Meet the fuel of the future today. Produce blue ammonia at the highest capacity with the lowest possible levelized cost. Decarbonize at mega scale while increasing the value of your ammonia product. Integrate blue ammonia solutions today to meet the demand of tomorrow.

Blue Ammonia. Tomorrow’s fuel. Ready today.

plant data.

Robert B. Fedich and Amalia Pantazidis, ExxonMobil Catalysts and Licensing LLC, USA, outline the benefits of a flexible initial process design for an amine unit on an offshore platform.

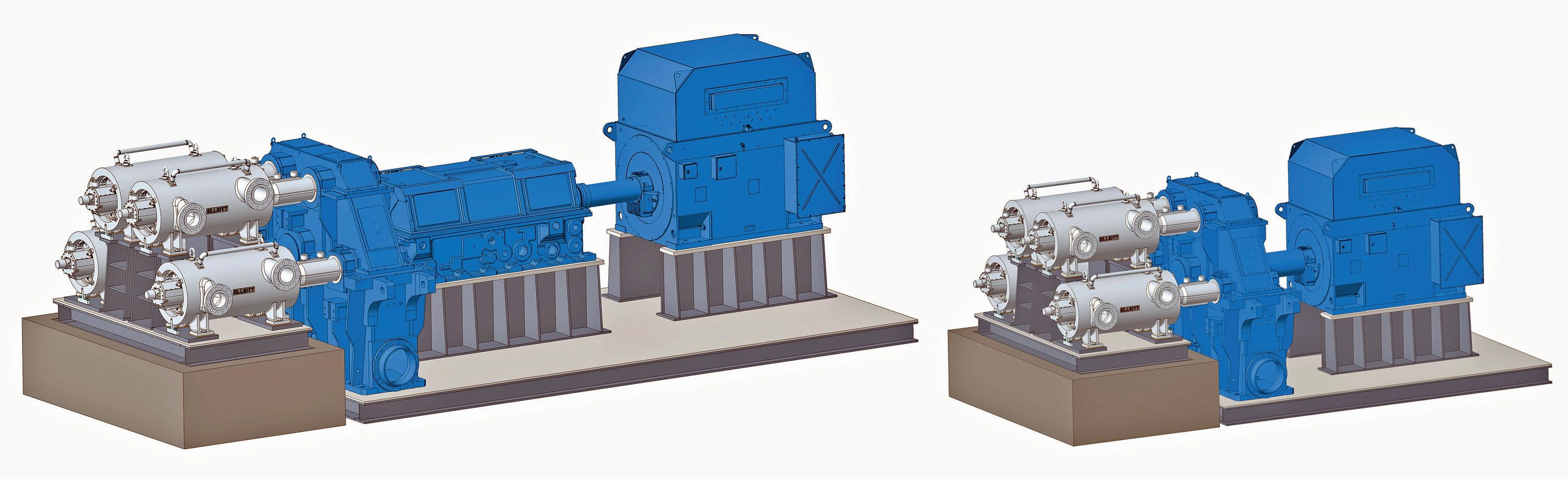

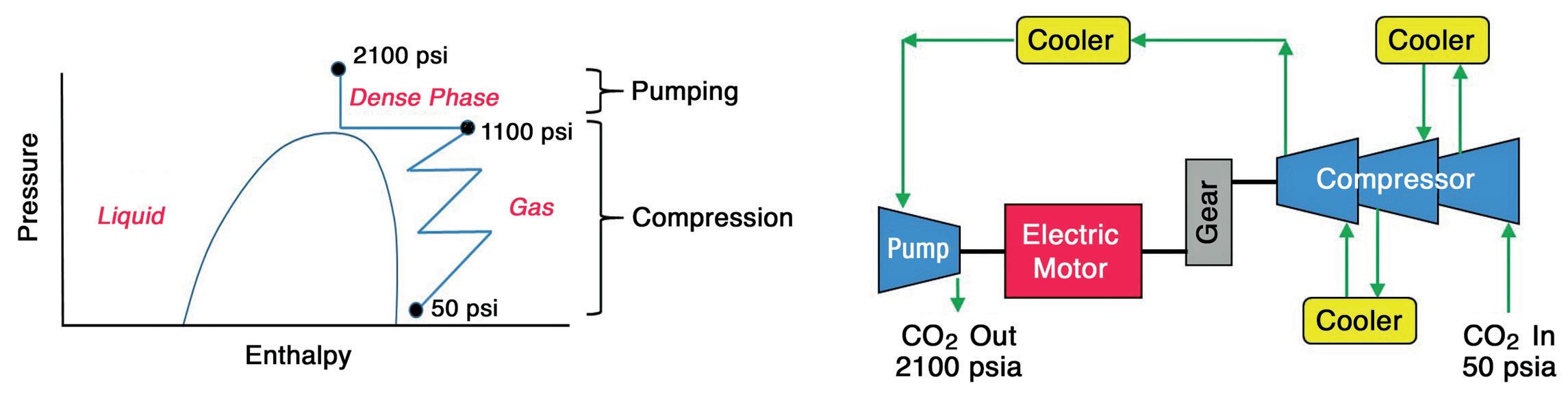

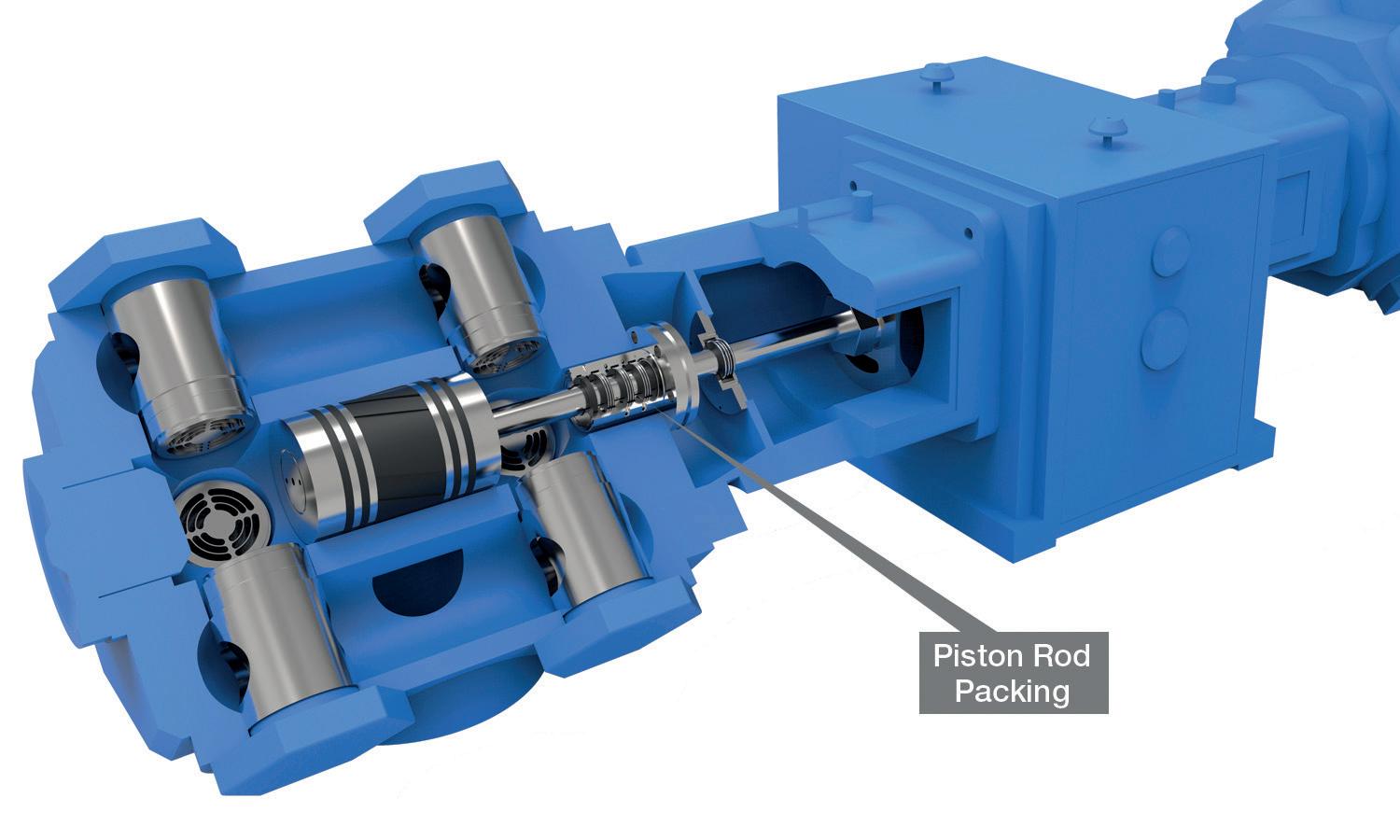

Klaus Brun, Elliott Group, USA, explains why the decarbonised energy economy requires customised compressor solutions for three primary value stream gases: hydrogen, carbon dioxide, and natural gas.

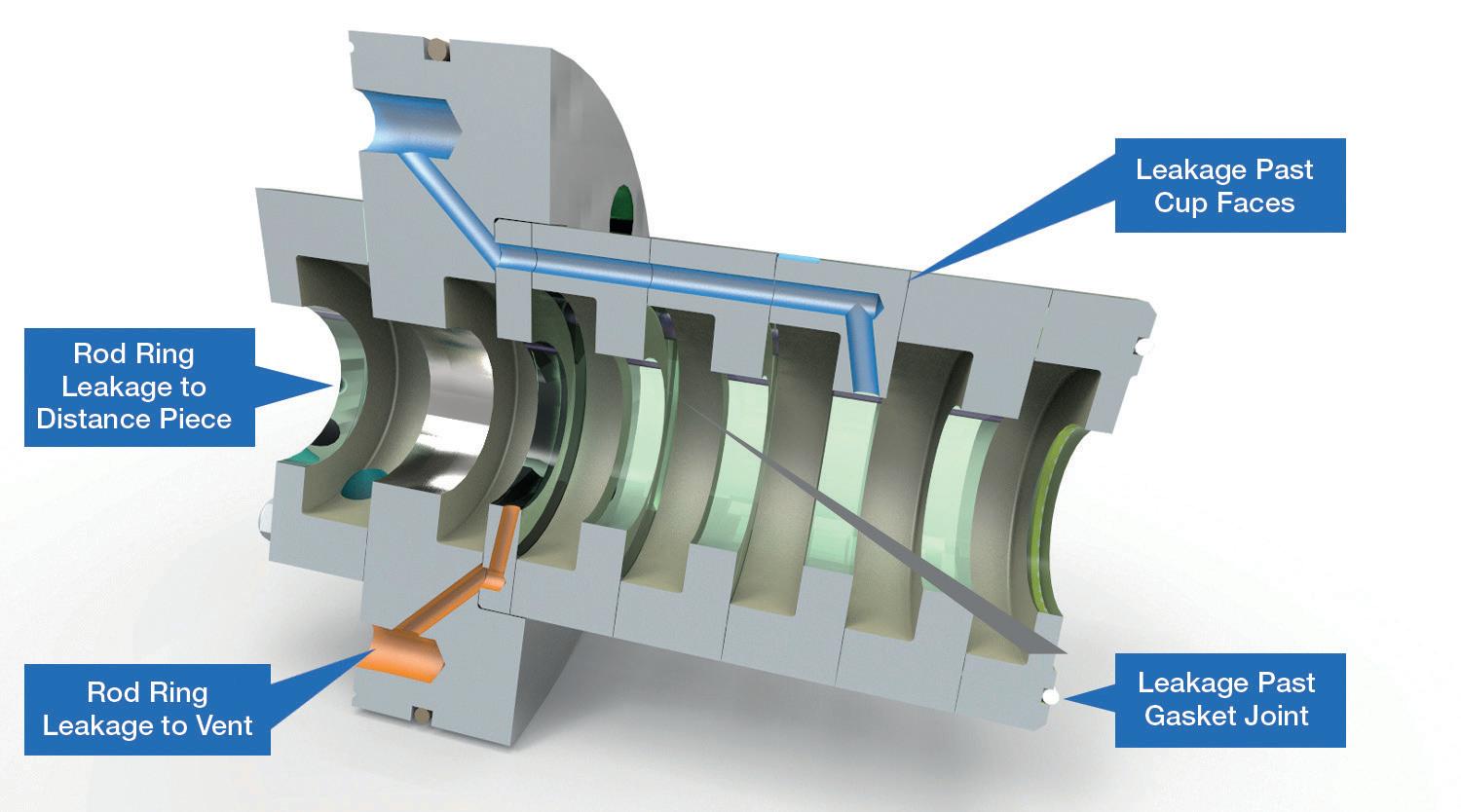

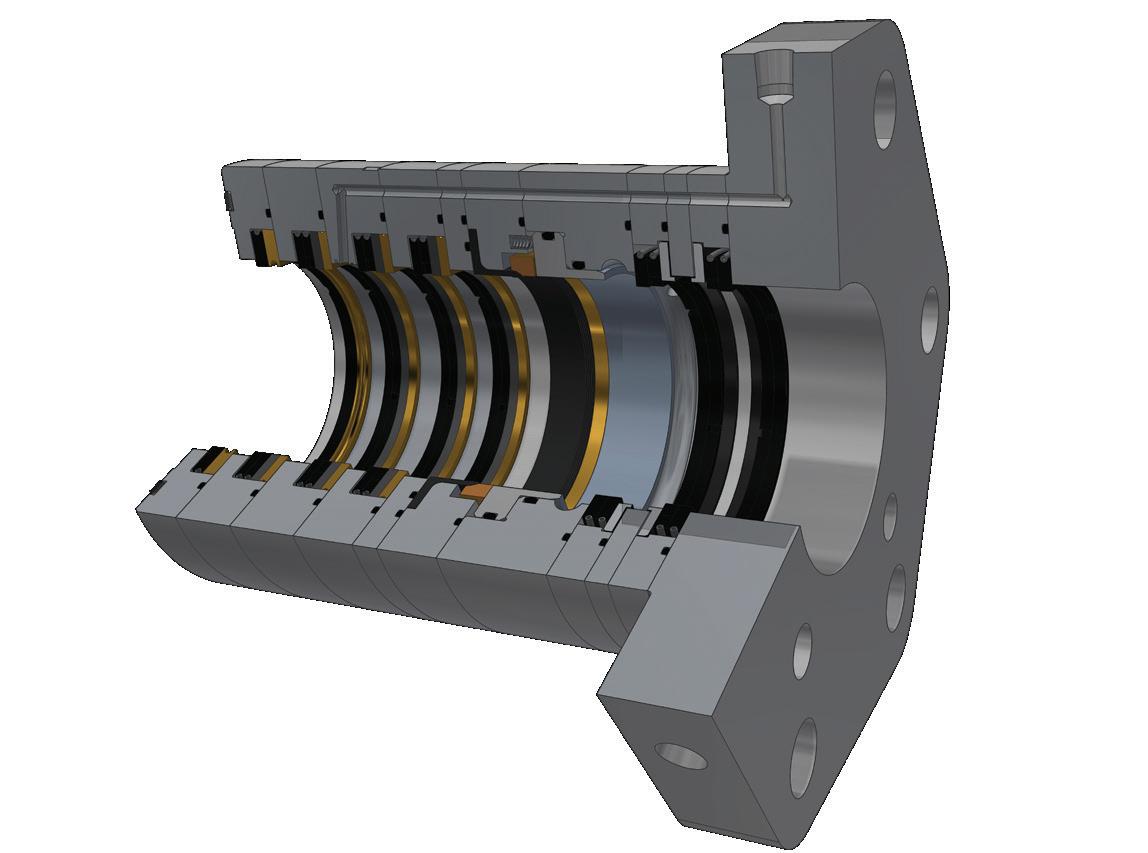

Craig Martin, Paul Modern and Juan Moreno, Cook Compression, explore two potential pathways to decarbonisation for energy companies.

