September 2023

www.mercuryadsorbents.com Optimized Mercury Removal With MERSORB® mercury adsorbent pellets MERSORB® mercury adsorbent pellets – a Trademark of Nucon International, Inc. (NUCON®) • PROVEN RELIABLE – EVEN IN CRACKED GAS • HIGH MERCURY CAPACITY – HOT, COLD, WET or DRY • MORE PELLET SIZES – MORE PROCESS DESIGN FLEXIBILITY • LOW MOISTURE – FAST START-UP • 40 YEARS EXPERIENCE – ADSORPTION PROCESS DESIGN Your Experts for Mercury Removal – in Ethylene Plants PROVEN PROCESS – PROVEN PRODUCTS AntiMercure® is a Registered Trademark of Selective Adsorption Associates, Inc. for its Process Engineering Services MERSORB® is a Registered Trademark of NUCON International, Inc. for its mercury adsorbent pallets • Cracked Gas • Ethane Feed Gas • LPG, Naphtha, & Light Condensate Feed Liquid • Regen. Gas from Cracked Gas Driers • Light Olefin Gas from FCC Units • AntiMercure® Process Engineering • MERSORB® mercury adsorbent pellets

Lopez, Hernando Salgado, Aaron Liew, Emmanouil Smaragdis and Corbett Senter, BASF, outline the

feeds, and the

the better

Neil Richards, PS Filter, Canada, considers the importance of effective filtration and separation techniques within the downstream oil and gas industry, in order to produce cleaner fuels.

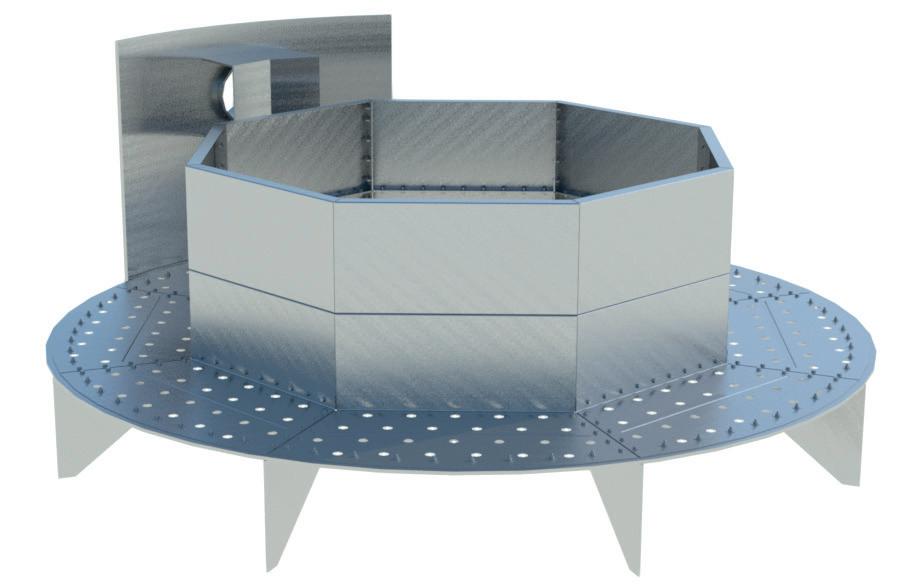

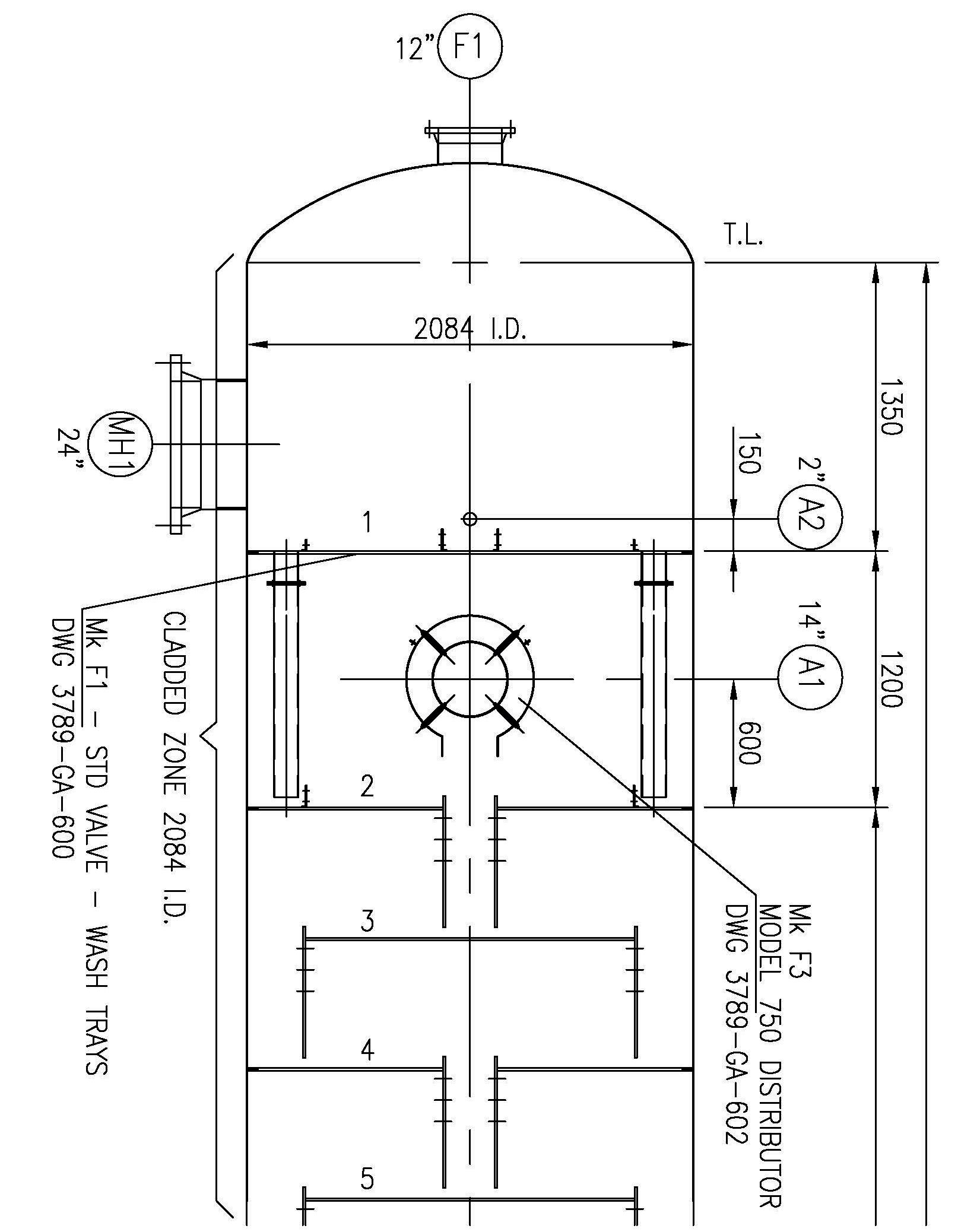

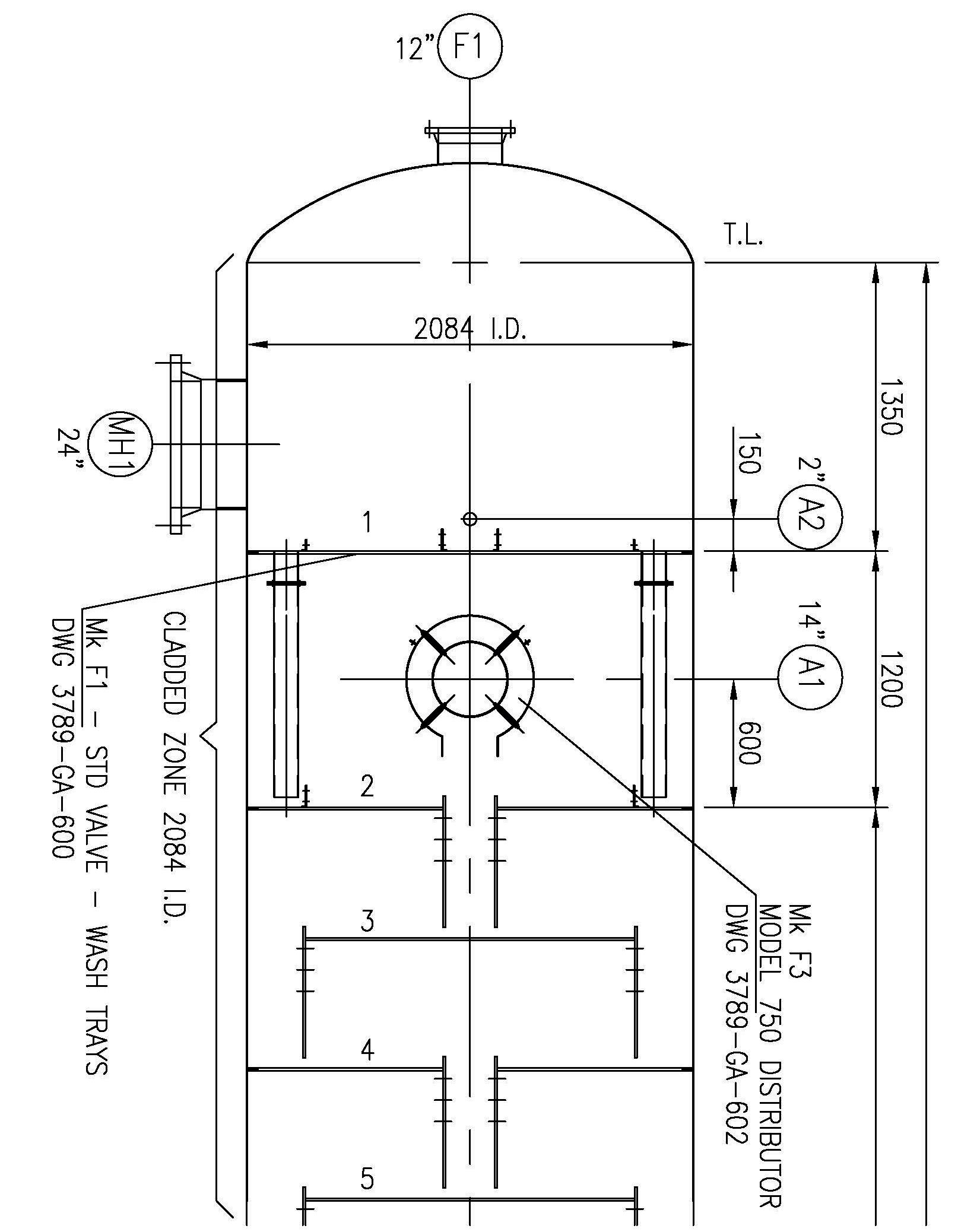

31 Two-phase feed distributors for distillation and absorption columns

Aadam F. Aryan, Distillation Equipment Company Ltd, UK, discusses the selection of appropriate feed arrangements for two-phase feeds, and lists several industrial examples.

