April 2024

Maximize asset value through specialty chemical experience and expertise.

03 Comment

05 World news

08

Evaluating risks and diversifying economies

Gord Cope, Contributing Editor, discusses the state of the refining and petrochemical sector in the MENA region and reveals how countries are looking to tap into the green fuels sector.

14 2024: the year the world wakes up to methane emissions?

Mark Naples, Umicore Coating Services, considers how the threat of methane emissions can finally be conquered in the oil and gas industry.

19 SAF: viability, scale and economic advantage

Paul Ticehurst, Johnson Matthey, UK, discusses the importance of sustainable aviation fuel (SAF) for decarbonisation, the technology that supports large-scale production of this fuel, and the economic benefits it could present.

23 A new value for plastic waste

Antonio Batistini, Enrico De Dominicis, Massimo Di Amato, Barbara Morico, Emma Palo, and Paola Sclafani, MAIRE, Italy, explore how depolymerisation technology can support the creation of new circular value chains in the plastics sector.

29 A new circular plastic ecosystem

Kae S. Wong, Fabrice Cuoq, Giri Anupam, Omid Emamjomeh and Christoph J. Dittrich, SABIC Global Technologies B.V., alongside Rasha H. Daadoush and Vishvedeep Bhatt, Aramco, highlight how adsorption is an effective way to stabilise and remove chlorides in plastic derived oil (PDO) to protect downstream assets.

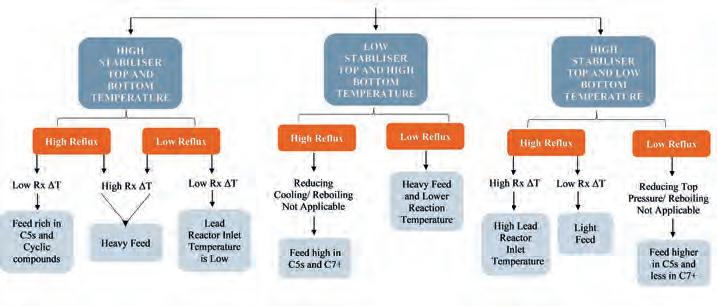

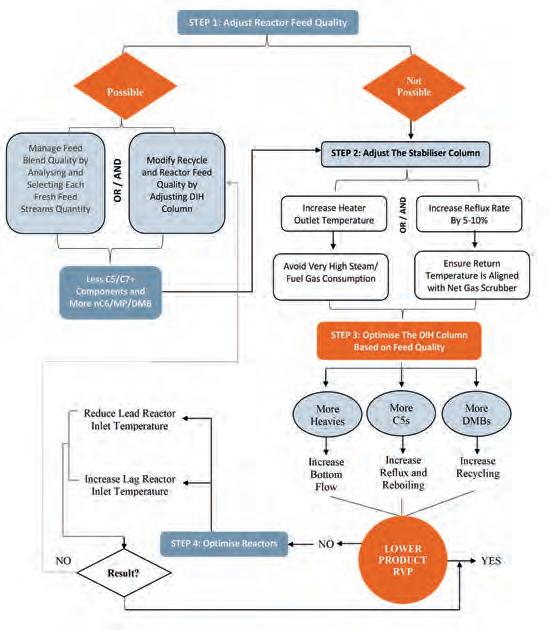

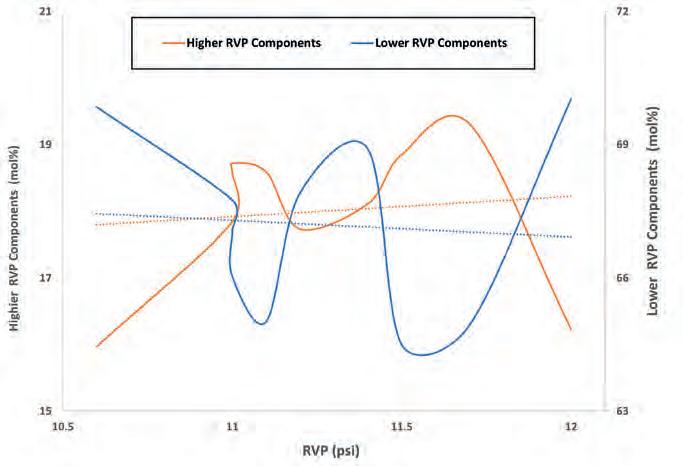

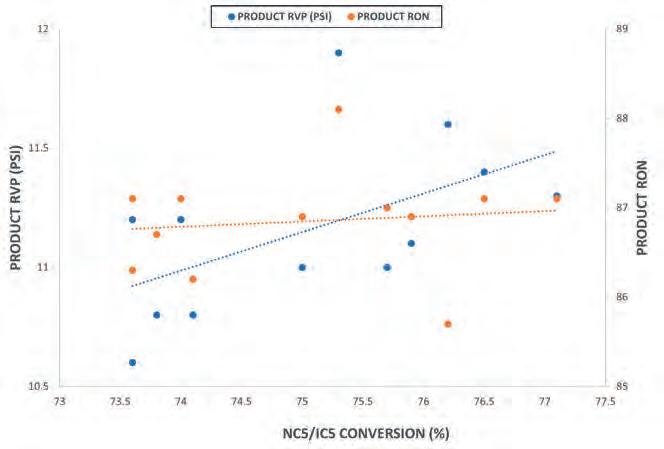

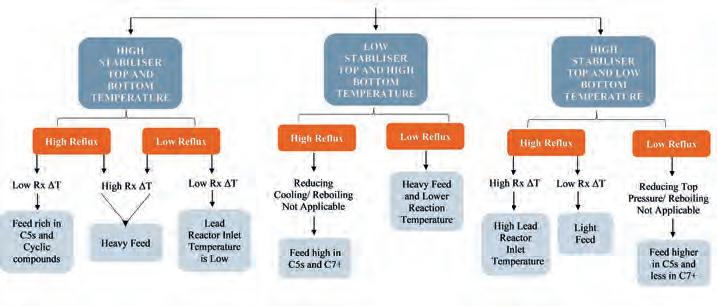

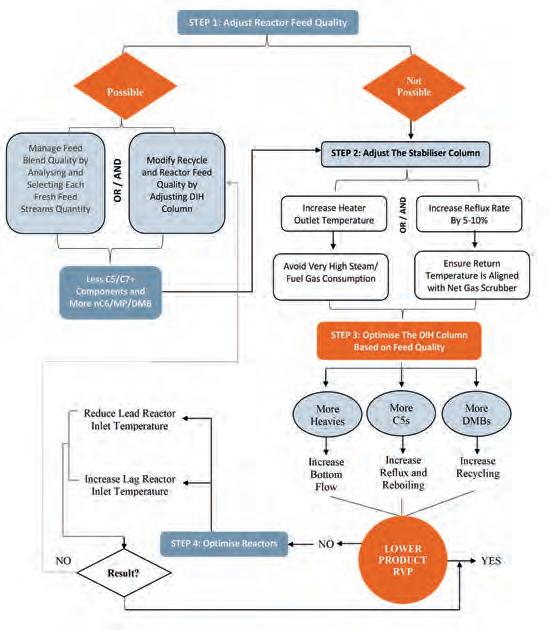

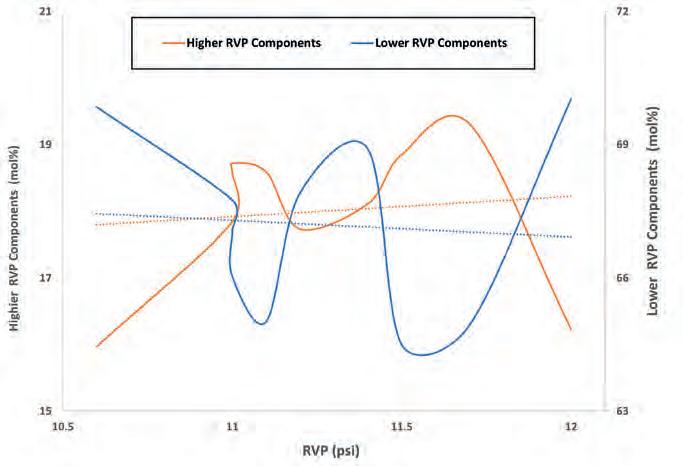

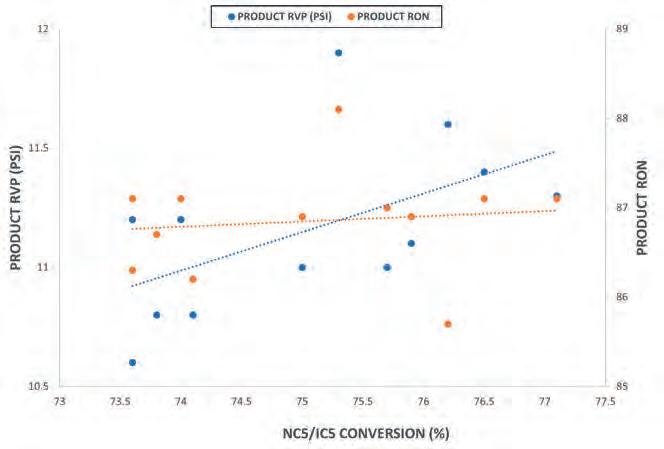

35 Guidelines for optimising C5/C6 isomerisation units

Fatemah Jameel Fraidoun, Kuwait National Petroleum Company (KNPC), presents a case study in which the Mina Al Ahmadi refinery optimised its isomerisation unit in order to reduce the isomerate Reid vapour pressure and maintain high research octane number.

