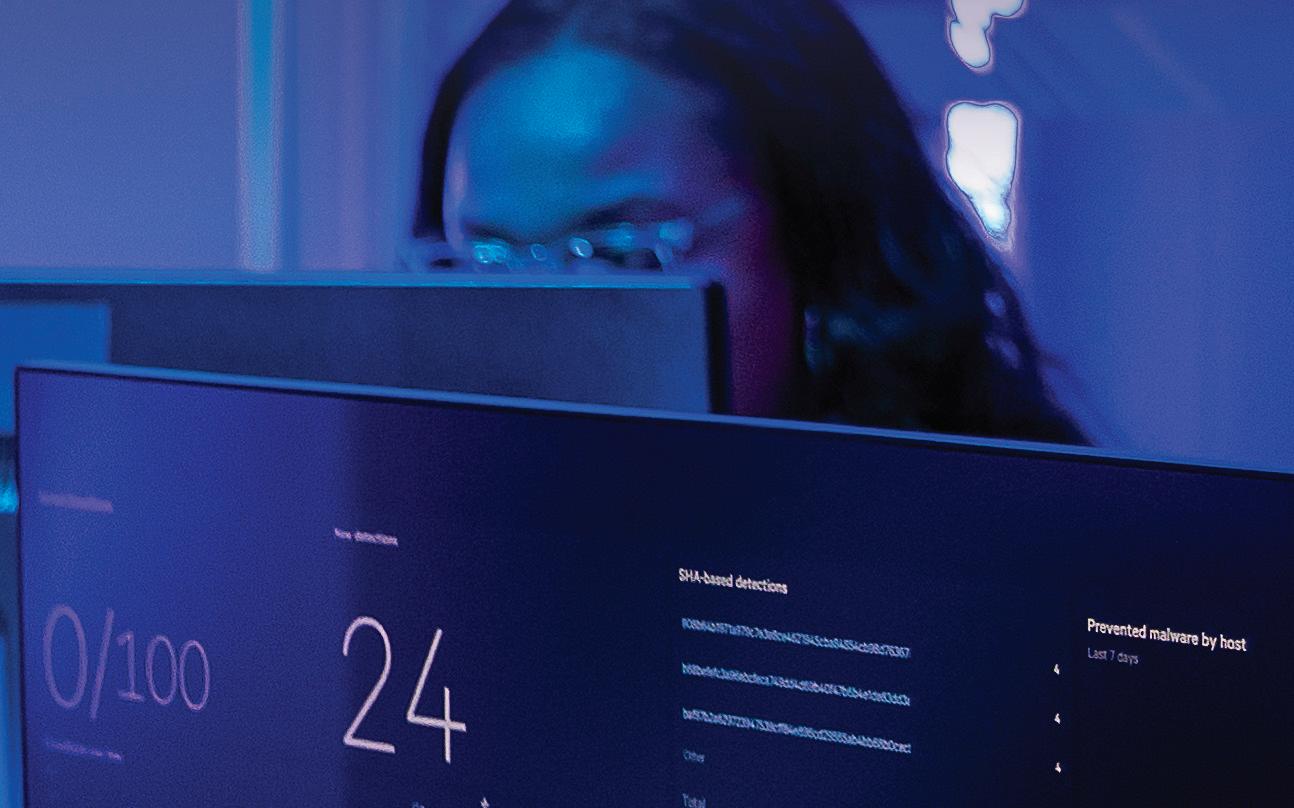

74 A necessary culture shift

Tim Gale, 1898 & Co., reveals why a change in the culture of engineering is required to achieve security of industrial control systems.

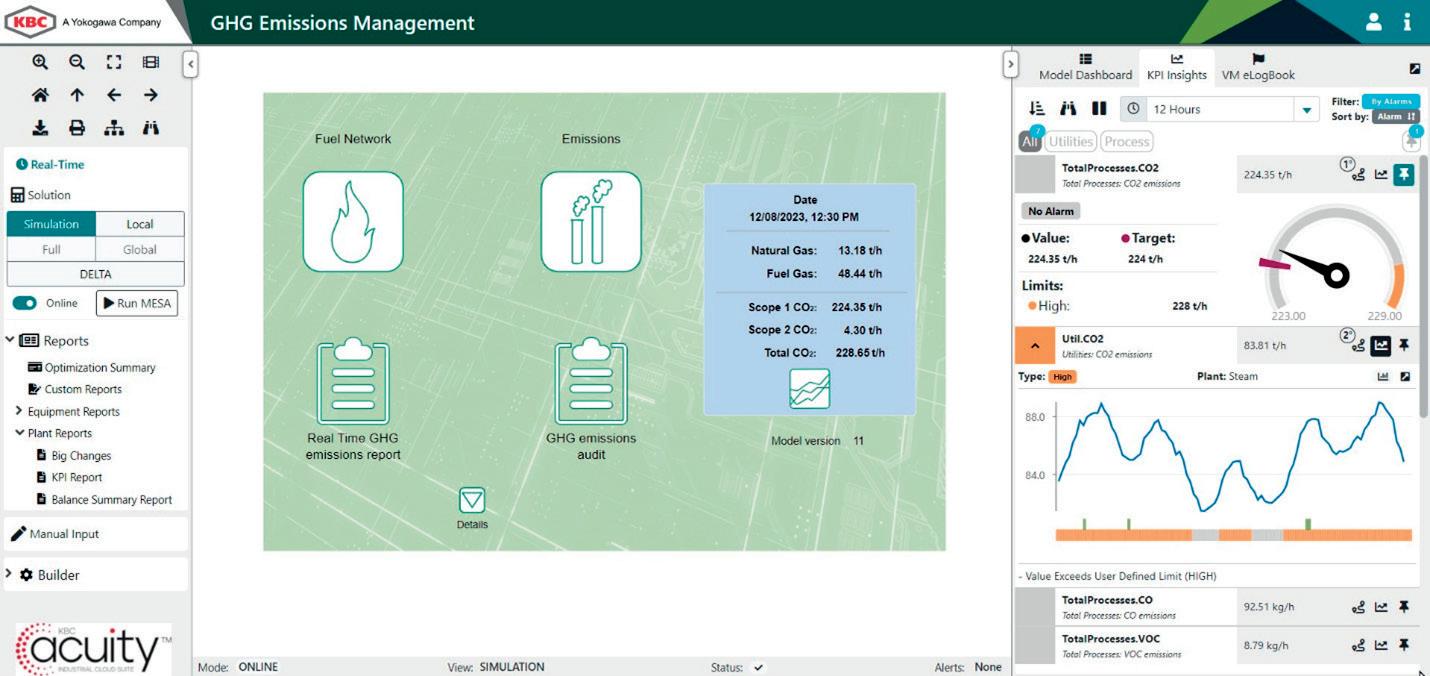

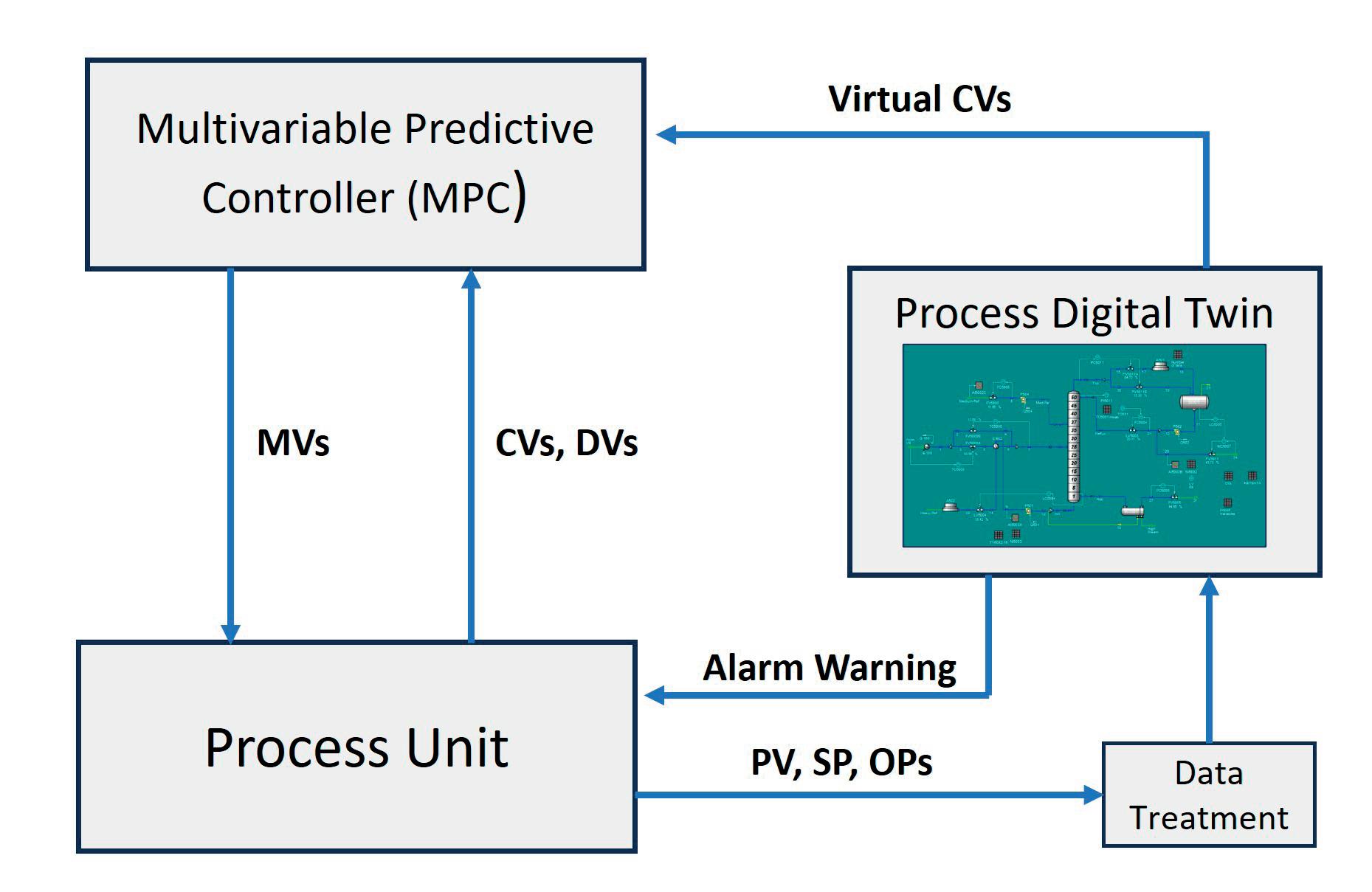

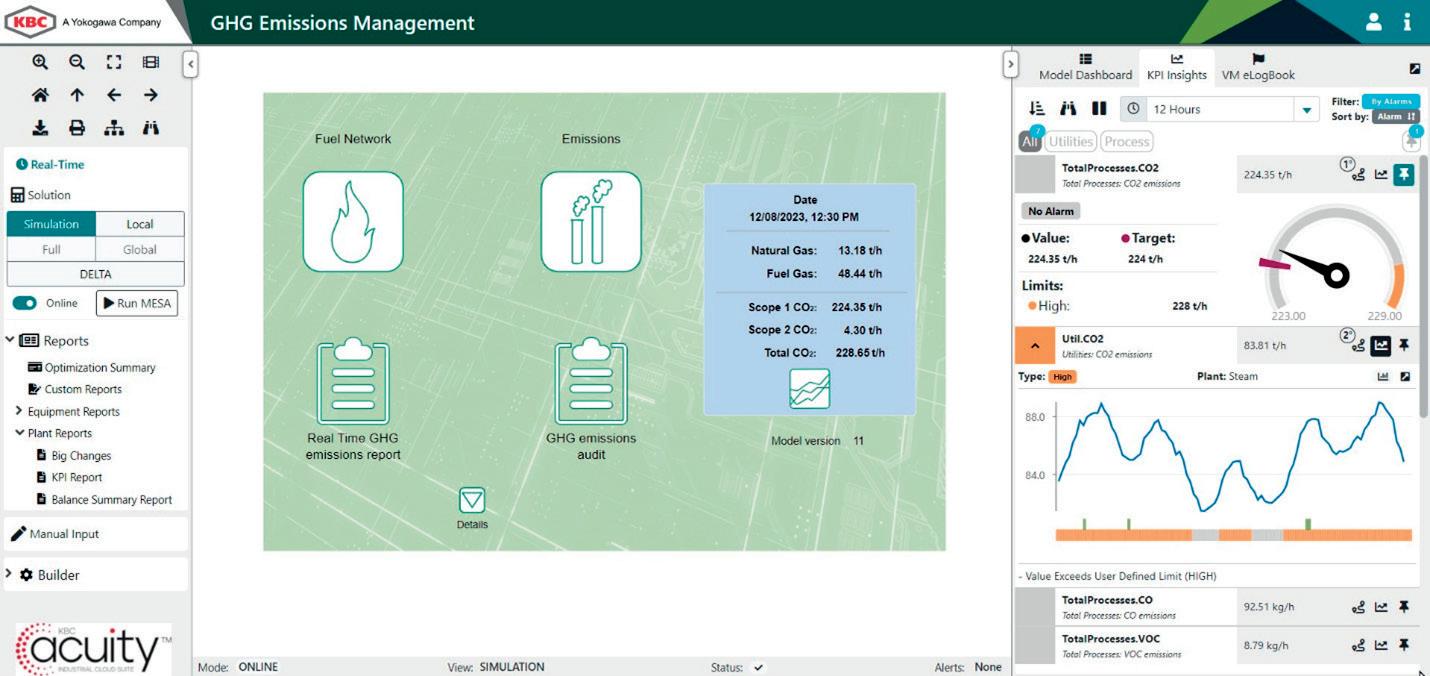

79 Industrial cloud transforms the refinery of the future

Soni Malik, Alessandro Speranza and Rolando Gabarron, KBC (A Yokogawa Company), discuss how IIoT technologies optimise operations to improve efficiency and reliability.

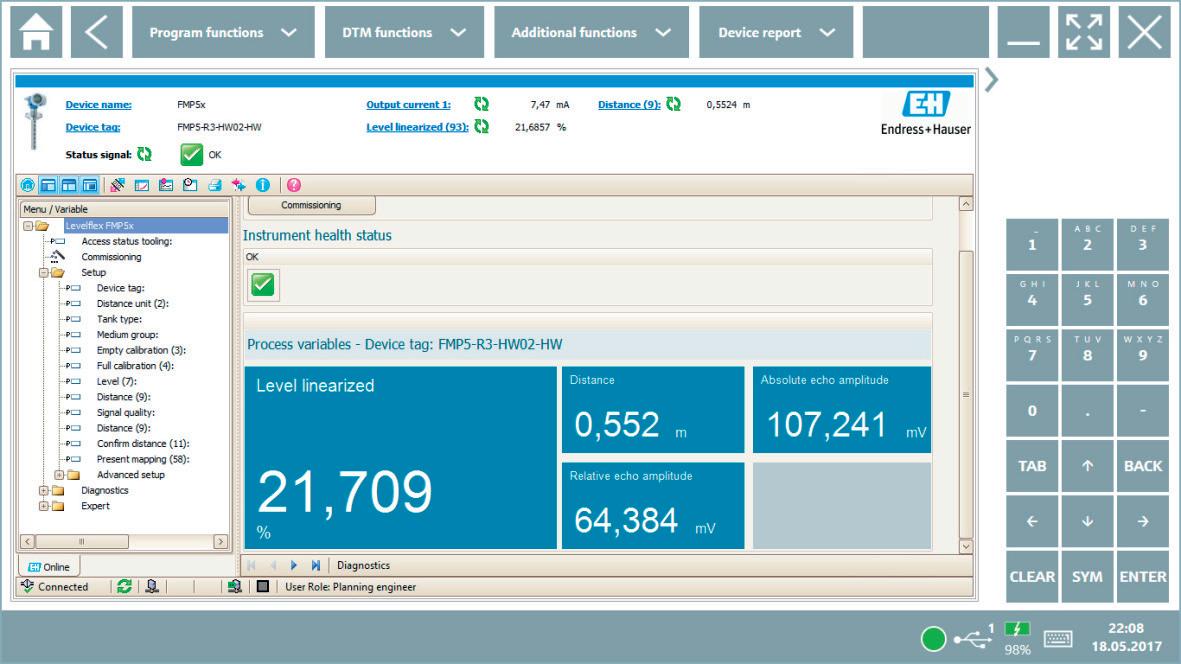

83 Staying ahead

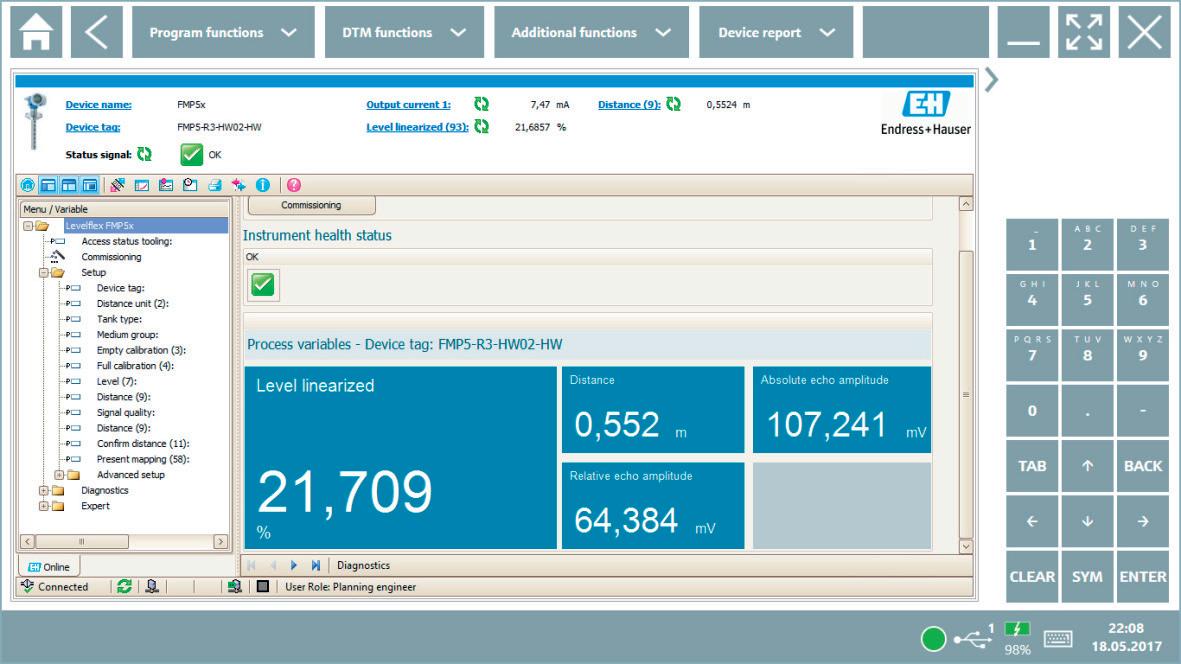

Ivan Kovtun, Endress+Hauser, Switzerland, explains how leveraging advanced digital technologies can transform the efficiency of inventory monitoring in the oil and gas industry.