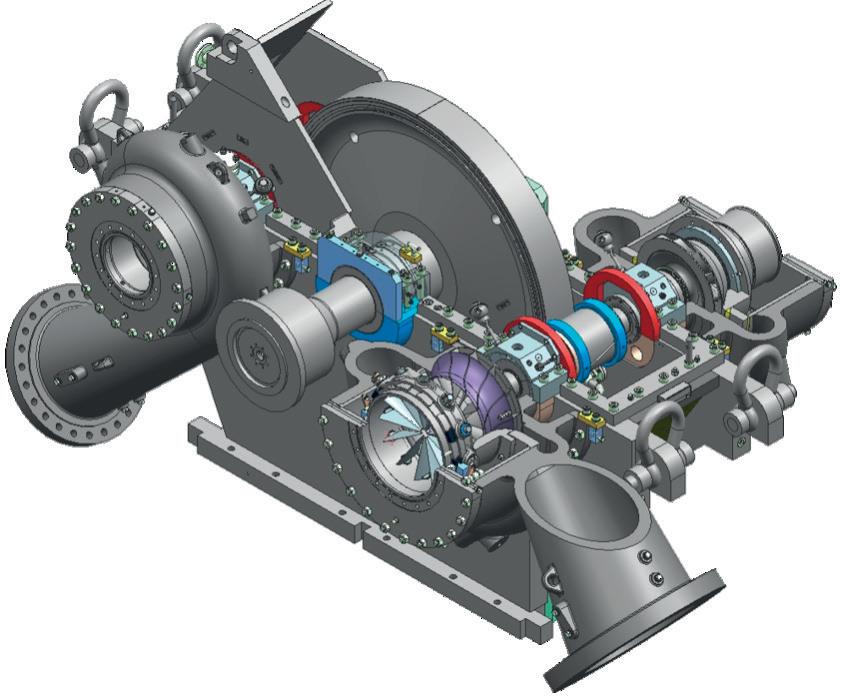

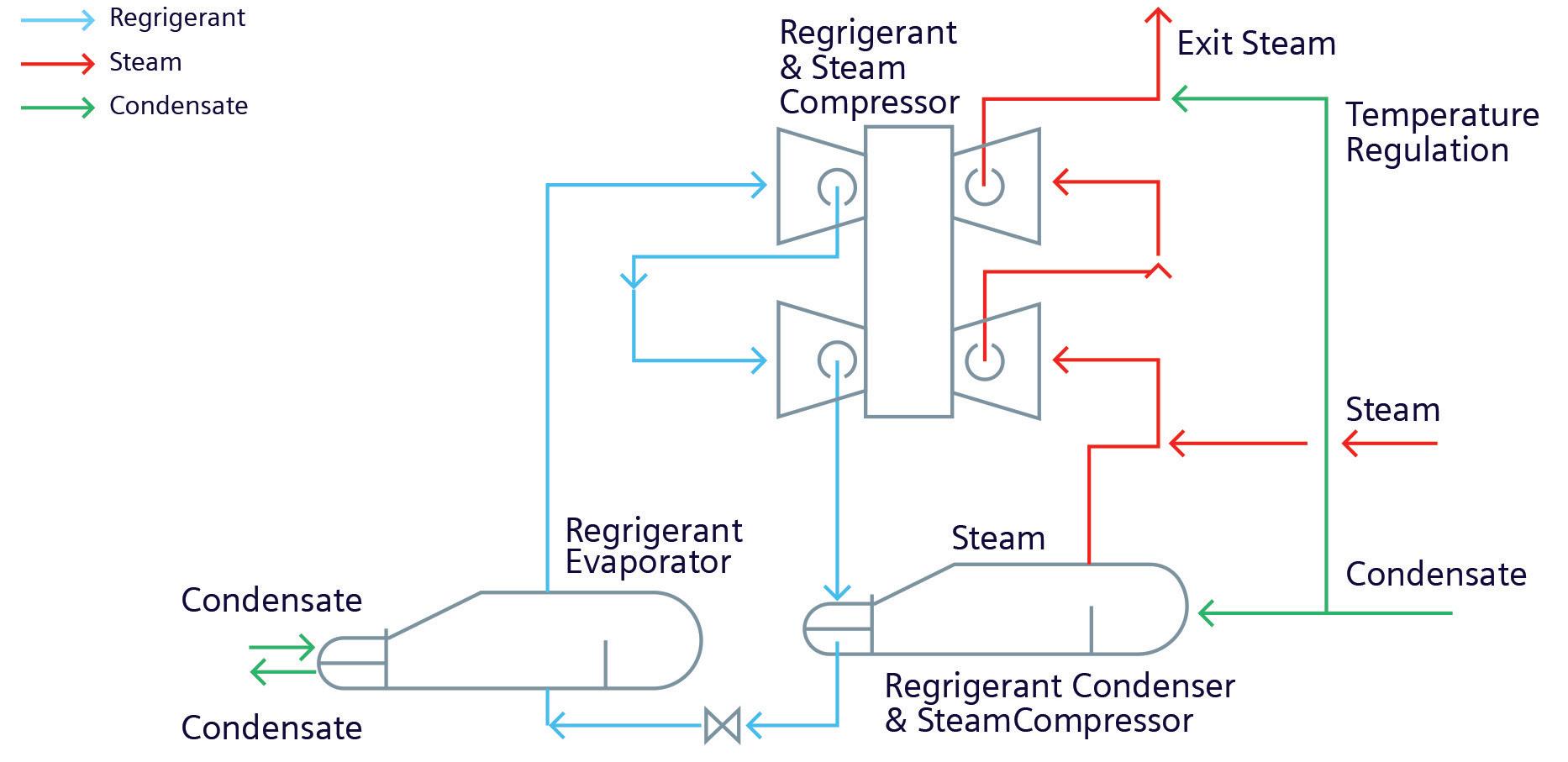

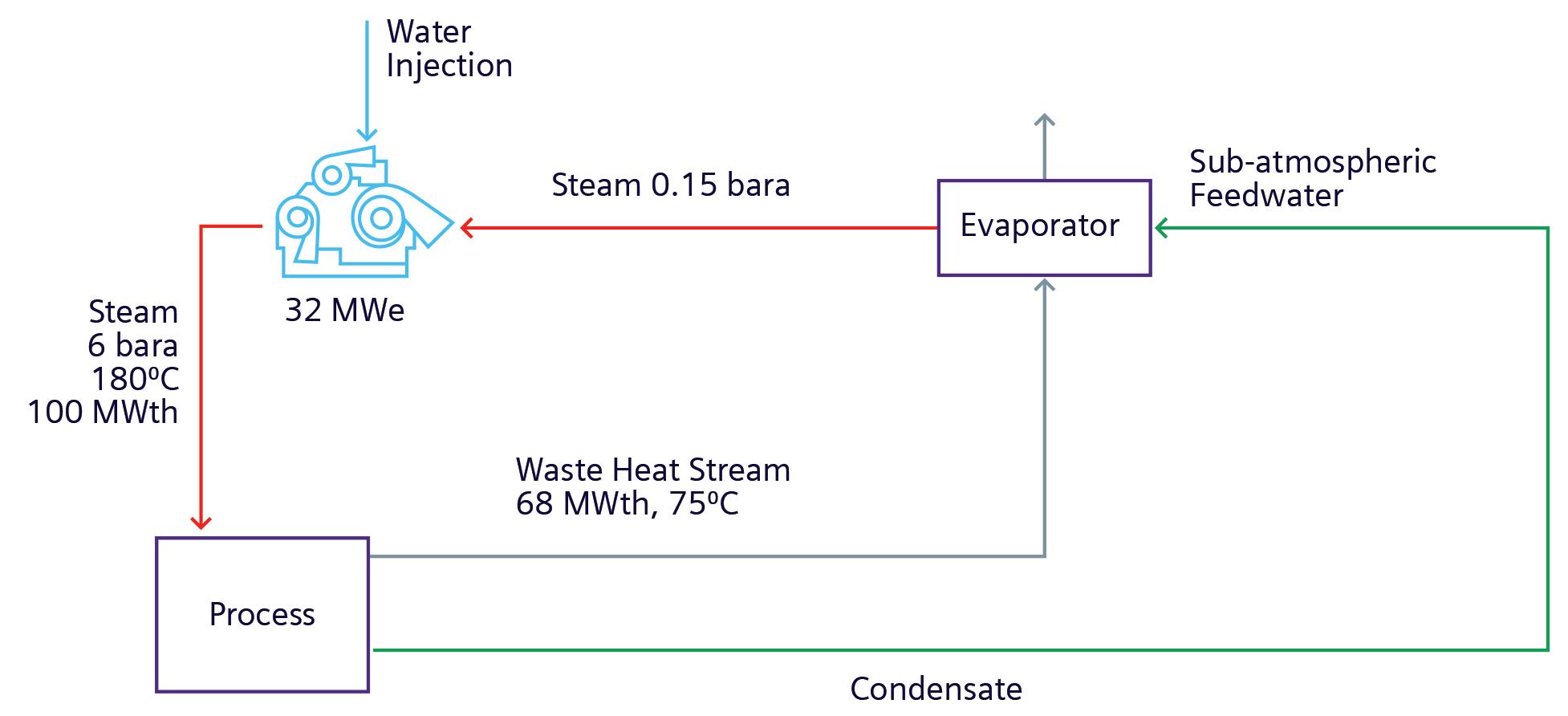

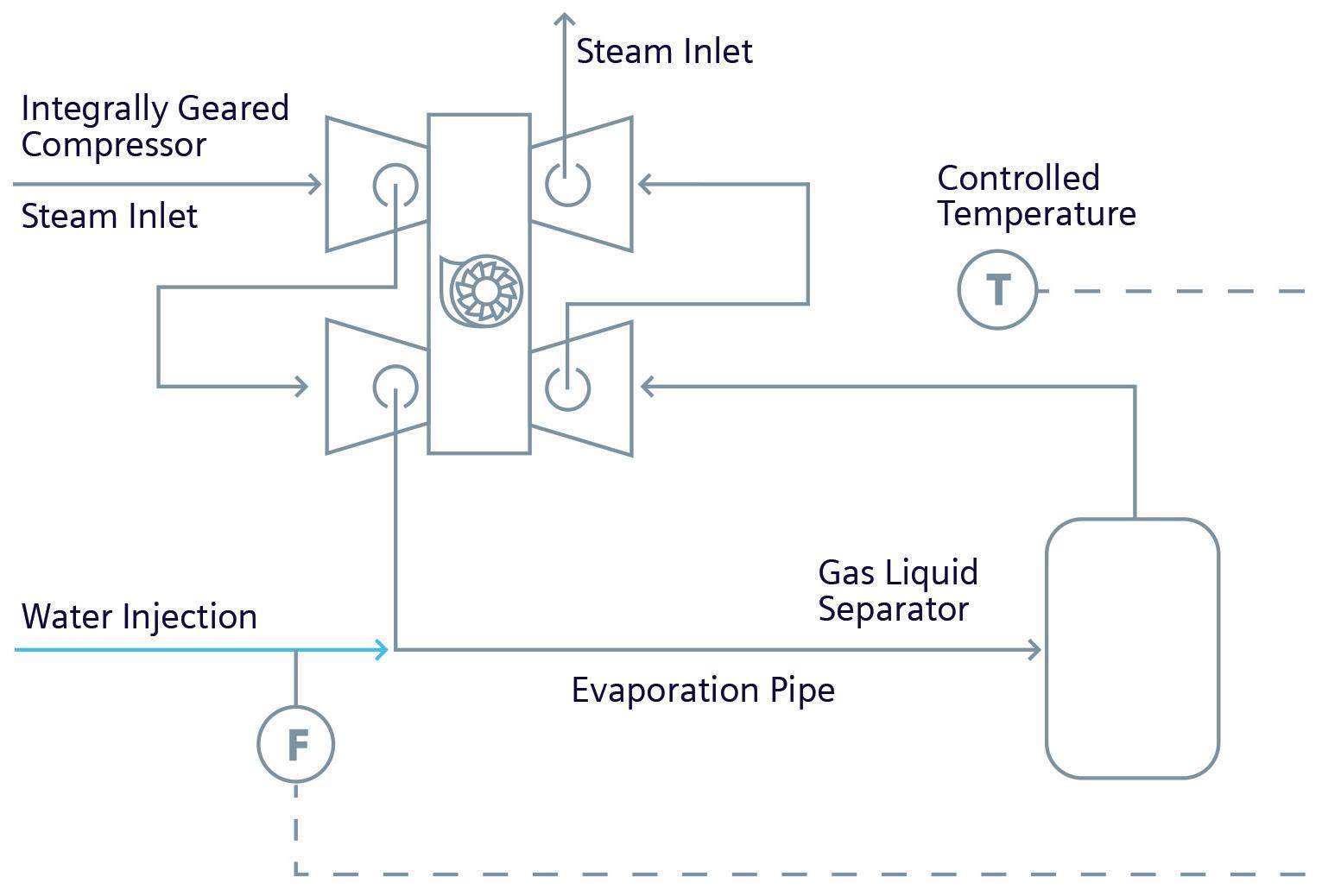

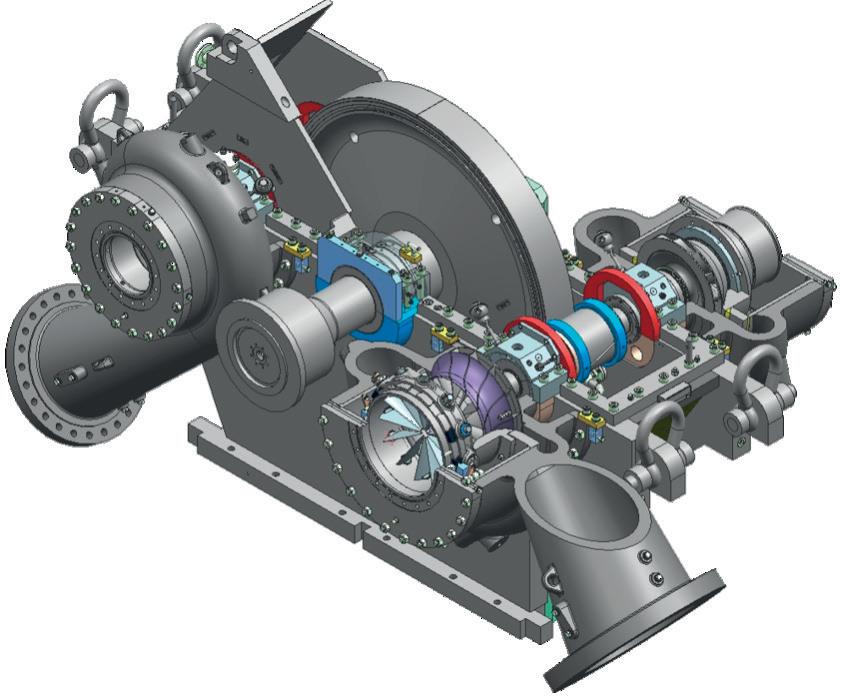

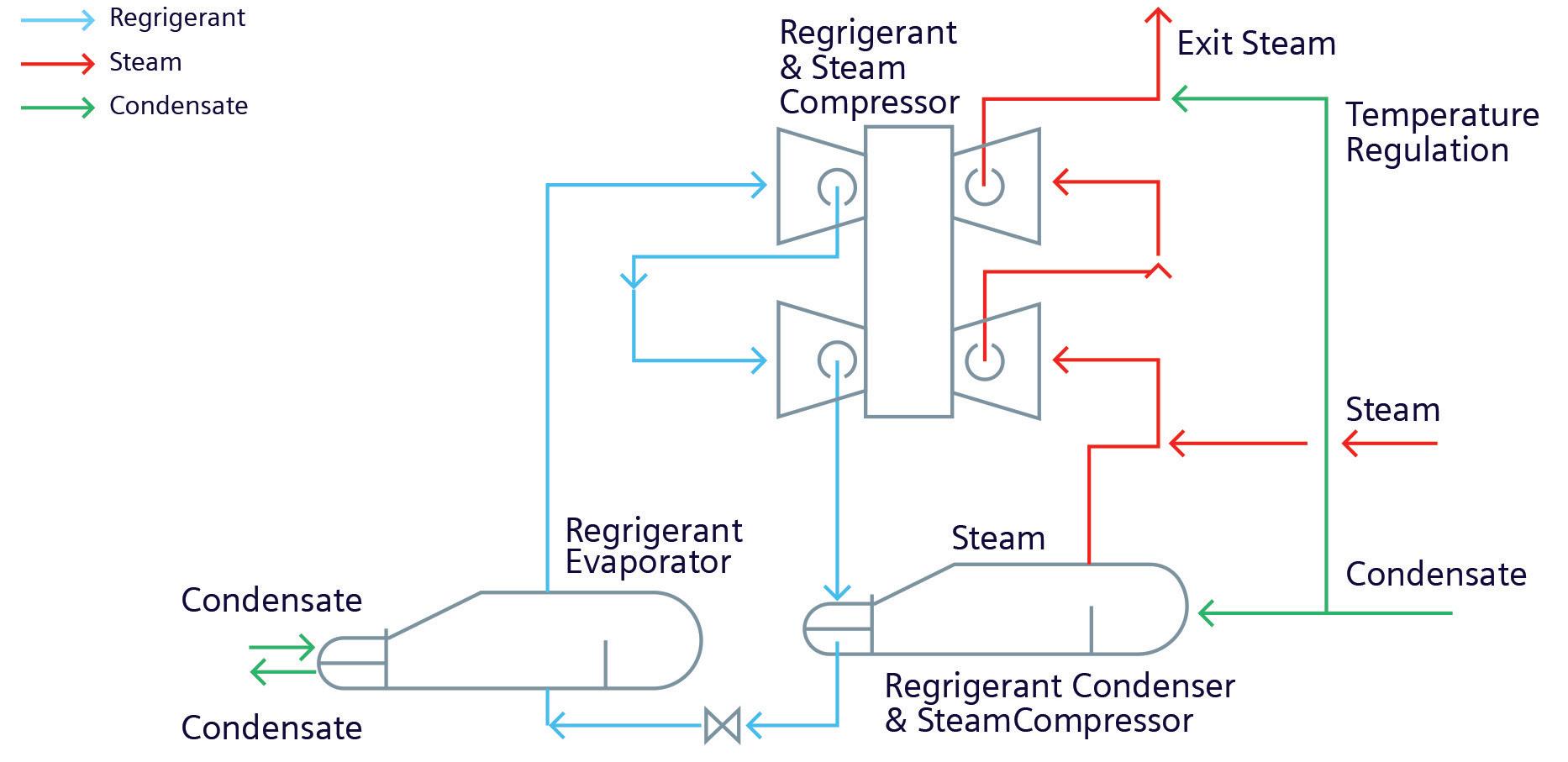

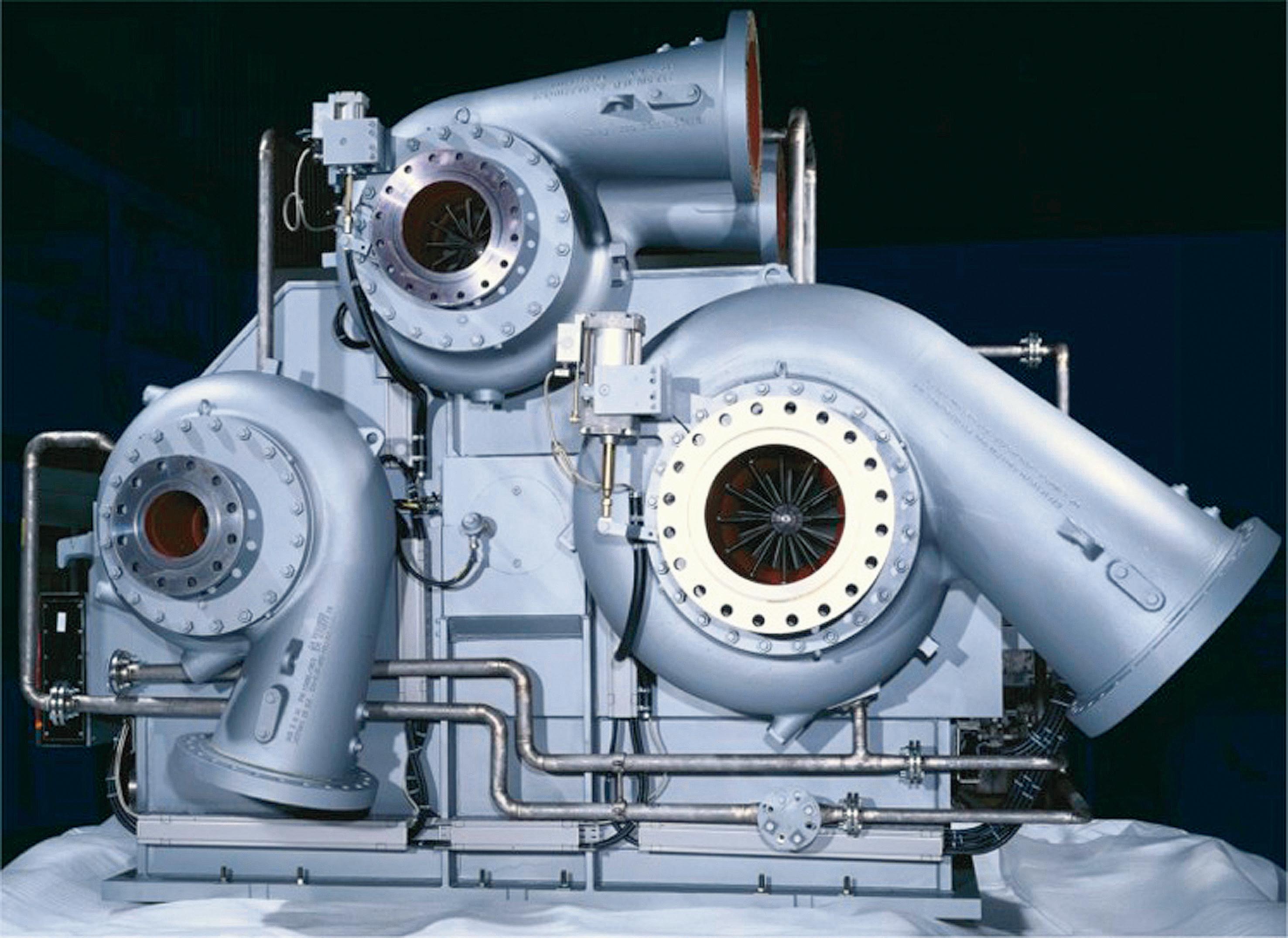

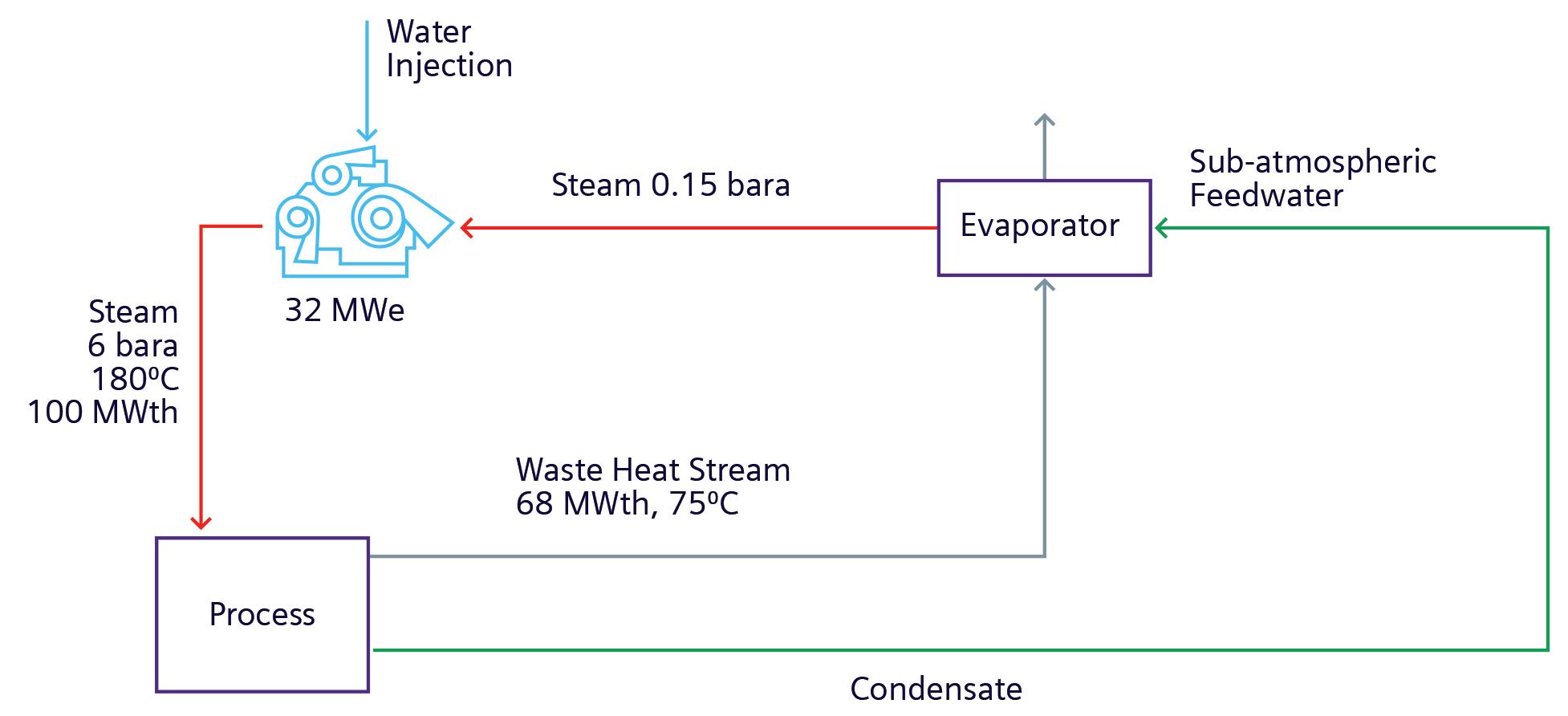

40 Opening pathways to decarbonisation

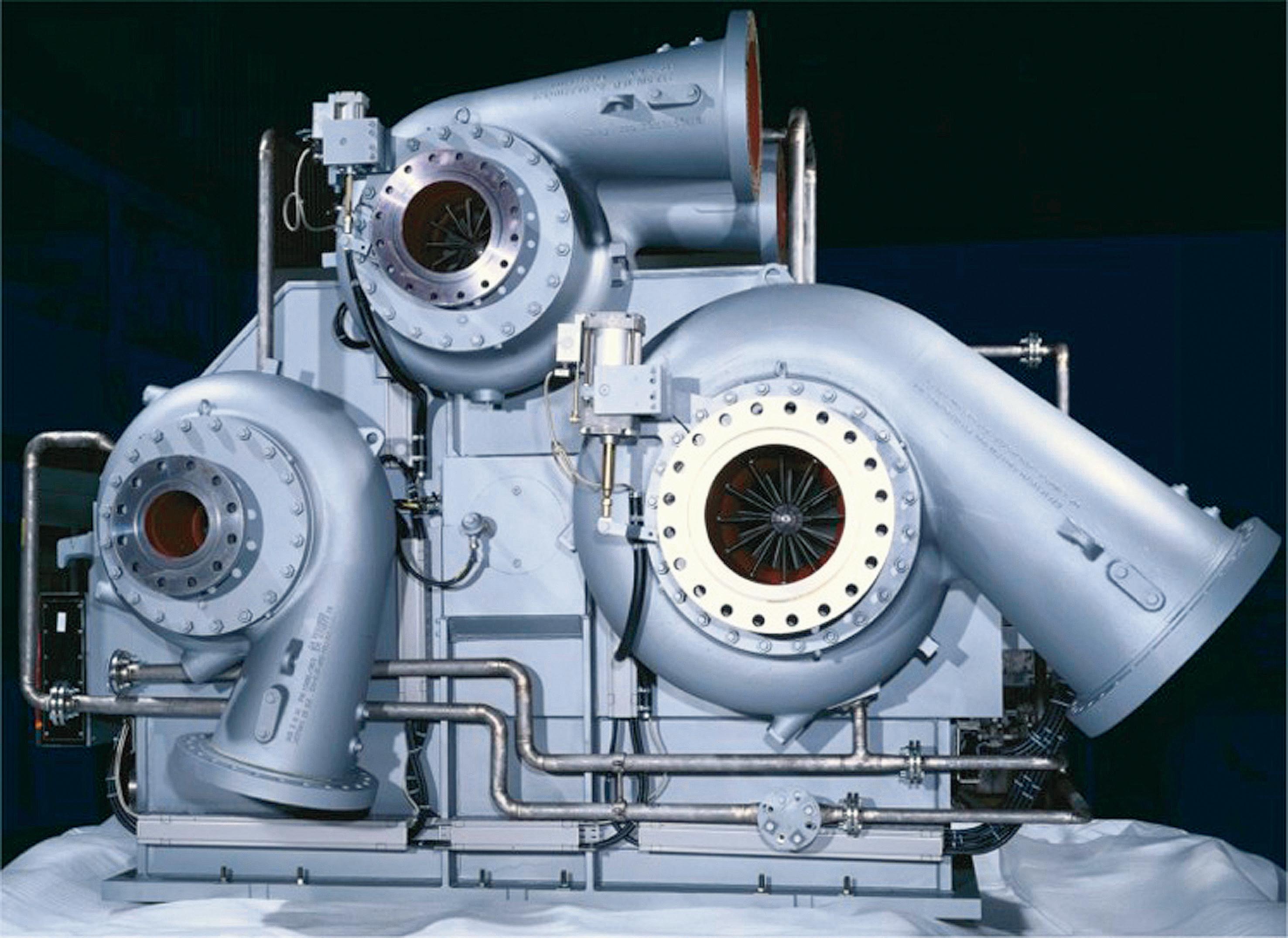

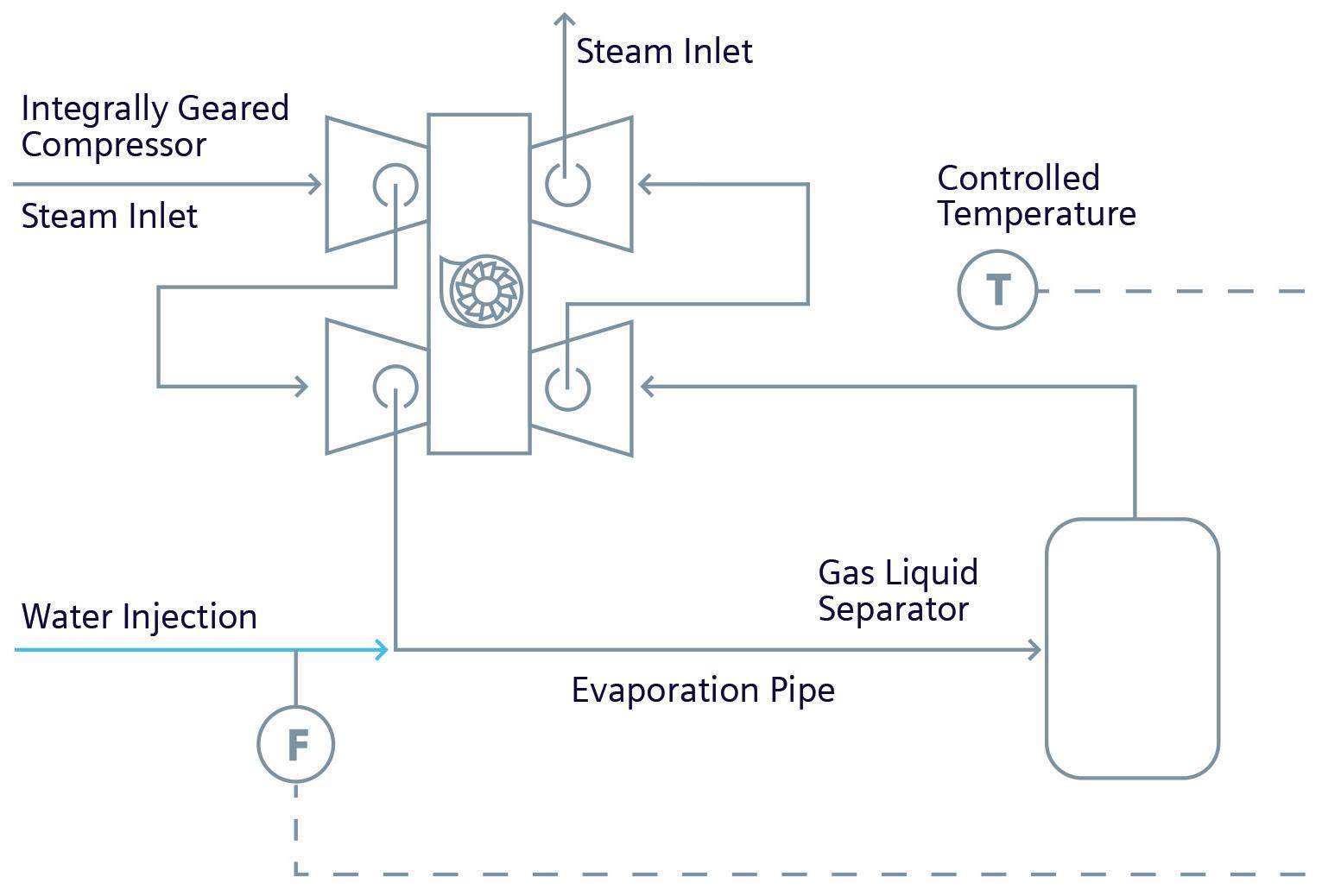

Lukas Biyikli, Siemens Energy, Germany, considers how it is possible to decarbonise industrial process heat through steam compression.

