March 2023

www.mercuryadsorbents.com Optimized Mercury Removal With MERSORB® mercury adsorbent pellets MERSORB® mercury adsorbent pellets – a Trademark of Nucon International, Inc. (NUCON®) • PROVEN RELIABLE – EVEN IN CRACKED GAS • HIGH MERCURY CAPACITY – HOT, COLD, WET or DRY • MORE PELLET SIZES – MORE PROCESS DESIGN FLEXIBILITY • LOW MOISTURE – FAST START-UP • 40 YEARS EXPERIENCE – ADSORPTION PROCESS DESIGN Your Experts for Mercury Removal – in Ethylene Plants PROVEN PROCESS – PROVEN PRODUCTS AntiMercure® is a Registered Trademark of Selective Adsorption Associates, Inc. for its Process Engineering Services MERSORB® is a Registered Trademark of NUCON International, Inc. for its mercury adsorbent pallets • Cracked Gas • Ethane Feed Gas • LPG, Naphtha, & Light Condensate Feed Liquid • Regen. Gas from Cracked Gas Driers • Light Olefin Gas from FCC Units • AntiMercure® Process Engineering • MERSORB® mercury adsorbent pellets

in order to develop a more mature cybersecurity posture.

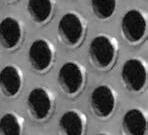

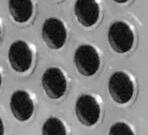

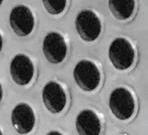

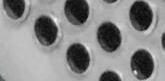

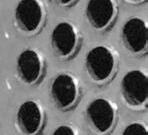