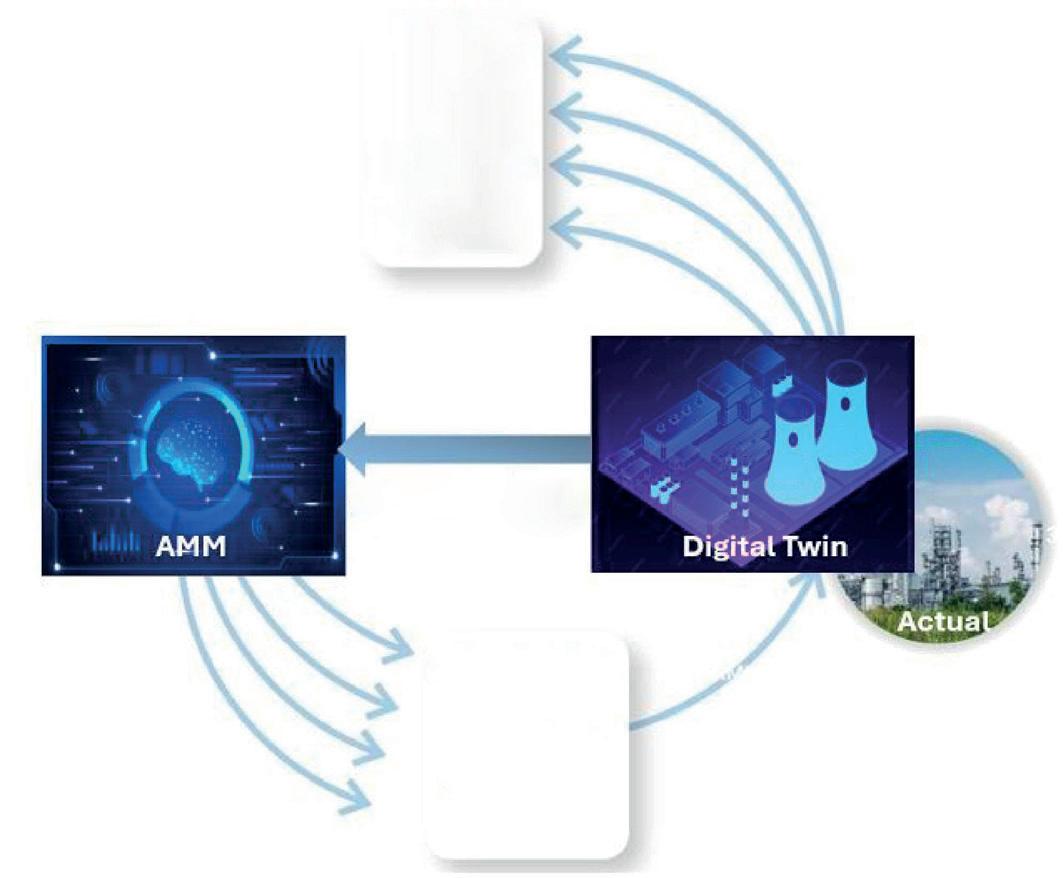

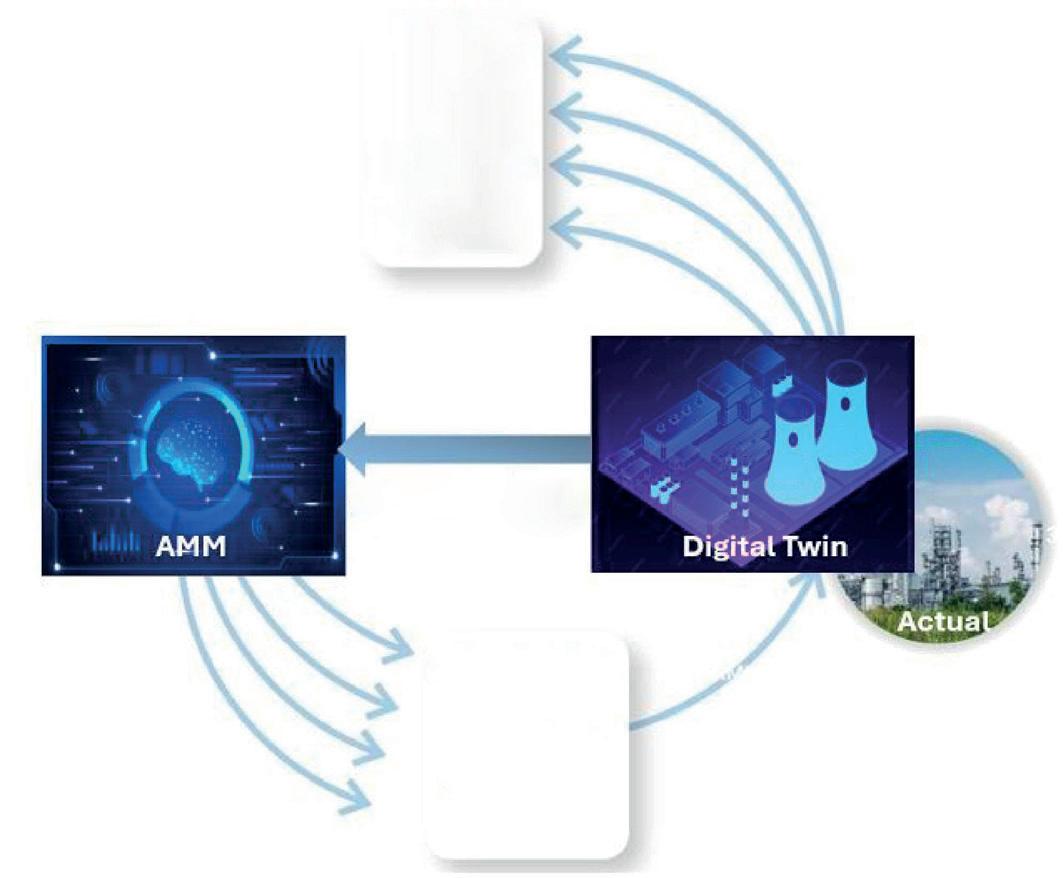

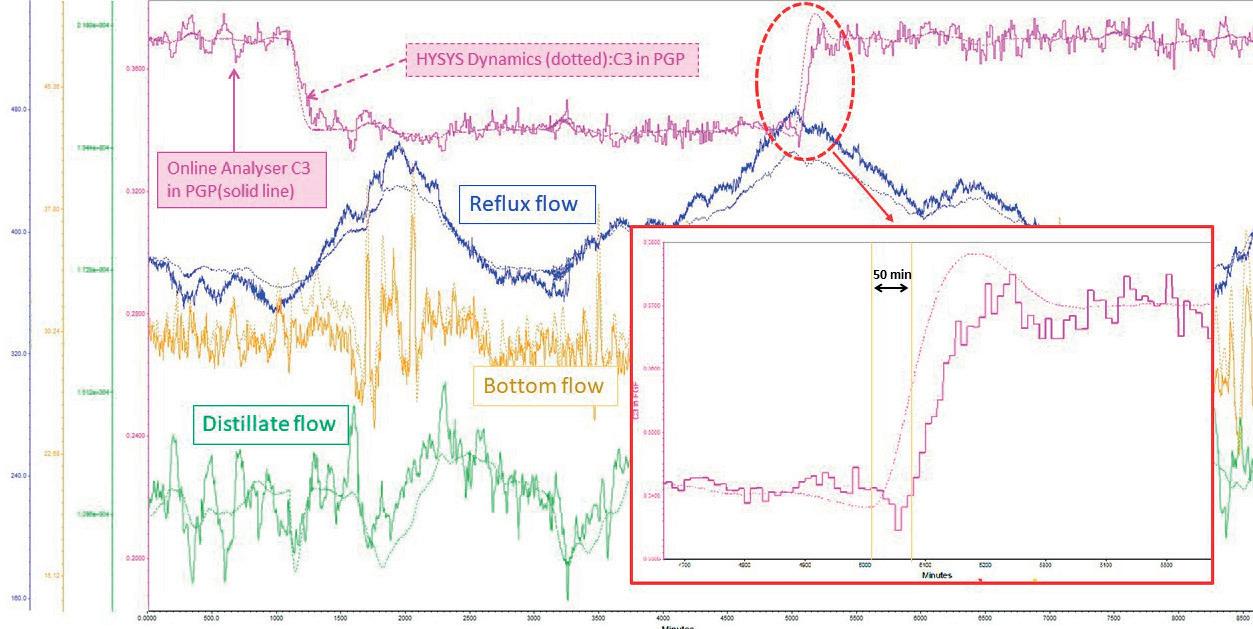

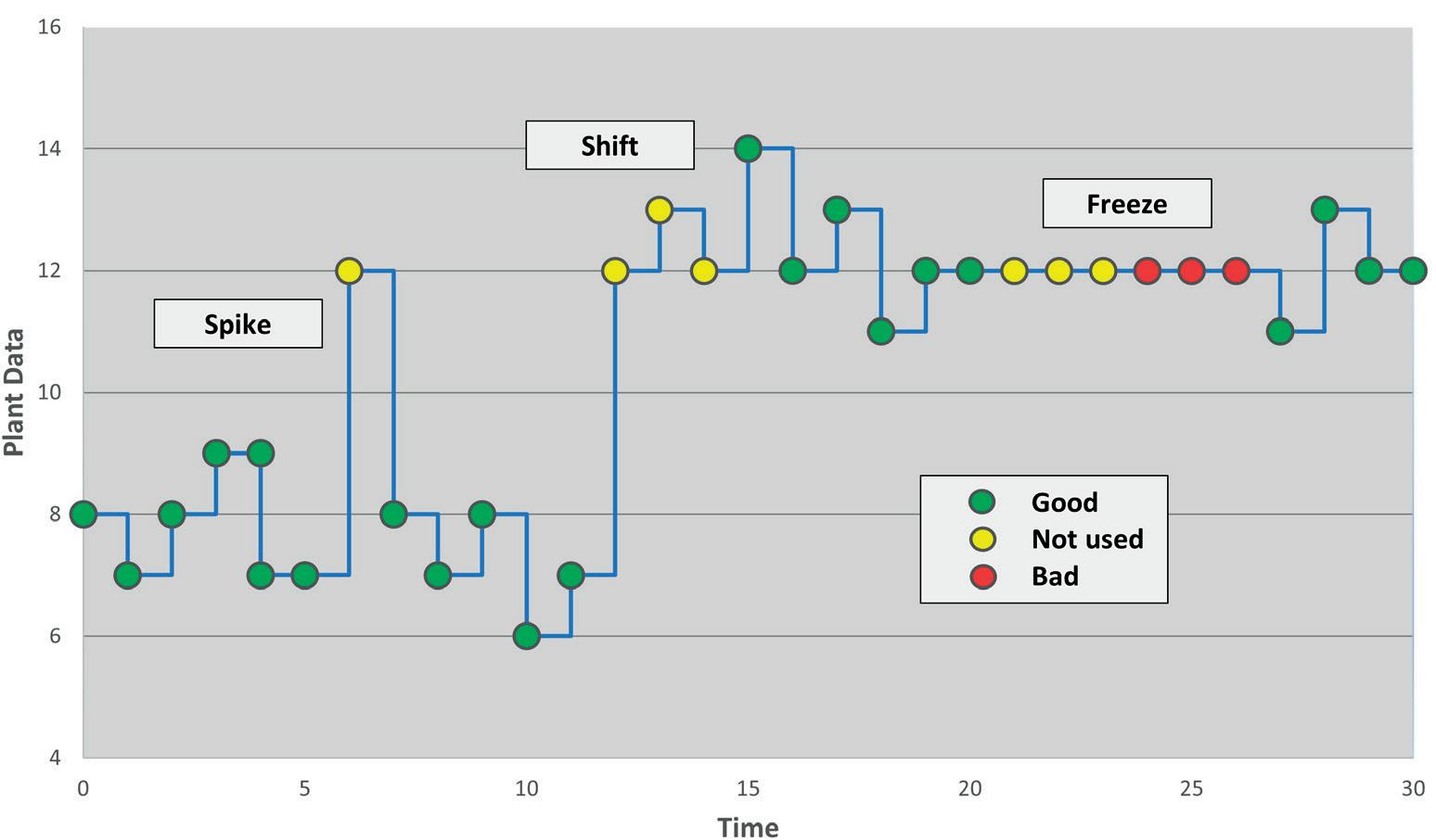

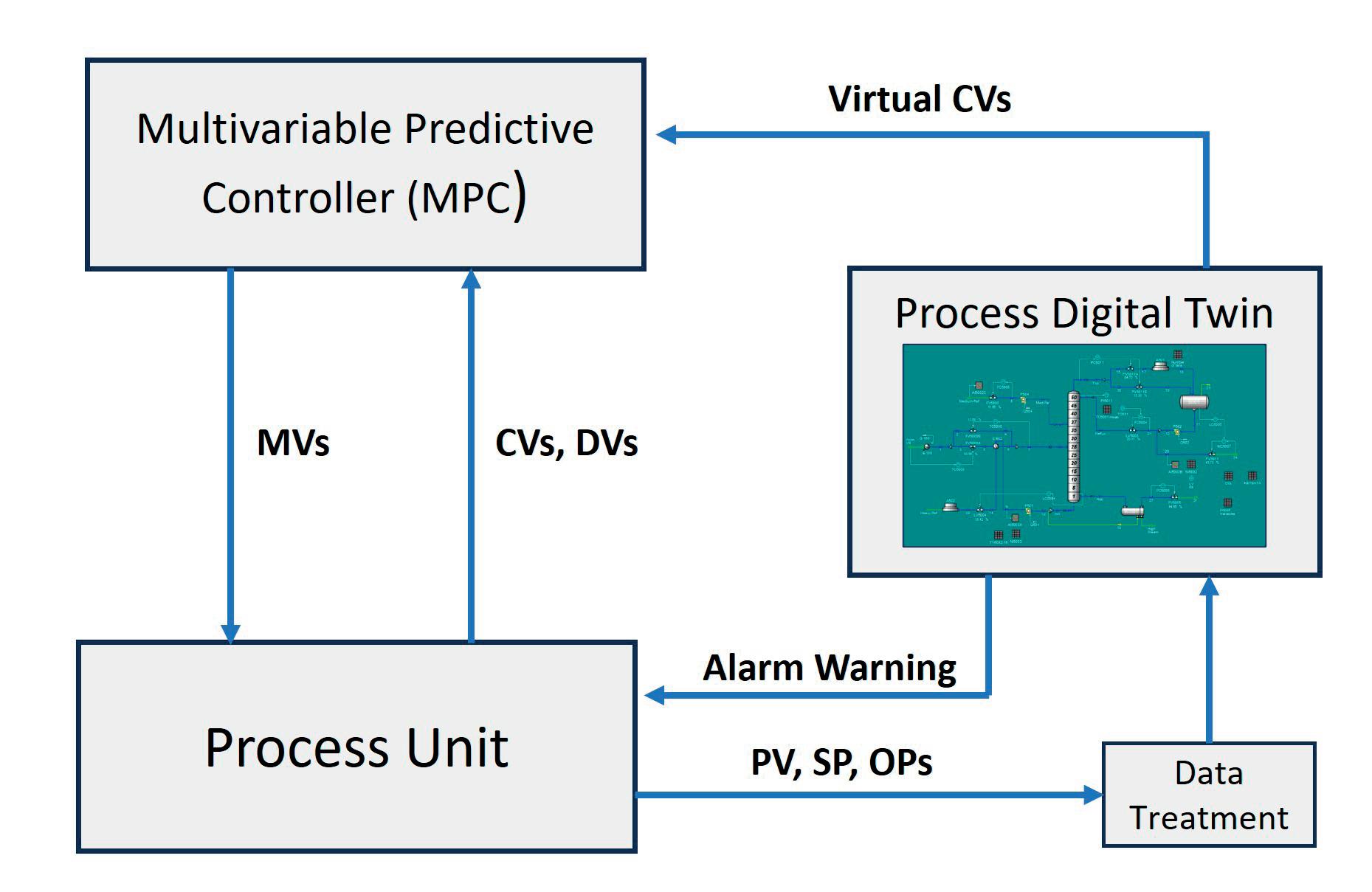

87 A new era in plant digitalisation

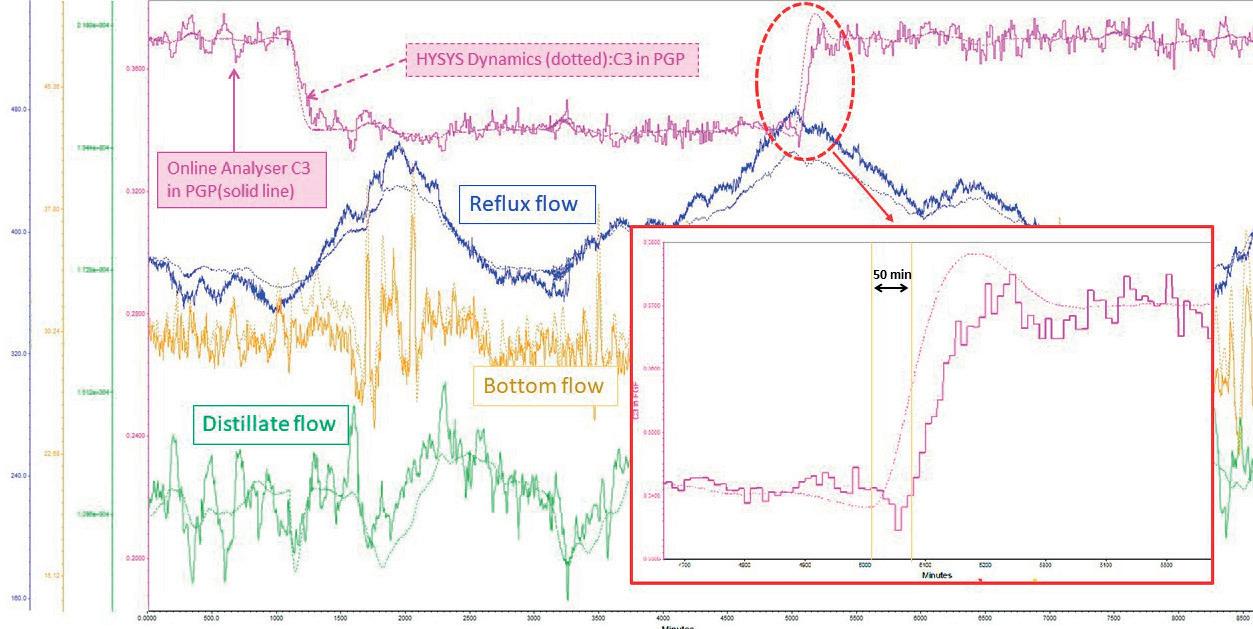

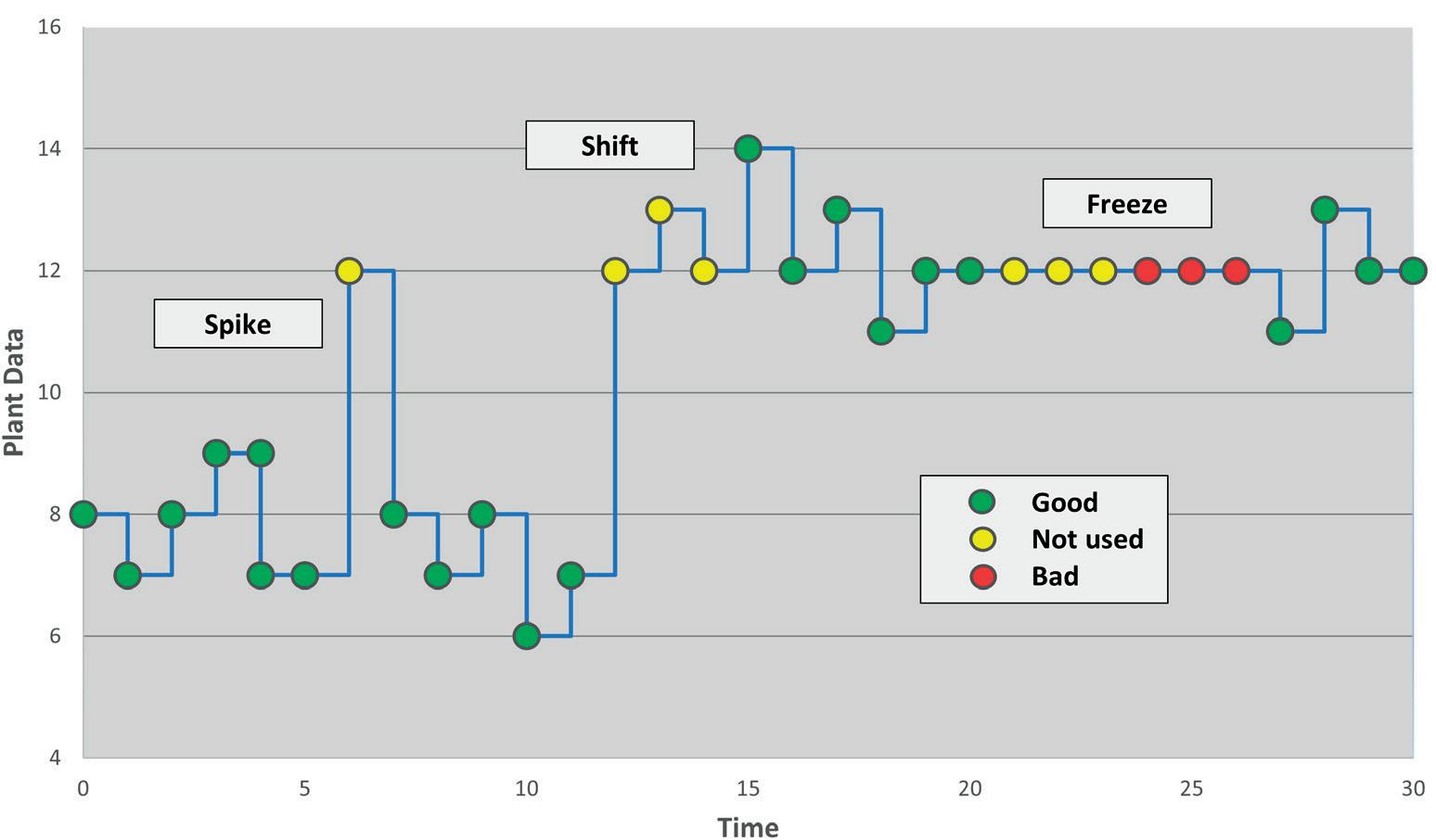

Aleix Monteso, Inprocess Technology, Spain, details the advantages of using digital twin technologies for plant optimisation.

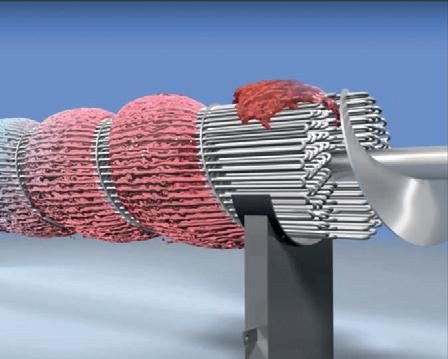

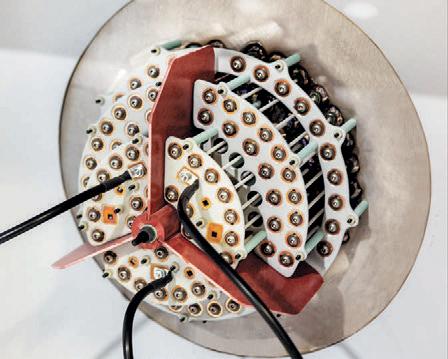

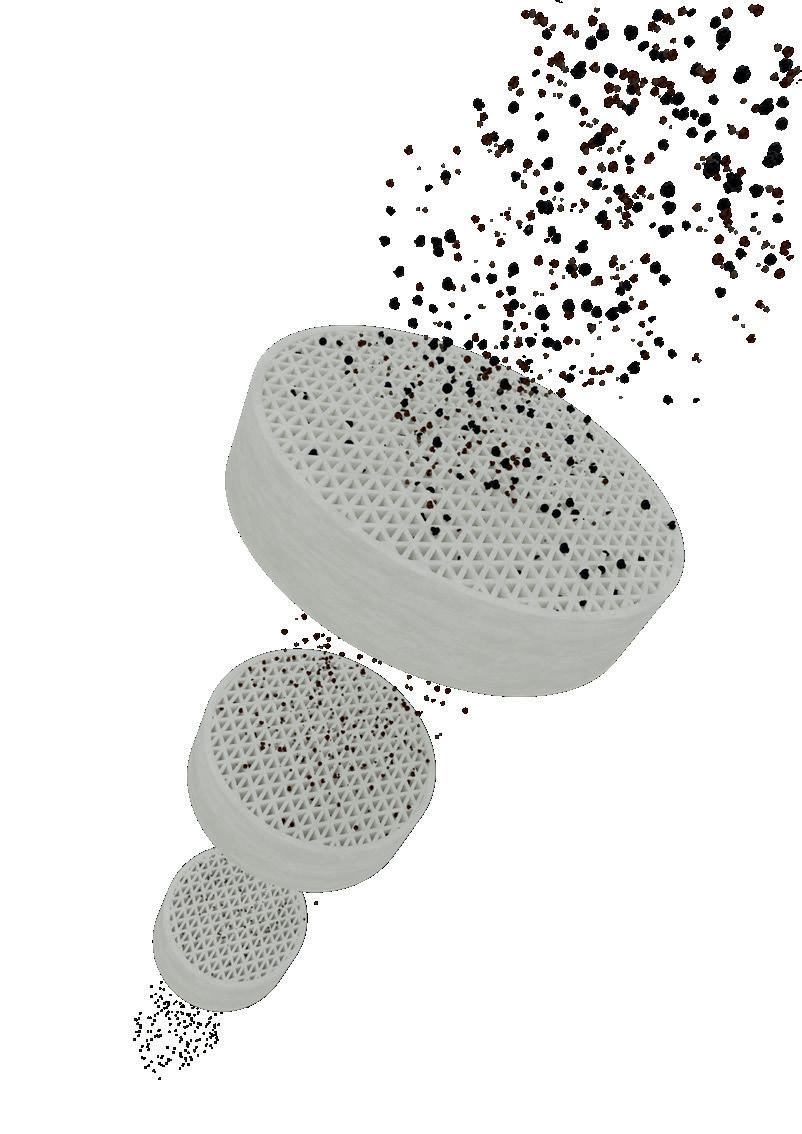

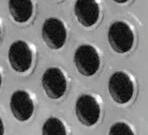

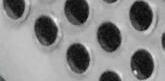

UNICAT’s Out Of This World Filtration ‘AFS’ is revolutionising performance. Optimised uniform flow channels create non-restrictive flow distribution and maximise foulant capture. AFS increases catalyst bed life by 50%+ and can capture any size particulate.

CBP019982 Hydrocarbon Engineering Like Join Hydrocarbon Engineering @HydrocarbonEng Follow CONVERSATION JOIN THE 2024 Member of ABC Audit Bureau of Circulations Copyright© Palladian Publications Ltd 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK. CONTENTS March 2024 Volume 29 Number 3 ISSN 1468-9340

Cut your CO2 emissions in half with ET Black™

Carbon Black Technology

ET Black™ is a state-ofthe-art technology that complies with the most stringent environmental regulations now and in the future.

Plus, the flexibility to produce all ASTM grades, and specialty grades, in a single plant. ET Black™, the technology of reference for producing carbon black obtained by thermal decomposition of highly aromatic oils.

Find out more at: www.igoforETBlack.com

CONTACT INFO

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O'Reilly callum.oreilly@palladianpublications.com

EDITORIAL ASSISTANT Poppy Clements poppy.clements@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES EXECUTIVE Sophie Birss sophie.birss@palladianpublications.com

PRODUCTION MANAGER Kyla Waller kyla.waller@palladianpublications.com

EVENTS MANAGER Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL CONTENT ASSISTANT Kristian Ilasko kristian.ilasko@palladianpublications.com

DIGITAL ADMINISTRATOR Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITORS

Yamaguchi Gordon Cope

CALLUM O'REILLY SENIOR EDITOR

Casual observers of American football will understand why the word ‘Swiftie’ was named as a finalist in the Oxford University Press’ 2023 ‘Word of the Year’ competition. This year’s Super Bowl attracted an estimated 123.4 million viewers in the US, making it the most watched broadcast since the Apollo 11 Moon landing in 1969. And, unless you’ve been hiding under a lunar rock, you’re probably aware that the record-breaking viewing numbers have been partly attributed to an army of Swifties (devoted Taylor Swift fans) who tuned in to watch the popstar’s boyfriend, Travis Kelce, in action for the Kansas City Chiefs. According to the Oxford University Press, the word Swiftie was more than 10 times more common in September 2023 than a year before, and its rise in prominence is evidence of a population that is influenced more than ever by public figures.