Lea Clauson, DeZURIK Inc., USA, presents a number of valve selection considerations for a refinery.

Luke Perry, Rotork, UK explains how maintenance of flow control assets can not only prevent failure, but also improve overall plant efficiency.

In part one of a two-part article, Prashanth Chandran, Nathan Hatcher and Ralph Weiland, Optimized Gas Treating, Inc., USA, detail the two perspectives that should be considered when setting expectations from simulation.

Ted Huck, MATCOR Inc., USA, explains why cathodic protection is a proven technology and a viable strategy for corrosion control and mitigation in hydrocarbon processing facilities.

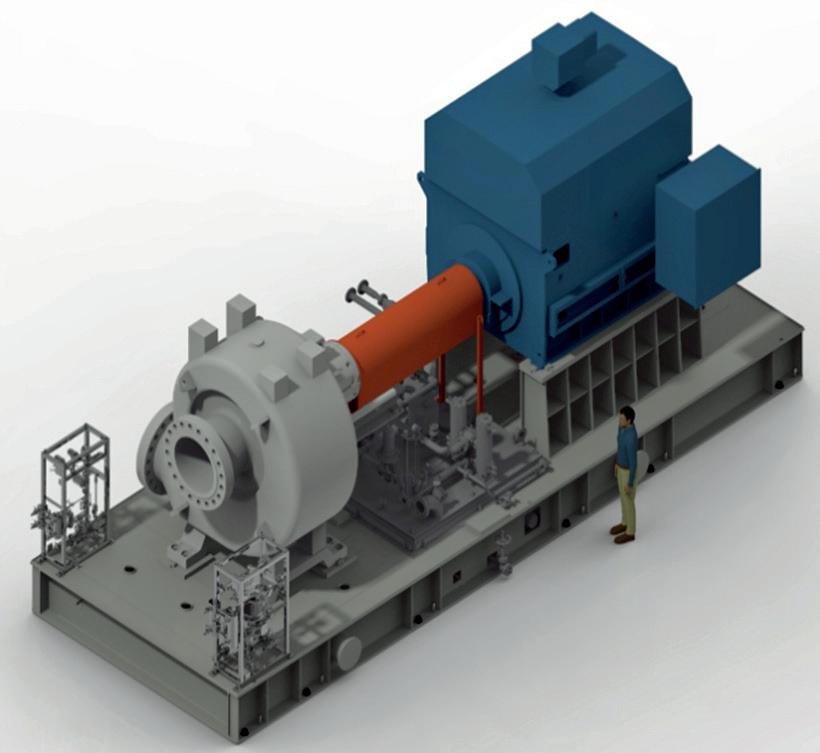

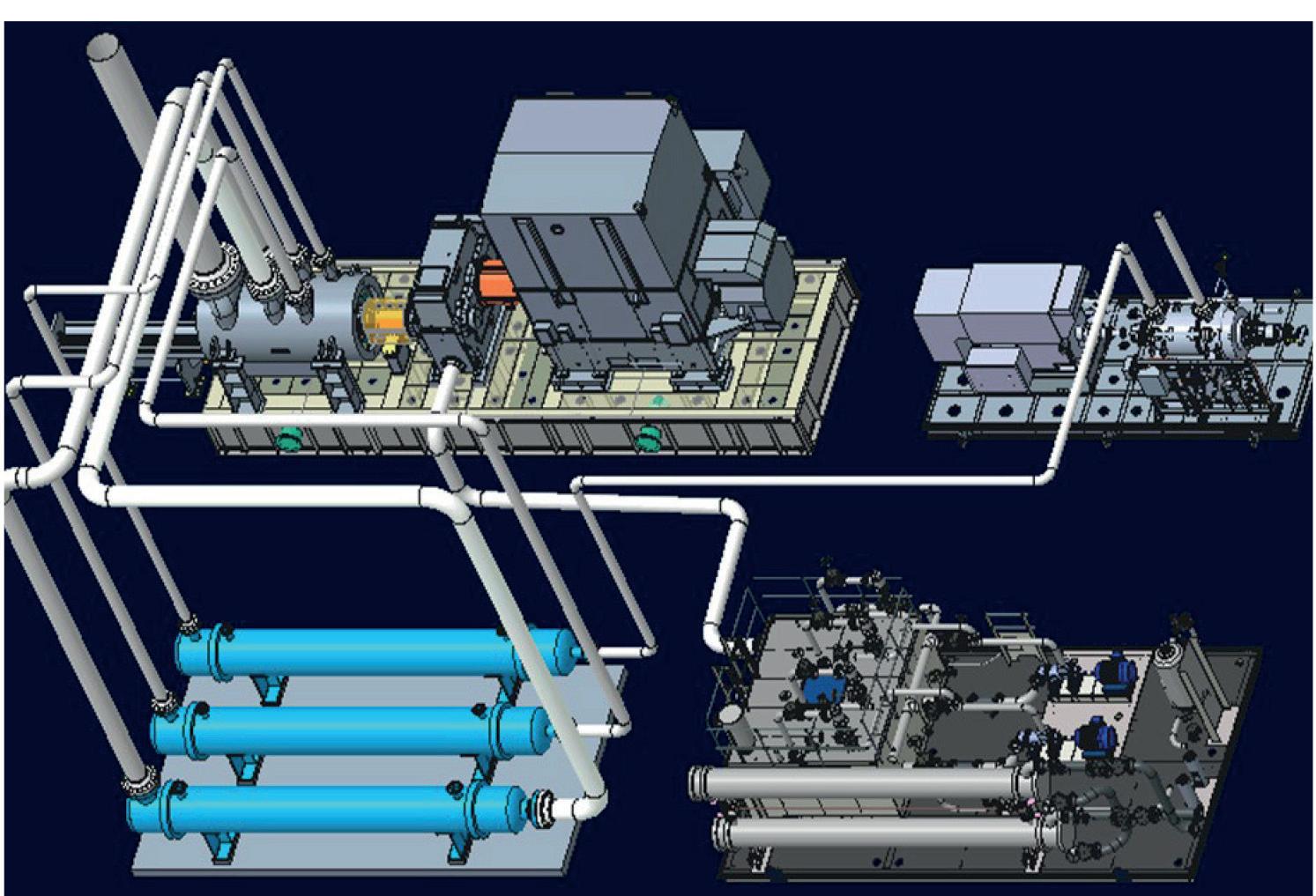

Elliott Group: a natural gas compression processing plant for dehydration.

For more information, please visit: www.elliott-turbo.com

ET Black™ is a state-ofthe-art technology that complies with the most stringent environmental regulations now and in the future.

Plus, the flexibility to produce all ASTM grades, and specialty grades, in a single plant. ET Black™, the technology of reference for producing carbon black obtained by thermal decomposition of highly aromatic oils.

Find out more at: www.igoforETBlack.com

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O'Reilly callum.oreilly@palladianpublications.com

ASSISTANT EDITOR Bella Weetch bella.weetch@palladianpublications.com

EDITORIAL ASSISTANT Isabelle Keltie isabelle.keltie@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES EXECUTIVE Sophie Birss sophie.birss@palladianpublications.com

PRODUCTION MANAGER Kyla Waller kyla.waller@palladianpublications.com

EVENTS MANAGER Louise Cameron louise.cameron@palladianpublications.com

EVENTS COORDINATOR Stirling Viljoen stirling.viljoen@palladianpublications.com

DIGITAL CONTENT ASSISTANT Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL ADMINISTRATOR Leah Jones leah.jones@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITOR

Nancy Yamaguchi Gordon Cope

SUBSCRIPTION RATES

Annual subscription £110 UK including postage /£125 overseas (postage airmail).

Two year discounted rate £176 UK including postage/£200 overseas (postage airmail).

SUBSCRIPTION CLAIMS

Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

APPLICABLE ONLY TO USA & CANADA

Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831.

Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032.

15 South Street, Farnham, Surrey

GU9 7QU, UK

Tel: +44 (0) 1252 718 999

Chapters 1 and 2 of the World Economic Forum (WEF)’s ‘Global Risks Report 2023’ are entitled ‘Today’s Crisis’ and ‘Tomorrow’s Catastrophes’, respectively. Whilst this is a rather solemn outlook for the year ahead, the reality is that we are faced with the continued threat of cost-of-living crises, political conflict, and social polarisation – among other things.

Specifically, the report states that “most respondents to the 2022-2023 Global Risks Perception Survey (GRPS) chose ‘energy supply crisis’; ‘cost-of-living crisis’; ‘rising inflation’; ‘food supply crisis’ and ‘cyberattacks on critical infrastructure’ as among the top risks for 2023 with the greatest potential impact on a global scale”.1 And so, amid the noise of economic recovery from COVID-19, the continued Russia-Ukraine conflict, and persistent cyberattacks, the issue of decarbonisation failed to make it into one of the top spots.

However, Saadia Zahidi, Managing Director of the WEF, notes that “the health and economic after-effects of the pandemic have quickly spiralled into compounding crises. Carbon emissions have climbed, as the post-pandemic global economy fired back up”.1 Despite the number of distracting dilemmas that we are up against today, it is clear that climate change remains a concern – perhaps more than ever. And in the wake of Davos 2023, we thought it fitting to reflect on how the energy sector is adapting to this catastrophe of tomorrow.

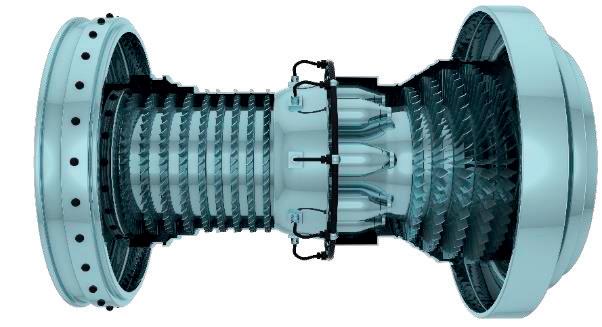

Several of the articles in this issue are cognisant of the oil and gas industry’s role in mitigating emissions. Elliott Group (p. 35) explores the development of new and optimised turbomachinery solutions to support the decarbonisation of the energy economy. On p. 41, Cook Compression discusses two potential pathways to decarbonisation – emission reduction and hydrogen fuel – and how new technologies are being developed to support energy companies. Similarly, Comprimo, part of Worley (p. 19) studies the options available for recovering carbon dioxide emissions and hydrogen from sulfur plants, and Bechtel Energy (p. 14) discusses the integration of an amine-based, post-combustion carbon capture unit with an LNG facility.

Additionally, our regional report, which focuses on Central and South America, begins by stating that one of the challenges that is set to inform the future of the region’s downstream sector is the global race to net zero. As such, there are moves to develop the hydrogen economy in Brazil in particular.

Whilst the WEF’s outlook for 2023 may seem glum, we hope that the key takeaway from this issue is that there are signs of recognition and progress towards a sustainable future within the oil and gas sector. There is an awareness of the fact that climate change is a worrying reality, and companies are looking at ways of adapting their operations in response to this.

Indeed, a recent headline from The Guardian read ‘What we learned at Davos: signs of hope emerge from the pessimism’. The article notes that whilst we have “become hard-wired for pessimism […] after surviving the horrors of the past three years there [is] a sense that there can’t be much more bad stuff out there and that, as a result, the only way is up from here”.2 Perhaps it is time to attempt a shift away from pessimism towards cautious optimism, instead.

1. ‘The Global Risks Report 2023’, World Economic Forum, 18th Edition.

2. ‘What we learned at Davos: signs of hope emerge from the pessimism’, The Guardian, (22 January 2023), https://www.theguardian.com/business/2023/jan/22/what-we-learnedat-davos-global-economy

End-to-end systems from receipt of molten sulphur to loading of solid material – single source supply by IPCO.

• Premium Rotoform pastillation.

• Duplex steel belts specifically alloyed to resist corrosion.

• High capacity drum granulation.

• Downstream storage – silo and open/closed stockpiles.

• Custom-built reclaimers for any location.

• Truck, rail and ship loading and bagging systems.

• Large scale block pouring.

Technip Energies has been awarded a contract to upgrade sulfur recovery facilities at Aramco’s Riyadh refinery.

This contract covers the implementation of three new tail gas treatment (TGT) units, improving the performance of the existing three sulfur recovery units (SRUs) to comply with more stringent regulations for sulfur dioxide (SO2) emissions, with recovery efficiency at more than 99.9%.

The project will be executed locally, leveraging Saudi economic resources and infrastructure.

The existing SRUs in the Riyadh refinery were designed and built by Technip Energies in the early 2000s.

Bhaskar Patel, Technip Energies’ SVP Sustainable Fuels, Chemicals & Circularity, commented: “We are pleased to be entrusted by Aramco to work on the upgrading programme of their refinery in Riyadh.

“By leveraging our long-standing relationship, which has been in place since the mid-1990s, we are committed to [making] this project another success, while utilising local resources and supply chain.”

Phillips 66 has announced that it has received ISCC PLUS certification for its Sweeny Refinery in Texas, US, to process oil made from waste plastics into feedstocks for new plastics.

ISCC is a sustainability certification system that covers all sustainable feedstocks, including circular feedstocks produced from plastic waste. Its ISCC PLUS certificate covers bio-based and recycled, or circular, raw materials.

The certification verifies that the refinery meets the standards to process pyrolysis oil made from hard-to-recycle waste plastics into circular ethane, circular propane, circular propylene and other sustainable feedstocks and petrochemical building blocks. The products will be used to support polymer producers that are advancing a circular economy for plastics.

BASF has broken ground on the third and final phase of the methylene diphenyl diisocyanate (MDI) expansion project at its Verbund site in Geismar, Louisiana, US, announced in July 2022. The company will increase production capacity to approximately 600 000 tpy by the middle of the decade.

The investment for this final expansion phase, which takes place from 2022 to 2025, amounts to US$780 million. Including the first and second phases, the investment volume totals around US$1 billion, making the MDI expansion project BASF’s largest wholly-owned investment in North America.

BASF welcomed Clay Schexnayder, Speaker of the House for the Louisiana State Legislature, for a ceremonial ‘tilling-of-the soil’ to officially mark the ground breaking of the final phase of the expansion.

Leveraging state-of-the-art technology, the expansion will showcase the highest safety standards combined with advanced digitalisation in its operations.

Irving Oil and Anaergia Inc. have announced a partnership that will supply Canada’s largest refinery with carbon-negative renewable natural gas (RNG), as well as Irving Oil’s other operations such as delivered natural gas.