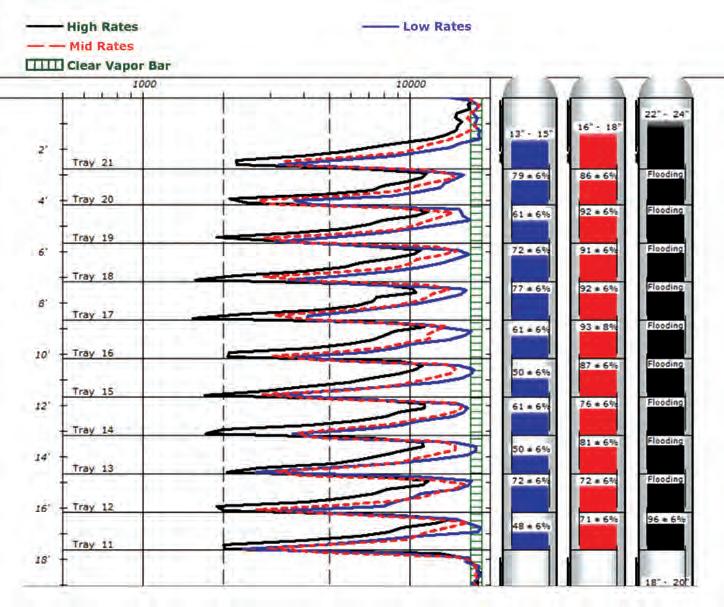

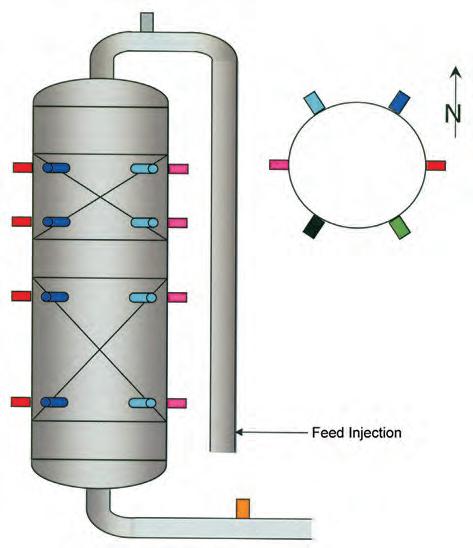

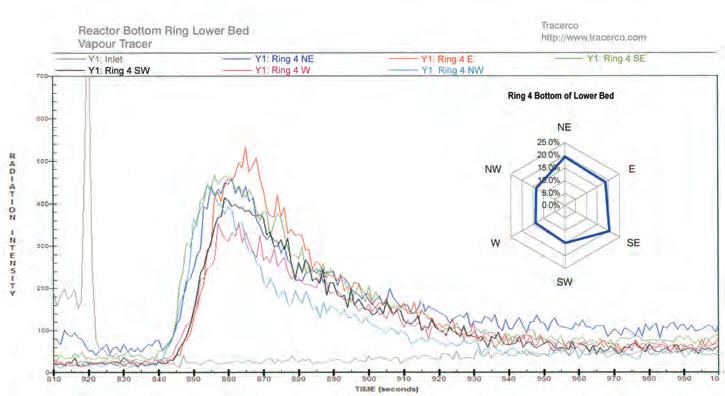

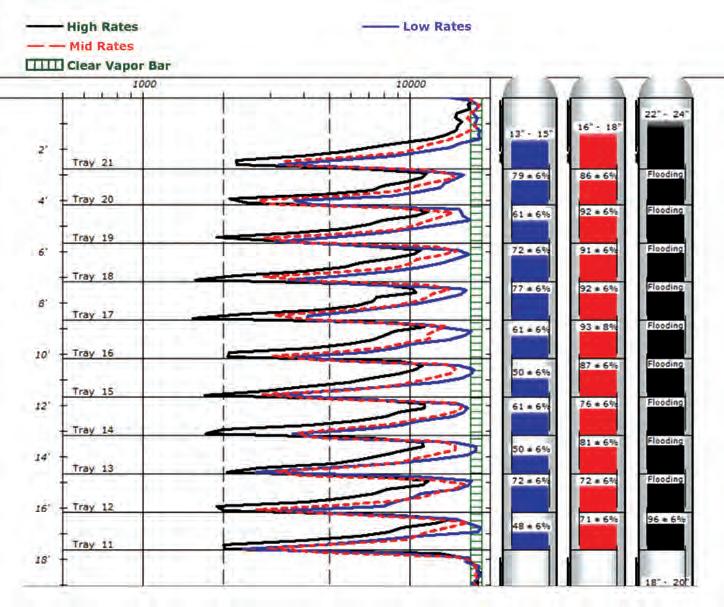

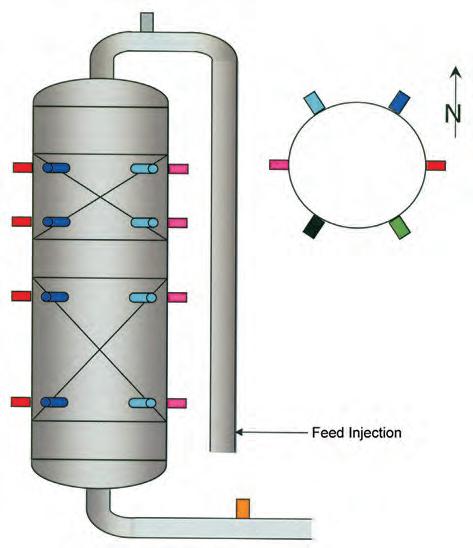

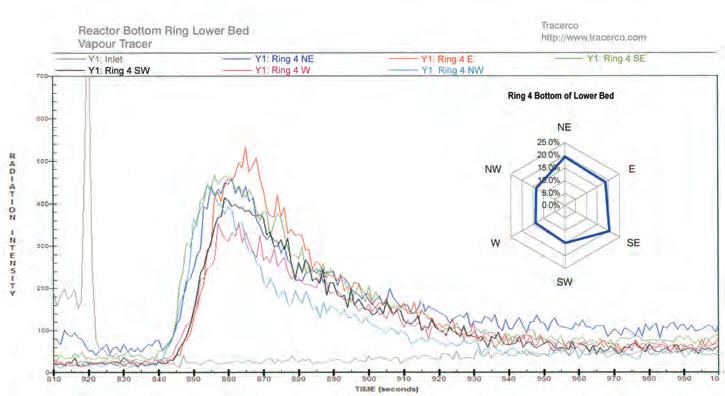

39 Diagnostic technologies for process optimisation

Jaspreet Nijjar, Tracerco, UK, explores the benefits offered by specialist scanning and radiotracer technologies in optimising processes.

45 Smarter, safer working

Mark Breese, Yokogawa RAP, considers the importance of digital control of work (CoW) systems in promoting more intelligent operations and an improved safety culture in the downstream industry.

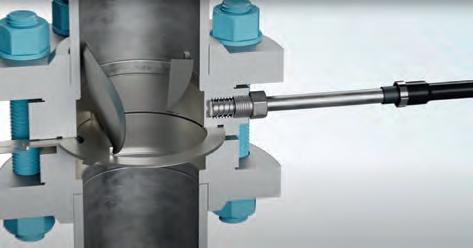

49 Simplifying safety in a complex world

Eric Sallee, OsecoElfab, explores how advances in rupture disc technology can help refineries and chemical processing facilities minimise overpressure risks and reduce emissions.

53 Surface engineering process and applications

Sunil Musali, MOGAS Surface Engineering, USA, discusses the use cases for thermal spraying and laser cladding in surface engineering.

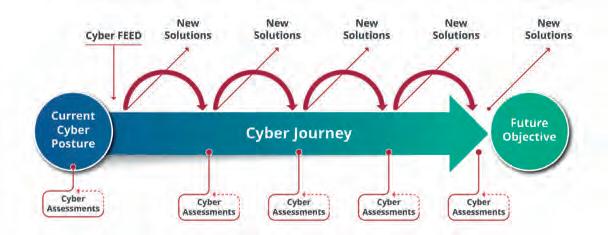

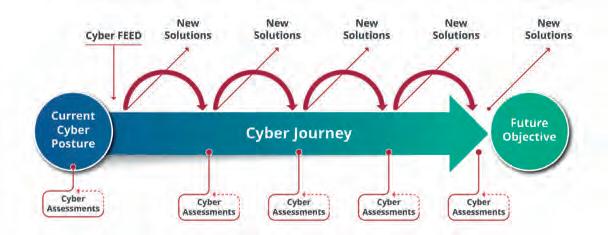

56 Navigating cybersecurity challenges

Paul Evans, Nozomi Networks, discusses the challenges faced by the downstream oil and gas industry as it embraces digitisation.

59

A specialised approach to assessing cybersecurity risks

Mary Sebastin and Saltanat Mashirova, Honeywell OT Cybersecurity, explain why cyber-physical risk assessments are essential in protecting petrochemical and oil and gas facilities from cybersecurity threats.

63 Cyber-enemies at the gate

Avoiding the cybersecurity problem is no longer a viable strategy, but putting protections in place is more straightforward than it seems. Alexandre Peixoto, Emerson, explains.

67 Sulfur review

Hydrocarbon Engineering presents a selection of the most advanced sulfur technolgies and services that are currently available to the downstream sector.

Halliburton Multi-Chem provides industrial water and process treatment solutions to refineries and petrochemical plants. Through onsite technical service and engineering support, the company helps customers with business goals, including improving reliability, increasing throughput, and enhancing the efficiency and flexibility of operating units. Halliburton Multi-Chem’s aim is to protect assets and maximise value.

CONTENTS April 2024 Volume 29 Number 4 ISSN 1468-9340 CBP019982 Hydrocarbon Engineering Like Join Hydrocarbon Engineering @HydrocarbonEng Follow CONVERSATION JOIN THE 2024 Member of ABC Audit Bureau of Circulations Copyright© Palladian Publications Ltd 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK. THIS MONTH'S FRONT COVER

Cut your CO2 emissions in half with ET Black™

Carbon Black Technology

ET Black™ is a state-ofthe-art technology that complies with the most stringent environmental regulations now and in the future.

Plus, the flexibility to produce all ASTM grades, and specialty grades, in a single plant. ET Black™, the technology of reference for producing carbon black obtained by thermal decomposition of highly aromatic oils.

Find out more at: www.igoforETBlack.com

CONTACT INFO

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O'Reilly callum.oreilly@palladianpublications.com

EDITORIAL ASSISTANT Poppy Clements poppy.clements@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES EXECUTIVE Sophie Birss sophie.birss@palladianpublications.com

PRODUCTION MANAGER Kyla Waller kyla.waller@palladianpublications.com

EVENTS MANAGER Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL CONTENT ASSISTANT Kristian Ilasko kristian.ilasko@palladianpublications.com

DIGITAL ADMINISTRATOR Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITORS Nancy Yamaguchi Gordon Cope

CALLUM O'REILLY SENIOR EDITOR

Back in February, the landing of a first commercial spacecraft on the Moon sparked a wave of excitement about a new era of private lunar exploration. The successful touchdown of US-based Intuitive Machines’ unmanned Odysseus lander marked the first time that a US craft has landed on the Moon since 1972, and it is hoped that it will change the face of planetary exploration. It could help to fund future state missions, and eventually aid plans to set up a permanent human base on the Moon (and beyond).

While the Odysseus lander grabbed most of the headlines, another vitally important space mission took place shortly after. On 4 March, a groundbreaking satellite designed to help protect the Earth’s climate successfully launched from Vandenberg Air Force Base in California, US. MethaneSAT – developed by a subsidiary of the Environmental Defense Fund (EDF) and partnered by the likes of Google, SpaceX, and the New Zealand Space Agency – will find and measure methane emissions over wide areas. The satellite, which will focus first on oil and gas operations, processes observed spectrographic data to calculate quantitative emission rates, revealing how much methane is emitted. “MethaneSAT’s superpower is the ability to precisely measure methane levels with high resolution over wide areas, including smaller, diffuse sources that account for most emissions in many regions”, said Steven Hamburg, EDF Chief Scientist and MethaneSAT Project Leader. “Knowing how much methane is coming from where and how the rates are changing is essential.”

According to the project backers, the unique capabilities of MethaneSAT will create unprecedented transparency. Interactive emissions data will be available free of charge, enabling anyone to see and compare emissions results by company, country or production basin. Ultimately, this will enable operators to find and fix problems faster.

As outlined in an excellent article from Umicore Coating Services that features in this issue of Hydrocarbon Engineering, the world seems to be finally waking up to the substantial threat posed by this invisible gas, and finding the solutions to conquer it. A number of new announcements to reduce methane emissions were made at the COP28 summit in Dubai, and over 150 countries have now signed up to the Global Methane Pledge to reduce methane emissions by at least 30% below 2020 levels by 2030.

What’s more, MethaneSAT is just one of the tools that is now available to help oil and gas producers to collect data on their emissions. Indeed, the team behind MethaneSAT point to a ‘complementary ecosystem’ of methane satellites for addressing emissions globally, including a satellite developed by the European Space Agency. A new global satellite methane detection and notification system (known as the Methane Alert and Response System, or MARS for short) is also extremely promising for the industry. As Mark Naples, Managing Director of Umicore Coating Services, explains in his exclusive article starting on p. 14 of this issue: “Energy suppliers could soon have access to a suite of tools and funding to reduce gaps in their understanding of where emissions are occurring, enabling them to act as never before against this invisible threat.”

SUBSCRIPTION RATES Annual subscription £110 UK including postage /£125 overseas (postage airmail). Two year discounted rate £176 UK including postage/£200 overseas (postage airmail). SUBSCRIPTION CLAIMS Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge. APPLICABLE ONLY TO USA & CANADA Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 701C Ashland Avenue, Folcroft, PA 19032. Periodicals postage paid at Philadelphia, PA & additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032.