Another finalist for word of the year was ‘prompt’. Although not the eventual winner (I’ll let you google the definition of ‘rizz’, if you’re not already familiar with the word), ‘prompt’ caught my attention as it refers to “an instruction given to an artificial intelligence (AI) program, algorithm, etc., which determines or influences the content it generates.” Oxford University Press notes that words relating to AI were particularly prominent in its data in 2023. And there is further evidence of this in a selection of other ‘Word of the Year’ winners announced by different organisations. The Collins English Dictionary selected ‘AI’ as its top word, while both the Cambridge Dictionary and Dictionary.com plumped for ‘hallucinate’, meaning when AI produces false information and presents it as if true and factual.

The team at Cambridge Dictionary explains that hallucinate was chosen as its word of the year as it gets to the heart of why people are talking about AI: “Generative AI is a powerful tool but one we’re all still learning to interact with safely and effectively.” Creating new language to understand this new technology is just one step in the process of learning how best to utilise AI while being aware of its potential weaknesses (and dangers).

The latest edition of Airswift’s ‘Global Energy Talent Index’ (GETI) shines a light on current attitudes towards AI in the energy sector. The annual energy workforce trends report, which surveyed nearly 12 000 energy professionals in 149 countries, highlights a cautious approach to AI adoption in the oil and gas sector. The report suggests that 24% of oil and gas professionals currently use AI, with 47% of respondents very optimistic about the future impact of AI. The majority of professionals expect AI to result in an uplift in their personal productivity (71%) and increase their job satisfaction (58%). Interestingly, AI uptake in the petrochemicals sector seems to be a little higher, with 30% of professionals already using AI and 82% of professionals feeling positive about the future impact of AI.

The report also indicates an awareness amongst workers that AI will increase demand for skills, with 62% of oil and gas professionals expecting AI to increase pressure on them to acquire new skills.

While it is positive to see the energy industry embracing the prospect of AI, the sector faces a difficult challenge to ensure that its workforce is equipped with the necessary skills to harness the full potential of this exciting new technology. As Janette Marx, CEO of Airswift, wisely points out in the GETI report, there is a delicate balance to be struck between technological advancement and nurturing the skills of the sector’s workforce.

SUBSCRIPTION RATES Annual subscription £110 UK including postage /£125 overseas (postage airmail). Two year discounted rate £176 UK including postage/£200

airmail).

CLAIMS Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge. APPLICABLE ONLY TO USA & CANADA Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 701C Ashland Avenue, Folcroft, PA 19032. Periodicals postage paid at Philadelphia, PA & additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032.

South Street, Farnham, Surrey GU9 7QU, UK

+44

1252 718 999 COM MENT

Nancy

overseas (postage

SUBSCRIPTION

15

Tel:

(0)

GUEST COM MENT

ROB BENEDICT VICE PRESIDENT OF PETROCHEMICALS AND MIDSTREAM, AMERICAN

FUEL & PETROCHEMICAL MANUFACTURERS (AFPM)

Plastics derived from petrochemicals enable incredible things in our lives it is impossible to imagine a modern hospital, grocery store, school or workplace without them. They are light, durable, energy efficient, and are responsible for less GHG emissions throughout their lifecycle than alternative materials. They provide the global population with a high quality of life and enable economies to thrive sustainably. It’s essential, though, that these products be re-used, recycled and recovered correctly.

AFPM believes ending plastic pollution requires multiple solutions. First, we must promote sustainable consumption and production of plastics. We also must continue to develop well-designed plastic products that are more easily reused and recycled. And, most importantly, we must create universal access to environmentally sound waste collection and management. Without improving waste collection and management, we cannot maximise the potential of recycling technologies that are critical to achieving circularity. We have to think differently and replace our linear economic model where plastic products have limited uses and are discarded as waste with a circular one, where used plastics are no longer perceived as waste but as feedstocks for recycling.

the end of 2024. We are committed to helping meet the agreement’s goals of eliminating plastic pollution, while also recognising the tremendous societal benefits of plastics.

Some are calling for limitations or bans of the production of certain polymers. These are not viable solutions to combating plastic pollution because they would deprive society of plastics’ benefits and negatively impact numerous supply chains, all while ignoring waste management issues that are the root cause of plastic pollution. Restrictions and bans also slow progress toward global sustainability goals.

We have to think differently and replace our linear economic model where plastic products have limited uses and are discarded as waste with a circular one, where used plastics are no longer perceived as waste but as feedstocks for recycling.

This is why the members of the American Fuel & Petrochemical Manufacturers (AFPM) support the United Nations (UN) development of a global agreement that helps end plastic pollution, unlocks innovation and accelerates a global transition to a circular economy. As an accredited organisation by the UN Environmental Program, AFPM is participating in negotiations aimed at developing a global agreement on plastics pollution by

Achieving the UN’s Sustainable Development Goals (SDGs) is simply not possible without petrochemicals and the plastics derived from them.

Instead, we need policies that promote innovation across the plastics value chain and do not stifle it. This includes policies that help to develop a circular economy by unlocking the potential of technologies like advanced recycling, which is critical to increasing the universe of recyclable products. We also need policies that improve waste collection and management across the world. But we also must allow individual nations to develop regionally appropriate strategies to eliminate plastic waste that are supplemented by global standards and metrics.

By working together to keep waste out of the environment, increase recycling rates and create a more circular economy for plastics through the advancements of technologies like advanced recycling, we can reach our shared goals of eliminating plastic pollution.

March 2024 HYDROCARBON ENGINEERING 5

MORE BUSINESS LESS CARBON NATURAL GAS, FUTURE READY.

The case for blue hydrogen is clear.

Topsoe is ready to help you scale up and bring emissions down using natural gas resources.

Take the lowest energy route to ultra-low carbon intensity hydrogen with Topsoe’s industry-leading reforming technologies and integrated carbon capture. Find out how: topsoe.com/bluehydrogen

WORLD NEWS

Qatar | QatarEnergy and CPChem celebrate construction start of Ras Laffan petrochemicals project

QatarEnergy and Chevron Phillips Chemical (CPChem) have celebrated the commencement of construction of a US$6 billion integrated polymers complex in Ras Laffan Industrial City, Qatar.

The 435 acre project site will include an ethane cracker with a capacity of 2.08 million tpy of ethylene, making it the largest ethane cracker in the Middle East and one of the largest in the world.

It will also include two high-density polyethylene derivative units with a total capacity of 1.68 million tpy.

The facility is designed to use energy-saving technology which, along with other measures, is expected to result in lower greenhouse gas emissions intensity than similar global facilities.

Site preparation began in June 2022, and startup is expected in late 2026.

Italy | KT (MAIRE) awarded contract by Eni

MAIRE has announced that its subsidiary KT - Kinetics Technology has been awarded an EPC contract by Eni to build a hydrogen production plant at Eni’s Livorno refinery.

The value of the contract is €123 million, and the project is scheduled for completion in 2026.

The plant will process natural gas and biogenic feedstocks to create hydrogen for the production of

biofuels for mobility at the Livorno site processing various biogenic feedstocks, mainly waste such as cooking oils and animal fats, and residues from the agribusiness industry.

The plant is designed so that a residual CO2 capture unit can be implemented at a later stage.

The construction of the new unit is part of Eni’s project to convert its Livorno plant into a biorefinery.

USA | Delek refinery selected for pilot carbon capture project

Delek US Holdings Inc. has been selected by the US Department of Energy (DOE)’s Office of Clean Energy Demonstrations to negotiate a cost-sharing agreement in support of a carbon capture pilot project in the Big Spring refinery, Texas, US.

The DOE Carbon Capture Large-Scale Pilot Project programme provides 70% cost-share for up to US$95 million of federal funding to support project development.

The project will deploy Svante Technologies Inc.’s second-generation carbon capture technology at the refinery’s fluidised catalytic cracking unit (FCCU), while maintaining existing production capabilities and turnaround schedule. Expectations for the project are to capture 145 000 tpy of carbon dioxide (CO2), as well as reduce pollutants, such as SO x and particulate matter. CO2 is expected to be transported by existing pipelines for permanent storage or utilisation.

China | Successful startup of Axens’ residue hydrocracking unit and high conversion hydrocracking unit at Shenghong’s integrated refinery

Axens’ hydrocracking unit, distillates hydrocracking unit and naphtha hydrotreating unit were successfully started at Shenghong Refining & Chemical complex in China’s province of Jiangsu.

These single train units aim to maximise naphtha production as well as improve the coker’s feed quality while processing steam cracker py-oil, diesel, vacuum gas oil, coker gas oil and vacuum

residue as feedstocks within this integrated complex.

In 2019, Shenghong selected Axens to provide the residue hydrocracking/HCK/NHT solutions for boosting naphtha production from its integrated refinery and petrochemical complex at Lianyungang City.

As part of these solutions, Axens delivered the complete process design package, high-performance catalysts,

proprietary reactor internals, specialised design of spiral tube heat exchangers (ZPJE), and full technical services from plant personnel training to plant start-up.

Jacques Rault, Executive Vice President, Technology and Technical Support, Axens, said: “We are extremely grateful to Shenghong for [its] collaborative approach and exceptional support provided during the design, commissioning and startup phases.”

March 2024 HYDROCARBON ENGINEERING 7

WORLD NEWS

DIARY DATES

02 - 04 April 2024

Sulphur World Symposium

Charleston, South Carolina, USA www.sulphurinstitute.org/symposium-2024

03 - 05 April 2024

26th Annual International Aboveground Storage Tank Conference & Trade Show Orlando, Florida, USA www.nistm.org

29 April - 03 May 2024

RefComm Galveston, Texas, USA

www.events.crugroup.com/refcomm

06 - 08 May 2024

ILTA Conference & Trade Show Houston, Texas, USA www.ilta.org

14 - 16 May 2024

Asia Turbomachinery & Pump Symposium Kuala Lumpur, Malaysia atps.tamu.edu

10 - 14 June 2024

ACHEMA Frankfurt, Germany www.achema.de/en

11 - 13 June 2024

Global Energy Show Canada Calgary, Alberta, Canada www.globalenergyshow.com

26 - 27 June 2024

Downstream USA Galveston, Texas, USA events.reutersevents.com/petchem/downstream-usa

20 - 22 August 2024

Turbomachinery & Pump Symposia Houston, Texas, USA tps.tamu.edu

17 - 20 September 2024

Gastech Houston, Texas, USA www.gastechevent.com

22 - 25 September 2024

GPA Midstream Convention San Antonio, Texas, USA www.gpamidstreamconvention.org

UK | Centrica agrees deal with Repsol for 1 million t of LNG to supply the UK

Centrica Energy and Repsol have announced the signing of a deal that will improve the UK’s energy security in the coming years. The deal will see Centrica purchase 1 million t of LNG shipments between 2025 and 2027. All of these cargoes are expected to be delivered to the Grain LNG import terminal in Kent.

The deal marks an additional move by Centrica to build further resilience in the UK’s energy security. It follows a 15 year, US$8 billion deal with Delfin Midstream in July 2023, a three-year supply agreement with Equinor that will heat 4.5 million UK

homes through to 2024, and the reopening and expansion of the Rough gas storage facility in October 2022 and June 2023, respectively. Rough now provides half of the UK’s total gas storage capacity with the potential to store over 50 billion ft3/d of gas, enough to heat almost 10% of UK homes throughout winter.

Cassim Mangerah, Managing Director, Centrica Energy, said: “One of the key pillars of our successful and growing LNG business is our partnership approach. Our new deal with Repsol will complement the Atlantic leg of our diversified and flexible portfolio.”

Germany | Air Liquide to reduce emissions

Air Liquide and Dow have renewed their industrial gas supply agreement in Stade, one of the largest chemical production sites in Lower Saxony, Germany. In this context, Air Liquide will supply industrial gases under a long-term agreement and invest close to €40 million in the modernisation of its assets, enabling operational efficiency and reducing CO2 emissions.

As part of the agreement, Air Liquide will modernise its existing production

assets – two air separation units (ASU), as well as one partial oxidation (POX) plant, to which it will add a new CO2 recycling solution. This will enable a circular use of the CO2 produced, reducing emissions by around 15 000 tpy, which represents 80% of direct CO2 emissions of the Air Liquide site. The modernisation of these assets will be completed in 2024. Air Liquide has been supplying industrial gases to Dow in Stade for more than 20 years.

USA | TotalEnergies converts feedstocks from plastic waste into circular polymers

TotalEnergies has converted feedstocks from plastic waste into circular polymers at its polypropylene plant in La Porte, Texas, US. The La Porte plant, one of the world’s largest polypropylene sites, will produce sustainably certified polymers suitable for a wide range of applications, including food grade packaging.

The petrochemical feedstock was provided by New Hope Energy’s ISCC+ certified advanced recycling

facility in Tyler, Texas. The feedstock was converted into monomers at the BASF TotalEnergies Petrochemicals (BTP) facility – a 60/40 joint venture (JV) between BASF and TotalEnergies based in Port Arthur, Texas – before being transformed into circular polymers at TotalEnergies’ polypropylene plant in La Porte, Texas.

Both the La Porte and BTP facilities received their ISCC+ certification in 2022.

March 2024 HYDROCARBON ENGINEERING 8

SPENT CATALYST RECYCLING MADE SUSTAINABLE

Become part of the best solution

low

Our state of the art processes and technologies and the use of renewable energy (hydropower), enable us to recycle base metals from spent catalysts with an unrivaled low carbon footprint: 85% lower CO 2-emission, compared to conventional mined metals.

Lower your footprint?

Contact us!

moxba.com

Recycling made Sustainable

©2024 Halliburton. All Rights Reserved. halliburton.com Superior Process and Water Treatment Solutions Driven by Service Excellence PROTECT ASSETS & MAXIMIZE VALUE

COMPLETE SOLUTIONS

Halliburton Multi-Chem offers a broad selection of chemistries, equipment, services and automation to ensure successful results.

COLLABORATIVE APPROACH

Through onsite technical service and engineering support, Halliburton Multi-Chem collaborates with you to deliver solutions to your challenges.

Improving reliability, increasing throughput and enhancing the efficiency and flexibility of operating units is important to you.

We are here to help.

12 March 2024 HYDROCARBON ENGINEERING

Nancy Yamaguchi, Contributing Editor, discusses US economic recovery, the gradual control of fuel prices and the long-term oil market outlook.

As the new year commences, there are abundant signs of recovery and renewed vigour in the US economy. Most of the public has yet to see this, or perhaps is unable to believe it. After the COVID-19 pandemic, markets collapsed, and recovery came in fits and spurts. Economists kept predicting recession, and the only hope seemed to be a distantly possible ‘soft landing’. Inflation hit new heights. The Federal Open Market Committee (often referred to as ‘the Fed’) steadily raised interest rates to contain it, with a long-term goal of 2% inflation. In February 2022, the federal funds effective interest rate was a mere 0.08%, having been slashed repeatedly to support the economy during the pandemic. Beginning in March 2022, the Fed began to raise rates, announcing seven rate increases in 2022 and five in 2023.1 Millions of people felt the pinch of

March 2024 13 HYDROCARBON ENGINEERING

inflated prices for goods, fuel, and food. Fed bashing became nearly as popular as generic government bashing. Mistrust of institutions has become reflexive. It is difficult to see that the economy is finally improving, particularly since there are no rapid fixes and smooth curves in recovery. The American attention span is ill-suited when it comes to policies and programmes that take years to bear fruit. For example, inflation has been coming under control, but the latest data released in mid-February showed that inflation ratcheted up again in January. This caused renewed doubt and even a bit of panic – the Dow Jones Industrial Average dropped 500 points. The Fed takes a long view. Already in January 2024, the Fed announced that it would not begin reducing interest rates until more data becomes available, clearly understanding that the battle against inflation has not yet been won.

The US is the world’s largest oil market and the largest economy, and therefore has a massive impact on the global economy and oil market. Has it fully recovered from the pandemic? This article discusses the US economic recovery, the rise and gradual control of fuel prices, the impacts on demand, and the long-term outlook.

US economic recovery

The path to economic recovery has been slow since the COVID-19 pandemic. It has relied upon hundreds of measures affecting millions of people. Unfortunately, the loud divisiveness of US politics detracts from the successes being achieved. The Fed steadfastly worked on monetary policy. The Biden Administration adopted a multi-pronged approach of ‘investing in people’ to rebuild the economy from the ground up. Congress passed major laws providing relief to citizens, businesses, and state and local governments suffering from the COVID-19 pandemic. These initiatives have taken time, but they are working: unemployment is at historic lows, jobs are being created, wages have grown, inflation is cooling, productivity and GDP are rising, fuel demand has grown. Table 1 provides an overview of key economic indicators in the post-COVID

years 2020 - 2023, with data for January 2024 included when available.

The US Bureau of Labor Statistics (BLS) reported that the US added 353 000 jobs in January 2024, detailed in its Employment Situation report, also known as ‘the Jobs Report’.2 This was nearly twice what had been expected. The unemployment rate in January 2024 remained at only 3.7%. The unemployment rate averaged historic lows of 3.6% in 2022 and 2023. In contrast, the COVID-19 pandemic caused unemployment to spike to 14.7% in April 2020.

Not only are more people finding jobs, wages are rising as well. According to the BLS, US average earnings were US$29.36/h in 2020. This rose to US$33.72/h in 2023, and they kept rising to US$34.55/h in January 2024. The BLS data show that wages are increasing more quickly than inflation, so people’s purchasing power is going up. The Consumer Price Index (CPI), the most widely used measure of inflation, rose by 4.7% in 2021 and 8.0% in 2022, before being brought down to 4.1% in 2023. This level remains higher than desired, but it is progress nonetheless, and it is difficult to contain inflation when oil prices are high.

The high cost of energy was a key culprit in overall CPI increases. WTI crude spot prices jumped from US$39.16/bbl in 2020 to US$68.13/bbl in 2021, and prices spiked to US$94.90/bbl in 2022. WTI prices eased somewhat to US$77.58/bbl in 2023, and they fell to US$73.56/bbl in January 2024.

The pandemic caused petroleum product demand to drop by -14.3% in 2020. Demand bounced back by 9.6% in 2022, then grew more slowly at 1.2% in 2022 and 0.6% in 2023.

The US Bureau of Economic Analysis (BEA) reported that GDP growth in 2019 was 2.5%. COVID-19 caused GDP to shrink -2.2% in 2020. GDP bounced back by 5.8% in 2021, then continued to grow at 1.9% in 2022 and 2.5% in 2023 – back to its pre-pandemic level. The BLS forecasts that US GDP will continue to grow at a rate averaging 1.9% each year between 2022 and 2032.3

Notes: unemployment rate, average hourly earnings, and CPI are per US Bureau of Labor Statistics. GDP per US Bureau of Economic Analysis.

March 2024 HYDROCARBON ENGINEERING 14

2020 2021 2022 2023 January 2024 Unemployment rate (%) 8.1 5.4 3.6 3.6 3.7 Average hourly earnings (US$) 29.36 30.61 32.26 33.72 34.55 CPI, annual increase (%) 1.2 4.7 8.0 4.1 GDP (% change) -2.2 5.8 1.9 2.5 Index of Consumer Sentiment 81.5 77.6 59 65.4 79 WTI spot price (US$/bbl) 39.16 68.13 94.90 77.58 73.56 Petroleum product demand growth (%) -14.30 9.60 1.20 0.60

Table 1. Improvement in US key economic indicators

Index of Consumer Sentiment

WTI spot price and petroleum product demand per EIA; 2023 data

January - November.

is per University of Michigan http://www.sca.isr.umich.edu/.

are

Get active with Valor ®

The solution for FCCs with high vanadium feeds

Want to get active?

Learn what Valor ®, BASF’s latest vanadium trapping technology, can do for you!

Less Sulfur + More Vanadium = More Conversion Cat/Oil Ratio Conversion, wt. % 76 72 68 64 Valor ® Conventional V-Trap 2 4 6

The Index of Consumer Sentiment, published by the University of Michigan, plummeted from 81.5 in 2020 to 59 in 2022. It recovered slowly, reaching 65.4 in 2023, then it surged to 79 in January 2024. According to the Surveys of Consumers Director: “Consumer sentiment confirmed its early-month reading, surging 13% to reach its highest level since July 2021, reflecting improvements in the outlook for both inflation and personal incomes. January’s gain has been exceeded only five times since 1978, one of which was last month at an even larger increase of 14%.”4

Consumer confidence is rebounding at last, most strongly at the end of 2023 and the beginning of 2024. To add a note of caution, however, the recovery was overdue, and it had to claw its way back from a deep trough: consumer confidence of 59 in 2022 was the most miserable in the history of the index, which has been published since 1952.

US demand recovery

Although consumer confidence is not boundless, it is climbing, and its recovery is based on ample evidence of improved economic conditions. People are working,

travelling, shopping, and seeking entertainment again. Fuel demand is recovering, though demand for key fuels has not regained pre-pandemic levels. Some of this was expected. Gasoline and diesel demand, for example, are forecast to gradually decline over time, so they would not be expected to regain former levels and grow again from that higher baseline. Programmes have been underway for years to improve fuel efficiency, promote the use of alternatives and renewables, and increase sales of electric vehicles. The COVID-19 pandemic also brought some changes that are considered structural and permanent, including a more widespread acceptance of and desire for a work week that includes at least some remote work.