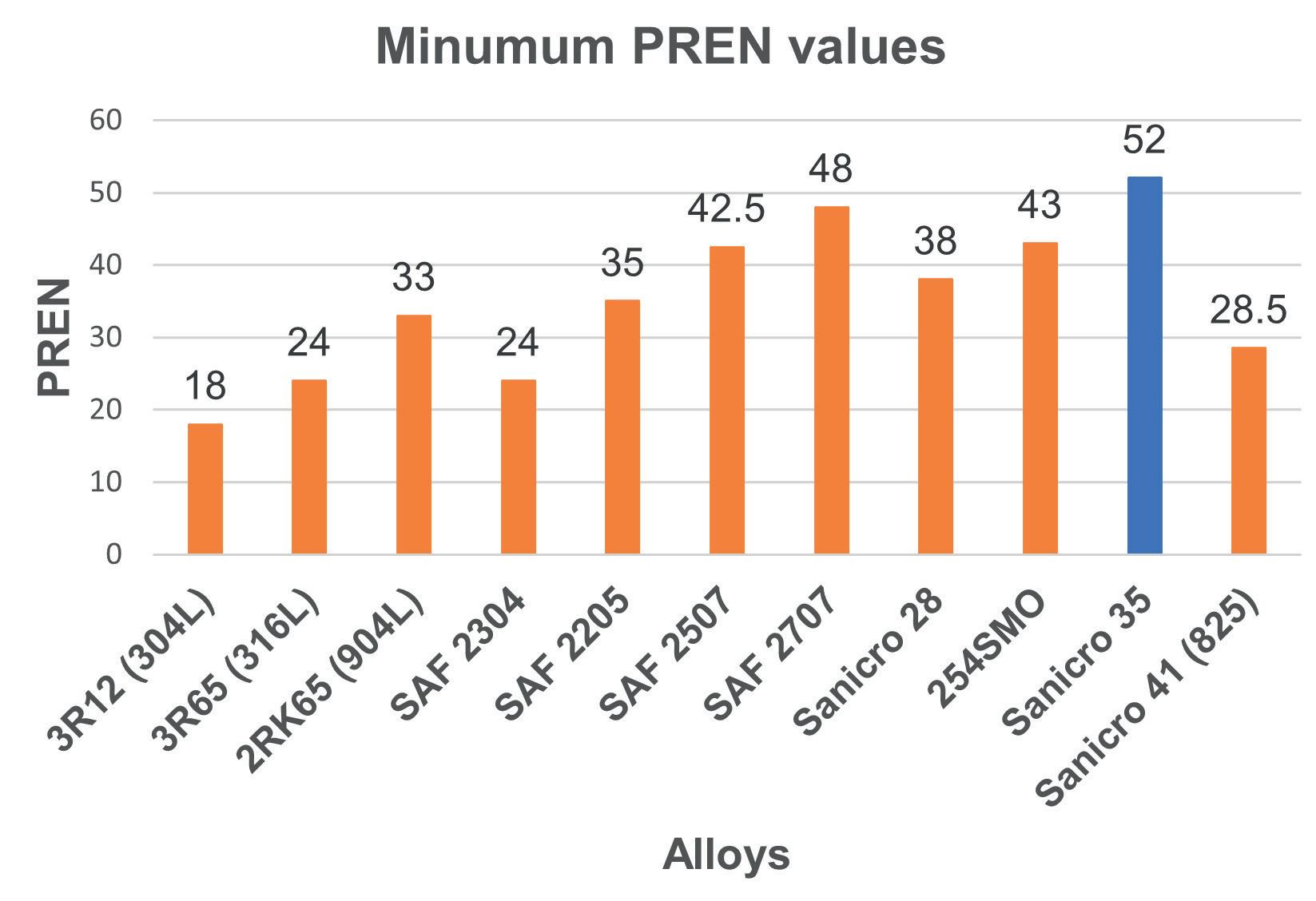

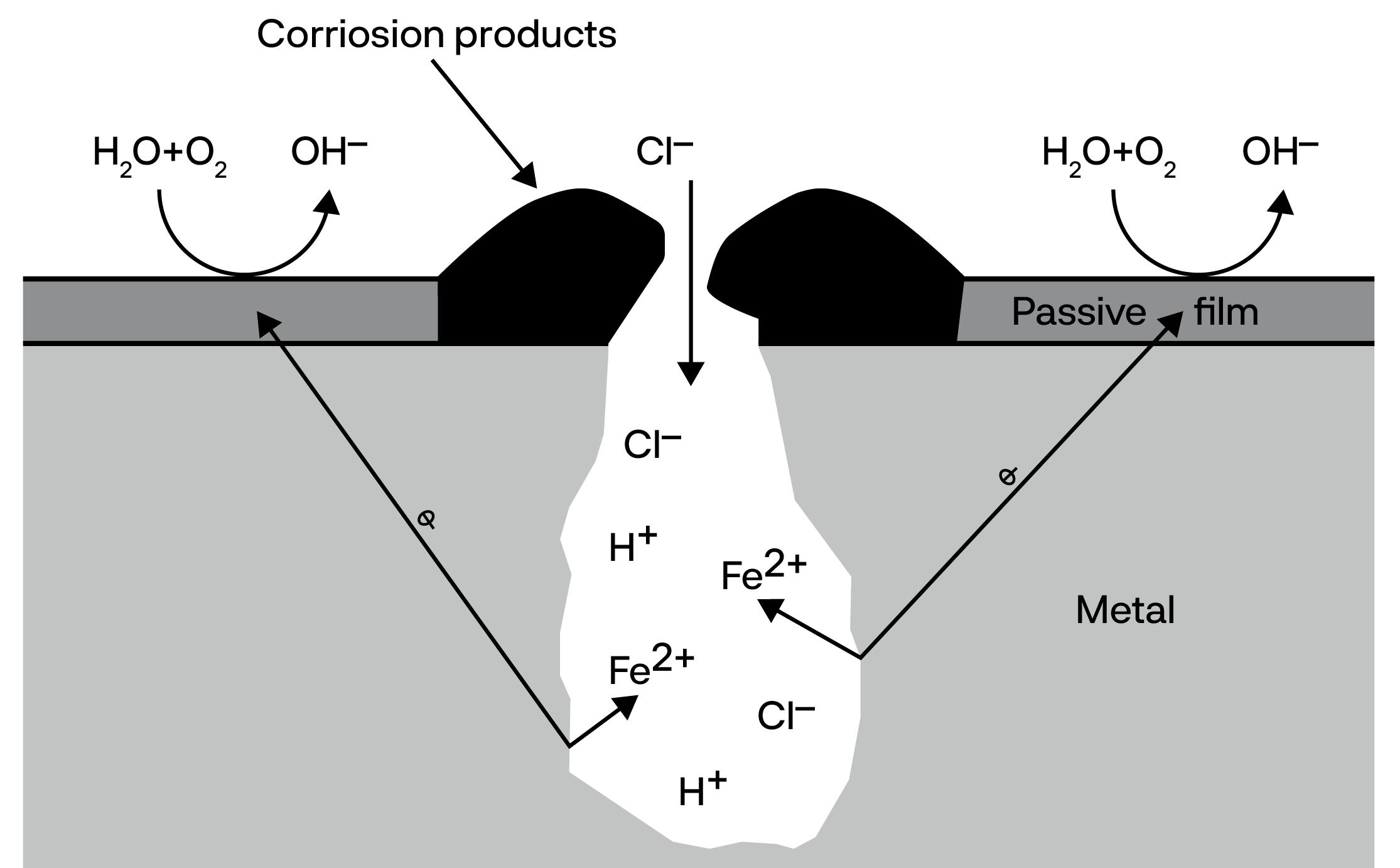

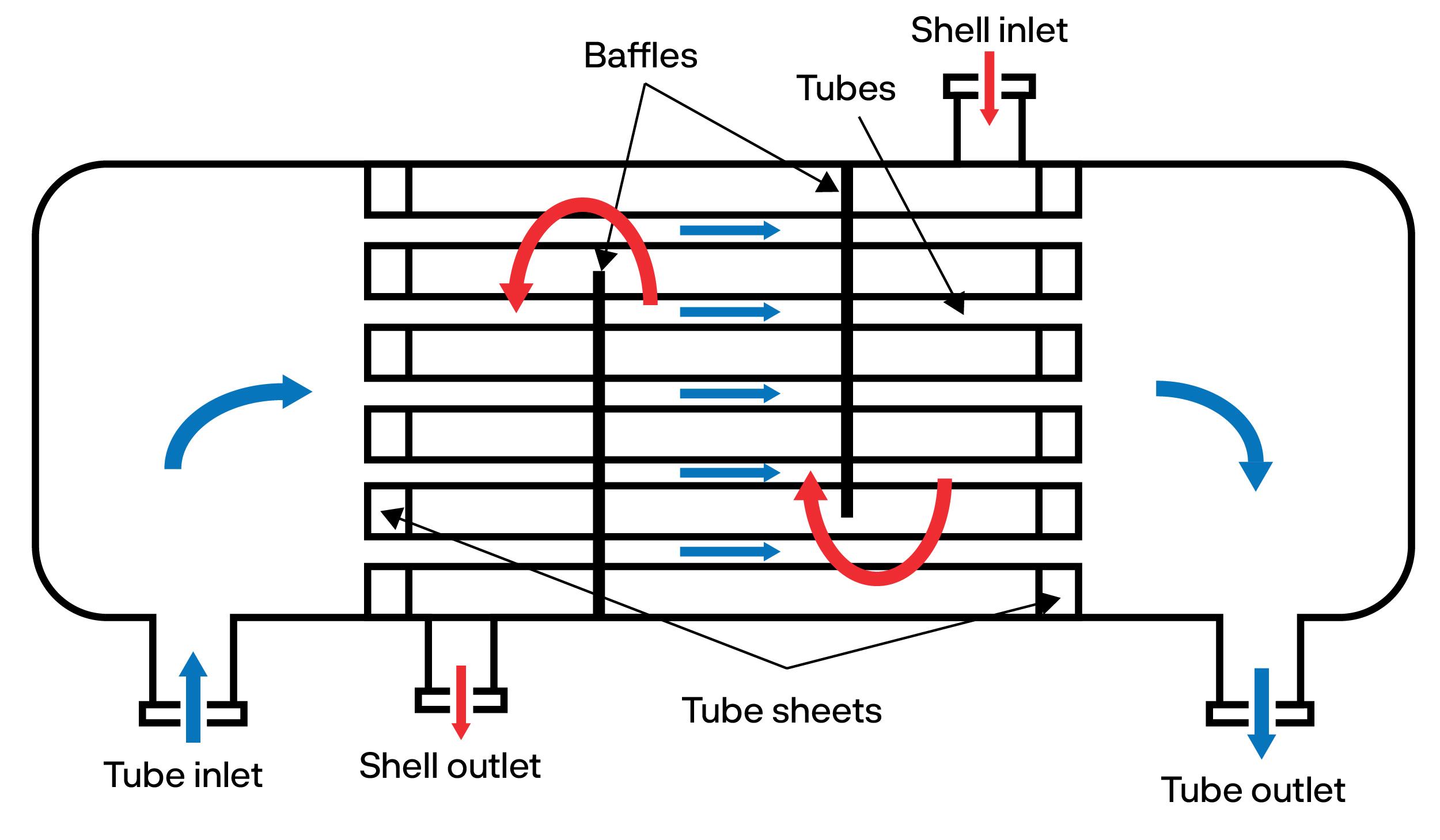

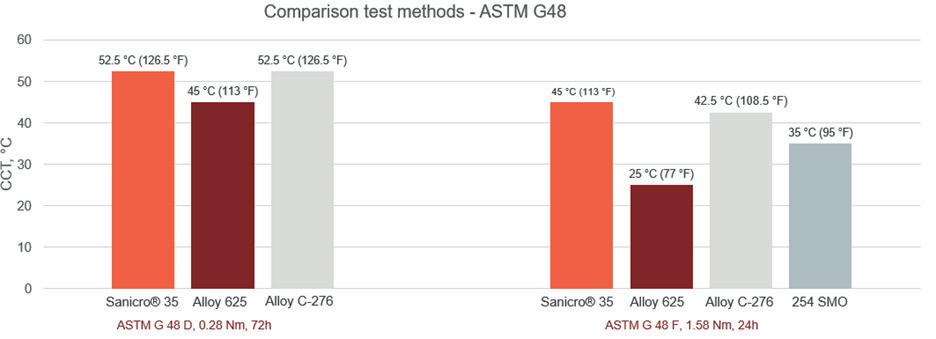

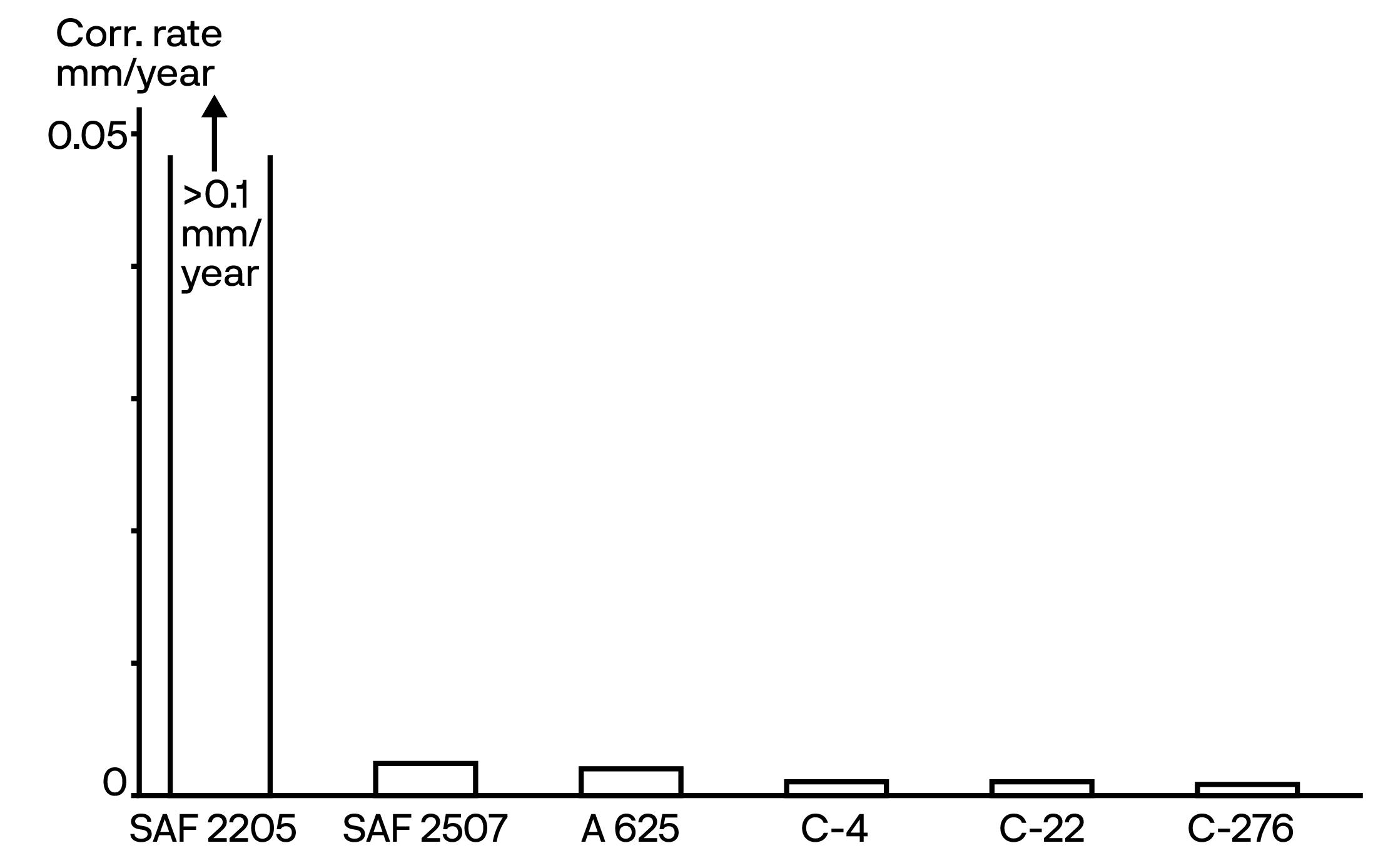

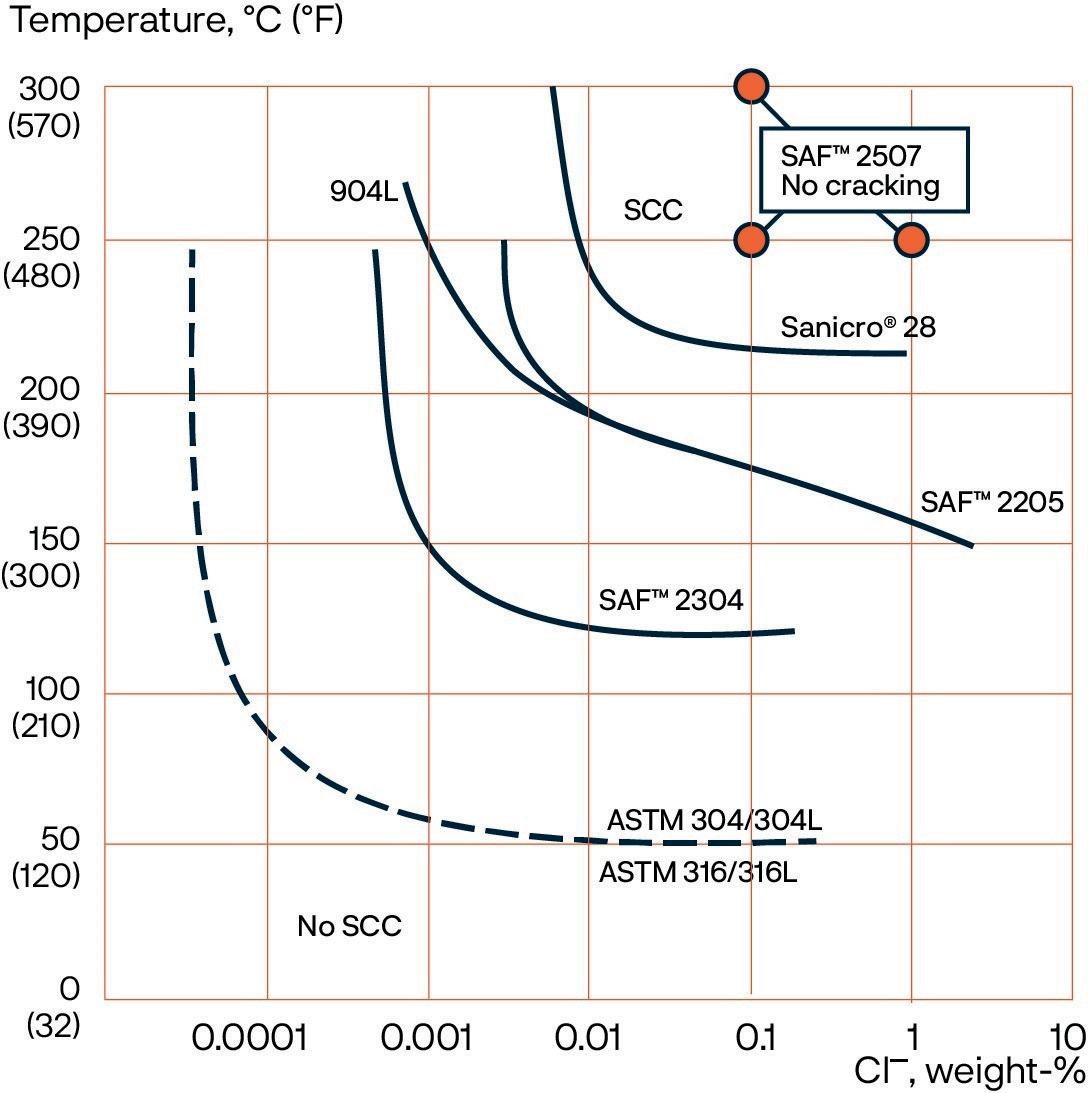

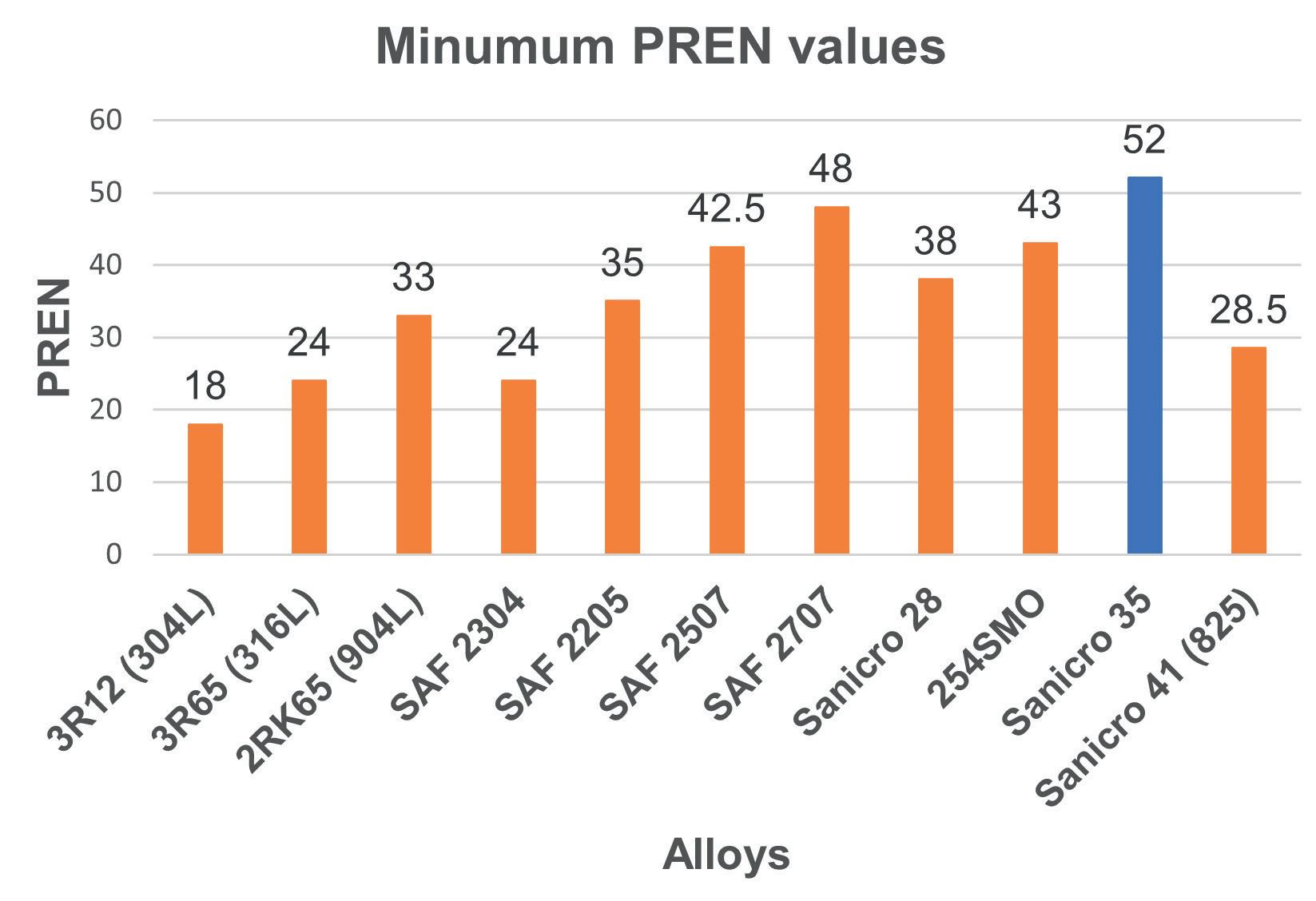

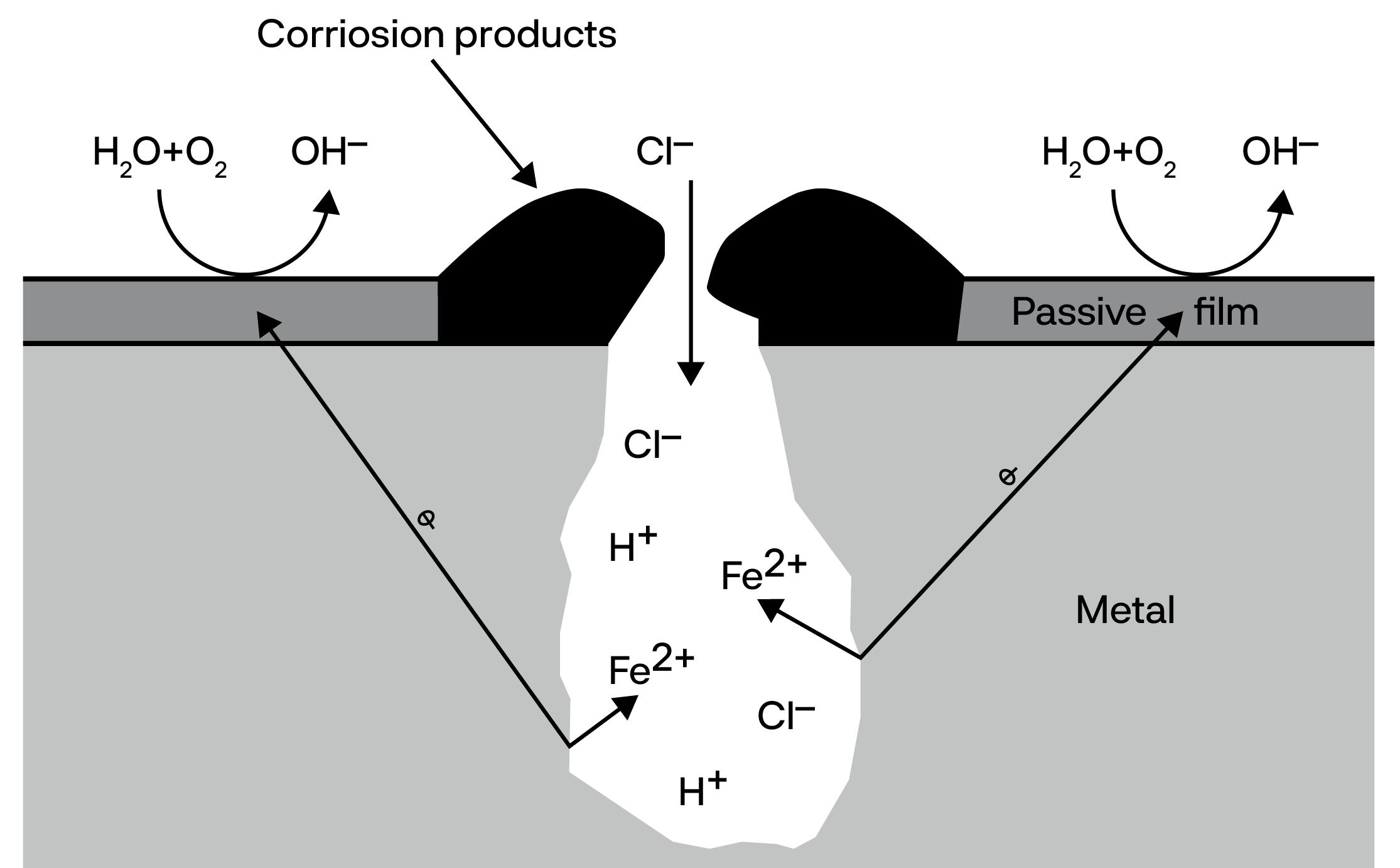

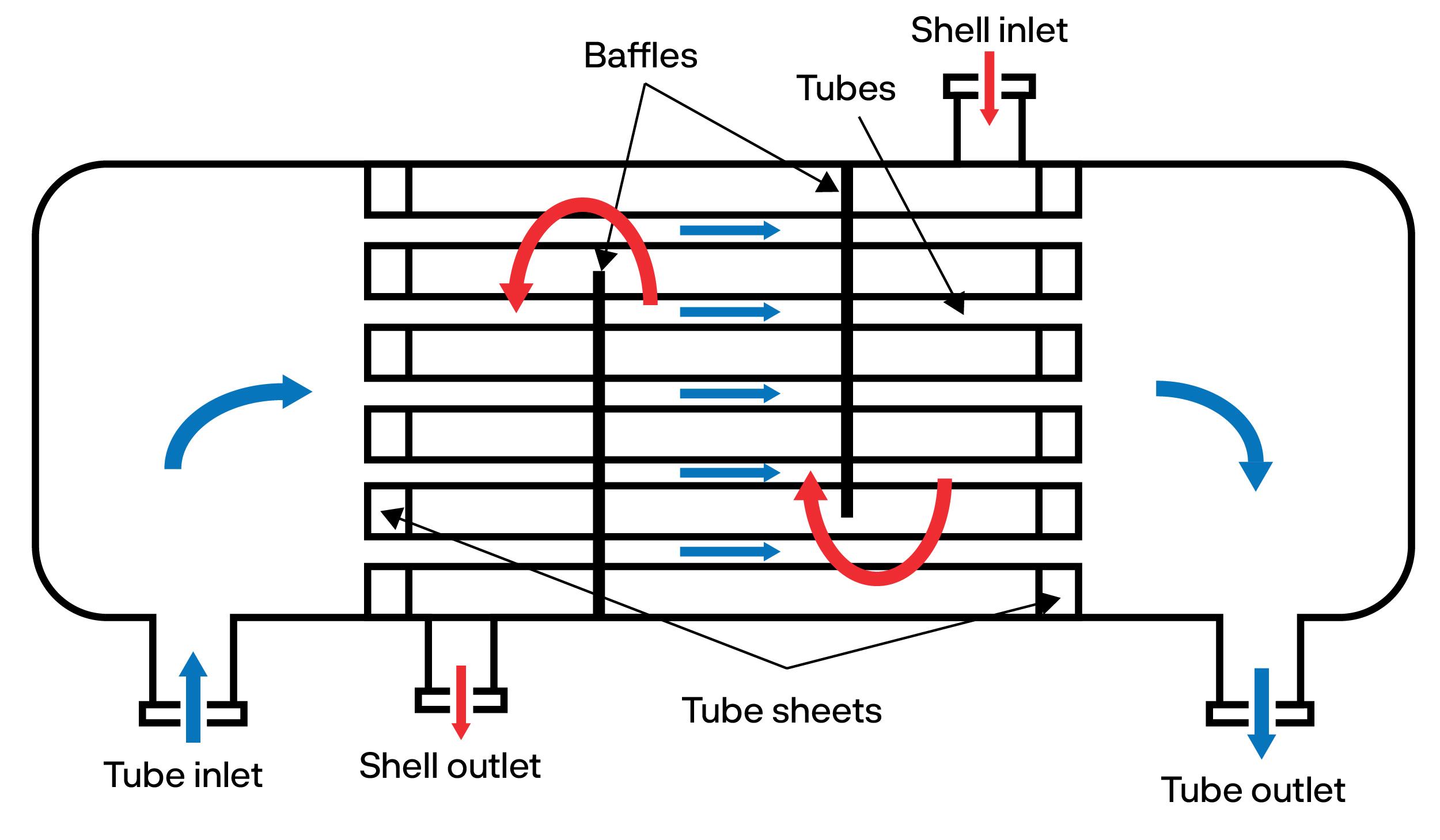

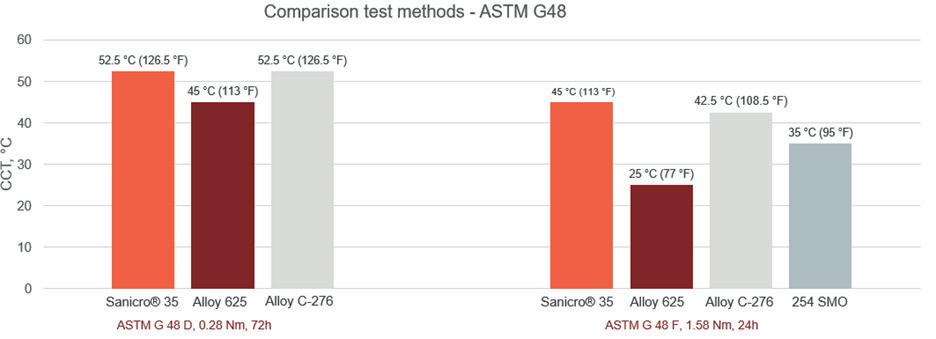

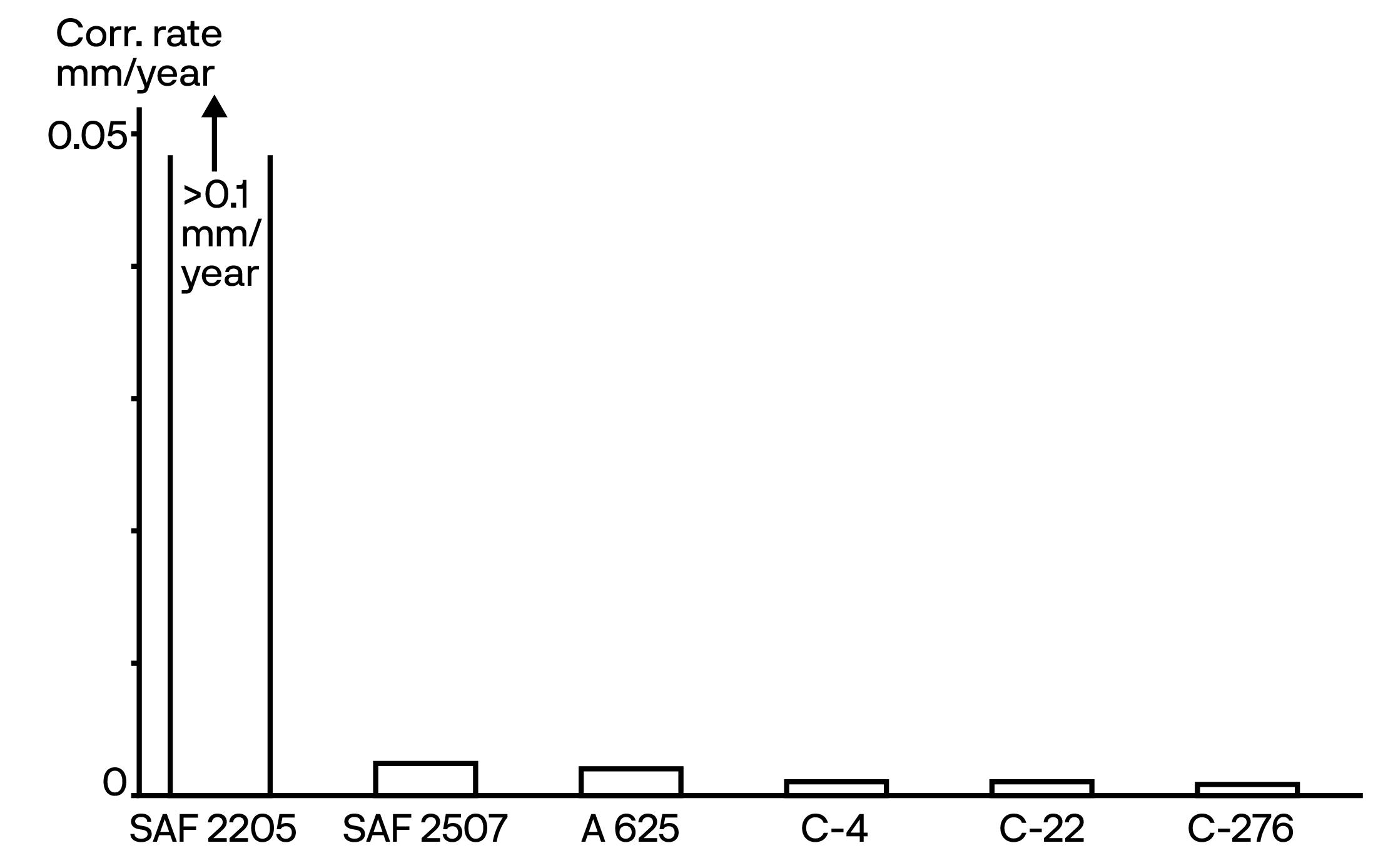

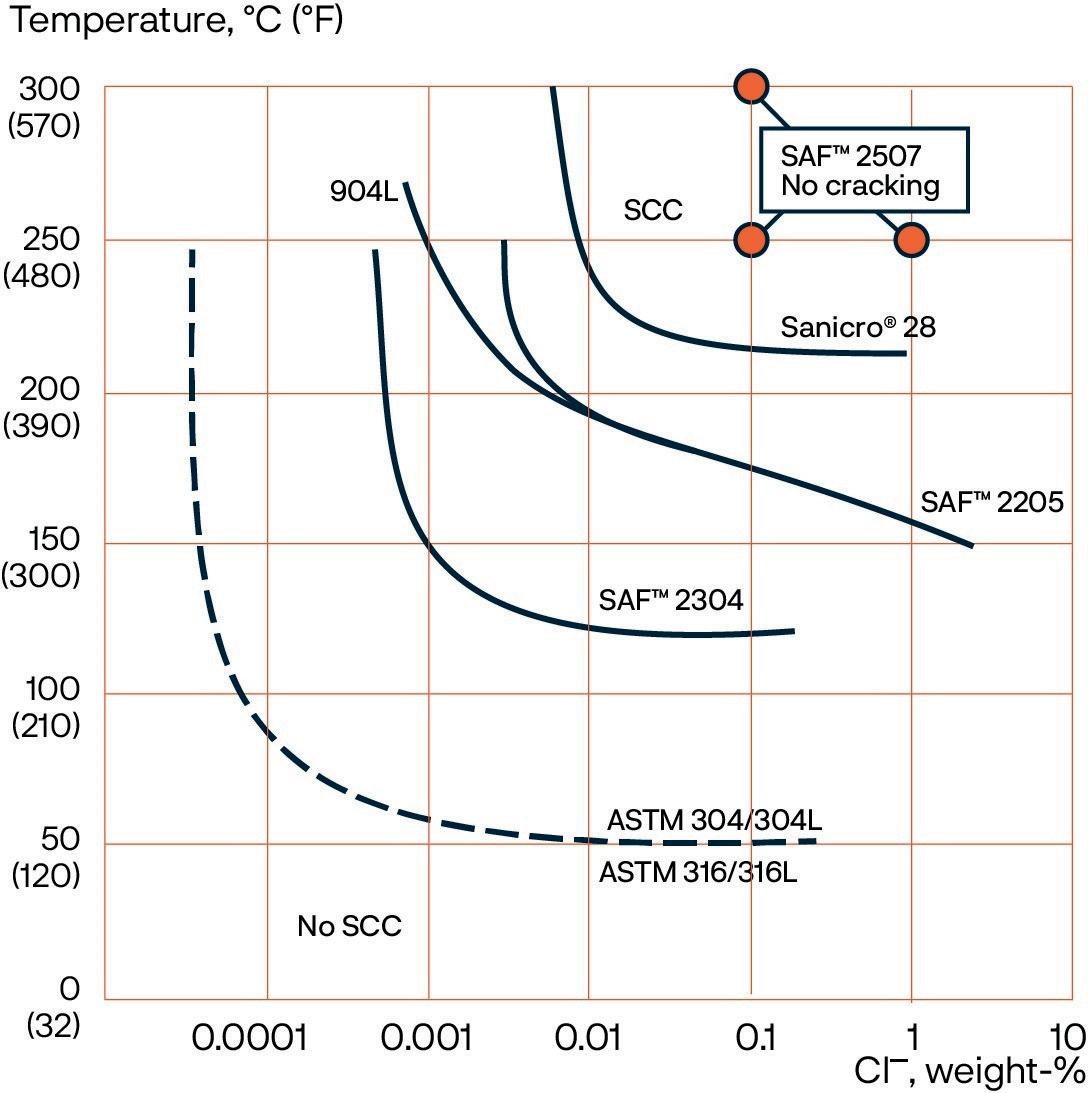

45 Selecting the right corrosion resistance

alloys

Luiza Esteves, Alleima, USA, compares the corrosion and mechanical resistance of advanced stainless steels and special alloys used in shell and tube heat exchangers in various chemical process industry applications.

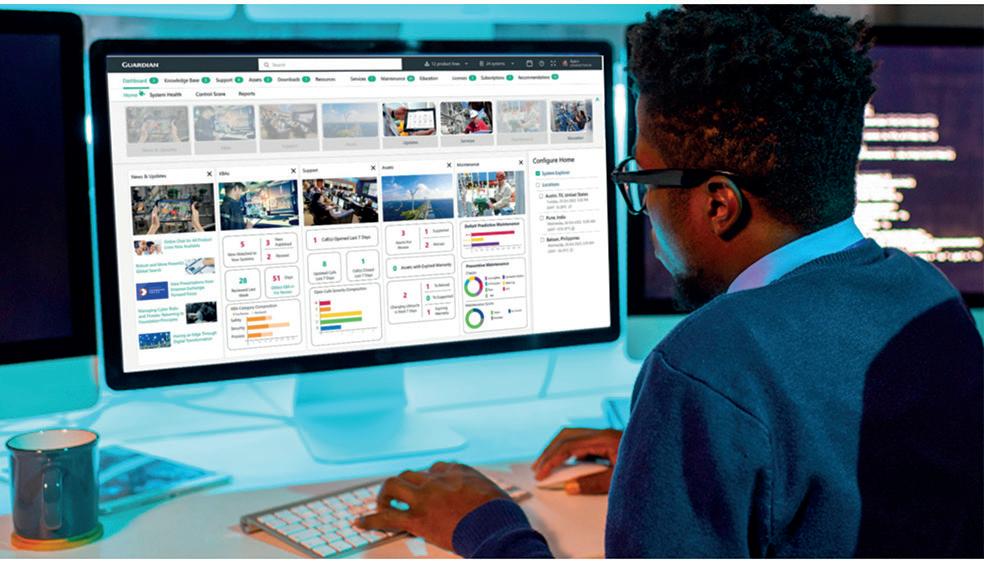

49 Taking back control

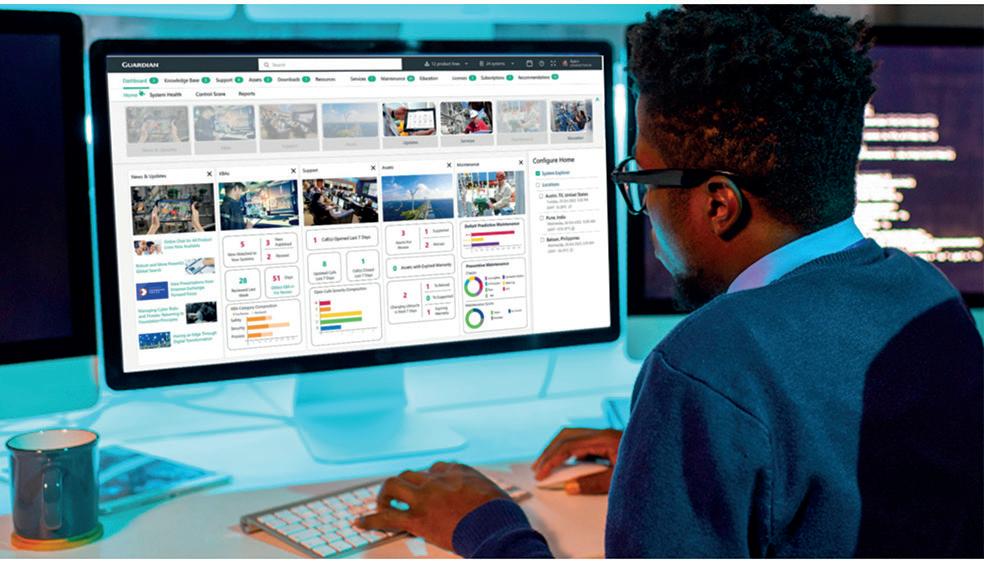

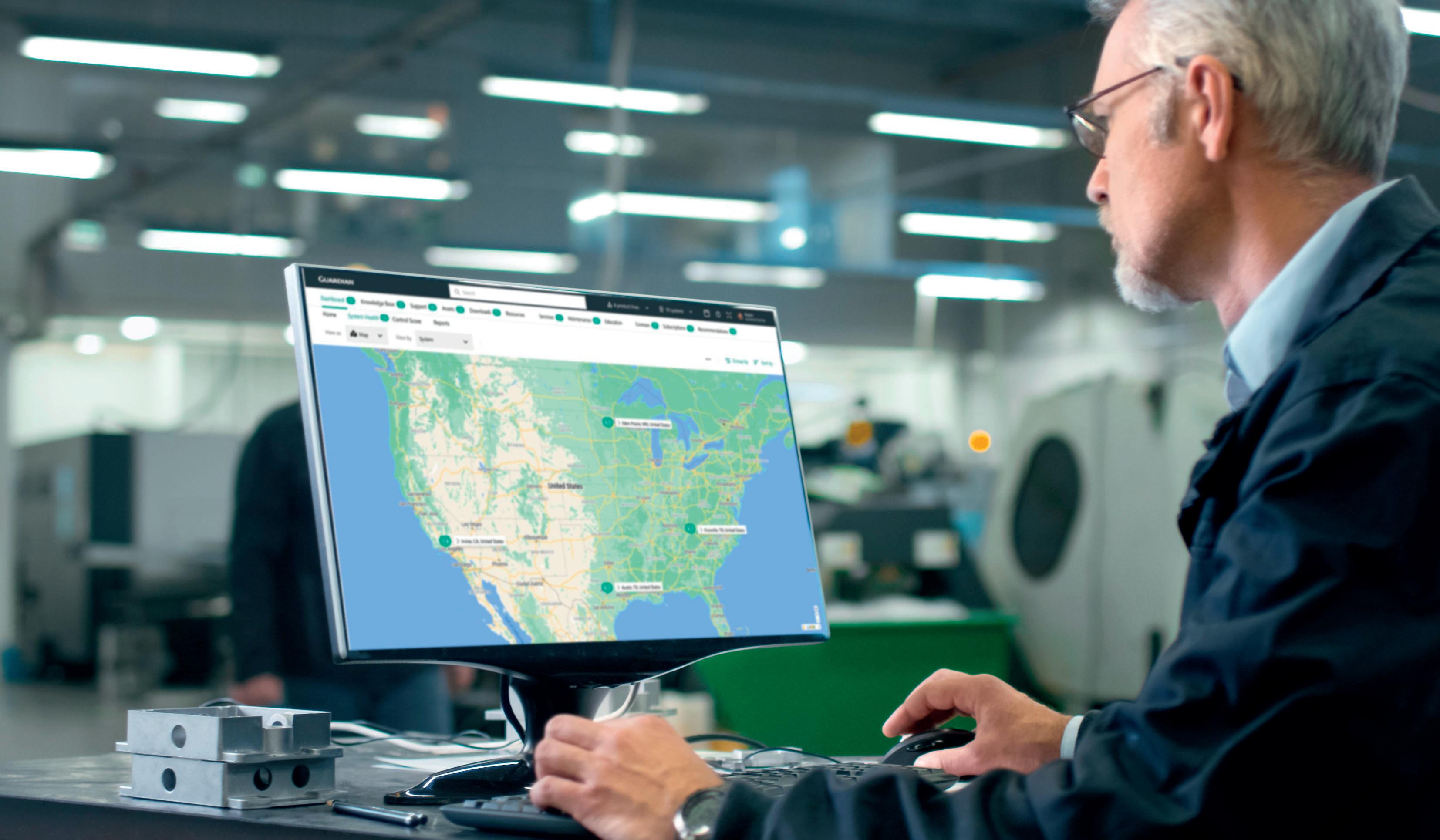

Nina Golder and Erik Lindhjem, Emerson, USA, explain how new life cycle maintenance tools can help companies manage the health of their automation assets.

53 An unbroken flow of information

Thomas Fahland, Implico, Germany, discusses how new data technology could lead to increased transparency across energy companies’ operations.