The RNG, which is made from organic matter instead of fossil fuels, will be produced at Anaergia’s Rhode Island bioenergy facility, where food waste and other organic wastes that would otherwise have been

landfilled are transformed into renewable fuel. The facility is designed to divert over 100 000 tpy of waste from landfills, and it is the largest anaerobic digester processing organic waste in New England.

Approximately 350 million ft3 of RNG will be supplied annually from Anaergia into the regional pipeline, where it will reduce the need for conventional natural gas supply to Irving Oil’s operations, including the

Saint John Refinery in New Brunswick, Canada.

This RNG is recognised as carbon-negative due to its ability to capture more methane emissions than the organic waste would have otherwise created when landfilled. In this way, Anaergia’s Rhode Island bioenergy facility prevents the release of more than 40 000 tpy of carbon dioxide (CO2)-equivalent greenhouse gas emissions.

14 - 16 March 2023

StocExpo Rotterdam, the Netherlands www.stocexpo.com

19 - 21 March 2023

AFPM Annual Meeting

San Antonio, Texas, USA www.afpm.org/events

19 - 23 March 2023

AMPP Annual Conference & Expo Denver, Colorado, USA ace.ampp.org

12 - 14 April 2023

25th International Aboveground Storage Tank Conference & Trade Show Orlando, Florida, USA www.nistm.org

25 - 27 April 2023

Sulphur World Symposium Edinburgh, Scotland www.sulphurinstitute.org/symposium-2023

08 - 12 May 2023

RefComm

Galveston, Texas, USA events.crugroup.com/refcomm

07 - 08 June 2023

Valve World Americas Expo & Conference Houston, Texas, USA www.valveworldexpoamericas.com

07 - 08 June 2023

Downstream USA 2023

Galveston, Texas, USA events.reutersevents.com/petchem/downstream-usa

13 - 15 June 2023

Global Energy Show Calgary, Alberta, Canada www.globalenergyshow.com

10 - 13 July 2023

LNG2023

Vancouver, British Columbia, Canada www.lng2023.org

05 - 08 September 2023

Gastech Singapore www.gastechevent.com

TotalEnergies has announced the start-up of the Deutsche Ostsee LNG import terminal, which will be operated by Deutsche ReGas and located in Lubmin, Germany.

TotalEnergies is contributing a floating storage and regasification unit (FSRU) and supplying LNG to the project.

In December 2022, TotalEnergies delivered one of the company’s two FSRUs to Deutsche Regas. The vessel has an annual regasification capacity of 5 billion m3 of gas – enough to cover approximately 5% of German demand.

Following Deutsche Regas’ open season procedure, in October 2022, TotalEnergies also contracted a regasification capacity of 2.6 billion m3/yr of gas, and began to deliver LNG from its global integrated portfolio to the Lubmin terminal.

“Thanks to the start-up of the Lubmin terminal, TotalEnergies will be able to [...] increase its imports to Europe to over 20 million tpy, or about 15% of the continent’s regasification capacity,” said Stéphane Michel, President Gas, Renewables & Power at TotalEnergies.

USD Clean Fuels LLC has announced its intention to build a new biofuels terminal in National City, California, US, that will have the capability to transload renewable diesel, biodiesel, ethanol and sustainable aviation fuel (SAF). The terminal will be served by the BNSF Railway and will provide efficient transportation of clean fuels to the area from the Midwest and US Gulf Coast. Pending receipt of all local and state permits, the terminal is

expected to be operational by early 2024.

The terminal development is supported by two investment-grade rated parties that signed long-term terminal service agreements. These agreements provide for the inbound shipment of renewable diesel, biodiesel, ethanol and SAF on rail, self-switching of the rail rack, and four truck loading spots that are equipped with in-line injection capabilities to provide quality finished products to customers.

Emerson will provide automation technologies, software and analytics for the Ras Laffan Petrochemical Complex in Qatar, as part of a consortium with Viasat Energy Services. The US$6 billion integrated polymers project, a joint venture (JV) between QatarEnergy and Chevron Phillips Chemical, is currently under construction and scheduled to go online in late 2026.

The project is QatarEnergy’s largest investment ever in the country’s petrochemical sector. The complex will include an ethane cracker with a capacity of 2.1 million tpy of ethylene, making it the largest ethane cracker in the Middle East and one of the biggest in the world. It also includes two high-density polyethylene derivative units with a total capacity of 1.7 million tpy.

According to the UN’s Economic Commission for Latin America, the population for Central and South America reached approximately 660 million in 2022, and is expected to rise to around 750 million by mid-century.1

While the trend would normally inspire investment in refining capacity and related infrastructure, the future of the region’s downstream sector is muddied by several complications: the global movement towards net zero emissions, the ongoing Ukraine war, politics, and hydrogen development. Depending on the jurisdiction, some factors will have a beneficial effect, others deleterious.

Colombia is South America’s third largest oil producer, with an output of over 700 000 bpd. It has only eight years left of reserves, however, and needs to significantly increase exploration in order to maintain production.

In September 2022, the country elected Gustavo Petro as its new President. The left-wing candidate had run on a platform of eliminating contracts for oil and gas exploration and a ban on fracking. Upon inauguration, he wasted little time replacing the board of directors of state-owned Ecopetrol with his own slate of candidates, cementing control over the largest producer and refiner in

the country. In addition to focusing on a transition to renewables such as wind and solar, Ecopetrol will be paying significantly higher revenues to the government. The changes will inevitably redirect expenditures away from maintenance of conventional energy assets. In early 2021, Ecopetrol announced that it was spending US$780 million over the next several years to modernise the century-old, 250 000 bpd Barrancabermeja refinery in the Caribbean port of Santander. An upgrade and expansion of its hydrocracking unit will reduce sulfur content in gasoline to 10 ppm. Water treatment and sulfur dioxide (SO2) reduction are also planned for the facility.

The ultimate fate of the refinery is now uncertain. In October 2022, President Petro visited the Barrancabermeja community (which is located at the mouth of the Magdalena River), and suggested that they begin switching their economic priorities from oil to the opportunities of monetising potable water; Colombia’s future energy needs would be supplied by renewables.

While a focus on renewables is admirable, the repercussions in several EU countries from over-dependence on wind and solar point to the hazards. Colombia, which relies on oil and gas for one-quarter of its revenues, can ill-afford missteps; protests from the

Gordon Cope, Contributing Editor, reflects on happenings in Central and South America’s downstream oil and gas sector in 2022, and forecasts what lies ahead for the region.

disaffected poor and violence from guerrilla groups already engulf many parts of the country.

Venezuela, with an estimated 304 billion bbl of reserves, has seen its output plummet from over 3 million bpd to an estimated 527 000 bpd in late 2021.

The lack of investment in maintenance has had a profoundly negative impact on the downstream sector. The Paraquana refinery complex, with a nameplate capacity of 940 000 bpd, has been the scene of a score of failures, including a crack in a holding tank that resulted in 3.6 million l of fuel spilling into the Gulf of Venezuela marine environment. Following a substandard refurbishment, the 140 000 bpd El Palito refinery in Carabobo State has been largely shut due to a leaking catalytic cracker.

Thanks to the disruptions and sanctions arising from the Ukraine war, the Biden administration has recently made overtures to Venezuela in regards to lifting sanctions (in November 2022 it granted US-based Chevron permission to resume operations at its oilfields for six months), but the downstream sector needs an estimated US$200 billion in investments to restore viability. Considering that most major oil companies have abandoned their assets in Venezuela, any comprehensive revitalisation is highly unlikely.

For the last several years, Brazil has been privatising many different parts of its economy, including the energy sector. State-controlled Petrobras has been divesting itself of major assets, including petrochemical plants, pipelines and refineries.

Eight refineries are on the disposal list. In December 2021, Petrobras finalised the sale of its 333 000 bpd Mataripe refinery in northeast Brazil to Arcelen. For the last year, the plant had been operating at under 70% capacity. The Abu Dhabi-based company, which paid US$1.8 billion for the facility, intends to return the plant to full capacity and to explore biorefining potential. In 2022, Petrobras also concluded the sale of its 6000 bpd SIX (Regap) refinery to the Canadian-based Forbes & Manhattan (F&M) for US$41.6 million.

Two other sales are pending final approval: the 46 000 bpd Isaac Sabbá refinery, sold to Atem Distribuidora for US$190 million, and the 800 bpd Lubrificantes e Derivados do Nordeste (Lubnor) refinery, acquired by Grepar Participações for US$34 million.

Petrobras is also instigating changes to produce biofuels. In 2020, it reconfigured its Repar refinery to produce 110 000 tpy of renewable diesel made from soybean oils. Between 2022 – 2026, it plans to spend US$600 million to add 505 000 tpy further capacity to its Paulinia and Cubatao refineries.

In October 2022, Brazil elected Luiz Inácio Lula da Silva (Lula), a former president, who formally took power in January 2023. Lula’s campaign platform had several planks affecting the energy sector. He vowed to rein in rising energy costs to the public (which had been passed on

during the previous Bolsonaro administration) by shielding them from international prices. While not looking to reverse finalised sales of Petrobras assets, re-examination of pending transactions has not been ruled out. The remaining four refineries, Abreu e Lima (Rnest), Presidente Getúlio Vargas (Repar), Alberto Pasqualini (Refap) and Gabriel Passos (Regap) are still technically up for sale, but the new, left-leaning administration increases the risk factor for potential buyers.

While Lula’s administration may attempt to slow privatisation of Petrobras’ downstream assets, upstream exploration is expected to continue largely unabated. During his first presidency from 2003 to 2010, Lula was a champion of pre-salt development. In October 2022, thanks largely to the pre-salt play, total crude production exceeded 4 million bpd (of which 3.4 million bpd came from offshore). Petrobras has committed a further spending of US$68 billion over the next five years to boost production further toward 5.3 million bpd by 2030.

Thanks to the populist policies of Mexican President, Andrés Manuel López Obrador (AMLO), the privatisation trend under the previous administration has been significantly reversed. New licensing rounds and joint ventures (JVs) between cash-strapped Pemex and deepwater operators have been cancelled.

In addition to this, the downstream sector has been impacted. In order to be more energy self-sufficient, AMLO has decreed an end to crude exports in order to supply Mexico’s fuel needs domestically. Pemex manages six refineries with a nominal capacity of approximately 1.5 million bpd – enough to meet domestic demand for gasoline, diesel and jet fuel. Most have been operating at reduced capacity due to lack of maintenance, however. The 315 000 bpd Tula refinery, near Mexico City, has operated at half capacity for the last several years. Pemex has earmarked US$2.6 billion in renovation funds to increase output, including a new coker.

Further, Pemex is constructing a new refinery. The 340 000 bpd Dos Bocas plant is being built in AMLO’s home state of Tabasco. Costs have soared from the original US$8 billion budget, and the refinery is now expected to cost US$12.5 billion. It was officially inaugurated on 1 July 2022 – the fourth anniversary of AMLO’s election. The refinery is now in its testing phase, but is not expected to begin producing significant amounts of fuel for several years. Although curtailing crude exports will provide the new refinery with sufficient feedstock when it is finally completed, the region has a shortage of natural gas, which could hinder production unless new gas pipelines to the Yucatan are completed over the next several years.

Mexico is also positioned to indirectly benefit from the surge in LNG demand due to the Ukraine war. Sempra Energy’s Energía Costa Azul (ECA) LNG, located in Baja California, is a former LNG import site. The 3 million tpy train was originally scheduled for completion in 2024, but the company says that construction delays have pushed the commissioning date into 2025. Sempra is

Effective asset management is more than digital tools and data. It requires the behind-the-scenes use of best practices and a deep understanding of heavy industry infrastructure.

When decades of EPC experience meets data analytics, our clients have a integrated solution for the reliability they require.

• Full-service solutions from design and construction to operations & maintenance

• Enhanced diagnostics to rapidly achieve your goals

• Data-driven operations & maintenance for maximized ROI

Let’s find ways to help you.

in talks with partners for a potential Phase 2 with a capacity of 12 million tpy.

The Mexico Pacific Ltd (MPL) LNG project is located south of ECA on the Sea of Cortez in Sonora State. The latest plan is to build three trains totalling 14.1 million tpy capacity in Phase 1, and a further three trains in Phase 2, doubling capacity to 28.2 million tpy. The company notes that it has secured Memorandum of Understanding (MoU) sales and purchase agreements from Asian utilities and supermajors seeking to diversify sources. Pending a final investment decision (FID) later in 2022, initial LNG is expected by 2026.

Both ECA and MPL are already served by major pipelines that are connected to Permian gas hubs. While LNG output is unlikely to enter the European market to displace Russian gas, their positions on the Pacific coast make them highly attractive to the energy-hungry Asian market.

Over the last decade, Guyana has transformed into one of the largest exporters of crude on the continent. Over 30 deepwater offshore discoveries by ExxonMobil and partners in the Stabroek Block have resulted in an estimated 11 billion bbl of recoverable oil resources, with the potential for far more discoveries. Several floating production, storage and offloading (FPSO) facilities are already in place. Liza Phase 1 and Liza Phase 2 are now producing an average of nearly 360 000 bpd of oil. It is projected that there will be a total of 12 FPSOs producing up to 1.5 million bpd by 2027.

The boom in production has attracted widespread interest in building new energy-related projects in Guyana. US-based Delta Energy and Petroleum Corp. (DEPC), for instance, has offered to construct four modular refineries, each with a 60 000 bpd capacity and the potential for 10 000 permanent jobs. The government, however, has noted that it does not wish to develop large-scale energy projects because they emit unacceptable levels of greenhouse gases (GHGs). Instead, they have invited proposals to finance and build a 30 000 bpd refinery in order to provide a safe, reliable source of fuel for the country. “This is for national security purposes to have energy security at home where we don’t run out of gas or diesel or anything like that” said Vice President, Bharrat Jagdeo.2 The government is looking for the successful bidders to begin construction in 2023, and complete it by 2025. Feedstock will be provided from the country’s share of oil production.

Over the last decade, investments in the unconventional Vaca Muerta shale play have resulted in significant growth of domestic crude production. Output has almost doubled from 100 000 bpd in mid-2020 to over 220 000 in mid-2022; total domestic production is now exceeding 600 000 bpd. The growth is expected to gradually help displace imports.

Argentina has approximately 600 000 bpd of domestic refining capacity. State-controlled YPF accounts for

around half, including the 189 000 La Plata refinery near Buenos Aires, and the 105 000 bpd Lujan de Cuyo refinery in Mendoza. In 2019, the company announced that it would spend more than US$2 billion to carry out a desulfurisation process at both plants. The work is expected to be finished in 2024.

The growth in gas production is also expected to offer opportunities for LNG exports. The Vaca Muerta produced 1.6 billion ft3/d of associated gas in early 2022, and is expected to exceed 4 billion ft3/d by 2030. For several years, YPF has been working to establish a floating LNG plant in the Atlantic port of Bahia Blanca. Now, with the planned construction of the US$1.6 billion Néstor Kirchner Gas Pipeline from Neuquén province to Buenos Aires in the populous north, other plans are emerging for land-based LNG export plants.