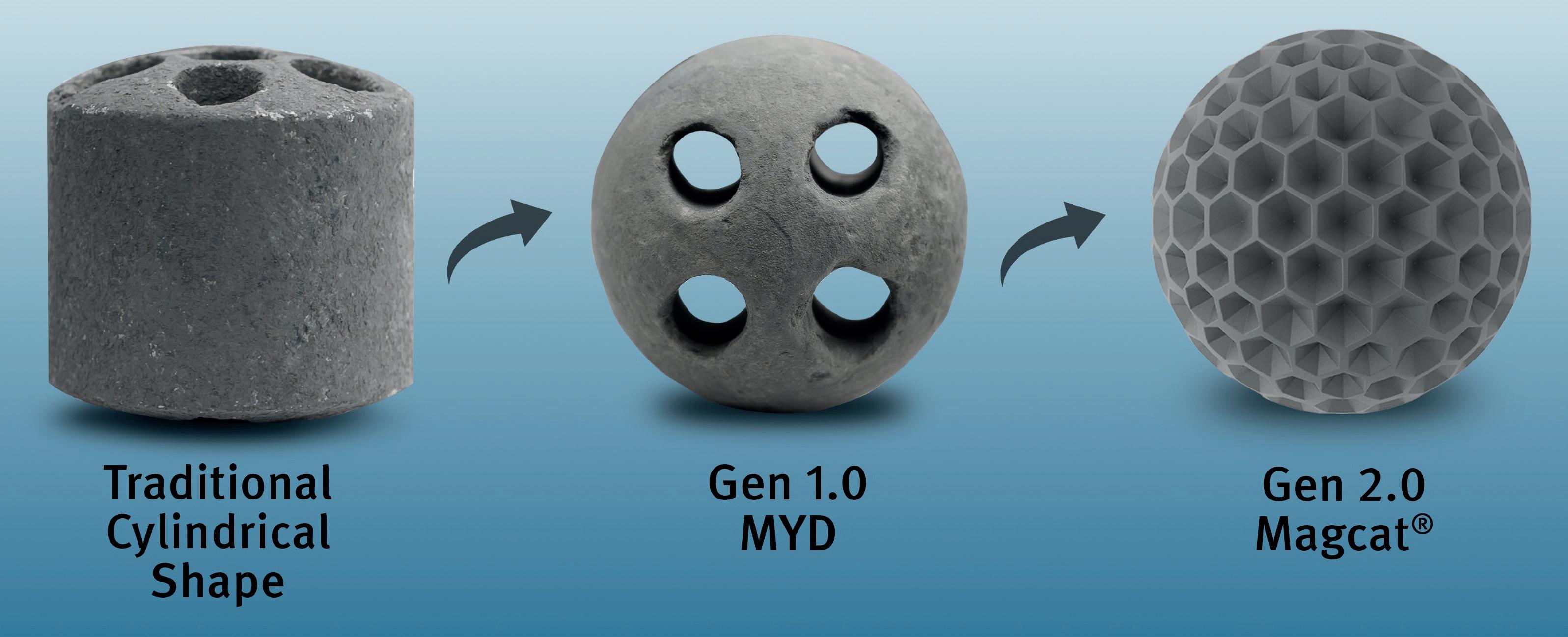

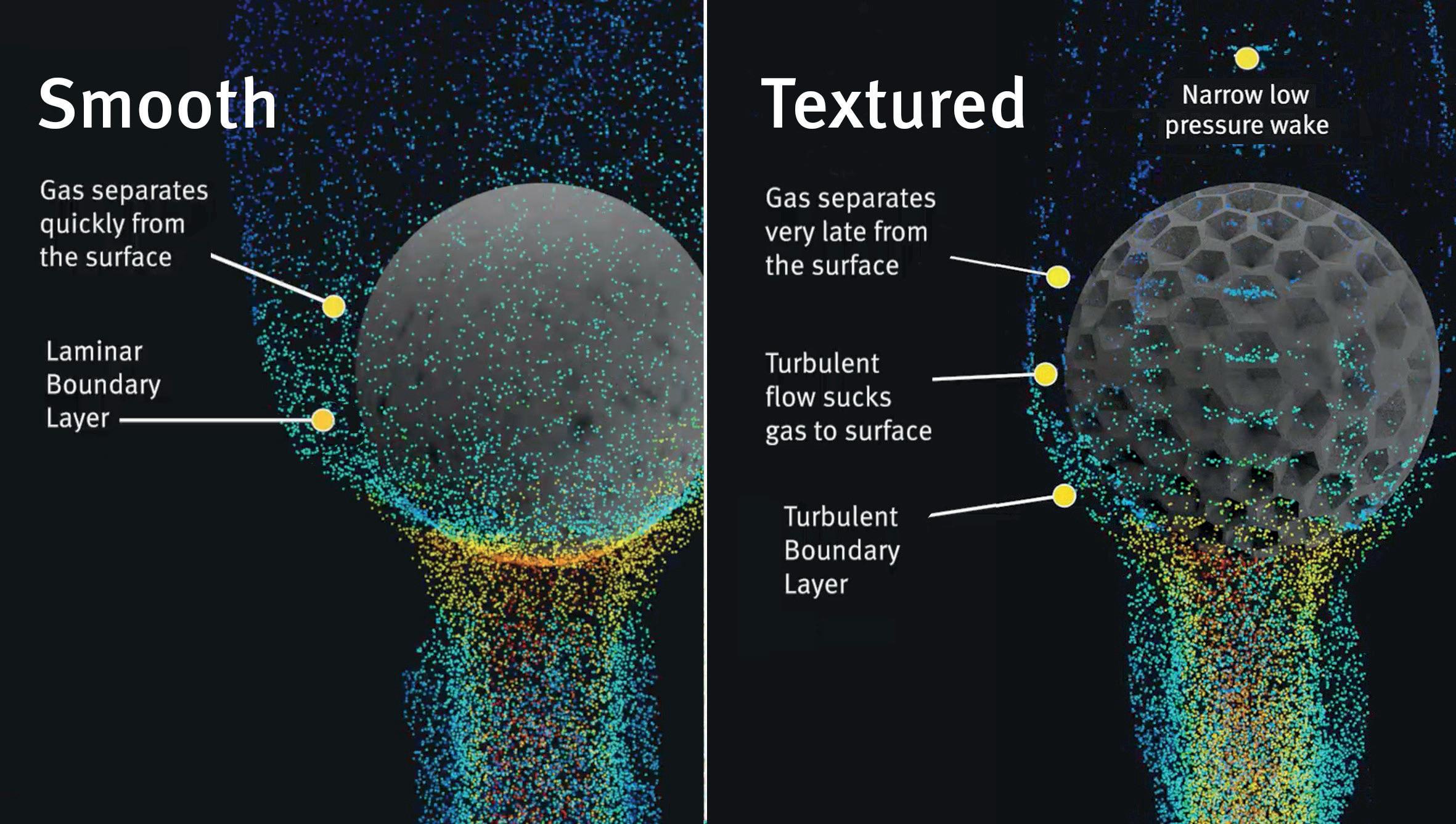

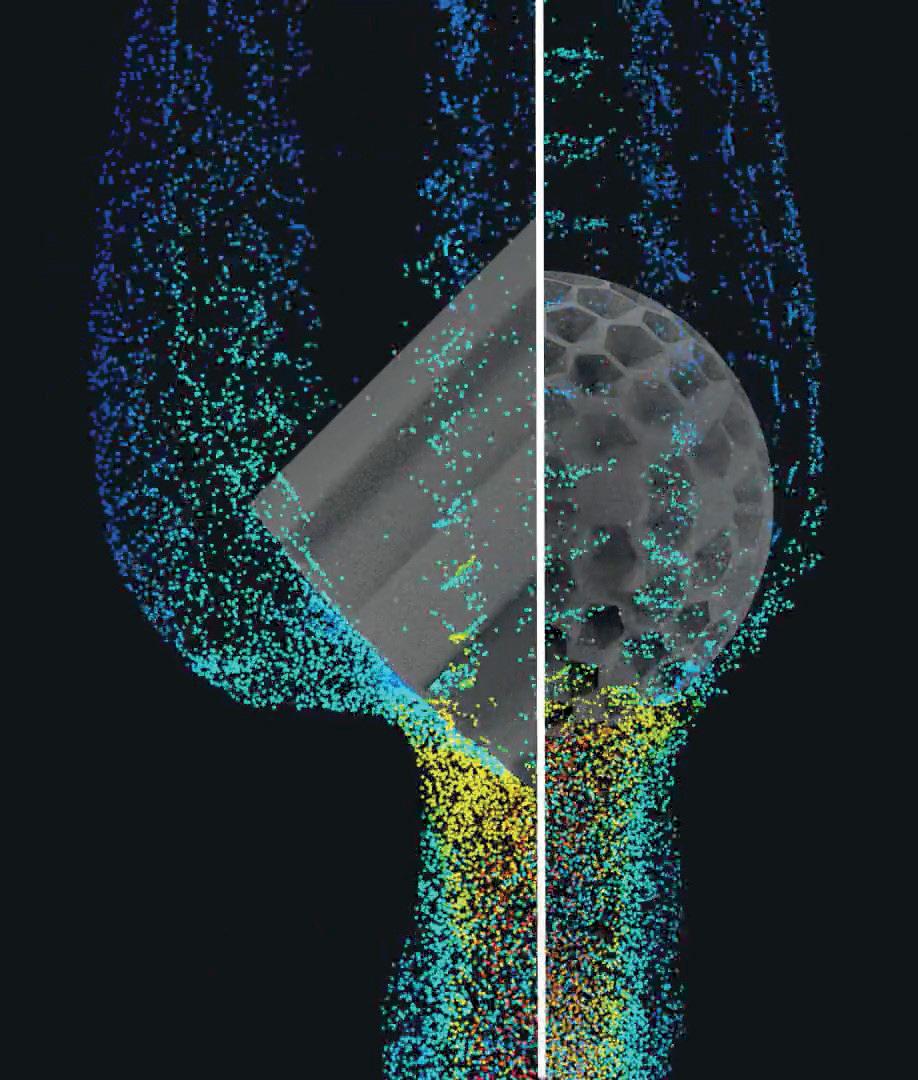

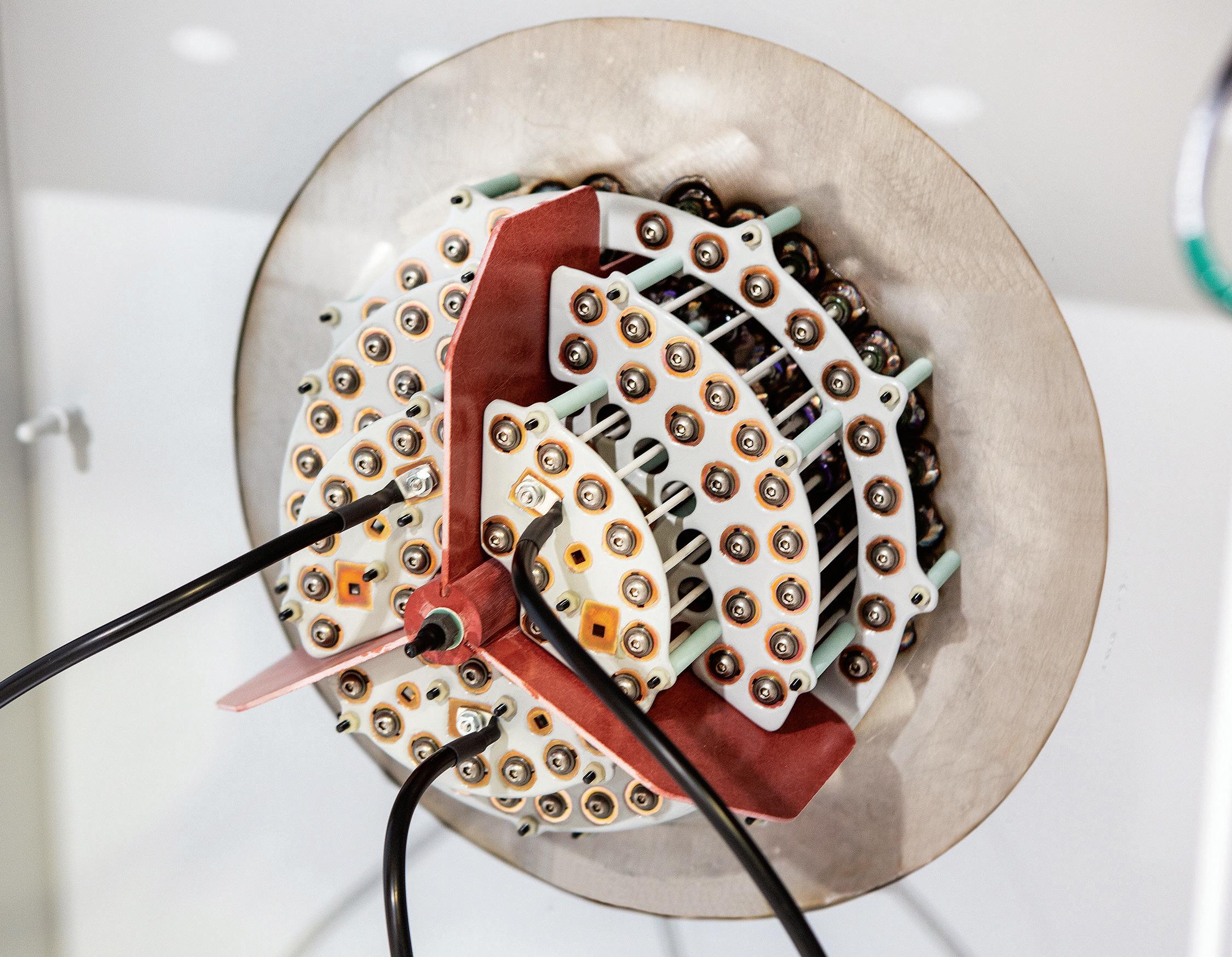

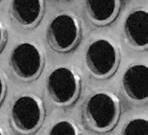

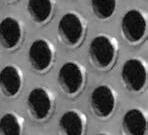

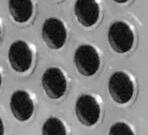

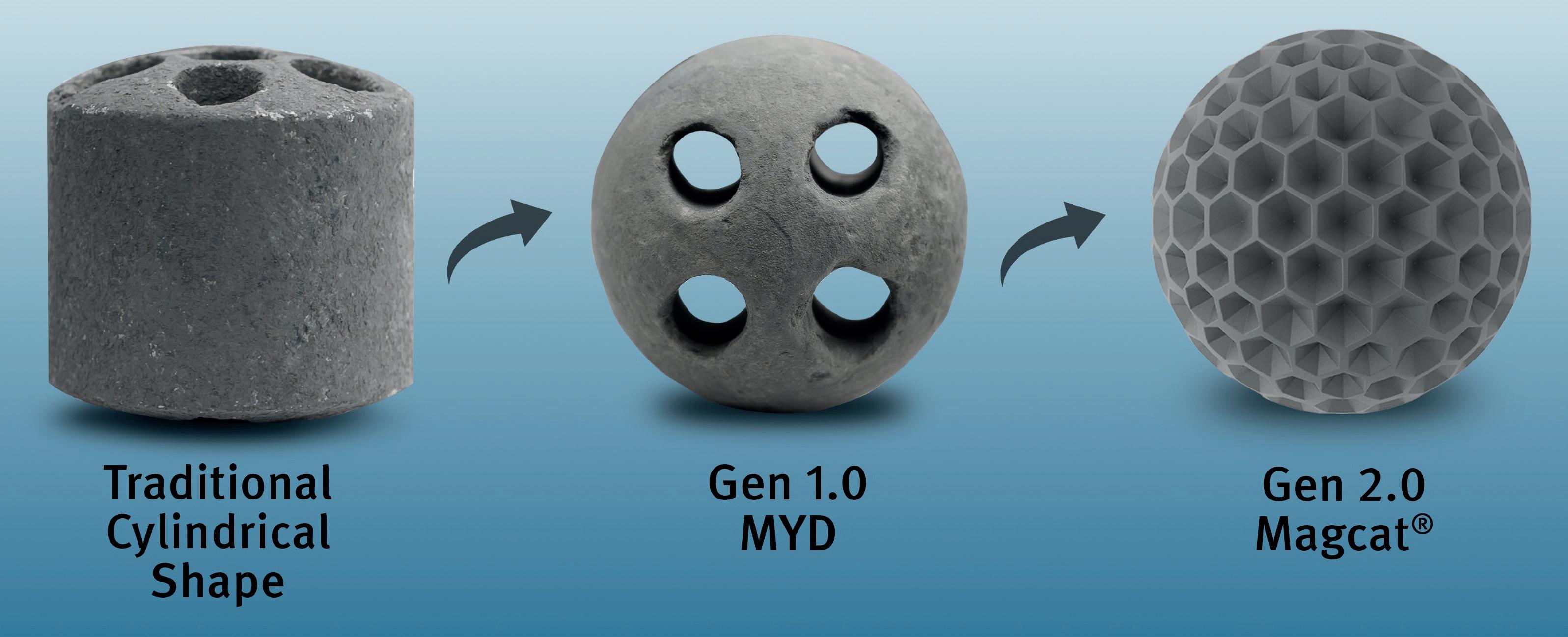

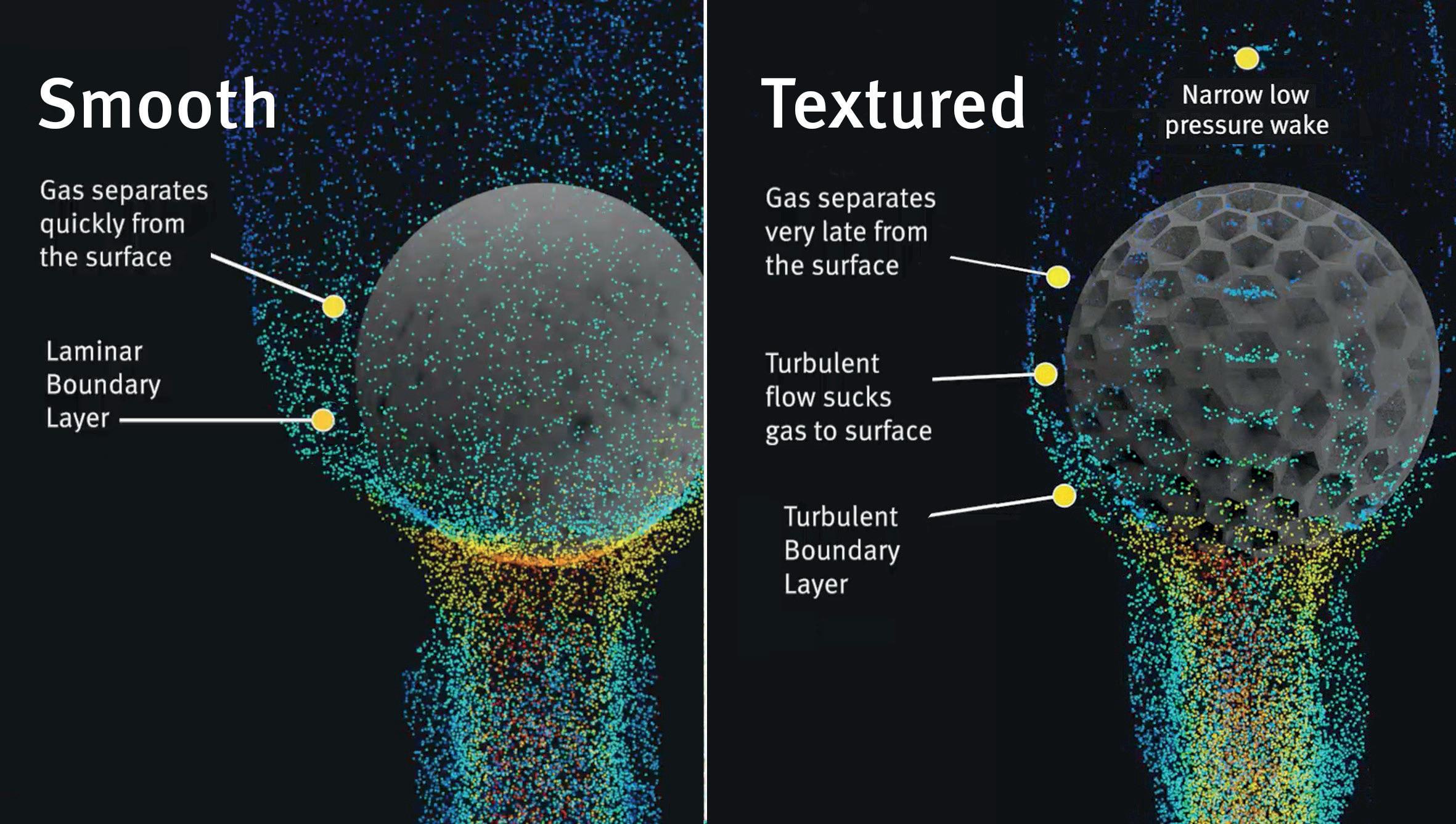

36 A step change in catalyst development

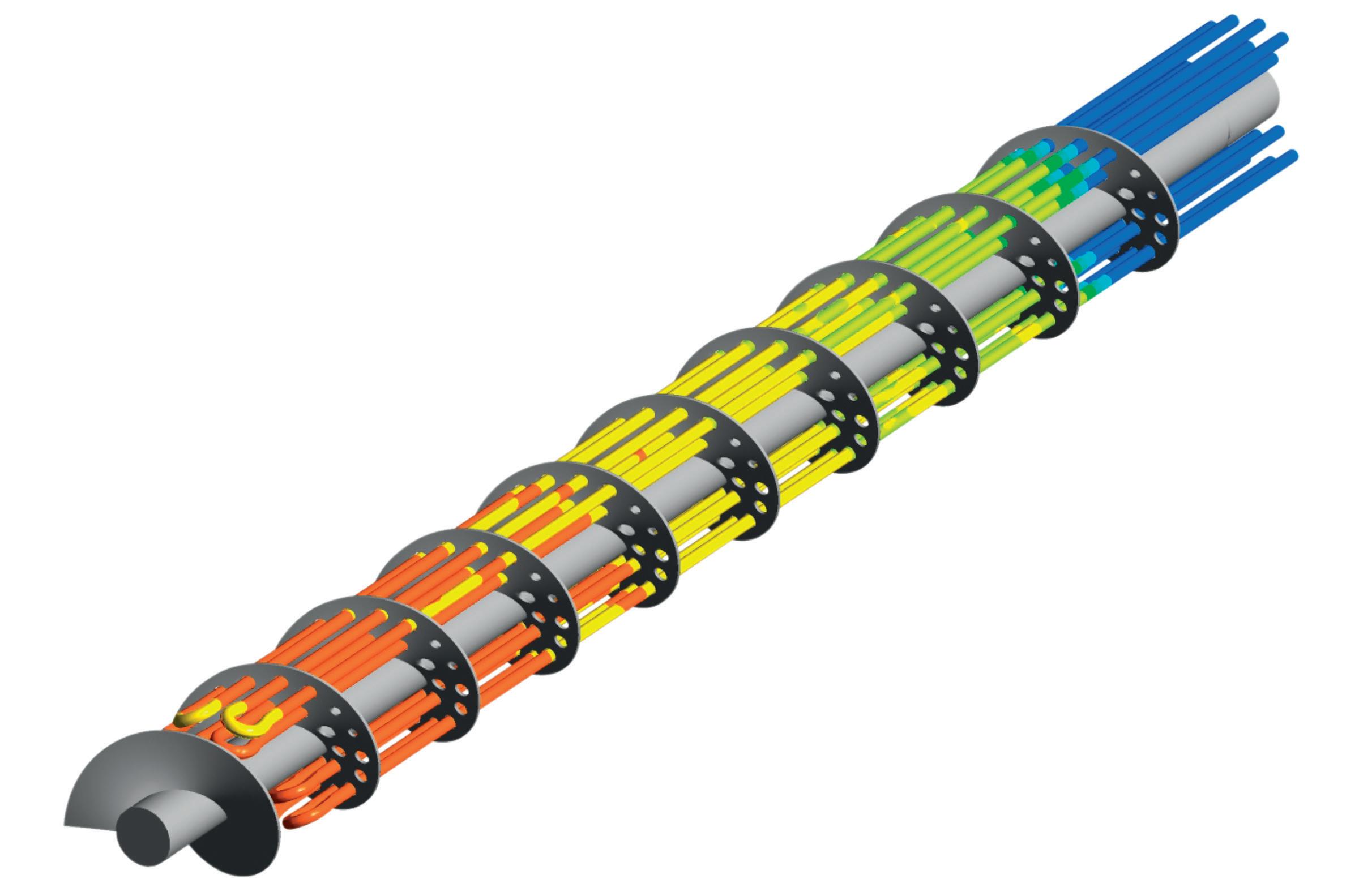

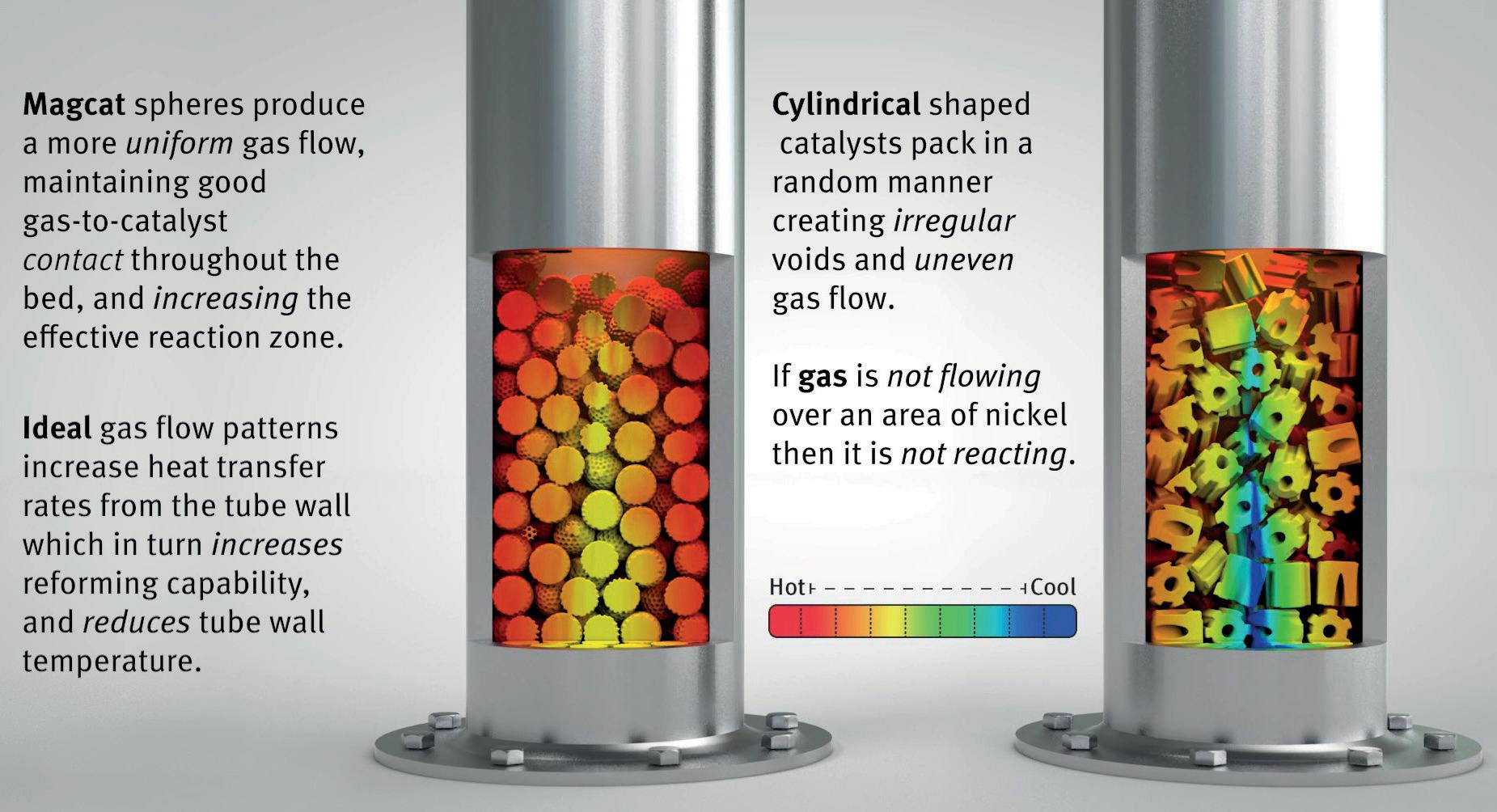

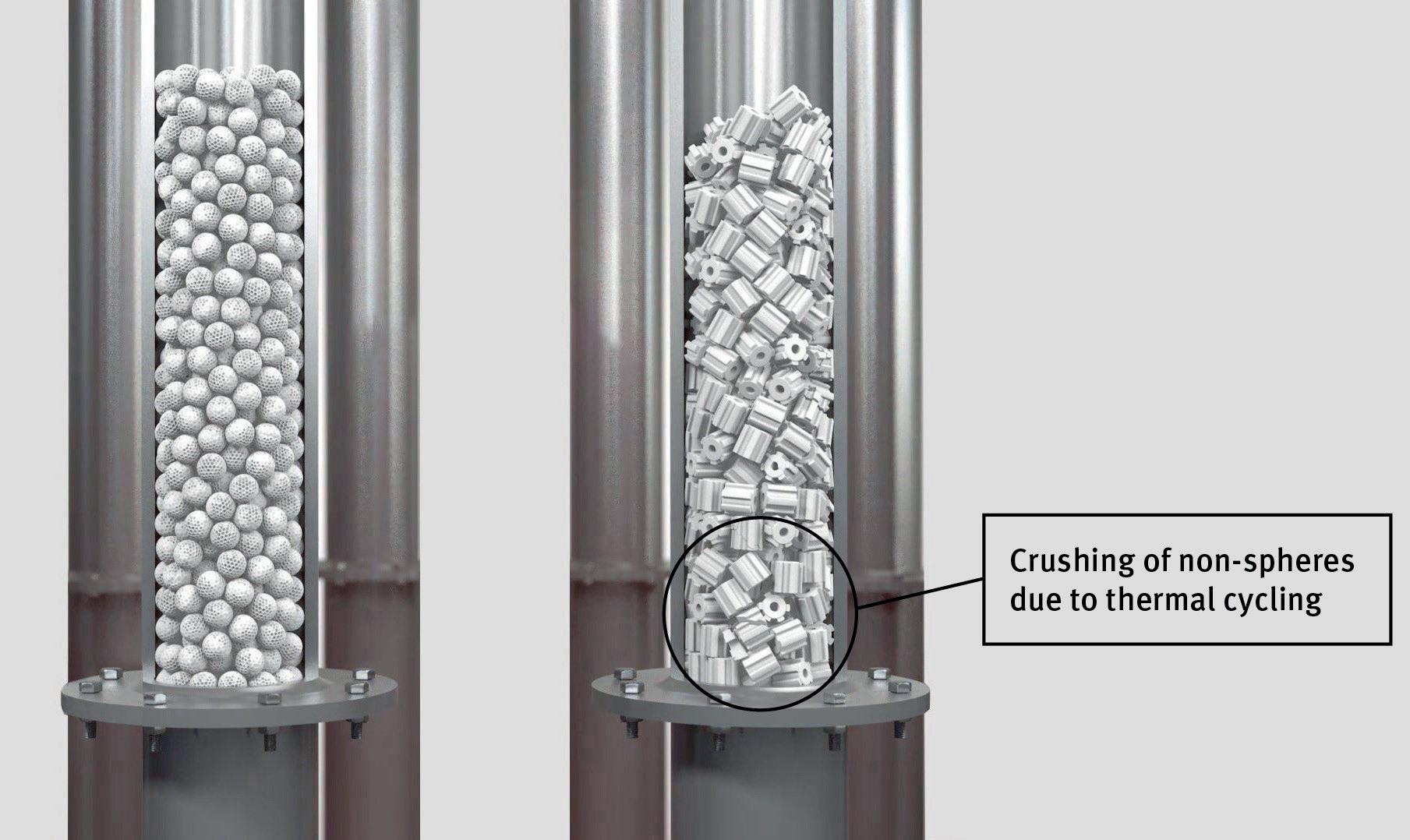

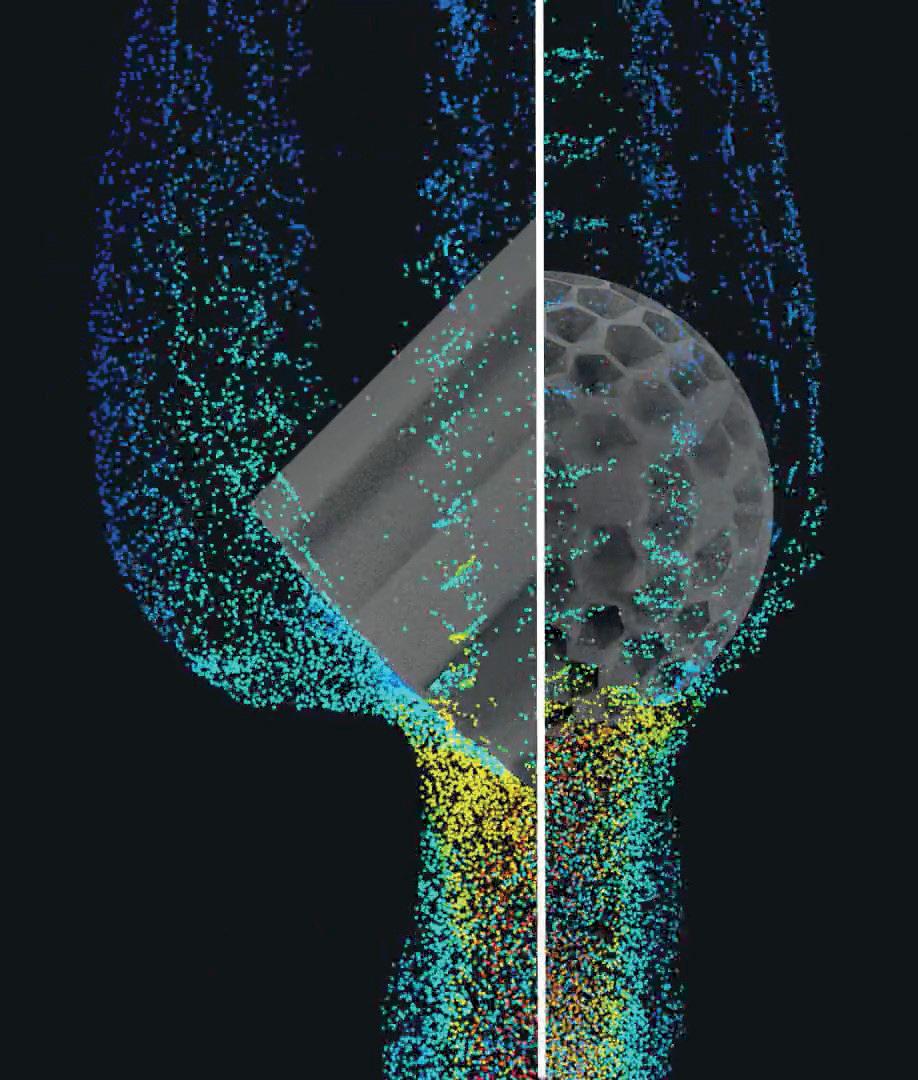

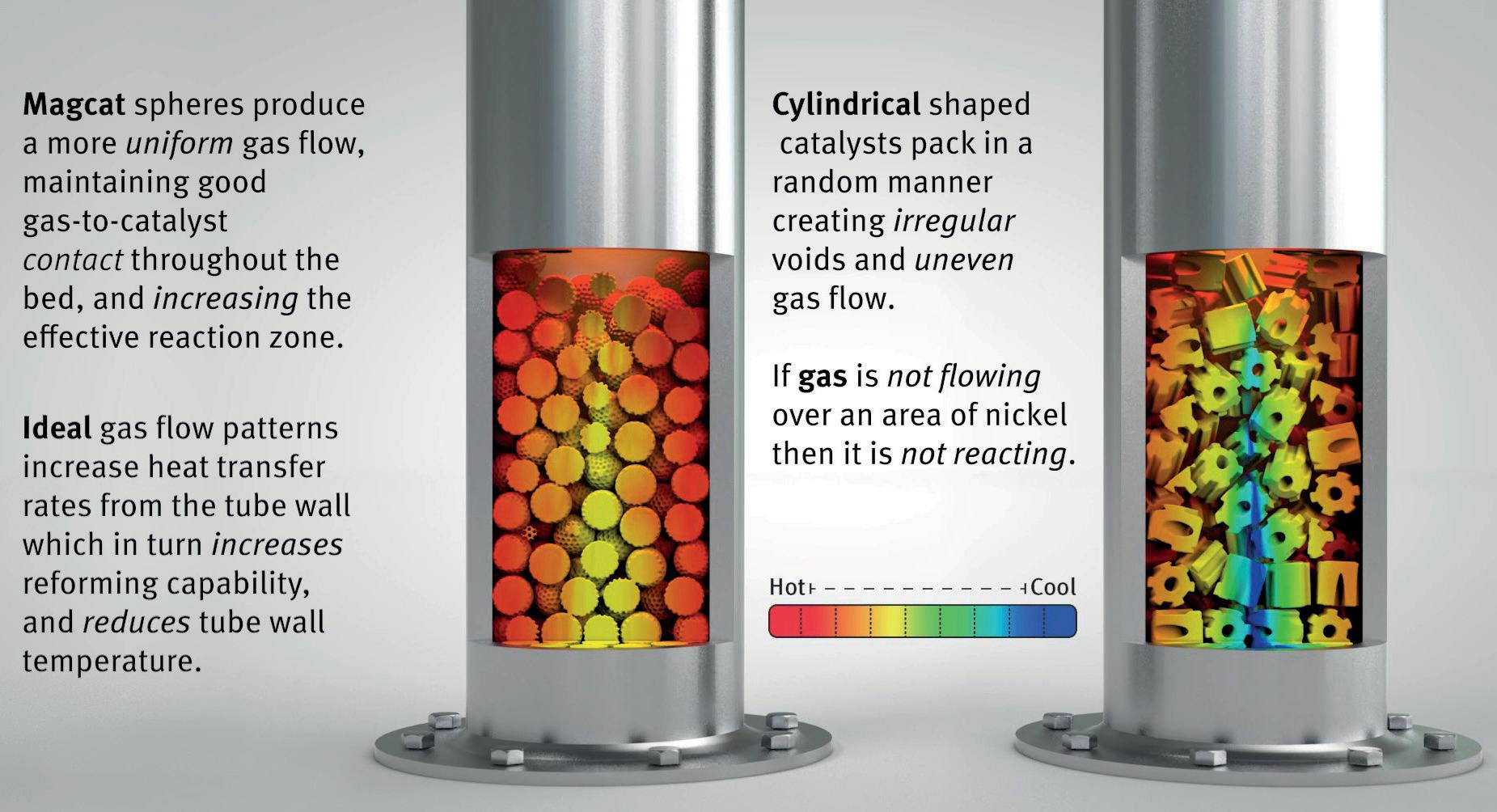

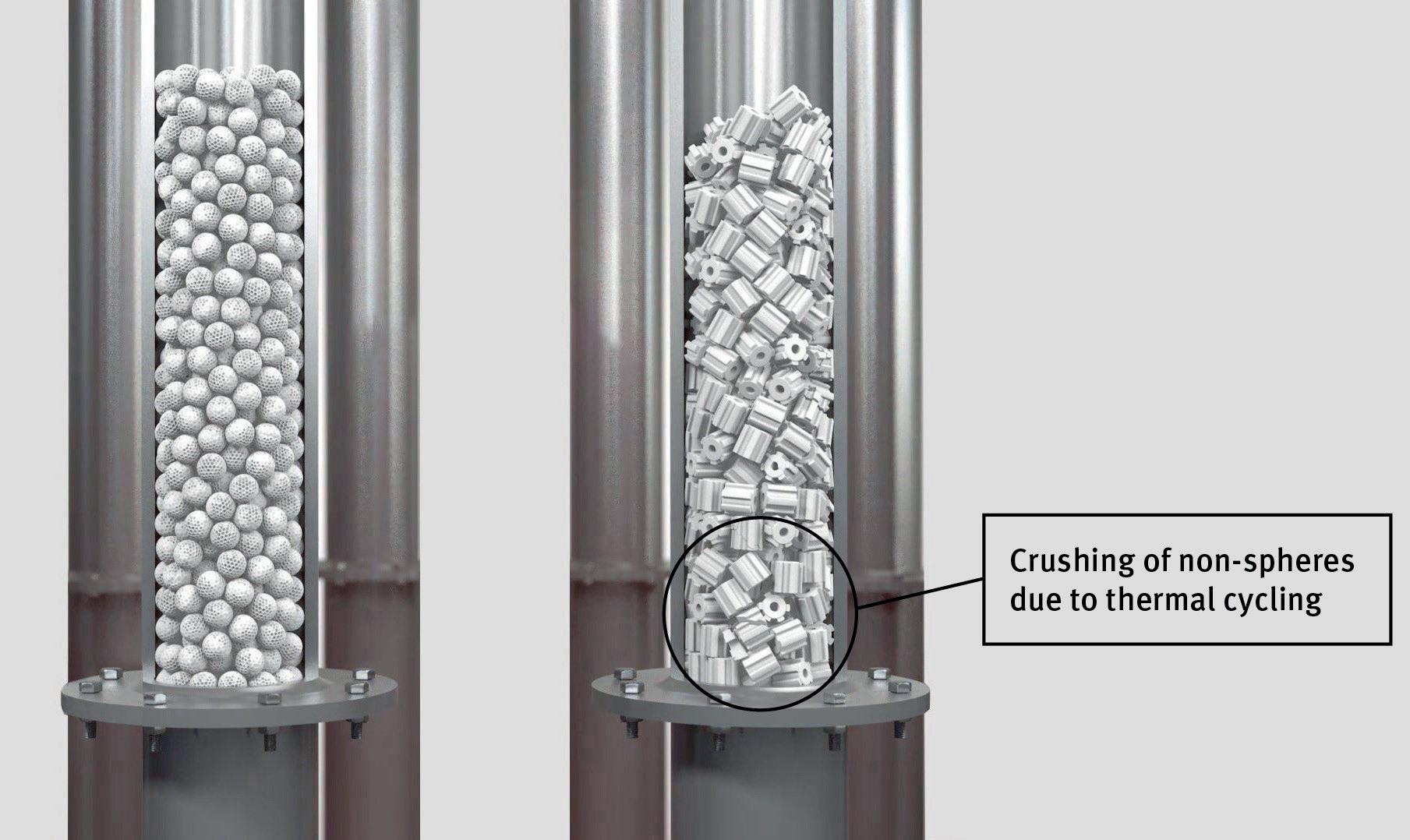

Mark Stuckey, UNICAT Catalyst Technologies LLC, discusses the emergence of next generation spherical catalysts and their impact on yield increases and reduced carbon dioxide (CO2) emissions in tubular reformers.

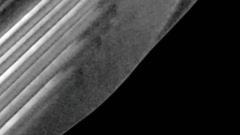

THIS MONTH'S FRONT COVER

44 Racing to find the right separation technology

Vic Scalco, General Atomics Electromagnetic Systems, USA, details the importance of selecting the correct separation technology in order to support growing petrochemical demand.