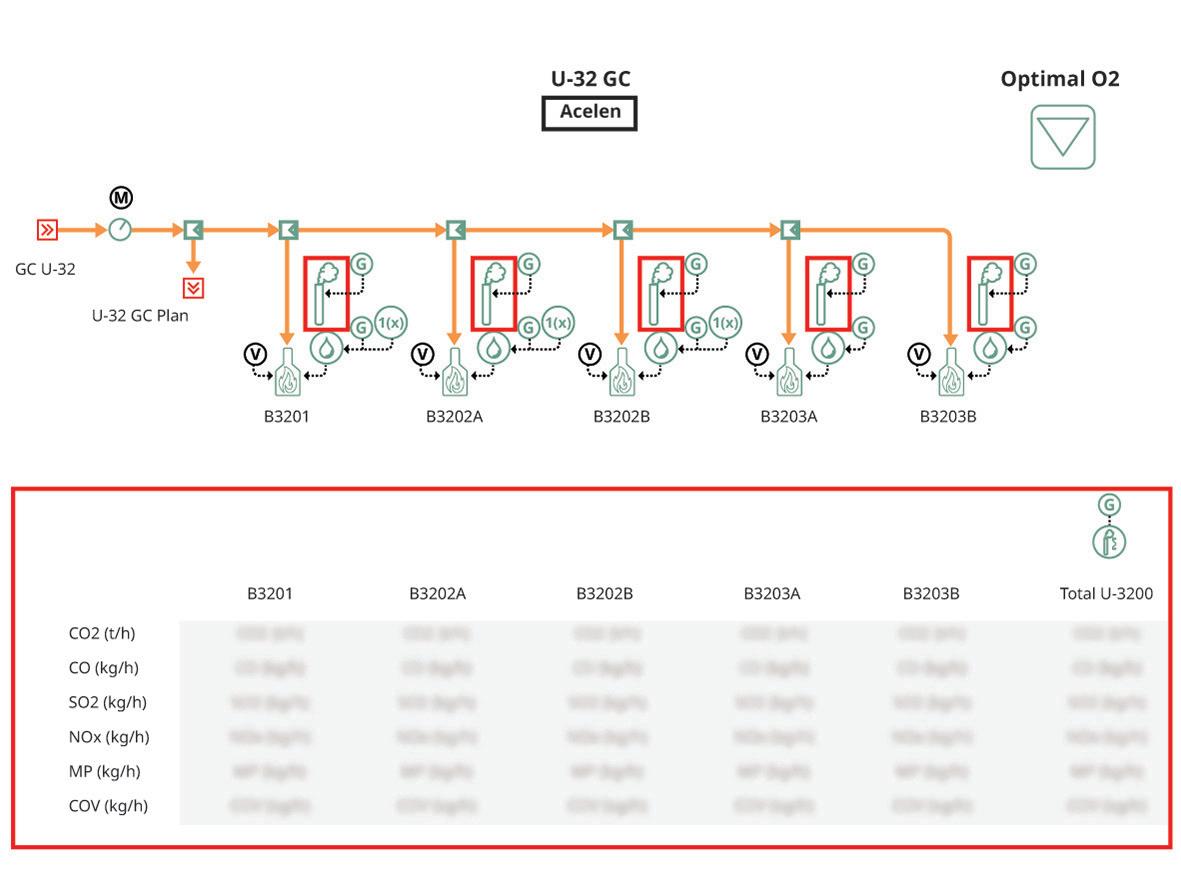

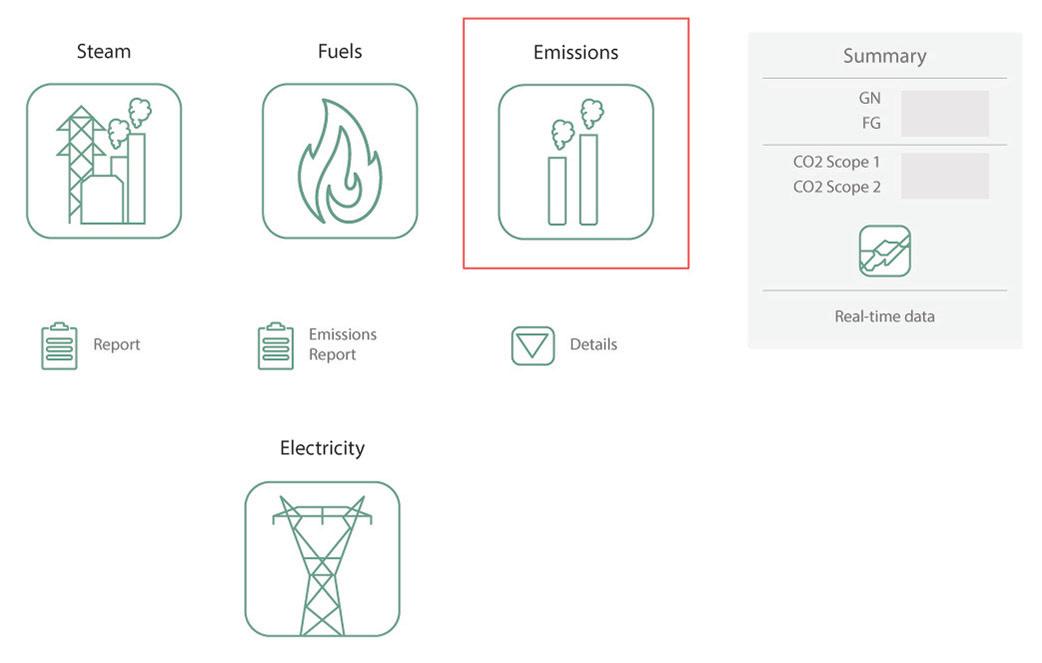

57 Bringing decarbonisation

to life

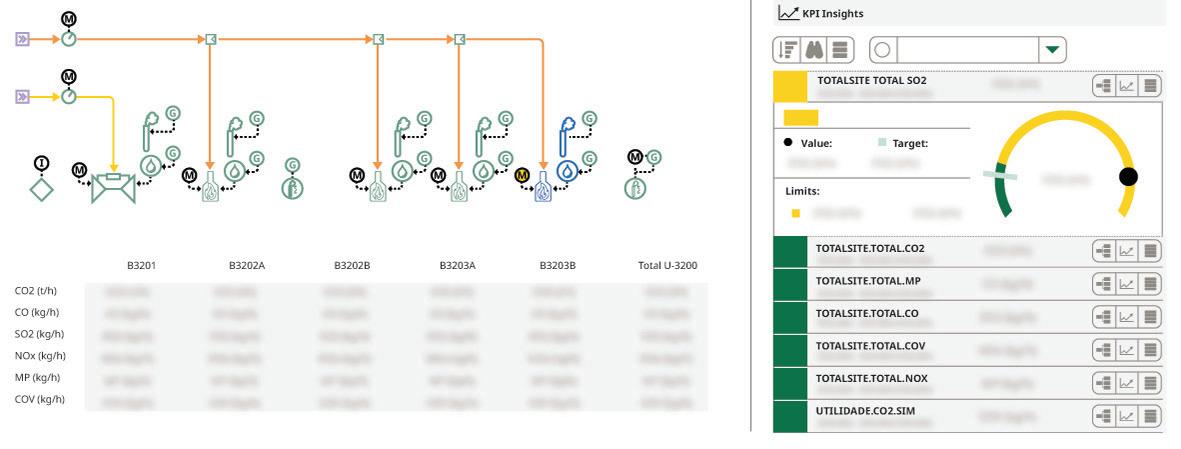

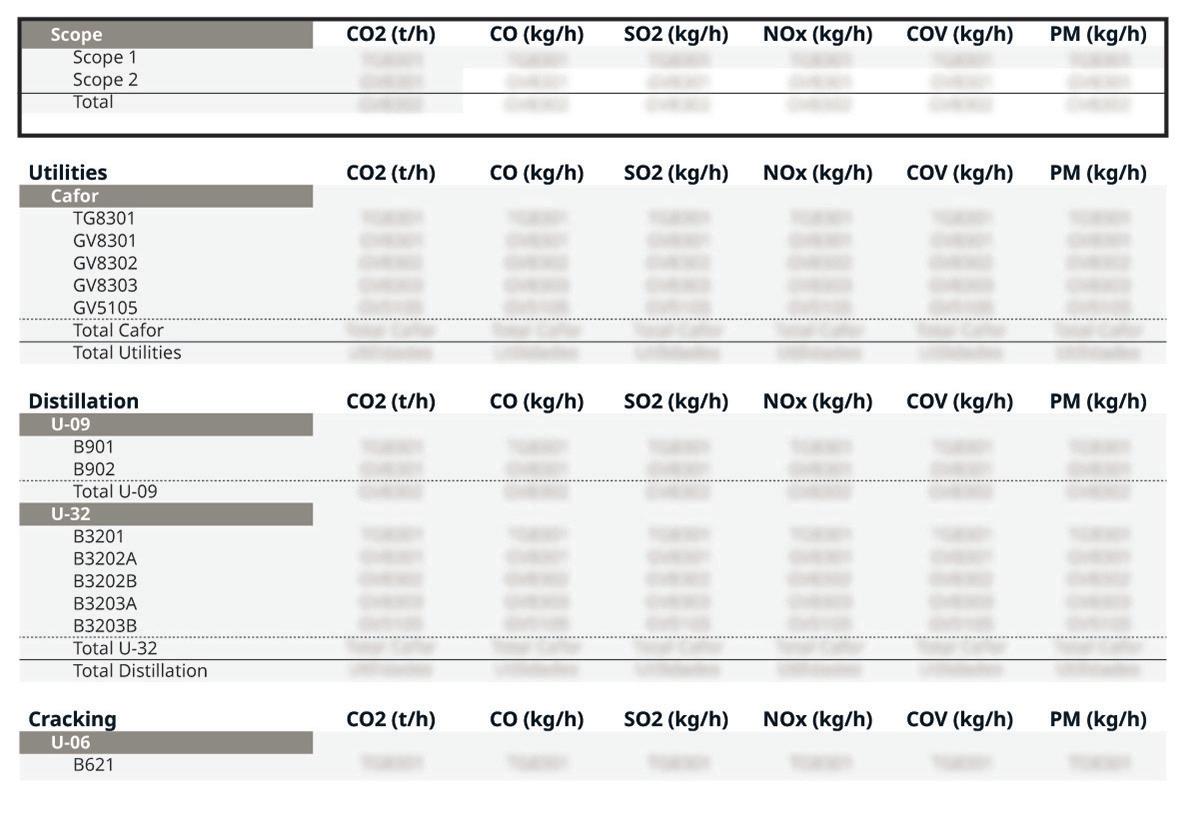

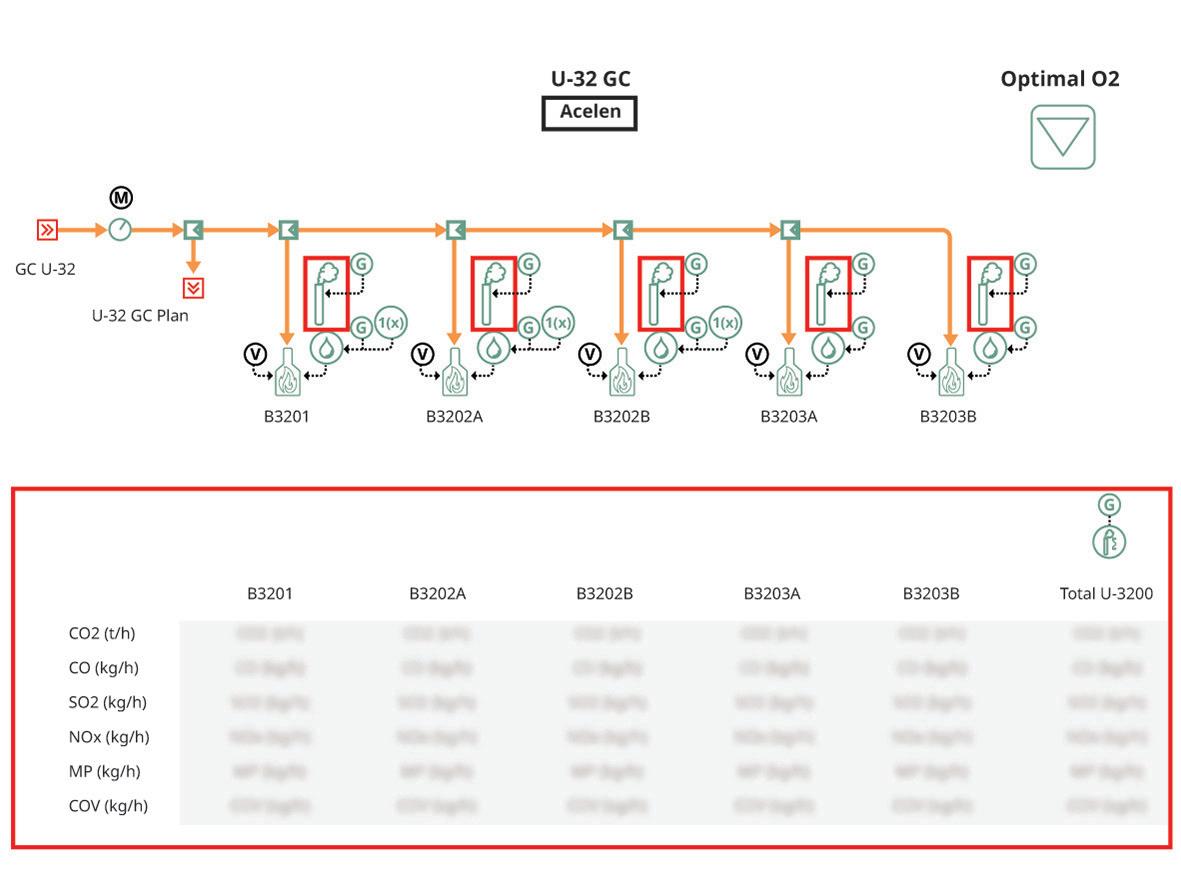

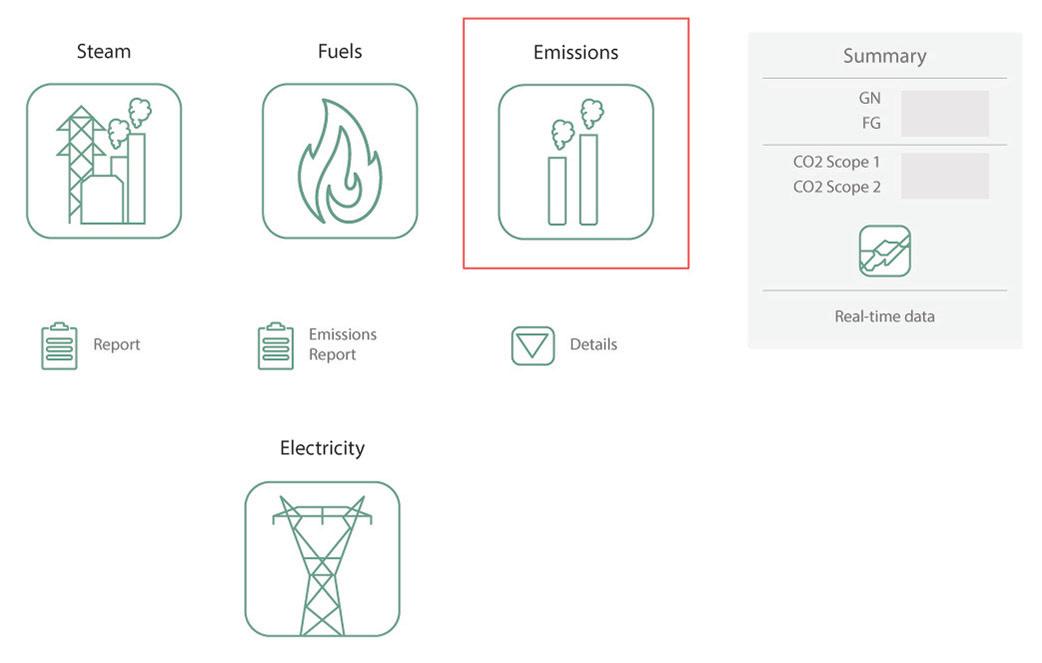

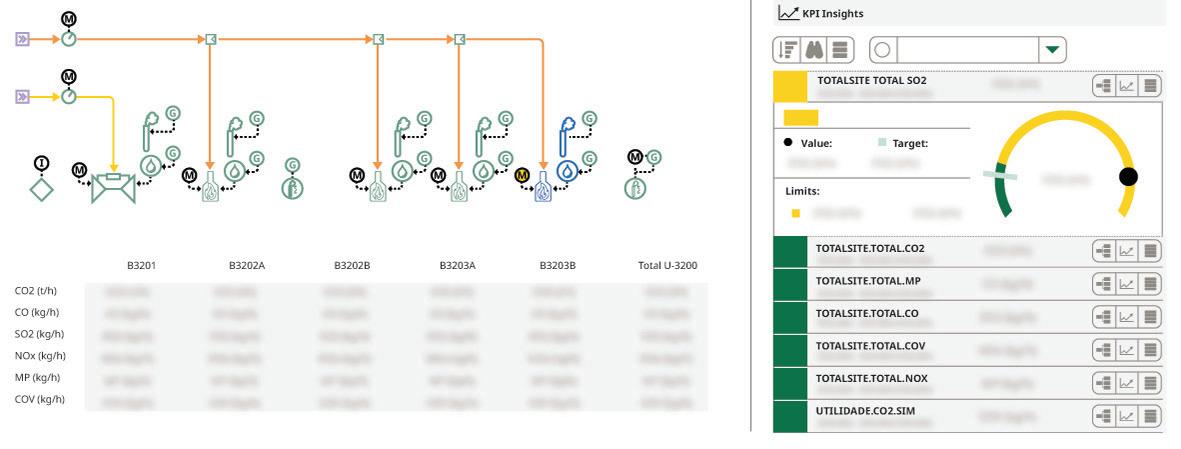

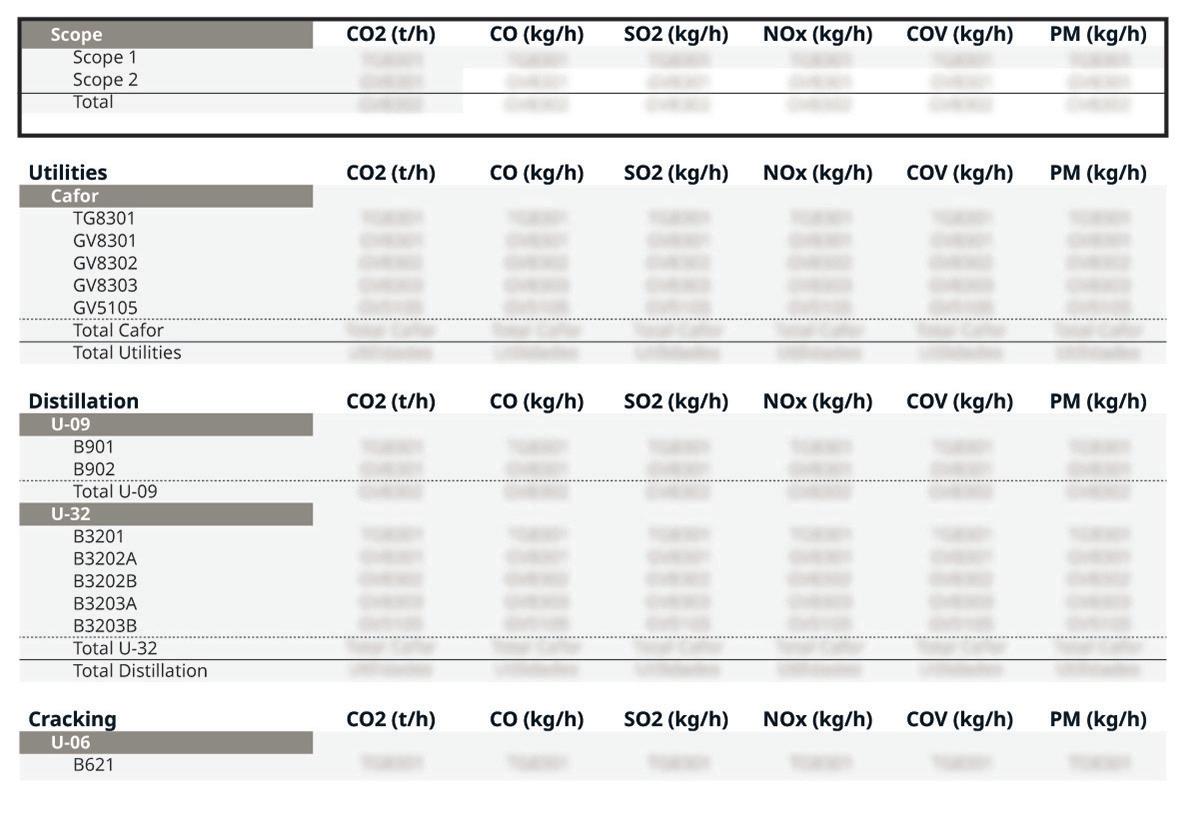

Pablo Jimenez-Asenjo, Federico Neira and Nicolas Visuara, KBC, alongside Rafael Rebouças de Araujo, Joana Variani and Juan Carlos Moreno, Acelen, explore how real-time emissions monitoring drives decarbonisation.

63 Frontline safety culture and digitisation

Graham Freeman, Intelex Technologies, ULC, examines how a resilient frontline safety culture can be upheld in the oil and gas industry.

67 Cybersecurity: a life cycle, not a destination

Tim Gale, 1898 & Co., USA, explores how a broader cybersecurity programme is required to protect critical process control and safety systems in the oil and gas industry.

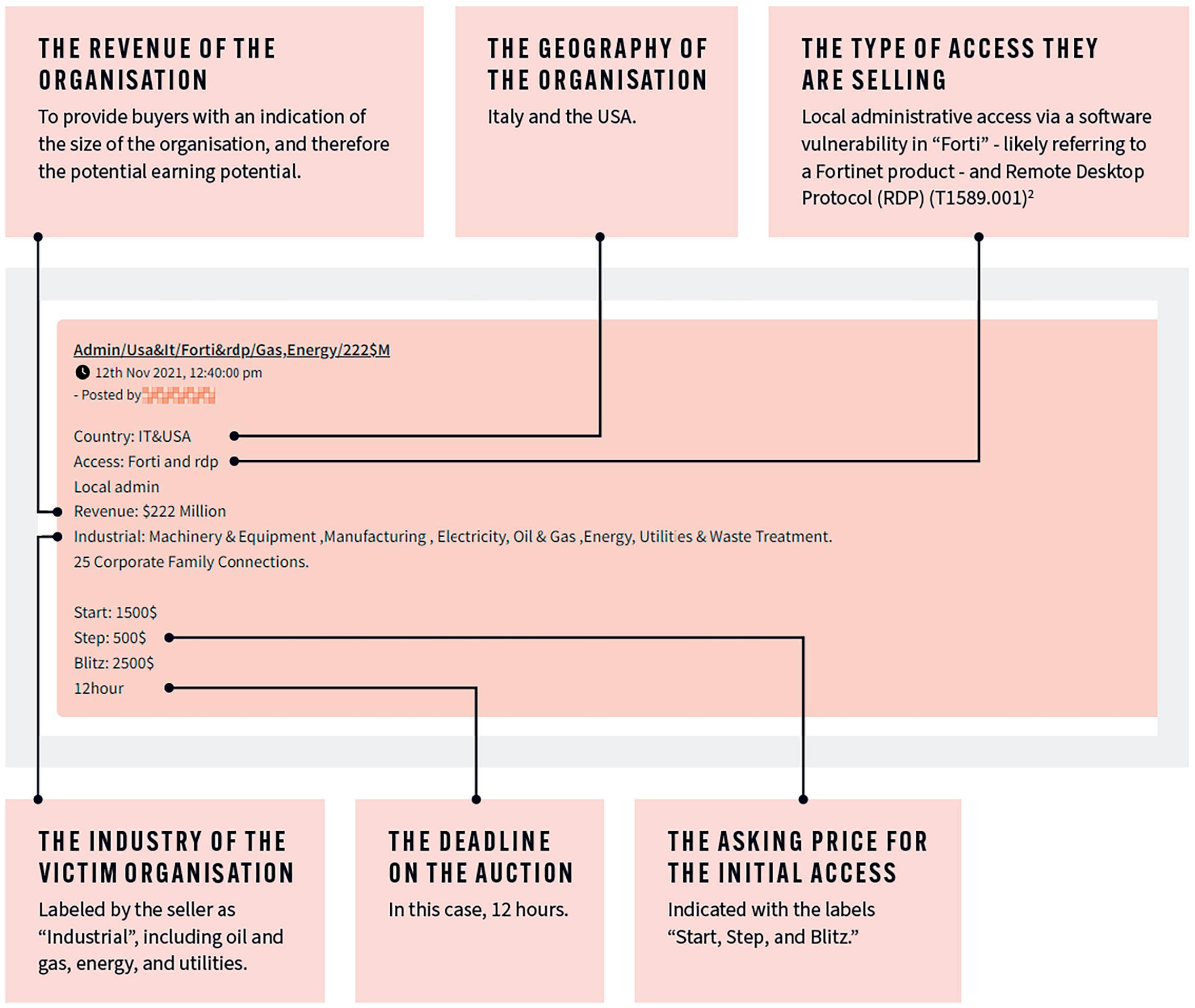

73 Unveiling the shadows

Dr. Gareth Owenson, Searchlight Cyber, UK, discusses how dark web intelligence can protect the oil and gas sectors.

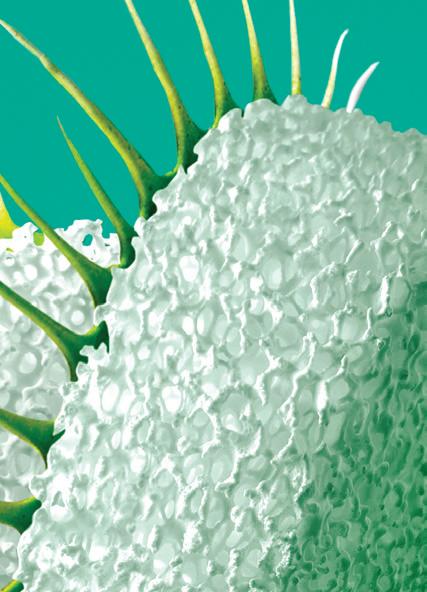

THIS MONTH'S FRONT COVER

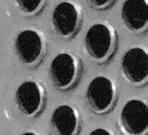

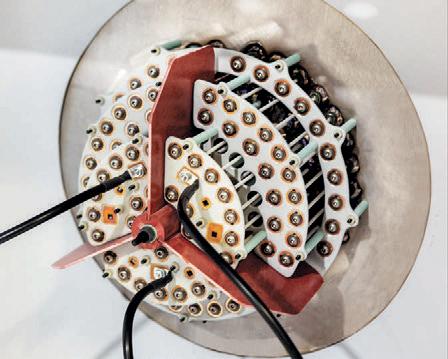

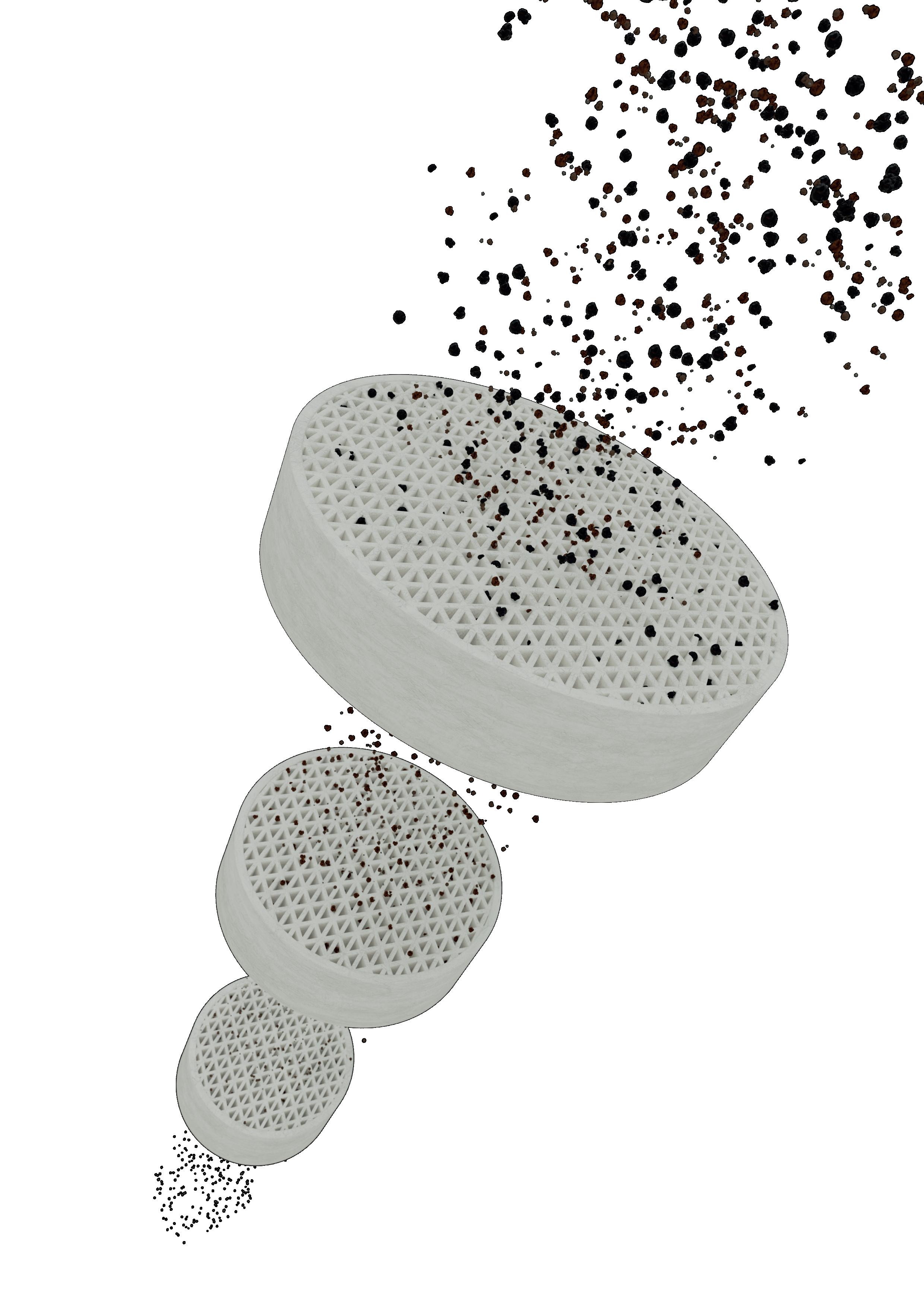

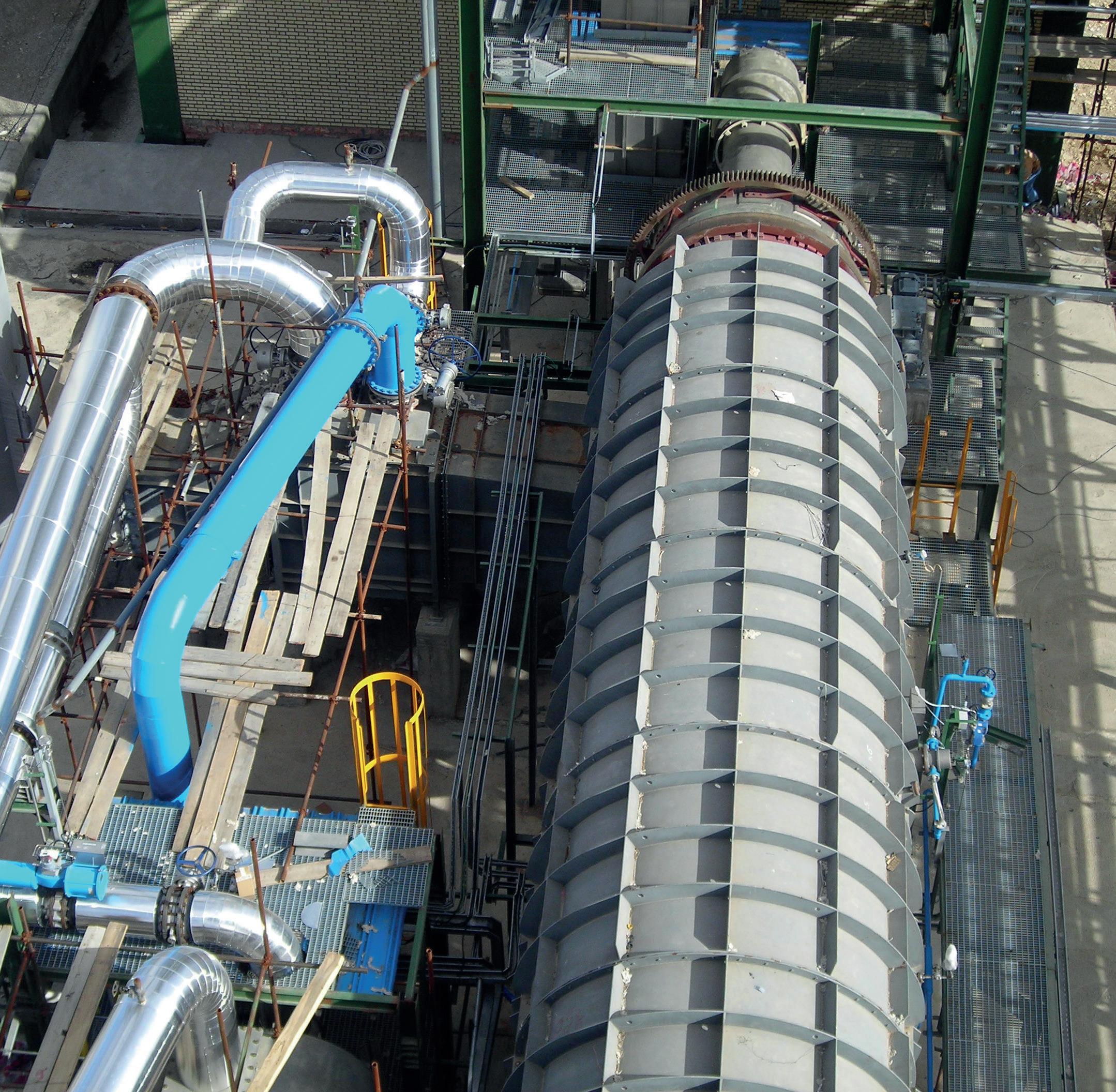

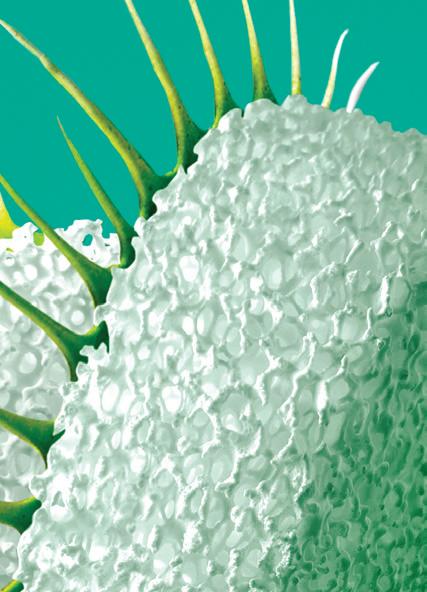

UNICAT’s Next Generation Filtration System ‘AFS’ has improvements in geometry, influencing capacity and pressure drop. AFS increases catalyst bed life by 50% +, offers high void space, and allows foulants to get deeper into the grading, resulting in significantly longer cycles.

CONTENTS CBP019982 Hydrocarbon Engineering Like Join Hydrocarbon Engineering @HydrocarbonEng Follow CONVERSATION JOIN THE 2023 Member of ABC Audit Bureau of Circulations Copyright© Palladian Publications Ltd 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK. September 2023 Volume 28 Number 09 ISSN 1468-9340 03 Comment 05 World news 08 Evaluating new opportunities in North America Gordon Cope, Contributing Editor, discusses how investors in North American refineries and petrochemicals are tacking in the face of adversarial winds, and evaluating new opportunities. 14 Next generation filtration

Michalec, James Esteban,

Catalyst Technologies, LLC, explore how

next generation technology can help to

and efficiency, while reducing costs and improving

21 Maximising potential

Miranda

challenges of maximising

importance of novel catalyst technology. 27 The cleaner

Tim

Will Bridges and Tom Ventham, UNICAT

innovative

increase bed cycle time

profitability.

Modesto

butylenes from residual

THE PATH TO SUSTAINABILITY ...

BEGINS WITH THE RIGHT CATALYST

Refineries face unprecedented challenges as the world demands cleaner production. Now more than ever, your operation needs to safeguard more than just the bottom line.

With our eye on your conventional and renewable needs, Topsoe is committed to delivering catalysts with unprecedented activity, selectivity, and lifetime for every application. All with the goal of ensuring that your business does even more good, and even less harm.

Because the most important catalyst for a sustainable future isn’t actually a catalyst, at all. It’s you.

Visit topsoe.com to learn more.

COM MENT

CONTACT INFO

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O'Reilly callum.oreilly@palladianpublications.com

EDITORIAL ASSISTANT Poppy Clements poppy.clements@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES EXECUTIVE Sophie Birss sophie.birss@palladianpublications.com

PRODUCTION MANAGER Kyla Waller kyla.waller@palladianpublications.com

EVENTS MANAGER Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL ADMINISTRATOR Leah Jones leah.jones@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITOR

Nancy Yamaguchi Gordon Cope

SUBSCRIPTION RATES

Annual subscription £110 UK including postage /£125 overseas (postage airmail).

Two year discounted rate £176 UK including postage/£200 overseas (postage airmail).

SUBSCRIPTION CLAIMS

Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

APPLICABLE ONLY TO USA & CANADA

Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032.

15 South Street, Farnham, Surrey

GU9 7QU, UK

Tel: +44 (0) 1252 718 999

CALLUM O'REILLY SENIOR EDITOR

White noise has played a big part in my life over the past year or so. My wife and I have tried various different apps, and lots of different sonic hues, in an attempt to get a good night’s sleep.

It’s not that we are discerning customers of aperiodic sound, but rather, our 15-month-old son is. And although he now sleeps peacefully through the night (karma will probably get me for writing that), we dare not change any aspect of his bed-time routine for fear of returning to the realm of insomnia. So white noise (or more specifically, brown noise) will continue to play softly from a speaker in his room until we’re brave enough to wean him off it!

We recently had to find a new source for our son’s brown noise addiction, as our subscription to a ‘paid-for’ app expired during the summer. After careful consideration, we decided that we couldn’t justify spending £30 for continued access to a “library of 60 premium sounds” (which seemed wholly essential a year or so ago). After all, we have found the genre of noise that works for us, and there are plenty of free white noise apps to choose from, as well as – we discovered – podcasts dedicated to playing nothing but white noise on loop.

These white noise podcasts recently hit the headlines after Bloomberg reported that Spotify has a “US$38 million white noise problem.”1 It seems that the music streaming service has been inadvertently pushing white noise and ambient podcasts to its listeners as part of its own “algorithmic push for ‘talk’ content (vs music)”. These podcasts are said to account for 3 million daily consumption hours on the platform (and I’m guessing that newborn babies are substantial consumers). Bloomberg reported last year that the creators of these podcasts could make at least US$18 000/month through advertisements that Spotify placed in their programmes.2 Once Spotify realised how much attention these white noise podcasts were attracting, it considered removing the shows and banning future uploads in order to redirect its audience to “comparable programming that was more economical for Spotify,” according to Bloomberg. However, this proposal did not come to fruition, despite some content creators reporting suspicious activity, such as their shows going missing from the platform.

Of course, there are hundreds of podcasts available that are substantially more rewarding than these white noise podcasts (unless, of course, you are a new parent). If you’re on the lookout for a new show to help you keep up-to-date with the latest developments in the oil and gas industry, then I’d like to point you in the direction of the Palladian Energy Podcast. The second season of the podcast is out now, and focuses on ‘sustainability in the oil and gas sector’. We talk to a number of experts on a range of topics including transitioning towards a greener future; learning to drive strategic sustainability goals; developing and implementing sustainable chemical solutions; and why climate change-related legal disputes are on the rise. By subscribing to the podcast, you will also have access to a whole host of interesting conversations that took place during season one, which explored ‘digitalisation in the energy industry’. Topics here include the role of digitalisation in the downstream sector, the benefits of embracing automation, the importance of cybersecurity, and how downstream companies can begin their digitalisation journeys. You can access the Palladian Energy Podcast from wherever you usually get your podcasts.

1. CARMAN, A., ‘Spotify Looked to Ban White Noise Podcasts to Become More Profitable’, Bloomberg, (17 August 2023).

2. ‘CARMAN, A., ‘Spotify Podcasters Are Making $18,000 a Month With Nothing But White Noise’, Bloomberg, (1 June 2022).

1. CARMAN, A., ‘Spotify Looked to Ban White Noise Podcasts to Become More Profitable’, Bloomberg, (17 August 2023).

2. ‘CARMAN, A., ‘Spotify Podcasters Are Making $18,000 a Month With Nothing But White Noise’, Bloomberg, (1 June 2022).

THE RENEWFINE CATALYST PORTFOLIO FOR RENEWABLE DIESEL & SAF

Sustainable Solutions, Limitless Potential

Ketjen’s ReNewFine Catalyst Portfolio for renewable diesel and sustainable aviation fuel is now commercially available.

Scan and learn more

WORLD NEWS

USA | Cheniere and BASF sign long-term LNG SPA

Cheniere Energy Inc. has announced that it has entered into a long-term LNG sales and purchase agreement (SPA) with BASF. Under the SPA, BASF has agreed to purchase up to approximately 0.8 million tpy of LNG from Cheniere on a free on board (FOB) basis for a purchase price indexed to the Henry Hub price, plus a fixed liquefaction fee. Deliveries will commence in mid-2026 and, subject

to a positive final investment decision (FID) with respect to the first train (Train Seven) of the Sabine Pass Liquefaction Expansion Project in Louisiana, US, will increase to approximately 0.8 million tpy upon the start of commercial operations of Train Seven. The term of the SPA extends through to 2043. The expansion project is being developed for up to approximately 20 million tpy of total LNG capacity.

USA | Cummins and Chevron advance strategic collaboration

Cummins and Chevron have announced a Memorandum of Understanding (MoU) to leverage complementary positioning in hydrogen, natural gas, and other lower carbon fuel value chains. This will expand the two companies’ previous strategic collaboration on hydrogen and renewable natural gas.

The collaboration is expected to encompass other liquid renewable

fuels, such as renewable gasoline blends, biodiesel and renewable diesel, and is intended to encourage commercial and industrial adoption in North America.

Cummins and Chevron will work together on enabling the commercial development at scale of alternative fuels production, transportation and delivery systems for industrial and commercial markets.

UK | Lummus and Biohydrogen Technologies partner on blue hydrogen technology

Lummus Technology and Biohydrogen Technologies have announced an agreement to develop and deploy advanced synthesis gas reactor technology primarily for the production of blue hydrogen.

Lummus’ Green Circle business unit will provide to Biohydrogen Technologies its expertise in hydrogen and synthesis gas plant design, reactor scale-up and design, and proprietary equipment supply.

“As the world looks for solutions to generate significant quantities of hydrogen for energy use while lowering CO2 emissions, Lummus is proud to partner with Biohydrogen Technologies to address this critical challenge for our industry and society,” said Leon de Bruyn, President and CEO of Lummus Technology. “By joining together, we will help further develop and deploy decarbonised solutions to the market.”

China | CPC Corp., Taiwan awards major contract to Sulzer and Axens

Sulzer Chemtech’s GT-BTX PluS and GT-AromatizationSM technologies, combined with Axens’ Prime-G+ technology, have been selected by CPC Corp., Taiwan (CPC Corp.) to streamline its oil to petrochemical value chain at its Talin Refinery in Kaohsiung, Taiwan.

CPC Corp. is undertaking an ambitious modernisation project of its Talin Refinery, an integrated refining and petrochemical production complex, to address growing petrochemical market needs. The company is implementing key technologies to

recover high volumes of valuable aromatic hydrocarbons from RFCC gasoline and other fuels.

Sulzer Chemtech’s licensed extractive distillation technologies will enable the recovery of high-quality key aromatics, namely benzene, toluene, and xylenes (BTX) from RFCC gasoline, as well as convert C4-C8 olefin-rich non-aromatics into additional aromatics. The solutions will offer a processing capacity of 32 000 bpd of RFCC gasoline and other aromatics-rich streams. Sulzer Chemtech will provide the

technologies, licenses, basic engineering, critical equipment, solvent, and catalyst, as well as technical services.

CPC Corp. will also leverage the alliance between Sulzer Chemtech and Axens to integrate additional hydrotreating solutions within the processing train, further reducing sulfur-based impurities in end products, relying on Axens’ Prime-G+ technology to ensure the selective desulfurisation of the gasoline. This will drive the production of high-grade petrochemicals and, ultimately, profitability.

September 2023 HYDROCARBON ENGINEERING 5

WORLD NEWS

DIARY DATES

17 - 21 September 2023

World Petroleum Congress

Calgary, Alberta, Canada www.24wpc.com

26 - 28 September 2023

Turbomachinery & Pump Symposia Houston, Texas, USA tps.tamu.edu

02 - 05 October 2023

ADIPEC

Abu Dhabi, UAE www.adipec.com

03 - 05 October 2023

AFPM Summit

Grapevine, Texas, USA summit.afpm.org

09 - 12 October 2023

2023 API Storage Tank Conference & Expo Denver, Colorado, USA events.api.org/2023-api-storage-tank-conference-expo

06 - 08 November 2023

Sulphur + Sulphuric Acid 2023 New Orleans, Louisiana, USA www.sulphurconference.com

13 - 16 November 2023

ERTC

Lake Maggiore, Italy worldrefiningassociation.com/event-events/ertc

05 - 07 December 2023

16th Annual National Aboveground Storage Tank Conference & Trade Show

The Woodlands, Texas, USA www.nistm.org

30 - 31 January 2024

NARTC

Houston, Texas, USA www.worldrefiningassociation.com/event-events/ nartc

03 - 07 March 2024

AMPP Annual Conference + Expo

New Orleans, Louisiana, USA ace.ampp.org

29 April - 03 May 2024

RefComm

Galveston, Texas, USA www.events.crugroup.com/refcomm

USA | Refinery outages amid lower capacity increase US gasoline crack spreads

Unplanned refinery outages and lower gasoline production capacity are increasing the costs of producing summer-grade gasoline in the US this summer, resulting in both higher US crack spreads and retail gasoline prices, according to the US Energy Information Administration (EIA).