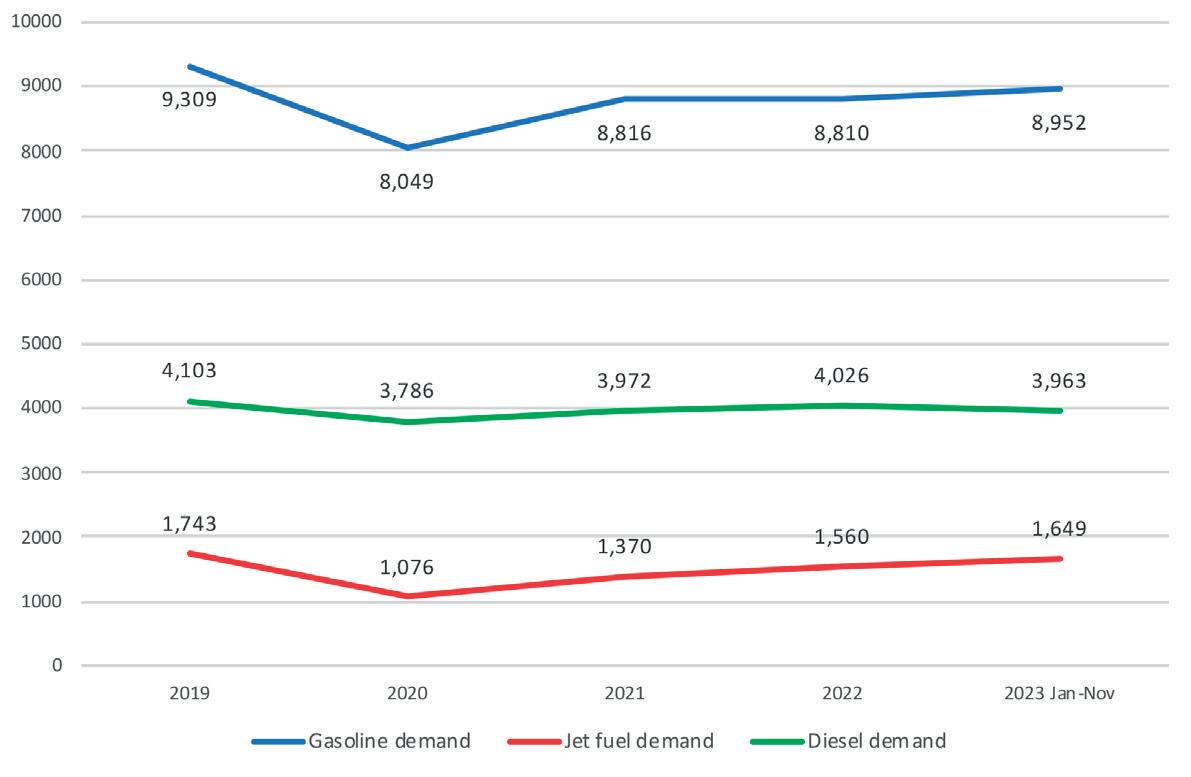

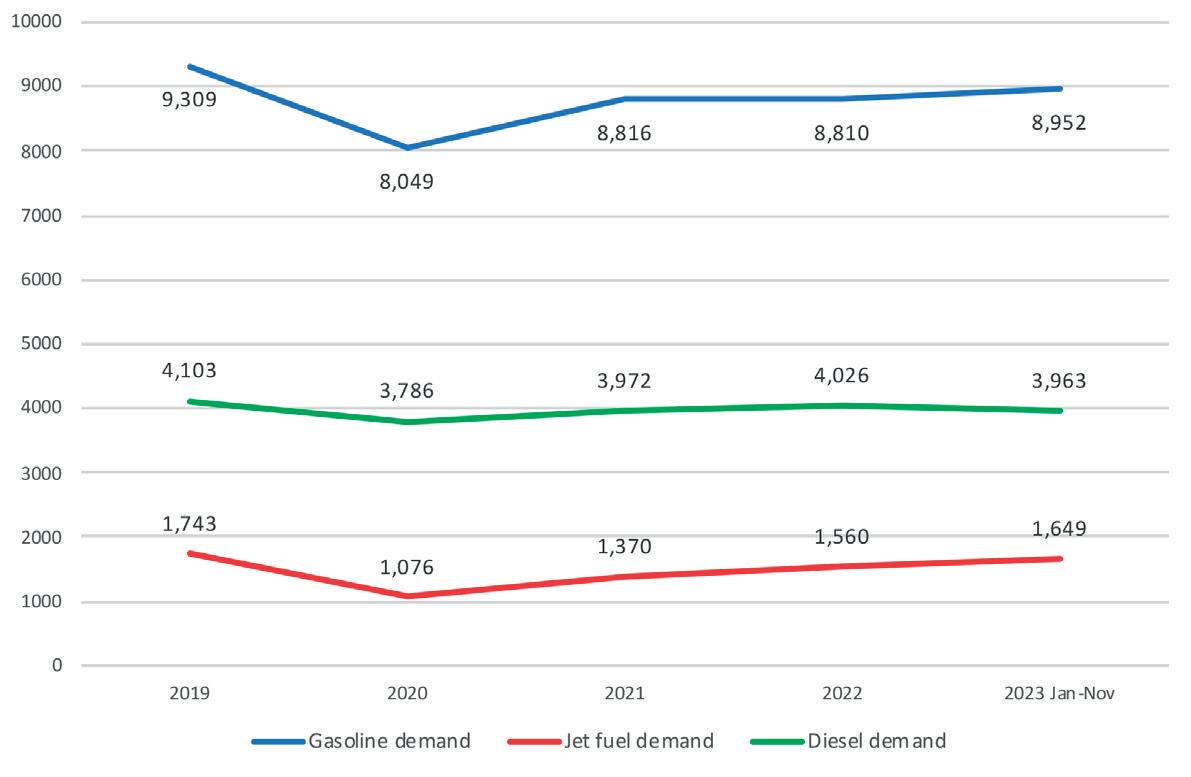

Focusing on the years since the pandemic, has demand for key fuels bounced back? Figure 1 tracks annual demand for gasoline, jet fuel, and diesel fuel from 2019 to the January - November period of 2023, as reported by the US Energy Information Administration (EIA). Demand for gasoline and jet fuel was hit hard by the pandemic. Gasoline demand of 9.309 million bpd in 2019 collapsed to 8.049 million bpd in 2020, a drop of 1.26 million bpd. To place this huge volume in perspective, the EU as a whole used 1.531 million bpd of gasoline in 2022, according to the Energy Institute and BP.5 US gasoline demand bounced back to 8.816 million bpd in 2021, flattened to 8.81 million bpd in 2022, and grew to 8.952 million bpd in January - November 2023. Year 2023 demand was approximately 357 000 bpd below its pre-pandemic level.

US demand for jet fuel plummeted in 2020 as travel bans were instituted. Demand of 1.743 million bpd in 2019 plunged to 1.076 million bpd in 2020, a drop of 667 000 bpd, or 38%. Demand recovered to 1.37 million bpd in 2021, 1.56 million bpd in 2022, and 1.649 million bpd in 2023 (January - November). Demand in 2023 was 94 000 bpd below its 2019 level.

Diesel demand fell from 4.103 million bpd in 2019 to 3.786 million bpd in 2020, a drop of 317 000 bpd. Demand recovered to 3.972 million bpd in 2021, 4.026 million bpd in 2022, and then declined again to 3.963 million bpd in January - November 2023. Diesel demand in 2023 was 140 000 bpd below its pre-pandemic level.

Totalling these three key fuels, demand in 2020 dropped 2.244 million bpd below its 2019 level. Demand grew in 2021, 2022 and 2023, but 2023 demand remains 592 000 bpd below its 2019 level.

Price-demand relationships

Energy prices were a major contributor to the soaring prices and inflation experienced in the US in recent years. Energy is a key ingredient to essentially every type of economic activity, and high energy prices have knock-on effects across all economic sectors. As the US emerged from

March 2024 HYDROCARBON ENGINEERING 16

Figure 1. US demand for key fuels since the COVID-19 pandemic (‘000 bpd). Source: US Energy Information Administration.

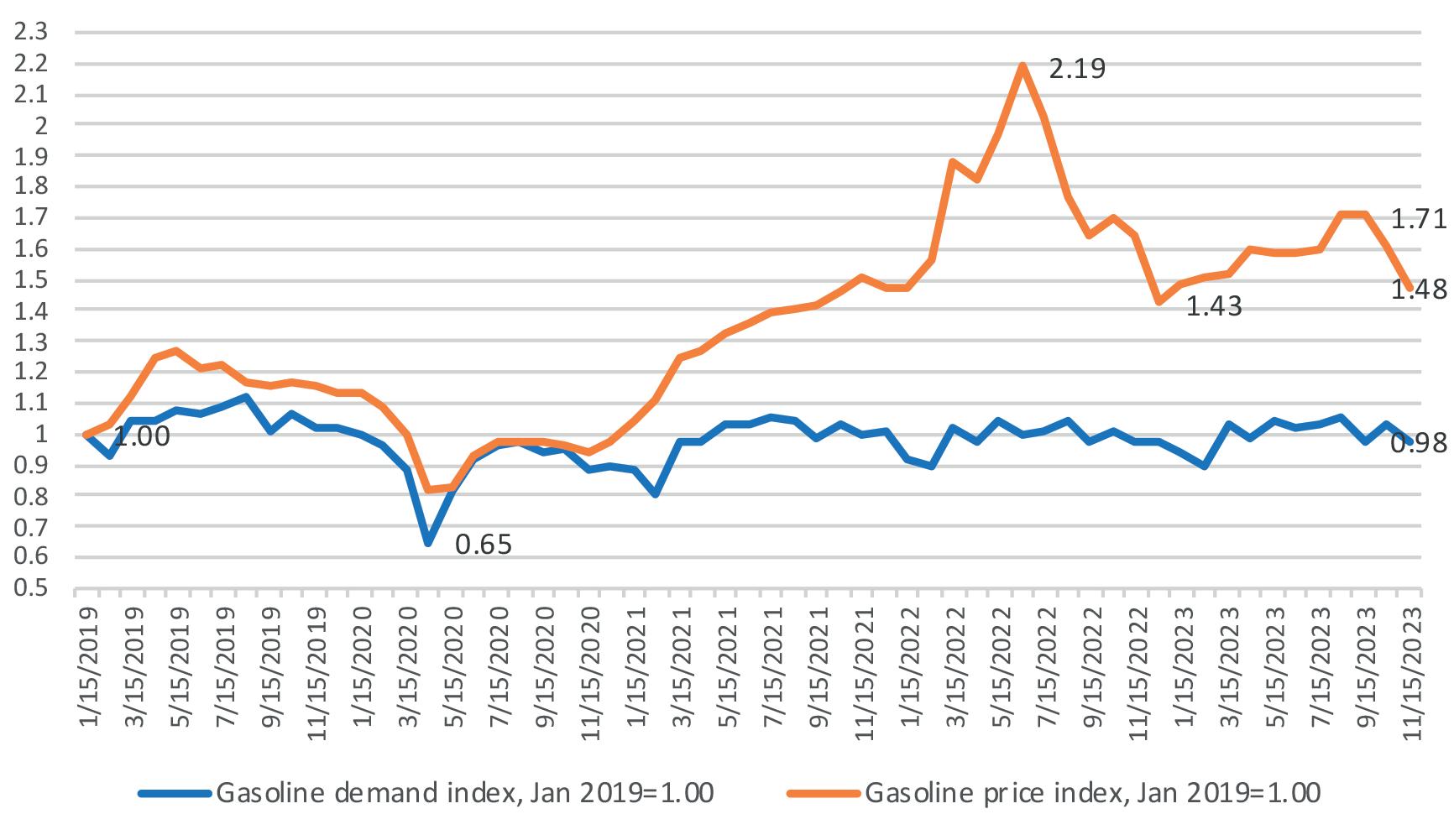

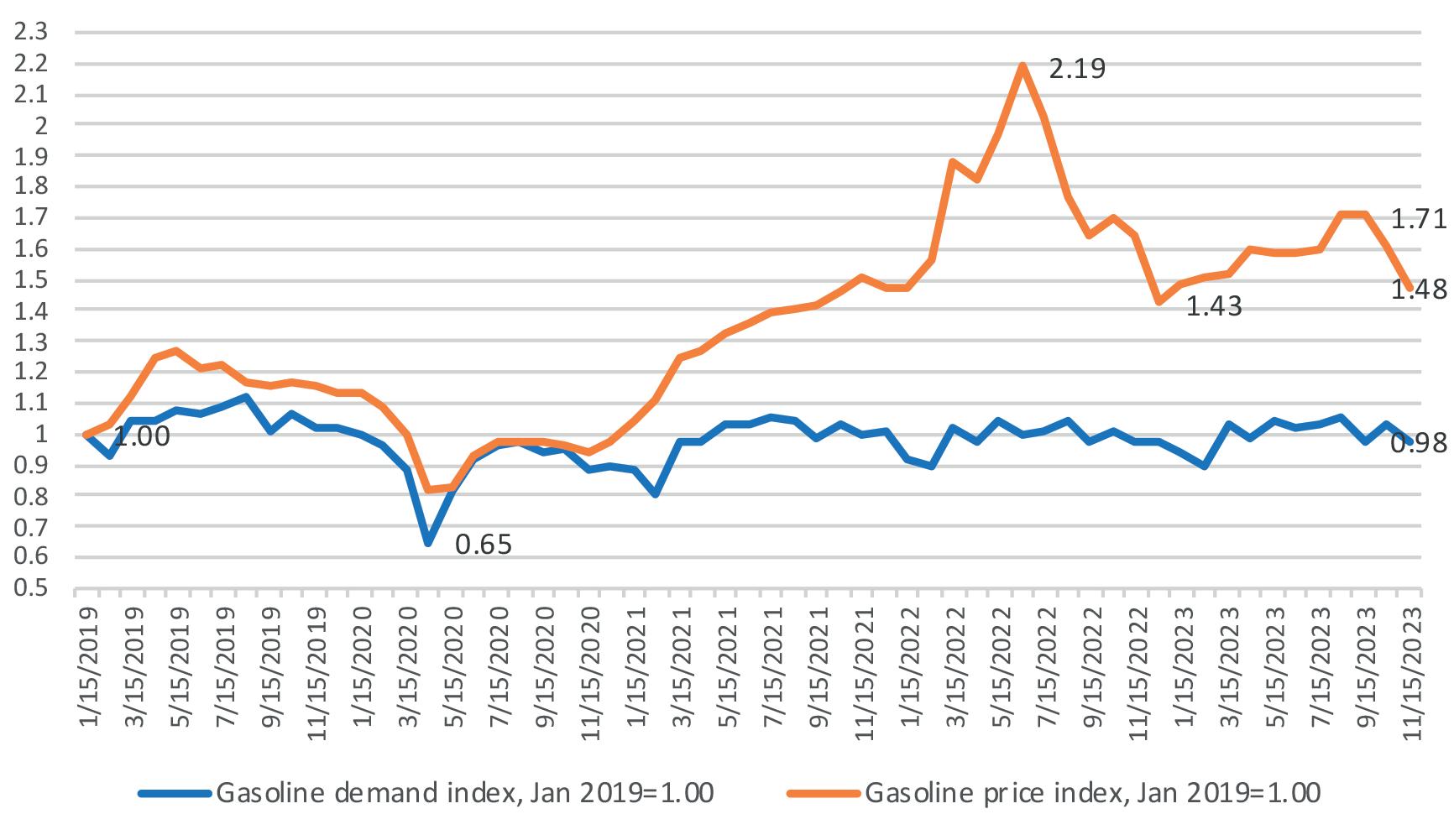

Figure 2. Gasoline demand vs price, indexed, Jan. 2019 = 1.00.

Capturing green opportunities

Carbon capture and storage or utilization (CCS/CCU) is a key strategy that businesses can adopt to reduce their CO2 emissions. By selecting the right technologies, pressing climate change mitigation targets can be met while benefitting from new revenue streams.

Sulzer Chemtech offers cost-effective solutions for solvent-based CO2 absorption, which maximize the amount of CO2 captured and minimize the energy consumption. To successfully overcome technical and economic challenges of this capture application, we specifically developed the structured packing MellapakCC™. This packing is currently applied in several leading CCS/CCU facilities worldwide, delivering considerable process advantages.

By partnering with Sulzer Chemtech – a mass transfer specialist with extensive experience in separation technology for carbon capture –businesses can implement tailored solutions that maximize their return on investment (ROI). With highly effective CCS/CCU facilities, decarbonization becomes an undertaking that can enhance sustainability and competitiveness at the same time. For more information: sulzer.com/chemtech

Visit us at ACHEMA in Frankfurt Hall 4 Stand D48

the pandemic, pent-up demand placed pressure on supply, and supply chain hiccups stymied recovery. Oil and energy prices and demand had fallen so low that investment had fallen, and it took time for supplies to come back onstream. The high prices, in turn, stifled demand and recovery.

Oil prices also rose, and remain high, because of geopolitical risk. The Russian invasion of Ukraine in early 2022 launched a protracted, grisly, and expensive war that continues to this day. It has dramatically changed the flow of oil. Adding to this, October 2023 brought armed conflict between Israel and Hamas-led forces in the Gaza Strip. Tensions have spread throughout the Middle East, adding risk to oil shipping lanes. It is not possible for oil markets to be calm with wars ongoing in Europe and the Middle East. High prices are expected to remain until peaceful resolution is found.

Figure 2 tracks the monthly changes in US gasoline demand and retail price. It allows side-by-side comparison of price and demand by calculating an index, with

January 2019 as the starting basis equal to 1.00. In April 2019, after many areas launched stay-at-home mandates, gasoline demand fell to 0.65 of the January 2019 starting point. Demand crept back up by mid-2021, but it has stagnated since then. This is explained in part by comparing the demand index with the retail price index. Retail gasoline prices slumped to 0.82 in April 2020, and they remained below 1.00 while the COVID-19 lockdowns remained in force. By 2021, however, gasoline prices began to rise, sharply breaking the link with demand.

Gasoline prices surged strongly when Russia invaded Ukraine, hitting a peak of 2.19 (219%) in June 2022. Although prices have moderated since then, the price index in November 2023 was 1.48; that is, prices were 48% higher than they had been in January 2019. In dollar terms, US retail gasoline prices (regular grade, all areas) were US$2.248/gal. in January 2019. They dropped to US$1.841/gal. in April 2020 during the lockdowns. Prices then spiked to an all-time high of US$4.929/gal. in June 2022. They dropped to an average of US$3.318/gal. in November 2023, and they fell again to US$3.134/gal. in December 2023. Although prices have fallen, they remain US$0.886/gal. above the starting price in January 2019.

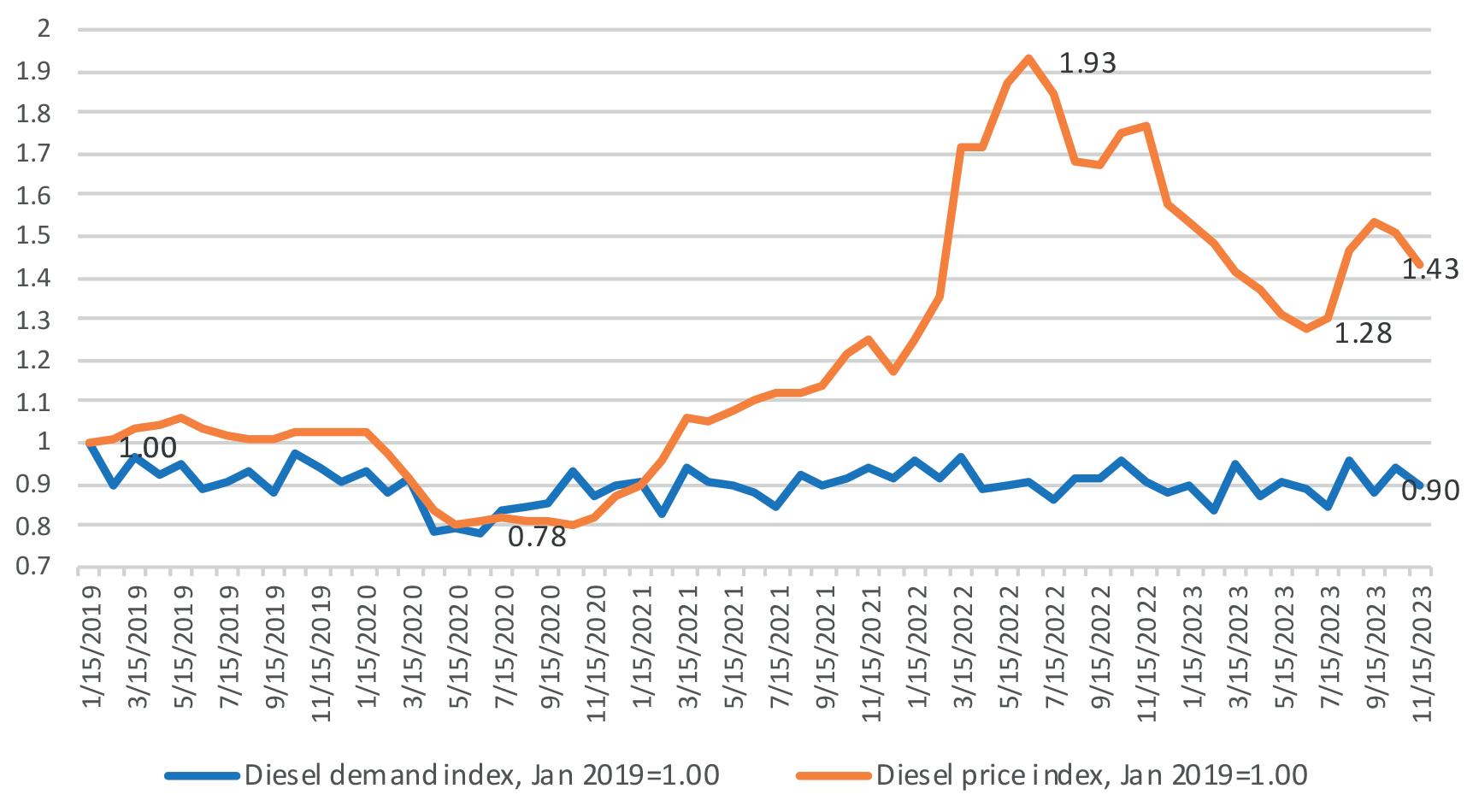

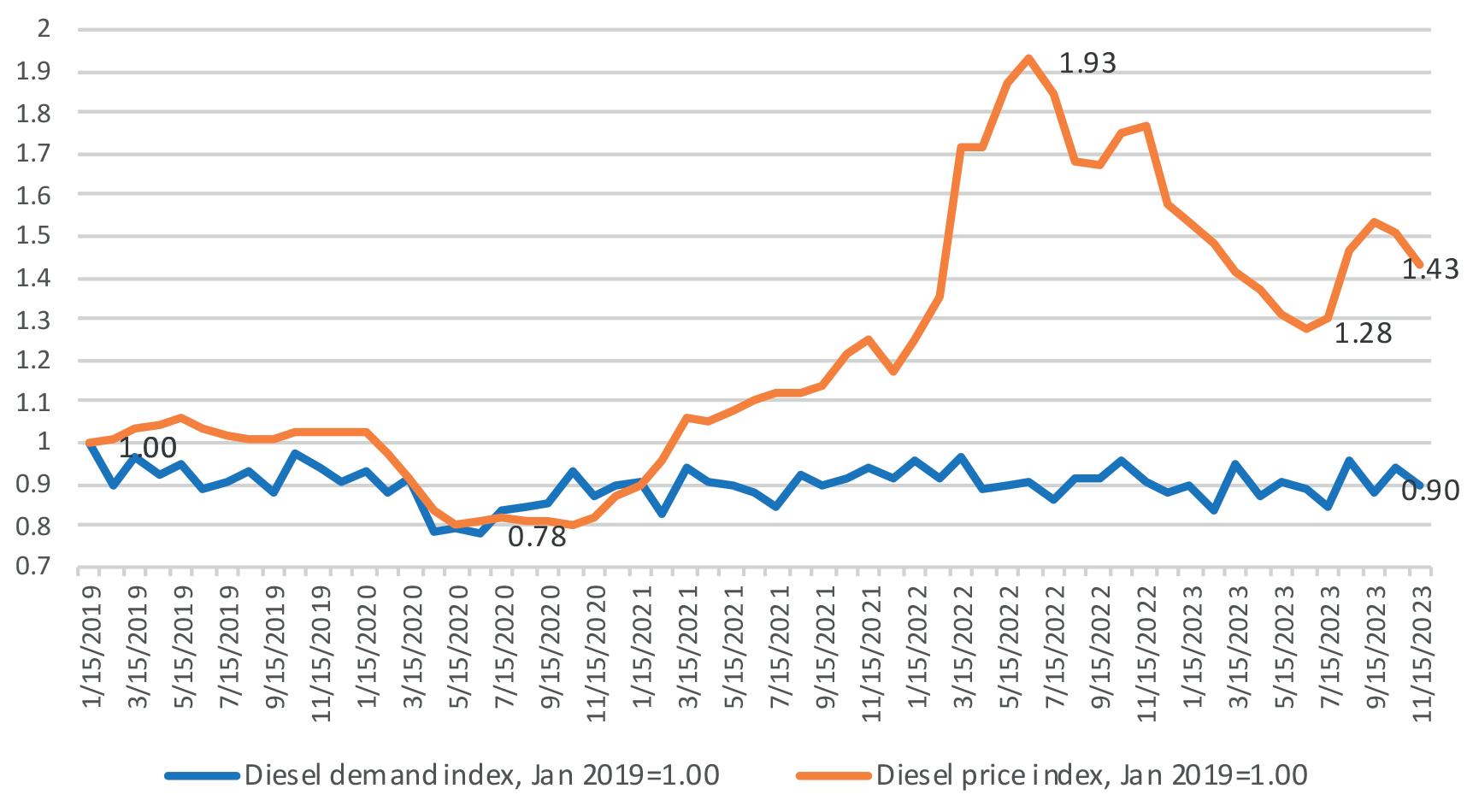

Figure 3 compares monthly changes in diesel demand with changes in price. The pattern resembles the one seen in the gasoline index, though it is less dramatic. Diesel demand fell to 0.79 in April 2020 relative to January 2019, while prices dropped to 0.84. Diesel demand has never regained its level of January 2019, hovering mainly in the range of 0.85 - 0.95, and averaging 0.90 in November 2023. As with gasoline, diesel prices began to pull away in 2021, and they spiked to 1.93 in June 2022. Diesel prices have eased since the peak, yet in November 2023 they remained 1.43 times as high as they were in January 2019. In US dollar

Source: US Energy Information Administration

March 2024 HYDROCARBON ENGINEERING 18

Figure 3. Diesel demand vs price, indexed, Jan. 2019 = 1.00. Source: calculated based on US EIA data.

capacity (‘000

(%) Refinery inputs Operable crude capacity Operating crude capacity Idle crude capacity Refinery utilisation (%) 2019 16993 18808 18439 370 90.4 2020 14723 18662 17989 674 78.9 2021 15674 18108 17403 704 86.6 2022 16485 17963 17806 157 91.8 2023 JanuaryNovember 16451 18237 17989 249 90.2 2020 - 2019 -2270 -146 -450 304 -12 2023 - 2019 -541.5 -571.1 -450.2 -121.3 -0.2

Table 2. US refinery inputs and

bpd), and utilisation

terms, US retail diesel prices (on-highway, all areas) were US$2.98/gal. in January 2019. Prices fell to US$2.492/gal. in April 2020, and they dropped to a nadir of US$2.389/gal. in October 2020. Subsequently, diesel prices skyrocketed to record highs of US$5.754/gal. in June 2022. Prices eased to US$4.254/gal. in November 2023, and fell again to US$3.972/gal. in December 2023.