South Street, Farnham, Surrey GU9 7QU, UK

+44 (0) 1252 718 999 COM MENT

15

Tel:

WORLD NEWS

Global | Methane emissions from the energy sector remained near record high in 2023

Methane emissions from the energy sector remained near a record high in 2023, according to new analysis from the International Energy Agency (IEA).

The IEA’s latest update of its ‘Global Methane Tracker’ is the first comprehensive assessment of global methane emissions since the COP28 climate summit concluded in December 2023. The new analysis finds that the production and use of fossil fuels resulted in close to 120 million t of methane emissions in

2023, a small rise compared with 2022.

According to the report, the top 10 emitting countries were responsible for around 80 million t of methane emissions from fossil fuels in 2023.

However, the IEA notes that substantial policies and regulations announced in recent months, as well as fresh pledges stemming from the COP28 climate summit, have the potential to put methane emissions into decline soon.

Canada | Pembina awards contract for RFS IV expansion

Pembina Infrastructure and Logistics LP has awarded Worley a contract for RFS IV, the expansion of Pembina’s existing Redwater propane-plus fractionation and storage complex in Alberta, Canada.

Under the contract, Worley will provide fabrication and module assembly from its Blackfalds and Edmonton modularisation yards.

The company will also provide field construction services at the Redwater complex.

Worley categorises this contract as transitional work.

1 RFS IV is expected to increase the fractionation capacity by 55 000 bpd (8744 m3), enabling the complex to meet increased demand in the region.

China | Clariant and Lummus awarded catalyst technology contract for new isobutane dehydrogenation plant

Clariant and its process partner

Lummus Technology have been selected by Huizhou Boeko Materials Co. Ltd to provide their CATOFIN catalyst and process technology for the dehydrogenation of isobutane at the new plant in Huizhou City, China. The process technology is exclusively licensed by Lummus Technology, while the tailor-made catalyst is supplied by Clariant.

This is the first time that Huizhou Boeko will license the CATOFIN technology at one of its sites.

The scope of this award includes the technology license and basic engineering. Once complete, the plant will produce 550 000 tpy of net isobutylene, which will serve as feedstock for the downstream production of methyl tertiary butyl ether (MTBE).

USA | TotalEnergies acquires Talos Low Carbon Solutions

TotalEnergies has signed an agreement to acquire 100% of Talos Low Carbon Solutions (TLCS), a US company focused on carbon capture and storage.

After completion of the transaction, TotalEnergies will own a 25% share in the Bayou Bend project, alongside Chevron (50%, operator) and Equinor (25%).

The Bayou Bend project is a major CO2 storage project located along the Texas Gulf Coast, close to the company’s assets in the region. TotalEnergies will also own a 65% operated interest in the

Harvest Bend (Louisiana) project and a 50% interest in the Coastal Bend (Texas) project. With Coastal Bend and Harvest Bend being located farther away from the company’s other existing assets, TotalEnergies’ intention is to divest its interest in these two projects after closing.

The Bayou Bend project is a carbon transportation and storage solution for industrial emitters located in the Houston Ship Channel and Beaumont – Port Arthur region, one of the largest industrial corridors in the US. Comprising licenses dedicated to CO2 storage,

offshore and onshore, covering approximately 600 km2, it could enable the storage of several hundred million tons of CO2

Patrick Pouyanné, Chairman and CEO of TotalEnergies, said: “TotalEnergies is pleased to enter the Bayou Bend project through the acquisition of Talos Low Carbon Solutions. Ideally located close to our Port Arthur refinery and our petrochemicals assets in La Porte, this project will be instrumental for the reduction of direct emissions from our US operations.”

April 2024 HYDROCARBON ENGINEERING 5

WORLD NEWS

DIARY DATES

29 April - 03 May 2024

RefComm Galveston, Texas, USA www.events.crugroup.com/refcomm

06 - 08 May 2024

ILTA Conference & Trade Show Houston, Texas, USA ilta2024.ilta.org

14 - 16 May 2024

Asia Turbomachinery & Pump Symposium Kuala Lumpur, Malaysia atps.tamu.edu

10 - 14 June 2024

ACHEMA Frankfurt, Germany www.achema.de/en

11 - 13 June 2024

Global Energy Show Canada Calgary, Alberta, Canada www.globalenergyshow.com

20 - 22 August 2024

Turbomachinery & Pump Symposia Houston, Texas, USA tps.tamu.edu

17 - 20 September 2024

Gastech Houston, Texas, USA www.gastechevent.com

22 - 25 September 2024

GPA Midstream Convention San Antonio, Texas, USA www.gpamidstreamconvention.org

15 - 17 October 2024

AFPM Summit New Orleans, Louisiana,, USA summit.afpm.org

04 - 06 November 2024

Sulphur + Sulphuric Acid 2024 Barcelona, Spain www.events.crugroup.com/sulphur

11 - 14 November 2024

ERTC

Lisbon, Portugal

www.worldrefiningassociation.com/event-events/ ertc

UAE | Technip Energies, JGC and NPCC receive LNTP for Ruwais LNG Project

Technip Energies, leader of a joint venture (TJN RUWAIS JV) with JGC and NPCC, has received a Limited Notice To Proceed (LNTP) from ADNOC to commence early engineering, procurement and construction (EPC) activities at the Ruwais low-carbon LNG project, located in Al Ruwais Industrial City, Abu Dhabi, UAE.

The project will consist of two natural gas liquefaction trains with a total LNG production capacity of 9.6 million tpy. The plant will use

electric-driven motors instead of conventional gas turbines and will be powered by nuclear energy.

The plant is set to be the first LNG export facility in the Middle East and North Africa (MENA) region to run on clean power, making it one of the lowest-carbon intensity LNG plants in the world.

The project will significantly enhance ADNOC’s LNG production capacity, aligning with global natural gas demand and the shift towards decarbonisation.

Canada | Air Products awards module fabrication agreement to Worley

Air Products Canada Ltd has awarded Worley an agreement to provide procurement, fabrication and modularisation services for its Net-Zero Hydrogen Energy Complex, located in Edmonton, Alberta, Canada.

Once operational, Air Products says that the net-zero complex will produce clean hydrogen and capture and permanently sequester carbon dioxide (CO2) emissions.

It is expected to position Alberta as the centre of western Canada’s hydrogen economy. Under the agreement, Worley’s Edmonton modularisation yard will fabricate and assemble process and pipe rack modules, implementing automated pipe-cutting techniques and robotic welding. Worley’s Edmonton modularisation yard is located adjacent to Air Products’ Net-Zero Hydrogen Energy Complex.

USA | EIA expects low natural gas prices

The US Energy Information Administration (EIA) expects the benchmark Henry Hub spot price to average about US$2.25/million Btu in 2024, a 10% decrease from 2023 and a 65% decrease from 2022.

In its March ‘Short-Term Energy Outlook’ (STEO), EIA forecasts that US natural gas inventories will be more than 30% higher than average at the end of the winter season following relatively low winter demand.

According to EIA’s forecast, low natural gas prices will slightly decrease domestic natural gas production in

2024 compared with record production in 2023.

EIA expects US crude oil production to continue growing in 2024 and 2025, with both years exceeding the production record set in 2023. Growth in US crude oil production should help offset the effects of continued voluntary OPEC+ oil production cuts announced recently, but EIA still expects a tight balance of global oil production and demand, which EIA forecasts will lead to higher Brent crude oil prices in 2024 than expected at the start of the year.

April 2024 HYDROCARBON ENGINEERING 6

Revamp to thrive in the new reality

Ever-changing market conditions, global economic challenges, and the shared journey of the energy transition all mean it is crucial to evaluate easy-to-implement and costeffective improvement opportunities. At Shell Catalysts & Technologies, our solutions open new possibilities for smarter investments while preserving cash through revamping, reconfiguring, or optimising your existing assets. Our experts co-create tailored solutions while keeping your margins in mind – ensuring the investments you make right now can help you maintain your competitive advantage into the future.

Learn more at catalysts.shell.com/revamps.

Gord Cope, Contributing Editor, discusses the state of the refining and petrochemical sector in the MENA region and reveals how countries are looking to tap into the green fuels sector.

8 April 2024 HYDROCARBON ENGINEERING

Turmoil abounds in the Middle East and North Africa. In addition to the Hamas-Israel war, Iran’s proxies are busy stirring up trouble in Yemen and Lebanon, while various domestic conflicts grip countries in Egypt, Algeria, Iraq and other jurisdictions. Yet, the region is ripe with fossil fuels and green energy potential that is greatly sought after by consuming nations in Europe and Asia.

Egypt produces approximately 680 000 bpd of crude, most of which is slated to be converted to fuels in its dozen domestic refineries. Several billion dollars are being spent upgrading various complexes, including a US$2 billion project to add a hydrocracker to Egyptian General Petroleum Corp.’s Assiut refinery. At the southern end of the Suez Canal, Red Sea Refining and Petrochemicals is building the Tahir refinery and petrochemicals plant in the port of Ain Sokhana. When completed later in the decade, it will have the capacities of 1.5 million tpy of ethylene and 600 000 tpy of propylene.

In May 2023, Suez Methanol Derivatives Co. (SMD) signed an agreement with Methanex Egypt to supply feedstock for its specialty-chemicals complex in the port of Damietta. The US$120 million complex is the first of its kind in Egypt, and will produce 140 000 tpy of urea formaldehyde concentrate, naphthalene formaldehyde and specialty resins for domestic and export markets. Construction is currently underway, with first product deliveries expected in October 2024.

Algeria’s oil and gas sector is in an enviable position. It ships approximately 45 billion m3 of natural gas annually through Mediterranean subsea pipelines and LNG tankers to Europe.

In addition, it produces 1.3 million bpd of light, sweet crude, the majority of which is exported.

In an effort to satisfy growing domestic demand, state-owned Sonatrach has launched an ambitious plan to expand the 670 000 bpd capacity of its domestic refineries. The Hassi Messaoud refinery, adjacent to its largest oilfield, is being enlarged from 23 000 bpd to 110 000 bpd capacity. It also plans to eventually expand and upgrade its Bishkra, Tiaret and Skikda refineries to similar capacities. But recent reports note that Sonatrach is at loggerheads with Samsung and Técnicas Reunidas (Hassi Messaoud’s EPC contractors) over costs associated with the US$3.7 billion expansion; negotiating a financial resolution may delay final investment decisions (FIDs) on the three latter refinery projects.

In December 2022, Saudi Aramco and TotalEnergies announced a joint plan to build a US$11 billion petrochemical facility in the Saudi port of Jubail adjacent to the existing SATORP refinery. The new complex will contain one of the largest mixed-load steam crackers in the Middle East, with a capacity to produce approximately 1.6 million tpy of ethylene and other gases. The feedstock is expected to underpin a further US$4 billion investment in related industrial sectors, including the manufacture of carbon fibres, lubricants, detergents, automotive parts and food additives. In June 2023, it was announced that Hyundai Engineering would build the mixed-feed crackers, Maire Tecnimont would construct two polyethylene units, and Sinopec Engineering would fabricate the tank farm. Tentative completion is set for 2027.

April 2024 9 HYDROCARBON ENGINEERING

Qatar continues to pursue its goal to be the world’s leading LNG exporter. In October 2023, it broke ground on the world’s largest LNG project, the North Field Expansion (NPE). When completed later in the decade, it will boost the country’s current capacity of 77 million tpy by a further 48 million tpy. That same month, it signed long-term deals with Shell to supply up to 3.5 million tpy of LNG for deliveries to the Netherlands, starting in 2026 when the first phase of its major expansion comes online. The news comes on the heels of a similar announcement between QatarEnergy and TotalEnergies to supply up to 3.5 million tpy to France. All deals are set at 27 years in duration.