Latin America produces approximately 4 million tpy of hydrogen, primarily for crude upgrading in refineries. While many jurisdictions have announced grand plans to develop green hydrogen economies, relatively few have advanced to the planning stage. In 2021, Australian firm Enegix announced plans to take advantage of northeast Brazil’s abundant wind and sunshine in Ceará state to construct a 600 000 tpy green hydrogen plant. The US$5.4 billion project is expected to take up to four years to construct after all construction permits are issued; most of the output is destined for the export market. During 2022, Ceará state also signed two MoUs, one with Japan-based Mitsui for the production of green hydrogen and ammonia at the port of Pecém, and the other with ABB Automation, a Swedish-Swiss company that specialises in the hydrogen value chain – from production and transport, to consumption.

While the repercussions of the Ukraine war are being felt in Central and South America, politics still play a major role in the region’s energy sectors. Venezuela has confiscated assets and Mexico has cancelled future international energy investments. This has led to severe deterioration of downstream assets in the former, and the diminishment of upstream activities in the latter. While the coffers of state-owned oil companies swell from increased export revenues, so does the political desire for net zero. What might have been a boon to countries in urgent need of infrastructure investment and modernisation may now be redirected toward environmental goals.

1. ‘Latin America and the Caribbean lost nearly 3 years of life expectancy at birth between 2019 and 2021 as a result of the COVID-19 pandemic’, ECLAC - United Nations, (22 August 2022), https://www.cepal.org/en/notes/latin-america-and-caribbeanlost-nearly-3-years-life-expectancy-birth-between-2019-and2021#:~:text=By%202022%2C%20estimates%20place%20 the,a%20total%20of%20751.9%20million.

2. ‘Oil refinery is to ensure Guyana does not run out of fuel, says Vice President’, OilNOW, (6 November 2022), https://oilnow.gy/ featured/oil-refinery-is-to-ensure-guyana-does-not-run-out-offuel-says-vice-president/

Jaleel Valappil, Bechtel Energy, USA, looks at how to ensure operability of hydrocarbon facilities with post-combustion carbon capture.

Global warming and climate change caused by greenhouse gases (GHG) have received widespread and growing concern in recent years. The challenge of meeting increasing global energy demands while mitigating climate change is an urgent one that the world needs to address. The natural gas/LNG industry has seen tremendous growth over the years, with several grassroots plants having been built around the world in order to meet global energy needs, and natural gas demand is expected to grow over the next decade. Most of the facilities use gas turbine drivers which emit a significant amount of flue gases that contain carbon dioxide (CO2). Fired heaters used in these facilities also emit CO2; and CO2 is also emitted by acid gas removal processes in the pre-treatment of feed gas prior to liquefaction.

Carbon capture and storage technology (CCS) is one opportunity to capture CO2 emissions from flue gases as a result of combustion processes. The captured CO2 can be stored in underground formations afterwards. CCS is becoming more popular in the power industry, where more than 30 power generation projects are currently under construction, or at various stages of development. LNG facilities are also expected to be designed or retrofitted with CCS in the future. However, most of the LNG plants that are currently in operation are not designed for carbon capture. For this reason, post-combustion CO2 capture (PCC) has an advantage over other alternatives because the technology can simply be implemented as an ‘end-of-the-pipe’ retrofit, without the need for significant changes to existing facilities. The most widely used technology for post-combustion CO2 capture is the amine solvent-based process.

The retrofitting of existing natural gas facilities with CO2 capture offers a promising opportunity to achieve a global reduction in CO2 emissions. With this, any operational disturbances in the hydrocarbon facility can impact the operation of carbon capture in an adverse way, and vice versa. Accounting for these interactions in the design of a carbon capture facility is important to ensuring reliable facility operation after start-up.

This article will discuss the integration of an amine-based, PCC unit with an LNG facility, and the effect of the integration on the LNG facility’s operation.

In order to obtain a full understanding of the transient characteristics of a hydrocarbon facility with PCC, both units can be combined in an integrated dynamic model for analysis. Dynamic simulation can play a pivotal role in identifying any operational bottlenecks under transient conditions for the integrated hydrocarbon and CO2 capture plants. The integrated model can also be a valuable means to establish operational strategies on both sides to account for the various upstream scenarios. As an alternative, individual unit models can be used to develop boundary conditions for each other in order to obtain a representative behaviour of the entire facility.

This article will present a case study where the exhaust from an LNG facility is sent to a carbon capture unit. The dynamic model of the waste heat recovery unit (WHRU), duct work and the associated equipment is used to ensure that the various transient scenarios in an LNG facility or in the PCC unit do not adversely impact the LNG plant’s operation. This is valuable for verifying the design of the PCC unit/integration, and identifying any operational recommendations for the integrated facility.

The three main options for carbon capture in hydrocarbon facilities are pre-combustion, post-combustion, and oxyfuel combustion. When compared to pre-combustion and oxyfuel combustion, post-combustion capture is considered to provide comparable performance with reduced technical risk and process complexity. Post-combustion can be installed without affecting the performance of the liquefaction process. Additionally, this option requires a minimum number of modifications to existing equipment, hence reducing risk. This makes post-combustion attractive for new LNG plants, or as a retrofit to existing plants. There is also a good amount of experience to support post-combustion capture in power plants, which makes it a less risky option. Additionally, downtime in a carbon capture plant does not have to affect LNG production, as the flue gas can be diverted to the atmosphere with an appropriate design.1

The use of amine-based solvent for PCC has attracted considerable interest in CO2 capture. This is a proven technology – existing PCC pilot plants already demonstrate the feasibility of

CO2 removal with amine solvent from flue gas, albeit at a modest scale. Monoethanolamine (MEA) is the most commonly used solvent in chemical absorption processes for CO2.

The integration of PCC with LNG plants is carried out by directing the flue gas from gas turbines to an amine-based carbon capture unit. This will include additional ducting, dampers, and possibly a blower to increase flue gas pressure. A WHRU unit may be used to further recover the heat from flue gas. The heat requirements for the reboiler can be provided by the existing hot oil or steam system in the facility. When integrating PCC into an existing facility, the following aspects must be considered in order to ensure reliable and safe operation:2

n Flexibility of operation: the ability to operate in an acceptable manner over a range of steady-state conditions. For example, this can include:

§ Operation at turndown rates (half rate/other) due to changing ambient conditions or other operational reasons.

§ Operation with no LNG production – with refrigeration compressors running in recycle, with gas turbines partially loaded.

n Controllability: ability to recover from process disturbances and move to new set points in a measured and timely fashion. This is dependent on both the design of the process and the underlying process control schemes.

n Start-up and shutdown: the start-up and shutdown of an LNG facility/PCC unit is a key operating scenario for the amine system that can induce major changes.

n Reliability/safety of operation: the ability to accommodate equipment failures and trips in a safe

manner. This includes trips of various equipment, e.g. valves failing to close, etc.

The design and integration of PCC needs to account for the various operational scenarios and disturbances in the LNG facility and the carbon capture unit. One of the main concerns with integration is the impact of upsets in a PCC facility affecting the LNG production. Large variations in gas turbine exhaust pressure can cause the turbine driver to trip, bringing LNG production to a halt and subsequently incurring very significant economic costs. The following are some of the key scenarios that impact the integrated system, and that should therefore be considered during design:

n LNG train trip/facility-wide shutdown.

n Trip of individual gas turbines.

n Turndown to half rate and to standby mode, with refrigeration compressors in recycle.

n Start-up of refrigeration compressors/PCC unit.

n Trip of flue gas blower.

n Failed closing of a flue gas damper.

n Operational upsets in the PCC unit.

The operability of the integrated LNG/PCC plant can be studied with advanced modelling tools to ensure that the design can handle these scenarios.

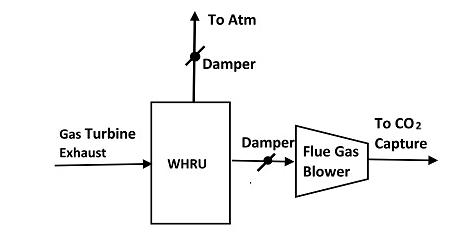

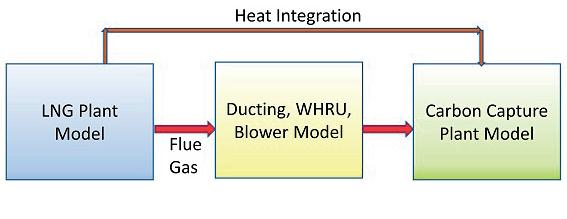

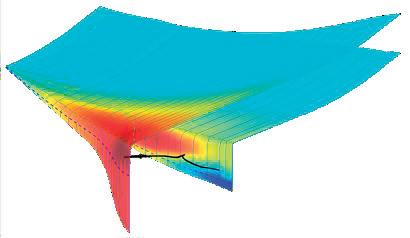

Dynamic simulation by way of utilising rigorous mathematical models has become influential in process design, design validation, control system verification, start-up support, and troubleshooting. Many recent developments in the simulation software and technology have led to the development of large-scale dynamic models and their use during the entire project life. The scope of the dynamic modelling for the integrated LNG/PCC facility can be divided into three areas, as shown in Figure 1. There are different options (model scope/methodology) to study the overall behaviour of the integrated LNG/PCC facility. This can be selected based on the scope and objectives of the analysis.

For a rigorous understanding of the transient characteristics of an LNG plant with PCC, a combined dynamic model is preferred. The transient responses of the LNG plant are well understood, and this has been studied over the years. The behaviour of an integrated LNG/PCC facility is a relatively recent development and can benefit from integrated model-based analysis. Another option is to have individual models of the three sections of the integrated facility, which can be run and used as the boundary condition for the next model. The upcoming case study looks at upsets in the interconnecting units affecting the LNG facility, and vice versa.

The modelling of LNG facilities is normally carried out during the detailed design phase. The use of these

We are a global market leader in reaction, separation, purification, static mixing as well as polymer processing technologies. With a comprehensive offering that includes process components all the way to complete process plants and technology licensing, we can serve a broad range of industries with key solutions to intensify processes, increase efficiency and improve product quality. With an ever-expanding portfolio of cutting-edge products that supports circularity while reducing material and energy use as well as emissions, we are the ideal partner to support the net zero transition of businesses across the chemical and polymer value chains. We also offer our technology innovations to support the sustainable manufacturing of bioplastics, renewable fuels, chemical recycling for unrecyclable materials as well as carbon capture technologies. www.sulzer.com

models for design and operation of LNG plants has become more widespread in recent years.3 The dynamic modelling of interconnecting ductwork, WHRU, and a flue gas blower can also be performed with available commercial dynamic modelling tools.

Much of the commercially-available process simulation software can be used to develop a dynamic model of amine-based CO2 capture processes.4 The first option to model this is to use an equilibrium-based modelling approach. Equilibrium-based modelling assumes that liquid and vapour phases reach equilibrium at theoretical stages, and that perfect mixing occurs at each stage. Equilibrium is rarely acquired in a reactive CO2 absorption process – especially during dynamic operation. The rate-based approach is more rigorous and considers the actual rates of mass and heat transfer, including chemical reactions. A rate-based approach is preferred for modelling reactive columns, as in the PCC process. The disadvantage of this approach is the computational requirements, as the rigorous rate-based approach results in extended systems of equations to be solved at each integration step.

This case study evaluates the integration of an amine-based PCC unit with an LNG facility, utilising gas turbines to drive refrigeration compressors. The normal design of such a facility routes the flue gas from turbines through WHRU to the exhaust stack and to the atmosphere. The addition of the PCC unit involves the introduction of additional ductwork, bypass dampers (to the atmosphere and the PCC unit), and a flue gas blower to increase pressure. The flue gas is further cooled in a heat exchanger and then routed to the absorber, where it is contacted with amine solvent to remove the CO2 from flue gas. The CO2-depleted flue gas is then released to the atmosphere (see Figure 2).

The main concern with the addition of a PCC unit is the possibility of impacting LNG production during various transient upsets in the PCC unit. The gas turbine exhaust outlet must be maintained within a pressure range to avoid a reduction in power output or a total turbine shutdown. Several scenarios were studied to evaluate the transient impact on the gas turbine outlet conditions.

A dynamic simulation model of the interconnecting unit (WHRU, flue gas blower, other equipment, and associated

piping) was developed to perform this study. This model was sufficient for this analysis, as the main interest was to evaluate the effect of upsets on GT outlet pressure (and to identify any mitigations needed). The following scenarios were studied with this model:

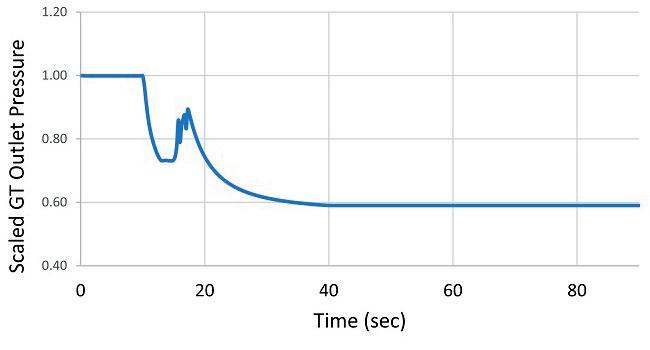

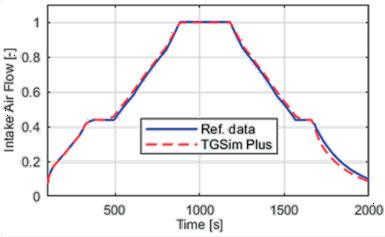

The flue gas blower trip is simulated to verify that the pressure at the GT outlet can be maintained within limits so that LNG plant operation is not affected. As soon as the flue gas blower is tripped, the damper to stack is signalled to open in order to avoid the excessive pressure increase in the system. The blower will coast down with speed response based on the rotational inertia of the string. The pressure at the GT outlet is shown in Figure 3. As can be seen, the pressure drops rapidly as the damper is opened along with the blower trip. This pre-emptive action prevented the pressure at the gas turbine outlet from increasing, due to trip of the blower. The pressure stabilises with the flue gas diverted entirely to the stack. An intermediate increase in pressure is due to the reduction in blower capacity while the damper is still opening.

The trip of a gas turbine will result in a rapid change in temperature and flow rate of flue gas at the inlet of the WHRU. The performance of the system during this scenario was studied. The profile of flue gas flow rate and temperature vs time from turbine vendor was used as the boundary condition.

Once the gas turbine is tripped, the flue gas flow reduces, decreasing the pressure at the inlet of the flue gas blower. The flue gas blower must be shut down to prevent significant vacuum formation at the suction. Shutting the flue gas blower too early can result in over pressuring the duct as the flue gas flow continues for some time. The appropriate time to shut down the blower was identified from simulation.

Several other scenarios were also evaluated with this model to identify any operability concerns. This included dampers fail closing, shutdown of the PCC unit, start-up of the PCC unit, and others. The transition from operation without PCC unit to PCC unit was simulated to verify the operating procedure for this transition. The starting point for this case was the operation with the flue gas diverted to the atmosphere with gas turbine flow rate at normal conditions. The right sequence and timings to open the main damper to the PCC unit, start up the flue gas blower, and close the damper to the atmosphere was verified using simulation.

1. ‘Techno-economic evaluation of CO2 capture in LNG’, IEAGHG Technical Report, (October 2019).

2. BUI, M., GUNAWAN, I., VERHEYEN, V., FERON, P., MEULEMAN, E., and ADELOJU, S., ‘Dynamic modelling and optimisation of flexible operation in post-combustion CO2 capture plants – a review’, Computers and Chemical Engineering, (2014).