Refinery utilisation and inputs

On the global front, the Russia-Ukraine war and the Israel-Hamas war are elevating oil prices. Crude oil feedstock costs are the largest element in US retail prices for fuel. There are also downstream issues supporting high retail prices. When fuel demand fell in early 2020, refinery utilisation and throughput also fell. In April 2020, US refinery utilisation sagged to 70.2%, after having been as high as 94.8% in August 2019. After the pandemic, economic activity and growth returned, but restarting the economy was a struggle, and restarting refineries was a struggle as well. Some refineries lagged in their ability to raise throughput to meet recovering demand, particularly during summer driving season. Some refineries had been placed in maintenance mode, and they subsequently were idled. It was impossible to predict when and if profitability would return. Refiners were reluctant to flood the market with refined fuel when US demand was depressed, and storage tanks were full. US refiners have grown more reliant on export markets, but the pandemic hit many of these markets as well, and bumping up refinery runs to expand exports seemed risky.

Table 2 provides details on US crude refinery inputs, capacity, and utilisation in the years 2019 through 2023 (January - November) according to the EIA. In 2019, US operating crude distillation capacity was 18.439 million bpd. Operating capacity was cut to 17.989 million bpd in 2020, and cut again to 17.403 million bpd in 2022, a loss of 1.036 million bpd of capacity. Utilisation rates were 90.4% in 2019, dropping sharply to 78.9% in 2020. Utilisation rates improved to 86.6% in 2021, partly because of capacity closures. Utilisation rates rose to 91.8% in 2022 and declined slightly to 90.2% in 2023. Operating capacity recovered to 17.806 million bpd in 2022 and 17.989 million bpd in 2023. Thus, although refinery utilisation rates in 2023 have returned to pre-pandemic levels, this has been achieved by cutting operating capacity by 450 000 bpd.

Refinery throughput plunged by 2.27 million bpd between 2019 and 2020, falling from 16.993 million bpd in 2019 to 14.723 million bpd in 2020 – the lowest level since 2009, in the midst of the Great Recession. Throughput averaged 16.451 million bpd in 2023, still 541 500 bpd below its 2019 level.

The future: AEO long-term forecast

The 2021 - 2023 years brought significant recovery from the COVID-19 slump. The US GDP is growing, job formation and wage growth have been excellent,

The Leading Simulator for CO2 Capture

Solvents:

• Primary, secondary, promoted amines

• CESAR1 (updated with data from DOE partnership & tested within EU-funded consortium “SCOPE”)

• Amino acid salts

• Enzyme catalysed & amine-promoted carbonates

• Ionic solvents

• High strength piperazine

• Chilled ammonia Applications:

• Stationary power generation

• CO2 capture from LNG-fueled ships

• Renewable methane from landfill gas and organic waste

• Hydrogen production via reforming Ferrybridge Pilot Plant, Ferrybridge, UK, 100 TPD

Reliable:

• New CESAR1 model updated with cutting edge lab and plant data from DOE partnership

• Thoroughly tested as part of EU-funded research consortium “SCOPE”

Contact

for a free trial Optimized Gas Treating, Inc. www.ogtrt.com +1 512 312 9424 Let ProTreat® Be

us

Your Guide

demand is recovering, and inflation is gradually coming under control. Refinery inputs and utilisation rates have improved. Oil prices are high, but down from their peak in the summer of 2022. What will the future bring?

Gasoline and diesel demand have recovered from the trough seen in 2020, but they are not back at their pre-pandemic levels. In November 2023, gasoline demand was approximately 90% of January 2019 demand. Diesel demand in November 2023 was approximately 98% of demand in January 2019. As noted, however, this recovery in demand occurred despite high prices, suggesting that this level of demand is robust and price-insensitive. Although volumes sold in 2023 were lower than they were in 2019, this is consistent with the long term expectations of demand.

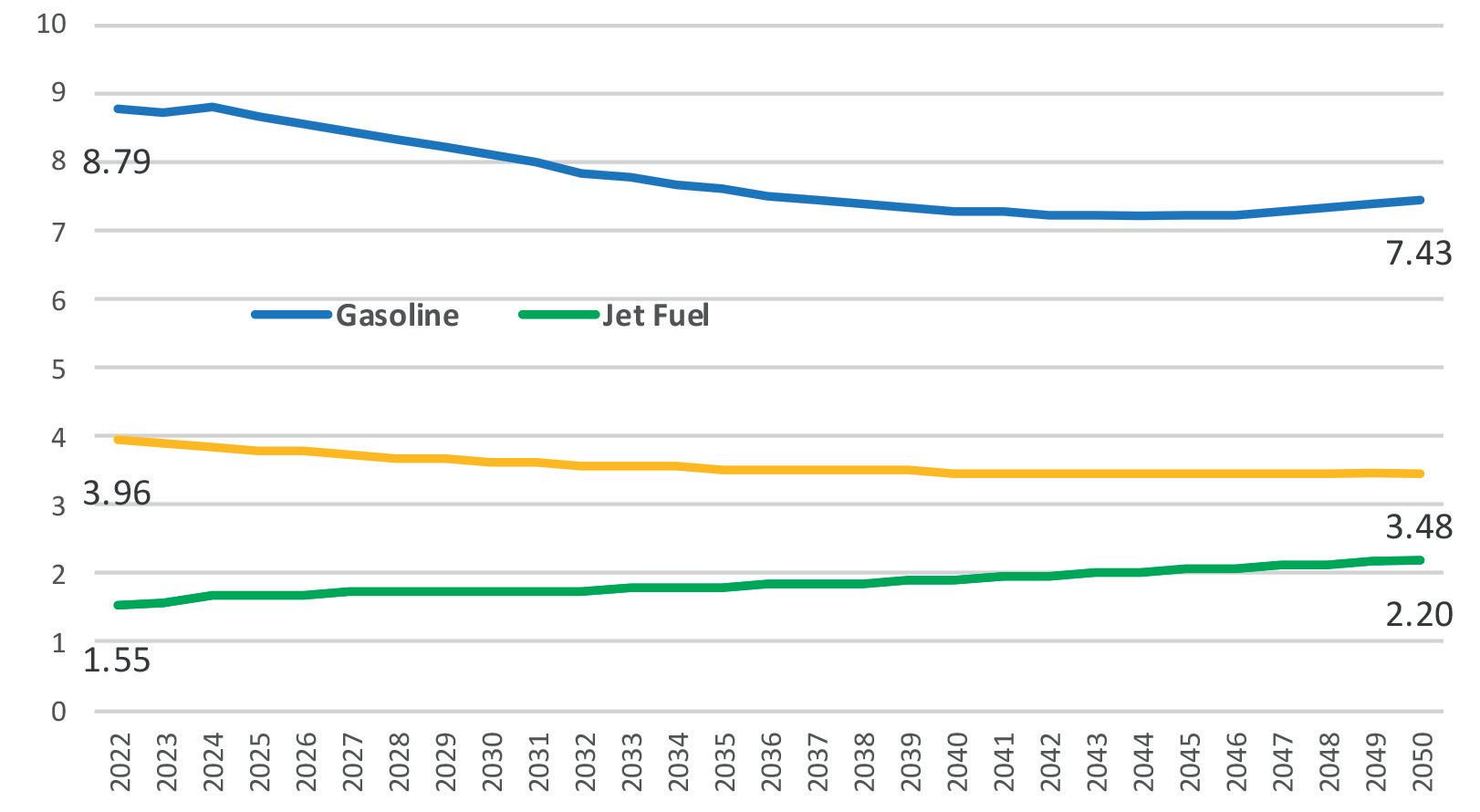

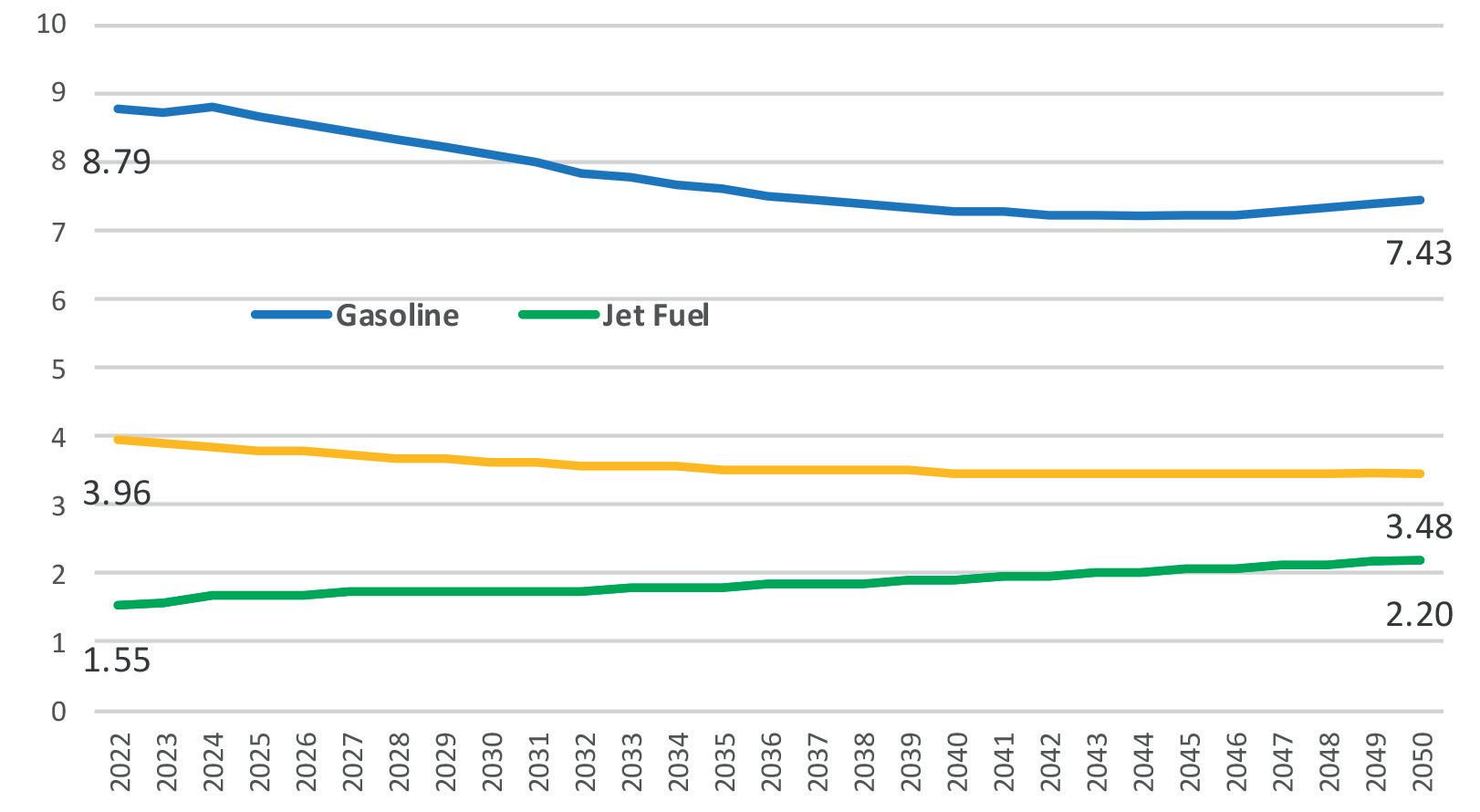

Figure 4 presents the long-term (2022 - 2050) forecast of gasoline, diesel, and jet fuel demand presented in the EIA’s Annual Energy Outlook (AEO.)6 The AEO forecasts that US gasoline will shrink by -0.6%/yr on average between 2022 and 2050. In volume terms, demand of 8.79 million bpd in 2022 will slide to 7.23 million bpd in 2024, then level off and increase slightly to 7.43 million bpd in 2050. Demand in 2050 will be 1.36 million bpd below demand in 2022.

Diesel demand is forecast to decline at an average rate of -0.46%/yr, falling from 3.96 million bpd in 2022 to 3.48 million bpd in 2050, a loss of 0.48 million bpd.

Only jet fuel demand is forecast to continue to grow. Demand of 1.55 million bpd in 2022 is expected to increase at an average rate of 1.27%/yr, with demand reaching 2.2 million bpd in 2050.

The AEO forecast does not include dramatic changes in oil prices. The reference case forecast assumes that the spot prices for WTI crude will rise from US$86/bbl in 2023 to US$91/bbl in 2024, so high prices are expected throughout this year. However, the AEO forecasts that WTI prices will subside to US$85/bbl in 2025, then begin a gradual climb to US$90/bbl in 2034, US$95/bbl in 2044, and US$98/bbl in 2050. Between 2022 and 2050, this will amount to a crude oil price increase of a mere 0.1%/yr. In contrast, refined product prices are forecast to decline between 2022 and 2050: gasoline by -0.8%/yr, diesel by -1.0%/yr, and jet fuel by -0.7%/yr. Therefore, the AEO is not assuming that fuel demand will be pressured down by

high prices; rather, the long-term decline will be structural and intended. For example, fuel efficiency is expected to increase by 0.8 - 1.4% depending on the type of vehicle, while the use of electricity in the transport sector is forecast to grow at 9.7%/yr between 2022 and 2050.

Conclusion: US recovery becoming visible

COVID-19 wrought havoc in the US and the world. The Centers for Disease Control and Prevention (CDC) reports that nearly 6.8 million people in the US have been hospitalised to date, and over 1.17 million have died. Stay-at-home orders were launched in 2020 to slow the spread of the disease. Even with this, there were weeks in 2020, 2021, and even 2022 with death tolls in the tens of thousands. The 2020 lockdowns closed businesses, and millions of people lost their jobs. The Bureau of Labor Statistics reported that 0.21 million people filed initial jobless claims during the week of 7 March 2020, consistent with historic averages. This skyrocketed to 6.87 million jobless claims during the week of 28 March 2020, after the lockdowns were launched. The Bureau of Economic Analysis reported that US GDP shrank -5.3% in 1Q20 and -28% in 2Q20.

At last, the US is recovering. The economy is expanding. Job formation has exceeded expectations. People are working, and their wages have increased. This has helped purchasing power keep up with inflation. Oil prices, and therefore prices for many goods and services, remain high. Much of this is attributed to the Russia-Ukraine war and the Israel-Hamas war.

US refineries are running at healthy utilisation rates, though capacity and throughput are below their 2019 levels. Fuel demand has risen, though it remains below its 2019 level. The AEO forecast anticipates that gasoline and diesel demand will gently decline in coming decades. Jet fuel demand has rebounded the most successfully, and demand is expected to continue to grow. The recovery of fuel demand has occurred despite high prices, indicating that a certain level of demand is robust and largely price-insensitive.

The US is the world’s largest economy, and its myriad parts function in mysterious and interconnected ways. The pandemic caused economic wounds that have taken years to heal. It is not easy to see signs of recovery. Yet they are all around, and at last becoming visible. If the country is able to stay the course, 2024 should continue to bring recovery.

References

1. https://www.federalreserve.gov/data.htm

2. The Employment Situation, January 2024, US Bureau of Labor Statistics, https://www.bls.gov.

3. https://www.bls.gov/opub/ted/2023/slower-growth-isexpected-in-the-population-labor-force-and-gross-domesticproduct-through-2032.htm

4. http://www.sca.isr.umich.edu/

5. Energy Institute and BP, Statistical Review of World Energy.

6. www.eia.gov/outlooks/aeo

March 2024 HYDROCARBON ENGINEERING 20

Figure 4. AEO forecast of demand for gasoline, jet fuel, and diesel (million bpd). Source: US EIA.

Colin Frazier, American Petroleum Institute (API), explains how the API’s Process Safety Site Assessment Program (PSSAP®) can help hydrocarbon processing plants improve the safety of operations.

With a history of safety advocacy dating back to 1924, the American Petroleum Institute (API)’s commitment to enhancing safety practices in the natural gas and oil industry is a proactive and continuous attempt to continually enhance safety benchmarks. This commitment has been shaped by evolving industry needs, reflecting a deep commitment to safety. In response to this commitment, API introduced the non-profit and voluntary Process Safety Site Assessment Program (PSSAP®) for the hydrocarbon and chemicals processing sector in 2012, which has been helping processing plants worldwide improve their process safety management programmes. Appropriate for any site that processes hydrocarbons or chemicals, PSSAP’s industry-created good practice protocols help sites guide their continuous improvement

efforts, whilst also providing necessary benchmarking that allows them to compare the maturity of their programmes with those of their peers.

Programmatic benchmarking efforts

PSSAP is applicable to any site that processes hydrocarbons, chemicals, or is otherwise regulated by OSHA’s Process Safety Management (PSM) regulations. While API does not conduct regulatory audits, PSSAP addresses many of the same areas covered by OSHA’s PSM. However, PSSAP diverges in its approach by drawing on industry expertise to inform what good practice looks like globally, aiming to help sites mature their process safety management programmes far beyond what is required by OSHA’s PSM.

March 2024 21 HYDROCARBON ENGINEERING

In addition to bringing expertise to these sites to help them understand industry good practices, API benchmarks these site-specific programmes. This quantification of site-specific maturity gives sites the ability to compare their performance, in a blinded and anonymous way, with the maturity of other sites. After their assessment, sites are given a readout of their performance and benchmarking information that provides them with a statistical-based analysis of their performance across the industry. Additionally, they can discuss with the assessors how to better mature programmes relative to the 600+ requirements contained in the PSSAP protocols, which can help sites populate continuous improvement plans.

Since 2012, API has conducted over 180 PSSAP assessments at sites around the world. These comprise refineries, petrochemical plants, LNG processing, tank farm operations (both adjacent to refineries and standalone), and chemical plants of varying sizes and throughput volumes. PSSAP is successful at assessing sites of all sizes, from small plants with relatively small throughput, all the way up to the largest refineries in the world with the highest throughput. As a result of the programme’s success at assessing such a large number of sites, API has confidence that the benchmarking is representative of the industry and can therefore be used to understand larger industry trends. API and the Advancing Process Safety Initiative (APS), a joint initiative to improve process safety with the American Fuel and Petrochemical Manufacturers (AFPM), analyse the

benchmarking data for both trends in industry-wide improvements and in areas that require further attention from industry to help improve performance.

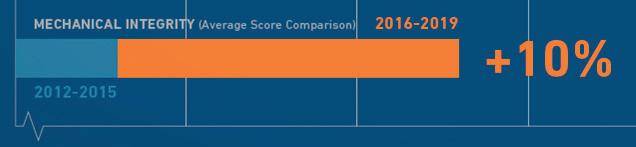

When PSSAP first analysed the benchmarking data, it was discovered that some specific topics within the mechanical integrity umbrella could use more specific emphasis and industry tools. As a result, APS began programmatic efforts to address walk-the-line topics, creating and distributing tools widely across the industry. Because of these efforts, PSSAP was able to quantify how well these programmes were improving across the industry in subsequent years. These walk-the-line efforts by APS were followed by an increase in the industry benchmarking average for the topic by approximately 40%.

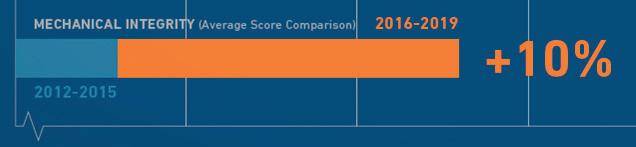

With the focus of walk-the-line efforts, a larger focus on mechanical integrity topics followed, and these combined efforts produced a benchmarking average increase of 10% across the entire mechanical integrity topics on average (Figure 1).

While these technical topics rarely get the attention they deserve, these stories are integral in explaining the industry’s commitment to continuous improvement in process safety management. Mechanical integrity is a foundational and arguably paramount topic in process safety management, and seeing this amount of improvement in the average industry benchmarking scores in less than a decade is a testament to the industry’s commitment to ensuring process safety at processing facilities.

PSSAP as a continuous improvement driver at sites

One of the questions API is continually asked by industry is: “Should we be doing these assessments at any particular cadence?”

Because these assessments are voluntary in nature, API’s advice has always been as follows: when you think you have made progress toward your continuous improvement plans, conduct a repeat assessment to assess and quantify those efforts. This considers that meaningful improvements to these process safety management programmes often take several years to plan and implement, as they take substantial resources, and sometimes face changes in company culture and/or company policies and procedures. This often takes time and diligence when working in large corporate management systems.