In late 2023, QatarEnergy and Chevron Phillips Chemical Co. secured US$4.4 billion in financing for a US$6 billion polymers facility in Qatar’s Ras Laffan Industrial City. The project will include the largest ethane cracker in the Middle East, with a capacity of 2.1 million tpy, as well as two, high-density polyethylene units with a total capacity of 1.7 million tpy. When completed in 2026, most of the output will be exported for use in durable goods such as gas and water distribution pipes.

Borouge is the UAE’s major petrochemical complex, located in the downstream hub of Ruwais. The plant, which is jointly owned by ADNOC and Austrian partner Borealis, produces 5 million tpy of poly-olefin compounds, which are used in a wide variety of industrial applications in Europe and Asia. The US$6.2 billion Borouge-4 expansion project is currently under construction, and will add 1.5 million tpy of capacity.

Kuwait holds approximately 100 billion bbl of crude reserves, and currently produces 2.7 million bpd. The state has plans to increase production to 3.25 million bpd by 2027, and to 4 million bpd by 2035. Kuwait Integrated Petroleum Industries Co. (KIPIC) is also commissioning the latest expansion of its Al Zour refinery complex in the Persian Gulf, boosting domestic refining capacity to 1.6 million bpd. A major new olefins plant is being built nearby. When completed in 2025, it will produce 2 million tpy of olefins and 1.44 million tpy of polymers.

Iraq currently produces 4.3 million bpd from 140 billion bbl of crude reserves. In January 2024, The Iraqi Ministry for Energy Affairs and Oil announced plans to increase oil production to 6 million bpd by the end of the decade. In addition, the country would like to reduce its dependency on imported refined products by increasing refining capacity. It currently has 16 refineries producing approximately 1 million bpd of fuel and related products. The government seeks to add a total of 320 000 bpd of new capacity, and has issued tenders to build the 150 000 bpd Nasiriyah in the Southern Dhi Qar Governorate, the 100 000 bpd Al-Kut refinery in eastern Iraq, and the 70 000 bpd Samawah refinery in southern Iraq. In addition, Iraq announced plans to finally initiate the Nibras petrochemical complex in Basra to leverage substantial gas reserves in the region. The JV between Shell and the federal government is expected to produce 1.8 million tpy of petrochemical products when it comes on-stream at the end of the decade.

Iran, with 156 billion bbl of crude reserves, has a refining capacity of 2.6 million bpd. It also has ambitious plans to expand its refining and petrochemical output; the country has

over 1.4 million bpd of new capacity on the books. The 360 000 bpd Siraf refinery project, designed to split condensate feedstock, is expected to start operations in 2025.

Green energy

MENA countries are hoping to tap into the lucrative, low-carbon fuel sector. While hot, arid conditions are a bane to agriculture, abundant wind and sun allow jurisdictions to use hydrolysis to produce green hydrogen. The energy-dense gas can then be converted into easily-transportable green ammonia for exports to Asia and Europe, where it can be used for utilities and fertilizers, dramatically reducing carbon footprints in these sectors.

Saudi Arabia is building an immense green ammonia plant in the NEOM project, a futuristic greenfield development in the country’s northwest, home to abundant solar and wind resources. The US$5 billion plant would produce up to 650 tpd (240 000 tpy), primarily for export.

As part of the UAE’s plan to supply up to 25% of imported, low-carbon hydrogen in key global markets, its state-owned subsidiary, Fertiglobe, has been shipping demonstration cargoes of blue ammonia to Germany. The ammonia was produced at the company’s Fertil plant in Abu Dhabi’s Ruwais industrial complex; the company is developing a greenfield, 1 million tpy low-carbon ammonia plant at the complex.

In 2022, Egypt announced its National Climate Strategy 2050, which outlined objectives to reduce carbon emissions and produce energy from renewable resources. In May 2023, it signed a US$450 million agreement with Norway’s Statec to build a green methanol plant in Damietta for the purpose of supplying low-carbon fuel for ships. Initial capacity is slated at 40 000 tpy, with the potential to increase to 200 000 tpy. Energy will be supplied by 40 MW of solar power and 120 MW of wind power.

In October 2023, Abu Dhabi’s state-owned ADNOC announced that it had awarded EPC contracts for the Hail and Ghasha Offshore Development. The project is a major milestone for the country’s net zero by 2045 goal; when completed, the two fields will yield 1.5 billion ft3/d, which will be piped ashore where facilities will sequester up to 2 million tpy of CO2 while producing low-carbon hydrogen. The National Petroleum Construction and Saipem S.p.A will build the artificial islands and subsea pipelines, and Tecnimont S.p,A. will construct the onshore CO² and sulfur recovery modules. ADNOC intends to have up to 10 million tpy of CO2 sequestration in place by 2030.

Oman has announced plans to produce 1 million tpy of renewable hydrogen by 2030, 3.75 million tpy by 2040 and 8.5 million tpy by 2050, with the intention of exporting the majority in various forms of ammonia. In addition to building extensive solar farms, the country, which exports 200 000 tpy of grey ammonia products, would need to spend tens of billions in order to massively expand its terminals capacities.

Morocco is a major producer of phosphate fertilizer, which is sold both in its pure form and mixed with other fertilizers. When ammonia prices spiked in the immediate aftermath of the Ukraine war, state-owned fertilizer producer OCP found itself spending almost US$2 billion on imports to meet its mixed-fertilizer contracts. OCP now plans to invest US$7 billion on constructing a green ammonia plant in the coastal town of

April 2024 HYDROCARBON ENGINEERING 10

Tarfaya. The facility is expected to produce 1 million tpy when it comes on-stream in 2027. While the price of green hydrogen is significantly higher, OCP views the investment as a hedge to reduce price volatility and increase security of supply.

Problems

The impacts of war continue to reverberate through the Middle East. For the last several years, Egypt, Israel and Jordan have been acting in concert to build a regional energy network to commercialise the gas discoveries in their respective offshore waters. Egypt, which acts as a regional energy hub for oil, gas, LNG and refined products, has been receiving approximately 800 million ft3/d of gas from Israel’s various fields, including Tamar. When the Hamas-Israel war began, Israel ordered the Tamar field to be shut-in, and to reroute production from the Leviathan field to Jordan. While the move proved temporary, Egypt suffered daily blackouts and disruptions to its LNG exports, and highlighted the fragility of regional energy markets. Houthi attacks on vessels transiting the Red Sea also constitute a major threat to movement of energy through the Suez Canal. In the short-term, vessels heading to Europe are being re-routed at great expense around the southern tip of Africa.

In the longer term, stakeholders contemplating investment in refining and petrochemical facilities in the region are obliged to reevaluate risk premiums, or to seek out more stable jurisdictions. In late 2023, QatarEnergy and Chevron Phillips Chemical Co. began construction of the US$8.5 billion Golden Triangle Polymers plant in Texas, US. The plant, located approximately 100 miles east of Houston, will feature a 2.08 million tpy ethylene cracker and two high-density polyethylene units with a combined capacity of 2 million tpy. In addition, QatarEnergy has invested US$11 billion in the Golden Pass LNG production facility, also located in Texas.

The potential for the new hydrogen economy carries a tremendous caveat; creating green hydrogen is still far more expensive than the traditional Haber-Bosch process, and advances in electrolysis and solar power, while promising, tantalisingly remain in the ‘next decade’ timeframe. In the meantime, geologists are discovering massive deposits of natural hydrogen in France and around the world, with the potential to drop prices for carbon-free hydrogen precipitously, potentially stranding billions of dollars of hydrolysis assets.

The future

Sanctions against Russian oil exports have had a knock-on effect in MENA; Indian refiners, for instance, once a reliable client, now use discounted Russian shipments for the majority of their feedstock. Jurisdictions without significant refining capacity have experienced economic shock as imported fuel prices have soared. Countries like Saudi Arabia and Qatar, which have the resources to initiate major projects to capture value through petrochemicals, fertilizers and alternate energy fuels, are working to diversify and cushion their economies to some extent. That investment philosophy is likely to continue for the remainder of the decade, creating opportunities for engineering firms, equipment manufacturers and infrastructure builders from Europe, North America and Asia.

Optimized Gas Treating, Inc 212 Cimarron Park Loop, Buda, TX 78610 www.ogtrt.com +1 512 312 9424 Contact us for a free trial SulphurPro® The ULTIMATE in Sulphur Plant Simulation

Based on Chemistry & Engineering Science SulphurPro® The ULTIMATE in Sulphur Plant simulation Optimized Gas Treating, Inc. 212 Cimarron Park Loop, Buda, TX 78610 www.ogtrt.com +1 512 312 9424 Contact us for a free trial

Native Sulphur

© 2024 Halliburton. All Rights Reserved.

Specialty Chemical Solutions

SUPERIOR PROCESS AND WATER TREATMENT SOLUTIONS DRIVEN BY SERVICE EXCELLENCE

Improving reliability, increasing throughput, and enhancing the efficiency and flexibility of operating units are important to you. Halliburton Multi-Chem offers a broad selection of chemistries, equipment, services, and automation to ensure successful results.

Through onsite technical service and engineering support, Multi-Chem collaborates with you to deliver solutions to your challenges. We’re here to help you.

halliburton.com/specialty-chemicals

Many of the countless stories focused on climate change all share a singular villain: carbon.

Carbon – specifically carbon dioxide (CO 2 ) – is central to the environmental conversation. Businesses market themselves to consumers as carbon neutral, technologies like carbon capture are touted as major breakthroughs, while phrases like ‘carbon footprint’ are part of cultural lexicon. This is good news for the fight against climate change, as CO 2 poses a serious long-term risk to the future of the planet.

However, this focus on carbon means that another emissions threat has – until now – slipped largely under the radar: methane. Even the oil and gas industry, a sector forced to continually focus on and invest in reducing harmful emissions, appears to have overlooked the risk posed by methane given the continued prevalence of gas flaring and venting at sites around the world. 1

Thankfully, there are signs that the world is waking up to this invisible threat. And the downstream oil and gas sector has the power to conquer this new threat – but it must change the way it thinks about methane leaks for good.

An invisible threat

Methane emissions represent one of the largest threats facing humankind today. Since the Industrial Revolution, this invisible gas has been responsible for approximately a third of the recorded rise in global temperatures. 2 Without immediate action, emissions from human sources are projected to

14 April 2024 HYDROCARBON ENGINEERING

Mark Naples, Umicore Coating Services, considers how the threat of methane emissions can finally be conquered in the oil and gas industry.

April 2024 15 HYDROCARBON ENGINEERING

increase by up to 13% in the next six years, causing significant and irreparable harm to the planet.

In terms of trapping heat, methane is much more potent than CO 2 and other greenhouse gases – but only for a relatively short time. When first emitted, methane traps roughly 100 times more heat than CO 2 . However, it also starts to break down more quickly, while CO 2 can persist for around a century. Over the course of 20 years, methane traps around 80 times as much heat as CO 2 . Over a century, that number drops to 28 times 3 – still significant, but its impact is blunted enough to allow mitigation to take place.

In other words, while methane emissions are dramatically accelerating the climate towards the 1.5°C warming threshold – beyond which scientists agree the environment would suffer irreparable damage – cutting emissions can reverse this course just as quickly.

Approximately 60% of all methane emissions are caused by human activity, and a third of this is produced by the energy sector through flaring, venting, and leaking infrastructure. 4 Estimates suggest that halving these emissions over the next 30 years will be instrumental in meeting the critical goal of reaching global net zero emissions by 2050.

Urgent action is needed – and the world is starting to wake up to the scale of what is required.