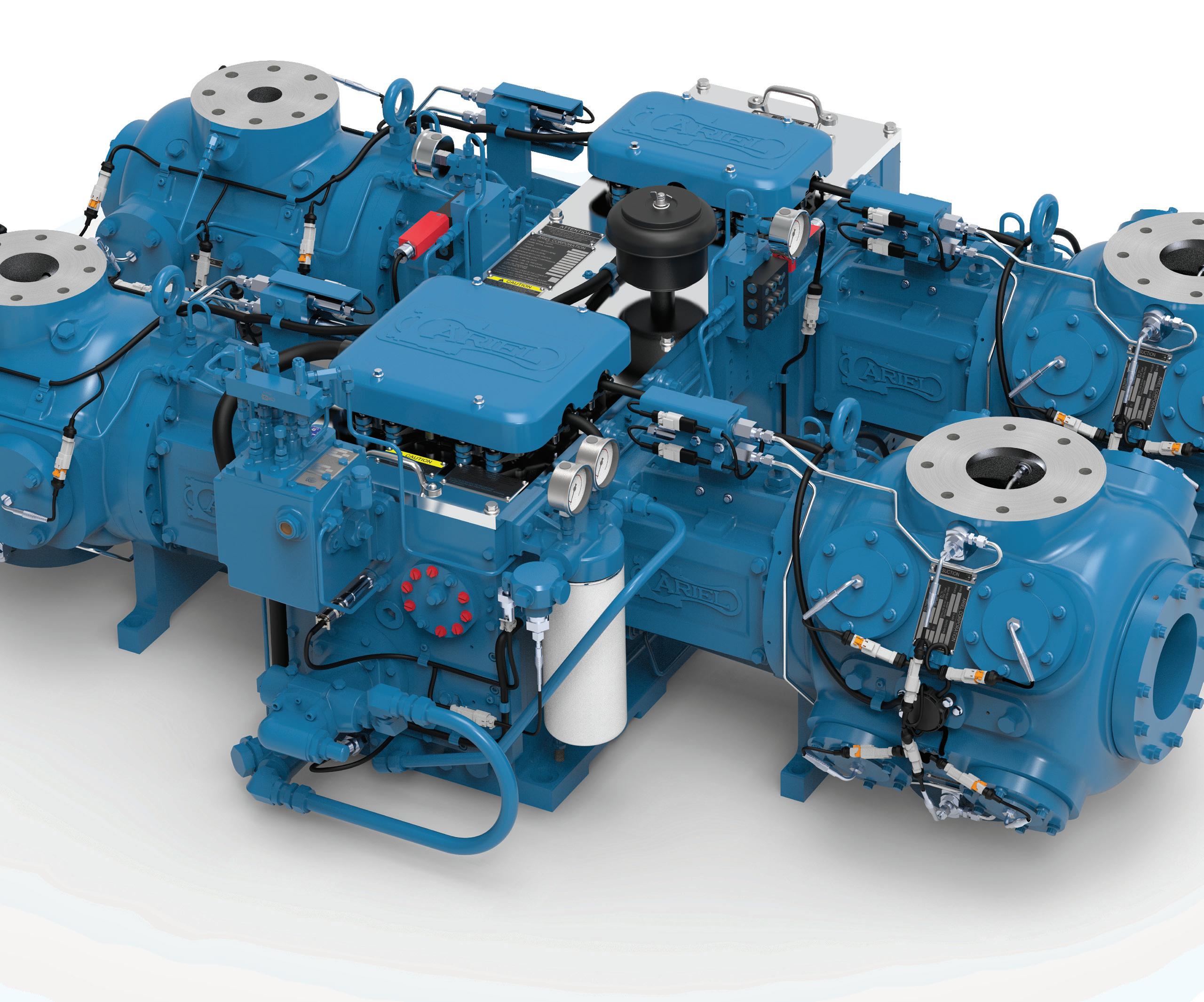

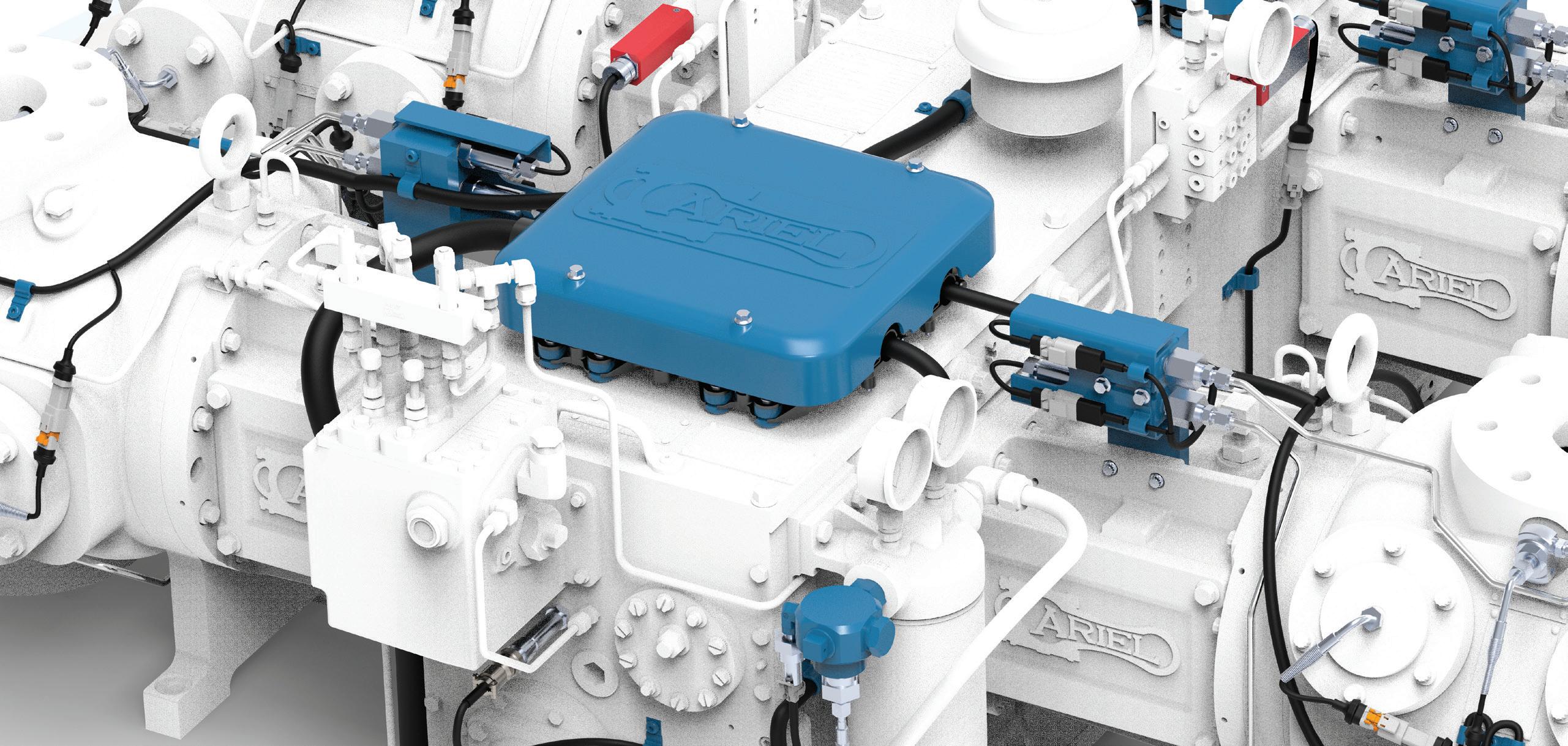

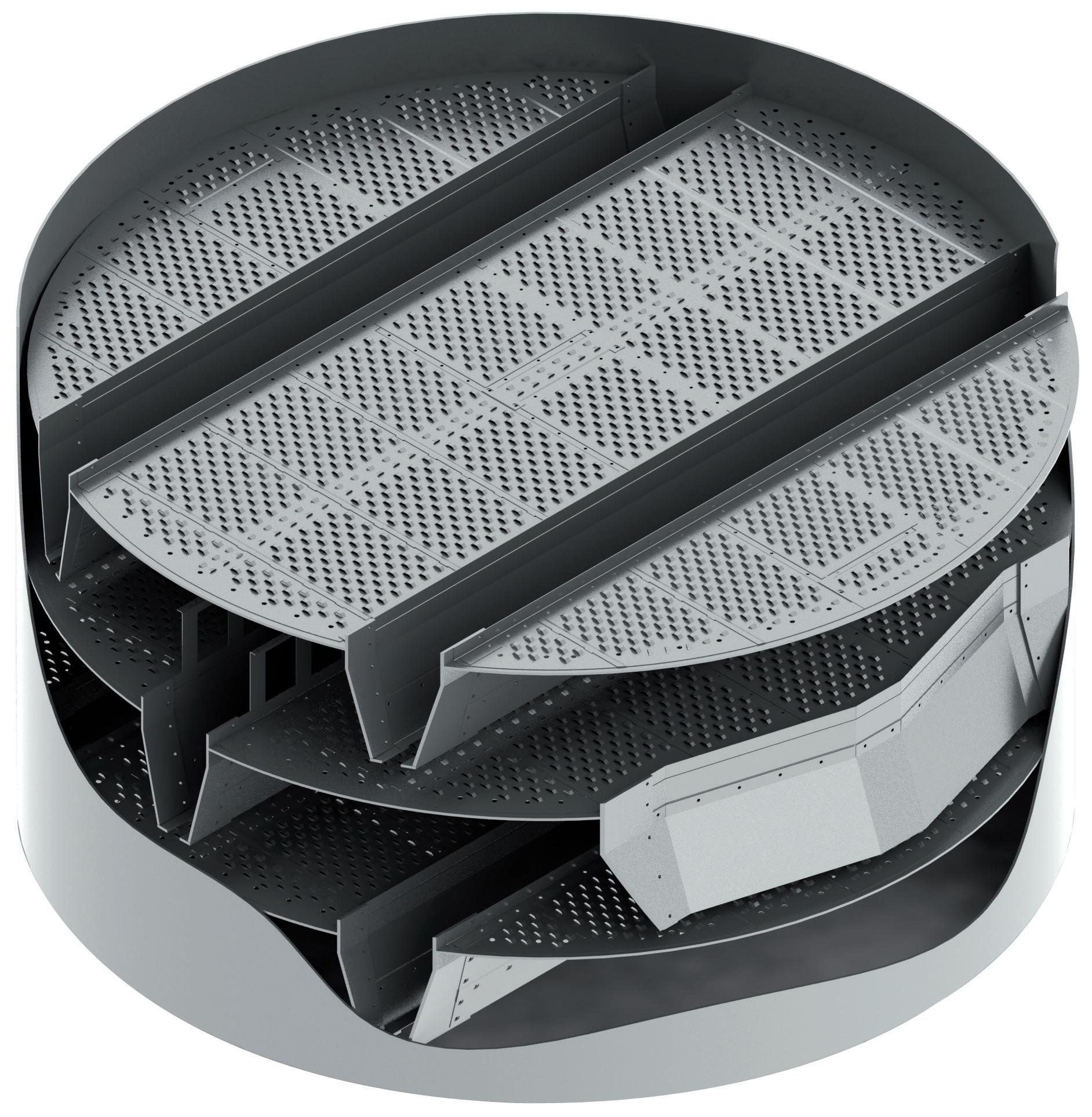

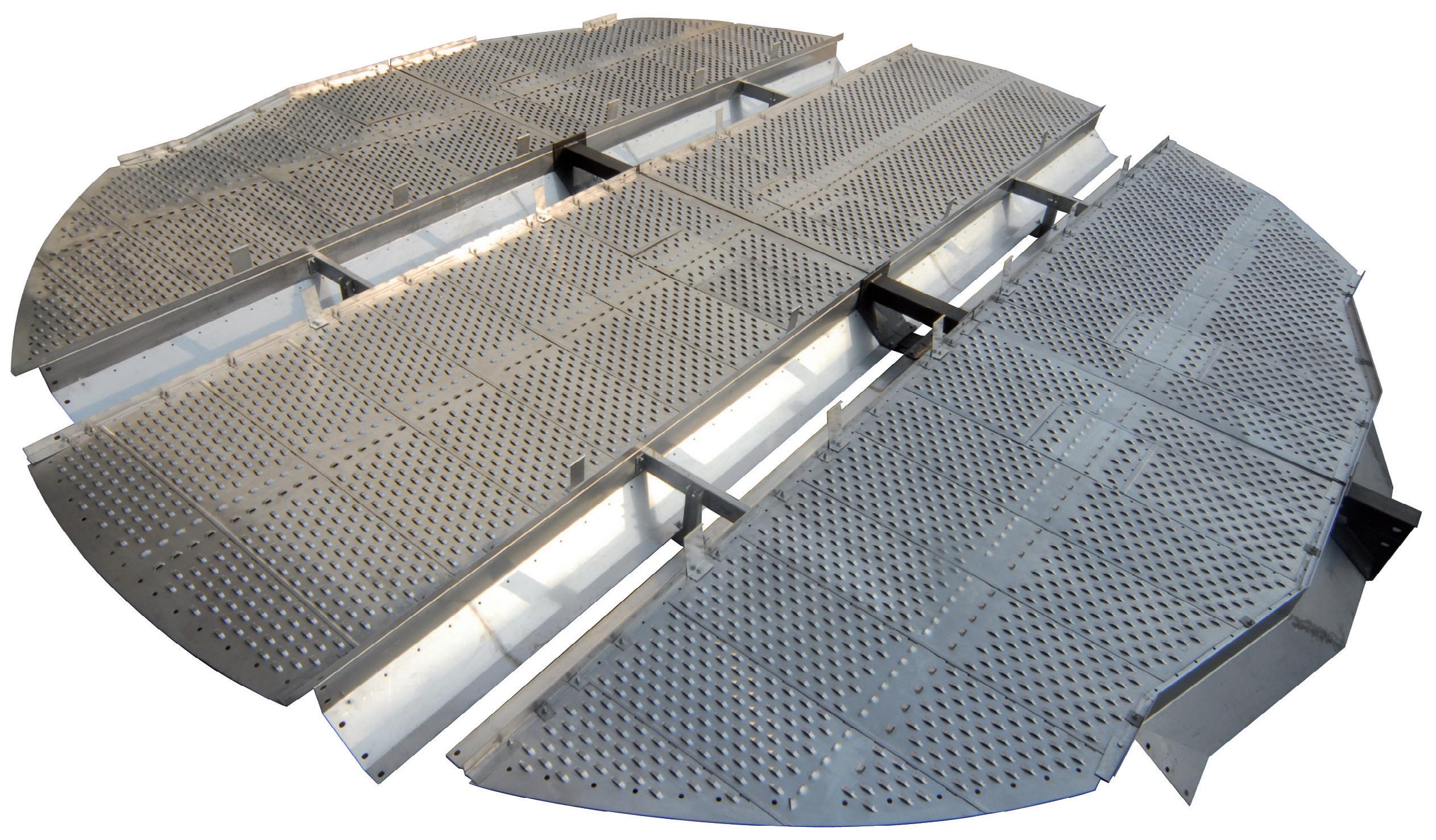

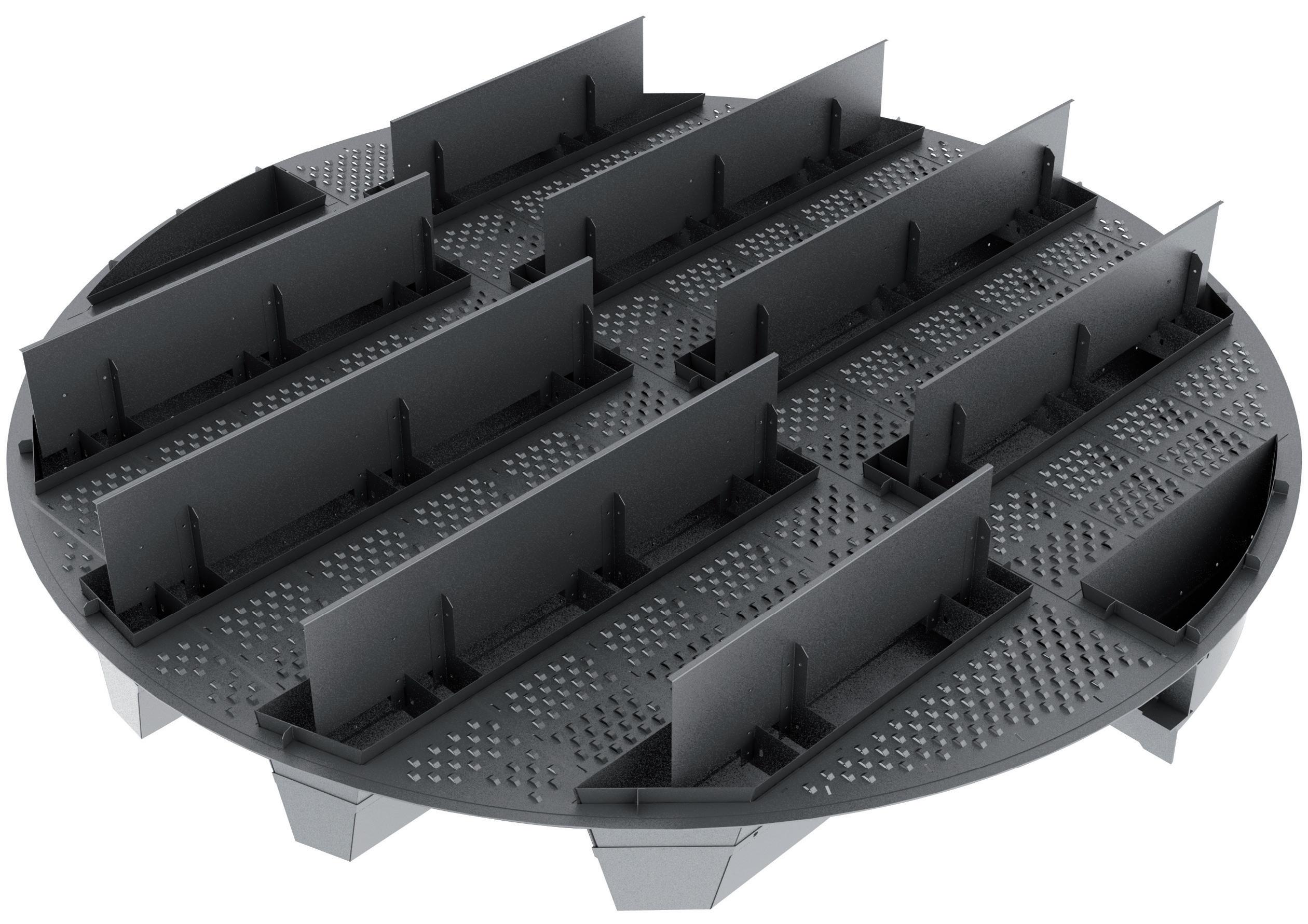

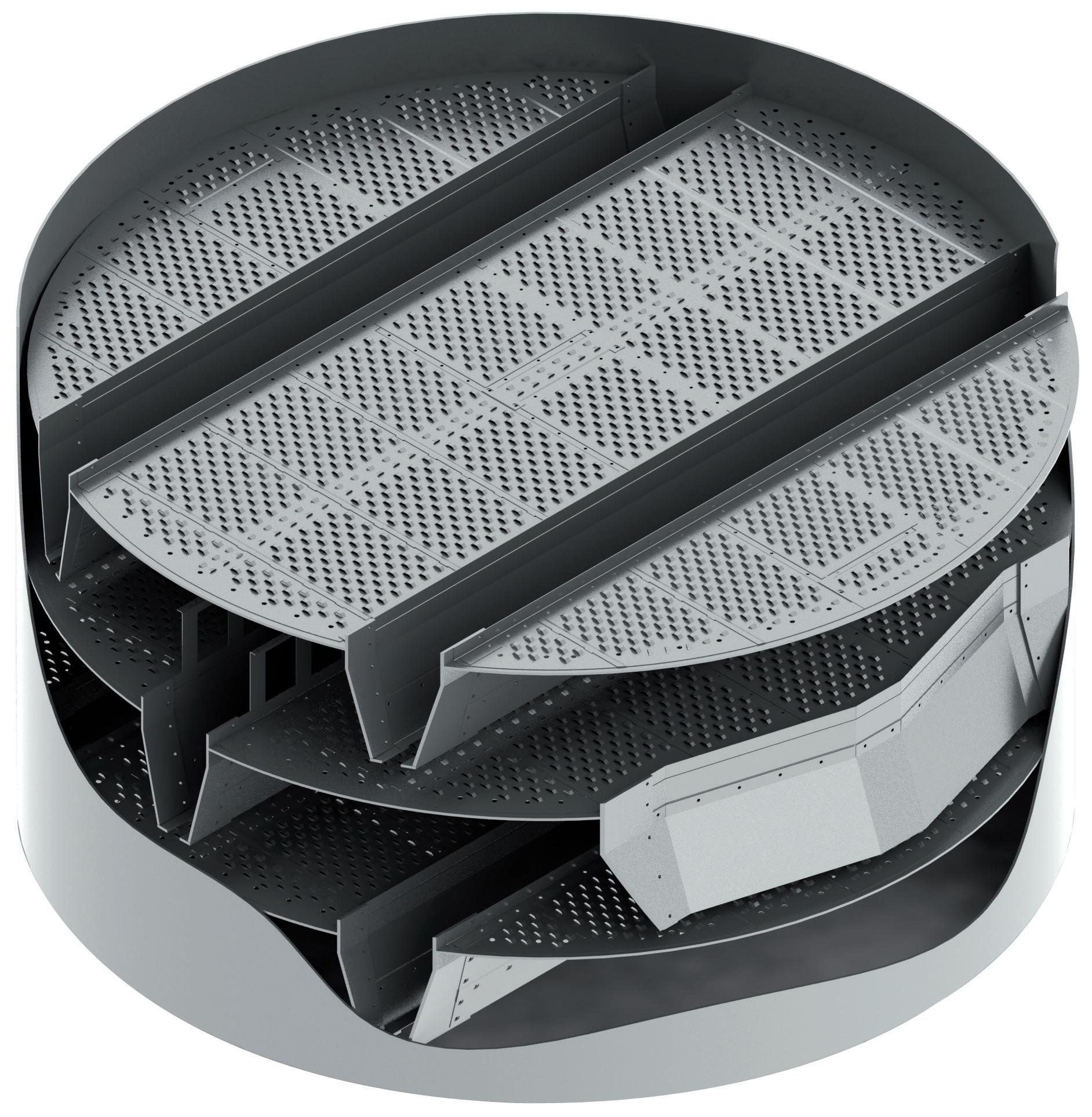

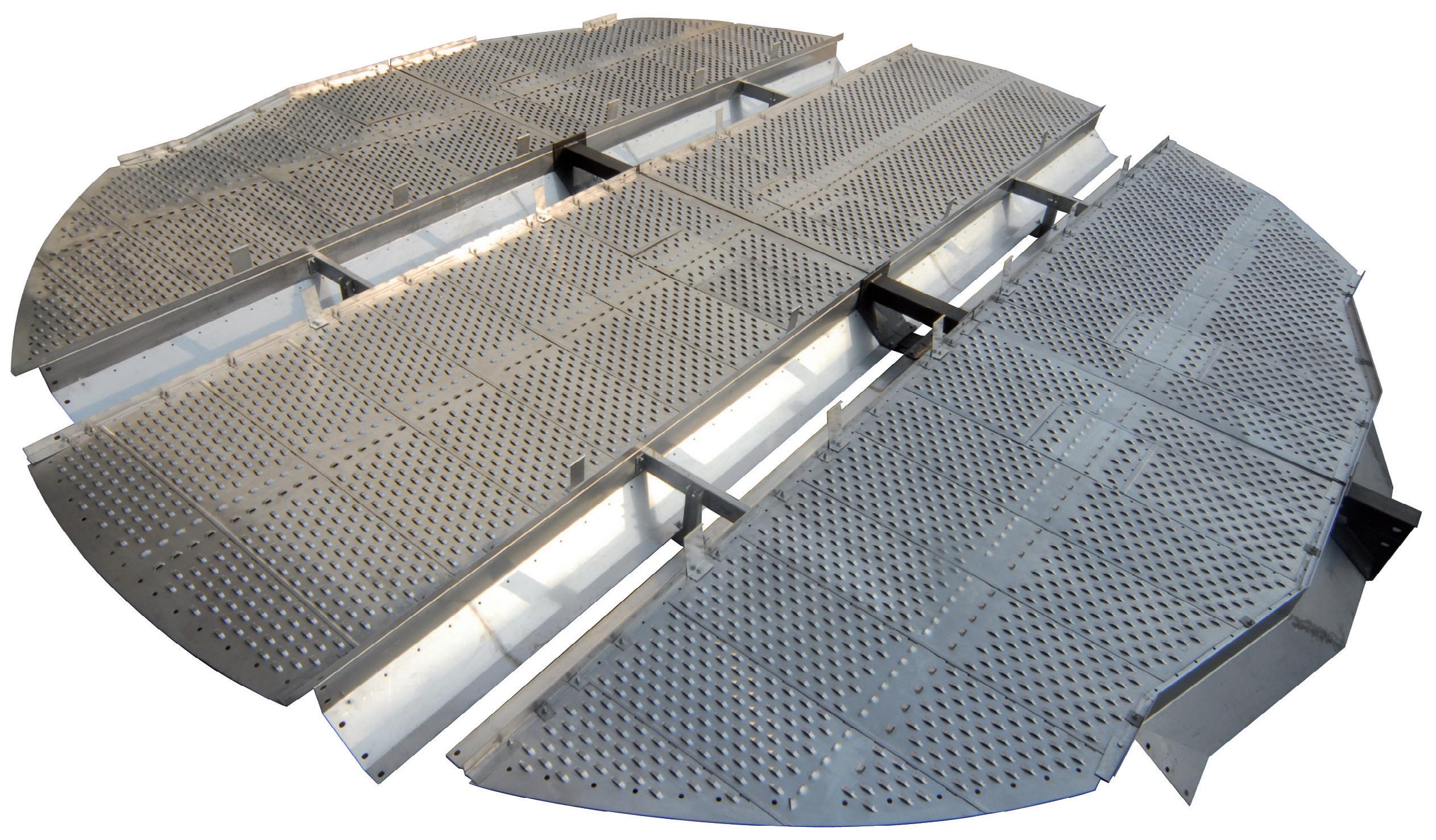

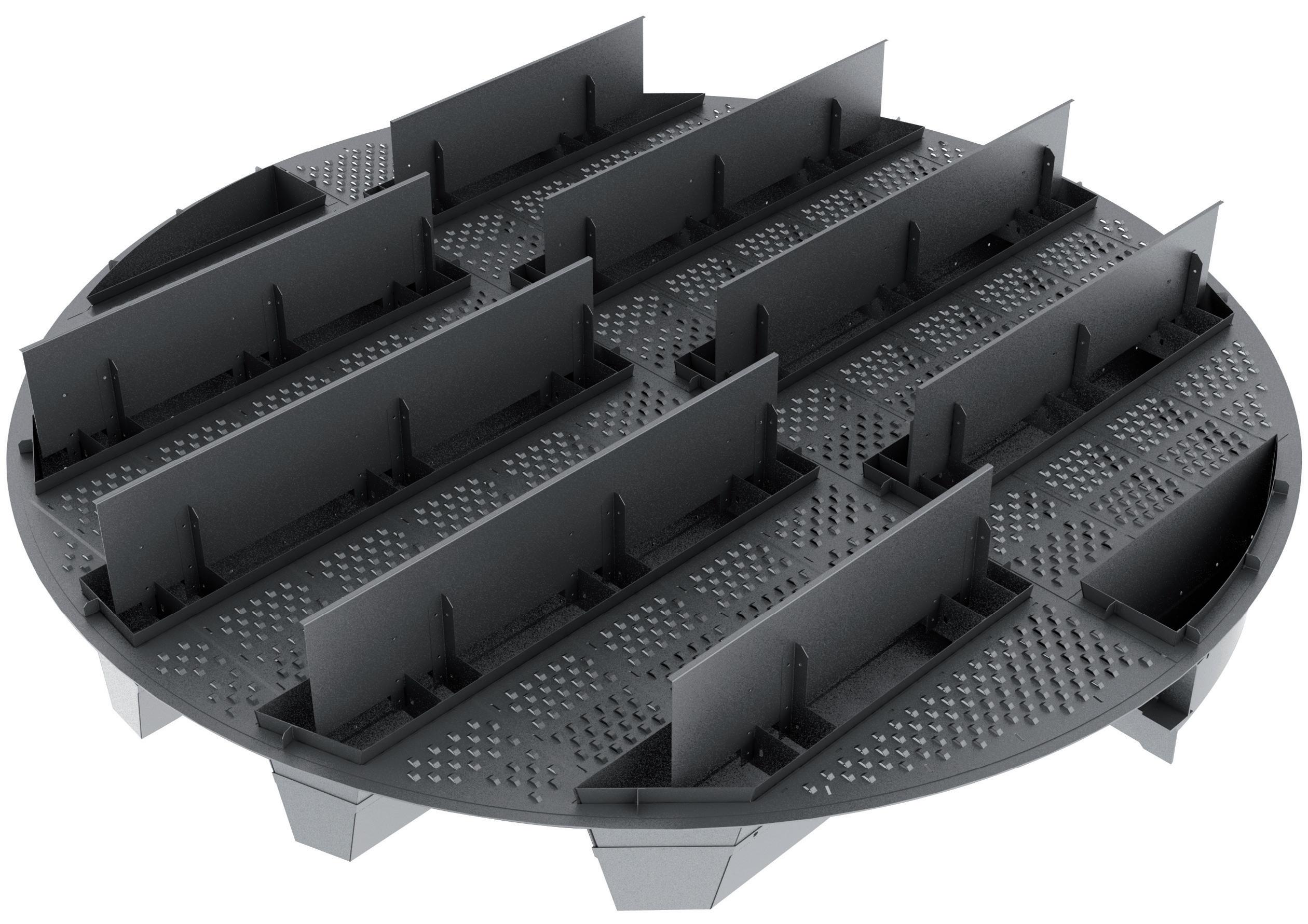

51 Trays for mega towers

Ang Chew Peng, Hou Peng-Cheng and Senthil Krishnamoorthy, Sulzer, discuss various types of high-performance trays for large diameter propylene fractionators.

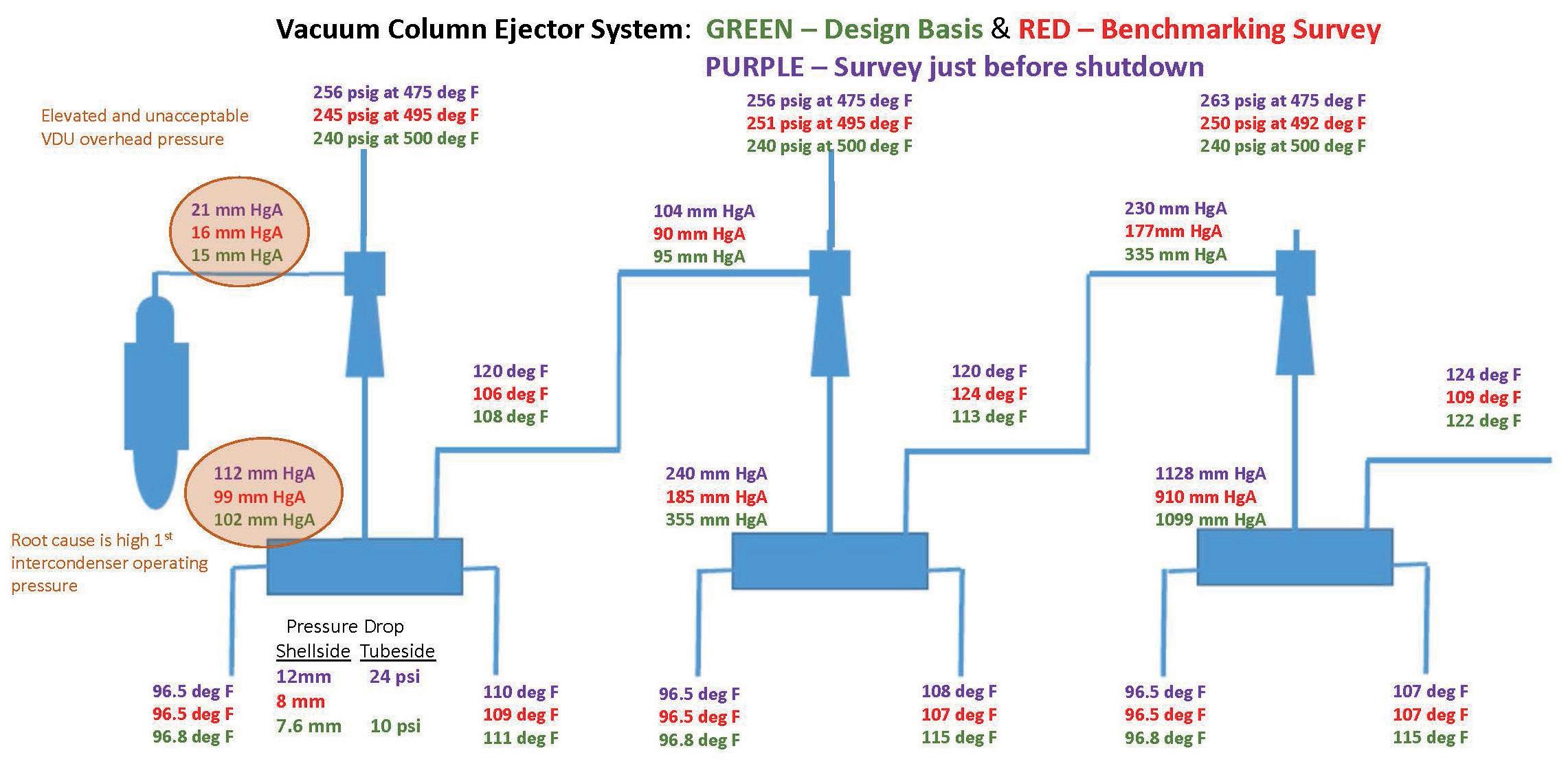

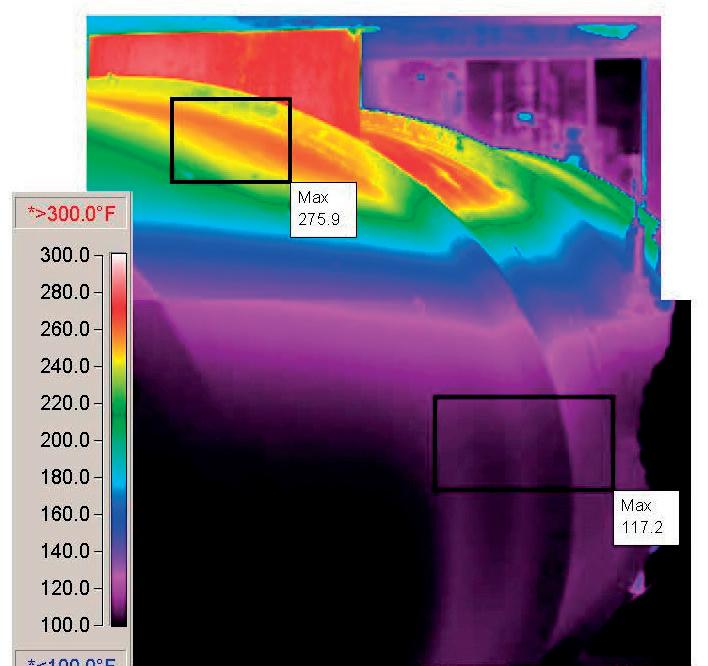

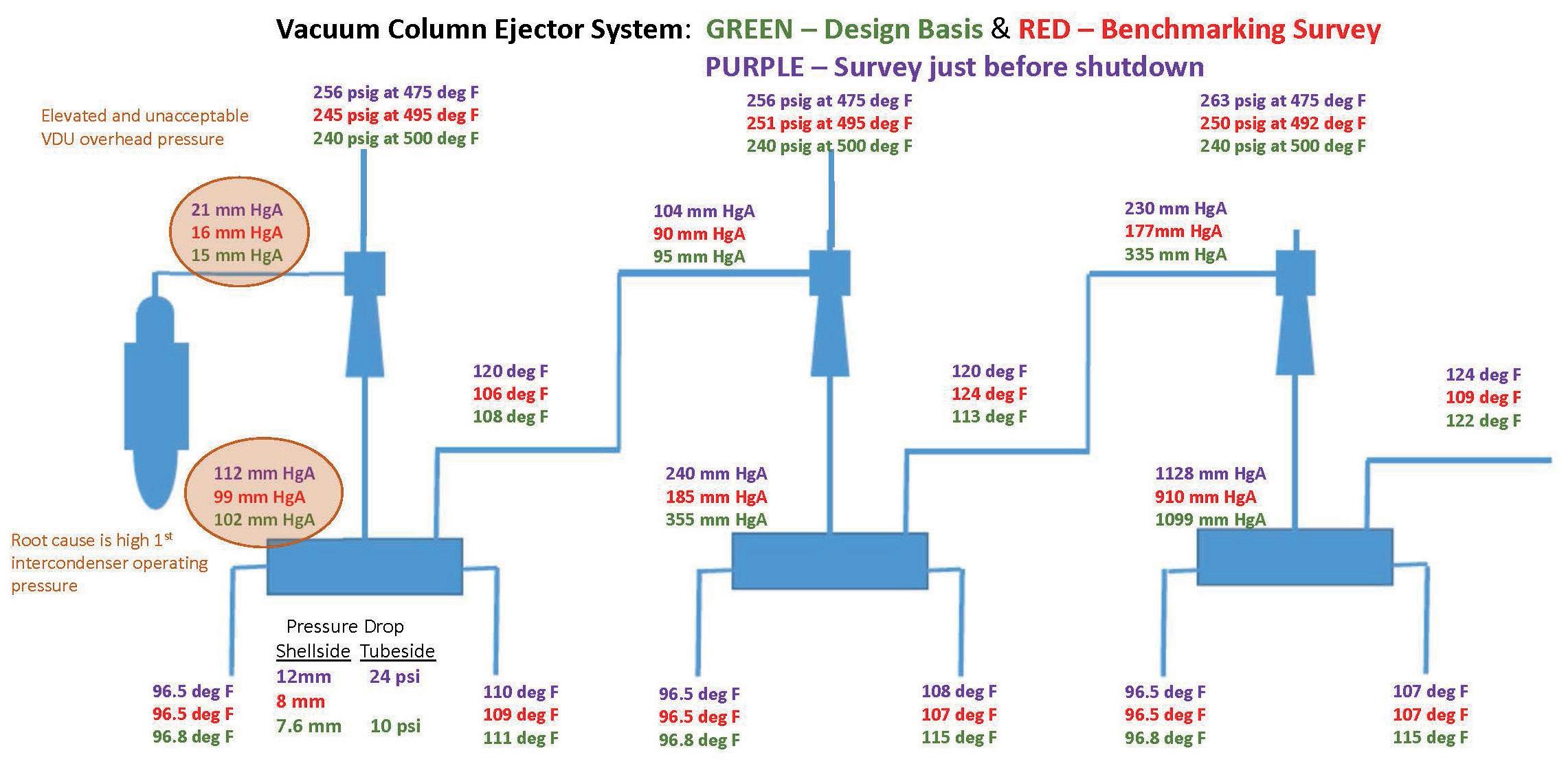

59 Lessons in VDU performance

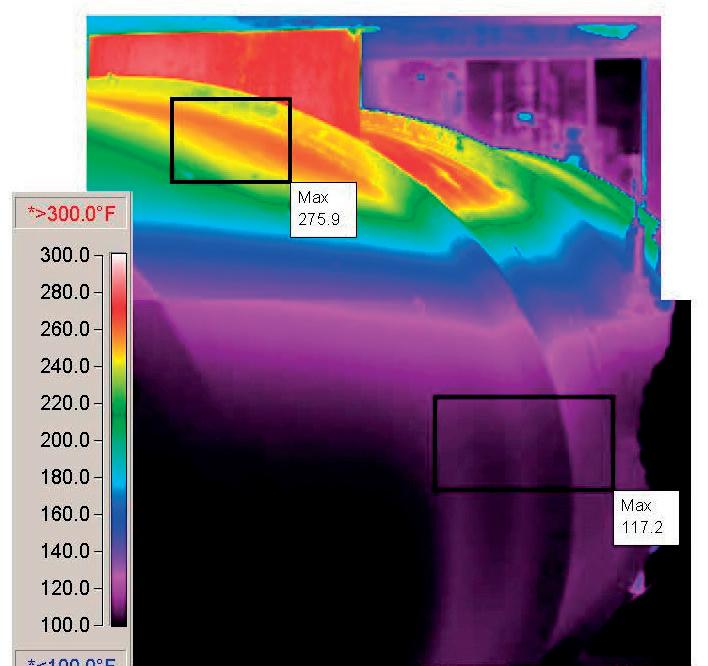

Jim Lines, Graham Corp., USA, lists the VDU ejector system field lessons learned by a performance improvement engineer, through the lens of four specific case studies.