3. MOKHATAB, S., MAK, J., VALAPPIL, J., and WOOD, D., ‘Handbook of Liquefied Natural Gas’, (2014).

4. CHUKUKWA, A., ENAASEN, N., KVAMSDAL, H. M., and HILLESTAD, M., ‘Dynamic modeling of post-combustion CO2 capture using amines – a review’, Energy Procedia, (2012).

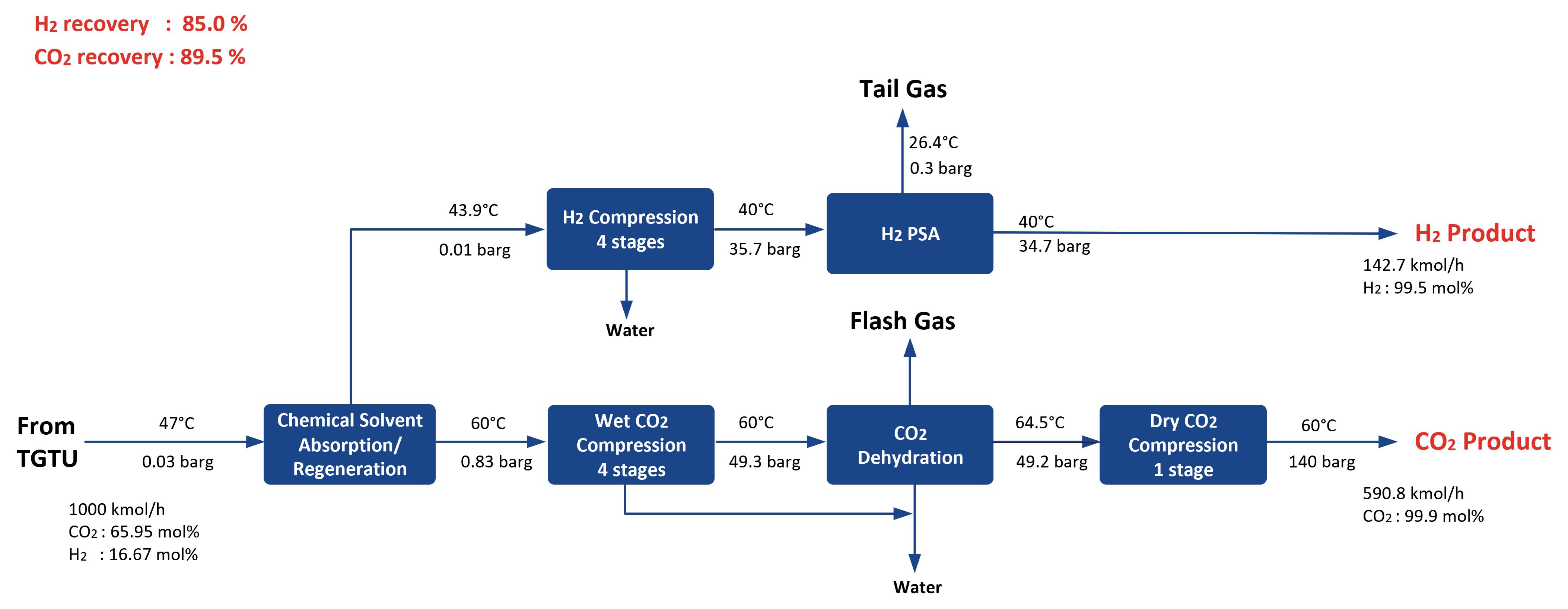

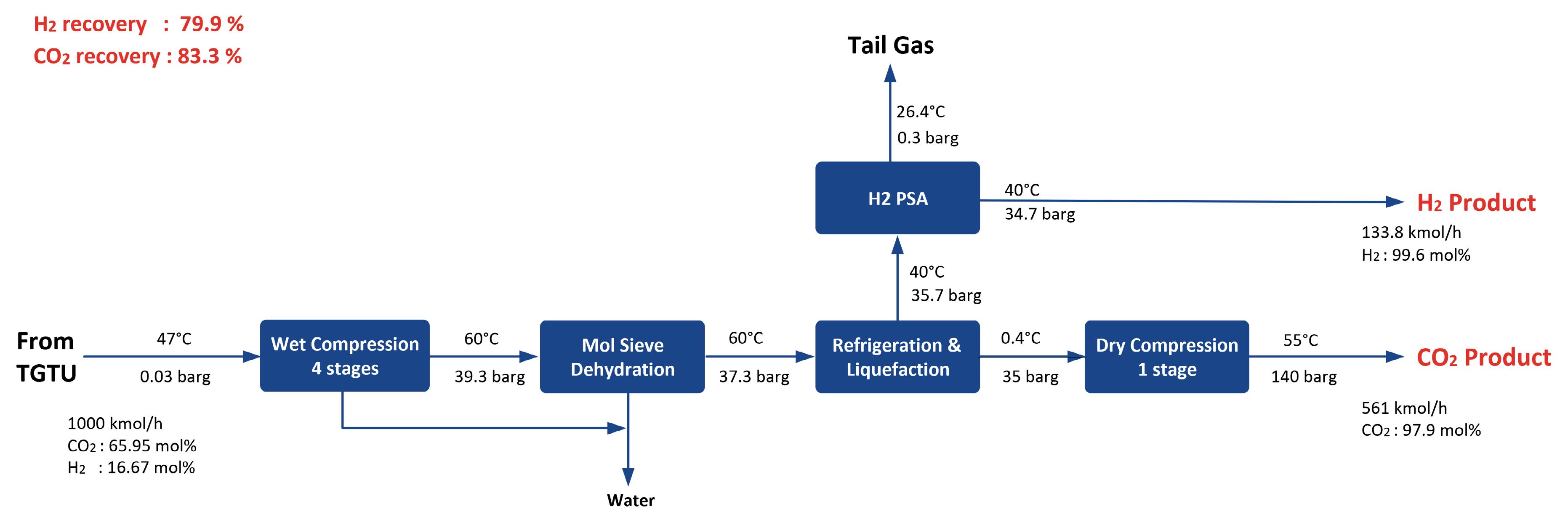

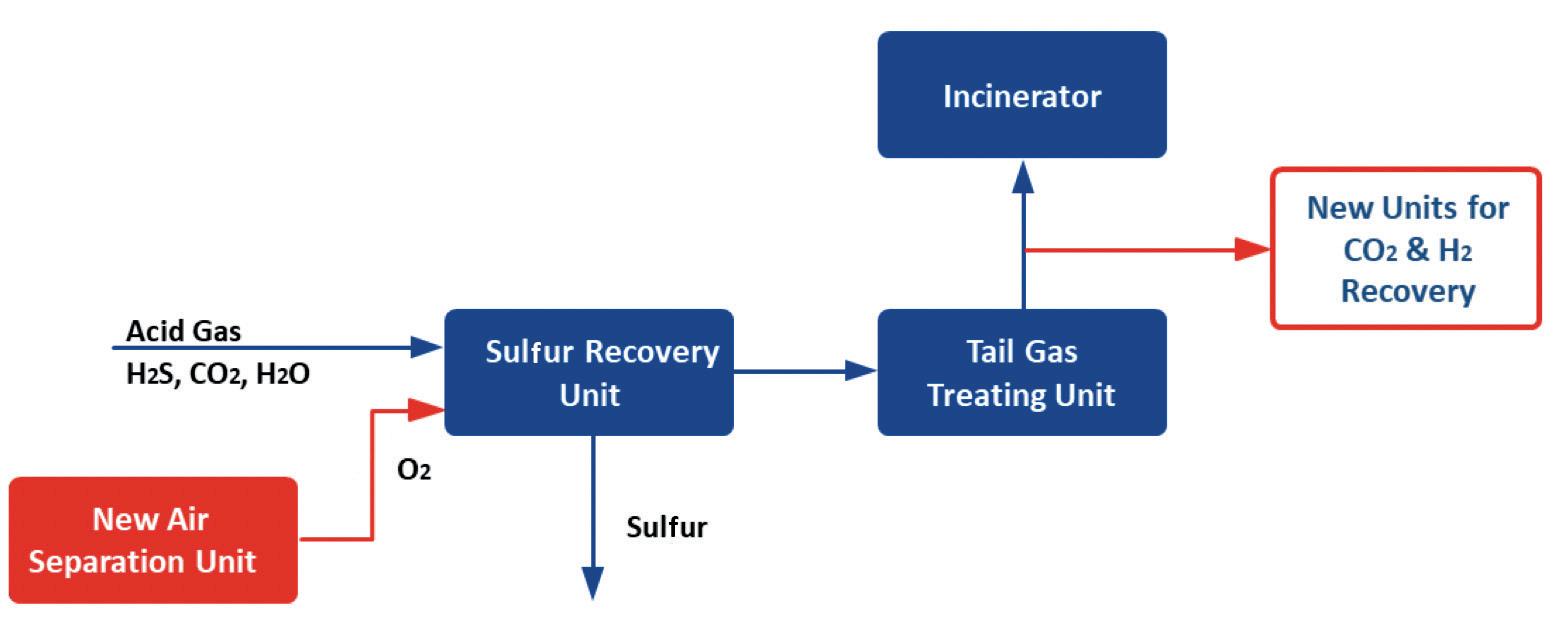

Camille Ventham and Gerrit Bloemendal, Comprimo, part of Worley, detail the process behind recovering carbon dioxide and hydrogen from sulfur plants.

As carbon dioxide (CO2) emissions are becoming an increasing issue in the oil and gas industry, and alternative fuels are being investigated, CO2 capture and hydrogen production technologies are under continuous development for improvement. One of the sources of CO2 emissions is the flue gas from sulfur recovery units (SRUs), especially in gas plants where substantial amounts of CO2 are present in the feed gas

to the SRU. This article will study the options that are available to recover this CO2 from the SRU, and in parallel recover hydrogen – a carbon-free fuel.

In order to maximise the potential for CO2 capture and hydrogen recovery, modifications have to be made to the SRU. This article will also present a case study highlighting these modifications, and evaluate the available technologies for optimised CO2 capture and hydrogen

recovery – both from a technical and a commercial perspective.

The line-up considered in this article is commonly applied in a natural gas plant, consisting of an amine base acid gas removal unit (AGRU) which removes the acid gas components from the main gas stream, resulting in an acid gas feed to the sulfur plant typically consisting of more than 60% hydrogen sulfide (H2S) and approximately 30% CO2, with the remainder being some hydrocarbons and water vapour.

The SRU considered is a standard modified Claus unit, consisting of a thermal stage followed by two catalytic stages. The tail gas of the Claus unit is routed to a tail gas treating unit (TGTU), in which the remainder of the sulfur species is converted to H2S, absorbed, and recycled to the Claus section. The overall recovery of the SRU and TGTU is more than 99.9%, which ensures that the flue gas from the incinerator section

contains less than 500 mg/Nm3 sulfur dioxide (SO2), which is considered to be state-of-the-art.

The potential locations that were identified for CO2 capture were the following:

n Front-end capture in the acid gas.

n Pre-combustion capture in the TGTU off gas.

n Post-combustion capture in the flue gas from the incinerator.

Previous studies showed that the optimum/preferred location for CO2 capture is in the off gas from the TGTU absorber, as front-end capture will require substantial modification to the AGRU, whereas post-combustion capture has to deal with strongly-diluted CO2 streams and requires flue gas pre-treatment before the gas can be handled in the CO2 capture system. In addition to this, neither front-end capture nor post-combustion technology are able to recover any hydrogen, as hydrogen is not present in the AGRU gas, whereas any produced hydrogen in the Claus unit is burned in the incinerator for post-combustion.

To maximise the production of hydrogen and minimise the dilution of the CO2, it is possible to convert the SRU from standard air operation to high level oxygen enrichment, such that the flow of inerts (mainly nitrogen) through the SRU is minimised. Figure 1 illustrates the proposed line-up with the optimum CO2 and hydrogen recovery unit.

For the plant that was studied, the sulfur processing capacity was considered to be adequate, and capacity increase was not required. The proposed modifications to the SRU/TGTU equipment were minimal, as less gas needed to be processed. Retrofitting the SRU/TGTU for a high level of oxygen enrichment only required modification of the burner to introduce the oxygen. The thermal reactor temperature was still within acceptable operating limits, as the acid gas was relatively lean. Single stage combustion in the thermal reactor could be retained.

The SRU is provided with a degassing system to remove dissolved H2S from the liquid sulfur, such that a premium sulfur quality is produced with less than 10 ppmwt H2S. This degassing system produces a vent air stream which is routed to the incinerator, where any sulfur species are converted to SO2. In air operation this results in a marginal increase of SO2 in the flue gas, but since the gas flow from the SRU is strongly reduced when there is no nitrogen in the TGTU off gas, the

Save time and cost by changing control valve quickly with a single seat ring versus a plug seat ring, bonnet gasket and seat gasket with a globe valve.

~20-50% lighter weight than same size globe valve and 30% more capacity to meet increased demand in throughput.

Erosive and cavitation resistant design with lower friction and higher precision above 450°.

Less leak path utilizing an integral bonnet to reduce the chance of emission(1).

(1) As compared to conventional positioners.

For more information, contact your local Baker Hughes representative or visit valves.bakerhughes.com

© Copyright Baker Hughes company. All rights reserved

SO2 resulting from the vent air is not diluted, leading to increased SO2 concentrations in the small flue gas stream, even though the absolute emission in kg/hr is reduced. For this reason, it is advised to align the emission values with the industry standard, and use the equations in the Environmental Protection Agency (EPA)’s New Source Performance Standards

– 40 CFR 60 Subparts J & Ja that cover SRUs.

With the above conversion to oxygen blown SRU, the gas from the TGTU absorber contains approximately 65% CO2, 16% hydrogen, 6% nitrogen, and traces of carbon monoxide (CO), H2S and carbonyl sulfide (COS). The absorber off gas is saturated with water vapour.

The options considered for CO2 recovery were the following:

n Chemical (amine-based) absorption.

n Cold flash.

n Adsorption.

n Physical solvent absorption.

n Membrane technology.

n Cryogenic separation.

From these options, a first screening showed that chemical absorption and cold flash were the most viable options, and these options were further evaluated in this study. For hydrogen recovery, pressure swing adsorption (PSA) was considered. Figure 2 shows a simplified block flow diagram for the cold flash option.

Cold flash Chemical solvent

Pros n Simplicity of the process

n Low equipment count

n No proprietary solvent – no license fee

n Lower utility consumption

n Inherent safety

The gas from the TGTU absorber is compressed to approximately 40 bar, and dried in a mol sieve unit. The dry gas is then cooled and partly liquefied by cooling against propane. In this step, the liquid CO2 is separated from the gas in a flash vessel. After separation, the CO2 is evaporated again and routed to a dry CO2 compression stage where it is boosted to 140 barg, which is the preferred pressure for the CO2 injection facilities. The non-condensed gas, which mainly consists of hydrogen, is routed to the PSA unit, where the hydrogen is separated with a purity of more than 99.5%. The remainder of the gas (mainly nitrogen, with traces of CO, H2S and COS) is routed to the incinerator before emitting the gas to atmosphere. The overall hydrogen recovery from the TGTU tail gas is around 80%, whereas the CO2 recovery is nearly 85%.