Wake up and smell the methane

In December 2023, representatives from major oil and gas companies around the world committed to action that will cut methane emissions by at least 30% by 2030. The Global Methane Pledge (GMP), made at the COP28 summit in Dubai, UAE, promises a huge leap forward in the fight against climate change. Partners of this agreement have announced that more than US$1 billion of new grant funding will be allocated to support action against methane – more than three times the pre-existing funding levels – and individual action is ongoing to reduce the impact of these harmful emissions further.

Over 150 nations have signed up to the GMP, a commitment to cut human-related methane emissions by 30% by the end of the decade. Included in the pledge is the prospect of financial penalties for businesses that fail to act. The US, for example, plans to introduce a fine of US$900/t of methane emitted this year, which will rise by 67% to US$1500/t in 2026.

Perhaps the most important commitment made at COP28 was the launch of the Data for Methane Action campaign. The Global Methane Hub plans to increase the funding available to governments to take advantage of previously unleveraged data. Alongside the full launch of a new Methane Alert and Response System (MARS), energy suppliers could soon have access to a suite of tools and funding to reduce gaps in their understanding of where emissions are occurring, enabling them to act as never before against this invisible threat.

Firm action at the political level – of the kind demonstrated at COP28 – was sorely needed. But all industries must do their bit to help deliver on these pledges, and few have the same potential to make a difference as the oil and gas industry.

April 2024 HYDROCARBON ENGINEERING 16

Figure 1. Capturing the vast amount of methane wasted each year across the oil and gas industry would mean progress for both the climate crisis and the energy crisis.

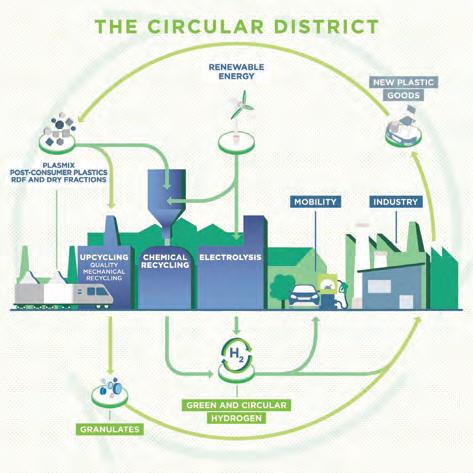

Figure 2. Modern sensing technology is highly scalable and available in increasingly small form-factor devices thanks to advances in laser absorption spectroscopy.

Let’s add circularity to heat exchangers

Net Zero. It’s what we all want. And heat exchangers will play a key role in helping us get there. By efficiently transferring energy, they help industry reduce dependency on natural gas and electricity. Not a bad thing in these times of uncertain energy supplies. But that’s just the start.

Now imagine quality HX tubing produced in a sustainable way that lasts longer, resists corrosion and extends the lifecycle of the heat exchanger by years.

Like our super-austenitic Sanicro® 35, which offers a smart alternative to costly nickel alloys. Or other Sanicro or duplex grades, depending on what you need.

Sound interresting? Let’s talk.

alleima.com

A clearer picture

To back these pledges up with action, oil and gas operations need better quality data than is currently available. Limitations in the data on methane emissions have effectively hidden the scale of the problem, preventing optimised action from being taken. For the downstream sector, this is particularly important, as this segment is responsible for 20% of fossil methane emissions on its own. 5

Of course, solving this is easier said than done. The GMP saw several new signatories at COP28, including Kenya, Angola, and Turkmenistan, the latter of which in particular has been highlighted as a methane ‘super-emitter’. More than 5600 super-emitter events have been recorded by UN research since 2019, with little overall reduction observed among many GMP signatories. In certain countries, emissions have even increased. 6 In 2022, two oil and gas fields alone in Turkmenistan were responsible for more global warming than all carbon emissions released by the UK that year. 7

Most oil and gas operators oversee many thousands of miles of pipelines, rendering manual checks impractical at best and expensive, ineffectual time sinks at worst. As a result, leaking pipelines have been widely accepted as a regrettable cost of doing business for decades.

This cost should not be as high as it currently is. In The Guardian’s major investigation of super-emitter events, the largest it found was from a major pipeline near Turkmenistan’s Caspian coast.

This is why the announcement of the MARS at COP28 is so promising for the industry. Recent years have seen rapid progress in satellite tracking and other modelling techniques that have significantly enhanced the capacity of oil and gas producers to collect data on their emissions beyond the upstream. Now, for the first time, it is economically feasible to monitor emissions from pipelines, refineries, and storage facilities thanks to systems like MARS. In collaboration with the Copernicus space programme, it represents the first global system that connects satellite-detected methane emissions with trackable notifications.

In a pilot phase that ran throughout 2023, MARS identified more than 1000 methane plumes from energy production and linked 400 of these to specific facilities. Tools like this are changing the picture of emissions and expanding the available approaches to ensure compliance with global commitments on methane.

This new tool is being supported by a worldwide campaign to encourage more comprehensive data collection. The Data to Methane Action campaign aims to improve the funding available to governments and businesses to enable radical reductions in methane emissions by targeting leaks and policy change. It is supported by satellite monitoring systems and scientific monitoring campaigns, providing transformational tools to help the energy sector scale up its efforts.

There are rewards for engaging in abatement strategies that go far beyond legal compliance, however. The International Energy Agency (IEA)

estimates that around 80% of methane emissions could be avoided at no net cost, because the cost of preventing the leaks will be offset by the market value of the captured gas – with downstream leak detection and repair (LDAR) being the most valuable. As energy prices around the world remain high, every molecule of methane leaked into the atmosphere is worth more than it ever has been.

Action on the ground

While oil and gas businesses wait to benefit from the monitoring systems announced at COP28, they can pre-emptively improve their emissions profiles by taking action on the ground. Thanks to technological advances, businesses today have access to a suite of monitoring solutions for identifying where leaks are occurring, chief among which are high-performance infrared (IR) sensors. These small devices generate beams of IR light that pass through a filter inside a sampling chamber that blocks certain wavelengths.

This means that only the desired wavelengths make it through the filter to a detector, which measures the attenuation of the light it receives to determine the precise concentrations of gases that may be present. Changing filters enable different wavelengths of light to reach the detector, which can, in turn, be used to check for different kinds of gases.

Certain gas analyser instruments incorporate laser diodes mounted on a thermo-electric cooler. This enables the laser’s wavelength to be tuned to match the absorption wavelength of a particular molecule, resulting in enhanced sensitivity and discrimination. These instruments benefit from a lower risk of false alarms, which can plague other common gas detection technologies.

These advanced emission tracking devices mean leak prevention is no longer a hypothetical concept. Supported by the growing groundswell of funding to improve monitoring solutions, today’s energy suppliers have a wealth of options available to track harmful leaks and start to address them.

For too long, the problems caused by invisible gas leaks have remained unseen. Now, the technology is widely available to address those problems, and there is the political will to use it. All that remains is for the oil and gas industry to capitalise – and 2024 could be the year the climate fightback begins.

References

1. https://www.worldbank.org/en/programs/gasflaringreduction/ global-flaring-data

2. https://www.iea.org/reports/global-methane-tracker-2023

3. https://climate.mit.edu/ask-mit/why-do-we-compare-methanecarbon-dioxide-over-100-year-timeframe-are-we-underrating

4. https://energy.ec.europa.eu/topics/oil-gas-and-coal/methaneemissions_en

5. https://www.iea.org/commentaries/the-case-for-regulatingdownstream-methane-emissions-from-oil-and-gas

6. https://www.theguardian.com/environment/2023/dec/02/ us-outlines-measures-to-cut-methane-emissions-by-80-innext-15-years

7. https://www.theguardian.com/world/2023/may/09/mindboggling-methane-emissions-from-turkmenistan-revealed

April 2024 HYDROCARBON ENGINEERING 18

Paul Ticehurst, Johnson Matthey, UK, discusses the importance of sustainable aviation fuel (SAF) for decarbonisation, the technology that supports large-scale production of this fuel, and the economic benefits it could present.

In November 2023, the first ever transatlantic flight in a commercial airliner using drop-in 100% SAF was successfully completed by Virgin Atlantic, representing an enormous step forward in decarbonising air travel. The question now is how can the technology be scaled and what is the wider potential of SAF?

SAF offers a solution to reduce the lifecycle emissions from aviation today, but its production also offers the promise of a huge positive impact on economies. Indeed, in the UK alone, Johnson Matthey and EY have calculated that,

if the UK meets its target of 10% SAF by 2030, not only will this save over 3 million tpy of CO2 from entering the atmosphere (equivalent to taking almost 2 million cars off UK roads), but, if produced locally, it will also add up to £11.9 billion gross value added (GVA) to the UK economy.1

100% SAF in existing aircraft

The key to unlocking the full potential of SAF lies in overcoming the challenges associated with its composition. Traditional jet fuel contains aromatic compounds.

April 2024 19 HYDROCARBON ENGINEERING

These ring-shaped molecules are an important component of the fuel as, among other properties, they enhance lubricity, lower freeze point, and interact with polymer seals in the current engines and fuelling systems to help prevent fuel leakage. Most bio-based fuels, including popular options like hydroprocessed esters and fatty acids (HEFA) and Fischer-Tropsch (FT) products, lack these aromatic compounds. This characteristic of these SAF components

can limit how much can be blended into conventional jet fuel which is currently limited to a maximum of 50%.

Addressing this challenge is synthesised aromatic kerosene (SAK), a bio-based, aromatic-rich component, which can be blended with other SAF pathways like HEFA or FT products to create drop-in 100% SAF. Virent, the original inventor of BioForming® sugars-to-aromatics (S2A), and Johnson Matthey have been working in close collaboration on this technology, which uses biomass sugars as feedstock. This innovation means 100% bio-based fuels can meet current jet fuel standards, offering a sustainable, high-performance fuel alternative.

SAK supplies the necessary aromatics for jet fuel and can be blended with a range of other SAF, accelerating the shift from conventional fuel to sustainable alternatives compatible with existing aviation technology. Compared with conventional jet fuel, blending SAF with SAK can reduce fine particulate emissions by up to 80%. The various demonstration flights using BioForm® SAK have also shown that SAK can be a ‘normaliser’ to ensure different SAF blendstocks can be brought within specification and meet aviation performance criteria.

SAF blended with BioForm SAK offers a promising path forward for the aviation industry in meeting its targets for decarbonisation, but its success hinges on several factors. The production of SAF and SAK must scale up to meet the demands of the global aviation industry. This expansion requires significant investment in production facilities and the development of robust supply chains.

Driving SAF production efficiency at scale – a view of the advancing FT potential

There are several different processes and feedstocks that are currently approved to produce SAF. These include HEFA, Alcohol to Jet (AtJ) and FT products. While AtJ technology is still developing, the conversion of waste, biomass or existing CO2 emissions into sustainable fuels via FT synthesis is technically proven at scale and, unlike HEFA, the process is not reliant on limited and sometimes conflicting feedstock resources.

FT is nothing new: the chemistry was developed in the 1920s by Franz Fischer and Hans Tropsch as a way of converting carbon sources into liquid hydrocarbons via syngas. However, the latest developments in FT technology mean the production of fuel from sustainable carbon sources has made the process more commercially viable at an industrial scale.

Catalysts are used in the FT process to increase the rate of reaction and efficiency of the process. Hydrogen and carbon monoxide are converted into long-chain paraffins or waxes as they pass through the catalyst. Pore diffusion and mass transfer are critical to the performance of the catalyst and, as the process is highly exothermic, reactor design requires efficient removal of heat from the system.

While different reactor and catalyst combinations have been widely used in the FT process, the FT CANSTM system, developed by BP and Johnson Matthey, enhances the process efficiency and intensifies the FT reaction. This results in catalyst volumes being reduced by more than 50%

April 2024 HYDROCARBON ENGINEERING 20

Figure 2. Wax and liquid produced by the FT process.