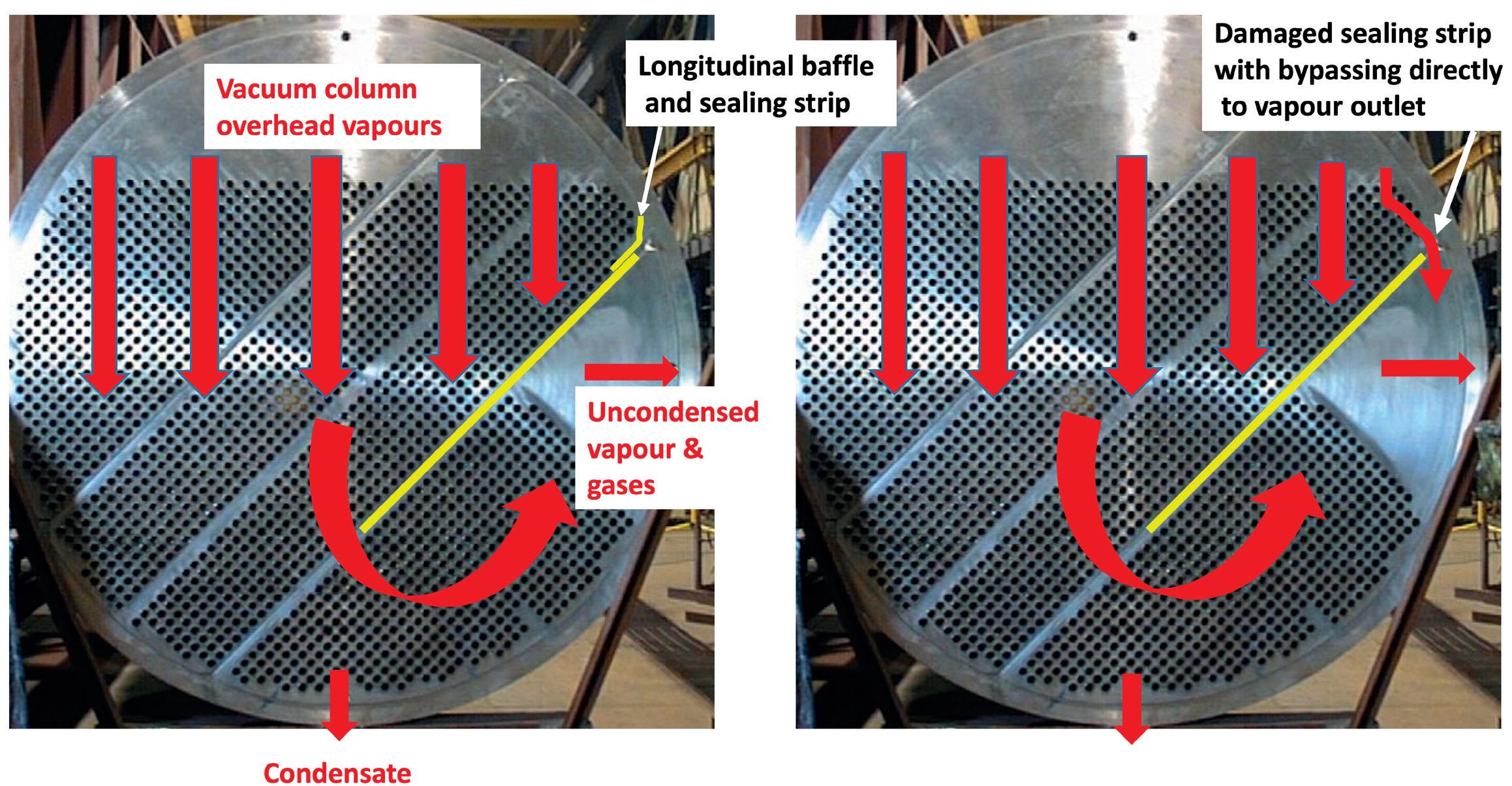

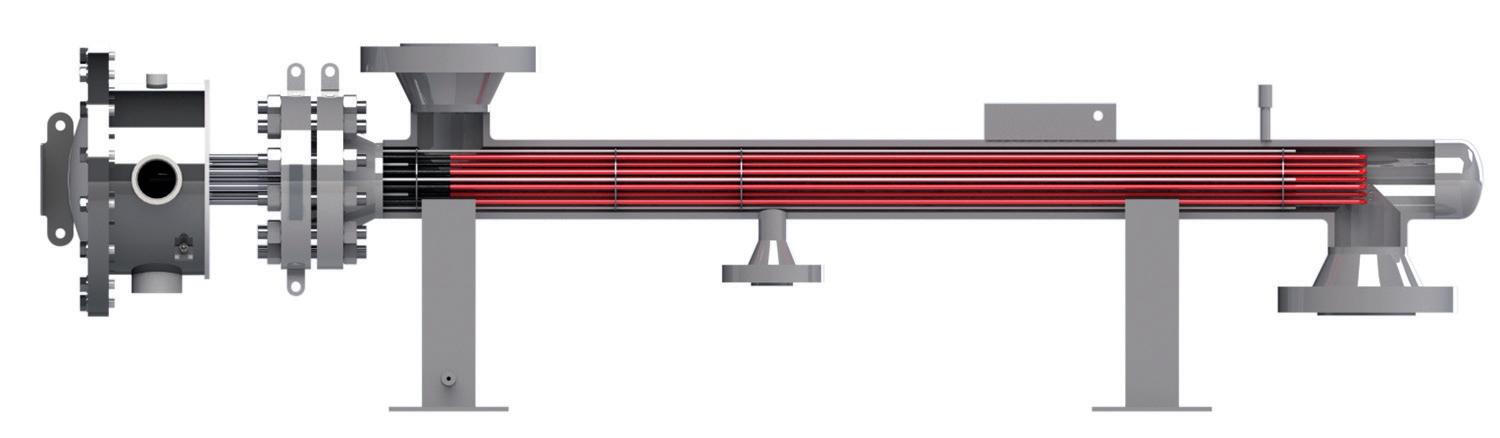

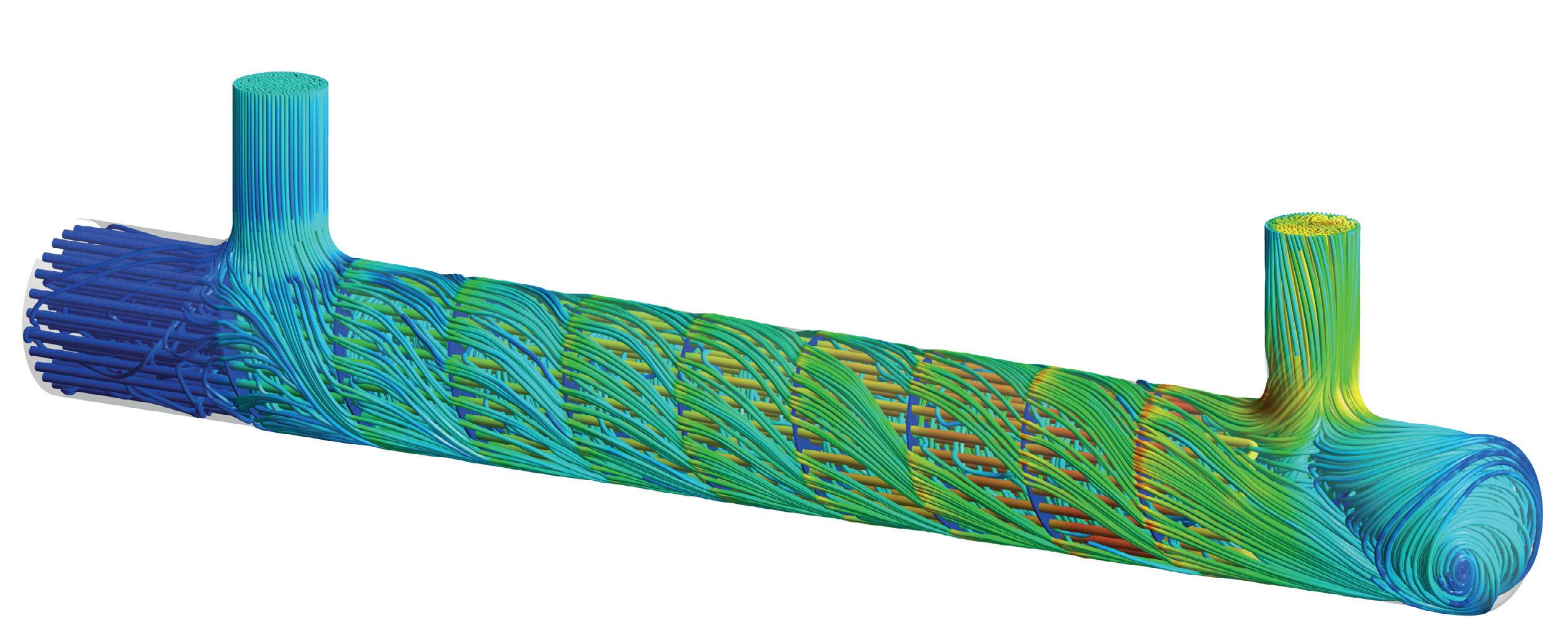

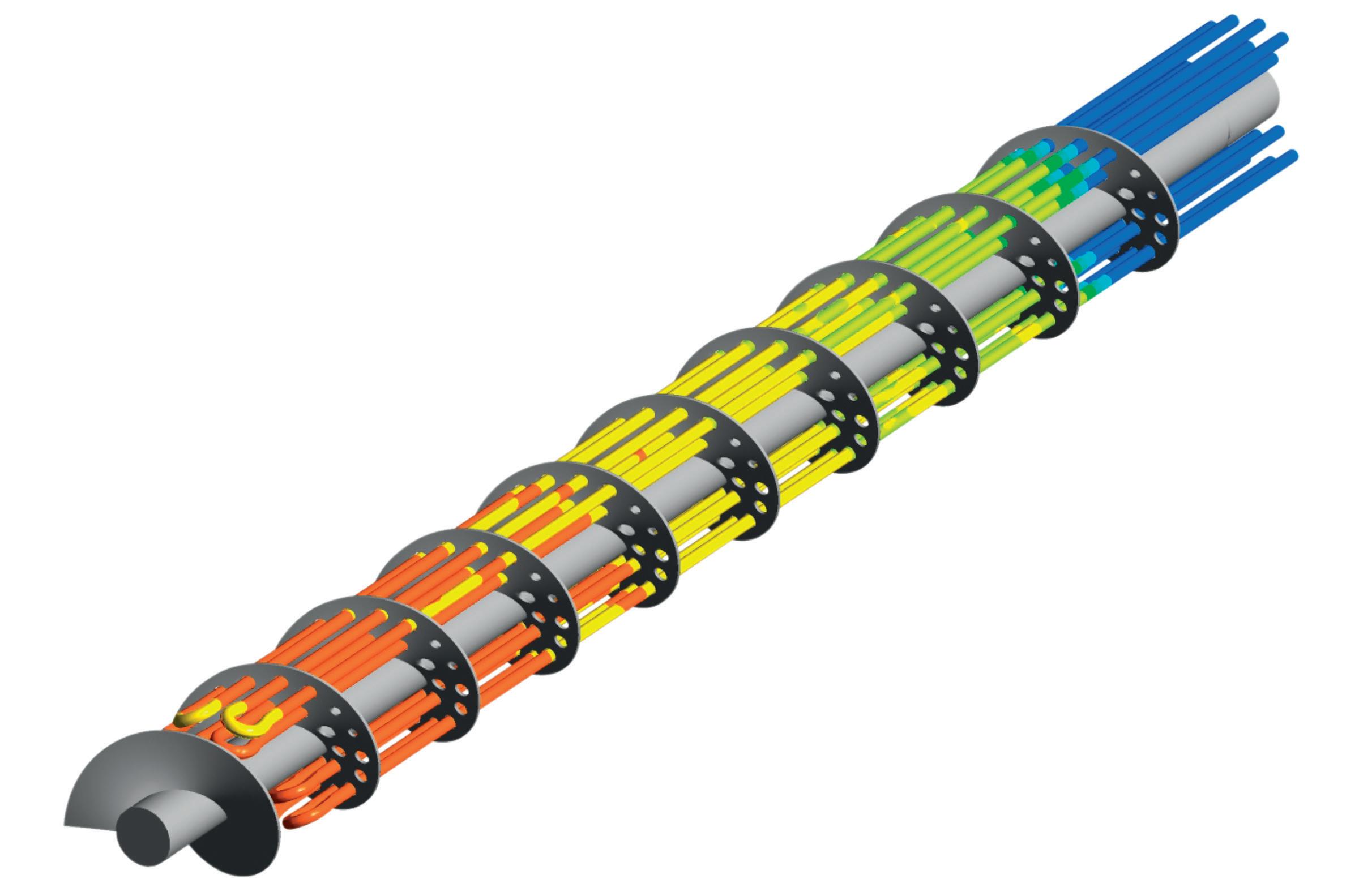

69 Time for a retrofit?

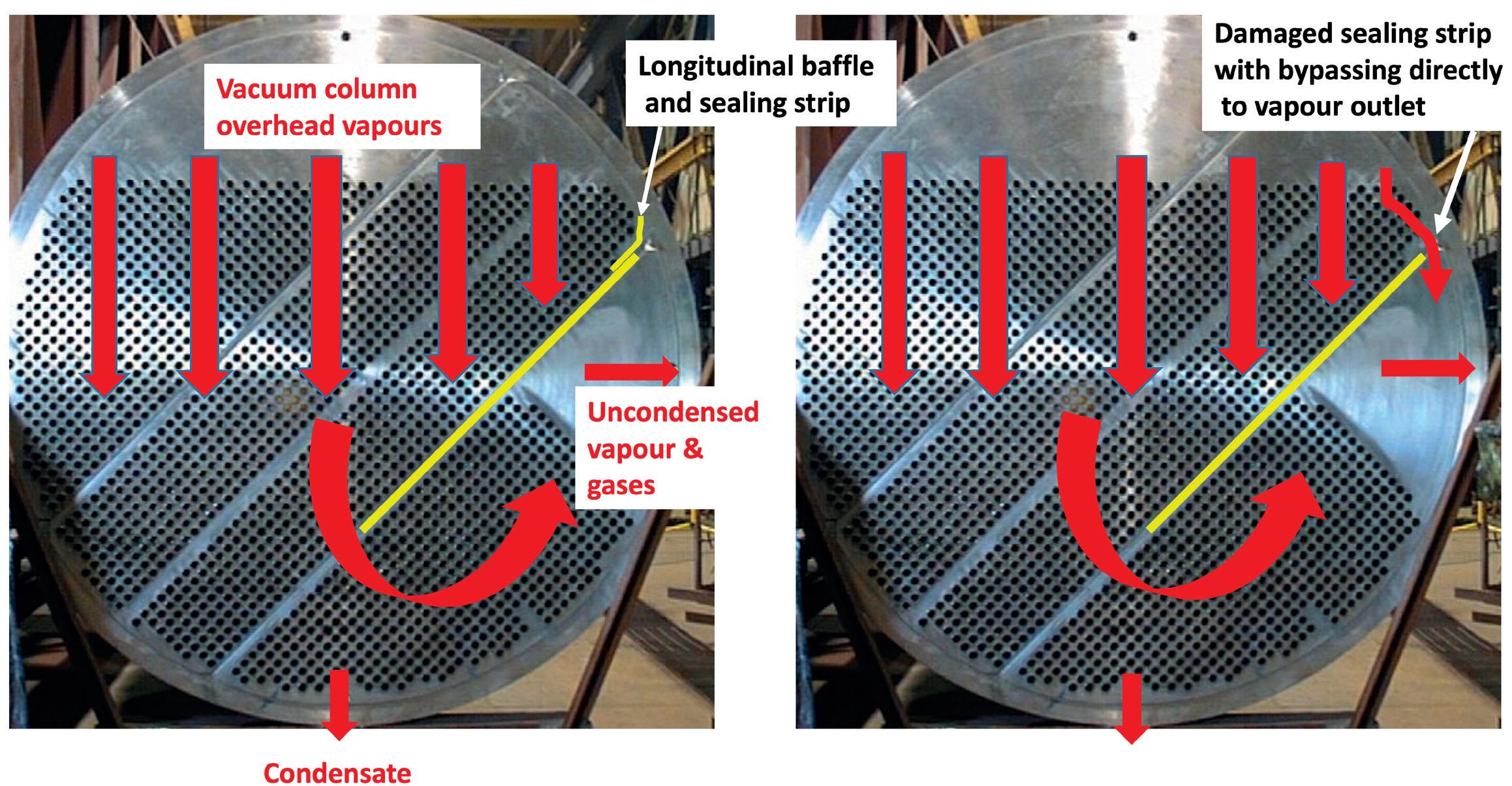

Nathan Hill, CALGAVIN, UK, discusses how to increase product retention through retrofitting condensers.

73

Breaking down the barriers

Dennis Long, Watlow, USA, explains the role that electric process heaters will have to play in the decarbonisation of hydrocarbon processing.

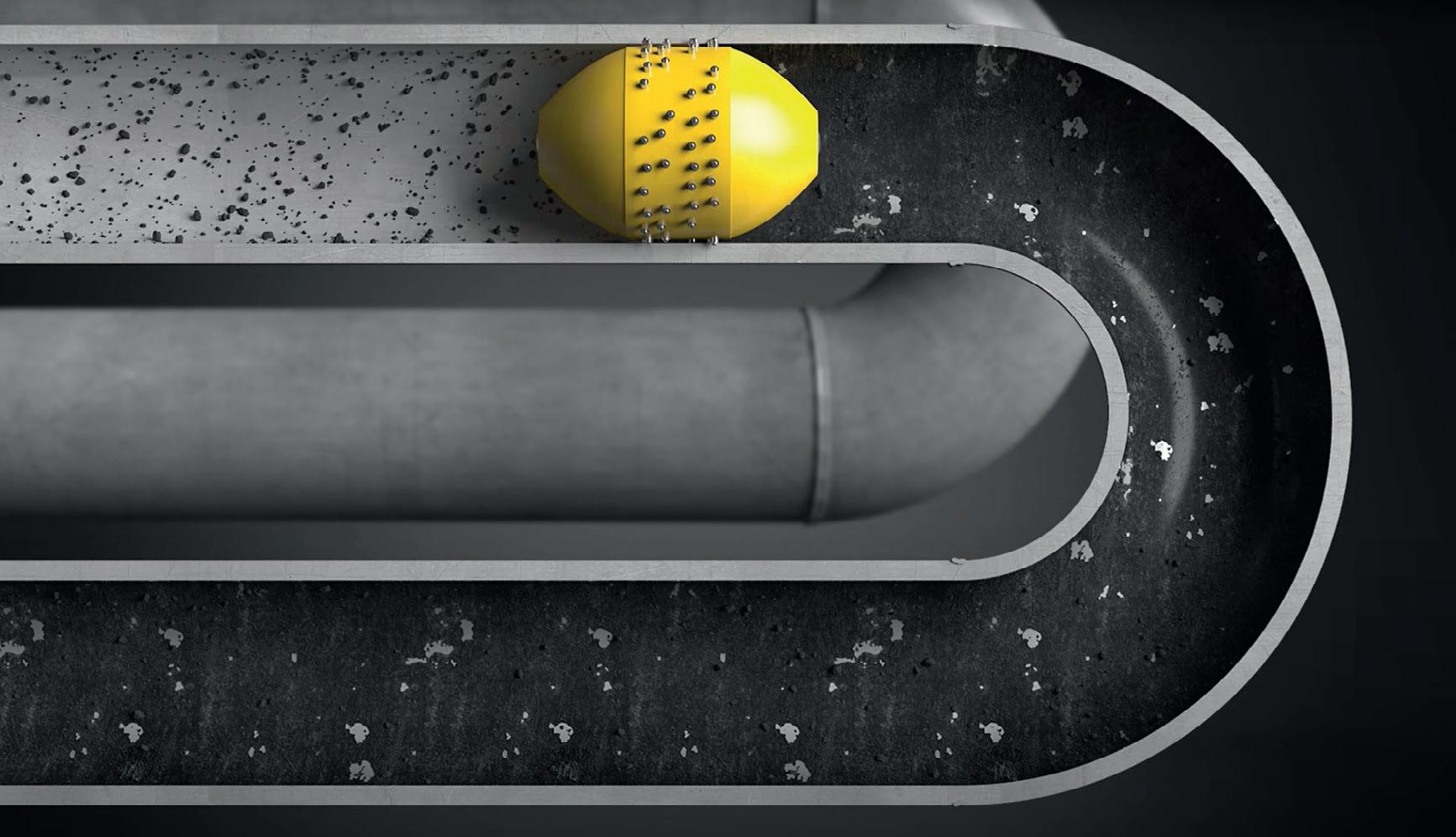

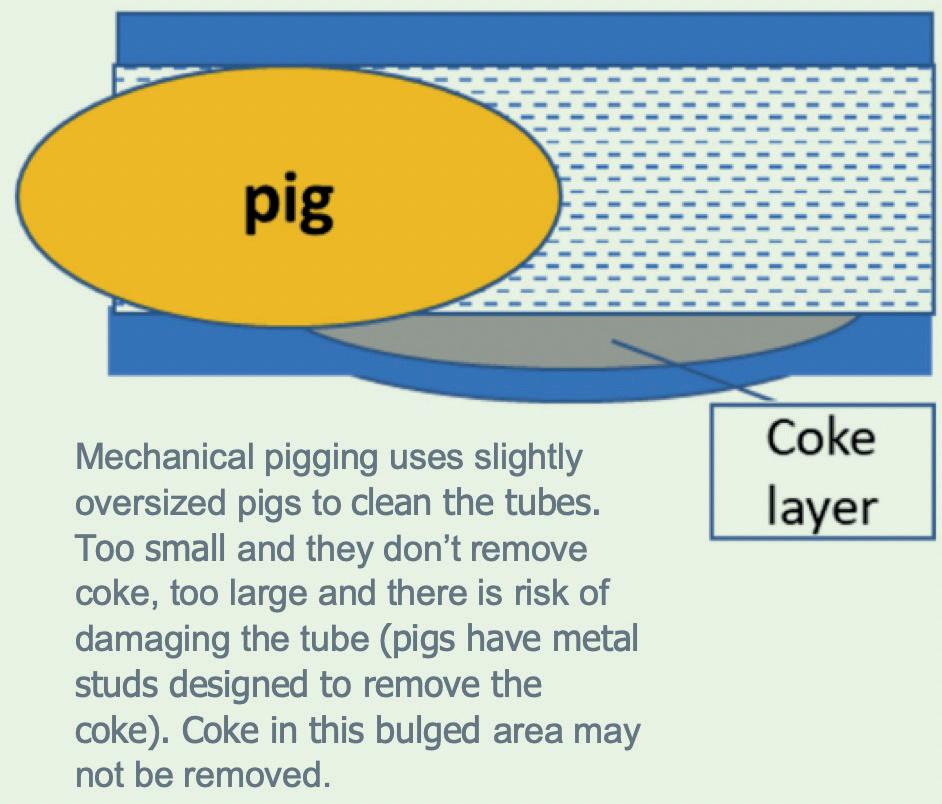

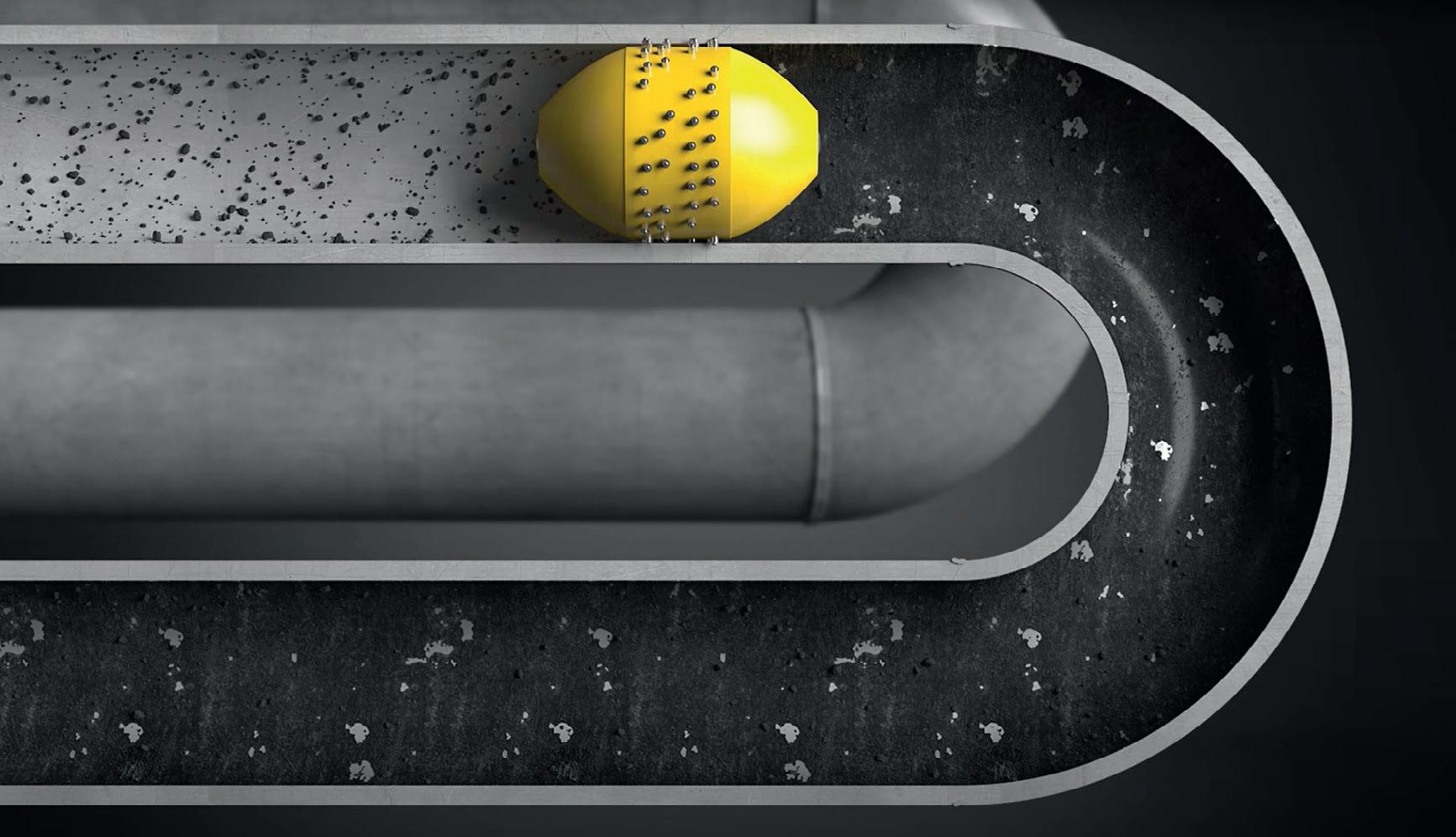

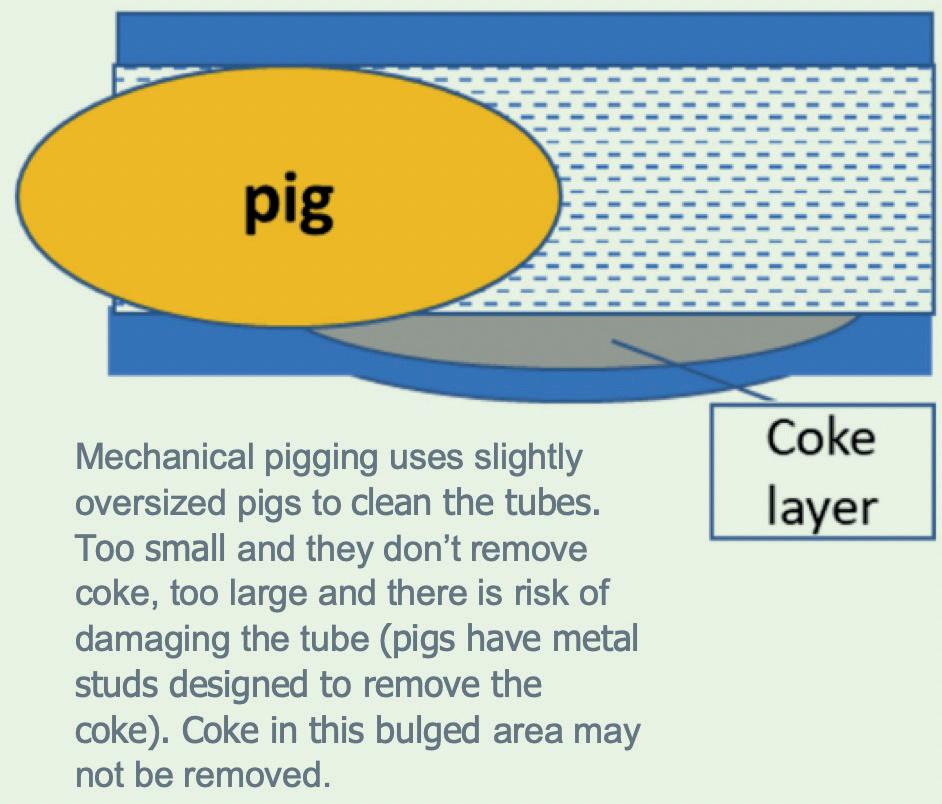

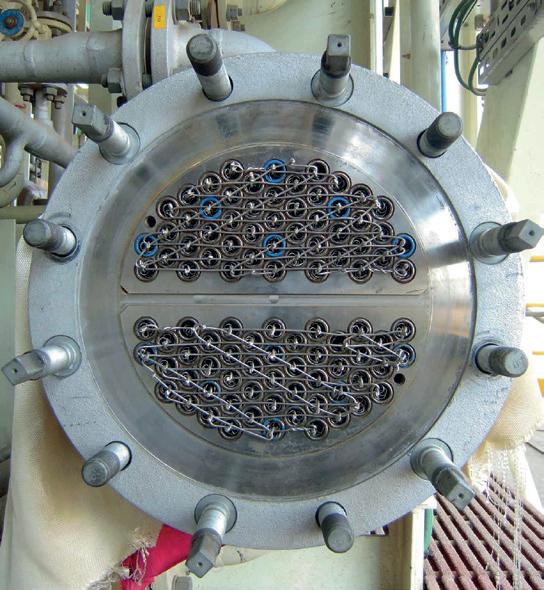

79 Heater tube cleaning and verification

Tom Gilmartin, Zerosumheater and a consultant for Quest Integrity, considers the effect of fouling on heater services, and introduces a new approach for confirming coil cleanliness.

85 Monitor, manage and minimise

Mark Naples, Umicore Coating Services Ltd, details how connected gas detection technology can help companies to comply with ESG needs.

UNICAT’s ‘next generation’ spherical catalysts have a proven advantage of energy efficiency, lower CO2 emissions, increased hydrogen production, and extended tube life. Magcat has been shown to increase hydrogen production, as well as reduce CO2 emissions by 10 – 20%, in ways that are easily implemented and which avoid equipment investment costs.

CONTENTS Hydrocarbon Engineering Like Join Hydrocarbon Engineering @HydrocarbonEng Follow CONVERSATION JOIN THE 2023 Member of ABC Audit Bureau of Circulations Copyright© Palladian Publications Ltd 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK. CBP006075 March 2023 Volume 28 Number 03 ISSN 1468-9340 03 Guest comment 05 World news 10 American gasoline: conditional love Nancy Yamaguchi, Contributing Editor, examines changing production, price and demand in the US gasoline market. 18 The next digital frontier: industrial autonomous operations Praveen Sam, Honeywell, USA, introduces a novel digital operating approach within the oil and gas industry. 23 Digitalisation with a clearer view Mika Kulin, Neste, explains how the company’s refinery in Porvoo, Finland, is integrating its different digital sources and automation systems into a single source of information. 27 Fending off threat Mike Hoffman, Dragos Inc., USA, discusses how refineries can protect critical ICS/OT systems from cyberattacks. 33 Building resilient infrastructure Leo Simonovich, Siemens Energy, USA, lists the important steps to be taken

TAKE-OFF. FROM AMBITION TO ACTION.

Ramp up production of sustainable aviation fuel. Together we can transform the aviation industry’s carbon intensity for the better. Keep planes in the air, and still be on track to zero. SAF reduces CO2 emissions by at least 85% when compared to conventional fuel. And we have the proven technologies to make it all happen. Now.

Turn your sustainable ambitions into a sustainable business.

Join Flight Plan Green. Find out how: topsoe.com/saf

FLIGHT

PLAN GREEN

GUEST COM MENT

CONTACT INFO

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O'Reilly callum.oreilly@palladianpublications.com

ASSISTANT EDITOR Bella Weetch bella.weetch@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES EXECUTIVE Sophie Birss sophie.birss@palladianpublications.com

PRODUCTION MANAGER Kyla Waller kyla.waller@palladianpublications.com

EVENTS MANAGER Louise Cameron louise.cameron@palladianpublications.com

EVENTS COORDINATOR Stirling Viljoen stirling.viljoen@palladianpublications.com

DIGITAL CONTENT ASSISTANT Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL ADMINISTRATOR Leah Jones leah.jones@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITOR Nancy Yamaguchi Gordon Cope

SUBSCRIPTION RATES

Annual subscription £110 UK including postage /£125 overseas (postage airmail).

Two year discounted rate £176 UK including postage/£200 overseas (postage airmail).

SUBSCRIPTION CLAIMS

Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

APPLICABLE ONLY TO USA & CANADA

Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032.

15 South Street, Farnham, Surrey

GU9 7QU, UK Tel: +44 (0) 1252 718 999

CHET THOMPSON PRESIDENT & CEO, AMERICAN FUEL & PETROCHEMICAL MANUFACTURERS (AFPM)

In a tight refined product market – which is certainly how we would characterise much of the past two years – it has been US refiners that have stepped up. Our industry ran full-out for most of 2022 making sure American consumers, our domestic economic centres and our allies had enough gasoline, diesel and jet fuel to keep everyone moving. Our refining sector leads the world in liquid fuel production and is effectively doing more than any other to bring better balance to the global market.

This is a utilisation story. The US refining kit (which is how we refer to our collective refining machinery across nearly 130 refineries) is one of the two largest in the world, with approximately 18 million bpd capacity. It is also the most complex, which means we have the greatest capability to refine the toughest types of crude oil.