Cons

n Technology readiness and maturity

n Proven technology

n High CO2 and hydrogen recovery

n Product quality

n Limited known applications for CO2 removal

n Lower CO2 and hydrogen recovery

n COS specification is not met

Figure 3 represents a simplified block flow diagram for the chemical absorption option. For this option, the gas from the TGTU absorber is routed to another absorber, which operates at near atmospheric pressure. The bulk of the CO2 is absorbed in the absorber, and that loaded solvent is stripped in a regenerator. From the regenerator the CO2 is routed to a compressor, and dehydrated. Ultimately, the CO2 is delivered to the injection facilities at 140 barg and a very high purity of 99.9%. The off gas from the CO2 absorber, which mainly consists of hydrogen, is compressed to nearly 40 barg. During compression, condensed water is separated, and the gas is routed to the PSA unit, where the hydrogen is separated with a purity of more than 99.5%. Similar to the cold flash option, the remainder of the gas (mainly nitrogen, with traces of CO, H2S and COS) is routed to the incinerator before emitting the gas to the atmosphere. The overall hydrogen recovery from the TGTU tail gas is around 85%, whereas the CO2 recovery is nearly 90%. With that, the performance of the chemical absorption is marginally better than for the cold flash option, but that can be tweaked at a later stage. Note that for Figures 2 and 3, a ‘normalised’ tail gas flow of 1000 kmol/hr from the TGTU absorber has been assumed.

n High equipment count

n More plot space required

n Construction logistics are more challenging due to higher equipment count and larger diameters

n COS hydrolysis uncertainty limits H2S content allowable in the TGTU off gas

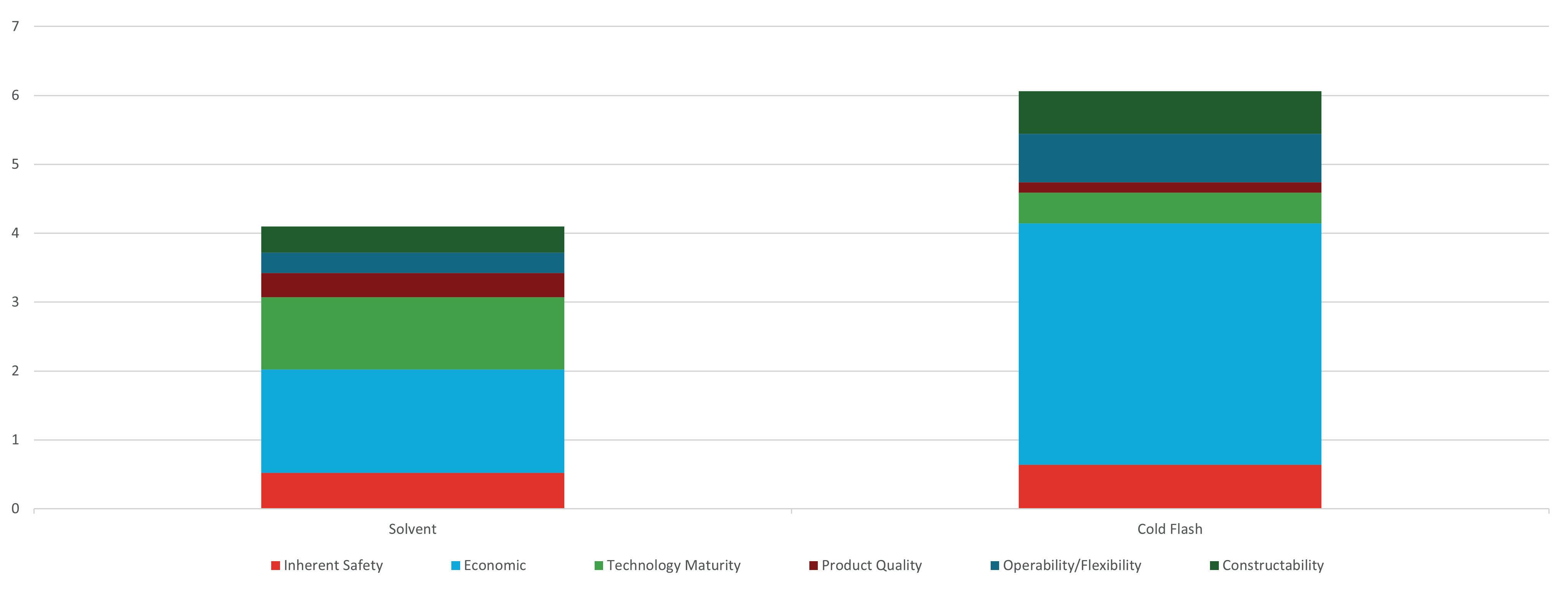

A qualitative first assessment of the cold flash and chemical solvent option is provided in Table 1.

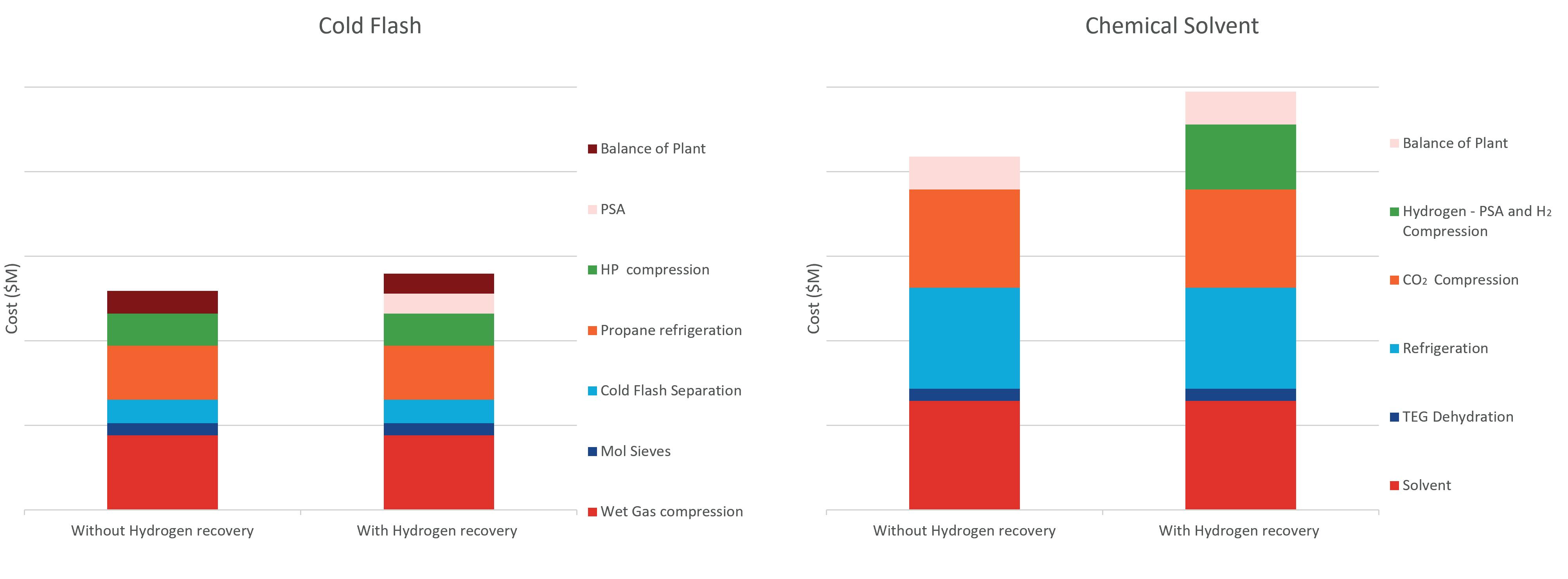

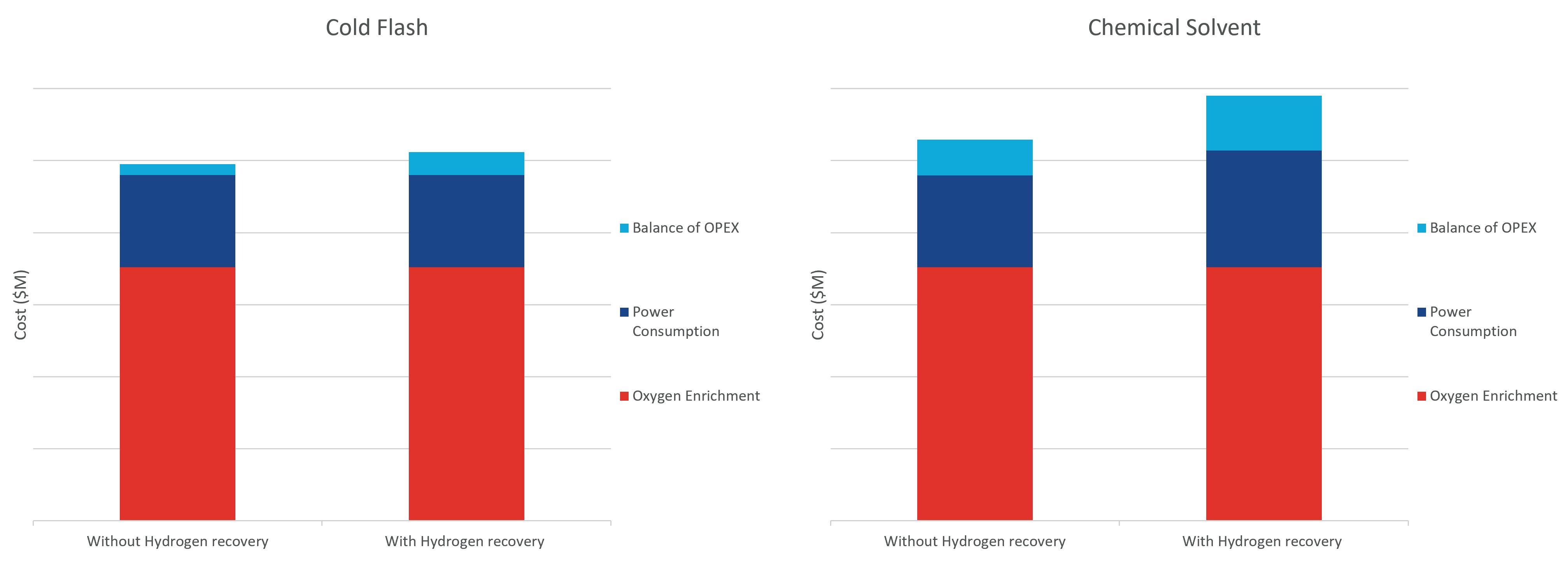

As in other comparison studies, a first step is to make a sized equipment list and a high-level capital cost estimate. For the cold flash option and for the chemical absorption option, this results in Figure 4.

From this graph it can be seen that the simple cold flash option without hydrogen recovery has the lowest investment cost, partly because it has the least amount of equipment and a high refrigeration cost for the chemical solvent option. The lower investment cost is determined by the fact that in the cold flash option only one compressor is required to compress the gas from the TGTU absorber to 40 barg. The addition

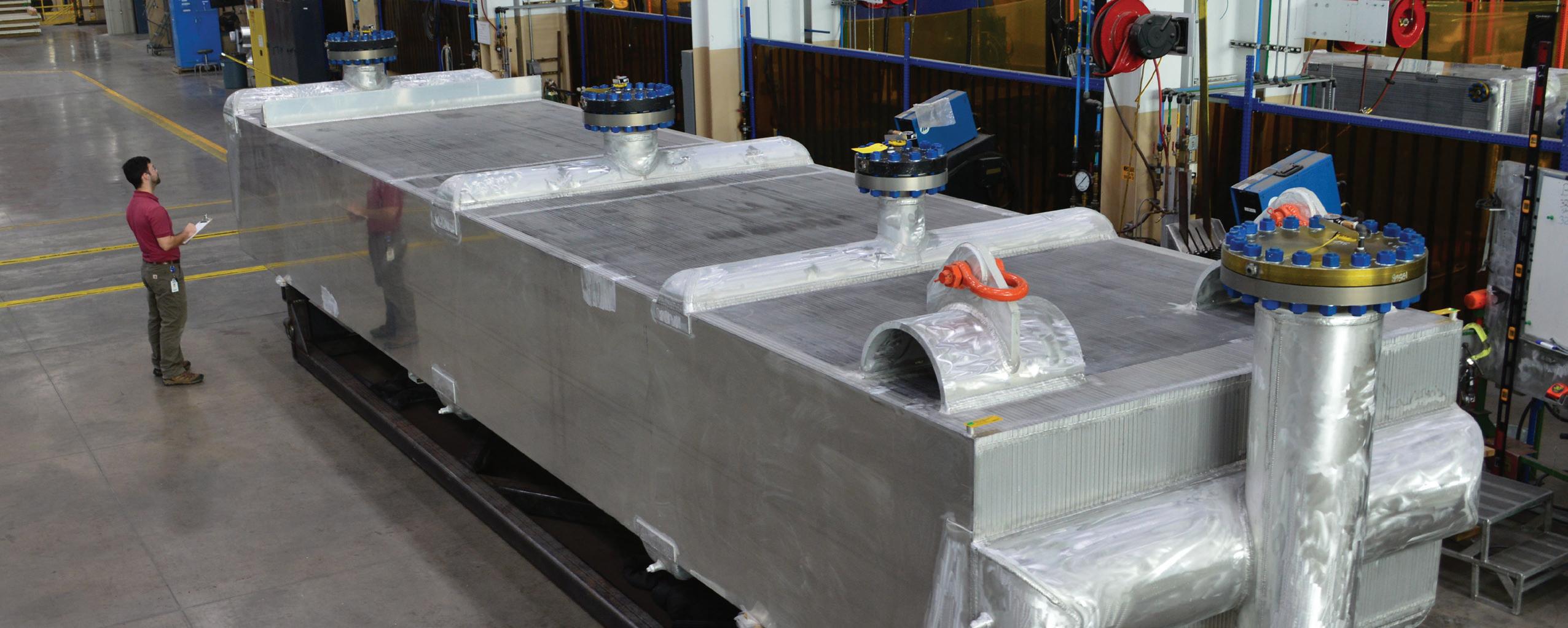

Chart is at the heart of midstream natural gas processing

Air Cooled Heat Exchangers

Integrated Process Plants

Brazed Aluminum Heat Exchangers

Nitrogen rejection, NGL recovery, liquefaction, compression, condensing and helium recovery rely on Chart engineered and built specialty equipment and systems.

www.Chart-EC.com

achx@ChartIndustries.com

of hydrogen recovery adds extra cost, but this will be paid out rapidly when the additional value of the recovered hydrogen is considered.

In a similar way, the operational cost can be estimated, resulting in Figure 5. Here, a similar trend as for the investment cost can be seen, with cold flash without hydrogen recovery resulting in the lowest operational cost, and chemical absorption with hydrogen recovery leading to the highest operational cost.

The capital cost and operating cost were subsequently used to develop the so-called Unit Technical Cost (UTC), which is the calculation of the cost per unit of product produced (in this case CO2 and hydrogen), taking into account the required investment cost and 20 years of operating cost. This UTC is normalised against the UTC for chemical absorption without hydrogen recovery, and is summarised in Table 2.