Figure 1. The FT CANS process flow.

Solutions to Fuel Sustainability

Lowering the carbon intensity of your enterprise requires innovation and collaboration. And despite disruptive global challenges and rapidly evolving technologies, solutions that continuously improve project development are more versatile than ever before.

From changing the fuels you use to capturing the carbon produced, redefine what’s possible with Black & Veatch. Learn more at

bv.com

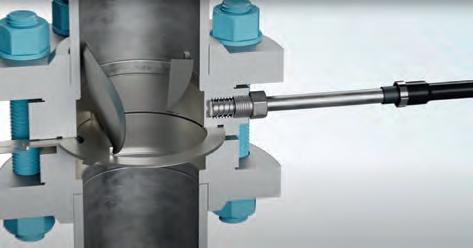

compared with conventional fixed bed reactor configurations, reducing capital costs, and increasing large-scale commercial viability. Multiple tubes, each containing around 60 - 80 CANS carriers filled with catalyst, are hosted in the reactor, meaning the system can be readily scaled across a very wide range of production volumes without impacting performance. The design of the reactor means that the gas is forced through the catalyst as it passes radially from the inside to the outside of the tube (Figure 1). By using a series of connected, smaller diameter catalyst beds, heat generated can be more tightly controlled and removed and pressure drop is lowered. The shorter catalyst bed achieved with CANS carriers compared to standard fixed-bed reactors means catalyst size can be optimised to reduce diffusion resistance and drive process efficiency by facilitating selectivity towards more desirable long-chain hydrocarbons.

Overall, the FT CANS configuration not only uses much less catalyst than a standard fixed bed reactor, but also requires 95% fewer tubes and a smaller installation footprint for the same scale of production. The technology provides a three-fold increase in production volume when compared with conventional fixed-bed reactors of the same size. The overall estimated cost reduction is up to 50% with a CO conversion rate of >90%. Step-change advances in technology such as this are pivotal in lowering the cost to produce SAF and enabling economically viable large-scale production to meet the increasing global demand.

Economies of scale – the economic impact of investment in SAF production

The investigations by EY and Johnson Matthey show the potential economic benefits of SAF production. If 10% of UK jet fuel is produced as SAF in the UK, this equates to up to £11.9 billion in GVA. This has been calculated in real terms and discounted for 3.5% SDR as based on the economic appraisal guidance from the HMT Green Book, broadly reflecting the uncertainty of future impacts. The total potential GVA includes direct, indirect, and induced GVA, and covers both construction and operational impacts. Direct GVA is derived from income from construction for SAF production (main facilities and upstream) and indirect from the wider effect on the supply chain. Induced GVA is based on the wider impact on the economy, allowing for the knock-on effects on other industries and services as the SAF industry begins to grow.

While the calculations carried out by EY are only applied to the UK, using domestic targets for SAF production and local economic landscape, it opens the question of what the impact of increased SAF production worldwide could have on global economies. While further research would be needed to quantify wider global economic benefits, international legislation is aligning to drive huge increases in SAF production out to 2050 and the emissions reduction potential is clear.

Antonio Batistini, Enrico De Dominicis, Massimo Di Amato, Barbara Morico, Emma Palo, and Paola Sclafani, MAIRE, Italy, explore how depolymerisation technology can support the creation of new circular value chains in the plastics sector.

Plastics are a fundamental material that we use every day. According to the Organisation for Economic Cooperation and Development (OECD)’s ‘Global Plastics Outlook’, published in February 2022, plastics production has increased nearly 230-fold, from 2 million t in 1950 to 460 million t in 2019, with a further projected increase to about 1231 million t in 2060.1

The success of plastics is now becoming its greatest threat. According to the OECD’s ‘Global Plastics Outlook Policy Scenarios to 2060’, published in June 2022, 353 million t of plastics waste were produced in 2019 alone, a number expected to reach more than 1000 million t by 2060; moreover, the plastics waste management system is severely inadequate, with only 33 million t being presently recycled and with about 153 million t being completely mismanaged.2

To tackle what is becoming a major global environmental crisis, in March 2022 the UN Environment Assembly adopted a resolution aimed at developing an international legally binding instrument to

April 2024 23 HYDROCARBON ENGINEERING

stop plastics pollution. During the negotiations held by the Intergovernmental Negotiating Committee on Plastics Pollution, organisations like the High Ambition Coalition to End Plastic Pollution put forward strong demands to place limits on plastics production and use.3 To comply with these exacting demands, the plastics industry must rapidly increase the effectiveness and efficiency of plastics waste recycling systems, establishing real and consequential plastics circular value chains.

A fully integrated approach to plastics circularity

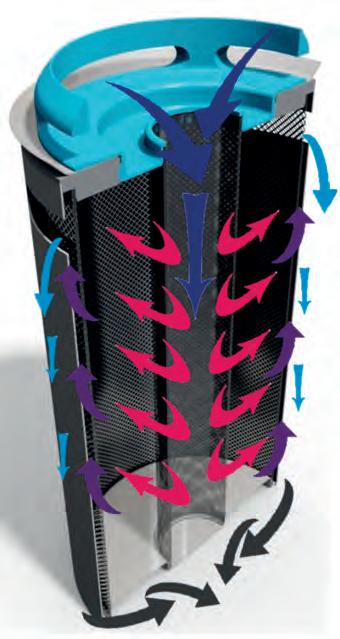

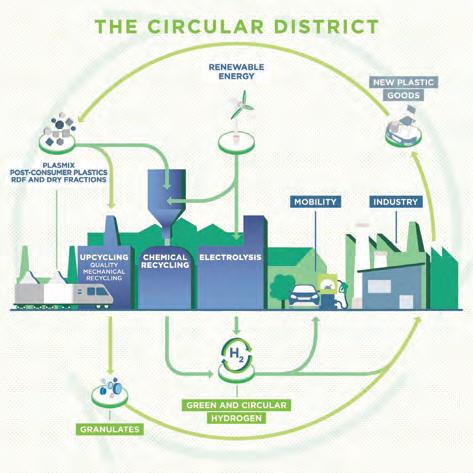

With the aim of developing technologies for mechanical and chemical recycling of waste, NEXTCHEM (MAIRE) has developed a Green Circular District Model (Figure 1) that consists of an integrated platform of green chemistry technologies, including upcycling and chemical recycling.

In this framework, MyRemono is a NEXTCHEM subsidiary that is focused on developing and licensing a novel and

efficient continuous depolymerisation technology for plastics chemical recycling, particularly for polymethyl methacrylate (PMMA), polystyrene (PS) and, in the future, polyolefins (PO).

MyRemono’s technology is located in the chemical recycling area of the Green Circular District Model, building on a chemical conversion process focused on the production of monomers from non-recyclable plastics. This technology can be applied to the above-mentioned polymers (PMMA, PS and PO), deriving both from industrial scraps and post-consumer waste, from which it can recover valuable monomers to produce virgin-like recycled polymers. This results in a viable solution to enhance plastics recycling, reduce the consumption of fossil-based materials, and address some of the main issues affecting mechanical recycling processes.

A tool for plastics chemical recycling

The depolymerisation technology can be categorised as a thermal-catalytic cracking process that results in monomers which can be recovered and reused for the production of a new virgin polymer.

The primary goal of this technology is to offer a valid solution to the growing global problem of pollution caused by plastic waste, capable of eliminating all the negative environmental and economic impacts generated by the practices currently used for the management of this type of waste.

This technology is a continuous process, based on a molten metal flow, maintained at a temperature ranging from 300 - 500°C. Polymeric materials to be treated are introduced in the form of grinded particles into the depolymerisation reactor. The proper mixing of the polymeric materials with the continuous molten metal flow improves the quality of both the breakdown of the polymers’ molecular bonds and the recombination of molecules to obtain the desired monomers, while reducing overall depolymerisation reaction times.

The depolymerisation reaction can be described as follows:

n When the polymers are immersed in the molten metal, the carbon-carbon bonds that form their molecules break down and the resulting radicals are fixed to the metal. In this step, a series of electrons is released, with consequent forming of aliphatic compounds.

n The molten metal assumes acid characteristics, the aliphatic components migrate to its surface, and therefore are protonated, becoming carbocations.

n Carbocations can undergo different types of reactions, such as breaking into two fragments, isomerising, or undergoing cyclisation. At the end of these reactions, they lose a proton, restoring the activity of the molten metal. They also migrate to the surface in the form of gas.

The main product generated by the reaction between polymers and the molten metal flow is a monomer-rich depolymerisation gas which, after emerging from the molten metal, is conveyed into a condensation or a cooling system.

The configuration of this latter part of the process is influenced by the type of polymer treated; for instance,

April 2024 HYDROCARBON ENGINEERING 24

Figure 1. NEXTCHEM’s Green Circular District Model.

Figure 2. MyRemono semi-industrial prototype under construction.

Our brands supporting your Oil & Gas Projects: PERFORMANCE, ENGINEERED. trilliumflow.com/hydrocarbon-eng

pump solutions are meticulously engineered and field-proven to ensure your seamless Oil & Gas downstream plant operations.

Our

RO-FT API 610

Pitot Tube Centrifugal Pump

AHPB AHPB-D BB5-type API 610 Centrifugal Pump

GABBIONETA

® - TERMOMECCANICA POMPE

DSA BB2-Type API 610 Centrifugal Pump

PUMPS

ROTO-JET ®

when processing PMMA and PS-based polymers, a liquid final product is generated, thus requiring a final condensation system. When treating polyolefins, the depolymerisation technology generates mainly a gaseous final product which requires a cooling system similar to that used in hydrocarbon-fed ethylene and propylene plants.

The type of polymer treated also influences either the composition and the quantity of the noncondensable or useless fraction of the depolymerisation gas which, depending on its characteristics, could be vented after

passing through a vent gas treatment system or used as an energy source to partially fuel the depolymerisation process.

The continuous flow of the molten metal also favours its continuous cleaning, eliminating the solid products generated during the breakdown of the polymers’ molecules, without requiring any stop to the depolymerisation process.

The molten metal can be lead, tin, zinc, antimony, cadmium and magnesium and mixtures thereof, optionally mixed with other metals and/or acid components.

Industrial application

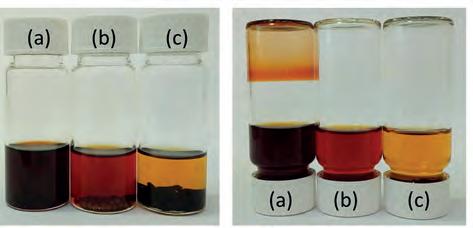

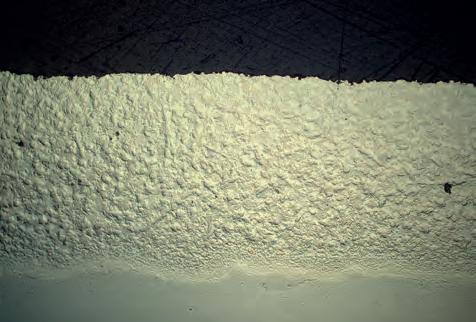

The depolymerisation technology has been tested through both lab-scale and semi-industrial scale prototypes (Figure 2) using different plastics waste and materials.