The crack spread the difference between petroleum product prices and crude oil prices is an indicator of underlying trends in refining, and it usually makes up about 25% of the retail gasoline price. During the

summer of 2023, US gasoline crack spreads had remained less than those of summer 2022, up until the final weeks of July and into August. Although US gasoline consumption has increased from last summer and inventories remain near five-year lows, recent developments in US refining activity are primarily driving crack spreads this summer.

Several unplanned refinery outages have prevented refiners from producing enough high-octane blendstock to meet summer demand.

China | INEOS and SINOPEC complete major petrochemicals deal

INEOS has completed the formation of a 50/50 joint venture with SINOPEC for the Tianjin Nangang Ethylene Project in China, which was announced in December 2022.

SINOPEC is currently constructing the plant, which is expected to be on-stream by April 2024.

The petrochemical complex includes a 1.2 million tpy cracker, a new 500 000 tpy high-density

polyethylene plant to produce INEOS pipe grade under license, and 11 other derivative units.

The completion of the agreement marks the continued progression of the significant petrochemical deals announced by the parties in July and December 2022, and highlights the close relationship and growing collaboration between SINOPEC and INEOS.

India | McDermott selected for petrochemical expansion project

McDermott has been awarded a project management consultancy (PMC) and engineering, procurement, and construction management (EPCM) contract for the Naphtha Cracker Expansion (Phase II) polypropylene expansion and new ethylene derivative unit project, by Indian Oil Corp. Ltd (IOCL).

The project is located at the Panipat Refinery and Petrochemical Complex, located 62 miles (100 km) from New Delhi, India.

The project will increase the ethylene production capacity of the naphtha cracker unit (NCU) by approximately 20%.

The additional ethylene and propylene production will act as feed for downstream polymer units. The polymer products will be used for the manufacture of household and industrial items, including containers, automobile parts, furniture, and heavy-duty films.

September 2023 HYDROCARBON ENGINEERING 6

Select The Best Catalyst With Confidence

Your Feed , Your Conditions

Commercial extrudates are tested with real feedstocks at industrial process conditions. Relevant refinery knowledge with industry experience.

Highest Data Q uality

Outstanding reactor-to-reactor repeatability. Tests performed by highly experienced staff with extensive catalysis knowledge.

Reliable Results

Test duplicates for improved accuracy.We can discriminate <1°C activity difference and <0.5 wt% in MD yield. Test catalysts side-by-side under the exact same conditions.

Validated by Catalyst Suppliers

Flowrence® technology validated by all catalyst suppliers. Pilot plant systems with unmatched accuracy. Results you can trust.

REFINERY CATALYST TESTING

rds@avantium.com Avantium R&D Solutions | +31 20 586 80 80

rds.avantium.com

8 September 2023 HYDROCARBON ENGINEERING

Gordon Cope, Contributing Editor, discusses how investors in North American refineries and petrochemicals are tacking in the face of adversarial winds, and evaluating new opportunities.

The international energy sector is entering a new world order. Nations are scrambling to find alternatives to Russian supplies of oil and gas, jurisdictions are reducing their carbon footprints, new fuels such as hydrogen are entering the market at warp speed, and the overriding priority of energy security is super-charging geopolitics. North America is blessed with abundant fossil fuels and a comprehensive downstream sector, but, like everyone else, must pivot to the new realities or be left in the dust by more nimble competitors.

Canada

Since the election of the Trudeau government in 2015, Canada’s oil and gas sector has been inundated by federal regulations geared to transitioning the country to a non-carbon economy. This has resulted in cancelled pipelines, regulatory delays and missed opportunities. When German Chancellor, Olaf Scholz, visited Canada in late 2022 seeking LNG exports to alleviate the loss of Russian imports, Justin Trudeau replied that there was “no business case” for building East Coast gasification facilities (Germany subsequently signed a 15-year contract with Qatar). Despite this, oil and gas remains the country’s number one export, accounting for CAN$104 billion in 2022, primarily in the form of crude shipments to the US.

Canada’s total refining capacity is approximately 2 million bpd. New clean fuel regulations established by the Canadian federal government require refiners to reach net-zero emissions by 2050. The Canadian Association of Petroleum Producers (CAPP) estimates that it will cost up to CAN$75 billion to reach that goal and

significant capital is already being deployed to reconfiguring existing facilities:

n In January 2023, Imperial Oil announced that it was investing CAN$720 million to create the largest renewable diesel facility in Canada. Initial production has already begun at Imperial’s Strathcona refinery near Edmonton, Alberta. When the module is commissioned in 2025, it will be able to produce 20 000 bpd from a feedstock of locally-sourced canola and soy, as well as blue hydrogen.

n Tidewater Renewables invested CAN$430 million to build Canada’s first stand-alone renewable diesel refinery. The plant, located in Prince George, British Columbia (B.C.), is expected to enter production in mid-2023. When it reaches full operational capacity, it will produce 170 million l/yr of fuel using canola oil, tallow and used cooking oil. Unlike biodiesel, which can be mixed with conventional diesel up to 10%, renewable diesel can be substituted 100%, reducing emissions by up to 90%.

n Since its purchase in late 2021, Newfoundland & Labrador’s Come By Chance refinery has been undergoing conversion to a biofuels refinery. Cresta Fund Management has revamped the facility’s hydrocracker and diesel hydro-treater to produce renewable diesel and sustainable aviation fuel (SAF). The bio-refinery will have the capacity to produce up to 18 000 bpd of renewable diesel and SAF, with production currently expected to begin during 2023. Cresta has also indicated that the capacity could later be expanded to 35 000 bpd, with the addition of a further

September 2023 9 HYDROCARBON ENGINEERING

stream of green ammonia fuel. Products are destined for both domestic and international markets.

In addition, Federated Co-operative is proposing a diesel project for its Regina facility, and Parkland Corp. is seeking a final investment decision (FID) for a CAN$600 million addition to its refinery in Burnaby, B.C.

LNG

For over a decade, various developers have been proposing LNG projects in B.C.; the province is finally seeing development.

LNG Canada, led by Shell, is completing its plant in Kitimat, B.C. The first phase of 14 million tpy is scheduled for completion in 2025. Construction of a 2.1 million tpy Woodfibre LNG plant near Squamish, B.C., is set to begin in late 2023, with a completion date in 2027. In March 2023, the B.C. government approved the construction of the Cedar LNG project, also near Kitimat. The CAN$2.4 billion floating LNG facility, which is majority owned by the Haisla First Nations, is expected to produce up to 4 million tpy.

The US

Refiners in the US are seeking to rebalance production in response to COVID-19 regulations and international fuel demand. According to the US Energy Information Administration (EIA), six US crude oil refineries have closed since the COVID-19 pandemic began, dropping US capacity from 18.98 million bpd to slightly under 18 million bpd. Now, refiners are reversing the trend.

In early January 2023, ExxonMobil completed a US$2 billion expansion at its 369 000 bpd refinery in Beaumont, Texas, US. The project, almost a decade in the making, will see the startup of a 250 000 bpd crude distillation unit (CDU), making it the second largest refinery in the US. The new capacity comes at a time when diesel and gasoline reserves are at five-year lows; refiners are receiving a very healthy US$35/bbl crack spread (the difference between the price of crude and refined fuels).

“Right now, margins are sensational,” said Garfield Miller, President of refining investment bank, Aegis Energy Advisers Corp. “These margins tell you that as far as the US Gulf Coast is concerned, there is plenty of demand relative to supply.”1

Kevin O’Leary, a panelist on the popular TV show, Shark Tank, has announced plans to build a US$14 billion refinery in the US. “At the end of the day, we can make our own energy here very clean,” he noted, in a television interview. “We haven’t built a refinery in America for decades because we can’t permit it. I’m going to find a state that wants to work with me. I’m going to get a permit and we’re going to do the right thing for America. We have to have more refineries.”2 The financier later commented that North Dakota would be a primary candidate due to its pro-fossil fuel stance.

LNG

Currently, US LNG plants are exporting approximately 13.4 billion ft3/d of gas; that number is expected to climb significantly over the next five years as new trains come online at the Golden Pass, Plaquemines and Corpus Christi sites, pushing exports above 20 billion ft3/d by 2028. When Sempra’s Port Arthur project and LNG projects in Mexico (using gas from the US) come on-stream, that figure could rise to 30 billion ft3/d within the decade.

In March 2023, Dubai-based energy company Qilak announced a plan to build a US$5 billion LNG plant in Alaska’s North Slope. The region has over 35 trillion ft3 of stranded gas, and is several thousand kilometres closer to key Asian markets than the massive Yamal Peninsula LNG complex in Russia. The initial phase would see up to four vessels per month delivering 4 million tpy to South Korea, Japan and Taiwan.

In April 2023, the US Department of Energy (DOE) approved exports from the proposed US$40 billion Alaska LNG project. The Alaska Gasline Development Corp. plans to start delivering up to 3.5 billion ft3/d of gas via an 800 mile pipeline running from the North Slope to an LNG plant on the Pacific coast. The latter announcement, coming on the heels of the Biden administration’s approval for the Willow conventional oilfield project in the Alaska Strategic Petroleum Reserve, left environmentalists aghast. Alaska state officials applauded the move.

In late 2022, Chevron Phillips Chemical and QatarEnergy announced they had reached FID on a new petrochemical complex in Orange, Texas. The Golden Triangle Polymers Co. will build a complex that includes a 2 million tpy ethane cracker, and two 1 million tpy high-density polyethylene units. The facility is expected to be completed by 2026.

Green potential

Net-zero regulations in Canada and the US are incentivising companies to invest in environmentally-friendly projects that create renewable fuels in North America. In February 2023, German-based RWE formed an alliance with LOTTE Chemical of Korea and Japan’s Mitsubishi, to build a clean ammonia production and export facility in the port of Corpus Christi, Texas. The plan is to build a series of units with a final capacity approaching 10 million tpy by 2030. Output will be in the form of both blue and green ammonia, and will be exported to Asia and Europe for use as both fuel and a source of renewable hydrogen.

In February 2023, EverWind, based in Nova Scotia, Canada, received approval from the provincial government to build a 300 MW hydrogen electrolysis and green ammonia plant in Port Hawkesbury, Nova Scotia. The CAN$6 billion project is intended to supply the German market by 2025.

Nutrien, a Canadian fertilizer company, is working in collaboration with Belgian shipping company, EXMAR, to develop an ammonia-powered shipping vessel. In late 2022, the company announced that it has plans to build the world’s largest clean ammonia facility at its existing complex in Geismar, Louisiana, US, near tidewater ports in New Orleans. Currently undergoing front-end engineering and design (FEED), the 1.2 million tpy plant would permanently remove up to 90% of CO2 emissions using carbon capture and sequestration (CCS) technology. An FID is expected by 2023; full production could commence by 2027.

Yara, a fertilizer company based in Norway, is teaming up with Enbridge to build a blue ammonia plant in Corpus Christi, Texas. The US$2.9 billion facility will produce up to 1.4 million tpy using carbon capture. The output will be used for low-carbon fertilizers, shipping fuel and utility power.

Hydrogen

ExxonMobil is advancing plans for a huge, low-carbon hydrogen and ammonia production facility, located in its

September 2023 HYDROCARBON ENGINEERING 10

Baytown, Texas, complex. In January 2023, it contracted with Technip Energies to conduct FEED in order to make an FID by 2024. When construction is finished in 2028, the new facility will produce up to 1 billion ft3/d of blue hydrogen by capturing and sequestering up to 98% of CO2 emissions. The output allows ExxonMobil and third party customers to produce low-carbon fuels and products.

Geopolitics

The war in Ukraine has exacerbated a great geopolitical divide between nations; on one side, the US, NATO and western allies, and on the other, Russia, China and many non-aligned nations in Africa and Asia. The former is mainly concerned about energy security, and the latter with buying cheap, embargo-busting Russian oil.

In the Middle East, loyalties are also being divided. Russia has found an ally in Iran, which supplies it with military kit, such as attack drones. Saudi Arabia relies on its traditional alliance with the US as a source of arms. Others try their best to sit on the fence, looking to maintain and grow market share in Asia and to wrangle concessions from both sides. Qatar, for instance, positions itself as a neutral supplier of LNG to all nations. In the last several months, it has signed major long-term contracts with both China (4 million tpy for 27 years, starting in 2026) and Germany (2 million tpy for 15 years, starting in 2026.)

However, it is telling that, when it comes to major internal investments, Qatar favours the west. In early 2022, Houston-based McDermott signed a contract for the engineering, procurement, construction and installation (EPCI) for the offshore components of the North Field Expansion Project in Qatar. McDermott categorised the size of the contract as one of the largest in its history. In addition, Qatar has partnered with US-based Chevron Phillips Chemical to build a US$6 billion ethylene plant located in the former’s Ras Laffan expansion. The complex will feature a 2.1 million tpy ethane cracker, and include two polyethylene trains with a total output of 1.7 million tpy of high-density polyethylene, bringing Qatar’s overall petrochemical production capacity to approximately 14 million tpy.

Conclusions

The regulatory pressure for net zero emissions over the next several decades will require hundreds of billions of dollars in downstream investments to capture and sequester CO2, and to switch to low-carbon biofuels and hydrogen. As the consumption of diesel and gasoline in North America gradually stagnates due to higher fuel efficiency and more electric vehicles, production will be geared toward greener fuels for both domestic consumption and export. National oil companies, including those in the Middle East, will increasingly look to North America as a means of diversifying assets into less geopolitically-fraught jurisdictions. In all, it will create significant opportunities for the downstream segment of oil and gas in Canada and the US to both evolve and seek new markets.

References

1. SEBA, E., ‘Exclusive-Exxon prepares to start $2 billion Texas oil refinery expansion’, Yahoo Finance, (13 January 2023), https://ca.finance.yahoo. com/news/exclusive-exxon-prepares-start-1-163315791.html

Let ProTreat® Be Your Guide

The Leading Simulator for CO2 Capture

Solvents:

• Primary, secondary, promoted amines

• CESAR1 (updated with data from DOE partnership & tested within EU-funded consortium “SCOPE”)

• Amino acid salts

• Enzyme catalysed & amine-promoted carbonates

• Ionic solvents

• High strength piperazine

• Chilled ammonia

Applications:

• Stationary power generation

• CO2 capture from LNG-fueled ships

• Renewable methane from landfill gas and organic waste

• Hydrogen production via reforming

Ferrybridge Pilot Plant, Ferrybridge, UK, 100 TPD

Reliable:

• New CESAR1 model updated with cutting edge lab and plant data from DOE partnership

• Thoroughly tested as part of EU-funded research consortium “SCOPE”

2. PARASKOVA, T., ‘O’Leary Looks For A US state to host his $14 billion refinery’, Oilprice.com, (15 April 2023), https://oilprice.com/Energy/ Crude-Oil/OLeary-Looks-For-A-US-State-To-Host-His-14-BillionRefinery.html Contact us

a

Optimized Gas Treating, Inc. www.ogtrt.com +1

for

free trial

512 312 9424

©2023 Halliburton. All Rights Reserved. halliburton.com Superior Process and Water Treatment Solutions Driven by Service Excellence PROTECT ASSETS & MAXIMIZE VALUE

COMPLETE SOLUTIONS

Halliburton Multi-Chem offers a broad selection of chemistries, equipment, services and automation to ensure timely and successful results.

COLLABORATIVE APPROACH

Through onsite technical service and engineering support, Halliburton Multi-Chem collaborates with you to deliver solutions to your challenges. Improving reliability, increasing throughput and enhancing the efficiency and flexibility of operating units is important to you.

We are here to help.

14 September 2023 HYDROCARBON ENGINEERING

Tim Michalec, James Esteban, Will Bridges and Tom Ventham, UNICAT Catalyst Technologies, LLC, explore how innovative next generation technology can help to increase bed cycle time and efficiency, while reducing costs and improving profitability.

Catalyst use in fixed bed reactors pre-dates the refining and petrochemical industries and is considered an essential component over a broad scope of applications. While fixed bed reactors are found in a wide variety of applications, there are many similarities between these operations despite a rich diversity of reactants and products.

Fixed bed reactor systems have two key failure modes which act to reduce the overall activity and life of catalyst bed materials:

n Feed poisons.

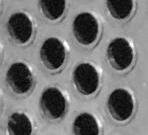

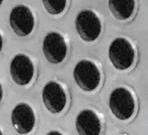

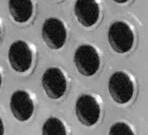

n Pressure drop (dP) due to particulate fouling (Figure 1).

Poisons that enter with feed impair the conversion abilities of primary catalysts and therefore impact product quality. Control of poisons, and resistance to impurities, are essential components of fixed bed reactor catalyst system design. Inherently, fixed bed reactors are also exceptional physical filtration devices. Unfortunately, this results in susceptibility to premature shutdown when overall system dP exceeds design parameters due to excessive fouling. Graded bed materials have been used at the inlet of hydroprocessing and hydrocracking reactors for decades to trap foulants and poisons

First generation: deep bed filter using spherical ceramics

Catalyst companies initially developed top bed grading systems targeting foulant filtering with varying degrees of success. Initially a series of smaller spherical supports were used that became known as ‘deep bed filtration’. A properly designed deep bed filter, based on particle size and distribution, will remove large proportions of particulate matter, provided it has sufficient depth. The problem is that it requires a significant portion of a catalyst bed to work properly, reducing the amount of active catalyst that can be used. A second problem is that only external void fraction can be used to filter particulates. Thirdly, accumulation of particulates in external void spaces redirects flow to paths of least resistance. Over time, decreased flow accessibility to the catalyst below was due to plugged sections of top bed grading.

Second

generation filter

systems: ‘wagon wheels’ and rings

Replacing inert support balls with ‘wagon wheels’ and rings improves internal flow channels around plugged external void spaces and improves flow. Filtering remains limited to external void spaces between wagon wheels. Run length is not dramatically improved when using wagon wheels and rings because internal void spaces of the smallest rings remain too large to filter the smallest particulates (‘fines’). Fines are trapped at interfaces between the smallest ring layer and main catalyst bed, which is the only external void fraction small enough to capture small particulates. Accumulation rapidly builds at this interface, void space decreases, dP increases, and end of run (EOR) due to high dP is quickly realised. Since the internal void space of wagon wheels and rings do not effectively filter or collect particulates, grading depths remain large to generate sufficient void space to be effective. Many industrial users must cut feed rate or skim the reactor when encountering high dP limitations. Both options reduce uptime and output, and analysis is required to determine the most cost-effective selection. At times, refiners find that a full discharge and reload with fresh catalyst and grading is more cost effective in comparison to the time and cost of multiple skims.

September 2023 15 HYDROCARBON ENGINEERING

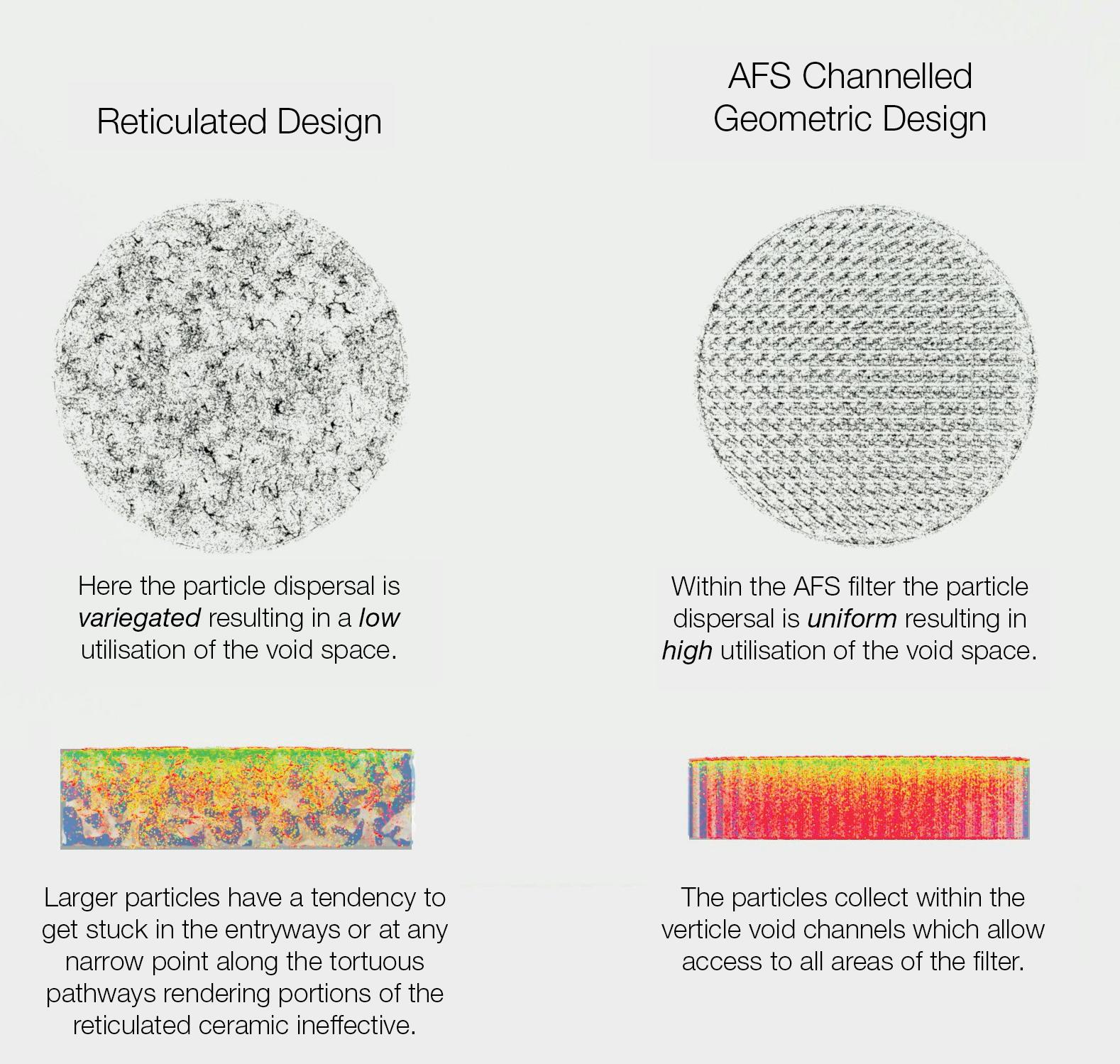

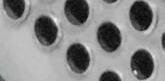

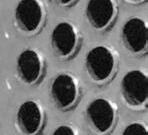

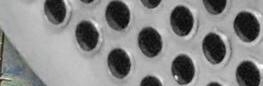

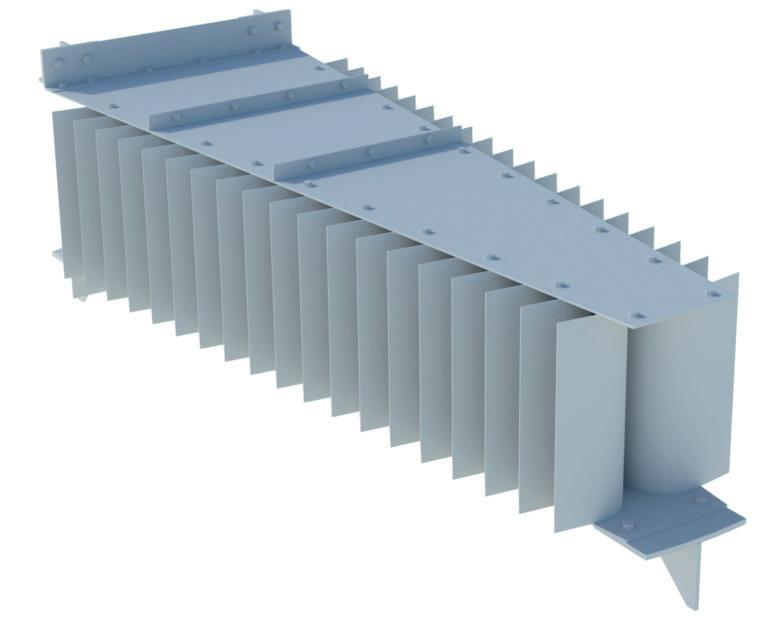

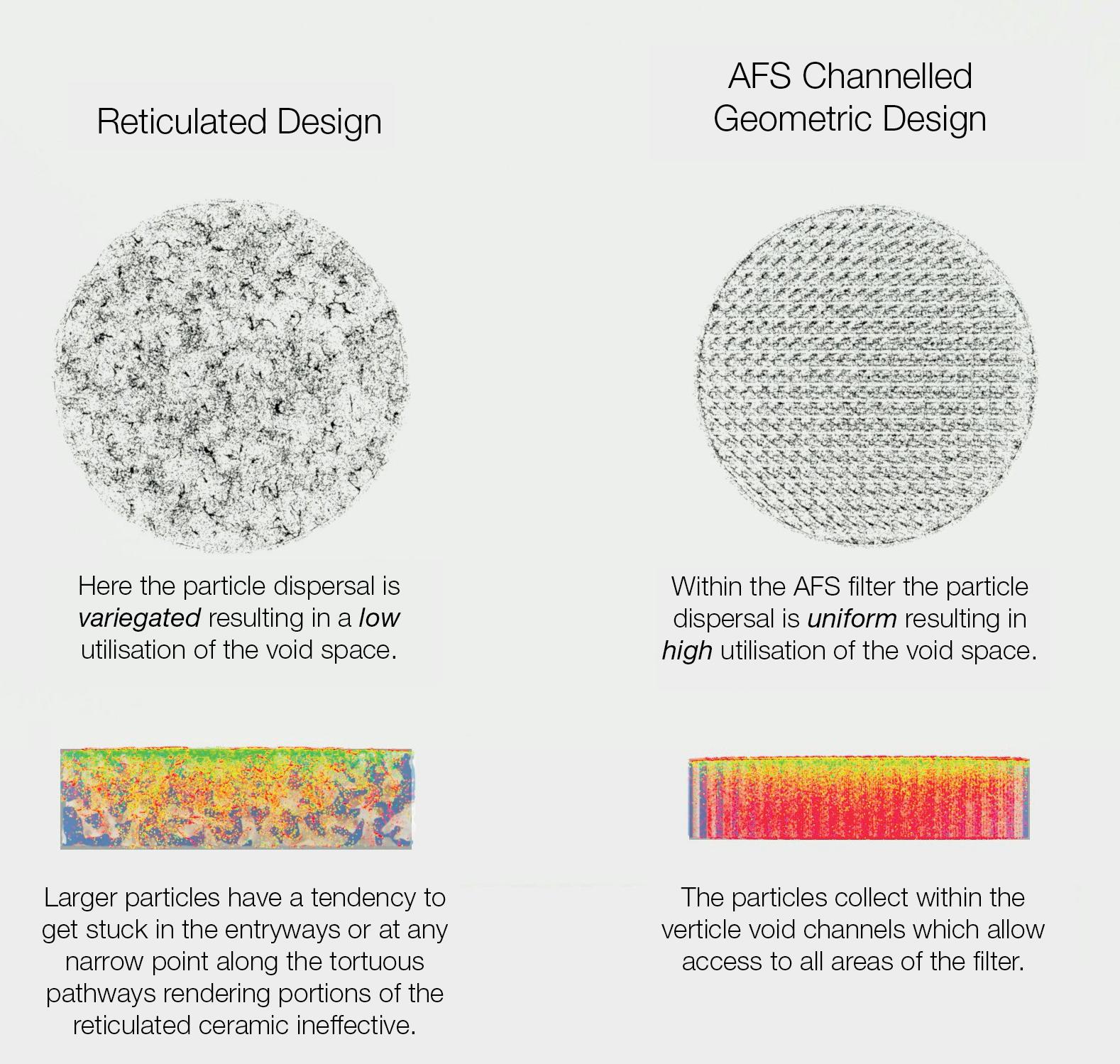

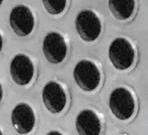

Third generation: advanced shapes for effective particulate filtration

Rings and medallions layered above the main bed catalyst was an innovation that produced a small step change in reactor system life cycles. This was further improved with the invention of reticulated ceramics, which enhanced particulate removal and reduced dP build during runs. Finally, a new product entered the market with regular fixed triangular openings that proved additional benefits beyond reticulated ceramics. These advanced filtration system (AFS) disks had higher strength, more disks per ft3, higher particulate pick-up capacity, and an overall deep bed filtration which led to even longer runs with lower dP build.

Adaptation to deep bed filtration systems has been a staple in catalyst system design for over a generation. It is this critical component of reactor system design where

UNICAT Catalyst Technologies continues to study, innovate and develop new solutions to advance overall reactor system performance. The company’s AFS technology couples next generation computational fluid dynamics (CFD) and process modelling to design products that can maximise performance. By fundamentally restructuring the way that grading material functions in a deep bed filtering process, AFS significantly reduces dP build, which delays onset of EOR dP limits and can increase flow through a vessel without an increase in bed depth.

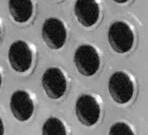

This paradigm shift is achieved with AFS by facilitating full access to all internal void space for particulate capture (Figure 2). As a result, less grading bed depth is required as internal void space collects particulates, without compromising external void space availability for fluid flow. Lower initial start of run (SOR) dP is also typically observed with AFS due to the higher overall void space.

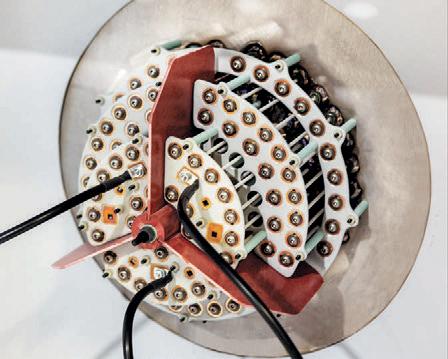

Other improvements that can be observed include uniformity of reactor radial temperature distribution, due to a reduction of dead spots in catalyst layers beneath areas of plugged top grading. The internal void space of AFS is dimensionally controlled using various triangular-shaped mesh grades that are sized for different particulate diameters within an overall range of 10 - 2500+ µ m. Required layer depth of different mesh sizes is calculated to optimise removal of the full range of particulates present in the process to maximise time before EOR dP is reached. UNICAT designs AFS loading schemes through careful analysis of particulate size distribution in reactor feed samples, observations from previous cycles (when using AFS or other advanced or basic grading technologies), and engineering experience.

While the functional objectives of AFS have remained much the same, the shape and design has evolved based on CFD modelling of filter capacity and system dP. A primary beenfit of AFS is durability, which is directly related to composition and shape. It is important to refiners that catalyst and grading materials exhibit exceptionally high robustness and crush strength. This is essential to withstand operating conditions and is also vital during transportation and loading activities. Breakage or damage to fresh materials loaded into fixed bed reactors leads to an elevated dP beginning from SOR.

Furthermore, when replacing only a portion of the catalyst load during a skim, it is of paramount importance that no additional small particles are introduced to the existing catalyst bed below. A geometric design and a uniform structure provide AFS with high durability and crush strength. The mesh structure provides exceptionally high useable void space relative to alternative technologies. These dual benefits provide refiners with advantages in both reduced dP for longer days on stream pressure, as well as enhanced protection of main bed catalyst materials.

September 2023 HYDROCARBON ENGINEERING 16

Figure 1. Common contaminates/foulants found in feed.

Polymers

Figure 2. Reticulated vs AFS channelled geometric design.

Iron Scales Carbon Coke Iron Sulfide Silica

Common contaminates/foulants are:

These contaminates can cause a variety of issues during hydrating: 1. Loss of activity within the catalyst bed

2. Differential pressure fluctuations

3. Shorter cycle lengths

Cut your CO2 emissions in half with ET Black™ Carbon Black Technology

ET Black™ is a state-ofthe-art technology that complies with the most stringent environmental regulations now and in the future.

Plus, the flexibility to produce all ASTM grades, and specialty grades, in a single plant. ET Black™, the technology of reference for producing carbon black obtained by thermal decomposition of highly aromatic oils.

Find out more at: www.igoforETBlack.com

Shape and size

Many examples exist in literature which highlight the importance of catalyst shape and size in terms of how these parameters influence activity, especially relating to fluid dynamics, diffusivity, and mass transfer. Therefore, it is equally important that shape and size be considered for

graded bed filtration media to provide enhanced fluid dynamics, without disrupting flow distribution. This is to achieve maximum catalyst utilisation, while providing high surface area and void space for particulate accumulation. AFS functions analogously to distillation column structured packing, where reactor feed passes through engineered channels designed to optimise surface contact without excessive resistance to fluid flow.

Loading

Typically, AFS grading is random packed (sock loaded) to give up to 80% total void fraction. Sock loaded AFS naturally configures in a manner where a significant proportion of the matrix face is exposed to feed flow. In vessels where it is important to load the highest number of pieces possible in order to maximise total contaminant capacity, AFS can be raked during loading in order to load approximately 10% more disks. AFS is also a valuable hold-down material due to its high density (~44+/- 10% lb per cuft). UNICAT has experienced cases replacing lower density grading with AFS to avoid damage previously found in reactors where top bed grading formed into vortex-shapes due to turbidity of feed at the top of the bed, leading to premature dP.

Active metal promoted options

With catalyst reactors being fixed in size, refiners are looking for ways to utilise every ft3 of space for as much benefit as possible. In addition to the removal of contaminants from feed streams, grades of AFS are available with a variety of enhanced chemical properties, including active versions that provide a staged activity profile as feed is introduced to the reactor bed. This allows many common main catalyst bed poisons to be actively captured on AFS media, in addition to providing mild hydrogenation in hydroprocessing units to protect from deposition of polymeric structures that result from rapid hydrogenation of light hydrocarbon components.