Our facilities process more crude oil every day than the US upstream produces, and we make more finished fuels, collectively, than the US consumes. For a kit of our size, to consistently have at least 90% of our refining muscle actively engaged in fuel production is a tremendous accomplishment, and a testament to the men and women of our industry who maintain our facilities and keep them running safely. To say I am proud of their work is an understatement.

Refineries regularly undergo maintenance, and every few years they undergo larger scale ‘turnarounds’ where production is halted and up to 1000 specialised workers – including engineers, electricians, pipefitters and steelworkers – come in to inspect entire facilities, refurbish units and complete building projects. As any veteran refiner will tell you, running full-out for as long as we have can be a source of wear and tear on facilities. And to maintain high utilisation rates when the market was at its tightest, some facilities elected to reschedule planned maintenance if that could be done safely.

Safety is the key word. Everything we do in the refining industry begins and ends with safety. While the US refining industry will continue to produce as much fuel as we safely can, there’s going to be some necessary dialing back for maintenance. Of course, ‘dialing back’ is relative, because US refineries – even while some facilities undergo maintenance – are still likely to maintain much higher utilisation rates than the rest of the world and continue leading in fuel production.

Refinery upkeep is a good thing because maintenance is a long-term investment in safe operations and will help us be ready, if needed, to run full-out for extended stretches in the future. And as an industry of ‘planners’, refiners also have arrangements in place before any turnaround starts to make sure customers have uninterrupted fuel deliveries.

Even while facilities are being maintained, global fuel supply and demand will continue rebalancing with our contributions and with significant refining capacity projects preparing to come online around the world. This next phase of US refinery leadership in a reconfigured global market is sure to be one to watch.

THE FUTURE OF CATALYSTS IS HERE

MAXIMIZING EVERY DROP

Ketjen's advanced catalysts are the industry's gold standard. Our tailored solutions deliver ever-increasing performance and technology for our customers so they can be more competitive in the marketplace.

Scan and learn more

WORLD NEWS

USA | EIA: US refinery utilisation to average more than 90% in 2023 and 2024

In its February ‘Short-Term Energy Outlook’ (STEO), the US Energy Information Administration (EIA) forecast that US refinery utilisation will remain similar to 2022, at above 90% over the next two years.

It is forecast that US refinery utilisation will average 90.8% in 2023, and then decrease slightly to 90.3% in 2024.

In 2020, average refinery utilisation dropped to 78.8%, the lowest annual rate since the EIA began collecting this data in 1997. However, by 2022, utilisation rates averaged closer to pre-pandemic levels at more than 91%.

Global refined product prices and crack spreads, which represent an estimate of refinery margins, grew substantially in the US in 2022, increasing refinery utilisation.

Slower economic growth is predicted in 2023 and 2024, which would reduce gasoline and diesel consumption compared with 2022, leading to a gradual decrease in petroleum product prices.

It is also forecast that increased production of finished petroleum products as a result of high refinery utilisation rates will contribute to lower prices.

Germany | First Middle East LNG cargo successfully delivered

ADNOC and RWE have announced the successful delivery of the first shipment of LNG from Abu Dhabi, UAE, to the Elbehafen floating LNG terminal in Brunsbüttel, Germany.

Produced by ADNOC Gas at Das Island, Abu Dhabi, the shipment of 137 000 m3 of LNG is the commissioning cargo for the new floating LNG terminal in Brunsbüttel, and the first ever LNG cargo to be shipped to Germany from the

Middle East. This landmark cargo follows the inaugural ammonia shipment in October 2022, and furthers cooperation on energy security, decarbonisation, and lower-carbon fuels between the UAE and Germany. It also marks an important milestone in developing Germany’s domestic LNG supply infrastructure, supporting the country’s energy security with natural gas.

Denmark | Technip Energies awarded FEED contract by Arcadia eFuels

Technip Energies has been awarded a FEED contract by Arcadia eFuels for the world’s first commercial e-fuels facility for sustainable aviation fuel (SAF) production in Vordingborg, Denmark. Pre-FEED and early works recently concluded, and the parties aim to support plant start-up in 2026.

Arcadia eFuels will use renewable electricity, water, and biogenic carbon dioxide (CO2) to produce e-fuels that can be used in traditional engines and supplied to the market in existing liquid fuel infrastructures.

The FEED covers the engineering of the first e-fuels plant that will produce approximately 80 000 tpy of e-jet fuel and e-naphtha, using novel yet proven technologies. It also covers the engineering of a 250 MW electrolyser plant to produce green hydrogen. The plant will be designed with a flexible product slate to allow for the production of e-diesel. These fuels allow airlines to cut carbon emissions proportionally, therefore providing the ability for airlines and heavy transportation to meet voluntary carbon reductions and proposed EU mandates for e-fuels use.

China | Shell Catalysts & Technologies to support CSPC Phase III

S hell Catalysts & Technologies (SC&T) has announced that it will provide its technologies and catalysts to the China National Offshore Oil Corp. (CNOOC) and Shell Petrochemicals Co. Ltd (CSPC) joint venture (JV) Phase III expansion.

Incorporated by CNOOC and Shell, CSPC is one of the largest petrochemicals JVs in China. Following the success of the existing Phase I and II projects, CSPC Phase III will include a

new 1.6 million tpy cracker, creating one of the world’s largest and most flexible integrated complexes.

In Phase III, some of Shell’s technologies will be deployed for the third time in CSPC with the latest state-of-the-art designs in terms of energy efficiency, scale and flexibility.

In addition, CSPC will build the largest linear alpha olefins (LAO) plant ever designed as part of a JV. The LAO are being licensed from Shell for the

first time. The rest of the process includes the Higher Olefins and Derivatives (HODer) value chain.

“We are very pleased to further support the growth of CSPC which is a world-scale asset,” said Seng Yee Loh, Vice President Sales Asia Pacific, SC&T. “The collaboration with the local team will produce operational efficiencies and is expected to help bring economic benefits to the facility.”

March 2023 HYDROCARBON ENGINEERING 5

IN BRIEF

the netherlands

Sulzer has signed an agreement with circular technology company, Fuenix Ecogy, to acquire a strategic stake in its plastic upcycling business. The partnership will drive the development, commercialisation and adoption of advanced, fully-integrated solutions for plastic waste processing.

south korea

LOTTE INEOS Chemical has announced plans to increase vinyl acetate monomer (VAM) production capacity to 700 000 t with the addition of a third VAM plant. The new plant is scheduled to start up by the end of 2025.

canada

Flowserve Corp. has reached an agreement to acquire Velan Inc. in an all-cash transaction valued at approximately US$245 million. The transaction is expected to close by the end of 2Q23.

europe

Neste and Wizz Air have agreed on the supply of Neste MY Sustainable Aviation FuelTM from 2025 onwards. The agreement gives Wizz Air the opportunity to purchase 36 000 tpy of Neste-produced sustainable aviation fuel (SAF) over a period of three years for the airline to use across its route network in Europe and the UK.

china

Venture Global LNG and China Gas Holdings Ltd have announced that the wholly-owned subsidiary, China Gas Hongda Energy Trading Co. Ltd, and Venture Global LNG have signed two 20-year LNG Sales and Purchase Agreements (SPA). Under the deals, China Gas will buy 1 million tpy of LNG on a free on board (FOB) basis from Plaquemines LNG, and another 1 milion tpy from the CP2 LNG export facility – both of which are located in Louisiana, US.

Colombia | Ecopetrol selects Honeywell technology for carbon capture study

Honeywell has been selected by Ecopetrol S.A. to develop a pre-feed engineering study for a HoneywellTM Advanced Solvent Carbon Capture (ASCC) modular demonstration unit, which will be used to evaluate carbon dioxide (CO2) capture from Ecopetrol fluid catalytic cracking (FCC) units.

FCC units are significant sources of CO2 emissions, accounting for 15 – 20% of overall emissions in a typical FCC-based refinery, including Ecopetrol’s refineries.

Honeywell UOP’s ASCC technology has been designed to

capture CO2 from post-combustion flue gases, which are more challenging to treat due to the low CO2 concentration and low pressure inherent in these sources.

The design target of the demonstration unit is to capture 30 tpd of CO2 from Ecopetrol FCC flue gas. If implemented, the demonstration unit will provide valuable information into the performance of this technology in reducing FCC emissions, with learnings that can be used to inform deployment of commercial-scale units in FCC service.

Belgium | INEOS secures financing for Project ONE

INEOS Olefins Belgium has raised €3.5 billion to support the construction and operation of Project ONE.

This is the largest investment in the European chemical sector for a generation. The new cracker, located in Antwerp, Belgium, will have the lowest carbon footprint in Europe – three times lower than the average European steam cracker, and less than half that of the 10% of best performers in Europe.

The plant also has the capability to operate entirely with low-carbon hydrogen, and has room for a carbon capture facility and future electric furnaces.

Jason Meers, CFO INEOS Project ONE, said: “Project ONE is a game changer for Europe. It will bring new opportunities to the chemical cluster in Antwerp as well as strengthen the resilience of the whole of the European chemical sector.”

Europe | Growing LNG demand to intensify competition with Asia

Europe’s increased need for LNG looks set to intensify competition with Asia for limited new supply available over the next two years, and may dominate LNG trade over the longer term, according to Shell’s ‘LNG Outlook 2023’.

European countries, including the UK, imported 121 million t of LNG in 2022, an increase of 60% compared to 2021, which enabled them to

withstand a slump in Russian pipeline gas imports following its invasion of Ukraine. A 15 million t fall in Chinese imports, combined with reduced imports by South Asian buyers, helped European countries to secure enough gas and avoid shortages. Europe’s rapidly rising appetite for LNG pushed prices to record highs and generated volatility in energy markets around the world.

March 2023 HYDROCARBON ENGINEERING 6

WORLD NEWS

WELCOME TO CALDERYS

We are a leading global provider for industries operating in high temperature conditions. Pushing the boundaries of innovation and excellence, we deliver high-quality materials and services adapted to a new, low-carbon era across a range of industries.

Chemicals Engineering & Petrochemicals:

- custom-made refractory solutions

- full range of services: from planning to project execution

- sustainable solutions, helping you transition to a low carbon era

www.calderys.com

WORLD NEWS

DIARY DATES

19 - 23 March 2023

AMPP Annual Conference & Expo Denver, Colorado, USA ace.ampp.org

26 - 28 March 2023

AFPM International Petrochemical Conference San Antonio, Texas, USA afpm.org/events/IPC23

12 - 14 April 2023

25th International Aboveground Storage Tank Conference & Trade Show Orlando, Florida, USA www.nistm.org

25 - 27 April 2023

Sulphur World Symposium Edinburgh, Scotland www.sulphurinstitute.org/symposium-2023

08 - 12 May 2023

RefComm

Galveston, Texas, USA events.crugroup.com/refcomm

22 - 24 May 2023

ILTA 2023 International Operating Conference and Trade Show Houston, Texas, USA www.ilta.org

07 - 08 June 2023

Valve World Americas Expo & Conference Houston, Texas, USA www.valveworldexpoamericas.com

07 - 08 June 2023

Downstream USA 2023

Galveston, Texas, USA events.reutersevents.com/petchem/downstream-usa

13 - 15 June 2023

Global Energy Show Calgary, Alberta, Canada www.globalenergyshow.com

10 - 13 July 2023

LNG2023

Vancouver, British Columbia, Canada www.lng2023.org

05 - 08 September 2023

Gastech Singapore www.gastechevent.com

The Netherlands | Shell and Hapag-Lloyd sign multi-year LNG supply agreement

Shell Western LNG B.V and Hapag-Lloyd have announced the signing of a multi-year agreement for the supply of LNG to Hapag-Lloyd’s ultra-large dual-fuel container vessels of 23 500+ 20 ft equivalent units (TEU).

Bunkering for these 12 new vessels is expected to commence during 2H23, and LNG will be supplied in the Port of Rotterdam, the Netherlands.

The modern ships will be deployed on Europe-Far East routes and call at major ports including Rotterdam (the Netherlands),

Hamburg (Germany), Singapore, and Shanghai (China).

Shell and Hapag-Lloyd have also entered into a strategic collaboration agreement intended to accelerate the further decarbonisation of alternative marine fuels. Initial focus will be given to developing the potential of additional low-carbon fuel solutions including liquefied biomethane and the hydrogen-based fuel, liquefied e-methane. Liquefied biomethane as a marine fuel has the potential to reduce greenhouse gas emissions by between 65 – 100%.

USA | ExxonMobil to utilise Topsoe technology for hydrogen facility

Topsoe has announced that it will deliver technology to ExxonMobil’s planned low-carbon hydrogen production facility in Baytown, Texas, US.

ExxonMobil’s low-carbon hydrogen, ammonia, and carbon capture facility is expected to generate up to 1 billion ft3/d of hydrogen, delivering low-carbon fuel to the Baytown olefins plant and other Houston-area facilities. Replacing natural gas with hydrogen at the Baytown olefins plant could

reduce the integrated complex’s carbon dioxide (CO2) emissions by up to 30%.

To produce the large amount of hydrogen needed by ExxonMobil, Topsoe will apply its SynCORTM technology, which enables mega-scale hydrogen production as well as cost-efficient carbon capture.

As technology integrator, Topsoe will guarantee the carbon intensity of the integrated low-carbon facility, as well as hydrogen production and carbon capture.

USA | Freeport LNG to restart operations

Freeport LNG Development L.P. has announced that it has received regulatory approval to commence commercial operations of its natural gas liquefaction and export facility.

This authorisation provides for the immediate full return to service of one liquefaction train that has already restarted, and the incremental restart and full return to service of a second train.

The restart and return to service of Freeport LNG’s third liquefaction train will require subsequent regulatory approval once certain operational conditions are met. A conservative ramp-up profile to establish three-train production of approximately 2 billion ft3/d is anticipated to occur over the next several weeks as stable operation of each incremental train is established and maintained.

March 2023 HYDROCARBON ENGINEERING 8

SPECIALIZED CATALYSTS

JOINTLY DEVELOPED SOLUTIONS FOR CLEANER FUELS AND MAXIMUM PERFORMANCE

Together with Advanced Refining Technologies LLC, CLG offers the most complete portfolio of hydroprocessing catalysts in the industry. We offer more experience than any other licensor providing leading technologies, expertise, and innovative solutions for refiners worldwide. To get the performance and flexibility needed to keep pace with changing market dynamics, start by visiting www.chevronlummus.com.

10 March 2023 HYDROCARBON ENGINEERING

Nancy Yamaguchi, Contributing Editor, examines changing production, price and demand in the US gasoline market.

“Americans love gasoline” is a statement that has been accepted as a fundamental, evolving from images of a car-crazy culture enjoying the freedom of a vast country and the wide-open road. With gasoline demand at approximately 8.8 million bpd, the US is the largest market in the world. For comparison, Europe in its entirety consumes only around 1.9 million bpd of gasoline. Yet American love for gasoline is not unconditional. Today, a more correct statement would read along the lines of “Americans love cheap, plentiful gasoline, with reduced emissions, in formulations specific to their locations, seasons, and vehicles, with loyalty programmes and clean convenience stores, perhaps from sellers less aligned with Greedy Big Oil.”

Recent years have brought extreme volatility to the gasoline market, bringing back memories of past price spikes and reviving consumer dissatisfaction. COVID-19 lockdowns forced a massive collapse in demand, followed by an oil price crash. Recovery came in fits and starts, hobbled by supply chain problems, waves of COVID-19 variants, rising prices, and inflationary pressures. Then, Russia invaded Ukraine in February 2022, contributing to record-high gasoline prices

during the summer 2022 driving season. Consumers generally find it easier to adjust to gradual increases in fuel prices than to cope with sudden price spikes. The optics have not been helped by the fact that the major oil companies are reporting record-high profits, which were projected to be over US$200 billion in 2022.

From the standpoint of ‘Greedy Big Oil’, the US is an essential market, and the goal is to keep it a profitable one. The US refining industry evolved largely to produce gasoline for US consumers, and the presence of this massive consumer base helped it to become the largest and most sophisticated in the world. It is a close, symbiotic relationship, but also one where both parties take the other for granted, and have other interests.

Current energy prices are a key contributor to overall price inflation. The US Bureau of Labor Statistics (BLS) reported a jump of 29.3% in Consumer Price Index (CPI) energy prices in the December 2020 – December 2021 period, declining to 7.3% in the December 2021 – December 2022 period. The COVID-19 pandemic caused a huge collapse-rebound cycle, the impacts of which are still

March 2023 11 HYDROCARBON ENGINEERING

affecting the market. Additionally, the Russia-Ukraine war constrained supply just as demand was rising. This article will focus on the US gasoline market, examining production, price and demand, and noting how the market is changing.

A gasoline-maximising industry shifts away from gasoline

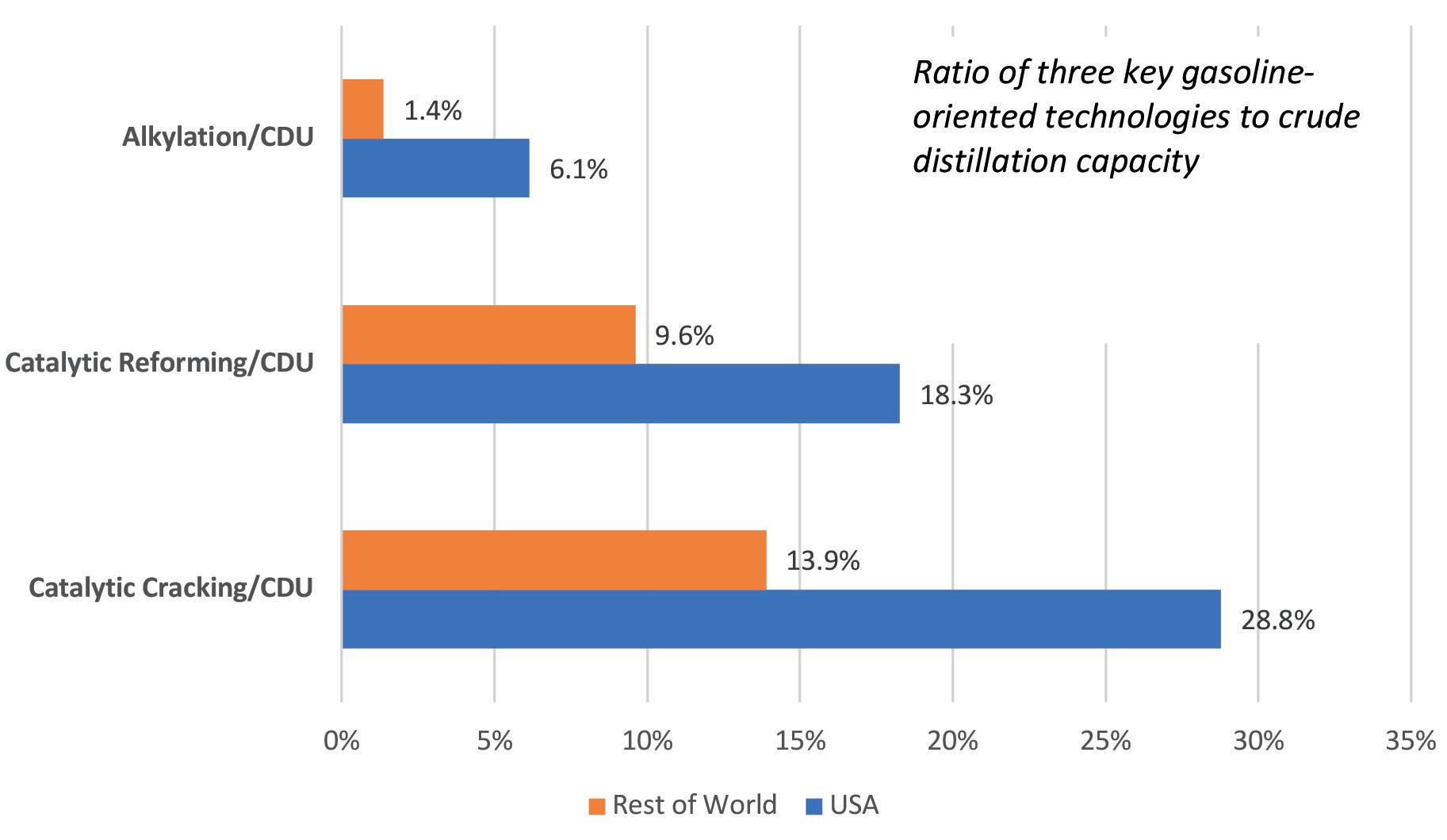

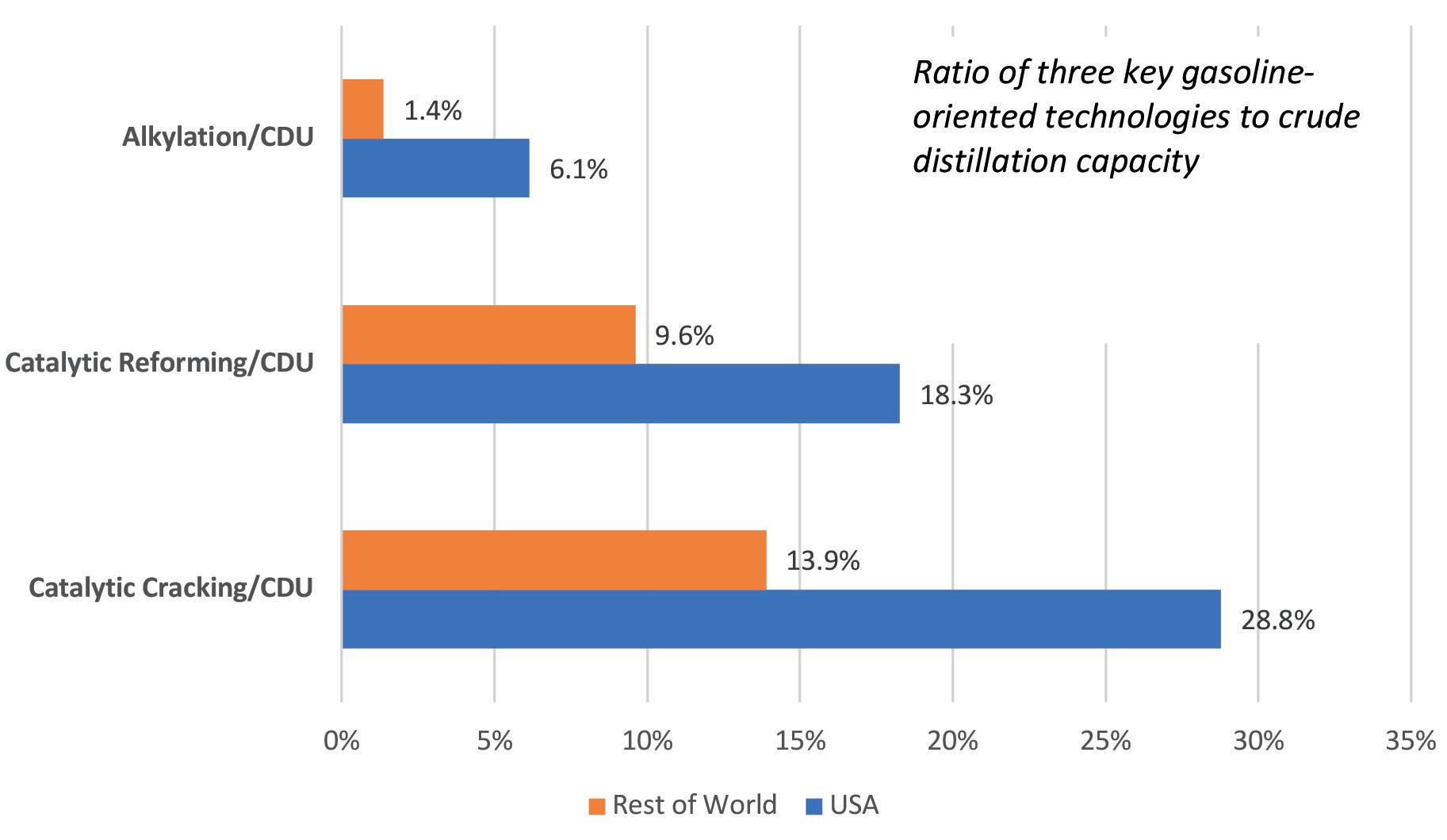

Serving the world’s largest gasoline market motivated the US refining industry to invest in a massive amount of gasoline-oriented technology. Figure 1 compares the ratios of three key gasoline-maximising technologies with crude distillation unit (CDU) capacity in the US vs the rest of the world. In the US, the alkylation to CDU ratio is 6.1%, relative to 1.4% in the rest of the world; catalytic reforming to CDU ratio is 18.3%, vs 9.6% in the rest of the world; and catalytic cracking to CDU is 28.8% in the US, vs 13.9% in the rest of the world.

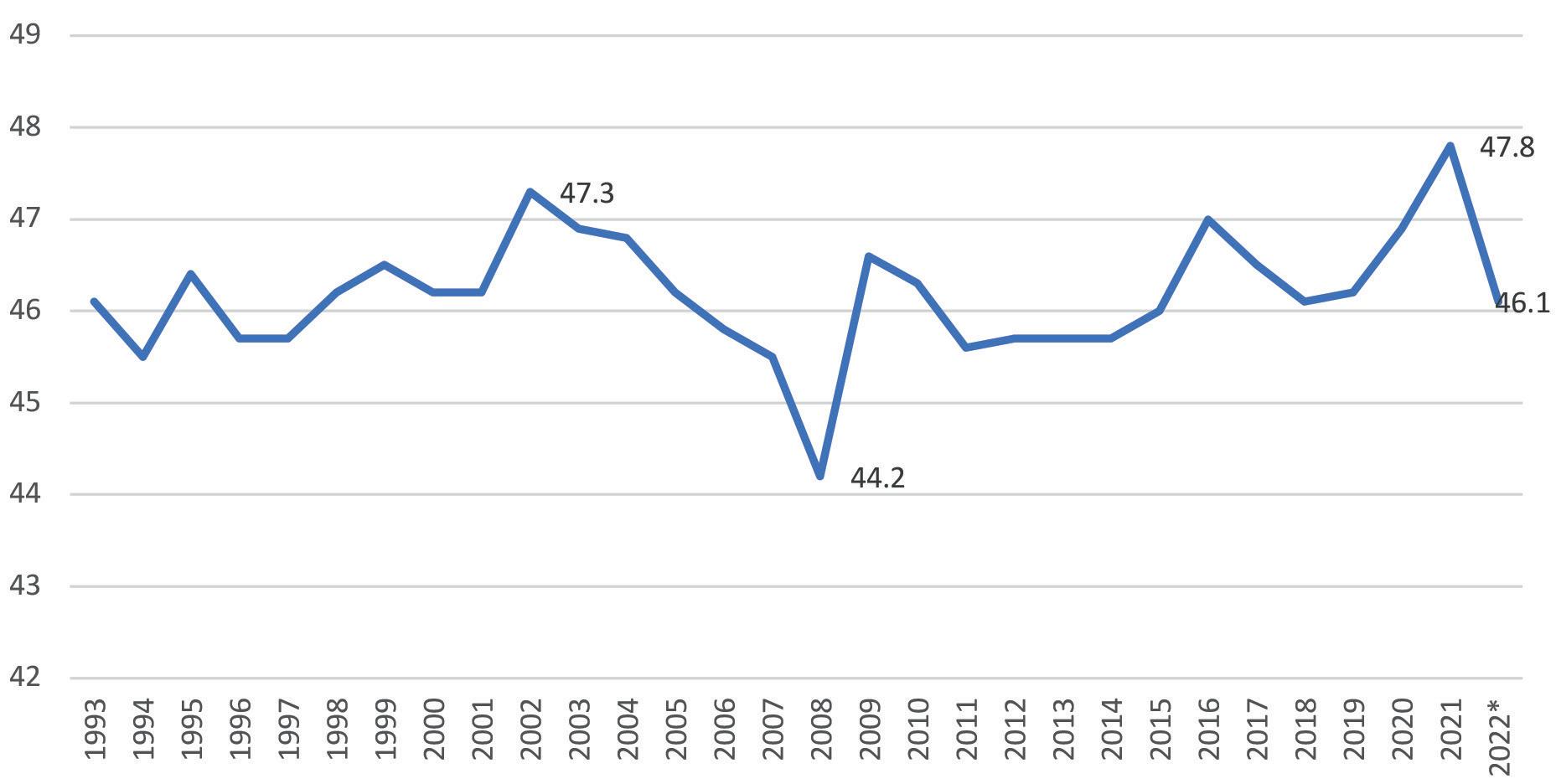

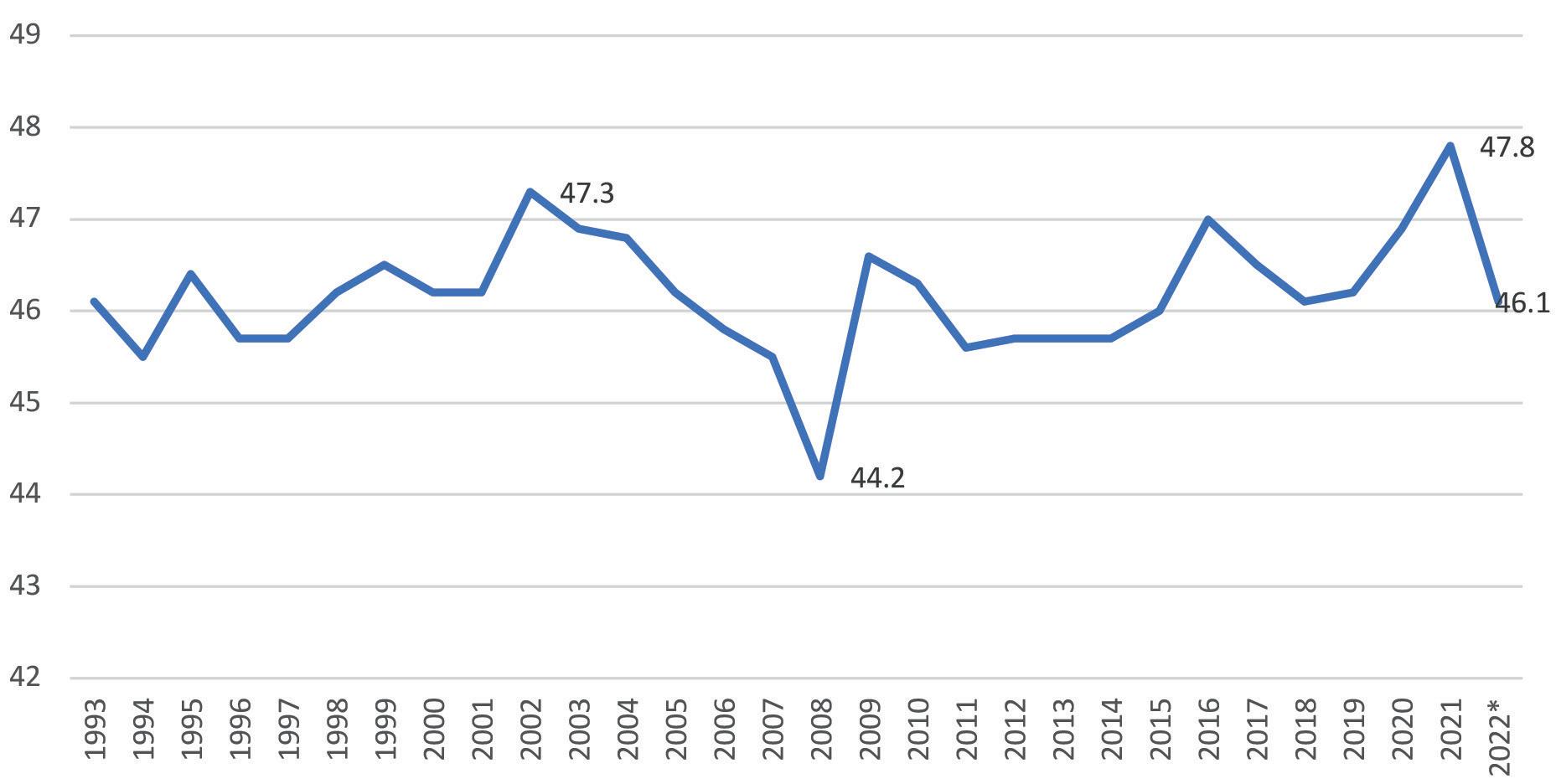

These technologies helped the US industry to achieve and maintain an exceptionally high yield of gasoline – the largest output in the world. Figure 2 shows US refinery yield of gasoline since 1993. The yield has ranged from a low of 44.2% in 2008 to a high of 47.8% in 2021, and it averaged approximately 46.1% in 2022. In volume terms, US refiners and blenders (who finish gasoline-ethanol blends) produced 9.529 million bpd of gasoline in 2021, and an estimated 9.574 million bpd of gasoline in 2022. Production records of over 10 million bpd were set in

2018 and 2019, before the COVID-19 pandemic prompted a drop to 8.742 million bpd output in 2020.