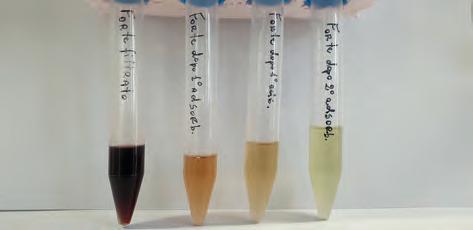

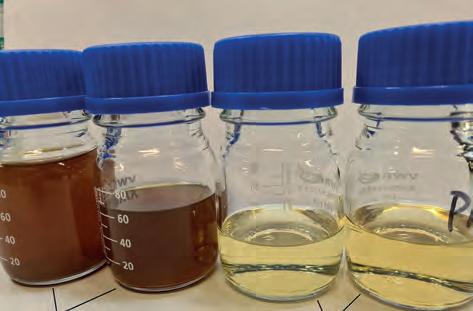

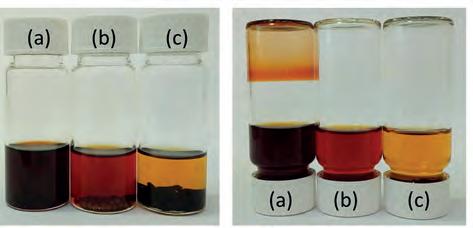

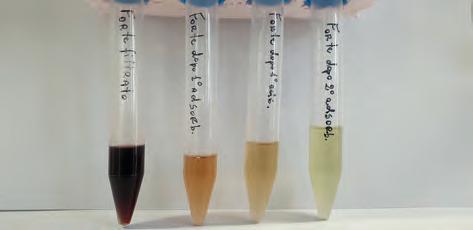

The most extensive tests have been performed using PMMA waste and materials (Figure 3), which could be consistently depolymerised to a high-quality recycled methyl methacrylate (rMMA). To perform the tests, a mixed-coloured PMMA regrind, with a granule size varying from 1 mm to 16 mm, was used as the main raw material.

The PMMA tests were primarily focused on identifying the optimal operational conditions for the depolymerisation process, in order to maximise both the recovery rate and the quality of the recovered recycled monomer rMMA. The tests achieved a recovery rate up to 95 wt% on the PMMA processed, with an MMA concentration up to 97 wt% on the raw rMMA.

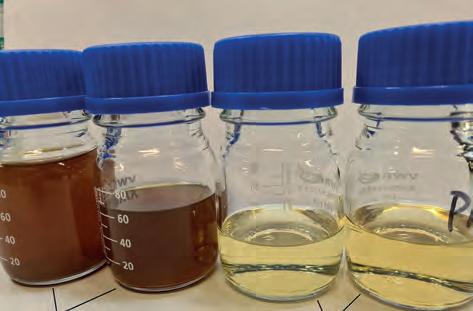

Secondly, a series of tests were carried out to identify the most efficient and effective purification system, including tests on activated carbon filtration (Figure 4) and nanofiltration (Figure 5), with varying degrees of success.

At the end of this second phase of testing, a purified rMMA with a quality suitable to generate a 100% rMMA-made cast sheet was achieved (Figure 6). Moreover, samples of this purified rMMA sent to third parties for analysis and production tests have been received with significant interest.

Building on the results obtained during the PMMA testing campaigns, MyRemono is developing its first industrial plant, focused on recycling PMMA into a high quality rMMA with a 99%+ MMA content, characterised by a carbon footprint that is approximately 96% lower than that of virgin MMA.4 This new plant will work in a continuous mode for an expected on-stream factor of about 7680 hr/yr, with a PMMA regrind throughput capacity of 650 kg/h and an overall yearly throughput capacity of approximately 5000 t. The plant will incorporate the following main features:

n PMMA reception and storage area.

n PMMA quality control platform and charging system.

n A depolymerisation unit.

n A condensation and a two-stage purification unit.

n A rMMA storage and loading system.

The PMMA is fed into the depolymerisation unit where it is mixed with the plant molten metal. The contact between the PMMA and the metal greatly amplifies the effectiveness of the thermal energy, breaking down the PMMA molecular bonds in a fast and efficient way, and produces a methyl methacrylate rich depolymerisation gas, together with some solid residue.

April 2024 HYDROCARBON ENGINEERING 26

Figure 3. PMMA regrind.

Figure 4. Activated carbon filtration, from left not filtered and filtered samples.

Figure 5. Nanofiltration, from left not filtered, retentates and permeates.

PRECISE, ACCURATE, RELIABLE

HTRI is the recognized leader in process heat transfer and heat exchanger technology. Our flagship product, Xchanger Suite, is considered the most advanced thermal process design and simulation software for rating, simulating, and/or designing a variety of heat transfer equipment. Our calculation methods draw from over six decades of industry-specific research and data, ensuring unparalleled accuracy and reliability in our solutions.

Version 9.2.1 introduces a wide range of new and updated capabilities, including circulation boiling models for kettle reboilers tubeside falling film methods heat transfer/pressure drop methods for tubeside non-Newtonian flow methods for downflow tubeside condensation pressure drop

When precision is paramount, trust in HTRI.

HTRI.NET/SOFTWARE/XCHANGER-SUITE

While the gas is fed to the condensation unit to become raw rMMA, the solid residue is accumulated inside a dedicated section of plant and from there it is periodically removed and sent to disposal, without requiring any plant stoppage.

The raw rMMA is then fed to the purification unit where, thanks to a two-stage process, it is purified from both MMA low and heavy boilers, as well as from other impurities, generating a high quality purified rMMA.

At the end of the purification step, the plant will have generated the following outputs:

n A purified rMMA stream.

n A MMA high boilers liquid stream used internally to generate energy on site.

n A MMA low boiler gaseous stream used internally to generate energy on site.

n A water stream generated during the purification step, to be sent for recovery or disposal.

n A solid residue stream generated during the depolymerisation step, to be sent for recovery or disposal.

The plant, which will be located in Montorio al Vomano in central Italy, is presently at the permitting phase and is due to start operations by 2H25. According to first forecasts, MyRemono is expected to license the technology starting from 2030.

Future applications

According to the preliminary tests performed on styrene-based and olefin-based polymers, the technology appears suitable to efficiently recycle these types of plastics waste and materials.

Tests performed on high impact polystyrene (HIPS) highlighted an interesting crude rStyrene quality (Figure 7), as well as a high recovery level. Analysis of MyRemono raw rStyrene has also been conducted by a third party.

Throughout 2024, further tests will be performed, which aim to maximise rStyrene quality and recovery rates, as well as demonstrate the technology’s applicability to other polystyrene-based streams.

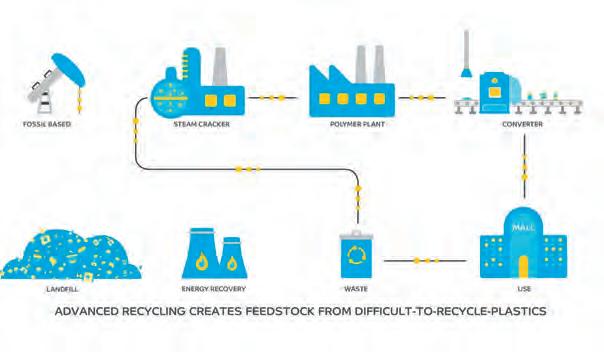

Tests with polyolefins demonstrated that the depolymerisation technology could work as a ‘polyolefin steam cracker’, returning these plastics into an ethylene- and propylene-rich gas, which could potentially be directly fed into the back-end of a steam cracker without requiring any further cracking process (Figure 8). MyRemono’s polyolefins application by-passes the clean-up and steam cracking phases, which provides a more efficient and cost-effective solution.

Between 2024 and 2025, tests will be performed aimed at confirming and optimising this additional technology application.

Conclusion

Boosting the scope of plastics waste recycling systems and establishing highly valuable plastics circular value chains is of paramount importance for the plastics and chemical sectors to thrive.

To achieve these objectives, the massive deployment of a combination of consolidated technologies and new recycling solutions is vital.

In this framework, MyRemono’s technology – combining advantages such as a continuous process, high energy-mass transfer ratio, short residence times and a high flexibility in treating different types of plastics waste within compact plants – is a valuable tool in the fight against plastics pollution, contributing to the decarbonisation of the plastic industry and strengthening the health of the plastics and chemical sectors.

References

1. ‘Global Plastics Outlook: Economic Drivers, Environmental Impacts and Policy Options’, OECD, (February 2022).

2. ‘Global Plastics Outlook Policy Scenarios to 2060’, OECD, (June 2022).

3. ‘Potential options for elements towards an international legally binding instrument by the co-chairs of the High Ambition Coalition to End Plastic Pollution’, High Ambition Coalition to End Plastic Pollution.

4. ECOINVENT 3.9.1 database for the conventional European production of virgin-MMA.

April 2024 HYDROCARBON ENGINEERING 28

Figure 6. MyRemono purified rMMA sample and rPMMA sheet 100% rMMA-made construction.

Figure 7. HIPS shreds and MyRemono’s rStyrene.

Figure 8. MyRemono route to polyolefin chemical recycling.

Kae S. Wong, Fabrice Cuoq, Giri Anupam, Omid Emamjomeh and Christoph J. Dittrich, SABIC Global Technologies B.V., alongside Rasha H. Daadoush and Vishvedeep Bhatt, Aramco, highlight how adsorption is an effective way to stabilise and remove chlorides in plastic derived oil (PDO) to protect downstream assets.

Plastics are ubiquitous in industrial and commodity applications. While more than 1 million t of plastics are produced and used every day, used plastics have created environmental challenges due to their long natural decomposition process. Global awareness about plastic pollution and its impact on ecosystems continues to grow. Producers are experiencing growing pressure from consumers to reduce plastic waste, and national

April 2024 29 HYDROCARBON ENGINEERING

governments, particularly in Europe, are introducing ambitious targets for a circular economy. All these factors are currently catalysing the development and implementation of plastic recycling technologies around the globe.

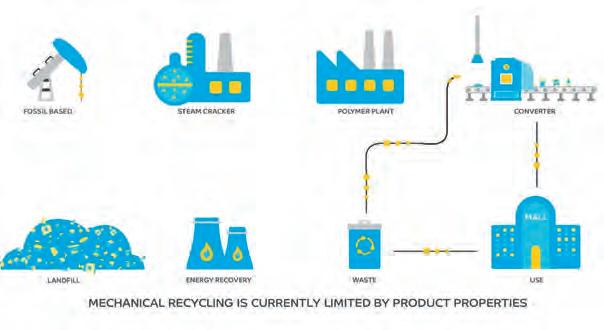

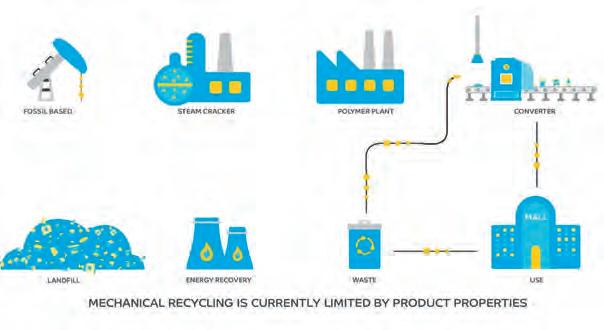

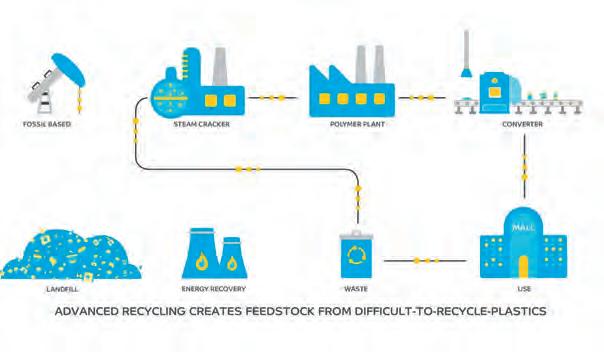

Plastic recycling recovers used plastic products at the end of their useful life and reprocesses them via mechanical and chemical recycling routes. Mechanical recycling uses mechanical processes such as sorting, washing, drying, grinding and compounding, to convert used plastics back into plastic products. Advanced recycling processes mostly rely on the pyrolysis of used plastic packaging, possibly after washing, into plastic

pyrolysis oil, which is also known as plastic derived oil (PDO). Both routes have their pros and cons and are complementary to each other (Figure 1). Mechanical recycling has the advantage of reprocessing used plastic directly in the converter, which is more energy efficient. Mechanical recycling has limitations on optimum recycling of plastic packaging waste because plastics are mostly recycled into applications that are not recyclable again after use. The product properties of mechanically recycled plastics are typically of lower value than for virgin plastics, which limits, combined with possible contaminants, the use in applications driven by high standards, for example in food or healthcare packaging. Mechanical recycling is mostly suitable to recycle pure thermoplastics, which are available via collection and sorting in large quantities. However, this collected waste also contains multilayer/multiproducts packaging applications, food residues and plastics which cannot be sorted for mechanical recycling for other reasons.