Future feedstocks

Advancement of co-processing bio-based feedstocks presents new and unforeseen challenges for refiners. The popular solution appears to be to process such feeds in fixed bed reactors, such as hydrotreaters and hydrocrackers. With high costs and short

September 2023 HYDROCARBON ENGINEERING 18

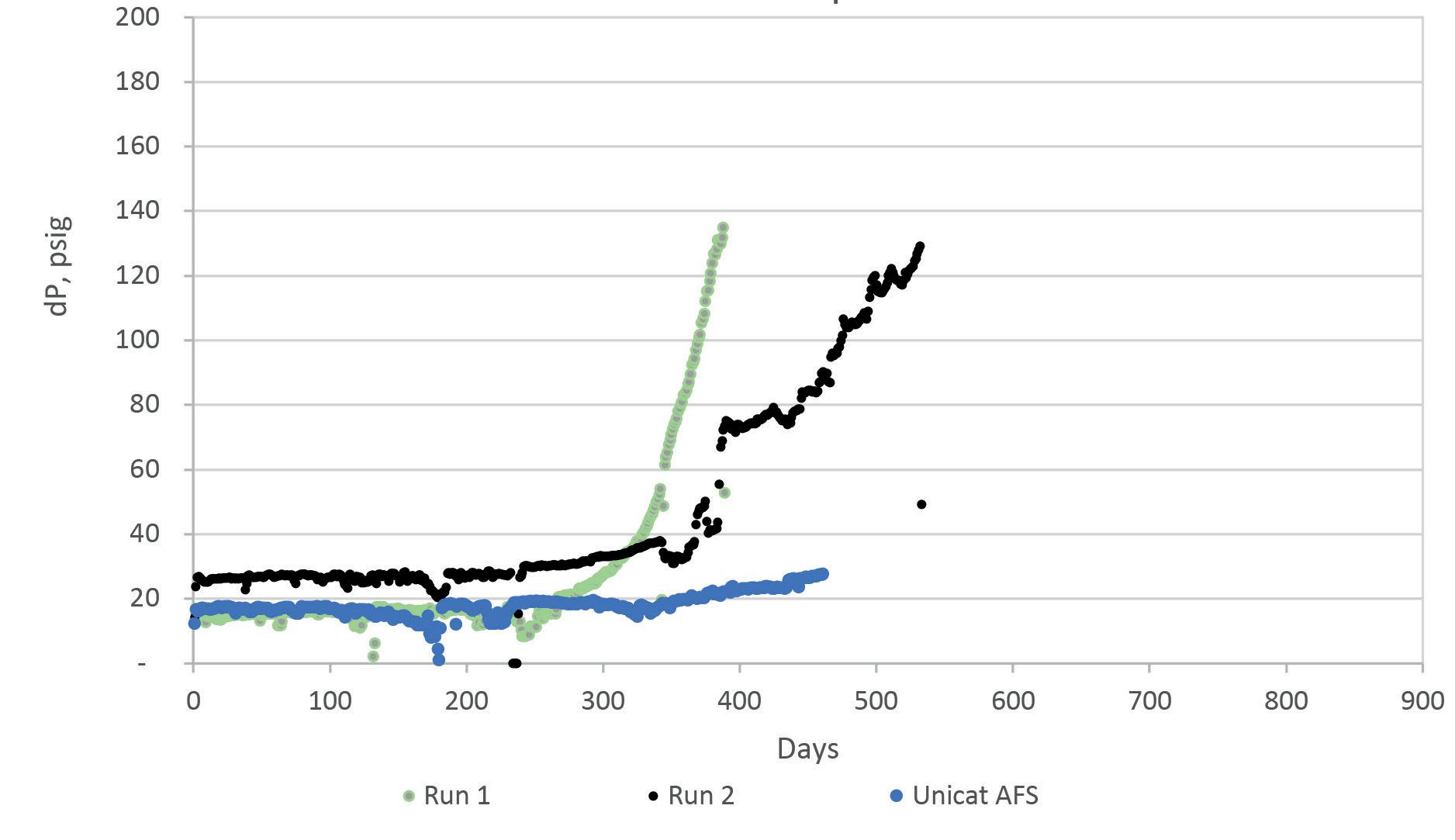

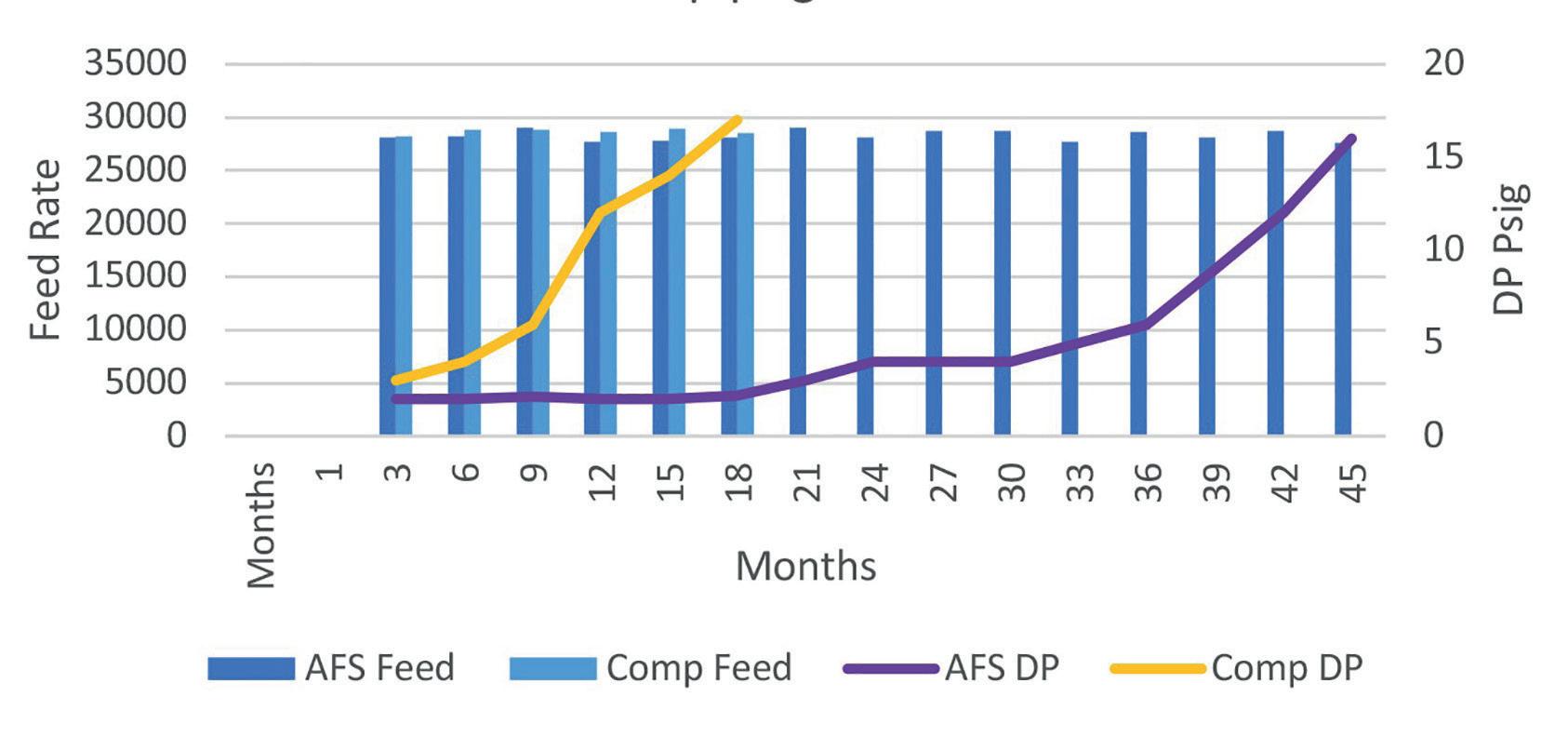

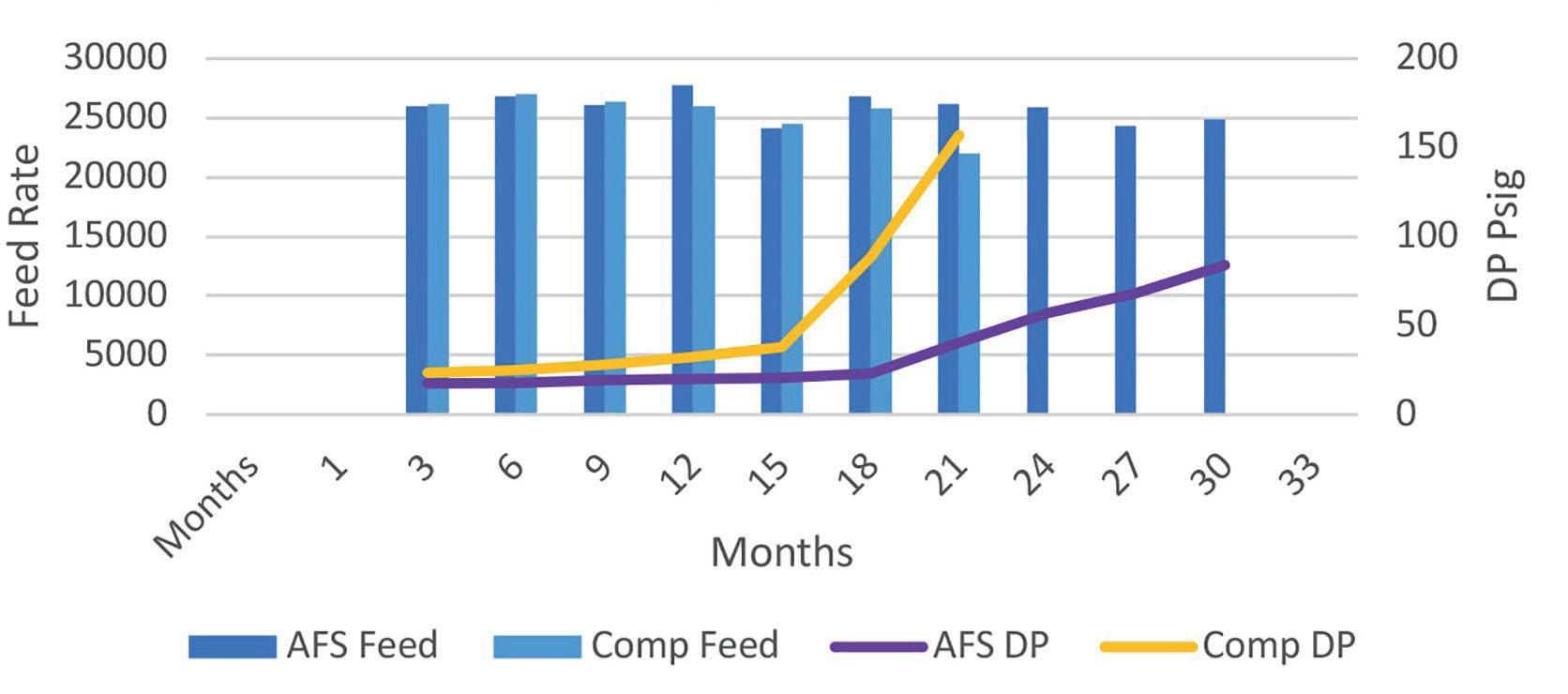

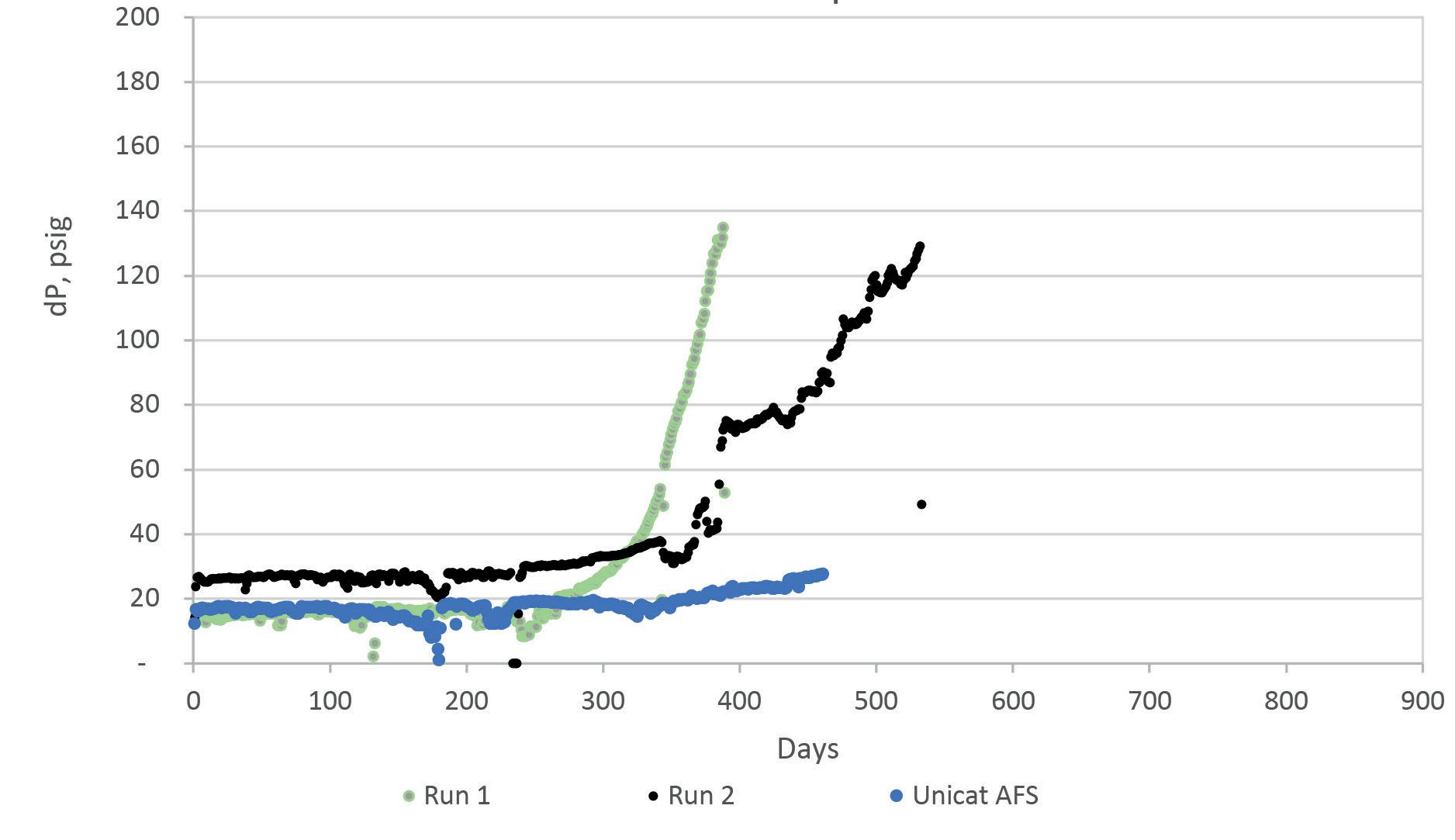

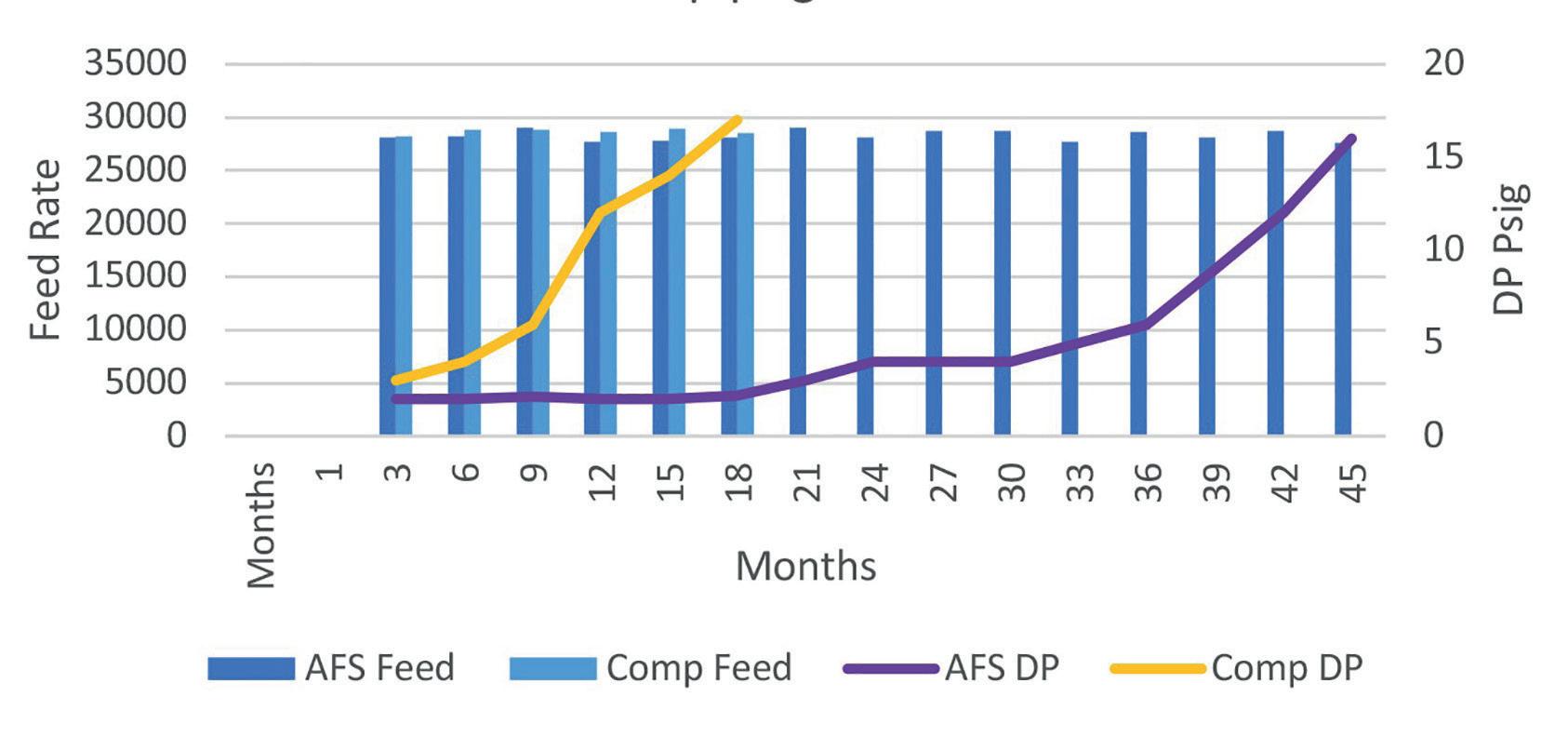

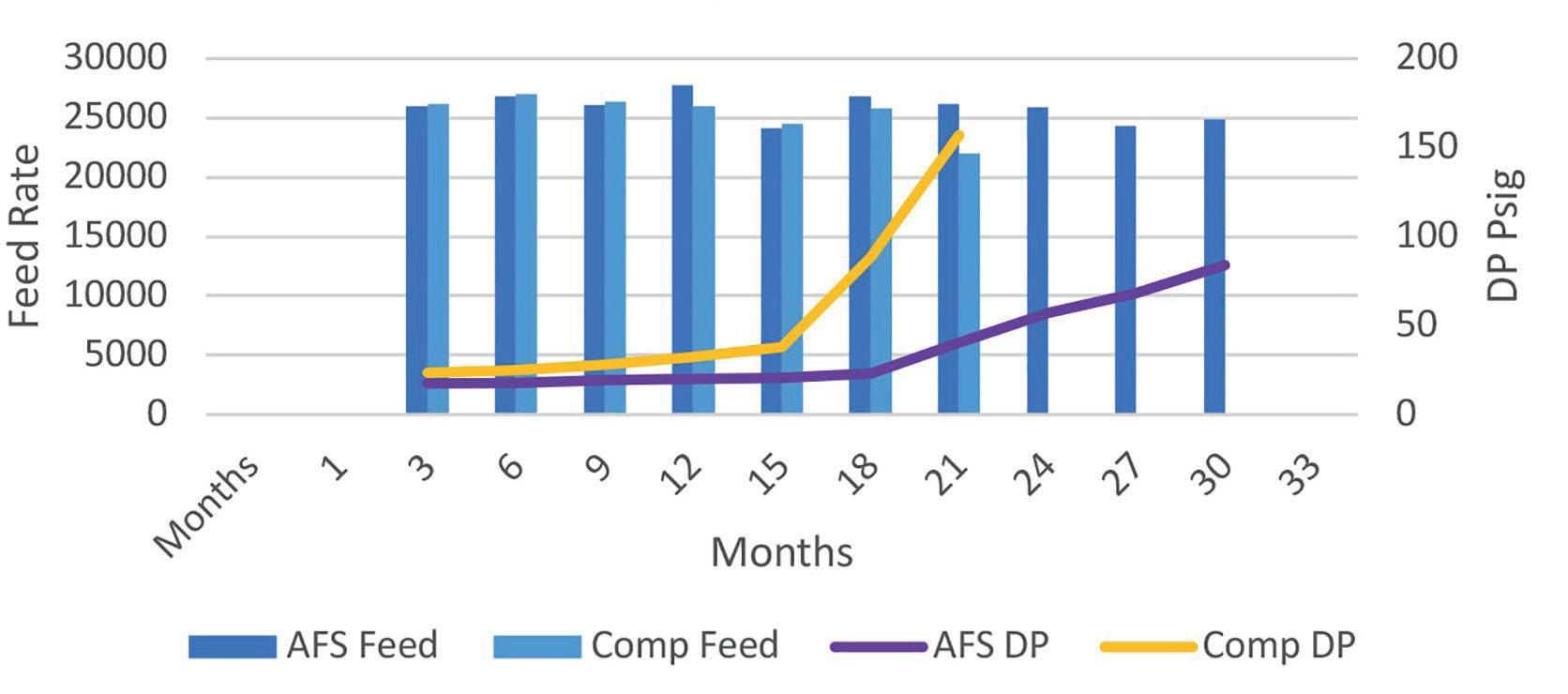

Figure 3a. AFS vs competitor grading. Pressure drop and feed rate comparison; with AFS a 150% longer cycle can be realised compared to competitor grading, leading to reduced costs, improved profitability and minimised down time.

Figure 3b. AFS vs competitor traditional reticulated grading.

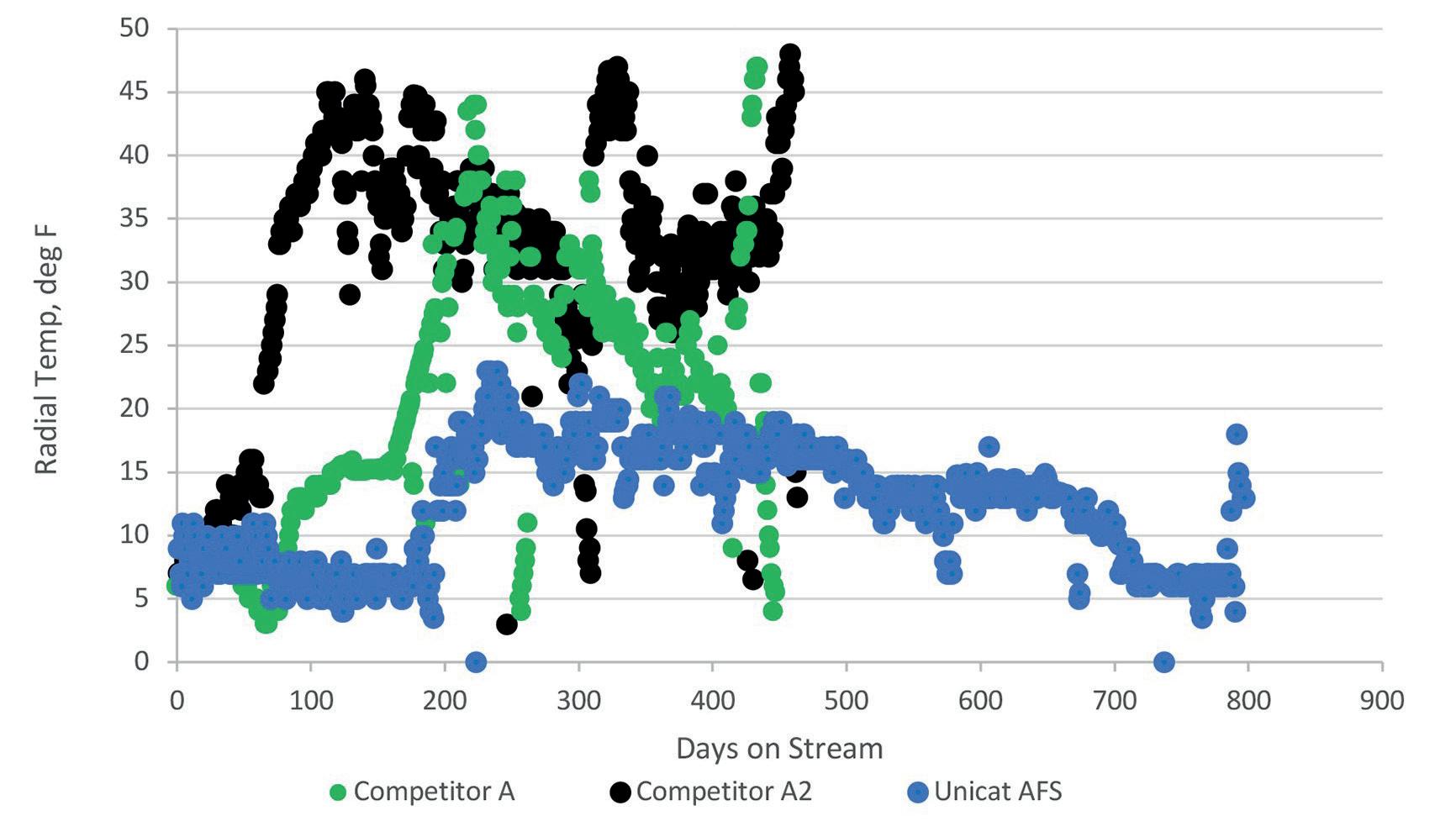

Figure 4. Case study: reactor pressure drop with similar feed rates and properties. SOR pressure drop significantly lower compared to the competition, leading to longer cycles and improved profitability.

lifetimes of advanced catalysts required for such hydroprocessing reactors, maximising the protection of the catalyst bed becomes even more essential. Additionally, the possibility of introducing new contaminants associated with bio-feeds requires careful consideration of the incumbent grading system before commencing such feed processing, such as oxygenates, gums, coke particles from pyrolysis, and other particulate material.

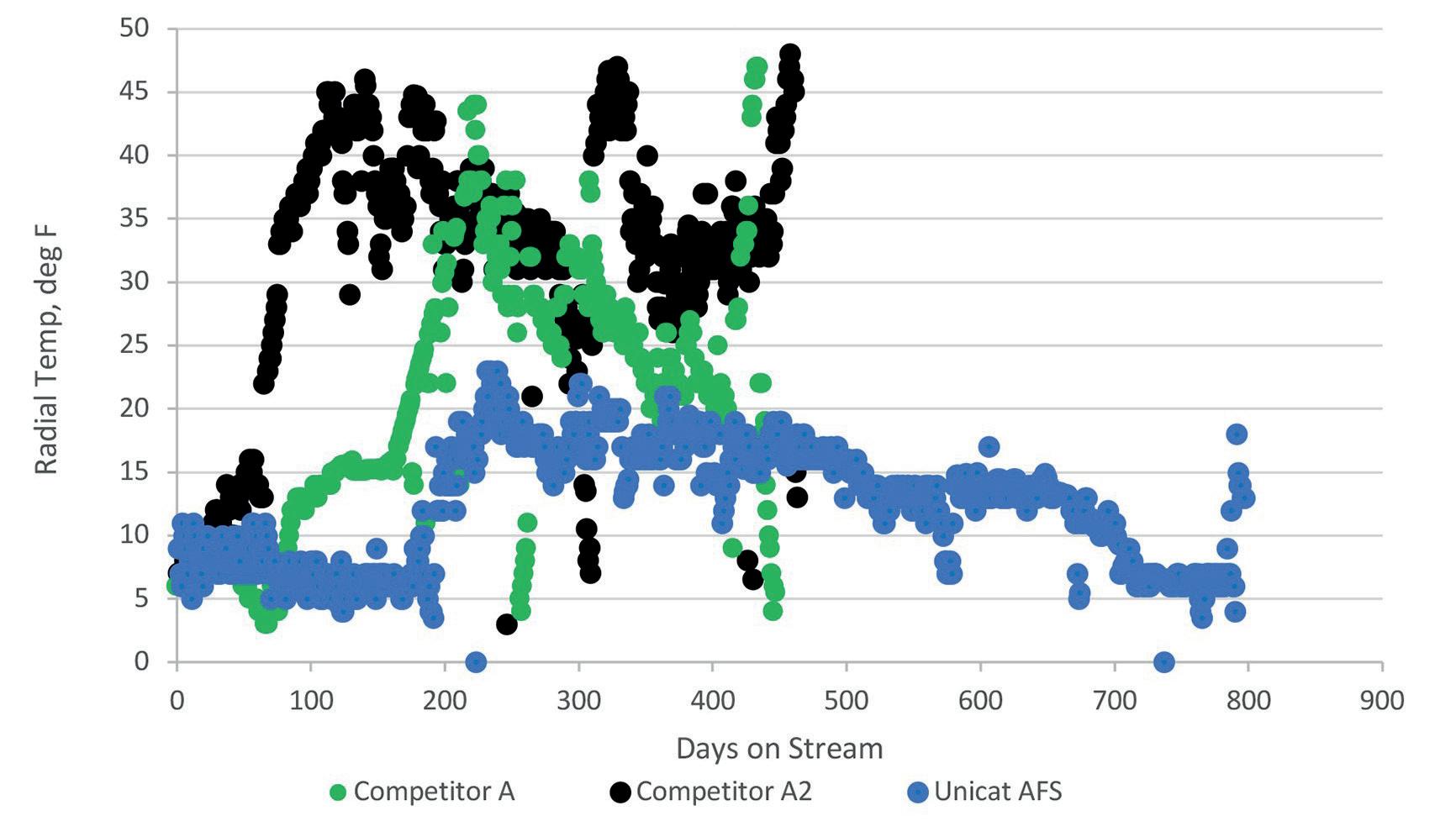

Conclusion

AFS is an advanced filter technology that can help refiners achieve significantly longer run lengths (Figure 3), lower dP (see Figures 3 and 4), better catalyst conversion retention, improved radial heat profiles (Figure 5), and increased reactor throughputs. This can apply to refiners processing both conventional crude based feeds and bio-based feeds, where challenges may be different, but the solution can be straightforward and cost-effective.

The technology can be applied in any fixed bed reactor or can be provided in flexible, skid-based units to treat flows ahead of a main reactor bed. This second option provides an opportunity to physically separate grading layers from the catalyst bed, allowing greater volumes of catalyst to be loaded to the main reactor, and contaminant management to be conducted more effectively and online, without interruption to the process. While achieving significantly longer run lengths, shorter turnarounds, and less catalyst wastage (i.e., costs), UNICAT supports refiners optimising their reactor loading designs through consecutive cycles to ensure the grading system remains functioning in the best way possible for the operator.

REMBE® Your Specialist for Pressure Relief Solutions. © REMBE® | All rights reserved rembe.com hello@rembe.com 9567 Yarborough Rd. | Fort Mill, SC 29707, USA T +1 704 716 7022 hello@rembe.us

Figure 5. Radial temperature profile: AFS vs reticulated grading. Radial temperatures are mitigated with AFS compared to other advanced grading technologies. In this application, AFS also gave significantly longer cycle length at 800 days vs other runs with alternative technology at under 500 days.

Fluidised catalytic cracking units (FCCUs) are a major source of global butylenes production, and global butylene consumption is expected to continue growing over the course of the coming years. Alkylate produced from butylenes offers a high value gasoline blending stock, as well as a raw material to produce petrochemicals. BASF reviewed the objectives of hundreds of global FCCU operations between 2018 and 2021, and observed that 40% of FCCUs identified increased LPG olefin yields in their objectives.1 FCCUs in North America clearly displayed the highest preference for butylenes over other LPG components. As the demand for butylenes has grown, new FCCU catalyst technologies have been developed to address this challenge and increase butylenes yields from FCCUs. This article will describe the challenges associated with the maximisation of butylenes yields in FCCUs which process resid feeds. These challenges include: elevated levels of nickel and vanadium in the feed; the need to balance high yields of olefins with the maintenance of catalyst activity; and the difficulty of upgrading heavy FCCU feed molecules. Various types of FCCU catalyst functionalities designed to help overcome these challenges, developed through collaboration with key refinery partners, will be discussed. Finally, a case study of a commercial refinery trial of the BASF Fourtitude catalyst will be presented. This is the

September 2023 21 HYDROCARBON ENGINEERING

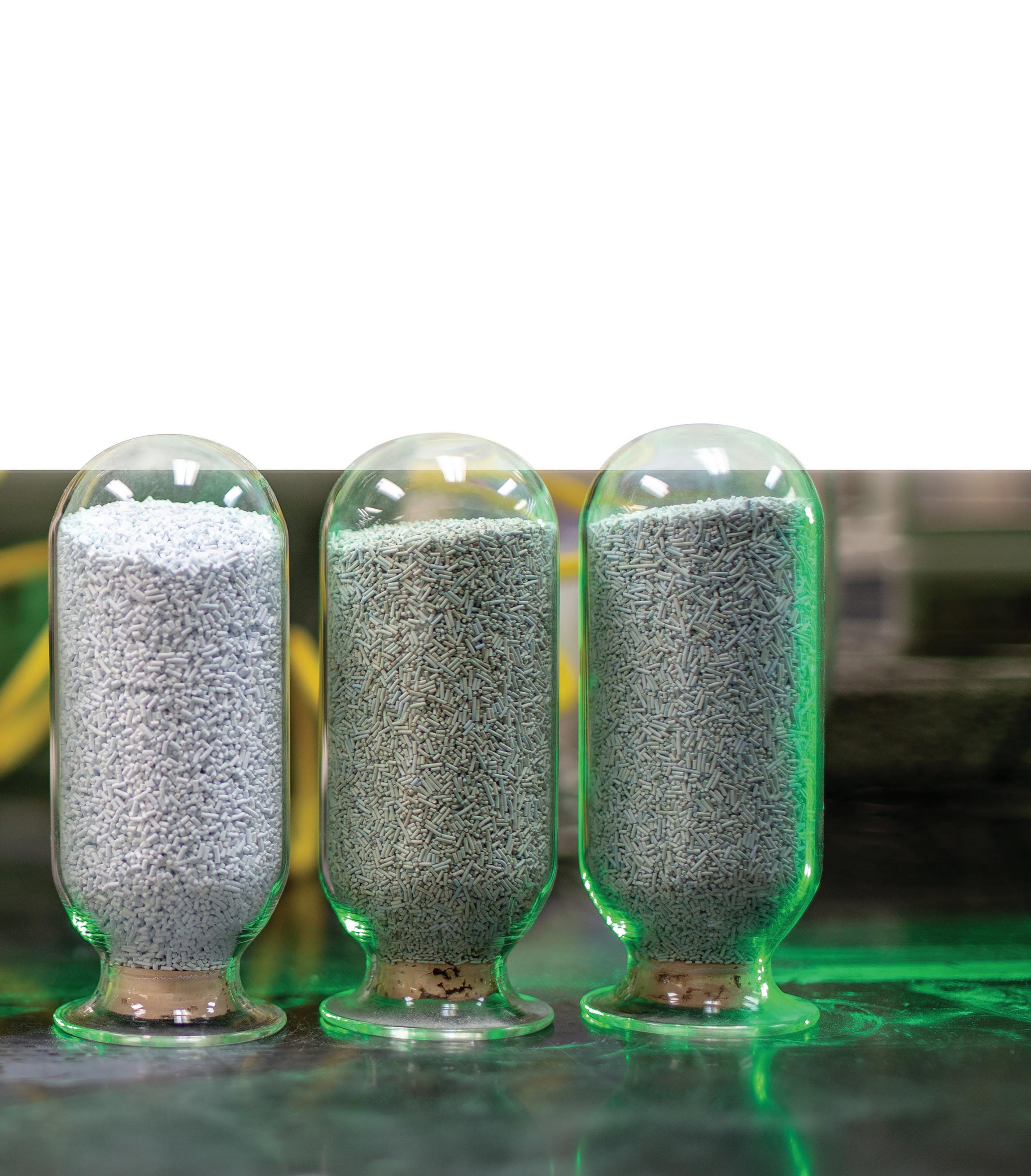

Modesto Miranda Lopez, Hernando Salgado, Aaron Liew, Emmanouil Smaragdis and Corbett Senter, BASF, outline the challenges of maximising butylenes from residual feeds, and the importance of novel catalyst technology.

third catalyst that has been introduced to the market using BASF’s Multiple Framework Topology (MFT) technology. The catalyst trial demonstrates how various catalyst functionalities can be combined to maximise yields and selectivity of butylenes from residual feedstocks.