Yet, while the US industry can easily achieve a 47 – 48% yield of gasoline, there has been a shift away from gasoline maximisation. In its continual quest to optimise refinery operations, the industry has cut output of low-value fuel oil and other products, reducing their yield from 13.7% in 2004 to 9.64% in 2022. This represents an average drop in yield of -1.9%/yr between 2004 – 2022. In recent years, the focus on maximising gasoline output has also shifted. Gasoline’s percentage yield of output fell modestly, at a rate of -0.1%/yr between 2004 – 2022. In 2004, gasoline accounted for 46.8% of refinery yield. In 2022, this share declined to approximately 46.1%. Yields of kerosene-based jet fuel also declined at -0.1%/yr between 2004 – 2022. In contrast, the new focus has been on increasing the yield of diesel. Diesel accounted for 23.9% of output in 2004, and this grew to 30.27% in 2022. This amounts to an increase in yield of 1.3%/yr on average between 2004 – 2022. In volume terms, US refiners are producing approximately 1.17 million bpd more diesel than they were in 2004. In 2000, the US was a modest exporter of diesel. In 2022 (January – October average), US diesel exports had surged to over 1.2 million bpd of diesel, and imports had essentially vanished.

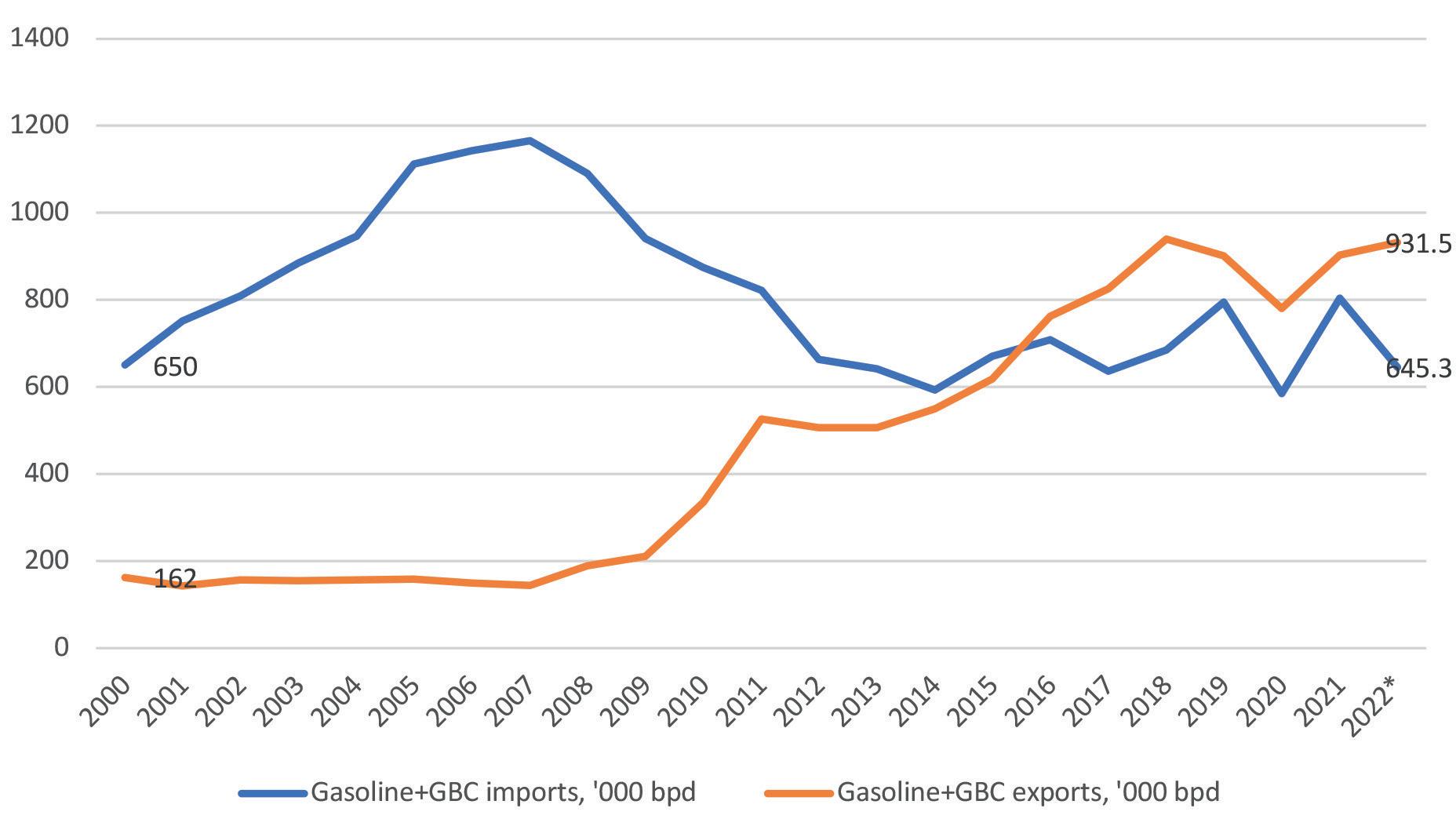

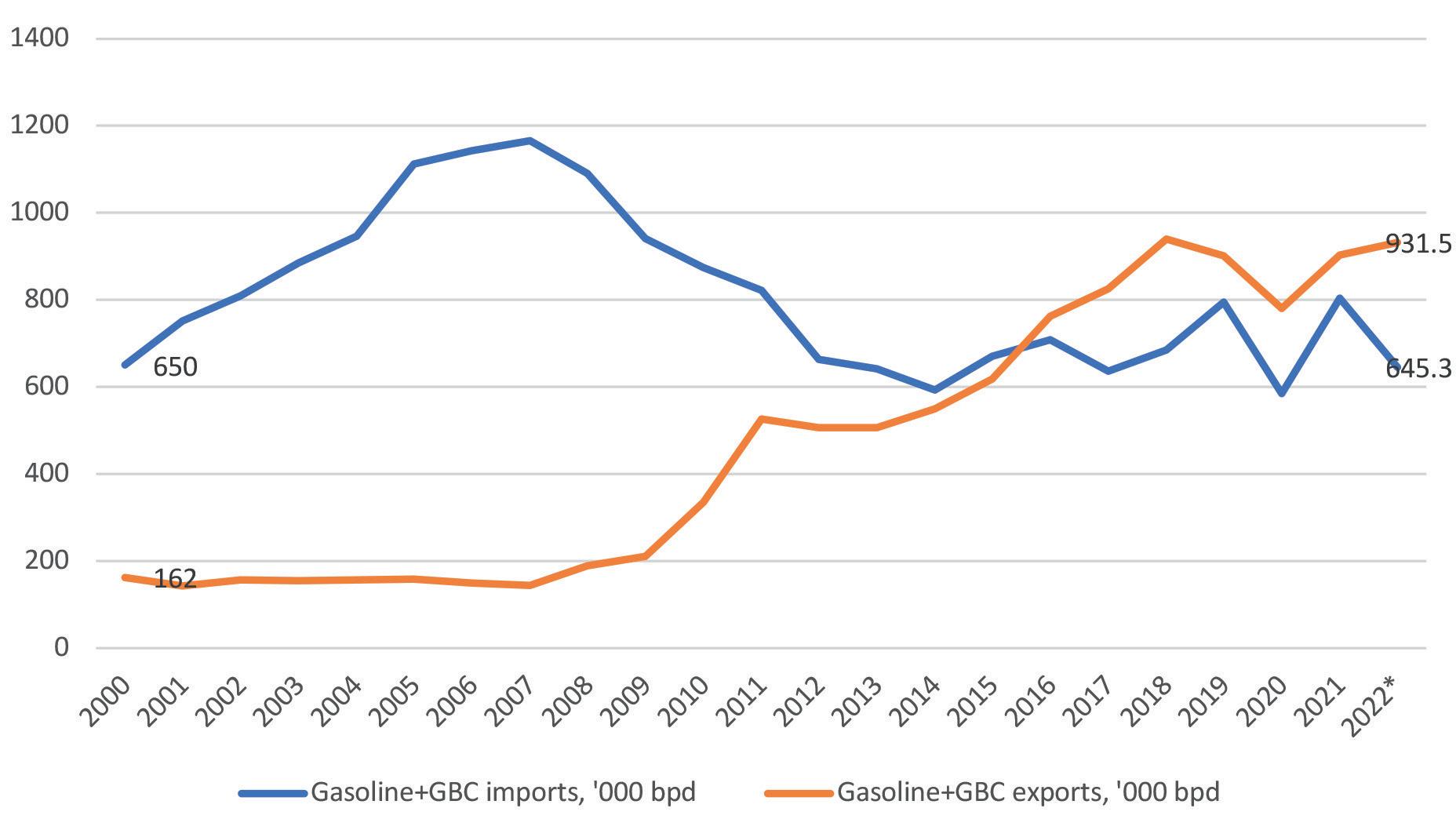

US refineries are therefore increasingly looking to export markets, and the incremental barrel of crude processed is processed for export. After years of being a significant importer of gasoline and gasoline blending components (GBC), the US has now transitioned into a net exporter of these materials. Figure 3 depicts this dramatic shift. In 2000, the US imported approximately 650 000 bpd of gasoline and GBC, while exporting 162 000 bpd. Imports grew to 1.166 million bpd in 2007, while exports remained flat. As will be discussed in the following section, oil prices spiked in 2008, and the Great Recession followed. Gasoline and GBC imports fell, and exports rose as refiners tried to cope with burgeoning inventories. Since then, imports have bumped along in the range of 600 000 – 800 000 bpd, while exports have continued to grow. In 2016, the two lines crossed, and the US became a net exporter of gasoline and GBC, with exports averaging 932 000 bpd, and imports averaging 645 000 bpd.

When confronted with high oil prices, consumers may look at exports with suspicion, positing that these excess supplies should be sold at discounted prices in the domestic market rather than being exported. This is not rational behaviour for a for-profit company. As domestic demand stagnates and production rises, exports have risen for nearly all petroleum products. Crude oil exports have also risen, particularly in places where pipelines are available to deliver crude oil to coastal export terminals. Balancing supply and demand in the US has always required two-way trades, but in recent years export markets have become a key determinant of the last barrels produced and processed.

March 2023 HYDROCARBON ENGINEERING 12

Figure 1. US refineries focus on gasoline-oriented technologies.

Figure 2. US refinery gasoline yield, % (source: EIA).

Gain a better perspective on hydroprocessing solutions. ART catalyst systems are designed to outperform and outlast the competition. Turn flexibility into opportunity. Learn more at arthydroprocessing.com

Volatility in gasoline prices

US consumers sometimes overlook the fact that gasoline prices are strongly moved by crude oil prices, and that pump prices will be influenced by geopolitics. The US Energy Information Administration (EIA) calculated that, in December 2022, the national average retail gasoline price was US$3.21/gal., and the components of this price were:

n 58% crude oil cost.

n 9% refining cost.

n 18% distribution and marketing cost.

n 16% taxes.

In the US, crude oil prices have a relatively stronger influence on pump prices because fuel taxes are low by the standards seen in other OECD countries. The US average pump price cited includes 16% tax; however, many countries face much higher tax burdens – as high as 50% or even 75%. A number of European consumers marvel at the fact that US consumers find prices of, say, US$4/gal. excessive, when they may pay twice this amount. Nonetheless, consumers grow accustomed to what is normal in their own markets, and they assess price swings from their own baseline.

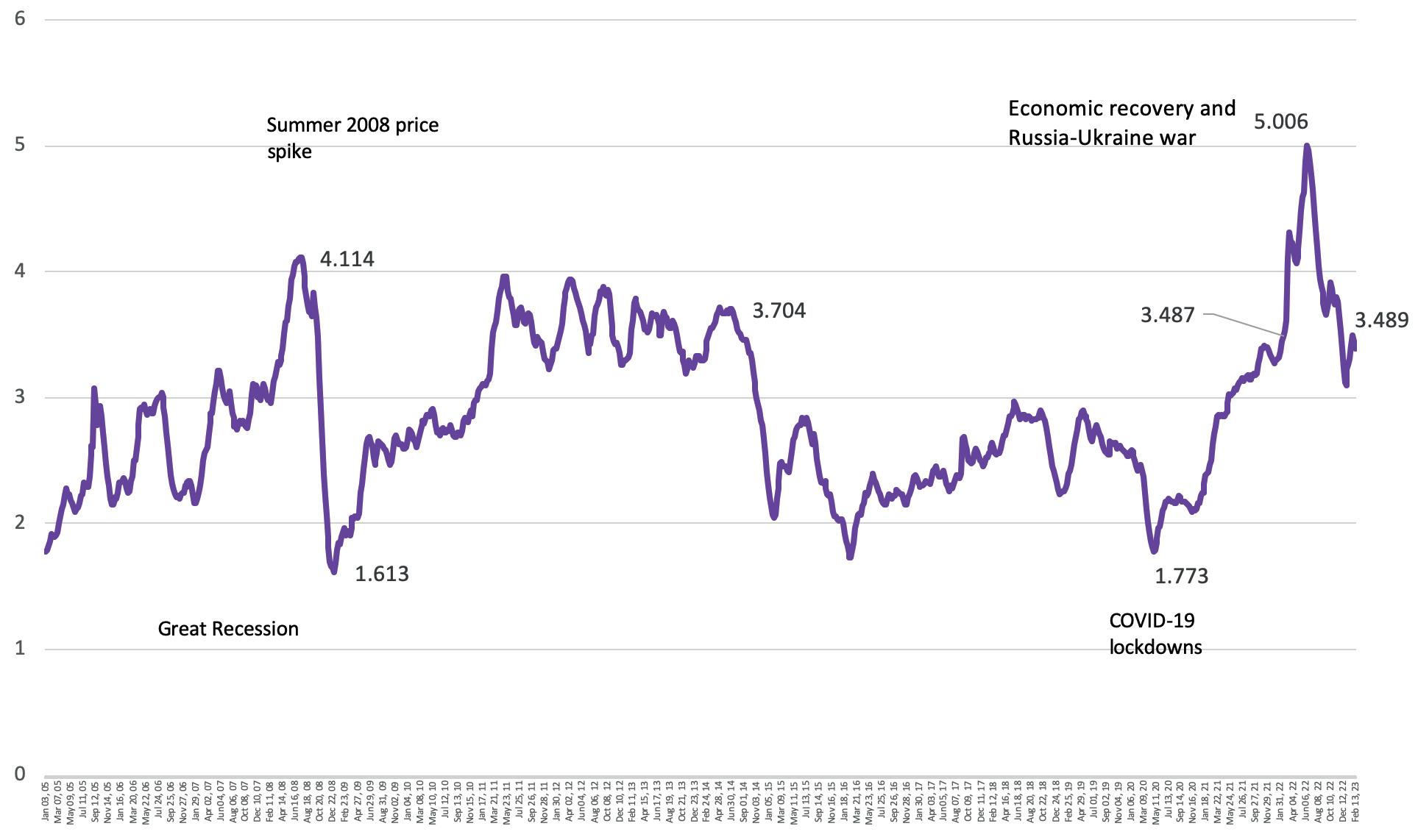

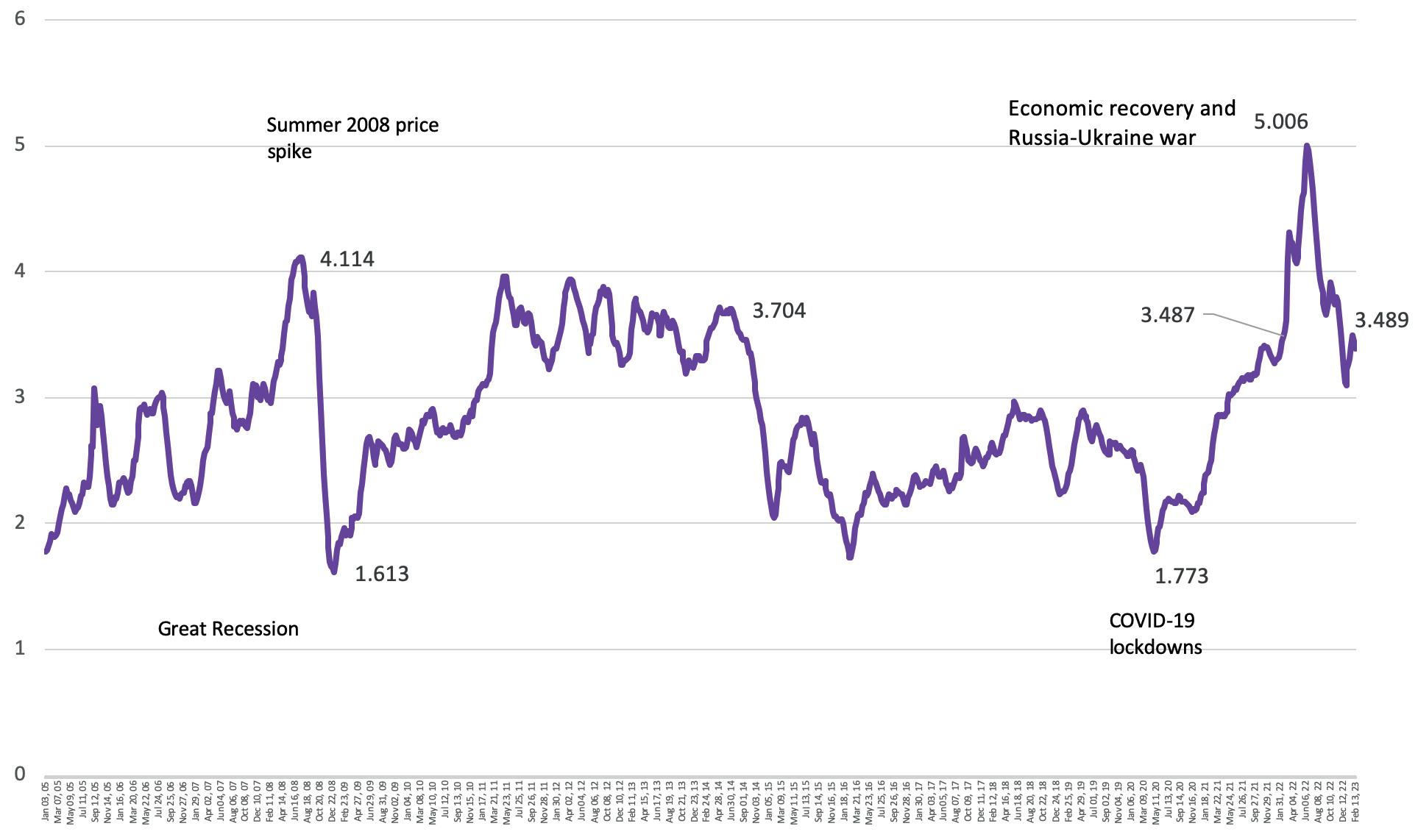

Figure 4 charts the course of retail gasoline prices over the 18-year period from January 2005 through to January 2023 (data as of the week of 30 January 2023). The price spike experienced in the summer of 2008 brought retail gasoline prices to all-time highs of US$4.11/gal. in July. The Great Recession in 2007 – 2009 was named the second-worst economic crisis in US history. Gasoline prices collapsed to lows of US$1.61/gal. in December 2008; unemployment rates hit 10% in 2009 – the highest since the Great Depression, when unemployment rates were estimated at over 24%. Gasoline prices recovered to the US$2 – 3/gal. range in 2010 – 2011, before surging again to the US$3 – 4/gal. range in 2011 – 2014, pushed up by economic recovery and strong demand for oil, particularly in the US and China. Conflict in the Middle East and Africa constrained the supply side, which further bolstered prices.

Demand growth waned, and the supply side received a surprise when the success of US hydrofracking created a major rebound in US crude production. Crude prices began to slide when Saudi Arabia launched its oil price war, intending to drive out some of the higher-cost producers. Prices dropped sharply when sanctions on Iran were lifted. Retail prices for gasoline fell below US$3/gal., and did not recover. COVID-19 lockdowns caused another price crash in 2020, with prices bottoming out at US$1.77/gal. in April 2020. It took over a year for prices to creep back to the US$3/gal. level.

From there, however, post-pandemic economic recovery was underway, plagued by supply chain issues. Prices began to climb; inflationary pressures mounted. According to the BLS, the December 2020 to December 2021 period brought an overall CPI increase of 7%, with gasoline showing the highest jump at 49.6%. In 2022, the gasoline CPI fell -1.5%, bringing some consumer relief, though the CPI for all items rose 6.5%. In 2022, one of the largest jumps was seen in airline fares, which rose 28.5%.

Russia’s invasion of Ukraine in early 2022 caused more market upheaval, and this long-lasting war is creating untold misery in Europe, where many consumers are facing a cold winter with high fuel prices. In the US, gasoline prices spiked to a new record-high of US$5.01/gal. during the summer driving season of 2022. Although gasoline prices retreated to below the US$4/gal. mark, they trended up during January 2023, and it appears likely that the 2023 summer driving season could see prices back in the vicinity of US$4/gal. Consumers widely perceive prices to be too high, particularly when contending with what the BLS reports as 2022 CPI increases of 10.4% in food prices, 14.3% in electricity prices, 19.3% increases in piped natural gas prices, 8.3% increases in rent, and 28.5% increases in airline fares. As will be discussed in the following section, demand has not bounced back.

Gasoline demand flattens and falls

US consumers are feeling the impacts of high fuel prices and inflation, and a number have felt

March 2023 HYDROCARBON ENGINEERING 14

Figure 4. US retail gasoline price, all regular formulations, US$/gal. (source: EIA).

Figure 3. US exports of gasoline and gasoline blending components, ‘000 bpd (source: EIA).

powerless as price-takers in the gasoline market. For many, gasoline is an essential commodity; switching away is not always possible in the short-term. However, each successive price shock has flattened the upward trajectory of demand recovery that followed. Figure 5 presents US annual demand

for gasoline from 1960 through to the January – October period of 2022. Demand grew swiftly from 1960 until the Arab Oil Embargo of 1973 – 1974. Demand recovered quickly until the Iranian Revolution in 1979 – 1980, cutting demand once again. US gasoline demand fell from 7.412 million bpd in 1978 to 6.539 million bpd in 1982.

By the mid-1980s, oil prices collapsed, and demand growth picked up, peaking at 9.286 million bpd in 2007 before the price spike of 2008 and the Great Recession. It then climbed back to 9.329 million bpd in 2018 and 9.309 million bpd in 2019. COVID-19 then caused a collapse to 8.049 million bpd in 2020 – a loss of 1.28 million bpd. Demand has not recovered to its pre-pandemic levels, and the author estimates that 2022 demand will be 8.755 million bpd.

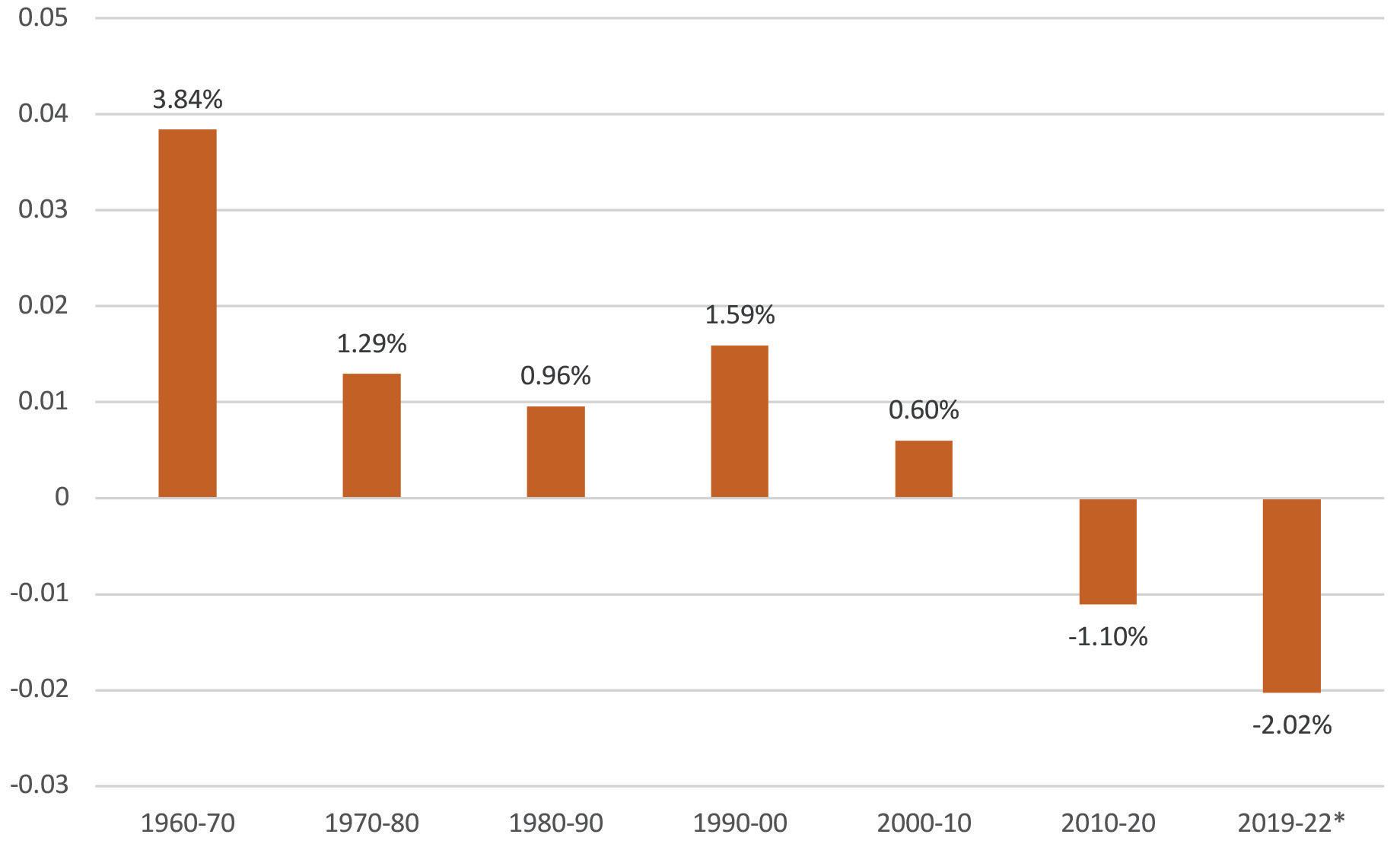

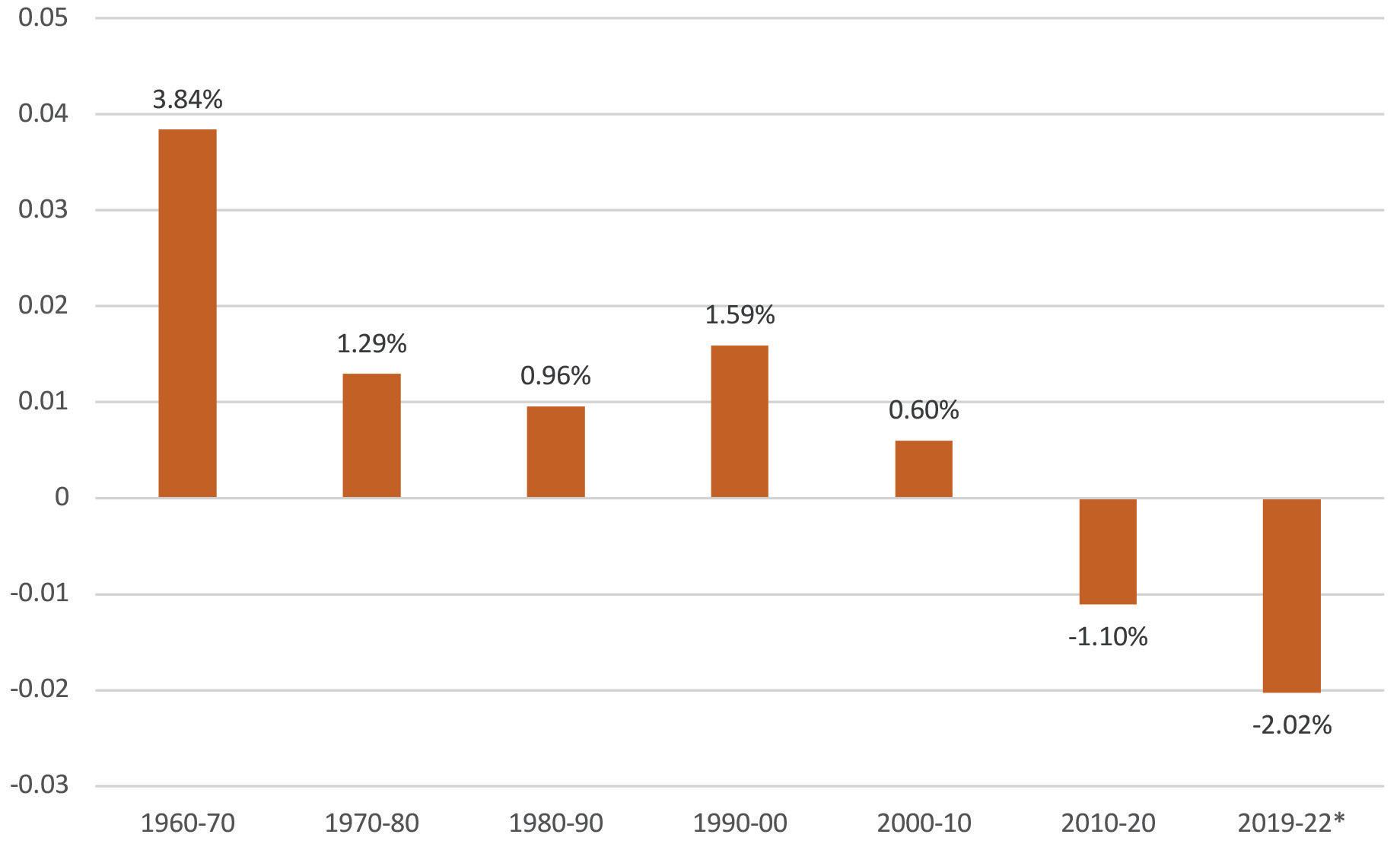

It is entirely possible that US gasoline demand will never again recover to the 9.3 million bpd level seen in the pre-pandemic years. Although the US will remain the world’s largest gasoline market for the foreseeable future, the rates of demand growth have slowed, and have gone negative in recent years, as illustrated in Figure 6. During the 1960s, gasoline demand grew robustly at rates averaging 3.8%/yr. The 1970s brought two oil price shocks, and demand growth rates fell to 1.3%/yr. The downturn extended into the 1980s, when growth rates averaged 1.0%/yr. By the mid-1980s, oil prices fell. During the 1990s, gasoline demand grew at a strong rate of 1.6%/yr. This was slashed to 0.6%/yr during the decade 2000 – 2010, which included the Great Recession.