From Table 2 it can be seen that the cold flash option with hydrogen recovery results in the lowest UTC. Despite the higher investment cost and the higher operating cost, the revenue from the recovered hydrogen yields a substantial improvement in the cash flow position, resulting in the lowest UTC for that option.

Although the economic criteria are a large factor in deciding which technology to select, other factors come into

play as well. The criteria considered are outlined below, each with their weight factor in the total evaluation:

n Inherent safety – 10%.

n Economic (UTC) – 50%.

n Technology maturity – 15%.

n Product quality – 5%.

n Operability/flexibility – 10%.

n Constructability – 10%.

These criteria are each ranked with a figure of between 1 and 10. Combined with the above weightage, this results in Figure 6. From this graph it can be concluded that the cold flash technology with PSA is the preferred technology for CO2 and hydrogen recovery.

This study concluded that 100% oxygen enrichment is the preferred route for processing the acid gas in the SRU when CO2 and hydrogen capture is to be considered, as it will result in the most concentrated/least diluted gas stream for the CO2 and hydrogen recovery, and minimise the investment cost and operating cost. In addition to this, 100% oxygen enrichment will result in the highest hydrogen formation in the thermal reactor, making hydrogen recovery an economical option. Considering the relative ease at which hydrogen can be recovered as a product, this additional processing step is highly recommended.

For the CO2 capture, the cold flash option seems to be the most promising one, as it results in the lowest (relative) UTC for the CO2 produced, and because of the simplicity of the process. Additionally, the operability, flexibility and constructability are considered more positive for the cold flash technology when compared to the chemical absorption technology.

It should be noted that this study was performed at a high level, and optimisations have not yet been addressed – and with no specific CO2 recovery target. In the next phase, the reduction of the cooling/refrigeration duty could be further evaluated, as well as potential reduction in equipment count. This might change the individual contributions for these criteria somewhat, but it is expected that it will not change the final conclusion that oxygen operation with cold flash and PSA is the preferred option for CO2 and hydrogen recovery downstream of an SRU/TGTU complex.

Diego Scilla, Siirtec Nigi S.p.A, Italy, introduces an atmospheric liquid sulfur degassing solution that has been developed based on plant data.

As safety and emission requirements from sulfur plants receive increasing attention, liquid sulfur degassing technology continues to play an important role in the sulfur recovery industry. The recovered liquid sulfur, produced and condensed by the Claus process, contains dissolved hydrogen sulfide (H2S) and chemically-bonded hydrogen polysulfides (H2Sx), which may evolve during storage and transportation.

H2S is a colourless, poisonous, corrosive and flammable gas. Furthermore, the dissolved H2S in liquid sulfur increases the friability of any type of its solid form (crushed bulk or prills). Degassing of liquid sulfur, i.e. the removal of the dissolved H2S and H2Sx, is aimed at reducing the hazards exposed to operating personnel in handling and transport operations, as well as increasing the quality of the final product.

Siirtec Nigi has experience in designing sulfur degassing systems – both atmospheric and at pressure. With this experience, a proprietary design of atmospheric sulfur degassing has been developed and realised, based upon plant data obtained over several operations and supported by the development of mathematical models of degassing principles.

Specific features of the Siirtec Nigi DegaSN process are the very high stripping efficiency that is capable of guaranteeing less than 10 ppm wt residual H2S in the liquid sulfur at very limited operating costs, with a compact design that does not require any extra plant area or the addition of catalyst/chemicals.

The liquid sulfur from the Claus process typically contains 300 – 500 ppm wt of dissolved H2S, mainly in the form of H2Sx. The total residual H2S concentration is influenced by the H2S vapour concentration (partial pressure), and the temperature at which the sulfur product is condensed. Most technology applications for liquid sulfur degassing on the market are grouped into three categories:

n Liquid catalyst application.

n Solid catalyst application.

n Air degassing.

Catalytic degassing presents known drawbacks such as low liquid sulfur quality due to the presence of impurities in the degassed sulfur; solid sulfur with a weaker strength;

environmental concerns associated with sulfur handling; higher operating costs compared to conventional air degassing; and higher plant complexity.

Moreover, even if injected catalyst quantity is limited, sulfur buyers often require sulfur from non-catalytic degassing. Misoperations, such as the excessive addition of liquid catalyst, can lead to the formation of salts, with consequent fouling of pumps, piping, etc.

Air degassing usually takes place in concrete pits or columns, where oxygen is the catalytic agent for polysulfides dissociation. The majority of these processes utilise a sweep air stream to remove H2S from the vapour space above the sulfur as it is released from the liquid phase.

The chemistry behind the degassing process is outlined below, as a two-step reaction:

n Decomposition of H2Sx to sulfur and H2S:

§ H2Sx (liquid) → H2S (dissolved) + (x-1)S (liquid)

n Desorption of H2S from liquid to gas phase:

§ H2S (dissolved) → H2S (gas)

As H2S is removed from the system, the equilibrium is driven to the right, resulting in a further breakdown of H2Sx with subsequent degassing of more H2S. Air degassing occurs through a combination of mass transfer of H2S to air bubbles, and through the decomposition of H2Sx

In particular, air acts as stripping gas for H2S separation, whilst oxygen acts as a catalyst for the H2Sx decomposition reaction and, to a minor extent, to oxidise H2S to sulfur dioxide (SO2), which further increases the liquid sulfur production of the plant (via the Claus reaction).

Stripping air shall be adequately distributed in the liquid sulfur to improve the contact with the hydrogenated sulfur species. The presence of oxygen is a key factor for H2Sx decomposition, while low operating pressure in the degassing system is the key parameter for H2S desorption.

When air degassing is performed at almost atmospheric pressure, as is the case for the DegaSN design, initial H2S mass transfer is slightly less effective compared to degassing processes under pressure, but it is nevertheless enough to promote required reactions in any commercial scenario, while final stripping is enhanced when compared to the other processes.

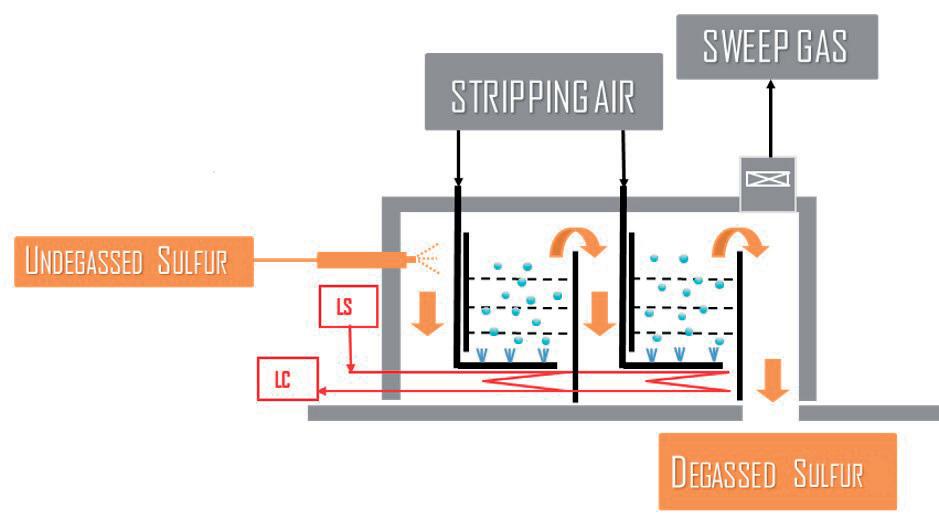

The DegaSN process consists of a concrete degassing box (see Figure 1), with an internal stainless steel lining equipped with two degassing sections with trays, where liquid sulfur flows upward co-currently with the stripping air, and then flows downward by gravity to the receiving vessel.

Liquid sulfur is fed to the degassing box through a sprayer before being contacted with the stripping air within the degassing sections. A fixed amount of low pressure (LP) steam and a slipstream of stripping air are mixed in the sprayer with the liquid sulfur. With such configuration, initial, significant separation of H2S from liquid sulfur occurs.

Each degassing section is equipped with rectangular mass transfer elements and can be easily designed with almost any aspect ratio, where limitations in plot space are restrictive. Stripping air is bubbled through the degassing elements, with the aim of providing intimate mixing between the gaseous and the liquid phase, and promoting mass transfer between the two phases.

As shown in Figure 2, liquid sulfur is initially collected in a chamber created against the first steel plate. It then flows upward through the first degassing stage, where atmospheric air is injected from the bottom of the section.

Overflowing from the second steel plate, sulfur is then collected in another chamber from where it feeds the second degassing stage where air injection is re-instated. Overflowing from the last steel plate, sulfur is then discharged to the receiving system.

The stripping air is distributed by means of dedicated spargers located below the mass transfer elements. The air is fed through heated nozzles located at the top of the concrete box (heating is typically recommended to be extended 10 – 15 m back on the stripping air feed line) to avoid cold spots – especially during start-ups and shutdowns. Spargers provide uniform distribution of the stripping air through the contacting volume crossed by the flowing liquid sulfur. The configuration of the spargers in terms of the shape and number of branches depends on the size of the contacting area, as well as the amount of stripping air fed into the system.

The temperature is maintained through dedicated steam coils, fed by LP steam. In principle, the steam coils should cover the entire floor of the degassing box in order to provide uniform heating. Draining of the degassing box is performed by the two external draining valves (one for each degassing section). The draining lines route the potentially off-spec liquid sulfur to the undegassed section of the sulfur pit. The routing takes into account the general requirements for liquid sulfur lines, these being slope, no pockets and jacketing. The draining valves are ball type, full bore, and steam jacketed, in compliance with liquid sulfur piping class requirements.

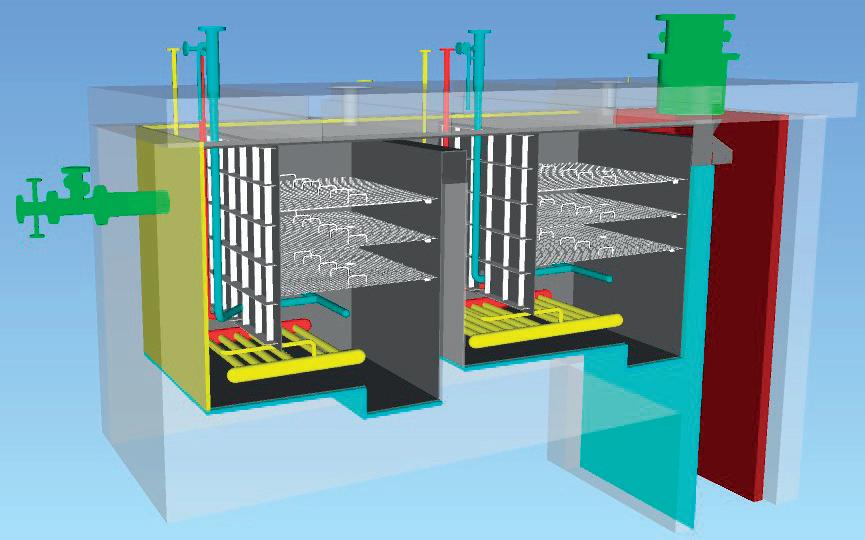

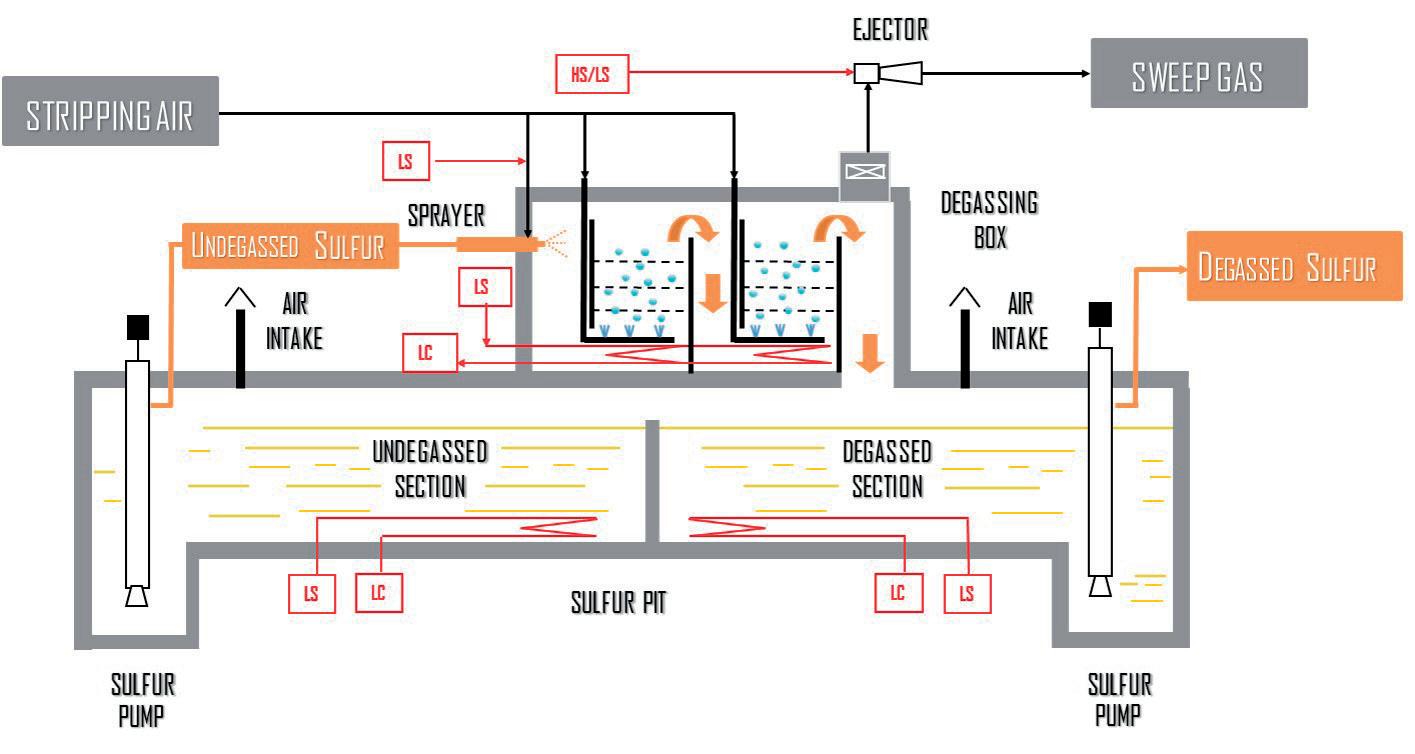

In most applications, the degassing box is installed above a concrete sulfur storage pit, saving plot space (Figure 3). However, the degassing box can also be installed externally from the pit depending on the layout constraints. An example of an integrated degassing system is represented in Figure 4.

Typically, the sulfur pit is divided into two sections separated by a partition wall: the undegassed sulfur section and the degassed sulfur section. The sulfur pit provides the operating storage capacity for the undegassed and degassed liquid sulfur. The sulfur pit and degassing box sizes are based on the specific project requirements, in terms of maximum load and storage capacity. The configuration may be adapted due to project contingencies requiring, for example, two standalone pit sections (undegassed/degassed), or integration with existing storage/degassing facilities.