Challenges of maximising butylenes from residual feeds

Designing a catalyst for butylenes maximisation in an FCCU that processes high levels of metals in its feed has a number of challenges associated with it. First, there should be a balancing act between the catalyst stability and the olefin selectivity. For example, rare earth oxides play a key role in catalyst stability. Increasing the rare earth content on zeolite in the catalyst will increase catalyst stability. However, increasing rare earth content on zeolite also increases the rate of hydride transfer reactions in the FCCU riser. This leads to a decrease in the yields of olefins from the FCCU, including butylenes.

Multipleframeworks

The second challenge is effectively dealing with elevated levels of metals present in the FCCU. The two most common contaminants are nickel, which increases hydrogen and coke yields, and vanadium, which primarily reduces catalyst activity through zeolite destruction. Using effective metals passivation technologies is crucial to effectively dealing with these contaminants. However, this is not always a straight-forward task, as nickel exists in different states, is immobile, and can be reactivated by Cl contaminant.2,3 On the other hand, vanadium is highly mobile in the FCCU environment and never truly deactivates as a contaminant.4 Therefore, careful consideration should be made regarding the strength and type of metal passivation technology. Finally, the appropriate amount of zeolite and matrix phases should be chosen so that bottoms upgrading and butylenes production can be maximised.

Catalyst development and solution

Fourtitude is a recent innovation that combines MFT with metal passivation technologies to offer advanced products for butylenes maximisation in FCCUs which process metals-containing, resid feed. The balance of all of these factors can be seen in Figure 1. The appropriate combination of MFT technology with metals passivation technologies comes from knowledge gained through laboratory experimental studies, in-unit catalyst trials, and collaboration with refiners.

As mentioned previously, vanadium and nickel are two of the most ubiquitous contaminant metals in FCCU feeds. Significant research has been carried out to understand the behaviour of nickel in an FCCU. Key findings include the fact that nickel exists in a variety of different oxidation states within an FCCU, is not mobile, and is less active when fully oxidised. The presence of chlorides in an FCCU can also reactivate oxidised nickel.2,3 A combination of boron-based technology (BBT) and specialty alumina is the most effective in passivating nickel. Boron and alumina are highly reactive towards nickel, and boron adds the functionality of being mobile. Consequently, their combination provides a versatile and robust method for dealing with the complexity of nickel contamination. In addition, the in-situ manufacturing method limits the amount of chlorides entering the FCCU with the catalyst and is another key design consideration which plays a role in reducing the impact of nickel.

Vanadium, unlike nickel, is highly mobile and works in combination with sodium to destroy zeolite framework and lower catalyst activity.4 Traditionally, alkali-based technologies, including MgO and CaO were used to passivate vanadium in FCC. However, the presence of sulfur presents challenges in using these alkali-based technologies. MgO and CaO are both highly reactive with sulfur in an FCCU environment, which limits their ability to passivate vanadium.

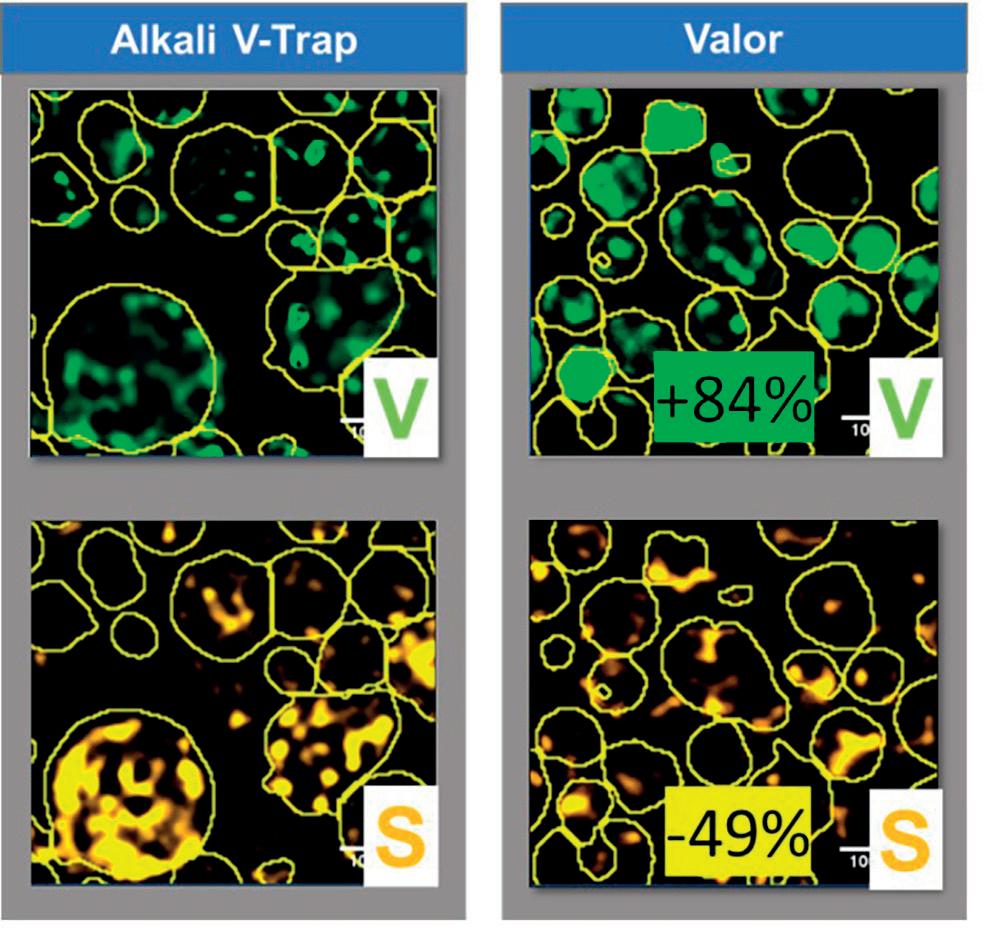

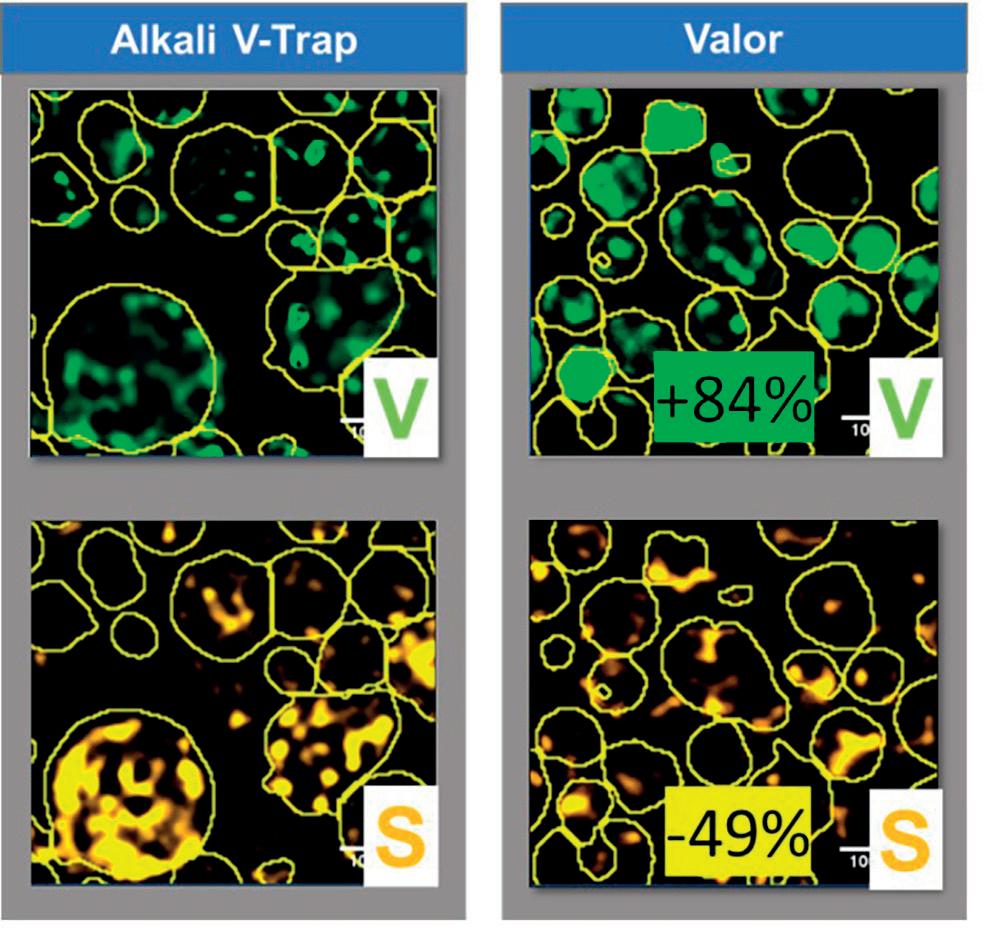

In response, BASF developed Valor, a rare earth-based vanadium passivation technology which shows much stronger tolerance to sulfur and is more effective in mitigating the impacts of vanadium. This improvement can be seen in Figure 2, as Valor shows significantly less sulfur uptake and, consequently, higher vanadium uptake, in a study where two vanadium passivation technologies, Valor and an alkali-based technology, were deactivated in the presence of

September 2023 HYDROCARBON ENGINEERING 22

Figure 1. Technology functions contributing to MFT technology.

High activity Low Acid site density Metal Passivation Ni-Passivation V-Trapping Active matrix

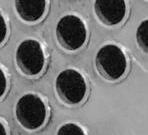

Figure 2. Scanning electron microscope images of vanadium and sulfur concentration of two different vanadium traps, following metalated deactivation. Amount quantified using ImageJ.

Pop-A-Plug ® Tube Plugs

ASME PCC-2 Compliant Heat Exchanger Tube Plugging System

Trusted by plants around the world as their go-to tube leak solution, Pop-A-Plug Tube Plugs from Curtiss-Wright are engineered for optimal performance throughout the life cycle of heat exchanger equipment. Controlled hydraulic installation eliminates welding and time-consuming pre-/post-weld heat treatments that can cause damage to tubes, tube sheet ligaments, and joints.

• No Welding Required

• Pressure Ratings Up to 7,000 PsiG (483 BarG)

• Simple Hydraulic Installation

• Helium Leak Tight Seal to 1x10 -10 cc/sec

• 100% Lot Tested to Ensure Unmatched Quality

• Wide Range of Sizes& ASME/ASTM Certified Materials Available

877.383.1029 l est-sales@curtisswright.com l cw-estgroup.com/he-23

sulfur and vanadium. The use of a secondary zeolitic framework is a strategy that can be used to maximise butylenes selectivity. In the Fourtitude catalyst development process, several potential zeolitic frameworks were screened using rapid laboratory testing to identify candidates that demonstrate improved butylenes selectivity. The best candidates were then further optimised by modifying the chemical and physical properties to further enhance butylenes yield. As a result, prototype testing developed specialty zeolites which could be used to increase butylenes selectivity over propylene while lowering saturates. Additionally, the zeolitic frameworks improved isomerisation of products, increasing gasoline octane values. These frameworks achieved the desired selectivity improvements, without sacrificing catalyst activity, nor generating more hydrogen and coke.

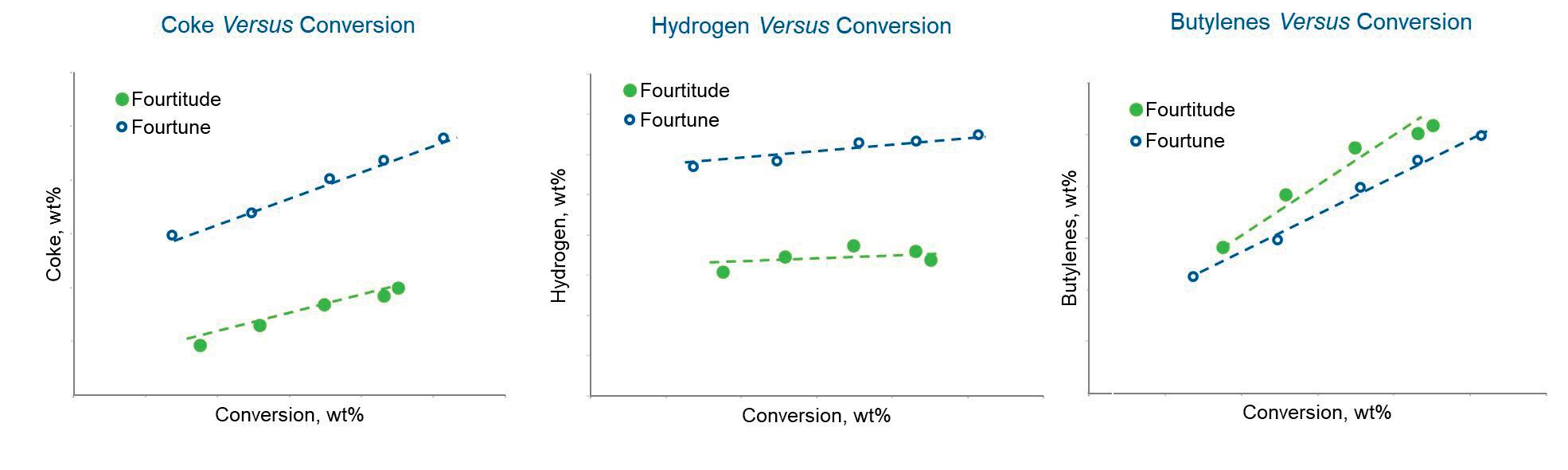

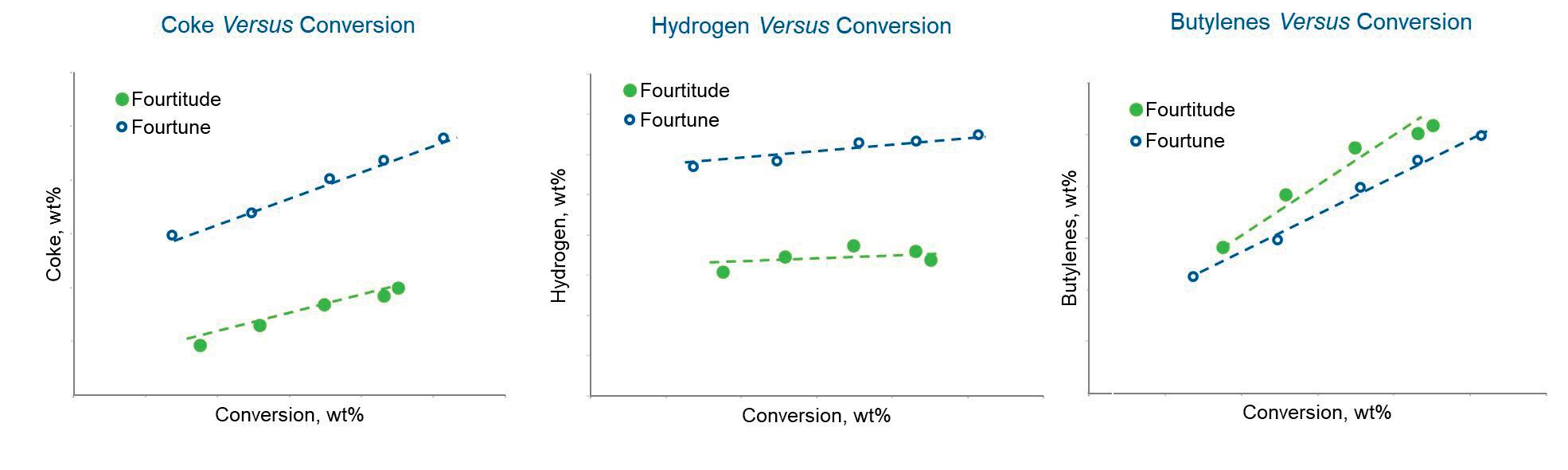

Finally, with identification of the appropriate metal passivation technologies and zeolitic frameworks, significant effort went into combining all of these features into a single catalyst to maximise butylenes yield and selectivity, limit yield of coke and hydrogen, maximise cracking of heavier feed molecules, and maintain catalyst activity. Fourtitude’s improved performance can be seen in pilot-scale testing against a previously developed MFT catalyst, Fourtune, which was designed to maximise butylenes in a non-resid environment (Figure 3). Test results clearly show that Fourtitude is able to maintain, and even slightly improve, butylenes selectivity compared to Fourtune and significantly lower coke and hydrogen yields.

Commercial trial

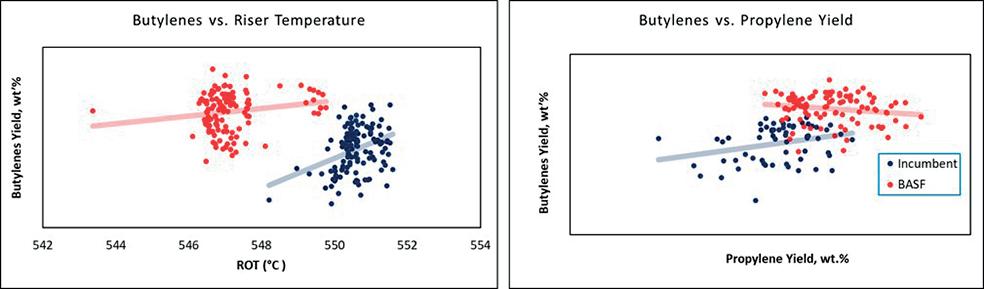

While robust performance in testing is a key step in the development of catalyst technology, catalytic performance must ultimately be demonstrated in commercial operation. An early trial of this catalyst occurred in a Europe, the Middle East, and Africa (EMEA) unit highly integrated with petrochemicals production. They had the objective of maximising butylenes yield, and improving bottoms upgrading, without sacrificing propylene production, and the unit processes a feed with high levels of metals (>3000 ppm NI and > 4000 ppm V on ECAT). The results of the trial can be seen in Figures 4 and 5.

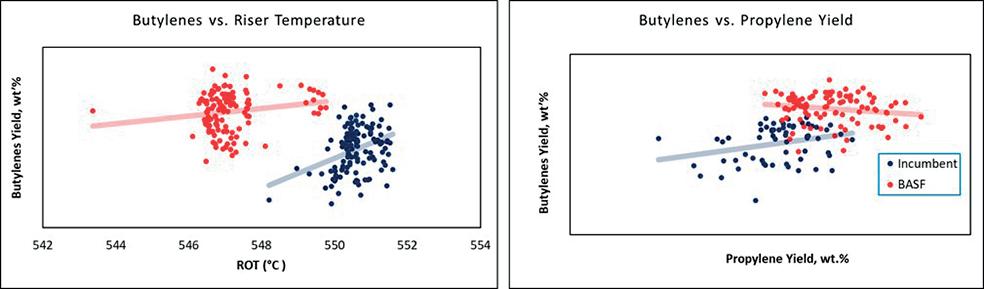

Figure 4 shows FCCU butylenes yields as a function of riser outlet temperature (ROT) and in comparison to propylene yields. The results of the trial indicate that, even at lower ROT, the FCCU was able to achieve approximately 1 wt.% higher yields of butylenes. This data also highlights the improved selectivity to butylenes, as the amount of butylenes produced compared to propylene also increased.

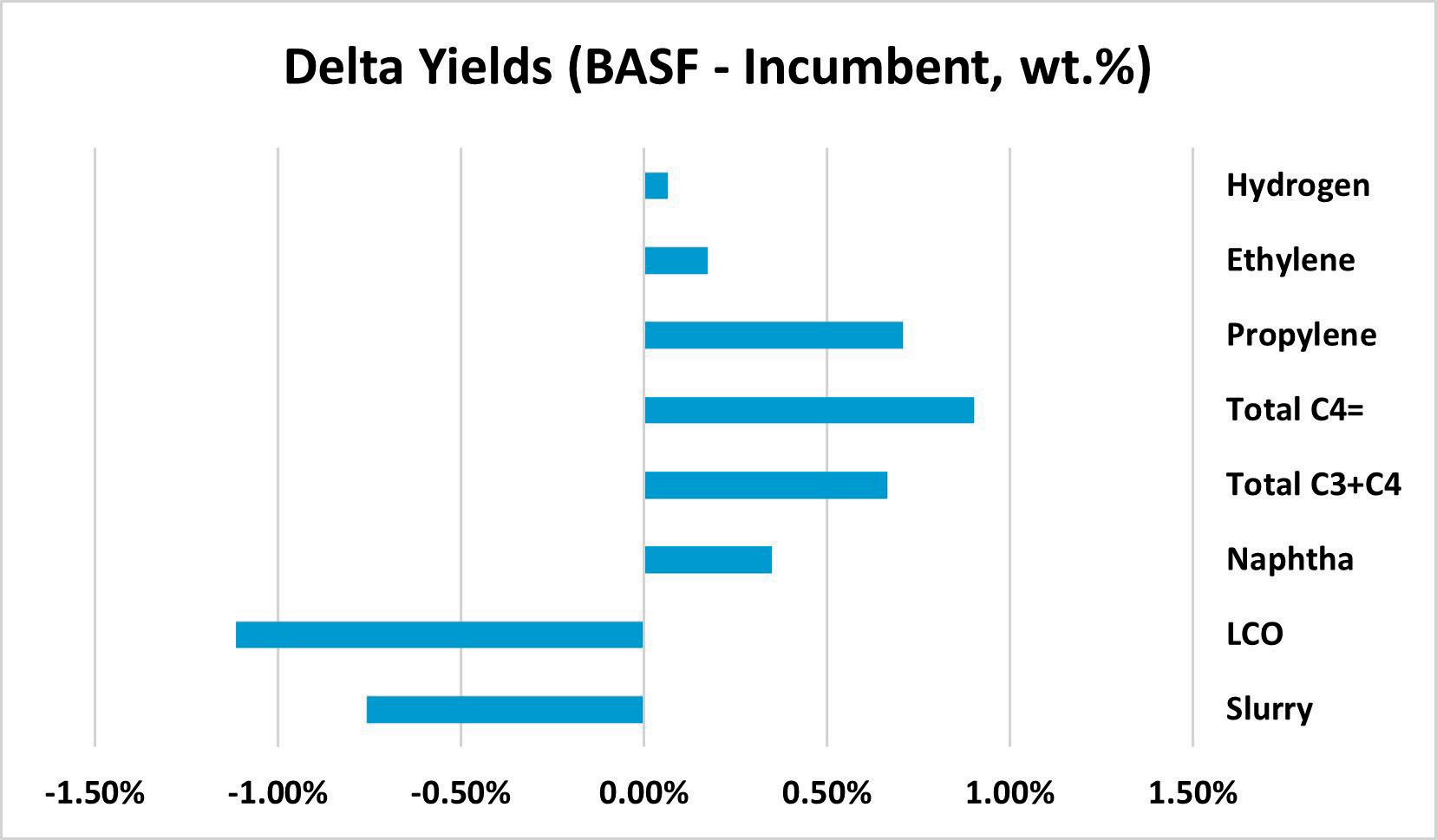

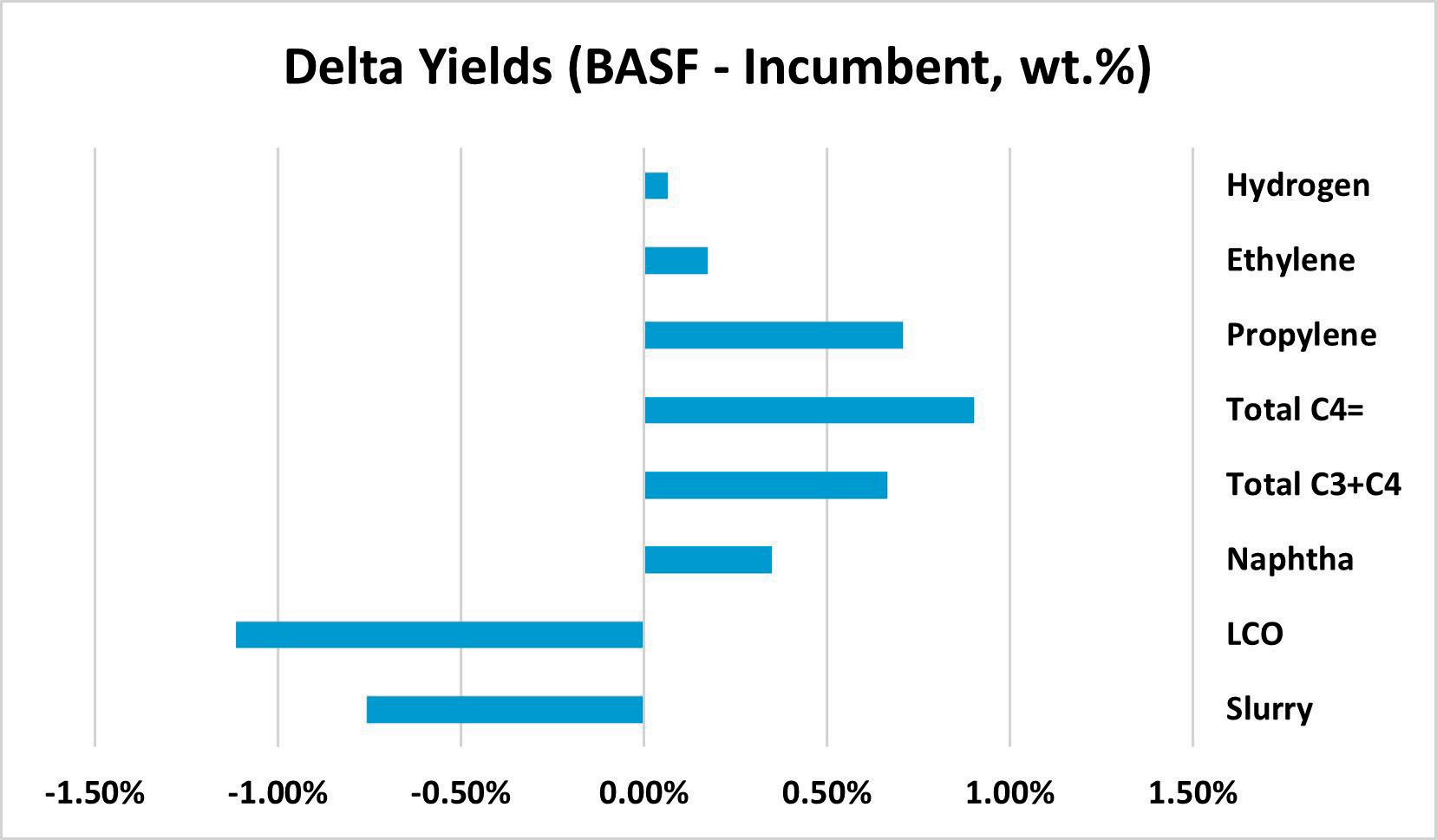

A post-audit of the Fourtitude catalyst trial was performed and the rest of the yield shifts at constant operating conditions can be seen in Figure 5. Once again, a clear increase in butylenes yield and selectivity was seen during the catalyst trial. Both LPG olefins increased as desired by the refinery, but the total LPG did not increase significantly, meaning that invaluable LPG saturate molecules (propane and butanes) decreased during this trial. This is a significant aspect of improving refinery profitability. Naphtha yields also increased as a result of increased conversion due

September 2023 HYDROCARBON ENGINEERING 24

Figure 4. Commercial trial results of Fourtitude vs incumbent catalyst.

Figure 3. Pilot-scale testing of Fourtitude vs. Fourtune catalysts.

2009 Renaissance Blvd., King of Prussia, PA 19046 USA Int’l: +1 610-941-4900 Fax: +1 610-941-9191 PARATHERM RELIABLE CONSISTENT RESULTS Proven, advanced formulations ideal for your processes, industry, and applications. More choices and better choices in heat transfer fluids based on our 35 years experience. www.paratherm.com

to improved activity and activity maintenance provided by the enhanced vanadium tolerance of the catalyst. Furthermore, there was a significant decrease in slurry yields as a result of improved bottoms upgrading. This was proof of both improved matrix functionality and preservation of zeolite from the improved vanadium tolerance, which is important for pre-cracking of heavy feed molecules. All of these changes occurred with a minimal increase in hydrogen yield, a testament to the ability of the catalyst to effectively passivate nickel. Hydrogen yields are also a function of product olefinicity and, in this case, an increase in hydrogen was expected, despite the improved metals passivation. This was due to the significant increase in olefins and decrease in

saturates. It was determined that the new Fourtitude catalyst provided an improvement of more than US$0.75/bbl when compared to the incumbent catalyst.

Conclusions

Many FCCUs have a strong incentive to maximise their production and selectivity of butylenes. This incentive is only expected to increase in the future as tighter vehicle standards increase demand for high-octane fuels, and the global demand for petrochemicals increases. As a result, there is a continued need to improve the ways in which butylenes yield and selectivity can be maximised from FCCUs which process residual feed. To achieve this improvement, several challenges must be faced, including overcoming contaminant metals, identifying appropriate zeolite frameworks, and balancing catalyst activity with selectivity. Many years of research and development, alongside collaboration with refiners, has enabled BASF to develop an FCCU catalyst solution which meets these challenges.

References

1. BASF survey based on request for proposal data received during 2018 - 2021 period.

2. CHARISTEIDIS, I.D., et. al.,‘Characterisation of Ni-hases and their transformations in fluid catalytic cracking (FCC) catalysts: Comparison of conventional vs boron-based ni-passivation’, Catalysts, (2023).

3. SENTER, C., et. al. ‘Role of chlorides in reactivation of contaminant nickel on fluid catalytic cracking (FCC) catalysts’, Applied Catalysis A: General, 611, (2021).

4. XU, X., et. al. ,‘Pathways for Y zeolite destruction: The role of sodium and vanadium’, J Catal, 207, (2002).

Figure 5. Summary of yield deltas of Fourtitude compared to incumbent catalyst.

Separation technology is a critical part of the downstream oil and gas industry, as it is used to separate the various components of crude oil and natural gas into different products. Some of the key areas where separation technology is utilised within the industry include:

n Refining: separation technology is used in the refining process to separate crude oil into its various components such as gasoline, diesel, jet fuel, and other fuels. This is achieved by way of distillation, whereby the crude oil is heated and the different components are separated based on their boiling points.

27 September 2023 HYDROCARBON ENGINEERING

Neil Richards, PS Filter, Canada, considers the importance of effective filtration and separation techniques within the downstream oil and gas industry, in order to produce cleaner fuels.

n Petrochemicals: used to separate the various chemicals and compounds that are derived from crude oil and natural gas. This is accomplished through processes such as fractionation and distillation, which allow for the separation of chemicals based on their physical and chemical properties.

n Gas processing: used to separate the natural gas from other gases and impurities, such as sulfur and carbon dioxide (CO 2). This is achieved with absorption and adsorption, which allow for the removal of impurities and the separation of different gases.

n Environmental protection: lastly, separation technology is also used to protect the environment by removing pollutants and contaminants from industrial wastewater and other waste streams. This is carried out through processes such as sedimentation, filtration and adsorption, which allow for the removal of solids, oils, and other contaminants from water and other waste streams.

Both filtration and separation are important processes, but they differ in their approach and in the level of efficiency that they provide.

Filtration is the process of removing solid particles and contaminants from liquids or gases using a porous medium such as a filter. In the downstream oil and gas industry, filtration is used to remove impurities such as dirt, sand and rust particles from crude oil and refined products such as gasoline, diesel and jet fuel. Filtration is typically used for removing larger particulates in the range of 1 – 100 µ m, and it is a cost-effective way of achieving a certain level of cleanliness for the products.

While both filtration and separation are important processes, separation technology is generally more expensive and requires more specialised equipment and expertise than filtration. However, separation technology can provide a much higher level of purity and separation efficiency than filtration, making it essential for many applications in the industry.

Sometimes, filtration and separation terminology are used interchangeably as they can be closely related but, in many cases, they are used in different processes to achieve varying results.

One of the key areas in which PS Filter has utilised effective contamination control (filtration) has been in the amine purification process, to separate solid particulates. When it comes to separation techniques, the company has used carbon adsorption to remove dissolved organics (hydrocarbons) in order to reduce operational and other possible downstream issues.

Amines are designed to remove hydrogen sulfide (H 2S) and carbon dioxide (CO 2) from natural gas. It is a common process that is used in refineries, petrochemical plants, gas processing plants, and other industries.

Effective equipment and media design are two key factors that need to be addressed to ensure that the amine is kept as clean as possible, for optimum performance. PS Filter’s scope of design and supply utilises physical filtration and separation (adsorption) in the amine system in conjunction with one another, to ensure optimum and safe performance. Ultimately, a clean amine system is the goal in order to achieve operational excellence.

Some of the immediate benefits that can be realised are as follows:

n Reduced foaming tendencies (reduced solid and liquid contamination).

n Increased gas throughput (clean amine performs effectively to remove H 2S/CO 2).

n Reduced operational labour and the associated costs related to increased contamination, which are avoided with an effective filtration-separation programme.

n Avoidance of excessive mechanical maintenance from corrosion-erosion contamination.