On the other hand, chemical recycling ensures mechanical and processing properties equivalent to the virgin material, making it an attractive recycling route for brand owners and customers that demand high quality packaging solutions. Chemical recycling enables the recycling of plastic waste streams for which there are no recycling solutions today. It recycles low quality, mixed plastic waste that is otherwise destined for incineration or landfill, back to the original polymer through pyrolysis to its molecular building blocks.

Other chemical recycling technologies that rely on solvolysis or biological/enzymatic degradation are being developed. However, these technologies are generally dedicated to the recycling of one specific polymer, e.g. PET, which requires high purity feedstock in a similar manner to mechanical recycling, and is generally not suitable for used polyolefins.

In the pyrolysis process, the used plastics are heated to approximately 400°C or more without adding oxygen, so the long chains cleave into shorter chains. Through the pyrolysis processes, the plastic waste is broken down to oil, (called pyrolysis oil or PDO) gas and a solid residue. The PDO is used as an alternative feedstock to replace fossil oil or naphtha and fed to a liquid cracker for the production of monomers

April 2024 HYDROCARBON ENGINEERING 30

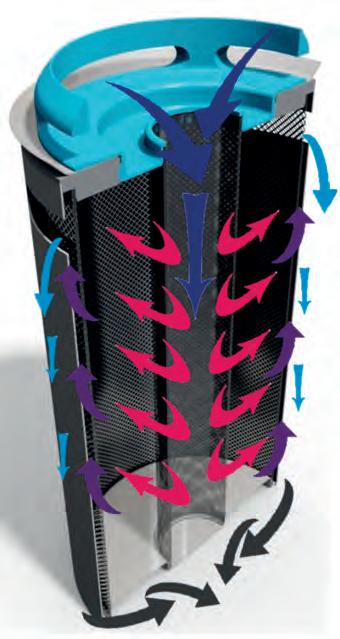

Figure 1. (a) Mechanical recycling and (b) chemical recycling of used plastics.

Figure 2. World’s first commercial unit for the chemical recycling of used plastic with the pyrolysis unit on the right and the hydrotreatment unit on the left (photograph taken in Geleen, the Netherlands in March 2023). Image courtesy of SABIC.

WE’RE COMMITTED TO YOUR EFFICIENCY

Our analyzers make tough SRU work a little easier

We know how hard it is to manage sulfur recovery unit (SRU) processes, and the levels of skill, concentration, and dedication your team needs.

That’s why we make sure you don’t have to worry about your analyzers, too. We’ve been designing industry-standard SRU analyzers for decades, focusing on reliability, longevity, accuracy, robust design, and ease of use.

We make analyzers for every part of the sulfur removal process – from SRU feed gas to the measurement of stack emissions, and everything in-between - so you get one convenient source for unparalleled engineering and support.

AMETEKPI.COM/SRU

such as ethylene or propylene that will be used to produce polyolefins.

Compared to fossil-based feedstock, PDO contains substantially higher amount of chlorides, nitrogen- and oxygen- containing components. Souchon et al mentioned that the organic chlorine (Cl) concentration in PDO can be up to two orders of magnitude higher compared to a fossil feed. 1 Those contaminants can have a detrimental impact on the assets, such as corrosion (from chlorinated and fluorinated species) and lead to fouling (from olefins and diolefins). As a result, further processing of PDO requires pre-treatment of the raw PDO to remove contaminants and reactive components, such as (di)olefins, chlorides, nitrogen- and oxygen-containing components. Additionally, unstable components in PDO can lead to precipitation and sedimentation of gum-like degradation products during transport and storage.

The PDO pre-treatment methods can be divided into physical and chemical techniques. Hydrotreatment is a chemical upgrading method which catalytically converts (di)olefins into saturated components,

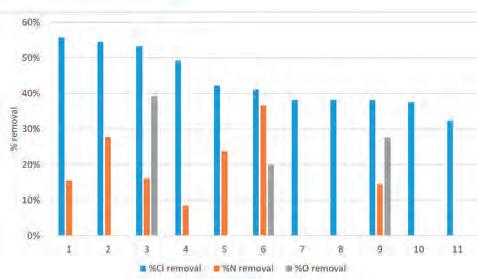

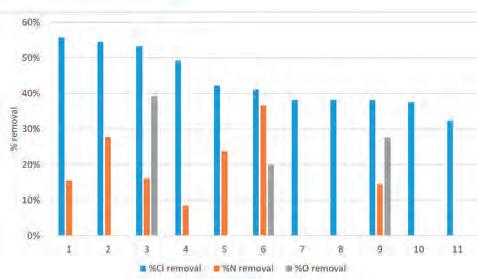

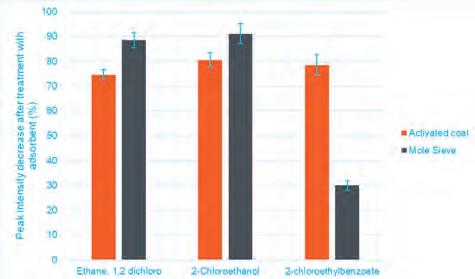

different solid adsorbents. The selected adsorbents include silica product 1 (1), clay product 1 (2), ion exchange resin (3), molecular sieve (4), clay product 2 (5), activated carbon product 1 (6), activated carbon product 2 (7), silica product 2 (8), washed activated carbon (9), clay product 3 (10), and calcium oxide (11).

nitrogen-containing components into ammonia, oxygen-containing components into water, and organic chlorinated components into hydrogen chloride. SABIC is building the first-of-its-kind commercial hydrotreating unit for this purpose (Figure 2). The physical upgrading methods, such as adsorption, absorption, filtration, liquid extraction and distillation, rely on removing the contaminants based on the physical properties of PDO components.

PDO characterisation

In order to validate effective upgrading methods, adequate analytical techniques are required. Understanding chloride speciation is critical as chlorides are amongst the most harmful components with regards to corrosion as they form hydrochloric acid during high temperature processing. Souchon et al summarise the standard methods of chlorine determination in crude oil and petroleum derivatives, e.g., ASTM D4929, ASTM D7536, UOP 779, etc. These standard methods only monitor the total Cl content, which may not be sufficient for Cl compounds originating from chlorinated polymers such as PVC. Cl speciation techniques (which are used to identify the type of chlorinated species) are essential to obtain a better insight for developing upgrading technologies and distinguishing organic chlorides from inorganic salts. 1-chlorobutane, 1,2-dichloroethane and 2-chloroethanol were the most abundant volatile organic Cl species identified in PDO samples analysed by gas chromatography with ICP tandem mass spectrometry, GC-ICP-MS/MS. 1

Pyridine and its derivatives, such as methylpyridines, are found in the naphtha fraction of PDO analysed by the 2D gas chromatography (GC X GC) coupled to four different detectors. 2 Regarding oxygenates, alcohols, ketones and ethers were detected.

SABIC recently developed a simple and affordable speciation method. The method uses a specific halogen detector (XSD) combined with 1D gas chromatography. Compounds are first identified using a separate GC X GC-MS system and added to the GC-XSD chromatogram using known retention time. Chloride salts and organic chloride compounds, such as chlorinated hydrocarbons, e.g., chlorethanol and chlorobenzonitrile, were successfully identified and quantified.

PDO upgrading via adsorption

Based on the PDO characterisation data, the heteroatoms in PDO are mainly polar in nature with low carbon numbers. Hence, some of the oxygen-, nitrogen-, and chloride-containing compounds in PDO can be adsorbed on solid adsorbents, such as activated carbon, solid alkali, solid acid, clays, silica, etc. Depending on the size and shape of the adsorbents, e.g., pellets, extrudates, powders, granules, etc., the adsorption vessel can be a fixed bed or a stirred slurry unit.

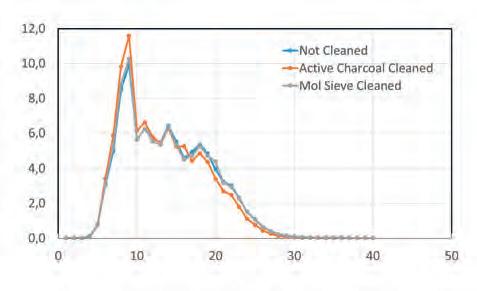

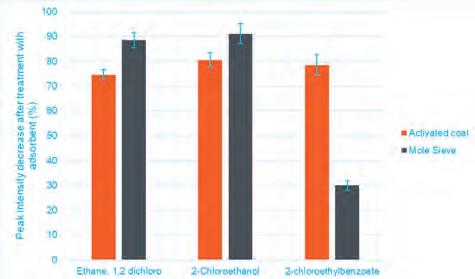

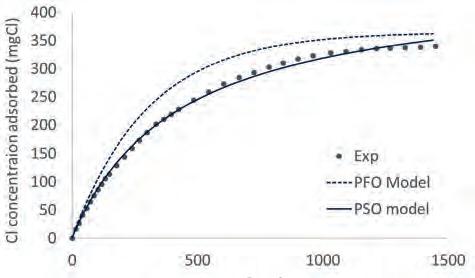

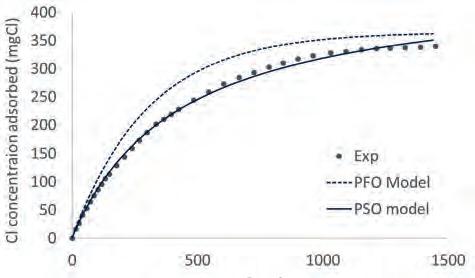

Figure 3 shows the reduction in the oxygen-, nitrogen- and chloride-containing compounds in the PDO, using selected solid adsorbents. All of the tested adsorbents show between 30 and 55% relative

April 2024 HYDROCARBON ENGINEERING 32

Figure 3. The reduction of oxygen compounds, nitrogen compounds, and chloride compounds in the used PDO, using

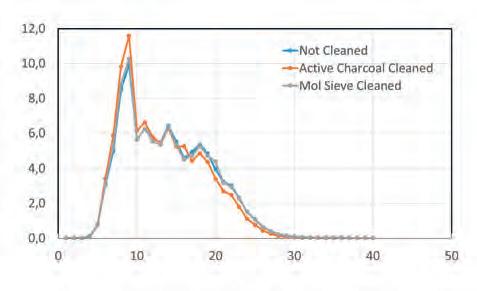

Figure 4. The changes in hydrocarbon composition (carbon number) for untreated and treated PDO using molecular sieves and activated carbon.

Cl reduction. These results have been obtained in batch (stirred batch slurry) experiments using these solid adsorbents at approximately 10 wt% and 24 hours contact time at 20°C. The initial atomic chloride concentration was 160 ppmw. 3