The 2010 – 2020 decade included the COVID-19 pandemic, and demand for gasoline shrank at an average rate of -1.1%/yr. The author estimates that between 2019 – 2022, US gasoline demand shrank by -2.0%/yr.

Alternatives to gasoline

Switching away from gasoline is a slow process, but it appears that the US has turned the corner. Demand has fallen, and Corporate Average Fuel Economy (CAFE) standards are also having a sustained impact on cutting fuel use and emissions. The government of President Biden is vigorously promoting clean energy technologies and moving to reduce carbon emissions.

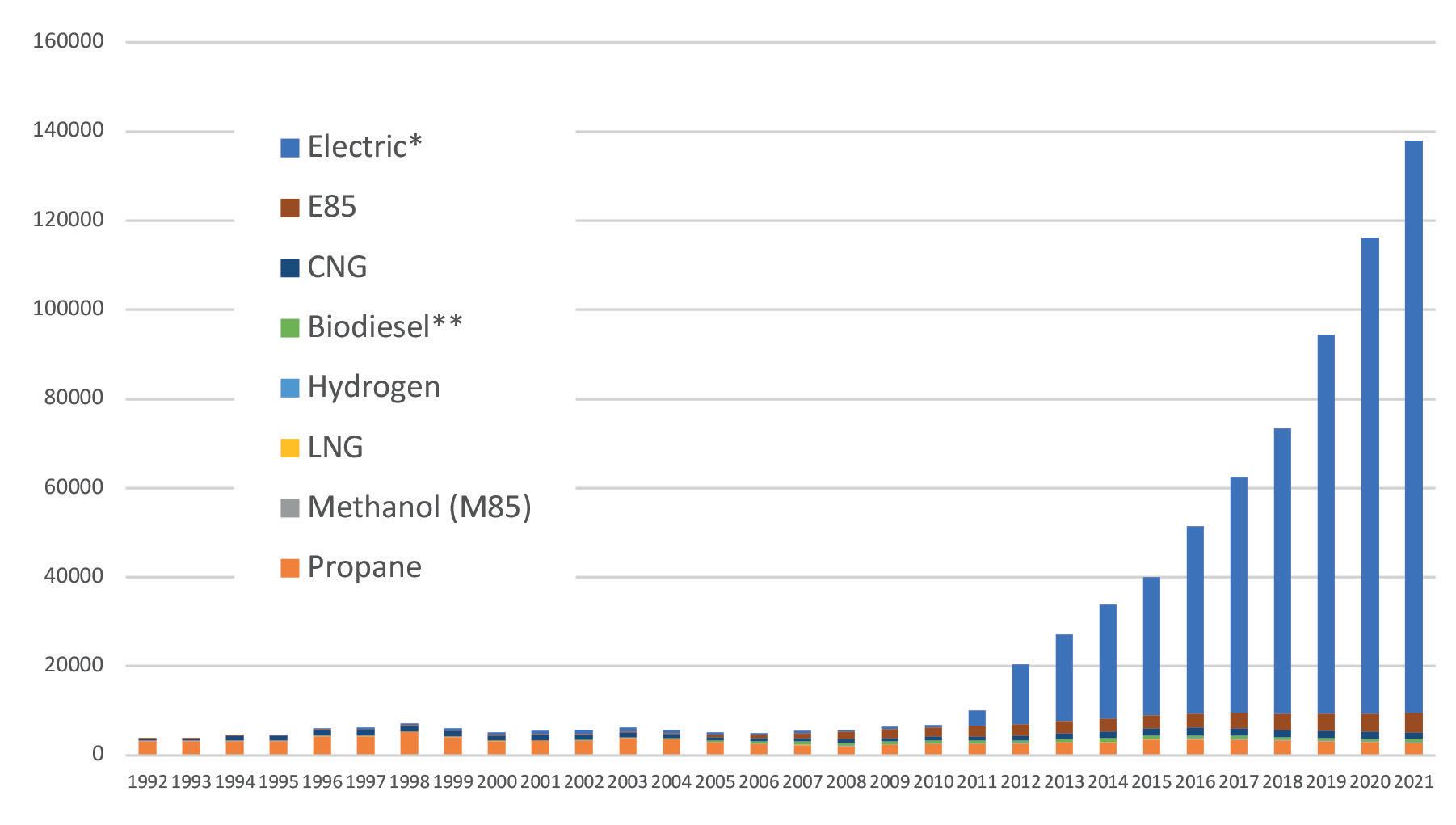

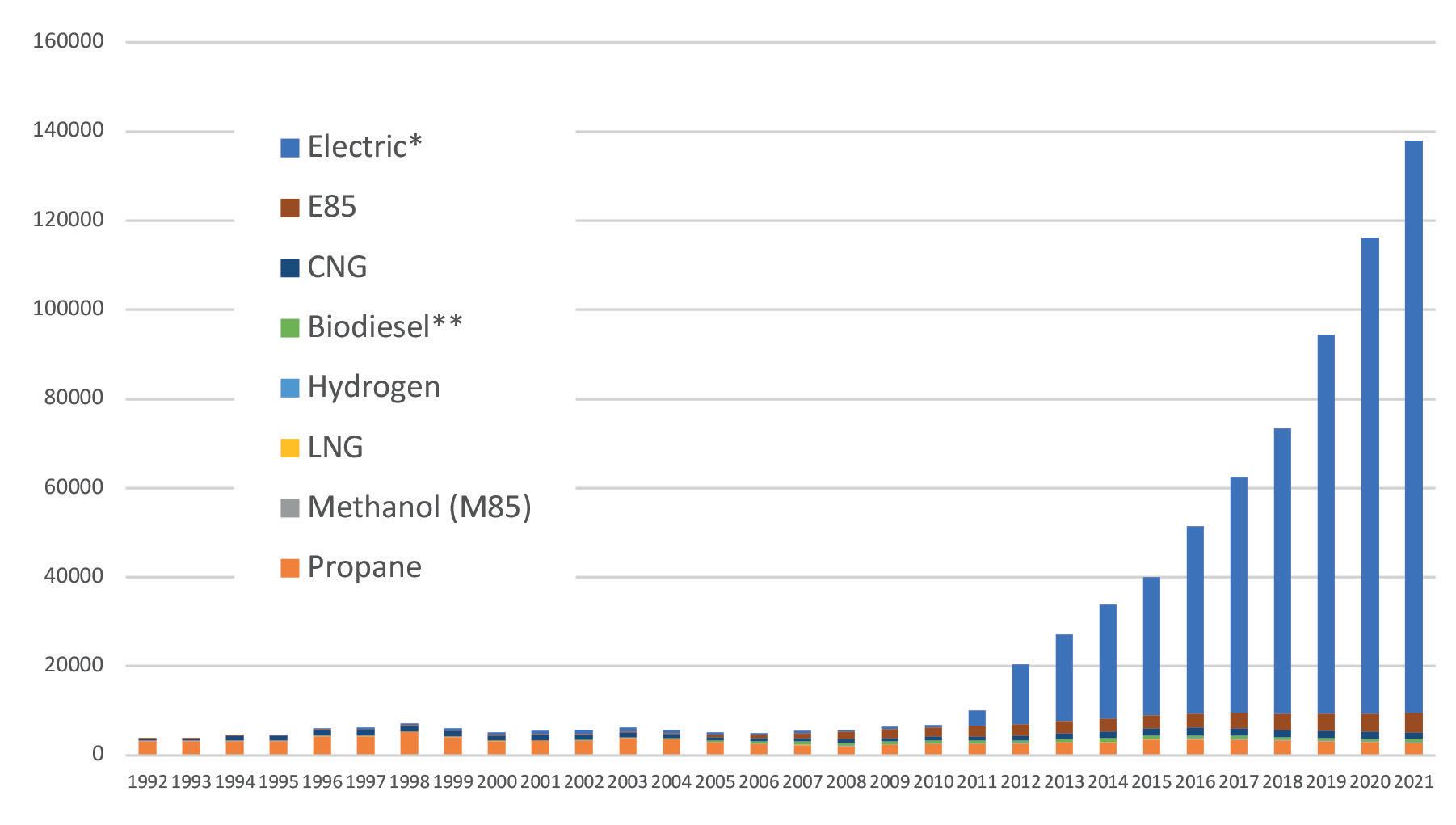

Alternative fuels are picking up pace. The Alternative Fuels Data Center (AFDC) tracks the number of fuelling stations each year for alternatives including propane, methanol, LNG, CNG, hydrogen, biodiesel, E85 and electric, shown in Figure 7. Over the years, these alternatives have contributed to the fuel mix, and many forecasts expected strong if not spectacular growth across the board. However, a number of these alternatives did not flourish, and some seemed to compete with each other rather than with gasoline. Methanol in its M85 blend has vanished; a hydrogen economy has not materialised; LNG as a transport fuel has

March 2023 HYDROCARBON ENGINEERING 16

Figure 5. US product supplied of finished motor gasoline, ‘000 bpd (source: EIA. 2022 is the author’s estimate).

Figure 6. US gasoline supplied, annual growth rates by decade, % (source: EIA, and author’s estimate of 2022).

Figure 7. US alternative fuelling stations by type (source: Alternative Fuels Data Center).

stagnated; propane use has dwindled. Modest growth has been achieved in stations dispensing CNG and biodiesel. E85 (blends of approximately 85% ethanol and 15% gasoline) stations have shown recent growth. In contrast, electric vehicle (EV) charging plugs have emerged in droves, and their numbers exceed all others by orders of magnitude. In 1995, AFDC reported 188 electric charging stations. In 2021, this number had skyrocketed to 128 474. There are several alternatives to gasoline, but the technological and economic advances in EVs have been astounding, while many other options have failed to gain traction. The Biden Administration has set a goal to ensure that 50% of all new passenger cars and light trucks sold in 2030 are EVs.

Conclusion: a new phase in the consumer-gasoline relationship

Gasoline is a valuable commodity; a single gallon of this energy-dense liquid can propel a car and driver for 30, 40 or even 50 miles, in vehicles that are safe and comfortable, cool in summer, warm in winter, wherever and whenever the driver wishes to go. What is all of that freedom and convenience worth? In some countries, such as Venezuela and Libya, government subsidies keep gasoline prices absurdly low – pennies per gallon. In other countries, governments place hefty taxes on gasoline to control consumption, and prices may be US$6 – 8/gal., or higher. In the US, prices are currently under US$4/gal. – well below all other OECD countries. Yet many consumers consider prices of US$4 – 5/gal. too high.

Gasoline producers and consumers are interdependent, but high prices to consumers, when coupled with record-high profits to oil companies, have heightened public resentment – despite the fact that the lion’s share of profits are being made in upstream petroleum, not in refining and marketing. During the Great Recession and COVID-19 lockdowns, for example, many refineries suffered negative margins. At the retail marketing level, the National Association of Convenience Stores (NACS) reported that 60% of the convenience stores selling fuel were owned by single-store operators rather than big oil companies. Many of these operators consider themselves fuel-neutral, and believe that their interests are more closely aligned with consumers than producers. Price spikes can squeeze the profits of a single-store operator. It takes a very patient consumer to listen to these points, however, when confronted with high prices and a possible recession in 2023.

withHybrid

The relationship between the American consumer and gasoline is changing. From the price spikes of the 1970s until now, each wave of demand recovery has been more sedate. The existing fleet is more efficient and less polluting; and more alternatives have emerged –particularly EVs. COVID-19 has popularised remote work, making it a permanent fixture. Refiners are thinking of export markets for their marginal barrels of output. Perhaps the relationship between gasoline producers and consumers is a mature one, and both parties are pursuing new interests. US gasoline demand may be on its way to a long, slow decline, but not a farewell.

Optimized Gas Treating, Inc 212 Cimarron Park Loop, Buda, TX 78610 www.ogtrt.com +1 512 312 9424 Now

Solvents N o withHybridSol S me Proven Technol OGT | ProTreat® Process Simulation

18 March 2023 HYDROCARBON ENGINEERING

We live in a world that continues to change and adapt to different industrial, technological, political and social realities. As a result of these changes, the oil and gas industry will inevitably need to adapt. The industry is responding to unprecedented levels of change driven by factors such as an increased focus on improving sustainability, new economic realities, and adapting to the future of the workforce.

As such, it is important to rethink the role of industrial digital transformation, which is now expected to deliver the next step change in ensuring safety, improving sustainability and reliability, enabling people, and increasing margin predictability. Making this a reality requires a shift towards industrial autonomous operations.

Envisioning industrial autonomous operations

Industrial autonomous operations is a vision for the future, where functions in operations embed higher levels of intelligence and close the loop with people and systems. This will enable people to focus on higher-level tasks. Although the industry has not reached the highest level of full autonomy, technology advancements have provided a good set of ingredients to allow for autonomous operations. Automation and control systems in a closed loop are becoming pervasive, and they continue to be complemented by different software-enabled capabilities such as advanced process control, alarm management, asset performance management, and remote monitoring. As automation and control systems move closer towards software and converge, current advances in cybersecurity, self-learning intelligent systems, and digital twins allow for increased autonomous operations.

With industrial autonomous operations, systems and processes will have increased adaptive capabilities enabled

through self-learning capabilities. These systems and processes will be bound by guardrails of cybersecurity, safety and reliability, which will be built with explainable artificial intelligence (AI) systems that utilise multiple simulation models serving as digital twins. Together, this will bring the next step change for industry, unlocking benefits that current digital capabilities do not support by intelligently, reliably and securely closing the loop with people and systems.

Setting objectives for the next digital frontier

The next frontier in industrial digital transformation will be the move towards intelligent and autonomous operations. Industrial autonomous operations will provide a step change in how the oil and gas industry can create its digital future. Over the past 40 years, some of the defining moments in the digital evolution of the industry include the adoption of automation systems and manufacturing execution systems, the implementation of applications such as advanced process control, and the use of enterprise resource planning systems. Currently, we are in a phase of broader adoption of cloud and AI/ML technologies as more use cases become scalable. The next major step will be closing the loop between intelligence displayed on a software application and an action through either people or systems. This will allow the industry to envision higher targets for digital transformation. These include:

n Zero-harm operations that keep people away from harm, predict operational risk, and ensure the integrity of operations.

n Significant sustainability improvements, achieved by maximising efficiencies or supporting new products such as renewable fuels.

n Maximising human potential by allowing people to focus on higher-level tasks.

March 2023 19 HYDROCARBON ENGINEERING

Praveen Sam, Honeywell, USA, introduces a novel digital operating approach within the oil and gas industry.

n Unlocking additional margin by optimising across a much broader envelope.

n Eliminating unplanned downtime, made possible by prevention of failures or autonomous recovery.

Accelerated innovation in the last decade has allowed us to create a path toward achieving this vision. As digital

technologies continue to mature, they also become more affordable, secure, and capable of faster value realisation.

The need for industrial-grade software

The road to an intelligent, autonomous future will require a change in how software is built. Industrial autonomous operations require industrial-grade software, which adds greater levels of trust, safety and reliability to software. This predictability is needed for autonomous operations. Some of the ingredients that make industrial-grade software are:

n Zero-trust cybersecurity: cybersecurity must move to a higher level of zero-trust whereby implied trust within each interaction is eliminated, and verification is built at each interaction.

n Explainable AI: AI provides intelligence, but autonomy requires AI to be self-learning in order to adapt to changes in the world over its life cycle. AI should also be explainable, as workers need to know why AI does what it does in order to let it autonomously control. Similarly, AI-enabled actions should always be safe and reliable.

n Digital twins: digital twins support deep learning for new AI models, and provide for verification before implementation. They can also evaluate many what-if scenarios to verify safety and expected results, before recommending or performing controlling actions.

n Secure integration with machines: software must also be able to safely integrate with smart machines such as control systems, robots, drones and other systems.

n Openness and interoperability: software must embrace a nature of being open, vendor-agnostic, and interoperable in order to allow industries to maximise their existing investments in multiple systems.

Opportunities for the industry

The future of autonomous operations is a vision that should not be relegated to the impossible, or an all-or-none ultimatum. Several aspects of industrial autonomous operations have already been implemented, and have generated value for the industry. Opportunities for applying autonomous operations include:

n Remote operations: decoupling the need for a physical presence near the control system or at any part of the operation is a big step forward – enabling control remotely, digitally enabling and connecting field workers with the control room, and permitting execution away from the control room.

n End-to-end optimisation: scaling optimisation from a single unit to multiple sites through integration with economic planning and scheduling allows for the achievement of a much broader optimisation envelope. Plantwide Optimizer is a proven technology in the market that empowers autonomous operations with intelligent closed-loop optimisation.

n Enterprise intelligence: setting the foundation for closing the loop between man and machine, industrial analytics deliver production insights at an enterprise scale, which delivers real-time monitoring of operations and analysis of multiple what-if scenarios to support decision making.

March 2023 HYDROCARBON ENGINEERING 20

Figure 1. Safety and people first: technologies such as drones and robots will ensure safety and elevate workers to focus on higher-level tasks.

Figure 2. Closing the loop between man and machine: the next frontier in industrial digital transformation will be the move towards intelligent autonomous operations.

Figure 3. Remote operations: decoupling the need for a physical presence, and connecting field workers so that actions can be executed away from the control room, is a big step forward.

The leader in Energy Optimization.

GEA means worldwide recognized evaporation, crystallization and distillation plants, in-house R&D facilities, vast know-how and expertise. We develop and design multi-stage, TVR & MVR heated plant concepts tailored to your specific needs. Get in touch today at gea.com/contact

Keeping people at the centre

Moving towards autonomous operations is a journey. This journey is human-centric and should not be viewed as a means to replace people. It allows us to rethink the future of work in the industry and adapt to changing workforce realities. As the industry continues to struggle with rebuilding lost expertise, worker enablement provides support for the emerging workforce through greater degrees of human inclusion, and elevates the current workforce to focus on higher-level tasks. Leaders who embark on a journey of autonomous operations must continuously embrace a human-centric approach.

Where to begin?

Realising value through intelligent operations requires a shift in mindset and the execution of a structured plan. In addition to setting targets for digital transformation, leaders should take the following steps:

n Prioritise the right function to prove value with autonomous operations: prove value with a digitally-mature use case of high business value. Opportunities such as end-to-end process optimisation or closing the loop with economic planning and scheduling demonstrate results that can create interest in attaining even higher objectives.

n Create an organisational foundation with supporting policies and practices: adapt organisational policies and digital practices to support industrial autonomous operations. Carefully designing organisational roles and responsibilities, security and audit policies, safety functions, and technology governance are necessary practices.

n Create a technology foundation with industrial-grade software: while industries can reuse most of their technology investments, leaders must strategically rethink the need to adopt new capabilities. Capabilities such as OT cybersecurity, explainable AI, monitoring for AI, and managing digital twins must be set up to ensure reliability of closed-loop functions.

n Continue to keep people at the centre and organise for change: everyone should be taken along as part of this journey toward autonomous operations. Managing change for people, supporting them through new processes, and elevating them towards higher-level tasks is necessary to ensure the long-term success of autonomous operations.

n Build the right governance and guardrails: increasing levels of AI and self-learning capabilities will require proper governance and guardrails to manage safety and reliability, including organisational practices that monitor the health and functioning of all AI systems.

Honeywell is building towards industrial autonomous operations with industrial-grade software that profitably improves safety, sustainability and productivity. The company brings learnings through its experience in shifting the industry towards greater levels of autonomous operations, and can effectively help drive this transformation.

Mika Kulin, Neste, explains how the company’s refinery in Porvoo, Finland, is integrating its different digital sources and automation systems into a single source of information.

In 2019, Neste Corp. started to further develop the digitalisation of its refinery in Porvoo, Finland. The refinery is in the Kilpilahti industrial area, which is the biggest chemical industry consortium in the Nordics. Its production capacity is approximately 12.5 million tpy, with the most important products being transportation and marine fuels, and base oil. It employs some 1000 people. It is a very complex plant comprised of four production lines and more than 40 production units, including two units that produce renewable diesel made from different types of waste. As a single product can have tens of different qualities, the refinery requires a high level of digitalisation and skilled personnel to enable efficiency.

High level of digitalisation

The refinery already had a high level of digitalisation and automation before the new project, Nappi, started up three years ago. The problem was that, for example, data from the processes, the material flow and the laboratory were split on different systems, making it hard to obtain an overall view of what was going on at the different process stages, and to optimise the process at any given time. When the project started in 2019 it was like a ‘digitalisation rehearsal,’ carried out as an agile development process in incremental steps. By not having a predetermined goal for the project, and by continuously listening to the end users,

March 2023 23 HYDROCARBON ENGINEERING

it was possible to smoothly adjust the solutions according to the input from operators and other staff involved.

The overall goal for the ongoing project is to provide the operating personnel, refinery management and supply chain management with new tools to monitor and adjust the processes according to changes in feedstock qualities, product requirements, and laboratory readings, for example.

The project started with the panel operators and the shift managers in mind, and in the beginning around 200 people had access to Nappi. Now, the system is expanding within the refinery; it has more than 500 users, and this number is rising.

More transparent process

Neste has put a lot of effort into digitalising the refinery’s process during the last few decades, using state-of-the-art tools to optimise the different processes in a number of ways. One of the key suppliers of the software solutions used at the refinery is NAPCON – a company that specialises in solutions for the process industry, and is also managing the Nappi project.

The problem was that although all of the systems at the refinery continuously collected a lot of information and were great tools for running production, they lacked transparency. As such, Neste decided to develop a kind of parachute system that was able to show a large amount of relevant data in a single view that could be expanded when needed, and was accessible to anyone involved in production at the refinery.

The term ‘agile’ is the key word in the process, as the project is light-footed and open to new ideas at any point during the course of the process. By involving operators and other potential end users at the refinery from day one, it was possible to change direction immediately if the users felt that the selected path did not live up to the real needs.

This means that Nappi is not just another refinery digitalisation programme; the key thing is the organisational change that the system enables. In essence, the system is an online platform that provides real-time situational awareness, enabling the whole organisation to be more efficient, and making it possible to react quickly to changing market needs, for example.

Centralised view

For different user groups at the refinery, the project means somewhat different things. While the refinery leadership team mainly uses the system for overall performance monitoring, a shift manager may enter production targets into the system for operators to follow, and to monitor how well the targets are achieved. For operators, the system offers an easy way to check the production targets and how they are met.

The way a modern refinery is working with the aid of digitalisation is not news to anybody working in the business, but one common challenge is that different systems run different parts of the refineries. With Nappi in place, it is now possible to gather and share common information in a centralised view and to combine it with the different dashboards used in production. The system also

enables more efficient communication within the refinery, which in turn leads to continuous performance improvements.

Gaining popularity

An example of how Nappi has evolved over time is that the system’s main screen has changed from a view with a lot of subgroups that was comprehensive but quite difficult to navigate, to a view now consisting of only a few dropdown menus and two important gauges: the refinery’s utilisation rate, and the number of production key performance indicators (KPIs) alarming. More precise data is then available through the expandable menus beneath the gauges, where the user can dig into the flows, qualities, scheduled targets, production constraints, blending performance and analysers.

It is now easy for any user to choose only the required information. Initially, Nappi was about providing data for end users, but further development has made it possible for end users to write data back into the system. Plant engineers are now using Nappi to inform users of changes in capacity constraints. These background comments enable organisation-wide learning. The simplified screen is a result of the fact that the users could offer their input throughout the project’s progress. Now, it is also possible for development ideas to be added into the system through a dedicated menu – a feature that is being used increasingly.

A fundamental consideration when developing Nappi is that the use of the system is totally voluntary. When analysing its usage over a period of two years, it is striking how this has constantly grown as new features have been introduced to meet the exact needs of the users. This demonstrates the strength of agile development compared to normal, large digitalisation projects with slow feedback circles.

Complex facility

As mentioned, the refinery is a complex plant, producing a number of different products – from gasoline and diesel, to base oil and renewable diesel. As the product mix is not based on four product lines producing strictly one quality each, but rather four production lines sharing the same assets while producing several different products, the system forms a complex four-way, end-to-end supply chain. When all the parameters are right, it is very efficient, but demands a lot of automation and harmonised production.

There were two main reasons why the refinery started to develop Nappi as an overall management system that utilises multiple pre-existing digital systems: to maintain the production at a high and profitable level, and to ensure the production of just the right quality of any product.

Nappi also offers the opportunity to have a long-term, future-oriented overview of the production, using data-based management, to an even larger extent than before. At the same time, the maintenance systems have also been improved by connecting them to Nappi, thus enhancing the transparency and improving the predictability of production. This has raised the safety and energy efficiency at the refinery, resulting in more carbon-efficient refining.

March 2023 HYDROCARBON ENGINEERING 24

Capturing green opportunities

Carbon capture and storage or utilization (CCS/CCU) is a key strategy that businesses can adopt to reduce their CO2 emissions. By selecting the right technologies, pressing climate change mitigation targets can be met while benefitting from new revenue streams.

Sulzer Chemtech offers cost-effective solutions for solvent-based CO² absorption, which maximize the amount of CO2 captured and minimize the energy consumption. To successfully overcome technical and economic challenges of this capture application, we specifically developed the structured packing MellapakCC™. This packing is currently applied in several leading CCS/CCU facilities worldwide, delivering considerable process advantages.

By partnering with Sulzer Chemtech – a mass transfer specialist with extensive experience in separation technology for carbon capture –businesses can implement tailored solutions that maximize their return on investment (ROI). With highly effective CCS/CCU facilities, decarbonization becomes an undertaking that can enhance sustainability and competitiveness at the same time. For more information: www.sulzer.com/chemtech

Utilising existing systems

However, Nappi does not mean that the traditional way of working itself has changed at the refinery; panel operators are still using the same dashboards as before to make fact-based decisions on how to improve performance, and how to utilise the full potential of the feedstock. Instead, it is a shortcut to utilising the huge amounts of data that are constantly collected in the distributed networks regarding feedstock, flows, temperature and pressure, for example.

Another big change is that the system provides both the operators and the staff involved in the production with an instant view over the process and the state of it, without them having to dig into different dedicated systems. As an example, the numerical targets that previously had to be sent by email or were found in different files can now be shared within Nappi. When considering all of the different organisational levels that might need the information, this feature alone has hugely streamlined the process at the refinery.

Smooth transformation

Nappi aims to optimise the processes of the four production lines as an entirety at the refinery. Because the system makes it possible to look at the processes from different angles, it also provides an opportunity to optimise the overall product mix by enhancing how the feedstock, energy and additives are used when producing different products.

Since the project started in 2019, the world has changed significantly due to COVID-19, the energy crisis, and the war

in Ukraine. The refinery has successfully and smoothly adapted to the changed world thanks to the overall level of digitalisation, and due to the advantages that Nappi offers the whole plant with regards to planning the production efficiently.

For example, the refinery management, engineers and maintenance have their own information needs, each of which were addressed during the project. It is now possible for maintenance to better plan and schedule service actions through Nappi, so that the production is disturbed as little as possible. The next step is to make the system even easier to use, but the refinery’s gap between targeted and realised production goals has already decreased thanks to the project.