September 2023 HYDROCARBON ENGINEERING 28

Figure 1. Spent amine cartridges, completely filled with solid contaminants.

Figure 2. A PS-Filter activated carbon adsorber (separation) amine system.

Meet the BASF Refining experts at AFPM Summit in Grapevine (Texas) from October 3–5 and learn all about Valor ® –our latest vanadium trapping technology.

We look forward to discussing coprocessing renewable and recyclable feedstocks in FCC at the ERTC Annual Meeting in Italy, from November 13–16.

Learn more about BASF Refinery Catalysts

n Reduced disposal costs of spent products (less severe environmental impact).

n Safer operational conditions (reduced operator exposure to hazardous materials).

n Removal of dissolved organics through activated carbon adsorption is of paramount importance in order to reduce the associated costs of chemical addition products such as anti-foam and corrosion inhibitors.

Operating a dirty amine system is never a good idea, and will result in increased costs to the operator. Clean amines should be bright and clear, indicating that the system is in excellent shape. When particulates build up, the amine becomes darker and can get to the point of a translucent black, indicating that processing issues could be on the horizon.

One common problem in gas processing operations is amine foaming. As fine solids build up, the surface tension of the amine changes and foam becomes

stabilised, contributing to reduced throughput for the plant, and the possibility of amine losses with carryover and off-specification gas downstream of the contactor.

Common contaminants in an amine system are iron sulfide particulates, and these can build up from a combination of factors, namely inadequate filtering. A minimum 10% of the amine should be filtered, and this is usually carried out with two filters piped in parallel, so that one filter can be serviced while the other is running, in order to maintain a constant filtering operation.

In addition to effective particulate filtration in the amine system, it is important to have an adequately sized charcoal adsorber system in the loop in order to adsorb dissolved organics such as hydrocarbons that can also contaminate the amine and contribute to the foaming tendency. It is also critical to note that only filtered amine should flow through the charcoal adsorber, and the effluent from this system should be filtered to ensure the capture of any carbon fines that could possibly migrate downstream and also contribute to foaming and other mechanical issues.

Some guidelines to help reduce amine foaming are to ensure that the filter-separation system is designed to meet the process flow rates and is effective to remove the particulates that can contaminate and build up in an amine system, leading to a plethora of problems that multiply over time.

If a filter system is undersized or uses filters that are not sufficient to remove the particle size of contaminants in the 10 µ m range, an operator may be unknowingly contributing to amine foaming.

To provide an effective filtration-separation system for the amine process, PS Filter utilises proprietary mechanical and adsorption medias to optimise performance based on the specific process conditions. It is important to work together with clients to understand their goals and expectations.

The energy industry is unique, as the products are ubiquitous and can enhance and enrich the lives for all the inhabitants on the planet.

Former Harvard Professor, Theodore Levitt, summarises the benefit of working together in unison for a common goal: “Sustained growth depends on how broadly you define your business and how carefully you gauge your customer needs”. Responsible and operationally-effective downstream energy production with effective filtration-separation is just one example in a complicated industry.

In collaboration with global partners, PS Filter is continuously evolving to utilise innovative and effective filtration and separation medias that are efficient and cost-effective. The goal is to improve operational and safe processes by providing the lowest cost per pound (lb) of contaminant separation. Working with clients, the company utilises various weighted criteria that they deem important for their specific production processes.

September 2023 HYDROCARBON ENGINEERING 30

Innovation feasibility criteria Applicability to this innovation Weighting of criteria’s importance (%) Improve operations Save costs by reducing operational labour costs 5 Reduce filtration costs Reduce physical number of filters used and total costs reduced based on comparable number of units 5 Reduce mechanical costs Reduce costs on rotating equipment and other process equipment in the system 5 Improve plant throughput Increase sales revenue and hence improve the bottom line 20 Extraneous variables Reduce chemical costs (solvent replacement, etc.) 5 Fewer disposal costs Reduce the amount of used product to be disposed and hence reduce overall disposal costs 10 Improve safety Reduce worker exposure time and frequency to hazardous material 50 Total weighting of all criteria 100

Table 1. Innovation feasibility: a summary

Figure 3. Amine gas treatment within a refinery.

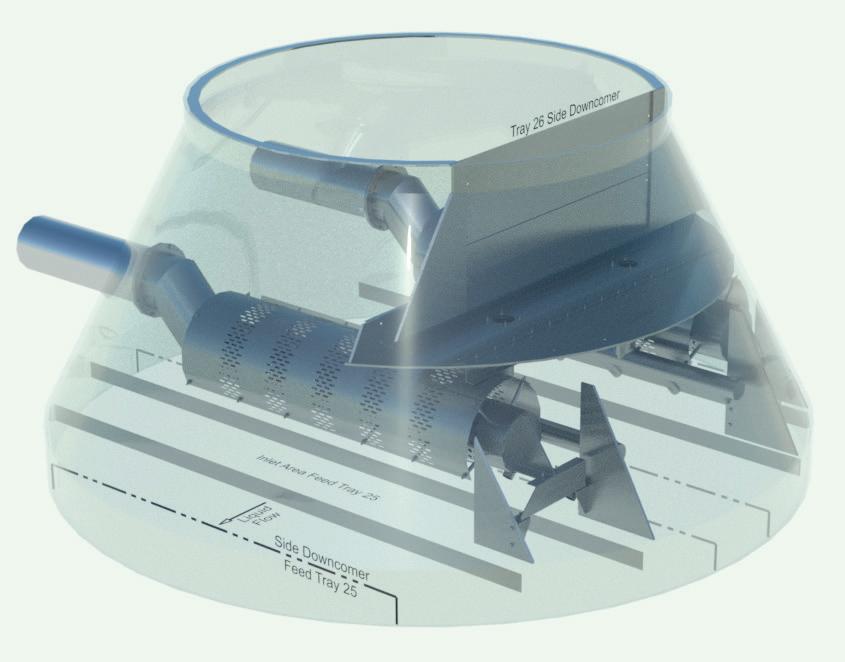

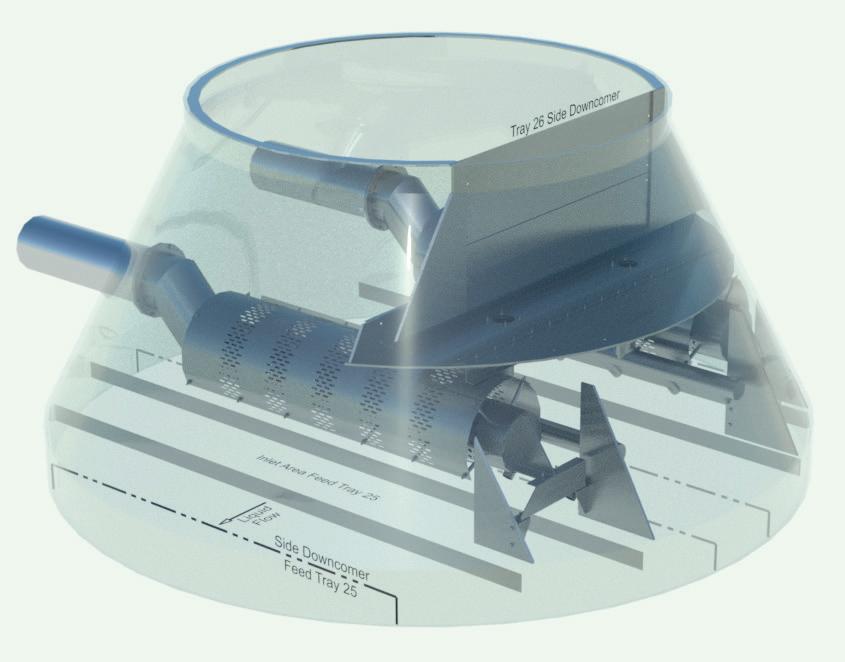

Aadam F. Aryan, Distillation Equipment Company Ltd, UK, discusses the selection of appropriate feed arrangements for two-phase feeds, and lists several industrial examples.

Many a column has been bottlenecked by a poor or completely incorrect feed arrangement, particularly where two-phase feeds are concerned. Selecting an appropriate arrangement not only increases the capacity of a column, but also enhances its efficiency. This article will outline some industrial examples, with relevant design guidelines.

There is no one solution that fits every scenario. What is feasible for a new column may not be possible for an existing one. Additionally, whether the column is packed or trayed will influence the decision making. Last but not least, the feed location – top, intermediate or at the bottom of the column – should also be considered.

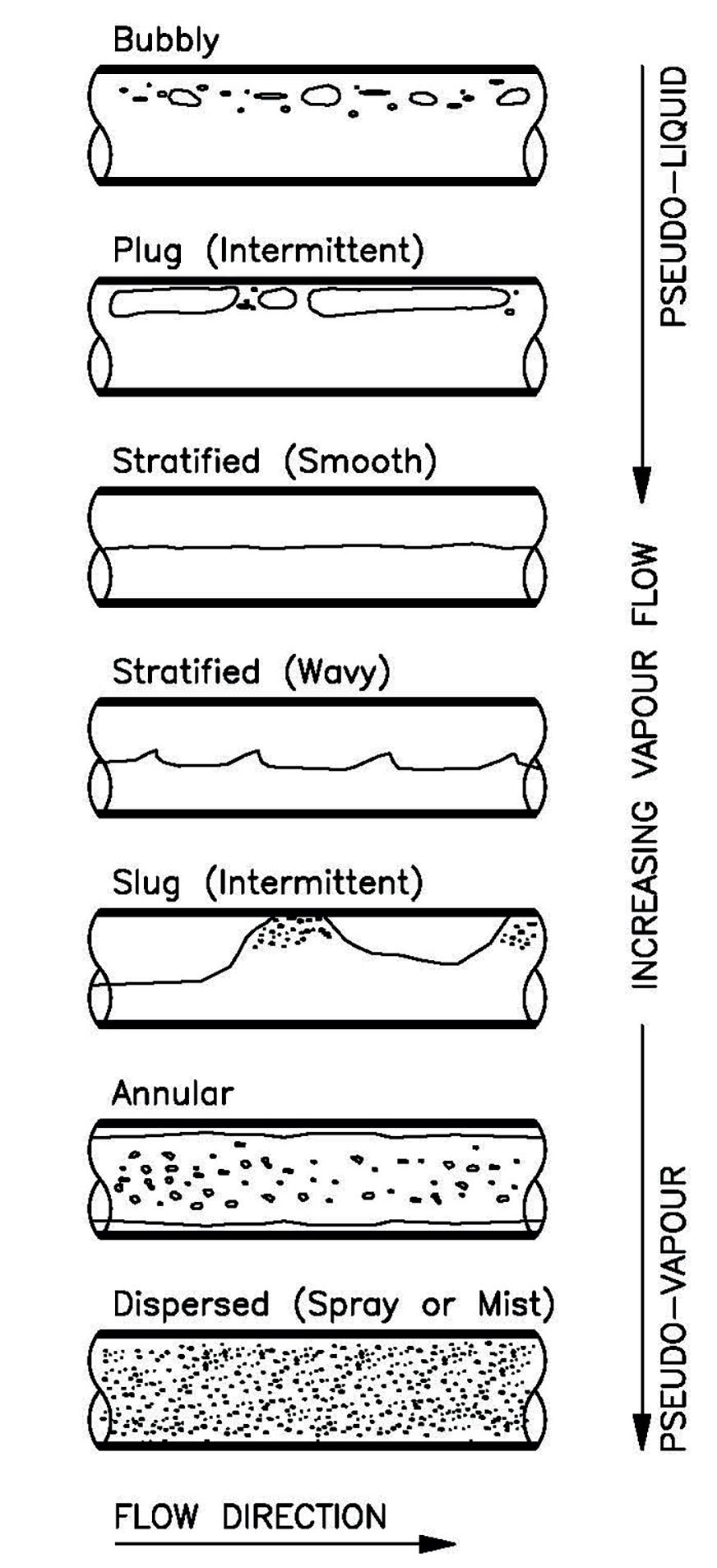

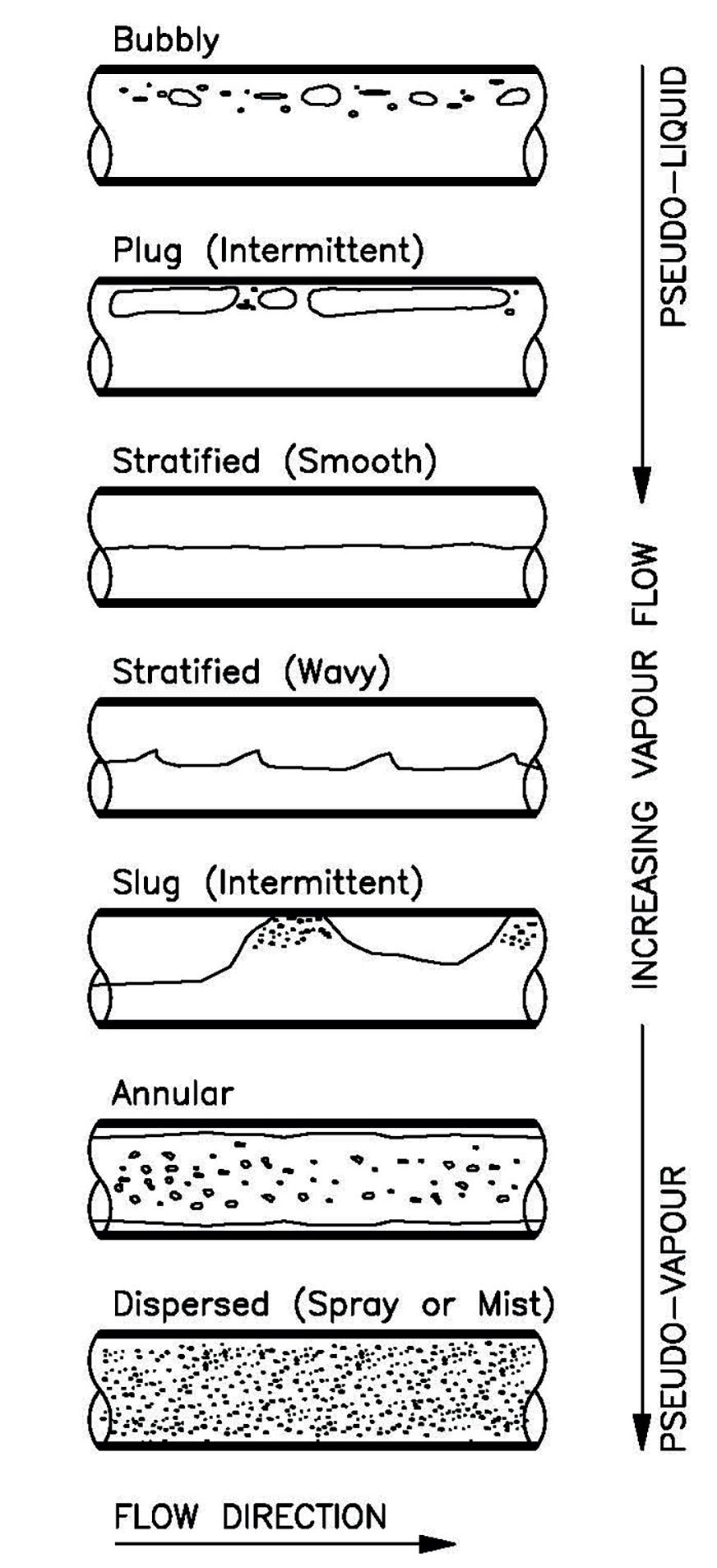

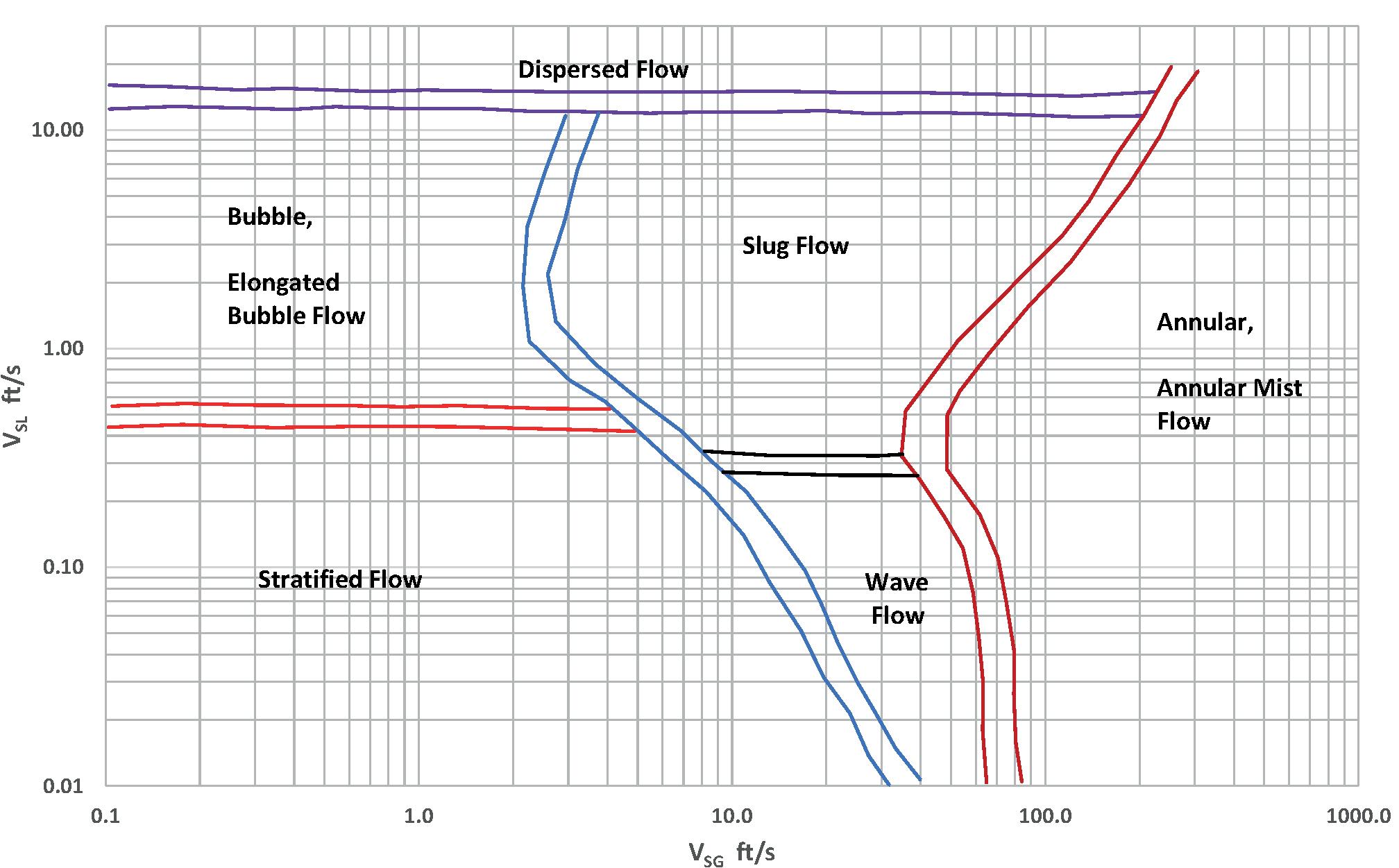

Flow regimes

In horizontal pipes, the flow regimes that can exist for two-phase flow are shown in Figure 1 (in order of increasing vapour flow). The flow regime depends on the flow rates and the properties of the two fluids.

Bubbly flow

At low vapour flow rates, the liquid will occupy the bulk of the cross-section of the pipe. Due to buoyancy, the vapour will flow in the form of bubbles, towards the top of the pipe.

Plug flow (intermittent flow)

As the vapour rate increases, the bubbles will coalesce, forming alternating plugs of liquid and vapour along the top of the pipe. Liquid will remain as the continuous phase along the bottom of the pipe.

September 2023 31 HYDROCARBON ENGINEERING

Stratified smooth flow

As the vapour rate increases further, the vapour also becomes a continuous phase. Vapour will flow at the top of the pipe, whilst liquid occupies the bottom.

Stratified wavy flow

As the vapour rate increases even more, since vapour moves appreciably faster than the liquid, the resulting friction at the interface between the two forms liquid waves. The wave amplitude increases proportionally to the vapour flow.

Slug flow (intermittent flow)

At a certain critical value of vapour flow, the crests of the liquid waves reach the top of the pipe, forming alternating frothy liquid slugs and vapour slugs. The velocity of both slugs will be greater than the average liquid velocity. Where a vapour slug occurs, the liquid level will be depressed such that vapour occupies a large part of the cross-section of the pipe.

Annular flow

At high vapour rates, the liquid flows as an annular film of varying thickness along the wall, while the vapour flows as a high speed core down the middle. Under these conditions, there is substantial slip between the phases. Part of the liquid is sheared off from the film by the

vapour, creating entrained liquid droplets along the core of the pipe. Simultaneously, turbulent eddies in the vapour will deposit droplets onto the liquid film. Due to gravity, the liquid film will be thicker at the bottom of the pipe than at the top.

Dispersed flow

Dispersed flow is also known as spray flow or mist flow. At very high vapour rates, the vapour velocity in annular flow becomes so high so that all the liquid film is torn away from the wall and is carried by the vapour as entrained droplets.

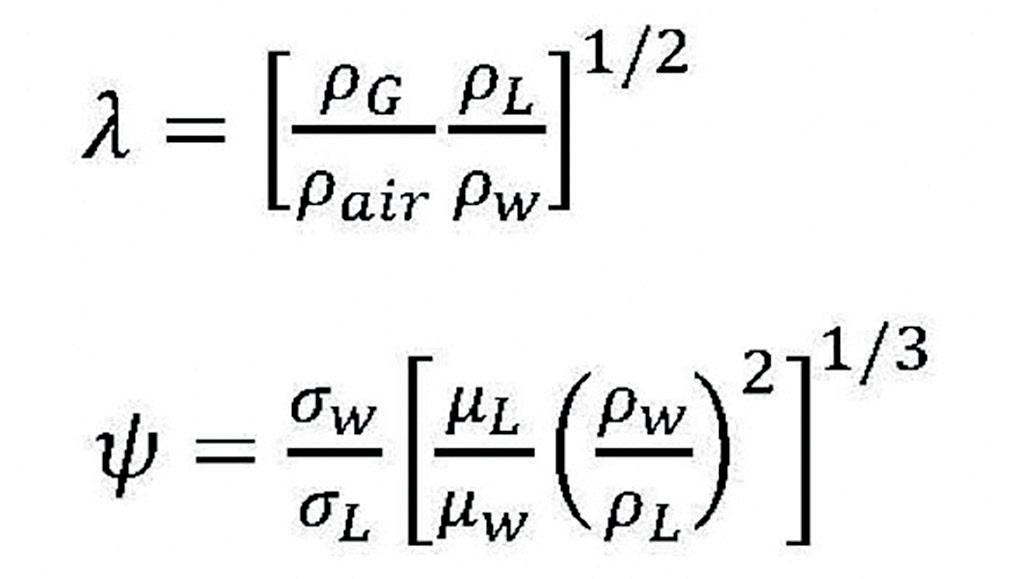

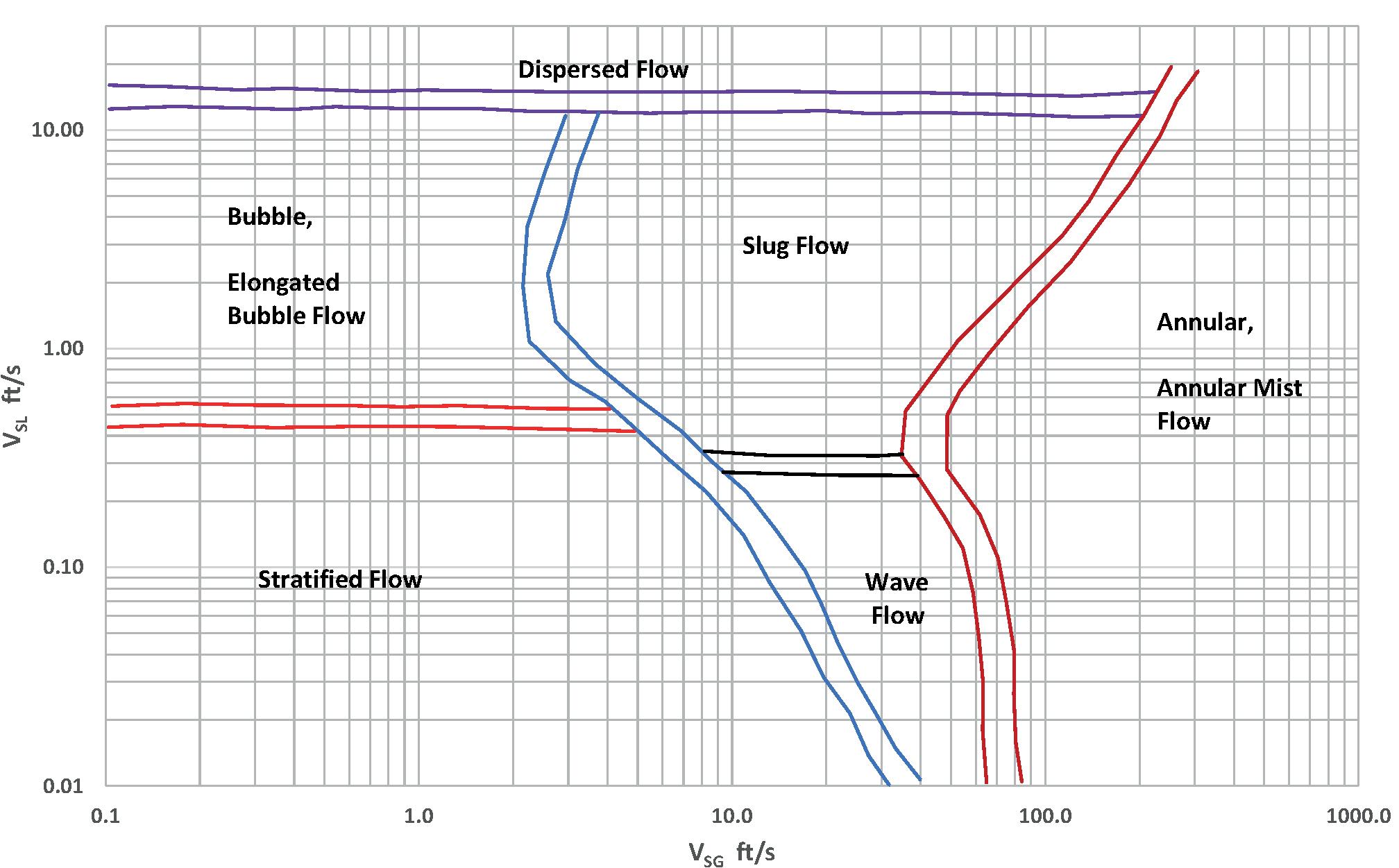

Flow regime maps

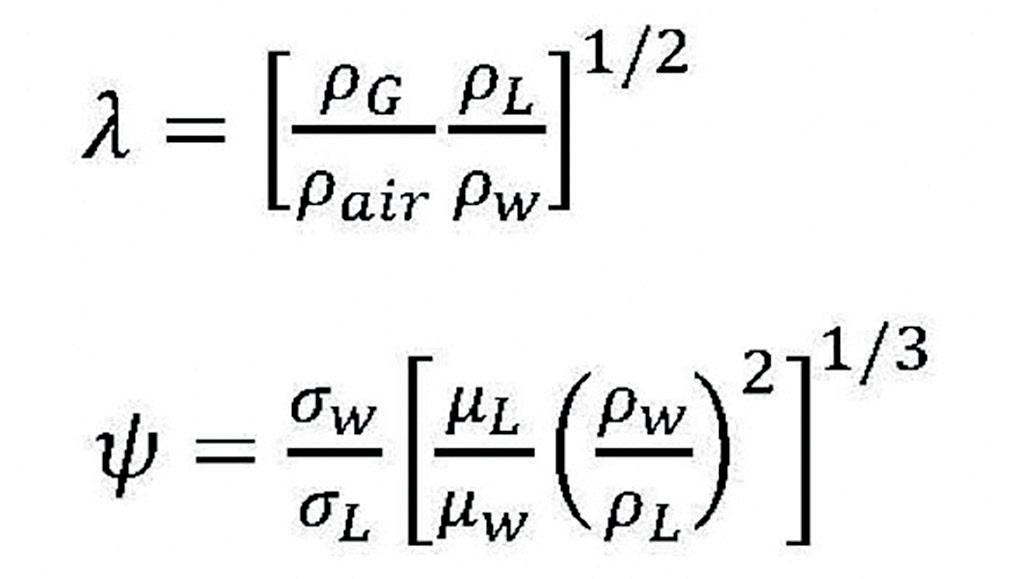

Understanding which flow regime is present assists the engineer in the design of an appropriate two-phase feed distributor. A number of flow regime maps have been published, however the maps do not necessarily agree with each other. One of the earliest and most widely used maps was created by Baker, as shown in Figure 2.1 Baker based his map on the air-water data of four earlier researchers, and used correction parameters λ and ψ to generalise the map for other fluids:

Where:

ρG = density of gas (vapour).

ρL = density of liquid.

ρair = density of air at ambient conditions.

ρW = density of water at ambient conditions.

μL = viscosity of liquid.

μW = viscosity of water at ambient conditions.

σ = surface tension – system.

σW = surface tension – water.

L = liquid mass velocity.

G = vapour mass velocity.

In Figure 2, the demarcation between each zone is distinct, whereas in reality, the change from one zone to another will be diffuse. A more recent map by Mandhane et al (see Figure 3) is based on nearly 6000 data points, generated by other researchers between 1962 - 1973.2 Here, the demarcations between the zones are shown as wider bands. There are also other proprietary maps based on the Froude number.

Stratified flow is desired in the inlet feed pipe. Intermittent flow, either plug or slug – and particularly the latter – should be avoided wherever possible. In the slug flow zone there is severe vibration and erosion. However, since the operating pressure dictates the system properties, the feed pipe diameter is the only parameter that can be changed to alter the flow regime. Where intermittent flow is unavoidable, appropriate mechanical features should be used to mitigate the effects of vibration and erosion.

September 2023 HYDROCARBON ENGINEERING 32

(1) (2)

Figure 1. Flow regimes for two-phase flow in horizontal pipes.

Electrical Tubular Heaters

A Unique Solution to Reduce Emissions

Click here to learn more

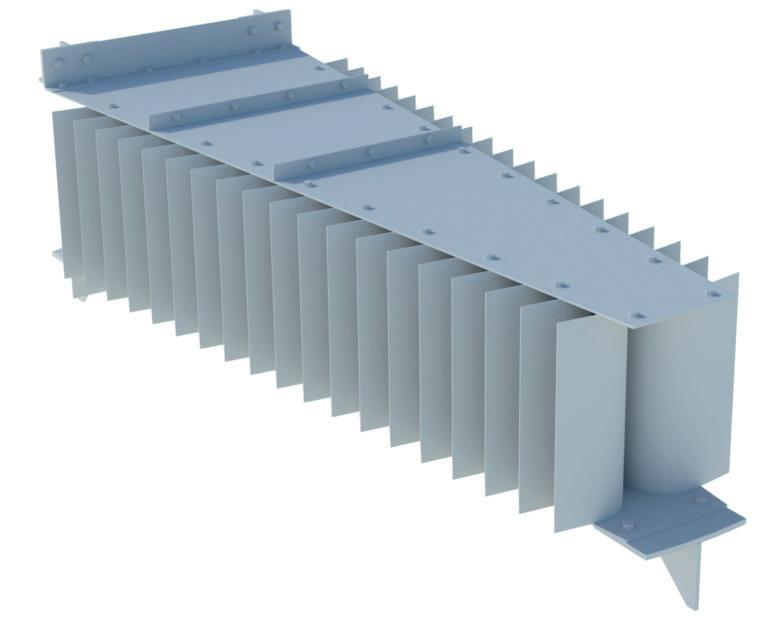

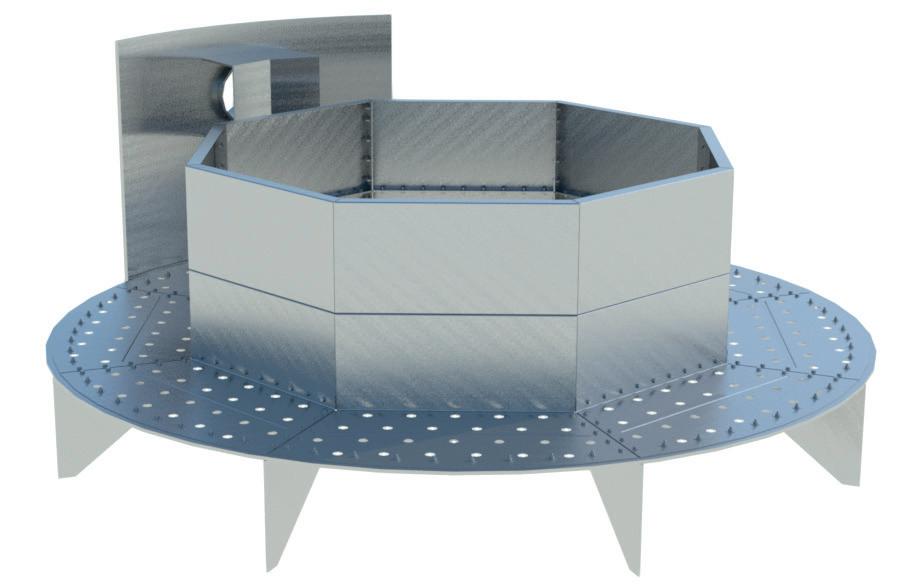

Types of two-phase feed distributors

Excluding vapour-horns for crude vacuum columns, there are three main types:

n Vane inlet device (VID): model 760.

n Perforated sparge pipe plus shroud: model 750.

n Flashing gallery: model 740.

VIDs – model 760

For the bottom of a distillation or absorption column, VIDs are an excellent choice of feed distributor. They have been used in many hundreds (if not thousands) of columns. The momentum of the inlet feed is substantially decreased in an incremental manner, by splitting the feed mixture into a series of flat jets. The device also separates solids and liquid from the vapour. A conventional VID will typically remove up to 95% of the incoming liquid.

Design criteria dictating whether or not to use a VID is based on the momentum of the mixed feed coming

through the inlet feed nozzle using the mixed feed properties (see Table 1).

The guidelines in Table 1 assume the mixed flow is uniform coming into the column/vessel. Straight pipe length outside the column should be at least 10x the diameter of the feed nozzle. Even this does not necessarily guarantee a uniform flow. In critical applications, CFD analysis of the feed arrangement should be considered.