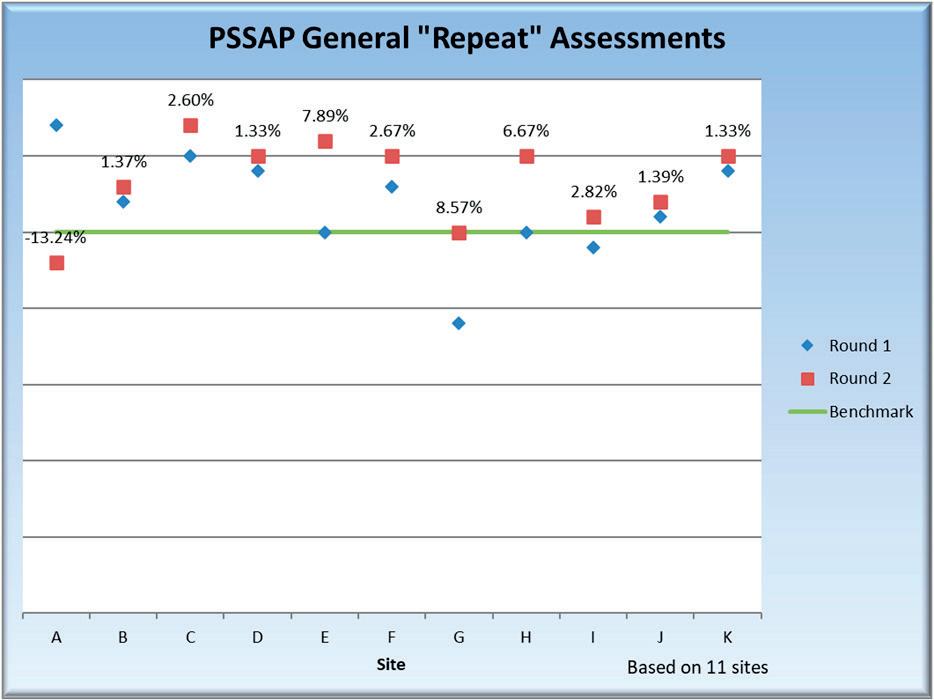

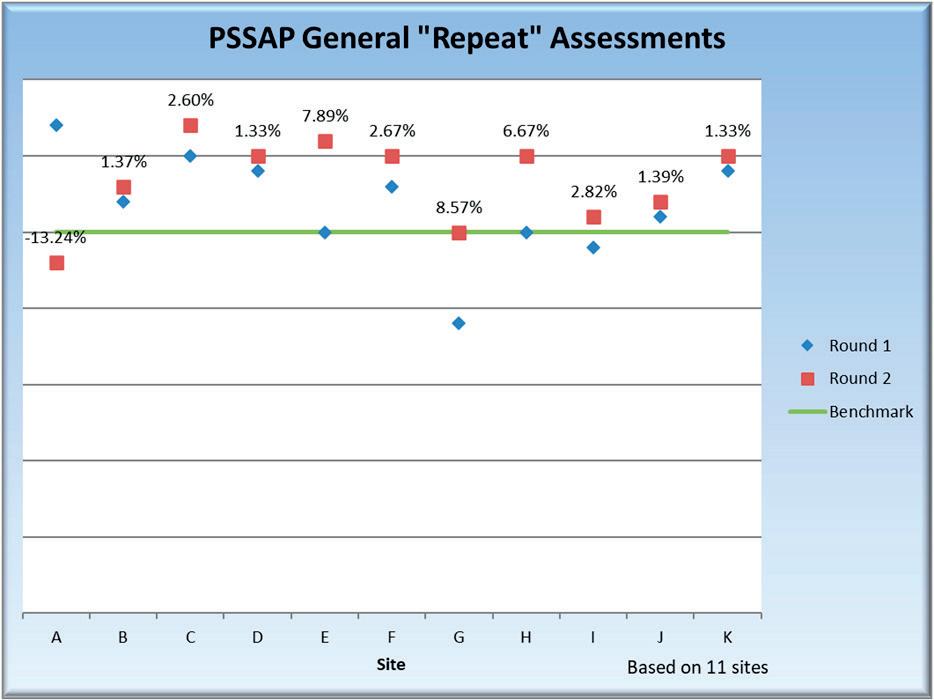

However, in 2023, API analysed sites that conducted repeat assessments to glean insights around repeat assessment cadence and when repeat assessments would be most beneficial. At the time of the analysis, 11 sites had conducted repeat assessments. Benchmarking data was reviewed to look for any areas of improvement, the time between these assessments, and other factors that could contribute to a site’s scoring changes. Below is an excerpt of a paper presented at ADIPEC in Abu Dhabi, UAE, in October 2023:

“As seen in Figure [2], all sites except for one, showed an increase in the scoring seen in subsequent assessments. The increase in scoring ranges from 1.33% to 8.57%. Additionally, it should be noted that all

March 2024 HYDROCARBON ENGINEERING 22

Figure 1. Average mechanical integrity performance scoring, comparing average scores seen from 2012 - 2015 with average scores seen from 2016 - 2019.

Figure 2. PSSAP assessments comparing total performance of a site’s first assessment with their second assessment as a percentage (%) of improvement.

The new 6X radar level sensor is so easy to use, it’s simply a pleasure. Because we know customers value not just ‘perfect technology’, but also making everyday life better and less complicated. We wouldn’t be VEGA if measurement technology was our only value.

PRECISION, SIMPLICITY, COMPATIBILITY. THE 6X ®. OUT NOW!

HOME OF VALUES.

VEGA.

GET TO KNOW THE 6X® www.vega.com/radar

sites, except for the one, scored above the overall ‘benchmark’. The benchmark in Figure [2] refers to the average score achieved by all the sites that have conducted assessments (average calculated in 2023). This is to say, the 10 sites who saw an improvement are performing better than the industry average in 2023.

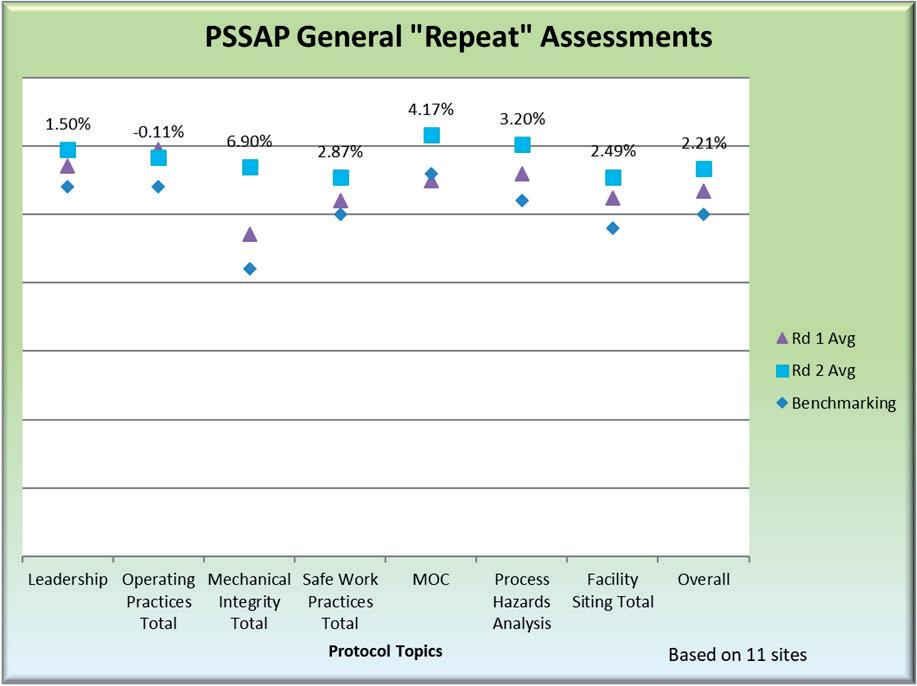

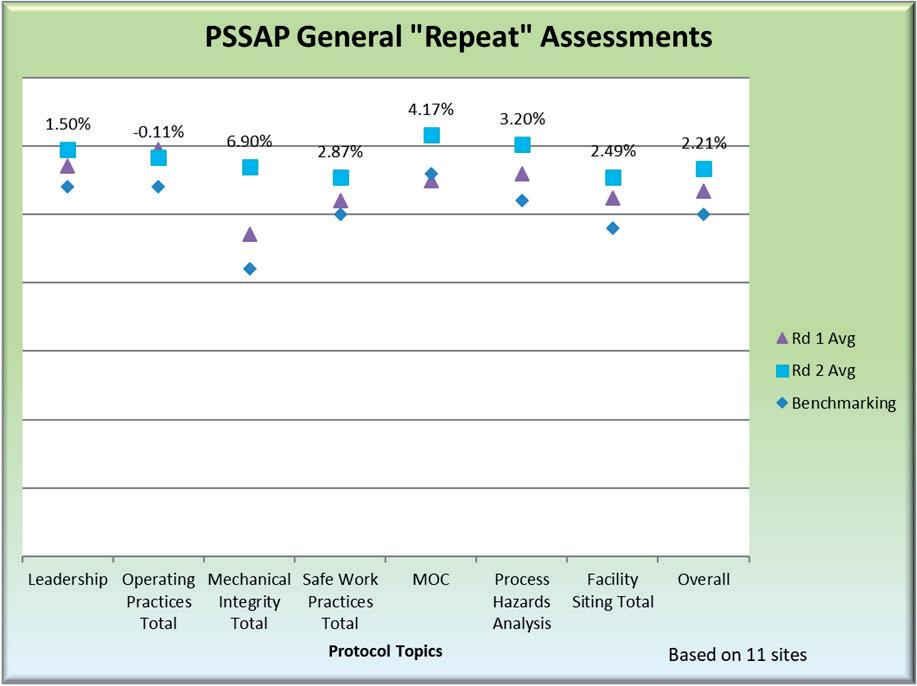

“This analysis presents some interesting findings: all protocols saw an increase in the average scoring per protocol, except for the operating practices protocol, which saw a decrease of 0.11%. Because the magnitude of change is so low, we do not believe there is a meaningful decrease in performance for that protocol. Conversely, those that saw improvement saw a much larger magnitude of change, ranging from a 1.5% average improvement to a 6.9% average improvement.

Of the improvements seen here, the mechanical integrity protocol is the most interesting, as it represents a key component of process safety management, one that PSSAP views as being weighted more heavily than others.”2

This aligns with the performance improvements across PSSAP that are being seen in the mechanical integrity assessment protocol, and it is good to see repeat assessments echo this trend. A 6.9% average improvement in scoring across 11 sites is a large increase, given the large scope and effort that mechanical integrity programmes represent.

Finally, of the 11 sites, those that saw the largest percentage improvements in their overall scores conducted repeat assessments between three and six years following their first assessment. This confirms API’s assumption that sites need time to truly implement meaningful change in these programmes. As a result, API can confidently assert that repeat assessments are effective at quantifying these improvements on a triennial cycle, assuming that sites dedicate the necessary resources to fulfil their commitments in their continuous improvement plans.

PSSAP’s future in the face of regulatory uncertainty

While PSSAP is not based on OSHA’s PSM regulation, and the API’s assessments are not regulatory audits, the topics covered as part of assessments are similar, albeit more focused on prevention rather than response. While API does not base assessment protocols on regulatory requirements, it is aware of how changes in regulations can impact industry and their management of programmes that are a component of regulatory compliance.

The American hazard materials processors are currently awaiting OSHA action in revising the PSM regulations; publication is expected soon. The refineries that API represents are no exception to this, and API is poised to comment on this regulation when it is proposed in the federal register. However, there will likely be implications that will need to be considered by PSSAP: if some good practices found in API protocols are made into minimum requirements, how will the programme change these requirements to ensure compliance is not the target? Should industry good-practice implementation be put on hold until we are comfortable with the new and/or changed requirements (just to name a few)?

PSSAP is committed to being a resource for companies in helping them continuously improve. PSSAP administrators are hopeful that participation in the programmes and pushing continuous improvements more broadly will help lessen the burden of compliance with the new OSHA PSM regulations. However, API and PSSAP will do what is necessary to evolve the programme to ensure it continues to be effective in the face of these upcoming changes.

API is planning one major change in 2024 that will ensure PSSAP continues to compliment OSHA PSM compliance efforts. A new offering involves a site licensing PSSAP protocols for their own use. This addition will help ensure that sites can conduct their OSHA PSM audits (separate from PSSAP) alongside PSSAP assessments. API has received considerable feedback that having to conduct these assessments separately presents resource strains. Conducting them side-by-side will help operators achieve their regulatory compliance goals while also using PSSAP to ensure that sites are looking at industry good practices simultaneously so that continuous improvements can continue to occur.

API believes this addition will inspire more sites to request assessments and will put good practice protocols in front of a more diverse audience.

Regardless of regulatory action, API and PSSAP are committed to being a key industry resource, sharing good practices and measuring site and industry-wide improvements so that the entire industry raises the bar on its performance expectations.

References

1. https://www.osha.gov/process-safety-management.

2. FRAZIER, C. M., and MENG, R. D., ‘Process Safety Site Assessment Program (PSSAP®): Do Repeat Assessments Help Assure Success?’, paper presented at ADIPEC, Abu Dhabi, UAE, October 2023, doi: https://doi.org/10.2118/216049-MS.

March 2024 HYDROCARBON ENGINEERING 24

Figure 3. Repeat assessment analysis focused on percent changes in average performance of all 11 sites which have conducted repeat PSSAP general assessments.

API’s

PARTICIPANTS

ENHANCING SAFETY PERFORMANCE ACROSS THE INDUSTRY PSSAP ® © 2024 – American Petroleum Institute, all rights reserved. API, PSSAP and the API and PSSAP logos are trademarks or registered trademarks of API in the United States and/or other countries. API Marketing & Communications: 2023-147 | PDF

learn more about PSSAP and take your first step toward your assessment, visit: ®

Process Safety Site Assessment Program (PSSAP®) demonstrates a commitment to a culture of safety and continuous improvement at refining, petrochemical and chemical sites.

www.API.org/PSSAP To

BENEFIT FROM SHARED LEARNING, INDUSTRY BENCHMARKING, EXPERIENCED

AND MORE

ASSESSORS

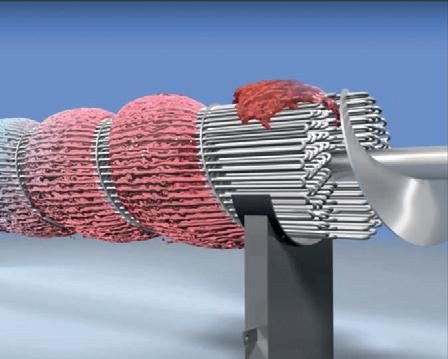

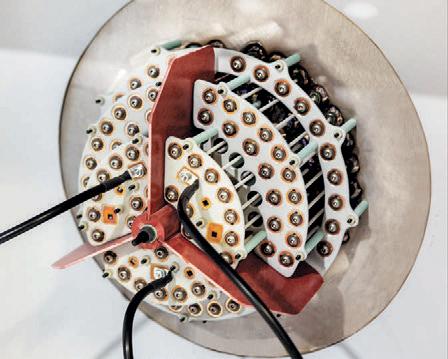

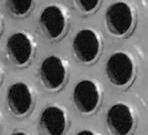

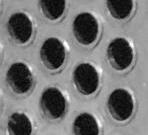

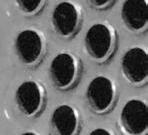

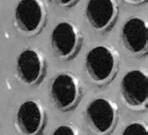

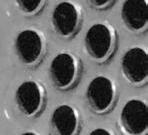

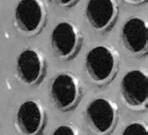

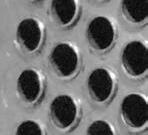

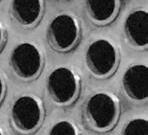

Richard Caulkin, Tim Michalec and James Esteban, UNICAT Catalyst Technologies LLC, explore how revolutionary scientific modelling allows tailored optimisation of filtration grading and loading profiles to deliver 50% improvements in catalyst bed life.

26 March 2024 HYDROCARBON ENGINEERING

Hydroprocessing is a crucial process in the refining and petrochemical industries, essential for producing high-quality fuels and meeting environmental standards. Included in the family of hydroprocessing applications are hydrotreating, hydrocracking, and hydroisomerisation, all of which play a key role in producing renewable fuels. During hydrotreating, raw feed streams react with hydrogen in fixed bed reactors that perform hydrodesulfurisation (HDS) – sulfur removal, hydrodenitrification (HDN) – nitrogen removal, hydrodemetallisation (HDM) –contaminant metals removal, and/or hydrodeoxygenation (HDO) – oxygen removal. Hydrocracking and hydroisomerisation processes also use fixed catalyst bed reactors that reconfigure hydrocarbon molecules through cracking and isomerisation reaction mechanisms. These catalyst beds operate at around 225 - 425°C and 30 - 150 bar, depending on the feed quality and processing conditions. These processes increase the efficiency of fuels and reduce harmful environmental contaminants in final products. Since these reactor systems have fixed catalyst beds, pressure drop across hydroprocessing reactors can be a challenge to maximising the overall life cycle of the catalyst materials.

High pressure drop in hydroprocessing reactors can lead to suboptimal catalyst performance, decreased reactor efficiency, feed maldistribution, shorter operating cycles, and increased operational, catalyst and maintenance costs. This article explores the use of UNICAT’s Advanced Filtration System (AFS) as a solution to mitigate pressure drop and enhance overall reactor performance.

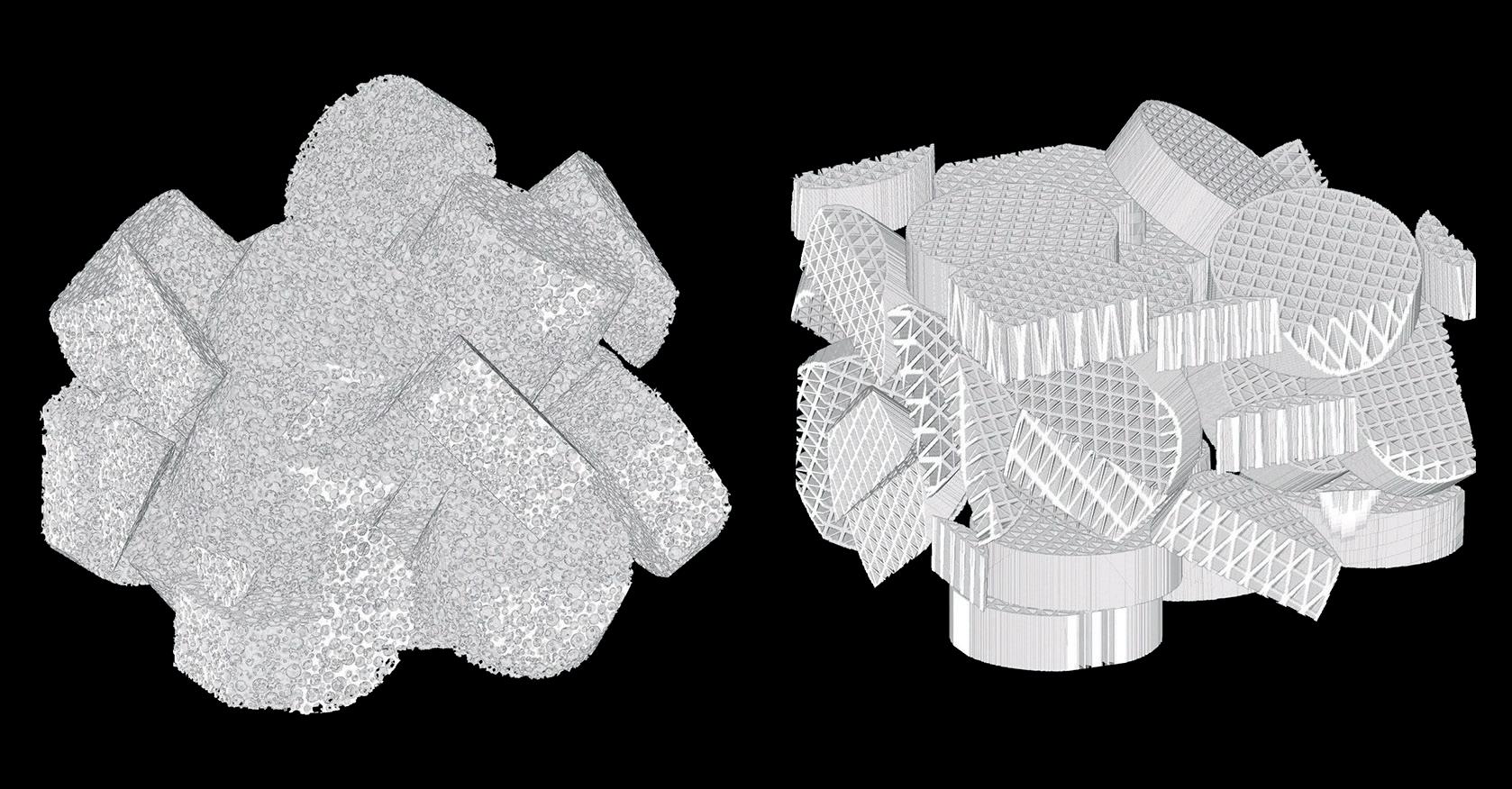

In addition to commercial data, a computational modelling case study of a generic hydroprocessing reactor is presented, highlighting comparative differences between reticulated ceramic and AFS filtration medias discussed.

Pressure drop discussion

High pressure drop in hydroprocessing reactors can negatively impact performance due to maldistribution of reactant streams, decreased conversion rates, shorter run cycles, and increased energy consumption. These issues not only impact the economic viability of hydroprocessing units, but also have negative environmental and regulatory impacts. Shorter operating cycles lead to increased spent catalyst disposal costs, lost revenue, and higher maintenance costs.

In hydroprocessing applications, the development of catalyst bed pressure drop is associated with catalyst bed fouling from a variety of potential causes including, but not limited to: feed stream contaminants, deposition of foulants, formation of coke, adverse side reaction products, and the deposition of feed poisons. These foulant materials can be deposited steadily throughout the operating cycle or during sudden unplanned events of adverse operating conditions, e.g. emergency shutdowns. Reactor pressure drop increases as the available void space in the catalyst bed is packed with foulant materials. New catalysts used in hydroprocessing applications have an available void space of approximately 35 - 40%. This available void space provides suitable volume for reactant vapour and liquid streams to evenly distribute across the catalyst bed, as well as provide longevity of performance and some tolerance for fouling over the cycle. As the available void space is decreased, pressure drop across the reactor increases and distribution of the reactant streams can be disrupted. This is where pressure drop mitigation grading plays a crucial role in catalyst bed protection. UNICAT’s AFS catalyst bed grading offers filtration that has nearly twice the available void space of fresh catalyst and is designed to evenly distribute foulants throughout the graded filtration media, as well as provide continuous flow channels to prevent the disruption of evenly distributed reactant streams.

March 2024 27 HYDROCARBON ENGINEERING

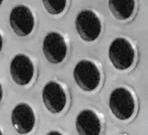

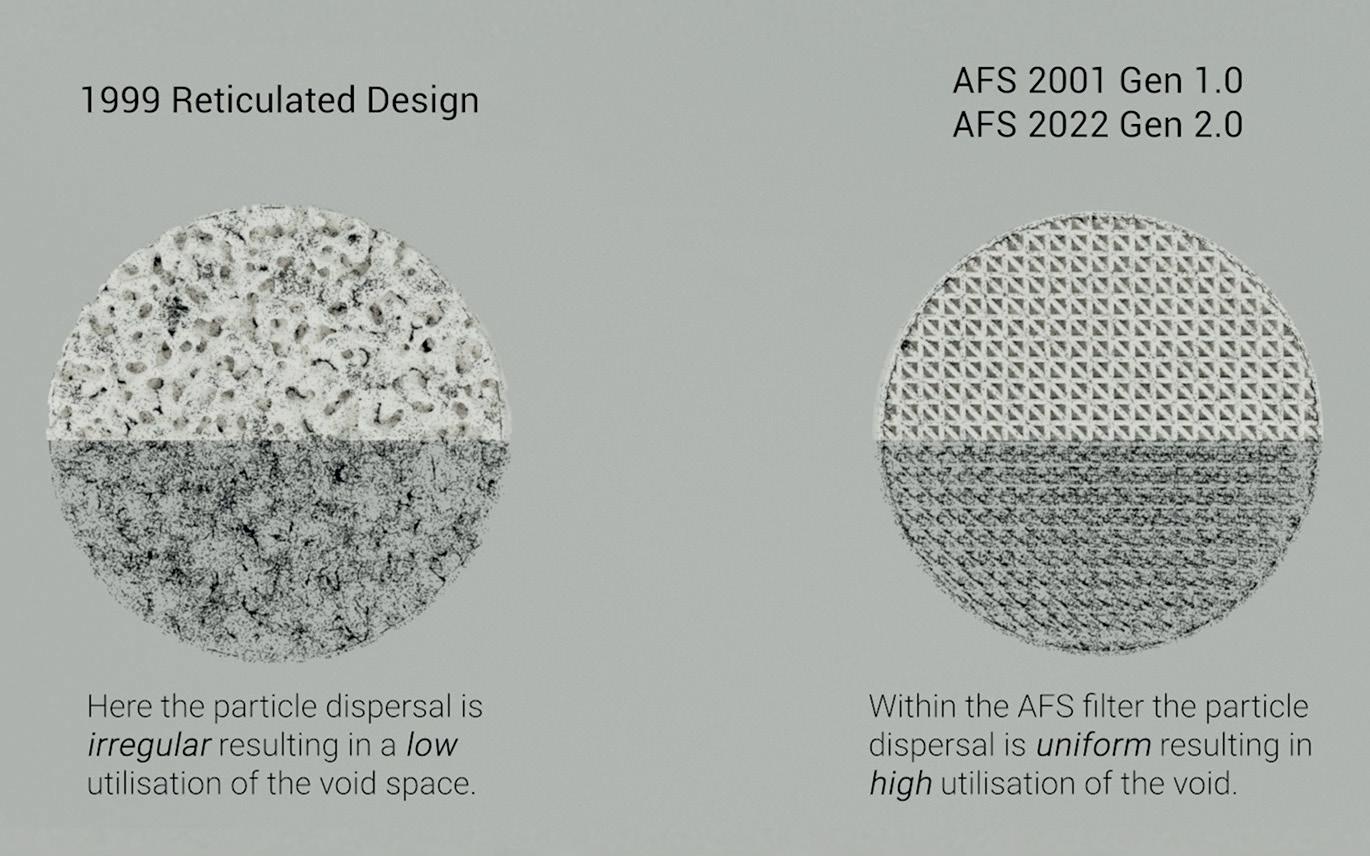

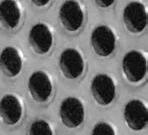

It is especially important to highlight that the distribution of reactant gas and liquid streams in mixed-phase applications is set by the reactor internal components. There are several case studies that highlight the importance of proper distribution achieved by modern reactor internals and the value associated with subsequent catalyst utilisation from upgrades in the mechanical components installed in these reactor systems. To maintain proper distribution, it is important that flow paths be maintained and not disrupted by either catalyst materials and/or foulants as they deposit in the reactor voids (Figure 1). UNICAT’s AFS is designed to provide high available void space to capture foulants, but also with uniform flow channels to allow for the retention of flow distribution to avoid poor catalyst utilisation (Figure 2). This results in greater catalyst utilisation over the entire lifecycle of the catalyst and a retention of even distribution.