The elemental liquid sulfur produced in the Claus process is discharged by gravity from the sulfur condensers to the sulfur pit. From the undegassed sulfur section, liquid sulfur is pumped to the degassing box where the degassing process takes place. The now degassed sulfur flows from the degassing box to the degassed section of the underlying sulfur pit.

After degassing, sulfur can be pumped from the pit –either directly to the tank truck, or to intermediate liquid sulfur storage. If the final sulfur product is handled as a solid, it is pumped to a storage block (where the sulfur is allowed to cool and solidify), or to sulfur-forming facilities.

The sulfur pit and degassing box are connected on the gas side, and both operate under slight vacuum. One or more ejectors, driven by saturated steam, are provided to ensure adequate sweeping of the sulfur pit through dedicated atmospheric air intake(s) located on the pit roof, resulting in a negative operating pressure.

Under these conditions, H2S is continuously released by the flowing liquid sulfur, accumulating in the vapour space of the sulfur pit, and causing an explosion hazard. Sweeping is then required to prevent the formation of explosive mixtures, and to ensure that H2S concentration in the vapour space remains below the lower explosive limit.

Stripping air is typically fed by the upstream Claus unit combustion air blowers, and so no extra blowers are needed. In a generic application, the stripping air flow rate is in the range of 2 – 4% of Claus combustion air requirements. Moreover, the low operating pressure of the DegaSN system results in very low operating duties required by the

already installed machine. This is an advantage over degassing systems at pressure, which require dedicated high duty blowers.

The degassing box sweep gas containing stripped H2S, together with the sweep air present in the sulfur pit vapour space (in case the two systems are connected), is moved by the steam ejector and routed to a thermal incinerator, or alternatively recycled back to the Claus process with minimal use of motive steam. Sweep gas recycle to the Claus process has the potential to maximise the sulfur recovery efficiency (SRE) of the unit, with minimal or no disturbances to the Claus reaction furnace operation.

As aforementioned, in typical sulfur degassing system applications, sweep gas contains a certain amount of sulfur (in the form of H2S and S-vapour) that can be recovered/recycled to the upstream Claus process in order to enhance the overall SRE.

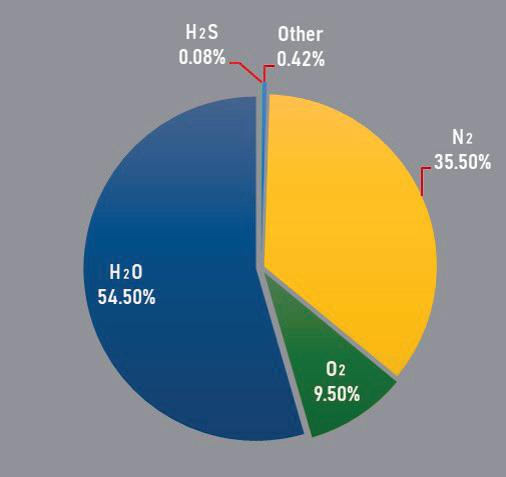

Figure 5 shows a typical sweep gas composition for an atmospheric liquid sulfur degassing system with air stripping. A conventional approach in recycling the degassing sweep gas is to route it back to the thermal stage of the Claus process, i.e. to the reaction furnace. The main component of this stream is water, which acts as a diluent for the reaction furnace operation. Consequently,

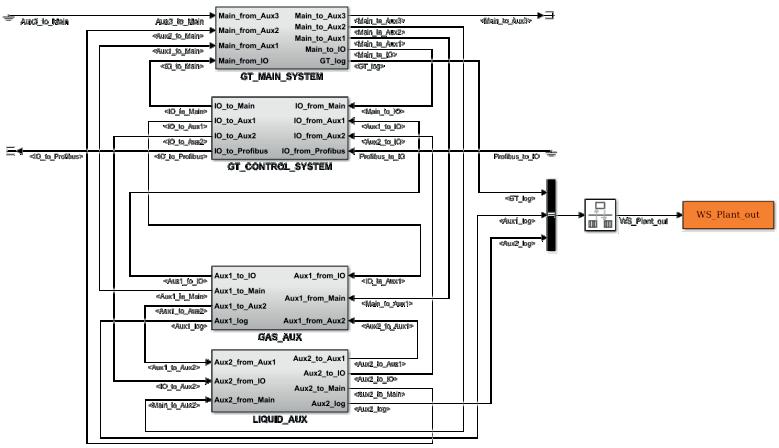

A REAL-TIME DYNAMIC SIMULATOR OF GAS TURBINES

DESIGN AND ANALYSIS OF GT MAIN SYSTEM AND AUXILIARIES

GT CONTROL SYSTEM VERIFICATION & VALIDATION BY HIL TESTING

SCENARIOS

Verify and validate the real GT Control System (GTCS)

Hardware-in-the-Loop (HIL) full system testing

Whole system performance analysis:

Accurate performance envelope

Start-up sequences

Normal and emergency shutdowns

Load rejection

Investigation of fault events

TECHNICAL DETAILS

0-D modelling

GT component modules libraries

Real-time compatibility at millisecond scale

User friendly GUI & pre-/post-processing tools

Split stages or whole compressor maps management

Single or bi-fuel combustion chambers

the impact of sweep gas recycle on Claus reaction furnace combustion is typically a 50°C (approximately) decrease in reaction temperature, which can be easily compensated by other unit adjustments (e.g. acid gas split or combustion air preheating).

On the other hand, the expected increase in overall SRE is around 0.05%, which allows for a significant reduction in the resulting SO2 emissions through the stack. In these cases, the combustion air demand to the reaction furnace has to be adjusted accordingly, as the sweep gas also contains some amount of oxygen.

The sulfur pit and degassing box are provided with heating coils to compensate for heat losses and keep the sulfur in liquid form. Therefore, the main utility required for a sulfur degassing system is typically steam.

Considering sulfur degassing system integration with the upstream Claus process, a valuable steam source comes from the heat recovered in the thermal and catalytic stages.

In particular, LP steam produced by sulfur condensers can be used in heating coils and ejectors (when sweep gas is routed to the incinerator); high pressure (HP) steam produced by the Claus waste heat boiler can be used for the ejectors when sweep gas is recycled to the Claus process.

In a typical SRU energy balance, where sweep gas is recycled to the Claus process, LP steam consumption for

the sulfur degassing system heating coils is around 3% of sulfur condenser production, while HP steam consumption for ejectors is less than 5% of waste heat boiler production.

The development of the DegaSN process dates back to the early 2000s. Its first application was in a gas field in North Africa, where its performance was tested during operation. Later on, additional tests on live plants in Italy were conducted at different loads with the aim to validate a theoretical model developed by Siirtec Nigi’s Research & Development department, based on the equilibrium and kinetics mainly between oxygen, H2S and H2Sx inside the liquid sulfur.

The model first evaluates the actual initial amount of H2S/H2Sx absorbed in the undegassed sulfur, which is defined by the following effluent conditions from each sulfur condenser:

n Liquid sulfur flow rate.

n Partial pressure of H2S.

n Condensers’ outlet temperature.

This data is then used to calculate the liquid sulfur load to the degassing system, the average sulfur temperature, and the average H2S partial pressure. The calculation of the total amount of H2S and H2Sx dissolved in undegassed

sulfur is based on Henry’s law, and corrected with specific coefficients.

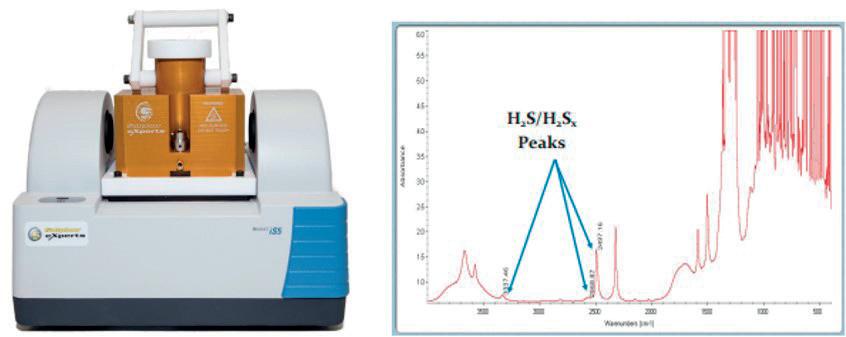

The rate of H 2 S x decomposition reaction and the relevant mass transfer are then calculated based on the velocity of liquid sulfur flowing through the degassing box contacting volume, together with stripping air, to promote the subsequent H 2 S stripping. The theoretical model used to design the DegaSN system has been tuned with field data suiting the required results. The performances were tested using Sulphur Experts’ FTIR. This technology is specifically designed for the measurement of H 2 S and H 2 S x dissolved in liquid sulfur (see Figure 6).

Siirtec Nigi has designed and built more than 30 sulfur degassing units around the world. This has increased over time with experience and optimisation of the process, improving operability and unit availability. The capacity range for a single unit is 5 – 500 tpd. As experience has been gained, a number of design specifics have been made:

n Keeping the liquid sulfur temperature within the correct temperature range has been proven successfully by using a dedicated steam pressure control for the steam supply to the heating coils, and can be considered as part of the design of the DegaSN system.

n In some cases, depending on the Claus unit design capacity and the operating conditions of the Claus process, a dedicated sulfur cooler is provided between the undegassed sulfur pumps and the degassing box in order to reach a stable degassing temperature and optimum sulfur viscosity, all while recovering sensible heat.

n All metal items in contact with the liquid sulfur and gas atmosphere are made in stainless steel.

n This is due to corrosion occurring when flowing liquid sulfur removes the protective layer accumulated on the metal surface.

The atmospheric DegaSN process has been specifically developed to provide a competitive technology for degassing of liquid sulfur, with the advantages of a simple, robust process with a compact layout. It has been implemented on several SRUs of different capacity.

This process offers a combination of air stripping and improved sulfur agitation, as well as very high stripping efficiency (achieving as low as 5 ppm wt of residual H2S), and limited operating cost. The system is designed to safely contain and process the liquid sulfur at the correct temperature and at near atmospheric pressure, thus allowing all DegaSN components to be designed as civil structures provided with internals, heating coils and valves.

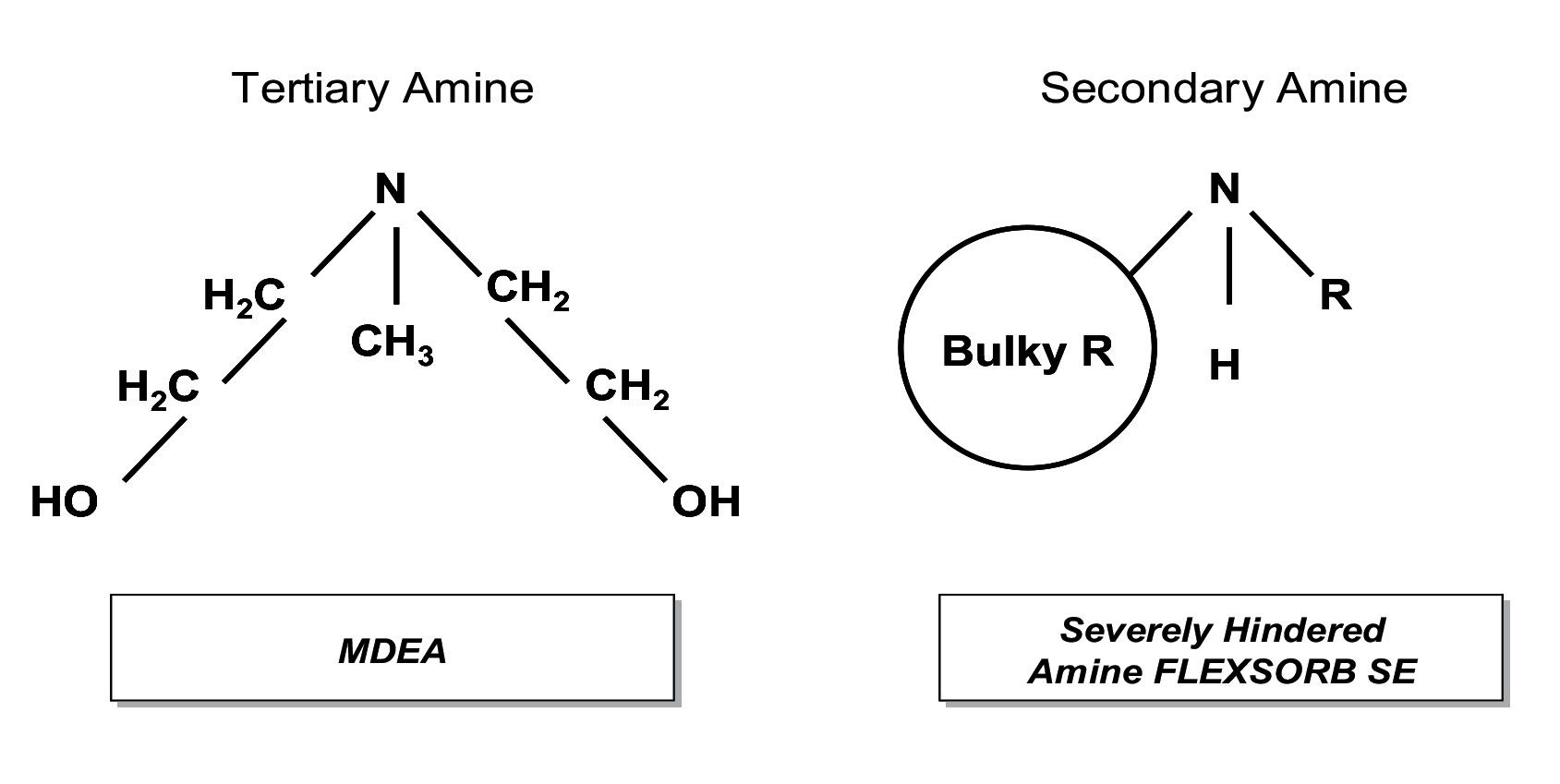

Robert B. Fedich and Amalia Pantazidis, ExxonMobil Catalysts and Licensing LLC, USA, outline the benefits of a flexible initial process design for an amine unit on an offshore platform.

When an offshore gas platform was designed more than 20 years ago, the engineers knew they had to face many challenges due to its location in about 300 ft of water and the inclement weather conditions in the Central North Sea. The reservoir itself is about 15 000 ft below the sea bed and is a high temperature, high pressure reservoir. A gas treating technology was required to produce export gas offshore which would meet sales gas quality specifications.

This is a joint venture license holder. Design gas production was less than 500 million standard ft3/d and condensate production was less than 100 000 bpd. The gas export pipeline is a

shared pipeline that requires both a low temperature separator and an amine plant to be installed on the offshore platform. The original sweetening duty of the amine plant is to remove hydrogen sulfide (H2S) from about 53 vppm to less than 1 vppm, while simultaneously controlling the export carbon dioxide (CO2) content in the sales gas within a limited range. The H2S specification of less than 1 vppm is very low compared to the typical range of 3 – 4 vppm, depending upon the region. The Wobbe index (heating value) of the export gas must be tightly controlled. The CO2 must be removed in the amine unit, designed for 3.4 mol% in the feed gas to 1.7 mol% in the treated gas. All of these requirements lead to a very

demanding duty of the amine plant, complicated by the fact that the amine plant will be installed in an offshore environment.