A different project

As a result of the agile development praxis used while developing Nappi, feedback from the users was continuously sent to the developers at NAPCON. The project was quite different from most other digitalisation projects that the company has been involved in; the biggest difference being that large industrial systems are usually developed out of sight of the real users until it is time to release version A. It can then be a time consuming and slow process to change the system if needed. By being continuously able to adapt the system according to immediate feedback at every small step along the way, the system has gradually grown according to the real needs of the users.

George, an industrial control systems (ICS) engineer at a large petrochemical plant, is monitoring operations when he notices something amiss with a burner management system on the sulfur recovery unit (SRU)’s thermal reactor, which appears to be malfunctioning and is on the verge of releasing high amounts of sulfur dioxide (SO2) and hydrogen sulfide (H2S) from the incinerator stack.

George’s first thought is that it is an equipment failure, but he should have been alerted by the base layer control system. The safety instrumented system (SIS) that is monitoring the burner management systems to ensure that processes stay within their defined engineering limits has failed to trip the unit.

This is the first sign that the incident is not the result of an equipment malfunction, but rather of a targeted attack – one that George and the plant’s cybersecurity team are unprepared for. The adversary carrying out the attack has been lurking in the plant’s network for nearly a year, dwelling unnoticed in the network and developing malware capabilities targeting emergency shutdown systems – ultimately leading to the first of two plant shutdowns. This scenario, drawn from a 2017 TRISIS malware attack on a Saudi Arabian plant, underscores the potential threats to oil and gas refineries and the lack of protections and detections that many plants have for their ICS and operational technology (OT) environments. The plant, being unable to identify the TRISIS intrusion, was blindsided by the attack, and did not have a robust plan for such a response. Ultimately, the plant was fortunate that the damage it suffered was not worse, because it very well could have been.

The question is: how do attacks like this happen? And what could the plant have done differently?

The threats are real

The downstream segment of the oil and gas value chain remains at risk of cyberattacks. Refining facilities are a key target for adversaries due to the centralised nature of operations, the presence of control systems, and the possibility for damage or destruction from highly-volatile processes.

March 2023 27 HYDROCARBON ENGINEERING

Mike Hoffman, Dragos Inc., USA, discusses how refineries can protect critical ICS/OT systems from cyberattacks.

All industrial operations are increasingly under attack. A 2021 Ponemon Institute study of industrial cybersecurity found that 63% of respondents said their organisations experienced an ICS/OT cybersecurity incident in the previous two years, at an average cost of nearly US$3 million per incident.1

Many industrial facilities are not especially well-prepared for these types of attacks, owing to a historic cultural divide between IT and OT security. Most industrial sites have partly integrated their IT systems with ICS/OT to improve efficiencies, but cybersecurity has not kept pace.

The study found that only:

n 43% of respondents said that their organisation’s cybersecurity policies and procedures were aligned with their ICS and OT security objectives.

n 35% said that IT and OT teams have a unified security strategy that secures both the IT and OT environments.

IT and OT may be linked via a plant’s network, but they are different. A lot of OT components are older and were not designed with security in mind. Whilst newer equipment is designed with security features, it can take a while to replace hardware that typically will run for 20 – 25 years. IT security methods will not work well with older OT systems, which require a different approach to deal with the type of threats that it faces.

In planning to protect ICS and OT, the downstream segment needs to be aware of the following types of attacks:

Targeted disruptions

Nation-state attacks on infrastructure and industry, such as those regularly occurring in the Russia-Ukraine war, can have serious consequences.2 The Colonial Pipeline ransomware attack, attributed to the DarkSide group based in Russia, shut down the

pipeline for almost a week and caused jet fuel shortages for many airlines, panic buying of gasoline in southern US states, and other disruptions.3

Attacks can have direct and indirect consequences. Many refineries have communities that have been built up around them, which would be affected. Shutting down a refinery will also affect the supply chain, for instance, because petroleum byproducts are used as feedstocks in many chemical processes.

Vendor compromises

These facilities receive frequent visits from vendors – for maintenance and for a variety of other reasons. A vendor might be upgrading a vibration monitoring system by installing a new server into the control network, for example. That vendor could very easily plug an infected laptop or USB drive into the network and unintentionally introduce malware into the OT environment.

Vulnerabilities of OT systems

Refineries are replete with physical safety systems, such as pressure release valves, flare systems, etc. As plants undergo process upgrades and debottlenecking projects to increase throughput, these physical systems are often not upgraded due to cost. As such, they are no longer capable of providing the protection required. As a result, plants, realising the need to mitigate residual process risks from these changes, have turned to safety instrumented systems (SIS).

SIS are highly-available systems that include sensors, logic solvers and actuators to monitor critical process systems and take action to shut the process down if predefined limits are exceeded. These systems provide the ultimate target for an attacker if the goal is to cause a catastrophic event.

In a scenario such as the Saudi Arabian plant attack, an SIS could be compromised and disabled so that it does not act. For example, it may be modified so that no trip is issued when a process reaches unsafe levels. If an attacker then goes after the distributed control system (DCS) that runs the plant and moves the pressures, flows or temperatures of a particular process outside of its operating envelope, an explosion could occur.

Today, plants generally have common architectures with a demilitarised zone (DMZ) or buffer zone between IT and OT to allow for remote access, file transfers, and other data movement. Many plants, however, rely on older ‘best practice’ architectures that are relatively flat across systems with the same functional level as opposed to smaller ‘zoned’ networks. These flat networks are ripe for lateral movement by adversaries, especially if they are protected with atrophying controls.

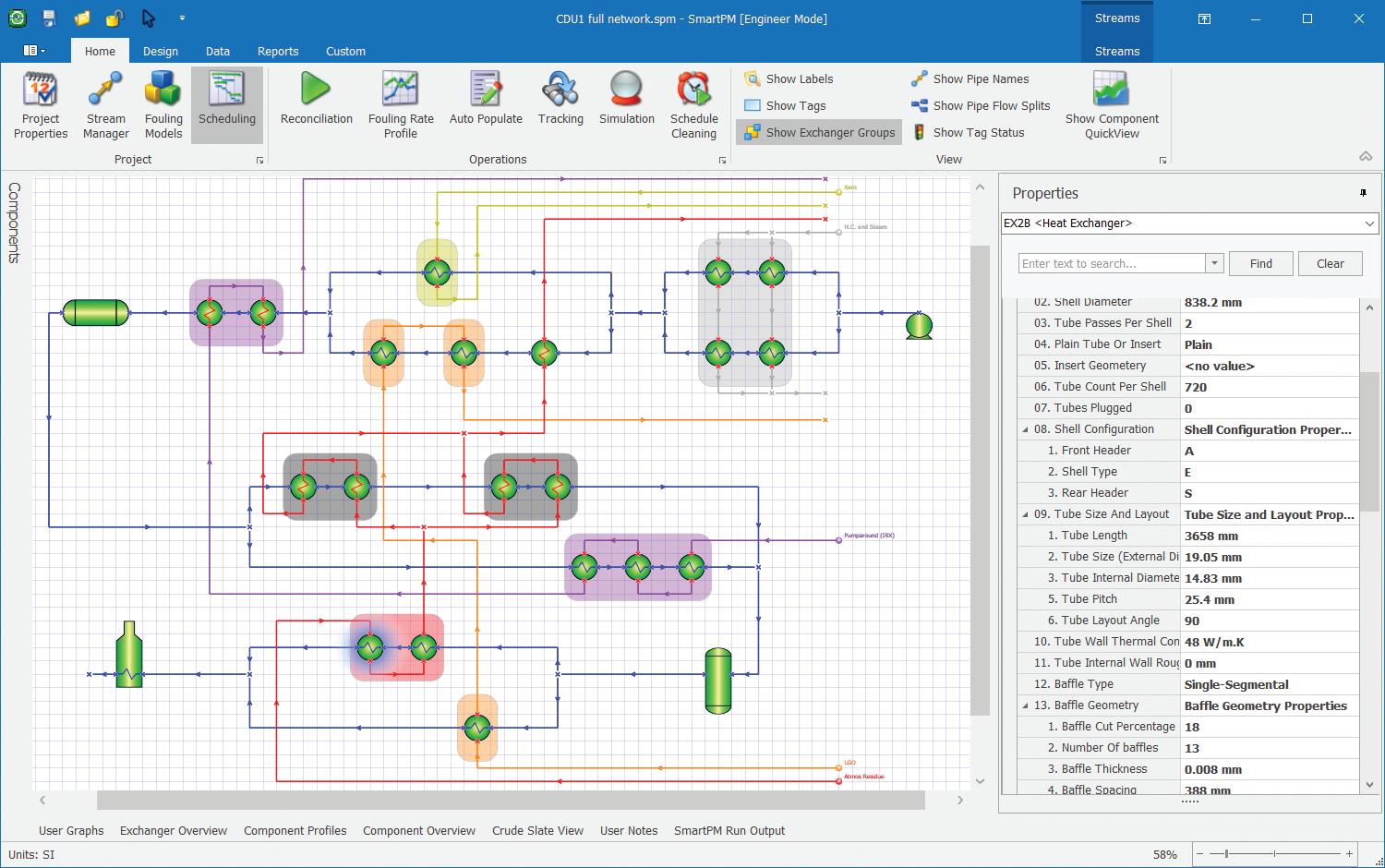

Many attacks will start by targeting corporate systems via phishing and other attempts to gain access, and then try to get through the DMZ – if one exists. Next, adversaries work to get past the operations systems (Level 3), supervisory controls (Level 2), and basic controls such as DCS controllers and programmable logic controllers (PLCs) (Level 1) to perform their final action or objective, which may include process manipulation (see Figure 1).

Firewalls typically sit between each functional level, or zone, including the firewalls that create the DMZ, but the fact is that many operators do not properly maintain their firewalls and are unaware of the actual data flows going across them, because they are not monitoring the network. Without having visibility

March 2023 HYDROCARBON ENGINEERING 28

Figure 1. Common plant IT/OT architecture.

Only ActiPhase® fi ltration technology has an active component that attacks soluble foulants in its reticulated chambers and transforms them into solids, so they can’t escape and wreak havoc deep in your reactor.

Foulants, beware.

Optimize crystaphase.com

into network traffic flows, it is challenging to ensure that firewall rule sets are correct.

Preparing for an attack

Refineries need to be sure that they have a defensible architecture, which starts with having equipment in place to monitor operations effectively. Monitoring can help detect attacks early on, before a physical impact is realised.

Adversaries performing targeted attacks must slowly work their way through an OT environment looking for DCS, SIS or PLCs, and they can spend months inside a network before acting. Such an attack requires a considerable amount of reconnaissance and reverse engineering before realising the action on objective. The numerous months that the adversary spent inside the Saudi Arabian system while developing TRISIS might be unusual, but the average ICS/OT cybersecurity incident is a nearly year-long event.

The amount of time it takes to carry out a targeted attack is one advantage that defenders have within OT. If the right protections and monitoring are in place, this gives defenders that much more time and opportunity to catch the attack before equipment or process manipulation occurs.

The necessary steps in preparing for an attack include:

Develop an incident response (IR) plan

Plant operators need to have a documented plan in place in order to respond to unusual activity involving OT. Practically all organisations have IR plans for IT, but those plans fail when leveraged directly in OT because of the differences in how the technologies operate and the actions to take on the systems once an incident is called. A response plan should address several important stages.

Detection

When unusual activity is detected by a SIS, for example, it is important to consider that there may be a cyber element at play. Equipment malfunctions, but times have changed, and the industrial community is beginning to adopt a cybersecurity mindset.

The first thing to do is determine whether an event is malicious through network security monitoring, collecting logs from systems and hosts, and analysing them. If the activity looks at all suspicious, the event can be raised to the level of an incident, which will trigger a response from the appropriate teams.

An IR plan serves as the foundation for every other stage of response, but only comes into play once equipment malfunction has been ruled out.

Containment

Once an event is raised to the level of an incident, the response stage shifts to containment. This involves scoping the incident to determine affected systems, which often includes collecting forensics evidence from systems, reviewing logs, and performing network monitoring. Foundational to containment is preparation by having contingency plans in place to understand what systems are required for minimal operation, or when a controlled shutdown may be required. Planning for containment is a team effort that should involve engineering, ICS/OT security, and operations.

This stage is likely to be when the plant would begin to isolate networks. During the Colonial attack, pipeline operators separated their OT from IT as part of containment. Isolating the OT network is one of the primary containment steps, but this can also have indirect business impacts. Containment can be broadly applied across OT and processing units, or isolated down to individual system(s), depending on the respective network architecture and intrusion scope.

Eradication

As systems are scoped for intrusion and contained, eradication begins to immediately remove the threat from the environment. There is no clean break in each of these steps, and containment, followed by eradication, is very much an iterative process. After systems are cleaned, monitoring levels must be drastically increased to ensure that the malware or adversary is completely removed from the environment. Otherwise, the threat may regain a foothold and start successive attacks.

Recovery

Once systems have been cleaned and the threat removed, the plant can bring systems back online. Crucial to this step is understanding minimal operating requirements and order of restoration. For example, domain controllers, application servers, and critical human-machine interfaces (HMIs) are often needed first before other OT systems are brought online.

An important part of recovery is having reliable back-ups. This is one area where OT and IT are similar, taking regular snapshots of servers and databases to aid in recovery.

One step to consider is having offline back-ups, which are essential in cases of ransomware, for instance. Ransomware actors will often target connected back-up systems along with production systems to prevent quick recovery and ensure that ransom payments are made. A secondary back-up that is disconnected or replicated to a secure cloud storage system can help speed up the process of restoring systems.

Conclusion

Current adversaries have shown that they can conduct attacks in the downstream segment while new, increasingly sophisticated adversaries are emerging. Refineries must adopt controls to counter these growing threats. A primary control that can be implemented is to have a tested incident response in place for OT, which includes steps for detecting a cyber event, followed by containment, eradication and restoration. Network security monitoring is foundational to enabling these incident response steps. Whilst ‘defence is doable’, it takes a plan with the right protective, detective and responsive capabilities to safeguard critical refinery operations.

References

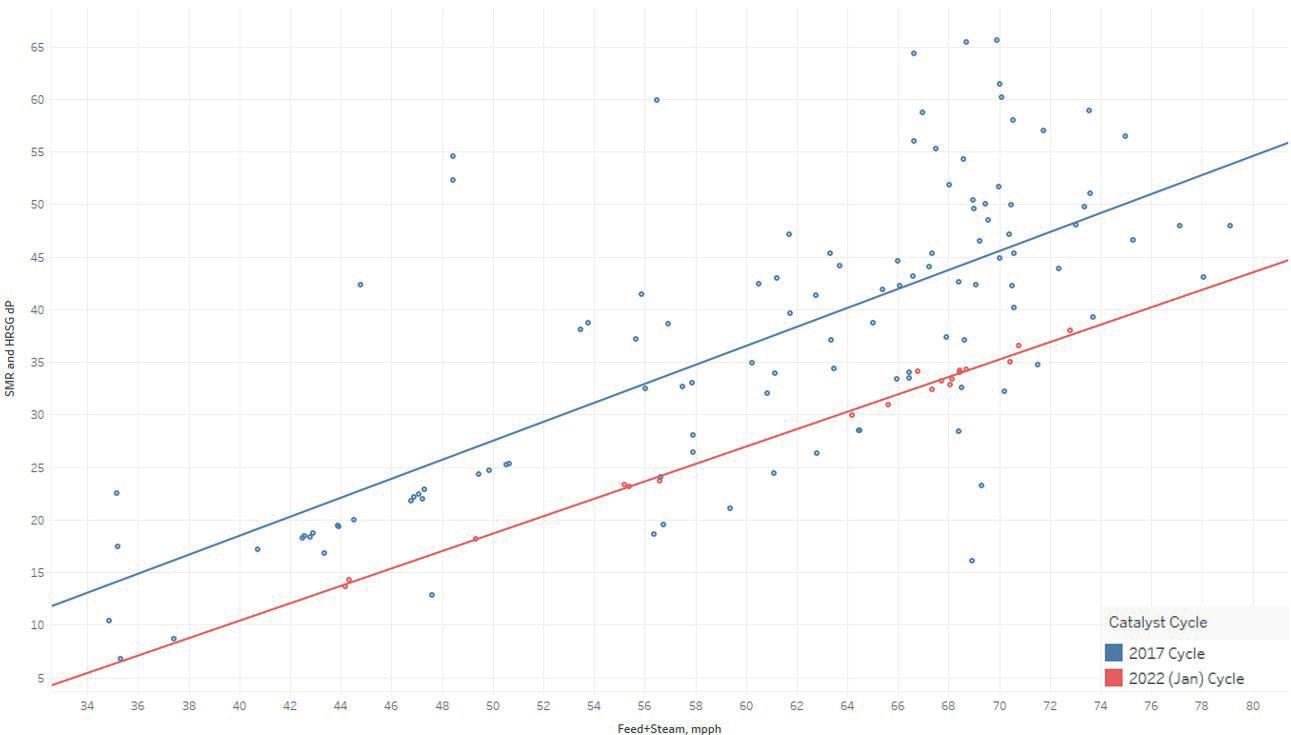

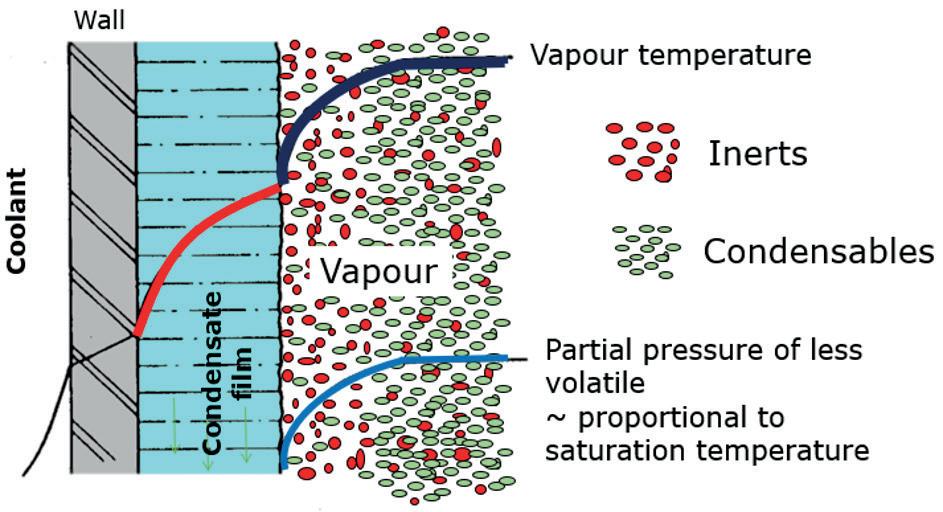

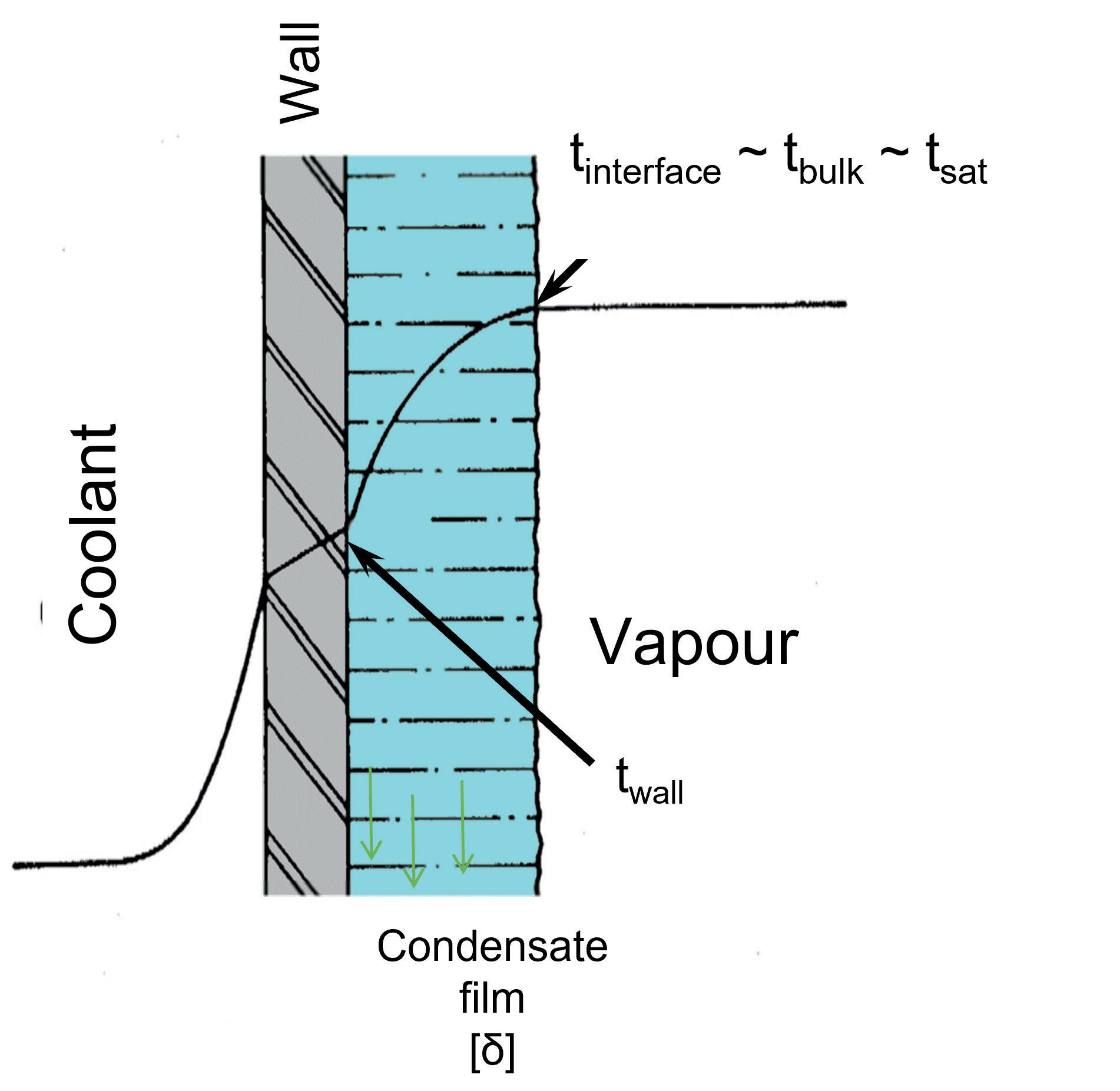

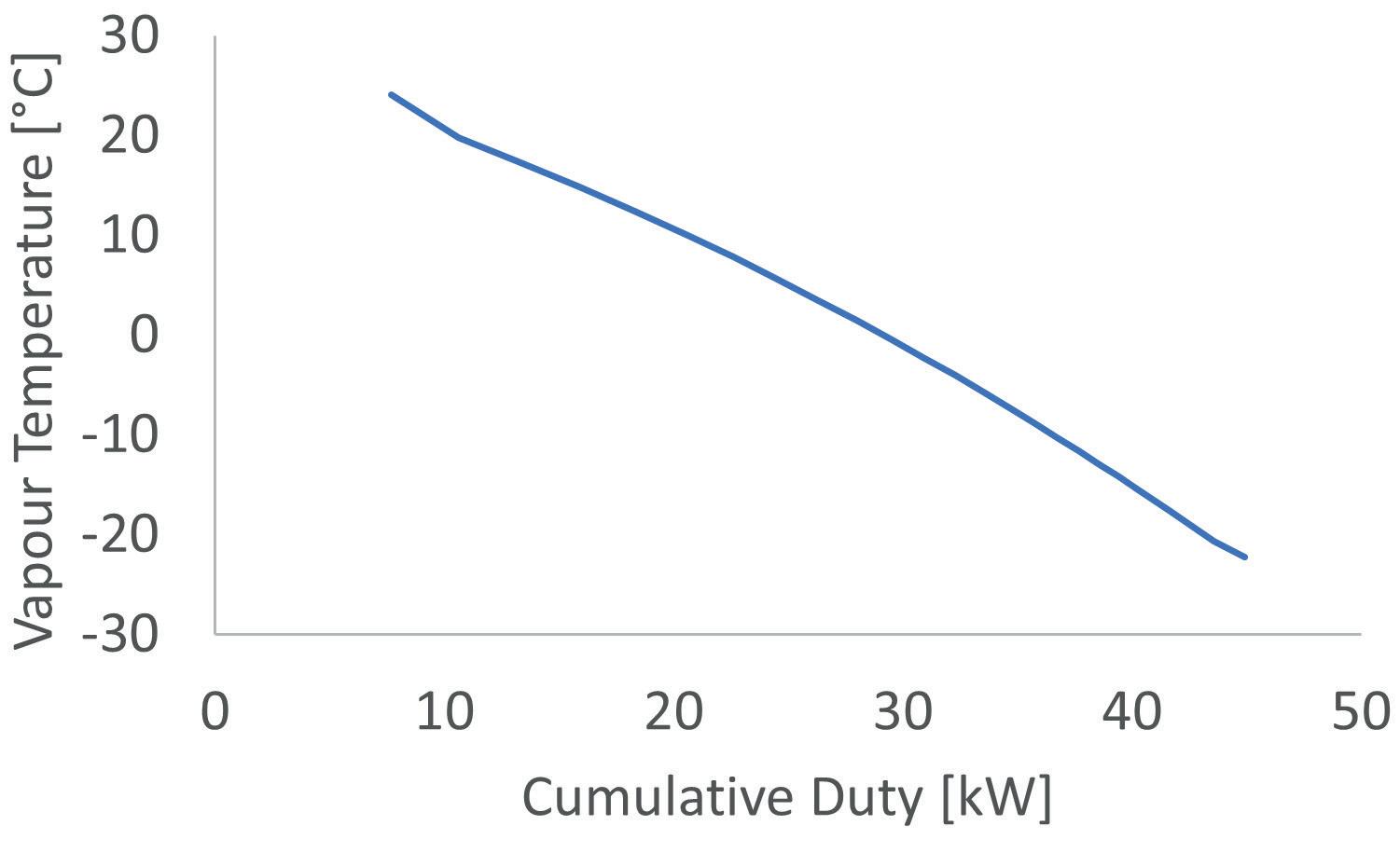

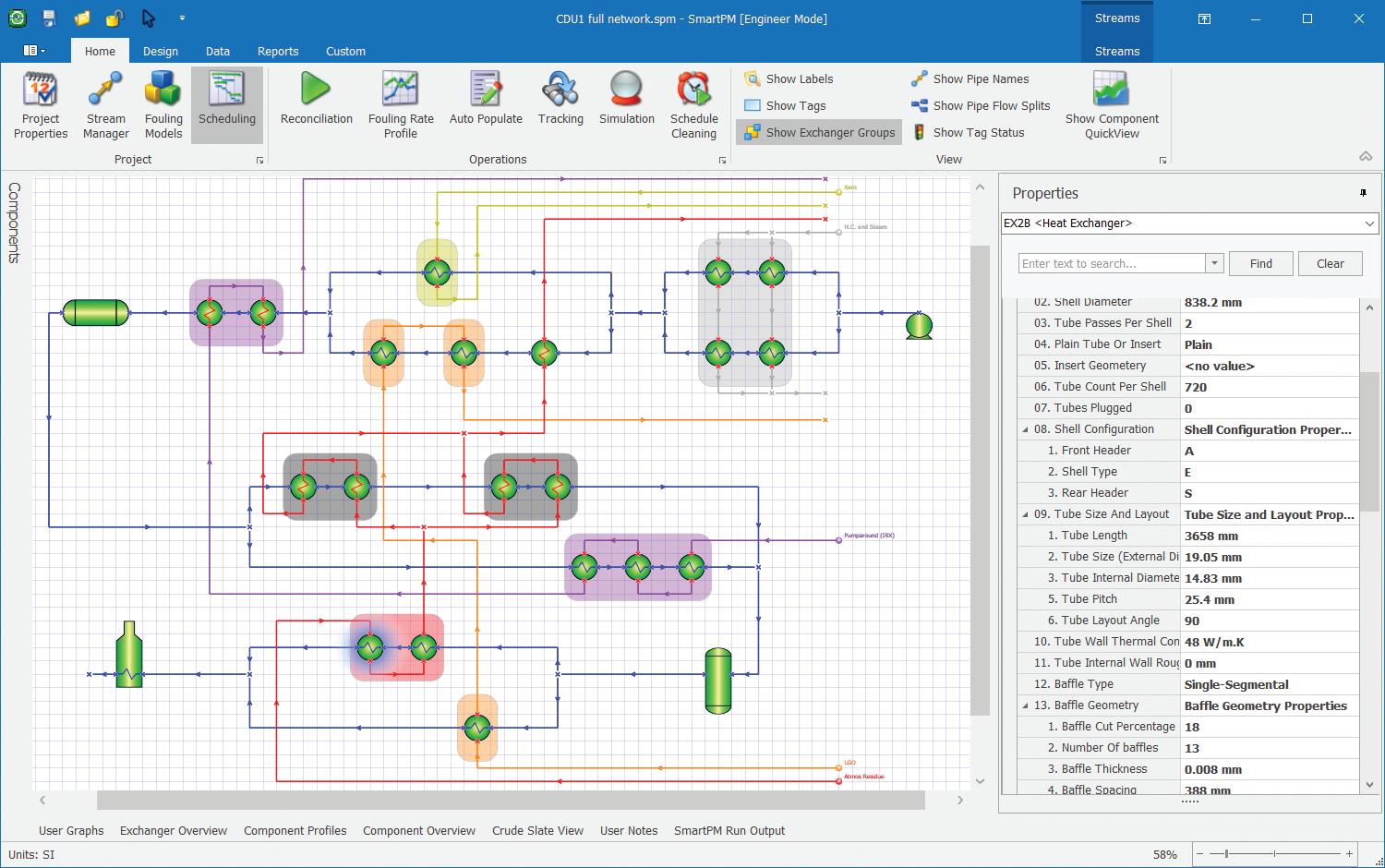

1. ‘2021 state of industrial cybersecurity’, Ponemon Institute, (November 2021), https://hub.dragos.com/hubfs/Reports/2021Ponemon-Institute-State-of-Industrial-Cybersecurity-Report. pdf?hsLang=en