Graded bed design

Implementing a well-designed grading system is one of the most effective ways to avoid long-term pressure drop increases. Initially, catalyst companies developed top bed grading systems to filter out fouling contaminants with varying degrees of success. These initial designs contained smaller spherical support balls, ‘wagon wheels’, and rings layered at the top of the bed. The

rings sat directly on top of the catalyst bed, which consists of cylinder or lobed catalyst particles. Using wagon wheels and rings was fairly successful, but it was limited due to internal void space in rings which are too large to filter the smallest contaminants. Particulates subsequently become trapped at the interface between graded ring layers – primarily between the final ring layer and the top of the catalyst bed. This area often has the only void spaces small enough to capture the smallest particulates. As these transition regions become packed, the overall cross-sectional open space is compromised, resulting in an increase in pressure drop, which can ultimately lead to premature shutdowns. Improvements in pressure drop protection from reticulated ceramics resulted in additional pressure drop protection.

The AFS has fixed triangular openings that provide enhanced particulate and contaminant trapping benefits. It offers high available void, high crush strength, optimised packing efficiency, low pressure drop and high particulate pick-up capacity. This deep bed filtration technology leads to longer cycles and improves unit profitability (Table 1).

UNICAT has combined commercial experience with detailed dynamic simulation technology to develop a new model for graded bed design. While AFS provides high capacity for particulate removal, it remains important that a complex model to complement this technology will provide optimal bed designs. Modelling applications demonstrate an increase in capacity for similarly sized graded beds with only traditional rings to AFS of up to 200%, and from reticulated ceramics to AFS of up to 150%. Due to the open design of AFS, effective capture volume is greater, which provides increases in catalyst cycle life by 1.5x to 2x respectively. Modelling enables bed grading designs to be optimised with cycle life targets and maximum catalyst activity without customers needing to wait multiple cycles before changing layer volumes. Historically, the primary method for graded bed design optimisation was to react in response to spent catalyst samples. The reality is that changes in design take one to two change out cycles before the collected evidence can be used to make improvements to the loading scheme. UNICAT combines historical performance with computational fluid dynamics (CFD) modelling to provide instant optimisation. This is important as processing objectives can change, and the company can respond to new operating targets for each operating cycle.

Case studies

The model used to generate data referenced within this case study is a packing prediction simulation tool, to which CFD can be applied to simulate fluid movement within the generated packing structures.

Within the model, both objects and the packing space are represented as collections of 3D pixels (voxels), with objects able to move independently of each other. As such, shapes of any complexity can be simulated, provided the resolution is sufficient to characterise the objects accurately.

In the case study reported, the external dimensions of AFS and reticulated pieces were roughly

March 2024 HYDROCARBON ENGINEERING 28

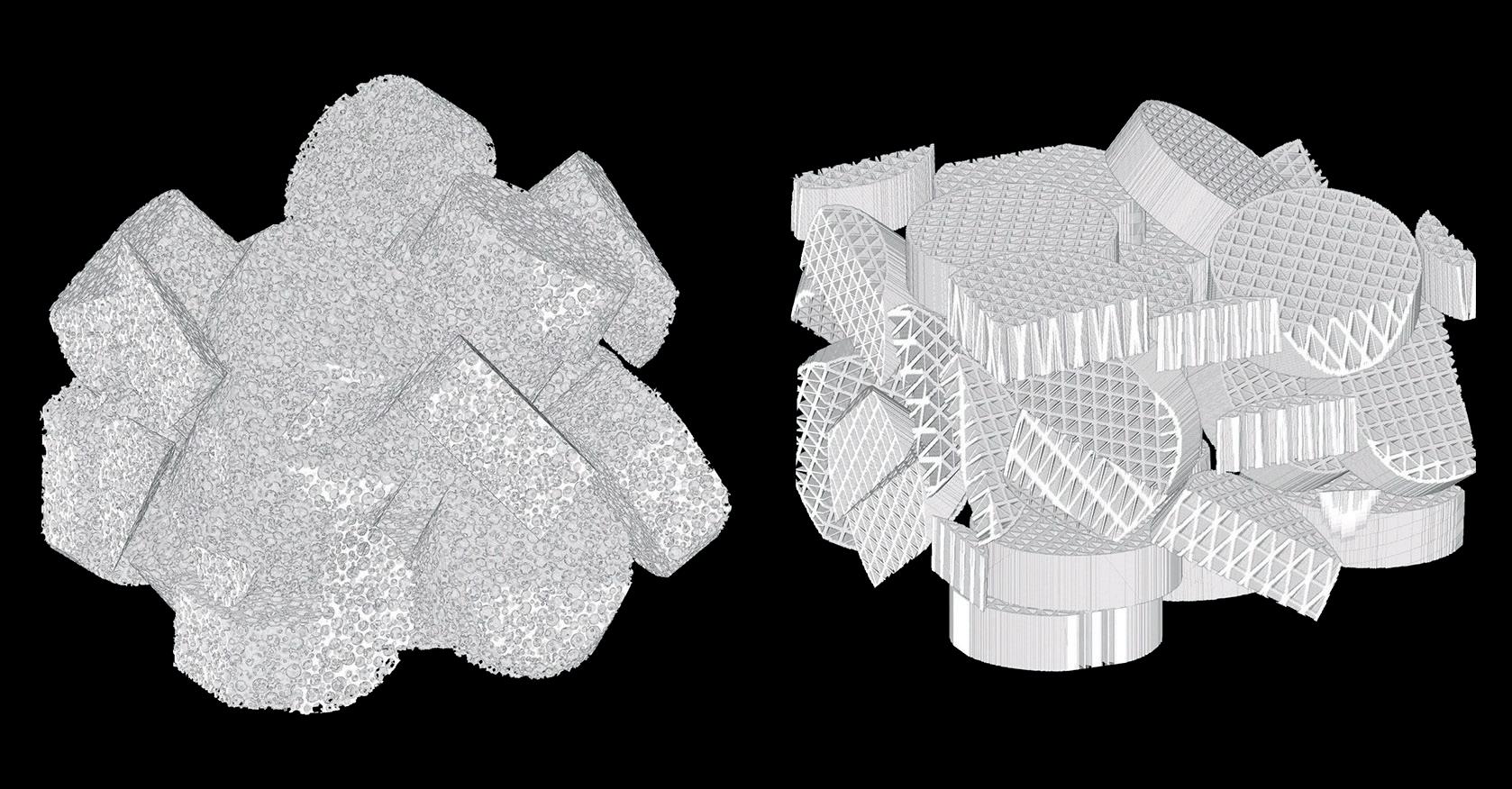

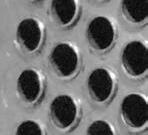

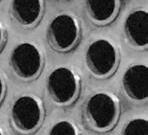

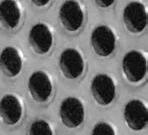

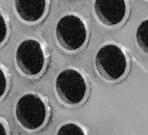

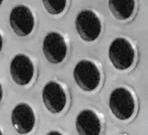

Figure 1. Cut-away images of (right) AFS 4510 and (left) reticulated ceramic filter media generated from UNICAT’s Revolutionary Computer Modelling Software.

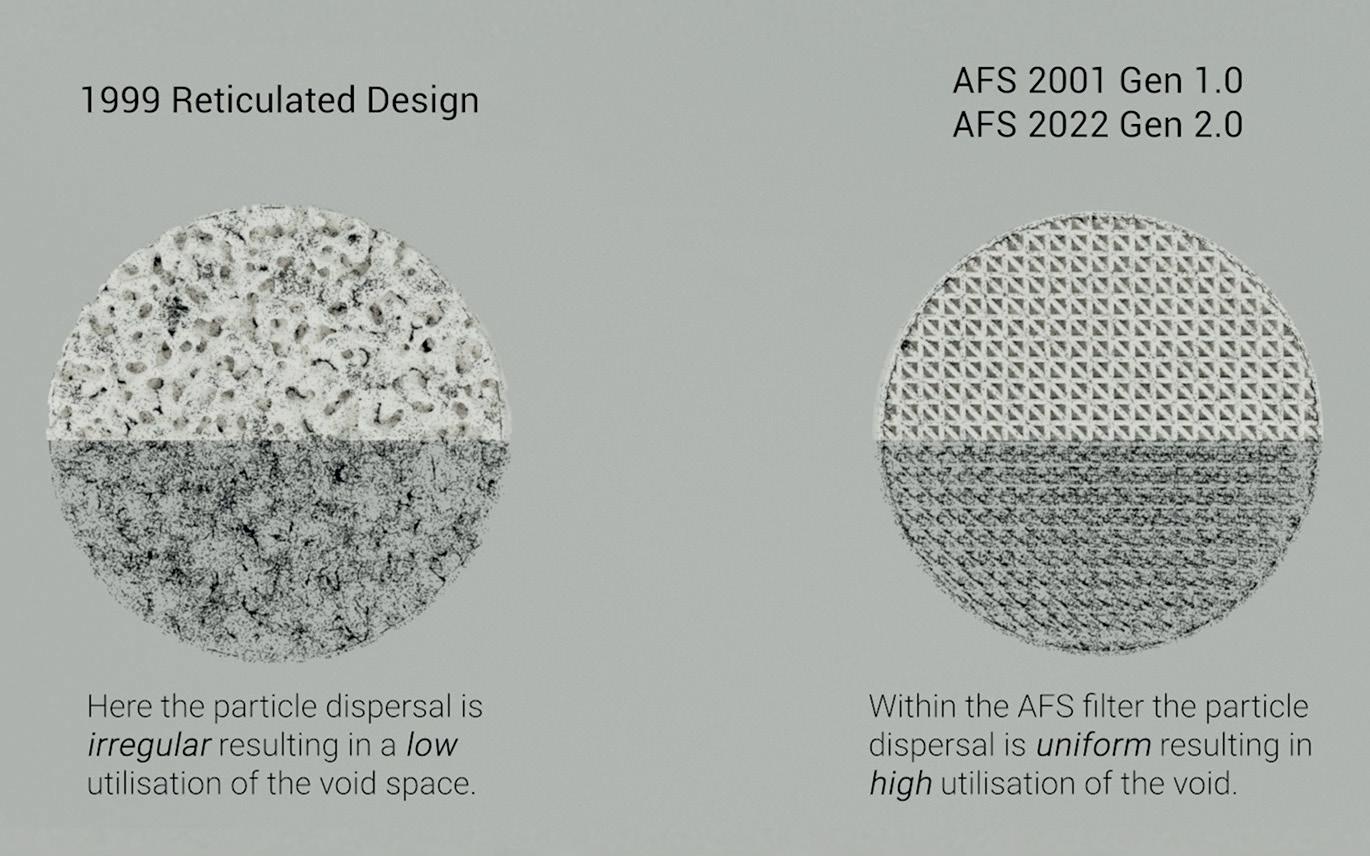

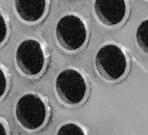

Figure 2. Showing the particle dispersal in Reticulated Design as irregular vs AFS being uniform.

equal; there is a 6% difference in total free void space between the graded AFS and the reticulated filter beds. However, internal capture volume differs by 33% in favour of AFS (Table 2).

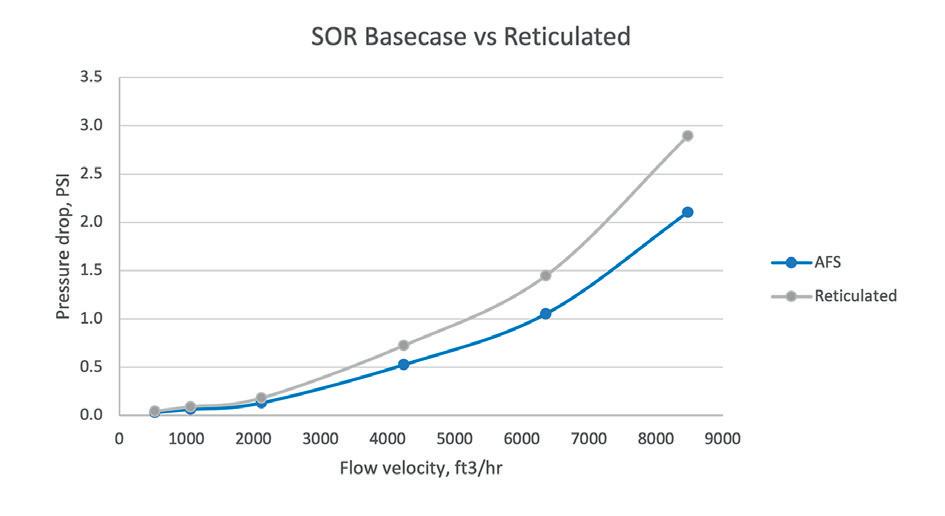

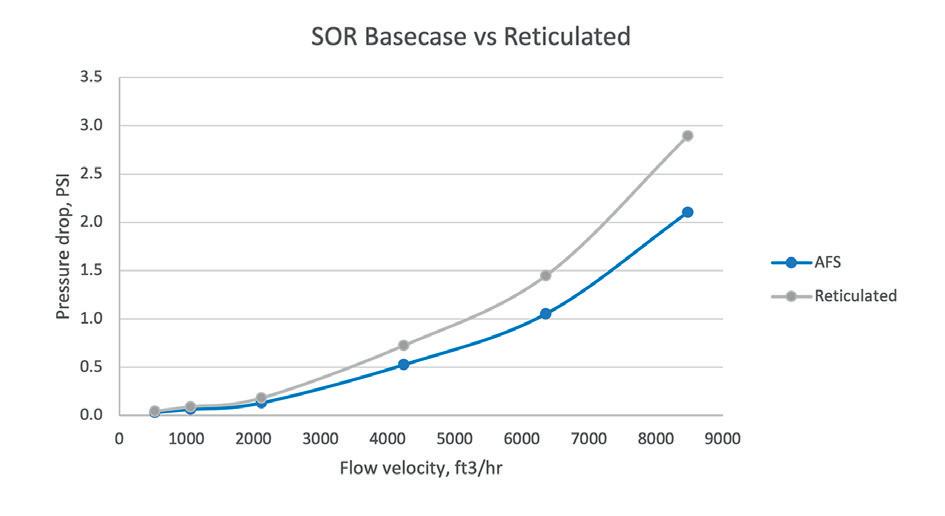

CFD simulations performed on the respective packings elucidated start of run pressure drops for the filter beds at different flow rates (Figure 3).

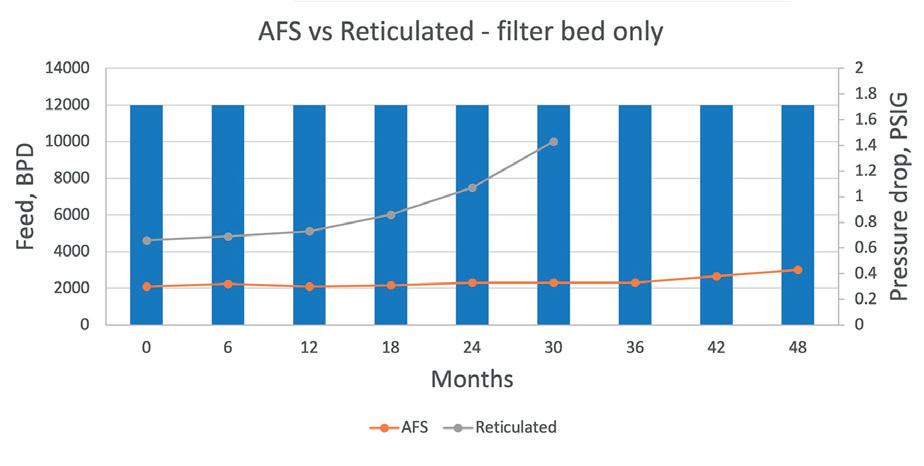

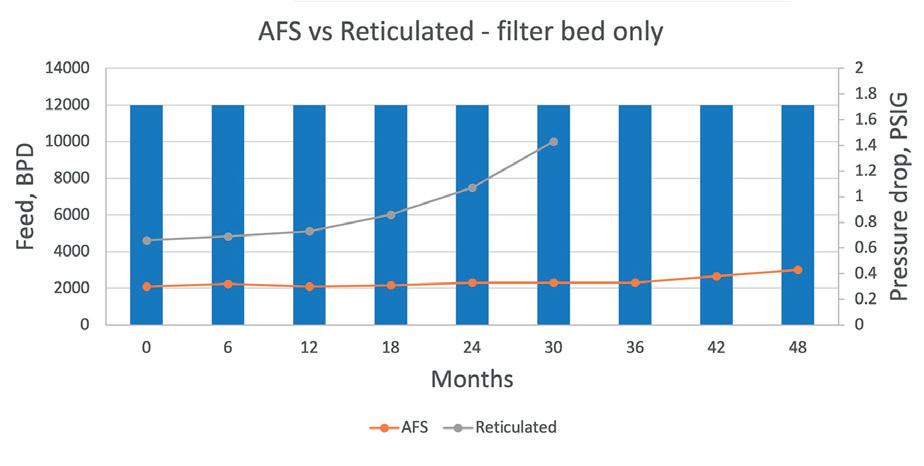

Modelling was undertaken to better understand how foulant of a specified particle size distribution and feed rate behaves when introduced to both filtration units over a typical

Reticulated ceramic AFS

Loading Reticulated ceramic various sizes AFS with silica-uptake rings

Lifetime Standard run 50% + run length for AFS

Note: both the loadings had equal grading volumes

internal capture volume, AFS

cycle (Figure 4). Solids were introduced in the reactor at a uniform rate of 5 mg/m3 over the life span, with the feed consisting of scales and flakes (> 1000 µm), coke (100 - 800 µm), iron sulfide fines (10 - 100 µm) and solid silica (10 - 50 µm). Particle size distribution was skewed to the fine size and was identical for both examples.

Pressure drop was measured incrementally at 6 month equivalent intervals over both filter beds. Both beds had a foulant removal efficiency of >98%.

Modelling demonstrated the differences between AFS and reticulated beds in terms of pressure drop stability vs onstream time. The highly tortuous internal paths within the reticulated pieces mean that foulants can block the void spaces relatively quickly, and do not fill each piece uniformly. Loading in each piece tends to occur quite high within the individual reticulated pieces, preventing effective filling of lower regions and preventing the full utilisation of the capture volume. Therefore, effective reticulated capture volume is around 50% of that of AFS (as opposed to the 33% measured), leading to increased pressure drop and greater feed maldistribution over a shorter cycle.

In the real-world data provided above, pressure drop begins to increase notably after 18 months for reticulated ceramics, compared to 36 months for the same feed conditions with AFS.

In order to provide a robust sense check for the CFD model, over the last two years UNICAT has had several optimised commercial applications which have validated the modelling software prediction tools within a 3% predictability range.

Conclusions

There is a clear correlation between the maximisation of catalyst bed lifecycle in hydroprocessing services and the application of pressure drop protection technologies for optimisation of overall process unit performance. In fixed bed reactor applications, AFS demonstrates several advantages leading to excellent performance regarding pressure drop protection and mitigation. AFS provides improvements in overall capture volume and initial pressure drop, which result in both lower SOR pressure drop, as well as sustained lower pressure drop. This results in a 150 - 200% lifecycle improvement.

AFS incorporates continuous uniform flow channels which are designed to improve both the even distribution of foulants as deposition occurs, as well as preserve the flow distribution set by the reactor internals. Preservation of flow channels provides maximisation of catalyst usage by supporting the even distribution of reaction components. The even distribution of foulants permits higher overall loading, optimal graded bed sizing, and reduction of catalyst change out cycles. This performance advantage is highlighted in the case study provided, demonstrating an overall longer operating cycle, as well as sustained lower pressure drop throughout the extended cycle.

Coupled with the experience of many commercial applications, UNICAT has developed a complex packing model for the simulation of performance and to develop predictive modelling capabilities. Scientific modelling allows tailored optimisation of graded bed requirements and loading profiles based on current reactor feed conditions. This provides a high level of confidence in the optimisation of process unit operating cycle life, as well as a real time method for performance predictions.

March 2024 HYDROCARBON ENGINEERING 30

Table 1. AFS vs reticulated ceramic

Bed height (in.) Reactor volume (ft3) Internal capture volume (ft3) AFS 211 999 194 Reticulated 211 999 139

Table 2. Comparison of

vs reticulated disc

Figure 3. AFS pressure drop vs reticulated over differing feed rates, start of run (SOR) for reactor Rx.

Figure 4. Predicted pressure drop vs time for an average feed rate of 12 000 bpd (2800 ft3/h or 80m3/hr).

Textured

agcat

www.globalhydrogenreview.com The Winter issue of GlobalHydrogenReview is out now Read the issue here Subscribe for free:

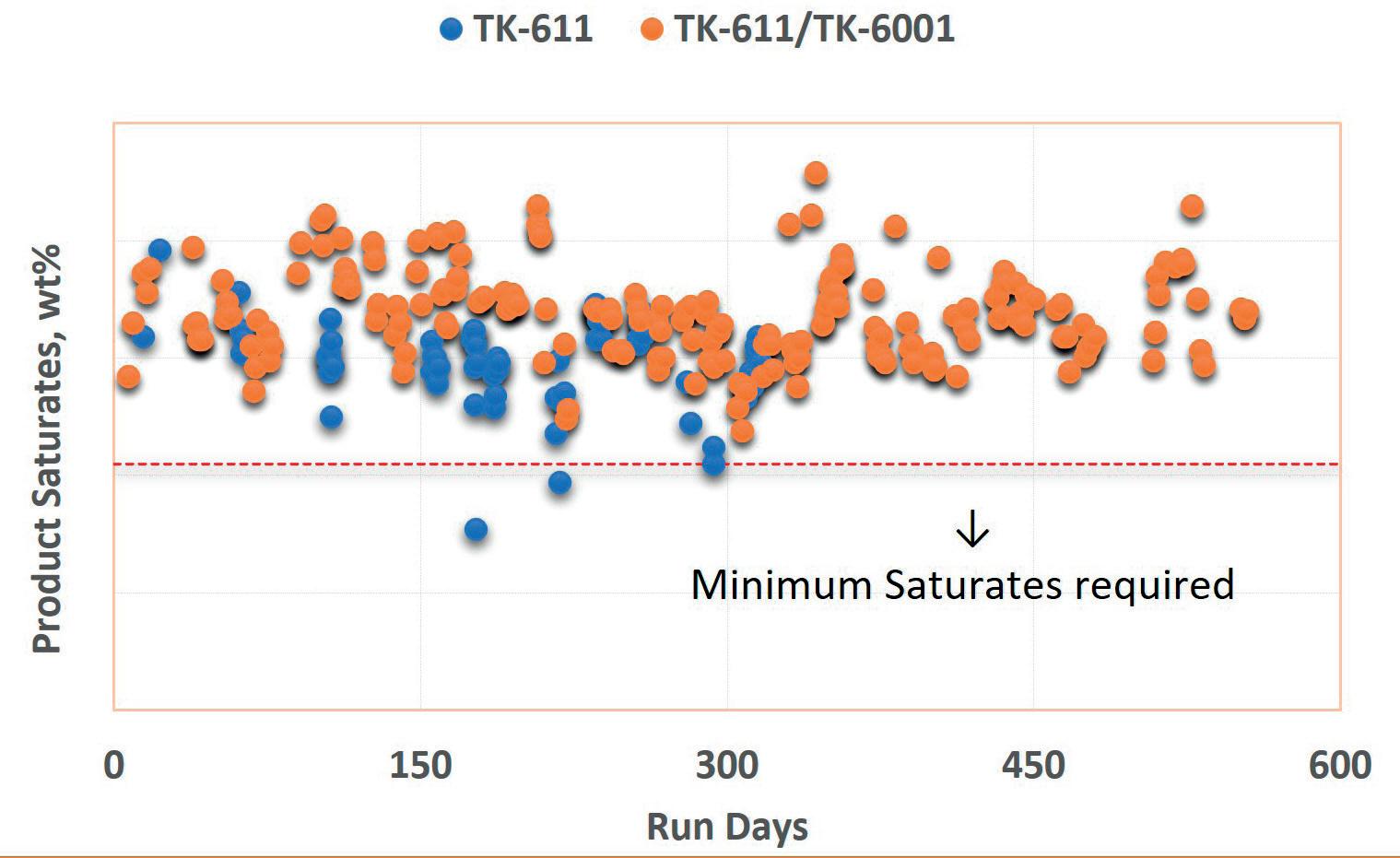

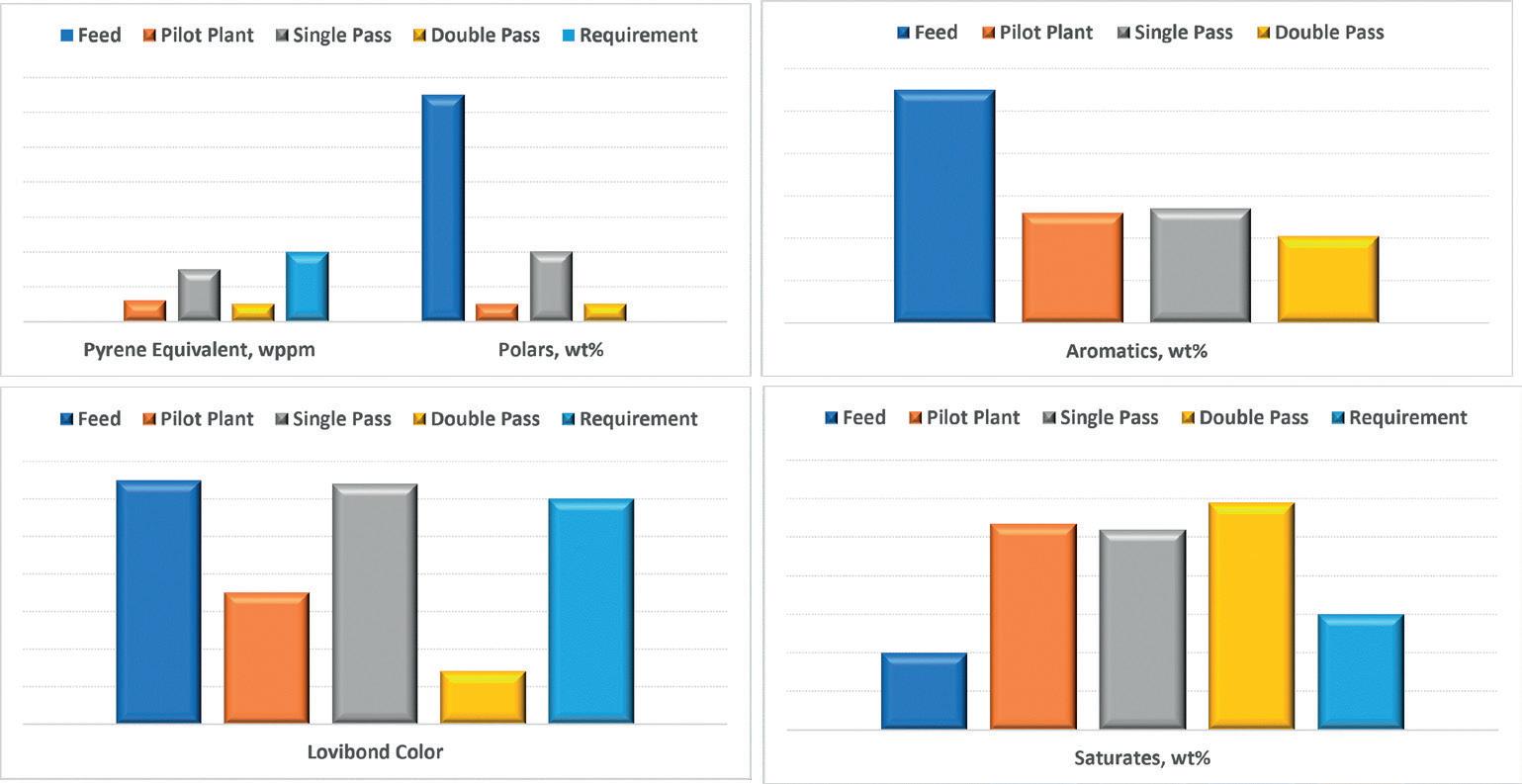

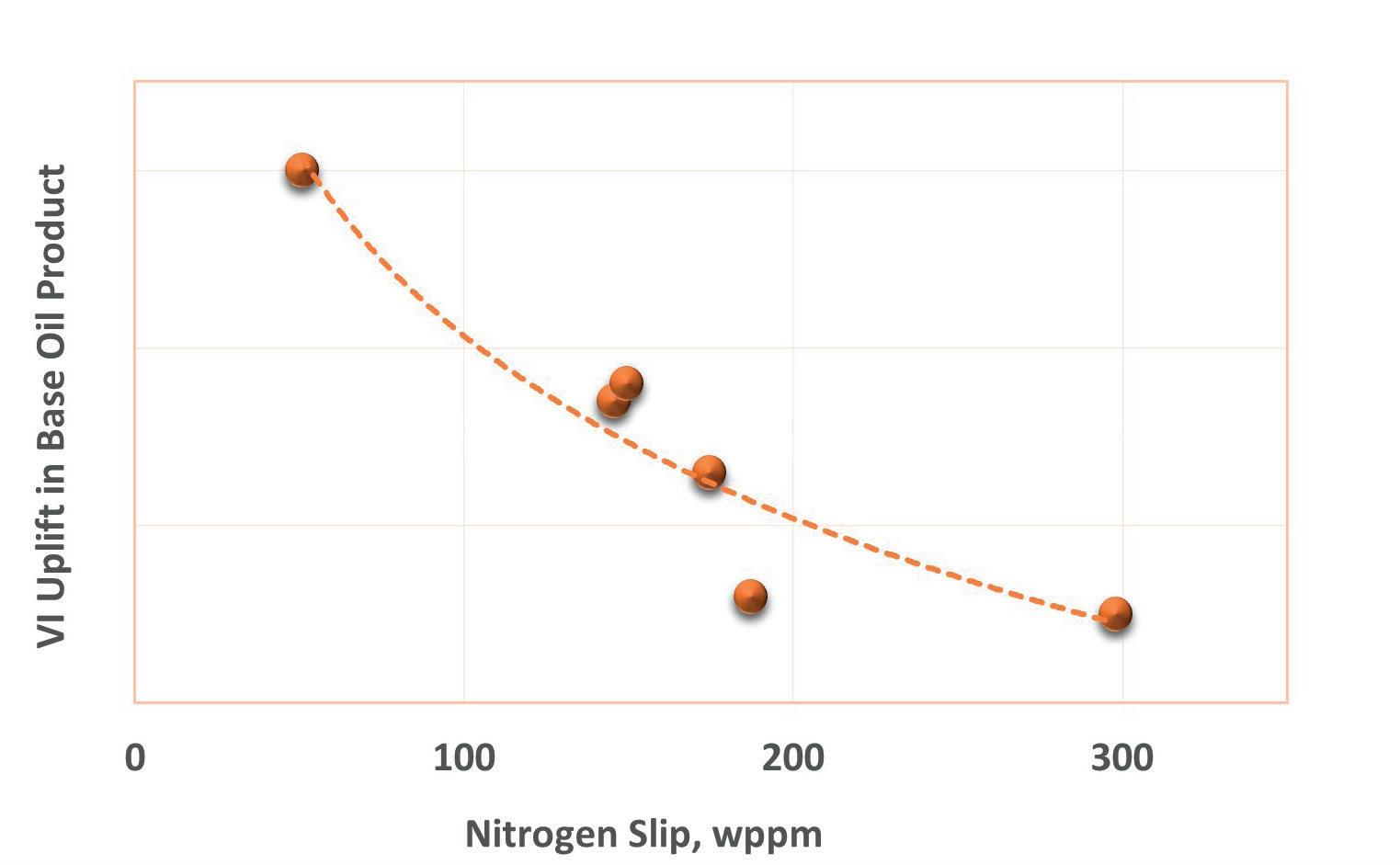

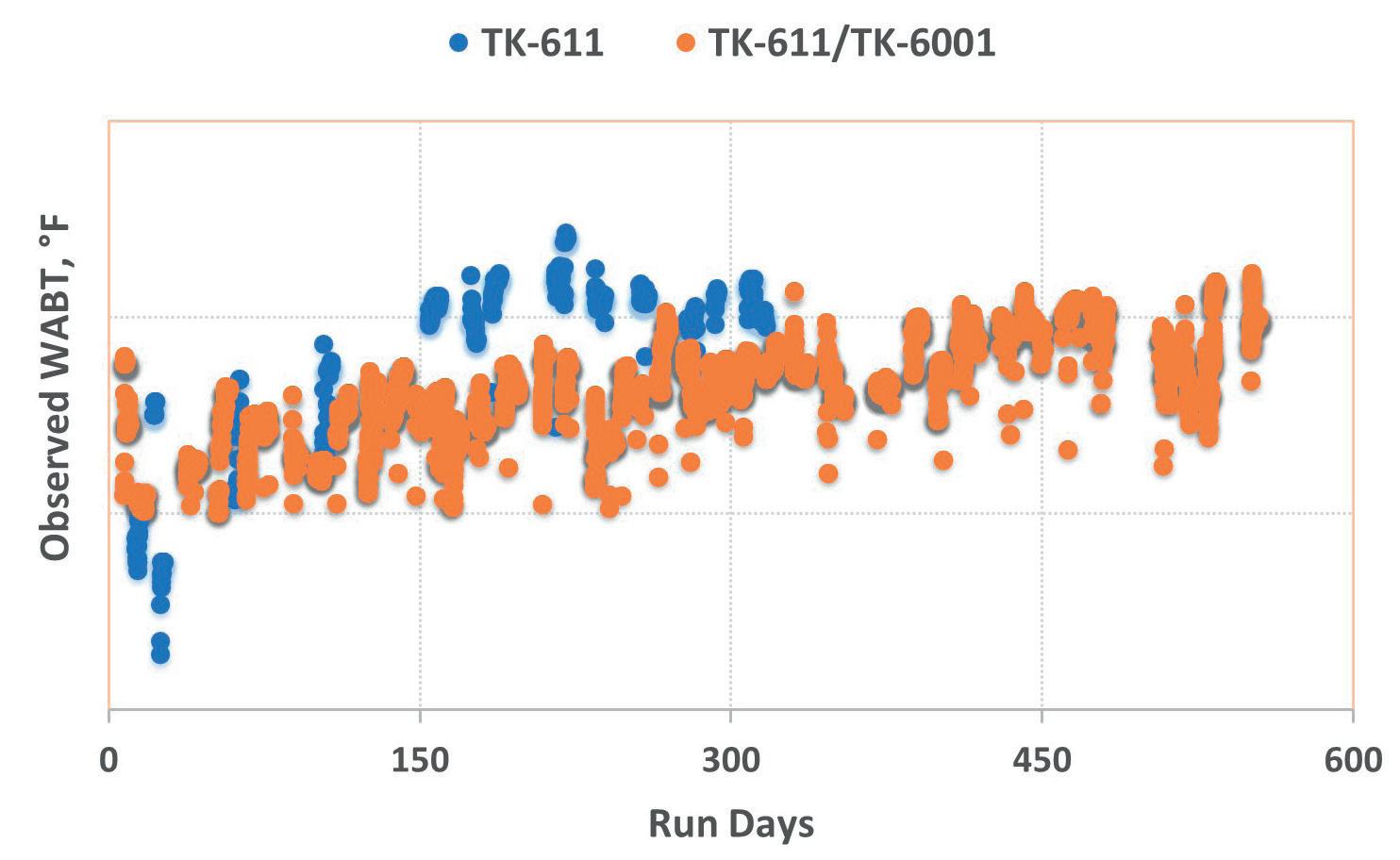

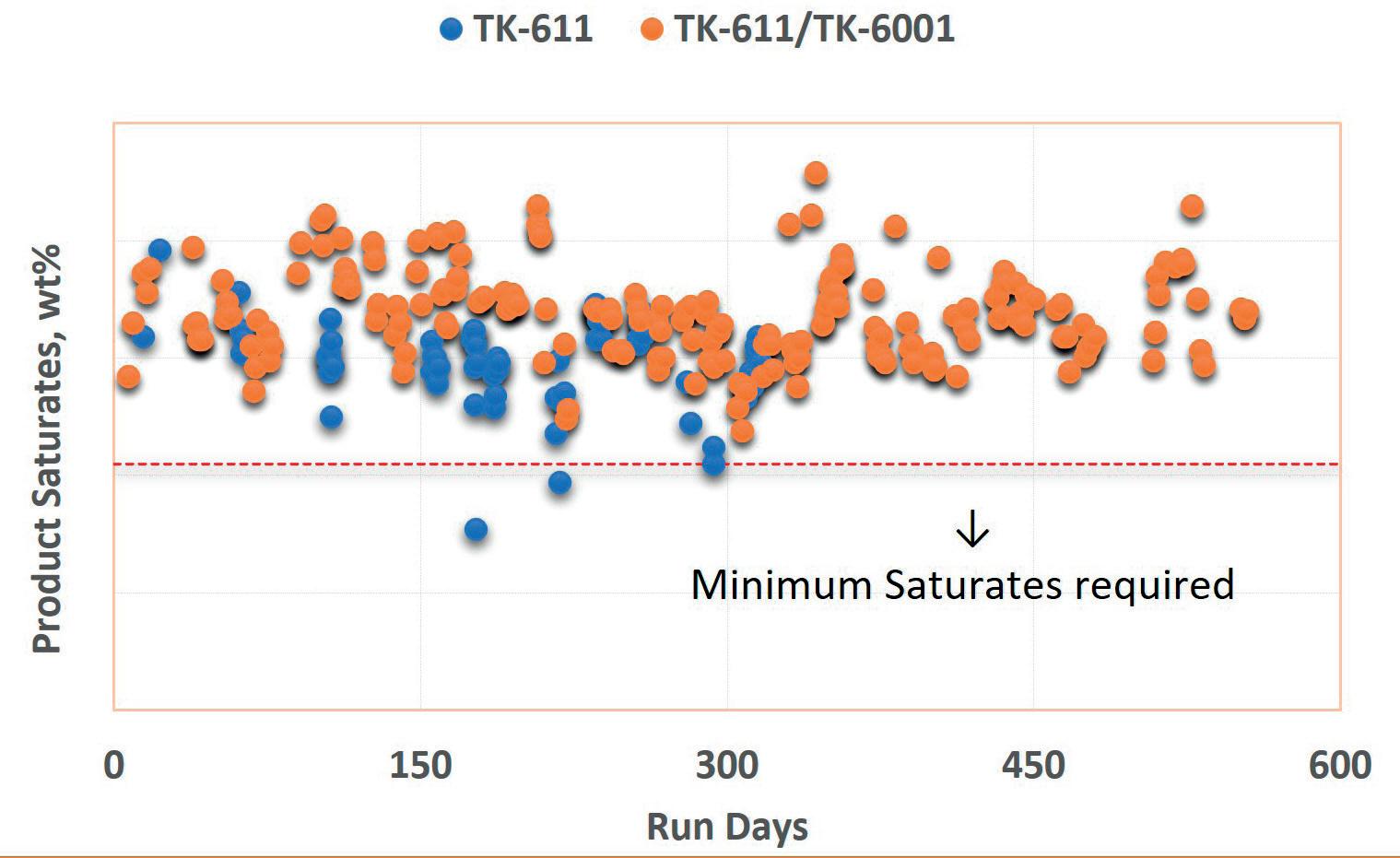

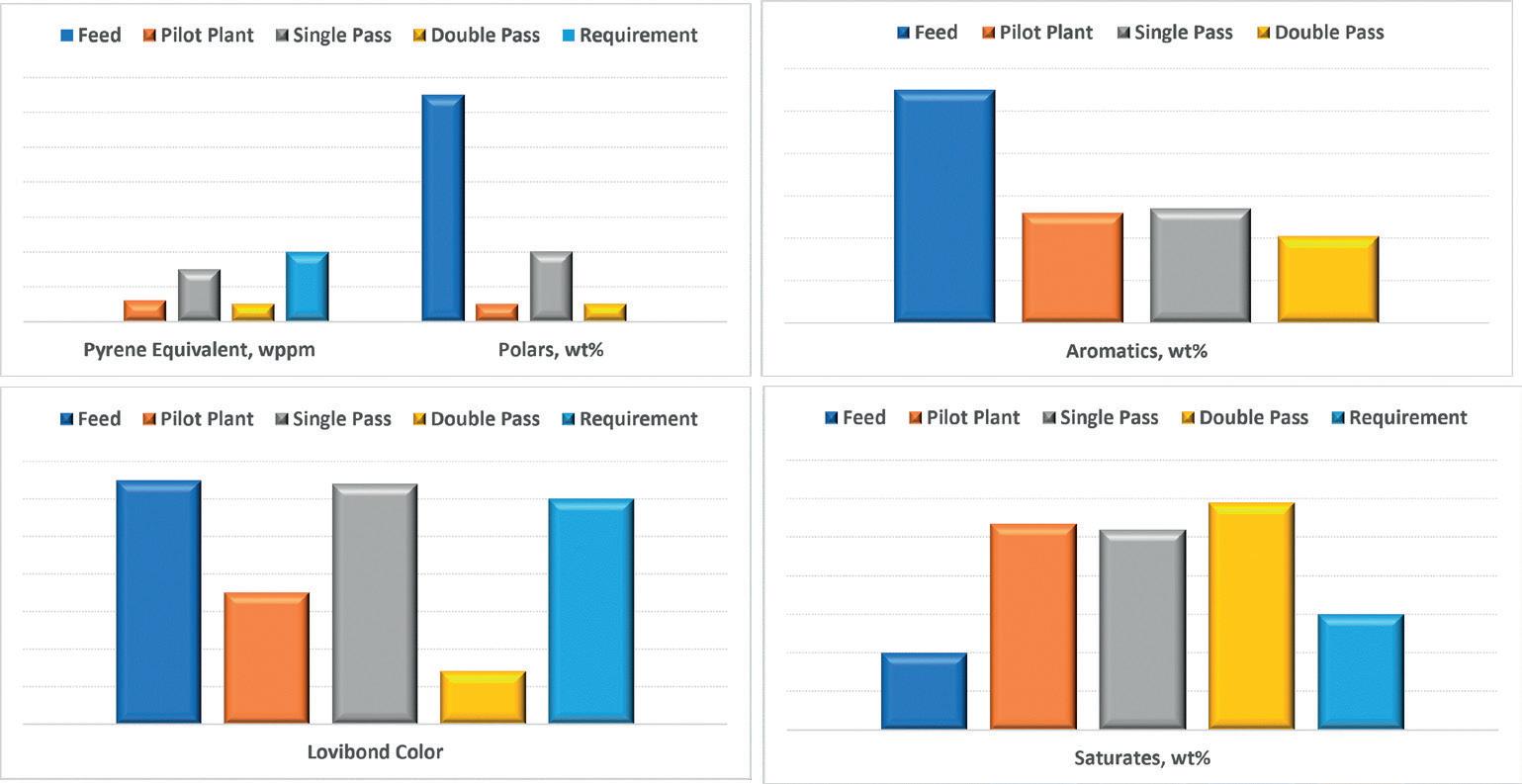

Lubricants, the finished product from base oil production along with special additives, touch nearly every aspect of our daily lives. Conventional solvent refining follows various chemical and physical separation methods, while modern hydroprocessing based technologies incorporate hydrogen environments for molecular rearrangement and selective cracking for maximum premium base stock production. The conventional lube manufacturing process includes multiple process steps of distillation and solvent extraction for VI upgrading, deasphalting to remove asphaltenes, solvent dewaxing for pour point improvement, hydrofinishing for colour control, and hydroprocessing for higher quality of base stocks produced. The distinction is usually that Group I base stocks are produced via conventional solvent-based technologies, while production of premium base stocks, i.e., Group II and III, utilises modern hydrotreating and/or hydrocracking technologies. The demand of premium base stocks will continue to grow in the future. The new capacities added to produce base oils are hydrocracking based technologies, which are expected to continue to play a substantial role in producing high quality lubes in the future. Emerging economies and growing industrialisation place a continually greater demand on lubricant yields and quality standards. Lube manufacturing technologies have advanced over time to support this requirement. According to market research, the 2023 lubricant market was valued at US$53 billion in 2022, with expected CAGR to be 3.9% from 2023 to 2030.1 This growth will be further fuelled by focus on energy efficiency and environmental sustainability, accelerating new innovations in lubricant composition. The lube oil feedstocks being derived from the bottom of the crude barrel present an inherent challenge of feed difficulty, therefore requiring advanced saturation, lube selective cracking, and dewaxing catalysts leading the way to produce high quality lubes.

Lube properties requirement

The base oil component largely dictates the performance characteristics of the finished lubricant. For perspective, up to 70% of automotive and diesel engine oils, and upwards to 99% in some industrial oils, is the base

Ashley Ashford and Rahul Singh, Topsoe, explain the importance of hydrocracking based technologies in producing high quality, sustainable lubricants.

March 2024 33 HYDROCARBON ENGINEERING

oil portion. There is a generally accepted classification of base oil groups set by API and outlined in Table 1.2 The idea is that within a group, base stocks of various viscosities, but compliant to these criteria, will be interchangeable without affecting performance.

Group I through III are derived from crude oil and the quality will largely depend on the refining process. Group II base oils are the first hydroprocessed category that may include a conversion catalyst, while Group III will certainly involve a conversion catalyst for the more stringent saturate and viscosity index (VI) requirements. The quality terms of greatest focus for Group I and II base oils are:

n Viscosity: a measure of fluidity.